Document

NETSTREIT REPORTS FIRST QUARTER 2023 FINANCIAL AND OPERATING RESULTS

– Net Income of $0.03 and Adjusted Funds from Operations (“AFFO”)1 of $0.30 per diluted share2 –

– Completed $112.7 Million of Net Investment Activity –

–Maintains AFFO Guidance and Net Investment Target for 2023 –

Dallas TX – April 26, 2023 – NETSTREIT Corp. (NYSE: NTST) or (the “Company”), today announced financial and operating results for the first quarter ended March 31, 2023.

“We are pleased to announce a solid start to 2023 and extend a warm welcome to the newest member of our leadership team, Chief Financial Officer Daniel Donlan. Despite a volatile market backdrop, NETSTREIT was able to successfully navigate and creatively source opportunities through multiple channels to produce attractive risk adjusted returns for our shareholders. We continue to scale our business and execute on our growth initiatives. We have ample liquidity on our balance sheet and will look to judiciously deploy that capital to drive attractive per share earnings growth and long-term value accretion for our shareholders in 2023 and beyond," said Mark Manheimer, Chief Executive Officer of NETSTREIT.

FIRST QUARTER 2023 HIGHLIGHTS2

•Net income per share of $0.03, compared to $0.04 in prior year period

•Core Funds from Operations (“Core FFO”)1 per share of $0.28, compared to $0.28 in prior year period

