| Delaware | 001-37795 | 36-2058176 | ||||||

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

||||||

1775 Tysons Blvd., 7th Floor, Tysons, VA |

22102 | |||||||

| (Address of Principal Executive Offices) | (Zip Code) | |||||||

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||

| Common Stock, $0.01 par value per share | PK | New York Stock Exchange | ||||||

| Exhibit Number |

Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |||||||

| Park Hotels & Resorts Inc. | ||||||||

Date: October 29, 2024 |

By: | /s/ Sean M. Dell’Orto | ||||||

| Sean M. Dell’Orto | ||||||||

| Executive Vice President, Chief Financial Officer and Treasurer | ||||||||

| Investor Contact | 1775 Tysons Boulevard, 7th Floor | ||||

| Ian Weissman | Tysons, VA 22102 | ||||

| + 1 571 302 5591 | www.pkhotelsandresorts.com | ||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||

| 2024 | 2023 | Change(1) |

2024 | 2023 | Change(1) |

||||||||||||||||||||||||||||||

| Comparable RevPAR | $ | 189.73 | $ | 183.64 | 3.3 | % | $ | 188.08 | $ | 180.33 | 4.3 | % | |||||||||||||||||||||||

| Comparable Occupancy | 78.1 | % | 75.6 | % | 2.5 | % pts | 75.7 | % | 73.5 | % | 2.2 | % pts | |||||||||||||||||||||||

| Comparable ADR | $ | 242.88 | $ | 242.89 | — | % | $ | 248.57 | $ | 245.34 | 1.3 | % | |||||||||||||||||||||||

| Comparable Total RevPAR | $ | 294.65 | $ | 283.82 | 3.8 | % | $ | 300.83 | $ | 287.74 | 4.5 | % | |||||||||||||||||||||||

Net income (loss) |

$ | 57 | $ | 31 | 83.9 | % | $ | 153 | $ | (82) | 286.6 | % | |||||||||||||||||||||||

Net income (loss) attributable to stockholders |

$ | 54 | $ | 27 | 100.0 | % | $ | 146 | $ | (90) | 262.2 | % | |||||||||||||||||||||||

| Operating income | $ | 95 | $ | 85 | 12.3 | % | $ | 308 | $ | 67 | 358.9 | % | |||||||||||||||||||||||

| Operating income margin | 14.6 | % | 12.5 | % | 210 | bps | 15.6 | % | 3.3 | % | 1,230 | bps | |||||||||||||||||||||||

| Comparable Hotel Adjusted EBITDA | $ | 170 | $ | 173 | (1.9) | % | $ | 539 | $ | 512 | 5.2 | % | |||||||||||||||||||||||

| Comparable Hotel Adjusted EBITDA margin | 27.2 | % | 28.8 | % | (160) | bps | 28.3 | % | 28.2 | % | 10 | bps | |||||||||||||||||||||||

| Adjusted EBITDA | $ | 159 | $ | 163 | (2.5) | % | $ | 514 | $ | 496 | 3.6 | % | |||||||||||||||||||||||

| Adjusted FFO attributable to stockholders | $ | 102 | $ | 108 | (5.6) | % | $ | 350 | $ | 329 | 6.4 | % | |||||||||||||||||||||||

Earnings (loss) per share - Diluted(1) |

$ | 0.26 | $ | 0.13 | 100.0 | % | $ | 0.69 | $ | (0.42) | 264.3 | % | |||||||||||||||||||||||

Adjusted FFO per share – Diluted(1) |

$ | 0.49 | $ | 0.51 | (3.9) | % | $ | 1.67 | $ | 1.52 | 9.9 | % | |||||||||||||||||||||||

| Weighted average shares outstanding – Diluted | 208 | 212 | (4) | 210 | 216 | (6) | |||||||||||||||||||||||||||||

| (unaudited) | Comparable ADR | Comparable Occupancy | Comparable RevPAR | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hotels | Rooms | 3Q24 | 3Q23 | Change(1) |

3Q24 | 3Q23 | Change | 3Q24 | 3Q23 | Change(1) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hawaii | 2 | 3,507 | $ | 312.86 | $ | 322.09 | (2.9 | %) | 87.0 | % | 92.0 | % | (5.0 | % pts) | $ | 272.29 | $ | 296.29 | (8.1 | %) | |||||||||||||||||||||||||||||||||||||||||||||

| Orlando | 3 | 2,325 | 201.39 | 188.44 | 6.9 | 65.1 | 60.2 | 4.9 | 131.18 | 113.54 | 15.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New York | 1 | 1,878 | 304.42 | 302.44 | 0.7 | 91.1 | 92.2 | (1.1) | 277.19 | 278.78 | (0.6) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Orleans | 1 | 1,622 | 173.42 | 157.49 | 10.1 | 64.3 | 56.4 | 7.9 | 111.44 | 88.82 | 25.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Boston | 3 | 1,536 | 281.13 | 267.12 | 5.2 | 87.6 | 86.1 | 1.5 | 246.23 | 230.03 | 7.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Southern California | 5 | 1,773 | 250.89 | 263.09 | (4.6) | 85.0 | 79.6 | 5.4 | 213.29 | 209.58 | 1.8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Key West | 2 | 461 | 362.17 | 409.71 | (11.6) | 65.3 | 25.1 | 40.2 | 236.53 | 103.07 | 129.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Chicago | 3 | 2,467 | 237.93 | 227.83 | 4.4 | 77.1 | 69.4 | 7.7 | 183.56 | 158.20 | 16.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Puerto Rico | 1 | 652 | 264.86 | 269.92 | (1.9) | 68.5 | 67.2 | 1.3 | 181.39 | 181.41 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Washington, D.C. | 2 | 1,085 | 181.93 | 173.20 | 5.0 | 75.1 | 77.3 | (2.2) | 136.56 | 133.77 | 2.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Denver | 1 | 613 | 204.78 | 202.05 | 1.4 | 74.4 | 81.8 | (7.4) | 152.25 | 165.19 | (7.8) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Miami | 1 | 393 | 185.86 | 177.55 | 4.7 | 72.9 | 71.3 | 1.6 | 135.57 | 126.59 | 7.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Seattle | 2 | 1,246 | 182.67 | 187.14 | (2.4) | 86.0 | 82.5 | 3.5 | 157.16 | 154.39 | 1.8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| San Francisco | 2 | 660 | 234.95 | 255.48 | (8.0) | 74.9 | 78.6 | (3.7) | 176.00 | 200.81 | (12.4) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 9 | 2,850 | 179.45 | 181.78 | (1.3) | 72.8 | 70.1 | 2.7 | 130.58 | 127.50 | 2.4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All Markets | 38 | 23,068 | $ | 242.88 | $ | 242.89 | — | % | 78.1 | % | 75.6 | % | 2.5 | % pts | $ | 189.73 | $ | 183.64 | 3.3 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||

| 2024 vs 2023 | 2024 vs 2023 | ||||||||||

| Resort | 1.5 | % | 4.0 | % | |||||||

| Urban | 5.4 | 3.9 | |||||||||

| Airport | 0.5 | 4.9 | |||||||||

| Suburban | 8.6 | 7.5 | |||||||||

| All Types | 3.3 | 4.3 | |||||||||

| (unaudited, dollars in millions) | ||||||||||||||||||||||||||

| Debt | Collateral | Interest Rate | Maturity Date |

As of

September 30, 2024

|

||||||||||||||||||||||

| Fixed Rate Debt | ||||||||||||||||||||||||||

| Mortgage loan | Hilton Denver City Center | 4.90% | March 2025(1) |

$ | 53 | |||||||||||||||||||||

| Mortgage loan | Hyatt Regency Boston | 4.25% | July 2026 | 125 | ||||||||||||||||||||||

| Mortgage loan | DoubleTree Hotel Spokane City Center | 3.62% | July 2026 | 14 | ||||||||||||||||||||||

| Mortgage loan | Hilton Hawaiian Village Beach Resort | 4.20% | November 2026 | 1,275 | ||||||||||||||||||||||

| Mortgage loan | Hilton Santa Barbara Beachfront Resort | 4.17% | December 2026 | 157 | ||||||||||||||||||||||

| Mortgage loan | DoubleTree Hotel Ontario Airport | 5.37% | May 2027 | 30 | ||||||||||||||||||||||

| 2028 Senior Notes | Unsecured | 5.88% | October 2028 | 725 | ||||||||||||||||||||||

| 2029 Senior Notes | Unsecured | 4.88% | May 2029 | 750 | ||||||||||||||||||||||

| 2030 Senior Notes | Unsecured | 7.00% | February 2030 | 550 | ||||||||||||||||||||||

| Finance lease obligations | 7.44% | 2024 to 2028 | 1 | |||||||||||||||||||||||

| Total Fixed Rate Debt | 5.10%(2) |

3,680 | ||||||||||||||||||||||||

| Variable Rate Debt | ||||||||||||||||||||||||||

Revolver(3) |

Unsecured | SOFR + 1.80%(4) |

December 2026 | — | ||||||||||||||||||||||

| 2024 Term Loan | Unsecured | SOFR + 1.75%(4) |

May 2027 | 200 | ||||||||||||||||||||||

| Total Variable Rate Debt | 6.81% | 200 | ||||||||||||||||||||||||

| Add: unamortized premium | — | |||||||||||||||||||||||||

| Less: unamortized deferred financing costs and discount | (25) | |||||||||||||||||||||||||

Total Debt(5)(6) |

5.19%(2) |

$ | 3,855 | |||||||||||||||||||||||

| (dollars in millions) | ||||||||||||||||||||||||||||||||

Projects & Scope of Work |

Estimated Start Date |

Estimated

Completion Date

|

Budget | Total Incurred | ||||||||||||||||||||||||||||

| Hilton Hawaiian Village Waikiki Beach Resort | ||||||||||||||||||||||||||||||||

Phase 1: Renovation of 392 guestrooms and the addition of 12 guestrooms through the conversion of suites to increase room count at the Rainbow Tower to 808 |

Q3 2024 | Q1 2025 | $ | 44 | $ | 17 | ||||||||||||||||||||||||||

Phase 2: Renovation of 404 guestrooms and the addition of 14 guestrooms through the conversion of suites to increase room count at the Rainbow Tower to 822 |

Q3 2025 | Q1 2026 | $ | 43 | $ | — | ||||||||||||||||||||||||||

Lobby renovation: Renovation of the Rainbow Tower lobby |

Q3 2025 | Q1 2026 | $ | 1 | $ | — | ||||||||||||||||||||||||||

| Hilton Waikoloa Village | ||||||||||||||||||||||||||||||||

Phase 1: Renovation of 197 guestrooms and the addition of 6 guestrooms through the conversion of suites to increase room count at the Palace Tower to 406 |

Q3 2024 | Q4 2024 | $ | 32 | $ | 12 | ||||||||||||||||||||||||||

Phase 2: Renovation of 203 guestrooms and the addition of 5 guestrooms through the conversion of suites to increase room count at the Palace Tower to 411 |

