Q3 2023 Update 1 Exhibit 99.1

Highlights 03 Financial Summary 04 Operational Summary 06 Vehicle Capacity 07 Core Technology 08 Other Highlights 09 Outlook 10 Photos & Charts 11 Key Metrics 16 Financial Statements 19 Additional Information 25

S U M M A R YH I G H L I G H T S (1) Excludes SBC (stock-based compensation) (2) Free cash flow = operating cash flow less capex (3) Includes cash, cash equivalents and investments (4) Calculated by dividing Cost of Automotive Sales Revenue by respective quarter’s new deliveries (ex-operating leases) Profitability 7.6% operating margin in Q3 $1.8B GAAP operating income in Q3 $1.9B GAAP net income in Q3 $2.3B non-GAAP net income1 in Q3 Our main objectives remained unchanged in Q3-2023: reducing cost per vehicle, free cash flow generation while maximizing delivery volumes and continued investment in AI and other growth projects. Our cost of goods sold per vehicle4 decreased to ~$37,500 in Q3. While production cost at our new factories remained higher than our established factories, we have implemented necessary upgrades in Q3 to enable further unit cost reductions. We continue to believe that an industry leader needs to be a cost leader. During a high interest rate environment, we believe focusing on investments in R&D and capital expenditures for future growth, while maintaining positive free cash flow, is the right approach. Year-to-date, our free cash flow reached $2.3B while our cash and investments position continues to improve. We have more than doubled the size of our AI training compute to accommodate for our growing dataset as well as our Optimus robot project. Our humanoid robot is currently being trained for simple tasks through AI rather than hard-coded software, and its hardware is being further upgraded. Lastly, with a combined gross profit generation of over $0.5B in Q3, our Energy Generation and Storage business and Services and Other business have become meaningful contributors to our profitability. Cash Operating cash flow of $3.3B in Q3 Free cash flow2 of $0.8B in Q3 $3.0B increase in our cash and investments3 QoQ to $26.1B Operations 4.0 GWh of Energy Storage deployed in Q3 More than doubled AI training compute

F I N A N C I A L S U M M A R Y (Unaudited) ($ in millions, except percentages and per share data) Q3-2022 Q4-2022 Q1-2023 Q2-2023 Q3-2023 YoY Total automotive revenues 18,692 21,307 19,963 21,268 19,625 5% Energy generation and storage revenue 1,117 1,310 1,529 1,509 1,559 40% Services and other revenue 1,645 1,701 1,837 2,150 2,166 32% Total revenues 21,454 24,318 23,329 24,927 23,350 9% Total gross profit 5,382 5,777 4,511 4,533 4,178 -22% Total GAAP gross margin 25.1% 23.8% 19.3% 18.2% 17.9% -719 bp Operating expenses 1,694 1,876 1,847 2,134 2,414 43% Income from operations 3,688 3,901 2,664 2,399 1,764 -52% Operating margin 17.2% 16.0% 11.4% 9.6% 7.6% -964 bp Adjusted EBITDA 4,968 5,404 4,267 4,653 3,758 -24% Adjusted EBITDA margin 23.2% 22.2% 18.3% 18.7% 16.1% -706 bp Net income attributable to common stockholders (GAAP) 3,292 3,687 2,513 2,703 1,853 -44% Net income attributable to common stockholders (non-GAAP) 3,654 4,106 2,931 3,148 2,318 -37% EPS attributable to common stockholders, diluted (GAAP) 0.95 1.07 0.73 0.78 0.53 -44% EPS attributable to common stockholders, diluted (non-GAAP) 1.05 1.19 0.85 0.91 0.66 -37% Net cash provided by operating activities 5,100 3,278 2,513 3,065 3,308 -35% Capital expenditures (1,803) (1,858) (2,072) (2,060) (2,460) 36% Free cash flow 3,297 1,420 441 1,005 848 -74% Cash, cash equivalents and investments 21,107 22,185 22,402 23,075 26,077 24% 4

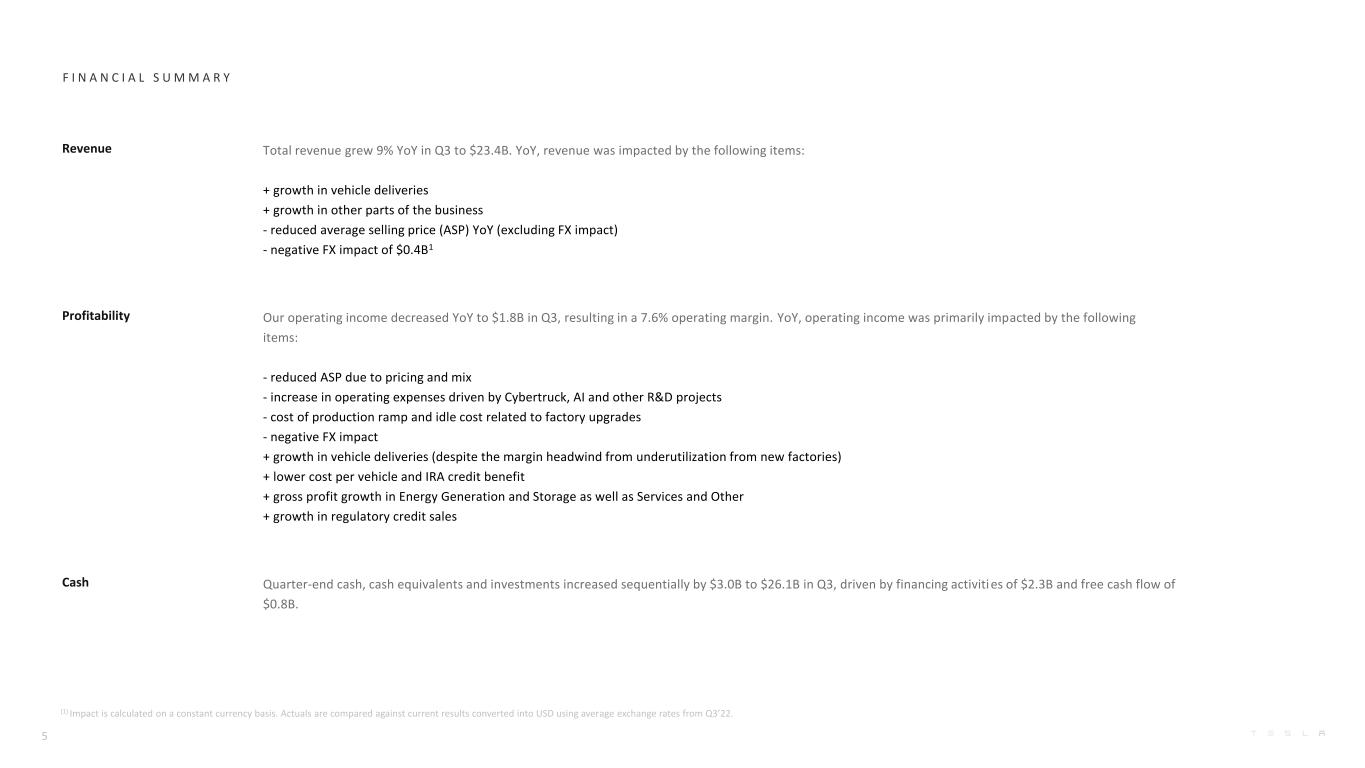

F I N A N C I A L S U M M A R Y 5 Revenue Total revenue grew 9% YoY in Q3 to $23.4B. YoY, revenue was impacted by the following items: + growth in vehicle deliveries + growth in other parts of the business - reduced average selling price (ASP) YoY (excluding FX impact) - negative FX impact of $0.4B1 Profitability Our operating income decreased YoY to $1.8B in Q3, resulting in a 7.6% operating margin. YoY, operating income was primarily impacted by the following items: - reduced ASP due to pricing and mix - increase in operating expenses driven by Cybertruck, AI and other R&D projects - cost of production ramp and idle cost related to factory upgrades - negative FX impact + growth in vehicle deliveries (despite the margin headwind from underutilization from new factories) + lower cost per vehicle and IRA credit benefit + gross profit growth in Energy Generation and Storage as well as Services and Other + growth in regulatory credit sales Cash Quarter-end cash, cash equivalents and investments increased sequentially by $3.0B to $26.1B in Q3, driven by financing activities of $2.3B and free cash flow of $0.8B. (1) Impact is calculated on a constant currency basis. Actuals are compared against current results converted into USD using average exchange rates from Q3’22.

