Document

Sonida Senior Living, Inc. Announces Fourth Quarter and Full Year 2023 Results

DALLAS, Texas – March 27, 2024 – Sonida Senior Living, Inc. (the “Company,” “we,” “our,” or “us”) (NYSE: SNDA) announced results for the fourth quarter and for the full year ended December 31, 2023.

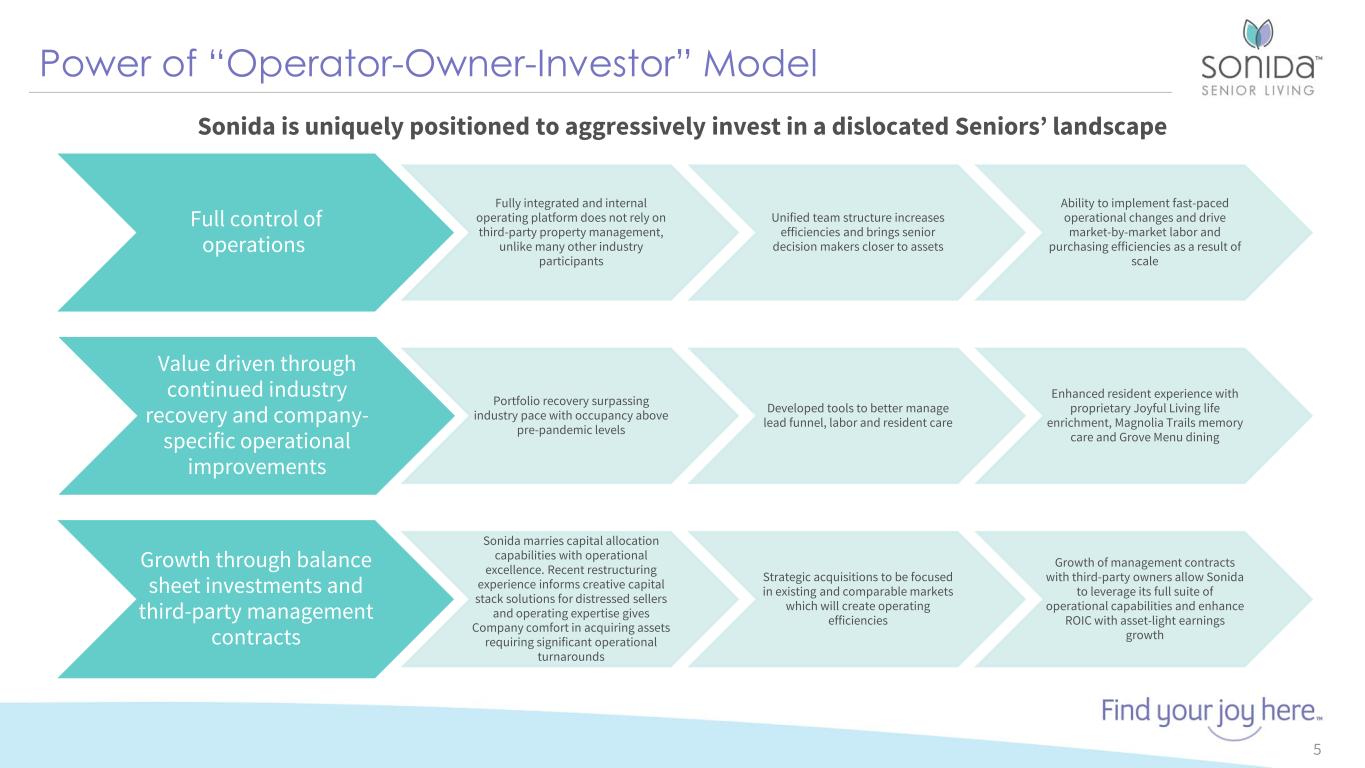

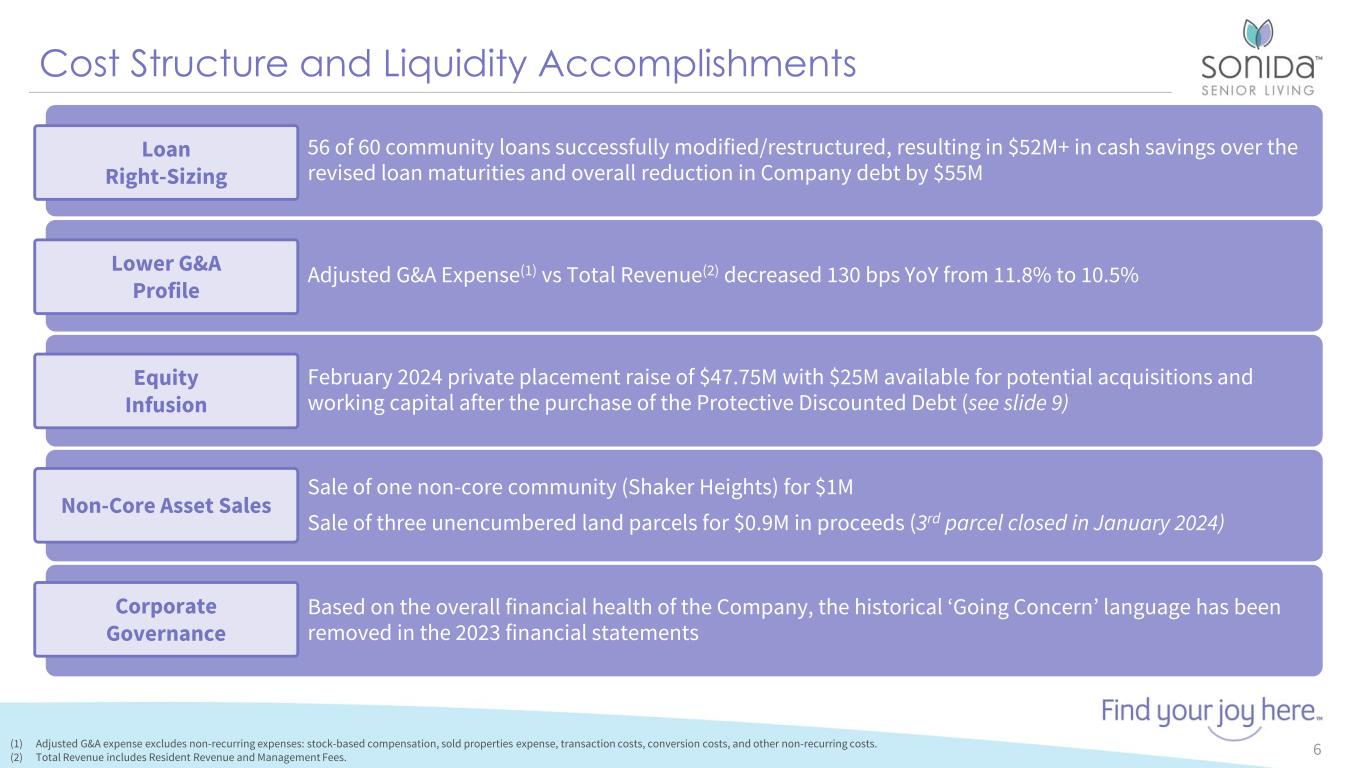

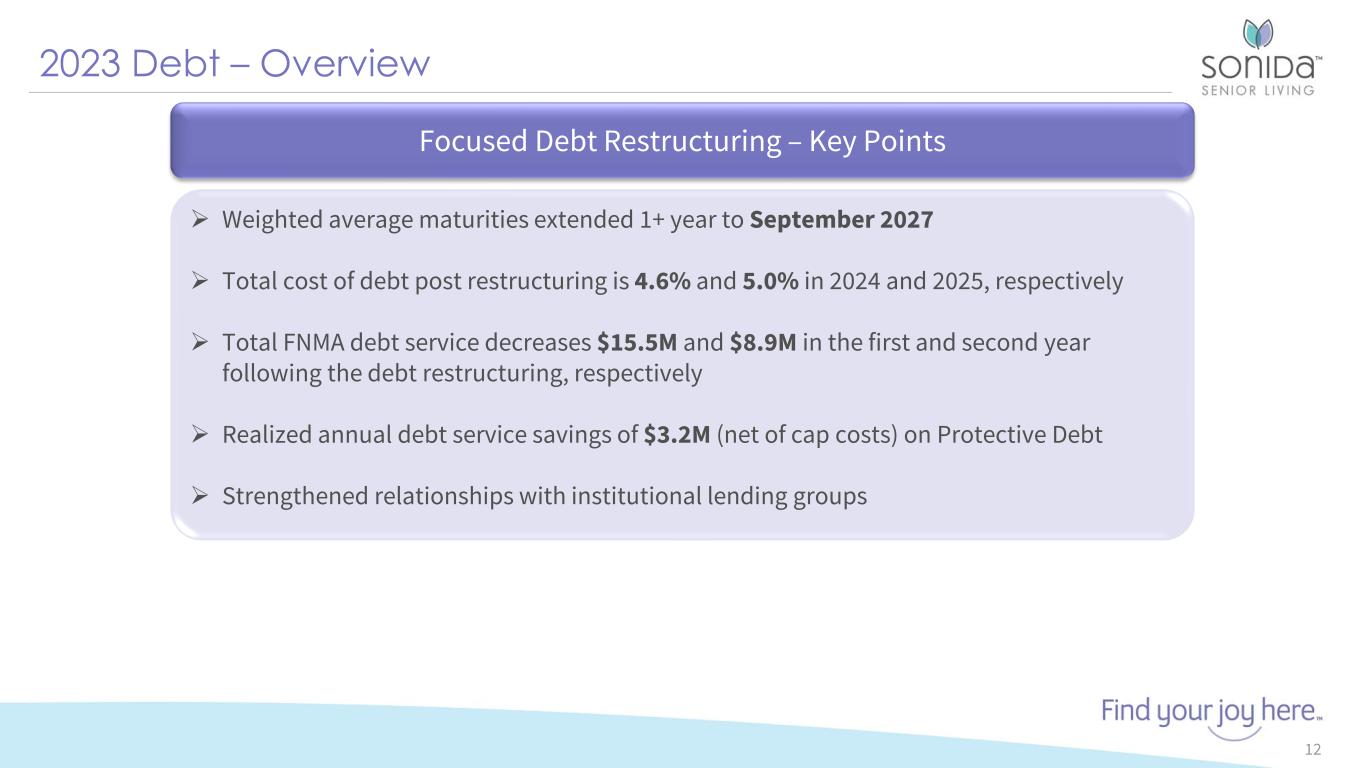

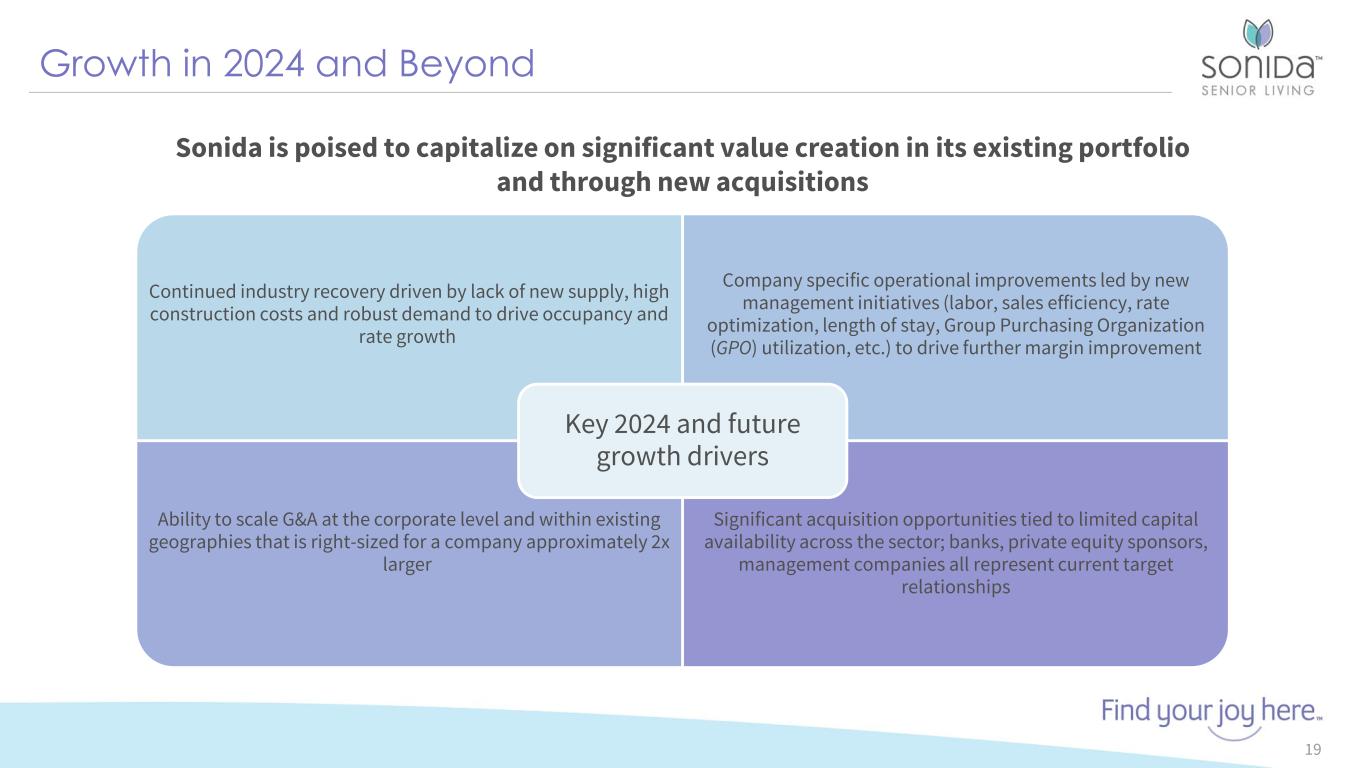

“2023 was a transformational year for Sonida. We achieved significant performance milestones while accomplishing key strategic objectives and delivering industry-leading care and services to our residents. These achievements included balance sheet optimization through the comprehensive restructuring of our debt culminating in the $47.8 million equity private placement that closed in the first quarter of 2024. The operational developments and greatly strengthened balance sheet establish Sonida as a differentiated operator, owner, and investor in Senior Living and position the Company to capitalize on near-term dislocation, which will drive the next chapter of value creation for our shareholders.” said Brandon Ribar, President and CEO.

