Document

GeneDx Reports Third Quarter 2025 Financial Results and Business Highlights

•Reported third quarter 2025 revenues of $116.7 million with 65% year-over-year growth in exome and genome test revenue

•Accelerated exome and genome volume growth to 33% year-over-year

•Expanded adjusted gross margin to 74% and generated adjusted net income1 of $14.7 million for the third quarter 2025

•Raised guidance to deliver between $425 and $428 million in revenue with between 53% to 55% full year growth in exome and genome revenue

•Granted FDA Breakthrough Device Designation for GeneDx ExomeDx™ and GenomeDx™

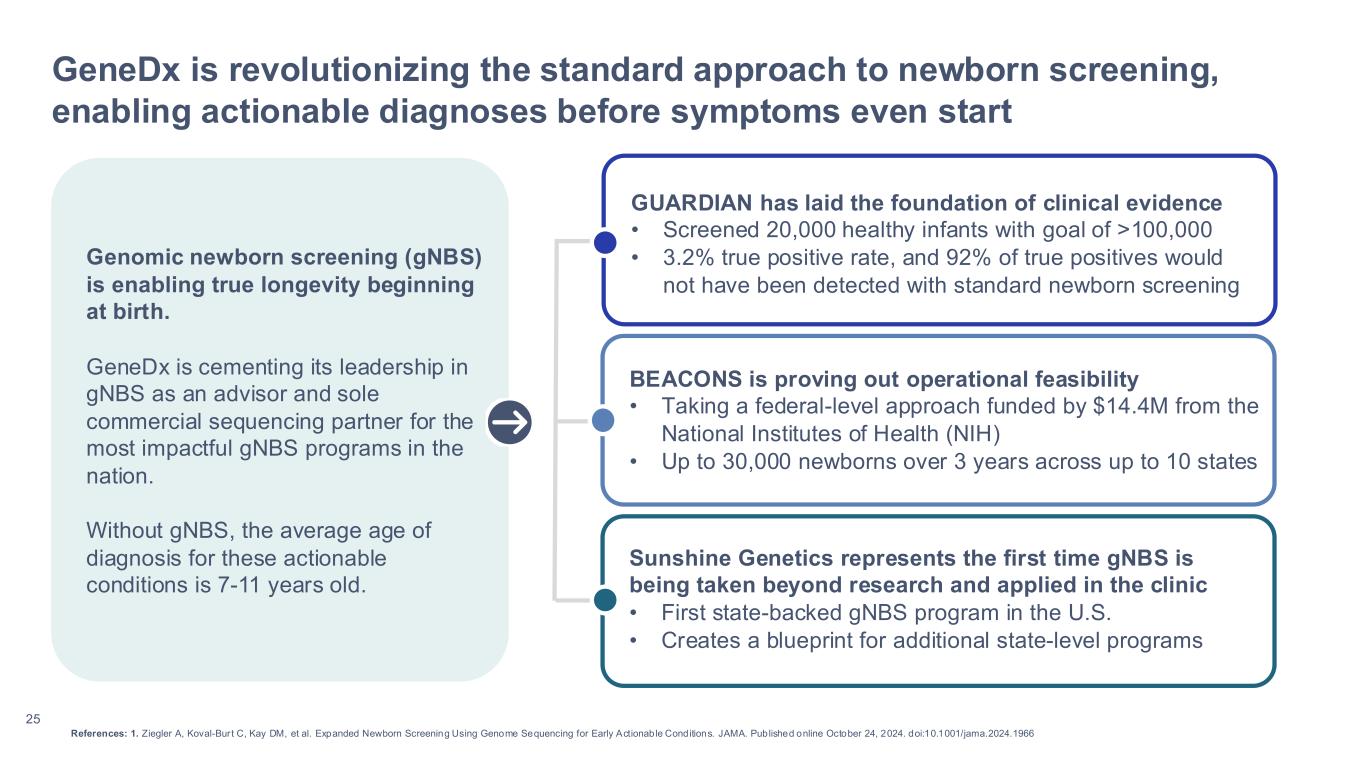

•Leading the nation in genomic newborn screening (gNBS) as the sole commercial testing provider for new gNBS programs, including the NIH BEACONS initiative and Sunshine Genetics Network

•Hosting conference call today at 8:30 a.m. ET

GAITHERSBURG, Md., October 28, 2025 — GeneDx Holdings Corp. (Nasdaq: WGS), a leader in delivering improved health outcomes through genomic insights, today reported its financial results for the third quarter of 2025.

“GeneDx’s accelerated growth reflects more than business momentum - it’s proof of the profound impact we’re making for families navigating rare disease and the broader transformation underway across healthcare,” said Katherine Stueland, President and CEO of GeneDx. “The FDA’s Breakthrough Device Designation for our ExomeDx™ and GenomeDx™ tests underscores our innovative leadership in delivering faster, more accurate diagnoses when every day matters. Powered by GeneDx Infinity™, we’re helping usher in a new era of proactive, personalized care that begins at birth - advancing precision medicine to improve outcomes and change lives.”

Third Quarter 2025 Financial Results (Unaudited)1,2

Revenues

•Revenues grew to $116.7 million, an increase of 52% year-over-year.

•Exome and genome test revenue grew to $98.9 million, an increase of 65% year-over-year.

Exome and genome volume

•Exome and genome test results volume grew to 25,702, an increase of 33% year-over-year.

•Exome and genome represented 43% of all tests, up from 33% in the third quarter of 2024.

