UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 31, 2025

VIVANI MEDICAL, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-36747 | 02-0692322 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

1350 S. Loop Road Alameda, California |

94502 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (415) 506-8462

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.0001 | VANI | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On March 31, 2025, Vivani Medical, Inc. (the “Company”) issued a press release entitled “Vivani Medical Provides Business Update and Reports Fourth Quarter and Full Year 2024 Financial Results”, which is attached to this Current Report as Exhibit 99.1.

The information contained in this Item 2.02 and Exhibit 99.1 hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as shall be expressly set forth by reference in such a filing.

Item 7.01. Regulation FD Disclosure

The Company from time to time presents and/or distributes to the investment community at various industry and other conferences slide presentations to provide updates and summaries of its business. These slides are attached to this Current Report on Form 8-K as Exhibit 99.2 and are incorporated by reference herein. The Company is also posting to the “Investors” portion of its website a copy of its current corporate slide presentation. The slides speak as of the date of this Current Report on Form 8-K. While the Company may elect to update the slides in the future or reflect events and circumstances occurring or existing after the date of this Current Report on Form 8-K, the Company specifically disclaims any obligation to do so.

The information contained in this Item 7.01 and Exhibit 99.2 hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, whether made before or after the date hereof, or the Exchange Act, except as shall be expressly set forth by reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. | Description | |

| 99.1 | Press Release dated March 31, 2025 entitled “Vivani Medical Provides Business Update and Reports Fourth Quarter and Full Year 2024 Financial Results”. | |

| 99.2 | Corporate Slides, as of March 31, 2025. | |

| 104 | The cover page of this Current Report on Form 8-K, formatted in Inline XBRL. | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| VIVANI MEDICAL, INC. | ||

| Date: March 31, 2025 | By: | /s/ Brigid A. Makes |

| Brigid A. Makes | ||

| Chief Financial Officer | ||

Exhibit 99.1

Vivani Medical Provides Business Update and

Reports Fourth Quarter and Full Year 2024 Financial Results

Successful initial administration and full enrollment in first-in-human LIBERATE-1 ™ study of NPM-115

(exenatide implant) in obese and overweight subjects with top-line data expected in mid-2025

Positive NPM-139 (semaglutide implant) preclinical weight loss data comparable to

injections of semaglutide, active ingredient in Ozempic®/Wegovy®, with potential for once-yearly dosing

Additional $8.25M equity financing which secures solid financial position into the second quarter of 2026,

supporting further development of NPM-139 and NPM-115 programs in chronic weight management

Alameda, CA -- (GLOBE NEWSWIRE) -- March 31, 2025 – Vivani Medical, Inc. (Nasdaq: VANI) (“Vivani” or the “Company”), a biopharmaceutical company developing miniaturized, ultra long-acting drug implants including its lead assets NPM-115 (exenatide implant) and NPM-139 (semaglutide implant) for chronic weight management in obese or overweight patients with one or more risk factors, today reported financial results for the fourth quarter and full year ended December 31, 2024, and provided a business update.

“During 2024, we transitioned Vivani to a clinical-stage biotechnology company and achieved significant milestones in both our NPM-115 and NPM-139 programs, both focused on transforming the treatment of chronic weight management targeting once or twice-yearly dosing,” said Adam Mendelsohn, Ph.D., Vivani’s Chief Executive Officer, “Our first-in-human LIBERATE-1 study continues to progress as planned with each implantation to date having been successful and we remain on track for top-line data in mid-2025. By providing key performance data on drug release, the value of LIBERATE-1 extends beyond the NPM-115 program by also informing the NPM-139 program as it advances in parallel.”

Dr. Mendelsohn added, “In March, we raised funding to support operations into the second quarter of 2026. Additionally, we continue to equip our dedicated facility in Alameda, California, to support the manufacturing of large-scale clinical trial materials and, ultimately, commercial supply.”

In response to the recent positive preclinical weight loss data with NPM-139, Vivani is now planning to advance NPM-139 towards clinical phase development in addition to the ongoing NPM-115 program.

Recent Business Highlights

On March 27, 2025, Vivani announced an $8.25 million equity financing which secures solid financial position into the second quarter of 2026 and enables acceleration of priority development programs, including NPM-115 and NPM-139 for the treatment of obesity and chronic weight management.

On March 26, 2025, Vivani announced promising preclinical data for NPM-139, its subdermal semaglutide implant that is under development for chronic weight management in obese and overweight individuals. These results reinforce Vivani’s commitment to addressing chronic weight management and other chronic diseases by leveraging its proprietary NanoPortal™ implant technology which is designed to enable smooth and steady delivery of therapeutic molecules including GLP-1 therapy. This development marks a significant advancement in improving medication adherence and patient convenience, addressing a critical gap in the treatment of chronic diseases including obesity and type 2 diabetes.

On March 13, 2025, Vivani also announced the successful administration of its first GLP-1 (exenatide) implant in the LIBERATE-1 clinical trial. This milestone marks a critical step toward addressing one of healthcare’s most pressing challenges: medication adherence in metabolic diseases involving chronic weight management and type 2 diabetes. The Company also announced full enrollment in the LIBERATE-1 study, which was achieved in just four weeks after enrollment of the first subject, signaling early potential interest for this six-month, subdermal GLP-1 implant and reaffirming previous estimates that top-line results should be available in mid-2025.

On March 12, 2025, the Company announced that it intends to spin off Cortigent, Inc. (“Cortigent”), a Delaware corporation and its wholly owned subsidiary, that develops brain implant devices to help people recover critical body functions, as an independent publicly traded company. The strategic goal of this transaction is to create two focused companies dedicated to driving current and future value in their respective therapeutic areas of expertise.

Moving forward, Vivani will focus on developing NPM-115, NPM-139 and its emerging pipeline of innovative miniature, ultra long-acting drug implants to treat patients with chronic diseases and high unmet medical need. The recent preclinical demonstration of NPM-139 comes on the heels of having rapidly enrolled and successfully administered the initial implants in LIBERATE-1, a first-in-human study with NPM-115, which is expected to pave the road for NPM-139 as development continues for both programs. Today, the Biopharm Division has grown to 35 full-time employees and its headquarters and operations are located at 1350 S. Loop Road, Alameda, California 94502.

