0 42 65 156 110 2 3 93 109 127 127 127 GENERAL PALETTE 0 42 65 2 87 133 71 126 163 120 163 198 Credit Private Equity Real Estate Secondary Solutions BUSINESS SECTOR PALETTE 192 212 229 Strategic Initiatives Third Quarter 2025 Earnings Presentation Exhibit 99.2

0 42 65 156 110 2 3 93 109 127 127 127 GENERAL PALETTE 0 42 65 2 87 133 71 126 163 120 163 198 Credit Private Equity Real Estate Secondary Solutions BUSINESS SECTOR PALETTE 192 212 229 Strategic Initiatives Disclaimer Statements included herein may constitute “forward-looking statementsˮ within the meaning of the Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934, as amended, which may relate to future events or the future performance or financial condition of Ares Commercial Real Estate Corporation (“ACREˮ or, the “Companyˮ), Ares Commercial Real Estate Management LLC (“ACREMˮ), a subsidiary of Ares Management Corporation (“Ares Corp.ˮ), Ares Corp., certain of their subsidiaries and certain funds and accounts managed by ACREM, Ares Corp. and/or their subsidiaries, including, without limitation, ACRE. These statements include, but are not limited to, statements about potential earnings, the resolution of underperforming loans, liquidity management, reduction or increase of CECL reserve, reduction or increase of available borrowings, the industry and the loan market and are not guarantees of future results or financial condition and involve a number of risks and uncertainties. Actual results could differ materially from those in the forward-looking statements as a result of a number of factors, including global economic trends and economic conditions, including high inflation, slower growth or recession, changes to fiscal and monetary policy, currency fluctuations, changes caused by tariffs and trade disputes with other countries, effects of a prolonged government shutdown, changes in interest rates, credit spreads and the Company's business and investment strategy, the Company's projected operating results, the return or impact of current and future investments, access to the financing and debt markets, the demand for commercial real estate loans, rates of prepayments on the Company’s mortgage loans and the effect on the Company’s business of such prepayments, availability of investment opportunities in mortgage-related and real estate-related investments and securities, ACREM’s ability to locate suitable investments for the Company, monitor, service and administer the Company’s investments and execute its investment strategy, and other risks described from time to time in ACRE’s filings within the Securities and Exchange Commission (“SECˮ). Any forward-looking statement, including any contained herein, speaks only as of the time of this release and none of ACRE, ARES Corp. nor ACREM undertakes any duty to update any forward-looking statements made herein. Any such forward-looking statements are made pursuant to the safe harbor provisions available under applicable securities laws. Ares Corp. is the parent to several registered investment advisers, including Ares Management LLC (“Ares Managementˮ) and ACREM. Collectively, Ares Corp., its affiliated entities, and all underlying subsidiary entities shall be referred to as “Aresˮ unless specifically noted otherwise. For a discussion regarding potential risks on ACRE, see Part I., Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operationsˮ and Part I., Item 1A. “Risk Factorsˮ in ACRE’s Annual Report on Form 10-K and Part II, Item 1A. "Risk Factors" in ACRE’s subsequent Quarterly Reports on Form 10-Q. The information contained in this presentation is summary information that is intended to be considered in the context of ACRE’s SEC filings and other public announcements that ACRE, ACREM or Ares may make, by press release or otherwise, from time to time. ACRE, ACREM and Ares undertake no duty or obligation to publicly update or revise the forward-looking statements or other information contained in this presentation. These materials contain information about ACRE, ACREM and Ares, and certain of their respective personnel and affiliates, information about their respective historical performance and general information about the market. You should not view information related to the past performance of ACRE, ACREM or Ares or information about the market, as indicative of future results, the achievement of which cannot be assured. Nothing in these materials should be construed as a recommendation to invest in any securities that may be issued by ACRE or any other fund or account managed by ACREM or Ares, or as legal, accounting or tax advice. None of ACRE, ACREM, Ares or any affiliate of ACRE, ACREM or Ares makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and nothing contained herein shall be relied upon as a promise or representation whether as to the past or future performance. Certain information set forth herein includes estimates and projections and involves significant elements of subjective judgment and analysis. Further, such information, unless otherwise stated, is before giving effect to management and incentive fees and deductions for taxes. No representations are made as to the accuracy of such estimates or projections or that all assumptions relating to such estimates or projections have been considered or stated or that such estimates or projections will be realized. In addition, in light of the various investment strategies of such other investment partnerships, funds and/or pools, it is noted that such other investment programs may have portfolio investments inconsistent with those of the investment vehicle or strategy discussed herein. These materials are not intended as an offer to sell, or the solicitation of an offer to purchase, any security, the offer and/or sale of which can only be made by definitive offering documentation. Any offer or solicitation with respect to any securities that may be issued by ACRE will be made only by means of definitive offering memoranda or prospectus, which will be provided to prospective investors and will contain material information that is not set forth herein, including risk factors relating to any such investment. For the definitions of certain terms used in this presentation, please refer to the "Glossary" slide in the appendix. This presentation may contain information obtained from third parties, including ratings from credit ratings agencies such as Standard & Poor’s. Such information has not been independently verified and, accordingly, ACRE makes no representation or warranty in respect of this information. Reproduction and distribution of third party content in any form is prohibited except with the prior written permission of the related third party. Third party content providers do not guarantee the accuracy, completeness, timeliness or availability of any information, including ratings, and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such content. THIRD PARTY CONTENT PROVIDERS GIVE NO EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. THIRD PARTY CONTENT PROVIDERS SHALL NOT BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, EXEMPLARY, COMPENSATORY, PUNITIVE, SPECIAL OR CONSEQUENTIAL DAMAGES, COSTS, EXPENSES, LEGAL FEES, OR LOSSES (INCLUDING LOST INCOME OR PROFITS AND OPPORTUNITY COSTS OR LOSSES CAUSED BY NEGLIGENCE) IN CONNECTION WITH ANY USE OF THEIR CONTENT, INCLUDING RATINGS. Credit ratings are statements of opinions and are not statements of fact or recommendations to purchase, hold or sell securities. They do not address the suitability of securities or the suitability of securities for investment purposes, and should not be relied on as investment advice. 2

