Document

|

|

|

|

|

|

|

NorthWestern Energy Group, Inc.

d/b/a NorthWestern Energy

3010 W. 69th Street

Sioux Falls, SD 57108

www.northwesternenergy.com

|

FOR IMMEDIATE RELEASE

NorthWestern Reports First Quarter 2024 Financial Results

Company reports GAAP diluted earnings per share of $1.06 for the quarter;

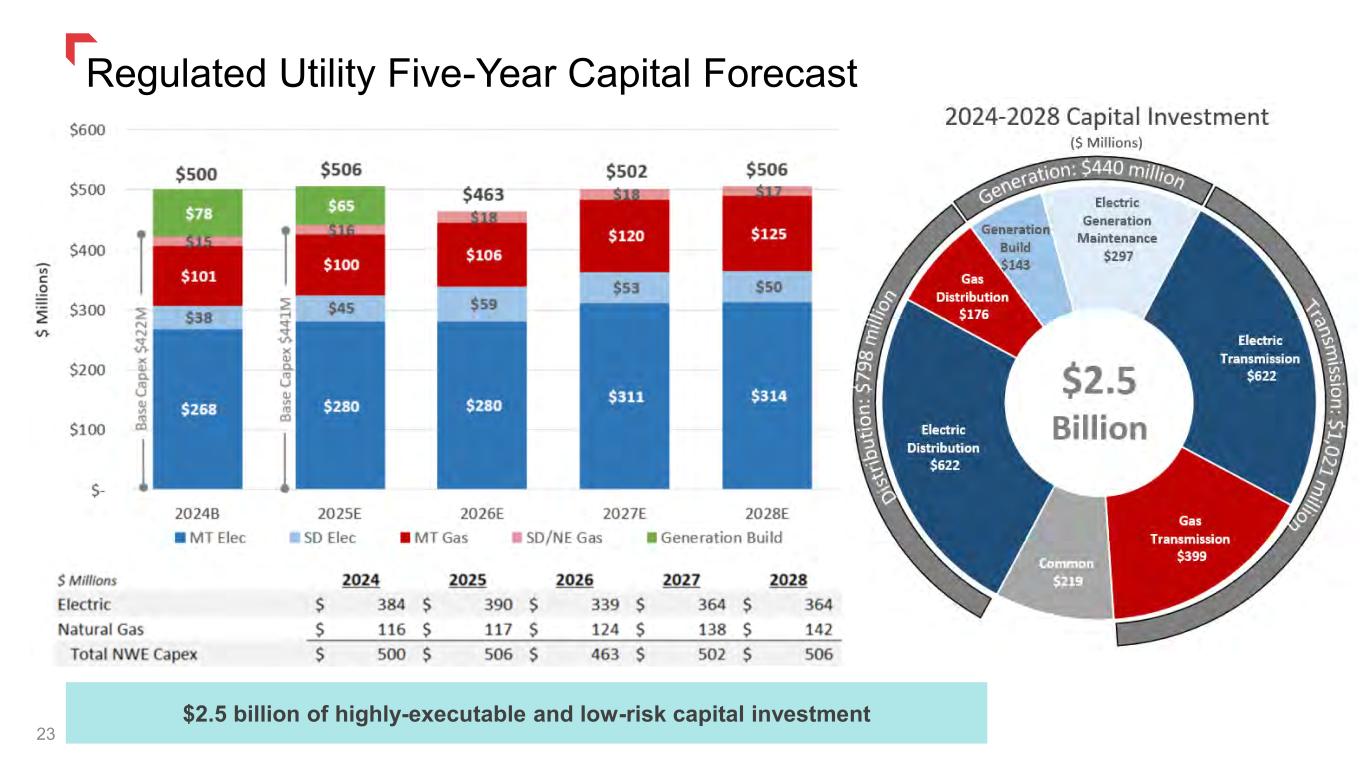

affirms 2024 earnings guidance and $500 million capital investment plan; and

announces a $0.65 per share quarterly dividend payable June 28, 2024

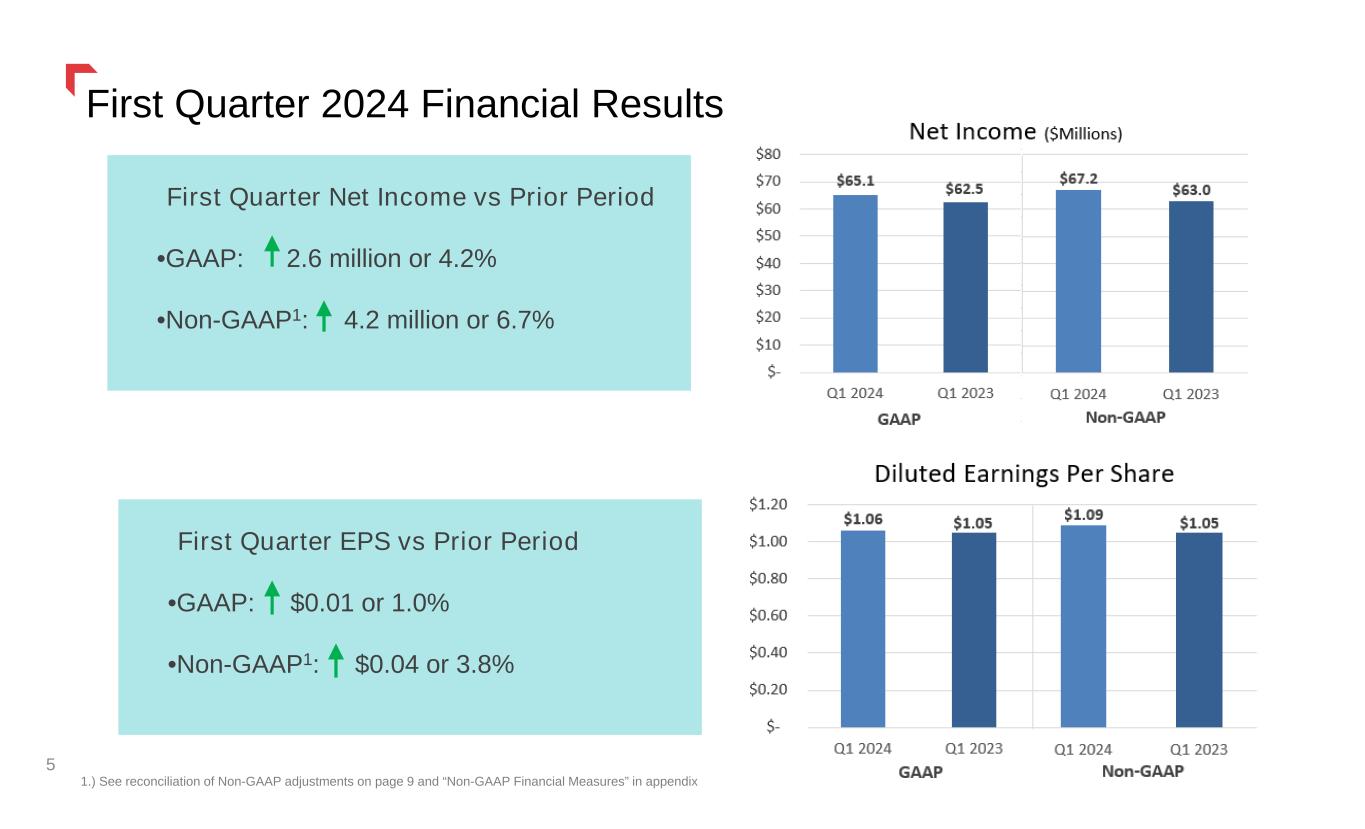

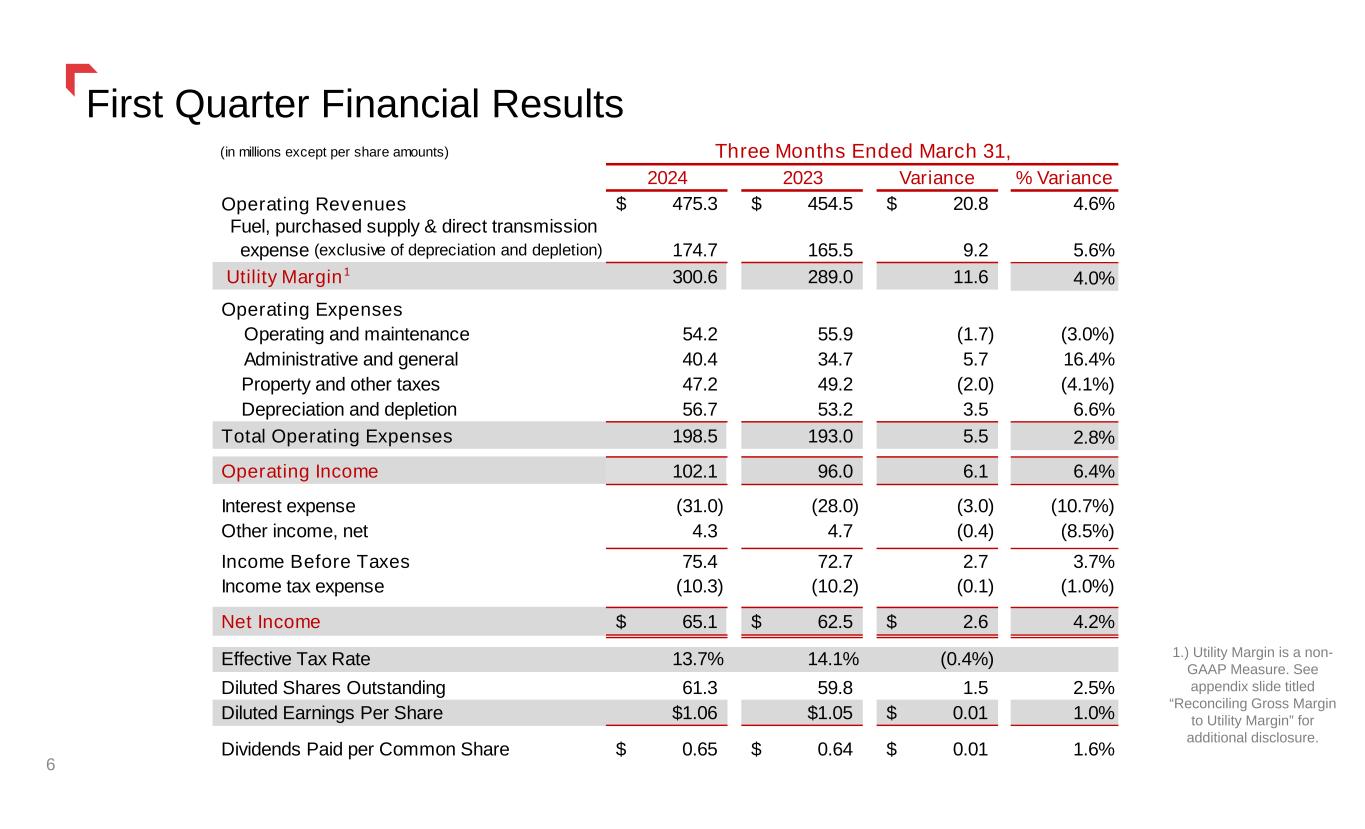

BUTTE, MT / SIOUX FALLS, SD - April 25, 2024 - NorthWestern Energy Group, Inc. d/b/a NorthWestern Energy (Nasdaq: NWE) reported financial results for the three months ended March 31, 2024. Net income for the period was $65.1 million, or $1.06 per diluted share, as compared with net income of $62.5 million, or $1.05 per diluted share, for the same period in 2023.

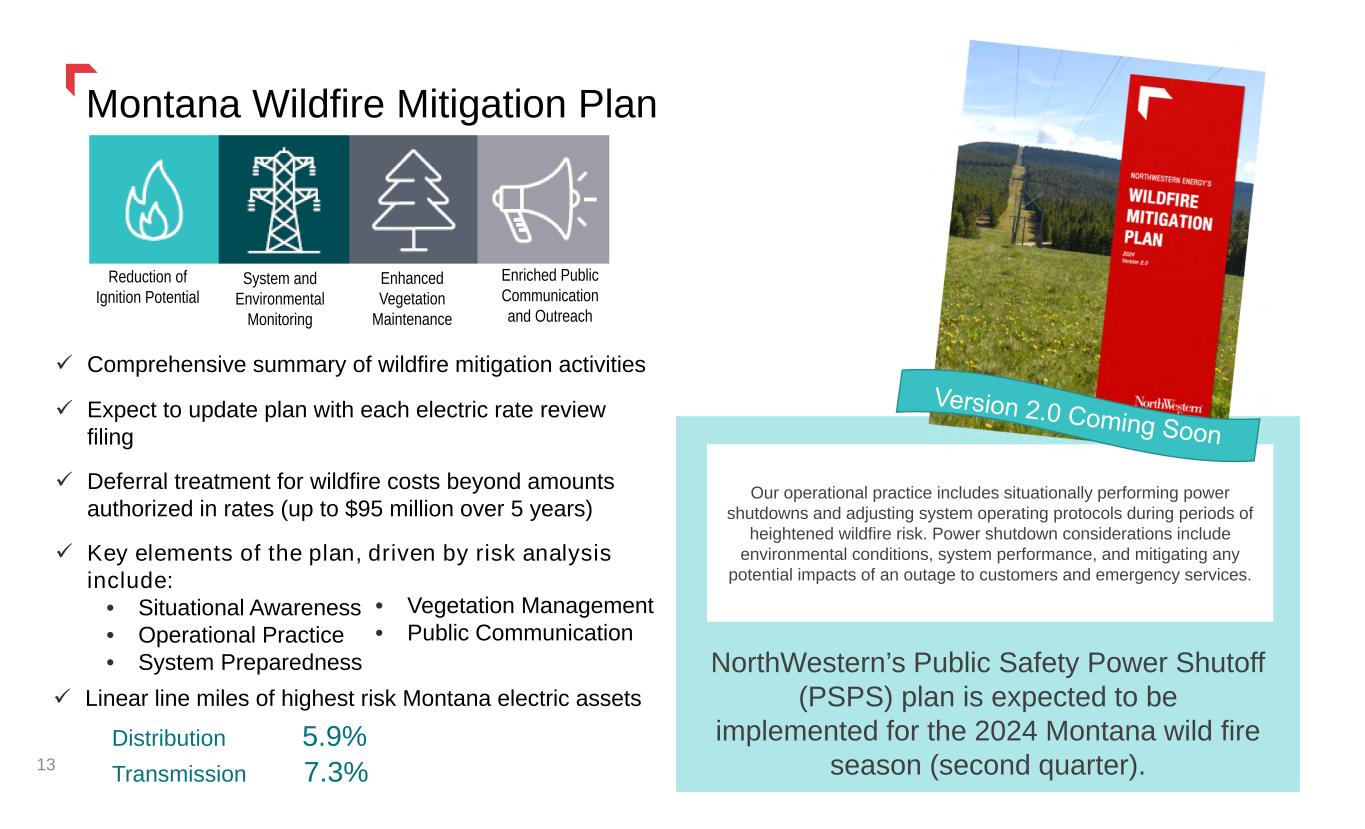

“Solid regulatory execution provided for quarter-over-earnings growth. New rates in Montana and South Dakota helped offset mild weather and a few one-time headwinds in the first quarter,” said Brian Bird, President and CEO. “We are affirming 2024 earnings guidance and remain on track to complete our $500 million capital plan, including the in-service of our 175 megawatt Yellowstone County Generating Station in Montana. Additionally, we expect to release our updated Wildfire Mitigation Plan soon which includes our new Public Safety Power Shutoff process. The plan recognizes and addresses the unique needs of our customers, communities and first responders.”

FIRST QUARTER 2024 COMPARED TO FIRST QUARTER 2023

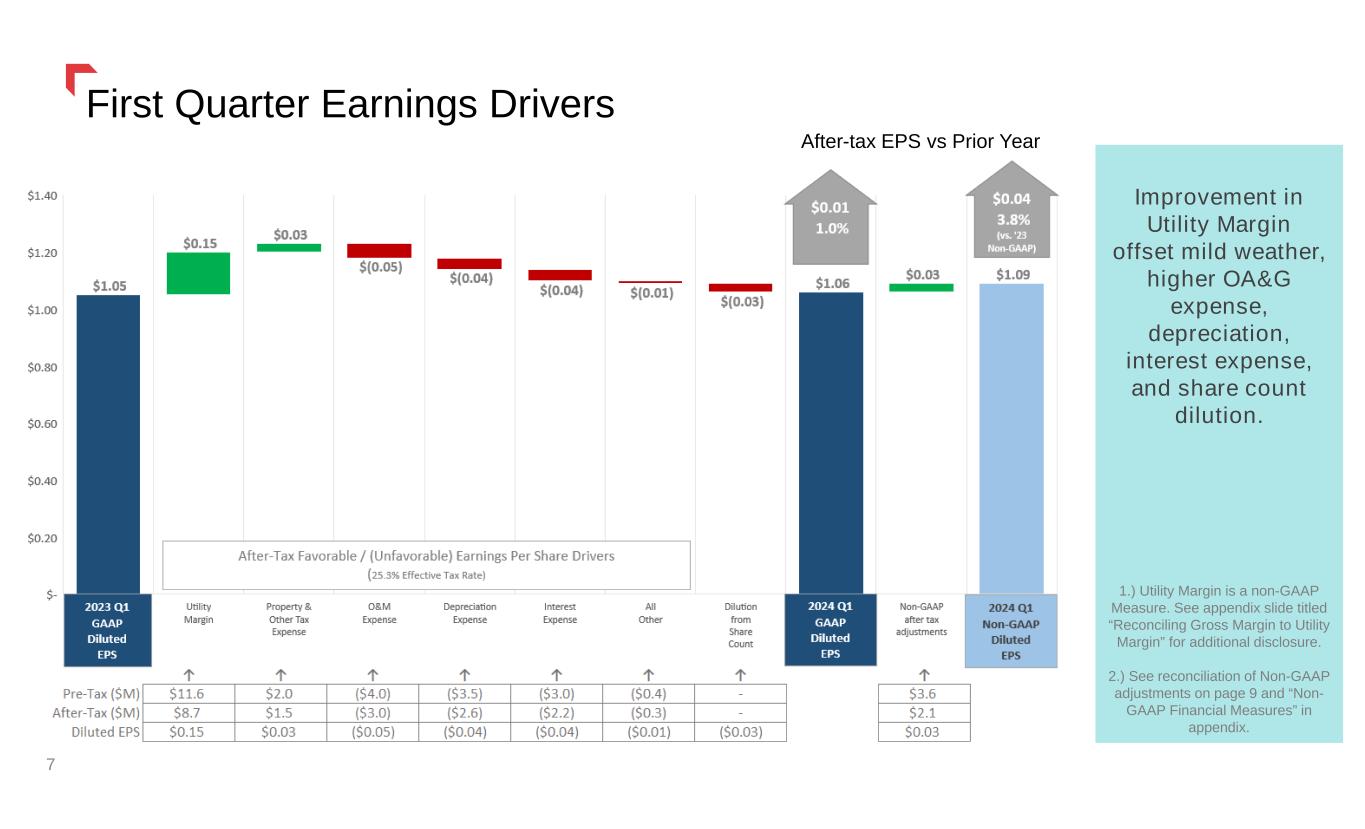

The increase in net income was primarily due to new base rates resulting from the Montana and South Dakota rate reviews, higher transmission revenues, and higher Montana property tax tracker collection, partly offset by lower electric and natural gas retail volumes, higher non-recoverable Montana electric supply costs, higher depreciation and depletion expense, higher operating, maintenance, and administrative expenses, and higher interest expense. Diluted earnings per share also increased as a result of higher net income but was partially offset by increased average shares outstanding due to equity issuances during 2023.

