Document

ADVANCED DRAINAGE SYSTEMS ANNOUNCES FIRST QUARTER

FISCAL 2026 RESULTS

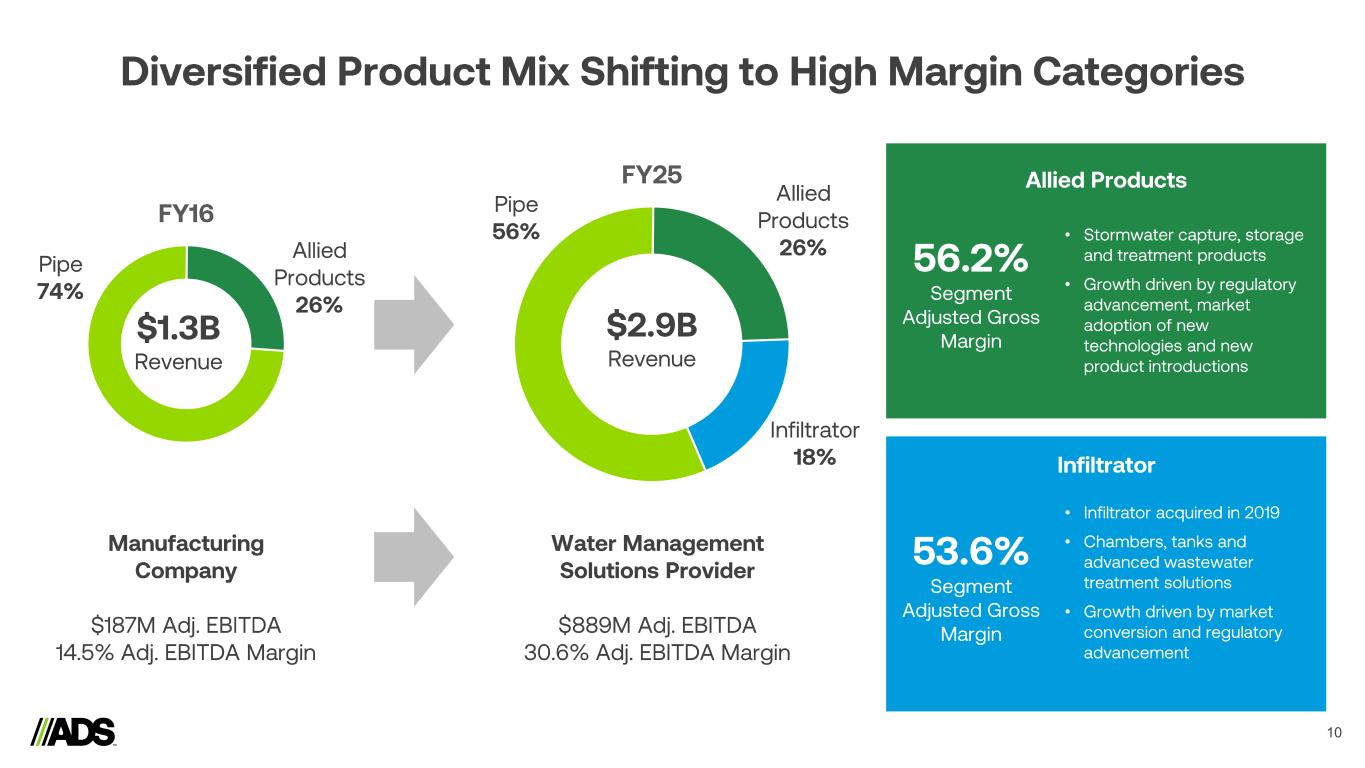

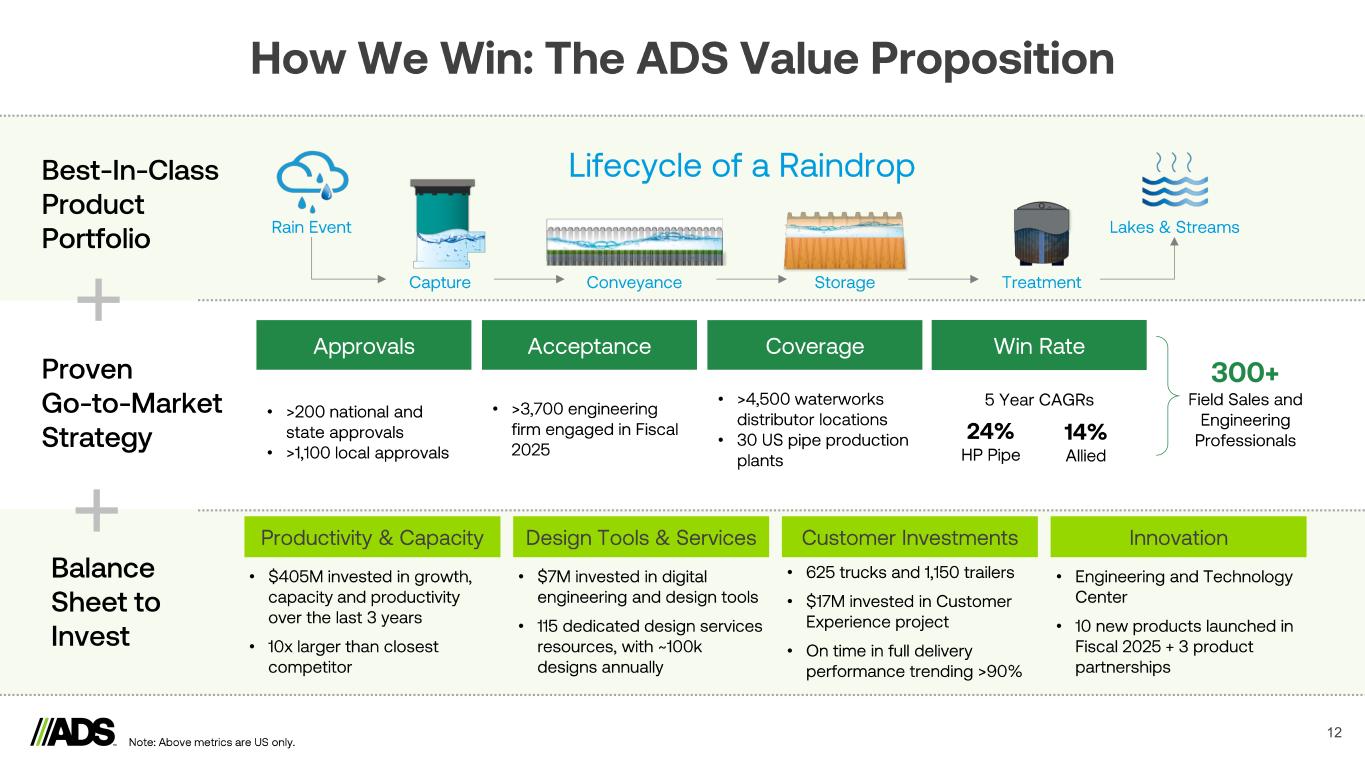

HILLIARD, Ohio – (August 7, 2025) – Advanced Drainage Systems, Inc. (NYSE: WMS) (“ADS” or the “Company”), a leading provider of innovative water management solutions in the stormwater and onsite wastewater industries today announced financial results for the fiscal first quarter ended June 30, 2025.

