UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 1, 2024

Glaukos Corporation

(Exact name of registrant as specified in its charter)

Delaware |

|

001-37463 |

|

33-0945406 |

(State or other jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

of incorporation) |

|

File Number) |

|

Identification No.) |

One Glaukos Way |

|

|

Aliso Viejo |

|

|

California |

|

92656 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (949) 367-9600

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Title of each class: |

|

Trading Symbol |

|

Name of each exchange on which registered: |

Common Stock |

|

GKOS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On May 1, 2024, Glaukos Corporation (the “Company”) issued a press release announcing its financial results for the first quarter ended March 31, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

The information contained in this Item 2.02 and in the accompanying Exhibit 99.1 shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended (the “Securities Act”), except as shall be expressly set forth by specific reference in such filing.

Item 7.01. Regulation FD Disclosure.

A Quarterly Summary containing supplemental business and financial information for the Company’s first quarter ended March 31, 2024 is furnished as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated by reference herein. A copy of the Quarterly Summary is also available in the “Financials & Filings” section of the Company’s investor relations website at https://investors.glaukos.com.

The information contained in this Item 7.01 and in the accompanying Exhibit 99.2 shall not be deemed filed for purposes of Section 18 of the Exchange Act, or incorporated by reference in any filing under the Exchange Act or the Securities Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Exhibit No. |

|

Description |

99.1 |

|

|

|

|

|

99.2 |

|

Quarterly Summary of Glaukos Corporation for the first quarter ended March 31, 2024 |

|

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

GLAUKOS CORPORATION |

||

|

|

||

|

By: |

/s/ Alex R. Thurman |

|

|

|

Name: |

Alex R. Thurman |

|

|

Title: |

Senior Vice President & Chief Financial Officer |

Date: May 1, 2024

EXHIBIT 99.1

FOR IMMEDIATE RELEASE

Contact:

Chris Lewis

Vice President, Investor Relations & Corporate Affairs

(949) 481-0510

clewis@glaukos.com

Glaukos Announces First Quarter 2024 Financial Results

Aliso Viejo, CA – May 1, 2024 – Glaukos Corporation (NYSE: GKOS), an ophthalmic pharmaceutical and medical technology company focused on novel therapies for the treatment of glaucoma, corneal disorders and retinal diseases, today announced financial results for the first quarter ended March 31, 2024. Key highlights include:

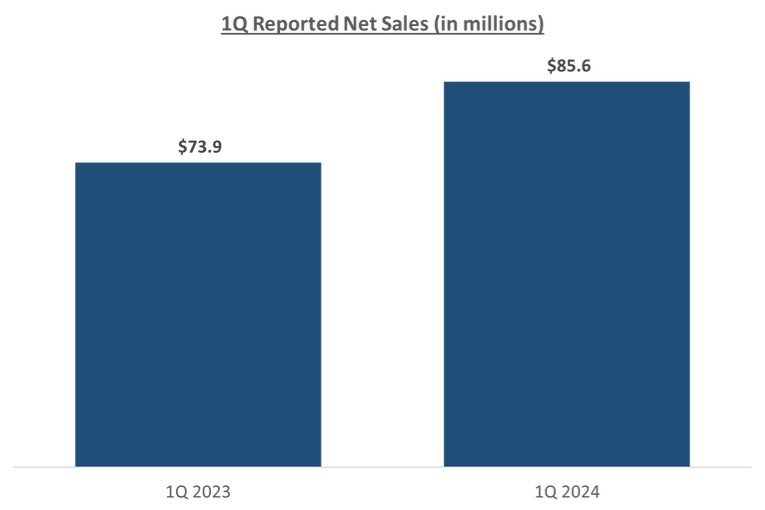

| ● | Record net sales of $85.6 million in Q1 2024 increased 16% year-over-year. |

| ● | Glaucoma record net sales of $67.2 million in Q1 2024 increased 20% year-over-year. |

| ● | Corneal Health net sales of $18.4 million in Q1 2024 increased 4% year-over-year. |

| ● | Gross margin of approximately 76% and non-GAAP gross margin of approximately 83% in Q1 2024. |

| ● | Raised 2024 net sales guidance to $357 to $365 million, compared to $350 million to $360 million previously. |

“Our record first quarter results reflect successful global execution of our key strategic plans,” said Thomas Burns, Glaukos chairman and chief executive officer. “We continue to successfully advance our robust pipeline of novel, dropless platform technologies designed to meaningfully advance the standard of care and improve outcomes for patients suffering from chronic eye diseases.”

First Quarter 2024 Financial Results

Net sales in the first quarter of 2024 of $85.6 million increased 16% on a reported and constant currency basis, compared to $73.9 million in the same period in 2023.

Gross margin for the first quarter of 2024 was approximately 76%, compared to approximately 76% in the same period in 2023. Non-GAAP gross margin for the first quarter of 2024 was approximately 83%, compared to approximately 83% in the same period in 2023.

Selling, general and administrative (SG&A) expenses for the first quarter of 2024 increased 16% to $62.0 million, compared to $53.6 million in the same period in 2023. Non-GAAP SG&A expenses for the first quarter of 2024 increased 16% to $61.3 million, compared to $52.9 million in the same period in 2023.

GAAP and non-GAAP research and development (R&D) expenses for the first quarter of 2024 decreased 13% to $30.7 million, compared to $35.2 million in the same period in 2023.

1

Loss from operations in the first quarter of 2024 was $39.1 million, compared to operating loss of $33.0 million in the first quarter of 2023. Non-GAAP loss from operations in the first quarter of 2024 was $32.8 million, compared to non-GAAP operating loss of $26.8 million in the first quarter of 2023.

Net loss in the first quarter of 2024 was $40.8 million, or ($0.82) per diluted share, compared to net loss of $34.6 million, or ($0.72) per diluted share, in the first quarter of 2023. Non-GAAP net loss in the first quarter of 2024 was $34.6 million, or ($0.70) per diluted share, compared to non-GAAP net loss of $28.4 million, or ($0.59) per diluted share, in the first quarter of 2023.

Included in non-GAAP loss from operations, non-GAAP net loss and non-GAAP EPS for the first quarter of 2024 is an acquired in-process R&D (IPR&D) charge of $11.7 million, which caused the non-GAAP loss per diluted share to have an additional loss of ($0.24) in the first quarter of 2024.

The company ended the first quarter of 2024 with approximately $279 million in cash and cash equivalents, short-term investments and restricted cash.

2024 Revenue Guidance

The company expects 2024 net sales to be in the range of $357 million to $365 million based on the latest foreign currency exchange rates.

