| Maryland | 001-36008 | 46-2024407 | ||||||||||||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) | ||||||||||||

| 11620 Wilshire Boulevard, Suite 1000 | ||||||||

| Los Angeles | ||||||||

| California | 90025 | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

||||

| Title of each class | Trading symbols | Name of each exchange on which registered | ||||||||||||

| Common Stock, $0.01 par value | REXR | New York Stock Exchange | ||||||||||||

| 5.875% Series B Cumulative Redeemable Preferred Stock | REXR-PB | New York Stock Exchange | ||||||||||||

| 5.625% Series C Cumulative Redeemable Preferred Stock | REXR-PC | New York Stock Exchange | ||||||||||||

| Exhibit Number |

Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

| Rexford Industrial Realty, Inc. | |||||

| April 16, 2025 |

/s/ Michael S. Frankel

|

||||

| Michael S. Frankel Co-Chief Executive Officer (Principal Executive Officer) |

|||||

| Rexford Industrial Realty, Inc. | |||||

| April 16, 2025 |

/s/ Howard Schwimmer

|

||||

| Howard Schwimmer Co-Chief Executive Officer (Principal Executive Officer) |

|||||

Q1 2025 Leasing Activity |

||||||||||||||||||||||||||

Releasing Spreads(1) |

||||||||||||||||||||||||||

# of Leases Executed |

SF of

Leasing

|

Net Effective |

Cash |

|||||||||||||||||||||||

New Leases |

54 | 882,403 | 3.2% | (5.4)% | ||||||||||||||||||||||

Renewal Leases |

84 | 1,511,946 | 29.4% | 20.2% | ||||||||||||||||||||||

Total Leases |

138 | 2,394,349 | 23.8% | 14.7% | ||||||||||||||||||||||

2025 Outlook (1) |

Q1 2025 Updated Guidance |

Initial

Guidance

|

||||||||||||

| Net Income Attributable to Common Stockholders per diluted share | $1.31 - $1.35 | $1.21 - $1.25 | ||||||||||||

| Company share of Core FFO per diluted share | $2.37 - $2.41 | $2.37 - $2.41 | ||||||||||||

Same Property Portfolio NOI Growth — Net Effective |

0.75% - 1.25% | 0.75% - 1.25% | ||||||||||||

Same Property Portfolio NOI Growth — Cash |

2.25% - 2.75% | 2.25% - 2.75% | ||||||||||||

Average Same Property Portfolio Occupancy (Full Year) (2) |

95.5% - 96.0% | 95.5% - 96.0% | ||||||||||||

General and Administrative Expenses (3) |

+/- $82.0M | +/- $82.0M | ||||||||||||

| Net Interest Expense | +/- $109.5M | $110.5M - $111.5M | ||||||||||||

2025 Estimate |

|||||||||||

| Low | High | ||||||||||

| Net income attributable to common stockholders | $ | 1.31 | $ | 1.35 | |||||||

| Company share of depreciation and amortization | 1.25 | 1.25 | |||||||||

Company share of gains on sale of real estate(1) |

(0.19) | (0.19) | |||||||||

| Company share of Core FFO | $ | 2.37 | $ | 2.41 | |||||||

| March 31, 2025 | December 31, 2024 | ||||||||||

| (unaudited) | |||||||||||

| ASSETS | |||||||||||

| Land | $ | 7,797,744 | $ | 7,822,290 | |||||||

| Buildings and improvements | 4,573,881 | 4,611,987 | |||||||||

| Tenant improvements | 181,632 | 188,217 | |||||||||

| Furniture, fixtures, and equipment | 132 | 132 | |||||||||

| Construction in progress | 386,719 | 333,690 | |||||||||

| Total real estate held for investment | 12,940,108 | 12,956,316 | |||||||||

| Accumulated depreciation | (1,021,151) | (977,133) | |||||||||

| Investments in real estate, net | 11,918,957 | 11,979,183 | |||||||||

| Cash and cash equivalents | 504,579 | 55,971 | |||||||||

| Restricted cash | 50,105 | — | |||||||||

Loan receivable, net |

123,359 | 123,244 | |||||||||

| Rents and other receivables, net | 17,622 | 15,772 | |||||||||

| Deferred rent receivable, net | 166,893 | 161,693 | |||||||||

| Deferred leasing costs, net | 70,404 | 67,827 | |||||||||

| Deferred loan costs, net | 1,642 | 1,999 | |||||||||

| Acquired lease intangible assets, net | 182,444 | 201,467 | |||||||||

Acquired indefinite-lived intangible asset |

5,156 | 5,156 | |||||||||

Interest rate swap assets |

5,580 | 8,942 | |||||||||

| Other assets | 20,730 | 26,964 | |||||||||

| Assets associated with real estate held for sale, net | 18,386 | — | |||||||||

| Total Assets | $ | 13,085,857 | $ | 12,648,218 | |||||||

| LIABILITIES & EQUITY | |||||||||||

| Liabilities | |||||||||||

| Notes payable | $ | 3,348,060 | $ | 3,345,962 | |||||||

| Accounts payable, accrued expenses and other liabilities | 141,999 | 149,707 | |||||||||

| Dividends and distributions payable | 105,285 | 97,823 | |||||||||

| Acquired lease intangible liabilities, net | 136,661 | 147,473 | |||||||||

| Tenant security deposits | 90,050 | 90,698 | |||||||||

Tenant prepaid rents |

88,822 | 90,576 | |||||||||

| Liabilities associated with real estate held for sale | 234 | — | |||||||||

| Total Liabilities | 3,911,111 | 3,922,239 | |||||||||

| Equity | |||||||||||

| Rexford Industrial Realty, Inc. stockholders’ equity | |||||||||||

Preferred stock, $0.01 par value per share, 10,050,000 shares authorized: |

|||||||||||

5.875% series B cumulative redeemable preferred stock, 3,000,000 shares outstanding at March 31, 2025 and December 31, 2024 ($75,000 liquidation preference) |

72,443 | 72,443 | |||||||||

5.625% series C cumulative redeemable preferred stock, 3,450,000 shares outstanding at March 31, 2025 and December 31, 2024 ($86,250 liquidation preference) |

83,233 | 83,233 | |||||||||

Common Stock,$ 0.01 par value per share, 489,950,000 authorized and 236,170,854 and 225,285,011 shares outstanding at March 31, 2025 and December 31, 2024, respectively |

2,362 | 2,253 | |||||||||

| Additional paid in capital | 9,116,069 | 8,601,276 | |||||||||

| Cumulative distributions in excess of earnings | (474,550) | (441,881) | |||||||||

| Accumulated other comprehensive loss | 3,582 | 6,746 | |||||||||

| Total stockholders’ equity | 8,803,139 | 8,324,070 | |||||||||

| Noncontrolling interests | 371,607 | 401,909 | |||||||||

| Total Equity | 9,174,746 | 8,725,979 | |||||||||

| Total Liabilities and Equity | $ | 13,085,857 | $ | 12,648,218 | |||||||

| Three Months Ended March 31, | |||||||||||

| 2025 | 2024 | ||||||||||

| REVENUES | |||||||||||

| Rental income | $ | 248,821 | $ | 210,990 | |||||||

| Management and leasing services | 142 | 132 | |||||||||

| Interest income | 3,324 | 2,974 | |||||||||

| TOTAL REVENUES | 252,287 | 214,096 | |||||||||

| OPERATING EXPENSES | |||||||||||

| Property expenses | 55,261 | 47,482 | |||||||||

| General and administrative | 19,868 | 19,980 | |||||||||

| Depreciation and amortization | 86,740 | 66,278 | |||||||||

| TOTAL OPERATING EXPENSES | 161,869 | 133,740 | |||||||||

| OTHER EXPENSES | |||||||||||

| Other expenses | 2,239 | 1,408 | |||||||||

| Interest expense | 27,288 | 14,671 | |||||||||

| TOTAL EXPENSES | 191,396 | 149,819 | |||||||||

| Gains on sale of real estate | 13,157 | — | |||||||||

| NET INCOME | 74,048 | 64,277 | |||||||||

| Less: net income attributable to noncontrolling interests | (2,849) | (2,906) | |||||||||

| NET INCOME ATTRIBUTABLE TO REXFORD INDUSTRIAL REALTY, INC. | 71,199 | 61,371 | |||||||||

| Less: preferred stock dividends | (2,314) | (2,314) | |||||||||

| Less: earnings attributable to participating securities | (539) | (418) | |||||||||

| NET INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS | $ | 68,346 | $ | 58,639 | |||||||

Net income attributable to common stockholders per share – basic |

$ | 0.30 | $ | 0.27 | |||||||

Net income attributable to common stockholders per share – diluted |

$ | 0.30 | $ | 0.27 | |||||||

| Weighted-average shares of common stock outstanding – basic | 227,396 | 214,402 | |||||||||

| Weighted-average shares of common stock outstanding – diluted | 227,396 | 214,438 | |||||||||

Same Property Portfolio Occupancy | |||||||||||||||||

| March 31, | |||||||||||||||||

| 2025 | 2024 | Change (basis points) | |||||||||||||||

Quarterly Weighted Average Occupancy:(1) |

|||||||||||||||||

| Los Angeles County | 95.6% | 97.2% | (160) bps | ||||||||||||||

| Orange County | 99.1% | 99.6% | (50) bps | ||||||||||||||

| Riverside / San Bernardino County | 96.7% | 94.8% | 190 bps | ||||||||||||||

| San Diego County | 96.0% | 98.2% | (220) bps | ||||||||||||||

| Ventura County | 91.4% | 96.2% | (480) bps | ||||||||||||||

| Same Property Portfolio Weighted Average Occupancy | 95.9% | 96.9% | (100) bps | ||||||||||||||

| Ending Occupancy: | 95.7% | 96.6% | (90) bps | ||||||||||||||

Same Property Portfolio NOI and Cash NOI |

|||||||||||||||||||||||

| Three Months Ended March 31, | |||||||||||||||||||||||

| 2025 | 2024 | $ Change | % Change | ||||||||||||||||||||

| Rental income | $ | 190,259 | $ | 188,059 | $ | 2,200 | 1.2 | % | |||||||||||||||

| Property expenses | 41,822 | 40,597 | 1,225 | 3.0 | % | ||||||||||||||||||

| Same Property Portfolio NOI | $ | 148,437 | $ | 147,462 | $ | 975 | 0.7 | % | |||||||||||||||

| Straight line rental revenue adjustment | (3,001) | (7,155) | 4,154 | (58.1) | % | ||||||||||||||||||

| Above/(below) market lease revenue adjustments | (4,872) | (6,437) | 1,565 | (24.3) | % | ||||||||||||||||||

| Same Property Portfolio Cash NOI | $ | 140,564 | $ | 133,870 | $ | 6,694 | 5.0 | % | |||||||||||||||

| Three Months Ended March 31, | |||||||||||

| 2025 | 2024 | ||||||||||

| Net income | $ | 74,048 | $ | 64,277 | |||||||

| General and administrative | 19,868 | 19,980 | |||||||||

| Depreciation and amortization | 86,740 | 66,278 | |||||||||

| Other expenses | 2,239 | 1,408 | |||||||||

| Interest expense | 27,288 | 14,671 | |||||||||

| Management and leasing services | (142) | (132) | |||||||||

| Interest income | (3,324) | (2,974) | |||||||||

| Gains on sale of real estate | (13,157) | — | |||||||||

| Net operating income (NOI) | $ | 193,560 | $ | 163,508 | |||||||

| Straight line rental revenue adjustment | (5,517) | (7,368) | |||||||||

Above/(below) market lease revenue adjustments |

(9,186) | (7,591) | |||||||||

| Cash NOI | $ | 178,857 | $ | 148,549 | |||||||

| NOI | $ | 193,560 | $ | 163,508 | |||||||

| Non-Same Property Portfolio rental income | (58,562) | (22,931) | |||||||||

| Non-Same Property Portfolio property expenses | 13,439 | 6,885 | |||||||||

| Same Property Portfolio NOI | $ | 148,437 | $ | 147,462 | |||||||

| Straight line rental revenue adjustment | (3,001) | (7,155) | |||||||||

| Above/(below) market lease revenue adjustments | (4,872) | (6,437) | |||||||||

| Same Property Portfolio Cash NOI | $ | 140,564 | $ | 133,870 | |||||||

| Three Months Ended March 31, | |||||||||||

| 2025 | 2024 | ||||||||||

| Net income | $ | 74,048 | $ | 64,277 | |||||||

| Adjustments: | |||||||||||

| Depreciation and amortization | 86,740 | 66,278 | |||||||||

| Gains on sale of real estate | (13,157) | — | |||||||||

| Funds From Operations (FFO) | $ | 147,631 | $ | 130,555 | |||||||

| Less: preferred stock dividends | (2,314) | (2,314) | |||||||||

Less: FFO attributable to noncontrolling interests(1) |

(5,394) | (5,188) | |||||||||

Less: FFO attributable to participating securities(2) |

(750) | (570) | |||||||||

| Company share of FFO | $ | 139,173 | $ | 122,483 | |||||||

| Company Share of FFO per common share – basic | $ | 0.61 | $ | 0.57 | |||||||

| Company Share of FFO per common share – diluted | $ | 0.61 | $ | 0.57 | |||||||