Upcoming Anticipated Milestones

| ● | Vivani anticipates the announcement of key milestones associated with the ongoing first-in-human LIBERATE-1 trial, including last subject implanted, and top-line results in mid-2025. |

| ● | Further announcements regarding the advancement of the NPM-139 program including projected timelines for filing an Investigational New Drug Application and pending regulatory clearance, initiation of an initial clinical trial. |

| ● | Vivani previously announced the submission of a Form S-1 registration statement to support an Initial Public Offering of Cortigent. This strategy has been revised to file a Form 10 registration statement with the U.S. Securities and Exchange Commission (“SEC”) to enable the spin-off of Cortigent into a fully independent, publicly traded company subject to listing and regulatory requirements. Assuming successful financing is secured, Cortigent plans to continue advancing its pioneering precision neurostimulation technology intended to provide meaningful visual perception to blind individuals and to accelerate the recovery of arm and hand movement in patients suffering from paralysis due to stroke. |

Fourth Quarter 2024 Financial Results

Note: Vivani (or the “Company”) refers to the consolidated company including the Biopharm Division and Cortigent. The Biopharm Division refers to the drug implant business, the main focus of the consolidated company.

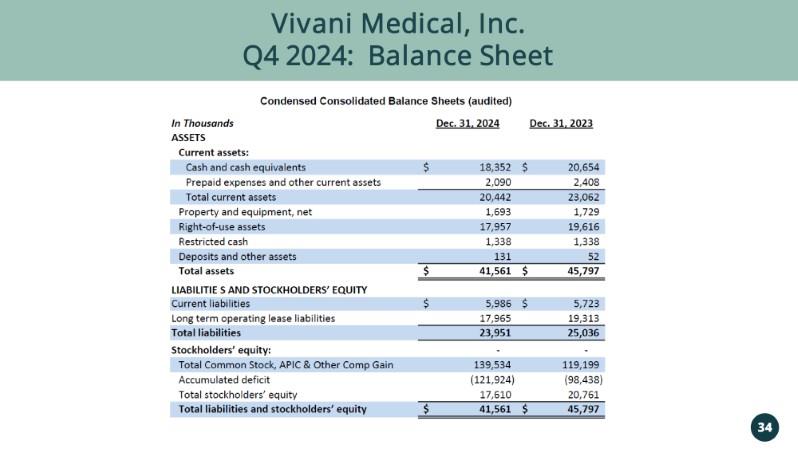

Cash Balance: As of December 31, 2024, Vivani had cash, cash equivalents and restricted cash totaling $19.7 million, compared to $22.0 million as of December 31, 2023. The decrease of $2.3 million is primarily attributed to a net loss of $23.5 million, and $0.6 million related to purchase of equipment, which was mostly offset by net proceeds of $19.1 million provided by the financing activities, non-cash items totaling $2.3 million which includes stock-based compensation, depreciation and amortization of property and equipment, and lease expense.

Research and development expenses: Research and development expenses during the fourth quarter of 2024 were $4.3 million, compared to $4.7 million during the fourth quarter of 2023. The decrease of $0.4 million, or 9%, was primarily attributable to staffing reduction and reduced use of outside services.

General and administrative expenses: General and administrative expenses during the fourth quarter of 2024 were $2.1 million, compared to $1.5 million during the fourth quarter of 2023. The increase of $0.6 million, or 43%, was primarily attributable to increased professional services and stock-based compensation expense from the Biopharm Division.

Other income (expense): Other income (expense), net during the fourth quarter of 2024 was $0.4 million, compared to $0.2 million during the fourth quarter of 2023. The increase of $0.2 million, or 124%, was primarily attributed to the tax credit earned on our Australian clinical trial investment.

Net Loss: The net loss during the fourth quarter of 2024 was $6.1 million, compared to $6.0 million during the fourth quarter of 2023. The change was insignificant.

Full Year 2024 Financial Results

Research and development expenses: Research and development expenses during the year ended December 31, 2024 was $15.7 million, compared to $17.0 million during the year ended December 31, 2023. The decrease of $1.2 million, or 7%, was primarily attributable to staffing reduction and reduced use of outside services from Cortigent, partially offset by the increase in our Biopharm Division's clinical trial related expenses.

General and administrative expenses: General and administrative expenses during the year ended December 31, 2024 was $8.9 million, compared to $10.0 million during the year ended December 31, 2023. The decrease of $1.1 million, or 11%, was primarily attributable to staffing reductions along with reduced outside legal services from Cortigent, partially offset by the increase in the professional services of our Biopharm Division.

Other income (expense), net: Other income (expense), net during the year ended December 31, 2024 was $1.2 million, compared to $1.3 million during the year ended December 31, 2023. The change was insignificant.

Net Loss: The net loss during the year ended December 31, 2024 was $23.5 million, compared to $25.7 million during the year ended December 31, 2023. The decrease in net loss of $2.2 million, or approximately 8%, was primarily attributable to staffing reduction and reduced use of outside services from Cortigent, partially offset by increased clinical trial related expenses and professional services from our Biopharm Division.

About Vivani Medical, Inc.

Leveraging its proprietary NanoPortal™ platform, Vivani develops therapeutic implants designed to deliver drug molecules steadily over extended periods of time with the goal of guaranteeing adherence, and potentially to improve patient tolerance to their medication. Vivani’s lead programs, NPM-139 (semaglutide implant) and NPM-115 (exenatide implant), are miniature, subdermal GLP-1 implants under development for chronic weight management in obese or overweight individuals designed for once or twice-yearly administration. Vivani’s emerging pipeline also includes NPM-119, which refers to the Company’s six-month, subdermal, GLP-1 (exenatide implant) under development for the treatment of type 2 diabetes. Development of a semaglutide implant for the treatment of type 2 diabetes is also under consideration. These NanoPortal™ implants are designed to provide patients with the opportunity to experience the full potential benefit of their medication by avoiding the challenges associated with the daily or weekly administration of oral and injectable medications.

