| New York | ||||||||

(State or other jurisdiction of incorporation) | ||||||||

|

1-9861

(Commission File Number)

|

16-0968385

(I.R.S. Employer Identification Number)

|

|||||||

One M&T Plaza, Buffalo, New York |

14203 | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||

Registrant's telephone number, including area code: (716) 635-4000 | ||||||||

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

||||

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

||||

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

||||

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

||||

Securities registered pursuant to Section 12(b) of the Act: | ||||||||

Title of Each Class |

Trading Symbols |

Name of Each Exchange on Which Registered |

||||||

| Common Stock, $.50 par value | MTB | New York Stock Exchange | ||||||

| Perpetual Fixed-to-Floating Rate Non-Cumulative Preferred Stock, Series H |

MTBPrH | New York Stock Exchange | ||||||

| Perpetual 7.500% Non-Cumulative Preferred Stock, Series J |

MTBPrJ | New York Stock Exchange | ||||||

| Exhibit No. | Exhibit Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

|||||||

| M&T BANK CORPORATION | |||||||||||||||||

| Date: | July 18, 2024 | By: |

/s/ Daryl N. Bible | ||||||||||||||

| Daryl N. Bible | |||||||||||||||||

| Senior Executive Vice President and Chief Financial Officer |

|||||||||||||||||

|

News Release |

||||

| One M&T Plaza, Buffalo, NY 14203 | July 18, 2024 | ||||

M&T Bank Corporation (NYSE:MTB) announces second quarter 2024 results | |||||

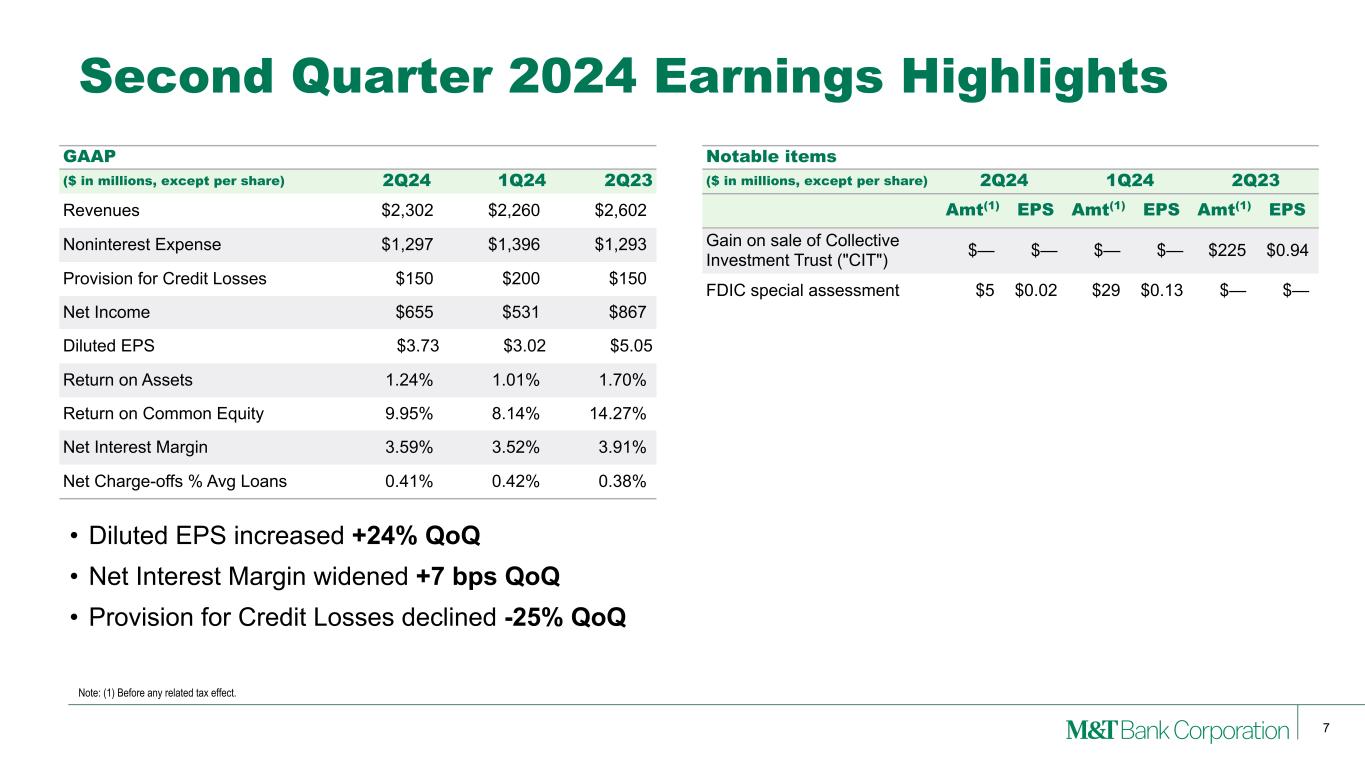

| (Dollars in millions, except per share data) | 2Q24 | 1Q24 | 2Q23 | |||||||||||||||||

| Earnings Highlights | ||||||||||||||||||||

| Net interest income | $ | 1,718 | $ | 1,680 | $ | 1,799 | ||||||||||||||

| Taxable-equivalent adjustment | 13 | 12 | 14 | |||||||||||||||||

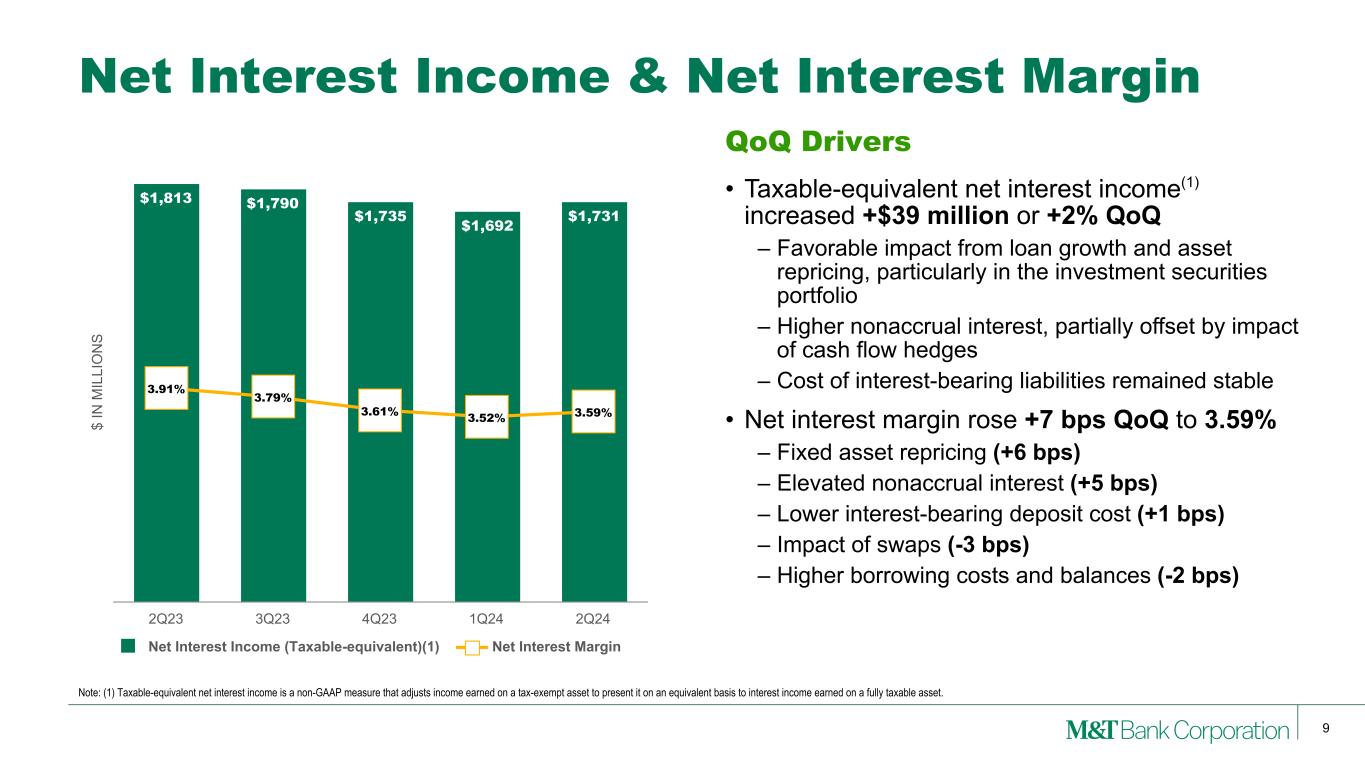

| Net interest income - taxable-equivalent | 1,731 | 1,692 | 1,813 | |||||||||||||||||

