First Quarter 2024 Supplemental Information APRIL 23, 2024

2 Legal Disclosures This presentation has been prepared for KKR Real Estate Finance Trust Inc. (NYSE: KREF) for the benefit of its stockholders. This presentation is solely for informational purposes in connection with evaluating the business, operations and financial results of KKR Real Estate Finance Trust Inc. and its subsidiaries (collectively, "KREF“ or the “Company”). This presentation is not and shall not be construed as an offer to purchase or sell, or the solicitation of an offer to purchase or sell, any securities, any investment advice or any other service by KREF. Nothing in this presentation constitutes the provision of any tax, accounting, financial, investment, regulatory, legal or other advice by KREF or its advisors. This presentation may not be referenced, quoted or linked by website by any third party, in whole or in part, except as agreed to in writing by KREF. This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which reflect the Company’s current views with respect to, among other things, its future operations and financial performance. You can identify these forward looking statements by the use of words such as “outlook,” “believe,” “expect,” “potential,” “continue,” “may,” “should,” “seek,” “approximately,” “predict,” “intend,” “will,” “plan,” “estimate,” “anticipate,” the negative version of these words, other comparable words or other statements that do not relate strictly to historical or factual matters. By their nature, forward-looking statements speak only as of the date they are made, are not statements of historical fact or guarantees of future performance and are subject to risks, uncertainties, assumptions or changes in circumstances that are difficult to predict or quantify. The forward-looking statements are based on the Company’s beliefs, assumptions and expectations, taking into account all information currently available to it. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to the Company or are within its control. Such forward-looking statements are subject to various risks and uncertainties, including, among other things: the general political, economic, competitive, and other conditions in the United States and in any foreign jurisdictions in which we invest; global economic trends and conditions, including heightened inflation, slower growth or recession, changes to fiscal and monetary policy, fluctuations in interest rates and credit spreads, labor shortages, currency fluctuations and challenges in global supply chains; deterioration in the performance of the properties securing our investments; difficulty accessing financing or raising capital; and the risks, uncertainties and factors set forth under Part I-Item 1A. “Risk Factors” of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as such factors may be updated from time to time in the Company’s periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in this release. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements and information included in this release and in the Company’s filings with the SEC. All forward-looking statements in this release speak only as of the date of this release. The Company undertakes no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by law. All forward looking statements in this presentation speak only as of April 23, 2024. KREF undertakes no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by law. All financial information in this presentation is as of March 31, 2024 unless otherwise indicated. This presentation also includes non-GAAP financial measures, including Distributable Earnings and Distributable Earnings per Diluted Share. Such non-GAAP financial measures should be considered only as supplemental to, and not as superior to, financial measures prepared in accordance with U.S. GAAP. Please refer to the Appendix of this presentation for a reconciliation of the non-GAAP financial measures included in this presentation to the most directly comparable financial measures prepared in accordance with U.S. GAAP.

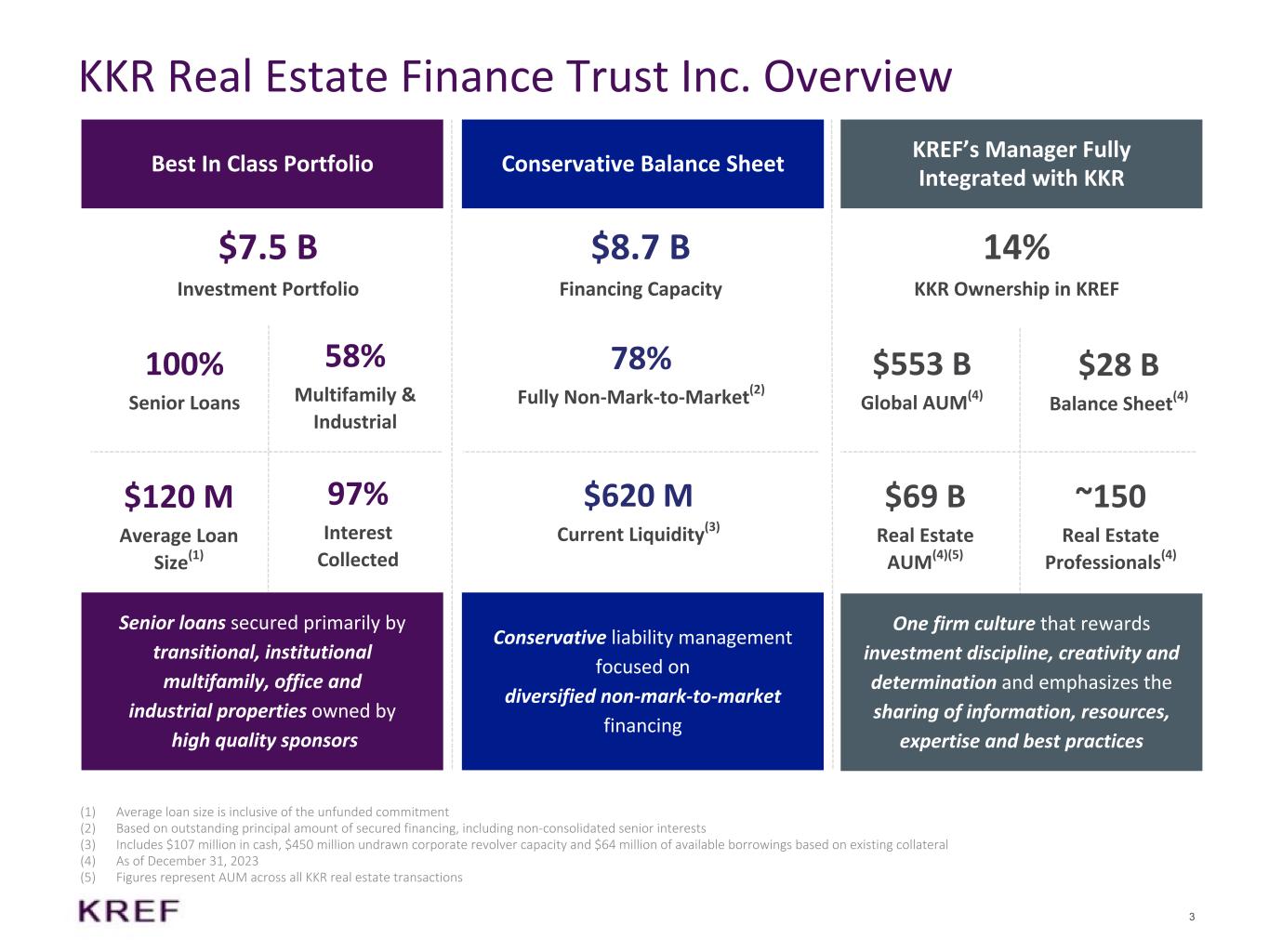

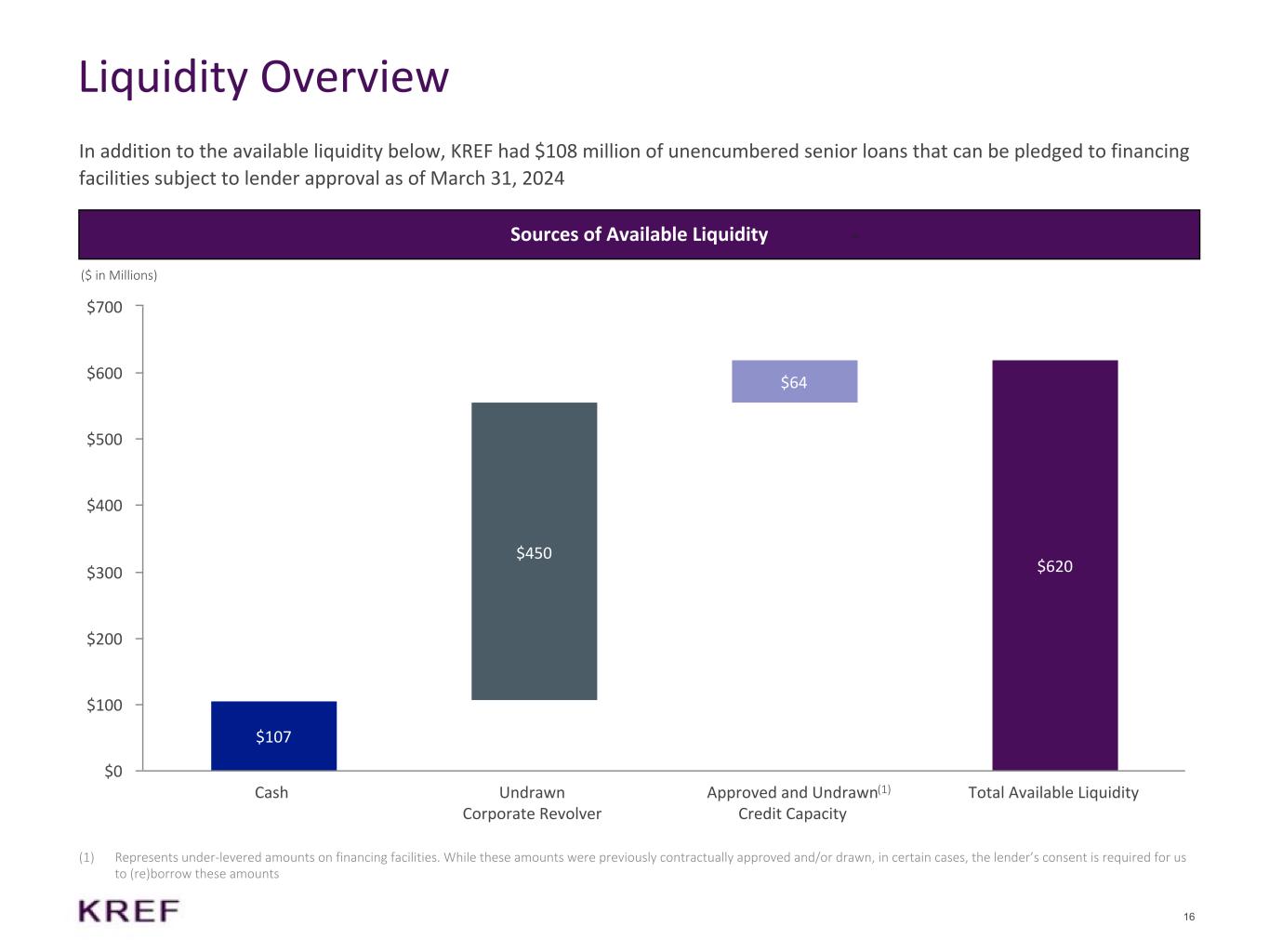

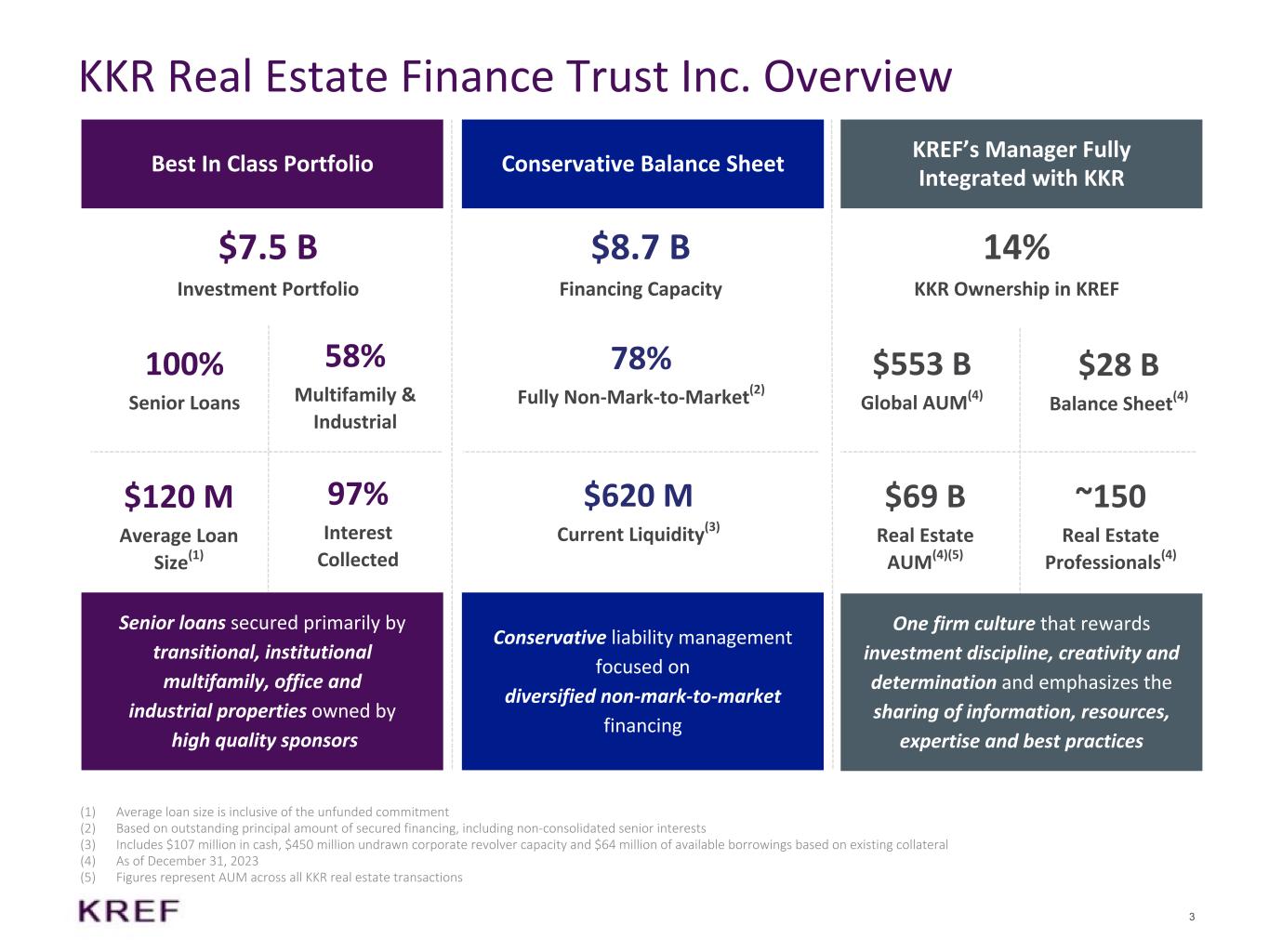

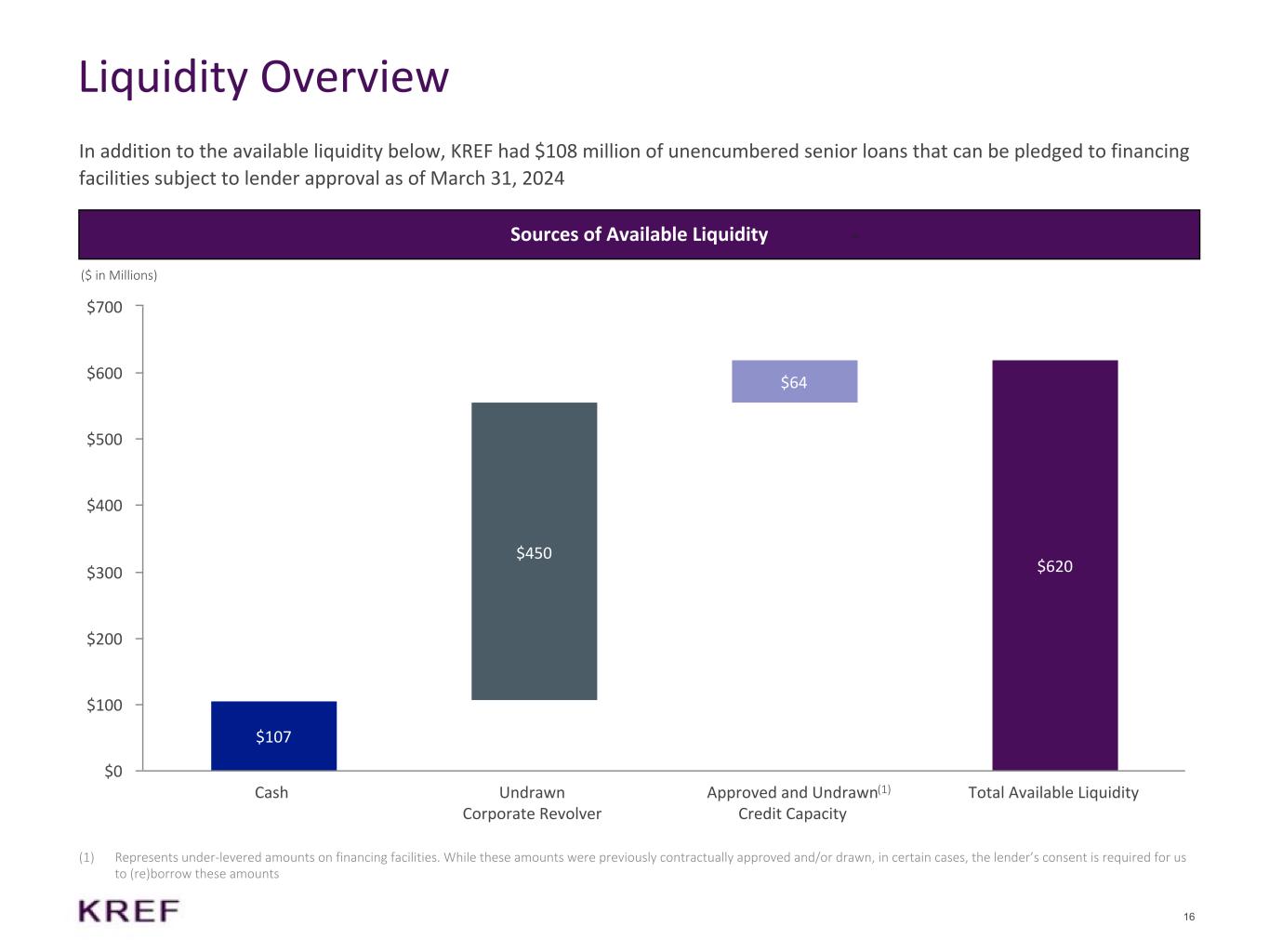

3 KKR Real Estate Finance Trust Inc. Overview Best In Class Portfolio Conservative Balance Sheet KREF’s Manager Fully Integrated with KKR $7.5 B Investment Portfolio 100% Senior Loans 58% Multifamily & Industrial $120 M Average Loan Size(1) 97% Interest Collected Senior loans secured primarily by transitional, institutional multifamily, office and industrial properties owned by high quality sponsors $8.7 B Financing Capacity 78% Fully Non-Mark-to-Market(2) Conservative liability management focused on diversified non-mark-to-market financing 14% KKR Ownership in KREF $620 M Current Liquidity(3) $553 B Global AUM(4) $28 B Balance Sheet(4) $69 B Real Estate AUM(4)(5) ~150 Real Estate Professionals(4) One firm culture that rewards investment discipline, creativity and determination and emphasizes the sharing of information, resources, expertise and best practices (1) Average loan size is inclusive of the unfunded commitment (2) Based on outstanding principal amount of secured financing, including non-consolidated senior interests (3) Includes $107 million in cash, $450 million undrawn corporate revolver capacity and $64 million of available borrowings based on existing collateral (4) As of December 31, 2023 (5) Figures represent AUM across all KKR real estate transactions

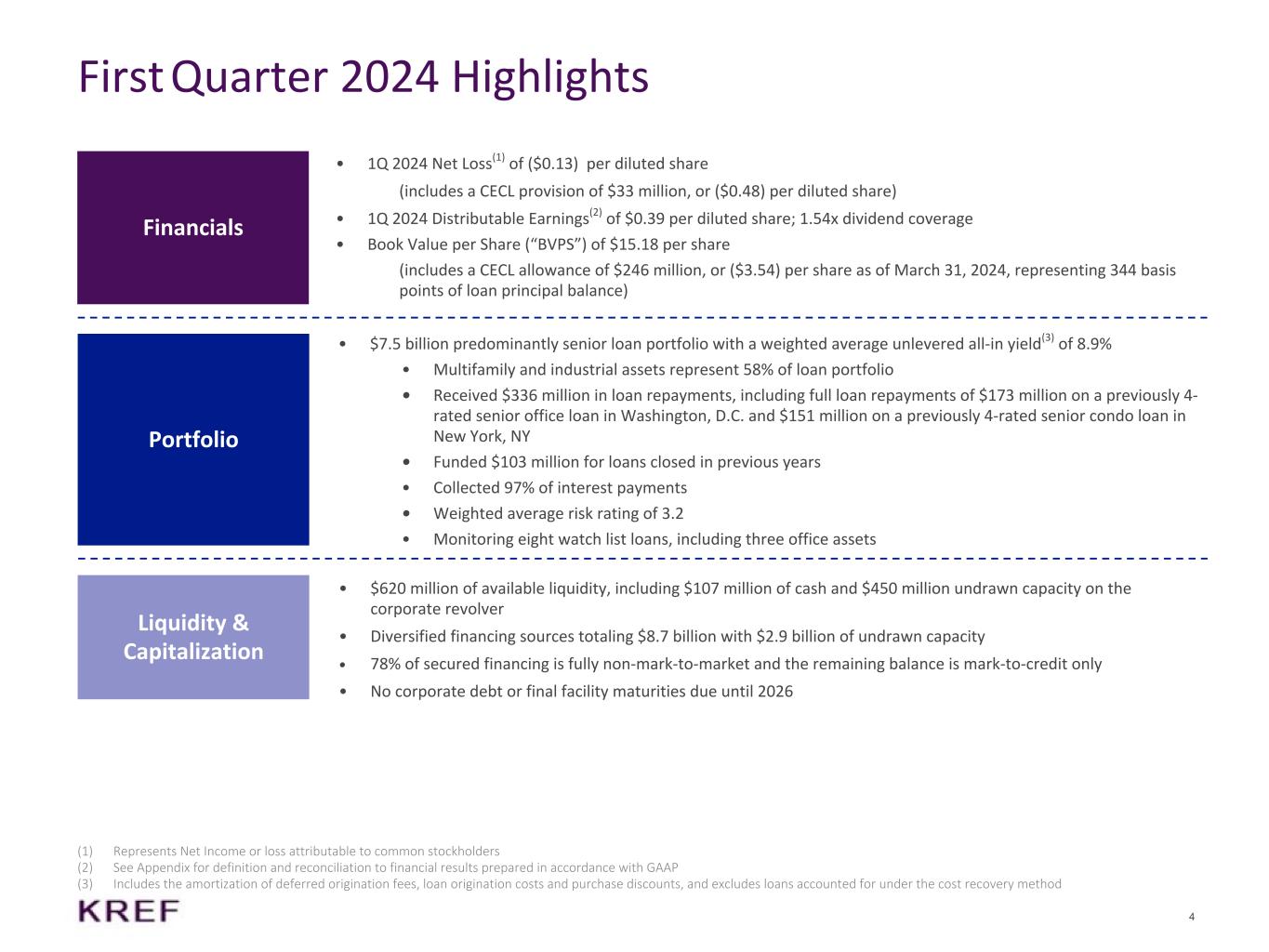

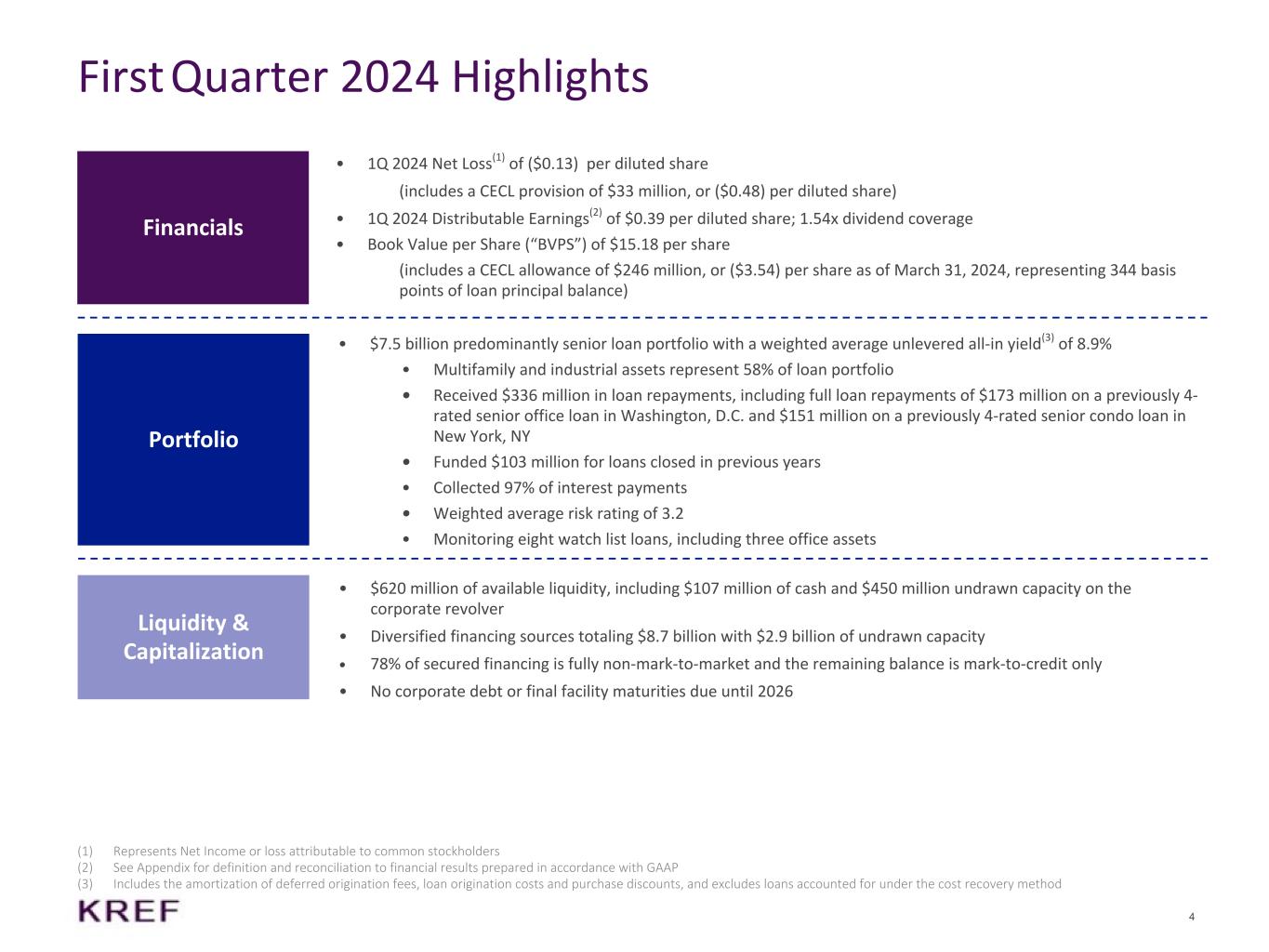

4 • 1Q 2024 Net Loss(1) of ($0.13) per diluted share (includes a CECL provision of $33 million, or ($0.48) per diluted share) • 1Q 2024 Distributable Earnings(2) of $0.39 per diluted share; 1.54x dividend coverage • Book Value per Share (“BVPS”) of $15.18 per share (includes a CECL allowance of $246 million, or ($3.54) per share as of March 31, 2024, representing 344 basis points of loan principal balance) First Quarter 2024 Highlights (1) Represents Net Income or loss attributable to common stockholders (2) See Appendix for definition and reconciliation to financial results prepared in accordance with GAAP (3) Includes the amortization of deferred origination fees, loan origination costs and purchase discounts, and excludes loans accounted for under the cost recovery method • $7.5 billion predominantly senior loan portfolio with a weighted average unlevered all-in yield(3) of 8.9% • Multifamily and industrial assets represent 58% of loan portfolio • Received $336 million in loan repayments, including full loan repayments of $173 million on a previously 4- rated senior office loan in Washington, D.C. and $151 million on a previously 4-rated senior condo loan in New York, NY • Funded $103 million for loans closed in previous years • Collected 97% of interest payments • Weighted average risk rating of 3.2 • Monitoring eight watch list loans, including three office assets Financials Portfolio Liquidity & Capitalization • $620 million of available liquidity, including $107 million of cash and $450 million undrawn capacity on the corporate revolver • Diversified financing sources totaling $8.7 billion with $2.9 billion of undrawn capacity • 78% of secured financing is fully non-mark-to-market and the remaining balance is mark-to-credit only • No corporate debt or final facility maturities due until 2026

