HBT Financial, Inc. July 22, 2024 Q2 2024 Results Presentation

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 1 Forward-Looking Statements Readers should note that in addition to the historical information contained herein, this presentation contains, and future oral and written statements of HBT Financial, Inc. (the "Company" or "HBT Financial" or "HBT") and its management may contain, "forward-looking statements" within the meanings of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally can be identified by the use of forward-looking terminology such as "will," "propose," "may," "plan," "seek," "expect," "intend," "estimate," "anticipate," "believe," "continue,“ or “should,” or similar terminology. Any forward-looking statements presented herein are made only as of the date of this presentation, and the Company does not undertake any obligation to update or revise any forward-looking statements to reflect changes in assumptions, the occurrence of unanticipated events, or otherwise. Factors that could cause actual results to differ materially from these forward-looking statements include, but are not limited to: (i) the strength of the local, state, national and international economies (including effects of inflationary pressures and supply chain constraints); (ii) the economic impact of any future terrorist threats and attacks, widespread disease or pandemics, acts of war or other threats thereof (including the Israeli-Palestinian conflict and the Russian invasion of Ukraine), or other adverse external events that could cause economic deterioration or instability in credit markets, and the response of the local, state and national governments to any such adverse external events; (iii) changes in accounting policies and practices, as may be adopted by state and federal regulatory agencies, the Financial Accounting Standards Board or the Public Company Accounting Oversight Board; (iv) changes in state and federal laws, regulations and governmental policies concerning the Company’s general business and any changes in response to the failures of other banks or as a result of the upcoming 2024 presidential election; (v) changes in interest rates and prepayment rates of the Company’s assets (including the effects of sustained, elevated interest rates); (vi) increased competition in the financial services sector, including from non-bank competitors such as credit unions and “fintech” companies, and the inability to attract new customers; (vii) changes in technology and the ability to develop and maintain secure and reliable electronic systems; (viii) unexpected results of acquisitions, which may include failure to realize the anticipated benefits of acquisitions and the possibility that transaction costs may be greater than anticipated; (ix) the loss of key executives or employees; (x) changes in consumer spending; (xi) unexpected outcomes of existing or new litigation involving the Company; (xii) the economic impact of exceptional weather occurrences such as tornadoes, floods and blizzards; (xiii) fluctuations in the value of securities held in our securities portfolio; (xiv) concentrations within our loan portfolio (including commercial real estate loans), large loans to certain borrowers, and large deposits from certain clients; (xv) the concentration of large deposits from certain clients who have balances above current FDIC insurance limits and may withdraw deposits to diversify their exposure; (xvi) the level of non-performing assets on our balance sheets; (xvii) interruptions involving our information technology and communications systems or third-party servicers; (xviii) breaches or failures of our information security controls or cybersecurity-related incidents, and (xix) the ability of the Company to manage the risks associated with the foregoing as well as anticipated. Readers should note that the forward-looking statements included in this presentation are not a guarantee of future events, and that actual events may differ materially from those made in or suggested by the forward-looking statements. Additional information concerning the Company and its business, including additional factors that could materially affect the Company’s financial results, is included in the Company’s filings with the Securities and Exchange Commission. Non-GAAP Financial Measures This presentation includes certain non-GAAP financial measures. While the Company believes these are useful measures for investors, they are not presented in accordance with GAAP. You should not consider non-GAAP measures in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. Because not all companies use identical calculations, the presentation herein of non-GAAP financial measures may not be comparable to other similarly titled measures of other companies. Tax-equivalent adjustments assume a federal tax rate of 21% and state tax rate of 9.5%. For a reconciliation of the non-GAAP measures we use to the most closely comparable GAAP measures, see the Appendix to this presentation.

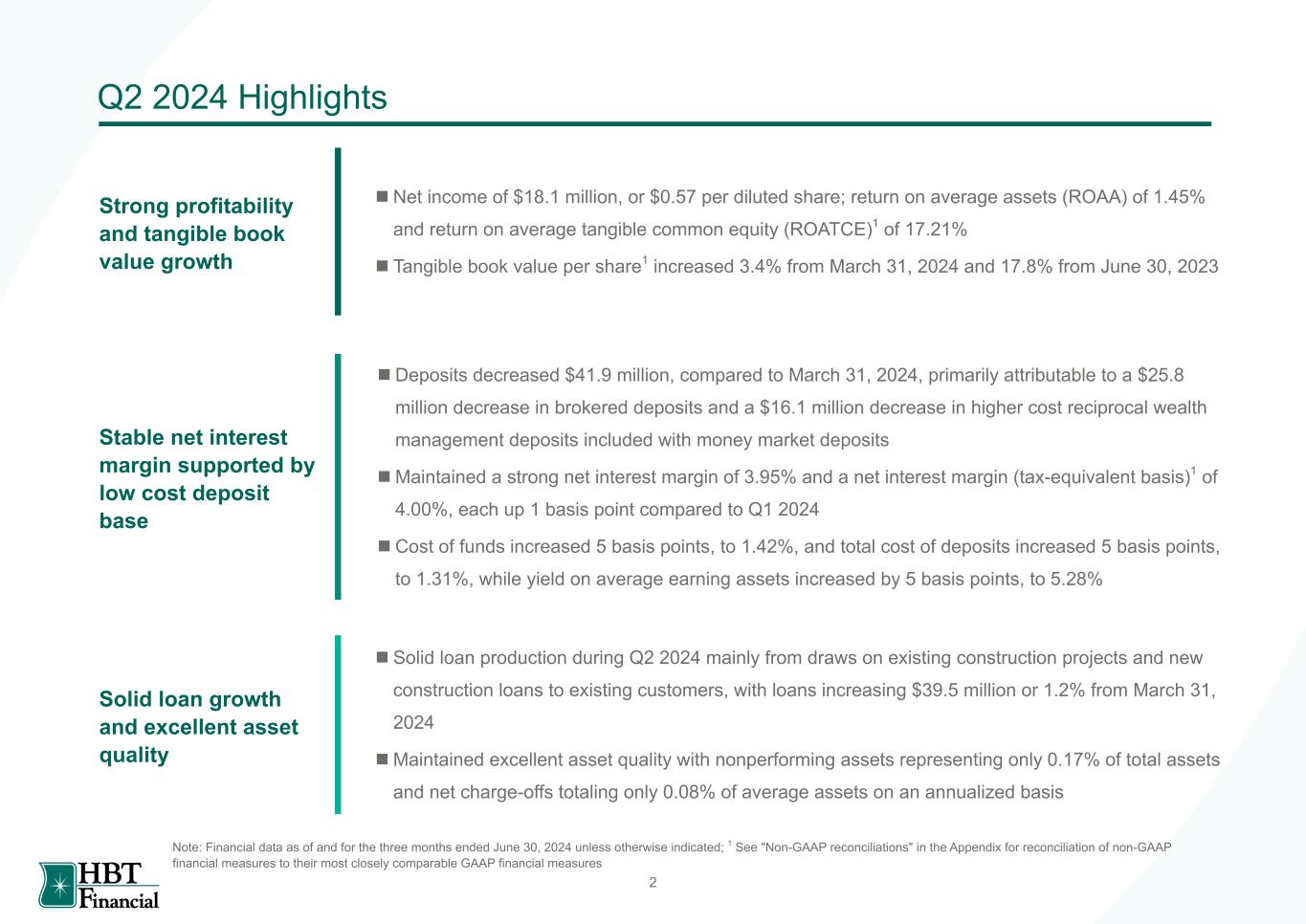

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 2 Q2 2024 Highlights Solid loan growth and excellent asset quality n Solid loan production during Q2 2024 mainly from draws on existing construction projects and new construction loans to existing customers, with loans increasing $39.5 million or 1.2% from March 31, 2024 n Maintained excellent asset quality with nonperforming assets representing only 0.17% of total assets and net charge-offs totaling only 0.08% of average assets on an annualized basis Strong profitability and tangible book value growth n Net income of $18.1 million, or $0.57 per diluted share; return on average assets (ROAA) of 1.45% and return on average tangible common equity (ROATCE)1 of 17.21% n Tangible book value per share1 increased 3.4% from March 31, 2024 and 17.8% from June 30, 2023 Stable net interest margin supported by low cost deposit base n Deposits decreased $41.9 million, compared to March 31, 2024, primarily attributable to a $25.8 million decrease in brokered deposits and a $16.1 million decrease in higher cost reciprocal wealth management deposits included with money market deposits n Maintained a strong net interest margin of 3.95% and a net interest margin (tax-equivalent basis)1 of 4.00%, each up 1 basis point compared to Q1 2024 n Cost of funds increased 5 basis points, to 1.42%, and total cost of deposits increased 5 basis points, to 1.31%, while yield on average earning assets increased by 5 basis points, to 5.28% Note: Financial data as of and for the three months ended June 30, 2024 unless otherwise indicated; 1 See "Non-GAAP reconciliations" in the Appendix for reconciliation of non-GAAP financial measures to their most closely comparable GAAP financial measures

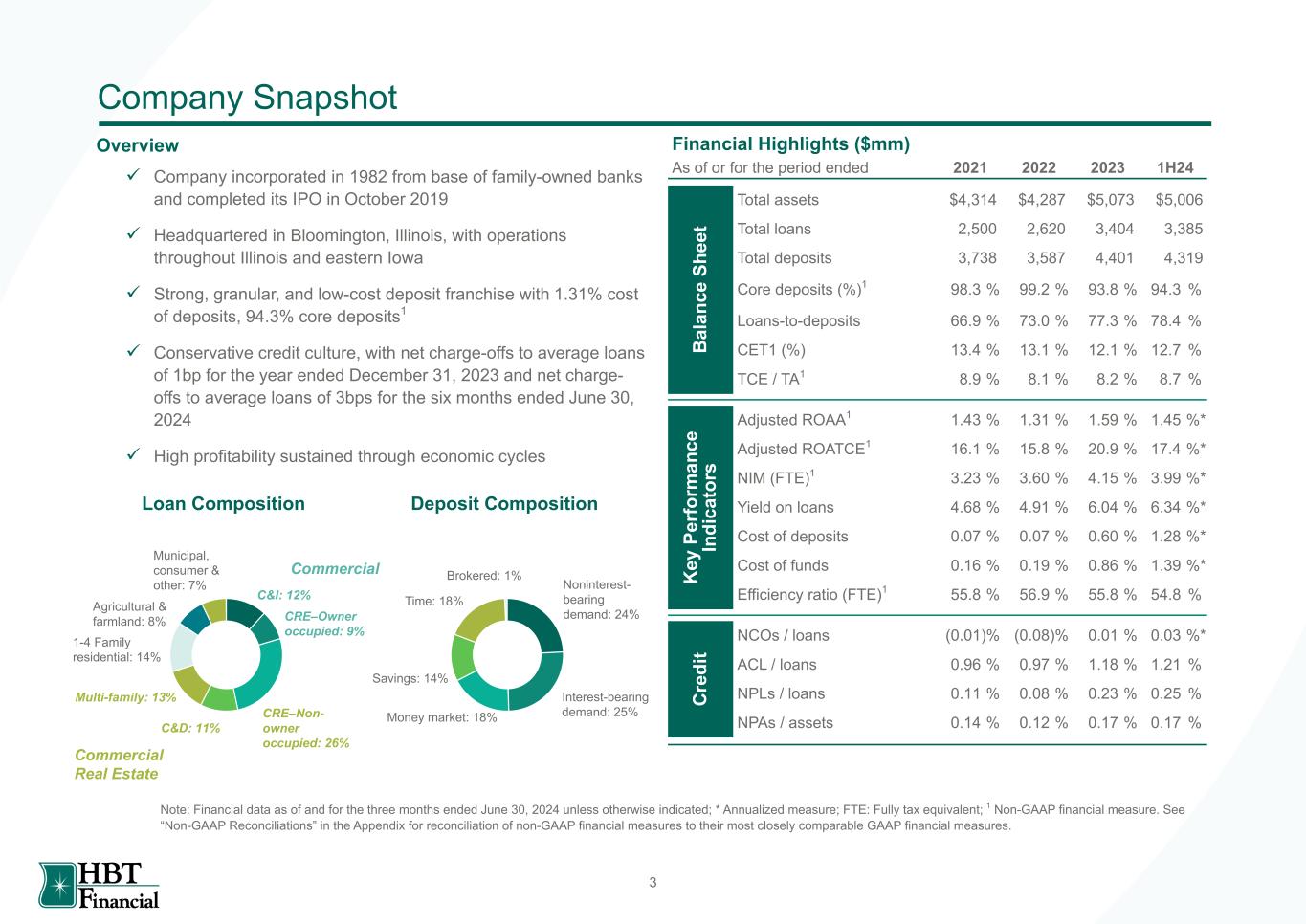

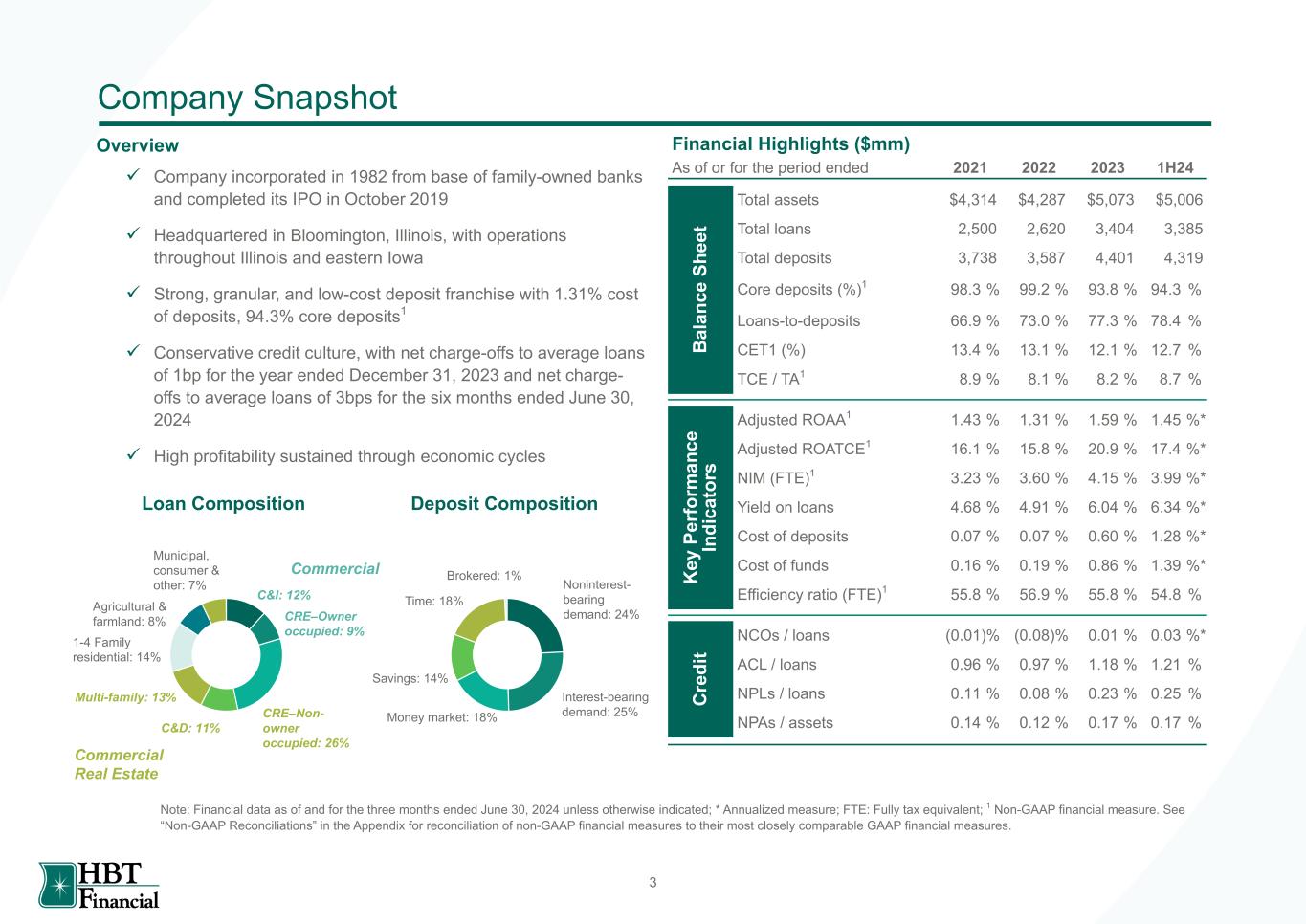

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 3 Financial Highlights ($mm) 2021 2022 2023 1H24As of or for the period ended B al an ce S he et Total assets $4,314 $4,287 $5,073 $5,006 Total loans 2,500 2,620 3,404 3,385 Total deposits 3,738 3,587 4,401 4,319 Core deposits (%)1 98.3 % 99.2 % 93.8 % 94.3 % Loans-to-deposits 66.9 % 73.0 % 77.3 % 78.4 % CET1 (%) 13.4 % 13.1 % 12.1 % 12.7 % TCE / TA1 8.9 % 8.1 % 8.2 % 8.7 % K ey P er fo rm an ce In di ca to rs Adjusted ROAA1 1.43 % 1.31 % 1.59 % 1.45 %* Adjusted ROATCE1 16.1 % 15.8 % 20.9 % 17.4 %* NIM (FTE)1 3.23 % 3.60 % 4.15 % 3.99 %* Yield on loans 4.68 % 4.91 % 6.04 % 6.34 %* Cost of deposits 0.07 % 0.07 % 0.60 % 1.28 %* Cost of funds 0.16 % 0.19 % 0.86 % 1.39 %* Efficiency ratio (FTE)1 55.8 % 56.9 % 55.8 % 54.8 % C re di t NCOs / loans (0.01) % (0.08) % 0.01 % 0.03 %* ACL / loans 0.96 % 0.97 % 1.18 % 1.21 % NPLs / loans 0.11 % 0.08 % 0.23 % 0.25 % NPAs / assets 0.14 % 0.12 % 0.17 % 0.17 % Company Snapshot Overview Loan Composition Note: Financial data as of and for the three months ended June 30, 2024 unless otherwise indicated; * Annualized measure; FTE: Fully tax equivalent; 1 Non-GAAP financial measure. See “Non-GAAP Reconciliations” in the Appendix for reconciliation of non-GAAP financial measures to their most closely comparable GAAP financial measures. Deposit Composition ü Company incorporated in 1982 from base of family-owned banks and completed its IPO in October 2019 ü Headquartered in Bloomington, Illinois, with operations throughout Illinois and eastern Iowa ü Strong, granular, and low-cost deposit franchise with 1.31% cost of deposits, 94.3% core deposits1 ü Conservative credit culture, with net charge-offs to average loans of 1bp for the year ended December 31, 2023 and net charge- offs to average loans of 3bps for the six months ended June 30, 2024 ü High profitability sustained through economic cycles Noninterest- bearing demand: 24% Interest-bearing demand: 25%Money market: 18% Savings: 14% Time: 18% Brokered: 1% C&I: 12% CRE–Owner occupied: 9% CRE–Non- owner occupied: 26% C&D: 11% Multi-family: 13% 1-4 Family residential: 14% Agricultural & farmland: 8% Municipal, consumer & other: 7% Commercial Commercial Real Estate

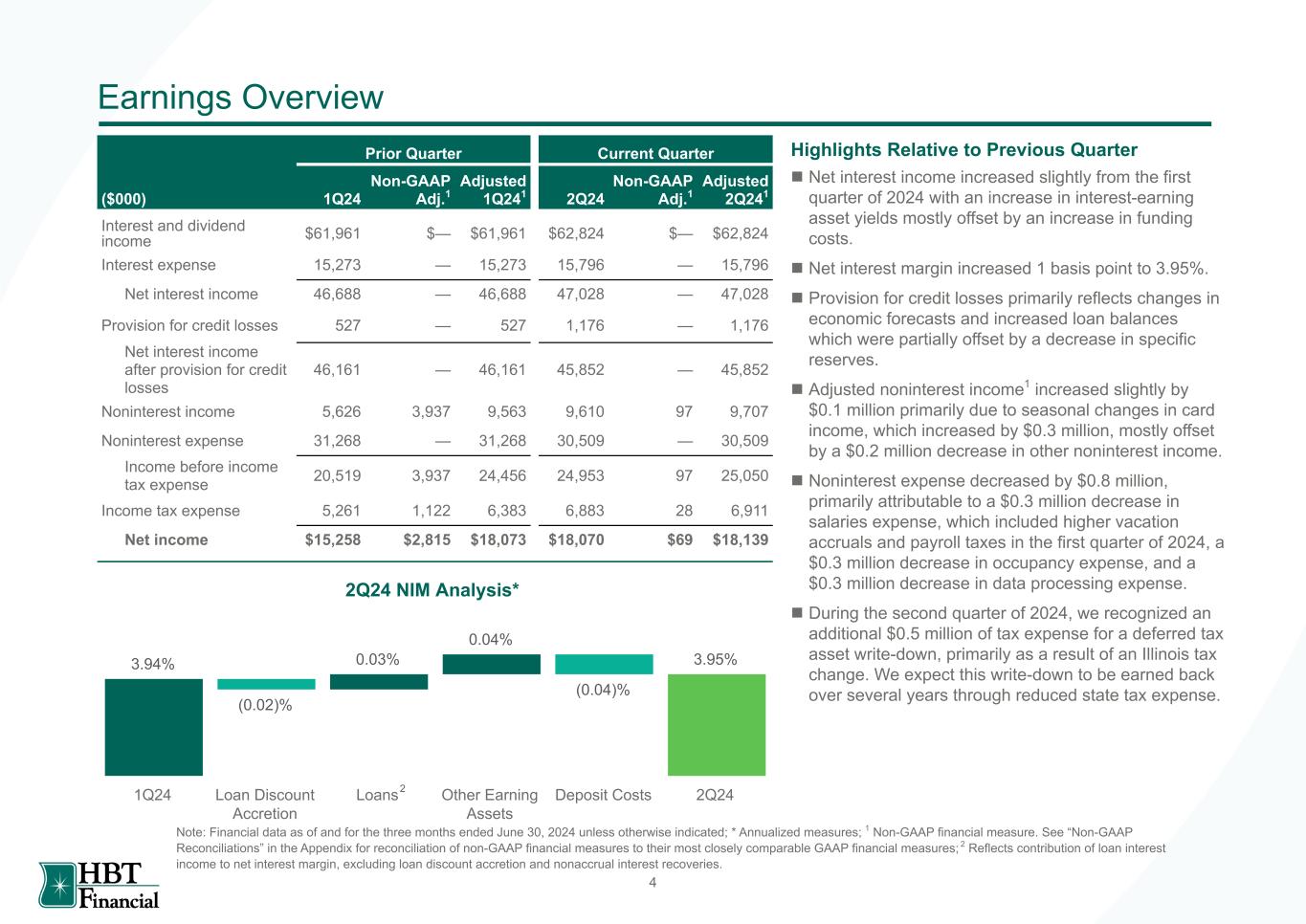

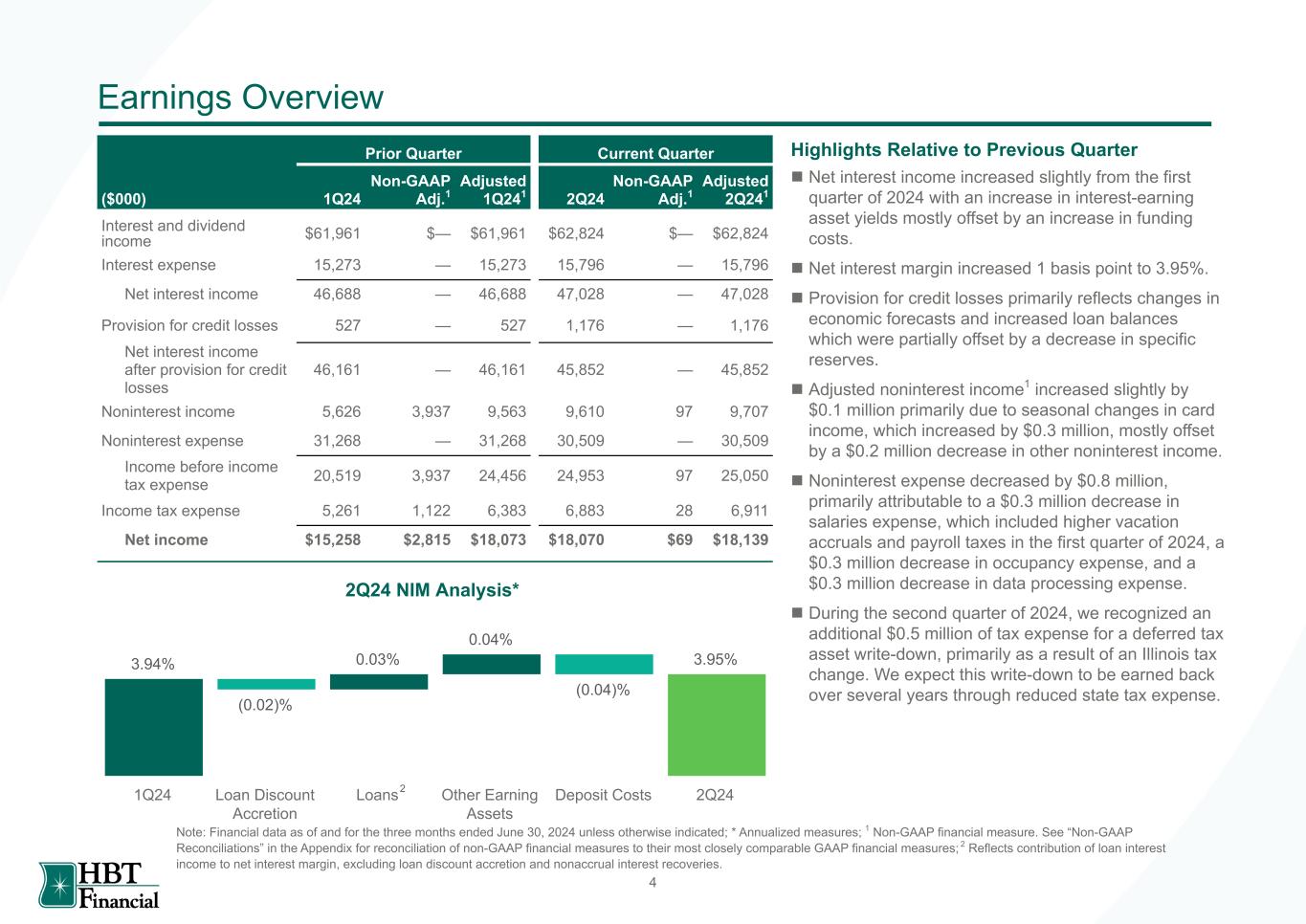

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 4 3.94% (0.02)% 0.03% 0.04% (0.04)% 3.95% 1Q24 Loan Discount Accretion Loans Other Earning Assets Deposit Costs 2Q24 Earnings Overview Prior Quarter Current Quarter ($000) 1Q24 Non-GAAP Adj.1 Adjusted 1Q241 2Q24 Non-GAAP Adj.1 Adjusted 2Q241 Interest and dividend income $61,961 $— $61,961 $62,824 $— $62,824 Interest expense 15,273 — 15,273 15,796 — 15,796 Net interest income 46,688 — 46,688 47,028 — 47,028 Provision for credit losses 527 — 527 1,176 — 1,176 Net interest income after provision for credit losses 46,161 — 46,161 45,852 — 45,852 Noninterest income 5,626 3,937 9,563 9,610 97 9,707 Noninterest expense 31,268 — 31,268 30,509 — 30,509 Income before income tax expense 20,519 3,937 24,456 24,953 97 25,050 Income tax expense 5,261 1,122 6,383 6,883 28 6,911 Net income $15,258 $2,815 $18,073 $18,070 $69 $18,139 Highlights Relative to Previous Quarter Note: Financial data as of and for the three months ended June 30, 2024 unless otherwise indicated; * Annualized measures; 1 Non-GAAP financial measure. See “Non-GAAP Reconciliations” in the Appendix for reconciliation of non-GAAP financial measures to their most closely comparable GAAP financial measures; 2 Reflects contribution of loan interest income to net interest margin, excluding loan discount accretion and nonaccrual interest recoveries. 2 2Q24 NIM Analysis* n Net interest income increased slightly from the first quarter of 2024 with an increase in interest-earning asset yields mostly offset by an increase in funding costs. n Net interest margin increased 1 basis point to 3.95%. n Provision for credit losses primarily reflects changes in economic forecasts and increased loan balances which were partially offset by a decrease in specific reserves. n Adjusted noninterest income1 increased slightly by $0.1 million primarily due to seasonal changes in card income, which increased by $0.3 million, mostly offset by a $0.2 million decrease in other noninterest income. n Noninterest expense decreased by $0.8 million, primarily attributable to a $0.3 million decrease in salaries expense, which included higher vacation accruals and payroll taxes in the first quarter of 2024, a $0.3 million decrease in occupancy expense, and a $0.3 million decrease in data processing expense. n During the second quarter of 2024, we recognized an additional $0.5 million of tax expense for a deferred tax asset write-down, primarily as a result of an Illinois tax change. We expect this write-down to be earned back over several years through reduced state tax expense.