Adjusted non-GAAP diluted earnings per share for the quarter ended March 31, 2024 was $1.09 as compared to $1.05 for the same period in 2023. See “Adjusted Non-GAAP Earnings” and “Non-GAAP Financial Measures” sections below for more information on these measures.

COMPANY UPDATES

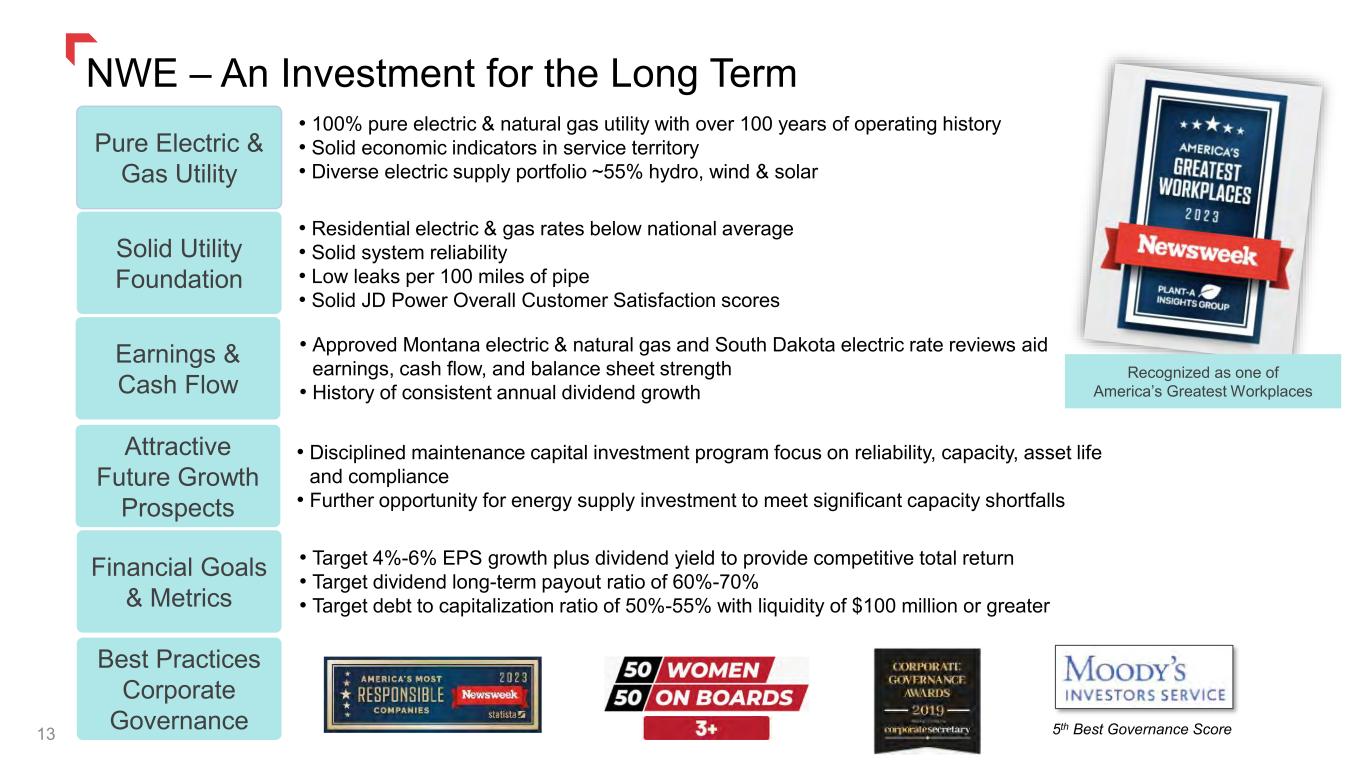

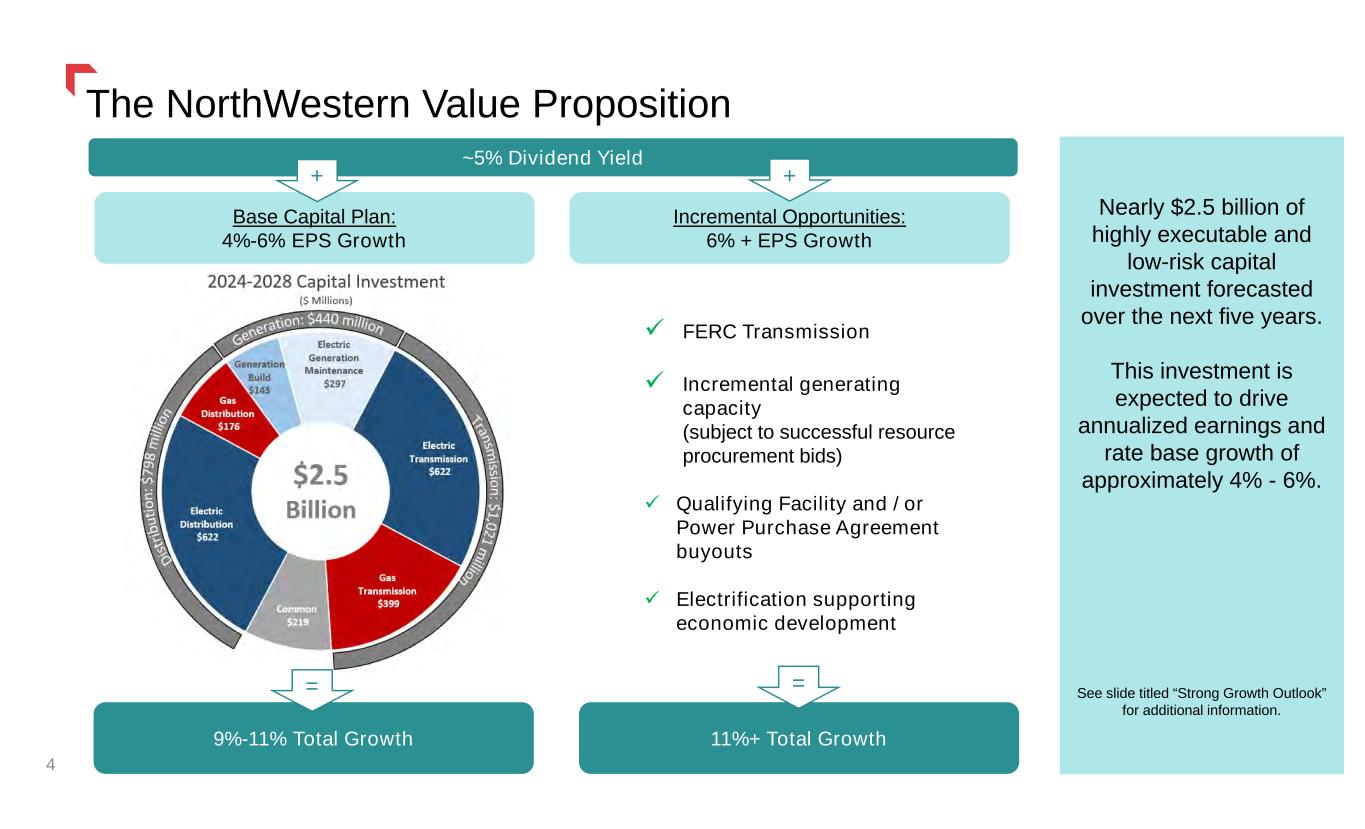

Affirming 2024 Earnings Guidance, Capital Plan and Long-Term EPS Growth

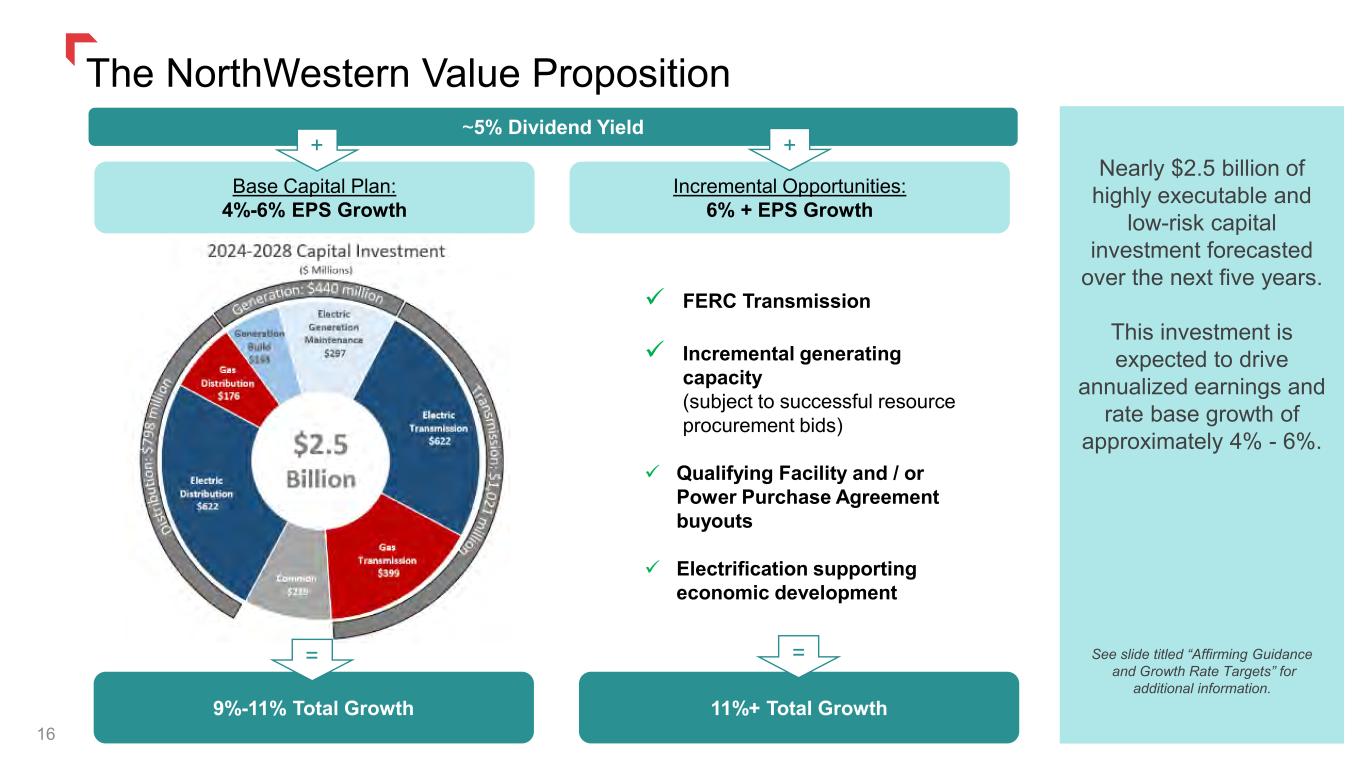

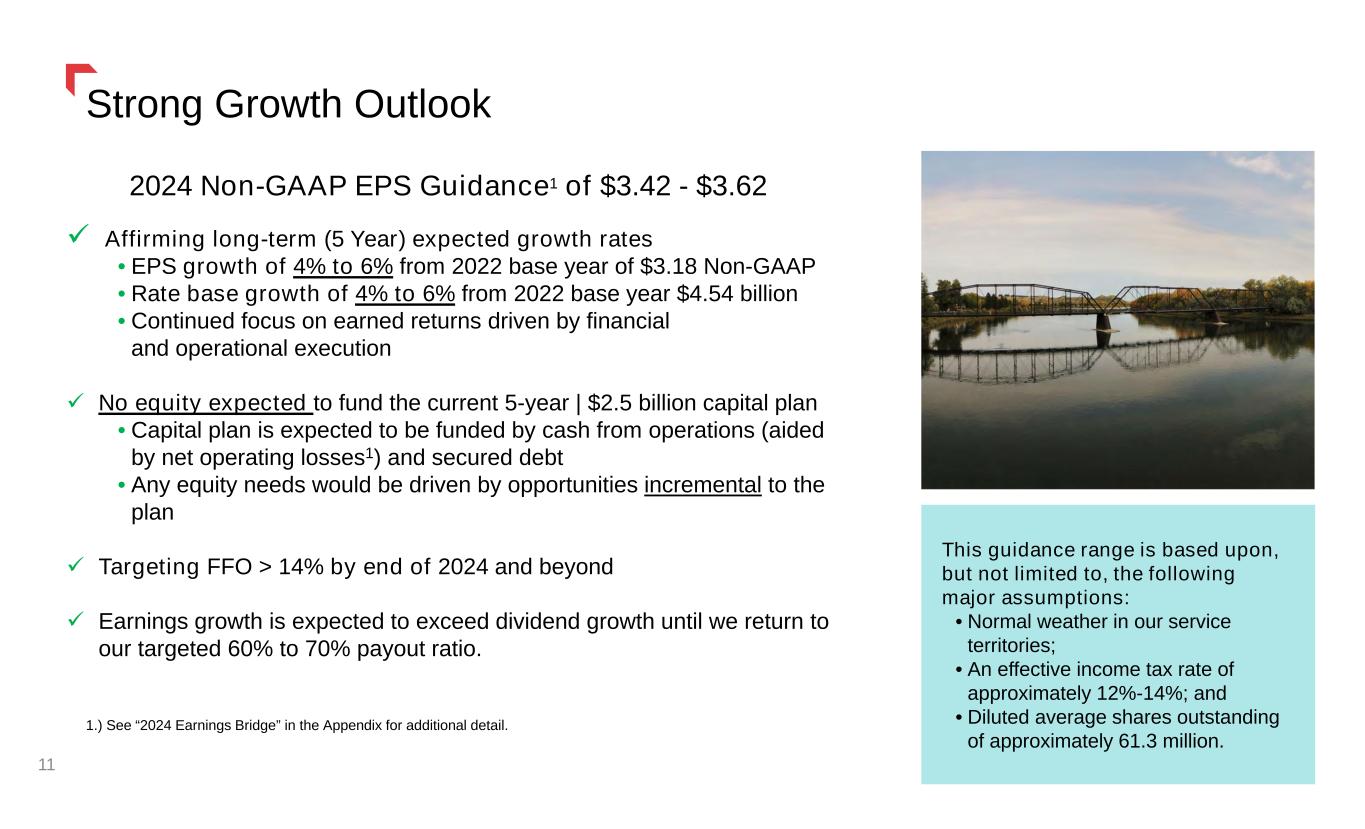

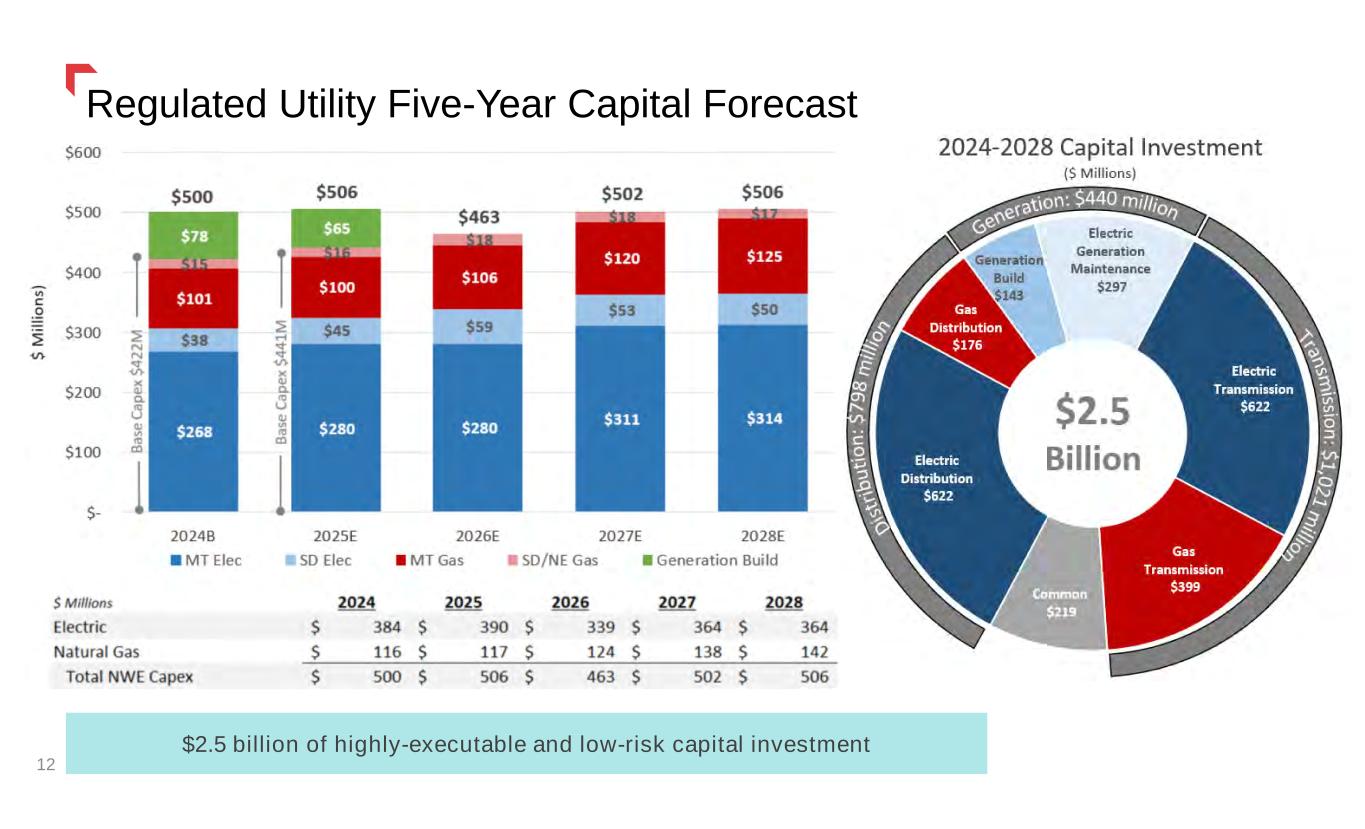

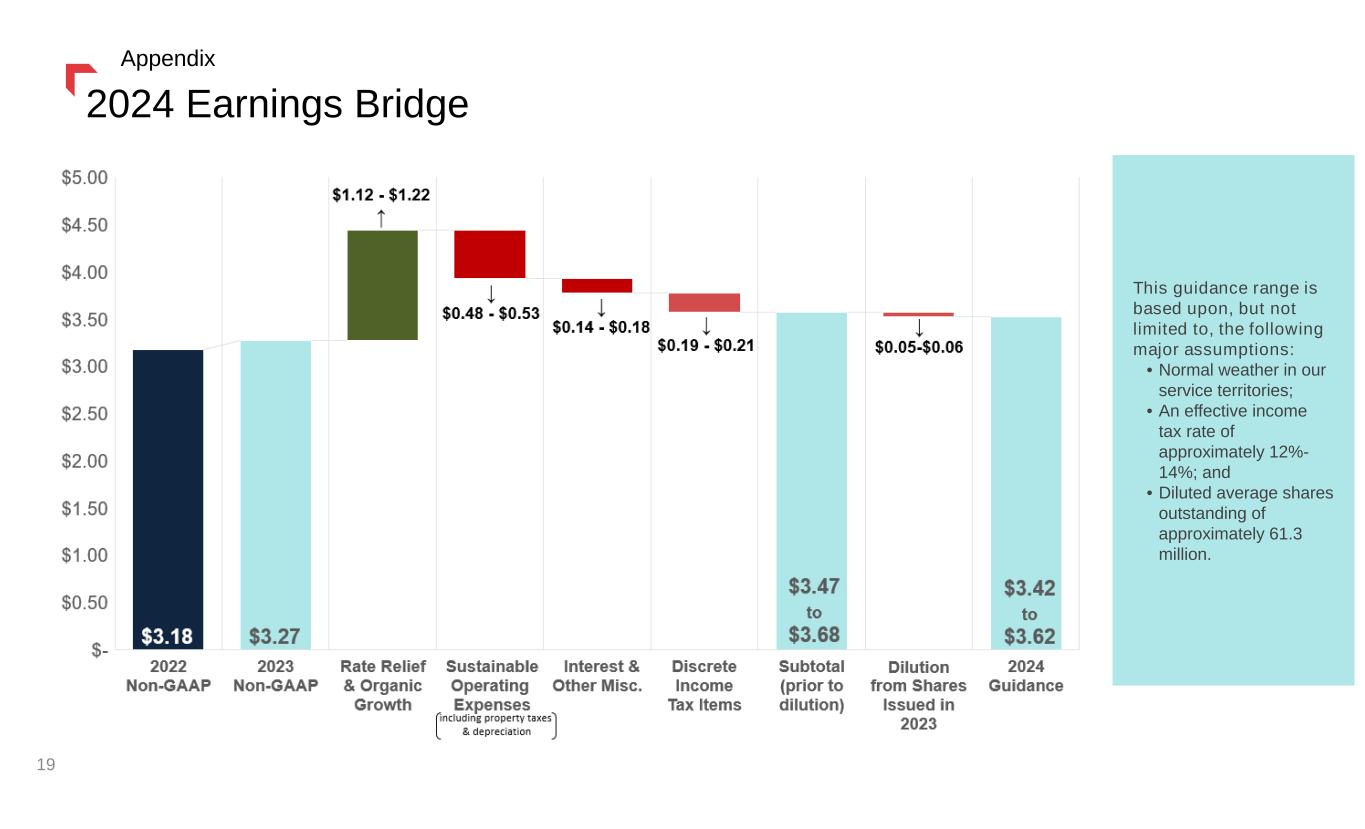

We are affirming 2024 diluted earnings guidance of $3.42 - $3.62 per diluted share and our $500 million capital plan. This guidance is based upon, but not limited to, the following major assumptions:

• Normal weather in our service territories;

• An effective income tax rate of approximately 12%-14%; and

• Diluted average shares outstanding of approximately 61.3 million.

NorthWestern Reports First Quarter 2024 Financial Results

April 25, 2024

Page 2

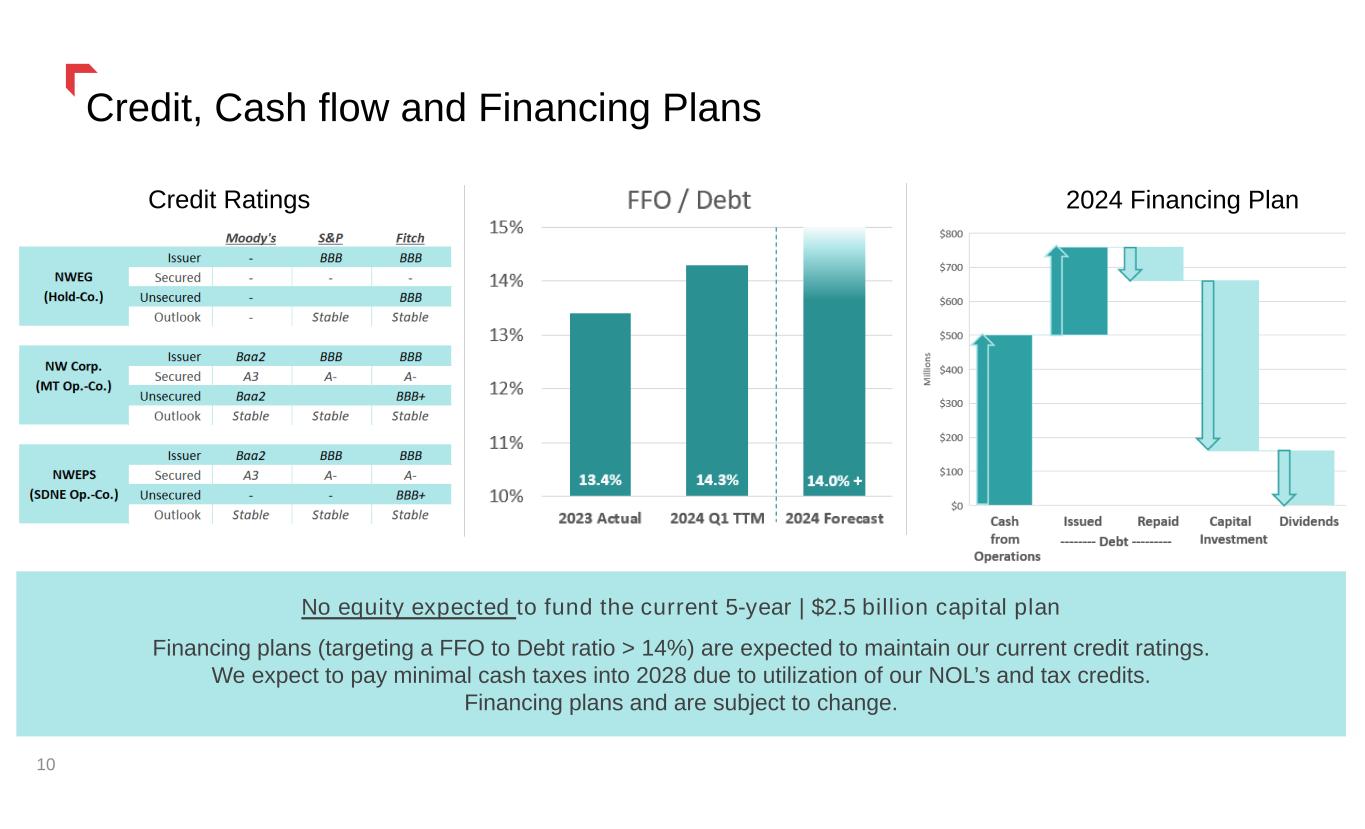

We are also affirming our long-term (5 year) diluted earnings per share growth guidance of 4% to 6% from a 2022 base year of $3.18 diluted earnings per share on a non-GAAP basis. We expect rate base growth of 4% to 6%. Our current capital investment program is sized to provide for no equity issuances. Future generation capacity additions or other strategic opportunities may require equity financing.

Dividend Declared

NorthWestern Energy Group's Board of Directors declared a quarterly common stock dividend of $0.65 per share payable June 28, 2024 to common shareholders of record as of June 14, 2024. Over the longer-term, we expect to maintain a dividend payout ratio within a targeted 60-70% range.

Additional information regarding this release can be found in the earnings presentation at

https://www.northwesternenergy.com/investors/earnings

[The remainder of page is intentionally left blank]

NorthWestern Reports First Quarter 2024 Financial Results

April 25, 2024

Page 3

CONSOLIDATED STATEMENT OF INCOME

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

|

Three Months Ended March 31, |

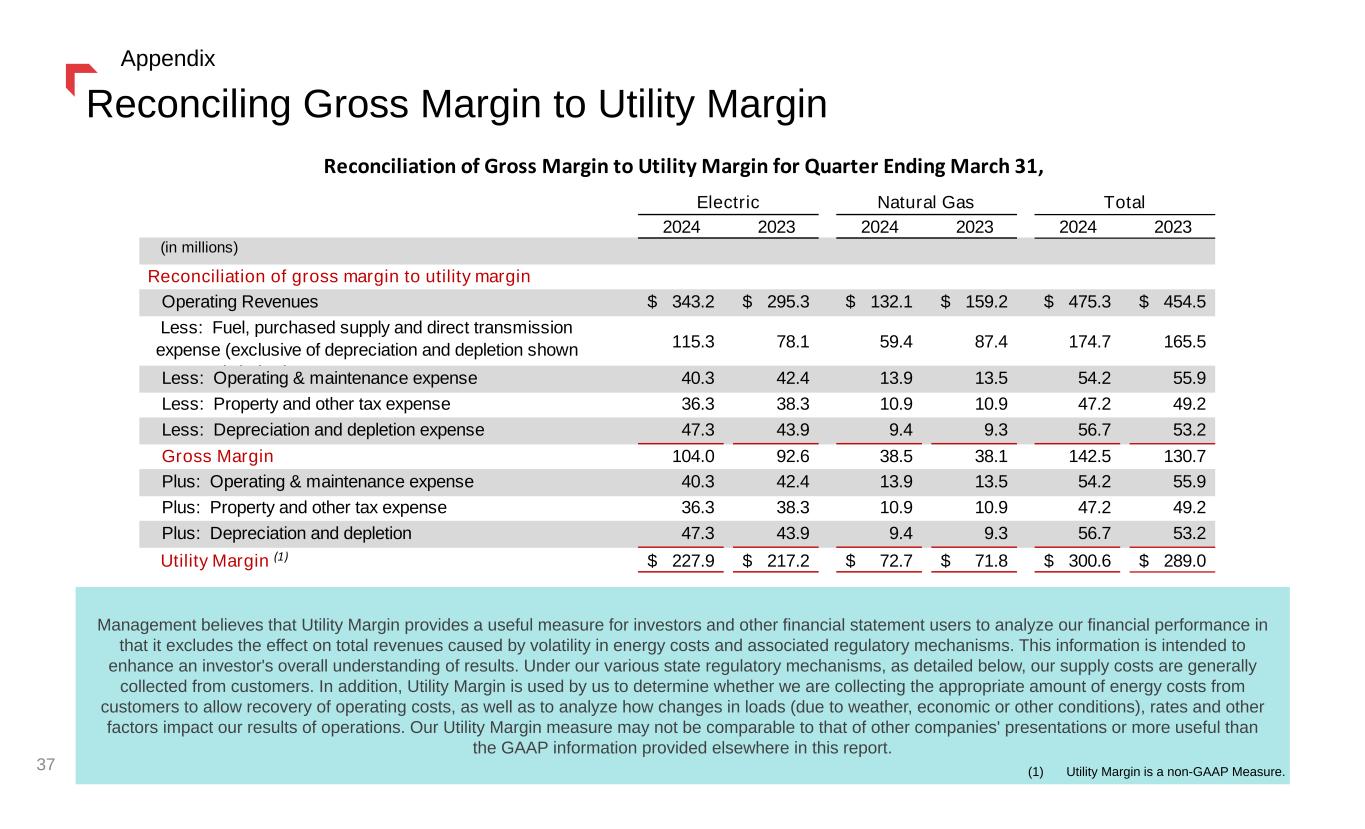

| Reconciliation of gross margin to utility margin: |

|

2024 |

|

2023 |

|

|

|

| Operating Revenues |

|

$ |

475.3 |

|

|

$ |

454.5 |

|

| Less: Fuel, purchased supply and direct transmission expense (exclusive of depreciation and depletion shown separately below) |

|

174.7 |

|

|

165.5 |

|

| Less: Operating and maintenance |

|

54.2 |

|

|

55.9 |

|

| Less: Property and other taxes |

|

47.2 |

|

|

49.2 |

|

| Less: Depreciation and depletion |

|

56.7 |

|

|

53.2 |

|

| Gross Margin |

|

$ |

142.5 |

|

|

$ |

130.7 |

|

|

|

|

|

|

| Operating and maintenance |

|

54.2 |

|

|

55.9 |

|

| Property and other taxes |

|

47.2 |

|

|

49.2 |

|

| Depreciation and depletion |

|

56.7 |

|

|

53.2 |

|

Utility Margin(1) |

|

$ |

300.6 |

|

|

$ |

289.0 |

|

1) Non-GAAP financial measure. See “Non-GAAP Financial Measures” below. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

| (in millions, except per share amounts) |

|

2024 |

|

2023 |

| Revenues |

|

$ |

475.3 |

|

|

$ |

454.5 |

|

Fuel, purchased supply and direct transmission expense(1) |

|

174.7 |

|

|

165.5 |

|

Utility Margin (2) |

|

300.6 |

|

|

289.0 |

|

|

|

|

|

|

| Operating and maintenance |

|

54.2 |

|

|

55.9 |

|

| Administrative and general |

|

40.4 |

|

|

34.7 |

|

| Property and other taxes |

|

47.2 |