Fourth Quarter and Full Year Highlights

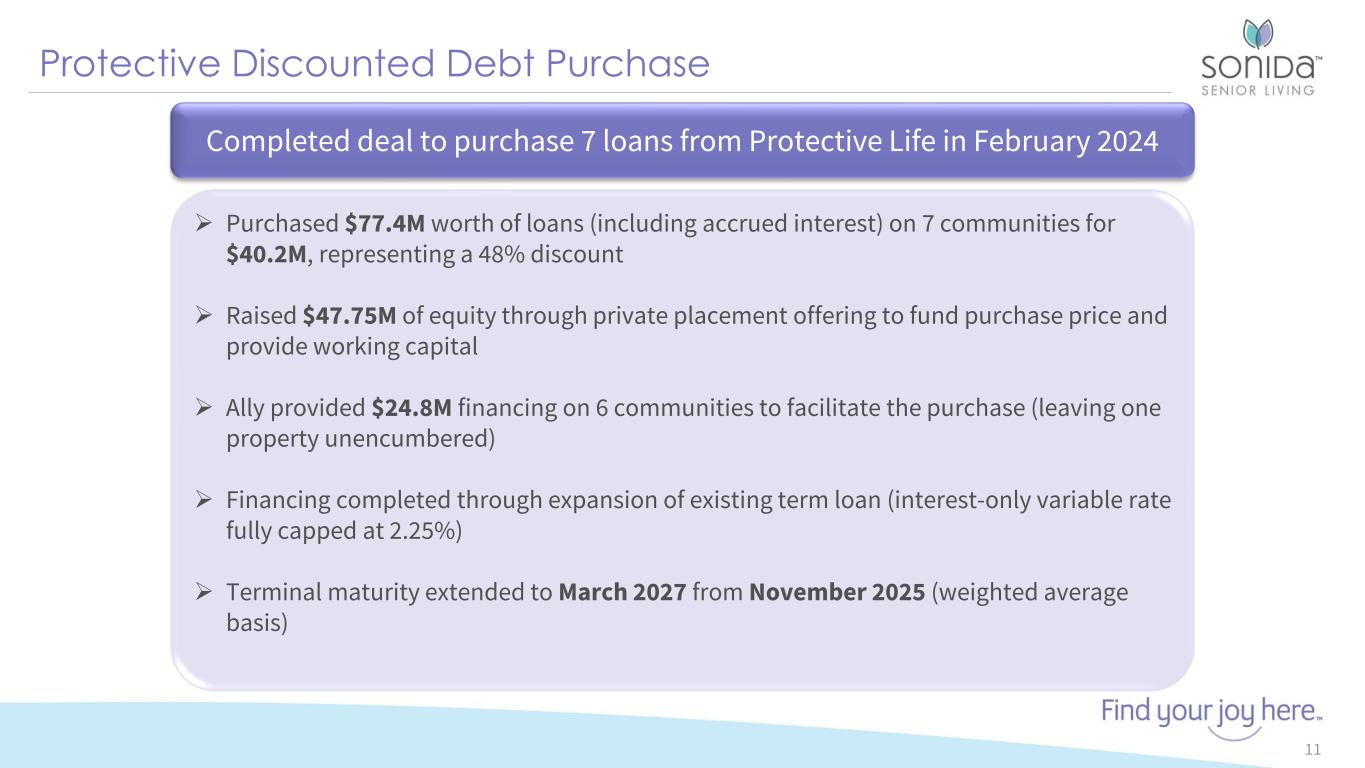

•Liquidity significantly improved, resolving any uncertainty around continuing as a going concern. This was facilitated by our private placement executed in February 2024 resulting in cash proceeds of $47.8 million and concurrent Protective Life debt purchase.