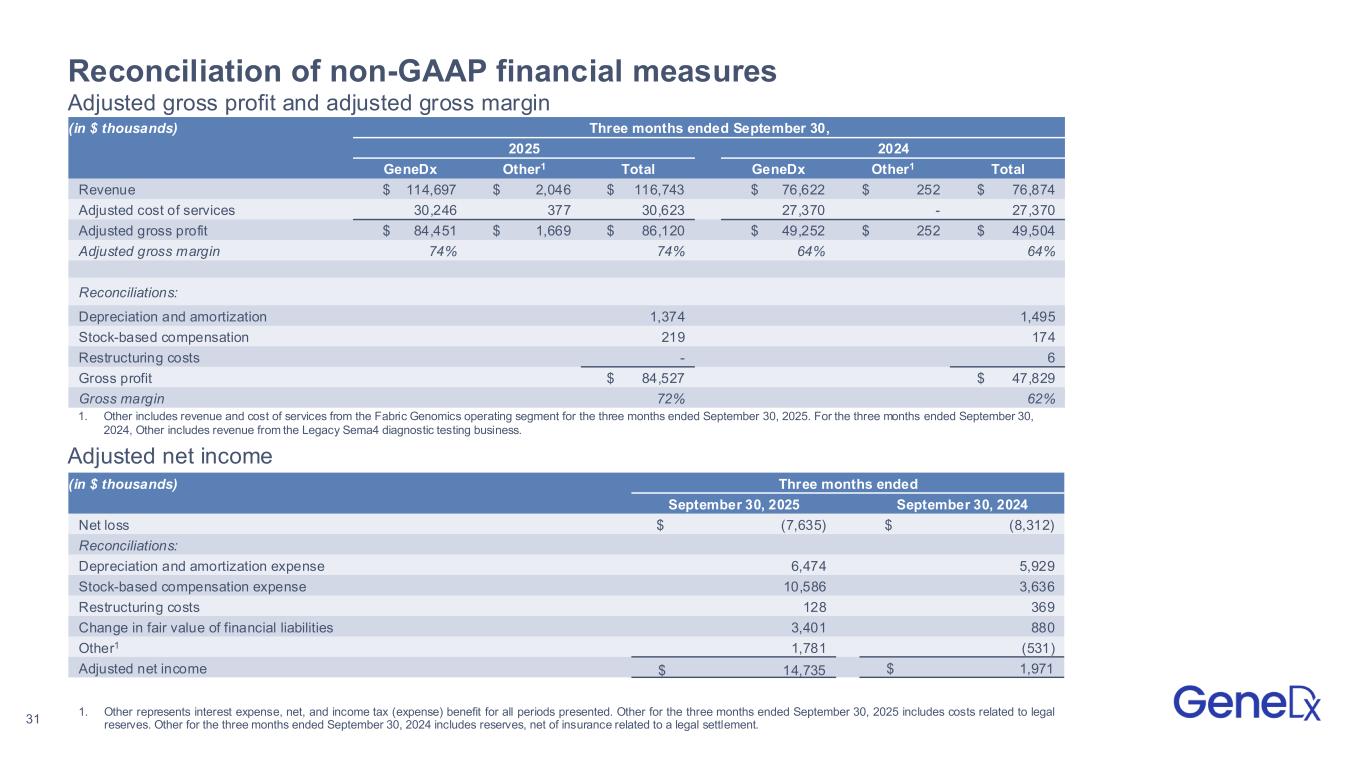

Gross margin

•Adjusted gross margin expanded to 74%, up from 64% in the third quarter of 2024.

◦GAAP gross margin was 72%.

Operating expenses

•Adjusted total operating expenses were $71.2 million, representing 61% of revenue in the third quarter of 2025, compared to 62% of revenue in the third quarter of 2024.

◦GAAP operating expenses were $87.8 million.

Net Income

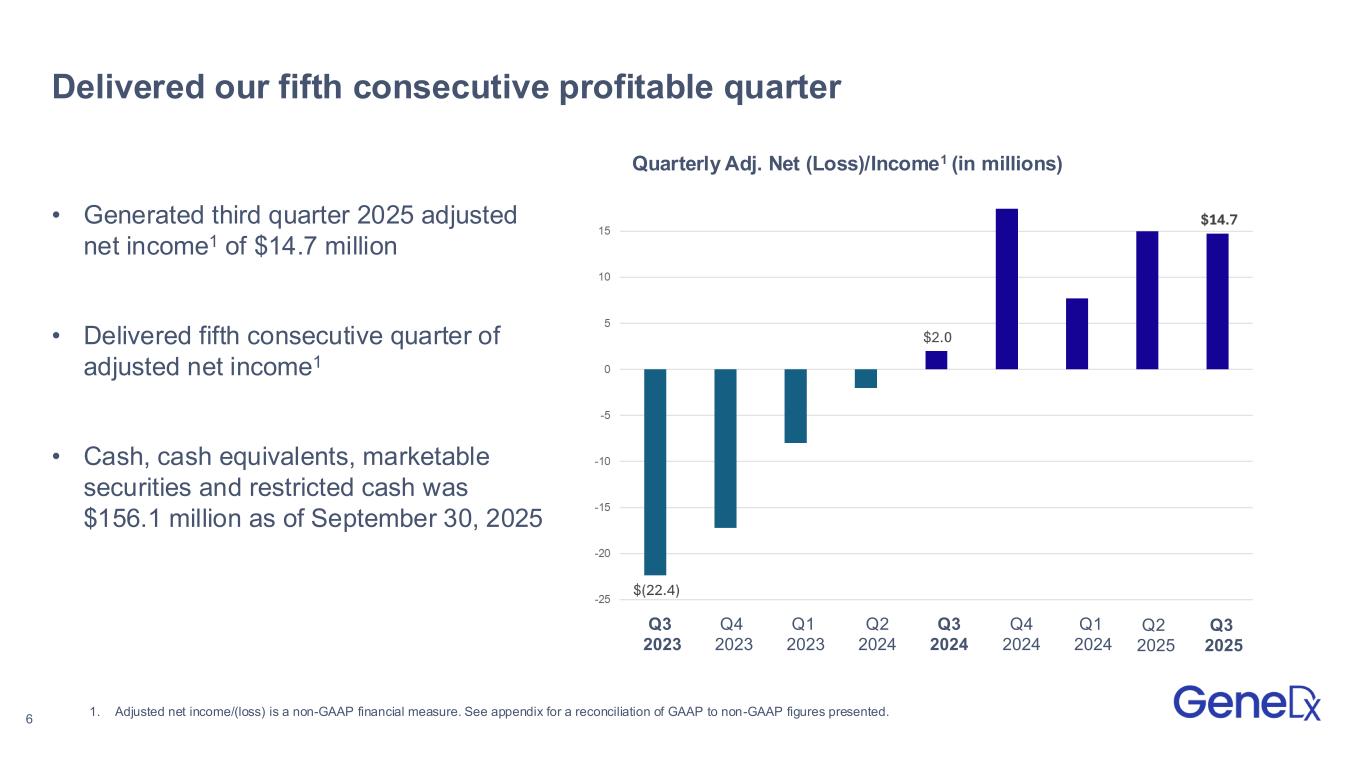

•Adjusted net income was $14.7 million compared to $2.0 million in the third quarter of 2024.

◦GAAP net loss was $7.6 million.

Cash position

•Cash, cash equivalents, marketable securities and restricted cash was $156.1 million as of September 30, 2025.

•Cash flow for the third quarter 2025 primarily included:

◦$8.8 million in free cash flow generated; and

◦$11.8 million in proceeds, net of fees, from the issuance of 101,367 shares of Class A common stock in connection with sales pursuant to our “at-the-market” offering.

1.Adjusted gross margin, adjusted total operating expenses and adjusted net income/(loss) are non-GAAP financial measures. See appendix for a reconciliation of GAAP to non-GAAP figures presented.

2.Revenue and adjusted gross margin growth rates in the comparative 2024 period exclude revenue and costs of sales from the exited Legacy Sema4 diagnostic testing business.

“The third quarter delivered volume acceleration coupled with gross margin expansion, and we’ve established a powerful scale advantage that sets the stage for profitable growth,” said Kevin Feeley, CFO of GeneDx. “As we capitalize on a rapidly expanding market, we’re investing to unlock sustainable, high growth with attractive margins.”