|

|

49.2 |

|

| Depreciation and depletion |

|

56.7 |

|

|

53.2 |

|

Total Operating Expenses (3) |

|

198.5 |

|

|

193.0 |

|

| Operating income |

|

102.1 |

|

|

96.0 |

|

| Interest expense, net |

|

(31.0) |

|

|

(28.0) |

|

| Other income, net |

|

4.3 |

|

|

4.7 |

|

| Income before income taxes |

|

75.4 |

|

|

72.7 |

|

| Income tax expense |

|

(10.3) |

|

|

(10.2) |

|

| Net Income |

|

65.1 |

|

|

62.5 |

|

| Basic Shares Outstanding |

|

61.3 |

|

|

59.8 |

|

| Earnings per Share - Basic |

|

$ |

1.06 |

|

|

$ |

1.05 |

|

| Diluted Shares Outstanding |

|

61.3 |

|

|

59.8 |

|

| Earnings per Share - Diluted |

|

$ |

1.06 |

|

|

$ |

1.05 |

|

|

|

|

|

|

| Dividends Declared per Common Share |

|

$ |

0.65 |

|

|

$ |

0.64 |

|

(1) Exclusive of depreciation and depletion expense.

(2) Utility Margin is a Non-GAAP financial measure. See "Reconciliation of gross margin to utility margin" above and “Non-GAAP Financial Measures” below.

(3) Excluding fuel, purchased supply and direct transmission expense. |

alte

NorthWestern Reports First Quarter 2024 Financial Results

April 25, 2024

Page 4

RECONCILIATION OF PRIMARY CHANGES DURING THE QUARTER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, 2024 vs. 2023 |

|

|

Pre-tax

Income |

|

Income Tax (Expense) Benefit (3) |

|

Net

Income |

|

Diluted

Earnings

Per Share |

|

|

(in millions, except EPS) |

|

|

| First Quarter, 2023 |

|

$ |

72.7 |

|

|

$ |

(10.2) |

|

|

$ |

62.5 |

|

|

$ |

1.05 |

|

Variance in revenue and fuel, purchased supply, and direct transmission expense(1) items impacting net income: |

|

|

|

|

|

|

|

|

| New base rates |

|

19.8 |

|

|

(5.0) |

|

|

14.8 |

|

|

0.25 |

|

| Higher electric transmission revenue |

|

3.5 |

|

|

(0.9) |

|

|

2.6 |

|

|

0.04 |

|

| Montana property tax tracker collections |

|

0.9 |

|

|

(0.2) |

|

|

0.7 |

|

|

0.01 |

|

| Higher non-recoverable Montana electric supply costs due to higher electric supply costs |

|

(3.5) |

|

|

0.9 |

|

|

(2.6) |

|

|

(0.04) |

|

| Lower natural gas retail volumes |

|

(3.5) |

|

|

0.9 |

|

|

(2.6) |

|

|

(0.04) |

|

| Lower electric retail volumes |

|

(3.2) |

|

|

0.8 |

|

|

(2.4) |

|

|

(0.04) |

|

| Lower revenue from higher production tax credits, offset within income tax benefit |

|

(0.5) |

|

|

0.5 |

|

|

— |

|

|

— |

|

| Other |

|

0.1 |

|

|

0.0 |

|

|

0.1 |

|

|

— |

|

|

|

|

|

|

|

|

|

— |

|

Variance in expense items(2) impacting net income: |

|

|

|

|

|

|

|

— |

|

| Higher operating, maintenance, and administrative expenses |

|

(4.3) |

|

|

1.1 |

|

|

(3.2) |

|

|

(0.05) |

|

| Higher depreciation expense |

|

(3.5) |

|

|

0.9 |

|

|

(2.6) |

|

|

(0.04) |

|

| Higher interest expense |

|

(3.0) |

|

|

0.8 |

|

|

(2.2) |

|

|

(0.04) |

|

| Higher property and other taxes not recoverable within trackers |

|

(0.4) |

|

|

0.1 |

|

|

(0.3) |

|

|

(0.01) |

|

| Other |

|

0.3 |

|

|

— |

|

|

0.3 |

|

|

— |

|

| Dilution from higher share count |

|

|

|

|

|

|

|

(0.03) |

|

| First Quarter, 2024 |

|

$ |

75.4 |

|

|

$ |

(10.3) |

|

|

$ |

65.1 |

|

|

1.06 |

|

| Change in Net Income |

|

|

|

|

|

$ |

2.6 |

|

|

$ |

0.01 |

|

(1) Exclusive of depreciation and depletion shown separately below

(2) Excluding fuel, purchased supply, and direct transmission expense

(3) Income Tax (Expense) Benefit calculation on reconciling items assumes blended federal plus state effective tax rate of 25.3%.