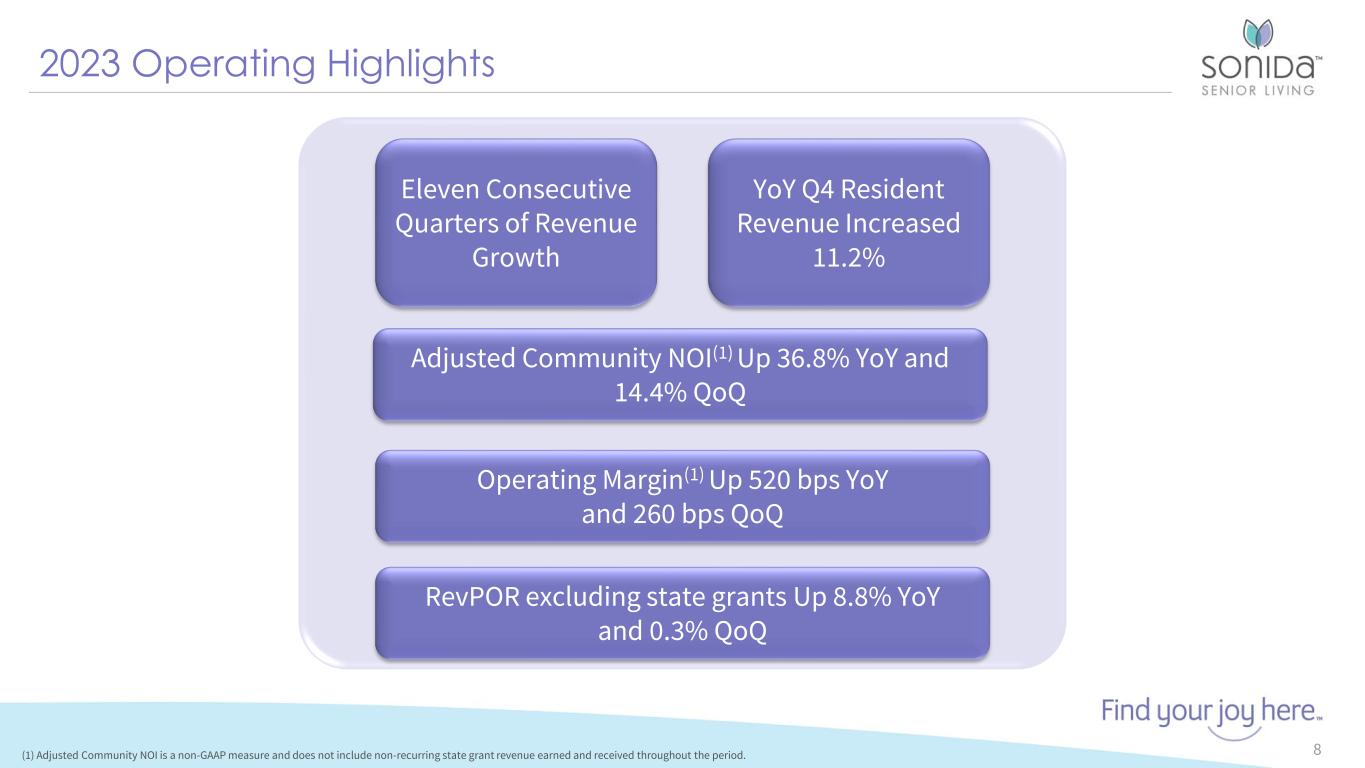

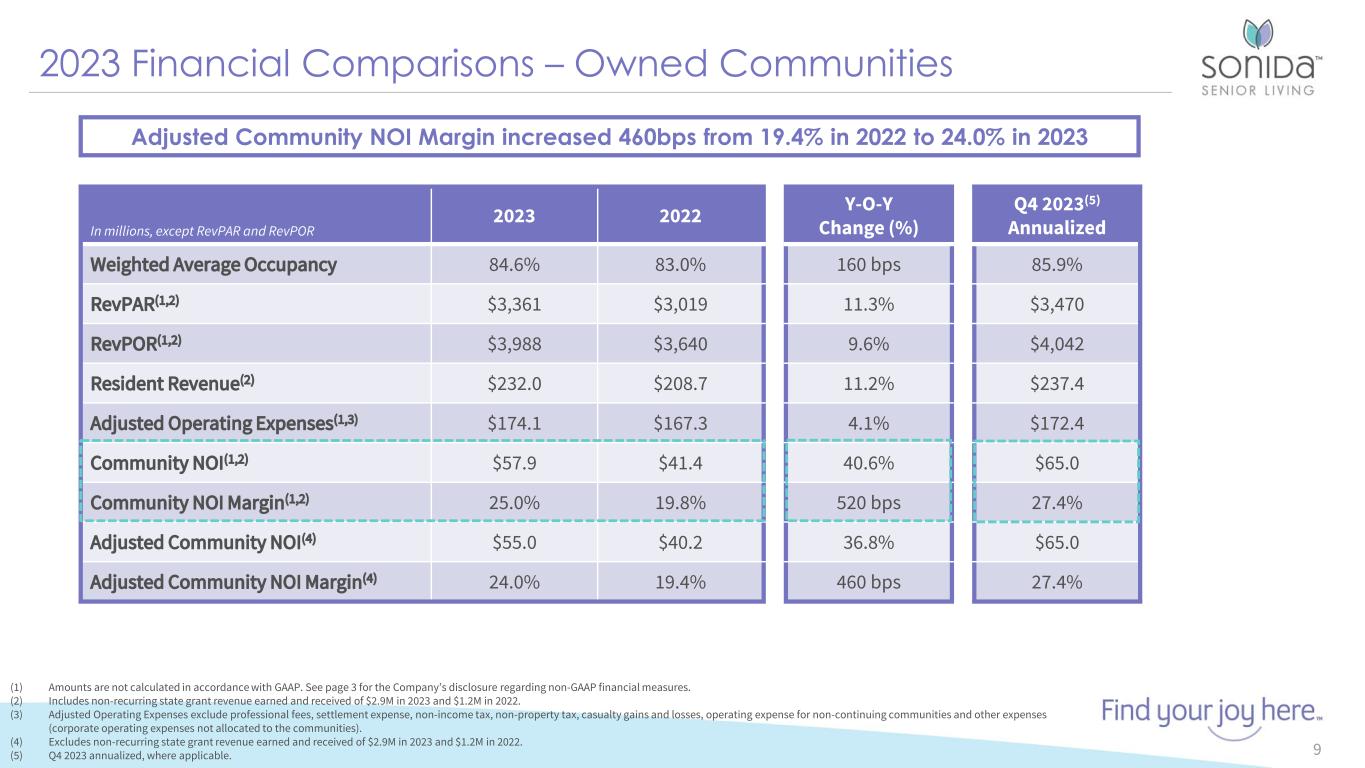

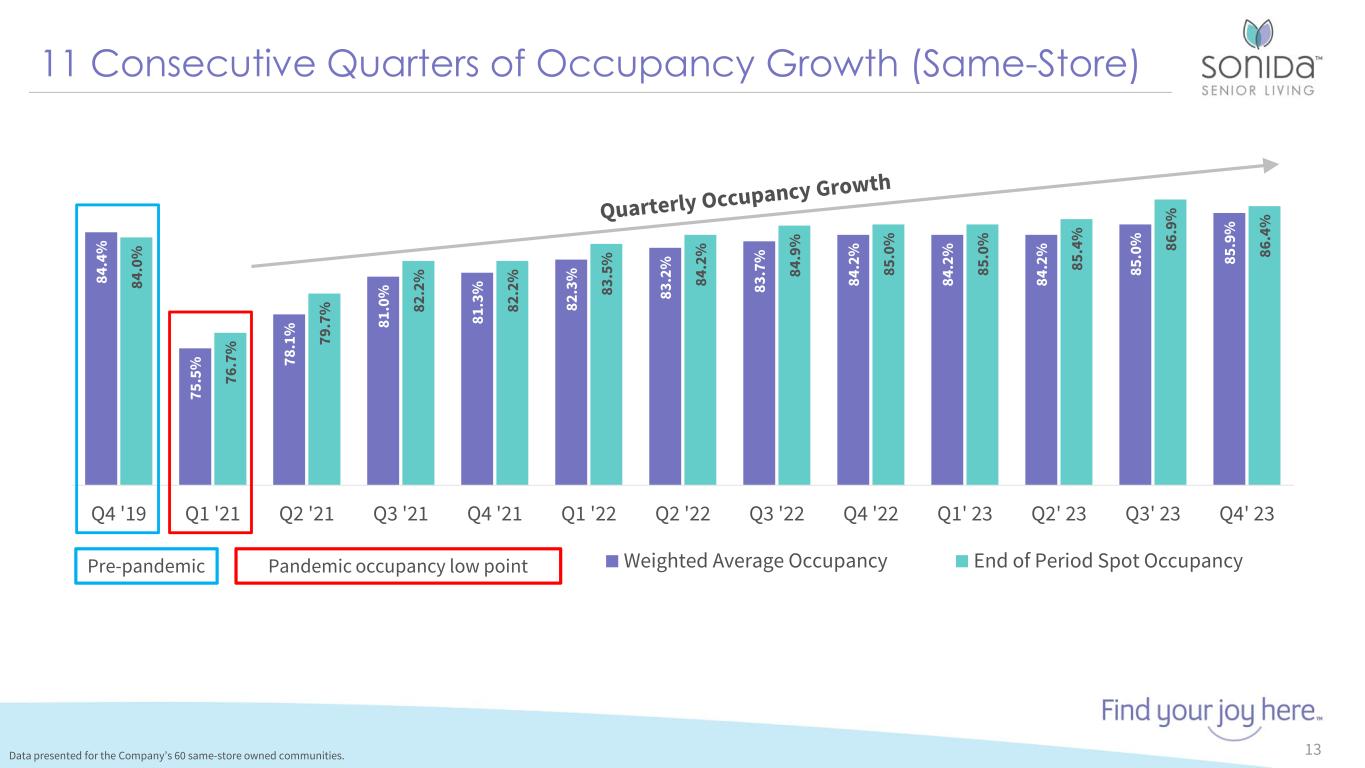

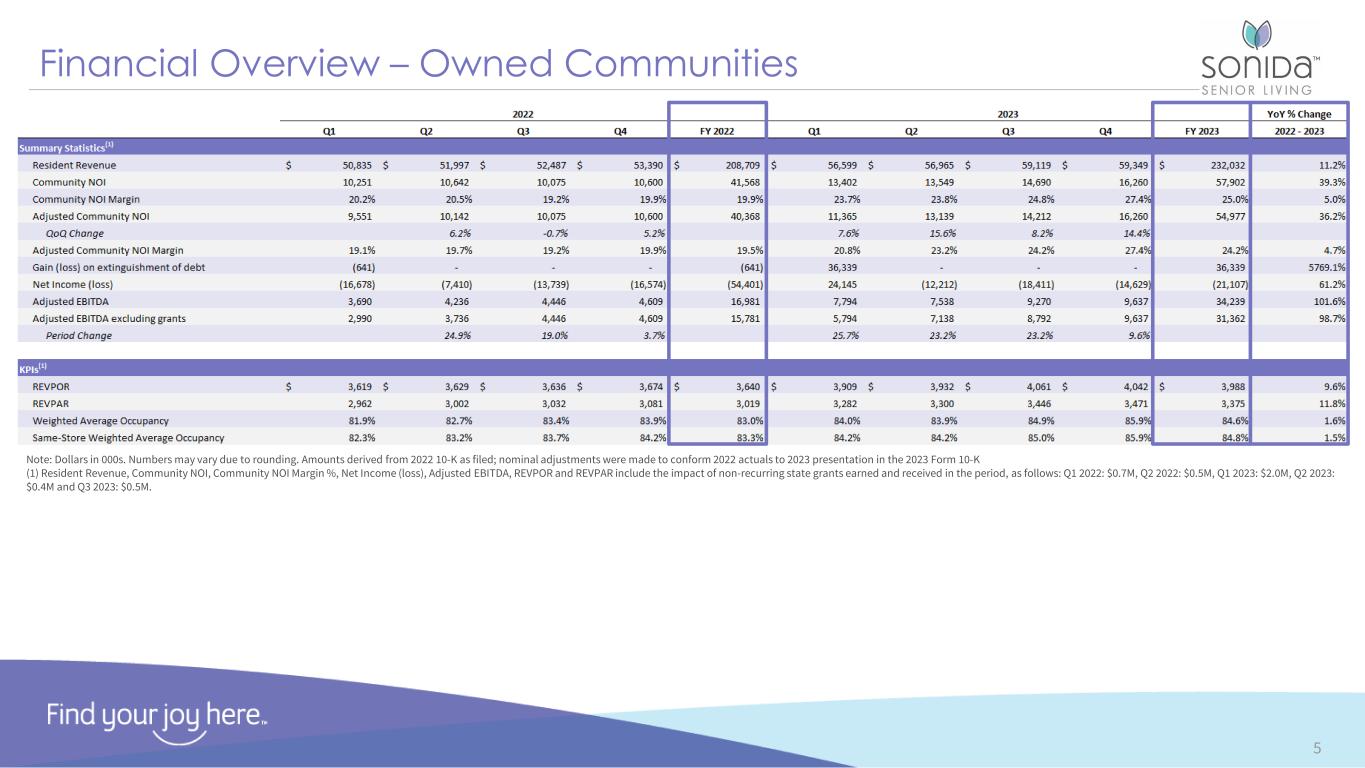

•Weighted average occupancy for the Company’s consolidated portfolio increased 200 basis points to 85.9%, comparing Q4 2023 to Q4 2022.

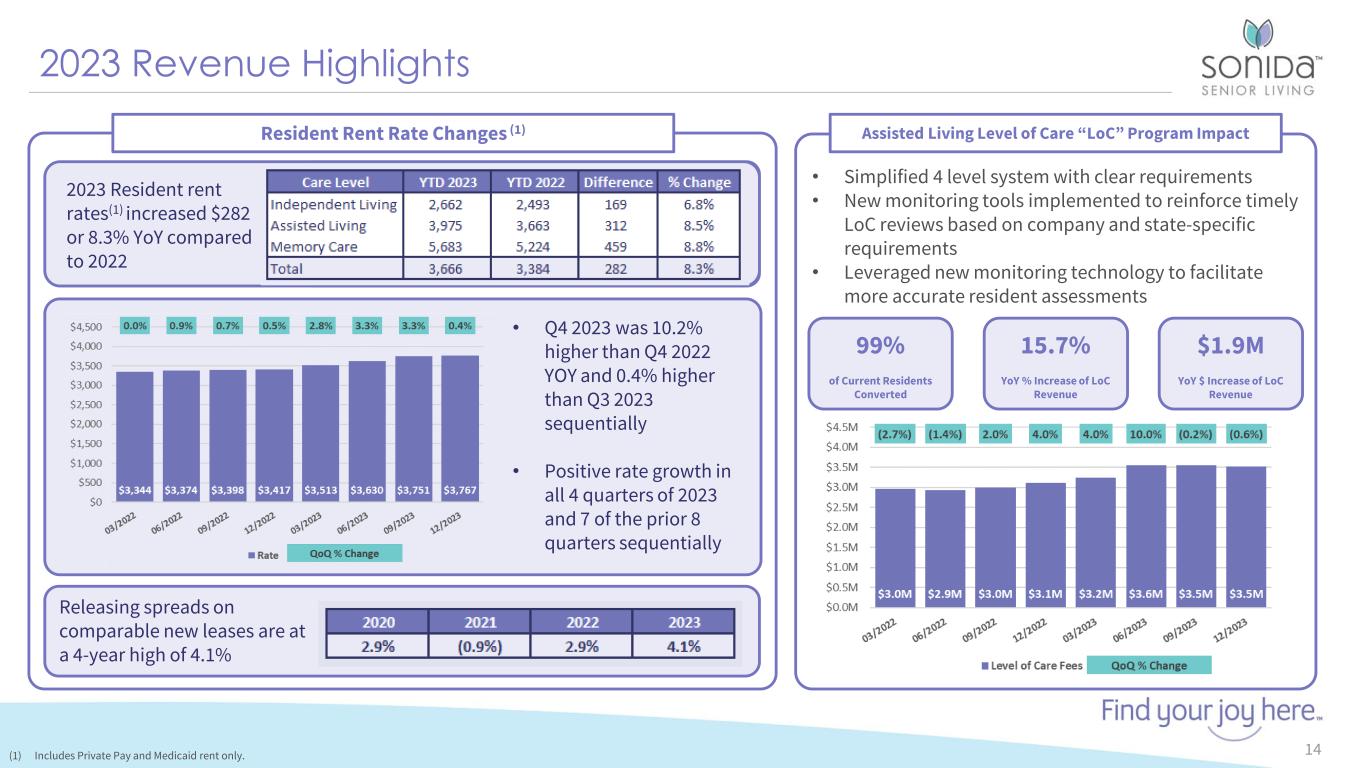

•Resident revenue increased $6.0 million, or 11.2%, comparing Q4 2023 to Q4 2022.

•Net loss for the fourth quarter was $14.6 million.

•Fourth quarter Adjusted EBITDA, a non-GAAP measure, was $9.3 million representing an increase of 103.5% year-over-year and 0.3% in sequential quarters, driven primarily by continued improvement in operations.

•Net cash provided by operating activities was $10.7 million year-to-date as compared to a net use of $2.6 million for the year ended 2022.

•Results for the Company’s consolidated portfolio of communities:

◦Q4 2023 vs. Q4 2022:

▪Revenue Per Available Unit (“RevPAR”) increased 12.6% to $3,470.

▪Revenue Per Occupied Unit (“RevPOR”) increased 10.0% to $4,042.

▪Community Net Operating Income, a non-GAAP measure, was $16.3 million and $10.3 million for Q4 2023 and Q4 2022, respectively, representing an increase of $6.0 million. There were no state grants received during these periods.

▪Community Net Operating Income Margin, a non-GAAP measure, was 27.4% and 19.3%, for Q4 2023 and Q4 2022, respectively.

◦Q4 2023 vs. Q3 2023:

▪RevPAR increased 70 basis points to $3,470.

▪RevPOR decreased 50 basis points to $4,042.

▪Community Net Operating Income increased $1.6 million to $16.3 million. Adjusted Community Net Operating Income, excluding $0.5 million of state grant revenue received in Q3 2023 (none recognized in Q4 2023), was $16.3 million and $14.2 million for Q4 2023 and Q3 2023, respectively.

▪Community Net Operating Income Margin was 27.4% and 24.8% for Q4 2023 and Q3 2023, respectively, representing an increase of 10.7%.

SONIDA SENIOR LIVING, INC.

SUMMARY OF CONSOLIDATED FINANCIAL RESULTS

THREE MONTHS ENDED AND YEARS ENDED DECEMBER 31, 2023 AND 2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

Three Months ended September 30, |

|

Years Ended December 31, |

|

2023 |

|

2022 |

|

2023 |

|

2023 |

|

2022 |

| Consolidated results |

|

|

|

|

|

|

|

|

|

Resident revenue (1) |

$ |

59,349 |

|

|

$ |

53,388 |

|

|

$ |

59,117 |

|

|

$ |

232,032 |

|

|

$ |

208,703 |

|

| Management fees |

586 |

|

|

523 |

|

|

569 |

|

|

2,191 |

|

|

2,359 |

|

| Operating expense |

44,367 |

|

|

45,073 |

|

|

44,486 |

|

|

177,323 |

|

|

171,635 |

|

| General and administrative expense |

9,946 |

|

|

6,723 |

|

|

8,615 |

|

|

32,198 |

|

|

30,286 |

|

| Gain (loss) on extinguishment of debt, net |

— |

|

|

— |

|

|

— |

|

|

36,339 |

|

|

(641) |

|

| Long-lived asset impairment |

— |

|

|

1,588 |

|

|

5,965 |

|

|

5,965 |

|

|

1,588 |

|

|

|

|

|

|

|

|

|

|

|

Other income (expense), net (2) |

(480) |

|

|

1,348 |

|

|

— |

|

|

(532) |

|

|

10,011 |

|

Loss before provision for income taxes (1) (2) |

(14,581) |

|

|

(16,742) |

|

|

(18,328) |

|

|

(20,854) |

|

|

(54,315) |

|

Net loss (1) (2) |

(14,629) |

|

|

(16,574) |

|

|

(18,411) |

|

|

(21,107) |

|

|

(54,401) |

|

Adjusted EBITDA (1) (3) |

9,302 |

|

|

4,572 |

|

|

9,270 |

|

|

33,904 |

|

|

16,981 |

|

Community net operating income (NOI) (3) |

$ |

16,260 |

|

|

$ |

10,324 |

|

|

$ |

14,690 |

|

|

$ |

57,899 |

|

|

$ |

41,418 |

|

Community net operating income margin (3) |

27.4 |

% |

|

19.3 |

% |

|

24.8 |

% |

|

25.0 |

% |

|

19.8 |

% |

Weighted average occupancy |

85.9 |

% |

|

83.9 |

% |

|

84.9 |

% |

|

84.6 |

% |

|

83.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes $0.0 million, $0.0 million, $0.5 million, $2.9 million and $1.2 million of state grant revenue received in Q4 2023, Q4 2022, Q3 2023, Full Year 2023 and Full Year 2022, respectively.

(2) Includes $9.1 million for Federal provider relief funds for Full Year 2022.

(3) Adjusted EBITDA, Community Net Operating Income and Community Net Operating Income Margin are financial measures that are not calculated in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). See “Reconciliations of Non-GAAP Financial Measures” for the Company's definition of such measures, reconciliations to the most comparable GAAP financial measures, and other information regarding the use of the Company's non-GAAP financial measures.