Webcast & Conference Call

The company will host a conference call and simultaneous webcast today at 1:30 p.m. PT (4:30 p.m. ET) to discuss the results and provide additional information about the company’s financial outlook. A link to the webcast is available on the company’s website at http://investors.glaukos.com. To participate in the conference call, please dial 888-210-2212 (U.S.) or 646-960-0390 (international) and enter Conference ID 7935742. A replay of the webcast will be archived on the company’s website following completion of the call.

Quarterly Summary Document

The company has posted a document on its Investor Relations website under the “Financials & Filings – Quarterly Results” section titled “Quarterly Summary.” This Quarterly Summary document is designed to provide the investment community with a summarized and easily accessible reference document that details the key facts associated with the quarter, the state of the company’s business objectives and strategies and any forward statements or guidance the company may make. This document is provided alongside the company’s earnings press release and is designed to be read by investors before the regularly scheduled quarterly conference call. As such, today’s conference call will be in a format primarily consisting of a questions and answers session, during which Glaukos will address any queries investors have regarding the company’s results. It is the company’s goal that this format will make its quarterly earnings process more efficient and impactful for the investment community going forward.

About Glaukos

Glaukos (www.glaukos.com) is an ophthalmic pharmaceutical and medical technology company focused on developing and commercializing novel therapies for the treatment of glaucoma, corneal disorders and retinal diseases. Glaukos first developed Micro-Invasive Glaucoma Surgery (MIGS) as an alternative to the traditional glaucoma treatment paradigm, launching its first MIGS device commercially in 2012, and continues to develop a portfolio of technologically distinct and leverageable platforms to support ongoing pharmaceutical and medical device innovations. Products or product candidates for each of these platforms are designed to advance the standard of care through better treatment options across the areas of glaucoma, corneal disorders and retinal diseases.

2

Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of federal securities laws. All statements other than statements of historical facts included in this press release that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements. These statements are based on management’s current expectations, assumptions, estimates and beliefs. Although we believe that we have a reasonable basis for forward-looking statements contained herein, we caution you that they are based on current expectations about future events affecting us and are subject to risks, uncertainties and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control, that may cause our actual results to differ materially from those expressed or implied by forward-looking statements in this press release. These potential risks and uncertainties that could cause actual results to differ materially from those described in forward-looking statements include, without limitation, uncertainties regarding the impact of the COVID-19 pandemic or other future public health crises on our business; the impact of general macroeconomic conditions including foreign currency fluctuations; the reduced physician fee and ASC facility fee reimbursement rate finalized by CMS for 2022 and 2023 for procedures utilizing the Company’s iStent family of products and its impact on our U.S. combo-cataract glaucoma revenue; our ability to continue to generate sales of our commercialized products and develop and commercialize additional products; our dependence on a limited number of third-party suppliers, some of which are single-source, for components of our products; the occurrence of a crippling accident, natural disaster, or other disruption at our primary facility, which may materially affect our manufacturing capacity and operations; securing or maintaining adequate coverage or reimbursement by third-party payors for procedures using the iStent, the iStent inject W, iAccess, iPRIME, iStent infinite, iDose TR, our corneal cross-linking products or other products in development; our ability to properly train, and gain acceptance and trust from ophthalmic surgeons in the use of our products; our ability to compete effectively in the medical device industry and against current and future technologies (including MIGS technologies); our compliance with federal, state and foreign laws and regulations for the approval and sale and marketing of our products and of our manufacturing processes; the lengthy and expensive clinical trial process and the uncertainty of timing and outcomes from any particular clinical trial or regulatory approval processes; the risk of recalls or serious safety issues with our products and the uncertainty of patient outcomes; our ability to protect, and the expense and time-consuming nature of protecting our intellectual property against third parties and competitors and the impact of any claims against us for infringement or misappropriation of third party intellectual property rights and any related litigation; and our ability to service our indebtedness. These and other known risks, uncertainties and factors are described in detail under the caption “Risk Factors” and elsewhere in our filings with the Securities and Exchange Commission (SEC), including in our Annual Report on Form 10-K for the year ended December 31, 2023, which was filed with the SEC on February 23, 2024, and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, which is expected to be filed with the SEC by May 10, 2024. Our filings with the SEC are available in the Investor Section of our website at www.glaukos.com or at www.sec.gov. In addition, information about the risks and benefits of our products is available on our website at www.glaukos.com. All forward-looking statements included in this press release are expressly qualified in their entirety by the foregoing cautionary statements. You are cautioned not to place undue reliance on the forward-looking statements in this press release, which speak only as of the date hereof. We do not undertake any obligation to update, amend or clarify these forward-looking statements whether as a result of new information, future events or otherwise, except as may be required under applicable securities law.

3

Statement Regarding Use of Non-GAAP Financial Measures

To supplement the consolidated financial results prepared in accordance with Generally Accepted Accounting Principles ("GAAP"), the Company uses certain non-GAAP historical financial measures. Management makes adjustments to the GAAP measures for items (both charges and gains) that (a) do not reflect the core operational activities of the Company, (b) are commonly adjusted within the Company's industry to enhance comparability of the Company's financial results with those of its peer group, or (c) are inconsistent in amount or frequency between periods (albeit such items are monitored and controlled with equal diligence relative to core operations). The Company uses the term "Non-GAAP" to exclude external acquisition-related costs incurred to effect a business combination; amortization of intangible assets acquired in a business combination, asset purchase transaction or other contractual relationship; impairment of goodwill and intangible assets; certain in-process R&D charges; fair value adjustments to contingent consideration liabilities and pre-acquisition contingencies arising from a business combination; integration and transition costs related to business combinations; fair market value adjustments to inventories acquired in a business combination or asset purchase transaction; restructuring charges, duplicative operating expenses, or asset write-offs (or reversals) associated with exiting or significantly downsizing a business; gain or loss from the sale of a business; gain or loss on the mark-to-market adjustment, impairment, or sale of long-term investments; mark-to-market adjustments on derivative instruments that hedge income or expense exposures in a future period; significant legal litigation costs and/or settlement expenses or proceeds legal and other associated expenses that are both unusual and significant related to governmental or internal inquiries; and significant discrete income and other tax adjustments related to transactions as well as changes in estimated acquisition-date tax effects associated with business combinations, and the impact from implementation of tax law changes and settlements. See “GAAP to Non-GAAP Reconciliations” for a reconciliation of each non-GAAP measure presented to the comparable GAAP financial measure.

In addition, in order to remove the impact of fluctuations in foreign currency exchange rates, the Company also presents certain net sales information on a constant currency basis, which represents the outcome that would have resulted had exchange rates in the current period been the same as the average exchange rates in effect in the comparable prior period. See “Reported Sales vs. Prior Periods” for a presentation of certain net sales information on a reported, GAAP and a constant currency basis.