| FFO | $ | 147,631 | $ | 130,555 | |||||||

| Adjustments: | |||||||||||

| Acquisition expenses | 79 | 50 | |||||||||

| Amortization of loss on termination of interest rate swaps | — | 59 | |||||||||

| Non-capitalizable demolition costs | 365 | 998 | |||||||||

Severance costs associated with workforce reduction(3) |

1,483 | — | |||||||||

| Core FFO | $ | 149,558 | $ | 131,662 | |||||||

| Less: preferred stock dividends | (2,314) | (2,314) | |||||||||

Less: Core FFO attributable to noncontrolling interest(1) |

(5,461) | (5,226) | |||||||||

Less: Core FFO attributable to participating securities(2) |

(760) | (575) | |||||||||

| Company share of Core FFO | $ | 141,023 | $ | 123,547 | |||||||

| Company share of Core FFO per common share – basic | $ | 0.62 | $ | 0.58 | |||||||

| Company share of Core FFO per common share – diluted | $ | 0.62 | $ | 0.58 | |||||||

| Weighted-average shares of common stock outstanding – basic | 227,396 | 214,402 | |||||||||

| Weighted-average shares of common stock outstanding – diluted | 227,396 | 214,438 | |||||||||

| Three Months Ended March 31, 2025 | |||||

| Net income | $ | 74,048 | |||

| Interest expense | 27,288 | ||||

| Depreciation and amortization | 86,740 | ||||

| Gains on sale of real estate | (13,157) | ||||

| Stock-based compensation amortization | 9,699 | ||||

| Acquisition expenses | 79 | ||||

Pro forma effect of dispositions(1) |

162 | ||||

Adjusted EBITDAre |

$ | 184,859 | |||

Table of Contents. |

||||||||

| Section | Page | ||||

| Corporate Data: | |||||

| Consolidated Financial Results: | |||||

| Portfolio Data: | |||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 2

|

|

||||||

Investor Company Summary. |

||||||||

| Executive Management Team | ||||||||

| Howard Schwimmer | Co-Chief Executive Officer, Director | |||||||

| Michael S. Frankel | Co-Chief Executive Officer, Director | |||||||

| Laura Clark | Chief Operating Officer | |||||||

| Michael Fitzmaurice | Chief Financial Officer | |||||||

David E. Lanzer |

General Counsel and Corporate Secretary | |||||||

| Board of Directors | ||||||||

| Richard Ziman | Chairman | |||||||

| Tyler H. Rose | Lead Independent Director | |||||||

| Howard Schwimmer | Co-Chief Executive Officer, Director | |||||||

| Michael S. Frankel | Co-Chief Executive Officer, Director | |||||||

| Robert L. Antin | Director | |||||||

| Diana J. Ingram | Director | |||||||

| Angela L. Kleiman | Director | |||||||

| Debra L. Morris | Director | |||||||

| Investor Relations Information | ||||||||

Mikayla Lynch | ||||||||

Director, Investor Relations and Capital Markets |

||||||||

mlynch@rexfordindustrial.com | ||||||||

| Equity Research Coverage | ||||||||||||||||||||||||||||||||

| BofA Securities | Jeffrey Spector | (646) 855-1363 | J.P. Morgan Securities | Michael Mueller | (212) 622-6689 | |||||||||||||||||||||||||||

| Barclays | Brendan Lynch | (212) 526-9428 | Jefferies LLC | Jonathan Petersen | (212) 284-1705 | |||||||||||||||||||||||||||

| BMO Capital Markets | John Kim | (212) 885-4115 | Mizuho Securities USA | Vikram Malhotra | (212) 282-3827 | |||||||||||||||||||||||||||

| BNP Paribas Exane | Nate Crossett | (646) 342-1588 | Robert W. Baird & Co. | Nicholas Thillman | (414) 298-5053 | |||||||||||||||||||||||||||

| Citigroup Investment Research | Craig Mailman | (212) 816-4471 | Scotiabank | Greg McGinniss | (212) 225-6906 | |||||||||||||||||||||||||||

| Colliers Securities | Barry Oxford | (203) 961-6573 | Truist Securities | Anthony Hau | (212) 303-4176 | |||||||||||||||||||||||||||

Deutsche Bank |

Omotayo Okusanya | (212) 250-9284 |

Wedbush Securities | Richard Anderson | (212) 931-7001 | |||||||||||||||||||||||||||

Evercore ISI |

Steve Sakwa | (212) 446-9462 | Wells Fargo Securities | Blaine Heck | (443) 263-6529 | |||||||||||||||||||||||||||

| Green Street Advisors | Vince Tibone | (949) 640-8780 | Wolfe Research | Andrew Rosivach | (646) 582-9250 | |||||||||||||||||||||||||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 3

|

|

||||||

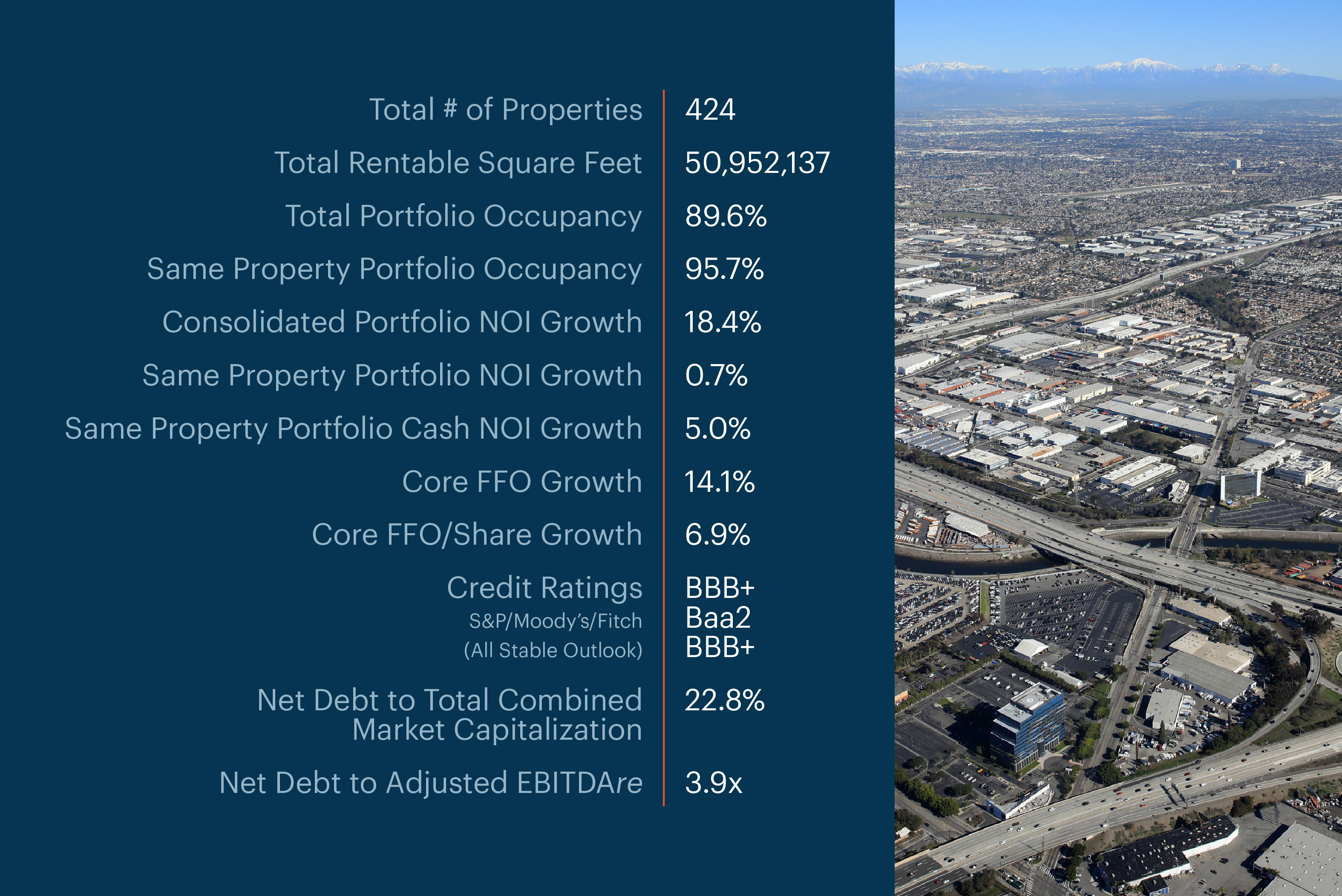

Company Overview. |

||||||||

| For the Quarter Ended March 31, 2025 | ||||||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 4

|

|

||||||

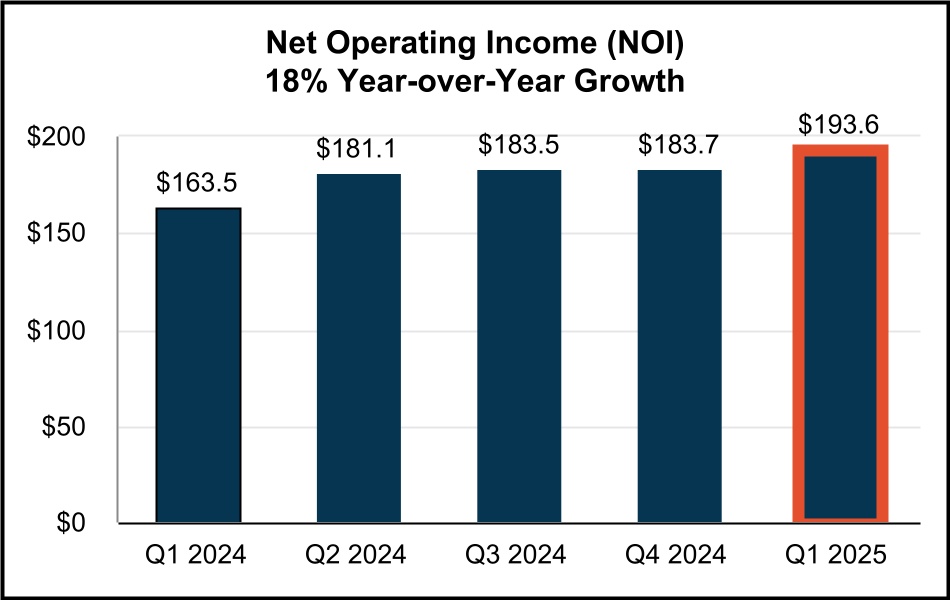

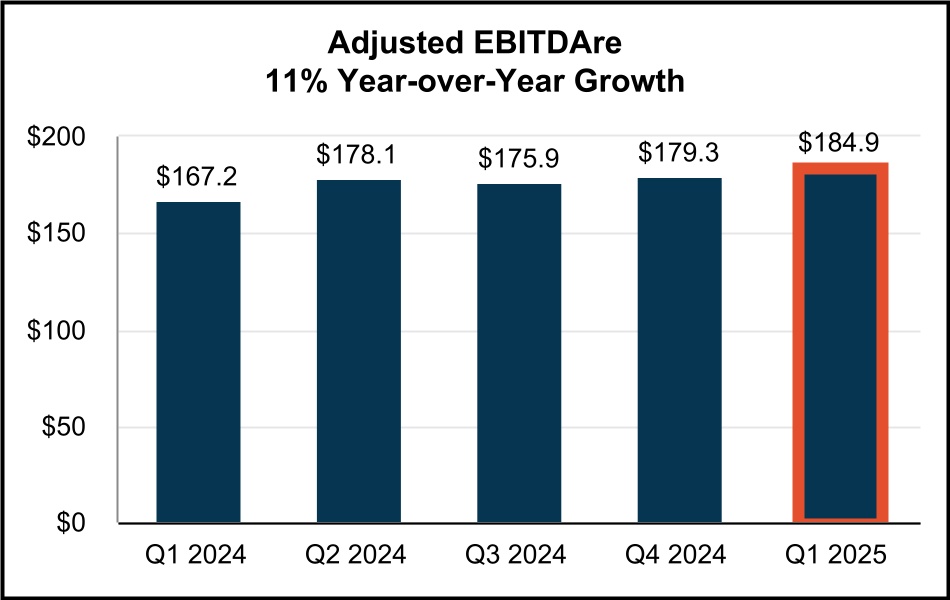

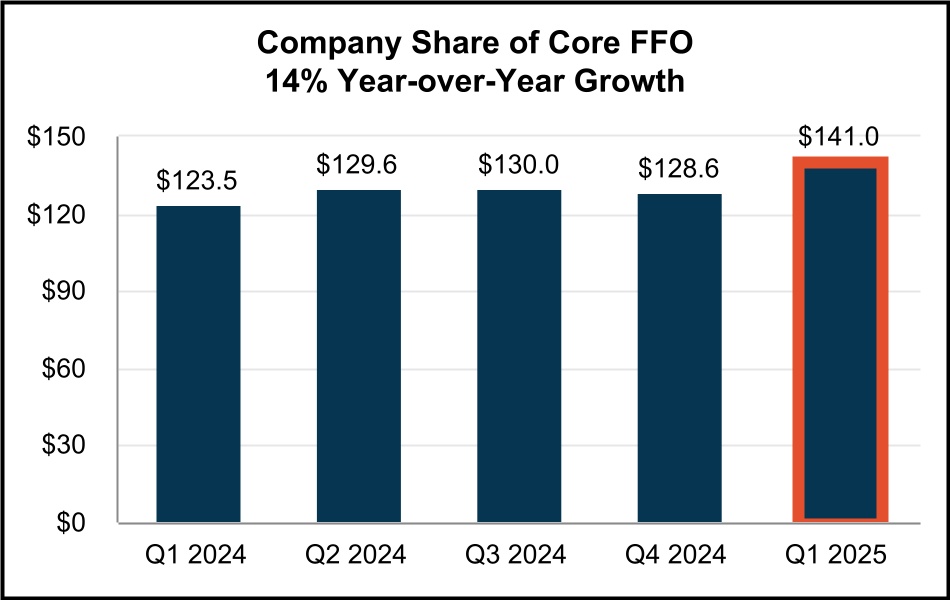

Highlights - Consolidated Financial Results. |

||||||||

| Quarterly Results | (in millions) | |||||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 5

