2022 Second Quarter Results Earnings Presentation

2 Presenters Michael Sacks Chairman and Chief Executive Officer Jonathan Levin President Pamela Bentley Chief Financial Officer Stacie Selinger Head of Investor Relations

3 Second Quarter 2022 Results $ billion June 30, 2021 June 30, 2022 % Change vs Q2 21 AUM $ 66.9 $ 71.2 6 % FPAUM 55.0 57.5 4 % Private Markets FPAUM 30.1 34.8 16 % Absolute Return Strategies FPAUM 24.9 22.7 (9) % CNYFPAUM 7.0 6.7 (5) % $ million Three Months Ended June 30, 2022 % Change vs Q2 21 Six Months Ended June 30, 2022 % Change vs Q2 YTD 21 GAAP Revenue $ 104.4 (13) % $ 209.5 (6) % GAAP net income attributable to GCM Grosvenor Inc. 7.6 1059 % 12.3 285 % Fee-Related Revenue2 91.5 8 % 182.1 9 % Private Markets Management Fees1 50.4 19 % 97.2 18 % Absolute Return Strategies Management Fees3 40.1 (1) % 82.8 3 % Fee-Related Earnings 32.6 19 % 64.3 22 % Adjusted EBITDA 35.2 15 % 72.4 19 % Adjusted Net Income4 22.1 14 % 45.9 20 % 1. Excludes fund reimbursement revenue for private markets of $1.0 million and $1.9 million for the three and six months ended June 30, 2022, respectively. 2. Excludes fund reimbursement revenue of $2.3 million and $4.9 million for the three and six months ended June 30, 2022, respectively. 3. Excludes fund reimbursement revenue for absolute return strategies of $1.3 million and $3.0 million for the three and six months ended June 30, 2022, respectively. 4. Reflects a corporate and blended statutory effective tax rate of 24.5% applied to Adjusted Pre-Tax Income for the three and six months ended June 30, 2022 and of 25.0% for the three and six months ended June 30, 2021. • Second quarter 2022 fundraising of $2.1 billion • Fee-Related Revenue growth driven by Private Markets management fee growth of 19% over Q2 20211 • GCM Grosvenor's Board of Directors approved a $0.10 per share dividend payable on September 15, 2022 to shareholders on record September 1, 2022 • GCM Grosvenor repurchased $10.0 million of Class A common stock and $1.9 million of warrants during the quarter, and $40.3 million remained in the approved share and warrant repurchase program as of June 30, 2022

0.3 0.7 0.2 0.6 1.1 0.1 0.3 Q1 2022 Q2 2022 Private Equity Infrastructure Real Estate Absolute Return Strategies Opportunistic 4 Fund Strategy Closed in Q2 22 ($mm) Closed through Q2 22 ($mm) Forecasted Next / First Closing Final Close GSF III PE Secondaries $190 $866 4Q 2022 Late 2022 CIS III Diversified Infrastructure $75 $542 3Q 2022 Early 2023 MAC III Multi-Asset Class $30 $729 4Q 2022 Mid 2023 GCF III PE Co-Investments $184 $184 4Q 2022 Mid 2024 LIF II Labor Impact Infrastructure N/A N/A TBD 2024+ Fundraising: Year-to-Date Through Q2 2022 $2.1 billion Q2 2022 Capital Raised $3.4 billion YTD Capital Raised $ billion YTD Fundraising By Strategy

$ billion 5 Second Quarter 2022 Fundraising Private Markets $2.1 0.1 2.0 Q2 2022 Absolute Return Strategies Absolute Return Strategies, 4% Opportunistic, 17% Private Equity, 29% Infrastructure, 50% Specialized Funds, 21% Customized Separate Accounts, 79% Americas, 61% EMEA, 6% APAC, 33% Pension, 39% Government / Sovereign, 28% Corporation, 7% Retail/Non- Institutional, 5% Insurance, 20% Other, 1% By Strategy By Channel By Structure By Geography

$ billion 6 Year-to-Date 2022 Fundraising Private Markets $3.4 0.3 3.1 Q2 YTD 2022 Absolute Return Strategies Absolute Return Strategies, 10% Opportunistic, 11% Private Equity, 25% Infrastructure, 52% Real Estate, 2% Specialized Funds, 22% Customized Separate Accounts, 78% Americas, 52% EMEA, 7% APAC, 41% Pension, 45% Government / Sovereign, 19% Corporation, 10% Retail/Non- Institutional, 9% Insurance, 13% Other, 1% Financial Institutions, 3% By Strategy By Channel By Structure By Geography

$14.4 $19.5 Q2 2021 Q2 2022 ESG and Impact Investments AUM ($bn) 5-6. See Notes towards the end of the document. 35% Diverse Managers Regionally Targeted Clean Energy Labor Impact Other ESG and Impact $12.3 billion $2.2 billion $1.6 billion $1.1 billion $5.6 billion ESG and Impact Remains a Core Driver of AUM Growth5 7 ESG and Impact AUM by Strategy6

$30.7 $35.2 Q2 21 Q2 22 $84.9 $91.5 42.3 50.4 40.7 40.1 1.9 1.0 Private Markets Absolute Return Strategies Administrative fees and other operating income Q2 21 Q2 22 $19.3 $22.1 19.3 22.1 Q2 21 Q2 22 8 15% $27.5 $32.6 27.5 32.6 Q2 21 Q2 22 19% 14% Q2 2022 over Q2 2021, $ million Strong Q2 2022 Growth Adjusted Net Income Fee-Related Earnings Adjusted EBITDA Fee-Related Revenue7 8% 7. Excludes fund reimbursement revenue of $2.6 million and $2.3 million for the three months ended June 30, 2021 and June 30, 2022, respectively. (1)% 19%

$52.6 $64.3 52.6 64.3 Q2 YTD 21 Q2 YTD 22 $60.9 $72.4 60.9 72.4 Q2 YTD 21 Q2 YTD 22 9 19% 20% $38.2 $45.9 38.2 45.9 Q2 YTD 21 Q2 YTD 22 22% YTD 2022 over YTD 2021, $ million Strong YTD 2022 Growth 9% $167.6 $182.1 82.7 97.2 80.6 82.8 4.3 2.1 Private Markets Absolute Return Strategies Administrative fees and other operating income Q2 YTD 21 Q2 YTD 22 Adjusted Net Income Fee-Related Earnings Adjusted EBITDA Fee-Related Revenue8 8. Excludes fund reimbursement revenue of $4.9 million for each of the six months ended June 30, 2021 and June 30, 2022. 3% 18%

$66.9 $71.2 55.0 57.5 7.0 6.7 4.9 7.0 Q2 2021 Q2 2022 $40.9 $47.6 30.1 34.8 6.9 6.63.9 6.2 Q2 2021 Q2 2022 CNYFPAUM Fees Charged on Scheduled Ramp-in $1.6 0.6 0.8 0.2 Remainder of 2022 2023 2024+ $26.0 $23.6 24.9 22.7 0.1 0.1 1.0 0.8 Q2 2021 Q2 2022 FPAUM Contracted not yet FPAUM ("CNYFPAUM") Other9 9. Includes mark to market, insider capital and non fee-paying AUM. Fees Charged on Invested Capital $5.1 $ billion Private Markets AUM Absolute Return Strategies AUM Total AUM Assets Under Management 10 16% 6% (9)%

Q2 2020 39% Private Markets Experiencing Strong Growth and Mix Shift FPAUM Has Shifted Towards Private Markets... 11 $27.1 $30.1 $34.8 Q2 2020 Q2 2021 Q2 2022 $36.5 $42.4 $50.4 Q2 2020 Q2 2021 Q2 2022 Private Markets Management Fees (mm) ...And Private Markets Management Fee Earnings Power Has Grown Private Markets FPAUM (bn) Q2 2022 47% % of Private Markets AUM in Secondaries, Co-Investments and Direct Investments 18% CAGR Q2 2020 55% Q2 2022 61% Private Markets % of Total FPAUM 13% CAGR

