| Delaware | 001-37795 | 36-2058176 | ||||||

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

||||||

1775 Tysons Blvd., 7th Floor, Tysons, VA |

22102 | |||||||

| (Address of Principal Executive Offices) | (Zip Code) | |||||||

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||

| Common Stock, $0.01 par value per share | PK | New York Stock Exchange | ||||||

| Exhibit Number |

Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |||||||

| Park Hotels & Resorts Inc. | ||||||||

Date: November 1, 2023 |

By: | /s/ Sean M. Dell’Orto | ||||||

| Sean M. Dell’Orto | ||||||||

| Executive Vice President, Chief Financial Officer and Treasurer | ||||||||

| Investor Contact | 1775 Tysons Boulevard, 7th Floor | ||||

| Ian Weissman | Tysons, VA 22102 | ||||

| + 1 571 302 5591 | www.pkhotelsandresorts.com | ||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||

| 2023 | 2022 | Change(1) |

2023 | 2022 | Change(1) |

||||||||||||||||||||||||||||||

| Current Hotels: | |||||||||||||||||||||||||||||||||||

| Current RevPAR | $ | 178.13 | $ | 172.91 | 3.0 | % | $ | 173.62 | $ | 154.77 | 12.2 | % | |||||||||||||||||||||||

| Current Occupancy | 73.9 | % | 71.4 | % | 2.5 | % pts | 71.1 | % | 64.3 | % | 6.8 | % pts | |||||||||||||||||||||||

| Current ADR | $ | 241.06 | $ | 242.21 | (0.5) | % | $ | 244.23 | $ | 240.80 | 1.4 | % | |||||||||||||||||||||||

| Current Total RevPAR | $ | 270.85 | $ | 260.57 | 3.9 | % | $ | 273.22 | $ | 240.52 | 13.6 | % | |||||||||||||||||||||||

| Comparable Hotels: | |||||||||||||||||||||||||||||||||||

| Comparable RevPAR | $ | 182.08 | $ | 177.12 | 2.8 | % | $ | 178.74 | $ | 162.01 | 10.3 | % | |||||||||||||||||||||||

| Comparable Occupancy | 75.3 | % | 72.6 | % | 2.7 | % pts | 73.2 | % | 67.1 | % | 6.1 | % pts | |||||||||||||||||||||||

| Comparable ADR | $ | 241.74 | $ | 243.91 | (0.9) | % | $ | 244.12 | $ | 241.30 | 1.2 | % | |||||||||||||||||||||||

| Comparable Total RevPAR | $ | 281.21 | $ | 270.89 | 3.8 | % | $ | 284.92 | $ | 254.23 | 12.1 | % | |||||||||||||||||||||||

| Net income (loss) | $ | 31 | $ | 40 | (22.5) | % | $ | (82) | $ | 138 | (159.4) | % | |||||||||||||||||||||||

| Net income (loss) attributable to stockholders | $ | 27 | $ | 35 | (22.9) | % | $ | (90) | $ | 128 | (170.3) | % | |||||||||||||||||||||||

| Operating income | $ | 85 | $ | 92 | (8.5) | % | $ | 67 | $ | 212 | (68.3) | % | |||||||||||||||||||||||

| Operating income margin | 12.5 | % | 13.9 | % | (140) | bps | 3.3 | % | 11.5 | % | (820) | bps | |||||||||||||||||||||||

| Current Hotel Adjusted EBITDA | $ | 173 | $ | 165 | 5.0 | % | $ | 514 | $ | 450 | 14.2 | % | |||||||||||||||||||||||

| Current Hotel Adjusted EBITDA margin | 26.3 | % | 26.0 | % | 30 | bps | 26.1 | % | 26.0 | % | 10 | bps | |||||||||||||||||||||||

| Comparable Hotel Adjusted EBITDA | $ | 172 | $ | 162 | 6.4 | % | $ | 509 | $ | 456 | 11.7 | % | |||||||||||||||||||||||

| Comparable Hotel Adjusted EBITDA margin | 28.4 | % | 27.7 | % | 70 | bps | 28.0 | % | 28.1 | % | (10) | bps | |||||||||||||||||||||||

| Adjusted EBITDA | $ | 163 | $ | 158 | 3.2 | % | $ | 496 | $ | 447 | 11.0 | % | |||||||||||||||||||||||

| Adjusted FFO attributable to stockholders | $ | 108 | $ | 94 | 14.9 | % | $ | 329 | $ | 251 | 31.1 | % | |||||||||||||||||||||||

Earnings (loss) per share – Diluted(1) |

$ | 0.13 | $ | 0.15 | (13.3) | % | $ | (0.42) | $ | 0.55 | (176.4) | % | |||||||||||||||||||||||

Adjusted FFO per share – Diluted(1) |

$ | 0.51 | $ | 0.42 | 21.4 | % | $ | 1.52 | $ | 1.09 | 39.4 | % | |||||||||||||||||||||||

| Weighted average shares outstanding – Diluted | 212 | 224 | (12) | 216 | 229 | (13) | |||||||||||||||||||||||||||||

| Current ADR | Current Occupancy | Current RevPAR | Current Occupancy | |||||||||||||||||||||||

| 2023 vs 2022 | 2023 vs 2022 | 2023 vs 2022 | 2023 | |||||||||||||||||||||||

| Q1 2023 | 6.7 | % | 14.1 | % pts | 36.5 | % | 64.8 | % | ||||||||||||||||||

| Q2 2023 | (0.2) | 3.9 | 5.3 | 74.4 | ||||||||||||||||||||||

| Jul 2023 | (3.4) | 3.3 | 1.0 | 75.9 | ||||||||||||||||||||||

| Aug 2023 | 1.5 | 2.6 | 5.4 | 72.2 | ||||||||||||||||||||||

| Sep 2023 | 0.8 | 1.6 | 3.0 | 73.6 | ||||||||||||||||||||||

| Q3 2023 | (0.5) | 2.5 | 3.0 | 73.9 | ||||||||||||||||||||||

| Preliminary Oct 2023 | 3.5 | 1.9 | 6.2 | 75.0 | ||||||||||||||||||||||

| Three Months Ended September 30, | ||||||||||||||||||||||||||

| Current ADR | Current Occupancy | Current RevPAR | Current Occupancy | |||||||||||||||||||||||

| 2023 vs 2022 | 2023 vs 2022 | 2023 vs 2022 | 2023 | |||||||||||||||||||||||

| Resort | (1.5) | % | (0.8) | % pts | (2.5) | % | 75.1 | % | ||||||||||||||||||

| Urban | 0.6 | 3.9 | 6.4 | 71.9 | ||||||||||||||||||||||

| Airport | 3.2 | 5.8 | 11.3 | 80.0 | ||||||||||||||||||||||

| Suburban | (1.4) | 1.2 | 0.3 | 69.4 | ||||||||||||||||||||||

| All Types | (0.5) | 2.5 | 3.0 | 73.9 | ||||||||||||||||||||||

| Nine Months Ended September 30, | ||||||||||||||||||||||||||

| Current ADR | Current Occupancy | Current RevPAR | Current Occupancy | |||||||||||||||||||||||

| 2023 vs 2022 | 2023 vs 2022 | 2023 vs 2022 | 2023 | |||||||||||||||||||||||

| Resort | (1.6) | % | 3.3 | % pts | 2.8 | % | 78.4 | % | ||||||||||||||||||

| Urban | 3.9 | 10.0 | 22.4 | 66.0 | ||||||||||||||||||||||

| Airport | 7.3 | 4.1 | 13.6 | 74.6 | ||||||||||||||||||||||

| Suburban | 4.0 | 6.9 | 16.3 | 65.2 | ||||||||||||||||||||||

| All Types | 1.4 | 6.8 | 12.2 | 71.1 | ||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||

| 2023 | 2022 | Change | 2023 | 2022 | Change | ||||||||||||||||||||||||||||||

| Group | 26.0 | % | 23.0 | % | 3.0 | % | 29.4 | % | 25.9 | % | 3.5 | % | |||||||||||||||||||||||

| Transient | 65.6 | 70.4 | (4.8) | 62.8 | 67.5 | (4.7) | |||||||||||||||||||||||||||||

| Contract | 6.2 | 4.5 | 1.7 | 5.6 | 4.4 | 1.2 | |||||||||||||||||||||||||||||

| Other | 2.2 | 2.1 | 0.1 | 2.2 | 2.2 | — | |||||||||||||||||||||||||||||

| (unaudited) | Current ADR | Current Occupancy | Current RevPAR | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hotels | Rooms | 3Q23 | 3Q22 | Change(1) |

3Q23 | 3Q22 | Change | 3Q23 | 3Q22 | Change(1) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hawaii | 2 | 3,507 | $ | 322.09 | $ | 319.46 | 0.8 | % | 92.0 | % | 89.7 | % | 2.3 | % pts | $ | 296.29 | $ | 286.37 | 3.5 | % | |||||||||||||||||||||||||||||||||||||||||||||

| San Francisco | 4 | 3,605 | 239.14 | 237.30 | 0.8 | 65.5 | 64.7 | 0.8 | 156.61 | 153.46 | 2.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Orlando | 3 | 2,325 | 188.44 | 188.84 | (0.2) | 60.3 | 59.3 | 1.0 | 113.54 | 111.82 | 1.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Orleans | 1 | 1,622 | 157.49 | 175.06 | (10.0) | 56.4 | 55.6 | 0.8 | 88.82 | 97.37 | (8.8) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Boston | 3 | 1,536 | 267.12 | 252.53 | 5.8 | 86.1 | 85.1 | 1.0 | 230.03 | 214.94 | 7.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New York | 1 | 1,878 | 302.44 | 290.39 | 4.1 | 92.2 | 74.4 | 17.8 | 278.78 | 215.92 | 29.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Southern California | 5 | 1,773 | 263.09 | 278.65 | (5.6) | 79.7 | 79.3 | 0.4 | 209.58 | 220.86 | (5.1) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Chicago | 3 | 2,467 | 227.83 | 236.69 | (3.7) | 69.4 | 68.4 | 1.0 | 158.20 | 161.94 | (2.3) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Key West(2) |

2 | 461 | 409.71 | 396.50 | 3.3 | 25.2 | 66.5 | (41.3) | 103.07 | 263.46 | (60.9) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Denver | 1 | 613 | 202.05 | 201.32 | 0.4 | 81.8 | 73.3 | 8.5 | 165.19 | 147.47 | 12.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Miami | 1 | 393 | 177.55 | 205.55 | (13.6) | 71.3 | 75.0 | (3.7) | 126.59 | 154.22 | (17.9) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Washington, D.C. | 2 | 1,085 | 173.20 | 160.78 | 7.7 | 77.2 | 66.5 | 10.7 | 133.77 | 107.03 | 25.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Seattle | 2 | 1,246 | 187.14 | 187.53 | (0.2) | 82.5 | 68.3 | 14.2 | 154.39 | 128.04 | 20.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 11 | 3,862 | 193.45 | 192.14 | 0.7 | 68.4 | 68.7 | (0.3) | 132.40 | 132.02 | 0.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All Markets | 41 | 26,373 | $ | 241.06 | $ | 242.21 | (0.5 | %) | 73.9 | % | 71.4 | % | 2.5 | % pts | $ | 178.13 | $ | 172.91 | 3.0 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended September 30, 2023 | Nine Months Ended September 30, 2023 | ||||||||||||||||||||||||||||||||||

| Comparable Hotels | Current Hotels |

Difference(1) |

Comparable Hotels | Current Hotels |

Difference(1) |

||||||||||||||||||||||||||||||

| RevPAR | $ | 182.08 | $ | 178.13 | 2.2 | % | $ | 178.74 | $ | 173.62 | 3.0 | % | |||||||||||||||||||||||

| Occupancy | 75.3 | % | 73.9 | % | 1.4 | % pts | 73.2 | % | 71.1 | % | 2.1 | % pts | |||||||||||||||||||||||

| ADR | $ | 241.74 | $ | 241.06 | 0.3 | % | $ | 244.12 | $ | 244.23 | — | % | |||||||||||||||||||||||

| Hotel Adjusted EBITDA margin | 28.4 | % | 26.3 | % | 210 | bps | 28.0 | % | 26.1 | % | 190 | bps | |||||||||||||||||||||||

| Three Months Ended September 30, 2023 | Nine Months Ended September 30, 2023 | ||||||||||||||||||||||||||||||||||

| Comparable Urban Hotels | Current Urban Hotels | Difference(1) |

Comparable Urban Hotels | Current Urban Hotels | Difference(1) |

||||||||||||||||||||||||||||||

| RevPAR | $ | 172.90 | $ | 166.62 | 3.8 | % | $ | 161.77 | $ | 154.84 | 4.5 | % | |||||||||||||||||||||||

