`

TABLE OF CONTENTS EARNINGS RELEASE i COMPANY OVERVIEW COMPANY PROFILE .......................................................................................................................................................................... 2 KEY METRICS AND GUIDANCE ...................................................................................................................................................... 4 FINANCIAL SUMMARY CONDENSED CONSOLIDATED BALANCE SHEETS ................................................................................................................... 6 CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS .......................................................................................... 7 CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS .......................................................................................... 8 SEGMENT RESULTS ......................................................................................................................................................................... 9 NET OPERATING INCOME ............................................................................................................................................................... 10 FUNDS FROM OPERATIONS AND ADJUSTED FUNDS FROM OPERATIONS ...................................................................... 12 EBITDA AND ADJUSTED EBITDA .................................................................................................................................................. 14 DEBT SUMMARY CAPITALIZATION AND FINANCIAL RATIOS ................................................................................................................................ 16 DEBT SUMMARY ................................................................................................................................................................................ 17 TRANSACTIONAL SUMMARY COMMERCIAL REAL ESTATE TRANSACTIONS, DEVELOPMENT, AND REDEVELOPMENT ........................................... 19 DEVELOPMENT OPPORTUNITIES ................................................................................................................................................. 20 CAPITAL EXPENDITURES ............................................................................................................................................................... 21 COMMERCIAL REAL ESTATE PORTFOLIO SUMMARY .................................................................................................................................................................... 23 NOI BY ASSET CLASS ...................................................................................................................................................................... 24 OCCUPANCY ....................................................................................................................................................................................... 25 IMPROVED PROPERTY REPORT ................................................................................................................................................... 26 GROUND LEASE REPORT ............................................................................................................................................................... 28 TENANT CONCENTRATION - TOP 20 TENANTS ........................................................................................................................ 29 LEASE EXPIRATION SCHEDULE ................................................................................................................................................... 30 NEW AND RENEWAL LEASE SUMMARY ...................................................................................................................................... 31 LAND OPERATIONS STATEMENT OF OPERATING PROFIT AND EBITDA ................................................................................................................ 33 COMPONENTS OF LAND OPERATIONS ....................................................................................................................................... 34 ADDITIONAL INFORMATION COMPONENTS OF NET ASSET VALUE ........................................................................................................................................ 36 GLOSSARY OF TERMS ..................................................................................................................................................................... 37 STATEMENT ON MANAGEMENT'S USE OF NON-GAAP FINANCIAL MEASURES ............................................................ 39

Forward-Looking Statements Statements in this Supplemental Information document that are not historical facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and involve a number of risks and uncertainties that could cause actual results to differ materially from those contemplated by the relevant forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding possible or assumed future results of operations, business strategies, growth opportunities and competitive positions. In addition, words such as “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates,” “projects,” “forecasts,” and future or conditional verbs such as “will,” “may,” “could,” “should,” and “would,” as well as any other statement that necessarily depends on future events, are intended to identify forward-looking statements. Such forward-looking statements speak only as of the date the statements were made and are not guarantees of future performance. Forward-looking statements are subject to a number of risks, uncertainties, assumptions and other factors that could cause actual results and the timing of certain events to differ materially from those expressed in or implied by the forward-looking statements. These factors include, but are not limited to, prevailing market conditions and other factors related to the Company's REIT status and the Company's business, and the risk factors discussed in Part I, Item 1A of the Company's most recent Form 10-K under the heading "Risk Factors", Form 10-Q, and other filings with the SEC. The information in this Supplemental Information document should be evaluated in light of these important risk factors. We do not undertake any obligation to update the Company's forward-looking statements. Basis of Presentation The information contained in this Supplemental Information document does not purport to disclose all items required by accounting principles generally accepted in the United States of America ("GAAP").

Alexander & Baldwin, Inc. Reports Third Quarter 2025 Results HONOLULU, (October 30, 2025) /PRNewswire/—Alexander & Baldwin, Inc. (NYSE: ALEX) ("A&B" or "Company"), a Hawai‘i-based owner, operator and developer of high-quality commercial real estate in Hawai‘i, today announced net income available to A&B common shareholders of $14.3 million, or $0.20 per diluted share, and Commercial Real Estate ("CRE") operating profit of $22.7 million for the third quarter of 2025. Q3 2025 Highlights • Funds From Operations ("FFO") of $21.4 million, or $0.29 per diluted share • FFO related to CRE and Corporate of $21.7 million, or $0.30 per diluted share • CRE Same-Store Net Operating Income ("NOI") increased 0.6% • Leased occupancy as of September 30, 2025, was 95.6% • Comparable blended leasing spreads for the improved portfolio were 4.4% • Advanced industrial development projects, with vertical construction underway for a build-to-suit facility at Maui Business Park and the groundbreaking of two new buildings at Komohana Industrial, which will add over 150,000 square feet ("sq. ft.") of gross leasable area ("GLA") upon completion. • Executed a lease renewal with anchor tenant in Kailua Town subsequent to the quarter-end, achieving an 11% lease renewal spread. Lance Parker, president and chief executive officer, stated: "We are pleased that overall third-quarter results exceeded expectations, and we remain confident in our full-year outlook. As a result, we are raising FFO guidance for the year. Our commercial real estate portfolio performed in line with expectations in the quarter. In addition, we executed a key lease renewal in Kailua Town, reinforcing continued leasing strength. We also advanced construction on two industrial projects, positioning us well for future growth. With increasing momentum in Hawai‘i’s investment market, we are encouraged by both internal and external growth opportunities." Consolidated Financial Results for Q3 2025 Below is a summary of select consolidated financial results. (dollars in thousands, except per share data) Three Months Ended September 30, 2025 2024 Net income (loss) available to A&B common shareholders $ 14,337 $ 18,998 Diluted earnings (loss) per share available to A&B shareholders $ 0.20 $ 0.26 (dollars in thousands, except per share data) Three Months Ended September 30, 2025 2024 FFO $ 21,409 $ 28,230 FFO per diluted share $ 0.29 $ 0.39 FFO per share related to CRE and Corporate $ 0.30 $ 0.28 Selling, general and administrative expense $ 6,083 $ 7,436 i

CRE Financial Results for Q3 2025 Below is a summary of select CRE financial results. (dollars in thousands) Three Months Ended September 30, 2025 2024 CRE operating revenue $ 50,213 $ 49,381 CRE operating profit $ 22,719 $ 22,829 Same-Store NOI $ 31,916 $ 31,731 Same-Store NOI Growth 0.6 % 4.1 % CRE Operating Results for Q3 2025 • During the third quarter of 2025, the Company executed 49 improved-property leases totaling approximately 163,800 sq. ft. of GLA, representing $3.3 million of annualized base rent. • Comparable leasing spreads across the improved property portfolio were 4.4% for the third quarter of 2025, which included 2.4% for retail and 6.0% for industrial spaces. • Select occupancy information is included below for each of the quarters ended September 30, 2025, June 30, 2025, and September 30, 2024. September 30, 2025 June 30, 2025 September 30, 2024 Change from prior quarter Change from prior year Leased Occupancy Total leased occupancy 95.6% 95.8% 94.0% (20) bps 160 bps Retail portfolio occupancy 95.5% 95.4% 92.9% 10 bps 260 bps Industrial portfolio occupancy 97.5% 98.2% 97.4% (70) bps 10 bps CRE Investment Activity for Q3 2025 • During the third quarter of 2025, the Company recognized selling profit of $2.6 million in connection with a tenant exercising its option to purchase three subdivided units at Kaka‘ako Commerce Center, a six-story industrial property. At the time of the exercise, the tenant was leasing two of the three subdivided units it committed to purchase. The sale of the three subdivided units is expected to close in the first quarter of 2026. • Advanced expansion of Komohana Industrial Park with the commencement of vertical construction of two new buildings totaling 121,000 sq. ft. of GLA. The buildings include a 91,000-square-foot build-to-suit distribution center that is pre-leased to Lowe's and a 30,000-square-foot speculative building. Construction is scheduled to be completed in the fourth quarter of 2026. • Construction continues on schedule for the 29,550-square-foot warehouse and distribution center at Maui Business Park. The single-tenant building features 32-foot clear height and can accommodate up to 14 dock- high loading bays. The facility is pre-leased and is expected to be placed in service in the first quarter of 2026. Balance Sheet, Capital Markets Activities, and Liquidity • As of September 30, 2025, the Company had total liquidity of $284.3 million, consisting of cash on hand of $17.3 million and $267.0 million available on its revolving line of credit. • Net Debt to Trailing Twelve Months ("TTM") Consolidated Adjusted EBITDA was 3.5 times as of September 30, 2025, with TTM Consolidated Adjusted EBITDA of $129.4 million for the twelve months ended September 30, 2025. Dividend • The Company paid a third quarter 2025 dividend of $0.2250 per share on October 7, 2025. • Consistent with historical practice, the Company's Board of Directors plans to declare a fourth quarter 2025 dividend in December 2025, with payment in January 2026. ii

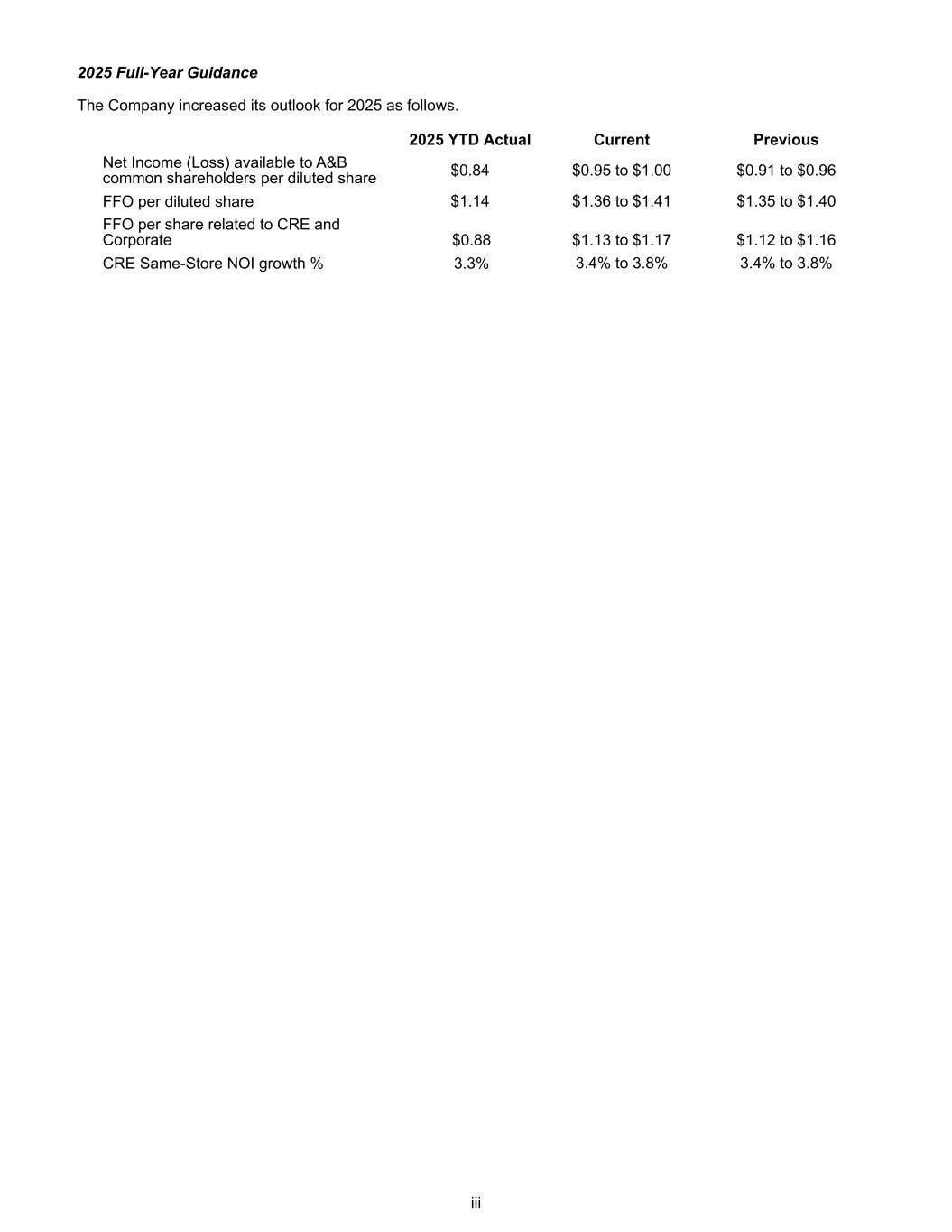

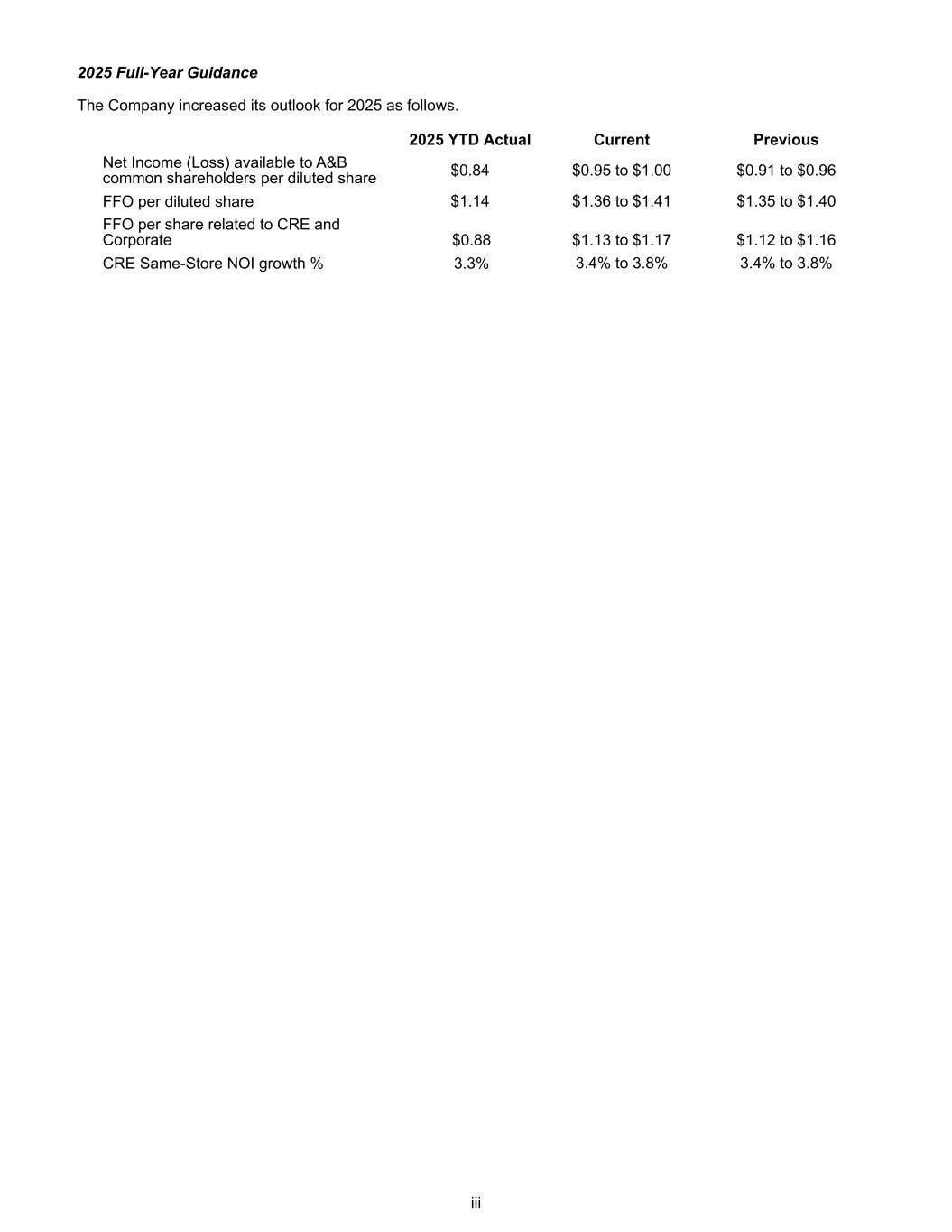

2025 Full-Year Guidance The Company increased its outlook for 2025 as follows. Net Income (Loss) available to A&B common shareholders per diluted share $0.84 $0.95 to $1.00 $0.91 to $0.96 FFO per diluted share $1.14 $1.36 to $1.41 $1.35 to $1.40 FFO per share related to CRE and Corporate $0.88 $1.13 to $1.17 $1.12 to $1.16 CRE Same-Store NOI growth % 3.3% 3.4% to 3.8% 3.4% to 3.8% 2025 YTD Actual Current Previous iii

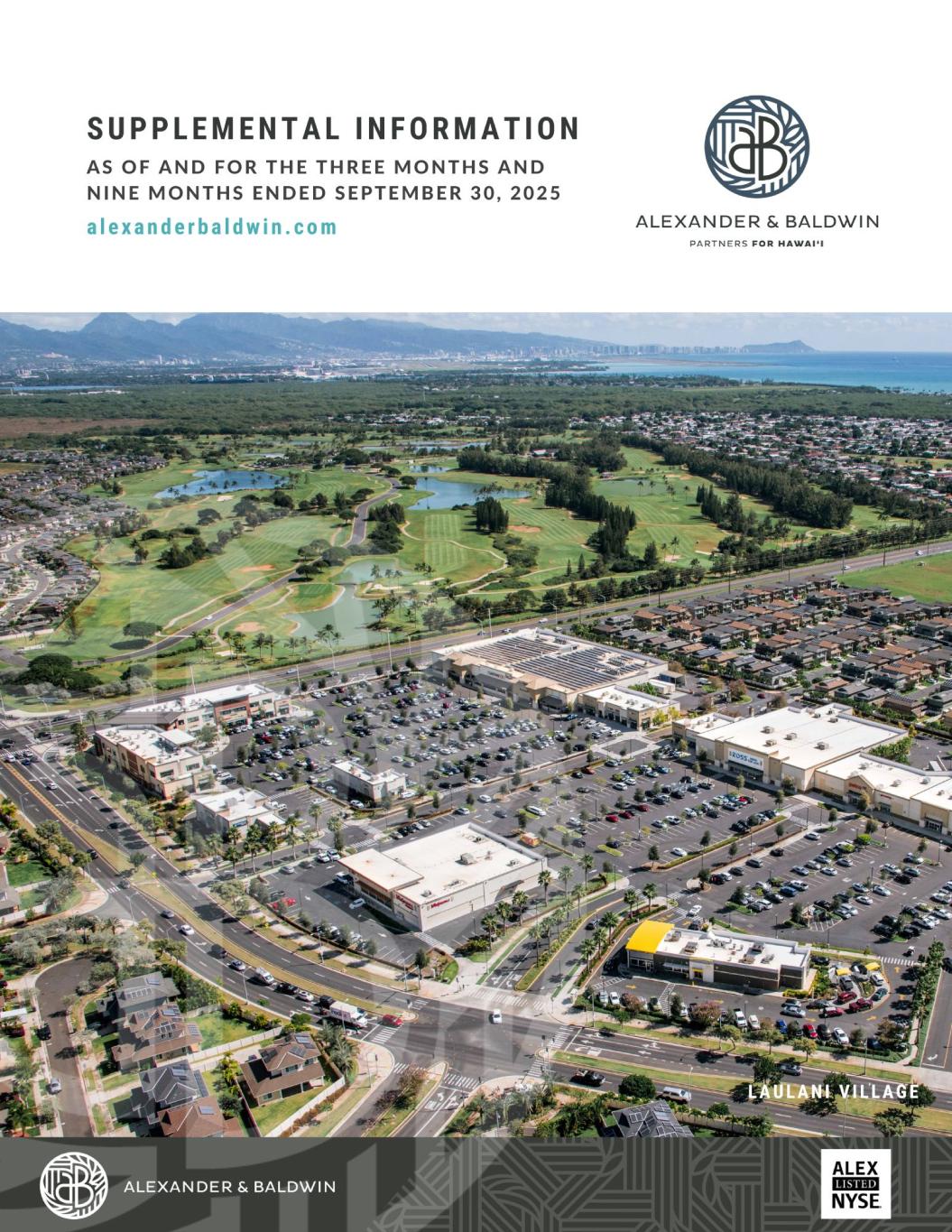

ABOUT ALEXANDER & BALDWIN Alexander & Baldwin, Inc. (NYSE: ALEX) (A&B) is the only publicly-traded real estate investment trust to focus exclusively on Hawai‘i commercial real estate and is the state's largest owner of grocery-anchored, neighborhood shopping centers. A&B owns, operates and manages approximately four million square feet of commercial space in Hawai‘i, including 21 retail centers, 14 industrial assets, four office properties, as well as 146 acres of ground lease assets. Over its 155-year history, A&B has evolved with the state's economy and played a leadership role in the development of the agricultural, transportation, tourism, construction, residential and commercial real estate industries. Learn more about A&B at www.alexanderbaldwin.com. Investor Contact: Clayton Chun (808) 525-8475 investorrelations@abhi.com iv

Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 1

COMPANY PROFILE Alexander & Baldwin, Inc. ("A&B" or the "Company") is a fully integrated real estate investment trust ("REIT") headquartered in Honolulu, Hawai‘i. The Company has a history of over 155 years of being an integral piece of Hawai‘i and its economy making it uniquely qualified to create value for shareholders through a strategy focused on asset management and growth primarily in its commercial real estate holdings in Hawai‘i. The Company operates in two reportable segments: Commercial Real Estate ("CRE") and Land Operations, and is composed of the following as of September 30, 2025: • A commercial real estate portfolio consisting of 21 retail centers, 14 industrial assets, and four office properties, representing a total of four million square feet of improved properties gross leasable area ("GLA"), including 2.5 million square feet of largely grocery/ drugstore-anchored retail centers; as well as 146 acres of ground lease assets throughout the Hawaiian islands, of which substantially all are leased pursuant to urban ground leases as of September 30, 2025; and 8.1 acres slated for build-to-suit development; and • A land operations portfolio consisting of approximately 3,100 acres of legacy landholdings and assets that are subject to the Company's simplification and monetization efforts, and 39 acres of core landholdings, including development activities. GEOGRAPHICALLY FOCUSED IMPROVED PROPERTY - GLA (SF) (in thousands) Ground (acres)Retail Industrial Office Total Oahu 1,724 1,038 37 2,799 85 Maui 284 164 109 556 61 Kauai 229 65 — 293 — Hawai‘i Island 222 87 — 309 — Total 2,459 1,353 146 3,957 146 Number of Properties 21 14 4 39 N/A Throughout this Supplemental Information document, references to "we," "our," "us" and "our Company" refer to Alexander & Baldwin, Inc., together with its consolidated subsidiaries. Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 2 $20,939 $5,885 $853 $5,083 The Company's commercial real estate portfolio is geographically focused in Hawai‘i, where it benefits from high barriers to entry, a stable and resilient economy, and where management has extensive market knowledge and deep local roots. As of September 30, 2025, GLA square footage ("SF") by the improved property asset class and location, and acres by ground leases location were as follows: 2.6% Q3 2025 NOI by ASSET CLASS (dollars in thousands) 18.0% 15.5% 63.9%

Executive Officers Lance Parker Clayton Chun President & Chief Executive Officer Executive Vice President, Chief Financial Officer & Treasurer Meredith Ching Executive Vice President, External Affairs Contact Information Equity Research Corporate Headquarters Alliance Global Partners Janney Montgomery Scott 822 Bishop Street Gaurav Mehta Rob Stevenson Honolulu, HI 96813 (646) 908-3825 (646) 840-3217 gmehta@allianceg.com robstevenson@janney.com Investor Relations Clayton Chun Citizens Capital Markets & Advisory Piper Sandler & Co. Executive Vice President, Chief Financial Officer & Treasurer Mitch Germain Alexander Goldfarb (808) 525-8475 (212) 906-3537 (212) 466-7937 investorrelations@abhi.com mitchell.germain@citizensbank.com alexander.goldfarb@psc.com Transfer Agent & Registrar Sidoti & Company, LLC Computershare Brendan McCarthy, CFA P.O. Box 43006 (212) 453-7057 Providence, RI 02940-3006 bmccarthy@sidoti.com (866) 442-6551 Other Company Information Overnight Correspondence Computershare Stock exchange listing: NYSE: ALEX 150 Royall Street, Suite 101 Corporate website: www.alexanderbaldwin.com Canton, MA 02021 Market capitalization at $1.3B September 30, 2025: 3-month average trading volume: 423K Shareholder website: www.computershare.com/investor Independent auditor: Deloitte & Touche LLP Online inquiries: www-us.computershare.com/investor/contact Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 3