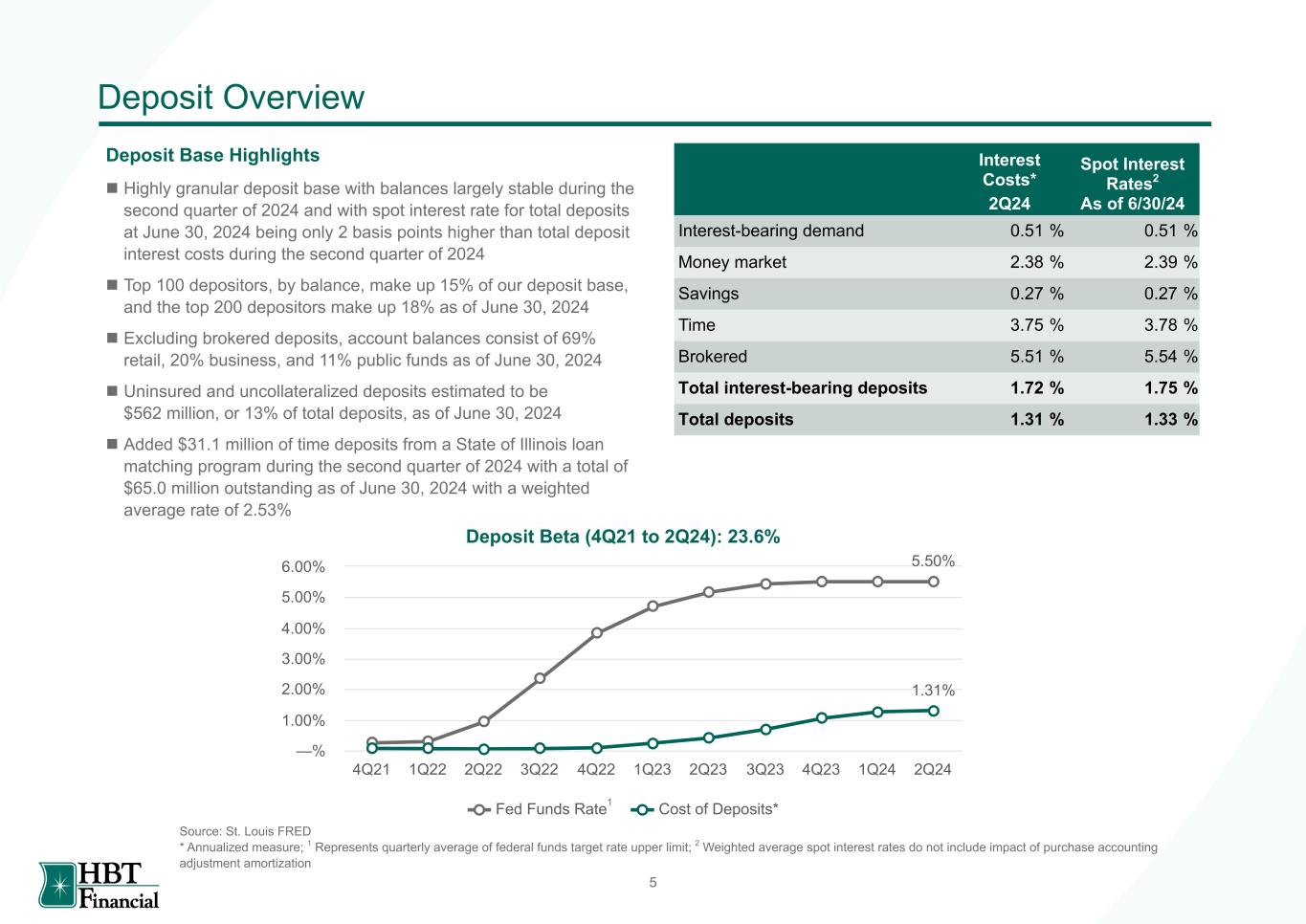

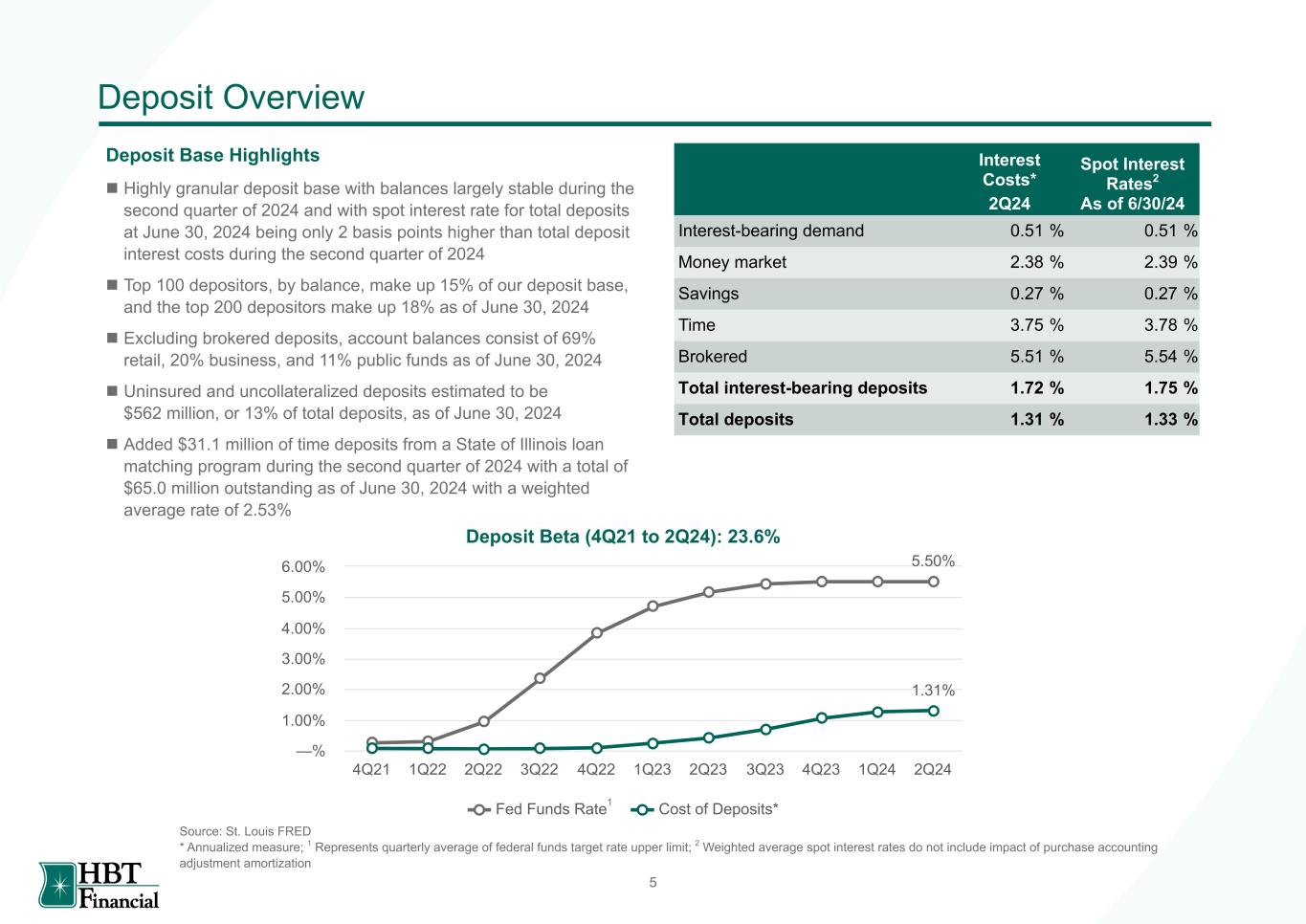

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 5 5.50% 1.31% Fed Funds Rate Cost of Deposits* 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 —% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% Deposit Overview Source: St. Louis FRED * Annualized measure; 1 Represents quarterly average of federal funds target rate upper limit; 2 Weighted average spot interest rates do not include impact of purchase accounting adjustment amortization Deposit Base Highlights n Highly granular deposit base with balances largely stable during the second quarter of 2024 and with spot interest rate for total deposits at June 30, 2024 being only 2 basis points higher than total deposit interest costs during the second quarter of 2024 n Top 100 depositors, by balance, make up 15% of our deposit base, and the top 200 depositors make up 18% as of June 30, 2024 n Excluding brokered deposits, account balances consist of 69% retail, 20% business, and 11% public funds as of June 30, 2024 n Uninsured and uncollateralized deposits estimated to be $562 million, or 13% of total deposits, as of June 30, 2024 n Added $31.1 million of time deposits from a State of Illinois loan matching program during the second quarter of 2024 with a total of $65.0 million outstanding as of June 30, 2024 with a weighted average rate of 2.53% Interest Costs* 2Q24 Spot Interest Rates2 As of 6/30/24 Interest-bearing demand 0.51 % 0.51 % Money market 2.38 % 2.39 % Savings 0.27 % 0.27 % Time 3.75 % 3.78 % Brokered 5.51 % 5.54 % Total interest-bearing deposits 1.72 % 1.75 % Total deposits 1.31 % 1.33 % 1 Deposit Beta (4Q21 to 2Q24): 23.6%

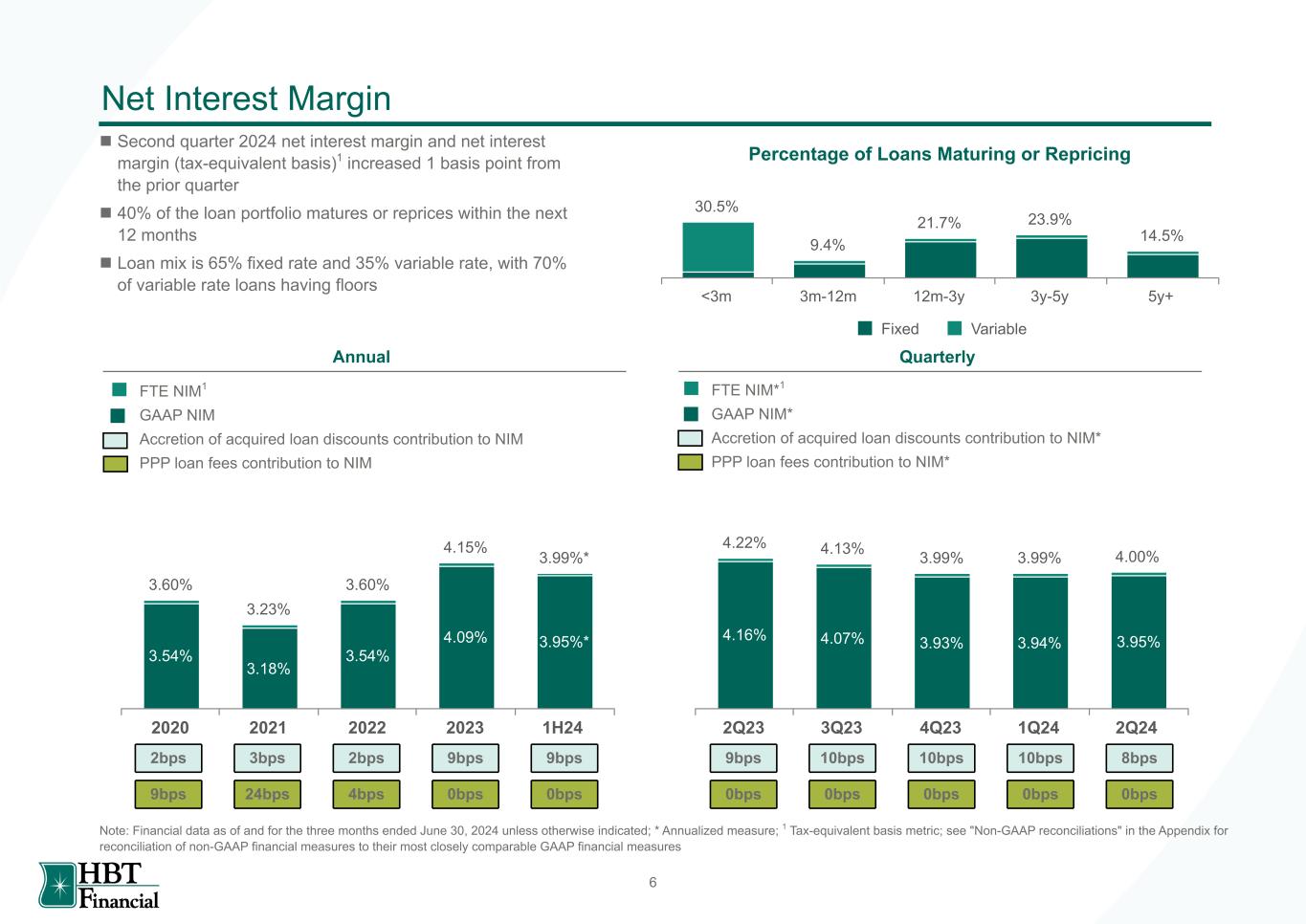

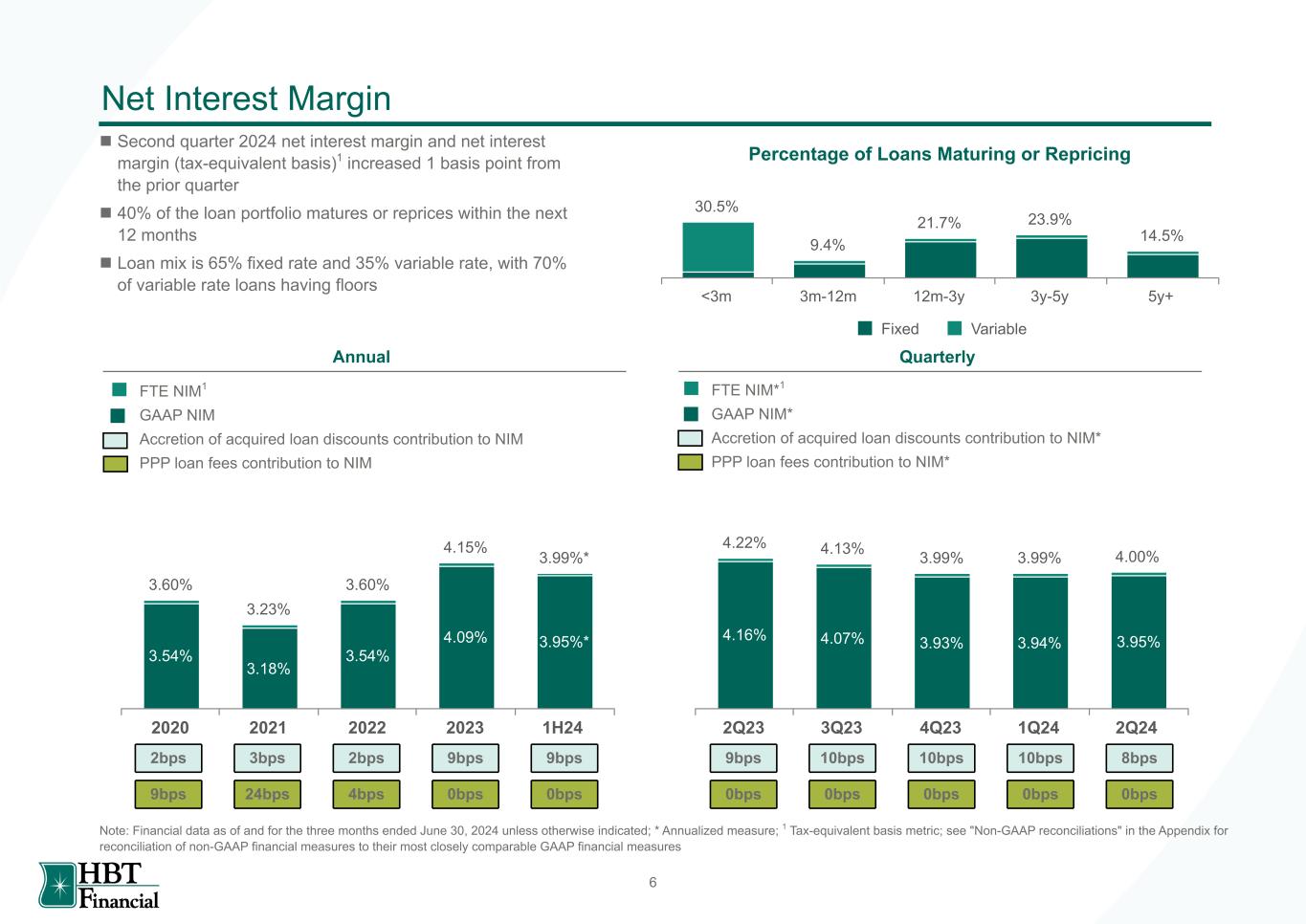

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 6 Net Interest Margin Annual Quarterly Note: Financial data as of and for the three months ended June 30, 2024 unless otherwise indicated; * Annualized measure; 1 Tax-equivalent basis metric; see "Non-GAAP reconciliations" in the Appendix for reconciliation of non-GAAP financial measures to their most closely comparable GAAP financial measures FTE NIM*1 GAAP NIM* Accretion of acquired loan discounts contribution to NIM* PPP loan fees contribution to NIM* FTE NIM1 GAAP NIM Accretion of acquired loan discounts contribution to NIM PPP loan fees contribution to NIM Percentage of Loans Maturing or Repricing 30.5% 9.4% 21.7% 23.9% 14.5% Fixed Variable <3m 3m-12m 12m-3y 3y-5y 5y+ 3.60% 3.23% 3.60% 4.15% 3.99%* 3.54% 3.18% 3.54% 4.09% 3.95%* 2020 2021 2022 2023 1H24 4.22% 4.13% 3.99% 3.99% 4.00% 4.16% 4.07% 3.93% 3.94% 3.95% 2Q23 3Q23 4Q23 1Q24 2Q24 2bps 3bps 2bps 9bps 9bps 9bps 24bps 4bps 0bps 0bps 9bps 10bps 10bps 10bps 8bps 0bps 0bps 0bps 0bps 0bps n Second quarter 2024 net interest margin and net interest margin (tax-equivalent basis)1 increased 1 basis point from the prior quarter n 40% of the loan portfolio matures or reprices within the next 12 months n Loan mix is 65% fixed rate and 35% variable rate, with 70% of variable rate loans having floors

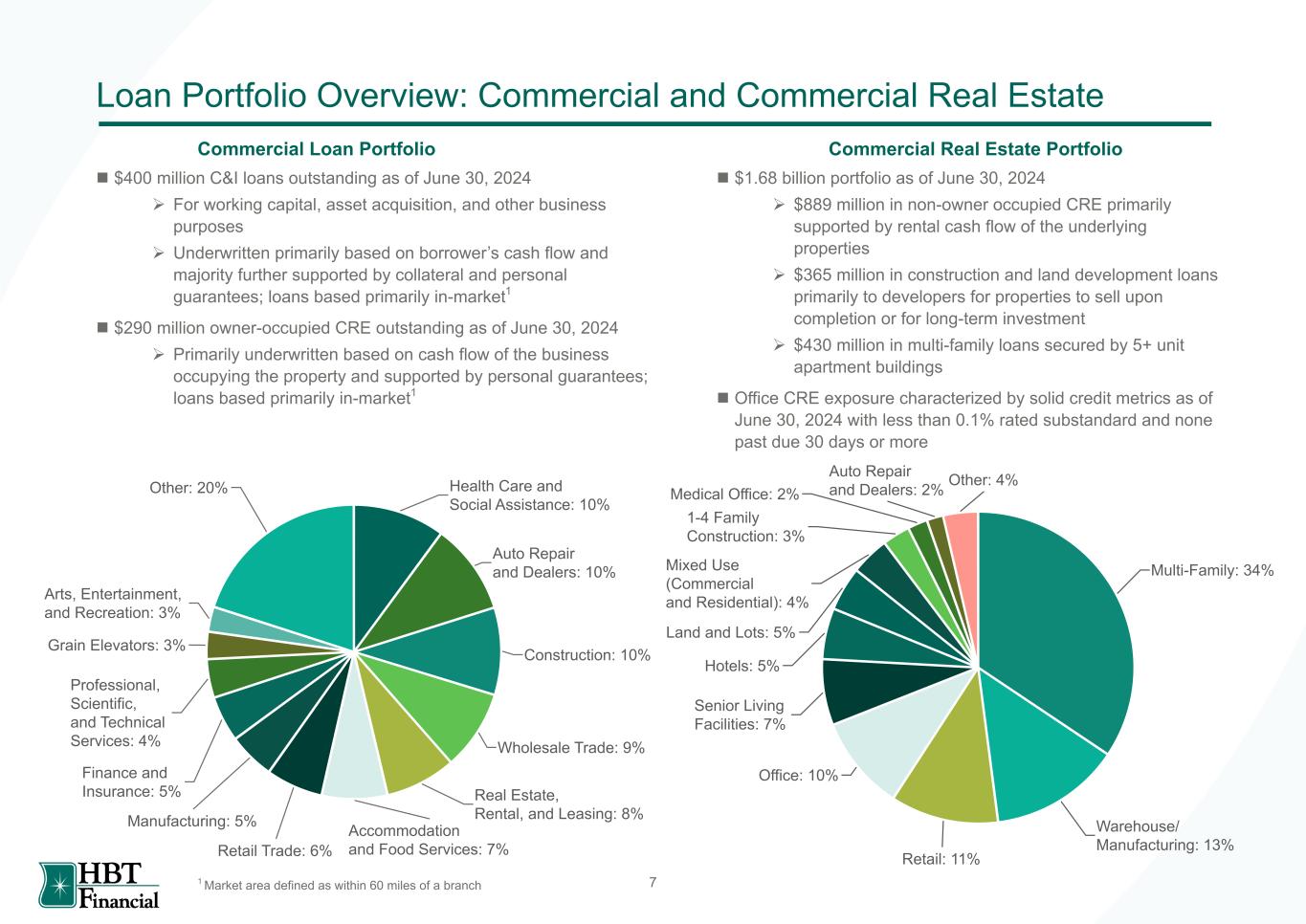

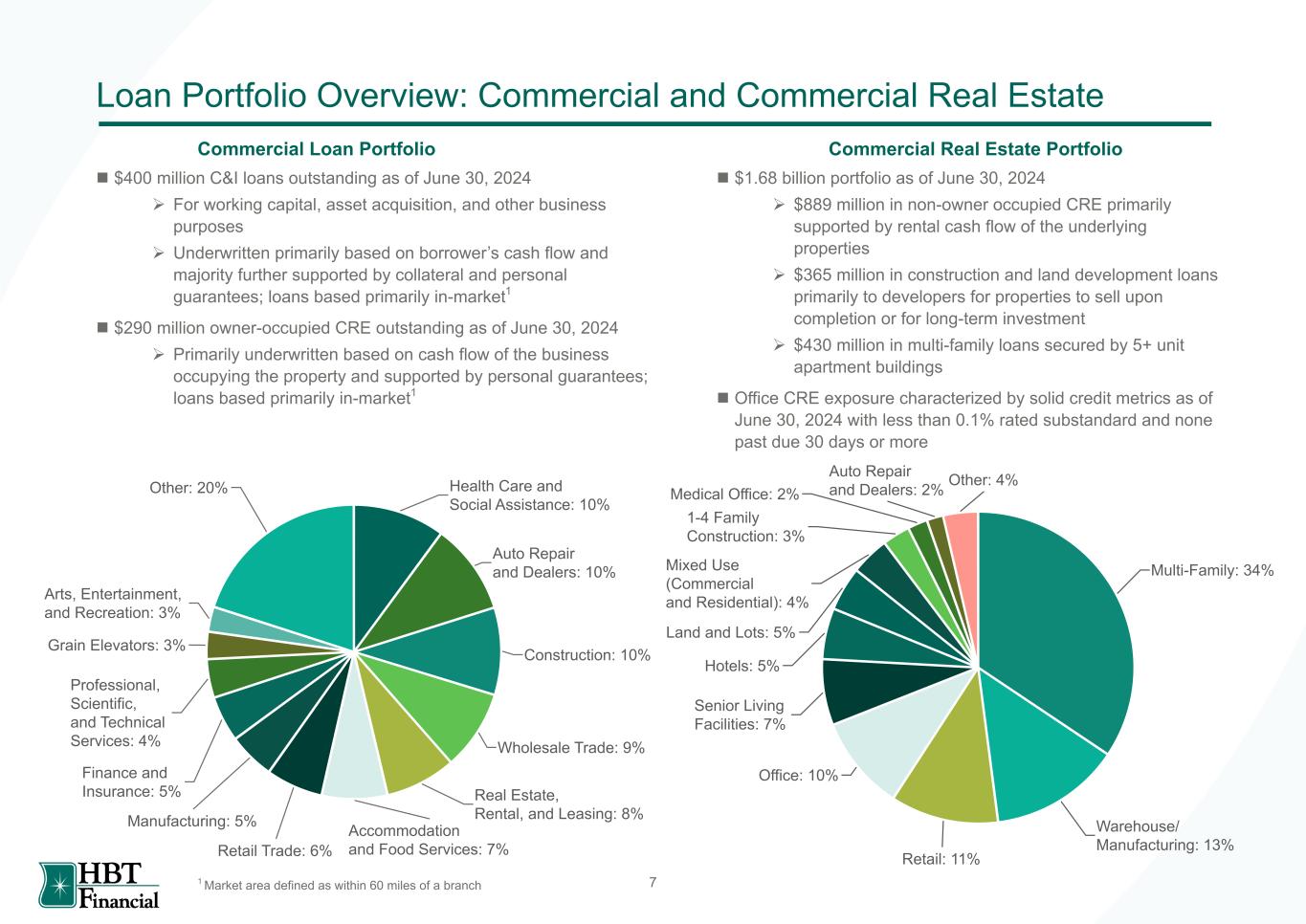

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 71 Market area defined as within 60 miles of a branch Loan Portfolio Overview: Commercial and Commercial Real Estate n $1.68 billion portfolio as of June 30, 2024 Ø $889 million in non-owner occupied CRE primarily supported by rental cash flow of the underlying properties Ø $365 million in construction and land development loans primarily to developers for properties to sell upon completion or for long-term investment Ø $430 million in multi-family loans secured by 5+ unit apartment buildings n Office CRE exposure characterized by solid credit metrics as of June 30, 2024 with less than 0.1% rated substandard and none past due 30 days or more Commercial Real Estate PortfolioCommercial Loan Portfolio n $400 million C&I loans outstanding as of June 30, 2024 Ø For working capital, asset acquisition, and other business purposes Ø Underwritten primarily based on borrower’s cash flow and majority further supported by collateral and personal guarantees; loans based primarily in-market1 n $290 million owner-occupied CRE outstanding as of June 30, 2024 Ø Primarily underwritten based on cash flow of the business occupying the property and supported by personal guarantees; loans based primarily in-market1 Health Care and Social Assistance: 10% Auto Repair and Dealers: 10% Construction: 10% Wholesale Trade: 9% Real Estate, Rental, and Leasing: 8% Accommodation and Food Services: 7%Retail Trade: 6% Manufacturing: 5% Finance and Insurance: 5% Professional, Scientific, and Technical Services: 4% Grain Elevators: 3% Arts, Entertainment, and Recreation: 3% Other: 20% Multi-Family: 34% Warehouse/ Manufacturing: 13% Retail: 11% Office: 10% Senior Living Facilities: 7% Hotels: 5% Land and Lots: 5% Mixed Use (Commercial and Residential): 4% 1-4 Family Construction: 3% Medical Office: 2% Auto Repair and Dealers: 2% Other: 4%

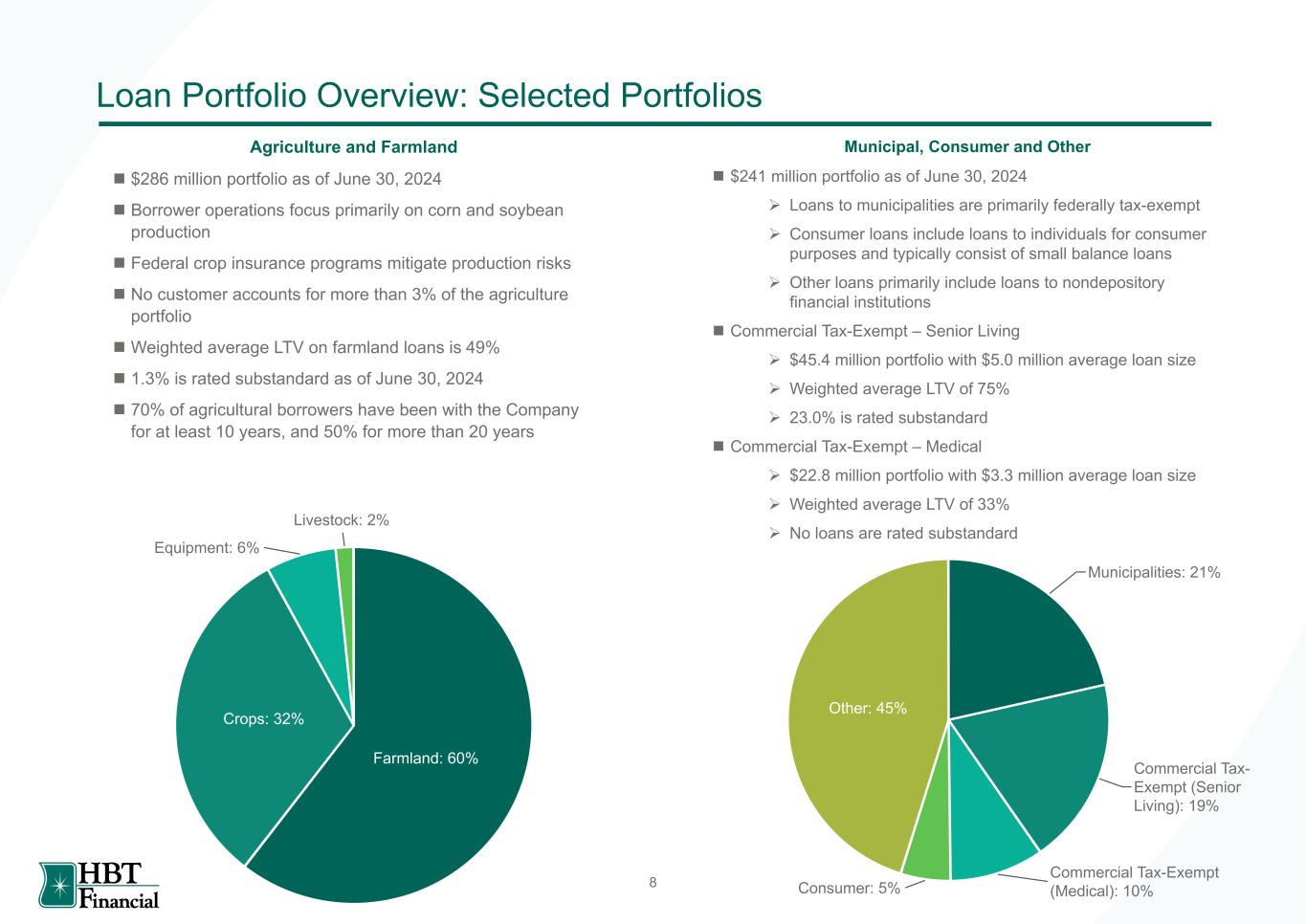

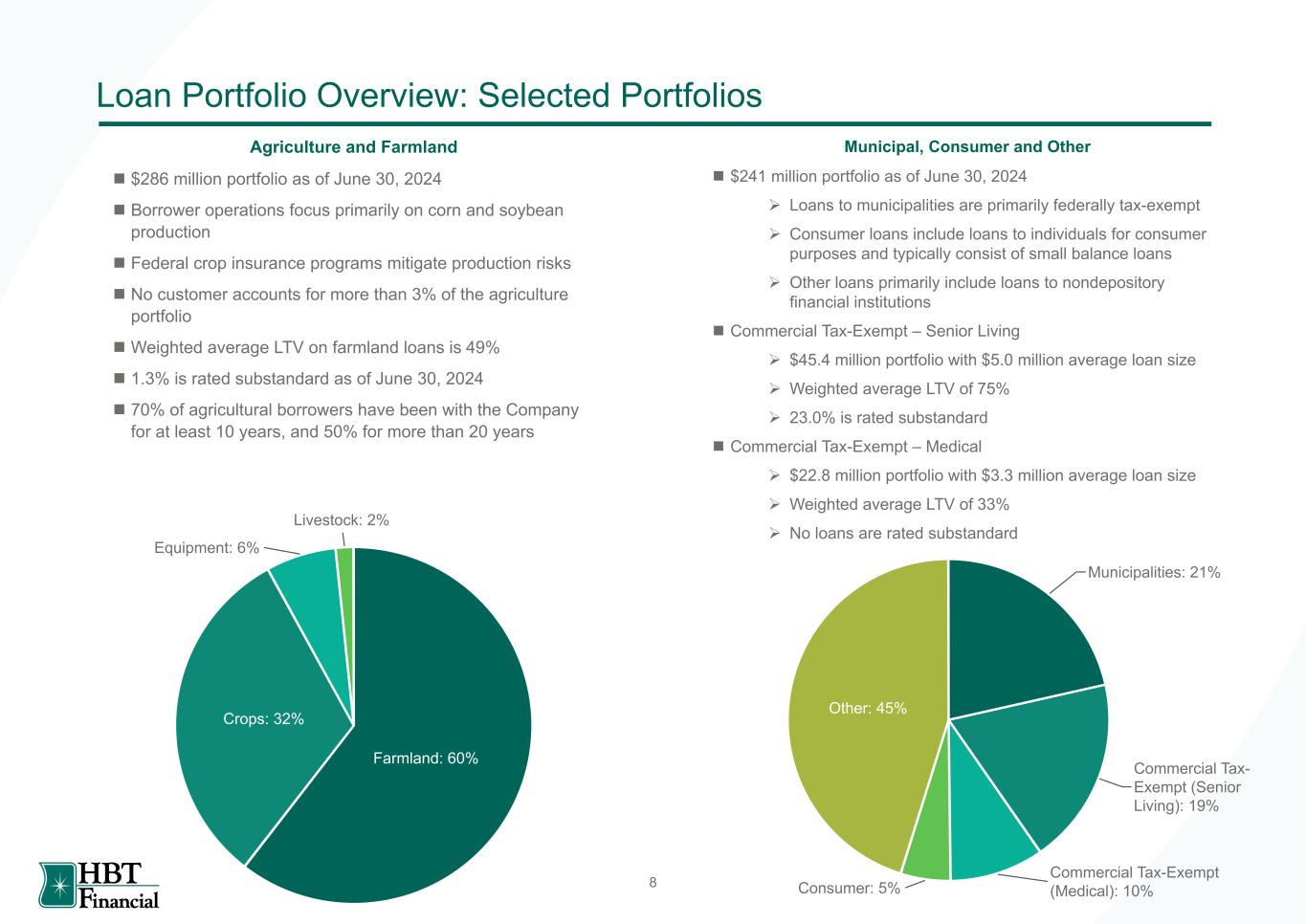

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 8 Loan Portfolio Overview: Selected Portfolios Agriculture and Farmland n $286 million portfolio as of June 30, 2024 n Borrower operations focus primarily on corn and soybean production n Federal crop insurance programs mitigate production risks n No customer accounts for more than 3% of the agriculture portfolio n Weighted average LTV on farmland loans is 49% n 1.3% is rated substandard as of June 30, 2024 n 70% of agricultural borrowers have been with the Company for at least 10 years, and 50% for more than 20 years Municipal, Consumer and Other n $241 million portfolio as of June 30, 2024 Ø Loans to municipalities are primarily federally tax-exempt Ø Consumer loans include loans to individuals for consumer purposes and typically consist of small balance loans Ø Other loans primarily include loans to nondepository financial institutions n Commercial Tax-Exempt – Senior Living Ø $45.4 million portfolio with $5.0 million average loan size Ø Weighted average LTV of 75% Ø 23.0% is rated substandard n Commercial Tax-Exempt – Medical Ø $22.8 million portfolio with $3.3 million average loan size Ø Weighted average LTV of 33% Ø No loans are rated substandard Farmland: 60% Crops: 32% Equipment: 6% Livestock: 2% Municipalities: 21% Commercial Tax- Exempt (Senior Living): 19% Commercial Tax-Exempt (Medical): 10%Consumer: 5% Other: 45%