| Occupancy | 74.9 | % | 71.9 | % | 3.0 | % pts | 69.8 | % | 66.0 | % | 3.8 | % pts | |||||||||||||||||||||||

| ADR | $ | 230.98 | $ | 231.72 | (0.3) | % | $ | 231.83 | $ | 234.50 | (1.1) | % | |||||||||||||||||||||||

| Hotel Adjusted EBITDA margin | 25.6 | % | 21.0 | % | 460 | bps | 21.2 | % | 17.8 | % | 340 | bps | |||||||||||||||||||||||

| 2023 Comparable Hotels | 2022 Comparable Hotels | 2023 vs 2022(1) |

2023 Current Hotels | 2022 Current Hotels | 2023 vs 2022(1) |

2023 Comparable vs Current(1) |

|||||||||||||||||||||||||||||||||||

| July | $ | 192.95 | $ | 191.56 | 0.7 | % | $ | 185.65 | $ | 183.83 | 1.0 | % | 3.9 | % | |||||||||||||||||||||||||||

| August | 170.95 | 162.85 | 5.0 | 167.49 | 158.97 | 5.4 | 2.1 | ||||||||||||||||||||||||||||||||||

| September | 182.35 | 176.95 | 3.1 | 181.35 | 176.02 | 3.0 | 0.6 | ||||||||||||||||||||||||||||||||||

| Q3 | 182.08 | 177.12 | 2.8 | 178.13 | 172.91 | 3.0 | 2.2 | ||||||||||||||||||||||||||||||||||

October(2) |

198.34 | 187.51 | 5.8 | 191.14 | 180.02 | 6.2 | 3.8 | ||||||||||||||||||||||||||||||||||

| (unaudited, dollars in millions) | ||||||||||||||||||||||||||

| Debt | Collateral | Interest Rate | Maturity Date | As of September 30, 2023 |

||||||||||||||||||||||

| Fixed Rate Debt | ||||||||||||||||||||||||||

| Mortgage loan | Hilton Denver City Center | 4.90% | March 2024(1) |

$ | 54 | |||||||||||||||||||||

| Mortgage loan | Hyatt Regency Boston | 4.25% | July 2026 | 129 | ||||||||||||||||||||||

| Mortgage loan | DoubleTree Hotel Spokane City Center | 3.62% | July 2026 | 14 | ||||||||||||||||||||||

| Mortgage loan | Hilton Hawaiian Village Beach Resort | 4.20% | November 2026 | 1,275 | ||||||||||||||||||||||

| Mortgage loan | Hilton Santa Barbara Beachfront Resort | 4.17% | December 2026 | 160 | ||||||||||||||||||||||

| Mortgage loan | DoubleTree Hotel Ontario Airport | 5.37% | May 2027 | 30 | ||||||||||||||||||||||

| 2025 Senior Notes | 7.50% | June 2025 | 650 | |||||||||||||||||||||||

| 2028 Senior Notes | 5.88% | October 2028 | 725 | |||||||||||||||||||||||

| 2029 Senior Notes | 4.88% | May 2029 | 750 | |||||||||||||||||||||||

| Comparable Fixed Rate Debt | 5.24%(2) |

3,787 | ||||||||||||||||||||||||

| Mortgage loan | Hilton San Francisco Union Square, Parc 55 San Francisco – a Hilton Hotel | 7.11%(3) |

November 2023 | 725 | ||||||||||||||||||||||

| Total Fixed Rate Debt | 5.54%(2) |

4,512 | ||||||||||||||||||||||||

| Variable Rate Debt | ||||||||||||||||||||||||||

Revolver(4) |

Unsecured | SOFR + 2.10% |

December 2026 | — | ||||||||||||||||||||||

| Total Variable Rate Debt | 7.43% | — | ||||||||||||||||||||||||

| Add: unamortized premium | 1 | |||||||||||||||||||||||||

| Less: unamortized deferred financing costs and discount | (23) | |||||||||||||||||||||||||

Total Debt(5) |

5.54%(2) |

$ | 4,490 | |||||||||||||||||||||||

| (dollars in millions) | ||||||||||||||||||||||||||||||||||||||||||||

| Project & Scope of Work | Start Date |

Estimated

Completion Date

|

Budget | Current Quarter Incurred |

Total Incurred | |||||||||||||||||||||||||||||||||||||||

| Waldorf Astoria Orlando and Signia by Hilton Orlando Bonnet Creek Complex | ||||||||||||||||||||||||||||||||||||||||||||

Meeting space expansion: To add more than 100,000 sq. ft. of meeting and event space |

Q4 2019 (Paused in 2020) |

Waldorf Astoria (Completed Q4 2022) Signia (Q1 2024) |

$ | 118 | $ | 7 | $ | 92 | ||||||||||||||||||||||||||||||||||||

| Guestroom, existing meeting space & lobby renovations | ||||||||||||||||||||||||||||||||||||||||||||

| Waldorf Astoria Orlando | ||||||||||||||||||||||||||||||||||||||||||||

•Guestroom, existing meeting space, lobby and other public space renovations |

Q3 2022 | Q2 2024 | 51 | 10 | 39 | |||||||||||||||||||||||||||||||||||||||

| Signia by Hilton Orlando Bonnet Creek: | ||||||||||||||||||||||||||||||||||||||||||||

•Existing meeting space and lobby renovations |

Q4 2019 | Q4 2022 (Substantially complete) |

21 | 2 | 19 | |||||||||||||||||||||||||||||||||||||||

•Guestroom renovations |

Q2 2019 | Q4 2019 | 25 | — | 25 | |||||||||||||||||||||||||||||||||||||||

Golf course renovations: Two phases of golf course renovations |

Phase 1 (Q2 2022) Phase 2 (Q2 2023) |

Phase 1 (Completed Q4 2022) Phase 2 (Q4 2023) |

9 | — | 4 | |||||||||||||||||||||||||||||||||||||||

Recreational amenities: Adding additional amenities, primarily at the pool |

Q3 2022 | Q1 2024 | 5 | — | 1 | |||||||||||||||||||||||||||||||||||||||

| Total | $ | 229 | $ | 19 | $ | 180 | ||||||||||||||||||||||||||||||||||||||

| Hilton Hawaiian Village Waikiki Beach Resort | ||||||||||||||||||||||||||||||||||||||||||||

Guestroom renovations: Three phases of guestroom renovations in the 1,020-room Tapa Tower |

Phase 1 (Q3 2019) Phase 2 (Q3 2022) Phase 3 (Q3 2023) |

Phase 1 (Completed Q4 2021) Phase 2 (Completed Q4 2022) Phase 3 (Q4 2023) |

$ | 84 | $ | 11 | $ | 72 | ||||||||||||||||||||||||||||||||||||

| Casa Marina Key West, Curio Collection | ||||||||||||||||||||||||||||||||||||||||||||

Complete renovation: Complete renovation of all 311 guestrooms, public spaces and certain hotel infrastructure |

Q1 2023 | Q4 2023 (Guestrooms) Q1 2024 (Restaurants) |

$ | 79 | $ | 33 | $ | 60 | ||||||||||||||||||||||||||||||||||||

| Hilton New Orleans Riverside | ||||||||||||||||||||||||||||||||||||||||||||

Guestroom renovations: Two phases of guestroom renovations in the 455-room Riverside building |

Q3 2019 (Paused in 2020) |

Q3 2023 (Substantially complete) |

$ | 11 | $ | 3 | $ | 9 | ||||||||||||||||||||||||||||||||||||

| New York Hilton Midtown | ||||||||||||||||||||||||||||||||||||||||||||

Ballroom renovations: Renovation of the Grand Ballroom |

Q2 2023 | Q3 2023 (Substantially complete) |

$ | 5 | $ | 1 | $ | 4 | ||||||||||||||||||||||||||||||||||||

(unaudited, dollars in millions, except per share amounts and RevPAR) |

||||||||||||||||||||||||||||||||

|

Full-Year 2023 Outlook

as of November 1, 2023

|

Full-Year 2023 Outlook

as of August 2, 2023(1)

|

Change at Midpoint |

||||||||||||||||||||||||||||||

| Metric | Low | High | Low | High | ||||||||||||||||||||||||||||

| Comparable RevPAR | $ | 177 | $ | 179 | N/A | N/A | N/A | |||||||||||||||||||||||||

| Comparable RevPAR change vs. 2022 | 7.5 | % | 9.0 | % | N/A | N/A | N/A | |||||||||||||||||||||||||

| Adjusted EBITDA | $ | 644 | $ | 668 | $ | 619 | $ | 679 | $ | 7 | ||||||||||||||||||||||

Comparable Hotel Adjusted EBITDA margin(2) |

27.7 | % | 28.2 | % | N/A | N/A | N/A | |||||||||||||||||||||||||

Comparable Hotel Adjusted EBITDA margin change vs. 2022(2) |

(40) | bps | 10 | bps | N/A | N/A | N/A | |||||||||||||||||||||||||

Adjusted FFO per share – Diluted(2) |

$ | 1.92 | $ | 2.03 | $ | 1.76 | $ | 2.02 | $ | 0.08 | ||||||||||||||||||||||

| September 30, 2023 | December 31, 2022 | ||||||||||

| (unaudited) | |||||||||||

| ASSETS | |||||||||||

| Property and equipment, net | $ | 8,028 | $ | 8,301 | |||||||

| Intangibles, net | 42 | 43 | |||||||||

| Cash and cash equivalents | 726 | 906 | |||||||||

| Restricted cash | 60 | 33 | |||||||||

Accounts receivable, net of allowance for doubtful accounts of $1 and $2 |

149 | 129 | |||||||||

| Prepaid expenses | 63 | 58 | |||||||||

| Other assets | 36 | 47 | |||||||||

| Operating lease right-of-use assets | 201 | 214 | |||||||||

TOTAL ASSETS (variable interest entities – $241 and $237) |

$ | 9,305 | $ | 9,731 | |||||||

| LIABILITIES AND EQUITY | |||||||||||

| Liabilities | |||||||||||

| Debt | $ | 4,490 | $ | 4,617 | |||||||

| Accounts payable and accrued expenses | 293 | 220 | |||||||||

| Due to hotel managers | 136 | 141 | |||||||||

| Other liabilities | 221 | 228 | |||||||||

| Operating lease liabilities | 225 | 234 | |||||||||

Total liabilities (variable interest entities – $218 and $219) |

5,365 | 5,440 | |||||||||

| Stockholders' Equity | |||||||||||

Common stock, par value $0.01 per share, 6,000,000,000 shares authorized, 210,672,182 shares issued and 209,983,781 shares outstanding as of September 30, 2023 and 224,573,858 shares issued and 224,061,745 shares outstanding as of December 31, 2022 |

2 | 2 | |||||||||

| Additional paid-in capital | 4,151 | 4,321 | |||||||||

| (Accumulated deficit) retained earnings | (169) | 16 | |||||||||

| Total stockholders' equity | 3,984 | 4,339 | |||||||||

| Noncontrolling interests | (44) | (48) | |||||||||

| Total equity | 3,940 | 4,291 | |||||||||

| TOTAL LIABILITIES AND EQUITY | $ | 9,305 | $ | 9,731 | |||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Revenues | |||||||||||||||||||||||

| Rooms | $ | 432 | $ | 428 | $ | 1,256 | $ | 1,153 | |||||||||||||||

| Food and beverage | 159 | 148 | 518 | 431 | |||||||||||||||||||

| Ancillary hotel | 66 | 67 | 203 | 198 | |||||||||||||||||||

| Other | 22 | 19 | 64 | 54 | |||||||||||||||||||

| Total revenues | 679 | 662 | 2,041 | 1,836 | |||||||||||||||||||

| Operating expenses | |||||||||||||||||||||||

| Rooms | 119 | 115 | 343 | 298 | |||||||||||||||||||

| Food and beverage | 122 | 115 | 377 | 321 | |||||||||||||||||||

| Other departmental and support | 161 | 162 | 484 | 453 | |||||||||||||||||||

| Other property-level | 59 | 58 | 182 | 173 | |||||||||||||||||||

| Management fees | 31 | 30 | 95 | 84 | |||||||||||||||||||

| Casualty and impairment loss | — | 3 | 204 | 4 | |||||||||||||||||||

| Depreciation and amortization | 65 | 67 | 193 | 204 | |||||||||||||||||||

| Corporate general and administrative | 18 | 16 | 50 | 48 | |||||||||||||||||||

| Other | 19 | 18 | 61 | 52 | |||||||||||||||||||

| Total expenses | 594 | 584 | 1,989 | 1,637 | |||||||||||||||||||

| Gain on sales of assets, net | — | 14 | 15 | 13 | |||||||||||||||||||

| Operating income | 85 | 92 | 67 | 212 | |||||||||||||||||||

| Interest income | 9 | 4 | 29 | 5 | |||||||||||||||||||

| Interest expense | (65) | (61) | (186) | (185) | |||||||||||||||||||

| Equity in earnings from investments in affiliates | 2 | 1 | 9 | 6 | |||||||||||||||||||