First Quarter Fiscal 2026 Results

•Net sales increased $14.5 million or 1.8% to $829.9 million

•Net income decreased $18.2 million or 11.2% to $144.1 million

•Net income per diluted share decreased $0.22 or 10.7% to $1.84

•Adjusted EBITDA (Non-GAAP) increased $2.7 million or 1.0% to $278.2 million

•Adjusted Earnings per share (Non-GAAP) decreased $0.11 or 5.3% to $1.95

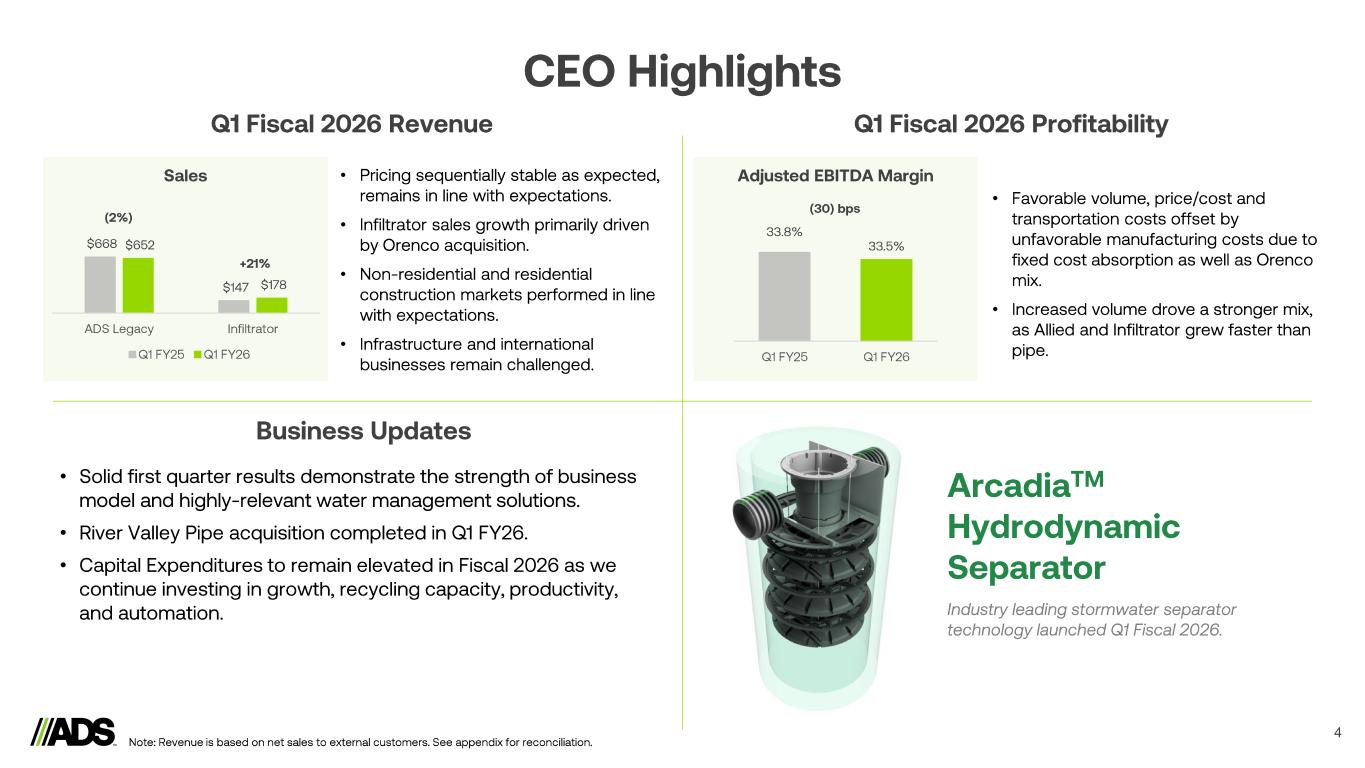

Scott Barbour, President and Chief Executive Officer of ADS commented, "We delivered strong results in the fiscal first quarter, with Adjusted EBITDA margin of 33.5%. Wet weather in May and June continued to delay project installations, and elevated interest rates remain a headwind. However, the ADS and Infiltrator teams executed well and remain focused on driving profitable growth and operational performance in a challenging macroeconomic environment."

"Investments in engineering, customer service, capacity, productivity and logistics all support long-term growth and profitability. We continue to develop innovative new product offerings, such as the Arcadia stormwater separator formally launched in the quarter, and Infiltrator continues to make meaningful progress in scaling our advanced treatment platform solutions at Orenco. Additionally, we acquired River Valley Pipe early in the quarter, which strengthened our presence in key geographies and provides future operational flexibility. Across the board, we are focused on the levers we can control, including managing costs, accelerating new product introductions, and most importantly, executing customer service improvements."

Barbour concluded, "The highly attractive water segments we operate in are supported by secular tailwinds and the growing awareness of the value of proper stormwater and onsite wastewater management, ultimately driving long-term demand for the Company's products. While cyclical, short-term pressures exist, the fundamentals of our business are resilient and we are well positioned to continue capitalizing on our value proposition, driving market conversion, and accelerating growth in more profitable areas such as Infiltrator and Allied products."