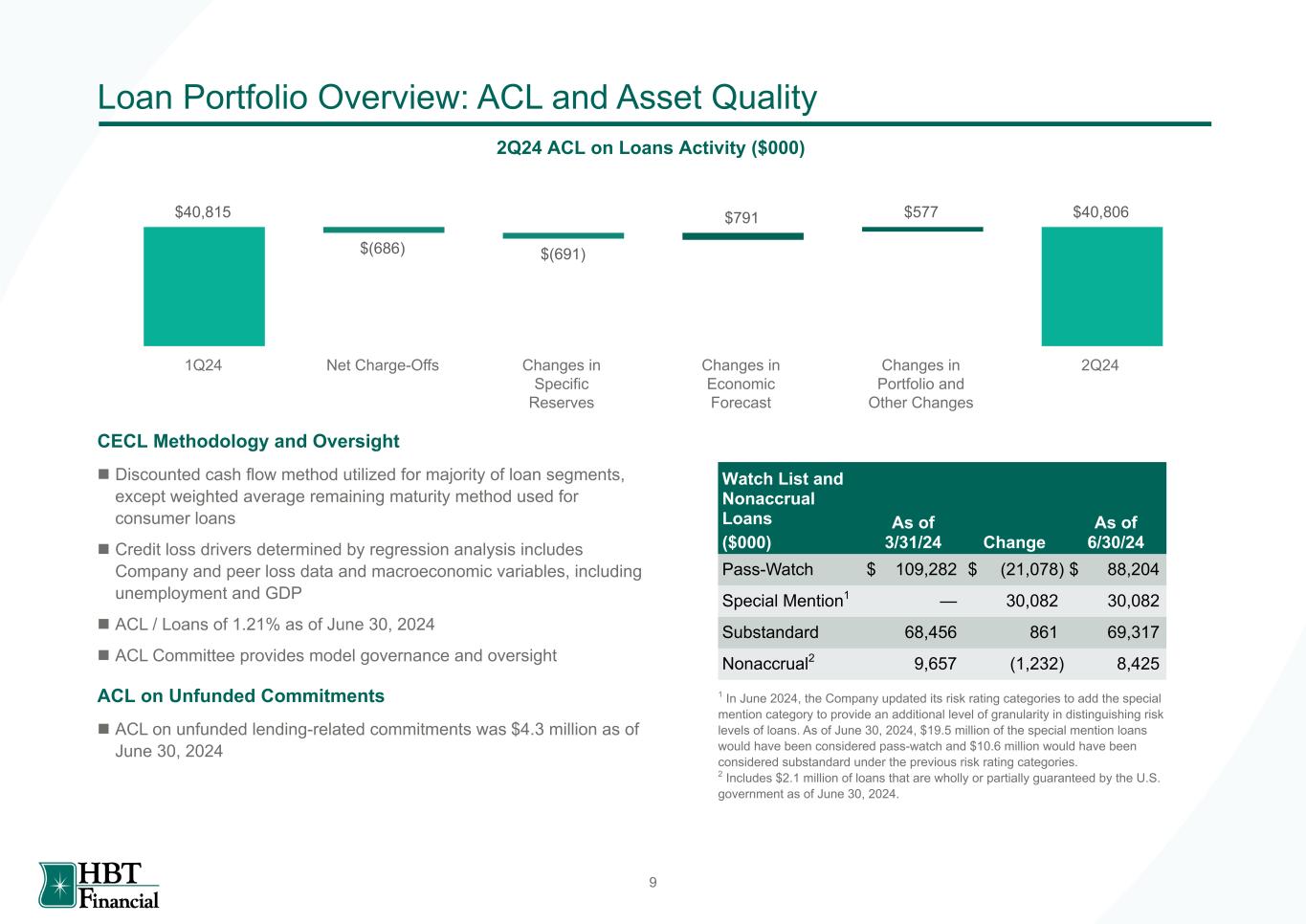

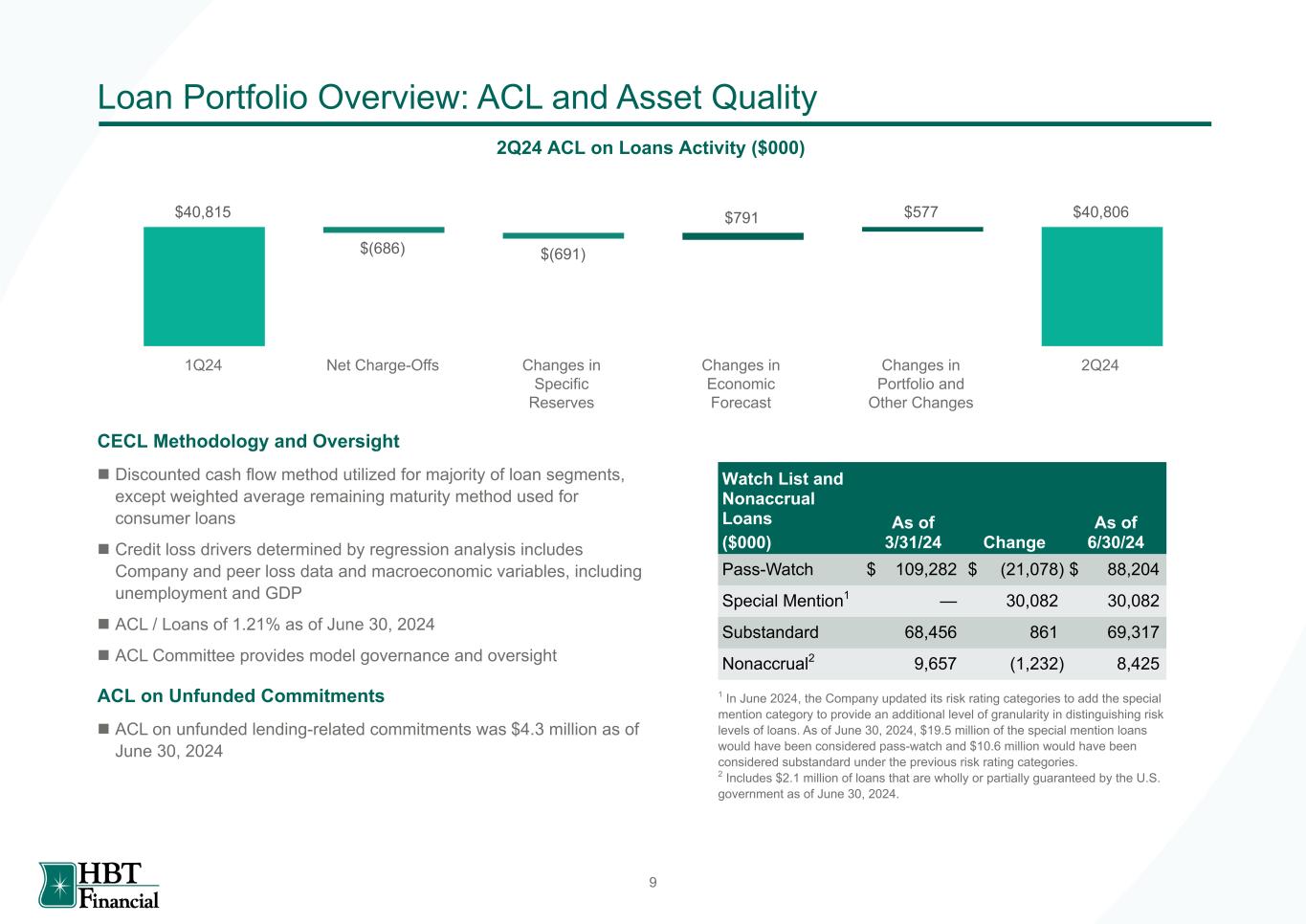

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 9 Loan Portfolio Overview: ACL and Asset Quality 2Q24 ACL on Loans Activity ($000) Watch List and Nonaccrual Loans ($000) As of 3/31/24 Change As of 6/30/24 Pass-Watch $ 109,282 $ (21,078) $ 88,204 Special Mention1 — 30,082 30,082 Substandard 68,456 861 69,317 Nonaccrual2 9,657 (1,232) 8,425 CECL Methodology and Oversight n Discounted cash flow method utilized for majority of loan segments, except weighted average remaining maturity method used for consumer loans n Credit loss drivers determined by regression analysis includes Company and peer loss data and macroeconomic variables, including unemployment and GDP n ACL / Loans of 1.21% as of June 30, 2024 n ACL Committee provides model governance and oversight ACL on Unfunded Commitments n ACL on unfunded lending-related commitments was $4.3 million as of June 30, 2024 1 In June 2024, the Company updated its risk rating categories to add the special mention category to provide an additional level of granularity in distinguishing risk levels of loans. As of June 30, 2024, $19.5 million of the special mention loans would have been considered pass-watch and $10.6 million would have been considered substandard under the previous risk rating categories. 2 Includes $2.1 million of loans that are wholly or partially guaranteed by the U.S. government as of June 30, 2024. $40,815 $(686) $(691) $791 $577 $40,806 1Q24 Net Charge-Offs Changes in Specific Reserves Changes in Economic Forecast Changes in Portfolio and Other Changes 2Q24

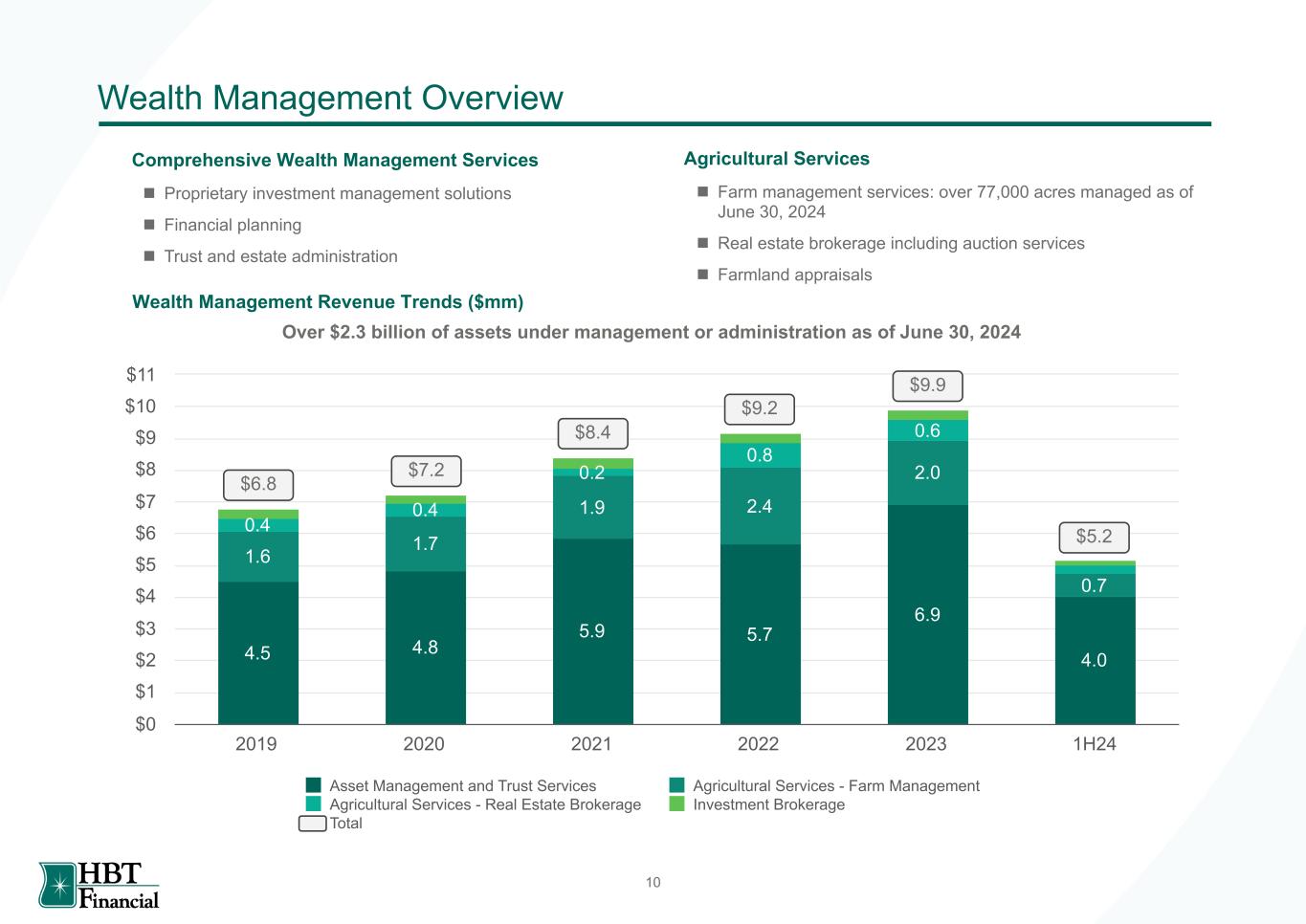

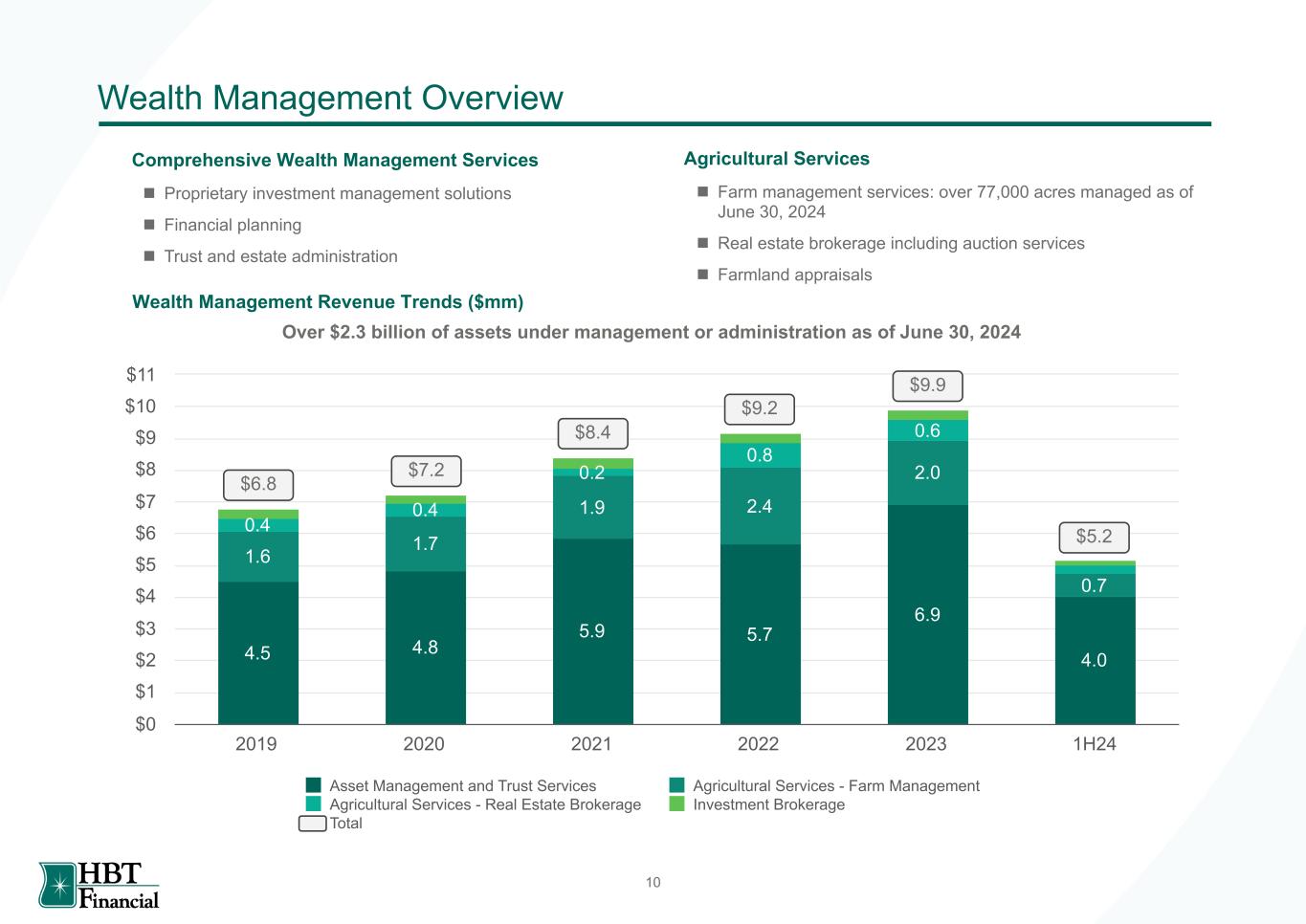

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 10 4.5 4.8 5.9 5.7 6.9 4.0 1.6 1.7 1.9 2.4 2.0 0.7 0.4 0.4 0.2 0.8 0.6 Asset Management and Trust Services Agricultural Services - Farm Management Agricultural Services - Real Estate Brokerage Investment Brokerage Total 2019 2020 2021 2022 2023 1H24 $0 $1 $2 $3 $4 $5 $6 $7 $8 $9 $10 $11 Wealth Management Overview Comprehensive Wealth Management Services n Proprietary investment management solutions n Financial planning n Trust and estate administration Wealth Management Revenue Trends ($mm) Agricultural Services n Farm management services: over 77,000 acres managed as of June 30, 2024 n Real estate brokerage including auction services n Farmland appraisals $5.2 $7.2 $8.4 $9.2 $9.9 Over $2.3 billion of assets under management or administration as of June 30, 2024 $6.8

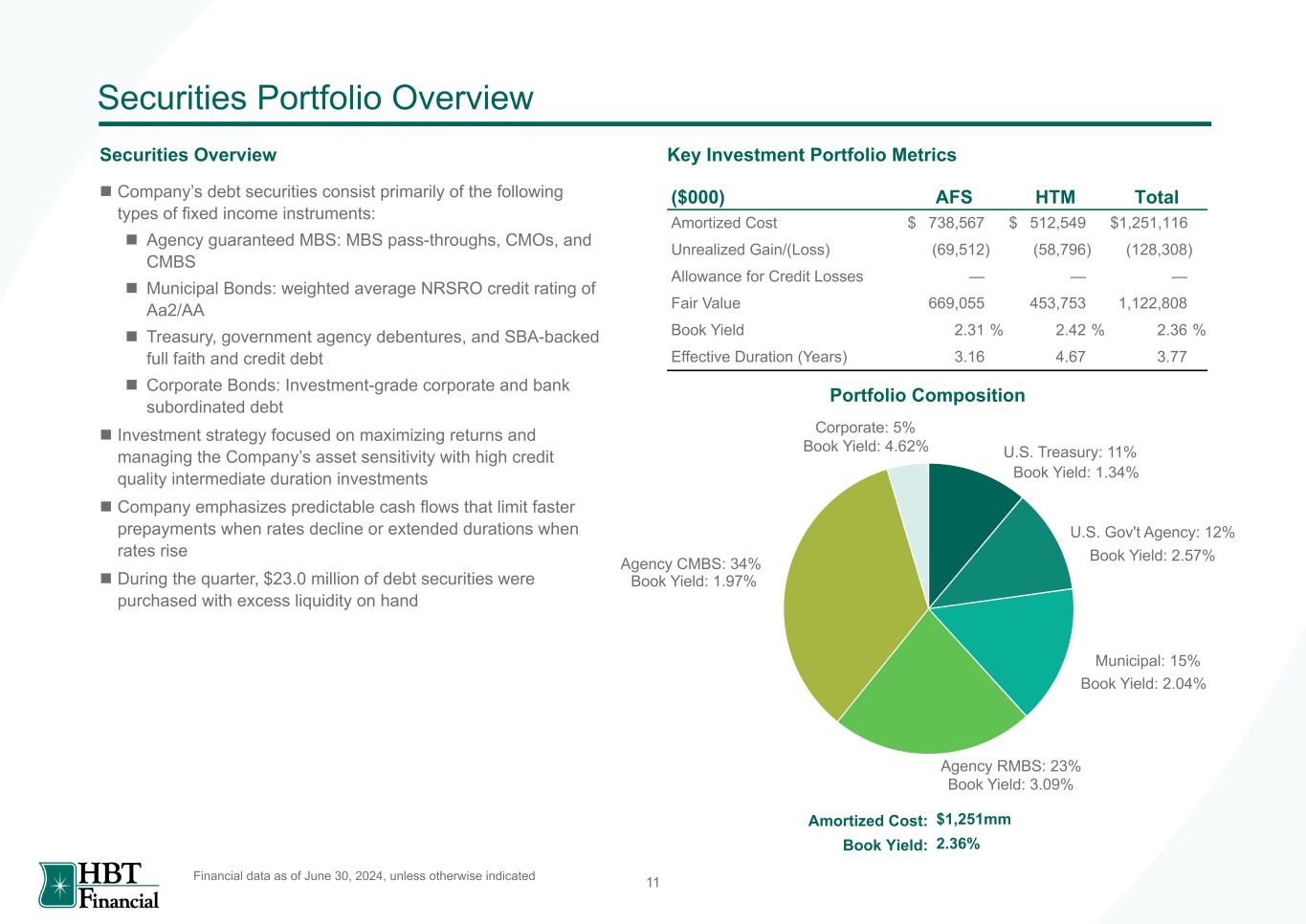

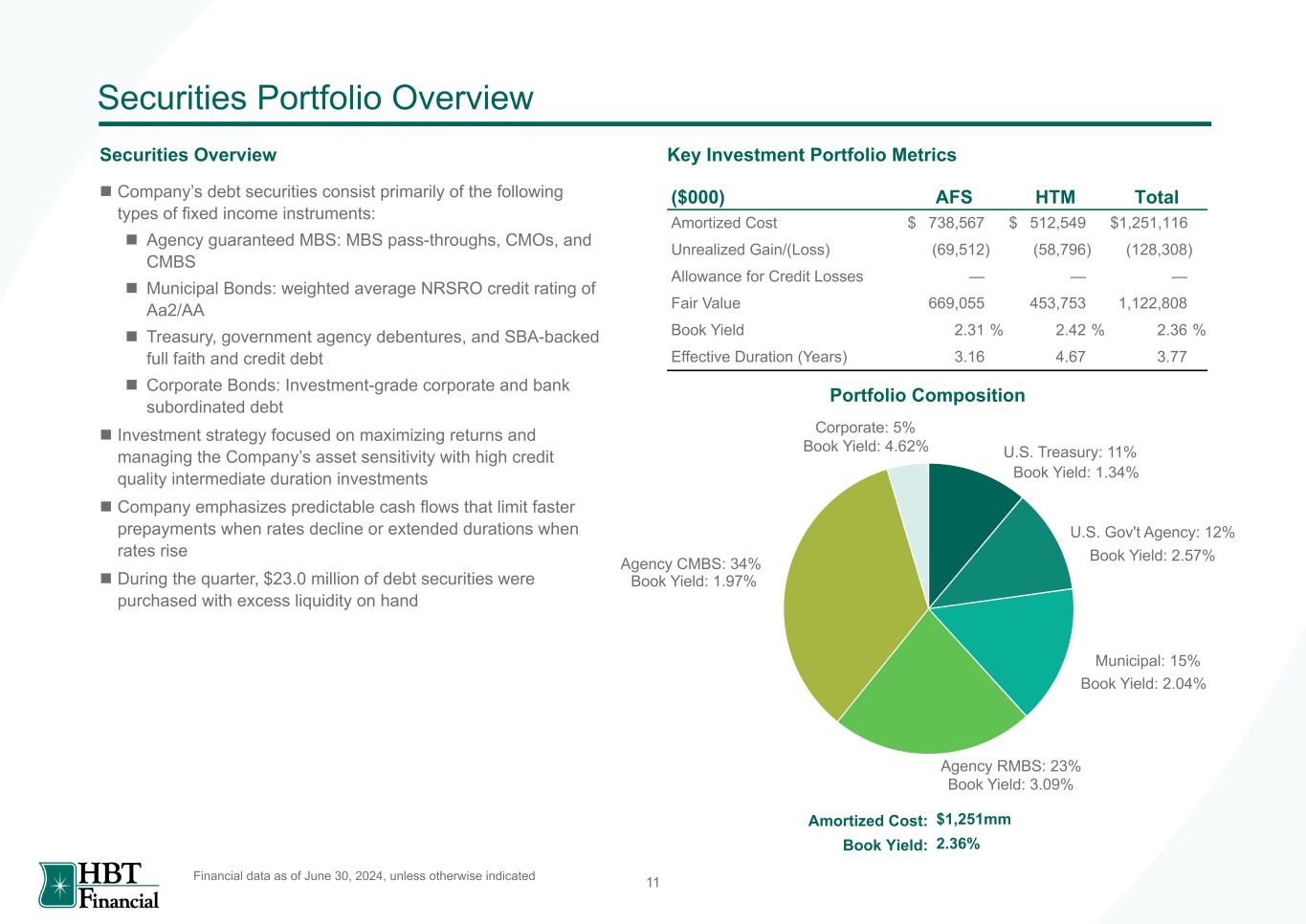

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 11 Securities Portfolio Overview Financial data as of June 30, 2024, unless otherwise indicated Securities Overview Key Investment Portfolio Metrics ($000) AFS HTM Total Amortized Cost $ 738,567 $ 512,549 $ 1,251,116 Unrealized Gain/(Loss) (69,512) (58,796) (128,308) Allowance for Credit Losses — — — Fair Value 669,055 453,753 1,122,808 Book Yield 2.31 % 2.42 % 2.36 % Effective Duration (Years) 3.16 4.67 3.77 Portfolio Composition U.S. Treasury: 11% U.S. Gov't Agency: 12% Municipal: 15% Agency RMBS: 23% Agency CMBS: 34% Corporate: 5% Amortized Cost: $1,251mm Book Yield: 2.36% Book Yield: 2.57% Book Yield: 1.97% Book Yield: 1.34% Book Yield: 2.04% Book Yield: 3.09% Book Yield: 4.62% n Company’s debt securities consist primarily of the following types of fixed income instruments: n Agency guaranteed MBS: MBS pass-throughs, CMOs, and CMBS n Municipal Bonds: weighted average NRSRO credit rating of Aa2/AA n Treasury, government agency debentures, and SBA-backed full faith and credit debt n Corporate Bonds: Investment-grade corporate and bank subordinated debt n Investment strategy focused on maximizing returns and managing the Company’s asset sensitivity with high credit quality intermediate duration investments n Company emphasizes predictable cash flows that limit faster prepayments when rates decline or extended durations when rates rise n During the quarter, $23.0 million of debt securities were purchased with excess liquidity on hand