4

GLAUKOS CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

(in thousands, except per share amounts)

|

|

Three Months Ended |

||||

|

|

March 31, |

||||

|

|

2024 |

|

2023 |

||

Net sales |

|

$ |

85,622 |

|

$ |

73,899 |

Cost of sales |

|

|

20,258 |

|

|

18,071 |

Gross profit |

|

|

65,364 |

|

|

55,828 |

Operating expenses: |

|

|

|

|

|

|

Selling, general and administrative |

|

|

61,975 |

|

|

53,650 |

Research and development |

|

|

30,726 |

|

|

35,171 |

Acquired in-process research and development |

|

|

11,729 |

|

|

— |

Total operating expenses |

|

|

104,430 |

|

|

88,821 |

Loss from operations |

|

|

(39,066) |

|

|

(32,993) |

Non-operating expense: |

|

|

|

|

|

|

Interest income |

|

|

3,083 |

|

|

1,648 |

Interest expense |

|

|

(3,450) |

|

|

(3,408) |

Other (expense) income, net |

|

|

(1,028) |

|

|

528 |

Total non-operating expense |

|

|

(1,395) |

|

|

(1,232) |

Loss before taxes |

|

|

(40,461) |

|

|

(34,225) |

Income tax provision |

|

|

377 |

|

|

401 |

Net loss |

|

$ |

(40,838) |

|

$ |

(34,626) |

|

|

|

|

|

|

|

Basic and diluted net loss per share |

|

$ |

(0.82) |

|

$ |

(0.72) |

|

|

|

|

|

|

|

Weighted average shares used to compute basic and diluted net loss per share |

|

|

49,580 |

|

|

47,881 |

5

GLAUKOS CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except par values)

|

|

March 31, |

|

December 31, |

||

|

|

2024 |

|

2023 |

||

|

|

(unaudited) |

|

|

|

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

42,495 |

|

$ |

93,467 |

Short-term investments |

|

|

230,365 |

|

|

201,964 |

Accounts receivable, net |

|

|

46,545 |

|

|

39,850 |

Inventory |

|

|

50,185 |

|

|

41,986 |

Prepaid expenses and other current assets |

|

|

19,020 |

|

|

18,194 |

Total current assets |

|

|

388,610 |

|

|

395,461 |

Restricted cash |

|

|

5,856 |

|

|

5,856 |

Property and equipment, net |

|

|

101,858 |

|

|

103,212 |

Operating lease right-of-use asset |

|

|

26,683 |

|

|

27,146 |

Finance lease right-of-use asset |

|

|

43,575 |

|

|

44,180 |

Intangible assets, net |

|

|

281,919 |

|

|

282,956 |

Goodwill |

|

|

66,134 |

|

|

66,134 |

Deposits and other assets |

|

|

18,703 |

|

|

15,469 |

Total assets |

|

$ |

933,338 |

|

$ |

940,414 |

|

|

|

|

|

|

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

12,752 |

|

$ |

13,440 |

Accrued liabilities |

|

|

59,486 |

|

|

60,574 |

Total current liabilities |

|

|

72,238 |

|

|

74,014 |

Convertible senior notes |

|

|

283,117 |

|

|

282,773 |

Operating lease liability |

|

|

30,110 |

|

|

30,427 |

Finance lease liability |

|

|

70,289 |

|

|

70,538 |

Deferred tax liability, net |

|

|

7,144 |

|

|

7,144 |

Other liabilities |

|

|

19,710 |

|

|

13,752 |

Total liabilities |

|

|

482,608 |

|

|

478,648 |

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Preferred stock, $0.001 par value; 5,000 shares authorized; no shares issued or outstanding |

|

|

— |

|

|

— |

Common stock, $0.001 par value; 150,000 shares authorized; 49,875 and 49,148 shares issued and 49,847 and 49,120 shares outstanding as of March 31, 2024 and December 31, 2023, respectively |

|

|

50 |

|

|

49 |

Additional paid-in capital |

|

|

1,089,280 |

|

|

1,059,751 |

Accumulated other comprehensive income (loss) |

|

|

1,437 |

|

|

1,165 |

Accumulated deficit |

|

|

(639,905) |

|

|

(599,067) |

Less treasury stock (28 shares as of March 31, 2024 and December 31, 2023 |

|

|

(132) |

|

|

(132) |

Total stockholders' equity |

|

|

450,730 |

|

|

461,766 |

Total liabilities and stockholders' equity |

|

$ |

933,338 |

|

$ |

940,414 |

6

GLAUKOS CORPORATION

GAAP to Non-GAAP Reconciliations

(in thousands, except per share amounts and percentage data)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 2024 |

|

Q1 2023 |

|

||||||||||||||

|

|

|

GAAP |

|

|

Adjustments |

|

|

Non-GAAP |

|

|

GAAP |

|

|

Adjustments |

|

|

Non-GAAP |

|

Cost of sales |

|

$ |

20,258 |

|

$ |

(5,523) |

(a) |

$ |

14,735 |

|

$ |

18,071 |

|

$ |

(5,523) |

(a) |

$ |

12,548 |

|

Gross Margin |

|

|

76.3 |

% |

|

6.5 |

% |

|

82.8 |

% |

|

75.5 |

% |

|

7.5 |

% |

|

83.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

$ |

61,975 |

|

$ |

(705) |

(b) |

$ |

61,270 |

|

$ |

53,650 |

|

$ |

(705) |

(b) |

$ |

52,945 |

|

Loss from operations |

|

$ |

(39,066) |

|

$ |

6,228 |

|

$ |

(32,838) |

|

$ |

(32,993) |

|

$ |

6,228 |

|

$ |

(26,765) |

|

Net loss |

|

$ |

(40,838) |

|

$ |

6,228 |

(c) |

$ |

(34,610) |

|

$ |

(34,626) |

|

$ |

6,228 |

(c) |

$ |

(28,398) |

|

Basic and diluted net loss per share |

|

$ |

(0.82) |

|

$ |

0.12 |

|

$ |

(0.70) |

|

$ |

(0.72) |

|

$ |

0.13 |

|

$ |

(0.59) |

|

(a) |

Cost of sales adjustments related to the acquisition of Avedro, Inc. (Avedro) for amortization of developed technology intangible assets of $5.5 million in Q1 2024 and Q1 2023. |

(b) |

Avedro acquisition-related expenses for amortization expense of customer relationship intangible assets of $0.7 million in Q1 2024 and Q1 2023. |

(c) |

Includes total tax effect for non-GAAP pre-tax adjustments. For non-GAAP adjustments associated with the U.S., the tax effect is $0 given the Company's U.S. taxable loss positions in both 2024 and 2023. |