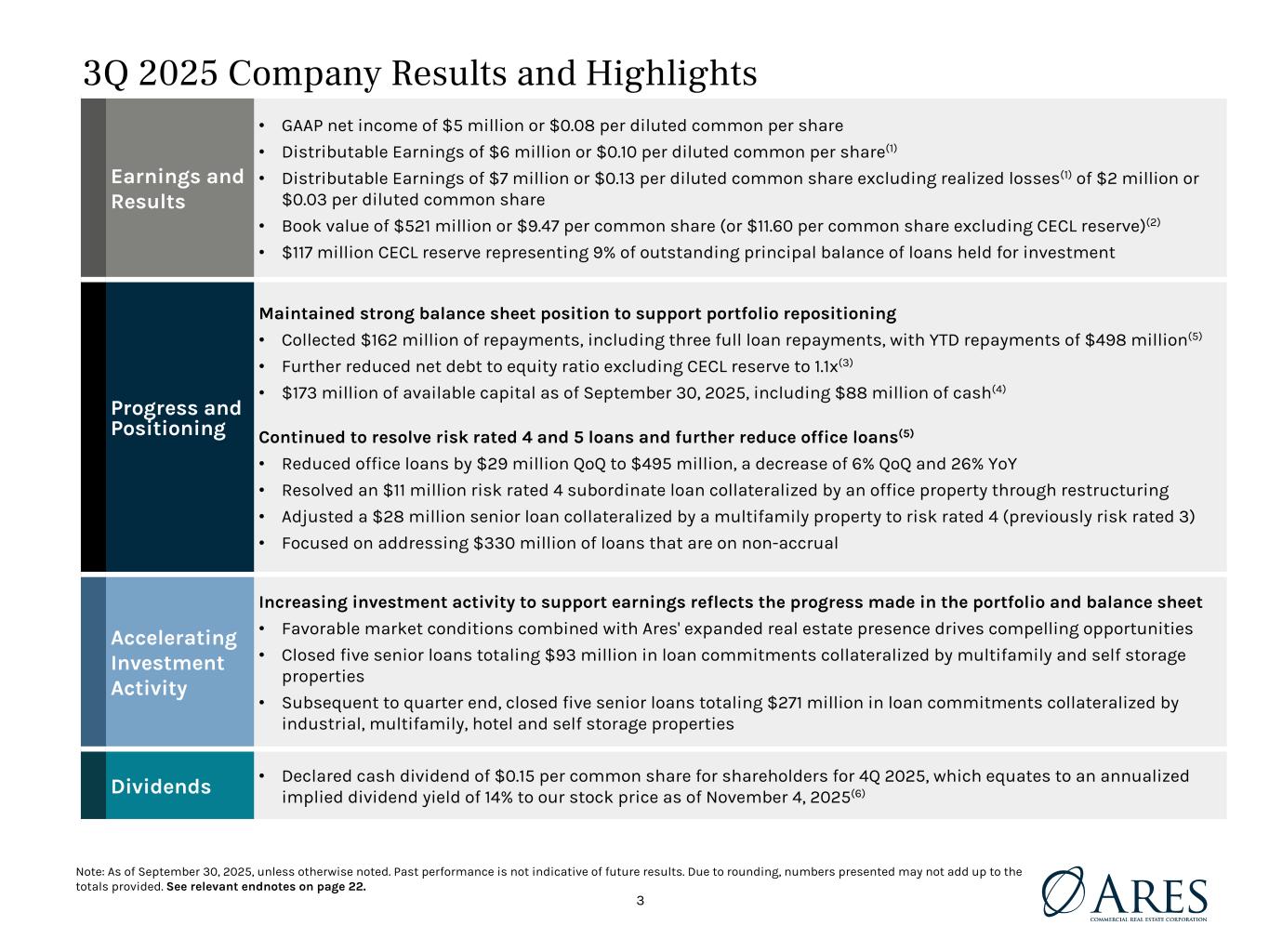

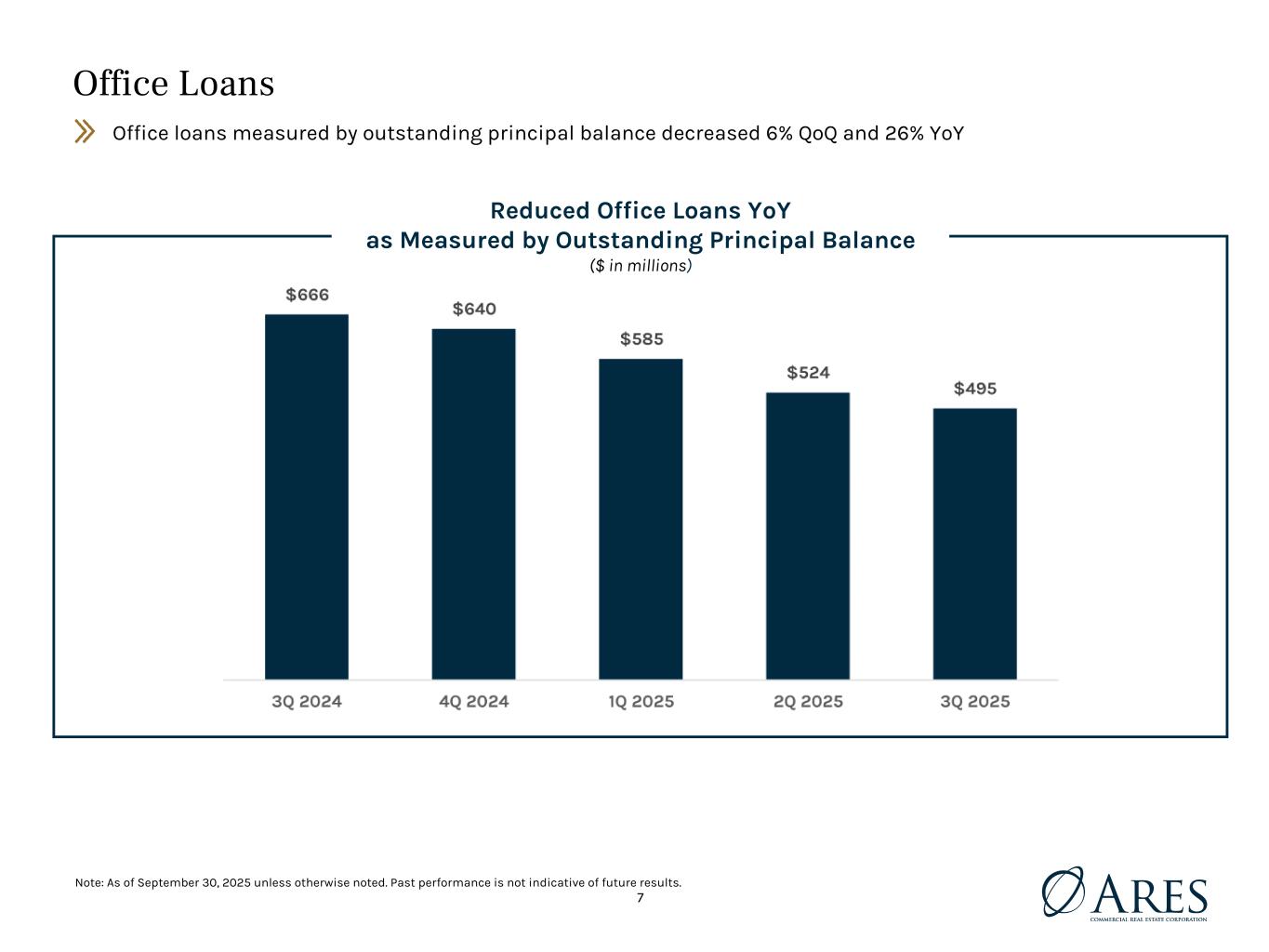

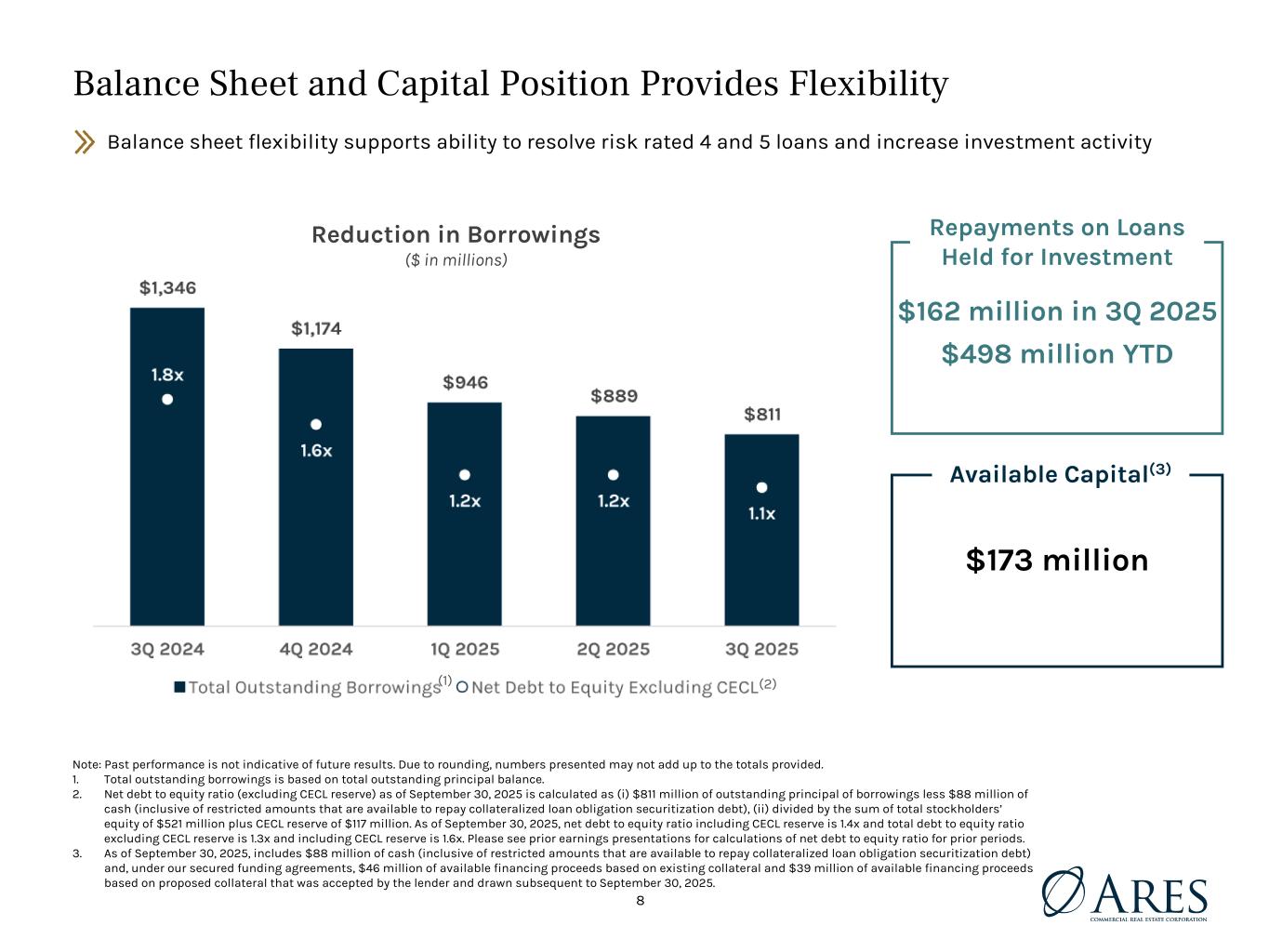

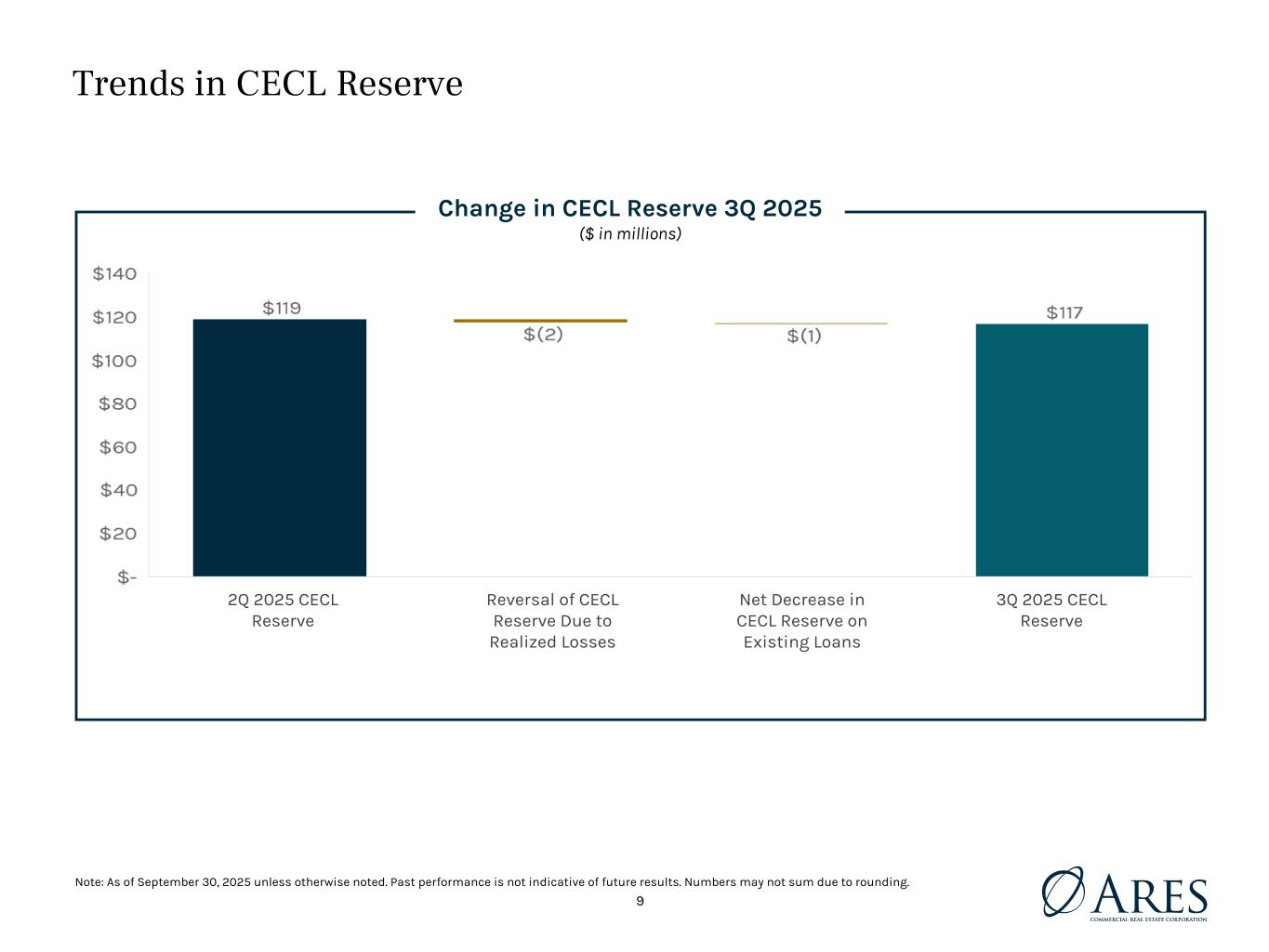

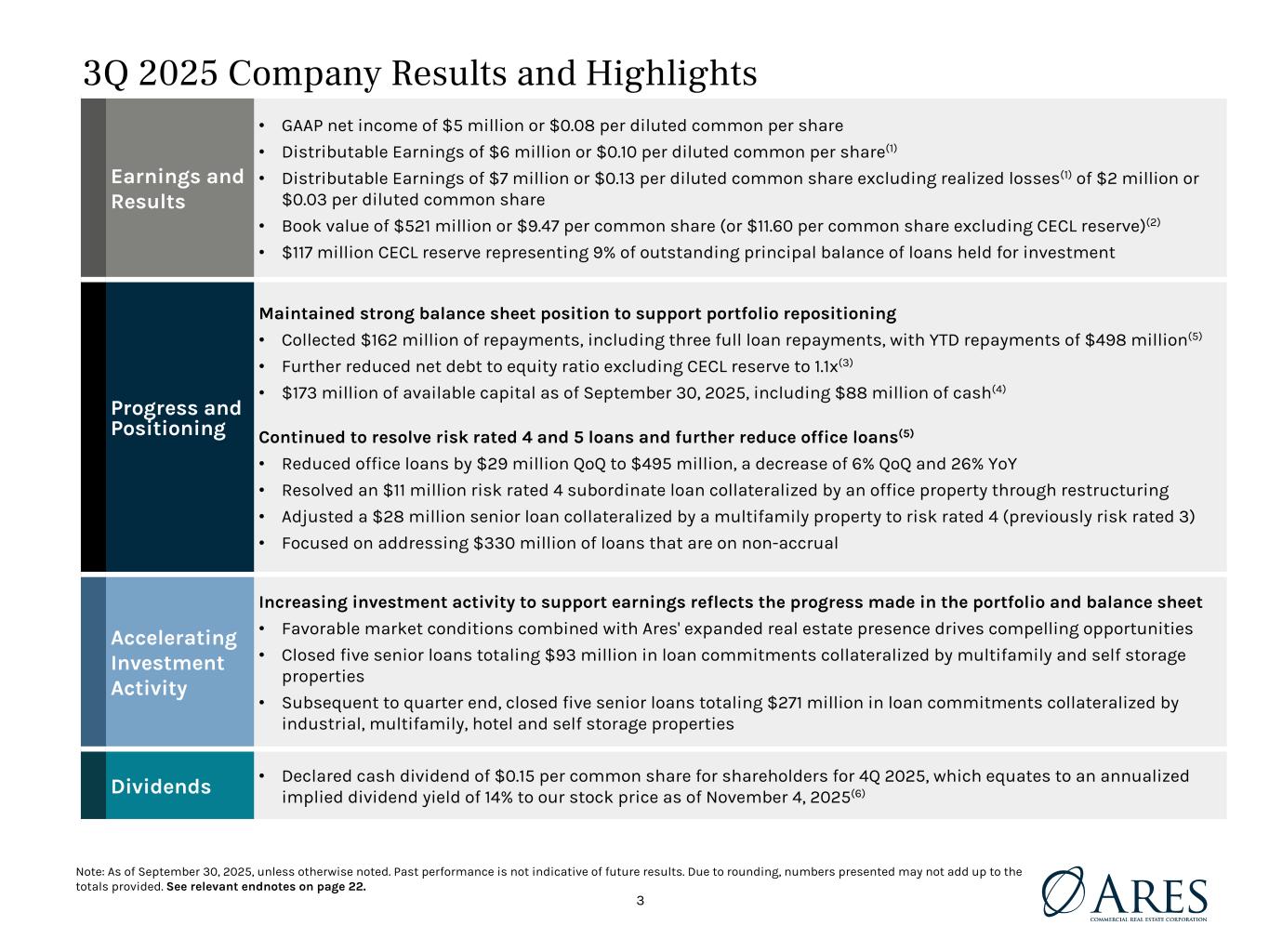

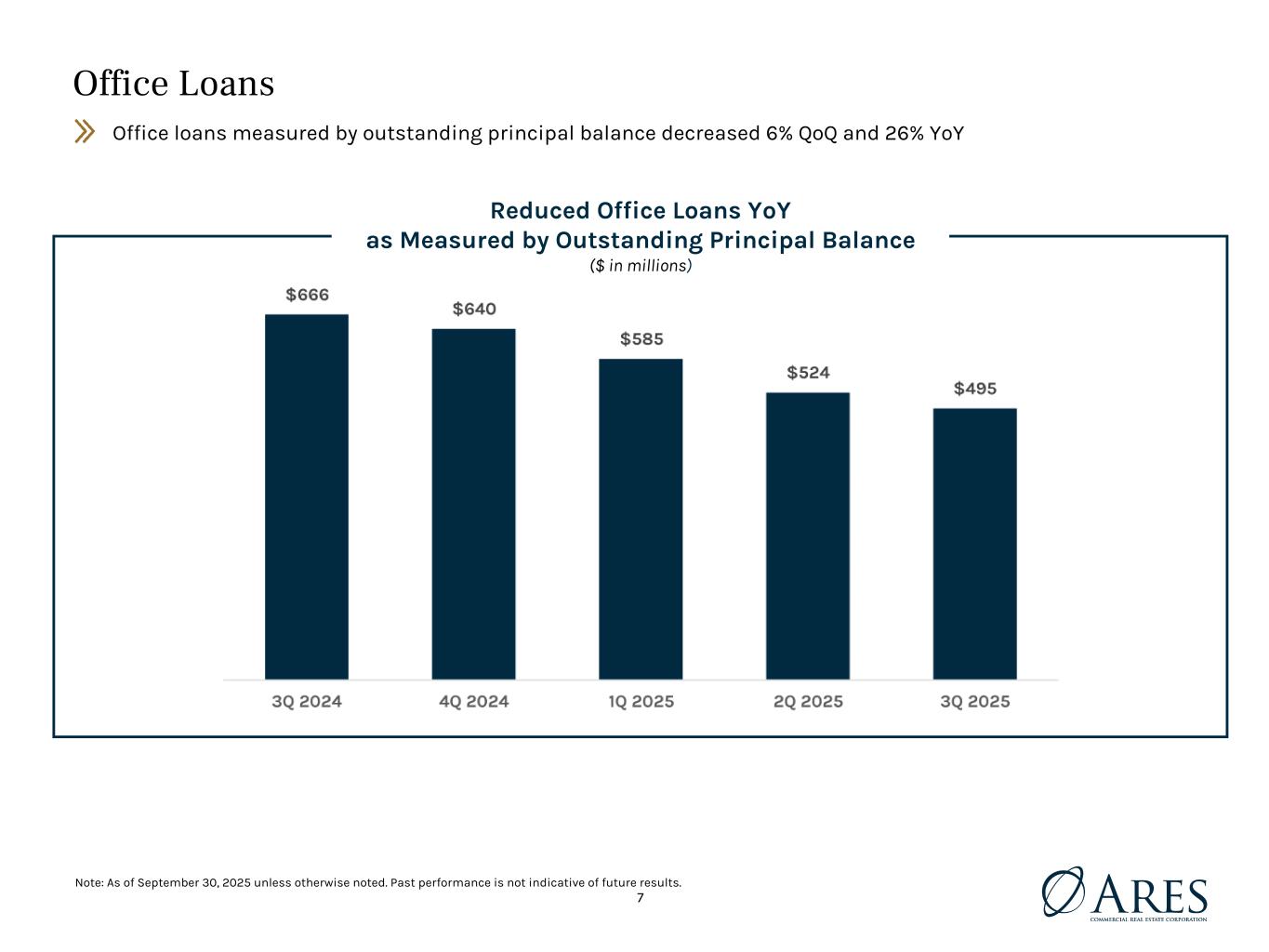

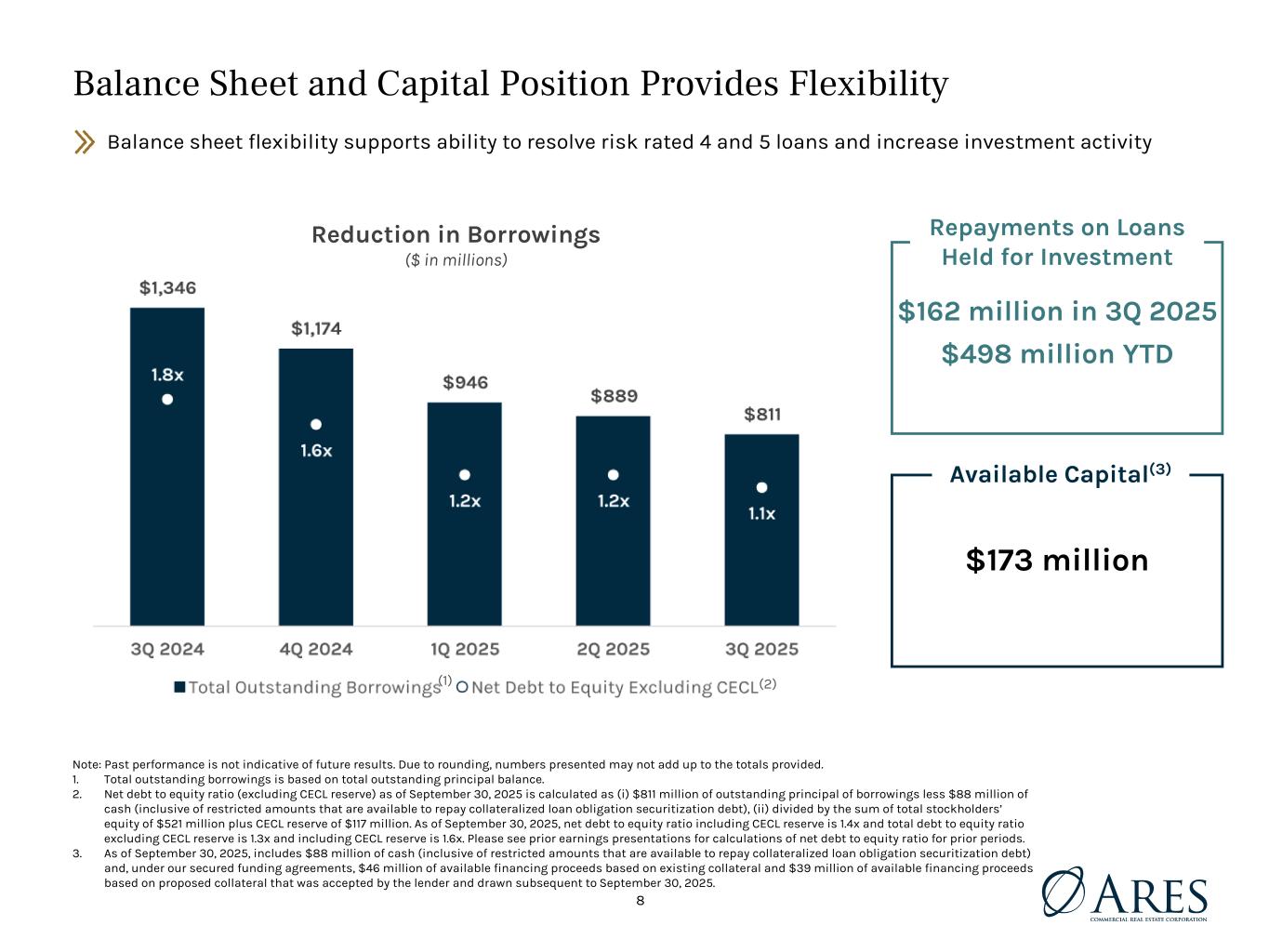

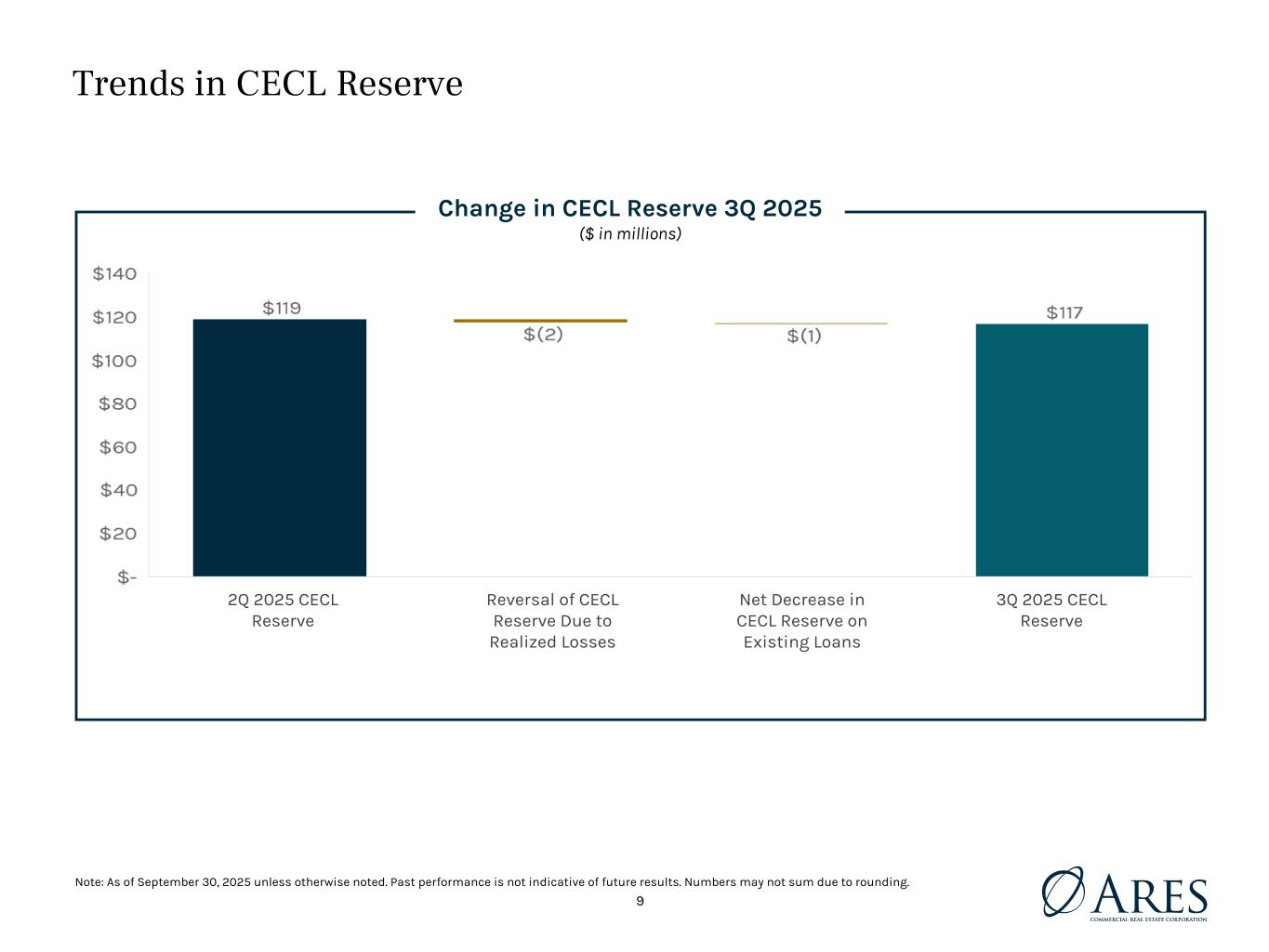

0 42 65 156 110 2 3 93 109 127 127 127 GENERAL PALETTE 0 42 65 2 87 133 71 126 163 120 163 198 Credit Private Equity Real Estate Secondary Solutions BUSINESS SECTOR PALETTE 192 212 229 Strategic Initiatives 3Q 2025 Company Results and Highlights Note: As of September 30, 2025, unless otherwise noted. Past performance is not indicative of future results. Due to rounding, numbers presented may not add up to the totals provided. See relevant endnotes on page 22. 3 Earnings and Results • GAAP net income of $5 million or $0.08 per diluted common per share • Distributable Earnings of $6 million or $0.10 per diluted common per share(1) • Distributable Earnings of $7 million or $0.13 per diluted common share excluding realized losses(1) of $2 million or $0.03 per diluted common share • Book value of $521 million or $9.47 per common share (or $11.60 per common share excluding CECL reserve)(2) • $117 million CECL reserve representing 9% of outstanding principal balance of loans held for investment Progress and Positioning Maintained strong balance sheet position to support portfolio repositioning • Collected $162 million of repayments, including three full loan repayments, with YTD repayments of $498 million(5) • Further reduced net debt to equity ratio excluding CECL reserve to 1.1x(3) • $173 million of available capital as of September 30, 2025, including $88 million of cash(4) Continued to resolve risk rated 4 and 5 loans and further reduce office loans(5) • Reduced office loans by $29 million QoQ to $495 million, a decrease of 6% QoQ and 26% YoY • Resolved an $11 million risk rated 4 subordinate loan collateralized by an office property through restructuring • Adjusted a $28 million senior loan collateralized by a multifamily property to risk rated 4 (previously risk rated 3) • Focused on addressing $330 million of loans that are on non-accrual Accelerating Investment Activity Increasing investment activity to support earnings reflects the progress made in the portfolio and balance sheet • Favorable market conditions combined with Ares' expanded real estate presence drives compelling opportunities • Closed five senior loans totaling $93 million in loan commitments collateralized by multifamily and self storage properties • Subsequent to quarter end, closed five senior loans totaling $271 million in loan commitments collateralized by industrial, multifamily, hotel and self storage properties Dividends • Declared cash dividend of $0.15 per common share for shareholders for 4Q 2025, which equates to an annualized implied dividend yield of 14% to our stock price as of November 4, 2025(6)