Results of Operations

Three months ended December 31, 2023 as compared to three months ended December 31, 2022

Revenues

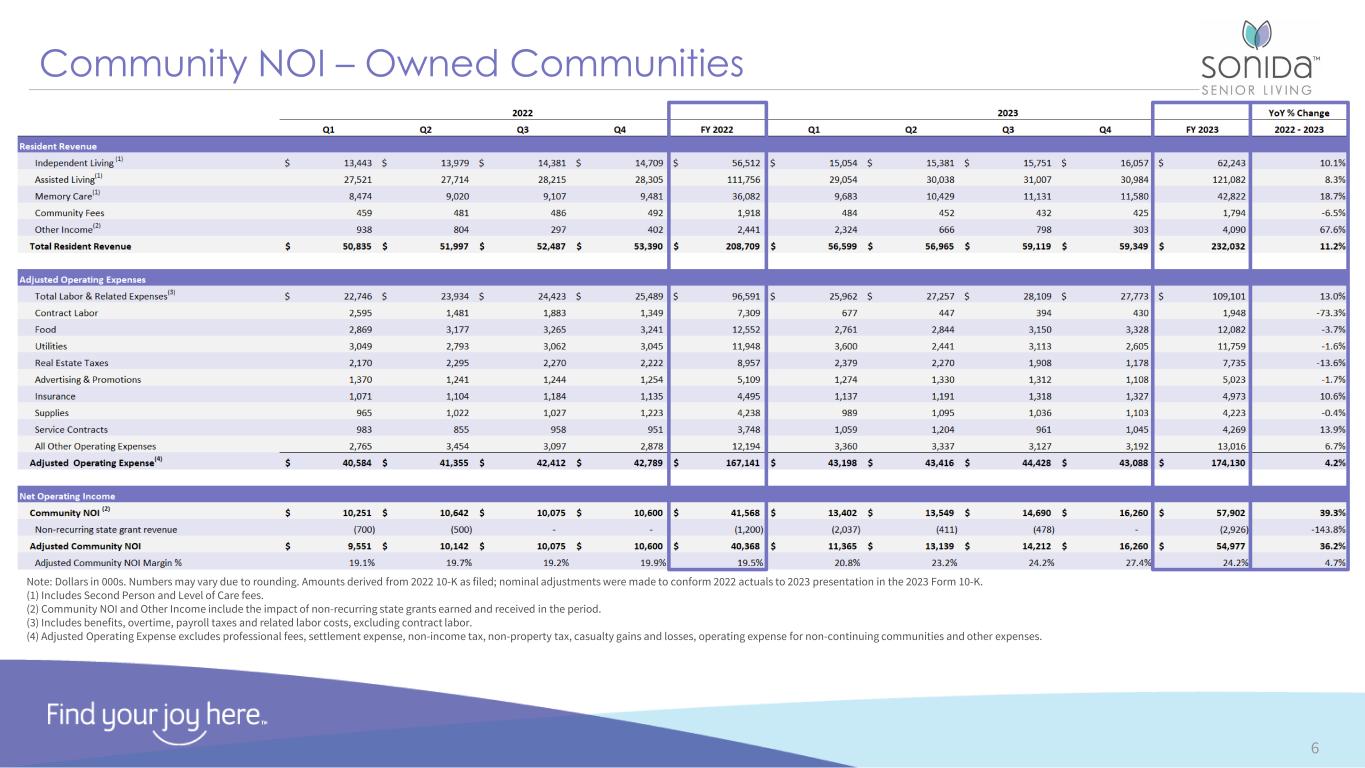

Resident revenue for the three months ended December 31, 2023 was $59.3 million as compared to $53.4 million for the three months ended December 31, 2022, an increase of $5.9 million, or 11.2%. The increase in revenue was primarily due to increased occupancy and increased average rent rates.

Expenses

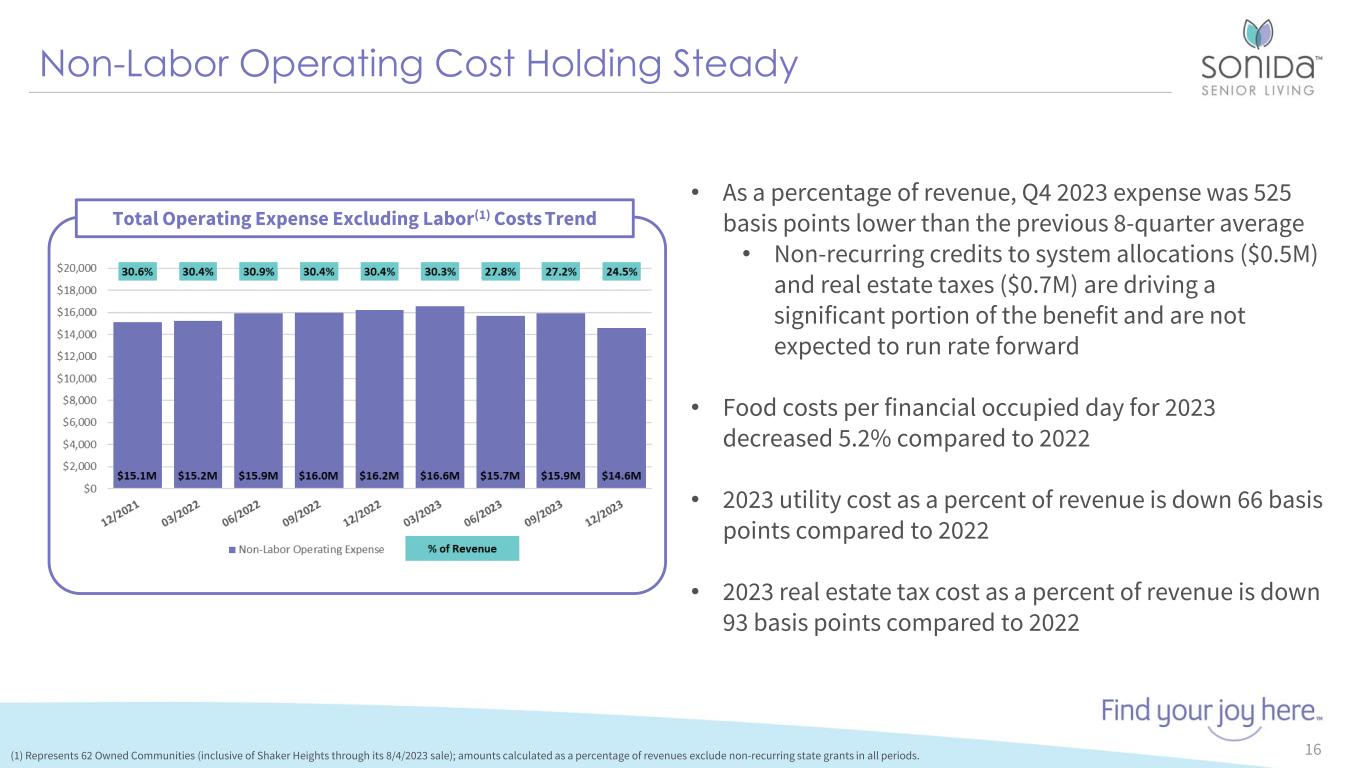

Operating expenses for the three months ended December 31, 2023 were $44.4 million as compared to $45.1 million for the three months ended December 31, 2022, a decrease of $0.7 million. The decrease is primarily due to a $1.0 million decrease in real estate taxes, a $0.5 million decrease in utility costs, and a $0.6 million decrease in other expenses, partially offset by a $1.4 million increase in labor and employee-related expenses.

General and administrative expenses for the three months ended December 31, 2023 were $9.9 million as compared to $6.7 million for the three months ended December 31, 2022, representing an increase of $3.2 million. This increase is primarily due to $2.0 million in transaction costs related to our 2023 loan modifications and other transaction related expenses and $0.3 million in information technology related expenses. The remaining variance of $0.9 million represents the inflationary impact from the remaining recurring general and administrative expenses.

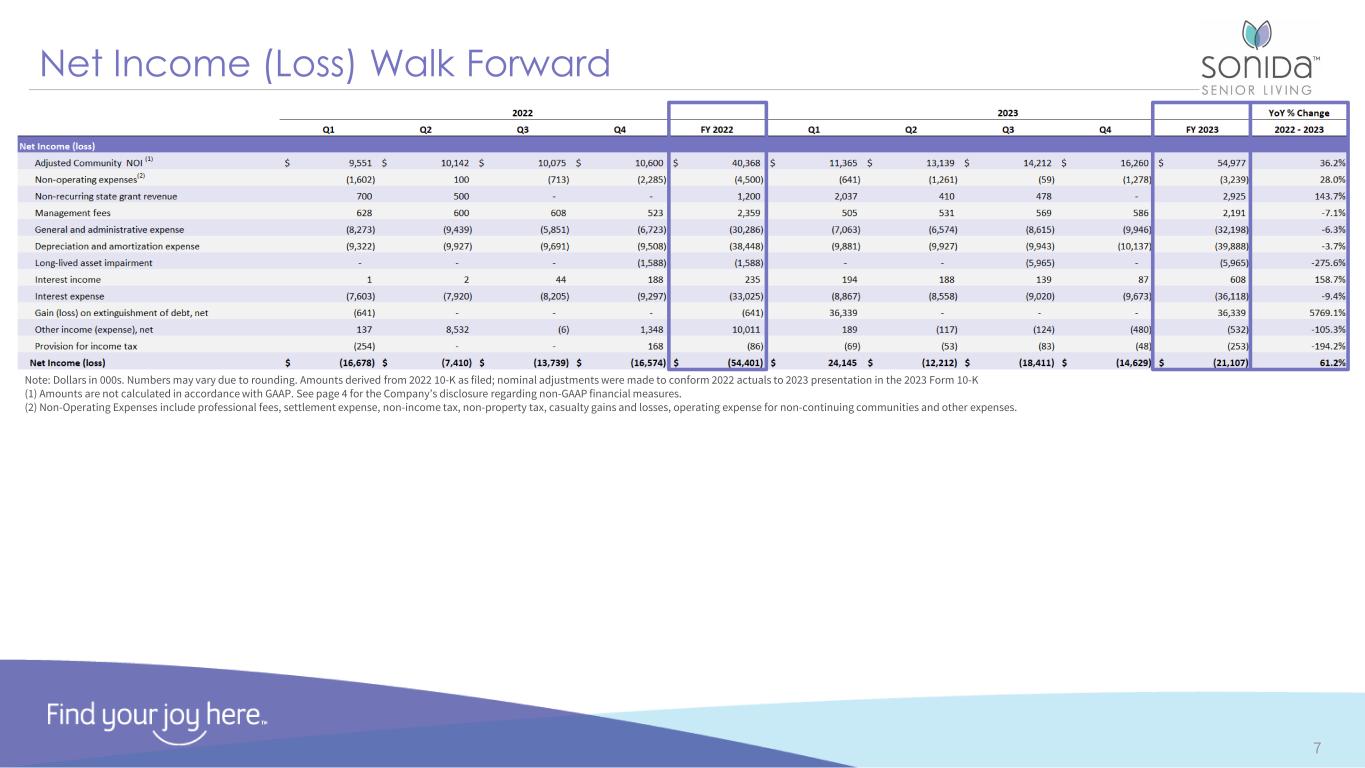

The Company reported a net loss of $14.6 million for the three months ended December 31, 2023, compared to a net loss of $16.6 million for the three months ended December 31, 2022. Significant factors impacting the comparison of net loss for these periods include long-lived asset impairment of $1.6 million in the three months ended December 31, 2022, offset by improved operational performance.

Adjusted EBITDA for the three months ended December 31, 2023 was $9.3 million compared to $4.6 million for the three months ended December 31, 2022. See “Reconciliation of Non-GAAP Financial Measures” below.

Year ended December 31, 2023 as compared to year ended December 31, 2022

Revenues

Resident revenue for the year ended December 31, 2023 was $232.0 million as compared to $208.7 million for the year ended December 31, 2022, an increase of $23.3 million, or 11.2%. The increase in revenue was primarily due to increased occupancy and increased average rent rates.

Expenses

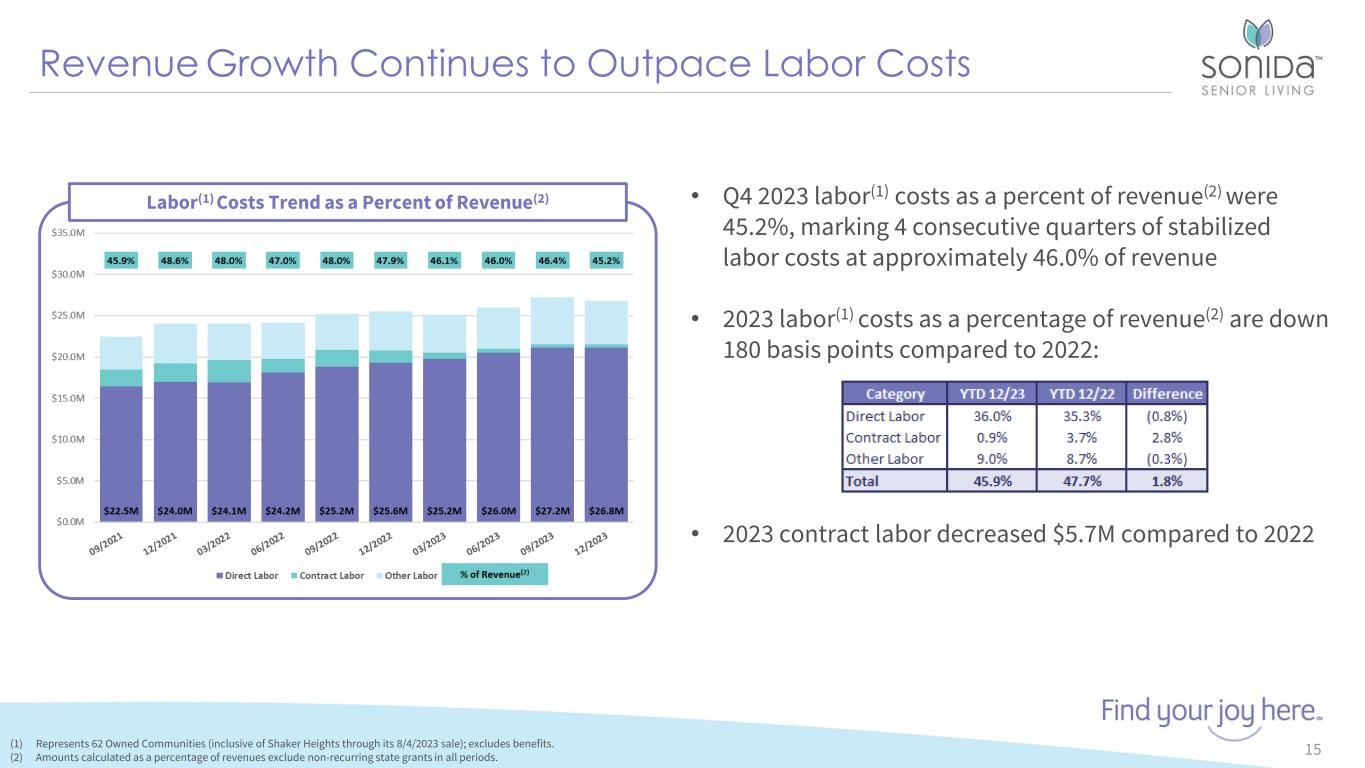

Operating expenses for the year ended December 31, 2023 were $177.3 million as compared to $171.6 million for the year ended December 31, 2022, representing an increase of $5.7 million. The increase is primarily due to increases of $7.2 million in labor and employee-related expenses, including premium labor, $1.0 million in information technology related expenses, partially offset by decreases in real estate taxes of $1.2 million, $0.9 million of saving in programming expenses, and a $0.4 million decrease in other expenses. The $1.0 million increase in information technology costs primarily relates to the Company’s upgrade of it’s Wi-Fi capabilities at its communities.