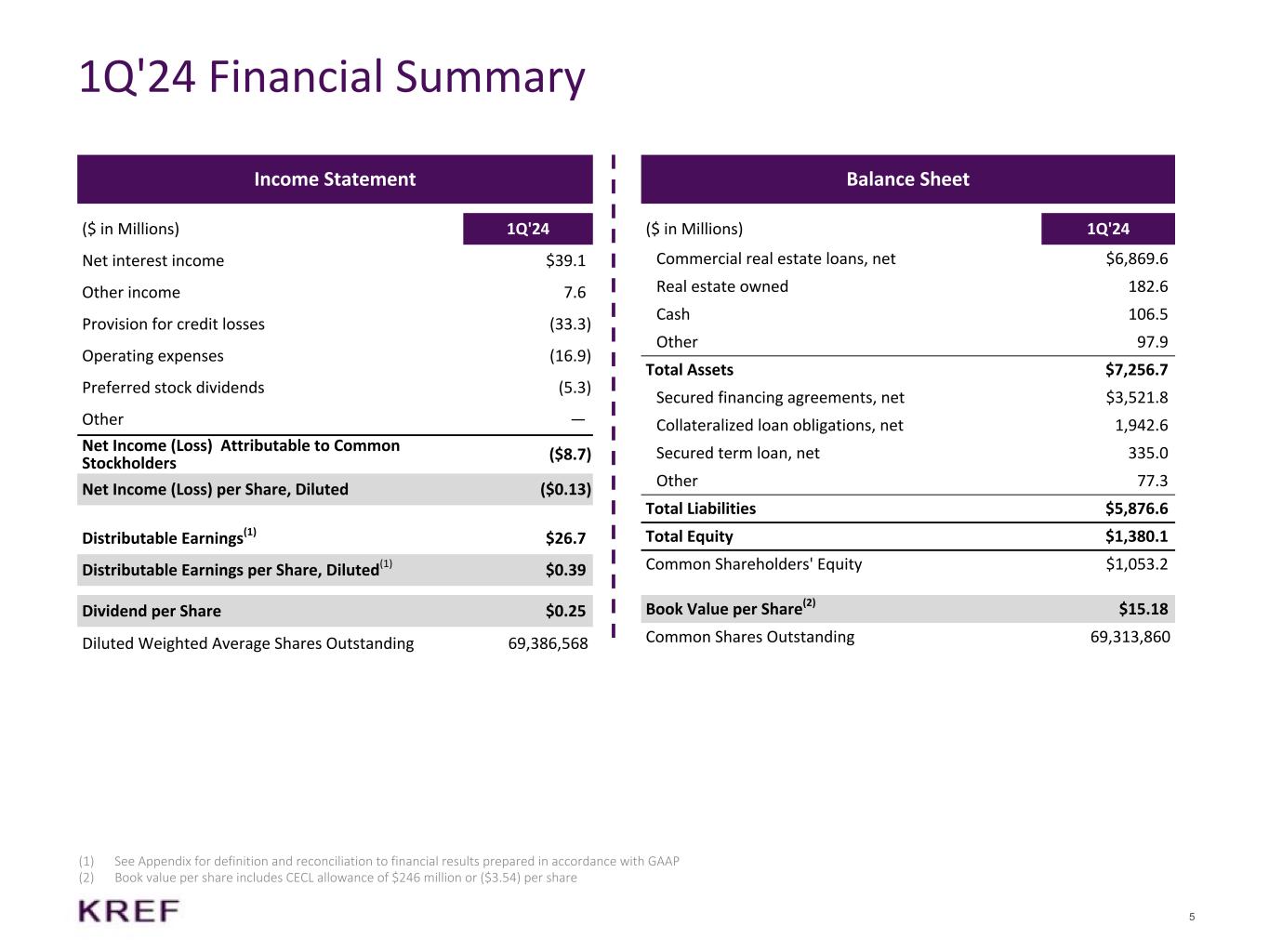

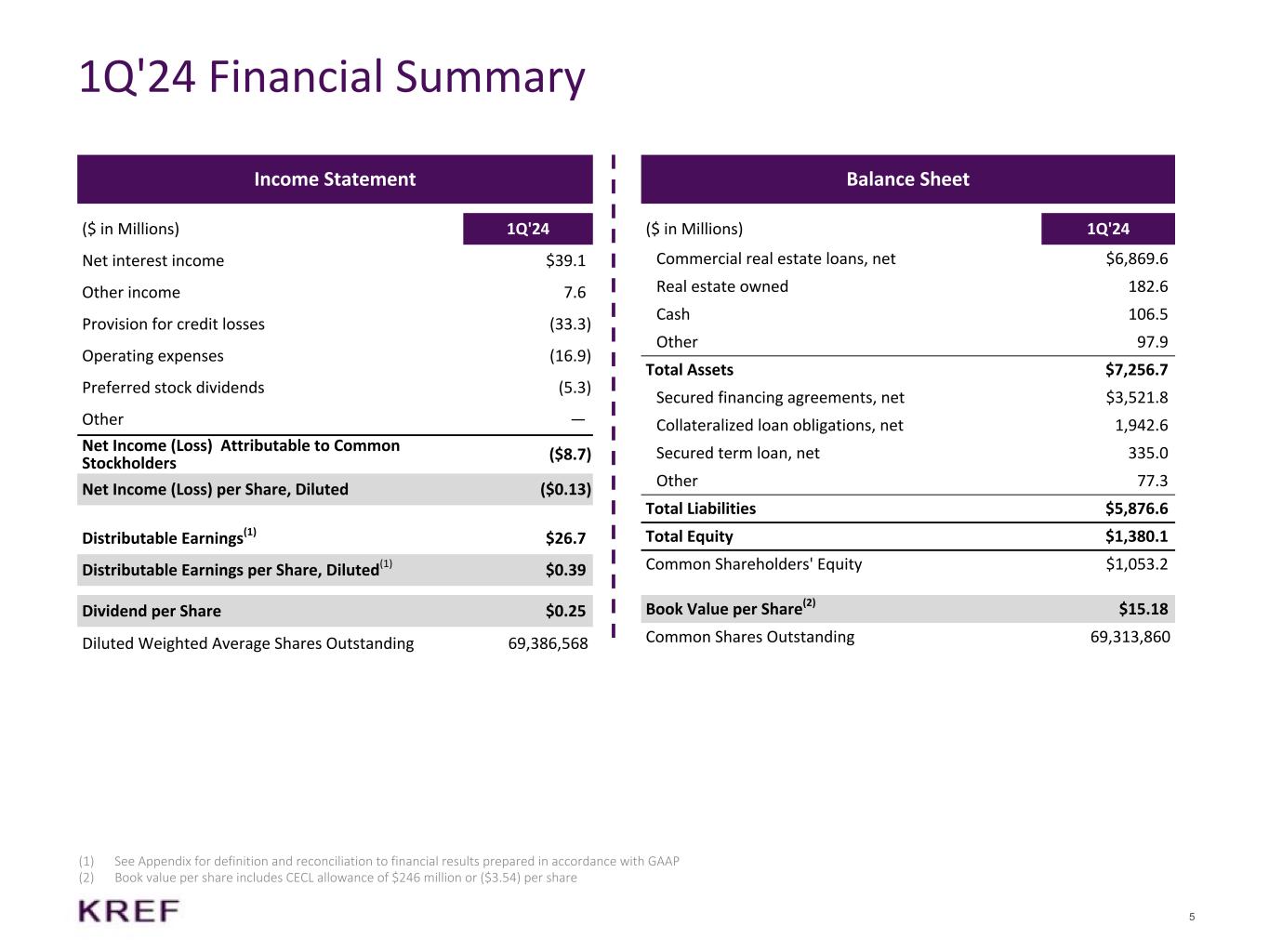

5 1Q'24 Financial Summary (1) See Appendix for definition and reconciliation to financial results prepared in accordance with GAAP (2) Book value per share includes CECL allowance of $246 million or ($3.54) per share Income Statement ($ in Millions) 1Q'24 Net interest income $39.1 Other income 7.6 Provision for credit losses (33.3) Operating expenses (16.9) Preferred stock dividends (5.3) Other — Net Income (Loss) Attributable to Common Stockholders ($8.7) Net Income (Loss) per Share, Diluted ($0.13) Distributable Earnings(1) $26.7 Distributable Earnings per Share, Diluted(1) $0.39 Dividend per Share $0.25 Diluted Weighted Average Shares Outstanding 69,386,568 Balance Sheet ($ in Millions) 1Q'24 Commercial real estate loans, net $6,869.6 Real estate owned 182.6 Cash 106.5 Other 97.9 Total Assets $7,256.7 Secured financing agreements, net $3,521.8 Collateralized loan obligations, net 1,942.6 Secured term loan, net 335.0 Other 77.3 Total Liabilities $5,876.6 Total Equity $1,380.1 Common Shareholders' Equity $1,053.2 Book Value per Share(2) $15.18 Common Shares Outstanding 69,313,860

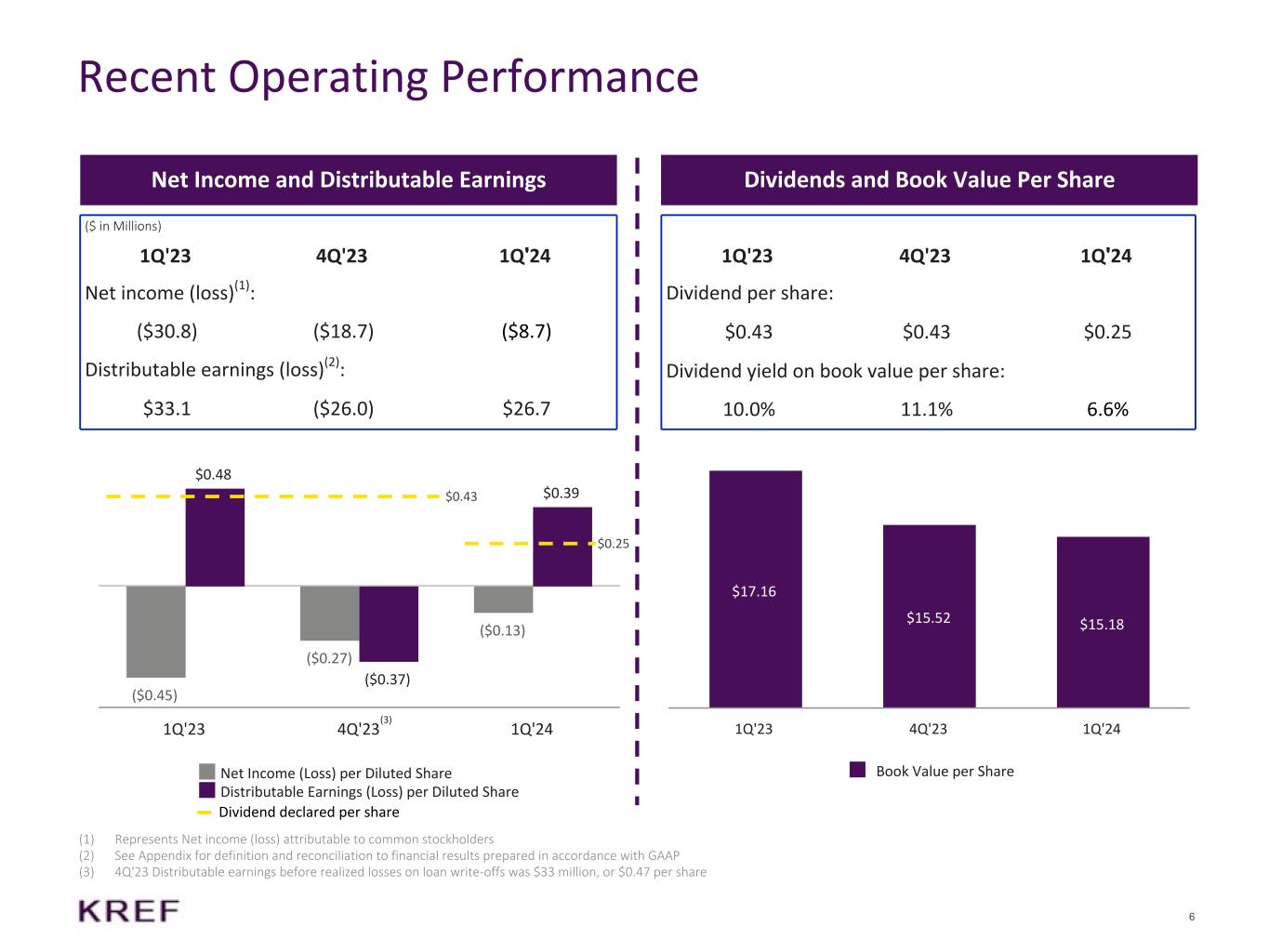

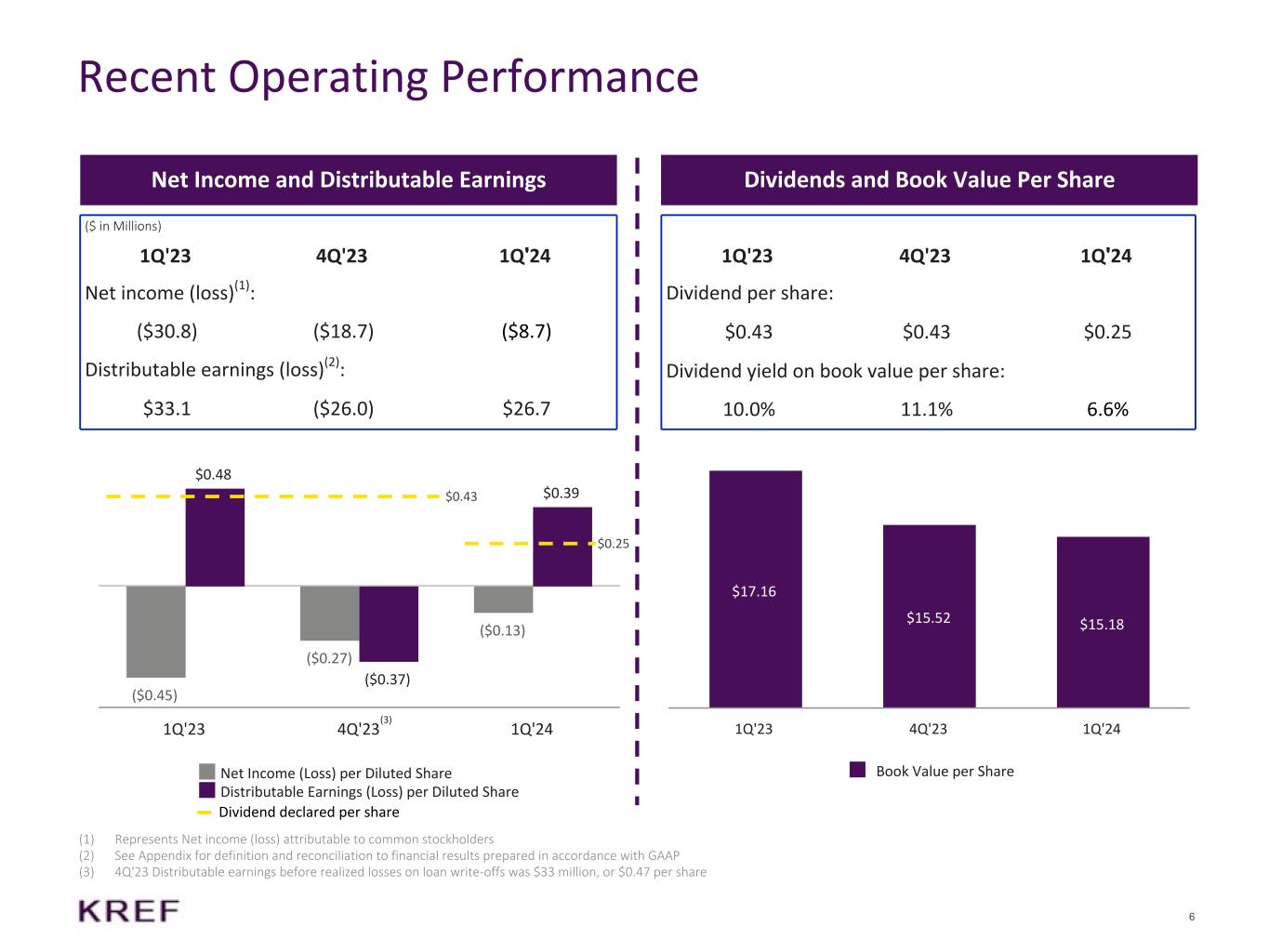

6 ($0.45) ($0.27) ($0.13) $0.48 ($0.37) $0.39 Net Income (Loss) per Diluted Share Distributable Earnings (Loss) per Diluted Share 1Q'23 4Q'23 1Q'24 $0.25 Recent Operating Performance (1) Represents Net income (loss) attributable to common stockholders (2) See Appendix for definition and reconciliation to financial results prepared in accordance with GAAP (3) 4Q'23 Distributable earnings before realized losses on loan write-offs was $33 million, or $0.47 per share Net Income and Distributable Earnings Dividends and Book Value Per Share ($ in Millions) 1Q'23 4Q'23 1Q'24 Net income (loss)(1): ($30.8) ($18.7) ($8.7) Distributable earnings (loss)(2): $33.1 ($26.0) $26.7 1Q'23 4Q'23 1Q'24 Dividend per share: $0.43 $0.43 $0.25 Dividend yield on book value per share: 10.0% 11.1% 6.6% $17.16 $15.52 $15.18 Book Value per Share 1Q'23 4Q'23 1Q'24 (3) $0.43 Dividend declared per share

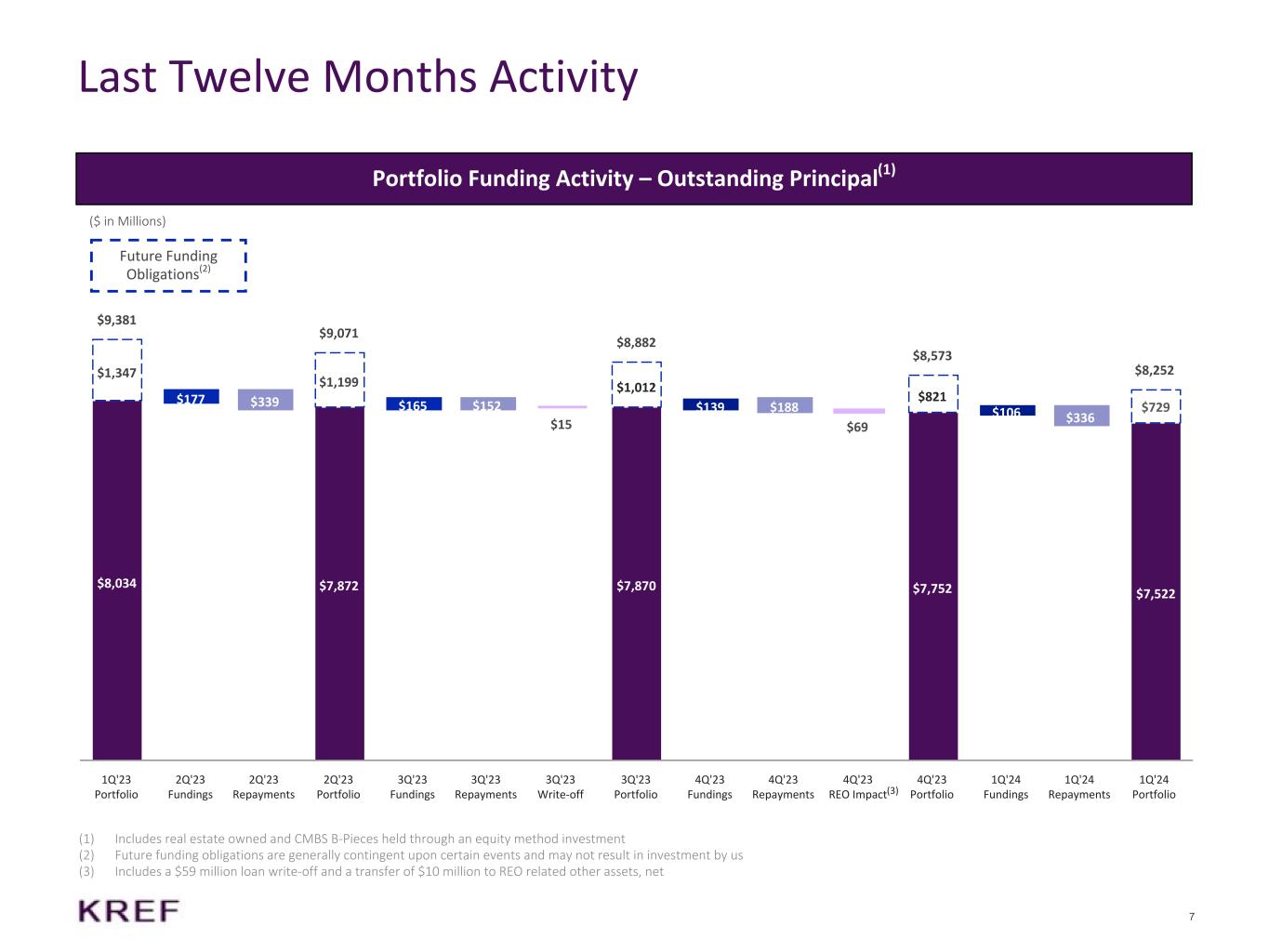

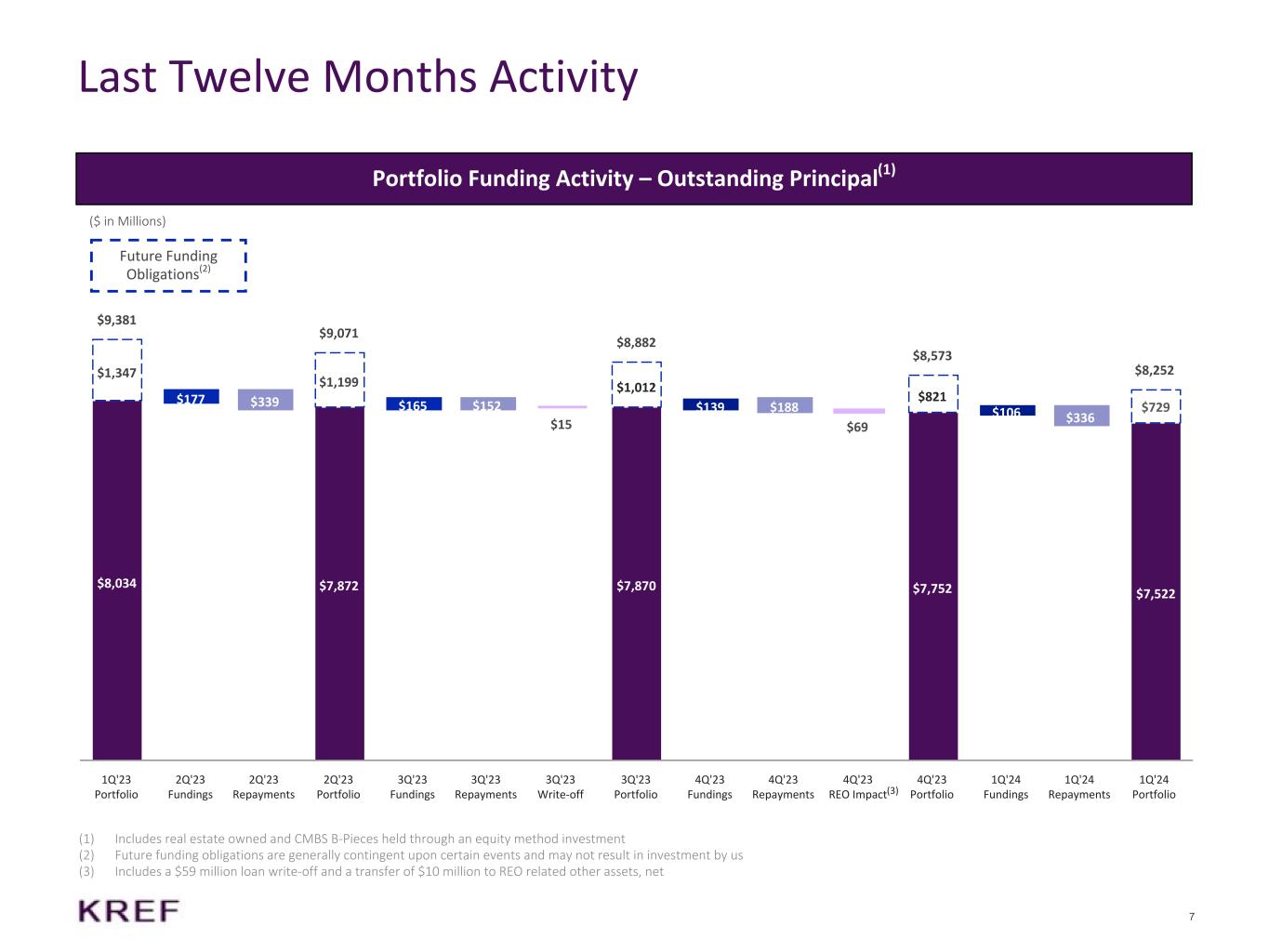

7 Last Twelve Months Activity (1) Includes real estate owned and CMBS B-Pieces held through an equity method investment (2) Future funding obligations are generally contingent upon certain events and may not result in investment by us (3) Includes a $59 million loan write-off and a transfer of $10 million to REO related other assets, net Portfolio Funding Activity – Outstanding Principal(1) Future Funding Obligations(2) ($ in Millions) $8,034 $8,034 $7,872 $7,872 $7,872 $7,885 $7,870 $7,870 $7,870 $7,821 $7,752 $7,752 $7,752 $7,522 $7,522 $1,347 $177 $339 $1,199 $165 $152 $15 $1,012 $139 $188 $69 $821 $106 $336 $729 $9,381 $9,071 $8,882 $8,573 $8,252 1Q'23 Portfolio 2Q'23 Fundings 2Q'23 Repayments 2Q'23 Portfolio 3Q'23 Fundings 3Q'23 Repayments 3Q'23 Write-off 3Q'23 Portfolio 4Q'23 Fundings 4Q'23 Repayments 4Q'23 REO Impact 4Q'23 Portfolio 1Q'24 Fundings 1Q'24 Repayments 1Q'24 Portfolio(3)