GeneDx Full Year 2025 Guidance

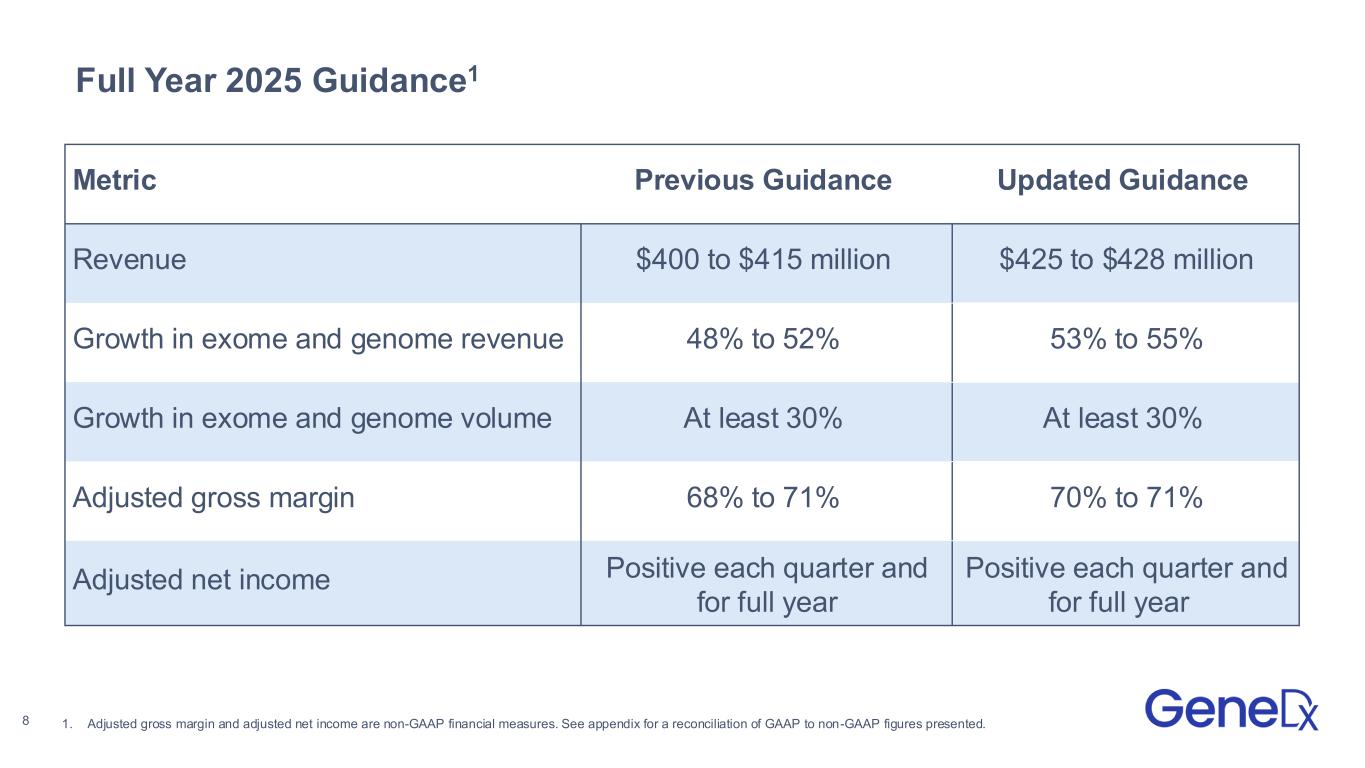

GeneDx has raised certain elements of its full year 2025 guidance and expects to deliver:

|

|

|

|

|

|

|

|

|

|

|

|

| Metric |

Previous Guidance |

|

Updated Guidance |

| Revenue |

$400 to $415 million |

|

$425 to $428 million |

| Growth in exome and genome revenue |

48% to 52% |

|

53% to 55% |

| Growth in exome and genome volume |

At least 30% |

|

At least 30% |

| Adjusted gross margin |

68% to 71% |

|

70% to 71% |

| Adjusted net income |

Positive each quarter and for full year |

|

Positive each quarter and for full year |

Third Quarter 2025 and Recent Business Highlights

Strategic Expansion and Market Leadership

•Introduced GeneDx InfinityTM, the largest rare disease dataset, which serves as the foundation for rare disease insights and powers GeneDx's ExomeDxTM and GenomeDxTM.