247 383 378 457 Unrealized Carried Interest - Firm Share Unrealized Carried Interest - Non-Firm Share Q2 21 Q2 22 52 101 230 155 122 180 Firm Share of Carried Interest by Vintage Year 2013 or Earlier 2014-2016 2017+ Highly Diversified Incentive Fee Opportunity Unrealized Carried Interest by Vintage Year12 10-13. See Notes towards the end of the document. 12 55% YoY Growth in Firm Share 34% YoY Growth in Unrealized Carry 11 • Annual Performance Fees: $31 million annual run-rate performance fee opportunity13, from 52 programs • Carried Interest: 137 programs in unrealized carried interest $ million 46% Firm Share40% Firm Share 25% Firm Share 45% Firm Share 56% Firm Share Firm Share of Carried Interest10,12 11

Key 2022 and Long-Term Growth Drivers 5, 14-17. See Notes towards the end of the document. International Geographies Insurance Solutions Non-institutional / Retail ESG / Impact5 Private Markets Secondaries / Co-Investments / Direct Infrastructure & Real Estate Scale Specialized Funds Grow with Existing Clients Compound Capital 13 New Channel Expansion17 Ž High-Growth StrategiesŒ Scale Core Capabilities LTM Flows 10% AUM 4% LTM Flows 14% AUM 3% LTM Flows 46% AUM 39% $18b AUM > > > 84%+ Of clients have added capital in last 3 years14 50%+ Of top clients are invested in more than 1 vertical15 Approximately 90% Private Markets Re-Up Rate16 31% YoY Increase Growth of Absolute Return Strategies FPAUM From Compounding $22b AUM $19.5b AUM 35% YoY Increase 33% YoY Increase in Infrastructure AUM 24% YoY Increase in Real Estate AUM

18. Reflects GAAP cash including $12 million of cash held at consolidated carry plan entities. 19. Represents firm share of Net Asset Value as of June 30, 2022. 20. Debt principal at pricing of L+250bps as of June 30, 2022, subject to a LIBOR floor of 50bps. 21. Excludes all outstanding letters of credit. 22. Warrants strike at $11.50 and are subject to early redemption or exercise at $18.00 per share. 14 • In accordance with the firm's $65 million stock repurchase authorization, GCM Grosvenor repurchased $10.0 million of Class A common stock and $1.9 million of warrants during the quarter ◦ $40.3 million remained in the approved share and warrant repurchase program as of June 30, 2022 Key Cash, Investment and Debt Metrics as of 06/30/22 ($mm) Cash and Cash Equivalents18 $ 78 Investments19 147 Cash and Investments 225 Unrealized Carried Interest19 383 Cash, Investments and Unrealized Carried Interest19 608 Debt20 395 Drawn Revolving Credit Facility ($48.2 million available)21 0 Summary of Ownership as of 06/30/22 (mm) Shares % Management Owned Shares 144.2 77 % Publicly Traded Shares 42.5 23 % Total Shares 186.7 100 % Warrants Outstanding22 17.7 Other Key Items

15 Three Months Ended Six Months Ended $000, except per share amounts and where otherwise noted Jun 30, 2021 Jun 30, 2022 Jun 30, 2021 Jun 30, 2022 Revenues Management fees $ 85,594 $ 92,830 $ 168,219 $ 184,940 Incentive fees 32,227 10,505 50,441 22,497 Other operating income 1,882 1,025 4,262 2,051 Total operating revenues 119,703 104,360 222,922 209,488 Expenses Employee compensation and benefits 75,834 61,429 159,187 127,334 General, administrative and other 21,651 23,093 46,183 44,351 Total operating expenses 97,485 84,522 205,370 171,685 Operating income 22,218 19,838 17,552 37,803 Investment income (loss) 13,459 (1,197) 26,507 9,663 Interest expense (4,563) (5,591) (9,054) (10,875) Other income (expense) (261) — 1,056 1 Change in fair value of warrant liabilities (6,738) 19,640 7,319 21,662 Net other income 1,897 12,852 25,828 20,451 Income before income taxes 24,115 32,690 43,380 58,254 Provision for income taxes 2,204 2,011 1,541 4,344 Net income 21,911 30,679 41,839 53,910 Less: Net income attributable to redeemable noncontrolling interest 11,738 — 19,827 — Less: Net income attributable to noncontrolling interests in subsidiaries 11,708 844 20,297 5,680 Less: Net income (loss) attributable to noncontrolling interests in GCMH (2,191) 22,230 (1,488) 35,899 Net income attributable to GCM Grosvenor Inc. $ 656 $ 7,605 $ 3,203 $ 12,331 Earnings (loss) per share of Class A common stock: Basic $ 0.01 $ 0.17 $ 0.07 $ 0.27 Diluted $ (0.02) $ 0.13 $ (0.04) $ 0.21 Weighted average shares of Class A common stock outstanding: Basic (in millions) 44.6 45.1 43.3 44.9 Diluted (in millions) 188.8 189.4 189.1 189.5 GAAP Statements of Income

16 23, 25-29. See Notes towards the end of the document. 24. Excludes fund reimbursement revenue of $2.6 million and $2.3 million for the three months ended June 30, 2021 and June 30, 2022, respectively, and $4.9 million for each of the six months ended June 30, 2021 and June 30, 2022. Three Months Ended Six Months Ended $000, except per share amounts and where otherwise noted Jun 30, 2021 Jun 30, 2022 Jun 30, 2021 Jun 30, 2022 Adjusted EBITDA Revenues Private markets strategies $ 42,360 $ 50,394 $ 82,733 $ 97,235 Absolute return strategies 40,680 40,123 80,572 82,834 Management fees, net24 83,040 90,517 163,305 180,069 Administrative fees and other operating income 1,882 1,025 4,262 2,051 Fee-Related Revenue 84,922 91,542 167,567 182,120 Less: Cash-based employee compensation and benefits, net25 (40,255) (40,520) (81,447) (81,383) General, administrative and other, net26 (17,211) (18,463) (33,471) (36,467) Fee-Related Earnings 27,456 32,559 52,649 64,270 Fee-Related Earnings Margin 32 % 36 % 31 % 35 % Incentive fees: Performance fees 2,891 317 9,004 1,318 Carried interest 29,336 10,188 41,437 21,179 Incentive fee related compensation and NCI: Cash-based incentive fee related compensation (868) (1,219) (2,701) (2,813) Carried interest compensation, net27 (17,967) (6,092) (25,470) (12,283) Carried interest attributable to noncontrolling interests (10,561) (1,706) (14,991) (3,521) Realized investment income, net of amount attributable to noncontrolling interests in subsidiaries28 — 793 — 3,457 Interest income 4 42 11 45 Other (income) expense 13 (42) 64 (44) Depreciation 407 395 880 794 Adjusted EBITDA 30,711 35,235 60,883 72,402 Adjusted EBITDA Margin 26 % 35 % 28 % 35 % Adjusted Net Income Per Share Adjusted EBITDA 30,711 35,235 60,883 72,402 Depreciation (407) (395) (880) (794) Interest expense (4,563) (5,591) (9,054) (10,875) Adjusted Pre-Tax Income 25,741 29,249 50,949 60,733 Adjusted income taxes29 (6,435) (7,166) (12,737) (14,880) Adjusted Net Income 19,306 22,083 38,212 45,853 Adjusted shares outstanding (in millions) 189.4 189.4 189.1 189.5 Adjusted Net Income per Share - diluted $ 0.10 $ 0.12 $ 0.20 $ 0.24 Summary of Non-GAAP Financial Measures23

Appendix

50+ Years of Alternative Asset Management Investing 18 Primary Direct Secondary Co- Invest Real Estate $4.2bn Absolute Return $23.6bn Private Equity $27.9bn ESG / Impact $19.5bn Alternative Credit $13.4bn Infrastructure $10.5bn 30-31. See Notes towards the end of the document. 71.2bn Assets under Management 31 1971 First year of investing 74% of AUM in customized separate accounts 517 Employees30 164 Investment professionals

One Platform That Spans the Alternatives Investing Universe Multiple Implementation Options Co-Investments Custom StructuresDirect InvestmentsPrimary Investments Secondaries Seeding Real Estate Absolute Return StrategiesPrivate Equity Infrastructure Credit ESG and Impact Our Strategic Advantage is Our Breadth and Flexibility Private Markets Across All Strategies 19 $71bn Assets under Management31 31. See Notes towards the end of the document.