Medication non-adherence occurs when patients do not take their medication as prescribed. This affects an alarming number of patients, approximately 50%, including those taking daily pills. Medication non-adherence, which contributes to more than $500 billion in annual avoidable healthcare costs and 125,000 potentially preventable deaths annually in the U.S. alone, is a primary and daunting reason why obese or overweight patients, and patients taking type 2 diabetes or other chronic disease treatments, face significant challenges in achieving positive real-world effectiveness. While the current GLP-1 landscape includes over 50 new molecular entities under clinical stage development, Vivani remains confident that its highly differentiated portfolio of miniature, ultra long-acting GLP-1 implants have the potential to provide an attractive therapeutic option for patients, prescribers and payers. For more information, please visit: www.vivani.com.

About Cortigent

Cortigent, formerly Second Sight Medical Products, Inc. and a wholly owned subsidiary of Vivani, is developing brain implant devices to help people recover critical body functions. Cortigent is a global leader in precision neurostimulation technology that provides meaningful visual perception (“artificial vision”) for blind people. Cortigent previously marketed the Argus II, the first and only artificial vision device approved by the U.S. Food and Drug Administration (“FDA”), to treat a rare form of blindness. The Argus II has helped hundreds of profoundly blind people to achieve meaningful visual perception. Cortigent’s next generation investigational system, the Orion, has been designed to treat blindness due to glaucoma, diabetic retinopathy, and other common causes. Orion has an FDA Breakthrough Device designation and in 2024, completed a 6-year Early Feasibility Study with encouraging safety and efficacy results. Cortigent’s platform technology combines advanced neuroscience with proprietary microelectronics, software, and data processing capabilities to create medical devices for alleviating serious medical conditions that cannot be treated with drugs. It is protected by an extensive intellectual property estate. Cortigent is also applying its core precision neurostimulation technology to the recovery of arm and hand motion in paralysis due to stroke. For more information and patient videos, please visit: www.cortigent.com.

Forward-Looking Statements

This press release contains certain “forward-looking statements” within the meaning of the “safe harbor” provisions of the US Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “target,” “believe,” “expect,” “will,” “may,” “anticipate,” “estimate,” “would,” “positioned,” “future,” and other similar expressions that in this press release, including statements regarding Vivani’s business, products in development, including the therapeutic potential thereof, the planned development therefor, the completion of the LIBERATE-1™ trial and reporting of trial results, Vivani’s emerging development plans for NPM-115, NPM-139, NPM-119, or Vivani’s plans with respect to its wholly owned subsidiary Cortigent, and Vivani’s technology, strategy, cash position and financial runway. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on Vivani’s current beliefs, expectations, and assumptions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of Vivani’s control. Actual results and outcomes may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause actual results and outcomes to differ materially from those indicated in the forward-looking statements include, among others, risks related to the development and commercialization of Vivani’s products, including NPM-115, NPM-139, and NPM-119; delays and changes in the development of Vivani’s products, including as a result of applicable laws, regulations and guidelines, potential delays in submitting and receiving regulatory clearance or approval to conduct Vivani’s development activities; risks related to the initiation, enrollment and conduct of Vivani’s planned clinical trials and the results therefrom; Vivani’s history of losses and Vivani’s ability to access additional capital or otherwise fund Vivani’s business; market conditions and the ability of Cortigent to complete its intended spin-off from the Company. There may be additional risks that the Company considers immaterial, or which are unknown. A further list and description of risks and uncertainties can be found in the Company’s most recent Annual Report on Form 10-K filed with the SEC filed on March 31, 2025, as updated by the Company’s subsequent Quarterly Reports on Form 10-Q. Any forward-looking statement made by Vivani in this press release is based only on information currently available to the Company and speaks only as of the date on which it is made. The Company undertakes no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of added information, future developments or otherwise, except as required by law.

Company Contacts:

Company Contact:

Donald Dwyer

Chief Business Officer

info@vivani.com

(415) 506-8462

Investor Relations

Contact:

Jami Taylor

Investor Relations Advisor

investors@vivani.com

(415) 506-8462

Media Contact:

Sean Leous

ICR Healthcare

Sean.Leous@ICRHealthcare.com

(646) 866-4012

VIVANI MEDICAL, INC.

AND SUBSIDIARIES

Condensed Consolidated Balance Sheets (audited)

(in thousands, except per share data)

| December 31, | ||||||||

| 2024 | 2023 | |||||||

| ASSETS | ||||||||

| CURRENT ASSETS: | ||||||||

| Cash and cash equivalents | $ | 18,352 | $ | 20,654 | ||||

| R&D tax incentive receivable |

253 | — | ||||||

| Prepaid expenses and other current assets | 1,837 | 2,408 | ||||||

| Total current assets | 20,442 | 23,062 | ||||||

| Property and equipment, net | 1,693 | 1,729 | ||||||

| Operating lease right-of-use assets, net | 17,957 | 19,616 | ||||||

| Restricted cash | 1,338 | 1,338 | ||||||

| Deposits and other assets | 131 | 52 | ||||||

| TOTAL ASSETS | $ | 41,561 | $ | 45,797 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| CURRENT LIABILITIES: | ||||||||

| Accounts payable | $ | 817 | $ | 542 | ||||

| Accrued expenses | 1,803 | 1,727 | ||||||

| Litigation accrual | 1,675 | 1,675 | ||||||

| Accrued compensation expense | 343 | 396 | ||||||

| Lease liability, current portion | 1,348 | 1,383 | ||||||

| Total current liabilities | 5,986 | 5,723 | ||||||

| Lease liability, noncurrent portion | 17,965 | 19,313 | ||||||

| TOTAL LIABILITIES | 23,951 | 25,036 | ||||||

| STOCKHOLDERS' EQUITY: | ||||||||

| Preferred stock, par value $0.0001 per share; 10,000 shares authorized; none outstanding | — | — | ||||||

| Common stock, par value $0.0001 per share; 300,000 shares authorized; shares issued and outstanding: 59,235 and 51,031 as of December 31, 2024 and 2023, respectively |

6 | 5 | ||||||

| Additional paid-in capital | 139,480 | 119,054 | ||||||

| Accumulated other comprehensive gain | 48 | 140 | ||||||

| Accumulated deficit | (121,924 | ) | (98,438 | ) | ||||

| TOTAL STOCKHOLDERS' EQUITY | 17,610 | 20,761 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 41,561 | $ | 45,797 | ||||

VIVANI MEDICAL, INC.

