Document

Wheels Up Announces December Quarter and Full Year 2024 Results

Financial performance illustrates momentum with business transformation

Fleet modernization underway, with 18 new Phenom jets entering Wheels Up’s controlled fleet and the company’s first Challengers set to enter service by April 1

John Verkamp appointed Chief Financial Officer, to join company on March 31

ATLANTA – March 11, 2025 – Wheels Up Experience Inc. (NYSE:UP) today announced financial results for the December quarter and full year ended 2024. Highlights of the December quarter and full year 2024, including GAAP results, non-GAAP financial measures and key performance metrics, are on page three and incorporated herein.

Commentary from Wheels Up’s Chief Executive Officer George Mattson about the company’s financial and operating results for the fourth quarter and year ended December 31, 2024 is included in an Investor Letter that can be found on Wheels Up’s Investor Relations website at https://investors.wheelsup.com.

December Quarter 2024 Results

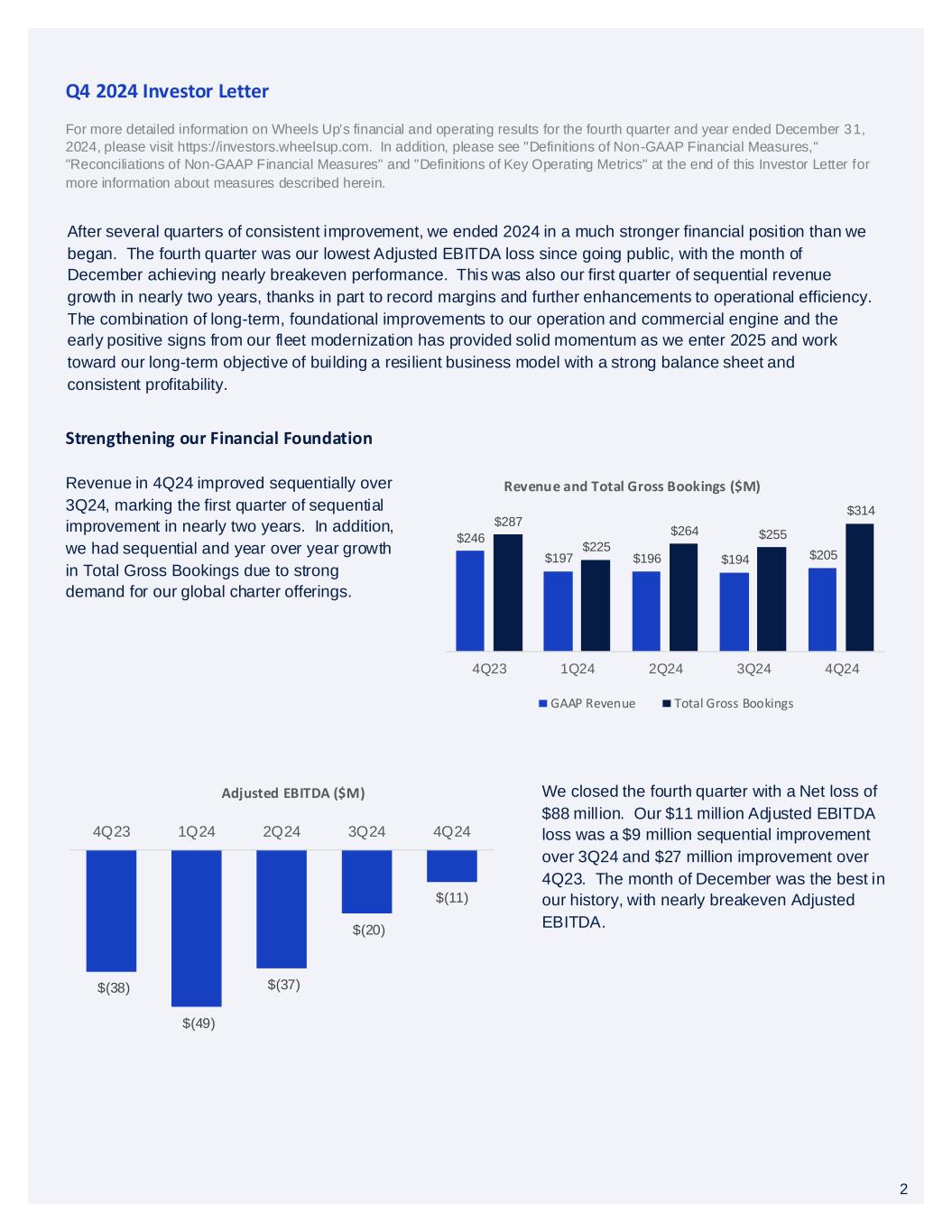

•Revenue of $204.8 million

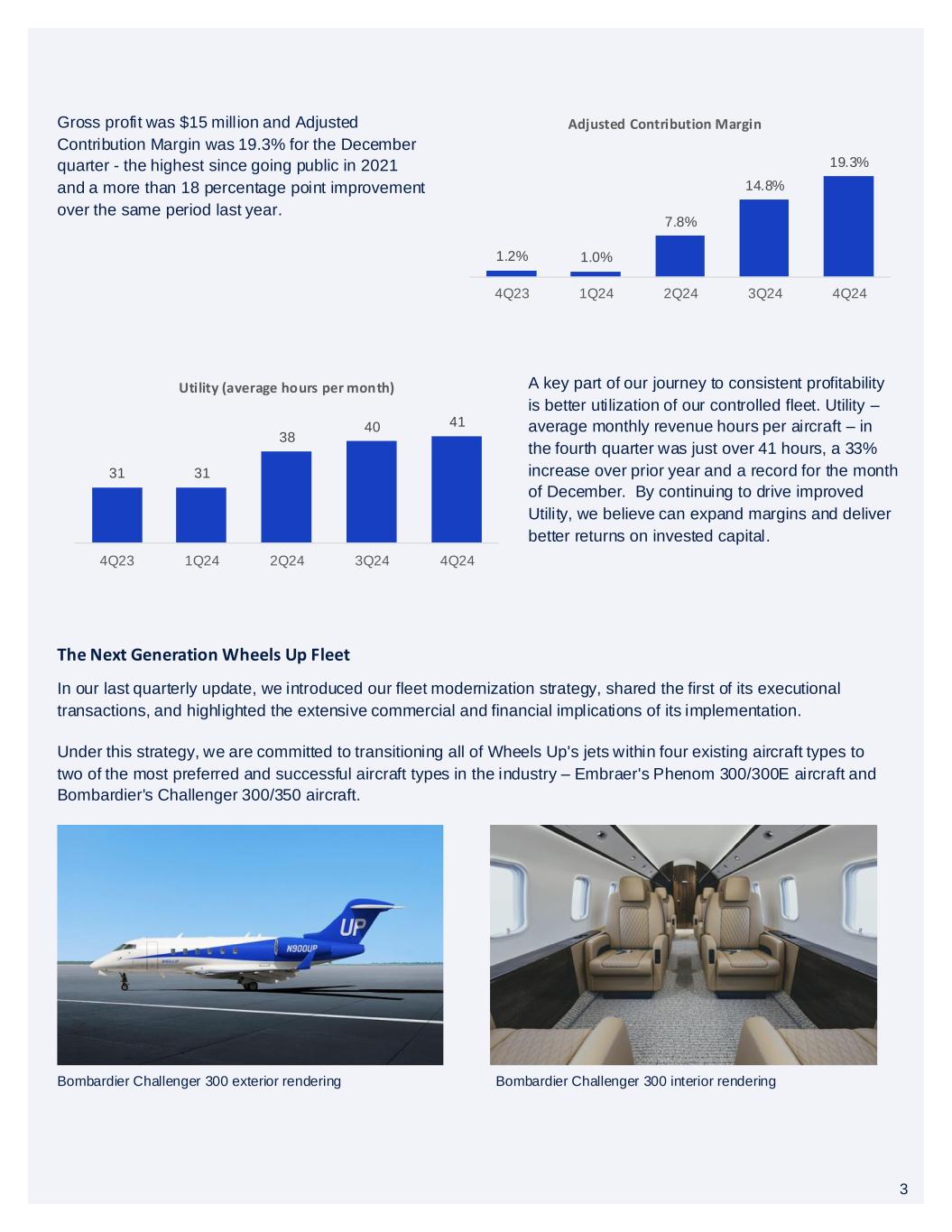

•Adjusted Contribution of $39.6 million equating to an Adjusted Contribution Margin of 19.3 percent