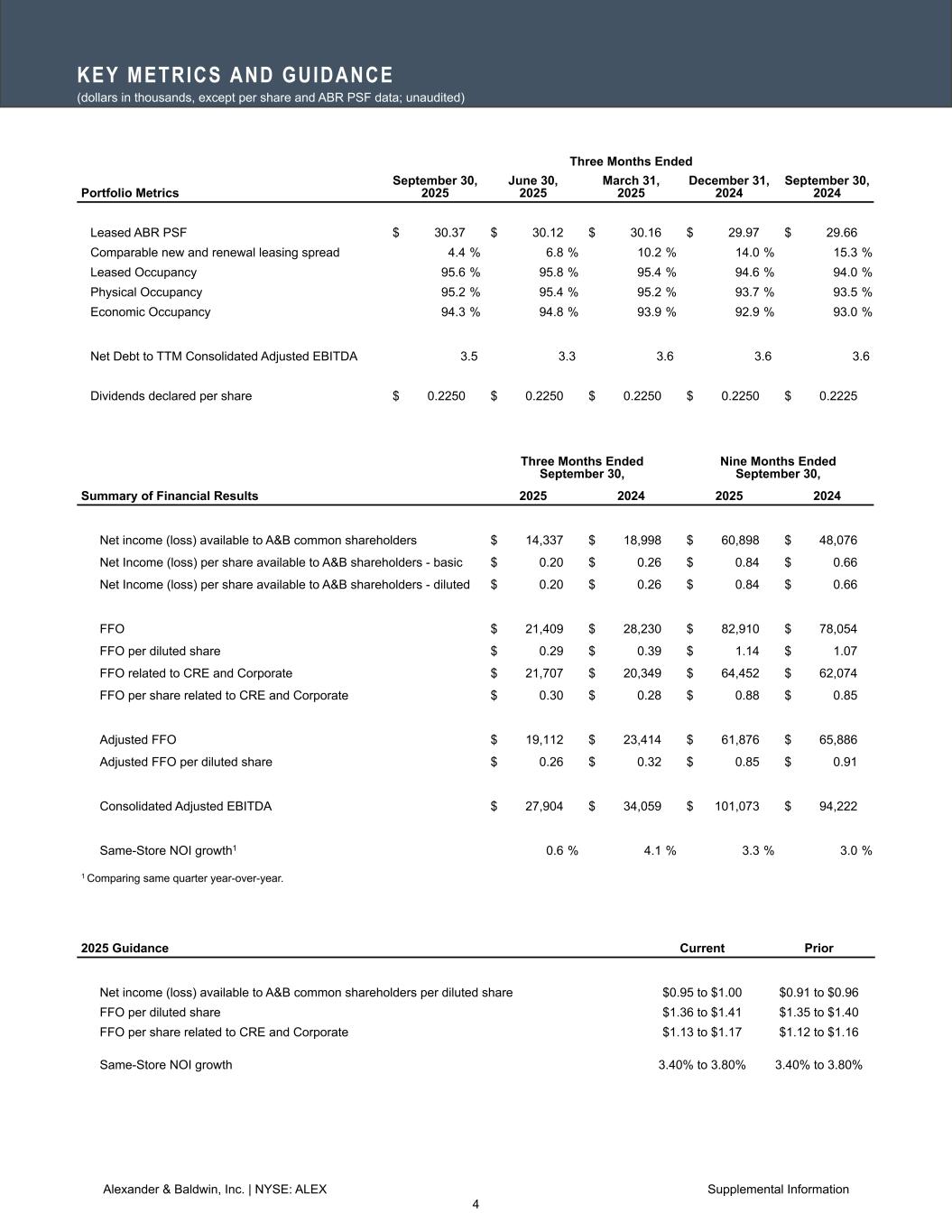

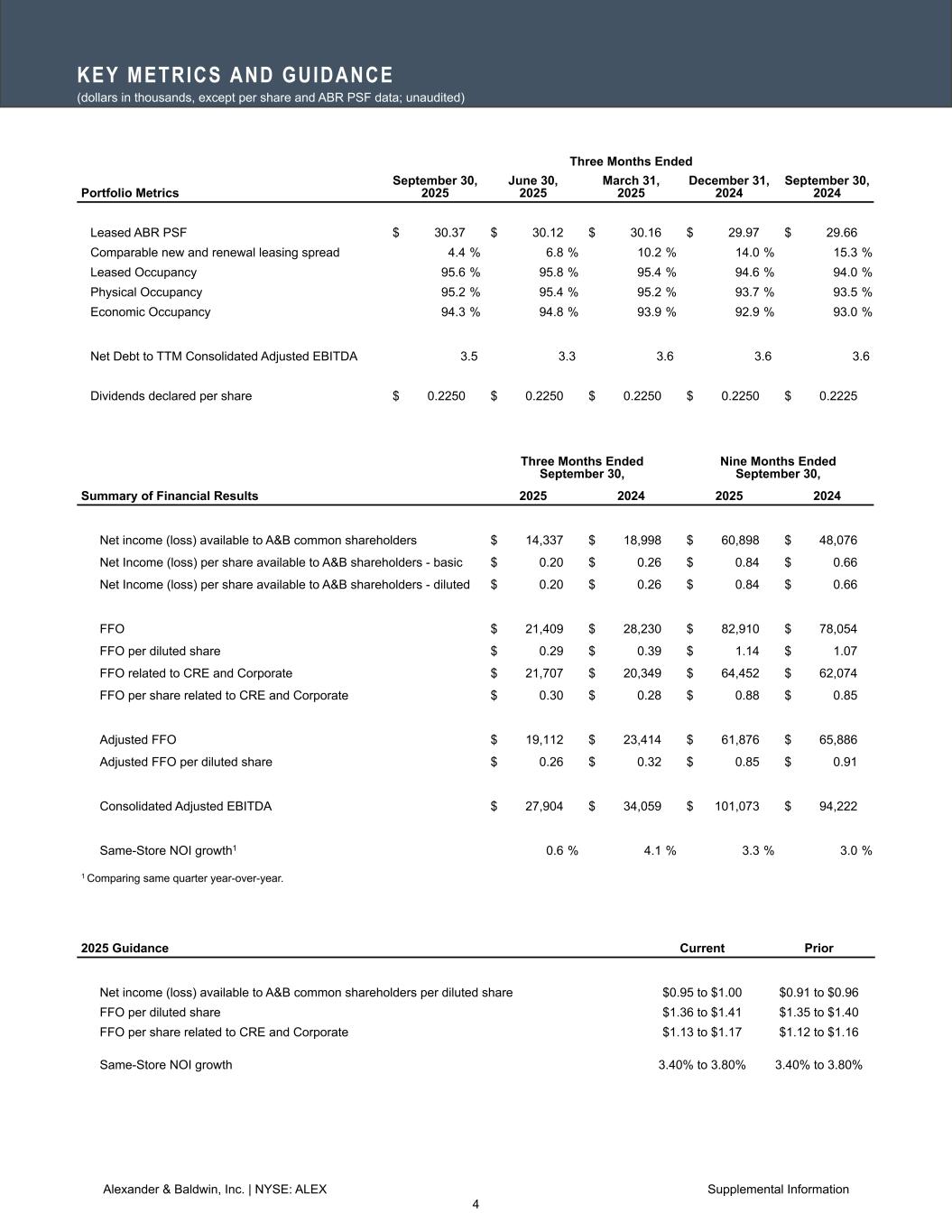

KEY METRICS AND GUIDANCE (dollars in thousands, except per share and ABR PSF data; unaudited) Three Months Ended Portfolio Metrics September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Leased ABR PSF $ 30.37 $ 30.12 $ 30.16 $ 29.97 $ 29.66 Comparable new and renewal leasing spread 4.4 % 6.8 % 10.2 % 14.0 % 15.3 % Leased Occupancy 95.6 % 95.8 % 95.4 % 94.6 % 94.0 % Physical Occupancy 95.2 % 95.4 % 95.2 % 93.7 % 93.5 % Economic Occupancy 94.3 % 94.8 % 93.9 % 92.9 % 93.0 % Net Debt to TTM Consolidated Adjusted EBITDA 3.5 3.3 3.6 3.6 3.6 Dividends declared per share $ 0.2250 $ 0.2250 $ 0.2250 $ 0.2250 $ 0.2225 Three Months Ended September 30, Nine Months Ended September 30, Summary of Financial Results 2025 2024 2025 2024 Net income (loss) available to A&B common shareholders $ 14,337 $ 18,998 $ 60,898 $ 48,076 Net Income (loss) per share available to A&B shareholders - basic $ 0.20 $ 0.26 $ 0.84 $ 0.66 Net Income (loss) per share available to A&B shareholders - diluted $ 0.20 $ 0.26 $ 0.84 $ 0.66 FFO $ 21,409 $ 28,230 $ 82,910 $ 78,054 FFO per diluted share $ 0.29 $ 0.39 $ 1.14 $ 1.07 FFO related to CRE and Corporate $ 21,707 $ 20,349 $ 64,452 $ 62,074 FFO per share related to CRE and Corporate $ 0.30 $ 0.28 $ 0.88 $ 0.85 Adjusted FFO $ 19,112 $ 23,414 $ 61,876 $ 65,886 Adjusted FFO per diluted share $ 0.26 $ 0.32 $ 0.85 $ 0.91 Consolidated Adjusted EBITDA $ 27,904 $ 34,059 $ 101,073 $ 94,222 Same-Store NOI growth1 0.6 % 4.1 % 3.3 % 3.0 % 1 Comparing same quarter year-over-year. 2025 Guidance Current Prior Net income (loss) available to A&B common shareholders per diluted share $0.95 to $1.00 $0.91 to $0.96 FFO per diluted share $1.36 to $1.41 $1.35 to $1.40 FFO per share related to CRE and Corporate $1.13 to $1.17 $1.12 to $1.16 Same-Store NOI growth 3.40% to 3.80% 3.40% to 3.80% Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 4

Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 5

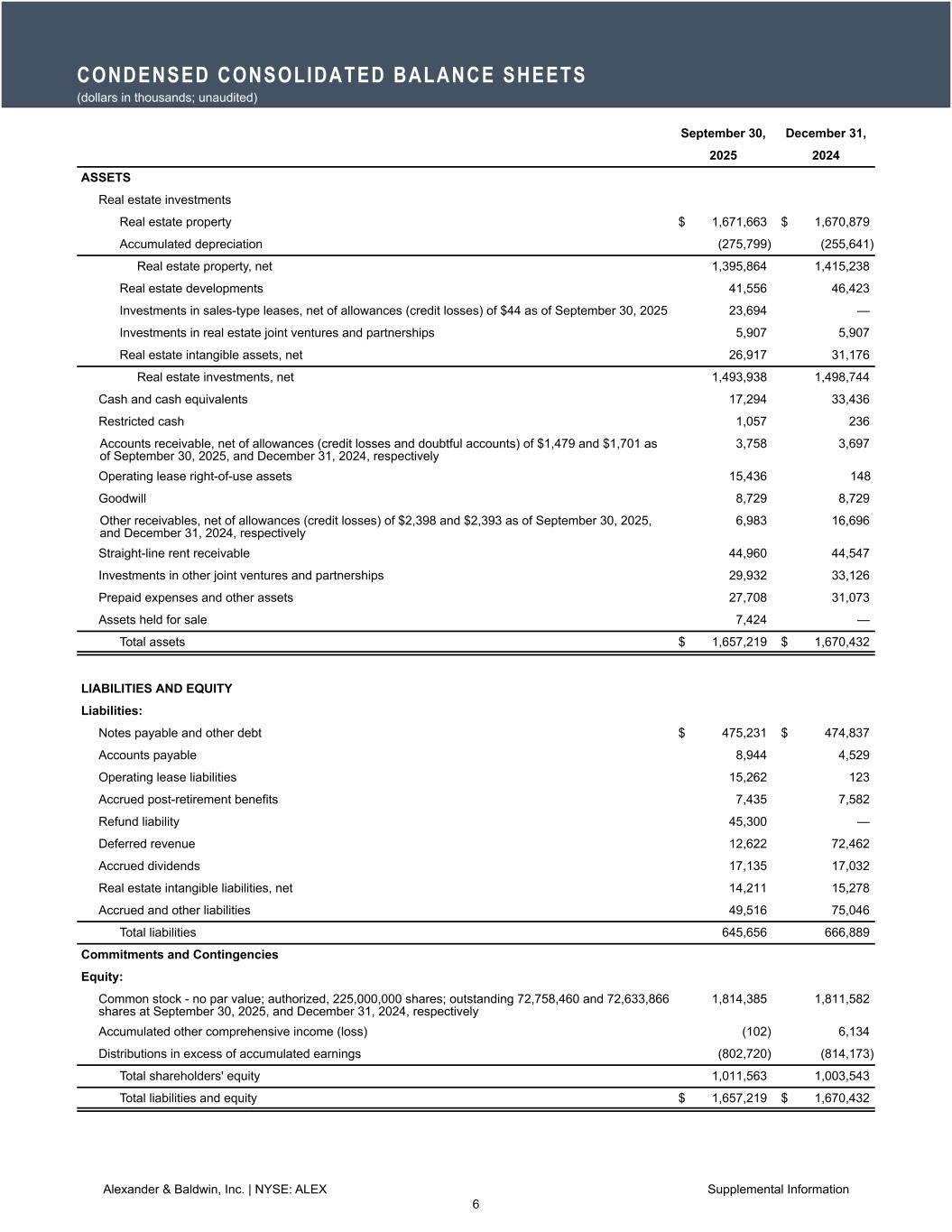

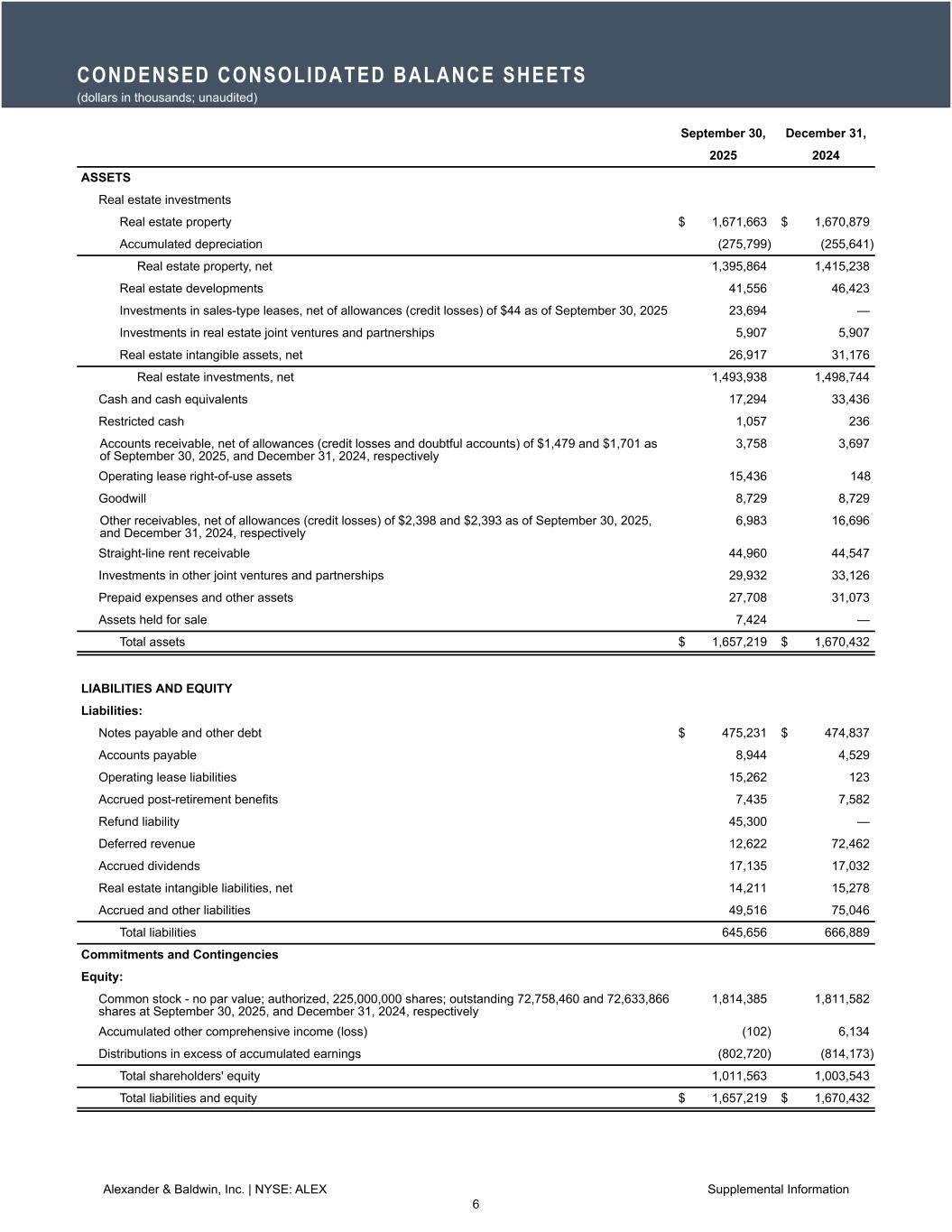

CONDENSED CONSOLIDATED BALANCE SHEETS (dollars in thousands; unaudited) September 30, December 31, 2025 2024 ASSETS Real estate investments Real estate property $ 1,671,663 $ 1,670,879 Accumulated depreciation (275,799) (255,641) Real estate property, net 1,395,864 1,415,238 Real estate developments 41,556 46,423 Investments in sales-type leases, net of allowances (credit losses) of $44 as of September 30, 2025 23,694 — Investments in real estate joint ventures and partnerships 5,907 5,907 Real estate intangible assets, net 26,917 31,176 Real estate investments, net 1,493,938 1,498,744 Cash and cash equivalents 17,294 33,436 Restricted cash 1,057 236 Accounts receivable, net of allowances (credit losses and doubtful accounts) of $1,479 and $1,701 as of September 30, 2025, and December 31, 2024, respectively 3,758 3,697 Operating lease right-of-use assets 15,436 148 Goodwill 8,729 8,729 Other receivables, net of allowances (credit losses) of $2,398 and $2,393 as of September 30, 2025, and December 31, 2024, respectively 6,983 16,696 Straight-line rent receivable 44,960 44,547 Investments in other joint ventures and partnerships 29,932 33,126 Prepaid expenses and other assets 27,708 31,073 Assets held for sale 7,424 — Total assets $ 1,657,219 $ 1,670,432 LIABILITIES AND EQUITY Liabilities: Notes payable and other debt $ 475,231 $ 474,837 Accounts payable 8,944 4,529 Operating lease liabilities 15,262 123 Accrued post-retirement benefits 7,435 7,582 Refund liability 45,300 — Deferred revenue 12,622 72,462 Accrued dividends 17,135 17,032 Real estate intangible liabilities, net 14,211 15,278 Accrued and other liabilities 49,516 75,046 Total liabilities 645,656 666,889 Commitments and Contingencies Equity: Common stock - no par value; authorized, 225,000,000 shares; outstanding 72,758,460 and 72,633,866 shares at September 30, 2025, and December 31, 2024, respectively 1,814,385 1,811,582 Accumulated other comprehensive income (loss) (102) 6,134 Distributions in excess of accumulated earnings (802,720) (814,173) Total shareholders' equity 1,011,563 1,003,543 Total liabilities and equity $ 1,657,219 $ 1,670,432 Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 6

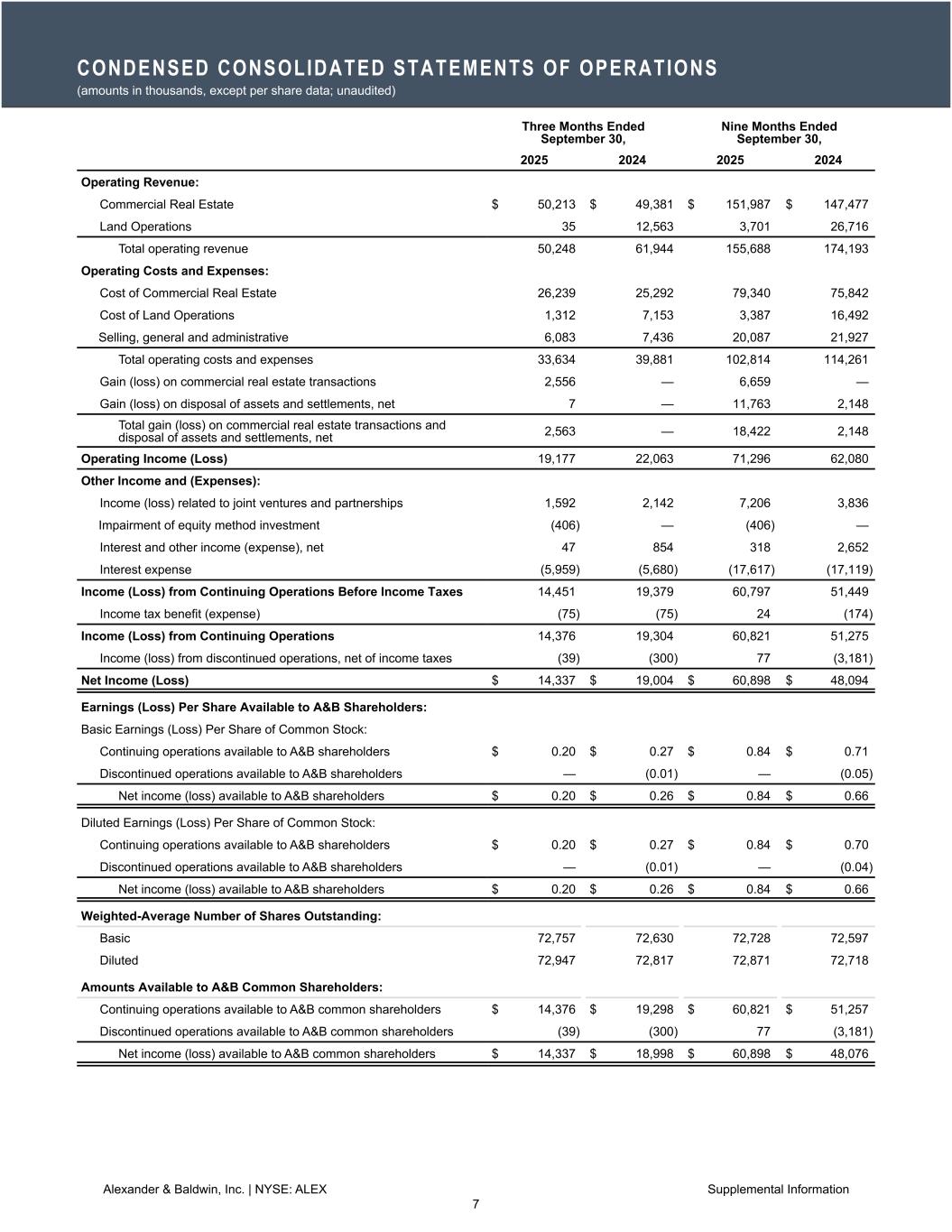

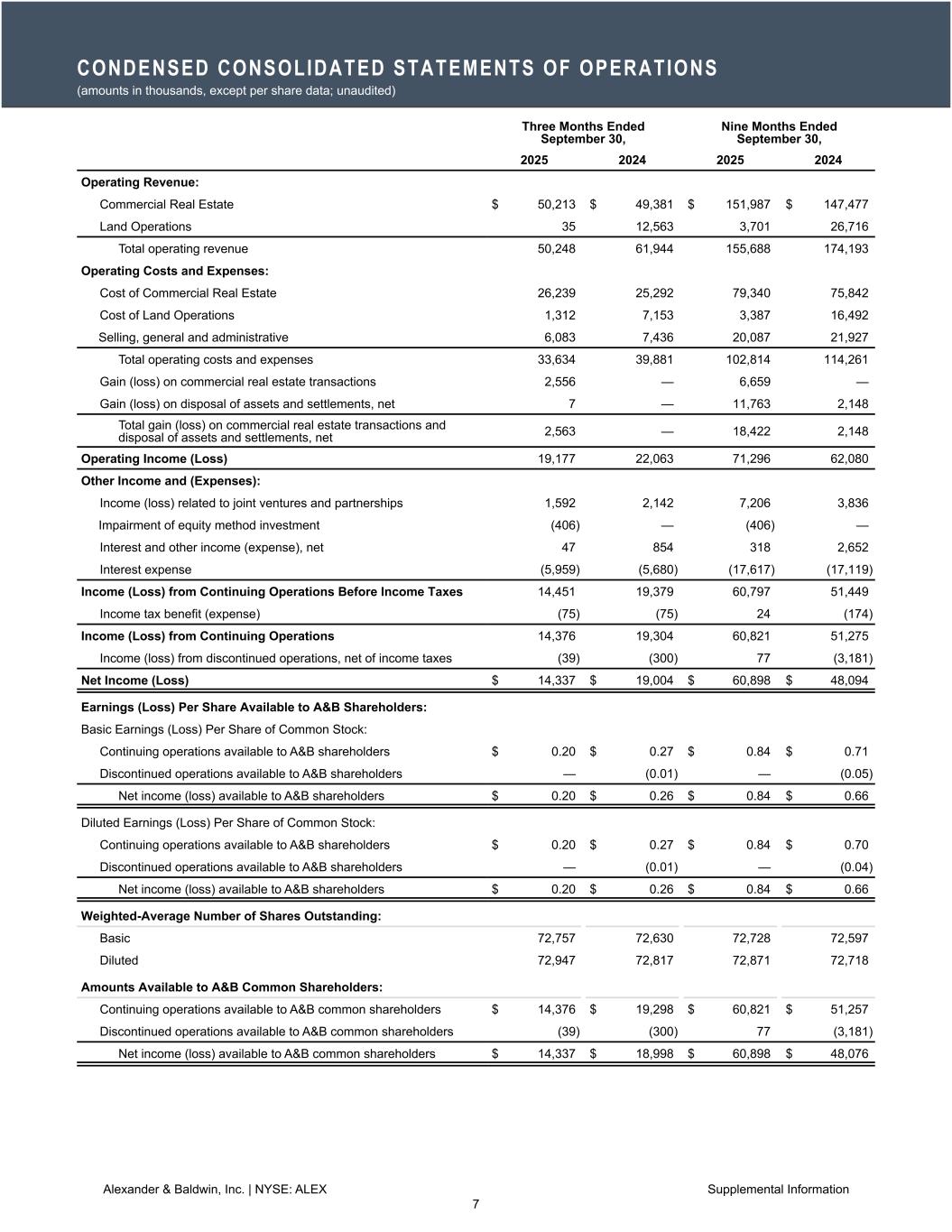

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (amounts in thousands, except per share data; unaudited) Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Operating Revenue: Commercial Real Estate $ 50,213 $ 49,381 $ 151,987 $ 147,477 Land Operations 35 12,563 3,701 26,716 Total operating revenue 50,248 61,944 155,688 174,193 Operating Costs and Expenses: Cost of Commercial Real Estate 26,239 25,292 79,340 75,842 Cost of Land Operations 1,312 7,153 3,387 16,492 Selling, general and administrative 6,083 7,436 20,087 21,927 Total operating costs and expenses 33,634 39,881 102,814 114,261 Gain (loss) on commercial real estate transactions 2,556 — 6,659 — Gain (loss) on disposal of assets and settlements, net 7 — 11,763 2,148 Total gain (loss) on commercial real estate transactions and disposal of assets and settlements, net 2,563 — 18,422 2,148 Operating Income (Loss) 19,177 22,063 71,296 62,080 Other Income and (Expenses): Income (loss) related to joint ventures and partnerships 1,592 2,142 7,206 3,836 Impairment of equity method investment (406) — (406) — Interest and other income (expense), net 47 854 318 2,652 Interest expense (5,959) (5,680) (17,617) (17,119) Income (Loss) from Continuing Operations Before Income Taxes 14,451 19,379 60,797 51,449 Income tax benefit (expense) (75) (75) 24 (174) Income (Loss) from Continuing Operations 14,376 19,304 60,821 51,275 Income (loss) from discontinued operations, net of income taxes (39) (300) 77 (3,181) Net Income (Loss) $ 14,337 $ 19,004 $ 60,898 $ 48,094 Earnings (Loss) Per Share Available to A&B Shareholders: Basic Earnings (Loss) Per Share of Common Stock: Continuing operations available to A&B shareholders $ 0.20 $ 0.27 $ 0.84 $ 0.71 Discontinued operations available to A&B shareholders — (0.01) — (0.05) Net income (loss) available to A&B shareholders $ 0.20 $ 0.26 $ 0.84 $ 0.66 Diluted Earnings (Loss) Per Share of Common Stock: Continuing operations available to A&B shareholders $ 0.20 $ 0.27 $ 0.84 $ 0.70 Discontinued operations available to A&B shareholders — (0.01) — (0.04) Net income (loss) available to A&B shareholders $ 0.20 $ 0.26 $ 0.84 $ 0.66 Weighted-Average Number of Shares Outstanding: Basic 72,757 72,630 72,728 72,597 Diluted 72,947 72,817 72,871 72,718 Amounts Available to A&B Common Shareholders: Continuing operations available to A&B common shareholders $ 14,376 $ 19,298 $ 60,821 $ 51,257 Discontinued operations available to A&B common shareholders (39) (300) 77 (3,181) Net income (loss) available to A&B common shareholders $ 14,337 $ 18,998 $ 60,898 $ 48,076 Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 7

