| Delaware | 001-38386 | 26-3039436 | |||||||||

| (State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|||||||||

| 675 Ponce de Leon Avenue NE, Suite 6000 | Atlanta | Georgia | 30308 | ||||||||

| (Address of principal executive offices, including zip code) | |||||||||||

| (888) | 798-5802 | ||||||||||

| (Registrant's telephone, including area code) | |||||||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading symbol | Name of each exchange on which registered | ||||||

| Common Stock | CDLX | The Nasdaq Stock Market LLC | ||||||

| Emerging growth company | ☐ |

||||

| Exhibit | Exhibit Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| Cardlytics, Inc. | |||||||||||

| Date: | November 1, 2022 | By: | /s/ Andrew Christiansen | ||||||||

| Andrew Christiansen | |||||||||||

|

Chief Financial Officer

(Principal Financial and Accounting Officer)

|

|||||||||||

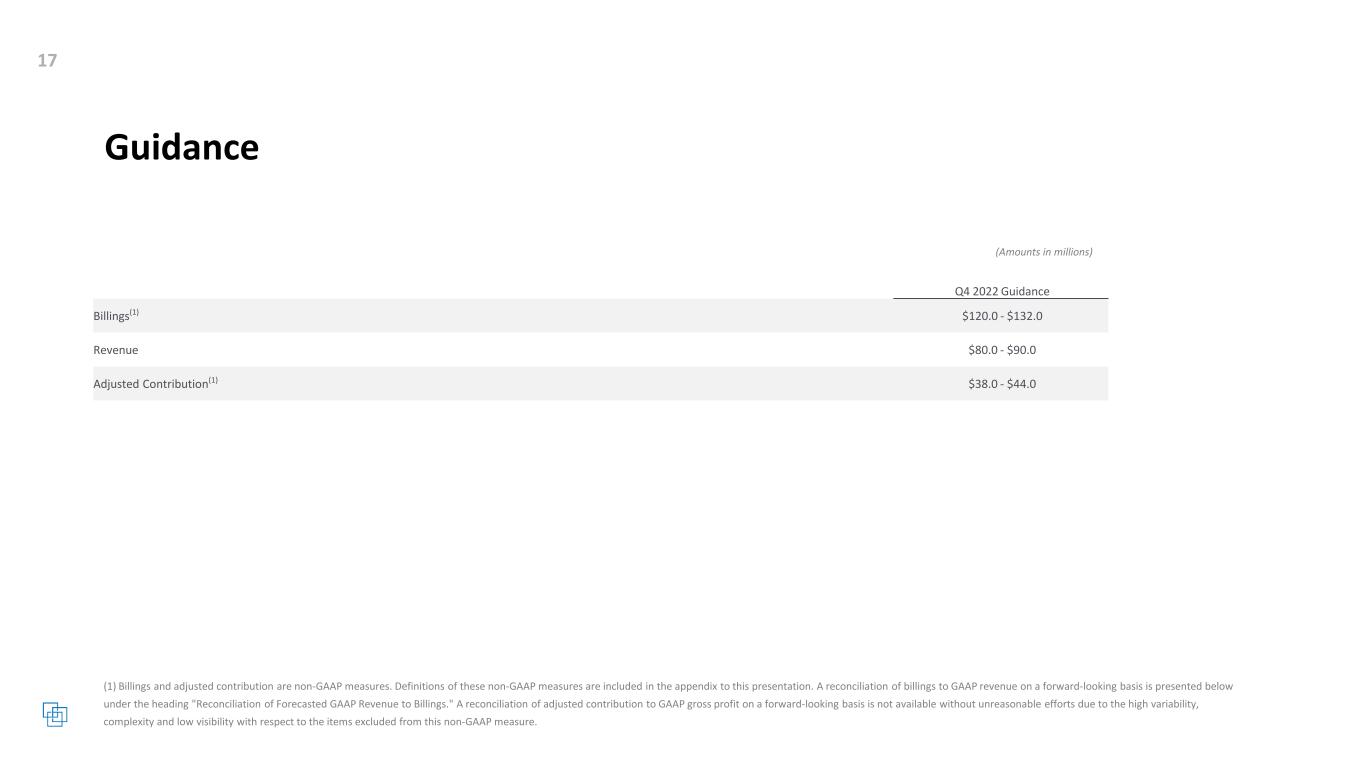

| Q4 2022 Guidance | |||||

Billings(1) |

$120.0 - $132.0 | ||||

| Revenue | $80.0 - $90.0 | ||||

Adjusted contribution(2) |

$38.0 - $44.0 | ||||

| September 30, 2022 | December 31, 2021 | ||||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 138,514 | $ | 233,467 | |||||||

| Restricted cash | 74 | 95 | |||||||||

| Accounts receivable and contract assets, net | 97,168 | 111,085 | |||||||||

| Other receivables | 4,675 | 6,097 | |||||||||

| Prepaid expenses and other assets | 8,697 | 7,981 | |||||||||

| Total current assets | 249,128 | 358,725 | |||||||||

| Long-term assets: | |||||||||||

| Property and equipment, net | 7,103 | 11,273 | |||||||||

| Right-of-use assets under operating leases, net | 9,276 | 10,196 | |||||||||

| Intangible assets, net | 113,878 | 125,550 | |||||||||

| Goodwill | 665,813 | 742,516 | |||||||||

| Capitalized software development costs, net | 18,377 | 13,131 | |||||||||

| Other long-term assets, net | 2,737 | 2,406 | |||||||||

| Total assets | $ | 1,066,312 | $ | 1,263,797 | |||||||

| Liabilities and stockholders' equity | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | 4,768 | $ | 4,619 | |||||||

| Accrued liabilities: | |||||||||||

| Accrued compensation | 12,940 | 12,136 | |||||||||

| Accrued expenses | 20,556 | 19,620 | |||||||||

| Partner Share liability | 41,051 | 46,595 | |||||||||

| Consumer Incentive liability | 48,353 | 52,602 | |||||||||

| Deferred revenue | 3,004 | 3,280 | |||||||||

| Current operating lease liabilities | 6,088 | 6,028 | |||||||||

| Current contingent consideration | 118,151 | 182,470 | |||||||||

| Total current liabilities | 254,911 | 327,350 | |||||||||

| Long-term liabilities: | |||||||||||

| Convertible senior notes, net | 225,678 | 184,398 | |||||||||

| Deferred liabilities | 58 | 173 | |||||||||

| Long-term operating lease liabilities | 5,135 | 6,801 | |||||||||

| Long-term contingent consideration | — | 49,825 | |||||||||

| Other long-term liabilities | 21 | 4,550 | |||||||||

| Total liabilities | 485,803 | 573,097 | |||||||||

| Stockholders’ equity: | |||||||||||

Common stock, $0.0001 par value—100,000 shares authorized and 33,043 and 33,534 shares issued and outstanding as of September 30, 2022 and December 31, 2021, respectively. |

9 | 9 | |||||||||

| Additional paid-in capital | 1,169,213 | 1,212,823 | |||||||||

| Accumulated other comprehensive income | 9,578 | 486 | |||||||||

| Accumulated deficit | (598,291) | (522,618) | |||||||||

| Total stockholders’ equity | 580,509 | 690,700 | |||||||||

| Total liabilities and stockholders’ equity | $ | 1,066,312 | $ | 1,263,797 | |||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

