Supplemental Information Fourth Quarter 2023

2 Table of Contents Page Company Highlights 4 Financial Information 8 Debt & Capitalization 23 Leasing Activity & Asset Management 28 Components of Net Asset Value 31 Property Information 33 Portfolio Characteristics 38 Notes & Definitions 58

3 Disclaimer Disclaimer on Forward-Looking Statements This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We intend for all such forward-looking statements to be covered by the applicable safe harbor provisions for forward- looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. The forward-looking statements contained in this document reflect our current views about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause our actual results to differ significantly from those expressed in any forward-looking statement. The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: general economic and financial conditions; market volatility; inflation; any potential recession or threat of recession; interest rates; recent and ongoing disruption in the debt and banking markets; tenant, geographic concentration, and the financial condition of our tenants; competition for tenants and competition with sellers of similar properties if we elect to dispose of our properties; our access to, and the availability of capital; whether we will be able to refinance or repay debt; whether work-from-home trends or other factors will impact the attractiveness of industrial and/or office assets; whether we will be successful in renewing leases as they expire; future financial and operating results, plans, objectives, expectations and intentions; our ability to manage cash flows; dilution resulting from equity issuances; expected sources of financing, including the ability to maintain the commitments under our revolving credit facility, and the availability and attractiveness of the terms of any such financing; legislative and regulatory changes that could adversely affect our business; our ability to maintain our status as a REIT and our Operating Partnership as a partnership for U.S. federal income tax purposes; our future capital expenditures, operating expenses, net income, operating income, cash flow and developments and trends of the real estate industry; whether we will be successful in the pursuit of our business plan, including any acquisitions, investments, or dispositions; whether we will succeed in our investment objectives; any fluctuation and/or volatility of the trading price of our common shares; risks associated with our dependence on key personnel whose continued service is not guaranteed; and other factors, including those discussed in Part I, Item 1A. “Risk Factors” and Part II, Item 7. “Management's Discussion and Analysis of Financial Condition and Results of Operations” of our most recent Annual Report on Form 10-K or Quarterly Report on Form 10-Q filed with the U.S. Securities and Exchange Commission. While forward-looking statements reflect our good faith beliefs, assumptions and expectations, they are not guarantees of future performance. The forward-looking statements speak only as of the date of this document. We disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes after the date of this document, except as required by applicable law. We caution investors not to place undue reliance on these forward-looking statements, which are based only on information currently available to us. Notice Regarding Non-GAAP Financial Measures. In addition to U.S. GAAP financial measures, this document contains and may refer to certain non-GAAP financial measures. These non-GAAP financial measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. These non-GAAP financial measures should not be considered replacements for, and should be read together with, the most comparable GAAP financial measures. Reconciliations to the most directly comparable GAAP financial measures and statements of why management believes these measures are useful to investors are included in this document.

Company Highlights

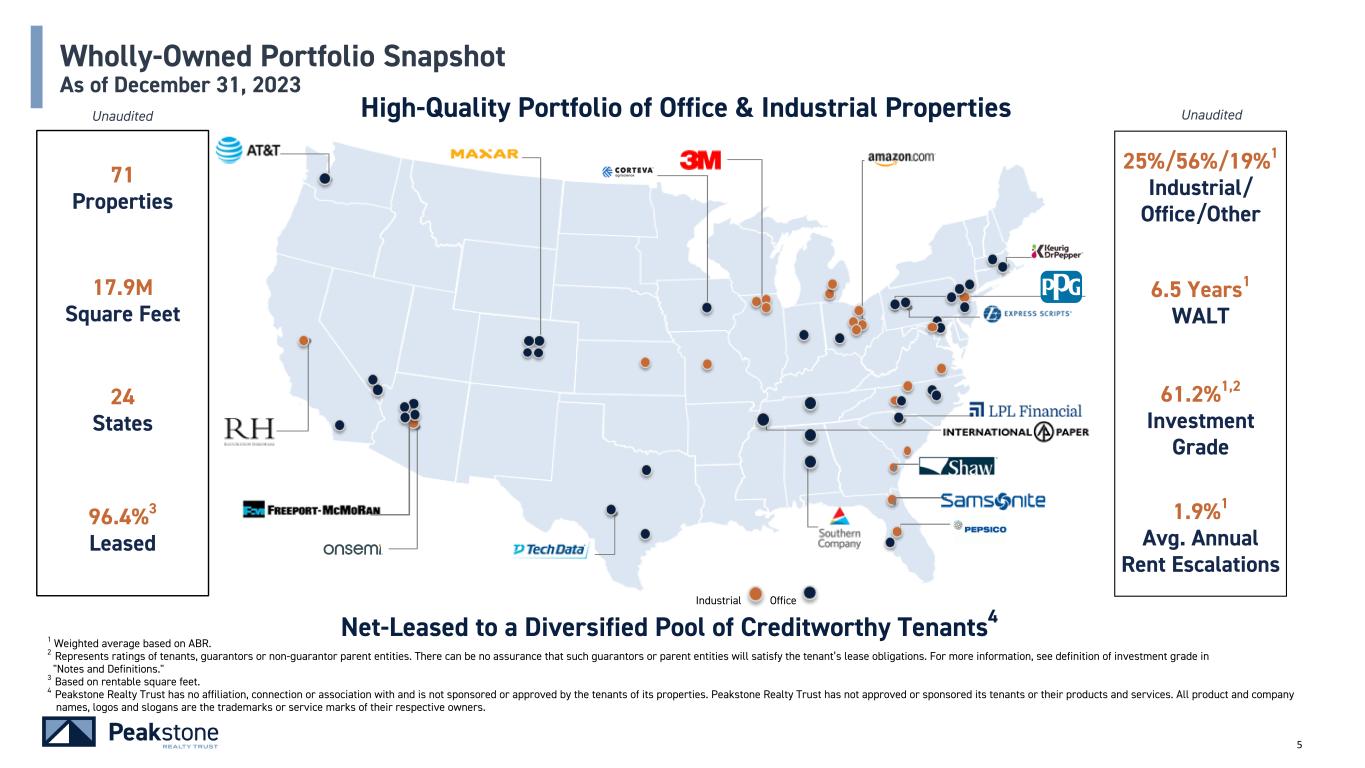

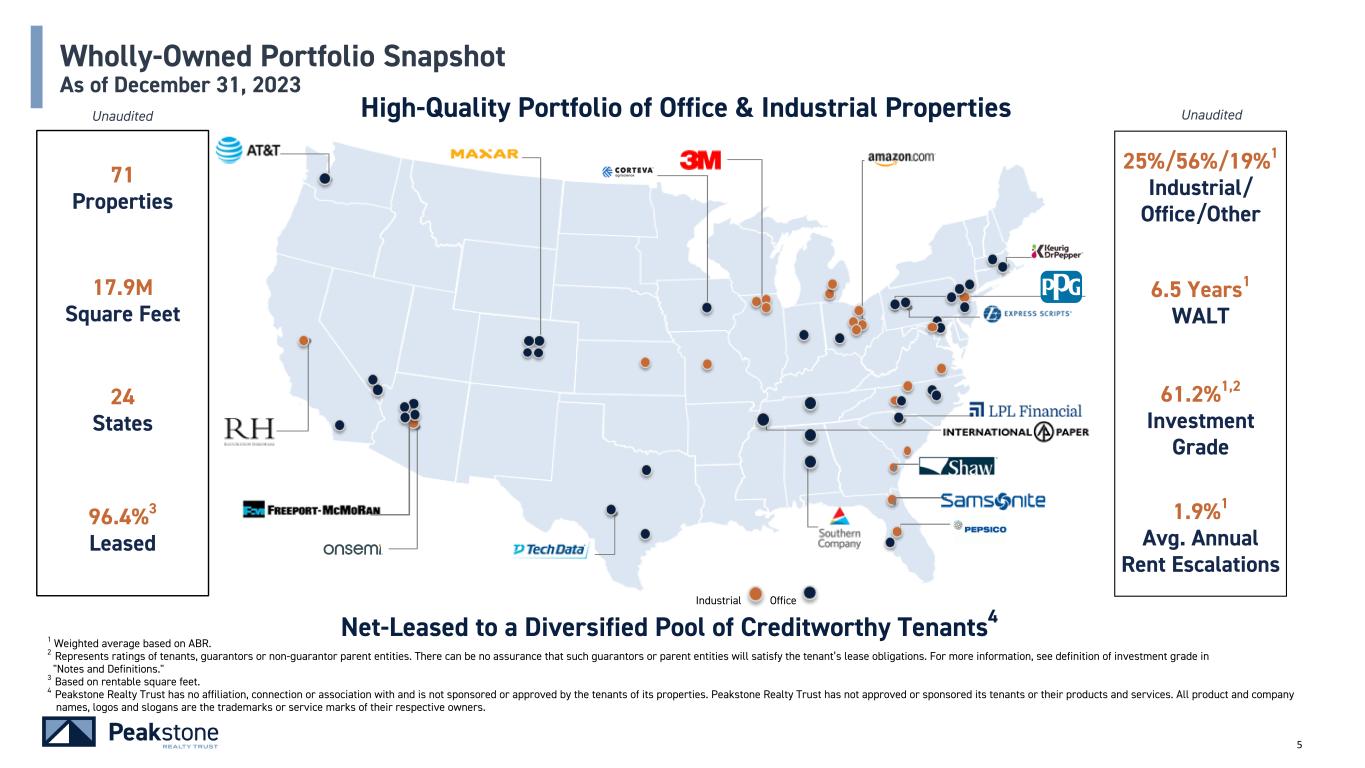

5 High-Quality Portfolio of Office & Industrial Properties Net-Leased to a Diversified Pool of Creditworthy Tenants4 71 Properties 17.9M Square Feet 24 States 96.4%3 Leased 25%/56%/19%1 Industrial/ Office/Other 6.5 Years1 WALT 61.2%1,2 Investment Grade 1.9%1 Avg. Annual Rent Escalations 1 Weighted average based on ABR. 2 Represents ratings of tenants, guarantors or non-guarantor parent entities. There can be no assurance that such guarantors or parent entities will satisfy the tenant’s lease obligations. For more information, see definition of investment grade in "Notes and Definitions." 3 Based on rentable square feet. 4 Peakstone Realty Trust has no affiliation, connection or association with and is not sponsored or approved by the tenants of its properties. Peakstone Realty Trust has not approved or sponsored its tenants or their products and services. All product and company names, logos and slogans are the trademarks or service marks of their respective owners. Industrial Office Wholly-Owned Portfolio Snapshot As of December 31, 2023 Unaudited Unaudited AT&T

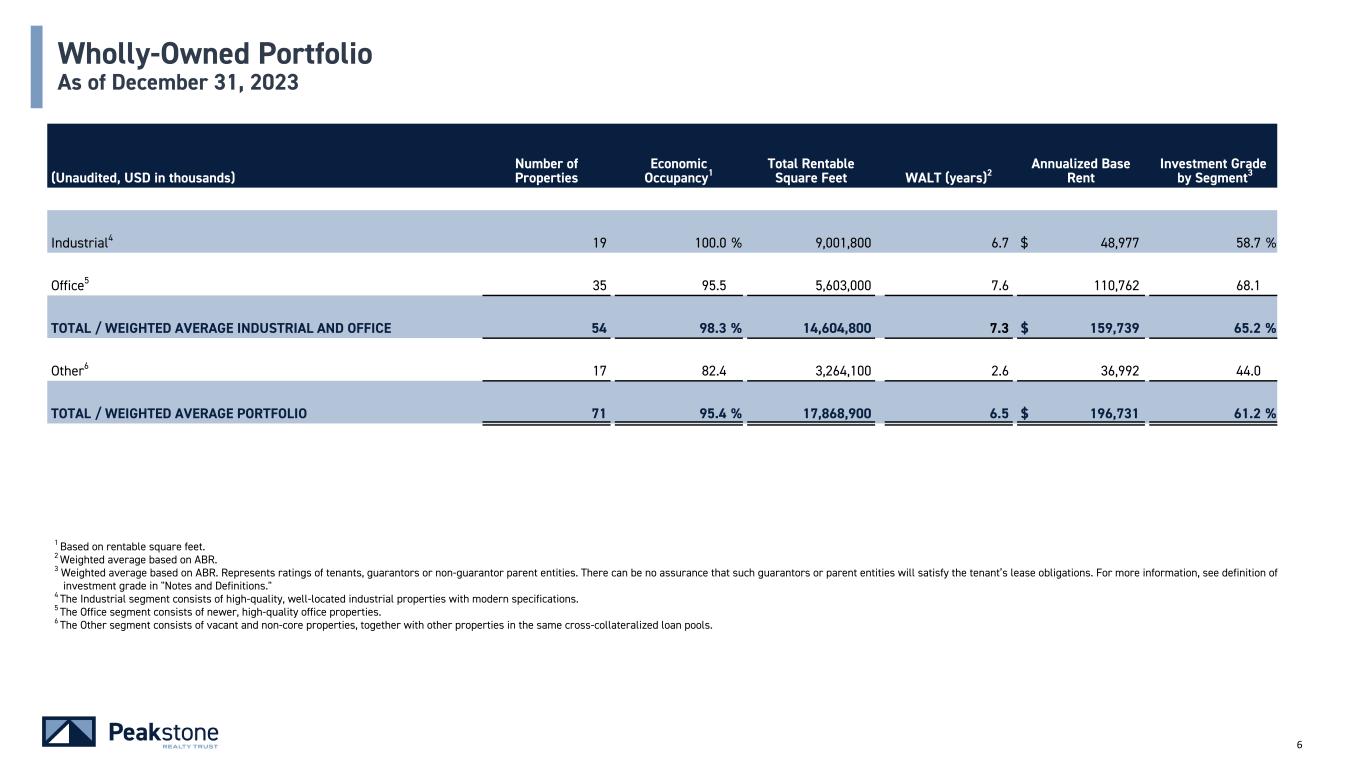

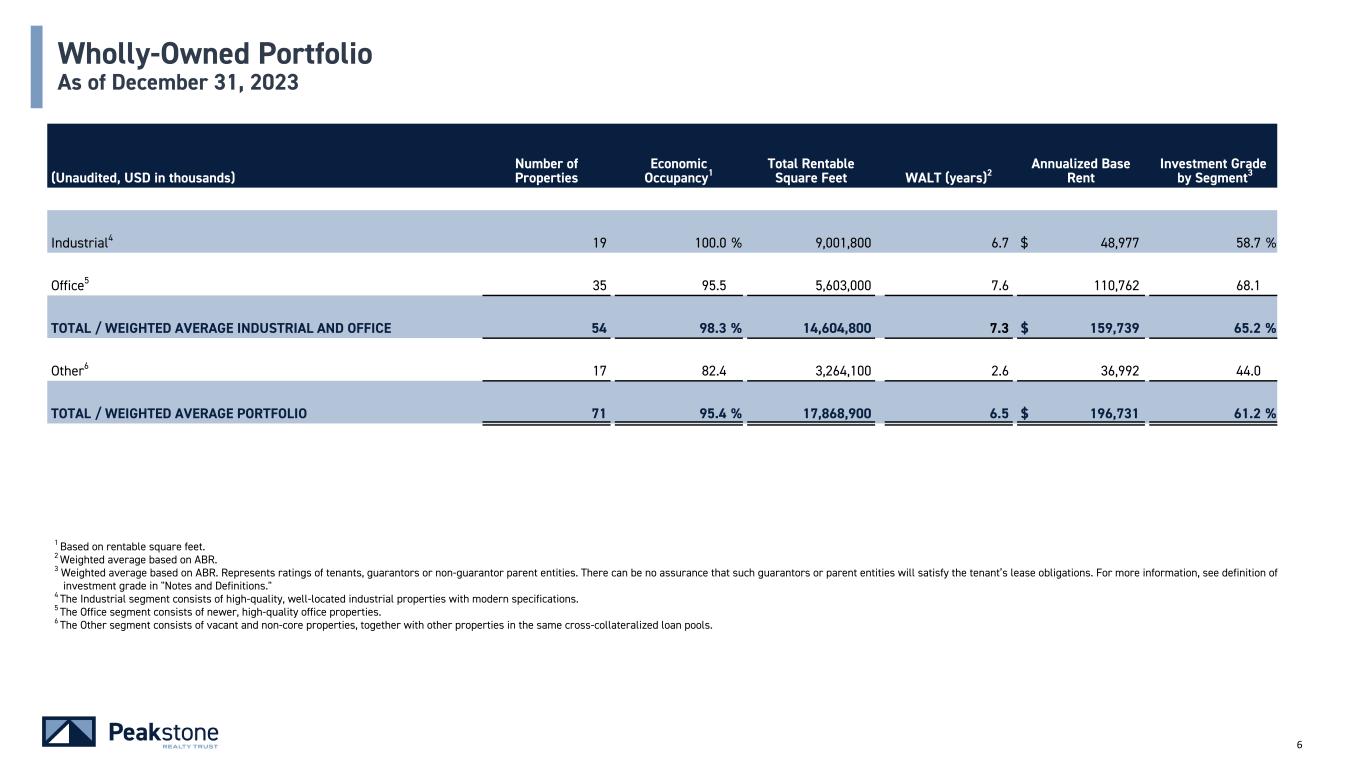

6 (Unaudited, USD in thousands) Number of Properties Economic Occupancy1 Total Rentable Square Feet WALT (years)2 Annualized Base Rent Investment Grade by Segment3 Industrial4 19 100.0 % 9,001,800 6.7 $ 48,977 58.7 % Office5 35 95.5 5,603,000 7.6 110,762 68.1 TOTAL / WEIGHTED AVERAGE INDUSTRIAL AND OFFICE 54 98.3 % 14,604,800 7.3 $ 159,739 65.2 % Other6 17 82.4 3,264,100 2.6 36,992 44.0 TOTAL / WEIGHTED AVERAGE PORTFOLIO 71 95.4 % 17,868,900 6.5 $ 196,731 61.2 % 1 Based on rentable square feet. 2 Weighted average based on ABR. 3 Weighted average based on ABR. Represents ratings of tenants, guarantors or non-guarantor parent entities. There can be no assurance that such guarantors or parent entities will satisfy the tenant’s lease obligations. For more information, see definition of ininvestment grade in "Notes and Definitions." 4 The Industrial segment consists of high-quality, well-located industrial properties with modern specifications. 5 The Office segment consists of newer, high-quality office properties. 6 The Other segment consists of vacant and non-core properties, together with other properties in the same cross-collateralized loan pools. Wholly-Owned Portfolio As of December 31, 2023

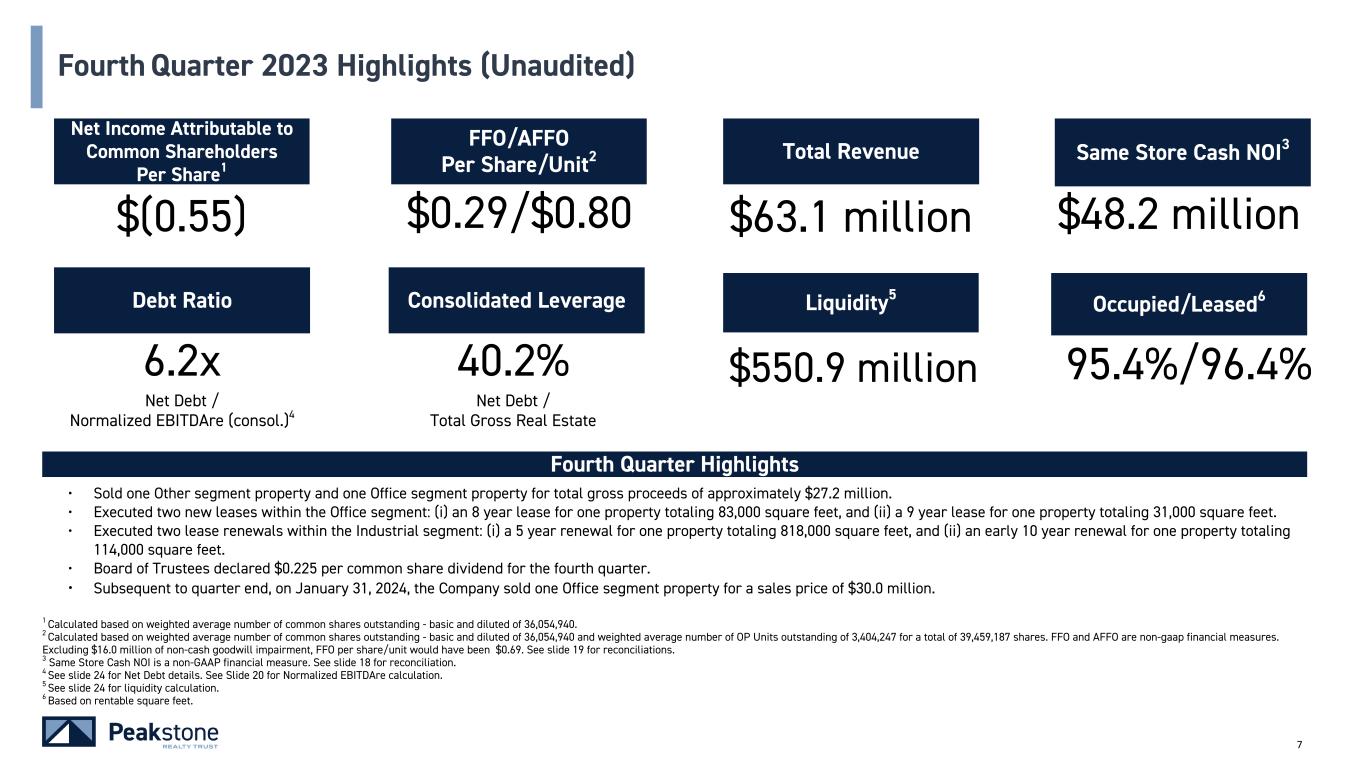

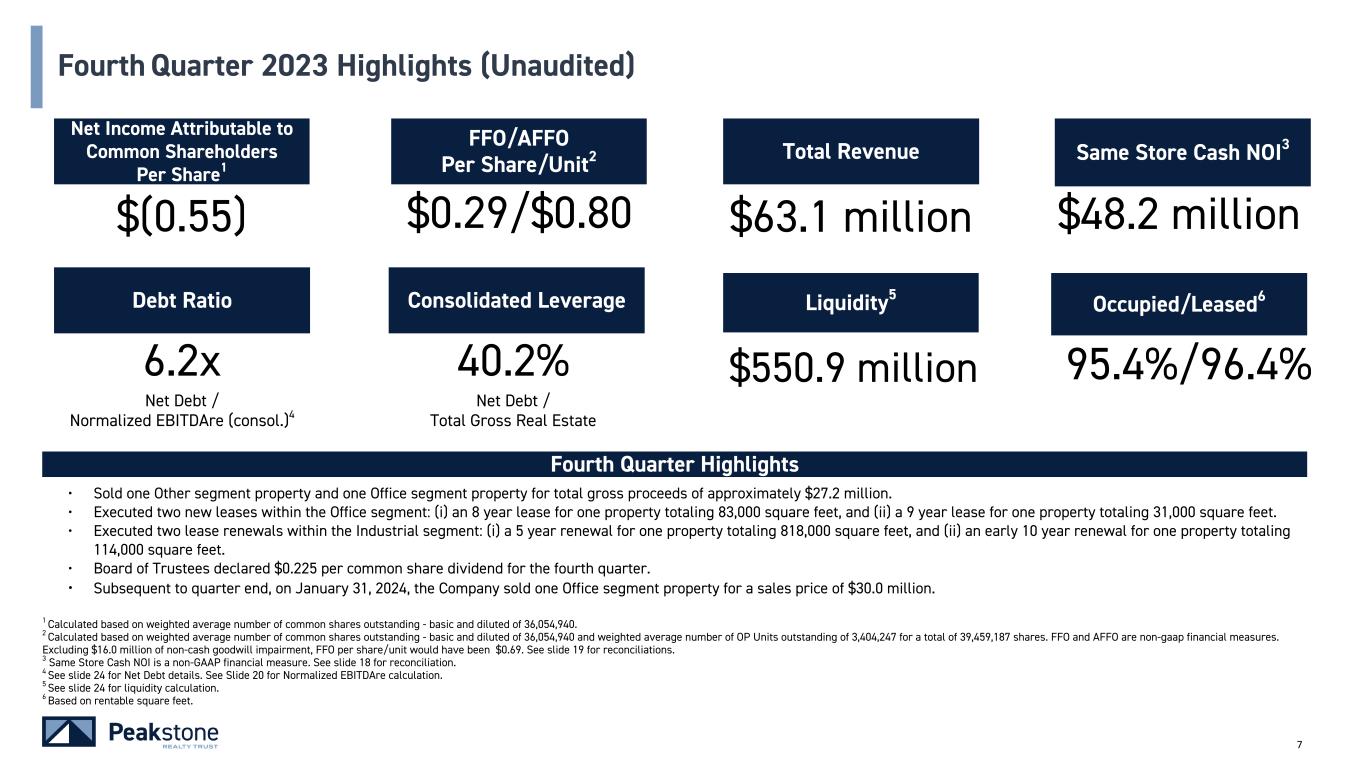

7 Consolidated Leverage $550.9 million40.2% Net Debt / Total Gross Real Estate $0.29/$0.80 FFO/AFFO Per Share/Unit2 6.2x Net Debt / Normalized EBITDAre (consol.)4 Total Revenue $63.1 million Same Store Cash NOI3 Liquidity5 1 Calculated based on weighted average number of common shares outstanding - basic and diluted of 36,054,940. 2 Calculated based on weighted average number of common shares outstanding - basic and diluted of 36,054,940 and weighted average number of OP Units outstanding of 3,404,247 for a total of 39,459,187 shares. FFO and AFFO are non-gaap financial measures. Excluding $16.0 million of non-cash goodwill impairment, FFO per share/unit would have been $0.69. See slide 19 for reconciliations. 3 Same Store Cash NOI is a non-GAAP financial measure. See slide 18 for reconciliation. 4 See slide 24 for Net Debt details. See Slide 20 for Normalized EBITDAre calculation. 5 See slide 24 for liquidity calculation. 6 Based on rentable square feet. 95.4%/96.4% Occupied/Leased6 Fourth Quarter Highlights • Sold one Other segment property and one Office segment property for total gross proceeds of approximately $27.2 million. • Executed two new leases within the Office segment: (i) an 8 year lease for one property totaling 83,000 square feet, and (ii) a 9 year lease for one property totaling 31,000 square feet. • Executed two lease renewals within the Industrial segment: (i) a 5 year renewal for one property totaling 818,000 square feet, and (ii) an early 10 year renewal for one property totaling 114,000 square feet. • Board of Trustees declared $0.225 per common share dividend for the fourth quarter. • Subsequent to quarter end, on January 31, 2024, the Company sold one Office segment property for a sales price of $30.0 million. Fourth Quarter 2023 Highlights (Unaudited) Net Income Attributable to Common Shareholders Per Share1 $(0.55) Debt Ratio $48.2 million

Financial Information

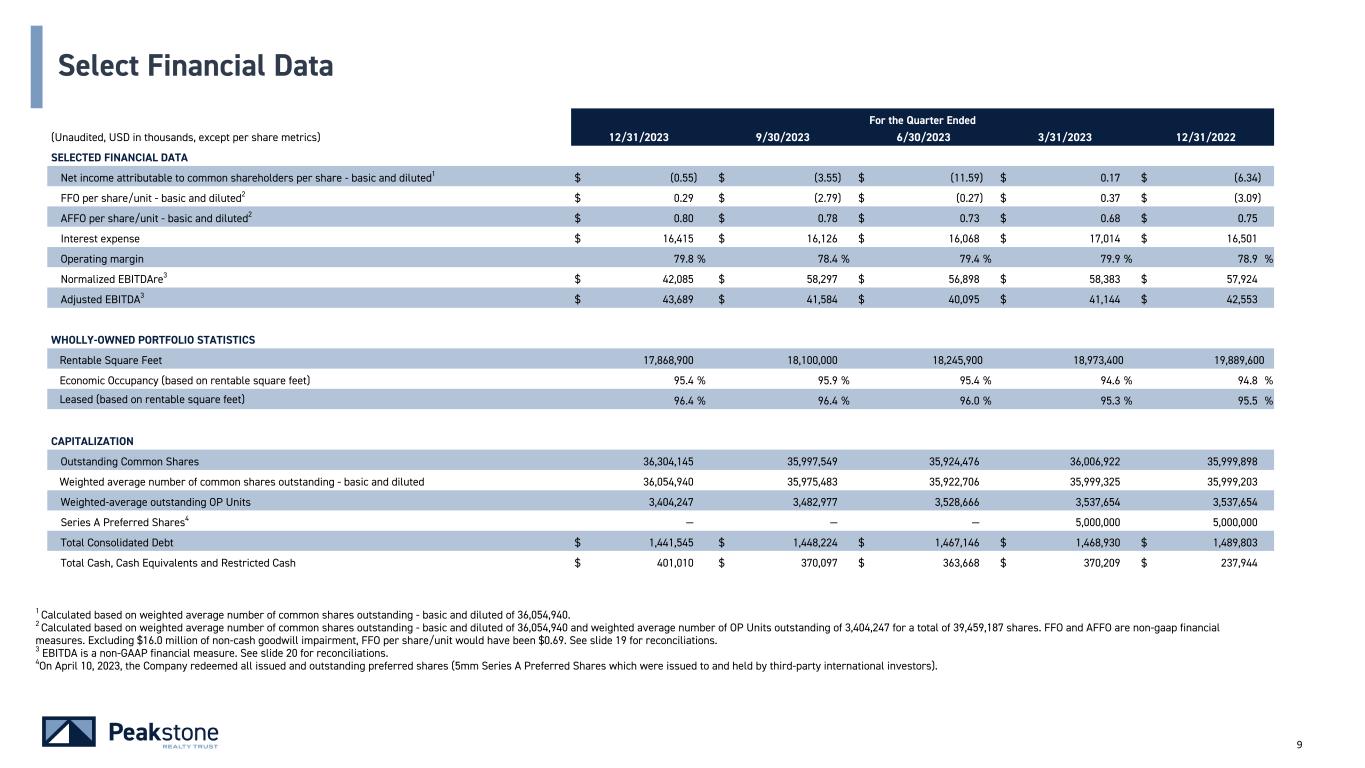

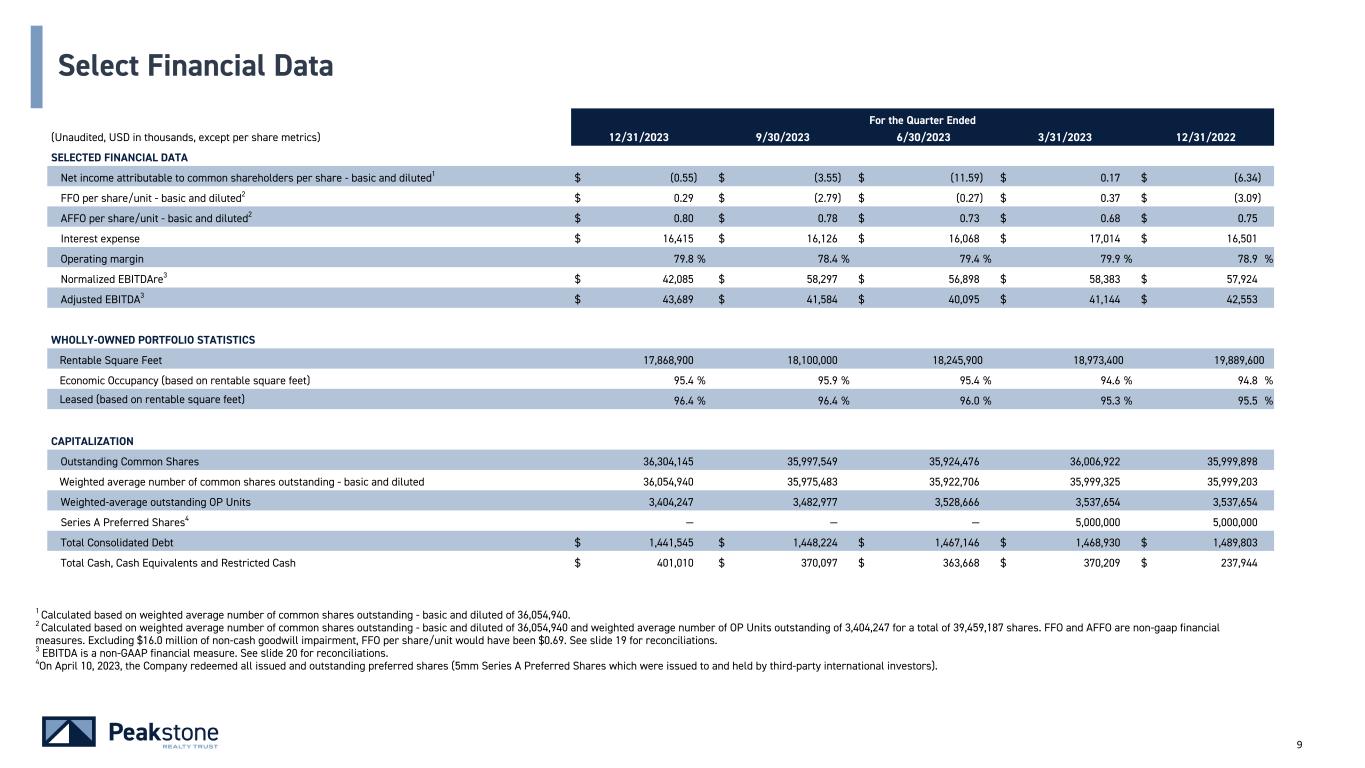

9 1 Calculated based on weighted average number of common shares outstanding - basic and diluted of 36,054,940. 2 Calculated based on weighted average number of common shares outstanding - basic and diluted of 36,054,940 and weighted average number of OP Units outstanding of 3,404,247 for a total of 39,459,187 shares. FFO and AFFO are non-gaap financial measures. Excluding $16.0 million of non-cash goodwill impairment, FFO per share/unit would have been $0.69. See slide 19 for reconciliations. 3 EBITDA is a non-GAAP financial measure. See slide 20 for reconciliations. 4On April 10, 2023, the Company redeemed all issued and outstanding preferred shares (5mm Series A Preferred Shares which were issued to and held by third-party international investors). For the Quarter Ended (Unaudited, USD in thousands, except per share metrics) 12/31/2023 9/30/2023 6/30/2023 3/31/2023 12/31/2022 SELECTED FINANCIAL DATA Net income attributable to common shareholders per share - basic and diluted1 $ (0.55) $ (3.55) $ (11.59) $ 0.17 $ (6.34) FFO per share/unit - basic and diluted2 $ 0.29 $ (2.79) $ (0.27) $ 0.37 $ (3.09) AFFO per share/unit - basic and diluted2 $ 0.80 $ 0.78 $ 0.73 $ 0.68 $ 0.75 Interest expense $ 16,415 $ 16,126 $ 16,068 $ 17,014 $ 16,501 Operating margin 79.8 % 78.4 % 79.4 % 79.9 % 78.9 % Normalized EBITDAre3 $ 42,085 $ 58,297 $ 56,898 $ 58,383 $ 57,924 Adjusted EBITDA3 $ 43,689 $ 41,584 $ 40,095 $ 41,144 $ 42,553 WHOLLY-OWNED PORTFOLIO STATISTICS Rentable Square Feet 17,868,900 18,100,000 18,245,900 18,973,400 19,889,600 Economic Occupancy (based on rentable square feet) 95.4 % 95.9 % 95.4 % 94.6 % 94.8 % Leased (based on rentable square feet) 96.4 % 96.4 % 96.0 % 95.3 % 95.5 % CAPITALIZATION Outstanding Common Shares 36,304,145 35,997,549 35,924,476 36,006,922 35,999,898 Weighted average number of common shares outstanding - basic and diluted 36,054,940 35,975,483 35,922,706 35,999,325 35,999,203 Weighted-average outstanding OP Units 3,404,247 3,482,977 3,528,666 3,537,654 3,537,654 Series A Preferred Shares4 — — — 5,000,000 5,000,000 Total Consolidated Debt $ 1,441,545 $ 1,448,224 $ 1,467,146 $ 1,468,930 $ 1,489,803 Total Cash, Cash Equivalents and Restricted Cash $ 401,010 $ 370,097 $ 363,668 $ 370,209 $ 237,944 Select Financial Data

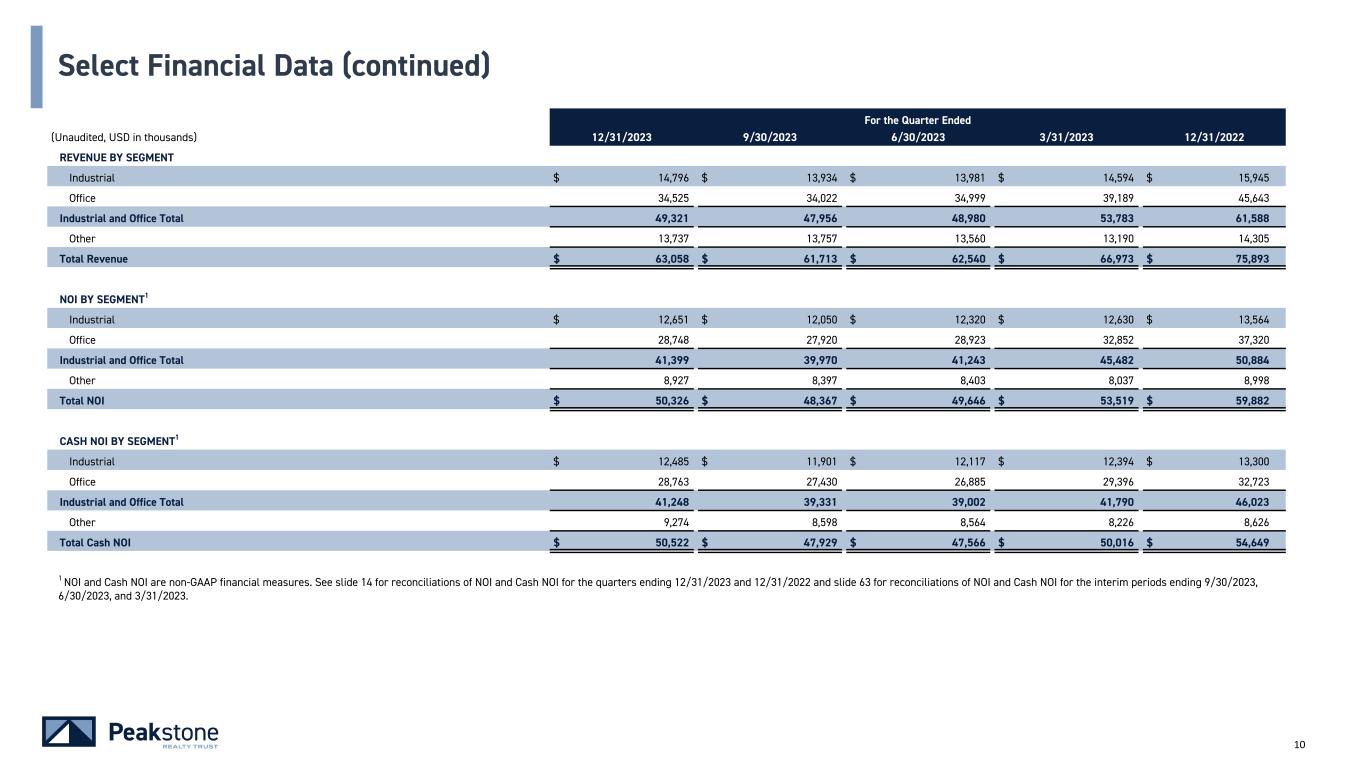

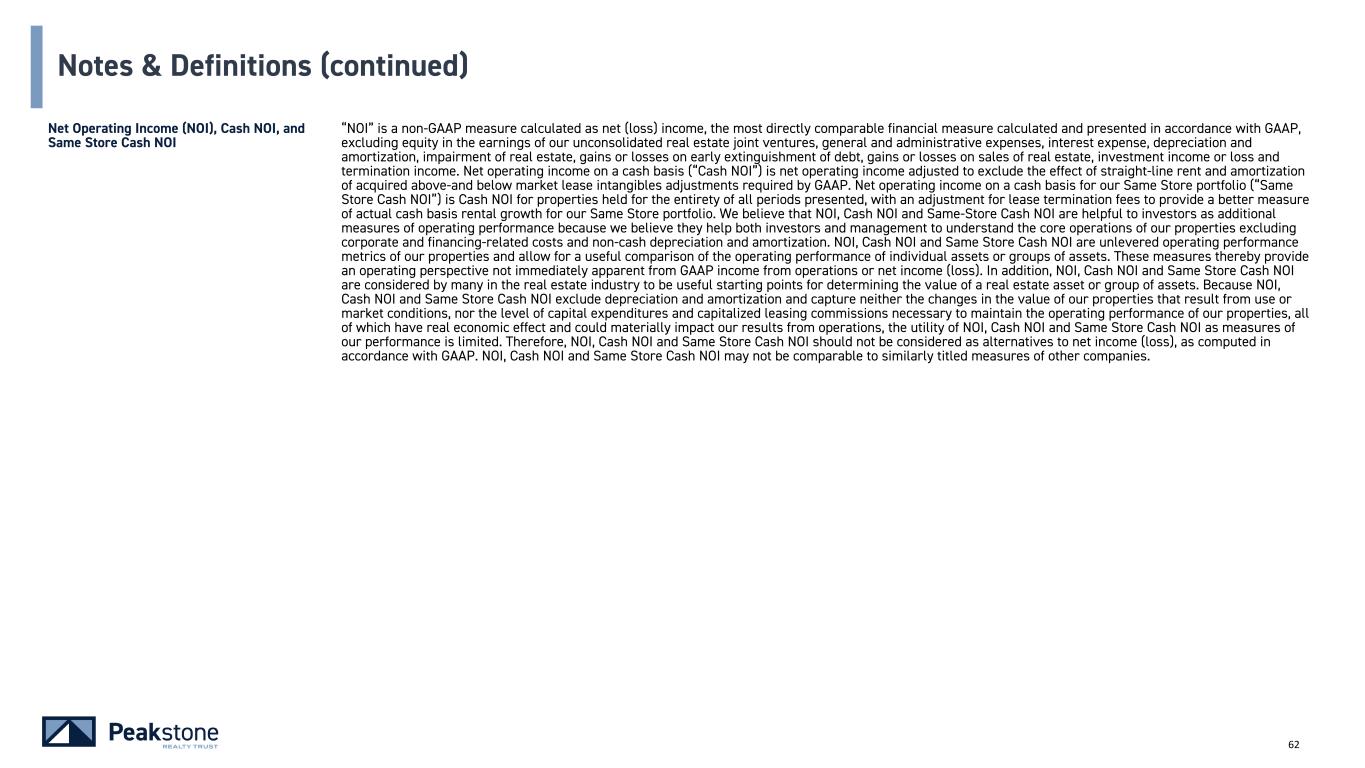

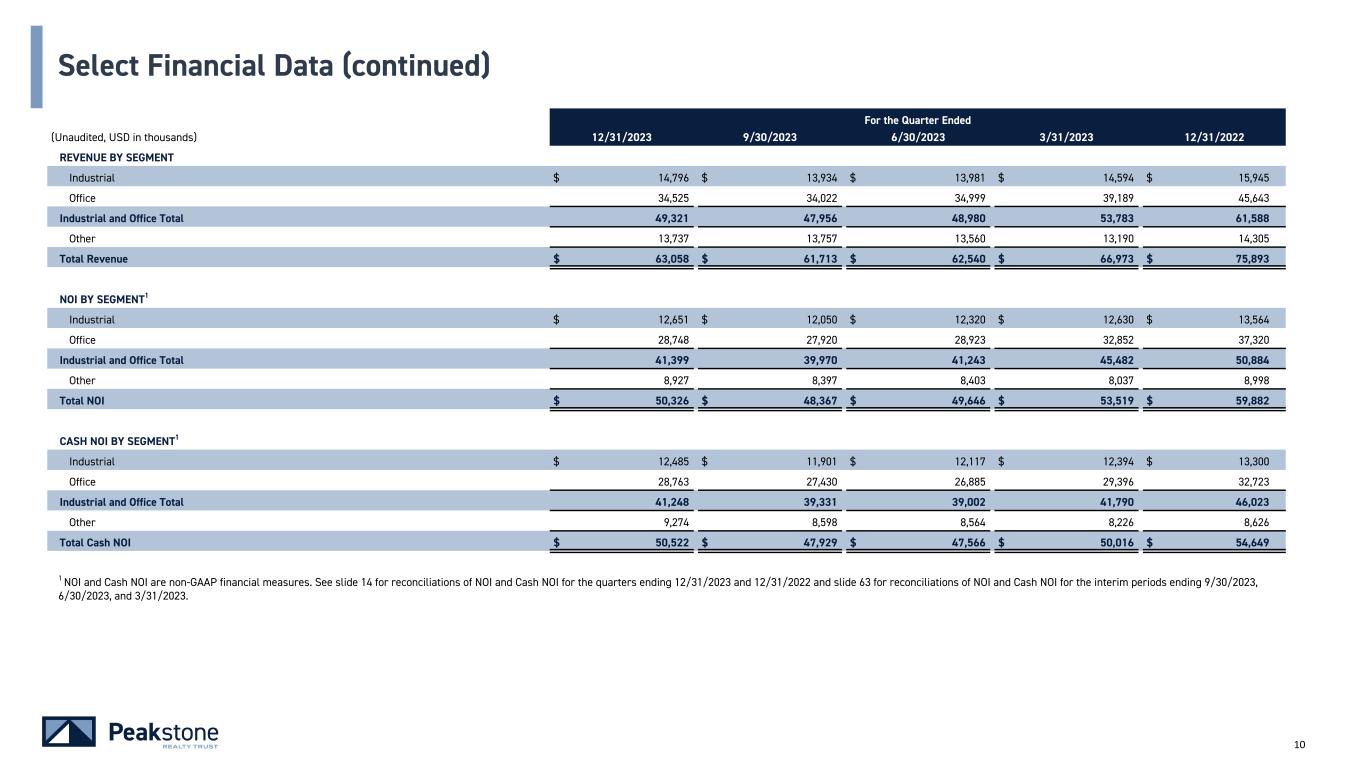

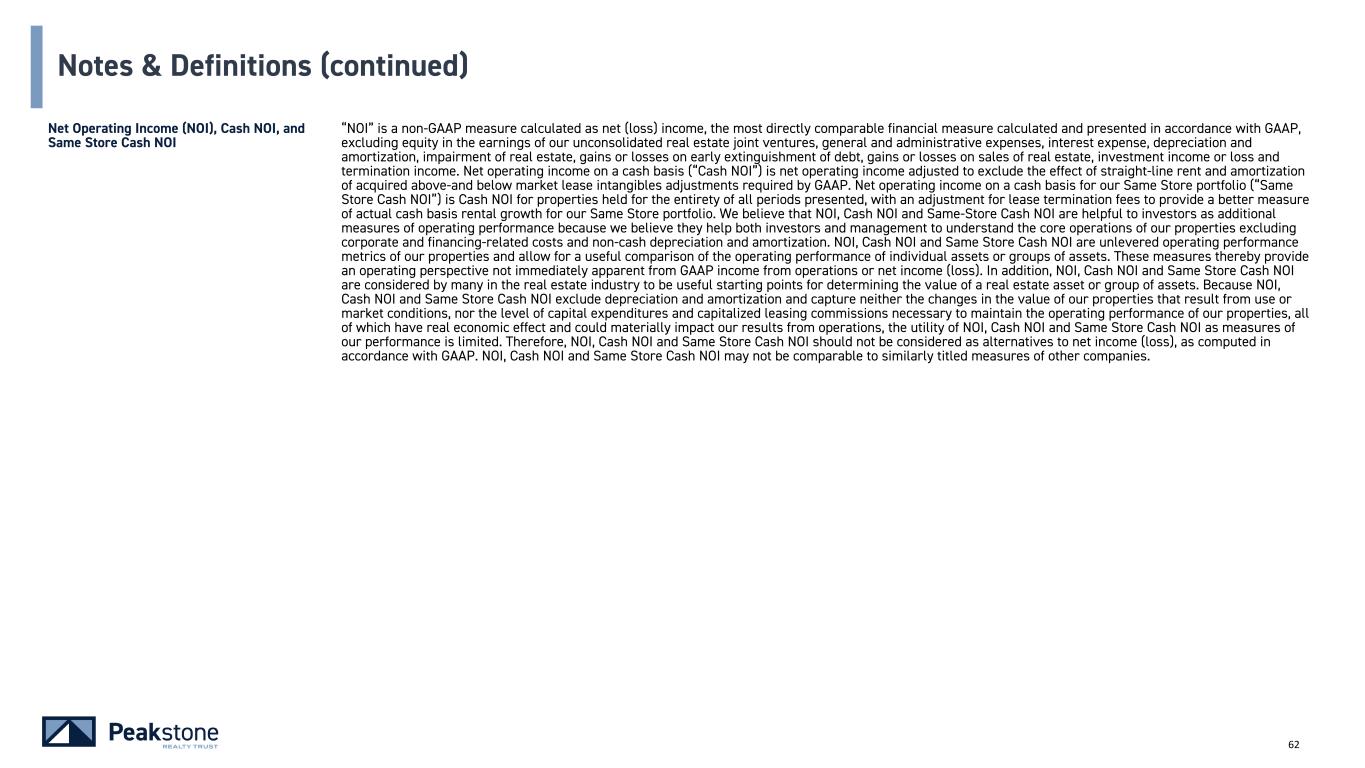

10 For the Quarter Ended (Unaudited, USD in thousands) 12/31/2023 9/30/2023 6/30/2023 3/31/2023 12/31/2022 REVENUE BY SEGMENT Industrial $ 14,796 $ 13,934 $ 13,981 $ 14,594 $ 15,945 Office 34,525 34,022 34,999 39,189 45,643 Industrial and Office Total 49,321 47,956 48,980 53,783 61,588 Other 13,737 13,757 13,560 13,190 14,305 Total Revenue $ 63,058 $ 61,713 $ 62,540 $ 66,973 $ 75,893 NOI BY SEGMENT1 Industrial $ 12,651 $ 12,050 $ 12,320 $ 12,630 $ 13,564 Office 28,748 27,920 28,923 32,852 37,320 Industrial and Office Total 41,399 39,970 41,243 45,482 50,884 Other 8,927 8,397 8,403 8,037 8,998 Total NOI $ 50,326 $ 48,367 $ 49,646 $ 53,519 $ 59,882 CASH NOI BY SEGMENT1 Industrial $ 12,485 $ 11,901 $ 12,117 $ 12,394 $ 13,300 Office 28,763 27,430 26,885 29,396 32,723 Industrial and Office Total 41,248 39,331 39,002 41,790 46,023 Other 9,274 8,598 8,564 8,226 8,626 Total Cash NOI $ 50,522 $ 47,929 $ 47,566 $ 50,016 $ 54,649 Select Financial Data (continued) 1 NOI and Cash NOI are non-GAAP financial measures. See slide 14 for reconciliations of NOI and Cash NOI for the quarters ending 12/31/2023 and 12/31/2022 and slide 63 for reconciliations of NOI and Cash NOI for the interim periods ending 9/30/2023, 6/30/2023, and 3/31/2023.