7

Reported Sales vs. Prior Periods (in thousands)

|

|

|

|

|

|

|

|

|

|

|

Year-over-Year Percent Change |

|

Quarter-over-Quarter Percent Change |

|

||||||||

|

|

1Q 2024 |

|

1Q 2023 |

|

4Q 2023 |

|

Reported |

|

Operations (1) |

|

Currency (2) |

|

Reported |

|

Operations (1) |

|

Currency (2) |

|

|||

International Glaucoma |

|

$ |

25,238 |

|

$ |

21,118 |

|

$ |

21,857 |

|

19.5 |

% |

21.4 |

% |

(1.9) |

% |

15.5 |

% |

14.5 |

% |

1.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Net Sales |

|

$ |

85,622 |

|

$ |

73,899 |

|

$ |

82,365 |

|

15.9 |

% |

16.4 |

% |

(0.5) |

% |

4.0 |

% |

3.7 |

% |

0.3 |

% |

(1) |

Operational growth excludes the effect of translational currency |

(2) |

Calculated by converting the current period numbers using the prior period’s average foreign exchange rates |

8

Exhibit 99.2

|

MAY 1, 2024 |

|

|

GLAUKOS CORPORATION (NYSE: GKOS)

FIRST QUARTER 2024 IN REVIEW

Important Information

This document is intended to be read by investors in advance of regularly scheduled quarterly conference calls and was designed to provide a review of Glaukos Corporation’s recent financial and operational performance and general business outlook.

Please see “Forward-Looking Statements” and “Statement Regarding Use of Non-GAAP Financial Measures” in the “Additional Information” section of this document.

Conference Call Information

Date: |

May 1, 2024 |

|

|

Time: |

4:30 p.m. ET / 1:30 p.m. PT |

|

|

Dial-in numbers: |

1-888-210-2212 (U.S.), 1-646-960-0390 (International) |

|

|

Confirmation ID: |

7935742 |

|

|

Live webcast: |

Events page at the Glaukos Investor Relations website at http://investors.glaukos.com or at this link. |

|

|

Webcast replay: |

A replay of the webcast will be archived on the Glaukos Investor Relations website following completion of the call. |

1

|

MAY 1, 2024 |

|

|

FIRST QUARTER 2024 FINANCIAL RESULTS SUMMARY

Business Description |

Ophthalmic pharmaceutical and medical technology company focused on developing and commercializing novel, dropless platform therapies designed to disrupt the conventional standard of care and improve outcomes for patients suffering from chronic eye diseases |

Disease Categories |

Glaucoma Corneal Health Retinal Disease |

Revenue (Growth) |

1Q 2024 $85.6 million (+16% reported and constant currency vs. 1Q 2023) |

Gross Margin (Non-GAAP) |

1Q 2024 ~83% (versus ~83% in 1Q 2023) |

Cash & Cash Equivalents, Short-Term Investments, and Restricted Cash |

$278.7 million as of March 31, 2024 (versus $301.3 million as of December 31, 2023) |

FY2024 Sales Guidance |

FY 2024 global consolidated revenues of $357 - $365 million expected (versus $350 - $360 million previously) |

See “Statement Regarding Use of Non-GAAP Financial Measures” and the Non-GAAP reconciliations included within the Additional Information section of this document. Reconciliations for each of constant currency revenue growth, Non-GAAP Gross Margin, and the other non-GAAP financial measures disclosed in this document to the most directly comparable GAAP financial measure are provided.

2

|

MAY 1, 2024 |

|

|

Revenue Performance & Commercial Overview

Global Consolidated Revenue Performance

Glaukos reported record first quarter net revenues of $85.6 million that were up 16% on a reported and constant currency basis versus 1Q 2023. Our first quarter performance reflected continued solid execution across our global Glaucoma and Corneal Health franchises.

Franchise Revenue Performance

3

|

MAY 1, 2024 |

|

|

U.S. Glaucoma

Our first quarter U.S. Glaucoma net revenues were approximately $42.0 million, representing year-over-year growth of 20% versus 1Q 2023 driven by iStent infinite® and our overall iStent® portfolio.

During the first quarter, we also commenced initial commercial launch activities for iDose® TR, our revolutionary, micro-invasive, injectable therapy designed to lower intraocular pressure in patients with open-angle glaucoma or ocular hypertension. iDose TR is a first-of-its-kind intracameral procedural pharmaceutical designed to deliver glaucoma drug therapy for up to three years.

International Glaucoma

Our first quarter International Glaucoma record net revenues were approximately $25.2 million, representing year-over-year reported growth of 20%, or 21% on a constant currency basis, versus 1Q 2023. The strong growth internationally during the first quarter was broad-based as we continue to scale our international infrastructure and increasingly drive MIGS forward as the standard of care in each region and every major market in the world.

We remain in the early stages of expanding our IG initiatives globally ahead of what we hope will be supported by a healthy cadence of new product approvals and expanding market access in the years to come.

Corneal Health

Our first quarter Corneal Health net revenues were approximately $18.4 million, representing year-over-year growth of 4% versus 1Q 2023, including U.S. Photrexa® sales of $15.1 million, which increased 7% year-over-year. These first quarter results do include, in particular, the impact of our entry as a company into the Medicaid Drug Rebate Program (MDRP). These dynamics were anticipated and will continue to impact Photrexa realized revenues going forward.

We continue to focus on expanding access for keratoconus patients suffering from this rare disease.

4

|

MAY 1, 2024 |

|

|

Additional Commercial Updates & Commentary

We have had several additional positive commercial updates worth highlighting here:

| ✓ | Advanced commercial launch activities in the U.S. for iStent infinite in the first quarter of 2024 |

| o | Interventional glaucoma efforts and improved facility economics driving increased utilization of iStent infinite in standalone procedures for patients that have failed prior medical and surgical therapy |

| o | Focused on key market access initiatives to support consistent and dependable professional fee payment, with five of the seven MACs now including CPT code 0671T on their latest fee schedules |

| ✓ | Commenced initial commercial launch activities for iDose TR |

| o | Initial targeted wave of 15 surgeons all successfully completed their initial iDose TR procedures during 1Q 2024; the early feedback and outcomes have been very positive |

| o | As a reminder, these early access surgeons provide valuable insight to our training and field teams that helps to optimize training and skill transfer to our salesforce and surgical community, supporting our expanded training and broader launch efforts over the course of 2024 |

| ✓ | Achieved several positive reimbursement developments designed to support fulsome coverage and payment for the iDose TR procedural pharmaceutical over time |