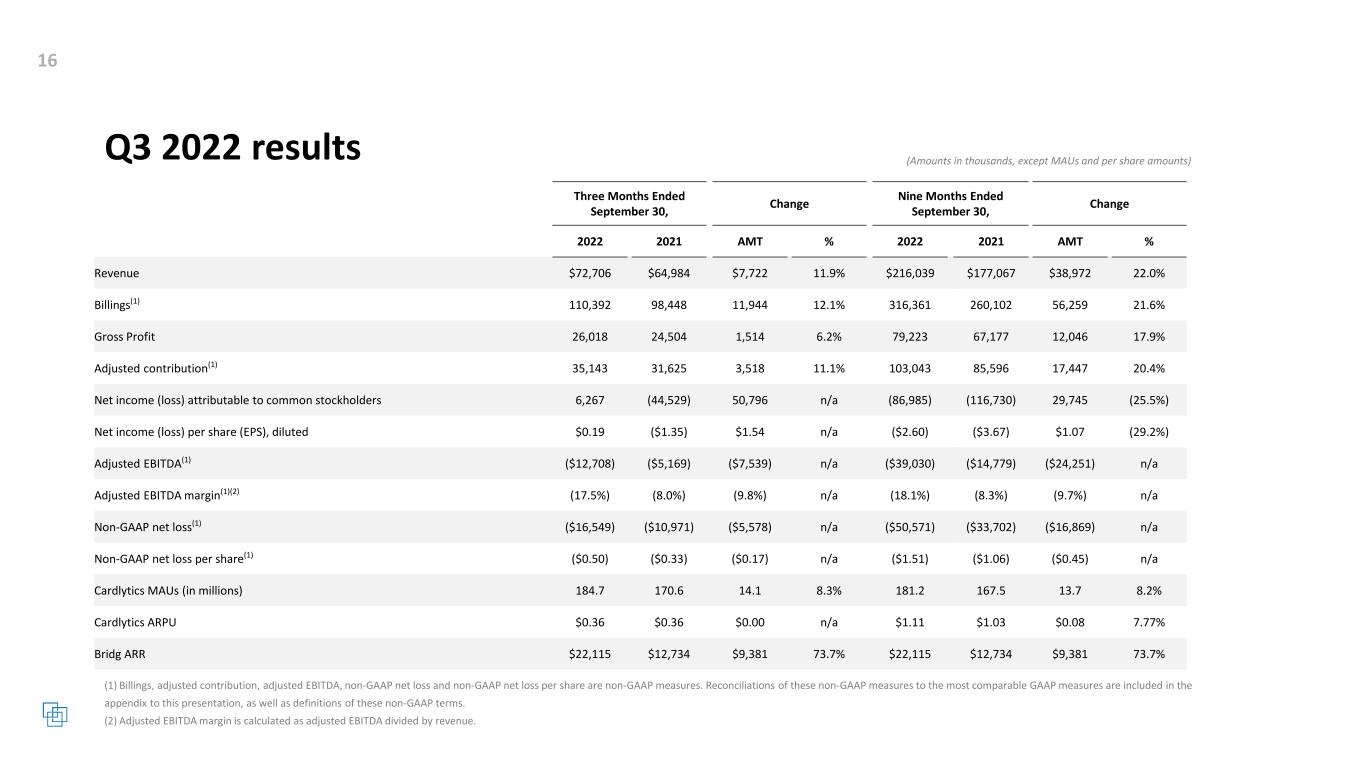

| Revenue | $ | 72,706 | $ | 64,984 | $ | 216,039 | $ | 177,067 | |||||||||||||||

| Costs and expenses: | |||||||||||||||||||||||

| Partner Share and other third-party costs | 37,563 | 34,090 | 112,996 | 93,814 | |||||||||||||||||||

| Delivery costs | 9,125 | 6,390 | 23,820 | 16,076 | |||||||||||||||||||

| Sales and marketing expense | 18,289 | 16,733 | 57,920 | 46,998 | |||||||||||||||||||

| Research and development expense | 13,762 | 11,141 | 39,634 | 26,293 | |||||||||||||||||||

| General and administration expense | 19,972 | 20,073 | 61,381 | 49,136 | |||||||||||||||||||

| Acquisition and integration (benefit) costs | (1,867) | 1,714 | (4,269) | 22,926 | |||||||||||||||||||

| Change in fair value of contingent consideration | (46,126) | 6,261 | (114,144) | 7,741 | |||||||||||||||||||

| Goodwill impairment | — | — | 83,149 | — | |||||||||||||||||||

| Depreciation and amortization expense | 10,468 | 8,375 | 30,695 | 20,273 | |||||||||||||||||||

| Total costs and expenses | 61,186 | 104,777 | 291,182 | 283,257 | |||||||||||||||||||

| Operating income (loss) | 11,520 | (39,793) | (75,143) | (106,190) | |||||||||||||||||||

| Other expense: | |||||||||||||||||||||||

| Interest expense, net | (580) | (3,193) | (2,406) | (9,316) | |||||||||||||||||||

| Foreign currency loss | (4,673) | (1,543) | (10,882) | (1,224) | |||||||||||||||||||

| Total other expense | (5,253) | (4,736) | (13,288) | (10,540) | |||||||||||||||||||

| Income (loss) before income taxes | 6,267 | (44,529) | (88,431) | (116,730) | |||||||||||||||||||

| Income tax benefit | — | — | 1,446 | — | |||||||||||||||||||

| Net income (loss) | 6,267 | (44,529) | (86,985) | (116,730) | |||||||||||||||||||

| Net income (loss) attributable to common stockholders | $ | 6,267 | $ | (44,529) | $ | (86,985) | $ | (116,730) | |||||||||||||||

| Net income (loss) per share attributable to common stockholders, basic | $ | 0.19 | $ | (1.35) | $ | (2.60) | $ | (3.67) | |||||||||||||||

| Net income (loss) per share attributable to common stockholders, diluted | $ | 0.19 | $ | (1.35) | $ | (2.60) | $ | (3.67) | |||||||||||||||

| Weighted-average common shares outstanding, basic | 32,950 | 33,101 | 33,455 | 31,802 | |||||||||||||||||||

| Weighted-average common shares outstanding, diluted | 33,269 | 33,101 | 33,455 | 31,802 | |||||||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Delivery costs | $ | 920 | $ | 552 | $ | 2,416 | $ | 1,382 | |||||||||||||||

| Sales and marketing | 1,428 | 3,841 | 8,765 | 9,928 | |||||||||||||||||||

| Research and development | 1,968 | 3,170 | 9,419 | 7,132 | |||||||||||||||||||

| General and administration | 1,451 | 9,267 | 11,594 | 18,973 | |||||||||||||||||||

| Total stock-based compensation | $ | 5,767 | $ | 16,830 | $ | 32,194 | $ | 37,415 | |||||||||||||||

| Nine Months Ended September 30, |

|||||||||||

| 2022 | 2021 | ||||||||||

| Operating activities | |||||||||||

| Net Loss | $ | (86,985) | $ | (116,730) | |||||||

| Adjustments to reconcile net income (loss) to net cash used in operating activities: | |||||||||||

| Credit loss expense | 949 | 1,440 | |||||||||

| Depreciation and amortization | 30,695 | 20,273 | |||||||||

| Amortization of financing costs charged to interest expense | 1,192 | 701 | |||||||||

| Accretion of debt discount and non-cash interest expense | — | 7,078 | |||||||||

| Amortization of right-of-use assets | 4,230 | 3,770 | |||||||||

| Stock-based compensation expense | 32,194 | 37,415 | |||||||||

| Goodwill impairment | 83,149 | — | |||||||||

| Change in fair value of contingent consideration | (114,144) | 7,741 | |||||||||

| Other non-cash expense (income), net | 10,524 | 1,275 | |||||||||

| Deferred implementation costs | — | 2,343 | |||||||||

| Income tax benefit | (1,446) | — | |||||||||

| Change in operating assets and liabilities: | |||||||||||

| Accounts receivable | 15,082 | (757) | |||||||||

| Prepaid expenses and other assets | (456) | (1,296) | |||||||||

| Accounts payable | 111 | 42 | |||||||||

| Other accrued expenses | (5,814) | (2,626) | |||||||||

| Partner Share liability | (5,836) | (2,171) | |||||||||

| Consumer Incentive liability | (4,248) | 3,534 | |||||||||

| Net cash used in operating activities | (40,803) | (37,968) | |||||||||

| Investing activities | |||||||||||

| Acquisition of property and equipment | (1,090) | (2,145) | |||||||||

| Acquisition of patents | (73) | (68) | |||||||||

| Capitalized software development costs | (9,170) | (6,937) | |||||||||

| Business acquisitions, net of cash acquired | (2,274) | (494,131) | |||||||||

| Net cash used in investing activities | (12,607) | (503,281) | |||||||||

| Financing activities | |||||||||||

| Principal payments of debt | (24) | — | |||||||||

| Proceeds from issuance of common stock | 397 | 486,163 | |||||||||

| Repurchase of common stock | (40,000) | — | |||||||||

| Deferred equity issuance costs | — | (190) | |||||||||

| Debt issuance costs | (181) | (200) | |||||||||

| Net cash received (used in) provided by financing activities | (39,808) | 485,773 | |||||||||

| Effect of exchange rates on cash, cash equivalents and restricted cash | (1,756) | (393) | |||||||||

| Net decrease in cash, cash equivalents and restricted cash | (94,974) | (55,869) | |||||||||

| Cash, cash equivalents, and restricted cash — Beginning of period | 233,562 | 293,349 | |||||||||

| Cash, cash equivalents, and restricted cash — End of period | $ | 138,588 | $ | 237,480 | |||||||

| Three Months Ended September 30, |

Change | Nine Months Ended September 30, |

Change | ||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | $ | % | 2022 | 2021 | $ | % | ||||||||||||||||||||||||||||||||||||||||