Q3 2025 | Q4 2025 | $ | 33 | $ | — | ||||||||||||||||||||||||||

Lobby renovation: Renovation of the Palace Tower lobby |

Q3 2025 | Q4 2025 | $ | 3 | — | |||||||||||||||||||||||||||

| Hilton New Orleans Riverside | ||||||||||||||||||||||||||||||||

Phase 1: Renovation of 250 guestrooms at the 1,167-room Main Tower |

Q3 2024 | Q4 2024 | $ | 16 | $ | 12 | ||||||||||||||||||||||||||

Phase 2: Renovation of 437 guestrooms at the 1,167-room Main Tower |

Q2 2025 | Q3 2025 | $ | 31 | $ | — | ||||||||||||||||||||||||||

| September 30, 2024 | December 31, 2023 | ||||||||||

| (unaudited) | |||||||||||

| ASSETS | |||||||||||

| Property and equipment, net | $ | 7,413 | $ | 7,459 | |||||||

| Contract asset | 804 | 760 | |||||||||

| Intangibles, net | 42 | 42 | |||||||||

| Cash and cash equivalents | 480 | 717 | |||||||||

| Restricted cash | 38 | 33 | |||||||||

Accounts receivable, net of allowance for doubtful accounts of $3 and $3 |

124 | 112 | |||||||||

| Prepaid expenses | 57 | 59 | |||||||||

| Other assets | 38 | 40 | |||||||||

| Operating lease right-of-use assets | 177 | 197 | |||||||||

TOTAL ASSETS (variable interest entities – $231 and $236) |

$ | 9,173 | $ | 9,419 | |||||||

| LIABILITIES AND EQUITY | |||||||||||

| Liabilities | |||||||||||

| Debt | $ | 3,855 | $ | 3,765 | |||||||

| Debt associated with hotels in receivership | 725 | 725 | |||||||||

| Accrued interest associated with hotels in receivership | 79 | 35 | |||||||||

| Accounts payable and accrued expenses | 240 | 210 | |||||||||

| Dividends payable | 57 | 362 | |||||||||

| Due to hotel managers | 111 | 131 | |||||||||

| Other liabilities | 187 | 200 | |||||||||

| Operating lease liabilities | 212 | 223 | |||||||||

Total liabilities (variable interest entities – $215 and $218) |

5,466 | 5,651 | |||||||||

| Stockholders' Equity | |||||||||||

Common stock, par value $0.01 per share, 6,000,000,000 shares authorized, 207,257,541 shares issued and 206,403,675 shares outstanding as of September 30, 2024 and 210,676,264 shares issued and 209,987,581 shares outstanding as of December 31, 2023 |

2 | 2 | |||||||||

| Additional paid-in capital | 4,103 | 4,156 | |||||||||

| Accumulated deficit | (353) | (344) | |||||||||

| Total stockholders' equity | 3,752 | 3,814 | |||||||||

| Noncontrolling interests | (45) | (46) | |||||||||

| Total equity | 3,707 | 3,768 | |||||||||

| TOTAL LIABILITIES AND EQUITY | $ | 9,173 | $ | 9,419 | |||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Revenues | |||||||||||||||||||||||

| Rooms | $ | 403 | $ | 432 | $ | 1,193 | $ | 1,256 | |||||||||||||||

| Food and beverage | 157 | 159 | 521 | 518 | |||||||||||||||||||

| Ancillary hotel | 68 | 66 | 196 | 203 | |||||||||||||||||||

| Other | 21 | 22 | 64 | 64 | |||||||||||||||||||

| Total revenues | 649 | 679 | 1,974 | 2,041 | |||||||||||||||||||

| Operating expenses | |||||||||||||||||||||||

| Rooms | 107 | 119 | 314 | 343 | |||||||||||||||||||

| Food and beverage | 112 | 122 | 356 | 377 | |||||||||||||||||||

| Other departmental and support | 154 | 161 | 454 | 484 | |||||||||||||||||||

| Other property | 65 | 59 | 174 | 182 | |||||||||||||||||||

| Management fees | 30 | 31 | 93 | 95 | |||||||||||||||||||

| Impairment and casualty loss | — | — | 13 | 204 | |||||||||||||||||||

| Depreciation and amortization | 63 | 65 | 192 | 193 | |||||||||||||||||||

| Corporate general and administrative | 17 | 18 | 52 | 50 | |||||||||||||||||||

| Other | 21 | 19 | 62 | 61 | |||||||||||||||||||

| Total expenses | 569 | 594 | 1,710 | 1,989 | |||||||||||||||||||

| Gain on sale of assets, net | — | — | — | 15 | |||||||||||||||||||

| Gain on derecognition of assets | 15 | — | 44 | — | |||||||||||||||||||

| Operating income | 95 | 85 | 308 | 67 | |||||||||||||||||||

| Interest income | 6 | 9 | 16 | 29 | |||||||||||||||||||

| Interest expense | (54) | (51) | (161) | (155) | |||||||||||||||||||

| Interest expense associated with hotels in receivership | (15) | (14) | (44) | (31) | |||||||||||||||||||

| Equity in earnings from investments in affiliates | 28 | 2 | 29 | 9 | |||||||||||||||||||

| Other (loss) gain, net | (1) | — | (4) | 4 | |||||||||||||||||||

| Income (loss) before income taxes | 59 | 31 | 144 | (77) | |||||||||||||||||||

| Income tax (expense) benefit | (2) | — | 9 | (5) | |||||||||||||||||||

| Net income (loss) | 57 | 31 | 153 | (82) | |||||||||||||||||||

| Net income attributable to noncontrolling interests | (3) | (4) | (7) | (8) | |||||||||||||||||||

| Net income (loss) attributable to stockholders | $ | 54 | $ | 27 | $ | 146 | $ | (90) | |||||||||||||||

| Earnings (loss) per share: | |||||||||||||||||||||||

| Earnings (loss) per share - Basic | $ | 0.26 | $ | 0.13 | $ | 0.70 | $ | (0.42) | |||||||||||||||

| Earnings (loss) per share - Diluted | $ | 0.26 | $ | 0.13 | $ | 0.69 | $ | (0.42) | |||||||||||||||

| Weighted average shares outstanding – Basic | 206 | 212 | 208 | 216 | |||||||||||||||||||

| Weighted average shares outstanding – Diluted | 208 | 212 | 210 | 216 | |||||||||||||||||||

| (unaudited, in millions) | Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Net income (loss) | $ | 57 | $ | 31 | $ | 153 | $ | (82) | |||||||||||||||

| Depreciation and amortization expense | 63 | 65 | 192 | 193 | |||||||||||||||||||

| Interest income | (6) | (9) | (16) | (29) | |||||||||||||||||||

| Interest expense | 54 | 51 | 161 | 155 | |||||||||||||||||||

Interest expense associated with hotels in receivership(1) |

15 | 14 | 44 | 31 | |||||||||||||||||||

| Income tax expense (benefit) | 2 | — | (9) | 5 | |||||||||||||||||||

| Interest expense, income tax and depreciation and amortization included in equity in earnings from investments in affiliates | 4 | 2 | 9 | 7 | |||||||||||||||||||

| EBITDA | 189 | 154 | 534 | 280 | |||||||||||||||||||

Gain on sales of assets, net(2) |

(19) | — | (19) | (15) | |||||||||||||||||||

Gain on derecognition of assets(1) |

(15) | — | (44) | — | |||||||||||||||||||

Gain on sale of investments in affiliates(3) |

— | — | — | (3) | |||||||||||||||||||

| Share-based compensation expense | 5 | 5 | 14 | 14 | |||||||||||||||||||

| Impairment and casualty loss | — | — | 13 | 204 | |||||||||||||||||||

| Other items | (1) | 4 | 16 | 16 | |||||||||||||||||||

| Adjusted EBITDA | $ | 159 | $ | 163 | $ | 514 | $ | 496 | |||||||||||||||

| (unaudited, dollars in millions) | Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Adjusted EBITDA | $ | 159 | $ | 163 | $ | 514 | $ | 496 | |||||||||||||||

| Less: Adjusted EBITDA from investments in affiliates | (3) | (4) | (19) | (19) | |||||||||||||||||||

Add: All other(1) |

12 | 14 | 41 | 40 | |||||||||||||||||||

| Hotel Adjusted EBITDA | 168 | 173 | 536 | 517 | |||||||||||||||||||

| Less: Adjusted EBITDA from hotels disposed of | 2 | 1 | 3 | — | |||||||||||||||||||

| Less: Adjusted EBITDA from the Hilton San Francisco Hotels | — | (1) | — | (5) | |||||||||||||||||||

| Comparable Hotel Adjusted EBITDA | $ | 170 | $ | 173 | $ | 539 | $ | 512 | |||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Total Revenues | $ | 649 | $ | 679 | $ | 1,974 | $ | 2,041 | |||||||||||||||

| Less: Other revenue | (21) | (22) | (64) | (64) | |||||||||||||||||||

| Less: Revenues from hotels disposed of | (3) | (4) | (9) | (20) | |||||||||||||||||||

| Less: Revenues from the Hilton San Francisco Hotels | — | (51) | — | (145) | |||||||||||||||||||

| Comparable Hotel Revenues | $ | 625 | $ | 602 | $ | 1,901 | $ | 1,812 | |||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||

| 2024 | 2023 | Change(2) |

2024 | 2023 | Change(2) |

||||||||||||||||||||||||||||||

| Total Revenues | $ | 649 | $ | 679 | (4.4) | % | $ | 1,974 | $ | 2,041 | (3.3) | % | |||||||||||||||||||||||

| Operating income | $ | 95 | $ | 85 | 12.3 | % | $ | 308 | $ | 67 | 358.9 | % | |||||||||||||||||||||||

Operating income margin(2) |

14.6 | % | 12.5 | % | 210 | bps | 15.6 | % | 3.3 | % | 1,230 | bps | |||||||||||||||||||||||

| Comparable Hotel Revenues | $ | 625 | $ | 602 | 3.8 | % | $ | 1,901 | $ | 1,812 | 4.9 | % | |||||||||||||||||||||||

| Comparable Hotel Adjusted EBITDA | $ | 170 | $ | 173 | (1.9) | % | $ | 539 | $ | 512 | 5.2 | % | |||||||||||||||||||||||

Comparable Hotel Adjusted EBITDA margin(2) |

27.2 | % | 28.8 | % | (160) | bps | 28.3 | % | 28.2 | % | 10 | bps | |||||||||||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Net income (loss) attributable to stockholders | $ | 54 | $ | 27 | $ | 146 | $ | (90) | |||||||||||||||

| Depreciation and amortization expense | 63 | 65 | 192 | 193 | |||||||||||||||||||

| Depreciation and amortization expense attributable to noncontrolling interests | (1) | (1) | (3) | (3) | |||||||||||||||||||

| Gain on sales of assets, net | — | — | — | (15) | |||||||||||||||||||

Gain on derecognition of assets(1) |

(15) | — | (44) | — | |||||||||||||||||||

Gain on sale of investments in affiliates(2) |

— | — | — | (3) | |||||||||||||||||||

| Impairment loss | — | — | 12 | 202 | |||||||||||||||||||

| Equity investment adjustments: | |||||||||||||||||||||||

| Equity in earnings from investments in affiliates | (28) | (2) | (29) | (9) | |||||||||||||||||||

| Pro rata FFO of investments in affiliates | 9 | 2 | 14 | 12 | |||||||||||||||||||

| Nareit FFO attributable to stockholders | 82 | 91 | 288 | 287 | |||||||||||||||||||

| Casualty loss | — | — | 1 | 2 | |||||||||||||||||||

| Share-based compensation expense | 5 | 5 | 14 | 14 | |||||||||||||||||||

Interest expense associated with hotels in receivership(1) |

15 | 6 | 44 | 8 | |||||||||||||||||||

Other items |

— | 6 | 3 | 18 | |||||||||||||||||||

| Adjusted FFO attributable to stockholders | $ | 102 | $ | 108 | $ | 350 | $ | 329 | |||||||||||||||

