Document

Grove Announces Fourth Quarter and Full Year 2023 Financial Results

•Fourth Quarter Adjusted EBITDA of $0.1 million, positive for the second quarter in a row

•Positive Fourth Quarter Operating Cash Flow of $1.1M

•Record Net Revenue per Order of $66.83

•Announces Fiscal 2024 Revenue and Adjusted EBITDA Guidance

SAN FRANCISCO, CA — March 6, 2024 — Grove Collaborative Holdings, Inc. (NYSE: GROV) (“Grove” or “the Company”), a leading sustainable consumer products company and certified B Corporation, today reported fourth quarter and full year 2023 financial results for the year ended December 31, 2023.

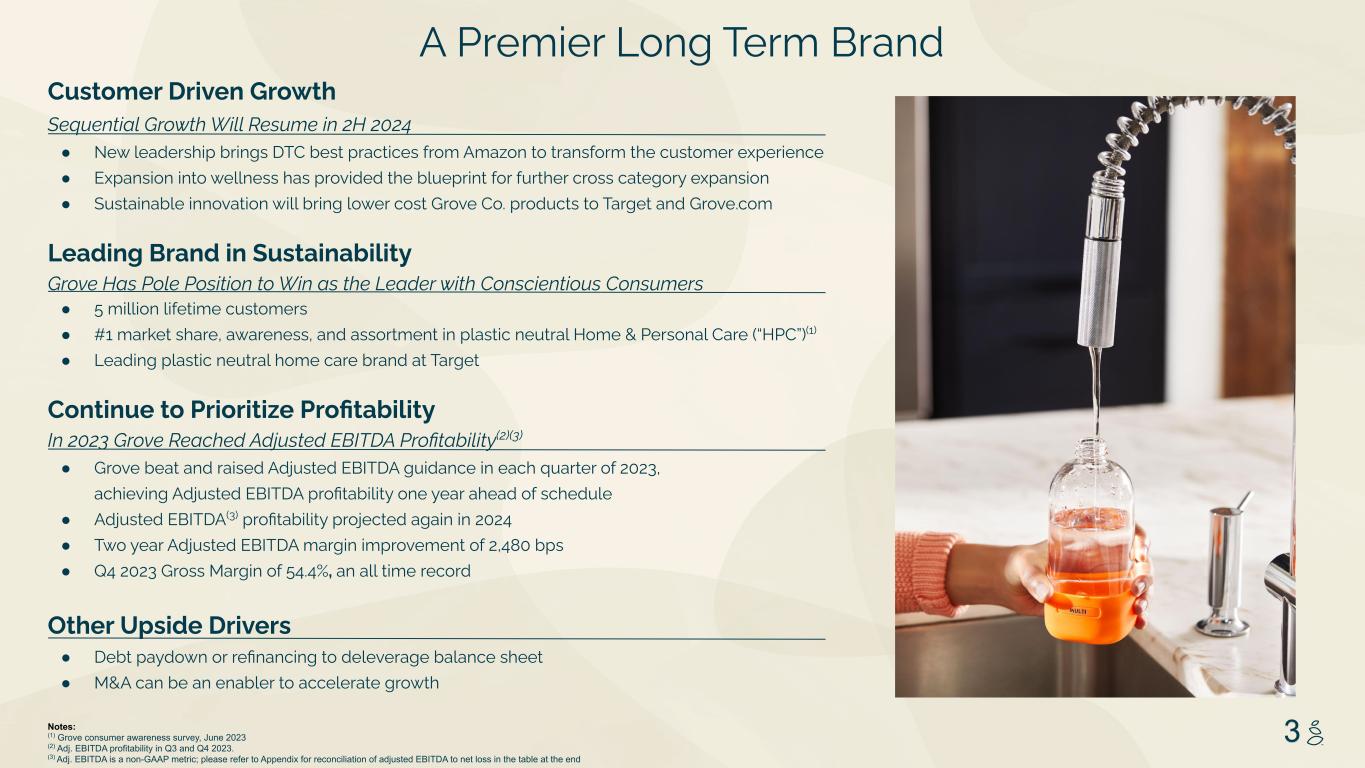

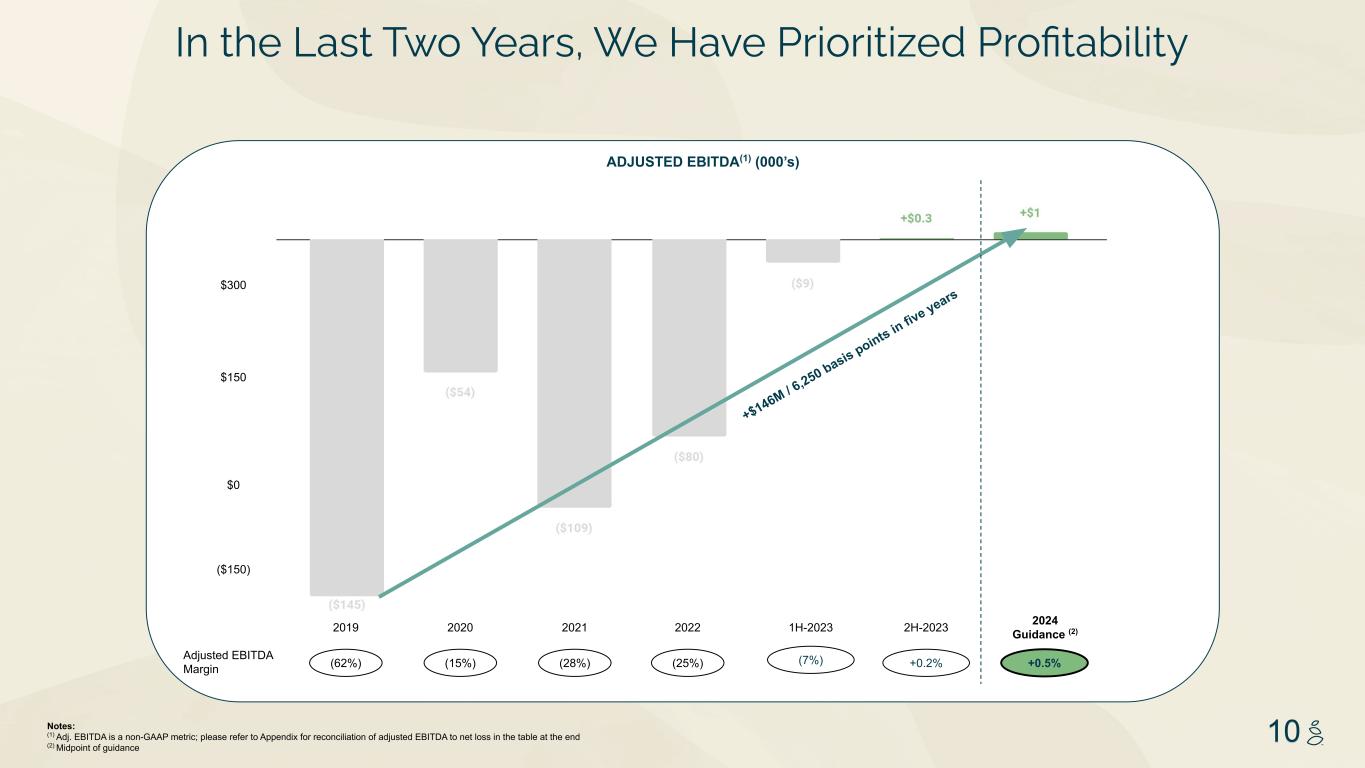

Grove Collaborative’s fourth quarter 2023 financial results include several milestones for the Company, including its second consecutive quarter of positive Adjusted EBITDA, positive Operating Cash Flow, and a new record for Net Revenue per Order. These results reflect progress in improving bottom-line-results, and set the Company up to deliver profitable sequential revenue growth in the second half of 2024.

“I’m incredibly proud of the Grove Collaborative team and their hard work to deliver positive Adjusted EBITDA for the second quarter in a row, and Operating Cash Flow in two of the last three quarters, building momentum for the future as we continue on our path to being the most trusted brand for conscientious customers who are making the right choices for their families and the planet,” said Jeff Yurcisin, Chief Executive Officer of Grove Collaborative. “This past quarter has been the start of a critical business transformation as we create incentives for customers to build the most wallet- and planet-friendly box possible, and roll out a robust product pipeline prioritizing sustainability and convenience. We have an unyielding resolve to drive profitable, sustainable growth and shareholder value by putting the customer at the center of everything that we do and, as a result, in the second half of 2024, we expect to deliver sequential quarterly revenue growth. Moreover, we expect to be Adjusted EBITDA positive for the full year and expect the momentum to continue into 2025 where we plan to be growing and profitable for the entire year.”