|

|

||||||

Financial and Portfolio Highlights and Capitalization Data.(1) |

||||||||

| (in thousands except share and per share data and portfolio statistics) | ||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| March 31, 2025 | December 31, 2024 | September 30, 2024 | June 30, 2024 | March 31, 2024 | |||||||||||||||||||||||||

| Financial Results: | |||||||||||||||||||||||||||||

| Total rental income | $ | 248,821 | $ | 239,737 | $ | 238,396 | $ | 232,973 | $ | 210,990 | |||||||||||||||||||

| Net income | $ | 74,048 | $ | 64,910 | $ | 70,722 | $ | 86,017 | $ | 64,277 | |||||||||||||||||||

| Net Operating Income (NOI) | $ | 193,560 | $ | 183,731 | $ | 183,529 | $ | 181,068 | $ | 163,508 | |||||||||||||||||||

| Company share of Core FFO | $ | 141,023 | $ | 128,562 | $ | 130,011 | $ | 129,575 | $ | 123,547 | |||||||||||||||||||

| Company share of Core FFO per common share - diluted | $ | 0.62 | $ | 0.58 | $ | 0.59 | $ | 0.60 | $ | 0.58 | |||||||||||||||||||

Adjusted EBITDAre |

$ | 184,859 | $ | 179,347 | $ | 175,929 | $ | 178,106 | $ | 167,207 | |||||||||||||||||||

| Dividend declared per common share | $ | 0.4300 | $ | 0.4175 | $ | 0.4175 | $ | 0.4175 | $ | 0.4175 | |||||||||||||||||||

| Portfolio Statistics: | |||||||||||||||||||||||||||||

| Portfolio rentable square feet (“RSF”) | 50,952,137 | 50,788,225 | 50,067,981 | 49,710,628 | 49,162,216 | ||||||||||||||||||||||||

| Ending occupancy | 89.6% | 91.3% | 93.0% | 93.7% | 92.8% | ||||||||||||||||||||||||

Ending occupancy excluding repositioning/redevelopment(2) |

95.1% | 96.0% | 97.6% | 97.9% | 96.9% | ||||||||||||||||||||||||

Net Effective Rent Change(3) |

23.8% | 55.4% | 39.2% | 67.7% | 53.0% | ||||||||||||||||||||||||

Cash Rent Change(3) |

14.7% | 41.0% | 26.7% | 49.0% | 33.6% | ||||||||||||||||||||||||

| Same Property Portfolio Performance: | |||||||||||||||||||||||||||||

Same Property Portfolio ending occupancy(4) |

95.7% | 96.3% | 96.8% | 97.4% | 96.6% | ||||||||||||||||||||||||

Same Property Portfolio NOI growth(5) |

0.7% | ||||||||||||||||||||||||||||

Same Property Portfolio Cash NOI growth(5) |

5.0% | ||||||||||||||||||||||||||||

| Capitalization: | |||||||||||||||||||||||||||||

Total shares and units issued and outstanding at period end(6) |

244,310,773 | 233,295,793 | 227,278,210 | 225,623,274 | 224,992,152 | ||||||||||||||||||||||||

| Series B and C Preferred Stock and Series 1, 2 and 3 CPOP Units | $ | 173,250 | $ | 213,956 | $ | 213,956 | $ | 214,000 | $ | 241,031 | |||||||||||||||||||

| Total equity market capitalization | $ | 9,738,017 | $ | 9,233,171 | $ | 11,648,323 | $ | 10,274,542 | $ | 11,558,136 | |||||||||||||||||||

| Total consolidated debt | $ | 3,379,383 | $ | 3,379,622 | $ | 3,386,273 | $ | 3,386,559 | $ | 3,389,088 | |||||||||||||||||||

| Total combined market capitalization (net debt plus equity) | $ | 12,612,821 | $ | 12,556,822 | $ | 14,972,760 | $ | 13,535,391 | $ | 14,610,264 | |||||||||||||||||||

| Ratios: | |||||||||||||||||||||||||||||

| Net debt to total combined market capitalization | 22.8% | 26.5% | 22.2% | 24.1% | 20.9% | ||||||||||||||||||||||||

Net debt to Adjusted EBITDAre (quarterly results annualized) |

3.9x | 4.6x | 4.7x | 4.6x | 4.6x | ||||||||||||||||||||||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 6

|

|

||||||

Guidance. |

||||||||

| As of March 31, 2025 | ||||||||

| METRIC | Q1-2025 UPDATED GUIDANCE |

INITIAL 2025

GUIDANCE

|

YTD RESULTS AS OF MARCH 31, 2025 | |||||||||||||||||

Net Income Attributable to Common Stockholders per diluted share (1)(2) |

$1.31 - $1.35 | $1.21 - $1.25 | $0.30 | |||||||||||||||||

Company share of Core FFO per diluted share (1)(2) |

$2.37 - $2.41 | $2.37 - $2.41 | $0.62 | |||||||||||||||||

Same Property Portfolio NOI Growth - GAAP (3) |

0.75% - 1.25% | 0.75% - 1.25% | 0.7% | |||||||||||||||||

Same Property Portfolio NOI Growth - Cash (3) |

2.25% - 2.75% | 2.25% - 2.75% | 5.0% | |||||||||||||||||

Average Same Property Portfolio Occupancy (Full Year) (3)(4) |

95.5% - 96.0% | 95.5% - 96.0% | 95.9% | |||||||||||||||||

Net General and Administrative Expenses (5) |

+/- $82.0M | +/- $82.0M | $19.9M | |||||||||||||||||

| Net Interest Expense | +/- $109.5M | $110.5M - $111.5M | $27.3M | |||||||||||||||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 7

|

|

||||||

Guidance (Continued). |

||||||||

| As of March 31, 2025 | ||||||||

| Earnings Components | Range ($ per share) |

Notes | ||||||||||||||||||

2025 Core FFO Per Diluted Share Guidance (Previous) |

$2.37 | $2.41 | Initial 2025 Guidance |

|||||||||||||||||

| Same Property Portfolio NOI Growth | — | — | FY 2025 SP NOI Growth (GAAP) Guidance range of 0.75% - 1.25% |

|||||||||||||||||

YTD Closed Dispositions |

(0.01) | (0.01) | NOI related to $103M of dispositions closed since prior guidance |

|||||||||||||||||

Net General & Administrative Expenses |

— | — | FY 2025 Guidance range of +/- $82.0M |

|||||||||||||||||

| Net Interest Expense | 0.01 | 0.01 | FY 2025 Guidance range of +/- $109.5M |

|||||||||||||||||

2025 Core FFO Per Diluted Share Guidance (Updated) |

$2.37 | $2.41 | ||||||||||||||||||

| Core FFO Per Diluted Share Annual Growth | 1% | 3% | ||||||||||||||||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 8

|

|

||||||

Consolidated Balance Sheets. |

||||||||

| (unaudited and in thousands) | ||||||||

| March 31, 2025 | December 31, 2024 | September 30, 2024 | June 30, 2024 | March 31, 2024 | |||||||||||||||||||||||||

| ASSETS | |||||||||||||||||||||||||||||

| Land | $ | 7,797,744 | $ | 7,822,290 | $ | 7,703,232 | $ | 7,650,740 | $ | 7,568,720 | |||||||||||||||||||

| Buildings and improvements | 4,573,881 | 4,611,987 | 4,416,032 | 4,330,709 | 4,260,512 | ||||||||||||||||||||||||

| Tenant improvements | 181,632 | 188,217 | 181,785 | 178,832 | 172,707 | ||||||||||||||||||||||||

| Furniture, fixtures, and equipment | 132 | 132 | 132 | 132 | 132 | ||||||||||||||||||||||||

| Construction in progress | 386,719 | 333,690 | 370,431 | 343,275 | 258,413 | ||||||||||||||||||||||||

| Total real estate held for investment | 12,940,108 | 12,956,316 | 12,671,612 | 12,503,688 | 12,260,484 | ||||||||||||||||||||||||

| Accumulated depreciation | (1,021,151) | (977,133) | (925,373) | (874,413) | (827,576) | ||||||||||||||||||||||||

| Investments in real estate, net | 11,918,957 | 11,979,183 | 11,746,239 | 11,629,275 | 11,432,908 | ||||||||||||||||||||||||

| Cash and cash equivalents | 504,579 | 55,971 | 61,836 | 125,710 | 336,960 | ||||||||||||||||||||||||

| Restricted cash | 50,105 | — | — | — | — | ||||||||||||||||||||||||

| Loan receivable, net | 123,359 | 123,244 | 123,129 | 123,014 | 122,899 | ||||||||||||||||||||||||

| Rents and other receivables, net | 17,622 | 15,772 | 17,315 | 17,685 | 17,896 | ||||||||||||||||||||||||

| Deferred rent receivable, net | 166,893 | 161,693 | 151,637 | 140,196 | 130,694 | ||||||||||||||||||||||||

| Deferred leasing costs, net | 70,404 | 67,827 | 69,152 | 68,161 | 61,017 | ||||||||||||||||||||||||

| Deferred loan costs, net | 1,642 | 1,999 | 2,356 | 2,713 | 3,069 | ||||||||||||||||||||||||

Acquired lease intangible assets, net(1) |

182,444 | 201,467 | 205,510 | 220,021 | 223,698 | ||||||||||||||||||||||||

Acquired indefinite-lived intangible asset |

5,156 | 5,156 | 5,156 | 5,156 | 5,156 | ||||||||||||||||||||||||

Interest rate swap assets |

5,580 | 8,942 | 3,880 | 16,510 | 16,737 | ||||||||||||||||||||||||

| Other assets | 20,730 | 26,964 | 34,092 | 18,501 | 22,114 | ||||||||||||||||||||||||

| Acquisition related deposits | — | — | — | 1,250 | 7,975 | ||||||||||||||||||||||||

Assets associated with real estate held for sale, net(2) |

18,386 | — | — | — | — | ||||||||||||||||||||||||

| Total Assets | $ | 13,085,857 | $ | 12,648,218 | $ | 12,420,302 | $ | 12,368,192 | $ | 12,381,123 | |||||||||||||||||||

| LIABILITIES & EQUITY | |||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||

| Notes payable | $ | 3,348,060 | $ | 3,345,962 | $ | 3,350,190 | $ | 3,348,697 | $ | 3,349,120 | |||||||||||||||||||

| Interest rate swap liability | — | — | 295 | — | — | ||||||||||||||||||||||||

| Accounts payable, accrued expenses and other liabilities | 141,999 | 149,707 | 169,084 | 153,993 | 148,920 | ||||||||||||||||||||||||

| Dividends and distributions payable | 105,285 | 97,823 | 95,288 | 94,582 | 94,356 | ||||||||||||||||||||||||

Acquired lease intangible liabilities, net(3) |

136,661 | 147,473 | 155,328 | 163,109 | 171,687 | ||||||||||||||||||||||||

| Tenant security deposits | 90,050 | 90,698 | 91,983 | 91,162 | 91,034 | ||||||||||||||||||||||||