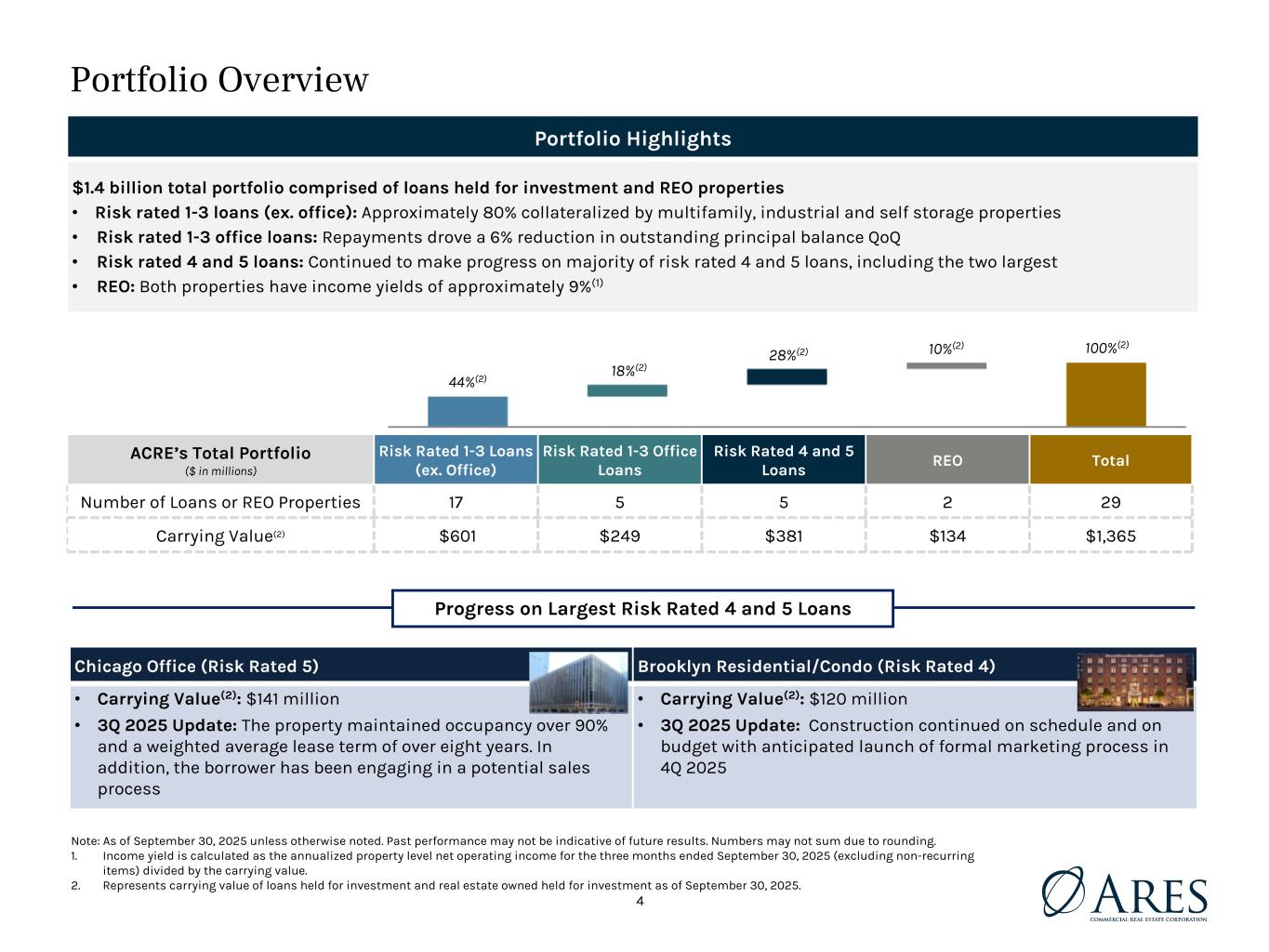

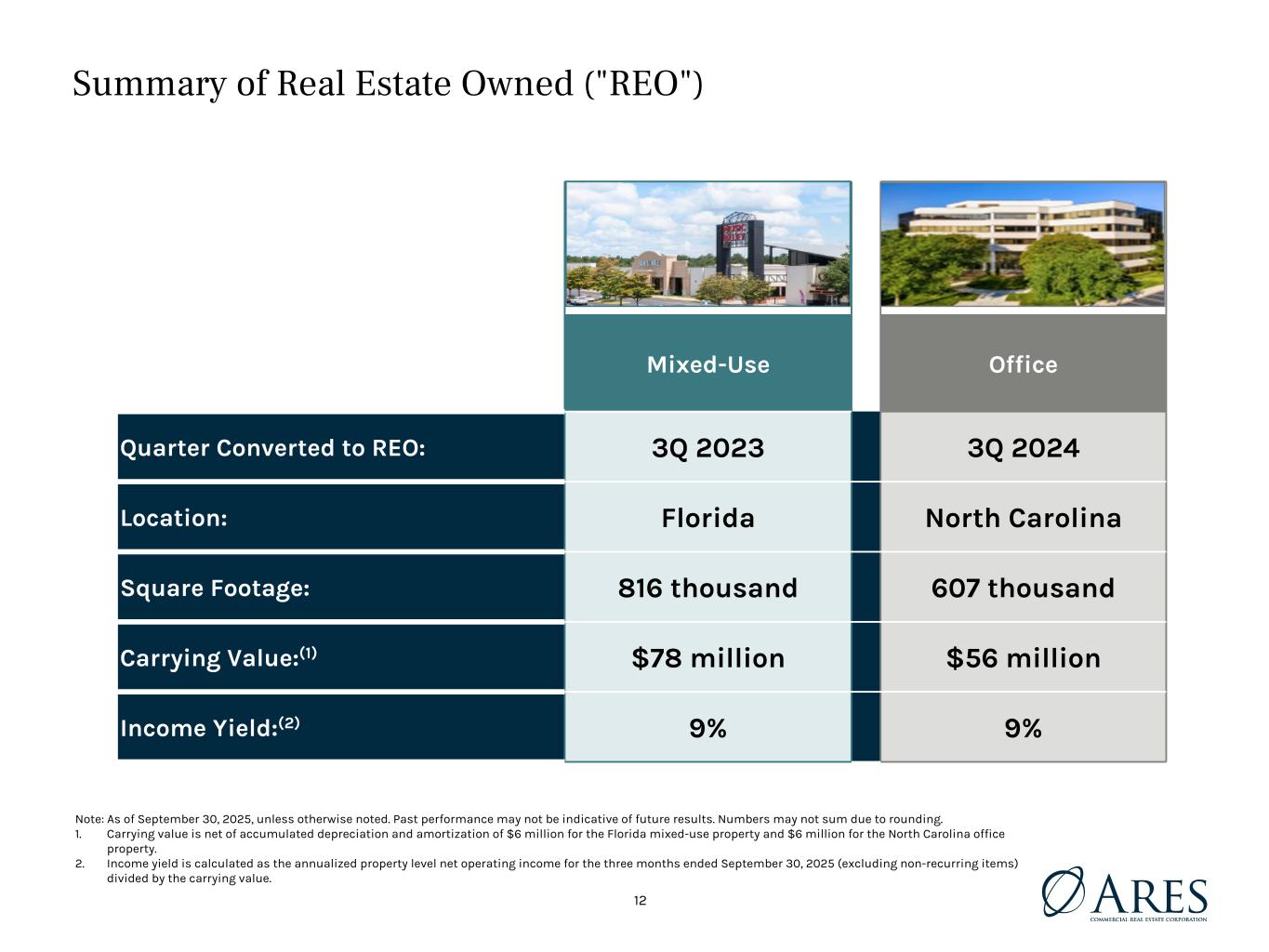

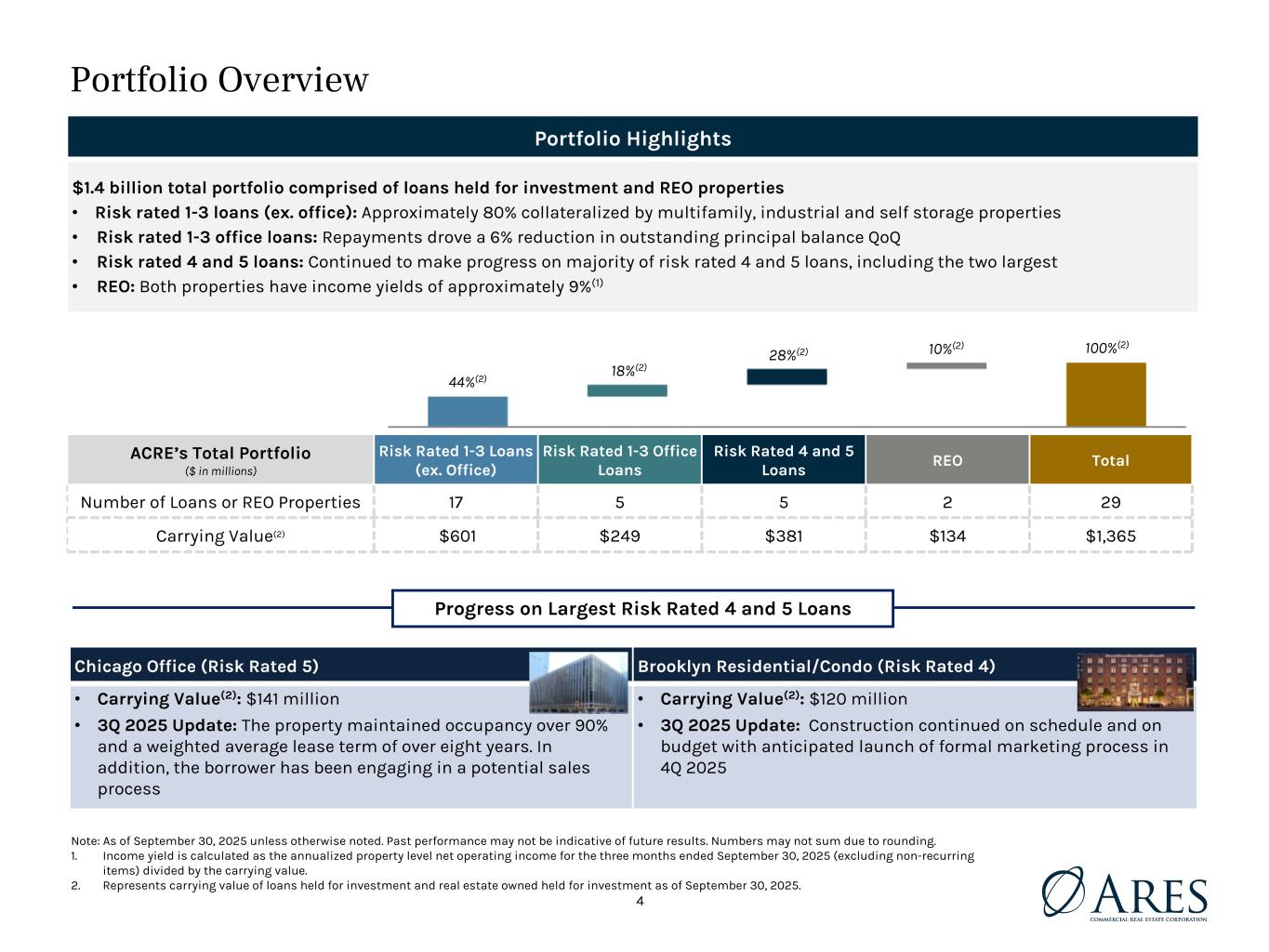

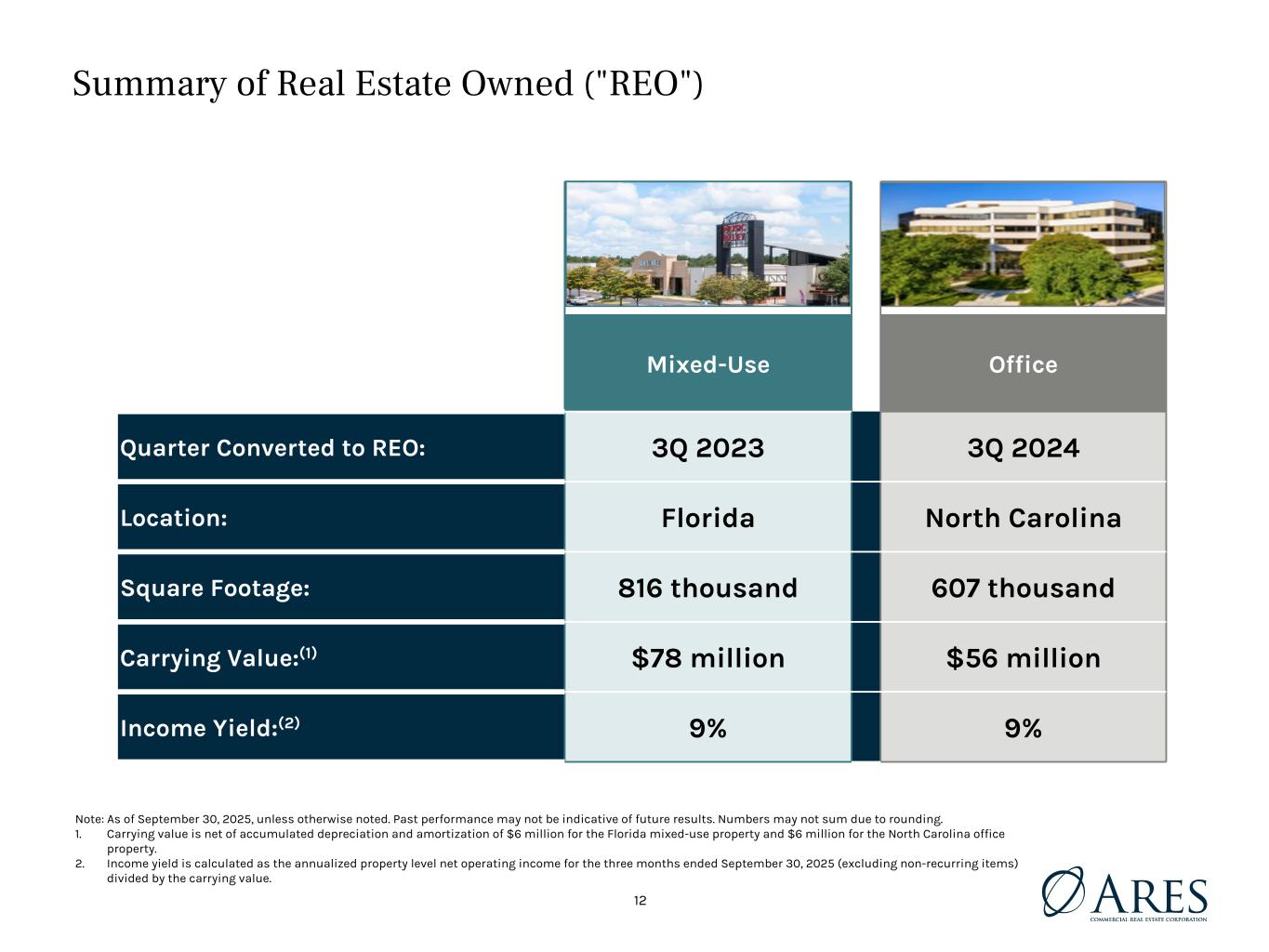

0 42 65 156 110 2 3 93 109 127 127 127 GENERAL PALETTE 0 42 65 2 87 133 71 126 163 120 163 198 Credit Private Equity Real Estate Secondary Solutions BUSINESS SECTOR PALETTE 192 212 229 Strategic Initiatives Portfolio Overview Portfolio Highlights $1.4 billion total portfolio comprised of loans held for investment and REO properties • Risk rated 1-3 loans (ex. office): Approximately 80% collateralized by multifamily, industrial and self storage properties • Risk rated 1-3 office loans: Repayments drove a 6% reduction in outstanding principal balance QoQ • Risk rated 4 and 5 loans: Continued to make progress on majority of risk rated 4 and 5 loans, including the two largest • REO: Both properties have income yields of approximately 9%(1) Note: As of September 30, 2025 unless otherwise noted. Past performance may not be indicative of future results. Numbers may not sum due to rounding. 1. Income yield is calculated as the annualized property level net operating income for the three months ended September 30, 2025 (excluding non-recurring items) divided by the carrying value. 2. Represents carrying value of loans held for investment and real estate owned held for investment as of September 30, 2025. Progress on Largest Risk Rated 4 and 5 Loans Chicago Office (Risk Rated 5) Brooklyn Residential/Condo (Risk Rated 4) • Carrying Value(2): $141 million • 3Q 2025 Update: The property maintained occupancy over 90% and a weighted average lease term of over eight years. In addition, the borrower has been engaging in a potential sales process • Carrying Value(2): $120 million • 3Q 2025 Update: Construction continued on schedule and on budget with anticipated launch of formal marketing process in 4Q 2025 ACRE’s Total Portfolio ($ in millions) Risk Rated 1-3 Loans (ex. Office) Risk Rated 1-3 Office Loans Risk Rated 4 and 5 Loans REO Total Number of Loans or REO Properties 17 5 5 2 29 Carrying Value(2) $601 $249 $381 $134 $1,365 100%(2) 44%(2) 18%(2) 10%(2) 28%(2) 4

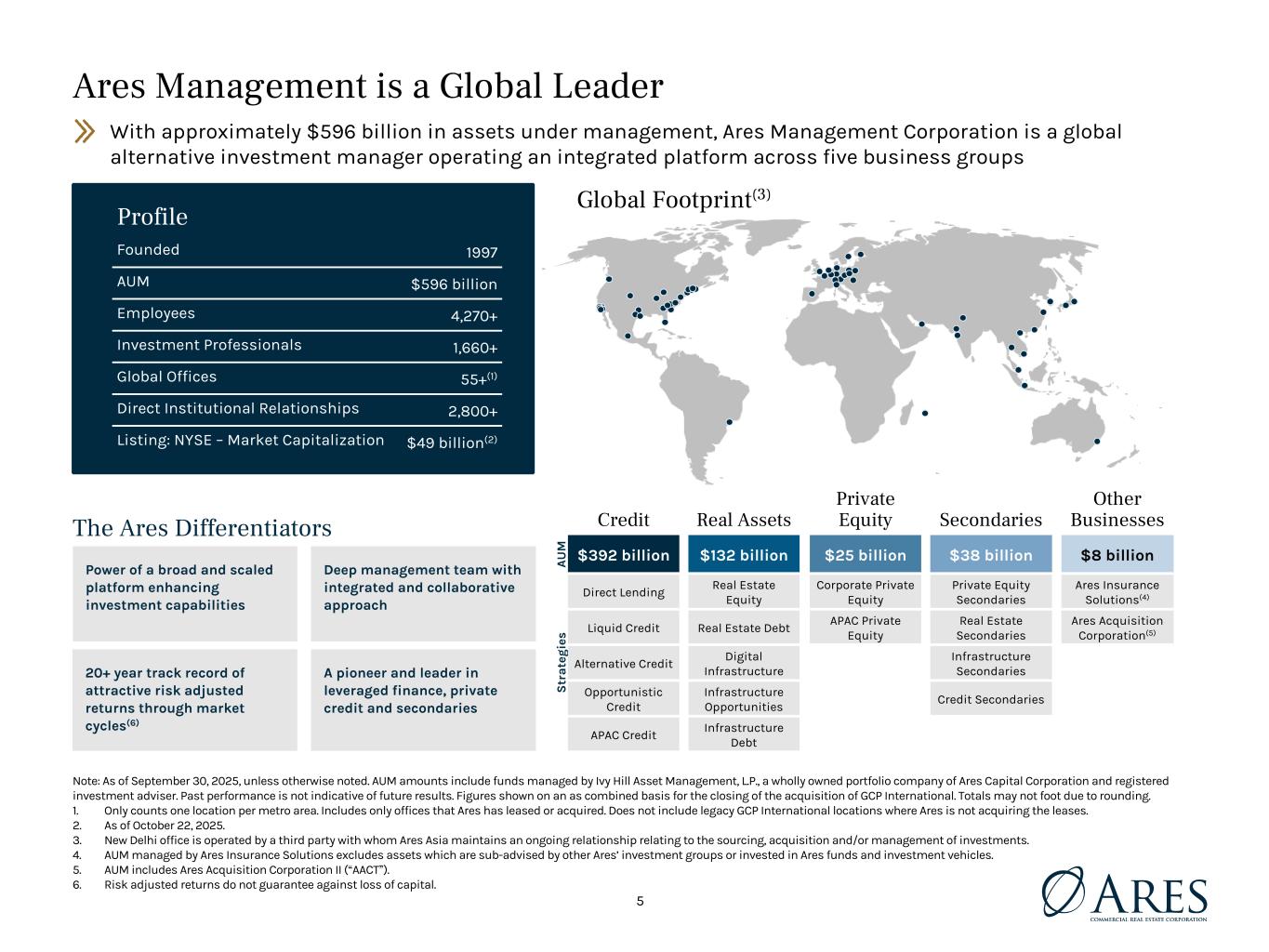

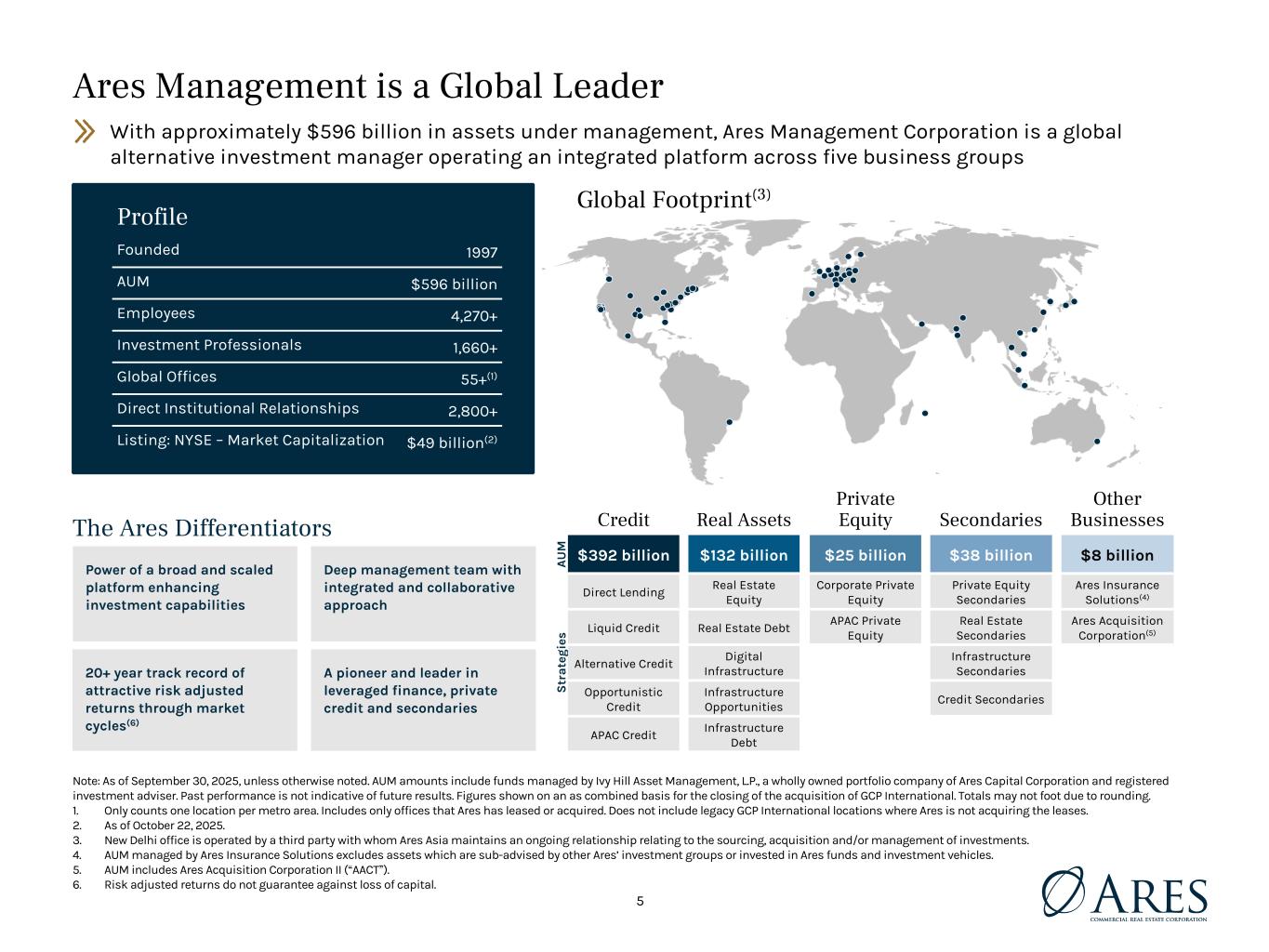

0 42 65 155 112 42 4 94 109 127 127 127 0 42 65 2 87 133 71 126 163 120 163 198 Credit Private Equity Real Estate Strategi c Initiativ es BUSINE SS SECTOR PALETT E GENER AL PALETT E Ares Management is a Global Leader With approximately $596 billion in assets under management, Ares Management Corporation is a global alternative investment manager operating an integrated platform across five business groups Power of a broad and scaled platform enhancing investment capabilities Deep management team with integrated and collaborative approach 20+ year track record of attractive risk adjusted returns through market cycles(6) A pioneer and leader in leveraged finance, private credit and secondaries The Ares Differentiators Note: As of September 30, 2025, unless otherwise noted. AUM amounts include funds managed by Ivy Hill Asset Management, L.P., a wholly owned portfolio company of Ares Capital Corporation and registered investment adviser. Past performance is not indicative of future results. Figures shown on an as combined basis for the closing of the acquisition of GCP International. Totals may not foot due to rounding. 1. Only counts one location per metro area. Includes only offices that Ares has leased or acquired. Does not include legacy GCP International locations where Ares is not acquiring the leases. 2. As of October 22, 2025. 3. New Delhi office is operated by a third party with whom Ares Asia maintains an ongoing relationship relating to the sourcing, acquisition and/or management of investments. 4. AUM managed by Ares Insurance Solutions excludes assets which are sub-advised by other Ares’ investment groups or invested in Ares funds and investment vehicles. 5. AUM includes Ares Acquisition Corporation II (“AACTˮ). 6. Risk adjusted returns do not guarantee against loss of capital. Global Footprint(3) Credit Real Assets Private Equity Secondaries Other Businesses A U M $392 billion $132 billion $25 billion $38 billion $8 billion S tr a te gi es Direct Lending Real Estate Equity Corporate Private Equity Private Equity Secondaries Ares Insurance Solutions(4) Liquid Credit Real Estate Debt APAC Private Equity Real Estate Secondaries Ares Acquisition Corporation(5) Alternative Credit Digital Infrastructure Infrastructure Secondaries Opportunistic Credit Infrastructure Opportunities Credit Secondaries APAC Credit Infrastructure Debt Profile Founded 1997 AUM $596 billion Employees 4,270+ Investment Professionals 1,660+ Global Offices 55+(1) Direct Institutional Relationships 2,800+ Listing: NYSE – Market Capitalization $49 billion(2) 5

