Document

NOBLE CORPORATION PLC ANNOUNCES FOURTH QUARTER AND FULL YEAR 2024 RESULTS

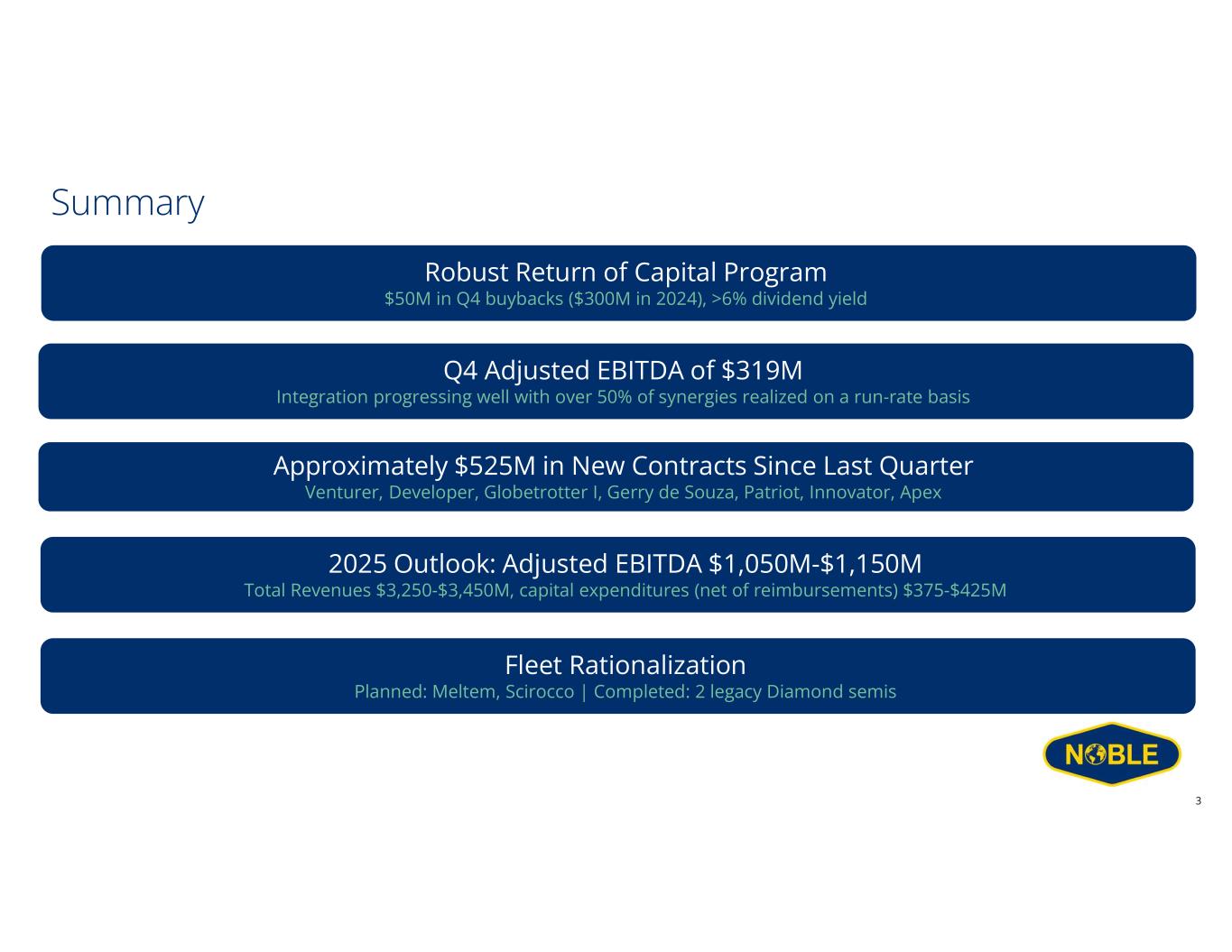

•Over $575 million of capital returned via dividends and share buybacks in 2024.

•Diamond integration progressing on plan, with half of $100 million targeted synergies realized to date.

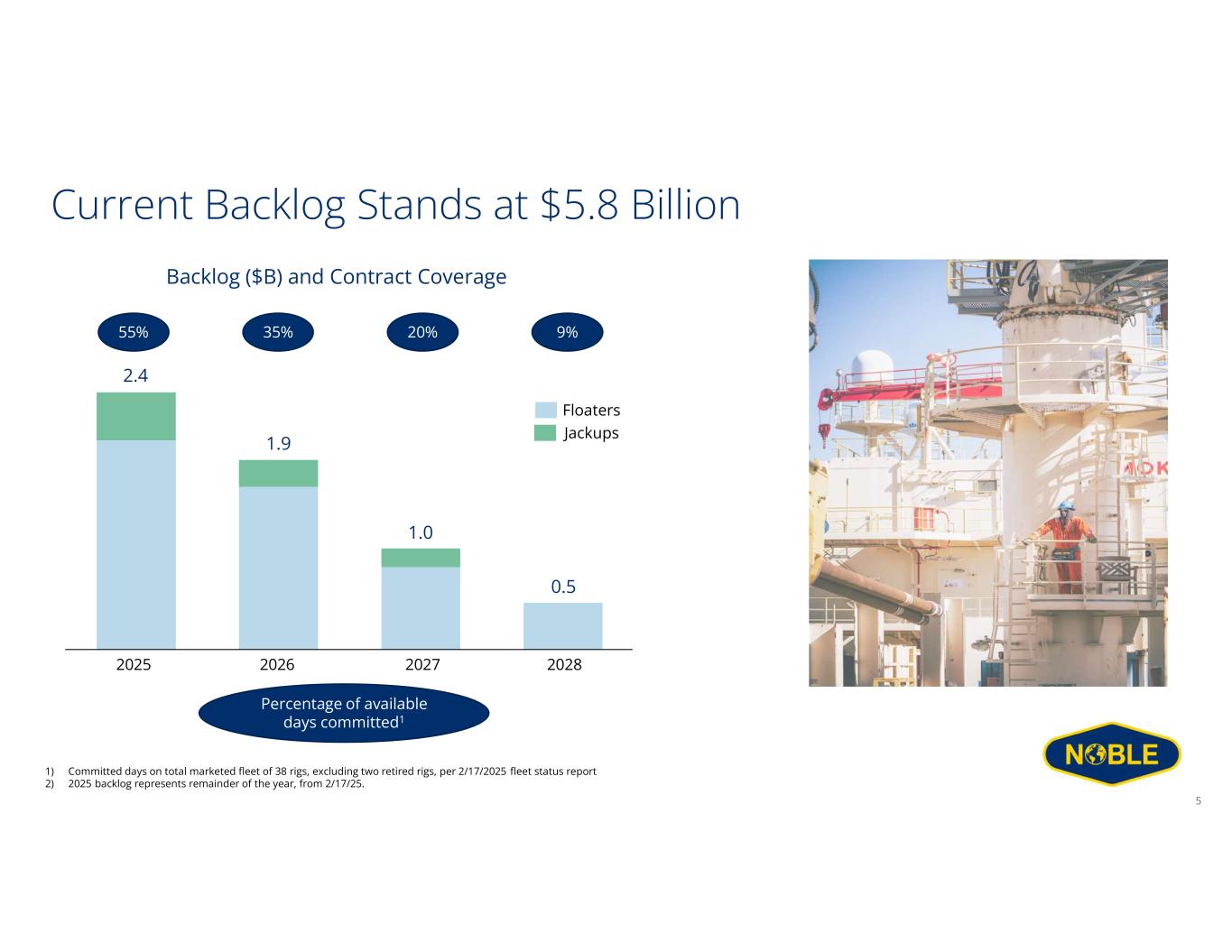

•Approximately $525 million in new contract awards since November, with total backlog at $5.8 billion.