•Net loss of $87.5 million or $(0.13) per share

•Adjusted EBITDA loss of $11.3 million

Full Year 2024 Results

•Revenue of $792.1 million

•Adjusted Contribution of $85.7 million equating to an Adjusted Contribution Margin of 10.8 percent

•Net loss of $339.6 million or $(0.49) per share

•Adjusted EBITDA loss of $117.9 million

“After several quarters of consistent improvement, we ended 2024 in a much stronger financial position than we began. The fourth quarter was our lowest Adjusted EBITDA loss since going public, with the month of December achieving nearly breakeven performance. This was also our first quarter of sequential revenue growth in nearly two years, thanks in part to record margins and further enhancements to operational efficiency,” said Wheels Up Chief Executive Officer George Mattson. “The combination of long-term, foundational improvements to our operation and commercial engine and the early positive signs from our fleet modernization has provided solid momentum as we enter 2025 and work toward our long-term objective of building a resilient business model with a strong balance sheet and consistent profitability.”

Business highlights

•John Verkamp named new Chief Financial Officer. The company announced the appointment of John Verkamp as Chief Financial Officer, effective March 31. With a two-decade track record of financial leadership at GE and GE Vernova, including his most recent role as CFO of Gas Power Global Services, John brings a deep understanding of complex operations and will oversee the company’s global finance organization.

•Higher Utility and operational efficiency driving more profitable flying. The company’s top priority has been realigning its product, fleet and flying to better meet customer demand. As a result, Gross profit increased $34 million year over year in the December quarter despite a $42 million decline in revenue. Adjusted Contribution Margin increased by more than 18 percentage points year over year to 19.3 percent, due primarily to a 33 percent increase in Utility during the December quarter.

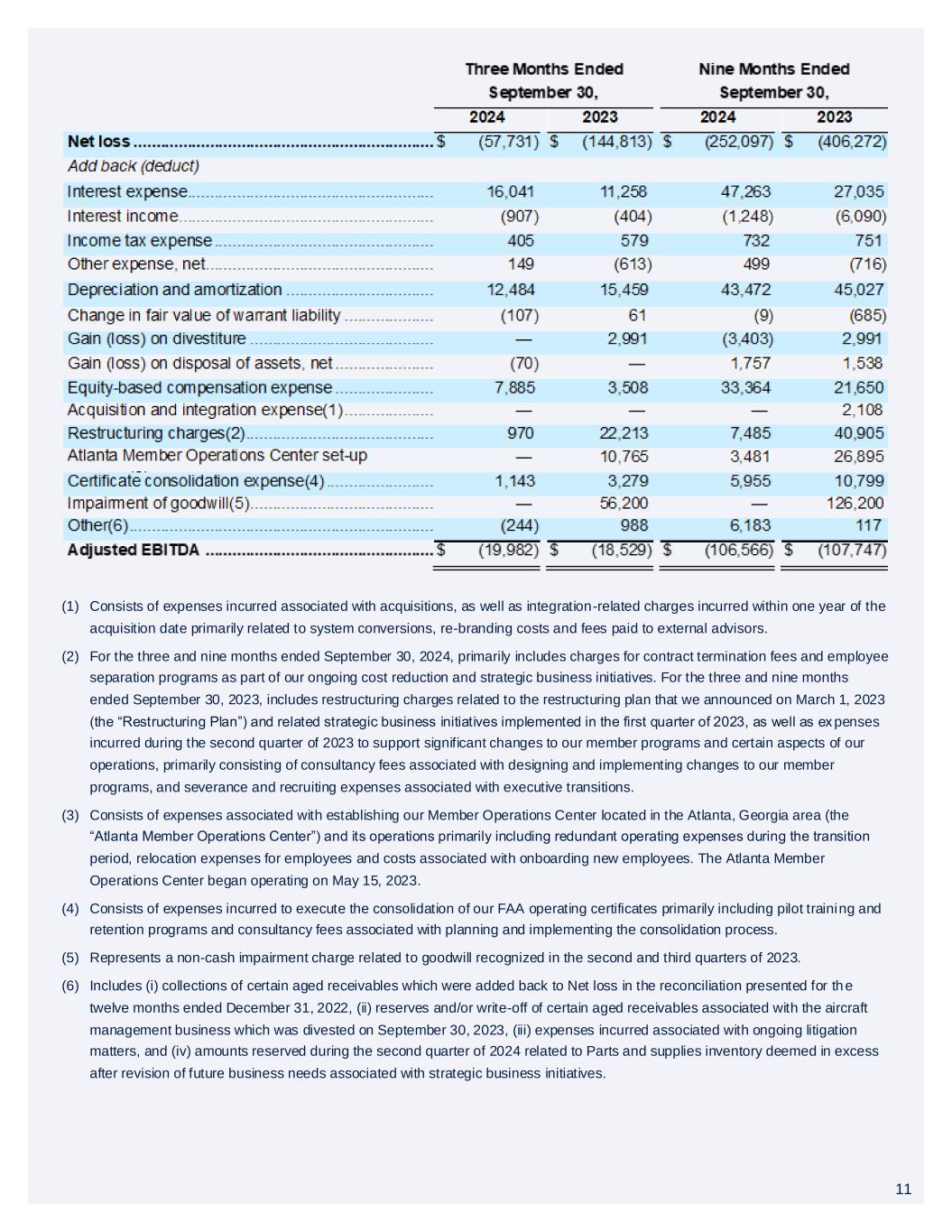

•Transforming the Wheels Up fleet. During the quarter, the company announced its fleet modernization strategy, which we expect will result in the transition of Wheels Up's four existing jet aircraft types to two of the most preferred and successful aircraft types in the industry – Embraer's Phenom 300/300E and Bombardier's Challenger 300/350 aircraft. As part of this strategy, the company added 18 Phenom aircraft and retired 50 owned and leased legacy jets and King Air aircraft during 2024. Results for the December quarter include a non-cash $9 million charge associated with reserving for excess parts inventory from aircraft expected to exit the fleet.

•Improving operational performance. A key component of Wheels Up’s strategic growth plan is to deliver the industry’s most reliable operation for our customers. During the December quarter, the company delivered a 98 percent Completion Rate and 80 percent On-Time Performance. We experienced weather, air traffic control and other uncontrollable factors during the December quarter, as well as the additional demands our operations placed on our smaller legacy fleet, that when combined challenged On-Time Performance. As the fleet rapidly transitions to a modernized and more reliable fleet, we expect to be able to drive both higher On-Time Performance and Utility.

•Industry-leading partnership with Delta. Together with Delta, we are developing first-of-their-kind global aviation solutions for Delta’s corporate and premium leisure customers, combining commercial and private air travel to create a seamless and flexible aviation experience. We have continued to build on the momentum of our partnership, commercially and operationally, and are still in the early stages of realizing its full potential.

•New Revolving Credit Facility. The company closed on a five-year, $332 million secured revolving credit facility with Bank of America. Delta provided credit support for the facility, enhancing Wheels Up’s access to capital and on more attractive terms than would otherwise have been available. This new revolving facility financed the purchase of 17 Phenom aircraft from GrandView Aviation, added $84.3 million of cash, before certain transaction-related expenses, to the company’s balance sheet, and provides additional borrowing support for future fleet acquisitions. In addition, the new revolving facility refinanced Wheels Up’s existing owned fleet at improved terms and the December quarter results include a non-cash $14 million loss on the extinguishment of debt.