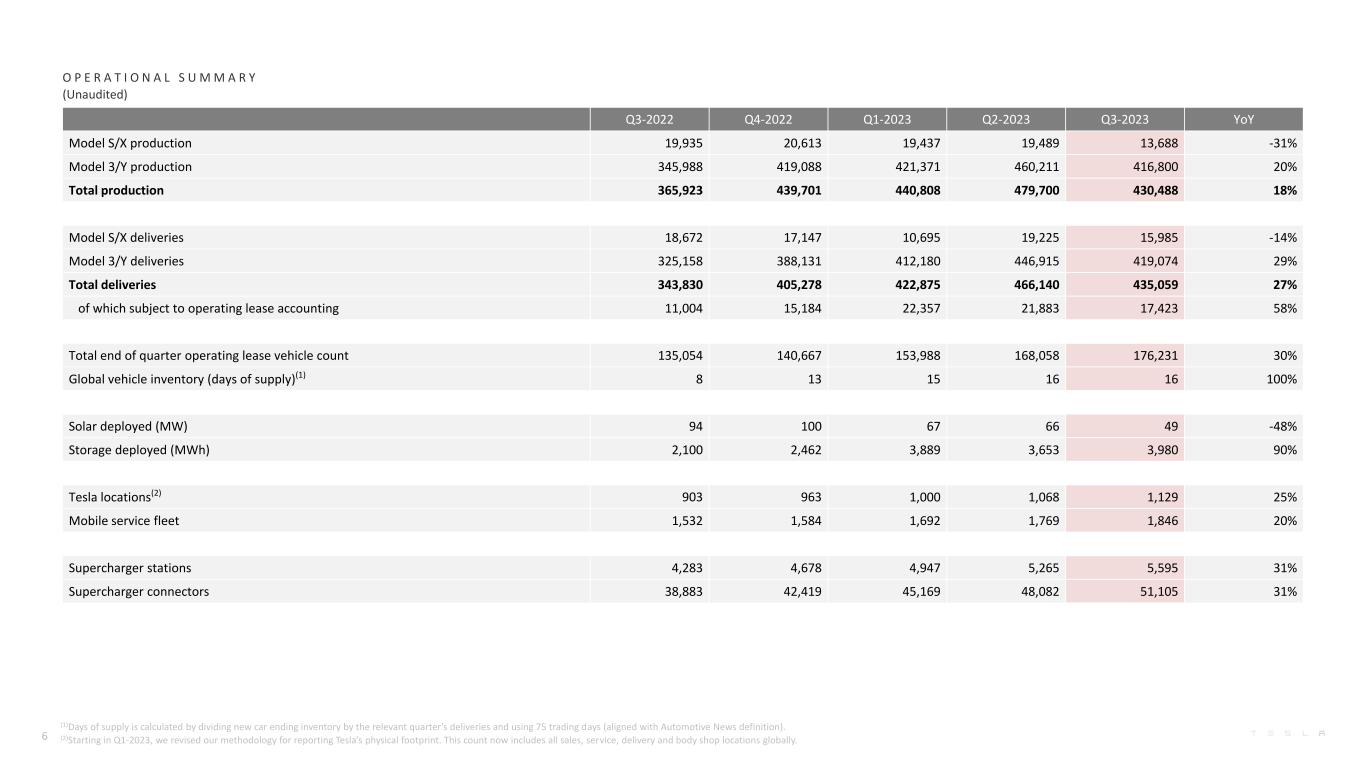

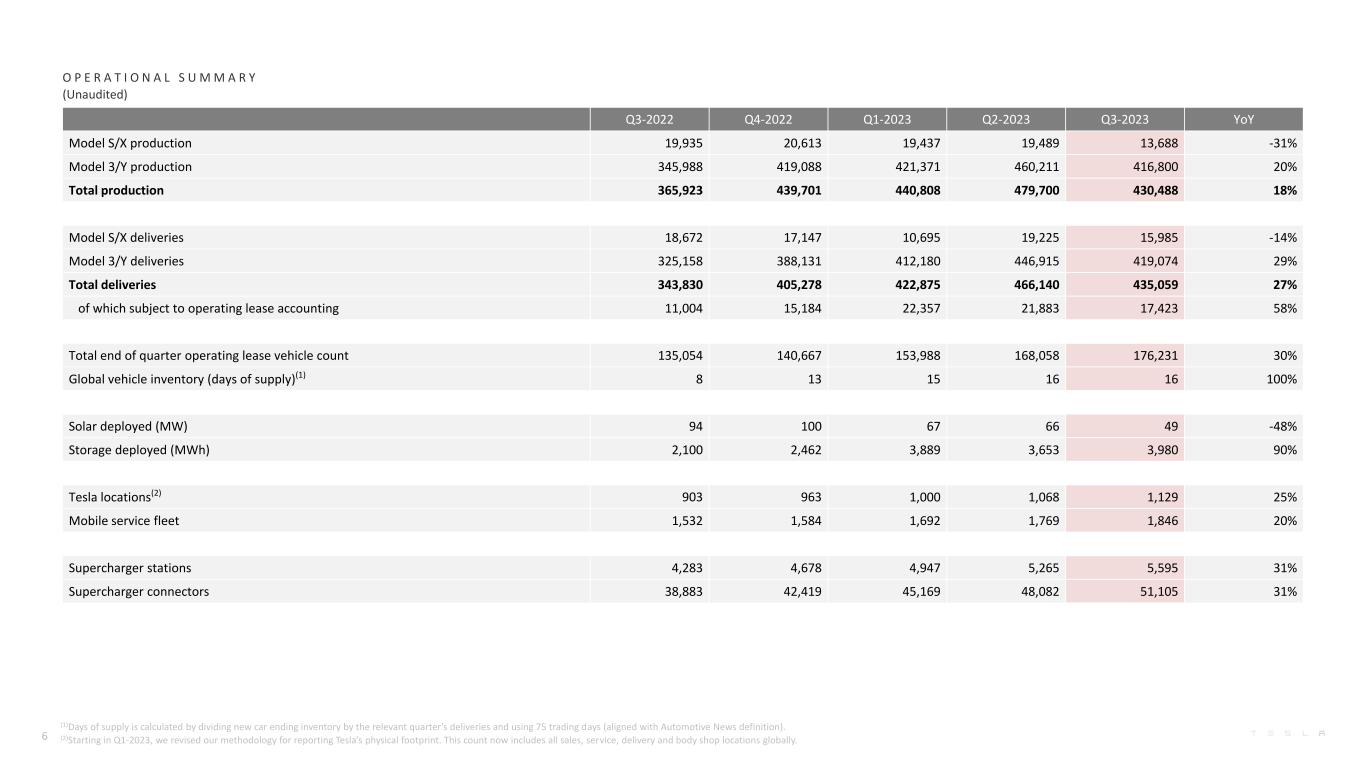

Q3-2022 Q4-2022 Q1-2023 Q2-2023 Q3-2023 YoY Model S/X production 19,935 20,613 19,437 19,489 13,688 -31% Model 3/Y production 345,988 419,088 421,371 460,211 416,800 20% Total production 365,923 439,701 440,808 479,700 430,488 18% Model S/X deliveries 18,672 17,147 10,695 19,225 15,985 -14% Model 3/Y deliveries 325,158 388,131 412,180 446,915 419,074 29% Total deliveries 343,830 405,278 422,875 466,140 435,059 27% of which subject to operating lease accounting 11,004 15,184 22,357 21,883 17,423 58% Total end of quarter operating lease vehicle count 135,054 140,667 153,988 168,058 176,231 30% Global vehicle inventory (days of supply)(1) 8 13 15 16 16 100% Solar deployed (MW) 94 100 67 66 49 -48% Storage deployed (MWh) 2,100 2,462 3,889 3,653 3,980 90% Tesla locations(2) 903 963 1,000 1,068 1,129 25% Mobile service fleet 1,532 1,584 1,692 1,769 1,846 20% Supercharger stations 4,283 4,678 4,947 5,265 5,595 31% Supercharger connectors 38,883 42,419 45,169 48,082 51,105 31% (1)Days of supply is calculated by dividing new car ending inventory by the relevant quarter’s deliveries and using 75 trading days (aligned with Automotive News definition). (2)Starting in Q1-2023, we revised our methodology for reporting Tesla’s physical footprint. This count now includes all sales, service, delivery and body shop locations globally. O P E R A T I O N A L S U M M A R Y (Unaudited) 6