Tenant prepaid rents |

88,822 | 90,576 | 93,218 | 101,473 | 110,727 | ||||||||||||||||||||||||

Liabilities associated with real estate held for sale(2) |

234 | — | — | — | — | ||||||||||||||||||||||||

| Total Liabilities | 3,911,111 | 3,922,239 | 3,955,386 | 3,953,016 | 3,965,844 | ||||||||||||||||||||||||

| Equity | |||||||||||||||||||||||||||||

| Series B preferred stock, net ($75,000 liquidation preference) | 72,443 | 72,443 | 72,443 | 72,443 | 72,443 | ||||||||||||||||||||||||

| Series C preferred stock, net ($86,250 liquidation preference) | 83,233 | 83,233 | 83,233 | 83,233 | 83,233 | ||||||||||||||||||||||||

| Preferred stock | 155,676 | 155,676 | 155,676 | 155,676 | 155,676 | ||||||||||||||||||||||||

| Common stock | 2,362 | 2,253 | 2,195 | 2,178 | 2,178 | ||||||||||||||||||||||||

| Additional paid in capital | 9,116,069 | 8,601,276 | 8,318,979 | 8,235,484 | 8,233,127 | ||||||||||||||||||||||||

| Cumulative distributions in excess of earnings | (474,550) | (441,881) | (407,695) | (381,507) | (370,720) | ||||||||||||||||||||||||

| Accumulated other comprehensive income (loss) | 3,582 | 6,746 | 1,474 | 13,834 | 13,922 | ||||||||||||||||||||||||

| Total stockholders’ equity | 8,803,139 | 8,324,070 | 8,070,629 | 8,025,665 | 8,034,183 | ||||||||||||||||||||||||

| Noncontrolling interests | 371,607 | 401,909 | 394,287 | 389,511 | 381,096 | ||||||||||||||||||||||||

| Total Equity | 9,174,746 | 8,725,979 | 8,464,916 | 8,415,176 | 8,415,279 | ||||||||||||||||||||||||

| Total Liabilities and Equity | $ | 13,085,857 | $ | 12,648,218 | $ | 12,420,302 | $ | 12,368,192 | $ | 12,381,123 | |||||||||||||||||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 9

|

|

||||||

Consolidated Statements of Operations. |

||||||||

| Quarterly Results | (unaudited and in thousands, except share and per share data) | |||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Mar 31, 2025 | Dec 31, 2024 | Sep 30, 2024 | Jun 30, 2024 | Mar 31, 2024 | |||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||

Rental income(1) |

$ | 248,821 | $ | 239,737 | $ | 238,396 | $ | 232,973 | $ | 210,990 | |||||||||||||||||||

| Management and leasing services | 142 | 167 | 156 | 156 | 132 | ||||||||||||||||||||||||

| Interest income | 3,324 | 2,991 | 3,291 | 4,444 | 2,974 | ||||||||||||||||||||||||

| Total Revenues | 252,287 | 242,895 | 241,843 | 237,573 | 214,096 | ||||||||||||||||||||||||

| Operating Expenses | |||||||||||||||||||||||||||||

| Property expenses | 55,261 | 56,006 | 54,867 | 51,905 | 47,482 | ||||||||||||||||||||||||

| General and administrative | 19,868 | 21,940 | 20,926 | 19,307 | 19,980 | ||||||||||||||||||||||||

| Depreciation and amortization | 86,740 | 71,832 | 69,241 | 67,896 | 66,278 | ||||||||||||||||||||||||

| Total Operating Expenses | 161,869 | 149,778 | 145,034 | 139,108 | 133,740 | ||||||||||||||||||||||||

| Other Expenses | |||||||||||||||||||||||||||||

| Other expenses | 2,239 | 34 | 492 | 304 | 1,408 | ||||||||||||||||||||||||

| Interest expense | 27,288 | 28,173 | 27,340 | 28,412 | 14,671 | ||||||||||||||||||||||||

| Total Expenses | 191,396 | 177,985 | 172,866 | 167,824 | 149,819 | ||||||||||||||||||||||||

| Gains on sale of real estate | 13,157 | — | 1,745 | 16,268 | — | ||||||||||||||||||||||||

| Net Income | 74,048 | 64,910 | 70,722 | 86,017 | 64,277 | ||||||||||||||||||||||||

| Less: net income attributable to noncontrolling interests | (2,849) | (2,725) | (2,952) | (3,541) | (2,906) | ||||||||||||||||||||||||

| Net income attributable to Rexford Industrial Realty, Inc. | 71,199 | 62,185 | 67,770 | 82,476 | 61,371 | ||||||||||||||||||||||||

| Less: preferred stock dividends | (2,314) | (2,315) | (2,314) | (2,315) | (2,314) | ||||||||||||||||||||||||

| Less: earnings allocated to participating securities | (539) | (457) | (395) | (409) | (418) | ||||||||||||||||||||||||

| Net income attributable to common stockholders | $ | 68,346 | $ | 59,413 | $ | 65,061 | $ | 79,752 | $ | 58,639 | |||||||||||||||||||

| Earnings per Common Share | |||||||||||||||||||||||||||||

| Net income attributable to common stockholders per share - basic | $ | 0.30 | $ | 0.27 | $ | 0.30 | $ | 0.37 | $ | 0.27 | |||||||||||||||||||

| Net income attributable to common stockholders per share - diluted | $ | 0.30 | $ | 0.27 | $ | 0.30 | $ | 0.37 | $ | 0.27 | |||||||||||||||||||

| Weighted average shares outstanding - basic | 227,395,984 | 222,516,006 | 218,759,979 | 217,388,908 | 214,401,661 | ||||||||||||||||||||||||

| Weighted average shares outstanding - diluted | 227,395,984 | 222,856,120 | 219,133,037 | 217,388,908 | 214,437,913 | ||||||||||||||||||||||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 10

|

|

||||||

Consolidated Statements of Operations. |

||||||||

| Quarterly Results (continued) | (unaudited and in thousands, except share and per share data) | |||||||

| Three Months Ended March 31, | |||||||||||

| 2025 | 2024 | ||||||||||

| Revenues | |||||||||||

| Rental income | $ | 248,821 | $ | 210,990 | |||||||

| Management and leasing services | 142 | 132 | |||||||||

| Interest income | 3,324 | 2,974 | |||||||||

| Total Revenues | 252,287 | 214,096 | |||||||||

| Operating Expenses | |||||||||||

| Property expenses | 55,261 | 47,482 | |||||||||

| General and administrative | 19,868 | 19,980 | |||||||||

| Depreciation and amortization | 86,740 | 66,278 | |||||||||

| Total Operating Expenses | 161,869 | 133,740 | |||||||||

| Other Expenses | |||||||||||

| Other expenses | 2,239 | 1,408 | |||||||||

| Interest expense | 27,288 | 14,671 | |||||||||

| Total Expenses | 191,396 | 149,819 | |||||||||

| Gains on sale of real estate | 13,157 | — | |||||||||

| Net Income | 74,048 | 64,277 | |||||||||

| Less: net income attributable to noncontrolling interests | (2,849) | (2,906) | |||||||||

| Net income attributable to Rexford Industrial Realty, Inc. | 71,199 | 61,371 | |||||||||

| Less: preferred stock dividends | (2,314) | (2,314) | |||||||||

| Less: earnings allocated to participating securities | (539) | (418) | |||||||||

| Net income attributable to common stockholders | $ | 68,346 | $ | 58,639 | |||||||

| Net income attributable to common stockholders per share – basic | $ | 0.30 | $ | 0.27 | |||||||

| Net income attributable to common stockholders per share – diluted | $ | 0.30 | $ | 0.27 | |||||||

| Weighted-average shares of common stock outstanding – basic | 227,395,984 | 214,401,661 | |||||||||

| Weighted-average shares of common stock outstanding – diluted | 227,395,984 | 214,437,913 | |||||||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 11

|

|

||||||

Non-GAAP FFO and Core FFO Reconciliations.(1) |

||||||||

| (unaudited and in thousands, except share and per share data) | ||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| March 31, 2025 | December 31, 2024 | September 30, 2024 | June 30, 2024 | March 31, 2024 | |||||||||||||||||||||||||

| Net Income | $ | 74,048 | $ | 64,910 | $ | 70,722 | $ | 86,017 | $ | 64,277 | |||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||

| Depreciation and amortization | 86,740 | 71,832 | 69,241 | 67,896 | 66,278 | ||||||||||||||||||||||||

| Gains on sale of real estate | (13,157) | — | (1,745) | (16,268) | — | ||||||||||||||||||||||||

NAREIT Defined Funds From Operations (FFO) |

147,631 | 136,742 | 138,218 | 137,645 | 130,555 | ||||||||||||||||||||||||

| Less: preferred stock dividends | (2,314) | (2,315) | (2,314) | (2,315) | (2,314) | ||||||||||||||||||||||||

Less: FFO attributable to noncontrolling interests(2) |

(5,394) | (5,283) | (5,389) | (5,410) | (5,188) | ||||||||||||||||||||||||

Less: FFO attributable to participating securities(3) |

(750) | (624) | (566) | (582) | (570) | ||||||||||||||||||||||||

| Company share of FFO | $ | 139,173 | $ | 128,520 | $ | 129,949 | $ | 129,338 | $ | 122,483 | |||||||||||||||||||

| Company share of FFO per common share‐basic | $ | 0.61 | $ | 0.58 | $ | 0.59 | $ | 0.59 | $ | 0.57 | |||||||||||||||||||

| Company share of FFO per common share‐diluted | $ | 0.61 | $ | 0.58 | $ | 0.59 | $ | 0.59 | $ | 0.57 | |||||||||||||||||||

| FFO | $ | 147,631 | $ | 136,742 | $ | 138,218 | $ | 137,645 | $ | 130,555 | |||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||

| Acquisition expenses | 79 | 9 | 6 | 58 | 50 | ||||||||||||||||||||||||

| Amortization of loss on termination of interest rate swaps | — | 34 | 59 | 59 | 59 | ||||||||||||||||||||||||

| Non-capitalizable demolition costs | 365 | — | — | 129 | 998 | ||||||||||||||||||||||||

Severance costs associated with workforce reduction(4) |

1,483 | — | — | — | — | ||||||||||||||||||||||||

| Core FFO | 149,558 | 136,785 | 138,283 | 137,891 | 131,662 | ||||||||||||||||||||||||

| Less: preferred stock dividends | (2,314) | (2,315) | (2,314) | (2,315) | (2,314) | ||||||||||||||||||||||||

Less: Core FFO attributable to noncontrolling interests(2) |

(5,461) | (5,284) | (5,391) | (5,418) | (5,226) | ||||||||||||||||||||||||

Less: Core FFO attributable to participating securities(3) |

(760) | (624) | (567) | (583) | (575) | ||||||||||||||||||||||||

| Company share of Core FFO | $ | 141,023 | $ | 128,562 | $ | 130,011 | $ | 129,575 | $ | 123,547 | |||||||||||||||||||

| Company share of Core FFO per common share‐basic | $ | 0.62 | $ | 0.58 | $ | 0.59 | $ | 0.60 | $ | 0.58 | |||||||||||||||||||

| Company share of Core FFO per common share‐diluted | $ | 0.62 | $ | 0.58 | $ | 0.59 | $ | 0.60 | $ | 0.58 | |||||||||||||||||||

| Weighted-average shares outstanding-basic | 227,395,984 | 222,516,006 | 218,759,979 | 217,388,908 | 214,401,661 | ||||||||||||||||||||||||