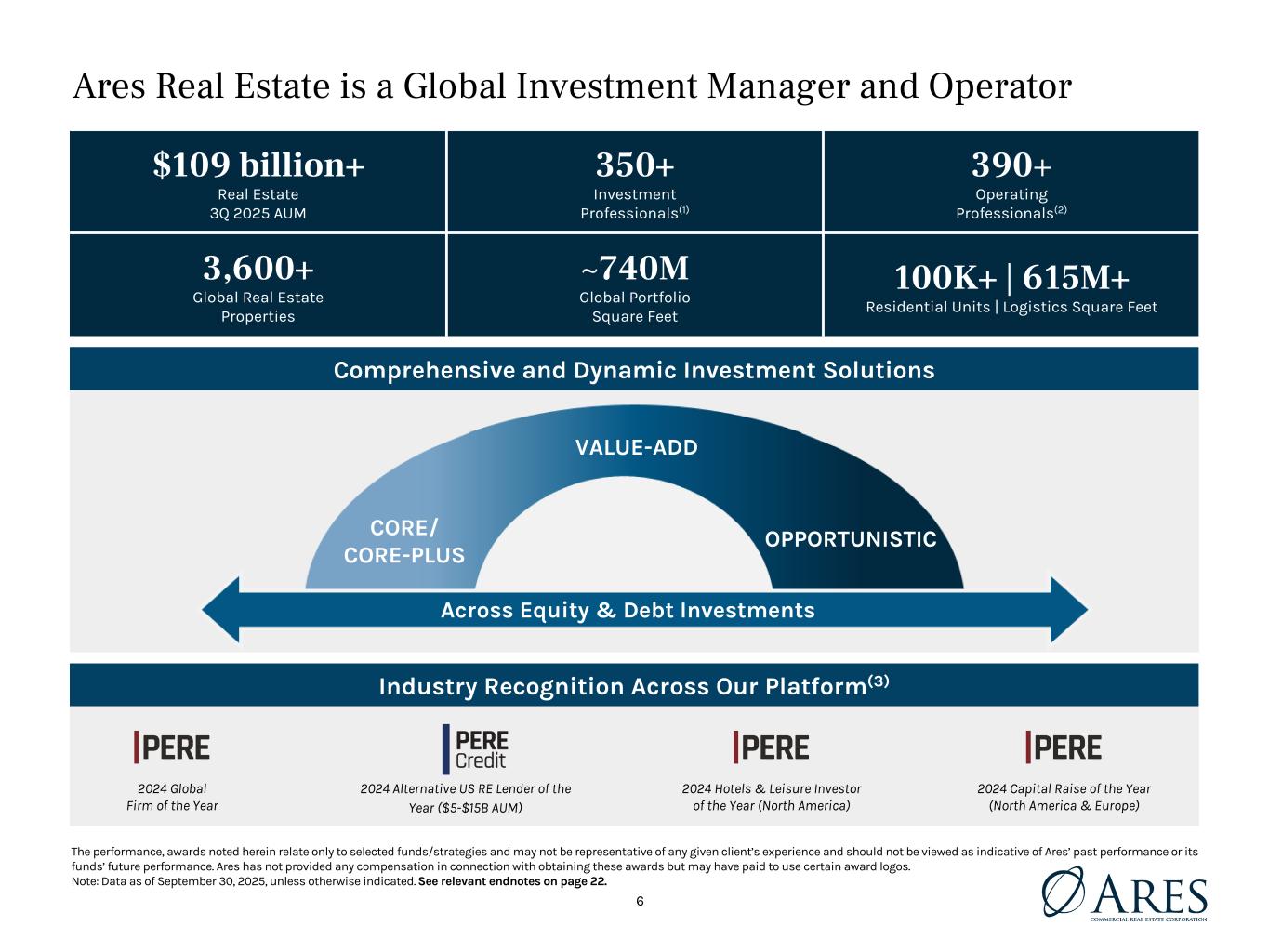

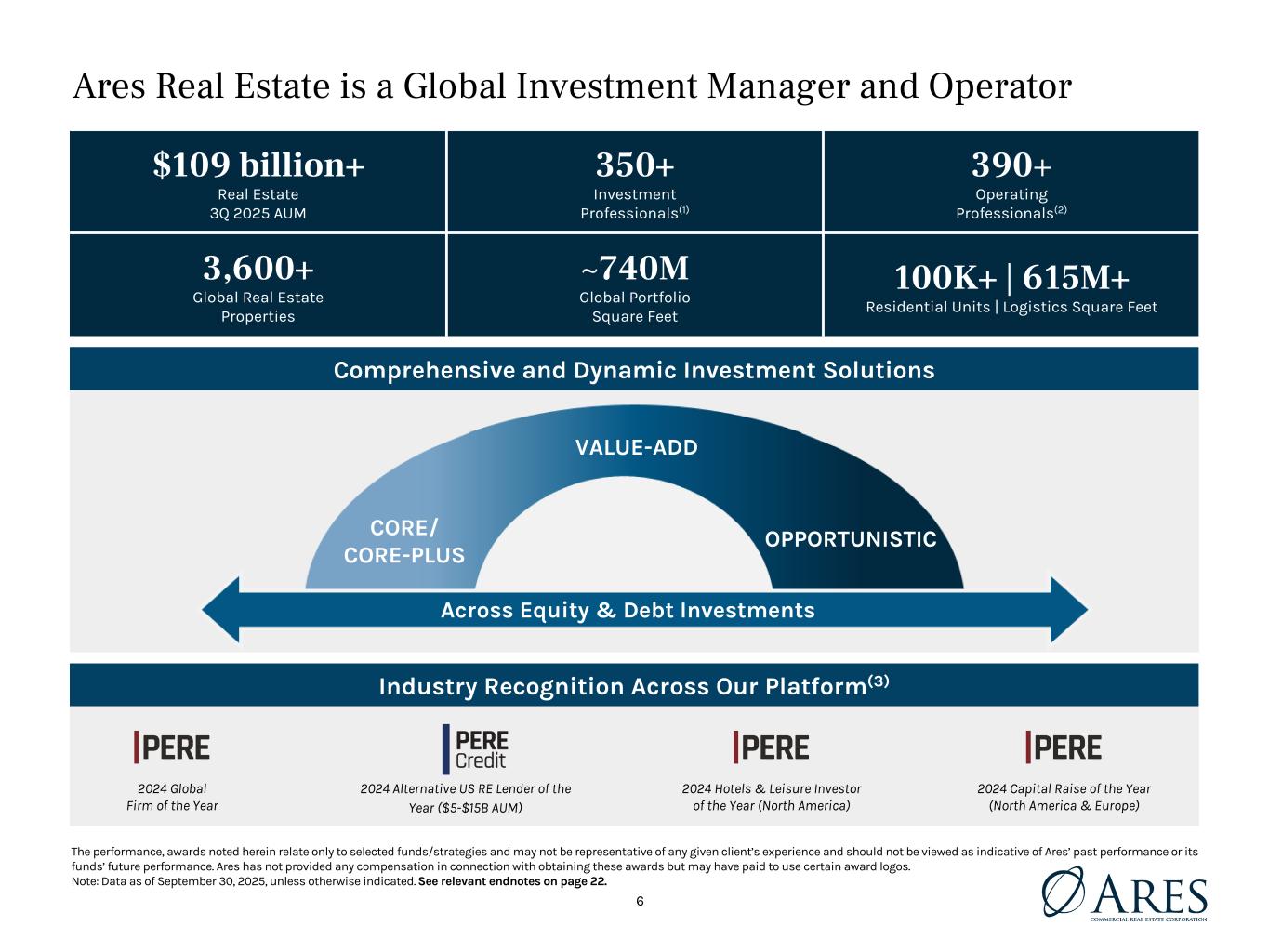

0 42 65 155 112 42 4 94 109 127 127 127 0 42 65 2 87 133 71 126 163 120 163 198 Credit Private Equity Real Estate Strategi c Initiativ es BUSINE SS SECTOR PALETT E GENER AL PALETT E Ares Real Estate is a Global Investment Manager and Operator $109 billion+ Real Estate 3Q 2025 AUM 350+ Investment Professionals(1) 390+ Operating Professionals(2) 3,600+ Global Real Estate Properties ~740M Global Portfolio Square Feet 100K+ | 615M+ Residential Units | Logistics Square Feet Risk Spectrum The performance, awards noted herein relate only to selected funds/strategies and may not be representative of any given client’s experience and should not be viewed as indicative of Ares’ past performance or its funds’ future performance. Ares has not provided any compensation in connection with obtaining these awards but may have paid to use certain award logos. Note: Data as of September 30, 2025, unless otherwise indicated. See relevant endnotes on page 22. Comprehensive and Dynamic Investment Solutions CORE/ CORE-PLUS OPPORTUNISTIC VALUE-ADD 2024 Alternative US RE Lender of the Year ($5-$15B AUM) Industry Recognition Across Our Platform(3) 2024 Global Firm of the Year 2024 Hotels & Leisure Investor of the Year (North America) 2024 Capital Raise of the Year (North America & Europe) 6 Across Equity & D bt Investments

0 42 65 156 110 2 3 93 109 127 127 127 GENERAL PALETTE 0 42 65 2 87 133 71 126 163 120 163 198 Credit Private Equity Real Estate Secondary Solutions BUSINESS SECTOR PALETTE 192 212 229 Strategic Initiatives Office Loans Office loans measured by outstanding principal balance decreased 6% QoQ and 26% YoY Note: As of September 30, 2025 unless otherwise noted. Past performance is not indicative of future results. Reduced Office Loans YoY as Measured by Outstanding Principal Balance ($ in millions) 7

0 42 65 156 110 2 3 93 109 127 127 127 GENERAL PALETTE 0 42 65 2 87 133 71 126 163 120 163 198 Credit Private Equity Real Estate Secondary Solutions BUSINESS SECTOR PALETTE 192 212 229 Strategic Initiatives Balance Sheet and Capital Position Provides Flexibility Balance sheet flexibility supports ability to resolve risk rated 4 and 5 loans and increase investment activity Note: Past performance is not indicative of future results. Due to rounding, numbers presented may not add up to the totals provided. 1. Total outstanding borrowings is based on total outstanding principal balance. 2. Net debt to equity ratio (excluding CECL reserve) as of September 30, 2025 is calculated as (i) $811 million of outstanding principal of borrowings less $88 million of cash (inclusive of restricted amounts that are available to repay collateralized loan obligation securitization debt), (ii) divided by the sum of total stockholders’ equity of $521 million plus CECL reserve of $117 million. As of September 30, 2025, net debt to equity ratio including CECL reserve is 1.4x and total debt to equity ratio excluding CECL reserve is 1.3x and including CECL reserve is 1.6x. Please see prior earnings presentations for calculations of net debt to equity ratio for prior periods. 3. As of September 30, 2025, includes $88 million of cash (inclusive of restricted amounts that are available to repay collateralized loan obligation securitization debt) and, under our secured funding agreements, $46 million of available financing proceeds based on existing collateral and $39 million of available financing proceeds based on proposed collateral that was accepted by the lender and drawn subsequent to September 30, 2025. Reduction in Borrowings ($ in millions) Repayments on Loans Held for Investment Available Capital(3) $162 million in 3Q 2025 $498 million YTD $173 million 8 (1) (2)

0 42 65 156 110 2 3 93 109 127 127 127 GENERAL PALETTE 0 42 65 2 87 133 71 126 163 120 163 198 Credit Private Equity Real Estate Secondary Solutions BUSINESS SECTOR PALETTE 192 212 229 Strategic Initiatives Trends in CECL Reserve Note: As of September 30, 2025 unless otherwise noted. Past performance is not indicative of future results. Numbers may not sum due to rounding. Change in CECL Reserve 3Q 2025 ($ in millions) 2Q 2025 CECL Reserve 3Q 2025 CECL Reserve Reversal of CECL Reserve Due to Realized Losses Net Decrease in CECL Reserve on Existing Loans 9

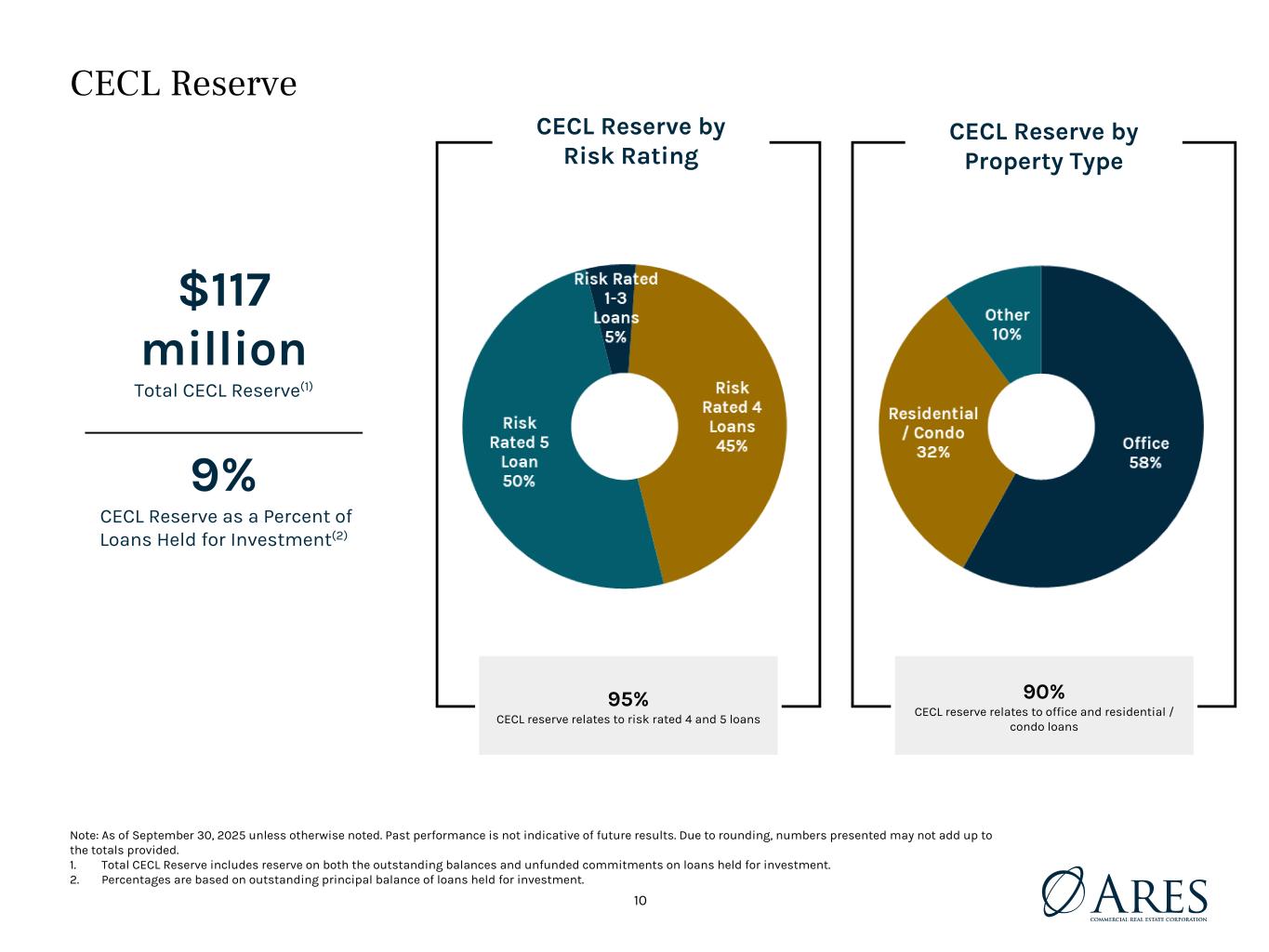

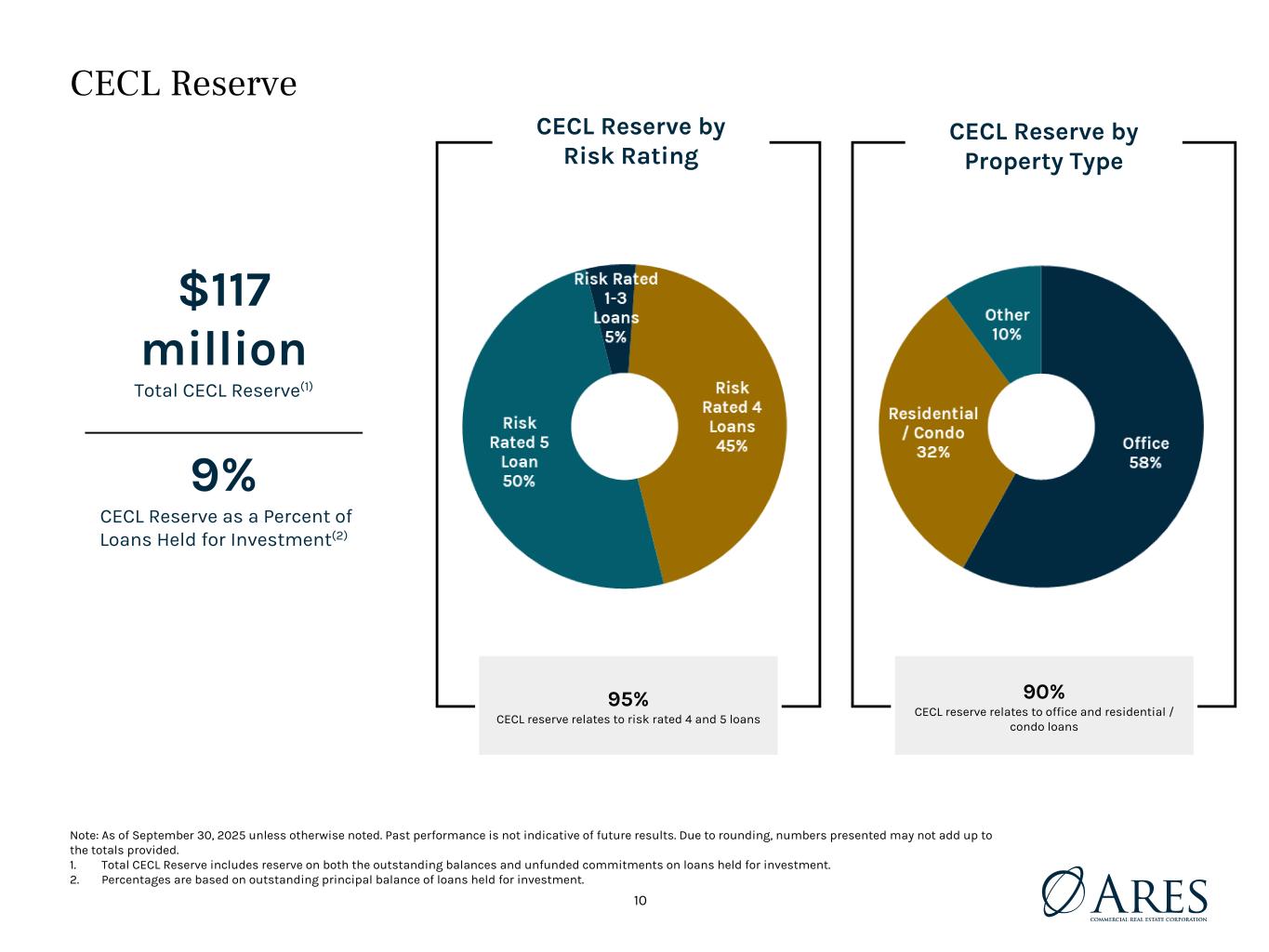

0 42 65 156 110 2 3 93 109 127 127 127 GENERAL PALETTE 0 42 65 2 87 133 71 126 163 120 163 198 Credit Private Equity Real Estate Secondary Solutions BUSINESS SECTOR PALETTE 192 212 229 Strategic Initiatives CECL Reserve CECL Reserve by Risk Rating $117 million Total CECL Reserve(1) 9% CECL Reserve as a Percent of Loans Held for Investment(2) 95% CECL reserve relates to risk rated 4 and 5 loans Note: As of September 30, 2025 unless otherwise noted. Past performance is not indicative of future results. Due to rounding, numbers presented may not add up to the totals provided. 1. Total CECL Reserve includes reserve on both the outstanding balances and unfunded commitments on loans held for investment. 2. Percentages are based on outstanding principal balance of loans held for investment. CECL Reserve by Property Type 90% CECL reserve relates to office and residential / condo loans 10