Fourth Quarter 2023 Financial Results

Revenue, Net was $59.9 million, down 3.1% from the third quarter of 2023, and down 19.2% year-over-year. The sequential and year-over-year declines were driven by a decrease in Direct to Consumer (“DTC”)1 orders from lower advertising spend throughout 2022 and 2023, partially offset by an increase in DTC net revenue per order.

Gross Margin was 54.4%, improving 60 basis points from the third quarter of 2023 and 740 basis points year-over-year. The sequential and year-over-year improvements were mostly due to the sell-through of previously reserved inventory.

Operating Expenses were $40.5 million, increasing 8.5% from the third quarter of 2023, but down 35.9% compared to the fourth quarter of 2022. Fourth quarter operating expenses include $3.3 million of restructuring expenses and an increase of $1.5 million in stock-based compensation charges due to an accounting true up in the third quarter.

Net Loss Margin was (15.8%), compared to (15.9%) in the third quarter of 2023 and (17.1%) in the fourth quarter of 2022.

Adjusted EBITDA Margin2 was 0.2%, positive for the second quarter in a row, down 10 basis points from the third quarter of 2023, but up 1,310 basis points from the fourth quarter of 2022.

The Company ended the fourth quarter of 2023 with $94.9 million in Cash, Cash equivalents, and Restricted Cash, an increase of $0.2 million versus the prior quarter, primarily driven by $1.1 million of operating cash flow offset by $0.5 million of capital expenditures.

Fourth Quarter 2023 Key Business Highlights:

|

|

|

|

|

|

|

|

|

|

|

|

| (in thousands, except DTC Net Revenue Per Order and percentages) |

Three Months Ended December 31, |

| 2023 |

|

2022 |

| Financial and Operating Data |

|

|

|

| Grove Brands % Net Revenue |

44 |

% |

|

46 |

% |

| DTC Total Orders |

864 |

|

|

1,132 |

|

| DTC Active Customers |

920 |

|

|

1,377 |

|

| DTC Net Revenue Per Order |

$ |

67 |

|

|

$ |

63 |

|

Grove Brands % of Net Revenue represented 44% of net revenue in the fourth quarter of 2023, down 30 basis points quarter-over-quarter and 70 basis points year-over-year. The sequential and year-over-year declines were largely due to a decrease in Grove Brand products in existing customer orders as we continued to expand our third-party product offering, especially our product selection in the Health and Wellness category, relative to Grove Brand products.

Direct to Consumer (DTC) Total Orders were 0.9 million, down 5.8% quarter-over-quarter and 23.7% year-over-year. The year-over-year and sequential declines were due to lower advertising spend throughout 2022 and 2023.

DTC Active Customers were 0.9 million, down 9.7% quarter-over-quarter and 33.2% year-over-year. The year-over-year and sequential declines were due to lower advertising spend.

DTC Net Revenue Per Order was $66.83 in the fourth quarter of 2023, another record for Grove, up 2.4% quarter-over-quarter and 5.4% year-over-year. The year-over-year improvement was due to a mix shift towards existing customer orders (as opposed to first orders) and an increase in the average number of units per order.

Plastic Intensity Score3

Plastic Intensity Across the Entire Grove Business - including both Grove Brands and third-party products through online sales and retail partners - was 1.07 pounds of plastic4 per $100 in net revenue in the fourth quarter of 2023, an improvement from 1.11 pounds in the third quarter of 2023 and 1.08 pounds in the fourth quarter of 2022.

Plastic Intensity for Grove Brands Only across online and retail sales was 1.07 pounds of plastic per $100 in revenue in the fourth quarter of 2023, an improvement from 1.14 pounds in the third quarter of 2023, but up from 0.98 pounds in the fourth quarter of 2022.

•Our Grove Co. 100% Recycled Plastic Trash Bags are the primary driver of the year-over-year plastic intensity increase for our Grove Brands. Excluding this product category, Grove Brands plastic intensity was 0.57 pounds in the fourth quarter of 2023, an improvement from the third quarter of 2023 of 0.63 pounds but slightly up from 0.56 pounds in the fourth quarter of 2022. We are continuing to explore ways to reduce plastic in this category while providing customers with an effective product experience, but we see recycled plastic as the current, best available material.