Financial and Operating Highlights(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, |

|

|

|

2024 |

|

2023 |

|

% Change |

Active Members(2) |

5,369 |

|

|

9,947 |

|

|

(46) |

% |

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

(In thousands, except Active Users, Utility, Live Flight Legs, Private Jet Gross Bookings per Live Flight Leg and percentages) |

2024 |

|

2023 |

|

% Change |

| Active Users |

7,286 |

|

|

10,744 |

|

|

(32) |

% |

|

|

|

|

|

|

| On-Time Performance (D-60) |

80 |

% |

|

87 |

% |

|

n/m |

|

|

|

|

|

|

| Completion Rate |

98 |

% |

|

98 |

% |

|

n/m |

|

|

|

|

|

|

| Utility |

41.1 |

|

31.0 |

|

33 |

% |

|

|

|

|

|

|

| Live Flight Legs |

12,731 |

|

|

14,374 |

|

|

(11) |

% |

|

|

|

|

|

|

| Private Jet Gross Bookings |

$ |

212,395 |

|

|

$ |

243,278 |

|

|

(13) |

% |

|

|

|

|

|

|

| Total Gross Bookings |

$ |

313,861 |

|

|

$ |

286,646 |

|

|

9 |

% |

|

|

|

|

|

|

| Private Jet Gross Bookings per Live Flight Leg |

$ |

16,683 |

|

|

$ |

16,925 |

|

|

(1) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

|

|

(In thousands, except percentages) |

2024 |

|

2023 |

|

$ Change |

|

% Change |

| Revenue |

$ |

204,815 |

|

|

$ |

246,380 |

|

|

$ |

(41,565) |

|

|

(17) |

% |

| Gross profit (loss) |

$ |

15,475 |

|

|

$ |

(18,051) |

|

|

$ |

33,526 |

|

|

n/m |

| Adjusted Contribution |

$ |

39,616 |

|

|

$ |

2,848 |

|

|

$ |

36,768 |

|

|

n/m |

| Adjusted Contribution Margin |

19.3 |

% |

|

1.2 |

% |

|

n/a |

|

18 |

pp |

| Net loss |

$ |

(87,538) |

|

|

$ |

(81,115) |

|

|

$ |

(6,423) |

|

|

(8) |

% |

| Adjusted EBITDA |

$ |

(11,307) |

|

|

$ |

(38,121) |

|

|

$ |

26,814 |

|

|

70 |

% |

| Net cash provided by (used in) operating activities |

$ |

37,926 |

|

|

$ |

(3,791) |

|

|

$ |

41,717 |

|

|

n/m |

|

|

|

|

|

|

|

|

|

Twelve Months Ended December 31, |

|

|

|

|

(In thousands, except percentages) |

2024 |

|

2023 |

|

$ Change |

|

% Change |

| Revenue |

$ |

792,104 |

|

|

$ |

1,253,317 |

|

|

$ |

(461,213) |

|

|

(37) |

% |

| Gross profit (loss) |

$ |

2,483 |

|

|

$ |

(37,722) |

|

|

$ |

40,205 |

|

|

n/m |

| Adjusted Contribution |

$ |

85,687 |

|

|

$ |

62,536 |

|

|

$ |

23,151 |

|

|

37 |

% |

| Adjusted Contribution Margin |

10.8 |

% |

|

5.0 |

% |

|

n/a |

|

6 |

pp |

| Net loss |

$ |

(339,635) |

|

|

$ |

(487,387) |

|

|

$ |

147,752 |

|

|

30 |

% |

| Adjusted EBITDA |

$ |

(117,873) |

|

|

$ |

(145,868) |

|

|

$ |

27,995 |

|

|

19 |

% |

| Net cash used in operating activities |

$ |

(77,888) |

|

|

$ |

(665,285) |

|

|

$ |

587,397 |

|

|

88 |

% |

__________________

(1)For information regarding Wheels Up's use and definitions of our key operating metrics and non-GAAP financial measures, see “Definitions of Key Operating Metrics, “Definitions of Non-GAAP Financial Measures” and “Reconciliations of Non-GAAP Financial Measures” sections herein.

(2)Active Members as of December 31, 2024 includes the impact of the company’s decision to discontinue Pay-As-You-Go and Connect membership options in July 2024.

n/m Not meaningful

About Wheels Up

Wheels Up is a leading provider of on-demand private aviation in the U.S. and one of the largest companies in the industry. Wheels Up offers a complete global aviation solution with a large and diverse fleet and a global network of safety vetted charter operators, all backed by an uncompromising commitment to safety and service. Customers can access charter and membership programs, as well as unique commercial travel benefits through a one-of-a-kind, strategic partnership with Delta Air Lines. Wheels Up also offers freight, safety and security solutions and managed services to individuals, industry, government and civil organizations.

Wheels Up is guided by the mission to deliver a premium solution for every customer journey. With the Wheels Up mobile app and website, members and customers have the digital convenience to search, book and fly.

Cautionary Note Regarding Forward-Looking Statements

This press release contains certain “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements provide current expectations of future circumstances or events based on certain assumptions and include any statement, projection or forecast that does not directly relate to any historical or current fact. Forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside of the control of Wheels Up Experience Inc. (“Wheels Up”, or “we”, “us”, or “our”), that could cause actual results to differ materially from the results discussed in the forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding: (i) Wheels Up’s growth plans, the size, demand, competition in and growth potential of the markets for Wheels Up’s service offerings and the degree of market adoption of Wheels Up’s member programs, charter offerings and any future services it may offer; (ii) the potential impact of Wheels Up’s cost reduction and operational efficiency initiatives on its business and results of operations, including timing, magnitude and possible effects on liquidity levels and working capital; (iii) Wheels Up’s fleet modernization strategy first announced in October 2024, its ability to execute such strategy on the timeline that it currently anticipates and the expected commercial, financial and operational impacts to Wheels Up; (iv) Wheels Up’s liquidity, future cash flows and certain restrictions related to its indebtedness obligations, as well as its ability to perform under its contractual and indebtedness obligations; (v) Wheels Up’s ability to achieve positive Adjusted EBITDA (as defined herein) in the future pursuant to the most recent schedule that it has announced; (vi) the potential impacts or benefits from pursuing strategic actions involving Wheels Up or its subsidiaries or affiliates, including, among others, acquisitions and divestitures, new debt or equity financings, refinancings of existing indebtedness, or commercial partnerships or arrangements; (vii) the expected impact and timing of certain personnel transitions; and (viii) the impacts of general economic and geopolitical conditions on Wheels Up’s business and the aviation industry, including due to, among others, fluctuations in interest rates, inflation, foreign currencies, taxes, tariffs and trade policies, and consumer and business spending decisions. The words “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “expect,” “future,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strive,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that statement is not forward-looking. We have identified certain known material risk factors applicable to Wheels Up in our Annual Report on Form 10-K for the year ended December 31, 2023 filed with the U.S. Securities and Exchange Commission (“SEC”) on March 7, 2024 and our other filings with the SEC. It is not always possible for us to predict how new risks and uncertainties that arise from time to time may affect us. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Except as required by law, we do not intend to update any of these forward-looking statements after the date of this press release.

Use of Non-GAAP Financial Measures

This press release includes certain non-GAAP financial measures, such as Adjusted EBITDA, Adjusted Contribution and Adjusted Contribution Margin. These non-GAAP financial measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”) and should not be considered as an alternative to Revenue or any component thereof, Net income (loss), Operating income (loss) or any other performance measures derived in accordance with GAAP. Definitions and reconciliations of non-GAAP financial measures to their most comparable GAAP counterparts are included in the sections titled “Definitions of Non-GAAP Financial Measures” and “Reconciliations of Non-GAAP Financial Measures,” respectively, in this press release. Wheels Up believes that these non-GAAP financial measures provide useful supplemental information to investors about Wheels Up. However, there are certain limitations related to the use of these non-GAAP financial measures and their nearest GAAP equivalents, including that they exclude significant expenses that are required to be recorded in Wheels Up’s financial measures under GAAP. Other companies may calculate non-GAAP financial measures differently, or may use other measures to calculate their financial performance, and therefore, Wheels Up’s non-GAAP financial measures may not be directly comparable to similarly titled measures of other companies. Additionally, to the extent that forward-looking non-GAAP financial measures are provided, they are presented on a non-GAAP basis without reconciliations of such forward-looking non-GAAP financial measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations.