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (dollars in thousands; unaudited) Nine Months Ended September 30, 2025 2024 Cash Flows from Operating Activities: Net income (loss) $ 60,898 $ 48,094 Adjustments to reconcile net income (loss) to net cash provided by (used in) operations: (Income) loss from discontinued operations (77) 3,181 Depreciation and amortization 28,912 26,979 Provision for (reversal of) credit losses 44 (628) (Gain) loss on commercial real estate transactions (6,659) — (Gain) loss on disposal of assets and settlements, net (11,763) (2,148) Impairment of assets and equity method investment 406 — (Gain) loss on de-designated interest rate swap valuation adjustment — (3,675) Share-based compensation expense 4,096 3,654 (Income) loss related to joint ventures, net of operating cash distributions (3,206) (3,062) Changes in operating assets and liabilities: Trade and other receivables (358) (611) Prepaid expenses and other assets (2,293) (3,649) Development/other property inventory 6,824 8,018 Accrued post-retirement benefits (147) (1,798) Accounts payable 637 (1,188) Refund liability (10,000) — Accrued and other liabilities (267) 2,225 Operating cash flows from continuing operations 67,047 75,392 Operating cash flows from discontinued operations (91) (1,718) Net cash provided by (used in) operations 66,956 73,674 Cash Flows from Investing Activities: Capital expenditures for acquisitions — (29,826) Capital expenditures for property, plant and equipment (37,068) (11,878) Proceeds from disposal of assets 3,412 41 Contributions to investments in joint ventures and partnerships (155) (158) Distributions of capital and other receipts from investments in affiliates and other investments 3,383 974 Investing cash flows from continuing operations (30,428) (40,847) Investing cash flows from discontinued operations — 15,000 Net cash provided by (used in) investing activities (30,428) (25,847) Cash Flows from Financing Activities: Proceeds from issuance of notes payable and other debt — 60,000 Payments of notes payable and other debt and deferred financing costs (33,933) (86,785) Borrowings (payments) on line-of-credit agreement, net 33,000 35,000 Cash dividends paid (49,327) (48,822) Repurchases of common stock and other payments (1,589) (2,818) Financing cash flows from continuing operations (51,849) (43,425) Net cash provided by (used in) financing activities (51,849) (43,425) Cash, Cash Equivalents, and Restricted Cash Net increase (decrease) in cash, cash equivalents, and restricted cash (15,321) 4,402 Balance, beginning of period 33,672 13,753 Balance, end of period $ 18,351 $ 18,155 Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 8

SEGMENT RESULTS (dollars in thousands; unaudited) Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Segment Operating Revenue Commercial Real Estate1 $ 50,213 $ 49,387 $ 151,987 $ 147,496 Land Operations 35 12,563 3,701 26,716 Total segment operating revenue 50,248 61,950 155,688 174,212 Operating Profit (Loss): Commercial Real Estate1 22,719 22,829 68,350 67,421 Land Operations2 (298) 7,881 18,458 15,980 Total operating profit (loss) 22,421 30,710 86,808 83,401 Gain (loss) on commercial real estate transactions 2,556 — 6,659 — Interest expense (5,959) (5,680) (17,617) (17,119) Corporate and other expense (4,567) (5,651) (15,053) (14,833) Income (Loss) from Continuing Operations Before Income Taxes 14,451 19,379 60,797 51,449 Income tax benefit (expense) (75) (75) 24 (174) Income (Loss) from Continuing Operations 14,376 19,304 60,821 51,275 Income (loss) from discontinued operations, net of income taxes (39) (300) 77 (3,181) Net Income (Loss) $ 14,337 $ 19,004 $ 60,898 $ 48,094 1 Commercial Real Estate segment operating revenue and operating profit (loss) includes immaterial intersegment operating revenue, primarily from the Land Operations segment, that is eliminated in the consolidated results of operations. 2 Land Operations segment operating profit (loss) includes immaterial intersegment operating expense, from the Commercial Real Estate segment, that is eliminated in the consolidated results of operations. Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 9

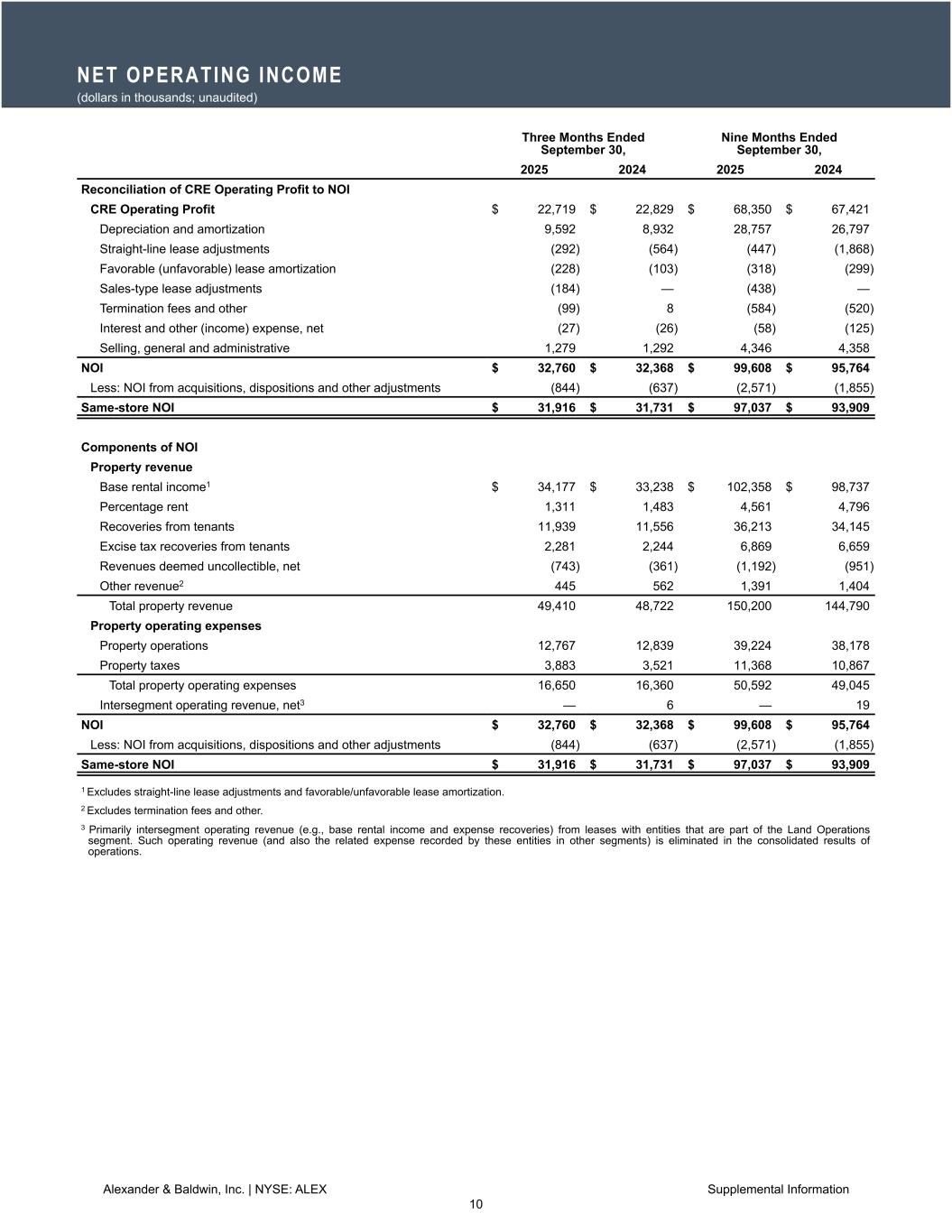

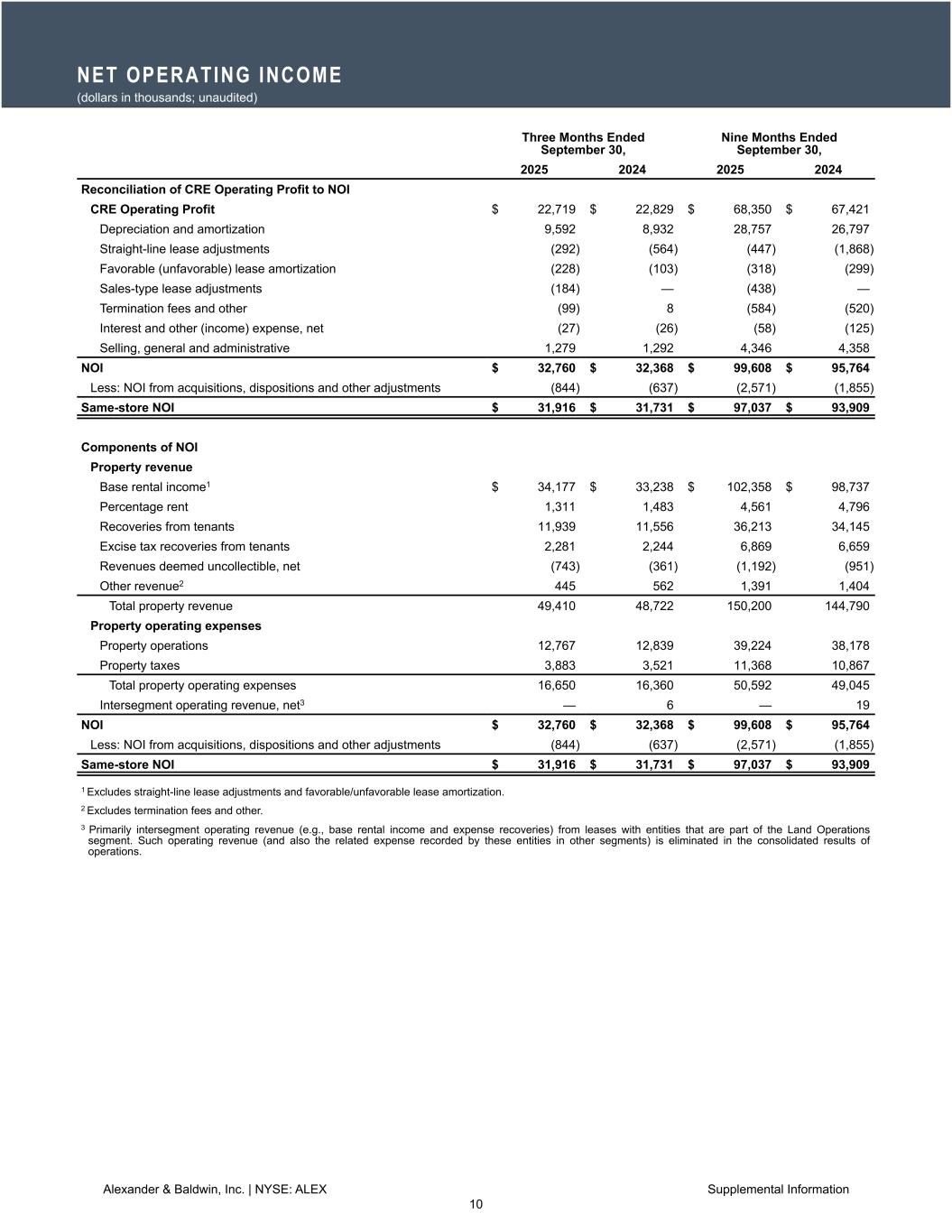

NET OPERATING INCOME (dollars in thousands; unaudited) Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Reconciliation of CRE Operating Profit to NOI CRE Operating Profit $ 22,719 $ 22,829 $ 68,350 $ 67,421 Depreciation and amortization 9,592 8,932 28,757 26,797 Straight-line lease adjustments (292) (564) (447) (1,868) Favorable (unfavorable) lease amortization (228) (103) (318) (299) Sales-type lease adjustments (184) — (438) — Termination fees and other (99) 8 (584) (520) Interest and other (income) expense, net (27) (26) (58) (125) Selling, general and administrative 1,279 1,292 4,346 4,358 NOI $ 32,760 $ 32,368 $ 99,608 $ 95,764 Less: NOI from acquisitions, dispositions and other adjustments (844) (637) (2,571) (1,855) Same-store NOI $ 31,916 $ 31,731 $ 97,037 $ 93,909 Components of NOI Property revenue Base rental income1 $ 34,177 $ 33,238 $ 102,358 $ 98,737 Percentage rent 1,311 1,483 4,561 4,796 Recoveries from tenants 11,939 11,556 36,213 34,145 Excise tax recoveries from tenants 2,281 2,244 6,869 6,659 Revenues deemed uncollectible, net (743) (361) (1,192) (951) Other revenue2 445 562 1,391 1,404 Total property revenue 49,410 48,722 150,200 144,790 Property operating expenses Property operations 12,767 12,839 39,224 38,178 Property taxes 3,883 3,521 11,368 10,867 Total property operating expenses 16,650 16,360 50,592 49,045 Intersegment operating revenue, net3 — 6 — 19 NOI $ 32,760 $ 32,368 $ 99,608 $ 95,764 Less: NOI from acquisitions, dispositions and other adjustments (844) (637) (2,571) (1,855) Same-store NOI $ 31,916 $ 31,731 $ 97,037 $ 93,909 1 Excludes straight-line lease adjustments and favorable/unfavorable lease amortization. 2 Excludes termination fees and other. 3 Primarily intersegment operating revenue (e.g., base rental income and expense recoveries) from leases with entities that are part of the Land Operations segment. Such operating revenue (and also the related expense recorded by these entities in other segments) is eliminated in the consolidated results of operations. Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 10

Changes in the Same-Store portfolio as it relates to the comparable prior period and the current period are as follows: Added Date Asset Class Type Property GLA (SF) 05/23 Industrial Acquisition Kaomi Loop Industrial 33,200 Removed Date Asset Class Type Property GLA (SF) 01/25 Ground Other2 Various 0.5 acres1 01/25 Industrial Other2 Harbor Industrial 51,100 01/25 Office Other2 Kahului Office Building 59,100 01/25 Retail Other2 Kahului Shopping Center 49,100 1Total acres presented for ground leases as such leases would not be comparable from a GLA (SF) perspective 2Properties fully or partially taken out of service for the purpose of redevelopment or repositioning. Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 11

FUNDS FROM OPERATIONS AND ADJUSTED FUNDS FROM OPERATIONS (amounts in thousands, except per share data; unaudited) Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Net Income (Loss) available to A&B common shareholders $ 14,337 $ 18,998 $ 60,898 $ 48,076 Depreciation and amortization of commercial real estate properties 9,589 8,932 28,748 26,797 (Gain) loss on commercial real estate transactions1 (2,556) — (6,659) — (Income) loss from discontinued operations, net of income taxes 39 300 (77) 3,181 FFO 21,409 28,230 82,910 78,054 Add (deduct) Adjusted FFO defined adjustments (Gain) loss on sale of legacy business2 — — — (2,125) Non-cash changes to liabilities related to legacy operations3 250 — (11,407) 2,193 Provision for (reversal of) current expected credit losses 26 (628) 44 (628) Impairment of equity method investment 406 — 406 — Legacy joint venture (income) loss4 (1,592) (2,142) (7,424) (3,836) (Gain) loss on fair value adjustments related to interest rate swaps — — — (3,675) Non-recurring financing-related charges — — — 2,350 Amortization of share-based compensation 1,359 1,266 4,096 3,654 Maintenance capital expenditures5 (2,056) (2,503) (5,644) (7,745) Leasing commissions paid (382) (389) (1,126) (927) Sales-type lease interest income adjustments (210) — (482) — Straight-line lease adjustments (292) (564) (447) (1,868) Amortization of net debt premiums or discounts and deferred financing costs 422 247 1,268 738 Favorable (unfavorable) lease amortization (228) (103) (318) (299) Adjusted FFO $ 19,112 $ 23,414 $ 61,876 $ 65,886 Net income available to A&B common shareholders per diluted share $ 0.20 $ 0.26 $ 0.84 $ 0.66 FFO per diluted share $ 0.29 $ 0.39 $ 1.14 $ 1.07 Adjusted FFO per diluted share $ 0.26 $ 0.32 $ 0.85 $ 0.91 Weighted average diluted shares outstanding (FFO/Adjusted FFO) 72,947 72,817 72,871 72,718 1 Includes selling profits from sales-type leases. 2 Amounts in 2024 are primarily due to the favorable resolution of contingent liabilities related to the prior year sale of a legacy business. 3 Amounts in 2025 are mainly related to the favorable resolution of rights and obligations from a land sale in a prior year, partially offset by transfer of the Company's interest in a joint venture of $2.7 million. Amounts in 2024 are primarily related to environmental reserves associated with legacy business activities in the Land Operations segment. 4 Includes joint ventures engaged in legacy business activities within the Land Operations segment. 5 Includes ongoing maintenance capital expenditures only. Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 12

FUNDS FROM OPERATIONS AND ADJUSTED FUNDS FROM OPERATIONS (amounts in thousands, except per share data; unaudited) Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Net Income (Loss) available to A&B common shareholders $ 14,337 $ 18,998 $ 60,898 $ 48,076 Depreciation and amortization of commercial real estate properties 9,589 8,932 28,748 26,797 (Gain) loss on commercial real estate transactions1 (2,556) — (6,659) — (Income) loss from discontinued operations, net of income taxes 39 300 (77) 3,181 Land Operations operating (profit) loss 298 (7,881) (18,458) (15,980) FFO related to CRE and Corporate $ 21,707 $ 20,349 $ 64,452 $ 62,074 Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 CRE Operating Profit $ 22,719 $ 22,829 $ 68,350 $ 67,421 Corporate and other expense (4,567) (5,651) (15,053) (14,833) CRE properties depreciation and amortization 9,589 8,932 28,748 26,797 Interest expense (5,959) (5,680) (17,617) (17,119) Income tax benefit (expense) (75) (75) 24 (174) Distributions to participating securities — (6) — (18) FFO related to CRE and Corporate $ 21,707 $ 20,349 $ 64,452 $ 62,074 Net income available to A&B common shareholders per diluted share $ 0.20 $ 0.26 $ 0.84 $ 0.66 FFO per diluted share related to CRE and Corporate $ 0.30 $ 0.28 $ 0.88 $ 0.85 Weighted average diluted shares outstanding (FFO/Adjusted FFO) 72,947 72,817 72,871 72,718 1Includes selling profits from sales-type leases. Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 13

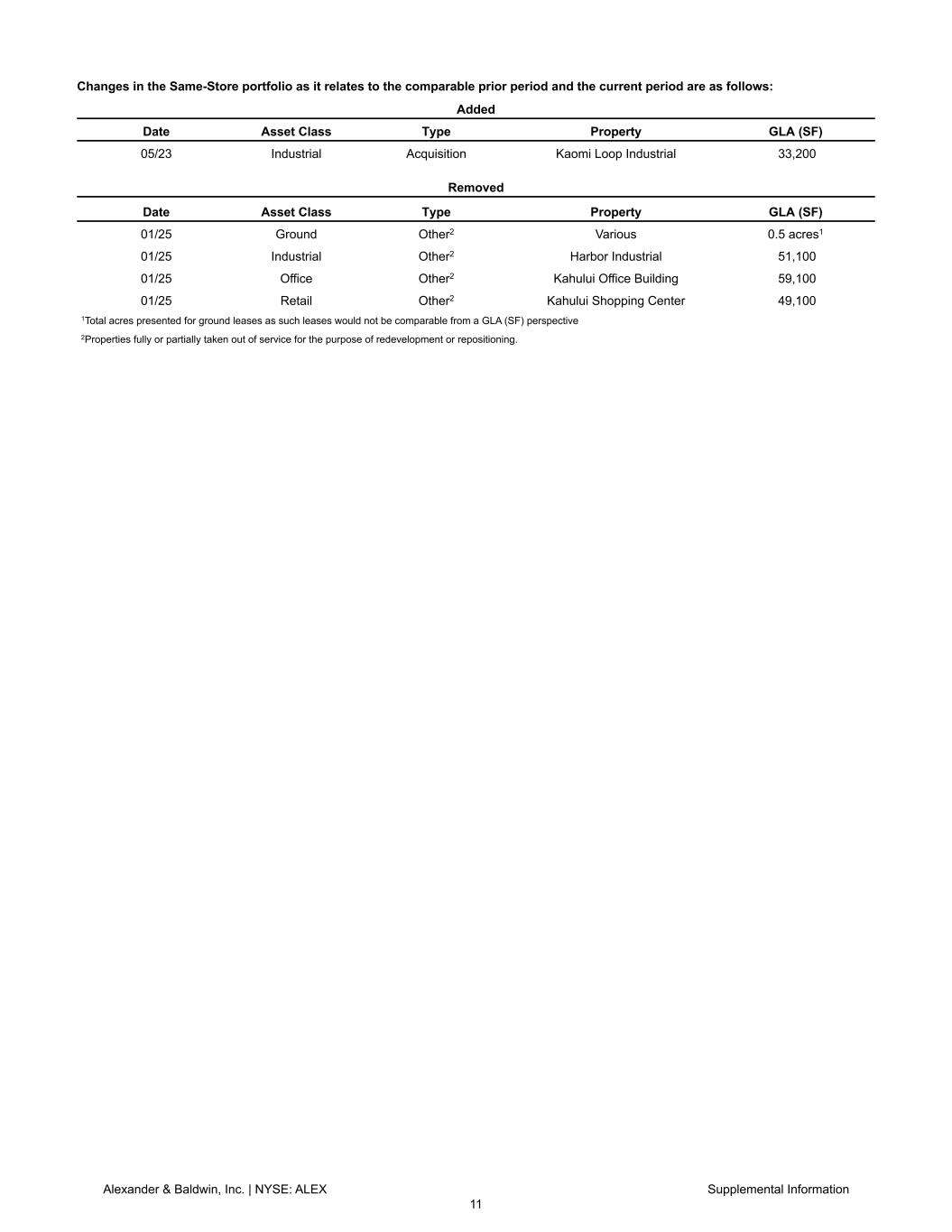

EBITDA AND ADJUSTED EBITDA (dollars in thousands; unaudited) Three Months Ended September 30, Nine Months Ended September 30, TTM September 30, 2025 2024 2025 2024 2025 Net Income (Loss) $ 14,337 $ 19,004 $ 60,898 $ 48,094 $ 73,341 Adjustments: Depreciation and amortization 9,644 9,000 28,912 26,979 38,245 Interest expense 5,959 5,680 17,617 17,119 23,667 Income tax expense (benefit) 75 75 (24) 174 (24) Consolidated EBITDA $ 30,015 $ 33,759 $ 107,403 $ 92,366 $ 135,229 Impairment of assets and equity method investment 406 — 406 — 662 (Gain) loss on commercial real estate transactions1 (2,556) — (6,659) — (6,659) (Gain) loss on fair value adjustments related to interest rate swaps — — — (3,675) — Non-recurring financing-related charges — — — 2,350 — (Income) loss from discontinued operations, net of income taxes and excluding depreciation, amortization and interest expense 39 300 (77) 3,181 208 Consolidated Adjusted EBITDA $ 27,904 $ 34,059 $ 101,073 $ 94,222 $ 129,440 Discrete items impacting the respective periods - income/(loss): Gain (loss) on disposal of assets and settlements, net $ 7 $ — $ 11,763 $ 2,148 $ 11,763 1Includes selling profits from sales-type leases. Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 14

Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 15

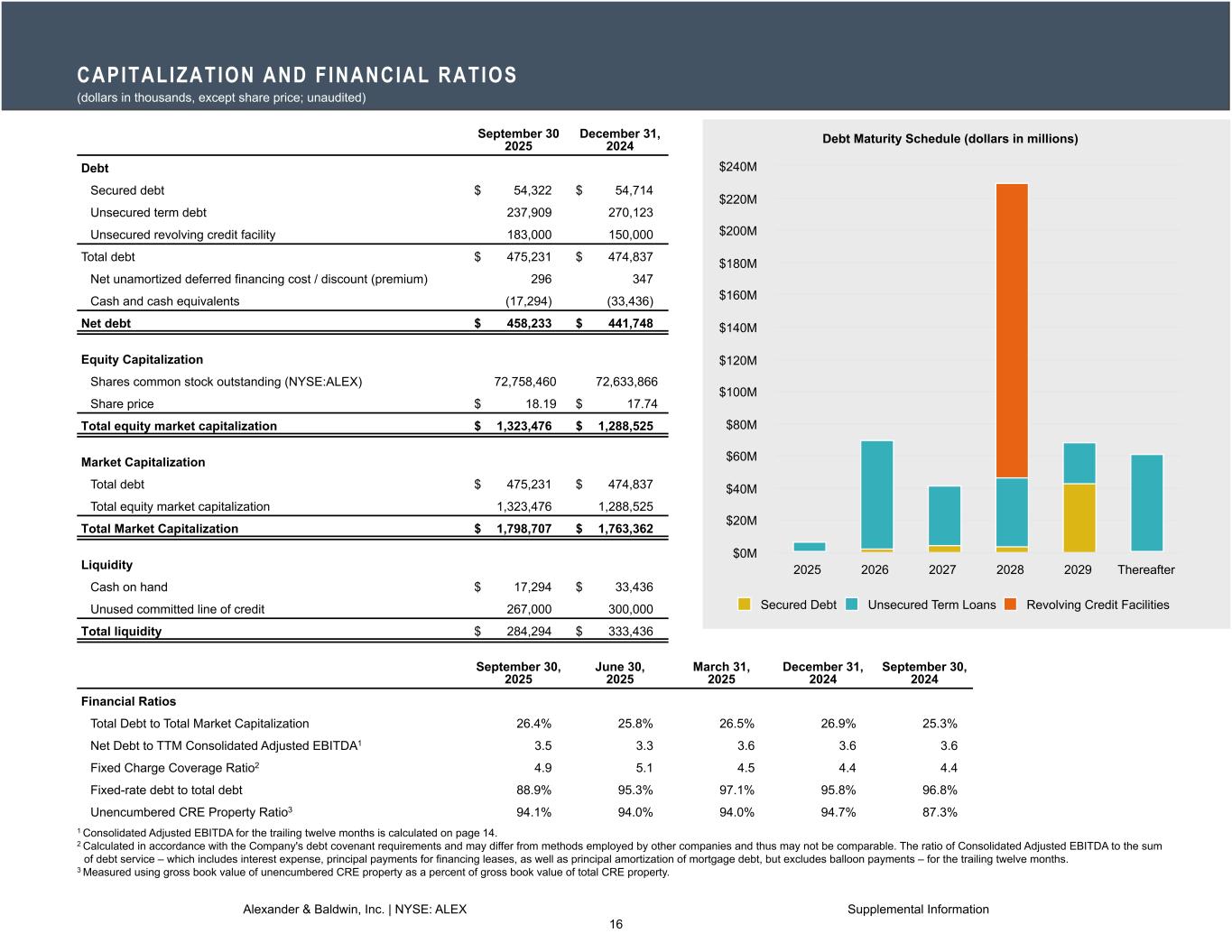

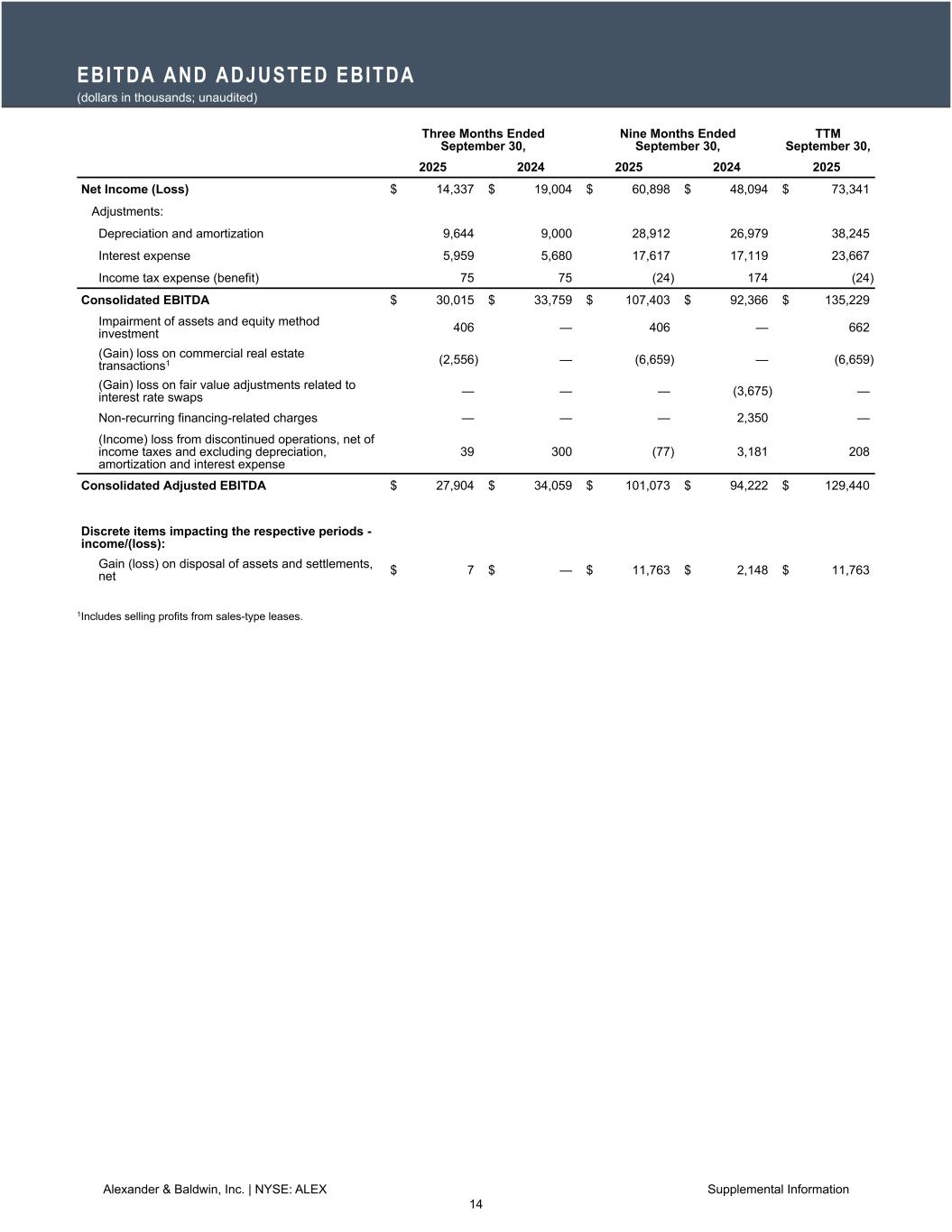

CAPITALIZATION AND FINANCIAL RATIOS (dollars in thousands, except share price; unaudited) September 30 2025 December 31, 2024 Debt Secured debt $ 54,322 $ 54,714 Unsecured term debt 237,909 270,123 Unsecured revolving credit facility 183,000 150,000 Total debt $ 475,231 $ 474,837 Net unamortized deferred financing cost / discount (premium) 296 347 Cash and cash equivalents (17,294) (33,436) Net debt $ 458,233 $ 441,748 Equity Capitalization Shares common stock outstanding (NYSE:ALEX) 72,758,460 72,633,866 Share price $ 18.19 $ 17.74 Total equity market capitalization $ 1,323,476 $ 1,288,525 Market Capitalization Total debt $ 475,231 $ 474,837 Total equity market capitalization 1,323,476 1,288,525 Total Market Capitalization $ 1,798,707 $ 1,763,362 Liquidity Cash on hand $ 17,294 $ 33,436 Unused committed line of credit 267,000 300,000 Total liquidity $ 284,294 $ 333,436 September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Financial Ratios Total Debt to Total Market Capitalization 26.4 % 25.8 % 26.5 % 26.9 % 25.3 % Net Debt to TTM Consolidated Adjusted EBITDA1 3.5 3.3 3.6 3.6 3.6 Fixed Charge Coverage Ratio2 4.9 5.1 4.5 4.4 4.4 Fixed-rate debt to total debt 88.9 % 95.3 % 97.1 % 95.8 % 96.8 % Unencumbered CRE Property Ratio3 94.1 % 94.0 % 94.0 % 94.7 % 87.3 % 1 Consolidated Adjusted EBITDA for the trailing twelve months is calculated on page 14. 2 Calculated in accordance with the Company's debt covenant requirements and may differ from methods employed by other companies and thus may not be comparable. The ratio of Consolidated Adjusted EBITDA to the sum of debt service – which includes interest expense, principal payments for financing leases, as well as principal amortization of mortgage debt, but excludes balloon payments – for the trailing twelve months. 3 Measured using gross book value of unencumbered CRE property as a percent of gross book value of total CRE property. Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 16 Debt Maturity Schedule (dollars in millions) Secured Debt Unsecured Term Loans Revolving Credit Facilities 2025 2026 2027 2028 2029 Thereafter $0M $20M $40M $60M $80M $100M $120M $140M $160M $180M $200M $220M $240M

DEBT SUMMARY (dollars in thousands; unaudited) Scheduled Principal Payments Debt Interest Rate (%) Weighted -average Interest Rate (%) Maturity Date Weighted -average Maturity (Years) 2025 2026 2027 2028 2029 Thereafter Total Principal Premium (discount)/ debt issuance costs, net Total Secured: Photovoltaic Financing (1) 4.76% (1) 2.8 94 388 2,012 1,293 191 954 4,932 — 4,932 Manoa Marketplace (2) 3.14% 2029 3.6 481 1,948 2,018 2,081 42,942 — 49,470 (80) 49,390 Subtotal / Wtd Avg 3.28% 3.5 $ 575 $ 2,336 $ 4,030 $ 3,374 $ 43,133 $ 954 $ 54,402 $ (80) $ 54,322 Unsecured: Series B Note 5.55% 5.55% 2026 0.3 — 2,000 — — — — 2,000 — 2,000 Series C Note 5.56% 5.56% 2026 0.8 — 4,000 — — — — 4,000 — 4,000 Series F Note 4.35% 4.35% 2026 1.0 — 4,000 — — — — 4,000 — 4,000 Series H Note 4.04% 4.04% 2026 1.2 — 50,000 — — — — 50,000 — 50,000 Series K Note 4.81% 4.81% 2027 1.6 — — 34,500 — — — 34,500 (79) 34,421 Series G Note 3.88% 3.88% 2027 1.0 6,000 7,000 2,625 — — — 15,625 — 15,625 Series L Note 4.89% 4.89% 2028 2.6 — — — 18,000 — — 18,000 — 18,000 Series I Note 4.16% 4.16% 2028 3.3 — — — 25,000 — — 25,000 — 25,000 Term Loan 5 4.30% 4.30% 2029 4.3 — — — — 25,000 — 25,000 — 25,000 Series M Note 6.09% 6.09% 2032 6.6 — — — — — 60,000 60,000 (137) 59,863 Subtotal / Wtd Avg 4.81% 3.2 $ 6,000 $ 67,000 $ 37,125 $ 43,000 $ 25,000 $ 60,000 $ 238,125 $ (216) $ 237,909 Revolving Credit Facilities: A&B Revolver (3) 4.97% 2028 (4) 3.1 $ — $ — $ — $ 183,000 $ — $ — $ 183,000 $ — $ 183,000 Subtotal / Wtd Avg 4.97% 3.1 $ — $ — $ — $ 183,000 $ — $ — $ 183,000 $ — $ 183,000 Total / Wtd Avg 4.70% 3.2 $ 6,575 $ 69,336 $ 41,155 $ 229,374 $ 68,133 $ 60,954 $ 475,527 $ (296) $ 475,231 (1) Financing leases have a weighted average discount rate of 4.76% and maturity dates ranging from 2027 to 2030. (2) Loan has a stated interest rate of SOFR plus 1.35% but is swapped through maturity to a 3.14% fixed rate. (3) Loan has a stated interest rate of SOFR plus 1.05% based on a pricing grid, plus a SOFR adjustment of 0.10%. $130.0 million is swapped through maturity to a 4.76% weighted average fixed rate. (4) A&B Revolver has two six-month optional term extensions. Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 17

Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 18

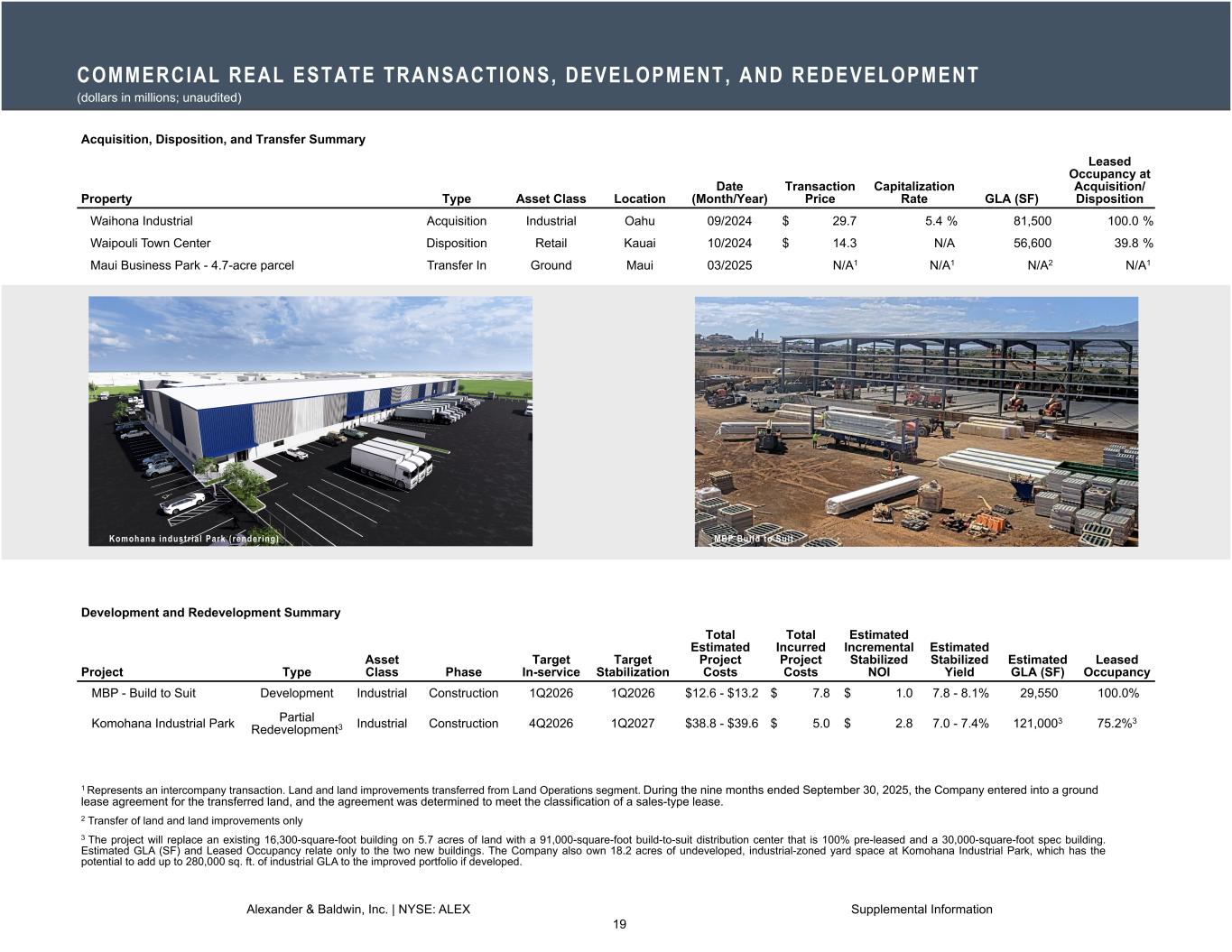

COMMERCIAL REAL ESTATE TRANSACTIONS, DEVELOPMENT, AND REDEVELOPMENT (dollars in millions; unaudited) Acquisition, Disposition, and Transfer Summary Property Type Asset Class Location Date (Month/Year) Transaction Price Capitalization Rate GLA (SF) Leased Occupancy at Acquisition/ Disposition Waihona Industrial Acquisition Industrial Oahu 09/2024 $ 29.7 5.4 % 81,500 100.0 % Waipouli Town Center Disposition Retail Kauai 10/2024 $ 14.3 N/A 56,600 39.8 % Maui Business Park - 4.7-acre parcel Transfer In Ground Maui 03/2025 N/A1 N/A1 N/A2 N/A1 Development and Redevelopment Summary Project Type Asset Class Phase Target In-service Target Stabilization Total Estimated Project Costs Total Incurred Project Costs Estimated Incremental Stabilized NOI Estimated Stabilized Yield Estimated GLA (SF) Leased Occupancy MBP - Build to Suit Development Industrial Construction 1Q2026 1Q2026 $12.6 - $13.2 $ 7.8 $ 1.0 7.8 - 8.1% 29,550 100.0% Komohana Industrial Park Partial Redevelopment3 Industrial Construction 4Q2026 1Q2027 $38.8 - $39.6 $ 5.0 $ 2.8 7.0 - 7.4% 121,0003 75.2%3 1 Represents an intercompany transaction. Land and land improvements transferred from Land Operations segment. During the nine months ended September 30, 2025, the Company entered into a ground lease agreement for the transferred land, and the agreement was determined to meet the classification of a sales-type lease. 2 Transfer of land and land improvements only 3 The project will replace an existing 16,300-square-foot building on 5.7 acres of land with a 91,000-square-foot build-to-suit distribution center that is 100% pre-leased and a 30,000-square-foot spec building. Estimated GLA (SF) and Leased Occupancy relate only to the two new buildings. The Company also own 18.2 acres of undeveloped, industrial-zoned yard space at Komohana Industrial Park, which has the potential to add up to 280,000 sq. ft. of industrial GLA to the improved portfolio if developed. Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 19 Komohana industr ia l Park ( render ing) MBP Bui ld to Sui t

DEVELOPMENT OPPORTUNITIES Our portfolio has numerous potential development opportunities to create future shareholder value using our existing land bank. These opportunities could be subject to government approvals, lender consents, tenant consents, market conditions, availability of debt and/or equity financing, etc. These are opportunities only and may not ultimately be pursued. Opportunities that the Company has elected to pursue are presented in the Development and Redevelopment Summary. Square footages are estimates only and may differ materially from actual square footages should the Company pursue the development opportunity. Development Opportunities Property Location Segment Current Asset Class Developable Area (in acres) GLA Estimate (in square feet) Opportunity Komahana Industrial Park Oahu CRE Industrial 18.2 280,000 Development of Industrial GLA Kapolei Business Park West Oahu CRE Ground 36.4 508,000 Development of Industrial GLA Maui Business Park1 Maui Land Operations1 N/A 24.0 520,000 Development of Industrial or Retail GLA 1 Land and land improvements classified as Real Estate Development within the Land Operations segment and currently available for sale, build-to-suit, or ground lease opportunities. Would represent an intercompany transaction.in which the land and land improvements would be transferred from Land Operations to CRE if the Company elected to pursue development. Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 20 Oahu Maui Komohana Industr ia l Park ( render ing) Kapole i Business Park West ( render ing) Maui Business Park - North Project ( render ing) Maui Business Park - Ho'okele Project ( render ing)

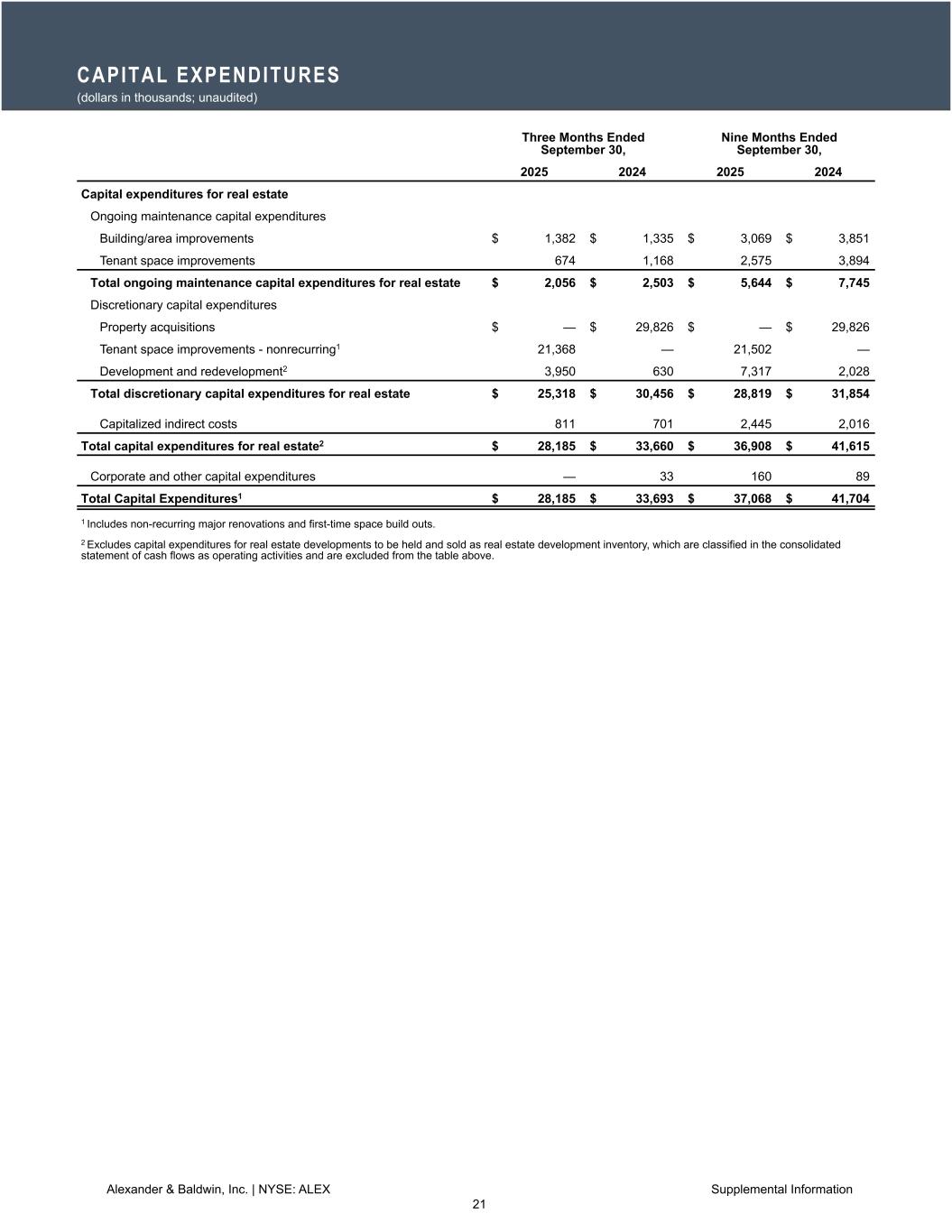

CAPITAL EXPENDITURES (dollars in thousands; unaudited) Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Capital expenditures for real estate Ongoing maintenance capital expenditures Building/area improvements $ 1,382 $ 1,335 $ 3,069 $ 3,851 Tenant space improvements 674 1,168 2,575 3,894 Total ongoing maintenance capital expenditures for real estate $ 2,056 $ 2,503 $ 5,644 $ 7,745 Discretionary capital expenditures Property acquisitions $ — $ 29,826 $ — $ 29,826 Tenant space improvements - nonrecurring1 21,368 — 21,502 — Development and redevelopment2 3,950 630 7,317 2,028 Total discretionary capital expenditures for real estate $ 25,318 $ 30,456 $ 28,819 $ 31,854 Capitalized indirect costs 811 701 2,445 2,016 Total capital expenditures for real estate2 $ 28,185 $ 33,660 $ 36,908 $ 41,615 Corporate and other capital expenditures — 33 160 89 Total Capital Expenditures1 $ 28,185 $ 33,693 $ 37,068 $ 41,704 1 Includes non-recurring major renovations and first-time space build outs. 2 Excludes capital expenditures for real estate developments to be held and sold as real estate development inventory, which are classified in the consolidated statement of cash flows as operating activities and are excluded from the table above. Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 21

Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 22

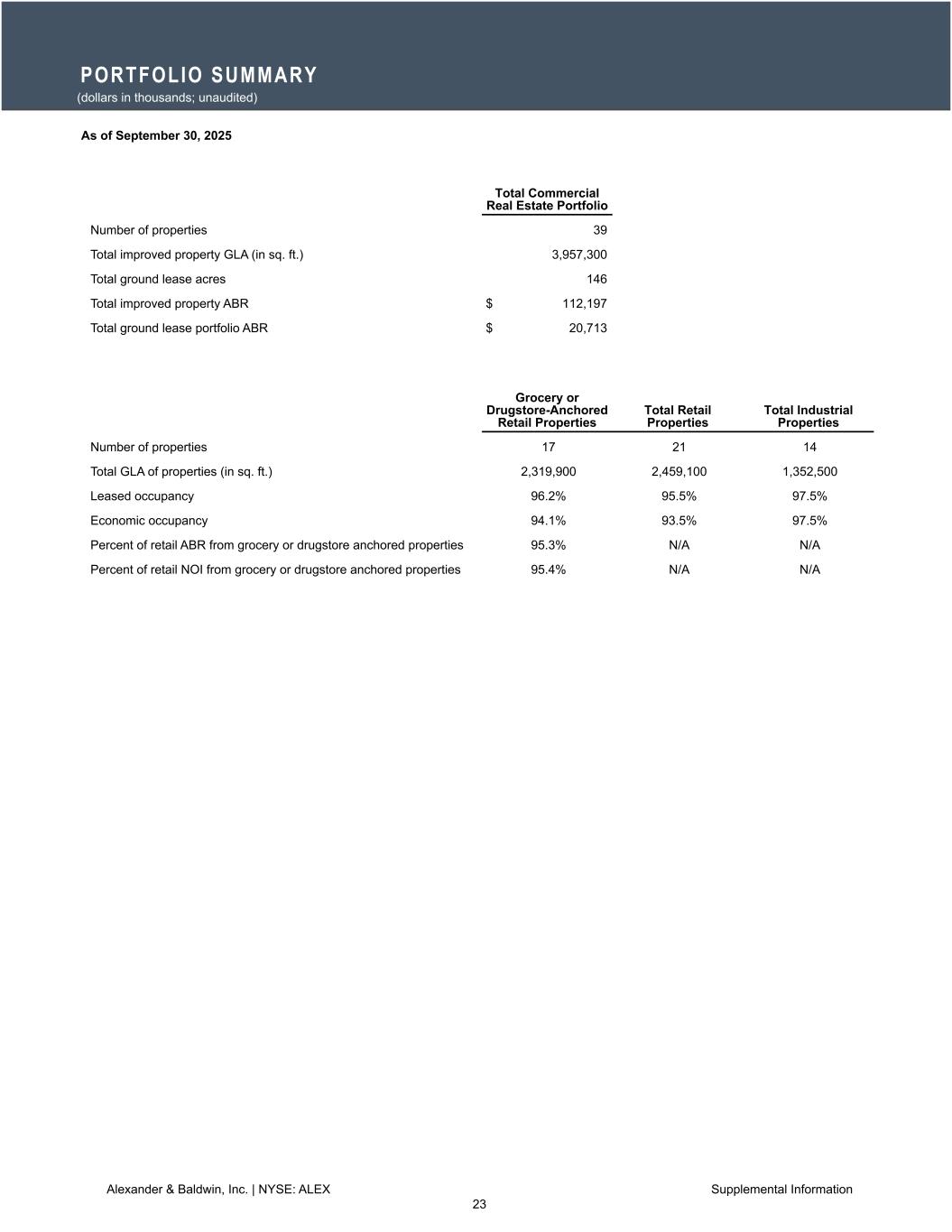

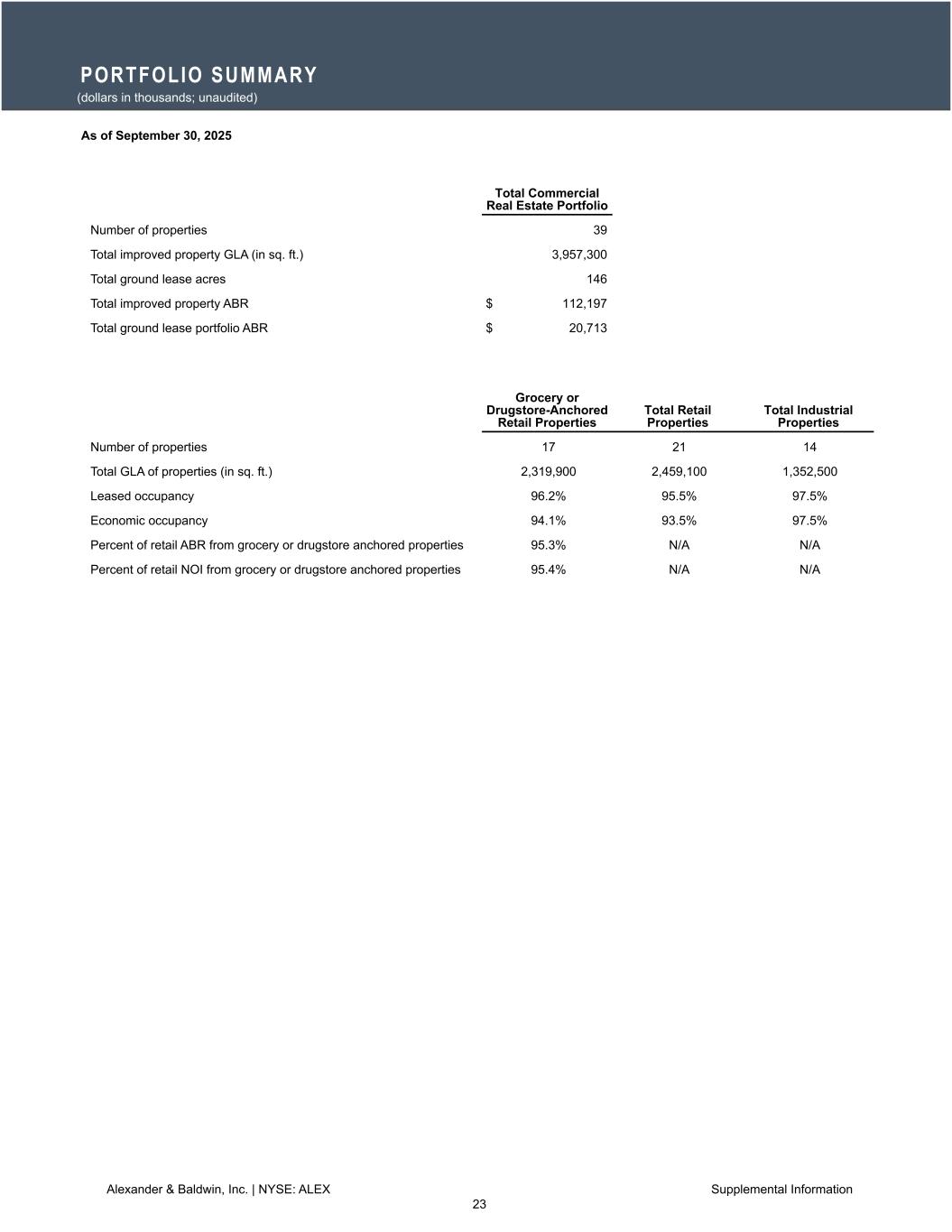

PORTFOLIO SUMMARY (dollars in thousands; unaudited) As of September 30, 2025 Total Commercial Real Estate Portfolio Number of properties 39 Total improved property GLA (in sq. ft.) 3,957,300 Total ground lease acres 146 Total improved property ABR $ 112,197 Total ground lease portfolio ABR $ 20,713 Grocery or Drugstore-Anchored Retail Properties Total Retail Properties Total Industrial Properties Number of properties 17 21 14 Total GLA of properties (in sq. ft.) 2,319,900 2,459,100 1,352,500 Leased occupancy 96.2% 95.5% 97.5% Economic occupancy 94.1% 93.5% 97.5% Percent of retail ABR from grocery or drugstore anchored properties 95.3% N/A N/A Percent of retail NOI from grocery or drugstore anchored properties 95.4% N/A N/A Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 23

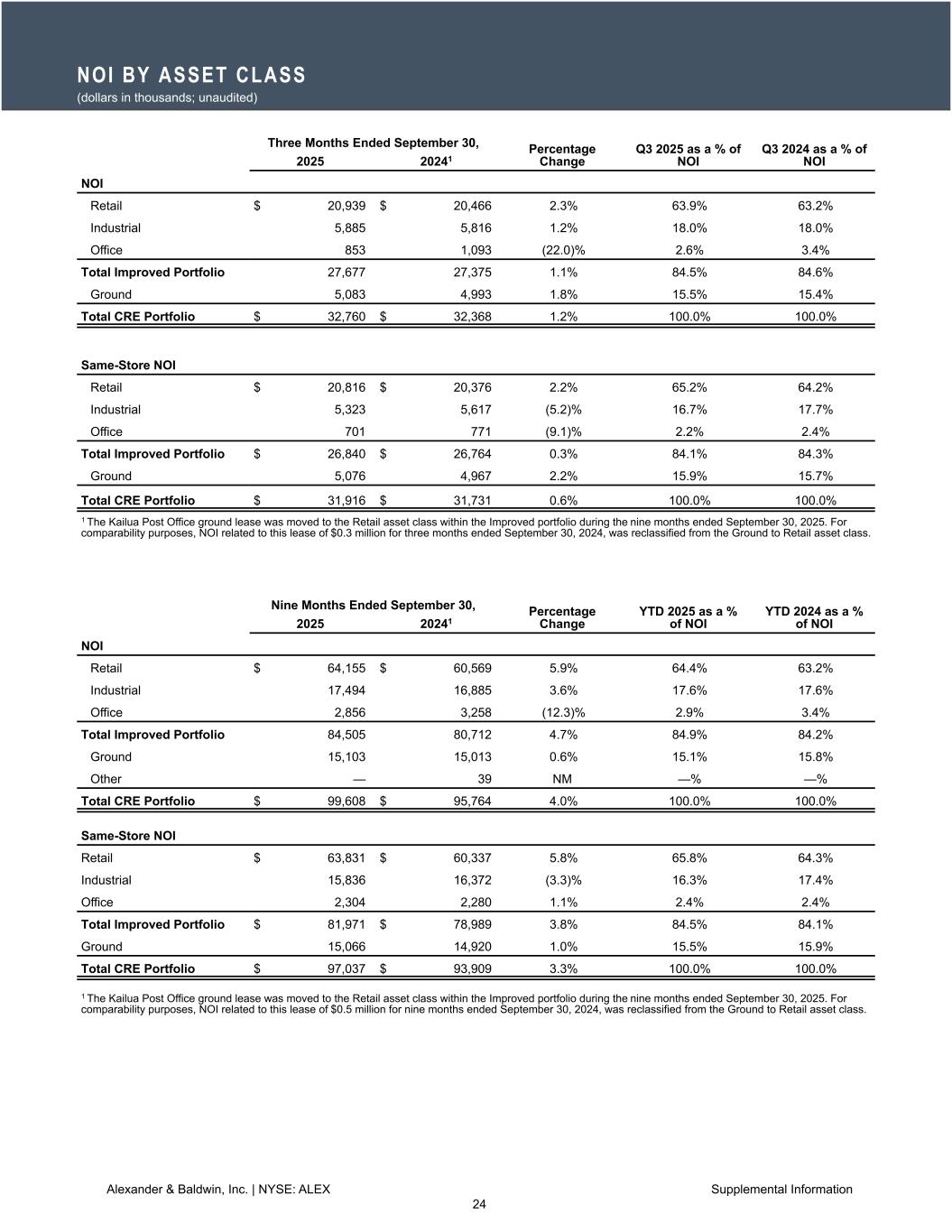

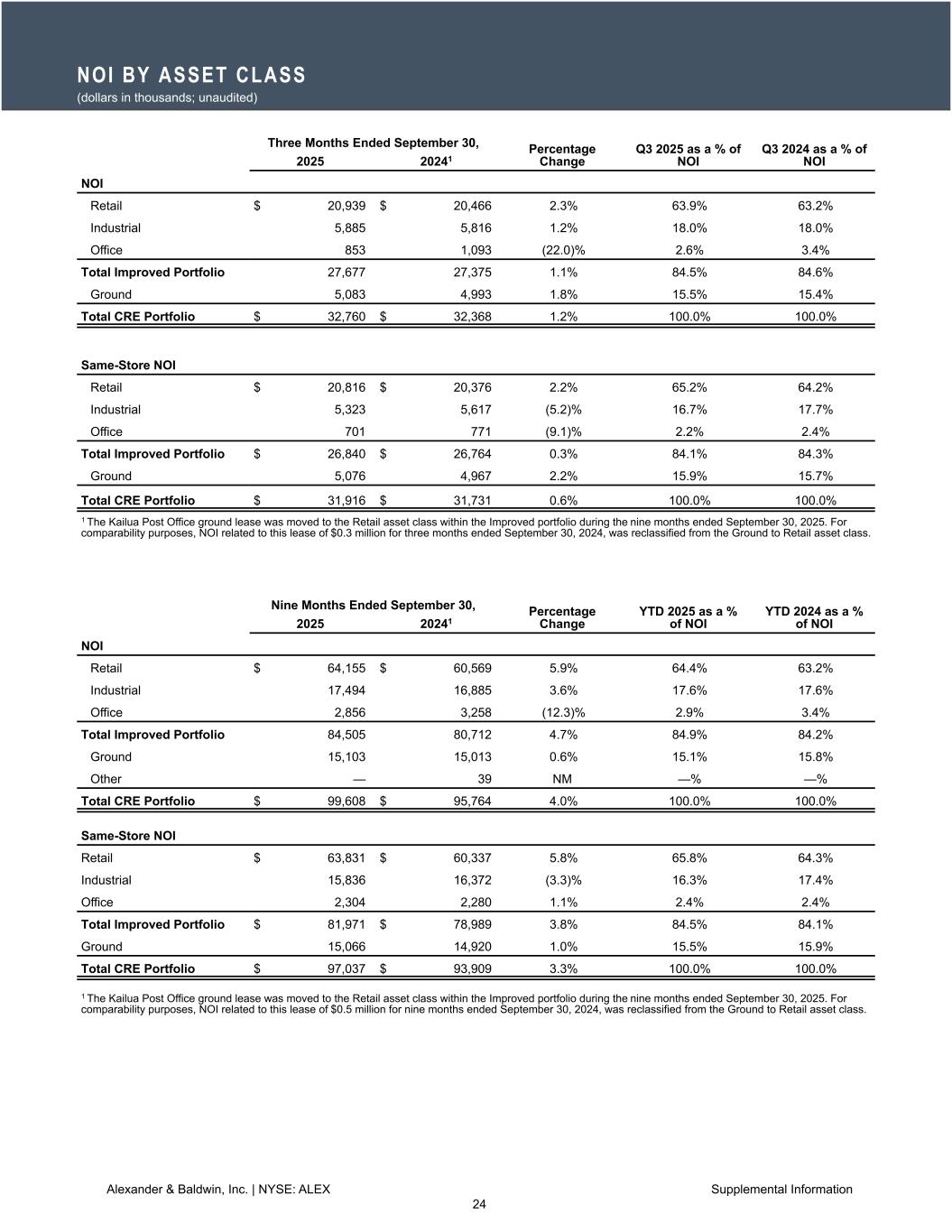

NOI BY ASSET CLASS (dollars in thousands; unaudited) Three Months Ended September 30, Percentage Change Q3 2025 as a % of NOI Q3 2024 as a % of NOI2025 20241 NOI Retail $ 20,939 $ 20,466 2.3% 63.9% 63.2% Industrial 5,885 5,816 1.2% 18.0% 18.0% Office 853 1,093 (22.0)% 2.6% 3.4% Total Improved Portfolio 27,677 27,375 1.1% 84.5% 84.6% Ground 5,083 4,993 1.8% 15.5% 15.4% Total CRE Portfolio $ 32,760 $ 32,368 1.2% 100.0% 100.0% Same-Store NOI Retail $ 20,816 $ 20,376 2.2% 65.2% 64.2% Industrial 5,323 5,617 (5.2)% 16.7% 17.7% Office 701 771 (9.1)% 2.2% 2.4% Total Improved Portfolio $ 26,840 $ 26,764 0.3% 84.1% 84.3% Ground 5,076 4,967 2.2% 15.9% 15.7% Total CRE Portfolio $ 31,916 $ 31,731 0.6% 100.0% 100.0% 1 The Kailua Post Office ground lease was moved to the Retail asset class within the Improved portfolio during the nine months ended September 30, 2025. For comparability purposes, NOI related to this lease of $0.3 million for three months ended September 30, 2024, was reclassified from the Ground to Retail asset class. Nine Months Ended September 30, Percentage Change YTD 2025 as a % of NOI YTD 2024 as a % of NOI2025 20241 NOI Retail $ 64,155 $ 60,569 5.9% 64.4% 63.2% Industrial 17,494 16,885 3.6% 17.6% 17.6% Office 2,856 3,258 (12.3)% 2.9% 3.4% Total Improved Portfolio 84,505 80,712 4.7% 84.9% 84.2% Ground 15,103 15,013 0.6% 15.1% 15.8% Other — 39 NM —% —% Total CRE Portfolio $ 99,608 $ 95,764 4.0% 100.0% 100.0% Same-Store NOI Retail $ 63,831 $ 60,337 5.8% 65.8% 64.3% Industrial 15,836 16,372 (3.3)% 16.3% 17.4% Office 2,304 2,280 1.1% 2.4% 2.4% Total Improved Portfolio $ 81,971 $ 78,989 3.8% 84.5% 84.1% Ground 15,066 14,920 1.0% 15.5% 15.9% Total CRE Portfolio $ 97,037 $ 93,909 3.3% 100.0% 100.0% 1 The Kailua Post Office ground lease was moved to the Retail asset class within the Improved portfolio during the nine months ended September 30, 2025. For comparability purposes, NOI related to this lease of $0.5 million for nine months ended September 30, 2024, was reclassified from the Ground to Retail asset class. Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 24

OCCUPANCY (unaudited) As of September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Leased Occupancy Retail 95.5% 95.4% 95.2% 95.2% 92.9% Industrial 97.5% 98.2% 97.3% 95.2% 97.4% Office 80.4% 79.9% 79.5% 79.8% 80.6% Total Leased Occupancy 95.6% 95.8% 95.4% 94.6% 94.0% Economic Occupancy Retail 93.5% 93.8% 93.2% 92.8% 91.4% Industrial 97.5% 98.2% 97.1% 95.0% 97.2% Office 79.2% 79.8% 76.2% 74.7% 79.3% Total Economic Occupancy 94.3% 94.8% 93.9% 92.9% 93.0% Same-Store Leased Occupancy Retail 95.7% 95.6% 95.4% 95.4% 94.4% Industrial 98.5% 98.8% 97.5% 95.1% 97.4% Office 97.1% 96.2% 96.2% 94.4% 94.4% Total Same-Store Leased Occupancy 96.7% 96.7% 96.1% 95.3% 95.4% Same-Store Economic Occupancy Retail 93.7% 94.0% 93.4% 93.0% 92.8% Industrial 98.5% 98.8% 97.2% 94.8% 97.1% Office 96.2% 96.2% 96.2% 94.4% 94.4% Total Same-Store Economic Occupancy 95.3% 95.6% 94.7% 93.6% 94.3% Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 25