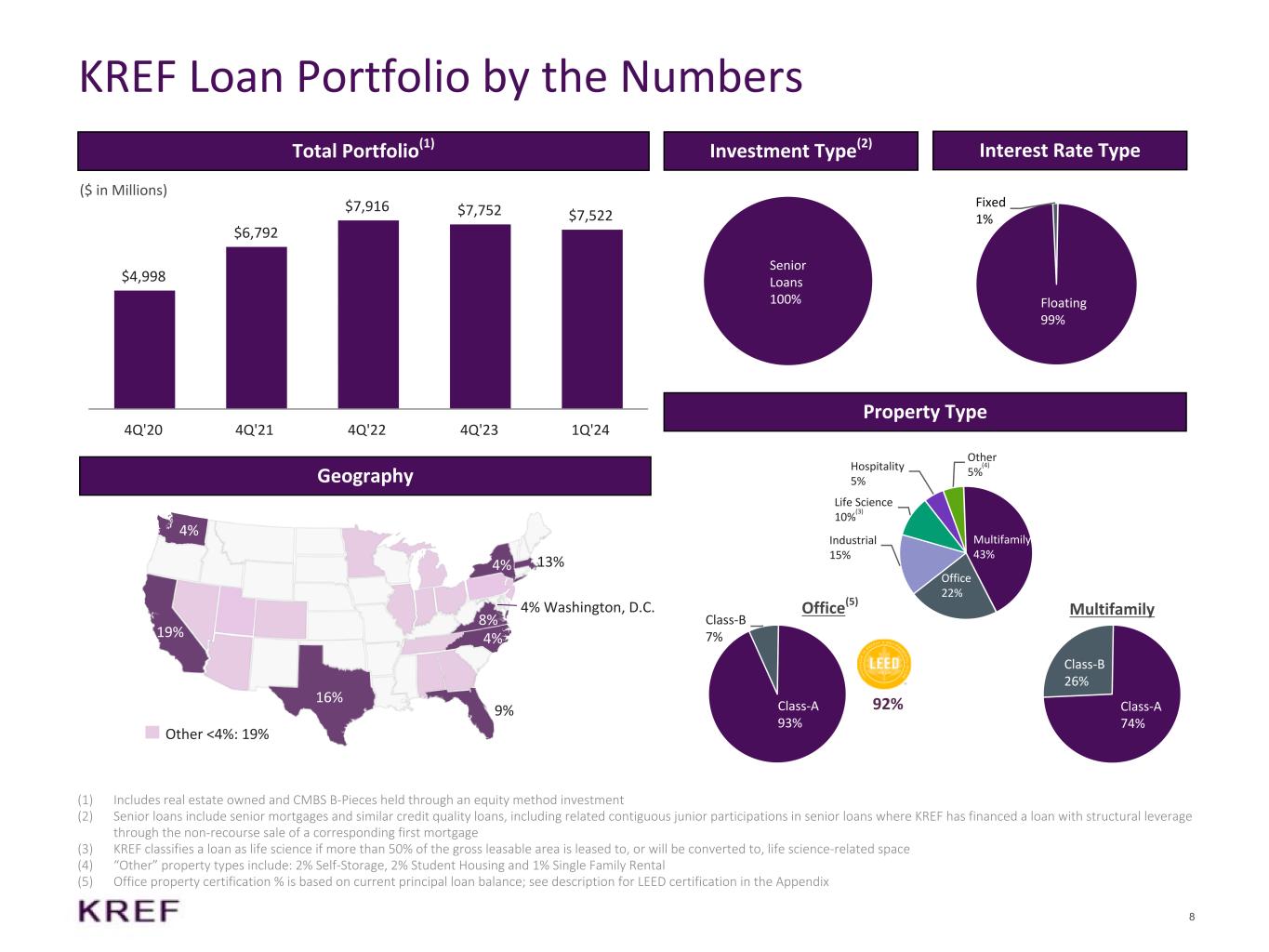

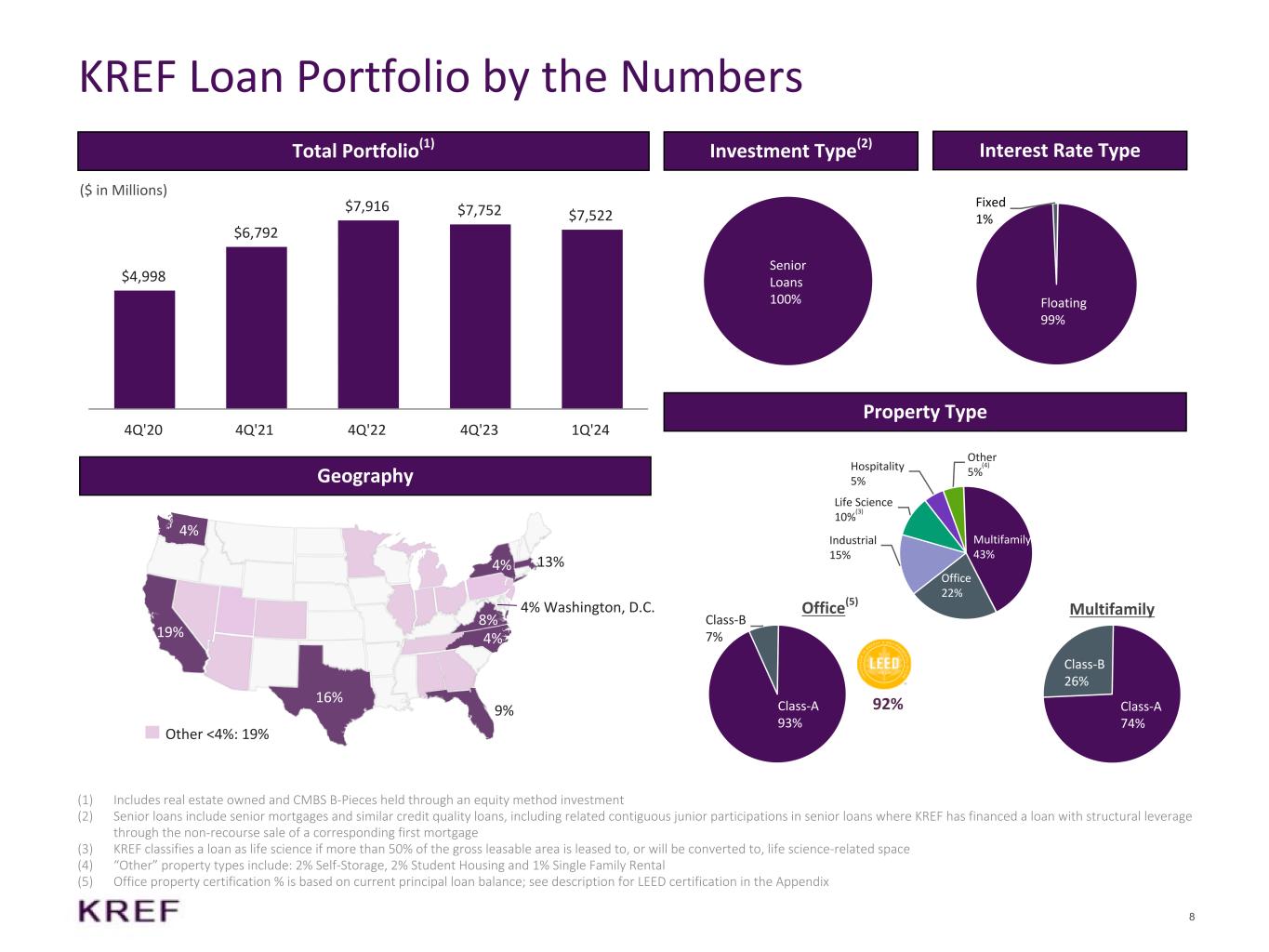

8 Class-A 74% Class-B 26% KREF Loan Portfolio by the Numbers (1) Includes real estate owned and CMBS B-Pieces held through an equity method investment (2) Senior loans include senior mortgages and similar credit quality loans, including related contiguous junior participations in senior loans where KREF has financed a loan with structural leverage through the non-recourse sale of a corresponding first mortgage (3) KREF classifies a loan as life science if more than 50% of the gross leasable area is leased to, or will be converted to, life science-related space (4) “Other” property types include: 2% Self-Storage, 2% Student Housing and 1% Single Family Rental (5) Office property certification % is based on current principal loan balance; see description for LEED certification in the Appendix Geography Investment Type(2) Property Type Interest Rate TypeTotal Portfolio(1) 4% 8% 9% 16% 19% 13% Other <4%: 19% ($ in Millions) 92% Office(5)4% Washington, D.C. $4,998 $6,792 $7,916 $7,752 $7,522 4Q'20 4Q'21 4Q'22 4Q'23 1Q'24 Senior Loans 100% Floating 99% Fixed 1% Multifamily Class-A 93% Class-B 7% Multifamily 43% Office 22% Industrial 15% Life Science 10% Hospitality 5% Other 5% (3) (4) 4% 4%

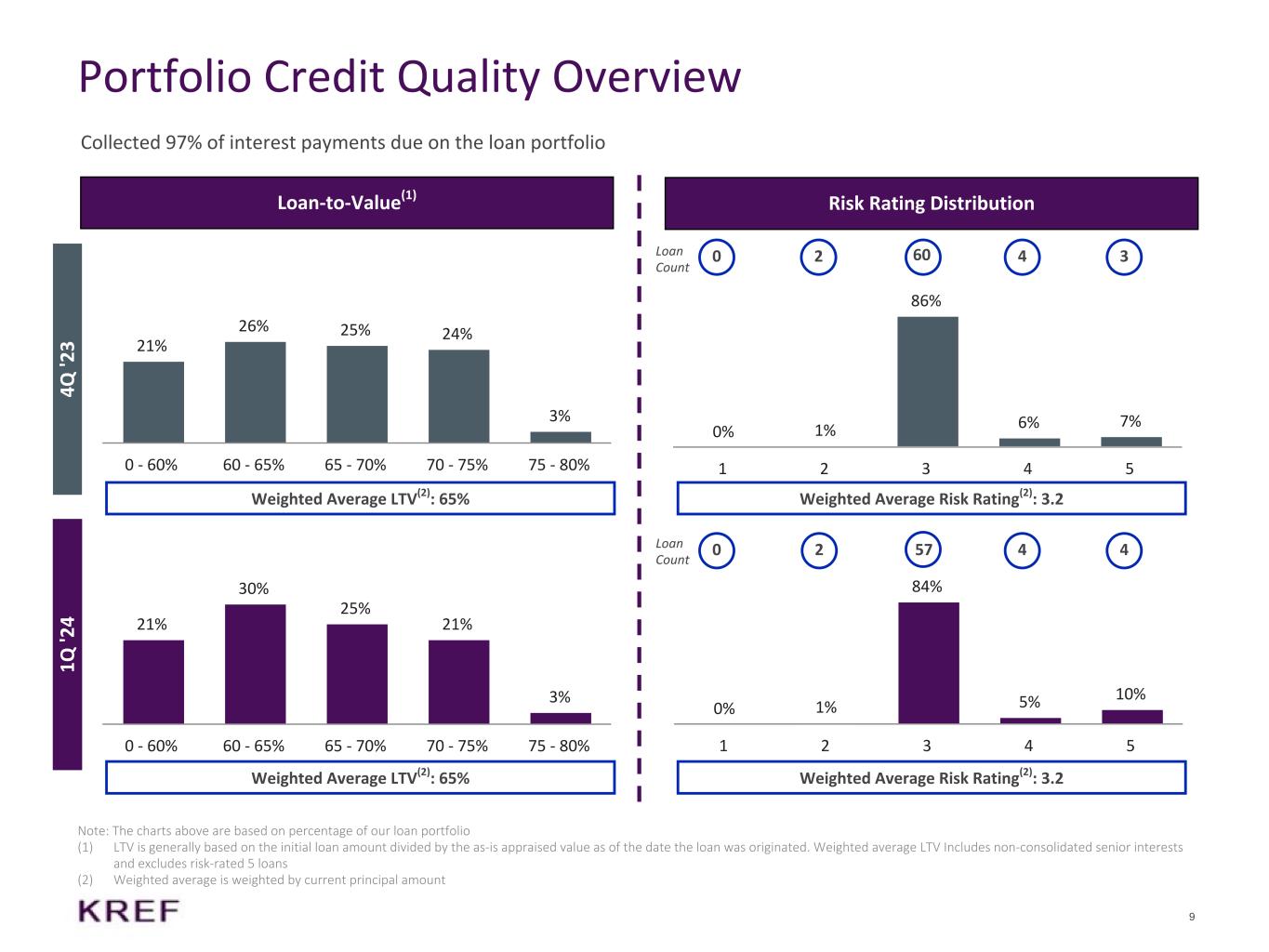

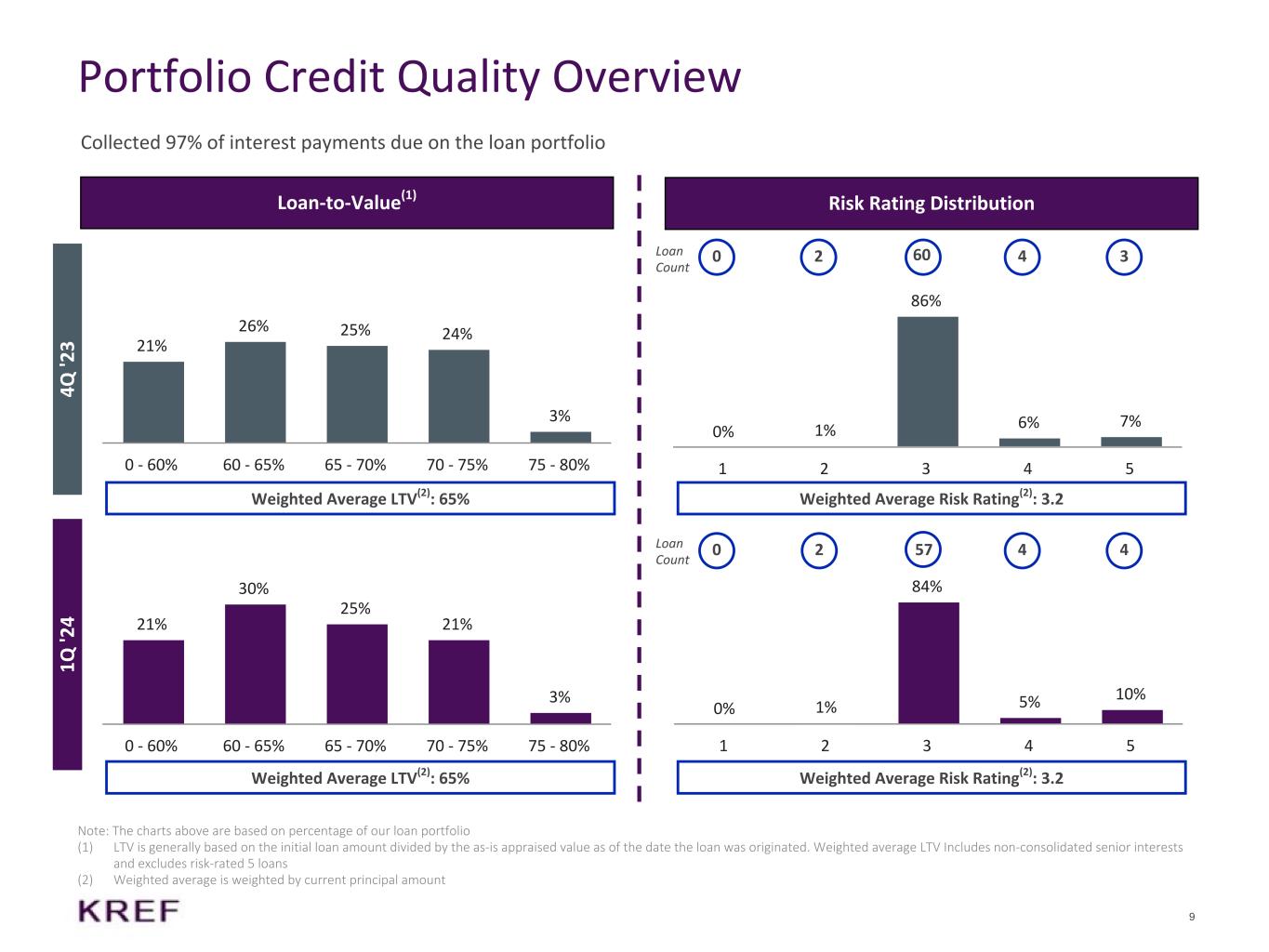

9 0% 1% 86% 6% 7% 1 2 3 4 5 Weighted Average Risk Rating(2): 3.2 Portfolio Credit Quality Overview Note: The charts above are based on percentage of our loan portfolio (1) LTV is generally based on the initial loan amount divided by the as-is appraised value as of the date the loan was originated. Weighted average LTV Includes non-consolidated senior interests and excludes risk-rated 5 loans (2) Weighted average is weighted by current principal amount Collected 97% of interest payments due on the loan portfolio Loan-to-Value(1) Risk Rating Distribution Weighted Average LTV(2): 65% Loan Count 1Q '2 4 Weighted Average LTV(2): 65% Weighted Average Risk Rating(2): 3.2 4Q '2 3 21% 26% 25% 24% 3% 0 - 60% 60 - 65% 65 - 70% 70 - 75% 75 - 80% 21% 30% 25% 21% 3% 0 - 60% 60 - 65% 65 - 70% 70 - 75% 75 - 80% 0 2 4 360 0 2 4 457Loan Count 0% 1% 84% 5% 10% 1 2 3 4 5

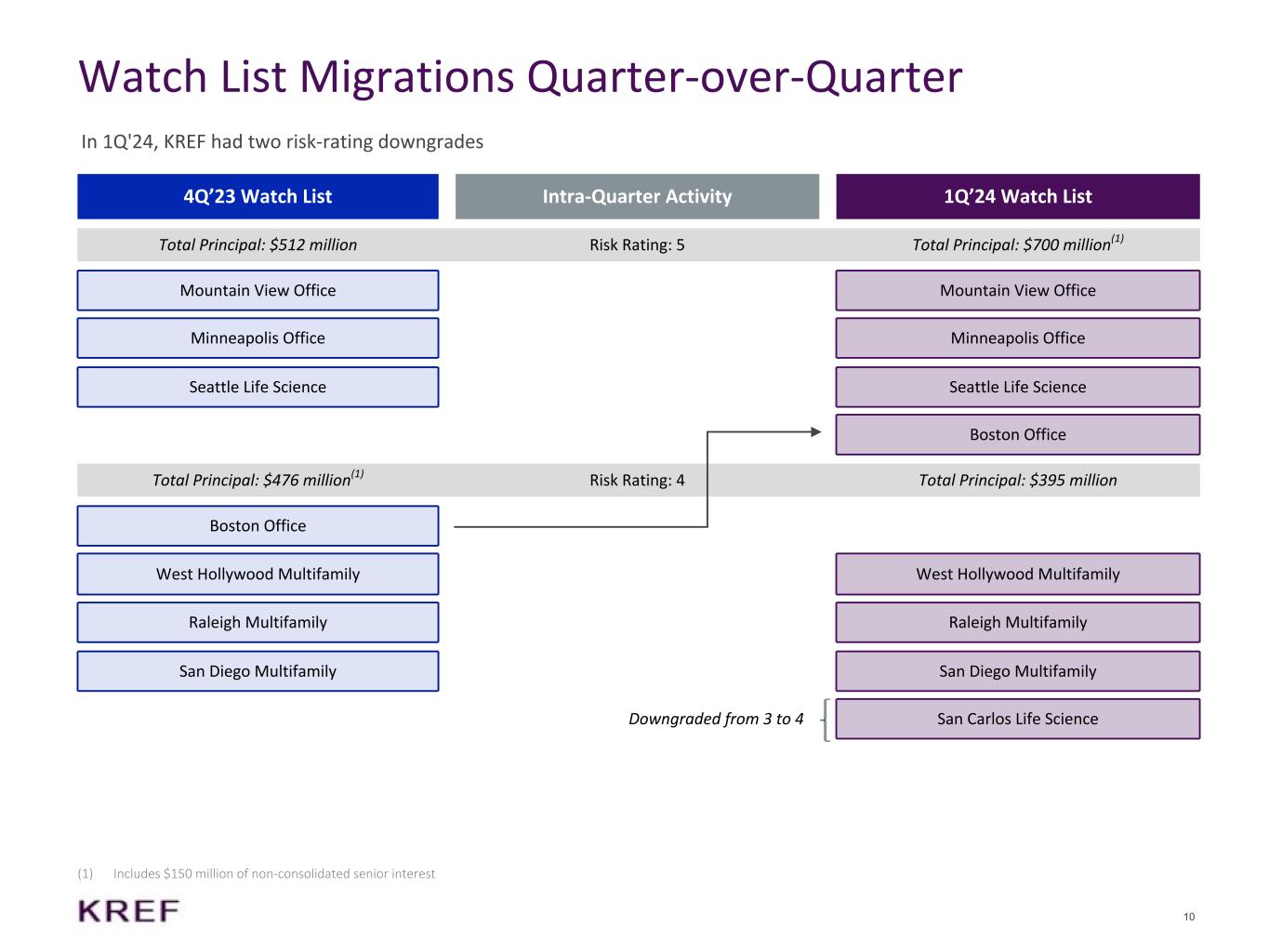

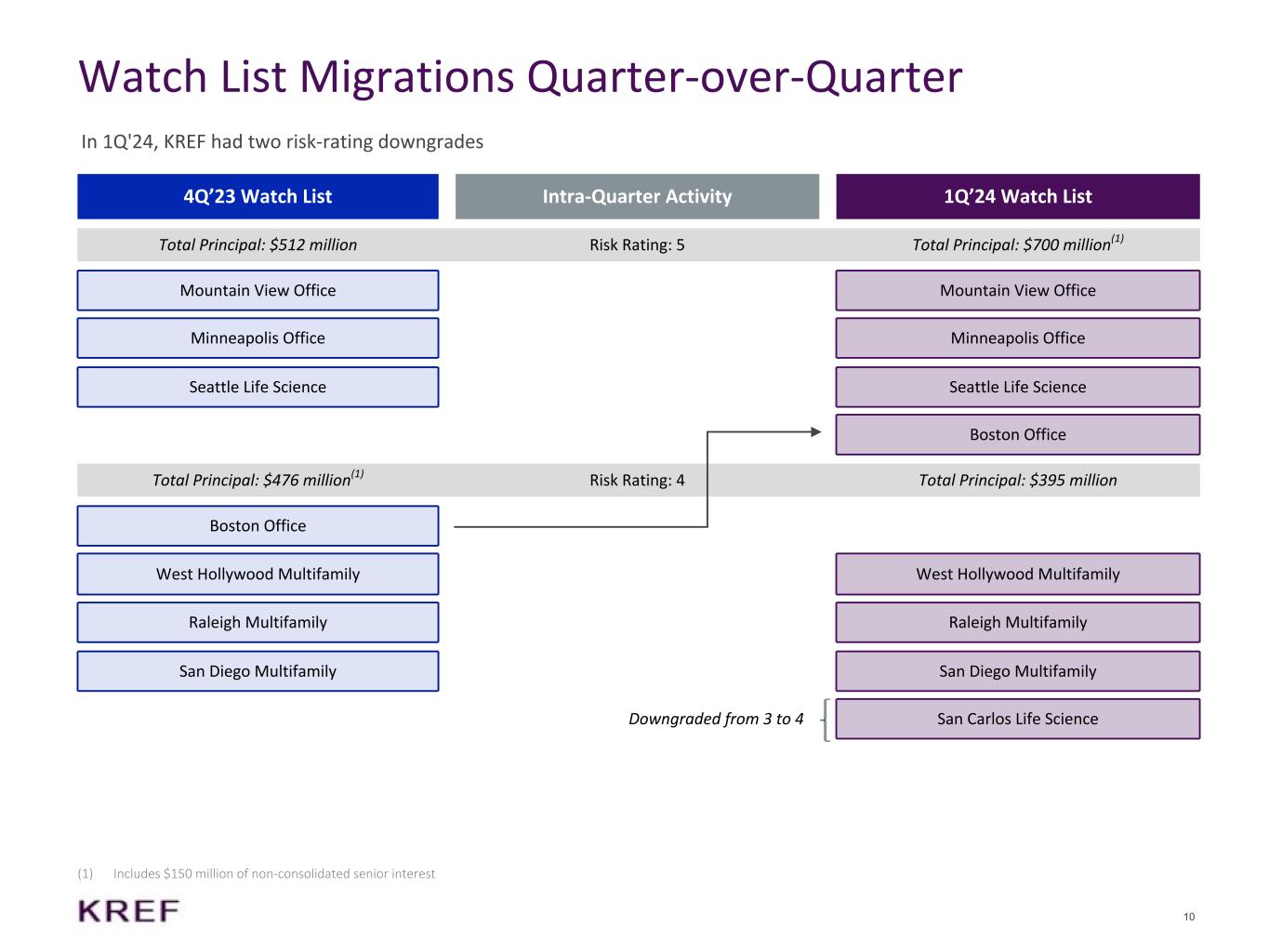

10 Watch List Migrations Quarter-over-Quarter In 1Q'24, KREF had two risk-rating downgrades 4Q’23 Watch List Intra-Quarter Activity 1Q’24 Watch List Total Principal: $512 million Risk Rating: 5 Total Principal: $700 million(1) Mountain View Office Mountain View Office Minneapolis Office Minneapolis Office Seattle Life Science Seattle Life Science Boston Office Total Principal: $476 million(1) Risk Rating: 4 Total Principal: $395 million Boston Office West Hollywood Multifamily West Hollywood Multifamily Raleigh Multifamily Raleigh Multifamily San Diego Multifamily San Diego Multifamily Downgraded from 3 to 4 San Carlos Life Science (1) Includes $150 million of non-consolidated senior interest