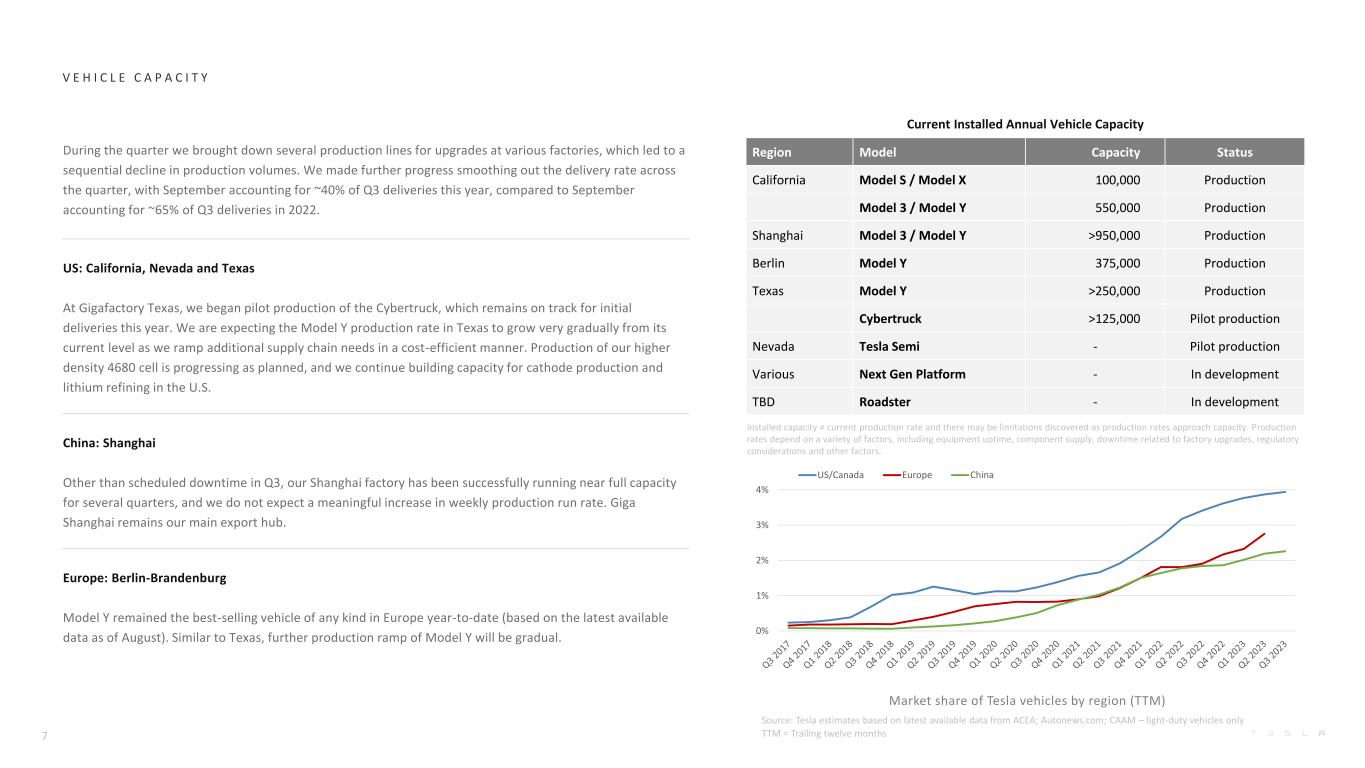

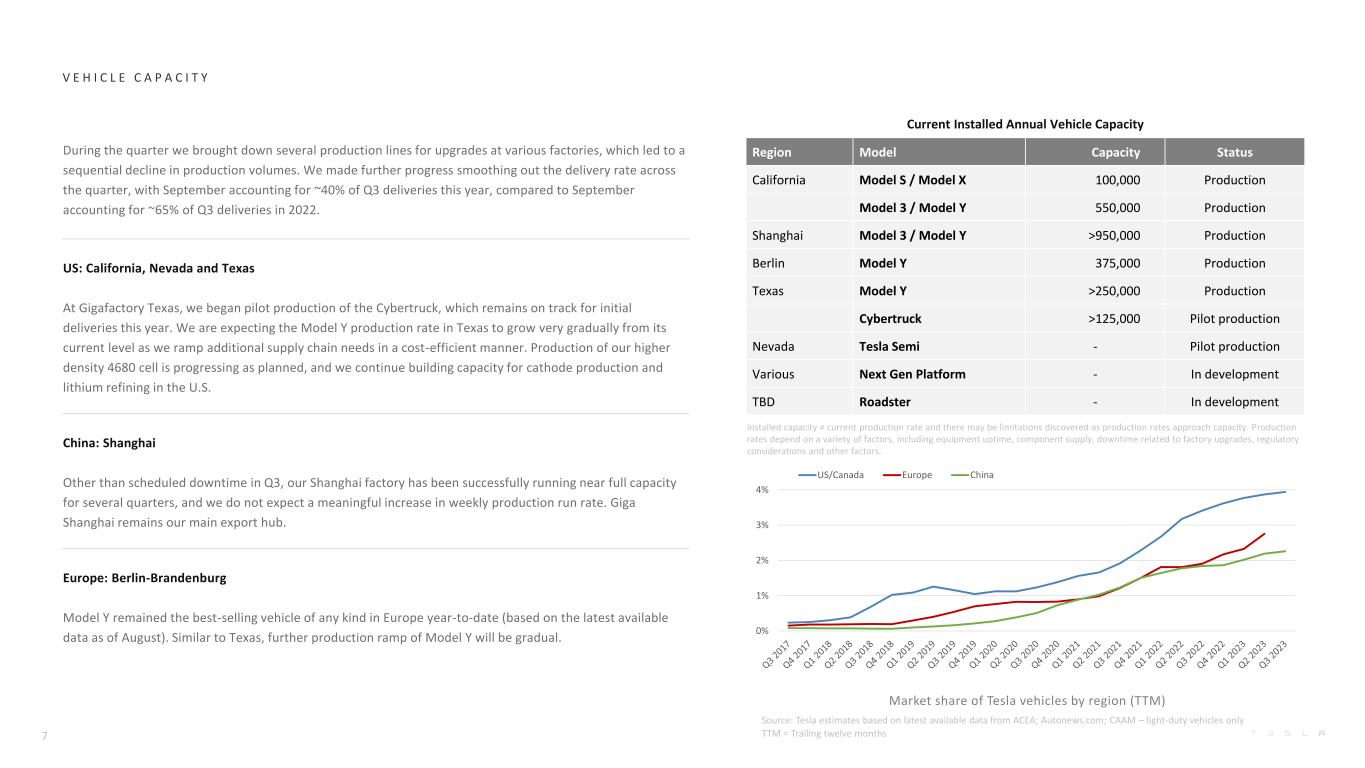

V E H I C L E C A P A C I T Y Current Installed Annual Vehicle Capacity Region Model Capacity Status California Model S / Model X 100,000 Production Model 3 / Model Y 550,000 Production Shanghai Model 3 / Model Y >950,000 Production Berlin Model Y 375,000 Production Texas Model Y >250,000 Production Cybertruck >125,000 Pilot production Nevada Tesla Semi - Pilot production Various Next Gen Platform - In development TBD Roadster - In development Installed capacity ≠ current production rate and there may be limitations discovered as production rates approach capacity. Production rates depend on a variety of factors, including equipment uptime, component supply, downtime related to factory upgrades, regulatory considerations and other factors. Market share of Tesla vehicles by region (TTM) Source: Tesla estimates based on latest available data from ACEA; Autonews.com; CAAM – light-duty vehicles only TTM = Trailing twelve months7 During the quarter we brought down several production lines for upgrades at various factories, which led to a sequential decline in production volumes. We made further progress smoothing out the delivery rate across the quarter, with September accounting for ~40% of Q3 deliveries this year, compared to September accounting for ~65% of Q3 deliveries in 2022. US: California, Nevada and Texas At Gigafactory Texas, we began pilot production of the Cybertruck, which remains on track for initial deliveries this year. We are expecting the Model Y production rate in Texas to grow very gradually from its current level as we ramp additional supply chain needs in a cost-efficient manner. Production of our higher density 4680 cell is progressing as planned, and we continue building capacity for cathode production and lithium refining in the U.S. China: Shanghai Other than scheduled downtime in Q3, our Shanghai factory has been successfully running near full capacity for several quarters, and we do not expect a meaningful increase in weekly production run rate. Giga Shanghai remains our main export hub. Europe: Berlin-Brandenburg Model Y remained the best-selling vehicle of any kind in Europe year-to-date (based on the latest available data as of August). Similar to Texas, further production ramp of Model Y will be gradual. 0% 1% 2% 3% 4% US/Canada Europe China

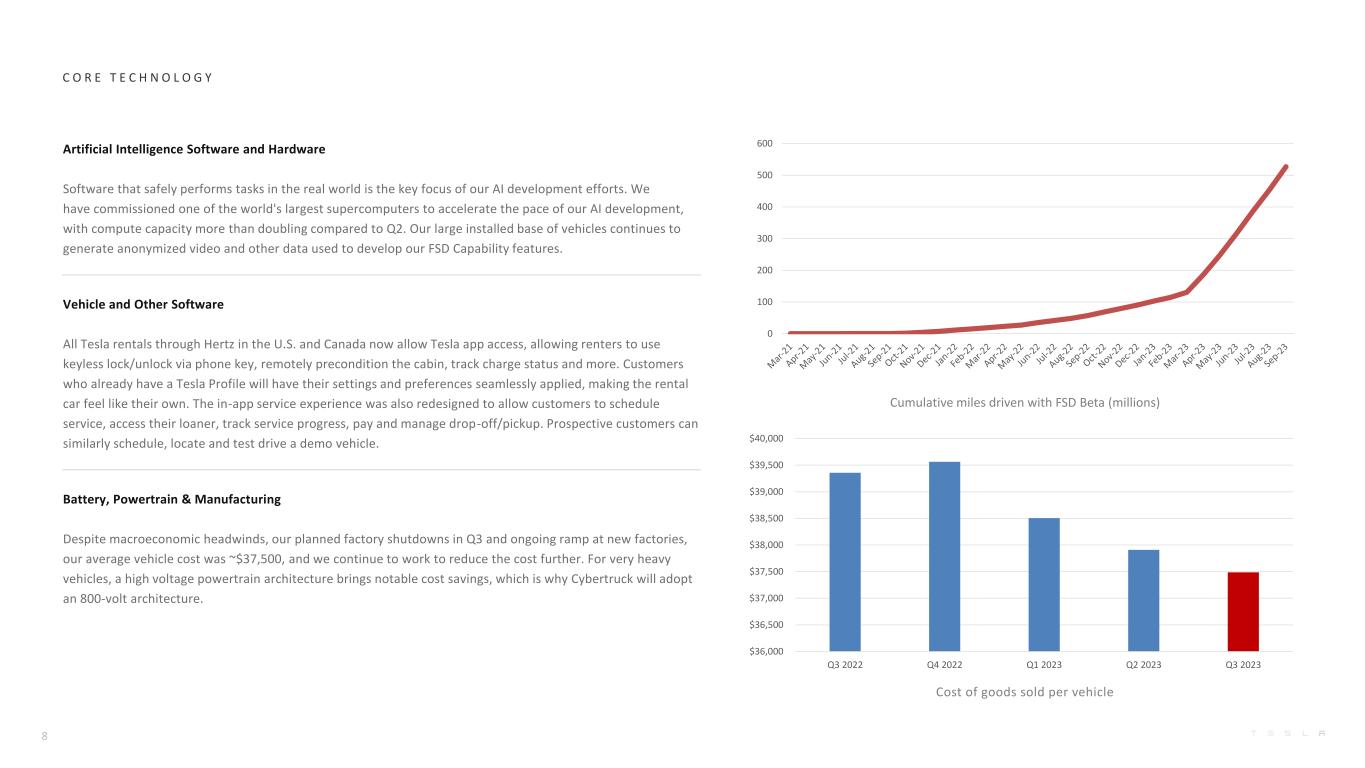

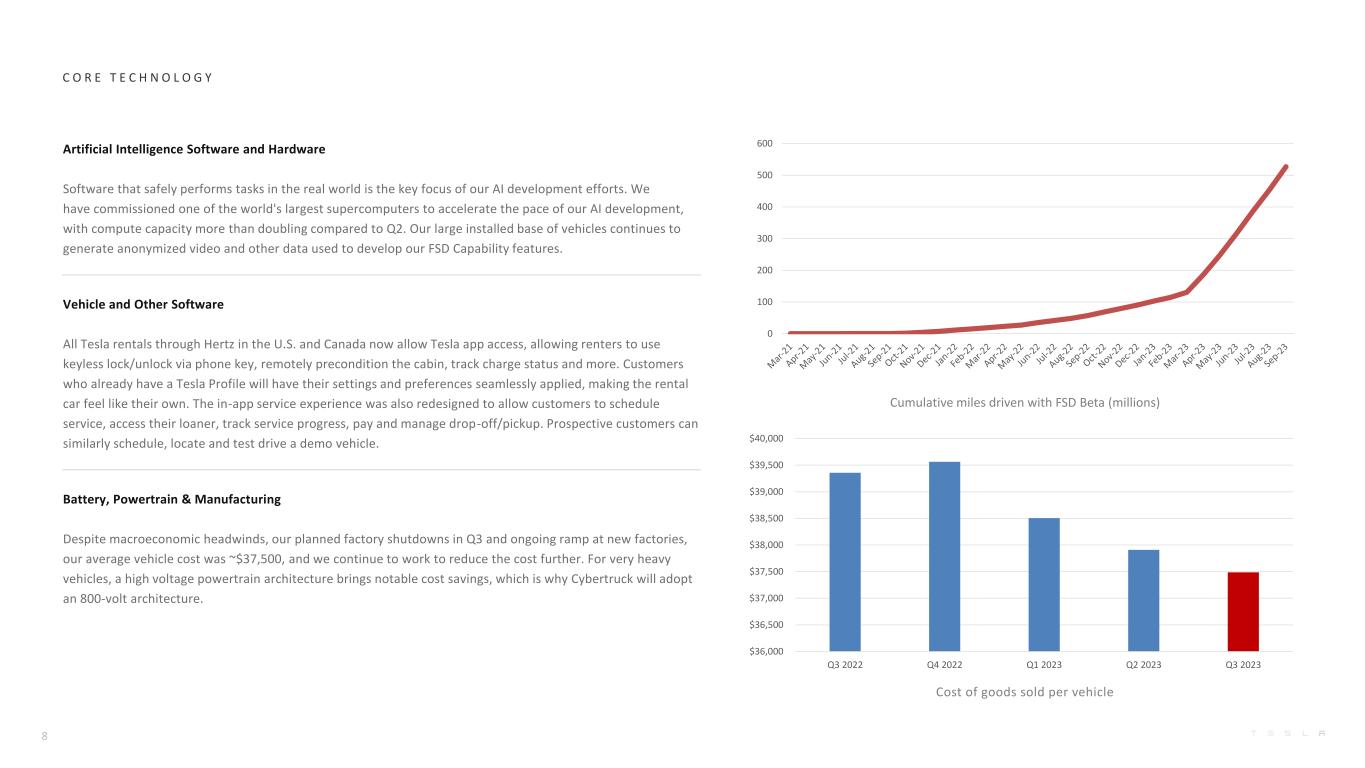

Cost of goods sold per vehicle C O R E T E C H N O L O G Y Cumulative miles driven with FSD Beta (millions) 8 Artificial Intelligence Software and Hardware Software that safely performs tasks in the real world is the key focus of our AI development efforts. We have commissioned one of the world's largest supercomputers to accelerate the pace of our AI development, with compute capacity more than doubling compared to Q2. Our large installed base of vehicles continues to generate anonymized video and other data used to develop our FSD Capability features. Vehicle and Other Software All Tesla rentals through Hertz in the U.S. and Canada now allow Tesla app access, allowing renters to use keyless lock/unlock via phone key, remotely precondition the cabin, track charge status and more. Customers who already have a Tesla Profile will have their settings and preferences seamlessly applied, making the rental car feel like their own. The in-app service experience was also redesigned to allow customers to schedule service, access their loaner, track service progress, pay and manage drop-off/pickup. Prospective customers can similarly schedule, locate and test drive a demo vehicle. Battery, Powertrain & Manufacturing Despite macroeconomic headwinds, our planned factory shutdowns in Q3 and ongoing ramp at new factories, our average vehicle cost was ~$37,500, and we continue to work to reduce the cost further. For very heavy vehicles, a high voltage powertrain architecture brings notable cost savings, which is why Cybertruck will adopt an 800-volt architecture. 0 100 200 300 400 500 600 $36,000 $36,500 $37,000 $37,500 $38,000 $38,500 $39,000 $39,500 $40,000 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023