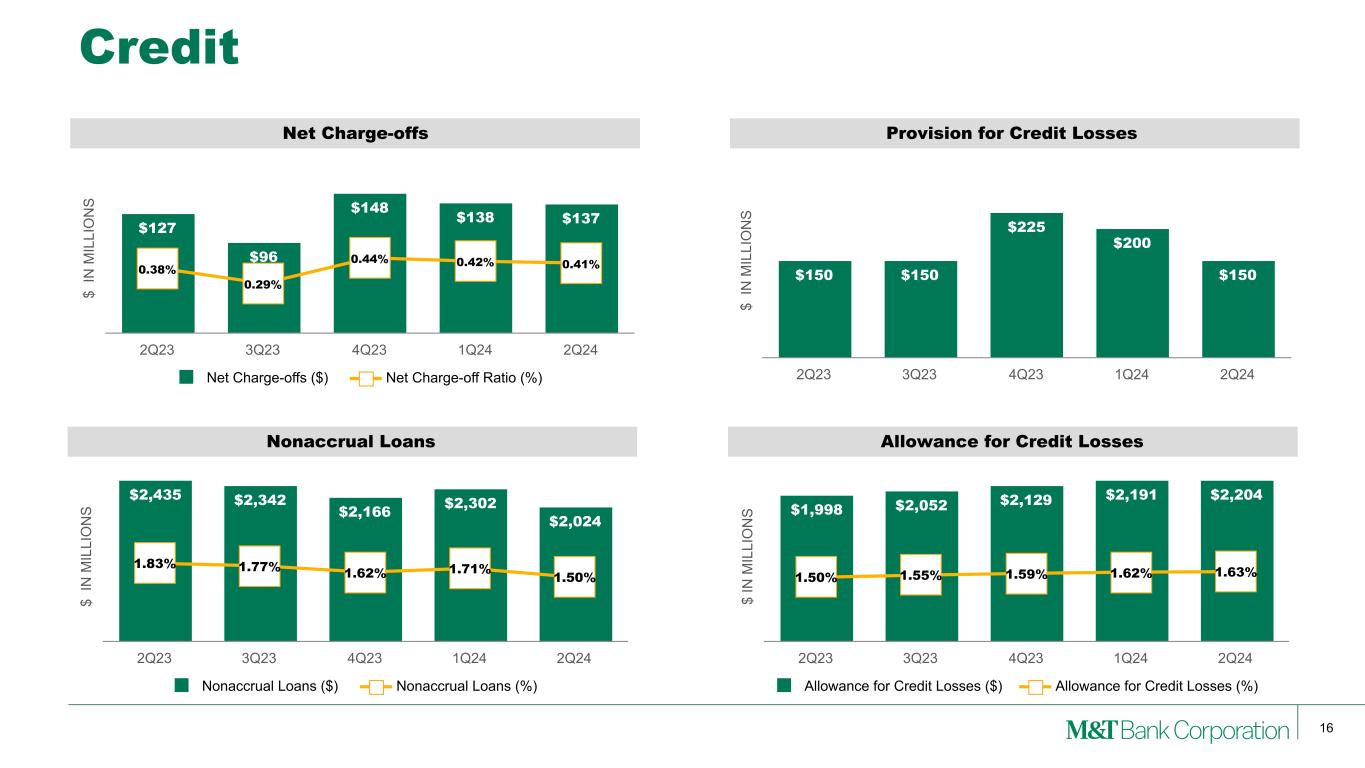

| Provision for credit losses | 150 | 200 | 150 | |||||||||||||||||

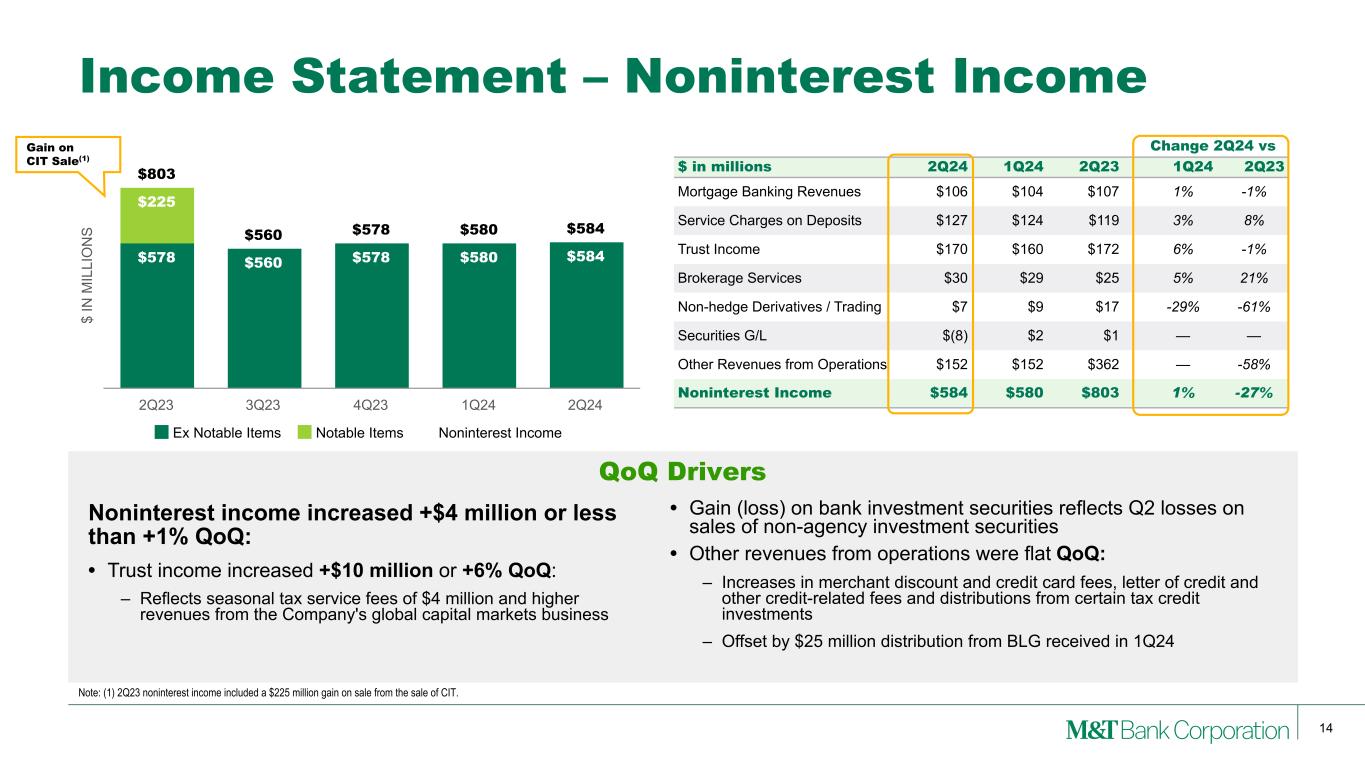

| Noninterest income | 584 | 580 | 803 | |||||||||||||||||

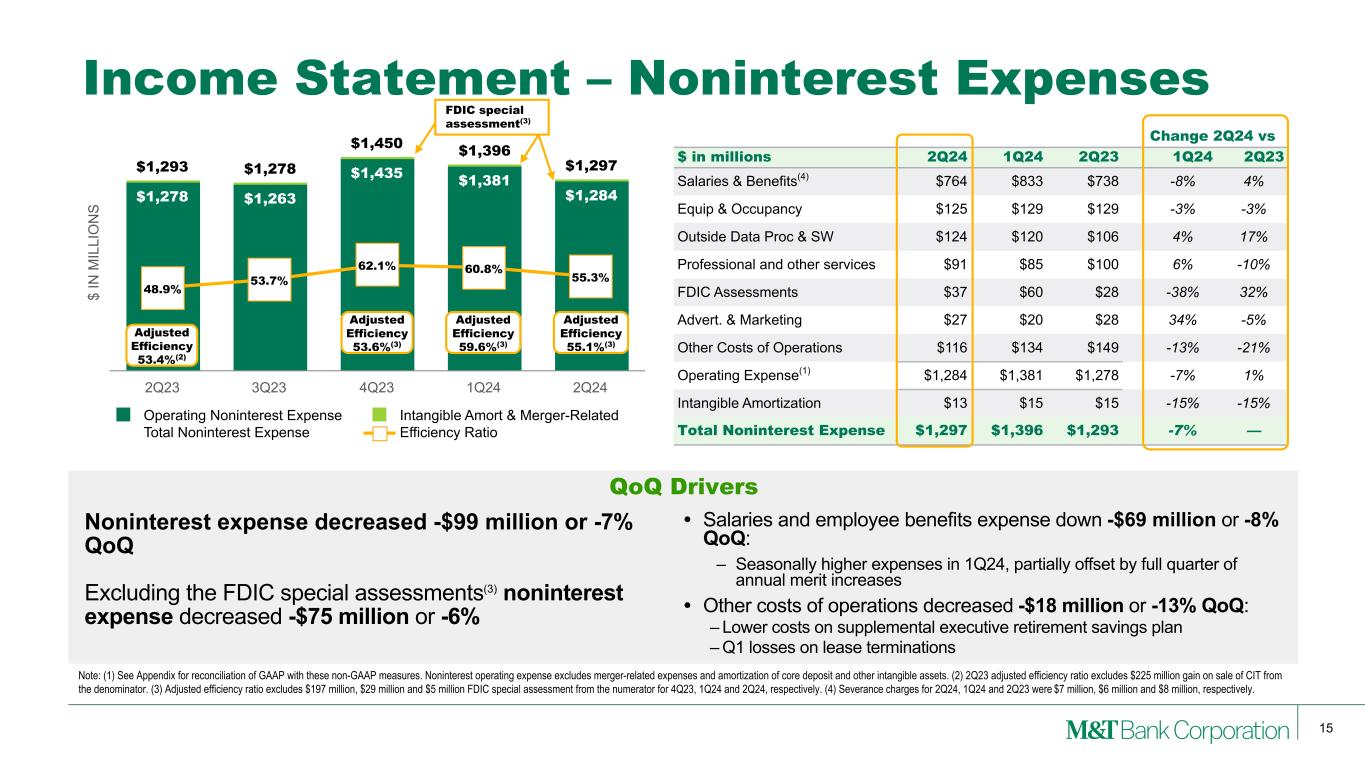

| Noninterest expense | 1,297 | 1,396 | 1,293 | |||||||||||||||||

| Net income | 655 | 531 | 867 | |||||||||||||||||

| Net income available to common shareholders - diluted | 626 | 505 | 841 | |||||||||||||||||

| Diluted earnings per common share | 3.73 | 3.02 | 5.05 | |||||||||||||||||

| Return on average assets - annualized | 1.24 | % | 1.01 | % | 1.70 | % | ||||||||||||||

| Return on average common shareholders' equity - annualized | 9.95 | 8.14 | 14.27 | |||||||||||||||||

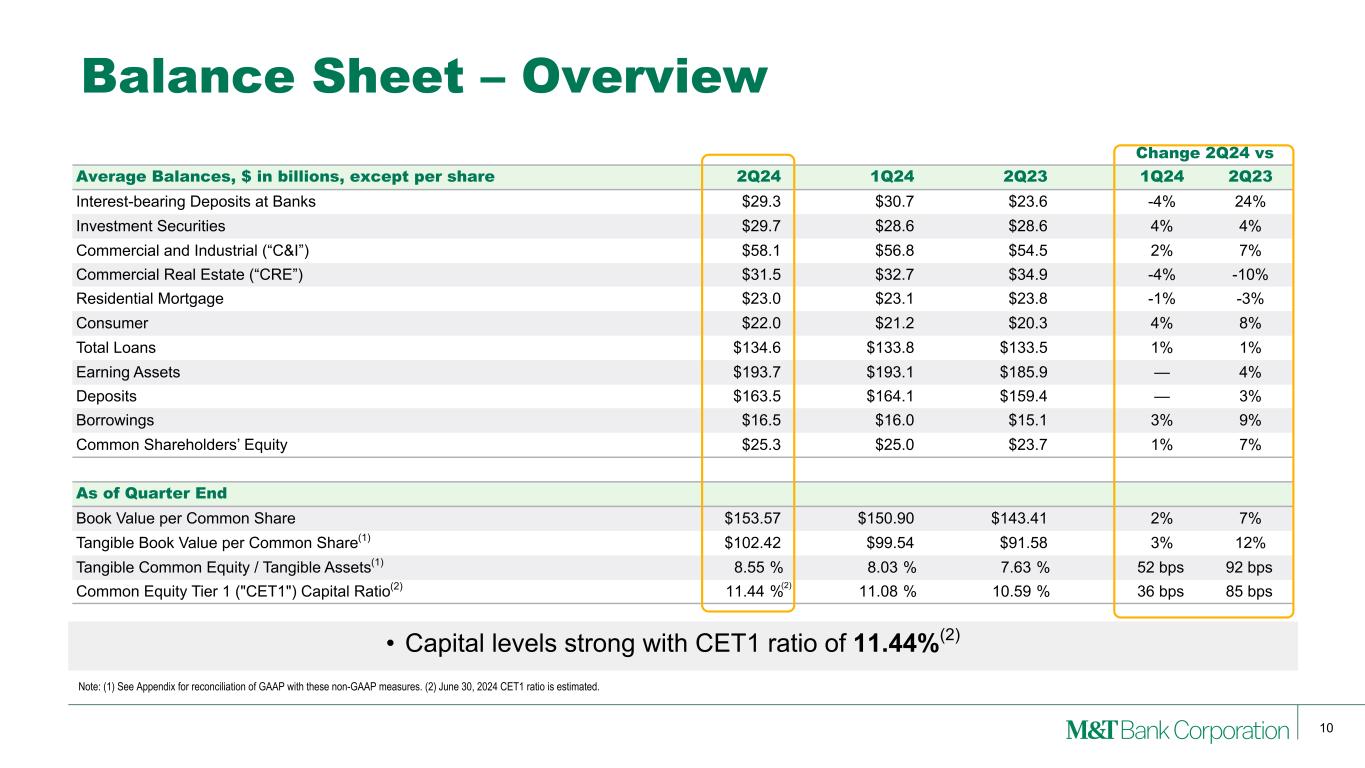

| Average Balance Sheet | ||||||||||||||||||||

| Total assets | $ | 211,981 | $ | 211,478 | $ | 204,376 | ||||||||||||||

| Interest-bearing deposits at banks | 29,294 | 30,647 | 23,617 | |||||||||||||||||