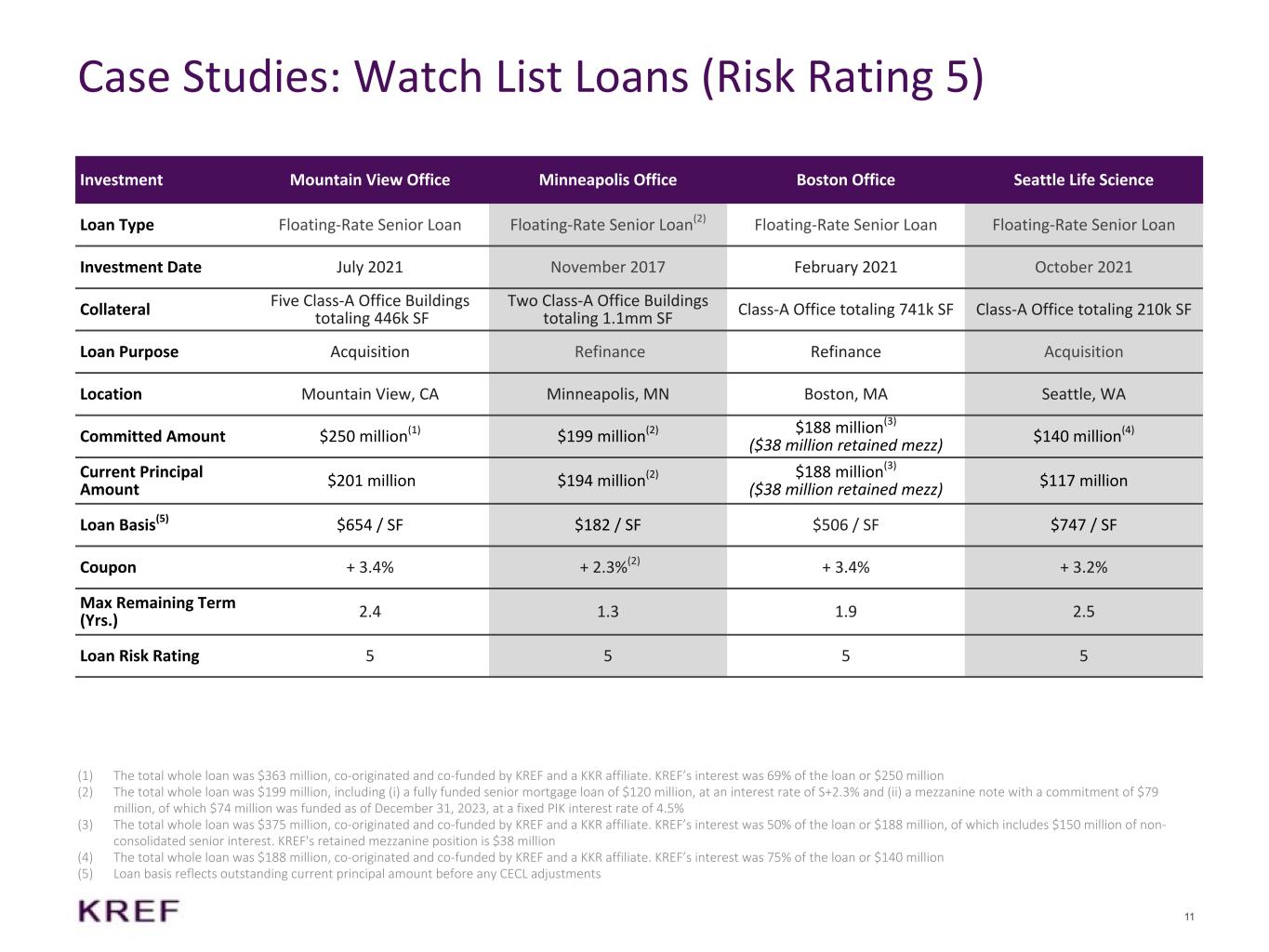

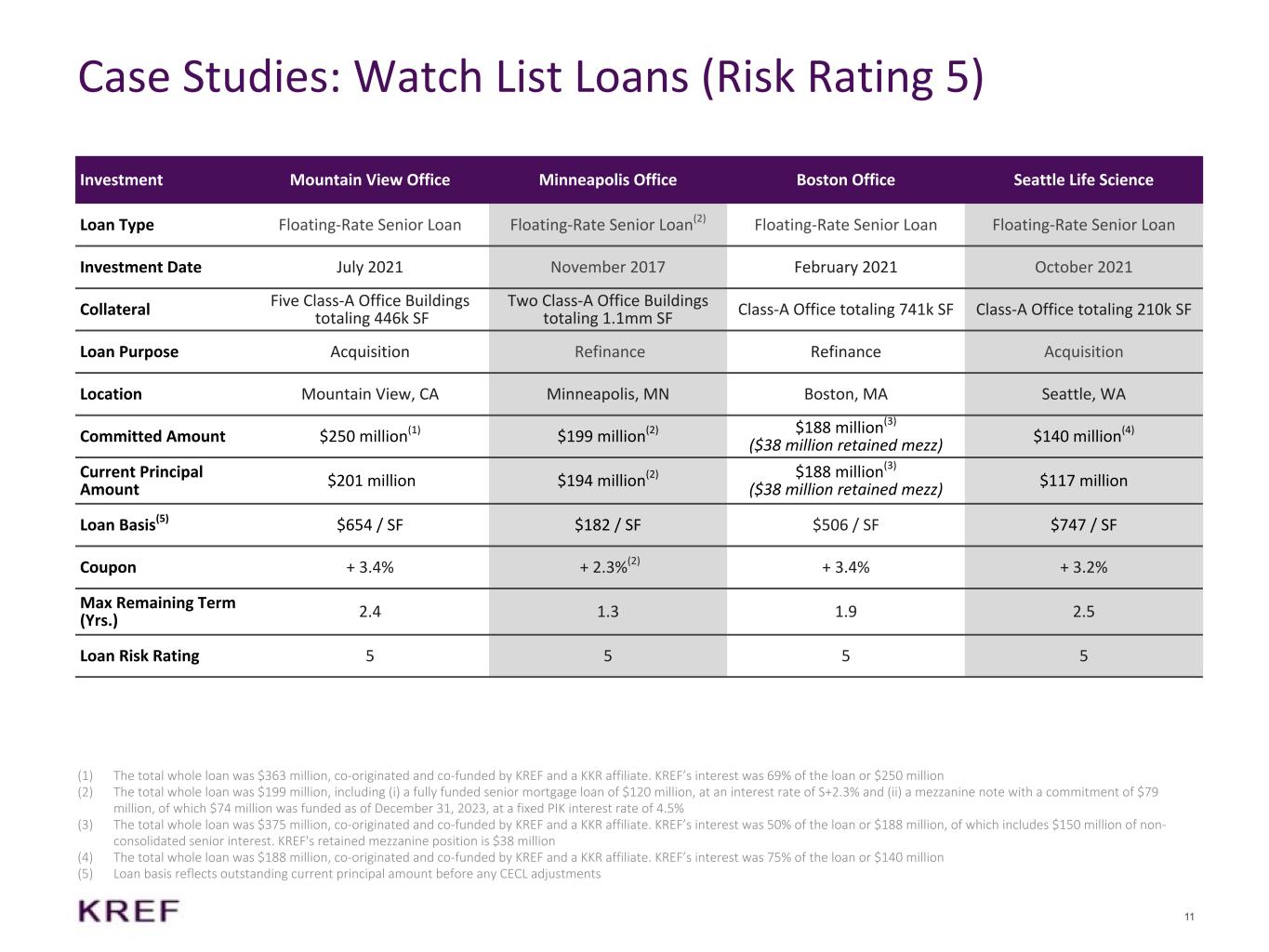

11 Case Studies: Watch List Loans (Risk Rating 5) Investment Mountain View Office Minneapolis Office Boston Office Seattle Life Science Loan Type Floating-Rate Senior Loan Floating-Rate Senior Loan(2) Floating-Rate Senior Loan Floating-Rate Senior Loan Investment Date July 2021 November 2017 February 2021 October 2021 Collateral Five Class-A Office Buildings totaling 446k SF Two Class-A Office Buildings totaling 1.1mm SF Class-A Office totaling 741k SF Class-A Office totaling 210k SF Loan Purpose Acquisition Refinance Refinance Acquisition Location Mountain View, CA Minneapolis, MN Boston, MA Seattle, WA Committed Amount $250 million(1) $199 million(2) $188 million(3) ($38 million retained mezz) $140 million(4) Current Principal Amount $201 million $194 million(2) $188 million(3) ($38 million retained mezz) $117 million Loan Basis(5) $654 / SF $182 / SF $506 / SF $747 / SF Coupon + 3.4% + 2.3%(2) + 3.4% + 3.2% Max Remaining Term (Yrs.) 2.4 1.3 1.9 2.5 Loan Risk Rating 5 5 5 5 (1) The total whole loan was $363 million, co-originated and co-funded by KREF and a KKR affiliate. KREF’s interest was 69% of the loan or $250 million (2) The total whole loan was $199 million, including (i) a fully funded senior mortgage loan of $120 million, at an interest rate of S+2.3% and (ii) a mezzanine note with a commitment of $79 million, of which $74 million was funded as of December 31, 2023, at a fixed PIK interest rate of 4.5% (3) The total whole loan was $375 million, co-originated and co-funded by KREF and a KKR affiliate. KREF’s interest was 50% of the loan or $188 million, of which includes $150 million of non- consolidated senior interest. KREF's retained mezzanine position is $38 million (4) The total whole loan was $188 million, co-originated and co-funded by KREF and a KKR affiliate. KREF’s interest was 75% of the loan or $140 million (5) Loan basis reflects outstanding current principal amount before any CECL adjustments

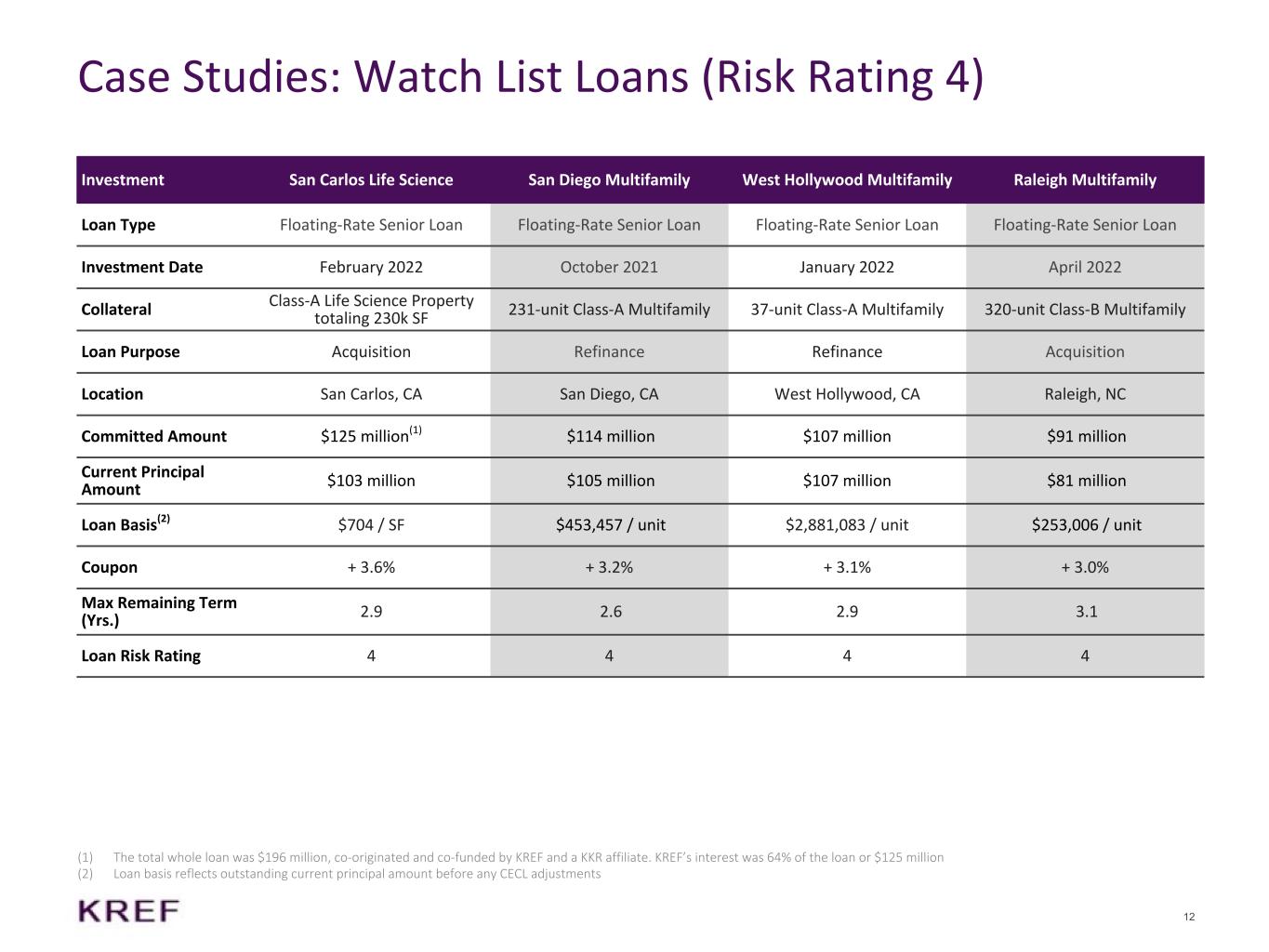

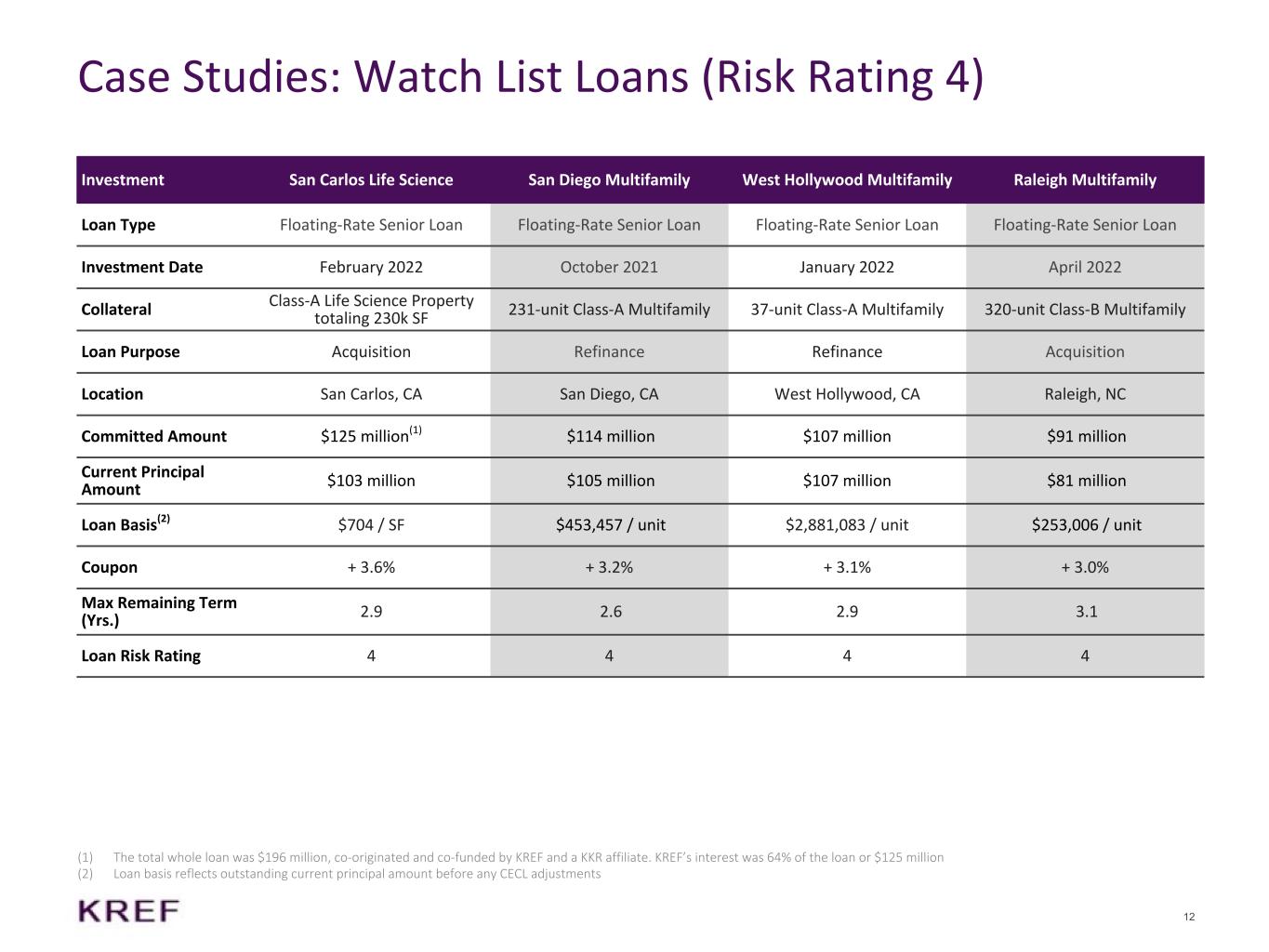

12 Case Studies: Watch List Loans (Risk Rating 4) Investment San Carlos Life Science San Diego Multifamily West Hollywood Multifamily Raleigh Multifamily Loan Type Floating-Rate Senior Loan Floating-Rate Senior Loan Floating-Rate Senior Loan Floating-Rate Senior Loan Investment Date February 2022 October 2021 January 2022 April 2022 Collateral Class-A Life Science Property totaling 230k SF 231-unit Class-A Multifamily 37-unit Class-A Multifamily 320-unit Class-B Multifamily Loan Purpose Acquisition Refinance Refinance Acquisition Location San Carlos, CA San Diego, CA West Hollywood, CA Raleigh, NC Committed Amount $125 million(1) $114 million $107 million $91 million Current Principal Amount $103 million $105 million $107 million $81 million Loan Basis(2) $704 / SF $453,457 / unit $2,881,083 / unit $253,006 / unit Coupon + 3.6% + 3.2% + 3.1% + 3.0% Max Remaining Term (Yrs.) 2.9 2.6 2.9 3.1 Loan Risk Rating 4 4 4 4 (1) The total whole loan was $196 million, co-originated and co-funded by KREF and a KKR affiliate. KREF’s interest was 64% of the loan or $125 million (2) Loan basis reflects outstanding current principal amount before any CECL adjustments

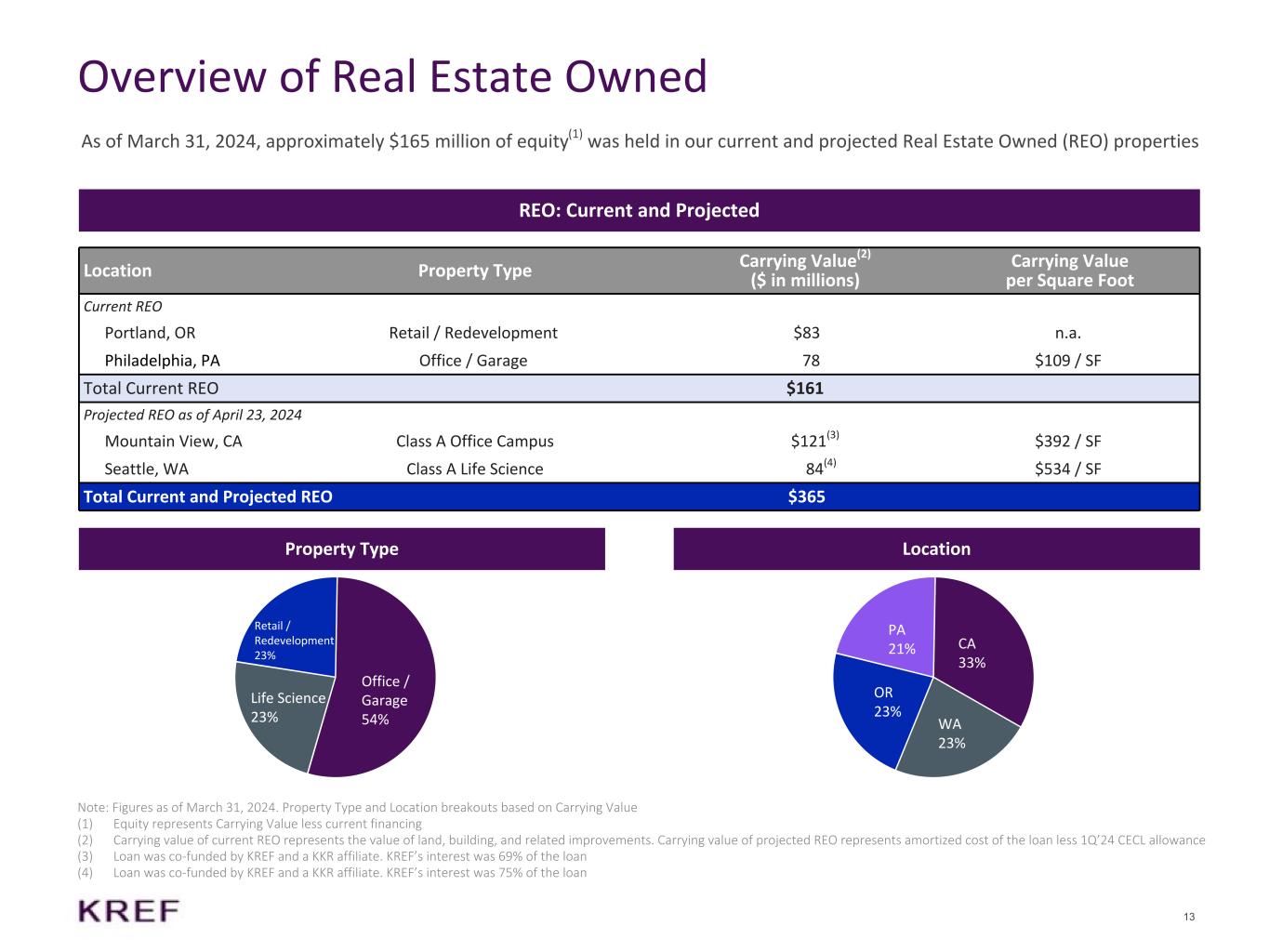

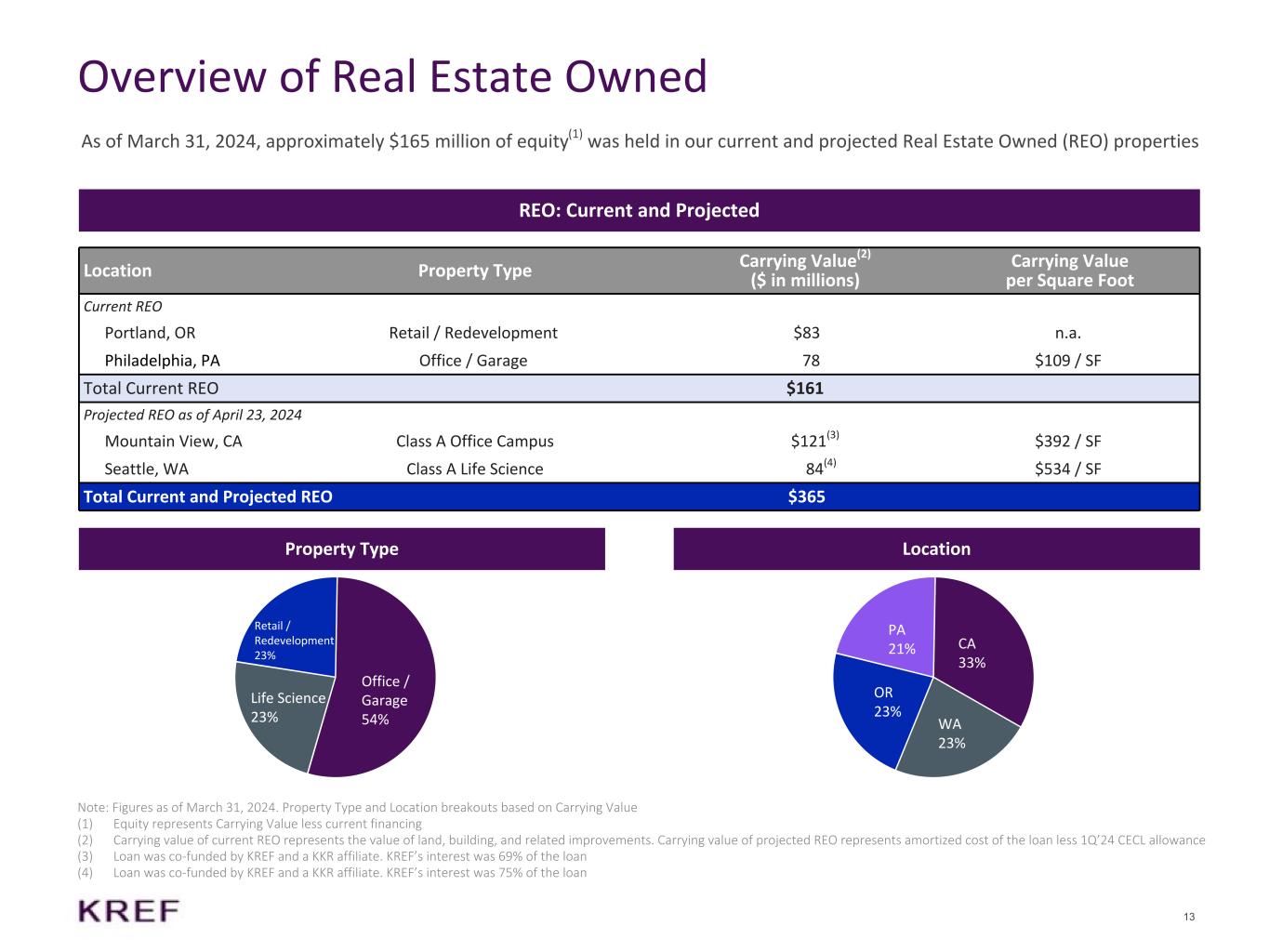

13 Overview of Real Estate Owned REO: Current and Projected Location Property Type Carrying Value(2) ($ in millions) Carrying Value per Square Foot Current REO Portland, OR Retail / Redevelopment $83 n.a. Philadelphia, PA Office / Garage 78 $109 / SF Total Current REO $161 Projected REO as of April 23, 2024 Mountain View, CA Class A Office Campus $121(3) $392 / SF Seattle, WA Class A Life Science 84(4) $534 / SF Total Current and Projected REO $365 Property Type Location Note: Figures as of March 31, 2024. Property Type and Location breakouts based on Carrying Value (1) Equity represents Carrying Value less current financing (2) Carrying value of current REO represents the value of land, building, and related improvements. Carrying value of projected REO represents amortized cost of the loan less 1Q’24 CECL allowance (3) Loan was co-funded by KREF and a KKR affiliate. KREF’s interest was 69% of the loan (4) Loan was co-funded by KREF and a KKR affiliate. KREF’s interest was 75% of the loan As of March 31, 2024, approximately $165 million of equity(1) was held in our current and projected Real Estate Owned (REO) properties Office / Garage 54% Life Science 23% Retail / Redevelopment 23% CA 33% WA 23% OR 23% PA 21%