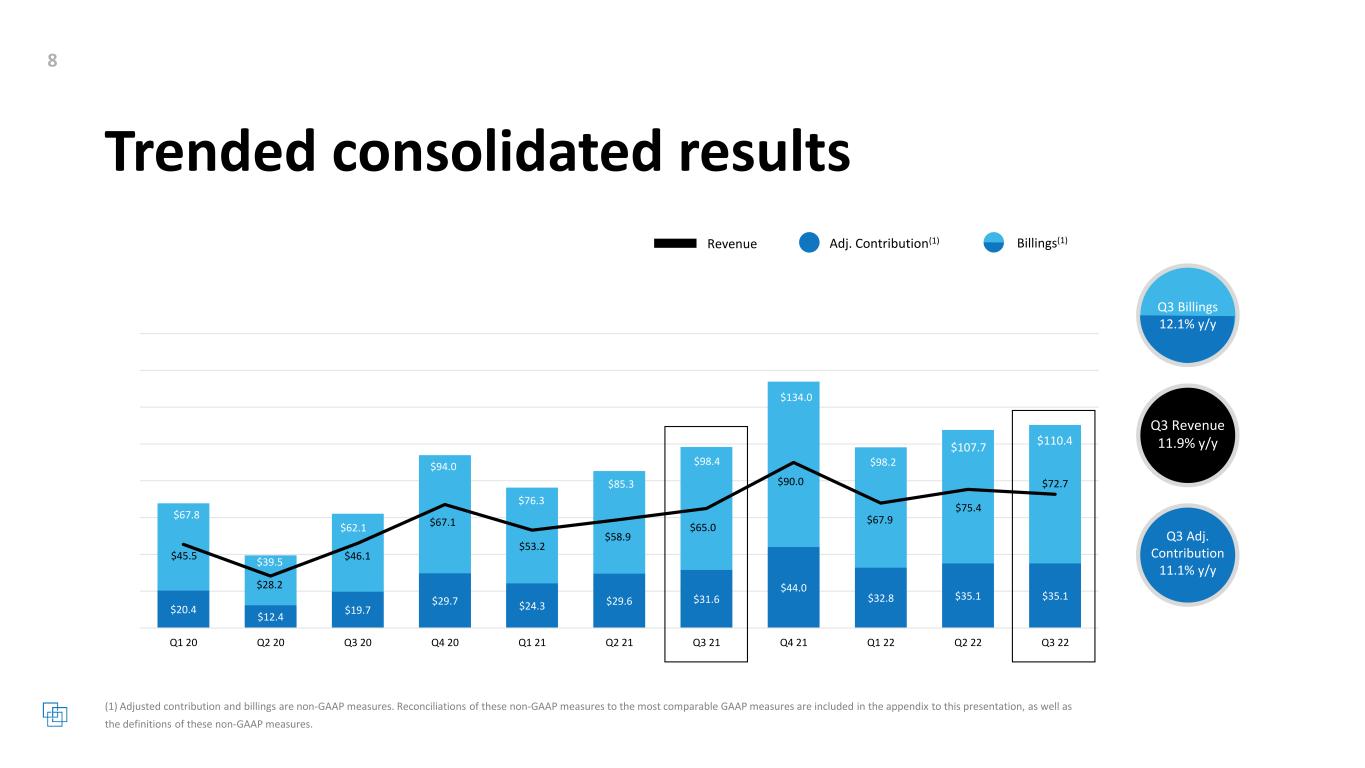

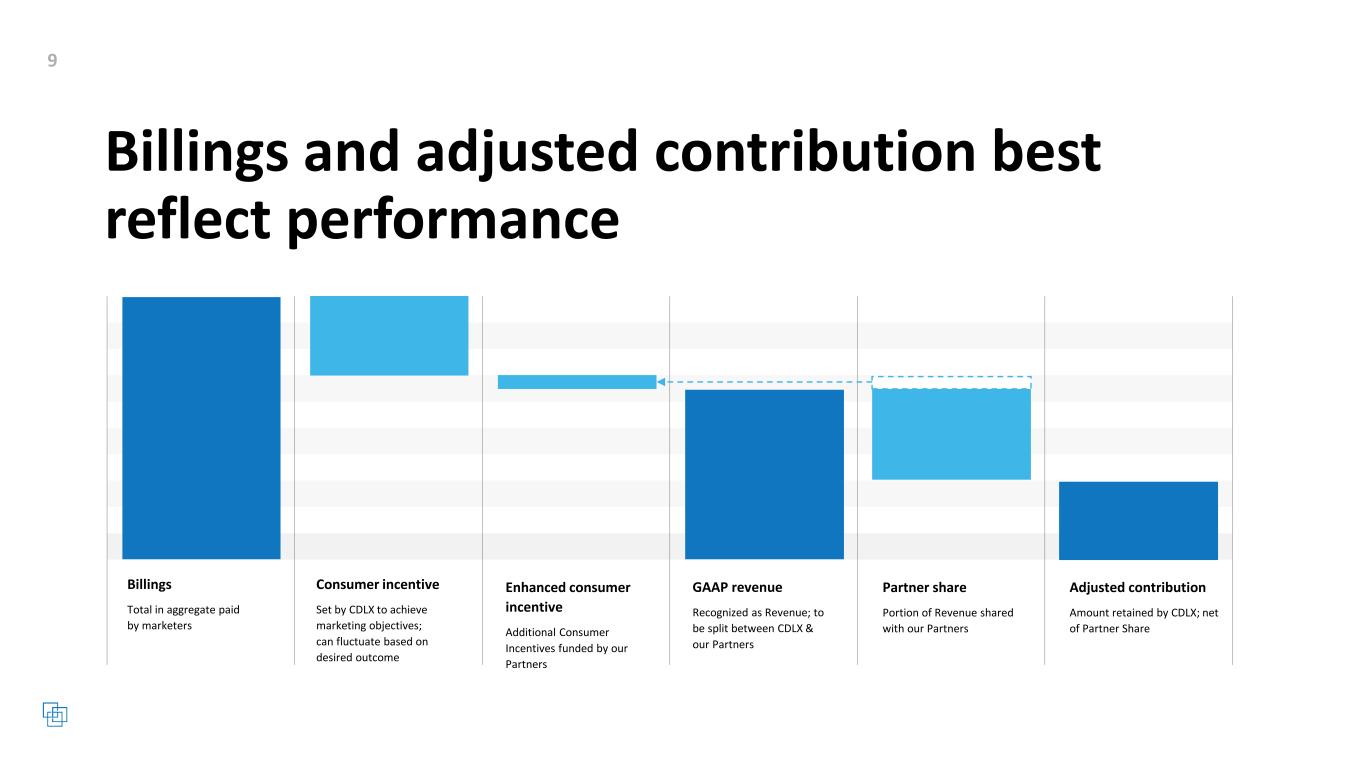

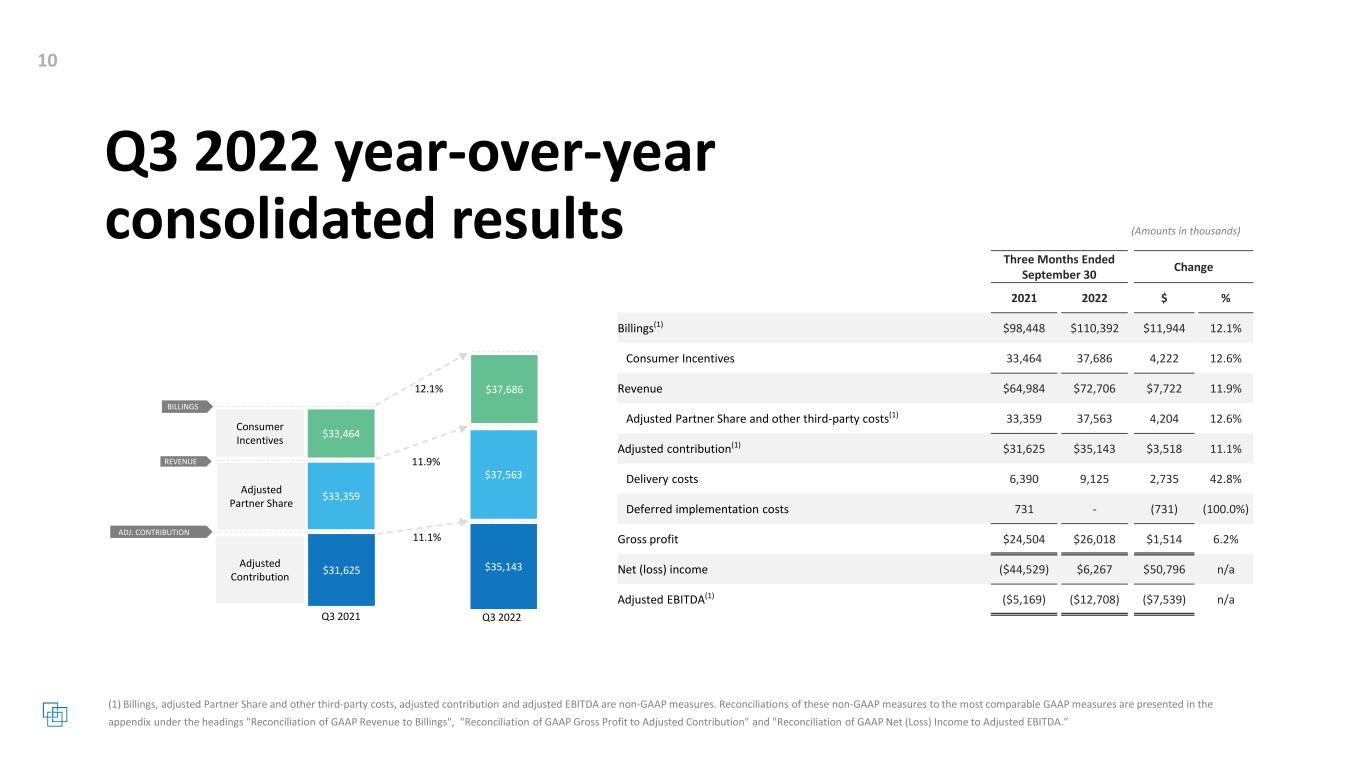

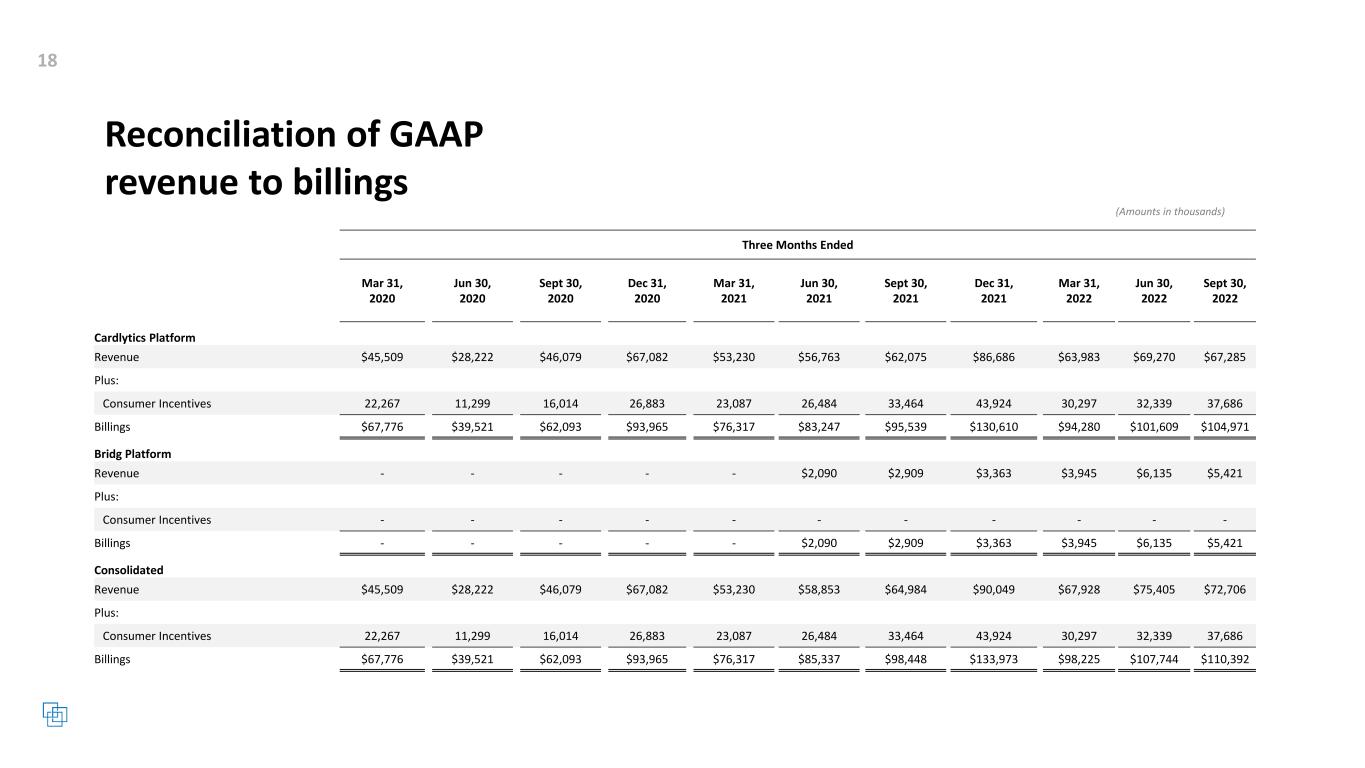

Billings(1) |

$ | 110,392 | $ | 98,448 | $ | 11,944 | 12 | % | $ | 316,361 | $ | 260,102 | $ | 56,259 | 22 | % | |||||||||||||||||||||||||||||||

| Consumer Incentives | 37,686 | 33,464 | 4,222 | 13 | 100,322 | 83,035 | 17,287 | 21 | |||||||||||||||||||||||||||||||||||||||

| Revenue | 72,706 | 64,984 | 7,722 | 12 | 216,039 | 177,067 | 38,972 | 22 | |||||||||||||||||||||||||||||||||||||||

Adjusted Partner Share and other third-party costs(1) |

37,563 | 33,359 | 4,204 | 13 | 112,996 | 91,471 | 21,525 | 24 | |||||||||||||||||||||||||||||||||||||||

Adjusted contribution(1) |

35,143 | 31,625 | 3,518 | 11 | 103,043 | 85,596 | 17,447 | 20 | |||||||||||||||||||||||||||||||||||||||

| Delivery costs | 9,125 | 6,390 | 2,735 | 43 | 23,820 | 16,076 | 7,744 | 48 | |||||||||||||||||||||||||||||||||||||||

| Deferred implementation costs | — | 731 | (731) | (100) | — | 2,343 | (2,343) | (100) | |||||||||||||||||||||||||||||||||||||||

| Gross profit | $ | 26,018 | $ | 24,504 | $ | 1,514 | 6 | % | $ | 79,223 | $ | 67,177 | $ | 12,046 | 18 | % | |||||||||||||||||||||||||||||||

| Net income (loss) | $ | 6,267 | $ | (44,529) | $ | 50,796 | 114 | % | $ | (86,985) | $ | (116,730) | $ | 29,745 | (25) | % | |||||||||||||||||||||||||||||||