Fourth Quarter 2023 Operational Highlights

Our strategic pillars, which we announced in the third quarter of 2023 to drive continued success and work towards profitable growth, are our customer, sustainability, and profitability. We are excited to share the following related updates for Q4:

1.Customer-driven growth: Highlights from the fourth quarter related to our customer priorities include:

a.Changing Our Growth Model: Began implementing a significant and transformative shift in our business model that more closely aligns with ecommerce best practices and first order customer experiences while creating incentives for customers to opt into a program that allows them to subscribe and save on individual products. The program is foundational to enabling customers to receive the most planet- and wallet-friendly box possible.

b.Third-Party Category and Selection Expansion: Expanded our assortment of third-party brands to include selections from Ancient Nutrition, Compostic, The Honest Company, and WishGardens, as well as dozens of new products from existing third-party brands.

c.Grove Co. Product Innovation: Launched our Grove Co. Bottle Wash Power Packs and streamlined our Grove Brands strategy to consolidate under our flagship Grove Co. brand.

d.Health and Wellness Growth: Grew the percentage of orders containing a wellness product in the fourth quarter of 2023 by more than 75% when compared to the fourth quarter of 2022, and established a dedicated Health and Wellness Advisory Board of medical clinicians to guide our continued growth in this category.

e.Improved Customer Experience: Made changes to our website experience by improving personalized product recommendations that appear on a customer’s individual homepage.

f.VIP Program Updates: Announced exclusive pricing in our VIP Shop for themed product assortments and bundles each month, including discounts up to 40% off for our most loyal customers.

2.Sustainability: Highlights from the fourth quarter related to our sustainability priorities include:

a.15 Millions Pounds of Plastic Collected: Recovered 15 million pounds of nature- and ocean-bound single-use plastic since 2020 through our plastic neutrality commitment and ongoing partnership with plastic recovery platforms.

b.Beyond Plastic™ Badging5: Launched a digital badging system on products across our site that meet Grove’s Beyond Plastic™ standard, including 100% Plastic Free, 95%+ Plastic Free, and No Single Use Plastic.

3.Profitability: Highlights from the fourth quarter related to our profitability priorities include:

a.Ongoing improvement of operating costs: Executed initiatives, including vendor, partner, and contract negotiations, to increase our operating leverage and improve profitability. We also took additional action in the first quarter of 2024 to further optimize our operating costs and expense structure, including the reduction of our headquarters lease footprint and optimization of our fulfillment network footprint.

Full Year 2023 Financial Results

Net revenue of $259.3 million, which landed within the Company’s full-year guidance range, decreased 19.4% year-over-year, driven by a decrease in DTC orders from a reduction in advertising spend, offset by an increase in DTC net revenue per order.

Gross margin of 53.0%, up 490 basis points year-over-year driven by the full year impact of the online order related fees that we began charging in the fourth quarter of 2022, a decrease in lower margin first orders, and sell-through of previously reserved for inventory.

Operating Expenses of $172.6 million, down 41.6% year-over-year due to lower advertising expenses, product development expenses, and selling, general and administrative expenses.

Net loss margin of (16.7%), an improvement of 1,060 basis points year-over-year.

Adjusted EBITDA margin6 of (3.5%), an improvement of 2,130 basis points year-over-year.

Plastic Intensity of 1.10 pounds of plastic per $100 of revenue in 2023, a decrease compared to 1.17 pounds in 2022.

Financial Outlook:

Chief Financial Officer Sergio Cervantes commented, “2023 was a step-change year for the Company where we made significant strides towards sustainable profitability, delivering positive Adjusted EBITDA in the third and fourth quarters, a strong result and a demonstration of our ability to manage our cost structure and commitment to the long term health of the business. As we look forward to 2024, revenue will decline again in the first quarter, but we expect to deliver sequential revenue growth in the second half of the year, while also balancing advertising efficiency and profitability. We believe that the transformational changes during 2023 and early 2024 have set us up well to achieve this outcome.”

Grove is providing the following guidance:

For the 12-month period ending December 31, 2024, we expect:

•Net revenue of $215 to $225 million, and

•Adjusted EBITDA margin of 0.0% to 1.0%

Conference Call Information:

The Company will host an investor conference call and webcast to review these financial results at 5:00pm ET / 2:00pm PT on March 6, 2024. The webcast can be accessed at https://investors.grove.co/. The conference call can be accessed by calling 877-413-7205. International callers may dial 201-689-8537. A replay of the call will be available until March 20, 2024 and can be accessed by dialing 877-660-6853 or 201-612-7415, access code: 13744474. The webcast will remain available on the Company’s investor relations website for 6 months following the webcast.

About Grove Collaborative Holdings, Inc.