First Quarter Fiscal 2026 Results

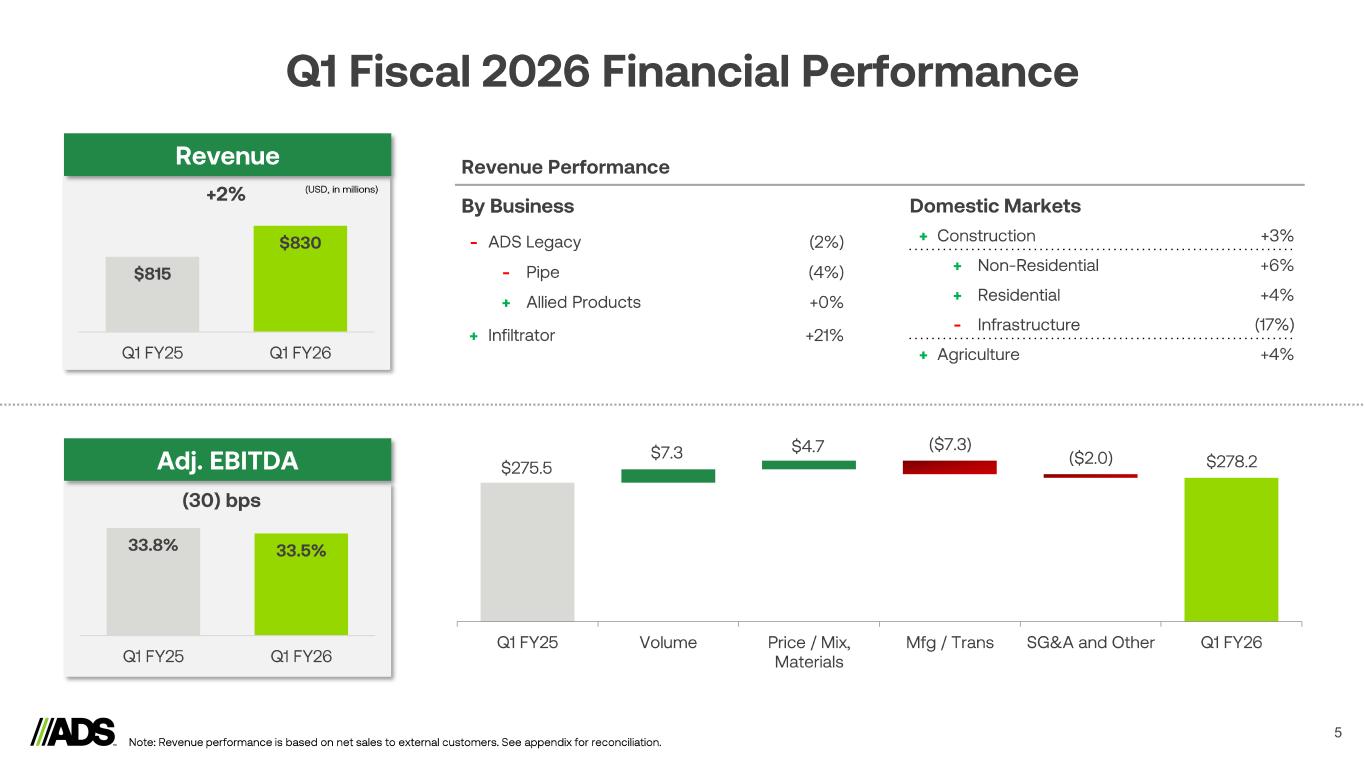

Net sales increased $14.5 million, or 1.8%, to $829.9 million, as compared to $815.3 million in the prior year quarter. Domestic pipe sales decreased $10.9 million, or 2.5%, to $415.5 million. Domestic allied products & other sales increased $3.6 million, or 1.9%, to $187.5 million. Infiltrator sales increased $31.1 million, or 21.1%, to $178.4 million, primarily due to the acquisition of Orenco Systems, Inc. ("Orenco"). Infiltrator organic revenue increased 0.7%. The overall increase in domestic net sales was primarily driven by acquisitions, as well as growth in the non-residential and residential construction end markets. International sales decreased $9.2 million, or 16.0%, to $48.5 million.

Gross profit decreased $2.0 million, or 0.6%, to $330.4 million as compared to $332.5 million in the prior year. The decrease in gross profit is primarily driven by unfavorable fixed cost absorption as well as the mix impact from the inclusion of Orenco. This unfavorability was partially offset by favorable price/cost and mix of construction market and Infiltrator sales.

Selling, general and administrative expenses increased $9.9 million, or 10.5% to $104.0 million, as compared to $94.1 million. As a percentage of sales, selling, general and administrative expense was 12.5% as compared to 11.5% in the prior year, primarily driven by the acquisition of Orenco.

Net income per diluted share decreased $0.22, or 10.7%, to $1.84, as compared to $2.06 per share in the prior year quarter, primarily due to the factors mentioned above.

Adjusted EBITDA (Non-GAAP) increased $2.7 million, or 1.0%, to $278.2 million, as compared to $275.5 million in the prior year, primarily due to the factors mentioned above. As a percentage of net sales, Adjusted EBITDA was 33.5% as compared to 33.8% in the prior year.

Segment sales results are based on Net sales to external customers. Reconciliations of GAAP to Non-GAAP financial measures for Adjusted EBITDA, Free Cash Flow and Adjusted Earnings per Share have been provided in the financial statement tables included in this press release. An explanation of these measures is also included below under the heading “Non-GAAP Financial Measures.”