| Other gain, net | — | 1 | 4 | 98 | |||||||||||||||||||

| Income (loss) before income taxes | 31 | 37 | (77) | 136 | |||||||||||||||||||

| Income tax benefit (expense) | — | 3 | (5) | 2 | |||||||||||||||||||

| Net income (loss) | 31 | 40 | (82) | 138 | |||||||||||||||||||

| Net income attributable to noncontrolling interests | (4) | (5) | (8) | (10) | |||||||||||||||||||

| Net income (loss) attributable to stockholders | $ | 27 | $ | 35 | $ | (90) | $ | 128 | |||||||||||||||

| Earnings (loss) per share: | |||||||||||||||||||||||

| Earnings (loss) per share – Basic | $ | 0.13 | $ | 0.15 | $ | (0.42) | $ | 0.55 | |||||||||||||||

| Earnings (loss) per share – Diluted | $ | 0.13 | $ | 0.15 | $ | (0.42) | $ | 0.55 | |||||||||||||||

| Weighted average shares outstanding – Basic | 212 | 224 | 216 | 229 | |||||||||||||||||||

| Weighted average shares outstanding – Diluted | 212 | 224 | 216 | 229 | |||||||||||||||||||

| (unaudited, in millions) | Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Net income (loss) | $ | 31 | $ | 40 | $ | (82) | $ | 138 | |||||||||||||||

| Depreciation and amortization expense | 65 | 67 | 193 | 204 | |||||||||||||||||||

| Interest income | (9) | (4) | (29) | (5) | |||||||||||||||||||

| Interest expense | 65 | 61 | 186 | 185 | |||||||||||||||||||

| Income tax (benefit) expense | — | (3) | 5 | (2) | |||||||||||||||||||

| Interest expense, income tax and depreciation and amortization included in equity in earnings from investments in affiliates | 2 | 2 | 7 | 7 | |||||||||||||||||||

| EBITDA | 154 | 163 | 280 | 527 | |||||||||||||||||||

| Gain on sales of assets, net | — | (14) | (15) | (13) | |||||||||||||||||||

Gain on sale of investments in affiliates(1) |

— | — | (3) | (92) | |||||||||||||||||||

| Share-based compensation expense | 5 | 4 | 14 | 13 | |||||||||||||||||||

| Casualty and impairment loss | — | 3 | 204 | 4 | |||||||||||||||||||

| Other items | 4 | 2 | 16 | 8 | |||||||||||||||||||

| Adjusted EBITDA | $ | 163 | $ | 158 | $ | 496 | $ | 447 | |||||||||||||||

| (unaudited, dollars in millions) | Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Adjusted EBITDA | $ | 163 | $ | 158 | $ | 496 | $ | 447 | |||||||||||||||

| Less: Adjusted EBITDA from investments in affiliates | (4) | (4) | (19) | (20) | |||||||||||||||||||

Add: All other(1) |

14 | 13 | 40 | 37 | |||||||||||||||||||

| Hotel Adjusted EBITDA | 173 | 167 | 517 | 464 | |||||||||||||||||||

| Less: Adjusted EBITDA from hotels disposed of | — | (2) | (3) | (14) | |||||||||||||||||||

| Current Hotel Adjusted EBITDA | 173 | 165 | 514 | 450 | |||||||||||||||||||

| Less: Adjusted EBITDA from the Hilton San Francisco Hotels | (1) | (3) | (5) | 6 | |||||||||||||||||||

| Comparable Hotel Adjusted EBITDA | $ | 172 | $ | 162 | $ | 509 | $ | 456 | |||||||||||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Total Revenues | $ | 679 | $ | 662 | $ | 2,041 | $ | 1,836 | |||||||||||||||

| Less: Other revenue | (22) | (19) | (64) | (54) | |||||||||||||||||||

| Less: Revenues from hotels disposed of | — | (11) | (10) | (51) | |||||||||||||||||||

| Current Hotel Revenues | 657 | 632 | 1,967 | 1,731 | |||||||||||||||||||

| Less: Revenues from the Hilton San Francisco Hotels | (51) | (48) | (145) | (105) | |||||||||||||||||||

| Comparable Hotel Revenues | $ | 606 | $ | 584 | $ | 1,822 | $ | 1,626 | |||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||

| 2023 | 2022 | Change(2) |

2023 | 2022 | Change(2) |

||||||||||||||||||||||||||||||

| Total Revenues | $ | 679 | $ | 662 | 2.4 | % | $ | 2,041 | $ | 1,836 | 11.1 | % | |||||||||||||||||||||||

| Operating income | $ | 85 | $ | 92 | (8.5) | % | $ | 67 | $ | 212 | (68.3) | % | |||||||||||||||||||||||

Operating income margin(2) |

12.5 | % | 13.9 | % | (140) | bps | 3.3 | % | 11.5 | % | (820) | bps | |||||||||||||||||||||||

| Current Hotel Revenues | $ | 657 | $ | 632 | 3.9 | % | $ | 1,967 | $ | 1,731 | 13.6 | % | |||||||||||||||||||||||

| Current Hotel Adjusted EBITDA | $ | 173 | $ | 165 | 5.0 | % | $ | 514 | $ | 450 | 14.2 | % | |||||||||||||||||||||||

Current Hotel Adjusted EBITDA margin(2) |

26.3 | % | 26.0 | % | 30 | bps | 26.1 | % | 26.0 | % | 10 | bps | |||||||||||||||||||||||

| Comparable Hotel Revenues | $ | 606 | $ | 584 | 3.8 | % | $ | 1,822 | $ | 1,626 | 12.1 | % | |||||||||||||||||||||||

| Comparable Hotel Adjusted EBITDA | $ | 172 | $ | 162 | 6.4 | % | $ | 509 | $ | 456 | 11.7 | % | |||||||||||||||||||||||

Comparable Hotel Adjusted EBITDA margin(2) |

28.4 | % | 27.7 | % | 70 | bps | 28.0 | % | 28.1 | % | (10) | bps | |||||||||||||||||||||||

| (unaudited, dollars in millions) | Three Months Ended September 30, 2023 |

Nine Months Ended September 30, 2023 |

|||||||||

| Current Hotel Adjusted EBITDA | $ | 173 | $ | 514 | |||||||

| Less: Adjusted EBITDA from non-urban hotels | (116) | (377) | |||||||||

| Current Urban Hotel Adjusted EBITDA | 57 | 137 | |||||||||

| Less: Adjusted EBITDA from the Hilton San Francisco Hotels | (1) | (5) | |||||||||

| Comparable Urban Hotel Adjusted EBITDA | $ | 56 | $ | 132 | |||||||

| Three Months Ended September 30, 2023 |

Nine Months Ended September 30, 2023 |

||||||||||

| Current Hotel Revenues | $ | 657 | $ | 1,967 | |||||||

| Less: Revenues from non-urban hotels | (388) | (1,198) | |||||||||

| Current Urban Hotel Revenues | 269 | 769 | |||||||||

| Less: Revenues from the Hilton San Francisco Hotels | (51) | (145) | |||||||||

| Comparable Urban Hotel Revenues | $ | 218 | $ | 624 | |||||||

| Three Months Ended September 30, 2023 |

Nine Months Ended September 30, 2023 |

||||||||||

| Current Urban Hotel Revenues | $ | 269 | $ | 769 | |||||||

| Current Urban Hotel Adjusted EBITDA | $ | 57 | $ | 137 | |||||||

Current Urban Hotel Adjusted EBITDA margin(1) |

21.0 | % | 17.8 | % | |||||||

| Comparable Urban Hotel Revenues | $ | 218 | $ | 624 | |||||||

| Comparable Urban Hotel Adjusted EBITDA | $ | 56 | $ | 132 | |||||||

Comparable Urban Hotel Adjusted EBITDA margin(1) |

25.6 | % | 21.2 | % | |||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Net income (loss) attributable to stockholders | $ | 27 | $ | 35 | $ | (90) | $ | 128 | |||||||||||||||

| Depreciation and amortization expense | 65 | 67 | 193 | 204 | |||||||||||||||||||

| Depreciation and amortization expense attributable to noncontrolling interests | (1) | (1) | (3) | (3) | |||||||||||||||||||

| Gain on sales of assets, net | — | (14) | (15) | (13) | |||||||||||||||||||

Gain on sale of investments in affiliates(1) |

— | — | (3) | (92) | |||||||||||||||||||

| Impairment loss | — | — | 202 | — | |||||||||||||||||||

| Equity investment adjustments: | |||||||||||||||||||||||

| Equity in earnings from investments in affiliates | (2) | (1) | (9) | (6) | |||||||||||||||||||

| Pro rata FFO of investments in affiliates | 2 | 1 | 12 | 11 | |||||||||||||||||||

| Nareit FFO attributable to stockholders | 91 | 87 | 287 | 229 | |||||||||||||||||||

| Casualty loss | — | 3 | 2 | 4 | |||||||||||||||||||

| Share-based compensation expense | 5 | 4 | 14 | 13 | |||||||||||||||||||

Other items(2) |

12 | — | 26 | 5 | |||||||||||||||||||

| Adjusted FFO attributable to stockholders | $ | 108 | $ | 94 | $ | 329 | $ | 251 | |||||||||||||||

Nareit FFO per share – Diluted(3) |

$ | 0.43 | $ | 0.39 | $ | 1.33 | $ | 1.00 | |||||||||||||||

Adjusted FFO per share – Diluted(3) |

$ | 0.51 | $ | 0.42 | $ | 1.52 | $ | 1.09 | |||||||||||||||

| Weighted average shares outstanding – Diluted | 212 | 224 | 216 | 229 | |||||||||||||||||||

| (unaudited, in millions) | |||||||||||||||||

|

Current

September 30, 2023

|

SF Mortgage Loan Adjustments(1) |

Comparable September 30, 2023(1) |

|||||||||||||||

| Debt | $ | 4,490 | $ | (725) | $ | 3,765 | |||||||||||

| Add: unamortized deferred financing costs and discount | 23 | — | 23 | ||||||||||||||

| Less: unamortized premium | (1) | — | (1) | ||||||||||||||

| Debt, excluding unamortized deferred financing cost, premiums and discounts

|

4,512 | (725) | 3,787 | ||||||||||||||

| Add: Park's share of unconsolidated affiliates debt, excluding unamortized deferred financing costs

|

169 | — | 169 | ||||||||||||||

| Less: cash and cash equivalents | (726) | 162 | (564) | ||||||||||||||

| Less: restricted cash | (60) | 26 | (34) | ||||||||||||||

| Net debt | $ | 3,895 | $ | (537) | $ | 3,358 | |||||||||||

| About Park and Safe Harbor Disclosure | ||||||||

2 |

|

|||||||

|

||||||||||||||

| Table of Contents | ||||||||||||||

3 |

|

|||||||

| Financial Statements | |||||

4 |

|

|||||||

| Financial Statements | ||||||||

| Condensed Consolidated Balance Sheets | ||||||||

| (in millions, except share and per share data) | September 30, 2023 | December 31, 2022 | |||||||||

| (unaudited) | |||||||||||

| ASSETS | |||||||||||

| Property and equipment, net | $ | 8,028 | $ | 8,301 | |||||||

| Intangibles, net | 42 | 43 | |||||||||

| Cash and cash equivalents | 726 | 906 | |||||||||

| Restricted cash | 60 | 33 | |||||||||

Accounts receivable, net of allowance for doubtful accounts of $1 and $2 |

149 | 129 | |||||||||

| Prepaid expenses | 63 | 58 | |||||||||

| Other assets | 36 | 47 | |||||||||

| Operating lease right-of-use assets | 201 | 214 | |||||||||

TOTAL ASSETS (variable interest entities – $241 and $237) |

$ | 9,305 | $ | 9,731 | |||||||

| LIABILITIES AND EQUITY | |||||||||||

| Liabilities | |||||||||||

| Debt | $ | 4,490 | $ | 4,617 | |||||||

| Accounts payable and accrued expenses | 293 | 220 | |||||||||

| Due to hotel managers | 136 | 141 | |||||||||

| Other liabilities | 221 | 228 | |||||||||

| Operating lease liabilities | 225 | 234 | |||||||||

Total liabilities (variable interest entities – $218 and $219) |

5,365 | 5,440 | |||||||||

| Stockholders' Equity | |||||||||||

Common stock, par value $0.01 per share, 6,000,000,000 shares authorized, 210,672,182 shares issued and 209,983,781 shares outstanding as of September 30, 2023 and 224,573,858 shares issued and 224,061,745 shares outstanding as of December 31, 2022 |