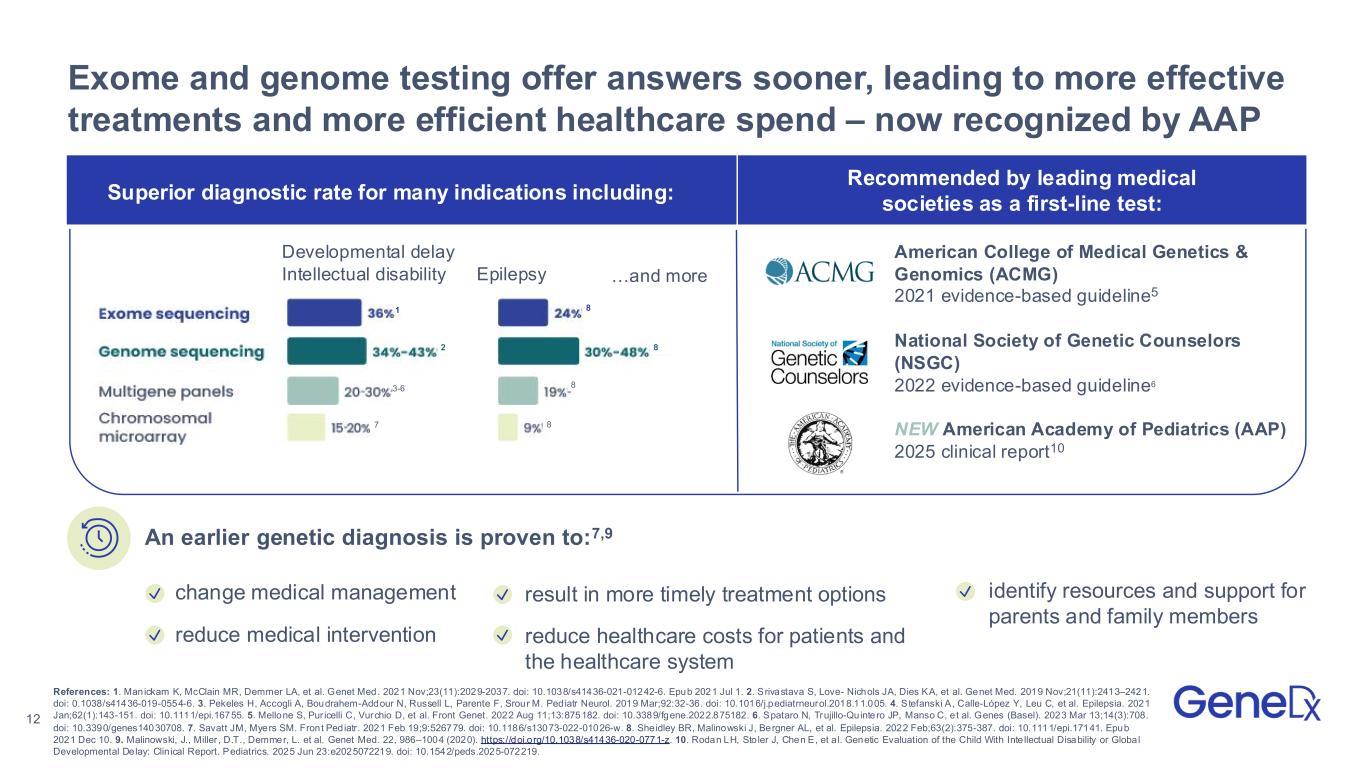

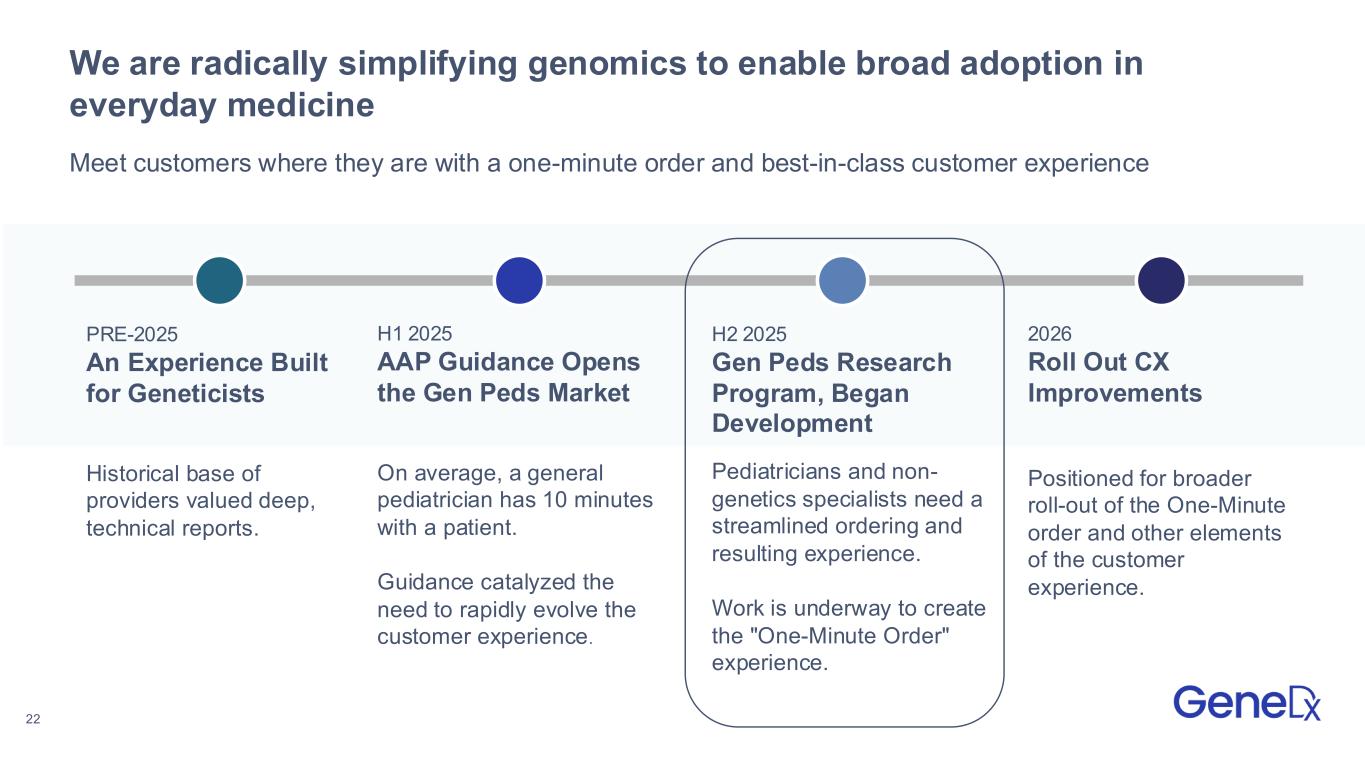

•Exhibited at the American Academy of Pediatrics (AAP) Annual Meeting, educating pediatricians about the updated AAP guidance recommending exome and genome sequencing as first-tier tests for children with global developmental delay or intellectual disability.