SIGNIFICANT TRENDS AND REGULATION

Refer to the NorthWestern Energy Group Annual Report on the Form 10-K for the year ended December 31, 2023 for disclosure of the significant trends and regulations that could have a significant impact on our business. These significant trends and regulations have not changed materially since such disclosure, except as follows:

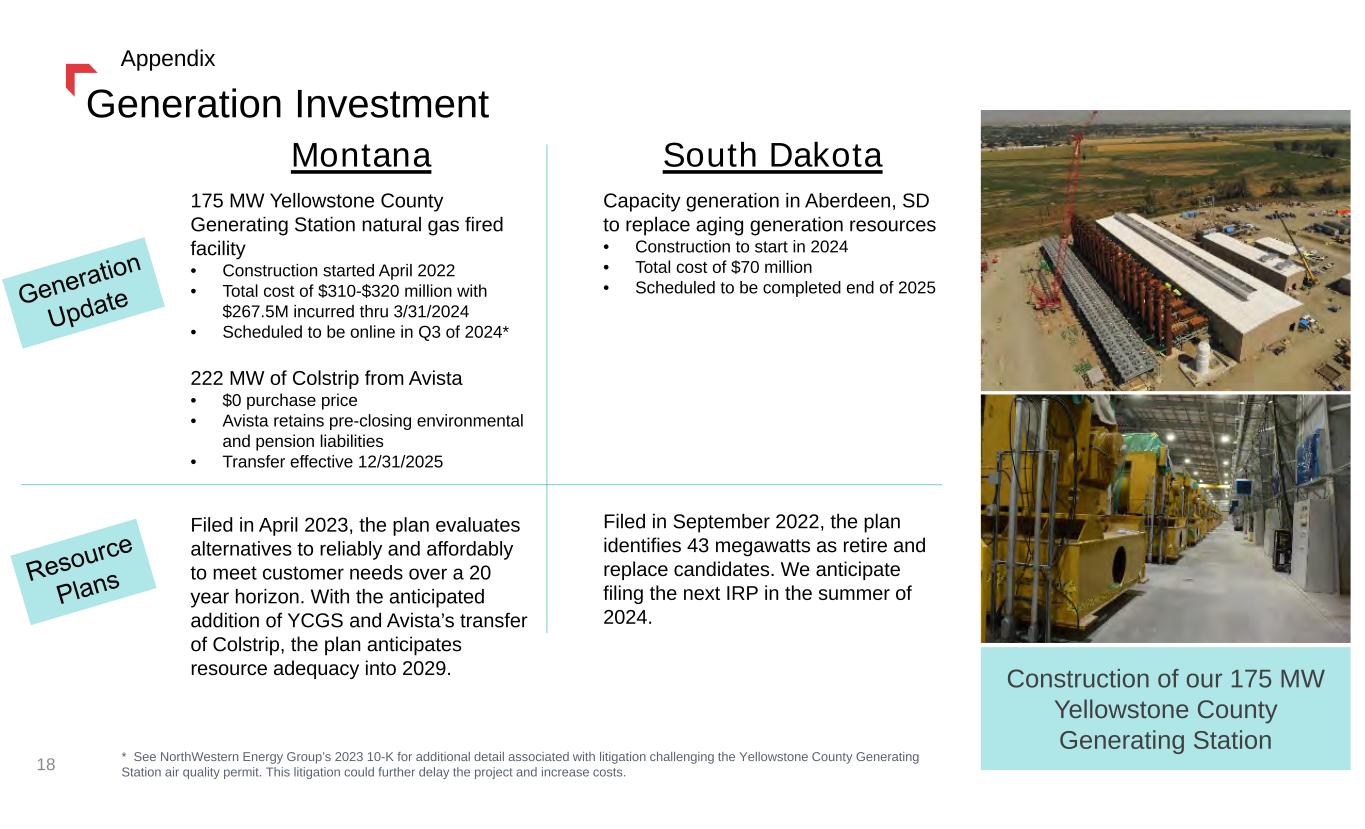

Yellowstone County 175 MW plant

Construction of the new generation facility continues to progress and we expect the plant to be operational by the end of the third quarter 2024. The lawsuit challenging the Yellowstone County Generating Station air quality permit, which required us to suspend construction activities for a period of time, as well as additional related legal and construction challenges, delayed the project timing and have increased costs.

NorthWestern Reports First Quarter 2024 Financial Results

April 25, 2024

Page 5

As of March 31, 2024, total costs of approximately $267.5 million have been incurred, with expected total costs of approximately $310.0 million to $320.0 million.

Montana Rate Review

We anticipate filing a Montana electric and natural gas rate review with the Montana Public Service Commission (MPSC) in the third quarter of 2024 based on a 2023 test year. Within this rate review filing we also anticipate a prudence review of the Yellowstone County Generating Station.

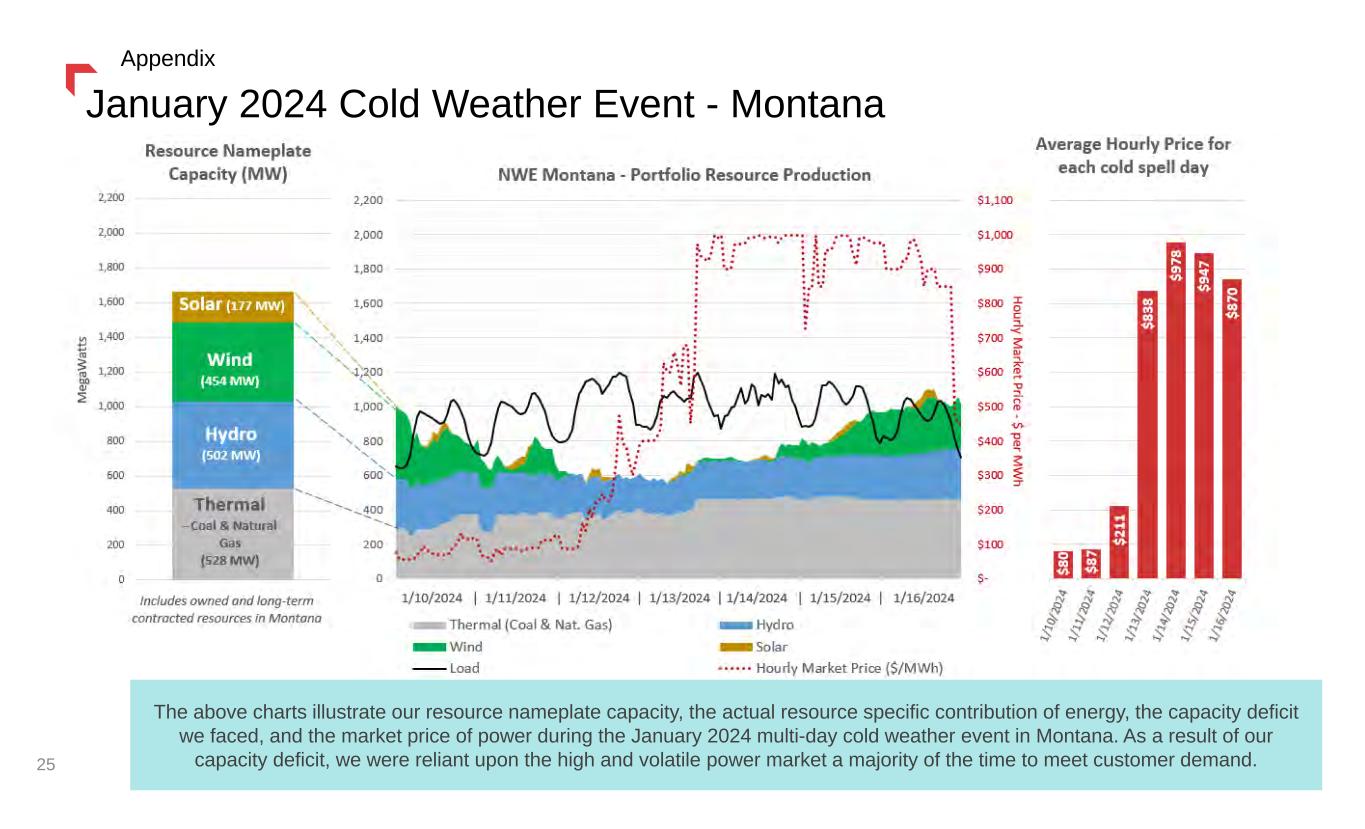

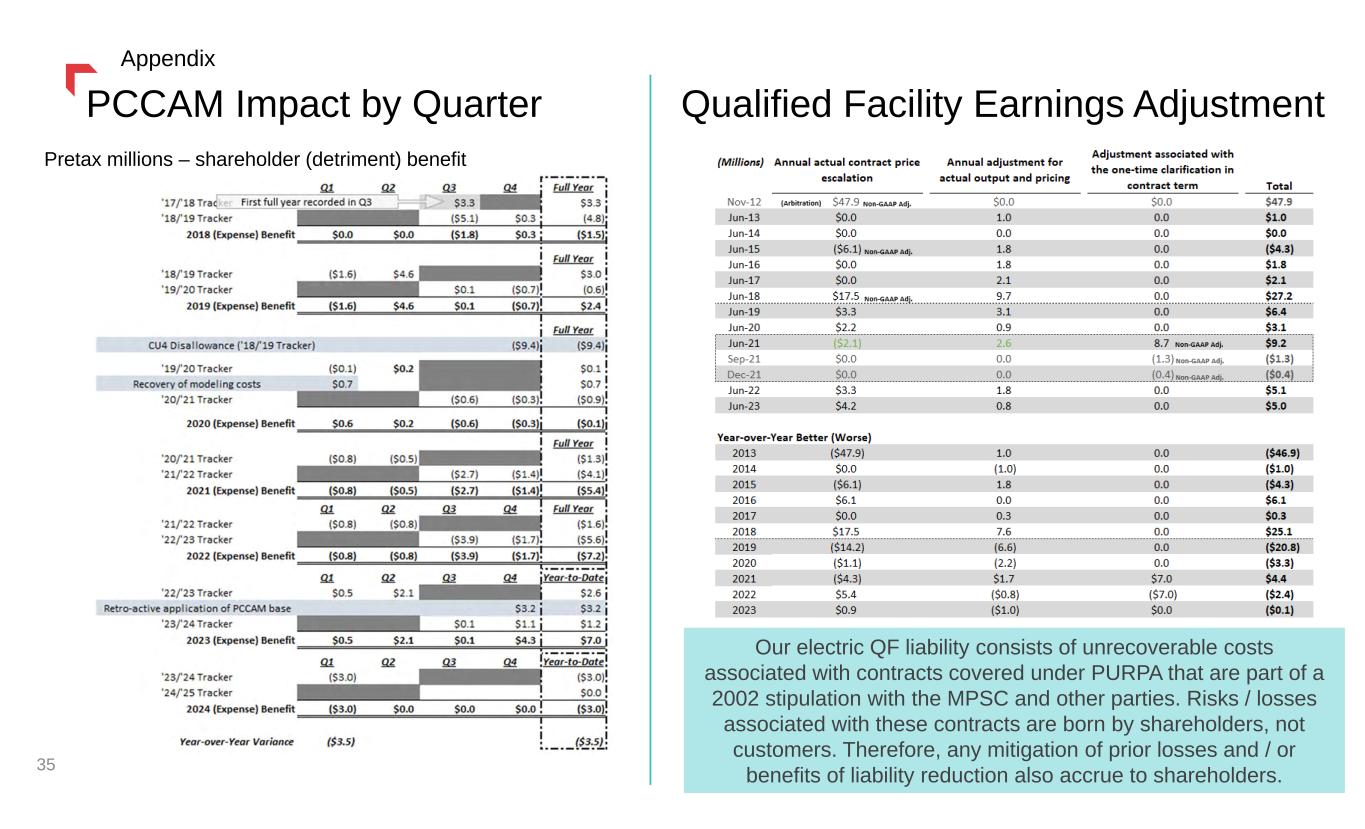

Power Costs and Credits Adjustment Mechanism (PCCAM)

As of March 31, 2024, we have under-collected our total Montana electric supply costs for the July 2023 through June 2024 PCCAM year by approximately $24.0 million. The significant increase to our under-collected costs during the three months ended March 31, 2024 was driven by a January cold weather event in our service territory. We also remained under-collected for the July 2022 through June 2023 PCCAM year by approximately $8.5 million, which we expect to recover within rates by June 2024. We submit quarterly and annual PCCAM filings with the MPSC to recover, or refund, under- or over-collected Montana electric supply costs. PCCAM rates are being adjusted through the quarterly filings to provide a more timely recovery of deferred balances instead of annual recovery.

Under the PCCAM, net costs higher or lower than the PCCAM Base (excluding qualifying facility costs) are allocated 90 percent to Montana customers and 10 percent to shareholders. For the three months ended March 31, 2024, we under-collected supply costs of $27.1 million resulting in an increase in our under-collection of costs, and recorded a decrease in pre-tax earnings of $3.0 million (10 percent of the PCCAM Base cost variance). For the three months ended March 31, 2023, we over-collected costs of $4.3 million resulting in a decrease to the under-collection of costs, and recorded an increase in pre-tax earnings of $0.5 million.