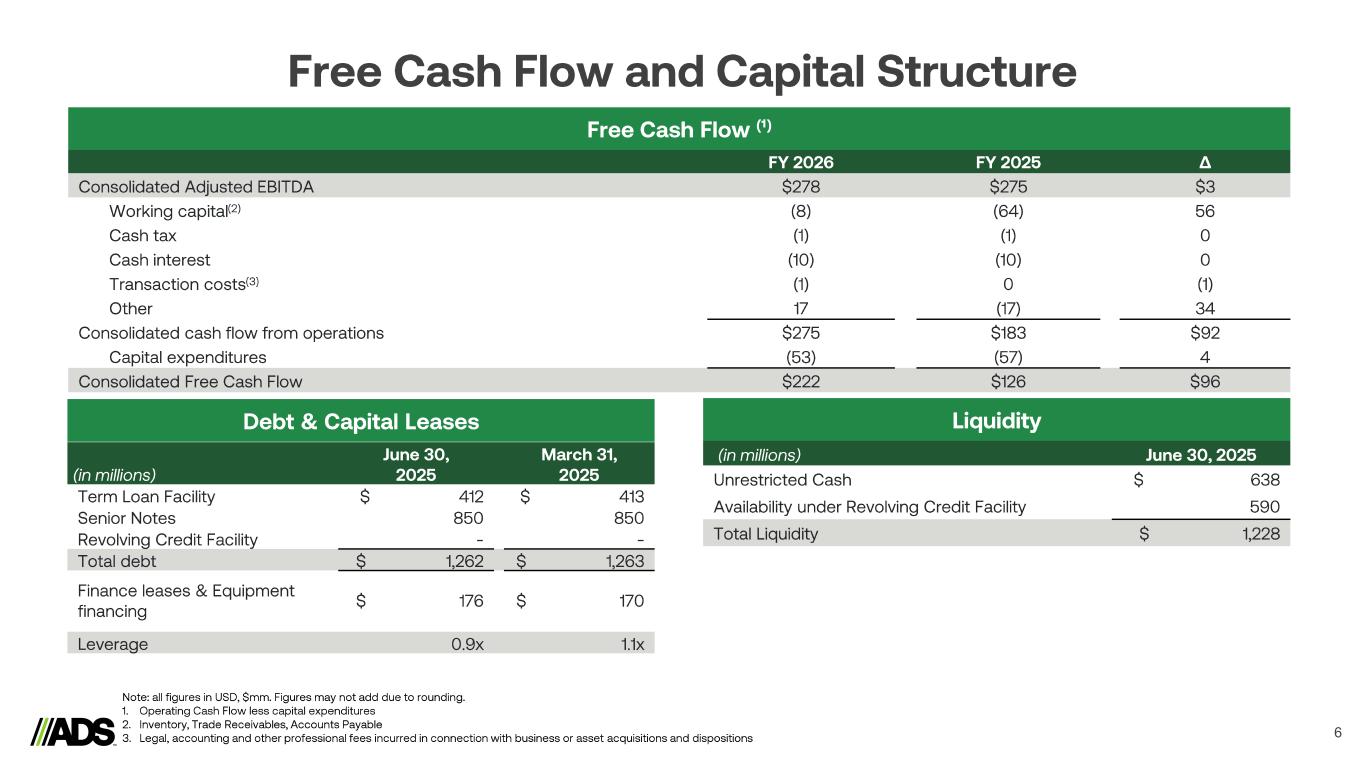

Balance Sheet and Liquidity

Net cash provided by operating activities was $275.0 million, as compared to $183.4 million in the prior year. Free cash flow (Non-GAAP) was $222.4 million, as compared to $125.7 million in the prior year. Net debt (total debt and finance lease obligations net of cash) was $792.0 million as of June 30, 2025, a decrease of $170.4 million from March 31, 2025.

ADS had total liquidity of $1,228.1 million, comprised of cash of $638.3 million as of June 30, 2025 and $589.9 million of availability under committed credit facilities. As of June 30, 2025, the Company’s trailing-twelve-month leverage ratio was 0.9 times Adjusted EBITDA.

In the three months ended June 30, 2025, the Company did not repurchase shares of its common stock. As of June 30, 2025, approximately $147.7 million of common stock may be repurchased under the Company's existing share repurchase authorization.

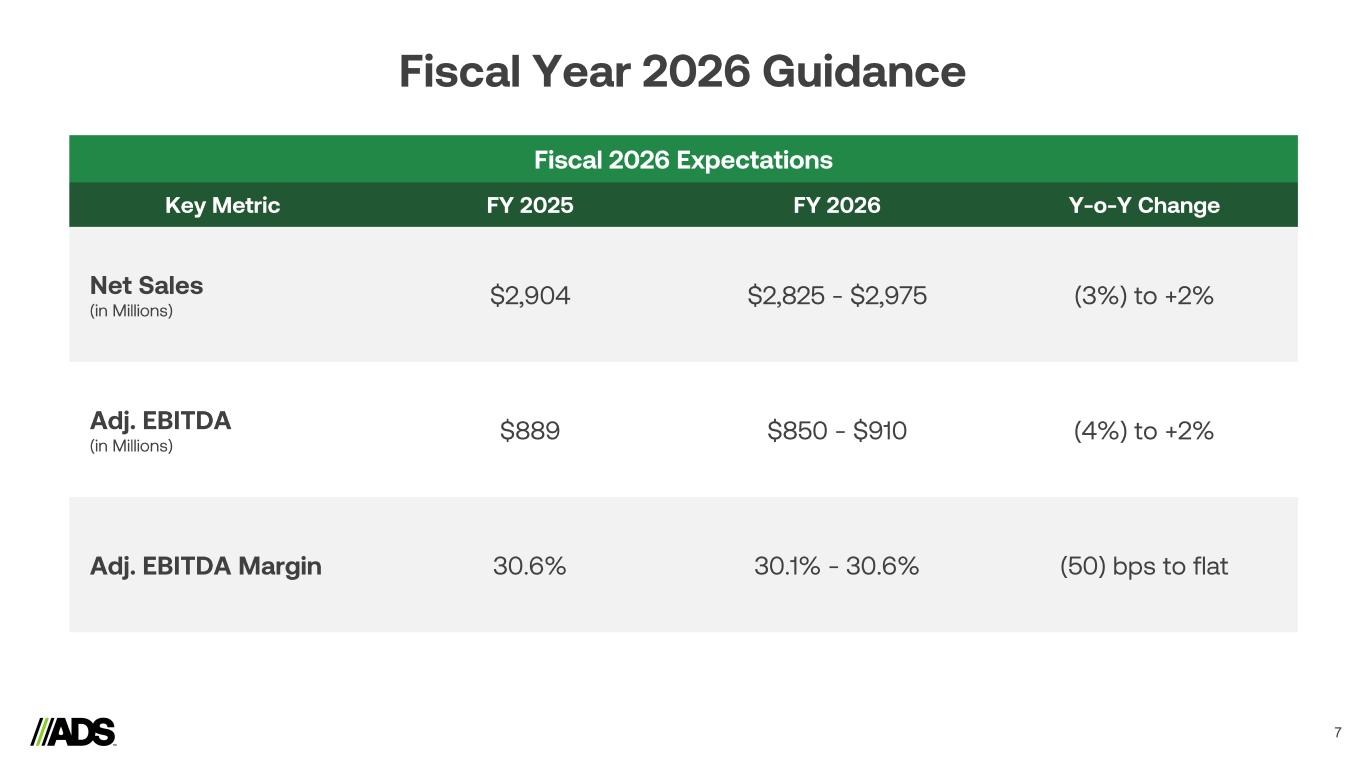

Fiscal 2026 Outlook

Based on current visibility, backlog of existing orders and business trends, the Company is confirming its previously issued financial targets for fiscal 2026. Net sales are expected to be in the range of $2.825 billion to $2.975 billion and Adjusted EBITDA is expected to be in the range of $850 million to $910 million. Capital expenditures are expected to be in the range of $200 million to $225 million.

Conference Call Information

Webcast: Interested investors and other parties can listen to a webcast of the live conference call by logging in through the Investor Relations section of the Company's website at https://investors.ads-pipe.com/events-and-presentations. An online replay will be available on the same website following the call.

Teleconference: To participate in the live teleconference, participants may register at https://registrations.events/direct/Q4I4578675314. After registering, participants will receive a confirmation through email, including dial in details and unique conference call codes for entry. Registration is open through the live call. To ensure participants are connected for the full call, please register at least 10 minutes before the start of the call.