•AFFO per share of $0.30, compared to $0.29 in prior year period

PORTFOLIO UPDATE

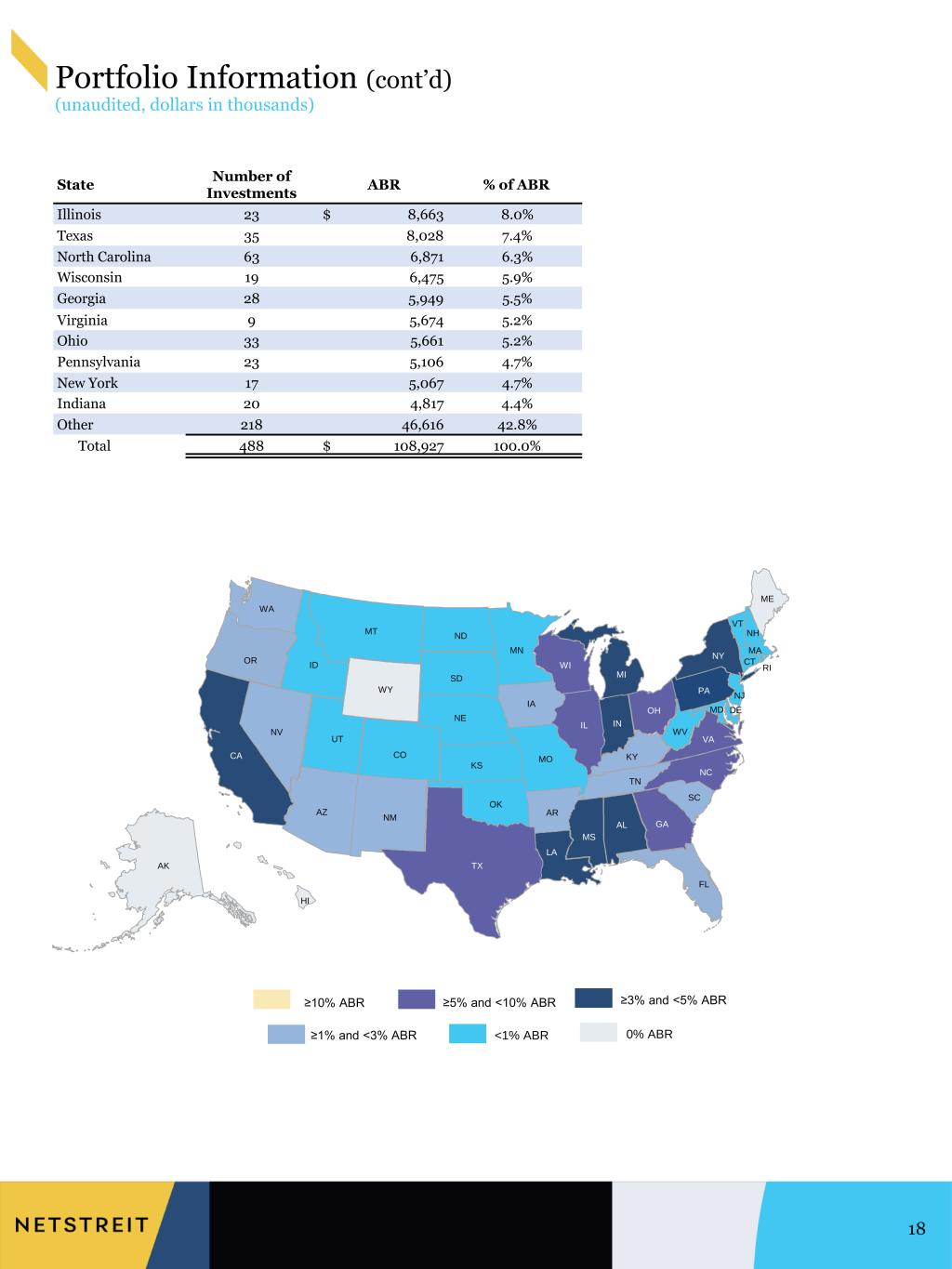

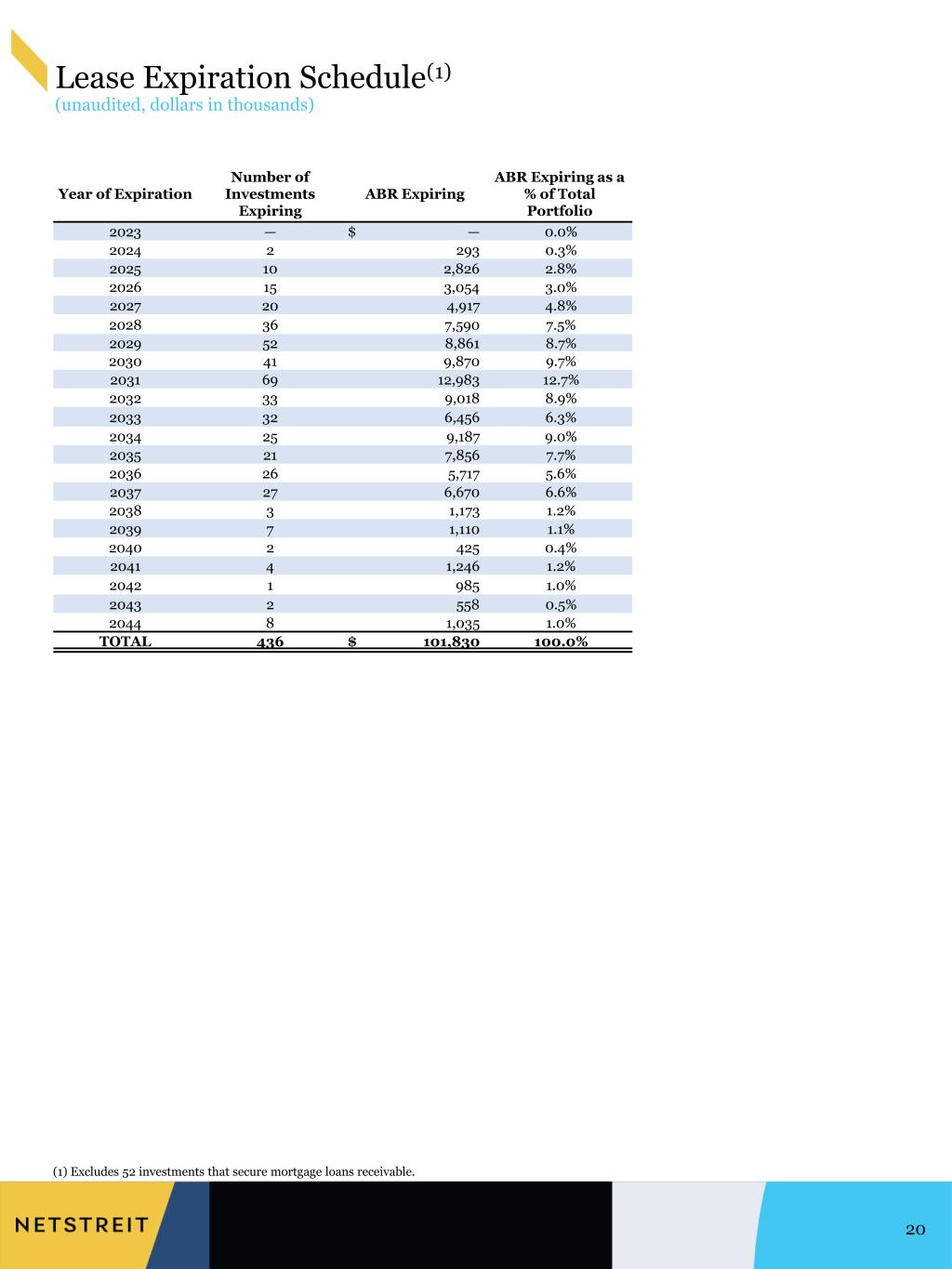

As of March 31, 2023, the NETSTREIT portfolio consisted of 488 investments with 83 total tenants, contributing $108.9 million of annualized base rent3, with a weighted-average remaining lease term of 9.4 years4, of which 67.1% were occupied by investment grade rated tenants5 and 14.9% were occupied by tenants with investment grade profiles6. The portfolio remained 100.0% occupied as of March 31, 2023.

INVESTMENT ACTIVITY

During the quarter ended March 31, 2023, the Company invested $128.6 million at a blended cash yield7 of 7.7%.

In the first quarter, the Company invested $67.7 million in the acquisition of 20 properties at a cash yield of 6.9%. Acquisitions completed during the quarter had a weighted-average remaining lease term of 9.4 years.

The Company entered into two mortgage loans receivable, totaling $46.1 million, at a weighted average cash yield of 9.3%. Both loans have three years of term, include yield maintenance provisions, and are secured by a first lien position on 49 properties leased by Speedway, a subsidiary of 7-Eleven.

The Company commenced rent on two development projects that had total costs of $14.8 million, and also provided $4.5 million of funding to support on-going development projects.

The Company completed eight dispositions for $15.9 million in total gross proceeds during the quarter, which equated to a 6.8% cash yield.

Investments made during the quarter were 78.4% investment grade and 16.6% investment grade profile, based on annualized base rent on investments. The quarter's transaction activity increased the total tenant count to 83 from 81 tenants and increased geographic diversity to 45 states from 44 at the end of 2022.