AND SUBSIDIARIES

Condensed Consolidated Statements of Operations (audited)

(in thousands, except per share data)

| Three Months Ended December 31, | Twelve Months Ended December 31, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Operating expenses: | ||||||||||||||||

| Research and development, net of grants |

$ | 4,297 | $ | 4,708 | $ | 15,745 | $ | 16,968 | ||||||||

| General and administrative, net of grants | 2,163 | 1,509 | 8,932 | 9,997 | ||||||||||||

| Total operating expenses | 6,460 | 6,217 | 24,677 | 26,965 | ||||||||||||

| Loss from operations |

(6,460 | ) | (6,217 | ) | (24,677 | ) | (26,965 | ) | ||||||||

| Other income (expense), net | 410 | 191 | 1,191 | 1,313 | ||||||||||||

| Net loss | $ | (6,050 | ) | $ | (6,026 | ) | $ | (23,486 | ) | $ | (25,652 | ) | ||||

| Net loss per common share - basic and diluted |

$ | (0.11 | ) | $ | (0.12 | ) | $ | (0.43 | ) | $ | (0.50 | ) | ||||

| Weighted average shares outstanding - basic and diluted | 57,423 | 51,025 | 54,981 | 50,853 | ||||||||||||

Exhibit 99.2

Nasdaq: VANI www.vivani.com March 2025

Disclaimers The following slides and any accompanying oral presentation contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the "safe harbor" created by those sections. All statements in this release that are not based on historical fact are "forward looking statements." These statements may be identified by words such as "estimates," "anticipates," "projects," "plans" or "planned," "strategy," “goal," "seeks," "may," "will," "expects," "intends," "believes," "should," and similar expressions, or the negative versions thereof, and which also may be identified by their context. All statements that address operating performance or events or developments that Vivani Medical, Inc. ("Vivani", the "Company", "we" or "us) expects or anticipates will occur in the future, such as stated objectives or goals, our products and their therapeutic potential and planned development, the indications that we intend to target, our technology, our business and strategy, milestones, addressable markets, or that are not otherwise historical facts, are forward-looking statements. While management has based any forward-looking statements included in this presentation on its current expectations, the information on which such expectations were based may change. Forward-looking statements involve inherent risks and uncertainties which could cause actual results to differ materially from those in the forward-looking statements as a result of various factors. These risks and uncertainties include, but are not limited to, that we may fail to commence our planned future clinical trials for products under development; conduct any pre-clinical activities of our other products; our products may not demonstrate safety or efficacy in clinical trials; we may fail to secure marketing approvals for our products; there may be delays in regulatory approval or changes in regulatory framework that are out of our control; our estimation of addressable markets of our products may be inaccurate; we may fail to timely raise additional required funding; more efficient competitors or more effective competing treatment may emerge; we may be involved in disputes surrounding the use of our intellectual property crucial to our success; we may not be able to attract and retain key employees and qualified personnel; earlier study results may not be predictive of later stage study outcomes; and we are dependent on third-parties for some or all aspects of our product manufacturing, research and preclinical and clinical testing. Additional risks and uncertainties are described in our Annual Report on Form 10-K filed on March 31, 2025, and our subsequent filings with the SEC. We urge you to consider those risks and uncertainties in evaluating our forward-looking statements. We caution readers not to place undue reliance upon any such forwardlooking statements, which speak only as of the date made. Except as otherwise required by the federal securities laws, we disclaim any obligation or undertaking to publicly release any updates or revisions to any forward-looking statement contained herein (or elsewhere) to reflect any change in our expectations with regard thereto, or any change in events, conditions, or circumstances on which any such statement is based. Certain information contained in this presentation relates to or is based on studies, publications, surveys and other data obtained from third party sources and the Company’s own internal estimates and research. While we believe these third-party sources to be reliable as of the date of this presentation, we have not independently verified, and make no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third-party sources. Finally, while we believe our own internal research is reliable, such research has not been verified by any independent source. All of our therapies are still investigational and have not been approved by any regulatory authority for any use.

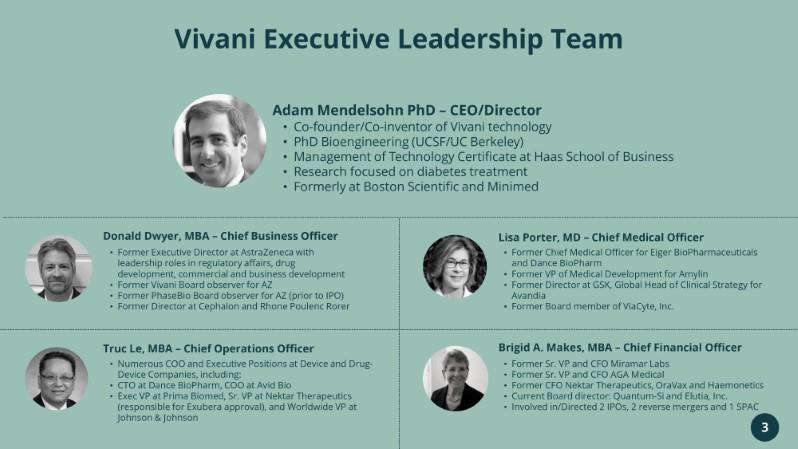

Vivani Executive Leadership Team • Co-founder/Co-inventor of Vivani technology • PhD Bioengineering (UCSF/UC Berkeley) • Management of Technology Certificate at Haas School of Business • Research focused on diabetes treatment • Formerly at Boston Scientific and Minimed Adam Mendelsohn PhD – CEO/Director • Numerous COO and Executive Positions at Device and DrugDevice Companies, including: • CTO at Dance BioPharm, COO at Avid Bio • Exec VP at Prima Biomed, Sr. VP at Nektar Therapeutics (responsible for Exubera approval), and Worldwide VP at Johnson & Johnson Truc Le, MBA – Chief Operations Officer • Former Chief Medical Officer for Eiger BioPharmaceuticals and Dance BioPharm • Former VP of Medical Development for Amylin • Former Director at GSK, Global Head of Clinical Strategy for Avandia • Former Board member of ViaCyte, Inc. Lisa Porter, MD – Chief Medical Officer • Former Sr. VP and CFO Miramar Labs • Former Sr. VP and CFO AGA Medical • Former CFO Nektar Therapeutics, OraVax and Haemonetics • Current Board director: Quantum-Si and Elutia, Inc. • Involved in/Directed 2 IPOs, 2 reverse mergers and 1 SPAC