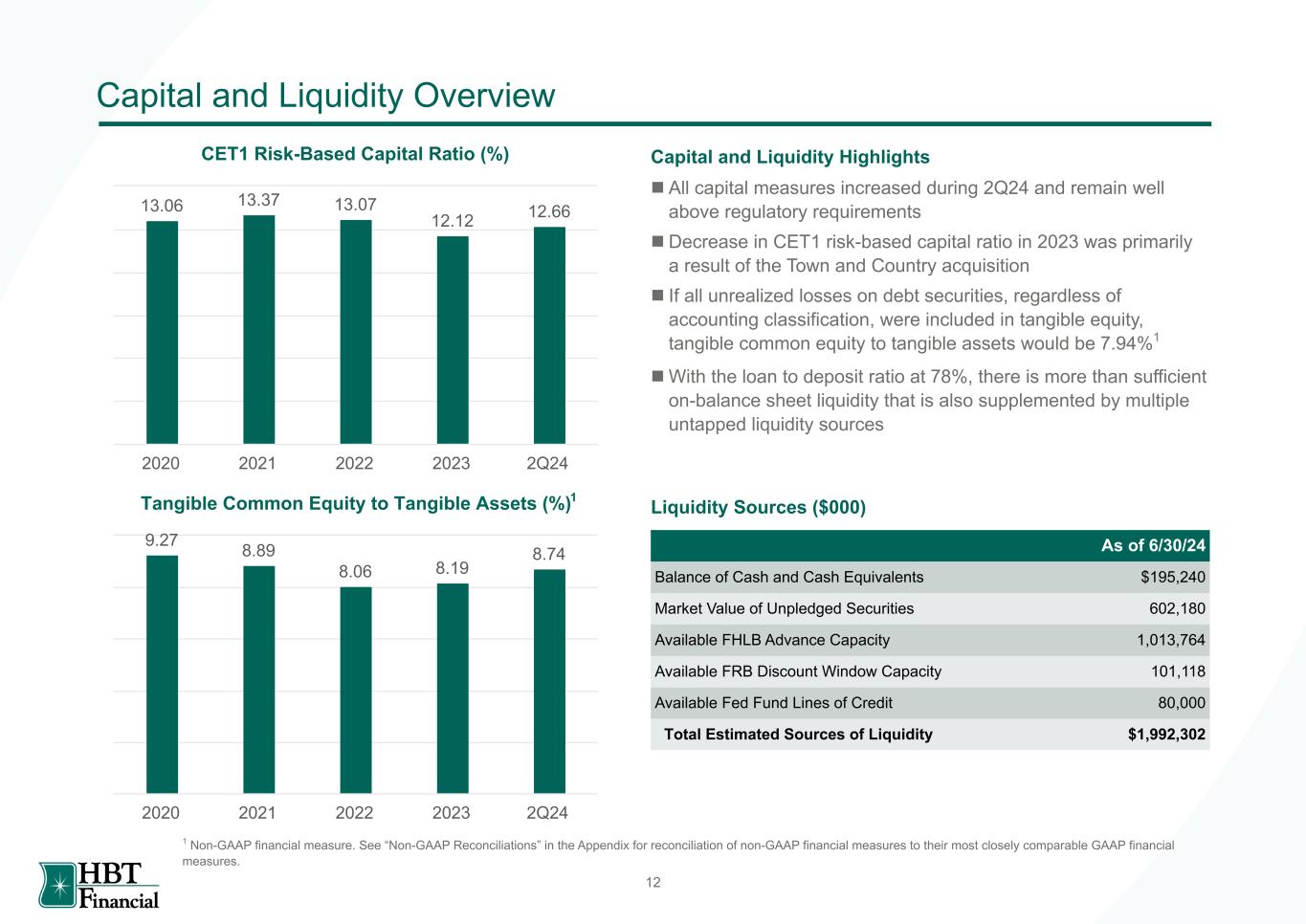

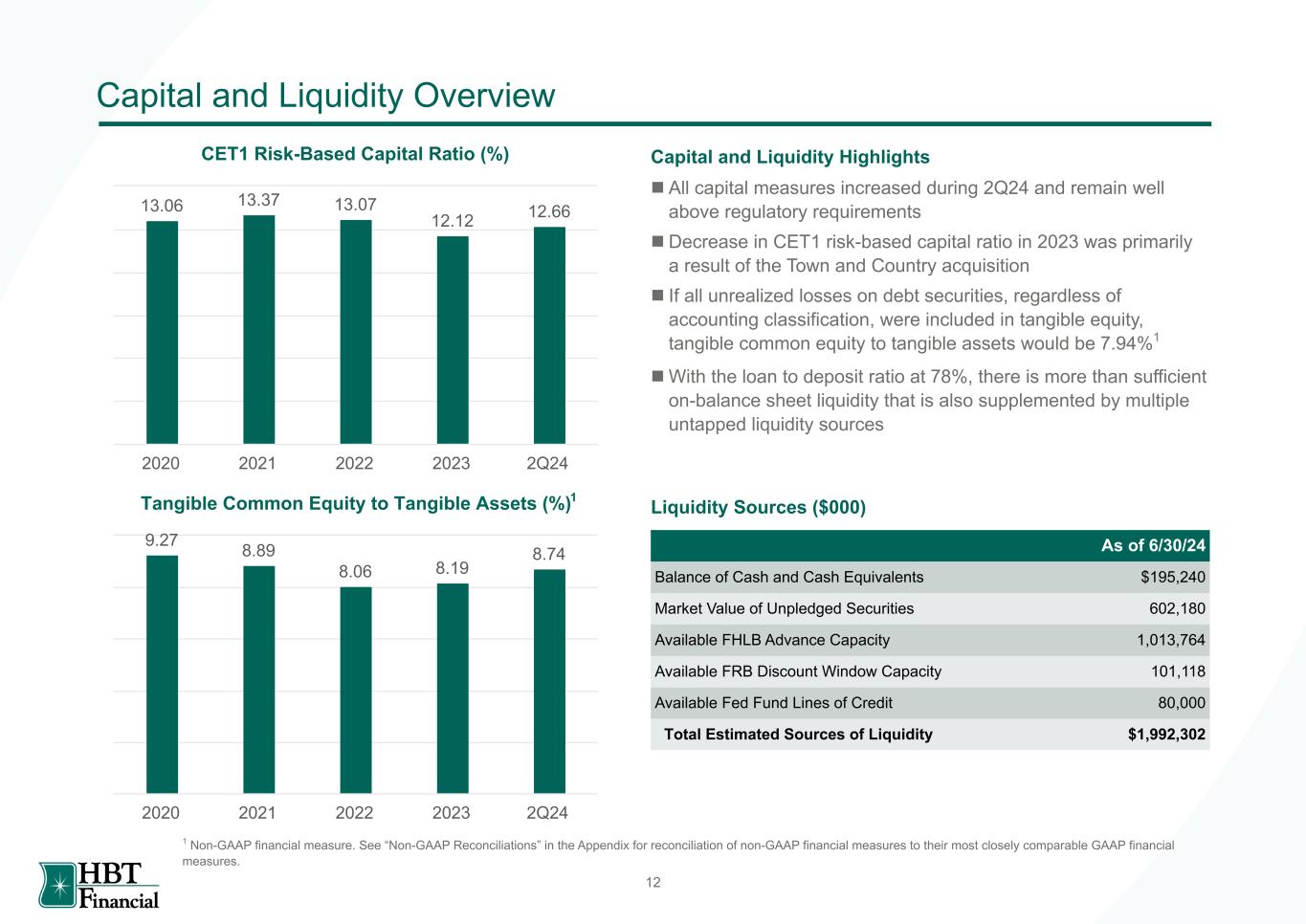

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 12 Capital and Liquidity Overview Liquidity Sources ($000) 1 Non-GAAP financial measure. See “Non-GAAP Reconciliations” in the Appendix for reconciliation of non-GAAP financial measures to their most closely comparable GAAP financial measures. As of 6/30/24 Balance of Cash and Cash Equivalents $195,240 Market Value of Unpledged Securities 602,180 Available FHLB Advance Capacity 1,013,764 Available FRB Discount Window Capacity 101,118 Available Fed Fund Lines of Credit 80,000 Total Estimated Sources of Liquidity $1,992,302 Capital and Liquidity Highlights n All capital measures increased during 2Q24 and remain well above regulatory requirements n Decrease in CET1 risk-based capital ratio in 2023 was primarily a result of the Town and Country acquisition n If all unrealized losses on debt securities, regardless of accounting classification, were included in tangible equity, tangible common equity to tangible assets would be 7.94%1 n With the loan to deposit ratio at 78%, there is more than sufficient on-balance sheet liquidity that is also supplemented by multiple untapped liquidity sources CET1 Risk-Based Capital Ratio (%) 13.06 13.37 13.07 12.12 12.66 2020 2021 2022 2023 2Q24 Tangible Common Equity to Tangible Assets (%) 9.27 8.89 8.06 8.19 8.74 2020 2021 2022 2023 2Q24 1

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 13 Near-Term Outlook n Loan pipelines remain similar to 2Q24; however, total loans are expected to be flat to slightly down in 3Q24 due to elevated payoffs n Deposit balances expected to remain stable in 3Q24 n Investment portfolio is expected to decrease as we plan to reinvest approximately half of the $29 million of forecast principal cash flows n NIM has stabilized and is expected to remain at or near current levels in 3Q24 and 4Q24, based on the current interest rate outlook and liquidity position n Noninterest income during the remainder of 2024 is expected to grow in low single digits n Noninterest expense expected to be between $30 million and $32 million per quarter for 2024 n Asset quality expected to remain solid, although normalization in credit metrics could occur and provision for credit losses could increase if the unemployment rate increases or economic conditions deteriorate n Stock repurchase program will continue to be used opportunistically with $10.6 million available under the current plan through January 1, 2025 n Current capital levels and operational structure support M&A should the right opportunity arise

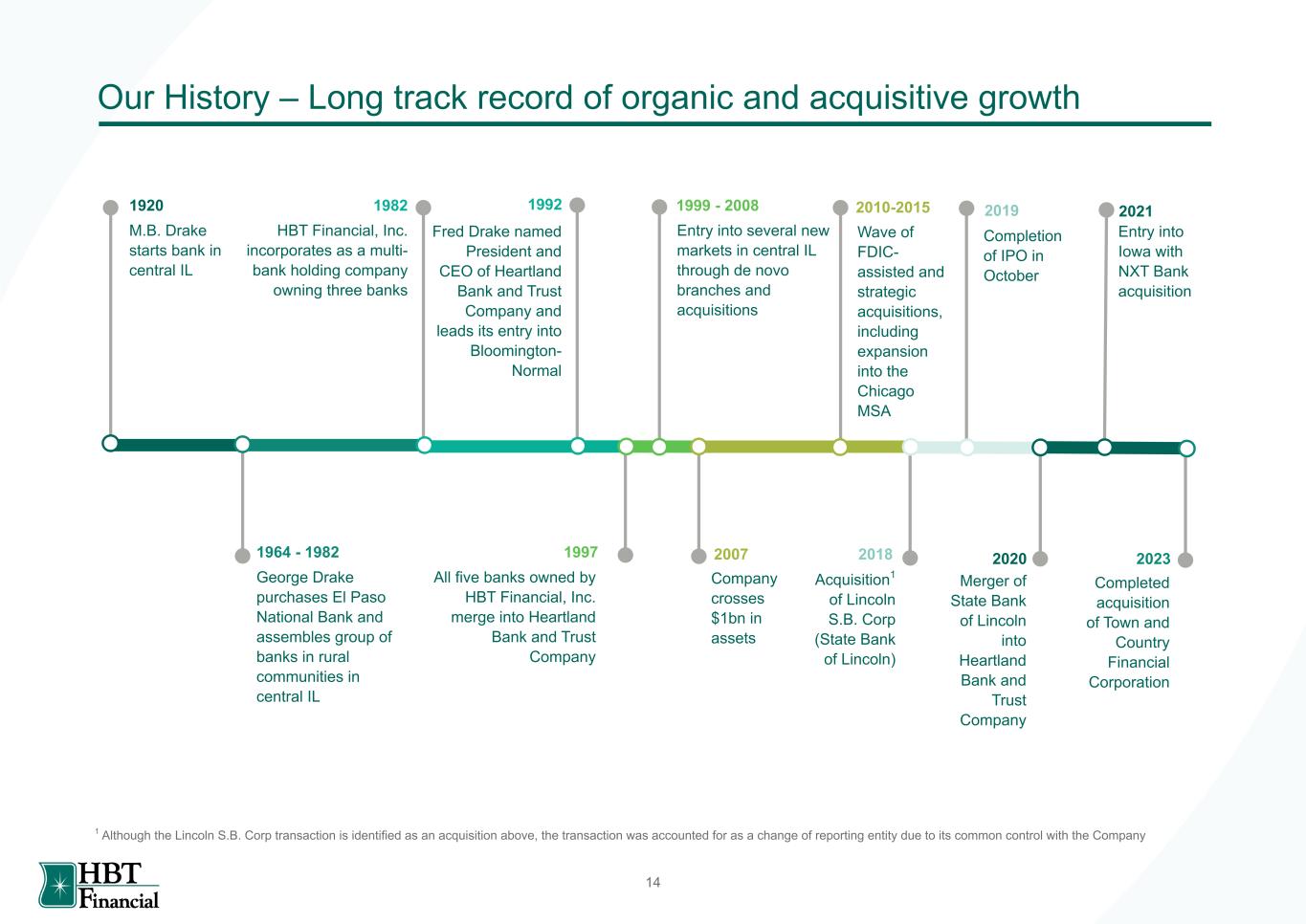

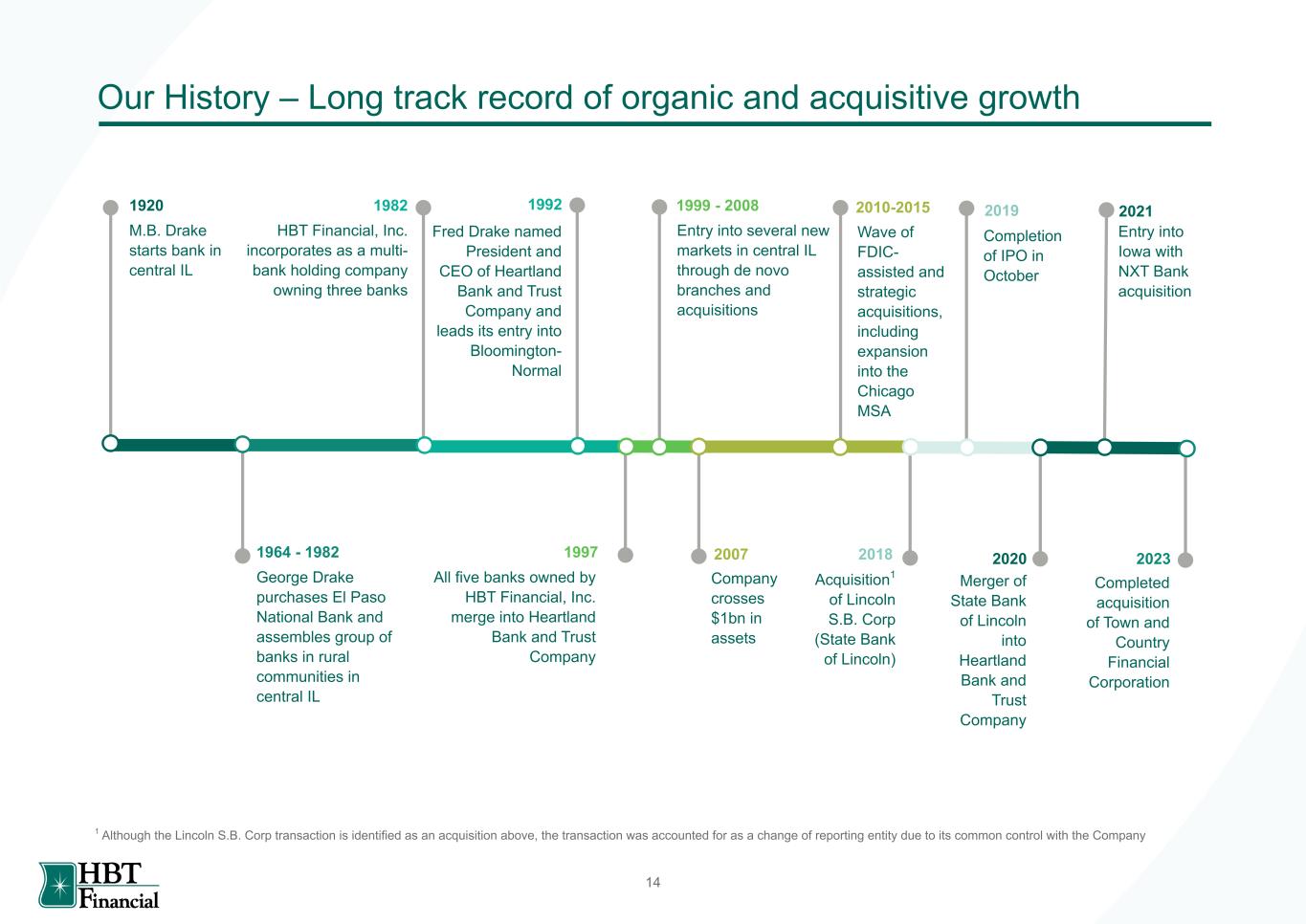

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 14 Our History – Long track record of organic and acquisitive growth Fred Drake named President and CEO of Heartland Bank and Trust Company and leads its entry into Bloomington- Normal 1992 1964 - 1982 George Drake purchases El Paso National Bank and assembles group of banks in rural communities in central IL M.B. Drake starts bank in central IL 1920 HBT Financial, Inc. incorporates as a multi- bank holding company owning three banks 1982 1997 All five banks owned by HBT Financial, Inc. merge into Heartland Bank and Trust Company Wave of FDIC- assisted and strategic acquisitions, including expansion into the Chicago MSA 2010-2015 Acquisition1 of Lincoln S.B. Corp (State Bank of Lincoln) 2018 Company crosses $1bn in assets 2007 1999 - 2008 Entry into several new markets in central IL through de novo branches and acquisitions 1 Although the Lincoln S.B. Corp transaction is identified as an acquisition above, the transaction was accounted for as a change of reporting entity due to its common control with the Company 2019 Completion of IPO in October 2020 Merger of State Bank of Lincoln into Heartland Bank and Trust Company 2021 Entry into Iowa with NXT Bank acquisition 2023 Completed acquisition of Town and Country Financial Corporation

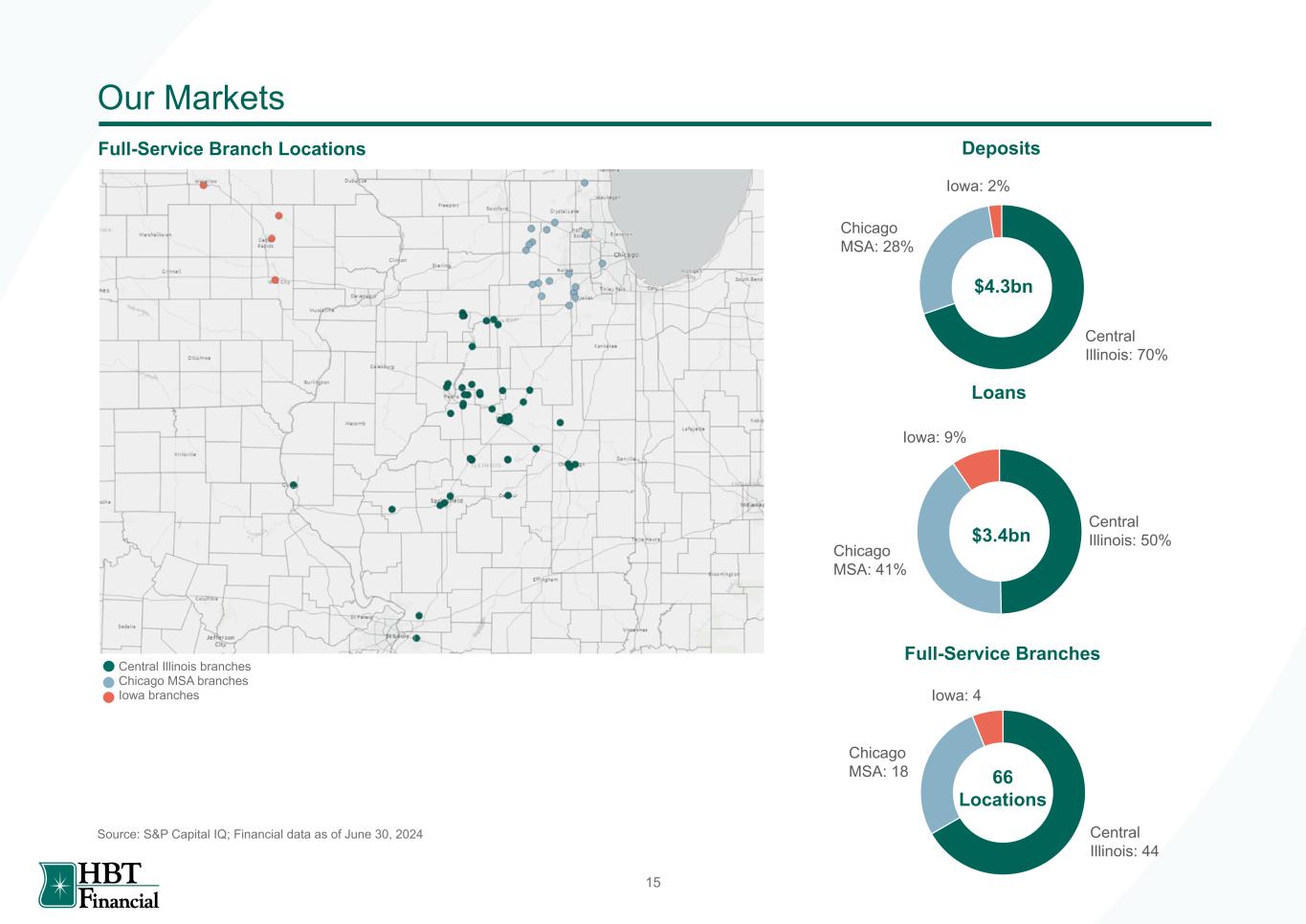

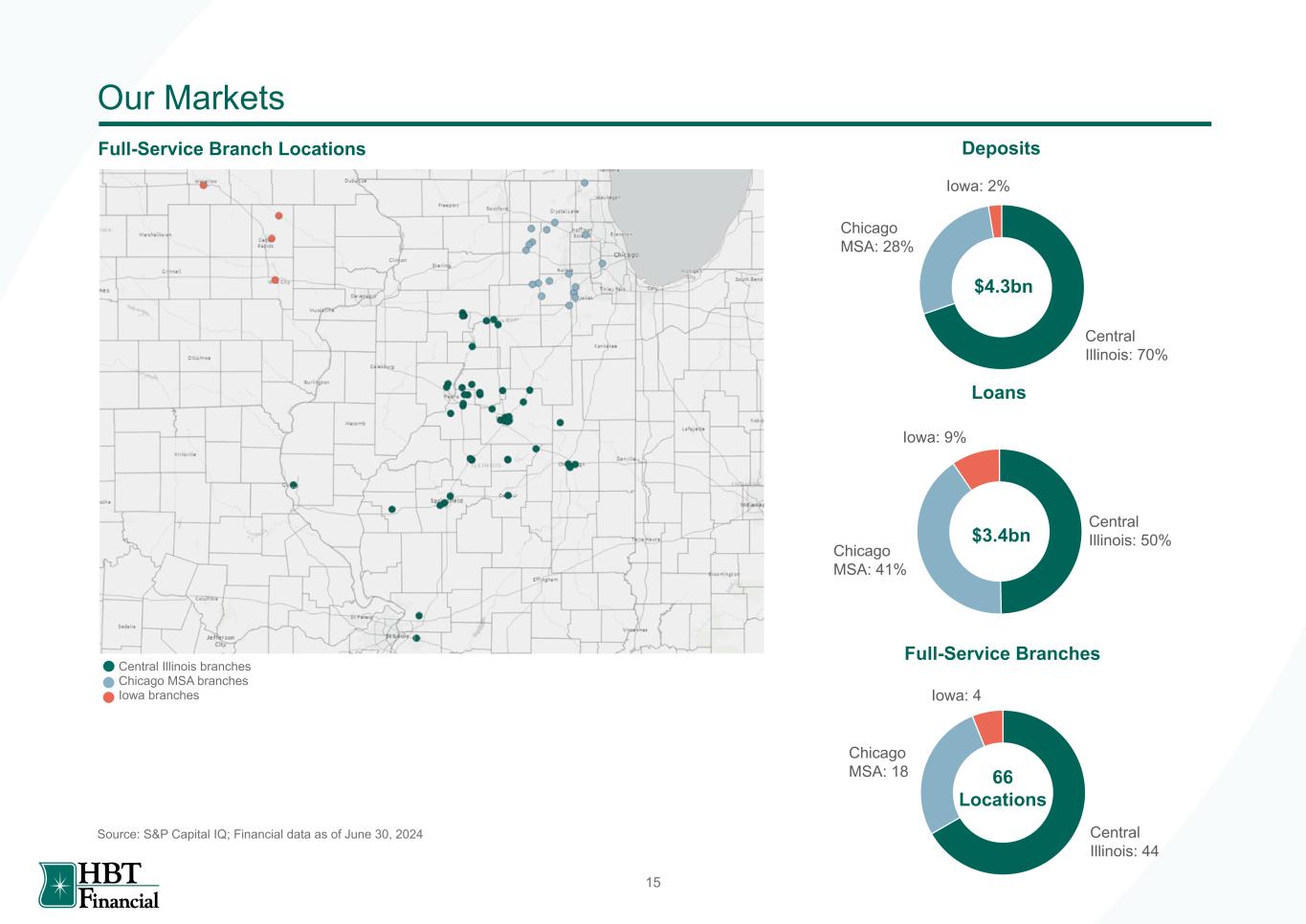

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 15 Full-Service Branches Central Illinois: 44 Chicago MSA: 18 Iowa: 4 Central Illinois branches Chicago MSA branches Iowa branches Our Markets Source: S&P Capital IQ; Financial data as of June 30, 2024 Full-Service Branch Locations Deposits Central Illinois: 70% Chicago MSA: 28% Iowa: 2% $4.3bn Loans Central Illinois: 50% Chicago MSA: 41% Iowa: 9% $3.4bn 66 Locations

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 16 Business Strategy n Drake family involved in central Illinois banking since 1920 n Management lives and works in our communities n Community banking and relationship-based approach stems from adherence to our Midwestern values n Committed to providing products and services to support the unique needs of our customer base n Vast majority of loans originated to borrowers residing within 60 miles of a branch n Robust underwriting standards will continue to be a hallmark of the Company n Maintained sound credit quality and minimal originated problem asset levels during the Great Recession n Diversified loan portfolio primarily within footprint n Underwriting continues to be a strength as evidenced by NCOs / loans of (0.08)% during 2022, 0.01% during 2023, and 0.03% during 1H24; NPLs / loans of 0.08% at 2022; 0.23% at 2023, and 0.25% at 2Q24 n Positioned to be the acquirer of choice for many potential partners in and adjacent to our existing markets n Successful integration of 10 community bank acquisitions2 since 2007 n Chicago MSA, in particular, has ~80 banking institutions with less than $2bn in assets n 1.31% adjusted ROAA3 and 3.60% NIM (FTE)4 during 2022; 1.59% adjusted ROAA3 and 4.15% NIM (FTE)4 during 2023; 1.45% adjusted ROAA3 and 3.99% NIM (FTE)4 during 1H24 n Highly profitable through the Great Recession n Highly defensible market position (Top 2 deposit share rank in 6 of 7 largest central Illinois markets in which the Company operates1) that contributes to our strong core deposit base and funding advantage n Continued deployment of our excess deposit funding (78% loan-to-deposit ratio as of 2Q24) into attractive loan opportunities in larger, more diversified markets n Efficient decision-making process provides a competitive advantage over the larger and more bureaucratic money center and super regional financial institutions that compete in our markets Preserve strong ties to our communities Deploy excess deposit funding into loan growth opportunities Maintain a prudent approach to credit underwriting Pursue strategic acquisitions and sustain strong profitability FTE: Fully tax equivalent; 1 Source: S&P Capital IQ, data as of June 30, 2023; 2 Includes merger with Lincoln S.B. Corp in 2018, although the transaction was accounted for as a change of reporting entity due to its common control with Company; 3 Metrics based on adjusted net income, which is a non-GAAP metric; for reconciliation with GAAP metrics, see “Non-GAAP reconciliations” in Appendix; 4 Metrics presented on tax-equivalent basis; for reconciliation with GAAP metric, see “Non-GAAP reconciliations” in Appendix. Small enough to know you, big enough to serve you

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 17 Experienced executive management team with deep community ties Fred L. Drake Executive Chairman 41 years with Company 44 years in industry J. Lance Carter President and Chief Executive Officer 22 years with Company 30 years in industry Lawrence J. Horvath Chief Lending Officer 14 years with Company 38 years in industry Mark W. Scheirer Chief Credit Officer 13 years with Company 32 years in industry Andrea E. Zurkamer Chief Risk Officer 11 years with Company 24 years in industry Diane H. Lanier Chief Retail Officer 27 years with Company 39 years in industry Peter Chapman Chief Financial Officer Joined HBT in Oct. 2022 30 years in industry

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 18 Talented Board of Directors with deep financial services industry experience Fred L. Drake Executive Chairman • Director since 1984 • 41 years with Company • 44 years in industry J. Lance Carter Director • Director since 2011 • President and CEO of HBT Financial and Heartland Bank • 22 years with Company • 30 years in industry Patrick F. Busch Director • Director since 1998 • Vice Chairman of Heartland Bank • 29 years with Company • 46 years in industry Eric E. Burwell Director • Director since 2005 • Owner, Burwell Management Company • Invests in a variety of real estate, private equity, venture capital and liquid investments Linda J. Koch Director • Director since 2020 • Former President and CEO of the Illinois Bankers Association • 36 years in industry Gerald E. Pfeiffer Director • Director since 2019 • Former Partner at CliftonLarsonAllen LLP with 46 years of industry experience • Former CFO of Bridgeview Bancorp Allen C. Drake Director • Director since 1981 • Retired EVP with 27 years of experience at Company • Formerly responsible for Company’s lending, administration, technology, personnel, accounting, trust and strategic planning Dr. C. Alvin Bowman Director • Director since 2019 • Former President of Illinois State University • 36 years in higher education Roger A. Baker Director • Director since 2022 • Former Chairman and President of NXT Bancorporation • 15 years in industry

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 19 Investment Highlights 3 1 2 4 Track record of successfully integrating acquisitions Consistent performance through economic cycles and consistent out-performance of peers drives long-term shareholder value Strong, granular, low-cost deposit base provides funding for diversified loan portfolio and loan growth opportunities Prudent risk management