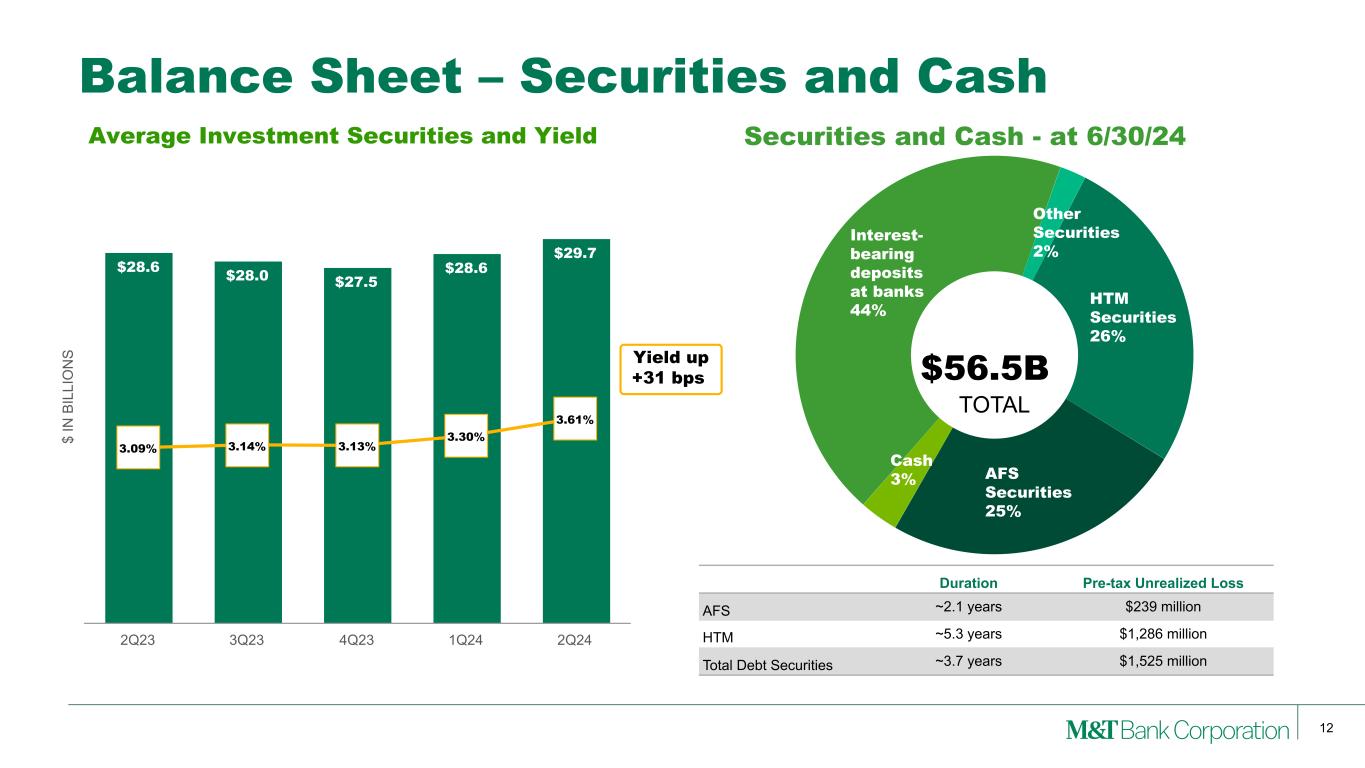

| Investment securities | 29,695 | 28,587 | 28,623 | |||||||||||||||||

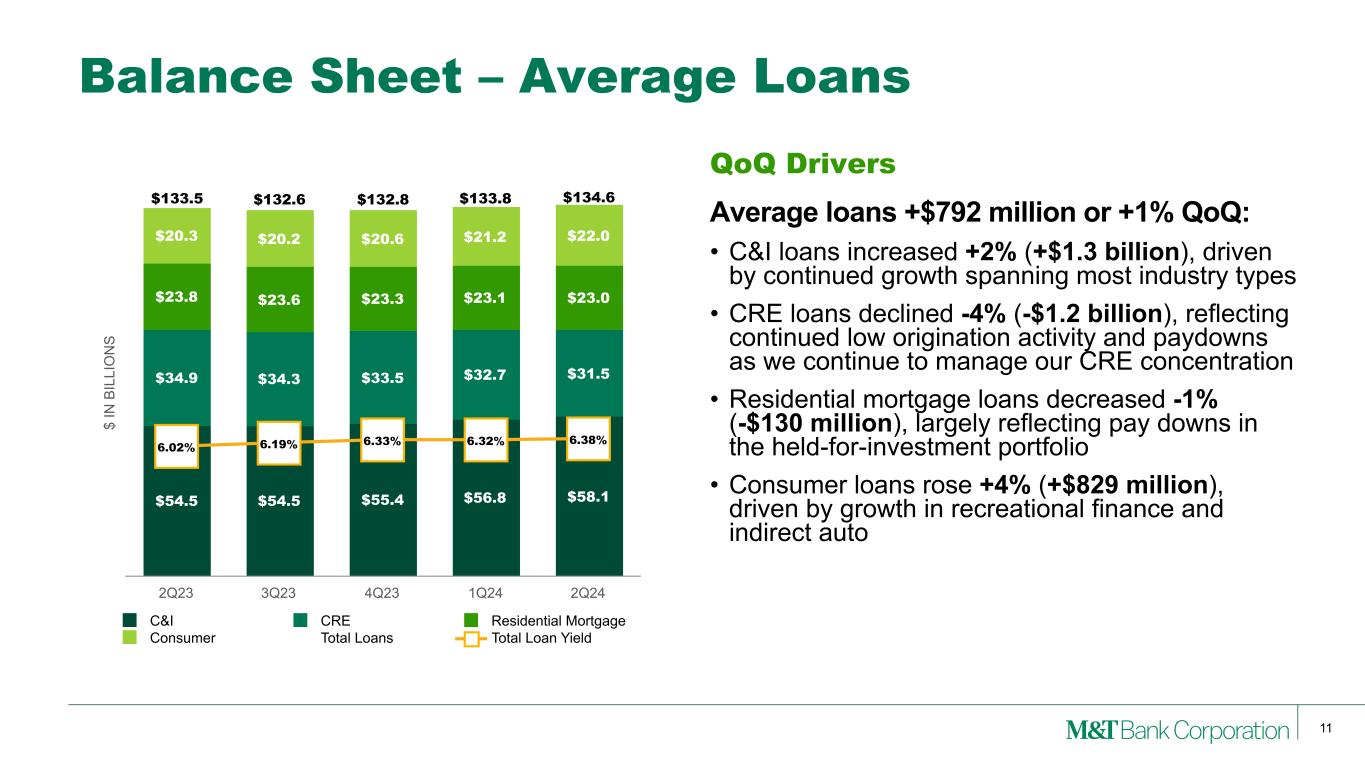

| Loans and leases, net of unearned discount | 134,588 | 133,796 | 133,545 | |||||||||||||||||

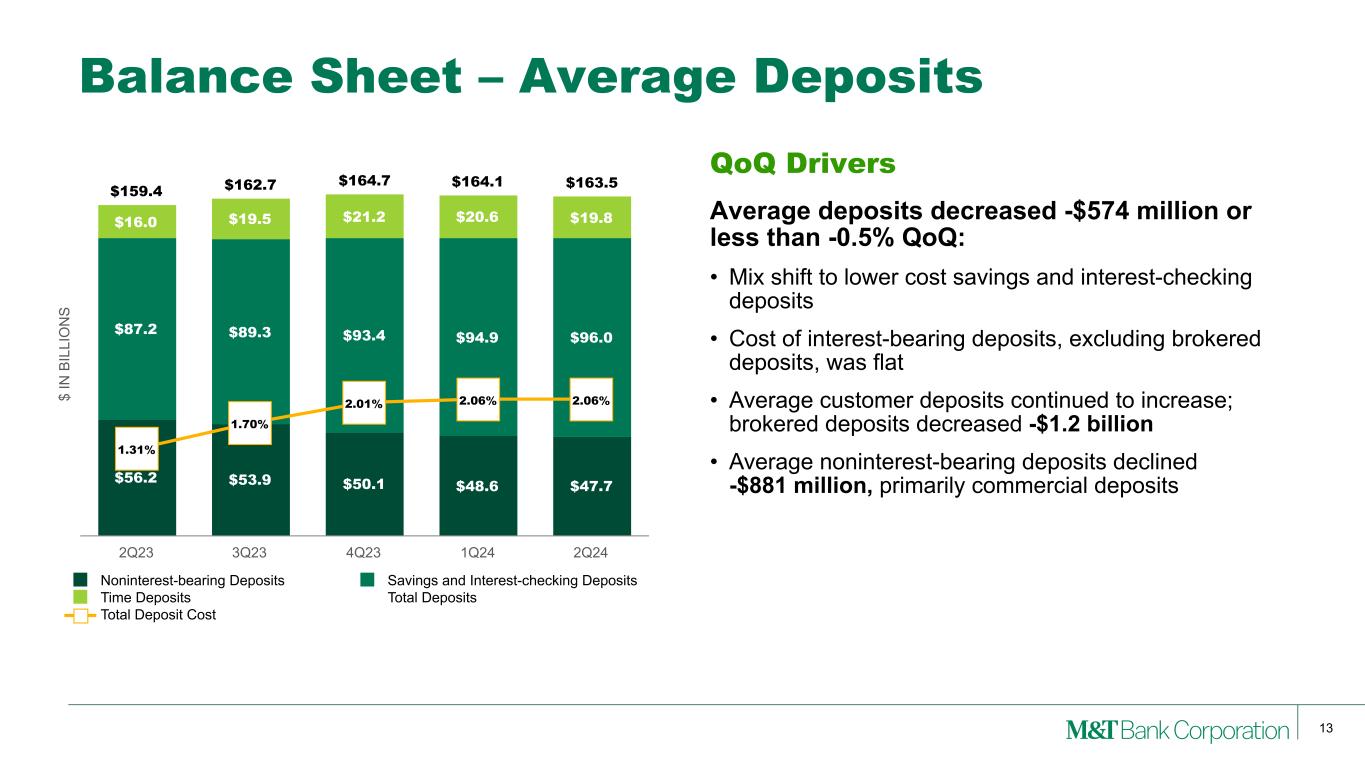

| Deposits | 163,491 | 164,065 | 159,399 | |||||||||||||||||

| Borrowings | 16,452 | 16,001 | 15,055 | |||||||||||||||||

| Selected Ratios | ||||||||||||||||||||

| (Amounts expressed as a percent, except per share data) | ||||||||||||||||||||

| Net interest margin | 3.59 | % | 3.52 | % | 3.91 | % | ||||||||||||||

| Efficiency ratio | 55.3 | 60.8 | 48.9 | |||||||||||||||||

| Net charge-offs to average total loans - annualized | .41 | .42 | .38 | |||||||||||||||||

| Allowance for credit losses to total loans | 1.63 | 1.62 | 1.50 | |||||||||||||||||

| Nonaccrual loans to total loans | 1.50 | 1.71 | 1.83 | |||||||||||||||||

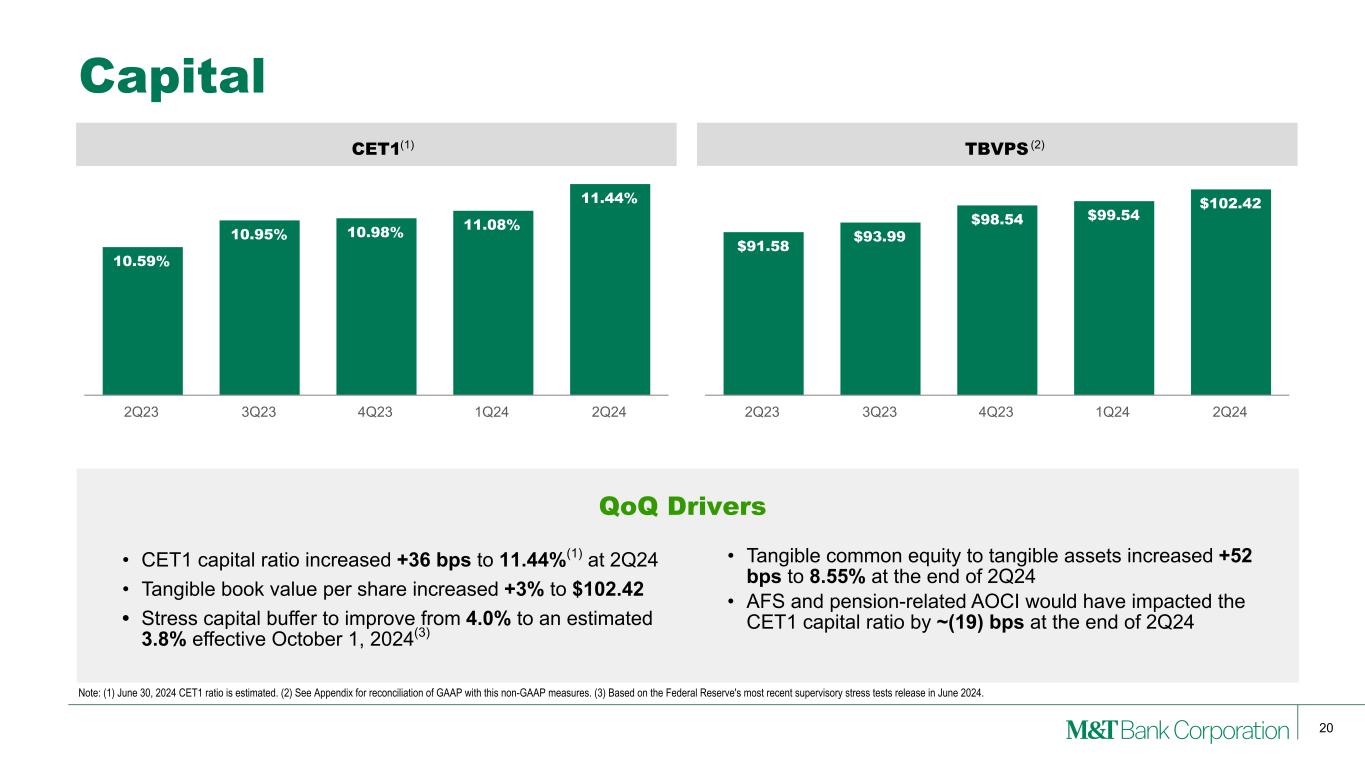

| Common equity Tier 1 ("CET1") capital ratio (1) | 11.44 | 11.08 | 10.59 | |||||||||||||||||

| Common shareholders' equity per share | $ | 153.57 | $ | 150.90 | $ | 143.41 | ||||||||||||||

| Financial Highlights | ||

| Chief Financial Officer Commentary | ||

|

Second Quarter 2024 Results | ||||

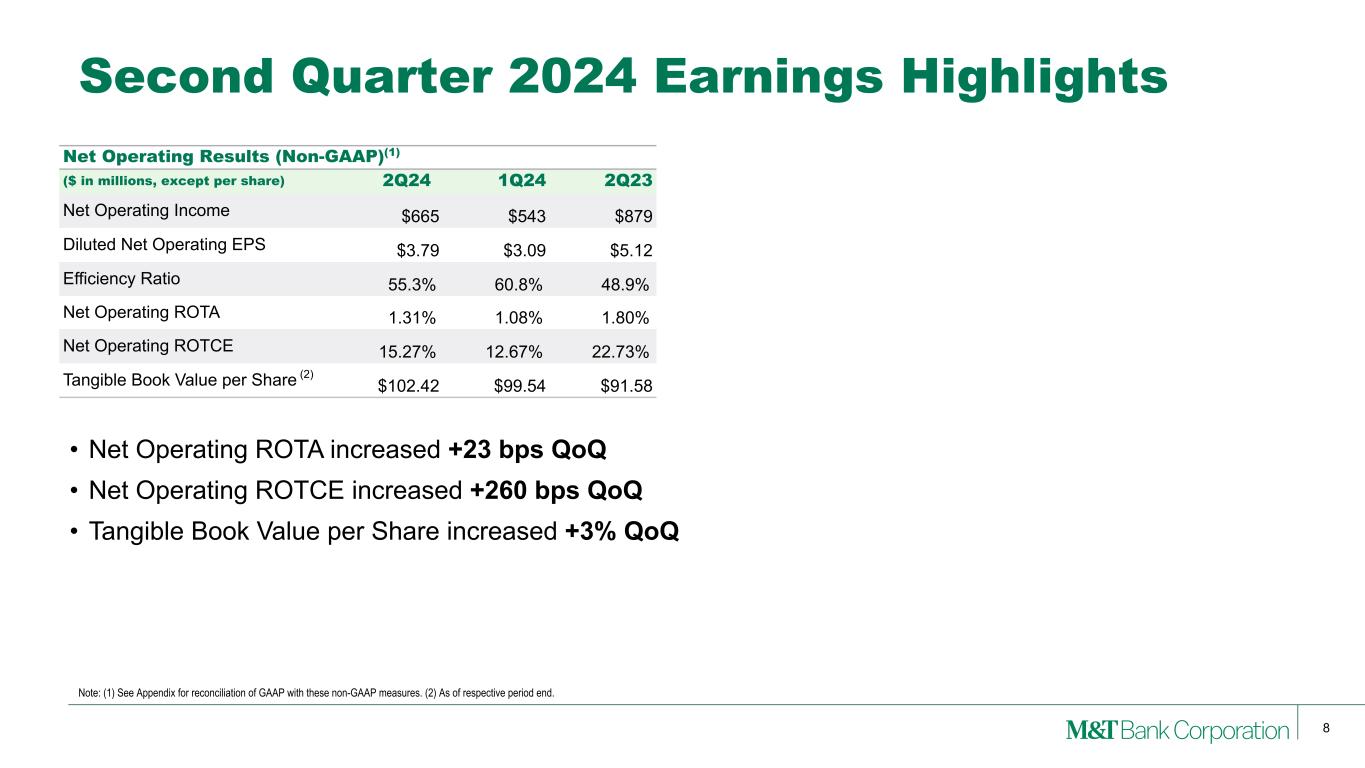

| Non-GAAP Measures (1) | ||||||||||||||||||||||||||||||||

| Change 2Q24 vs. | Change 2Q24 vs. | |||||||||||||||||||||||||||||||

| (Dollars in millions, except per share data) | 2Q24 | 1Q24 | 1Q24 | 2Q23 | 2Q23 | |||||||||||||||||||||||||||