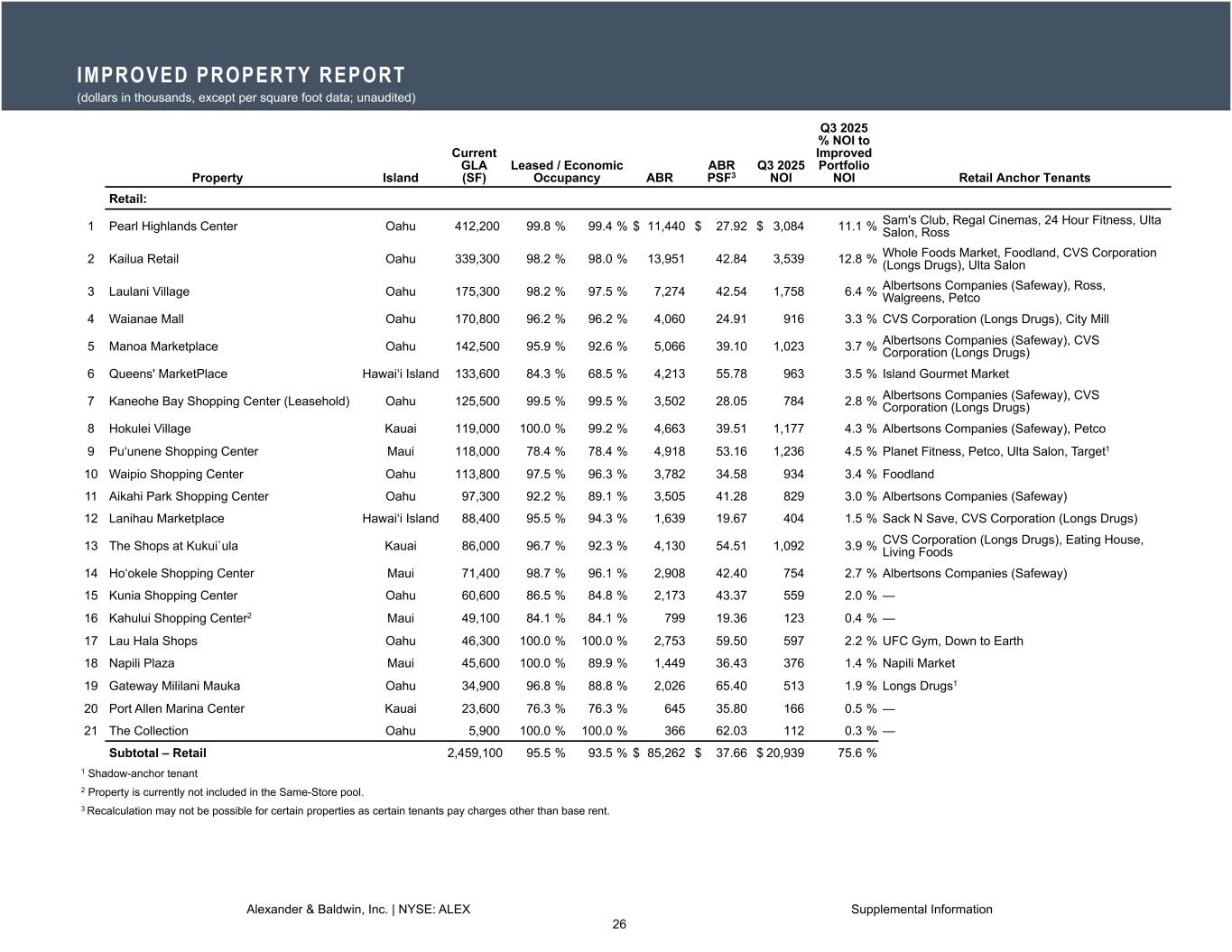

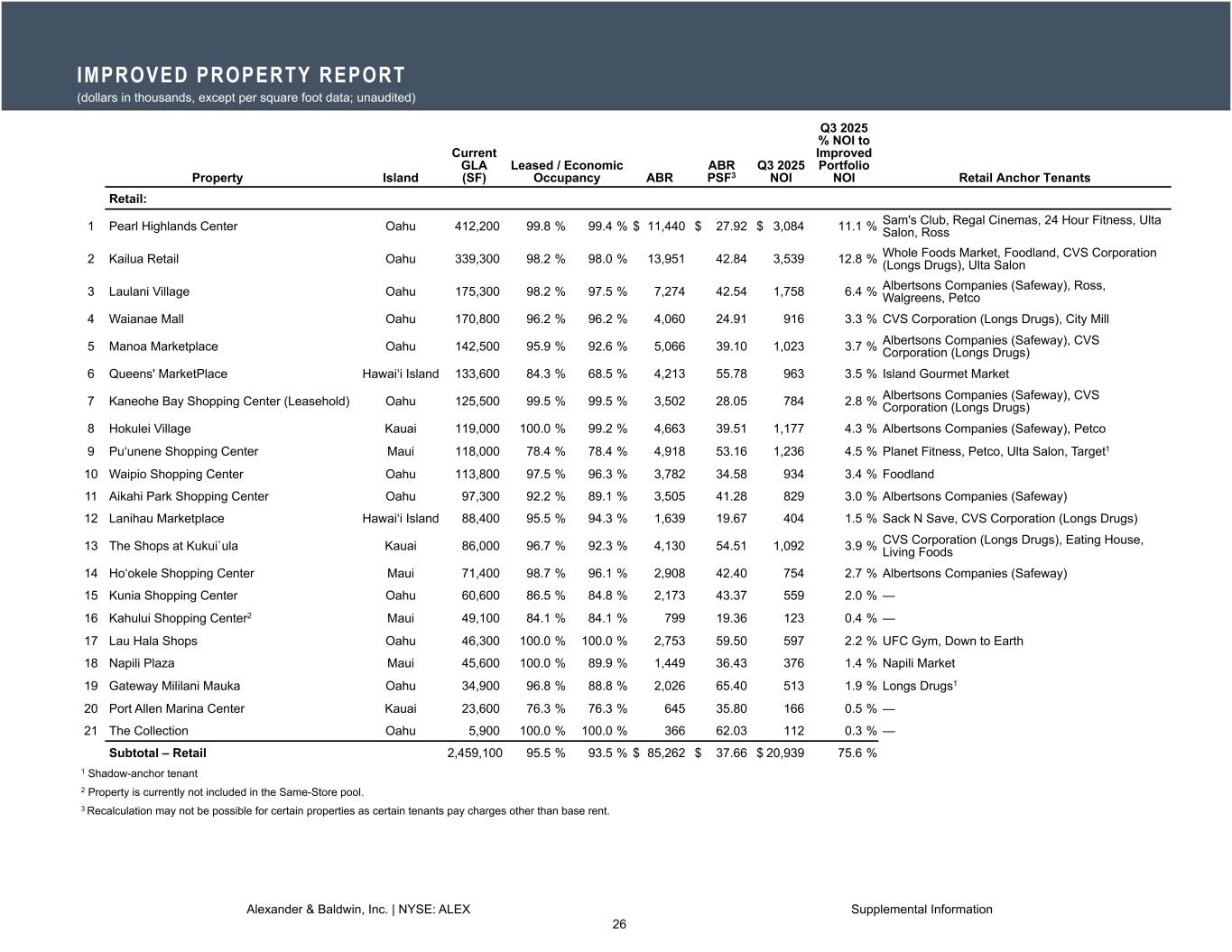

IMPROVED PROPERTY REPORT (dollars in thousands, except per square foot data; unaudited) Retail: 1 Pearl Highlands Center Oahu 412,200 99.8 % 99.4 % $ 11,440 $ 27.92 $ 3,084 11.1 % Sam's Club, Regal Cinemas, 24 Hour Fitness, Ulta Salon, Ross 2 Kailua Retail Oahu 339,300 98.2 % 98.0 % 13,951 42.84 3,539 12.8 % Whole Foods Market, Foodland, CVS Corporation (Longs Drugs), Ulta Salon 3 Laulani Village Oahu 175,300 98.2 % 97.5 % 7,274 42.54 1,758 6.4 % Albertsons Companies (Safeway), Ross, Walgreens, Petco 4 Waianae Mall Oahu 170,800 96.2 % 96.2 % 4,060 24.91 916 3.3 % CVS Corporation (Longs Drugs), City Mill 5 Manoa Marketplace Oahu 142,500 95.9 % 92.6 % 5,066 39.10 1,023 3.7 % Albertsons Companies (Safeway), CVS Corporation (Longs Drugs) 6 Queens' MarketPlace Hawai‘i Island 133,600 84.3 % 68.5 % 4,213 55.78 963 3.5 % Island Gourmet Market 7 Kaneohe Bay Shopping Center (Leasehold) Oahu 125,500 99.5 % 99.5 % 3,502 28.05 784 2.8 % Albertsons Companies (Safeway), CVS Corporation (Longs Drugs) 8 Hokulei Village Kauai 119,000 100.0 % 99.2 % 4,663 39.51 1,177 4.3 % Albertsons Companies (Safeway), Petco 9 Pu‘unene Shopping Center Maui 118,000 78.4 % 78.4 % 4,918 53.16 1,236 4.5 % Planet Fitness, Petco, Ulta Salon, Target1 10 Waipio Shopping Center Oahu 113,800 97.5 % 96.3 % 3,782 34.58 934 3.4 % Foodland 11 Aikahi Park Shopping Center Oahu 97,300 92.2 % 89.1 % 3,505 41.28 829 3.0 % Albertsons Companies (Safeway) 12 Lanihau Marketplace Hawai‘i Island 88,400 95.5 % 94.3 % 1,639 19.67 404 1.5 % Sack N Save, CVS Corporation (Longs Drugs) 13 The Shops at Kukui`ula Kauai 86,000 96.7 % 92.3 % 4,130 54.51 1,092 3.9 % CVS Corporation (Longs Drugs), Eating House, Living Foods 14 Ho‘okele Shopping Center Maui 71,400 98.7 % 96.1 % 2,908 42.40 754 2.7 % Albertsons Companies (Safeway) 15 Kunia Shopping Center Oahu 60,600 86.5 % 84.8 % 2,173 43.37 559 2.0 % — 16 Kahului Shopping Center2 Maui 49,100 84.1 % 84.1 % 799 19.36 123 0.4 % — 17 Lau Hala Shops Oahu 46,300 100.0 % 100.0 % 2,753 59.50 597 2.2 % UFC Gym, Down to Earth 18 Napili Plaza Maui 45,600 100.0 % 89.9 % 1,449 36.43 376 1.4 % Napili Market 19 Gateway Mililani Mauka Oahu 34,900 96.8 % 88.8 % 2,026 65.40 513 1.9 % Longs Drugs1 20 Port Allen Marina Center Kauai 23,600 76.3 % 76.3 % 645 35.80 166 0.5 % — 21 The Collection Oahu 5,900 100.0 % 100.0 % 366 62.03 112 0.3 % — Subtotal – Retail 2,459,100 95.5 % 93.5 % $ 85,262 $ 37.66 $ 20,939 75.6 % 1 Shadow-anchor tenant 2 Property is currently not included in the Same-Store pool. 3 Recalculation may not be possible for certain properties as certain tenants pay charges other than base rent. Property Island Current GLA (SF) Leased / Economic Occupancy ABR ABR PSF3 Q3 2025 NOI Q3 2025 % NOI to Improved Portfolio NOI Retail Anchor Tenants Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 26

IMPROVED PROPERTY REPORT (dollars in thousands, except per square foot data; unaudited) Industrial: 1 Komohana Industrial Park Oahu 222,000 100.0 % 100.0 % $ 3,614 $ 16.28 $ 1,301 4.7 % 2 Kaka‘ako Commerce Center Oahu 201,100 96.3 % 96.3 % 2,682 13.99 659 2.4 % 3 Waipio Industrial Oahu 158,400 98.6 % 98.6 % 3,005 19.24 737 2.7 % 4 Opule Industrial Oahu 151,500 100.0 % 100.0 % 2,787 18.40 639 2.3 % 5 P&L Warehouse Maui 104,100 98.1 % 98.1 % 1,741 17.04 448 1.6 % 6 Kapolei Enterprise Center Oahu 93,100 100.0 % 100.0 % 1,799 19.33 432 1.6 % 7 Honokohau Industrial Hawai‘i Island 86,700 100.0 % 100.0 % 1,465 16.89 319 1.1 % 8 Waihona Industrial2 Oahu 81,500 100.0 % 100.0 % 1,620 19.88 405 1.5 % 9 Kailua Industrial / Other Oahu 68,900 95.2 % 95.2 % 1,273 19.41 258 0.9 % 10 Port Allen Center Kauai 64,600 95.7 % 95.7 % 846 13.70 240 0.9 % 11 Harbor Industrial2 Maui 51,100 67.9 % 67.9 % 550 15.84 157 0.6 % 12 Kaomi Loop Industrial Oahu 33,200 100.0 % 100.0 % 559 16.82 139 0.5 % 13 Kahai Street Industrial Oahu 27,900 100.0 % 100.0 % 435 15.60 109 0.4 % 14 Maui Lani Industrial Maui 8,400 100.0 % 100.0 % 165 19.64 42 0.1 % Subtotal – Industrial 1,352,500 97.5 % 97.5 % $ 22,541 $ 17.12 $ 5,885 21.3 % Office: 1 Kahului Office Building2 Maui 59,100 69.7 % 68.0 % $ 1,245 $ 30.94 $ 195 0.7 % 2 Gateway at Mililani Mauka South Oahu 37,100 100.0 % 100.0 % 1,924 51.80 487 1.8 % 3 Kahului Office Center Maui 35,800 94.1 % 92.2 % 1,096 33.22 214 0.8 % 4 Lono Center2 Maui 13,700 37.2 % 37.2 % 129 32.23 (43) (0.2) % Subtotal – Office 145,700 80.4 % 79.2 % $ 4,394 $ 38.42 $ 853 3.1 % 39 Total – Improved Portfolio 3,957,300 95.6 % 94.3 % $ 112,197 $ 30.37 $ 27,677 100.0 % 1 Shadow-anchor tenant 2 Property is currently not included in the Same-Store pool. 3 Recalculation may not be possible for certain properties as certain tenants pay charges other than base rent. Property Island Current GLA (SF) Leased / Economic Occupancy ABR ABR PSF3 Q3 2025 NOI Q3 2025 % NOI to Improved Portfolio NOI Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 27

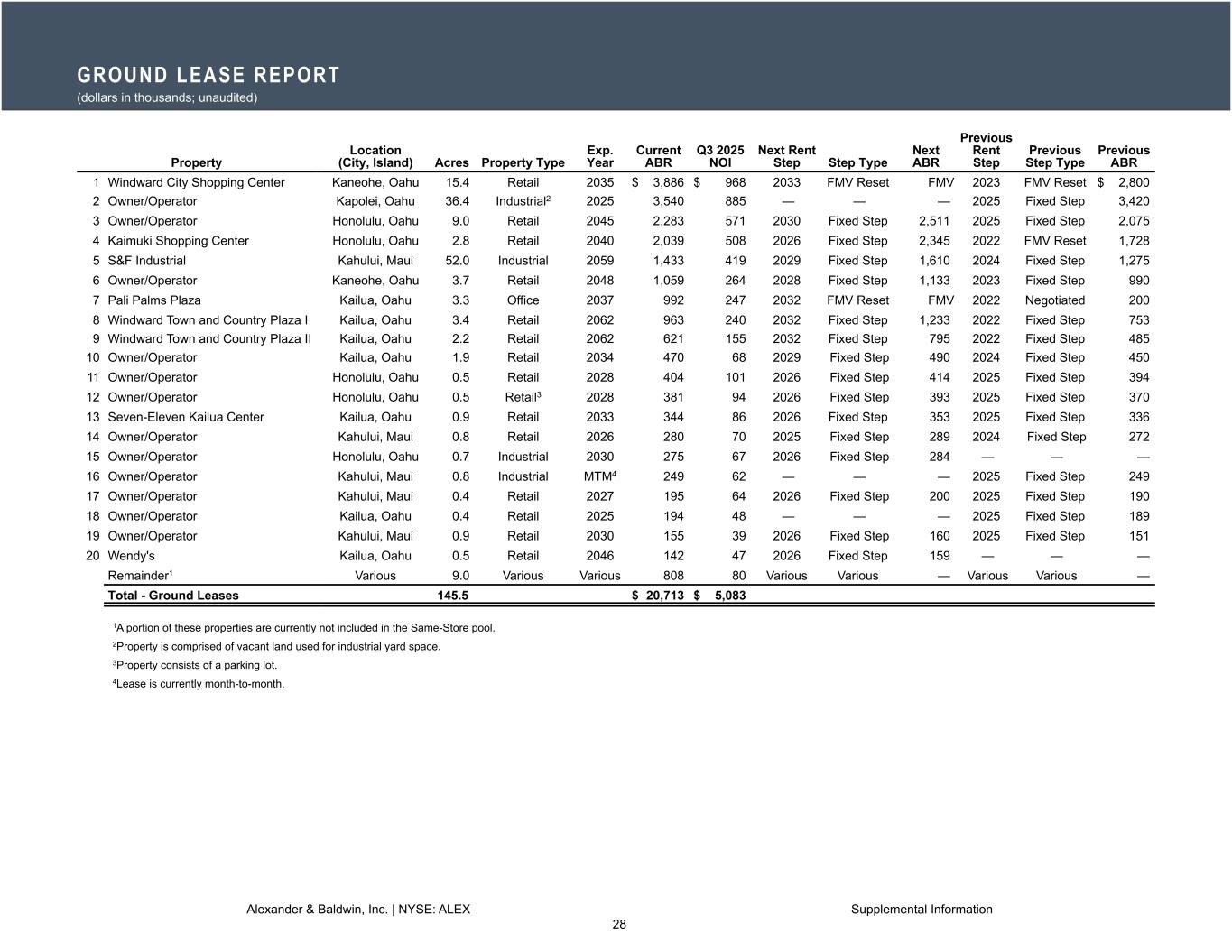

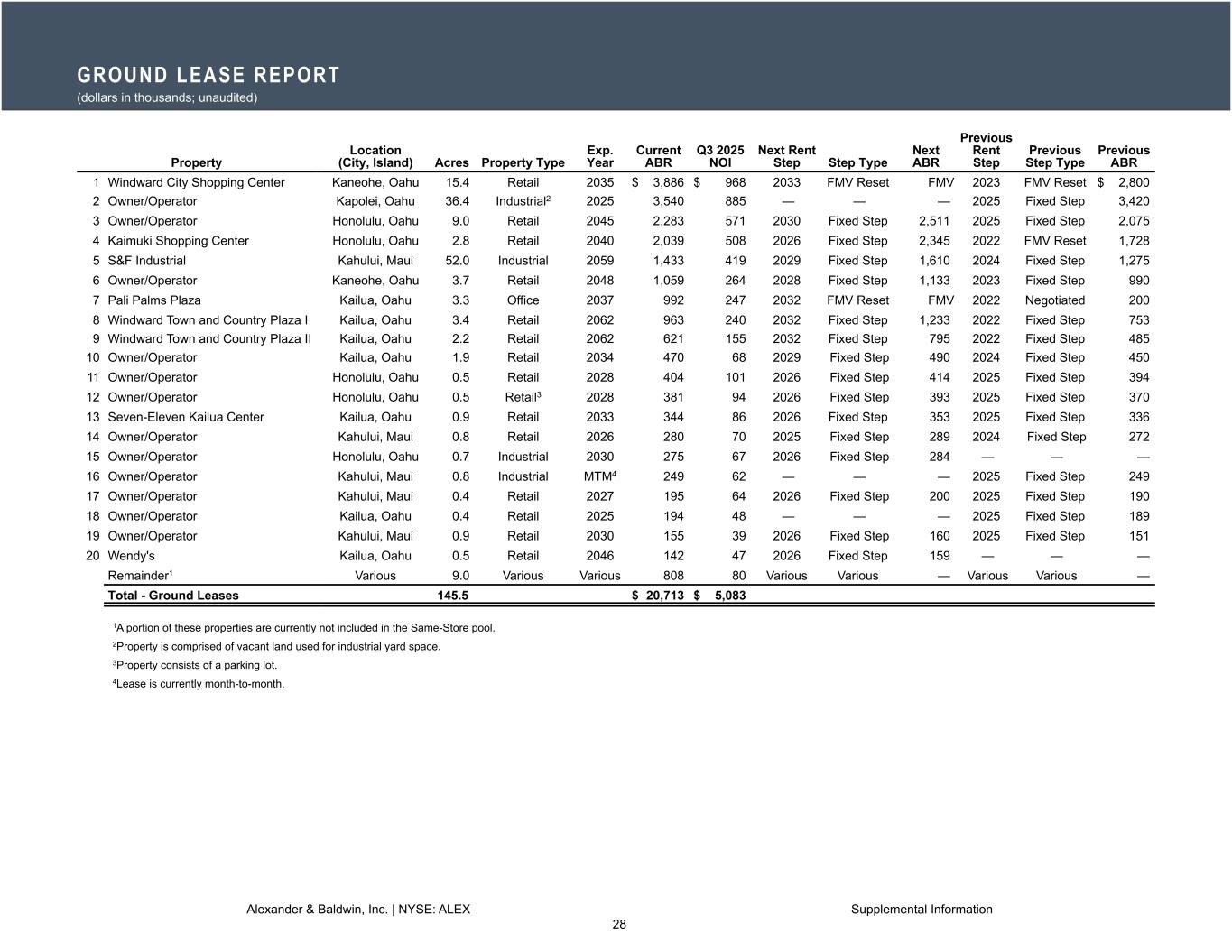

GROUND LEASE REPORT (dollars in thousands; unaudited) Property Location (City, Island) Acres Property Type Exp. Year Current ABR Q3 2025 NOI Next Rent Step Step Type Next ABR Previous Rent Step Previous Step Type Previous ABR 1 Windward City Shopping Center Kaneohe, Oahu 15.4 Retail 2035 $ 3,886 $ 968 2033 FMV Reset FMV 2023 FMV Reset $ 2,800 2 Owner/Operator Kapolei, Oahu 36.4 Industrial2 2025 3,540 885 — — — 2025 Fixed Step 3,420 3 Owner/Operator Honolulu, Oahu 9.0 Retail 2045 2,283 571 2030 Fixed Step 2,511 2025 Fixed Step 2,075 4 Kaimuki Shopping Center Honolulu, Oahu 2.8 Retail 2040 2,039 508 2026 Fixed Step 2,345 2022 FMV Reset 1,728 5 S&F Industrial Kahului, Maui 52.0 Industrial 2059 1,433 419 2029 Fixed Step 1,610 2024 Fixed Step 1,275 6 Owner/Operator Kaneohe, Oahu 3.7 Retail 2048 1,059 264 2028 Fixed Step 1,133 2023 Fixed Step 990 7 Pali Palms Plaza Kailua, Oahu 3.3 Office 2037 992 247 2032 FMV Reset FMV 2022 Negotiated 200 8 Windward Town and Country Plaza I Kailua, Oahu 3.4 Retail 2062 963 240 2032 Fixed Step 1,233 2022 Fixed Step 753 9 Windward Town and Country Plaza II Kailua, Oahu 2.2 Retail 2062 621 155 2032 Fixed Step 795 2022 Fixed Step 485 10 Owner/Operator Kailua, Oahu 1.9 Retail 2034 470 68 2029 Fixed Step 490 2024 Fixed Step 450 11 Owner/Operator Honolulu, Oahu 0.5 Retail 2028 404 101 2026 Fixed Step 414 2025 Fixed Step 394 12 Owner/Operator Honolulu, Oahu 0.5 Retail3 2028 381 94 2026 Fixed Step 393 2025 Fixed Step 370 13 Seven-Eleven Kailua Center Kailua, Oahu 0.9 Retail 2033 344 86 2026 Fixed Step 353 2025 Fixed Step 336 14 Owner/Operator Kahului, Maui 0.8 Retail 2026 280 70 2025 Fixed Step 289 2024 Fixed Step 272 15 Owner/Operator Honolulu, Oahu 0.7 Industrial 2030 275 67 2026 Fixed Step 284 — — — 16 Owner/Operator Kahului, Maui 0.8 Industrial MTM4 249 62 — — — 2025 Fixed Step 249 17 Owner/Operator Kahului, Maui 0.4 Retail 2027 195 64 2026 Fixed Step 200 2025 Fixed Step 190 18 Owner/Operator Kailua, Oahu 0.4 Retail 2025 194 48 — — — 2025 Fixed Step 189 19 Owner/Operator Kahului, Maui 0.9 Retail 2030 155 39 2026 Fixed Step 160 2025 Fixed Step 151 20 Wendy's Kailua, Oahu 0.5 Retail 2046 142 47 2026 Fixed Step 159 — — — Remainder1 Various 9.0 Various Various 808 80 Various Various — Various Various — Total - Ground Leases 145.5 $ 20,713 $ 5,083 1A portion of these properties are currently not included in the Same-Store pool. 2Property is comprised of vacant land used for industrial yard space. 3Property consists of a parking lot. 4Lease is currently month-to-month. Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 28

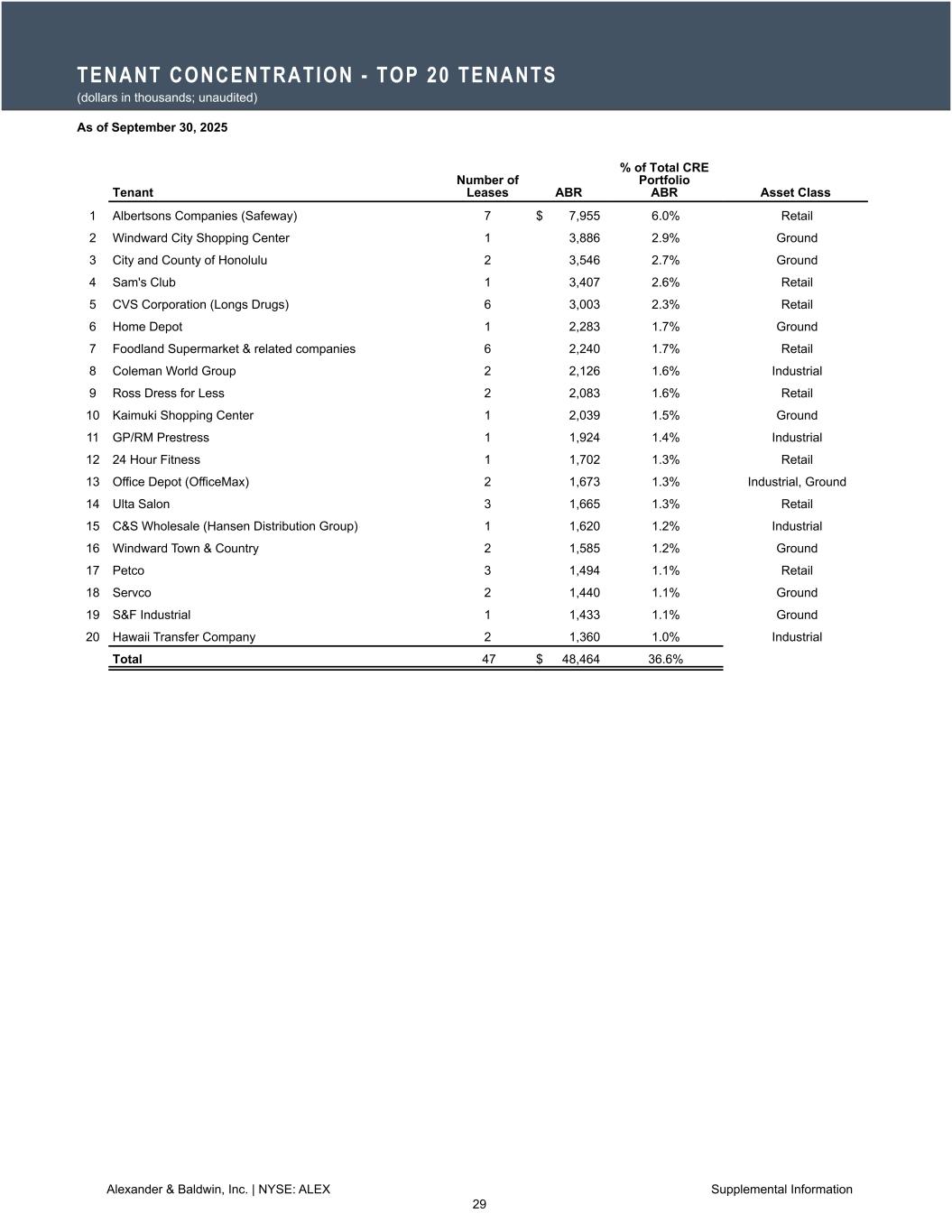

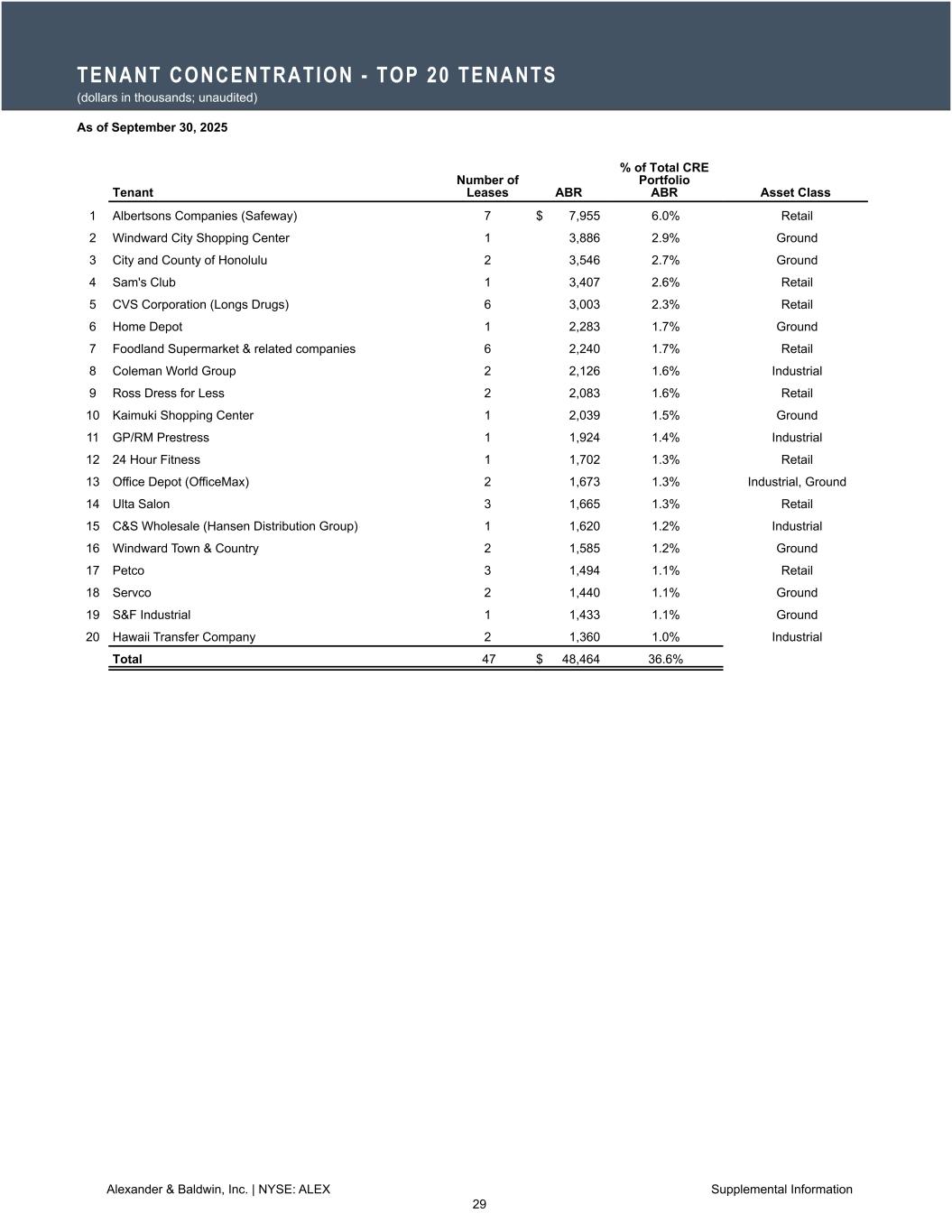

TENANT CONCENTRATION - TOP 20 TENANTS (dollars in thousands; unaudited) As of September 30, 2025 Tenant Number of Leases ABR % of Total CRE Portfolio ABR Asset Class 1 Albertsons Companies (Safeway) 7 $ 7,955 6.0% Retail 2 Windward City Shopping Center 1 3,886 2.9% Ground 3 City and County of Honolulu 2 3,546 2.7% Ground 4 Sam's Club 1 3,407 2.6% Retail 5 CVS Corporation (Longs Drugs) 6 3,003 2.3% Retail 6 Home Depot 1 2,283 1.7% Ground 7 Foodland Supermarket & related companies 6 2,240 1.7% Retail 8 Coleman World Group 2 2,126 1.6% Industrial 9 Ross Dress for Less 2 2,083 1.6% Retail 10 Kaimuki Shopping Center 1 2,039 1.5% Ground 11 GP/RM Prestress 1 1,924 1.4% Industrial 12 24 Hour Fitness 1 1,702 1.3% Retail 13 Office Depot (OfficeMax) 2 1,673 1.3% Industrial, Ground 14 Ulta Salon 3 1,665 1.3% Retail 15 C&S Wholesale (Hansen Distribution Group) 1 1,620 1.2% Industrial 16 Windward Town & Country 2 1,585 1.2% Ground 17 Petco 3 1,494 1.1% Retail 18 Servco 2 1,440 1.1% Ground 19 S&F Industrial 1 1,433 1.1% Ground 20 Hawaii Transfer Company 2 1,360 1.0% Industrial Total 47 $ 48,464 36.6% Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 29