For more information on these non-GAAP financial measures, see the sections titled “Definitions of Non-GAAP Financial Measures” and “Reconciliations of Non-GAAP Financial Measures” included in this press release.

Contacts

Investors:

ir@wheelsup.com

Media:

press@wheelsup.com

WHEELS UP EXPERIENCE INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, in thousands except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Revenue |

$ |

204,815 |

|

|

$ |

246,380 |

|

|

$ |

792,104 |

|

|

$ |

1,253,317 |

|

|

|

|

|

|

|

|

|

| Costs and expenses: |

|

|

|

|

|

|

|

| Cost of revenue (exclusive of items shown separately below) |

176,266 |

|

|

250,925 |

|

|

733,075 |

|

|

1,232,506 |

|

| Technology and development |

9,486 |

|

|

11,608 |

|

|

40,690 |

|

|

61,873 |

|

| Sales and marketing |

21,371 |

|

|

17,328 |

|

|

84,317 |

|

|

88,828 |

|

| General and administrative |

38,350 |

|

|

23,539 |

|

|

137,594 |

|

|

145,873 |

|

| Depreciation and amortization |

13,074 |

|

|

13,506 |

|

|

56,546 |

|

|

58,533 |

|

| (Gain) loss on sale of aircraft held for sale |

(1,942) |

|

|

(5,611) |

|

|

(4,622) |

|

|

(16,939) |

|

Loss on disposal of assets, net |

3,295 |

|

|

— |

|

|

3,295 |

|

|

— |

|

| Impairment of goodwill |

— |

|

|

— |

|

|

— |

|

|

126,200 |

|

| Total costs and expenses |

259,900 |

|

|

311,295 |

|

|

1,050,895 |

|

|

1,696,874 |

|

|

|

|

|

|

|

|

|

| Loss from operations |

(55,085) |

|

|

(64,915) |

|

|

(258,791) |

|

|

(443,557) |

|

|

|

|

|

|

|

|

|

| Other income (expense) |

|

|

|

|

|

|

|

| Gain (loss) on divestiture |

357 |

|

|

— |

|

|

2,003 |

|

|

(2,991) |

|

| Loss on extinguishment of debt |

(14,914) |

|

|

(1,595) |

|

|

(17,714) |

|

|

(4,401) |

|

| Change in fair value of warrant liability |

(17) |

|

|

54 |

|

|

(8) |

|

|

739 |

|

| Interest income |

922 |

|

|

31 |

|

|

2,170 |

|

|

6,121 |

|

| Interest expense |

(18,089) |

|

|

(14,220) |

|

|

(65,352) |

|

|

(41,255) |

|

| Other income (expense), net |

(218) |

|

|

162 |

|

|

(717) |

|

|

(660) |

|

| Total other income (expense) |

(31,959) |

|

|

(15,568) |

|

|

(79,618) |

|

|

(42,447) |

|

|

|

|

|

|

|

|

|

| Loss before income taxes |

(87,044) |

|

|

(80,483) |

|

|

(338,409) |

|

|

(486,004) |

|

|

|

|

|

|

|

|

|

| Income tax benefit (expense) |

(494) |

|

|

(632) |

|

|

(1,226) |

|

|

(1,383) |

|

|

|

|

|

|

|

|

|

| Net loss |

(87,538) |

|

|

(81,115) |

|

|

(339,635) |

|

|

(487,387) |

|

| Less: Net loss attributable to non-controlling interests |

— |

|

|

— |

|

|

— |

|

|

— |

|

| Net loss attributable to Wheels Up Experience Inc. |

$ |

(87,538) |

|

|

$ |

(81,115) |

|

|

$ |

(339,635) |

|

|

$ |

(487,387) |

|

|

|

|

|

|

|

|

|

| Net loss per share of Common Stock |

|

|

|

|

|

|

|

| Basic and diluted |

$ |

(0.13) |

|

|

$ |

(0.14) |

|

|

$ |

(0.49) |

|

|

$ |

(3.69) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average shares of Common Stock outstanding: |

|

|

|

|

|

|

|

| Basic and diluted |

697,836,353 |

|

|

576,426,623 |

|

|

697,713,626 |

|

|

132,194,747 |

|

|

|

|

|

|

|

|

|

WHEELS UP EXPERIENCE INC.

CONSOLIDATED BALANCE SHEETS

(Unaudited, in thousands, except share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2024 |

|

December 31, 2023 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

216,426 |

|

|

$ |

263,909 |

|

| Accounts receivable, net |

32,316 |

|

|

38,237 |

|

| Other receivables |

1,182 |

|

|

11,528 |

|

| Parts and supplies inventories, net |

12,177 |

|

|

20,400 |

|

| Aircraft inventory |

— |

|

|

1,862 |

|

| Aircraft held for sale |

35,663 |

|

|

30,496 |

|

| Prepaid expenses |

23,546 |

|

|

55,715 |

|

| Other current assets |

10,759 |

|

|

11,887 |

|

| Total current assets |

332,069 |

|

|

434,034 |

|

| Property and equipment, net |

348,339 |

|

|

337,714 |

|

| Operating lease right-of-use assets |

56,911 |

|

|

68,910 |

|

| Goodwill |

217,045 |

|

|

218,208 |

|

| Intangible assets, net |

96,904 |

|

|

117,766 |

|

| Restricted cash |

30,042 |

|

|

28,916 |

|

| Other non-current assets |

76,701 |

|

|

110,512 |

|

| Total assets |

$ |

1,158,011 |

|

|

$ |

1,316,060 |

|

|

|

|

|

| LIABILITIES AND EQUITY |

|

|

|

| Current liabilities: |

|

|

|

| Current maturities of long-term debt |

$ |

31,748 |

|

|

$ |

23,998 |

|

| Accounts payable |

29,977 |

|

|

32,973 |

|

| Accrued expenses |

89,484 |

|

|

102,475 |

|

| Deferred revenue, current |

749,432 |

|

|

723,246 |

|

| Operating lease liabilities, current |

13,953 |

|

|

22,869 |

|

| Intangible liabilities, current |

1,525 |

|

|

1,525 |

|

| Other current liabilities |

1,165 |

|

|

416 |

|

| Total current liabilities |

917,284 |

|

|

907,502 |

|

| Long-term debt, net |

376,308 |

|

|

235,074 |

|

| Deferred revenue, non-current |

180 |

|

|

983 |

|

| Operating lease liabilities, non-current |

50,810 |

|

|

54,956 |

|

| Warrant liability |

20 |

|

|

12 |

|

| Intangible liabilities, non-current |

9,152 |

|

|

10,677 |

|

| Other non-current liabilities |

485 |

|

|

6,983 |

|

| Total liabilities |

1,354,239 |

|

|

1,216,187 |

|

|

|

|

|

| Mezzanine equity: |

|

|

|

| Executive performance award |

5,881 |

|

|

2,476 |

|

| Total mezzanine equity |

5,881 |

|

|

2,476 |

|

| Stockholders’ equity: |

|

|

|

| Common stock, $0.0001 par value; 1,500,000,000 authorized; 698,342,097 and 697,131,838 shares issued and 697,902,646 and 696,856,131 common shares outstanding as of as of December 31, 2024 and December 31, 2023, respectively |