| Net operating income | $ | 665 | $ | 543 | 22 | % | $ | 879 | -24 | % | ||||||||||||||||||||||

| Diluted net operating earnings per common share | 3.79 | 3.09 | 23 | 5.12 | -26 | |||||||||||||||||||||||||||

| Annualized return on average tangible assets | 1.31 | % | 1.08 | % | 1.80 | % | ||||||||||||||||||||||||||

| Annualized return on average tangible common equity | 15.27 | 12.67 | 22.73 | |||||||||||||||||||||||||||||

| Efficiency ratio | 55.3 | 60.8 | 48.9 | |||||||||||||||||||||||||||||

| Tangible equity per common share | $ | 102.42 | $ | 99.54 | 3 | $ | 91.58 | 12 | ||||||||||||||||||||||||

| Taxable-equivalent Net Interest Income | ||||||||||||||||||||||||||||||||

| Change 2Q24 vs. | Change 2Q24 vs. | |||||||||||||||||||||||||||||||

| (Dollars in millions) | 2Q24 | 1Q24 | 1Q24 | 2Q23 | 2Q23 | |||||||||||||||||||||||||||

| Average earning assets | $ | 193,676 | $ | 193,135 | — | % | $ | 185,936 | 4 | % | ||||||||||||||||||||||

| Average interest-bearing liabilities | 132,209 | 131,451 | 1 | 118,274 | 12 | |||||||||||||||||||||||||||

| Net interest income - taxable-equivalent | 1,731 | 1,692 | 2 | 1,813 | -5 | |||||||||||||||||||||||||||

| Yield on average earning assets | 5.82 | % | 5.74 | % | 5.46 | % | ||||||||||||||||||||||||||

| Cost of interest-bearing liabilities | 3.26 | 3.26 | 2.43 | |||||||||||||||||||||||||||||

| Net interest spread | 2.56 | 2.48 | 3.03 | |||||||||||||||||||||||||||||

| Net interest margin | 3.59 | 3.52 | 3.91 | |||||||||||||||||||||||||||||

|

Second Quarter 2024 Results | ||||

| Average Earning Assets | ||||||||||||||||||||||||||||||||

| Change 2Q24 vs. | Change 2Q24 vs. | |||||||||||||||||||||||||||||||

| (Dollars in millions) | 2Q24 | 1Q24 | 1Q24 | 2Q23 | 2Q23 | |||||||||||||||||||||||||||

| Interest-bearing deposits at banks | $ | 29,294 | $ | 30,647 | -4 | % | $ | 23,617 | 24 | % | ||||||||||||||||||||||

| Trading account | 99 | 105 | -6 | 151 | -34 | |||||||||||||||||||||||||||

| Investment securities | 29,695 | 28,587 | 4 | 28,623 | 4 | |||||||||||||||||||||||||||

| Loans and leases, net of unearned discount | ||||||||||||||||||||||||||||||||

| Commercial and industrial | 58,152 | 56,821 | 2 | 54,572 | 7 | |||||||||||||||||||||||||||

| Real estate - commercial | 31,458 | 32,696 | -4 | 34,903 | -10 | |||||||||||||||||||||||||||

| Real estate - consumer | 23,006 | 23,136 | -1 | 23,781 | -3 | |||||||||||||||||||||||||||

| Consumer | 21,972 | 21,143 | 4 | 20,289 | 8 | |||||||||||||||||||||||||||

| Total loans and leases, net | 134,588 | 133,796 | 1 | 133,545 | 1 | |||||||||||||||||||||||||||

| Total earning assets | $ | 193,676 | $ | 193,135 | — | $ | 185,936 | 4 | ||||||||||||||||||||||||

|

Second Quarter 2024 Results | ||||

| Average Interest-bearing Liabilities | ||||||||||||||||||||||||||||||||

| Change 2Q24 vs. | Change 2Q24 vs. | |||||||||||||||||||||||||||||||

| (Dollars in millions) | 2Q24 | 1Q24 | 1Q24 | 2Q23 | 2Q23 | |||||||||||||||||||||||||||

| Interest-bearing deposits | ||||||||||||||||||||||||||||||||

| Savings and interest-checking deposits | $ | 95,955 | $ | 94,867 | 1 | % | $ | 87,210 | 10 | % | ||||||||||||||||||||||

| Time deposits | 19,802 | 20,583 | -4 | 16,009 | 24 | |||||||||||||||||||||||||||

| Total interest-bearing deposits | 115,757 | 115,450 | — | 103,219 | 12 | |||||||||||||||||||||||||||

| Short-term borrowings | 4,962 | 6,228 | -20 | 7,539 | -34 | |||||||||||||||||||||||||||

| Long-term borrowings | 11,490 | 9,773 | 18 | 7,516 | 53 | |||||||||||||||||||||||||||

| Total interest-bearing liabilities | $ | 132,209 | $ | 131,451 | 1 | $ | 118,274 | 12 | ||||||||||||||||||||||||

| Brokered savings and interest-checking deposits |

$ | 8,193 | $ | 8,030 | 2 | % | $ | 3,754 | 118 | % | ||||||||||||||||||||||

| Brokered time deposits | 3,826 | 5,193 | -26 | 6,873 | -44 | |||||||||||||||||||||||||||

| Total brokered deposits | $ | 12,019 | $ | 13,223 | -9 | $ | 10,627 | 13 | ||||||||||||||||||||||||

|

Second Quarter 2024 Results | ||||

| Provision for Credit Losses/Asset Quality | ||||||||||||||||||||||||||||||||

| Change 2Q24 vs. |

Change 2Q24 vs. |

|||||||||||||||||||||||||||||||

| (Dollars in millions) | 2Q24 | 1Q24 | 1Q24 | 2Q23 | 2Q23 | |||||||||||||||||||||||||||

| At end of quarter | ||||||||||||||||||||||||||||||||

| Nonaccrual loans | $ | 2,024 | $ | 2,302 | -12 | % | $ | 2,435 | -17 | % | ||||||||||||||||||||||

| Real estate and other foreclosed assets | 33 | 38 | -16 | 43 | -23 | |||||||||||||||||||||||||||

| Total nonperforming assets | 2,057 | 2,340 | -12 | 2,478 | -17 | |||||||||||||||||||||||||||

| Accruing loans past due 90 days or more (1) | 233 | 297 | -21 | 380 | -39 | |||||||||||||||||||||||||||

| Nonaccrual loans as % of loans outstanding | 1.50 | % | 1.71 | % | 1.83 | % | ||||||||||||||||||||||||||

| Allowance for credit losses | $ | 2,204 | $ | 2,191 | 1 | $ | 1,998 | 10 | ||||||||||||||||||||||||

| Allowance for credit losses as % of loans outstanding | 1.63 | % | 1.62 | % | 1.50 | % | ||||||||||||||||||||||||||

| For the period | ||||||||||||||||||||||||||||||||

| Provision for credit losses | $ | 150 | $ | 200 | -25 | $ | 150 | — | ||||||||||||||||||||||||

| Net charge-offs | 137 | 138 | -1 | 127 | 8 | |||||||||||||||||||||||||||

| Net charge-offs as % of average loans (annualized) | .41 | % | .42 | % | .38 | % | ||||||||||||||||||||||||||

|

Second Quarter 2024 Results | ||||

| Noninterest Income | ||||||||||||||||||||||||||||||||

| Change 2Q24 vs. | Change 2Q24 vs. | |||||||||||||||||||||||||||||||

| (Dollars in millions) | 2Q24 | 1Q24 | 1Q24 | 2Q23 | 2Q23 | |||||||||||||||||||||||||||

| Mortgage banking revenues | $ | 106 | $ | 104 | 1 | % | $ | 107 | -1 | % | ||||||||||||||||||||||

| Service charges on deposit accounts | 127 | 124 | 3 | 119 | 8 | |||||||||||||||||||||||||||

| Trust income | 170 | 160 | 6 | 172 | -1 | |||||||||||||||||||||||||||

| Brokerage services income | 30 | 29 | 5 | 25 | 21 | |||||||||||||||||||||||||||

| Trading account and other non-hedging derivative gains |

7 | 9 | -29 | 17 | -61 | |||||||||||||||||||||||||||

| Gain (loss) on bank investment securities | (8) | 2 | — | 1 | — | |||||||||||||||||||||||||||

| Other revenues from operations | 152 | 152 | — | 362 | -58 | |||||||||||||||||||||||||||

| Total | $ | 584 | $ | 580 | 1 | $ | 803 | -27 | ||||||||||||||||||||||||

|

Second Quarter 2024 Results | ||||

| Noninterest Expense | ||||||||||||||||||||||||||||||||

| Change 2Q24 vs. | Change 2Q24 vs. | |||||||||||||||||||||||||||||||

| (Dollars in millions) | 2Q24 | 1Q24 | 1Q24 | 2Q23 | 2Q23 | |||||||||||||||||||||||||||

| Salaries and employee benefits | $ | 764 | $ | 833 | -8 | % | $ | 738 | 4 | % | ||||||||||||||||||||||

| Equipment and net occupancy | 125 | 129 | -3 | 129 | -3 | |||||||||||||||||||||||||||

| Outside data processing and software | 124 | 120 | 4 | 106 | 17 | |||||||||||||||||||||||||||

| Professional and other services | 91 | 85 | 6 | 100 | -10 | |||||||||||||||||||||||||||

| FDIC assessments | 37 | 60 | -38 | 28 | 32 | |||||||||||||||||||||||||||

| Advertising and marketing | 27 | 20 | 34 | 28 | -5 | |||||||||||||||||||||||||||

| Amortization of core deposit and other intangible assets | 13 | 15 | -15 | 15 | -15 | |||||||||||||||||||||||||||

| Other costs of operations | 116 | 134 | -13 | 149 | -21 | |||||||||||||||||||||||||||

| Total | $ | 1,297 | $ | 1,396 | -7 | $ | 1,293 | — | ||||||||||||||||||||||||

|

Second Quarter 2024 Results | ||||

| Income Taxes | ||

| Capital | ||||||||||||||||||||

| 2Q24 | 1Q24 | 2Q23 | ||||||||||||||||||

| CET1 | 11.44 | % | (1) | 11.08 | % | 10.59 | % | |||||||||||||

| Tier 1 capital | 13.22 | (1) | 12.38 | 11.91 | ||||||||||||||||

| Total capital | 14.87 | (1) | 14.04 | 13.71 | ||||||||||||||||

| Tangible capital – common | 8.55 | 8.03 | 7.63 | |||||||||||||||||

| Conference Call | ||

| About M&T | ||

|

Second Quarter 2024 Results | ||||

| Forward-Looking Statements | ||

|

Second Quarter 2024 Results | ||||

| Three months ended | Six months ended | ||||||||||||||||||||||||||||||||||

| June 30, | June 30, | ||||||||||||||||||||||||||||||||||

| (Dollars in millions, except per share, shares in thousands) | 2024 | 2023 | Change | 2024 | 2023 | Change | |||||||||||||||||||||||||||||

| Performance | |||||||||||||||||||||||||||||||||||

| Net income | $ | 655 | $ | 867 | -25 | % | $ | 1,186 | $ | 1,569 | -24 | % | |||||||||||||||||||||||

| Net income available to common shareholders | 626 | 841 | -26 | 1,131 | 1,516 | -25 | |||||||||||||||||||||||||||||

| Per common share: | |||||||||||||||||||||||||||||||||||

| Basic earnings | 3.75 | 5.07 | -26 | 6.79 | 9.09 | -25 | |||||||||||||||||||||||||||||

| Diluted earnings | 3.73 | 5.05 | -26 | 6.76 | 9.06 | -25 | |||||||||||||||||||||||||||||

| Cash dividends | 1.35 | 1.30 | 4 | 2.65 | 2.60 | 2 | |||||||||||||||||||||||||||||

| Common shares outstanding: | |||||||||||||||||||||||||||||||||||

| Average - diluted (1) | 167,659 | 166,320 | 1 | 167,372 | 167,359 | — | |||||||||||||||||||||||||||||

| Period end (2) | 167,225 | 165,894 | 1 | 167,225 | 165,894 | 1 | |||||||||||||||||||||||||||||

| Return on (annualized): | |||||||||||||||||||||||||||||||||||

| Average total assets | 1.24 | % | 1.70 | % | 1.13 | % | 1.55 | % | |||||||||||||||||||||||||||

| Average common shareholders' equity | 9.95 | 14.27 | 9.05 | 13.02 | |||||||||||||||||||||||||||||||

| Taxable-equivalent net interest income | $ | 1,731 | $ | 1,813 | -5 | $ | 3,423 | $ | 3,645 | -6 | |||||||||||||||||||||||||

| Yield on average earning assets | 5.82 | % | 5.46 | % | 5.78 | % | 5.31 | % | |||||||||||||||||||||||||||

| Cost of interest-bearing liabilities | 3.26 | 2.43 | 3.26 | 2.15 | |||||||||||||||||||||||||||||||

| Net interest spread | 2.56 | 3.03 | 2.52 | 3.16 | |||||||||||||||||||||||||||||||

| Contribution of interest-free funds | 1.03 | .88 | 1.04 | .81 | |||||||||||||||||||||||||||||||