Launched in 2016 as a Certified B Corp, Grove Collaborative Holdings, Inc. (NYSE: GROV) is transforming consumer products into a positive force for human and environmental good. Driven by the belief that sustainability is the only future, Grove creates and curates more than 200 high-performing eco-friendly brands of household cleaning, personal care, health and wellness, laundry, clean beauty, baby, and pet care products serving millions of households across the United States each year. With a flexible monthly delivery model and access to knowledgeable Grove Guides, Grove makes it easy for everyone to build sustainable routines and Be a Force of Nature.

Every product Grove offers — from its flagship brand of sustainably powerful home care essentials, Grove Co., to its exceptional third-party brands — has been thoroughly vetted against the Grove Feel Good Standard, which guarantees strict ingredients criteria, 100% plastic neutral orders, carbon neutral shipments, and the highest quality performance in addition to being certified cruelty-free and ethically produced. Grove is a public benefit corporation on a mission to move Beyond Plastic™ and is available at select retailers nationwide, making sustainable home care products even more accessible. For more information, visit www.grove.com.

1 Direct to Consumer is defined as our website and mobile application.

2 Adjusted EBITDA margin is a non-GAAP financial measure. See “Non-GAAP Financial Measures” for a description of adjusted EBITDA and a reconciliation of adjusted EBITDA to net loss in the table at the end of this press release.

3 Grove defines plastic intensity as pounds of plastic used per $100 in revenue as a way to hold itself accountable for the pace at which it decouples revenue from the use of plastic.

4 To calculate plastic intensity, Grove Collaborative defines "plastic" as any of the following materials within both products and packaging: plastic resin codes #1-7 (from the ASTM International Resin Identification Coding System), inclusive of polyvinyl alcohol (PVA, PVOH, PVAl), silicone, bioplastics, and any plastic liners, coatings, and resins

5 For each product sold on our website, Grove Collaborative collects product and packaging data from our suppliers and/or brand partners to calculate the total plastic weight and determines what percentage of the product is plastic by weight. We also evaluate if the product contains durable or reusable plastic, defined by the Environmental Protection Agency as lasting 3 years or more, to determine if a product contains no single-use plastic. This information is then used to determine if each product meets our Beyond Plastic TM standard and qualifies for one of our three digital badges: “100% Plastic Free”, “95%+ Plastic Free” and “No Single Use Plastic.”

6 Adjusted EBITDA margin is a non-GAAP financial measure. See “Non-GAAP Financial Measures” for a description of adjusted EBITDA and a reconciliation of adjusted EBITDA to net loss in the table at the end of this press release.

Caution Concerning Forward-Looking Statements

This press release contains "forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about our delivering profitable revenue growth in the second half of 2024, our expectation that we will be Adjusted EBITDA positive in 2024 and the momentum will continue in 2025, our plan to be growing and profitable in 2025, our balancing advertising efficiency and profitability, changes in 2023 setting us up for 2024, our first quarter 2024 revenue, and our 2024 guidance for Net revenue and Adjusted EBITDA margin. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. The forward-looking statements contained in this press release are based on our current expectations and beliefs in light of our experience and perception of historical trends, current conditions and expected future developments and their potential effects on the Company as well as other factors we believe are appropriate under the circumstances. There can be no assurance that future developments affecting the Company will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements, including changes in business, market, financial, political and legal conditions; legal and regulatory matters and developments, risks relating to the uncertainty of the projected financial information; our ability to successfully expand our business; competition; the uncertain effects of the COVID-19 pandemic; risks relating to inflation and interest rates; effectiveness of our ecommerce platform and selling efforts; demand for our products and other brands that we sell and those factors discussed in documents we have filed, or to be filed, with the U.S. Securities and Exchange Commission. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. All forward-looking statements in this press release are made as of the date hereof, based on information available to Grove as of the date hereof, and Grove assumes no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Non-GAAP Financial Measures