O T H E R H I G H L I G H T S 9 Services & Other gross profit ($M) Energy Storage Energy storage deployments increased by 90% YoY in Q3 to 4.0 GWh, our highest quarterly deployment ever. Continued growth in deployments was driven by the ongoing ramp of our Megafactory in Lathrop, CA toward full capacity of 40 GWh with the phase two expansion. Production rate improved further sequentially in Q3. Solar Solar deployments declined on a sequential and YoY basis to 49 MW. Sustained high interest rates and the end of net metering in California have created downward pressure on solar demand. Services and Other business As our global fleet size grows, our Services and Other business continues to grow successfully, with Supercharging, insurance and body shop & part sales being the core drivers of profit growth YoY. Pay-per-use Supercharging remains a profitable business for the company, even as we scale capital expenditures. Our team is focused on materially expanding Supercharging capacity and further improving capacity management in anticipation of other OEMs joining our network. 0 1 2 3 4 (200) (150) (100) (50) — 50 100 150 200 Energy Storage deployments (GWh)

O U T L O O K 10 Volume We are planning to grow production as quickly as possible in alignment with the 50% CAGR target we began guiding to in early 2021. In some years we may grow faster and some we may grow slower, depending on a number of factors. For 2023, we expect to remain ahead of the long -term 50% CAGR with around 1.8 million vehicles for the year. Cash We have ample liquidity to fund our product roadmap, long-term capacity expansion plans and other expenses. Furthermore, we will manage the business such that we maintain a strong balance sheet during this uncertain period. Profit While we continue to execute on innovations to reduce the cost of manufacturing and operations, over time, we expect our hardware-related profits to be accompanied by an acceleration of AI, software and fleet-based profits. Product Cybertruck deliveries remain on track for later this year. In addition, we continue to make progress on our next generation p latform.

P H O T O S & C H A R T S

M O D E L Y S T A R T I N G P R I C E I N C L U S I V E O F N A T I O N A L A N D S T A T E L E V E L S U B S I D I E S* 12 *Not all consumers are eligible for all subsidies. Exclusive of local and utility subsidies. Please see additional details at https://www.tesla.com/support/incentives.

C Y B E R T R U C K D E L I V E R I E S B E G I N I N N O V E M B E R 2 0 2 3 13

M E G A P A C K F A C T O R Y I N L A T H R O P , C A L I F O R N I A 14

G I G A F A C T O R Y S H A N G H A I - O N E M I L L I O N T H M O D E L Y P R O D U C E D 15

Vehicle Deliveries (millions of units) K E Y M E T R I C S Q U A R T E R L Y (Unaudited) Operating Cash Flow ($B) Free Cash Flow ($B) Net Income ($B) Adjusted EBITDA ($B) 16 0.0 0.1 0.2 0.3 0.4 0.5 4 Q -2 0 2 0 1 Q -2 0 2 1 2 Q -2 0 2 1 3 Q -2 0 2 1 4 Q -2 0 2 1 1 Q -2 0 2 2 2 Q -2 0 2 2 3 Q -2 0 2 2 4 Q -2 0 2 2 1 Q -2 0 2 3 2 Q -2 0 2 3 3 Q -2 0 2 3 0 1 2 3 4 5 6 4 Q -2 0 2 0 1 Q -2 0 2 1 2 Q -2 0 2 1 3 Q -2 0 2 1 4 Q -2 0 2 1 1 Q -2 0 2 2 2 Q -2 0 2 2 3 Q -2 0 2 2 4 Q -2 0 2 2 1 Q -2 0 2 3 2 Q -2 0 2 3 3 Q -2 0 2 3 0 1 2 3 4 5 6 4 Q -2 0 2 0 1 Q -2 0 2 1 2 Q -2 0 2 1 3 Q -2 0 2 1 4 Q -2 0 2 1 1 Q -2 0 2 2 2 Q -2 0 2 2 3 Q -2 0 2 2 4 Q -2 0 2 2 1 Q -2 0 2 3 2 Q -2 0 2 3 3 Q -2 0 2 3

