UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 13, 2024

VIVANI MEDICAL, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-36747 | 02-0692322 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) | ||

|

1350 S. Loop Road Alameda, California |

94502 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (415) 506-8462

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| Common Stock, par value $0.0001 | VANI | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 13, 2024, Vivani Medical, Inc. (the “Company”) issued a press release entitled “Vivani Medical Provides Business Update and Reports Third Quarter 2024 Financial Results”, which is attached to this Current Report as Exhibit 99.1.

The information contained in this Item 2.02 and Exhibit 99.1 hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as shall be expressly set forth by reference in such a filing.

Item 7.01. Regulation FD Disclosure

The Company from time to time presents and/or distributes to the investment community at various industry and other conferences slide presentations to provide updates and summaries of its business. These slides are attached to this Current Report on Form 8-K as Exhibit 99.2 and are incorporated by reference herein. The Company is also posting to the “Investors” portion of its website a copy of its current corporate slide presentation. The slides speak as of the date of this Current Report on Form 8-K. While the Company may elect to update the slides in the future or reflect events and circumstances occurring or existing after the date of this Current Report on Form 8-K, the Company specifically disclaims any obligation to do so.

The information contained in this Item 7.01 and Exhibit 99.2 hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, whether made before or after the date hereof, or the Exchange Act, except as shall be expressly set forth by reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. | Description | |

| 99.1 | Press Release dated November 13, 2024 entitled “Vivani Medical Provides Business Update and Reports Third Quarter 2024 Financial Results”. | |

| 99.2 | Corporate Slides, as of November 13, 2024. | |

| 104 | The cover page of this Current Report on Form 8-K, formatted in Inline XBRL. | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| VIVANI MEDICAL, INC. | ||

| Date: November 13, 2024 | By: | /s/ Brigid Makes |

| Brigid Makes | ||

| Chief Financial Officer | ||

Exhibit 99.1

Vivani Medical Provides Business Update Including $5M Equity

Financing and Reports Third Quarter 2024 Financial Results

Regulatory approval to initiate first-in-human study with a miniature, ultra long-acting GLP-1 (exenatide) implant in obese or overweight individuals in Australia

Miniature, ultra long-acting GLP-1 implant produced sham-implant adjusted liver fat reduction of 82% in an obese mouse model from a single administration with expected twice-yearly dosing

Announces $5M equity financing which secures solid financial position into late 2025, supporting projected completion of first-in-human study and data read-out

Alameda, CA -- (BUSINESS WIRE) – November 13, 2024 – Vivani Medical, Inc. (Nasdaq: VANI) (“Vivani” or the “Company”), a biopharmaceutical company developing miniaturized, long-acting drug implants, today reported financial results for the third quarter ended September 30, 2024, and provided a business update.

Vivani’s Chief Executive Officer Adam Mendelsohn, Ph.D., stated, “We made significant progress advancing our proprietary GLP-1 implants for obesity and chronic weight management in the third quarter, and we anticipate the initiation of our first-in-human clinical study, named LIBERATE-1, in the fourth quarter of this year. After choosing to conduct our initial first-in-human study in Australia, in part to take advantage of potentially significant rebates from the Australian government, we were excited to receive the regulatory approvals to initiate LIBERATE-1, as a key element of our NPM-115 clinical program in overweight and obese individuals. Today’s $5 million common stock financing announcement puts us in an excellent position to complete LIBERATE-1 and continue development of our pipeline programs in 2025.”

Dr. Mendelsohn added, “Our NanoPortal drug delivery technology has the potential to directly address medication non-adherence which is responsible for approximately 125,000 avoidable deaths each year in the US alone, more than caused by breast, colorectal and liver cancer combined. In addition, approximately 50% of patients with chronic diseases, including patients with obesity and type 2 diabetes, do not take their medicine as prescribed in the real world, a statistic which holds for both daily orals as well as weekly injectables. GLP-1 drugs have already improved the health of millions of people with obesity and type 2 diabetes, but the future potential impact of these medicines to improve global health across a variety of new indications is even more remarkable. At Vivani, we are addressing the tremendous opportunity to revolutionize the treatment of chronic diseases, including obesity, with our emerging pipeline of miniature, ultra long-acting drug implants specifically designed to ensure medication adherence with twice-yearly, and potentially once-yearly, administration that will allow patients to achieve the full potential benefits of their medicine.”