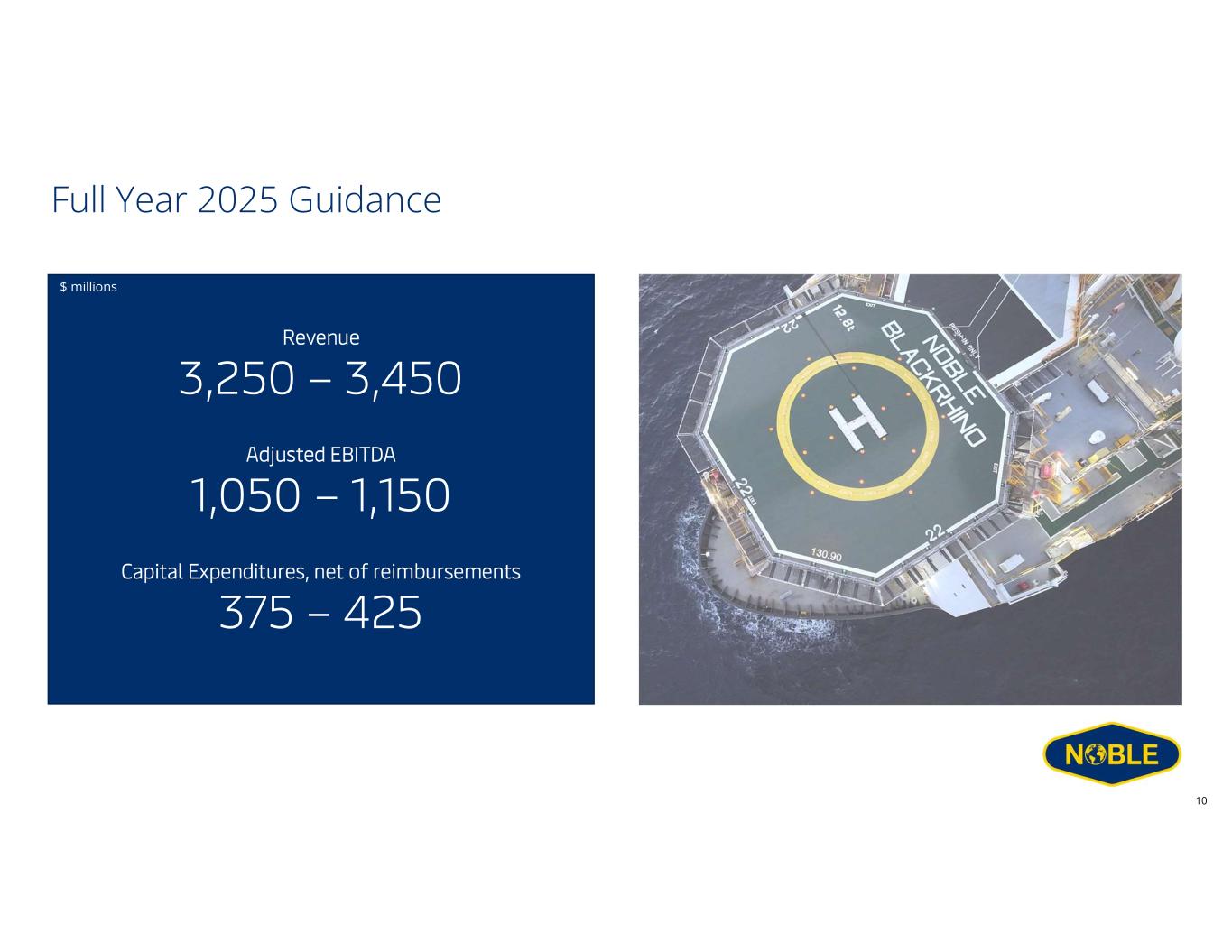

•Full Year 2025 Guidance provided as follows: Total Revenue $3,250 to $3,450 million, Adjusted EBITDA $1,050 to $1,150 million, and Capital Expenditures (net of reimbursements) $375 to $425 million.

HOUSTON, TEXAS, February 17, 2025 - Noble Corporation plc (NYSE: NE, “Noble”, or the “Company”) today reported fourth quarter and full year 2024 results.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

| (in millions, except per share amounts) |

|

December 31, 2024 |

|

September 30, 2024 |

|

December 31, 2023 |

| Total Revenue |

|

$ |

927 |

|

|

$ |

801 |

|

|

$ |

643 |

|

| Contract Drilling Services Revenue |

|

882 |

|

|

764 |

|

|

609 |

|

| Net Income (Loss) |

|

97 |

|

|

61 |

|

|

150 |

|

| Adjusted EBITDA* |

|

319 |

|

|

291 |

|

|

201 |

|

| Adjusted Net Income (Loss)* |

|

91 |

|

|

89 |

|

|

56 |

|

| Basic Earnings (Loss) Per Share |

|

0.60 |

|

|

0.41 |

|

|

1.06 |

|

| Diluted Earnings (Loss) Per Share |

|

0.59 |

|

|

0.40 |

|

|

1.03 |

|

| Adjusted Diluted Earnings (Loss) Per Share* |

|

0.56 |

|

|

0.58 |

|

|

0.39 |

|

|

|

|

|

|

|

|

| * A Non-GAAP supporting schedule is included with the statements and schedules attached to this press release. |

Robert W. Eifler, President and Chief Executive Officer of Noble, stated “The fourth quarter capped our first full quarter incorporating the Diamond acquisition, with solid results. We have also had a number of important contract wins recently which collectively have augmented our revenue coverage for 2025 and 2026. Integration is progressing well with over half of the $100 million targeted synergies realized to date. Our recent decision to retire the cold stacked drillships Pacific Meltem and Pacific Scirocco reflects our commitment to cost discipline, focusing resources on our core active fleet. I would like to thank all of our employees for your continued focus and dedication through this exciting growth journey for our business.”