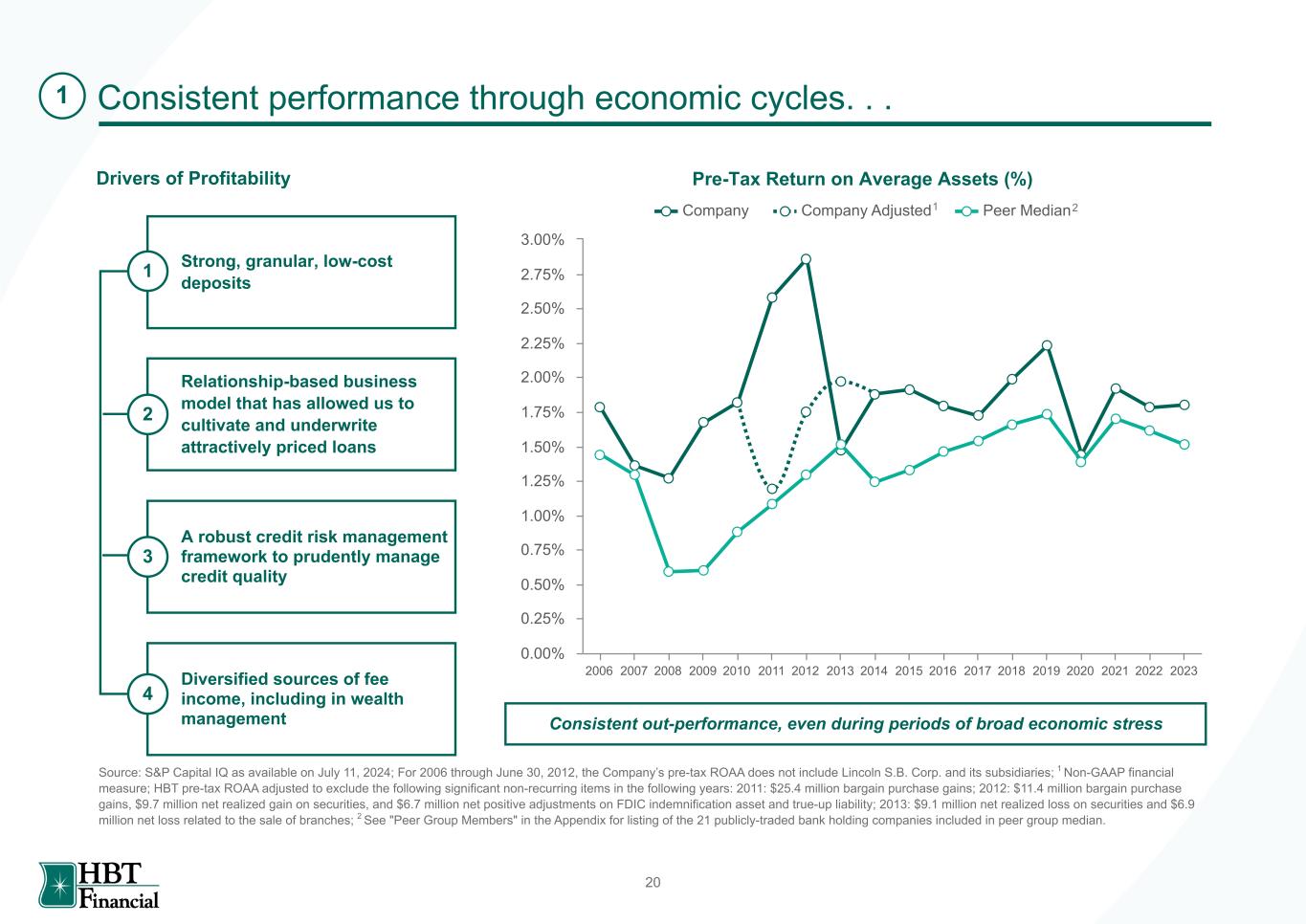

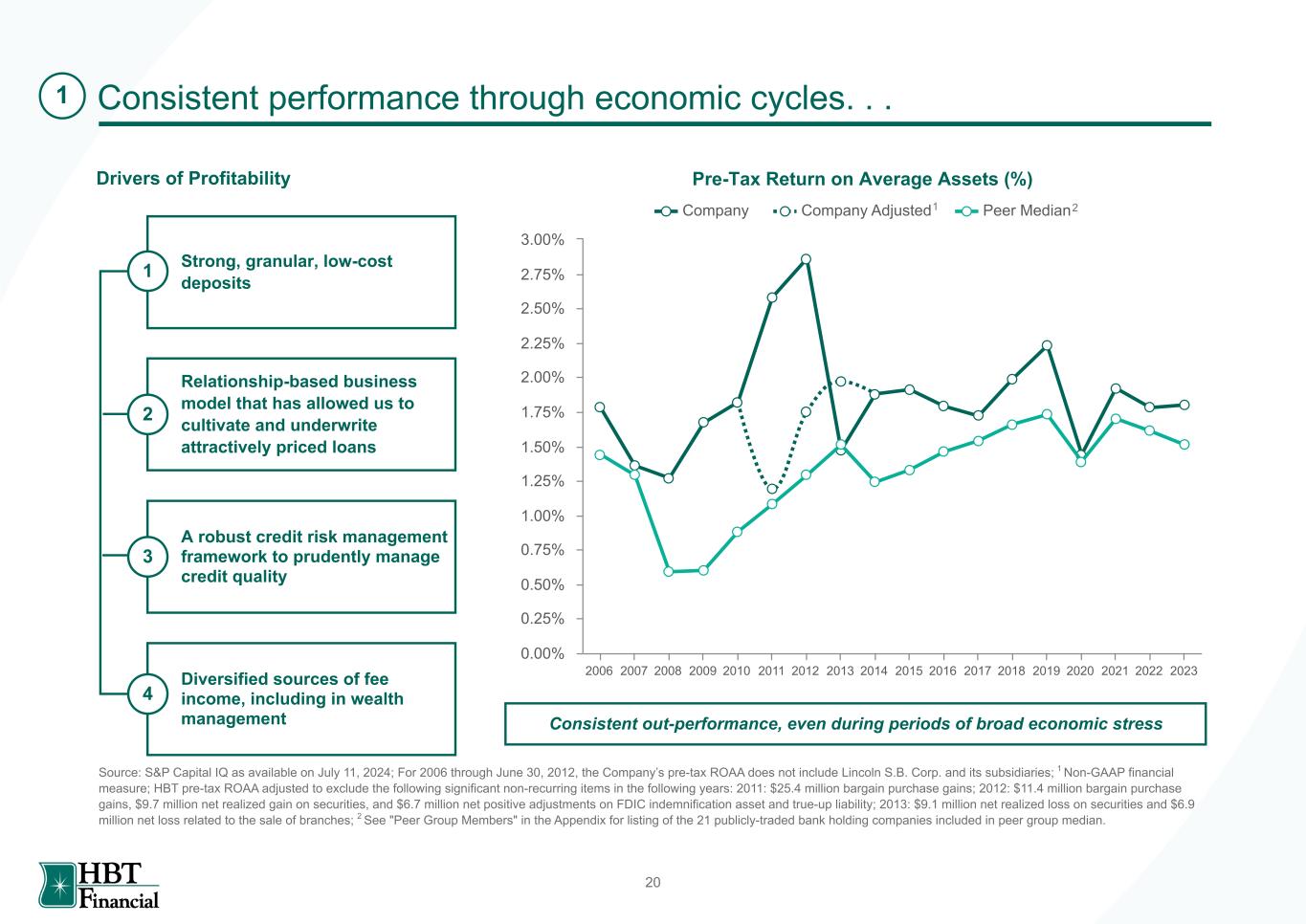

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 20 Consistent performance through economic cycles. . . Drivers of Profitability Source: S&P Capital IQ as available on July 11, 2024; For 2006 through June 30, 2012, the Company’s pre-tax ROAA does not include Lincoln S.B. Corp. and its subsidiaries; 1 Non-GAAP financial measure; HBT pre-tax ROAA adjusted to exclude the following significant non-recurring items in the following years: 2011: $25.4 million bargain purchase gains; 2012: $11.4 million bargain purchase gains, $9.7 million net realized gain on securities, and $6.7 million net positive adjustments on FDIC indemnification asset and true-up liability; 2013: $9.1 million net realized loss on securities and $6.9 million net loss related to the sale of branches; 2 See "Peer Group Members" in the Appendix for listing of the 21 publicly-traded bank holding companies included in peer group median. Strong, granular, low-cost deposits1 Relationship-based business model that has allowed us to cultivate and underwrite attractively priced loans A robust credit risk management framework to prudently manage credit quality Diversified sources of fee income, including in wealth management 4 Consistent out-performance, even during periods of broad economic stress 1 2 3 Pre-Tax Return on Average Assets (%) Company Company Adjusted Peer Median 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 0.00% 0.25% 0.50% 0.75% 1.00% 1.25% 1.50% 1.75% 2.00% 2.25% 2.50% 2.75% 3.00% 1 2

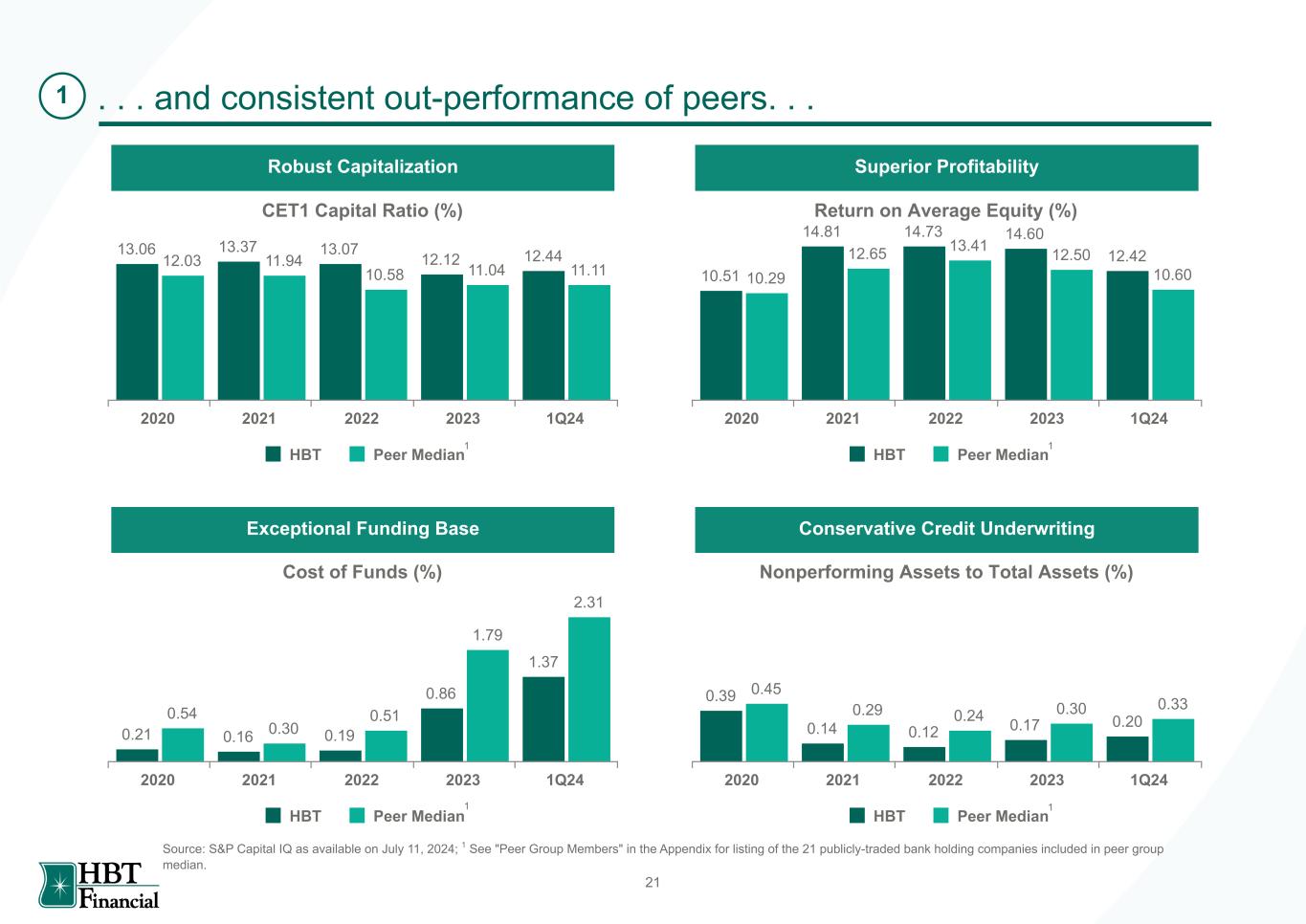

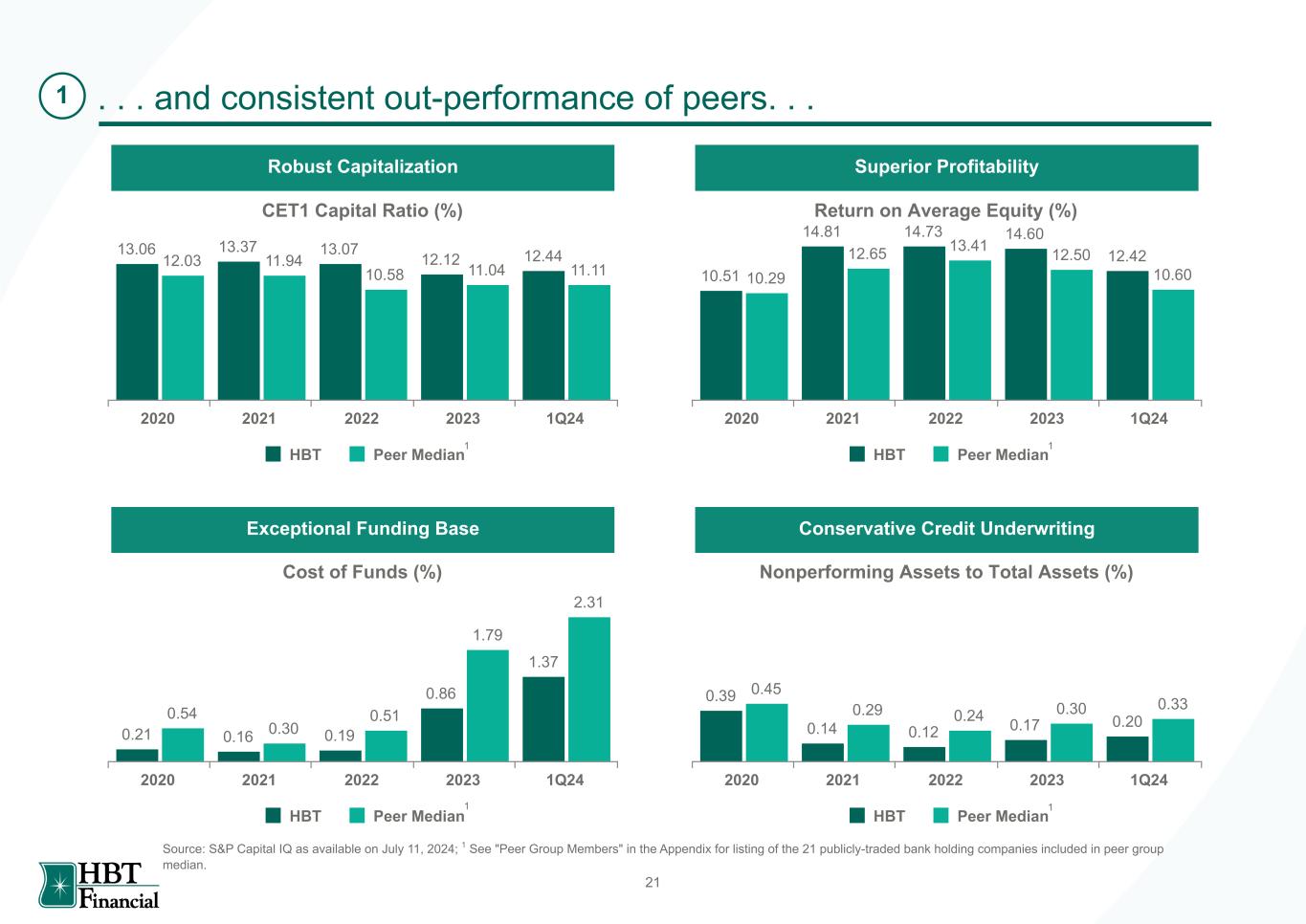

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 21 . . . and consistent out-performance of peers. . .1 CET1 Capital Ratio (%) 13.06 13.37 13.07 12.12 12.4412.03 11.94 10.58 11.04 11.11 HBT Peer Median 2020 2021 2022 2023 1Q24 Return on Average Equity (%) 10.51 14.81 14.73 14.60 12.42 10.29 12.65 13.41 12.50 10.60 HBT Peer Median 2020 2021 2022 2023 1Q24 Cost of Funds (%) 0.21 0.16 0.19 0.86 1.37 0.54 0.30 0.51 1.79 2.31 HBT Peer Median 2020 2021 2022 2023 1Q24 Nonperforming Assets to Total Assets (%) 0.39 0.14 0.12 0.17 0.20 0.45 0.29 0.24 0.30 0.33 HBT Peer Median 2020 2021 2022 2023 1Q24 Robust Capitalization Superior Profitability Exceptional Funding Base Conservative Credit Underwriting Source: S&P Capital IQ as available on July 11, 2024; 1 See "Peer Group Members" in the Appendix for listing of the 21 publicly-traded bank holding companies included in peer group median. 1 11 1

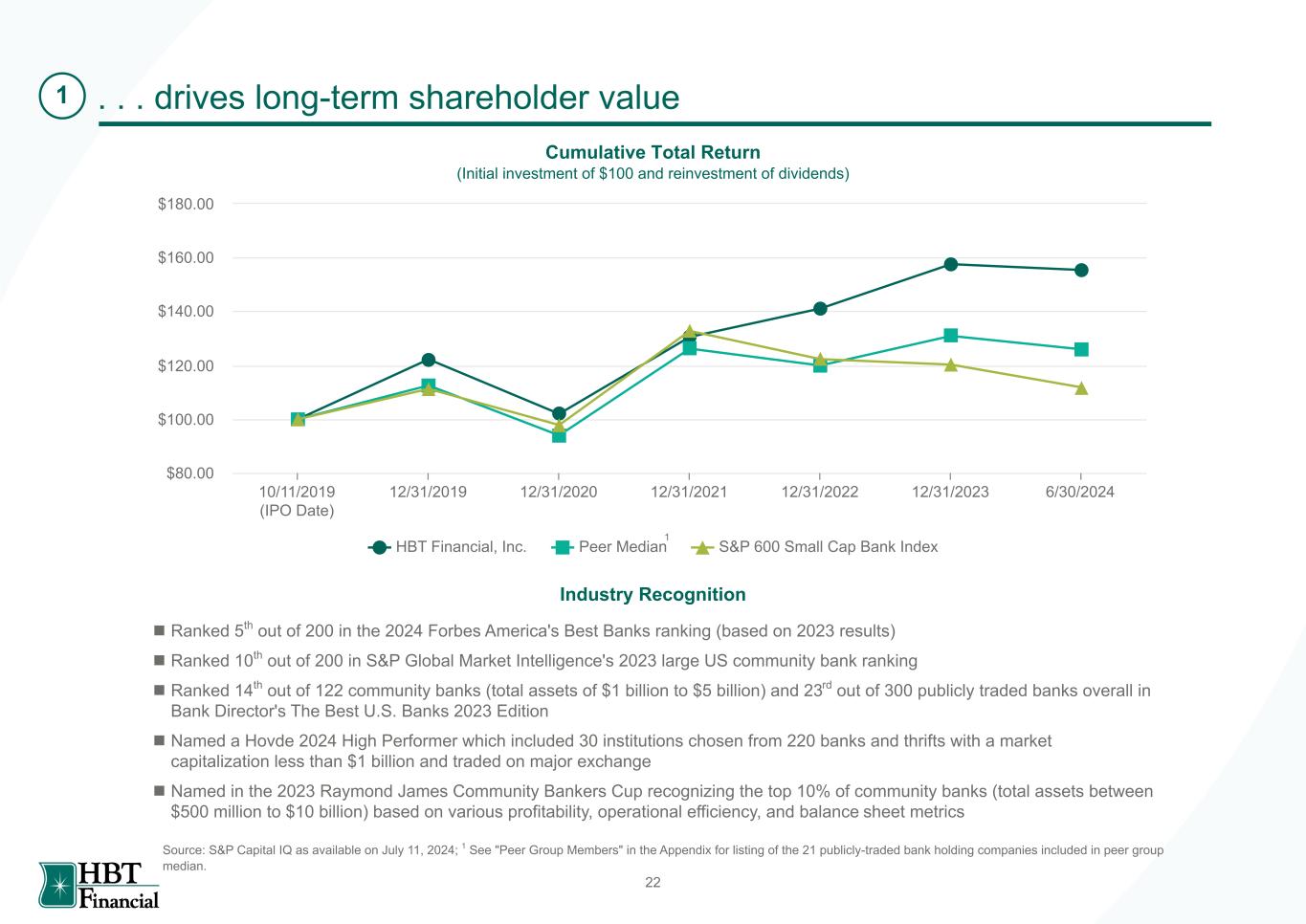

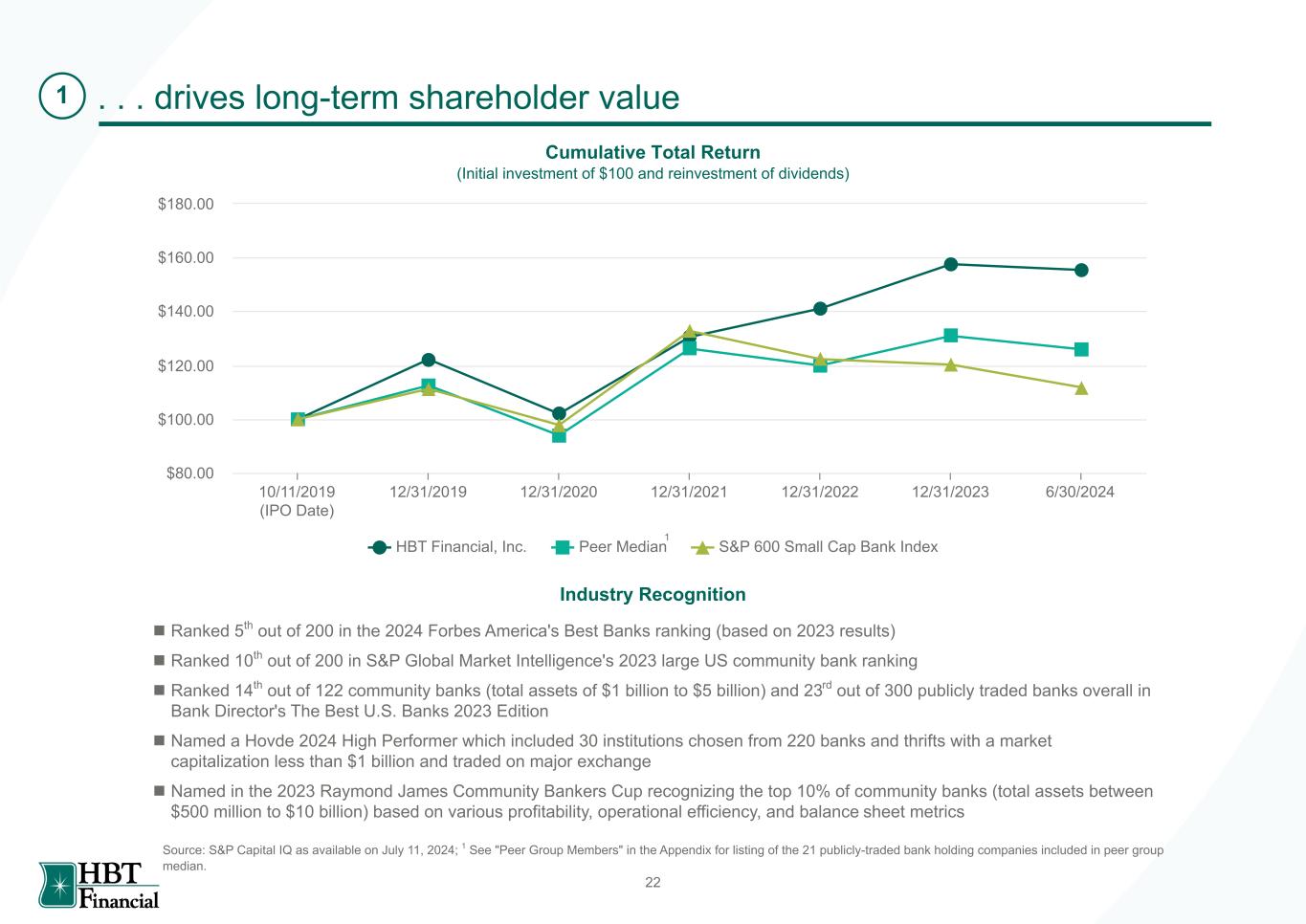

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 22 . . . drives long-term shareholder value1 HBT Financial, Inc. Peer Median S&P 600 Small Cap Bank Index 10/11/2019 (IPO Date) 12/31/2019 12/31/2020 12/31/2021 12/31/2022 12/31/2023 6/30/2024 $80.00 $100.00 $120.00 $140.00 $160.00 $180.00 Industry Recognition n Ranked 5th out of 200 in the 2024 Forbes America's Best Banks ranking (based on 2023 results) n Ranked 10th out of 200 in S&P Global Market Intelligence's 2023 large US community bank ranking n Ranked 14th out of 122 community banks (total assets of $1 billion to $5 billion) and 23rd out of 300 publicly traded banks overall in Bank Director's The Best U.S. Banks 2023 Edition n Named a Hovde 2024 High Performer which included 30 institutions chosen from 220 banks and thrifts with a market capitalization less than $1 billion and traded on major exchange n Named in the 2023 Raymond James Community Bankers Cup recognizing the top 10% of community banks (total assets between $500 million to $10 billion) based on various profitability, operational efficiency, and balance sheet metrics Source: S&P Capital IQ as available on July 11, 2024; 1 See "Peer Group Members" in the Appendix for listing of the 21 publicly-traded bank holding companies included in peer group median. Cumulative Total Return (Initial investment of $100 and reinvestment of dividends) 1

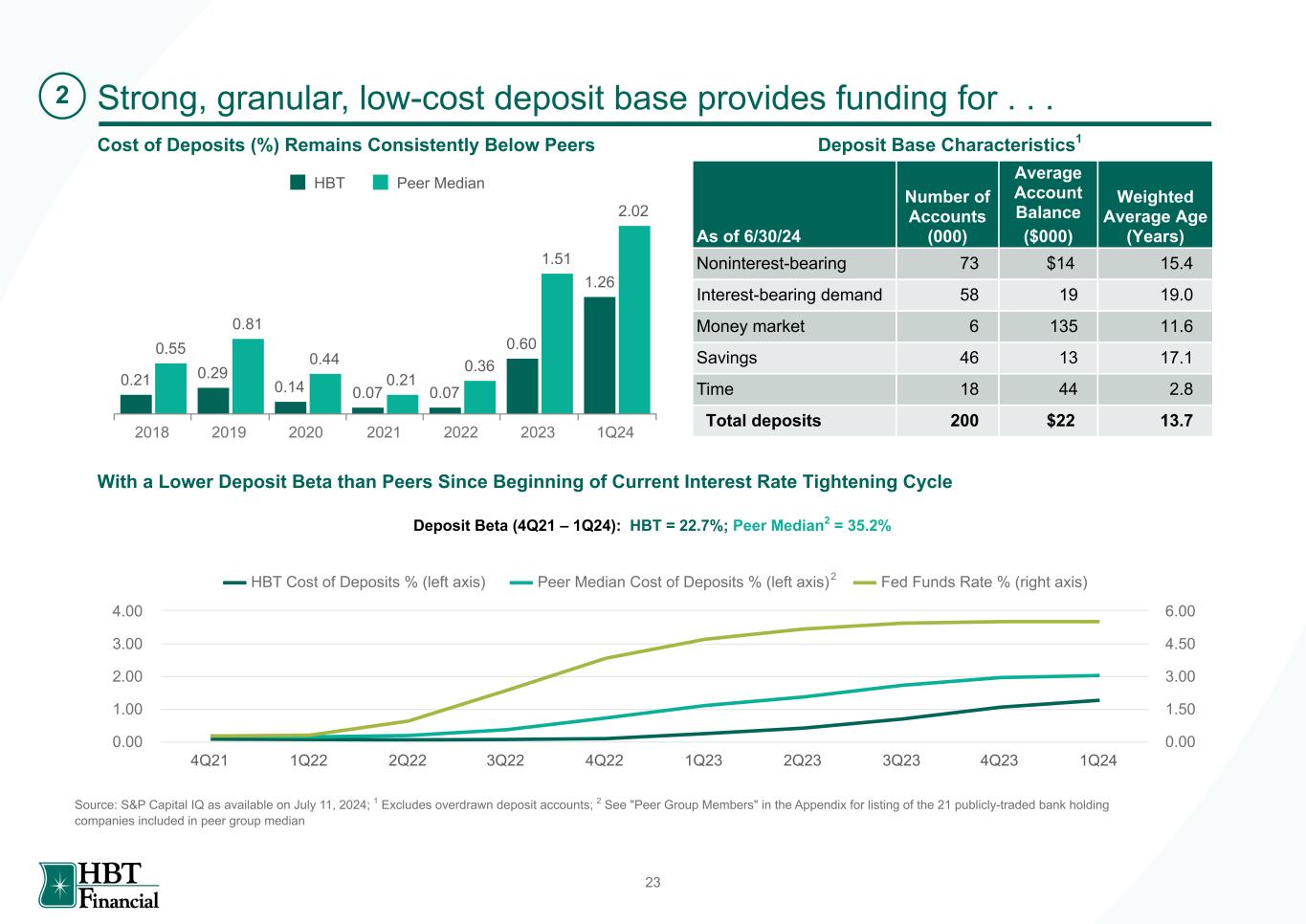

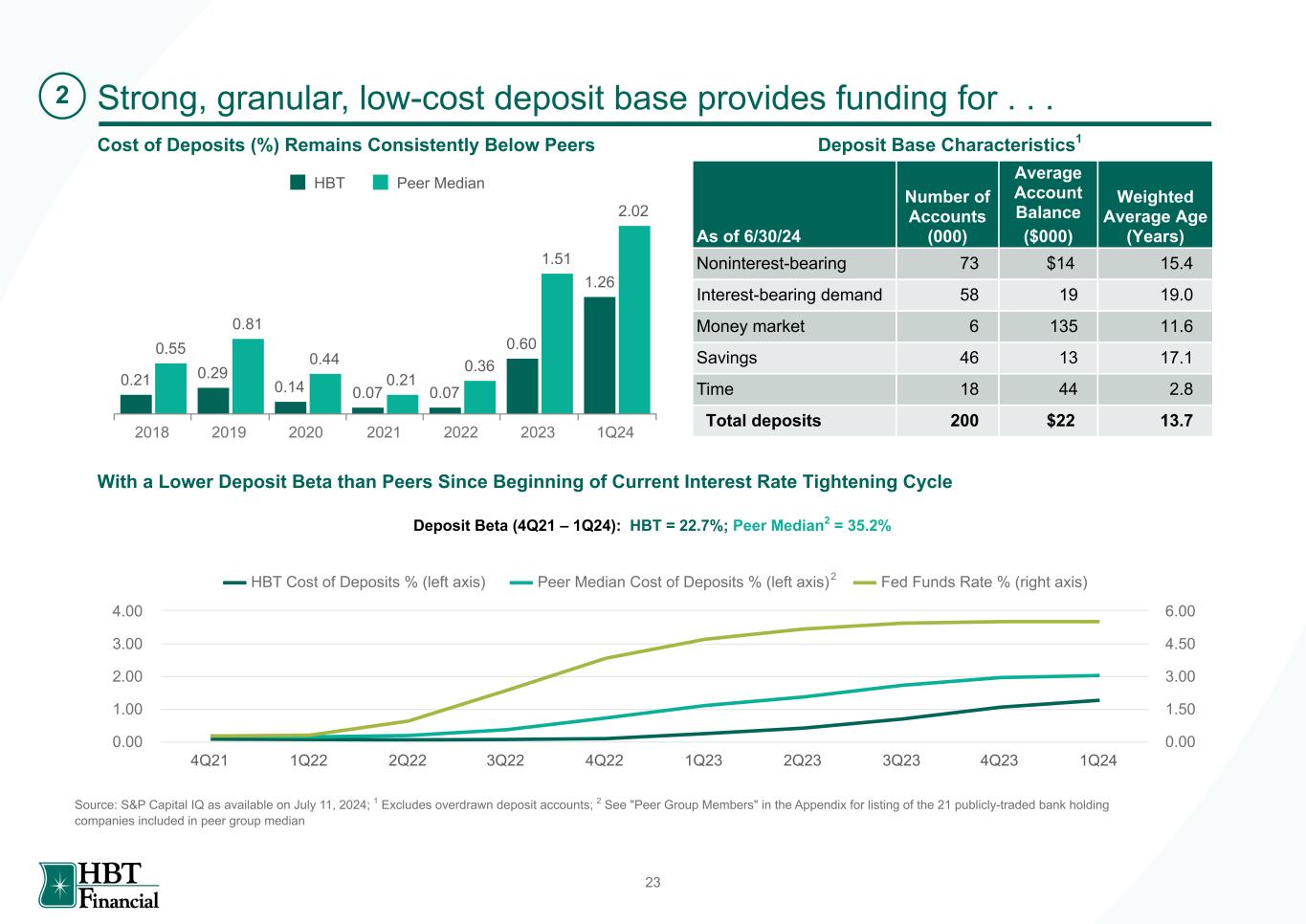

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 23 0.21 0.29 0.14 0.07 0.07 0.60 1.26 0.55 0.81 0.44 0.21 0.36 1.51 2.02 HBT Peer Median 2018 2019 2020 2021 2022 2023 1Q24 HBT Cost of Deposits % (left axis) Peer Median Cost of Deposits % (left axis) Fed Funds Rate % (right axis) 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 0.00 1.00 2.00 3.00 4.00 0.00 1.50 3.00 4.50 6.00 Strong, granular, low-cost deposit base provides funding for . . . Cost of Deposits (%) Remains Consistently Below Peers Source: S&P Capital IQ as available on July 11, 2024; 1 Excludes overdrawn deposit accounts; 2 See "Peer Group Members" in the Appendix for listing of the 21 publicly-traded bank holding companies included in peer group median 1 2 With a Lower Deposit Beta than Peers Since Beginning of Current Interest Rate Tightening Cycle 2 Deposit Beta (4Q21 – 1Q24): HBT = 22.7%; Peer Median2 = 35.2% As of 6/30/24 Number of Accounts (000) Average Account Balance ($000) Weighted Average Age (Years) Noninterest-bearing 73 $14 15.4 Interest-bearing demand 58 19 19.0 Money market 6 135 11.6 Savings 46 13 17.1 Time 18 44 2.8 Total deposits 200 $22 13.7 Deposit Base Characteristics1