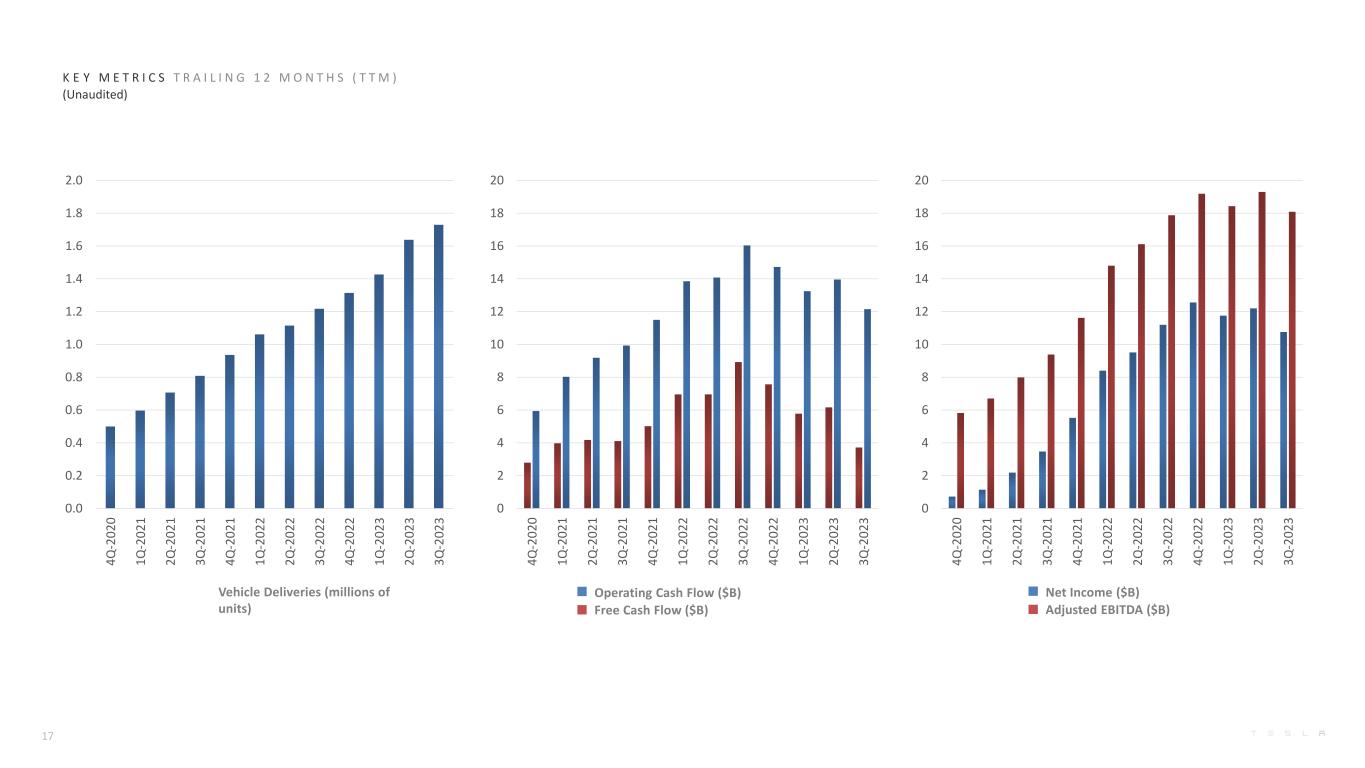

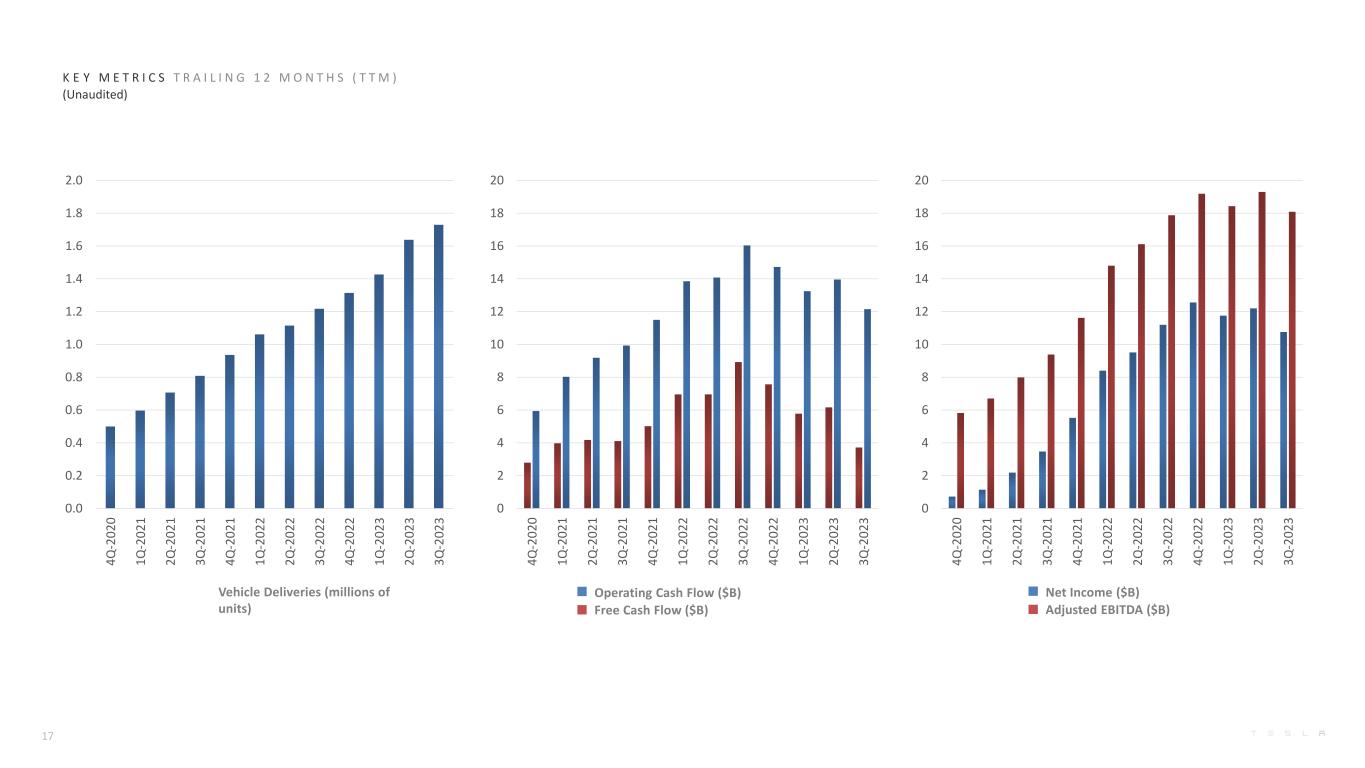

Operating Cash Flow ($B) Free Cash Flow ($B) K E Y M E T R I C S T R A I L I N G 1 2 M O N T H S ( T T M ) (Unaudited) Net Income ($B) Adjusted EBITDA ($B) 17 Vehicle Deliveries (millions of units) 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0 4 Q -2 0 2 0 1 Q -2 0 2 1 2 Q -2 0 2 1 3 Q -2 0 2 1 4 Q -2 0 2 1 1 Q -2 0 2 2 2 Q -2 0 2 2 3 Q -2 0 2 2 4 Q -2 0 2 2 1 Q -2 0 2 3 2 Q -2 0 2 3 3 Q -2 0 2 3 0 2 4 6 8 10 12 14 16 18 20 4 Q -2 0 2 0 1 Q -2 0 2 1 2 Q -2 0 2 1 3 Q -2 0 2 1 4 Q -2 0 2 1 1 Q -2 0 2 2 2 Q -2 0 2 2 3 Q -2 0 2 2 4 Q -2 0 2 2 1 Q -2 0 2 3 2 Q -2 0 2 3 3 Q -2 0 2 3 0 2 4 6 8 10 12 14 16 18 20 4 Q -2 0 2 0 1 Q -2 0 2 1 2 Q -2 0 2 1 3 Q -2 0 2 1 4 Q -2 0 2 1 1 Q -2 0 2 2 2 Q -2 0 2 2 3 Q -2 0 2 2 4 Q -2 0 2 2 1 Q -2 0 2 3 2 Q -2 0 2 3 3 Q -2 0 2 3

K E Y M E T R I C S T R A I L I N G 1 2 M O N T H S ( T T M ) (Unaudited) 18 YoY Revenue Growth Operating Margin Source: OEM financial disclosures, Bloomberg Auto Industry includes: Tesla, BMW, Mercedes-Benz, Ford, GM, Honda, Hyundai, Nissan, Toyota and VW. Stellantis is excluded given limited historical disclosures due to the recent merger between FCA and PSA. Auto Industry operating margin is calculated by dividing the sum of USD equivalent operating profits for the entire industry by the USD equivalent revenues for respective periods. -20% -10% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% Q 3 -2 0 1 9 Q 4 -2 0 1 9 Q 1 -2 0 2 0 Q 2 -2 0 2 0 Q 3 -2 0 2 0 Q 4 -2 0 2 0 Q 1 -2 0 2 1 Q 2 -2 0 2 1 Q 3 -2 0 2 1 Q 4 -2 0 2 1 Q 1 -2 0 2 2 Q 2 -2 0 2 2 Q 3 -2 0 2 2 Q 4 -2 0 2 2 Q 1 -2 0 2 3 Q 2 -2 0 2 3 Q 3 -2 0 2 3 Tesla Auto Industry S&P 500 -4% -2% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% Q 3 -2 0 1 9 Q 4 -2 0 1 9 Q 1 -2 0 2 0 Q 2 -2 0 2 0 Q 3 -2 0 2 0 Q 4 -2 0 2 0 Q 1 -2 0 2 1 Q 2 -2 0 2 1 Q 3 -2 0 2 1 Q 4 -2 0 2 1 Q 1 -2 0 2 2 Q 2 -2 0 2 2 Q 3 -2 0 2 2 Q 4 -2 0 2 2 Q 1 -2 0 2 3 Q 2 -2 0 2 3 Q 3 -2 0 2 3 Tesla Auto Industry S&P 500

F I N A N C I A L S T A T E M E N T S

In millions of USD or shares as applicable, except per share data Q3-2022 Q4-2022 Q1-2023 Q2-2023 Q3-2023 REVENUES Automotive sales 17,785 20,241 18,878 20,419 18,582 Automotive regulatory credits 286 467 521 282 554 Automotive leasing 621 599 564 567 489 Total automotive revenues 18,692 21,307 19,963 21,268 19,625 Energy generation and storage 1,117 1,310 1,529 1,509 1,559 Services and other 1,645 1,701 1,837 2,150 2,166 Total revenues 21,454 24,318 23,329 24,927 23,350 COST OF REVENUES Automotive sales 13,099 15,433 15,422 16,841 15,656 Automotive leasing 381 352 333 338 301 Total automotive cost of revenues 13,480 15,785 15,755 17,179 15,957 Energy generation and storage 1,013 1,151 1,361 1,231 1,178 Services and other 1,579 1,605 1,702 1,984 2,037 Total cost of revenues 16,072 18,541 18,818 20,394 19,172 Gross profit 5,382 5,777 4,511 4,533 4,178 OPERATING EXPENSES Research and development 733 810 771 943 1,161 Selling, general and administrative 961 1,032 1,076 1,191 1,253 Restructuring and other — 34 — — — Total operating expenses 1,694 1,876 1,847 2,134 2,414 INCOME FROM OPERATIONS 3,688 3,901 2,664 2,399 1,764 Interest income 86 157 213 238 282 Interest expense (53) (33) (29) (28) (38) Other (expense) income, net (85) (42) (48) 328 37 INCOME BEFORE INCOME TAXES 3,636 3,983 2,800 2,937 2,045 Provision for income taxes 305 276 261 323 167 NET INCOME 3,331 3,707 2,539 2,614 1,878 Net income (loss) attributable to noncontrolling interests and redeemable noncontrolling interests in subsidiaries 39 20 26 (89) 25 NET INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS 3,292 3,687 2,513 2,703 1,853 Net income per share of common stock attributable to common stockholders Basic $ 1.05 $ 1.18 $ 0.80 $ 0.85 $ 0.58 Diluted $ 0.95 $ 1.07 $ 0.73 $ 0.78 $ 0.53 Weighted average shares used in computing net income per share of common stock Basic 3,146 3,160 3,166 3,171 3,176 Diluted 3,468 3,471 3,468 3,478 3,493 S T A T E M E N T O F O P E R A T I O N S (Unaudited) 20