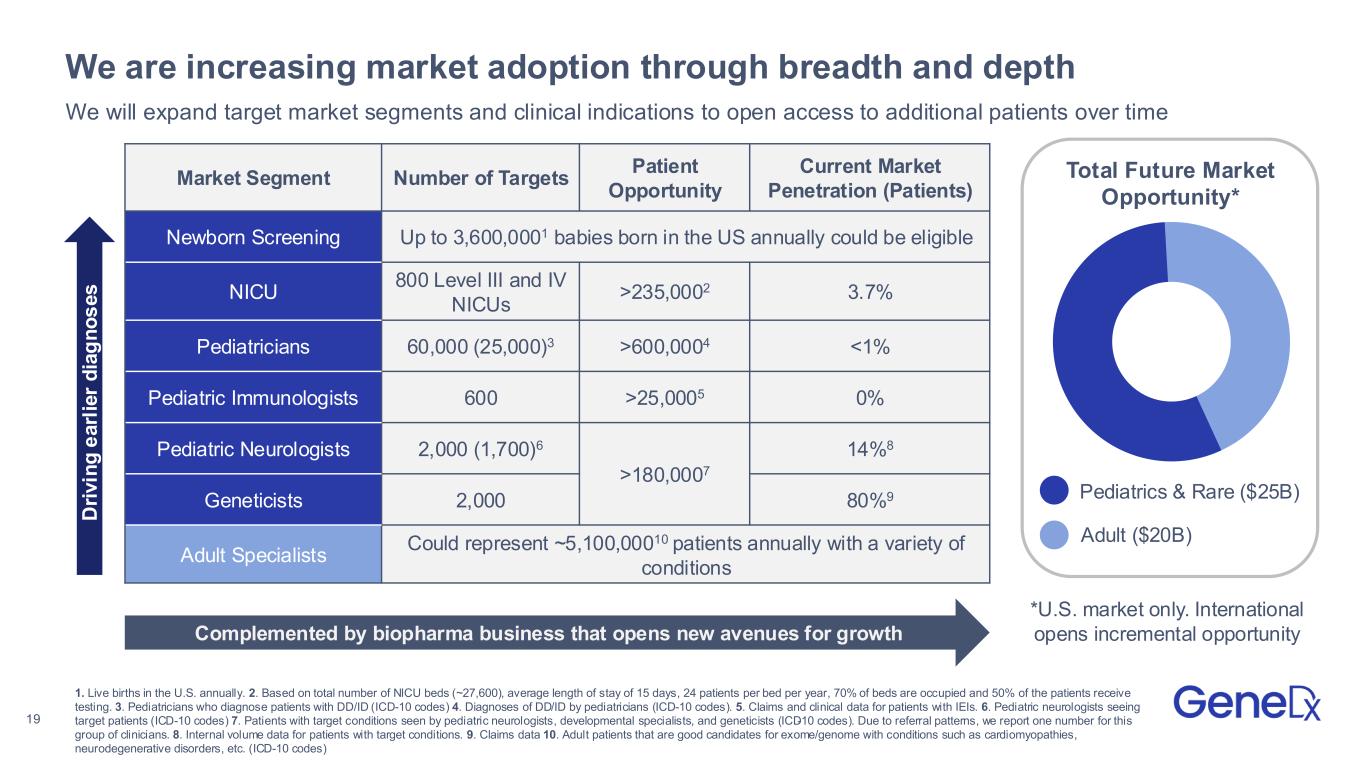

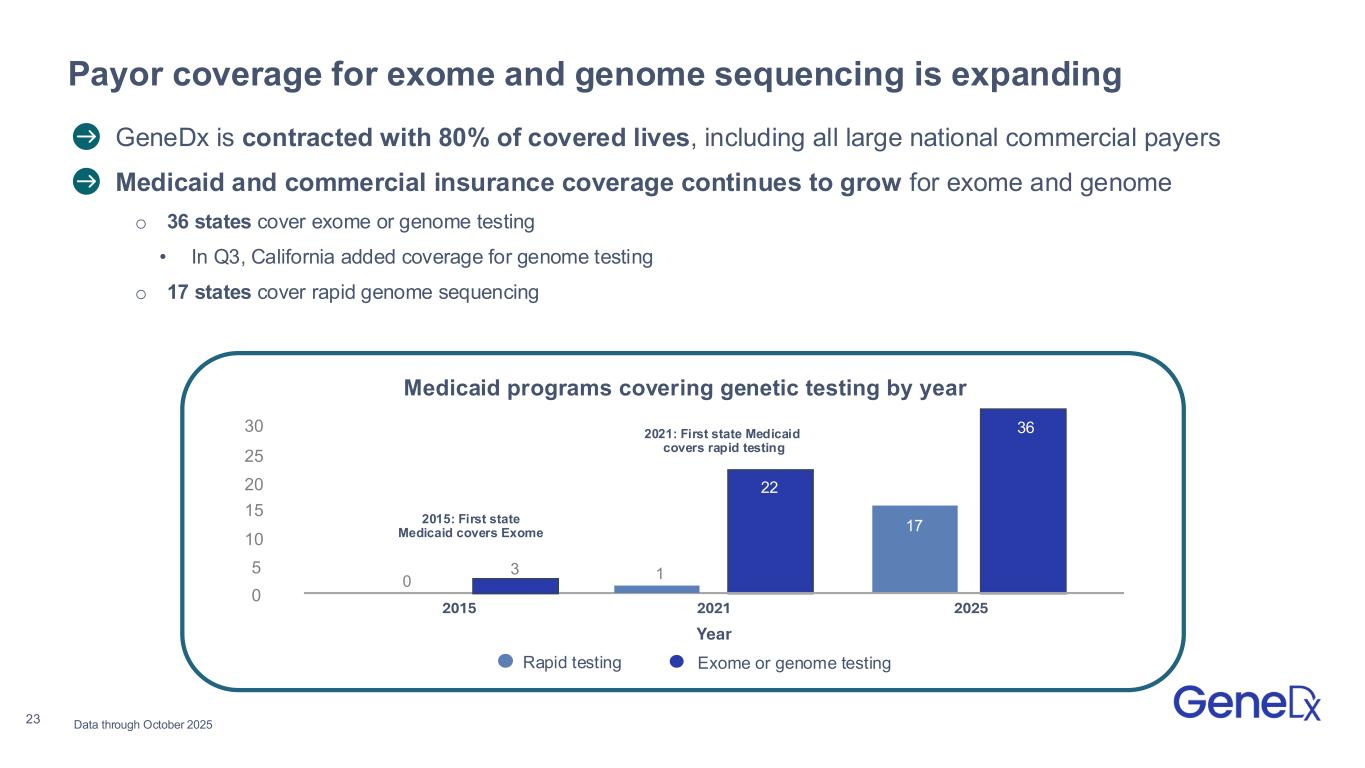

•Expanded coverage of whole genome sequencing with California Medicaid (Medi-Cal), opening access to testing in the nation’s most populous state and bringing the number of states covering exome or genome testing in the outpatient setting to 36.

•Announced the Autism Partnership Program in partnership with Jaguar Gene Therapy, expanding access to exome and genome testing for patients suspected of having SHANK3-related autism spectrum disorder (ASD) and Phelan-McDermid syndrome - the leading single-gene cause of ASD.

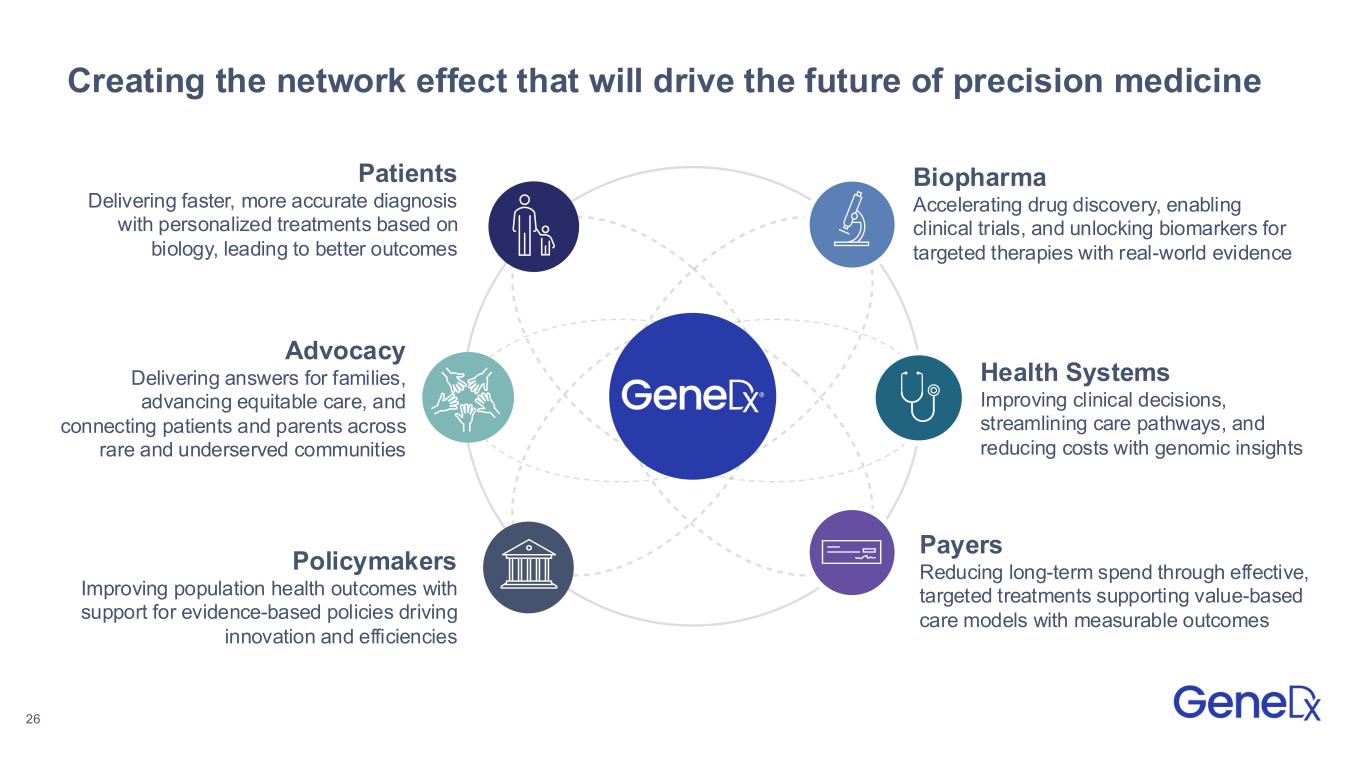

•Appointed Lisa Gurry as Chief Business Officer and Dr. Mimi Lee as Chief Precision Medicine Officer to accelerate precision medicine across policymakers, health systems, biopharmaceutical companies, advocacy groups, and payers to help more families with the power of data, AI, and clinical expertise.