Nareit FFO per share – Diluted(3) |

$ | 0.40 | $ | 0.43 | $ | 1.37 | $ | 1.33 | |||||||||||||||

Adjusted FFO per share – Diluted(3) |

$ | 0.49 | $ | 0.51 | $ | 1.67 | $ | 1.52 | |||||||||||||||

| Weighted average shares outstanding – Diluted | 208 | 212 | 210 | 216 | |||||||||||||||||||

| (unaudited, in millions) | |||||

September 30, 2024 |

|||||

| Debt | $ | 3,855 | |||

| Add: unamortized deferred financing costs and discount | 25 | ||||

| Less: unamortized premium | — | ||||

| Debt, excluding unamortized deferred financing cost, premiums and discounts

|

3,880 | ||||

Add: Park's share of unconsolidated affiliates debt, excluding unamortized deferred financing costs |

157 | ||||

| Less: cash and cash equivalents | (480) | ||||

| Less: restricted cash | (38) | ||||

| Net Debt | $ | 3,519 | |||

| About Park and Safe Harbor Disclosure | ||||||||

2 |

|

|||||||

|

||||||||||||||

| Table of Contents | ||||||||||||||

| 8. Analyst Coverage | ||||||||||||||

3 |

|

|||||||

| Financial Statements | |||||

4 |

|

|||||||

| Financial Statements | ||||||||

Condensed Consolidated Balance Sheets |

||||||||

| (in millions, except share and per share data) | September 30, 2024 | December 31, 2023 | |||||||||

| (unaudited) | |||||||||||

| ASSETS | |||||||||||

| Property and equipment, net | $ | 7,413 | $ | 7,459 | |||||||

| Contract asset | 804 | 760 | |||||||||

| Intangibles, net | 42 | 42 | |||||||||

| Cash and cash equivalents | 480 | 717 | |||||||||

| Restricted cash | 38 | 33 | |||||||||

Accounts receivable, net of allowance for doubtful accounts of $3 and $3 |

124 | 112 | |||||||||

| Prepaid expenses | 57 | 59 | |||||||||

| Other assets | 38 | 40 | |||||||||

| Operating lease right-of-use assets | 177 | 197 | |||||||||

TOTAL ASSETS (variable interest entities – $231 and $236) |

$ | 9,173 | $ | 9,419 | |||||||

| LIABILITIES AND EQUITY | |||||||||||

| Liabilities | |||||||||||

| Debt | $ | 3,855 | $ | 3,765 | |||||||

| Debt associated with hotels in receivership | 725 | 725 | |||||||||

| Accrued interest associated with hotels in receivership | 79 | 35 | |||||||||

| Accounts payable and accrued expenses | 240 | 210 | |||||||||

| Dividends payable | 57 | 362 | |||||||||

| Due to hotel managers | 111 | 131 | |||||||||

| Other liabilities | 187 | 200 | |||||||||

| Operating lease liabilities | 212 | 223 | |||||||||

Total liabilities (variable interest entities – $215 and $218) |

5,466 | 5,651 | |||||||||

| Stockholders' Equity | |||||||||||

Common stock, par value $0.01 per share, 6,000,000,000 shares authorized, 207,257,541 shares issued and 206,403,675 shares outstanding as of September 30, 2024 and 210,676,264 shares issued and 209,987,581 shares outstanding as of December 31, 2023 |

2 | 2 | |||||||||

| Additional paid-in capital | 4,103 | 4,156 | |||||||||

| Accumulated deficit | (353) | (344) | |||||||||

| Total stockholders' equity | 3,752 | 3,814 | |||||||||

| Noncontrolling interests | (45) | (46) | |||||||||

| Total equity | 3,707 | 3,768 | |||||||||

| TOTAL LIABILITIES AND EQUITY | $ | 9,173 | $ | 9,419 | |||||||

5 |

|

|||||||

| Financial Statements (continued) | ||||||||

Condensed Consolidated Statements of Operations |

||||||||

| (unaudited, in millions, except per share data) | ||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Revenues | |||||||||||||||||||||||

| Rooms | $ | 403 | $ | 432 | $ | 1,193 | $ | 1,256 | |||||||||||||||

| Food and beverage | 157 | 159 | 521 | 518 | |||||||||||||||||||

| Ancillary hotel | 68 | 66 | 196 | 203 | |||||||||||||||||||

| Other | 21 | 22 | 64 | 64 | |||||||||||||||||||

| Total revenues | 649 | 679 | 1,974 | 2,041 | |||||||||||||||||||

| Operating expenses | |||||||||||||||||||||||

| Rooms | 107 | 119 | 314 | 343 | |||||||||||||||||||

| Food and beverage | 112 | 122 | 356 | 377 | |||||||||||||||||||

| Other departmental and support | 154 | 161 | 454 | 484 | |||||||||||||||||||

| Other property | 65 | 59 | 174 | 182 | |||||||||||||||||||

| Management fees | 30 | 31 | 93 | 95 | |||||||||||||||||||

| Impairment and casualty loss | — | — | 13 | 204 | |||||||||||||||||||

| Depreciation and amortization | 63 | 65 | 192 | 193 | |||||||||||||||||||

| Corporate general and administrative | 17 | 18 | 52 | 50 | |||||||||||||||||||

| Other | 21 | 19 | 62 | 61 | |||||||||||||||||||

| Total expenses | 569 | 594 | 1,710 | 1,989 | |||||||||||||||||||

| Gain on sale of assets, net | — | — | — | 15 | |||||||||||||||||||

| Gain on derecognition of assets | 15 | — | 44 | — | |||||||||||||||||||

| Operating income | 95 | 85 | 308 | 67 | |||||||||||||||||||

| Interest income | 6 | 9 | 16 | 29 | |||||||||||||||||||

| Interest expense | (54) | (51) | (161) | (155) | |||||||||||||||||||

| Interest expense associated with hotels in receivership | (15) | (14) | (44) | (31) | |||||||||||||||||||

| Equity in earnings from investments in affiliates | 28 | 2 | 29 | 9 | |||||||||||||||||||

| Other (loss) gain, net | (1) | — | (4) | 4 | |||||||||||||||||||

| Income (loss) before income taxes | 59 | 31 | 144 | (77) | |||||||||||||||||||

| Income tax (expense) benefit | (2) | — | 9 | (5) | |||||||||||||||||||

| Net income (loss) | 57 | 31 | 153 | (82) | |||||||||||||||||||

| Net income attributable to noncontrolling interests | (3) | (4) | (7) | (8) | |||||||||||||||||||

| Net income (loss) attributable to stockholders | $ | 54 | $ | 27 | $ | 146 | $ | (90) | |||||||||||||||

| Earnings (loss) per share: | |||||||||||||||||||||||

| Earnings (loss) per share – Basic | $ | 0.26 | $ | 0.13 | $ | 0.70 | $ | (0.42) | |||||||||||||||

| Earnings (loss) per share – Diluted | $ | 0.26 | $ | 0.13 | $ | 0.69 | $ | (0.42) | |||||||||||||||

| Weighted average shares outstanding – Basic | 206 | 212 | 208 | 216 | |||||||||||||||||||

| Weighted average shares outstanding – Diluted | 208 | 212 | 210 | 216 | |||||||||||||||||||

6 |

|

|||||||

| Supplementary Financial Information | |||||

7 |

|

|||||||

| Supplementary Financial Information | ||||||||

| EBITDA and Adjusted EBITDA | ||||||||

| (unaudited, in millions) | Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Net income (loss) | $ | 57 | $ | 31 | $ | 153 | $ | (82) | |||||||||||||||

| Depreciation and amortization expense | 63 | 65 | 192 | 193 | |||||||||||||||||||

| Interest income | (6) | (9) | (16) | (29) | |||||||||||||||||||

| Interest expense | 54 | 51 | 161 | 155 | |||||||||||||||||||

Interest expense associated with hotels in receivership(1) |

15 | 14 | 44 | 31 | |||||||||||||||||||

| Income tax expense (benefit) | 2 | — | (9) | 5 | |||||||||||||||||||

Interest expense, income tax and depreciation and amortization included in equity in earnings from investments in affiliates |

4 | 2 | 9 | 7 | |||||||||||||||||||

| EBITDA | 189 | 154 | 534 | 280 | |||||||||||||||||||

Gain on sale of assets, net(2) |

(19) | — | (19) | (15) | |||||||||||||||||||

Gain on derecognition of assets(1) |

(15) | — | (44) | — | |||||||||||||||||||

Gain on sale of investments in affiliates(3) |

— | — | — | (3) | |||||||||||||||||||

| Share-based compensation expense | 5 | 5 | 14 | 14 | |||||||||||||||||||

| Impairment and casualty loss | — | — | 13 | 204 | |||||||||||||||||||

| Other items | (1) | 4 | 16 | 16 | |||||||||||||||||||

| Adjusted EBITDA | $ | 159 | $ | 163 | $ | 514 | $ | 496 | |||||||||||||||

8 |

|

|||||||

| Supplementary Financial Information (continued) | ||||||||

Comparable Hotel Adjusted EBITDA and Comparable Hotel Adjusted EBITDA Margin |

||||||||

| (unaudited, dollars in millions) | |||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Adjusted EBITDA | $ | 159 | $ | 163 | $ | 514 | $ | 496 | |||||||||||||||

| Less: Adjusted EBITDA from investments in affiliates | (3) | (4) | (19) | (19) | |||||||||||||||||||

Add: All other(1) |

12 | 14 | 41 | 40 | |||||||||||||||||||

| Hotel Adjusted EBITDA | 168 | 173 | 536 | 517 | |||||||||||||||||||

| Less: Adjusted EBITDA from hotels disposed of | 2 | 1 | 3 | — | |||||||||||||||||||

| Less: Adjusted EBITDA from the Hilton San Francisco Hotels | — | (1) | — | (5) | |||||||||||||||||||

Comparable Hotel Adjusted EBITDA |

$ | 170 | $ | 173 | $ | 539 | $ | 512 | |||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Total Revenues | $ | 649 | $ | 679 | $ | 1,974 | $ | 2,041 | |||||||||||||||

| Less: Other revenue | (21) | (22) | (64) | (64) | |||||||||||||||||||

| Less: Revenues from hotels disposed of | (3) | (4) | (9) | (20) | |||||||||||||||||||

| Less: Revenue from the Hilton San Francisco Hotels | — | (51) | — | (145) | |||||||||||||||||||

Comparable Hotel Revenues |

$ | 625 | $ | 602 | $ | 1,901 | $ | 1,812 | |||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||

| 2024 | 2023 | Change(2) |

2024 | 2023 | Change(2) |

||||||||||||||||||||||||||||||

| Total Revenues | $ | 649 | $ | 679 | (4.4) | % | $ | 1,974 | $ | 2,041 | (3.3) | % | |||||||||||||||||||||||

| Operating income | $ | 95 | $ | 85 | 12.3 | % | $ | 308 | $ | 67 | 358.9 | % | |||||||||||||||||||||||

Operating income margin(2) |

14.6 | % | 12.5 | % | 210 | bps | 15.6 | % | 3.3 | % | 1,230 | bps | |||||||||||||||||||||||