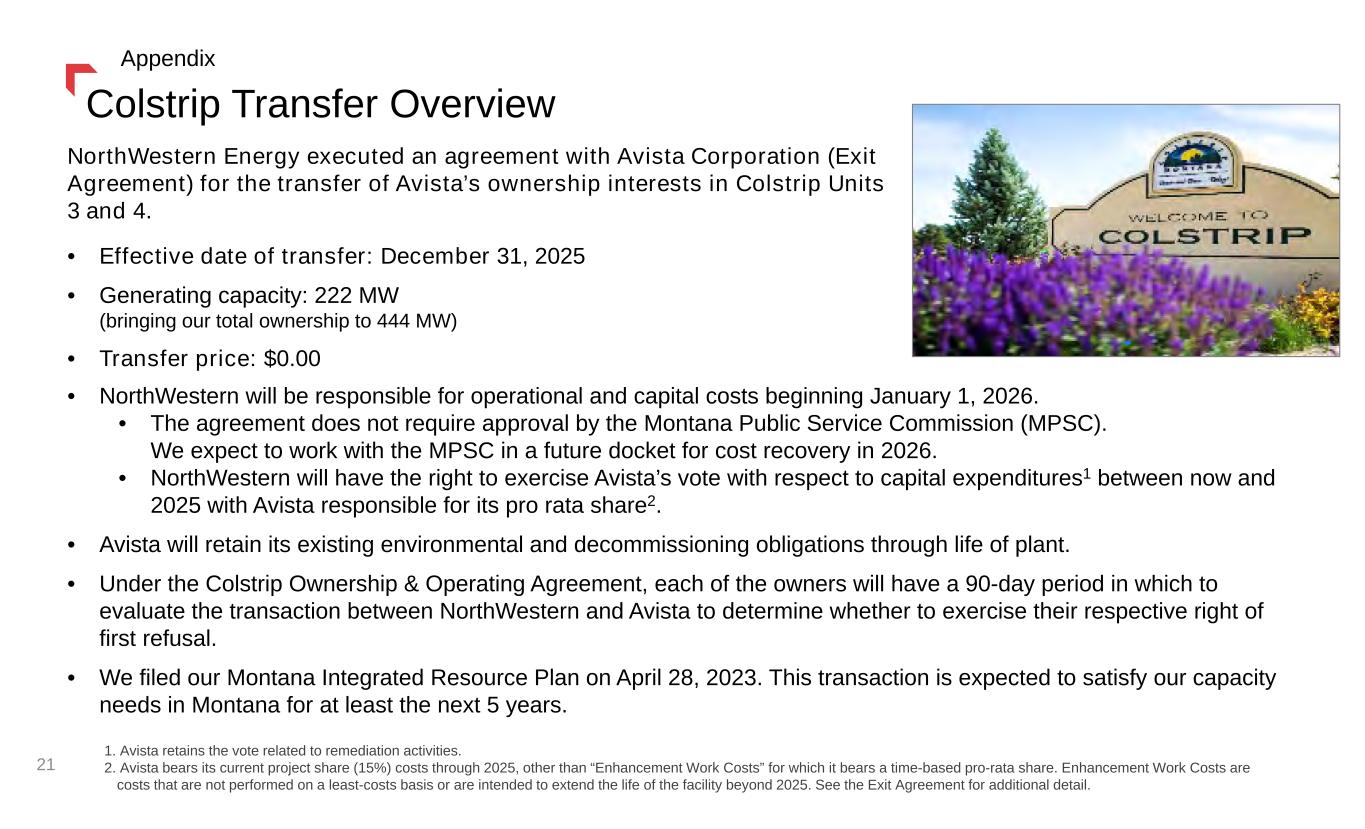

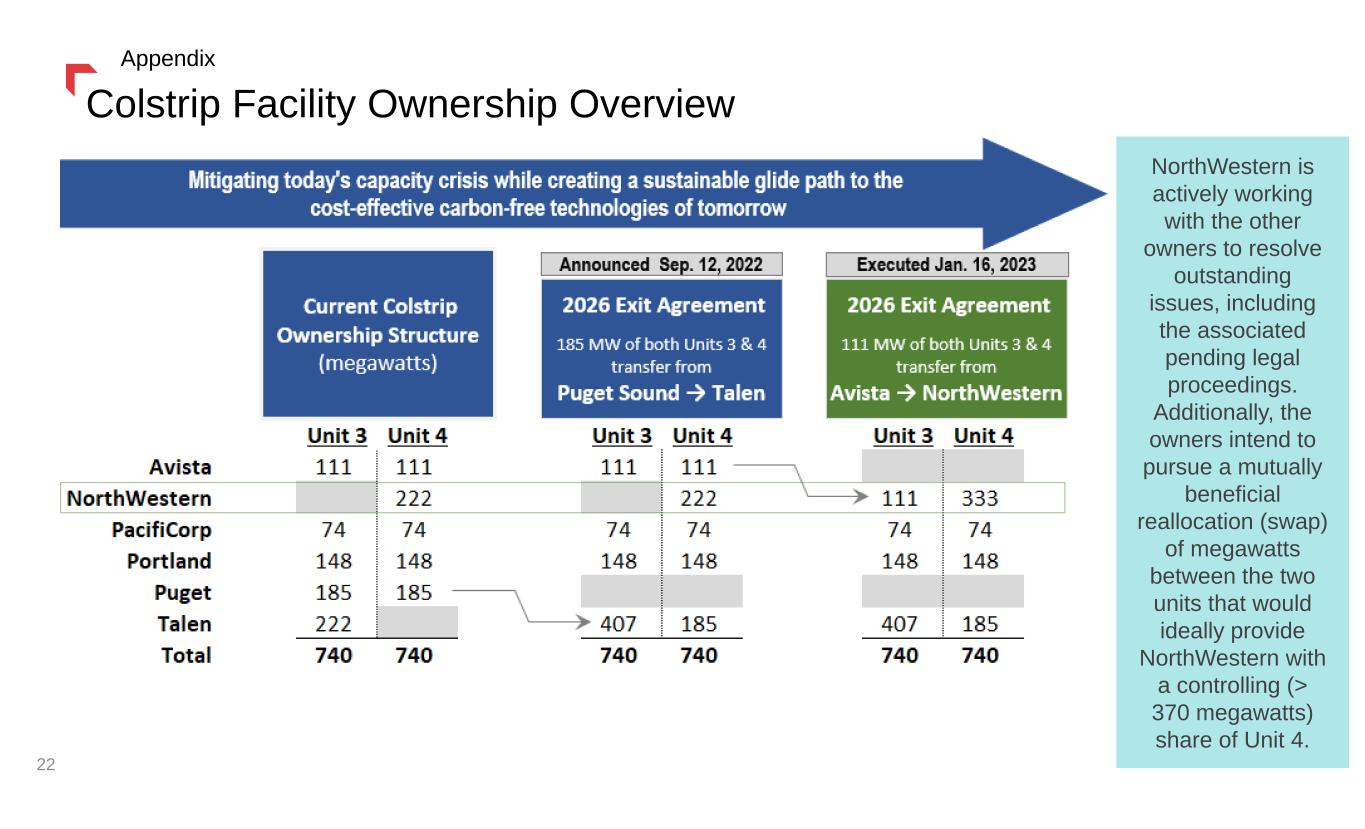

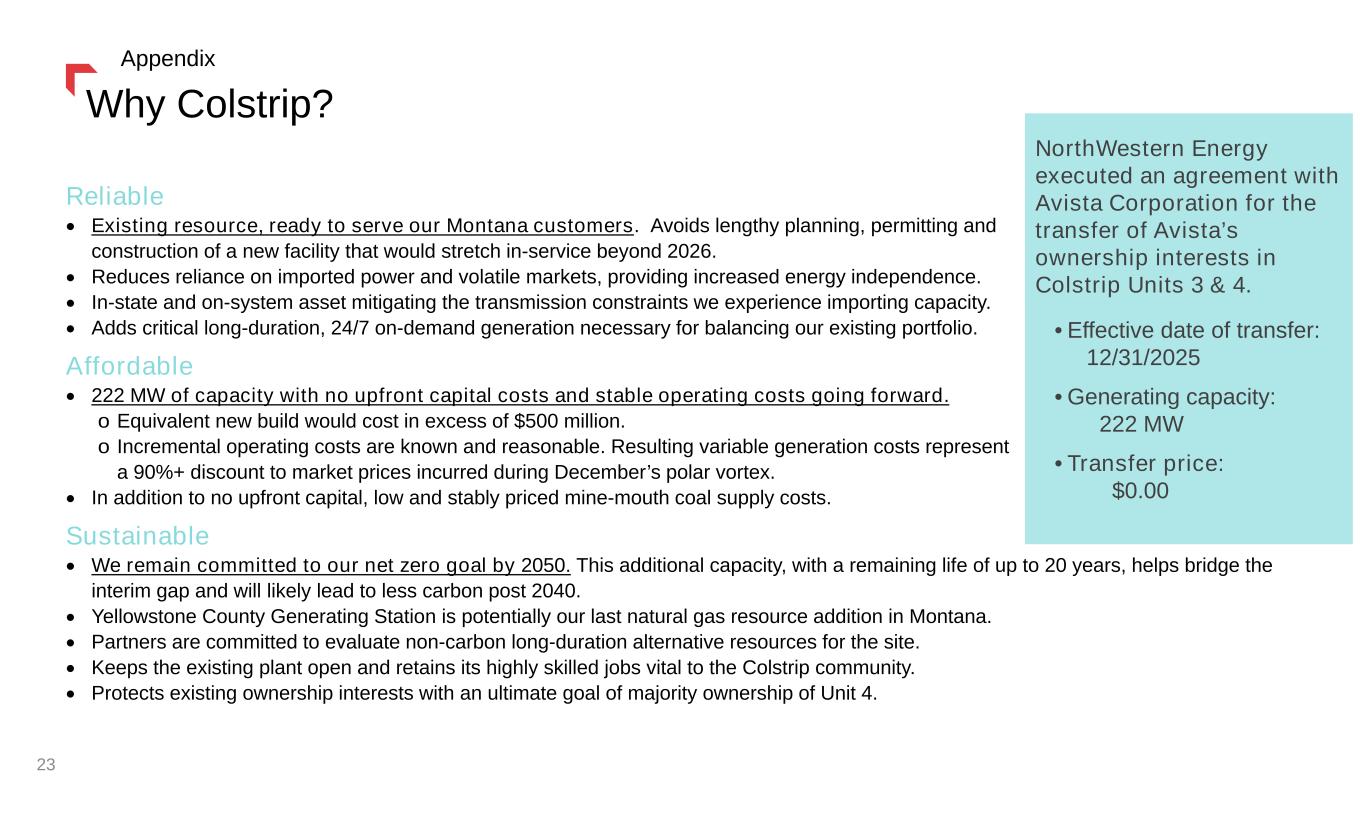

Our electric supply from owned and long-term contracted resources is not adequate to meet our peak-demand needs. Because of this, the volatility of market prices for energy on peak-demand days, even if only for a few days in duration, exposes us to potentially significant market purchases that could negatively impact our results of operations and cash flows. The construction of the Yellowstone County Generating Station and acquisition of Avista's Colstrip Units 3 and 4 interests are expected to reduce our exposure to market purchases.

Environmental Protection Agency (EPA) Rules

Draft GHG emission standards for existing coal-fired facilities and new coal and gas-fired facilities, including enhanced MATS rules, were released by the EPA in the second quarter of 2023. Our review of these draft rules indicated they would require potentially expensive upgrades at Colstrip Units 3 and 4 to comply, with proposed compliance dates that may not be achievable and / or require technology that is unproven, resulting in significant impacts to costs of the facilities. On April 25, 2024, the EPA released final rules related to GHG emission standards for existing coal-fired facilities and new coal and natural gas-fired facilities as well as final rules strengthening the MATS requirements. The final MATS and GHG Rules will require compliance as early as 2028 and 2032, respectively. We are evaluating how the final GHG and MATS Rules may impact our coal-fired generation facilities and operations.

NorthWestern Reports First Quarter 2024 Financial Results

April 25, 2024

Page 6

EXPLANATION OF CONSOLIDATED RESULTS

Three Months Ended March 31, 2024 Compared with the Three Months Ended March 31, 2023

Consolidated gross margin for the three months ended March 31, 2024 was $142.5 million as compared with $130.7 million in 2023, an increase of $11.8 million, or 9.0 percent. This increase was primarily due to new base rates resulting from the Montana and South Dakota rate reviews, higher transmission revenues, and higher Montana property tax tracker collections, partly offset by lower electric and natural gas retail volumes, higher non-recoverable Montana electric supply costs, and higher depreciation and depletion expense.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

| (in millions) |

|

2024 |

|

2023 |

|

|

| Reconciliation of gross margin to utility margin: |

|

|

|

|

| Operating Revenues |

|

$ |

475.3 |

|

|

$ |

454.5 |

|

| Less: Fuel, purchased supply and direct transmission expense (exclusive of depreciation and depletion shown separately below) |

|

174.7 |

|

|

165.5 |

|

| Less: Operating and maintenance |

|

54.2 |

|

|

55.9 |

|

| Less: Property and other taxes |

|

47.2 |

|

|

49.2 |

|

| Less: Depreciation and depletion |

|

56.7 |

|

|

53.2 |

|

| Gross Margin |

|

142.5 |

|

|

130.7 |

|

|

|

|

|

|

| Operating and maintenance |

|

54.2 |

|

|

55.9 |

|

| Property and other taxes |

|

47.2 |

|

|

49.2 |

|

| Depreciation and depletion |

|

56.7 |

|

|

53.2 |

|

Utility Margin(1) |

|

$ |

300.6 |

|

|

$ |

289.0 |

|

(1) Non-GAAP financial measure. See “Non-GAAP Financial Measures” below. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