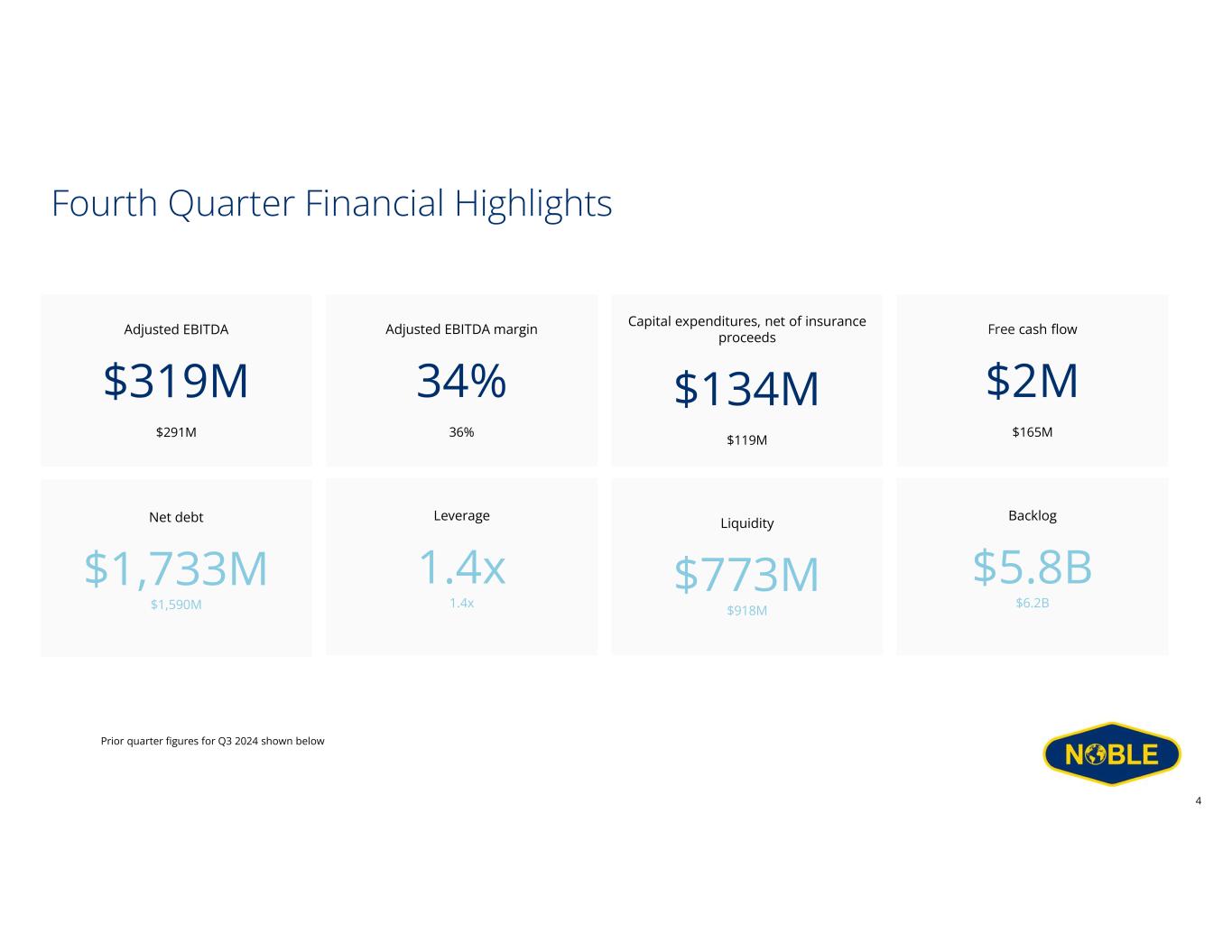

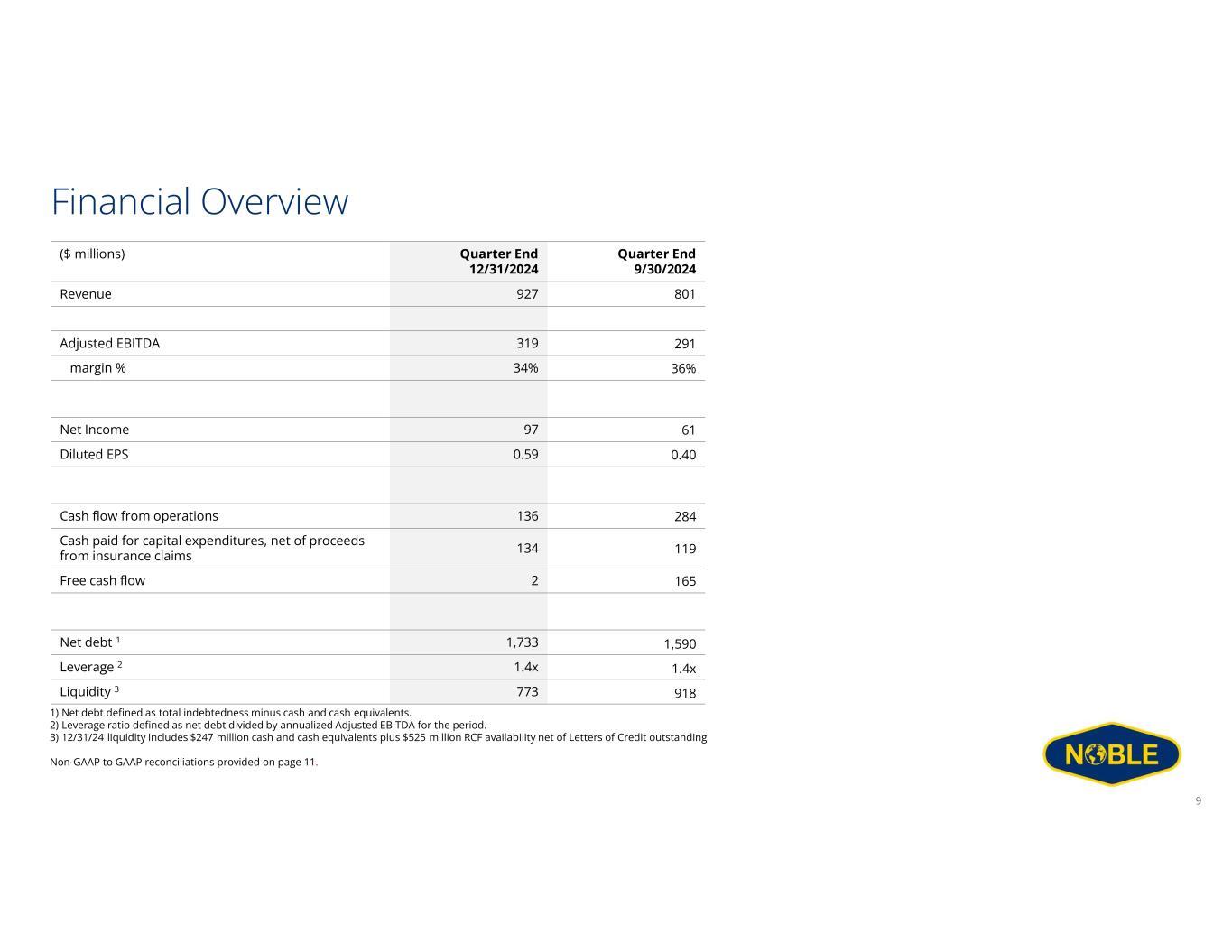

Fourth Quarter Results

Contract drilling services revenue for the fourth quarter of 2024 totaled $882 million compared to $764 million in the third quarter, with the sequential increase driven by a full quarter contribution of the Diamond Offshore acquisition. Marketed fleet utilization was 77% in the three months ended December 31, 2024, compared to 82% in the previous quarter. Contract drilling services costs for the fourth quarter were $527 million, up from $434 million in the third quarter. Net income increased to $97 million in the fourth quarter, up from $61 million in the third quarter, and Adjusted EBITDA increased to $319 million in the fourth quarter, up from $291 million in the third quarter. Fourth quarter Adjusted EBITDA included approximately $40 million related to the early termination of the Noble Deliverer. Net cash provided by operating activities in the fourth quarter was $136 million, capital expenditures were $141 million offset by proceeds from insurance claims of $7 million, and free cash flow (non-GAAP) was $2 million.

Balance Sheet and Capital Allocation

The Company's balance sheet as of December 31, 2024, reflected total debt principal value of $1,950 million and cash (and cash equivalents) of $247 million. Share repurchases totaled $50 million during the fourth quarter, bringing full year 2024 share repurchases to $300 million, in addition to $278 million in dividends paid during the year.

Today, Noble’s Board of Directors approved a quarterly interim dividend of $0.50 per share for the first quarter of 2025. This dividend is expected to be paid on March 20, 2025, to shareholders of record at close of business on March 5, 2025. Future quarterly dividends and other shareholder returns will be subject to, amongst other things, approval by the Board of Directors, and may be modified as market conditions dictate.