Comparable Hotel Revenues |

$ | 625 | $ | 602 | 3.8 | % | $ | 1,901 | $ | 1,812 | 4.9 | % | |||||||||||||||||||||||

Comparable Hotel Adjusted EBITDA |

$ | 170 | $ | 173 | (1.9) | % | $ | 539 | $ | 512 | 5.2 | % | |||||||||||||||||||||||

Comparable Hotel Adjusted EBITDA margin(2) |

27.2 | % | 28.8 | % | (160) | bps | 28.3 | % | 28.2 | % | 10 | bps | |||||||||||||||||||||||

9 |

|

|||||||

| Supplementary Financial Information (continued) | ||||||||

| Nareit FFO and Adjusted FFO | ||||||||

(unaudited, in millions, except per share data) |

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||

| 2024 | 2023 | 2023 | 2022 | ||||||||||||||||||||

| Net income (loss) attributable to stockholders | $ | 54 | $ | 27 | $ | 146 | $ | (90) | |||||||||||||||

| Depreciation and amortization expense | 63 | 65 | 192 | 193 | |||||||||||||||||||

Depreciation and amortization expense attributable to noncontrolling interests |

(1) | (1) | (3) | (3) | |||||||||||||||||||

| Gain on sale of assets, net | — | — | — | (15) | |||||||||||||||||||

Gain on derecognition of assets(1) |

(15) | — | (44) | — | |||||||||||||||||||

Gain on sale of investments in affiliates(2) |

— | — | — | (3) | |||||||||||||||||||

| Impairment loss | — | — | 12 | 202 | |||||||||||||||||||

| Equity investment adjustments: | |||||||||||||||||||||||

| Equity in earnings from investments in affiliates | (28) | (2) | (29) | (9) | |||||||||||||||||||

| Pro rata FFO of investments in affiliates | 9 | 2 | 14 | 12 | |||||||||||||||||||

| Nareit FFO attributable to stockholders | 82 | 91 | 288 | 287 | |||||||||||||||||||

| Casualty loss | — | — | 1 | 2 | |||||||||||||||||||

| Share-based compensation expense | 5 | 5 | 14 | 14 | |||||||||||||||||||

Interest expense associated with hotels in receivership(1) |

15 | 6 | 44 | 8 | |||||||||||||||||||

| Other items | — | 6 | 3 | 18 | |||||||||||||||||||

| Adjusted FFO attributable to stockholders | $ | 102 | $ | 108 | $ | 350 | $ | 329 | |||||||||||||||

Nareit FFO per share – Diluted(3) |

$ | 0.40 | $ | 0.43 | $ | 1.37 | $ | 1.33 | |||||||||||||||

Adjusted FFO per share – Diluted(3) |

$ | 0.49 | $ | 0.51 | $ | 1.67 | $ | 1.52 | |||||||||||||||

Weighted average shares outstanding – Diluted(4) |

208 | 212 | 210 | 216 | |||||||||||||||||||

10 |

|

|||||||

| Supplementary Financial Information (continued) | ||||||||

| General and Administrative Expenses | ||||||||

| (unaudited, in millions) | Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Corporate general and administrative expenses | $ | 17 | $ | 18 | $ | 52 | $ | 50 | |||||||||||||||

| Less: | |||||||||||||||||||||||

| Share-based compensation expense | 5 | 5 | 14 | 14 | |||||||||||||||||||

| Other corporate expenses | 1 | — | 3 | 2 | |||||||||||||||||||

| G&A, excluding expenses not included in Adjusted EBITDA | $ | 11 | $ | 13 | $ | 35 | $ | 34 | |||||||||||||||

11 |

|

|||||||

| Supplementary Financial Information (continued) | ||||||||

| Net Debt and Net Debt to Comparable Adjusted EBITDA Ratio | ||||||||

| (unaudited, in millions) | |||||||||||

September 30, 2024 |

December 31, 2023 | ||||||||||

| Debt | $ | 3,855 | $ | 3,765 | |||||||

| Add: unamortized deferred financing costs and discount | 25 | 22 | |||||||||

| Less: unamortized premium | — | (1) | |||||||||

Debt, excluding unamortized deferred financing cost, premiums and discounts |

3,880 | 3,786 | |||||||||

Add: Park's share of unconsolidated affiliates debt, excluding unamortized deferred financing costs(1) |

157 | 147 | |||||||||

Less: cash and cash equivalents(2) |

(480) | (555) | |||||||||

| Less: restricted cash | (38) | (33) | |||||||||

| Net Debt | $ | 3,519 | $ | 3,345 | |||||||

TTM Comparable Adjusted EBITDA(3) |

$ | 679 | $ | 652 | |||||||

| Net Debt to TTM Comparable Adjusted EBITDA ratio | 5.18x | 5.13x | |||||||||

12 |

|

|||||||

Portfolio and Operating Metrics |

|||||

13 |

|

|||||||

| Portfolio and Operating Metrics | ||||||||

Hotel Portfolio as of October 29, 2024 |

||||||||

| Hotel Name | Total Rooms | Market |

Meeting Space

(square feet)

|

Ownership | Equity Ownership |

Debt

(in millions)

|

|||||||||||||||||||||||||||||

| Comparable Portfolio | |||||||||||||||||||||||||||||||||||

| Hilton Hawaiian Village Waikiki Beach Resort | 2,860 | Hawaii | 150,000 | Fee Simple | 100% | $ | 1,275 | ||||||||||||||||||||||||||||

| New York Hilton Midtown | 1,878 | New York | 151,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| Hilton New Orleans Riverside | 1,622 | New Orleans | 158,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| Hilton Chicago | 1,544 | Chicago | 234,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| Signia by Hilton Orlando Bonnet Creek | 1,009 | Orlando | 234,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| DoubleTree Hotel Seattle Airport | 850 | Seattle | 41,000 | Leasehold | 100% | — | |||||||||||||||||||||||||||||

| Hilton Orlando Lake Buena Vista | 814 | Orlando | 86,000 | Leasehold | 100% | — | |||||||||||||||||||||||||||||

| Caribe Hilton | 652 | Puerto Rico | 65,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| Hilton Waikoloa Village | 647 | Hawaii | 241,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| DoubleTree Hotel Washington DC – Crystal City | 627 | Washington, D.C. | 36,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

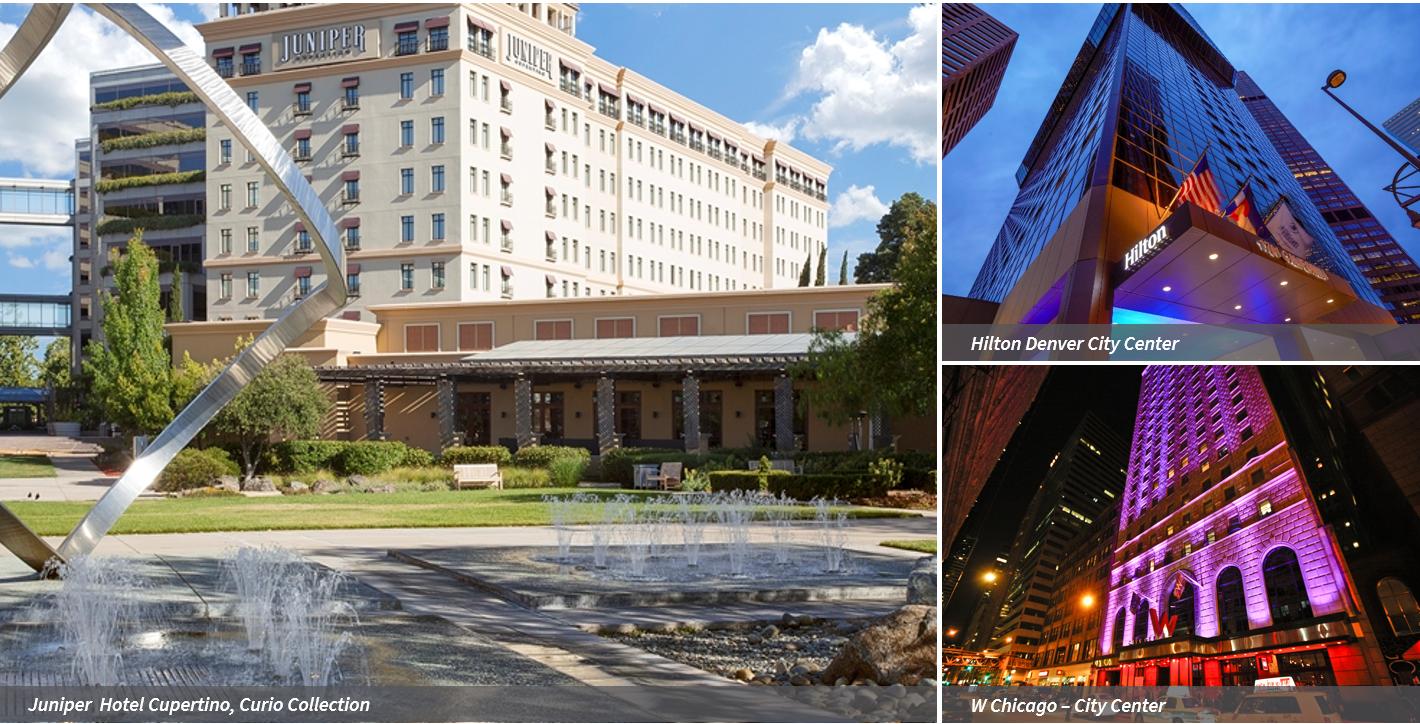

| Hilton Denver City Center | 613 | Denver | 50,000 | Fee Simple | 100% | $ | 53 | ||||||||||||||||||||||||||||

| Hilton Boston Logan Airport | 604 | Boston | 30,000 | Leasehold | 100% | — | |||||||||||||||||||||||||||||

| W Chicago – Lakeshore | 520 | Chicago | 20,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| DoubleTree Hotel San Jose | 505 | Other U.S. | 48,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| Hyatt Regency Boston | 502 | Boston | 30,000 | Fee Simple | 100% | $ | 125 | ||||||||||||||||||||||||||||

| Waldorf Astoria Orlando | 502 | Orlando | 62,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| Hilton Salt Lake City Center | 500 | Other U.S. | 24,000 | Leasehold | 100% | — | |||||||||||||||||||||||||||||

| DoubleTree Hotel Ontario Airport | 482 | Southern California | 27,000 | Fee Simple | 67% | $ | 30 | ||||||||||||||||||||||||||||

| Hilton McLean Tysons Corner | 458 | Washington, D.C. | 28,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| Hyatt Regency Mission Bay Spa and Marina | 438 | Southern California | 24,000 | Leasehold | 100% | — | |||||||||||||||||||||||||||||

| Boston Marriott Newton | 430 | Boston | 34,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| W Chicago – City Center | 403 | Chicago | 13,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| Hilton Seattle Airport & Conference Center | 396 | Seattle | 40,000 | Leasehold | 100% | — | |||||||||||||||||||||||||||||

| Royal Palm South Beach Miami, a Tribute Portfolio Resort | 393 | Miami | 11,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| DoubleTree Hotel Spokane City Center | 375 | Other U.S. | 21,000 | Fee Simple | 10% | $ | 14 | ||||||||||||||||||||||||||||

| Hilton Santa Barbara Beachfront Resort | 360 | Southern California | 62,000 | Fee Simple | 50% | $ | 157 | ||||||||||||||||||||||||||||

| JW Marriott San Francisco Union Square | 344 | San Francisco | 12,000 | Leasehold | 100% | — | |||||||||||||||||||||||||||||

| Hyatt Centric Fisherman's Wharf | 316 | San Francisco | 19,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| Hilton Short Hills | 314 | Other U.S. | 21,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| Casa Marina Key West, Curio Collection | 311 | Key West | 53,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