2 | 2 | |||||||||

| Additional paid-in capital | 4,151 | 4,321 | |||||||||

| (Accumulated deficit) retained earnings | (169) | 16 | |||||||||

| Total stockholders' equity | 3,984 | 4,339 | |||||||||

| Noncontrolling interests | (44) | (48) | |||||||||

| Total equity | 3,940 | 4,291 | |||||||||

| TOTAL LIABILITIES AND EQUITY | $ | 9,305 | $ | 9,731 | |||||||

5 |

|

|||||||

| Financial Statements (continued) | ||||||||

| Condensed Consolidated Statements of Operations | ||||||||

| (unaudited, in millions, except per share data) | ||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||

| 2023 | 2022 | 2019 | 2023 | 2022 | 2019 | ||||||||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||||||||

| Rooms | $ | 432 | $ | 428 | $ | 430 | $ | 1,256 | $ | 1,153 | $ | 1,267 | |||||||||||||||||||||||

| Food and beverage | 159 | 148 | 156 | 518 | 431 | 534 | |||||||||||||||||||||||||||||

| Ancillary hotel | 66 | 67 | 64 | 203 | 198 | 174 | |||||||||||||||||||||||||||||

| Other | 22 | 19 | 22 | 64 | 54 | 59 | |||||||||||||||||||||||||||||

| Total revenues | 679 | 662 | 672 | 2,041 | 1,836 | 2,034 | |||||||||||||||||||||||||||||

| Operating expenses | |||||||||||||||||||||||||||||||||||

| Rooms | 119 | 115 | 114 | 343 | 298 | 334 | |||||||||||||||||||||||||||||

| Food and beverage | 122 | 115 | 117 | 377 | 321 | 371 | |||||||||||||||||||||||||||||

| Other departmental and support | 161 | 162 | 153 | 484 | 453 | 453 | |||||||||||||||||||||||||||||

| Other property-level | 59 | 58 | 54 | 182 | 173 | 152 | |||||||||||||||||||||||||||||

| Management fees | 31 | 30 | 32 | 95 | 84 | 101 | |||||||||||||||||||||||||||||

| Casualty and impairment loss, net | — | 3 | 8 | 204 | 4 | 8 | |||||||||||||||||||||||||||||

| Depreciation and amortization | 65 | 67 | 61 | 193 | 204 | 184 | |||||||||||||||||||||||||||||

| Corporate general and administrative | 18 | 16 | 14 | 50 | 48 | 47 | |||||||||||||||||||||||||||||

| Acquisition costs | — | — | 59 | — | — | 65 | |||||||||||||||||||||||||||||

| Other | 19 | 18 | 23 | 61 | 52 | 61 | |||||||||||||||||||||||||||||

| Total expenses | 594 | 584 | 635 | 1,989 | 1,637 | 1,776 | |||||||||||||||||||||||||||||

| Gain on sales of assets, net | — | 14 | 1 | 15 | 13 | 20 | |||||||||||||||||||||||||||||

| Operating income | 85 | 92 | 38 | 67 | 212 | 278 | |||||||||||||||||||||||||||||

| Interest income | 9 | 4 | 2 | 29 | 5 | 5 | |||||||||||||||||||||||||||||

| Interest expense | (65) | (61) | (33) | (186) | (185) | (98) | |||||||||||||||||||||||||||||

| Equity in earnings from investments in affiliates | 2 | 1 | 3 | 9 | 6 | 18 | |||||||||||||||||||||||||||||

| Other gain (loss), net | — | 1 | (1) | 4 | 98 | (1) | |||||||||||||||||||||||||||||

| Income (loss) before income taxes | 31 | 37 | 9 | (77) | 136 | 202 | |||||||||||||||||||||||||||||

| Income tax benefit (expense) | — | 3 | — | (5) | 2 | (12) | |||||||||||||||||||||||||||||

| Net income (loss) | 31 | 40 | 9 | (82) | 138 | 190 | |||||||||||||||||||||||||||||

| Net income attributable to noncontrolling interests | (4) | (5) | (4) | (8) | (10) | (7) | |||||||||||||||||||||||||||||

| Net income (loss) attributable to stockholders | $ | 27 | $ | 35 | $ | 5 | $ | (90) | $ | 128 | $ | 183 | |||||||||||||||||||||||

| Earnings (loss) per share: | |||||||||||||||||||||||||||||||||||

| Earnings (loss) per share – Basic | $ | 0.13 | $ | 0.15 | $ | 0.02 | $ | (0.42) | $ | 0.55 | $ | 0.90 | |||||||||||||||||||||||

| Earnings (loss) per share – Diluted | $ | 0.13 | $ | 0.15 | $ | 0.02 | $ | (0.42) | $ | 0.55 | $ | 0.90 | |||||||||||||||||||||||

| Weighted average shares outstanding – Basic | 212 | 224 | 206 | 216 | 229 | 203 | |||||||||||||||||||||||||||||

| Weighted average shares outstanding – Diluted | 212 | 224 | 207 | 216 | 229 | 204 | |||||||||||||||||||||||||||||

6 |

|

|||||||

| Supplementary Financial Information | |||||

7 |

|

|||||||

| Supplementary Financial Information | ||||||||

| EBITDA and Adjusted EBITDA | ||||||||

| (unaudited, in millions) | Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||||||||||

| 2023 | 2022 | 2019 | 2023 | 2022 | 2019 | ||||||||||||||||||||||||||||||

| Net income (loss) | $ | 31 | $ | 40 | $ | 9 | $ | (82) | $ | 138 | $ | 190 | |||||||||||||||||||||||

| Depreciation and amortization expense | 65 | 67 | 61 | 193 | 204 | 184 | |||||||||||||||||||||||||||||

| Interest income | (9) | (4) | (2) | (29) | (5) | (5) | |||||||||||||||||||||||||||||

| Interest expense | 65 | 61 | 33 | 186 | 185 | 98 | |||||||||||||||||||||||||||||

| Income tax (benefit) expense | — | (3) | — | 5 | (2) | 12 | |||||||||||||||||||||||||||||

Interest expense, income tax and depreciation and amortization included in equity in earnings from investments in affiliates |

2 | 2 | 7 | 7 | 7 | 19 | |||||||||||||||||||||||||||||

| EBITDA | 154 | 163 | 108 | 280 | 527 | 498 | |||||||||||||||||||||||||||||

| Gain on sales of assets, net | — | (14) | (1) | (15) | (13) | (20) | |||||||||||||||||||||||||||||

Gain on sale of investments in affiliates(1) |

— | — | — | (3) | (92) | — | |||||||||||||||||||||||||||||

| Acquisition costs | — | — | 59 | — | — | 65 | |||||||||||||||||||||||||||||

| Severance expense | — | — | — | — | — | 2 | |||||||||||||||||||||||||||||

| Share-based compensation expense | 5 | 4 | 4 | 14 | 13 | 12 | |||||||||||||||||||||||||||||

| Casualty and impairment loss, net | — | 3 | 8 | 204 | 4 | 8 | |||||||||||||||||||||||||||||

| Other items | 4 | 2 | 2 | 16 | 8 | (2) | |||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 163 | $ | 158 | $ | 180 | $ | 496 | $ | 447 | $ | 563 | |||||||||||||||||||||||

8 |

|

|||||||

| Supplementary Financial Information (continued) | ||||||||

| Current Hotel Adjusted EBITDA and Current Hotel Adjusted EBITDA Margin | ||||||||

| (unaudited, dollars in millions) | |||||||||||||||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||

| 2023 | 2022 | 2019 | 2023 | 2022 | 2019 | ||||||||||||||||||||||||||||||

Adjusted EBITDA(1) |

$ | 163 | $ | 158 | $ | 180 | $ | 496 | $ | 447 | $ | 563 | |||||||||||||||||||||||

| Less: Adjusted EBITDA from investments in affiliates | (4) | (4) | (9) | (19) | (20) | (31) | |||||||||||||||||||||||||||||

Add: All other(2) |

14 | 13 | 12 | 40 | 37 | 41 | |||||||||||||||||||||||||||||

| Hotel Adjusted EBITDA | 173 | 167 | 183 | 517 | 464 | 573 | |||||||||||||||||||||||||||||

| Add: Adjusted EBITDA from hotels acquired | — | — | 39 | — | — | 129 | |||||||||||||||||||||||||||||

| Less: Adjusted EBITDA from hotels disposed of | — | (2) | (19) | (3) | (14) | (80) | |||||||||||||||||||||||||||||

| Current Hotel Adjusted EBITDA | $ | 173 | $ | 165 | $ | 203 | $ | 514 | $ | 450 | $ | 622 | |||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||

| 2023 | 2022 | 2019 | 2023 | 2022 | 2019 | ||||||||||||||||||||||||||||||

| Total Revenues | $ | 679 | $ | 662 | $ | 672 | $ | 2,041 | $ | 1,836 | $ | 2,034 | |||||||||||||||||||||||

| Less: Other revenue | (22) | (19) | (22) | (64) | (54) | (59) | |||||||||||||||||||||||||||||

| Add: Revenues from hotels acquired | — | — | 125 | — | — | 406 | |||||||||||||||||||||||||||||

| Less: Revenues from hotels disposed of | — | (11) | (70) | (10) | (51) | (260) | |||||||||||||||||||||||||||||

| Current Hotel Revenues | $ | 657 | $ | 632 | $ | 705 | $ | 1,967 | $ | 1,731 | $ | 2,121 | |||||||||||||||||||||||

| Three Months Ended September 30, | 2023 vs 2022 | 2023 vs 2019 | |||||||||||||||||||||||||||

| 2023 | 2022 | 2019 | Change(3) |

Change(3) |

|||||||||||||||||||||||||

| Total Revenues | $ | 679 | $ | 662 | $ | 672 | 2.4 | % | 0.9 | % | |||||||||||||||||||

| Operating income | $ | 85 | $ | 92 | $ | 38 | (8.5) | % | 116.5 | % | |||||||||||||||||||

Operating income margin(3) |

12.5 | % | 13.9 | % | 5.8 | % | (140) | bps | 670 | bps | |||||||||||||||||||

| Current Hotel Revenues | $ | 657 | $ | 632 | $ | 705 | 3.9 | % | (6.8) | % | |||||||||||||||||||

| Current Hotel Adjusted EBITDA | $ | 173 | $ | 165 | $ | 203 | 5.0 | % | (14.8) | % | |||||||||||||||||||

Current Hotel Adjusted EBITDA margin(3) |

26.3 | % | 26.0 | % | 28.8 | % | 30 | bps | (250) | bps | |||||||||||||||||||

| Nine Months Ended September 30, | 2023 vs 2022 | 2023 vs 2019 | |||||||||||||||||||||||||||

| 2023 | 2022 | 2019 | Change(3) |

Change(3) |

|||||||||||||||||||||||||

| Total Revenues | $ | 2,041 | $ | 1,836 | $ | 2,034 | 11.1 | % | 0.3 | % | |||||||||||||||||||

| Operating income | $ | 67 | $ | 212 | $ | 278 | (68.3) | % | (76.0) | % | |||||||||||||||||||

Operating income margin(3) |

3.3 | % | 11.5 | % | 13.7 | % | (820) | bps | (1,040) | bps | |||||||||||||||||||

| Current Hotel Revenues | $ | 1,967 | $ | 1,731 | $ | 2,121 | 13.6 | % | (7.3) | % | |||||||||||||||||||

| Current Hotel Adjusted EBITDA | $ | 514 | $ | 450 | $ | 622 | 14.2 | % | (17.3) | % | |||||||||||||||||||

Current Hotel Adjusted EBITDA margin(3) |

26.1 | % | 26.0 | % | 29.3 | % | 10 | bps | (320) | bps | |||||||||||||||||||

9 |

|

|||||||

| Supplementary Financial Information (continued) | ||||||||

| Nareit FFO and Adjusted FFO | ||||||||

(unaudited, in millions, except per share data) |

||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||

| 2023 | 2022 | 2019 | 2023 | 2022 | 2019 | ||||||||||||||||||||||||||||||

| Net income (loss) attributable to stockholders | $ | 27 | $ | 35 | $ | 5 | $ | (90) | $ | 128 | $ | 183 | |||||||||||||||||||||||

| Depreciation and amortization expense | 65 | 67 | 61 | 193 | 204 | 184 | |||||||||||||||||||||||||||||