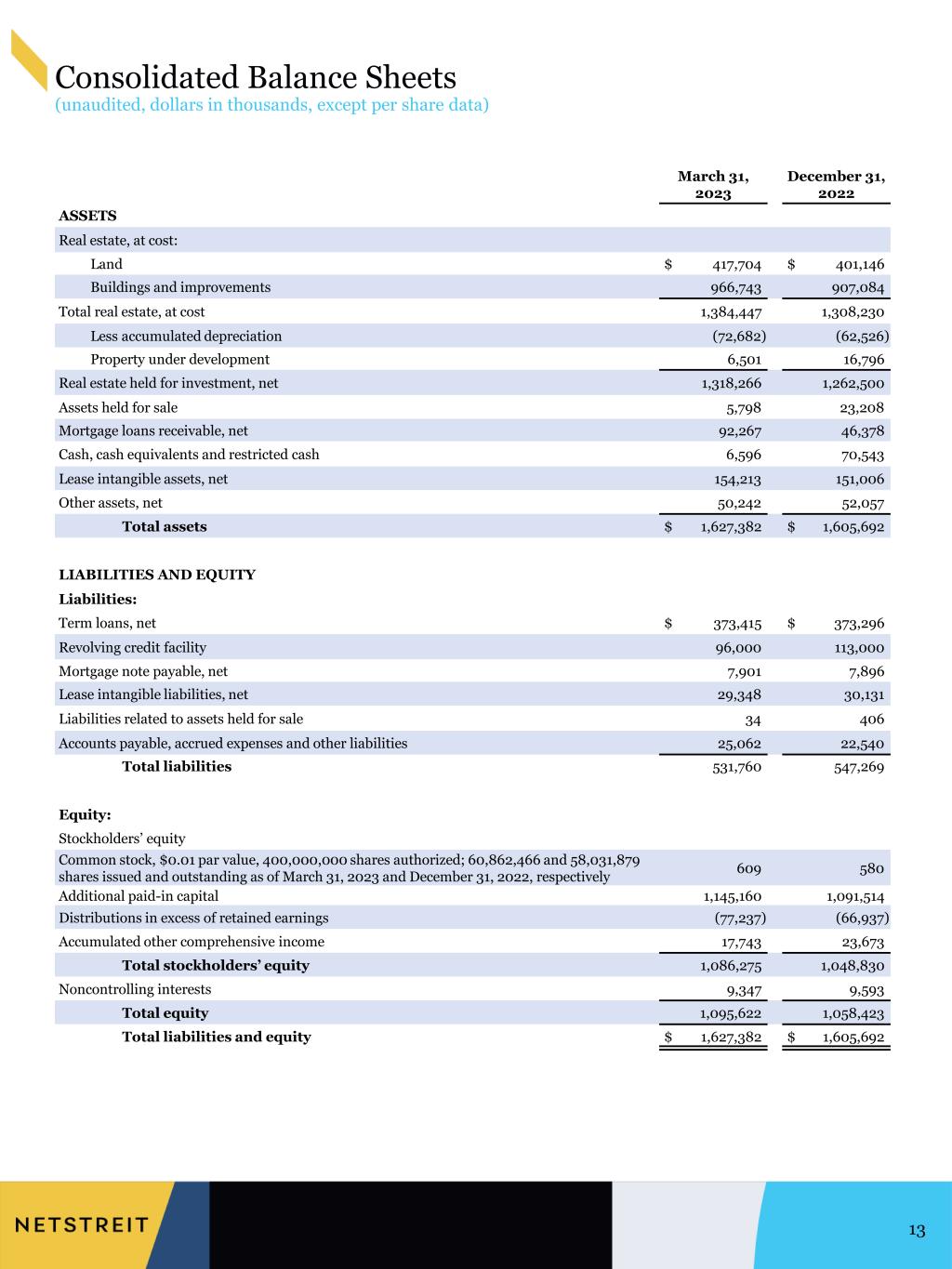

BALANCE SHEET AND LIQUIDITY

At quarter end, total debt outstanding was $479.5 million, with a weighted average term of 3.4 years and a quarter end contractual interest rate, including the impact of the fixed rate swap, of 3.4% (excluding the impact of deferred fee amortization). 80% of the Company’s debt was at a fixed rate and the Company’s net debt to annualized adjusted EBITDAre ratio was 5.1x. After giving consideration to the remaining shares in the forward sales agreement, the Company's net debt to annualized adjusted EBITDAre ratio was 4.1x. Additionally, the ending cash balance was $6.6 million, and the Company had $304.0 million available on its revolving line of credit. Including unsettled forward equity, total liquidity at quarter end was $401.8 million.

During the first quarter, the Company issued 146,745 shares of common stock at a weighted average price, net of transaction costs, of $19.96 per share in connection with the ATM program for net proceeds of approximately $2.9 million.

On March 30, 2023, the Company settled 2,612,736 shares of common stock, receiving net proceeds from the offering of $50.0 million. As of March 31, 2023, 4,763,320 shares remained unsettled under the August 2022 forward sale agreements. The Company will have until August 3, 2023 to settle the forward sale agreements.

DIVIDEND

On April 25, 2023, the Company’s Board of Directors declared a quarterly cash dividend of $0.20 per share for the second quarter of 2023, which will be paid on June 15, 2023 to shareholders of record on June 1, 2023.

2023 OUTLOOK

The Company is maintaining its full year 2023 AFFO per share guidance of $1.17 to $1.23 per share. The Company expects net investment activity, including acquisitions, developments where rent commenced, and mortgage loans receivable, net of dispositions, to be at least $400.0 million in 2023.