Adjusted EBITDA(1) |

$ | (12,708) | $ | (5,169) | $ | (7,539) | (146) | % | $ | (39,030) | $ | (14,779) | $ | (24,251) | 164 | % | |||||||||||||||||||||||||||||||

| Three Months Ended September 30, 2022 |

Three Months Ended September 30, 2021 |

||||||||||||||||||||||||||||||||||

| Cardlytics Platform | Bridg Platform | Consolidated | Cardlytics Platform | Bridg Platform | Consolidated | ||||||||||||||||||||||||||||||

| Revenue | $ | 67,285 | $ | 5,421 | $ | 72,706 | $ | 62,075 | $ | 2,909 | $ | 64,984 | |||||||||||||||||||||||

| Plus: | |||||||||||||||||||||||||||||||||||

| Consumer Incentives | 37,686 | — | 37,686 | 33,464 | — | 33,464 | |||||||||||||||||||||||||||||

| Billings | $ | 104,971 | $ | 5,421 | $ | 110,392 | $ | 95,539 | $ | 2,909 | $ | 98,448 | |||||||||||||||||||||||

| Nine Months Ended September 30, 2022 |

Nine Months Ended September 30, 2021 |

||||||||||||||||||||||||||||||||||

| Cardlytics Platform | Bridg Platform | Consolidated | Cardlytics Platform | Bridg Platform | Consolidated | ||||||||||||||||||||||||||||||

| Revenue | $ | 200,538 | $ | 15,501 | $ | 216,039 | $ | 172,068 | $ | 4,999 | $ | 177,067 | |||||||||||||||||||||||

| Plus: | |||||||||||||||||||||||||||||||||||

| Consumer Incentives | 100,322 | — | 100,322 | 83,035 | — | 83,035 | |||||||||||||||||||||||||||||

| Billings | $ | 300,860 | $ | 15,501 | $ | 316,361 | $ | 255,103 | $ | 4,999 | $ | 260,102 | |||||||||||||||||||||||

| Three Months Ended September 30, 2022 |

Three Months Ended September 30, 2021 |

||||||||||||||||||||||||||||||||||

| Cardlytics Platform | Bridg Platform | Consolidated | Cardlytics Platform | Bridg Platform | Consolidated | ||||||||||||||||||||||||||||||

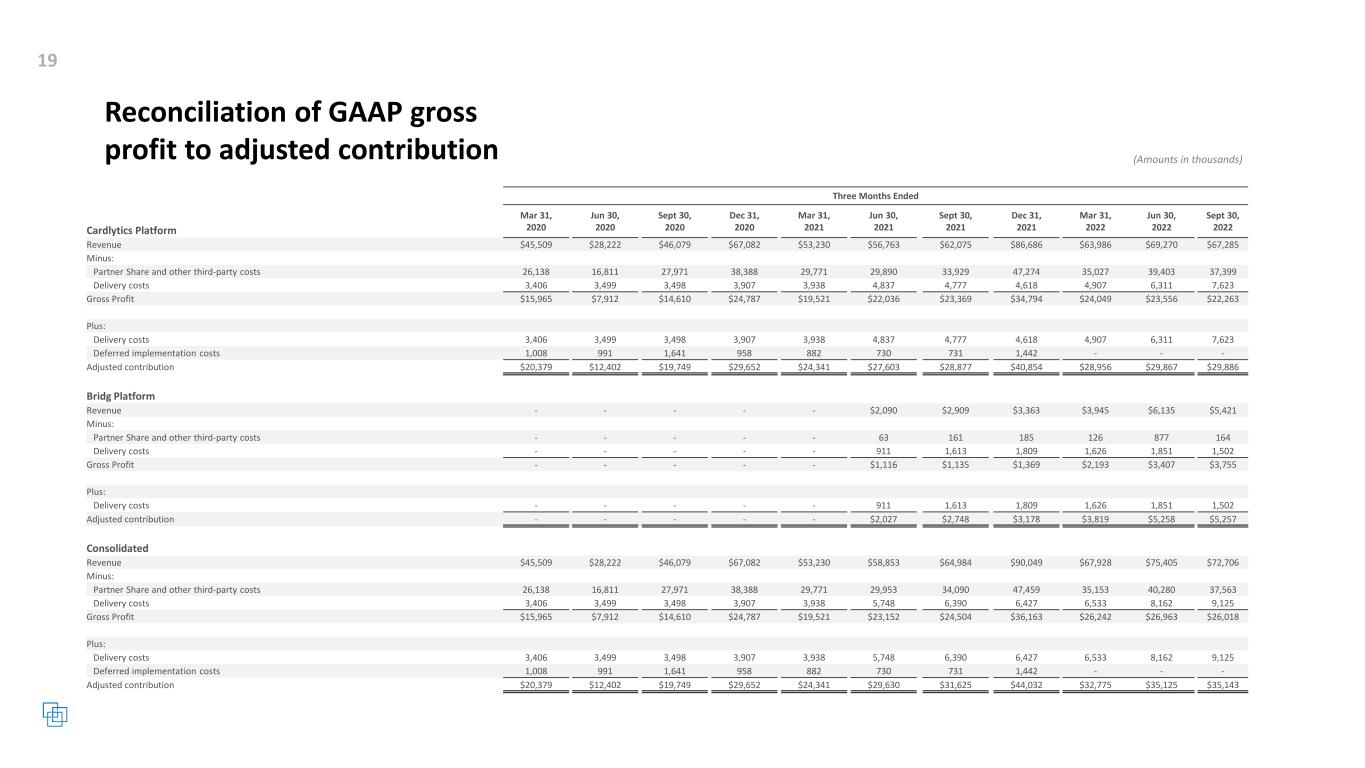

| Revenue | $ | 67,285 | $ | 5,421 | $ | 72,706 | $ | 62,075 | $ | 2,909 | $ | 64,984 | |||||||||||||||||||||||

| Minus: | |||||||||||||||||||||||||||||||||||

| Partner Share and other third-party costs | 37,399 | 164 | 37,563 | 33,929 | 161 | 34,090 | |||||||||||||||||||||||||||||

Delivery costs(1) |

7,623 | 1,502 | 9,125 | 4,777 | 1,613 | 6,390 | |||||||||||||||||||||||||||||

| Gross profit | 22,263 | 3,755 | 26,018 | 23,369 | 1,135 | 24,504 | |||||||||||||||||||||||||||||

| Plus: | |||||||||||||||||||||||||||||||||||

Delivery costs(1) |

7,623 | 1,502 | 9,125 | 4,777 | 1,613 | 6,390 | |||||||||||||||||||||||||||||

Deferred implementation costs(2) |

— | — | — | 731 | — | 731 | |||||||||||||||||||||||||||||

| Adjusted contribution | $ | 29,886 | $ | 5,257 | $ | 35,143 | $ | 28,877 | $ | 2,748 | $ | 31,625 | |||||||||||||||||||||||

| Three Months Ended September 30, 2022 |

Three Months Ended September 30, 2021 |

||||||||||||||||||||||||||||||||||

| Cardlytics Platform | Bridg Platform | Consolidated | Cardlytics Platform | Bridg Platform | Consolidated | ||||||||||||||||||||||||||||||