Operating Highlights and Backlog

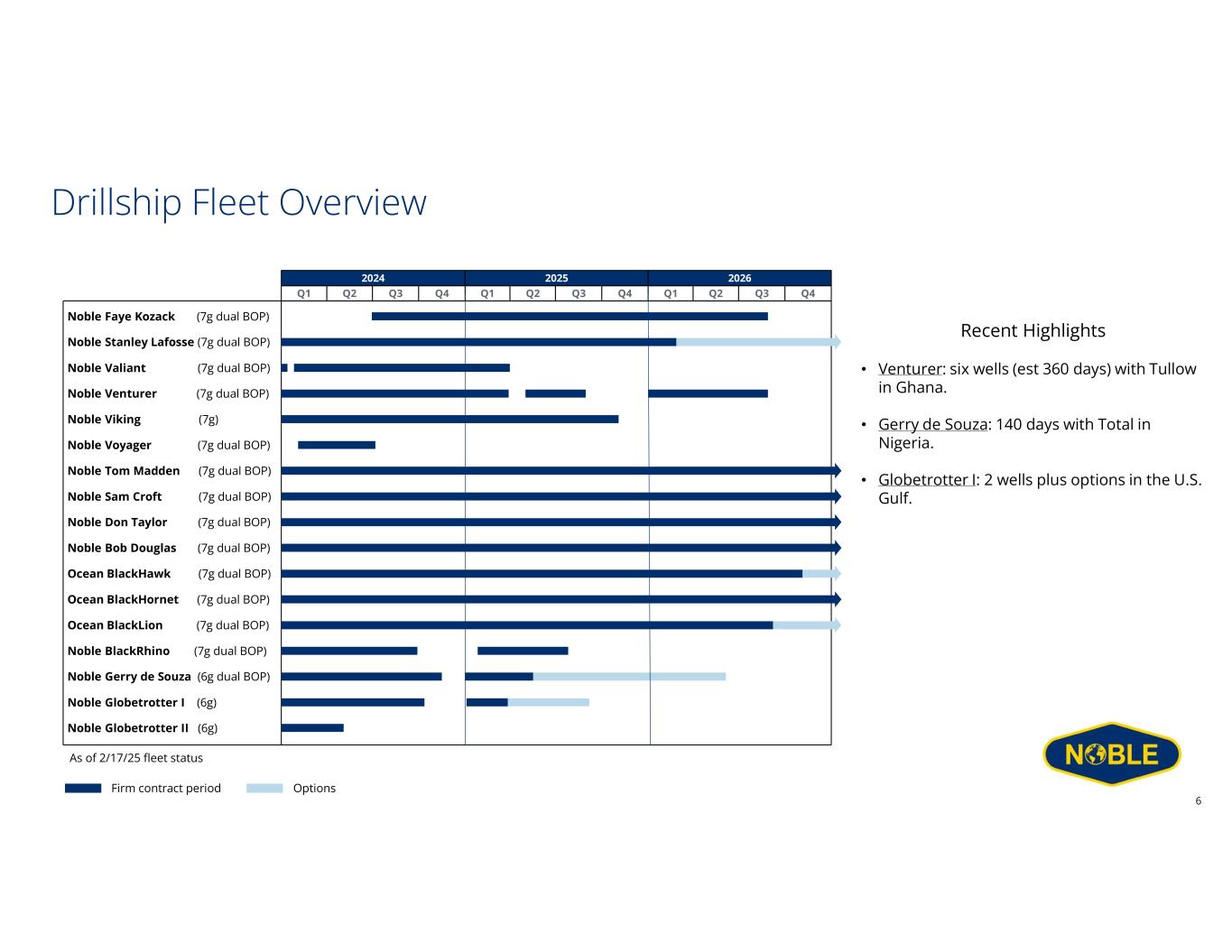

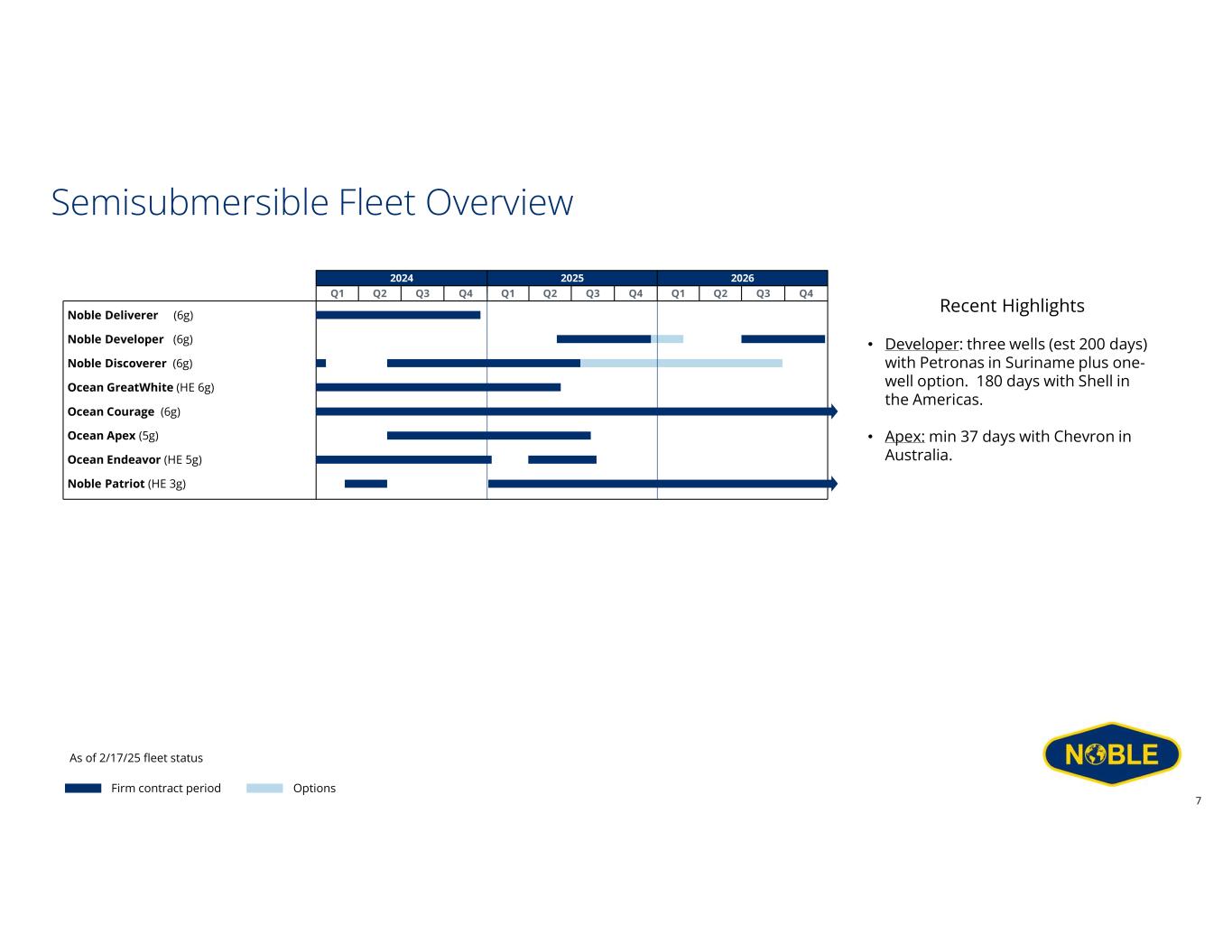

Noble's marketed fleet of twenty-five floaters was 74% contracted through the fourth quarter, compared with 81% in the prior quarter, primarily due to transitory idle time on the Noble BlackRhino, Noble Gerry de Souza and Noble Globetrotter I, each of which has resumed operations in January. Recent backlog additions since last quarter have added close to four rig years of total floater backlog and meaningfully reduced 2025 open exposure across the floater fleet. Recent dayrate fixtures for Tier-1 drillships have been in the mid-to-high $400,000s, with 6th generation floater fixtures between the low $300,000s to low $400,000s per day.