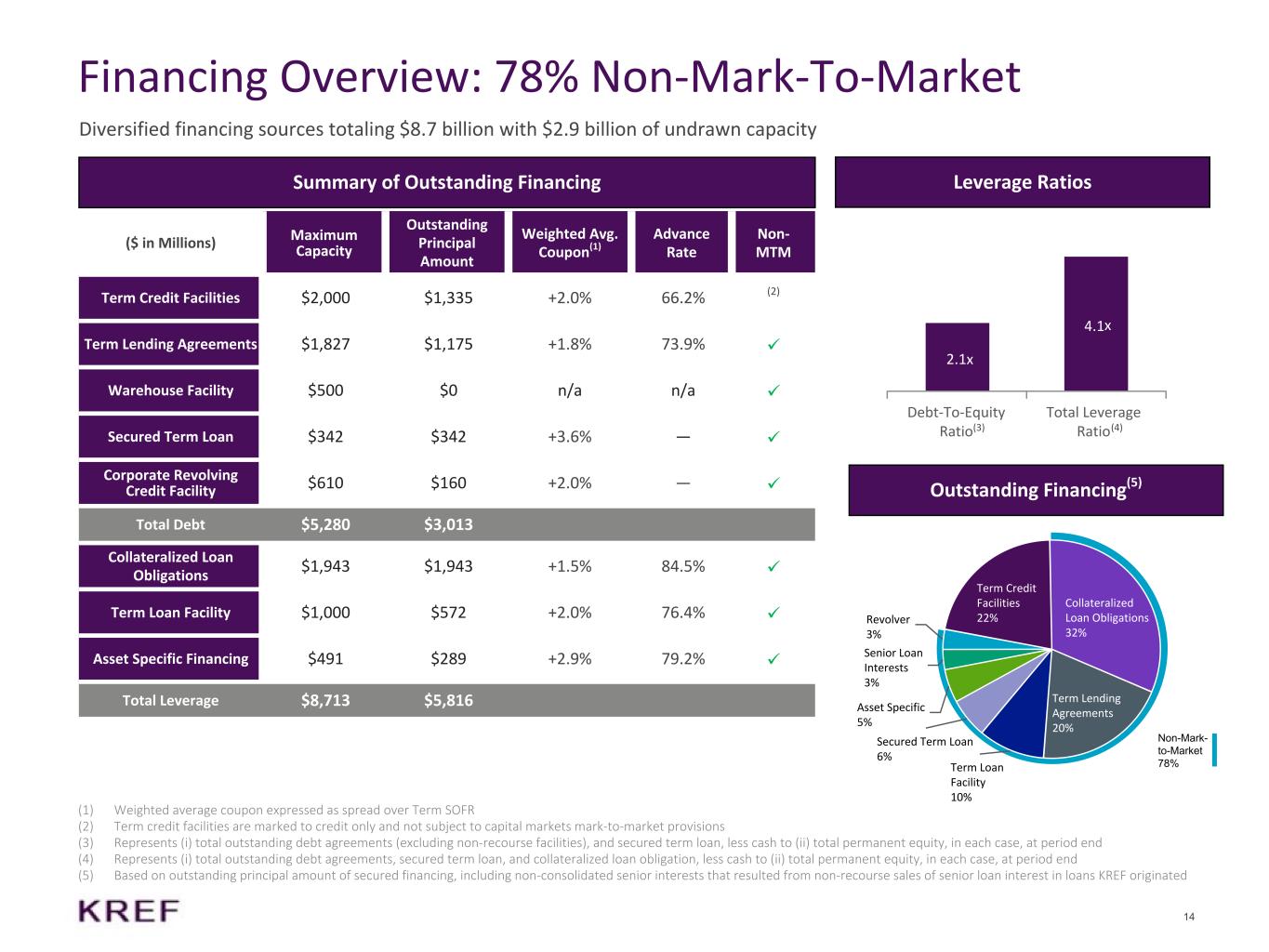

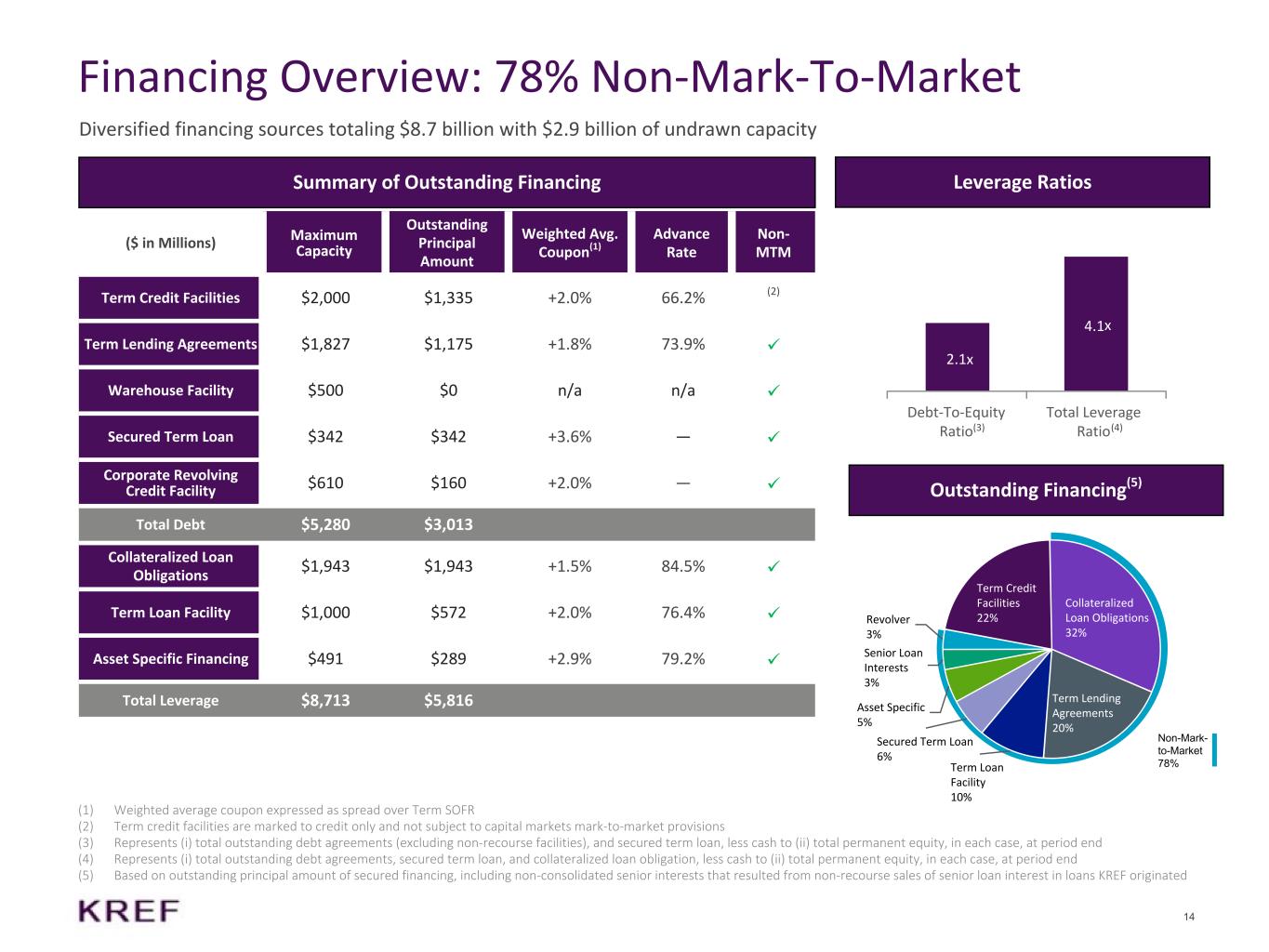

14 Financing Overview: 78% Non-Mark-To-Market Diversified financing sources totaling $8.7 billion with $2.9 billion of undrawn capacity Summary of Outstanding Financing Leverage Ratios (3) Outstanding Financing(5) ($ in Millions) Maximum Capacity Outstanding Principal Amount Weighted Avg. Coupon(1) Advance Rate Non- MTM Term Credit Facilities $2,000 $1,335 +2.0% 66.2% (2) Term Lending Agreements $1,827 $1,175 +1.8% 73.9% ü Warehouse Facility $500 $0 n/a n/a ü Secured Term Loan $342 $342 +3.6% — ü Corporate Revolving Credit Facility $610 $160 +2.0% — ü Total Debt $5,280 $3,013 Collateralized Loan Obligations $1,943 $1,943 +1.5% 84.5% ü Term Loan Facility $1,000 $572 +2.0% 76.4% ü Asset Specific Financing $491 $289 +2.9% 79.2% ü Total Leverage $8,713 $5,816 2.1 4.1 Debt-To-Equity Ratio Total Leverage Ratio(4) x x (1) Weighted average coupon expressed as spread over Term SOFR (2) Term credit facilities are marked to credit only and not subject to capital markets mark-to-market provisions (3) Represents (i) total outstanding debt agreements (excluding non-recourse facilities), and secured term loan, less cash to (ii) total permanent equity, in each case, at period end (4) Represents (i) total outstanding debt agreements, secured term loan, and collateralized loan obligation, less cash to (ii) total permanent equity, in each case, at period end (5) Based on outstanding principal amount of secured financing, including non-consolidated senior interests that resulted from non-recourse sales of senior loan interest in loans KREF originated Collateralized Loan Obligations 32% Term Lending Agreements 20% Term Loan Facility 10% Secured Term Loan 6% Asset Specific 5% Senior Loan Interests 3% Revolver 3% Term Credit Facilities 22% Non-Mark- to-Market 78%

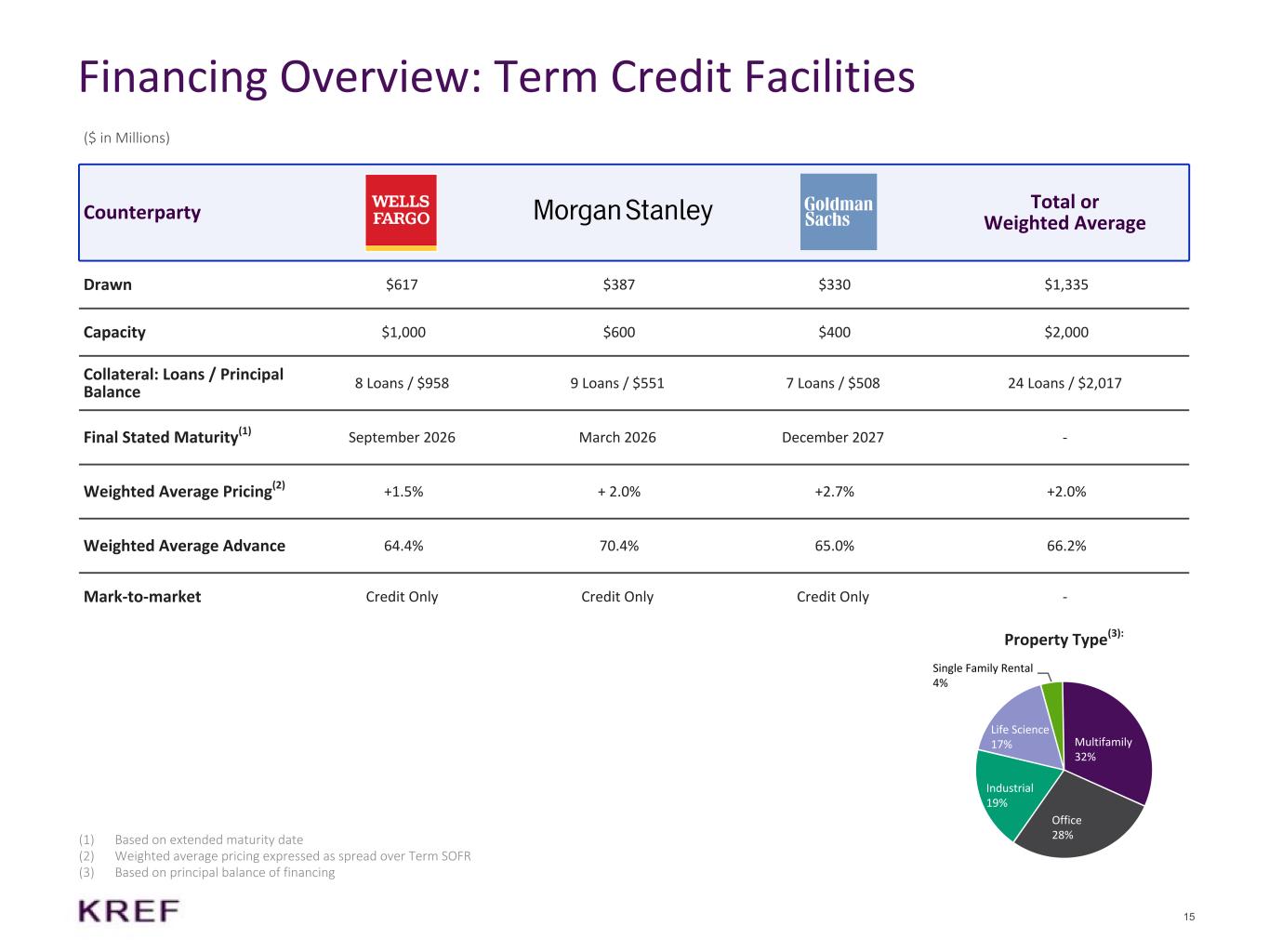

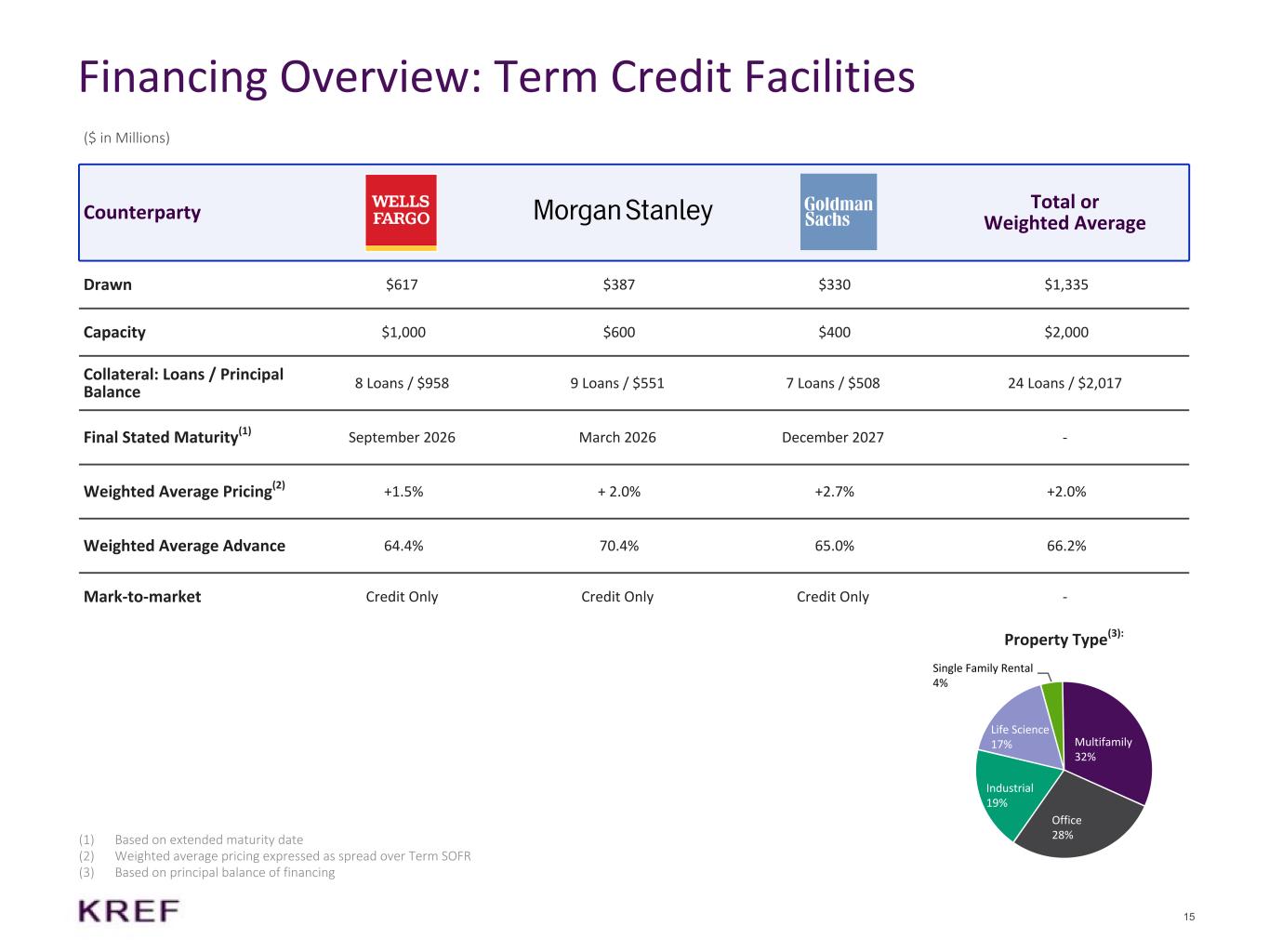

15 Financing Overview: Term Credit Facilities Counterparty Total or Weighted Average Drawn $617 $387 $330 $1,335 Capacity $1,000 $600 $400 $2,000 Collateral: Loans / Principal Balance 8 Loans / $958 9 Loans / $551 7 Loans / $508 24 Loans / $2,017 Final Stated Maturity(1) September 2026 March 2026 December 2027 - Weighted Average Pricing(2) +1.5% + 2.0% +2.7% +2.0% Weighted Average Advance 64.4% 70.4% 65.0% 66.2% Mark-to-market Credit Only Credit Only Credit Only - ($ in Millions) (1) Based on extended maturity date (2) Weighted average pricing expressed as spread over Term SOFR (3) Based on principal balance of financing Property Type(3): Multifamily 32% Office 28% Industrial 19% Life Science 17% Single Family Rental 4%

16 $107 $557 $107 $450 $64 $620 Cash Undrawn Corporate Revolver Approved and Undrawn Credit Capacity Total Available Liquidity $0 $100 $200 $300 $400 $500 $600 $700 Liquidity Overview (1) Represents under-levered amounts on financing facilities. While these amounts were previously contractually approved and/or drawn, in certain cases, the lender’s consent is required for us to (re)borrow these amounts ($ in Millions) Sources of Available Liquidity In addition to the available liquidity below, KREF had $108 million of unencumbered senior loans that can be pledged to financing facilities subject to lender approval as of March 31, 2024 (4) (1)

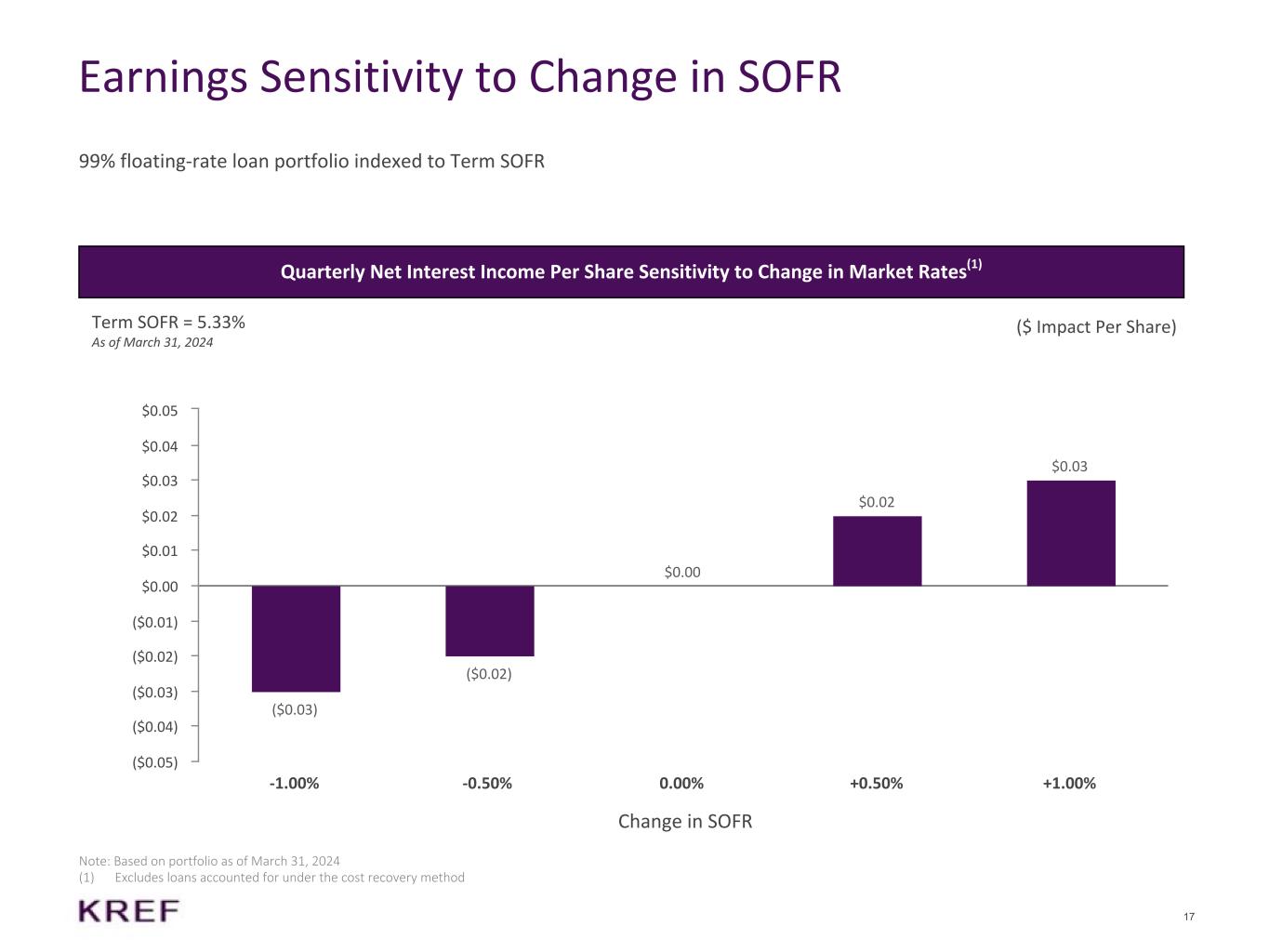

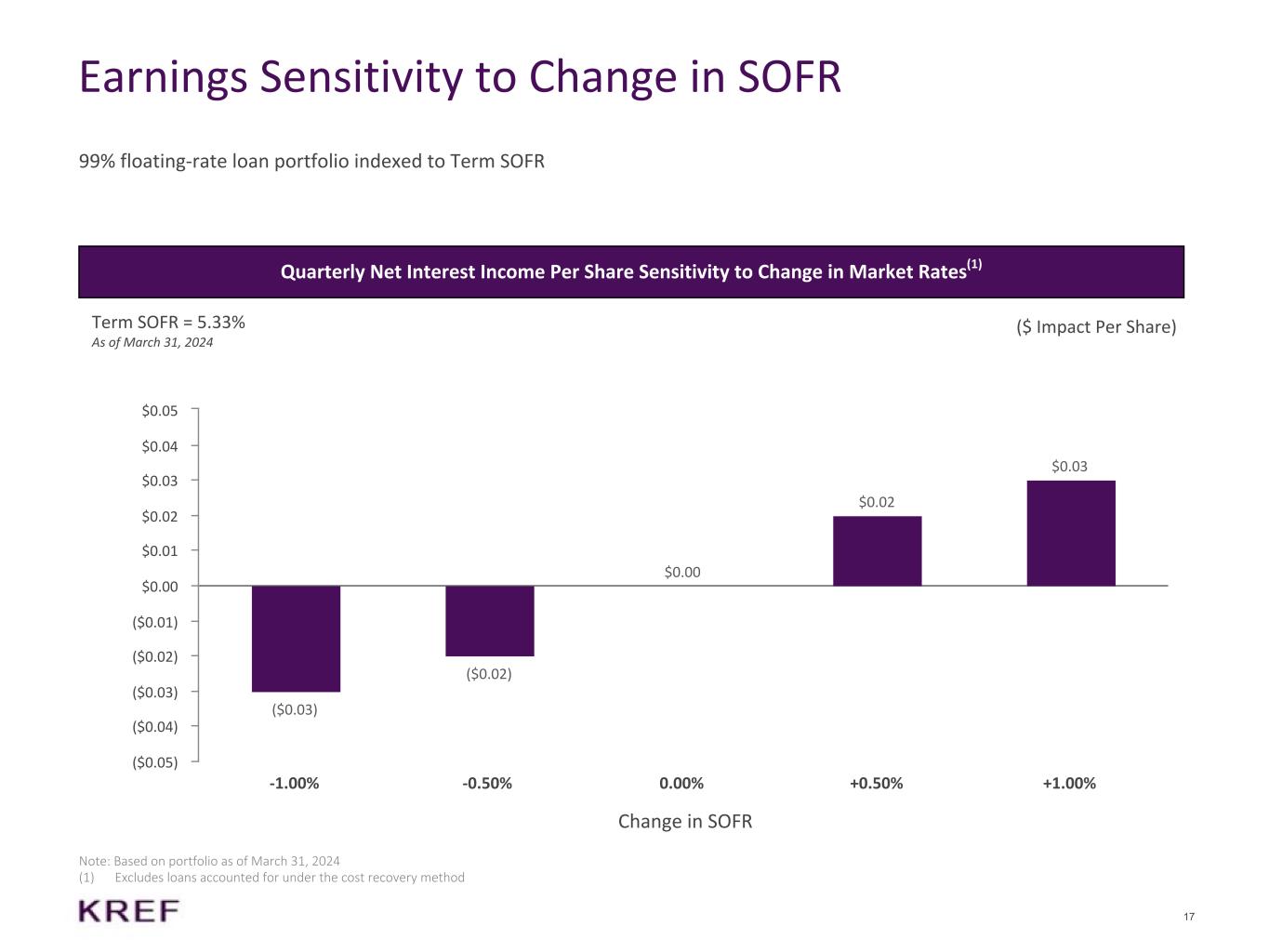

17 Earnings Sensitivity to Change in SOFR 99% floating-rate loan portfolio indexed to Term SOFR Quarterly Net Interest Income Per Share Sensitivity to Change in Market Rates(1) Term SOFR = 5.33% As of March 31, 2024 ($ Impact Per Share) Note: Based on portfolio as of March 31, 2024 Change in SOFR ($0.03) ($0.02) $0.00 $0.02 $0.03 -1.00% -0.50% 0.00% +0.50% +1.00% ($0.05) ($0.04) ($0.03) ($0.02) ($0.01) $0.00 $0.01 $0.02 $0.03 $0.04 $0.05 (1) Excludes loans accounted for under the cost recovery method