•Appointed Dr. Thomas Fuchs, MD, PhD, to the board of directors, contributing his background at the intersection of AI and human health to support GeneDx’s business and mission.

Innovation & Clinical Leadership

•Granted FDA Breakthrough Device Designation for GeneDx ExomeDx™ and GenomeDx™ associated with causes of life-threatening diseases or genetic disorders to aid in diagnosis of symptomatic patients, underscoring GeneDx’s leadership in genomic medicine and critical role in delivering fast, accurate answers for patients with rare disease.

•Expanded leadership in genomic newborn screening through participation in key programs, including:

◦Announced participation in the nation’s first multi-state genomic newborn screening initiative, BEACONS (Building Evidence and Collaboration for GenOmics in Nationwide Newborn Screening), which was launched with a $14.4 million NIH award to enroll up to 30,000 newborns in as many as 10 states over the next three years.

◦Announced a partnership with Florida’s Sunshine Genetics Network to launch the nation’s first state-backed genomic newborn screening program and offer whole genome sequencing for newborns at select academic medical centers and hospitals, providing families and clinicians the opportunity for early detection and diagnosis of rare diseases.

•Added to the company’s 1,000+ publications and growing by showcasing pioneering research at the American Society of Human Genetics (ASHG) Annual Meeting including:

◦AI and machine learning approaches in rare disease diagnosis: In a study of over 250,000 exome and genome trios, GeneDx’s machine learning approach addresses challenges of identifying de novo variants with high accuracy and throughput, enabling greater efficiency and scalability.

◦The genetic causes of autism: In a study of over 62,000 individuals affected with autism, researchers highlight a core set of over 250 genes associated with autism and found moderate genetic correlations between autism and schizophrenia, epilepsy, and bipolar disorder.

◦Genomic newborn screening (gNBS): Updated results from the GUARDIAN study reports data from 15,000 newborns and demonstrates high enrollment rates, positive parental experiences, and meaningful follow-up outcomes – reinforcing the value of gNBS in accelerating time to diagnosis.

◦Clinical validation for long read sequencing: Long-read sequencing approaches demonstrate strong potential to improve clinical diagnostics, accurately detecting repeat expansions and resolving difficult-to-sequence regions.

•Showcased leadership in genomic newborn screening at the International Consortium of Newborn Sequencing (ICoNS), with data presented on GeneDx’s more than 22,000 newborns sequenced.

Webcast and Conference Call Details

GeneDx will host a conference call today, October 28, 2025, at 8:30 a.m. Eastern Time. Investors interested in listening to the conference call are required to register online. A live and archived webcast of the event will be available on the “Events” section of the GeneDx investor relations website at https://ir.genedx.com/.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and the U.S. Private Securities Litigation Reform Act of 1995, including statements regarding our future performance and our market opportunity, including our expected full year 2025 reported revenue, growth in exome and genome revenue and volume, adjusted gross margin and adjusted net income guidance. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to: (i) our ability to implement business plans, goals and forecasts, and identify and realize additional opportunities, (ii) the risk of downturns and a changing regulatory landscape in the highly competitive healthcare industry, (iii) the size and growth of the market in which we operate, and (iv) our ability to pursue our new strategic direction. The foregoing list of factors is not exhaustive. A further list and description of risks, uncertainties and other matters can be found in the “Risk Factors” section of our Annual Report on Form 10-K for the fiscal year ended December 31, 2024 and our Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2025, June 30, 2025 and September 30, 2025, and other documents filed by us from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and we assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. We do not give any assurance that we will achieve our expectations.

About GeneDx

GeneDx (Nasdaq: WGS) is the global leader in rare disease diagnosis, transforming the way medicine is practiced by making genomics the starting point for health, not the last resort. We bring together unmatched clinical expertise, advanced technology, and the power of GeneDx Infinity™ – the largest rare disease dataset – built over 25 years from millions of genomic tests and deep clinical insights. This unparalleled foundation powers our ExomeDx™ and GenomeDx™ tests, giving clinicians the highest likelihood of delivering a timely, accurate diagnosis. GeneDx is shaping the future of healthcare by moving the standard of care from sick care to proactive healthcare. While our roots are in rare disease diagnosis, our commitment extends beyond – growing with the families we serve – as a trusted partner at every stage of life. For more information, visit genedx.com and connect with us on LinkedIn, Facebook, and Instagram.

Investor Relations Contact:

Investors@GeneDx.com

Media Contact:

Press@GeneDx.com

Volume & Revenue 1,2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3Q25 |

|

2Q25 |

|

1Q25 |

|

4Q24 |

|

3Q24 |

| Volumes |

|

|

|

|

|

|

|

|

|

| Whole exome, whole genome |

25,702 |

|

23,246 |

|

20,562 |

|

20,676 |

|

19,262 |

| Hereditary cancer |

1,511 |

|

2,677 |

|

2,725 |

|

3,486 |

|

4,672 |

| Other panels |

33,003 |

|

31,833 |

|

28,228 |

|

30,115 |

|

35,095 |

| Total |

60,216 |

|

57,756 |

|

51,515 |

|

54,277 |

|

59,029 |

|

|

|

|

|

|

|

|

|

|

| Revenue ($ millions) |

|

|

|

|

|

|

|

|

|

| Whole exome, whole genome |

$ |

98.9 |

|

|

$ |

86.0 |

|

|

$ |

71.4 |

|

|

$ |

78.8 |

|

|

$ |

60.0 |

|

| Hereditary cancer |

1.2 |

|

|

1.8 |

|

|

2.2 |

|

|

2.8 |

|

|

3.3 |

|

| Other panels |

13.4 |

|

|

12.3 |

|

|

12.1 |

|

|

12.3 |

|

|

13.8 |

|

| Data information |

1.5 |

|

|

2.0 |

|

|

1.4 |

|

|

1.4 |

|

|

(0.5) |

|

Software and interpretation services |

1.7 |

|

|

0.6 |

|

|

— |

|

|

— |

|

|

— |

|

| Total |

$ |

116.7 |

|

|

$ |

102.7 |

|

|

$ |

87.1 |

|

|

$ |

95.3 |

|

|

$ |

76.6 |

|

1.Excludes volume and revenue from the exited Legacy Sema4 diagnostic testing business for the third and fourth quarters of 2024.

2.Diagnostic testing volume and revenue amounts for the second quarter of 2025 revised to conform with current period presentation combining GeneDx and Fabric Genomics.