Depreciation and amortization expense attributable to noncontrolling interests |

(1) | (1) | (1) | (3) | (3) | (3) | |||||||||||||||||||||||||||||

| Gain on sales of assets, net | — | (14) | (1) | (15) | (13) | (20) | |||||||||||||||||||||||||||||

Gain on sale of investments in affiliates(1) |

— | — | — | (3) | (92) | — | |||||||||||||||||||||||||||||

| Impairment loss | — | — | — | 202 | — | — | |||||||||||||||||||||||||||||

| Equity investment adjustments: | |||||||||||||||||||||||||||||||||||

| Equity in earnings from investments in affiliates | (2) | (1) | (3) | (9) | (6) | (18) | |||||||||||||||||||||||||||||

| Pro rata FFO of investments in affiliates | 2 | 1 | 6 | 12 | 11 | 27 | |||||||||||||||||||||||||||||

| Nareit FFO attributable to stockholders | 91 | 87 | 67 | 287 | 229 | 353 | |||||||||||||||||||||||||||||

| Casualty loss, net | — | 3 | 7 | 2 | 4 | 7 | |||||||||||||||||||||||||||||

| Severance expense | — | — | — | — | — | 2 | |||||||||||||||||||||||||||||

| Acquisition costs | — | — | 59 | — | — | 65 | |||||||||||||||||||||||||||||

| Share-based compensation expense | 5 | 4 | 4 | 14 | 13 | 12 | |||||||||||||||||||||||||||||

| Other items | 12 | — | 3 | 26 | 5 | 1 | |||||||||||||||||||||||||||||

| Adjusted FFO attributable to stockholders | $ | 108 | $ | 94 | $ | 140 | $ | 329 | $ | 251 | $ | 440 | |||||||||||||||||||||||

Nareit FFO per share – Diluted(2) |

$ | 0.43 | $ | 0.39 | $ | 0.33 | $ | 1.33 | $ | 1.00 | $ | 1.73 | |||||||||||||||||||||||

Adjusted FFO per share – Diluted(2) |

$ | 0.51 | $ | 0.42 | $ | 0.68 | $ | 1.52 | $ | 1.09 | $ | 2.16 | |||||||||||||||||||||||

Weighted average shares outstanding – Diluted(3) |

212 | 224 | 207 | 216 | 229 | 204 | |||||||||||||||||||||||||||||

10 |

|

|||||||

| Supplementary Financial Information (continued) | ||||||||

| General and Administrative Expenses | ||||||||

| (unaudited, in millions) | Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Corporate general and administrative expenses | $ | 18 | $ | 16 | $ | 50 | $ | 48 | |||||||||||||||

| Less: | |||||||||||||||||||||||

| Share-based compensation expense | 5 | 4 | 14 | 13 | |||||||||||||||||||

| Other items | — | — | 2 | 3 | |||||||||||||||||||

| G&A, excluding expenses not included in Adjusted EBITDA | $ | 13 | $ | 12 | $ | 34 | $ | 32 | |||||||||||||||

11 |

|

|||||||

| Supplementary Financial Information (continued) | ||||||||

| Net Debt and Net Debt to TTM Adjusted EBITDA Ratio | ||||||||

| (unaudited, in millions) | Current | SF Mortgage Loan Adjustments(1) |

Comparable | ||||||||||||||

| September 30, 2023 | September 30, 2023(1) |

||||||||||||||||

| Debt | $ | 4,490 | $ | (725) | $ | 3,765 | |||||||||||

| Add: unamortized deferred financing costs and discount | 23 | — | 23 | ||||||||||||||

| Less: unamortized premium | (1) | — | (1) | ||||||||||||||

Debt, excluding unamortized deferred financing cost, premiums and discounts |

4,512 | (725) | 3,787 | ||||||||||||||

Add: Park's share of unconsolidated affiliates debt, excluding unamortized deferred financing costs |

169 | — | 169 | ||||||||||||||

| Less: cash and cash equivalents | (726) | 162 | (564) | ||||||||||||||

| Less: restricted cash | (60) | 26 | (34) | ||||||||||||||

| Net debt | $ | 3,895 | $ | (537) | $ | 3,358 | |||||||||||

TTM Adjusted EBITDA(2) |

$ | 648 | $ | — | $ | 648 | |||||||||||

| Net debt to TTM Adjusted EBITDA ratio | 6.01x | 5.18x | |||||||||||||||

| Current | SF Mortgage Loan Adjustments(1) |

Comparable | |||||||||||||||

| December 31, 2022 | December 31, 2022(1) |

||||||||||||||||

| Debt | $ | 4,617 | $ | (725) | $ | 3,892 | |||||||||||

| Add: unamortized deferred financing costs and discount | 30 | — | 30 | ||||||||||||||

| Less: unamortized premium | (3) | — | (3) | ||||||||||||||

Debt, excluding unamortized deferred financing cost, premiums and discounts |

4,644 | (725) | 3,919 | ||||||||||||||

Add: Park's share of unconsolidated affiliates debt, excluding unamortized deferred financing costs |

169 | — | 169 | ||||||||||||||

| Less: cash and cash equivalents | (906) | 162 | (744) | ||||||||||||||

| Less: restricted cash | (33) | — | (33) | ||||||||||||||

| Net debt | $ | 3,874 | $ | (563) | $ | 3,311 | |||||||||||

TTM Adjusted EBITDA(2) |

$ | 580 | $ | 11 | $ | 591 | |||||||||||

| Net debt to TTM Adjusted EBITDA ratio | 6.68x | 5.60x | |||||||||||||||

12 |

|

|||||||

| Outlook | |||||

13 |

|

|||||||

| Outlook | ||||||||

Full-Year 2023 Outlook and Assumptions |

||||||||

Park is not providing a full year 2023 outlook for net income, net income attributable to stockholders, earnings per share, operating income and operating income margin and the accompanying reconciliations as all the information necessary for the calculation of the gain (loss) on derecognition of assets and income tax expense resulting from the Hilton San Francisco Hotels being placed into receivership is not yet available, and Park is unable to reasonably estimate such amounts without unreasonable burden or efforts. These amounts are expected to be material; however, they are not expected to materially affect Park’s outlook for Adjusted EBITDA, Hotel Adjusted EBITDA, Hotel Adjusted EBITDA margin, Adjusted FFO or Adjusted FFO per share. Park expects full-year 2023 operating results to be as follows: | ||||||||||||||||||||||||||||||||

| (unaudited, dollars in millions, except per share amounts and RevPAR) | ||||||||||||||||||||||||||||||||

|

Full-Year 2023 Outlook

as of November 1, 2023

|

Full-Year 2023 Outlook

as of August 2, 2023(1)

|

Change at Midpoint |

||||||||||||||||||||||||||||||

| Metric | Low | High | Low | High | ||||||||||||||||||||||||||||

| Comparable RevPAR | $ | 177 | $ | 179 | N/A | N/A | N/A | |||||||||||||||||||||||||

| Comparable RevPAR change vs. 2022 | 7.5 | % | 9.0 | % | N/A | N/A | N/A | |||||||||||||||||||||||||

| Adjusted EBITDA | $ | 644 | $ | 668 | $ | 619 | $ | 679 | $ | 7 | ||||||||||||||||||||||

Comparable Hotel Adjusted EBITDA margin(2) |

27.7 | % | 28.2 | % | N/A | N/A | N/A | |||||||||||||||||||||||||

Comparable Hotel Adjusted EBITDA margin change vs. 2022(2) |

(40) | bps | 10 | bps | N/A | N/A | N/A | |||||||||||||||||||||||||

Adjusted FFO per share – Diluted(2) |

$ | 1.92 | $ | 2.03 | $ | 1.76 | $ | 2.02 | $ | 0.08 | ||||||||||||||||||||||

14 |

|

|||||||

Portfolio and Operating Metrics |

|||||

15 |

|

|||||||

| Portfolio and Operating Metrics | ||||||||

Hotel Portfolio as of September 30, 2023(1) |

||||||||

| Hotel Name | Total Rooms | Market |

Meeting Space

(square feet)

|

Ownership | Equity Ownership |

Debt

(in millions)

|

|||||||||||||||||||||||||||||

| Comparable Portfolio | |||||||||||||||||||||||||||||||||||

| Hilton Hawaiian Village Waikiki Beach Resort | 2,860 | Hawaii | 150,000 | Fee Simple | 100% | $ | 1,275 | ||||||||||||||||||||||||||||

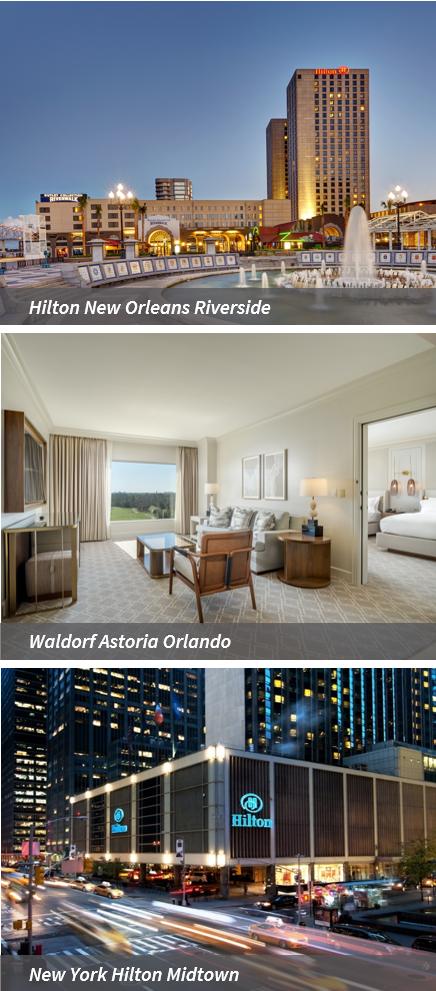

| New York Hilton Midtown | 1,878 | New York | 151,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| Hilton New Orleans Riverside | 1,622 | New Orleans | 158,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| Hilton Chicago | 1,544 | Chicago | 234,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| Signia by Hilton Orlando Bonnet Creek | 1,009 | Orlando | 157,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| DoubleTree Hotel Seattle Airport | 850 | Seattle | 41,000 | Leasehold | 100% | — | |||||||||||||||||||||||||||||

| Hilton Orlando Lake Buena Vista | 814 | Orlando | 86,000 | Leasehold | 100% | — | |||||||||||||||||||||||||||||

| Caribe Hilton | 652 | Other U.S. | 65,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

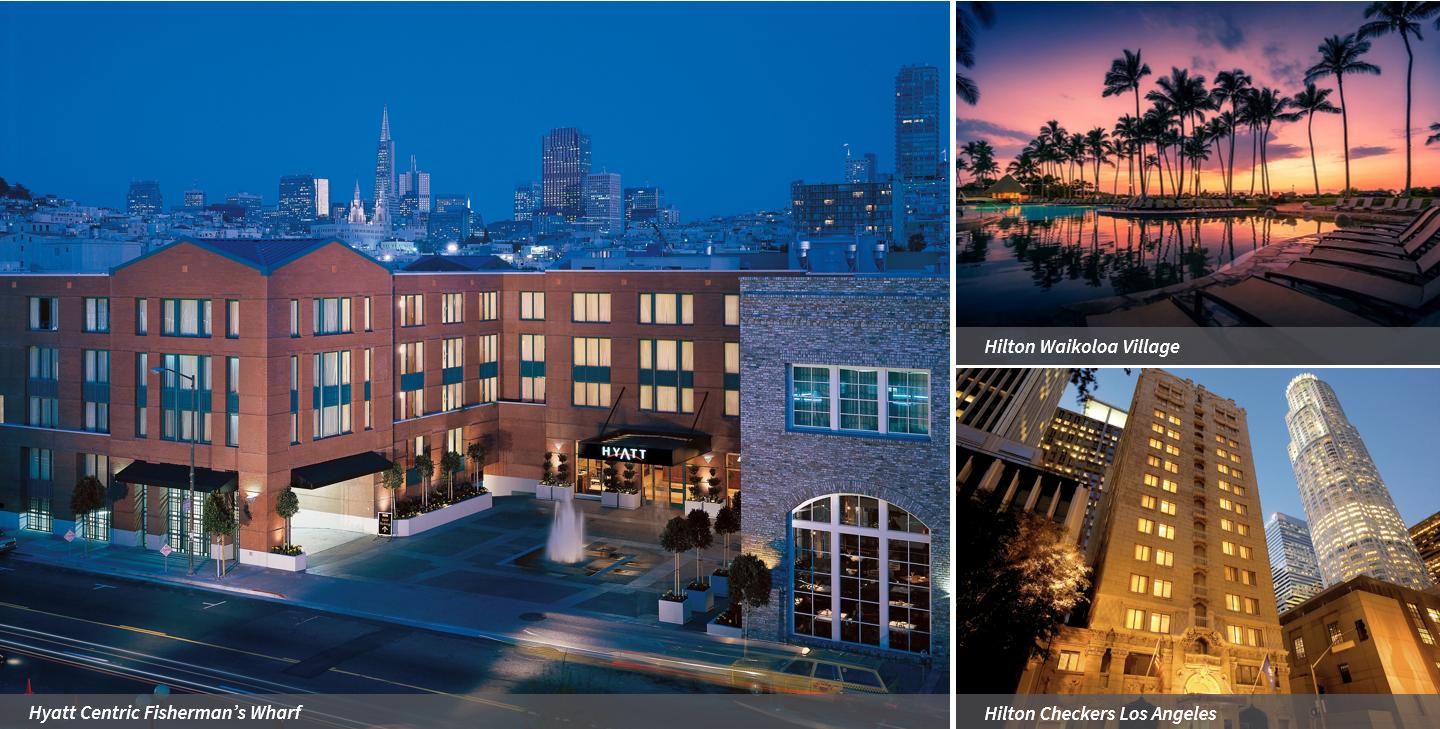

| Hilton Waikoloa Village | 647 | Hawaii | 241,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| DoubleTree Hotel Washington DC – Crystal City | 627 | Washington, D.C. | 36,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