Some of the financial information and data contained in this press release, such as Adjusted EBITDA and adjusted EBITDA margin, have not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). These non-GAAP measures, and other measures that are calculated using such non-GAAP measures, are an addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP and should not be considered as an alternative to revenue, operating income, profit before tax, net income or any other performance measures derived in accordance with GAAP. A reconciliation of historical adjusted EBITDA to Net Income is provided in the tables at the end of this press release. The reconciliation of projected adjusted EBITDA and adjusted EBITDA Margin to the closest corresponding GAAP measure is not available without unreasonable effort on a forward-looking basis due to the high variability, complexity, and low visibility with respect to the charges excluded from these non-GAAP measures, such as the impact of depreciation and amortization of fixed assets, amortization of internal use software, the effects of net interest expense (income), other expense (income), and non-cash stock based compensation expense. Grove believes these non-GAAP measures of financial results, including on a forward-looking basis, provide useful information to management and investors regarding certain financial and business trends relating to Grove’s financial condition and results of operations. Grove’s management uses these non-GAAP measures for trend analyses and for budgeting and planning purposes. Grove believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating projected operating results and trends in and in comparing Grove’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. Management of Grove does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. There are a number of limitations related to the use of these non-GAAP measures and their nearest GAAP equivalents. Other companies may calculate non-GAAP measures differently, or may use other measures to calculate their financial performance, and therefore Grove’s non-GAAP measures may not be directly comparable to similarly titled measures of other companies.

We calculate Adjusted EBITDA as net income (loss), adjusted to exclude: stock-based compensation expense; depreciation and amortization; remeasurement of convertible preferred stock warrant liability; changes in fair values of derivative liabilities; transaction costs allocated to derivative liabilities upon closing of the transaction where we became a publicly traded company; interest income; interest expense; restructuring and severance related costs; loss on extinguishment of debt; provision for income taxes and certain litigation and legal settlement expenses. We define Adjusted EBITDA Margin as Adjusted EBITDA divided by net revenue. Because Adjusted EBITDA excludes these elements that are otherwise included in our GAAP financial results, this measure has limitations when compared to net loss determined in accordance with GAAP. Further, Adjusted EBITDA is not necessarily comparable to similarly titled measures used by other companies. For these reasons, investors should not consider Adjusted EBITDA in isolation from, or as a substitute for, net loss determined in accordance with GAAP.

Grove Collaborative Holdings, Inc.

Consolidated Balance Sheets

(In thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

2023 |

|

2022 |

|

(Unaudited) |

|

|

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

86,411 |

|

|

$ |

81,084 |

|

| Restricted cash |

5,650 |

|

|

11,950 |

|

| Inventory, net |

28,776 |

|

|

44,132 |

|

| Prepaid expenses and other current assets |

3,359 |

|

|

4,844 |

|

| Total current assets |

124,196 |

|

|

142,010 |

|

| Restricted cash |

2,802 |

|

|

2,951 |

|

| Property and equipment, net |

11,625 |

|

|

14,530 |

|

| Operating lease right-of-use assets |

9,612 |

|

|

12,362 |

|

| Other long-term assets |

2,507 |

|

|

2,192 |

|

| Total assets |

$ |

150,742 |

|

|

$ |

174,045 |

|

| Liabilities, Redeemable Convertible Preferred Stock and Stockholders’ Equity (Deficit) |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

8,074 |

|

|

$ |

10,712 |

|

| Accrued expenses |

16,020 |

|

|

31,354 |

|

| Deferred revenue |

7,154 |

|

|

10,878 |

|

| Operating lease liabilities, current |

3,489 |

|

|

3,705 |

|

| Other current liabilities |

306 |

|

|

249 |

|

| Debt, current |

— |

|

|

575 |

|

| Total current liabilities |

35,043 |

|

|

57,473 |

|

| Debt, noncurrent |

71,662 |

|

|

60,620 |

|

| Operating lease liabilities, noncurrent |

14,404 |

|

|

16,192 |

|

| Derivative liabilities |

11,511 |

|

|

13,227 |

|

| Total liabilities |

132,620 |

|

|

147,512 |

|

| Commitments and contingencies |

|

|

|

| Redeemable convertible preferred stock |

10,000 |

|

|

— |

|

| Stockholders’ equity: |

|

|

|

| Common stock |

4 |

|

|

4 |

|

| Additional paid-in capital |

629,208 |

|

|

604,387 |

|

| Accumulated deficit |

(621,090) |

|

|

(577,858) |

|

| Total stockholders’ equity |

8,122 |

|

|

26,533 |

|

| Total liabilities, redeemable convertible preferred stock and stockholders’ equity |

$ |

150,742 |

|

|

$ |

174,045 |

|

Grove Collaborative Holdings, Inc.