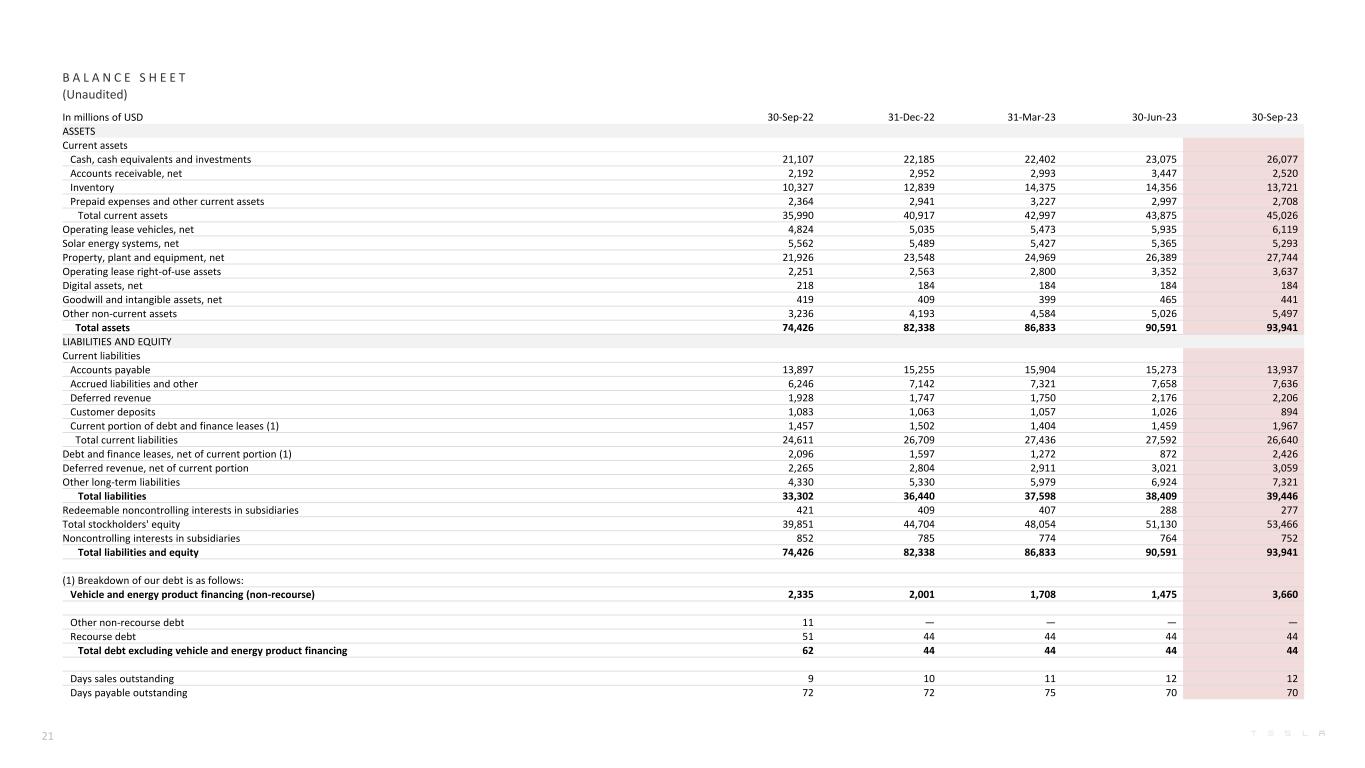

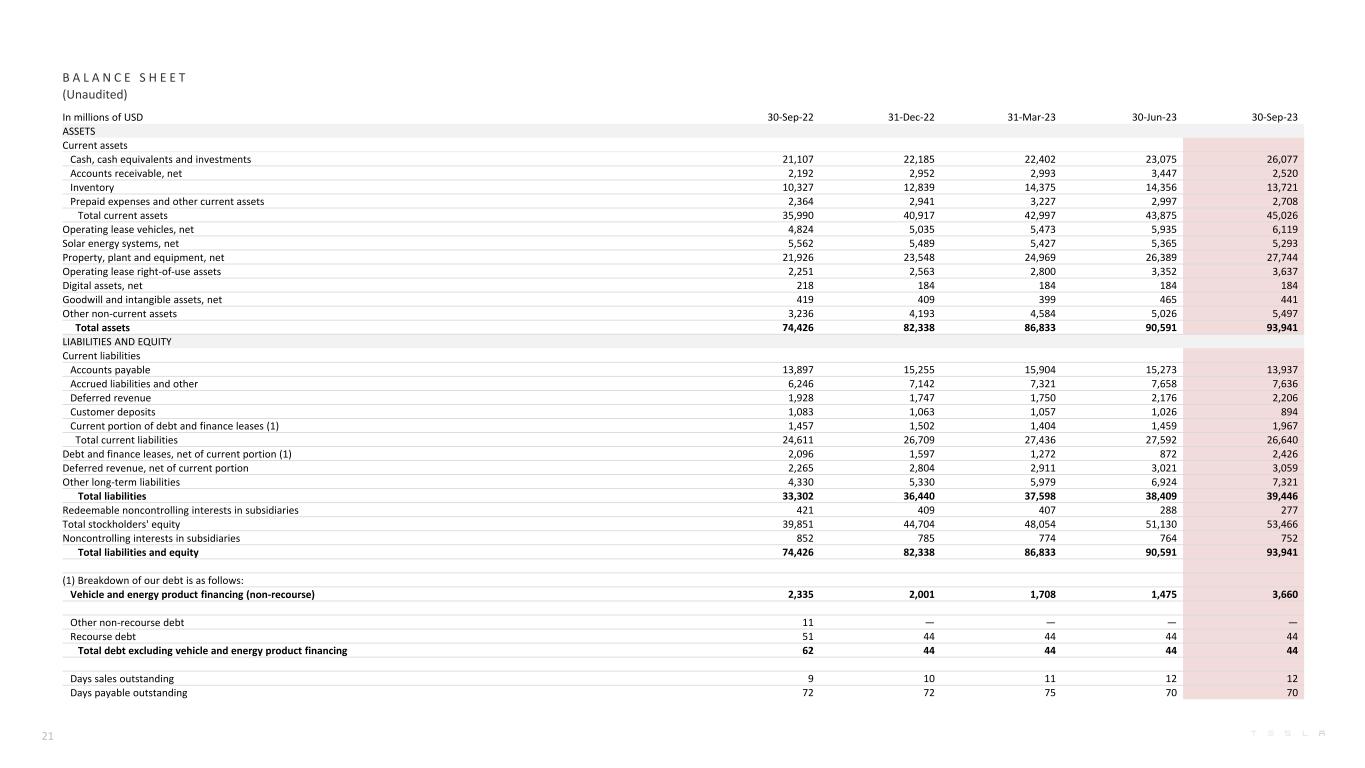

B A L A N C E S H E E T (Unaudited) In millions of USD 30-Sep-22 31-Dec-22 31-Mar-23 30-Jun-23 30-Sep-23 ASSETS Current assets Cash, cash equivalents and investments 21,107 22,185 22,402 23,075 26,077 Accounts receivable, net 2,192 2,952 2,993 3,447 2,520 Inventory 10,327 12,839 14,375 14,356 13,721 Prepaid expenses and other current assets 2,364 2,941 3,227 2,997 2,708 Total current assets 35,990 40,917 42,997 43,875 45,026 Operating lease vehicles, net 4,824 5,035 5,473 5,935 6,119 Solar energy systems, net 5,562 5,489 5,427 5,365 5,293 Property, plant and equipment, net 21,926 23,548 24,969 26,389 27,744 Operating lease right-of-use assets 2,251 2,563 2,800 3,352 3,637 Digital assets, net 218 184 184 184 184 Goodwill and intangible assets, net 419 409 399 465 441 Other non-current assets 3,236 4,193 4,584 5,026 5,497 Total assets 74,426 82,338 86,833 90,591 93,941 LIABILITIES AND EQUITY Current liabilities Accounts payable 13,897 15,255 15,904 15,273 13,937 Accrued liabilities and other 6,246 7,142 7,321 7,658 7,636 Deferred revenue 1,928 1,747 1,750 2,176 2,206 Customer deposits 1,083 1,063 1,057 1,026 894 Current portion of debt and finance leases (1) 1,457 1,502 1,404 1,459 1,967 Total current liabilities 24,611 26,709 27,436 27,592 26,640 Debt and finance leases, net of current portion (1) 2,096 1,597 1,272 872 2,426 Deferred revenue, net of current portion 2,265 2,804 2,911 3,021 3,059 Other long-term liabilities 4,330 5,330 5,979 6,924 7,321 Total liabilities 33,302 36,440 37,598 38,409 39,446 Redeemable noncontrolling interests in subsidiaries 421 409 407 288 277 Total stockholders' equity 39,851 44,704 48,054 51,130 53,466 Noncontrolling interests in subsidiaries 852 785 774 764 752 Total liabilities and equity 74,426 82,338 86,833 90,591 93,941 (1) Breakdown of our debt is as follows: Vehicle and energy product financing (non-recourse) 2,335 2,001 1,708 1,475 3,660 Other non-recourse debt 11 — — — — Recourse debt 51 44 44 44 44 Total debt excluding vehicle and energy product financing 62 44 44 44 44 Days sales outstanding 9 10 11 12 12 Days payable outstanding 72 72 75 70 70 21