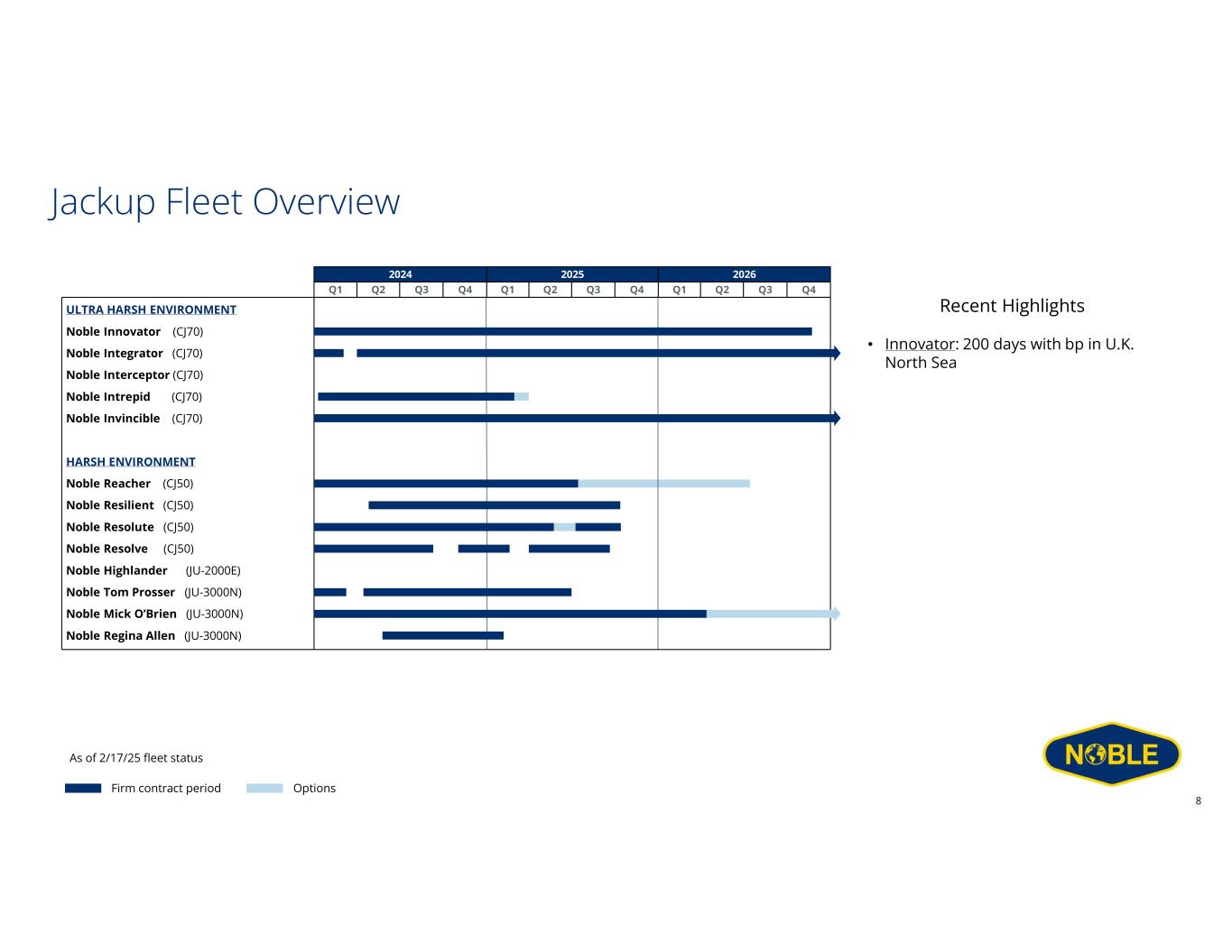

Utilization of Noble's thirteen marketed jackups was 82% in the fourth quarter, versus 83% utilization during the third quarter. Jackup utilization is expected to decrease slightly in the first quarter due to contract gaps. Leading edge dayrates for harsh environment jackups have remained relatively stable, while utilization visibility for 2025 is slightly lower compared to 2024.

Subsequent to last quarter’s earnings press release, new contracts with total contract value of approximately $525 million (including additional services and mobilization payments, but excluding extension options) include the following:

•Noble Venturer was awarded a contract with Tullow for six wells in Ghana, with a total contract value of $171 million expected to commence in May 2025 with an estimated duration of 360 days (120 days in 2025, then resuming for remaining 240 days in 2026).

•Noble Developer was awarded a three well contract (plus one option well) with Petronas in Suriname that is scheduled to commenced in June 2025 with a total contract value of $84 million (including additional services, mobilization and demobilization) associated with the estimated firm duration of 200 days excluding option. Additionally, Noble Developer was subsequently awarded a 180 day contract with Shell in the Americas with an approximate total contract value of $70 million (including mobilization and demobilization), scheduled to commence in the third quarter of 2026.

•Noble Globetrotter I was awarded a one well contract plus six option wells in the U.S. Gulf which commenced in January. The maximum total scope assuming all options are exercised is approximately $70 million over slightly greater than 200 days.

•Noble Gerry de Souza received a 140-day extension with TotalEnergies in Nigeria which commenced in January. Additional options comprising slightly over one year remain.

•Noble Patriot had options for sixteen wells exercised by TAQA, representing approximately one additional year of backlog in the UK North Sea into early 2029.

•Noble Innovator had an option exercised by bp for two wells in the UK North Sea with estimated duration of 200 days (from May 2026 to November 2026) at a dayrate of $155,000.

•Ocean Apex was extended for an additional scope of a minimum of 37 days in Australia into the third quarter of 2025.

Noble's backlog as of February 17, 2025, stands at $5.8 billion.

Outlook

For the full year 2025, today Noble announces a guidance range for Total Revenue of $3,250 to $3,450 million, Adjusted EBITDA in the range of $1,050 to $1,150 million, and Capital Expenditures (net of reimbursements) between $375 to $425 million.

Commenting on Noble’s outlook, Mr. Eifler stated, “We are encouraged by the depth and breadth of our active discussions with customers and line of sight to potentially contracting all of our tier-1 drillships this year for programs commencing throughout 2025-2026.

2024 are expected to support meaningfully higher free cash flow this year, which we intend to direct toward dividends and share repurchases.”

Noble’s high quality backlog and lower capex requirements for 2025 compared to Due to the forward-looking nature of Adjusted EBITDA and Capital Expenditures (net of reimbursements), management cannot reliably predict certain of the necessary components of the most directly comparable forward-looking GAAP measure, net income and capital expenditures, respectively. Accordingly, the Company is unable to present a quantitative reconciliation of such forward-looking non-GAAP financial measure to the most directly comparable forward-looking GAAP financial measure without unreasonable effort. The unavailable information could have a significant effect on Noble’s full year 2025 GAAP financial results.

Conference Call

Noble will host a conference call related to its fourth quarter 2024 results on Tuesday, February 18, 2025 at 9:00 a.m. U.S. Central Time. Interested parties may dial +1 800-715-9871 and refer to conference ID 31391 approximately 15 minutes prior to the scheduled start time. Additionally, a live webcast link will be available on the Investor Relations section of the Company’s website. A webcast replay will be accessible for a limited time following the scheduled call.

For additional information, visit www.noblecorp.com or e-mail investors@noblecorp.com.

Contact Noble Corporation plc

Ian Macpherson

Vice President - Investor Relations

+1 713-239-6019

imacpherson@noblecorp.com

About Noble Corporation plc

Noble is a leading offshore drilling contractor for the oil and gas industry. The Company owns and operates one of the most modern, versatile, and technically advanced fleets in the offshore drilling industry. Noble and its predecessors have been engaged in the contract drilling of oil and gas wells since 1921. Noble performs, through its subsidiaries, contract drilling services with a fleet of offshore drilling units focused largely on ultra-deepwater and high specification jackup drilling opportunities in both established and emerging regions worldwide. Additional information on Noble is available at www.noblecorp.com.

Forward-looking Statements

This communication includes “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, as amended. All statements other than statements of historical facts included in this communication are forward looking statements, including those regarding future guidance, including revenue, adjusted EBITDA, the offshore drilling market and demand fundamentals, realization and timing of integration synergies, costs, the benefits or results of acquisitions or dispositions such as the acquisition of Diamond Offshore Drilling, Inc. (the “Diamond Transaction”), free cash flow expectations, capital expenditures, capital allocation expectations, including planned dividends and share repurchases, contract backlog, rig demand, expected future contracts, anticipated contract start dates, major project schedules, dayrates and duration, any asset sales or the retirement of rigs, access to capital and fleet condition and utilization, timing and amount of insurance recoveries and 2025 financial guidance. Forward-looking statements involve risks, uncertainties and assumptions, and actual results may differ materially from any future results expressed or implied by such forward-looking statements. When used in this communication, or in the documents incorporated by reference, the words “guidance,” “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “on track,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would,” “achieve,” “shall,” “target,” “will” and similar expressions are intended to be among the statements that identify forward looking statements. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we cannot assure you that such expectations will prove to be correct. These forward-looking statements speak only as of the date of this communication and we undertake no obligation to revise or update any forward-looking statement for any reason, except as required by law. Risks and uncertainties include, but are not limited to, those detailed in Noble’s most recent Annual Report on Form 10-K, Quarterly Reports Form 10-Q and other filings with the U.S. Securities and Exchange Commission, including, but not limited to, risks related to the recently completed Diamond Transaction, including the risk that the benefits of the transaction may not be fully realized or may take longer to realize than expected, market conditions, customer actions and regulatory changes. We cannot control such risk factors and other uncertainties, and in many cases, we cannot predict the risks and uncertainties that could cause our actual results to differ materially from those indicated by the forward-looking statements. You should consider these risks and uncertainties when you are evaluating us. With respect to our capital allocation policy, distributions to shareholders in the form of either dividends or share buybacks are subject to the Board of Directors’ assessment of factors such as business development, growth strategy, current leverage and financing needs.

There can be no assurance that a dividend or buyback program will be declared or continued.