Certain of the forward-looking financial measures above are provided on a non-GAAP basis. The Company does not provide a reconciliation of such forward-looking measures to the most directly comparable financial measures calculated and presented in accordance with GAAP because to do so would be potentially misleading and not practical given the difficulty of projecting event driven transactional and other non-core operating items in any future period. The magnitude of these items, however, may be significant.

EARNINGS WEBCAST AND CONFERENCE CALL

A conference call will be held on Thursday, April 27, 2023 at 11:00 AM ET. During the conference call the Company’s officers will review first quarter performance, discuss recent events, and conduct a question and answer period.

The webcast will be accessible on the “Investor Relations” section of the Company’s website at www.NETSTREIT.com. To listen to the live webcast, please go to the site at least fifteen minutes prior to the scheduled start time to register, as well as download and install any necessary audio software. A replay of the webcast will be available for 90 days on the Company’s website shortly after the call.

The conference call can also be accessed by dialing 1-844-826-3035 for domestic callers or 1-412-317-5195 for international callers. A dial-in replay will be available starting shortly after the call until May 4, 2023, which can be accessed by dialing 1-844-512-2921 for domestic callers or 1-412-317-6671 for international callers. The passcode for this dial-in replay is 10177948.

SUPPLEMENTAL PACKAGE

The Company’s supplemental package will be available prior to the conference call in the Investor Relations section of the Company’s website at www.investors.netstreit.com.

About NETSTREIT

NETSTREIT is an internally managed real estate investment trust (REIT) based in Dallas, Texas that specializes in acquiring single-tenant net lease retail properties nationwide. The growing portfolio consists of high-quality properties leased to e-commerce resistant tenants with healthy balance sheets. Led by a management team of seasoned commercial real estate executives, NETSTREIT’s strategy is to create the highest quality net lease retail portfolio in the country with the goal of generating consistent cash flows and dividends for its investors.

Investor Relations

ir@netstreit.com

972-597-4825

(1) Non-GAAP financial measure. See "Non-GAAP Financial Measures".

(2) All per share amounts herein include weighted average common shares of 58,155,738, weighted average operating partnership units of 511,402, weighted average unvested restricted stock units of 175,859, and weighted average unsettled shares under open forward equity contracts of 40,387 for the three-months ended March 31, 2023.

(3) Annualized base rent, or ABR, is annualized contractual base rent in place as of the most recent quarter end for all leases that commenced as of that date, and annualized cash interest on mortgage loans receivable in place as of that date.

(4) Weighted by ABR, excluding lease extension options and investments associated with mortgage loans receivable.

(5) Investments, or investments that are subsidiaries of a parent entity, with a credit rating of BBB- (S&P/Fitch), Baa3 (Moody's) or NAIC2 (National Association of Insurance Commissioners) or higher.

(6) Unrated investments with more than $1.0 billion in annual sales and a debt to adjusted EBITDA ratio of less than 2.0x.

(7) Cash yield is the annualized base rent contractually due from acquired properties, completed developments, and interest income from mortgage loans receivable, divided by the gross investment amount, or gross proceeds in the case of dispositions.

NON-GAAP FINANCIAL MEASURES

This press release contains non-GAAP financial measures, including FFO, Core FFO, AFFO, EBITDA, EBITDAre, Adjusted EBITDAre, NOI, and Cash NOI. A reconciliation from net loss available to common shareholders to each non-GAAP financial measure, and definitions of each non-GAAP measure, are included below.

FORWARD LOOKING STATEMENTS

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include, without limitation, statements concerning our business and growth strategies, investment, financing and leasing activities, trends in our business, including trends in the market for single-tenant, retail commercial real estate, and macroeconomic conditions, including inflation, rising interest rates and instability in the banking system. Words such as “expects,” “anticipates,” “intends,” “plans,” “likely,” “will,” “believes,” “seeks,” “estimates,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from the results of operations or plans expressed or implied by such forward-looking statements. Although we believe that the assumptions underlying the forward-looking statements contained herein are reasonable, any of the assumptions could be inaccurate, and therefore such statements included in this press release may not prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us or any other person that the results or conditions described in such statements or our objectives and plans will be achieved. For a further discussion of these and other factors that could impact future results, performance or transactions, see the information under the heading “Risk Factors” in our Form 10-K for the year ended December 31, 2022 filed with the Securities and Exchange Commission (the “SEC”) on February 23, 2023 and other reports filed with the SEC from time to time. Forward-looking statements and such risks, uncertainties and other factors speak only as of the date of this press release. New risks and uncertainties may arise over time and it is not possible for us to predict those events or how they may affect us. Many of the risks identified herein and in our periodic reports have been and will continue to be heightened as a result of the ongoing and numerous adverse effects arising from rising interest rates and instability in macroeconomic conditions. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein, to reflect any change in our expectations with regard thereto, or any other change in events, conditions or circumstances on which any such statement is based, except to the extent otherwise required by law.