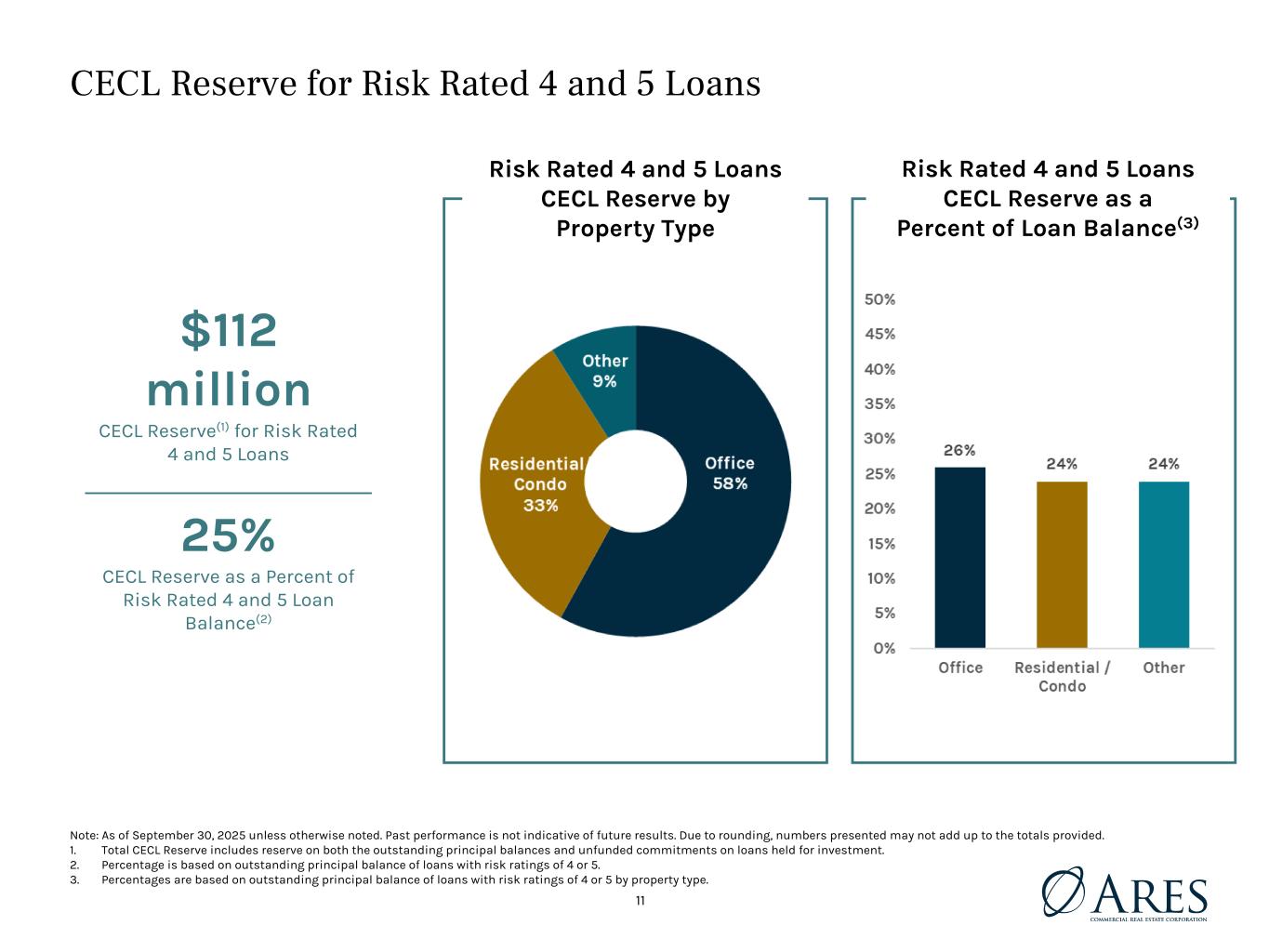

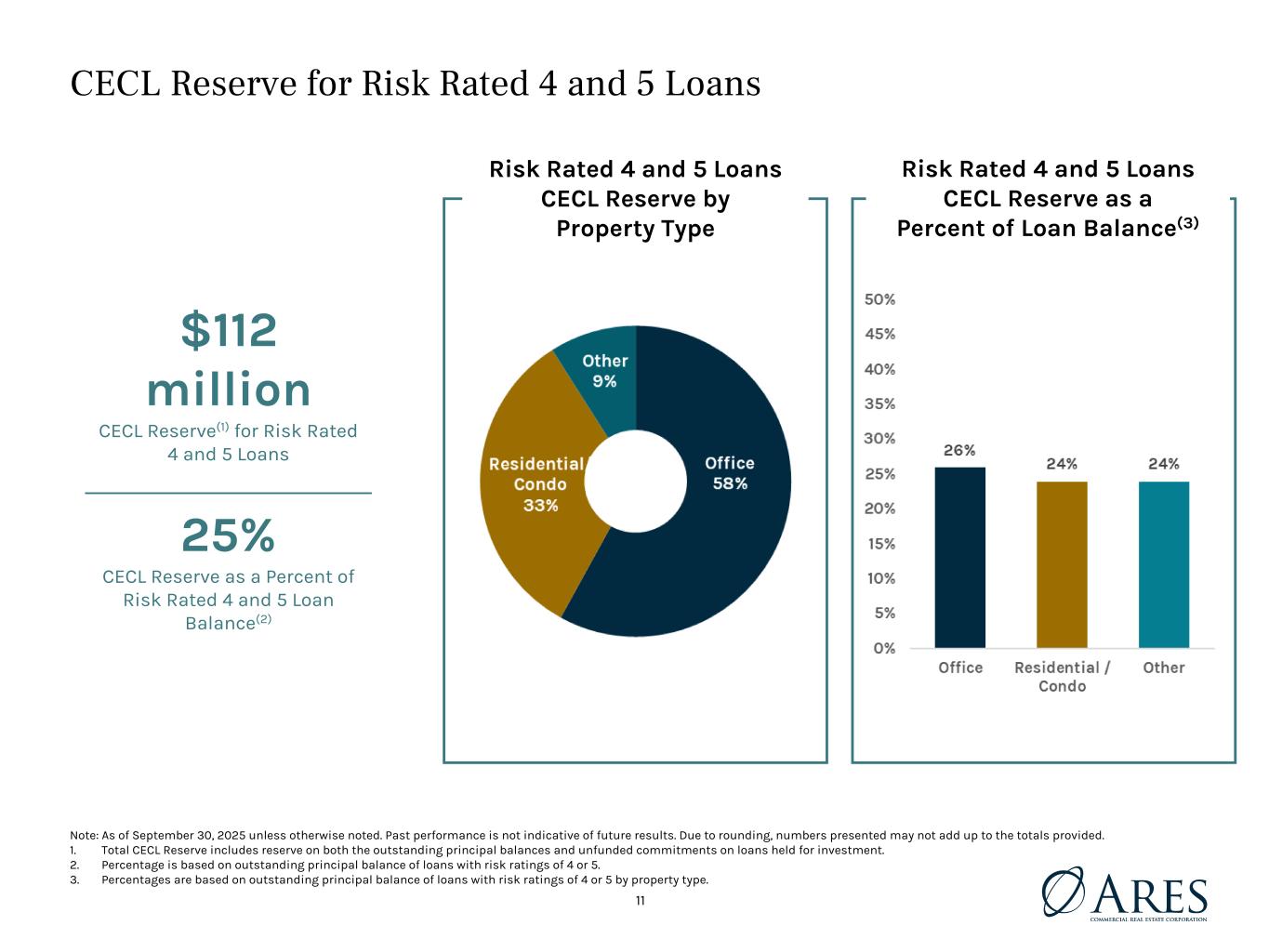

0 42 65 156 110 2 3 93 109 127 127 127 GENERAL PALETTE 0 42 65 2 87 133 71 126 163 120 163 198 Credit Private Equity Real Estate Secondary Solutions BUSINESS SECTOR PALETTE 192 212 229 Strategic Initiatives CECL Reserve for Risk Rated 4 and 5 Loans Risk Rated 4 and 5 Loans CECL Reserve by Property Type $112 million CECL Reserve(1) for Risk Rated 4 and 5 Loans 25% CECL Reserve as a Percent of Risk Rated 4 and 5 Loan Balance(2) Risk Rated 4 and 5 Loans CECL Reserve as a Percent of Loan Balance(3) 11 Note: As of September 30, 2025 unless otherwise noted. Past performance is not indicative of future results. Due to rounding, numbers presented may not add up to the totals provided. 1. Total CECL Reserve includes reserve on both the outstanding principal balances and unfunded commitments on loans held for investment. 2. Percentage is based on outstanding principal balance of loans with risk ratings of 4 or 5. 3. Percentages are based on outstanding principal balance of loans with risk ratings of 4 or 5 by property type.

0 42 65 156 110 2 3 93 109 127 127 127 GENERAL PALETTE 0 42 65 2 87 133 71 126 163 120 163 198 Credit Private Equity Real Estate Secondary Solutions BUSINESS SECTOR PALETTE 192 212 229 Strategic Initiatives Summary of Real Estate Owned ("REO") Note: As of September 30, 2025, unless otherwise noted. Past performance may not be indicative of future results. Numbers may not sum due to rounding. 1. Carrying value is net of accumulated depreciation and amortization of $6 million for the Florida mixed-use property and $6 million for the North Carolina office property. 2. Income yield is calculated as the annualized property level net operating income for the three months ended September 30, 2025 (excluding non-recurring items) divided by the carrying value. 12 Mixed-Use Office Quarter Converted to REO: 3Q 2023 3Q 2024 Location: Florida North Carolina Square Footage: 816 thousand 607 thousand Carrying Value:(1) $78 million $56 million Income Yield:(2) 9% 9%

0 42 65 156 110 2 3 93 109 127 127 127 GENERAL PALETTE 0 42 65 2 87 133 71 126 163 120 163 198 Credit Private Equity Real Estate Secondary Solutions BUSINESS SECTOR PALETTE 192 212 229 Strategic Initiatives Appendix

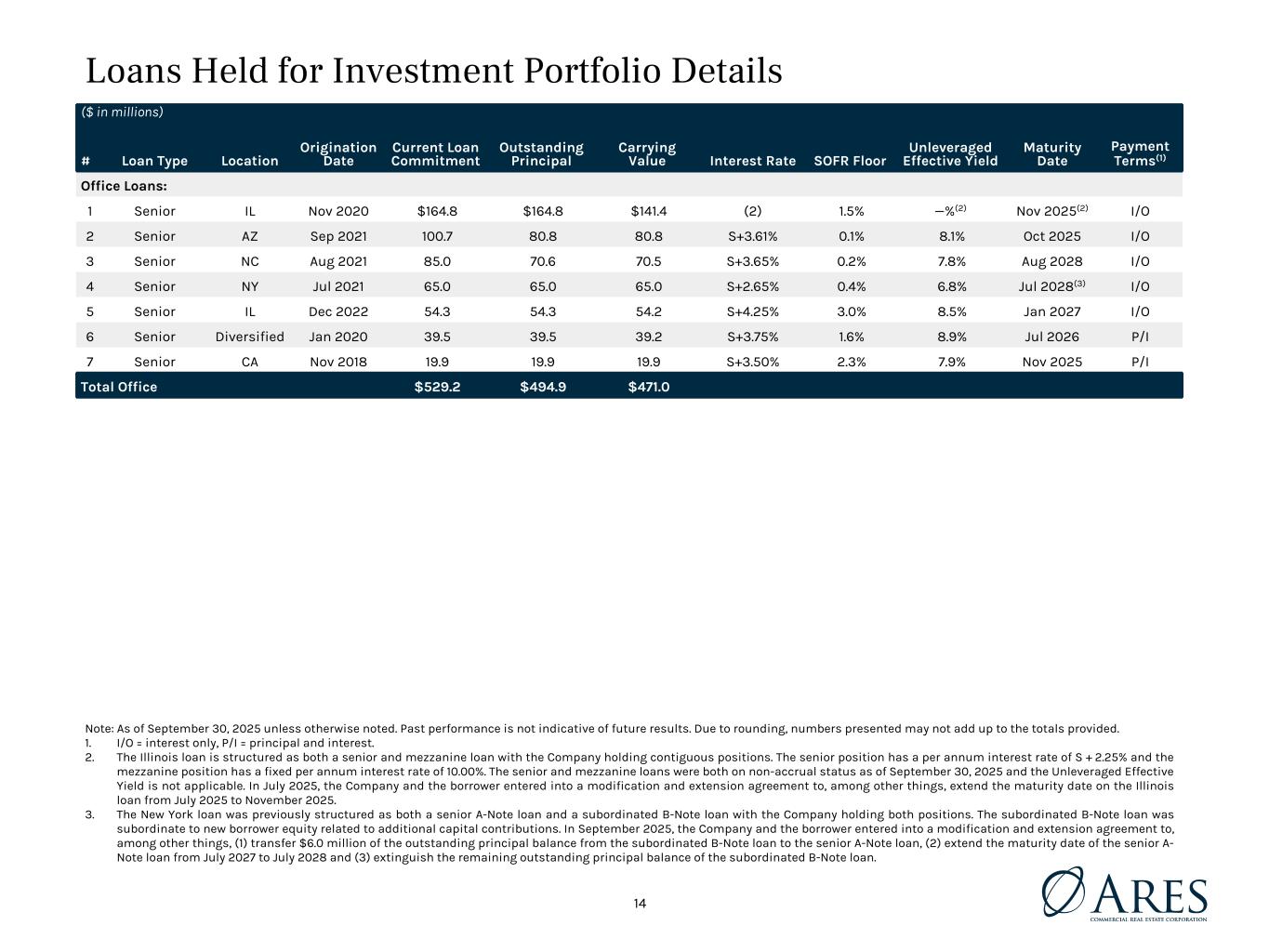

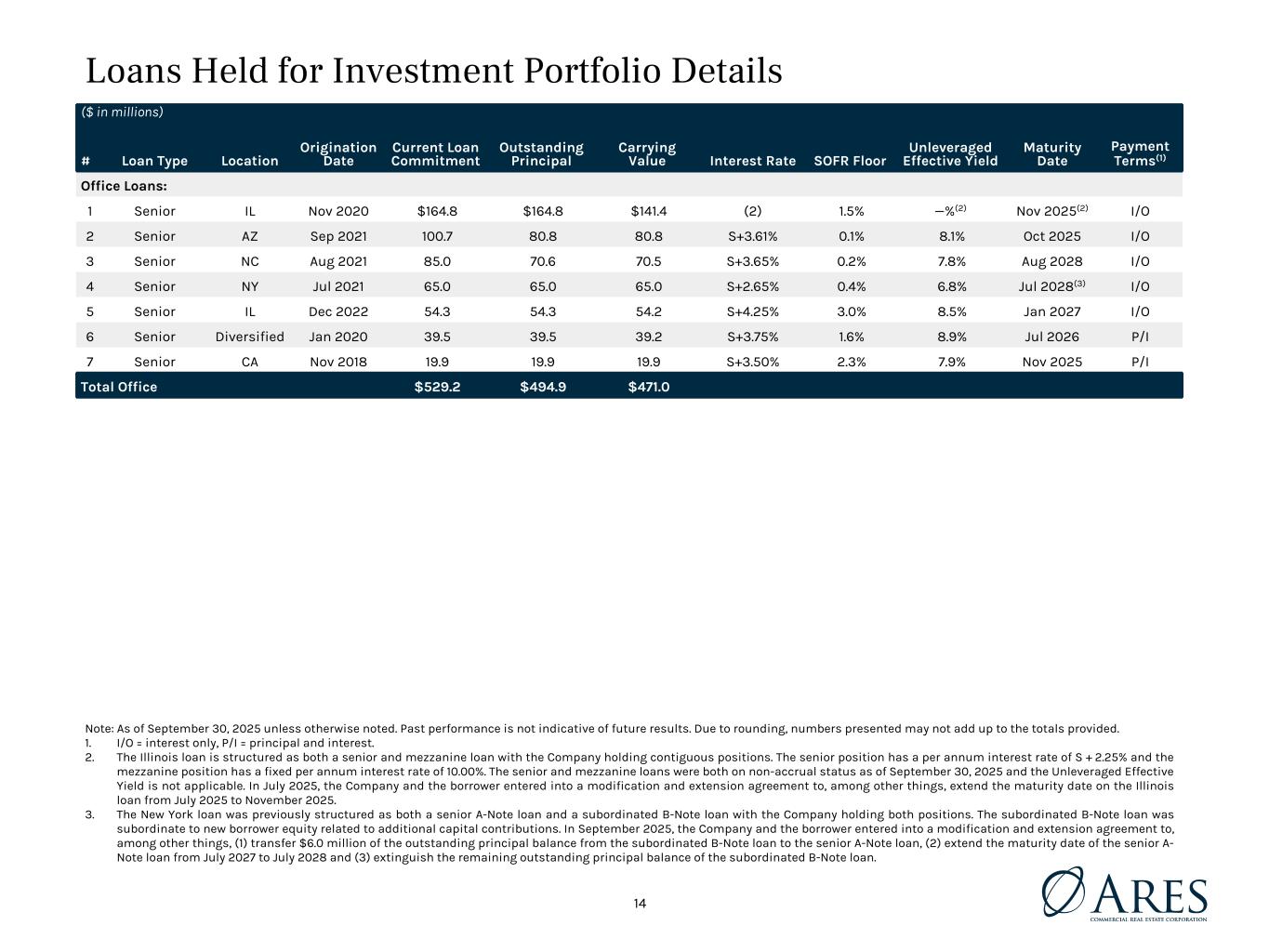

0 42 65 156 110 2 3 93 109 127 127 127 GENERAL PALETTE 0 42 65 2 87 133 71 126 163 120 163 198 Credit Private Equity Real Estate Secondary Solutions BUSINESS SECTOR PALETTE 192 212 229 Strategic Initiatives Loans Held for Investment Portfolio Details ($ in millions) # Loan Type Location Origination Date Current Loan Commitment Outstanding Principal Carrying Value Interest Rate SOFR Floor Unleveraged Effective Yield Maturity Date Payment Terms(1) Office Loans: 1 Senior IL Nov 2020 $164.8 $164.8 $141.4 (2) 1.5% —%(2) Nov 2025(2) I/O 2 Senior AZ Sep 2021 100.7 80.8 80.8 S+3.61% 0.1% 8.1% Oct 2025 I/O 3 Senior NC Aug 2021 85.0 70.6 70.5 S+3.65% 0.2% 7.8% Aug 2028 I/O 4 Senior NY Jul 2021 65.0 65.0 65.0 S+2.65% 0.4% 6.8% Jul 2028(3) I/O 5 Senior IL Dec 2022 54.3 54.3 54.2 S+4.25% 3.0% 8.5% Jan 2027 I/O 6 Senior Diversified Jan 2020 39.5 39.5 39.2 S+3.75% 1.6% 8.9% Jul 2026 P/I 7 Senior CA Nov 2018 19.9 19.9 19.9 S+3.50% 2.3% 7.9% Nov 2025 P/I Total Office $529.2 $494.9 $471.0 Note: As of September 30, 2025 unless otherwise noted. Past performance is not indicative of future results. Due to rounding, numbers presented may not add up to the totals provided. 1. I/O = interest only, P/I = principal and interest. 2. The Illinois loan is structured as both a senior and mezzanine loan with the Company holding contiguous positions. The senior position has a per annum interest rate of S + 2.25% and the mezzanine position has a fixed per annum interest rate of 10.00%. The senior and mezzanine loans were both on non-accrual status as of September 30, 2025 and the Unleveraged Effective Yield is not applicable. In July 2025, the Company and the borrower entered into a modification and extension agreement to, among other things, extend the maturity date on the Illinois loan from July 2025 to November 2025. 3. The New York loan was previously structured as both a senior A-Note loan and a subordinated B-Note loan with the Company holding both positions. The subordinated B-Note loan was subordinate to new borrower equity related to additional capital contributions. In September 2025, the Company and the borrower entered into a modification and extension agreement to, among other things, (1) transfer $6.0 million of the outstanding principal balance from the subordinated B-Note loan to the senior A-Note loan, (2) extend the maturity date of the senior A- Note loan from July 2027 to July 2028 and (3) extinguish the remaining outstanding principal balance of the subordinated B-Note loan. 14