70 |

|

|

70 |

|

| Additional paid-in capital |

1,921,581 |

|

|

1,879,009 |

|

| Accumulated deficit |

(2,102,895) |

|

|

(1,763,260) |

|

| Accumulated other comprehensive loss |

(12,662) |

|

|

(10,704) |

|

| Treasury stock, at cost, 439,451 and 275,707 shares, respectively |

(8,203) |

|

|

(7,718) |

|

| Total Wheels Up Experience Inc. stockholders’ equity |

(202,109) |

|

|

97,397 |

|

| Non-controlling interests |

— |

|

|

— |

|

| Total stockholders’ equity |

(202,109) |

|

|

97,397 |

|

| Total liabilities and equity |

$ |

1,158,011 |

|

|

$ |

1,316,060 |

|

WHEELS UP EXPERIENCE INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve Months Ended December 31, |

|

2024 |

|

2023 |

| Cash flows from operating activities: |

|

|

|

| Net loss |

$ |

(339,635) |

|

|

$ |

(487,387) |

|

| Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

| Depreciation and amortization |

56,546 |

|

|

58,533 |

|

| Amortization of deferred financing costs and debt discount |

8,711 |

|

|

329 |

|

| Payment in kind interest |

43,412 |

|

|

10,453 |

|

| Equity-based compensation |

45,977 |

|

|

25,633 |

|

| Change in fair value of warrant liability |

8 |

|

|

(739) |

|

| Provision for expected credit losses |

2,728 |

|

|

1,705 |

|

| Reserve for excess and obsolete inventory |

12,063 |

|

|

3,923 |

|

| Loss on extinguishment of debt |

17,714 |

|

|

4,401 |

|

| Gain on sale of aircraft held for sale |

(4,622) |

|

|

(16,939) |

|

| Impairment of goodwill |

— |

|

|

126,200 |

|

| Other |

(4,796) |

|

|

4,893 |

|

| Changes in assets and liabilities: |

|

|

|

| Accounts receivable |

2,794 |

|

|

30,062 |

|

| Other receivables |

4,349 |

|

|

(3,164) |

|

| Parts and supplies inventories |

2,861 |

|

|

4,686 |

|

| Aircraft inventory |

1,673 |

|

|

11,010 |

|

| Prepaid expenses |

30,117 |

|

|

(17,315) |

|

| Other non-current assets |

33,803 |

|

|

(32,289) |

|

| Operating lease liabilities, net |

(1,322) |

|

|

(552) |

|

| Accounts payable |

(2,882) |

|

|

(8,089) |

|

| Accrued expenses |

(11,233) |

|

|

(35,110) |

|

| Deferred revenue |

25,383 |

|

|

(348,419) |

|

| Other assets and liabilities |

(1,537) |

|

|

2,890 |

|

| Net cash used in operating activities |

(77,888) |

|

|

(665,285) |

|

|

|

|

|

| Cash flows from investing activities: |

|

|

|

| Purchases of property and equipment |

(122,811) |

|

|

(20,168) |

|

| Capitalized software development costs |

(15,021) |

|

|

(16,497) |

|

|

|

|

|

| Proceeds from sale of divested business |

7,894 |

|

|

13,200 |

|

| Purchases of aircraft held for sale |

(2,408) |

|

|

(4,240) |

|

| Proceeds from sale of aircraft held for sale, net |

85,560 |

|

|

68,308 |

|

| Other |

105 |

|

|

267 |

|

| Net cash (used in) provided by investing activities |

(46,681) |

|

|

40,870 |

|

|

|

|

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

| Purchase of shares for treasury |

(485) |

|

|

(28) |

|

| Purchase of fractional shares |

— |

|

|

(3) |

|

| Proceeds from notes payable |

— |

|

|

70,000 |

|

| Repayment of notes payable |

— |

|

|

(70,000) |

|

| Proceeds from long-term debt |

327,201 |

|

|

382,200 |

|

| Repayments of long-term debt |

(246,460) |

|

|

(59,523) |

|

| Payment of debt issuance costs |

(1,594) |

|

|

(21,692) |

|

| Net cash provided by financing activities |

78,662 |

|

|

300,954 |

|

|

|

|

|

| Effect of exchange rate changes on cash |

(450) |

|

|

(3,867) |

|

|

|

|

|

| NET DECREASE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH |

(46,357) |

|

|

(327,328) |

|

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH BEGINNING OF PERIOD |

292,825 |

|

|

620,153 |

|

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH END OF PERIOD |

$ |

246,468 |

|

|

$ |

292,825 |

|

Definitions of Non-GAAP Financial Measures

Adjusted EBITDA. We calculate Adjusted EBITDA as Net income (loss) adjusted for (i) Interest income (expense), (ii) Income tax expense, (iii) Depreciation and amortization, (iv) Equity-based compensation expense, (v) Acquisition and integration related expenses and (vi) other items not indicative of our ongoing operating performance, including but not limited to, restructuring charges.

We include Adjusted EBITDA as a supplemental measure for assessing operating performance, to be used in conjunction with bonus program target achievement determinations, strategic internal planning, annual budgeting, allocating resources and making operating decisions, and to provide useful information for historical period-to-period comparisons of our business, as it removes the effect of certain non-cash expenses and other items not indicative of our ongoing operating performance.

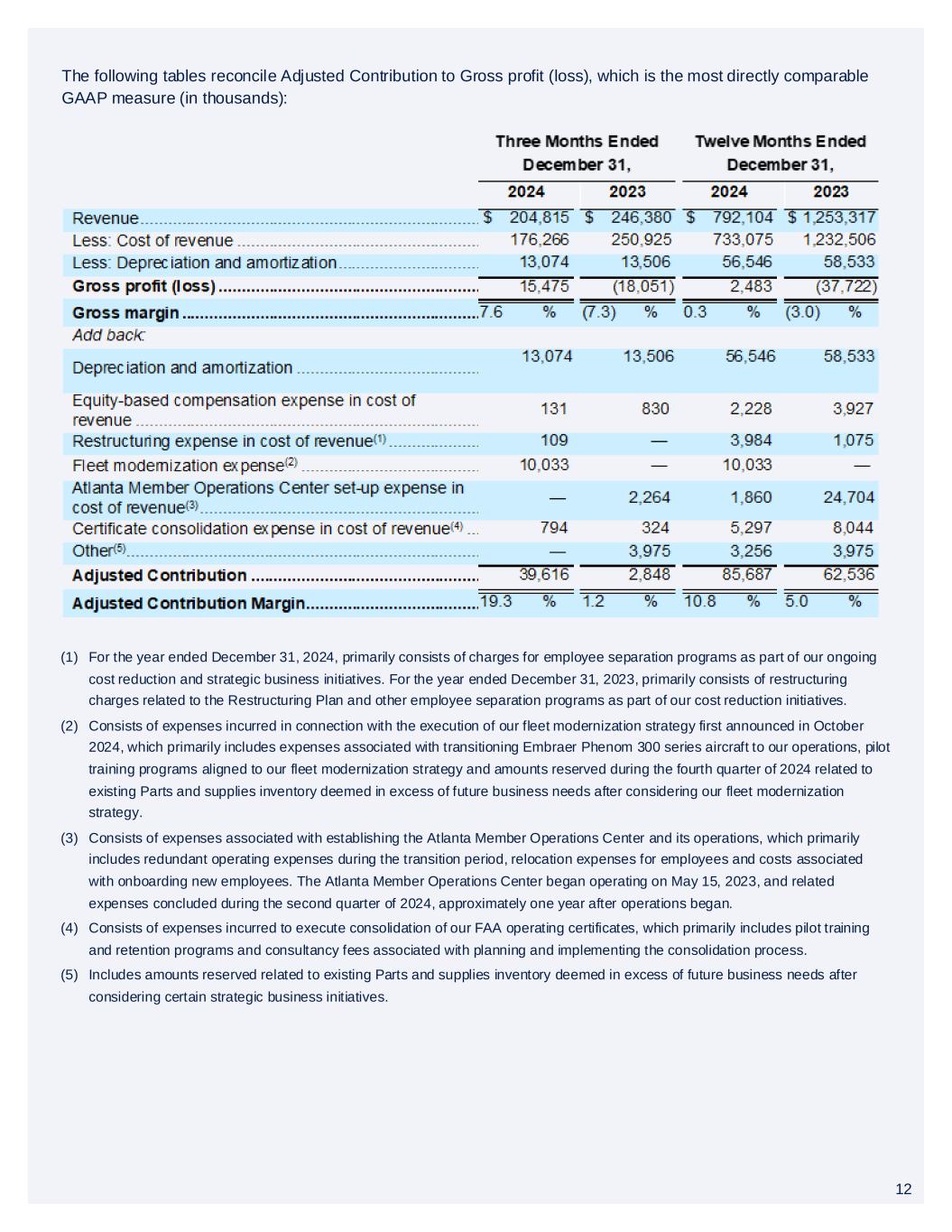

Adjusted Contribution & Adjusted Contribution Margin. We calculate Adjusted Contribution as Gross profit (loss) excluding Depreciation and amortization and adjusted further for equity-based compensation included in Cost of revenue and other items included in Cost of revenue that are not indicative of our ongoing operating performance. Adjusted Contribution Margin is calculated by dividing Adjusted Contribution by total revenue.