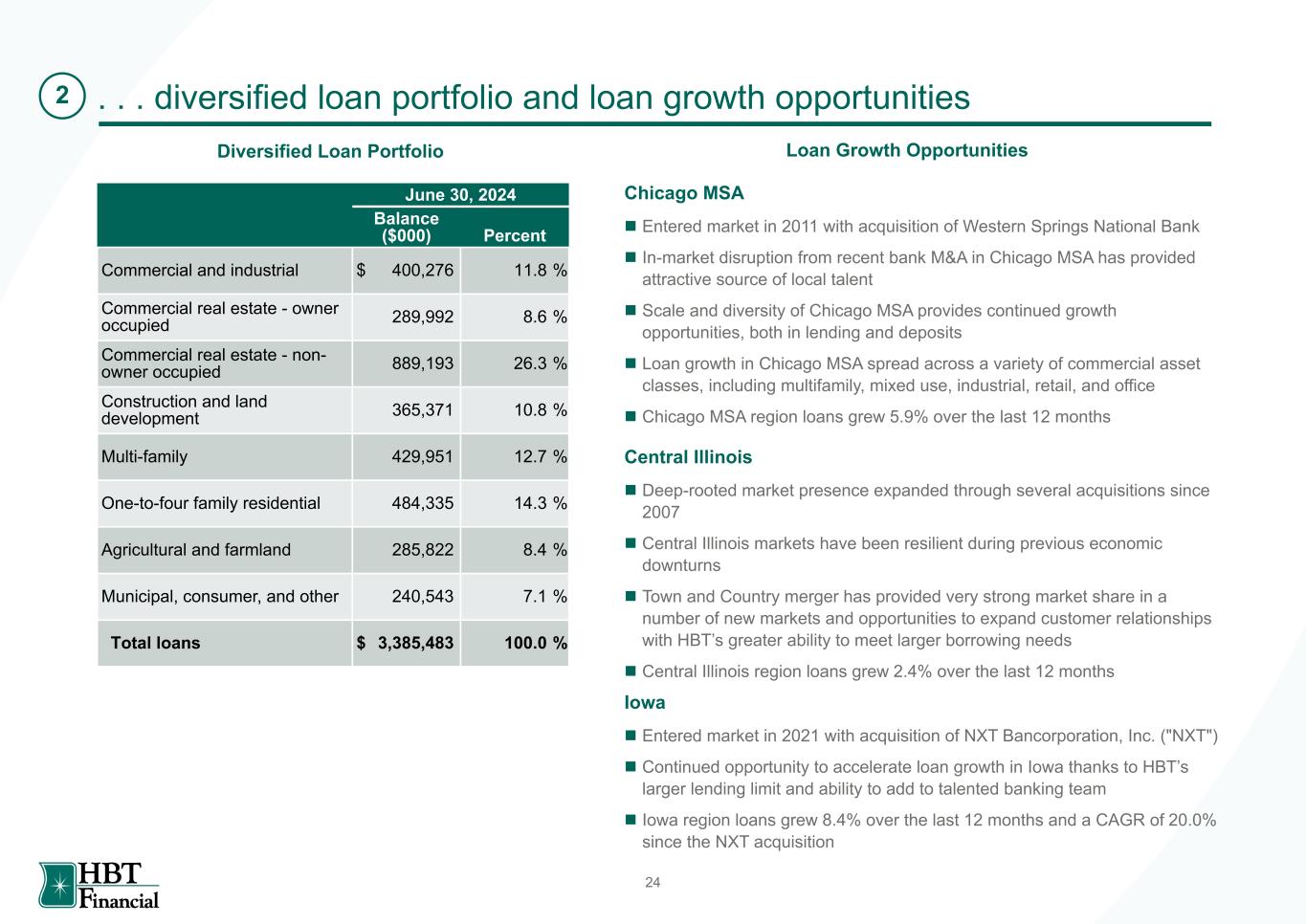

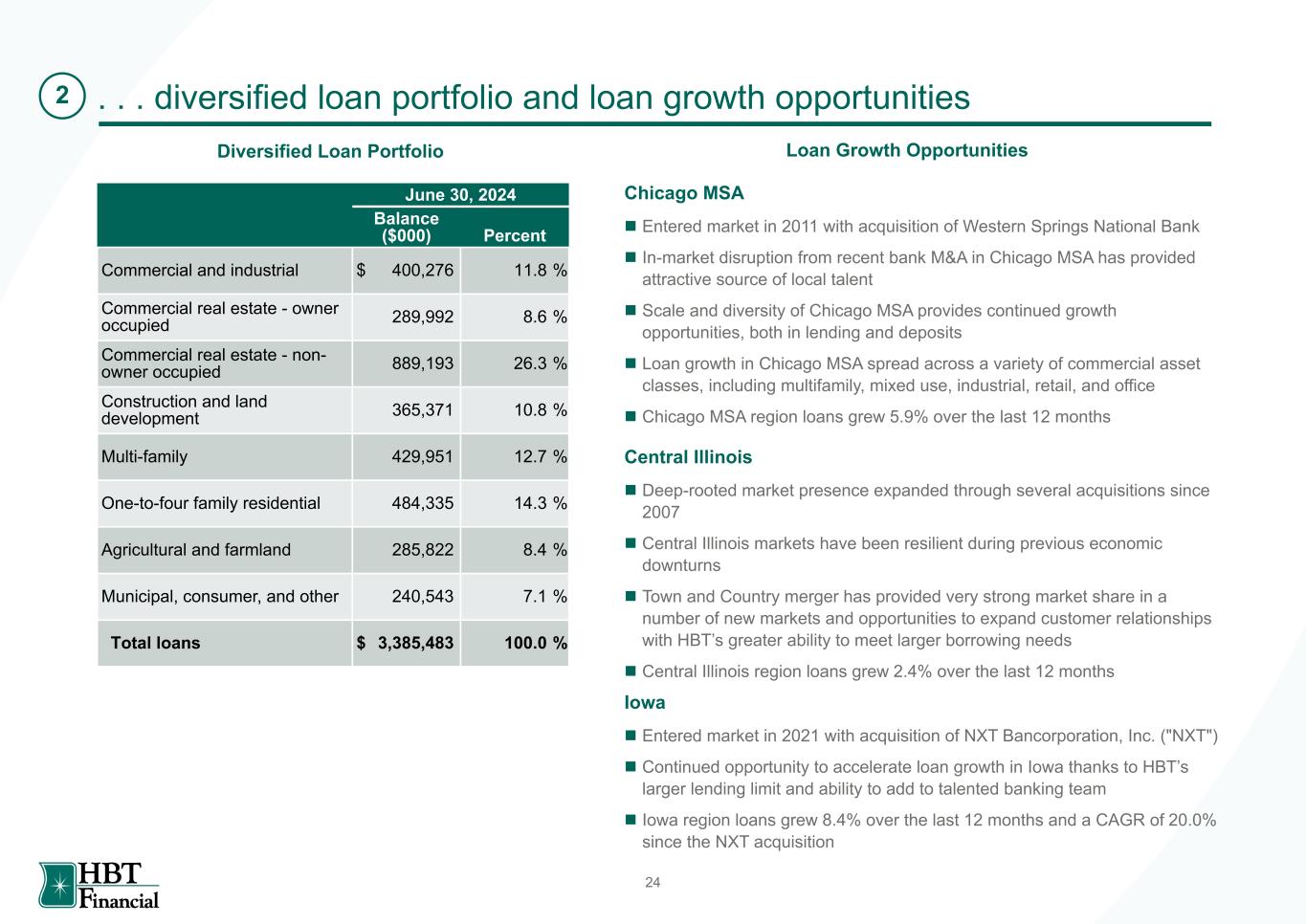

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 24 . . . diversified loan portfolio and loan growth opportunities2 Chicago MSA n Entered market in 2011 with acquisition of Western Springs National Bank n In-market disruption from recent bank M&A in Chicago MSA has provided attractive source of local talent n Scale and diversity of Chicago MSA provides continued growth opportunities, both in lending and deposits n Loan growth in Chicago MSA spread across a variety of commercial asset classes, including multifamily, mixed use, industrial, retail, and office n Chicago MSA region loans grew 5.9% over the last 12 months Central Illinois n Deep-rooted market presence expanded through several acquisitions since 2007 n Central Illinois markets have been resilient during previous economic downturns n Town and Country merger has provided very strong market share in a number of new markets and opportunities to expand customer relationships with HBT’s greater ability to meet larger borrowing needs n Central Illinois region loans grew 2.4% over the last 12 months Iowa n Entered market in 2021 with acquisition of NXT Bancorporation, Inc. ("NXT") n Continued opportunity to accelerate loan growth in Iowa thanks to HBT’s larger lending limit and ability to add to talented banking team n Iowa region loans grew 8.4% over the last 12 months and a CAGR of 20.0% since the NXT acquisition Loan Growth Opportunities June 30, 2024 Balance ($000) Percent Commercial and industrial $ 400,276 11.8 % Commercial real estate - owner occupied 289,992 8.6 % Commercial real estate - non- owner occupied 889,193 26.3 % Construction and land development 365,371 10.8 % Multi-family 429,951 12.7 % One-to-four family residential 484,335 14.3 % Agricultural and farmland 285,822 8.4 % Municipal, consumer, and other 240,543 7.1 % Total loans $ 3,385,483 100.0 % Diversified Loan Portfolio

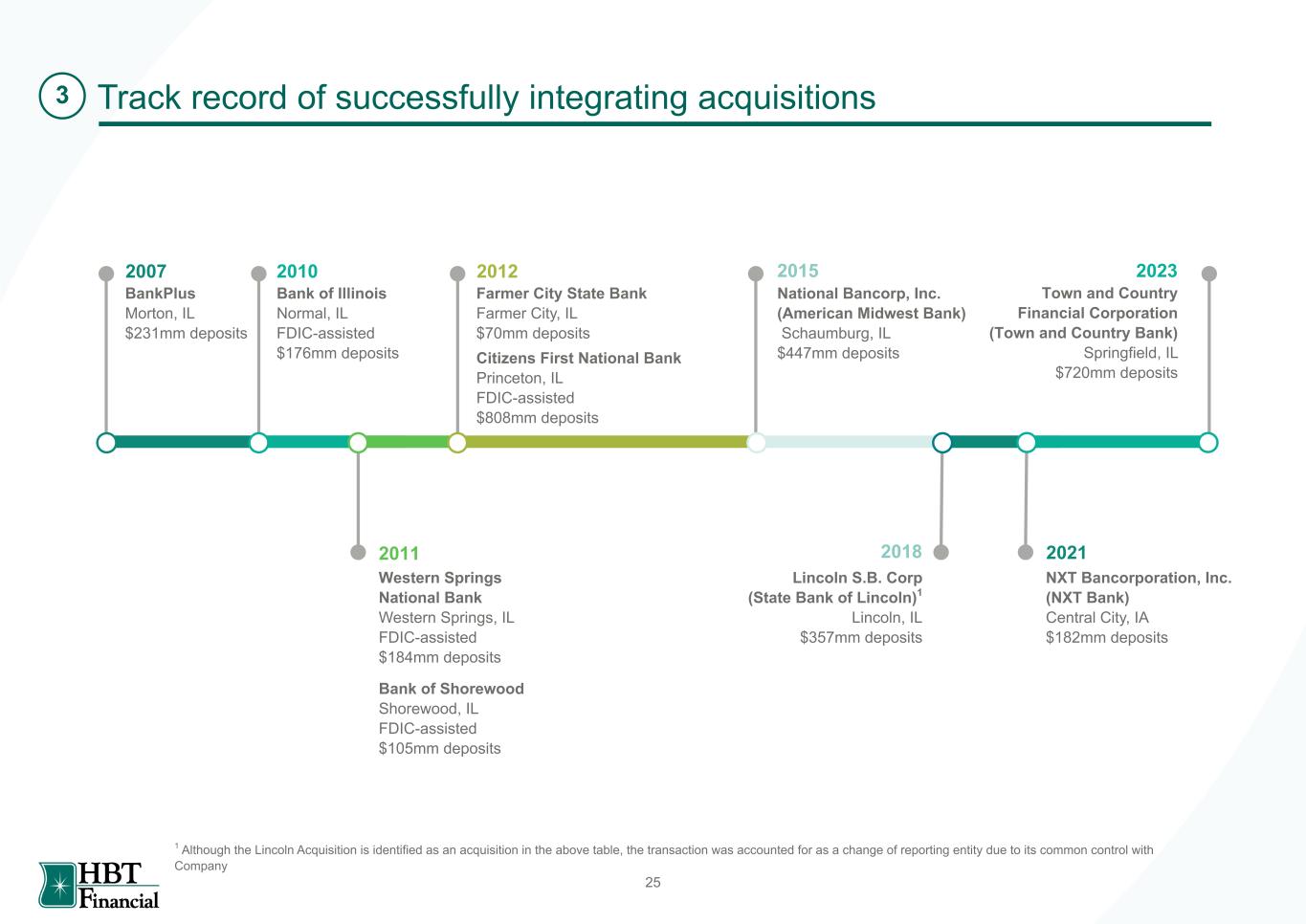

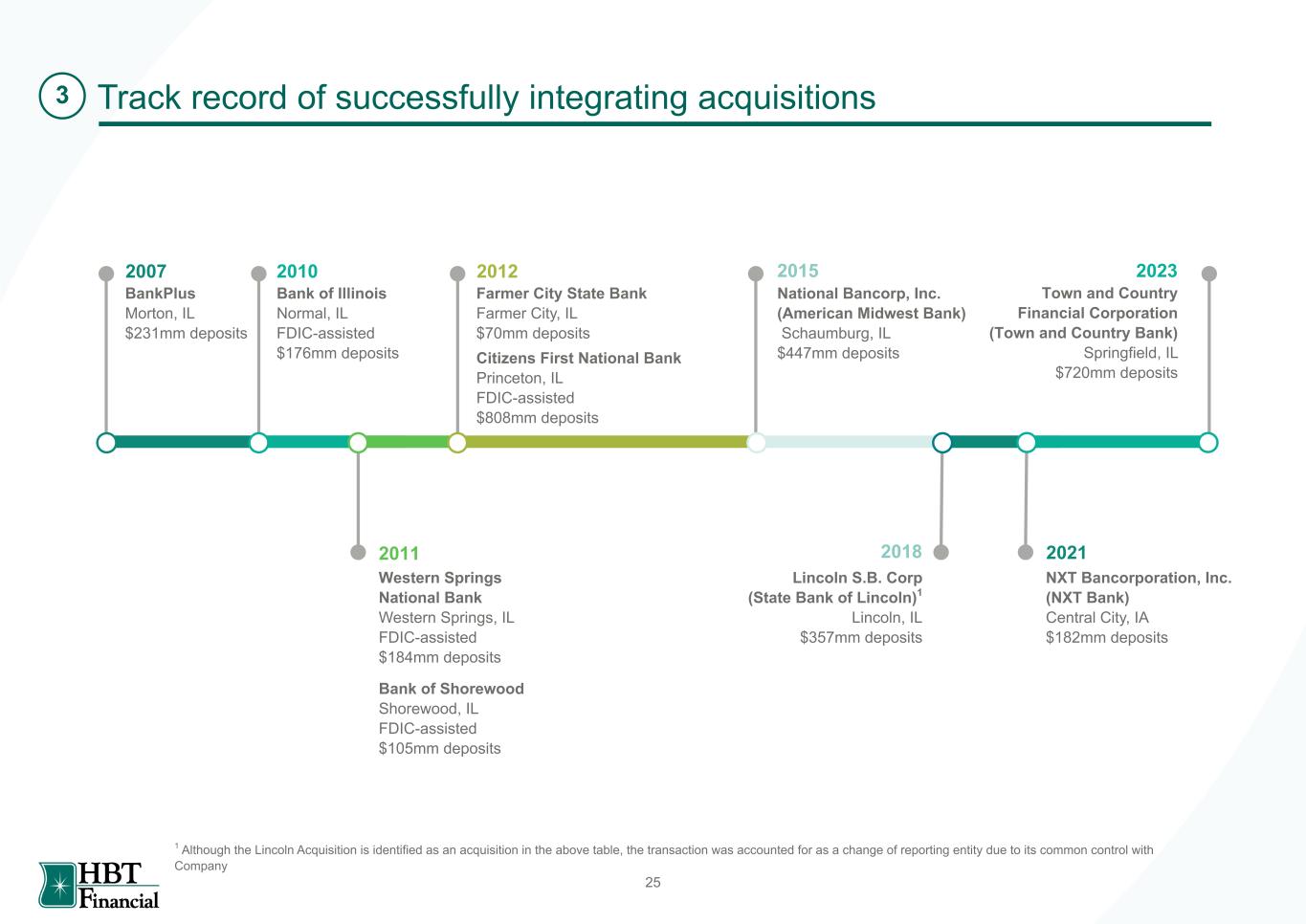

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 25 Track record of successfully integrating acquisitions BankPlus Morton, IL $231mm deposits 2007 2012 Bank of Illinois Normal, IL FDIC-assisted $176mm deposits Western Springs National Bank Western Springs, IL FDIC-assisted $184mm deposits 2011 Citizens First National Bank Princeton, IL FDIC-assisted $808mm deposits 2018 Farmer City State Bank Farmer City, IL $70mm deposits 20152010 Bank of Shorewood Shorewood, IL FDIC-assisted $105mm deposits National Bancorp, Inc. (American Midwest Bank) Schaumburg, IL $447mm deposits Lincoln S.B. Corp (State Bank of Lincoln)1 Lincoln, IL $357mm deposits 1 Although the Lincoln Acquisition is identified as an acquisition in the above table, the transaction was accounted for as a change of reporting entity due to its common control with Company 2021 NXT Bancorporation, Inc. (NXT Bank) Central City, IA $182mm deposits Town and Country Financial Corporation (Town and Country Bank) Springfield, IL $720mm deposits 2023 3

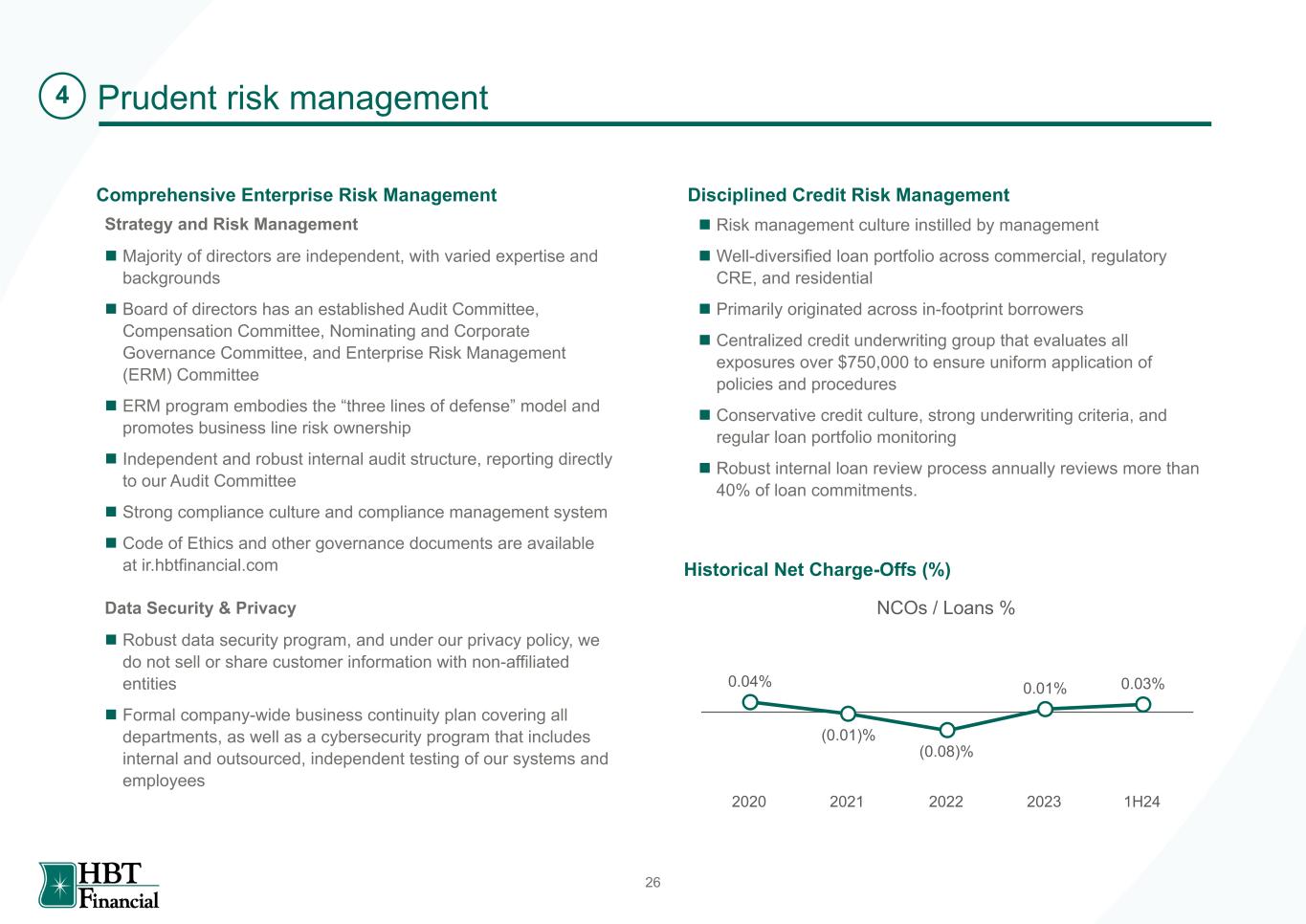

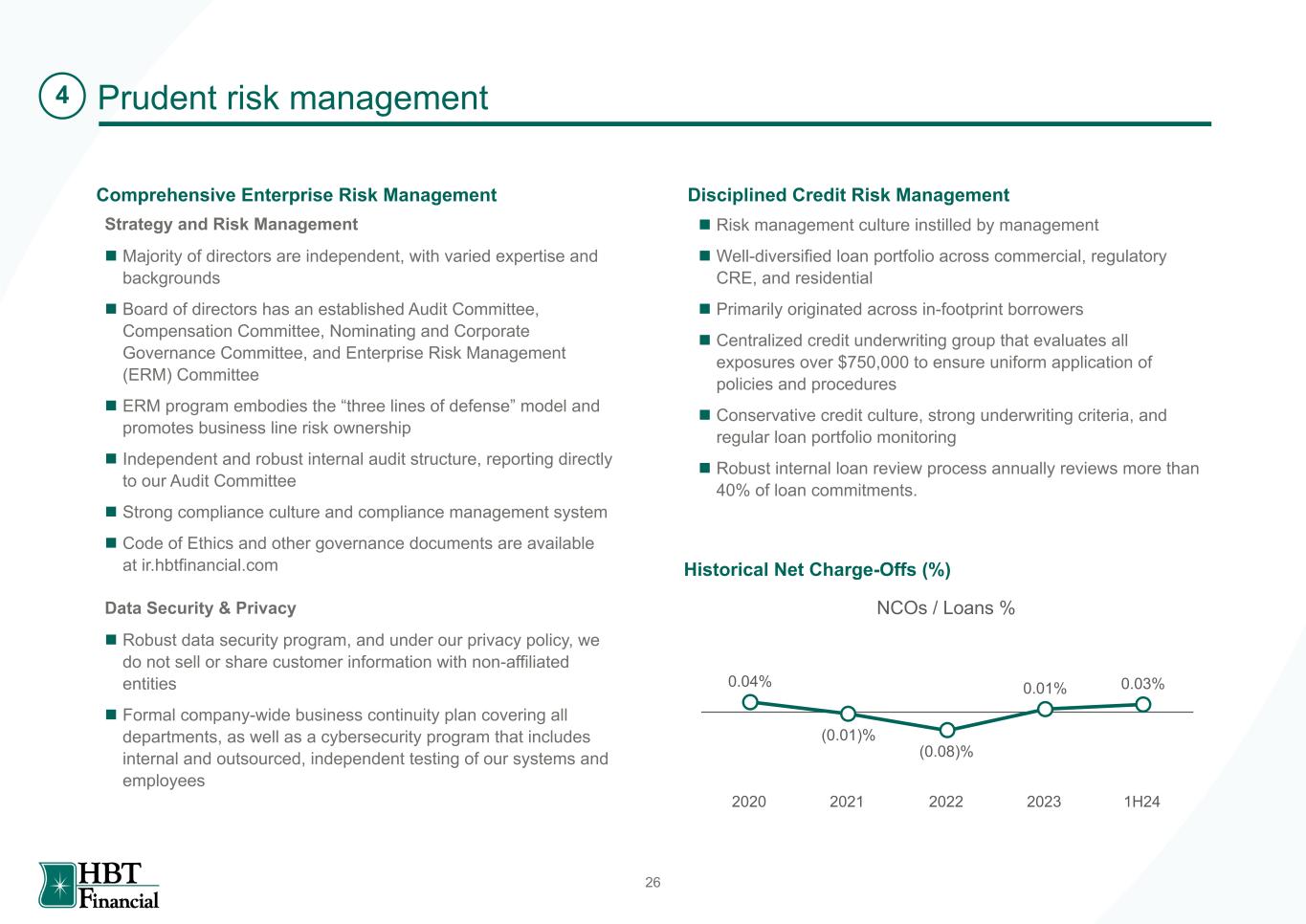

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 26 Prudent risk management n Risk management culture instilled by management n Well-diversified loan portfolio across commercial, regulatory CRE, and residential n Primarily originated across in-footprint borrowers n Centralized credit underwriting group that evaluates all exposures over $750,000 to ensure uniform application of policies and procedures n Conservative credit culture, strong underwriting criteria, and regular loan portfolio monitoring n Robust internal loan review process annually reviews more than 40% of loan commitments. Strategy and Risk Management n Majority of directors are independent, with varied expertise and backgrounds n Board of directors has an established Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee, and Enterprise Risk Management (ERM) Committee n ERM program embodies the “three lines of defense” model and promotes business line risk ownership n Independent and robust internal audit structure, reporting directly to our Audit Committee n Strong compliance culture and compliance management system n Code of Ethics and other governance documents are available at ir.hbtfinancial.com Data Security & Privacy n Robust data security program, and under our privacy policy, we do not sell or share customer information with non-affiliated entities n Formal company-wide business continuity plan covering all departments, as well as a cybersecurity program that includes internal and outsourced, independent testing of our systems and employees Comprehensive Enterprise Risk Management Disciplined Credit Risk Management Historical Net Charge-Offs (%) 4 NCOs / Loans % 0.04% (0.01)% (0.08)% 0.01% 0.03% 2020 2021 2022 2023 1H24