Weighted-average shares outstanding-diluted(5) |

227,395,984 | 222,856,120 | 219,133,037 | 217,388,908 | 214,437,913 | ||||||||||||||||||||||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 12

|

|

||||||

Non-GAAP FFO and Core FFO Reconciliations.(1) |

||||||||

| (unaudited and in thousands, except share and per share data) | ||||||||

| Three Months Ended March 31, | |||||||||||

| 2025 | 2024 | ||||||||||

| Net Income | $ | 74,048 | $ | 64,277 | |||||||

| Adjustments: | |||||||||||

| Depreciation and amortization | 86,740 | 66,278 | |||||||||

| Gains on sale of real estate | (13,157) | — | |||||||||

| Funds From Operations (FFO) | 147,631 | 130,555 | |||||||||

| Less: preferred stock dividends | (2,314) | (2,314) | |||||||||

| Less: FFO attributable to noncontrolling interests | (5,394) | (5,188) | |||||||||

| Less: FFO attributable to participating securities | (750) | (570) | |||||||||

| Company share of FFO | $ | 139,173 | $ | 122,483 | |||||||

| Company share of FFO per common share‐basic | $ | 0.61 | $ | 0.57 | |||||||

| Company share of FFO per common share‐diluted | $ | 0.61 | $ | 0.57 | |||||||

| FFO | $ | 147,631 | $ | 130,555 | |||||||

| Adjustments: | |||||||||||

| Acquisition expenses | 79 | 50 | |||||||||

| Amortization of loss on termination of interest rate swaps | — | 59 | |||||||||

| Non-capitalizable demolition costs | 365 | 998 | |||||||||

Severance costs associated with workforce reduction(2) |

1,483 | — | |||||||||

| Core FFO | 149,558 | 131,662 | |||||||||

| Less: preferred stock dividends | (2,314) | (2,314) | |||||||||

| Less: Core FFO attributable to noncontrolling interests | (5,461) | (5,226) | |||||||||

| Less: Core FFO attributable to participating securities | (760) | (575) | |||||||||

| Company share of Core FFO | $ | 141,023 | $ | 123,547 | |||||||

| Company share of Core FFO per common share‐basic | $ | 0.62 | $ | 0.58 | |||||||

| Company share of Core FFO per common share‐diluted | $ | 0.62 | $ | 0.58 | |||||||

| Weighted-average shares outstanding-basic | 227,395,984 | 214,401,661 | |||||||||

| Weighted-average shares outstanding-diluted | 227,395,984 | 214,437,913 | |||||||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 13

|

|

||||||

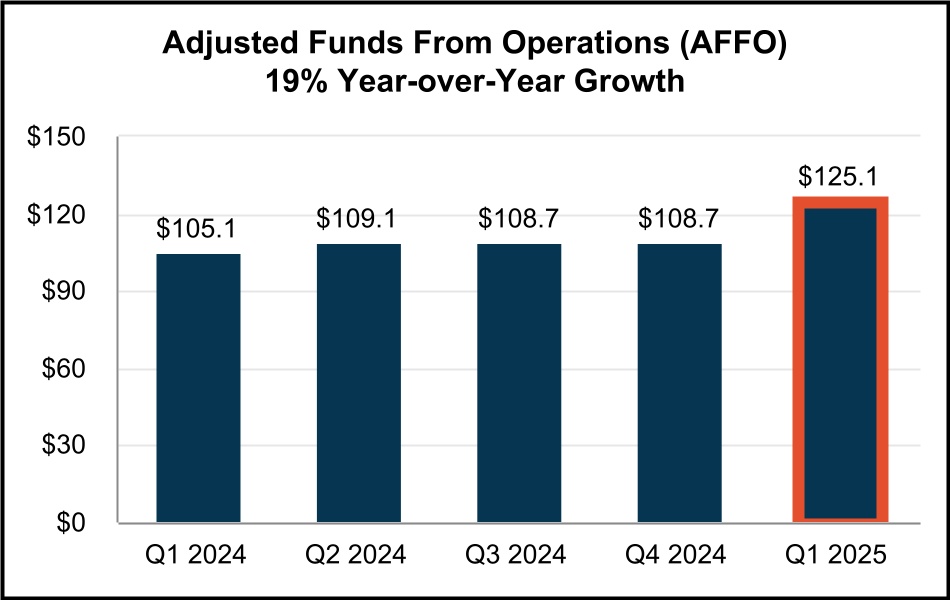

Non-GAAP AFFO Reconciliation.(1) |

||||||||

| (unaudited and in thousands, except share and per share data) | ||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

March 31, 2024 |

|||||||||||||||||||||||||

Funds From Operations(2) |

$ | 147,631 | $ | 136,742 | $ | 138,218 | $ | 137,645 | $ | 130,555 | |||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||

| Amortization of deferred financing costs | 1,134 | 1,246 | 1,252 | 1,266 | 1,011 | ||||||||||||||||||||||||

| Non-cash stock compensation | 9,699 | 11,539 | 9,918 | 11,057 | 9,088 | ||||||||||||||||||||||||

| Amortization related to termination/settlement of interest rate derivatives | 77 | 112 | 136 | 137 | 137 | ||||||||||||||||||||||||

| Note payable (discount) premium amortization, net | 1,560 | 1,534 | 1,511 | 1,491 | 293 | ||||||||||||||||||||||||

| Non-capitalizable demolition costs | 365 | — | — | 129 | 998 | ||||||||||||||||||||||||

| Severance costs associated with workforce reduction | 1,483 | — | — | — | — | ||||||||||||||||||||||||

| Deduct: | |||||||||||||||||||||||||||||

| Preferred stock dividends | (2,314) | (2,315) | (2,314) | (2,315) | (2,314) | ||||||||||||||||||||||||

Straight line rental revenue adjustment(3) |

(5,517) | (10,057) | (11,441) | (9,567) | (7,368) | ||||||||||||||||||||||||

| Above/(below) market lease revenue adjustments | (9,186) | (6,159) | (6,635) | (7,268) | (7,591) | ||||||||||||||||||||||||

Capitalized payments(4) |

(13,321) | (12,102) | (13,900) | (12,280) | (13,163) | ||||||||||||||||||||||||

| Accretion of net loan origination fees | (115) | (115) | (115) | (115) | (115) | ||||||||||||||||||||||||

Recurring capital expenditures(5) |

(1,311) | (7,882) | (5,254) | (3,502) | (2,990) | ||||||||||||||||||||||||

2nd generation tenant improvements(6) |

(162) | (296) | (18) | (123) | (226) | ||||||||||||||||||||||||

2nd generation leasing commissions(7) |

(4,879) | (3,520) | (2,660) | (7,436) | (3,231) | ||||||||||||||||||||||||

| Adjusted Funds From Operations (AFFO) | $ | 125,144 | $ | 108,727 | $ | 108,698 | $ | 109,119 | $ | 105,084 | |||||||||||||||||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 14

|

|

||||||

Statement of Operations Reconciliations - NOI, Cash NOI, EBITDAre and Adjusted EBITDAre.(1) | ||||||||

| (unaudited and in thousands) | ||||||||

| NOI and Cash NOI | |||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Mar 31, 2025 | Dec 31, 2024 | Sep 30, 2024 | Jun 30, 2024 | Mar 31, 2024 | |||||||||||||||||||||||||

Rental income(2)(3)(4) |

$ | 248,821 | $ | 239,737 | $ | 238,396 | $ | 232,973 | $ | 210,990 | |||||||||||||||||||

| Less: Property expenses | 55,261 | 56,006 | 54,867 | 51,905 | 47,482 | ||||||||||||||||||||||||

| Net Operating Income (NOI) | $ | 193,560 | $ | 183,731 | $ | 183,529 | $ | 181,068 | $ | 163,508 | |||||||||||||||||||

Above/(below) market lease revenue adjustments |

(9,186) | (6,159) | (6,635) | (7,268) | (7,591) | ||||||||||||||||||||||||

| Straight line rental revenue adjustment | (5,517) | (10,057) | (11,441) | (9,567) | (7,368) | ||||||||||||||||||||||||

| Cash NOI | $ | 178,857 | $ | 167,515 | $ | 165,453 | $ | 164,233 | $ | 148,549 | |||||||||||||||||||

EBITDAre and Adjusted EBITDAre |

|||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Mar 31, 2025 | Dec 31, 2024 | Sep 30, 2024 | Jun 30, 2024 | Mar 31, 2024 | |||||||||||||||||||||||||

| Net income | $ | 74,048 | $ | 64,910 | $ | 70,722 | $ | 86,017 | $ | 64,277 | |||||||||||||||||||

| Interest expense | 27,288 | 28,173 | 27,340 | 28,412 | 14,671 | ||||||||||||||||||||||||

| Depreciation and amortization | 86,740 | 71,832 | 69,241 | 67,896 | 66,278 | ||||||||||||||||||||||||

| Gains on sale of real estate | (13,157) | — | (1,745) | (16,268) | — | ||||||||||||||||||||||||

EBITDAre |

$ | 174,919 | $ | 164,915 | $ | 165,558 | $ | 166,057 | $ | 145,226 | |||||||||||||||||||

| Stock-based compensation amortization | 9,699 | 11,539 | 9,918 | 11,057 | 9,088 | ||||||||||||||||||||||||

| Acquisition expenses | 79 | 9 | 6 | 58 | 50 | ||||||||||||||||||||||||

Pro forma effect of acquisitions(5) |

— | 2,884 | 426 | 1,058 | 12,843 | ||||||||||||||||||||||||

Pro forma effect of dispositions(6) |

162 | — | 21 | (124) | — | ||||||||||||||||||||||||

Adjusted EBITDAre |

$ | 184,859 | $ | 179,347 | $ | 175,929 | $ | 178,106 | $ | 167,207 | |||||||||||||||||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 15

|

|

||||||

Same Property Portfolio Performance.(1) |

||||||||

| (unaudited and dollars in thousands) | ||||||||

| Same Property Portfolio: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of properties | 292 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Square Feet | 38,380,256 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Same Property Portfolio NOI and Cash NOI: | ||||||||||||||||||||||||||

| Three Months Ended March 31, | ||||||||||||||||||||||||||

| 2025 | 2024 | $ Change | % Change | |||||||||||||||||||||||

Rental income(2)(3)(4) |

$ | 190,259 | $ | 188,059 | $ | 2,200 | 1.2% | |||||||||||||||||||

| Property expenses | 41,822 | 40,597 | 1,225 | 3.0% | ||||||||||||||||||||||

| Same Property Portfolio NOI | $ | 148,437 | $ | 147,462 | $ | 975 | 0.7% | (4) |

||||||||||||||||||

Straight-line rental revenue adjustment |

(3,001) | (7,155) | 4,154 | (58.1)% | ||||||||||||||||||||||

Above/(below) market lease revenue adjustments |

(4,872) | (6,437) | 1,565 | (24.3)% | ||||||||||||||||||||||

| Same Property Portfolio Cash NOI | $ | 140,564 | $ | 133,870 | $ | 6,694 | 5.0% | (4) |

||||||||||||||||||

| Same Property Portfolio Occupancy: | |||||||||||||||||||||||||||||

| Three Months Ended March 31, | |||||||||||||||||||||||||||||

| 2025 | 2024 | Year-over-Year Change (basis points) |

Three Months Ended December 31, 2024 | Sequential Change (basis points) |

|||||||||||||||||||||||||

Quarterly Weighted Average Occupancy:(5) |

|||||||||||||||||||||||||||||

| Los Angeles County | 95.6% | 97.2% | (160) bps | 96.7% | (110) bps | ||||||||||||||||||||||||

| Orange County | 99.1% | 99.6% | (50) bps | 99.2% | (10) bps | ||||||||||||||||||||||||

| Riverside / San Bernardino County | 96.7% | 94.8% | 190 bps | 96.7% | — bps | ||||||||||||||||||||||||

| San Diego County | 96.0% | 98.2% | (220) bps | 95.6% | 40 bps | ||||||||||||||||||||||||

| Ventura County | 91.4% | 96.2% | (480) bps | 91.1% | 30 bps | ||||||||||||||||||||||||

| Quarterly Weighted Average Occupancy | 95.9% | 96.9% | (100) bps | 96.5% | (60) bps | ||||||||||||||||||||||||

| Ending Occupancy: | 95.7% | 96.6% | (90) bps | 96.3% | (60) bps | ||||||||||||||||||||||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 16

|

|

||||||

Capitalization Summary. |

||||||||

| (unaudited and in thousands, except share and per share data) | ||||||||

| Capitalization as of March 31, 2025 | ||||||||

| Description | March 31, 2025 | December 31, 2024 | September 30, 2024 | June 30, 2024 | March 31, 2024 | ||||||||||||||||||||||||

Common shares outstanding(1) |

235,610,472 | 224,868,888 | 219,102,342 | 217,404,848 | 217,382,937 | ||||||||||||||||||||||||

Operating partnership units outstanding(2) |

8,700,301 | 8,426,905 | 8,175,868 | 8,218,426 | 7,609,215 | ||||||||||||||||||||||||

| Total shares and units outstanding at period end | 244,310,773 | 233,295,793 | 227,278,210 | 225,623,274 | 224,992,152 | ||||||||||||||||||||||||

| Share price at end of quarter | $ | 39.15 | $ | 38.66 | $ | 50.31 | $ | 44.59 | $ | 50.30 | |||||||||||||||||||

| Common Stock and Operating Partnership Units - Capitalization | $ | 9,564,767 | $ | 9,019,215 | $ | 11,434,367 | $ | 10,060,542 | $ | 11,317,105 | |||||||||||||||||||

Series B and C Cumulative Redeemable Preferred Stock(3) |

$ | 161,250 | $ | 161,250 | $ | 161,250 | $ | 161,250 | $ | 161,250 | |||||||||||||||||||

4.43937% Series 1 Cumulative Redeemable Convertible Preferred Units(4) |

— | — | — | — | 27,031 | ||||||||||||||||||||||||

4.00% Series 2 Cumulative Redeemable Convertible Preferred Units(4) |

— | 40,706 | 40,706 | 40,750 | 40,750 | ||||||||||||||||||||||||

3.00% Series 3 Cumulative Redeemable Convertible Preferred Units(4) |

12,000 | 12,000 | 12,000 | 12,000 | 12,000 | ||||||||||||||||||||||||

| Preferred Equity | $ | 173,250 | $ | 213,956 | $ | 213,956 | $ | 214,000 | $ | 241,031 | |||||||||||||||||||

| Total Equity Market Capitalization | $ | 9,738,017 | $ | 9,233,171 | $ | 11,648,323 | $ | 10,274,542 | $ | 11,558,136 | |||||||||||||||||||

| Total Debt | $ | 3,379,383 | $ | 3,379,622 | $ | 3,386,273 | $ | 3,386,559 | $ | 3,389,088 | |||||||||||||||||||

| Less: Cash and cash equivalents | (504,579) | (55,971) | (61,836) | (125,710) | (336,960) | ||||||||||||||||||||||||

| Net Debt | $ | 2,874,804 | $ | 3,323,651 | $ | 3,324,437 | $ | 3,260,849 | $ | 3,052,128 | |||||||||||||||||||

| Total Combined Market Capitalization (Net Debt plus Equity) | $ | 12,612,821 | $ | 12,556,822 | $ | 14,972,760 | $ | 13,535,391 | $ | 14,610,264 | |||||||||||||||||||

| Net debt to total combined market capitalization | 22.8 | % | 26.5 | % | 22.2 | % | 24.1 | % | 20.9 | % | |||||||||||||||||||