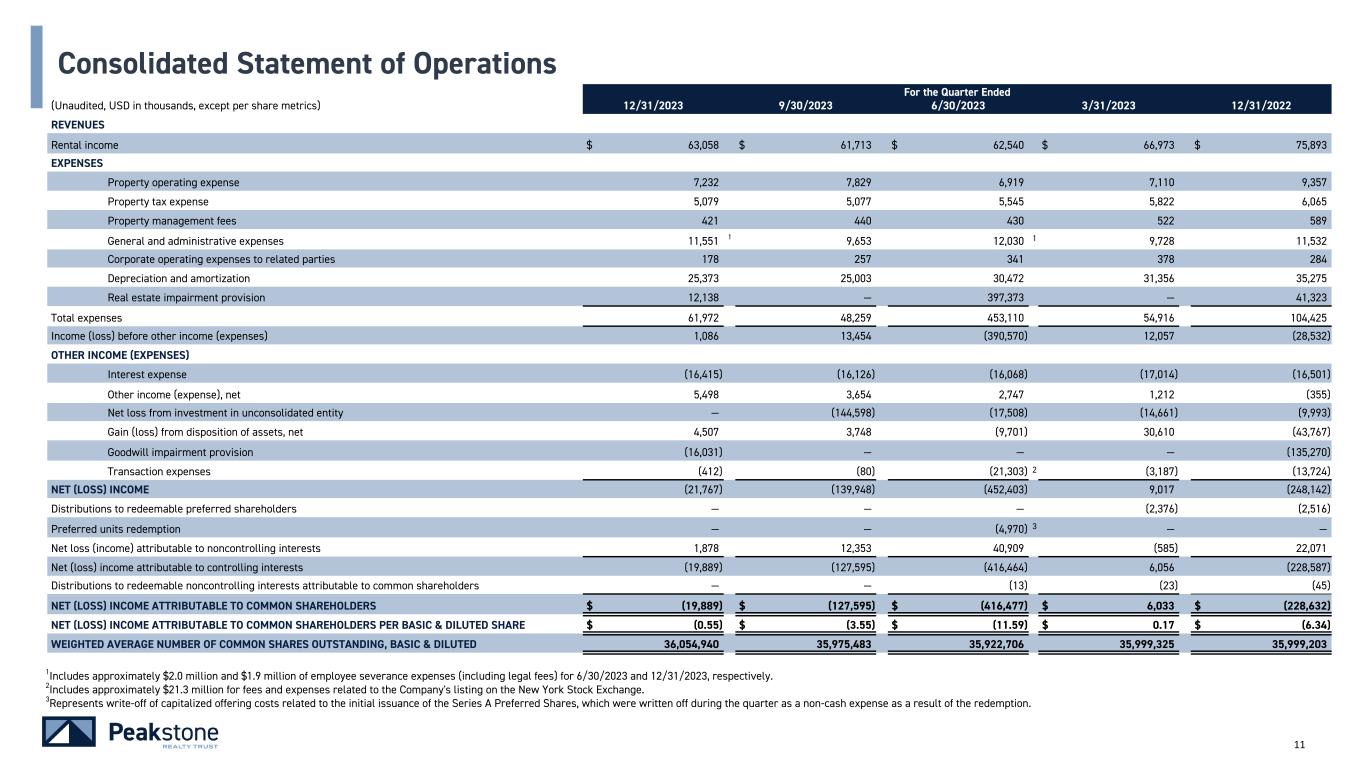

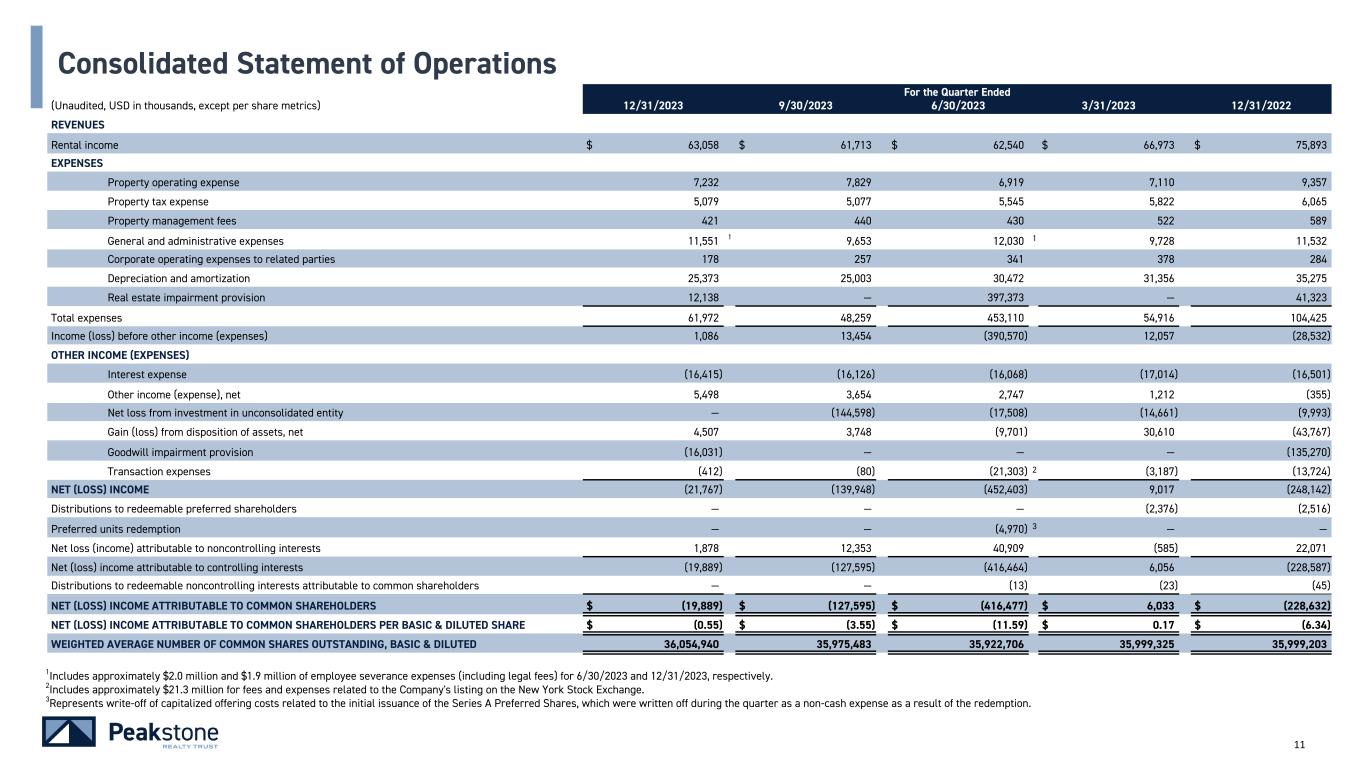

11 For the Quarter Ended (Unaudited, USD in thousands, except per share metrics) 12/31/2023 9/30/2023 6/30/2023 3/31/2023 12/31/2022 REVENUES Rental income $ 63,058 $ 61,713 $ 62,540 $ 66,973 $ 75,893 EXPENSES Property operating expense 7,232 7,829 6,919 7,110 9,357 Property tax expense 5,079 5,077 5,545 5,822 6,065 Property management fees 421 440 430 522 589 General and administrative expenses 11,551 1 9,653 12,030 1 9,728 11,532 Corporate operating expenses to related parties 178 257 341 378 284 Depreciation and amortization 25,373 25,003 30,472 31,356 35,275 Real estate impairment provision 12,138 — 397,373 — 41,323 Total expenses 61,972 48,259 453,110 54,916 104,425 Income (loss) before other income (expenses) 1,086 13,454 (390,570) 12,057 (28,532) OTHER INCOME (EXPENSES) Interest expense (16,415) (16,126) (16,068) (17,014) (16,501) Other income (expense), net 5,498 3,654 2,747 1,212 (355) Net loss from investment in unconsolidated entity — (144,598) (17,508) (14,661) (9,993) Gain (loss) from disposition of assets, net 4,507 3,748 (9,701) 30,610 (43,767) Goodwill impairment provision (16,031) — — — (135,270) Transaction expenses (412) (80) (21,303) 2 (3,187) (13,724) NET (LOSS) INCOME (21,767) (139,948) (452,403) 9,017 (248,142) Distributions to redeemable preferred shareholders — — — (2,376) (2,516) Preferred units redemption — — (4,970) 3 — — Net loss (income) attributable to noncontrolling interests 1,878 12,353 40,909 (585) 22,071 Net (loss) income attributable to controlling interests (19,889) (127,595) (416,464) 6,056 (228,587) Distributions to redeemable noncontrolling interests attributable to common shareholders — — (13) (23) (45) NET (LOSS) INCOME ATTRIBUTABLE TO COMMON SHAREHOLDERS $ (19,889) $ (127,595) $ (416,477) $ 6,033 $ (228,632) NET (LOSS) INCOME ATTRIBUTABLE TO COMMON SHAREHOLDERS PER BASIC & DILUTED SHARE $ (0.55) $ (3.55) $ (11.59) $ 0.17 $ (6.34) WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING, BASIC & DILUTED 36,054,940 35,975,483 35,922,706 35,999,325 35,999,203 Consolidated Statement of Operations 1Includes approximately $2.0 million and $1.9 million of employee severance expenses (including legal fees) for 6/30/2023 and 12/31/2023, respectively. 2Includes approximately $21.3 million for fees and expenses related to the Company's listing on the New York Stock Exchange. 3Represents write-off of capitalized offering costs related to the initial issuance of the Series A Preferred Shares, which were written off during the quarter as a non-cash expense as a result of the redemption.

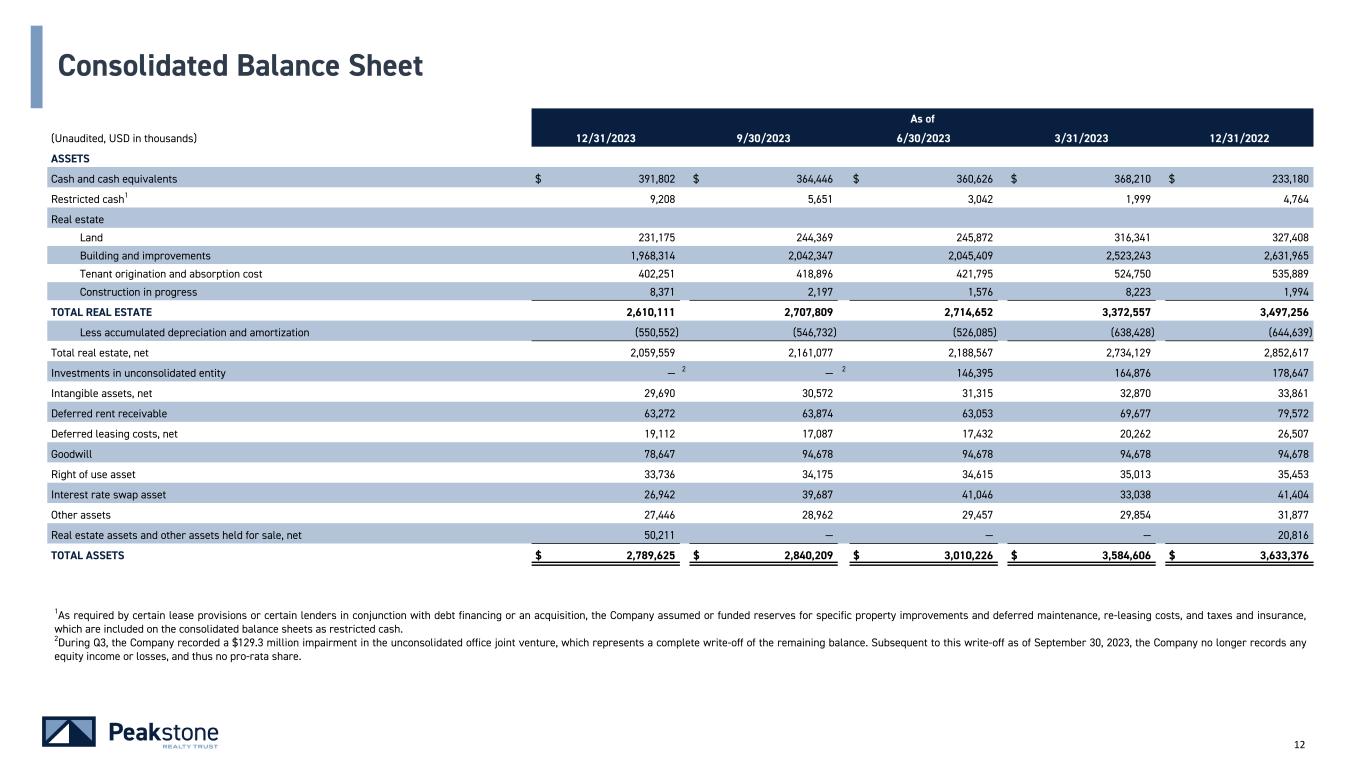

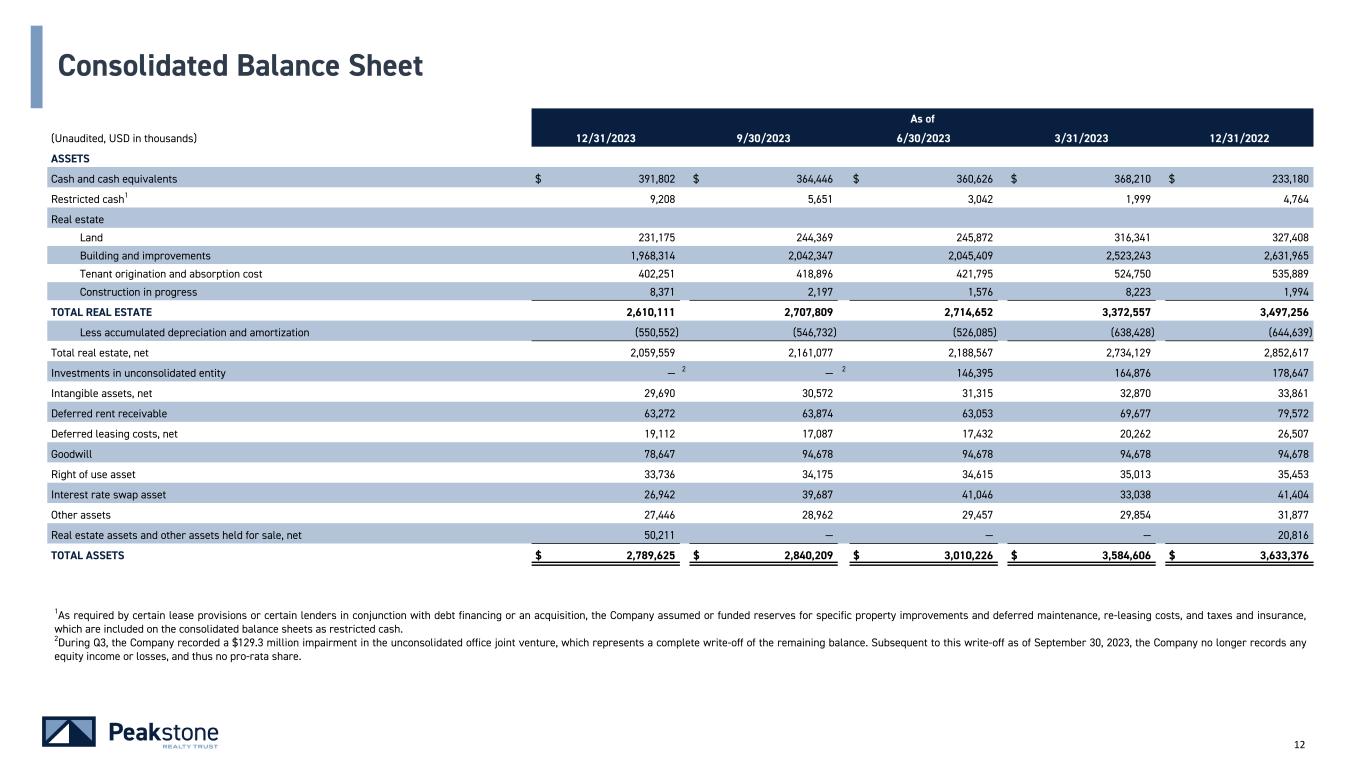

12 As of (Unaudited, USD in thousands) 12/31/2023 9/30/2023 6/30/2023 3/31/2023 12/31/2022 ASSETS Cash and cash equivalents $ 391,802 $ 364,446 $ 360,626 $ 368,210 $ 233,180 Restricted cash1 9,208 5,651 3,042 1,999 4,764 Real estate Land 231,175 244,369 245,872 316,341 327,408 Building and improvements 1,968,314 2,042,347 2,045,409 2,523,243 2,631,965 Tenant origination and absorption cost 402,251 418,896 421,795 524,750 535,889 Construction in progress 8,371 2,197 1,576 8,223 1,994 TOTAL REAL ESTATE 2,610,111 2,707,809 2,714,652 3,372,557 3,497,256 Less accumulated depreciation and amortization (550,552) (546,732) (526,085) (638,428) (644,639) Total real estate, net 2,059,559 2,161,077 2,188,567 2,734,129 2,852,617 Investments in unconsolidated entity — 2 — 2 146,395 164,876 178,647 Intangible assets, net 29,690 30,572 31,315 32,870 33,861 Deferred rent receivable 63,272 63,874 63,053 69,677 79,572 Deferred leasing costs, net 19,112 17,087 17,432 20,262 26,507 Goodwill 78,647 94,678 94,678 94,678 94,678 Right of use asset 33,736 34,175 34,615 35,013 35,453 Interest rate swap asset 26,942 39,687 41,046 33,038 41,404 Other assets 27,446 28,962 29,457 29,854 31,877 Real estate assets and other assets held for sale, net 50,211 — — — 20,816 TOTAL ASSETS $ 2,789,625 $ 2,840,209 $ 3,010,226 $ 3,584,606 $ 3,633,376 Consolidated Balance Sheet 1As required by certain lease provisions or certain lenders in conjunction with debt financing or an acquisition, the Company assumed or funded reserves for specific property improvements and deferred maintenance, re-leasing costs, and taxes and insurance, which are included on the consolidated balance sheets as restricted cash. 2During Q3, the Company recorded a $129.3 million impairment in the unconsolidated office joint venture, which represents a complete write-off of the remaining balance. Subsequent to this write-off as of September 30, 2023, the Company no longer records any equity income or losses, and thus no pro-rata share.

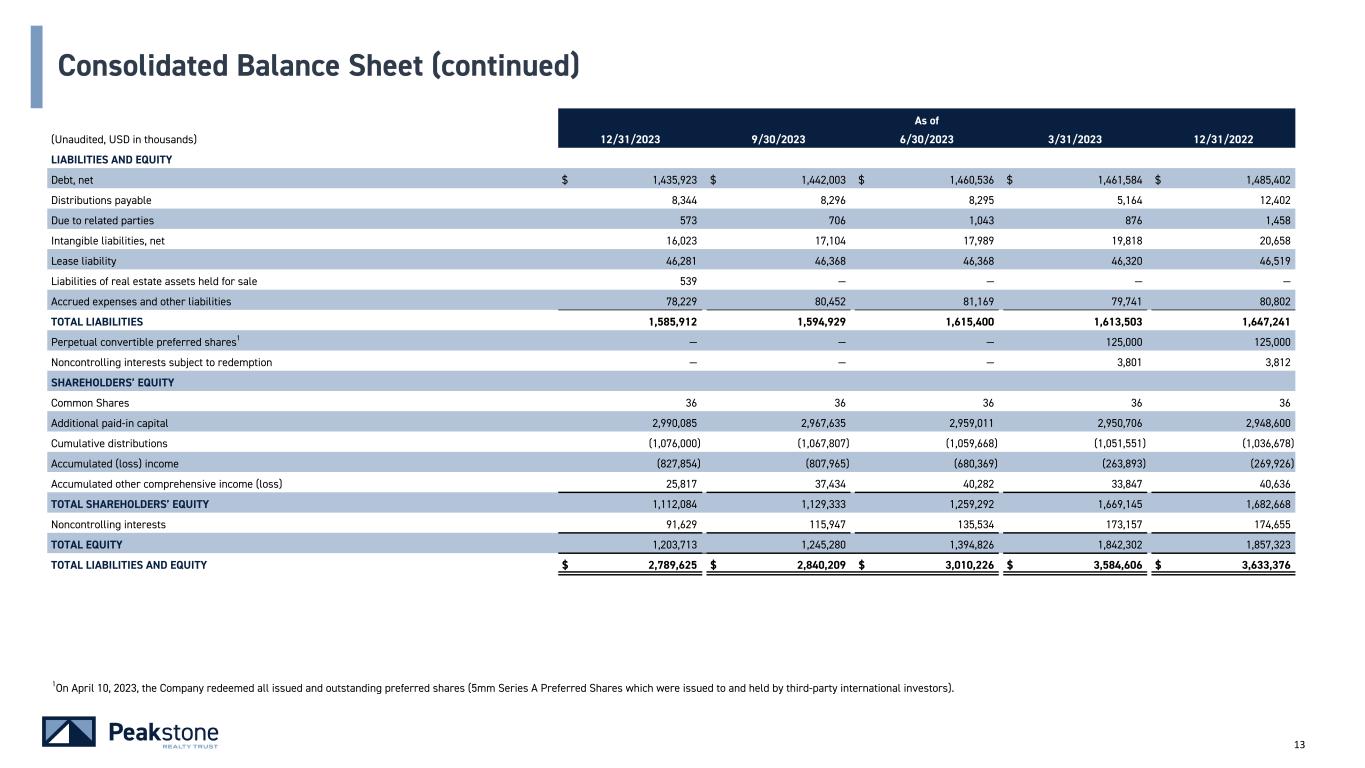

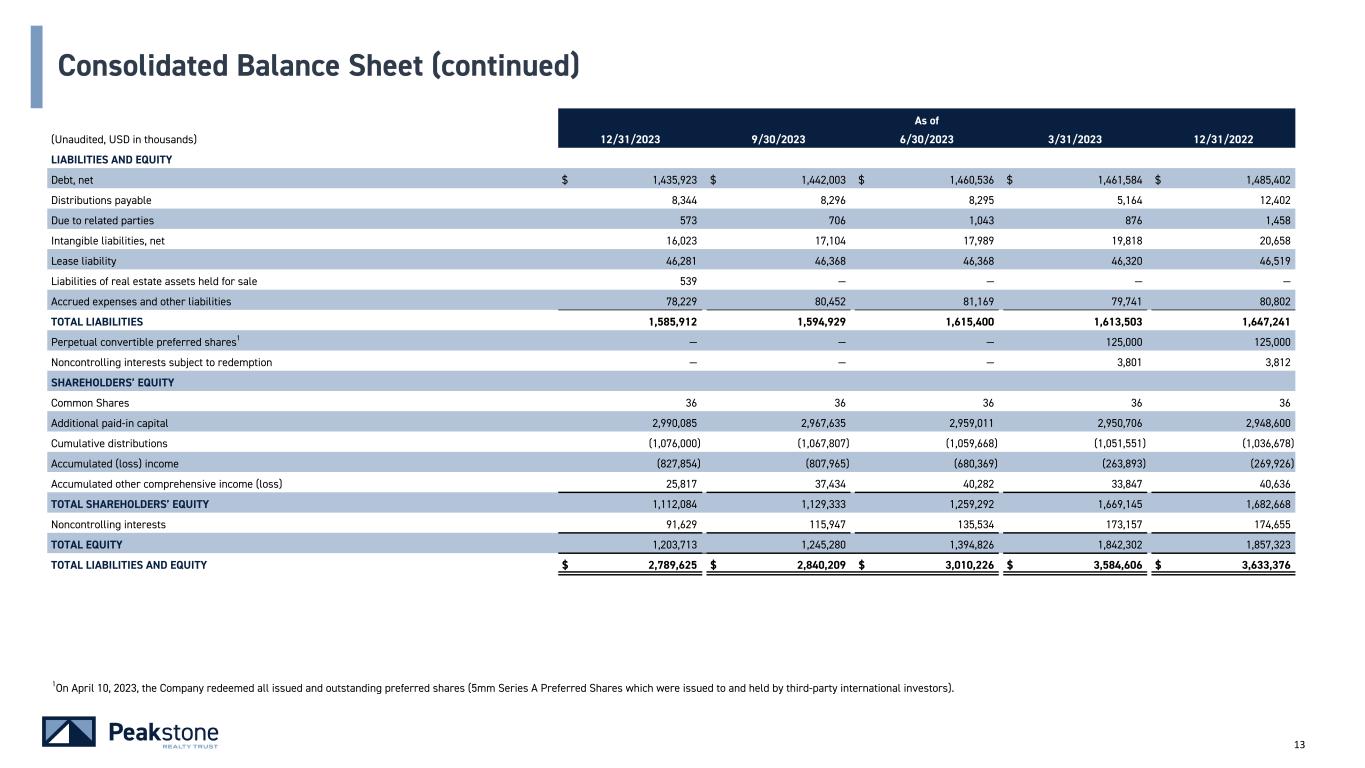

13 As of (Unaudited, USD in thousands) 12/31/2023 9/30/2023 6/30/2023 3/31/2023 12/31/2022 LIABILITIES AND EQUITY Debt, net $ 1,435,923 $ 1,442,003 $ 1,460,536 $ 1,461,584 $ 1,485,402 Distributions payable 8,344 8,296 8,295 5,164 12,402 Due to related parties 573 706 1,043 876 1,458 Intangible liabilities, net 16,023 17,104 17,989 19,818 20,658 Lease liability 46,281 46,368 46,368 46,320 46,519 Liabilities of real estate assets held for sale 539 — — — — Accrued expenses and other liabilities 78,229 80,452 81,169 79,741 80,802 TOTAL LIABILITIES 1,585,912 1,594,929 1,615,400 1,613,503 1,647,241 Perpetual convertible preferred shares1 — — — 125,000 125,000 Noncontrolling interests subject to redemption — — — 3,801 3,812 SHAREHOLDERS’ EQUITY Common Shares 36 36 36 36 36 Additional paid-in capital 2,990,085 2,967,635 2,959,011 2,950,706 2,948,600 Cumulative distributions (1,076,000) (1,067,807) (1,059,668) (1,051,551) (1,036,678) Accumulated (loss) income (827,854) (807,965) (680,369) (263,893) (269,926) Accumulated other comprehensive income (loss) 25,817 37,434 40,282 33,847 40,636 TOTAL SHAREHOLDERS’ EQUITY 1,112,084 1,129,333 1,259,292 1,669,145 1,682,668 Noncontrolling interests 91,629 115,947 135,534 173,157 174,655 TOTAL EQUITY 1,203,713 1,245,280 1,394,826 1,842,302 1,857,323 TOTAL LIABILITIES AND EQUITY $ 2,789,625 $ 2,840,209 $ 3,010,226 $ 3,584,606 $ 3,633,376 Consolidated Balance Sheet (continued) 1On April 10, 2023, the Company redeemed all issued and outstanding preferred shares (5mm Series A Preferred Shares which were issued to and held by third-party international investors).

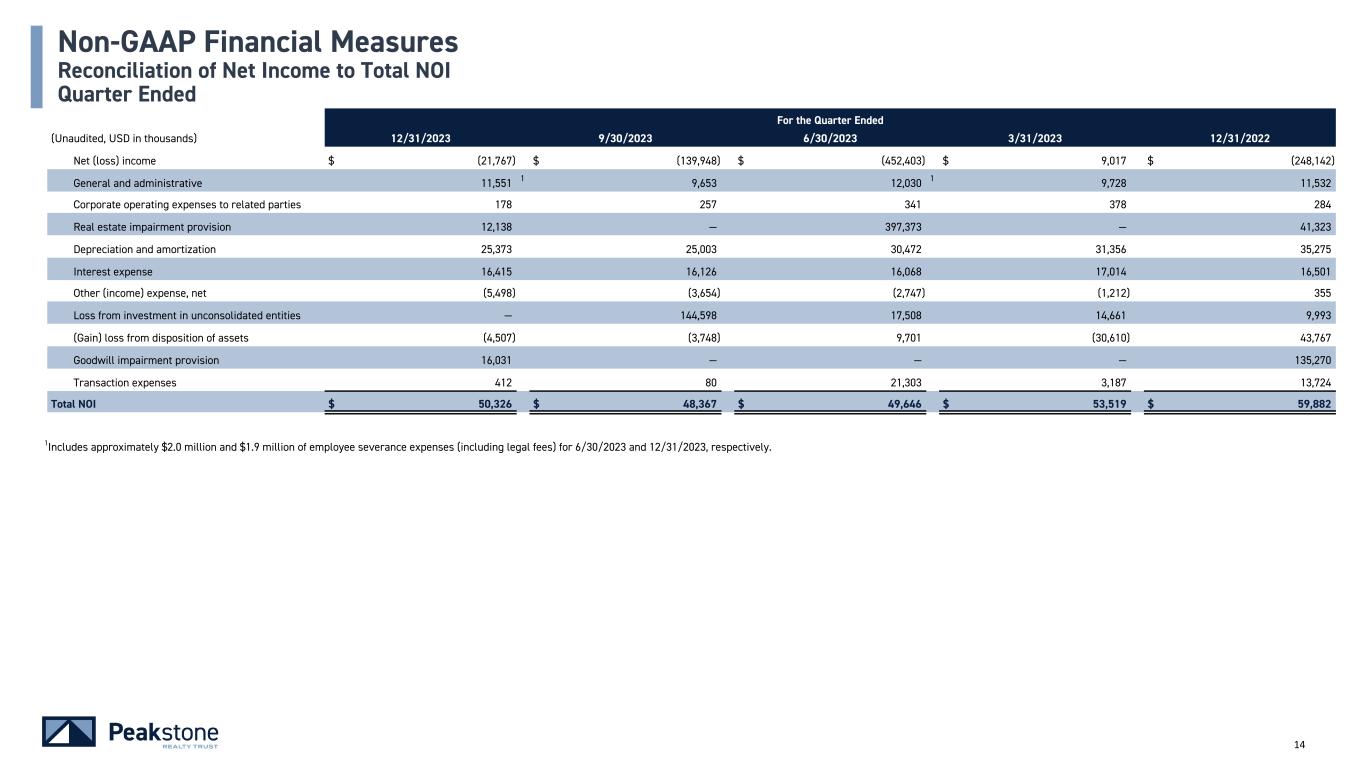

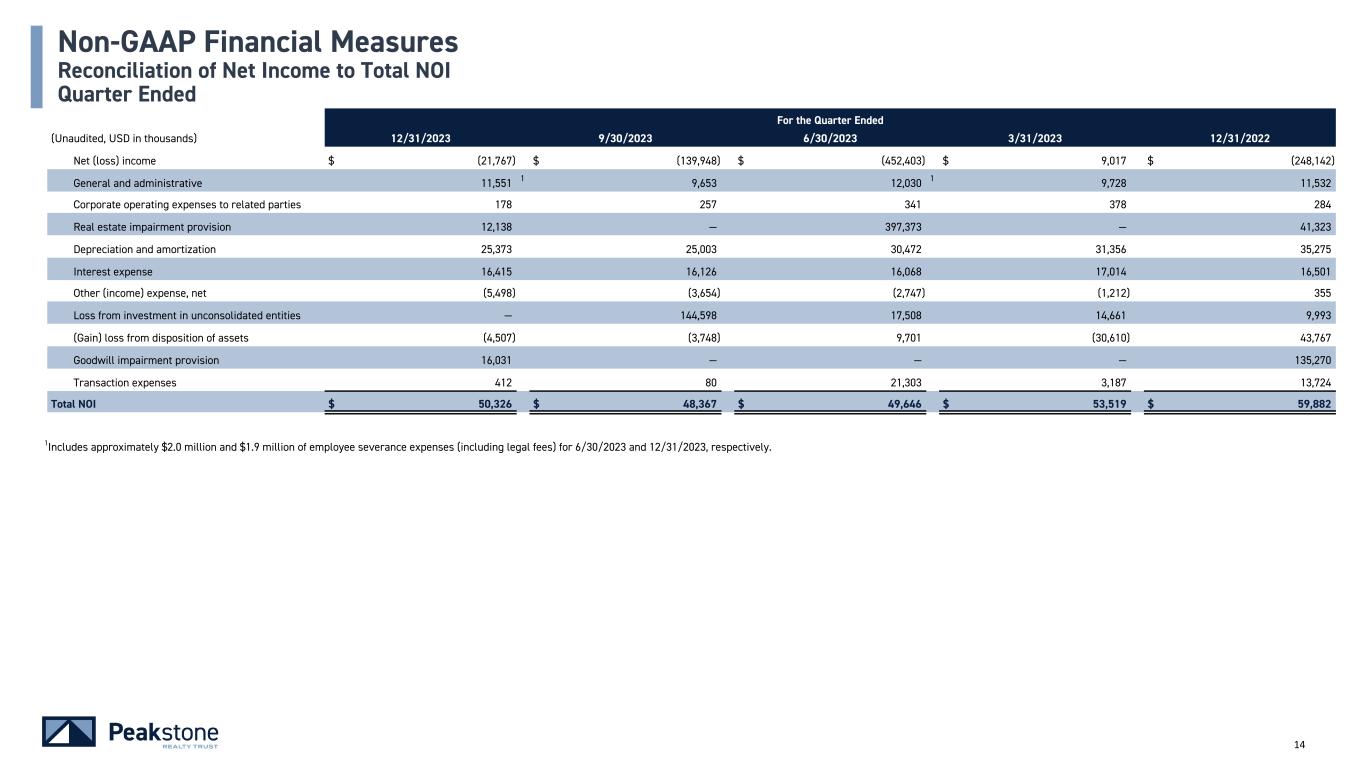

14 For the Quarter Ended (Unaudited, USD in thousands) 12/31/2023 9/30/2023 6/30/2023 3/31/2023 12/31/2022 Net (loss) income $ (21,767) $ (139,948) $ (452,403) $ 9,017 $ (248,142) General and administrative 11,551 1 9,653 12,030 1 9,728 11,532 Corporate operating expenses to related parties 178 257 341 378 284 Real estate impairment provision 12,138 — 397,373 — 41,323 Depreciation and amortization 25,373 25,003 30,472 31,356 35,275 Interest expense 16,415 16,126 16,068 17,014 16,501 Other (income) expense, net (5,498) (3,654) (2,747) (1,212) 355 Loss from investment in unconsolidated entities — 144,598 17,508 14,661 9,993 (Gain) loss from disposition of assets (4,507) (3,748) 9,701 (30,610) 43,767 Goodwill impairment provision 16,031 — — — 135,270 Transaction expenses 412 80 21,303 3,187 13,724 Total NOI $ 50,326 $ 48,367 $ 49,646 $ 53,519 $ 59,882 Non-GAAP Financial Measures Reconciliation of Net Income to Total NOI Quarter Ended 1Includes approximately $2.0 million and $1.9 million of employee severance expenses (including legal fees) for 6/30/2023 and 12/31/2023, respectively.

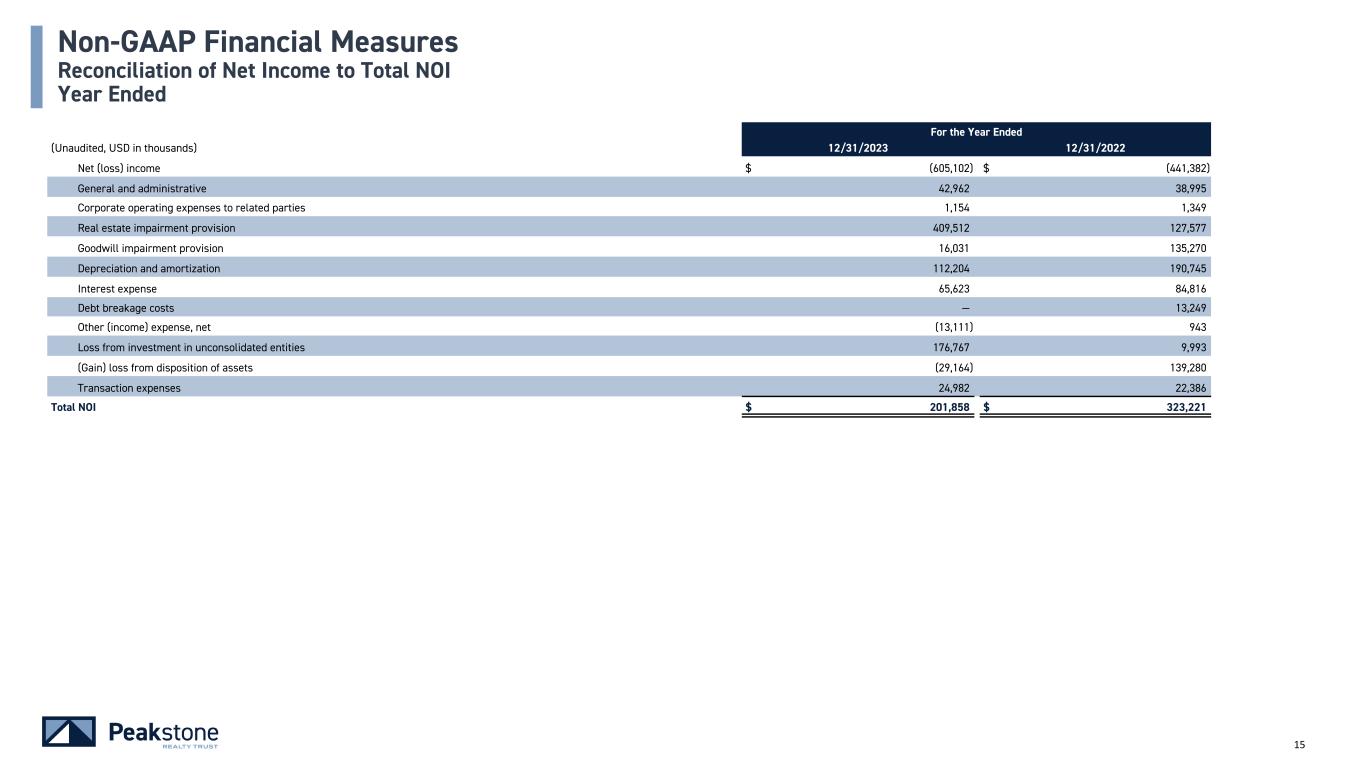

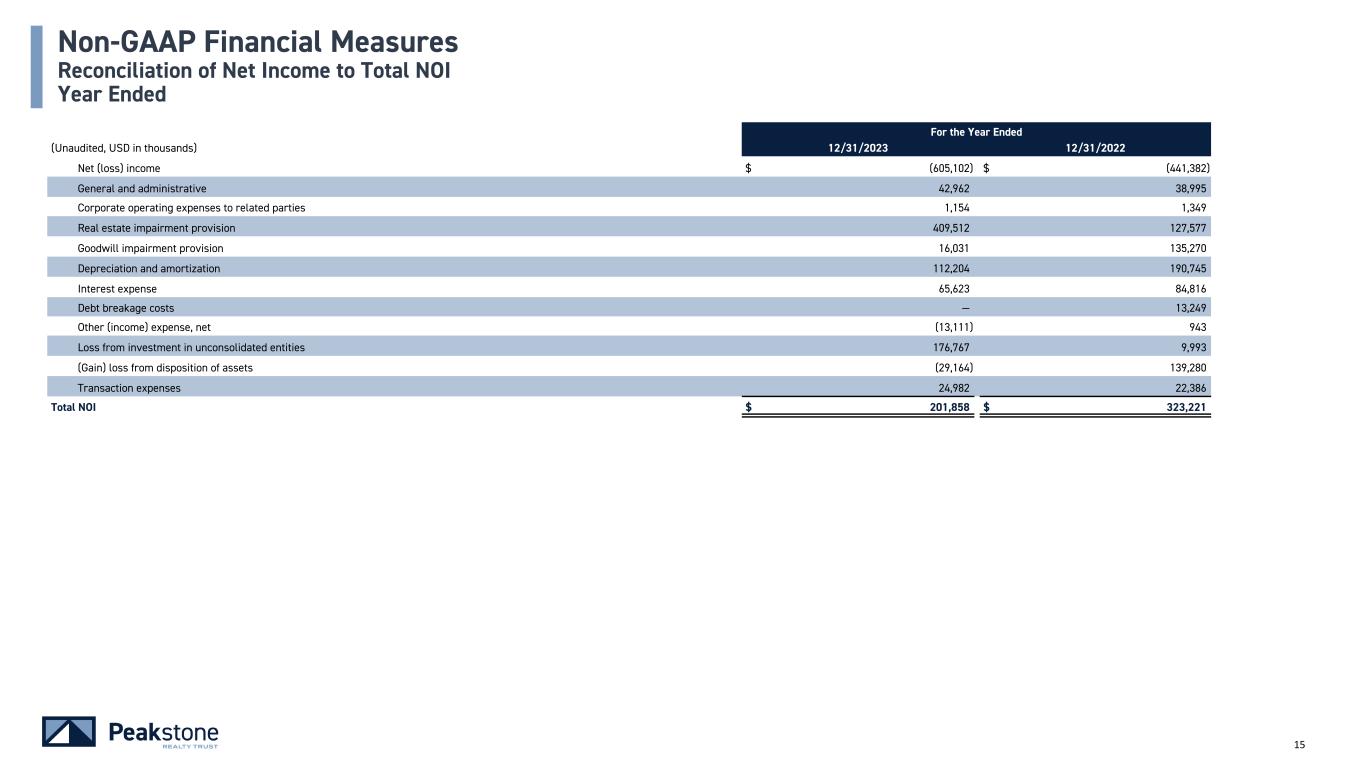

15 For the Year Ended (Unaudited, USD in thousands) 12/31/2023 12/31/2022 Net (loss) income $ (605,102) $ (441,382) General and administrative 42,962 38,995 Corporate operating expenses to related parties 1,154 1,349 Real estate impairment provision 409,512 127,577 Goodwill impairment provision 16,031 135,270 Depreciation and amortization 112,204 190,745 Interest expense 65,623 84,816 Debt breakage costs — 13,249 Other (income) expense, net (13,111) 943 Loss from investment in unconsolidated entities 176,767 9,993 (Gain) loss from disposition of assets (29,164) 139,280 Transaction expenses 24,982 22,386 Total NOI $ 201,858 $ 323,221 Non-GAAP Financial Measures Reconciliation of Net Income to Total NOI Year Ended

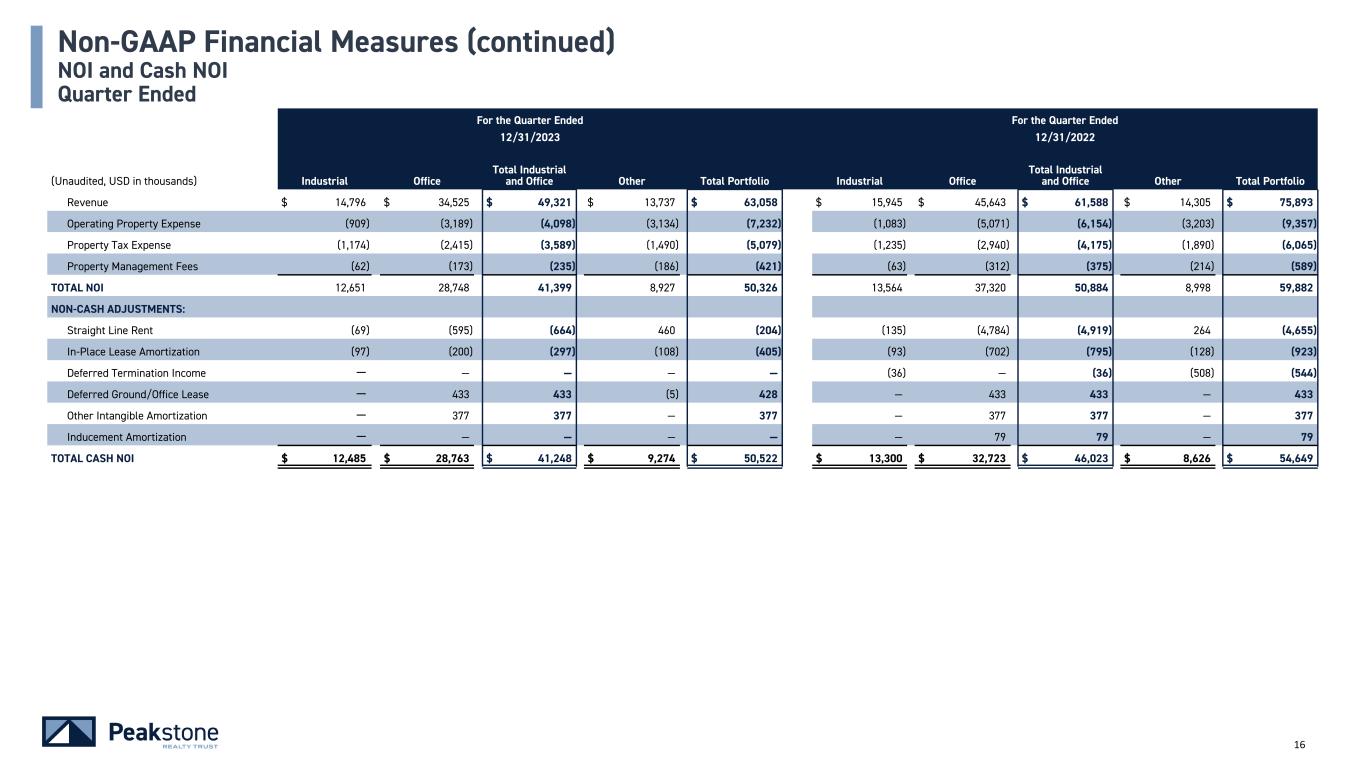

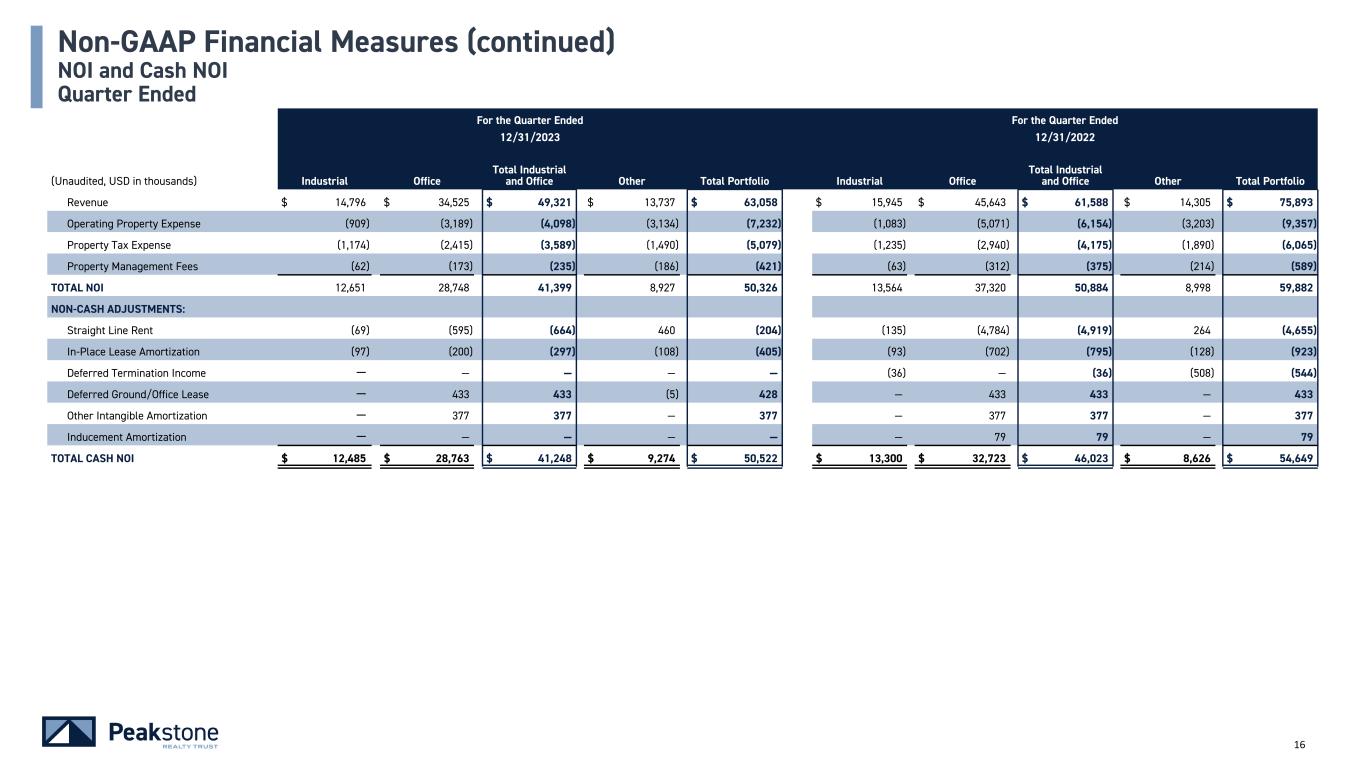

16 For the Quarter Ended For the Quarter Ended 12/31/2023 12/31/2022 (Unaudited, USD in thousands) Industrial Office Total Industrial and Office Other Total Portfolio Industrial Office Total Industrial and Office Other Total Portfolio Revenue $ 14,796 $ 34,525 $ 49,321 $ 13,737 $ 63,058 $ 15,945 $ 45,643 $ 61,588 $ 14,305 $ 75,893 Operating Property Expense (909) (3,189) (4,098) (3,134) (7,232) (1,083) (5,071) (6,154) (3,203) (9,357) Property Tax Expense (1,174) (2,415) (3,589) (1,490) (5,079) (1,235) (2,940) (4,175) (1,890) (6,065) Property Management Fees (62) (173) (235) (186) (421) (63) (312) (375) (214) (589) TOTAL NOI 12,651 28,748 41,399 8,927 50,326 13,564 37,320 50,884 8,998 59,882 NON-CASH ADJUSTMENTS: Straight Line Rent (69) (595) (664) 460 (204) (135) (4,784) (4,919) 264 (4,655) In-Place Lease Amortization (97) (200) (297) (108) (405) (93) (702) (795) (128) (923) Deferred Termination Income — — — — — (36) — (36) (508) (544) Deferred Ground/Office Lease — 433 433 (5) 428 — 433 433 — 433 Other Intangible Amortization — 377 377 — 377 — 377 377 — 377 Inducement Amortization — — — — — — 79 79 — 79 TOTAL CASH NOI $ 12,485 $ 28,763 $ 41,248 $ 9,274 $ 50,522 $ 13,300 $ 32,723 $ 46,023 $ 8,626 $ 54,649 Non-GAAP Financial Measures (continued) NOI and Cash NOI Quarter Ended