Flexible Delivery Formats Fuel Client Extension Opportunities • 74% of AUM • Specifically tailored program to client objectives and constraints • Extension of staff • Provide value-add ancillary services, including administering capital, on behalf of certain of our clients • Evergreen and closed-ended options • Approximately 90% re-up success16 • 26% of AUM • Turnkey solution • Across investment strategies • Lower required investment to access • Risk return objectives and fund strategy developed by GCMG to meet the market’s needs • Evergreen and closed-ended options • 13 years average client tenure across top 25 clients by AUM • 84%+ of top clients added capital in last 3 years14 • 50%+ of top clients are invested in more than one vertical15 • Proven success extending client relationships into new strategies and investment types 14-16. See Notes towards the end of the document. 20

21 Note: AUM as of June 30, 2022. Management fees for the twelve months ended June 30, 2022. 32. Institutional clients as of March 31, 2022. Strong Value Proposition Attracts Tenured and Diversified Clients 42% 14% 8% 16% 6% 7% 6% Our client base is institutional and stable % of AUM Our client base is global % of AUM Our client base is diversified % of management fees No single client contributes more than 5% of our management fees 64% 24% 12% Government/ Sovereign Corporation Retail / Non- Institutional Other Financial Institutions 57% 14% 9% 4% 4% 9% 61%23% 10% 6% AmericasAPAC EMEA Rest of world 21% 13% 66% Other Top 1-10 Top 11-20 Pensions $71B of AUM across over 500 institutional clients32 13yrs Average relationship of our 25 largest clients by AUM 84% of 25 largest clients by AUM have expanded investment relationship in the last 3 years 3% Insurance

22 Illustrative Client Economic Value Proposition: Absolute Return Strategies Example: $300M Fee Paying; $300M Non-Fee Paying. Assuming 0% gross return. 33. This hypothetical portfolio has an annual performance fee component of 5% over a hurdle (capped at 5%) of 90-day U.S. T-Bill plus 2%. 34. Fee savings is shown for illustrative purposes only, and is not intended to imply that any GCM Grosvenor portfolio will achieve such savings over any period. Fee savings varies by GCM Grosvenor portfolio and our calculation of fee savings is subject to a number of assumptions. Fee savings may be greater at higher rates of return for certain portfolios. 35. Reflects the weighted-average GCM Grosvenor portfolio-level management fee across the fee-paying and non-fee-paying portions reflected above, assuming a 50/50 AUM split between the two. In practice many large institutional clients have greater than 50% of their absolute return programs being managed on a direct basis and consequently the value of a relationship with GCM Grosvenor is greater. Fee savings at the underlying fund level Management fee at the GCM Grosvenor portfolio level Fee Paying33 $300 million Non-Fee Paying $300 million 60 bps 0 bps (50 bps)34 Constructive GCM Grosvenor management fee35 30 bps Less fee savings (50 bps) GCM Grosvenor management fee, net of fee savings 10 bps Constructive GCM Grosvenor management fee, net of fee savings (20 bps) GCM Grosvenor achieves fee savings in portfolios we both manage and advise. (50 bps)34 (50 bps) ◦ GCM Grosvenor offers large Absolute Return Strategies clients a ‘hybrid model’ through which the firm provides advisory services for a non-fee paying client directed portfolio alongside the client’s GCM managed fee-paying portfolio ◦ Under this structure, the client benefits from GCM Grosvenor’s fee savings derived as a consequence of our size and scale ◦ This structure results in a highly advantageous constructive fee

23 Illustrative Client Economic Value Proposition: Private Markets Example: $1.0Bn Program – Direct Primary Program vs. Direct Primary + GCM Grosvenor-Managed Co-Investment Program Direct Primary Only Program $1.0 billion Management fee at the underlying fund level 200 bps Management fee at the GCM Grosvenor portfolio level 0 bps Total Management Fees 200 bps Carried interest at the underlying fund level 20% Carried interest at the GCM Grosvenor portfolio level 0% Total Carried Interest 20% 200 bps 0 bps 20% 0% Direct Primaries Program $650 million GCM Grosvenor Managed Co-Investment Program $350 million 0 bps 100 bps 0% 10% 165 bps ~16.5%

Supplemental Information

25 $000 Dec 31, 2021 Jun 30, 2022 Assets Cash and cash equivalents $ 96,185 $ 78,483 Management fees receivable 21,693 18,291 Incentive fees receivable 91,601 11,936 Due from related parties 11,777 10,634 Investments 226,345 222,957 Premises and equipment, net 5,411 5,266 Lease right-of-use assets — 13,873 Intangible assets, net 6,256 5,098 Goodwill 28,959 28,959 Deferred tax assets, net 68,542 65,625 Other assets 24,855 46,687 Total assets 581,624 507,809 Liabilities and Equity (Deficit) Accrued compensation and benefits 98,132 26,003 Employee related obligations 30,397 31,516 Debt 390,516 389,068 Payable to related parties pursuant to the tax receivable agreement 59,366 59,313 Lease liabilities — 17,726 Warrant liabilities 30,981 6,749 Accrued expenses and other liabilities 28,033 22,386 Total liabilities 637,425 552,761 Commitments and contingencies Preferred stock, $0.0001 par value, 100,000,000 shares authorized, none issued — — Class A common stock, $0.0001 par value, 700,000,000 authorized; 43,964,090 and 42,530,342 issued and outstanding as of December 31, 2021 and June 30, 2022, respectively 4 4 Class B common stock, $0.0001 par value, 500,000,000 authorized, none issued — — Class C common stock, $0.0001 par value, 300,000,000 authorized; 144,235,246 issued and outstanding as of December 31, 2021 and June 30, 2022 14 14 Additional paid-in capital 1,501 1,775 Accumulated other comprehensive income (loss) (1,007) 2,984 Retained earnings (26,222) (22,400) Total GCM Grosvenor Inc. deficit (25,710) (17,623) Noncontrolling interests in subsidiaries 96,687 82,938 Noncontrolling interests in GCMH (126,778) (110,267) Total deficit (55,801) (44,952) Total liabilities and equity (deficit) $ 581,624 $ 507,809 GAAP Balance Sheets

26 Three Months Ended Six Months Ended $000 Jun 30, 2021 Mar 31, 2022 Jun 30, 2022 Jun 30, 2021 Jun 30, 2022 Components of GAAP Employee Compensation and Benefits Cash-based employee compensation and benefits, net36 $ 40,255 $ 40,863 $ 40,520 $ 81,447 $ 81,383 Cash-based incentive fee related compensation 868 1,594 1,219 2,701 2,813 Carried interest compensation, net37 17,967 6,191 6,092 25,470 12,283 Partnership interest-based compensation 10,026 7,115 7,027 14,929 14,142 Equity-based compensation 5,604 9,881 5,604 32,640 15,485 Severance 802 513 268 1,390 781 Other non-cash compensation 683 84 752 1,624 836 Non-cash carried interest compensation (371) (336) (53) (1,014) (389) GAAP employee compensation and benefits $ 75,834 $ 65,905 $ 61,429 $ 159,187 $ 127,334 36-37. See Notes towards the end of the document. Components of GAAP Expenses

27 Three Months Ended Six Months Ended $000 Jun 30, 2021 Mar 31, 2022 Jun 30, 2022 Jun 30, 2021 Jun 30, 2022 Net Incentive Fees Attributable to GCM Grosvenor Incentive fees: Performance fees $ 2,891 $ 1,001 $ 317 $ 9,004 $ 1,318 Carried interest 29,336 10,991 10,188 41,437 21,179 Total Incentive Fees $ 32,227 $ 11,992 $ 10,505 $ 50,441 $ 22,497 Less incentive fees contractually owed to others: Cash carried interest compensation (17,596) (5,855) (6,039) (24,456) (11,894) Non-cash carried interest compensation (371) (336) (53) (1,014) (389) Carried interest attributable to redeemable noncontrolling interest holder (6,154) — — (8,059) — Carried interest attributable to other noncontrolling interest holders, net (4,407) (1,815) (1,706) (6,932) (3,521) Firm share of incentive fees11 3,699 3,986 2,707 9,980 6,693 Less: Cash-based incentive fee related compensation (868) (1,594) (1,219) (2,701) (2,813) Net incentive fees attributable to GCM Grosvenor $ 2,831 $ 2,392 $ 1,488 $ 7,279 $ 3,880 % of Firm Share of Incentive Fees 77 % 60 % 55 % 73 % 58 % Reconciliation to Non-GAAP Metrics 11. See Notes towards the end of the document.