| Net interest margin | 3.59 | 3.91 | 3.56 | 3.97 | |||||||||||||||||||||||||||||||

| Net charge-offs to average total net loans (annualized) | .41 | .38 | .41 | .30 | |||||||||||||||||||||||||||||||

| Net operating results (3) | |||||||||||||||||||||||||||||||||||

| Net operating income | $ | 665 | $ | 879 | -24 | $ | 1,208 | $ | 1,594 | -24 | |||||||||||||||||||||||||

| Diluted net operating earnings per common share | 3.79 | 5.12 | -26 | 6.89 | 9.21 | -25 | |||||||||||||||||||||||||||||

| Return on (annualized): | |||||||||||||||||||||||||||||||||||

| Average tangible assets | 1.31 | % | 1.80 | % | 1.20 | % | 1.65 | % | |||||||||||||||||||||||||||

| Average tangible common equity | 15.27 | 22.73 | 13.99 | 20.90 | |||||||||||||||||||||||||||||||

| Efficiency ratio | 55.3 | 48.9 | 58.0 | 52.0 | |||||||||||||||||||||||||||||||

| At June 30, | |||||||||||||||||||||||||||||||||||

| Loan quality | 2024 | 2023 | Change | ||||||||||||||||||||||||||||||||

| Nonaccrual loans | $ | 2,024 | $ | 2,435 | -17 | % | |||||||||||||||||||||||||||||

| Real estate and other foreclosed assets | 33 | 43 | -23 | ||||||||||||||||||||||||||||||||

| Total nonperforming assets | $ | 2,057 | $ | 2,478 | -17 | ||||||||||||||||||||||||||||||

| Accruing loans past due 90 days or more (4) | $ | 233 | $ | 380 | -39 | ||||||||||||||||||||||||||||||

| Government guaranteed loans included in totals above: | |||||||||||||||||||||||||||||||||||

| Nonaccrual loans | $ | 64 | $ | 40 | 61 | ||||||||||||||||||||||||||||||

| Accruing loans past due 90 days or more | 215 | 294 | -27 | ||||||||||||||||||||||||||||||||

| Nonaccrual loans to total loans | 1.50 | % | 1.83 | % | |||||||||||||||||||||||||||||||

| Allowance for credit losses to total loans | 1.63 | 1.50 | |||||||||||||||||||||||||||||||||

| Additional information | |||||||||||||||||||||||||||||||||||

| Period end common stock price | $ | 151.36 | $ | 123.76 | 22 | ||||||||||||||||||||||||||||||

| Domestic banking offices | 957 | 996 | -4 | ||||||||||||||||||||||||||||||||

| Full time equivalent employees | 22,110 | 22,946 | -4 | ||||||||||||||||||||||||||||||||

|

Second Quarter 2024 Results | ||||

| Three months ended | |||||||||||||||||||||||||||||

| June 30, | March 31, | December 31, | September 30, | June 30, | |||||||||||||||||||||||||

| (Dollars in millions, except per share, shares in thousands) | 2024 | 2024 | 2023 | 2023 | 2023 | ||||||||||||||||||||||||

| Performance | |||||||||||||||||||||||||||||

| Net income | $ | 655 | $ | 531 | $ | 482 | $ | 690 | $ | 867 | |||||||||||||||||||

| Net income available to common shareholders | 626 | 505 | 457 | 664 | 841 | ||||||||||||||||||||||||

| Per common share: | |||||||||||||||||||||||||||||

| Basic earnings | 3.75 | 3.04 | 2.75 | 4.00 | 5.07 | ||||||||||||||||||||||||

| Diluted earnings | 3.73 | 3.02 | 2.74 | 3.98 | 5.05 | ||||||||||||||||||||||||

| Cash dividends | 1.35 | 1.30 | 1.30 | 1.30 | 1.30 | ||||||||||||||||||||||||

| Common shares outstanding: | |||||||||||||||||||||||||||||

| Average - diluted (1) | 167,659 | 167,084 | 166,731 | 166,570 | 166,320 | ||||||||||||||||||||||||

| Period end (2) | 167,225 | 166,724 | 166,149 | 165,970 | 165,894 | ||||||||||||||||||||||||

| Return on (annualized): | |||||||||||||||||||||||||||||

| Average total assets | 1.24 | % | 1.01 | % | .92 | % | 1.33 | % | 1.70 | % | |||||||||||||||||||

| Average common shareholders' equity | 9.95 | 8.14 | 7.41 | 10.99 | 14.27 | ||||||||||||||||||||||||

| Taxable-equivalent net interest income | $ | 1,731 | $ | 1,692 | $ | 1,735 | $ | 1,790 | $ | 1,813 | |||||||||||||||||||

| Yield on average earning assets | 5.82 | % | 5.74 | % | 5.73 | % | 5.62 | % | 5.46 | % | |||||||||||||||||||

| Cost of interest-bearing liabilities | 3.26 | 3.26 | 3.17 | 2.83 | 2.43 | ||||||||||||||||||||||||

| Net interest spread | 2.56 | 2.48 | 2.56 | 2.79 | 3.03 | ||||||||||||||||||||||||

| Contribution of interest-free funds | 1.03 | 1.04 | 1.05 | 1.00 | .88 | ||||||||||||||||||||||||

| Net interest margin | 3.59 | 3.52 | 3.61 | 3.79 | 3.91 | ||||||||||||||||||||||||

| Net charge-offs to average total net loans (annualized) | .41 | .42 | .44 | .29 | .38 | ||||||||||||||||||||||||

| Net operating results (3) | |||||||||||||||||||||||||||||

| Net operating income | $ | 665 | $ | 543 | $ | 494 | $ | 702 | $ | 879 | |||||||||||||||||||

| Diluted net operating earnings per common share | 3.79 | 3.09 | 2.81 | 4.05 | 5.12 | ||||||||||||||||||||||||

| Return on (annualized): | |||||||||||||||||||||||||||||

| Average tangible assets | 1.31 | % | 1.08 | % | .98 | % | 1.41 | % | 1.80 | % | |||||||||||||||||||

| Average tangible common equity | 15.27 | 12.67 | 11.70 | 17.41 | 22.73 | ||||||||||||||||||||||||

| Efficiency ratio | 55.3 | 60.8 | 62.1 | 53.7 | 48.9 | ||||||||||||||||||||||||

| June 30, | March 31, | December 31, | September 30, | June 30, | |||||||||||||||||||||||||

| Loan quality | 2024 | 2024 | 2023 | 2023 | 2023 | ||||||||||||||||||||||||

| Nonaccrual loans | $ | 2,024 | $ | 2,302 | $ | 2,166 | $ | 2,342 | $ | 2,435 | |||||||||||||||||||

| Real estate and other foreclosed assets | 33 | 38 | 39 | 37 | 43 | ||||||||||||||||||||||||

| Total nonperforming assets | $ | 2,057 | $ | 2,340 | $ | 2,205 | $ | 2,379 | $ | 2,478 | |||||||||||||||||||

| Accruing loans past due 90 days or more (4) | $ | 233 | $ | 297 | $ | 339 | $ | 354 | $ | 380 | |||||||||||||||||||

| Government guaranteed loans included in totals above: | |||||||||||||||||||||||||||||

| Nonaccrual loans | $ | 64 | $ | 62 | $ | 53 | $ | 40 | $ | 40 | |||||||||||||||||||

| Accruing loans past due 90 days or more | 215 | 244 | 298 | 269 | 294 | ||||||||||||||||||||||||

| Nonaccrual loans to total loans | 1.50 | % | 1.71 | % | 1.62 | % | 1.77 | % | 1.83 | % | |||||||||||||||||||

| Allowance for credit losses to total loans | 1.63 | 1.62 | 1.59 | 1.55 | 1.50 | ||||||||||||||||||||||||

| Additional information | |||||||||||||||||||||||||||||

| Period end common stock price | $ | 151.36 | $ | 145.44 | $ | 137.08 | $ | 126.45 | $ | 123.76 | |||||||||||||||||||

| Domestic banking offices | 957 | 958 | 961 | 967 | 996 | ||||||||||||||||||||||||

| Full time equivalent employees | 22,110 | 21,927 | 21,980 | 22,424 | 22,946 | ||||||||||||||||||||||||

|

Second Quarter 2024 Results | ||||

| Three months ended | Six months ended | ||||||||||||||||||||||||||||||||||

| June 30, | June 30, | ||||||||||||||||||||||||||||||||||

| (Dollars in millions) | 2024 | 2023 | Change | 2024 | 2023 | Change | |||||||||||||||||||||||||||||

| Interest income | $ | 2,789 | $ | 2,516 | 11 | % | $ | 5,534 | $ | 4,843 | 14 | % | |||||||||||||||||||||||

| Interest expense | 1,071 | 717 | 50 | 2,136 | 1,226 | 74 | |||||||||||||||||||||||||||||

| Net interest income | 1,718 | 1,799 | -5 | 3,398 | 3,617 | -6 | |||||||||||||||||||||||||||||

| Provision for credit losses | 150 | 150 | — | 350 | 270 | 30 | |||||||||||||||||||||||||||||

| Net interest income after provision for credit losses | 1,568 | 1,649 | -5 | 3,048 | 3,347 | -9 | |||||||||||||||||||||||||||||

| Other income | |||||||||||||||||||||||||||||||||||

| Mortgage banking revenues | 106 | 107 | -1 | 210 | 192 | 9 | |||||||||||||||||||||||||||||

| Service charges on deposit accounts | 127 | 119 | 8 | 251 | 232 | 8 | |||||||||||||||||||||||||||||

| Trust income | 170 | 172 | -1 | 330 | 366 | -10 | |||||||||||||||||||||||||||||

| Brokerage services income | 30 | 25 | 21 | 59 | 49 | 21 | |||||||||||||||||||||||||||||

| Trading account and other non-hedging derivative gains |

7 | 17 | -61 | 16 | 28 | -44 | |||||||||||||||||||||||||||||

| Gain (loss) on bank investment securities | (8) | 1 | — | (6) | 1 | — | |||||||||||||||||||||||||||||

| Other revenues from operations | 152 | 362 | -58 | 304 | 522 | -42 | |||||||||||||||||||||||||||||

| Total other income | 584 | 803 | -27 | 1,164 | 1,390 | -16 | |||||||||||||||||||||||||||||

| Other expense | |||||||||||||||||||||||||||||||||||

| Salaries and employee benefits | 764 | 738 | 4 | 1,597 | 1,546 | 3 | |||||||||||||||||||||||||||||

| Equipment and net occupancy | 125 | 129 | -3 | 254 | 256 | -1 | |||||||||||||||||||||||||||||

| Outside data processing and software | 124 | 106 | 17 | 244 | 212 | 15 | |||||||||||||||||||||||||||||

| Professional and other services | 91 | 100 | -10 | 176 | 225 | -22 | |||||||||||||||||||||||||||||

| FDIC assessments | 37 | 28 | 32 | 97 | 58 | 67 | |||||||||||||||||||||||||||||

| Advertising and marketing | 27 | 28 | -5 | 47 | 59 | -20 | |||||||||||||||||||||||||||||

| Amortization of core deposit and other intangible assets |

13 | 15 | -15 | 28 | 32 | -14 | |||||||||||||||||||||||||||||

| Other costs of operations | 116 | 149 | -21 | 250 | 264 | -5 | |||||||||||||||||||||||||||||

| Total other expense | 1,297 | 1,293 | — | 2,693 | 2,652 | 2 | |||||||||||||||||||||||||||||

| Income before income taxes | 855 | 1,159 | -26 | 1,519 | 2,085 | -27 | |||||||||||||||||||||||||||||

| Applicable income taxes | 200 | 292 | -32 | 333 | 516 | -36 | |||||||||||||||||||||||||||||

| Net income | $ | 655 | $ | 867 | -25 | % | $ | 1,186 | $ | 1,569 | -24 | % | |||||||||||||||||||||||

|

Second Quarter 2024 Results | ||||

| Three months ended | |||||||||||||||||||||||||||||

| June 30, | March 31, | December 31, | September 30, | June 30, | |||||||||||||||||||||||||

| (Dollars in millions) | 2024 | 2024 | 2023 | 2023 | 2023 | ||||||||||||||||||||||||

| Interest income | $ | 2,789 | $ | 2,745 | $ | 2,740 | $ | 2,641 | $ | 2,516 | |||||||||||||||||||

| Interest expense | 1,071 | 1,065 | 1,018 | 866 | 717 | ||||||||||||||||||||||||

| Net interest income | 1,718 | 1,680 | 1,722 | 1,775 | 1,799 | ||||||||||||||||||||||||

| Provision for credit losses | 150 | 200 | 225 | 150 | 150 | ||||||||||||||||||||||||

| Net interest income after provision for credit losses | 1,568 | 1,480 | 1,497 | 1,625 | 1,649 | ||||||||||||||||||||||||

| Other income | |||||||||||||||||||||||||||||

| Mortgage banking revenues | 106 | 104 | 112 | 105 | 107 | ||||||||||||||||||||||||

| Service charges on deposit accounts | 127 | 124 | 121 | 121 | 119 | ||||||||||||||||||||||||

| Trust income | 170 | 160 | 159 | 155 | 172 | ||||||||||||||||||||||||

| Brokerage services income | 30 | 29 | 26 | 27 | 25 | ||||||||||||||||||||||||

| Trading account and other non-hedging derivative gains |

7 | 9 | 11 | 9 | 17 | ||||||||||||||||||||||||

| Gain (loss) on bank investment securities | (8) | 2 | 4 | — | 1 | ||||||||||||||||||||||||

| Other revenues from operations | 152 | 152 | 145 | 143 | 362 | ||||||||||||||||||||||||