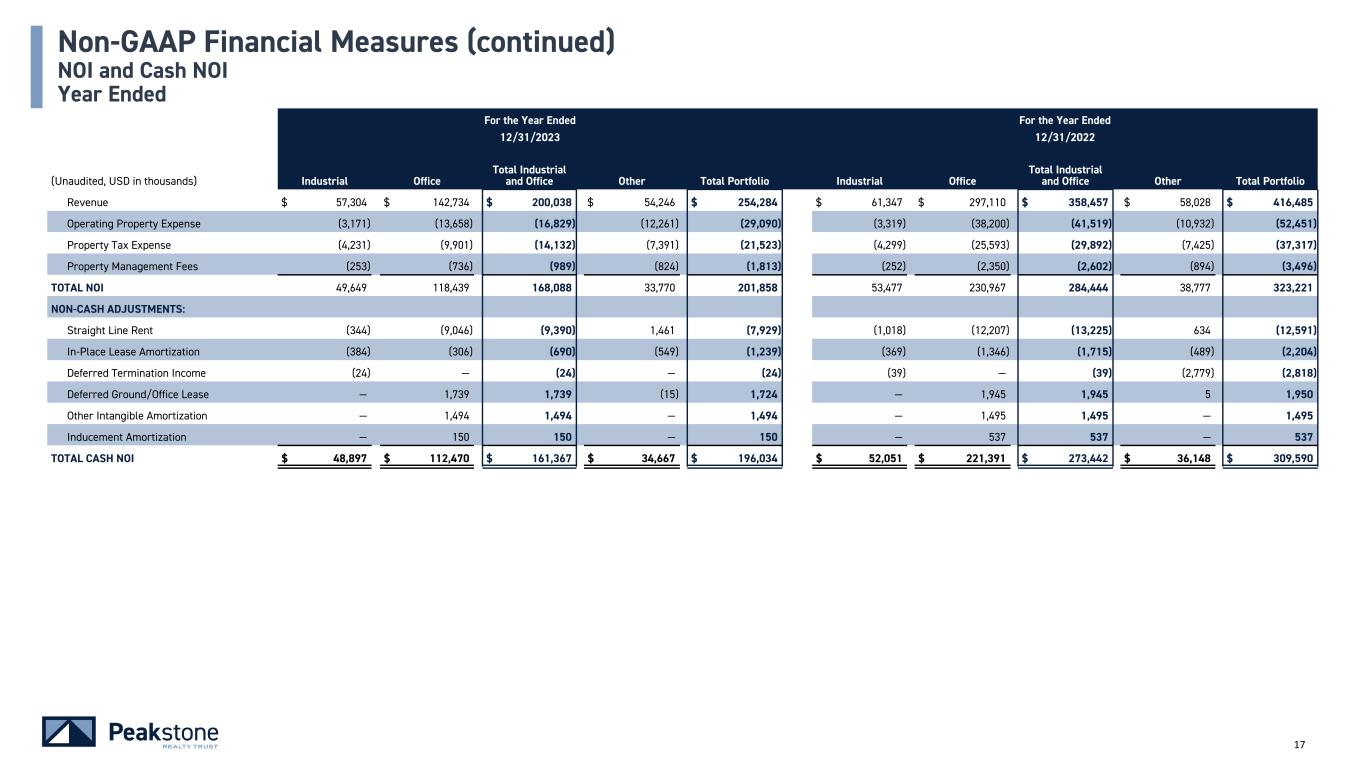

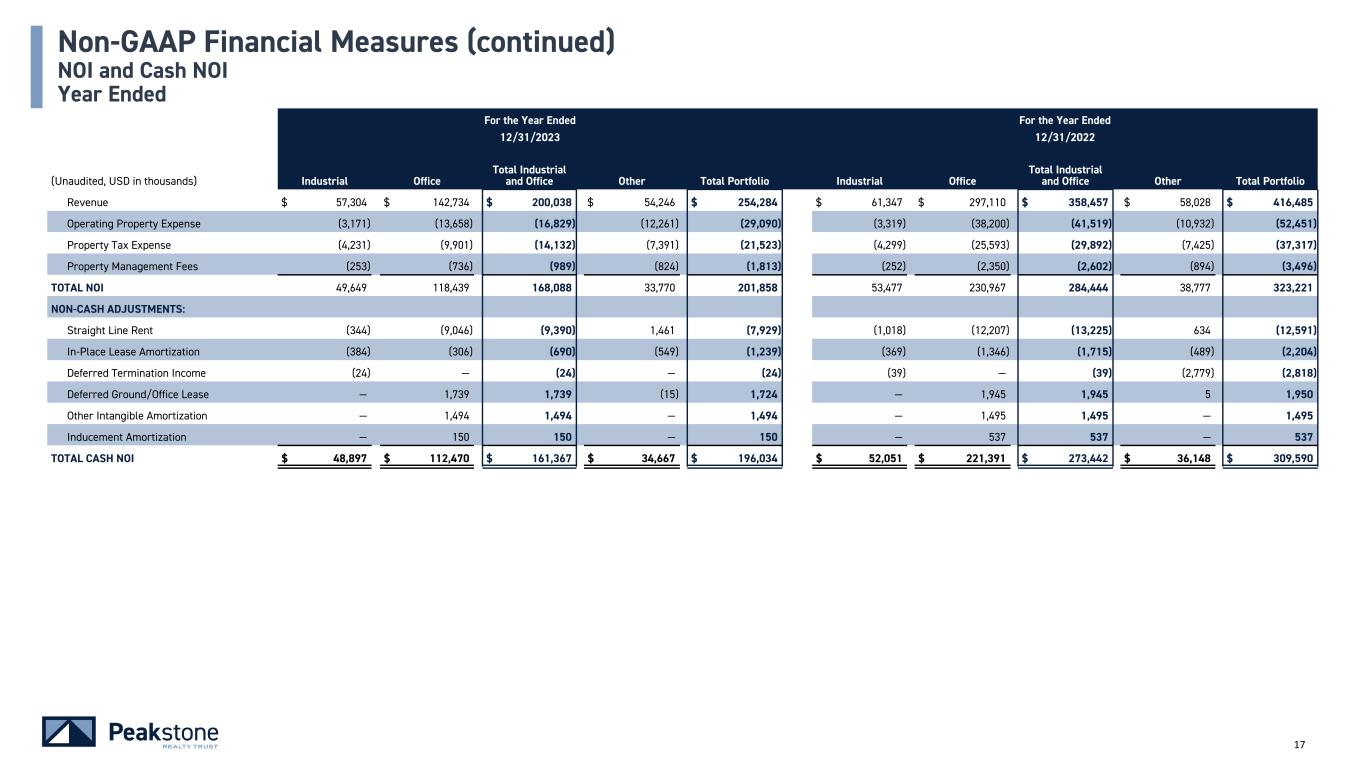

17 For the Year Ended For the Year Ended 12/31/2023 12/31/2022 (Unaudited, USD in thousands) Industrial Office Total Industrial and Office Other Total Portfolio Industrial Office Total Industrial and Office Other Total Portfolio Revenue $ 57,304 $ 142,734 $ 200,038 $ 54,246 $ 254,284 $ 61,347 $ 297,110 $ 358,457 $ 58,028 $ 416,485 Operating Property Expense (3,171) (13,658) (16,829) (12,261) (29,090) (3,319) (38,200) (41,519) (10,932) (52,451) Property Tax Expense (4,231) (9,901) (14,132) (7,391) (21,523) (4,299) (25,593) (29,892) (7,425) (37,317) Property Management Fees (253) (736) (989) (824) (1,813) (252) (2,350) (2,602) (894) (3,496) TOTAL NOI 49,649 118,439 168,088 33,770 201,858 53,477 230,967 284,444 38,777 323,221 NON-CASH ADJUSTMENTS: Straight Line Rent (344) (9,046) (9,390) 1,461 (7,929) (1,018) (12,207) (13,225) 634 (12,591) In-Place Lease Amortization (384) (306) (690) (549) (1,239) (369) (1,346) (1,715) (489) (2,204) Deferred Termination Income (24) — (24) — (24) (39) — (39) (2,779) (2,818) Deferred Ground/Office Lease — 1,739 1,739 (15) 1,724 — 1,945 1,945 5 1,950 Other Intangible Amortization — 1,494 1,494 — 1,494 — 1,495 1,495 — 1,495 Inducement Amortization — 150 150 — 150 — 537 537 — 537 TOTAL CASH NOI $ 48,897 $ 112,470 $ 161,367 $ 34,667 $ 196,034 $ 52,051 $ 221,391 $ 273,442 $ 36,148 $ 309,590 Non-GAAP Financial Measures (continued) NOI and Cash NOI Year Ended

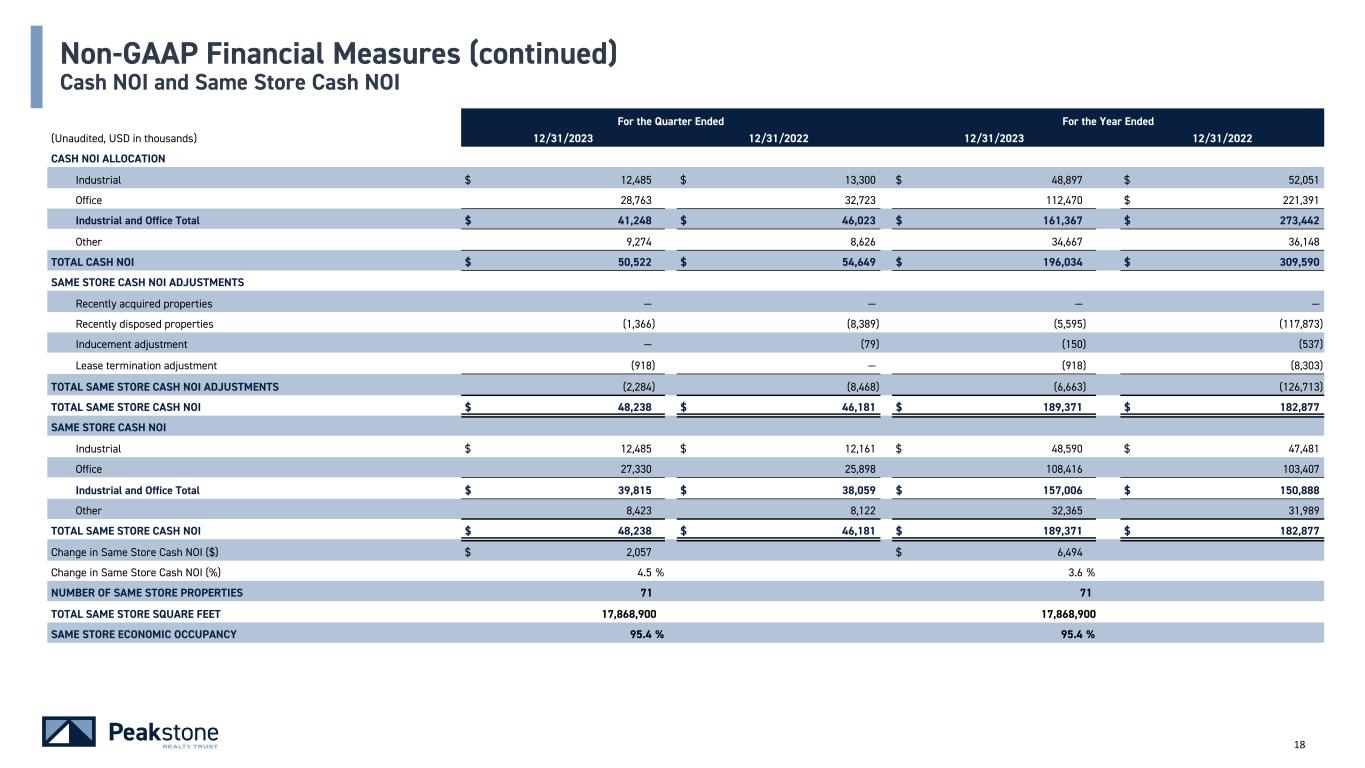

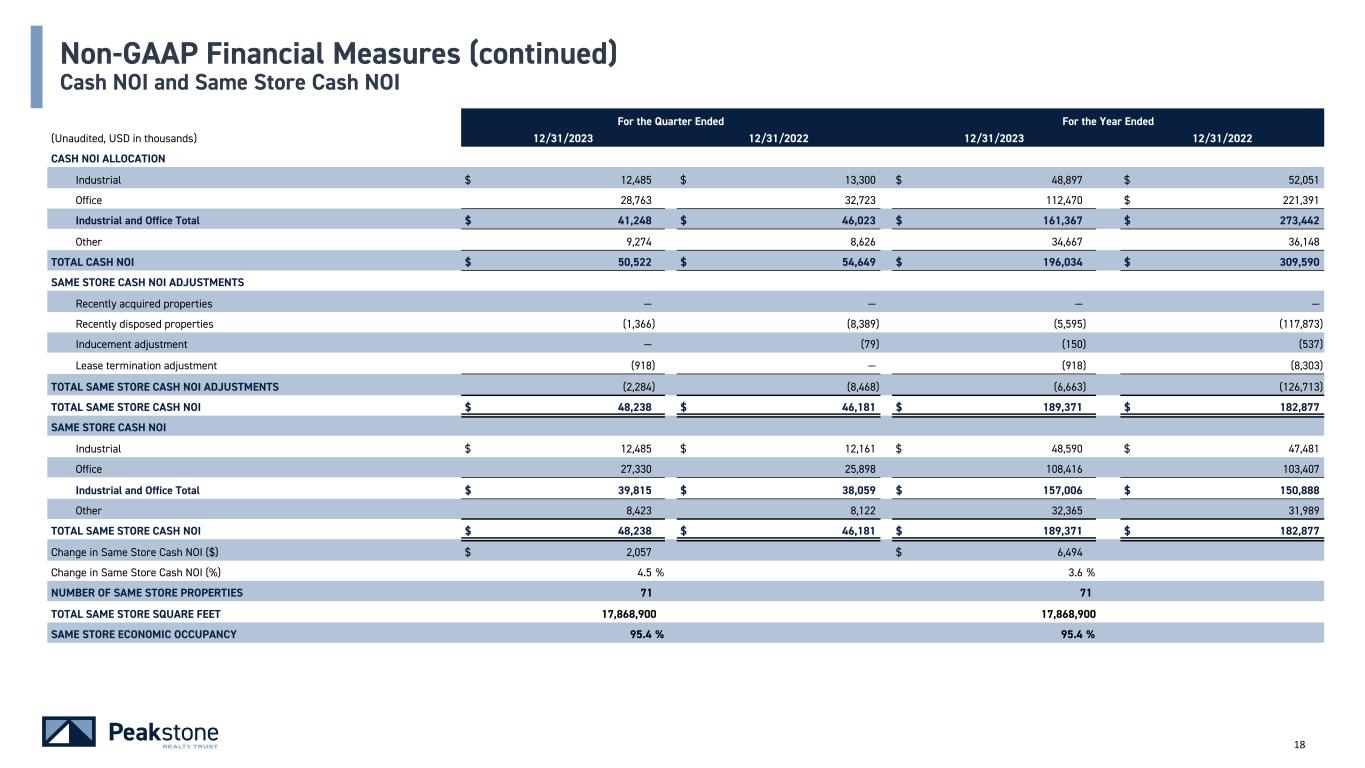

18 For the Quarter Ended For the Year Ended (Unaudited, USD in thousands) 12/31/2023 12/31/2022 12/31/2023 12/31/2022 CASH NOI ALLOCATION Industrial $ 12,485 $ 13,300 $ 48,897 $ 52,051 Office 28,763 32,723 112,470 $ 221,391 Industrial and Office Total $ 41,248 $ 46,023 $ 161,367 $ 273,442 Other 9,274 8,626 34,667 36,148 TOTAL CASH NOI $ 50,522 $ 54,649 $ 196,034 $ 309,590 SAME STORE CASH NOI ADJUSTMENTS Recently acquired properties — — — — Recently disposed properties (1,366) (8,389) (5,595) (117,873) Inducement adjustment — (79) (150) (537) Lease termination adjustment (918) — (918) (8,303) TOTAL SAME STORE CASH NOI ADJUSTMENTS (2,284) (8,468) (6,663) (126,713) TOTAL SAME STORE CASH NOI $ 48,238 $ 46,181 $ 189,371 $ 182,877 SAME STORE CASH NOI Industrial $ 12,485 $ 12,161 $ 48,590 $ 47,481 Office 27,330 25,898 108,416 103,407 Industrial and Office Total $ 39,815 $ 38,059 $ 157,006 $ 150,888 Other 8,423 8,122 32,365 31,989 TOTAL SAME STORE CASH NOI $ 48,238 $ 46,181 $ 189,371 $ 182,877 Change in Same Store Cash NOI ($) $ 2,057 $ 6,494 Change in Same Store Cash NOI (%) 4.5 % 3.6 % NUMBER OF SAME STORE PROPERTIES 71 71 TOTAL SAME STORE SQUARE FEET 17,868,900 17,868,900 SAME STORE ECONOMIC OCCUPANCY 95.4 % 95.4 % Non-GAAP Financial Measures (continued) Cash NOI and Same Store Cash NOI

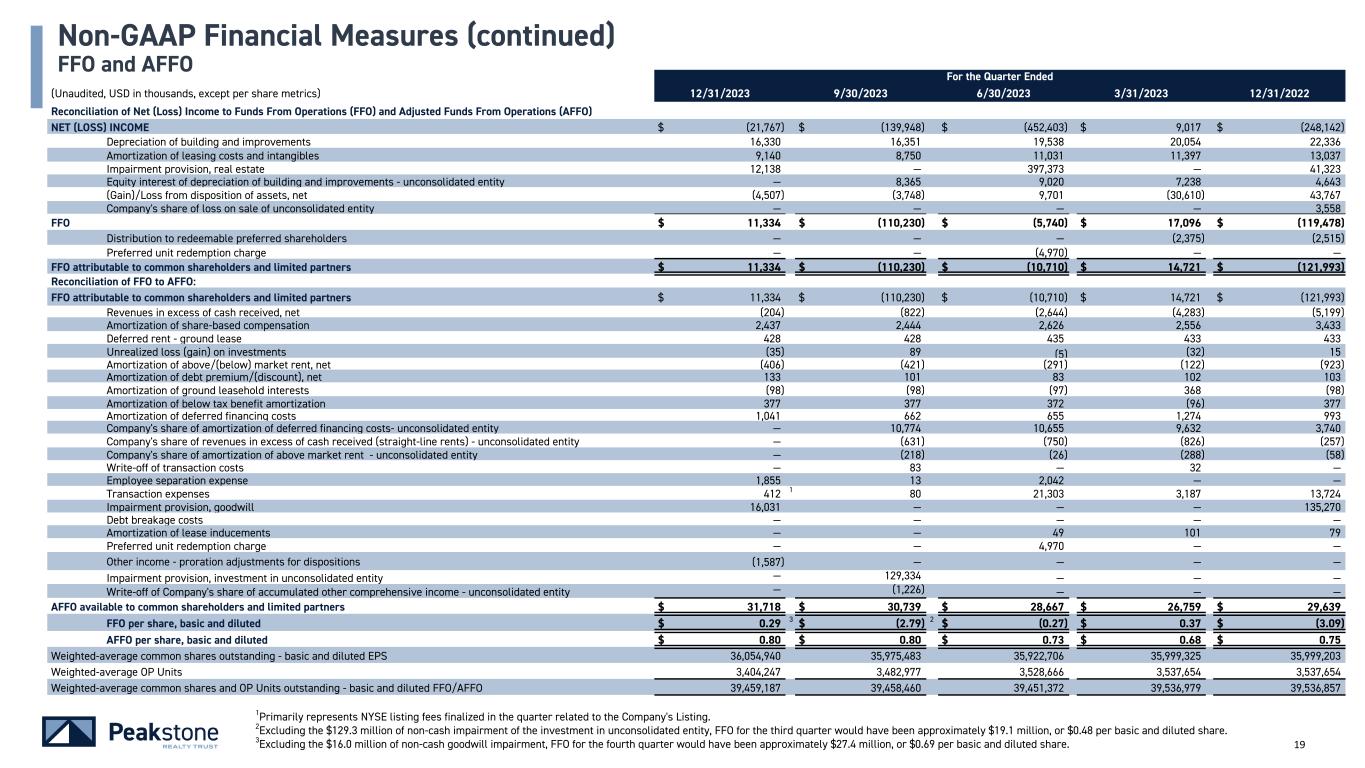

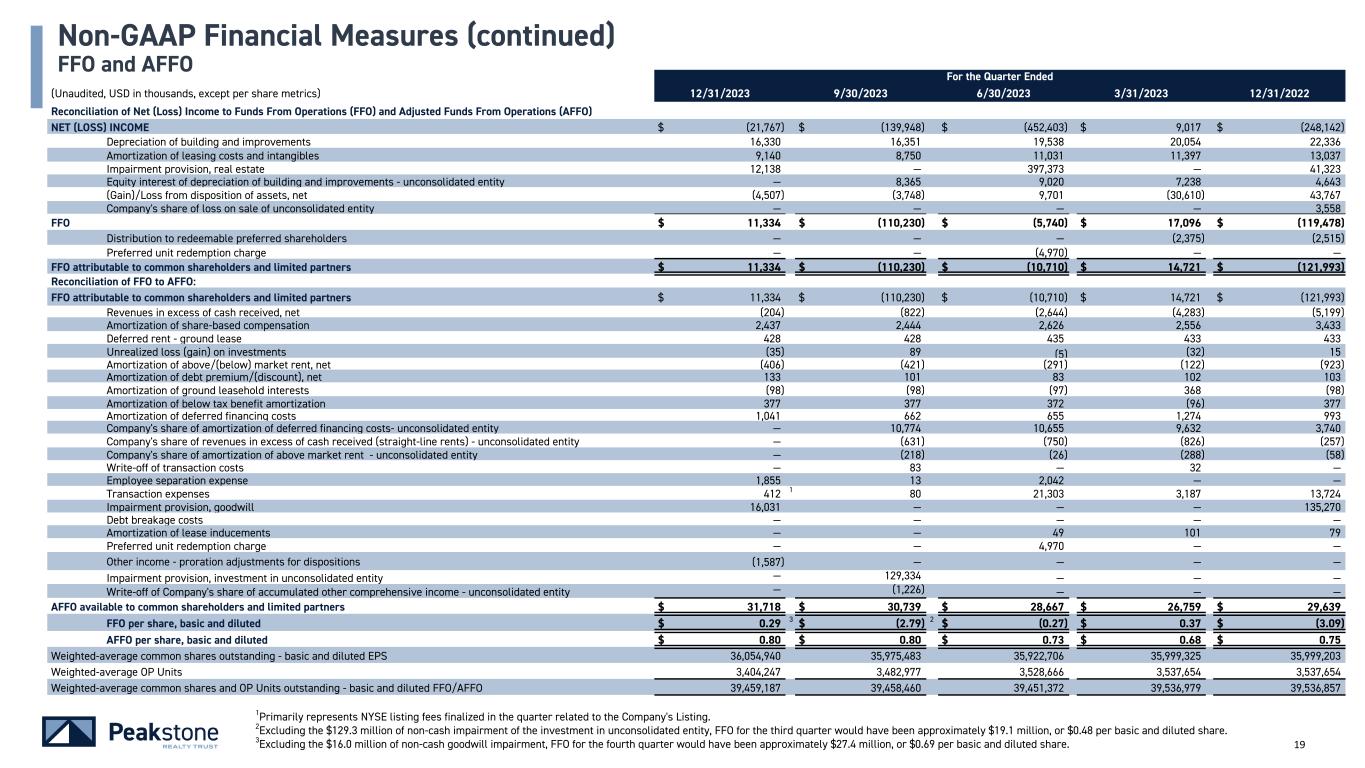

19 For the Quarter Ended (Unaudited, USD in thousands, except per share metrics) 12/31/2023 9/30/2023 6/30/2023 3/31/2023 12/31/2022 Reconciliation of Net (Loss) Income to Funds From Operations (FFO) and Adjusted Funds From Operations (AFFO) NET (LOSS) INCOME $ (21,767) $ (139,948) $ (452,403) $ 9,017 $ (248,142) Depreciation of building and improvements 16,330 16,351 19,538 20,054 22,336 Amortization of leasing costs and intangibles 9,140 8,750 11,031 11,397 13,037 Impairment provision, real estate 12,138 — 397,373 — 41,323 Equity interest of depreciation of building and improvements - unconsolidated entity — 8,365 9,020 7,238 4,643 (Gain)/Loss from disposition of assets, net (4,507) (3,748) 9,701 (30,610) 43,767 Company's share of loss on sale of unconsolidated entity — — — — 3,558 FFO $ 11,334 $ (110,230) $ (5,740) $ 17,096 $ (119,478) Distribution to redeemable preferred shareholders — — — (2,375) (2,515) Preferred unit redemption charge — — (4,970) — — FFO attributable to common shareholders and limited partners $ 11,334 $ (110,230) $ (10,710) $ 14,721 $ (121,993) Reconciliation of FFO to AFFO: FFO attributable to common shareholders and limited partners $ 11,334 $ (110,230) $ (10,710) $ 14,721 $ (121,993) Revenues in excess of cash received, net (204) (822) (2,644) (4,283) (5,199) Amortization of share-based compensation 2,437 2,444 2,626 2,556 3,433 Deferred rent - ground lease 428 428 435 433 433 Unrealized loss (gain) on investments (35) 89 (5) (32) 15 Amortization of above/(below) market rent, net (406) (421) (291) (122) (923) Amortization of debt premium/(discount), net 133 101 83 102 103 Amortization of ground leasehold interests (98) (98) (97) 368 (98) Amortization of below tax benefit amortization 377 377 372 (96) 377 Amortization of deferred financing costs 1,041 662 655 1,274 993 Company's share of amortization of deferred financing costs- unconsolidated entity — 10,774 10,655 9,632 3,740 Company's share of revenues in excess of cash received (straight-line rents) - unconsolidated entity — (631) (750) (826) (257) Company's share of amortization of above market rent - unconsolidated entity — (218) (26) (288) (58) Write-off of transaction costs — 83 — 32 — Employee separation expense 1,855 13 2,042 — — Transaction expenses 412 1 80 21,303 3,187 13,724 Impairment provision, goodwill 16,031 — — — 135,270 Debt breakage costs — — — — — Amortization of lease inducements — — 49 101 79 Preferred unit redemption charge — — 4,970 — — Other income - proration adjustments for dispositions (1,587) — — — — Impairment provision, investment in unconsolidated entity — 129,334 — — — Write-off of Company's share of accumulated other comprehensive income - unconsolidated entity — (1,226) — — — AFFO available to common shareholders and limited partners $ 31,718 $ 30,739 $ 28,667 $ 26,759 $ 29,639 FFO per share, basic and diluted $ 0.29 3 $ (2.79) 2 $ (0.27) $ 0.37 $ (3.09) AFFO per share, basic and diluted $ 0.80 $ 0.80 $ 0.73 $ 0.68 $ 0.75 Weighted-average common shares outstanding - basic and diluted EPS 36,054,940 35,975,483 35,922,706 35,999,325 35,999,203 Weighted-average OP Units 3,404,247 3,482,977 3,528,666 3,537,654 3,537,654 Weighted-average common shares and OP Units outstanding - basic and diluted FFO/AFFO 39,459,187 39,458,460 39,451,372 39,536,979 39,536,857 Non-GAAP Financial Measures (continued) FFO and AFFO 1Primarily represents NYSE listing fees finalized in the quarter related to the Company's Listing. 2Excluding the $129.3 million of non-cash impairment of the investment in unconsolidated entity, FFO for the third quarter would have been approximately $19.1 million, or $0.48 per basic and diluted share. 3Excluding the $16.0 million of non-cash goodwill impairment, FFO for the fourth quarter would have been approximately $27.4 million, or $0.69 per basic and diluted share.

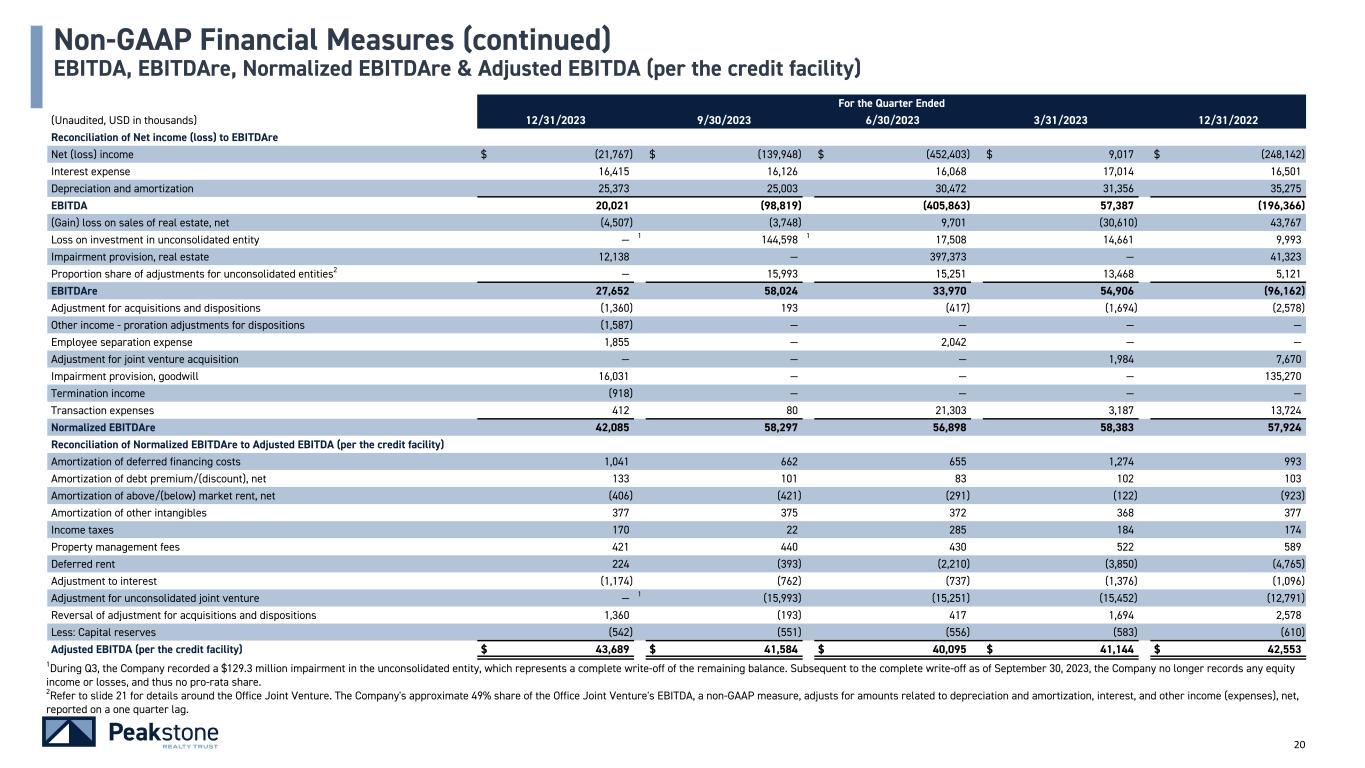

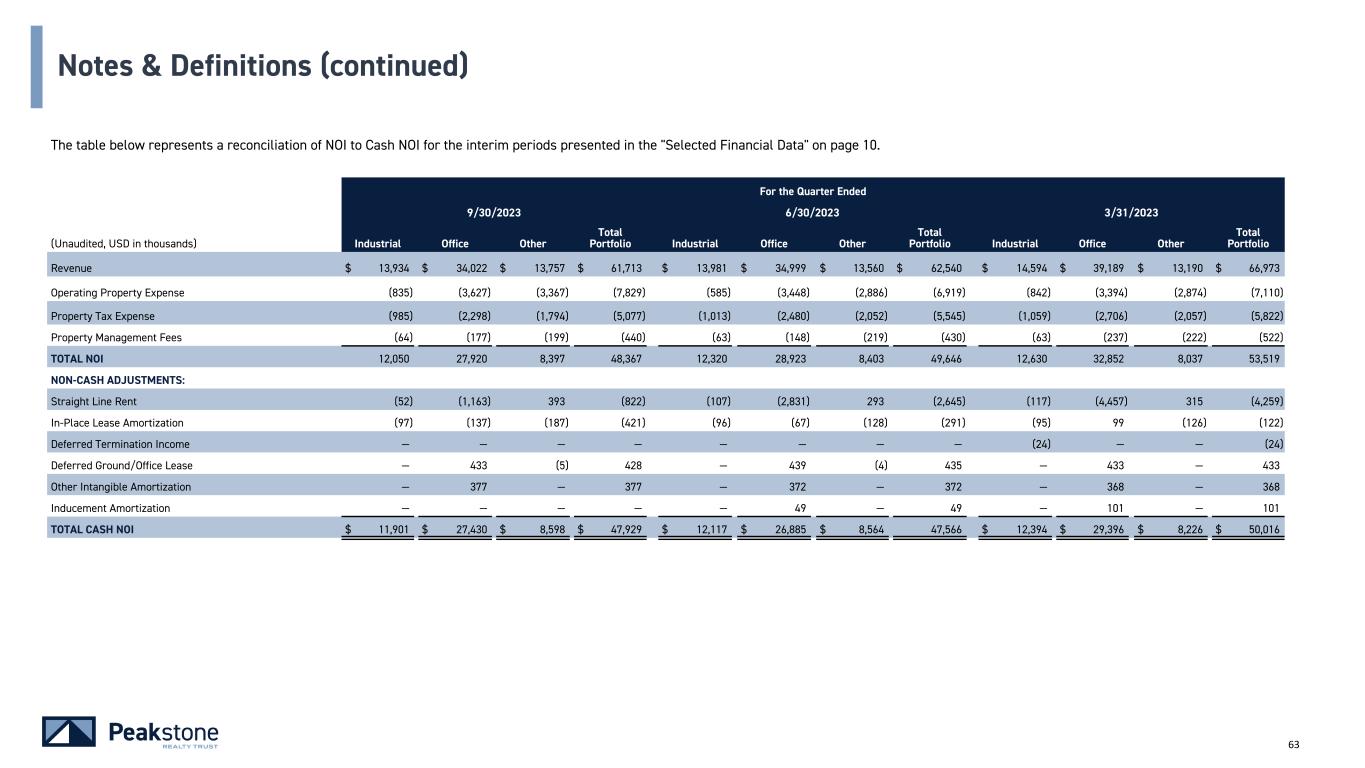

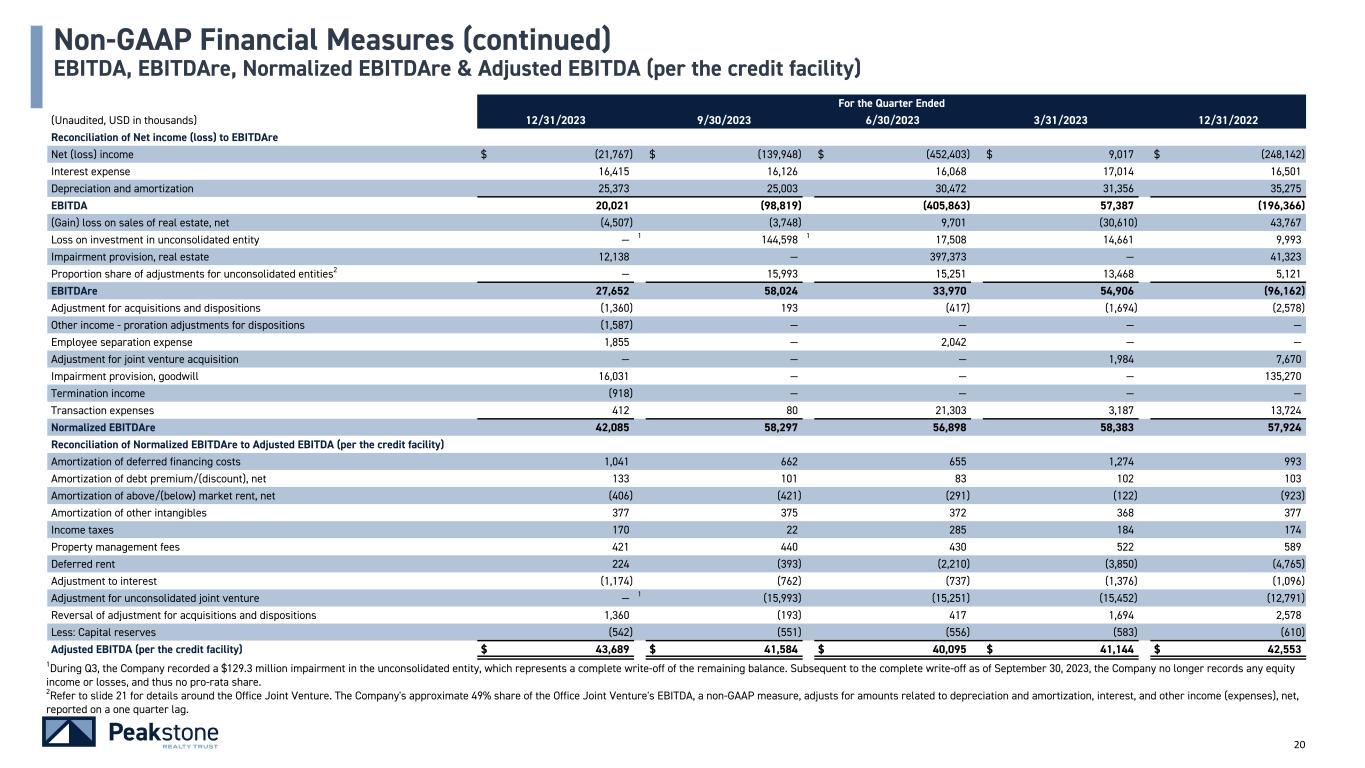

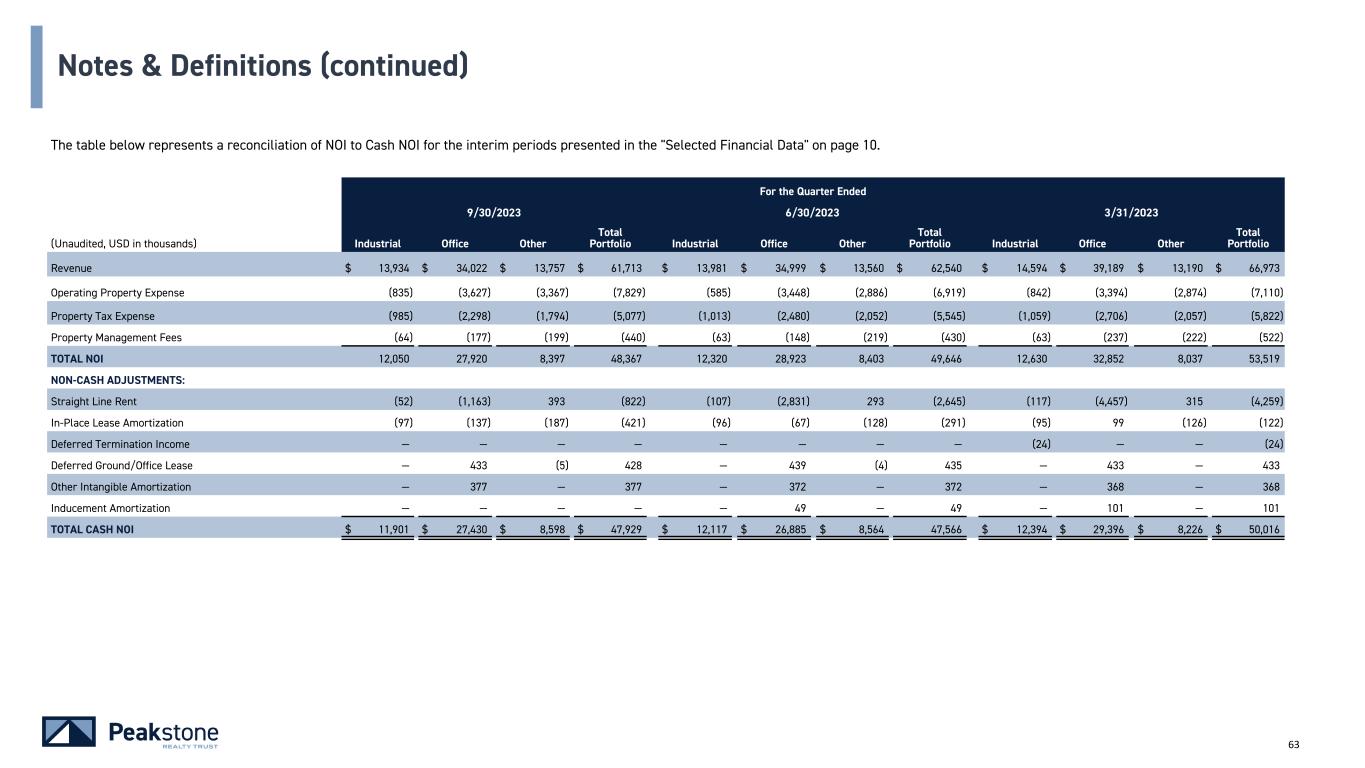

20 For the Quarter Ended (Unaudited, USD in thousands) 12/31/2023 9/30/2023 6/30/2023 3/31/2023 12/31/2022 Reconciliation of Net income (loss) to EBITDAre Net (loss) income $ (21,767) $ (139,948) $ (452,403) $ 9,017 $ (248,142) Interest expense 16,415 16,126 16,068 17,014 16,501 Depreciation and amortization 25,373 25,003 30,472 31,356 35,275 EBITDA 20,021 (98,819) (405,863) 57,387 (196,366) (Gain) loss on sales of real estate, net (4,507) (3,748) 9,701 (30,610) 43,767 Loss on investment in unconsolidated entity — 1 144,598 1 17,508 14,661 9,993 Impairment provision, real estate 12,138 — 397,373 — 41,323 Proportion share of adjustments for unconsolidated entities2 — 15,993 15,251 13,468 5,121 EBITDAre 27,652 58,024 33,970 54,906 (96,162) Adjustment for acquisitions and dispositions (1,360) 193 (417) (1,694) (2,578) Other income - proration adjustments for dispositions (1,587) — — — — Employee separation expense 1,855 — 2,042 — — Adjustment for joint venture acquisition — — — 1,984 7,670 Impairment provision, goodwill 16,031 — — — 135,270 Termination income (918) — — — — Transaction expenses 412 80 21,303 3,187 13,724 Normalized EBITDAre 42,085 58,297 56,898 58,383 57,924 Reconciliation of Normalized EBITDAre to Adjusted EBITDA (per the credit facility) Amortization of deferred financing costs 1,041 662 655 1,274 993 Amortization of debt premium/(discount), net 133 101 83 102 103 Amortization of above/(below) market rent, net (406) (421) (291) (122) (923) Amortization of other intangibles 377 375 372 368 377 Income taxes 170 22 285 184 174 Property management fees 421 440 430 522 589 Deferred rent 224 (393) (2,210) (3,850) (4,765) Adjustment to interest (1,174) (762) (737) (1,376) (1,096) Adjustment for unconsolidated joint venture — 1 (15,993) (15,251) (15,452) (12,791) Reversal of adjustment for acquisitions and dispositions 1,360 (193) 417 1,694 2,578 Less: Capital reserves (542) (551) (556) (583) (610) Adjusted EBITDA (per the credit facility) $ 43,689 $ 41,584 $ 40,095 $ 41,144 $ 42,553 Non-GAAP Financial Measures (continued) EBITDA, EBITDAre, Normalized EBITDAre & Adjusted EBITDA (per the credit facility) 1During Q3, the Company recorded a $129.3 million impairment in the unconsolidated entity, which represents a complete write-off of the remaining balance. Subsequent to the complete write-off as of September 30, 2023, the Company no longer records any equity income or losses, and thus no pro-rata share. 2Refer to slide 21 for details around the Office Joint Venture. The Company's approximate 49% share of the Office Joint Venture's EBITDA, a non-GAAP measure, adjusts for amounts related to depreciation and amortization, interest, and other income (expenses), net, reported on a one quarter lag.

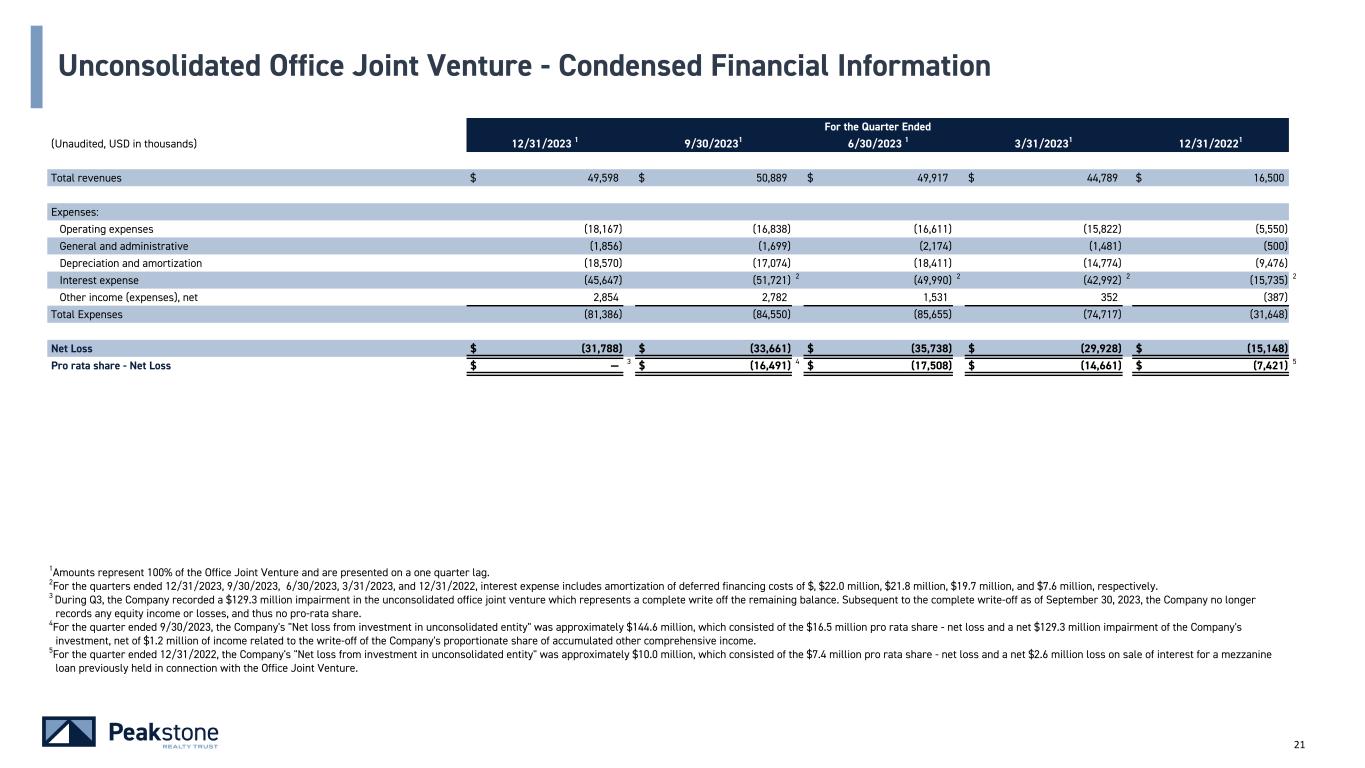

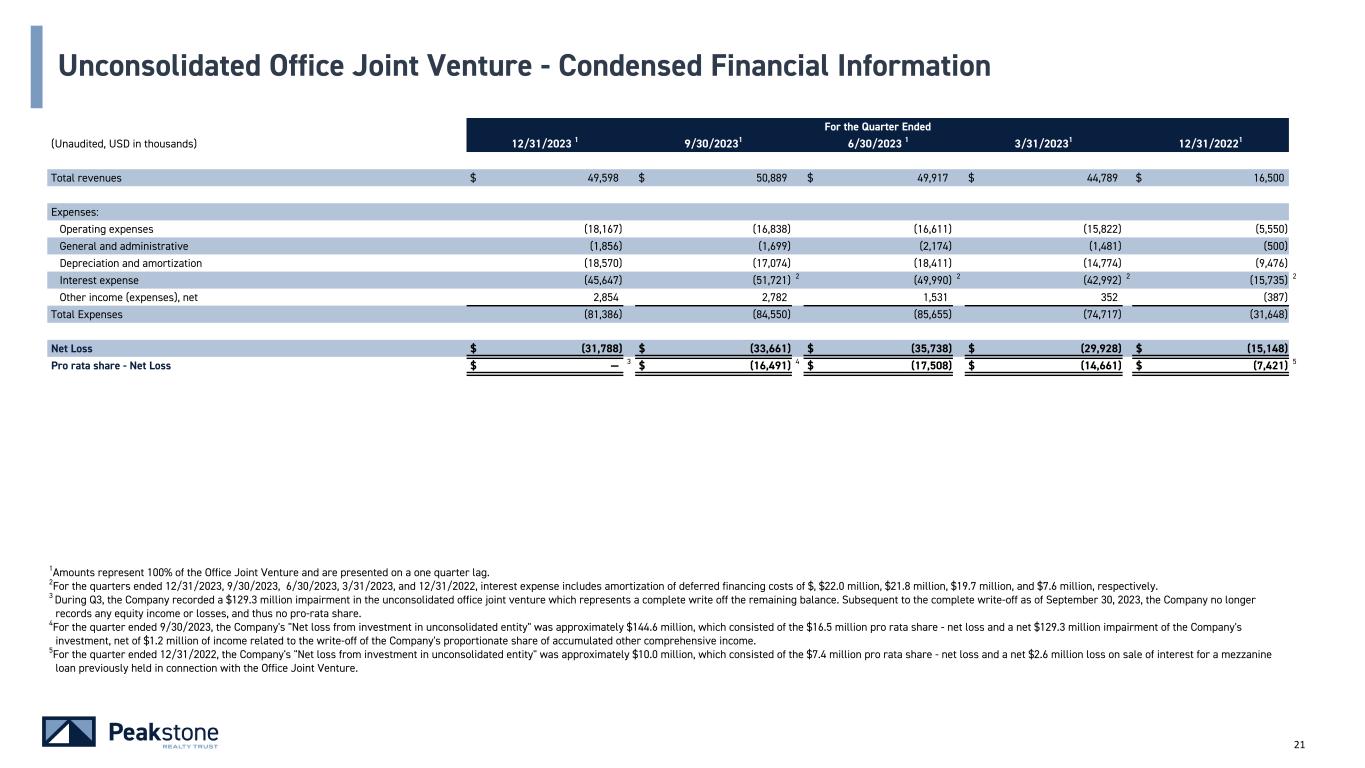

21 For the Quarter Ended (Unaudited, USD in thousands) 12/31/2023 1 9/30/20231 6/30/2023 1 3/31/20231 12/31/20221 Total revenues $ 49,598 $ 50,889 $ 49,917 $ 44,789 $ 16,500 Expenses: Operating expenses (18,167) (16,838) (16,611) (15,822) (5,550) General and administrative (1,856) (1,699) (2,174) (1,481) (500) Depreciation and amortization (18,570) (17,074) (18,411) (14,774) (9,476) Interest expense (45,647) (51,721) 2 (49,990) 2 (42,992) 2 (15,735) 2 Other income (expenses), net 2,854 2,782 1,531 352 (387) Total Expenses (81,386) (84,550) (85,655) (74,717) (31,648) Net Loss $ (31,788) $ (33,661) $ (35,738) $ (29,928) $ (15,148) Pro rata share - Net Loss $ — 3 $ (16,491) 4 $ (17,508) $ (14,661) $ (7,421) 5 Unconsolidated Office Joint Venture - Condensed Financial Information 1Amounts represent 100% of the Office Joint Venture and are presented on a one quarter lag. 2For the quarters ended 12/31/2023, 9/30/2023, 6/30/2023, 3/31/2023, and 12/31/2022, interest expense includes amortization of deferred financing costs of $, $22.0 million, $21.8 million, $19.7 million, and $7.6 million, respectively. 3 During Q3, the Company recorded a $129.3 million impairment in the unconsolidated office joint venture which represents a complete write off the remaining balance. Subsequent to the complete write-off as of September 30, 2023, the Company no longer records any equity income or losses, and thus no pro-rata share. 4For the quarter ended 9/30/2023, the Company's "Net loss from investment in unconsolidated entity" was approximately $144.6 million, which consisted of the $16.5 million pro rata share - net loss and a net $129.3 million impairment of the Company's investment, net of $1.2 million of income related to the write-off of the Company's proportionate share of accumulated other comprehensive income. 5For the quarter ended 12/31/2022, the Company's "Net loss from investment in unconsolidated entity" was approximately $10.0 million, which consisted of the $7.4 million pro rata share - net loss and a net $2.6 million loss on sale of interest for a mezzanine loan previously held in connection with the Office Joint Venture.