28 Three Months Ended Six Months Ended $000 Jun 30, 2021 Mar 31, 2022 Jun 30, 2022 Jun 30, 2021 Jun 30, 2022 Adjusted Pre-Tax Income & Adjusted Net Income Net income attributable to GCM Grosvenor Inc. $ 656 $ 4,726 $ 7,605 $ 3,203 $ 12,331 Plus: Net income (loss) attributable to noncontrolling interests in GCMH (2,191) 13,669 22,230 (1,488) 35,899 Provision for income taxes 2,204 2,333 2,011 1,541 4,344 Change in fair value of derivatives — — — (1,934) — Change in fair value of warrant liabilities 6,738 (2,022) (19,640) (7,319) (21,662) Amortization expense 583 579 579 1,166 1,158 Severance 802 513 268 1,390 781 Transaction expenses38 1,183 79 1,625 6,483 1,704 Loss on extinguishment of debt — — — 675 — Changes in tax receivable agreement liability and other 274 127 — 282 127 Partnership interest-based compensation 10,026 7,115 7,027 14,929 14,142 Equity-based compensation 5,604 9,881 5,604 32,640 15,485 Other non-cash compensation 683 84 752 1,624 836 Less: Unrealized investment (income) loss, net of noncontrolling interests (450) (5,264) 1,241 (1,229) (4,023) Non-cash carried interest compensation (371) (336) (53) (1,014) (389) Adjusted Pre-Tax Income 25,741 31,484 29,249 50,949 60,733 Less: Adjusted income taxes29 (6,435) (7,714) (7,166) (12,737) (14,880) Adjusted Net Income $ 19,306 $ 23,770 $ 22,083 $ 38,212 $ 45,853 29, 38. See Notes towards the end of the document. Reconciliation to Non-GAAP Metrics

29 Three Months Ended Six Months Ended $000 Jun 30, 2021 Mar 31, 2022 Jun 30, 2022 Jun 30, 2021 Jun 30, 2022 Adjusted EBITDA Adjusted Net Income $ 19,306 $ 23,770 $ 22,083 $ 38,212 $ 45,853 Plus: Adjusted income taxes29 6,435 7,714 7,166 12,737 14,880 Depreciation expense 407 399 395 880 794 Interest expense 4,563 5,284 5,591 9,054 10,875 Adjusted EBITDA $ 30,711 $ 37,167 $ 35,235 $ 60,883 $ 72,402 Fee-Related Earnings Adjusted EBITDA 30,711 37,167 35,235 60,883 72,402 Less: Incentive fees (32,227) (11,992) (10,505) (50,441) (22,497) Depreciation expense (407) (399) (395) (880) (794) Other non-operating income (17) (1) — (75) (1) Realized investment income, net of amount attributable to noncontrolling interests in subsidiaries28 — (2,664) (793) — (3,457) Plus: Incentive fee-related compensation 18,835 7,785 7,311 28,171 15,096 Carried interest attributable to redeemable noncontrolling interest holder 6,154 — — 8,059 — Carried interest attributable to other noncontrolling interest holders, net 4,407 1,815 1,706 6,932 3,521 Fee-Related Earnings $ 27,456 $ 31,711 $ 32,559 $ 52,649 $ 64,270 28-29. See Notes towards the end of the document. Reconciliation to Non-GAAP Metrics

30 Three Months Ended Six Months Ended $000, except per share amounts and where otherwise noted Jun 30, 2021 March 31, 2022 Jun 30, 2022 Jun 30, 2021 Jun 30, 2022 Adjusted Net Income Per Share Adjusted Net Income $ 19,306 $ 23,770 $ 22,083 $ 38,212 $ 45,853 Weighted-average shares of Class A common stock outstanding - basic (in millions) 44.6 44.6 45.1 43.3 44.9 Exercise of private warrants - incremental shares under the treasury stock method (in millions) — — — 0.2 — Exercise of public warrants - incremental shares under the treasury stock method (in millions) — — — 1.4 — Exchange of partnership units (in millions) 144.2 144.2 144.2 144.2 144.2 Assumed vesting of RSUs - incremental shares under the treasury stock method (in millions) — 0.8 — — 0.4 Weighted-average shares of Class A common stock outstanding - diluted (in millions) 188.8 189.7 189.4 189.1 189.5 Effective dilutive warrants, if antidilutive for GAAP (in millions) 0.6 — — — — Effective RSUs, if antidilutive for GAAP (in millions) 0.1 — — — — Adjusted shares - diluted (in millions) 189.4 189.7 189.4 189.1 189.5 Adjusted Net Income Per Share - diluted $ 0.10 $ 0.13 $ 0.12 $ 0.20 $ 0.24 Note: Amounts may not foot due to rounding. Reconciliation to Adjusted Net Income Per Share

31 $mm Private Markets Strategies Absolute Return Strategies Total FPAUM Contracted Not Yet FPAUM Total AUM Fee-Paying AUM Beginning of Period (April 1, 2022) $ 33,847 $ 24,012 $ 57,859 $ 6,545 $ 71,338 Contributions from CNYFPAUM 634 8 642 Contributions from New Capital Raised 788 75 863 Withdrawals (74) (520) (594) Distributions (238) — (238) Change in Market Value (33) (796) (829) Foreign Exchange and Other (151) (100) (251) End of Period Balance (June 30, 2022) $ 34,773 $ 22,679 $ 57,452 $ 6,669 $ 71,204 % Change 3 % -6 % -1 % 2 % 0 % Three Months Ended June 30, 2022 Quarterly Change in FPAUM and AUM Six Months Ended June 30, 2022 $mm Private Markets Strategies Absolute Return Strategies Total FPAUM Contracted Not Yet FPAUM Total AUM Fee-Paying AUM Beginning of Period (January 1, 2022) $ 33,080 $ 25,575 $ 58,655 $ 7,683 $ 72,130 Contributions from CNYFPAUM 1,706 24 1,730 Contributions from New Capital Raised 1,162 320 1,482 Withdrawals (83) (957) (1,040) Distributions (781) (24) (805) Change in Market Value (133) (2,121) (2,254) Foreign Exchange and Other (178) (138) (316) End of Period Balance (June 30, 2022) $ 34,773 $ 22,679 $ 57,452 $ 6,669 $ 71,204 % Change 5 % -11 % -2 % -13 % -1 %