NOBLE CORPORATION plc AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Operating revenues |

|

|

|

|

|

|

|

|

| Contract drilling services |

|

$ |

882,089 |

|

|

$ |

609,241 |

|

|

$ |

2,918,767 |

|

|

$ |

2,461,715 |

|

| Reimbursables and other |

|

45,252 |

|

|

33,738 |

|

|

139,051 |

|

|

127,303 |

|

|

|

927,341 |

|

|

642,979 |

|

|

3,057,818 |

|

|

2,589,018 |

|

| Operating costs and expenses |

|

|

|

|

|

|

|

|

| Contract drilling services |

|

527,251 |

|

|

373,760 |

|

|

1,687,164 |

|

|

1,452,281 |

|

| Reimbursables |

|

36,283 |

|

|

24,158 |

|

|

105,479 |

|

|

91,642 |

|

| Depreciation and amortization |

|

141,279 |

|

|

82,933 |

|

|

428,626 |

|

|

301,345 |

|

| General and administrative |

|

31,273 |

|

|

32,985 |

|

|

140,499 |

|

|

128,413 |

|

| Merger and integration costs |

|

20,261 |

|

|

13,286 |

|

|

109,424 |

|

|

60,335 |

|

(Gain) loss on sale of operating assets, net |

|

— |

|

|

— |

|

|

(17,357) |

|

|

— |

|

| Hurricane losses and (recoveries), net |

|

— |

|

|

(41,823) |

|

|

— |

|

|

(19,703) |

|

|

|

756,347 |

|

|

485,299 |

|

|

2,453,835 |

|

|

2,014,313 |

|

| Operating income (loss) |

|

170,994 |

|

|

157,680 |

|

|

603,983 |

|

|

574,705 |

|

| Other income (expense) |

|

|

|

|

|

|

|

|

| Interest expense, net of amount capitalized |

|

(39,720) |

|

|

(14,600) |

|

|

(94,211) |

|

|

(59,139) |

|

| Gain (loss) on extinguishment of debt, net |

|

— |

|

|

— |

|

|

— |

|

|

(26,397) |

|

| Interest income and other, net |

|

(6,812) |

|

|

1,777 |

|

|

(17,438) |

|

|

18,069 |

|

| Gain on bargain purchase |

|

— |

|

|

— |

|

|

— |

|

|

5,005 |

|

| Income (loss) before income taxes |

|

124,462 |

|

|

144,857 |

|

|

492,334 |

|

|

512,243 |

|

| Income tax benefit (provision) |

|

(27,814) |

|

|

4,843 |

|

|

(43,981) |

|

|

(30,341) |

|

| Net income (loss) |

|

$ |

96,648 |

|

|

$ |

149,700 |

|

|

$ |

448,353 |

|

|

$ |

481,902 |

|

| Per share data |

|

|

|

|

|

|

|

|

| Basic: |

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

0.60 |

|

|

$ |

1.06 |

|

|

$ |

3.01 |

|

|

$ |

3.48 |

|

| Diluted: |

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

0.59 |

|

|

$ |

1.03 |

|

|

$ |

2.96 |

|

|

$ |

3.32 |

|

NOBLE CORPORATION plc AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2024 |

|

December 31, 2023 |

| ASSETS |

|

|

|

|

| Current assets |

|

|

|

|

| Cash and cash equivalents |

|

$ |

247,303 |

|

|

$ |

360,794 |

|

| Accounts receivable, net |

|

796,961 |

|

|

548,844 |

|

| Prepaid expenses and other current assets |

|

214,600 |

|

|

152,110 |

|

| Total current assets |

|

1,258,864 |

|

|

1,061,748 |

|

| Intangible assets |

|

214 |

|

|

10,128 |

|

| Property and equipment, at cost |

|

6,904,731 |

|

|

4,591,936 |

|

| Accumulated depreciation |

|

(868,914) |

|

|

(467,600) |

|

| Property and equipment, net |

|

6,035,817 |

|

|

4,124,336 |

|

|

|

|

|

|

| Other assets |

|

568,605 |

|

|

311,225 |

|

| Total assets |

|

$ |

7,863,500 |

|

|

$ |

5,507,437 |

|

| LIABILITIES AND EQUITY |

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

397,622 |

|

|

$ |

395,165 |

|

| Accrued payroll and related costs |

|

116,877 |

|

|

97,313 |

|

| Other current liabilities |

|

295,863 |

|

|

149,202 |

|

| Total current liabilities |

|

810,362 |

|

|

641,680 |

|

| Long-term debt |

|

1,980,186 |

|

|

586,203 |

|

| Other liabilities |

|

412,986 |

|

|

307,451 |

|

| Noncurrent contract liabilities |

|

8,580 |

|

|

50,863 |

|

| Total liabilities |

|

3,212,114 |

|

|

1,586,197 |

|

| Commitments and contingencies |

|

|

|

|

| Total shareholders’ equity |

|

4,651,386 |

|

|

3,921,240 |

|

| Total liabilities and equity |

|

$ |

7,863,500 |

|

|

$ |

5,507,437 |

|

NOBLE CORPORATION plc AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve Months Ended December 31, |

|

2024 |

|

2023 |

| Cash flows from operating activities |

|

|

|

| Net income (loss) |

$ |

448,353 |

|

|

$ |

481,902 |

|

| Adjustments to reconcile net income (loss) to net cash flow from operating activities: |

|

|

|

| Depreciation and amortization |

428,626 |

|

|

301,345 |

|

| Amortization of intangible assets and contract liabilities, net |

(60,032) |

|

|

(106,776) |

|

| Gain on bargain purchase |

— |

|

|

(5,005) |

|

| (Gain) loss on extinguishment of debt, net |

— |

|

|

26,397 |

|

| (Gain) loss on sale of operating assets, net |

(17,357) |

|

|

— |

|

| Changes in components of working capital and other operating activities |

(144,115) |

|

|

(123,526) |

|

| Net cash provided by (used in) operating activities |

655,475 |

|

|

574,337 |

|

| Cash flows from investing activities |

|

|

|

| Capital expenditures |

(575,315) |

|

|

(409,581) |

|

| Proceeds from insurance claims |

23,297 |

|

|

18,809 |

|

| Cash paid in stock-based business combinations, net |

(417,041) |

|

|

— |

|

| Proceeds from disposal of assets, net |

10,040 |

|

|

24,264 |

|

|

|

|

|

| Net cash provided by (used in) investing activities |

(959,019) |

|

|

(366,508) |

|

| Cash flows from financing activities |

|

|

|

| Issuance of debt |

824,000 |

|

|

600,000 |

|

| Repayments of debt |

— |

|

|

(673,411) |

|

| Borrowing on credit facilities |

35,000 |

|

|

— |

|

| Repayments of credit facilities |

(35,000) |

|

|

— |

|

| Debt issuance costs |

(10,002) |

|

|

(24,914) |

|

| Debt extinguishment costs |

— |

|

|

(25,697) |

|

| Warrant exercised |

1,443 |

|

|

485 |

|

| Share repurchases |

(299,989) |

|

|

(94,826) |

|

| Dividend payments |

(277,831) |

|

|

(98,804) |

|

| Taxes withheld on employee stock transaction |

(66,057) |

|

|

(8,624) |

|

| Finance lease payments |

(6,064) |

|

|

— |

|

| Other |

22,578 |

|

|

— |

|

| Net cash provided by (used in) financing activities |

188,078 |

|

|

(325,791) |

|

| Net increase (decrease) in cash, cash equivalents and restricted cash |

(115,466) |

|

|

(117,962) |

|

| Cash, cash equivalents and restricted cash, beginning of period |

367,745 |

|

|

485,707 |

|

| Cash, cash equivalents and restricted cash, end of period |

$ |

252,279 |

|

|

$ |

367,745 |

|

NOBLE CORPORATION plc AND SUBSIDIARIES

OPERATIONAL INFORMATION

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Rig Utilization |

|

Three Months Ended |

|

December 31, 2024 |

|

September 30, 2024 |

|

December 31, 2023 |

| Floaters |

68 |

% |

|

72 |

% |

|

63 |

% |

| Jackups |

82 |

% |

|

83 |

% |

|

61 |

% |

| Total |

73 |

% |

|

76 |

% |

|

62 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Days |

|

Three Months Ended |

|

December 31, 2024 |

|

September 30, 2024 |

|

December 31, 2023 |

| Floaters |

1,713 |

|

|

1,418 |

|

|

1,101 |

|

| Jackups |

978 |

|

|

991 |

|

|

785 |

|

| Total |

2,691 |

|

|

2,409 |

|

|

1,886 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Dayrates |

|

Three Months Ended |

|

December 31, 2024 |

|

September 30, 2024 |

|

December 31, 2023 |

| Floaters |

$ |

419,909 |

|

|

$ |

424,199 |

|

|

$ |

437,827 |

|

| Jackups |

152,419 |

|

|

155,585 |

|

|

147,954 |

|

| Total |

$ |

322,746 |

|

|

$ |

315,295 |

|

|

$ |

317,150 |

|

NOBLE CORPORATION plc AND SUBSIDIARIES

CALCULATION OF BASIC AND DILUTED NET INCOME/(LOSS) PER SHARE

(In thousands, except per share amounts)