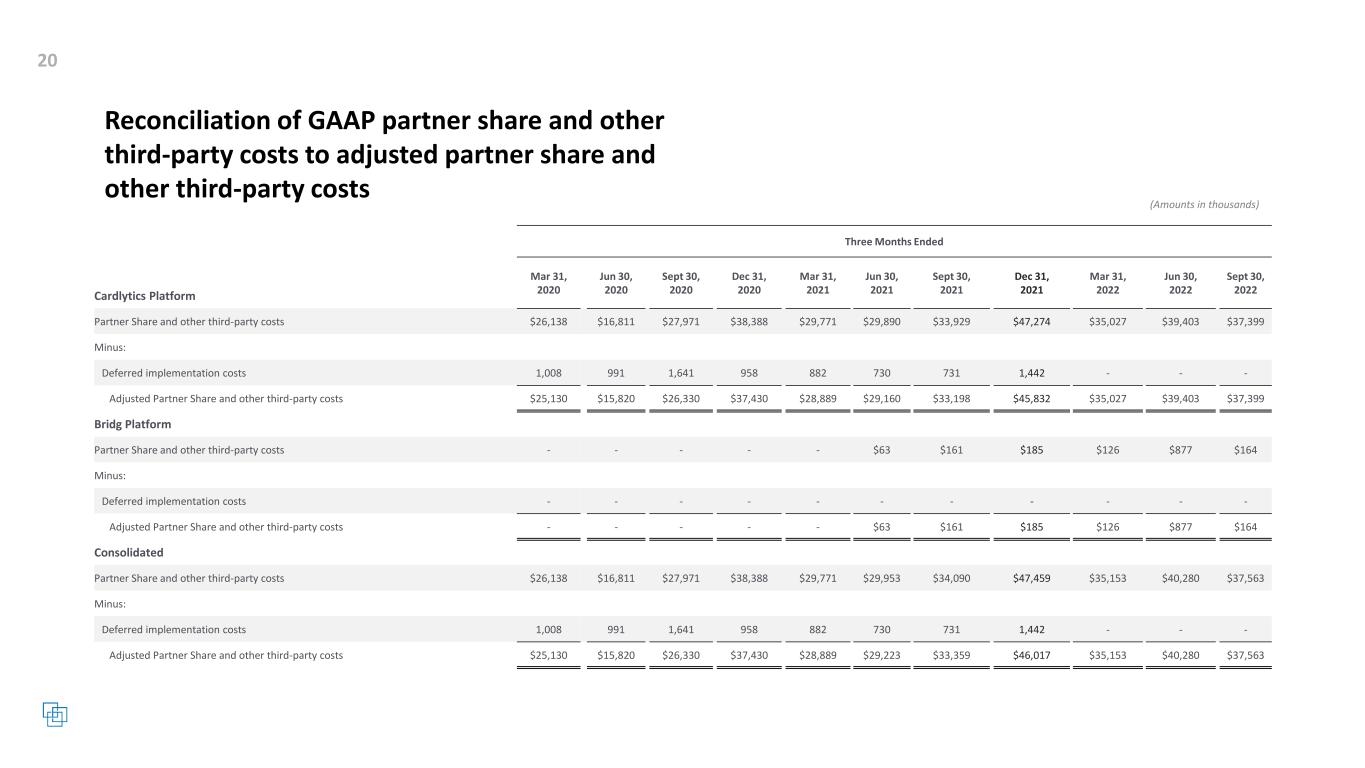

| Partner Share and other third-party costs | $ | 37,399 | $ | 164 | $ | 37,563 | $ | 33,929 | $ | 161 | $ | 34,090 | |||||||||||||||||||||||

| Minus: | |||||||||||||||||||||||||||||||||||

| Deferred implementation costs | — | — | — | 731 | — | 731 | |||||||||||||||||||||||||||||

| Adjusted Partner Share and other third-party costs | $ | 37,399 | $ | 164 | $ | 37,563 | $ | 33,198 | $ | 161 | $ | 33,359 | |||||||||||||||||||||||

| Nine Months Ended September 30, 2022 |

Nine Months Ended September 30, 2021 |

||||||||||||||||||||||||||||||||||

| Cardlytics Platform | Bridg Platform | Consolidated | Cardlytics Platform | Bridg Platform | Consolidated | ||||||||||||||||||||||||||||||

| Revenue | $ | 200,538 | $ | 15,501 | $ | 216,039 | $ | 172,068 | $ | 4,999 | $ | 177,067 | |||||||||||||||||||||||

| Minus: | |||||||||||||||||||||||||||||||||||

| Partner Share and other third-party costs | 111,829 | 1,167 | 112,996 | 93,590 | 224 | 93,814 | |||||||||||||||||||||||||||||

Delivery costs(1) |

18,841 | 4,979 | 23,820 | 13,552 | 2,524 | 16,076 | |||||||||||||||||||||||||||||

| Gross profit | 69,868 | 9,355 | 79,223 | 64,926 | 2,251 | 67,177 | |||||||||||||||||||||||||||||

| Plus: | |||||||||||||||||||||||||||||||||||

Delivery costs(1) |

18,841 | 4,979 | 23,820 | 13,552 | 2,524 | 16,076 | |||||||||||||||||||||||||||||

Deferred implementation costs(2) |

— | — | — | 2,343 | — | 2,343 | |||||||||||||||||||||||||||||

| Adjusted contribution | $ | 88,709 | $ | 14,334 | $ | 103,043 | $ | 80,821 | $ | 4,775 | $ | 85,596 | |||||||||||||||||||||||

| Nine Months Ended September 30, 2022 |

Nine Months Ended September 30, 2021 |

||||||||||||||||||||||||||||||||||

| Cardlytics Platform | Bridg Platform | Consolidated | Cardlytics Platform | Bridg Platform | Consolidated | ||||||||||||||||||||||||||||||

| Partner Share and other third-party costs | $ | 111,829 | $ | 1,167 | $ | 112,996 | $ | 93,590 | $ | 224 | $ | 93,814 | |||||||||||||||||||||||

| Minus: | |||||||||||||||||||||||||||||||||||

| Deferred implementation costs | — | — | — | 2,343 | — | 2,343 | |||||||||||||||||||||||||||||

| Adjusted Partner Share and other third-party costs | $ | 111,829 | $ | 1,167 | $ | 112,996 | $ | 91,247 | $ | 224 | $ | 91,471 | |||||||||||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

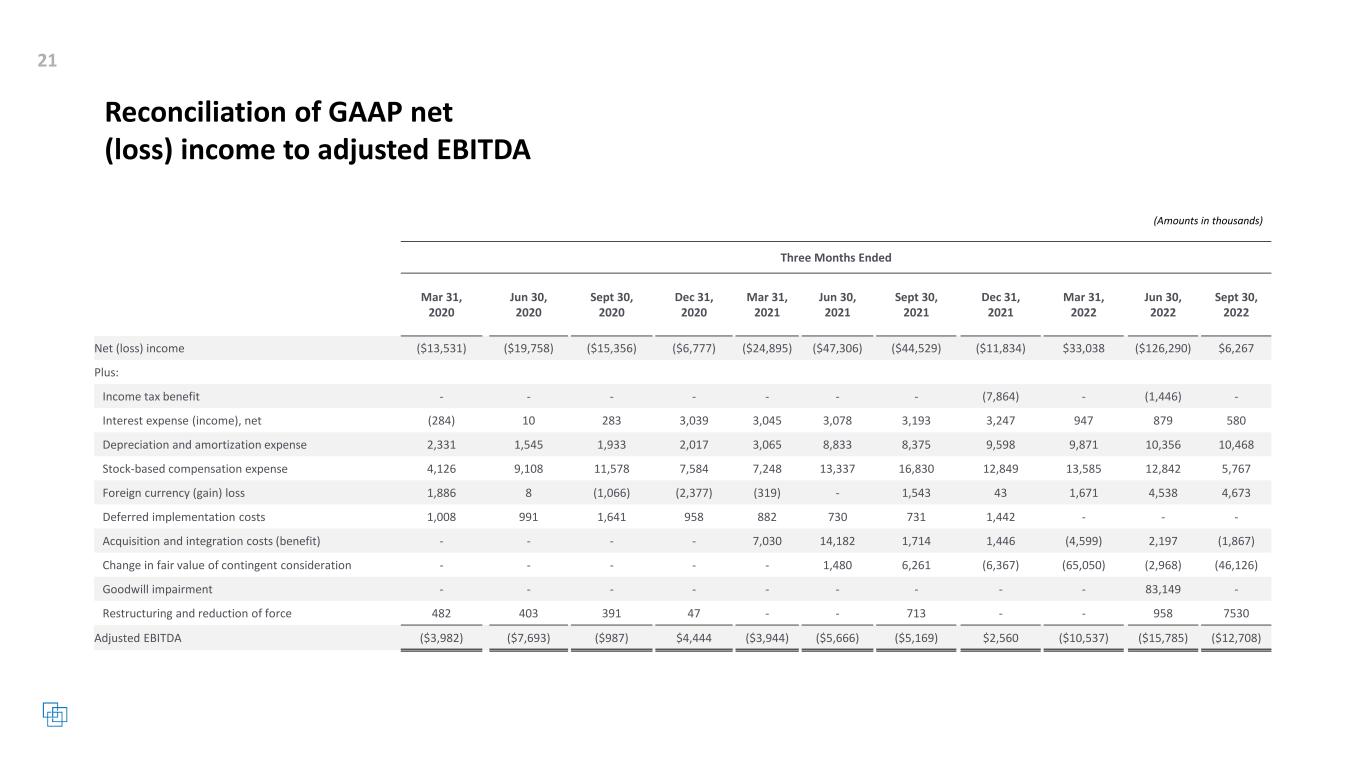

| Net income (loss) | $ | 6,267 | $ | (44,529) | $ | (86,985) | $ | (116,730) | |||||||||||||||