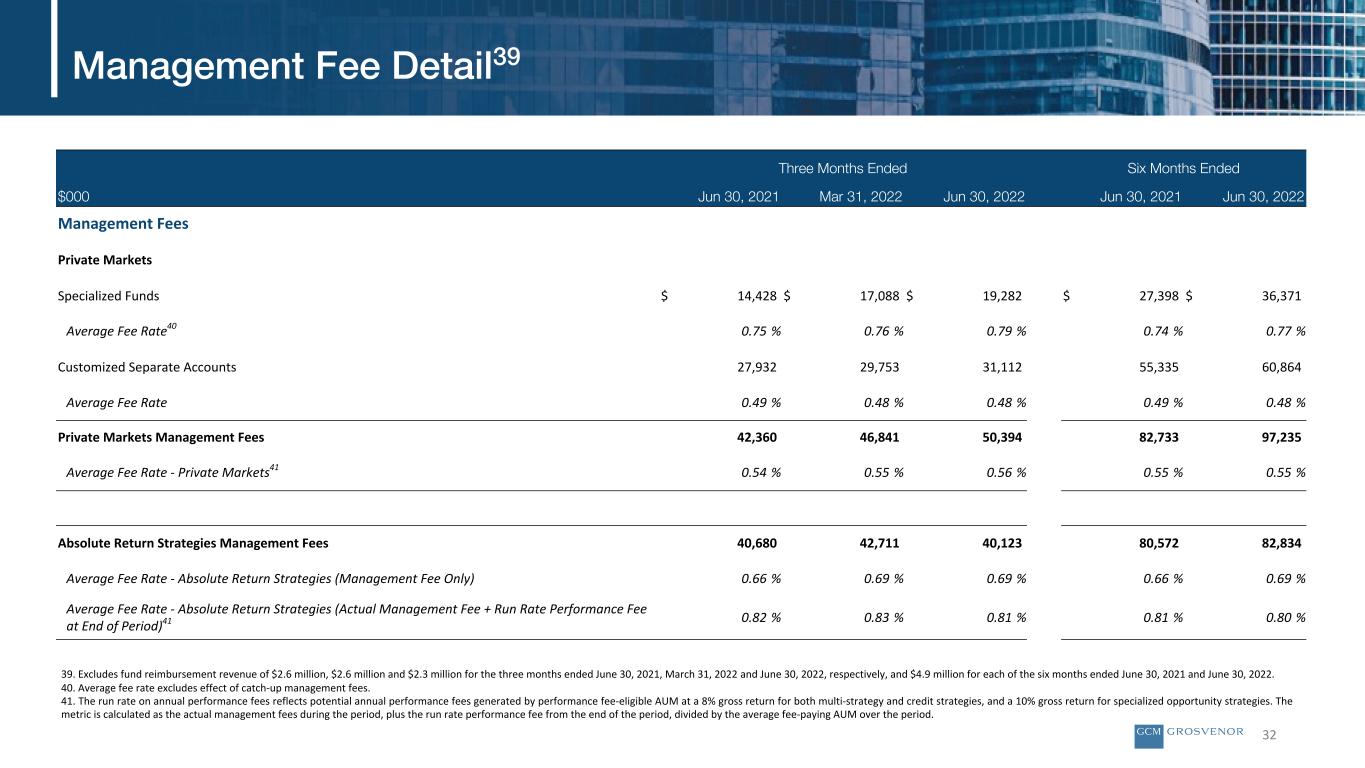

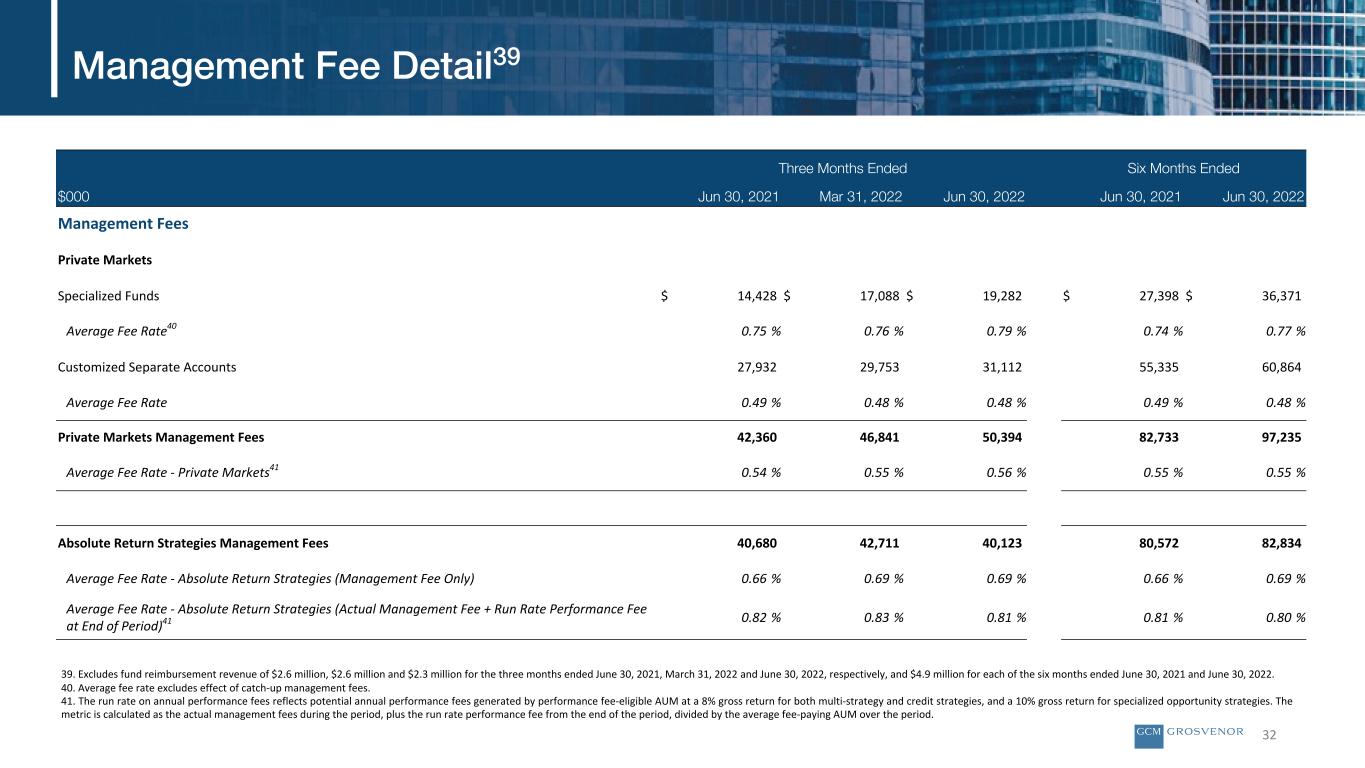

32 Three Months Ended Six Months Ended $000 Jun 30, 2021 Mar 31, 2022 Jun 30, 2022 Jun 30, 2021 Jun 30, 2022 Management Fees Private Markets Specialized Funds $ 14,428 $ 17,088 $ 19,282 $ 27,398 $ 36,371 Average Fee Rate40 0.75 % 0.76 % 0.79 % 0.74 % 0.77 % Customized Separate Accounts 27,932 29,753 31,112 55,335 60,864 Average Fee Rate 0.49 % 0.48 % 0.48 % 0.49 % 0.48 % Private Markets Management Fees 42,360 46,841 50,394 82,733 97,235 Average Fee Rate - Private Markets41 0.54 % 0.55 % 0.56 % 0.55 % 0.55 % Absolute Return Strategies Management Fees 40,680 42,711 40,123 80,572 82,834 Average Fee Rate - Absolute Return Strategies (Management Fee Only) 0.66 % 0.69 % 0.69 % 0.66 % 0.69 % Average Fee Rate - Absolute Return Strategies (Actual Management Fee + Run Rate Performance Fee at End of Period)41 0.82 % 0.83 % 0.81 % 0.81 % 0.80 % 39. Excludes fund reimbursement revenue of $2.6 million, $2.6 million and $2.3 million for the three months ended June 30, 2021, March 31, 2022 and June 30, 2022, respectively, and $4.9 million for each of the six months ended June 30, 2021 and June 30, 2022. 40. Average fee rate excludes effect of catch-up management fees. 41. The run rate on annual performance fees reflects potential annual performance fees generated by performance fee-eligible AUM at a 8% gross return for both multi-strategy and credit strategies, and a 10% gross return for specialized opportunity strategies. The metric is calculated as the actual management fees during the period, plus the run rate performance fee from the end of the period, divided by the average fee-paying AUM over the period. Management Fee Detail39