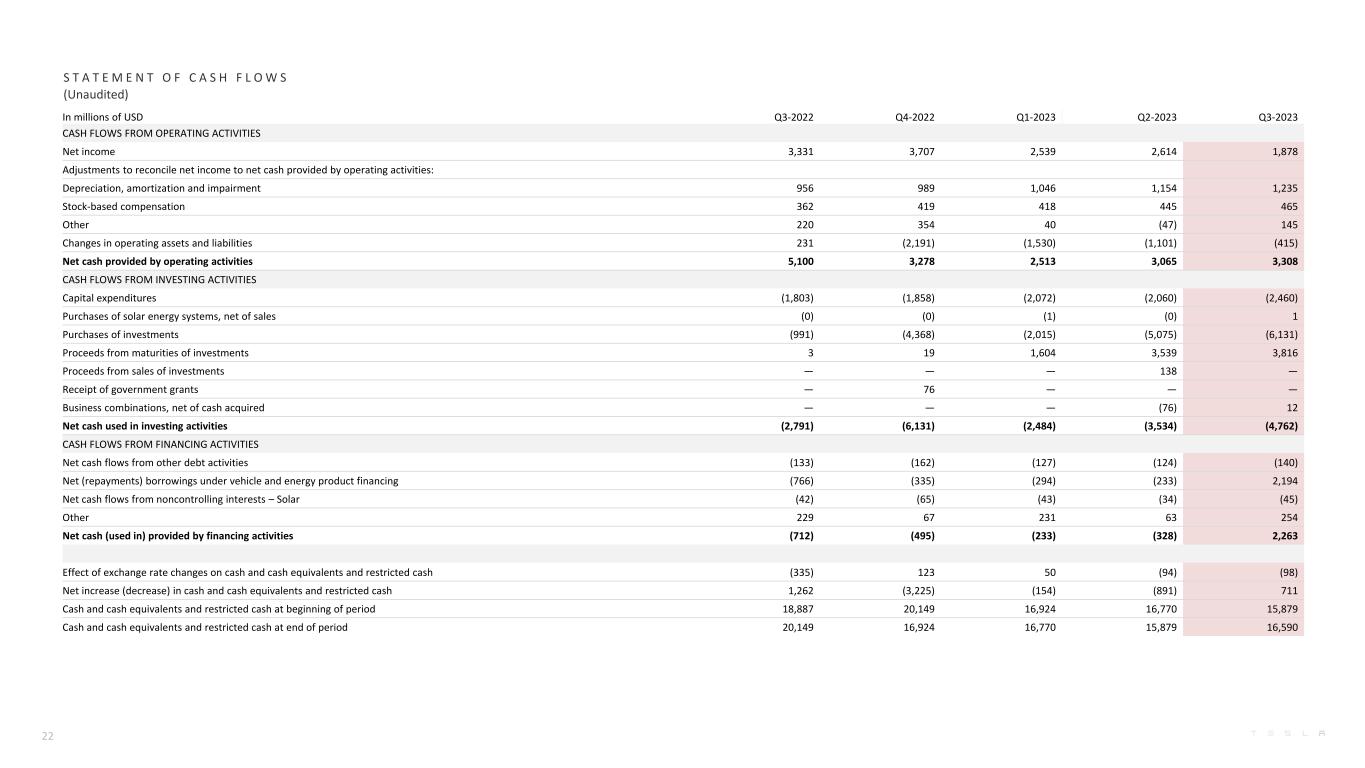

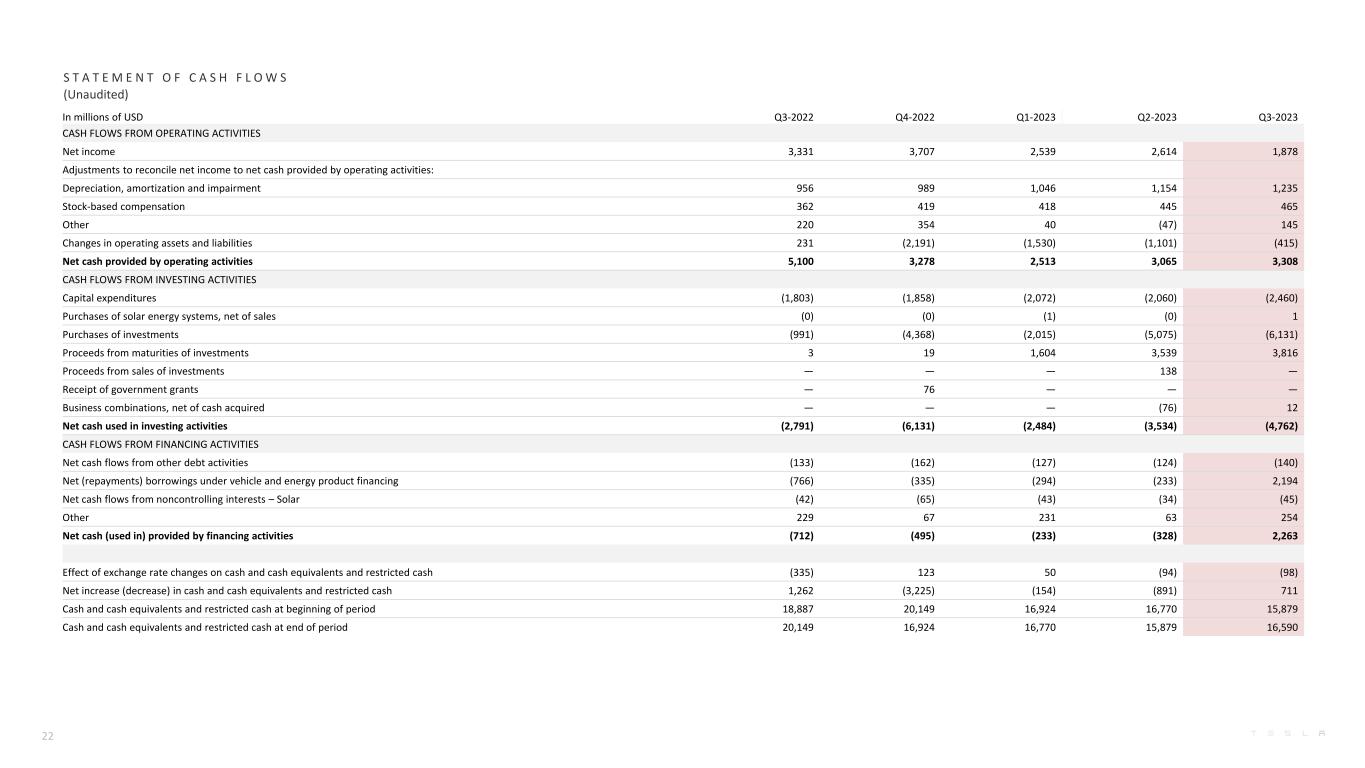

In millions of USD Q3-2022 Q4-2022 Q1-2023 Q2-2023 Q3-2023 CASH FLOWS FROM OPERATING ACTIVITIES Net income 3,331 3,707 2,539 2,614 1,878 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation, amortization and impairment 956 989 1,046 1,154 1,235 Stock-based compensation 362 419 418 445 465 Other 220 354 40 (47) 145 Changes in operating assets and liabilities 231 (2,191) (1,530) (1,101) (415) Net cash provided by operating activities 5,100 3,278 2,513 3,065 3,308 CASH FLOWS FROM INVESTING ACTIVITIES Capital expenditures (1,803) (1,858) (2,072) (2,060) (2,460) Purchases of solar energy systems, net of sales (0) (0) (1) (0) 1 Purchases of investments (991) (4,368) (2,015) (5,075) (6,131) Proceeds from maturities of investments 3 19 1,604 3,539 3,816 Proceeds from sales of investments — — — 138 — Receipt of government grants — 76 — — — Business combinations, net of cash acquired — — — (76) 12 Net cash used in investing activities (2,791) (6,131) (2,484) (3,534) (4,762) CASH FLOWS FROM FINANCING ACTIVITIES Net cash flows from other debt activities (133) (162) (127) (124) (140) Net (repayments) borrowings under vehicle and energy product financing (766) (335) (294) (233) 2,194 Net cash flows from noncontrolling interests – Solar (42) (65) (43) (34) (45) Other 229 67 231 63 254 Net cash (used in) provided by financing activities (712) (495) (233) (328) 2,263 Effect of exchange rate changes on cash and cash equivalents and restricted cash (335) 123 50 (94) (98) Net increase (decrease) in cash and cash equivalents and restricted cash 1,262 (3,225) (154) (891) 711 Cash and cash equivalents and restricted cash at beginning of period 18,887 20,149 16,924 16,770 15,879 Cash and cash equivalents and restricted cash at end of period 20,149 16,924 16,770 15,879 16,590 S T A T E M E N T O F C A S H F L O W S (Unaudited) 22