Vivani Medical, Inc. 4 Lead programs include NPM-115 (high-dose exenatide) and NPM-139 (semaglutide). These miniature, subdermal, GLP-1 implants are under development for chronic weight management in obese and overweight individuals with once or twice-yearly dosing. Pipeline also includes IND-cleared NPM-119 (exenatide) implant under development for type 2 diabetes designed for twice-yearly dosing. An innovative, clinical-stage biopharmaceutical company developing a portfolio of ultra longacting, miniature, drug implants to treat chronic diseases. NanoPortal platform technology enables the design of implants aimed at improving medication non-adherence and tolerability. Multiple potentially transformational milestones are anticipated in 2025 including completion of the First-in-human, LIBERATE-1 trial and availability of top-line data. In addition, acceleration of the NPM-139 (semaglutide implant) program toward clinical development is also anticipated.

Company Pipeline If Approved, Vivani Products will Compete in Markets with Large Potential Indication Feasibility Pre-Clinical Clinical Market Size* Human Type 2 Diabetes Human Obesity NPM-119 exenatide >$60B NPM-139 >$60B Vivani * Estimated Market Sizes where Vivani products would compete, if approved. Does not represent future sales or revenue estimates of Vivani pipeline products. Evaluate Pharma’s “World Preview 2024: Pharma’s Growth Burst July 2024” estimates $130B in GLP-1 sales by 2030. We assume >$60B for Obesity/Chronic Weight Management and >$60B for Type 2 Diabetes by 2030. ** In Partnership with Okava Pharmaceuticals, Inc.

Drug Implants Proprietary Platform Technology

GLP-1 (exenatide) Implant and Applicator 7 Approximate size of implant expected for type 2 diabetes indication

Designed to assure adherence Minimally-fluctuating and tunable delivery profiles Potential application with many molecular types

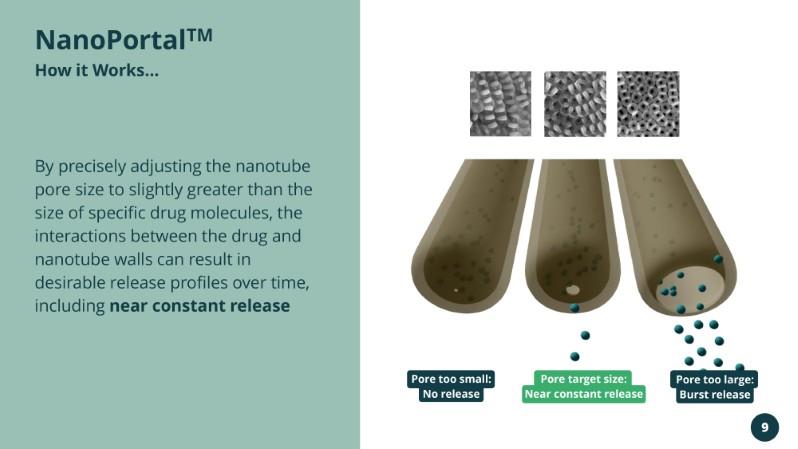

NanoPortalTM How it Works...By precisely adjusting the nanotube pore size to slightly greater than the size of specific drug molecules, the interactions between the drug and nanotube walls can result in desirable release profiles over time, including near constant release

NanoPortal delivers near-constant / minimallyfluctuating drug release Day 1 timepoint includes cumulative release over the first day including a separately measured 1st hour of release, which was ~7 µg for the high-dose and ~4 µg for the low-dose. Values are mean ± SD. Fluctuations during each 2.5-hour interval are within measurement error 10 Minimal Fluctuations with 2.5-hour interval sampling Individual Release Profiles (n=6) *Release-rates include exenatide and related substances.

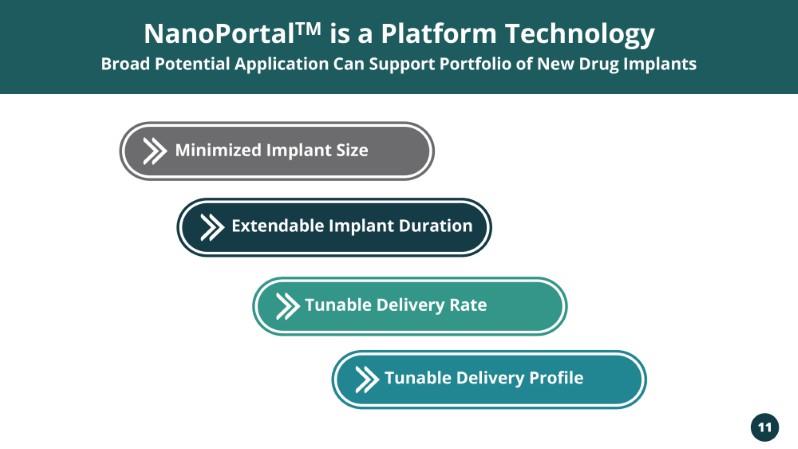

NanoPortalTM is a Platform Technology Broad Potential Application Can Support Portfolio of New Drug Implants Minimized Implant Size Extendable Implant Duration Tunable Delivery Rate Tunable Delivery Profile

(Intarcia) • FDA alleges that daily variations in drug release may be responsible for clinical safety signals which prevented regulatory approval • Larger Device (4mm x 45mm) • Insertion using larger 6-gauge needle • Minimally fluctuating drug release profile observed in pre-clinical studies directly addresses ITCA 650 regulatory challenges • Smaller Device (2.2mm x 21.5mm)* • Insertion using smaller 11-gauge needle NanoPortal implant technology designed to avoid earlier device challenges Six-month exenatide implant NanoPortalTM Six-month exenatide implant Osmotic Pump