About the Company

Advanced Drainage Systems is a leading manufacturer of innovative stormwater and onsite wastewater solutions that manages the world’s most precious resource: water. ADS and its subsidiary, Infiltrator Water Technologies, provide superior stormwater drainage and onsite wastewater products used in a wide variety of markets and applications including commercial, residential, infrastructure and agriculture, while delivering unparalleled customer service. ADS manages the industry’s largest company-owned fleet, an expansive sales team, and a vast manufacturing network of approximately 63 manufacturing plants and 35 distribution centers. The company is one of the largest plastic recycling companies in North America, ensuring over half a billion pounds of plastic is kept out of landfills every year. Founded in 1966, ADS’ water management solutions are designed to last for decades. To learn more, visit the Company’s website at www.adspipe.com.

Forward Looking Statements

Certain statements in this press release may be deemed to be forward-looking statements. These statements are not historical facts but rather are based on the Company’s current expectations, estimates and projections regarding the Company’s business, operations and other factors relating thereto. Words such as “may,” “will,” “could,” “would,” “should,” “anticipate,” “predict,” “potential,” “continue,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “confident” and similar expressions are used to identify these forward-looking statements. Factors that could cause actual results to differ from those reflected in forward-looking statements relating to our operations and business include: fluctuations in the price and availability of resins and other raw materials, new tariff policies, and our ability to pass any increased costs of raw materials and tariffs on to our customers; disruption or volatility in general business, political and economic conditions in the markets in which we operate; cyclicality and seasonality of the non-residential and residential construction markets and infrastructure spending; the risks of increasing competition in our existing and future markets; uncertainties surrounding the integration and realization of anticipated benefits of acquisitions or doing so within the intended timeframe; the effect of weather or seasonality; the loss of any of our significant customers; the risks of doing business internationally; the risks of conducting a portion of our operations through joint ventures; our ability to expand into new geographic or product markets; the risk associated with manufacturing processes; the effects of global climate change and any related regulatory responses; our ability to protect against cybersecurity incidents and disruptions or failures of our IT systems; our ability to assess and monitor the effects of artificial intelligence, machine learning, and robotics on our business and operations; our ability to manage our supply purchasing and customer credit policies; our ability to control labor costs and to attract, train and retain highly qualified employees and key personnel; our ability to protect our intellectual property rights; changes in laws and regulations, including environmental laws and regulations; our ability to appropriately address any environmental, social or governance concerns that may arise from our activities; the risks associated with our current levels of indebtedness, including borrowings under our existing credit agreement and outstanding indebtedness under our existing senior notes; and other risks and uncertainties described in the Company’s filings with the SEC. New risks and uncertainties emerge from time to time and it is not possible for the Company to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this press release. In light of the significant uncertainties inherent in the forward-looking information included herein, the inclusion of such information should not be regarded as a representation by the Company or any other person that the Company’s expectations, objectives or plans will be achieved in the timeframe anticipated or at all. Investors are cautioned not to place undue reliance on the Company’s forward-looking statements and the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

For more information, please contact:

Michael Higgins

VP, Corporate Strategy & Investor Relations

(614) 658-0050

Michael.Higgins@adspipe.com

Financial Statements

ADVANCED DRAINAGE SYSTEMS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

| (In thousands, except per share data) |

2025 |

|

2024 |

|

|

|

|

| Net sales |

$ |

829,880 |

|

|

$ |

815,336 |

|

|

|

|

|

| Cost of goods sold |

499,442 |

|

|

482,882 |

|

|

|

|

|

| Gross profit |

330,438 |

|

|

332,454 |

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

| Selling, general and administrative |

103,961 |

|

|

94,052 |

|

|

|

|

|

Loss on disposal of assets and costs from exit and disposal activities |

7,024 |

|

|

292 |

|

|

|

|

|

| Intangible amortization |

13,707 |

|

|

11,895 |

|

|

|

|

|

| Income from operations |

205,746 |

|

|

226,215 |

|

|

|

|

|

| Other expense: |

|

|

|

|

|

|

|

| Interest expense |

23,029 |

|

|

22,824 |

|

|

|

|

|

| Interest income and other, net |

(6,705) |

|

|

(7,116) |

|

|

|

|

|

| Income before income taxes |

189,422 |

|

|

210,507 |

|

|

|

|

|

| Income tax expense |

46,674 |

|

|

49,886 |

|

|

|

|

|

| Equity in net income of unconsolidated affiliates |

(1,343) |

|

|

(1,701) |

|

|

|

|

|

| Net income |

144,091 |

|

|

162,322 |

|

|

|

|

|

| Less: net income attributable to noncontrolling interest |

169 |

|

|

920 |

|

|

|

|

|

| Net income attributable to ADS |

$ |

143,922 |

|

|

$ |

161,402 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Weighted average common shares outstanding: |

|

|

|

|

|

|

|

| Basic |

77,641 |

|

|

77,540 |

|

|

|

|

|

| Diluted |

78,122 |

|

|

78,282 |

|

|

|

|

|

| Net income per share: |

|

|

|

|

|

|

|

| Basic |

$ |

1.85 |

|

|

$ |

2.08 |

|

|

|

|

|

| Diluted |

$ |

1.84 |

|

|

$ |

2.06 |

|

|

|

|

|

| Cash dividends declared per share |

$ |

0.18 |

|

|

$ |

0.16 |

|

|

|

|

|

ADVANCED DRAINAGE SYSTEMS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

| |

As of |

| (Amounts in thousands) |

June 30, 2025 |

|

March 31, 2025 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

| Cash |

$ |

638,268 |

|

|

$ |

463,319 |

|

| Receivables, net |

379,786 |

|

|

333,221 |

|

| Inventories |

453,695 |

|

|

488,269 |

|

| Other current assets |

45,277 |

|

|

39,974 |

|

| Total current assets |

1,517,026 |

|

|

1,324,783 |

|

| Property, plant and equipment, net |

1,078,728 |

|

|

1,051,040 |

|

| Other assets: |

|

|

|

| Goodwill |

725,698 |

|

|

720,223 |

|

| Intangible assets, net |

437,326 |

|

|

448,060 |

|

| Other assets |

151,167 |

|

|

146,254 |

|

| Total assets |

$ |

3,909,945 |

|

|

$ |

3,690,360 |

|

| LIABILITIES, MEZZANINE EQUITY AND STOCKHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