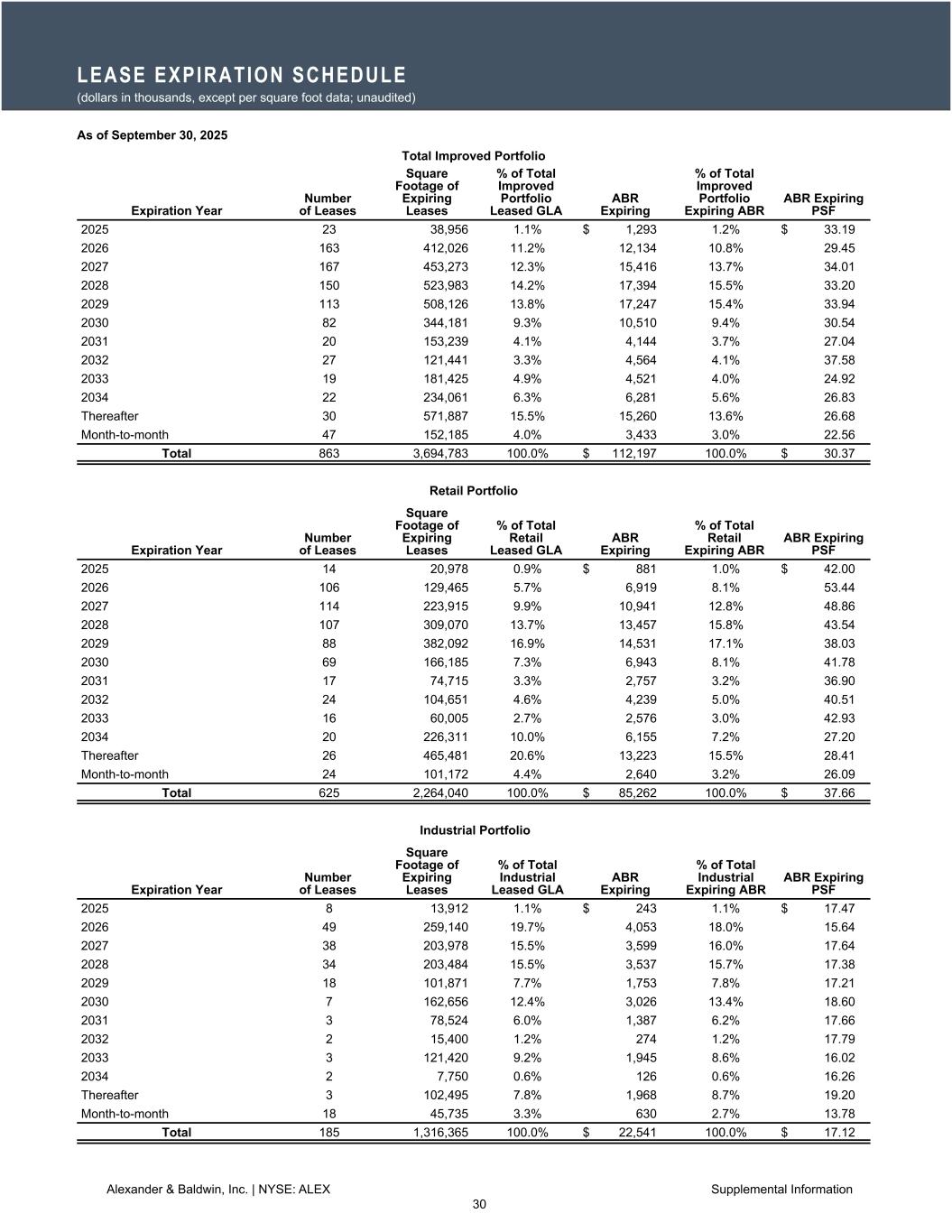

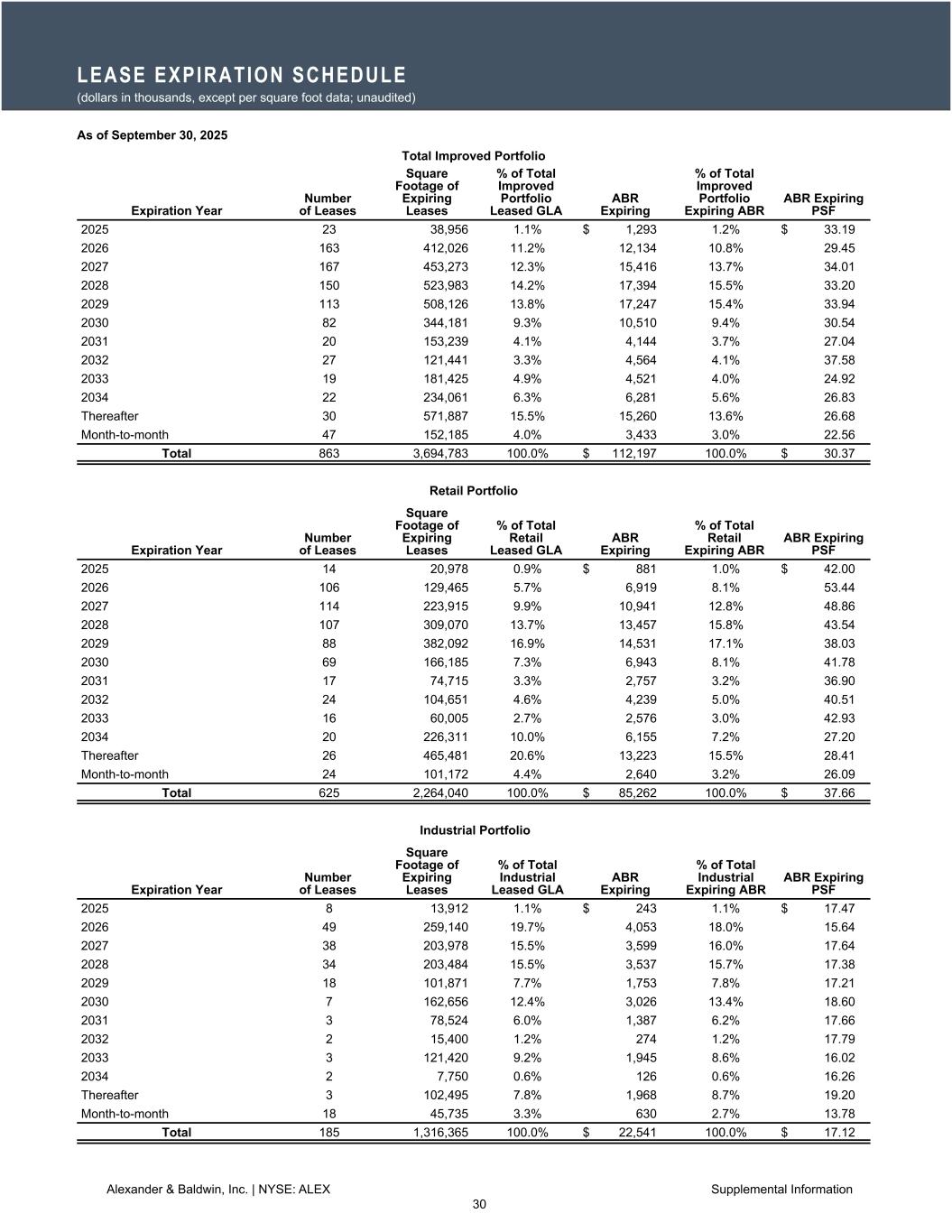

LEASE EXPIRATION SCHEDULE (dollars in thousands, except per square foot data; unaudited) As of September 30, 2025 Total Improved Portfolio Expiration Year Number of Leases Square Footage of Expiring Leases % of Total Improved Portfolio Leased GLA ABR Expiring % of Total Improved Portfolio Expiring ABR ABR Expiring PSF 2025 23 38,956 1.1% $ 1,293 1.2% $ 33.19 2026 163 412,026 11.2% 12,134 10.8% 29.45 2027 167 453,273 12.3% 15,416 13.7% 34.01 2028 150 523,983 14.2% 17,394 15.5% 33.20 2029 113 508,126 13.8% 17,247 15.4% 33.94 2030 82 344,181 9.3% 10,510 9.4% 30.54 2031 20 153,239 4.1% 4,144 3.7% 27.04 2032 27 121,441 3.3% 4,564 4.1% 37.58 2033 19 181,425 4.9% 4,521 4.0% 24.92 2034 22 234,061 6.3% 6,281 5.6% 26.83 Thereafter 30 571,887 15.5% 15,260 13.6% 26.68 Month-to-month 47 152,185 4.0% 3,433 3.0% 22.56 Total 863 3,694,783 100.0% $ 112,197 100.0% $ 30.37 Retail Portfolio Expiration Year Number of Leases Square Footage of Expiring Leases % of Total Retail Leased GLA ABR Expiring % of Total Retail Expiring ABR ABR Expiring PSF 2025 14 20,978 0.9% $ 881 1.0% $ 42.00 2026 106 129,465 5.7% 6,919 8.1% 53.44 2027 114 223,915 9.9% 10,941 12.8% 48.86 2028 107 309,070 13.7% 13,457 15.8% 43.54 2029 88 382,092 16.9% 14,531 17.1% 38.03 2030 69 166,185 7.3% 6,943 8.1% 41.78 2031 17 74,715 3.3% 2,757 3.2% 36.90 2032 24 104,651 4.6% 4,239 5.0% 40.51 2033 16 60,005 2.7% 2,576 3.0% 42.93 2034 20 226,311 10.0% 6,155 7.2% 27.20 Thereafter 26 465,481 20.6% 13,223 15.5% 28.41 Month-to-month 24 101,172 4.4% 2,640 3.2% 26.09 Total 625 2,264,040 100.0% $ 85,262 100.0% $ 37.66 Industrial Portfolio Expiration Year Number of Leases Square Footage of Expiring Leases % of Total Industrial Leased GLA ABR Expiring % of Total Industrial Expiring ABR ABR Expiring PSF 2025 8 13,912 1.1% $ 243 1.1% $ 17.47 2026 49 259,140 19.7% 4,053 18.0% 15.64 2027 38 203,978 15.5% 3,599 16.0% 17.64 2028 34 203,484 15.5% 3,537 15.7% 17.38 2029 18 101,871 7.7% 1,753 7.8% 17.21 2030 7 162,656 12.4% 3,026 13.4% 18.60 2031 3 78,524 6.0% 1,387 6.2% 17.66 2032 2 15,400 1.2% 274 1.2% 17.79 2033 3 121,420 9.2% 1,945 8.6% 16.02 2034 2 7,750 0.6% 126 0.6% 16.26 Thereafter 3 102,495 7.8% 1,968 8.7% 19.20 Month-to-month 18 45,735 3.3% 630 2.7% 13.78 Total 185 1,316,365 100.0% $ 22,541 100.0% $ 17.12 Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 30

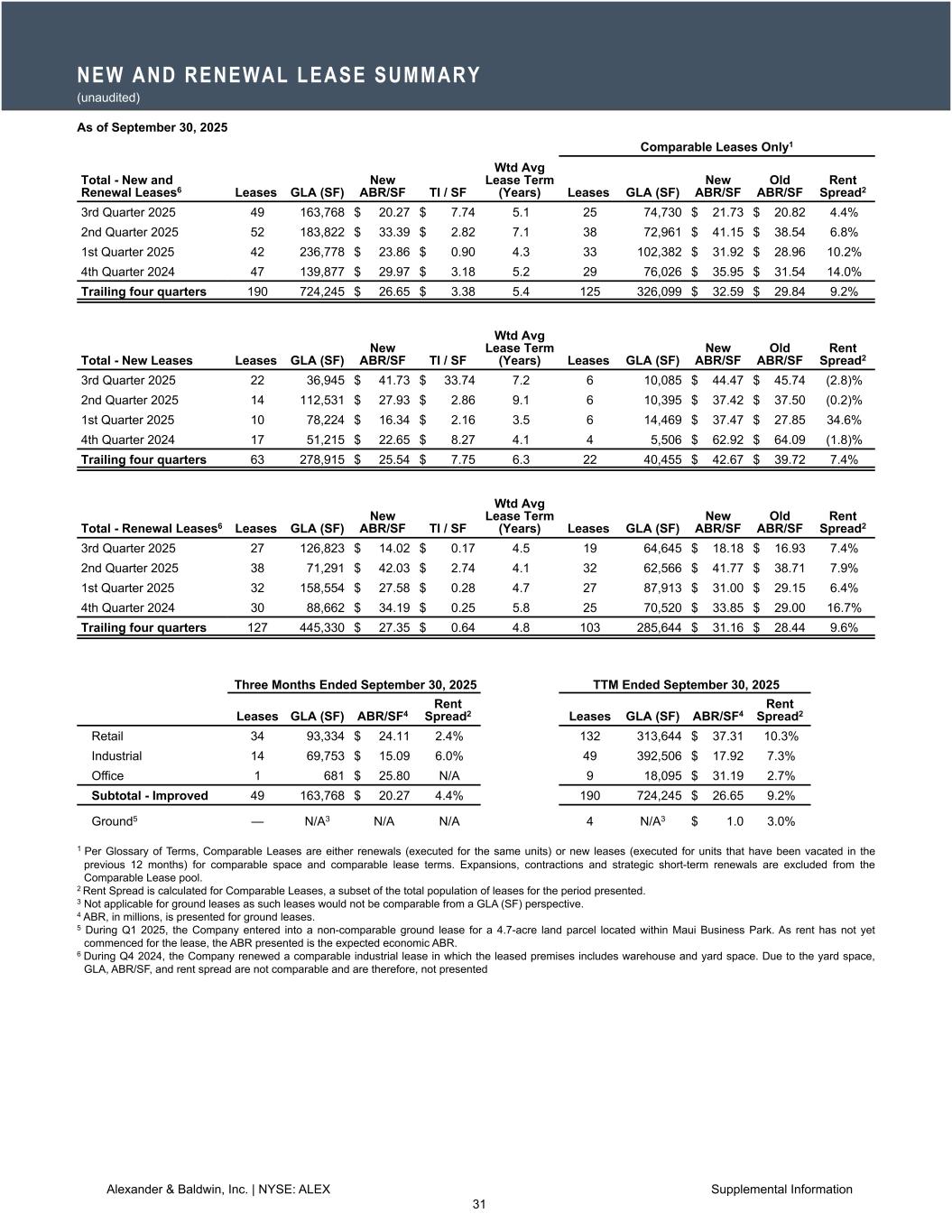

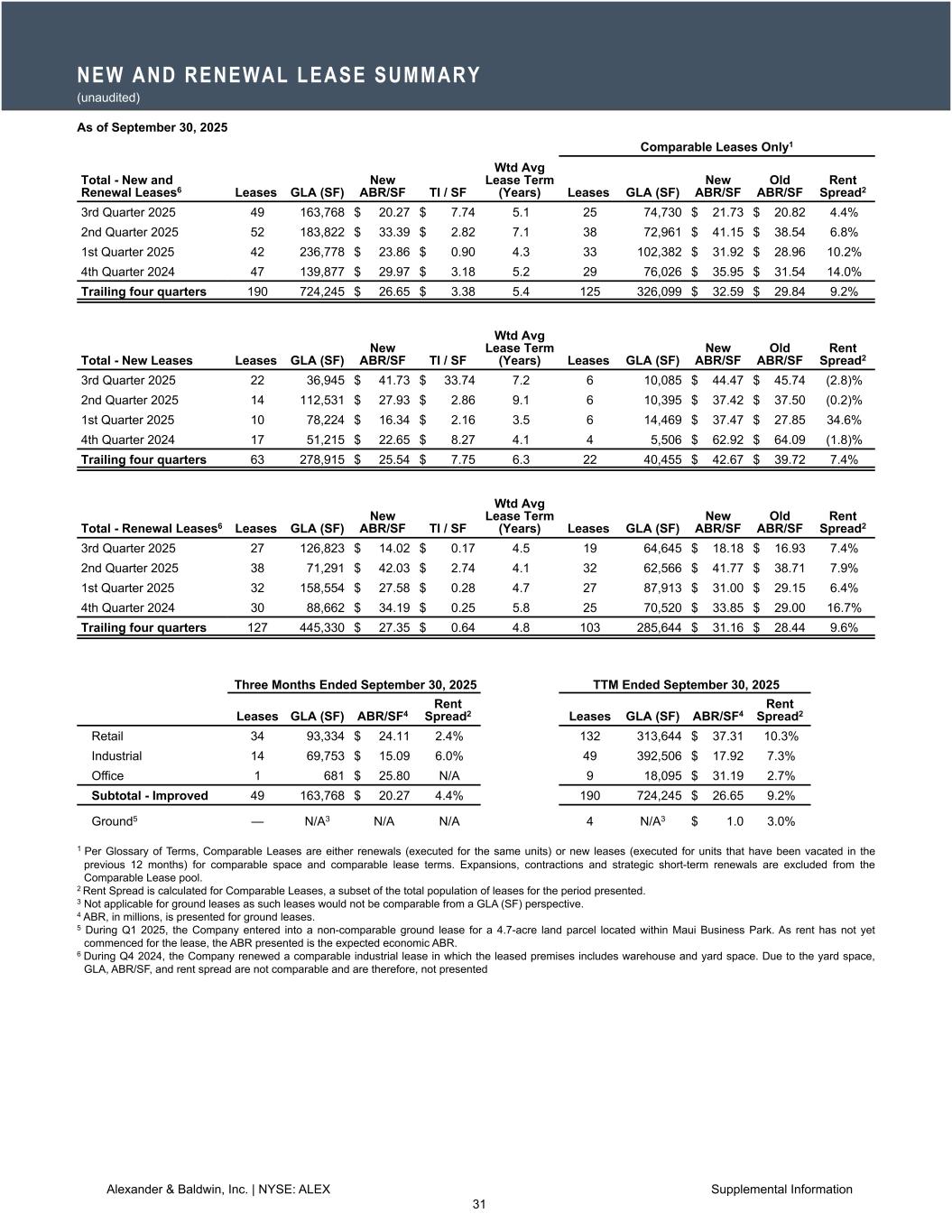

NEW AND RENEWAL LEASE SUMMARY (unaudited) As of September 30, 2025 Comparable Leases Only1 Total - New and Renewal Leases6 Leases GLA (SF) New ABR/SF TI / SF Wtd Avg Lease Term (Years) Leases GLA (SF) New ABR/SF Old ABR/SF Rent Spread2 3rd Quarter 2025 49 163,768 $ 20.27 $ 7.74 5.1 25 74,730 $ 21.73 $ 20.82 4.4% 2nd Quarter 2025 52 183,822 $ 33.39 $ 2.82 7.1 38 72,961 $ 41.15 $ 38.54 6.8% 1st Quarter 2025 42 236,778 $ 23.86 $ 0.90 4.3 33 102,382 $ 31.92 $ 28.96 10.2% 4th Quarter 2024 47 139,877 $ 29.97 $ 3.18 5.2 29 76,026 $ 35.95 $ 31.54 14.0% Trailing four quarters 190 724,245 $ 26.65 $ 3.38 5.4 125 326,099 $ 32.59 $ 29.84 9.2% Total - New Leases Leases GLA (SF) New ABR/SF TI / SF Wtd Avg Lease Term (Years) Leases GLA (SF) New ABR/SF Old ABR/SF Rent Spread2 3rd Quarter 2025 22 36,945 $ 41.73 $ 33.74 7.2 6 10,085 $ 44.47 $ 45.74 (2.8)% 2nd Quarter 2025 14 112,531 $ 27.93 $ 2.86 9.1 6 10,395 $ 37.42 $ 37.50 (0.2)% 1st Quarter 2025 10 78,224 $ 16.34 $ 2.16 3.5 6 14,469 $ 37.47 $ 27.85 34.6% 4th Quarter 2024 17 51,215 $ 22.65 $ 8.27 4.1 4 5,506 $ 62.92 $ 64.09 (1.8)% Trailing four quarters 63 278,915 $ 25.54 $ 7.75 6.3 22 40,455 $ 42.67 $ 39.72 7.4% Total - Renewal Leases6 Leases GLA (SF) New ABR/SF TI / SF Wtd Avg Lease Term (Years) Leases GLA (SF) New ABR/SF Old ABR/SF Rent Spread2 3rd Quarter 2025 27 126,823 $ 14.02 $ 0.17 4.5 19 64,645 $ 18.18 $ 16.93 7.4% 2nd Quarter 2025 38 71,291 $ 42.03 $ 2.74 4.1 32 62,566 $ 41.77 $ 38.71 7.9% 1st Quarter 2025 32 158,554 $ 27.58 $ 0.28 4.7 27 87,913 $ 31.00 $ 29.15 6.4% 4th Quarter 2024 30 88,662 $ 34.19 $ 0.25 5.8 25 70,520 $ 33.85 $ 29.00 16.7% Trailing four quarters 127 445,330 $ 27.35 $ 0.64 4.8 103 285,644 $ 31.16 $ 28.44 9.6% Three Months Ended September 30, 2025 TTM Ended September 30, 2025 Leases GLA (SF) ABR/SF4 Rent Spread2 Leases GLA (SF) ABR/SF4 Rent Spread2 Retail 34 93,334 $ 24.11 2.4% 132 313,644 $ 37.31 10.3% Industrial 14 69,753 $ 15.09 6.0% 49 392,506 $ 17.92 7.3% Office 1 681 $ 25.80 N/A 9 18,095 $ 31.19 2.7% Subtotal - Improved 49 163,768 $ 20.27 4.4% 190 724,245 $ 26.65 9.2% Ground5 — N/A3 N/A N/A 4 N/A3 $ 1.0 3.0% 1 Per Glossary of Terms, Comparable Leases are either renewals (executed for the same units) or new leases (executed for units that have been vacated in the previous 12 months) for comparable space and comparable lease terms. Expansions, contractions and strategic short-term renewals are excluded from the Comparable Lease pool. 2 Rent Spread is calculated for Comparable Leases, a subset of the total population of leases for the period presented. 3 Not applicable for ground leases as such leases would not be comparable from a GLA (SF) perspective. 4 ABR, in millions, is presented for ground leases. 5 During Q1 2025, the Company entered into a non-comparable ground lease for a 4.7-acre land parcel located within Maui Business Park. As rent has not yet commenced for the lease, the ABR presented is the expected economic ABR. 6 During Q4 2024, the Company renewed a comparable industrial lease in which the leased premises includes warehouse and yard space. Due to the yard space, GLA, ABR/SF, and rent spread are not comparable and are therefore, not presented Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 31

Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 32

LAND OPERATIONS STATEMENT OF OPERATING PROFIT AND EBITDA (dollars in thousands; unaudited) Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Land Operations operating revenue Development sales revenue $ — $ 1,853 $ — $ 5,989 Unimproved/other property sales revenue — 10,557 3,358 20,182 Other operating revenue1 35 153 343 545 Total Land Operations operating revenue 35 12,563 3,701 26,716 Development cost of sales — (1,089) — (3,615) Unimproved/other property land cost of sales (57) (5,357) (510) (7,214) Other operating costs and expenses2 (1,004) (713) (2,626) (3,494) (Expense) income from changes to liabilities related to legacy operations (250) — (250) (2,193) Selling, general and administrative (181) (236) (456) (874) Gain (loss) on disposal of assets and settlements, net3 7 — 11,788 2,148 Impairment of equity method investment (406) — (406) — Earnings (loss) from joint ventures 1,592 2,142 7,206 3,836 Interest and other income (expense), net (34) 571 11 670 Total Land Operations operating profit (loss) $ (298) $ 7,881 $ 18,458 $ 15,980 Three Months Ended September 30, Nine Months Ended September 30, TTM September 30, 2025 2024 2025 2024 2025 Land Operations Operating Profit (Loss) $ (298) $ 7,881 $ 18,458 $ 15,980 $ 21,400 Land Operations depreciation and amortization 3 3 8 9 10 Land Operations EBITDA $ (295) $ 7,884 $ 18,466 $ 15,989 $ 21,410 Impairment of assets 406 — 406 — 406 Land Operations Adjusted EBITDA $ 111 $ 7,884 $ 18,872 $ 15,989 $ 21,816 1 Other operating revenue includes revenue related to leasing of legacy agricultural lands during the three and nine months ended September 30, 2025 and September 30, 2024. 2 Other operating costs and expenses includes intersegment operating charges primarily from CRE that are eliminated in the consolidated results of operations. 3 Amounts in 2025 are related to favorable resolution of rights and obligations from a prior year land sale. Amounts in 2024 are primarily due to the favorable resolution of contingent liabilities related to the prior year sale of a legacy business. Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 33