NanoPortal addresses key ITCA-650 release-rate variability issue flagged by FDA as root cause of non-approvability (Intarcia) Osmotic Pump, ITCA 650 NanoPortalTM (Vivani) 13 “The clinical data in the three pivotal clinical trials for ITCA 650 including the high rates of GI side effects, discontinuations, and an increased risk of AKI comprise safety signals whose root cause can reasonably be concluded to be irregular and uncontrolled exenatide release.” FDA Memorandum July 29, 2022, page 33 * *Data includes exenatide and related substances In vitro data, including daily release intervals, from the 4 NanoPortal exenatide implants with the highest day-to-day variability out of 17 tested, provided by Vivani to FDA and helped facilitate IND clearance In vitro data, including daily release intervals, from the 4 ITCA 650 devices with the highest day-to-day variability out of 12 tested, presented by FDA during September 2023 Advisory Committee Hearing with Intarcia

Vivani Lead Program NPM-115 High-Dose Exenatide Implant for Chronic Weight Management Targeting the Rapidly Growing GLP-1 RA Market

Priority Program NPM-115: Development of 6-Month Exenatide (Glucagon-like Peptide 1 Receptor Agonist) Implant for Chronic Weight Management in Obese or Overweight Patients • Tremendous unmet medical need in Obesity1 : • 764M people living with obesity • 15M (2%) taking an anti-obesity medication • GLP-1 monotherapy may provide adequate weight loss for the majority of patients2 • Preclinical data with NPM-115 has demonstrated similar magnitude of weight loss for exenatide and semaglutide injection • NPM-115 target profile may provide an attractive alternative to life-long injections or pills for long-term maintenance of GLP-1 therapy for weight management

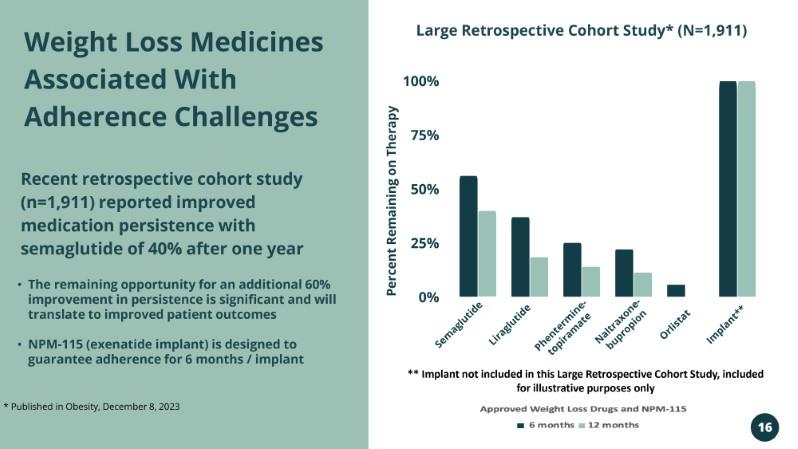

Weight Loss Medicines Associated With Adherence Challenges Recent retrospective cohort study (n=1,911) reported improved medication persistence with semaglutide of 40% after one year The remaining opportunity for an additional 60% improvement in persistence is significant and will translate to improved patient outcomes • NPM-115 (exenatide implant) is designed to guarantee adherence for 6 months / implant ** Implant not included in this Large Retrospective Cohort Study, included for illustrative purposes only

GLP-1 Discontinuation Can Lead to Rapid HungerInduced Weight Rebound in Animals and Huma Sudden GLP-1 withdrawal produces immediate rebound hunger, leading to rapid weight regain mediated by greater food consumption

Exenatide implant associated with comparable weight loss to semaglutide in preclinical study 18 Weight loss in high fat diet-induced obese mice. (A) % weight change from baseline for a single administration of exenatide implant (~530 nmol/kg/day) vs weekly Ozempic injections (semaglutide, 2,700 nmol/kg/week), corrected to control (sham implant) at 28 days; (B) % weight change from baseline over time from a single administration of exenatide implant (~530 nmol/kg/day) vs. weekly Ozempic injections (semaglutide, 2,700 nmol/kg/week), corrected to control

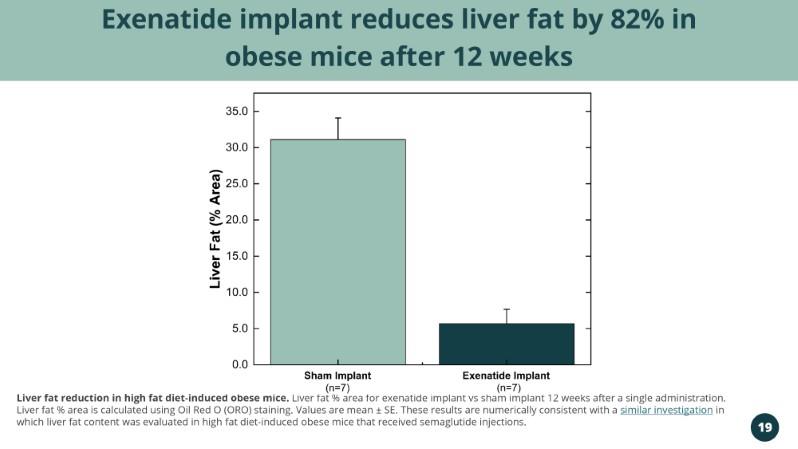

Exenatide implant reduces liver fat by 82% in obese mice after 12 weeks 19 Liver fat reduction in high fat diet-induced obese mice. Liver fat % area for exenatide implant vs sham implant 12 weeks after a single administration. Liver fat % area is calculated using Oil Red O (ORO) staining. Values are mean ± SE. These results are numerically consistent with a similar investigation in which liver fat content was evaluated in high fat diet-induced obese mice that received semaglutide injections.