33 Strategy Commitments Contributions Distributions Current Value Investment Net TVPI Investment Net IRR PME IRR PME Index Private Equity Primary Fund Investments42 $ 12,271 $ 13,361 $ 22,055 $ 2,972 1.87 14.2 % 9.6 % S&P 500 Secondaries Investments43 409 381 447 154 1.58 18.3 % 12.5 % S&P 500 Co-Investments/Direct Investments44 3,003 2,876 4,726 789 1.92 21.6 % 15.1 % S&P 500 Infrastructure45 2,470 2,486 3,346 757 1.65 12.2 % 6.3 % MSCI World Infrastructure Real Estate46 586 621 877 88 1.55 20.6 % 8.6 % FNERTR Index ESG and Impact Strategies Diverse Managers47 2,060 2,191 3,194 1,326 2.06 24.9 % 13.9 % S&P 500 Labor Impact Investments N/A N/A N/A N/A N/A N/A N/A MSCI World Infrastructure Note: Returns for each strategy are presented from the date the firm established a dedicated team focused on such strategy through March 31, 2022. Investment net returns are net of investment-related fees and expenses, including fees paid to underlying managers, but do not reflect management fees, incentive compensation, or carried interest to GCM Grosvenor or any expenses of any account or vehicle GCM Grosvenor manages. Data does not include investments that were transferred at the request of investors prior to liquidation and are no longer managed by GCM Grosvenor. Past performance is not necessarily indicative of future results. 42-47. See Notes towards the end of the document. Realized and Partially Realized Investments ($ billion) Private Markets Strategies Performance Metrics

34 Strategy Commitments Contributions Distributions Current Value Investment Net TVPI Investment Net IRR PME IRR PME Index Private Equity Primary Fund Investments42 $ 22,758 $ 20,648 $ 25,341 $ 9,626 1.69 13.2 % 11.0 % S&P 500 Secondary Investments43 1,279 1,152 641 1,182 1.58 21.1 % 15.0 % S&P 500 Co-Investments/Direct Investments44 6,771 6,349 5,006 5,963 1.73 20.2 % 15.6 % S&P 500 Infrastructure45 7,499 6,219 4,184 4,341 1.37 10.0 % 6.8 % MSCI World Infrastructure Real Estate46 2,961 2,264 1,352 1,493 1.26 13.0 % 11.7 % FNERTR Index Multi-Asset Class Programs 2,884 2,820 1,482 2,605 1.45 30.0 % N/A N/A ESG and Impact Strategies Diverse Managers47 8,851 7,027 4,472 7,368 1.68 21.3 % 15.3 % S&P 500 Labor Impact Investments 508 485 18 561 1.19 15.2 % 7.5 % MSCI World Infrastructure Note: Returns for each strategy are presented from the date the firm established a dedicated team focused on such strategy through March 31, 2022. Investment net returns are net of investment-related fees and expenses, including fees paid to underlying managers, but do not reflect management fees, incentive compensation, or carried interest to GCM Grosvenor or any expenses of any account or vehicle GCM Grosvenor manages. Data does not include investments that were transferred at the request of investors prior to liquidation and are no longer managed by GCM Grosvenor. Past performance is not necessarily indicative of future results. 42-47. See Notes towards the end of the document. All Investments ($ billion) Private Markets Strategies Performance Metrics

35 Annualized Returns Periods Ended June 30, 2022 Assets Under Management as of June 30, 2022 (Bn) Three Months Ended June 30, 2022 Year to Date One Year Three Year Five Year Since Inception Gross Net Gross Net Gross Net Gross Net Gross Net Gross Net Absolute Return Strategies (Overall) $ 23.6 (3.6) % (3.7) % (8.6) % (8.8) % (5.6) % (6.1) % 4.5 % 3.8 % 4.3 % 3.6 % 6.7 % 5.7 % GCMLP Diversified Multi-Strategy Composite $ 11.8 (3.1) % (3.3) % (8.6) % (8.9) % (5.0) % (5.6) % 5.0 % 4.3 % 4.5 % 3.8 % 7.7 % 6.4 % Note: Absolute Return Strategies (Overall) is since 1996. GCMLP Diversified Multi-Strategy Composite is since 1993. Absolute Return Strategies Performance