We include Adjusted Contribution and Adjusted Contribution Margin as supplemental measures for assessing operating performance and for the following: to be used to understand our ability to achieve profitability over time through scale and leveraging costs; and to provide useful information for historical period-to-period comparisons of our business and to identify trends.

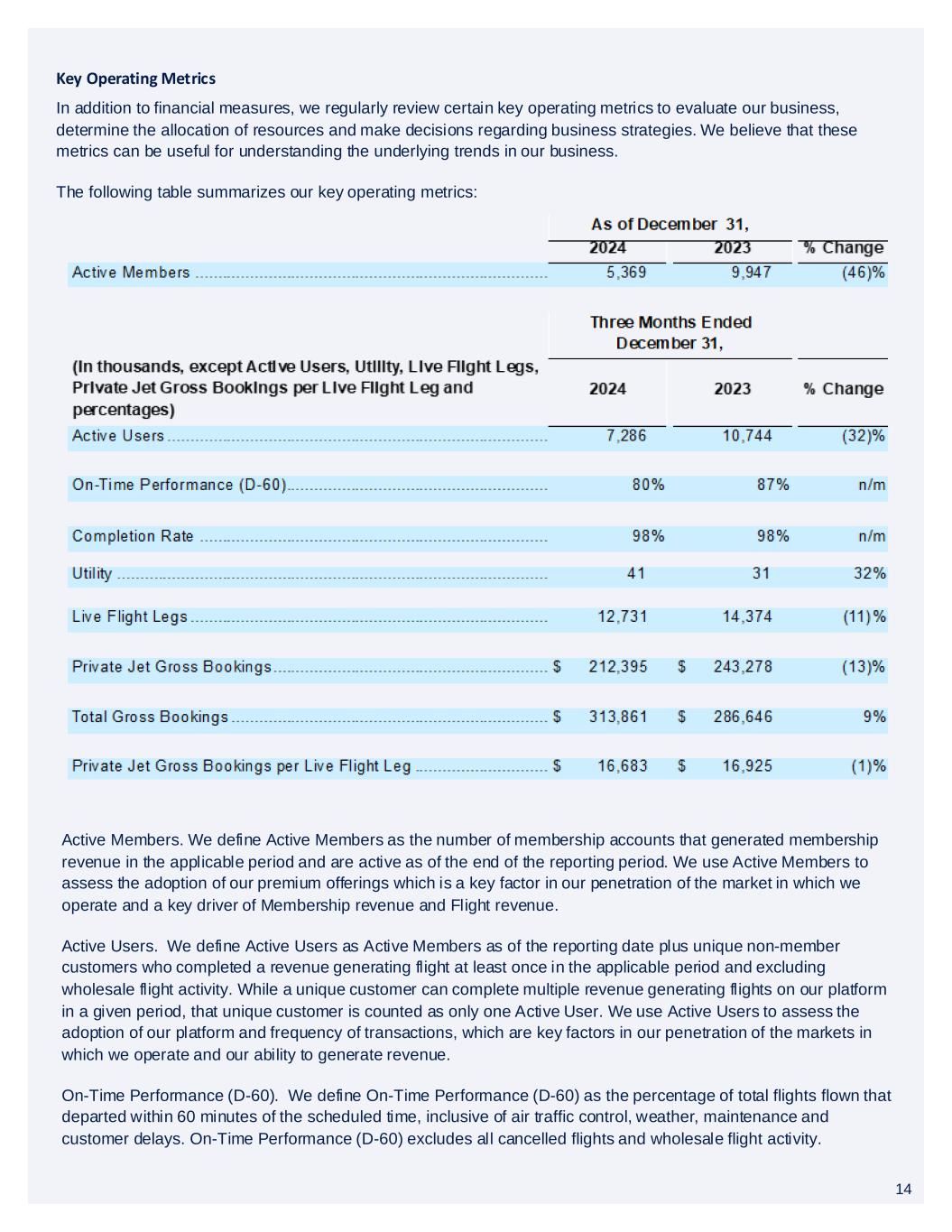

Definitions of Key Operating Metrics

Active Members. We define Active Members as the number of membership accounts that generated membership revenue in the applicable period and are active as of the end of the reporting period. We use Active Members to assess the adoption of our premium offerings which is a key factor in our penetration of the market in which we operate and a key driver of Membership revenue and Flight revenue.

Active Users. We define Active Users as Active Members as of the reporting date plus unique non-member customers who completed a revenue generating flight at least once in the applicable period and excluding wholesale flight activity. While a unique customer can complete multiple revenue generating flights on our platform in a given period, that unique customer is counted as only one Active User. We use Active Users to assess the adoption of our platform and frequency of transactions, which are key factors in our penetration of the markets in which we operate and our ability to generate revenue.

On-Time Performance (D-60). We define On-Time Performance (D-60) as the percentage of total flights flown that departed within 60 minutes of the scheduled time, inclusive of air traffic control, weather, maintenance and customer delays. On-Time Performance (D-60) excludes all cancelled flights and wholesale flight activity.

Completion Rate. We define Completion Rate as the percentage of total scheduled flights operated and completed. Completion Rate excludes customer-initiated flight cancellations and wholesale flight activity.

Utility. We define Utility for the applicable period as the total revenue generating flight hours flown on our controlled fleet, excluding empty repositioning legs, divided by the monthly average number of available aircraft in our controlled fleet. Utility is expressed as a monthly average. We measure the revenue generating flight hours for a given flight on our controlled aircraft as the actual flight time from takeoff to landing. We determine the number of aircraft in our controlled fleet available for revenue generating flights at the end of the applicable month and exclude aircraft then classified as held for sale. We believe Utility is a useful metric to measure the efficiency of our operations, our ability to generate a return on our assets and the impact of our fleet modernization strategy.

Live Flight Legs. We define Live Flight Legs as the number of completed one-way revenue generating private jet flight legs in the applicable period, excluding empty repositioning legs and owner legs related to aircraft under management. We believe Live Flight Legs is a useful metric to measure the scale and usage of our platform and our ability to generate Flight revenue.

Private Jet Gross Bookings & Total Gross Bookings. We define Private Jet Gross Bookings as the total gross spend by our members and customers on all private jet flight services under our member programs and charter offerings (excluding all group charter flights, which are charter flights with 15 or more passengers (“Group Charter Flights”), and cargo flight services (“Cargo Services”)). We believe Private Jet Gross Bookings provides useful information about the aggregate amount our members and customers spend with Wheels Up versus our competitors.

We define Total Gross Bookings as the total gross spend by our members and customers on all private jet flight services under our member programs and charter offerings, Group Charter Flights and Cargo Services. We believe Total Gross Bookings provides useful information about the scale of the overall global aviation solutions that we provide our members and customers.

For each of Private Jet Gross Bookings and Total Gross Bookings, the total gross spend by our members and customers is the amount invoiced to the member or customer and includes the cost of the flight and related services, such as catering, ground transportation, certain taxes, fees and surcharges. We use Private Jet Gross Bookings and Total Gross Bookings to provide useful information for historical period-to-period comparisons of our business and to identify trends, including relative to our competitors. Our calculation of Private Jet Gross Bookings and Total Gross Bookings may not be comparable to similarly titled measures reported by other companies.