14 |

|

|||||||

| Portfolio and Operating Metrics (continued) | ||||||||

Hotel Portfolio as of October 29, 2024 |

||||||||

| Hotel Name | Total Rooms | Market |

Meeting Space

(square feet)

|

Ownership | Equity Ownership |

Debt(1)

(in millions)

|

|||||||||||||||||||||||||||||

| Comparable Portfolio (continued) | |||||||||||||||||||||||||||||||||||

| DoubleTree Hotel San Diego – Mission Valley | 300 | Southern California | 24,000 | Leasehold | 100% | — | |||||||||||||||||||||||||||||

| Embassy Suites Kansas City Plaza | 266 | Other U.S. | 11,000 | Leasehold | 100% | — | |||||||||||||||||||||||||||||

| Embassy Suites Austin Downtown South Congress | 262 | Other U.S. | 2,000 | Leasehold | 100% | — | |||||||||||||||||||||||||||||

| DoubleTree Hotel Sonoma Wine Country | 245 | Other U.S. | 27,000 | Leasehold | 100% | — | |||||||||||||||||||||||||||||

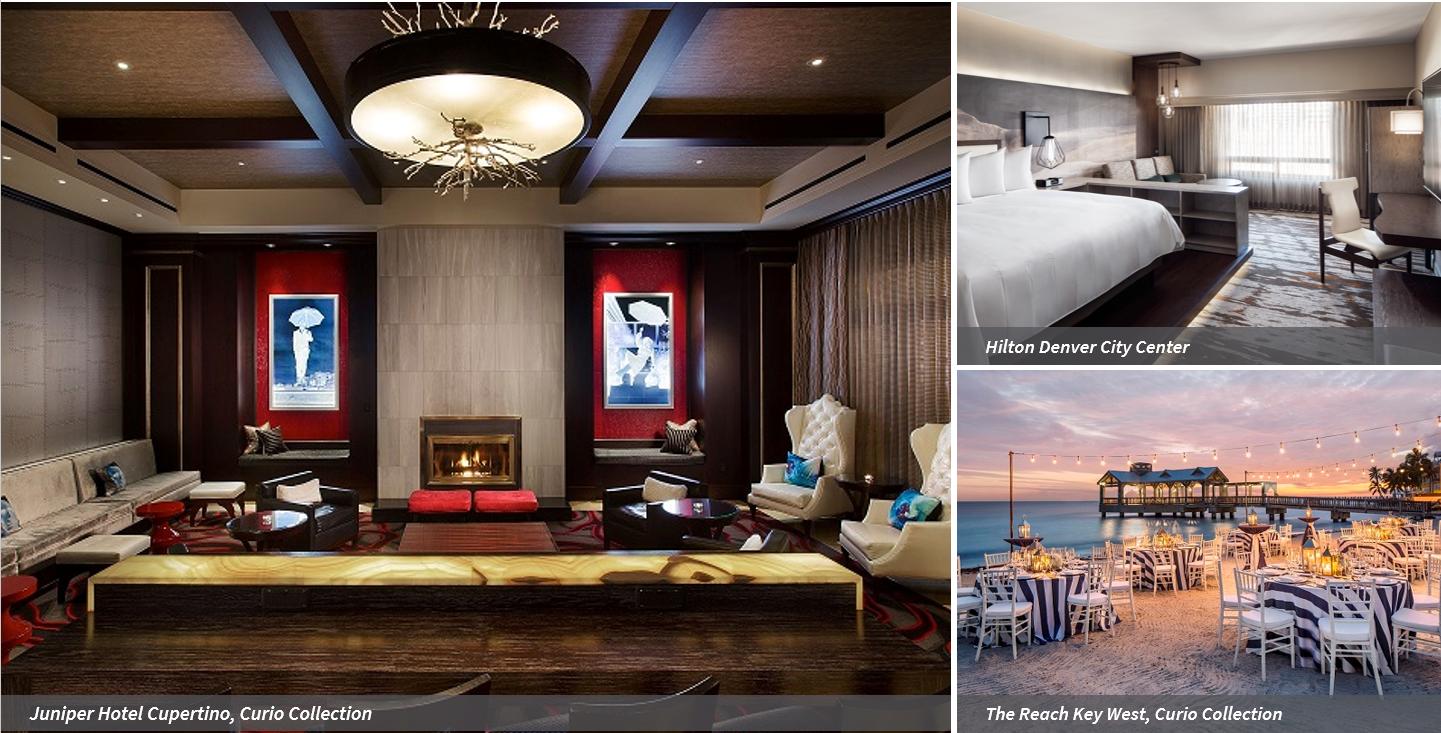

| Juniper Hotel Cupertino, Curio Collection | 224 | Other U.S. | 5,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| Hilton Checkers Los Angeles | 193 | Southern California | 3,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| DoubleTree Hotel Durango | 159 | Other U.S. | 7,000 | Leasehold | 100% | — | |||||||||||||||||||||||||||||

| The Reach Key West, Curio Collection | 150 | Key West | 18,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| Total Comparable Portfolio (38 Hotels) | 23,068 | 2,122,000 | $ | 1,654 | |||||||||||||||||||||||||||||||

| Unconsolidated Joint Venture Portfolio | |||||||||||||||||||||||||||||||||||

| Hilton Orlando | 1,424 | Orlando | 236,000 | Fee Simple | 20% | $ | 105 | ||||||||||||||||||||||||||||

| Capital Hilton | 559 | Washington, D.C. | 30,000 | Fee Simple | 25% | $ | 27 | ||||||||||||||||||||||||||||

| Embassy Suites Alexandria Old Town | 288 | Washington, D.C. | 11,000 | Fee Simple | 50% | $ | 25 | ||||||||||||||||||||||||||||

| Total Unconsolidated Joint Venture Portfolio (3 Hotels) | 2,271 | 277,000 | $ | 157 | |||||||||||||||||||||||||||||||

| Grand Total (41 Hotels) | 25,339 | 2,399,000 | $ | 1,811 | |||||||||||||||||||||||||||||||

15 |

|

|||||||

| Portfolio and Operating Metrics (continued) | ||||||||

Comparable Hotels by Market: Q3 2024 vs. Q3 2023 |

||||||||

| (unaudited) | Comparable ADR | Comparable Occupancy | Comparable RevPAR | Comparable Total RevPAR | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hotels | Rooms | 3Q24 | 3Q23 | Change(1) |

3Q24 | 3Q23 | Change | 3Q24 | 3Q23 | Change(1) |

3Q24 | 3Q23 | Change(1) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hawaii | 2 | 3,507 | $ | 312.86 | $ | 322.09 | (2.9) | % | 87.0 | % | 92.0 | % | (5.0) | % pts | $ | 272.29 | $ | 296.29 | (8.1) | % | $ | 449.95 | $ | 501.43 | (10.3) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Orlando | 3 | 2,325 | 201.39 | 188.44 | 6.9 | 65.1 | 60.2 | 4.9 | 131.18 | 113.54 | 15.5 | 289.13 | 231.41 | 24.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New York | 1 | 1,878 | 304.42 | 302.44 | 0.7 | 91.1 | 92.2 | (1.1) | 277.19 | 278.78 | (0.6) | 419.61 | 411.92 | 1.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Orleans | 1 | 1,622 | 173.42 | 157.49 | 10.1 | 64.3 | 56.4 | 7.9 | 111.44 | 88.82 | 25.5 | 214.56 | 171.76 | 24.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Boston | 3 | 1,536 | 281.13 | 267.12 | 5.2 | 87.6 | 86.1 | 1.5 | 246.23 | 230.03 | 7.0 | 299.59 | 286.95 | 4.4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Southern California | 5 | 1,773 | 250.89 | 263.09 | (4.6) | 85.0 | 79.6 | 5.4 | 213.29 | 209.58 | 1.8 | 318.08 | 322.87 | (1.5) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Key West(2) |

2 | 461 | 362.17 | 409.71 | (11.6) | 65.3 | 25.1 | 40.2 | 236.53 | 103.07 | 129.5 | 384.78 | 154.73 | 148.7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Chicago | 3 | 2,467 | 237.93 | 227.83 | 4.4 | 77.1 | 69.4 | 7.7 | 183.56 | 158.20 | 16.0 | 278.83 | 241.82 | 15.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Puerto Rico | 1 | 652 | 264.86 | 269.92 | (1.9) | 68.5 | 67.2 | 1.3 | 181.39 | 181.41 | — | 295.95 | 281.53 | 5.1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Washington, D.C. | 2 | 1,085 | 181.93 | 173.20 | 5.0 | 75.1 | 77.3 | (2.2) | 136.56 | 133.77 | 2.1 | 193.12 | 194.47 | (0.7) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Denver | 1 | 613 | 204.78 | 202.05 | 1.4 | 74.4 | 81.8 | (7.4) | 152.25 | 165.19 | (7.8) | 227.29 | 234.01 | (2.9) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Miami | 1 | 393 | 185.86 | 177.55 | 4.7 | 72.9 | 71.3 | 1.6 | 135.57 | 126.59 | 7.1 | 191.88 | 180.44 | 6.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Seattle | 2 | 1,246 | 182.67 | 187.14 | (2.4) | 86.0 | 82.5 | 3.5 | 157.16 | 154.39 | 1.8 | 198.72 | 198.79 | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| San Francisco | 2 | 660 | 234.95 | 255.48 | (8.0) | 74.9 | 78.6 | (3.7) | 176.00 | 200.81 | (12.4) | 231.49 | 257.73 | (10.2) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 9 | 2,850 | 179.45 | 181.78 | (1.3) | 72.8 | 70.1 | 2.7 | 130.58 | 127.50 | 2.4 | 176.72 | 172.11 | 2.7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All Markets | 38 | 23,068 | $ | 242.88 | $ | 242.89 | — | % | 78.1 | % | 75.6 | % | 2.5 | % pts | $ | 189.73 | $ | 183.64 | 3.3 | % | $ | 294.65 | $ | 283.82 | 3.8 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

16 |

|

|||||||

| Portfolio and Operating Metrics (continued) | ||||||||

Comparable Hotels by Market: Q3 2024 vs. Q3 2023 |

||||||||

| (unaudited, dollars in millions) | Comparable Hotel Adjusted EBITDA |

Comparable Hotel Revenue |

Comparable Hotel Adjusted EBITDA Margin |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hotels | Rooms | 3Q24 | 3Q23 | Change(1) |

3Q24 | 3Q23 | Change(1) |

3Q24 | 3Q23 | Change | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hawaii | 2 | 3,507 | $ | 56 | $ | 69 | (18.4) | % | $ | 145 | $ | 162 | (10.3) | % | 38.7 | % | 42.6 | % | (390) | bps | ||||||||||||||||||||||||||||||||||||||||||||||||

| Orlando | 3 | 2,325 | 14 | 7 | 95.4 | 62 | 49 | 24.9 | 21.3 | 13.6 | 770 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New York | 1 | 1,878 | 13 | 10 | 28.3 | 72 | 71 | 1.9 | 18.2 | 14.4 | 380 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Orleans | 1 | 1,622 | 9 | 6 | 57.2 | 32 | 26 | 24.9 | 27.7 | 22.0 | 570 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Boston | 3 | 1,536 | 15 | 14 | 8.9 | 42 | 41 | 4.4 | 35.5 | 34.0 | 150 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Southern California | 5 | 1,773 | 18 | 18 | (0.7) | 52 | 53 | (1.5) | 34.9 | 34.6 | 30 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Key West(2) |