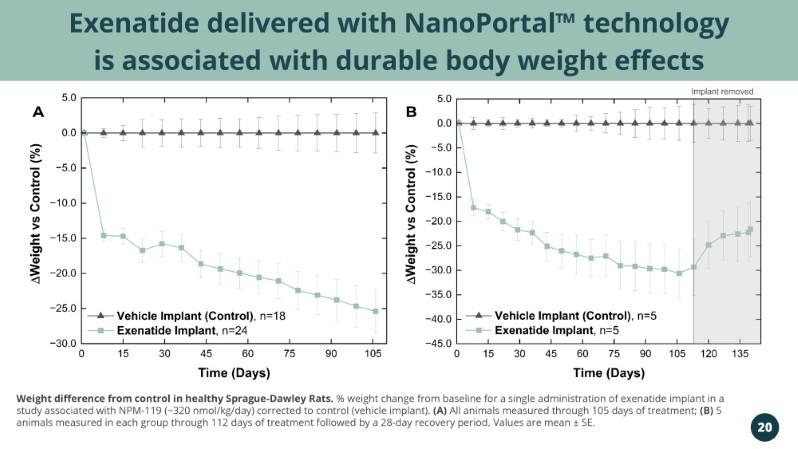

Exenatide delivered with NanoPortal technology is associated with durable body weight effects 20 Weight difference from control in healthy Sprague-Dawley Rats. % weight change from baseline for a single administration of exenatide implant in a study associated with NPM-119 (~320 nmol/kg/day) corrected to control (vehicle implant). (A) All animals measured through 105 days of treatment; (B) 5 animals measured in each group through 112 days of treatment followed by a 28-day recovery period. Values are mean ± SE.

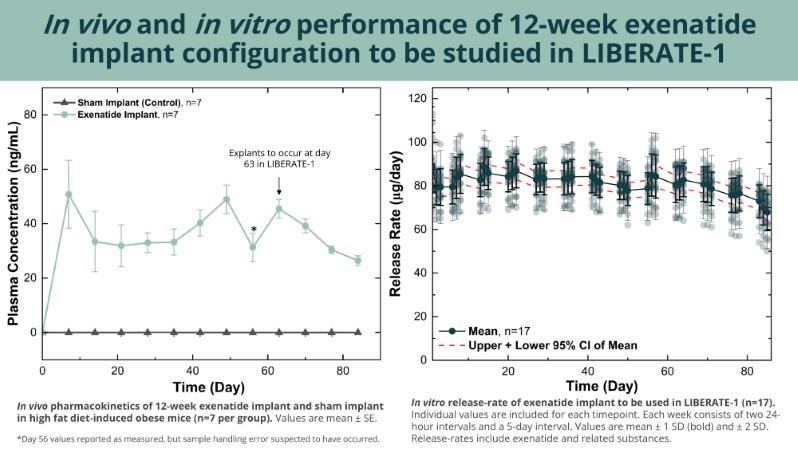

In vivo and in vitro performance of 12-week exenatide implant configuration to be studied in LIBERATE-1 In vivo pharmacokinetics of 12-week exenatide implant and sham implant in high fat diet-induced obese mice (n=7 per group). Values are mean ± SE. *Day 56 values reported as measured, but sample handling error suspected to have occurred. * Explants to occur at day 63 in LIBERATE-1 In vitro release-rate of exenatide implant to be used in LIBERATE-1 (n=17). Individual values are included for each timepoint. Each week consists of two 24- hour intervals and a 5-day interval. Values are mean ± 1 SD (bold) and ± 2 SD. Release-rates include exenatide and related substances.

6-Month exenatide implant preclinical proof-of-concept achieved Implants removed * 22 Pharmacokinetics of 6-month exenatide implant in male Sprague-Dawley rats (n=6) Exenatide antibody-positive animals are not included in this data set. Values are mean ± SD. *2 of 6 implants are responsible for higher Day 1 exenatide concentrations which is not expected to occur in the configuration to be used in the clinic. ** The estimated exenatide EC50 is 51.4 pg/mL when exenatide antibody titers are < 125 and 84 pg/mL when exenatide antibody titers are >= 125. These exenatide EC50 estimates are consistent with the exenatide EC50 estimate, 83.5 pg/mL, from the FDA Clinical Pharmacology review of BYDUREON

Proposed First-in-Human Trial: LIBERATE-1 Primary Objectives: NPM-119 (N=8) 23 Safety/tolerability assessment and full pharmacokinetic characterization. Changes in weight will also be assessed. Key Inclusion/Exclusion Criteria: 18-55 years old; overweight or obese (BMI 27-40) Otherwise healthy (no T2DM, normal renal function

NPM-115 Clinical + Regulatory Development Near-Term Plan November 2023 – Vivani announced NPM-115 clinical program (high-dose exenatide implant) for chronic weight management. February 2024 – Company reported positive preclinical study results demonstrating comparable weight loss between exenatide implant and Ozempic/Wegovy (semaglutide injection) and a strategic shift to focus on obesity and chronic weight management. December 2024 – Company announced screening and enrollment of LIBERATE-1 in obese and overweight patients in Australia. March 2025 – Multiple human subjects administered NPM-115 GLP-1 implant, well tolerated, Full study enrollment completed. 24 Year(s) Milestone Status 2023 Announced NPM-115 Program to Evaluate High Dose Exenatide Implant for Chronic Weight Management November 2023 2024 Reported Positive Weight Loss in Preclinical Study February 2024 2024 Announced Initiation of Screening and Enrollment of First-InHuman, LIBERATE-1 Stu

NPM-119 Exenatide Implant for Type 2 Diabetes

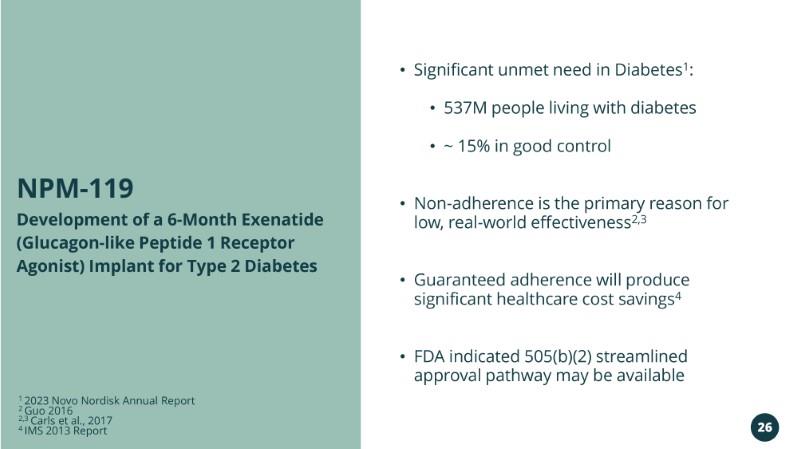

Significant unmet need in Diabetes1 : • 537M people living with diabetes • ~ 15% in good control • Non-adherence is the primary reason for low, real-world effectiveness2,3 • Guaranteed adherence will produce significant healthcare cost savings4 • FDA indicated 505(b)(2) streamlined approval pathway may be available Development of a 6-Month Exenatide (Glucagon-like Peptide 1 Receptor Agonist) Implant for Type 2 Diabetes