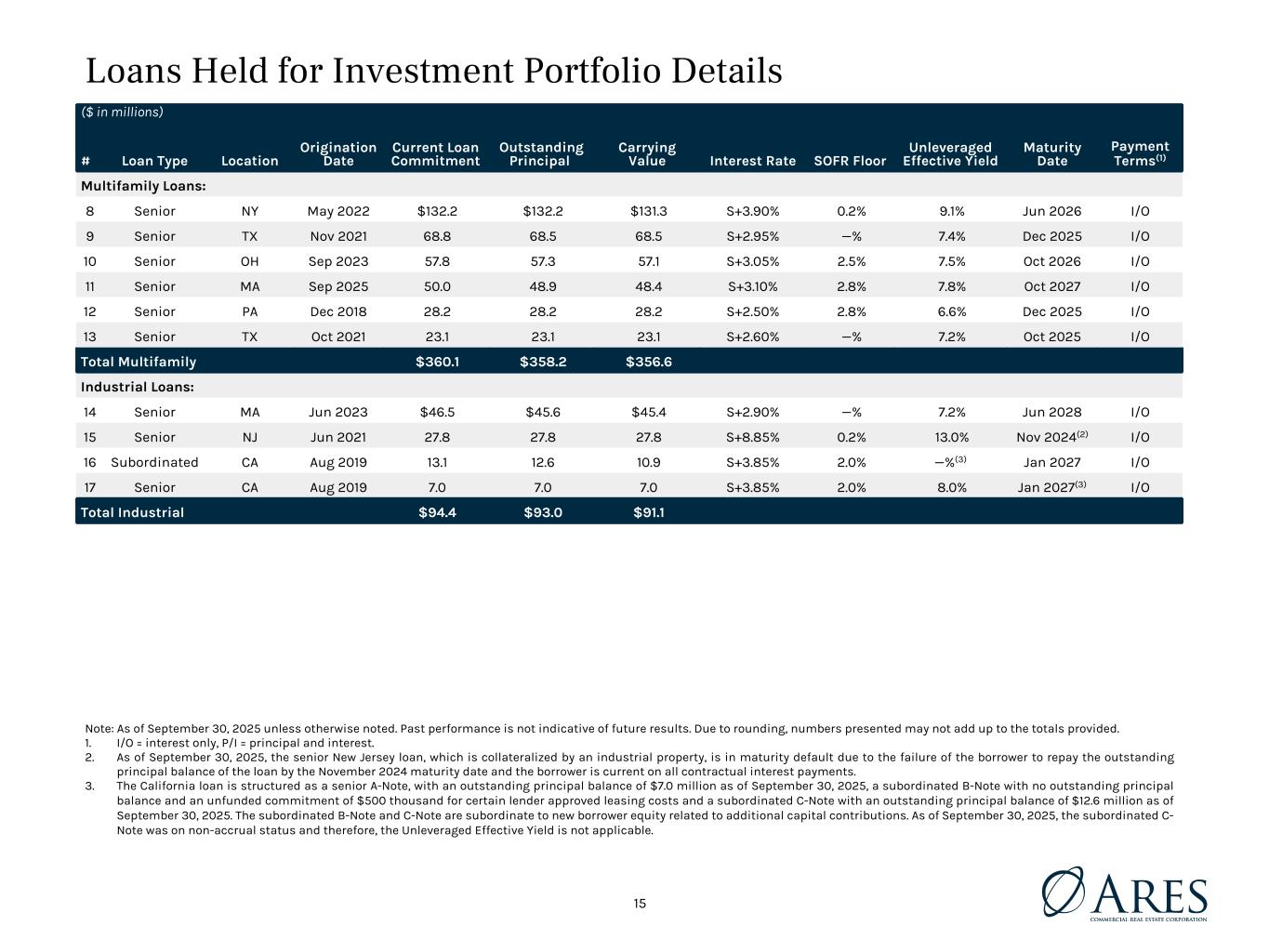

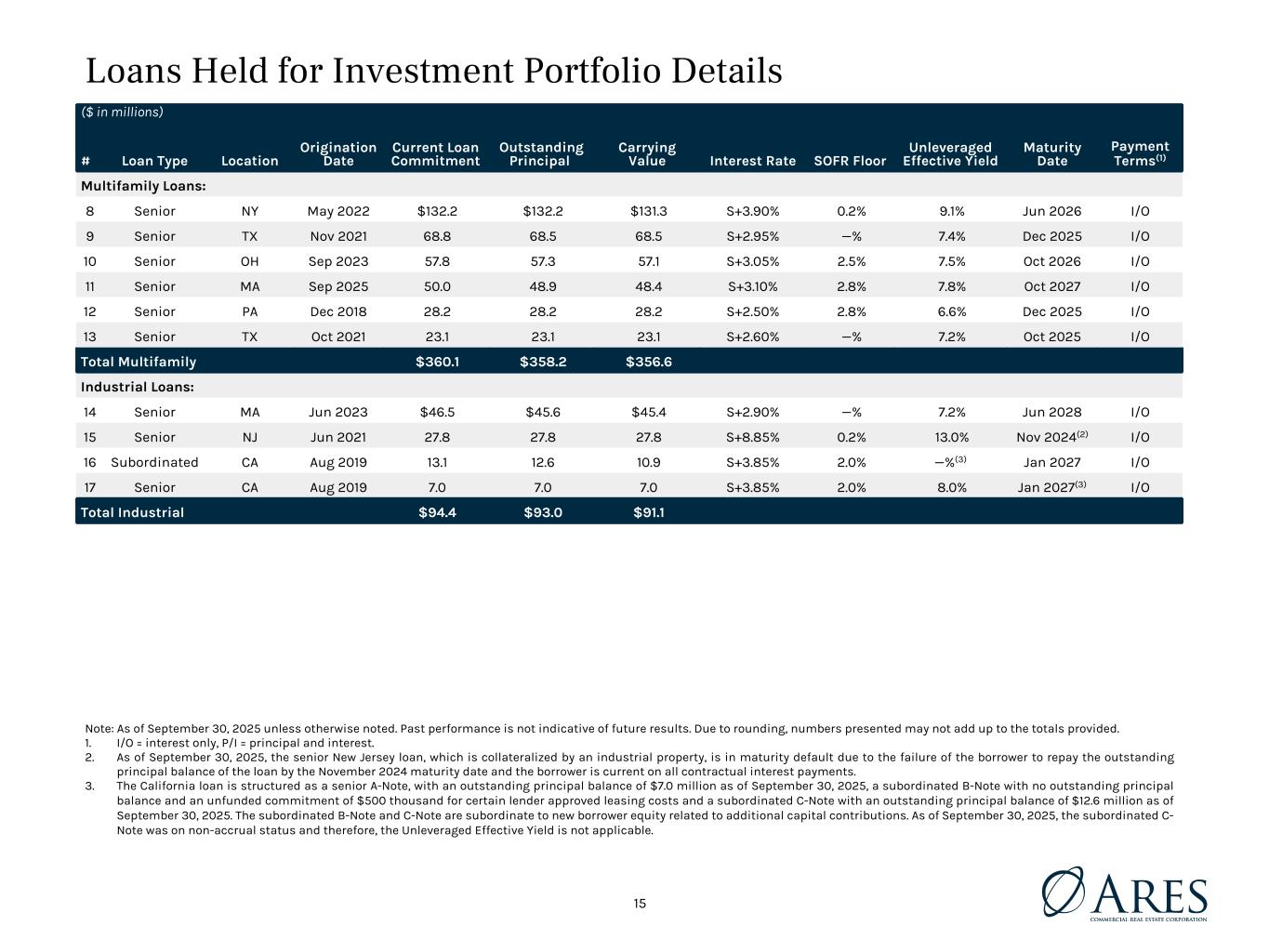

0 42 65 156 110 2 3 93 109 127 127 127 GENERAL PALETTE 0 42 65 2 87 133 71 126 163 120 163 198 Credit Private Equity Real Estate Secondary Solutions BUSINESS SECTOR PALETTE 192 212 229 Strategic Initiatives Loans Held for Investment Portfolio Details ($ in millions) # Loan Type Location Origination Date Current Loan Commitment Outstanding Principal Carrying Value Interest Rate SOFR Floor Unleveraged Effective Yield Maturity Date Payment Terms(1) Multifamily Loans: 8 Senior NY May 2022 $132.2 $132.2 $131.3 S+3.90% 0.2% 9.1% Jun 2026 I/O 9 Senior TX Nov 2021 68.8 68.5 68.5 S+2.95% —% 7.4% Dec 2025 I/O 10 Senior OH Sep 2023 57.8 57.3 57.1 S+3.05% 2.5% 7.5% Oct 2026 I/O 11 Senior MA Sep 2025 50.0 48.9 48.4 S+3.10% 2.8% 7.8% Oct 2027 I/O 12 Senior PA Dec 2018 28.2 28.2 28.2 S+2.50% 2.8% 6.6% Dec 2025 I/O 13 Senior TX Oct 2021 23.1 23.1 23.1 S+2.60% —% 7.2% Oct 2025 I/O Total Multifamily $360.1 $358.2 $356.6 Industrial Loans: 14 Senior MA Jun 2023 $46.5 $45.6 $45.4 S+2.90% —% 7.2% Jun 2028 I/O 15 Senior NJ Jun 2021 27.8 27.8 27.8 S+8.85% 0.2% 13.0% Nov 2024(2) I/O 16 Subordinated CA Aug 2019 13.1 12.6 10.9 S+3.85% 2.0% —%(3) Jan 2027 I/O 17 Senior CA Aug 2019 7.0 7.0 7.0 S+3.85% 2.0% 8.0% Jan 2027(3) I/O Total Industrial $94.4 $93.0 $91.1 Note: As of September 30, 2025 unless otherwise noted. Past performance is not indicative of future results. Due to rounding, numbers presented may not add up to the totals provided. 1. I/O = interest only, P/I = principal and interest. 2. As of September 30, 2025, the senior New Jersey loan, which is collateralized by an industrial property, is in maturity default due to the failure of the borrower to repay the outstanding principal balance of the loan by the November 2024 maturity date and the borrower is current on all contractual interest payments. 3. The California loan is structured as a senior A-Note, with an outstanding principal balance of $7.0 million as of September 30, 2025, a subordinated B-Note with no outstanding principal balance and an unfunded commitment of $500 thousand for certain lender approved leasing costs and a subordinated C-Note with an outstanding principal balance of $12.6 million as of September 30, 2025. The subordinated B-Note and C-Note are subordinate to new borrower equity related to additional capital contributions. As of September 30, 2025, the subordinated C- Note was on non-accrual status and therefore, the Unleveraged Effective Yield is not applicable. 15

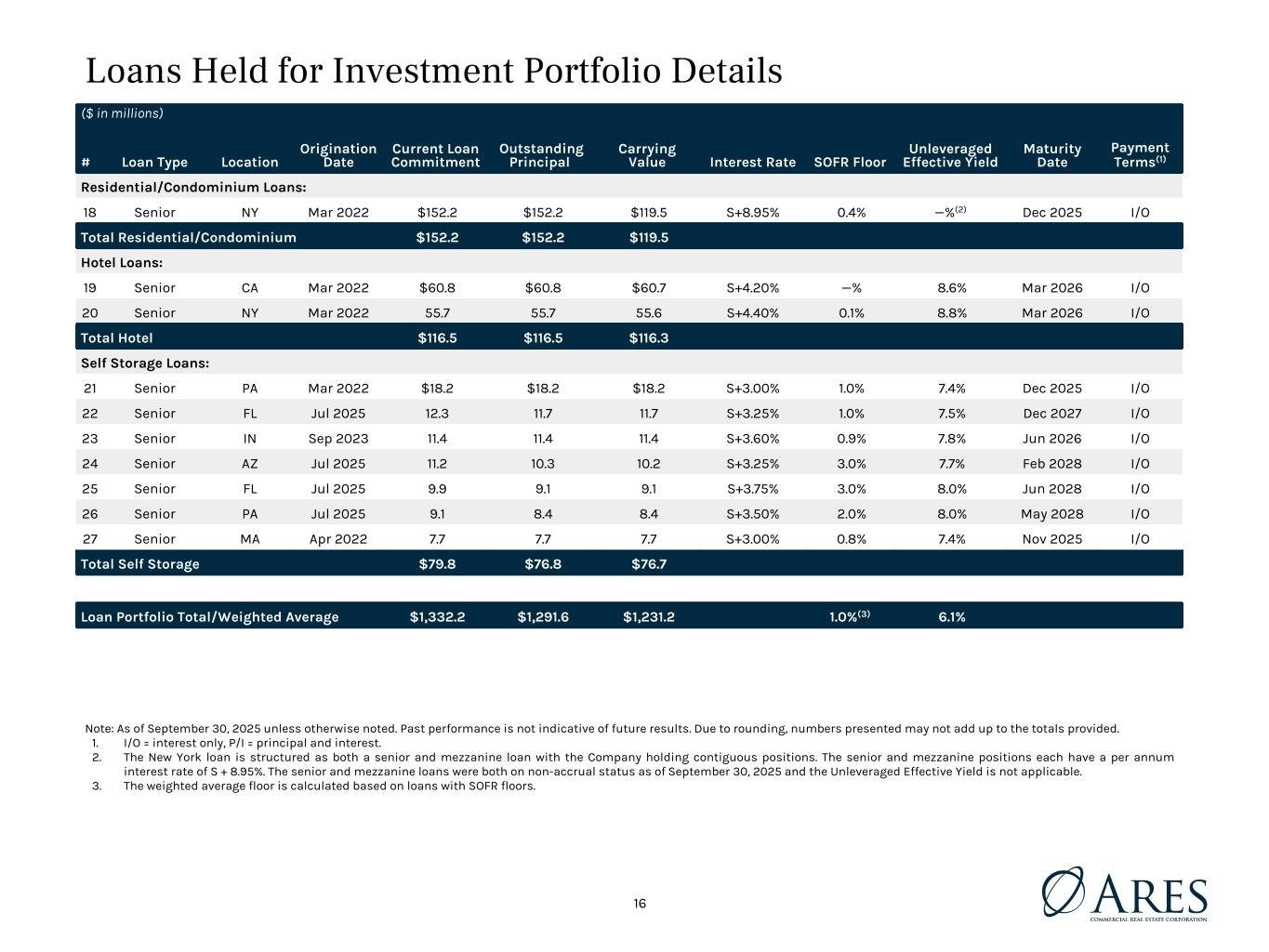

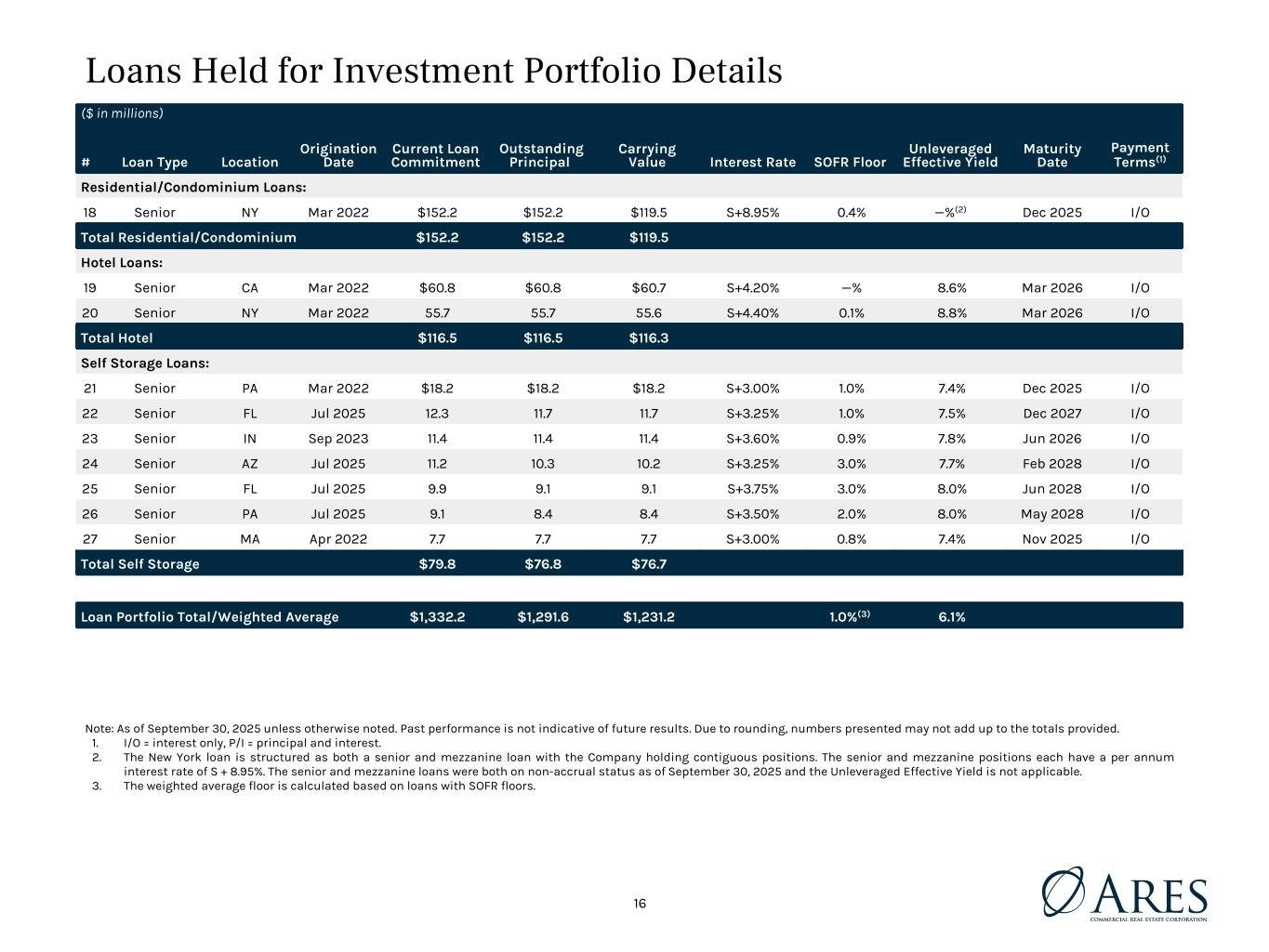

0 42 65 156 110 2 3 93 109 127 127 127 GENERAL PALETTE 0 42 65 2 87 133 71 126 163 120 163 198 Credit Private Equity Real Estate Secondary Solutions BUSINESS SECTOR PALETTE 192 212 229 Strategic Initiatives ($ in millions) # Loan Type Location Origination Date Current Loan Commitment Outstanding Principal Carrying Value Interest Rate SOFR Floor Unleveraged Effective Yield Maturity Date Payment Terms(1) Residential/Condominium Loans: 18 Senior NY Mar 2022 $152.2 $152.2 $119.5 S+8.95% 0.4% —%(2) Dec 2025 I/O Total Residential/Condominium $152.2 $152.2 $119.5 Hotel Loans: 19 Senior CA Mar 2022 $60.8 $60.8 $60.7 S+4.20% —% 8.6% Mar 2026 I/O 20 Senior NY Mar 2022 55.7 55.7 55.6 S+4.40% 0.1% 8.8% Mar 2026 I/O Total Hotel $116.5 $116.5 $116.3 Self Storage Loans: 21 Senior PA Mar 2022 $18.2 $18.2 $18.2 S+3.00% 1.0% 7.4% Dec 2025 I/O 22 Senior FL Jul 2025 12.3 11.7 11.7 S+3.25% 1.0% 7.5% Dec 2027 I/O 23 Senior IN Sep 2023 11.4 11.4 11.4 S+3.60% 0.9% 7.8% Jun 2026 I/O 24 Senior AZ Jul 2025 11.2 10.3 10.2 S+3.25% 3.0% 7.7% Feb 2028 I/O 25 Senior FL Jul 2025 9.9 9.1 9.1 S+3.75% 3.0% 8.0% Jun 2028 I/O 26 Senior PA Jul 2025 9.1 8.4 8.4 S+3.50% 2.0% 8.0% May 2028 I/O 27 Senior MA Apr 2022 7.7 7.7 7.7 S+3.00% 0.8% 7.4% Nov 2025 I/O Total Self Storage $79.8 $76.8 $76.7 Loan Portfolio Total/Weighted Average $1,332.2 $1,291.6 $1,231.2 1.0%(3) 6.1% Loans Held for Investment Portfolio Details Note: As of September 30, 2025 unless otherwise noted. Past performance is not indicative of future results. Due to rounding, numbers presented may not add up to the totals provided. 1. I/O = interest only, P/I = principal and interest. 2. The New York loan is structured as both a senior and mezzanine loan with the Company holding contiguous positions. The senior and mezzanine positions each have a per annum interest rate of S + 8.95%. The senior and mezzanine loans were both on non-accrual status as of September 30, 2025 and the Unleveraged Effective Yield is not applicable. 3. The weighted average floor is calculated based on loans with SOFR floors. 16