| Total other income | 584 | 580 | 578 | 560 | 803 | ||||||||||||||||||||||||

| Other expense | |||||||||||||||||||||||||||||

| Salaries and employee benefits | 764 | 833 | 724 | 727 | 738 | ||||||||||||||||||||||||

| Equipment and net occupancy | 125 | 129 | 134 | 131 | 129 | ||||||||||||||||||||||||

| Outside data processing and software | 124 | 120 | 114 | 111 | 106 | ||||||||||||||||||||||||

| Professional and other services | 91 | 85 | 99 | 89 | 100 | ||||||||||||||||||||||||

| FDIC assessments | 37 | 60 | 228 | 29 | 28 | ||||||||||||||||||||||||

| Advertising and marketing | 27 | 20 | 26 | 23 | 28 | ||||||||||||||||||||||||

| Amortization of core deposit and other intangible assets |

13 | 15 | 15 | 15 | 15 | ||||||||||||||||||||||||

| Other costs of operations | 116 | 134 | 110 | 153 | 149 | ||||||||||||||||||||||||

| Total other expense | 1,297 | 1,396 | 1,450 | 1,278 | 1,293 | ||||||||||||||||||||||||

| Income before income taxes | 855 | 664 | 625 | 907 | 1,159 | ||||||||||||||||||||||||

| Applicable income taxes | 200 | 133 | 143 | 217 | 292 | ||||||||||||||||||||||||

| Net income | $ | 655 | $ | 531 | $ | 482 | $ | 690 | $ | 867 | |||||||||||||||||||

|

Second Quarter 2024 Results | ||||

| June 30, | |||||||||||||||||

| (Dollars in millions) | 2024 | 2023 | Change | ||||||||||||||

| ASSETS | |||||||||||||||||

| Cash and due from banks | $ | 1,778 | $ | 1,848 | -4 | % | |||||||||||

| Interest-bearing deposits at banks | 24,792 | 27,107 | -9 | ||||||||||||||

| Trading account | 99 | 137 | -28 | ||||||||||||||

| Investment securities | 29,894 | 27,917 | 7 | ||||||||||||||

| Loans and leases, net of unearned discount: | |||||||||||||||||

| Commercial and industrial | 60,027 | 54,699 | 10 | ||||||||||||||

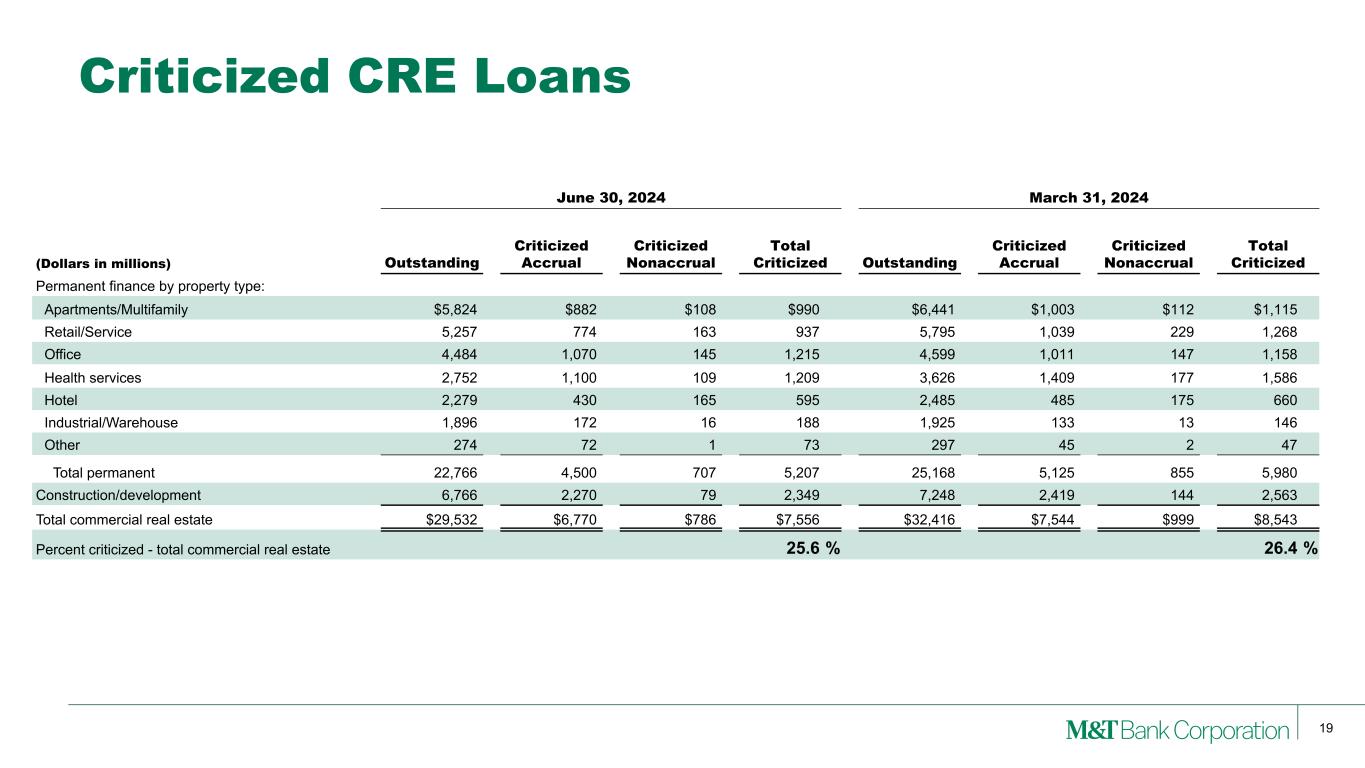

| Real estate - commercial | 29,532 | 34,634 | -15 | ||||||||||||||

| Real estate - consumer | 23,003 | 23,762 | -3 | ||||||||||||||

| Consumer | 22,440 | 20,249 | 11 | ||||||||||||||

| Total loans and leases, net | 135,002 | 133,344 | 1 | ||||||||||||||

| Less: allowance for credit losses | 2,204 | 1,998 | 10 | ||||||||||||||

| Net loans and leases | 132,798 | 131,346 | 1 | ||||||||||||||

| Goodwill | 8,465 | 8,465 | — | ||||||||||||||

| Core deposit and other intangible assets | 119 | 177 | -32 | ||||||||||||||

| Other assets | 10,910 | 10,675 | 2 | ||||||||||||||

| Total assets | $ | 208,855 | $ | 207,672 | 1 | % | |||||||||||

| LIABILITIES AND SHAREHOLDERS' EQUITY | |||||||||||||||||

| Noninterest-bearing deposits | $ | 47,729 | $ | 54,938 | -13 | % | |||||||||||

| Interest-bearing deposits | 112,181 | 107,120 | 5 | ||||||||||||||

| Total deposits | 159,910 | 162,058 | -1 | ||||||||||||||

| Short-term borrowings | 4,764 | 7,908 | -40 | ||||||||||||||

| Accrued interest and other liabilities | 4,438 | 4,488 | -1 | ||||||||||||||

| Long-term borrowings | 11,319 | 7,417 | 53 | ||||||||||||||

| Total liabilities | 180,431 | 181,871 | -1 | ||||||||||||||

| Shareholders' equity: | |||||||||||||||||

| Preferred | 2,744 | 2,011 | 36 | ||||||||||||||

| Common | 25,680 | 23,790 | 8 | ||||||||||||||

| Total shareholders' equity | 28,424 | 25,801 | 10 | ||||||||||||||

| Total liabilities and shareholders' equity | $ | 208,855 | $ | 207,672 | 1 | % | |||||||||||

|

Second Quarter 2024 Results | ||||

| June 30, | March 31, | December 31, | September 30, | June 30, | |||||||||||||||||||||||||

| (Dollars in millions) | 2024 | 2024 | 2023 | 2023 | 2023 | ||||||||||||||||||||||||

| ASSETS | |||||||||||||||||||||||||||||

| Cash and due from banks | $ | 1,778 | $ | 1,695 | $ | 1,731 | $ | 1,769 | $ | 1,848 | |||||||||||||||||||

| Interest-bearing deposits at banks | 24,792 | 32,144 | 28,069 | 30,114 | 27,107 | ||||||||||||||||||||||||

| Trading account | 99 | 99 | 106 | 137 | 137 | ||||||||||||||||||||||||

| Investment securities | 29,894 | 28,496 | 26,897 | 27,336 | 27,917 | ||||||||||||||||||||||||

| Loans and leases, net of unearned discount: | |||||||||||||||||||||||||||||

| Commercial and industrial | 60,027 | 57,897 | 57,010 | 54,891 | 54,699 | ||||||||||||||||||||||||

| Real estate - commercial | 29,532 | 32,416 | 33,003 | 33,741 | 34,634 | ||||||||||||||||||||||||

| Real estate - consumer | 23,003 | 23,076 | 23,264 | 23,448 | 23,762 | ||||||||||||||||||||||||

| Consumer | 22,440 | 21,584 | 20,791 | 20,275 | 20,249 | ||||||||||||||||||||||||

| Total loans and leases, net | 135,002 | 134,973 | 134,068 | 132,355 | 133,344 | ||||||||||||||||||||||||

| Less: allowance for credit losses | 2,204 | 2,191 | 2,129 | 2,052 | 1,998 | ||||||||||||||||||||||||

| Net loans and leases | 132,798 | 132,782 | 131,939 | 130,303 | 131,346 | ||||||||||||||||||||||||

| Goodwill | 8,465 | 8,465 | 8,465 | 8,465 | 8,465 | ||||||||||||||||||||||||

| Core deposit and other intangible assets | 119 | 132 | 147 | 162 | 177 | ||||||||||||||||||||||||

| Other assets | 10,910 | 11,324 | 10,910 | 10,838 | 10,675 | ||||||||||||||||||||||||

| Total assets | $ | 208,855 | $ | 215,137 | $ | 208,264 | $ | 209,124 | $ | 207,672 | |||||||||||||||||||

| LIABILITIES AND SHAREHOLDERS' EQUITY | |||||||||||||||||||||||||||||

| Noninterest-bearing deposits | $ | 47,729 | $ | 50,578 | $ | 49,294 | $ | 53,787 | $ | 54,938 | |||||||||||||||||||

| Interest-bearing deposits | 112,181 | 116,618 | 113,980 | 110,341 | 107,120 | ||||||||||||||||||||||||

| Total deposits | 159,910 | 167,196 | 163,274 | 164,128 | 162,058 | ||||||||||||||||||||||||

| Short-term borrowings | 4,764 | 4,795 | 5,316 | 6,731 | 7,908 | ||||||||||||||||||||||||

| Accrued interest and other liabilities | 4,438 | 4,527 | 4,516 | 4,946 | 4,488 | ||||||||||||||||||||||||

| Long-term borrowings | 11,319 | 11,450 | 8,201 | 7,123 | 7,417 | ||||||||||||||||||||||||

| Total liabilities | 180,431 | 187,968 | 181,307 | 182,928 | 181,871 | ||||||||||||||||||||||||

| Shareholders' equity: | |||||||||||||||||||||||||||||

| Preferred | 2,744 | 2,011 | 2,011 | 2,011 | 2,011 | ||||||||||||||||||||||||

| Common | 25,680 | 25,158 | 24,946 | 24,185 | 23,790 | ||||||||||||||||||||||||

| Total shareholders' equity | 28,424 | 27,169 | 26,957 | 26,196 | 25,801 | ||||||||||||||||||||||||

| Total liabilities and shareholders' equity | $ | 208,855 | $ | 215,137 | $ | 208,264 | $ | 209,124 | $ | 207,672 | |||||||||||||||||||