In Wheels Up’s Annual Report on Form 10-K for the year ended December 31, 2023 and Quarterly Reports on Form 10-Q for each of the three months ended March 31, 2024 and June 30, 2024, as well as certain other earnings materials furnished in connection therewith, “Total Private Jet Flight Transaction Value” and “Total Flight Transaction Value” were presented as non-GAAP financial measures, and “Total Private Jet Flight Transaction Value per Live Flight Leg” was presented as a key operating metric. To improve the clarity of our reports filed with the SEC and to use comparable terminology to other registrants, beginning with our Quarterly Report on Form 10-Q for the three months ended September 30, 2024, we relabeled “Total Private Jet Flight Transaction Value,” “Total Flight Transaction Value” and “Total Private Jet Flight Transaction Value per Live Flight Leg” as Private Jet Gross Bookings, Total Gross Bookings and Private Jet Gross Bookings per Live Flight Leg, respectively. In addition, we began presenting Private Jet Gross Bookings and Total Gross Bookings as key operating metrics given their usage. We will no longer present Private Jet Charter FTV or Other Charter FTV, which were included in such past filings.

Private Jet Gross Bookings per Live Flight Leg. We use Private Jet Gross Bookings per Live Flight Leg to measure the average gross spend by our members and customers on all private jet flight services under our member programs and charter offerings (excluding Group Charter Flights and Cargo Services) for each Live Flight Leg.

Reconciliations of Non-GAAP Financial Measures

Adjusted EBITDA

The following tables reconcile Adjusted EBITDA to Net loss, which is the most directly comparable GAAP measure (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Net loss |

$ |

(87,538) |

|

|

$ |

(81,115) |

|

|

$ |

(339,635) |

|

|

$ |

(487,387) |

|

| Add back (deduct): |

|

|

|

|

|

|

|

| Interest expense |

18,089 |

|

|

14,220 |

|

|

65,352 |

|

|

41,255 |

|

| Interest income |

(922) |

|

|

(31) |

|

|

(2,170) |

|

|

(6,121) |

|

| Income tax expense |

494 |

|

|

632 |

|

|

1,226 |

|

|

1,383 |

|

| Other expense, net |

218 |

|

|

1,376 |

|

|

717 |

|

|

660 |

|

| Depreciation and amortization |

13,074 |

|

|

13,506 |

|

|

56,546 |

|

|

58,533 |

|

| Change in fair value of warrant liability |

17 |

|

|

(54) |

|

|

8 |

|

|

(739) |

|

| (Gain) loss on divestiture |

1,400 |

|

|

— |

|

|

(2,003) |

|

|

2,991 |

|

| Loss on disposal of assets, net |

1,538 |

|

|

— |

|

|

3,295 |

|

|

— |

|

| Equity-based compensation expense |

12,613 |

|

|

3,983 |

|

|

45,977 |

|

|

25,633 |

|

| Impairment of goodwill |

— |

|

|

— |

|

|

— |

|

|

126,200 |

|

Acquisition and integration expense(1) |

— |

|

|

— |

|

|

— |

|

|

2,108 |

|

Restructuring charges(2) |

365 |

|

|

2,749 |

|

|

7,850 |

|

|

43,655 |

|

Fleet modernization expense(3) |

28,135 |

|

|

— |

|

|

28,135 |

|

|

— |

|

Atlanta Member Operations Center set-up expense(4) |

— |

|

|

3,673 |

|

|

3,481 |

|

|

30,568 |

|

Certificate consolidation expense(5) |

794 |

|

|

576 |

|

|

6,749 |

|

|

11,375 |

|

Other(6) |

416 |

|

|

3,901 |

|

|

6,599 |

|

|

4,018 |

|

| Adjusted EBITDA |

$ |

(11,307) |

|

|

$ |

(38,121) |

|

|

$ |

(117,873) |

|

|

$ |

(145,868) |

|

__________________

(1)Consists of expenses incurred associated with acquisitions, as well as integration-related charges incurred within one year of the applicable acquisition date, which are primarily related to system conversions, re-branding costs and fees paid to external advisors.

(2)For the year ended December 31, 2024, primarily consists of charges for contract termination fees and employee separation programs as part of our ongoing cost reduction and strategic business initiatives. For the year ended December 31, 2023, primarily consists of restructuring charges related to the restructuring plan that we announced on March 1, 2023 (the “Restructuring Plan”) and related strategic business expenses incurred to support significant changes to our member programs and certain aspects of our operations, which primarily include consultancy fees associated with designing and implementing changes to our member programs and obtaining financing, and severance and recruiting expenses associated with executive transitions and other employee separation programs as part of our cost reduction initiatives.

(3)Consists of expenses incurred in connection with the execution of our fleet modernization strategy first announced in October 2024, which primarily includes expenses associated with transitioning Embraer Phenom 300 series aircraft to our operations, pilot training programs aligned to our fleet modernization strategy, amounts reserved during the fourth quarter of 2024 related to existing Parts and supplies inventory deemed in excess of future business needs after considering our fleet modernization strategy and loss on debt extinguishment of $14.4 million associated with the redemption in-full of the Company’s former 2022 equipment notes on November 13, 2024.

(4)Consists of expenses associated with establishing the Member Operations Center located in the Atlanta, Georgia area (the “Atlanta Member Operations Center”) and its operations, which primarily includes redundant operating expenses during the transition period, relocation expenses for employees and costs associated with onboarding new employees. The Atlanta Member Operations Center began operating on May 15, 2023, and related expenses concluded during the second quarter of 2024, approximately one year after operations began.

(5)Consists of expenses incurred to execute consolidation of our FAA operating certificates, which primarily includes pilot training and retention programs and consultancy fees associated with planning and implementing the consolidation process.

(6)Includes: (i) for both periods presented above, (a) collections of certain aged receivables which were added back to Net loss in the reconciliation presented for the year ended December 31, 2022, which for the periods presented above increase the Adjusted EBITDA loss, and (b) amounts reserved related to existing Parts and supplies inventory deemed in excess of future business needs after considering certain strategic business initiatives; (ii) for the year ended December 31, 2024, (a) reserves and/or write-offs of certain aged receivables associated with our former aircraft management business divested on September 30, 2023, and (b) expenses incurred in connection with ongoing litigation matters; and (iii) for the year ended December 31, 2023, charges related to an individually immaterial litigation settlement during the third quarter of 2023.

Refer to “Supplemental Expense Information” below, for further information.

Adjusted Contribution and Adjusted Contribution Margin

The following tables reconcile Adjusted Contribution to Gross profit (loss), which is the most directly comparable GAAP measure (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Revenue |

$ |

204,815 |

|

|

$ |

246,380 |

|

|

$ |

792,104 |

|

|

$ |

1,253,317 |

|

| Less: Cost of revenue |

176,266 |

|

|

250,925 |

|

|

733,075 |

|

|

1,232,506 |

|

| Less: Depreciation and amortization |

13,074 |

|

|

13,506 |

|

|

56,546 |

|

|

58,533 |

|

| Gross profit (loss) |

15,475 |

|

|

(18,051) |

|

|

2,483 |

|

|

(37,722) |

|

| Gross margin |

7.6% |

|

(7.3)% |

|

0.3% |

|

(3.0)% |

| Add back: |

|

|

|

|

|

|

|

| Depreciation and amortization |

13,074 |

|

|

13,506 |

|

|

56,546 |

|

|

58,533 |

|

| Equity-based compensation expense in cost of revenue |

131 |

|

|

830 |

|

|

2,228 |

|

|

3,927 |

|

Restructuring expense in cost of revenue(1) |

109 |

|

|

— |

|

|

3,984 |

|

|

1,075 |

|

Fleet modernization expense(2) |

10,033 |

|

|

— |

|

|

10,033 |

|

|

— |

|

Atlanta Member Operations Center set-up expense in cost of revenue(3) |

— |

|

|

2,264 |

|

|

1,860 |

|

|

24,704 |

|

Certificate consolidation expense in cost of revenue(4) |

794 |

|

|

324 |

|

|

5,297 |

|

|

8,044 |

|

Other(5) |

— |

|

|

3,975 |

|

|

3,256 |

|

|

3,975 |

|

| Adjusted Contribution |

$ |

39,616 |

|

|

$ |

2,848 |

|

|

$ |

85,687 |

|

|

$ |

62,536 |

|

| Adjusted Contribution Margin |

19.3% |

|

1.2% |

|

10.8% |

|

5.0% |

__________________

(1)For the year ended December 31, 2024, primarily consists of charges for employee separation programs as part of our ongoing cost reduction and strategic business initiatives. For the year ended December 31, 2023, primarily consists of restructuring charges related to the Restructuring Plan and other employee separation programs as part of our cost reduction initiatives.