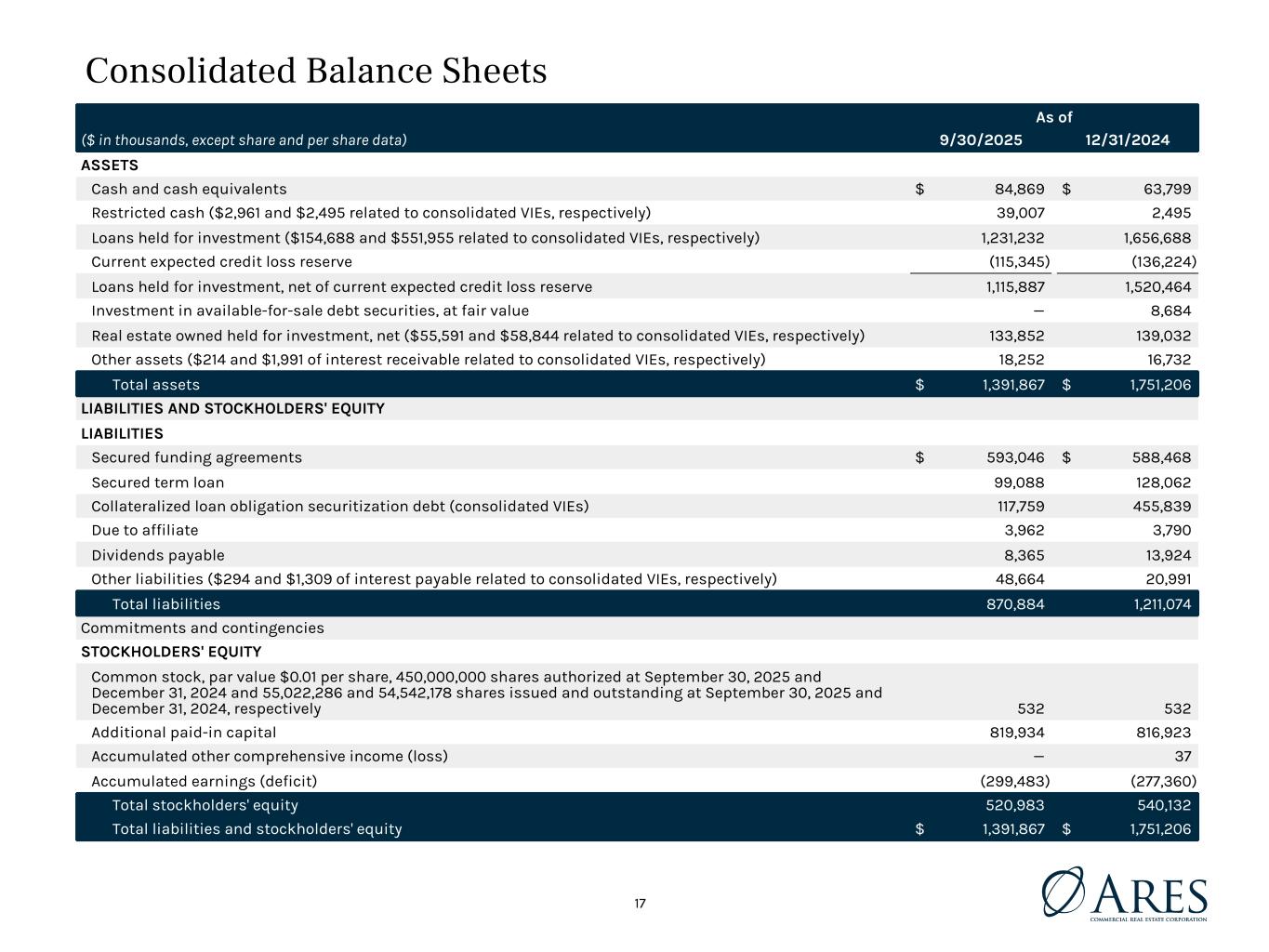

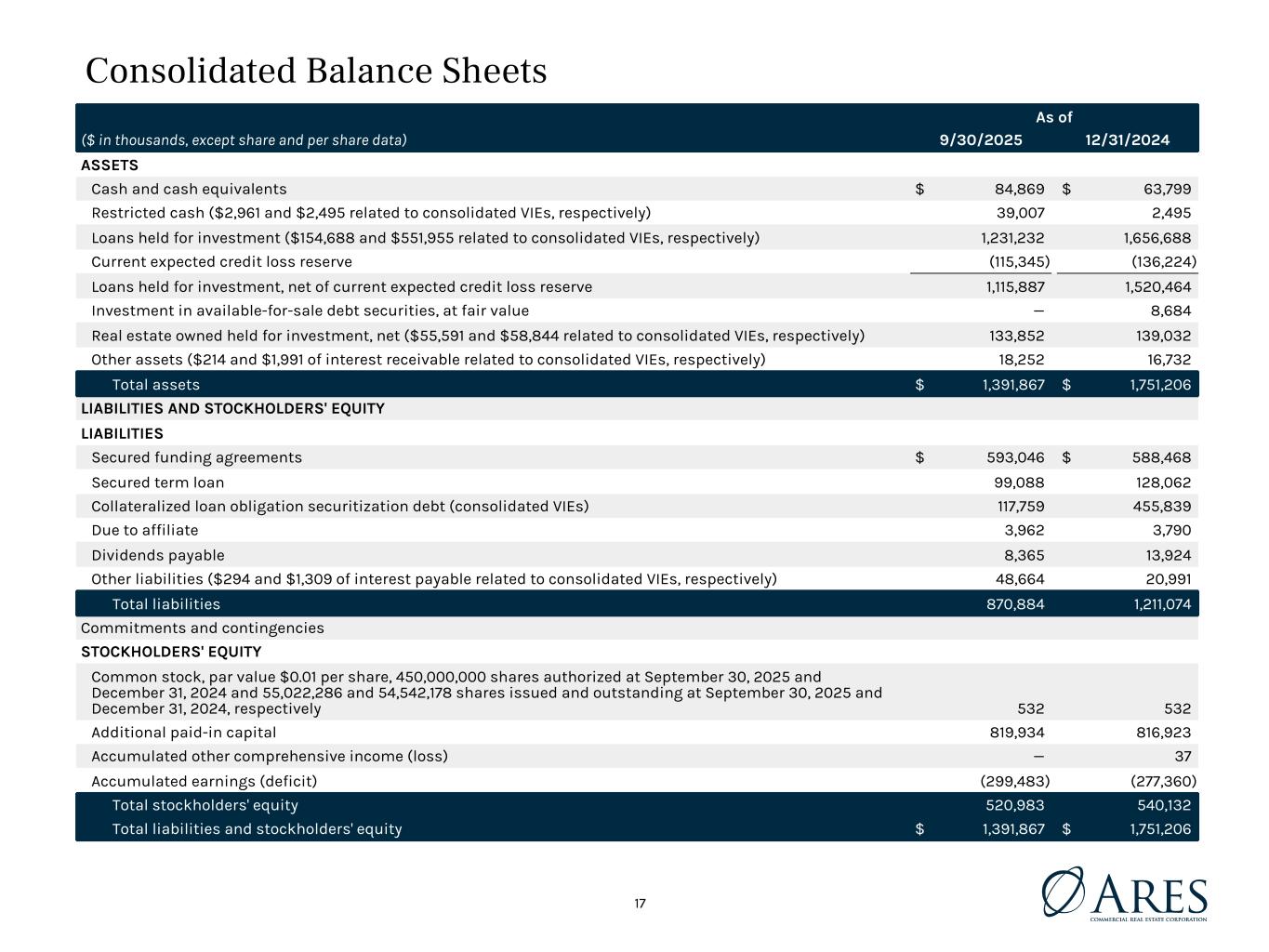

0 42 65 155 112 42 4 94 109 127 127 127 0 42 65 2 87 133 71 126 163 120 163 198 Credit Private Equity Real Estate Strategi c Initiativ es BUSINE SS SECTOR PALETT E GENER AL PALETT E As of ($ in thousands, except share and per share data) 9/30/2025 12/31/2024 ASSETS Cash and cash equivalents $ 84,869 $ 63,799 Restricted cash ($2,961 and $2,495 related to consolidated VIEs, respectively) 39,007 2,495 Loans held for investment ($154,688 and $551,955 related to consolidated VIEs, respectively) 1,231,232 1,656,688 Current expected credit loss reserve (115,345) (136,224) Loans held for investment, net of current expected credit loss reserve 1,115,887 1,520,464 Investment in available-for-sale debt securities, at fair value — 8,684 Real estate owned held for investment, net ($55,591 and $58,844 related to consolidated VIEs, respectively) 133,852 139,032 Other assets ($214 and $1,991 of interest receivable related to consolidated VIEs, respectively) 18,252 16,732 Total assets $ 1,391,867 $ 1,751,206 LIABILITIES AND STOCKHOLDERS' EQUITY LIABILITIES Secured funding agreements $ 593,046 $ 588,468 Secured term loan 99,088 128,062 Collateralized loan obligation securitization debt (consolidated VIEs) 117,759 455,839 Due to affiliate 3,962 3,790 Dividends payable 8,365 13,924 Other liabilities ($294 and $1,309 of interest payable related to consolidated VIEs, respectively) 48,664 20,991 Total liabilities 870,884 1,211,074 Commitments and contingencies STOCKHOLDERS' EQUITY Common stock, par value $0.01 per share, 450,000,000 shares authorized at September 30, 2025 and December 31, 2024 and 55,022,286 and 54,542,178 shares issued and outstanding at September 30, 2025 and December 31, 2024, respectively 532 532 Additional paid-in capital 819,934 816,923 Accumulated other comprehensive income (loss) — 37 Accumulated earnings (deficit) (299,483) (277,360) Total stockholders' equity 520,983 540,132 Total liabilities and stockholders' equity $ 1,391,867 $ 1,751,206 Consolidated Balance Sheets 17

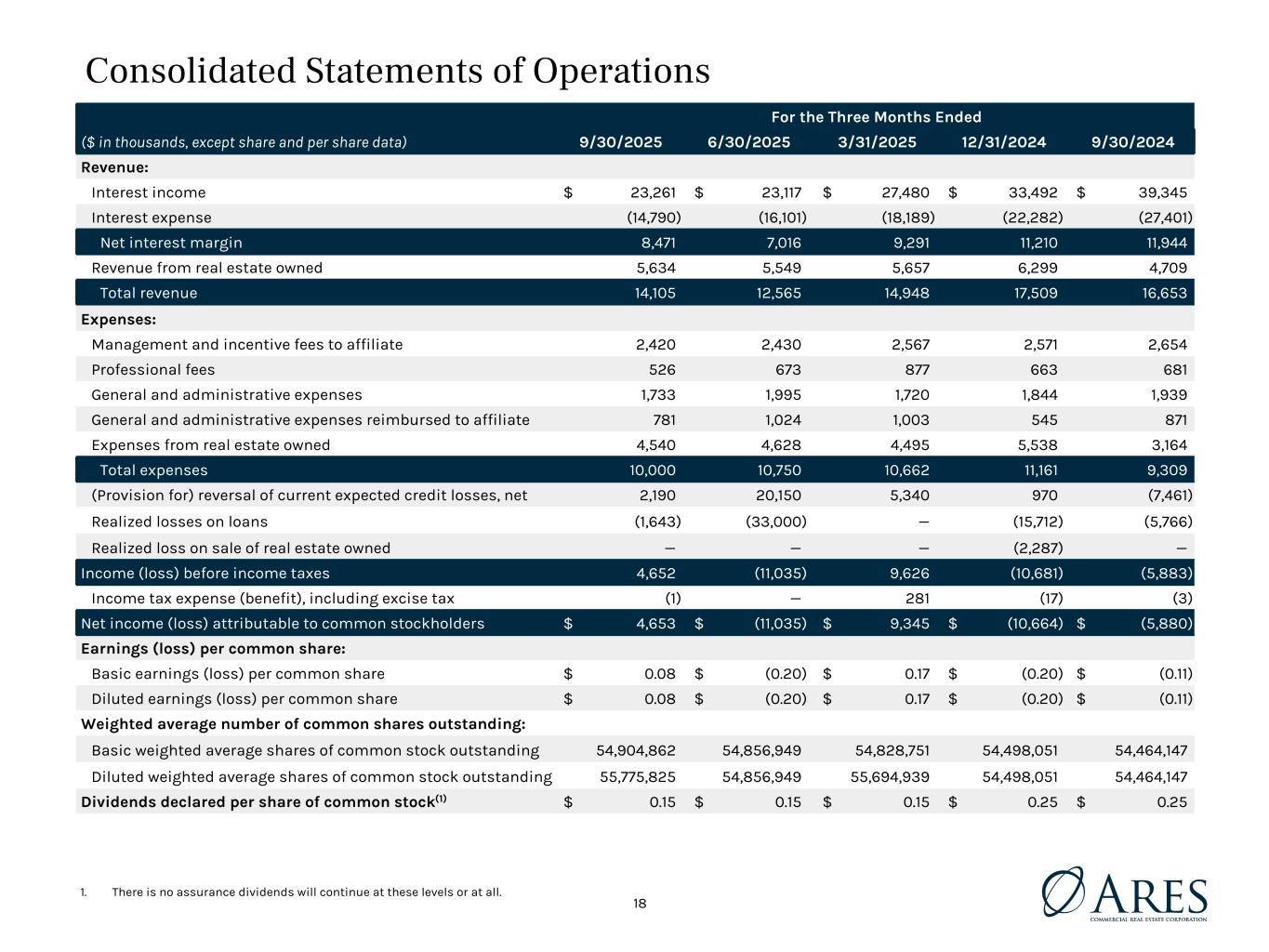

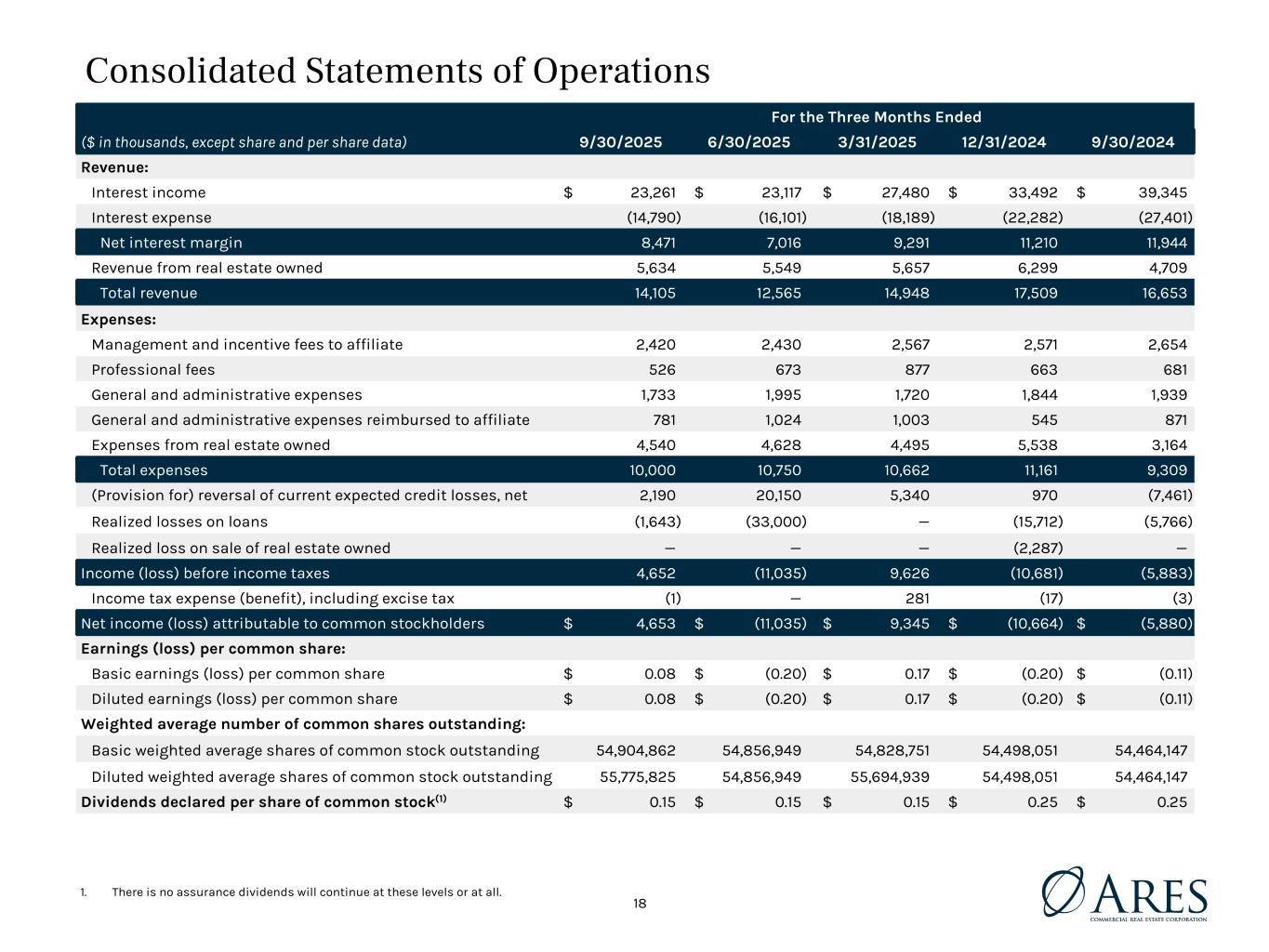

0 42 65 155 112 42 4 94 109 127 127 127 0 42 65 2 87 133 71 126 163 120 163 198 Credit Private Equity Real Estate Strategi c Initiativ es BUSINE SS SECTOR PALETT E GENER AL PALETT E Consolidated Statements of Operations For the Three Months Ended ($ in thousands, except share and per share data) 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Revenue: Interest income $ 23,261 $ 23,117 $ 27,480 $ 33,492 $ 39,345 Interest expense (14,790) (16,101) (18,189) (22,282) (27,401) Net interest margin 8,471 7,016 9,291 11,210 11,944 Revenue from real estate owned 5,634 5,549 5,657 6,299 4,709 Total revenue 14,105 12,565 14,948 17,509 16,653 Expenses: Management and incentive fees to affiliate 2,420 2,430 2,567 2,571 2,654 Professional fees 526 673 877 663 681 General and administrative expenses 1,733 1,995 1,720 1,844 1,939 General and administrative expenses reimbursed to affiliate 781 1,024 1,003 545 871 Expenses from real estate owned 4,540 4,628 4,495 5,538 3,164 Total expenses 10,000 10,750 10,662 11,161 9,309 (Provision for) reversal of current expected credit losses, net 2,190 20,150 5,340 970 (7,461) Realized losses on loans (1,643) (33,000) — (15,712) (5,766) Realized loss on sale of real estate owned — — — (2,287) — Income (loss) before income taxes 4,652 (11,035) 9,626 (10,681) (5,883) Income tax expense (benefit), including excise tax (1) — 281 (17) (3) Net income (loss) attributable to common stockholders $ 4,653 $ (11,035) $ 9,345 $ (10,664) $ (5,880) Earnings (loss) per common share: Basic earnings (loss) per common share $ 0.08 $ (0.20) $ 0.17 $ (0.20) $ (0.11) Diluted earnings (loss) per common share $ 0.08 $ (0.20) $ 0.17 $ (0.20) $ (0.11) Weighted average number of common shares outstanding: Basic weighted average shares of common stock outstanding 54,904,862 54,856,949 54,828,751 54,498,051 54,464,147 Diluted weighted average shares of common stock outstanding 55,775,825 54,856,949 55,694,939 54,498,051 54,464,147 Dividends declared per share of common stock(1) $ 0.15 $ 0.15 $ 0.15 $ 0.25 $ 0.25 1. There is no assurance dividends will continue at these levels or at all. 18