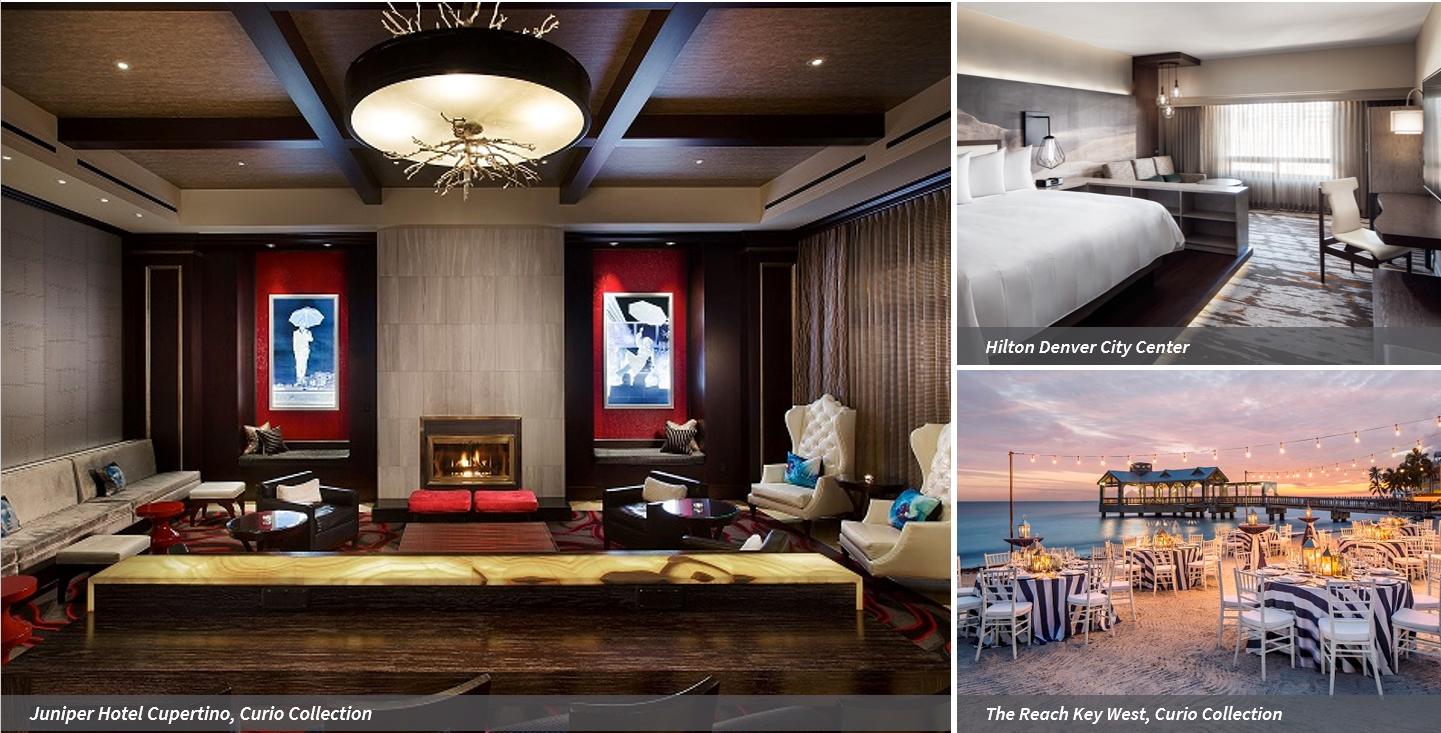

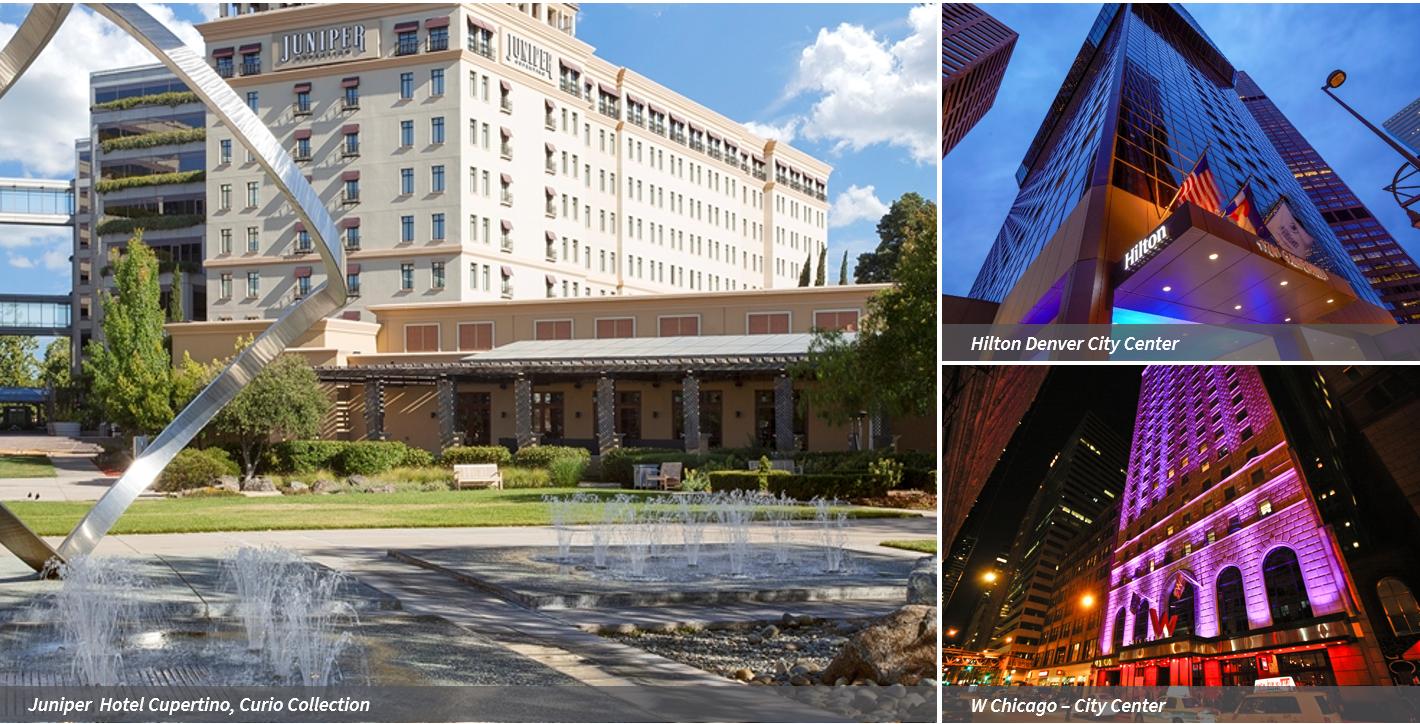

| Hilton Denver City Center | 613 | Denver | 50,000 | Fee Simple | 100% | $ | 54 | ||||||||||||||||||||||||||||

| Hilton Boston Logan Airport | 604 | Boston | 30,000 | Leasehold | 100% | — | |||||||||||||||||||||||||||||

| W Chicago – Lakeshore | 520 | Chicago | 20,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| DoubleTree Hotel San Jose | 505 | Other U.S. | 48,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| Hyatt Regency Boston | 502 | Boston | 30,000 | Fee Simple | 100% | $ | 129 | ||||||||||||||||||||||||||||

| Waldorf Astoria Orlando | 502 | Orlando | 47,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| Hilton Salt Lake City Center | 500 | Other U.S. | 24,000 | Leasehold | 100% | — | |||||||||||||||||||||||||||||

| DoubleTree Hotel Ontario Airport | 482 | Southern California | 27,000 | Fee Simple | 67% | $ | 30 | ||||||||||||||||||||||||||||

| Hilton McLean Tysons Corner | 458 | Washington, D.C. | 28,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| Hyatt Regency Mission Bay Spa and Marina | 438 | Southern California | 24,000 | Leasehold | 100% | — | |||||||||||||||||||||||||||||

| Boston Marriott Newton | 430 | Boston | 34,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| W Chicago – City Center | 403 | Chicago | 13,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| Hilton Seattle Airport & Conference Center | 396 | Seattle | 40,000 | Leasehold | 100% | — | |||||||||||||||||||||||||||||

| Royal Palm South Beach Miami, a Tribute Portfolio Resort | 393 | Miami | 11,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| DoubleTree Hotel Spokane City Center | 375 | Other U.S. | 21,000 | Fee Simple | 10% | $ | 14 | ||||||||||||||||||||||||||||

| Hilton Santa Barbara Beachfront Resort | 360 | Southern California | 62,000 | Fee Simple | 50% | $ | 160 | ||||||||||||||||||||||||||||

| Hilton Oakland Airport | 360 | Other U.S. | 15,000 | Leasehold | 100% | — | |||||||||||||||||||||||||||||

| JW Marriott San Francisco Union Square | 344 | San Francisco | 12,000 | Leasehold | 100% | — | |||||||||||||||||||||||||||||

| Hyatt Centric Fisherman's Wharf | 316 | San Francisco | 19,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| Hilton Short Hills | 314 | Other U.S. | 21,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| Casa Marina Key West, Curio Collection | 311 | Key West | 21,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

16 |

|

|||||||

| Portfolio and Operating Metrics (continued) | ||||||||

Hotel Portfolio as of September 30, 2023(1) |

||||||||

| Hotel Name | Total Rooms | Market |

Meeting Space

(square feet)

|

Ownership | Equity Ownership |

Debt(2)

(in millions)

|

|||||||||||||||||||||||||||||

| Comparable Portfolio (continued) | |||||||||||||||||||||||||||||||||||

| DoubleTree Hotel San Diego – Mission Valley | 300 | Southern California | 24,000 | Leasehold | 100% | — | |||||||||||||||||||||||||||||

| Embassy Suites Kansas City Plaza | 266 | Other U.S. | 11,000 | Leasehold | 100% | — | |||||||||||||||||||||||||||||

| Embassy Suites Austin Downtown South Congress | 262 | Other U.S. | 2,000 | Leasehold | 100% | — | |||||||||||||||||||||||||||||

| DoubleTree Hotel Sonoma Wine Country | 245 | Other U.S. | 50,000 | Leasehold | 100% | — | |||||||||||||||||||||||||||||

| Juniper Hotel Cupertino, Curio Collection | 224 | Other U.S. | 5,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| Hilton Checkers Los Angeles | 193 | Southern California | 3,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

| DoubleTree Hotel Durango | 159 | Other U.S. | 7,000 | Leasehold | 100% | — | |||||||||||||||||||||||||||||

| The Reach Key West, Curio Collection | 150 | Key West | 18,000 | Fee Simple | 100% | — | |||||||||||||||||||||||||||||