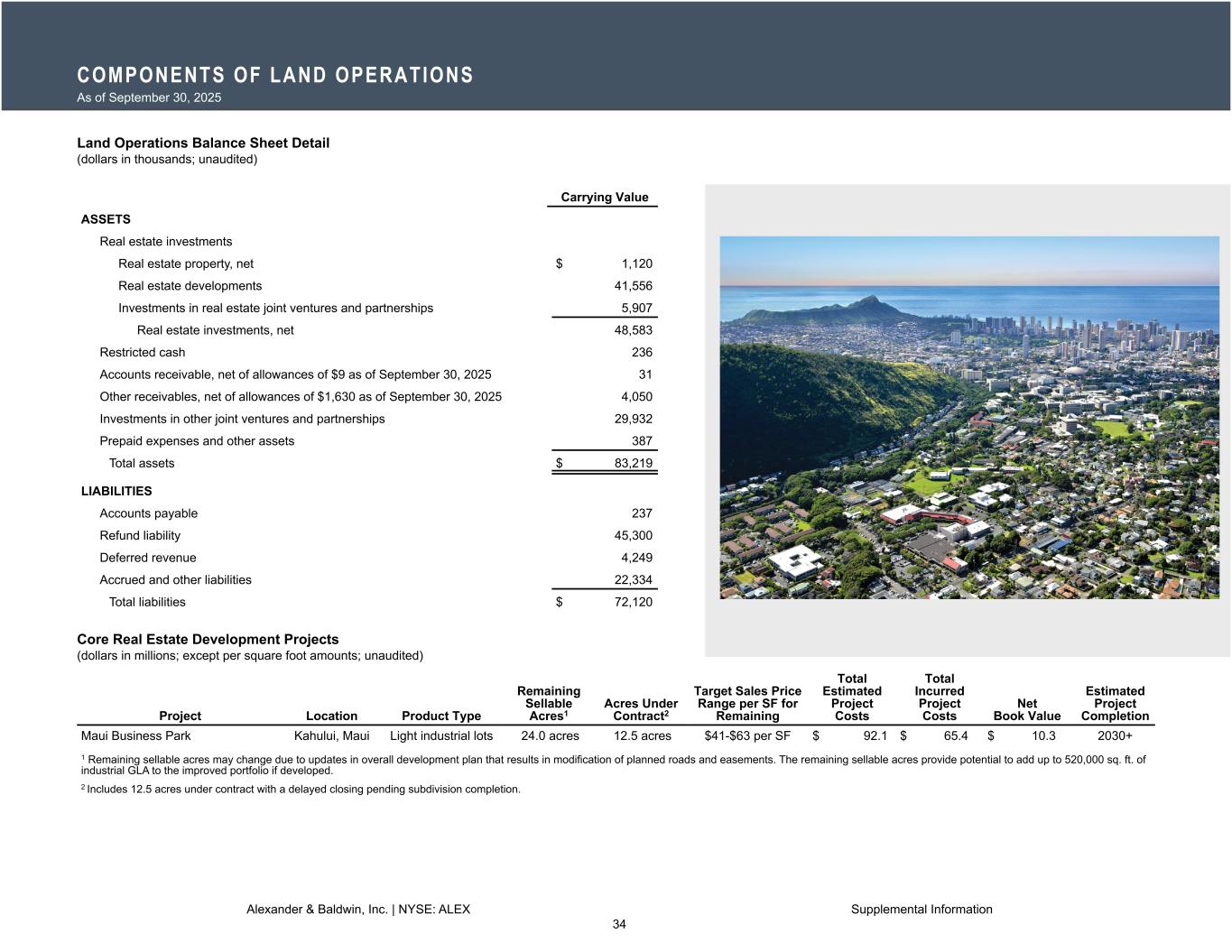

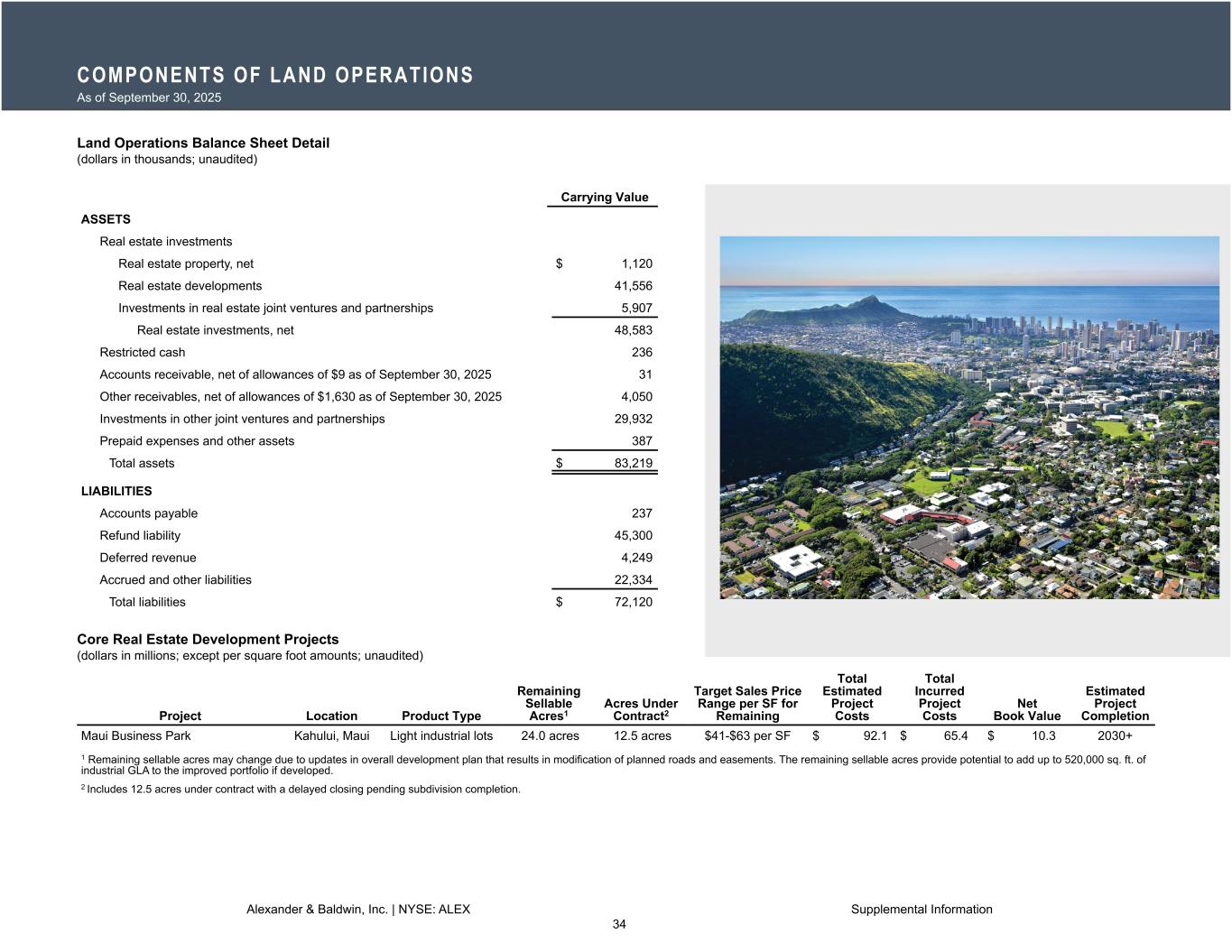

COMPONENTS OF LAND OPERATIONS As of September 30, 2025 Land Operations Balance Sheet Detail (dollars in thousands; unaudited) Carrying Value ASSETS Real estate investments Real estate property, net $ 1,120 Real estate developments 41,556 Investments in real estate joint ventures and partnerships 5,907 Real estate investments, net 48,583 Restricted cash 236 Accounts receivable, net of allowances of $9 as of September 30, 2025 31 Other receivables, net of allowances of $1,630 as of September 30, 2025 4,050 Investments in other joint ventures and partnerships 29,932 Prepaid expenses and other assets 387 Total assets $ 83,219 — LIABILITIES Accounts payable 237 Refund liability 45,300 Deferred revenue 4,249 Accrued and other liabilities 22,334 Total liabilities $ 72,120 Core Real Estate Development Projects (dollars in millions; except per square foot amounts; unaudited) Project Location Product Type Remaining Sellable Acres1 Acres Under Contract2 Target Sales Price Range per SF for Remaining Total Estimated Project Costs Total Incurred Project Costs Net Book Value Estimated Project Completion Maui Business Park Kahului, Maui Light industrial lots 24.0 acres 12.5 acres $41-$63 per SF $ 92.1 $ 65.4 $ 10.3 2030+ 1 Remaining sellable acres may change due to updates in overall development plan that results in modification of planned roads and easements. The remaining sellable acres provide potential to add up to 520,000 sq. ft. of industrial GLA to the improved portfolio if developed. 2 Includes 12.5 acres under contract with a delayed closing pending subdivision completion. Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 34

Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 35

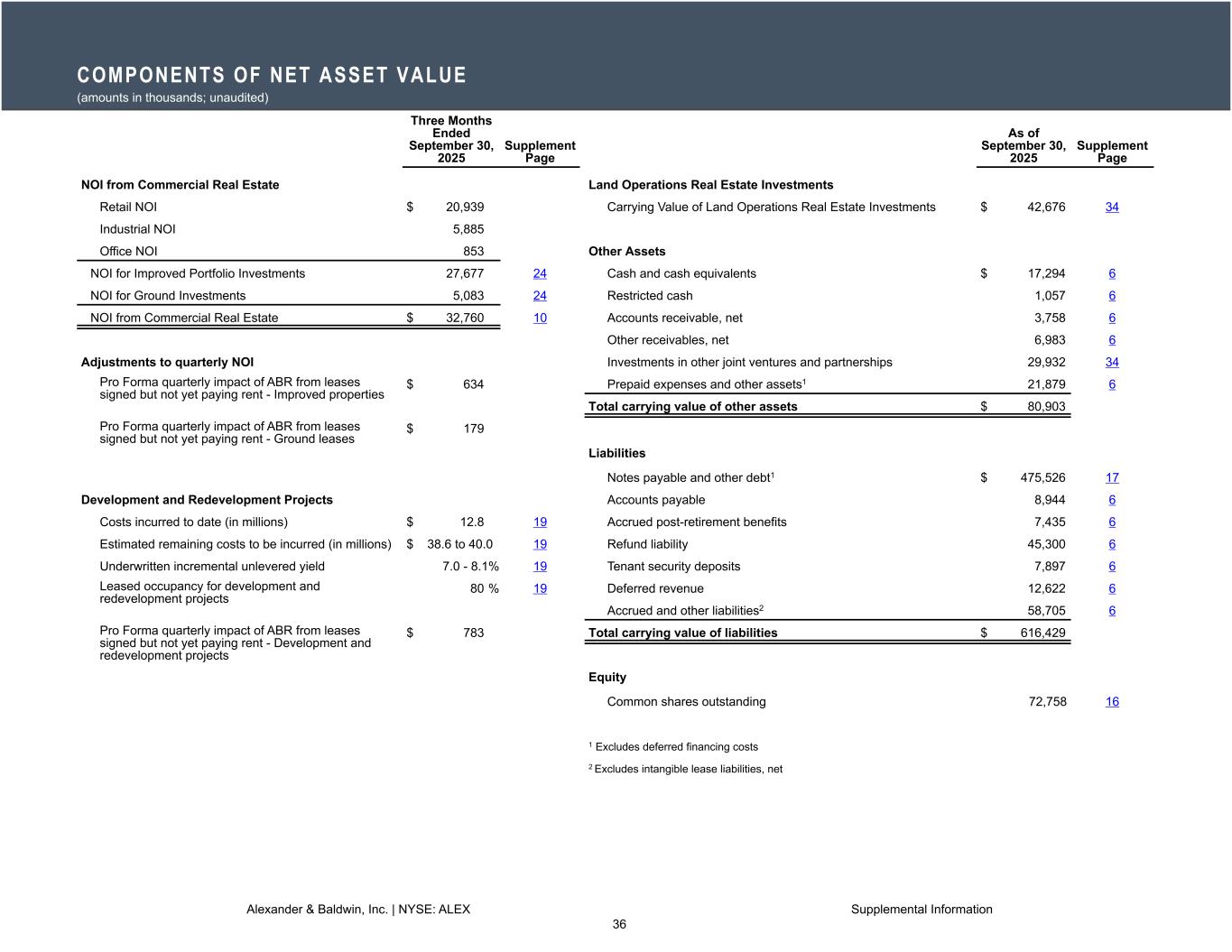

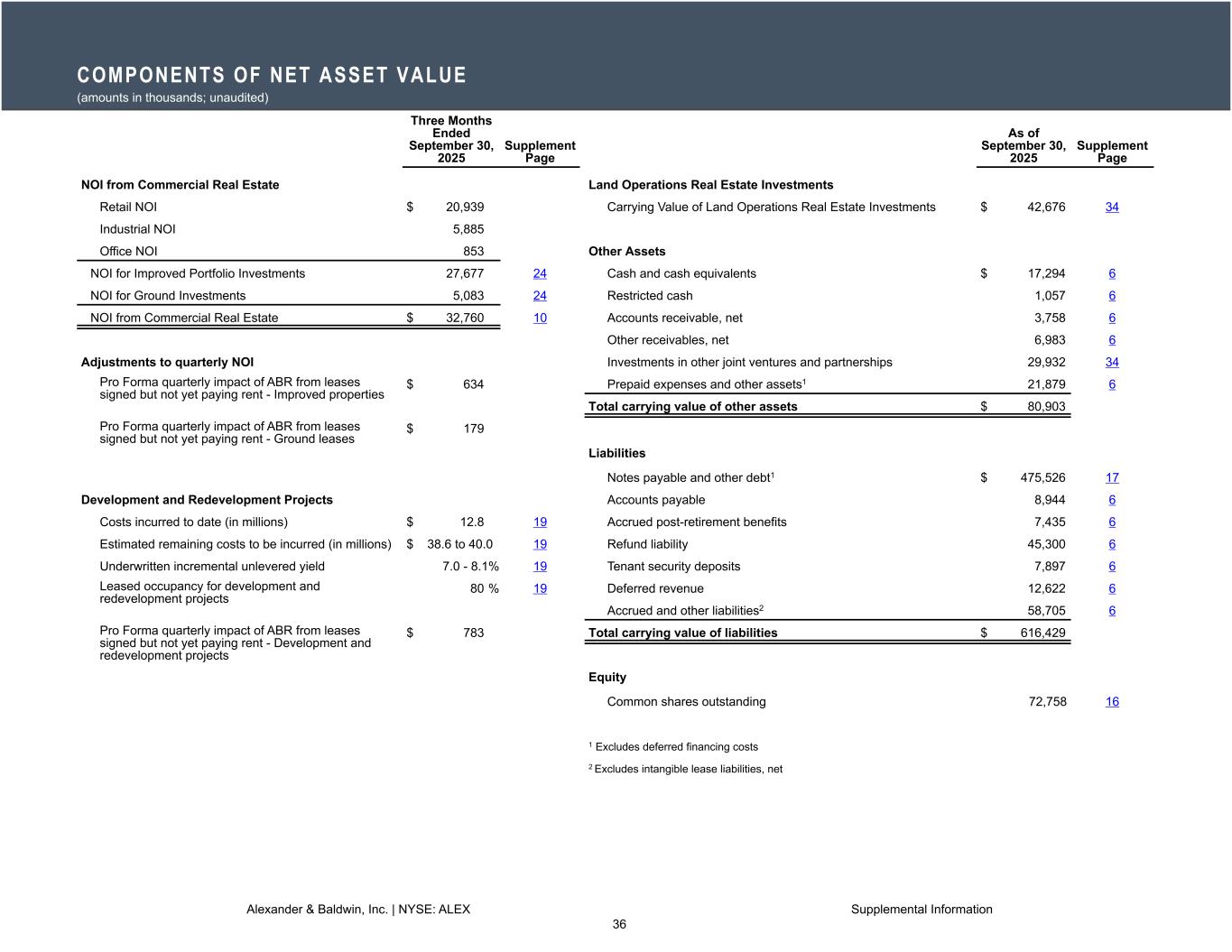

COMPONENTS OF NET ASSET VALUE (amounts in thousands; unaudited) Three Months Ended September 30, 2025 Supplement Page As of September 30, 2025 Supplement Page NOI from Commercial Real Estate Land Operations Real Estate Investments Retail NOI $ 20,939 Carrying Value of Land Operations Real Estate Investments $ 42,676 34 Industrial NOI 5,885 Office NOI 853 Other Assets NOI for Improved Portfolio Investments 27,677 24 Cash and cash equivalents $ 17,294 6 NOI for Ground Investments 5,083 24 Restricted cash 1,057 6 NOI from Commercial Real Estate $ 32,760 10 Accounts receivable, net 3,758 6 Other receivables, net 6,983 6 Adjustments to quarterly NOI Investments in other joint ventures and partnerships 29,932 34 Pro Forma quarterly impact of ABR from leases signed but not yet paying rent - Improved properties $ 634 Prepaid expenses and other assets1 21,879 6 Total carrying value of other assets $ 80,903 Pro Forma quarterly impact of ABR from leases signed but not yet paying rent - Ground leases $ 179 Liabilities Notes payable and other debt1 $ 475,526 17 Development and Redevelopment Projects Accounts payable 8,944 6 Costs incurred to date (in millions) $ 12.8 19 Accrued post-retirement benefits 7,435 6 Estimated remaining costs to be incurred (in millions) $ 38.6 to 40.0 19 Refund liability 45,300 6 Underwritten incremental unlevered yield 7.0 - 8.1% 19 Tenant security deposits 7,897 6 Leased occupancy for development and redevelopment projects 80 % 19 Deferred revenue 12,622 6 Accrued and other liabilities2 58,705 6 Pro Forma quarterly impact of ABR from leases signed but not yet paying rent - Development and redevelopment projects $ 783 Total carrying value of liabilities $ 616,429 Equity Common shares outstanding 72,758 16 1 Excludes deferred financing costs 2 Excludes intangible lease liabilities, net Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 36

GLOSSARY OF TERMS ABR Annualized Base Rent ("ABR") is the current month's contractual base rent multiplied by 12. Base rent is presented without consideration of percentage rent that may, in some cases, be significant. Capitalization Rate Estimated in-place NOI for the property divided by the property’s contractual purchase or sale price. Comparable Lease Comparable Leases are either renewals (executed for the same units) or new leases (executed for units that have been vacated in the previous 12 months) for comparable space and comparable lease terms. Expansions, contractions and strategic short-term renewals are excluded from the Comparable Lease pool. CRE Portfolio Composed of (1) retail, industrial and office improved properties subject to operating leases ("Improved Portfolio") and (2) assets subject to ground leases ("Ground Leases") within the CRE segment. Debt-service Coverage Ratio The ratio of Consolidated Adjusted EBITDA to the sum of debt service – which includes interest expense, principal payments for financing leases and term debt, as well as principal amortization of mortgage debt, but excludes balloon payments – for the trailing twelve months. EBITDA (or Consolidated Adjusted EBITDA) Earnings Before Interest, Taxes, Depreciation and Amortization ("EBITDA") is calculated on a consolidated basis ("Consolidated EBITDA") by adjusting the Company’s consolidated net income (loss) to exclude the impact of interest expense, income taxes and depreciation and amortization. EBITDA is calculated at the segment level ("Segment EBITDA" or "Land Operations EBITDA") by adjusting segment operating profit (which excludes interest expense and income taxes) to add back depreciation and amortization recorded at the respective segment. Consolidated Adjusted EBITDA is calculated by adjusting Consolidated EBITDA for items identified as non-recurring, infrequent or unusual that are not expected to recur in the Company’s core business. FFO Funds from operations (“FFO”) is a widely used supplemental non-GAAP financial measure of REITs' operating performance. FFO is computed in accordance with standards established by the National Association of Real Estate Investment Trusts (“Nareit”) and is calculated as follows: net income (loss) available to A&B common shareholders (calculated in accordance with GAAP), excluding (1) depreciation and amortization related to real estate, (2) gains and losses from the sale of certain real estate assets and selling profit or loss recognized on sales-type leases, (3) gains and losses from change in control, (4) impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity, and (5) income (loss) from discontinued operations related to legacy business operations. FFO related to CRE and Corporate is a supplemental non-GAAP measure that refines FFO to reflect the operating performance of the Company's commercial real estate business. FFO related to CRE and Corporate is calculated by adjusting FFO to exclude the operating performance of the Company’s Land Operations segment. The Company also provides a reconciliation from CRE Operating Profit to FFO related to CRE and Corporate by including corporate, interest, and income tax expenses attributable to its commercial real estate business, and by excluding gains or losses on and depreciation and amortization of CRE properties, as well as distributions to participating securities. Management believes that FFO related to CRE and Corporate provides an additional measure to compare the Company’s performance by excluding legacy items from the Land Operations segment. Adjusted FFO is calculated by excluding from FFO certain items not related to ongoing property operations including share-based compensation, straight-line lease adjustments and other non-cash adjustments, such as amortization of market lease adjustments, non-cash income related to sales-type leases, debt premium or discount and deferred financing cost amortization, maintenance capital expenditures, leasing commissions, provision for current expected credit losses and other non-comparable and non-operating items, including certain gains, losses, income, and expenses related to the Company’s legacy business operations and assets. The Company reconciles FFO, FFO related to CRE and Corporate and Adjusted FFO to the most directly-comparable GAAP measure, Net Income (Loss) available to A&B common shareholders. The Company's FFO, FFO related to CRE and Corporate and Adjusted FFO may not be comparable to such metrics reported by other REITs due to possible differences in the interpretation of the current Nareit definition used by such REITs. GAAP Generally accepted accounting principles in the United States of America. GLA Gross leasable area ("GLA") measured in square feet ("SF"). GLA is periodically adjusted based on remeasurement or reconfiguration of space and may change period over period for these remeasurements. Maintenance Capital Expenditures As it relates to CRE segment capital expenditures (i.e., capitalizable costs on a cash basis), normalized recurring expenditures necessary to maintain building value, the current income stream and position in the market. Such expenditures may include building/area improvements and tenant space improvements. Net Debt Net Debt is calculated by adjusting the Company's total debt to its notional amount (by excluding unamortized premium, discount and capitalized loan fees) and by subtracting cash and cash equivalents recorded in the Company's consolidated balance sheets. Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 37

NOI Net Operating Income ("NOI") represents total Commercial Real Estate contract-based operating revenue that is realizable (i.e., assuming collectability is deemed probable) less the direct property-related operating expenses paid or payable in cash. The calculation of NOI excludes the impact of depreciation and amortization (e.g., depreciation related to capitalized costs for improved properties, other capital expenditures for building/area improvements and tenant space improvements, as well as amortization of leasing commissions); straight-line lease adjustments; non- cash income related to sales-type leases; amortization of favorable/unfavorable lease assets/liabilities; lease termination income; interest and other income (expense), net; selling, general, administrative and other income and expenses (not directly associated with the property); and impairment of commercial real estate assets. Occupancy The Physical Occupancy percentage calculates the square footage leased and commenced (i.e., measured when the lessee has physical access to the space) as a percentage of total available improved property space at the end of the period reported. The Leased Occupancy percentage calculates the square footage leased (i.e., the space has been committed to by a lessee under a signed lease agreement) as a percentage of total available improved property square footage as of the end of the period reported. The Economic Occupancy percentage calculates the square footage under leases for which the lessee is contractually obligated to make lease-related payments (i.e., subsequent to the rent commencement date) to total available improved property square footage as of the end of the period reported. PSF Per square foot of GLA. Rent Spread Percentage change in ABR in the first year of a signed lease relative to the ABR in the last year of the prior lease. Same-Store The Company reports NOI and Occupancy on a Same-Store basis, which includes the results of properties that were owned, operated, and stabilized for the entirety of the prior calendar year and current reporting period, year-to-date. The Same-Store pool excludes properties under development, and properties acquired or sold during either of the comparable reporting periods. The Same-Store pool may also exclude properties that are fully or partially taken out of service for the purpose of redevelopment or repositioning. Management judgment is involved in the classification of properties for exclusion from the same-store pool when they are no longer considered stabilized due to redevelopment or other factors. Properties are moved into the Same-Store pool after one full calendar year of stabilized operation. Stabilization New developments and redevelopments are generally considered stabilized upon the initial attainment of 90% economic occupancy. Straight-line Rent Non-cash revenue related to a GAAP requirement to average tenant rents over the life of the lease, regardless of the actual cash collected in the reporting period. TTM Trailing twelve months. Year Built Year of most recent repositioning/redevelopment or year built if no repositioning/redevelopment has occurred. Alexander & Baldwin, Inc. | NYSE: ALEX Supplemental Information 38