Recent Business Highlights

In July 2024, the Company announced that it expects to initiate the first clinical study in the NPM-115 program in the fourth quarter of 2024 in Australia, pending regulatory clearance in that country. The NPM-115 clinical program will evaluate the investigational 6-month GLP-1 implant for chronic weight management in patients who are either obese or overweight with a related comorbidity.

In September 2024, the Company announced that the Bellberry Human Research Ethics Committee approved, and the Therapeutic Goods Administration in Australia formally acknowledged a first-in-human clinical trial of the Company’s miniature, subdermal GLP-1 (exenatide) implant in obese and overweight subjects.

Also in September 2024, the Company reported that its exenatide implant produced sham-implant adjusted liver fat reduction of 82% in an obese mouse model from a single administration with expected twice-yearly dosing. The Company previously announced sham-implant adjusted preclinical weight loss of 20%, which is comparable to the weight loss produced from the semaglutide (active ingredient in Ozempic®/Wegovy®) injection control arm in the same study.

On November 8, 2024, the Company entered into a private sale transaction with one of its independent directors whereby the Company sold an aggregate of 3,968,253 shares of the Company’s common stock to the director at a price of $1.26 per share. The gross proceeds from this private sale transaction were $5.0 million which secures Vivani’s financial position into late 2025 and supports projected completion of the first-in-human study and data read-out.

Upcoming Anticipated Milestones

| ● |

Vivani plans to initiate LIBERATE-1, a Phase 1, first-in-human study of a miniature, ultra long-acting GLP-1 (exenatide) implant to investigate the safety, tolerability and full pharmacokinetic profile in obese or overweight subjects. The trial will enroll participants who will be titrated on weekly semaglutide injections for 8 weeks (0.25 mg/week for 4 weeks followed by 0.5 mg/week for 4 weeks) before being randomized to receive a single administration of Vivani’s exenatide implant (n=8), weekly exenatide injections (n=8), or weekly 1 mg semaglutide injections (n=8) for a 9-week treatment duration. Changes in weight will be measured. Data is projected to be available in 2025. |

| ● | Vivani will present at the Innovation in Obesity Therapeutics Summit – West Coast on December 10-12, 2024, in San Diego, CA. |

Ozempic® and Wegovy® are registered trademarks of Novo Nordisk A/S.

Third Quarter 2024 Financial Results

Cash balance: As of September 30, 2024, Vivani had cash, cash equivalents and restricted cash totaling $21.0 million, compared to $26.3 million as of June 30, 2024. The decrease of $5.3 million is attributed to a net loss of $6.0 million, a decrease of $0.3 million changes in operating assets and liabilities, partially offset by $0.6 million in non-cash items for depreciation and amortization of property and equipment, stock-based compensation and lease expense, and a net cash of $0.4 million provided by financing activities.

Research and development expense: Research and development expense during the three months ended September 30, 2024 was $4.2 million, compared to $4.4 million during the three months ended September 30, 2023. The decrease of $0.2 million, or 5%, was primarily attributable to staffing reduction in Vivani’s neurostimulation business and reduced use of outside services, partially offset by the increase in Alameda site facility expenses.

General and administrative expense: General and administrative expense during the three months ended September 30, 2024 was $2.1 million, compared to $2.7 million during the three months ended September 30, 2023. The decrease of $0.6 million, or 22%, was attributable to staffing reduction in Vivani’s neurostimulation business along with reduced outside legal and other professional services.

Other income, net: Other income, net during the three months ended September 30, 2024 was $0.3 million, compared to $0.4 million during the three months ended September 30, 2023. The change was not significant.

Net Loss: The net loss during the three months ended September 30, 2024 was $6.0 million, compared to $6.8 million during the three months ended September 30, 2023. The decrease in net loss of $0.8 million was primarily attributable to a decrease in operating expenses of $0.8 million.

About Vivani Medical, Inc.