Current Drug Adherence Challenge "Drugs don't work in people that don't take them NPM-119* Designed to Enable 100% Adherence through Implant Duration Dual Incentive to Adopt Technology that Improves Adherence • Pharmaceutical revenue is increased • Healthcare costs are decreased Current Drug Adherence Challenge "Drugs don't work in people that don't take them" Real-world Adherence * NPM-119’s exenatide implant – under development, designed to enable 100% adherence, not approved in any market"

Patient research indicates strong adoption potential for a miniature, 6-month exenatide implant dQ&A insights reported market research during FDA Advisory Board to review ITCA 650 (exenatide implant) on September 21, 2023 28 56% of patients responded “likely” or “definitely” to get an exenatide implant if FDA approved, prescriber recommended, and covered by insurance

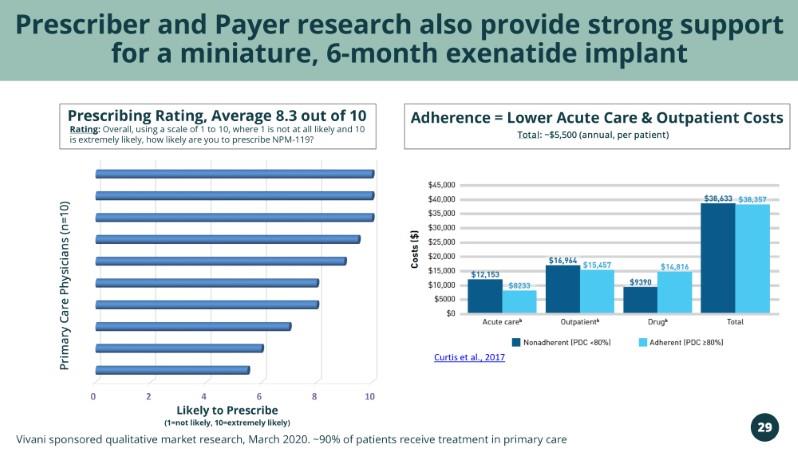

Prescriber and Payer research also provide strong support for a miniature, 6-month exenatide implant Rating: Overall, using a scale of 1 to 10, where 1 is not at all likely and 10 is extremely likely, how likely are you to prescribe NPM-119? Vivani sponsored qualitative market research, March 2020. ~90% of patients receive treatment in primary care

Development of once or twice-yearly Semaglutide (Glucagon-like Peptide 1 Receptor Agonist) Implant for Chronic Weight Management in Obese or Overweight Patients Semaglutide products Ozempic® and Wegovy® generated ~$25B in sales in 2024 • More than half of patients regularly miss doses based on real-world adherence data • NPM-139 is initially being designed for once or twice-yearly dosing. • In addition to obesity, the semaglutide implant is also under consideration for treatment of type 2 diabetes

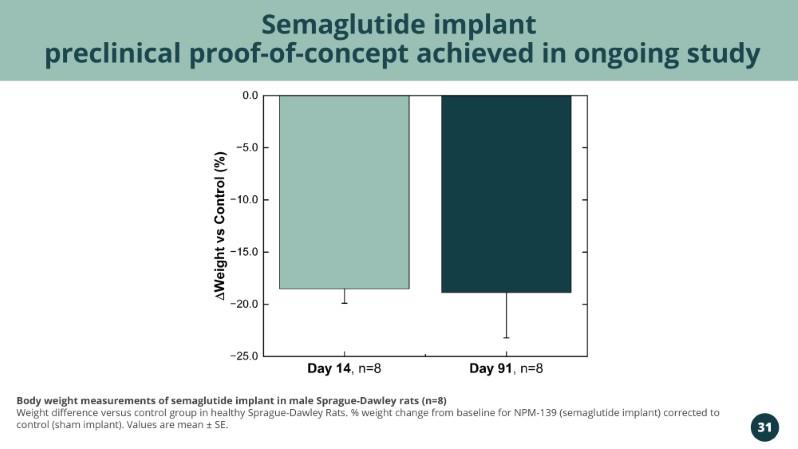

Semaglutide implant preclinical proof-of-concept achieved in ongoing study 31 Body weight measurements of semaglutide implant in male Sprague-Dawley rats (n=8) Weight difference versus control group in healthy Sprague-Dawley Rats. % weight change from baseline for NPM-139 (semaglutide implant) corrected to control (sham implant). Values are mean ± SE.4

Vivani Medical, Inc. Financial Information

Vivani Medical, Inc. Q4 2024: Income/(Loss) Statement

Vivani Medical, Inc. Q4 2024: Balance Sheet

Vivani Medical, Inc. Q4 2024: Cap Table 35 As of December 31, 2024 Equity WAEP* Number of Shares Common Stock 59,234,688 Stock Options $2.52 6,809,230 RSUs - 695,000 Warrants $3.42 9,340,442 Fully Diluted Shares 76,079, 360 *Weighted Average Exercise Pric

Vivani Medical, Inc. 36 Lead programs include NPM-115 (high-dose exenatide) and NPM-139 (semaglutide). These miniature, subdermal, GLP-1 implants are under development for chronic weight management in obese and overweight individuals with once or twice-yearly dosing. Pipeline also includes IND-cleared NPM-119 (exenatide) implant under development for type 2 diabetes designed for twice-yearly dosing. An innovative, clinical-stage biopharmaceutical company developing a portfolio of ultra longacting, miniature, drug implants to treat chronic diseases. NanoPortal platform technology enables the design of implants aimed at improving medication non-adherence and tolerability. Multiple potentially transformational milestones are anticipated in 2025 including completion of the First-in-human, LIBERATE-1 trial and availability of top-line data. In addition, acceleration of the NPM-139 (semaglutide implant) program toward clinical development is also anticipated