Net debt to Adjusted EBITDAre (quarterly results annualized)(5) |

3.9x | 4.6x | 4.7x | 4.6x | 4.6x | ||||||||||||||||||||||||

Net debt & preferred equity to Adjusted EBITDAre (quarterly results annualized)(5) |

4.1x | 4.9x | 5.0x | 4.9x | 4.9x | ||||||||||||||||||||||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 17

|

|

||||||

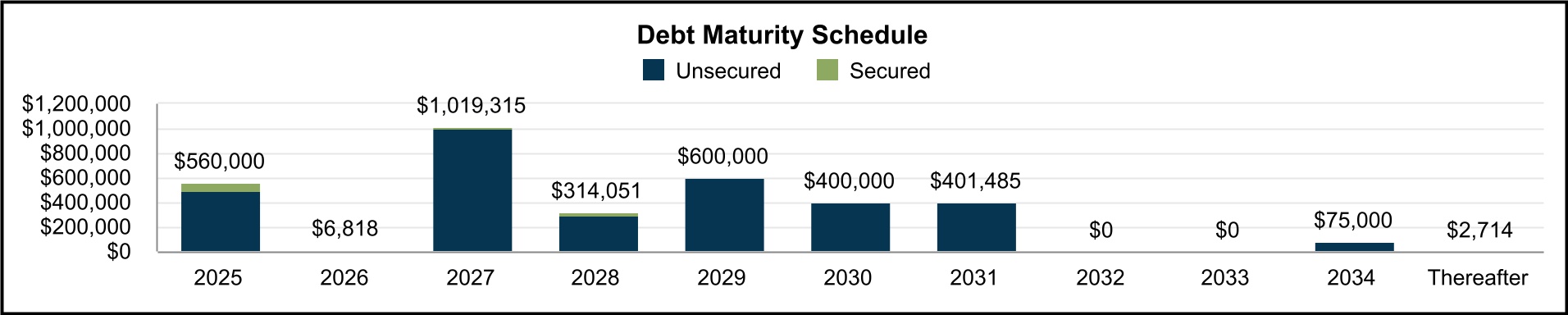

Debt Summary. |

||||||||

| (unaudited and dollars in thousands) | ||||||||

| Debt Detail: | ||||||||||||||||||||||||||

| As of March 31, 2025 | ||||||||||||||||||||||||||

| Debt Description | Maturity Date | Stated Interest Rate |

Effective

Interest Rate(1)

|

Principal

Balance(2)

|

||||||||||||||||||||||

| Unsecured Debt: | ||||||||||||||||||||||||||

$1.0 Billion Revolving Credit Facility(3) |

5/26/2026(4) |

SOFR+0.725%(5) |

5.235% | $ | — | |||||||||||||||||||||

| $400M Term Loan Facility | 7/18/2025(4) |

SOFR+0.80%(5) |

4.872%(6) |

400,000 | ||||||||||||||||||||||

| $100M Senior Notes | 8/6/2025 | 4.290% | 4.290% | 100,000 | ||||||||||||||||||||||

$575M Exchangeable 2027 Senior Notes(7) |

3/15/2027 | 4.375% | 4.375% | 575,000 | ||||||||||||||||||||||

| $300M Term Loan Facility | 5/26/2027 | SOFR+0.80%(5) |

3.717%(8) |

300,000 | ||||||||||||||||||||||

| $125M Senior Notes | 7/13/2027 | 3.930% | 3.930% | 125,000 | ||||||||||||||||||||||

| $300M Senior Notes | 6/15/2028 | 5.000% | 5.000% | 300,000 | ||||||||||||||||||||||

$575M Exchangeable 2029 Senior Notes(7) |

3/15/2029 | 4.125% | 4.125% | 575,000 | ||||||||||||||||||||||

| $25M Series 2019A Senior Notes | 7/16/2029 | 3.880% | 3.880% | 25,000 | ||||||||||||||||||||||

| $400M Senior Notes | 12/1/2030 | 2.125% | 2.125% | 400,000 | ||||||||||||||||||||||

| $400M Senior Notes - Green Bond | 9/1/2031 | 2.150% | 2.150% | 400,000 | ||||||||||||||||||||||

| $75M Series 2019B Senior Notes | 7/16/2034 | 4.030% | 4.030% | 75,000 | ||||||||||||||||||||||

| Secured Debt: | ||||||||||||||||||||||||||

| $60M Term Loan Facility | 10/27/2025(9) |

SOFR+1.250%(9) |

5.060%(10) |

60,000 | ||||||||||||||||||||||

| 701-751 Kingshill Place | 1/5/2026 | 3.900% | 3.900% | 6,818 | ||||||||||||||||||||||

| 13943-13955 Balboa Boulevard | 7/1/2027 | 3.930% | 3.930% | 14,115 | ||||||||||||||||||||||

| 2205 126th Street | 12/1/2027 | 3.910% | 3.910% | 5,200 | ||||||||||||||||||||||

| 2410-2420 Santa Fe Avenue | 1/1/2028 | 3.700% | 3.700% | 10,300 | ||||||||||||||||||||||

| 11832-11954 La Cienega Boulevard | 7/1/2028 | 4.260% | 4.260% | 3,751 | ||||||||||||||||||||||

| 1100-1170 Gilbert Street (Gilbert/La Palma) | 3/1/2031 | 5.125% | 5.125% | 1,485 | ||||||||||||||||||||||

| 7817 Woodley Avenue | 8/1/2039 | 4.140% | 4.140% | 2,714 | ||||||||||||||||||||||

| Total Debt | 3.835% | $ | 3,379,383 | |||||||||||||||||||||||

Debt Composition: |

||||||||||||||||||||||||||||||||

| Category | Weighted Average Term Remaining (yrs)(11) |

Stated Interest Rate | Effective Interest Rate | Balance | % of Total | |||||||||||||||||||||||||||

| Fixed | 3.3 | 3.835% (See Table Above) |

3.835% | $ | 3,379,383 | 100% | ||||||||||||||||||||||||||

| Variable | — | — | —% | $ | — | 0% | ||||||||||||||||||||||||||

| Secured | 1.7 | 4.588% | $ | 104,383 | 3% | |||||||||||||||||||||||||||

| Unsecured | 3.4 | 3.811% | $ | 3,275,000 | 97% | |||||||||||||||||||||||||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 18

|

|

||||||

Debt Summary (Continued). |

||||||||

| (unaudited and dollars in thousands) | ||||||||

Debt Maturity Schedule(12): |

||||||||||||||||||||||||||||||||

| Year | Secured |

Unsecured | Total | % Total | Effective Interest Rate(1) |

|||||||||||||||||||||||||||

| 2025 | $ | 60,000 | $ | 500,000 | $ | 560,000 | 17 | % | 4.788 | % | ||||||||||||||||||||||

| 2026 | 6,818 | — | 6,818 | — | % | 3.900 | % | |||||||||||||||||||||||||

| 2027 | 19,315 | 1,000,000 | 1,019,315 | 30 | % | 4.118 | % | |||||||||||||||||||||||||

| 2028 | 14,051 | 300,000 | 314,051 | 9 | % | 4.948 | % | |||||||||||||||||||||||||

| 2029 | — | 600,000 | 600,000 | 18 | % | 4.115 | % | |||||||||||||||||||||||||

| 2030 | — | 400,000 | 400,000 | 12 | % | 2.125 | % | |||||||||||||||||||||||||

| 2031 | 1,485 | 400,000 | 401,485 | 12 | % | 2.161 | % | |||||||||||||||||||||||||

| 2032 | — | — | — | — | % | — | % | |||||||||||||||||||||||||

| 2033 | — | — | — | — | % | — | % | |||||||||||||||||||||||||

| 2034 | — | 75,000 | 75,000 | 2 | % | 4.030 | % | |||||||||||||||||||||||||

| Thereafter | 2,714 | — | 2,714 | 0 | % | 4.140 | % | |||||||||||||||||||||||||

| Total | $ | 104,383 | $ | 3,275,000 | $ | 3,379,383 | 100 | % | 3.835 | % | ||||||||||||||||||||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 19

|

|

||||||

Operations. |

||||||||

| Quarterly Results | ||||||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 20

|

|

||||||

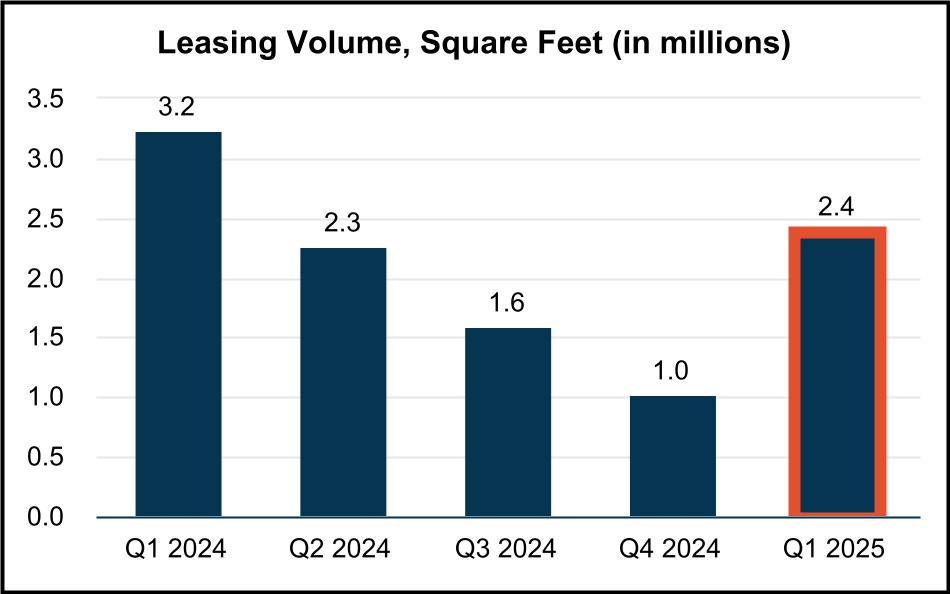

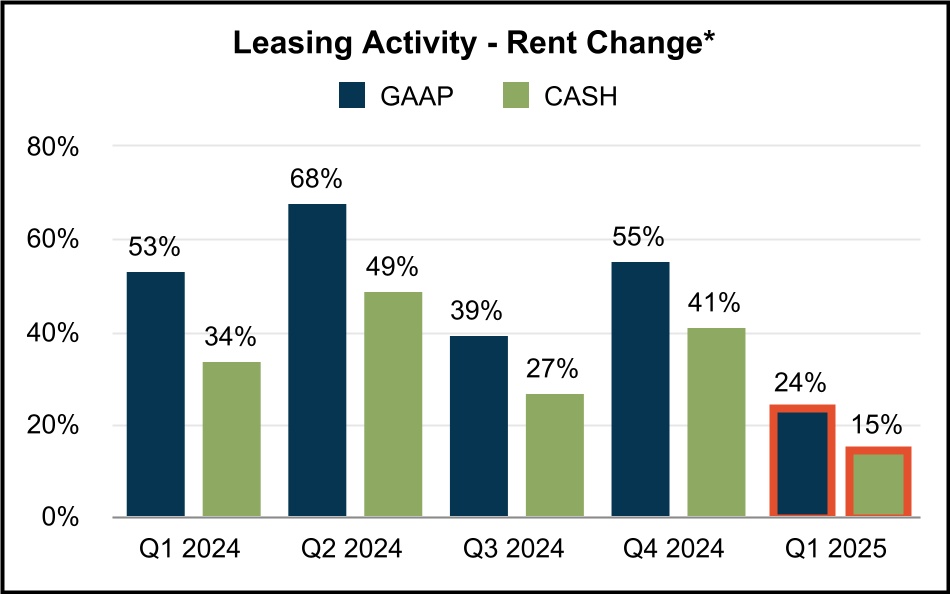

Executed Leasing Statistics and Trends. |

||||||||

| (unaudited results) | ||||||||

| Executed Leasing Activity and Weighted Average New / Renewal Leasing Spreads: | ||||||||

| Three Months Ended | ||||||||||||||||||||||||||||||||

| Mar 31, 2025 | Dec 31, 2024 | Sep 30, 2024 | Jun 30, 2024 | Mar 31, 2024 | ||||||||||||||||||||||||||||

| Leasing Spreads: | ||||||||||||||||||||||||||||||||

Net Effective Rent Change(1) |

23.8 | % | 55.4 | % | 39.2 | % | 67.7 | % | 53.0 | % | ||||||||||||||||||||||

Cash Rent Change(1) |

14.7 | % | 41.0 | % | 26.7 | % | 49.0 | % | 33.6 | % | ||||||||||||||||||||||

Leasing Activity (SF):(2) |

||||||||||||||||||||||||||||||||

| New leases | 882,403 | 330,334 | 994,566 | 1,033,006 | 830,941 | |||||||||||||||||||||||||||

| Renewal leases | 1,511,946 | 684,961 | 599,529 | 1,228,905 | 2,398,076 | |||||||||||||||||||||||||||

| Total leasing activity | 2,394,349 | 1,015,295 | 1,594,095 | 2,261,911 | 3,229,017 | |||||||||||||||||||||||||||

| Total expiring leases | (3,102,514) | (2,436,160) | (1,677,064) | (2,038,430) | (3,819,253) | |||||||||||||||||||||||||||

| Expiring leases - placed into repositioning/redevelopment | 833,218 | 996,035 | 476,821 | 175,533 | 732,083 | |||||||||||||||||||||||||||