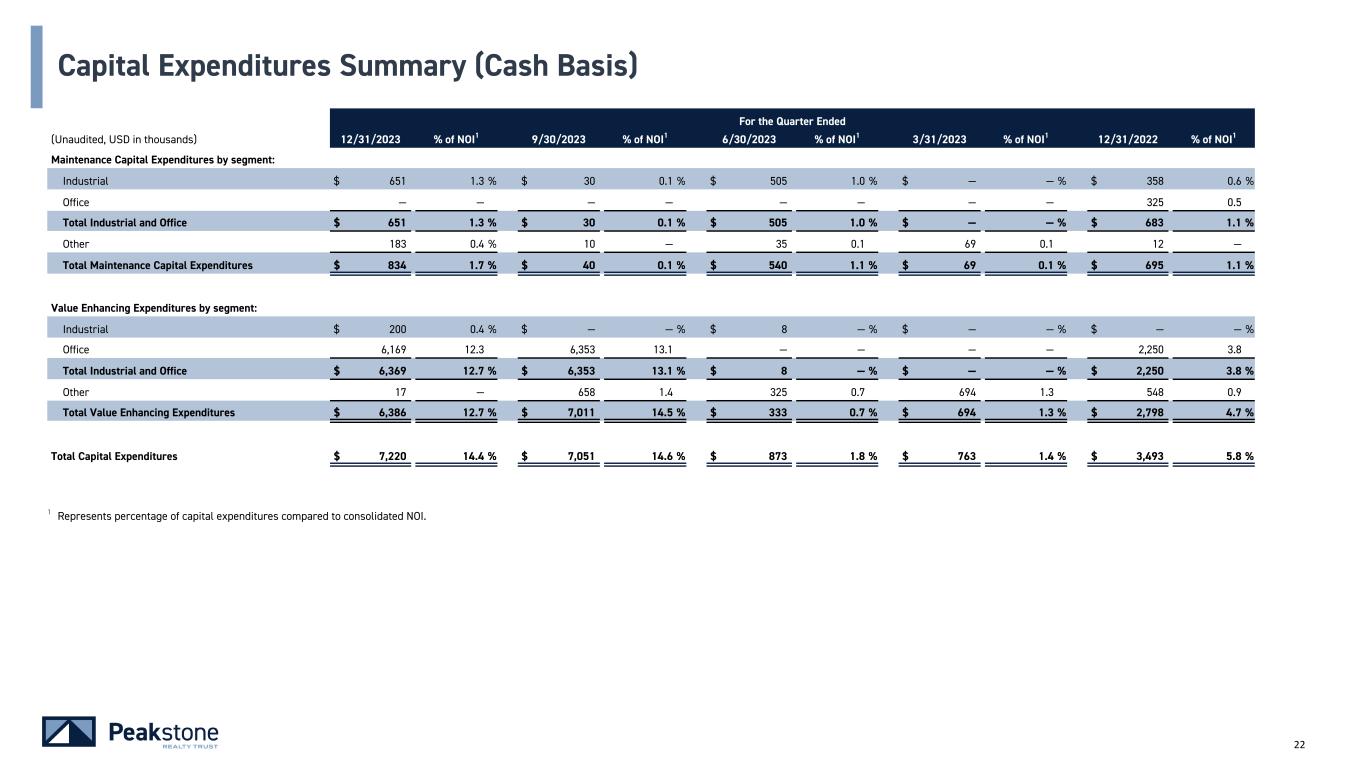

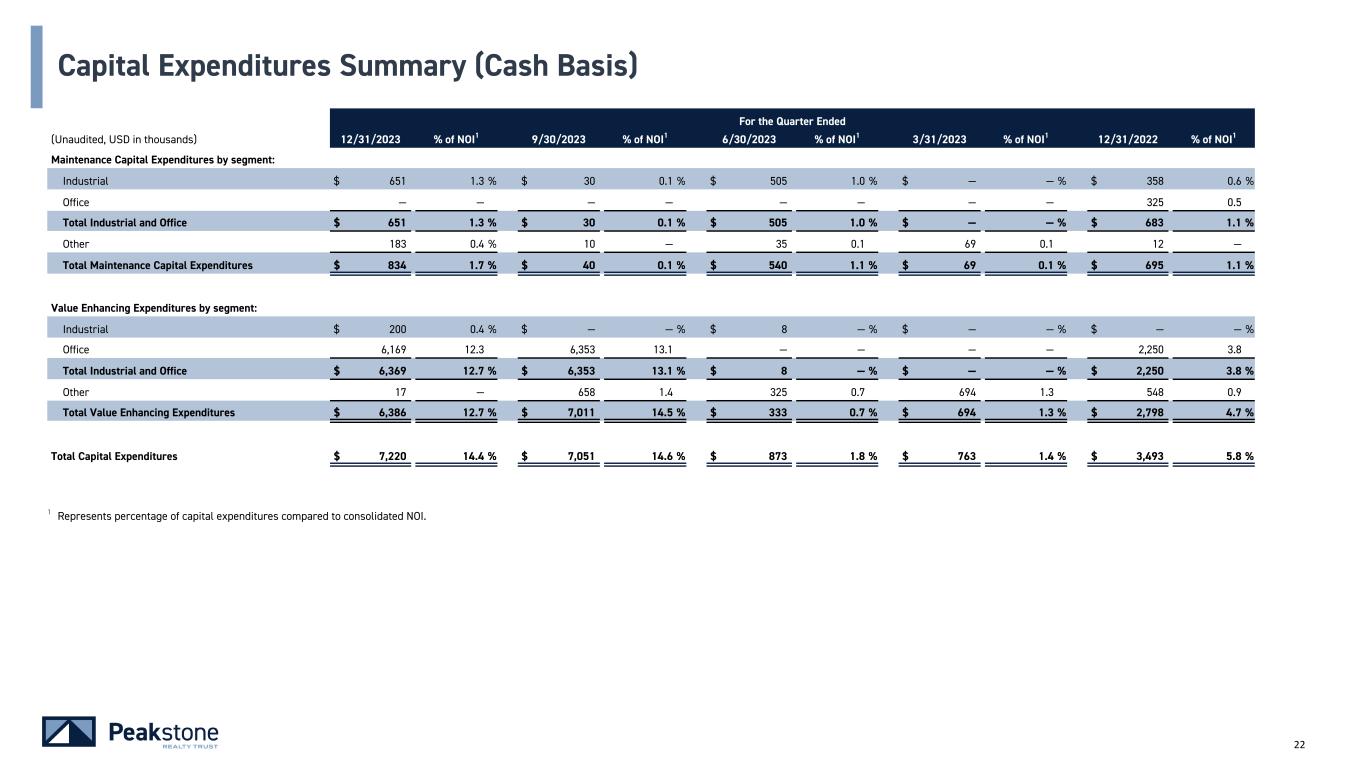

22 For the Quarter Ended (Unaudited, USD in thousands) 12/31/2023 % of NOI1 9/30/2023 % of NOI1 6/30/2023 % of NOI1 3/31/2023 % of NOI1 12/31/2022 % of NOI1 Maintenance Capital Expenditures by segment: Industrial $ 651 1.3 % $ 30 0.1 % $ 505 1.0 % $ — — % $ 358 0.6 % Office — — — — — — — — 325 0.5 Total Industrial and Office $ 651 1.3 % $ 30 0.1 % $ 505 1.0 % $ — — % $ 683 1.1 % Other 183 0.4 % 10 — 35 0.1 69 0.1 12 — Total Maintenance Capital Expenditures $ 834 1.7 % $ 40 $ — 0.1 % $ 540 1.1 % $ 69 0.1 % $ 695 1.1 % Value Enhancing Expenditures by segment: Industrial $ 200 0.4 % $ — — % $ 8 — % $ — — % $ — — % Office 6,169 12.3 6,353 13.1 — — — — 2,250 3.8 Total Industrial and Office $ 6,369 12.7 % $ 6,353 13.1 % $ 8 — % $ — — % $ 2,250 3.8 % Other 17 — 658 1.4 325 0.7 694 1.3 548 0.9 Total Value Enhancing Expenditures $ 6,386 12.7 % $ 7,011 14.5 % $ 333 0.7 % $ 694 1.3 % $ 2,798 4.7 % Total Capital Expenditures $ 7,220 14.4 % $ 7,051 14.6 % $ 873 1.8 % $ 763 1.4 % $ 3,493 5.8 % 1 Represents percentage of capital expenditures compared to consolidated NOI. Capital Expenditures Summary (Cash Basis)

Debt & Capitalization

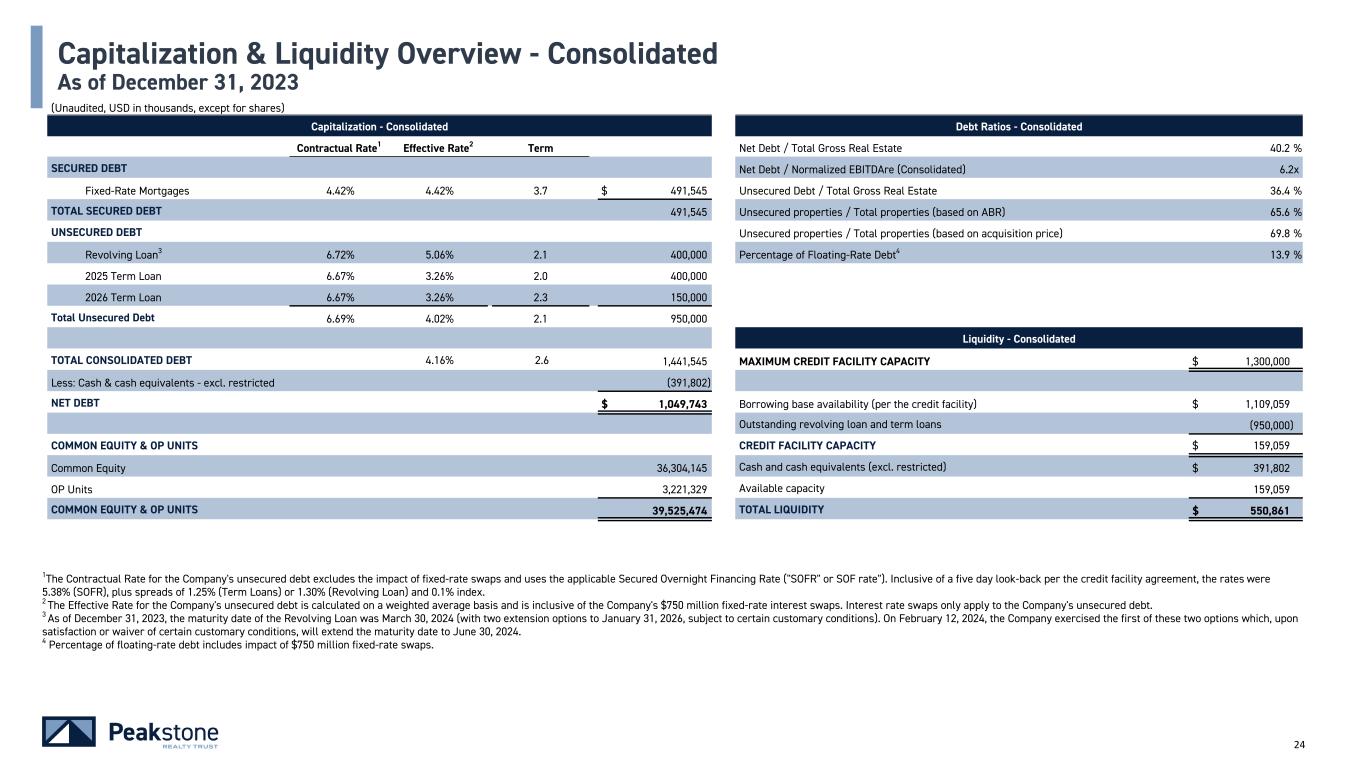

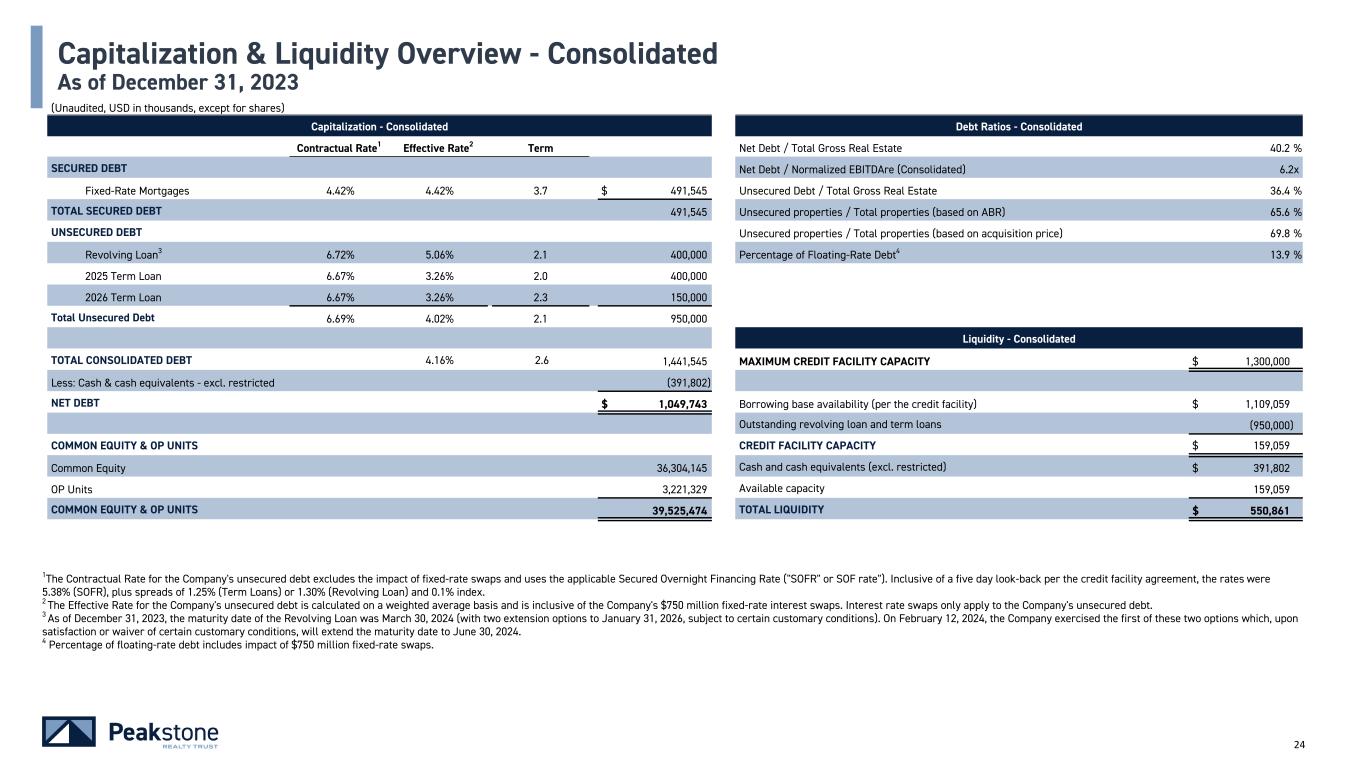

24 1The Contractual Rate for the Company's unsecured debt excludes the impact of fixed-rate swaps and uses the applicable Secured Overnight Financing Rate ("SOFR" or SOF rate"). Inclusive of a five day look-back per the credit facility agreement, the rates were 5.38% (SOFR), plus spreads of 1.25% (Term Loans) or 1.30% (Revolving Loan) and 0.1% index. 2 The Effective Rate for the Company's unsecured debt is calculated on a weighted average basis and is inclusive of the Company's $750 million fixed-rate interest swaps. Interest rate swaps only apply to the Company's unsecured debt. 3 As of December 31, 2023, the maturity date of the Revolving Loan was March 30, 2024 (with two extension options to January 31, 2026, subject to certain customary conditions). On February 12, 2024, the Company exercised the first of these two options which, upon satisfaction or waiver of certain customary conditions, will extend the maturity date to June 30, 2024. 4 Percentage of floating-rate debt includes impact of $750 million fixed-rate swaps. (Unaudited, USD in thousands, except for shares) Capitalization - Consolidated Debt Ratios - Consolidated Contractual Rate1 Effective Rate2 Term Net Debt / Total Gross Real Estate 40.2 % SECURED DEBT Net Debt / Normalized EBITDAre (Consolidated) 6.2x Fixed-Rate Mortgages 4.42% 4.42% 3.7 $ 491,545 Unsecured Debt / Total Gross Real Estate 36.4 % TOTAL SECURED DEBT 491,545 Unsecured properties / Total properties (based on ABR) 65.6 % UNSECURED DEBT Unsecured properties / Total properties (based on acquisition price) 69.8 % Revolving Loan3 6.72% 5.06% 2.1 400,000 Percentage of Floating-Rate Debt4 13.9 % 2025 Term Loan 6.67% 3.26% 2.0 400,000 2026 Term Loan 6.67% 3.26% 2.3 150,000 Total Unsecured Debt 6.69% 4.02% 2.1 950,000 Liquidity - Consolidated TOTAL CONSOLIDATED DEBT 4.16% 2.6 1,441,545 MAXIMUM CREDIT FACILITY CAPACITY $ 1,300,000 Less: Cash & cash equivalents - excl. restricted (391,802) NET DEBT $ 1,049,743 Borrowing base availability (per the credit facility) $ 1,109,059 Outstanding revolving loan and term loans (950,000) COMMON EQUITY & OP UNITS CREDIT FACILITY CAPACITY $ 159,059 Common Equity 36,304,145 Cash and cash equivalents (excl. restricted) $ 391,802 OP Units 3,221,329 Available capacity 159,059 COMMON EQUITY & OP UNITS 39,525,474 TOTAL LIQUIDITY $ 550,861 Capitalization & Liquidity Overview - Consolidated As of December 31, 2023

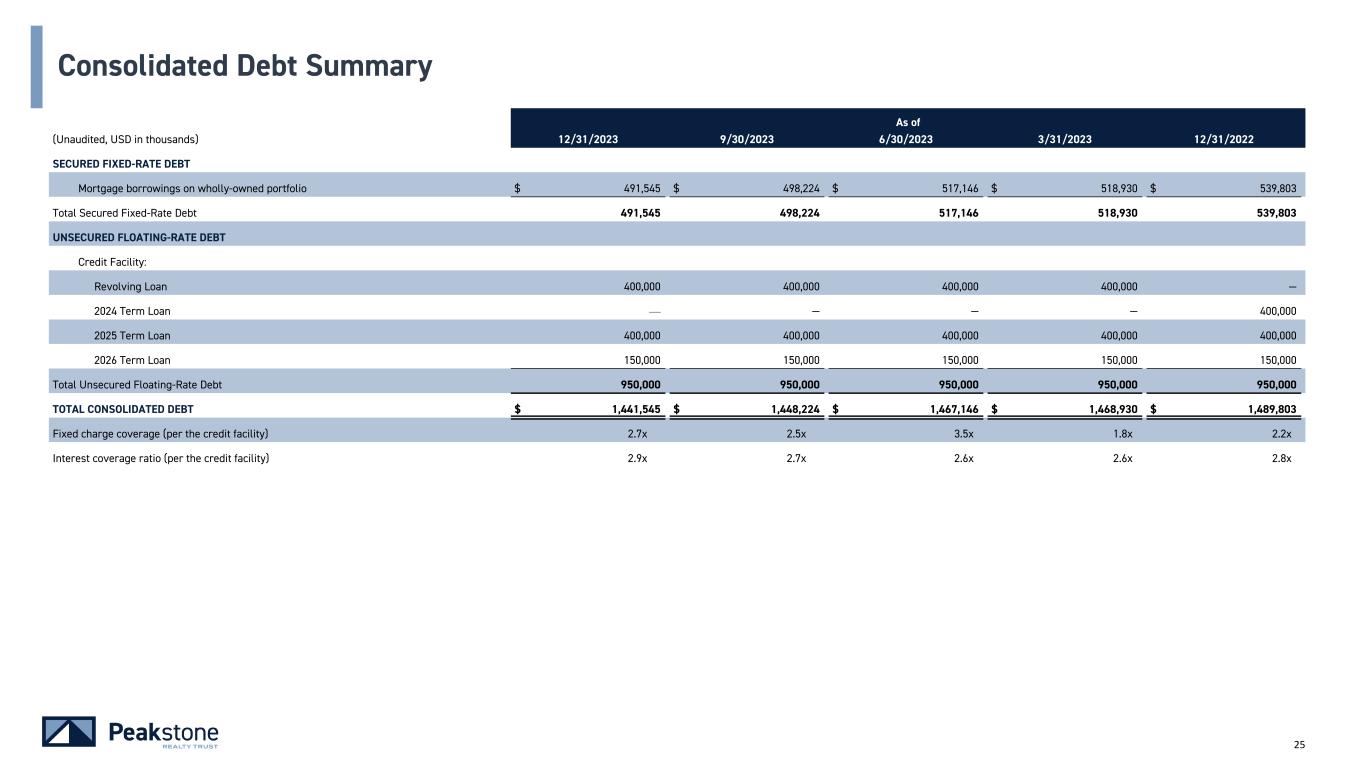

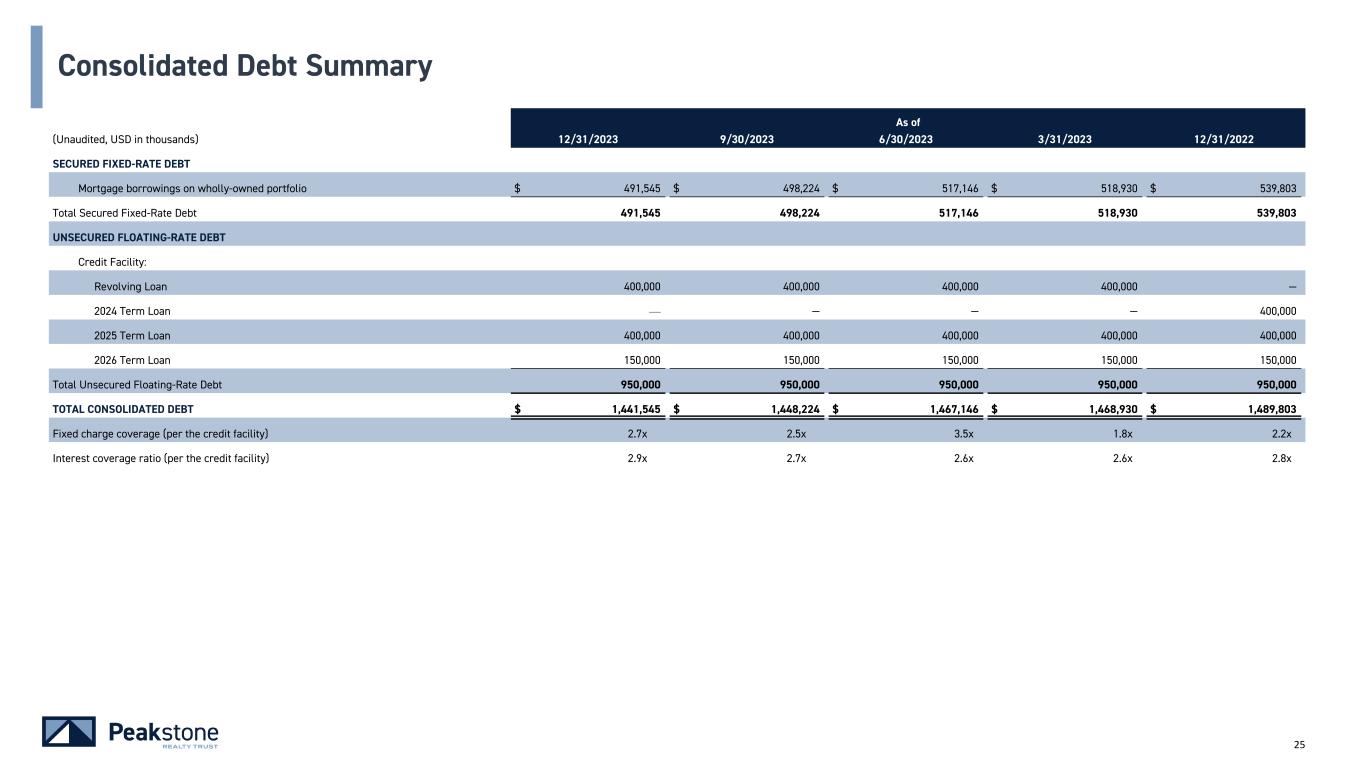

25 As of (Unaudited, USD in thousands) 12/31/2023 9/30/2023 6/30/2023 3/31/2023 12/31/2022 SECURED FIXED-RATE DEBT Mortgage borrowings on wholly-owned portfolio $ 491,545 $ 498,224 $ 517,146 $ 518,930 $ 539,803 Total Secured Fixed-Rate Debt 491,545 498,224 517,146 518,930 539,803 UNSECURED FLOATING-RATE DEBT Credit Facility: Revolving Loan 400,000 400,000 400,000 400,000 — 2024 Term Loan — — — — 400,000 2025 Term Loan 400,000 400,000 400,000 400,000 400,000 2026 Term Loan 150,000 150,000 150,000 150,000 150,000 Total Unsecured Floating-Rate Debt 950,000 950,000 950,000 950,000 950,000 TOTAL CONSOLIDATED DEBT $ 1,441,545 $ 1,448,224 $ 1,467,146 $ 1,468,930 $ 1,489,803 Fixed charge coverage (per the credit facility) 2.7x 2.5x 3.5x 1.8x 2.2x Interest coverage ratio (per the credit facility) 2.9x 2.7x 2.6x 2.6x 2.8x Consolidated Debt Summary

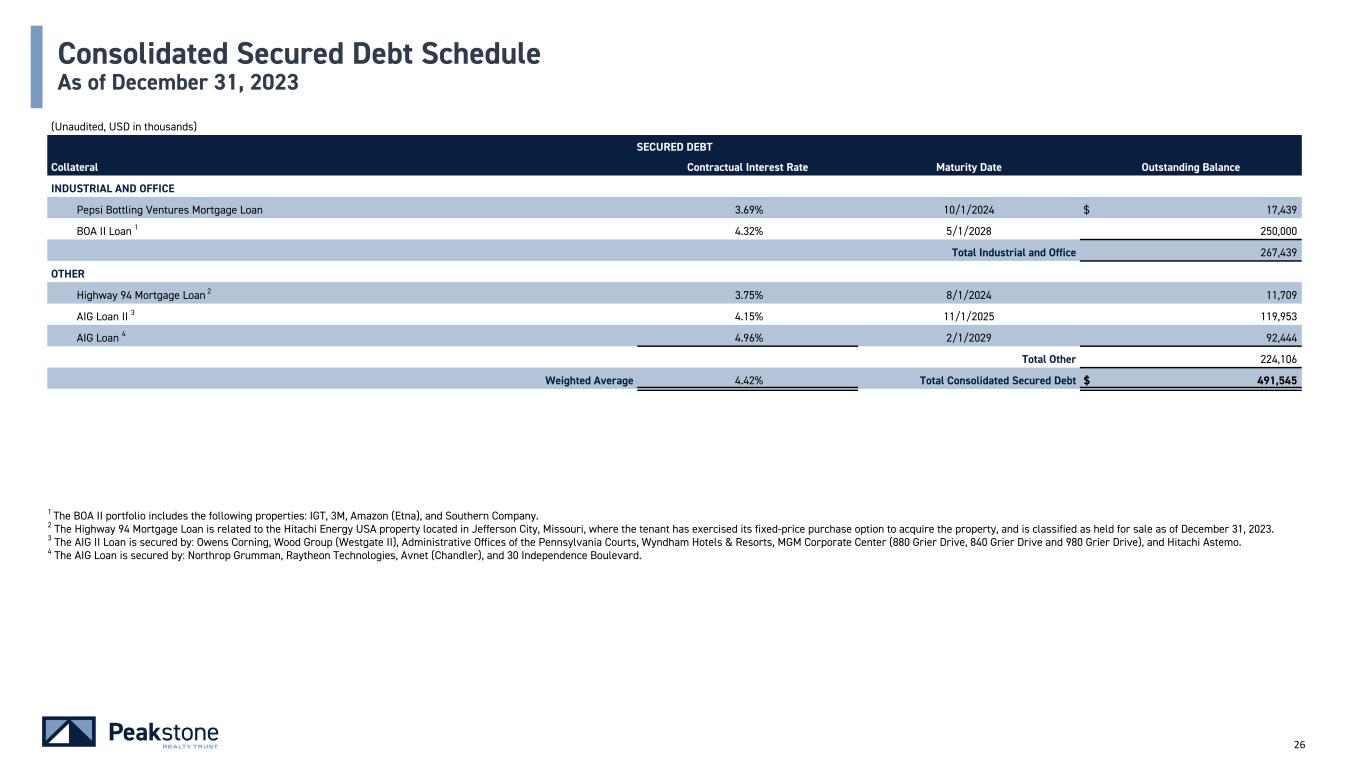

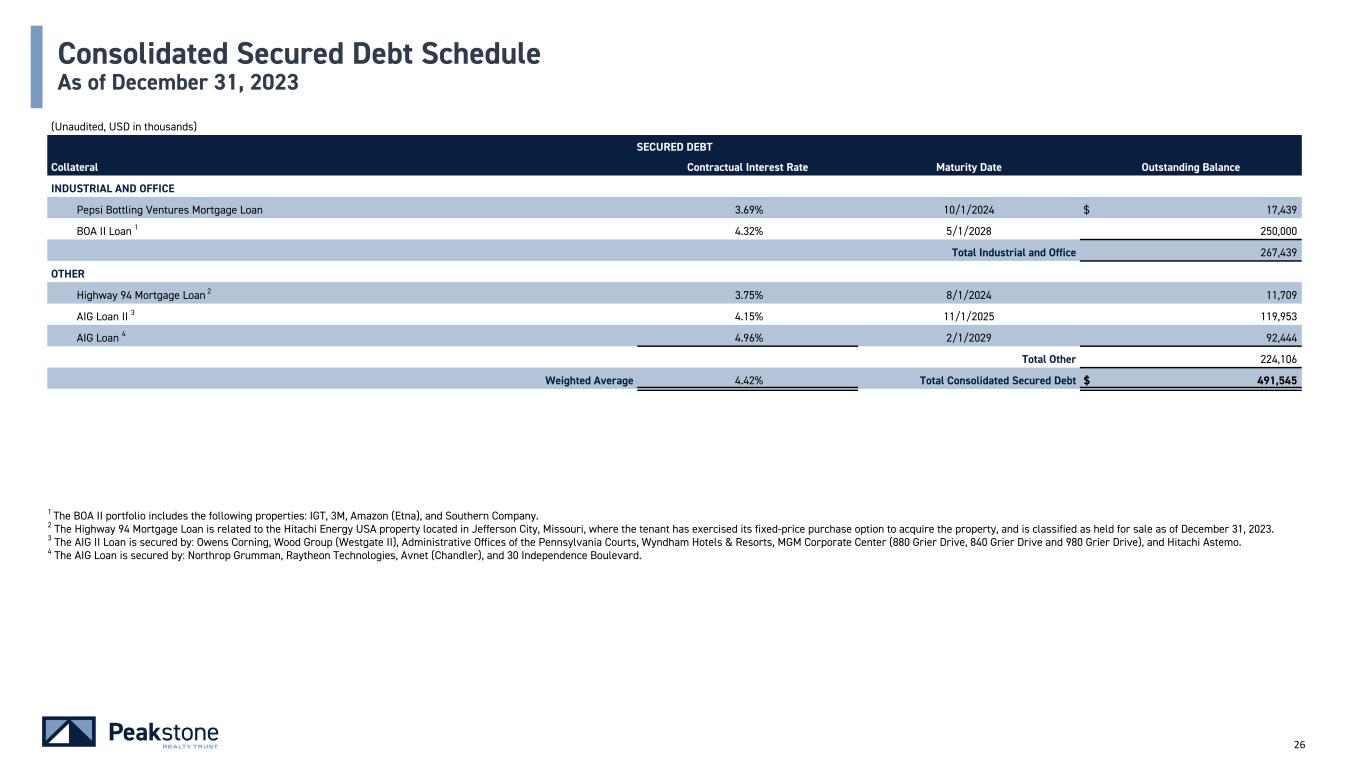

26 (Unaudited, USD in thousands) SECURED DEBT Collateral Contractual Interest Rate Maturity Date Outstanding Balance INDUSTRIAL AND OFFICE Pepsi Bottling Ventures Mortgage Loan 3.69% 10/1/2024 $ 17,439 BOA II Loan 1 4.32% 5/1/2028 250,000 Total Industrial and Office 267,439 OTHER Highway 94 Mortgage Loan 2 3.75% 8/1/2024 11,709 AIG Loan II 3 4.15% 11/1/2025 119,953 AIG Loan 4 4.96% 2/1/2029 92,444 Total Other 224,106 Weighted Average 4.42% Total Consolidated Secured Debt $ 491,545 1 The BOA II portfolio includes the following properties: IGT, 3M, Amazon (Etna), and Southern Company. 2 The Highway 94 Mortgage Loan is related to the Hitachi Energy USA property located in Jefferson City, Missouri, where the tenant has exercised its fixed-price purchase option to acquire the property, and is classified as held for sale as of December 31, 2023. 3 The AIG II Loan is secured by: Owens Corning, Wood Group (Westgate II), Administrative Offices of the Pennsylvania Courts, Wyndham Hotels & Resorts, MGM Corporate Center (880 Grier Drive, 840 Grier Drive and 980 Grier Drive), and Hitachi Astemo. 4 The AIG Loan is secured by: Northrop Grumman, Raytheon Technologies, Avnet (Chandler), and 30 Independence Boulevard. Consolidated Secured Debt Schedule As of December 31, 2023

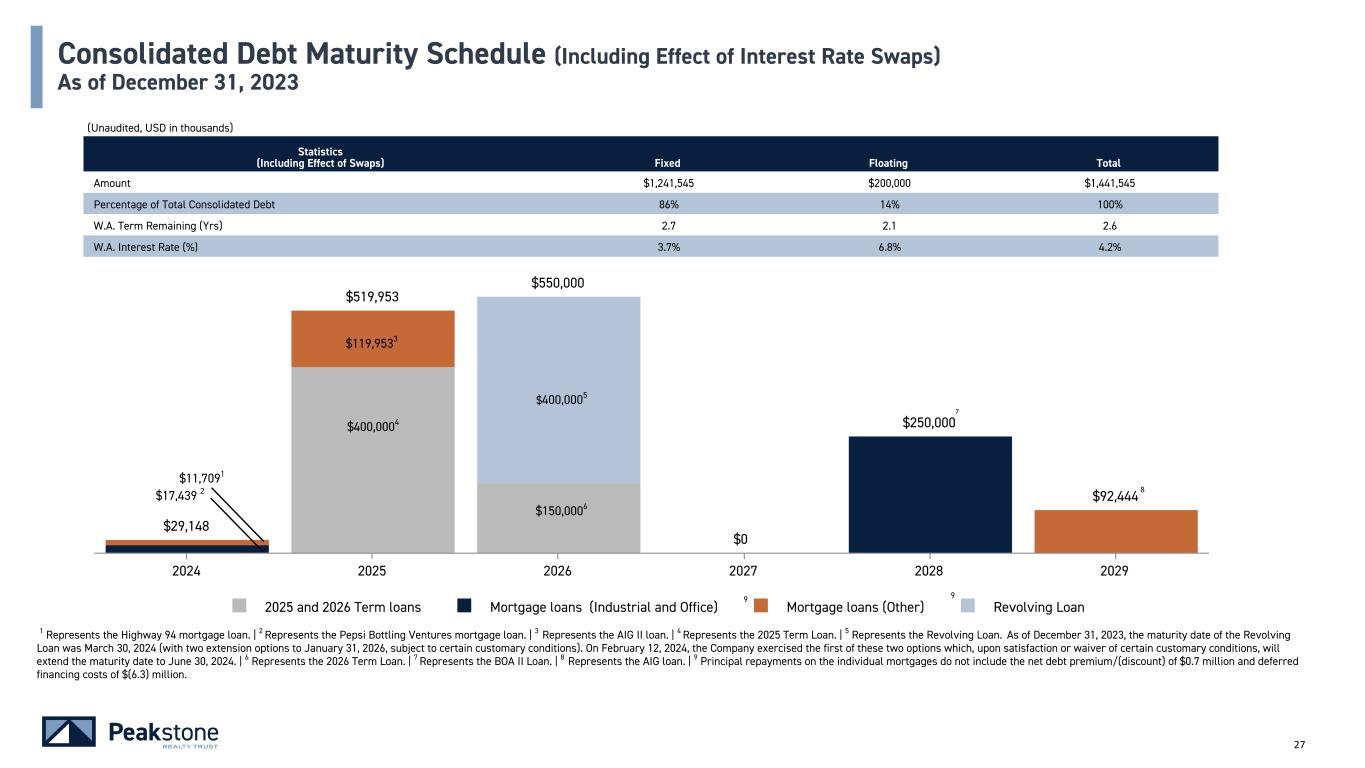

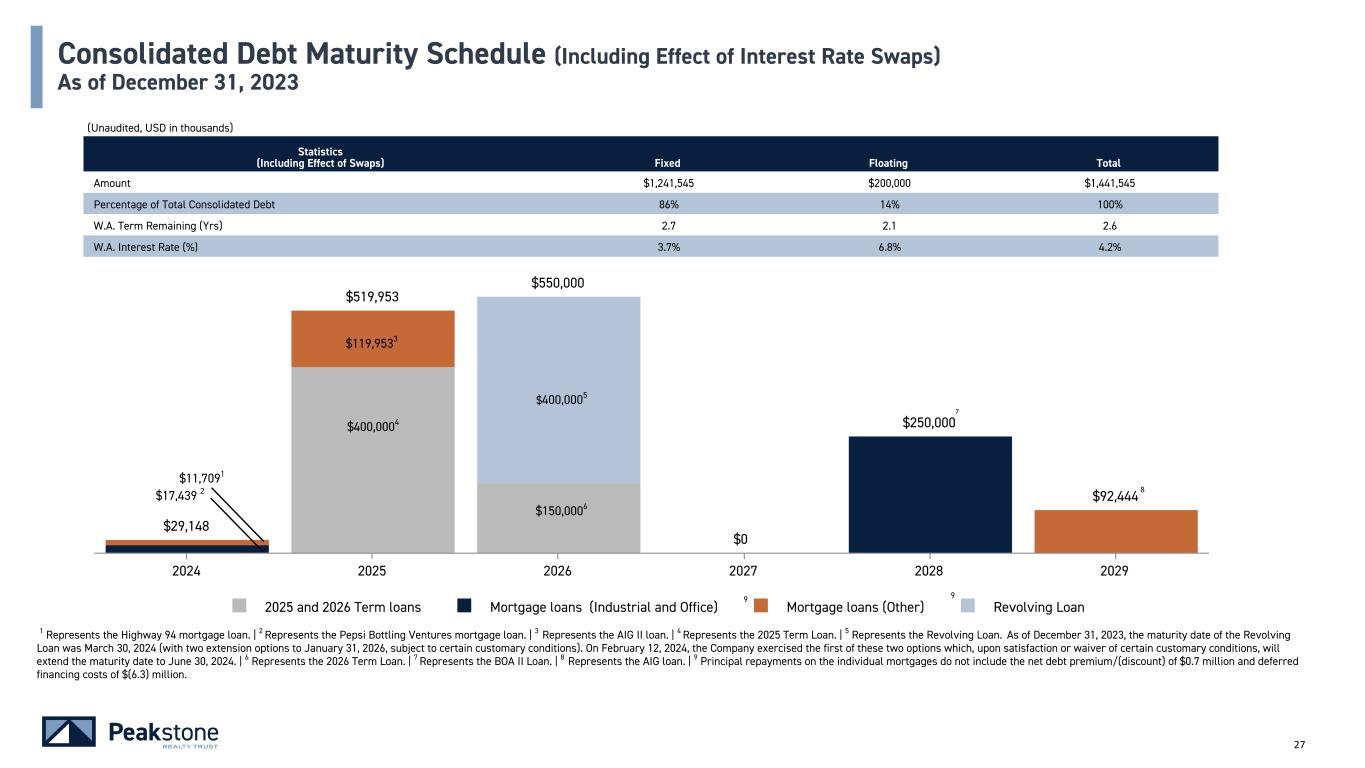

27 1 Represents the Highway 94 mortgage loan. | 2 Represents the Pepsi Bottling Ventures mortgage loan. | 3 Represents the AIG II loan. | 4 Represents the 2025 Term Loan. | 5 Represents the Revolving Loan. As of December 31, 2023, the maturity date of the Revolving Loan was March 30, 2024 (with two extension options to January 31, 2026, subject to certain customary conditions). On February 12, 2024, the Company exercised the first of these two options which, upon satisfaction or waiver of certain customary conditions, will extend the maturity date to June 30, 2024. | 6 Represents the 2026 Term Loan. | 7 Represents the BOA II Loan. | 8 Represents the AIG loan. | 9 Principal repayments on the individual mortgages do not include the net debt premium/(discount) of $0.7 million and deferred financing costs of $(6.3) million. $141,194(1) $200,000(3) $400,000(5) $29,148 $519,953 $550,000 $250,000 $92,444 2025 and 2026 Term loans Mortgage loans (Industrial and Office) Mortgage loans (Other) Revolving Loan 2024 2025 2026 2027 2028 2029 (Unaudited, USD in thousands) Statistics (Including Effect of Swaps) Fixed Floating Total Amount $1,241,545 $200,000 $1,441,545 Percentage of Total Consolidated Debt 86% 14% 100% W.A. Term Remaining (Yrs) 2.7 2.1 2.6 W.A. Interest Rate (%) 3.7% 6.8% 4.2% (1) 7 8 $119,9533 $400,0004 $17,439 2 $11,7091 Consolidated Debt Maturity Schedule (Including Effect of Interest Rate Swaps) As of December 31, 2023 $150,0006 $400,0005 9 9 $0

Leasing Activity & Asset Management

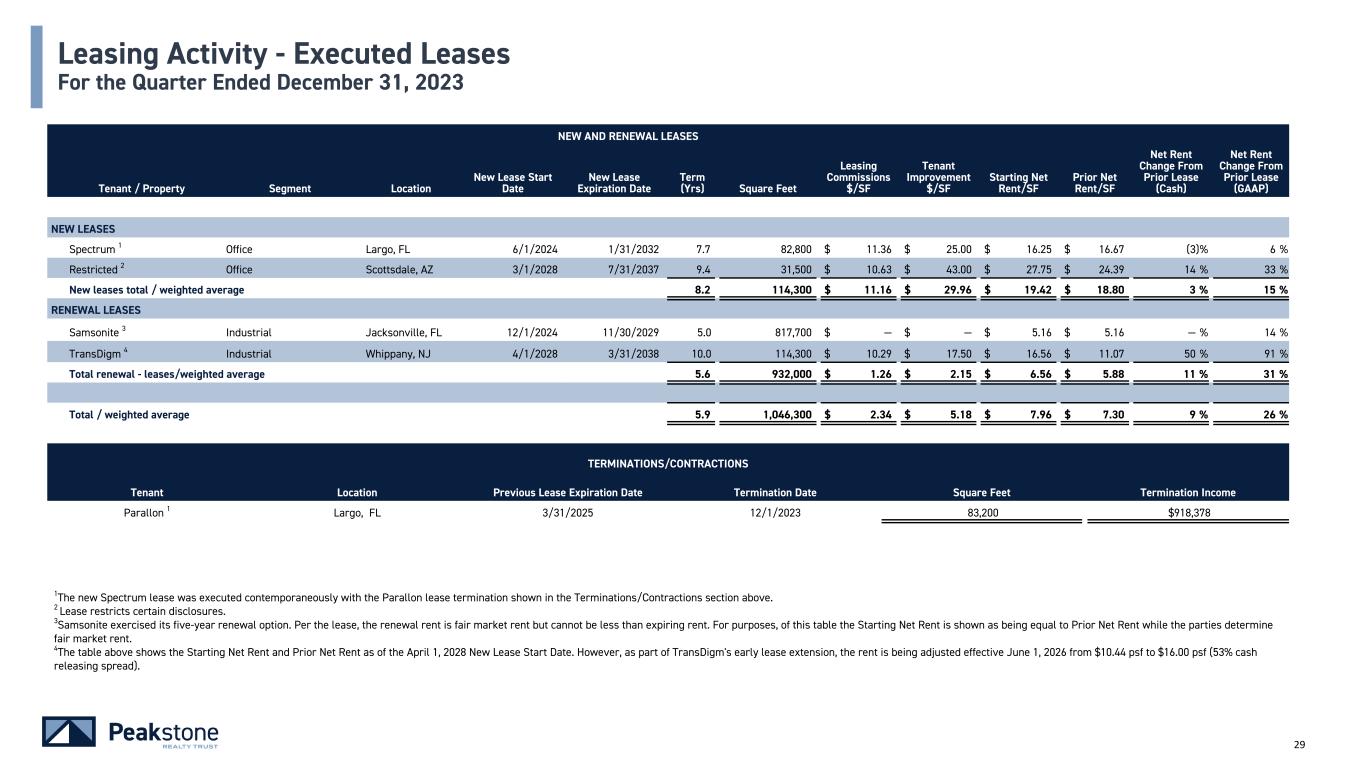

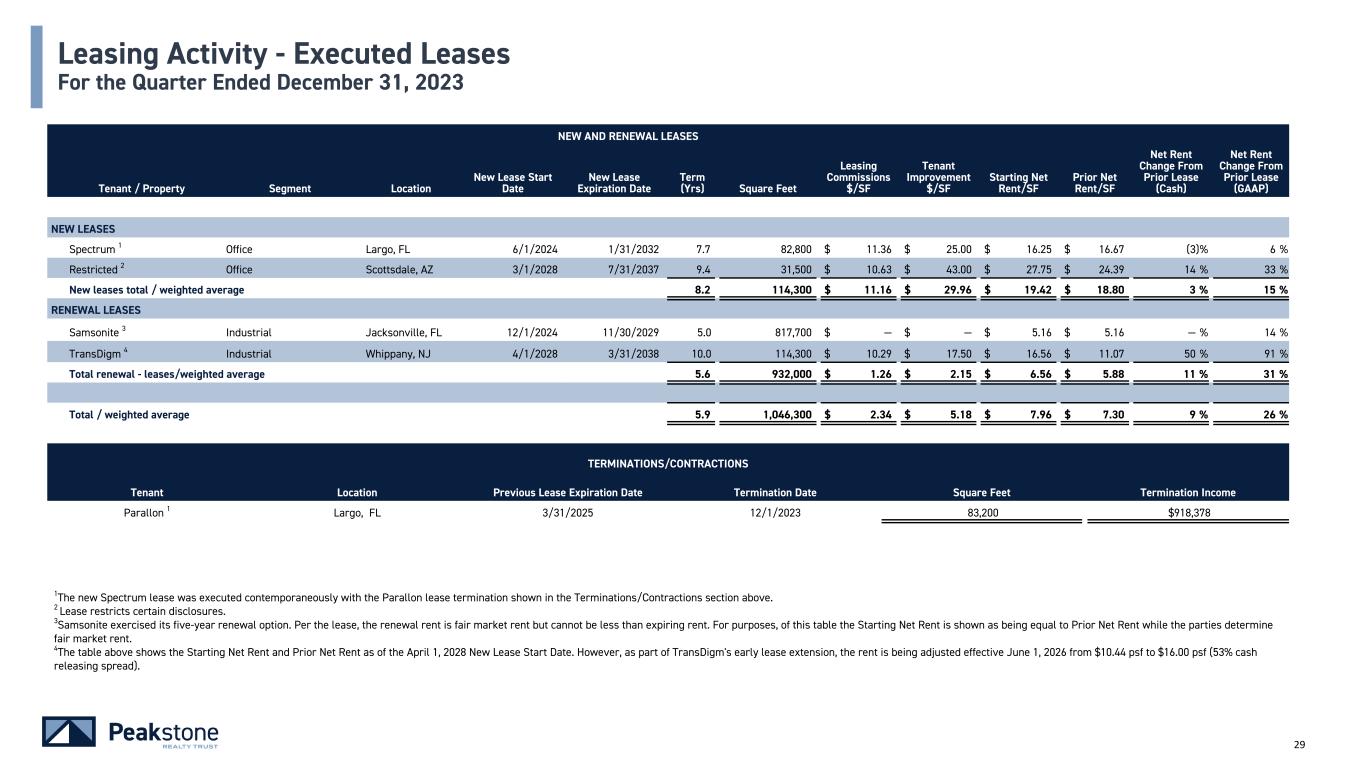

29 NEW AND RENEWAL LEASES Tenant / Property Segment Location New Lease Start Date New Lease Expiration Date Term (Yrs) Square Feet Leasing Commissions $/SF Tenant Improvement $/SF Starting Net Rent/SF Prior Net Rent/SF Net Rent Change From Prior Lease (Cash) Net Rent Change From Prior Lease (GAAP) NEW LEASES Spectrum 1 Office Largo, FL 6/1/2024 1/31/2032 7.7 82,800 $ 11.36 $ 25.00 $ 16.25 $ 16.67 (3) % 6 % Restricted 2 Office Scottsdale, AZ 3/1/2028 7/31/2037 9.4 31,500 $ 10.63 $ 43.00 $ 27.75 $ 24.39 14 % 33 % New leases total / weighted average 8.2 114,300 $ 11.16 $ 29.96 $ 19.42 $ 18.80 3 % 15 % RENEWAL LEASES Samsonite 3 Industrial Jacksonville, FL 12/1/2024 11/30/2029 5.0 817,700 $ — $ — $ 5.16 $ 5.16 — % 14 % TransDigm 4 Industrial Whippany, NJ 4/1/2028 3/31/2038 10.0 114,300 $ 10.29 $ 17.50 $ 16.56 $ 11.07 50 % 91 % Total renewal - leases/weighted average 5.6 932,000 $ 1.26 $ 2.15 $ 6.56 $ 5.88 11 % 31 % Total / weighted average 5.9 1,046,300 $ 2.34 $ 5.18 $ 7.96 $ 7.30 9 % 26 % TERMINATIONS/CONTRACTIONS Tenant Location Previous Lease Expiration Date Termination Date Square Feet Termination Income Parallon 1 Largo, FL 3/31/2025 12/1/2023 83,200 $918,378 Leasing Activity - Executed Leases For the Quarter Ended December 31, 2023 1The new Spectrum lease was executed contemporaneously with the Parallon lease termination shown in the Terminations/Contractions section above. 2 Lease restricts certain disclosures. 3Samsonite exercised its five-year renewal option. Per the lease, the renewal rent is fair market rent but cannot be less than expiring rent. For purposes, of this table the Starting Net Rent is shown as being equal to Prior Net Rent while the parties determine fair market rent. 4The table above shows the Starting Net Rent and Prior Net Rent as of the April 1, 2028 New Lease Start Date. However, as part of TransDigm's early lease extension, the rent is being adjusted effective June 1, 2026 from $10.44 psf to $16.00 psf (53% cash releasing spread).