2 | 461 | 3 | (1) | 359.6 | 16 | 7 | 148.7 | 21.4 | (20.6) | 4,200 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Chicago(3) |

3 | 2,467 | 16 | 21 | (25.6) | 63 | 55 | 15.3 | 24.6 | 38.1 | (1,350) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Puerto Rico | 1 | 652 | 3 | 3 | 8.9 | 18 | 17 | 5.1 | 18.0 | 17.4 | 60 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Washington, D.C. | 2 | 1,085 | 4 | 5 | (12.0) | 19 | 19 | (0.7) | 21.1 | 23.8 | (270) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Denver | 1 | 613 | 5 | 6 | (14.7) | 13 | 13 | (2.9) | 37.6 | 42.8 | (520) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Miami | 1 | 393 | 1 | 1 | 11.3 | 7 | 7 | 6.3 | 15.6 | 14.9 | 70 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Seattle | 2 | 1,246 | 4 | 5 | (11.4) | 23 | 23 | — | 19.7 | 22.2 | (250) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| San Francisco | 2 | 660 | — | 2 | (79.6) | 14 | 15 | (10.2) | 3.3 | 14.6 | (1,130) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 9 | 2,850 | 9 | 7 | (4.0) | 47 | 44 | 2.7 | 17.5 | 18.7 | (120) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All Markets | 38 | 23,068 | $ | 170 | $ | 173 | (1.9) | % | $ | 625 | $ | 602 | 3.8 | % | 27.2 | % | 28.8 | % | (160) | bps | ||||||||||||||||||||||||||||||||||||||||||||||||

17 |

|

|||||||

| Portfolio and Operating Metrics (continued) | ||||||||

Comparable Hotels by Market: YTD Q3 2024 vs. YTD Q3 2023 |

||||||||

| (unaudited) | Comparable ADR |

Comparable Occupancy |

Comparable RevPAR |

Comparable Total RevPAR |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hotels | Rooms | 2024 | 2023 | Change(1) |

2024 | 2023 | Change | 2024 | 2023 | Change(1) |

2024 | 2023 | Change(1) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hawaii | 2 | 3,507 | $ | 309.45 | $ | 307.21 | 0.7 | % | 88.0 | % | 91.1 | % | (3.1) | % pts | $ | 272.45 | $ | 279.86 | (2.6) | % | $ | 460.21 | $ | 487.31 | (5.6) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Orlando | 3 | 2,325 | 243.32 | 233.57 | 4.2 | 69.2 | 66.9 | 2.3 | 168.41 | 156.38 | 7.7 | 373.27 | 320.86 | 16.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New York | 1 | 1,878 | 293.33 | 289.56 | 1.3 | 84.8 | 82.7 | 2.1 | 248.86 | 239.56 | 3.9 | 394.35 | 365.14 | 8.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Orleans | 1 | 1,622 | 207.59 | 202.89 | 2.3 | 68.5 | 65.0 | 3.5 | 142.30 | 132.04 | 7.8 | 256.03 | 246.24 | 4.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Boston | 3 | 1,536 | 253.61 | 242.51 | 4.6 | 82.6 | 79.7 | 2.9 | 209.46 | 193.36 | 8.3 | 269.14 | 251.02 | 7.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Southern California | 5 | 1,773 | 226.08 | 238.10 | (5.0) | 80.5 | 77.0 | 3.5 | 181.99 | 183.21 | (0.7) | 284.33 | 288.78 | (1.5) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Key West(2) |

2 | 461 | 542.07 | 529.29 | 2.4 | 75.5 | 48.9 | 26.6 | 409.00 | 258.40 | 58.3 | 621.24 | 375.99 | 65.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Chicago | 3 | 2,467 | 225.56 | 221.77 | 1.7 | 63.3 | 59.7 | 3.6 | 142.70 | 132.28 | 7.9 | 221.04 | 204.28 | 8.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Puerto Rico | 1 | 652 | 303.20 | 290.52 | 4.4 | 75.7 | 78.3 | (2.6) | 229.40 | 227.31 | 0.9 | 350.36 | 348.98 | 0.4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Washington, D.C. | 2 | 1,085 | 192.97 | 180.82 | 6.7 | 74.6 | 74.3 | 0.3 | 143.90 | 134.24 | 7.2 | 209.07 | 195.65 | 6.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Denver | 1 | 613 | 194.39 | 195.19 | (0.4) | 69.1 | 72.5 | (3.4) | 134.34 | 141.50 | (5.1) | 202.43 | 206.72 | (2.1) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Miami | 1 | 393 | 267.10 | 258.14 | 3.5 | 81.1 | 80.1 | 1.0 | 216.65 | 206.92 | 4.7 | 285.94 | 277.79 | 2.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Seattle | 2 | 1,246 | 162.96 | 169.50 | (3.9) | 77.5 | 70.2 | 7.3 | 126.37 | 119.08 | 6.1 | 170.13 | 162.00 | 5.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| San Francisco | 2 | 660 | 255.91 | 272.10 | (6.0) | 71.9 | 70.4 | 1.5 | 183.97 | 191.56 | (4.0) | 244.10 | 257.53 | (5.2) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 9 | 2,850 | 181.57 | 183.01 | (0.8) | 68.9 | 66.5 | 2.4 | 125.04 | 121.62 | 2.8 | 171.16 | 166.67 | 2.7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All Markets | 38 | 23,068 | $ | 248.57 | $ | 245.34 | 1.3 | % | 75.7 | % | 73.5 | % | 2.2 | % pts | $ | 188.08 | $ | 180.33 | 4.3 | % | $ | 300.83 | $ | 287.74 | 4.5 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

18 |

|

|||||||

| Portfolio and Operating Metrics (continued) | ||||||||

Comparable Hotels by Market: YTD Q3 2024 vs. YTD Q3 2023 |

||||||||

| (unaudited, dollars in millions) | Comparable Hotel Adjusted EBITDA |

Comparable Hotel Revenue |

Comparable Hotel Adjusted EBITDA Margin |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hotels | Rooms | 2024 | 2023 | Change(1) |

2024 | 2023 | Change(1) |

2024 | 2023 | Change | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hawaii | 2 | 3,507 | $ | 176 | $ | 190 | (7.0) | % | $ | 442 | $ | 467 | (5.2) | % | 39.8 | % | 40.6 | % | (80) | bps | ||||||||||||||||||||||||||||||||||||||||||||||||

| Orlando | 3 | 2,325 | 75 | 60 | 26.0 | 238 | 204 | 16.8 | 31.6 | 29.3 | 230 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New York | 1 | 1,878 | 25 | 19 | 30.1 | 203 | 187 | 8.4 | 12.2 | 10.2 | 200 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Orleans | 1 | 1,622 | 39 | 40 | (3.5) | 114 | 109 | 4.4 | 33.9 | 36.7 | (280) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Boston(2) |

3 | 1,536 | 41 | 32 | 26.1 | 113 | 105 | 7.6 | 36.0 | 30.7 | 530 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Southern California | 5 | 1,773 | 42 | 44 | (4.2) | 138 | 140 | (1.2) | 30.2 | 31.2 | (100) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Key West(3) |

2 | 461 | 31 | 14 | 131.8 | 78 | 47 | 65.8 | 40.0 | 28.6 | 1,140 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Chicago(4) |

3 | 2,467 | 21 | 23 | (10.4) | 149 | 138 | 8.6 | 13.9 | 16.9 | (300) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Puerto Rico | 1 | 652 | 17 | 17 | (0.4) | 63 | 62 | 0.8 | 26.7 | 27.0 | (30) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Washington, D.C. | 2 | 1,085 | 16 | 14 | 12.0 | 62 | 58 | 7.2 | 25.7 | 24.6 | 110 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Denver | 1 | 613 | 12 | 13 | (6.4) | 34 | 35 | (1.7) | 35.4 | 37.2 | (180) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Miami | 1 | 393 | 11 | 11 | 6.7 | 31 | 30 | 3.3 | 37.0 | 35.8 | 120 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Seattle | 2 | 1,246 | 7 | 7 | (7.9) | 58 | 55 | 5.4 | 11.6 | 13.3 | (170) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| San Francisco | 2 | 660 | 4 | 7 | (41.3) | 44 | 46 | (4.9) | 9.6 | 15.5 | (590) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 9 | 2,850 | 22 | 21 | 0.5 | 134 | 129 | 3.1 | 16.6 | 17.0 | (40) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All Markets | 38 | 23,068 | $ | 539 | $ | 512 | 5.2 | % | $ | 1,901 | $ | 1,812 | 4.9 | % | 28.3 | % | 28.2 | % | 10 | bps | ||||||||||||||||||||||||||||||||||||||||||||||||

19 |

|

|||||||

| Portfolio and Operating Metrics (continued) | ||||||||

Core Hotels: Q3 2024 vs. Q3 2023 |

||||||||

| (unaudited) | ADR | Occupancy | RevPAR | Total RevPAR | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3Q24 | 3Q23 | Change(1) |

3Q24 | 3Q23 | Change | 3Q24 | 3Q23 | Change(1) |

3Q24 | 3Q23 | Change(1) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Core Hotels | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | Hilton Hawaiian Village Waikiki Beach Resort | $ | 313.56 | $ | 317.24 | (1.2) | % | 89.8 | % | 93.7 | % | (3.9) | % pts | $ | 281.46 | $ | 297.03 | (5.2) | % | $ | 437.63 | $ | 473.02 | (7.5) | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | Hilton Waikoloa Village | 309.16 | 345.83 | (10.6) | 75.0 | 84.8 | (9.8) | 231.76 | 293.04 | (20.9) | 504.39 | 627.01 | (19.6) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | Signia by Hilton Orlando Bonnet Creek | 191.36 | 178.86 | 7.0 | 68.1 | 66.7 | 1.4 | 130.32 | 119.30 | 9.2 | 325.94 | 275.34 | 18.4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | Waldorf Astoria Orlando | 305.04 | 285.42 | 6.9 | 64.2 | 47.2 | 17.0 | 195.74 | 134.50 | 45.5 | 400.42 | 246.64 | 62.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5 | Hilton Orlando Lake Buena Vista | 148.93 | 154.87 | (3.8) | 62.1 | 60.4 | 1.7 | 92.41 | 93.48 | (1.1) | 174.85 | 167.55 | 4.4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6 | New York Hilton Midtown | 304.42 | 302.44 | 0.7 | 91.1 | 92.2 | (1.1) | 277.19 | 278.78 | (0.6) | 419.61 | 411.92 | 1.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7 | Hilton New Orleans Riverside | 173.42 | 157.49 | 10.1 | 64.3 | 56.4 | 7.9 | 111.44 | 88.82 | 25.5 | 214.56 | 171.76 | 24.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8 | Hilton Boston Logan Airport | 298.36 | 281.38 | 6.0 | 92.6 | 97.7 | (5.1) | 276.39 | 275.09 | 0.5 | 327.49 | 342.35 | (4.3) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9 | Hyatt Regency Boston | 304.37 | 287.13 | 6.0 | 93.4 | 86.6 | 6.8 | 284.33 | 248.73 | 14.3 | 341.49 | 300.05 | 13.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10 | Boston Marriott Newton | 216.31 | 209.54 | 3.2 | 73.7 | 69.2 | 4.5 | 159.38 | 144.91 | 10.0 | 211.49 | 193.85 | 9.1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 11 | Hilton Santa Barbara Beachfront Resort | 404.88 | 393.21 | 3.0 | 82.5 | 82.8 | (0.3) | 334.00 | 325.58 | 2.6 | 496.97 | 500.27 | (0.7) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 12 | Hyatt Regency Mission Bay Spa and Marina | 288.98 | 338.17 | (14.5) | 86.8 | 73.6 | 13.2 | 250.78 | 248.85 | 0.8 | 408.64 | 429.66 | (4.9) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 13 | Hilton Checkers Los Angeles | 198.22 | 211.31 | (6.2) | 81.7 | 80.3 | 1.4 | 162.01 | 169.68 | (4.5) | 200.74 | 197.18 | 1.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 14 | Casa Marina Key West, Curio Collection(2) |