18 Appendix

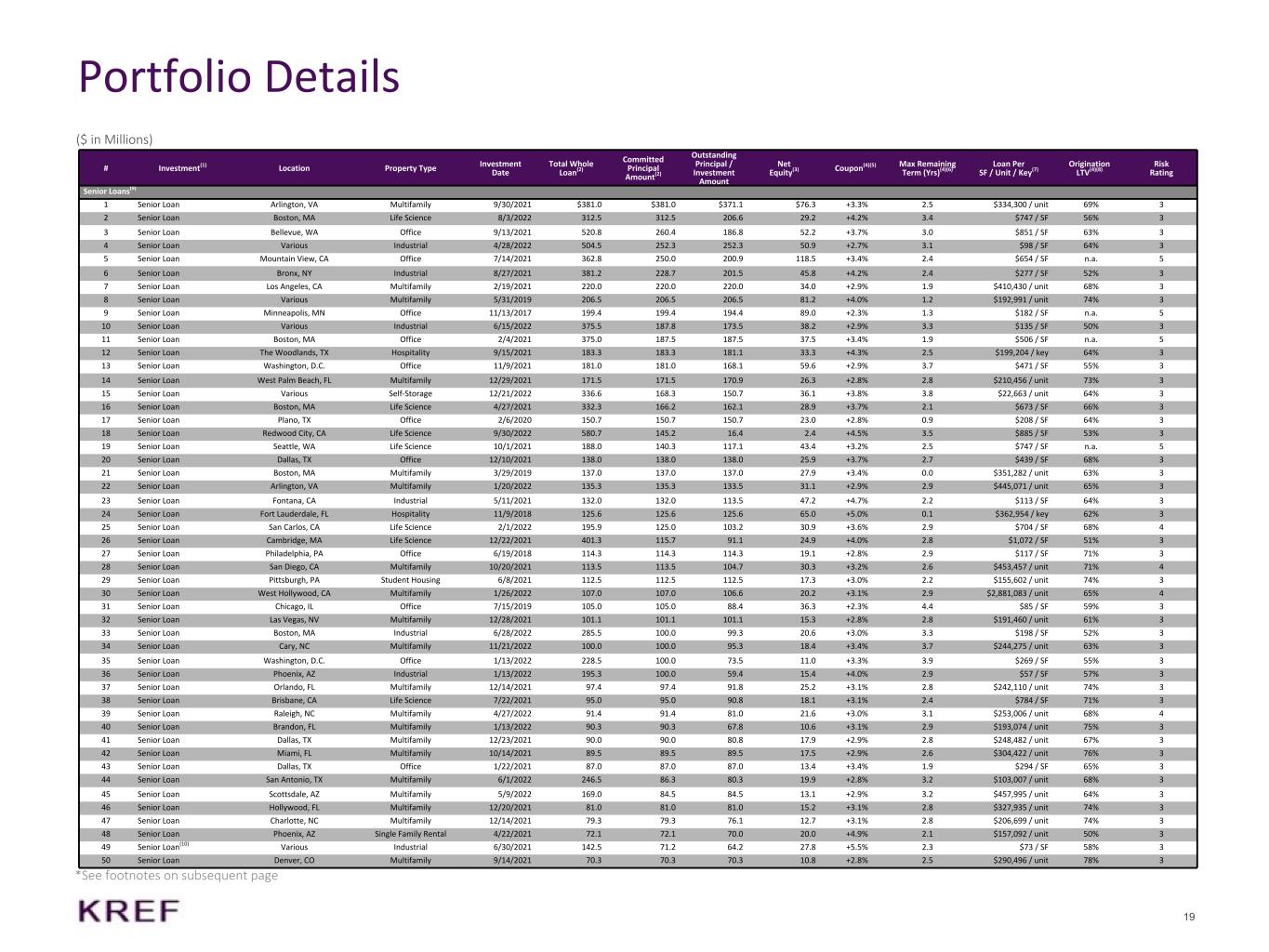

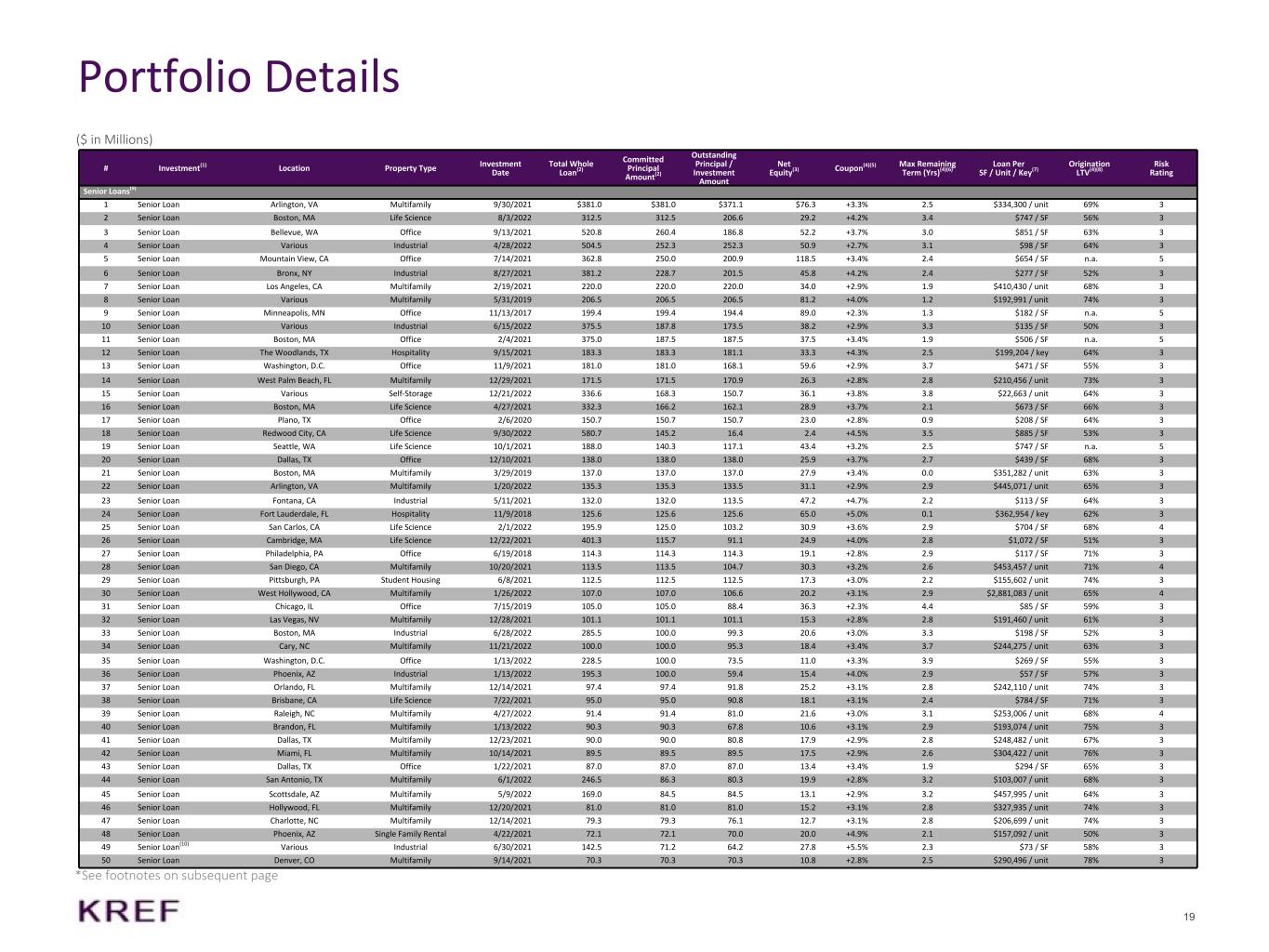

19 Portfolio Details ($ in Millions) # Investment(1) Location Property Type Investment Date Total Whole Loan(2) Committed Principal Amount(2) Outstanding Principal / Investment Amount Net Equity(3) Coupon(4)(5) Max Remaining Term (Yrs)(4)(6) Loan Per SF / Unit / Key(7) Origination LTV(4)(8) Risk Rating Senior Loans(9) 1 Senior Loan Arlington, VA Multifamily 9/30/2021 $381.0 $381.0 $371.1 $76.3 +3.3% 2.5 $334,300 / unit 69% 3 2 Senior Loan Boston, MA Life Science 8/3/2022 312.5 312.5 206.6 29.2 +4.2% 3.4 $747 / SF 56% 3 3 Senior Loan Bellevue, WA Office 9/13/2021 520.8 260.4 186.8 52.2 +3.7% 3.0 $851 / SF 63% 3 4 Senior Loan Various Industrial 4/28/2022 504.5 252.3 252.3 50.9 +2.7% 3.1 $98 / SF 64% 3 5 Senior Loan Mountain View, CA Office 7/14/2021 362.8 250.0 200.9 118.5 +3.4% 2.4 $654 / SF n.a. 5 6 Senior Loan Bronx, NY Industrial 8/27/2021 381.2 228.7 201.5 45.8 +4.2% 2.4 $277 / SF 52% 3 7 Senior Loan Los Angeles, CA Multifamily 2/19/2021 220.0 220.0 220.0 34.0 +2.9% 1.9 $410,430 / unit 68% 3 8 Senior Loan Various Multifamily 5/31/2019 206.5 206.5 206.5 81.2 +4.0% 1.2 $192,991 / unit 74% 3 9 Senior Loan Minneapolis, MN Office 11/13/2017 199.4 199.4 194.4 89.0 +2.3% 1.3 $182 / SF n.a. 5 10 Senior Loan Various Industrial 6/15/2022 375.5 187.8 173.5 38.2 +2.9% 3.3 $135 / SF 50% 3 11 Senior Loan Boston, MA Office 2/4/2021 375.0 187.5 187.5 37.5 +3.4% 1.9 $506 / SF n.a. 5 12 Senior Loan The Woodlands, TX Hospitality 9/15/2021 183.3 183.3 181.1 33.3 +4.3% 2.5 $199,204 / key 64% 3 13 Senior Loan Washington, D.C. Office 11/9/2021 181.0 181.0 168.1 59.6 +2.9% 3.7 $471 / SF 55% 3 14 Senior Loan West Palm Beach, FL Multifamily 12/29/2021 171.5 171.5 170.9 26.3 +2.8% 2.8 $210,456 / unit 73% 3 15 Senior Loan Various Self-Storage 12/21/2022 336.6 168.3 150.7 36.1 +3.8% 3.8 $22,663 / unit 64% 3 16 Senior Loan Boston, MA Life Science 4/27/2021 332.3 166.2 162.1 28.9 +3.7% 2.1 $673 / SF 66% 3 17 Senior Loan Plano, TX Office 2/6/2020 150.7 150.7 150.7 23.0 +2.8% 0.9 $208 / SF 64% 3 18 Senior Loan Redwood City, CA Life Science 9/30/2022 580.7 145.2 16.4 2.4 +4.5% 3.5 $885 / SF 53% 3 19 Senior Loan Seattle, WA Life Science 10/1/2021 188.0 140.3 117.1 43.4 +3.2% 2.5 $747 / SF n.a. 5 20 Senior Loan Dallas, TX Office 12/10/2021 138.0 138.0 138.0 25.9 +3.7% 2.7 $439 / SF 68% 3 21 Senior Loan Boston, MA Multifamily 3/29/2019 137.0 137.0 137.0 27.9 +3.4% 0.0 $351,282 / unit 63% 3 22 Senior Loan Arlington, VA Multifamily 1/20/2022 135.3 135.3 133.5 31.1 +2.9% 2.9 $445,071 / unit 65% 3 23 Senior Loan Fontana, CA Industrial 5/11/2021 132.0 132.0 113.5 47.2 +4.7% 2.2 $113 / SF 64% 3 24 Senior Loan Fort Lauderdale, FL Hospitality 11/9/2018 125.6 125.6 125.6 65.0 +5.0% 0.1 $362,954 / key 62% 3 25 Senior Loan San Carlos, CA Life Science 2/1/2022 195.9 125.0 103.2 30.9 +3.6% 2.9 $704 / SF 68% 4 26 Senior Loan Cambridge, MA Life Science 12/22/2021 401.3 115.7 91.1 24.9 +4.0% 2.8 $1,072 / SF 51% 3 27 Senior Loan Philadelphia, PA Office 6/19/2018 114.3 114.3 114.3 19.1 +2.8% 2.9 $117 / SF 71% 3 28 Senior Loan San Diego, CA Multifamily 10/20/2021 113.5 113.5 104.7 30.3 +3.2% 2.6 $453,457 / unit 71% 4 29 Senior Loan Pittsburgh, PA Student Housing 6/8/2021 112.5 112.5 112.5 17.3 +3.0% 2.2 $155,602 / unit 74% 3 30 Senior Loan West Hollywood, CA Multifamily 1/26/2022 107.0 107.0 106.6 20.2 +3.1% 2.9 $2,881,083 / unit 65% 4 31 Senior Loan Chicago, IL Office 7/15/2019 105.0 105.0 88.4 36.3 +2.3% 4.4 $85 / SF 59% 3 32 Senior Loan Las Vegas, NV Multifamily 12/28/2021 101.1 101.1 101.1 15.3 +2.8% 2.8 $191,460 / unit 61% 3 33 Senior Loan Boston, MA Industrial 6/28/2022 285.5 100.0 99.3 20.6 +3.0% 3.3 $198 / SF 52% 3 34 Senior Loan Cary, NC Multifamily 11/21/2022 100.0 100.0 95.3 18.4 +3.4% 3.7 $244,275 / unit 63% 3 35 Senior Loan Washington, D.C. Office 1/13/2022 228.5 100.0 73.5 11.0 +3.3% 3.9 $269 / SF 55% 3 36 Senior Loan Phoenix, AZ Industrial 1/13/2022 195.3 100.0 59.4 15.4 +4.0% 2.9 $57 / SF 57% 3 37 Senior Loan Orlando, FL Multifamily 12/14/2021 97.4 97.4 91.8 25.2 +3.1% 2.8 $242,110 / unit 74% 3 38 Senior Loan Brisbane, CA Life Science 7/22/2021 95.0 95.0 90.8 18.1 +3.1% 2.4 $784 / SF 71% 3 39 Senior Loan Raleigh, NC Multifamily 4/27/2022 91.4 91.4 81.0 21.6 +3.0% 3.1 $253,006 / unit 68% 4 40 Senior Loan Brandon, FL Multifamily 1/13/2022 90.3 90.3 67.8 10.6 +3.1% 2.9 $193,074 / unit 75% 3 41 Senior Loan Dallas, TX Multifamily 12/23/2021 90.0 90.0 80.8 17.9 +2.9% 2.8 $248,482 / unit 67% 3 42 Senior Loan Miami, FL Multifamily 10/14/2021 89.5 89.5 89.5 17.5 +2.9% 2.6 $304,422 / unit 76% 3 43 Senior Loan Dallas, TX Office 1/22/2021 87.0 87.0 87.0 13.4 +3.4% 1.9 $294 / SF 65% 3 44 Senior Loan San Antonio, TX Multifamily 6/1/2022 246.5 86.3 80.3 19.9 +2.8% 3.2 $103,007 / unit 68% 3 45 Senior Loan Scottsdale, AZ Multifamily 5/9/2022 169.0 84.5 84.5 13.1 +2.9% 3.2 $457,995 / unit 64% 3 46 Senior Loan Hollywood, FL Multifamily 12/20/2021 81.0 81.0 81.0 15.2 +3.1% 2.8 $327,935 / unit 74% 3 47 Senior Loan Charlotte, NC Multifamily 12/14/2021 79.3 79.3 76.1 12.7 +3.1% 2.8 $206,699 / unit 74% 3 48 Senior Loan Phoenix, AZ Single Family Rental 4/22/2021 72.1 72.1 70.0 20.0 +4.9% 2.1 $157,092 / unit 50% 3 49 Senior Loan(10) Various Industrial 6/30/2021 142.5 71.2 64.2 27.8 +5.5% 2.3 $73 / SF 58% 3 50 Senior Loan Denver, CO Multifamily 9/14/2021 70.3 70.3 70.3 10.8 +2.8% 2.5 $290,496 / unit 78% 3 *See footnotes on subsequent page

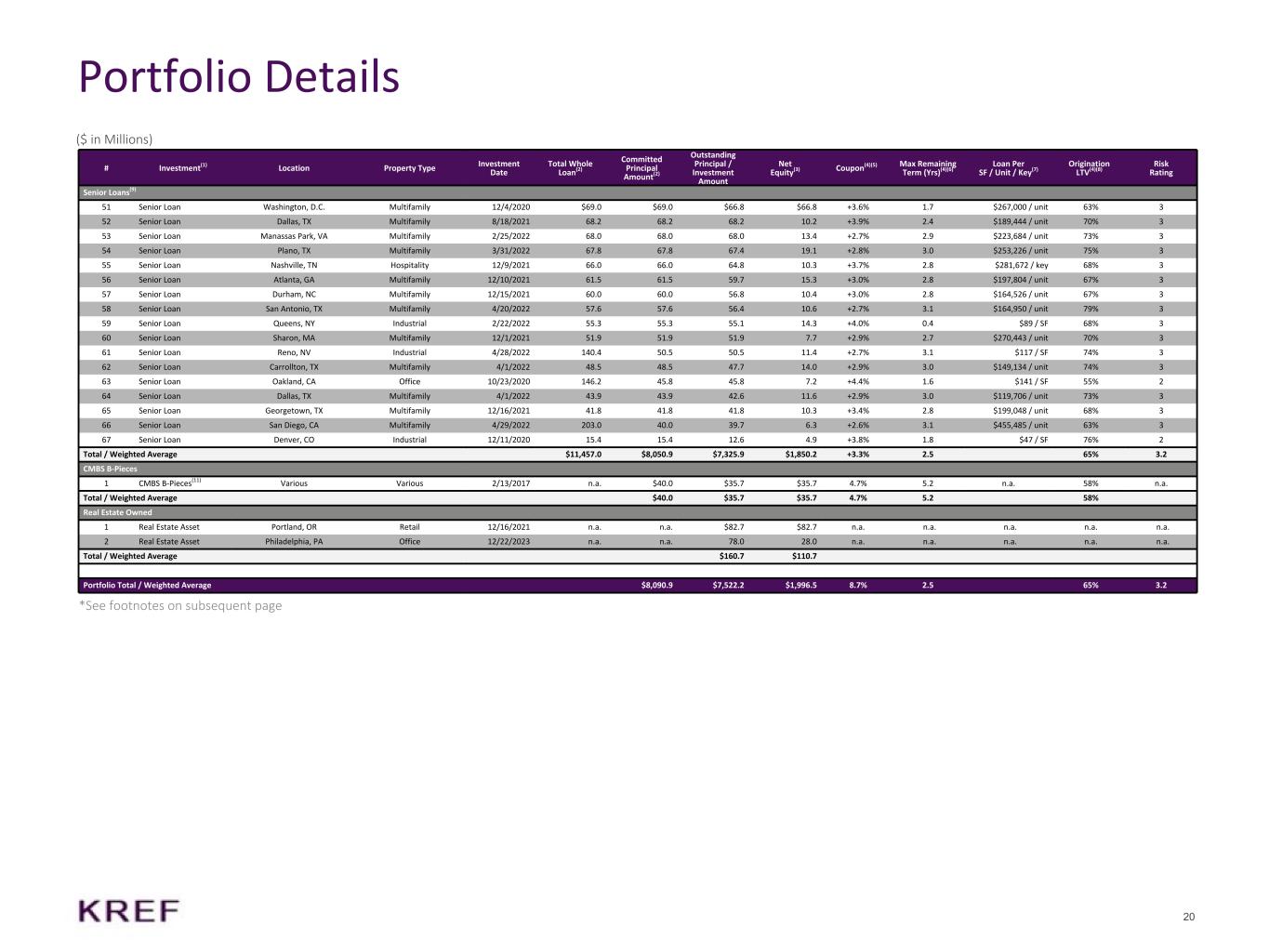

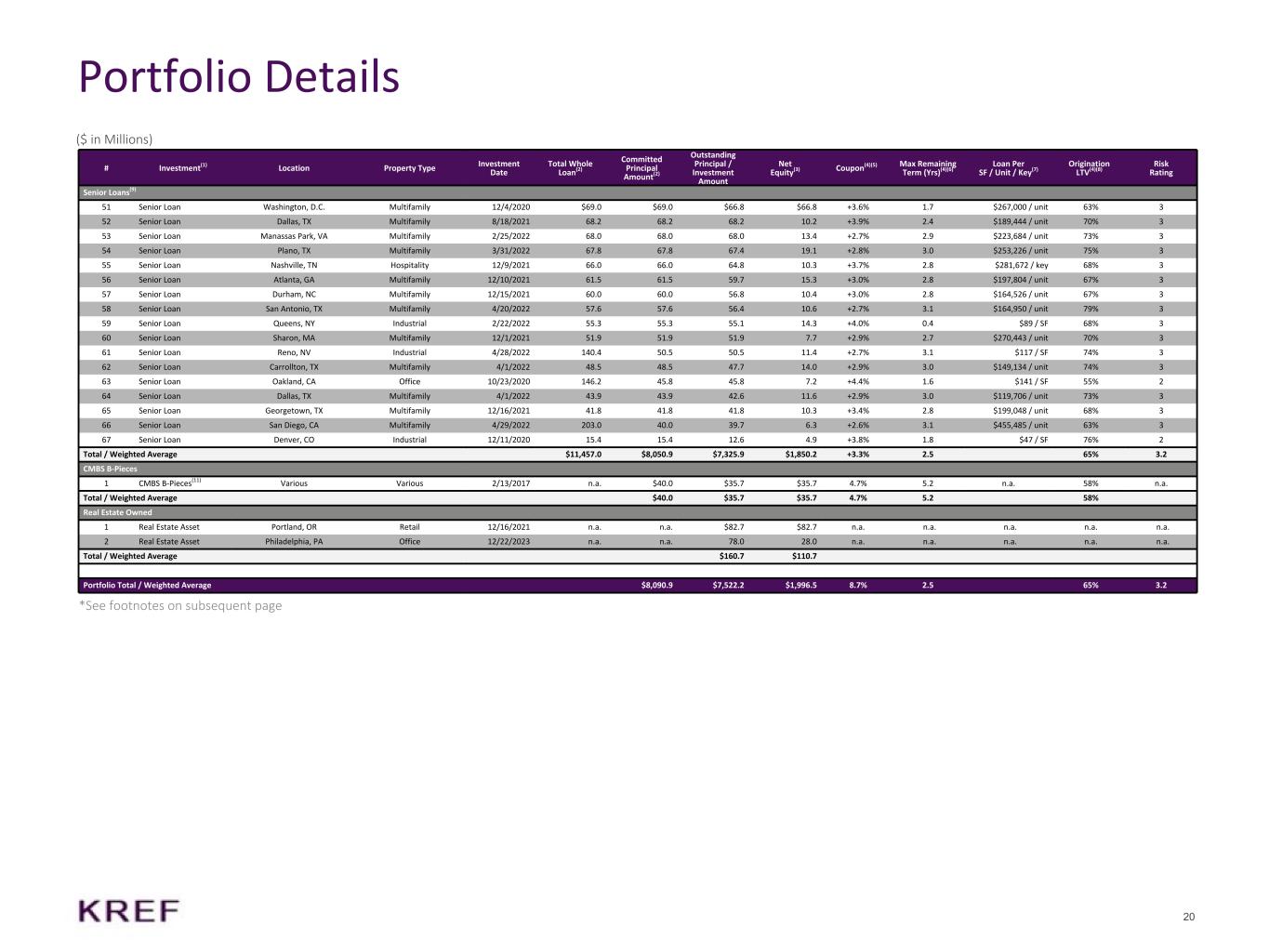

20 Portfolio Details *See footnotes on subsequent page ($ in Millions) # Investment(1) Location Property Type Investment Date Total Whole Loan(2) Committed Principal Amount(2) Outstanding Principal / Investment Amount Net Equity(3) Coupon(4)(5) Max Remaining Term (Yrs)(4)(6) Loan Per SF / Unit / Key(7) Origination LTV(4)(8) Risk Rating Senior Loans(9) 51 Senior Loan Washington, D.C. Multifamily 12/4/2020 $69.0 $69.0 $66.8 $66.8 +3.6% 1.7 $267,000 / unit 63% 3 52 Senior Loan Dallas, TX Multifamily 8/18/2021 68.2 68.2 68.2 10.2 +3.9% 2.4 $189,444 / unit 70% 3 53 Senior Loan Manassas Park, VA Multifamily 2/25/2022 68.0 68.0 68.0 13.4 +2.7% 2.9 $223,684 / unit 73% 3 54 Senior Loan Plano, TX Multifamily 3/31/2022 67.8 67.8 67.4 19.1 +2.8% 3.0 $253,226 / unit 75% 3 55 Senior Loan Nashville, TN Hospitality 12/9/2021 66.0 66.0 64.8 10.3 +3.7% 2.8 $281,672 / key 68% 3 56 Senior Loan Atlanta, GA Multifamily 12/10/2021 61.5 61.5 59.7 15.3 +3.0% 2.8 $197,804 / unit 67% 3 57 Senior Loan Durham, NC Multifamily 12/15/2021 60.0 60.0 56.8 10.4 +3.0% 2.8 $164,526 / unit 67% 3 58 Senior Loan San Antonio, TX Multifamily 4/20/2022 57.6 57.6 56.4 10.6 +2.7% 3.1 $164,950 / unit 79% 3 59 Senior Loan Queens, NY Industrial 2/22/2022 55.3 55.3 55.1 14.3 +4.0% 0.4 $89 / SF 68% 3 60 Senior Loan Sharon, MA Multifamily 12/1/2021 51.9 51.9 51.9 7.7 +2.9% 2.7 $270,443 / unit 70% 3 61 Senior Loan Reno, NV Industrial 4/28/2022 140.4 50.5 50.5 11.4 +2.7% 3.1 $117 / SF 74% 3 62 Senior Loan Carrollton, TX Multifamily 4/1/2022 48.5 48.5 47.7 14.0 +2.9% 3.0 $149,134 / unit 74% 3 63 Senior Loan Oakland, CA Office 10/23/2020 146.2 45.8 45.8 7.2 +4.4% 1.6 $141 / SF 55% 2 64 Senior Loan Dallas, TX Multifamily 4/1/2022 43.9 43.9 42.6 11.6 +2.9% 3.0 $119,706 / unit 73% 3 65 Senior Loan Georgetown, TX Multifamily 12/16/2021 41.8 41.8 41.8 10.3 +3.4% 2.8 $199,048 / unit 68% 3 66 Senior Loan San Diego, CA Multifamily 4/29/2022 203.0 40.0 39.7 6.3 +2.6% 3.1 $455,485 / unit 63% 3 67 Senior Loan Denver, CO Industrial 12/11/2020 15.4 15.4 12.6 4.9 +3.8% 1.8 $47 / SF 76% 2 Total / Weighted Average $11,457.0 $8,050.9 $7,325.9 $1,850.2 +3.3% 2.5 65% 3.2 CMBS B-Pieces 1 CMBS B-Pieces(11) Various Various 2/13/2017 n.a. $40.0 $35.7 $35.7 4.7% 5.2 n.a. 58% n.a. Total / Weighted Average $40.0 $35.7 $35.7 4.7% 5.2 58% Real Estate Owned 1 Real Estate Asset Portland, OR Retail 12/16/2021 n.a. n.a. $82.7 $82.7 n.a. n.a. n.a. n.a. n.a. 2 Real Estate Asset Philadelphia, PA Office 12/22/2023 n.a. n.a. 78.0 28.0 n.a. n.a. n.a. n.a. n.a. Total / Weighted Average $160.7 $110.7 Portfolio Total / Weighted Average $8,090.9 $7,522.2 $1,996.5 8.7% 2.5 65% 3.2