Leveraging its proprietary NanoPortalTM platform, Vivani develops biopharmaceutical implants designed to deliver drug molecules steadily over extended periods of time with the goal of guaranteeing adherence, and potentially to improve patient tolerance to their medication. Vivani’s lead program, NPM-115, utilizes a miniature, six-month, subdermal, GLP-1 (exenatide) implant under development for chronic weight management in obese or overweight individuals. Vivani’s emerging pipeline also includes the NPM-139 (semaglutide implant) which is also under development for chronic weight management in obese and overweight individuals. The semaglutide implant has the added potential benefit of once-yearly administration. NPM-119 refers to the Company’s type 2 diabetes development program utilizing a six-month, subdermal exenatide implant. Both the NPM-115 and NPM-119 programs utilize exenatide based products with a higher-dose associated with the NPM-115 program for chronic weight management in obese or overweight patients. These NanoPortal implants are designed to provide patients with the opportunity to realize the full potential benefit of their medication by avoiding the challenges associated with the daily or weekly administration of orals and injectables. Medication non-adherence occurs when patients do not take their medication as prescribed. This affects an alarming number of patients, approximately 50%, including those taking daily pills. Medication non-adherence, which contributes to more than $500 billion in annual avoidable healthcare costs and 125,000 potentially preventable deaths annually in the U.S. alone, is a primary and daunting reason obese or overweight patients, and patients taking type 2 diabetes or other chronic disease treatments face significant challenges in achieving positive real-world effectiveness. While the current GLP-1 landscape includes over 50 new molecular entities under clinical stage development, Vivani remains confident that its highly differentiated portfolio of miniature long-acting GLP-1 implants have the potential to provide an attractive therapeutic option for patients, prescribers and payers.

About Cortigent, Inc.

Vivani’s wholly owned subsidiary, Cortigent, Inc. (“Cortigent”), is developing precision neurostimulation systems intended to help patients recover critical body functions. Investigational devices include Orion®, designed to provide artificial vision to people who are profoundly blind, and a new system intended to accelerate the recovery of arm and hand function in patients who are partially paralyzed due to stroke. Cortigent has developed, manufactured, and marketed an implantable visual prosthetic device, Argus II®, that delivered meaningful visual perception to blind individuals. Vivani continues to assess strategic options for advancing Cortigent’s pioneering technology.

Forward-Looking Statements

This press release contains certain “forward-looking statements” within the meaning of the “safe harbor” provisions of the US Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “target,” “believe,” “expect,” “will,” “may,” “anticipate,” “estimate,” “would,” “positioned,” “future,” and other similar expressions that in this press release, including statements regarding Vivani’s business, products in development, including the therapeutic potential thereof, the planned development therefor, the initiation of the LIBERATE-1 trial and reporting of trial results, Vivani’s emerging development plans for NPM-115, NPM-139, or Vivani’s plans with respect to Cortigent and its proposed initial public offering, technology, strategy, cash position and financial runway. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on Vivani’s current beliefs, expectations, and assumptions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of Vivani’s control. Actual results and outcomes may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause actual results and outcomes to differ materially from those indicated in the forward-looking statements include, among others, risks related to the development and commercialization of Vivani’s products, including NPM-115 and NPM-119; delays and changes in the development of Vivani’s products, including as a result of applicable laws, regulations and guidelines, potential delays in submitting and receiving regulatory clearance or approval to conduct Vivani’s development activities, including Vivani’s ability to commence clinical development of NPM-119; risks related to the initiation, enrollment and conduct of Vivani’s planned clinical trials and the results therefrom; Vivani’s history of losses and Vivani’s ability to access additional capital or otherwise fund Vivani’s business; market conditions and the ability of Cortigent to complete its initial public offering. There may be additional risks that the Company considers immaterial, or which are unknown. A further list and description of risks and uncertainties can be found in the Company’s most recent Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission filed on March 26, 2024, as updated by the Company’s subsequent Quarterly Reports on Form 10-Q. Any forward-looking statement made by Vivani in this press release is based only on information currently available to the Company and speaks only as of the date on which it is made. The Company undertakes no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of added information, future developments or otherwise, except as required by law.

Company Contact:

Donald Dwyer

Chief Business Officer

info@vivani.com

(415) 506-8462

Investor Relations Contact:

Jami Taylor

Investor Relations Advisor

investors@vivani.com

(415) 506-8462

Media Contact:

Sean Leous

ICR Westwicke

Sean.Leous@westwicke.com

(646) 866-4012

VIVANI MEDICAL, INC.