Consolidated Statements of Operations

(In thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

Year Ended

December 31, |

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

|

|

|

|

| Revenue, net |

$ |

59,857 |

|

|

$ |

74,036 |

|

|

$ |

259,278 |

|

|

$ |

321,527 |

|

|

|

|

|

| Cost of goods sold |

27,295 |

|

|

39,245 |

|

|

121,919 |

|

|

166,875 |

|

|

|

|

|

| Gross profit |

32,562 |

|

|

34,791 |

|

|

137,359 |

|

|

154,652 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

| Advertising |

3,900 |

|

|

6,910 |

|

|

21,292 |

|

|

66,269 |

|

|

|

|

|

| Product development |

4,555 |

|

|

4,576 |

|

|

16,401 |

|

|

22,503 |

|

|

|

|

|

| Selling, general and administrative |

32,050 |

|

|

51,703 |

|

|

134,929 |

|

|

206,863 |

|

|

|

|

|

| Operating loss |

(7,943) |

|

|

(28,398) |

|

|

(35,263) |

|

|

(140,983) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

4,159 |

|

|

2,767 |

|

|

16,077 |

|

|

9,685 |

|

|

|

|

|

| Loss on extinguishment of debt |

— |

|

|

4,663 |

|

|

— |

|

|

4,663 |

|

|

|

|

|

| Changes in fair value of derivative liabilities |

(1,514) |

|

|

(22,383) |

|

|

(216) |

|

|

(71,532) |

|

|

|

|

|

| Other expense (income), net |

(1,113) |

|

|

(781) |

|

|

(7,930) |

|

|

3,862 |

|

|

|

|

|

| Interest and other expense (income), net |

1,532 |

|

|

(15,734) |

|

|

7,931 |

|

|

(53,322) |

|

|

|

|

|

| Loss before provision for income taxes |

(9,475) |

|

|

(12,664) |

|

|

(43,194) |

|

|

(87,661) |

|

|

|

|

|

| Provision for income taxes |

10 |

|

|

19 |

|

|

38 |

|

|

54 |

|

|

|

|

|

| Net loss |

$ |

(9,485) |

|

|

$ |

(12,683) |

|

|

$ |

(43,232) |

|

|

$ |

(87,715) |

|

|

|

|

|

| Less: Accretion on redeemable convertible preferred stock |

19 |

|

|

— |

|

|

(957) |

|

|

— |

|

|

|

|

|

| Less: Accumulated dividends on redeemable convertible preferred stock |

(150) |

|

|

— |

|

|

(233) |

|

|

— |

|

|

|

|

|

| Net loss attributable to common stockholders, basic and diluted |

$ |

(9,616) |

|

|

$ |

(12,683) |

|

|

$ |

(44,422) |

|

|

$ |

(87,715) |

|

|

|

|

|

| Net loss per share attributable to common stockholders, basic and diluted |

$ |

(0.27) |

|

|

$ |

(0.39) |

|

|

$ |

(1.28) |

|

|

$ |

(4.85) |

|

|

|

|

|

| Weighted-average shares used in computing net loss per share attributable to common stockholders, basic and diluted |

35,893,031 |

|

|

32,412,045 |

|

|

34,797,582 |

|

|

18,101,407 |

|

|

|

|

|

Grove Collaborative Holdings, Inc.

Consolidated Statements of Cash Flows

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

2023 |

|

2022 |

|

(Unaudited) |

|

|

| Cash Flows from Operating Activities |

|

|

|

| Net loss |

$ |

(43,232) |

|

|

$ |

(87,715) |

|

| Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

| Remeasurement of convertible preferred stock warrant liability |

— |

|

|

(1,616) |

|

| Stock-based compensation |

15,513 |

|

|

45,660 |

|

| Depreciation and amortization |

5,824 |

|

|

5,716 |

|

| Changes in fair value of derivative liabilities |

(216) |

|

|

(71,532) |

|

| (Reduction of) transaction costs allocated to derivative liabilities upon Business Combination |