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 27 Appendix

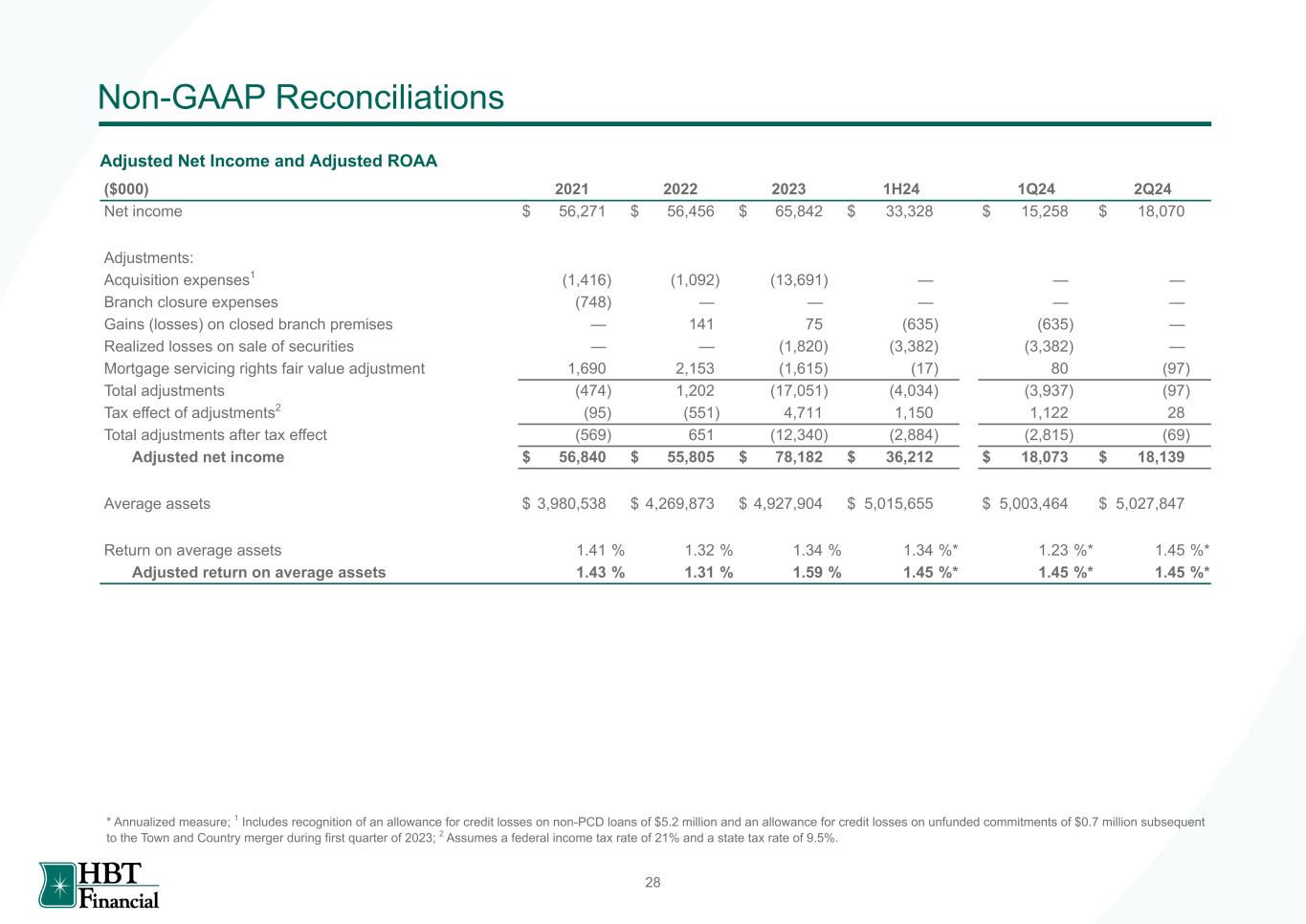

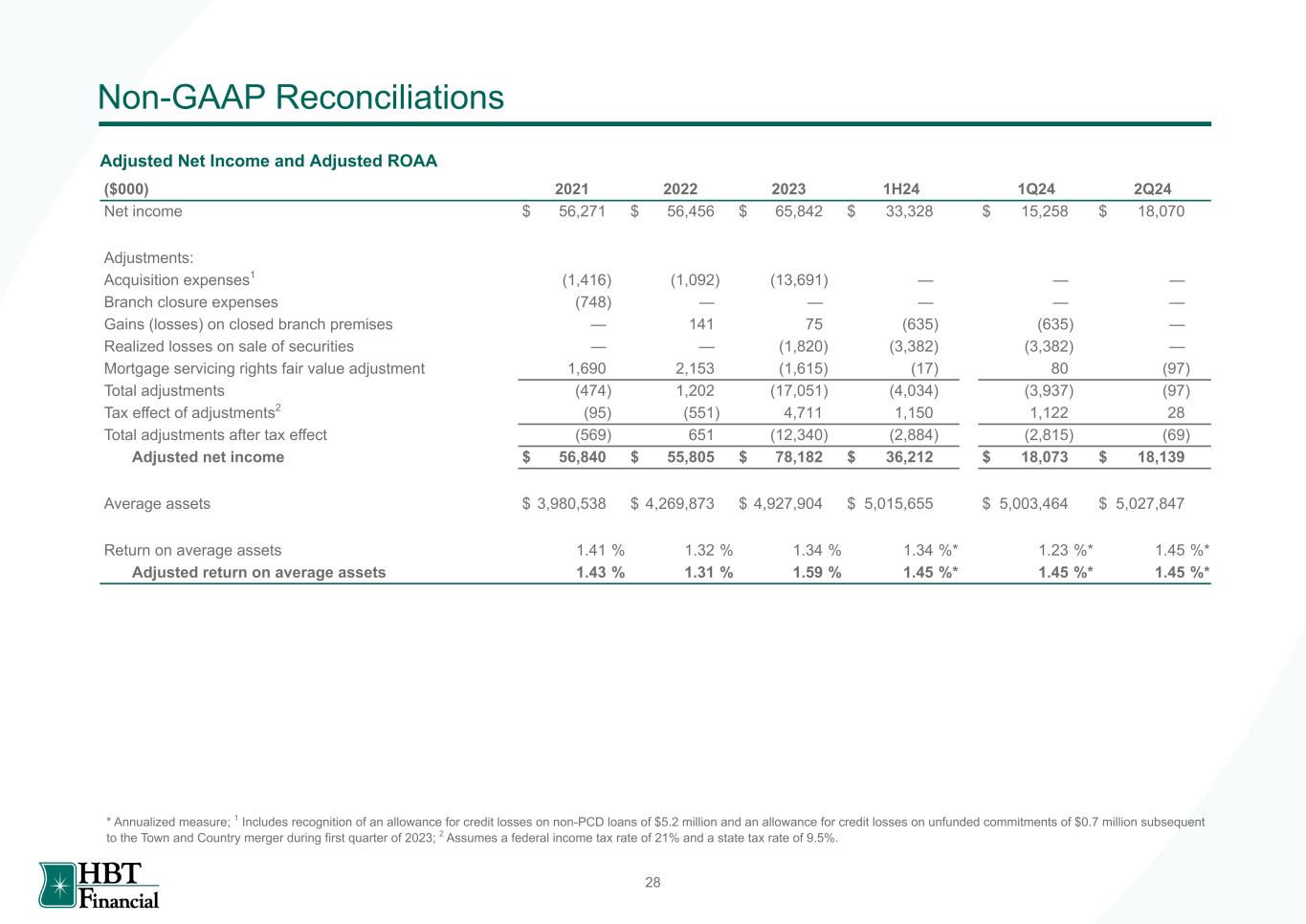

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 28 Non-GAAP Reconciliations Adjusted Net Income and Adjusted ROAA ($000) 2021 2022 2023 1H24 1Q24 2Q24 Net income $ 56,271 $ 56,456 $ 65,842 $ 33,328 $ 15,258 $ 18,070 Adjustments: Acquisition expenses1 (1,416) (1,092) (13,691) — — — Branch closure expenses (748) — — — — — Gains (losses) on closed branch premises — 141 75 (635) (635) — Realized losses on sale of securities — — (1,820) (3,382) (3,382) — Mortgage servicing rights fair value adjustment 1,690 2,153 (1,615) (17) 80 (97) Total adjustments (474) 1,202 (17,051) (4,034) (3,937) (97) Tax effect of adjustments2 (95) (551) 4,711 1,150 1,122 28 Total adjustments after tax effect (569) 651 (12,340) (2,884) (2,815) (69) Adjusted net income $ 56,840 $ 55,805 $ 78,182 $ 36,212 $ 18,073 $ 18,139 Average assets $ 3,980,538 $ 4,269,873 $ 4,927,904 $ 5,015,655 $ 5,003,464 $ 5,027,847 Return on average assets 1.41 % 1.32 % 1.34 % 1.34 %* 1.23 %* 1.45 %* Adjusted return on average assets 1.43 % 1.31 % 1.59 % 1.45 %* 1.45 %* 1.45 %* * Annualized measure; 1 Includes recognition of an allowance for credit losses on non-PCD loans of $5.2 million and an allowance for credit losses on unfunded commitments of $0.7 million subsequent to the Town and Country merger during first quarter of 2023; 2 Assumes a federal income tax rate of 21% and a state tax rate of 9.5%.

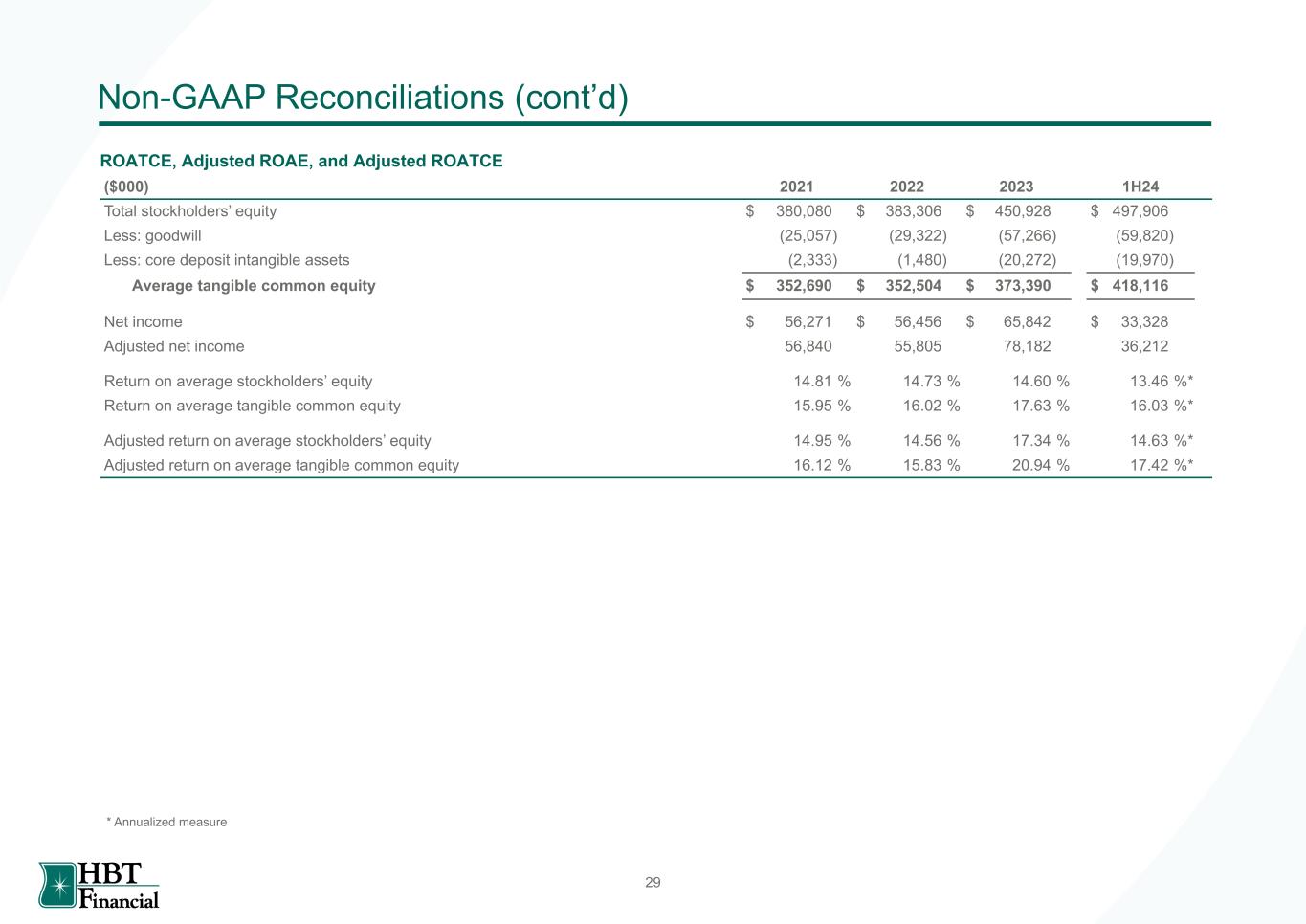

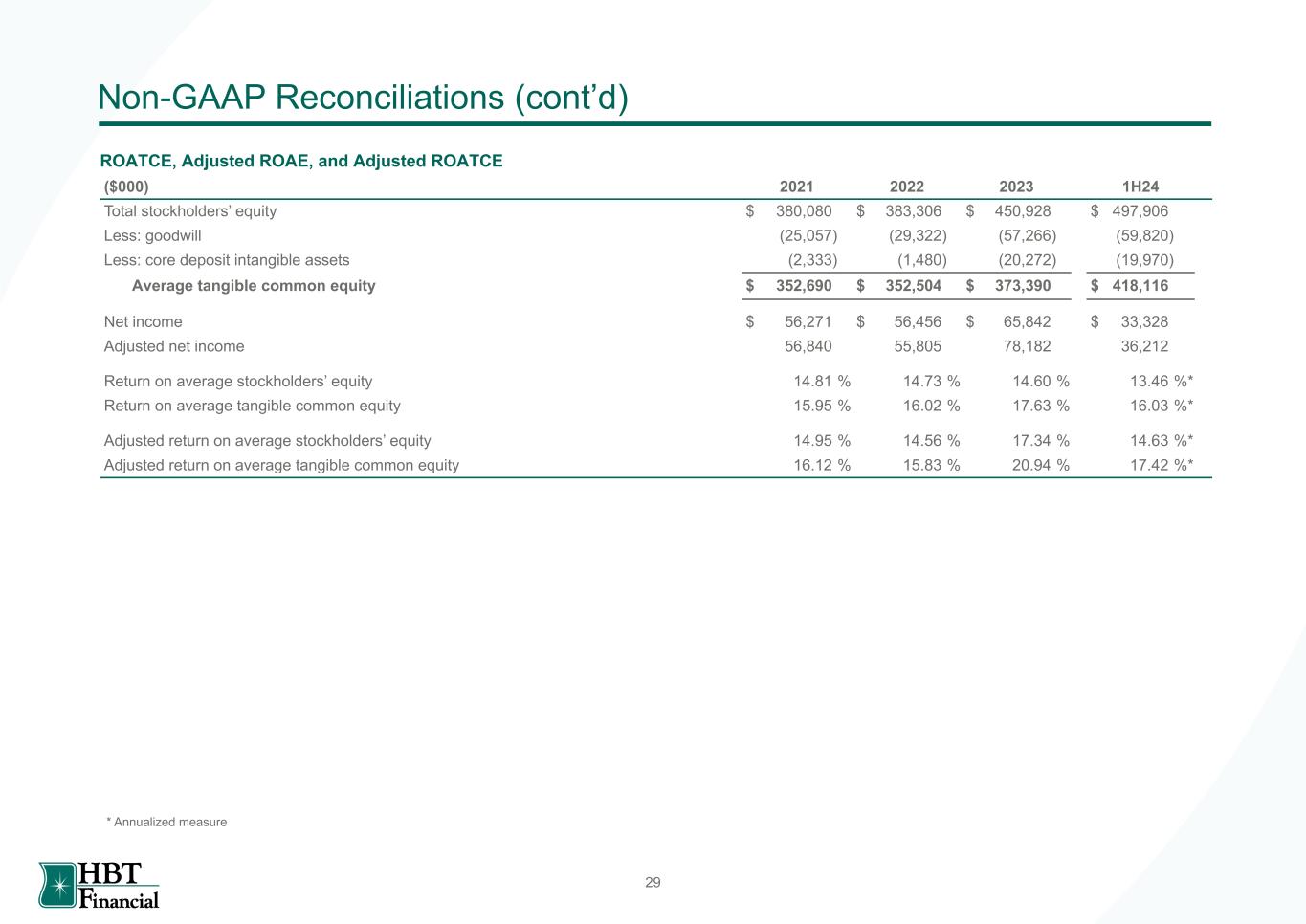

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 29 Non-GAAP Reconciliations (cont’d) ROATCE, Adjusted ROAE, and Adjusted ROATCE ($000) 2021 2022 2023 1H24 Total stockholders’ equity $ 380,080 $ 383,306 $ 450,928 $ 497,906 Less: goodwill (25,057) (29,322) (57,266) (59,820) Less: core deposit intangible assets (2,333) (1,480) (20,272) (19,970) Average tangible common equity $ 352,690 $ 352,504 $ 373,390 $ 418,116 Net income $ 56,271 $ 56,456 $ 65,842 $ 33,328 Adjusted net income 56,840 55,805 78,182 36,212 Return on average stockholders’ equity 14.81 % 14.73 % 14.60 % 13.46 %* Return on average tangible common equity 15.95 % 16.02 % 17.63 % 16.03 %* Adjusted return on average stockholders’ equity 14.95 % 14.56 % 17.34 % 14.63 %* Adjusted return on average tangible common equity 16.12 % 15.83 % 20.94 % 17.42 %* * Annualized measure

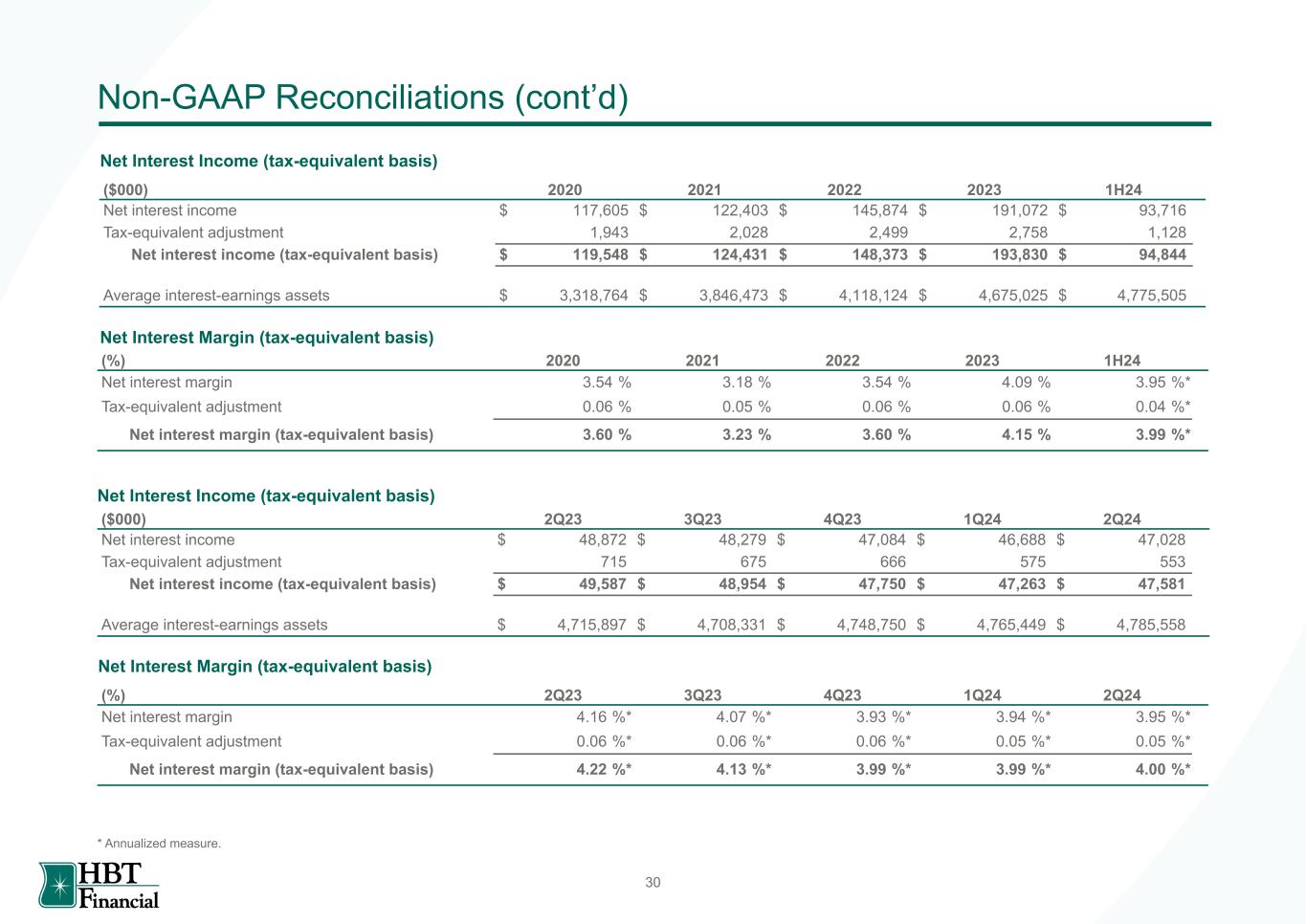

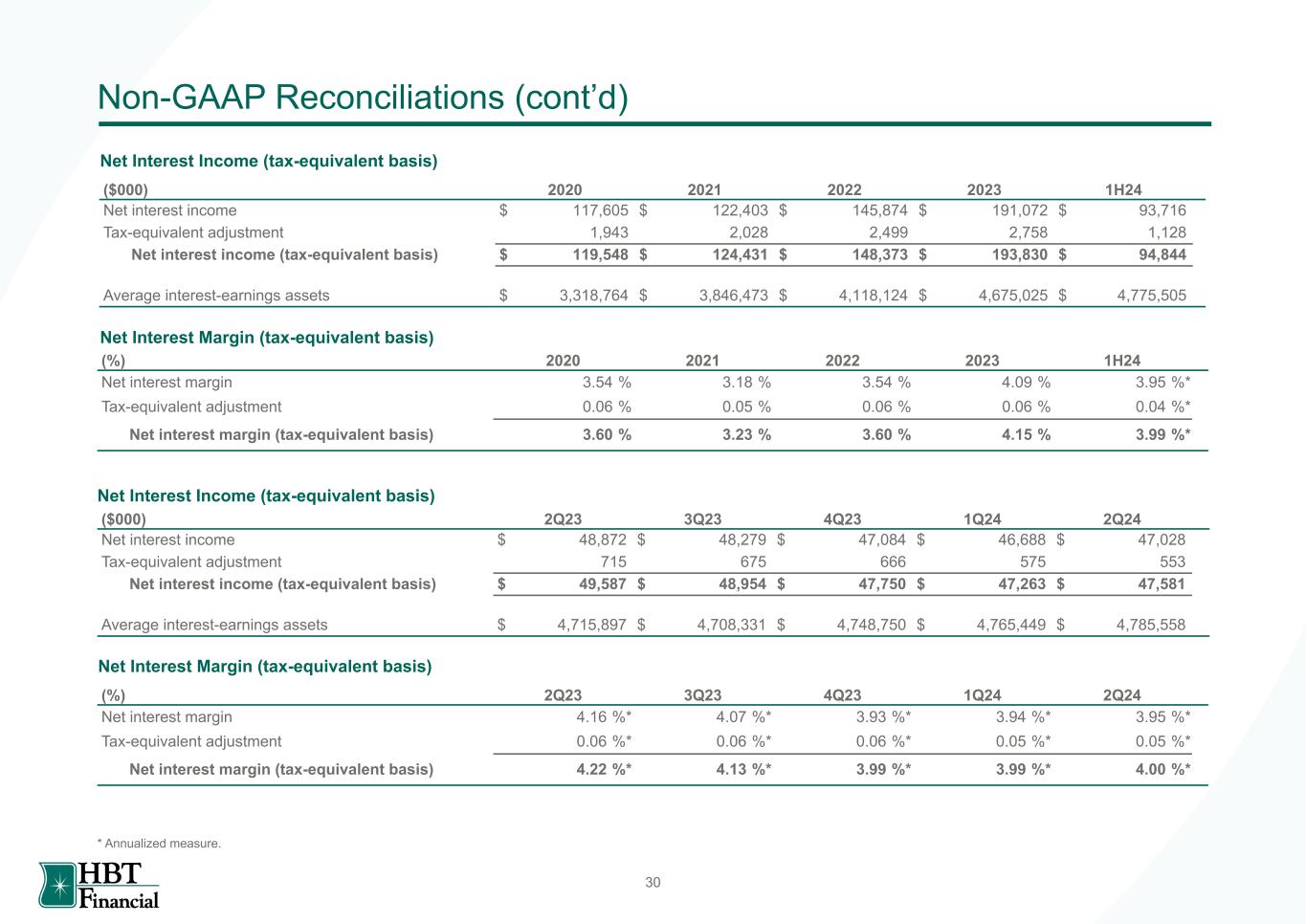

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 30 Non-GAAP Reconciliations (cont’d) ($000) 2020 2021 2022 2023 1H24 Net interest income $ 117,605 $ 122,403 $ 145,874 $ 191,072 $ 93,716 Tax-equivalent adjustment 1,943 2,028 2,499 2,758 1,128 Net interest income (tax-equivalent basis) $ 119,548 $ 124,431 $ 148,373 $ 193,830 $ 94,844 Average interest-earnings assets $ 3,318,764 $ 3,846,473 $ 4,118,124 $ 4,675,025 $ 4,775,505 Net Interest Income (tax-equivalent basis) Net Interest Margin (tax-equivalent basis) * Annualized measure. (%) 2020 2021 2022 2023 1H24 Net interest margin 3.54 % 3.18 % 3.54 % 4.09 % 3.95 %* Tax-equivalent adjustment 0.06 % 0.05 % 0.06 % 0.06 % 0.04 %* Net interest margin (tax-equivalent basis) 3.60 % 3.23 % 3.60 % 4.15 % 3.99 %* Net Interest Income (tax-equivalent basis) Net Interest Margin (tax-equivalent basis) ($000) 2Q23 3Q23 4Q23 1Q24 2Q24 Net interest income $ 48,872 $ 48,279 $ 47,084 $ 46,688 $ 47,028 Tax-equivalent adjustment 715 675 666 575 553 Net interest income (tax-equivalent basis) $ 49,587 $ 48,954 $ 47,750 $ 47,263 $ 47,581 Average interest-earnings assets $ 4,715,897 $ 4,708,331 $ 4,748,750 $ 4,765,449 $ 4,785,558 (%) 2Q23 3Q23 4Q23 1Q24 2Q24 Net interest margin 4.16 %* 4.07 %* 3.93 %* 3.94 %* 3.95 %* Tax-equivalent adjustment 0.06 %* 0.06 %* 0.06 %* 0.05 %* 0.05 %* Net interest margin (tax-equivalent basis) 4.22 %* 4.13 %* 3.99 %* 3.99 %* 4.00 %*