AND SUBSIDIARIES

Condensed Consolidated Balance Sheets (unaudited)

(In thousands, except per share data)

| September 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 19,646 | $ | 20,654 | ||||

| Prepaid expenses and other current assets | 1,753 | 2,408 | ||||||

| Total current assets | 21,399 | 23,062 | ||||||

| Property and equipment, net | 1,644 | 1,729 | ||||||

| Right-of-use assets | 18,383 | 19,616 | ||||||

| Restricted cash | 1,338 | 1,338 | ||||||

| Other assets | 132 | 52 | ||||||

| Total assets | $ | 42,896 | $ | 45,797 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 815 | $ | 542 | ||||

| Accrued expenses | 2,024 | 1,727 | ||||||

| Litigation accrual | 1,675 | 1,675 | ||||||

| Accrued compensation expense | 371 | 396 | ||||||

| Current operating lease liabilities | 1,385 | 1,383 | ||||||

| Total current liabilities | 6,270 | 5,723 | ||||||

| Long-term operating lease liabilities | 18,294 | 19,313 | ||||||

| Total liabilities | 24,564 | 25,036 | ||||||

| Commitments and contingencies (Note 12) | ||||||||

| Stockholders’ equity: | ||||||||

| Preferred stock, par value $0.0001 per share; 10,000 shares authorized; none outstanding | - | - | ||||||

| Common stock, par value $0.0001 per share; 300,000 shares authorized; shares issued and outstanding: 55,266 and 51,031 at September 30, 2024 and December 31, 2023, respectively | 6 | 5 | ||||||

| Additional paid-in capital | 134,108 | 119,054 | ||||||

| Accumulated other comprehensive income | 92 | 140 | ||||||

| Accumulated deficit | (115,874 | ) | (98,438 | ) | ||||

| Total stockholders’ equity | 18,332 | 20,761 | ||||||

| Total liabilities and stockholders’ equity | $ | 42,896 | $ | 45,797 | ||||

VIVANI MEDICAL, INC.

AND SUBSIDIARIES

Condensed Consolidated Statements of Operations (unaudited)

(In thousands, except per share data)

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Operating expenses: | ||||||||||||||||

| Research and development, net of grants | $ | 4,203 | $ | 4,441 | $ | 11,442 | $ | 12,260 | ||||||||

| General and administrative, net of grants | 2,106 | 2,703 | 6,775 | 8,488 | ||||||||||||

| Total operating expenses | 6,309 | 7,144 | 18,217 | 20,748 | ||||||||||||

| Loss from operations | (6,309 | ) | (7,144 | ) | (18,217 | ) | (20,748 | ) | ||||||||

| Other income, net | 268 | 362 | 781 | 1,122 | ||||||||||||

| Net loss | $ | (6,041 | ) | $ | (6,782 | ) | $ | (17,436 | ) | $ | (19,626 | ) | ||||

| Net loss per common share - basic and diluted | $ | (0.11 | ) | $ | (0.13 | ) | $ | (0.32 | ) | $ | (0.39 | ) | ||||

| Weighted average common shares outstanding - basic and diluted | 55,247 | 50,837 | 54,161 | 50,757 | ||||||||||||

Vivani Medical, Inc. Guaranteed Adherence. Better Outcomes.Nasdaq: VANI WWW.Vivani.com

Disclaimers The following slides and any accompanying oral presentation contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the "safe harbor" created by those sections. All statements in this release that are not based on historical fact are "forward looking statements." These statements may be identified by words such as "estimates," "anticipates," "projects," "plans" or "planned," "strategy," “goal," "seeks," "may," "will," "expects," "intends," "believes," "should," and similar expressions, or the negative versions thereof, and which also may be identified by their context. All statements that address operating performance or events or developments that Vivani Medical, Inc. ("Vivani", the "Company", "we" or "us) expects or anticipates will occur in the future, such as stated objectives or goals, our products and their therapeutic potential and planned development, the indications that we intend to target, our technology, our business and strategy, milestones, addressable markets, or that are not otherwise historical facts, are forward-looking statements. While management has based any forward-looking statements included in this presentation on its current expectations, the information on which such expectations were based may change. Forward-looking statements involve inherent risks and uncertainties which could cause actual results to differ materially from those in the forward-looking statements as a result of various factors. These risks and uncertainties include, but are not limited to, that we may fail to complete any required pre-clinical activities for NPM-115, NPM-119, or otherwise commence our planned clinical trials for these products under development; conduct any pre-clinical activities of our other products; our products may not demonstrate safety or efficacy in clinical trials; we may fail to secure marketing approvals for our products; there may be delays in regulatory approval or changes in regulatory framework that are out of our control; our estimation of addressable

Vivani Executive Leadership Team Adam Mendelsohn PhD – CEO/Director Co-founder/Co-inventor of Vivani technology

Vivani Medical, Inc. An innovative, biopharmaceutical company developing a portfolio of ultra long-acting, miniature, drug implants to treat chronic diseases. NanoPortal™ platform technology enables the design of implants aimed at improving medication non-adherence and tolerability.