2024 |

|

2023 |

|

Change |

|

% Change |

|

(dollars in millions) |

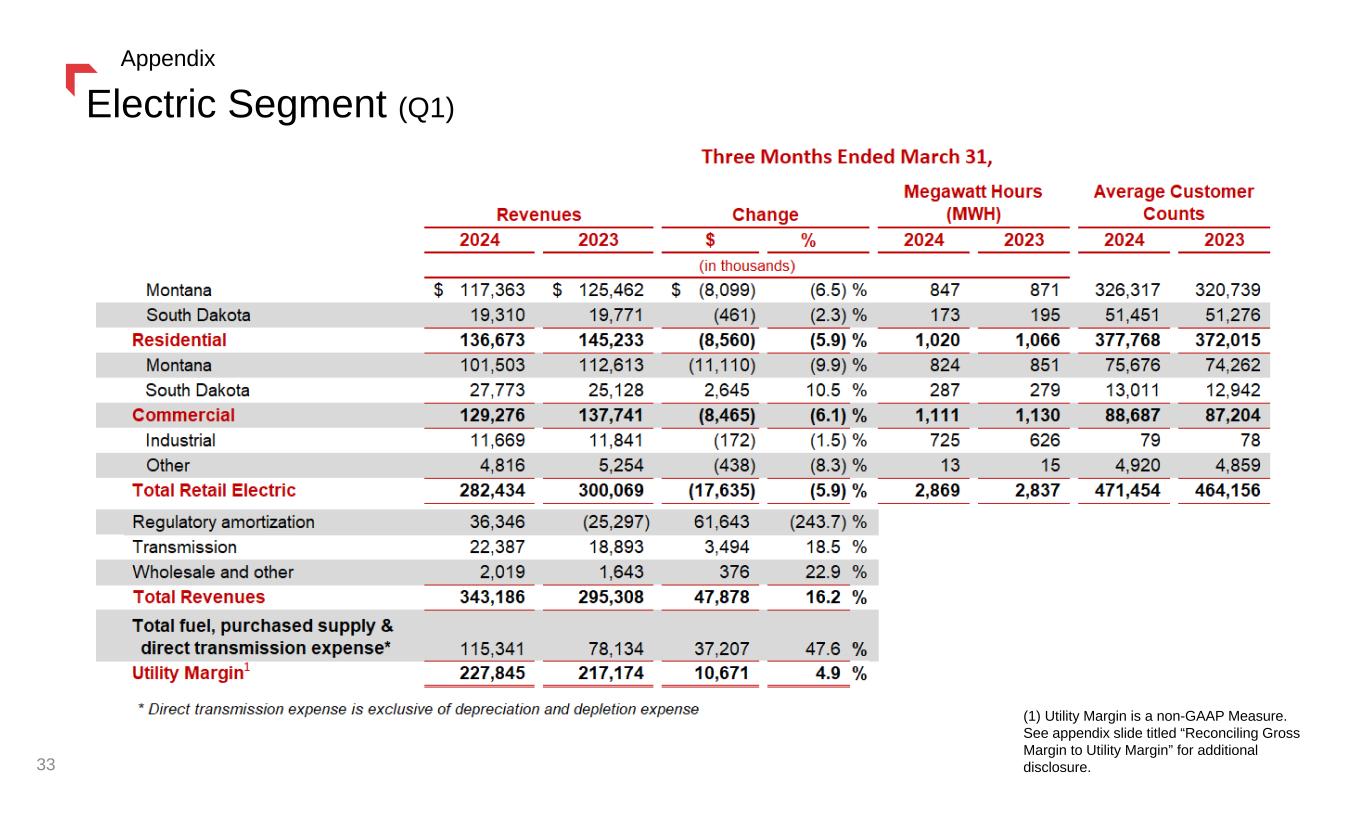

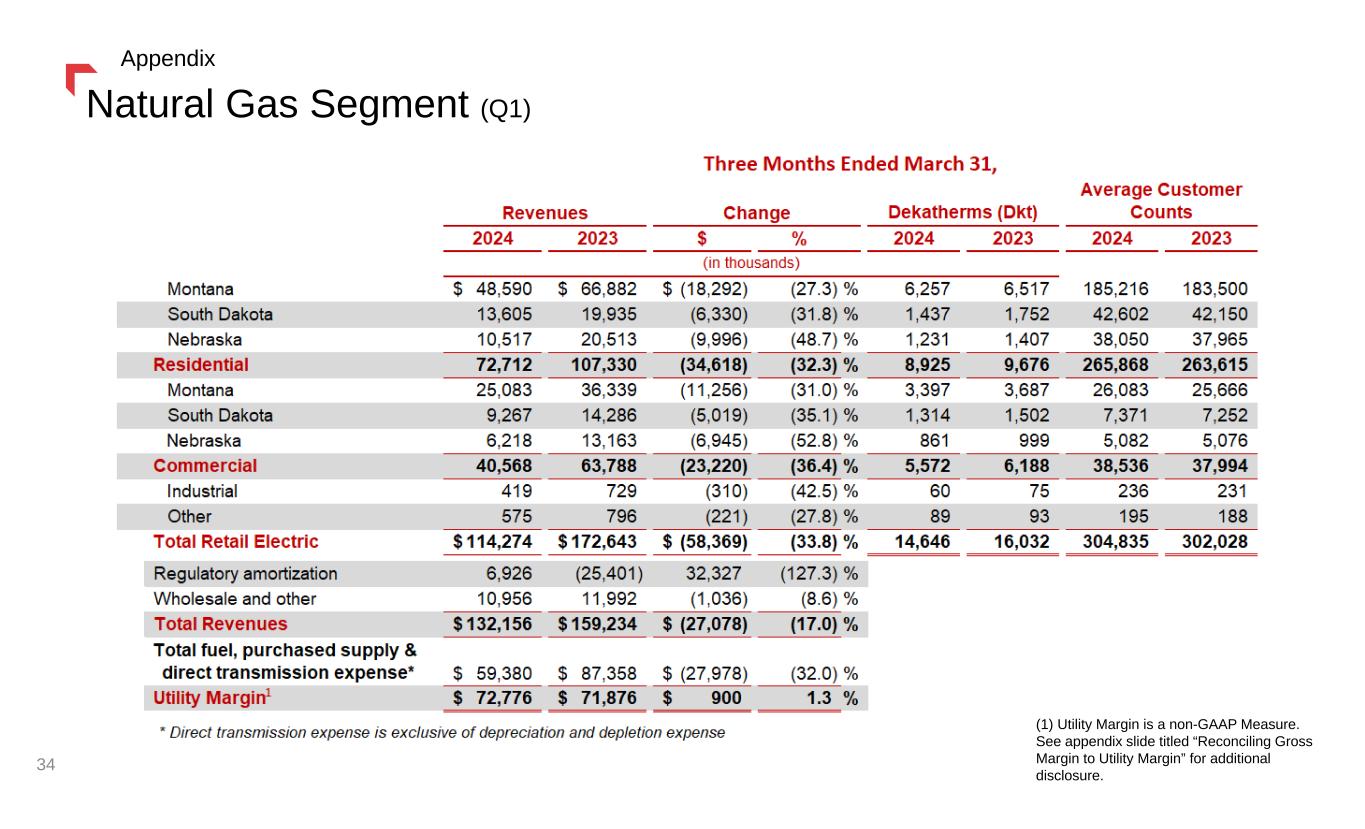

| Utility Margin |

|

|

|

|

|

|

|

| Electric |

$ |

227.9 |

|

|

$ |

217.2 |

|

|

$ |

10.7 |

|

|

4.9 |

% |

| Natural Gas |

72.7 |

|

|

71.8 |

|

|

0.9 |

|

|

1.3 |

|

| Total Utility Margin(1) |

$ |

300.6 |

|

|

$ |

289.0 |

|

|

$ |

11.6 |

|

|

4.0 |

% |

(1) Non-GAAP financial measure. See “Non-GAAP Financial Measures” below. |

|

|

|

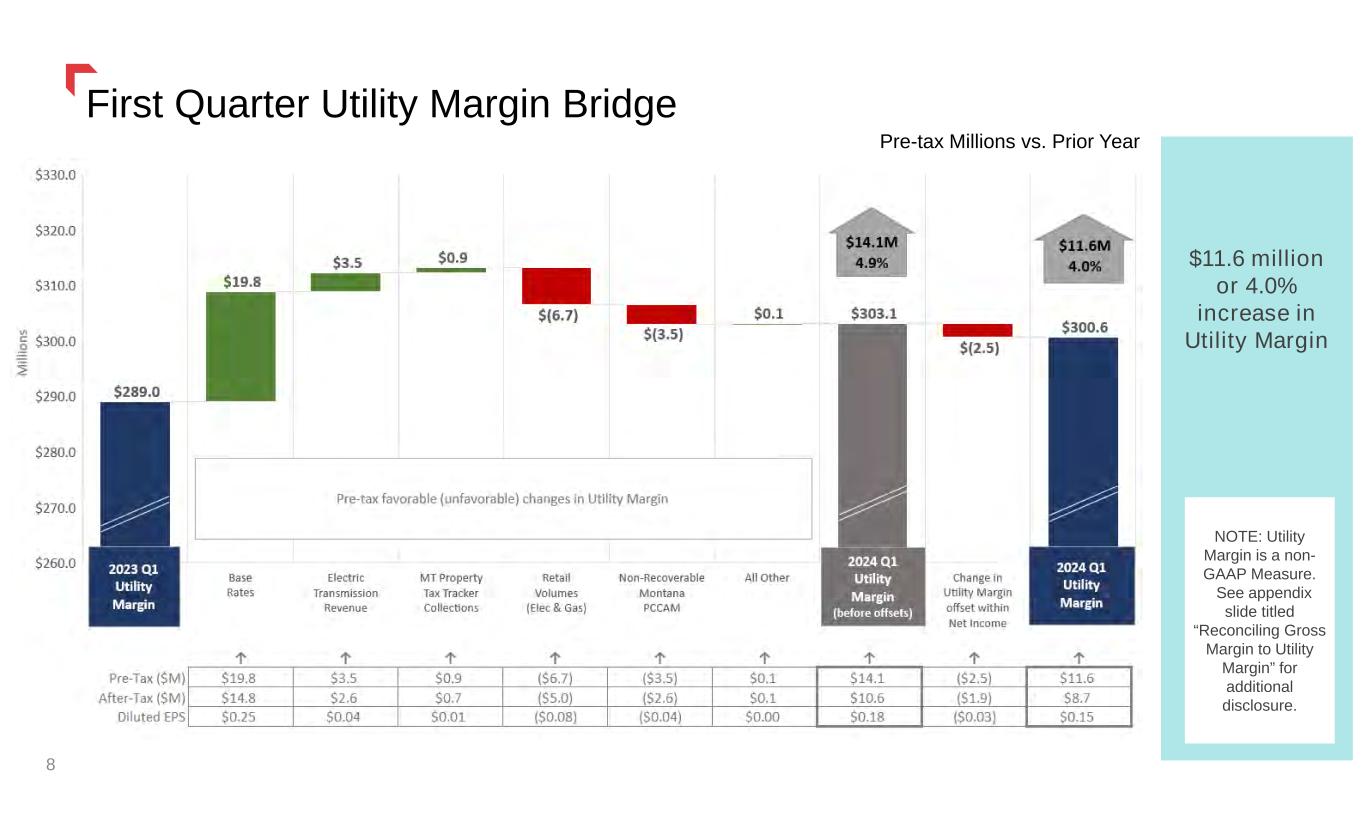

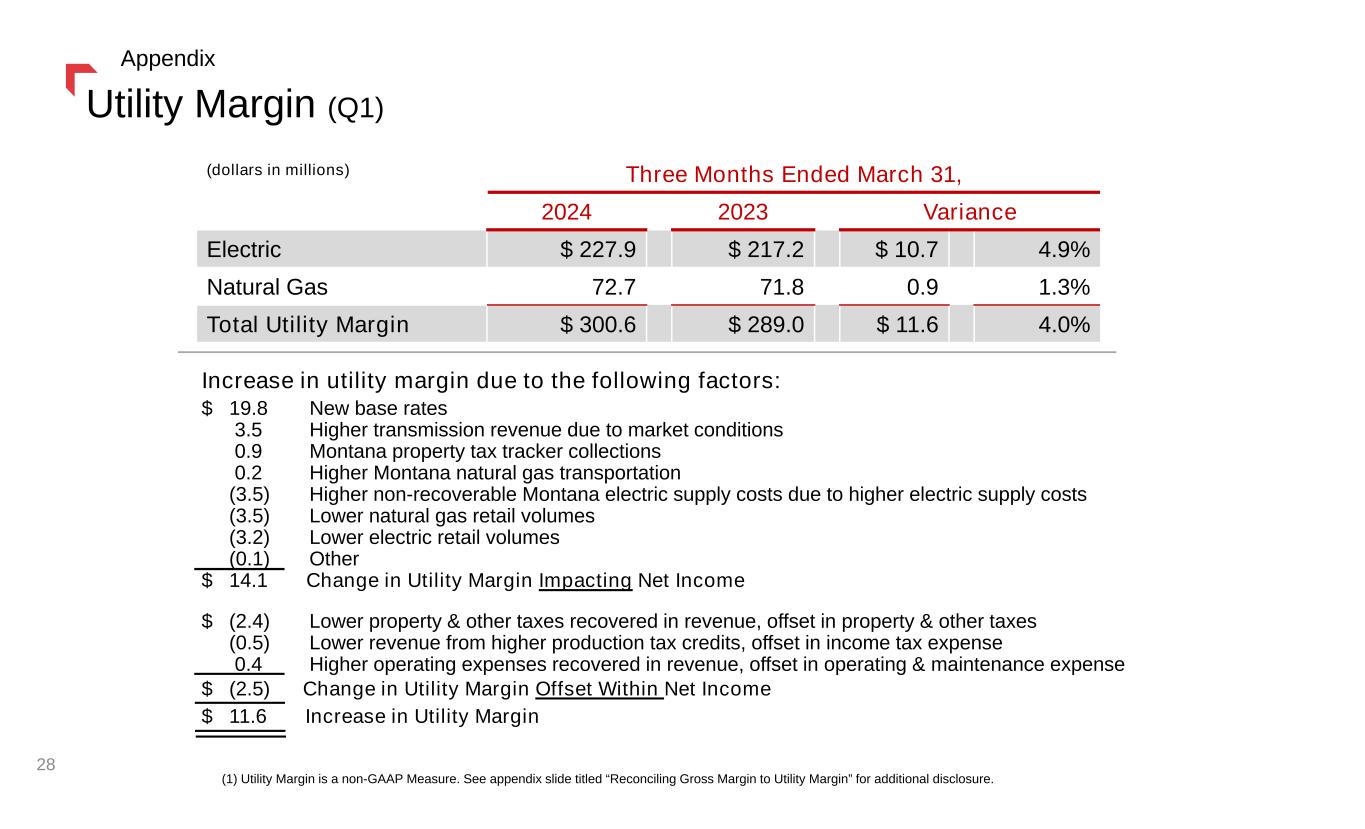

Consolidated utility margin for the three months ended March 31, 2024 was $300.6 million as compared with $289.0 million for the same period in 2023, an increase of $11.6 million, or 4.0 percent.

NorthWestern Reports First Quarter 2024 Financial Results

April 25, 2024

Page 7

Primary components of the change in utility margin include the following (in millions):

|

|

|

|

|

|

|

Utility Margin

2024 vs. 2023 |

| Utility Margin Items Impacting Net Income |

|

| New base rates |

$ |

19.8 |

|

| Higher transmission revenue due to market conditions |

3.5 |

|

| Montana property tax tracker collections |

0.9 |

|

| Higher Montana natural gas transportation |

0.2 |

|

| Higher non-recoverable Montana electric supply costs due to higher electric supply costs |

(3.5) |

|

| Lower natural gas retail volumes |

(3.5) |

|

| Lower electric retail volumes |

(3.2) |

|

| Other |

(0.1) |

|

| Change in Utility Margin Items Impacting Net Income |

14.1 |

|

| Utility Margin Items Offset Within Net Income |

|

| Lower property and other taxes recovered in revenue, offset in property and other taxes |

(2.4) |

|

| Lower revenue from higher production tax credits, offset in income tax expense |

(0.5) |

|

| Higher operating expenses recovered in revenue, offset in operating and maintenance expense |

0.4 |

|

| Change in Utility Margin Items Offset Within Net Income |

(2.5) |

|

Increase in Consolidated Utility Margin(1) |

$ |

11.6 |

|

| (1) Non-GAAP financial measure. See “Non-GAAP Financial Measures” below. |

|

Lower electric retail volumes were driven by unfavorable weather in Montana and South Dakota impacting residential demand and lower commercial demand, partly offset by customer growth. Lower natural gas retail volumes were driven by unfavorable weather in Montana and South Dakota impacting residential and commercial demand.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended March 31, |

| |

2024 |

|

2023 |

|

Change |

|

% Change |

| ($ in millions) |

|

| Operating Expenses (excluding fuel, purchased supply and direct transmission expense) |

|

|

|

|

|

|

|

| Operating and maintenance |

$ |

54.2 |

|

|

$ |

55.9 |

|

|

$ |

(1.7) |

|

|

(3.0) |

% |

| Administrative and general |

40.4 |

|

|

34.7 |

|

|

5.7 |

|

|

16.4 |

|

| Property and other taxes |

47.2 |

|

|

49.2 |

|

|

(2.0) |

|

|

(4.1) |

|

| Depreciation and depletion |

56.7 |

|

|

53.2 |

|

|

3.5 |

|

|

6.6 |

|

| Total Operating Expenses (excluding fuel, purchased supply and direct transmission expense) |

$ |

198.5 |

|

|

$ |

193.0 |

|

|

$ |

5.5 |

|

|

2.8 |

% |

NorthWestern Reports First Quarter 2024 Financial Results

April 25, 2024

Page 8

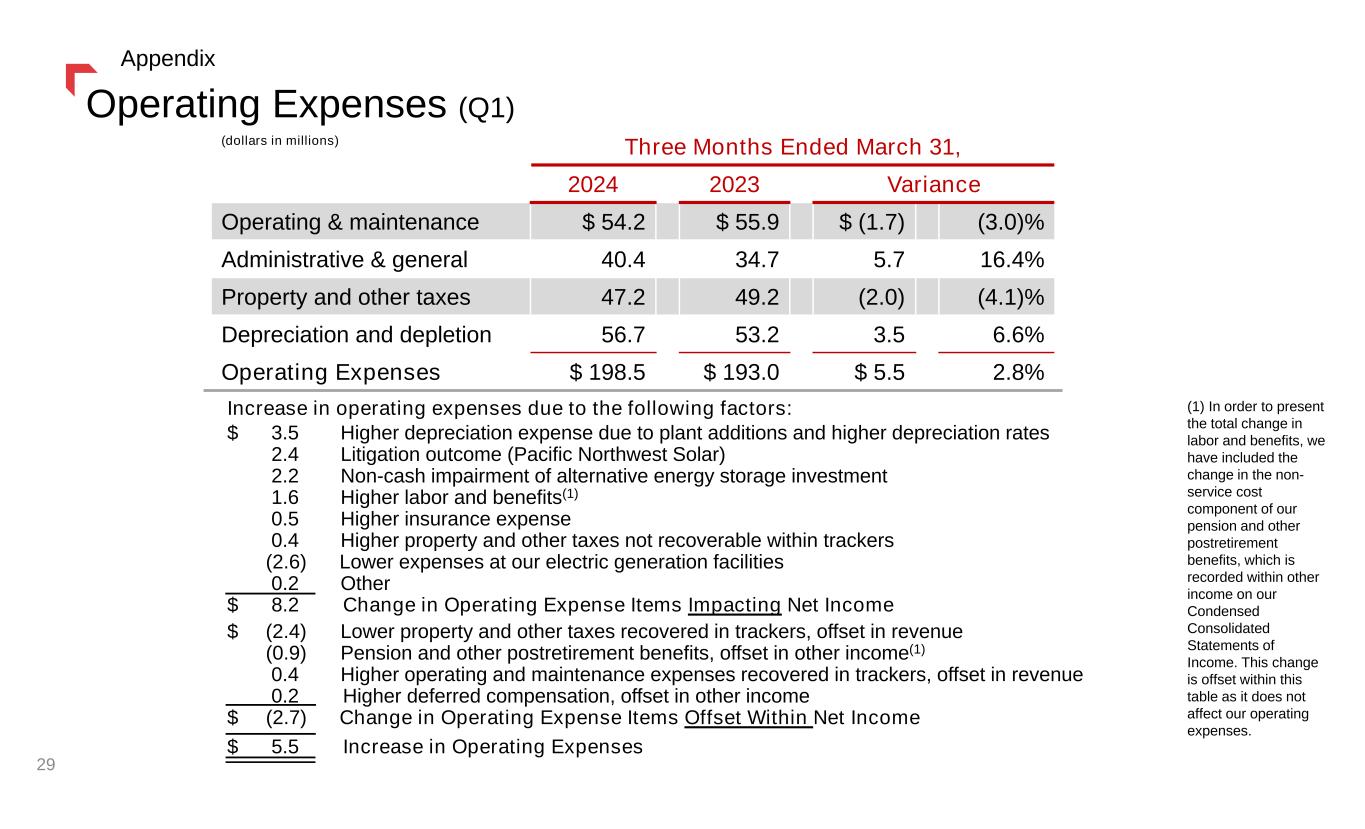

Consolidated operating expenses, excluding fuel, purchased supply and direct transmission expense, were $198.5 million for the three months ended March 31, 2024, as compared with $193.0 million for the three months ended March 31, 2023. Primary components of the change include the following (in millions):

|

|

|

|

|

|

|

Operating Expenses |

|

2024 vs. 2023 |

| Operating Expenses (excluding fuel, purchased supply and direct transmission expense) Impacting Net Income |

|

| Higher depreciation expense due to plant additions and higher depreciation rates |

$ |

3.5 |

|

| Litigation outcome (Pacific Northwest Solar) |

2.4 |

|

| Impairment of alternative energy storage investment |

2.2 |

|

Higher labor and benefits(1) |

1.6 |

|

| Higher insurance expense |

0.5 |

|

| Higher property and other taxes not recoverable within trackers |

0.4 |

|

| Lower expenses at our electric generation facilities |

(2.6) |

|

| Other |

0.2 |

|

| Change in Items Impacting Net Income |

8.2 |

|

|

|

| Operating Expenses Offset Within Net Income |

|

| Lower property and other taxes recovered in trackers, offset in revenue |

(2.4) |

|

Pension and other postretirement benefits, offset in other income(1) |

(0.9) |

|

| Higher operating and maintenance expenses recovered in trackers, offset in revenue |

0.4 |

|

| Higher deferred compensation, offset in other income |

0.2 |

|

| Change in Items Offset Within Net Income |

(2.7) |

|

| Increase in Operating Expenses (excluding fuel, purchased supply and direct transmission expense) |

$ |

5.5 |

|

| (1) In order to present the total change in labor and benefits, we have included the change in the non-service cost component of our pension and other postretirement benefits, which is recorded within other income on our Condensed Consolidated Statements of Income. This change is offset within this table as it does not affect our operating expenses |

We estimate property taxes throughout each year, and update those estimates based on valuation reports received from the Montana Department of Revenue. Under Montana law, we are allowed to track the increases and decreases in the actual level of state and local taxes and fees and adjust our rates to recover the increase or decrease between rate cases less the amount allocated to Federal Energy Regulatory Commission-jurisdictional customers and net of the associated income tax benefit.

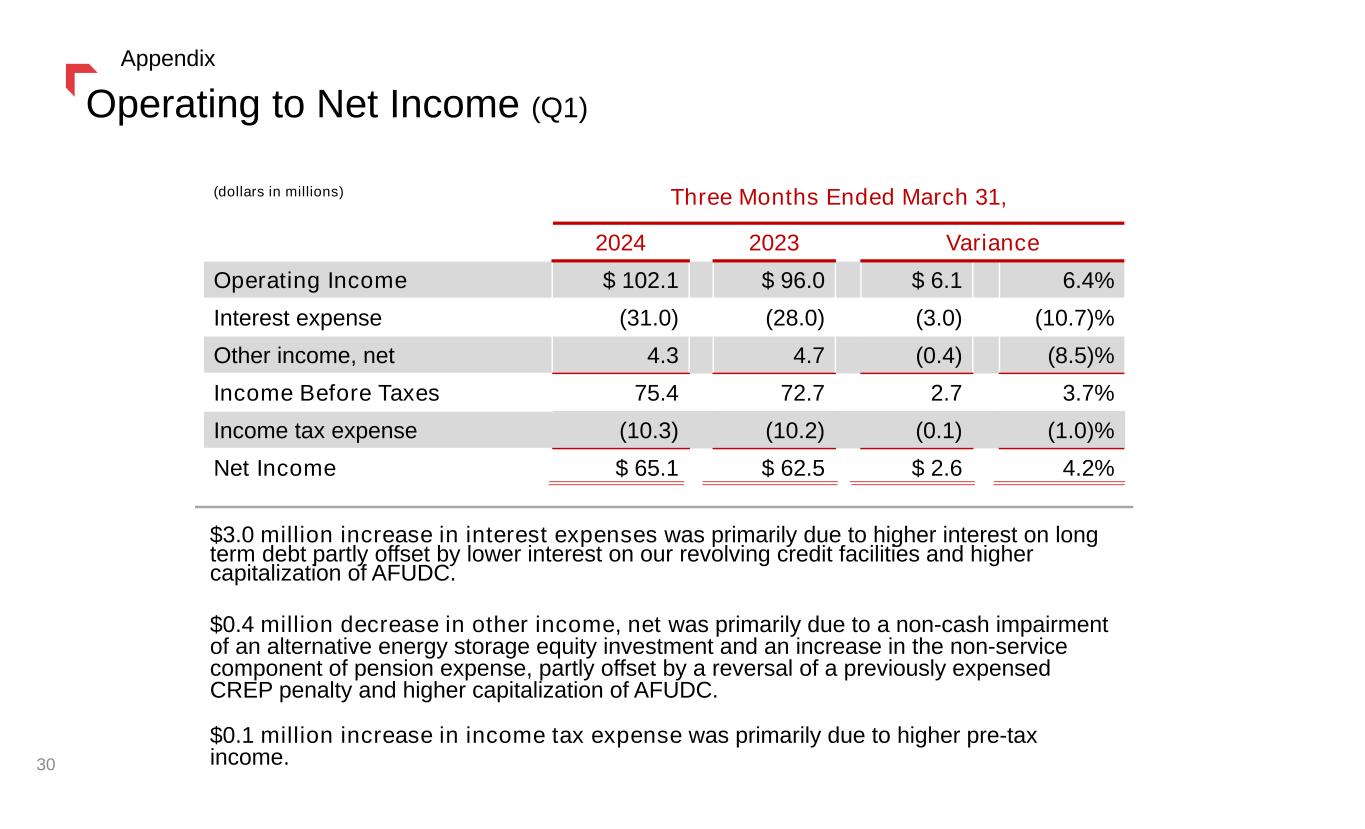

Consolidated operating income for the three months ended March 31, 2024 was $102.1 million as compared with $96.0 million in the same period of 2023. This increase was primarily driven by new base rates resulting from the Montana and South Dakota rate reviews, higher transmission revenues, and higher Montana property tax tracker collections, partly offset by lower electric and natural gas retail volumes, higher non-recoverable Montana electric supply costs, higher depreciation and depletion expense, and higher operating, administrative and general expenses.