Unaudited Select Financial Information (in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, 2025 |

|

Three months ended September 30, 2024 |

|

GeneDx |

|

Other1 |

|

Total |

|

GeneDx |

|

Other1 |

|

Total |

| Revenue |

$114,697 |

|

$2,046 |

|

$116,743 |

|

$76,622 |

|

$252 |

|

$76,874 |

| Adjusted cost of services |

30,246 |

|

377 |

|

30,623 |

|

27,370 |

|

— |

|

27,370 |

Adjusted gross profit |

$84,451 |

|

$1,669 |

|

$86,120 |

|

$49,252 |

|

$252 |

|

$49,504 |

| Adjusted gross margin % |

73.6% |

|

81.6% |

|

73.8% |

|

64.3% |

|

100.0% |

|

64.4% |

1.Other includes revenue and cost of services from the Fabric Genomics operating segment for the three months ended September 30, 2025. For the three months ended September 30, 2024, Other includes revenue from the Legacy Sema4 diagnostic testing business.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, 2025 |

|

Reported |

|

Depreciation and amortization |

|

Stock-based compensation expense |

|

Restructuring costs |

|

Change in FV of financial liabilities |

|

|

|

Other2 |

|

Adjusted |

| Diagnostic test revenue |

$ |

113,523 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

$ |

— |

|

|

$ |

113,523 |

|

| Other revenue |

3,220 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

3,220 |

|

| Total revenue |

116,743 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

116,743 |

|

| Cost of services |

32,216 |

|

|

(1,374) |

|

|

(219) |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

30,623 |

|

Gross profit |

84,527 |

|

|

1,374 |

|

|

219 |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

86,120 |

|

| Gross margin |

72.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

73.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

19,829 |

|

|

(242) |

|

|

(1,749) |

|

|

196 |

|

|

— |

|

|

|

|

— |

|

|

18,034 |

|

| Selling and marketing |

23,510 |

|

|

(1,334) |

|

|

(1,674) |

|

|

(136) |

|

|

— |

|

|

|

|

— |

|

|

20,366 |

|

| General and administrative |

44,439 |

|

|

(3,524) |

|

|

(6,944) |

|

|

(188) |

|

|

— |

|

|

|

|

(974) |

|

|

32,809 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) income from operations |

(3,251) |

|

|

6,474 |

|

|

10,586 |

|

|

128 |

|

|

— |

|

|

|

|

974 |

|

|

14,911 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

(562) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

562 |

|

|

— |

|

| Other income (expense), net |

(3,575) |

|

|

— |

|

|

— |

|

|

— |

|

|

3,401 |

|

|

|

|

(2) |

|

|

(176) |

|

Income tax expense |

(247) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

247 |

|

|

— |

|

Net (loss) income |

$ |

(7,635) |

|

|

$ |

6,474 |

|

|

$ |

10,586 |

|

|

$ |

128 |

|

|

$ |

3,401 |

|

|

|

|

$ |

1,781 |

|

|

$ |

14,735 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic (loss) earnings per share1 |

$ |

(0.27) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

0.51 |

|

Diluted (loss) earnings per share1 |

$ |

(0.27) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

0.49 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, 2024 |

|

Reported |

|

Depreciation and amortization |

|

Stock-based compensation expense |

|

Restructuring costs |

|

Change in FV of financial liabilities |

|

|

|

Other2 |

|

Adjusted |

| Diagnostic test revenue |

$ |

77,418 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

$ |

— |

|

|

$ |

77,418 |

|

| Other revenue |

(544) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

(544) |

|

| Total revenue |

76,874 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

76,874 |

|

| Cost of services |

29,045 |

|

|

(1,495) |

|

|

(174) |

|

|

(6) |

|

|

— |

|

|

|

|

— |

|

|

27,370 |

|

Gross profit |

47,829 |

|

|

1,495 |

|

|

174 |

|

|

6 |

|

|

— |

|

|

|

|

— |

|

|

49,504 |

|

| Gross margin |

62.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

64.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

11,665 |

|

|

(222) |

|

|

(537) |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

10,906 |

|

| Selling and marketing |

17,025 |

|

|

(1,225) |

|

|

(394) |

|

|

(55) |

|

|

— |

|

|

|

|

— |

|

|

15,351 |

|

| General and administrative |

26,919 |

|

|

(2,987) |

|

|

(2,531) |

|

|

(308) |

|

|

— |

|

|

|

|

— |

|

|

21,093 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) income from operations |

(7,780) |

|

|

5,929 |

|

|

3,636 |

|

|

369 |

|

|

— |

|

|

|

|

— |

|

|

2,154 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

(843) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

843 |

|

|

— |

|

| Other income (expense), net |

264 |

|

|

— |

|

|

— |

|

|

— |

|

|

880 |

|

|

|

|

(1,327) |

|

|

(183) |

|

| Income tax benefit |

47 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

(47) |

|

|

— |

|

Net (loss) income |

$ |

(8,312) |

|

|

$ |

5,929 |

|

|

$ |

3,636 |

|

|

$ |

369 |

|

|

$ |

880 |

|

|

|

|

$ |

(531) |

|

|

$ |

1,971 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic (loss) earnings per share1 |

$ |

(0.31) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

0.07 |

|

Diluted (loss) earnings per share1 |

$ |

(0.31) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

0.07 |

|

1.Basic and diluted (loss) earnings per share are calculated based on 28,797,730 and 30,152,510 weighted average shares outstanding for the three months ended September 30, 2025, respectively, and 27,095,986 and 28,836,909 weighted average shares outstanding for the three months ended September 30, 2024, respectively.

2.Other represents interest expense, net, and income tax (expense) benefit for all periods presented. For the three months ended September 30, 2025, Other includes costs related to legal reserves. For the three months ended September 30, 2024, Other includes reserves, net of insurance related to a legal settlement.

GeneDx Holdings Corp.

Condensed Consolidated Balance Sheets

(in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2025 (Unaudited) |

|

December 31, 2024 |

| Assets: |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

95,968 |

|

|

$ |

85,212 |

|

| Marketable securities |

59,111 |

|

|

55,973 |

|

| Accounts receivable |

60,938 |

|

|

37,629 |

|

|

|

|

|

| Inventory, net |

10,569 |

|

|

10,650 |

|

| Prepaid expenses and other current assets |

10,997 |

|

|

8,504 |

|

| Total current assets |

237,583 |

|

|

197,968 |

|

| Operating lease right-of-use assets |

24,200 |

|

|

25,613 |

|

| Property and equipment, net |

42,422 |

|

|

32,893 |

|

| Goodwill |

12,798 |

|

|

— |

|

| Intangible assets, net |

172,585 |

|

|

158,600 |

|

Other assets1 |

4,314 |

|

|

4,306 |

|

| Total assets |

$ |

493,902 |

|

|

$ |

419,380 |

|

| Liabilities and Stockholders’ Equity: |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable and accrued expenses |

$ |

50,334 |

|

|

$ |

30,983 |

|

|

|

|

|

| Short-term lease liabilities |

4,429 |

|

|

3,336 |

|

| Other current liabilities |

32,858 |

|

|

20,498 |

|

| Total current liabilities |

87,621 |

|

|

54,817 |

|

| Long-term debt, net of current portion |

51,579 |

|

|

51,913 |

|

| Long-term lease liabilities |

57,153 |

|

|

60,919 |

|

| Other liabilities |

4,258 |

|

|

5,519 |

|

| Deferred taxes |

1,033 |

|

|

965 |

|

| Total liabilities |

201,644 |

|

|

174,133 |

|

| Stockholders’ Equity: |

|

|

|

| Preferred stock |

— |

|

|

— |

|

| Class A common stock |

2 |

|

|

2 |

|

| Additional paid-in capital |

1,647,083 |

|

|

1,596,889 |

|

| Accumulated deficit |

(1,355,829) |

|

|

(1,352,474) |

|

| Accumulated other comprehensive income |

1,002 |

|

|

830 |

|

| Total stockholders’ equity |

292,258 |

|

|

245,247 |

|

| Total liabilities and stockholders’ equity |

$ |

493,902 |

|

|

$ |

419,380 |

|

1.Other assets includes $1.0 million of restricted cash as of both September 30, 2025 and December 31, 2024.