General and administrative expenses for the year ended December 31, 2023 were $32.2 million as compared to $30.3 million for year ended December 31, 2022, an increase of $1.9 million. The increase is partially due to $4.0 million in transaction costs related to our 2023 loan modifications and other transaction related expenses, partially offset by a $1.6 million decrease in stock-based compensation expense as a result of prior year forfeiture credits in connection with executive personnel changes and a $1.0 million decrease in insurance costs in connection with the Company's transition to a new broker. The remaining variance of $0.5 million represents the inflationary impact from the remaining recurring general and administrative expenses.

Gain on extinguishment of debt for the year ended December 31, 2023 was $36.3 million as compared to a loss on extinguishment of debt of $0.6 million for the year ended December 31, 2022. The 2023 gain was related to the derecognition of notes payable and liabilities as a result of the transition of legal ownership of two communities to the Federal National Mortgage Association (“Fannie Mae”).

During the year ended December 31, 2023, the Company recorded a non-cash impairment charge of $6.0 million related to one owned community, compared to a $1.6 million non-cash impairment charge on one community during the year ended December 31, 2022.

Other expense for the year ended December 31, 2023 was $0.5 million as compared to other income of $10.0 million for the year ended December 31, 2022, which included $9.1 million of CARES Act funding for healthcare-related expenses and lost revenues attributable to COVID-19.

As a result of the foregoing factors, the Company reported net loss of $21.1 million and $54.4 million for the years ended December 31, 2023 and December 31, 2022, respectively.

Adjusted EBITDA for the year ended December 31, 2023 was $33.9 million compared to $17.0 million for the year ended December 31, 2022. See “Reconciliation of Non-GAAP Financial Measures” below.

Liquidity, Capital Resources, and Subsequent Events

Liquidity

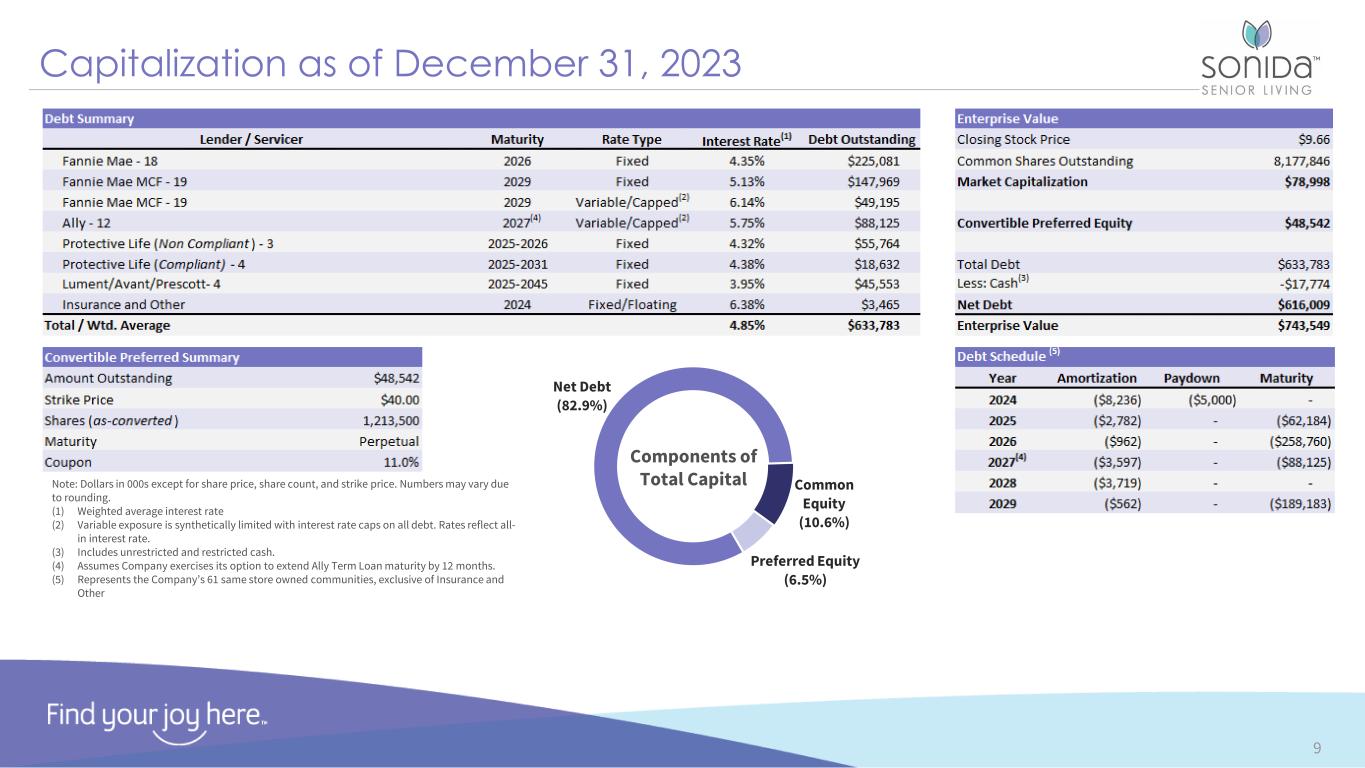

At the beginning of 2023, the Company's liquidity conditions, including operating losses and net working capital deficits, raised substantial doubt about the Company's ability to continue as a going concern. As a result of increases in occupancy and rates occurring throughout 2023 and into the first quarter of 2024, annually scheduled rental rate increases in March 2024 and in connection with the 2024 private placement transaction and Protective Life loan purchase, the Company has substantially improved its liquidity position. Please see details below of the transactions which have increased cash on hand significantly. Based on these events, the Company concluded it has adequate cash to meet its obligations as they become due for the 12-month period following the date the December 31, 2023 financial statements are issued.

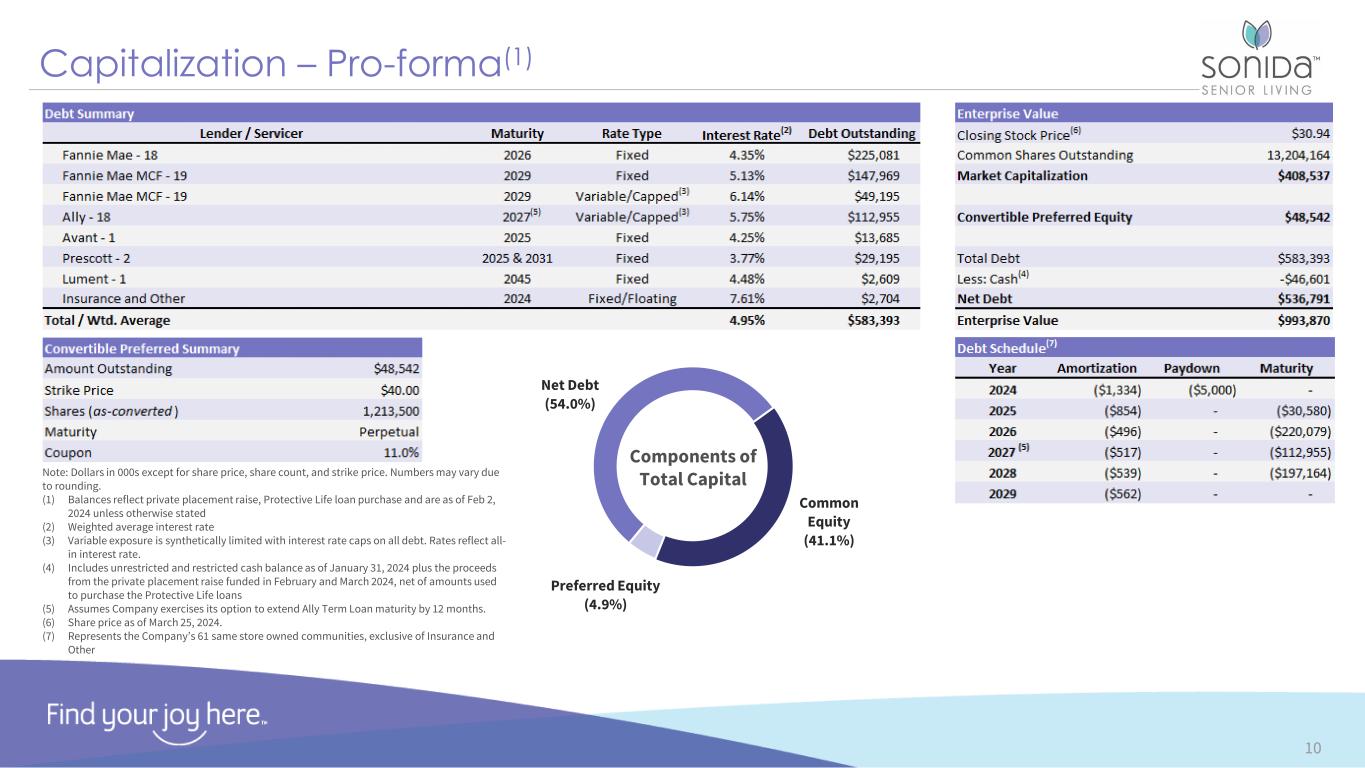

Securities Purchase Agreement

On February 1, 2024, the Company entered into a securities purchase agreement (the “Securities Purchase Agreement”) with affiliates of Conversant Capital and shareholders (together, the “Purchasers”), pursuant to which the Purchasers agreed to purchase from the Company, and the Company agreed to sell to the Purchasers, in a private placement transaction (the “Private Placement”) pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended, an aggregate of 5,026,318 shares (the “Shares”) of the Company’s Common Stock, par value $0.01 per share, at a price of $9.50 per share.

The Private Placement occurred in two closings. At the first closing, which was completed on February 1, 2024, the Company issued and sold an aggregate of 3,350,878 Shares to the Purchasers and received gross cash proceeds of $31.8 million. At the second closing, which occurred on March 22, 2024, the Company issued the remaining 1,675,440 Shares to the Purchasers and received additional gross cash proceeds of $15.9 million.

The Company intends to use this new capital for working capital, continued investments in community improvements, acquisitions of new communities, broader community programming and other general corporate purposes.

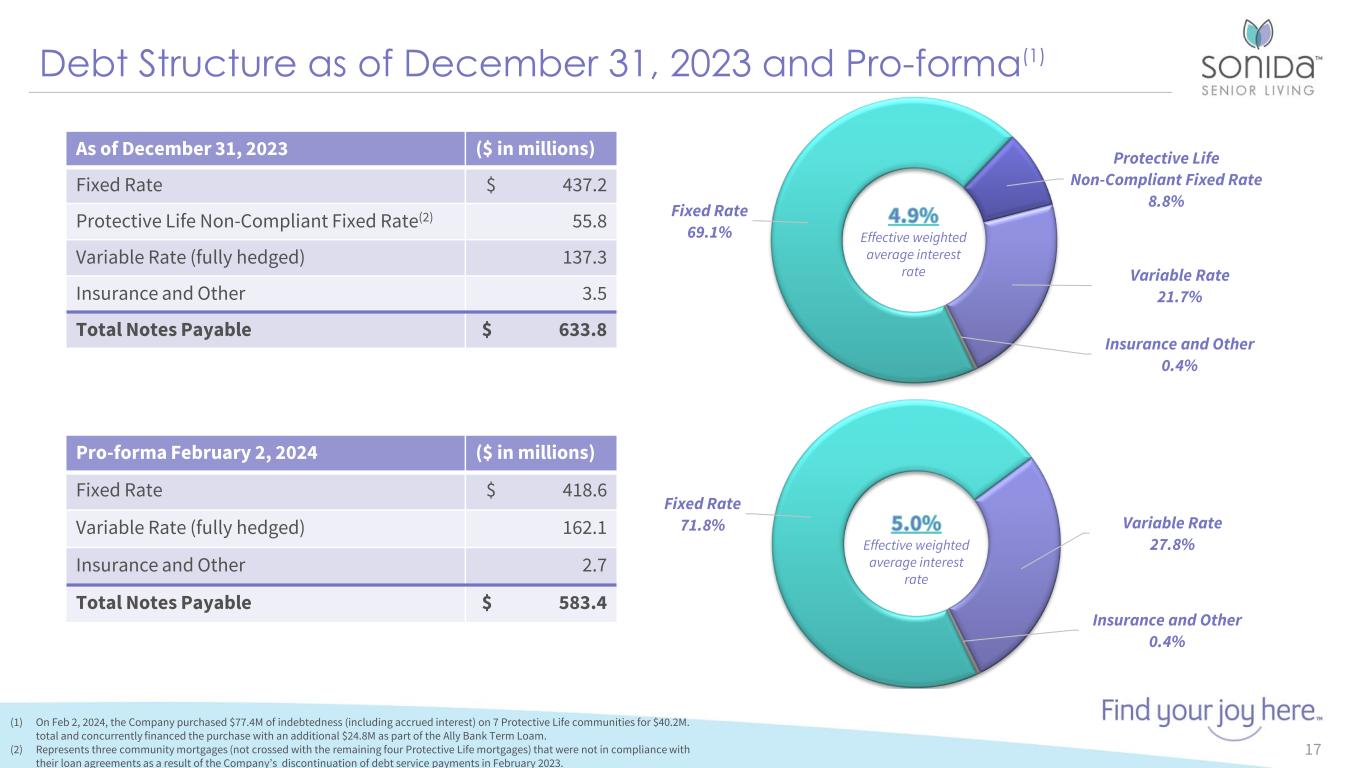

Protective Life Loans

On February 2, 2024, the Company completed the Protective Life loan purchase of the total outstanding principal balance of $74.4 million from Protective Life Insurance Company (“Protective Life”) that was secured by seven of the Company’s senior living communities for a purchase price of $40.2 million. In addition to its aggregate deposits of $1.5 million made in December 2023 and January 2024, the Company funded the remaining cash portion of the purchase price (including one-time closing costs) with $15.4 million of net proceeds from the sale of the Shares at the first closing of the Private Placement. The Company obtained additional debt proceeds through its existing loan facility with Ally Bank for the remaining portion of the purchase price, as described below. The Company terminated these loans after completion of the purchase from Protective Life.