NETSTREIT CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2023 |

|

December 31, 2022 |

| Assets |

|

|

|

| Real estate, at cost: |

|

|

|

| Land |

$ |

417,704 |

|

|

$ |

401,146 |

|

| Buildings and improvements |

966,743 |

|

|

907,084 |

|

| Total real estate, at cost |

1,384,447 |

|

|

1,308,230 |

|

| Less accumulated depreciation |

(72,682) |

|

|

(62,526) |

|

| Property under development |

6,501 |

|

|

16,796 |

|

| Real estate held for investment, net |

1,318,266 |

|

|

1,262,500 |

|

| Assets held for sale |

5,798 |

|

|

23,208 |

|

| Mortgage loans receivable, net |

92,267 |

|

|

46,378 |

|

| Cash, cash equivalents and restricted cash |

6,596 |

|

|

70,543 |

|

| Lease intangible assets, net |

154,213 |

|

|

151,006 |

|

| Other assets, net |

50,242 |

|

|

52,057 |

|

| Total assets |

$ |

1,627,382 |

|

|

$ |

1,605,692 |

|

| Liabilities and equity |

|

|

|

| Liabilities: |

|

|

|

| Term loans, net |

$ |

373,415 |

|

|

$ |

373,296 |

|

| Revolving credit facility |

96,000 |

|

|

113,000 |

|

| Mortgage note payable, net |

7,901 |

|

|

7,896 |

|

| Lease intangible liabilities, net |

29,348 |

|

|

30,131 |

|

| Liabilities related to assets held for sale |

34 |

|

|

406 |

|

| Accounts payable, accrued expenses and other liabilities |

25,062 |

|

|

22,540 |

|

| Total liabilities |

531,760 |

|

|

547,269 |

|

| Commitments and contingencies |

|

|

|

| Equity: |

|

|

|

| Stockholders’ equity |

|

|

|

Common stock, $0.01 par value, 400,000,000 shares authorized; 60,862,466 and 58,031,879 shares issued and outstanding as of March 31, 2023 and December 31, 2022, respectively |

609 |

|

|

580 |

|

| Additional paid-in capital |

1,145,160 |

|

|

1,091,514 |

|

| Distributions in excess of retained earnings |

(77,237) |

|

|

(66,937) |

|

| Accumulated other comprehensive income |

17,743 |

|

|

23,673 |

|

| Total stockholders’ equity |

1,086,275 |

|

|

1,048,830 |

|

| Noncontrolling interests |

9,347 |

|

|

9,593 |

|

| Total equity |

1,095,622 |

|

|

1,058,423 |

|

| Total liabilities and equity |

$ |

1,627,382 |

|

|

$ |

1,605,692 |

|

NETSTREIT CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(In thousands, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