Company Pipeline If Approved, Vivani Products will Compete in Markets with Large Potential

Drug Implants Proprietary Platform Technology

GLP-1 (exenatide) Implant and Applicator

NanoPortalTM:Innovative Delivery Technology Designed to assure adherence

By precisely adjusting nanotubes to molecule size, interactions between drug and nanotube walls can result in desirable release profiles over time, including near constant release

NanoPortal delivers near-constant / minimally-fluctuating drug release

NanoPortalTM is a Platform Technology Broad Potential Application Can Support Portfolio of New Drug Implants

NanoPortal implant technology designed to avoid earlier device challenges

Vivani Lead Program NPM-115 High-Dose Exenatide Implant for Chronic Weight Management

Lead Program NPM-115: Development of 6-Month Exenatide (Glucagon-like Peptide 1 Receptor Agonist) Implant for Chronic Weight Management in Obese or Overweight Patients

Weight Loss Medicines Associated With Adherence Challenges Recent retrospective cohort study (n=1,911) reported improved medication persistence with semaglutide of 40% after one year

Exenatide implant associated with comparable weight loss to semaglutide in preclinical study

Exenatide implant reduces liver fat by 82% in obese mice after 12 weeks

Exenatide delivered with NanoPortal™ technology is associated with durable body weight effects

In vivo and in vitro performance of 12-week exenatide implant configuration to be studied in LIBERATE-1

6-Month exenatide implant preclinical proof-of-concept achieved

Proposed First-in-Human Trial: LIBERATE-1 Primary Objectives:

NPM-115 Clinical + Regulatory Development Near-Term Plan

NPM-119 Exenatide Implant for Type 2 Diabetes

Development of a 6-Month Exenatide (Glucagon-like Peptide 1 Receptor Agonist) Implant for Type 2 Diabetes

Current Drug Adherence Challenge "Drugs don't work in people that don't take them"

Patient research indicates strong adoption potential for a miniature, 6-month exenatide implant

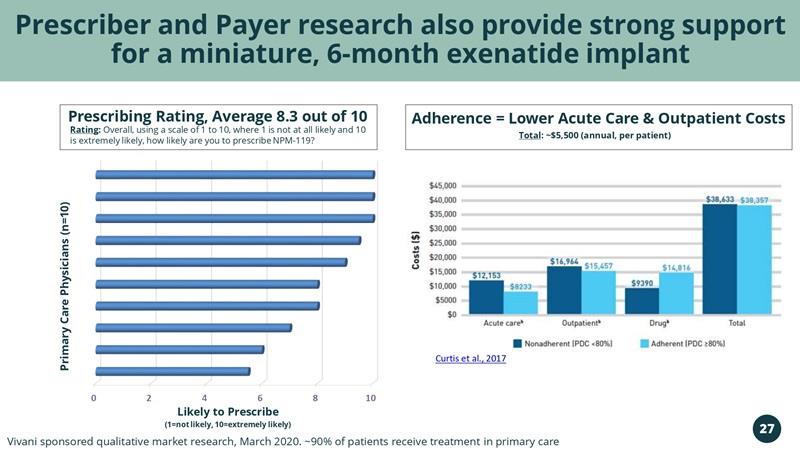

Prescriber and Payer research also provide strong support for a miniature, 6-month exenatide implant

NPM-119 Clinical + Regulatory Development Near-Term Plan

Vivani Medical, Inc. Q3 2024: Income/(Loss) Statement

Vivani Medical, Inc. Q3 2024: Balance Sheet*

Vivani Medical, Inc. Q3 2024: Cap Table

An innovative, biopharmaceutical company developing a portfolio of ultra long-acting, miniature, drug implants to treat chronic diseases. NanoPortal™ platform technology enables the design of implants aimed at improving medication non-adherence and tolerability.