Consolidated interest expense was $31.0 million for the three months ended March 31, 2024 as compared with $28.0 million for the same period of 2023. This increase was due to higher interest on long term debt partly offset by lower interest on our revolving credit facilities and higher capitalization of Allowance for Funds Used During Construction (AFUDC).

Consolidated other income was $4.3 million for the three months ended March 31, 2024 as compared with $4.7 million for the same period of 2023. This decrease was primarily due to a $2.5 million non-cash impairment of an alternative energy storage equity investment and an increase in the non-service component of pension expense, partly offset by a $2.3 million reversal of a previously expensed Community Renewable Energy Project penalty due to a favorable legal ruling and higher capitalization of AFUDC.

NorthWestern Reports First Quarter 2024 Financial Results

April 25, 2024

Page 9

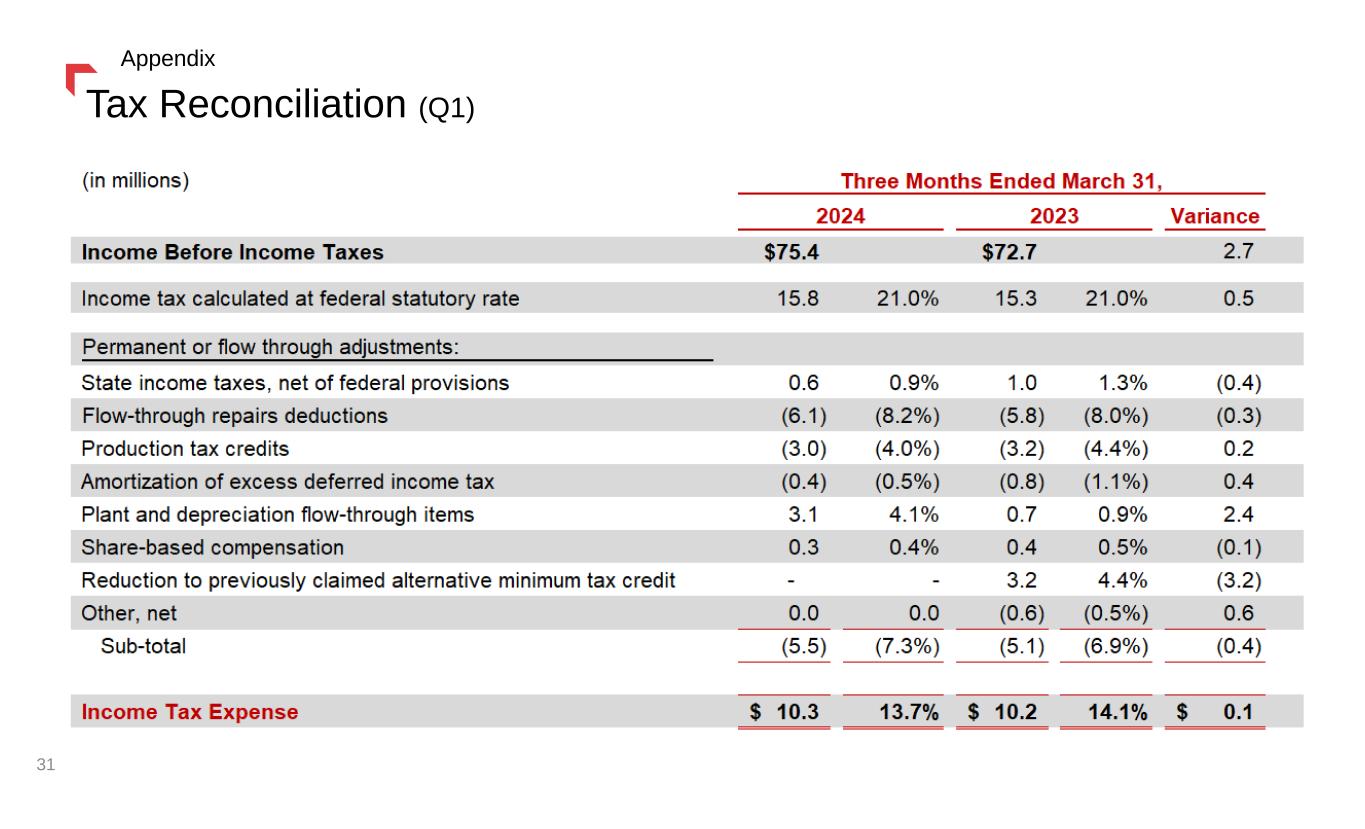

Consolidated income tax expense was $10.3 million for the three months ended March 31, 2024 as compared to an income tax benefit of $10.2 million for the same period of 2023. Our effective tax rate for the three months ended March 31, 2024 was 13.7% as compared with 14.1% for the same period in 2023.

The following table summarizes the differences between our effective tax rate and the federal statutory rate ($ in millions):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

2024 |

|

2023 |

| Income Before Income Taxes |

$ |

75.4 |

|

|

|

|

$ |

72.7 |

|

|

|

|

|

|

|

|

|

|

|

| Income tax calculated at federal statutory rate |

15.8 |

|

|

21.0 |

% |

|

15.3 |

|

|

21.0 |

% |

|

|

|

|

|

|

|

|

| Permanent or flow-through adjustments: |

|

|

|

|

|

|

|

| State income tax, net of federal provisions |

0.6 |

|

|

0.9 |

|

|

1.0 |

|

|

1.3 |

|

| Flow-through repairs deductions |

(6.1) |

|

|

(8.2) |

|

|

(5.8) |

|

|

(8.0) |

|

| Production tax credits |

(3.0) |

|

|

(4.0) |

|

|

(3.2) |

|

|

(4.4) |

|

| Amortization of excess deferred income tax |

(0.4) |

|

|

(0.5) |

|

|

(0.8) |

|

|

(1.1) |

|

| Plant and depreciation flow-through items |

3.1 |

|

|

4.1 |

|

|

0.7 |

|

|

0.9 |

|

| Share-based compensation |

0.3 |

|

|

0.4 |

|

|

0.4 |

|

|

0.5 |

|

| Reduction to previously claimed alternative minimum tax credit |

— |

|

|

— |

|

|

3.2 |

|

|

4.4 |

|

| Other, net |

0.0 |

|

|

0.0 |

|

|

(0.6) |

|

|

(0.5) |

|

|

(5.5) |

|

|

(7.3) |

|

|

(5.1) |

|

|

(6.9) |

|

|

|

|

|

|

|

|

|

| Income tax expense |

$ |

10.3 |

|

|

13.7 |

% |

|

$ |

10.2 |

|

|

14.1 |

% |

|

|

|

|

|

|

|

|

We compute income tax expense for each quarter based on the estimated annual effective tax rate for the year, adjusted for certain discrete items. Our effective tax rate typically differs from the federal statutory tax rate primarily due to the regulatory impact of flowing through federal and state tax benefits of repairs deductions, state tax benefit of accelerated tax depreciation deductions (including bonus depreciation when applicable) and production tax credits.

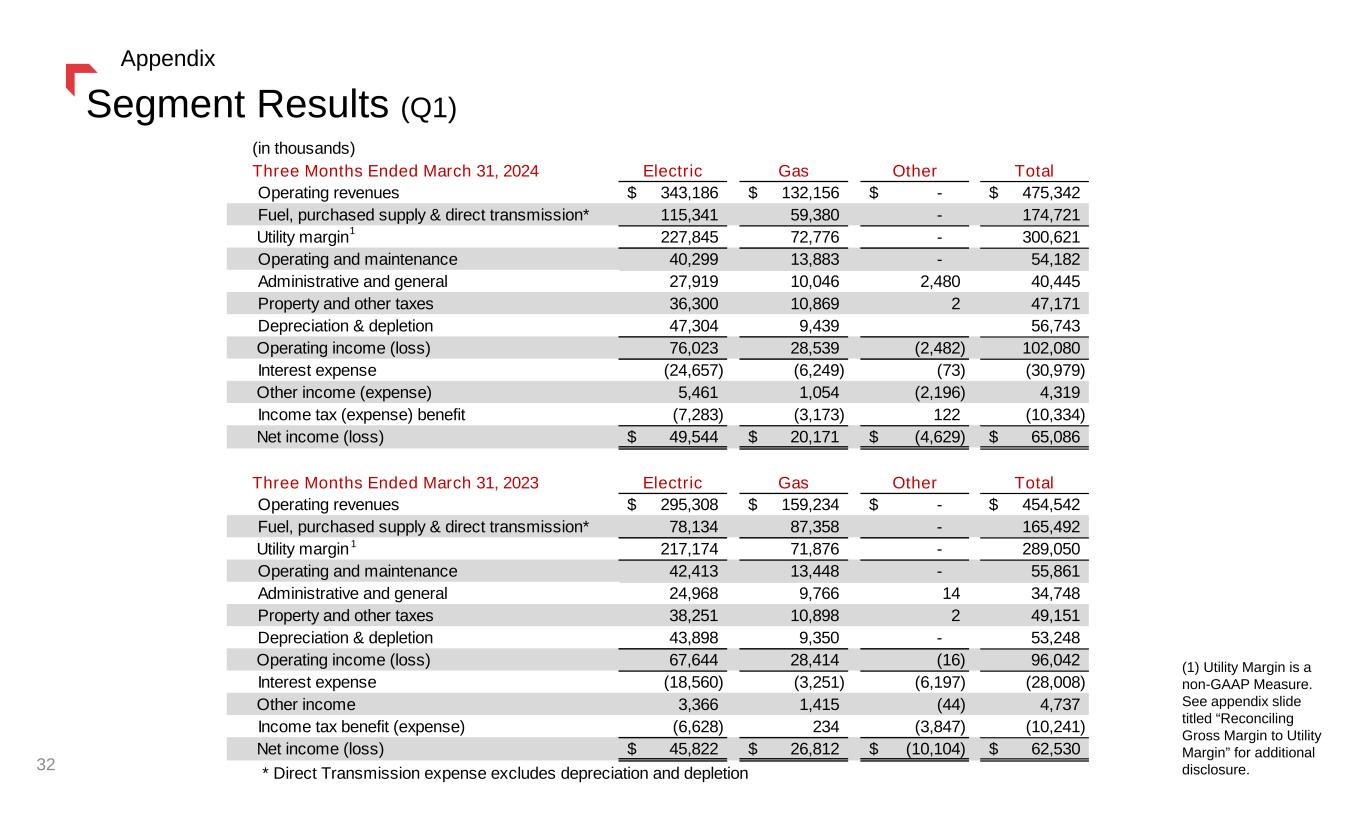

Consolidated net income for the three months ended March 31, 2024 was $65.1 million as compared with $62.5 million for the same period in 2023. This increase was primarily due to new base rates resulting from the Montana and South Dakota rate reviews, higher transmission revenues, and higher Montana property tax tracker collection, partly offset by lower electric and natural gas retail volumes, higher non-recoverable Montana electric supply costs, higher depreciation and depletion expense, higher operating, maintenance, and administrative expenses, and higher interest expense.

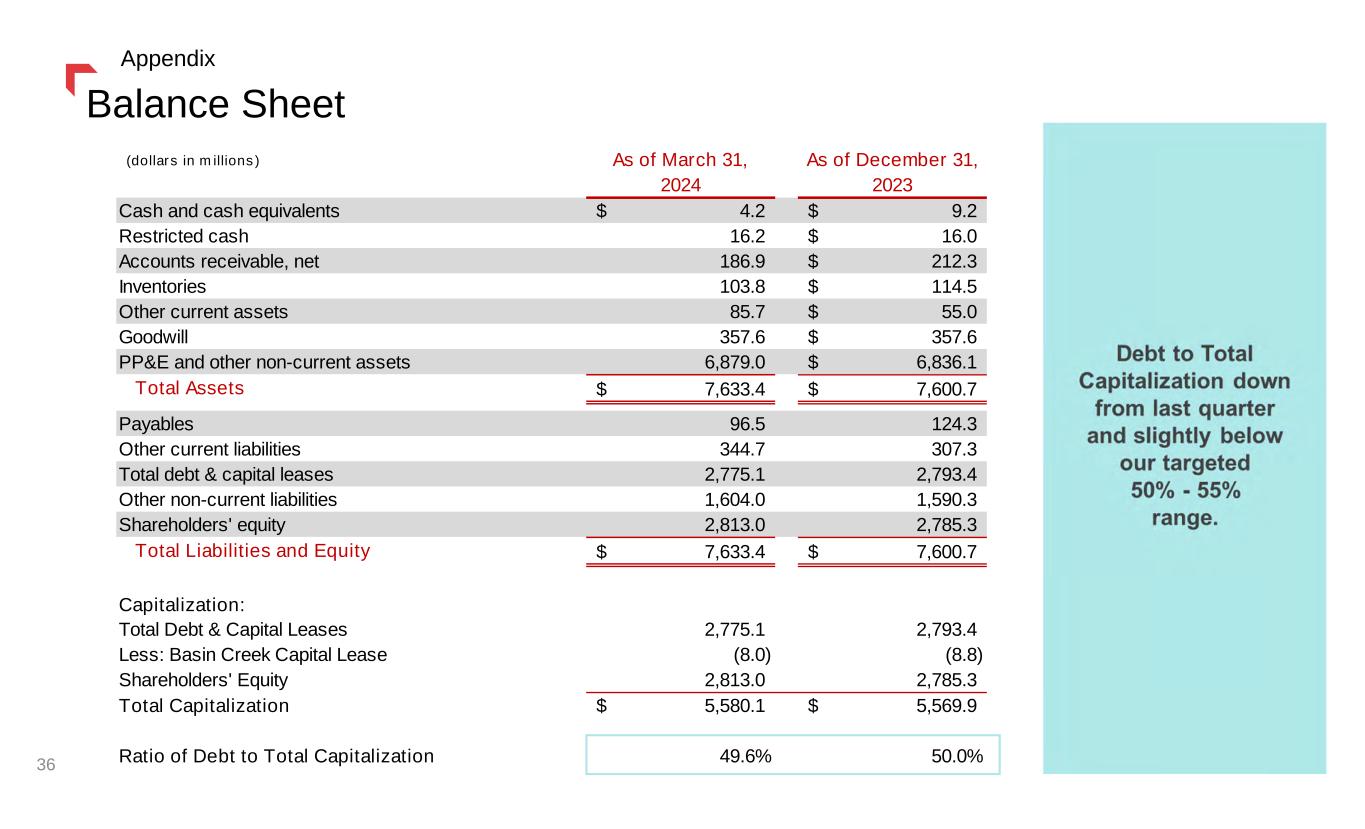

LIQUIDITY AND OTHER CONSIDERATIONS

Liquidity and Capital Resources

As of March 31, 2024, our total net liquidity was approximately $418.2 million, including $4.2 million of cash and $414.0 million of revolving credit facility availability with no letters of credit outstanding. This compares to total net liquidity one year ago at March 31, 2023 of $363.7 million.

NorthWestern Reports First Quarter 2024 Financial Results

April 25, 2024

Page 10

Earnings Per Share

Basic earnings per share are computed by dividing earnings applicable to common stock by the weighted average number of common shares outstanding for the period. Diluted earnings per share reflect the potential dilution of common stock equivalent shares that could occur if unvested shares were to vest. Common stock equivalent shares are calculated using the treasury stock method, as applicable. The dilutive effect is computed by dividing earnings applicable to common stock by the weighted average number of common shares outstanding plus the effect of the outstanding unvested restricted stock and performance share awards. Average shares used in computing the basic and diluted earnings per share are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

March 31, 2024 |

|

March 31, 2023 |

| Basic computation |

61,265,967 |

|

|

59,776,195 |

|

| Dilutive effect of: |

|

|

|

Performance share awards(1) |

43,652 |

|

|

13,009 |

|

| Diluted computation |

61,309,619 |

|

|

59,789,204 |

|

(1) Performance share awards are included in diluted weighted average number of shares outstanding based upon what would be issued if the end of the most recent reporting period was the end of the term of the award.

As of March 31, 2024, there were 54,182 shares from performance and restricted share awards which were antidilutive and excluded from the earnings per share calculations, compared to 69,853 shares as of March 31, 2023.