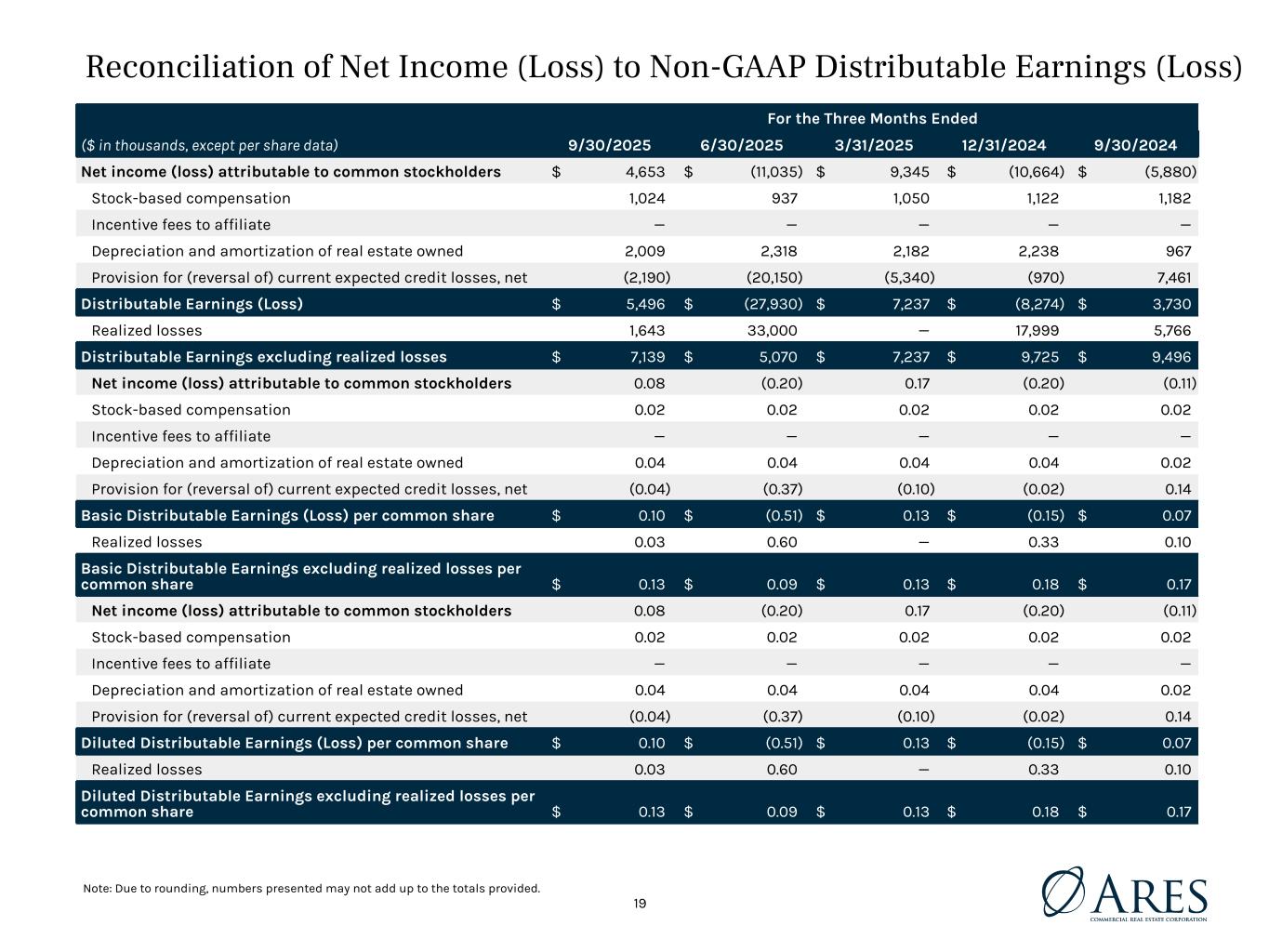

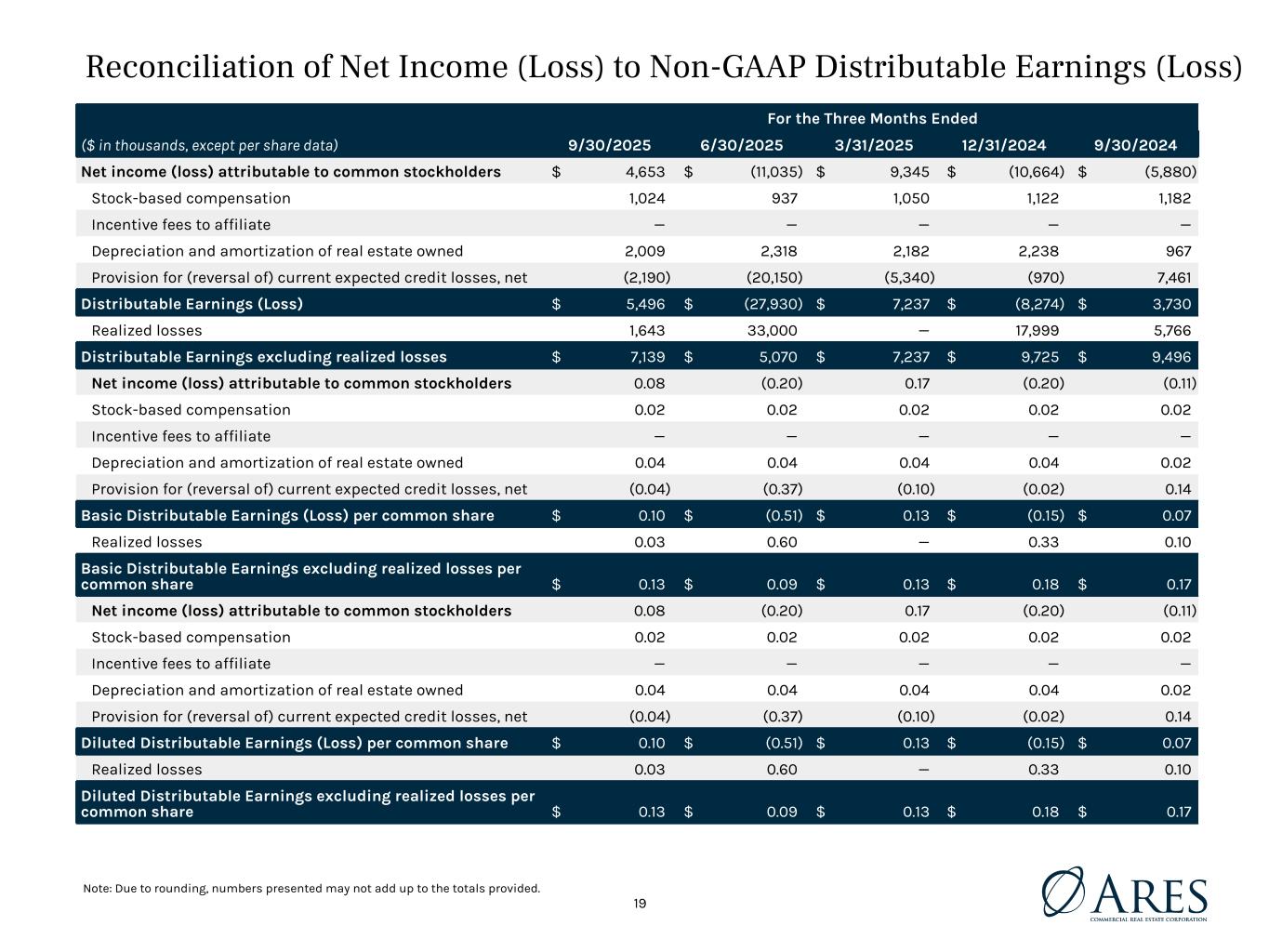

0 42 65 155 112 42 4 94 109 127 127 127 0 42 65 2 87 133 71 126 163 120 163 198 Credit Private Equity Real Estate Strategi c Initiativ es BUSINE SS SECTOR PALETT E GENER AL PALETT E Reconciliation of Net Income (Loss) to Non-GAAP Distributable Earnings (Loss) For the Three Months Ended ($ in thousands, except per share data) 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Net income (loss) attributable to common stockholders $ 4,653 $ (11,035) $ 9,345 $ (10,664) $ (5,880) Stock-based compensation 1,024 937 1,050 1,122 1,182 Incentive fees to affiliate — — — — — Depreciation and amortization of real estate owned 2,009 2,318 2,182 2,238 967 Provision for (reversal of) current expected credit losses, net (2,190) (20,150) (5,340) (970) 7,461 Distributable Earnings (Loss) $ 5,496 $ (27,930) $ 7,237 $ (8,274) $ 3,730 Realized losses 1,643 33,000 — 17,999 5,766 Distributable Earnings excluding realized losses $ 7,139 $ 5,070 $ 7,237 $ 9,725 $ 9,496 Net income (loss) attributable to common stockholders 0.08 (0.20) 0.17 (0.20) (0.11) Stock-based compensation 0.02 0.02 0.02 0.02 0.02 Incentive fees to affiliate — — — — — Depreciation and amortization of real estate owned 0.04 0.04 0.04 0.04 0.02 Provision for (reversal of) current expected credit losses, net (0.04) (0.37) (0.10) (0.02) 0.14 Basic Distributable Earnings (Loss) per common share $ 0.10 $ (0.51) $ 0.13 $ (0.15) $ 0.07 Realized losses 0.03 0.60 — 0.33 0.10 Basic Distributable Earnings excluding realized losses per common share $ 0.13 $ 0.09 $ 0.13 $ 0.18 $ 0.17 Net income (loss) attributable to common stockholders 0.08 (0.20) 0.17 (0.20) (0.11) Stock-based compensation 0.02 0.02 0.02 0.02 0.02 Incentive fees to affiliate — — — — — Depreciation and amortization of real estate owned 0.04 0.04 0.04 0.04 0.02 Provision for (reversal of) current expected credit losses, net (0.04) (0.37) (0.10) (0.02) 0.14 Diluted Distributable Earnings (Loss) per common share $ 0.10 $ (0.51) $ 0.13 $ (0.15) $ 0.07 Realized losses 0.03 0.60 — 0.33 0.10 Diluted Distributable Earnings excluding realized losses per common share $ 0.13 $ 0.09 $ 0.13 $ 0.18 $ 0.17 19 Note: Due to rounding, numbers presented may not add up to the totals provided.

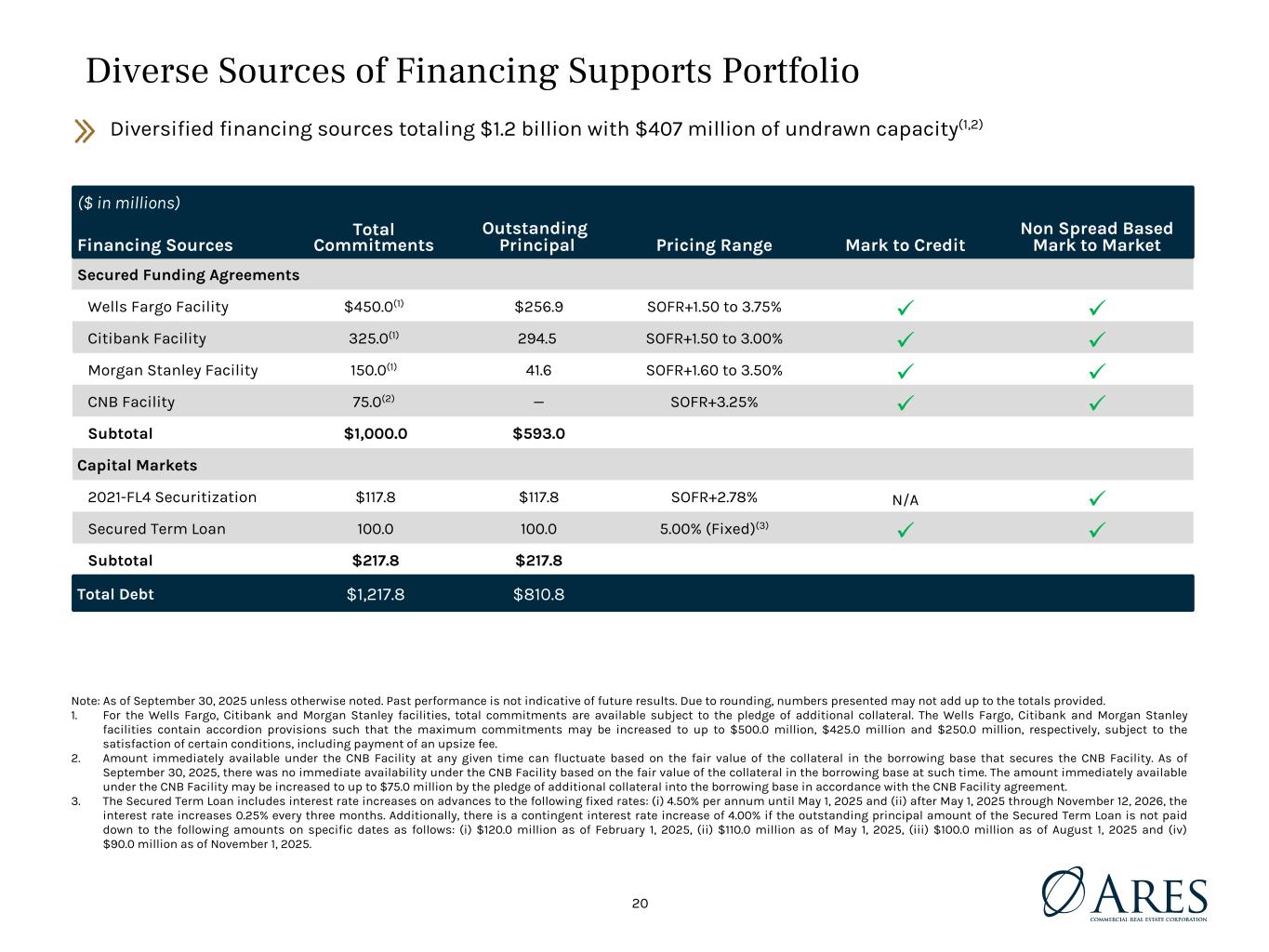

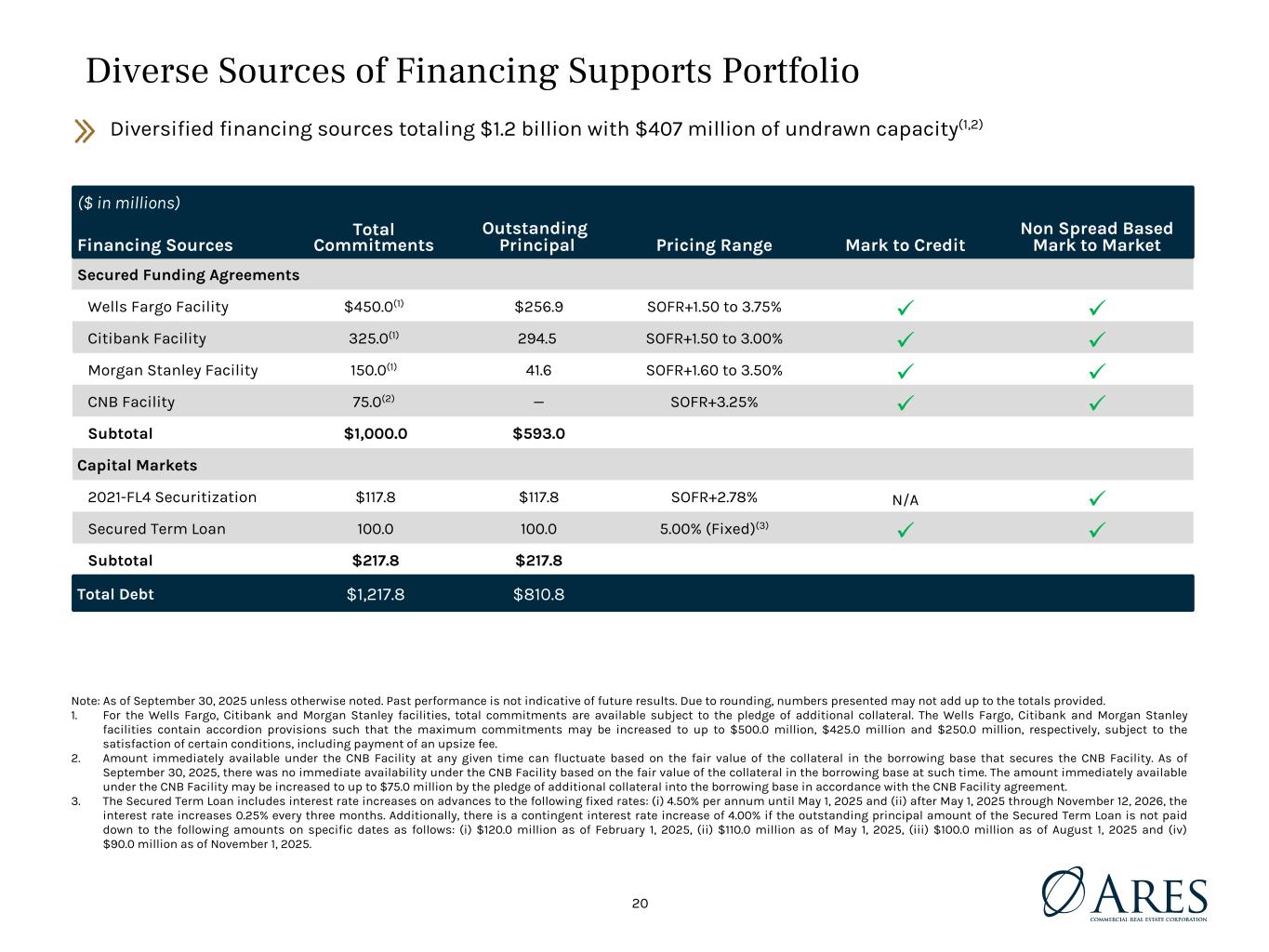

0 42 65 156 110 2 3 93 109 127 127 127 GENERAL PALETTE 0 42 65 2 87 133 71 126 163 120 163 198 Credit Private Equity Real Estate Secondary Solutions BUSINESS SECTOR PALETTE 192 212 229 Strategic Initiatives Diverse Sources of Financing Supports Portfolio ($ in millions) Financing Sources Total Commitments Outstanding Principal Pricing Range Mark to Credit Non Spread Based Mark to Market Secured Funding Agreements Wells Fargo Facility $450.0(1) $256.9 SOFR+1.50 to 3.75% ü ü Citibank Facility 325.0(1) 294.5 SOFR+1.50 to 3.00% ü ü Morgan Stanley Facility 150.0(1) 41.6 SOFR+1.60 to 3.50% ü ü CNB Facility 75.0(2) — SOFR+3.25% ü ü Subtotal $1,000.0 $593.0 Capital Markets 2021-FL4 Securitization $117.8 $117.8 SOFR+2.78% N/A ü Secured Term Loan 100.0 100.0 5.00% (Fixed)(3) ü ü Subtotal $217.8 $217.8 Total Debt $1,217.8 $810.8 Note: As of September 30, 2025 unless otherwise noted. Past performance is not indicative of future results. Due to rounding, numbers presented may not add up to the totals provided. 1. For the Wells Fargo, Citibank and Morgan Stanley facilities, total commitments are available subject to the pledge of additional collateral. The Wells Fargo, Citibank and Morgan Stanley facilities contain accordion provisions such that the maximum commitments may be increased to up to $500.0 million, $425.0 million and $250.0 million, respectively, subject to the satisfaction of certain conditions, including payment of an upsize fee. 2. Amount immediately available under the CNB Facility at any given time can fluctuate based on the fair value of the collateral in the borrowing base that secures the CNB Facility. As of September 30, 2025, there was no immediate availability under the CNB Facility based on the fair value of the collateral in the borrowing base at such time. The amount immediately available under the CNB Facility may be increased to up to $75.0 million by the pledge of additional collateral into the borrowing base in accordance with the CNB Facility agreement. 3. The Secured Term Loan includes interest rate increases on advances to the following fixed rates: (i) 4.50% per annum until May 1, 2025 and (ii) after May 1, 2025 through November 12, 2026, the interest rate increases 0.25% every three months. Additionally, there is a contingent interest rate increase of 4.00% if the outstanding principal amount of the Secured Term Loan is not paid down to the following amounts on specific dates as follows: (i) $120.0 million as of February 1, 2025, (ii) $110.0 million as of May 1, 2025, (iii) $100.0 million as of August 1, 2025 and (iv) $90.0 million as of November 1, 2025. Diversified financing sources totaling $1.2 billion with $407 million of undrawn capacity(1,2) 20

0 42 65 156 110 2 3 93 109 127 127 127 GENERAL PALETTE 0 42 65 2 87 133 71 126 163 120 163 198 Credit Private Equity Real Estate Secondary Solutions BUSINESS SECTOR PALETTE 192 212 229 Strategic Initiatives Glossary Distributable Earnings (Loss) Distributable Earnings (Loss) is a non-GAAP financial measure that helps the Company evaluate its financial performance excluding the effects of certain transactions and GAAP adjustments that it believes are not necessarily indicative of its current loan origination portfolio and operations. To maintain the Company’s REIT status, the Company is generally required to annually distribute to its stockholders substantially all of its taxable income. The Company believes the disclosure of Distributable Earnings (Loss) provides useful information to investors regarding the Company's ability to pay dividends, which the Company believes is one of the principal reasons investors invest in the Company. The presentation of this additional information is not meant to be considered in isolation or as a substitute for financial results prepared in accordance with GAAP. Distributable Earnings (Loss) is defined as net income (loss) computed in accordance with GAAP, excluding non-cash equity compensation expense, the incentive fees the Company pays to its Manager, depreciation and amortization (to the extent that any of the Company’s target investments are structured as debt and the Company forecloses on any properties underlying such debt), any unrealized gains, losses or other non-cash items recorded in net income (loss) for the period, regardless of whether such items are included in other comprehensive income or loss, or in net income (loss), one-time events pursuant to changes in GAAP and certain non-cash charges after discussions between the Company’s manager and the Company’s independent directors and after approval by a majority of the Company’s independent directors. Loan balances that are deemed to be uncollectible are written-off as a realized loss and are included in Distributable Earnings (Loss). Distributable Earnings (Loss) is aligned with the calculation of “Core Earnings,ˮ which is defined in the Management Agreement and is used to calculate the incentive fees the Company pays to its Manager. Distributable Earnings excluding realized losses is Distributable Earnings (Loss) further adjusted to exclude realized losses. 21

0 42 65 156 110 2 3 93 109 127 127 127 GENERAL PALETTE 0 42 65 2 87 133 71 126 163 120 163 198 Credit Private Equity Real Estate Secondary Solutions BUSINESS SECTOR PALETTE 192 212 229 Strategic Initiatives Endnotes 3Q 2025 Company Results and Highlights; page 3 Note: As of September 30, 2025 unless otherwise noted. Past performance is not indicative of future results. Due to rounding, numbers may not add up to the totals provided. 1. Distributable Earnings (Loss) and Distributable Earnings excluding realized losses are non-GAAP financial measures. See page 21 for Distributable Earnings (Loss) and Distributable Earnings excluding realized losses definitions and page 19 for the Reconciliation of Net Income (Loss) to Non-GAAP Distributable Earnings (Loss) and Distributable Earnings excluding realized losses. 2. Book value per common share excluding CECL reserve is calculated as (i) total stockholders’ equity of $521 million plus CECL reserve of $117 million divided by (ii) total outstanding common shares of 55,022,286 as of September 30, 2025. 3. Net debt to equity ratio (excluding CECL reserve) is calculated as (i) outstanding principal of borrowings less cash (inclusive of restricted amounts that are available to repay collateralized loan obligation securitization debt), (ii) divided by the sum of total stockholders’ equity plus CECL reserve at the end of the quarter. Net debt to equity ratio including CECL reserve is 1.4x as of September 30, 2025. Total debt to equity ratio excluding CECL reserve is 1.3x and including CECL reserve is 1.6x as of September 30, 2025. Please see prior earnings presentations for calculations of net debt to equity ratio for prior periods. 4. As of September 30, 2025, includes $88 million of cash (inclusive of restricted amounts that are available to repay collateralized loan obligation securitization debt) and, under our secured funding agreements, $46 million of available financing proceeds based on existing collateral and $39 million of available financing proceeds based on proposed collateral that was accepted by the lender and drawn subsequent to September 30, 2025. 5. Amounts based on outstanding principal balance for loans held for investment. 6. Source: Bloomberg stock price for ACRE as of November 4, 2025. Ares Real Estate is a Global Investment Manager and Operator; page 6 1. Investment professionals include Investment Management, Portfolio Management and Development personnel. Employee data reflects post-close structure as of September 30, 2025. 2. Operating professionals include Asset Management, Construction Management, Property Management, Debt Capital Markets, Due Diligence & Quantitative Development personnel. Employee data reflects post-close structure as of September 30, 2025. 3. The performance, awards/ratings noted herein relate only to selected funds/strategies and may not be representative of any given client’s experience and should not be viewed as indicative of Ares’ past performance or its funds’ future performance. 22

0 42 65 156 110 2 3 93 109 127 127 127 GENERAL PALETTE 0 42 65 2 87 133 71 126 163 120 163 198 Credit Private Equity Real Estate Secondary Solutions BUSINESS SECTOR PALETTE 192 212 229 Strategic Initiatives