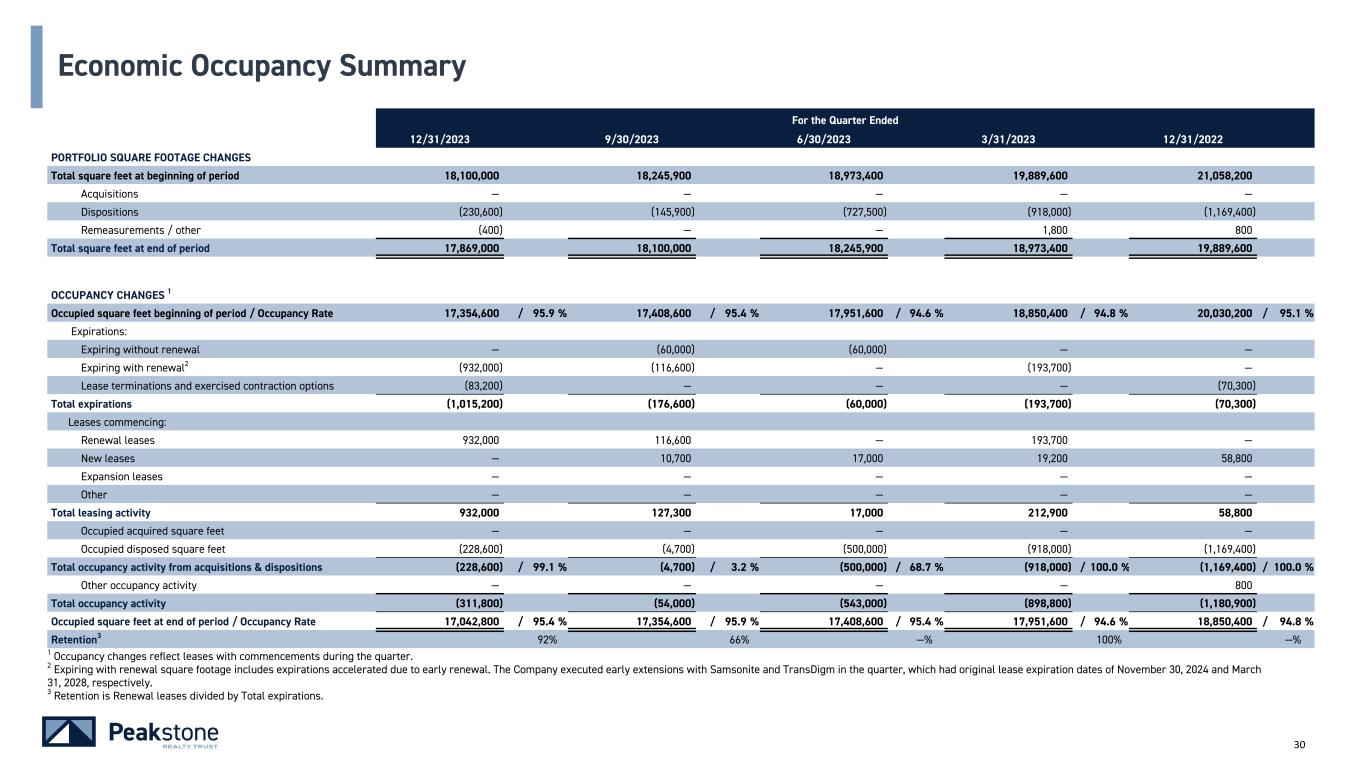

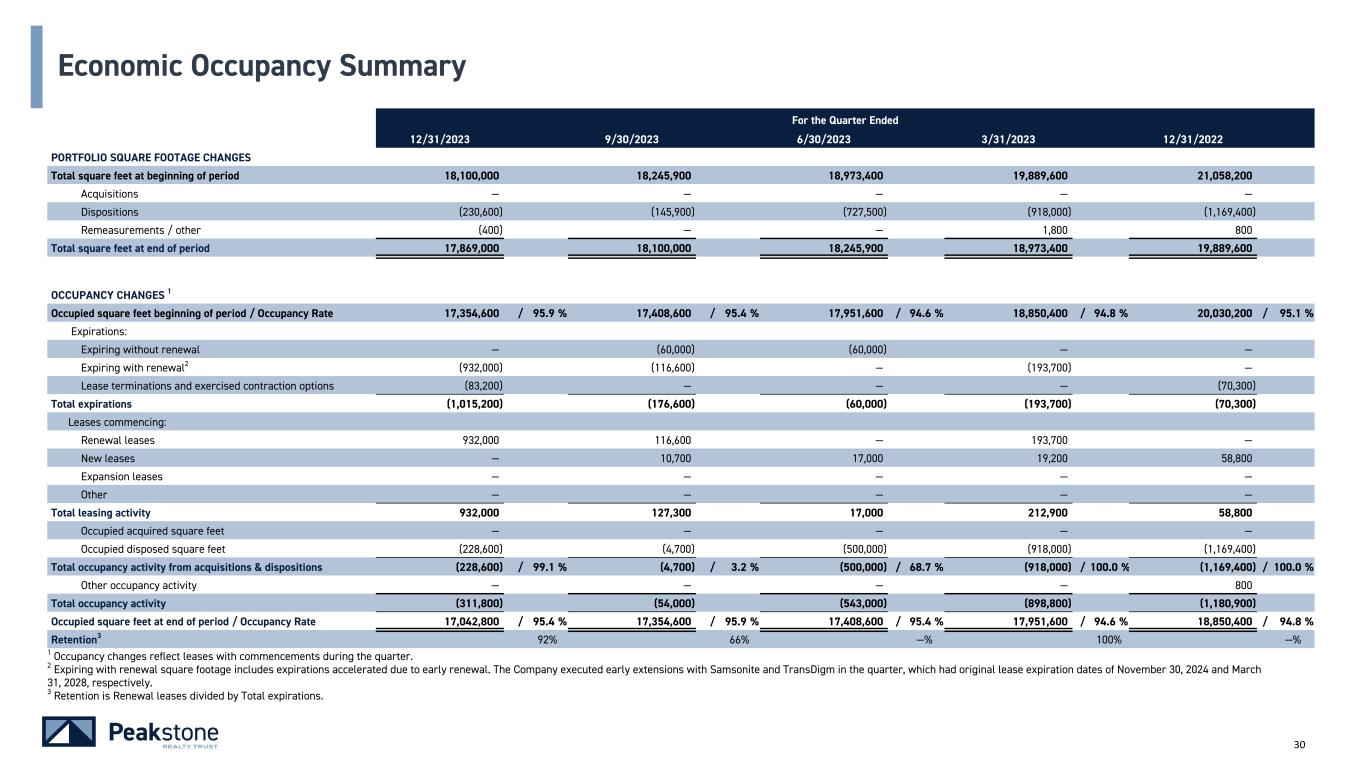

30 1 Occupancy changes reflect leases with commencements during the quarter. 2 Expiring with renewal square footage includes expirations accelerated due to early renewal. The Company executed early extensions with Samsonite and TransDigm in the quarter, which had original lease expiration dates of November 30, 2024 and March 31, 2028, respectively. 3 Retention is Renewal leases divided by Total expirations. For the Quarter Ended 12/31/2023 9/30/2023 6/30/2023 3/31/2023 12/31/2022 PORTFOLIO SQUARE FOOTAGE CHANGES Total square feet at beginning of period 18,100,000 18,245,900 18,973,400 19,889,600 21,058,200 Acquisitions — — — — — Dispositions (230,600) (145,900) (727,500) (918,000) (1,169,400) Remeasurements / other (400) — — 1,800 800 Total square feet at end of period 17,869,000 18,100,000 18,245,900 18,973,400 19,889,600 OCCUPANCY CHANGES 1 Occupied square feet beginning of period / Occupancy Rate 17,354,600 / 95.9 % 17,408,600 / 95.4 % 17,951,600 / 94.6 % 18,850,400 / 94.8 % 20,030,200 / 95.1 % Expirations: Expiring without renewal — (60,000) (60,000) — — Expiring with renewal2 (932,000) (116,600) — (193,700) — Lease terminations and exercised contraction options (83,200) — — — (70,300) Total expirations (1,015,200) (176,600) (60,000) (193,700) (70,300) Leases commencing: Renewal leases 932,000 116,600 — 193,700 — New leases — 10,700 17,000 19,200 58,800 Expansion leases — — — — — Other — — — — — Total leasing activity 932,000 127,300 17,000 212,900 58,800 Occupied acquired square feet — — — — — Occupied disposed square feet (228,600) (4,700) (500,000) (918,000) (1,169,400) Total occupancy activity from acquisitions & dispositions (228,600) / 99.1 % (4,700) / 3.2 % (500,000) / 68.7 % (918,000) / 100.0 % (1,169,400) / 100.0 % Other occupancy activity — — — — 800 Total occupancy activity (311,800) (54,000) (543,000) (898,800) (1,180,900) Occupied square feet at end of period / Occupancy Rate 17,042,800 / 95.4 % 17,354,600 / 95.9 % 17,408,600 / 95.4 % 17,951,600 / 94.6 % 18,850,400 / 94.8 % Retention3 92% 66% —% 100% —% Economic Occupancy Summary

Components of Net Asset Value

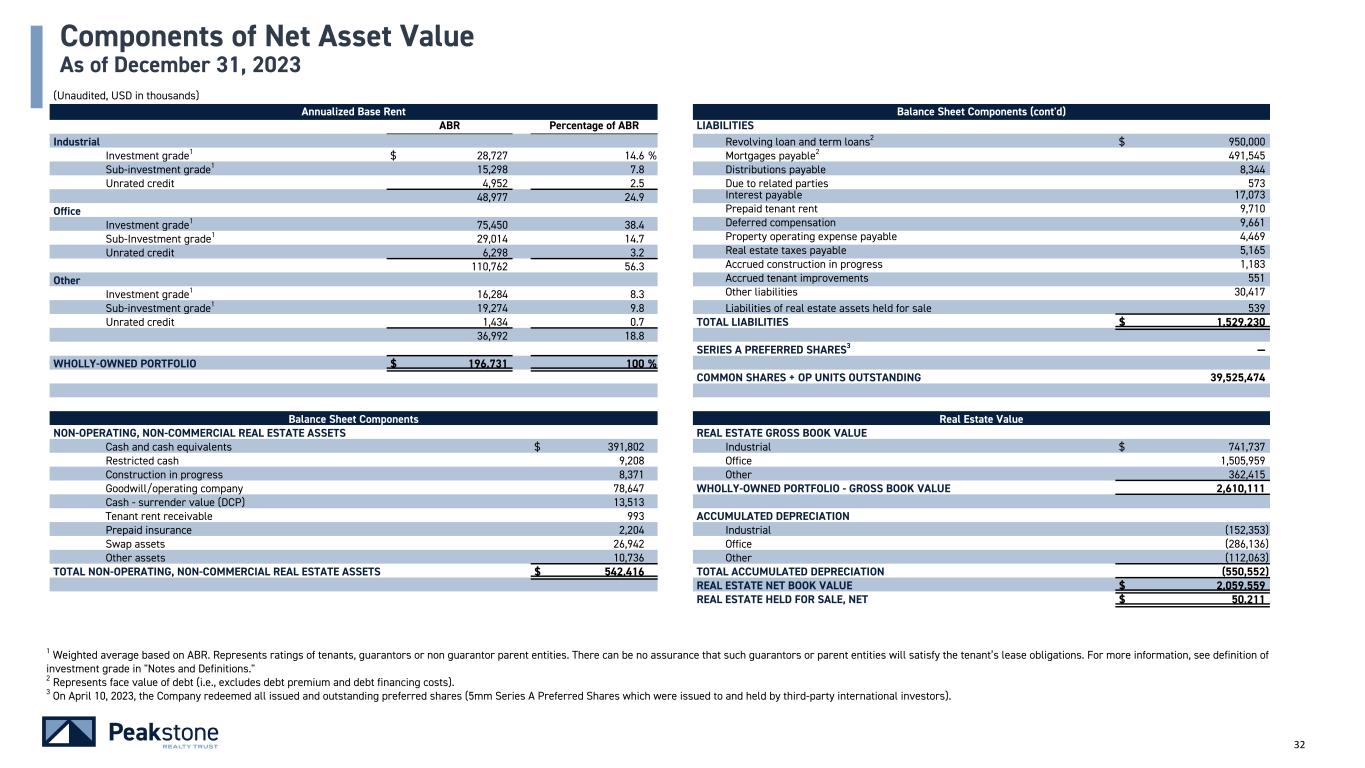

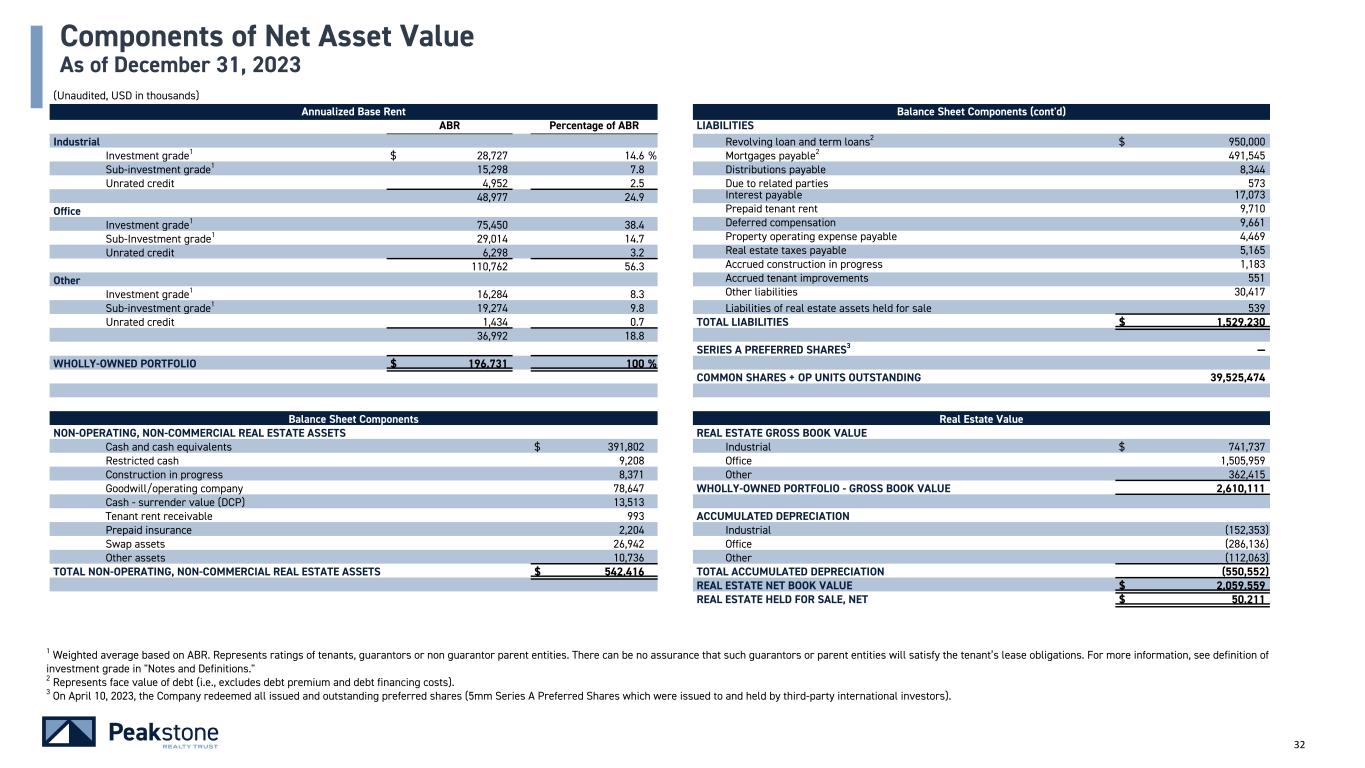

32 (Unaudited, USD in thousands) Annualized Base Rent Balance Sheet Components (cont'd) ABR Percentage of ABR LIABILITIES Industrial Revolving loan and term loans2 $ 950,000 Investment grade1 $ 28,727 14.6 % Mortgages payable2 491,545 Sub-investment grade1 15,298 7.8 Distributions payable 8,344 Unrated credit 4,952 2.5 Due to related parties 573 48,977 24.9 Interest payable 17,073 Office Prepaid tenant rent 9,710 Investment grade1 75,450 38.4 Deferred compensation 9,661 Sub-Investment grade1 29,014 14.7 Property operating expense payable 4,469 Unrated credit 6,298 3.2 Real estate taxes payable 5,165 110,762 56.3 Accrued construction in progress 1,183 Other Accrued tenant improvements 551 Investment grade1 16,284 8.3 Other liabilities 30,417 Sub-investment grade1 19,274 9.8 Liabilities of real estate assets held for sale 539 Unrated credit 1,434 0.7 TOTAL LIABILITIES $ 1,529,230 36,992 18.8 SERIES A PREFERRED SHARES3 — WHOLLY-OWNED PORTFOLIO $ 196,731 100 % COMMON SHARES + OP UNITS OUTSTANDING 39,525,474 Balance Sheet Components Real Estate Value NON-OPERATING, NON-COMMERCIAL REAL ESTATE ASSETS REAL ESTATE GROSS BOOK VALUE Cash and cash equivalents $ 391,802 Industrial $ 741,737 Restricted cash 9,208 Office 1,505,959 Construction in progress 8,371 Other 362,415 Goodwill/operating company 78,647 WHOLLY-OWNED PORTFOLIO - GROSS BOOK VALUE 2,610,111 Cash - surrender value (DCP) 13,513 Tenant rent receivable 993 ACCUMULATED DEPRECIATION Prepaid insurance 2,204 Industrial (152,353) Swap assets 26,942 Office (286,136) Other assets 10,736 Other (112,063) TOTAL NON-OPERATING, NON-COMMERCIAL REAL ESTATE ASSETS $ 542,416 TOTAL ACCUMULATED DEPRECIATION (550,552) REAL ESTATE NET BOOK VALUE $ 2,059,559 REAL ESTATE HELD FOR SALE, NET $ 50,211 Components of Net Asset Value As of December 31, 2023 1 Weighted average based on ABR. Represents ratings of tenants, guarantors or non guarantor parent entities. There can be no assurance that such guarantors or parent entities will satisfy the tenant’s lease obligations. For more information, see definition of investment grade in "Notes and Definitions." 2 Represents face value of debt (i.e., excludes debt premium and debt financing costs). 3 On April 10, 2023, the Company redeemed all issued and outstanding preferred shares (5mm Series A Preferred Shares which were issued to and held by third-party international investors).

Property Information

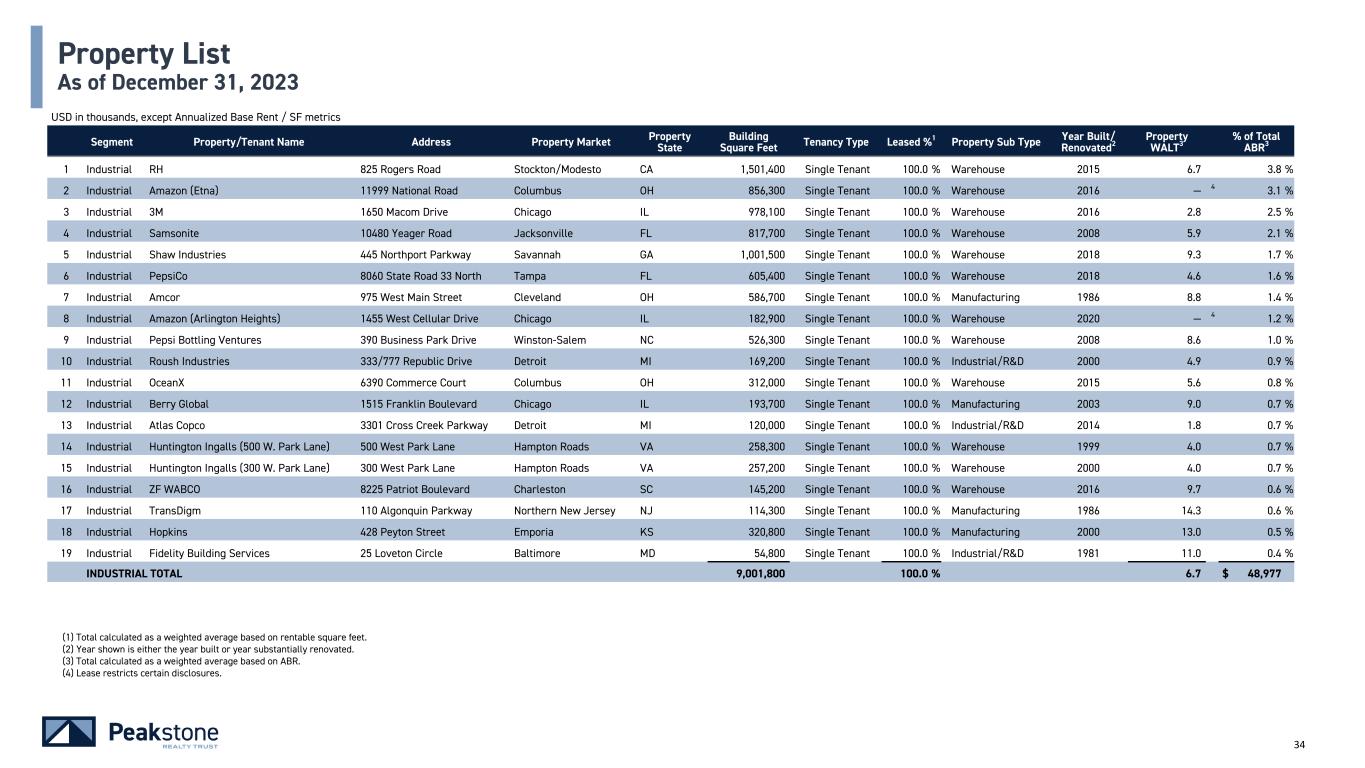

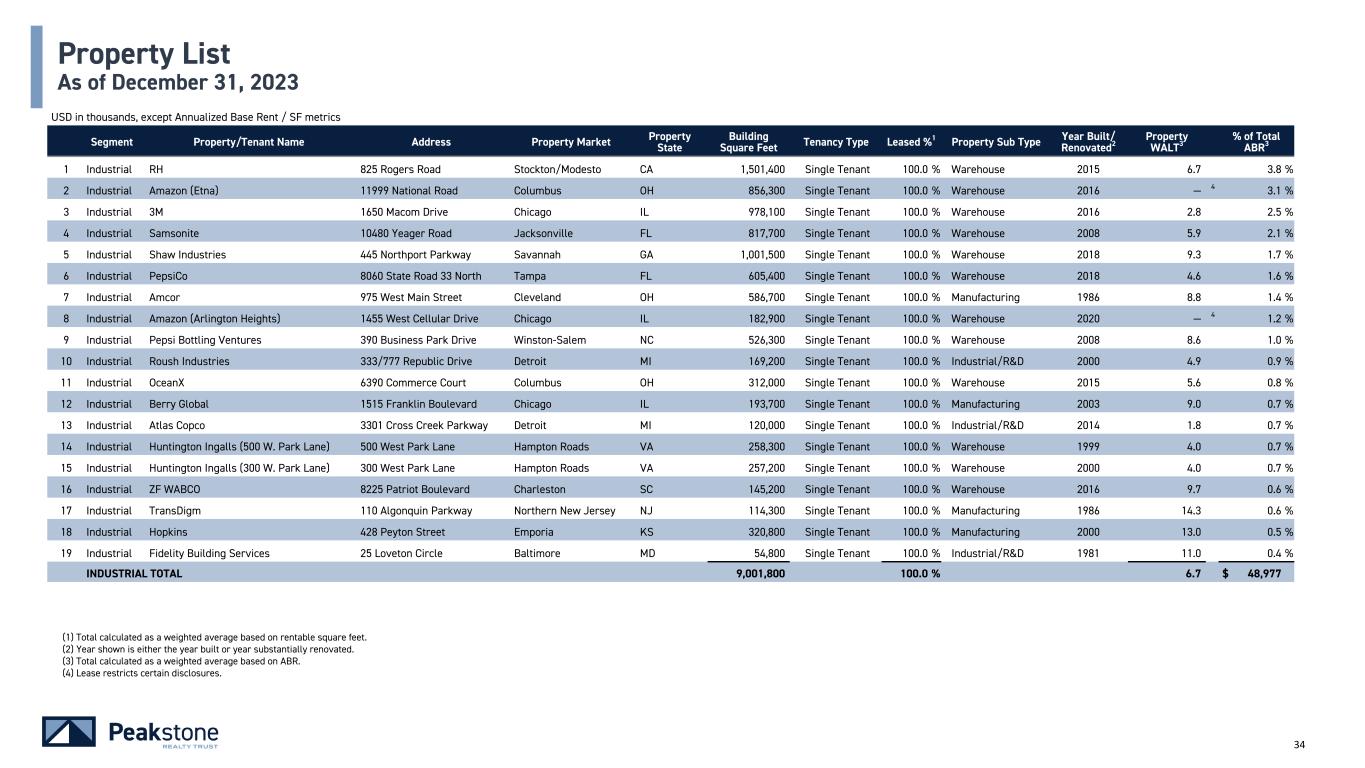

34 USD in thousands, except Annualized Base Rent / SF metrics Segment Property/Tenant Name Address Property Market Property State Building Square Feet Tenancy Type Leased %1 Property Sub Type Year Built/ Renovated2 Property WALT3 % of Total ABR3 1 Industrial RH 825 Rogers Road Stockton/Modesto CA 1,501,400 Single Tenant 100.0 % Warehouse 2015 6.7 3.8 % 2 Industrial Amazon (Etna) 11999 National Road Columbus OH 856,300 Single Tenant 100.0 % Warehouse 2016 — 4 3.1 % 3 Industrial 3M 1650 Macom Drive Chicago IL 978,100 Single Tenant 100.0 % Warehouse 2016 2.8 2.5 % 4 Industrial Samsonite 10480 Yeager Road Jacksonville FL 817,700 Single Tenant 100.0 % Warehouse 2008 5.9 2.1 % 5 Industrial Shaw Industries 445 Northport Parkway Savannah GA 1,001,500 Single Tenant 100.0 % Warehouse 2018 9.3 1.7 % 6 Industrial PepsiCo 8060 State Road 33 North Tampa FL 605,400 Single Tenant 100.0 % Warehouse 2018 4.6 1.6 % 7 Industrial Amcor 975 West Main Street Cleveland OH 586,700 Single Tenant 100.0 % Manufacturing 1986 8.8 1.4 % 8 Industrial Amazon (Arlington Heights) 1455 West Cellular Drive Chicago IL 182,900 Single Tenant 100.0 % Warehouse 2020 — 4 1.2 % 9 Industrial Pepsi Bottling Ventures 390 Business Park Drive Winston-Salem NC 526,300 Single Tenant 100.0 % Warehouse 2008 8.6 1.0 % 10 Industrial Roush Industries 333/777 Republic Drive Detroit MI 169,200 Single Tenant 100.0 % Industrial/R&D 2000 4.9 0.9 % 11 Industrial OceanX 6390 Commerce Court Columbus OH 312,000 Single Tenant 100.0 % Warehouse 2015 5.6 0.8 % 12 Industrial Berry Global 1515 Franklin Boulevard Chicago IL 193,700 Single Tenant 100.0 % Manufacturing 2003 9.0 0.7 % 13 Industrial Atlas Copco 3301 Cross Creek Parkway Detroit MI 120,000 Single Tenant 100.0 % Industrial/R&D 2014 1.8 0.7 % 14 Industrial Huntington Ingalls (500 W. Park Lane) 500 West Park Lane Hampton Roads VA 258,300 Single Tenant 100.0 % Warehouse 1999 4.0 0.7 % 15 Industrial Huntington Ingalls (300 W. Park Lane) 300 West Park Lane Hampton Roads VA 257,200 Single Tenant 100.0 % Warehouse 2000 4.0 0.7 % 16 Industrial ZF WABCO 8225 Patriot Boulevard Charleston SC 145,200 Single Tenant 100.0 % Warehouse 2016 9.7 0.6 % 17 Industrial TransDigm 110 Algonquin Parkway Northern New Jersey NJ 114,300 Single Tenant 100.0 % Manufacturing 1986 14.3 0.6 % 18 Industrial Hopkins 428 Peyton Street Emporia KS 320,800 Single Tenant 100.0 % Manufacturing 2000 13.0 0.5 % 19 Industrial Fidelity Building Services 25 Loveton Circle Baltimore MD 54,800 Single Tenant 100.0 % Industrial/R&D 1981 11.0 0.4 % INDUSTRIAL TOTAL 9,001,800 100.0 % 6.7 $ 48,977 (1) Total calculated as a weighted average based on rentable square feet. (2) Year shown is either the year built or year substantially renovated. (3) Total calculated as a weighted average based on ABR. (4) Lease restricts certain disclosures. Property List As of December 31, 2023

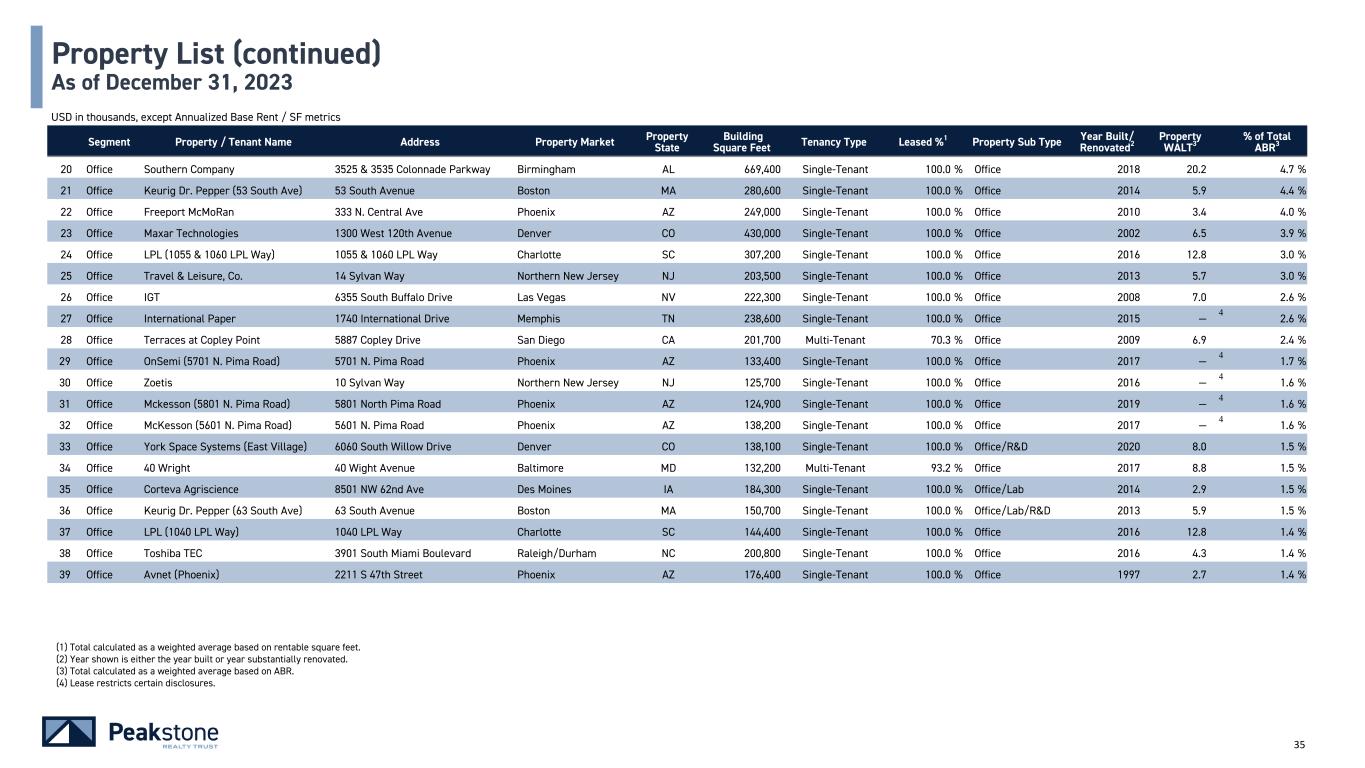

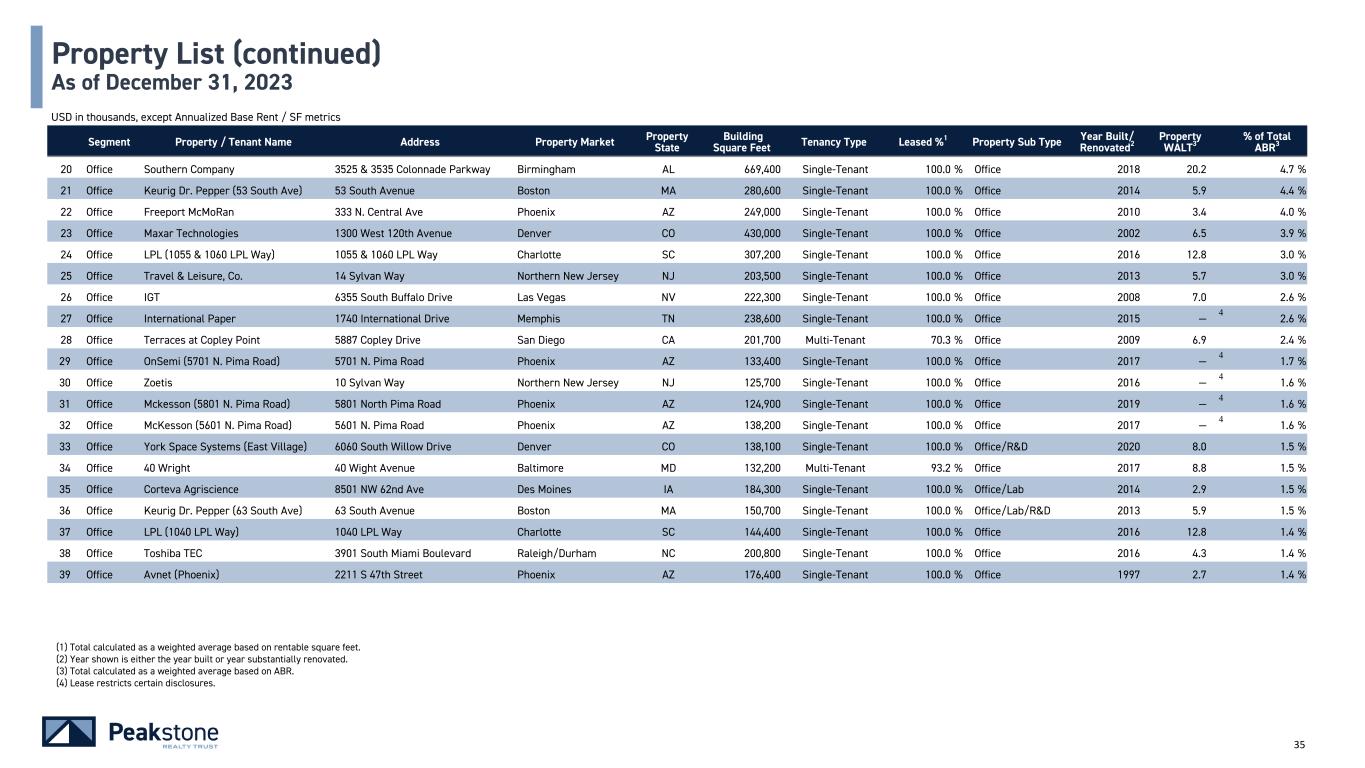

35 USD in thousands, except Annualized Base Rent / SF metrics Segment Property / Tenant Name Address Property Market Property State Building Square Feet Tenancy Type Leased %1 Property Sub Type Year Built/ Renovated2 Property WALT3 % of Total ABR3 20 Office Southern Company 3525 & 3535 Colonnade Parkway Birmingham AL 669,400 Single-Tenant 100.0 % Office 2018 20.2 4.7 % 21 Office Keurig Dr. Pepper (53 South Ave) 53 South Avenue Boston MA 280,600 Single-Tenant 100.0 % Office 2014 5.9 4.4 % 22 Office Freeport McMoRan 333 N. Central Ave Phoenix AZ 249,000 Single-Tenant 100.0 % Office 2010 3.4 4.0 % 23 Office Maxar Technologies 1300 West 120th Avenue Denver CO 430,000 Single-Tenant 100.0 % Office 2002 6.5 3.9 % 24 Office LPL (1055 & 1060 LPL Way) 1055 & 1060 LPL Way Charlotte SC 307,200 Single-Tenant 100.0 % Office 2016 12.8 3.0 % 25 Office Travel & Leisure, Co. 14 Sylvan Way Northern New Jersey NJ 203,500 Single-Tenant 100.0 % Office 2013 5.7 3.0 % 26 Office IGT 6355 South Buffalo Drive Las Vegas NV 222,300 Single-Tenant 100.0 % Office 2008 7.0 2.6 % 27 Office International Paper 1740 International Drive Memphis TN 238,600 Single-Tenant 100.0 % Office 2015 — 4 2.6 % 28 Office Terraces at Copley Point 5887 Copley Drive San Diego CA 201,700 Multi-Tenant 70.3 % Office 2009 6.9 2.4 % 29 Office OnSemi (5701 N. Pima Road) 5701 N. Pima Road Phoenix AZ 133,400 Single-Tenant 100.0 % Office 2017 — 4 1.7 % 30 Office Zoetis 10 Sylvan Way Northern New Jersey NJ 125,700 Single-Tenant 100.0 % Office 2016 — 4 1.6 % 31 Office Mckesson (5801 N. Pima Road) 5801 North Pima Road Phoenix AZ 124,900 Single-Tenant 100.0 % Office 2019 — 4 1.6 % 32 Office McKesson (5601 N. Pima Road) 5601 N. Pima Road Phoenix AZ 138,200 Single-Tenant 100.0 % Office 2017 — 4 1.6 % 33 Office York Space Systems (East Village) 6060 South Willow Drive Denver CO 138,100 Single-Tenant 100.0 % Office/R&D 2020 8.0 1.5 % 34 Office 40 Wright 40 Wight Avenue Baltimore MD 132,200 Multi-Tenant 93.2 % Office 2017 8.8 1.5 % 35 Office Corteva Agriscience 8501 NW 62nd Ave Des Moines IA 184,300 Single-Tenant 100.0 % Office/Lab 2014 2.9 1.5 % 36 Office Keurig Dr. Pepper (63 South Ave) 63 South Avenue Boston MA 150,700 Single-Tenant 100.0 % Office/Lab/R&D 2013 5.9 1.5 % 37 Office LPL (1040 LPL Way) 1040 LPL Way Charlotte SC 144,400 Single-Tenant 100.0 % Office 2016 12.8 1.4 % 38 Office Toshiba TEC 3901 South Miami Boulevard Raleigh/Durham NC 200,800 Single-Tenant 100.0 % Office 2016 4.3 1.4 % 39 Office Avnet (Phoenix) 2211 S 47th Street Phoenix AZ 176,400 Single-Tenant 100.0 % Office 1997 2.7 1.4 % Property List (continued) As of December 31, 2023 (1) Total calculated as a weighted average based on rentable square feet. (2) Year shown is either the year built or year substantially renovated. (3) Total calculated as a weighted average based on ABR. (4) Lease restricts certain disclosures.

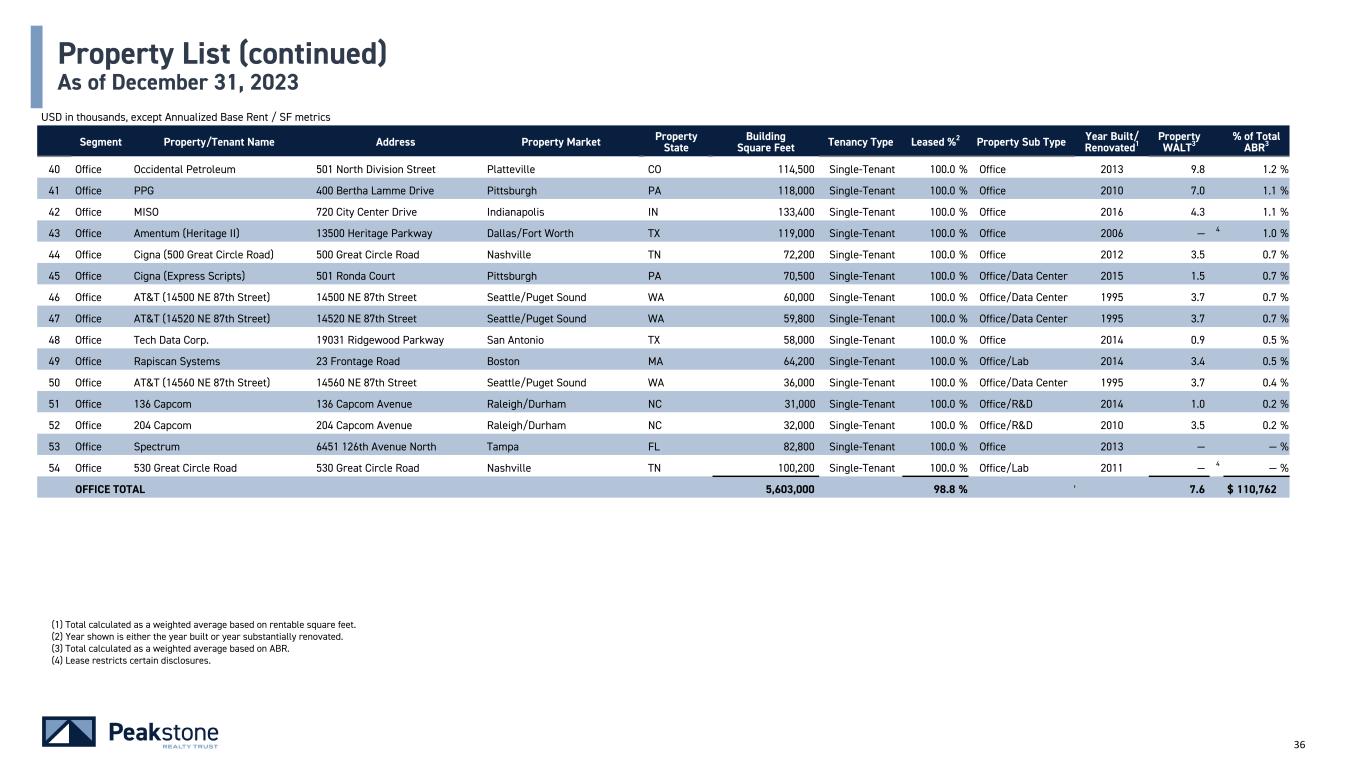

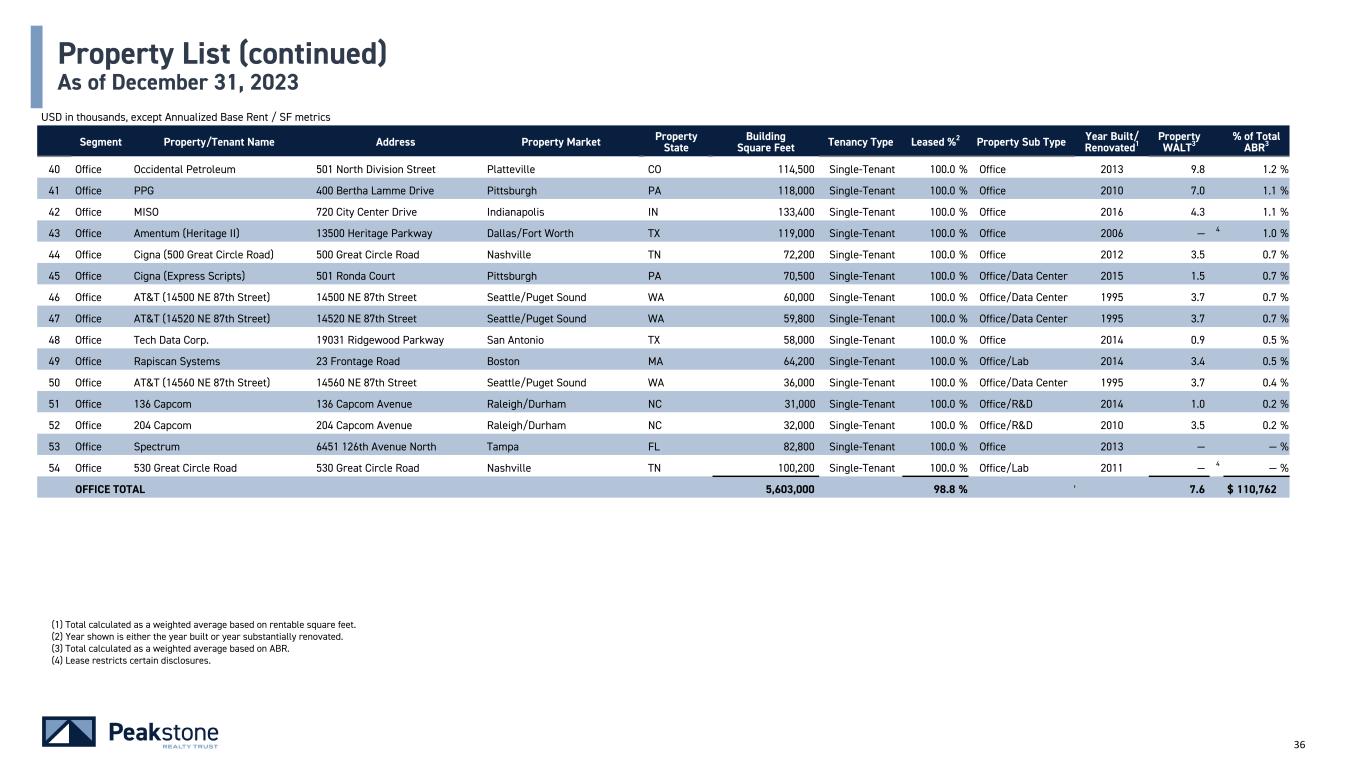

36 USD in thousands, except Annualized Base Rent / SF metrics Segment Property/Tenant Name Address Property Market Property State Building Square Feet Tenancy Type Leased %2 Property Sub Type Year Built/ Renovated1 Property WALT3 % of Total ABR3 40 Office Occidental Petroleum 501 North Division Street Platteville CO 114,500 Single-Tenant 100.0 % Office 2013 9.8 1.2 % 41 Office PPG 400 Bertha Lamme Drive Pittsburgh PA 118,000 Single-Tenant 100.0 % Office 2010 7.0 1.1 % 42 Office MISO 720 City Center Drive Indianapolis IN 133,400 Single-Tenant 100.0 % Office 2016 4.3 1.1 % 43 Office Amentum (Heritage II) 13500 Heritage Parkway Dallas/Fort Worth TX 119,000 Single-Tenant 100.0 % Office 2006 — 4 1.0 % 44 Office Cigna (500 Great Circle Road) 500 Great Circle Road Nashville TN 72,200 Single-Tenant 100.0 % Office 2012 3.5 0.7 % 45 Office Cigna (Express Scripts) 501 Ronda Court Pittsburgh PA 70,500 Single-Tenant 100.0 % Office/Data Center 2015 1.5 0.7 % 46 Office AT&T (14500 NE 87th Street) 14500 NE 87th Street Seattle/Puget Sound WA 60,000 Single-Tenant 100.0 % Office/Data Center 1995 3.7 0.7 % 47 Office AT&T (14520 NE 87th Street) 14520 NE 87th Street Seattle/Puget Sound WA 59,800 Single-Tenant 100.0 % Office/Data Center 1995 3.7 0.7 % 48 Office Tech Data Corp. 19031 Ridgewood Parkway San Antonio TX 58,000 Single-Tenant 100.0 % Office 2014 0.9 0.5 % 49 Office Rapiscan Systems 23 Frontage Road Boston MA 64,200 Single-Tenant 100.0 % Office/Lab 2014 3.4 0.5 % 50 Office AT&T (14560 NE 87th Street) 14560 NE 87th Street Seattle/Puget Sound WA 36,000 Single-Tenant 100.0 % Office/Data Center 1995 3.7 0.4 % 51 Office 136 Capcom 136 Capcom Avenue Raleigh/Durham NC 31,000 Single-Tenant 100.0 % Office/R&D 2014 1.0 0.2 % 52 Office 204 Capcom 204 Capcom Avenue Raleigh/Durham NC 32,000 Single-Tenant 100.0 % Office/R&D 2010 3.5 0.2 % 53 Office Spectrum 6451 126th Avenue North Tampa FL 82,800 Single-Tenant 100.0 % Office 2013 — — % 54 Office 530 Great Circle Road 530 Great Circle Road Nashville TN 100,200 Single-Tenant 100.0 % Office/Lab 2011 — 4 — % OFFICE TOTAL 5,603,000 98.8 % 7.7 7.6 $ 110,762 Property List (continued) As of December 31, 2023 (1) Total calculated as a weighted average based on rentable square feet. (2) Year shown is either the year built or year substantially renovated. (3) Total calculated as a weighted average based on ABR. (4) Lease restricts certain disclosures.