|

Second Quarter 2024 Results | ||||

| Three months ended | Change in balance | Six months ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| June 30, | March 31, | June 30, | June 30, 2024 from | June 30, | Change | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions) | 2024 | 2024 | 2023 | March 31, | June 30, | 2024 | 2023 | in | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance | Rate | Balance | Rate | Balance | Rate | 2024 | 2023 | Balance | Rate | Balance | Rate | balance | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ASSETS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits at banks | $ | 29,294 | 5.50 | % | $ | 30,647 | 5.49 | % | $ | 23,617 | 5.14 | % | -4 | % | 24 | % | $ | 29,971 | 5.50 | % | $ | 23,963 | 4.89 | % | 25 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Trading account | 99 | 3.47 | 105 | 3.42 | 151 | 2.66 | -6 | -34 | 102 | 3.45 | 136 | 2.50 | -25 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment securities | 29,695 | 3.61 | 28,587 | 3.30 | 28,623 | 3.09 | 4 | 4 | 29,141 | 3.46 | 28,126 | 3.04 | 4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans and leases, net of unearned discount: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | 58,152 | 7.04 | 56,821 | 6.99 | 54,572 | 6.63 | 2 | 7 | 57,486 | 7.01 | 53,531 | 6.47 | 7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Real estate - commercial | 31,458 | 6.38 | 32,696 | 6.36 | 34,903 | 6.38 | -4 | -10 | 32,077 | 6.37 | 35,089 | 6.14 | -9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Real estate - consumer | 23,006 | 4.32 | 23,136 | 4.28 | 23,781 | 4.10 | -1 | -3 | 23,071 | 4.30 | 23,775 | 4.03 | -3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer | 21,972 | 6.61 | 21,143 | 6.54 | 20,289 | 5.88 | 4 | 8 | 21,558 | 6.58 | 20,388 | 5.77 | 6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total loans and leases, net | 134,588 | 6.38 | 133,796 | 6.32 | 133,545 | 6.02 | 1 | 1 | 134,192 | 6.35 | 132,783 | 5.87 | 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total earning assets | 193,676 | 5.82 | 193,135 | 5.74 | 185,936 | 5.46 | — | 4 | 193,406 | 5.78 | 185,008 | 5.31 | 5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Goodwill | 8,465 | 8,465 | 8,473 | — | — | 8,465 | 8,482 | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Core deposit and other intangible assets | 126 | 140 | 185 | -10 | -32 | 133 | 192 | -31 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other assets | 9,714 | 9,738 | 9,782 | — | -1 | 9,725 | 9,810 | -1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 211,981 | $ | 211,478 | $ | 204,376 | — | % | 4 | % | $ | 211,729 | $ | 203,492 | 4 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LIABILITIES AND SHAREHOLDERS' EQUITY | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Savings and interest-checking deposits | $ | 95,955 | 2.59 | % | $ | 94,867 | 2.61 | % | $ | 87,210 | 1.69 | % | 1 | % | 10 | % | $ | 95,411 | 2.60 | % | $ | 87,629 | 1.49 | % | 9 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Time deposits | 19,802 | 4.41 | 20,583 | 4.41 | 16,009 | 3.77 | -4 | 24 | 20,192 | 4.41 | 13,832 | 3.49 | 46 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 115,757 | 2.90 | 115,450 | 2.93 | 103,219 | 2.02 | — | 12 | 115,603 | 2.91 | 101,461 | 1.76 | 14 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Short-term borrowings | 4,962 | 5.62 | 6,228 | 5.42 | 7,539 | 5.11 | -20 | -34 | 5,595 | 5.51 | 6,273 | 4.94 | -11 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Long-term borrowings | 11,490 | 5.83 | 9,773 | 5.81 | 7,516 | 5.43 | 18 | 53 | 10,631 | 5.82 | 7,017 | 5.36 | 52 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 132,209 | 3.26 | 131,451 | 3.26 | 118,274 | 2.43 | 1 | 12 | 131,829 | 3.26 | 114,751 | 2.15 | 15 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | 47,734 | 48,615 | 56,180 | -2 | -15 | 48,175 | 59,001 | -18 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 4,293 | 4,393 | 4,237 | -2 | 1 | 4,343 | 4,208 | 3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | 184,236 | 184,459 | 178,691 | — | 3 | 184,347 | 177,960 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholders' equity | 27,745 | 27,019 | 25,685 | 3 | 8 | 27,382 | 25,532 | 7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders' equity |

$ | 211,981 | $ | 211,478 | $ | 204,376 | — | % | 4 | % | $ | 211,729 | $ | 203,492 | 4 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest spread | 2.56 | 2.48 | 3.03 | 2.52 | 3.16 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Contribution of interest-free funds | 1.03 | 1.04 | .88 | 1.04 | .81 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest margin | 3.59 | % | 3.52 | % | 3.91 | % | 3.56 | % | 3.97 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Second Quarter 2024 Results | ||||

| Three months ended | Six months ended | ||||||||||||||||||||||

| June 30, | June 30, | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| (Dollars in millions, except per share) | |||||||||||||||||||||||

| Income statement data | |||||||||||||||||||||||

| Net income | |||||||||||||||||||||||

| Net income | $ | 655 | $ | 867 | $ | 1,186 | $ | 1,569 | |||||||||||||||

| Amortization of core deposit and other intangible assets (1) | 10 | 12 | 22 | 25 | |||||||||||||||||||

| Net operating income | $ | 665 | $ | 879 | $ | 1,208 | $ | 1,594 | |||||||||||||||

| Earnings per common share | |||||||||||||||||||||||

| Diluted earnings per common share | $ | 3.73 | $ | 5.05 | $ | 6.76 | $ | 9.06 | |||||||||||||||

| Amortization of core deposit and other intangible assets (1) | .06 | .07 | .13 | .15 | |||||||||||||||||||

| Diluted net operating earnings per common share | $ | 3.79 | $ | 5.12 | $ | 6.89 | $ | 9.21 | |||||||||||||||

| Other expense | |||||||||||||||||||||||

| Other expense | $ | 1,297 | $ | 1,293 | $ | 2,693 | $ | 2,652 | |||||||||||||||

| Amortization of core deposit and other intangible assets | (13) | (15) | (28) | (32) | |||||||||||||||||||

| Noninterest operating expense | $ | 1,284 | $ | 1,278 | $ | 2,665 | $ | 2,620 | |||||||||||||||

| Efficiency ratio | |||||||||||||||||||||||

| Noninterest operating expense (numerator) | $ | 1,284 | $ | 1,278 | $ | 2,665 | $ | 2,620 | |||||||||||||||

| Taxable-equivalent net interest income | $ | 1,731 | $ | 1,813 | $ | 3,423 | $ | 3,645 | |||||||||||||||

| Other income | 584 | 803 | 1,164 | 1,390 | |||||||||||||||||||

| Less: Gain (loss) on bank investment securities | (8) | 1 | (6) | 1 | |||||||||||||||||||

| Denominator | $ | 2,323 | $ | 2,615 | $ | 4,593 | $ | 5,034 | |||||||||||||||

| Efficiency ratio | 55.3 | % | 48.9 | % | 58.0 | % | 52.0 | % | |||||||||||||||

| Balance sheet data | |||||||||||||||||||||||

| Average assets | |||||||||||||||||||||||

| Average assets | $ | 211,981 | $ | 204,376 | $ | 211,729 | $ | 203,492 | |||||||||||||||

| Goodwill | (8,465) | (8,473) | (8,465) | (8,482) | |||||||||||||||||||

| Core deposit and other intangible assets | (126) | (185) | (133) | (192) | |||||||||||||||||||

| Deferred taxes | 30 | 46 | 32 | 47 | |||||||||||||||||||

| Average tangible assets | $ | 203,420 | $ | 195,764 | $ | 203,163 | $ | 194,865 | |||||||||||||||

| Average common equity | |||||||||||||||||||||||

| Average total equity | $ | 27,745 | $ | 25,685 | $ | 27,382 | $ | 25,532 | |||||||||||||||

| Preferred stock | (2,405) | (2,011) | (2,208) | (2,011) | |||||||||||||||||||

| Average common equity | 25,340 | 23,674 | 25,174 | 23,521 | |||||||||||||||||||

| Goodwill | (8,465) | (8,473) | (8,465) | (8,482) | |||||||||||||||||||

| Core deposit and other intangible assets | (126) | (185) | (133) | (192) | |||||||||||||||||||

| Deferred taxes | 30 | 46 | 32 | 47 | |||||||||||||||||||

| Average tangible common equity | $ | 16,779 | $ | 15,062 | $ | 16,608 | $ | 14,894 | |||||||||||||||

| At end of quarter | |||||||||||||||||||||||

| Total assets | |||||||||||||||||||||||

| Total assets | $ | 208,855 | $ | 207,672 | |||||||||||||||||||

| Goodwill | (8,465) | (8,465) | |||||||||||||||||||||

| Core deposit and other intangible assets | (119) | (177) | |||||||||||||||||||||

| Deferred taxes | 31 | 44 | |||||||||||||||||||||

| Total tangible assets | $ | 200,302 | $ | 199,074 | |||||||||||||||||||

| Total common equity | |||||||||||||||||||||||

| Total equity | $ | 28,424 | $ | 25,801 | |||||||||||||||||||

| Preferred stock | (2,744) | (2,011) | |||||||||||||||||||||

| Common equity | 25,680 | 23,790 | |||||||||||||||||||||

| Goodwill | (8,465) | (8,465) | |||||||||||||||||||||

| Core deposit and other intangible assets | (119) | (177) | |||||||||||||||||||||

| Deferred taxes | 31 | 44 | |||||||||||||||||||||

| Total tangible common equity | $ | 17,127 | $ | 15,192 | |||||||||||||||||||

|

Second Quarter 2024 Results | ||||

| Three months ended | |||||||||||||||||||||||||||||

| June 30, | March 31, | December 31, | September 30, | June 30, | |||||||||||||||||||||||||

| 2024 | 2024 | 2023 | 2023 | 2023 | |||||||||||||||||||||||||

| (Dollars in millions, except per share) | |||||||||||||||||||||||||||||

| Income statement data | |||||||||||||||||||||||||||||

| Net income | |||||||||||||||||||||||||||||

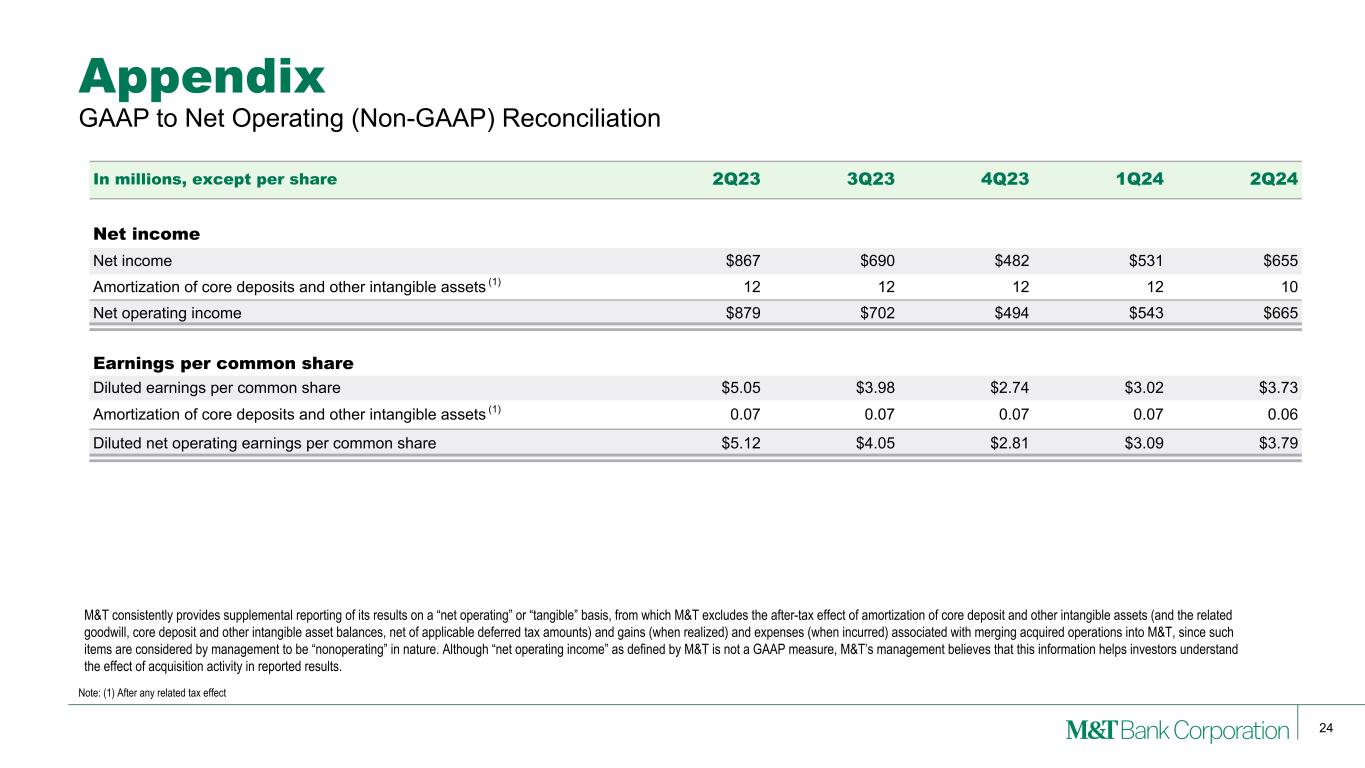

| Net income | $ | 655 | $ | 531 | $ | 482 | $ | 690 | $ | 867 | |||||||||||||||||||

| Amortization of core deposit and other intangible assets (1) | 10 | 12 | 12 | 12 | 12 | ||||||||||||||||||||||||

| Net operating income | $ | 665 | $ | 543 | $ | 494 | $ | 702 | $ | 879 | |||||||||||||||||||

| Earnings per common share | |||||||||||||||||||||||||||||

| Diluted earnings per common share | $ | 3.73 | $ | 3.02 | $ | 2.74 | $ | 3.98 | $ | 5.05 | |||||||||||||||||||

| Amortization of core deposit and other intangible assets (1) | .06 | .07 | .07 | .07 | .07 | ||||||||||||||||||||||||

| Diluted net operating earnings per common share | $ | 3.79 | $ | 3.09 | $ | 2.81 | $ | 4.05 | $ | 5.12 | |||||||||||||||||||