[The remainder of page is intentionally left blank]

NorthWestern Reports First Quarter 2024 Financial Results

April 25, 2024

Page 11

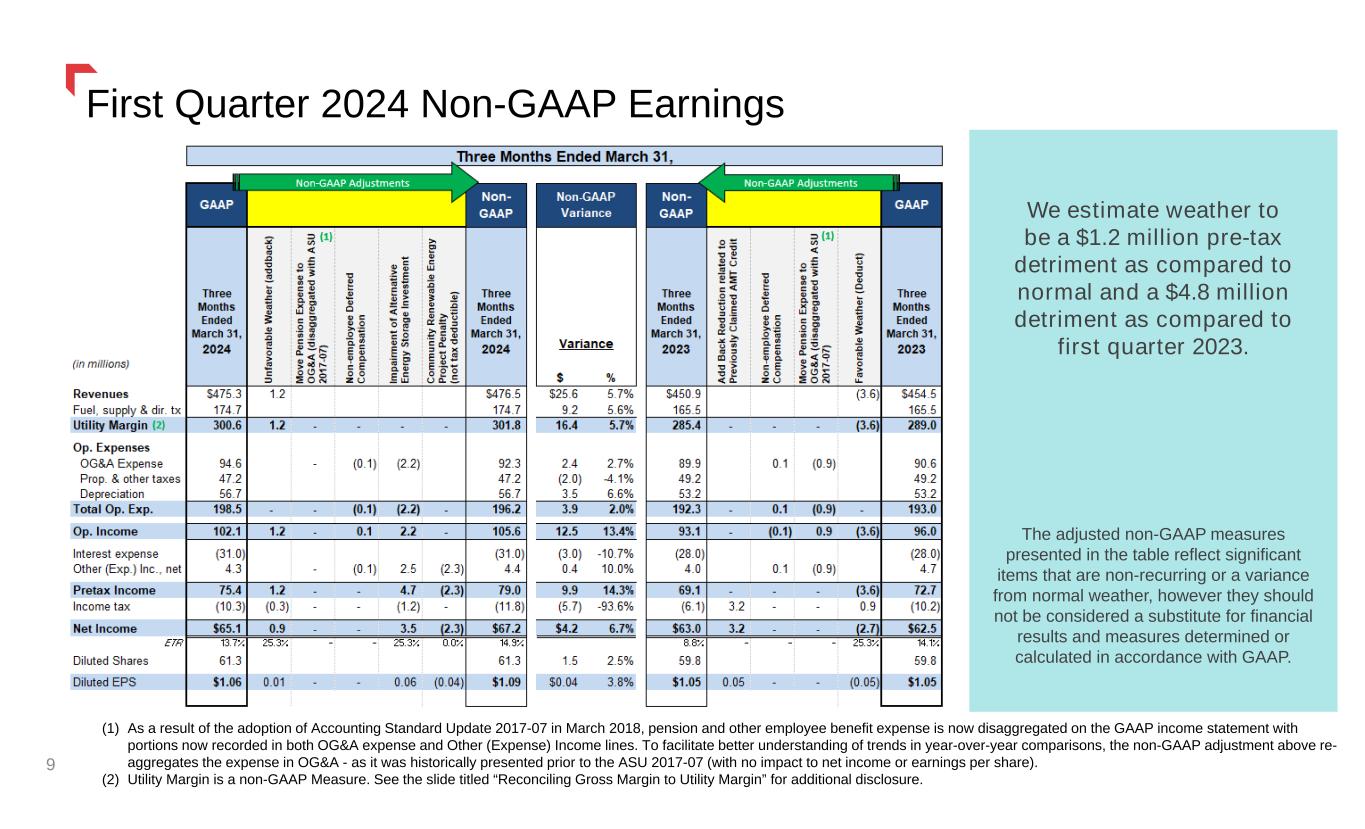

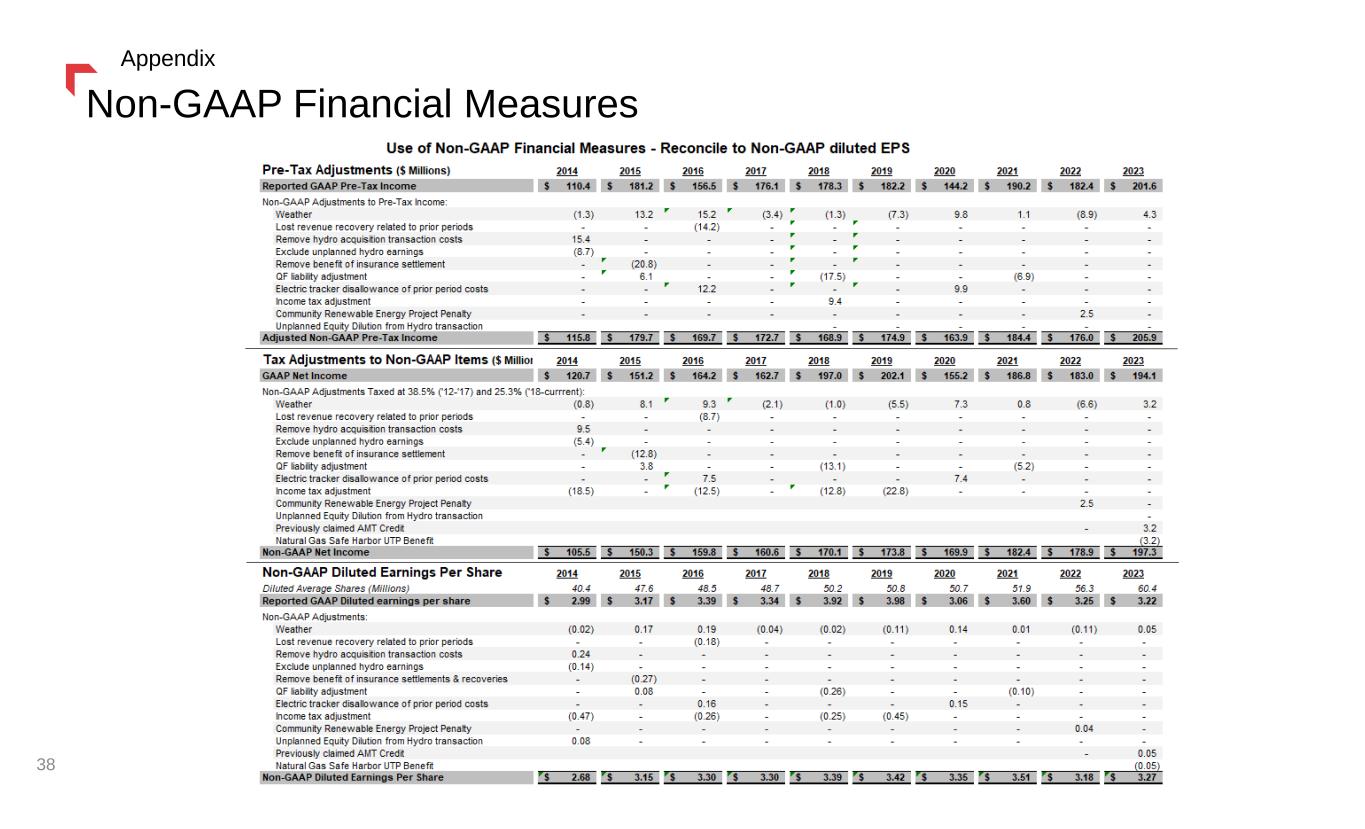

Adjusted Non-GAAP Earnings

We reported GAAP earnings of $1.06 per diluted share for the three months-ended March 31, 2024 and $1.05 per diluted share for the same period in 2023. Adjusted Non-GAAP earnings per diluted share for the same periods are $1.09 and $1.05, respectively. A reconciliation of items factored into our Adjusted Non-GAAP diluted earnings are summarized below. The amount below represents a non-GAAP measure that may provide users of this data with additional meaningful information regarding the impact of certain items on our expected earnings. More information on this measure can be found in the "Non-GAAP Financial Measures" section below.

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions, except EPS) |

|

|

|

|

|

| Three Months Ended March 31, 2024 |

|

Pre-tax

Income |

Net(1)

Income |

Diluted

EPS |

| 2024 Reported GAAP |

$75.4 |

$65.1 |

$1.06 |

|

|

|

|

| Non-GAAP Adjustments: |

Unfavorable weather as compared to normal |

1.2 |

|

0.9 |

|

0.01 |

|

| Impairment of alternative energy storage investment |

4.7 |

|

3.5 |

|

0.06 |

|

| Community Renewable Energy Project penalty (not tax deductible) |

(2.3) |

|

(2.3) |

|

(0.04) |

|

|

|

|

|

| 2024 Adj. Non-GAAP |

$79.0 |

$67.2 |

$1.09 |

|

|

|

|

|

|

|

|

| Three Months Ended March 31, 2023 |

|

Pre-tax

Income |

Net(1)

Income |

Diluted

EPS |

| 2023 Reported GAAP |

$72.7 |

$62.5 |

$ |

1.05 |

|

|

|

|

|

| Non-GAAP Adjustments: |

Favorable weather as compared to normal |

(3.6) |

|

(2.7) |

|

(0.05) |

|

| Previously claimed AMT credit |

— |

|

3.2 |

|

0.05 |

|

|

|

|

|

| 2023 Adj. Non-GAAP |

$69.1 |

$63.0 |

$1.05 |

|

|

|

|

| (1) Income tax rate on reconciling items assumes blended federal plus state effective tax rate of 25.3%. |

Company Hosting Earnings Webcast

NorthWestern will also host an investor earnings webcast on Friday, April 26, 2024, at 3:00 p.m. Eastern time to review its financial results for the quarter ending March 31, 2024. To register for the webcast, please visit www.northwesternenergy.com/earnings-registration. After registration, a link to access the event will be emailed to the address provided. Please note that a unique and valid email address is required for each attendee to access the webinar. Please go to the site at least 10 minutes in advance of the webinar to register. An archived webcast will be available shortly after the event and remain active for one year.

NorthWestern Reports First Quarter 2024 Financial Results

April 25, 2024

Page 12

Notice of Virtual Annual Stockholders Meeting

The virtual Annual Stockholders Meeting will be held on Friday, April 26, 2024, at 11:00 am Eastern Time. A virtual Annual Meeting enables our stockholders — regardless of size, resources, or physical location — to participate in the meeting at no cost. We are committed to ensuring that stockholders will be afforded the same rights and opportunities to participate at our virtual meeting as they would in person.

The Annual Meeting will be webcast live and can be accessed by visiting www.virtualshareholdermeeting.com/NWE2024 To participate in the meeting, please go to the site at least 10 minutes in advance of the meeting and follow the check-in procedures.

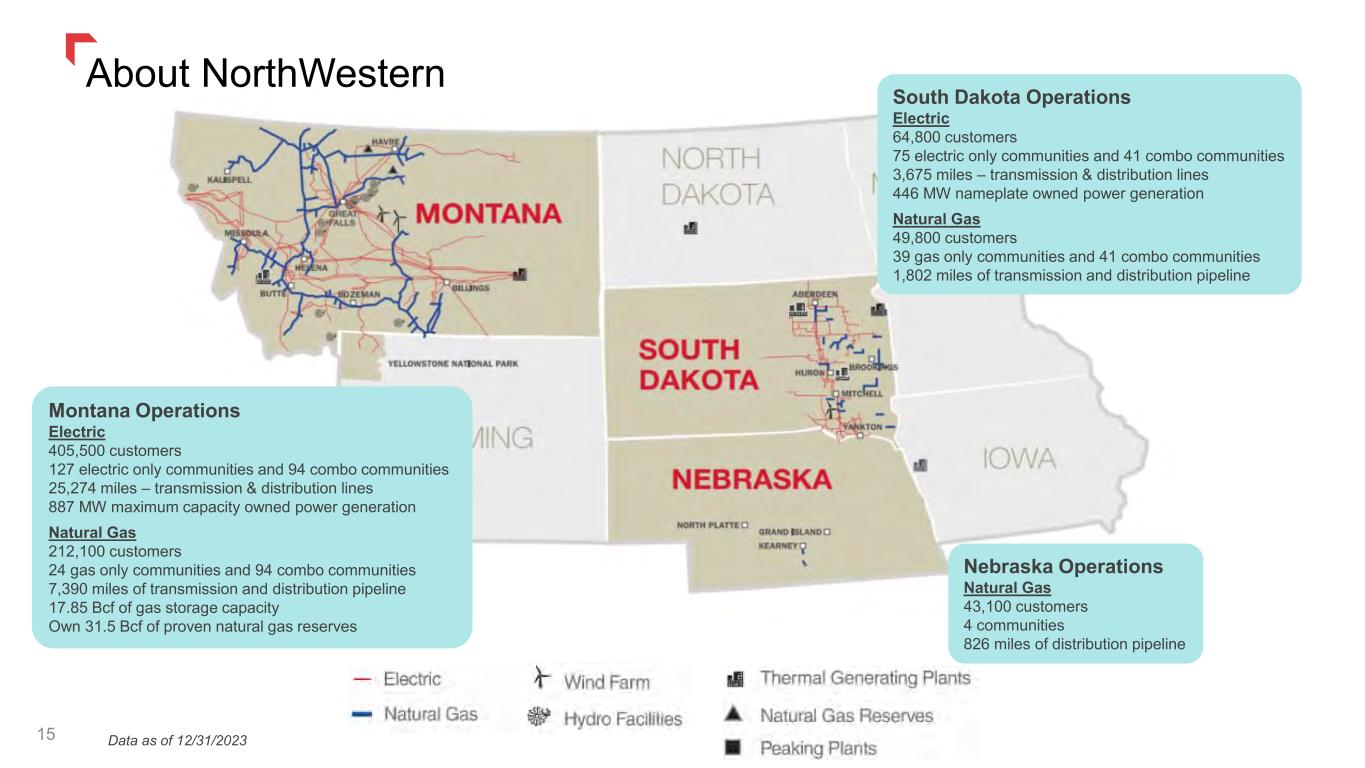

NorthWestern Energy - DELIVERING A BRIGHT FUTURE

NorthWestern Energy Group, Inc., doing business as NorthWestern Energy, provides essential energy infrastructure and valuable services that enrich lives and empower communities while serving as long-term partners to our customers and communities. We work to deliver safe, reliable, and innovative energy solutions that create value for customers, communities, employees, and investors. We do this by providing low-cost and reliable service performed by highly-adaptable and skilled employees. We provide electricity and / or natural gas to approximately 775,300 customers in Montana, South Dakota, Nebraska, and Yellowstone National Park. Our operations in Montana and Yellowstone National Park are conducted through our subsidiary, NW Corp, and our operations in South Dakota and Nebraska are conducted through our subsidiary, NWE Public Service. We have provided service in South Dakota and Nebraska since 1923 and in Montana since 2002.

Non-GAAP Financial Measures

This press release includes financial information prepared in accordance with GAAP, as well as other financial measures, such as Utility Margin, Adjusted Non-GAAP pretax income, Adjusted Non-GAAP net income and Adjusted Non-GAAP Diluted EPS that are considered “non-GAAP financial measures.” Generally, a non-GAAP financial measure is a numerical measure of a company’s financial performance, financial position or cash flows that excludes (or includes) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP.

We define Utility Margin as Operating Revenues less fuel, purchased supply and direct transmission expense (exclusive of depreciation and depletion) as presented in our Consolidated Statements of Income. This measure differs from the GAAP definition of Gross Margin due to the exclusion of Operating and maintenance, Property and other taxes, and Depreciation and depletion expenses, which are presented separately in our Consolidated Statements of Income. A reconciliation of Utility Margin to Gross Margin, the most directly comparable GAAP measure, is included in the press release above.

Management believes that Utility Margin provides a useful measure for investors and other financial statement users to analyze our financial performance in that it excludes the effect on total revenues caused by volatility in energy costs and associated regulatory mechanisms. This information is intended to enhance an investor's overall understanding of results. Under our various state regulatory mechanisms, as detailed below, our supply costs are generally collected from customers. In addition, Utility Margin is used by us to determine whether we are collecting the appropriate amount of energy costs from customers to allow for recovery of operating costs, as well as to analyze how changes in loads (due to weather, economic or other conditions), rates and other factors impact our results of operations. Our Utility Margin measure may not be comparable to that of other companies' presentations or more useful than the GAAP information provided elsewhere in this report.

NorthWestern Reports First Quarter 2024 Financial Results

April 25, 2024

Page 13

Management also believes the presentation of Adjusted Non-GAAP pre-tax income, Adjusted Non-GAAP net income and Adjusted Non-GAAP Diluted EPS is more representative of normal earnings than GAAP pre-tax income, net income and EPS due to the exclusion (or inclusion) of certain impacts that are not reflective of ongoing earnings. The presentation of these non-GAAP measures is intended to supplement investors' understanding of our financial performance and not to replace other GAAP measures as an indicator of actual operating performance. Our measures may not be comparable to other companies' similarly titled measures.

Special Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including, without limitation, the information under "Reconciliation of Non-GAAP Items." Forward-looking statements involve risks and uncertainties, which could cause actual results or outcomes to differ materially from those expressed. We caution that while we make such statements in good faith and believe such statements are based on reasonable assumptions, including without limitation, management's examination of historical operating trends, data contained in records and other data available from third parties, we cannot assure you that we will achieve our projections. Factors that may cause such differences include, but are not limited to:

•adverse determinations by regulators, as well as potential adverse federal, state, or local legislation or regulation, including costs of compliance with existing and future environmental requirements, and wildfire damages in excess of liability insurance coverage, could have a material effect on our liquidity, results of operations and financial condition;

•the impact of extraordinary external events and natural disasters, such as a wide-spread or global pandemic, geopolitical events, earthquake, flood, drought, lightning, weather, wind, and fire, could have a material effect on our liquidity, results of operations and financial condition;

•acts of terrorism, cybersecurity attacks, data security breaches, or other malicious acts that cause damage to our generation, transmission, or distribution facilities, information technology systems, or result in the release of confidential customer, employee, or company information;

•supply chain constraints, recent high levels of inflation for product, services and labor costs, and their impact on capital expenditures, operating activities, and/or our ability to safely and reliably serve our customers;

•changes in availability of trade credit, creditworthiness of counterparties, usage, commodity prices, fuel supply costs or availability due to higher demand, shortages, weather conditions, transportation problems or other developments, may reduce revenues or may increase operating costs, each of which could adversely affect our liquidity and results of operations;

•unscheduled generation outages or forced reductions in output, maintenance or repairs, which may reduce revenues and increase operating costs or may require additional capital expenditures or other increased operating costs; and

•adverse changes in general economic and competitive conditions in the U.S. financial markets and in our service territories.

Our 2023 Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, reports on Form 8-K and other Securities and Exchange Commission filings discuss some of the important risk factors that may affect our business, results of operations and financial condition. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Investor Relations Contact: Media Contact:

Travis Meyer (605) 978-2967 Jo Dee Black (866) 622-8081

travis.meyer@northwestern.com jodee.black@northwestern.com