| Current maturities of debt obligations |

$ |

9,310 |

|

|

$ |

9,934 |

|

| Current maturities of finance lease obligations |

35,212 |

|

|

33,143 |

|

| Accounts payable |

227,079 |

|

|

218,024 |

|

| Other accrued liabilities |

161,226 |

|

|

137,295 |

|

| Accrued income taxes |

38,777 |

|

|

— |

|

| Total current liabilities |

471,604 |

|

|

398,396 |

|

| Long-term debt obligations, net |

1,250,050 |

|

|

1,251,589 |

|

| Long-term finance lease obligations |

135,671 |

|

|

131,000 |

|

| Deferred tax liabilities |

186,784 |

|

|

190,416 |

|

| Other liabilities |

87,560 |

|

|

83,171 |

|

| Total liabilities |

2,131,669 |

|

|

2,054,572 |

|

| Mezzanine equity: |

|

|

|

| Redeemable common stock |

87,985 |

|

|

92,652 |

|

| Total mezzanine equity |

87,985 |

|

|

92,652 |

|

| Stockholders’ equity: |

|

|

|

| Common stock |

11,700 |

|

|

11,694 |

|

| Paid-in capital |

1,294,545 |

|

|

1,277,694 |

|

| Common stock in treasury, at cost |

(1,226,091) |

|

|

(1,219,408) |

|

| Accumulated other comprehensive loss |

(31,603) |

|

|

(37,178) |

|

| Retained earnings |

1,622,535 |

|

|

1,492,634 |

|

| Total ADS stockholders’ equity |

1,671,086 |

|

|

1,525,436 |

|

| Noncontrolling interest in subsidiaries |

19,205 |

|

|

17,700 |

|

| Total stockholders’ equity |

1,690,291 |

|

|

1,543,136 |

|

| Total liabilities, mezzanine equity and stockholders’ equity |

$ |

3,909,945 |

|

|

$ |

3,690,360 |

|

ADVANCED DRAINAGE SYSTEMS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended June 30, |