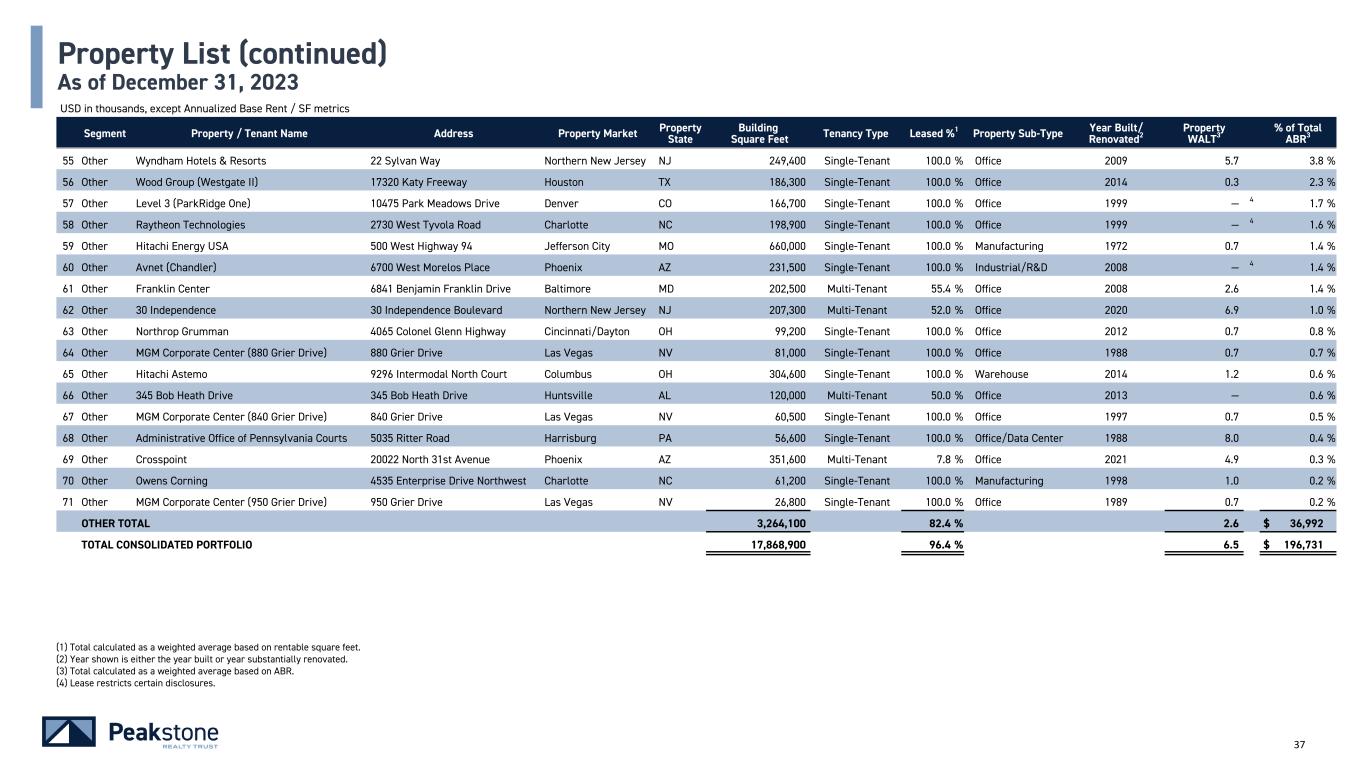

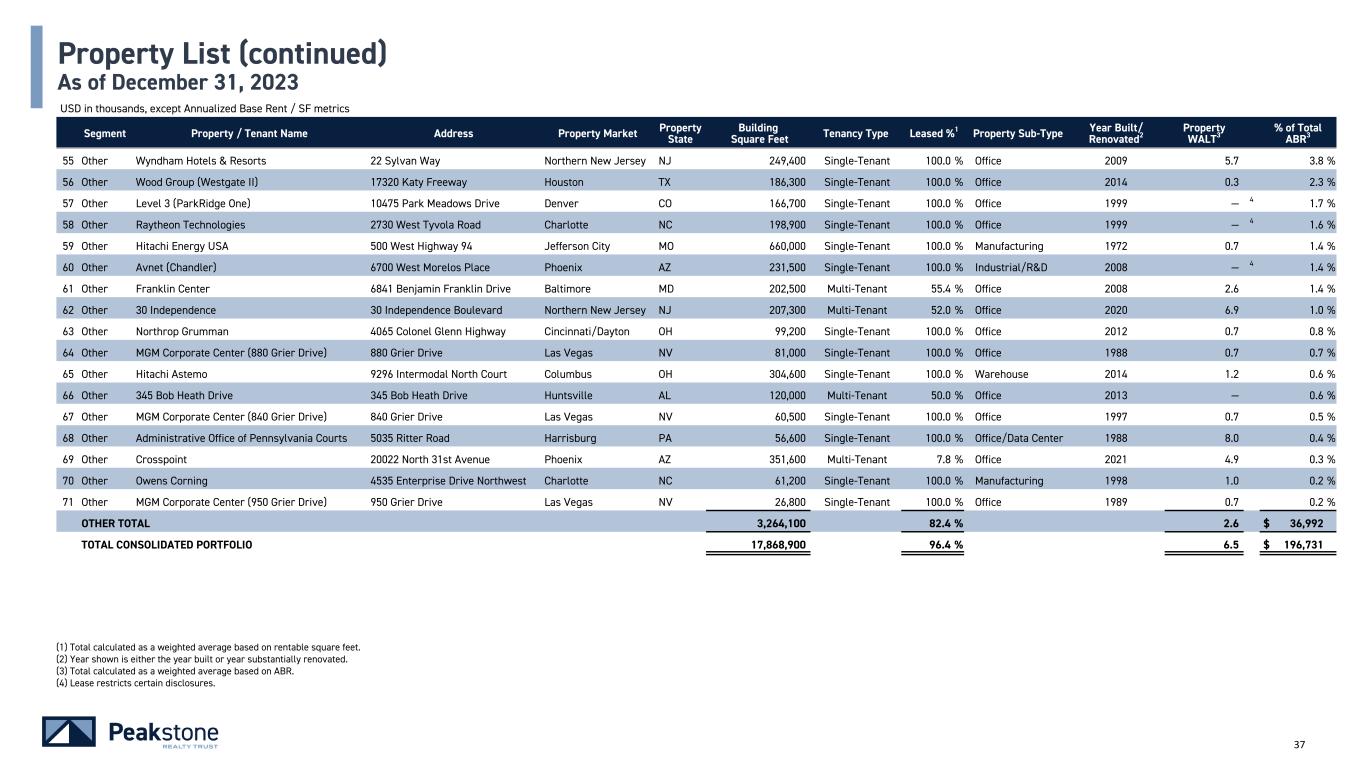

37 Property List (continued) As of December 31, 2023 USD in thousands, except Annualized Base Rent / SF metrics Segment Property / Tenant Name Address Property Market Property State Building Square Feet Tenancy Type Leased %1 Property Sub-Type Year Built/ Renovated2 Property WALT3 % of Total ABR3 55 Other Wyndham Hotels & Resorts 22 Sylvan Way Northern New Jersey NJ 249,400 Single-Tenant 100.0 % Office 2009 5.7 3.8 % 56 Other Wood Group (Westgate II) 17320 Katy Freeway Houston TX 186,300 Single-Tenant 100.0 % Office 2014 0.3 2.3 % 57 Other Level 3 (ParkRidge One) 10475 Park Meadows Drive Denver CO 166,700 Single-Tenant 100.0 % Office 1999 — 4 1.7 % 58 Other Raytheon Technologies 2730 West Tyvola Road Charlotte NC 198,900 Single-Tenant 100.0 % Office 1999 — 4 1.6 % 59 Other Hitachi Energy USA 500 West Highway 94 Jefferson City MO 660,000 Single-Tenant 100.0 % Manufacturing 1972 0.7 1.4 % 60 Other Avnet (Chandler) 6700 West Morelos Place Phoenix AZ 231,500 Single-Tenant 100.0 % Industrial/R&D 2008 — 4 1.4 % 61 Other Franklin Center 6841 Benjamin Franklin Drive Baltimore MD 202,500 Multi-Tenant 55.4 % Office 2008 2.6 1.4 % 62 Other 30 Independence 30 Independence Boulevard Northern New Jersey NJ 207,300 Multi-Tenant 52.0 % Office 2020 6.9 1.0 % 63 Other Northrop Grumman 4065 Colonel Glenn Highway Cincinnati/Dayton OH 99,200 Single-Tenant 100.0 % Office 2012 0.7 0.8 % 64 Other MGM Corporate Center (880 Grier Drive) 880 Grier Drive Las Vegas NV 81,000 Single-Tenant 100.0 % Office 1988 0.7 0.7 % 65 Other Hitachi Astemo 9296 Intermodal North Court Columbus OH 304,600 Single-Tenant 100.0 % Warehouse 2014 1.2 0.6 % 66 Other 345 Bob Heath Drive 345 Bob Heath Drive Huntsville AL 120,000 Multi-Tenant 50.0 % Office 2013 — 0.6 % 67 Other MGM Corporate Center (840 Grier Drive) 840 Grier Drive Las Vegas NV 60,500 Single-Tenant 100.0 % Office 1997 0.7 0.5 % 68 Other Administrative Office of Pennsylvania Courts 5035 Ritter Road Harrisburg PA 56,600 Single-Tenant 100.0 % Office/Data Center 1988 8.0 0.4 % 69 Other Crosspoint 20022 North 31st Avenue Phoenix AZ 351,600 Multi-Tenant 7.8 % Office 2021 4.9 0.3 % 70 Other Owens Corning 4535 Enterprise Drive Northwest Charlotte NC 61,200 Single-Tenant 100.0 % Manufacturing 1998 1.0 0.2 % 71 Other MGM Corporate Center (950 Grier Drive) 950 Grier Drive Las Vegas NV 26,800 Single-Tenant 100.0 % Office 1989 0.7 0.2 % OTHER TOTAL 3,264,100 82.4 % 2.6 $ 36,992 TOTAL CONSOLIDATED PORTFOLIO 17,868,900 96.4 % 6.5 $ 196,731 (1) Total calculated as a weighted average based on rentable square feet. (2) Year shown is either the year built or year substantially renovated. (3) Total calculated as a weighted average based on ABR. (4) Lease restricts certain disclosures.

Portfolio Characteristics

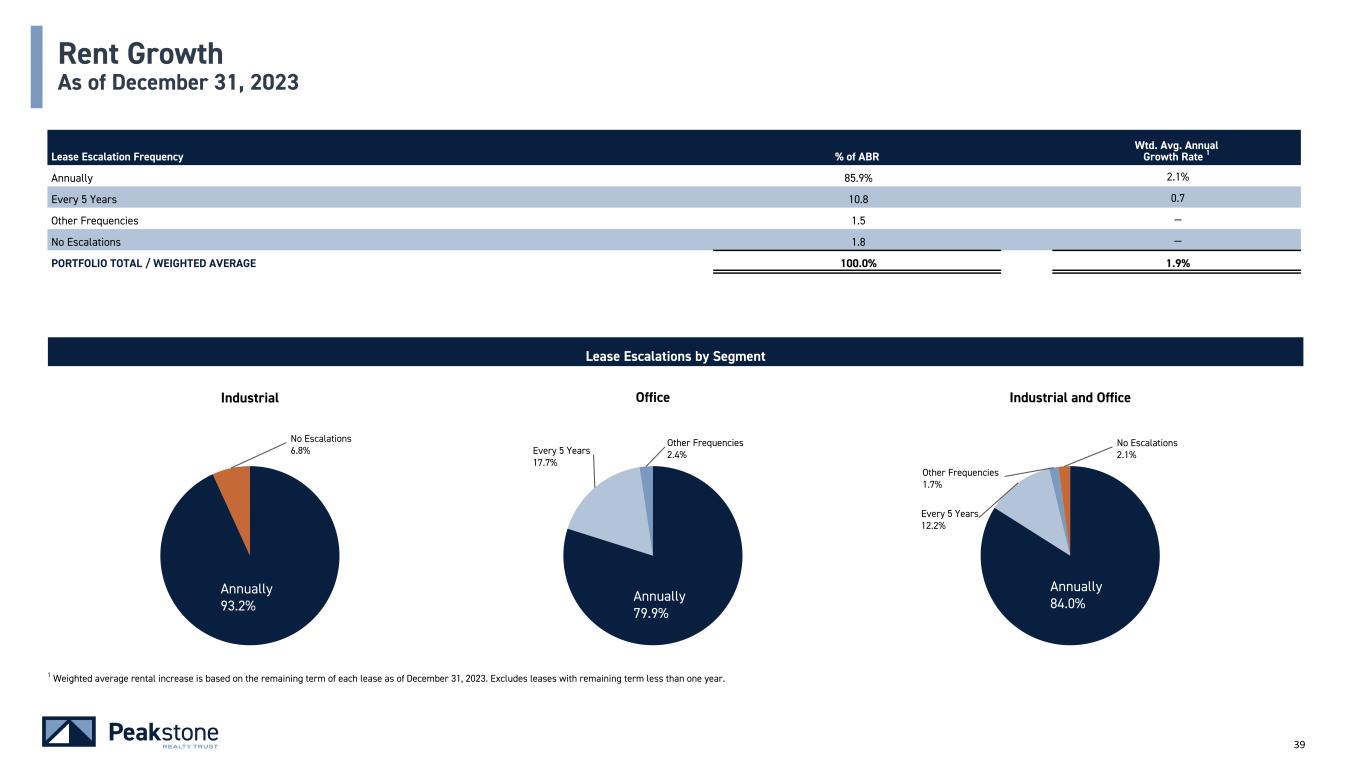

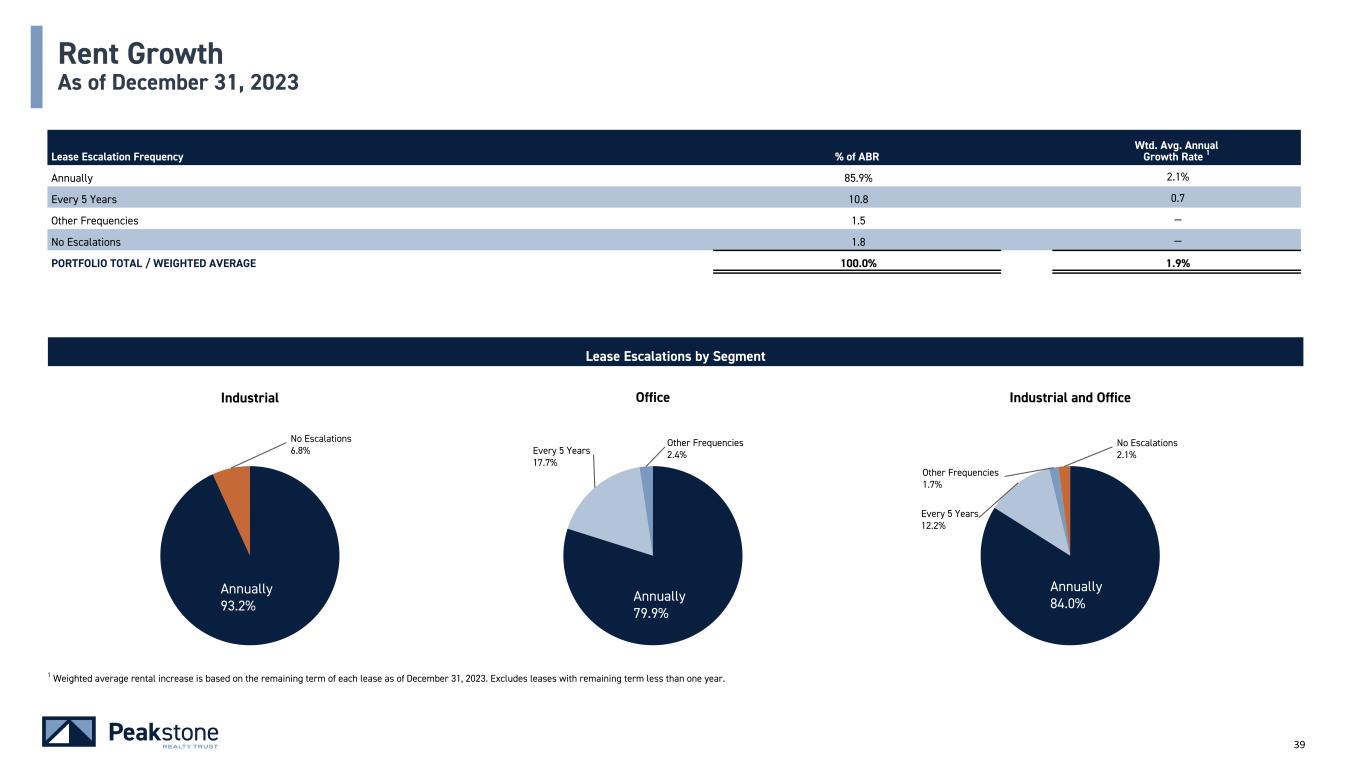

39 1 Weighted average rental increase is based on the remaining term of each lease as of December 31, 2023. Excludes leases with remaining term less than one year. Lease Escalation Frequency % of ABR Wtd. Avg. Annual Growth Rate 1 Annually 85.9% 2.1% Every 5 Years 10.8 0.7 Other Frequencies 1.5 — No Escalations 1.8 — PORTFOLIO TOTAL / WEIGHTED AVERAGE 100.0% 1.9% Rent Growth As of December 31, 2023 Annually 84.0% Every 5 Years 12.2% Other Frequencies 1.7% No Escalations 2.1% Annually 93.2% No Escalations 6.8% Annually 79.9% Every 5 Years 17.7% Other Frequencies 2.4% Industrial Industrial and OfficeOffice Lease Escalations by Segment

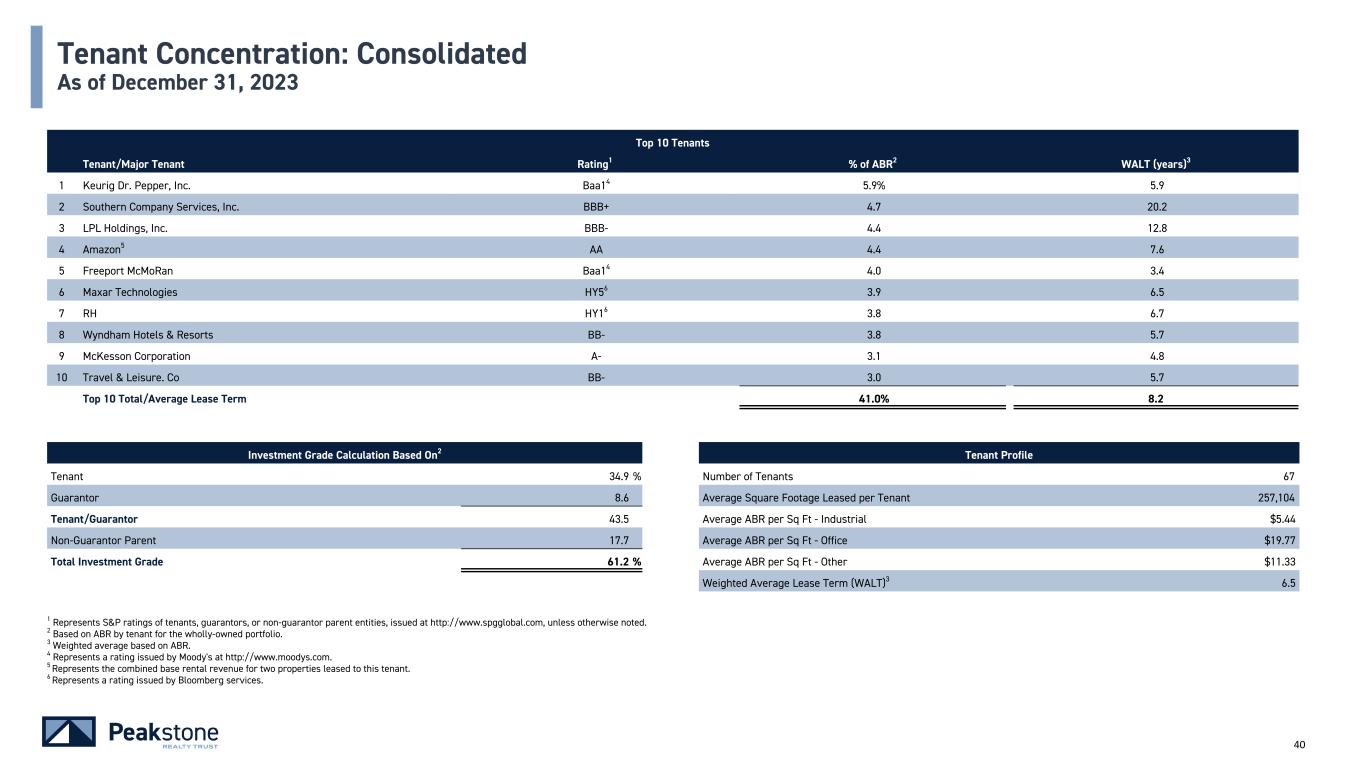

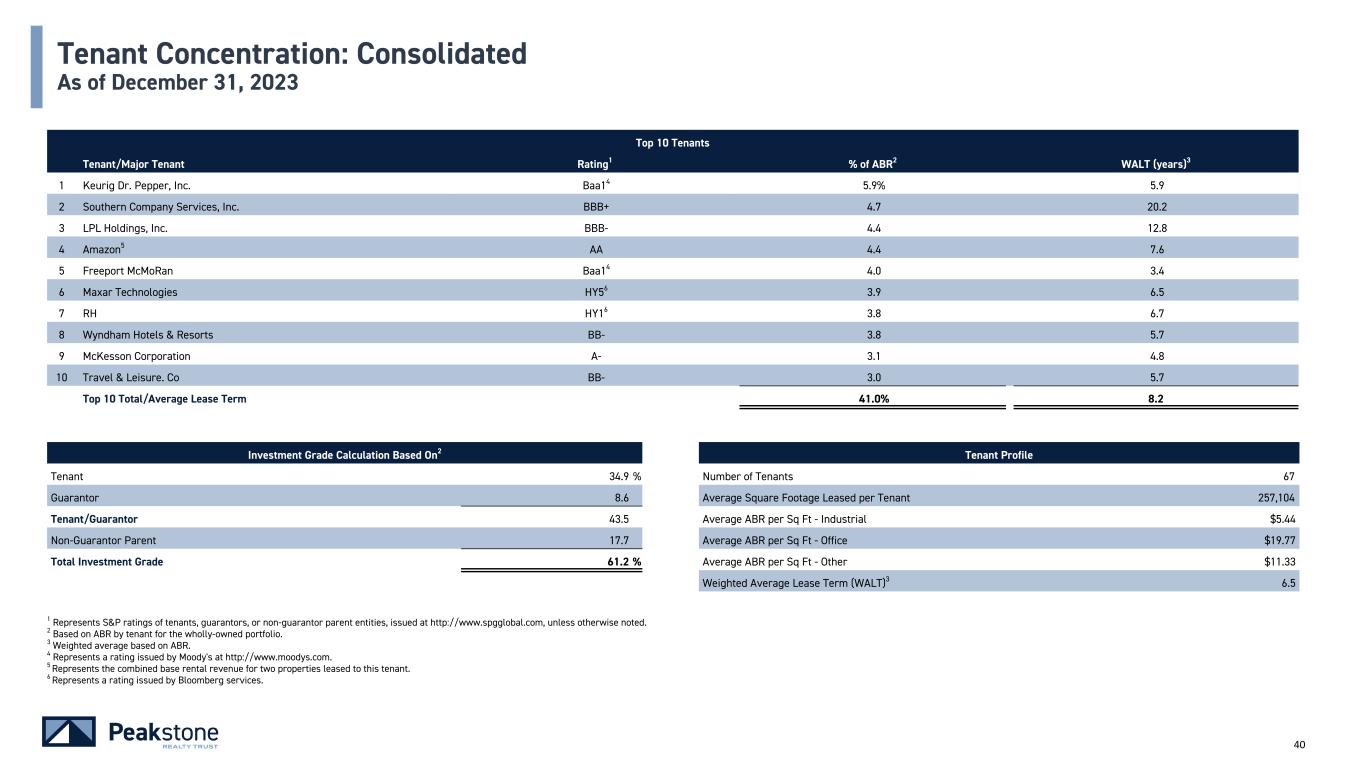

40 Top 10 Tenants Tenant/Major Tenant Rating1 % of ABR2 WALT (years)3 1 Keurig Dr. Pepper, Inc. Baa14 5.9% 5.9 2 Southern Company Services, Inc. BBB+ 4.7 20.2 3 LPL Holdings, Inc. BBB- 4.4 12.8 4 Amazon5 AA 4.4 7.6 5 Freeport McMoRan Baa14 4.0 3.4 6 Maxar Technologies HY56 3.9 6.5 7 RH HY16 3.8 6.7 8 Wyndham Hotels & Resorts BB- 3.8 5.7 9 McKesson Corporation A- 3.1 4.8 10 Travel & Leisure. Co BB- 3.0 5.7 Top 10 Total/Average Lease Term 41.0% 8.2 Investment Grade Calculation Based On2 Tenant Profile Tenant 34.9 % Number of Tenants 67 Guarantor 8.6 Average Square Footage Leased per Tenant 257,104 Tenant/Guarantor 43.5 Average ABR per Sq Ft - Industrial $5.44 Non-Guarantor Parent 17.7 Average ABR per Sq Ft - Office $19.77 Total Investment Grade 61.2 % Average ABR per Sq Ft - Other $11.33 Weighted Average Lease Term (WALT)3 6.5 Tenant Concentration: Consolidated As of December 31, 2023 1 Represents S&P ratings of tenants, guarantors, or non-guarantor parent entities, issued at http://www.spgglobal.com, unless otherwise noted. 2 Based on ABR by tenant for the wholly-owned portfolio. 3 Weighted average based on ABR. 4 Represents a rating issued by Moody's at http://www.moodys.com. 5 Represents the combined base rental revenue for two properties leased to this tenant. 6 Represents a rating issued by Bloomberg services.

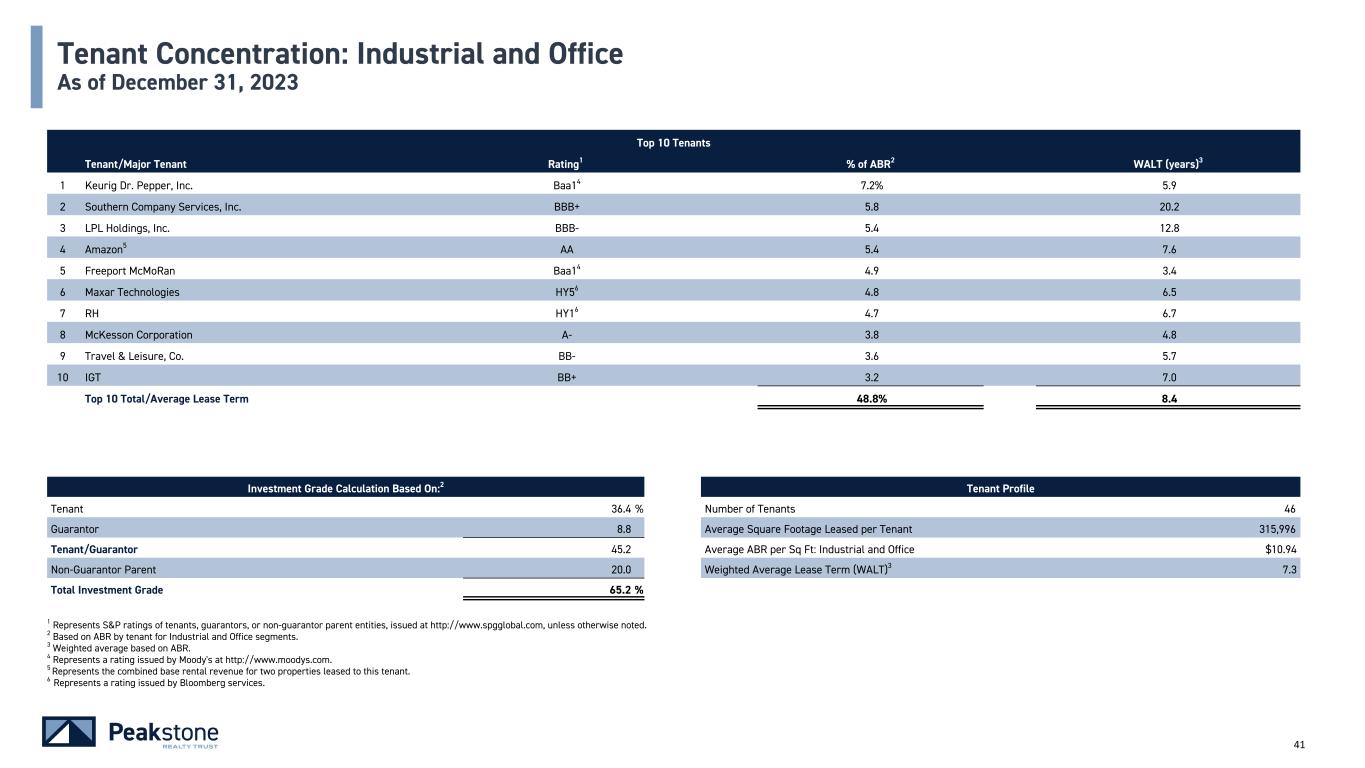

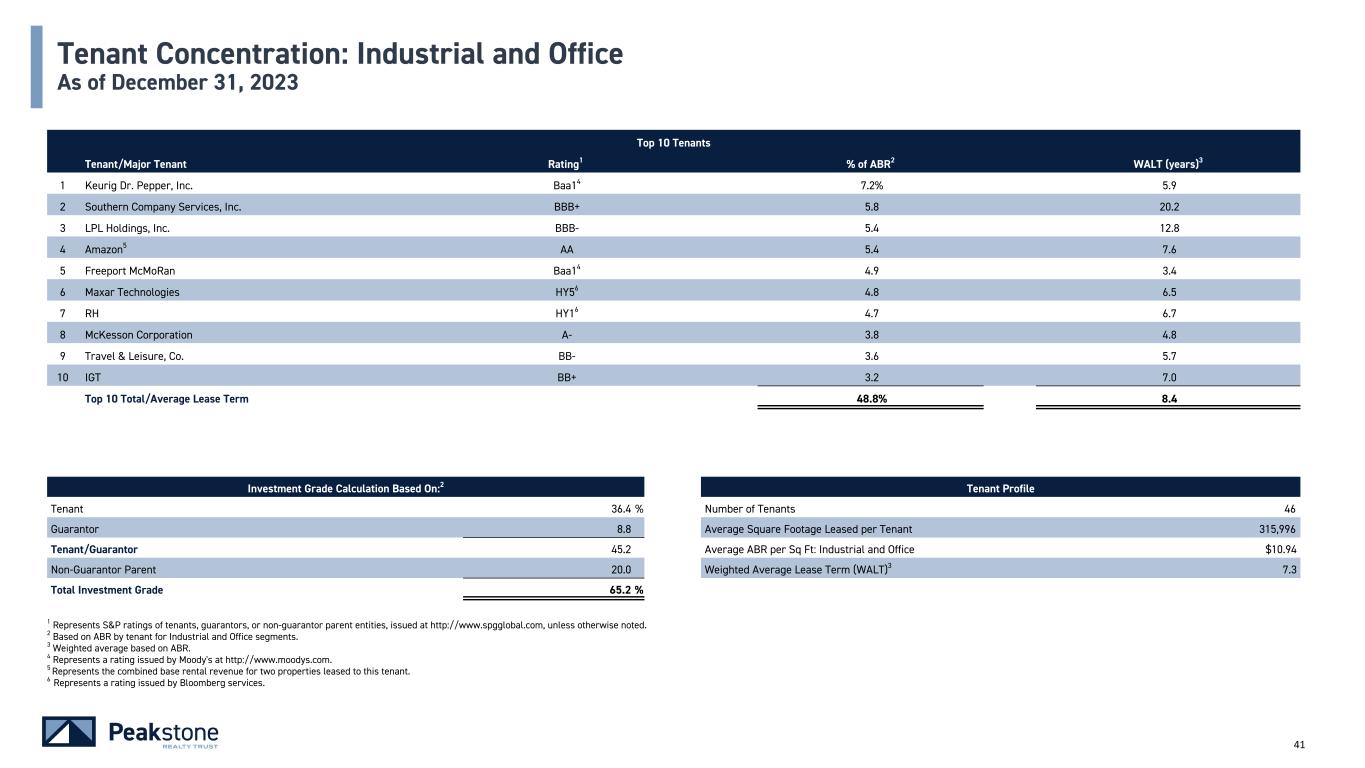

41 Top 10 Tenants Tenant/Major Tenant Rating1 % of ABR2 WALT (years)3 1 Keurig Dr. Pepper, Inc. Baa14 7.2% 5.9 2 Southern Company Services, Inc. BBB+ 5.8 20.2 3 LPL Holdings, Inc. BBB- 5.4 12.8 4 Amazon5 AA 5.4 7.6 5 Freeport McMoRan Baa14 4.9 3.4 6 Maxar Technologies HY56 4.8 6.5 7 RH HY16 4.7 6.7 8 McKesson Corporation A- 3.8 4.8 9 Travel & Leisure, Co. BB- 3.6 5.7 10 IGT BB+ 3.2 7.0 Top 10 Total/Average Lease Term 48.8% 8.4 Investment Grade Calculation Based On:2 Tenant Profile Tenant 36.4 % Number of Tenants 46 Guarantor 8.8 Average Square Footage Leased per Tenant 315,996 Tenant/Guarantor 45.2 Average ABR per Sq Ft: Industrial and Office $10.94 Non-Guarantor Parent 20.0 Weighted Average Lease Term (WALT)3 7.3 Total Investment Grade 65.2 % Tenant Concentration: Industrial and Office As of December 31, 2023 1 Represents S&P ratings of tenants, guarantors, or non-guarantor parent entities, issued at http://www.spgglobal.com, unless otherwise noted. 2 Based on ABR by tenant for Industrial and Office segments. 3 Weighted average based on ABR. 4 Represents a rating issued by Moody's at http://www.moodys.com. 5 Represents the combined base rental revenue for two properties leased to this tenant. 6 Represents a rating issued by Bloomberg services.

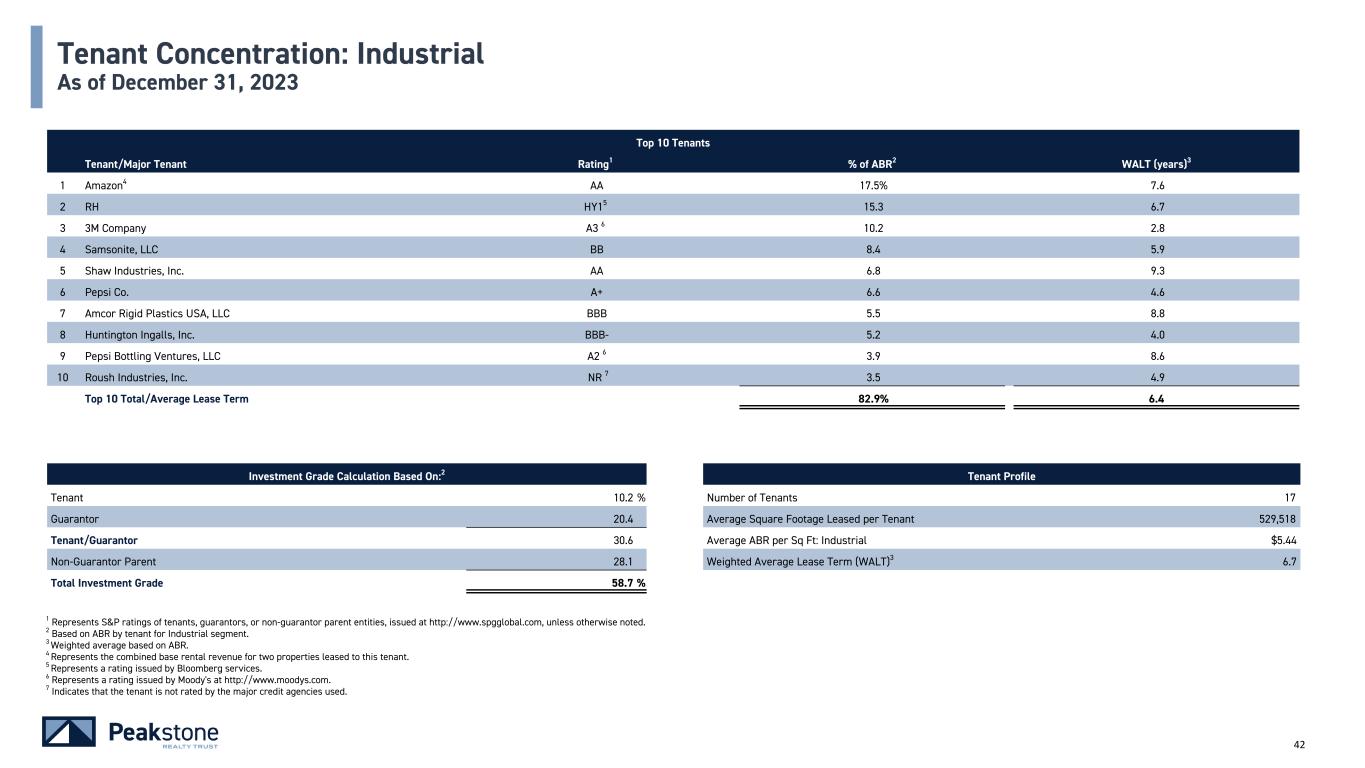

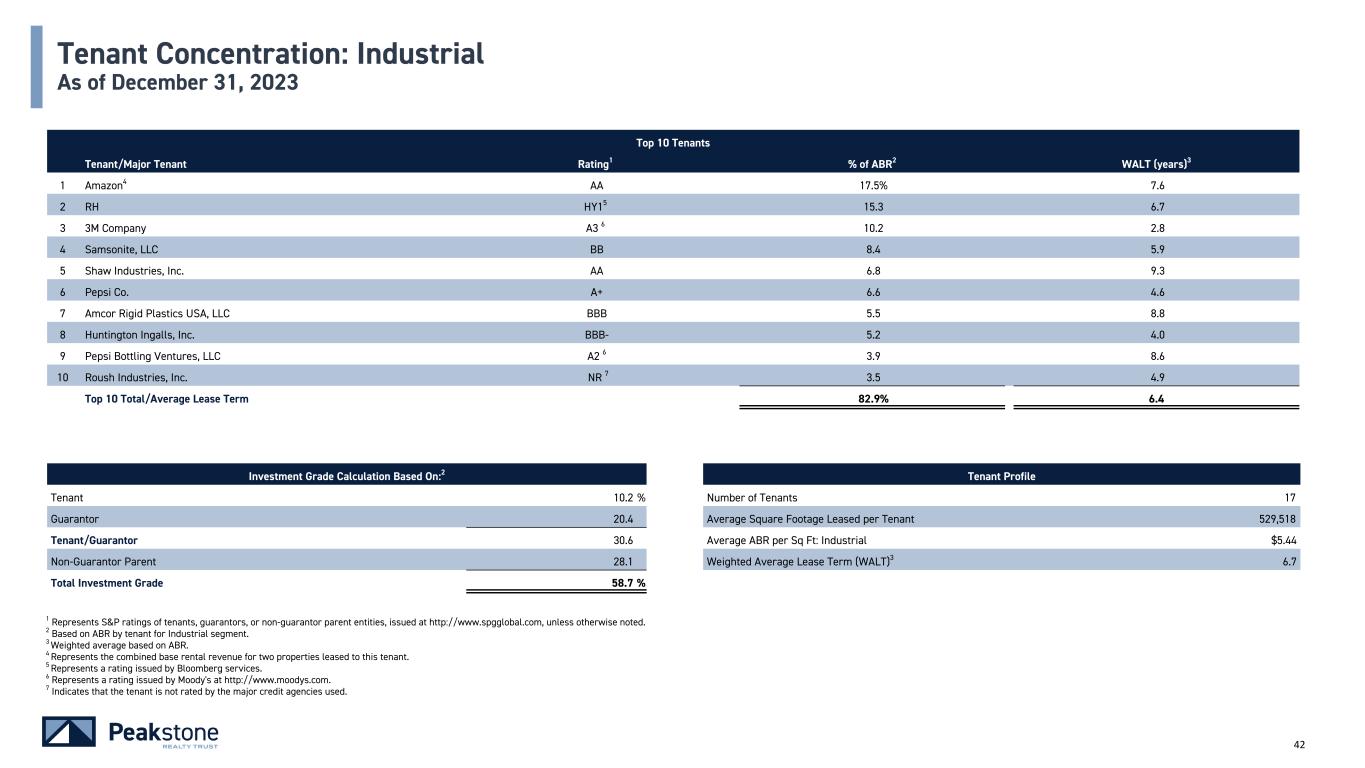

42 Top 10 Tenants Tenant/Major Tenant Rating1 % of ABR2 WALT (years)3 1 Amazon4 AA 17.5% 7.6 2 RH HY15 15.3 6.7 3 3M Company A3 6 10.2 2.8 4 Samsonite, LLC BB 8.4 5.9 5 Shaw Industries, Inc. AA 6.8 9.3 6 Pepsi Co. A+ 6.6 4.6 7 Amcor Rigid Plastics USA, LLC BBB 5.5 8.8 8 Huntington Ingalls, Inc. BBB- 5.2 4.0 9 Pepsi Bottling Ventures, LLC A2 6 3.9 8.6 10 Roush Industries, Inc. NR 7 3.5 4.9 Top 10 Total/Average Lease Term 82.9% 6.4 Investment Grade Calculation Based On:2 Tenant Profile Tenant 10.2 % Number of Tenants 17 Guarantor 20.4 Average Square Footage Leased per Tenant 529,518 Tenant/Guarantor 30.6 Average ABR per Sq Ft: Industrial $5.44 Non-Guarantor Parent 28.1 Weighted Average Lease Term (WALT)3 6.7 Total Investment Grade 58.7 % Tenant Concentration: Industrial As of December 31, 2023 1 Represents S&P ratings of tenants, guarantors, or non-guarantor parent entities, issued at http://www.spgglobal.com, unless otherwise noted. 2 Based on ABR by tenant for Industrial segment. 3 Weighted average based on ABR. 4 Represents the combined base rental revenue for two properties leased to this tenant. 5 Represents a rating issued by Bloomberg services. 6 Represents a rating issued by Moody's at http://www.moodys.com. 7 Indicates that the tenant is not rated by the major credit agencies used.

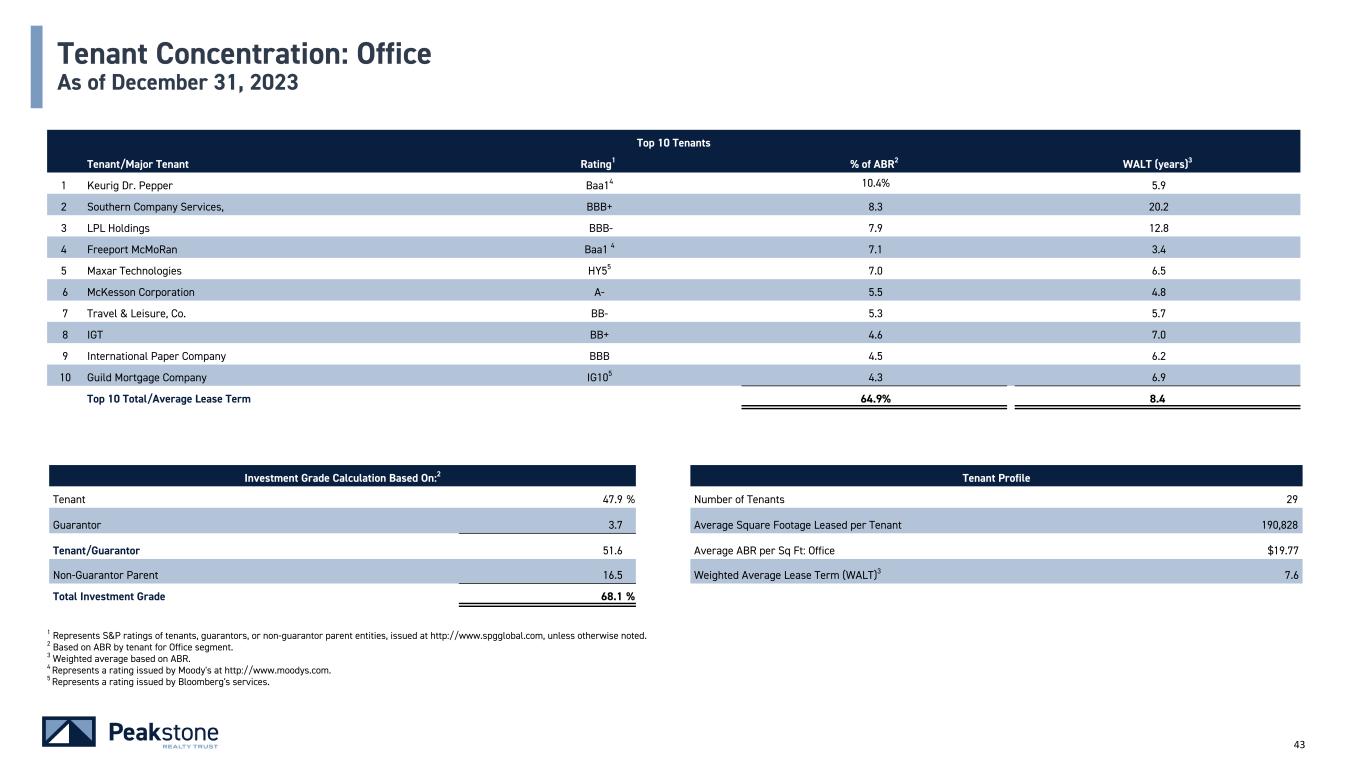

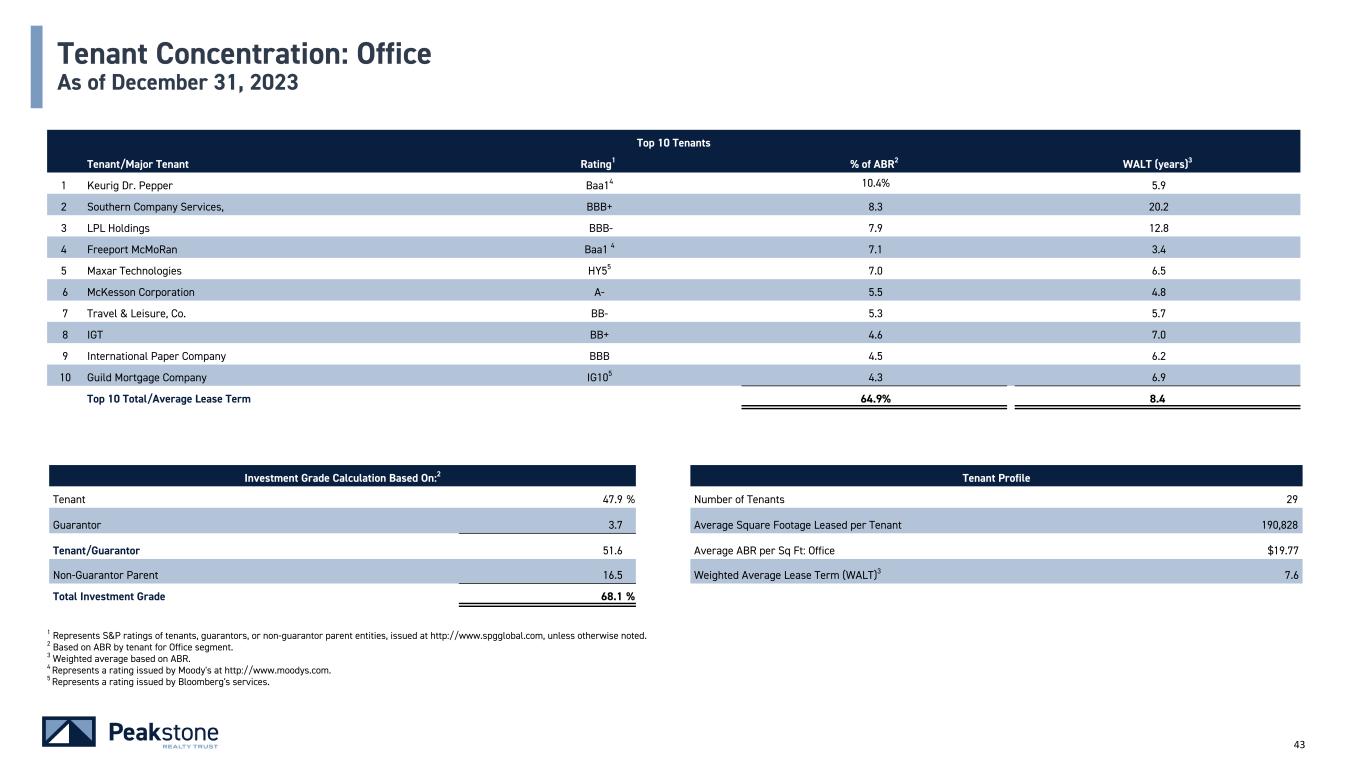

43 Top 10 Tenants Tenant/Major Tenant Rating1 % of ABR2 WALT (years)3 1 Keurig Dr. Pepper Baa14 10.4% 5.9 2 Southern Company Services, BBB+ 8.3 20.2 3 LPL Holdings BBB- 7.9 12.8 4 Freeport McMoRan Baa1 4 7.1 3.4 5 Maxar Technologies HY55 7.0 6.5 6 McKesson Corporation A- 5.5 4.8 7 Travel & Leisure, Co. BB- 5.3 5.7 8 IGT BB+ 4.6 7.0 9 International Paper Company BBB 4.5 6.2 10 Guild Mortgage Company IG105 4.3 6.9 Top 10 Total/Average Lease Term 64.9% 8.4 Investment Grade Calculation Based On:2 Tenant Profile Tenant 47.9 % Number of Tenants 29 Guarantor 3.7 Average Square Footage Leased per Tenant 190,828 Tenant/Guarantor 51.6 Average ABR per Sq Ft: Office $19.77 Non-Guarantor Parent 16.5 Weighted Average Lease Term (WALT)3 7.6 Total Investment Grade 68.1 % Tenant Concentration: Office As of December 31, 2023 1 Represents S&P ratings of tenants, guarantors, or non-guarantor parent entities, issued at http://www.spgglobal.com, unless otherwise noted. 2 Based on ABR by tenant for Office segment. 3 Weighted average based on ABR. 4 Represents a rating issued by Moody's at http://www.moodys.com. 5 Represents a rating issued by Bloomberg's services.