| o | First, CMS assigned a unique, permanent J-code for iDose TR, J7355, set to become effective on July 1, 2024. This new J-code, once effective, is expected to increase patient access here in the U.S. and should provide more streamlined, consistent, and dependable coverage and payment for iDose TR as we advance and ultimately accelerate our initial commercial launch activities. |

| o | Second, CMS assigned the CPT codes that are designed to be used to cover the procedural component of iDose TR, 0660T and 0661T, to ambulatory payment classification, or APC, 5492, effective April 1, 2024. This translates into a national average facility fee of nearly $3,900 in the HOPD setting and more than $2,000 in the ASC setting. |

| o | Third, we have participated in several initial education meetings with MACs as part of our efforts to secure professional fee coverage and payment over the course of 2024. |

| o | Fourth, we successfully entered into the MDRP. |

5

|

MAY 1, 2024 |

|

|

| o | And fifth, we have successfully commenced early initiatives to secure coverage for commercial and Medicare Advantage plans, efforts that we plan to accelerate in the second half of 2024 after the J-code is effective. |

| ✓ | Secured several international regulatory approvals, including for iStent infinite in Australia and Brazil and for PRESERFLO® MicroShunt in Brazil and several additional Latin American countries |

6

|

MAY 1, 2024 |

|

|

2024 Revenue Guidance Raised to Reflect Strong Start to the Year

Glaukos now expects full-year 2024 global consolidated net sales of $357 - $365 million, up from its previous guidance of $350 - $360 million. This upwardly revised guidance attempts to take into consideration:

| ● | Potential growing contributions from iStent infinite |

| ● | Potential growing contributions from iDose TR, which are expected to be modest in the first half of 2024 and more back-end weighted in the latter part of 2024 into 2025 |

| ● | Potential ordering pattern volatility within our U.S. Glaucoma franchise during the first half of 2024 due to uncertainty associated with MAC LCDs |

| ● | The continued estimated impact on U.S. Glaucoma volumes related to professional fee reimbursement for combination-cataract trabecular bypass surgery versus other more invasive alternatives |

| ● | Potential headwinds within our U.S. Corneal Health franchise associated with our entry as a company into the MDRP |

| ● | The latest foreign currency exchange spot rates as of our 1Q 2024 earnings call on May 1, 2024 |

| ● | Combo-cataract MIGS competition globally |

7

|

MAY 1, 2024 |

|

|

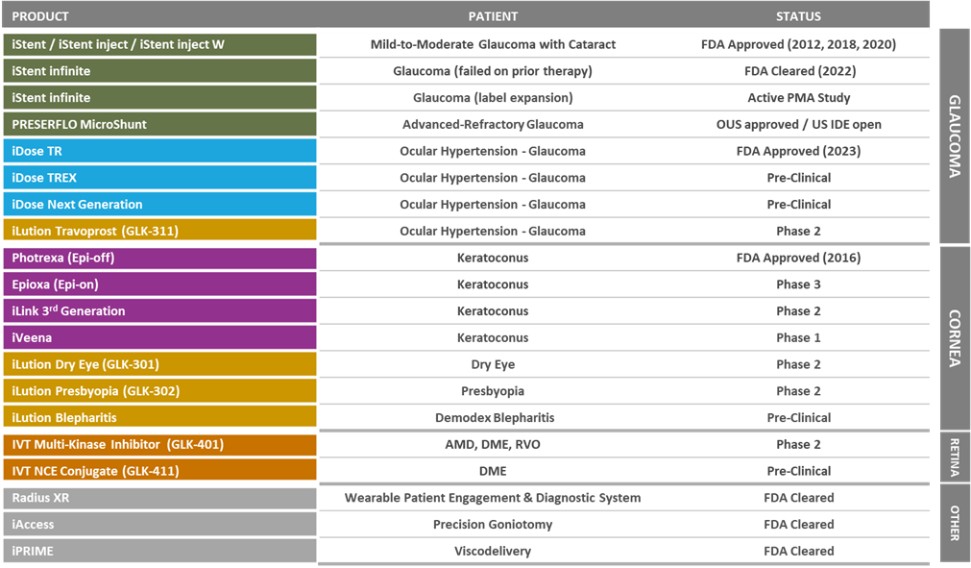

Research & Development / Pipeline Overview

Pipeline Summary

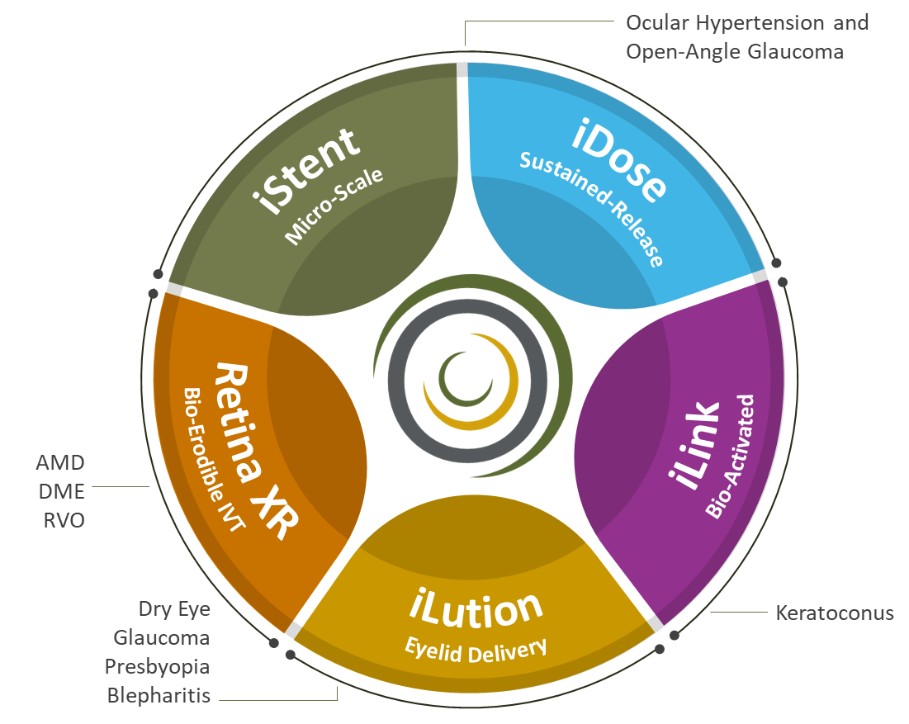

Our five key dropless technology therapy platforms designed to disrupt traditional treatment paradigms and generate cascades of future innovation are as follows:

| ● | iStent® micro-scale surgical devices |

| ● | iDose® sustained-release procedural pharmaceuticals |

| ● | iLution™ transdermal pharmaceuticals |

| ● | iLink® bio-activated pharmaceuticals |

| ● | Retina XR bio-erodible sustained-release pharmaceuticals |

8

|

MAY 1, 2024 |

|

|

Key R&D and Pipeline Updates

We are continuing to prudently invest in and advance our fulsome pipeline of core novel platforms, supported by approximately $600 million of investment into our R&D programs since 2018 alone. Recent updates in our pipeline include:

| ✓ | Announced FDA approval of iDose TR (4Q 2023) |

| o | Commenced initial commercial launch activites for iDose TR (1Q 2024) |

| ✓ | Advancing patient enrollment in PMA pivotal trial for iStent infinite in mild-to-moderate glaucoma patients |

| ✓ | Advancing patient enrollment in first-in-human Retina XR clinical development program for IVT multi-kinase inhibitor in wet AMD patients (GLK-401) |

| ✓ | Advancing patient enrollment in Phase 2a clinical trial for iLution™ Travoprost; initial data readout expected later this year |

| ✓ | Progressing towards trial completion in second half of 2024 for second Phase 3 confirmatory pivotal trial for Epioxa™ (Epi-on) |

| o | Phase 3 confirmatory trial results together with already-completed first Phase 3 trial expected to support targeted NDA submission for Epioxa by the end of 2024 |

| ✓ | Advancing patient enrollment in two Phase 2 trials for third-generation iLink therapy |

| ✓ | PRESERFLO MicroShunt |

| o | U.S. Investigation Device Excemption (IDE) application open; targeting clinical study commencement in 2024 |

| o | Ongoing regulatory submissions and approvals in Latin America |

| ✓ | Preparing to commence Phase 3 clincial trial for iDose TREX, our next-generation iDose therapy, by the end of 2024 |

9

|

MAY 1, 2024 |

|

|

Product / Pipeline Chart

10

|

MAY 1, 2024 |

|

|

Other Financial Performance Overview

As a reminder, we discuss our financial performance on a non-GAAP basis and summarize our GAAP performance. We encourage investors to review our GAAP to non-GAAP reconciliation which can be found in our earnings press release, the Additional Information section contained herein, as well as the Investor Relations section of our website.

First quarter 2024 financial performance summary:

|

|

1Q 2024: 83% 1Q 2023: 83% YoY ∆: (-20 bps) |

Please note that our non-GAAP adjustments to cost of goods sold include substantial amounts related to Avedro acquisition accounting |

|

|

1Q 2024: $61.3M 1Q 2023: $52.9M YoY ∆: +16% |

●

(-2%) sequential decrease vs $62.3M in 4Q 2023

●

YoY increase primarily reflects commercial and G&A investments globally and new product launch activities

|

|

|

1Q 2024: $30.7M 1Q 2023: $35.2M YoY ∆: (-13%) |

●

(-17%) sequential decrease vs $37.1M in 4Q 2023

●

YoY and QoQ decreases reflect continued investment in and advancement of R&D programs offset by elevated expenses in prior year period associated with iDose TR NDA filing fee and related submission prep activities

|

|

|

1Q 2024: $92.0M 1Q 2023: $88.1M YoY ∆: +4% |

●

(-7%) sequential decrease vs $99.4M in 4Q 2023

|

|

|

Op Loss (Non-GAAP) 1Q 2024 ($32.8M) 1Q 2023: ($26.8M) Net Loss (Non-GAAP) 1Q 2024: ($34.6M) 1Q 2023: ($28.4M) Diluted EPS (Non-GAAP) 1Q 2024: ($0.70) 1Q 2023: ($0.59) |

●

Included in non-GAAP loss from operations, non-GAAP net loss and non-GAAP EPS for the first quarter of 2024 is an acquired in-process R&D (IPR&D) charge of $11.7 million, which caused the non-GAAP loss per diluted share to have an additional loss of ($0.24) in the first quarter of 2024 (see Other Important Updates section for more details)

|

|

|

1Q 2024: $1.0M 1Q 2023: $6.9M YoY ∆: (-$5.9M) |

●

Capital expenditures moderating to levels more consistent with historical norms, a trend expected to continue throughout 2024

●

YoY decrease reflects the substantial completion of Aliso Viejo, CA and Burlington, MA facilities

|

|

|

1Q 2024: $278.7M 4Q 2023: $301.3M QoQ ∆: (-$22.6M) |

●

Operating expenses and payout of annual bonuses

|

11

|

MAY 1, 2024 |

|

|

Other Important Updates

| Ø | The Company announced the release of its 2023 Sustainability Report (April 2024) |

| ◾ | The report highlights the company’s continued commitment and progress on its key corporate sustainability initiatives. |

| ◾ | Over the course of 2023, Glaukos undertook several actions to support and further improve its corporate sustainability efforts, including the following highlights: |

| ● | Donated over $10 million in products to underserved regions around the world. |

| ● | Established a second product distribution site, resulting in reduced shipping costs, the elimination of 6.4 million air miles and reduction in associated GHG emissions. |

| ● | Implemented new employee benefits and leadership development programs. |

| ● | Increased the number of patients who received assistance through one of Glaukos’ patient assistance programs. |

| ● | Obtained ISO 14001 certification on its Burlington, MA site. |

| ● | Increased the number and percentage of women in its workforce. |

| ● | Launched Glaukos World Cafe Coffee n’ Chats, a DEI-related learning session focused on exploring and discussing relevant topics. |

| ● | In conjunction with the FDA approval of iDose TR, launched the iDose your Dose philanthropic initiative, pledging that for every iDose TR sold, an equal number of iDose TR units will be made available for qualifying charitable donation requests in the U.S. and around the globe for recipients that satisfy independent eligibility requirements. |

| ◾ | For additional information and highlights, please see Glaukos’ 2023 Sustainability Report, which can be found on the company’s website here. |

| ◾ | Glaukos’ sustainability initiatives are overseen by the company’s board of directors. |

| Ø | The Company filed its 2024 Proxy Statement ahead of its 2024 Annual Meeting scheduled to be held on Thursday, May 30, 2024, at 9AM PT (April 2024) |

| ◾ | For additional information, please see Glaukos’ 2024 Proxy Statement on the company’s website here. |

| Ø | During 1Q 2024, the Company acquired 100% of the outstanding equity interests in a clinical-stage biopharma company focused on developing novel therapeutics for a rare ophthalmic disease and recorded an IPR&D charge of $11.7 million in connection with the transaction. |