2023 |

|

2022 |

| Revenues |

|

|

|

| Rental revenue (including reimbursable) |

$ |

28,474 |

|

|

$ |

20,921 |

|

| Interest income on loans receivable |

978 |

|

|

411 |

|

| Total revenues |

29,452 |

|

|

21,332 |

|

| Operating expenses |

|

|

|

| Property |

3,936 |

|

|

2,932 |

|

| General and administrative |

4,909 |

|

|

4,190 |

|

| Depreciation and amortization |

14,949 |

|

|

10,980 |

|

| Transaction costs |

109 |

|

|

165 |

|

| Total operating expenses |

23,903 |

|

|

18,267 |

|

| Other income (expense) |

|

|

|

| Interest expense, net |

(3,944) |

|

|

(1,169) |

|

| Gain (loss) on sales of real estate, net |

(319) |

|

|

161 |

|

| Other income |

152 |

|

|

— |

|

| Total other expense, net |

(4,111) |

|

|

(1,008) |

|

| Net income before income taxes |

1,438 |

|

|

2,057 |

|

| Income tax benefit (expense) |

43 |

|

|

(91) |

|

| Net income |

1,481 |

|

|

1,966 |

|

| Net income attributable to noncontrolling interests |

9 |

|

|

24 |

|

| Net income attributable to common stockholders |

$ |

1,472 |

|

|

$ |

1,942 |

|

| Amounts available to common stockholders per common share: |

|

|

|

| Basic |

$ |

0.03 |

|

|

$ |

0.04 |

|

| Diluted |

$ |

0.03 |

|

|

$ |

0.04 |

|

| Weighted average common shares: |

|

|

|

| Basic |

58,155,738 |

|

|

44,415,807 |

|

| Diluted |

58,883,386 |

|

|

45,600,810 |

|

| Other comprehensive income: |

|

|

|

| Net income |

$ |

1,481 |

|

|

$ |

1,966 |

|

| Change in value on derivatives, net |

(5,979) |

|

|

6,211 |

|

| Total comprehensive income (loss) |

(4,498) |

|

|

8,177 |

|

| Comprehensive income (loss) attributable to noncontrolling interests |

(40) |

|

|

100 |

|

| Comprehensive income (loss) attributable to common stockholders |

$ |

(4,458) |

|

|

$ |

8,077 |

|

NETSTREIT CORP. AND SUBSIDIARIES

RECONCILIATION OF NET INCOME TO FFO, CORE FFO AND ADJUSTED FFO

(In thousands, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

2023 |

|

2022 |

|

(Unaudited) |

| Net income |

$ |

1,481 |

|

|

$ |

1,966 |

|

| Depreciation and amortization of real estate |

14,884 |

|

|

10,862 |

|

| Loss (gain) on sales of real estate, net |

319 |

|

|

(161) |

|

| FFO |

16,684 |

|

|

12,667 |

|

| Adjustments: |

|

|

|

| Non-recurring severance and related charges |

13 |

|

|

— |

|

| Other non-recurring expenses (income) |

(12) |

|

|

— |

|

| Core FFO |

16,685 |

|

|

12,667 |

|

| Adjustments: |

|

|

|

| Straight-line rent adjustments |

(311) |

|

|

(526) |

|

| Amortization of deferred financing costs |

308 |

|

|

157 |

|

| Amortization of above/below-market assumed debt |

29 |

|

|

— |

|

| Amortization of loan origination costs |

28 |

|

|

13 |

|

| Amortization of lease-related intangibles |

(213) |

|

|

(165) |

|

| Capitalized interest expense |

(134) |

|

|

(56) |

|

| Non-cash compensation expense |

1,027 |

|

|

1,045 |

|

| AFFO |

$ |

17,419 |

|

|

$ |

13,135 |

|

|

|

|

|

| Weighted average common shares outstanding, basic |

58,155,738 |

|

|

44,415,807 |

|

| Operating partnership units outstanding |

511,402 |

|

|

550,673 |

|

| Unvested restricted stock units |

175,859 |

|

|

294,272 |

|

| Unsettled shares under open forward equity contracts |

40,387 |

|

|

340,058 |

|

| Weighted average common shares outstanding, diluted |

58,883,386 |

|

|

45,600,810 |

|

|

|

|

|

| FFO per common share, diluted |

$ |

0.28 |

|

|

$ |

0.28 |

|

| Core FFO per common share, diluted |

$ |

0.28 |

|

|

$ |

0.28 |

|

| AFFO per common share, diluted |

$ |

0.30 |

|

|

$ |

0.29 |

|

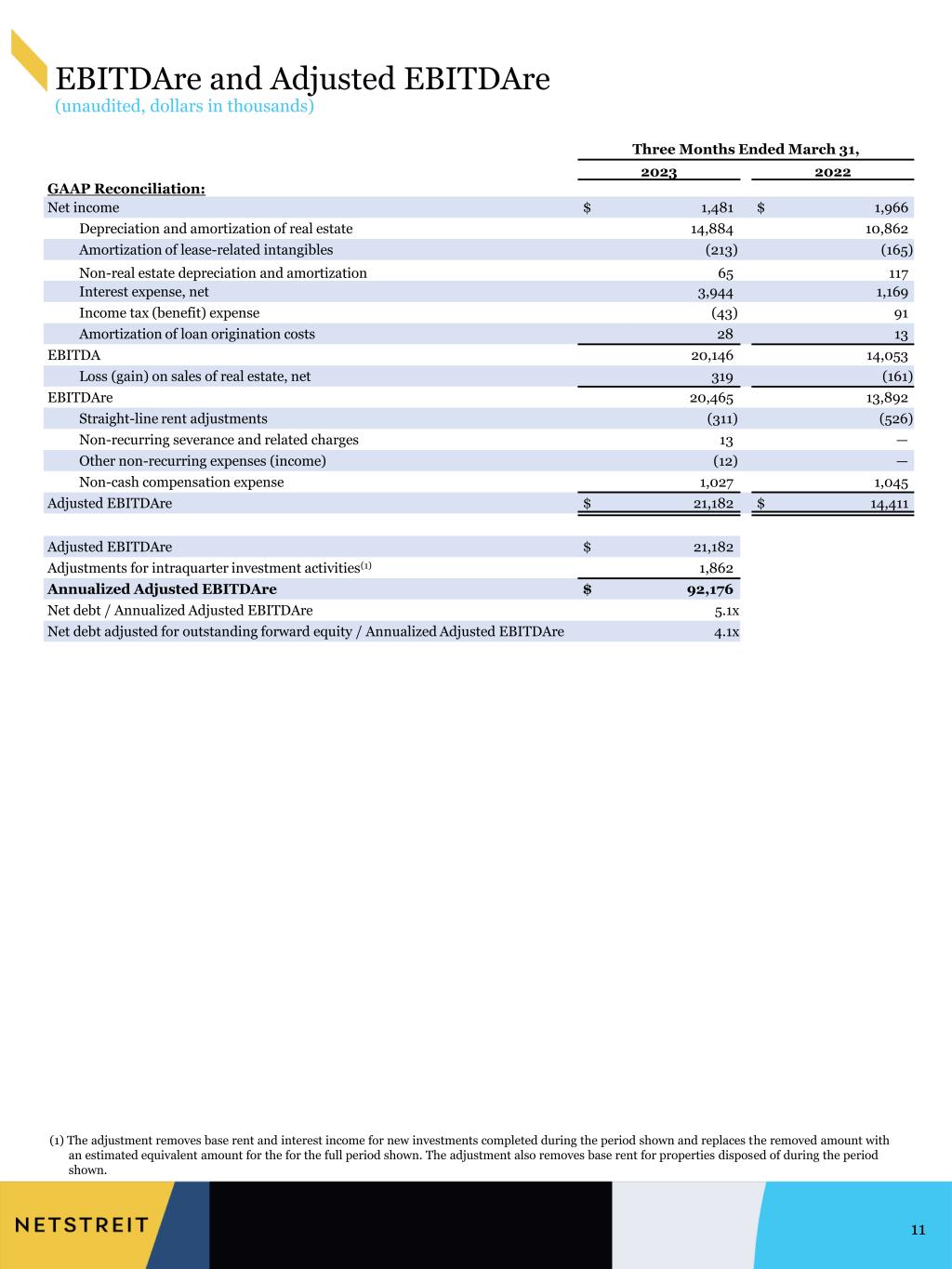

RECONCILIATION OF NET INCOME TO EBITDA, EBITDAre AND ADJUSTED EBITDAre