| (Amounts in thousands) |

2025 |

|

2024 |

| Cash Flow from Operating Activities |

|

|

|

| Net income |

$ |

144,091 |

|

|

$ |

162,322 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

| Depreciation and amortization |

50,228 |

|

|

41,098 |

|

| Deferred income taxes |

(3,748) |

|

|

(942) |

|

| Loss on disposal of assets and costs from exit and disposal activities |

7,024 |

|

|

292 |

|

| Stock-based compensation |

8,404 |

|

|

6,977 |

|

| Amortization of deferred financing charges |

511 |

|

|

511 |

|

| Fair market value adjustments to derivatives |

77 |

|

|

45 |

|

| Equity in net income of unconsolidated affiliates |

(1,343) |

|

|

(1,701) |

|

| Other operating activities |

809 |

|

|

(3,754) |

|

| Changes in working capital: |

|

|

|

| Receivables |

(42,126) |

|

|

(46,991) |

|

| Inventories |

40,001 |

|

|

(25,025) |

|

| Prepaid expenses and other current assets |

(5,945) |

|

|

(3,726) |

|

| Accounts payable, accrued expenses, and other liabilities |

76,994 |

|

|

54,320 |

|

| Net cash provided by operating activities |

274,977 |

|

|

183,426 |

|

| Cash Flows from Investing Activities |

|

|

|

| Capital expenditures |

(52,598) |

|

|

(57,715) |

|

| Acquisition, net of cash acquired |

(19,576) |

|

|

— |

|

| Other investing activities |

2,240 |

|

|

498 |

|

| Net cash used in investing activities |

(69,934) |

|

|

(57,217) |

|

| Cash Flows from Financing Activities |

|

|

|

| Payments on syndicated Term Loan Facility |

(1,750) |

|

|

(1,750) |

|

| Payments on Equipment Financing |

(933) |

|

|

(1,342) |

|

| Payments on finance lease obligations |

(8,335) |

|

|

(5,513) |

|

| Repurchase of common stock |

— |

|

|

(49,245) |

|

| Cash dividends paid |

(13,980) |

|

|

(12,428) |

|

| Proceeds from exercise of stock options |

549 |

|

|

6,978 |

|

| Payment of withholding taxes on vesting of restricted stock units |

(6,683) |

|

|

(10,558) |

|

| Other financing activities |

— |

|

|

(37) |

|

| Net cash used in financing activities |

(31,132) |

|

|

(73,895) |

|

| Effect of exchange rate changes on cash |

1,098 |

|

|

(792) |

|

| Net change in cash |

175,009 |

|

|

51,522 |

|

| Cash and restricted cash at beginning of period |

469,271 |

|

|

495,848 |

|

| Cash and restricted cash at end of period |

$ |

644,280 |

|

|

$ |

547,370 |

|

|

|

|

|

| RECONCILIATION TO BALANCE SHEET |

|

|

|

| Cash |

$ |

638,268 |

|

|

$ |

541,637 |

|

| Restricted cash |

6,012 |

|

5,733 |

| Total cash and restricted cash |

$ |

644,280 |

|

|

$ |

547,370 |

|

Selected Financial Data

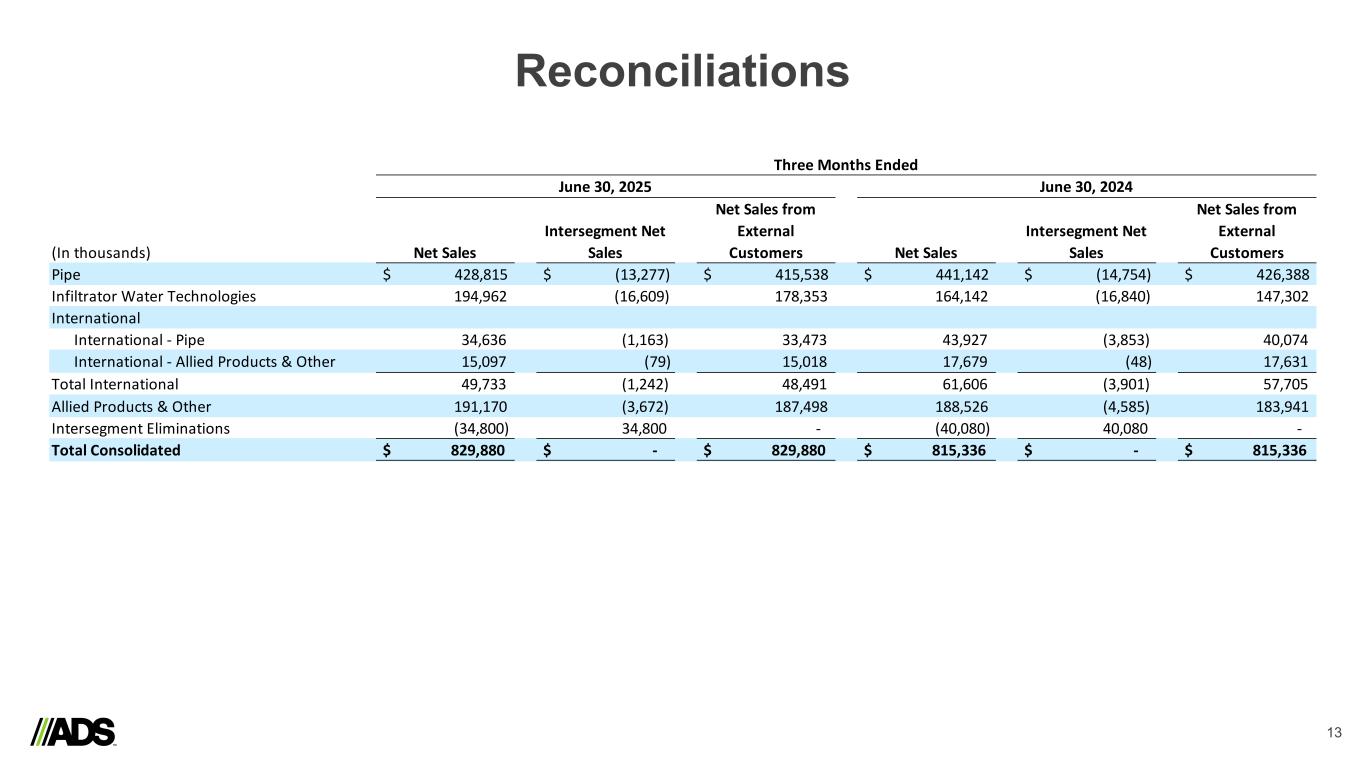

The following tables set forth net sales by reportable segment for each of the periods indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

| |

June 30, 2025 |

|

June 30, 2024(a) |

| (In thousands) |

Net Sales |

|

Intersegment Net Sales |

|

Net Sales from External Customers |

|

Net Sales |

|

Intersegment Net Sales |

|

Net Sales from External Customers |

| Pipe |

$ |

428,815 |

|

|

$ |

(13,277) |

|

|

$ |

415,538 |

|

|

$ |

441,142 |

|

|

$ |

(14,754) |

|

|

$ |

426,388 |

|

| Infiltrator |

194,962 |

|

|

(16,609) |

|

|

178,353 |

|

|

164,142 |

|

|

(16,840) |

|

|

147,302 |

|

| International |

|

|

|

|

|

|

|

|

|

|

|

| International - Pipe |

34,636 |

|

|

(1,163) |

|

|

33,473 |

|

|

43,927 |

|

|

(3,853) |

|

|

40,074 |

|

| International - Allied Products & Other |

15,097 |

|

|

(79) |

|

|

15,018 |

|

|

17,679 |

|

|

(48) |

|

|

17,631 |

|

| Total International |

49,733 |

|

|

(1,242) |

|

|

48,491 |

|

|

61,606 |

|

|

(3,901) |

|

|

57,705 |

|

| Allied Products & Other |

191,170 |

|

|

(3,672) |

|

|

187,498 |

|

|

188,526 |

|

|

(4,585) |

|

|

183,941 |

|

| Intersegment Eliminations |

(34,800) |

|

|

34,800 |

|

|

— |

|

|

(40,080) |

|

|

40,080 |

|

|

— |

|

| Total Consolidated |

$ |

829,880 |

|

|

$ |

— |

|

|

$ |

829,880 |

|

|

$ |

815,336 |

|

|

$ |

— |

|

|

$ |

815,336 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) In the first quarter of fiscal 2026, the Company realigned certain products used in wastewater applications to the Infiltrator reportable segment. The Company transitioned its ARC Septic Chambers from Allied Products & Other and certain pipe products used in wastewater applications from Pipe. Prior period segment information for fiscal 2025 has been recast to conform to the fiscal 2026 presentation.

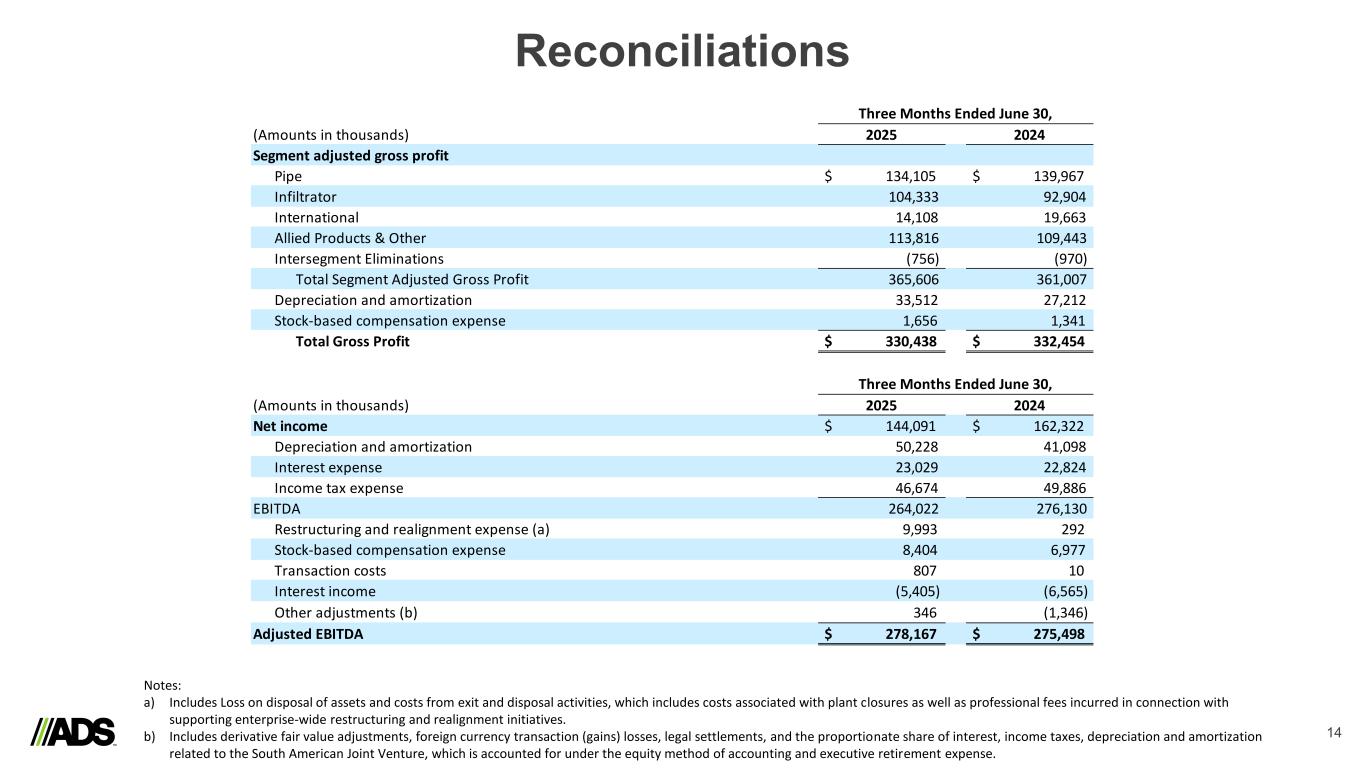

Non-GAAP Financial Measures

This press release contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). ADS management uses non-GAAP measures in its analysis of the Company’s performance. Investors are encouraged to review the reconciliation of non-GAAP financial measures to the comparable GAAP results available in the accompanying tables.