GeneDx Holdings Corp.

Condensed Consolidated Statements of Operations (Unaudited)

(in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Revenue |

|

|

|

|

|

|

|

| Diagnostic test revenue |

$ |

113,523 |

|

|

$ |

77,418 |

|

|

$ |

299,382 |

|

|

$ |

207,961 |

|

| Other revenue |

3,220 |

|

|

(544) |

|

|

7,168 |

|

|

1,849 |

|

| Total revenue |

116,743 |

|

|

76,874 |

|

|

306,550 |

|

|

209,810 |

|

| Cost of services |

32,216 |

|

|

29,045 |

|

|

92,645 |

|

|

81,618 |

|

| Gross profit |

84,527 |

|

|

47,829 |

|

|

213,905 |

|

|

128,192 |

|

| Research and development |

19,829 |

|

|

11,665 |

|

|

47,485 |

|

|

34,134 |

|

| Selling and marketing |

23,510 |

|

|

17,025 |

|

|

61,274 |

|

|

49,695 |

|

| General and administrative |

44,439 |

|

|

26,919 |

|

|

103,988 |

|

|

76,382 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss (income) from operations |

(3,251) |

|

|

(7,780) |

|

|

1,158 |

|

|

(32,019) |

|

|

|

|

|

|

|

|

|

| Non-operating (expenses) income, net |

|

|

|

|

|

|

|

| Change in fair value of financial liabilities |

(3,401) |

|

|

(880) |

|

|

(2,320) |

|

|

(11,390) |

|

| Interest expense, net |

(562) |

|

|

(843) |

|

|

(2,019) |

|

|

(2,334) |

|

| Other (expense) income, net |

(174) |

|

|

1,144 |

|

|

274 |

|

|

(12,300) |

|

| Total non-operating expense, net |

(4,137) |

|

|

(579) |

|

|

(4,065) |

|

|

(26,024) |

|

| Loss before income taxes |

(7,388) |

|

|

(8,359) |

|

|

$ |

(2,907) |

|

|

$ |

(58,043) |

|

| Income tax (expense) benefit |

(247) |

|

|

47 |

|

|

(448) |

|

|

319 |

|

| Net loss |

$ |

(7,635) |

|

|

$ |

(8,312) |

|

|

$ |

(3,355) |

|

|

$ |

(57,724) |

|

|

|

|

|

|

|

|

|

| Weighted-average shares outstanding of Class A common stock |

28,797,730 |

|

|

27,095,986 |

|

|

28,505,657 |

|

26,593,877 |

| Basic and diluted loss per share, Class A common stock |

$ |

(0.27) |

|

|

$ |

(0.31) |

|

|

$ |

(0.12) |

|

|

$ |

(2.17) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GeneDx Holdings Corp.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine months ended September 30, |

|

2025 |

|

2024 |

|

|

| Operating activities |

|

|

|

|

|

| Net loss |

$ |

(3,355) |

|

|

$ |

(57,724) |

|

|

|

Adjustments to reconcile net loss to net cash provided by (used in) operating activities: |

|

|

|

|

|

| Depreciation and amortization expense |

18,343 |

|

|

16,395 |

|

|

|

| Stock-based compensation expense |

22,382 |

|

|

6,293 |

|

|

|

| Change in fair value of financial liabilities |

2,320 |

|

|

11,390 |

|

|

|

| Deferred tax expense (benefit) |

448 |

|

|

(319) |

|

|

|

| Provision for excess and obsolete inventory |

152 |

|

|

137 |

|

|

|

| Legal reserves |

810 |

|

|

12,123 |

|

|

|

| Change in third party payor reserves |

8,746 |

|

|

737 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other |

2,382 |

|

|

2,639 |

|

|

|

Change in operating assets and liabilities: |

|

|

|

|

|

| Accounts receivable |

(22,799) |

|

|

(5,850) |

|

|

|

| Inventory |

(72) |

|

|

(2,131) |

|

|

|

| Accounts payable and accrued expenses |

5,185 |

|

|

(7,807) |

|

|

|

| Other assets and liabilities |

1,827 |

|

|

(1,196) |

|

|

|

| Net cash provided by (used in) operating activities |

36,369 |

|

|

(25,313) |

|

|

|

| Investing activities |

|

|

|

|

|

| Acquisition of business, net of cash acquired |

(33,195) |

|

|

— |

|

|

|

| Purchases of property and equipment |

(14,670) |

|

|

(2,441) |

|

|

|

|

|

|

|

|

|

| Purchases of marketable securities |

(36,535) |

|

|

(52,725) |

|

|

|

| Proceeds from sales of marketable securities |

— |

|

|

598 |

|

|

|

| Proceeds from maturities of marketable securities |

33,955 |

|

|

24,955 |

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

(50,445) |

|

|

(29,613) |

|

|

|

| Financing activities |

|

|

|

|

|

| Proceeds from offerings, net of issuance costs |

25,568 |

|

|

14,589 |

|

|

|

| Proceeds from issuance of common stock pursuant to employee stock purchase plan |

1,262 |

|

|

— |

|

|

|

| Exercise of stock options |

982 |

|

|

247 |

|

|

|

| Long-term debt principal payments |

(906) |

|

|

(198) |

|

|

|

| Finance lease principal payments |

(2,074) |

|

|

(1,499) |

|

|

|

| Net cash provided by financing activities |

24,832 |

|

|

13,139 |

|

|

|

Net increase (decrease) in cash, cash equivalents and restricted cash |

10,756 |

|

|

(41,787) |

|

|

|

| Cash, cash equivalents and restricted cash, at beginning of period |

86,202 |

|

|

100,668 |

|

|

|

Cash, cash equivalents and restricted cash, at end of period (1) |

$ |

96,958 |

|

|

$ |

58,881 |

|

|

|

|

|

|

|

|

|

| Supplemental disclosures of cash flow information |

|

|

|

|

|

| Cash paid for interest |

$ |

4,835 |

|

|

$ |

5,035 |

|

|

|

| Cash paid for taxes |

$ |

1,039 |

|

|

$ |

910 |

|

|

|

| Stock consideration paid pursuant to exercise of Perceptive warrant |

$ |

— |

|

|

$ |

12,586 |

|

|

|

| Purchases of property and equipment in accounts payable and accrued expenses |

$ |

4,472 |

|

|

$ |

2,612 |

|

|

|

| Assets acquired under capital lease obligations |

$ |

— |

|

|

$ |

689 |

|

|

|

(1)Cash, cash equivalents and restricted cash as of September 30, 2025 excludes marketable securities of $59.1 million.