Ally Term Loan Expansion

On February 2, 2024, in connection with the Protective Life loan purchase, the Company expanded its outstanding loan obligation with Ally Bank in the amount of $24.8 million that was secured by six of the the Company’s senior living communities. As part of the agreement with Ally, the Company expanded its current interest rate cap to include the additional loan obligation at a cost of $0.6 million.

Cash flows

The table below presents a summary of the Company’s net cash provided by (used in) operating, investing, and financing activities (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Years ended December 31, |

|

|

|

2023 |

|

2022 |

|

|

|

|

| Net cash provided by (used in) operating activities |

$ |

10,683 |

|

|

$ |

(2,578) |

|

|

|

|

|

| Net cash used in investing activities |

(16,562) |

|

|

(36,904) |

|

|

|

|

|

| Net cash used in financing activities |

(7,113) |

|

|

(22,652) |

|

|

|

|

|

| Decrease in cash and cash equivalents |

$ |

(12,992) |

|

|

$ |

(62,134) |

|

|

|

|

|

In addition to $4.1 million of unrestricted cash balances on hand at December 31, 2023, our future liquidity will depend in part upon our operating performance, which will be affected by prevailing economic conditions, and financial, business and other factors, some of which are beyond our control. Principal sources of liquidity are expected to be cash flows from operations, proceeds from equity financings, and proceeds from debt refinancings or loan modifications. During 2023, we entered into loan modifications with Fannie Mae, a loan amendment with Ally Bank, including a revised limited payment guaranty, and a $13.5 million equity commitment with Conversant. As of December 31, 2023, $3.5 million remains in the equity commitment.

The Company, from time to time, considers and evaluates financial and capital raising transactions related to its portfolio, including debt refinancings, purchases and sales of assets and other transactions. There can be no assurance that the Company will continue to generate cash flows at or above current levels, or that the Company will be able to obtain the capital necessary to meet the Company’s short and long-term capital requirements.

Recent changes in the current economic environment, and other future changes, could result in decreases in the fair value of assets, slowing of transactions, and the tightening of liquidity and credit markets. These impacts could make securing debt or refinancings for the Company or buyers of the Company’s properties more difficult or on terms not acceptable to the Company. The Company’s actual liquidity and capital funding requirements depend on numerous factors, including its operating results, its capital expenditures for community investment, and general economic conditions, as well as other factors described in the Company’s SEC filings.

Conference Call Information

The Company will host a conference call with senior management to discuss the Company’s financial results for the fourth quarter and full year 2023, on Wednesday March 27, 2024, at 12:30 p.m. Eastern Time. To participate, dial 877-407-0989 (no passcode required). A link to the simultaneous webcast of the teleconference will be available at: https://www.webcast-eqs.com/register/sonidaseniorliving_q42023_en/en

For the convenience of the Company’s shareholders and the public, the conference call will be recorded and available for replay starting March 28, 2024 through April 11, 2024. To access the conference call replay, call 877-660-6853, passcode 13743706. A transcript of the call will be posted in the Investor Relations section of the Company’s website.

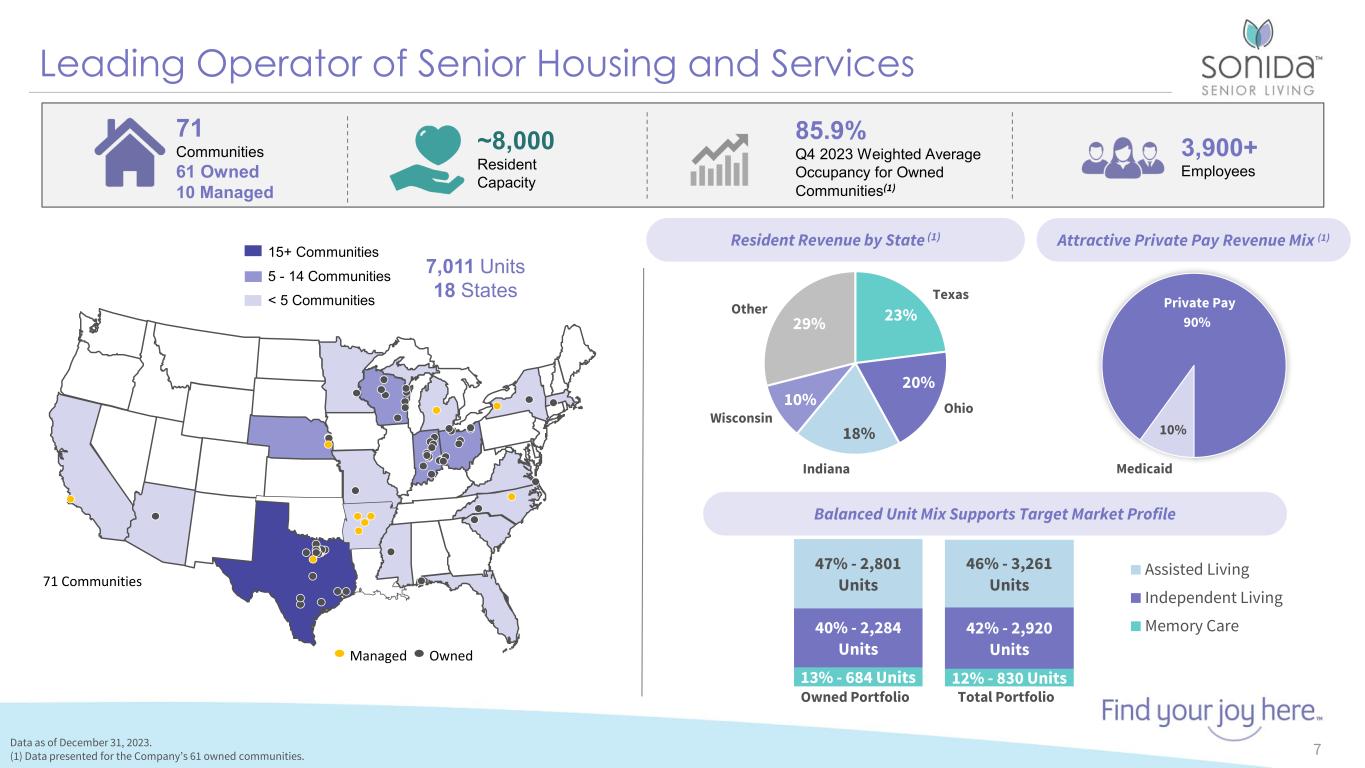

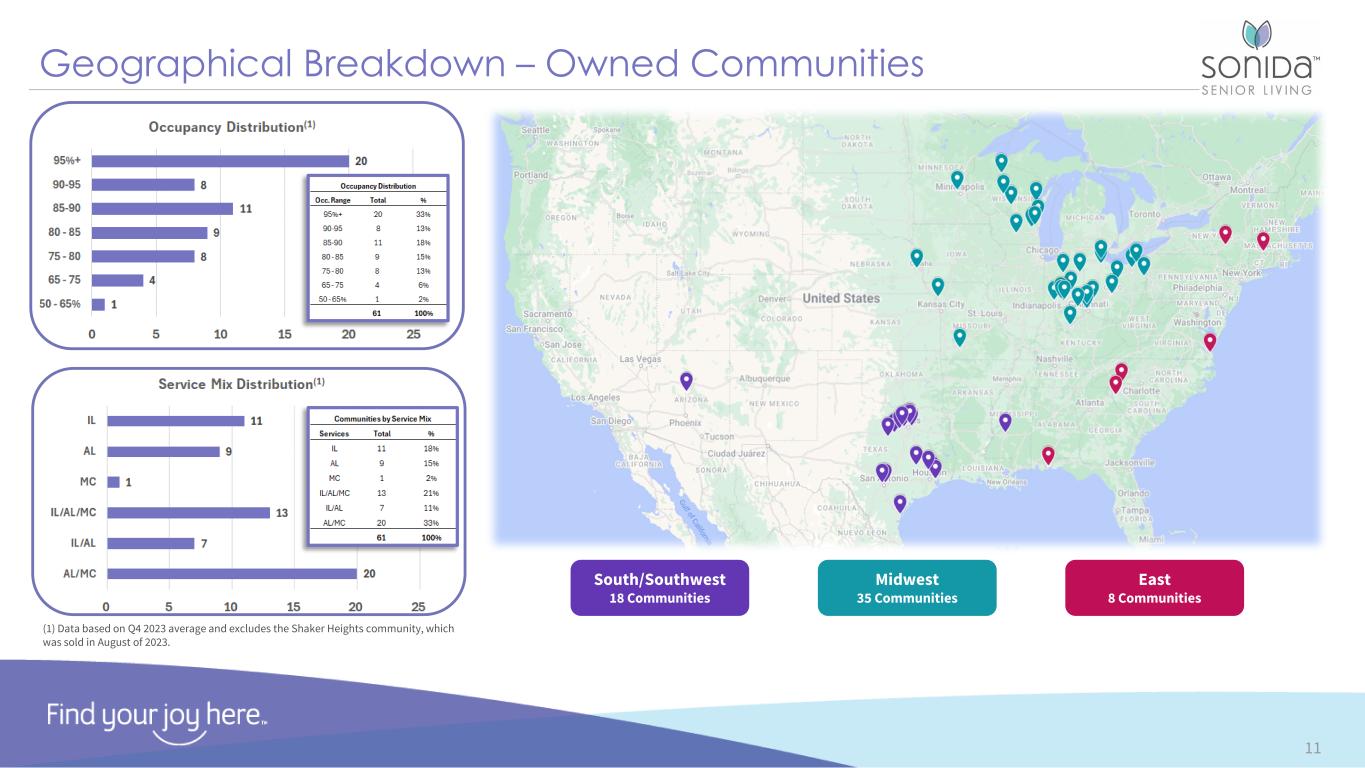

About the Company

Dallas-based Sonida Senior Living, Inc. is a leading owner-operator of independent living, assisted living and memory care communities and services for senior adults. The Company provides compassionate, resident-centric services and care as well as engaging programming operating 71 senior housing communities in 18 states with an aggregate capacity of approximately 8,000 residents, including 61 communities which the Company owns and 10 communities that the Company third-party manages. For more information, visit www.sonidaseniorliving.com or connect with the Company on Facebook, Twitter or LinkedIn.

Definitions of RevPAR and RevPOR

RevPAR, or average monthly revenue per available unit, is defined by the Company as resident revenue for the period, divided by the weighted average number of available units in the corresponding portfolio for the period, divided by the number of months in the period.

RevPOR, or average monthly revenue per occupied unit, is defined by the Company as resident revenue for the period, divided by the weighted average number of occupied units in the corresponding portfolio for the period, divided by the number of months in the period.

Safe Harbor

This release contains forward-looking statements which are subject to certain risks and uncertainties that could cause our actual results and financial condition of Sonida Senior Living, Inc. (the “Company,” “we,” “our” or “us”) to differ materially from those indicated in the forward-looking statements, including, among others, the risks, uncertainties and factors set forth under “Item. 1A. Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the Securities and Exchange Commission (the “SEC”) on March 27, 2024, and also include the following: the Company’s ability to generate sufficient cash flows from operations, proceeds from equity issuances and debt financings, and proceeds from the sale of assets to satisfy its short and long-term debt obligations and to fund the Company’s acquisitions and capital improvement projects to expand, redevelop, and/or reposition its senior living communities; increases in market interest rates that increase the cost of certain of our debt obligations; increased competition for, or a shortage of, skilled workers, including due to general labor market conditions, along with wage pressures resulting from such increased competition, low unemployment levels, use of contract labor, minimum wage increases and/or changes in overtime laws; the Company’s ability to obtain additional capital on terms acceptable to it; the Company’s ability to extend or refinance its existing debt as such debt matures; the Company’s compliance with its debt agreements, including certain financial covenants and the risk of cross-default in the event such non-compliance occurs; the Company’s ability to complete acquisitions and dispositions upon favorable terms or at all; the risk of oversupply and increased competition in the markets which the Company operates; the Company’s ability to improve and maintain controls over financial reporting and remediate the identified material weakness discussed in Item 9 of our Annual Report on Form 10-K; the cost and difficulty of complying with applicable licensure, legislative oversight, or regulatory changes; risks associated with current global economic conditions and general economic factors such as inflation, the consumer price index, commodity costs, fuel and other energy costs, competition in the labor market, costs of salaries, wages, benefits, and insurance, interest rates, and tax rates; the impact from or the potential emergence and effects of a future epidemic, pandemic, outbreak of infectious disease or other health crisis; and changes in accounting principles and interpretations.