(3,745) |

|

|

6,873 |

|

| Non-cash interest expense |

3,833 |

|

|

586 |

|

| Inventory reserve |

372 |

|

|

7,036 |

|

| Loss on extinguishment of debt |

— |

|

|

4,663 |

|

| Asset impairment charges |

2,495 |

|

|

5,300 |

|

| Other non-cash expenses |

135 |

|

|

274 |

|

| Changes in operating assets and liabilities: |

|

|

|

| Inventory |

14,984 |

|

|

3,285 |

|

| Prepaids and other assets |

1,672 |

|

|

3,114 |

|

| Accounts payable |

(2,574) |

|

|

(10,518) |

|

| Accrued expenses |

2,216 |

|

|

(5,004) |

|

| Deferred revenue |

(3,724) |

|

|

(389) |

|

| Operating lease right-of-use assets and liabilities |

(1,603) |

|

|

(130) |

|

| Other liabilities |

57 |

|

|

(1,864) |

|

| Net cash used in operating activities |

(7,993) |

|

|

(96,261) |

|

|

|

|

|

| Cash Flows from Investing Activities |

|

|

|

| Purchase of property and equipment |

(2,985) |

|

|

(4,222) |

|

| Net cash used in investing activities |

(2,985) |

|

|

(4,222) |

|

|

|

|

|

| Cash Flows from Financing Activities |

|

|

|

| Proceeds from issuance of common stock upon Closing of Business Combination |

— |

|

|

97,100 |

|

| Proceeds from the issuance of common stock |

— |

|

|

4,924 |

|

| Proceeds from issuance of redeemable convertible preferred stock, convertible common stock, and common stock warrants |

10,000 |

|

|

27,500 |

|

| Payment of transaction costs related to the Closing of the Business Combination, the ELOC Agreement and convertible preferred stock issuance costs |

(4,555) |

|

|

(6,558) |

|

| Proceeds from the issuance of debt |

7,500 |

|

|

70,820 |

|

| Payment of debt issuance costs |

(925) |

|

|

(2,463) |

|

| Repayment of debt |

(575) |

|

|

(5,180) |

|

| Payment of debt upon extinguishment |

— |

|

|

(66,034) |

|

| Net proceeds (payments) related to stock-based award activities |

(1,589) |

|

|

(2,017) |

|

| Net cash provided by financing activities |

9,856 |

|

|

118,092 |

|

|

|

|

|

| Net increase (decrease) in cash, cash equivalents and restricted cash |

(1,122) |

|

|

17,609 |

|

| Cash, cash equivalents and restricted cash at beginning of period |

95,985 |

|

|

78,376 |

|

| Cash, cash equivalents and restricted cash at end of period |

$ |

94,863 |

|

|

95,985 |

|

Grove Collaborative Holdings, Inc.

Non-GAAP Financial Measures

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended

December 31,

|

|

Year Ended

December 31,

|

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

| Reconciliation of Net Loss to Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

| Net loss |

$ |

(9,485) |

|

|

$ |

(12,683) |

|

|

$ |

(43,232) |

|

|

$ |

(87,715) |

|

| Stock-based compensation |

3,572 |

|

|

11,312 |

|

|

15,513 |

|

|

45,660 |

|

| Depreciation and amortization |

1,465 |

|

|

1,425 |

|

|

5,824 |

|

|

5,716 |

|

| Remeasurement of convertible preferred stock warrant liability |

— |

|

|

— |

|

|

— |

|

|

(1,616) |

|

| Changes in fair value of derivative liabilities |

(1,514) |

|

|

(22,383) |

|

|

(216) |

|

|

(71,532) |

|

| (Reduction of) transaction costs allocated to derivative liabilities upon Business Combination |

— |

|

|

— |

|

|

(3,745) |

|

|

6,873 |

|

| Interest income |

(1,148) |

|

|

(521) |

|

|

(3,773) |

|

|

(521) |

|

| Interest expense |

4,159 |

|

|

2,767 |

|

|

16,077 |

|

|

9,685 |

|

| Restructuring expenses |

3,258 |

|

|

5,887 |

|

|

3,811 |

|

|

8,879 |

|

| Loss on extinguishment of debt |

— |

|

|

4,663 |

|

|

— |

|

|

4,663 |

|

| Provision for income taxes |

10 |

|

|

19 |

|

|

38 |

|

|

54 |

|

| Litigation and legal settlement expenses |

(180) |

|

|

— |

|

|

520 |

|

|

— |

|

| Total Adjusted EBITDA |

$ |

137 |

|

|

$ |

(9,514) |

|

|

$ |

(9,183) |

|

|

$ |

(79,854) |

|

| Net loss margin |

(15.8) |

% |

|

(17.1) |

% |

|

(16.7) |

% |

|

(27.3) |

% |

| Adjusted EBITDA margin |

0.2 |

% |

|

(12.9) |

% |

|

(3.5) |

% |

|

(24.8) |

% |

Investor Relations Contact

ir@grove.co

Media Relations Contact

Ryan.Zimmerman@grove.co

Source: Grove Collaborative Holdings, Inc.