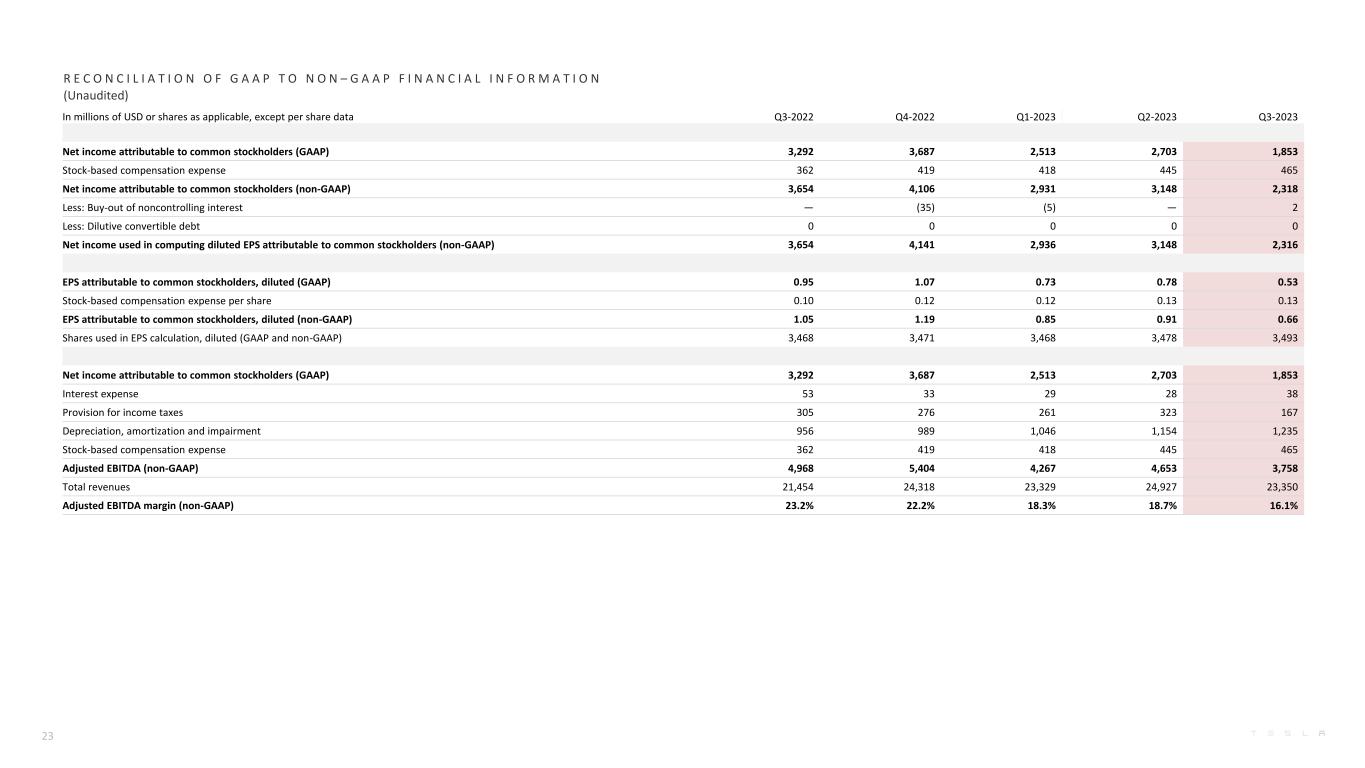

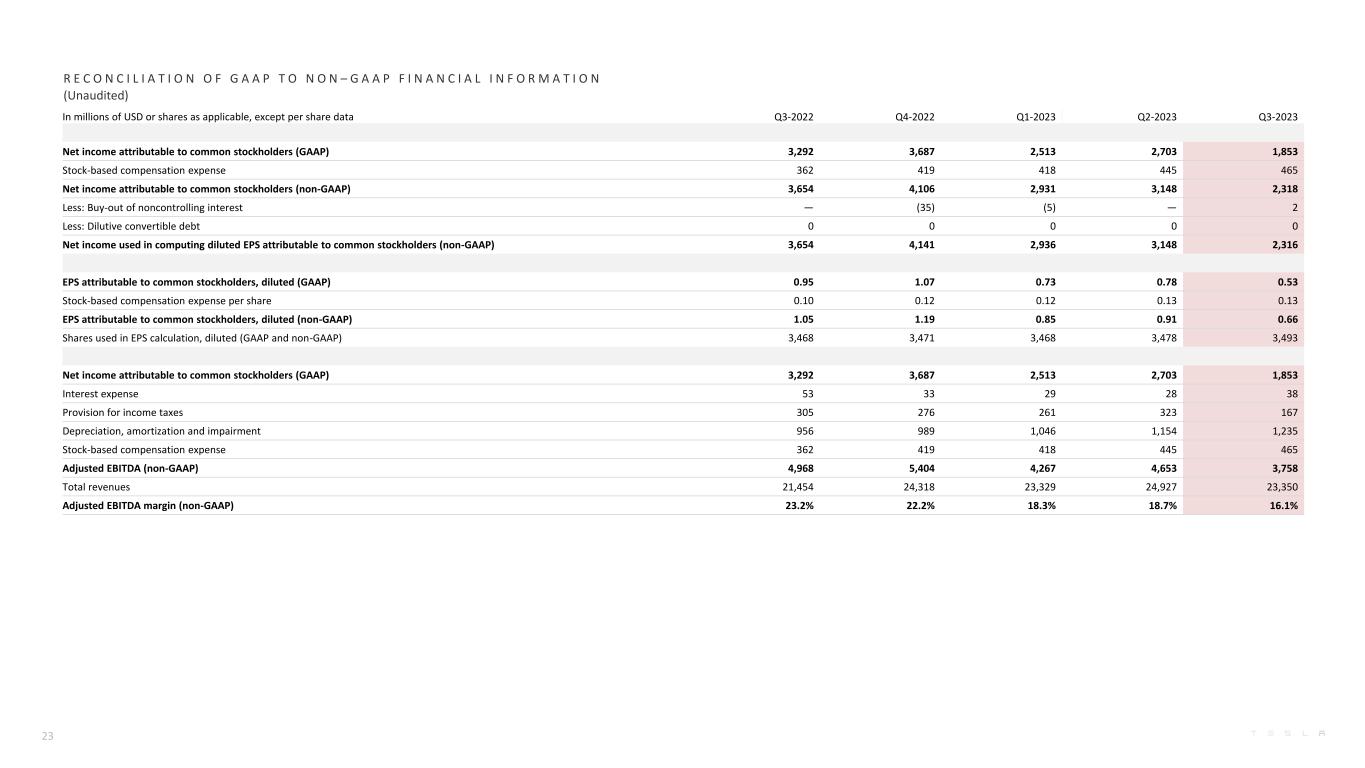

In millions of USD or shares as applicable, except per share data Q3-2022 Q4-2022 Q1-2023 Q2-2023 Q3-2023 Net income attributable to common stockholders (GAAP) 3,292 3,687 2,513 2,703 1,853 Stock-based compensation expense 362 419 418 445 465 Net income attributable to common stockholders (non-GAAP) 3,654 4,106 2,931 3,148 2,318 Less: Buy-out of noncontrolling interest — (35) (5) — 2 Less: Dilutive convertible debt 0 0 0 0 0 Net income used in computing diluted EPS attributable to common stockholders (non-GAAP) 3,654 4,141 2,936 3,148 2,316 EPS attributable to common stockholders, diluted (GAAP) 0.95 1.07 0.73 0.78 0.53 Stock-based compensation expense per share 0.10 0.12 0.12 0.13 0.13 EPS attributable to common stockholders, diluted (non-GAAP) 1.05 1.19 0.85 0.91 0.66 Shares used in EPS calculation, diluted (GAAP and non-GAAP) 3,468 3,471 3,468 3,478 3,493 Net income attributable to common stockholders (GAAP) 3,292 3,687 2,513 2,703 1,853 Interest expense 53 33 29 28 38 Provision for income taxes 305 276 261 323 167 Depreciation, amortization and impairment 956 989 1,046 1,154 1,235 Stock-based compensation expense 362 419 418 445 465 Adjusted EBITDA (non-GAAP) 4,968 5,404 4,267 4,653 3,758 Total revenues 21,454 24,318 23,329 24,927 23,350 Adjusted EBITDA margin (non-GAAP) 23.2% 22.2% 18.3% 18.7% 16.1% R E C O N C I L I A T I O N O F G A A P T O N O N – G A A P F I N A N C I A L I N F O R M A T I O N (Unaudited) 23

R E C O N C I L I A T I O N O F G A A P T O N O N – G A A P F I N A N C I A L I N F O R M A T I O N (Unaudited) In millions of USD 4Q-2020 1Q-2021 2Q-2021 3Q-2021 4Q-2021 1Q-2022 2Q-2022 3Q-2022 4Q-2022 1Q-2023 2Q-2023 3Q-2023 Net cash provided by operating activities – TTM (GAAP) 5,943 8,024 9,184 9,931 11,497 13,851 14,078 16,031 14,724 13,242 13,956 12,164 Capital expenditures – TTM (3,157) (4,050) (5,009) (5,823) (6,482) (6,901) (7,126) (7,110) (7,158) (7,463) (7,793) (8,450) Free cash flow – TTM (non-GAAP) 2,786 3,974 4,175 4,108 5,015 6,950 6,952 8,921 7,566 5,779 6,163 3,714 In millions of USD 4Q-2020 1Q-2021 2Q-2021 3Q-2021 4Q-2021 1Q-2022 2Q-2022 3Q-2022 4Q-2022 1Q-2023 2Q-2023 3Q-2023 Net income attributable to common stockholders – TTM (GAAP) 721 1,143 2,181 3,468 5,519 8,399 9,516 11,190 12,556 11,751 12,195 10,756 Interest expense – TTM 748 678 583 546 371 333 302 229 191 159 143 128 Provision for income taxes – TTM 292 359 453 490 699 976 1,066 1,148 1,132 1,047 1,165 1,027 Depreciation, amortization and impairment – TTM 2,322 2,390 2,504 2,681 2,911 3,170 3,411 3,606 3,747 3,913 4,145 4,424 Stock-based compensation expense – TTM 1,734 2,137 2,264 2,196 2,121 1,925 1,812 1,699 1,560 1,560 1,644 1,747 Adjusted EBITDA – TTM (non-GAAP) 5,817 6,707 7,985 9,381 11,621 14,803 16,107 17,872 19,186 18,430 19,292 18,082 TTM = Trailing twelve months In millions of USD 1Q-2020 2Q-2020 3Q-2020 4Q-2020 1Q-2021 2Q-2021 3Q-2021 4Q-2021 1Q-2022 2Q-2022 3Q-2022 4Q-2022 1Q-2023 2Q-2023 3Q-2023 Net cash (used in) provided by operating activities (GAAP) (440) 964 2,400 3,019 1,641 2,124 3,147 4,585 3,995 2,351 5,100 3,278 2,513 3,065 3,308 Capital expenditures (455) (546) (1,005) (1,151) (1,348) (1,505) (1,819) (1,810) (1,767) (1,730) (1,803) (1,858) (2,072) (2,060) (2,460) Free cash flow (non-GAAP) (895) 418 1,395 1,868 293 619 1,328 2,775 2,228 621 3,297 1,420 441 1,005 848 In millions of USD 1Q-2020 2Q-2020 3Q-2020 4Q-2020 1Q-2021 2Q-2021 3Q-2021 4Q-2021 1Q-2022 2Q-2022 3Q-2022 4Q-2022 1Q-2023 2Q-2023 3Q-2023 Net income attributable to common stockholders (GAAP) 16 104 331 270 438 1,142 1,618 2,321 3,318 2,259 3,292 3,687 2,513 2,703 1,853 Interest expense 169 170 163 246 99 75 126 71 61 44 53 33 29 28 38 Provision for income taxes 2 21 186 83 69 115 223 292 346 205 305 276 261 323 167 Depreciation, amortization and impairment 553 567 584 618 621 681 761 848 880 922 956 989 1,046 1,154 1,235 Stock-based compensation expense 211 347 543 633 614 474 475 558 418 361 362 419 418 445 465 Adjusted EBITDA (non-GAAP) 951 1,209 1,807 1,850 1,841 2,487 3,203 4,090 5,023 3,791 4,968 5,404 4,267 4,653 3,758 24

A D D I T I O N A L I N F O R M A T I O N WEBCAST INFORMATION Tesla will provide a live webcast of its third quarter 2023 financial results conference call beginning at 4:30 p.m. CT on October 18, 2023 at ir.tesla.com. This webcast will also be available for replay for approximately one year thereafter. CERTAIN TERMS When used in this update, certain terms have the following meanings. Our vehicle deliveries include only vehicles that have been transferred to end customers with all paperwork correctly completed. Our energy product deployment volume includes both customer units installed and equipment sales; we report installations at time of commissioning for storage projects or inspection for solar projects, and equipment sales at time of delivery. "Adjusted EBITDA" is equal to (i) net income (loss) attributable to common stockholders before (ii)(a) interest expense, (b) provision for income taxes, (c) depreciation, amortization and impairment and (d) stock-based compensation expense, which is the same measurement for this term pursuant to the performance-based stock option award granted to our CEO in 2018. "Free cash flow" is operating cash flow less capital expenditures. Average cost per vehicle is cost of automotive sales divided by new vehicle deliveries (excluding operating leases). “Days sales outstanding” is equal to (i) average accounts receivable, net for the period divided by (ii) total revenues and multiplied by (iii) the number of days in the period. “Days payable outstanding” is equal to (i) average accounts payable for the period divided by (ii) total cost of revenues and multiplied by (iii) the number of days in the period. “Days of supply” is calculated by dividing new car ending inventory by the relevant quarter’s deliveries and using 75 trading days. Constant currency impacts are calculated by comparing actuals against current results converted into USD using average exchange rates from the prior period. NON-GAAP FINANCIAL INFORMATION Consolidated financial information has been presented in accordance with GAAP as well as on a non-GAAP basis to supplement our consolidated financial results. Our non-GAAP financial measures include non-GAAP net income (loss) attributable to common stockholders, non-GAAP net income (loss) attributable to common stockholders on a diluted per share basis (calculated using weighted average shares for GAAP diluted net income (loss) attributable to common stockholders), Adjusted EBITDA, Adjusted EBITDA margin and free cash flow. These non-GAAP financial measures also facilitate management’s internal comparisons to Tesla’s historical performance as well as comparisons to the operating results of other companies. Management believes that it is useful to supplement its GAAP financial statements with this non-GAAP information because management uses such information internally for its operating, budgeting and financial planning purposes. Management also believes that presentation of the non-GAAP financial measures provides useful information to our investors regarding our financial condition and results of operations, so that investors can see through the eyes of Tesla management regarding important financial metrics that Tesla uses to run the business and allowing investors to better understand Tesla’s performance. Non-GAAP information is not prepared under a comprehensive set of accounting rules and therefore, should only be read in conjunction with financial information reported under U.S. GAAP when understanding Tesla’s operating performance. A reconciliation between GAAP and non-GAAP financial information is provided above. FORWARD-LOOKING STATEMENTS Certain statements in this update, including statements in the “Outlook” section; statements relating to the future development, ramp, production and capacity, demand and market growth, cost, pricing and profitability, investment, deliveries, deployment, availability and other features and improvements and timing of existing and future Tesla products and technologies such as Model 3, Model Y, Model X, Model S, Cybertruck, our next generation vehicle platform, our Dojo training computers, our Autopilot, Full Self-Driving and other vehicle software and AI enabled products, our battery cells, our Supercharging network and our energy storage and solar products; statements regarding operating margin, operating profits, spending and liquidity; and statements regarding expansion, improvements and/or ramp and related timing at our factories are “forward-looking statements” that are subject to risks and uncertainties. These forward-looking statements are based on management’s current expectations, and as a result of certain risks and uncertainties, actual results may differ materially from those projected. The following important factors, without limitation, could cause actual results to differ materially from those in the forward-looking statements: uncertainties in future macroeconomic and regulatory conditions arising from the current global pandemic; the risk of delays in launching and manufacturing our products and features cost- effectively; our ability to grow our sales, delivery, installation, servicing and charging capabilities and effectively manage this growth; consumers’ demand for electric vehicles generally and our vehicles specifically; the ability of suppliers to deliver components according to schedules, prices, quality and volumes acceptable to us, and our ability to manage such components effectively; any issues with lithium-ion cells or other components manufactured at our factories; our ability to ramp our factories in accordance with our plans; our ability to procure supply of battery cells, including through our own manufacturing; risks relating to international expansion; any failures by Tesla products to perform as expected or if product recalls occur; the risk of product liability claims; competition in the automotive and energy product markets; our ability to maintain public credibility and confidence in our long-term business prospects; our ability to manage risks relating to our various product financing programs; the status of government and economic incentives for electric vehicles and energy products; our ability to attract, hire and retain key employees and qualified personnel and ramp our installation teams; our ability to maintain the security of our information and production and product systems; our compliance with various regulations and laws applicable to our operations and products, which may evolve from time to time; risks relating to our indebtedness and financing strategies; and adverse foreign exchange movements. More information on potential factors that could affect our financial results is included from time to time in our Securities and Exchange Commission filings and reports, including the risks identified under the section captioned “Risk Factors” in our annual report on Form 10-K filed with the SEC on January 31, 2023. Tesla disclaims any obligation to update information contained in these forward-looking statements whether as a result of new information, future events or otherwise. 25