Net absorption(3) |

125,053 | (424,830) | 393,852 | 399,014 | 141,847 | |||||||||||||||||||||||||||

Retention rate(4) |

68 | % | 51 | % | 52 | % | 68 | % | 82 | % | ||||||||||||||||||||||

Retention + Backfill rate(5) |

82 | % | 62 | % | 72 | % | 80 | % | 87 | % | ||||||||||||||||||||||

Executed Leasing Activity and Change in Annual Rental Rates and Turnover Costs for Current Quarter Leases:(6) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net Effective Rent |

Cash Rent | Turnover Costs(7) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| First Quarter 2025: | # Leases Signed |

SF of Leasing |

Wtd. Avg. Lease Term (Years) |

Current Lease |

Prior Lease |

Rent Change |

Current Lease |

Prior Lease |

Rent Change |

Wtd. Avg. Abatement (Months) |

Tenant

Improvements

per SF

|

Leasing

Commissions

per SF

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New | 54 | 882,403 | 4.6 | $18.80 | $18.21 | 3.2% | $18.44 | $19.49 | (5.4)% | 2.7 | $2.49 | $5.20 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Renewal | 84 | 1,511,946 | 4.1 | $16.07 | $12.42 | 29.4% | $15.97 | $13.29 | 20.2% | 3.0 | $0.43 | $1.81 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total / Wtd. Average | 138 | 2,394,349 | 4.3 | $16.50 | $13.32 | 23.8% | $16.36 | $14.26 | 14.7% | 2.9 | $0.75 | $2.34 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 21

|

|

||||||

Portfolio Overview. |

||||||||

| At March 31, 2025 | (unaudited results) | |||||||

| Consolidated Portfolio: | ||||||||

| Rentable Square Feet | Ending Occupancy % | In-Place ABR(3) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Market | # of Properties |

Same Property Portfolio |

Non-Same Property Portfolio |

Total Portfolio |

Same Property Portfolio |

Non-Same Property Portfolio |

Total

Portfolio(1)

|

Total Portfolio

Excluding

Repositioning/

Redevelopment(2)

|

Total (in 000’s) |

Per Square Foot |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Central LA | 21 | 2,803,152 | 451,803 | 3,254,955 | 96.8 | % | 61.7 | % | 91.9 | % | 99.6 | % | $ | 40,372 | $13.49 | |||||||||||||||||||||||||||||||||||||||||||||||

| Greater San Fernando Valley | 74 | 5,485,235 | 1,698,421 | 7,183,656 | 96.0 | % | 66.7 | % | 89.1 | % | 95.0 | % | 109,518 | $17.11 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Mid-Counties | 39 | 2,984,568 | 1,591,336 | 4,575,904 | 94.7 | % | 78.7 | % | 89.2 | % | 96.3 | % | 68,023 | $16.67 | ||||||||||||||||||||||||||||||||||||||||||||||||

| San Gabriel Valley | 47 | 3,457,113 | 2,464,137 | 5,921,250 | 94.6 | % | 64.7 | % | 82.2 | % | 87.2 | % | 67,904 | $13.96 | ||||||||||||||||||||||||||||||||||||||||||||||||

| South Bay | 81 | 6,303,807 | 1,497,195 | 7,801,002 | 94.4 | % | 67.2 | % | 89.2 | % | 95.0 | % | 160,509 | $23.07 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Los Angeles County | 262 | 21,033,875 | 7,702,892 | 28,736,767 | 95.2 | % | 68.3 | % | 88.0 | % | 94.1 | % | 446,326 | $17.64 | ||||||||||||||||||||||||||||||||||||||||||||||||

| North Orange County | 25 | 1,094,369 | 1,580,440 | 2,674,809 | 98.1 | % | 66.2 | % | 79.2 | % | 99.0 | % | 39,750 | $18.76 | ||||||||||||||||||||||||||||||||||||||||||||||||

| OC Airport | 10 | 1,099,985 | 106,604 | 1,206,589 | 98.8 | % | 100.0 | % | 98.9 | % | 98.9 | % | 22,996 | $19.27 | ||||||||||||||||||||||||||||||||||||||||||||||||

| South Orange County | 10 | 448,762 | 183,098 | 631,860 | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 10,728 | $16.98 | ||||||||||||||||||||||||||||||||||||||||||||||||

| West Orange County | 10 | 852,079 | 436,759 | 1,288,838 | 100.0 | % | 76.5 | % | 92.0 | % | 96.5 | % | 19,604 | $16.53 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Orange County | 55 | 3,495,195 | 2,306,901 | 5,802,096 | 99.0 | % | 72.4 | % | 88.4 | % | 98.5 | % | 93,078 | $18.14 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Inland Empire East | 1 | 33,258 | — | 33,258 | 100.0 | % | — | % | 100.0 | % | 100.0 | % | 661 | $19.86 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Inland Empire West | 53 | 8,621,513 | 920,735 | 9,542,248 | 96.9 | % | 86.5 | % | 95.9 | % | 97.4 | % | 138,693 | $15.15 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Riverside / San Bernardino County | 54 | 8,654,771 | 920,735 | 9,575,506 | 96.9 | % | 86.5 | % | 95.9 | % | 97.5 | % | 139,354 | $15.17 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Central San Diego | 21 | 1,349,009 | 784,895 | 2,133,904 | 97.7 | % | 67.4 | % | 86.5 | % | 95.2 | % | 37,615 | $20.37 | ||||||||||||||||||||||||||||||||||||||||||||||||

| North County San Diego | 14 | 1,336,558 | 143,663 | 1,480,221 | 93.4 | % | 100.0 | % | 94.0 | % | 94.4 | % | 21,211 | $15.24 | ||||||||||||||||||||||||||||||||||||||||||||||||

| San Diego County | 35 | 2,685,567 | 928,558 | 3,614,125 | 95.5 | % | 72.4 | % | 89.6 | % | 94.9 | % | 58,826 | $18.17 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Ventura | 18 | 2,510,848 | 712,795 | 3,223,643 | 91.5 | % | 74.0 | % | 87.7 | % | 91.6 | % | 37,504 | $13.27 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Ventura County | 18 | 2,510,848 | 712,795 | 3,223,643 | 91.5 | % | 74.0 | % | 87.7 | % | 91.6 | % | 37,504 | $13.27 | ||||||||||||||||||||||||||||||||||||||||||||||||

| CONSOLIDATED TOTAL / WTD AVG | 424 | 38,380,256 | 12,571,881 | 50,952,137 | 95.7 | % | 71.0 | % | 89.6 | % | 95.1 | % | $ | 775,088 | $16.97 | |||||||||||||||||||||||||||||||||||||||||||||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 22

|

|

||||||

Leasing Statistics (Continued). |

||||||||

| (unaudited results) | ||||||||

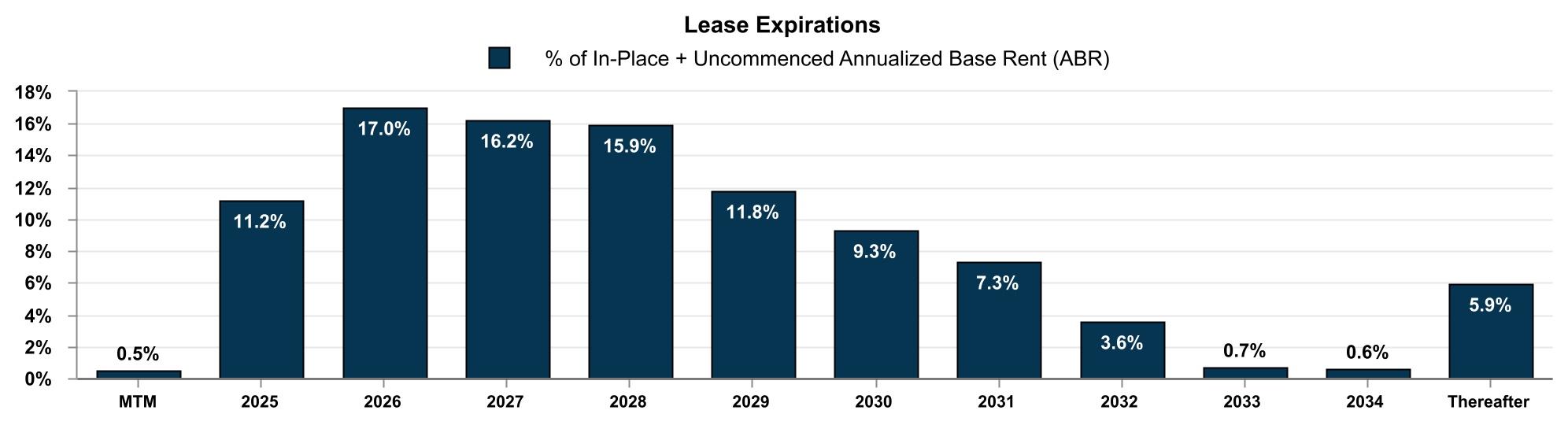

| Lease Expiration Schedule as of March 31, 2025: | ||||||||

| Year of Lease Expiration | # of Leases Expiring |

Total Rentable Square Feet |

In-Place + Uncommenced ABR (in thousands) |

In-Place + Uncommenced ABR per SF |

||||||||||||||||||||||

| Available | — | 2,137,986 | $ | — | $— | |||||||||||||||||||||

Repositioning/Redevelopment(1) |

— | 2,766,170 | — | $— | ||||||||||||||||||||||

| MTM Tenants | 8 | 214,625 | 3,802 | $17.71 | ||||||||||||||||||||||

| 2025 | 275 | 5,287,862 | 87,724 | $16.59 | ||||||||||||||||||||||

| 2026 | 420 | 8,900,867 | 133,310 | $14.98 | ||||||||||||||||||||||

| 2027 | 332 | 7,370,573 | 126,935 | $17.22 | ||||||||||||||||||||||

| 2028 | 226 | 6,660,057 | 124,784 | $18.74 | ||||||||||||||||||||||

| 2029 | 163 | 5,026,768 | 92,296 | $18.36 | ||||||||||||||||||||||

| 2030 | 102 | 4,642,254 | 72,519 | $15.62 | ||||||||||||||||||||||

| 2031 | 29 | 3,838,252 | 57,018 | $14.86 | ||||||||||||||||||||||

| 2032 | 23 | 1,392,533 | 28,074 | $20.16 | ||||||||||||||||||||||

| 2033 | 9 | 296,735 | 5,763 | $19.42 | ||||||||||||||||||||||

| 2034 | 5 | 199,139 | 4,345 | $21.82 | ||||||||||||||||||||||

| Thereafter | 36 | 2,218,316 | 46,585 | $21.00 | ||||||||||||||||||||||

| Total Portfolio | 1,628 | 50,952,137 | $ | 783,155 | $17.01 | |||||||||||||||||||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 23

|

|

||||||

Top Tenants and Lease Segmentation. |

||||||||

| (unaudited results) | ||||||||

Top 20 Tenants as of March 31, 2025 |

||||||||

| Tenant | Submarket | Leased Rentable SF |

In-Place + Uncommenced

ABR (in 000’s)(1)

|

% of In-Place +

Uncommenced ABR(1)

|

In-Place + Uncommenced

ABR per SF(1)

|

Lease Expiration |

||||||||||||||||||||||||||||||||

| Tireco, Inc. | Inland Empire West | 1,101,840 | $19,251 | 2.5% | $17.47 | 1/31/2027 | ||||||||||||||||||||||||||||||||