12

|

MAY 1, 2024 |

|

|

|

|

|

|

|

|

13

|

MAY 1, 2024 |

|

|

Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of federal securities laws. All statements other than statements of historical facts included in this presentation that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements. These statements are based on management’s current expectations, assumptions, estimates and beliefs. Although we believe that we have a reasonable basis for forward-looking statements contained herein, we caution you that they are based on current expectations about future events affecting us and are subject to risks, uncertainties and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control, that may cause our actual results to differ materially from those expressed or implied by forward-looking statements in this presentation. These potential risks and uncertainties that could cause actual results to differ materially from those described in forward-looking statements include, without limitation, uncertainties regarding the impact of the COVID-19 pandemic or other public health crises on our business; the impact of general macroeconomic conditions including foreign currency fluctuations; the reduced physician fee and ASC facility fee reimbursement rate finalized by CMS for 2022 and 2023 for procedures utilizing the Company’s iStent family of products and its impact on our U.S. combo-cataract glaucoma revenue; our ability to continue to generate sales of our commercialized products and develop and commercialize additional products; our dependence on a limited number of third-party suppliers, some of which are single-source, for components of our products; the occurrence of a crippling accident, natural disaster, or other disruption at our primary facility, which may materially affect our manufacturing capacity and operations; securing or maintaining adequate coverage or reimbursement by third-party payors for procedures using the iStent, the iStent inject W, iAccess, iPRIME, iStent infinite, iDose TR, our corneal cross-linking products or other products in development; our ability to properly train, and gain acceptance and trust from ophthalmic surgeons in the use of our products; our ability to compete effectively in the medical device industry and against current and future technologies (including MIGS technologies); our compliance with federal, state and foreign laws and regulations for the approval and sale and marketing of our products and of our manufacturing processes; the lengthy and expensive clinical trial process and the uncertainty of timing and outcomes from any particular clinical trial or regulatory approval processes; the risk of recalls or serious safety issues with our products and the uncertainty of patient outcomes; our ability to protect, and the expense and time-consuming nature of protecting our intellectual property against third parties and competitors and the impact of any claims against us for infringement or misappropriation of third party intellectual property rights and any related litigation; and our ability to service our indebtedness. These and other known risks, uncertainties and factors are described in detail under the caption “Risk Factors” and elsewhere in our filings with the Securities and Exchange Commission (SEC), including our Annual Report on Form 10-K for the year ended December 31, 2023, which was filed with the SEC on February 23, 2024, and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, which is expected to be filed with the SEC by May 10, 2024. Our filings with the SEC are available in the Investor Section of our website at www.glaukos.com or at www.sec.gov. In addition, information about the risks and benefits of our products is available on our website at www.glaukos.com. All forward-looking statements included in this press release are expressly qualified in their entirety by the foregoing cautionary statements. You are cautioned not to place undue reliance on the forward-looking statements in this press release, which speak only as of the date hereof. We do not undertake any obligation to update, amend or clarify these forward-looking statements whether as a result of new information, future events or otherwise, except as may be required under applicable securities law.

14

|

MAY 1, 2024 |

|

|

Statement Regarding Use of Non-GAAP Financial Measures

To supplement the consolidated financial results prepared in accordance with Generally Accepted Accounting Principles (“GAAP”), the Company uses certain non-GAAP historical financial measures. Management makes adjustments to the GAAP measures for items (both charges and gains) that (a) do not reflect the core operational activities of the Company, (b) are commonly adjusted within the Company’s industry to enhance comparability of the Company’s financial results with those of its peer group, or (c) are inconsistent in amount or frequency between periods (albeit such items are monitored and controlled with equal diligence relative to core operations). The Company uses the term “Non-GAAP” to exclude external acquisition-related costs incurred to effect a business combination; amortization of intangible assets acquired in a business combination, asset purchase transaction or other contractual relationship; impairment of goodwill and intangible assets; certain in-process R&D charges; fair value adjustments to contingent consideration liabilities and pre-acquisition contingencies arising from a business combination; integration and transition costs related to business combinations; fair market value adjustments to inventories acquired in a business combination or asset purchase transaction; restructuring charges, duplicative operating expenses, or asset write-offs (or reversals) associated with exiting or significantly downsizing a business; gain or loss from the sale of a business; gain or loss on the mark-to-market adjustment, impairment, or sale of long-term investments; mark-to-market adjustments on derivative instruments that hedge income or expense exposures in a future period; significant legal litigation costs and/or settlement expenses or proceeds; legal and other associated expenses that are both unusual and significant related to governmental or internal inquiries; and significant discrete income and other tax adjustments related to transactions as well as changes in estimated acquisition-date tax effects associated with business combinations, and the impact from implementation of tax law changes and settlements. See “Primary GAAP to Non-GAAP Reconciliations” for a reconciliation of each non-GAAP measure presented to the comparable GAAP financial measure. Beginning in the second quarter of 2022, we no longer exclude certain upfront and contingent milestone payments in connection with collaborative and licensing arrangements and certain in-process R&D charges for non-GAAP reporting and disclosure purposes.

In addition, in order to remove the impact of fluctuations in foreign currency exchange rates, the Company also presents certain net sales information on a constant currency basis, which represents the outcome that would have resulted had exchange rates in the current period been the same as the average exchange rates in effect in the comparable prior period. See “Additional GAAP to Non-GAAP Reconciliations” for a presentation of certain net sales information on a reported, GAAP and a constant currency basis.

15

|

MAY 1, 2024 |

|

|

GAAP Income Statement

GLAUKOS CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

(in thousands, except per share amounts)

|

|

Three Months Ended |

||||

|

|

March 31, |

||||

|

|

2024 |

|

2023 |

||

Net sales |

|

$ |

85,622 |

|

$ |

73,899 |

Cost of sales |

|

|

20,258 |

|

|

18,071 |

Gross profit |

|

|

65,364 |

|

|

55,828 |

Operating expenses: |

|

|

|

|

|

|

Selling, general and administrative |

|

|

61,975 |

|

|

53,650 |

Research and development |

|

|

30,726 |

|

|

35,171 |

Acquired in-process research and development |

|

|

11,729 |

|

|

— |

Total operating expenses |

|

|

104,430 |

|

|

88,821 |

Loss from operations |

|

|

(39,066) |

|

|

(32,993) |

Non-operating expense: |

|

|

|

|

|

|

Interest income |

|

|

3,083 |

|

|

1,648 |

Interest expense |

|

|

(3,450) |

|

|

(3,408) |

Other (expense) income, net |

|

|

(1,028) |

|

|

528 |

Total non-operating expense |

|

|

(1,395) |

|

|

(1,232) |

Loss before taxes |

|

|

(40,461) |

|

|

(34,225) |

Income tax provision |

|

|

377 |

|

|

401 |

Net loss |

|

$ |

(40,838) |

|

$ |

(34,626) |

|

|

|

|

|

|

|

Basic and diluted net loss per share |

|

$ |

(0.82) |

|

$ |

(0.72) |

|

|

|

|

|

|

|

Weighted average shares used to compute basic and diluted net loss per share |

|

|

49,580 |

|

|

47,881 |

16

|

MAY 1, 2024 |

|

|

GAAP Balance Sheet

GLAUKOS CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except par values)