374.06 | — | 100.0 | 66.7 | — | 66.7 | 249.52 | (0.05) | 100.0 | 399.92 | 0.65 | 100.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 15 | The Reach Key West, Curio Collection | 335.83 | 409.85 | (18.1) | 62.4 | 77.3 | (14.9) | 209.60 | 316.86 | (33.9) | 353.41 | 474.20 | (25.5) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 16 | Hilton Chicago | 221.52 | 219.49 | 0.9 | 80.7 | 67.8 | 12.9 | 178.78 | 148.75 | 20.2 | 302.42 | 255.37 | 18.4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 17 | W Chicago – City Center | 314.82 | 283.34 | 11.1 | 64.9 | 68.1 | (3.2) | 204.34 | 192.94 | 5.9 | 244.45 | 238.21 | 2.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 18 | W Chicago – Lakeshore | 238.79 | 211.22 | 13.1 | 76.1 | 75.5 | 0.6 | 181.66 | 159.32 | 14.0 | 235.45 | 204.38 | 15.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 19 | DoubleTree Hotel Washington DC – Crystal City | 167.88 | 164.77 | 1.9 | 76.5 | 81.2 | (4.7) | 128.39 | 133.73 | (4.0) | 168.82 | 194.02 | (13.0) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 20 | Hilton Denver City Center | 204.78 | 202.05 | 1.4 | 74.4 | 81.8 | (7.4) | 152.25 | 165.19 | (7.8) | 227.29 | 234.01 | (2.9) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 21 | Royal Palm South Beach Miami | 185.86 | 177.55 | 4.7 | 72.9 | 71.3 | 1.6 | 135.57 | 126.59 | 7.1 | 191.88 | 180.44 | 6.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 22 | Hyatt Centric Fisherman's Wharf | 201.64 | 221.12 | (8.8) | 81.5 | 85.4 | (3.9) | 164.26 | 188.66 | (12.9) | 219.06 | 251.64 | (12.9) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 23 | JW Marriott San Francisco Union Square | 271.12 | 292.67 | (7.4) | 68.9 | 72.4 | (3.5) | 186.79 | 211.96 | (11.9) | 242.91 | 263.33 | (7.8) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 24 | DoubleTree Hotel San Jose | 178.26 | 171.33 | 4.0 | 61.9 | 61.0 | 0.9 | 110.43 | 104.67 | 5.5 | 154.44 | 157.72 | (2.1) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 25 | Juniper Hotel Cupertino, Curio Collection | 186.82 | 188.22 | (0.7) | 75.1 | 69.4 | 5.7 | 140.28 | 130.61 | 7.4 | 154.96 | 149.12 | 3.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Core Hotels | 258.48 | 257.58 | 0.4 | 78.1 | 75.7 | 2.4 | 201.76 | 194.86 | 3.5 | 319.75 | 307.87 | 3.9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All Other Hotels | 190.23 | 193.04 | (1.5) | 78.3 | 75.4 | 2.9 | 148.99 | 145.62 | 2.3 | 209.65 | 202.35 | 3.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Comparable Hotels | $ | 242.88 | $ | 242.89 | — | % | 78.1 | % | 75.6 | % | 2.5 | % pts | $ | 189.73 | $ | 183.64 | 3.3 | % | $ | 294.65 | $ | 283.82 | 3.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

20 |

|

|||||||

| Portfolio and Operating Metrics (continued) | ||||||||

Core Hotels: Q3 2024 vs. Q3 2023 |

||||||||

| (unaudited, dollars in millions) | Hotel Adjusted EBITDA | Hotel Revenue | Hotel Adjusted EBITDA Margin | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3Q24 | 3Q23 | Change(1) |

3Q24 | 3Q23 | Change(1) |

3Q24 | 3Q23 | Change | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Core Hotels | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | Hilton Hawaiian Village Waikiki Beach Resort | $ | 47 | $ | 55 | (13.5) | % | $ | 115 | $ | 124 | (7.5) | % | 41.0 | % | 43.9 | % | (290) | bps | ||||||||||||||||||||||||||||||||||||||||

| 2 | Hilton Waikoloa Village | 9 | 14 | (37.1) | 30 | 37 | (19.6) | 29.8 | 38.1 | (830) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | Signia by Hilton Orlando Bonnet Creek | 8 | 5 | 45.8 | 30 | 25 | 18.4 | 25.4 | 20.6 | 480 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | Waldorf Astoria Orlando | 4 | — | 1,029.4 | 18 | 11 | 62.3 | 19.5 | (3.4) | 2,290 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 5 | Hilton Orlando Lake Buena Vista | 2 | 2 | 1.6 | 13 | 13 | 4.4 | 14.5 | 14.9 | (40) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 6 | New York Hilton Midtown | 13 | 10 | 28.3 | 72 | 71 | 1.9 | 18.2 | 14.4 | 380 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 7 | Hilton New Orleans Riverside | 9 | 6 | 57.2 | 32 | 26 | 24.9 | 27.7 | 22.0 | 570 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 8 | Hilton Boston Logan Airport | 6 | 6 | (1.0) | 18 | 19 | (4.3) | 33.1 | 32.0 | 110 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 9 | Hyatt Regency Boston | 7 | 6 | 17.0 | 16 | 14 | 13.8 | 41.9 | 40.8 | 110 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 10 | Boston Marriott Newton | 2 | 2 | 15.7 | 9 | 8 | 9.1 | 28.4 | 26.8 | 160 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 11 | Hilton Santa Barbara Beachfront Resort | 9 | 9 | (0.9) | 16 | 17 | (0.7) | 54.7 | 54.8 | (10) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 12 | Hyatt Regency Mission Bay Spa and Marina | 5 | 5 | 4.4 | 16 | 17 | (4.9) | 29.1 | 26.5 | 260 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 13 | Hilton Checkers Los Angeles | 1 | 1 | 6.1 | 4 | 4 | 1.8 | 20.0 | 19.2 | 80 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 14 | Casa Marina Key West, Curio Collection(2) |

3 | (3) | 180.4 | 11 | — | 100.0 | 23.1 | — | 2,310 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 15 | The Reach Key West, Curio Collection | — | 2 | (56.1) | 5 | 7 | (25.5) | 17.5 | 29.7 | (1,220) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 16 | Hilton Chicago(3) |

11 | 13 | (9.2) | 44 | 36 | 18.4 | 26.5 | 34.6 | (810) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 17 | W Chicago – City Center(3) |

2 | 4 | (54.8) | 9 | 9 | 2.6 | 20.5 | 46.5 | (2,600) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 18 | W Chicago – Lakeshore(3) |

2 | 4 | (45.9) | 11 | 10 | 15.2 | 20.4 | 43.5 | (2,310) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 19 | DoubleTree Hotel Washington DC – Crystal City | 2 | 3 | (30.7) | 10 | 11 | (13.0) | 22.5 | 28.3 | (580) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 20 | Hilton Denver City Center | 5 | 6 | (14.7) | 13 | 13 | (2.9) | 37.6 | 42.8 | (520) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 21 | Royal Palm South Beach Miami | 1 | 1 | 11.3 | 7 | 7 | 6.3 | 15.6 | 14.9 | 70 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 22 | Hyatt Centric Fisherman's Wharf | — | 2 | (50.7) | 6 | 7 | (12.9) | 13.8 | 24.4 | (1,060) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 23 | JW Marriott San Francisco Union Square | — | 1 | (180.4) | 8 | 8 | (7.8) | (5.4) | 6.1 | (1,150) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 24 | DoubleTree Hotel San Jose | — | 1 | (40.2) | 7 | 7 | (2.1) | 5.2 | 8.5 | (330) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 25 | Juniper Hotel Cupertino, Curio Collection | 1 | 1 | 5.8 | 4 | 3 | 3.9 | 18.7 | 18.4 | 30 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total Core Hotels | 149 | 156 | (1.9) | 524 | 504 | 3.9 | 28.5 | 30.2 | (170) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| All Other Hotels | 21 | 17 | (1.5) | 101 | 98 | 3.6 | 20.0 | 21.0 | (100) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Comparable Hotels | $ | 170 | $ | 173 | (1.9) | % | $ | 625 | $ | 602 | 3.8 | % | 27.2 | % | 28.8 | % | (160) | bps | |||||||||||||||||||||||||||||||||||||||||

21 |

|

|||||||

| Portfolio and Operating Metrics (continued) | ||||||||

Core Hotels: YTD Q3 2024 vs. YTD Q3 2023 |

||||||||

| (unaudited) | ADR | Occupancy | RevPAR | Total RevPAR | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2024 | 2023 | Change(1) |

2024 | 2023 | Change | 2024 | 2023 | Change(1) |

2024 | 2023 | Change(1) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Core Hotels | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | Hilton Hawaiian Village Waikiki Beach Resort | $ | 306.83 | $ | 301.06 | 1.9 | % | 90.3 | % | 92.9 | % | (2.6) | % pts | $ | 277.09 | $ | 279.76 | (1.0) | % | $ | 440.52 | $ | 455.83 | (3.4) | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | Hilton Waikoloa Village | 322.86 | 337.65 | (4.4) | 78.0 | 83.0 | (5.0) | 251.95 | 280.29 | (10.1) | 547.24 | 626.45 | (12.6) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | Signia by Hilton Orlando Bonnet Creek | 232.76 | 217.66 | 6.9 | 73.2 | 69.9 | 3.3 | 170.47 | 152.13 | 12.1 | 439.50 | 354.85 | 23.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | Waldorf Astoria Orlando | 374.96 | 359.53 | 4.3 | 61.8 | 56.9 | 4.9 | 231.72 | 204.72 | 13.2 | 451.20 | 387.59 | 16.4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5 | Hilton Orlando Lake Buena Vista | 184.32 | 189.74 | (2.9) | 68.8 | 69.5 | (0.7) | 126.81 | 131.85 | (3.8) | 243.12 | 237.57 | 2.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6 | New York Hilton Midtown | 293.33 | 289.56 | 1.3 | 84.8 | 82.7 | 2.1 | 248.86 | 239.56 | 3.9 | 394.35 | 365.14 | 8.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7 | Hilton New Orleans Riverside | 207.59 | 202.89 | 2.3 | 68.5 | 65.0 | 3.5 | 142.30 | 132.04 | 7.8 | 256.03 | 246.24 | 4.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8 | Hilton Boston Logan Airport | 260.63 | 247.76 | 5.2 | 92.8 | 93.6 | (0.8) | 241.99 | 231.96 | 4.3 | 298.11 | 293.28 | 1.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9 | Hyatt Regency Boston | 276.91 | 263.84 | 5.0 | 85.0 | 78.9 | 6.1 | 235.51 | 208.28 | 13.1 | 296.34 | 262.84 | 12.7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10 | Boston Marriott Newton | 204.16 | 199.07 | 2.6 | 65.3 | 61.1 | 4.2 | 133.36 | 121.72 | 9.6 | 196.69 | 177.85 | 10.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 11 | Hilton Santa Barbara Beachfront Resort | 338.62 | 349.50 | (3.1) | 74.3 | 72.1 | 2.2 | 251.52 | 252.04 | (0.2) | 389.93 | 405.06 | (3.7) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 12 | Hyatt Regency Mission Bay Spa and Marina | 254.76 | 293.50 | (13.2) | 80.5 | 69.5 | 11.0 | 204.97 | 203.83 | 0.6 | 357.58 | 358.67 | (0.3) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 13 | Hilton Checkers Los Angeles | 198.89 | 216.22 | (8.0) | 71.9 | 73.6 | (1.7) | 142.95 | 158.98 | (10.1) | 177.71 | 185.81 | (4.4) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 14 | Casa Marina Key West, Curio Collection(2) |