Total Comparable Portfolio (39 Hotels) |

23,428 | 2,036,000 | $ | 1,662 | |||||||||||||||||||||||||||||||

| Hilton San Francisco Union Square | 1,921 | San Francisco | 135,000 | Fee Simple | 100% | $ | 725 | (3) |

|||||||||||||||||||||||||||

| Parc 55 San Francisco – a Hilton Hotel | 1,024 | San Francisco | 32,000 | Fee Simple | 100% | — | (3) |

||||||||||||||||||||||||||||

| Hilton San Francisco Hotels (2 Hotels) | 2,945 | 167,000 | $ | 725 | |||||||||||||||||||||||||||||||

| Total Current Portfolio (41 Hotels) | 26,373 | 2,203,000 | $ | 2,387 | |||||||||||||||||||||||||||||||

| Unconsolidated Joint Venture Portfolio | |||||||||||||||||||||||||||||||||||

| Hilton Orlando | 1,424 | Orlando | 236,000 | Fee Simple | 20% | $ | 95 | ||||||||||||||||||||||||||||

| Capital Hilton | 550 | Washington, D.C. | 30,000 | Fee Simple | 25% | $ | 25 | ||||||||||||||||||||||||||||

| Hilton La Jolla Torrey Pines | 394 | Southern California | 41,000 | Leasehold | 25% | $ | 24 | ||||||||||||||||||||||||||||

| Embassy Suites Alexandria Old Town | 288 | Washington, D.C. | 11,000 | Fee Simple | 50% | $ | 25 | ||||||||||||||||||||||||||||

Total Unconsolidated Joint Venture Portfolio (4 Hotels) |

2,656 | 318,000 | $ | 169 | |||||||||||||||||||||||||||||||

| Grand Total (45 Hotels) | 29,029 | 2,521,000 | $ | 2,556 | |||||||||||||||||||||||||||||||

17 |

|

|||||||

| Portfolio and Operating Metrics (continued) | ||||||||

Current Hotels by Market: Q3 2023 vs. Q3 2022 |

||||||||

| (unaudited) | Current ADR | Current Occupancy | Current RevPAR | Current Total RevPAR | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hotels | Rooms | 3Q23 | 3Q22 | Change(1) |

3Q23 | 3Q22 | Change | 3Q23 | 3Q22 | Change(1) |

3Q23 | 3Q22 | Change(1) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hawaii | 2 | 3,507 | $ | 322.09 | $ | 319.46 | 0.8 | % | 92.0 | % | 89.7 | % | 2.3 | % pts | $ | 296.29 | $ | 286.37 | 3.5 | % | $ | 501.43 | $ | 489.59 | 2.4 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

San Francisco(2) |

4 | 3,605 | 239.14 | 237.30 | 0.8 | 65.5 | 64.7 | 0.8 | 156.61 | 153.46 | 2.1 | 201.14 | 199.48 | 0.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Orlando | 3 | 2,325 | 188.44 | 188.84 | (0.2) | 60.3 | 59.3 | 1.0 | 113.54 | 111.82 | 1.5 | 231.41 | 224.75 | 3.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Orleans | 1 | 1,622 | 157.49 | 175.06 | (10.0) | 56.4 | 55.6 | 0.8 | 88.82 | 97.37 | (8.8) | 171.76 | 177.75 | (3.4) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Boston | 3 | 1,536 | 267.12 | 252.53 | 5.8 | 86.1 | 85.1 | 1.0 | 230.03 | 214.94 | 7.0 | 286.95 | 268.84 | 6.7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New York | 1 | 1,878 | 302.44 | 290.39 | 4.1 | 92.2 | 74.4 | 17.8 | 278.78 | 215.92 | 29.1 | 411.92 | 320.68 | 28.5 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Southern California | 5 | 1,773 | 263.09 | 278.65 | (5.6) | 79.7 | 79.3 | 0.4 | 209.58 | 220.86 | (5.1) | 322.87 | 316.81 | 1.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Chicago | 3 | 2,467 | 227.83 | 236.69 | (3.7) | 69.4 | 68.4 | 1.0 | 158.20 | 161.94 | (2.3) | 241.82 | 234.66 | 3.1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Key West(3) |

2 | 461 | 409.71 | 396.50 | 3.3 | 25.2 | 66.5 | (41.3) | 103.07 | 263.46 | (60.9) | 154.73 | 391.68 | (60.5) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Denver | 1 | 613 | 202.05 | 201.32 | 0.4 | 81.8 | 73.3 | 8.5 | 165.19 | 147.47 | 12.0 | 234.01 | 216.60 | 8.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Miami | 1 | 393 | 177.55 | 205.55 | (13.6) | 71.3 | 75.0 | (3.7) | 126.59 | 154.22 | (17.9) | 180.44 | 211.36 | (14.6) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Washington, D.C. | 2 | 1,085 | 173.20 | 160.78 | 7.7 | 77.2 | 66.5 | 10.7 | 133.77 | 107.03 | 25.0 | 194.47 | 156.41 | 24.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Seattle | 2 | 1,246 | 187.14 | 187.53 | (0.2) | 82.5 | 68.3 | 14.2 | 154.39 | 128.04 | 20.6 | 198.79 | 166.40 | 19.5 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 11 | 3,862 | 193.45 | 192.14 | 0.7 | 68.4 | 68.7 | (0.3) | 132.40 | 132.02 | 0.3 | 185.17 | 180.17 | 2.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All Markets | 41 | 26,373 | $ | 241.06 | $ | 242.21 | (0.5) | % | 73.9 | % | 71.4 | % | 2.5 | % pts | $ | 178.13 | $ | 172.91 | 3.0 | % | $ | 270.85 | $ | 260.57 | 3.9 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

18 |

|

|||||||

| Portfolio and Operating Metrics (continued) | ||||||||

Current Hotels by Market: Q3 2023 vs. Q3 2022 |

||||||||

| (unaudited, dollars in millions) | Current Hotel Adjusted EBITDA | Current Hotel Revenue | Current Hotel Adjusted EBITDA Margin | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hotels | Rooms | 3Q23 | 3Q22 | Change(1) |

3Q23 | 3Q22 | Change(1) |

3Q23 | 3Q22 | Change | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hawaii | 2 | 3,507 | $ | 69 | $ | 66 | 4.6 | % | $ | 162 | $ | 158 | 2.4 | % | 42.5 | % | 41.6 | % | 90 | bps | ||||||||||||||||||||||||||||||||||||||||||||||||

San Francisco(2) |

4 | 3,605 | 3 | 6 | (52.5) | 67 | 66 | 0.8 | 4.5 | 9.5 | (500) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Orlando | 3 | 2,325 | 7 | 9 | (28.9) | 49 | 48 | 3.0 | 13.6 | 19.7 | (610) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Orleans | 1 | 1,622 | 6 | 7 | (16.0) | 26 | 27 | (3.4) | 22.0 | 25.3 | (330) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Boston | 3 | 1,536 | 14 | 14 | 2.1 | 41 | 38 | 6.7 | 34.0 | 35.5 | (150) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New York | 1 | 1,878 | 10 | 3 | 224.8 | 71 | 55 | 28.5 | 14.4 | 5.7 | 870 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Southern California | 5 | 1,773 | 18 | 19 | (5.0) | 53 | 52 | 1.9 | 34.6 | 37.1 | (250) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Chicago(3) |

3 | 2,467 | 21 | 13 | 64.8 | 55 | 53 | 3.1 | 38.1 | 23.8 | 1,430 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Key West(4) |

2 | 461 | (1) | 4 | (132.9) | 7 | 17 | (60.5) | (20.5) | 24.7 | (4,520) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Denver | 1 | 613 | 6 | 5 | 17.6 | 13 | 12 | 8.0 | 42.8 | 39.3 | 350 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Miami | 1 | 393 | 1 | 2 | (49.7) | 7 | 8 | (14.6) | 14.9 | 25.3 | (1,040) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Washington, D.C. | 2 | 1,085 | 5 | 3 | 53.7 | 19 | 16 | 24.3 | 23.8 | 19.2 | 460 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Seattle | 2 | 1,246 | 5 | 3 | 47.5 | 23 | 19 | 19.5 | 22.2 | 18.0 | 420 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 11 | 3,862 | 9 | 11 | (0.1) | 64 | 63 | 2.8 | 16.2 | 16.7 | (50) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All Markets | 41 | 26,373 | $ | 173 | $ | 165 | 5.0 | % | $ | 657 | $ | 632 | 3.9 | % | 26.3 | % | 26.0 | % | 30 | bps | ||||||||||||||||||||||||||||||||||||||||||||||||

19 |

|

|||||||

| Portfolio and Operating Metrics (continued) | ||||||||

Current Hotels by Market: YTD Q3 2023 vs. YTD Q3 2022 |

||||||||

| (unaudited) | Current ADR | Current Occupancy | Current RevPAR | Current Total RevPAR | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hotels | Rooms | 2023 | 2022 | Change(1) |

2023 | 2022 | Change | 2023 | 2022 | Change(1) |

2023 | 2022 | Change(1) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hawaii | 2 | 3,507 | $ | 307.21 | $ | 294.71 | 4.2 | % | 91.1 | % | 84.8 | % | 6.3 | % pts | $ | 279.86 | $ | 249.89 | 12.0 | % | $ | 487.31 | $ | 437.40 | 11.4 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

San Francisco(2) |

4 | 3,605 | 251.46 | 239.61 | 4.9 | 57.1 | 46.9 | 10.2 | 143.62 | 112.39 | 27.8 | 194.32 | 151.78 | 28.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Orlando | 3 | 2,325 | 233.57 | 234.57 | (0.4) | 67.0 | 62.0 | 5.0 | 156.38 | 145.22 | 7.7 | 320.86 | 289.90 | 10.7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Orleans | 1 | 1,622 | 202.89 | 200.51 | 1.2 | 65.1 | 59.5 | 5.6 | 132.04 | 119.30 | 10.7 | 246.24 | 205.50 | 19.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Boston | 3 | 1,536 | 242.51 | 226.73 | 7.0 | 79.7 | 74.3 | 5.4 | 193.36 | 168.49 | 14.8 | 251.02 | 217.43 | 15.4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New York | 1 | 1,878 | 289.56 | 286.64 | 1.0 | 82.7 | 59.2 | 23.5 | 239.56 | 169.86 | 41.0 | 365.14 | 264.80 | 37.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Southern California | 5 | 1,773 | 238.10 | 248.78 | (4.3) | 76.9 | 74.2 | 2.7 | 183.21 | 184.77 | (0.8) | 288.78 | 273.41 | 5.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Chicago | 3 | 2,467 | 221.77 | 222.65 | (0.4) | 59.6 | 51.9 | 7.7 | 132.28 | 115.62 | 14.4 | 204.28 | 175.18 | 16.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Key West(3) |

2 | 461 | 529.29 | 576.54 | (8.2) | 48.8 | 74.7 | (25.9) | 258.40 | 430.97 | (40.0) | 375.99 | 616.55 | (39.0) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Denver | 1 | 613 | 195.19 | 182.81 | 6.8 | 72.5 | 67.0 | 5.5 | 141.50 | 122.42 | 15.6 | 206.72 | 182.73 | 13.1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Miami | 1 | 393 | 258.14 | 285.68 | (9.6) | 80.2 | 77.7 | 2.5 | 206.92 | 221.91 | (6.8) | 277.79 | 288.64 | (3.8) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Washington, D.C. | 2 | 1,085 | 180.82 | 158.69 | 14.0 | 74.2 | 62.6 | 11.6 | 134.24 | 99.33 | 35.1 | 195.65 | 143.61 | 36.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Seattle | 2 | 1,246 | 169.50 | 160.97 | 5.3 | 70.3 | 65.8 | 4.5 | 119.08 | 105.77 | 12.6 | 162.00 | 144.63 | 12.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 11 | 3,862 | 200.80 | 193.36 | 3.8 | 67.4 | 64.0 | 3.4 | 135.34 | 123.73 | 9.4 | 191.66 | 171.08 | 12.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All Markets | 41 | 26,373 | $ | 244.23 | $ | 240.80 | 1.4 | % | 71.1 | % | 64.3 | % | 6.8 | % pts | $ | 173.62 | $ | 154.77 | 12.2 | % | $ | 273.22 | $ | 240.52 | 13.6 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

20 |

|

|||||||

| Portfolio and Operating Metrics (continued) | ||||||||

Current Hotels by Market: YTD Q3 2023 vs. YTD Q3 2022 |

||||||||

| (unaudited, dollars in millions) | Current Hotel Adjusted EBITDA | Current Hotel Revenue | Current Hotel Adjusted EBITDA Margin | |||||||||||||||||||||||||||||||||||||||||||||||

| Hotels | Rooms | 2023 | 2022 | Change(1) |

2023 | 2022 | Change(1) |

2023 | 2022 | Change | ||||||||||||||||||||||||||||||||||||||||

| Hawaii | 2 | 3,507 | $ | 190 | $ | 176 | 7.4 | % | $ | 467 | $ | 419 | 11.4 | % | 40.6 | % | 42.1 | % | (150) | bps | ||||||||||||||||||||||||||||||