| Other expense | |||||||||||||||||||||||||||||

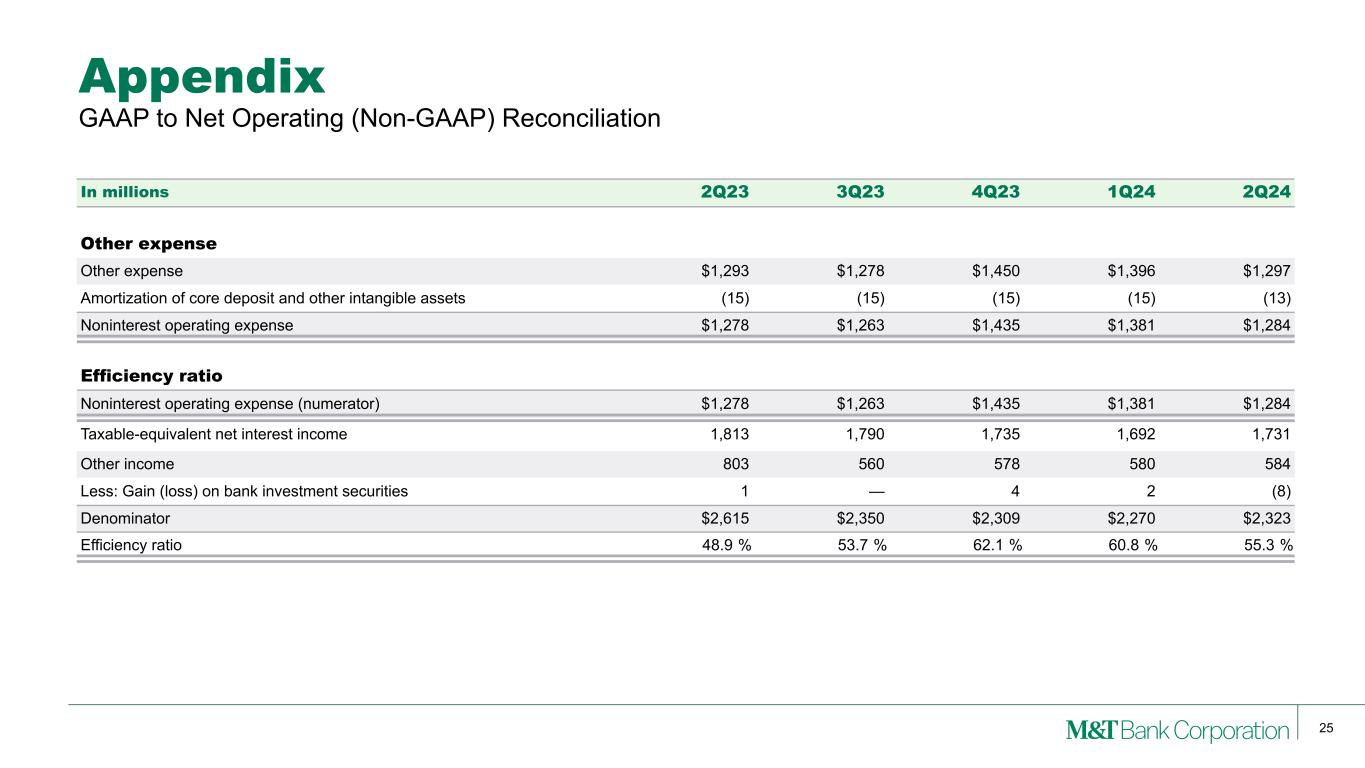

| Other expense | $ | 1,297 | $ | 1,396 | $ | 1,450 | $ | 1,278 | $ | 1,293 | |||||||||||||||||||

| Amortization of core deposit and other intangible assets | (13) | (15) | (15) | (15) | (15) | ||||||||||||||||||||||||

| Noninterest operating expense | $ | 1,284 | $ | 1,381 | $ | 1,435 | $ | 1,263 | $ | 1,278 | |||||||||||||||||||

| Efficiency ratio | |||||||||||||||||||||||||||||

| Noninterest operating expense (numerator) | $ | 1,284 | $ | 1,381 | $ | 1,435 | $ | 1,263 | $ | 1,278 | |||||||||||||||||||

| Taxable-equivalent net interest income | $ | 1,731 | $ | 1,692 | $ | 1,735 | $ | 1,790 | $ | 1,813 | |||||||||||||||||||

| Other income | 584 | 580 | 578 | 560 | 803 | ||||||||||||||||||||||||

| Less: Gain (loss) on bank investment securities | (8) | 2 | 4 | — | 1 | ||||||||||||||||||||||||

| Denominator | $ | 2,323 | $ | 2,270 | $ | 2,309 | $ | 2,350 | $ | 2,615 | |||||||||||||||||||

| Efficiency ratio | 55.3 | % | 60.8 | % | 62.1 | % | 53.7 | % | 48.9 | % | |||||||||||||||||||

| Balance sheet data | |||||||||||||||||||||||||||||

| Average assets | |||||||||||||||||||||||||||||

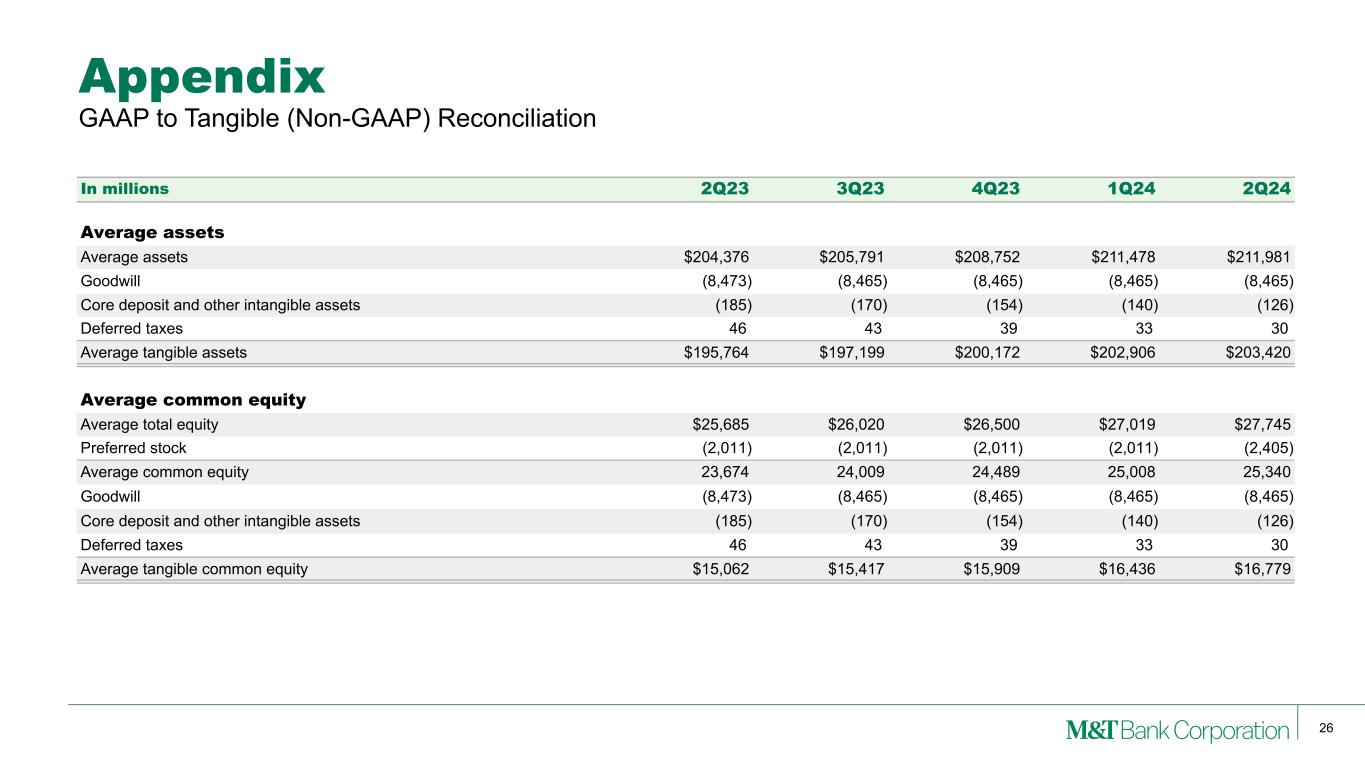

| Average assets | $ | 211,981 | $ | 211,478 | $ | 208,752 | $ | 205,791 | $ | 204,376 | |||||||||||||||||||

| Goodwill | (8,465) | (8,465) | (8,465) | (8,465) | (8,473) | ||||||||||||||||||||||||

| Core deposit and other intangible assets | (126) | (140) | (154) | (170) | (185) | ||||||||||||||||||||||||

| Deferred taxes | 30 | 33 | 39 | 43 | 46 | ||||||||||||||||||||||||

| Average tangible assets | $ | 203,420 | $ | 202,906 | $ | 200,172 | $ | 197,199 | $ | 195,764 | |||||||||||||||||||

| Average common equity | |||||||||||||||||||||||||||||

| Average total equity | $ | 27,745 | $ | 27,019 | $ | 26,500 | $ | 26,020 | $ | 25,685 | |||||||||||||||||||

| Preferred stock | (2,405) | (2,011) | (2,011) | (2,011) | (2,011) | ||||||||||||||||||||||||

| Average common equity | 25,340 | 25,008 | 24,489 | 24,009 | 23,674 | ||||||||||||||||||||||||

| Goodwill | (8,465) | (8,465) | (8,465) | (8,465) | (8,473) | ||||||||||||||||||||||||

| Core deposit and other intangible assets | (126) | (140) | (154) | (170) | (185) | ||||||||||||||||||||||||

| Deferred taxes | 30 | 33 | 39 | 43 | 46 | ||||||||||||||||||||||||

| Average tangible common equity | $ | 16,779 | $ | 16,436 | $ | 15,909 | $ | 15,417 | $ | 15,062 | |||||||||||||||||||

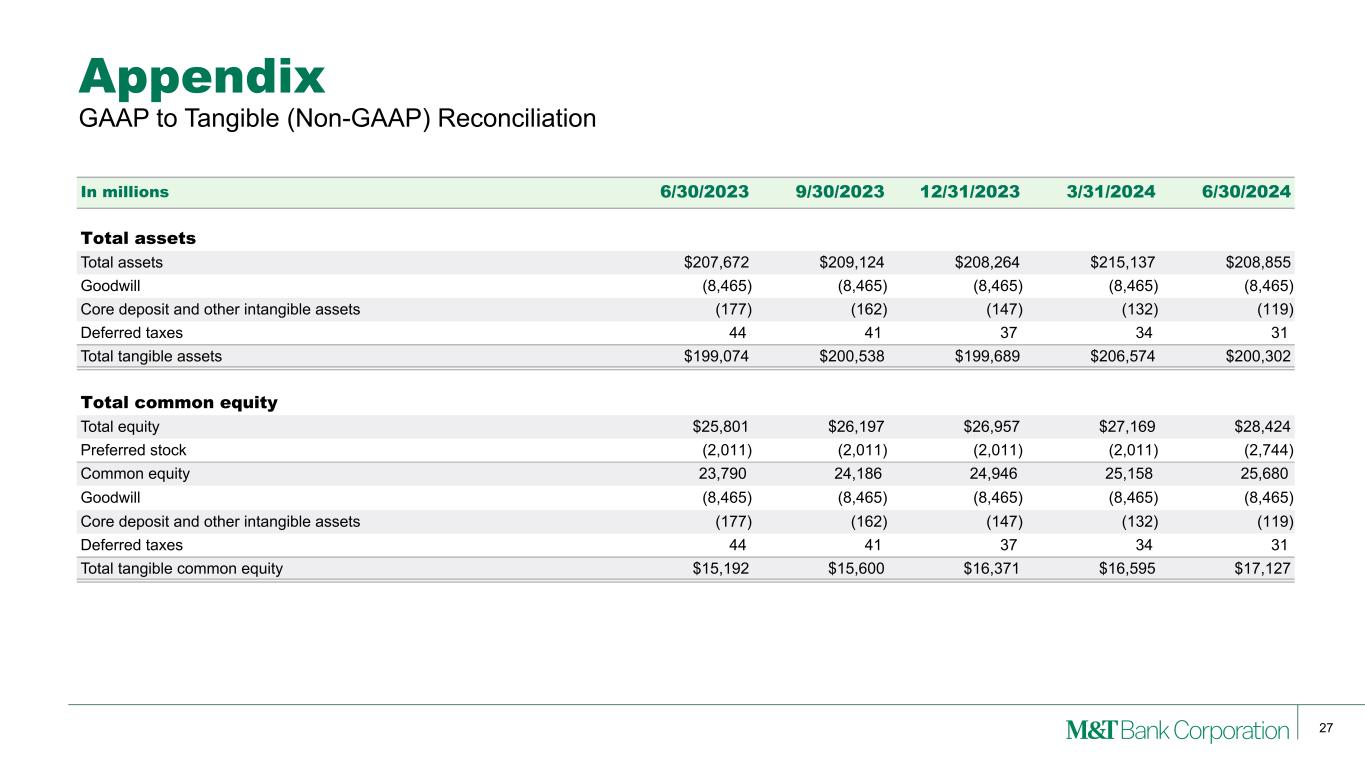

| At end of quarter | |||||||||||||||||||||||||||||

| Total assets | |||||||||||||||||||||||||||||

| Total assets | $ | 208,855 | $ | 215,137 | $ | 208,264 | $ | 209,124 | $ | 207,672 | |||||||||||||||||||

| Goodwill | (8,465) | (8,465) | (8,465) | (8,465) | (8,465) | ||||||||||||||||||||||||

| Core deposit and other intangible assets | (119) | (132) | (147) | (162) | (177) | ||||||||||||||||||||||||

| Deferred taxes | 31 | 34 | 37 | 41 | 44 | ||||||||||||||||||||||||

| Total tangible assets | $ | 200,302 | $ | 206,574 | $ | 199,689 | $ | 200,538 | $ | 199,074 | |||||||||||||||||||

| Total common equity | |||||||||||||||||||||||||||||

| Total equity | $ | 28,424 | $ | 27,169 | $ | 26,957 | $ | 26,197 | $ | 25,801 | |||||||||||||||||||

| Preferred stock | (2,744) | (2,011) | (2,011) | (2,011) | (2,011) | ||||||||||||||||||||||||

| Common equity | 25,680 | 25,158 | 24,946 | 24,186 | 23,790 | ||||||||||||||||||||||||

| Goodwill | (8,465) | (8,465) | (8,465) | (8,465) | (8,465) | ||||||||||||||||||||||||

| Core deposit and other intangible assets | (119) | (132) | (147) | (162) | (177) | ||||||||||||||||||||||||

| Deferred taxes | 31 | 34 | 37 | 41 | 44 | ||||||||||||||||||||||||

| Total tangible common equity | $ | 17,127 | $ | 16,595 | $ | 16,371 | $ | 15,600 | $ | 15,192 | |||||||||||||||||||