(Unaudited)

The following tables presents the computation of basic and diluted income (loss) per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

Twelve Months Ended

December 31, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Numerator: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

96,648 |

|

|

$ |

149,700 |

|

|

$ |

448,353 |

|

|

$ |

481,902 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Denominator: |

|

|

|

|

|

|

|

|

| Weighted average shares outstanding - basic |

|

160,257 |

|

|

141,054 |

|

|

148,733 |

|

|

138,380 |

|

| Dilutive effect of share-based awards |

|

1,512 |

|

|

3,158 |

|

|

1,512 |

|

|

3,158 |

|

| Dilutive effect of warrants |

|

1,048 |

|

|

1,763 |

|

|

1,394 |

|

|

3,659 |

|

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding - diluted |

|

162,817 |

|

|

145,975 |

|

|

151,639 |

|

|

145,197 |

|

| Per share data |

|

|

|

|

|

|

|

|

| Basic: |

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

0.60 |

|

|

$ |

1.06 |

|

|

$ |

3.01 |

|

|

$ |

3.48 |

|

| Diluted: |

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

0.59 |

|

|

$ |

1.03 |

|

|

$ |

2.96 |

|

|

$ |

3.32 |

|

NOBLE CORPORATION plc AND SUBSIDIARIES

NON-GAAP MEASURES AND RECONCILIATION

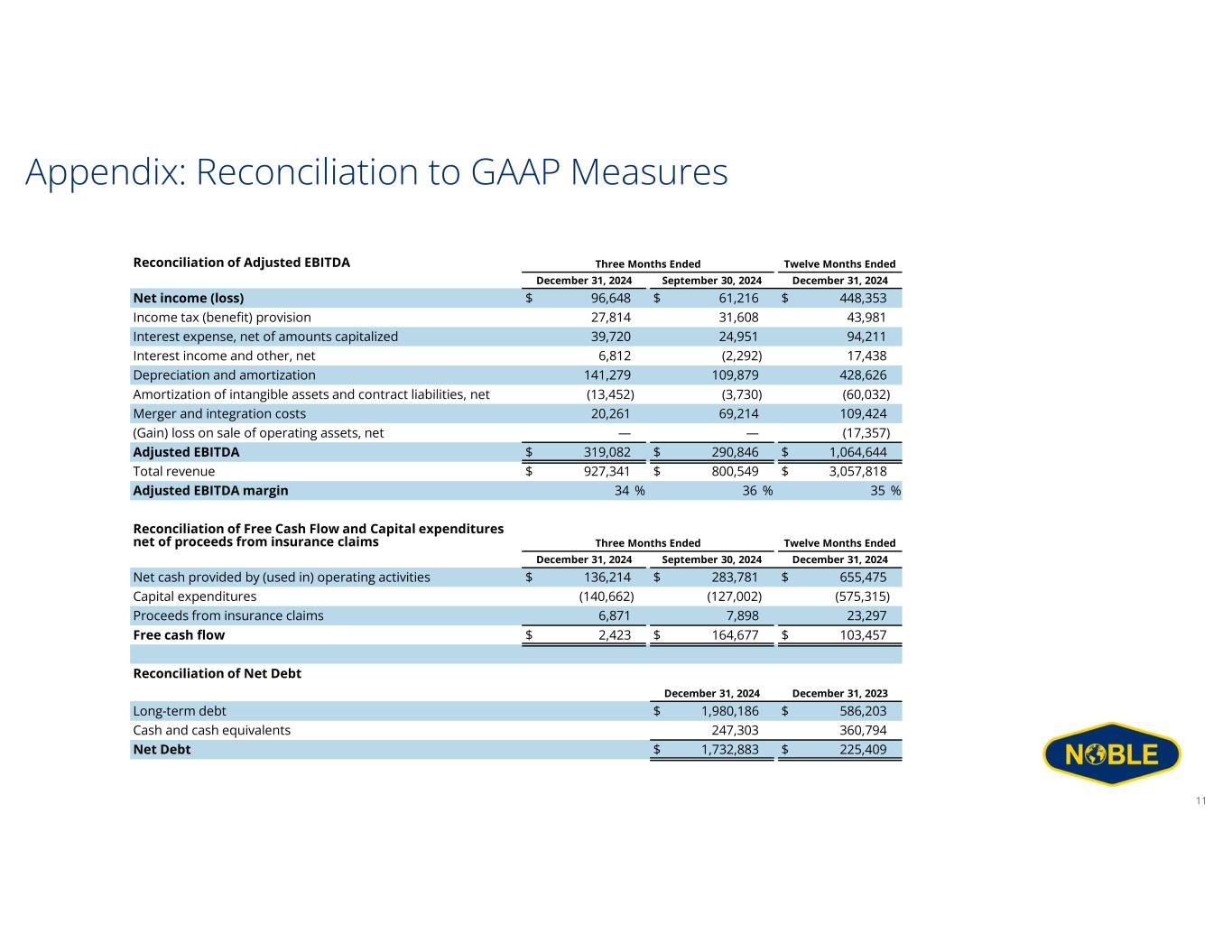

Certain non-GAAP measures and corresponding reconciliations to GAAP financial measures for the Company have been provided for meaningful comparisons between current results and prior operating periods. Generally, a non-GAAP financial measure is a numerical measure of a company’s performance, financial position, or cash flows that excludes or includes amounts that are not normally included or excluded in the most directly comparable measure calculated and presented in accordance with generally accepted accounting principles.

The Company defines “Adjusted EBITDA” as net income (loss) adjusted for interest expense, net of amounts capitalized; interest income and other, net; income tax benefit (provision); and depreciation and amortization expense, as well as, if applicable, gain (loss) on extinguishment of debt, net; losses on economic impairments; amortization of intangible assets and contract liabilities, net; restructuring and similar charges; costs related to mergers and integrations; and certain other infrequent operational events. We believe that the Adjusted EBITDA measure provides greater transparency of our core operating performance. We prepare Adjusted Net Income (Loss) by eliminating from Net Income (Loss) the impact of a number of non-recurring items we do not consider indicative of our on-going performance. We prepare Adjusted Diluted Earnings (Loss) per Share by eliminating from Diluted Earnings per Share the impact of a number of non-recurring items we do not consider indicative of our on-going performance. Similar to Adjusted EBITDA, we believe these measures help identify underlying trends that could otherwise be masked by the effect of the non-recurring items we exclude in the measure.

The Company also discloses free cash flow as a non-GAAP liquidity measure. Free cash flow is calculated as Net cash provided by (used in) operating activities less capital expenditures, net of proceeds from insurance claims. We believe Free Cash Flow is useful to investors because it measures our ability to generate or use cash. Once business needs and obligations are met, this cash can be used to reinvest in the company for future growth or to return to shareholders through dividend payments or share repurchases. We may have certain obligations such as non-discretionary debt service that are not deducted from the measure. Such business needs, obligations, and other non-discretionary expenditures that are not deducted from Free Cash Flow would reduce cash available for other uses including return of capital.

We believe that these non-GAAP financial measures provide useful information about our financial performance, enhance the overall understanding of our past performance and future prospects, and allow for greater transparency with respect to key metrics used by our management team for financial and operational decision-making. We are presenting these non-GAAP financial measures to assist investors in seeing our financial performance through the eyes of management, and because we believe that these measures provide an additional tool for investors to use in comparing our core financial performance over multiple periods with other companies in our industry.

These non-GAAP adjusted measures should be considered in addition to, and not as a substitute for, or superior to, contract drilling revenue, contract drilling costs, contract drilling margin, average daily revenue, operating income, cash flows from operations, or other measures of financial performance prepared in accordance with GAAP. Please see the following non-GAAP Financial Measures and Reconciliations for a complete description of the adjustments.