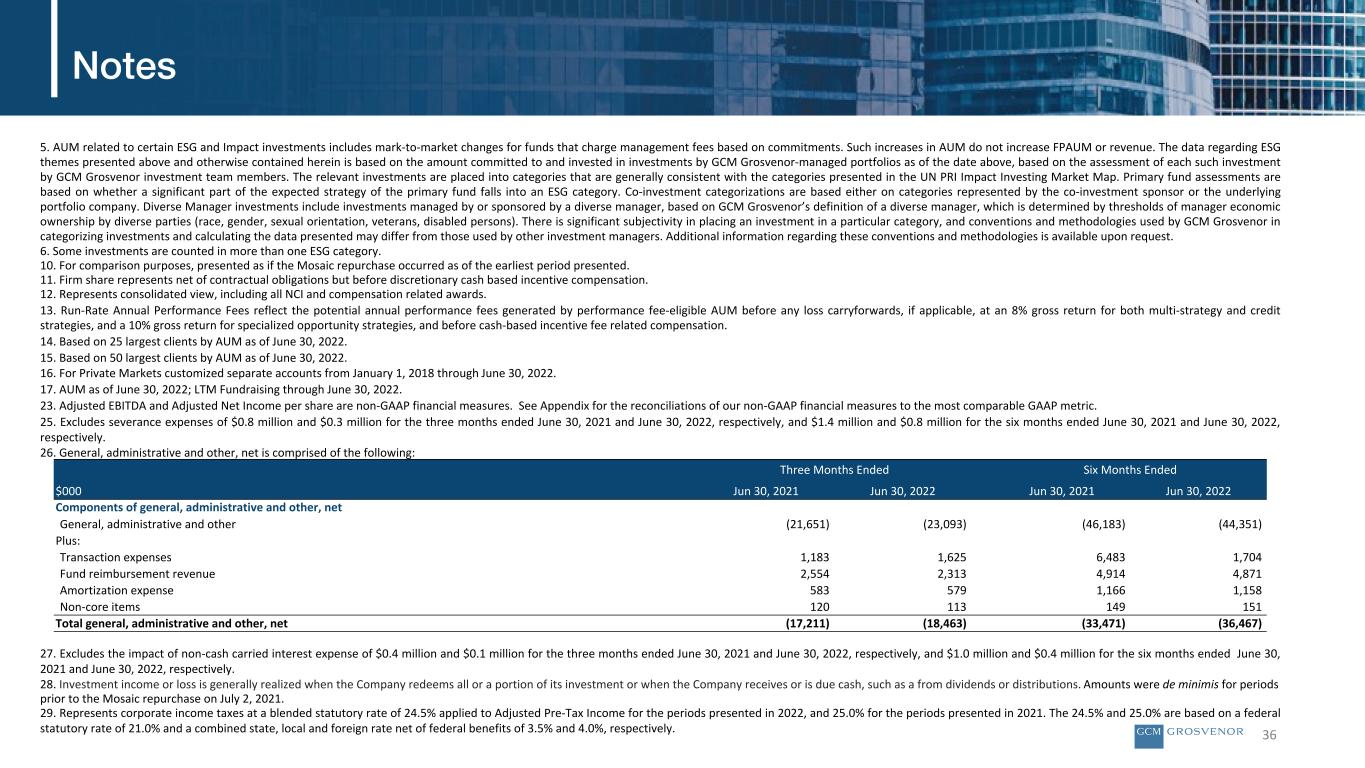

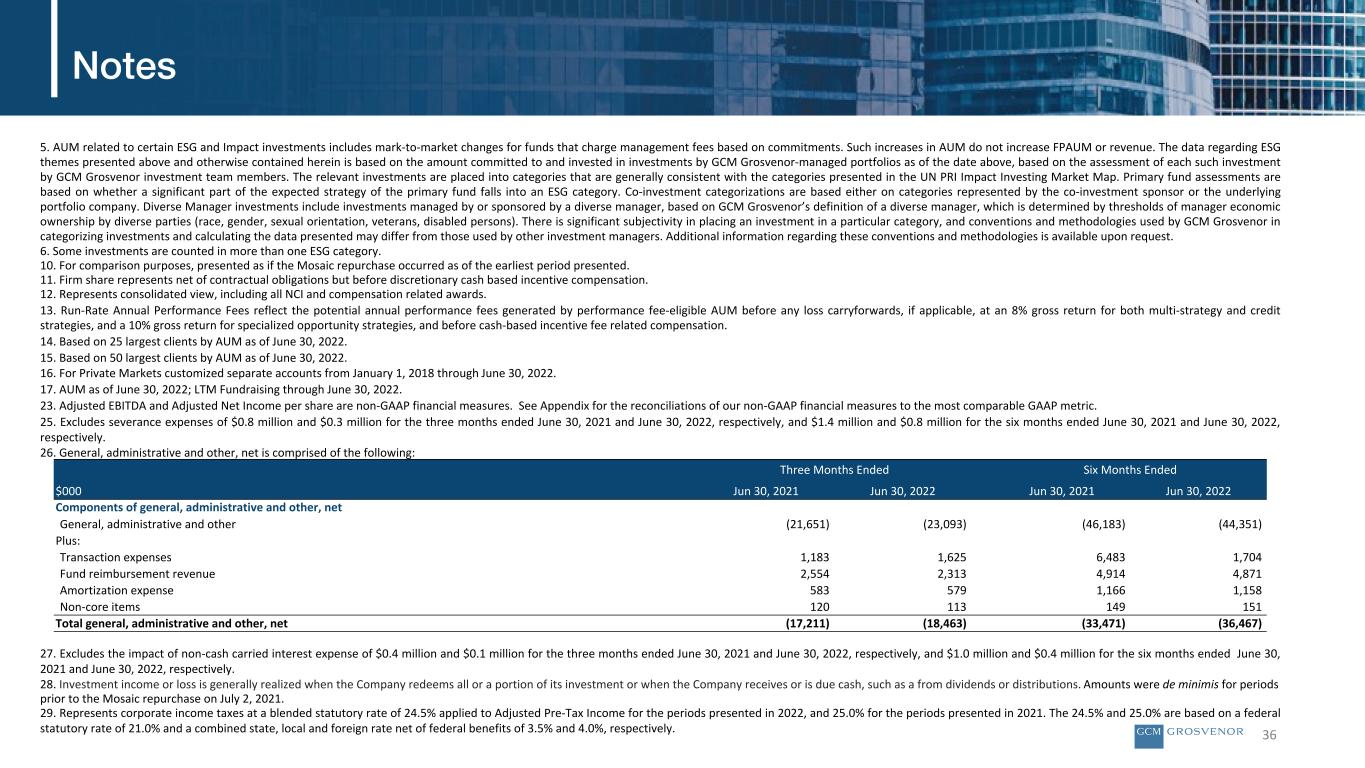

5. AUM related to certain ESG and Impact investments includes mark-to-market changes for funds that charge management fees based on commitments. Such increases in AUM do not increase FPAUM or revenue. The data regarding ESG themes presented above and otherwise contained herein is based on the amount committed to and invested in investments by GCM Grosvenor-managed portfolios as of the date above, based on the assessment of each such investment by GCM Grosvenor investment team members. The relevant investments are placed into categories that are generally consistent with the categories presented in the UN PRI Impact Investing Market Map. Primary fund assessments are based on whether a significant part of the expected strategy of the primary fund falls into an ESG category. Co-investment categorizations are based either on categories represented by the co-investment sponsor or the underlying portfolio company. Diverse Manager investments include investments managed by or sponsored by a diverse manager, based on GCM Grosvenor’s definition of a diverse manager, which is determined by thresholds of manager economic ownership by diverse parties (race, gender, sexual orientation, veterans, disabled persons). There is significant subjectivity in placing an investment in a particular category, and conventions and methodologies used by GCM Grosvenor in categorizing investments and calculating the data presented may differ from those used by other investment managers. Additional information regarding these conventions and methodologies is available upon request. 6. Some investments are counted in more than one ESG category. 10. For comparison purposes, presented as if the Mosaic repurchase occurred as of the earliest period presented. 11. Firm share represents net of contractual obligations but before discretionary cash based incentive compensation. 12. Represents consolidated view, including all NCI and compensation related awards. 13. Run-Rate Annual Performance Fees reflect the potential annual performance fees generated by performance fee-eligible AUM before any loss carryforwards, if applicable, at an 8% gross return for both multi-strategy and credit strategies, and a 10% gross return for specialized opportunity strategies, and before cash-based incentive fee related compensation. 14. Based on 25 largest clients by AUM as of June 30, 2022. 15. Based on 50 largest clients by AUM as of June 30, 2022. 16. For Private Markets customized separate accounts from January 1, 2018 through June 30, 2022. 17. AUM as of June 30, 2022; LTM Fundraising through June 30, 2022. 23. Adjusted EBITDA and Adjusted Net Income per share are non-GAAP financial measures. See Appendix for the reconciliations of our non-GAAP financial measures to the most comparable GAAP metric. 25. Excludes severance expenses of $0.8 million and $0.3 million for the three months ended June 30, 2021 and June 30, 2022, respectively, and $1.4 million and $0.8 million for the six months ended June 30, 2021 and June 30, 2022, respectively. 26. General, administrative and other, net is comprised of the following: 36 Three Months Ended Six Months Ended $000 Jun 30, 2021 Jun 30, 2022 Jun 30, 2021 Jun 30, 2022 Components of general, administrative and other, net General, administrative and other (21,651) (23,093) (46,183) (44,351) Plus: Transaction expenses 1,183 1,625 6,483 1,704 Fund reimbursement revenue 2,554 2,313 4,914 4,871 Amortization expense 583 579 1,166 1,158 Non-core items 120 113 149 151 Total general, administrative and other, net (17,211) (18,463) (33,471) (36,467) Notes 27. Excludes the impact of non-cash carried interest expense of $0.4 million and $0.1 million for the three months ended June 30, 2021 and June 30, 2022, respectively, and $1.0 million and $0.4 million for the six months ended June 30, 2021 and June 30, 2022, respectively. 28. Investment income or loss is generally realized when the Company redeems all or a portion of its investment or when the Company receives or is due cash, such as a from dividends or distributions. Amounts were de minimis for periods prior to the Mosaic repurchase on July 2, 2021. 29. Represents corporate income taxes at a blended statutory rate of 24.5% applied to Adjusted Pre-Tax Income for the periods presented in 2022, and 25.0% for the periods presented in 2021. The 24.5% and 25.0% are based on a federal statutory rate of 21.0% and a combined state, local and foreign rate net of federal benefits of 3.5% and 4.0%, respectively.

37 Notes (continued) 30. Employee data as of July 1, 2022. Individuals with dual responsibilities are counted only once. 31. AUM as of June 30, 2022 36. Excludes severance expenses of $0.8 million, $0.5 million and $0.3 million for the three months ended June 30, 2021, March 31, 2022 and June 30, 2022, respectively, and $1.4 million and $0.8 million for the six months ended June 30, 2021 and June 30, 2022, respectively. 37. Excludes the impact of non-cash carried interest expense of $0.4 million, $0.3 million and $0.1 million for the three months ended June 30, 2021, March 31, 2022 and and June 30, 2022, respectively, and $1.0 million and $0.4 million for the six months ended June 30, 2021 and June 30, 2022, respectively. 38. Represents 2021 expenses related to a debt offering, other contemplated corporate transactions, and other public company transition expenses and 2022 expenses related to contemplated corporate transactions. 42. Reflects primary fund investments since 2000. Excludes certain private markets credit fund investments outside of private equity programs. 43. GCM Grosvenor established a dedicated private equity secondaries vertical in September 2014. Track record reflects all secondaries investments since the new vertical was formed. 44. GCM Grosvenor established a dedicated Private Equity Co-Investment Sub-Committee and adopted a more targeted, active co-investment strategy in December 2008. Track record reflects co-investments/direct investments made since 2009. 45. Reflects infrastructure investments since 2006. Infrastructure investments exclude labor impact investments. 46. Reflects real estate investments since 2010. In 2010, GCM Grosvenor established a dedicated Real Estate team and adopted a more targeted, active real estate strategy. 47. Since 2007.