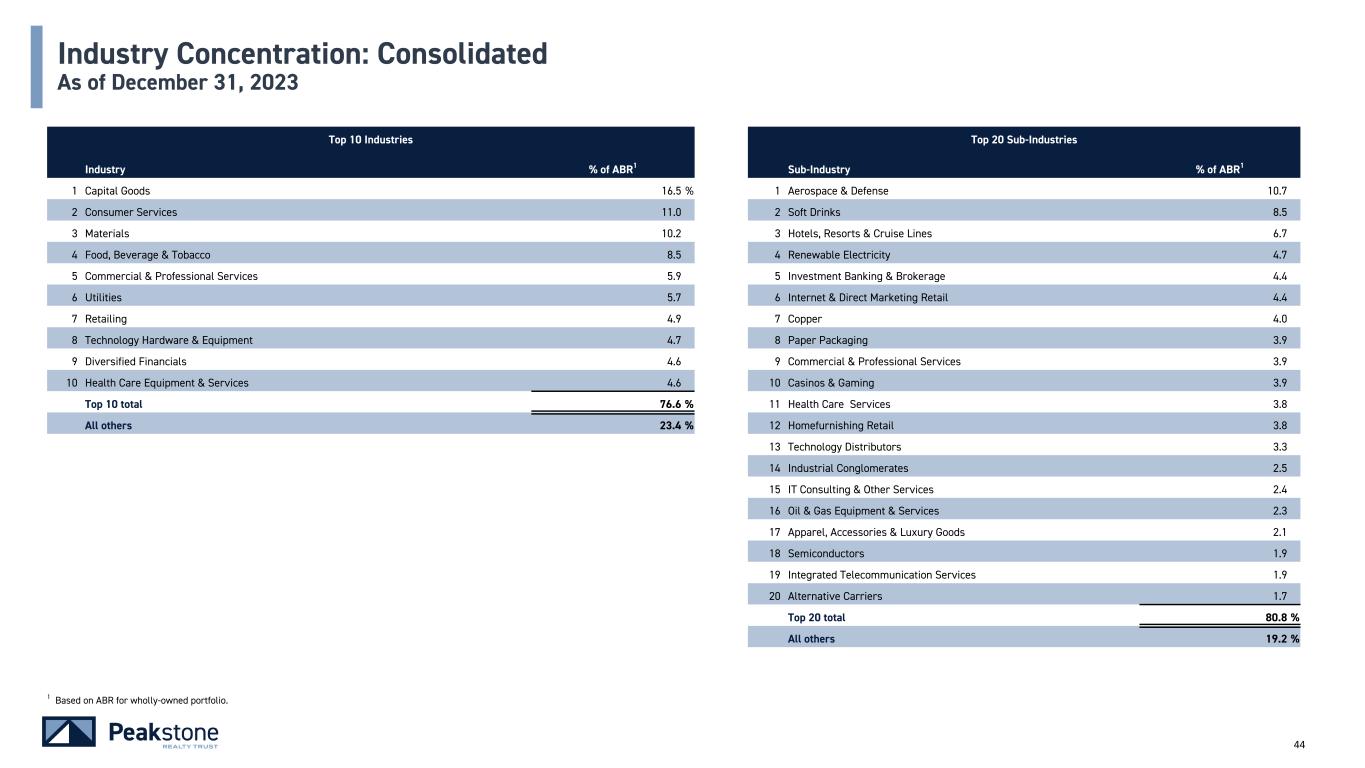

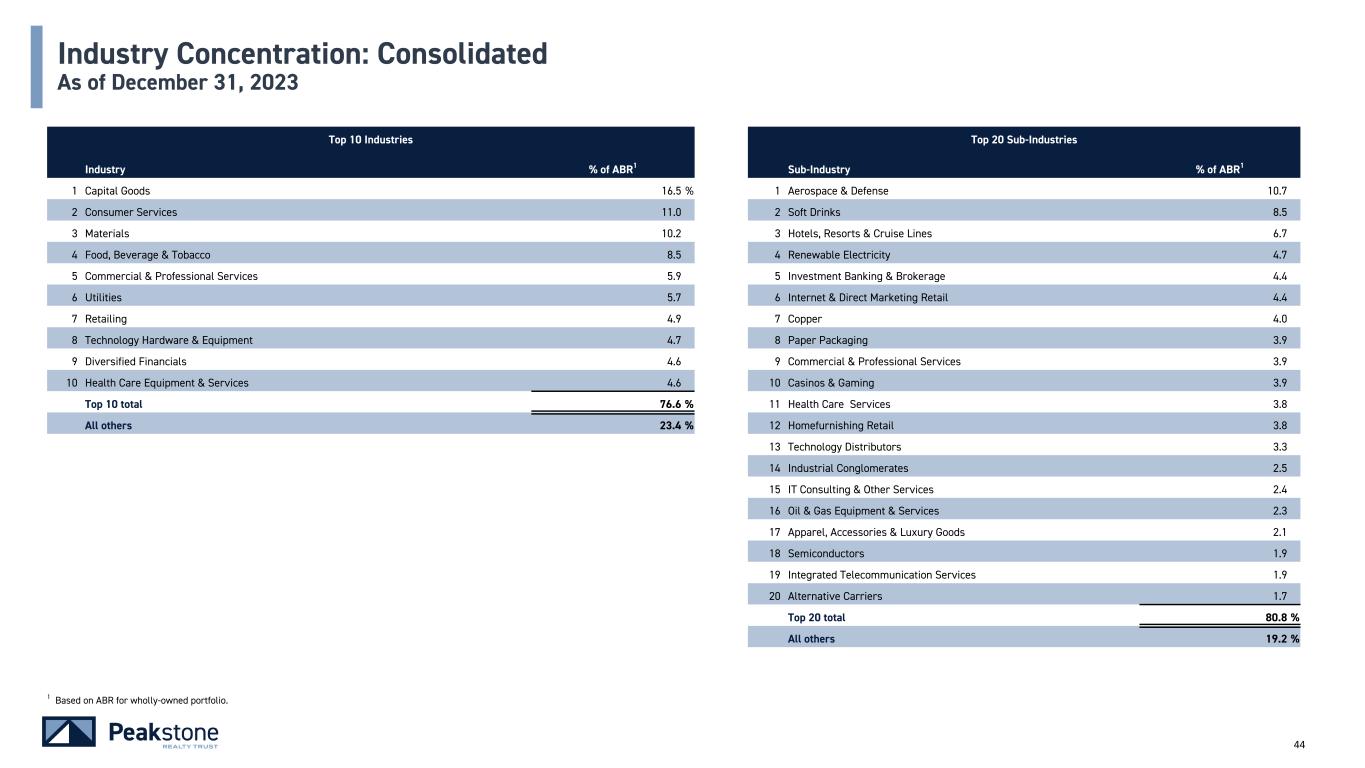

44 Industry Concentration: Consolidated As of December 31, 2023 Top 10 Industries Top 20 Sub-Industries Industry % of ABR1 Sub-Industry % of ABR1 1 Capital Goods 16.5 % 1 Aerospace & Defense 10.7 2 Consumer Services 11.0 2 Soft Drinks 8.5 3 Materials 10.2 3 Hotels, Resorts & Cruise Lines 6.7 4 Food, Beverage & Tobacco 8.5 4 Renewable Electricity 4.7 5 Commercial & Professional Services 5.9 5 Investment Banking & Brokerage 4.4 6 Utilities 5.7 6 Internet & Direct Marketing Retail 4.4 7 Retailing 4.9 7 Copper 4.0 8 Technology Hardware & Equipment 4.7 8 Paper Packaging 3.9 9 Diversified Financials 4.6 9 Commercial & Professional Services 3.9 10 Health Care Equipment & Services 4.6 10 Casinos & Gaming 3.9 Top 10 total 76.6 % 11 Health Care Services 3.8 All others 23.4 % 12 Homefurnishing Retail 3.8 13 Technology Distributors 3.3 14 Industrial Conglomerates 2.5 15 IT Consulting & Other Services 2.4 16 Oil & Gas Equipment & Services 2.3 17 Apparel, Accessories & Luxury Goods 2.1 18 Semiconductors 1.9 19 Integrated Telecommunication Services 1.9 20 Alternative Carriers 1.7 Top 20 total 80.8 % All others 19.2 % 1 Based on ABR for wholly-owned portfolio.

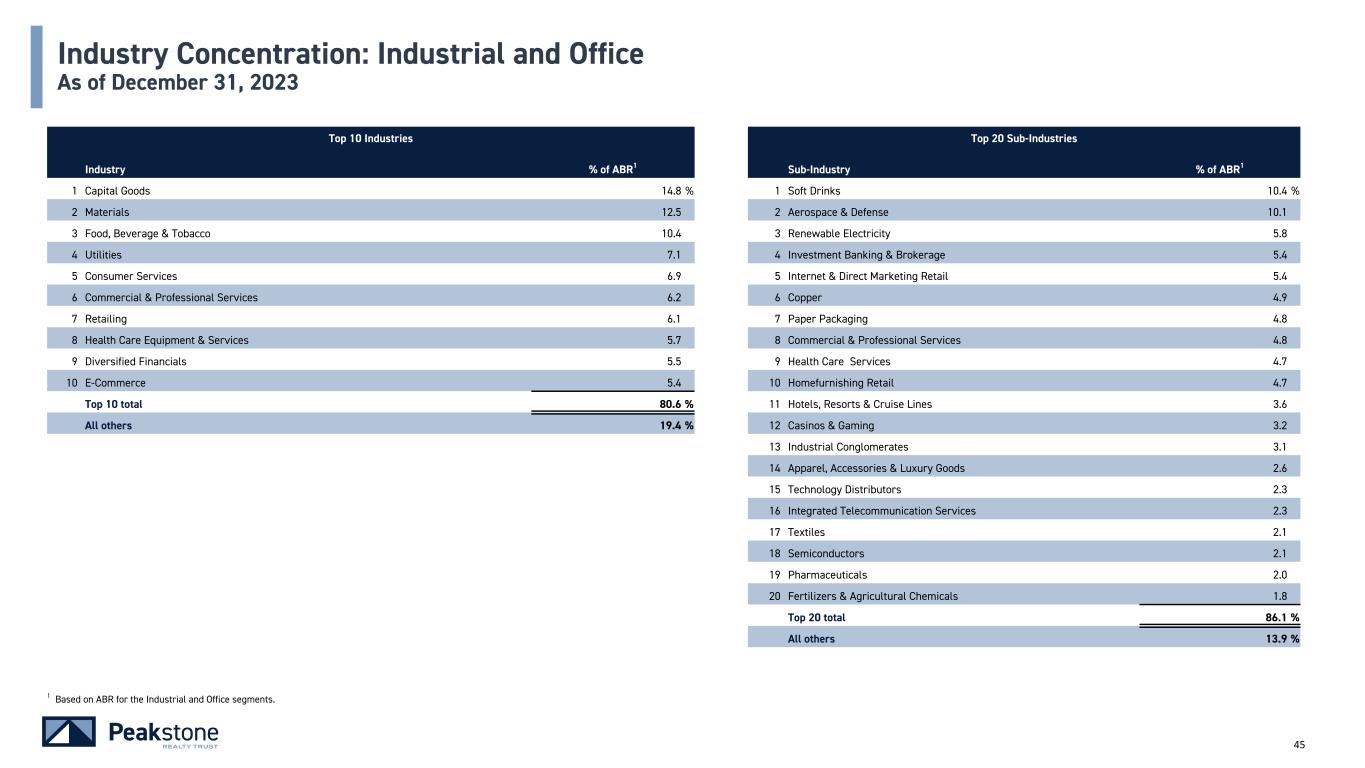

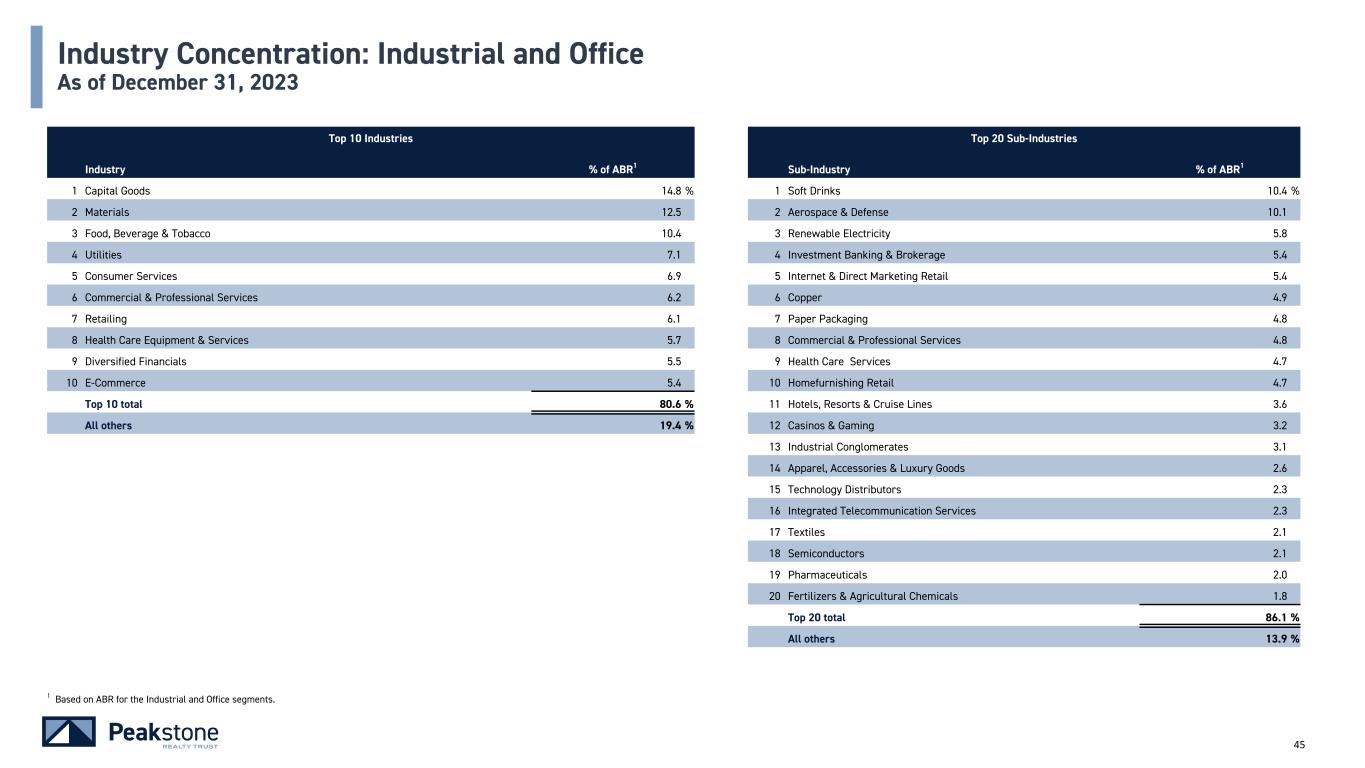

45 Industry Concentration: Industrial and Office As of December 31, 2023 Top 10 Industries Top 20 Sub-Industries Industry % of ABR1 Sub-Industry % of ABR1 1 Capital Goods 14.8 % 1 Soft Drinks 10.4 % 2 Materials 12.5 2 Aerospace & Defense 10.1 3 Food, Beverage & Tobacco 10.4 3 Renewable Electricity 5.8 4 Utilities 7.1 4 Investment Banking & Brokerage 5.4 5 Consumer Services 6.9 5 Internet & Direct Marketing Retail 5.4 6 Commercial & Professional Services 6.2 6 Copper 4.9 7 Retailing 6.1 7 Paper Packaging 4.8 8 Health Care Equipment & Services 5.7 8 Commercial & Professional Services 4.8 9 Diversified Financials 5.5 9 Health Care Services 4.7 10 E-Commerce 5.4 10 Homefurnishing Retail 4.7 Top 10 total 80.6 % 11 Hotels, Resorts & Cruise Lines 3.6 All others 19.4 % 12 Casinos & Gaming 3.2 13 Industrial Conglomerates 3.1 14 Apparel, Accessories & Luxury Goods 2.6 15 Technology Distributors 2.3 16 Integrated Telecommunication Services 2.3 17 Textiles 2.1 18 Semiconductors 2.1 19 Pharmaceuticals 2.0 20 Fertilizers & Agricultural Chemicals 1.8 Top 20 total 86.1 % All others 13.9 % 1 Based on ABR for the Industrial and Office segments.

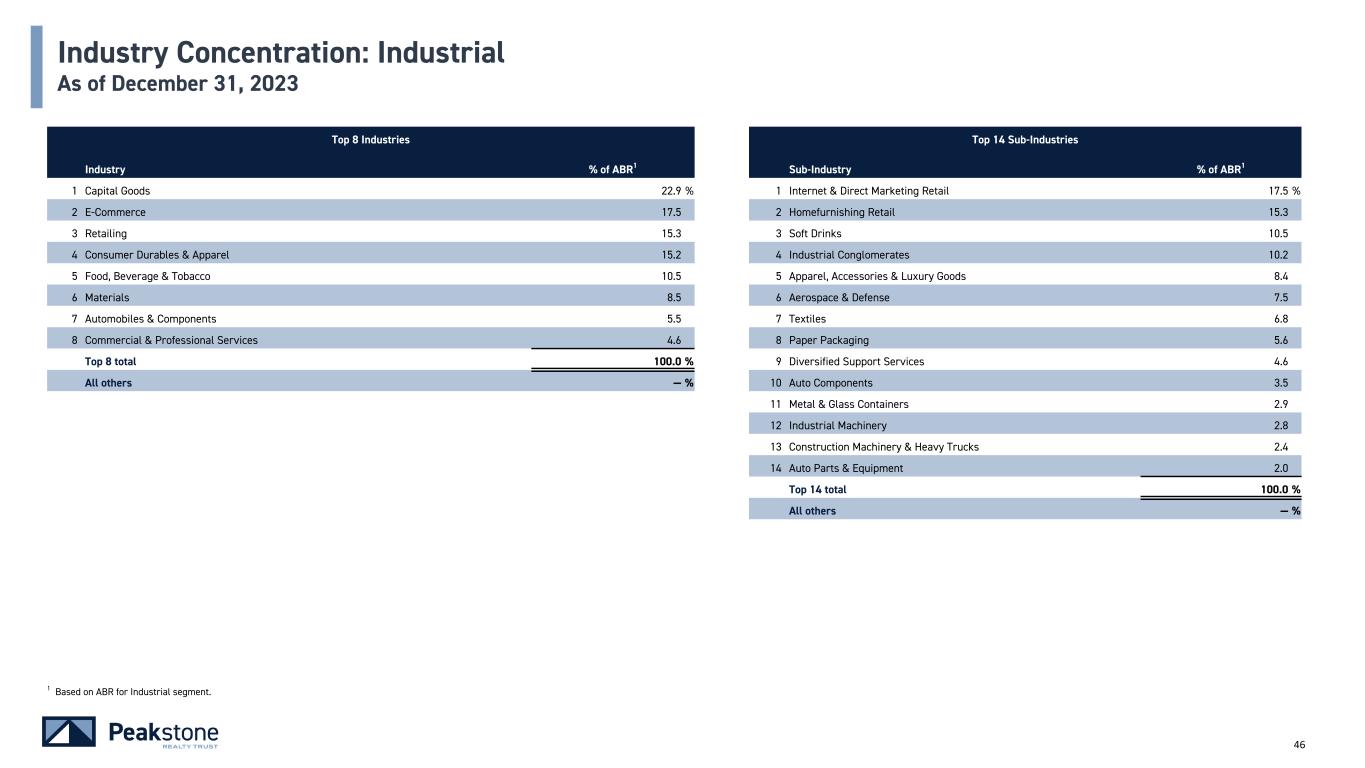

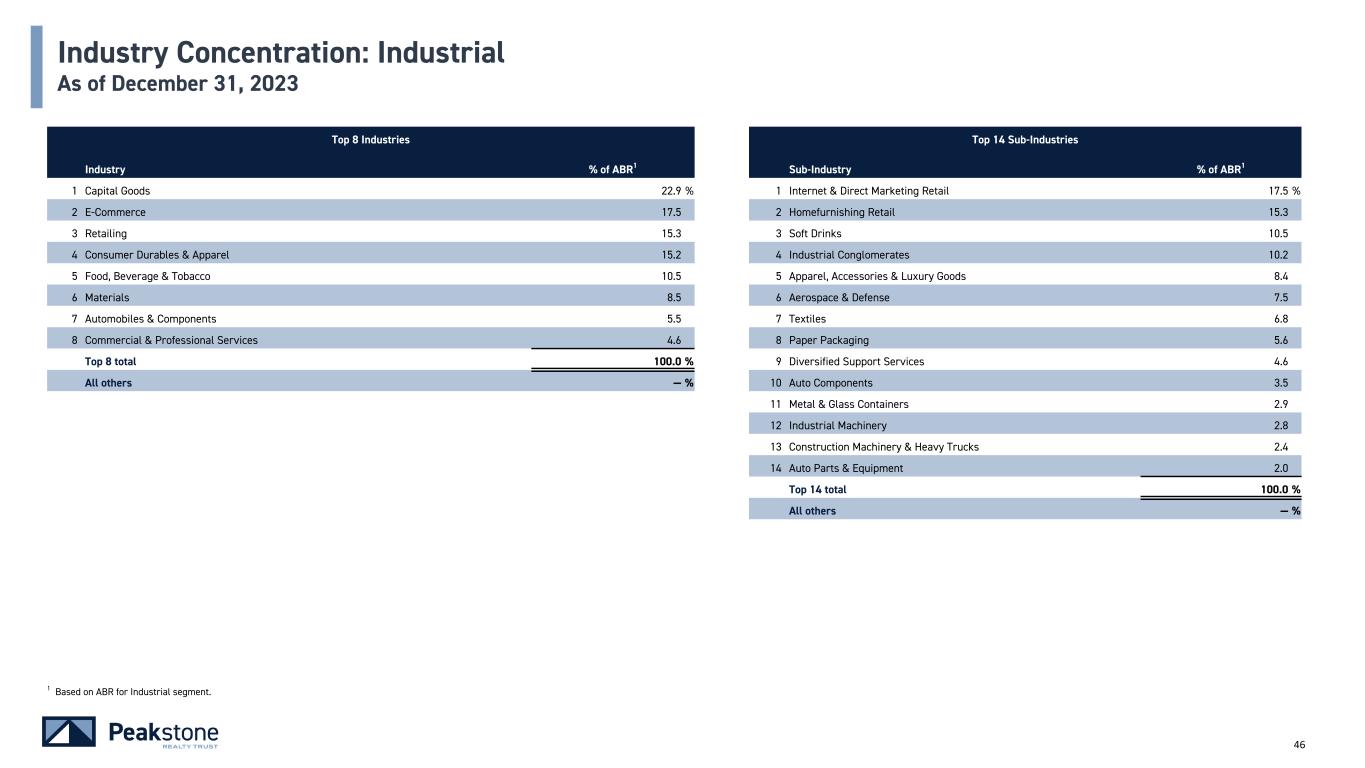

46 Industry Concentration: Industrial As of December 31, 20232021 Top 8 Industries Top 14 Sub-Industries Industry % of ABR1 Sub-Industry % of ABR1 1 Capital Goods 22.9 % 1 Internet & Direct Marketing Retail 17.5 % 2 E-Commerce 17.5 2 Homefurnishing Retail 15.3 3 Retailing 15.3 3 Soft Drinks 10.5 4 Consumer Durables & Apparel 15.2 4 Industrial Conglomerates 10.2 5 Food, Beverage & Tobacco 10.5 5 Apparel, Accessories & Luxury Goods 8.4 6 Materials 8.5 6 Aerospace & Defense 7.5 7 Automobiles & Components 5.5 7 Textiles 6.8 8 Commercial & Professional Services 4.6 8 Paper Packaging 5.6 Top 8 total 100.0 % 9 Diversified Support Services 4.6 All others — % 10 Auto Components 3.5 11 Metal & Glass Containers 2.9 12 Industrial Machinery 2.8 13 Construction Machinery & Heavy Trucks 2.4 14 Auto Parts & Equipment 2.0 Top 14 total 100.0 % All others — % 1 Based on ABR for Industrial segment.

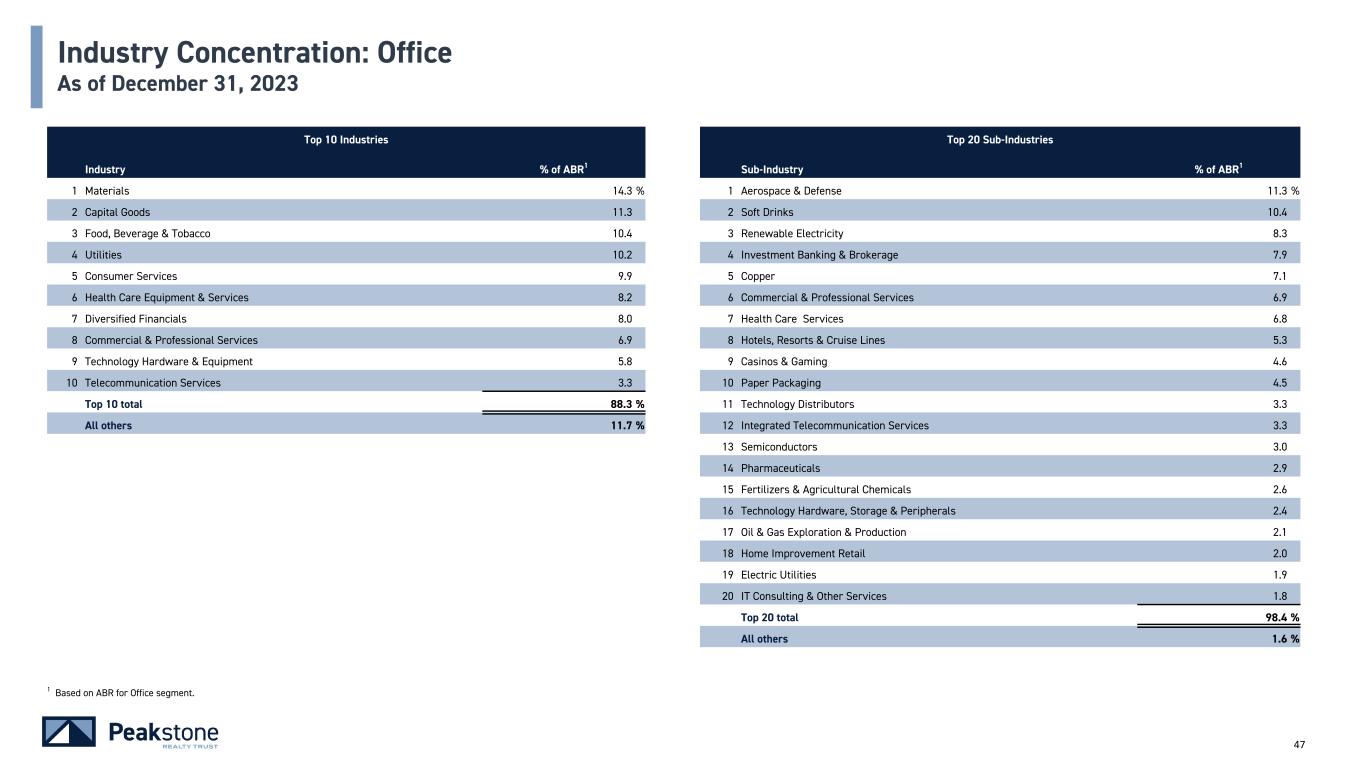

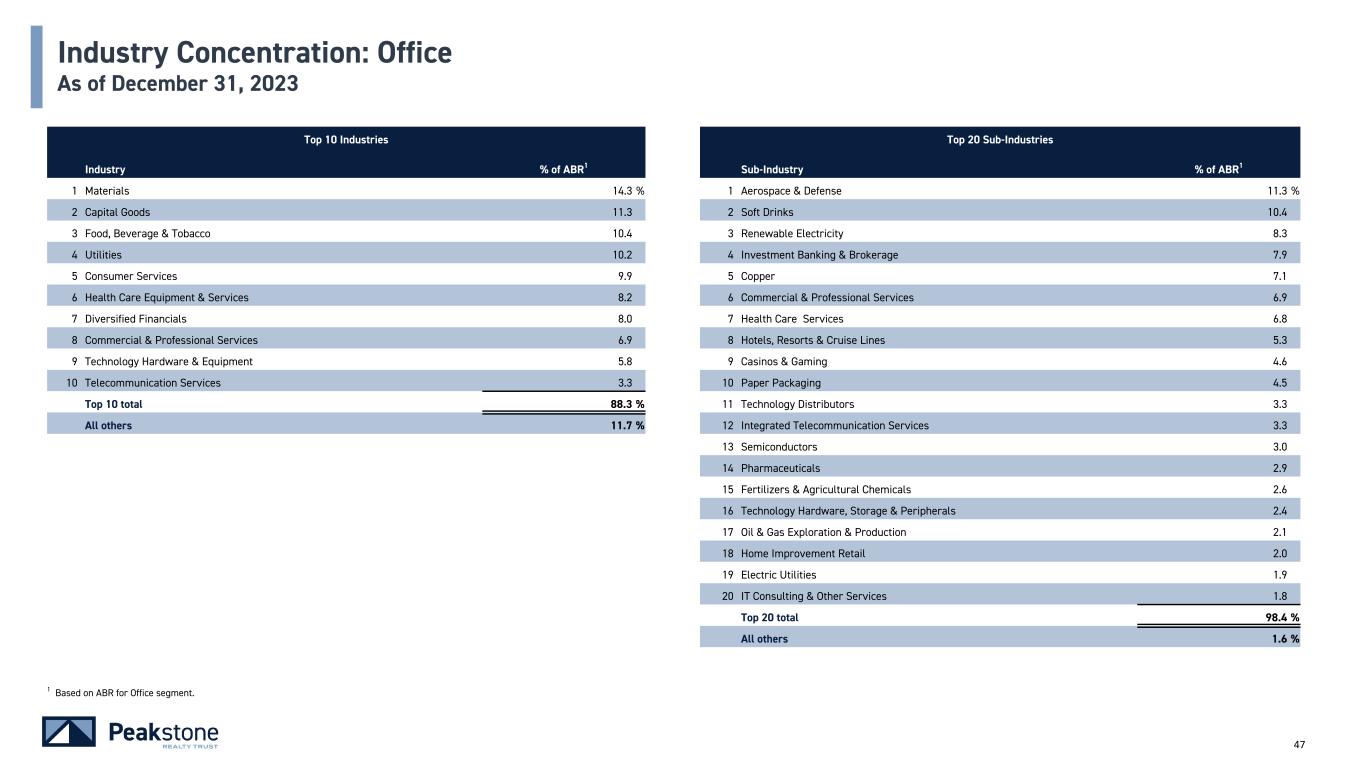

47 Industry Concentration: Office As of December 31, 2023 2021 Top 10 Industries Top 20 Sub-Industries Industry % of ABR1 Sub-Industry % of ABR1 1 Materials 14.3 % 1 Aerospace & Defense 11.3 % 2 Capital Goods 11.3 2 Soft Drinks 10.4 3 Food, Beverage & Tobacco 10.4 3 Renewable Electricity 8.3 4 Utilities 10.2 4 Investment Banking & Brokerage 7.9 5 Consumer Services 9.9 5 Copper 7.1 6 Health Care Equipment & Services 8.2 6 Commercial & Professional Services 6.9 7 Diversified Financials 8.0 7 Health Care Services 6.8 8 Commercial & Professional Services 6.9 8 Hotels, Resorts & Cruise Lines 5.3 9 Technology Hardware & Equipment 5.8 9 Casinos & Gaming 4.6 10 Telecommunication Services 3.3 10 Paper Packaging 4.5 Top 10 total 88.3 % 11 Technology Distributors 3.3 All others 11.7 % 12 Integrated Telecommunication Services 3.3 13 Semiconductors 3.0 14 Pharmaceuticals 2.9 15 Fertilizers & Agricultural Chemicals 2.6 16 Technology Hardware, Storage & Peripherals 2.4 17 Oil & Gas Exploration & Production 2.1 18 Home Improvement Retail 2.0 19 Electric Utilities 1.9 20 IT Consulting & Other Services 1.8 Top 20 total 98.4 % All others 1.6 % 1 Based on ABR for Office segment.

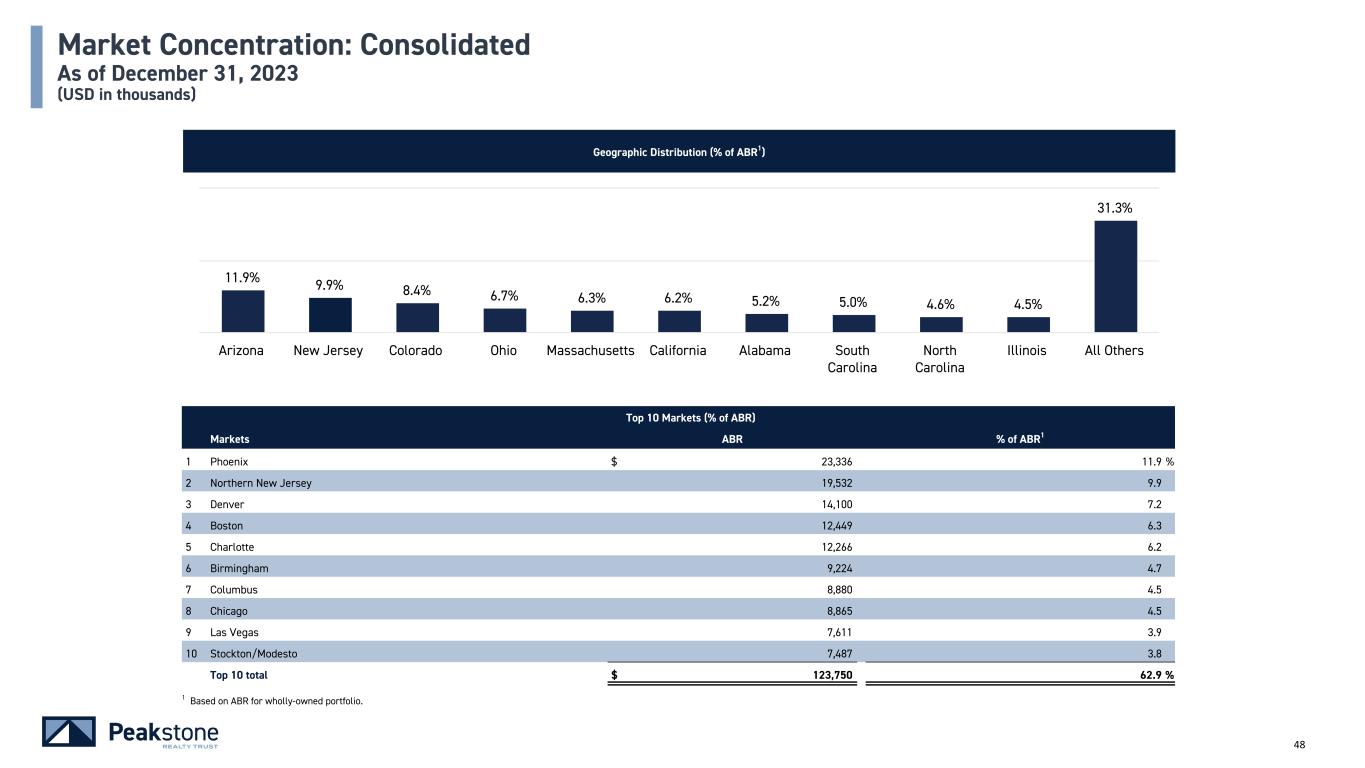

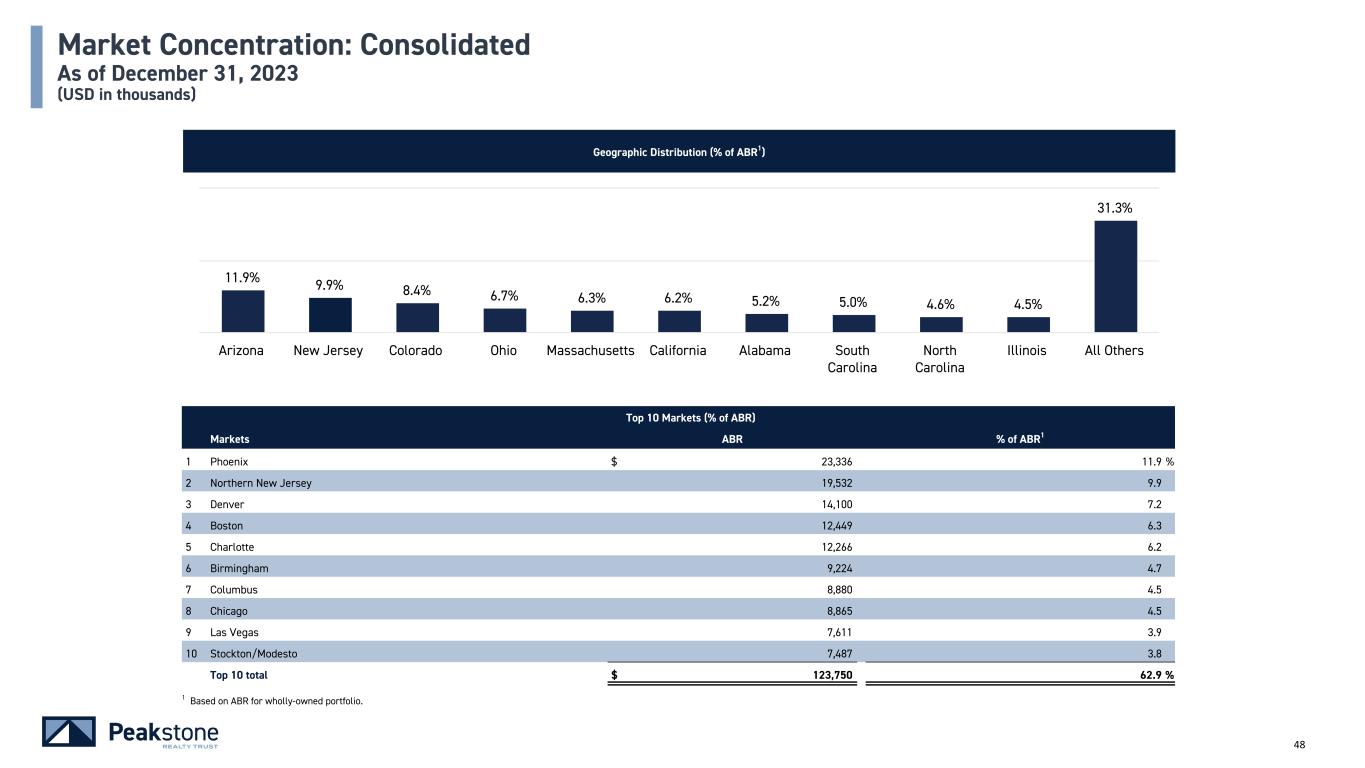

48 Geographic Distribution (% of ABR1) Market Concentration: Consolidated As of December 31, 2023 (USD in thousands) Top 10 Markets (% of ABR) Markets ABR % of ABR1 1 Phoenix $ 23,336 11.9 % 2 Northern New Jersey 19,532 9.9 3 Denver 14,100 7.2 4 Boston 12,449 6.3 5 Charlotte 12,266 6.2 6 Birmingham 9,224 4.7 7 Columbus 8,880 4.5 8 Chicago 8,865 4.5 9 Las Vegas 7,611 3.9 10 Stockton/Modesto 7,487 3.8 Top 10 total $ 123,750 62.9 % 11.9% 9.9% 8.4% 6.7% 6.3% 6.2% 5.2% 5.0% 4.6% 4.5% 31.3% Arizona New Jersey Colorado Ohio Massachusetts California Alabama South Carolina North Carolina Illinois All Others 1 Based on ABR for wholly-owned portfolio.

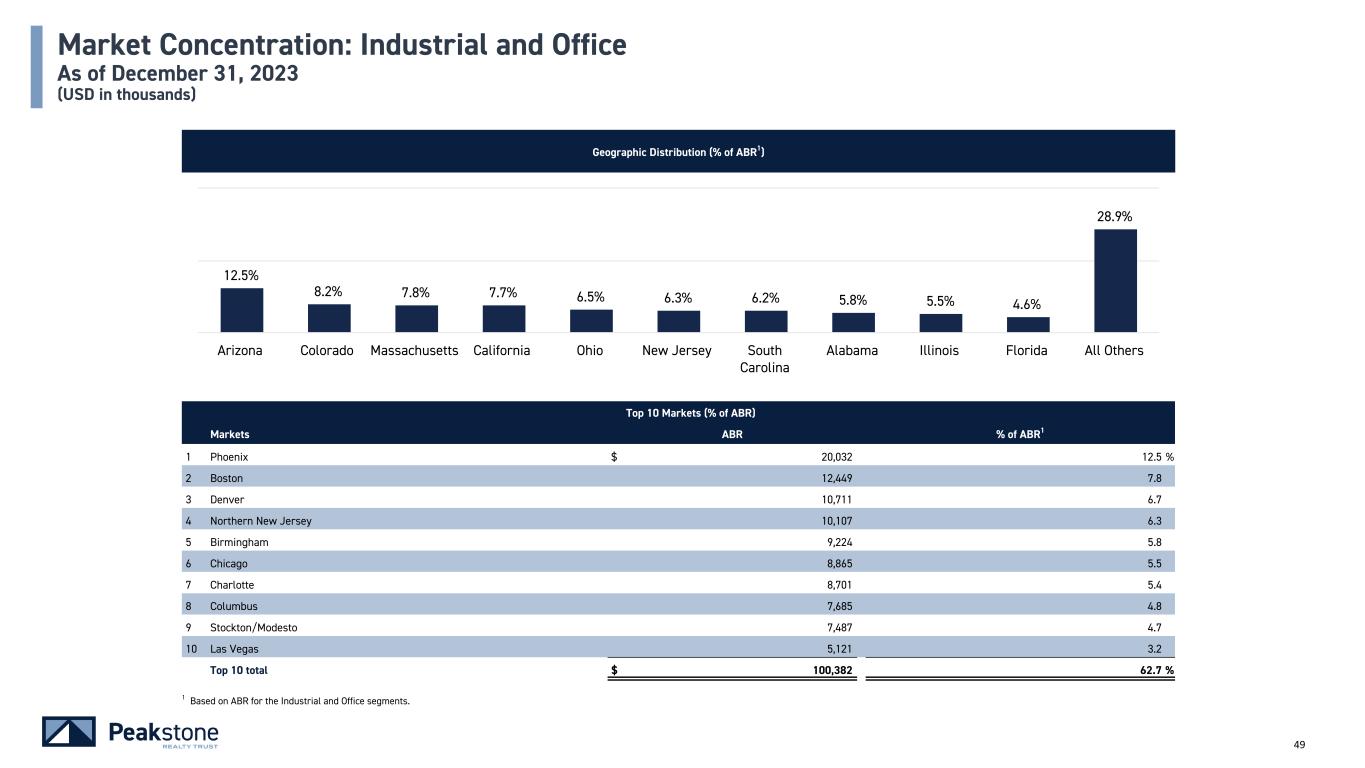

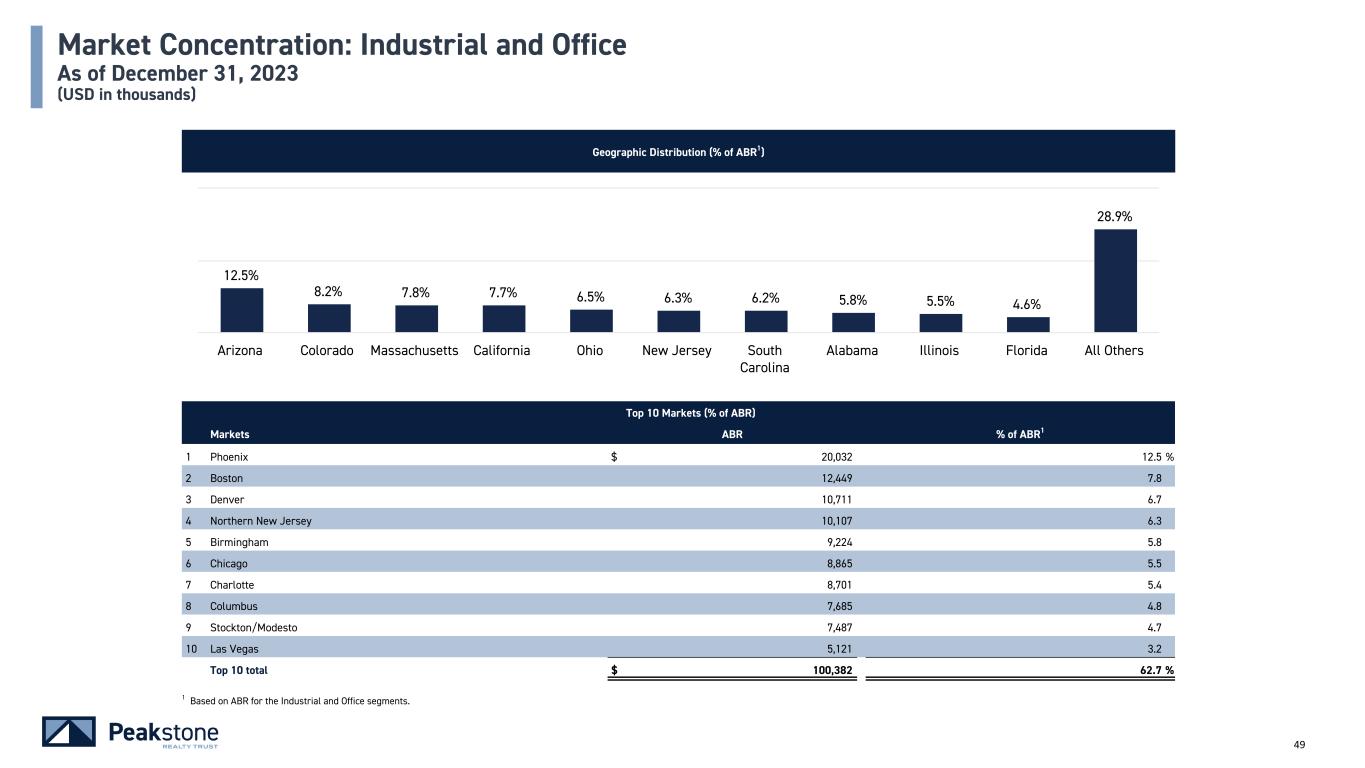

49 Geographic Distribution (% of ABR1) Market Concentration: Industrial and Office As of December 31, 2023 (USD in thousands) Top 10 Markets (% of ABR) Markets ABR % of ABR1 1 Phoenix $ 20,032 12.5 % 2 Boston 12,449 7.8 3 Denver 10,711 6.7 4 Northern New Jersey 10,107 6.3 5 Birmingham 9,224 5.8 6 Chicago 8,865 5.5 7 Charlotte 8,701 5.4 8 Columbus 7,685 4.8 9 Stockton/Modesto 7,487 4.7 10 Las Vegas 5,121 3.2 Top 10 total $ 100,382 62.7 % 12.5% 8.2% 7.8% 7.7% 6.5% 6.3% 6.2% 5.8% 5.5% 4.6% 28.9% Arizona Colorado Massachusetts California Ohio New Jersey South Carolina Alabama Illinois Florida All Others 1 Based on ABR for the Industrial and Office segments.