| L3 Technologies, Inc. | Multiple Submarkets(2) |

595,267 | $12,967 | 1.7% | $21.78 | 9/30/2031 | ||||||||||||||||||||||||||||||||

| Zenith Energy West Coast Terminals LLC | South Bay | —(3) |

$11,675 | 1.5% | $3.34(3) |

9/29/2041 | ||||||||||||||||||||||||||||||||

| IBY, LLC | San Gabriel Valley | 1,178,021 | $11,165 | 1.4% | $9.48 | 4/5/2031(4) |

||||||||||||||||||||||||||||||||

| Cubic Corporation | Central San Diego | 515,382 | $11,110 | 1.4% | $21.56 | 3/31/2038(5) |

||||||||||||||||||||||||||||||||

| Federal Express Corporation | Multiple Submarkets(6) |

527,861 | $10,397 | 1.3% | $19.70 | 11/30/2032(6) |

||||||||||||||||||||||||||||||||

GXO Logistics Supply Chain, Inc. |

Mid-Counties |

411,034 | $8,730 | 1.1% | $21.24 | 11/30/2028 | ||||||||||||||||||||||||||||||||

| Best Buy Stores, L.P. | Inland Empire West | 501,649 | $8,529 | 1.1% | $17.00 | 6/30/2029 | ||||||||||||||||||||||||||||||||

| The Hertz Corporation | South Bay | 38,680(7) |

$8,249 | 1.0% | $10.30(7) |

3/31/2026 | ||||||||||||||||||||||||||||||||

| Orora Packaging Solutions | Multiple Submarkets(8) |

476,065 | $7,845 | 1.0% | $16.48 | 9/30/2028(8) |

||||||||||||||||||||||||||||||||

| Top 10 Tenants | 5,345,799 | $109,918 | 14.0% | |||||||||||||||||||||||||||||||||||

| Top 11 - 20 Tenants | 3,258,530 | $50,476 | 6.4% | |||||||||||||||||||||||||||||||||||

| Total Top 20 Tenants | 8,604,329 | $160,394 | 20.4% | |||||||||||||||||||||||||||||||||||

| Lease Segmentation by Size: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Square Feet | Number of Leases |

Leased Building Rentable SF |

Building Rentable SF |

Building Leased % |

Building Leased % Excl. Repo/Redev |

In-Place +

Uncommenced ABR

(in 000’s)(1)

|

% of In-Place +

Uncommenced

ABR(1)

|

In-Place +

Uncommenced

ABR per SF(1)

|

|||||||||||||||||||||||||||||||||||||||||||||

| <4,999 | 592 | 1,439,346 | 1,570,951 | 91.6% | 92.0% | $ | 28,700 | 3.7% | $19.94 | ||||||||||||||||||||||||||||||||||||||||||||

| 5,000 - 9,999 | 231 | 1,653,135 | 1,777,814 | 93.0% | 95.1% | 31,470 | 4.0% | $19.04 | |||||||||||||||||||||||||||||||||||||||||||||

| 10,000 - 24,999 | 319 | 5,156,910 | 5,969,008 | 86.4% | 91.4% | 95,787 | 12.2% | $18.57 | |||||||||||||||||||||||||||||||||||||||||||||

| 25,000 - 49,999 | 174 | 6,424,933 | 7,362,260 | 87.3% | 94.5% | 110,457 | 14.1% | $17.19 | |||||||||||||||||||||||||||||||||||||||||||||

| 50,000 - 99,999 | 118 | 8,567,460 | 9,563,416 | 89.6% | 97.7% | 143,707 | 18.4% | $16.77 | |||||||||||||||||||||||||||||||||||||||||||||

| >100,000 | 121 | 22,557,657 | 24,460,148 | 92.2% | 96.3% | 325,342 | 41.5% | $14.42 | |||||||||||||||||||||||||||||||||||||||||||||

| Building Subtotal / Wtd. Avg. | 1,555 | 45,799,441 | (2) |

50,703,597 | (2) |

90.3% | (2) |

95.5% | $ | 735,463 | 93.9% | $16.06 | |||||||||||||||||||||||||||||||||||||||||

Land/IOS(3) |

28 | 8,544,650 | (4) |

45,114 | 5.8% | $5.28 | (4) |

||||||||||||||||||||||||||||||||||||||||||||||

Other(3) |

45 | 2,578 | 0.3% | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | 1,628 | $ | 783,155 | 100.0% | |||||||||||||||||||||||||||||||||||||||||||||||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 24

|

|

||||||

Capital Expenditure Summary. |

||||||||

| (unaudited results, in thousands, except square feet and per square foot data) | ||||||||

| Three months ended March 31, 2025 | ||||||||

| Year to Date | ||||||||||||||||||||

| Total | SF(1) |

PSF | ||||||||||||||||||

| Tenant Improvements: | ||||||||||||||||||||

| New Leases – 1st Generation | $ | 798 | 411,034 | $ | 1.94 | |||||||||||||||

| New Leases – 2nd Generation | 4 | 1,960 | $ | 2.04 | ||||||||||||||||

| Renewals | 158 | 356,450 | $ | 0.44 | ||||||||||||||||

| Total Tenant Improvements | $ | 960 | ||||||||||||||||||

| Leasing Commissions & Lease Costs: | ||||||||||||||||||||

| New Leases – 1st Generation | $ | 3,058 | 535,176 | $ | 5.71 | |||||||||||||||

| New Leases – 2nd Generation | 1,886 | 391,227 | $ | 4.82 | ||||||||||||||||

| Renewals | 2,993 | 1,635,689 | $ | 1.83 | ||||||||||||||||

| Total Leasing Commissions & Lease Costs | $ | 7,937 | ||||||||||||||||||

| Total Recurring Capex | $ | 1,311 | 51,075,653 | $ | 0.03 | |||||||||||||||

| Recurring Capex % of NOI | 0.7 | % | ||||||||||||||||||

| Recurring Capex % of Rental Income | 0.5 | % | ||||||||||||||||||

| Nonrecurring Capex: | ||||||||||||||||||||

Repositioning and Redevelopment in Process(2) |

$ | 39,455 | ||||||||||||||||||

Unit Renovation(3) |

2,910 | |||||||||||||||||||

Other(4) |

996 | |||||||||||||||||||

| Total Nonrecurring Capex | $ | 43,361 | 29,600,513 | $ | 1.46 | |||||||||||||||

Other Capitalized Costs(5) |

$ | 13,644 | ||||||||||||||||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 25

|

|

||||||

Properties and Space Under Repositioning/Redevelopment.(1) | ||||||||

| As of March 31, 2025 | (unaudited results, $ in millions) | |||||||

| Repositioning | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Repo/

Lease-Up

RSF(2)

|

Repo RSF

Leased %

3/31/2025

|

Est. Constr. Period(1) |

Purch.

Price(1)

|

Proj.

Repo

Costs(1)

|

Proj.

Total

Invest.(1)

|

Proj.

Remaining

Costs

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Property |

County |

Submarket |

Start | Target Complet. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CURRENT REPOSITIONING: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

19301 Santa Fe Avenue |

Los Angeles | South Bay |

LAND | —% | 2Q-24 | 2Q-25 | $ | 14.7 | $ | 5.7 | $ | 20.4 | $ | 3.9 | ||||||||||||||||||||||||||||||||||||||||||||||||

Harcourt & Susana |

Los Angeles | South Bay |

33,461 | —% | 2Q-24 | 3Q-25 | 54.4 | 10.2 | 64.6 | 4.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

8985 Crestmar Point(3) |

San Diego |

Central San Diego |

53,395 | —% | 4Q-24 | 3Q-25 | 8.1 | 5.5 | 13.6 | 2.4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

14955 Salt Lake Avenue |

Los Angeles | San Gabriel Valley |

45,930 | —% | 4Q-24 | 4Q-25 | 10.9 | 3.7 | 14.6 | 2.2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 218 Turnbull Canyon | Los Angeles | San Gabriel Valley |

191,095 | —% | 1Q-25 | 4Q-25 | 27.2 | 3.6 | 30.8 | 2.7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Total |

323,881 | $ | 115.3 | $ | 28.7 | $ | 144.0 | $ | 15.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Actual Cash NOI - 1Q 2025 | $0.4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Estimated Annualized Stabilized Cash NOI |

$7.9 - $8.7 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Estimated Unlevered Stabilized Yield |

5.5% - 6.0% |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Repo/

Lease-Up

RSF(2)

|

Repo RSF

Leased %

3/31/2025

|

Construction Period |

Purch.

Price(1)

|

Proj.

Repo

Costs(1)

|

Proj.

Total

Invest.(1)

|

Proj.

Remaining

Costs

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Property |

County |

Submarket |

Start | Complete |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LEASE-UP REPOSITIONING: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

11308-11350 Penrose Street(4) |

Los Angeles |

Greater San Fernando Valley | 71,547 | —% | 1Q-23 | 1Q-24 | $ | 12.1 | $ | 5.2 | $ | 17.3 | $ | 0.6 | ||||||||||||||||||||||||||||||||||||||||||||||||

14434-14527 San Pedro Street |

Los Angeles |

South Bay |

61,398 | —% | 3Q-23 | 1Q-25 | 49.8 | 14.2 | 64.0 | 1.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

1020 Bixby Drive |

Los Angeles |

San Gabriel Valley | 57,600 | —% | 1Q-24 | 3Q-24 | 16.5 | 3.3 | 19.8 | 0.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

17000 Kingsview Avenue |

Los Angeles | South Bay |

95,865 | —% | 1Q-24 | 1Q-25 | 14.0 | 4.3 | 18.3 | 1.7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

1315 Storm Parkway |

Los Angeles |

South Bay | 37,844 | —% | 2Q-24 | 4Q-24 | 8.5 | 3.5 | 12.0 | 0.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Total |

324,254 | $ | 100.9 | $ | 30.5 | $ | 131.4 | $ | 4.5 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Actual Cash NOI - 1Q 2025 | $(0.1) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Estimated Annualized Stabilized Cash NOI | $6.6 - $7.2 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Estimated Unlevered Stabilized Yield | 5.0% - 5.5% |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 26

|

|

||||||

Properties and Space Under Repositioning/Redevelopment (Continued).(1) | ||||||||

| As of March 31, 2025 | (unaudited results, $ in millions) | |||||||

| Repositioning | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Repo/

Lease-Up

RSF(2)

|

Repo RSF

Leased %

3/31/2025

|

Construction Period |

Purch.

Price(1)

|

Proj.

Repo

Costs(1)

|

Proj.

Total

Invest.(1)

|

Proj.

Remaining

Costs

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Property |

County |

Submarket |

Start | Complete |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STABILIZED REPOSITIONING: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

4039 Calle Platino |

San Diego |

North County San Diego |

73,807 | 100% | 2Q-23 | 1Q-24 | $ | 20.5 | $ | 4.3 | $ | 24.8 | $ | 0.2 | ||||||||||||||||||||||||||||||||||||||||||||||||

29120 Commerce Center Drive |

Los Angeles |

Greater San Fernando Valley |

135,258 | 100% | 3Q-23 | 1Q-25 | 27.1 | 3.1 | 30.2 | 0.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

East 27th Street(5) |

Los Angeles |

Central LA |

126,563 | 100% | 1Q-24 | 4Q-24 | 26.9 | 5.1 | 32.0 | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

122-125 N. Vinedo Avenue |

Los Angeles |

Greater San Fernando Valley | 48,520 | 100% | 1Q-24 | 4Q-24 | 5.3 | 3.9 | 9.2 | 0.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 29125 Avenue Paine | Los Angeles | Greater San Fernando Valley | 176,107 | 100% | 1Q-24 | 1Q-25 | 45.3 | 3.9 | 49.2 | 0.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Total |

560,255 | $ | 125.1 | $ | 20.3 | $ | 145.4 | $ | 1.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Actual Cash NOI - 1Q 2025 | $2.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Annualized Stabilized Cash NOI |

$10.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Achieved Unlevered Stabilized Yield |

7.6% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| OTHER REPOSITIONING: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

17 projects totaling 773,498 RSF with estimated costs < $2 million individually(6) |

$ | 21.1 | $ | 6.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Actual Cash NOI - 1Q 2025 | $4.1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Estimated Annualized Stabilized Cash NOI | $15.0 - $15.5 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Estimated Unlevered Stabilized Yield | 6.0% - 6.5% |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

First Quarter 2025

Supplemental Financial Reporting Package

|

Page 27

|

|

||||||

Properties and Space Under Repositioning/Redevelopment (Continued).(1) | ||||||||

| As of March 31, 2025 | (unaudited results, $ in millions) | |||||||

| Redevelopment | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Projected

RSF(7)

|

Property

Leased %

3/31/2025

|

Est. Constr. Period(1) |

Purch.

Price(1)

|

Proj.

Redev

Costs(1)

|

Proj.

Total

Invest.(1)

|

Proj.

Remaining

Costs

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Property |

County |

Submarket |

Start | Target Complet. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CURRENT REDEVELOPMENT: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||