(2)Consists of expenses incurred in connection with the execution of our fleet modernization strategy first announced in October 2024, which primarily includes expenses associated with transitioning Embraer Phenom 300 series aircraft to our operations, pilot training programs aligned to our fleet modernization strategy and amounts reserved during the fourth quarter of 2024 related to existing Parts and supplies inventory deemed in excess of future business needs after considering our fleet modernization strategy.

(3)Consists of expenses associated with establishing the Atlanta Member Operations Center and its operations, which primarily includes redundant operating expenses during the transition period, relocation expenses for employees and costs associated with onboarding new employees. The Atlanta Member Operations Center began operating on May 15, 2023, and related expenses concluded during the second quarter of 2024, approximately one year after operations began.

(4)Consists of expenses incurred to execute consolidation of our FAA operating certificates, which primarily includes pilot training and retention programs and consultancy fees associated with planning and implementing the consolidation process.

(5)Includes amounts reserved related to existing Parts and supplies inventory deemed in excess of future business needs after considering certain strategic business initiatives.

Supplemental Revenue Information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In thousands) |

Three months ended December 31, |

|

Change in |

| 2024 |

|

2023 |

|

$ |

|

% |

| Membership |

$ |

11,483 |

|

|

$ |

19,077 |

|

|

$ |

(7,594) |

|

|

(40) |

% |

| Flight |

163,897 |

|

|

202,374 |

|

|

(38,477) |

|

|

(19) |

% |

| Aircraft management |

2,147 |

|

|

10,398 |

|

|

(8,251) |

|

|

(79) |

% |

| Other |

27,288 |

|

|

14,531 |

|

|

12,757 |

|

|

88 |

% |

| Total |

$ |

204,815 |

|

|

$ |

246,380 |

|

|

$ |

(41,565) |

|

|

(17) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In thousands) |

Twelve Months Ended December 31, |

|

Change in |

| 2024 |

|

2023 |

|

$ |

|

% |

| Membership |

$ |

57,614 |

|

|

$ |

82,857 |

|

|

$ |

(25,243) |

|

|

(30) |

% |

| Flight |

633,865 |

|

|

884,065 |

|

|

(250,200) |

|

|

(28) |

% |

| Aircraft management |

9,707 |

|

|

175,829 |

|

|

(166,122) |

|

|

(94) |

% |

| Other |

90,918 |

|

|

110,566 |

|

|

(19,648) |

|

|

(18) |

% |

| Total |

$ |

792,104 |

|

|

$ |

1,253,317 |

|

|

$ |

(461,213) |

|

|

(37) |

% |

Supplemental Expense Information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In thousands) |

Three Months Ended

December 31, 2024 |

|

|

|

|

| Cost of revenue |

|

Technology and development |

|

Sales and marketing |

|

General and administrative |

|

Total |

|

|

| Equity-based compensation expense |

$ |

131 |

|

|

$ |

421 |

|

|

$ |

233 |

|

|

$ |

11,828 |

|

|

$ |

12,613 |

|

|

|

|

|

| Restructuring charges |

109 |

|

|

— |

|

|

— |

|

|

256 |

|

|

365 |

|

|

|

|

|

Fleet modernization expense(1) |

10,033 |

|

|

— |

|

|

33 |

|

|

3,666 |

|

|

28,135 |

|

|

|

|

|

| Certificate consolidation expense |

794 |

|

|

— |

|

|

— |

|

|

— |

|

|

794 |

|

|

|

|

|

| Other |

— |

|

|

— |

|

|

— |

|

|

416 |

|

|

416 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In thousands) |

Twelve Months Ended

December 31, 2024 |

|

|

|

|

| Cost of revenue |

|

Technology and development |

|

Sales and marketing |

|

General and administrative |

|

Total |

|

|

|

|

| Equity-based compensation expense |

$ |

2,228 |

|

|

$ |

1,302 |

|

|

$ |

661 |

|

|

$ |

41,786 |

|

|

$ |

45,977 |

|

|

|

|

|

| Restructuring charges |

3,984 |

|

|

— |

|

|

1,648 |

|

|

2,218 |

|

|

7,850 |

|

|

|

|

|

Fleet modernization expense(1) |

10,033 |

|

|

— |

|

|

33 |

|

|

3,666 |

|

|

28,135 |

|

|

|

|

|

| Atlanta Member Operations Center set-up expense |

1,860 |

|

|

— |

|

|

— |

|

|

1,621 |

|

|

3,481 |

|

|

|

|

|

| Certificate consolidation expense |

5,297 |

|

|

— |

|

|

— |

|

|

1,452 |

|

|

6,749 |

|

|

|

|

|

| Other |

3,256 |

|

|

— |

|

|

— |

|

|

3,343 |

|

|

6,599 |

|

|

|

|

|

__________________

(1)Total Fleet modernization expense includes loss on debt extinguishment of $14.4 million for the three and twelve months December 31, 2024 associated with the redemption in-full of the Company’s former 2022 equipment notes on November 13, 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In thousands) |

Three Months Ended December 31, 2023 |

|

|

|

|

| Cost of revenue |

|

Technology and development |

|

Sales and marketing |

|

General and administrative |

|

Total |

|

|

| Equity-based compensation expense |

$ |

830 |

|

|

$ |

319 |

|

|

$ |

(17) |

|

|

$ |

2,851 |

|

|

$ |

3,983 |

|

|

|

|

|

| Restructuring charges |

— |

|

|

— |

|

|

— |

|

|

2,749 |

|

|

2,749 |

|

|

|

|

|

| Atlanta Member Operations Center set-up expense |

2,264 |

|

|

— |

|

|

— |

|

|

1,409 |

|

|

3,673 |

|

|

|

|

|

| Certificate consolidation expense |

324 |

|

|

— |

|

|

— |

|

|

252 |

|

|

576 |

|

|

|

|

|

| Other |

3,975 |

|

|

— |

|

|

— |

|

|

(74) |

|

|

3,901 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In thousands) |

Twelve Months Ended December 31, 2023 |

|

|

|

|

| Cost of revenue |

|

Technology and development |

|

Sales and marketing |

|

General and administrative |

|

Total |

|

|

|

|

| Equity-based compensation expense |

$ |

3,927 |

|

|

$ |

2,096 |

|

|

$ |

1,764 |

|

|

$ |

17,846 |

|

|

$ |

25,633 |

|

|

|

|

|

| Acquisition and integration expenses |

— |

|

|

53 |

|

|

134 |

|

|

1,921 |

|

|

2,108 |

|

|

|

|

|

| Restructuring charges |

1,075 |

|

|

6,940 |

|

|

2,761 |

|

|

32,879 |

|

|

43,655 |

|

|

|

|

|

| Atlanta Member Operations Center set-up expense |

24,704 |

|

|

201 |

|

|

— |

|

|

5,662 |

|

|

30,568 |

|

|

|

|

|

| Certificate consolidation expense |

8,044 |

|

|

— |

|

|

— |

|

|

3,332 |

|

|

11,375 |

|

|

|

|

|

| Other |

3,975 |

|

|

— |

|

|

— |

|

|

43 |

|

|

4,018 |

|

|

|

|

|