| Plus: | |||||||||||||||||||||||

| Income tax benefit | — | — | (1,446) | — | |||||||||||||||||||

| Interest expense - net | 580 | 3,193 | 2,406 | 9,316 | |||||||||||||||||||

| Depreciation and amortization | 10,468 | 8,375 | 30,695 | 20,273 | |||||||||||||||||||

| Stock-based compensation expense | 5,767 | 16,830 | 32,194 | 37,415 | |||||||||||||||||||

| Foreign currency loss | 4,673 | 1,543 | 10,882 | 1,224 | |||||||||||||||||||

| Deferred implementation costs | — | 731 | — | 2,343 | |||||||||||||||||||

| Acquisition and integration (benefit) costs | (1,867) | 1,714 | (4,269) | 22,926 | |||||||||||||||||||

| Change in fair value of contingent consideration | (46,126) | 6,261 | (114,144) | 7,741 | |||||||||||||||||||

| Goodwill impairment | — | — | 83,149 | — | |||||||||||||||||||

| Restructuring and reduction of force | 7,530 | 713 | 8,488 | 713 | |||||||||||||||||||

| Adjusted EBITDA | $ | (12,708) | $ | (5,169) | $ | (39,030) | $ | (14,779) | |||||||||||||||

| Three Months Ended September 30, 2022 |

Three Months Ended September 30, 2021 |

||||||||||||||||||||||||||||||||||

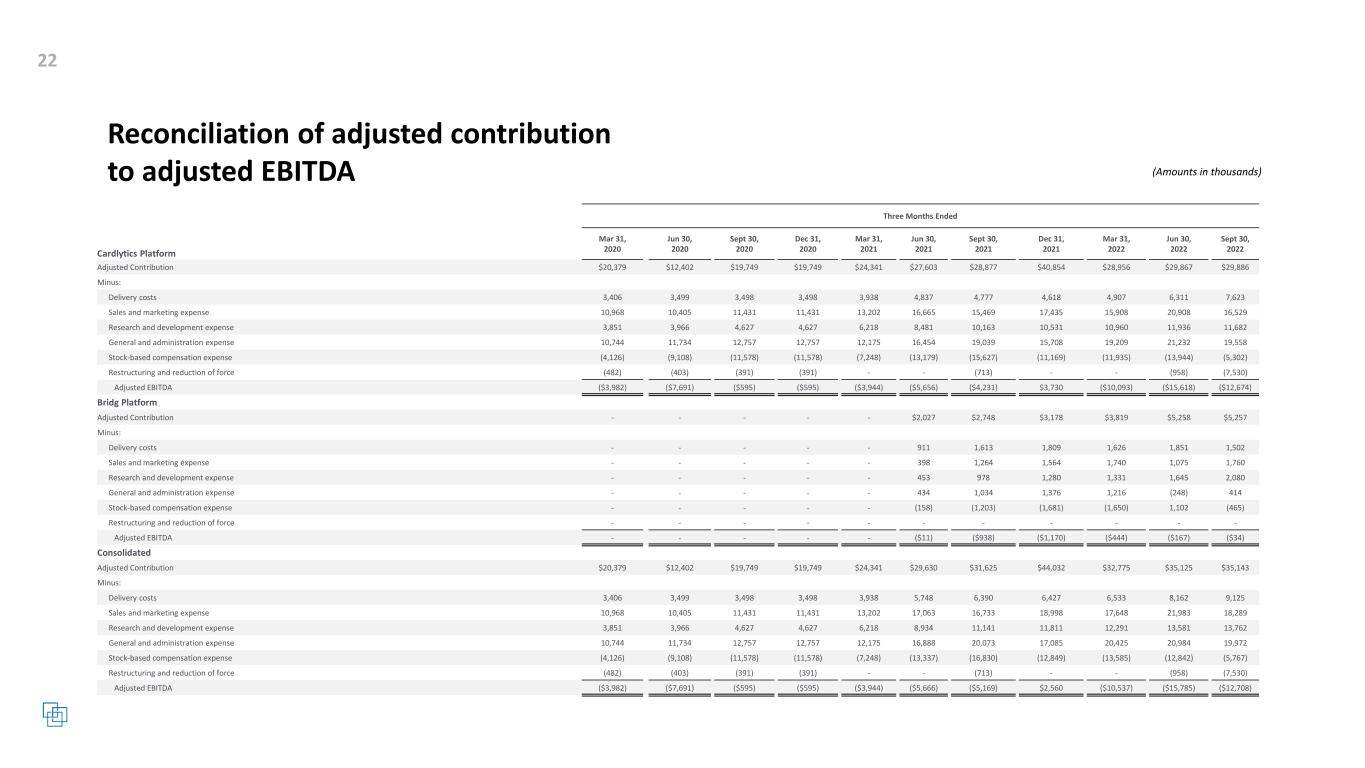

| Cardlytics Platform | Bridg Platform | Consolidated | Cardlytics Platform | Bridg Platform | Consolidated | ||||||||||||||||||||||||||||||

| Adjusted Contribution | $ | 29,886 | $ | 5,257 | $ | 35,143 | $ | 28,877 | $ | 2,748 | $ | 31,625 | |||||||||||||||||||||||

| Minus: | |||||||||||||||||||||||||||||||||||

| Delivery costs | 7,623 | 1,502 | 9,125 | 4,777 | 1,613 | 6,390 | |||||||||||||||||||||||||||||

| Sales and marketing expense | 16,529 | 1,760 | 18,289 | 15,469 | 1,264 | 16,733 | |||||||||||||||||||||||||||||

| Research and development expense | 11,682 | 2,080 | 13,762 | 10,163 | 978 | 11,141 | |||||||||||||||||||||||||||||

| General and administration expense | 19,558 | 414 | 19,972 | 19,039 | 1,034 | 20,073 | |||||||||||||||||||||||||||||

| Stock-based compensation expense | (5,302) | (465) | (5,767) | (15,627) | (1,203) | (16,830) | |||||||||||||||||||||||||||||

| Restructuring and reduction of force | (7,530) | — | (7,530) | (713) | — | (713) | |||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | (12,674) | $ | (34) | $ | (12,708) | $ | (4,231) | $ | (938) | $ | (5,169) | |||||||||||||||||||||||

| Nine Months Ended September 30, 2022 |

Nine Months Ended September 30, 2021 |

||||||||||||||||||||||||||||||||||

| Cardlytics Platform | Bridg Platform | Consolidated | Cardlytics Platform | Bridg Platform | Consolidated | ||||||||||||||||||||||||||||||

| Adjusted Contribution | $ | 88,709 | $ | 14,334 | $ | 103,043 | $ | 80,821 | $ | 4,775 | $ | 85,596 | |||||||||||||||||||||||

| Minus: | |||||||||||||||||||||||||||||||||||

| Delivery costs | 18,841 | 4,979 | 23,820 | 16,076 | — | 16,076 | |||||||||||||||||||||||||||||

| Sales and marketing expense | 53,345 | 4,575 | 57,920 | 45,257 | 1,741 | 46,998 | |||||||||||||||||||||||||||||

| Research and development expense | 34,577 | 5,057 | 39,634 | 26,135 | 158 | 26,293 | |||||||||||||||||||||||||||||

| General and administration expense | 59,999 | 1,382 | 61,381 | 49,136 | — | 49,136 | |||||||||||||||||||||||||||||

| Stock-based compensation expense | (31,181) | (1,013) | (32,194) | (37,415) | — | (37,415) | |||||||||||||||||||||||||||||

| Restructuring and reduction of force | (8,488) | — | (8,488) | (713) | — | (713) | |||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | (38,384) | $ | (646) | $ | (39,030) | $ | (17,655) | $ | 2,876 | $ | (14,779) | |||||||||||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