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

2023 |

|

2022 |

|

(Unaudited) |

| Net income |

$ |

1,481 |

|

|

$ |

1,966 |

|

| Depreciation and amortization of real estate |

14,884 |

|

|

10,862 |

|

| Amortization of lease-related intangibles |

(213) |

|

|

(165) |

|

| Non-real estate depreciation and amortization |

65 |

|

|

117 |

|

| Interest expense, net |

3,944 |

|

|

1,169 |

|

| Income tax (benefit) expense |

(43) |

|

|

91 |

|

| Amortization of loan origination costs |

28 |

|

|

13 |

|

| EBITDA |

20,146 |

|

|

14,053 |

|

| Adjustments: |

|

|

|

| Loss (gain) on sales of real estate, net |

319 |

|

|

(161) |

|

EBITDAre |

20,465 |

|

|

13,892 |

|

| Adjustments: |

|

|

|

| Straight-line rent adjustments |

(311) |

|

|

(526) |

|

| Non-recurring severance and related charges |

13 |

|

|

— |

|

| Other non-recurring expenses (income) |

(12) |

|

|

— |

|

| Non-cash compensation expense |

1,027 |

|

|

1,045 |

|

Adjusted EBITDAre |

$ |

21,182 |

|

|

$ |

14,411 |

|

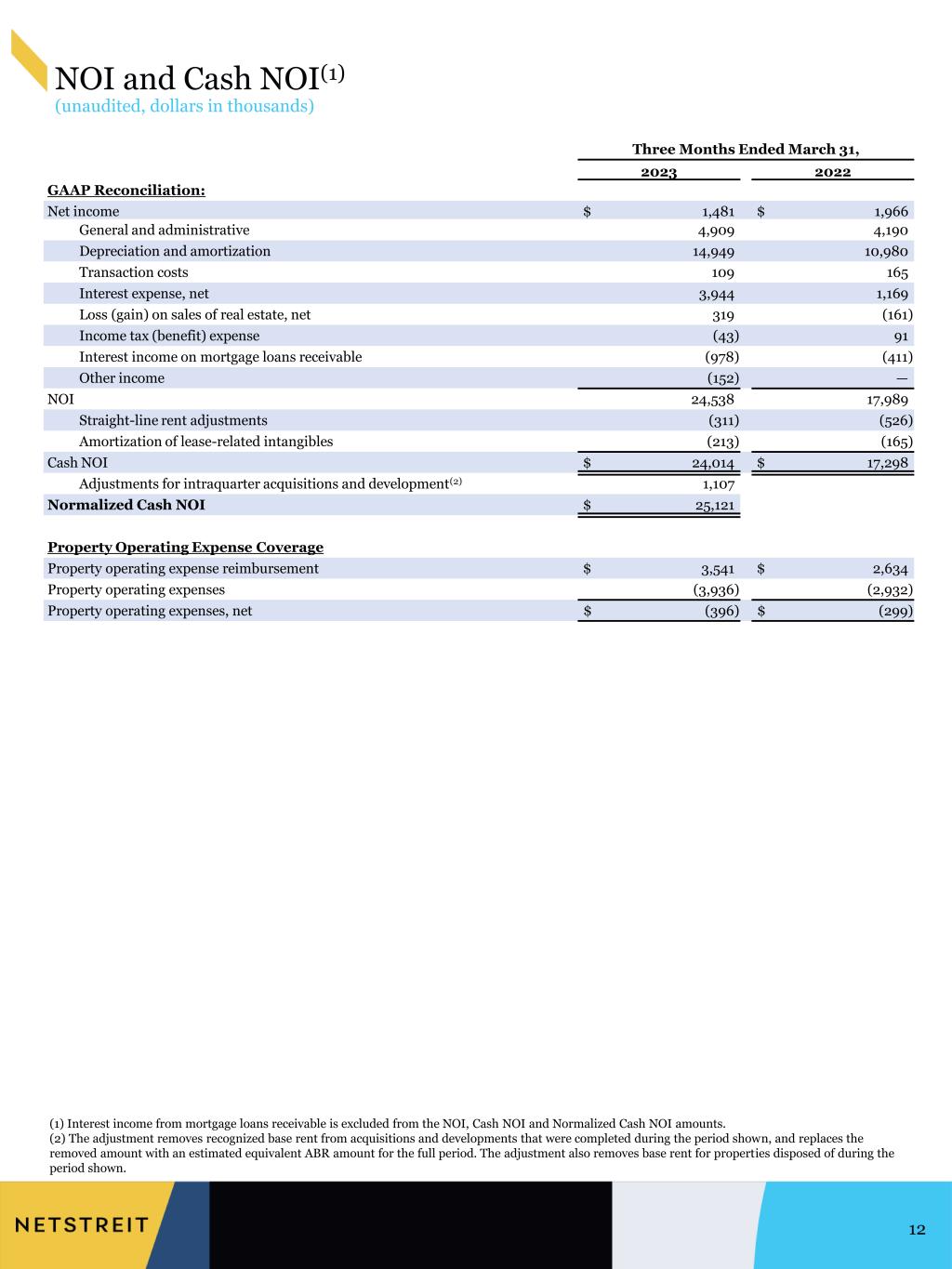

RECONCILIATION OF NET INCOME TO NOI AND CASH NOI

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

2023 |

|

2022 |

|

(Unaudited) |

| Net income |

$ |

1,481 |

|

|

$ |

1,966 |

|

| General and administrative |

4,909 |

|

|

4,190 |

|

| Depreciation and amortization |

14,949 |

|

|

10,980 |

|

| Transaction costs |

109 |

|

|

165 |

|

| Interest expense, net |

3,944 |

|

|

1,169 |

|

| Loss (gain) on sales of real estate, net |

319 |

|

|

(161) |

|

| Income tax (benefit) expense |

(43) |

|

|

91 |

|

| Interest income on mortgage loans receivable |

(978) |

|

|

(411) |

|

| Other income |

(152) |

|

|

— |

|

| NOI |

24,538 |

|

|

17,989 |

|

| Straight-line rent adjustments |

(311) |

|

|

(526) |

|

| Amortization of lease-related intangibles |

(213) |

|

|

(165) |

|

| Cash NOI |

$ |

24,014 |

|

|

$ |

17,298 |

|

NON-GAAP FINANCIAL MEASURES

FFO, Core FFO and AFFO

The National Association of Real Estate Investment Trusts ("NAREIT"), an industry trade group, has promulgated a widely accepted non-GAAP financial measure of operating performance known as FFO. Our FFO is net income in accordance with GAAP, excluding gains (or losses) resulting from dispositions of properties, plus depreciation and amortization and impairment charges on depreciable real property.

Core FFO is a non-GAAP financial measure defined as FFO adjusted to remove the effect of unusual and non-recurring items that are not expected to impact our operating performance or operations on an ongoing basis. These have included non-recurring severance and related charges and gains on insurance proceeds.

AFFO is a non-GAAP financial measure defined as Core FFO adjusted for GAAP net income related to non-cash revenues and expenses, such as straight-line rent, amortization of lease-related intangibles, capitalized interest expense, non-cash compensation expense, amortization of deferred financing costs, amortization of above/below-market assumed debt, and amortization of loan origination costs.

Historical cost accounting for real estate assets implicitly assumes that the value of real estate assets diminishes predictably over time. In fact, real estate values historically have risen or fallen with market conditions. FFO is intended to be a standard supplemental measure of operating performance that excludes historical cost depreciation and valuation adjustments from net income. We consider FFO to be useful in evaluating potential property acquisitions and measuring operating performance.