NOBLE CORPORATION plc AND SUBSIDIARIES

NON-GAAP MEASURES AND RECONCILIATION

(In thousands, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of Adjusted EBITDA |

|

|

|

|

|

|

|

|

Three Months Ended |

|

Twelve Months Ended |

|

|

December 31,

2024 |

|

September 30,

2024 |

|

December 31,

2023 |

|

December 31,

2024 |

|

December 31,

2023 |

| Net income (loss) |

|

$ |

96,648 |

|

|

$ |

61,216 |

|

|

$ |

149,700 |

|

|

$ |

448,353 |

|

|

$ |

481,902 |

|

| Income tax (benefit) provision |

|

27,814 |

|

|

31,608 |

|

|

(4,843) |

|

|

43,981 |

|

|

30,341 |

|

| Interest expense, net of amounts capitalized |

|

39,720 |

|

|

24,951 |

|

|

14,600 |

|

|

94,211 |

|

|

59,139 |

|

| Interest income and other, net |

|

6,812 |

|

|

(2,292) |

|

|

(1,777) |

|

|

17,438 |

|

|

(18,069) |

|

| Depreciation and amortization |

|

141,279 |

|

|

109,879 |

|

|

82,933 |

|

|

428,626 |

|

|

301,345 |

|

Amortization of intangible assets and contract liabilities, net |

|

(13,452) |

|

|

(3,730) |

|

|

(11,236) |

|

|

(60,032) |

|

|

(106,776) |

|

| Gain on bargain purchase |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(5,005) |

|

| (Gain) loss on extinguishment of debt, net |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

26,397 |

|

|

|

|

|

|

|

|

|

|

|

|

| Merger and integration costs |

|

20,261 |

|

|

69,214 |

|

|

13,286 |

|

|

109,424 |

|

|

60,335 |

|

(Gain) loss on sale of operating assets, net |

|

— |

|

|

— |

|

|

— |

|

|

(17,357) |

|

|

— |

|

| Hurricane losses and (recoveries), net |

|

— |

|

|

— |

|

|

(41,823) |

|

|

— |

|

|

(19,703) |

|

| Adjusted EBITDA |

|

$ |

319,082 |

|

|

$ |

290,846 |

|

|

$ |

200,840 |

|

|

$ |

1,064,644 |

|

$ |

— |

|

$ |

809,906 |

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of Income Tax Benefit (Provision) |

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Twelve Months Ended |

|

|

December 31,

2024 |

|

September 30,

2024 |

|

December 31,

2023 |

|

December 31,

2024 |

|

December 31,

2023 |

| Income tax benefit (provision) |

|

$ |

(27,814) |

|

|

$ |

(31,608) |

|

|

$ |

4,843 |

|

|

$ |

(43,981) |

|

|

$ |

(30,341) |

|

| Adjustments |

|

|

|

|

|

|

|

|

|

|

Amortization of intangible assets and contract liabilities, net |

|

859 |

|

|

90 |

|

|

6,508 |

|

|

1,108 |

|

|

19,835 |

|

| Joint taxation scheme compensation |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(1,981) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Discrete tax items |

|

(17,415) |

|

|

(37,688) |

|

|

(60,116) |

|

|

(136,698) |

|

|

(170,436) |

|

| Total adjustments |

|

(16,556) |

|

|

(37,598) |

|

|

(53,608) |

|

|

(135,590) |

|

|

(152,582) |

|

| Adjusted income tax benefit (provision) |

|

$ |

(44,370) |

|

|

$ |

(69,206) |

|

|

$ |

(48,765) |

|

|

$ |

(179,571) |

|

|

$ |

(182,923) |

|

NOBLE CORPORATION plc AND SUBSIDIARIES

NON-GAAP MEASURES AND RECONCILIATION

(In thousands, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of Adjusted Net Income (Loss) |

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Twelve Months Ended |

|

|

December 31,

2024 |

|

September 30,

2024 |

|

December 31,

2023 |

|

December 31,

2024 |

|

December 31,

2023 |

| Net income (loss) |

|

$ |

96,648 |

|

|

$ |

61,216 |

|

|

$ |

149,700 |

|

|

$ |

448,353 |

|

|

$ |

481,902 |

|

| Adjustments |

|

|

|

|

|

|

|

|

|

|

| Amortization of intangible assets and contract liabilities, net |

|

(12,593) |

|

|

(3,640) |

|

|

(4,728) |

|

|

(58,924) |

|

|

(86,941) |

|

Joint taxation scheme compensation |

|

4,018 |

|

|

— |

|

|

— |

|

|

4,018 |

|

|

(19,837) |

|

| Gain on bargain purchase |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(5,005) |

|

|

|

|

|

|

|

|

|

|

|

|

| Merger and integration costs |

|

20,261 |

|

|

69,214 |

|

|

13,286 |

|

|

109,424 |

|

|

60,335 |

|

(Gain) loss on sale of operating assets, net |

|

— |

|

|

— |

|

|

— |

|

|

(17,357) |

|

|

— |

|

| Hurricane losses and (recoveries), net |

|

— |

|

|

— |

|

|

(41,823) |

|

|

— |

|

|

(19,703) |

|

| (Gain) loss on extinguishment of debt, net |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

26,397 |

|

| Discrete tax items |

|

(17,415) |

|

|

(37,688) |

|

|

(60,116) |

|

|

(136,698) |

|

|

(170,436) |

|

| Total adjustments |

|

(5,729) |

|

|

27,886 |

|

|

(93,381) |

|

|

(99,537) |

|

|

(215,190) |

|

| Adjusted net income (loss) |

|

$ |

90,919 |

|

|

$ |

89,102 |

|

|

$ |

56,319 |

|

|

$ |

348,816 |

|

|

$ |

266,712 |

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of Diluted EPS |

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Twelve Months Ended |

|

|

December 31,

2024 |

|

September 30,

2024 |

|

December 31,

2023 |

|

December 31,

2024 |

|

December 31,

2023 |

| Unadjusted diluted EPS |

|

$ |

0.59 |

|

|

$ |

0.40 |

|

|

$ |

1.03 |

|

|

$ |

2.96 |

|

|

$ |

3.32 |

|

| Adjustments |

|

|

|

|

|

|

|

|

|

|

| Amortization of intangible assets and contract liabilities, net |

|

(0.08) |

|

|

(0.02) |

|

|

(0.03) |

|

|

(0.39) |

|

|

(0.60) |

|

Joint taxation scheme compensation |

|

0.02 |

|

|

— |

|

|

— |

|

|

0.03 |

|

|

(0.14) |

|

| Gain on bargain purchase |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(0.03) |

|

|

|

|

|

|

|

|

|

|

|

|

| Merger and integration costs |

|

0.12 |

|

|

0.45 |

|

|

0.09 |

|

|

0.72 |

|

|

0.42 |

|

(Gain) loss on sale of operating assets, net |

|

— |

|

|

— |

|

|

— |

|

|

(0.11) |

|

|

— |

|

| Hurricane losses and (recoveries), net |

|

— |

|

|

— |

|

|

(0.29) |

|

|

— |

|

|

(0.14) |

|

| (Gain) loss on extinguishment of debt, net |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

0.18 |

|

| Discrete tax items |

|

(0.09) |

|

|

(0.25) |

|

|

(0.41) |

|

|

(0.91) |

|

|

(1.17) |

|

| Total adjustments |

|

(0.03) |

|

|

0.18 |

|

|

(0.64) |

|

|

(0.66) |

|

|

(1.48) |

|

| Adjusted diluted EPS |

|

$ |

0.56 |

|

|

$ |

0.58 |

|

|

$ |

0.39 |

|

|

$ |

2.30 |

|

|

$ |

1.84 |

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of Free Cash Flow |

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Twelve Months Ended |

|

|

December 31,

2024 |

|

September 30,

2024 |

|

December 31,

2023 |

|

December 31,

2024 |

|

December 31,

2023 |

| Net cash provided by (used in) operating activities |

|

$ |

136,214 |

|

|

$ |

283,781 |

|

|

$ |

287,489 |

|

|

$ |

655,475 |

|

|

$ |

574,337 |

|

| Capital expenditures |

|

(140,662) |

|

|

(127,002) |

|

|

(141,450) |

|

|

(575,315) |

|

|

(409,581) |

|

| Proceeds from insurance claims |

|

6,871 |

|

|

7,898 |

|

|

18,809 |

|

|

23,297 |

|

|

18,809 |

|

| Free cash flow |

|

$ |

2,423 |

|

|

$ |

164,677 |

|

|

$ |

164,848 |

|

|

$ |

103,457 |

|

|

$ |

183,565 |

|