For information about Sonida Senior Living, visit www.sonidaseniorliving.com

Investor Contact: Kevin J. Detz, Chief Financial Officer, at 972-308-8343

Press Contact: media@sonidaliving.com.

SONIDA SENIOR LIVING, INC.

CONSOLIDATED STATEMENT OF OPERATIONS AND COMPREHENSIVE LOSS

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarters Ended December 31, |

|

Years Ended December 31, |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Revenues: |

|

|

|

|

|

|

|

| Resident revenue |

$ |

59,349 |

|

|

$ |

53,388 |

|

|

$ |

232,032 |

|

|

$ |

208,703 |

|

| Management fees |

586 |

|

|

523 |

|

|

2,191 |

|

|

2,359 |

|

| Managed community reimbursement revenue |

5,785 |

|

|

5,614 |

|

|

21,099 |

|

|

27,371 |

|

| Total revenues |

$ |

65,720 |

|

|

$ |

59,525 |

|

|

$ |

255,322 |

|

|

$ |

238,433 |

|

| Expenses: |

|

|

|

|

|

|

|

| Operating expense |

44,367 |

|

|

45,073 |

|

|

177,323 |

|

|

171,635 |

|

| General and administrative expense |

9,946 |

|

|

6,723 |

|

|

32,198 |

|

|

30,286 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization expense |

10,137 |

|

|

9,508 |

|

|

39,888 |

|

|

38,448 |

|

| Long-lived asset impairment |

— |

|

|

1,588 |

|

|

5,965 |

|

|

1,588 |

|

| Managed community reimbursement revenue |

5,785 |

|

|

5,614 |

|

|

21,099 |

|

|

27,371 |

|

| Total expenses |

70,235 |

|

|

68,506 |

|

|

276,473 |

|

|

269,328 |

|

| Other income (expense): |

|

|

|

|

|

|

|

| Interest income |

87 |

|

|

188 |

|

|

608 |

|

|

235 |

|

| Interest expense |

(9,673) |

|

|

(9,297) |

|

|

(36,118) |

|

|

(33,025) |

|

|

|

|

|

|

|

|

|

| Gain (loss) on extinguishment of debt, net |

— |

|

|

— |

|

|

36,339 |

|

|

(641) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense), net |

(480) |

|

|

1,348 |

|

|

(532) |

|

|

10,011 |

|

| Income (loss) before provision for income taxes |

(14,581) |

|

|

(16,742) |

|

|

(20,854) |

|

|

(54,315) |

|

| (Provision) benefit for income taxes |

(48) |

|

|

168 |

|

|

(253) |

|

|

(86) |

|

| Net loss |

$ |

(14,629) |

|

|

$ |

(16,574) |

|

|

$ |

(21,107) |

|

|

$ |

(54,401) |

|

| Dividends on Series A convertible preferred stock |

— |

|

|

— |

|

|

— |

|

|

(2,269) |

|

| Undeclared dividends on Series A convertible preferred stock |

(1,299) |

|

|

(1,168) |

|

|

(4,992) |

|

|

(2,300) |

|

|

|

|

|

|

|

|

|

| Net loss attributable to common stockholders |

$ |

(15,928) |

|

|

$ |

(17,742) |

|

|

$ |

(26,099) |

|

|

$ |

(58,970) |

|

| Per share data: |

|

|

|

|

|

|

|

| Basic net loss per share |

$ |

(2.17) |

|

|

$ |

(2.79) |

|

|

$ |

(3.85) |

|

|

$ |

(9.27) |

|

| Diluted net loss per share |

$ |

(2.17) |

|

|

$ |

(2.79) |

|

|

$ |

(3.85) |

|

|

$ |

(9.27) |

|

| Weighted average shares outstanding — basic |

7,331 |

|

|

6,365 |

|

|

6,786 |

|

|

6,359 |

|

| Weighted average shares outstanding — diluted |

7,331 |

|

|

6,365 |

|

|

6,786 |

|

|

6,359 |

|

| Comprehensive loss |

$ |

(14,629) |

|

|

$ |

(16,574) |

|

|

$ |

(21,107) |

|

|

$ |

(54,401) |

|

SONIDA SENIOR LIVING, INC.

CONSOLIDATED BALANCE SHEET

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2023 |

|

December 31, 2022 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

4,082 |

|

|

$ |

16,913 |

|

| Restricted cash |

13,668 |

|

|

13,829 |

|

| Accounts receivable, net |

8,017 |

|

|

6,114 |

|

| Federal and state income taxes receivable |

— |

|

|

2 |

|

| Prepaid expenses and other |

4,475 |

|

|

4,097 |

|

| Derivative assets, current |

2,103 |

|

|

2,611 |

|

| Total current assets |

32,345 |

|

|

43,566 |

|

| Property and equipment, net |

588,179 |

|

|

615,754 |

|

| Derivative assets, non-current |

— |

|

|

111 |

|

| Other assets, net |

936 |

|

|

1,837 |

|

| Total assets |

$ |

621,460 |

|

|

$ |

661,268 |

|

| LIABILITIES AND SHAREHOLDERS’ DEFICIT |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

11,375 |

|

|

$ |

7,272 |

|

| Accrued expenses |

42,388 |

|

|

36,944 |

|

| Current portion of notes payable, net of deferred loan costs |

42,323 |

|

|

46,029 |

|

| Current portion of deferred income |

4,041 |

|

|

3,419 |

|

|

|

|

|

| Federal and state income taxes payable |

215 |

|

|

— |

|

| Customer deposits |

519 |

|

|

653 |

|

| Total current liabilities |

100,861 |

|

95,187 |

|

94,317 |

|

|

|

|

|

| Other long-term liabilities |

49 |

|

|

113 |

|

| Notes payable, net of deferred loan costs and current portion |

587,099 |

|

|

625,002 |

|

| Total liabilities |

688,009 |

|

|

719,432 |

|

| Commitments and contingencies |

|

|

|

| Redeemable preferred stock: |

|

|

|

| Series A convertible preferred stock, $0.01 par value; 41 shares authorized, 41 shares issued and outstanding as of December 31, 2023 and 2022 |

48,542 |

|

|

43,550 |

|

| Shareholders’ deficit: |

|

|

|

Preferred stock, $0.01 par value: |

|

|

|

| Authorized shares — 15,000 as of December 31, 2023 and 2022; none issued or outstanding, except Series A convertible preferred stock as noted above |

— |

|

|

— |

|

Common stock, $0.01 par value: |

|

|

|

| Authorized shares — 15,000 as of December 31, 2023 and 2022; 8,178 and 6,670 shares issued and outstanding as of December 31, 2023 and 2022, respectively |

82 |

|

|

67 |

|

| Additional paid-in capital |

302,992 |

|

|

295,277 |

|

| Retained deficit |

(418,165) |

|

|

(397,058) |

|

| Total shareholders’ deficit |

(115,091) |

|

|

(101,714) |

|

| Total liabilities, redeemable preferred stock and shareholders’ deficit |

$ |

621,460 |

|

|

$ |

661,268 |

|

Sonida Senior Living, Inc.

Consolidated Statements of Cash Flows

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Years Ended December 31, |

| (In thousands) |

2023 |

|

2022 |

|

|

| Operating Activities |

|

|

|

|

|

| Net loss |

$ |

(21,107) |

|

|

$ |

(54,401) |

|

|

|

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: |

|

|

|

|

|

| Depreciation and amortization |

39,888 |

|

|

38,448 |

|

|

|

| Amortization of deferred loan costs |

1,552 |

|

|

1,281 |

|

|

|

| (Gain) loss on derivative instruments, net |

2,981 |

|

|

(19) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Write-off of other assets |

— |

|

|

535 |

|

|

|

| Loss on sale of assets, net |

118 |

|

|

43 |

|

|

|

| Long-lived asset impairment |

5,965 |

|

|

1,588 |

|

|

|

| Casualty impairments |

— |

|

|

1,100 |

|

|

|

| (Gain) loss on extinguishment of debt |

(36,339) |

|

|

641 |

|

|

|

| Provision for bad debt |

1,151 |

|

|

1,159 |

|

|

|

| Non-cash stock-based compensation expense |

2,749 |

|

|

4,327 |

|

|

|

| Other non-cash items |

(53) |

|

|

(498) |

|

|

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

| Accounts receivable, net |

(3,249) |

|

|

(2,354) |

|

|

|

|

|

|

|

|

|

| Prepaid expenses and other assets |

2,918 |

|

|

8,303 |

|

|

|

| Other assets, net |

276 |

|

|

(141) |

|

|

|

| Accounts payable and accrued expenses |

13,013 |

|

|

(2,245) |

|

|

|

| Federal and state income taxes receivable/payable |

217 |

|

|

(601) |

|

|

|

| Deferred income |

622 |

|

|

257 |

|

|

|

| Customer deposits |

(19) |

|

|

(1) |

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in) operating activities |

10,683 |

|

|

(2,578) |

|

|

|

| Investing Activities |

|

|

|

|

|

| Acquisition of new communities |

— |

|

|

(12,342) |

|

|

|

| Capital expenditures |

(17,938) |

|

|

(24,562) |

|

|

|

| Proceeds from sale of assets |

1,376 |

|

|

— |

|

|

|

| Net cash used in investing activities |

(16,562) |

|

|

(36,904) |

|

|

|

| Financing Activities |

|

|

|

|

|

| Proceeds from notes payable |

— |

|

|

88,125 |

|

|

|

| Repayments of notes payable |

(13,802) |

|

|

(102,351) |

|

|

|

| Deferred loan costs paid |

(825) |

|

|

(2,361) |

|

|

|

| Purchase of derivative assets |

(2,362) |

|

|

(2,703) |

|

|

|

| Proceeds from issuance of common stock |

10,000 |

|

|

— |

|

|

|

| Shares withheld for taxes |

— |

|

|

(261) |

|

|

|

| Dividends paid on Series A convertible preferred stock |

— |

|

|

(2,987) |

|

|

|

| Other financing costs |

(124) |

|

|

(114) |

|

|

|

| Net cash used in financing activities |

(7,113) |

|

|

(22,652) |

|

|

|

| Decrease in cash and cash equivalents |

(12,992) |

|

|

(62,134) |

|

|

|

| Cash and cash equivalents and restricted cash at beginning of year |

30,742 |

|

|

92,876 |

|

|

|

| Cash and cash equivalents and restricted cash at end of year |

$ |

17,750 |

|

|

$ |

30,742 |

|

|

|

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

This earnings release contains the financial measures (1) Community Net Operating Income and Adjusted Community Net Operating Income, (2) Community Net Operating Income Margin and Adjusted Community Net Operating Income Margin, (3) Adjusted EBITDA, (4) Revenue per Occupied Unit (RevPOR) and (5) Revenue per Available Unit (RevPAR), all of which are not calculated in accordance with U.S. GAAP. Presentations of these non-GAAP financial measures are intended to aid investors in better understanding the factors and trends affecting the Company’s performance and liquidity. However, investors should not consider these non-GAAP financial measures as a substitute for financial measures determined in accordance with GAAP, including net income (loss), income (loss) from operations, net cash provided by (used in) operating activities, or revenue. Investors are cautioned that amounts presented in accordance with the Company’s definitions of these non-GAAP financial measures may not be comparable to similar measures disclosed by other companies because not all companies calculate non-GAAP measures in the same manner. Investors are urged to review the following reconciliations of these non-GAAP financial measures from the most comparable financial measures determined in accordance with GAAP.

Community Net Operating Income and Consolidated Community Net Operating Income Margin are non-GAAP performance measures for the Company’s consolidated owned portfolio of communities that the Company defines as net income (loss) excluding: general and administrative expenses (inclusive of stock-based compensation expense), interest income, interest expense, other income/expense, provision for income taxes, settlement fees and expenses, depreciation and amortization expense, revenue and operating expenses from the Company’s disposed properties; and further adjusted to exclude income/expense associated with non-cash, non-operational, transactional, or organizational restructuring items that management does not consider as part of the Company’s underlying core operating performance and impacts the comparability of performance between periods. For the periods presented herein, such other items include depreciation and amortization expense, gain(loss) on extinguishment of debt, gain(loss) on disposition of assets, long-lived asset impairment, and loss on non-recurring settlements with third parties. The Community Net Operating Income Margin is calculated by dividing Community Net Operating Income by community resident revenue. Adjusted Community Net Operating Income and Adjusted Community Net Operating Income Margin are further adjusted to exclude the impact from non-recurring state grant funds received.

The Company believes that presentation of Community Net Operating Income, Community Net Operating Income Margin, Adjusted Community Net Operating Income, and Adjusted Community Net Operating Income Margin as performance measures are useful to investors because (i) they are one of the metrics used by the Company’s management to evaluate the performance of our core consolidated owed portfolio of communities, to review the Company’s comparable historic and prospective core operating performance of the consolidated owned communities, and to make day-to-day operating decisions; (ii) they provide an assessment of operational factors that management can impact in the short-term, namely revenues and the controllable cost structure of the organization, by eliminating items related to the Company’s financing and capital structure and other items that management does not consider as part of the Company’s underlying core operating performance, and impacts the comparability of performance between periods.