We further consider FFO, Core FFO and AFFO to be useful in determining funds available for payment of distributions. FFO, Core FFO and AFFO do not represent net income or cash flows from operations as defined by GAAP. You should not consider FFO, Core FFO and AFFO to be alternatives to net income as a reliable measure of our operating performance nor should you consider FFO, Core FFO and AFFO to be alternatives to cash flows from operating, investing or financing activities (as defined by GAAP) as measures of liquidity.

FFO, Core FFO and AFFO do not measure whether cash flow is sufficient to fund our cash needs, including principal amortization, capital improvements and distributions to stockholders. FFO, Core FFO and AFFO do not represent cash flows from operating, investing or financing activities as defined by GAAP. Further, FFO, Core FFO and AFFO as disclosed by other REITs might not be comparable to our calculations of FFO, Core FFO and AFFO.

EBITDA, EBITDAre and Adjusted EBITDAre

We compute EBITDA as earnings before interest expense, income tax expense, and depreciation and amortization. In 2017, NAREIT issued a white paper recommending that companies that report EBITDA also report EBITDAre. We compute EBITDAre in accordance with the definition adopted by NAREIT. NAREIT defines EBITDAre as EBITDA (as defined above) excluding gains (or losses) from the sales of depreciable property and impairment charges on depreciable real property.

Adjusted EBITDAre is a non-GAAP financial measure defined as EBITDAre further adjusted to exclude straight-line rent, non-cash compensation expense, non-recurring severance and related charges, and gain on insurance proceeds.

We present EBITDA, EBITDAre and Adjusted EBITDAre as they are measures commonly used in our industry. We believe that these measures are useful to investors and analysts because they provide supplemental information concerning our operating performance, exclusive of certain non-cash items and other costs. We use EBITDA, EBITDAre and Adjusted EBITDAre as measures of our operating performance and not as measures of liquidity.

EBITDA, EBITDAre and Adjusted EBITDAre do not include all items of revenue and expense included in net income, they do not represent cash generated from operating activities and they are not necessarily indicative of cash available to fund cash requirements; accordingly, they should not be considered alternatives to net income as a performance measure or cash flows from operations as a liquidity measure and should be considered in addition to, and not in lieu of, GAAP financial measures. Additionally, our computation of EBITDA, EBITDAre and Adjusted EBITDAre may differ from the methodology for calculating these metrics used by other equity REITs and, therefore, may not be comparable to similarly titled measures reported by other equity REITs.

NOI and Cash NOI

NOI and Cash NOI are non-GAAP financial measures which we use to assess our operating results. We compute NOI as net income (computed in accordance with GAAP), excluding general and administrative expenses, interest expense (or income), income tax expense, depreciation and amortization, gains (or losses) from the sales of depreciable property, impairment charges on depreciable real property, transaction costs, interest income on mortgage loans receivable, and other income (or expense). We further adjust NOI for non-cash components of straight-line rent and amortization of lease-related intangibles to derive Cash NOI. We believe NOI and Cash NOI provide useful and relevant information because they reflect only those income and expense items that are incurred at the property level and present such items on an unlevered basis.

NOI and Cash NOI are not measurements of financial performance under GAAP, and our NOI and Cash NOI may not be comparable to similarly titled measures of other companies. You should not consider our NOI and Cash NOI as alternatives to net income or cash flows from operating activities determined in accordance with GAAP.