San Francisco(2) |

4 | 3,605 | 12 | 1 | 1,715.7 | 191 | 149 | 28.0 | 6.2 | 0.5 | 570 | |||||||||||||||||||||||||||||||||||||||

| Orlando | 3 | 2,325 | 60 | 58 | 2.3 | 204 | 184 | 10.7 | 29.2 | 31.6 | (240) | |||||||||||||||||||||||||||||||||||||||

| New Orleans | 1 | 1,622 | 40 | 32 | 25.2 | 109 | 91 | 19.8 | 36.7 | 35.1 | 160 | |||||||||||||||||||||||||||||||||||||||

| Boston | 3 | 1,536 | 32 | 28 | 16.6 | 105 | 91 | 15.4 | 30.7 | 30.4 | 30 | |||||||||||||||||||||||||||||||||||||||

| New York | 1 | 1,878 | 19 | — | 60,573.1 | 187 | 136 | 37.9 | 10.1 | (0.1) | 1020 | |||||||||||||||||||||||||||||||||||||||

| Southern California | 5 | 1,773 | 44 | 45 | (2.1) | 140 | 132 | 5.6 | 31.2 | 33.7 | (250) | |||||||||||||||||||||||||||||||||||||||

Chicago(3) |

3 | 2,467 | 23 | 9 | 164.7 | 138 | 118 | 16.6 | 16.9 | 7.5 | 940 | |||||||||||||||||||||||||||||||||||||||

Key West(4) |

2 | 461 | 14 | 33 | (59.0) | 47 | 78 | (39.0) | 28.6 | 42.5 | (1390) | |||||||||||||||||||||||||||||||||||||||

| Denver | 1 | 613 | 13 | 11 | 20.6 | 35 | 31 | 13.1 | 37.1 | 34.8 | 230 | |||||||||||||||||||||||||||||||||||||||

| Miami | 1 | 393 | 11 | 12 | (13.6) | 30 | 31 | (3.8) | 35.8 | 39.9 | (410) | |||||||||||||||||||||||||||||||||||||||

| Washington, D.C. | 2 | 1,085 | 14 | 8 | 87.5 | 58 | 43 | 36.2 | 24.6 | 17.9 | 670 | |||||||||||||||||||||||||||||||||||||||

| Seattle | 2 | 1,246 | 7 | 6 | 15.6 | 55 | 49 | 12.0 | 13.3 | 12.9 | 40 | |||||||||||||||||||||||||||||||||||||||

| Other | 11 | 3,862 | 35 | 31 | 14.1 | 201 | 179 | 12.0 | 18.0 | 17.7 | 30 | |||||||||||||||||||||||||||||||||||||||

| All Markets | 41 | 26,373 | $ | 514 | $ | 450 | 14.2 | % | $ | 1,967 | $ | 1,731 | 13.6 | % | 26.1 | % | 26.0 | % | 10 | bps | ||||||||||||||||||||||||||||||

21 |

|

|||||||

| Portfolio and Operating Metrics (continued) | ||||||||

Core Hotels: Q3 2023 vs. Q3 2022 |

||||||||

| (unaudited) | ADR | Occupancy | RevPAR | Total RevPAR | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3Q23 | 3Q22 | Change(1) |

3Q23 | 3Q22 | Change | 3Q23 | 3Q22 | Change(1) |

3Q23 | 3Q22 | Change(1) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Core Hotels | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | Hilton Hawaiian Village Waikiki Beach Resort | $ | 317.24 | $ | 312.18 | 1.6 | % | 93.6 | % | 92.1 | % | 1.5 | % pts | $ | 297.03 | $ | 287.56 | 3.3 | % | $ | 473.02 | $ | 461.45 | 2.5 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| 2 | Hilton Waikoloa Village | 345.83 | 357.15 | (3.2) | 84.7 | 78.7 | 6.0 | 293.04 | 281.12 | 4.2 | 627.01 | 613.98 | 2.1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | JW Marriott San Francisco Union Square | 292.67 | 308.48 | (5.1) | 72.4 | 76.3 | (3.9) | 211.96 | 235.47 | (10.0) | 263.33 | 333.41 | (21.0) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | Hyatt Centric Fisherman's Wharf | 221.12 | 242.86 | (8.9) | 85.3 | 80.3 | 5.0 | 188.66 | 195.15 | (3.3) | 251.64 | 249.33 | 0.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5 | Signia by Hilton Orlando Bonnet Creek | 178.86 | 167.35 | 6.9 | 66.7 | 59.1 | 7.6 | 119.30 | 98.97 | 20.5 | 275.34 | 225.08 | 22.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 6 | Waldorf Astoria Orlando | 285.42 | 297.50 | (4.1) | 47.1 | 55.1 | (8.0) | 134.50 | 163.88 | (17.9) | 246.64 | 309.18 | (20.2) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 7 | Hilton Orlando Lake Buena Vista | 154.87 | 154.62 | 0.2 | 60.4 | 61.9 | (1.5) | 93.48 | 95.64 | (2.3) | 167.55 | 172.27 | (2.7) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 8 | Hilton New Orleans Riverside | 157.49 | 175.06 | (10.0) | 56.4 | 55.6 | 0.8 | 88.82 | 97.37 | (8.8) | 171.76 | 177.75 | (3.4) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 9 | Hyatt Regency Boston | 287.13 | 271.18 | 5.9 | 86.6 | 89.1 | (2.5) | 248.73 | 241.69 | 2.9 | 300.05 | 300.07 | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10 | Hilton Boston Logan Airport | 281.38 | 266.10 | 5.7 | 97.8 | 94.0 | 3.8 | 275.09 | 250.11 | 10.0 | 342.35 | 308.80 | 10.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 11 | Boston Marriott Newton | 209.54 | 197.61 | 6.0 | 69.2 | 68.0 | 1.2 | 144.91 | 134.31 | 7.9 | 193.85 | 176.27 | 10.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 12 | New York Hilton Midtown | 302.44 | 290.39 | 4.1 | 92.2 | 74.4 | 17.8 | 278.78 | 215.92 | 29.1 | 411.92 | 320.68 | 28.5 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 13 | Hilton Santa Barbara Beachfront Resort | 393.21 | 419.09 | (6.2) | 82.8 | 88.9 | (6.1) | 325.58 | 372.55 | (12.6) | 500.27 | 528.20 | (5.3) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 14 | Hyatt Regency Mission Bay Spa and Marina | 338.17 | 377.70 | (10.5) | 73.6 | 66.0 | 7.6 | 248.85 | 249.42 | (0.2) | 429.66 | 395.79 | 8.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 15 | Hilton Checkers Los Angeles | 211.31 | 226.70 | (6.8) | 80.3 | 74.2 | 6.1 | 169.68 | 168.20 | 0.9 | 197.18 | 190.75 | 3.4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 16 | Hilton Chicago | 219.49 | 221.09 | (0.7) | 67.8 | 67.8 | — | 148.75 | 149.79 | (0.7) | 255.37 | 243.50 | 4.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 17 | W Chicago – City Center | 283.34 | 302.48 | (6.3) | 68.1 | 66.0 | 2.1 | 192.94 | 199.52 | (3.3) | 238.21 | 233.56 | 2.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 18 | W Chicago – Lakeshore | 211.22 | 233.60 | (9.6) | 75.4 | 72.3 | 3.1 | 159.32 | 168.88 | (5.7) | 204.38 | 209.25 | (2.3) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 19 | Casa Marina Key West, Curio Collection(2) |

— | 388.55 | (100.0) | — | 63.6 | (63.6) | (0.05) | 247.24 | (100.0) | 0.65 | 374.30 | (99.8) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 20 | The Reach Key West, Curio Collection | 409.85 | 411.00 | (0.3) | 77.3 | 72.3 | 5.0 | 316.86 | 297.11 | 6.6 | 474.20 | 427.72 | 10.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 21 | Hilton Denver City Center | 202.05 | 201.32 | 0.4 | 81.8 | 73.3 | 8.5 | 165.19 | 147.47 | 12.0 | 234.01 | 216.60 | 8.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 22 | Royal Palm South Beach Miami | 177.55 | 205.55 | (13.6) | 71.3 | 75.0 | (3.7) | 126.59 | 154.22 | (17.9) | 180.44 | 211.36 | (14.6) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 23 | DoubleTree Hotel Washington DC – Crystal City | 164.77 | 150.42 | 9.5 | 81.2 | 72.4 | 8.8 | 133.73 | 108.81 | 22.9 | 194.02 | 149.00 | 30.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 24 | DoubleTree Hotel San Jose | 171.33 | 168.19 | 1.9 | 61.1 | 63.3 | (2.2) | 104.67 | 106.44 | (1.7) | 157.72 | 152.86 | 3.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 25 | Juniper Hotel Cupertino, Curio Collection | 188.22 | 227.23 | (17.2) | 69.4 | 79.2 | (9.8) | 130.61 | 180.02 | (27.4) | 149.12 | 201.28 | (25.9) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Core Hotels | 257.58 | 260.67 | (1.2) | 75.7 | 73.5 | 2.2 | 194.86 | 191.51 | 1.7 | 307.87 | 299.17 | 2.9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All Other Hotels | 190.62 | 188.09 | 1.3 | 74.3 | 69.9 | 4.4 | 141.57 | 131.51 | 7.7 | 196.69 | 181.26 | 8.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Comparable Hotels | 241.74 | 243.91 | (0.9) | 75.3 | 72.6 | 2.7 | 182.08 | 177.12 | 2.8 | 281.21 | 270.89 | 3.8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hilton San Francisco Union Square | 235.15 | 226.50 | 3.8 | 60.7 | 61.6 | (0.9) | 142.65 | 139.41 | 2.3 | 192.66 | 190.71 | 1.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Parc 55 San Francisco – a Hilton Hotel | 233.47 | 225.71 | 3.4 | 66.1 | 61.8 | 4.3 | 154.32 | 139.39 | 10.7 | 180.57 | 155.54 | 16.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Current Hotels | $ | 241.06 | $ | 242.21 | (0.5) | % | 73.9 | % | 71.4 | % | 2.5 | % pts | $ | 178.13 | $ | 172.91 | 3.0 | % | $ | 270.85 | $ | 260.57 | 3.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

22 |

|

|||||||

| Portfolio and Operating Metrics (continued) | ||||||||

Core Hotels: Q3 2023 vs. Q3 2022 |

||||||||

| (unaudited, dollars in millions) | Hotel Adjusted EBITDA | Hotel Revenue | Hotel Adjusted EBITDA Margin | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3Q23 | 3Q22 | Change(1) |

3Q23 | 3Q22 | Change(1) |

3Q23 | 3Q22 | Change | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Core Hotels | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1 | Hilton Hawaiian Village Waikiki Beach Resort | $ | 55 | $ | 51 | 7.0 | % | $ | 124 | $ | 121 | 2.5 | % | 43.9 | % | 42.1 | % | 180 | bps | ||||||||||||||||||||||||||||||||||||||||

| 2 | Hilton Waikoloa Village | 14 | 15 | (3.7) | 37 | 37 | 2.1 | 38.1 | 40.4 | (230) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 3 | JW Marriott San Francisco Union Square | 1 | 2 | (66.9) | 8 | 11 | (21.0) | 6.1 | 14.6 | (850) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 4 | Hyatt Centric Fisherman's Wharf | 2 | 2 | (6.2) | 7 | 7 | 0.9 | 24.4 | 26.3 | (190) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 5 | Signia by Hilton Orlando Bonnet Creek | 5 | 4 | 29.9 | 25 | 21 | 22.3 | 20.6 | 19.4 | 120 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 6 | Waldorf Astoria Orlando | — | 3 | (114.4) | 11 | 14 | (20.2) | (3.4) | 18.9 | (2,230) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 7 | Hilton Orlando Lake Buena Vista | 2 | 3 | (31.8) | 13 | 13 | (2.7) | 14.9 | 21.2 | (630) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 8 | Hilton New Orleans Riverside | 6 | 7 | (16.0) | 26 | 27 | (3.4) | 22.0 | 25.3 | (330) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 9 | Hyatt Regency Boston | 6 | 6 | (7.0) | 14 | 14 | — | 40.8 | 43.9 | (310) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 10 | Hilton Boston Logan Airport | 6 | 6 | 7.4 | 19 | 17 | 10.9 | 32.0 | 33.0 | (100) | |||||||||||||||||||||||||||||||||||||||||||||||||

| 11 | Boston Marriott Newton | 2 | 2 | 16.4 | 8 | 7 | 10.0 | 26.8 | 25.3 | 150 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 12 | New York Hilton Midtown | 10 | 3 | 224.8 | 71 | 55 | 28.5 | 14.4 | 5.7 | 870 | |||||||||||||||||||||||||||||||||||||||||||||||||