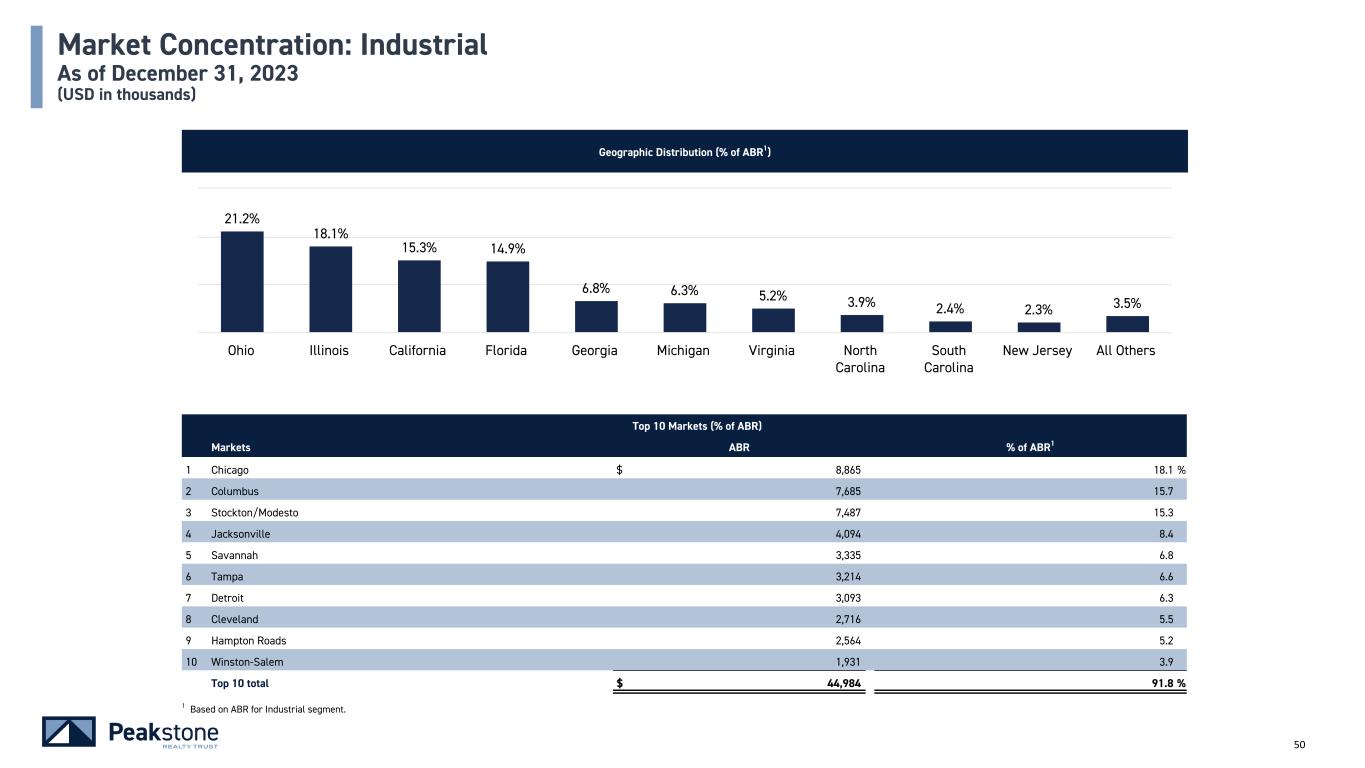

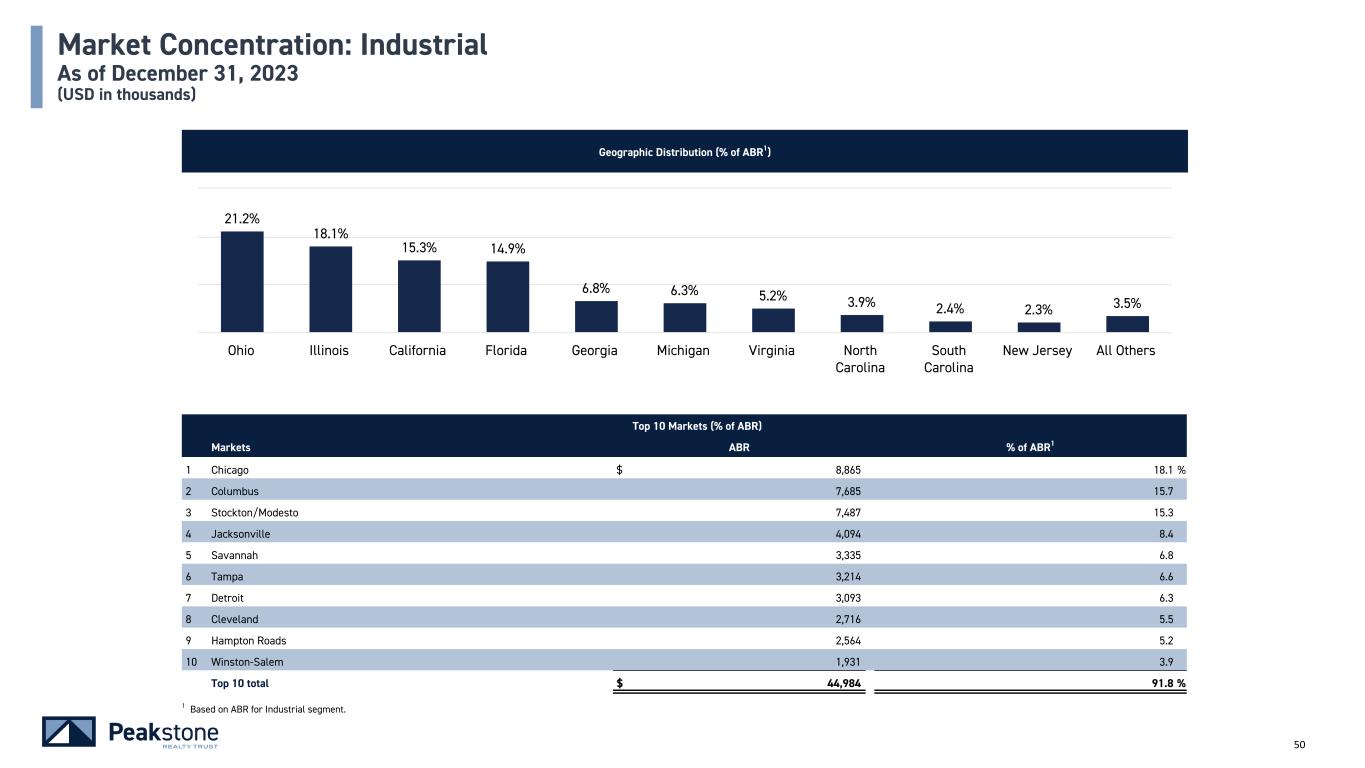

50 Geographic Distribution (% of ABR1) Market Concentration: Industrial As of December 31, 2023 (USD in thousands) Top 10 Markets (% of ABR) Markets ABR % of ABR1 1 Chicago $ 8,865 18.1 % 2 Columbus 7,685 15.7 3 Stockton/Modesto 7,487 15.3 4 Jacksonville 4,094 8.4 5 Savannah 3,335 6.8 6 Tampa 3,214 6.6 7 Detroit 3,093 6.3 8 Cleveland 2,716 5.5 9 Hampton Roads 2,564 5.2 10 Winston-Salem 1,931 3.9 Top 10 total $ 44,984 91.8 % 21.2% 18.1% 15.3% 14.9% 6.8% 6.3% 5.2% 3.9% 2.4% 2.3% 3.5% Ohio Illinois California Florida Georgia Michigan Virginia North Carolina South Carolina New Jersey All Others 1 Based on ABR for Industrial segment.

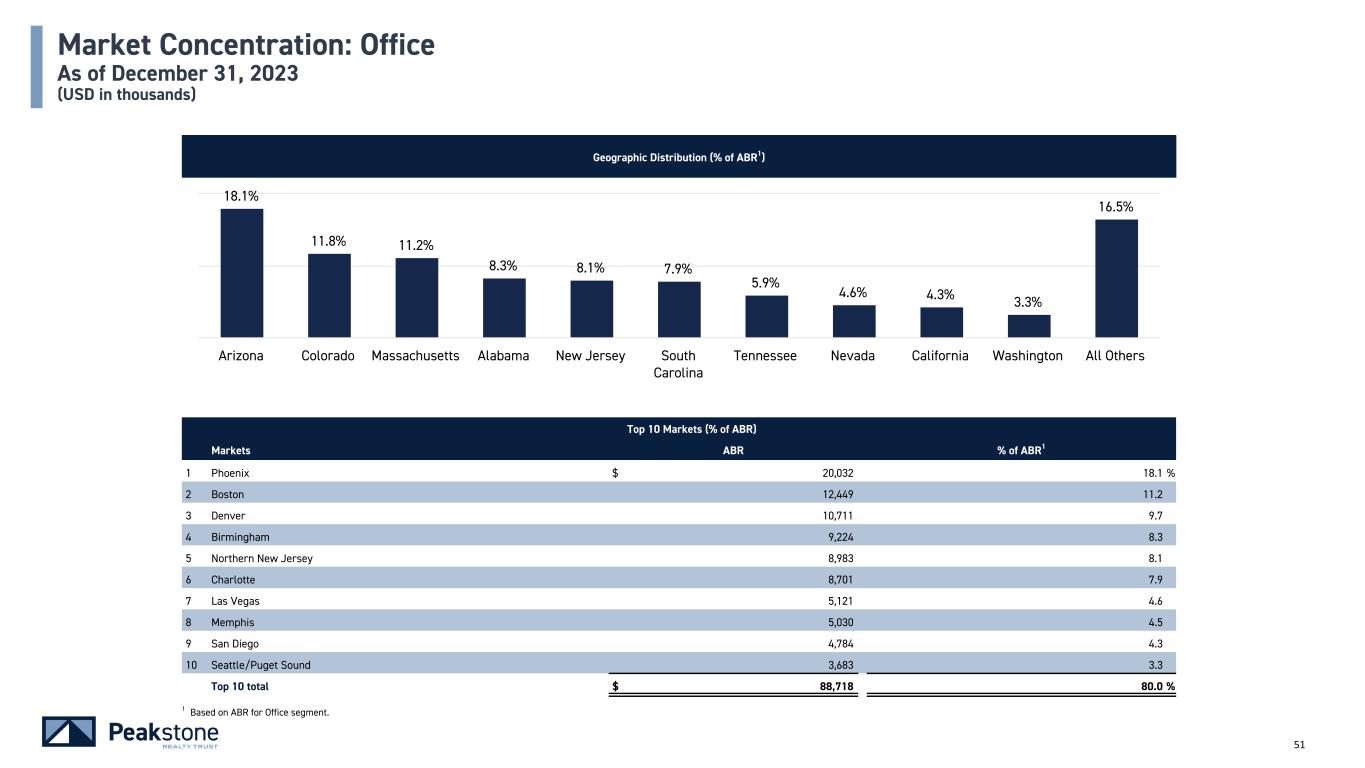

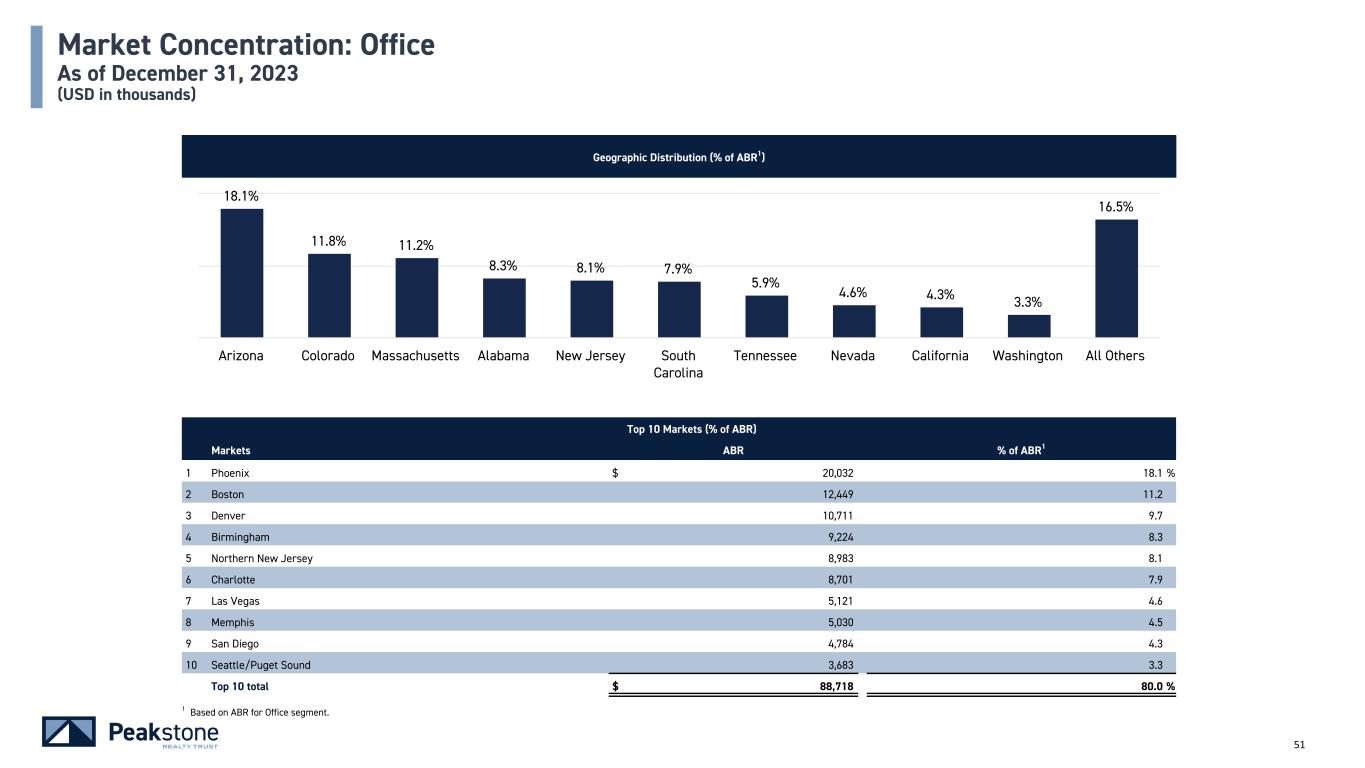

51 Geographic Distribution (% of ABR1) Market Concentration: Office As of December 31, 2023 (USD in thousands) Top 10 Markets (% of ABR) Markets ABR % of ABR1 1 Phoenix $ 20,032 18.1 % 2 Boston 12,449 11.2 3 Denver 10,711 9.7 4 Birmingham 9,224 8.3 5 Northern New Jersey 8,983 8.1 6 Charlotte 8,701 7.9 7 Las Vegas 5,121 4.6 8 Memphis 5,030 4.5 9 San Diego 4,784 4.3 10 Seattle/Puget Sound 3,683 3.3 Top 10 total $ 88,718 80.0 % 18.1% 11.8% 11.2% 8.3% 8.1% 7.9% 5.9% 4.6% 4.3% 3.3% 16.5% Arizona Colorado Massachusetts Alabama New Jersey South Carolina Tennessee Nevada California Washington All Others 1 Based on ABR for Office segment.

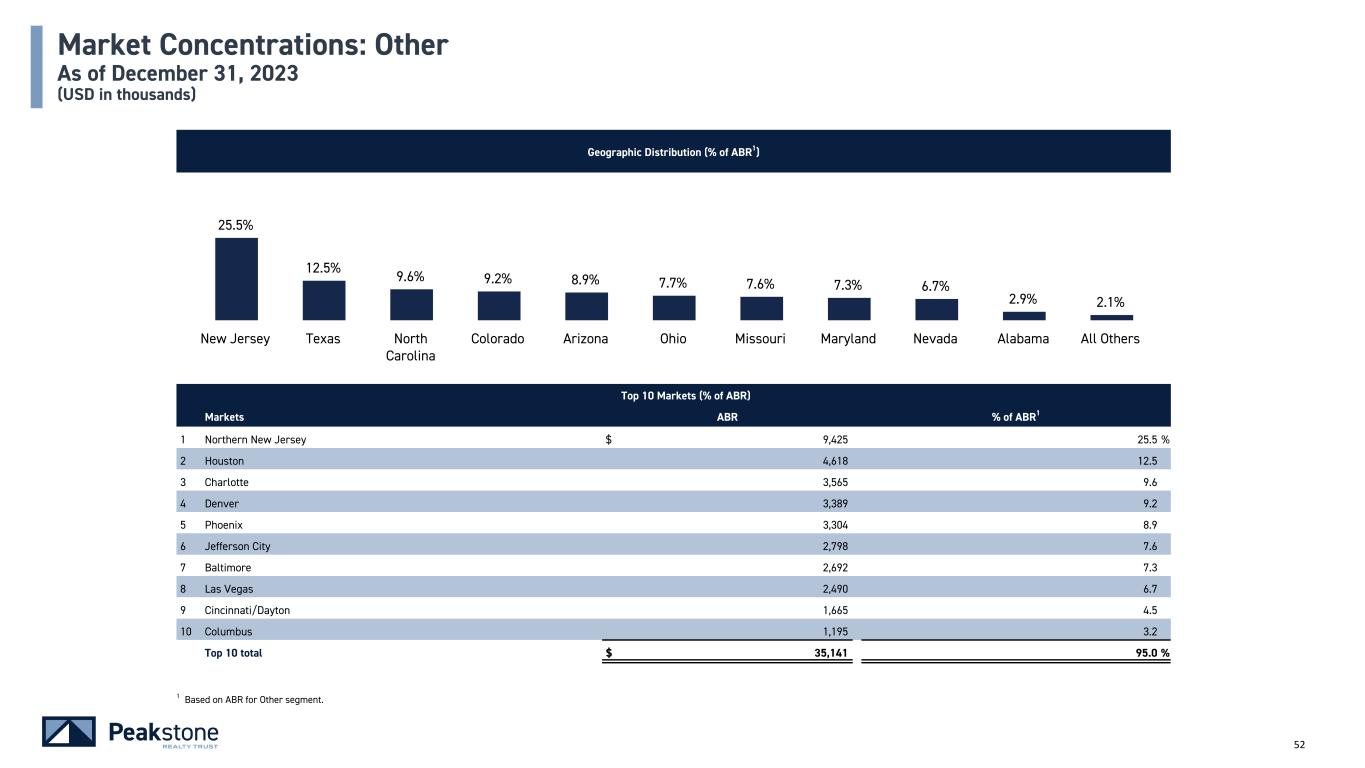

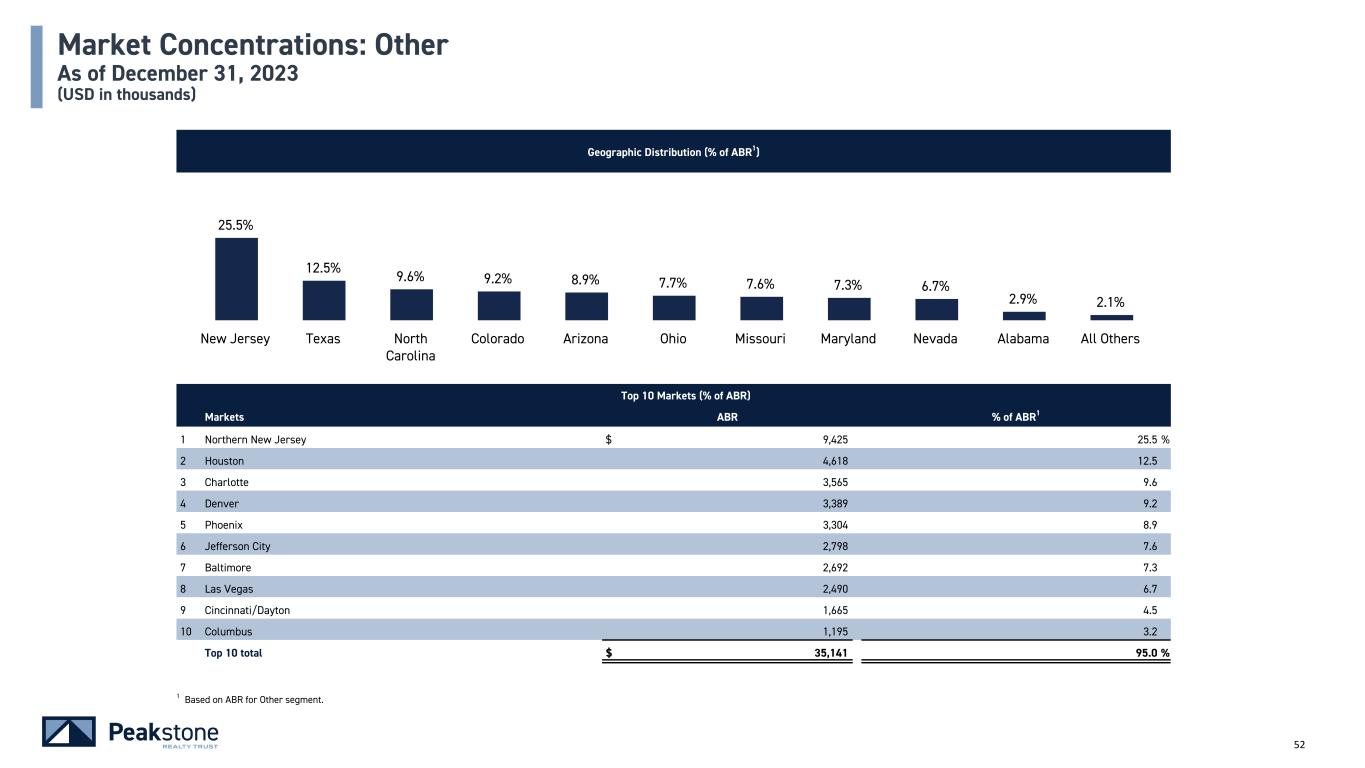

52 Geographic Distribution (% of ABR1) Market Concentrations: Other As of December 31, 2023 (USD in thousands) Top 10 Markets (% of ABR) Markets ABR % of ABR1 1 Northern New Jersey $ 9,425 25.5 % 2 Houston 4,618 12.5 3 Charlotte 3,565 9.6 4 Denver 3,389 9.2 5 Phoenix 3,304 8.9 6 Jefferson City 2,798 7.6 7 Baltimore 2,692 7.3 8 Las Vegas 2,490 6.7 9 Cincinnati/Dayton 1,665 4.5 10 Columbus 1,195 3.2 Top 10 total $ 35,141 95.0 % 25.5% 12.5% 9.6% 9.2% 8.9% 7.7% 7.6% 7.3% 6.7% 2.9% 2.1% New Jersey Texas North Carolina Colorado Arizona Ohio Missouri Maryland Nevada Alabama All Others 1 Based on ABR for Other segment.

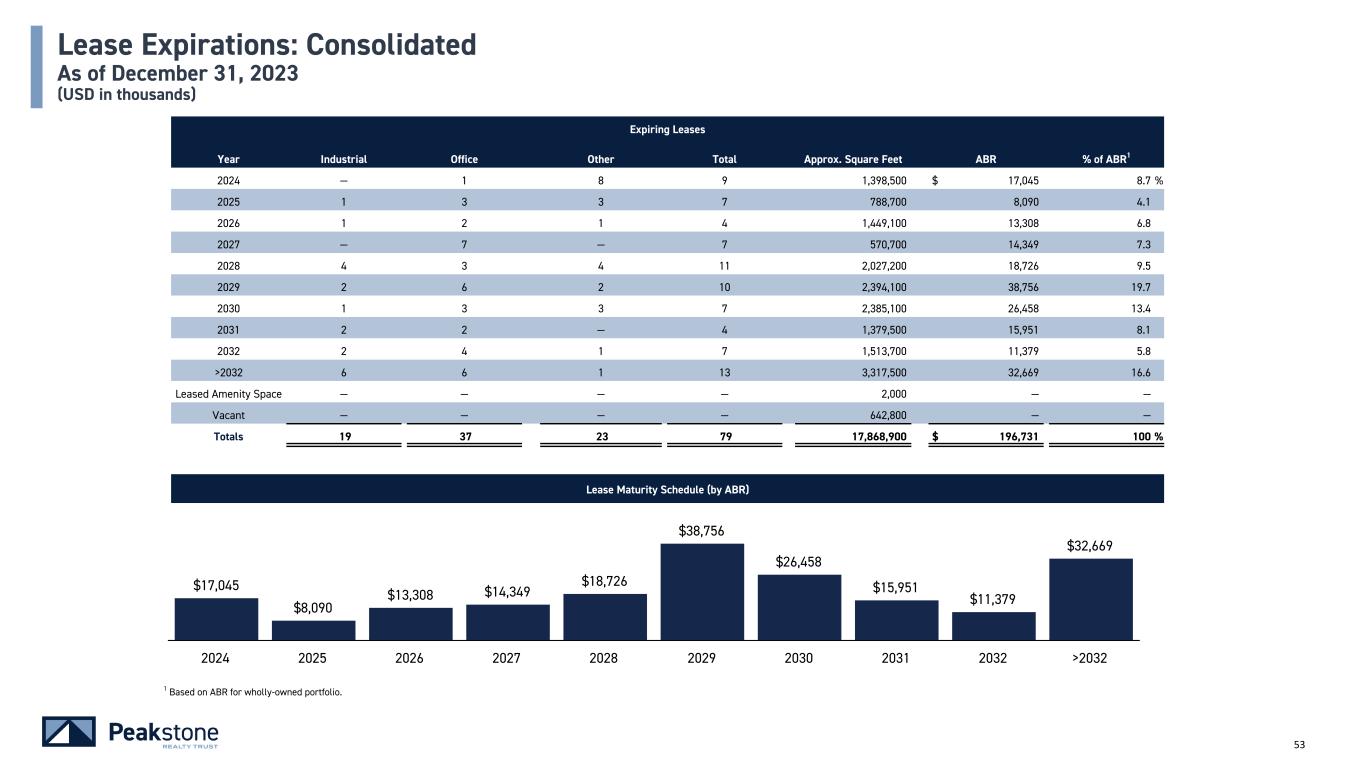

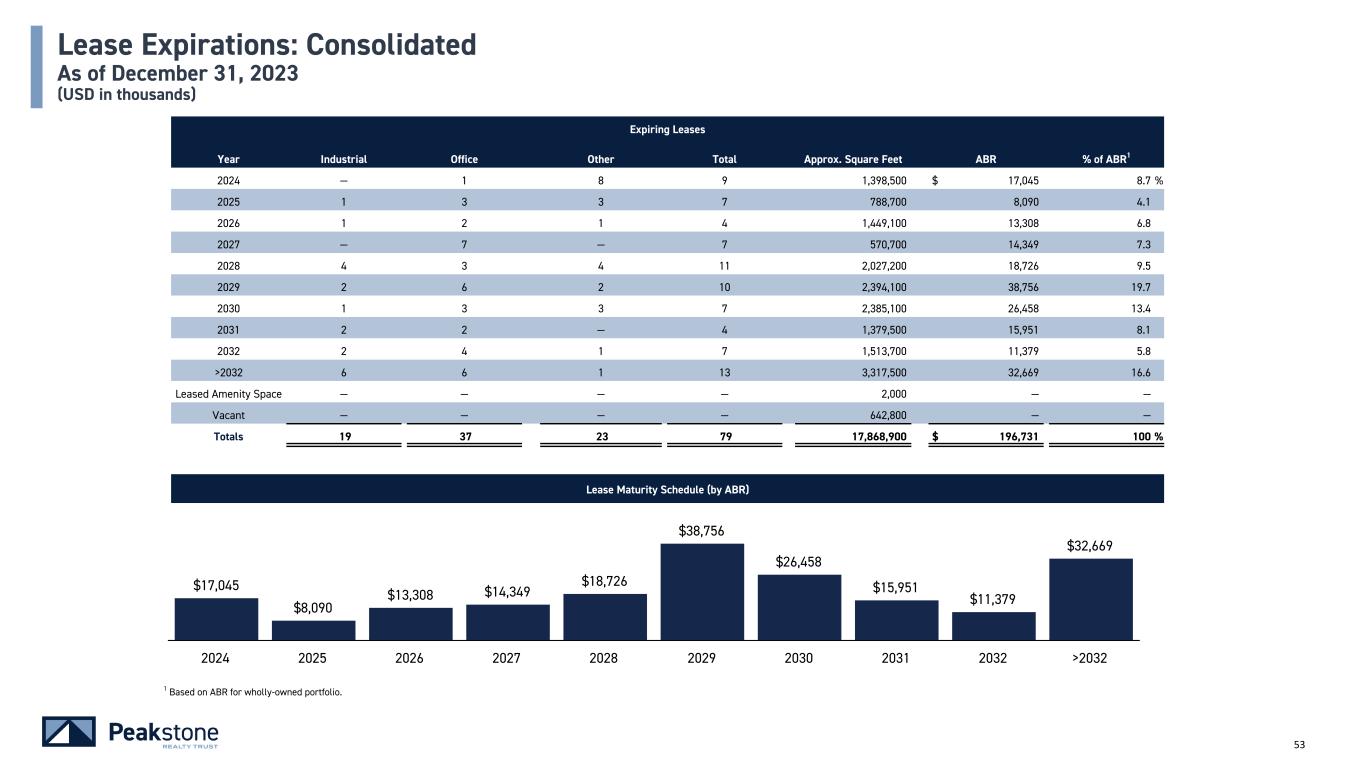

53 Lease Expirations: Consolidated As of December 31, 2023 (USD in thousands) Lease Maturity Schedule (by ABR) 1 Based on ABR for wholly-owned portfolio. $17,045 $8,090 $13,308 $14,349 $18,726 $38,756 $26,458 $15,951 $11,379 $32,669 2024 2025 2026 2027 2028 2029 2030 2031 2032 >2032 Expiring Leases Year Industrial Office Other Total Approx. Square Feet ABR % of ABR1 2024 — 1 8 9 1,398,500 $ 17,045 8.7 % 2025 1 3 3 7 788,700 8,090 4.1 2026 1 2 1 4 1,449,100 13,308 6.8 2027 — 7 — 7 570,700 14,349 7.3 2028 4 3 4 11 2,027,200 18,726 9.5 2029 2 6 2 10 2,394,100 38,756 19.7 2030 1 3 3 7 2,385,100 26,458 13.4 2031 2 2 — 4 1,379,500 15,951 8.1 2032 2 4 1 7 1,513,700 11,379 5.8 >2032 6 6 1 13 3,317,500 32,669 16.6 Leased Amenity Space — — — — 2,000 — — Vacant — — — — 642,800 — — Totals 19 37 23 79 17,868,900 $ 196,731 100 %

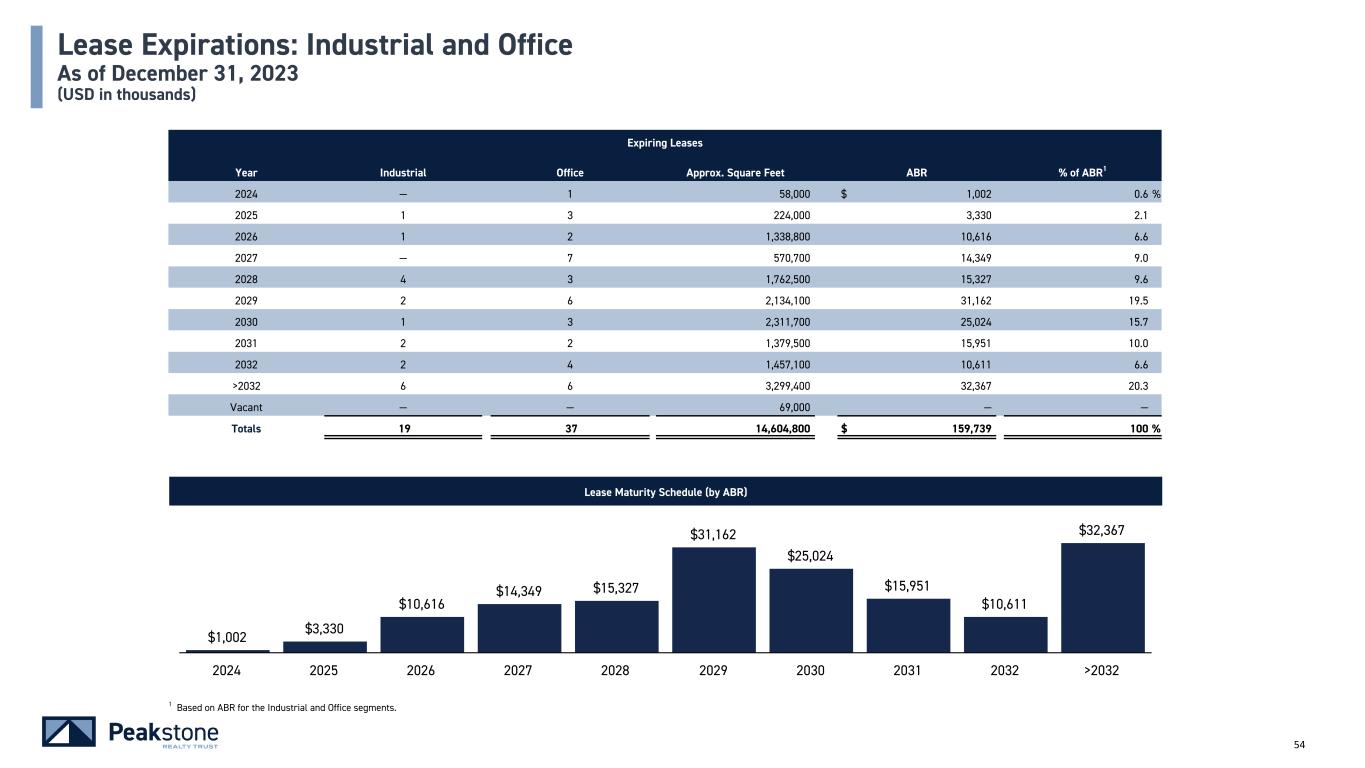

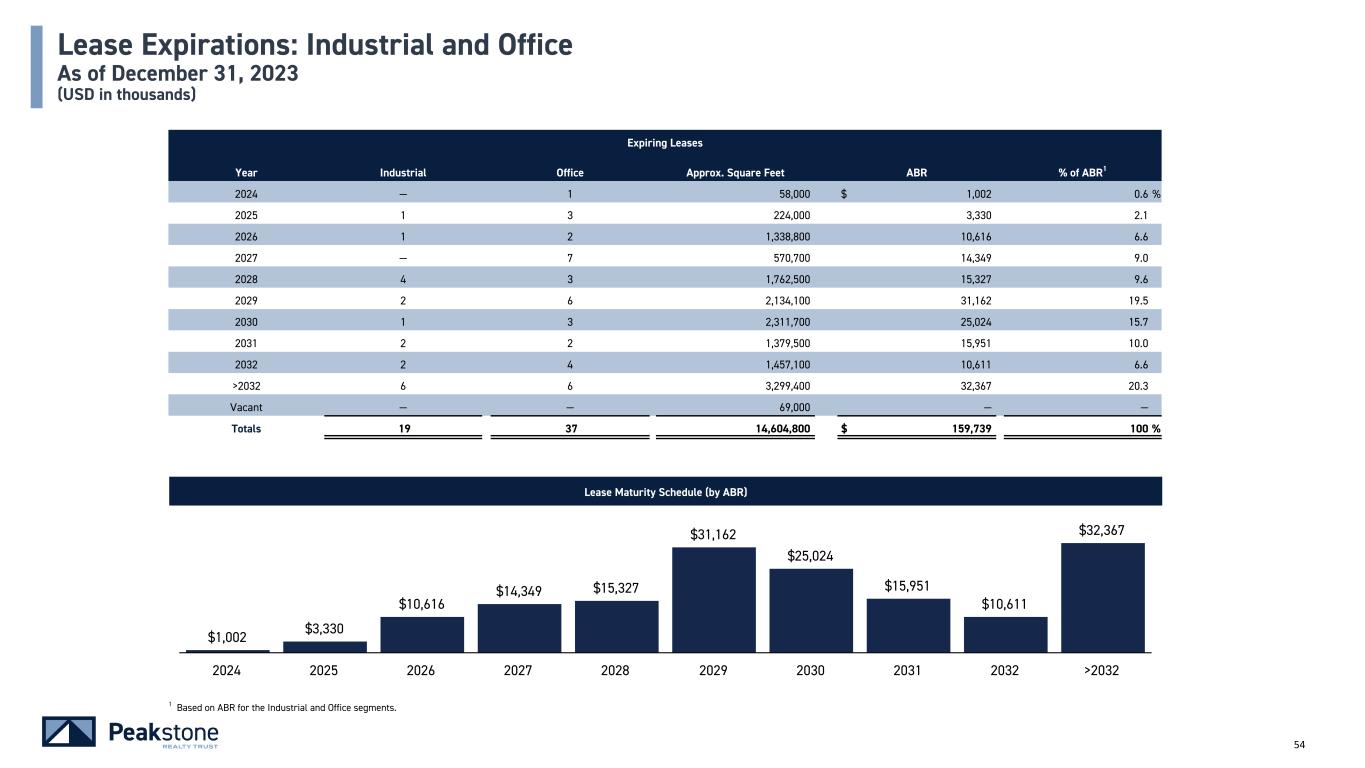

54 Lease Expirations: Industrial and Office As of December 31, 2023 (USD in thousands) Lease Maturity Schedule (by ABR) $1,002 $3,330 $10,616 $14,349 $15,327 $31,162 $25,024 $15,951 $10,611 $32,367 2024 2025 2026 2027 2028 2029 2030 2031 2032 >2032 Expiring Leases Year Industrial Office Approx. Square Feet ABR % of ABR1 2024 — 1 58,000 $ 1,002 0.6 % 2025 1 3 224,000 3,330 2.1 2026 1 2 1,338,800 10,616 6.6 2027 — 7 570,700 14,349 9.0 2028 4 3 1,762,500 15,327 9.6 2029 2 6 2,134,100 31,162 19.5 2030 1 3 2,311,700 25,024 15.7 2031 2 2 1,379,500 15,951 10.0 2032 2 4 1,457,100 10,611 6.6 >2032 6 6 3,299,400 32,367 20.3 Vacant — — 69,000 — — Totals 19 37 14,604,800 $ 159,739 100 % 1 Based on ABR for the Industrial and Office segments.

55 Lease Expirations: Industrial As of December 31, 2023 (USD in thousands) Lease Maturity Schedule (by ABR) $— $1,377 $5,000 $— $7,494 $5,613 $7,487 $8,590 $4,647 $8,769 2024 2025 2026 2027 2028 2029 2030 2031 2032 >2032 Expiring Leases Year Leases Approx. Square Feet ABR % of ABR1 2024 — — $ — — % 2025 1 120,000 1,377 2.8 2026 1 978,100 5,000 10.2 2027 — — — — 2028 4 1,290,100 7,494 15.3 2029 2 1,129,700 5,613 11.5 2030 1 1,501,400 7,487 15.3 2031 2 1,039,200 8,590 17.5 2032 2 1,113,000 4,647 9.5 >2032 6 1,830,300 8,769 17.9 Vacant — — — — Totals 19 9,001,800 $ 48,977 100.0 % 1 Based on ABR for Industrial segment.

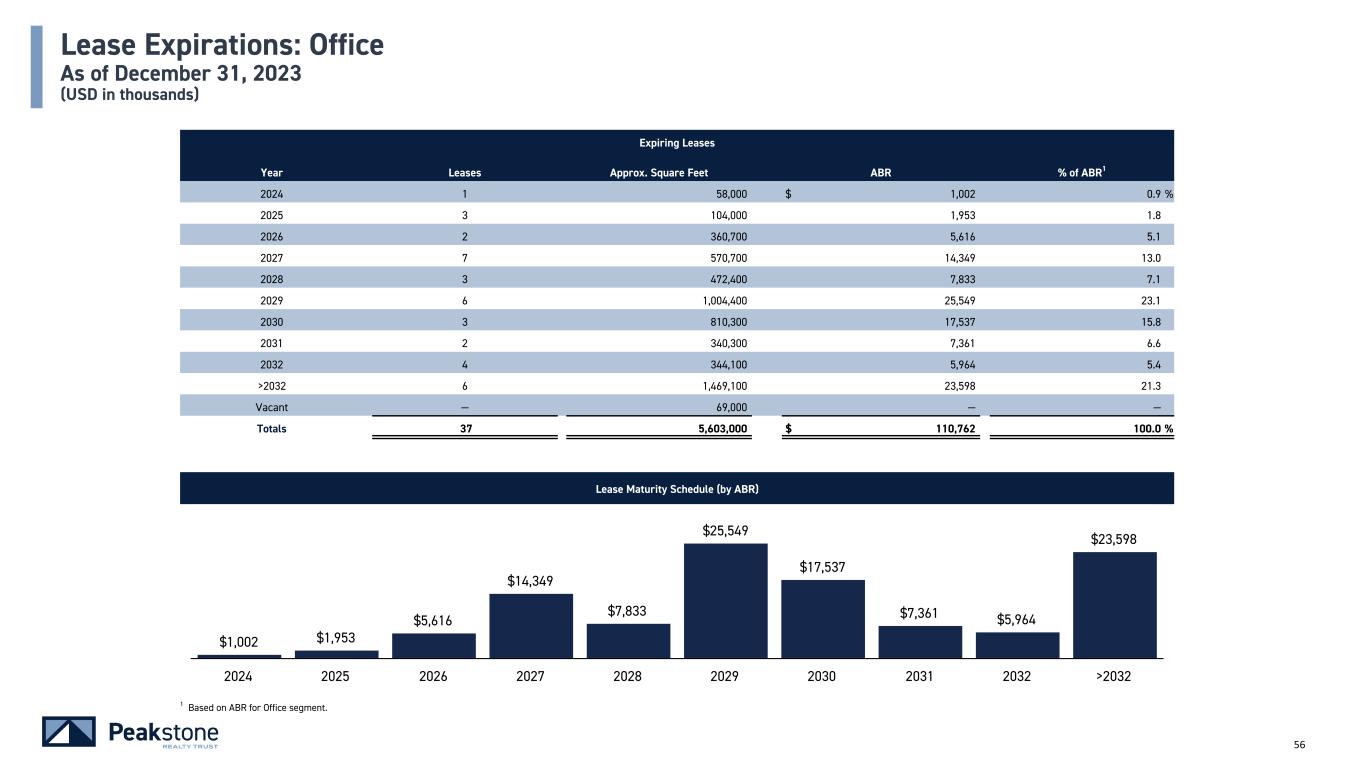

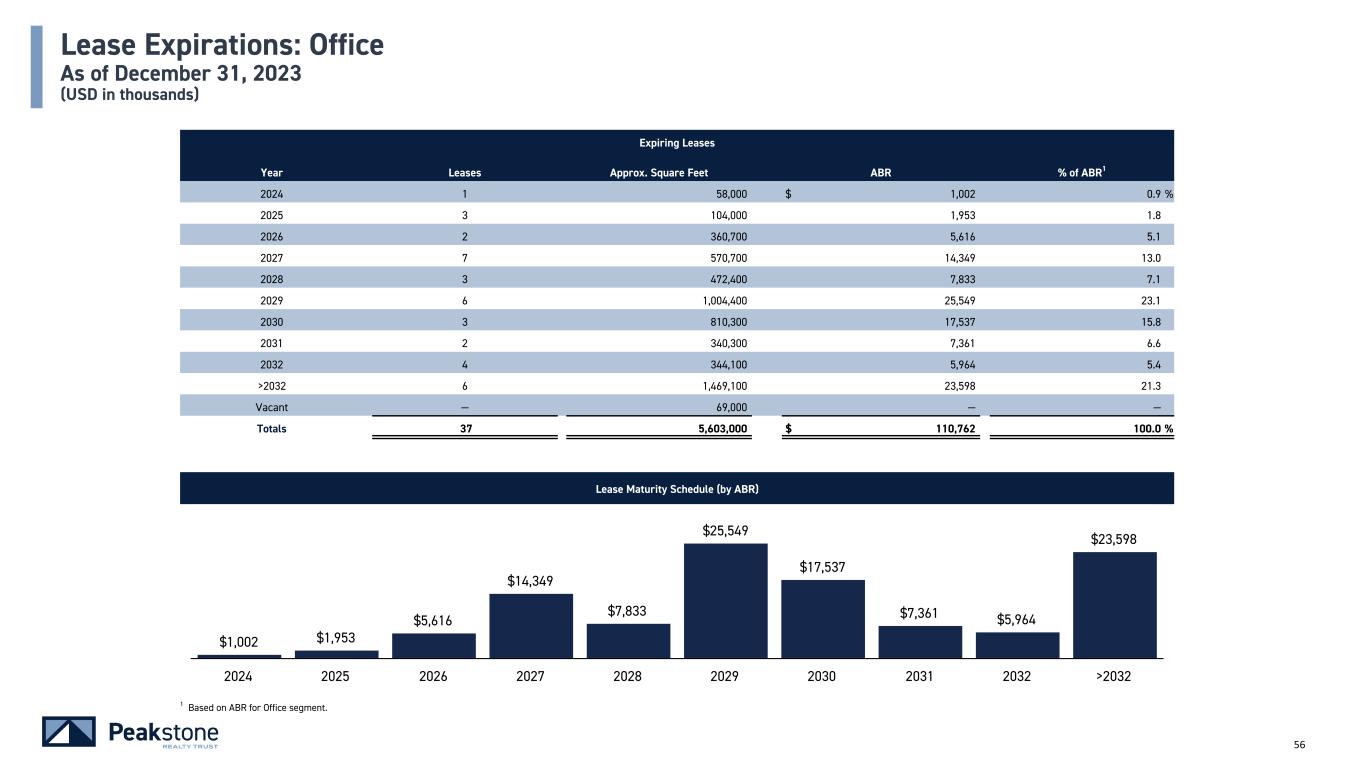

56 Lease Expirations: Office As of December 31, 2023 (USD in thousands) Lease Maturity Schedule (by ABR) $1,002 $1,953 $5,616 $14,349 $7,833 $25,549 $17,537 $7,361 $5,964 $23,598 2024 2025 2026 2027 2028 2029 2030 2031 2032 >2032 Expiring Leases Year Leases Approx. Square Feet ABR % of ABR1 2024 1 58,000 $ 1,002 0.9 % 2025 3 104,000 1,953 1.8 2026 2 360,700 5,616 5.1 2027 7 570,700 14,349 13.0 2028 3 472,400 7,833 7.1 2029 6 1,004,400 25,549 23.1 2030 3 810,300 17,537 15.8 2031 2 340,300 7,361 6.6 2032 4 344,100 5,964 5.4 >2032 6 1,469,100 23,598 21.3 Vacant — 69,000 — — Totals 37 5,603,000 $ 110,762 100.0 % 1 Based on ABR for Office segment.

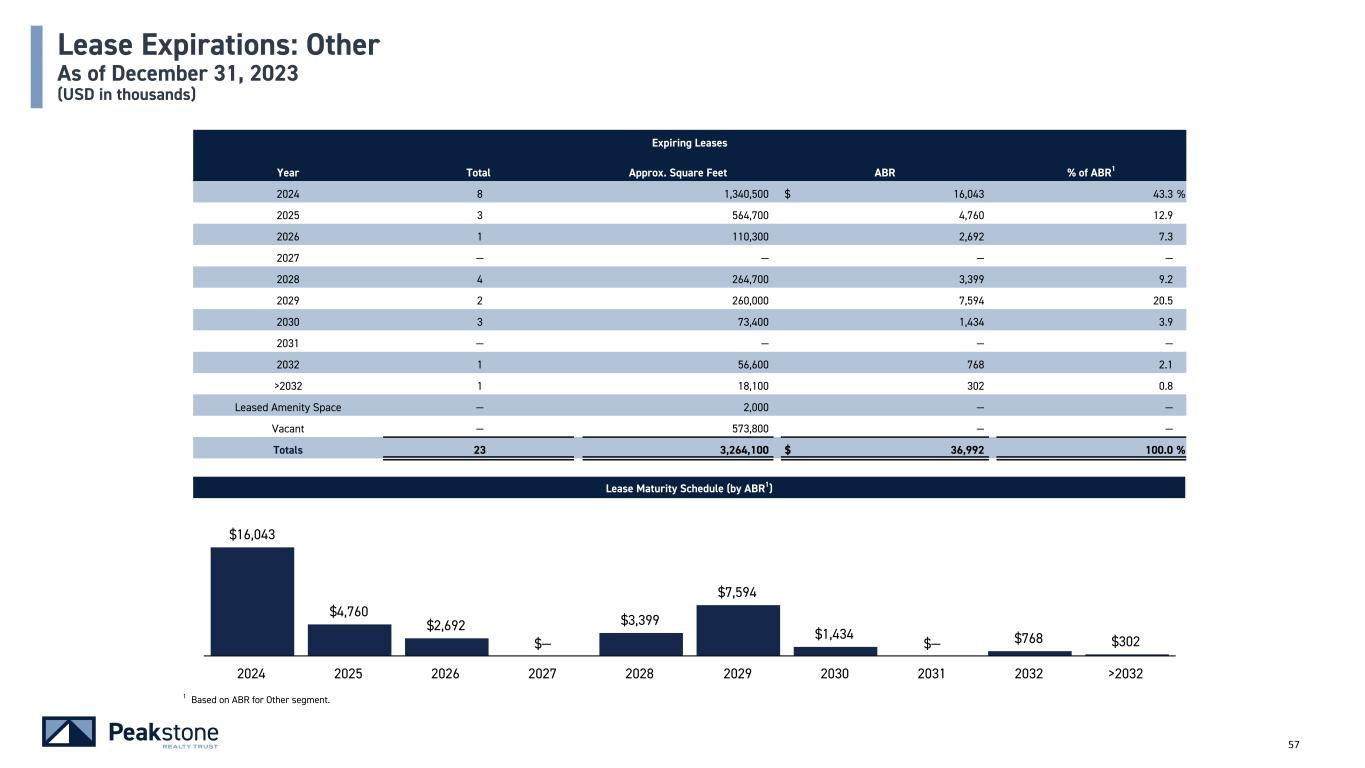

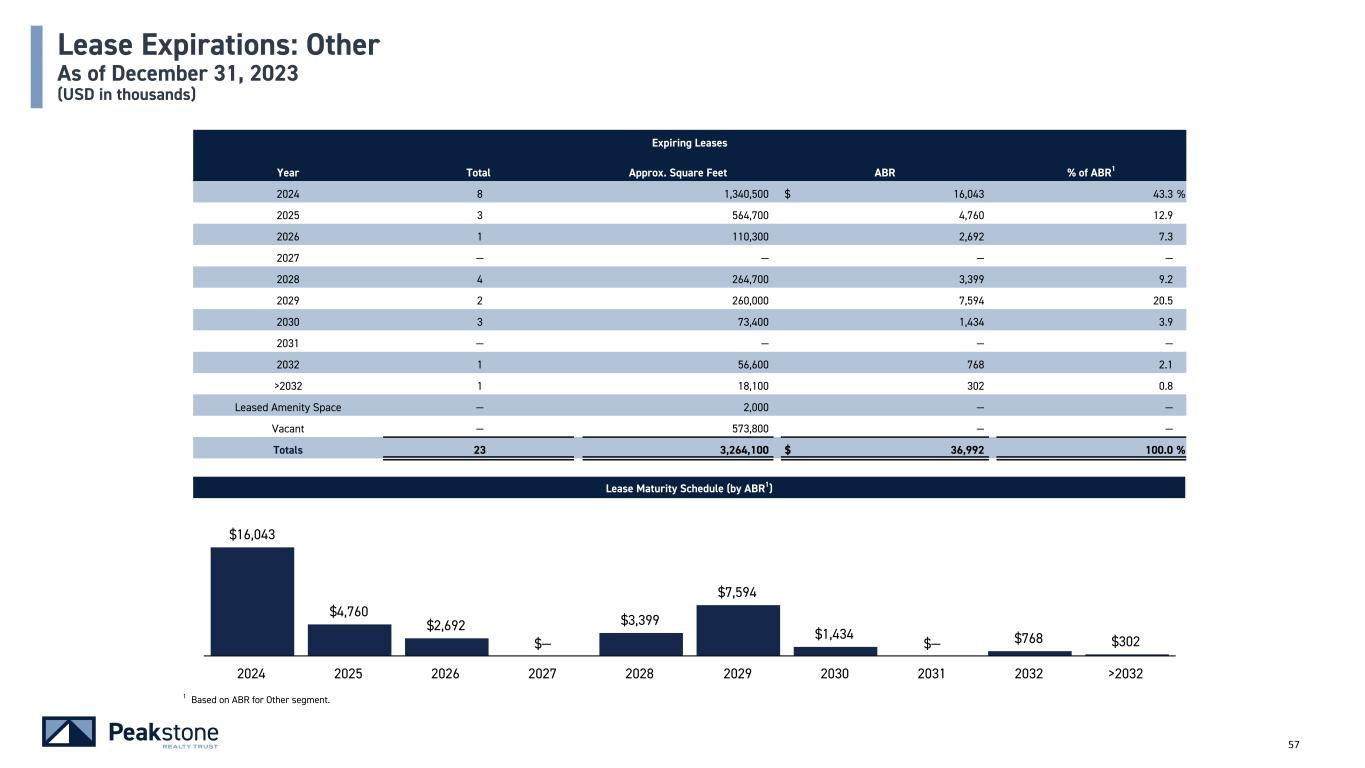

57 Lease Expirations: Other As of December 31, 2023 (USD in thousands) Lease Maturity Schedule (by ABR1) $16,043 $4,760 $2,692 $— $3,399 $7,594 $1,434 $— $768 $302 2024 2025 2026 2027 2028 2029 2030 2031 2032 >2032 Expiring Leases Year Total Approx. Square Feet ABR % of ABR1 2024 8 1,340,500 $ 16,043 43.3 % 2025 3 564,700 4,760 12.9 2026 1 110,300 2,692 7.3 2027 — — — — 2028 4 264,700 3,399 9.2 2029 2 260,000 7,594 20.5 2030 3 73,400 1,434 3.9 2031 — — — — 2032 1 56,600 768 2.1 >2032 1 18,100 302 0.8 Leased Amenity Space — 2,000 — — Vacant — 573,800 — — Totals 23 3,264,100 $ 36,992 100.0 % 1 Based on ABR for Other segment.

Notes & Definitions