Reconciliation of Non-GAAP Financial Measures

This press release includes references to Adjusted EBITDA, Free Cash Flow and Adjusted Earnings per Share, non-GAAP financial measures. These non-GAAP financial measures are used in addition to and in conjunction with results presented in accordance with GAAP. These measures are not intended to be substitutes for those reported in accordance with GAAP. Adjusted EBITDA and Free Cash Flow may be different from non-GAAP financial measures used by other companies, even when similar terms are used to identify such measures.

EBITDA and Adjusted EBITDA are non-GAAP financial measures that comprise net income before interest, income taxes, depreciation and amortization, stock-based compensation, non-cash charges and certain other expenses. The Company’s definition of Adjusted EBITDA may differ from similar measures used by other companies, even when similar terms are used to identify such measures. Adjusted EBITDA is a key metric used by management and the Company’s board of directors to assess financial performance and evaluate the effectiveness of the Company’s business strategies. Accordingly, management believes that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same manner as the Company’s management and board of directors. In order to provide investors with a meaningful reconciliation, the Company has provided a reconciliation of Adjusted EBITDA to net income.

Free Cash Flow is a non-GAAP financial measure that comprises cash flow from operating activities less capital expenditures. Free Cash Flow is a measure used by management and the Company’s board of directors to assess the Company’s ability to generate cash. Accordingly, management believes that Free Cash Flow provides useful information to investors and others in understanding and evaluating our ability to generate cash flow from operations after capital expenditures. In order to provide investors with a meaningful reconciliation, the Company has provided a reconciliation of cash flow from operating activities to Free Cash Flow.

Adjusted Earnings per Share excludes (gains) losses on disposals of assets or business, restructuring and realignment expenses, impairment charges and transaction costs. Adjusted Earnings per Share is a measure used by management and may be useful for investors to evaluate the Company's operational performance.

The following tables present a reconciliation of EBITDA and Adjusted EBITDA to Net Income, Free Cash Flow to Cash Flow from Operating Activities, and Adjusted Earnings per Share to Diluted Earnings per Share, the most comparable GAAP measures, for each of the periods indicated.

Reconciliation of Adjusted Gross Profit to Gross Profit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended

June 30, |

|

|

| (Amounts in thousands) |

2025 |

|

2024(a) |

|

|

|

|

| Segment Adjusted Gross Profit |

|

|

|

|

|

|

|

| Pipe |

$ |

134,105 |

|

|

$ |

139,967 |

|

|

|

|

|

| Infiltrator |

104,333 |

|

|

92,904 |

|

|

|

|

|

| International |

14,108 |

|

|

19,663 |

|

|

|

|

|

| Allied Products & Other |

113,816 |

|

|

109,443 |

|

|

|

|

|

| Intersegment Elimination |

(756) |

|

|

(970) |

|

|

|

|

|

| Total Segment Adjusted Gross Profit |

365,606 |

|

|

361,007 |

|

|

|

|

|

| Depreciation and amortization |

33,512 |

|

|

27,212 |

|

|

|

|

|

| Stock-based compensation expense |

1,656 |

|

|

1,341 |

|

|

|

|

|

| Total Gross Profit |

$ |

330,438 |

|

|

$ |

332,454 |

|

|

|

|

|

(a) In the first quarter of fiscal 2026, the Company realigned certain products used in wastewater applications to the Infiltrator reportable segment. The Company transitioned its ARC Septic Chambers from Allied Products & Other and certain pipe products used in wastewater applications from Pipe. Prior period segment information for fiscal 2025 has been recast to conform to the fiscal 2026 presentation.

Reconciliation of Adjusted EBITDA to Net Income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended

June 30, |

|

|

| (Amounts in thousands) |

2025 |

|

2024 |

|

|

|

|

| Net income |

$ |

144,091 |

|

|

$ |

162,322 |

|

|

|

|

|

| Depreciation and amortization |

50,228 |

|

|

41,098 |

|

|

|

|

|

| Interest expense |

23,029 |

|

|

22,824 |

|

|

|

|

|

| Income tax expense |

46,674 |

|

|

49,886 |

|

|

|

|

|

| EBITDA |

264,022 |

|

|

276,130 |

|

|

|

|

|

Restructuring and realignment expense(a) |

9,993 |

|

|

292 |

|

|

|

|

|

| Stock-based compensation expense |

8,404 |

|

|

6,977 |

|

|

|

|

|

| Transaction costs |

807 |

|

|

10 |

|

|

|

|

|

| Interest income |

(5,405) |

|

|

(6,565) |

|

|

|

|

|

Other adjustments(b) |

346 |

|

|

(1,346) |

|

|

|

|

|

| Adjusted EBITDA |

$ |

278,167 |

|

|

$ |

275,498 |

|

|

|

|

|

(a)Includes Loss on disposal of assets and costs from exit and disposal activities, which includes costs associated with plant closures, as well as professional fees incurred in connection with supporting enterprise-wide restructuring and realignment initiatives.

(b)Includes derivative fair value adjustments, foreign currency transaction (gains) losses, legal settlements, and the proportionate share of interest, income taxes, depreciation and amortization related to the South American Joint Venture, which is accounted for under the equity method of accounting and executive retirement expense.

Reconciliation of Free Cash Flow to Cash flow from Operating Activities

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended

June 30, |

| (Amounts in thousands) |

2025 |

|

2024 |

| Net cash flow from operating activities |

$ |

274,977 |

|

|

$ |

183,426 |

|

| Capital expenditures |

(52,598) |

|

|

(57,715) |

|

| Free cash flow |

$ |

222,379 |

|

|

$ |

125,711 |

|

Reconciliation of Diluted Earnings per Share to Adjusted Earnings per Share

The following table presents diluted earnings per share on an adjusted basis to supplement the Company's discussion of its results of operations herein.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended

June 30, |

|

|

|

2025 |

|

2024 |

|

|

|

|

| Diluted Earnings Per Share |

$ |

1.84 |

|

|

$ |

2.06 |

|

|

|

|

|

Restructuring and realignment expense |

0.13 |

|

|

— |

|

|

|

|

|

| Transaction costs |

0.01 |

|

|

— |

|

|

|

|

|

Income tax impact of adjustments (a) |

(0.03) |

|

|

— |

|

|

|

|

|

| Adjusted Earnings per Share |

$ |

1.95 |

|

|

$ |

2.06 |

|

|

|

|

|

(a) The income tax impact of adjustments to each period is based on the statutory tax rate.