38 Adjusted Net Income is a non-GAAP measure that we present on a pre-tax and after-tax basis to evaluate our profitability. Adjusted Pre-Tax Income represents net income attributable to GCM Grosvenor Inc. including (a) net income (loss) attributable to GCMH, excluding (b) provision (benefit) for income taxes, (c) changes in fair value of derivatives and warrant liabilities, (d) amortization expense, (e) partnership interest-based and non-cash compensation, (f) equity-based compensation, (g) unrealized investment income, (h) changes in tax receivable agreement liability and (i) certain other items that we believe are not indicative of our core performance, including charges related to corporate transactions and employee severance. We believe adjusted pre-tax income is useful to investors because it provides additional insight into the operating profitability of our business. Adjusted Net Income represents corporate income taxes at a blended statutory rate of 24.5% applied to Adjusted Pre-Tax Income for the three and six months ended June 30, 2022, respectively, and 25.0% for the three and six months ended June 30, 2021, respectively. The 24.5% and 25.0% are based on a federal statutory rate of 21.0% and a combined state, local and foreign rate net of federal benefits of 3.5% and 4.0%, respectively. Adjusted Net Income Per Share is a non-GAAP measure that is calculated by dividing Adjusted Net Income by adjusted shares outstanding. Adjusted shares outstanding assumes the hypothetical full exchange of limited partnership interests in GCMH into Class A common stock of GCM Grosvenor Inc., the dilution from outstanding warrants for Class A common stock of GCM Grosvenor Inc. and the dilution from outstanding equity-based compensation. Adjusted EBITDA is a non-GAAP measure which represents Adjusted Net Income excluding (a) adjusted income taxes, (b) depreciation and amortization expense and (c) interest expense on our outstanding debt. We believe Adjusted EBITDA is useful to investors because it enables them to better evaluate the performance of our core business across reporting periods. Adjusted EBITDA Margin represents Adjusted EBITDA as a percentage of our total operating revenues, net of fund expense reimbursements. Fee-Related Revenue ("FRR") is a non-GAAP measure used to highlight revenues from recurring management fees and administrative fees. FRR represents total operating revenues less (a) incentive fees and (b) fund reimbursement revenue. Fee-Related Earnings (“FRE”) is a non-GAAP measure used to highlight earnings from recurring management fees and administrative fees. FRE represents Adjusted EBITDA further adjusted to exclude (a) incentive fees and related compensation and (b) other non-operating income, and to include depreciation expense. We believe FRE is useful to investors because it provides additional insights into the management fee driven operating profitability of our business. FRE Margin represents FRE as a percentage of our management fee and other operating revenue, net of fund expense reimbursements. Adjusted Revenue represents total operating revenues excluding reimbursement of expenses paid on behalf of GCM Funds and affiliates. Net Incentive Fees Attributable to GCM Grosvenor is a non-GAAP measure used to highlight fees earned from incentive fees that are attributable to GCM Grosvenor. Net incentive fees represent incentive fees excluding (a) incentive fees contractually owed to others and (b) cash-based incentive fee related compensation. Fee-Paying Assets Under Management (“FPAUM” or “Fee-Paying AUM") is a key performance indicator we use to measure the assets from which we earn management fees. Our FPAUM comprises the assets in our customized separate accounts and specialized funds from which we derive management fees. We classify customized separate account revenue as management fees if the client is charged an asset-based fee, which includes the vast majority of our discretionary AUM accounts. The FPAUM for our private market strategies typically represents committed, invested or scheduled capital during the investment period and invested capital following the expiration or termination of the investment period. Substantially all of our private markets strategies funds earn fees based on commitments or net invested capital, which are not affected by market appreciation or depreciation. Our FPAUM for our absolute return strategy is based on net asset value. Our calculations of FPAUM may differ from the calculations of other asset managers, and as a result, this measure may not be comparable to similar measures presented by other asset managers. Our definition of FPAUM is not based on any definition that is set forth in the agreements governing the customized separate accounts or specialized funds that we manage. Certain Definitions and Use of Non-GAAP Financials and Key Performance Indicators

39 Contracted, Not Yet Fee-Paying AUM (“CNYFPAUM”) represents limited partner commitments during or prior to the initial commitment or investment period where fees are expected to be charged in the future based on invested capital (capital committed to underlying investments) or on a scheduled ramp-in of total commitments. New Capital Raised is new limited partner commitments where fees are charged immediately at the initial commitment date. Assets Under Management (“AUM”) reflects the sum of (a) FPAUM, (b) CNYFPAUM and (c) other mark-to-market, insider capital and non-fee-paying assets under management. GCM Grosvenor refers to the combined accounts of (a) Grosvenor Capital Management Holdings, LLLP ("LLLP" or "GCMH"), an Delaware limited liability limited partnership, and its consolidated subsidiaries and (b) GCM, L.L.C., a Delaware limited liability company. Transaction refers to the business combination announced August 3, 2020 and completed on November 17, 2020 through which CFAC merged with and into GCM Grosvenor Inc., ceasing the separate corporate existence of CFAC with GCM Grosvenor Inc. becoming the surviving corporation. Following the business combination, the financial statements of GCM Grosvenor Inc. will represent a continuation of the financial statements of GCM Grosvenor with the transaction being treated as the equivalent of GCM Grosvenor issuing stock for the net assets of GCM Grosvenor, Inc., accompanied by a recapitalization. CF Finance Acquisition Corp. (“CFAC”) (NASDAQ: CFFA) was a special purpose acquisition company sponsored by Cantor Fitzgerald, a leading global financial services firm. GCM Grosvenor Inc. was incorporated in Delaware as a wholly owned subsidiary of Grosvenor Capital Management Holdings, LLLP, formed for the purpose of completing the Transaction. Pursuant to the Transaction, Grosvenor Capital Management Holdings, LLLP cancelled its shares in GCM Grosvenor Inc. no longer making GCM Grosvenor Inc. a wholly owned subsidiary of Grosvenor Capital Management Holdings, LLLP. NM Not Meaningful Certain Definitions and Use of Non-GAAP Financials and Key Performance Indicators (continued)

40 Forward-Looking Statements This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding the expected future performance of GCM Grosvenor’s business, including anticipated incremental revenue from fundraising for specialized funds. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the historical performance of our funds may not be indicative of our future results; risks related to redemptions and termination of engagements; effect of the COVID-19 pandemic on our business; the variable nature of our revenues; competition in our industry; effects of domestic and foreign government regulation or compliance failures; operational risks and data security breaches; our ability to deal appropriately with conflicts of interest; market, geopolitical and economic conditions; identification and availability of suitable investment opportunities; risks relating to our internal control over financial reporting; and risks related to our ability to grow AUM and the performance of our investments. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” sections of the Annual Report on Form 10-K filed by GCM Grosvenor on February 25, 2022 and its other filings from time to time with the U.S. Securities and Exchange Commission. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward- looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and GCM Grosvenor assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law. Non-GAAP Financial Measures The non-GAAP financial measures contained in this presentation are not GAAP measures of GCM Grosvenor’s financial performance or liquidity and should not be considered as alternatives to net income (loss) as a measure of financial performance or cash flows from operations as measures of liquidity, or any other performance measure derived in accordance with GAAP. A reconciliation of such non-GAAP measures to their most directly comparable GAAP measure is included elsewhere in this presentation. You are encouraged to evaluate each adjustment to non-GAAP financial measures and the reasons management considers it appropriate for supplemental analysis. Our presentation of these measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. In addition, these measures may not be comparable to similarly titled measures used by other companies in our industry or across different industries. This presentation includes certain projections of non-GAAP financial measures including fee-related earnings. Due to the high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these projected measures, together with some of the excluded information not being ascertainable or accessible, GCM Grosvenor is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable effort. Consequently, no disclosure of estimated comparable GAAP measures is included and no reconciliation of the forward looking non GAAP financial measures is included. Disclaimer