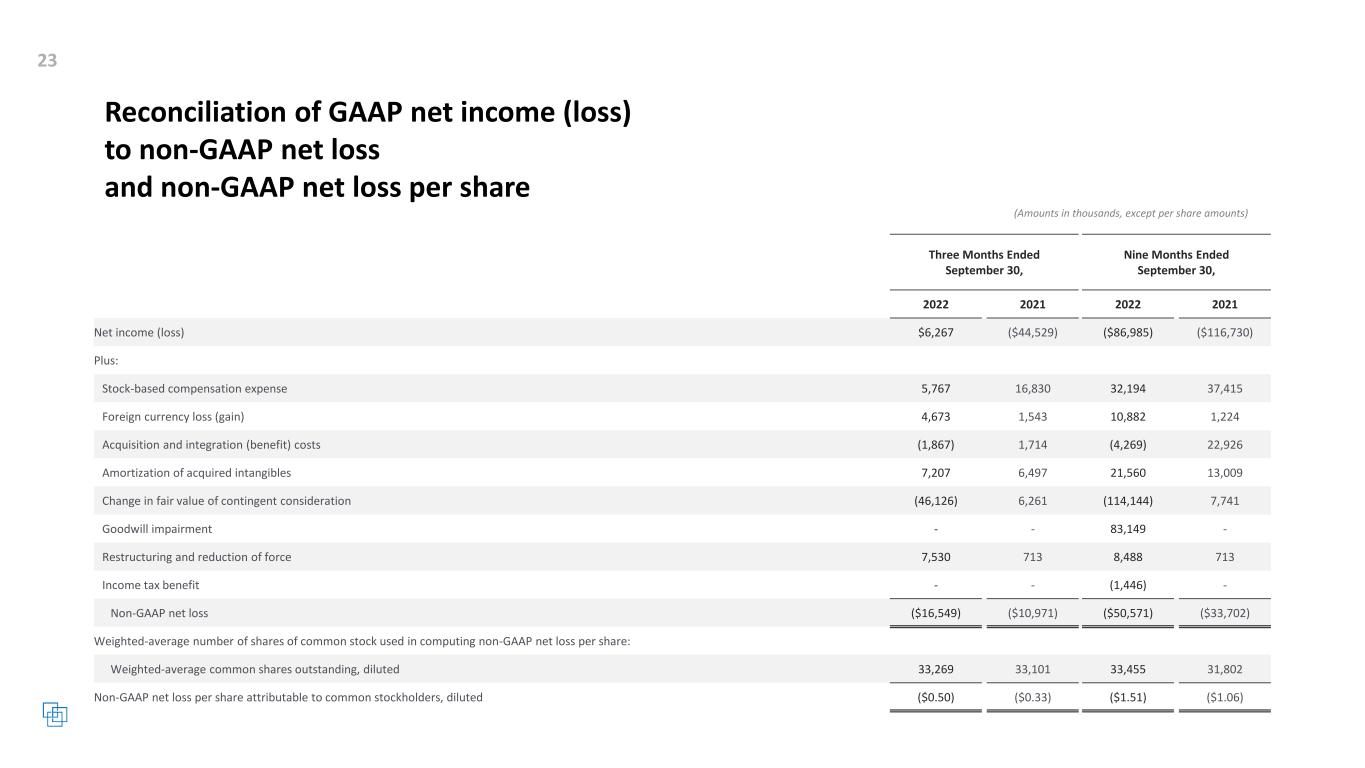

| Net income (loss) | $ | 6,267 | $ | (44,529) | $ | (86,985) | $ | (116,730) | |||||||||||||||

| Plus: | |||||||||||||||||||||||

| Stock-based compensation expense | 5,767 | 16,830 | 32,194 | 37,415 | |||||||||||||||||||

| Foreign currency loss | 4,673 | 1,543 | 10,882 | 1,224 | |||||||||||||||||||

| Acquisition and integration (benefit) costs | (1,867) | 1,714 | (4,269) | 22,926 | |||||||||||||||||||

| Amortization of acquired intangibles | 7,207 | 6,497 | 21,560 | 13,009 | |||||||||||||||||||

Change in fair value of contingent consideration |

(46,126) | 6,261 | (114,144) | 7,741 | |||||||||||||||||||

| Goodwill impairment | — | — | 83,149 | — | |||||||||||||||||||

| Restructuring and reduction of force | 7,530 | 713 | 8,488 | 713 | |||||||||||||||||||

| Income tax benefit | — | — | (1,446) | — | |||||||||||||||||||

| Non-GAAP net loss | $ | (16,549) | $ | (10,971) | $ | (50,571) | $ | (33,702) | |||||||||||||||

| Weighted-average number of shares of common stock used in computing non-GAAP net loss per share: | |||||||||||||||||||||||

| Non-GAAP weighted-average common shares outstanding, diluted | 33,269 | 33,101 | 33,455 | 31,802 | |||||||||||||||||||

| Non-GAAP net loss per share attributable to common stockholders, diluted | $ | (0.50) | $ | (0.33) | $ | (1.51) | $ | (1.06) | |||||||||||||||

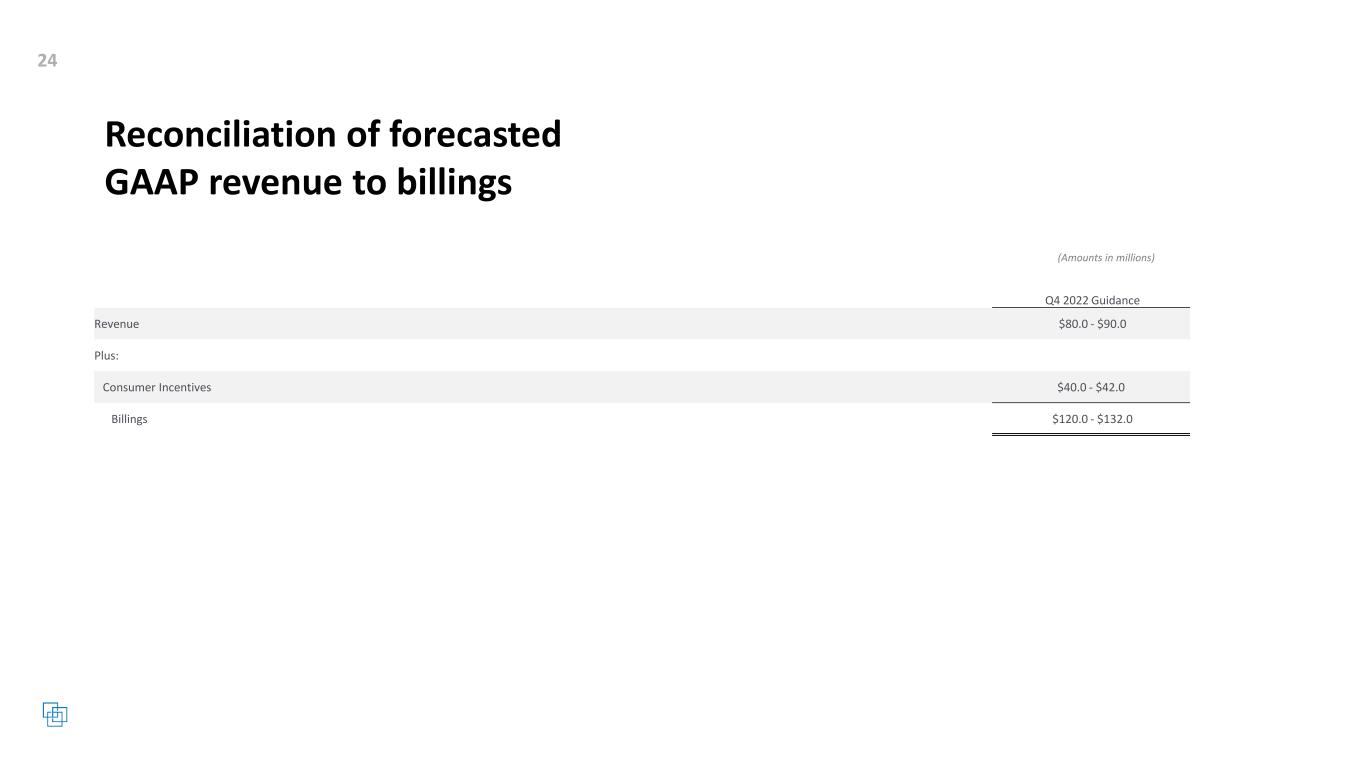

| Q4 2022 Guidance | |||||

| Revenue | $80.0 - $90.0 | ||||

| Plus: | |||||

| Consumer Incentives | $40.0 - $42.0 | ||||

| Billings | $120.0 - $132.0 | ||||