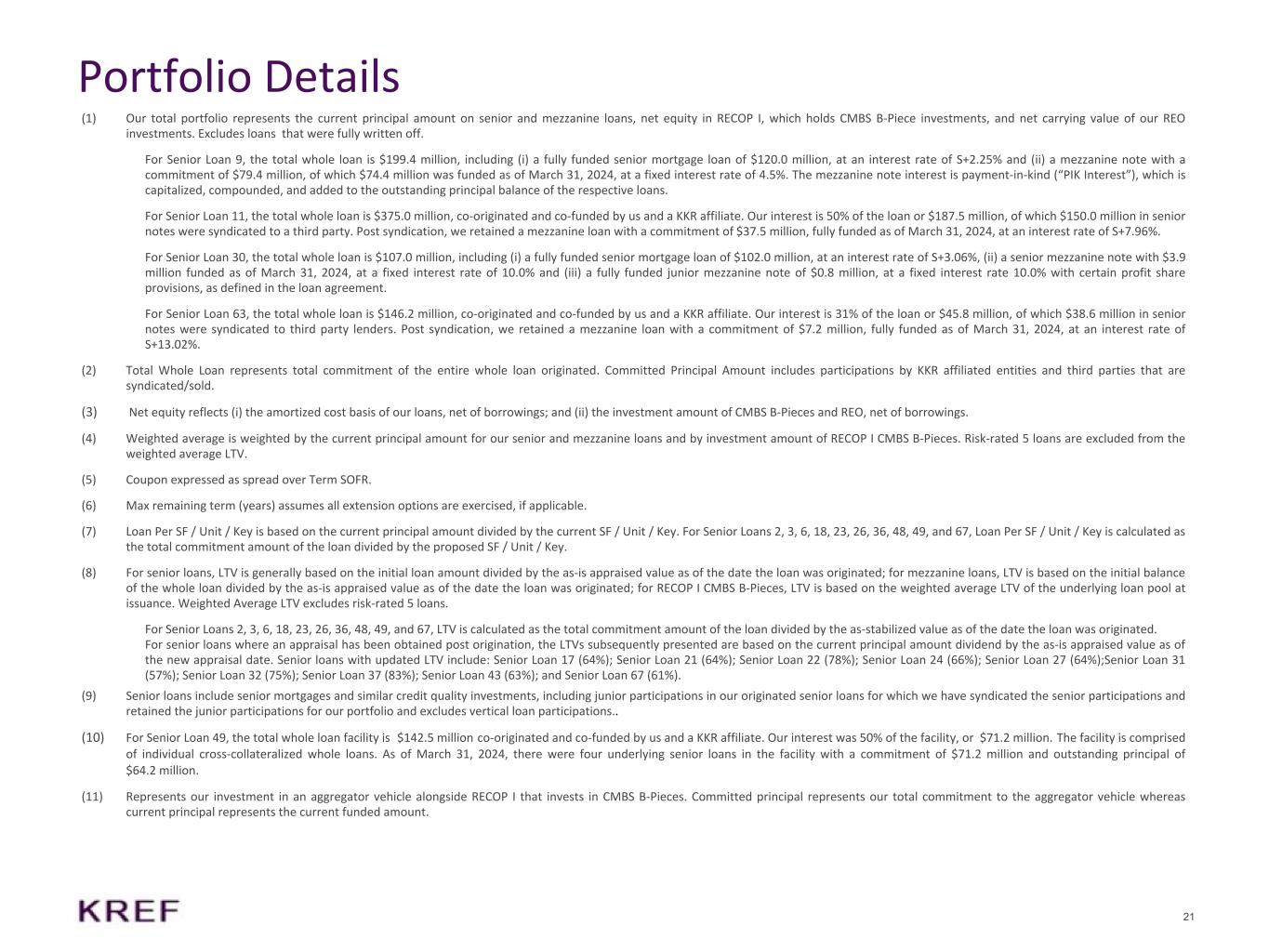

21 Portfolio Details (1) Our total portfolio represents the current principal amount on senior and mezzanine loans, net equity in RECOP I, which holds CMBS B-Piece investments, and net carrying value of our REO investments. Excludes loans that were fully written off. For Senior Loan 9, the total whole loan is $199.4 million, including (i) a fully funded senior mortgage loan of $120.0 million, at an interest rate of S+2.25% and (ii) a mezzanine note with a commitment of $79.4 million, of which $74.4 million was funded as of March 31, 2024, at a fixed interest rate of 4.5%. The mezzanine note interest is payment-in-kind (“PIK Interest”), which is capitalized, compounded, and added to the outstanding principal balance of the respective loans. For Senior Loan 11, the total whole loan is $375.0 million, co-originated and co-funded by us and a KKR affiliate. Our interest is 50% of the loan or $187.5 million, of which $150.0 million in senior notes were syndicated to a third party. Post syndication, we retained a mezzanine loan with a commitment of $37.5 million, fully funded as of March 31, 2024, at an interest rate of S+7.96%. For Senior Loan 30, the total whole loan is $107.0 million, including (i) a fully funded senior mortgage loan of $102.0 million, at an interest rate of S+3.06%, (ii) a senior mezzanine note with $3.9 million funded as of March 31, 2024, at a fixed interest rate of 10.0% and (iii) a fully funded junior mezzanine note of $0.8 million, at a fixed interest rate 10.0% with certain profit share provisions, as defined in the loan agreement. For Senior Loan 63, the total whole loan is $146.2 million, co-originated and co-funded by us and a KKR affiliate. Our interest is 31% of the loan or $45.8 million, of which $38.6 million in senior notes were syndicated to third party lenders. Post syndication, we retained a mezzanine loan with a commitment of $7.2 million, fully funded as of March 31, 2024, at an interest rate of S+13.02%. (2) Total Whole Loan represents total commitment of the entire whole loan originated. Committed Principal Amount includes participations by KKR affiliated entities and third parties that are syndicated/sold. (3) Net equity reflects (i) the amortized cost basis of our loans, net of borrowings; and (ii) the investment amount of CMBS B-Pieces and REO, net of borrowings. (4) Weighted average is weighted by the current principal amount for our senior and mezzanine loans and by investment amount of RECOP I CMBS B-Pieces. Risk-rated 5 loans are excluded from the weighted average LTV. (5) Coupon expressed as spread over Term SOFR. (6) Max remaining term (years) assumes all extension options are exercised, if applicable. (7) Loan Per SF / Unit / Key is based on the current principal amount divided by the current SF / Unit / Key. For Senior Loans 2, 3, 6, 18, 23, 26, 36, 48, 49, and 67, Loan Per SF / Unit / Key is calculated as the total commitment amount of the loan divided by the proposed SF / Unit / Key. (8) For senior loans, LTV is generally based on the initial loan amount divided by the as-is appraised value as of the date the loan was originated; for mezzanine loans, LTV is based on the initial balance of the whole loan divided by the as-is appraised value as of the date the loan was originated; for RECOP I CMBS B-Pieces, LTV is based on the weighted average LTV of the underlying loan pool at issuance. Weighted Average LTV excludes risk-rated 5 loans. For Senior Loans 2, 3, 6, 18, 23, 26, 36, 48, 49, and 67, LTV is calculated as the total commitment amount of the loan divided by the as-stabilized value as of the date the loan was originated. For senior loans where an appraisal has been obtained post origination, the LTVs subsequently presented are based on the current principal amount dividend by the as-is appraised value as of the new appraisal date. Senior loans with updated LTV include: Senior Loan 17 (64%); Senior Loan 21 (64%); Senior Loan 22 (78%); Senior Loan 24 (66%); Senior Loan 27 (64%);Senior Loan 31 (57%); Senior Loan 32 (75%); Senior Loan 37 (83%); Senior Loan 43 (63%); and Senior Loan 67 (61%). (9) Senior loans include senior mortgages and similar credit quality investments, including junior participations in our originated senior loans for which we have syndicated the senior participations and retained the junior participations for our portfolio and excludes vertical loan participations.. (10) For Senior Loan 49, the total whole loan facility is $142.5 million co-originated and co-funded by us and a KKR affiliate. Our interest was 50% of the facility, or $71.2 million. The facility is comprised of individual cross-collateralized whole loans. As of March 31, 2024, there were four underlying senior loans in the facility with a commitment of $71.2 million and outstanding principal of $64.2 million. (11) Represents our investment in an aggregator vehicle alongside RECOP I that invests in CMBS B-Pieces. Committed principal represents our total commitment to the aggregator vehicle whereas current principal represents the current funded amount.

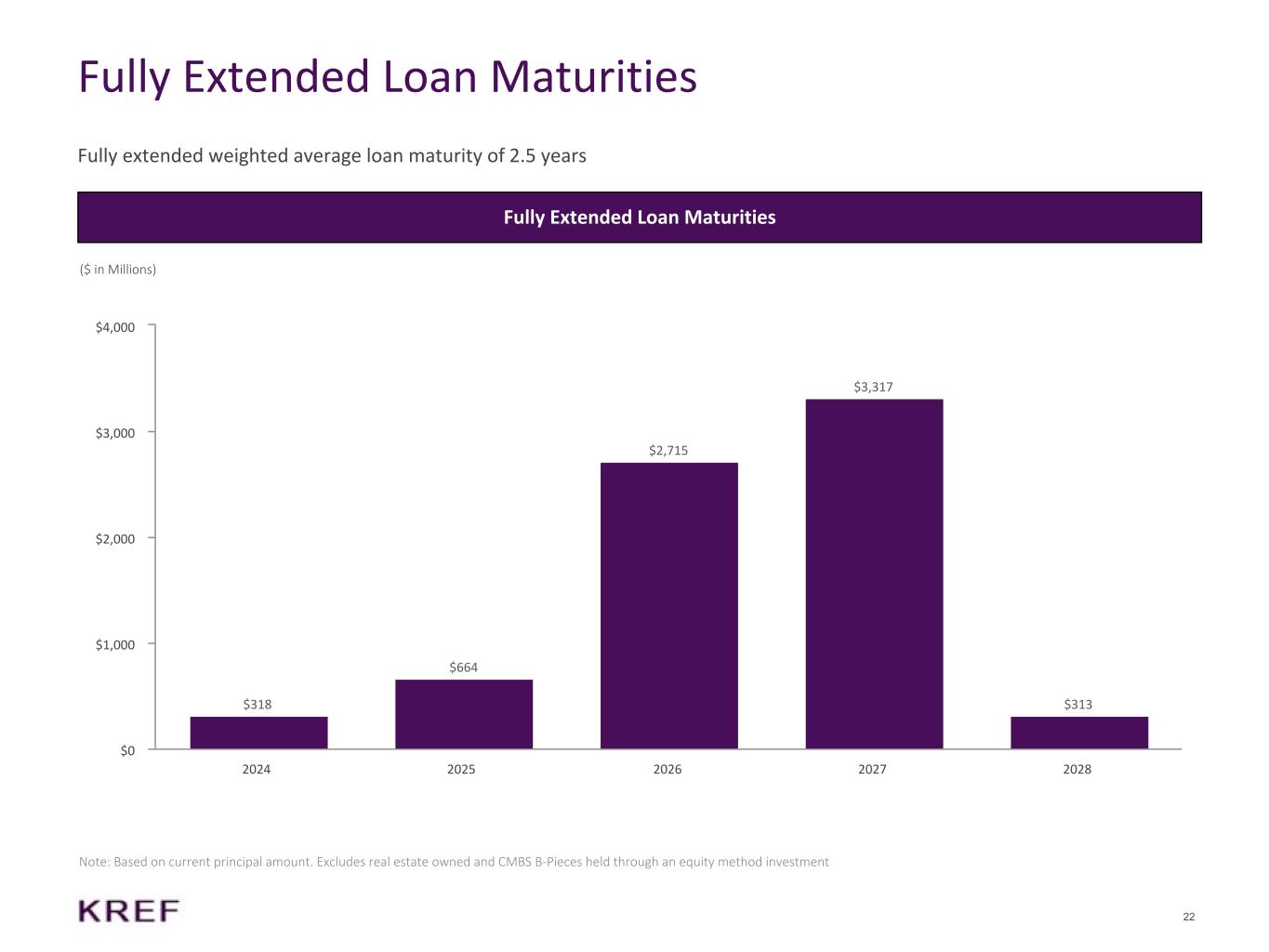

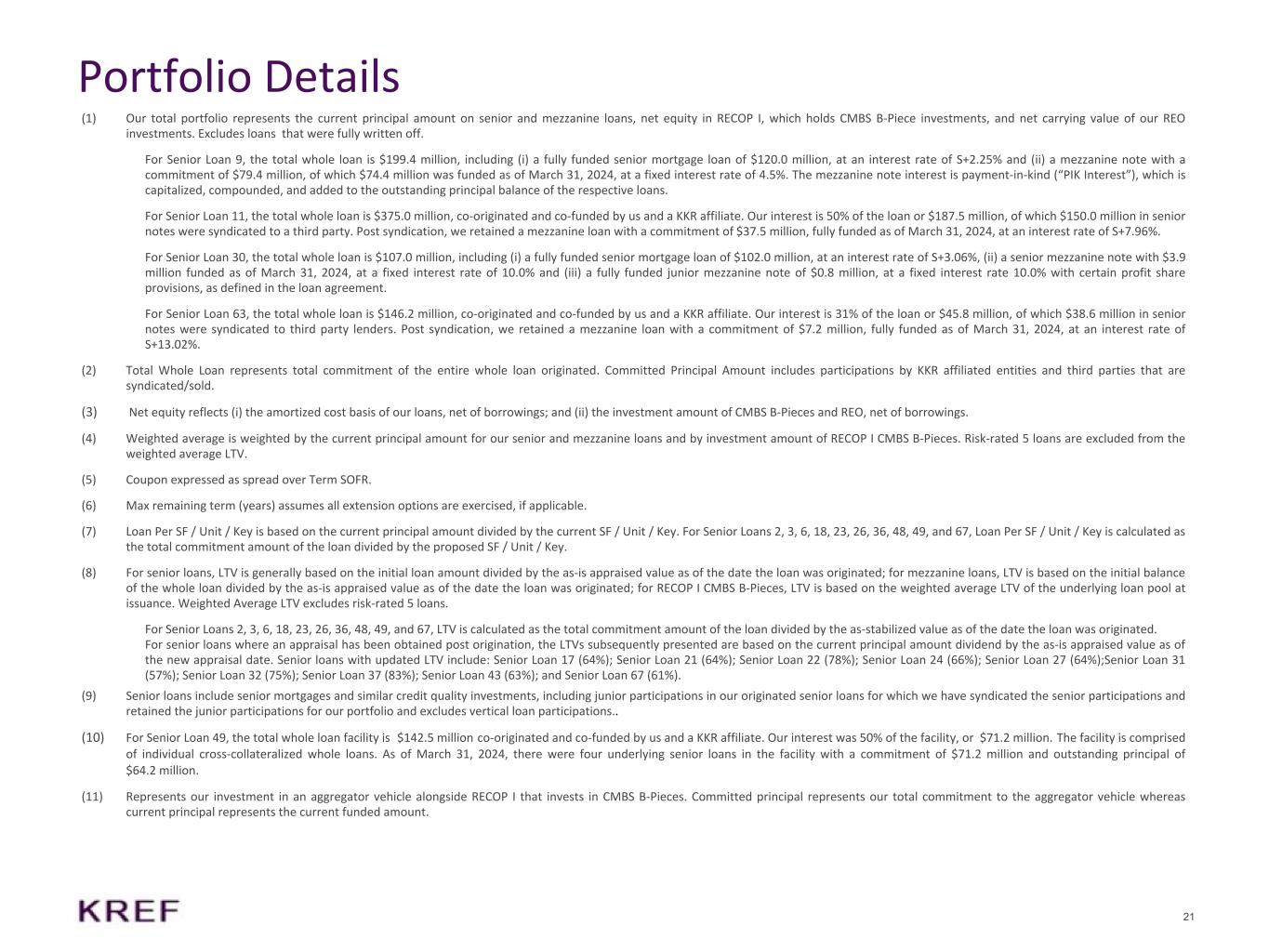

22 Fully Extended Loan Maturities Note: Based on current principal amount. Excludes real estate owned and CMBS B-Pieces held through an equity method investment Fully Extended Loan Maturities ($ in Millions) $318 $664 $2,715 $3,317 $313 2024 2025 2026 2027 2028 $0 $1,000 $2,000 $3,000 $4,000 Fully extended weighted average loan maturity of 2.5 years

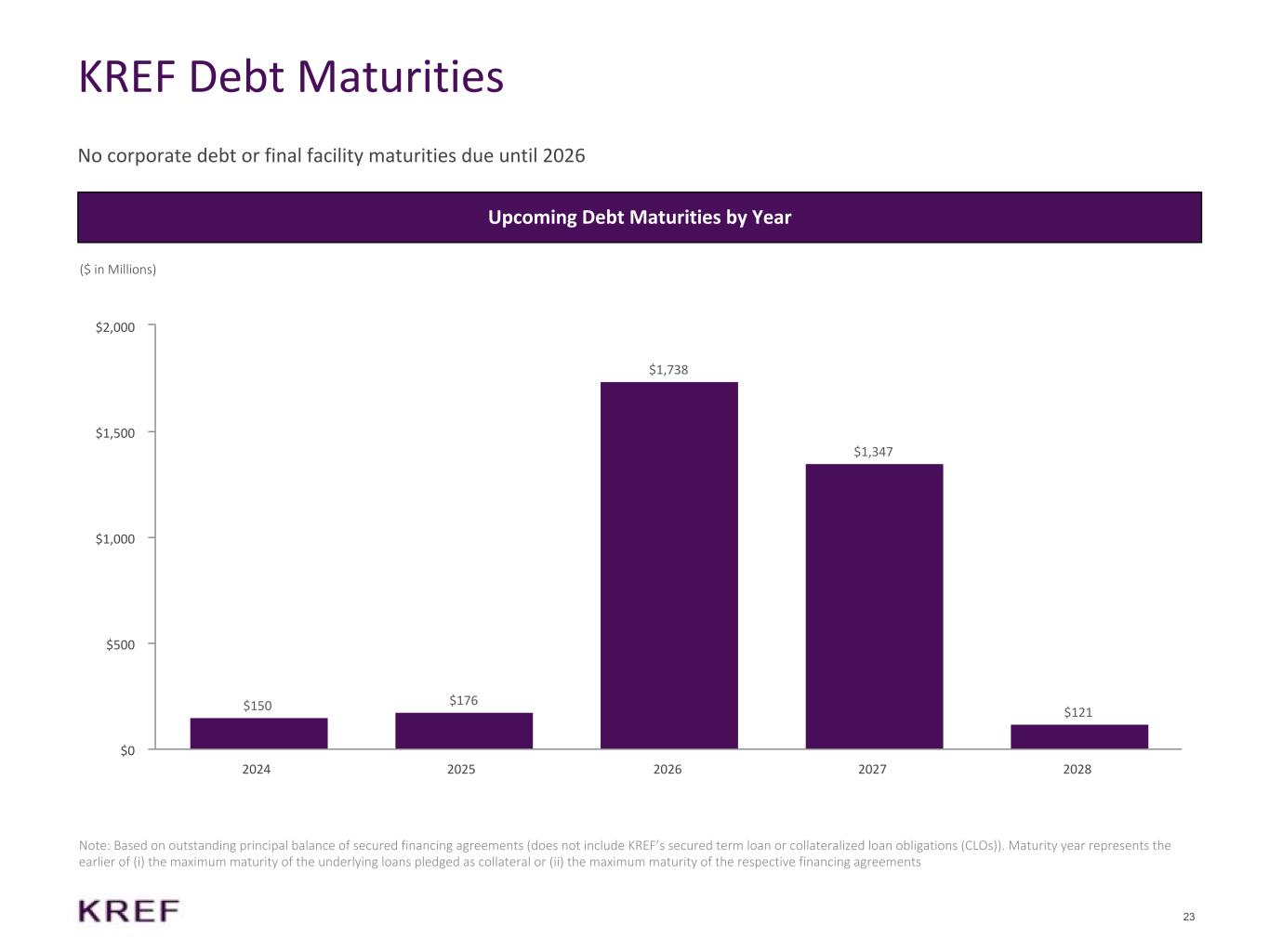

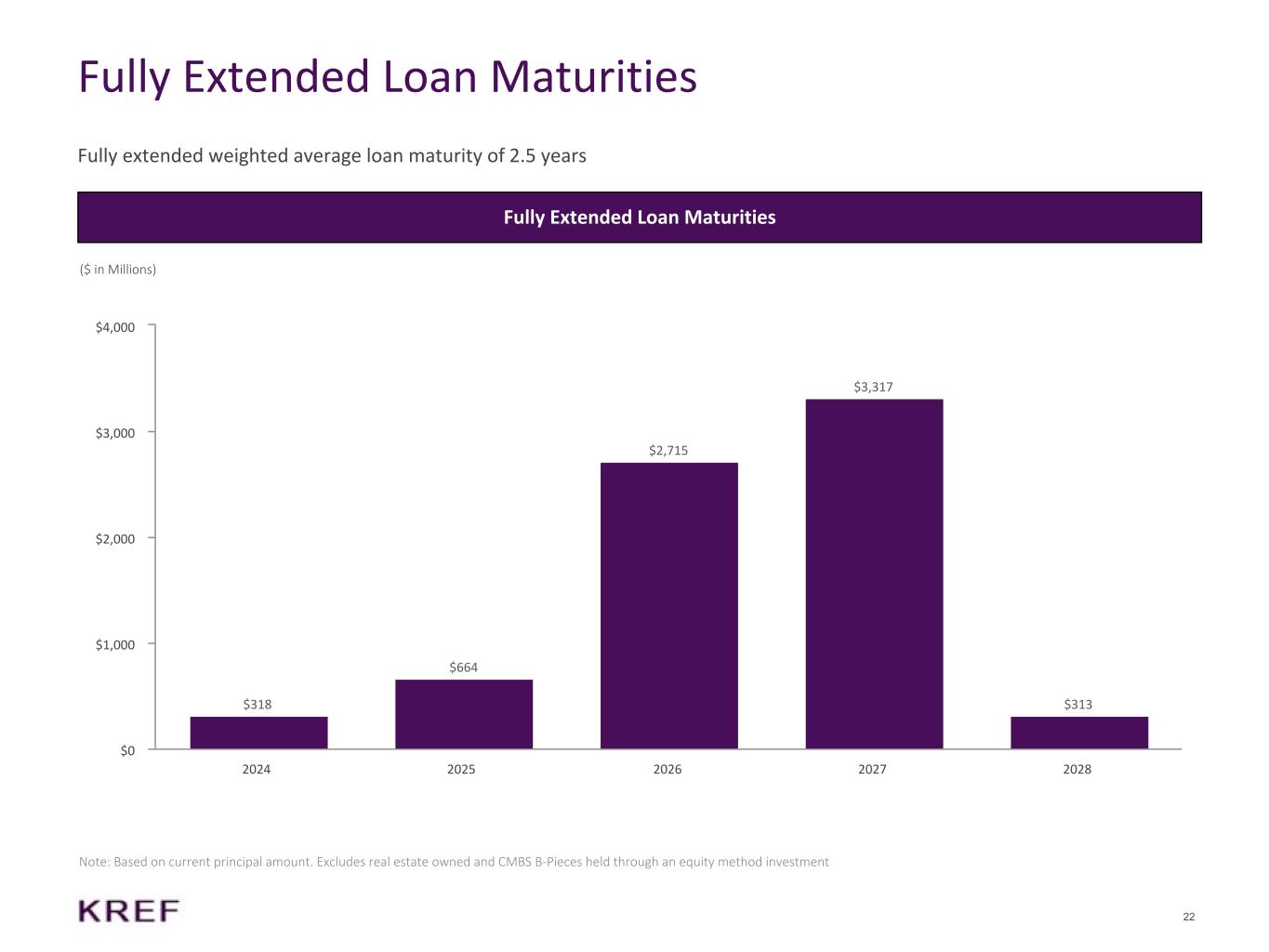

23 KREF Debt Maturities Note: Based on outstanding principal balance of secured financing agreements (does not include KREF’s secured term loan or collateralized loan obligations (CLOs)). Maturity year represents the earlier of (i) the maximum maturity of the underlying loans pledged as collateral or (ii) the maximum maturity of the respective financing agreements Upcoming Debt Maturities by Year ($ in Millions) $150 $176 $1,738 $1,347 $121 2024 2025 2026 2027 2028 $0 $500 $1,000 $1,500 $2,000 No corporate debt or final facility maturities due until 2026