553.85 | 538.58 | 2.8 | 74.8 | 34.2 | 40.6 | 414.27 | 184.25 | 124.8 | 633.94 | 272.49 | 132.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 15 | The Reach Key West, Curio Collection | 518.29 | 520.95 | (0.5) | 76.8 | 79.1 | (2.3) | 398.08 | 412.15 | (3.4) | 594.93 | 590.58 | 0.7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 16 | Hilton Chicago | 211.84 | 211.39 | 0.2 | 65.6 | 58.9 | 6.7 | 138.92 | 124.50 | 11.6 | 243.05 | 218.72 | 11.1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 17 | W Chicago – City Center | 298.49 | 280.19 | 6.5 | 56.9 | 58.9 | (2.0) | 169.72 | 164.87 | 2.9 | 204.67 | 201.66 | 1.5 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 18 | W Chicago – Lakeshore | 216.69 | 208.20 | 4.1 | 61.4 | 62.5 | (1.1) | 132.97 | 130.10 | 2.2 | 168.38 | 163.42 | 3.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 19 | DoubleTree Hotel Washington DC – Crystal City | 185.34 | 174.19 | 6.4 | 77.1 | 77.5 | (0.4) | 142.88 | 134.99 | 5.8 | 193.89 | 192.59 | 0.7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 20 | Hilton Denver City Center | 194.39 | 195.19 | (0.4) | 69.1 | 72.5 | (3.4) | 134.34 | 141.50 | (5.1) | 202.43 | 206.72 | (2.1) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 21 | Royal Palm South Beach Miami | 267.10 | 258.14 | 3.5 | 81.1 | 80.1 | 1.0 | 216.65 | 206.92 | 4.7 | 285.94 | 277.79 | 2.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 22 | Hyatt Centric Fisherman's Wharf | 191.53 | 205.38 | (6.7) | 75.5 | 74.1 | 1.4 | 144.66 | 152.25 | (5.0) | 191.59 | 209.55 | (8.6) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 23 | JW Marriott San Francisco Union Square | 321.07 | 339.93 | (5.5) | 68.5 | 66.9 | 1.6 | 220.07 | 227.68 | (3.3) | 292.33 | 301.59 | (3.1) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 24 | DoubleTree Hotel San Jose | 183.74 | 171.28 | 7.3 | 61.0 | 60.1 | 0.9 | 112.09 | 103.03 | 8.8 | 160.68 | 158.21 | 1.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 25 | Juniper Hotel Cupertino, Curio Collection | 199.36 | 193.07 | 3.3 | 73.4 | 62.8 | 10.6 | 146.33 | 121.31 | 20.6 | 164.56 | 140.28 | 17.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Core Hotels | 265.22 | 260.28 | 1.9 | 75.9 | 73.8 | 2.1 | 201.21 | 192.07 | 4.8 | 328.55 | 313.31 | 4.9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All Other Hotels | 191.50 | 193.84 | (1.2) | 75.0 | 72.5 | 2.5 | 143.62 | 140.55 | 2.2 | 206.94 | 201.15 | 2.9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Comparable Hotels | $ | 248.57 | $ | 245.34 | 1.3 | % | 75.7 | % | 73.5 | % | 2.2 | % pts | $ | 188.08 | $ | 180.33 | 4.3 | % | $ | 300.83 | $ | 287.74 | 4.5 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

22 |

|

|||||||

| Portfolio and Operating Metrics (continued) | ||||||||

Core Hotels: YTD Q3 2024 vs. YTD Q3 2023 |

||||||||

| (unaudited, dollars in millions) | Hotel Adjusted EBITDA | Hotel Revenue | Hotel Adjusted EBITDA Margin | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2024 | 2023 | Change(1) |

2024 | 2023 | Change(1) |

2024 | 2023 | Change | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Core Hotels | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | Hilton Hawaiian Village Waikiki Beach Resort | $ | 144 | $ | 148 | (2.9) | % | $ | 345 | $ | 356 | (3.0) | % | 41.6 | % | 41.5 | % | 10 | bps | ||||||||||||||||||||||||||||||||||||||||

| 2 | Hilton Waikoloa Village | 33 | 42 | (21.7) | 97 | 111 | (12.3) | 33.6 | 37.6 | (400) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | Signia by Hilton Orlando Bonnet Creek | 43 | 33 | 33.4 | 122 | 98 | 24.3 | 35.7 | 33.3 | 240 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | Waldorf Astoria Orlando | 16 | 11 | 51.2 | 62 | 53 | 16.8 | 26.3 | 20.3 | 600 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 5 | Hilton Orlando Lake Buena Vista | 15 | 16 | (5.4) | 54 | 53 | 2.7 | 28.4 | 30.8 | (240) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 6 | New York Hilton Midtown | 25 | 19 | 30.1 | 203 | 187 | 8.4 | 12.2 | 10.2 | 200 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 7 | Hilton New Orleans Riverside | 39 | 40 | (3.5) | 114 | 109 | 4.4 | 33.9 | 36.7 | (280) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 8 | Hilton Boston Logan Airport(2) |

16 | 14 | 14.0 | 49 | 48 | 2.0 | 32.4 | 29.0 | 340 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 9 | Hyatt Regency Boston(2) |

17 | 13 | 30.9 | 41 | 36 | 13.2 | 42.1 | 36.4 | 570 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 10 | Boston Marriott Newton(2) |

8 | 5 | 46.6 | 23 | 21 | 11.0 | 33.0 | 25.0 | 800 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 11 | Hilton Santa Barbara Beachfront Resort | 18 | 18 | (3.5) | 38 | 40 | (3.4) | 45.7 | 45.7 | — | |||||||||||||||||||||||||||||||||||||||||||||||||

| 12 | Hyatt Regency Mission Bay Spa and Marina | 11 | 11 | (4.6) | 43 | 43 | 0.1 | 25.1 | 26.3 | (120) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 13 | Hilton Checkers Los Angeles | 1 | 1 | 31.2 | 9 | 10 | (4.0) | 14.4 | 10.5 | 390 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 14 | Casa Marina Key West, Curio Collection(3) |

22 | 4 | 441.5 | 54 | 23 | 133.5 | 41.1 | 17.7 | 2,340 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 15 | The Reach Key West, Curio Collection | 9 | 9 | (2.7) | 24 | 24 | 1.1 | 37.6 | 39.1 | (150) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 16 | Hilton Chicago(4) |

16 | 15 | 6.1 | 103 | 92 | 11.5 | 16.0 | 16.8 | (80) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 17 | W Chicago – City Center(4) |

3 | 5 | (39.1) | 23 | 22 | 1.9 | 13.1 | 22.0 | (890) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 18 | W Chicago – Lakeshore(4) |

1 | 3 | (50.6) | 24 | 23 | 3.4 | 5.9 | 12.3 | (640) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 19 | DoubleTree Hotel Washington DC – Crystal City | 10 | 10 | (0.8) | 33 | 33 | 1.0 | 29.3 | 29.9 | (60) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 20 | Hilton Denver City Center | 12 | 13 | (6.4) | 34 | 35 | (1.7) | 35.4 | 37.2 | (180) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 21 | Royal Palm South Beach Miami | 11 | 11 | 6.7 | 31 | 30 | 3.3 | 37.0 | 35.8 | 120 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 22 | Hyatt Centric Fisherman's Wharf | 1 | 3 | (48.2) | 17 | 18 | (8.2) | 9.0 | 16.0 | (700) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 23 | JW Marriott San Francisco Union Square | 3 | 4 | (36.6) | 28 | 28 | (2.7) | 9.9 | 15.2 | (530) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 24 | DoubleTree Hotel San Jose | 2 | 2 | 29.4 | 22 | 21 | 1.9 | 10.1 | 8.0 | 210 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 25 | Juniper Hotel Cupertino, Curio Collection | 3 | 1 | 83.8 | 10 | 9 | 17.7 | 24.8 | 15.9 | 890 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Total Core Hotels | 479 | 451 | 6.2 | 1,603 | 1,523 | 5.3 | 29.9 | 29.6 | 30 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| All Other Hotels | 60 | 61 | (2.3) | 298 | 289 | 3.3 | 19.9 | 21.0 | (110) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Comparable Hotels | $ | 539 | $ | 512 | 5.2 | % | $ | 1,901 | $ | 1,812 | 4.9 | % | 28.3 | % | 28.2 | % | 10 | bps | |||||||||||||||||||||||||||||||||||||||||

23 |

|

|||||||

| Properties Acquired and Sold | |||||

24 |

|

|||||||

| Properties Acquired and Sold | ||||||||

| Properties Acquired | ||||||||

| Hotel | Location | Room Count | ||||||

| 2019 Acquisitions: | ||||||||

Chesapeake Lodging Trust Acquisition(1) |

||||||||

| Hilton Denver City Center | Denver, CO | 613 | ||||||

| W Chicago – Lakeshore | Chicago, IL | 520 | ||||||

| Hyatt Regency Boston | Boston, MA | 502 | ||||||

| Hyatt Regency Mission Bay Spa and Marina | San Diego, CA | 438 | ||||||

| Boston Marriott Newton | Newton, MA | 430 | ||||||

Le Meridien New Orleans(2) |

New Orleans, LA | 410 | ||||||

| W Chicago – City Center | Chicago, IL | 403 | ||||||

| Royal Palm South Beach Miami, a Tribute Portfolio Resort | Miami Beach, FL | 393 | ||||||

Le Meridien San Francisco(3) |

San Francisco, CA | 360 | ||||||

| JW Marriott San Francisco Union Square | San Francisco, CA | 344 | ||||||

| Hyatt Centric Fisherman’s Wharf | San Francisco, CA | 316 | ||||||

Hotel Indigo San Diego Gaslamp Quarter(4) |

San Diego, CA | 210 | ||||||

Courtyard Washington Capitol Hill/Navy Yard(4) |