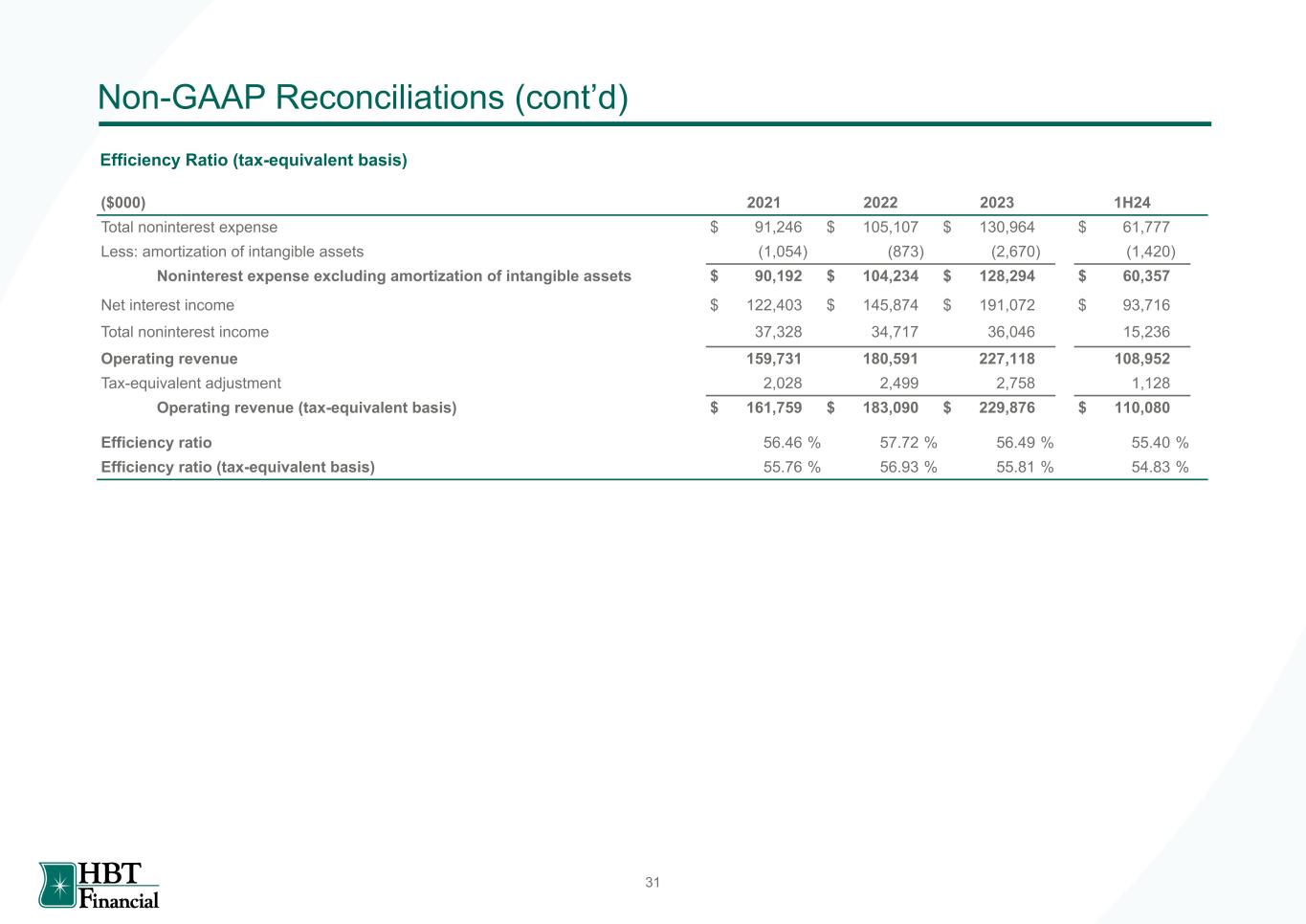

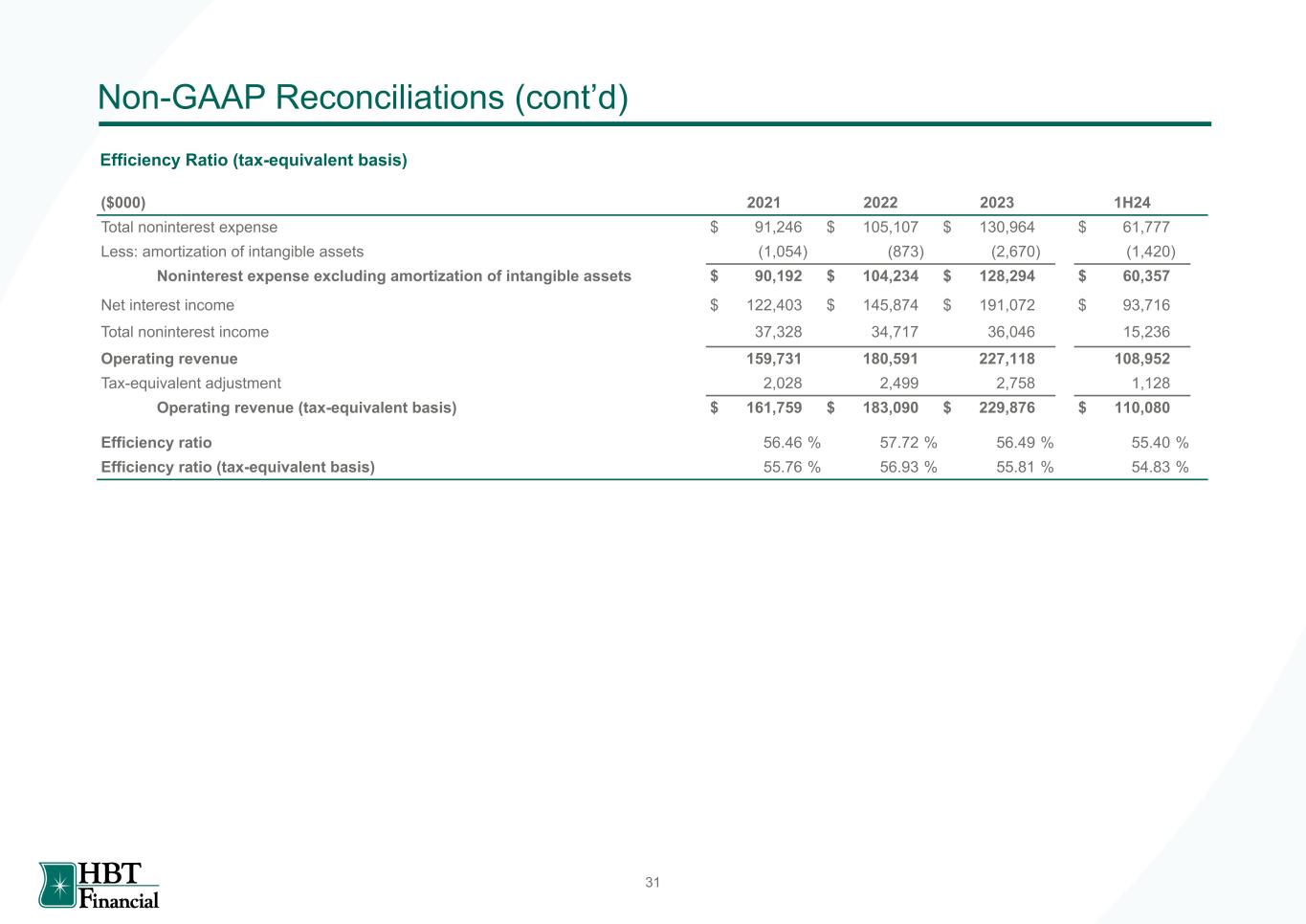

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 31 Non-GAAP Reconciliations (cont’d) Efficiency Ratio (tax-equivalent basis) ($000) 2021 2022 2023 1H24 Total noninterest expense $ 91,246 $ 105,107 $ 130,964 $ 61,777 Less: amortization of intangible assets (1,054) (873) (2,670) (1,420) Noninterest expense excluding amortization of intangible assets $ 90,192 $ 104,234 $ 128,294 $ 60,357 Net interest income $ 122,403 $ 145,874 $ 191,072 $ 93,716 Total noninterest income 37,328 34,717 36,046 15,236 Operating revenue 159,731 180,591 227,118 108,952 Tax-equivalent adjustment 2,028 2,499 2,758 1,128 Operating revenue (tax-equivalent basis) $ 161,759 $ 183,090 $ 229,876 $ 110,080 Efficiency ratio 56.46 % 57.72 % 56.49 % 55.40 % Efficiency ratio (tax-equivalent basis) 55.76 % 56.93 % 55.81 % 54.83 %

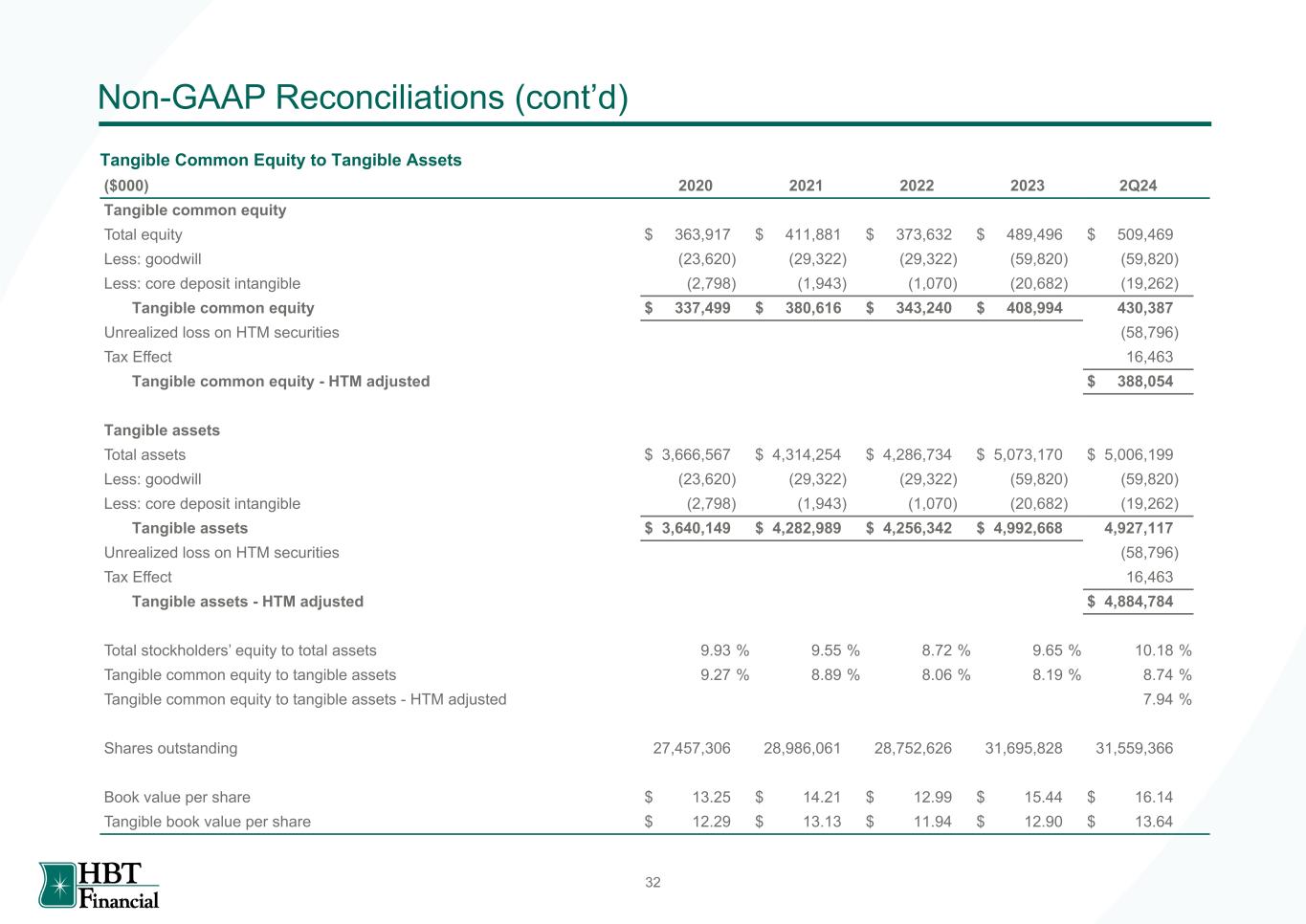

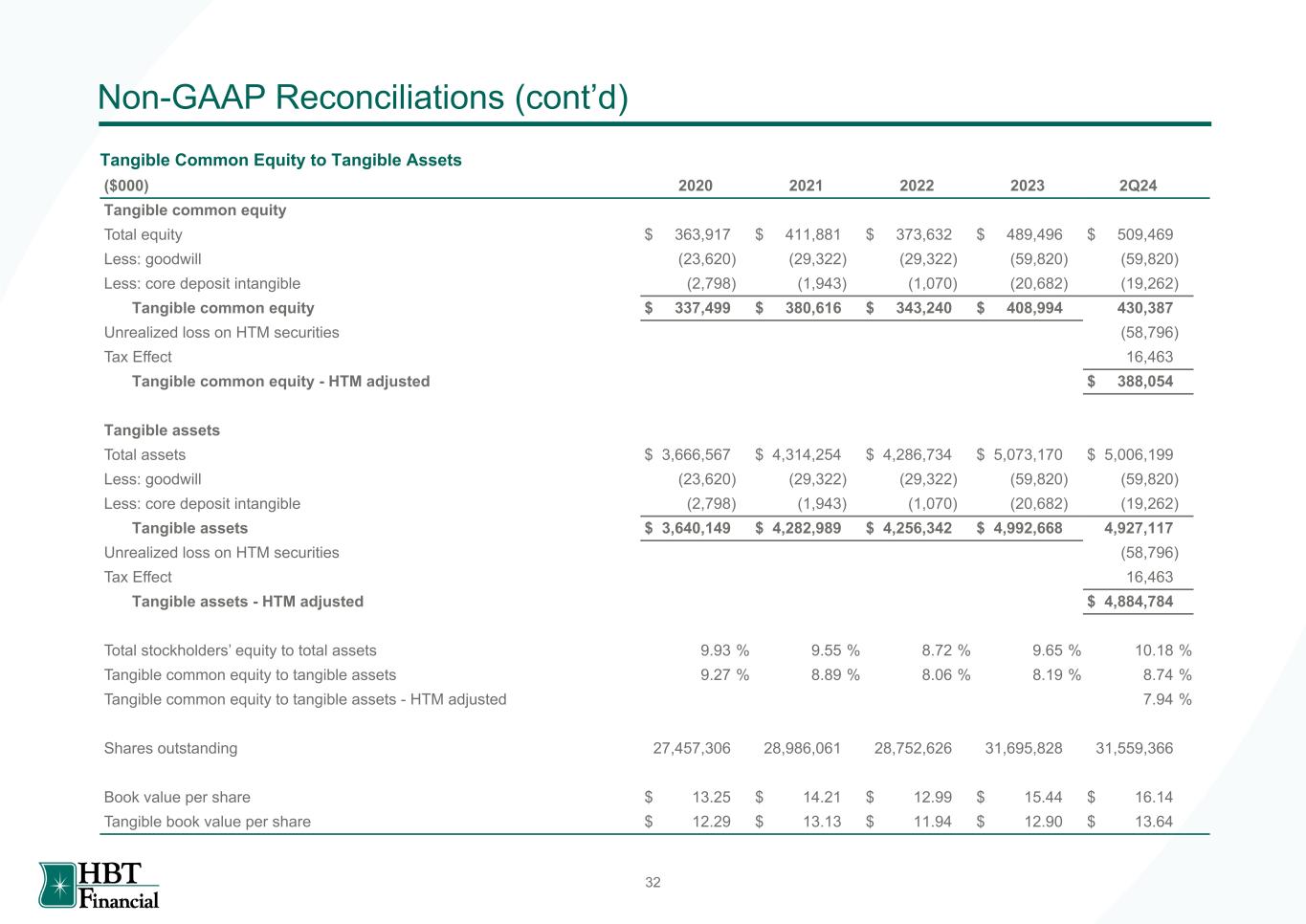

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 32 Non-GAAP Reconciliations (cont’d) ($000) 2020 2021 2022 2023 2Q24 Tangible common equity Total equity $ 363,917 $ 411,881 $ 373,632 $ 489,496 $ 509,469 Less: goodwill (23,620) (29,322) (29,322) (59,820) (59,820) Less: core deposit intangible (2,798) (1,943) (1,070) (20,682) (19,262) Tangible common equity $ 337,499 $ 380,616 $ 343,240 $ 408,994 430,387 Unrealized loss on HTM securities (58,796) Tax Effect 16,463 Tangible common equity - HTM adjusted $ 388,054 Tangible assets Total assets $ 3,666,567 $ 4,314,254 $ 4,286,734 $ 5,073,170 $ 5,006,199 Less: goodwill (23,620) (29,322) (29,322) (59,820) (59,820) Less: core deposit intangible (2,798) (1,943) (1,070) (20,682) (19,262) Tangible assets $ 3,640,149 $ 4,282,989 $ 4,256,342 $ 4,992,668 4,927,117 Unrealized loss on HTM securities (58,796) Tax Effect 16,463 Tangible assets - HTM adjusted $ 4,884,784 Total stockholders’ equity to total assets 9.93 % 9.55 % 8.72 % 9.65 % 10.18 % Tangible common equity to tangible assets 9.27 % 8.89 % 8.06 % 8.19 % 8.74 % Tangible common equity to tangible assets - HTM adjusted 7.94 % Shares outstanding 27,457,306 28,986,061 28,752,626 31,695,828 31,559,366 Book value per share $ 13.25 $ 14.21 $ 12.99 $ 15.44 $ 16.14 Tangible book value per share $ 12.29 $ 13.13 $ 11.94 $ 12.90 $ 13.64 Tangible Common Equity to Tangible Assets

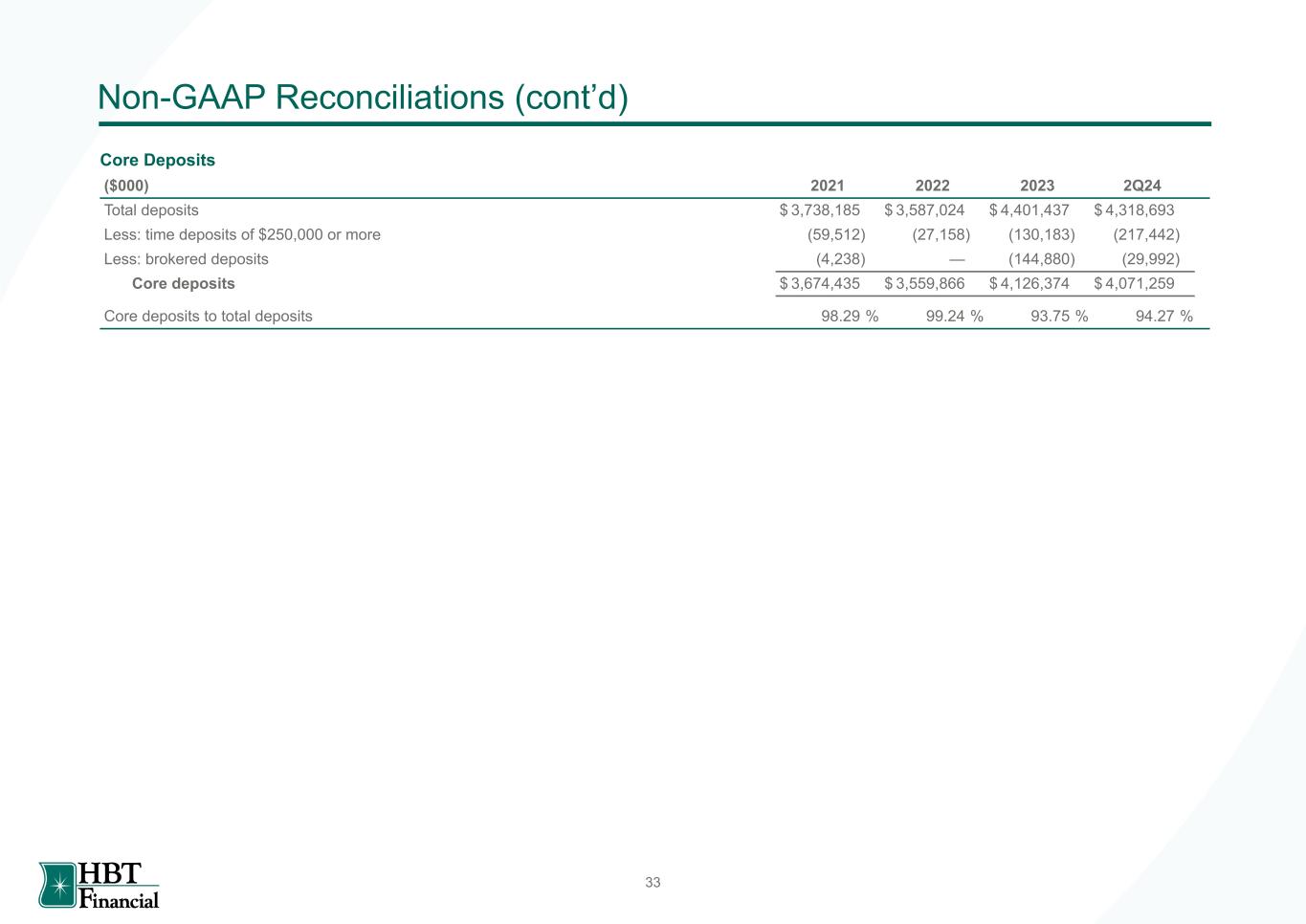

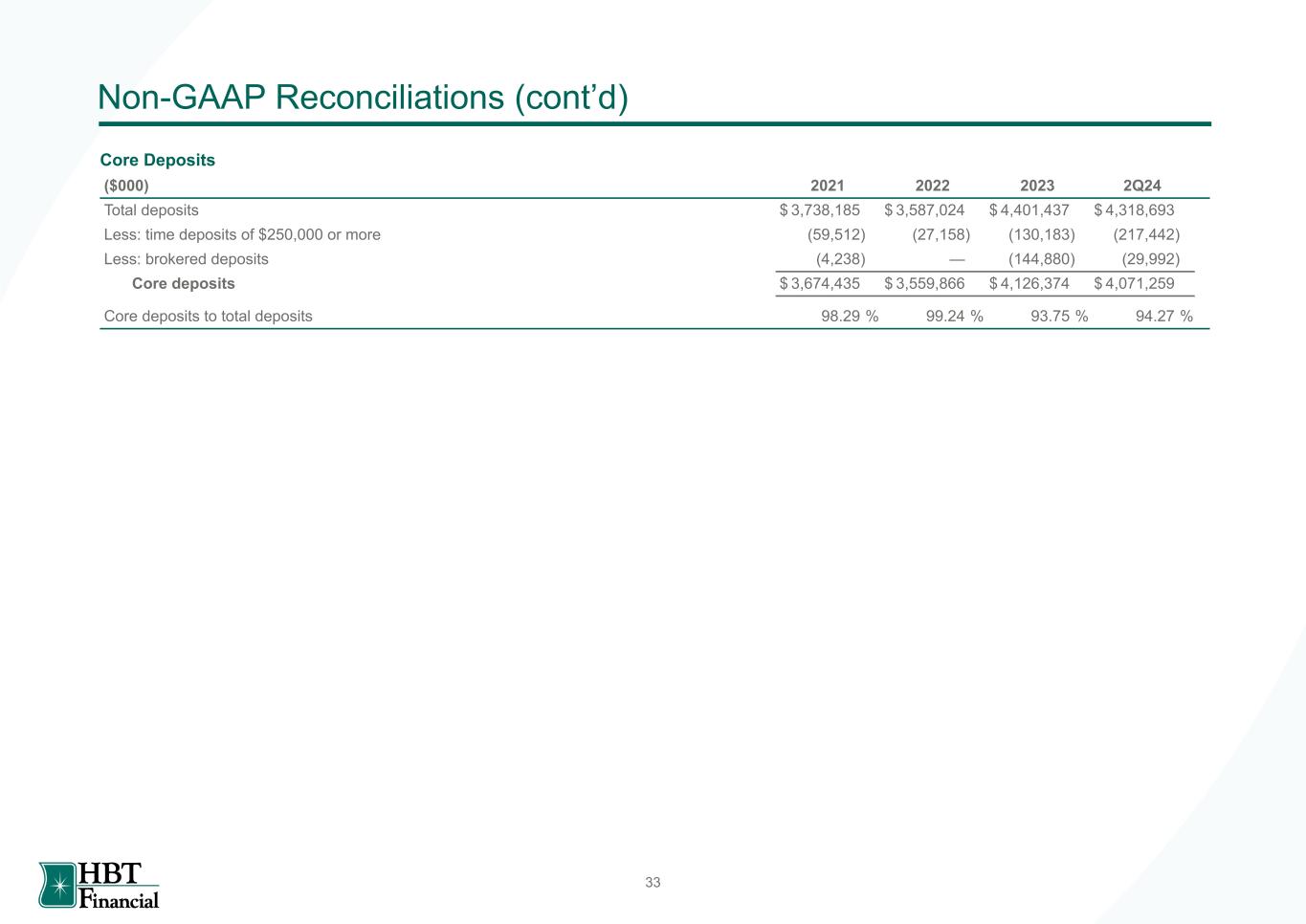

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 33 Non-GAAP Reconciliations (cont’d) ($000) 2021 2022 2023 2Q24 Total deposits $ 3,738,185 $ 3,587,024 $ 4,401,437 $ 4,318,693 Less: time deposits of $250,000 or more (59,512) (27,158) (130,183) (217,442) Less: brokered deposits (4,238) — (144,880) (29,992) Core deposits $ 3,674,435 $ 3,559,866 $ 4,126,374 $ 4,071,259 Core deposits to total deposits 98.29 % 99.24 % 93.75 % 94.27 % Core Deposits

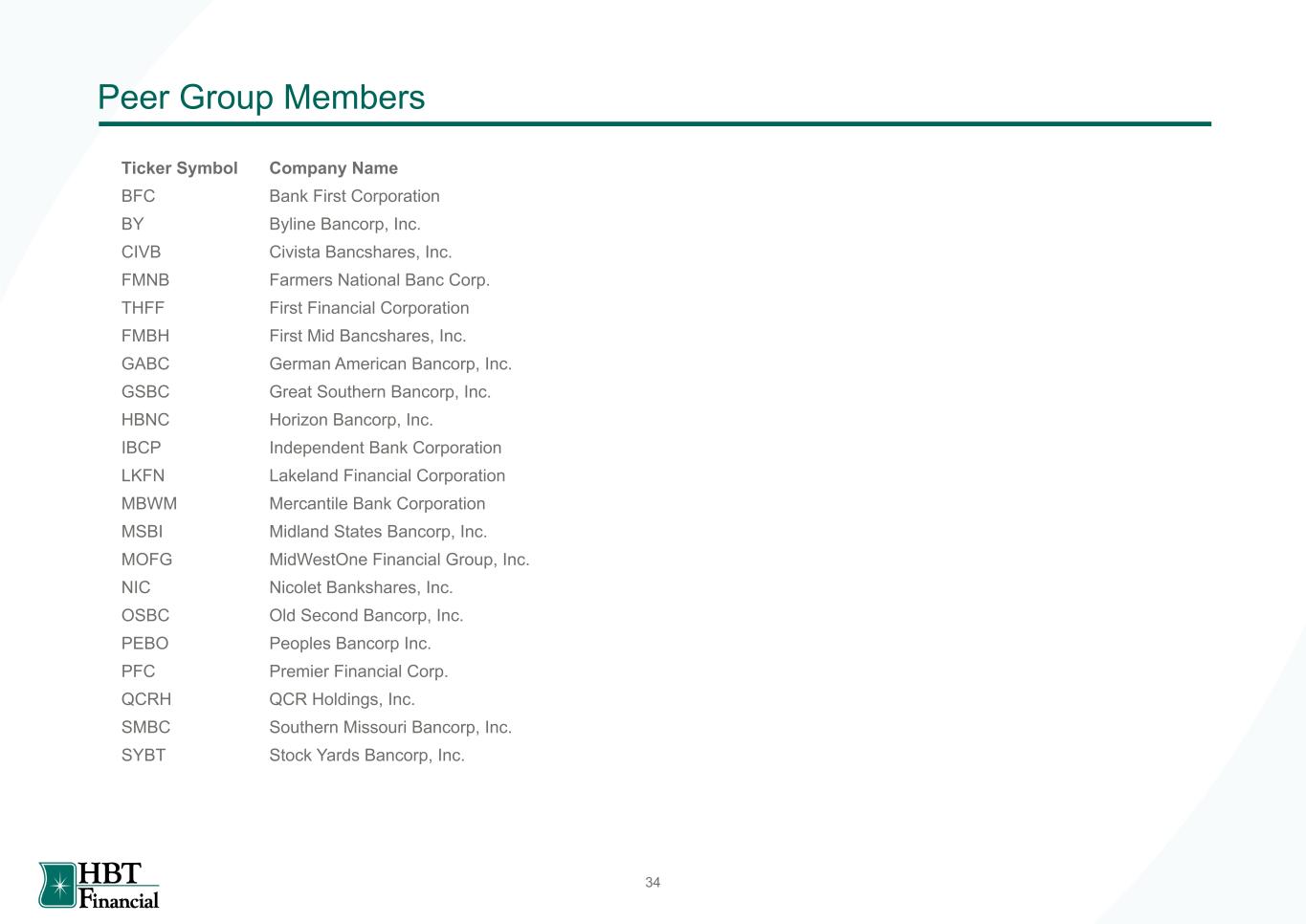

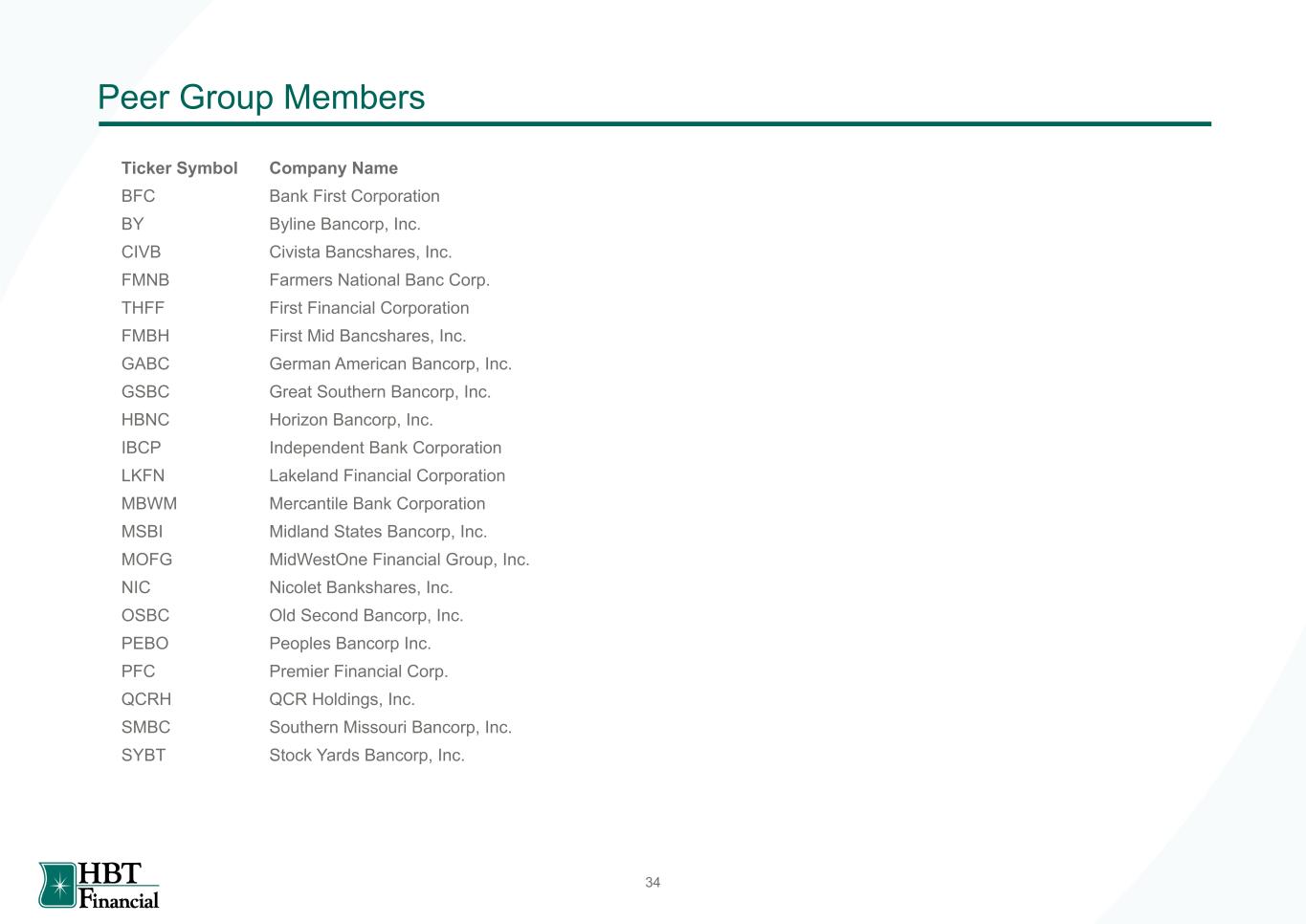

Arial 0 101 88 14 137 119 8 176 152 96 194 80 166 182 64 215 237 234 109 110 106 255 255 255 0 0 0 0 101 88 1st Level Bullet Text Charts Soft colors 211, 217, 216 211, 223, 220 217, 236, 215 211, 226, 222 242, 249, 248 249, 252, 251 250, 250, 250 229, 233, 213 34 Peer Group Members Ticker Symbol Company Name BFC Bank First Corporation BY Byline Bancorp, Inc. CIVB Civista Bancshares, Inc. FMNB Farmers National Banc Corp. THFF First Financial Corporation FMBH First Mid Bancshares, Inc. GABC German American Bancorp, Inc. GSBC Great Southern Bancorp, Inc. HBNC Horizon Bancorp, Inc. IBCP Independent Bank Corporation LKFN Lakeland Financial Corporation MBWM Mercantile Bank Corporation MSBI Midland States Bancorp, Inc. MOFG MidWestOne Financial Group, Inc. NIC Nicolet Bankshares, Inc. OSBC Old Second Bancorp, Inc. PEBO Peoples Bancorp Inc. PFC Premier Financial Corp. QCRH QCR Holdings, Inc. SMBC Southern Missouri Bancorp, Inc. SYBT Stock Yards Bancorp, Inc.

HBT Financial, Inc.