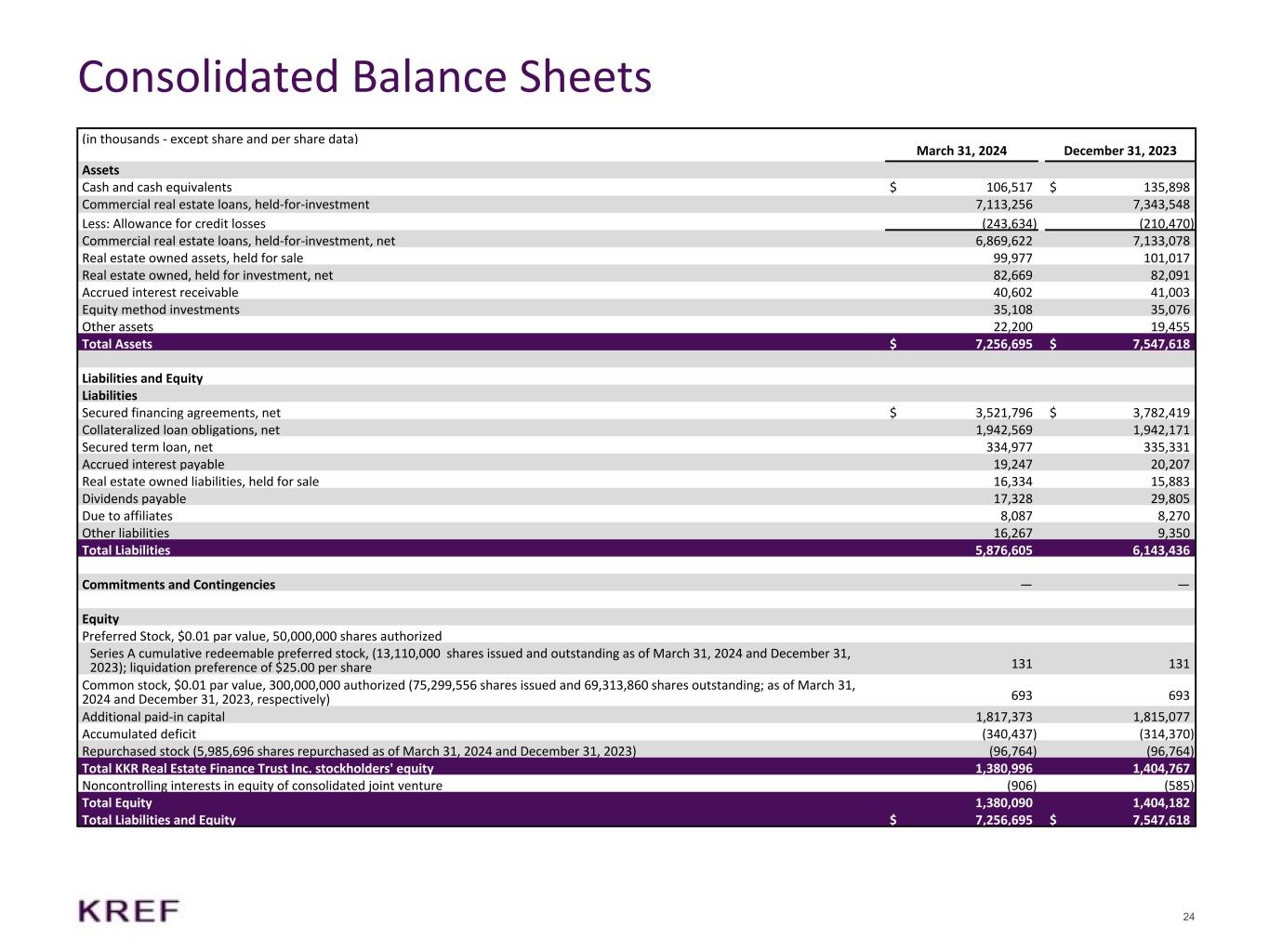

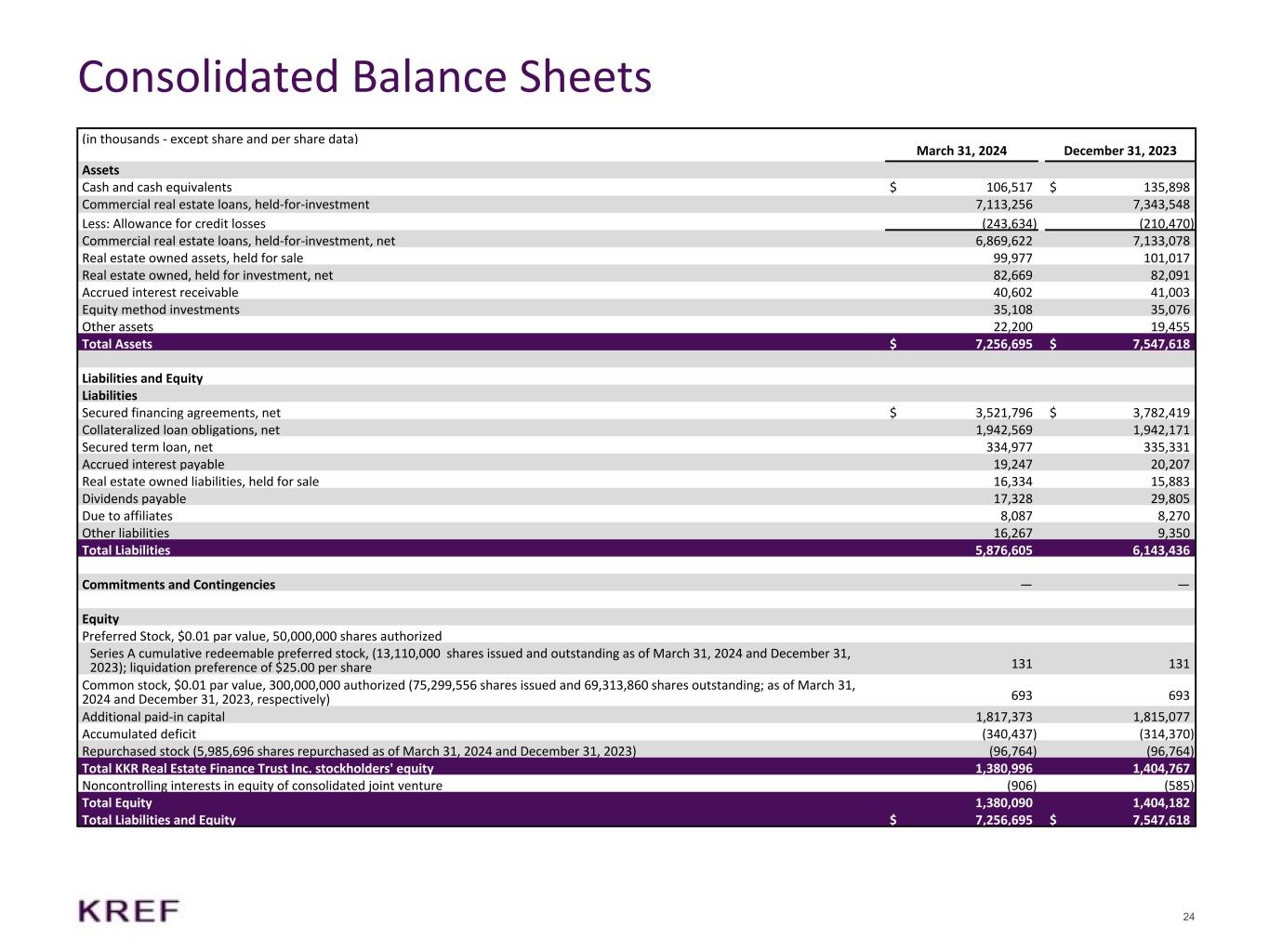

24 Consolidated Balance Sheets (in thousands - except share and per share data) March 31, 2024 December 31, 2023 Assets Cash and cash equivalents $ 106,517 $ 135,898 Commercial real estate loans, held-for-investment 7,113,256 7,343,548 Less: Allowance for credit losses (243,634) (210,470) Commercial real estate loans, held-for-investment, net 6,869,622 7,133,078 Real estate owned assets, held for sale 99,977 101,017 Real estate owned, held for investment, net 82,669 82,091 Accrued interest receivable 40,602 41,003 Equity method investments 35,108 35,076 Other assets 22,200 19,455 Total Assets $ 7,256,695 $ 7,547,618 Liabilities and Equity Liabilities Secured financing agreements, net $ 3,521,796 $ 3,782,419 Collateralized loan obligations, net 1,942,569 1,942,171 Secured term loan, net 334,977 335,331 Accrued interest payable 19,247 20,207 Real estate owned liabilities, held for sale 16,334 15,883 Dividends payable 17,328 29,805 Due to affiliates 8,087 8,270 Other liabilities 16,267 9,350 Total Liabilities 5,876,605 6,143,436 Commitments and Contingencies — — Equity Preferred Stock, $0.01 par value, 50,000,000 shares authorized Series A cumulative redeemable preferred stock, (13,110,000 shares issued and outstanding as of March 31, 2024 and December 31, 2023); liquidation preference of $25.00 per share 131 131 Common stock, $0.01 par value, 300,000,000 authorized (75,299,556 shares issued and 69,313,860 shares outstanding; as of March 31, 2024 and December 31, 2023, respectively) 693 693 Additional paid-in capital 1,817,373 1,815,077 Accumulated deficit (340,437) (314,370) Repurchased stock (5,985,696 shares repurchased as of March 31, 2024 and December 31, 2023) (96,764) (96,764) Total KKR Real Estate Finance Trust Inc. stockholders' equity 1,380,996 1,404,767 Noncontrolling interests in equity of consolidated joint venture (906) (585) Total Equity 1,380,090 1,404,182 Total Liabilities and Equity $ 7,256,695 $ 7,547,618

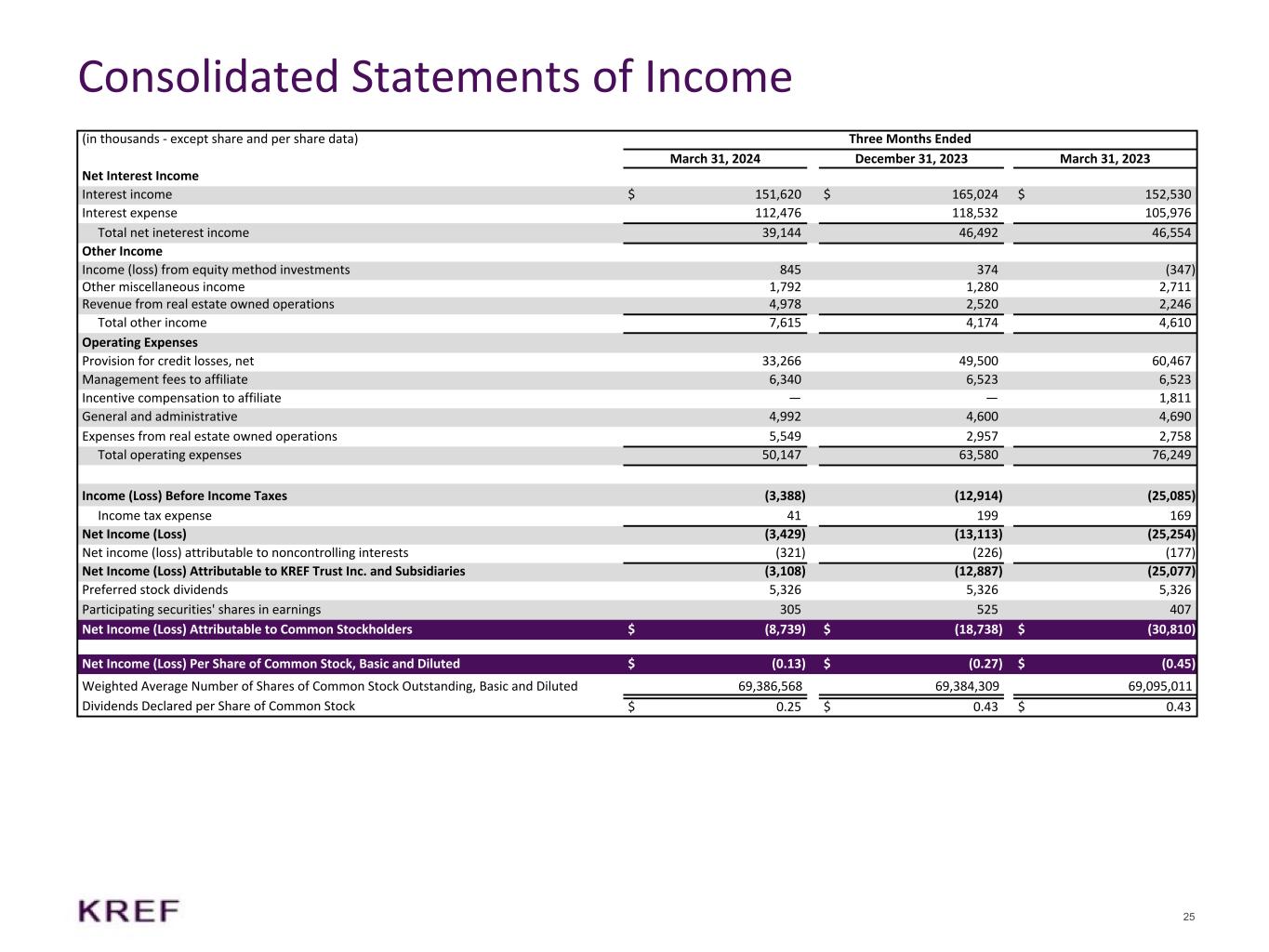

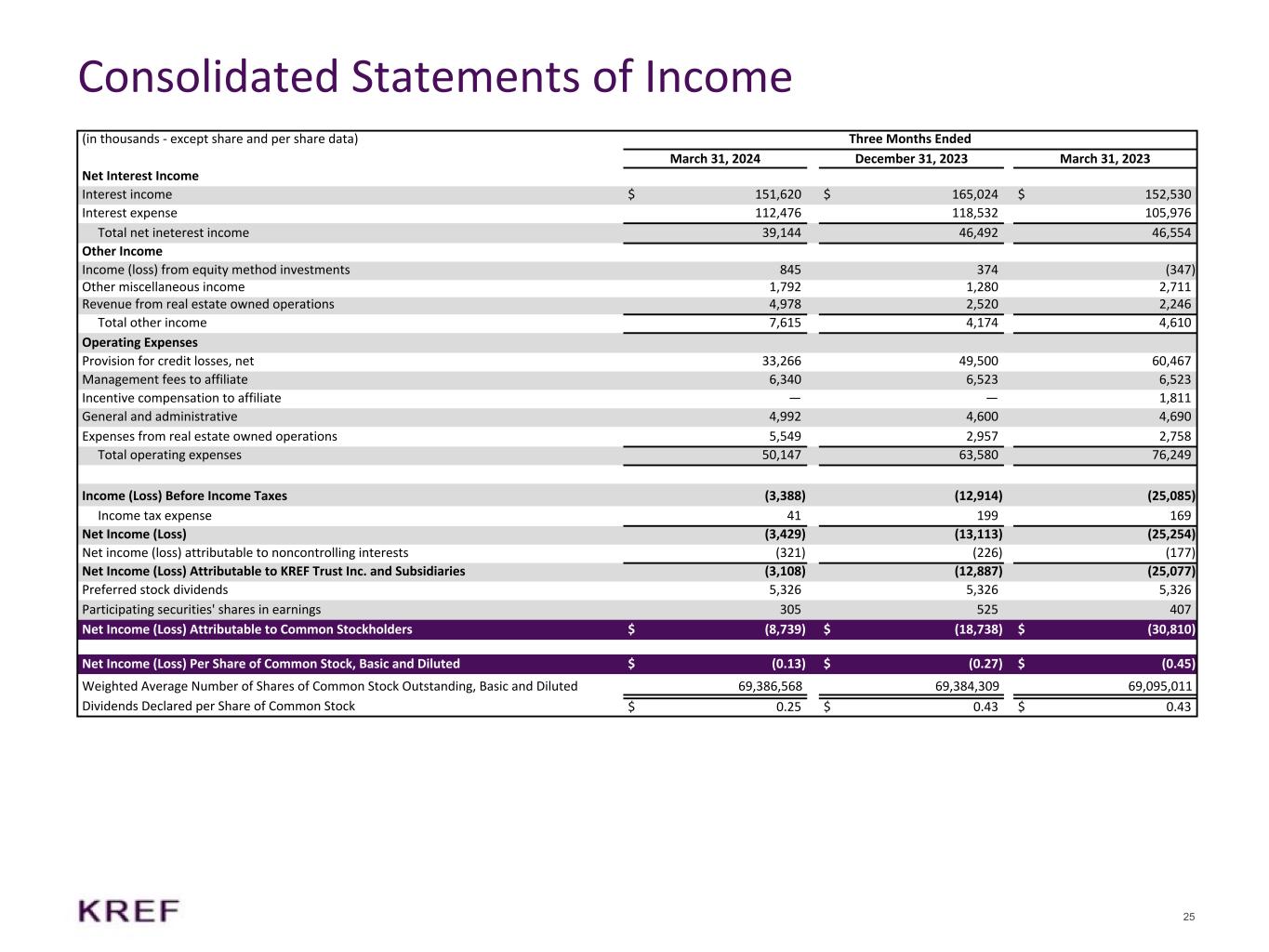

25 Consolidated Statements of Income (in thousands - except share and per share data) Three Months Ended March 31, 2024 December 31, 2023 March 31, 2023 Net Interest Income Interest income $ 151,620 $ 165,024 $ 152,530 Interest expense 112,476 118,532 105,976 Total net ineterest income 39,144 46,492 46,554 Other Income Income (loss) from equity method investments 845 374 (347) Other miscellaneous income 1,792 1,280 2,711 Revenue from real estate owned operations 4,978 2,520 2,246 Total other income 7,615 4,174 4,610 Operating Expenses Provision for credit losses, net 33,266 49,500 60,467 Management fees to affiliate 6,340 6,523 6,523 Incentive compensation to affiliate — — 1,811 General and administrative 4,992 4,600 4,690 Expenses from real estate owned operations 5,549 2,957 2,758 Total operating expenses 50,147 63,580 76,249 Income (Loss) Before Income Taxes (3,388) (12,914) (25,085) Income tax expense 41 199 169 Net Income (Loss) (3,429) (13,113) (25,254) Net income (loss) attributable to noncontrolling interests (321) (226) (177) Net Income (Loss) Attributable to KREF Trust Inc. and Subsidiaries (3,108) (12,887) (25,077) Preferred stock dividends 5,326 5,326 5,326 Participating securities' shares in earnings 305 525 407 Net Income (Loss) Attributable to Common Stockholders $ (8,739) $ (18,738) $ (30,810) Net Income (Loss) Per Share of Common Stock, Basic and Diluted $ (0.13) $ (0.27) $ (0.45) Weighted Average Number of Shares of Common Stock Outstanding, Basic and Diluted 69,386,568 69,384,309 69,095,011 Dividends Declared per Share of Common Stock $ 0.25 $ 0.43 $ 0.43

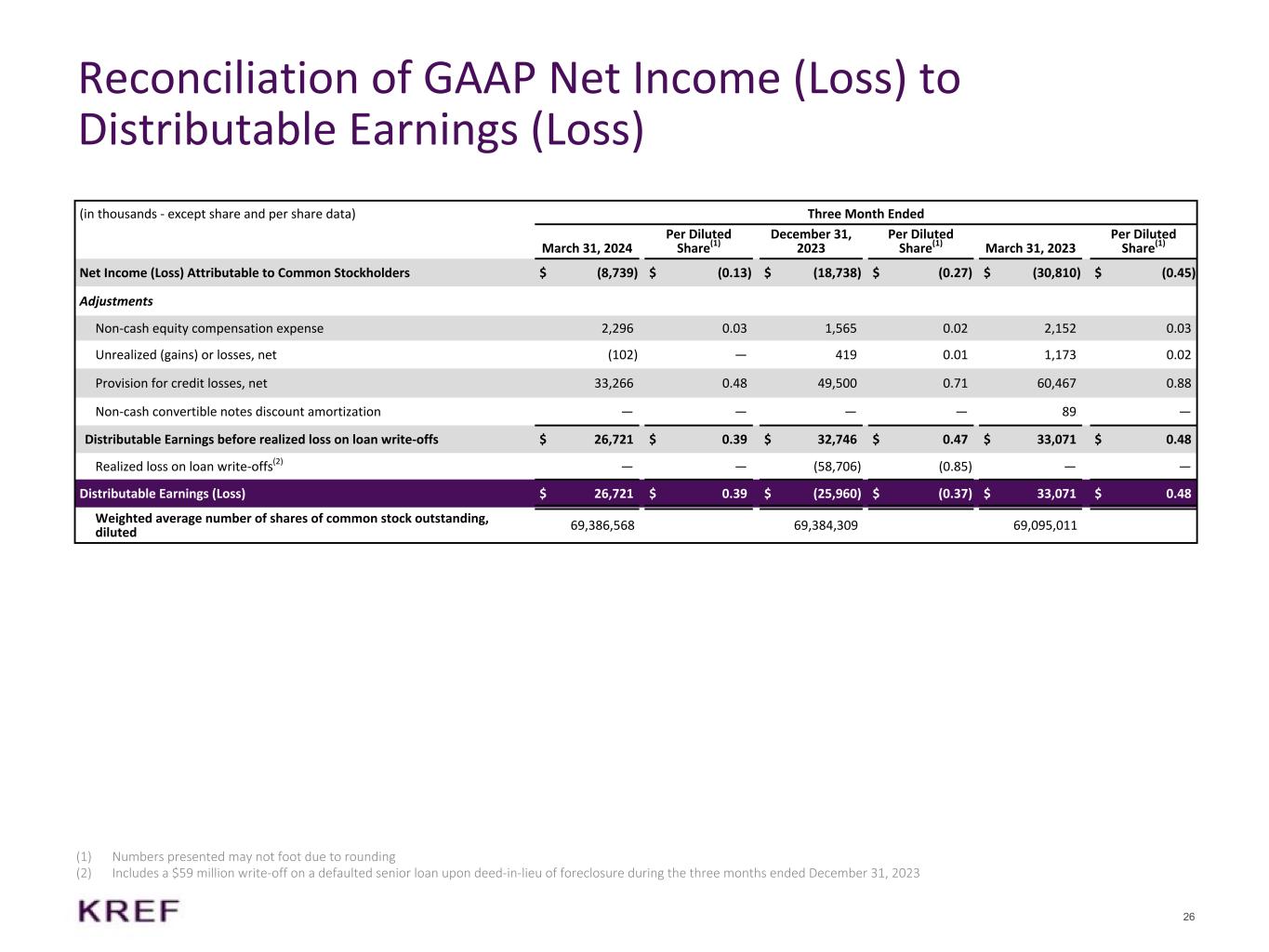

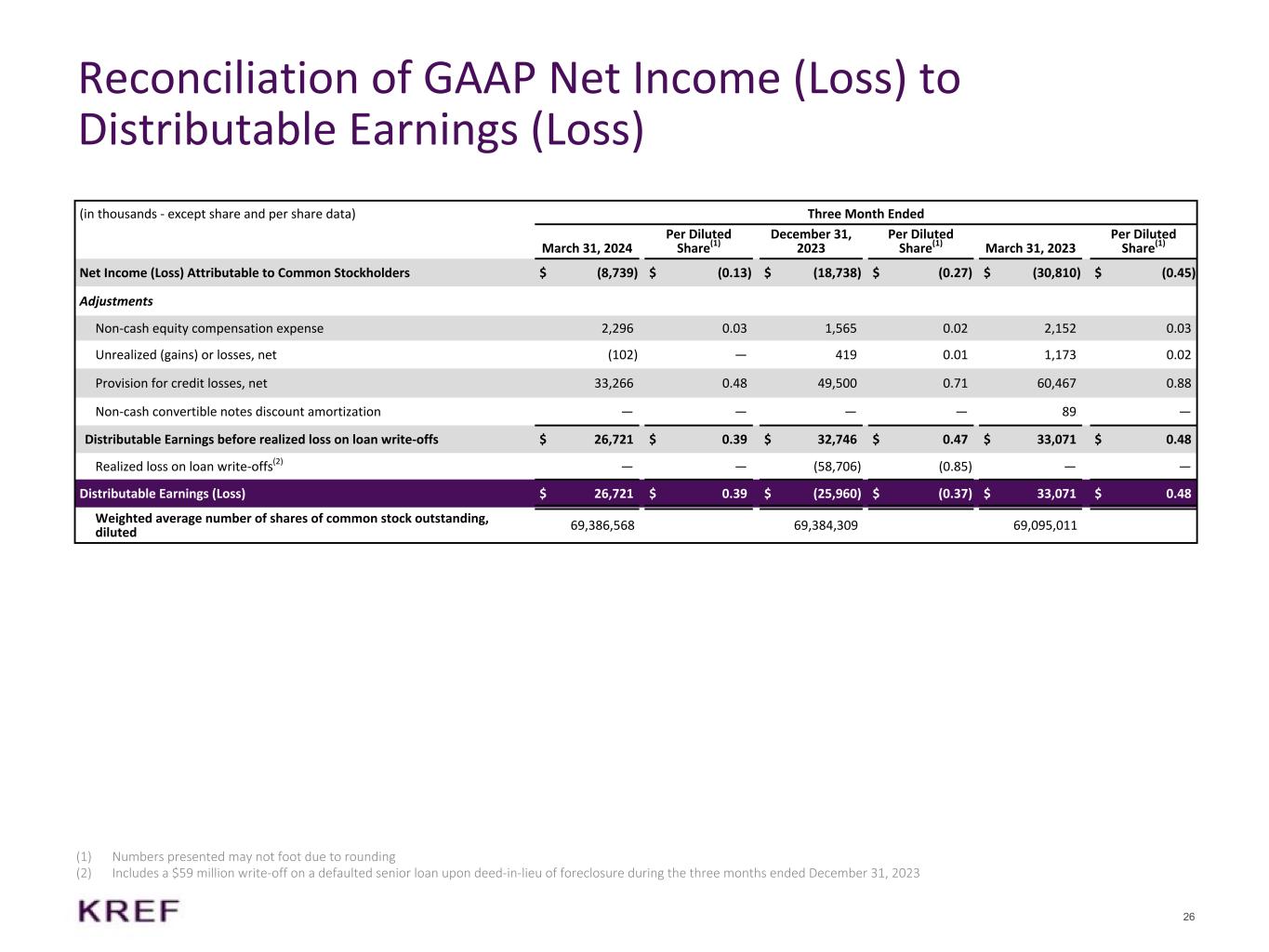

26 Reconciliation of GAAP Net Income (Loss) to Distributable Earnings (Loss) (1) Numbers presented may not foot due to rounding (2) Includes a $59 million write-off on a defaulted senior loan upon deed-in-lieu of foreclosure during the three months ended December 31, 2023 (in thousands - except share and per share data) Three Month Ended March 31, 2024 Per Diluted Share(1) December 31, 2023 Per Diluted Share(1) March 31, 2023 Per Diluted Share(1) Net Income (Loss) Attributable to Common Stockholders $ (8,739) $ (0.13) $ (18,738) $ (0.27) $ (30,810) $ (0.45) Adjustments Non-cash equity compensation expense 2,296 0.03 1,565 0.02 2,152 0.03 Unrealized (gains) or losses, net (102) — 419 0.01 1,173 0.02 Provision for credit losses, net 33,266 0.48 49,500 0.71 60,467 0.88 Non-cash convertible notes discount amortization — — — — 89 — Distributable Earnings before realized loss on loan write-offs $ 26,721 $ 0.39 $ 32,746 $ 0.47 $ 33,071 $ 0.48 Realized loss on loan write-offs(2) — — (58,706) (0.85) — — Distributable Earnings (Loss) $ 26,721 $ 0.39 $ (25,960) $ (0.37) $ 33,071 $ 0.48 Weighted average number of shares of common stock outstanding, diluted 69,386,568 69,384,309 69,095,011

27 Key Definitions “Distributable Earnings": The Company defines Distributable Earnings as net income (loss) attributable to common stockholders or, without duplication, owners of the Company's subsidiaries, computed in accordance with GAAP, including realized losses not otherwise included in GAAP net income (loss) and excluding (i) non-cash equity compensation expense, (ii) depreciation and amortization, (iii) any unrealized gains or losses or other similar non-cash items that are included in net income for the applicable reporting period, regardless of whether such items are included in other comprehensive income or loss, or in net income, and (iv) one-time events pursuant to changes in GAAP and certain material non-cash income or expense items agreed upon after discussions between the Company’s Manager and board of directors and after approval by a majority of the independent directors. The exclusion of depreciation and amortization from the calculation of Distributable Earnings only applies to debt investments related to real estate to the extent the Company forecloses upon the property or properties underlying such debt investments. Distributable Earnings should not be considered as a substitute for GAAP net income or taxable income. The Company cautions readers that its methodology for calculating Distributable Earnings may differ from the methodologies employed by other REITs to calculate the same or similar supplemental performance measures, and as a result, the Company’s reported Distributable Earnings may not be comparable to similar measures presented by other REITs. LEED: LEED is the most widely used green building rating system in the world. LEED certification provides independent verification of a building or neighborhood’s green features, allowing for the design, construction, operations and maintenance of resource-efficient, high-performing, healthy, cost-effective buildings.