Community Net Operating Income, Net Community Operating Income Margin, Adjusted Community Net Operating Income, and Adjusted Community Net Operating Income Margin have material limitations as a performance measure, including: (i) excluded general and administrative expenses are necessary to operate the Company and oversee its communities; (ii) excluded interest is necessary to operate the Company’s business under its current financing and capital structure; (iii) excluded depreciation, amortization, and impairment charges may represent the wear and tear and/or reduction in value of the Company’s communities, and other assets and may be indicative of future needs for capital expenditures; and (iv) the Company may incur income/expense similar to those for which adjustments are made, such as gain (loss) on debt extinguishment, gain(loss) on disposition of assets, loss on settlements, non-cash stock-based compensation expense, and transaction and other costs, and such income/expense may significantly affect the Company’s operating results.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in thousands) |

Three Months Ended

December 31, |

|

Quarter ended September 30, |

|

Years Ended

December 31, |

|

2023 |

|

2022 |

|

2023 |

|

2023 |

|

2022 |

| Consolidated Community Net Operating Income |

|

|

|

|

|

|

|

|

|

| Net loss |

$ |

(14,629) |

|

$ |

(16,574) |

|

$ |

(18,411) |

|

$ |

(21,107) |

|

$ |

(54,401) |

| General and administrative expense |

9,946 |

|

6,723 |

|

8,615 |

|

32,198 |

|

30,286 |

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization expense |

10,137 |

|

9,508 |

|

9,943 |

|

39,888 |

|

38,448 |

| Long-lived asset impairment |

— |

|

1,588 |

|

5,965 |

|

5,965 |

|

1,588 |

| Interest income |

(87) |

|

(188) |

|

(139) |

|

(608) |

|

(235) |

| Interest expense |

9,673 |

|

9,297 |

|

9,020 |

|

36,118 |

|

33,025 |

| (Gain) loss on extinguishment of debt, net |

— |

|

— |

|

— |

|

(36,339) |

|

641 |

|

|

|

|

|

|

|

|

|

|

| Other (income) expense, net |

480 |

|

(1,348) |

|

124 |

|

532 |

|

(10,011) |

| Provision (benefit) for income taxes |

48 |

|

(168) |

|

83 |

|

253 |

|

86 |

Settlement (income) fees and expense, net (1) |

692 |

|

1,486 |

|

(510) |

|

999 |

|

1,991 |

| Consolidated community net operating income |

16,260 |

|

10,324 |

|

14,690 |

|

57,899 |

|

41,418 |

| Resident revenue |

$ |

59,349 |

|

$ |

53,388 |

|

$ |

59,117 |

|

$ |

232,032 |

|

$ |

208,703 |

|

| Consolidated community net operating income margin |

27.4% |

|

19.3% |

|

24.8% |

|

25.0% |

|

19.8% |

|

|

|

|

|

|

|

|

|

|

COVID-19 state relief grants (2) |

— |

|

— |

|

478 |

|

2,926 |

|

1,213 |

| Adjusted resident revenue |

59,349 |

|

53,388 |

|

58,639 |

|

229,106 |

|

207,490 |

| Adjusted community net operating income |

$ |

16,260 |

|

$ |

10,324 |

|

$ |

14,212 |

|

$ |

54,973 |

|

$ |

40,205 |

| Adjusted community net operating income margin |

27.4 |

% |

|

19.3 |

% |

|

24.2 |

% |

|

24.0 |

% |

|

19.4 |

% |

(1) Settlement fees and expenses relate to non-recurring settlements with third parties for contract terminations, insurance claims, and related fees.

(2) COVID-19 relief revenue are grants and other funding received from third parties to aid in the COVID-19 response and includes state relief funds received.

ADJUSTED EBITDA (UNAUDITED)

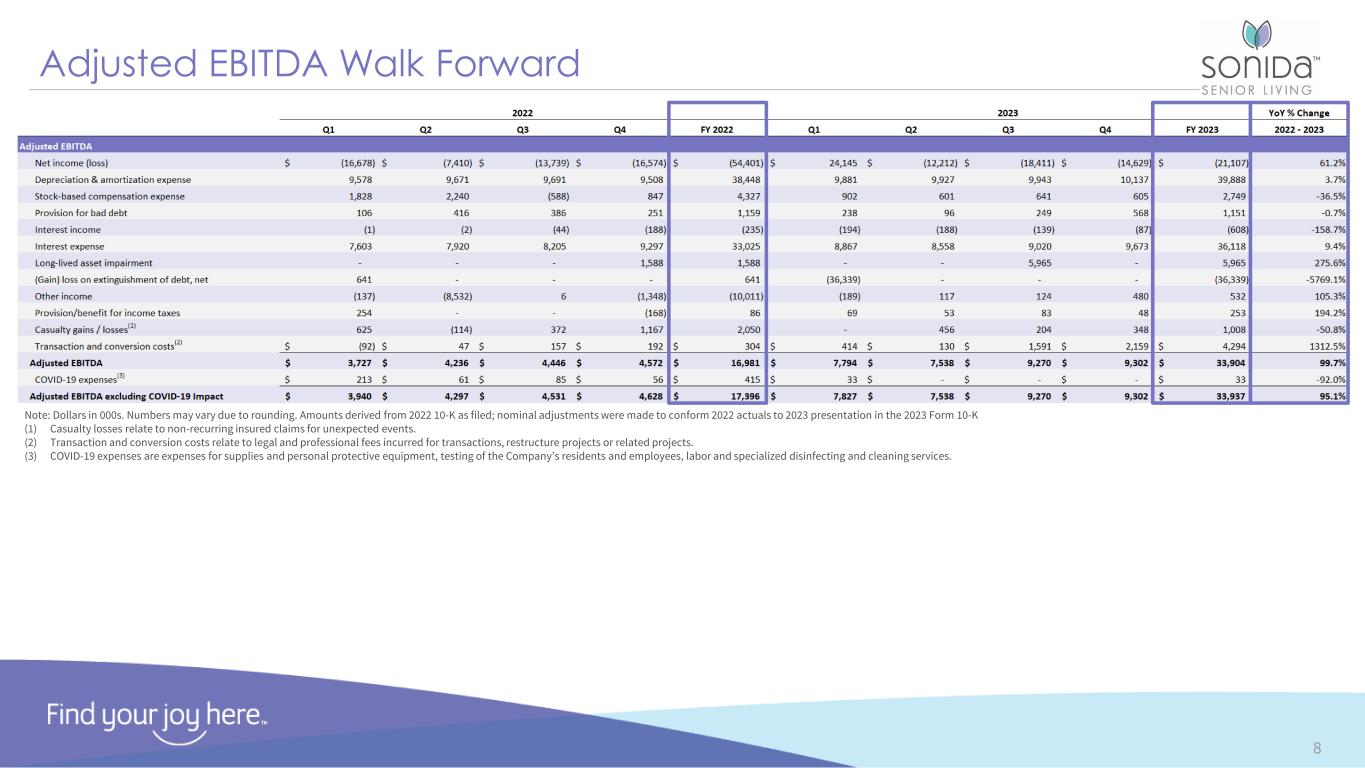

Adjusted EBITDA is a non-GAAP performance measure that the Company defines as net income (loss) excluding: depreciation and amortization expense, interest income, interest expense, other expense/income, provision for income taxes; and further adjusted to exclude income/expense associated with non-cash, non-operational, transactional, or organizational restructuring items that management does not consider as part of the Company’s underlying core operating performance and impacts the comparability of performance between periods. For the periods presented herein, such other items include stock-based compensation expense, provision for bad debts, gain (loss) on extinguishment of debt, long-lived asset impairment, casualty losses, and transaction and conversion costs.

The Company believes that presentation of Adjusted EBITDA as a performance measure is useful to investors because it provides an assessment of operational factors that management can impact in the short-term, namely revenues and the controllable cost structure of the organization, by eliminating items related to the Company’s financing and capital structure and other items that management does not consider as part of the Company’s underlying core operating performance and that management believes impact the comparability of performance between periods.

Adjusted EBITDA has material limitations as a performance measure, including: (i) excluded interest is necessary to operate the Company’s business under its current financing and capital structure; (ii) excluded depreciation, amortization and impairment charges may represent the wear and tear and/or reduction in value of the Company’s communities and other assets and may be indicative of future needs for capital expenditures; and (iii) the Company may incur income/expense similar to those for which adjustments are made, such as bad debts, gain(loss) on sale of assets, or gain(loss) on debt extinguishment, non-cash stock-based compensation expense and transaction and other costs, and such income/expense may significantly affect the Company’s operating results.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In thousands) |

Three Months Ended

December 31, |

|

Three months ended September 30, |

|

Years Ended

December 31, |

|

2023 |

|

2022 |

|

2023 |

|

2023 |

|

2022 |

| Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

| Net loss |

$ |

(14,629) |

|

|

$ |

(16,574) |

|

|

$ |

(18,411) |

|

|

$ |

(21,107) |

|

|

$ |

(54,401) |

|

| Depreciation and amortization expense |

10,137 |

|

|

9,508 |

|

|

9,943 |

|

|

39,888 |

|

|

38,448 |

|

| Stock-based compensation expense |

605 |

|

|

847 |

|

|

641 |

|

|

2,749 |

|

|

4,327 |

|

| Provision for bad debt |

568 |

|

|

251 |

|

|

249 |

|

|

1,151 |

|

|

1,159 |

|

| Interest income |

(87) |

|

|

(188) |

|

|

(139) |

|

|

(608) |

|

|

(235) |

|

| Interest expense |

9,673 |

|

|

9,297 |

|

|

9,020 |

|

|

36,118 |

|

|

33,025 |

|

| Long-lived asset impairment |

— |

|

|

1,588 |

|

|

5,965 |

|

|

5,965 |

|

|

1,588 |

|

| (Gain) loss on extinguishment of debt, net |

— |

|

|

— |

|

|

— |

|

|

(36,339) |

|

|

641 |

|

|

|

|

|

|

|

|

|

|

|

| Other (income) expense, net |

480 |

|

|

(1,348) |

|

|

124 |

|

|

532 |

|

|

(10,011) |

|

| Provision for income taxes |

48 |

|

|

(168) |

|

|

83 |

|

|

253 |

|

|

86 |

|

Casualty losses (1) |

348 |

|

|

1,167 |

|

|

204 |

|

|

1,008 |

|

|

2,050 |

|

Transaction and conversion costs (2) |

2,159 |

|

|

192 |

|

|

1,591 |

|

|

4,294 |

|

|

304 |

|

| Adjusted EBITDA |

$ |

9,302 |

|

|

$ |

4,572 |

|

|

$ |

9,270 |

|

|

$ |

33,904 |

|

|

$ |

16,981 |

|

(1) Casualty losses relate to non-recurring insured claims for unexpected events.

(2) Transaction and conversion costs relate to legal and professional fees incurred for transactions, restructuring projects, or related projects.

SUPPLEMENTAL INFORMATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fourth Quarter |

|

|

| (Dollars in thousands) |

2023 |

|

2022 |

|

Increase (decrease) |

|

Third Quarter 2023 |

|

Sequential increase (decrease) |

| Selected Operating Results |

|

|

|

|

|

|

|

|

|

| I. Consolidated community portfolio |

|

|

|

|

|

|

|

|

|

| Number of communities |

61 |

|

62 |

|

(1) |

|

61 |

|

— |

| Unit capacity |

5,700 |

|

5,776 |

|

(76) |

|

5,718 |

|

(18) |

Weighted average occupancy (1) |

85.9% |

|

83.9% |

|

2.0% |

|

84.9% |

|

1.0% |

| RevPAR |

$3,470 |

|

$3,081 |

|

$389 |

|

$3,446 |

|

$24 |

| RevPOR |

$4,042 |

|

$3,674 |

|

$368 |

|

$4,061 |

|

$(19) |

| Consolidated community net operating income |

$16,260 |

|

$10,324 |

|

$5,936 |

|

$14,690 |

|

$1,570 |

| Consolidated community net operating income margin |

27.4% |

|

19.3% |

|

8.1% |

|

24.8% |

|

2.6% |

Consolidated community net operating income, net of general and administrative expenses (2) |

$6,314 |

|

$3,601 |

|

$2,713 |

|

$6,075 |

|

$239 |

Consolidated community net operating income margin, net of general and administrative expenses (2) |

10.6% |

|

6.7% |

|

3.9% |

|

10.3% |

|

0.3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| II. Consolidated Debt Information |

|

|

|

|

|

|

|

|

|

| (Excludes insurance premium financing) |

|

|

|

|

|

|

|

|

|

Total variable rate mortgage debt (4) |

$137,320 |

|

$137,652 |

|

N/A |

|

$137,320 |

|

N/A |

| Total fixed rate debt |

492,998 |

|

535,303 |

|

N/A |

|

493,436 |

|

N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Weighted average occupancy represents actual days occupied divided by total number of available days during the quarter.

(2) General and administrative expenses exclude stock-based compensation expense in order to remove the fluctuation in fair value due to market volatility.

(3) Includes $0.0 million, $0.0 million, and $0.5 million of state grant revenue received in Q4 2023, Q4 2022, and Q3 2023, respectively. Excluding the grant revenue, Q3 2023 consolidated community NOI margin was 24.2%.

(4) As of December 31, 2023, the entire balance of our outstanding variable-rate debt obligations were covered by interest rate cap agreements.