|

|

March 31, |

|

December 31, |

||

|

|

2024 |

|

2023 |

||

|

|

(unaudited) |

|

|

|

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

42,495 |

|

$ |

93,467 |

Short-term investments |

|

|

230,365 |

|

|

201,964 |

Accounts receivable, net |

|

|

46,545 |

|

|

39,850 |

Inventory |

|

|

50,185 |

|

|

41,986 |

Prepaid expenses and other current assets |

|

|

19,020 |

|

|

18,194 |

Total current assets |

|

|

388,610 |

|

|

395,461 |

Restricted cash |

|

|

5,856 |

|

|

5,856 |

Property and equipment, net |

|

|

101,858 |

|

|

103,212 |

Operating lease right-of-use asset |

|

|

26,683 |

|

|

27,146 |

Finance lease right-of-use asset |

|

|

43,575 |

|

|

44,180 |

Intangible assets, net |

|

|

281,919 |

|

|

282,956 |

Goodwill |

|

|

66,134 |

|

|

66,134 |

Deposits and other assets |

|

|

18,703 |

|

|

15,469 |

Total assets |

|

$ |

933,338 |

|

$ |

940,414 |

|

|

|

|

|

|

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

12,752 |

|

$ |

13,440 |

Accrued liabilities |

|

|

59,486 |

|

|

60,574 |

Total current liabilities |

|

|

72,238 |

|

|

74,014 |

Convertible senior notes |

|

|

283,117 |

|

|

282,773 |

Operating lease liability |

|

|

30,110 |

|

|

30,427 |

Finance lease liability |

|

|

70,289 |

|

|

70,538 |

Deferred tax liability, net |

|

|

7,144 |

|

|

7,144 |

Other liabilities |

|

|

19,710 |

|

|

13,752 |

Total liabilities |

|

|

482,608 |

|

|

478,648 |

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Preferred stock, $0.001 par value; 5,000 shares authorized; no shares issued or outstanding |

|

|

— |

|

|

— |

Common stock, $0.001 par value; 150,000 shares authorized; 49,875 and 49,148 shares issued and 49,847 and 49,120 shares outstanding as of March 31, 2024 and December 31, 2023, respectively |

|

|

50 |

|

|

49 |

Additional paid-in capital |

|

|

1,089,280 |

|

|

1,059,751 |

Accumulated other comprehensive income (loss) |

|

|

1,437 |

|

|

1,165 |

Accumulated deficit |

|

|

(639,905) |

|

|

(599,067) |

Less treasury stock (28 shares as of March 31, 2024 and December 31, 2023 |

|

|

(132) |

|

|

(132) |

Total stockholders' equity |

|

|

450,730 |

|

|

461,766 |

Total liabilities and stockholders' equity |

|

$ |

933,338 |

|

$ |

940,414 |

17

|

MAY 1, 2024 |

|

|

Primary GAAP to Non-GAAP Reconciliations

GLAUKOS CORPORATION

GAAP to Non-GAAP Reconciliations

(in thousands, except per share amounts and percentage data)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 2024 |

|

Q1 2023 |

|

||||||||||||||

|

|

GAAP |

|

Adjustments |

|

Non-GAAP |

|

GAAP |

|

Adjustments |

|

Non-GAAP |

|

||||||

Cost of sales |

|

$ |

20,258 |

|

$ |

(5,523) |

(a) |

$ |

14,735 |

|

$ |

18,071 |

|

$ |

(5,523) |

(a) |

$ |

12,548 |

|

Gross Margin |

|

|

76.3 |

% |

|

6.5 |

% |

|

82.8 |

% |

|

75.5 |

% |

|

7.5 |

% |

|

83.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

$ |

61,975 |

|

$ |

(705) |

(b) |

$ |

61,270 |

|

$ |

53,650 |

|

$ |

(705) |

(b) |

$ |

52,945 |

|

Loss from operations |

|

$ |

(39,066) |

|

$ |

6,228 |

|

$ |

(32,838) |

|

$ |

(32,993) |

|

$ |

6,228 |

|

$ |

(26,765) |

|

Net loss |

|

$ |

(40,838) |

|

$ |

6,228 |

(c) |

$ |

(34,610) |

|

$ |

(34,626) |

|

$ |

6,228 |

(c) |

$ |

(28,398) |

|

Basic and diluted net loss per share |

|

$ |

(0.82) |

|

$ |

0.12 |

|

$ |

(0.70) |

|

$ |

(0.72) |

|

$ |

0.13 |

|

$ |

(0.59) |

|

| (a) | Cost of sales adjustments related to the acquisition of Avedro, Inc. (Avedro) for amortization of developed technology intangible assets of $5.5 million in Q1 2024 and Q1 2023. |

| (b) | Avedro acquisition-related expenses for amortization expense of customer relationship intangible assets of $0.7 million in Q1 2024 and Q1 2023. |

| (c) | Includes total tax effect for non-GAAP pre-tax adjustments. For non-GAAP adjustments associated with the U.S., the tax effect is $0 given the Company’s U.S. taxable loss positions in both 2024 and 2023. |

18

|

MAY 1, 2024 |

|

|

Additional GAAP to Non-GAAP Reconciliations

Reported Sales vs. Prior Periods (in thousands) |

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Year-over-Year Percent Change |

|

Quarter-over-Quarter Percent Change |

|

||||||||

|

|

1Q 2024 |

|

1Q 2023 |

|

4Q 2023 |

|

Reported |

|

Operations (1) |

|

Currency (2) |

|

Reported |

|

Operations (1) |

|

Currency (2) |

|

|||

International Glaucoma |

|

$ |

25,238 |

|

$ |

21,118 |

|

$ |

21,857 |

|

19.5 |

% |

21.4 |

% |

(1.9) |

% |

15.5 |

% |

14.5 |

% |

1.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Net Sales |

|

$ |

85,622 |

|

$ |

73,899 |

|

$ |

82,365 |

|

15.9 |

% |

16.4 |

% |

(0.5) |

% |

4.0 |

% |

3.7 |

% |

0.3 |

% |

(1) Operational growth excludes the effect of translational currency

(2) Calculated by converting the current period numbers using the prior period’s average foreign exchange rates

For Non-GAAP disclosures associated with the company’s past quarterly results, included with respect to the sequential comparisons included herein, please see reconciliations here.

19