Document

Exhibit 99.1

BANKUNITED, INC. REPORTS THIRD QUARTER 2023 RESULTS

Miami Lakes, Fla. — October 19, 2023 — BankUnited, Inc. (the “Company”) (NYSE: BKU) today announced financial results for the quarter ended September 30, 2023.

"This quarter we made significant progress on key strategic priorities. Margin, the funding mix, asset mix, capital and liquidity all improved, while continuing to prepare for a possible economic slowdown," said Rajinder Singh, Chairman, President and Chief Executive Officer.

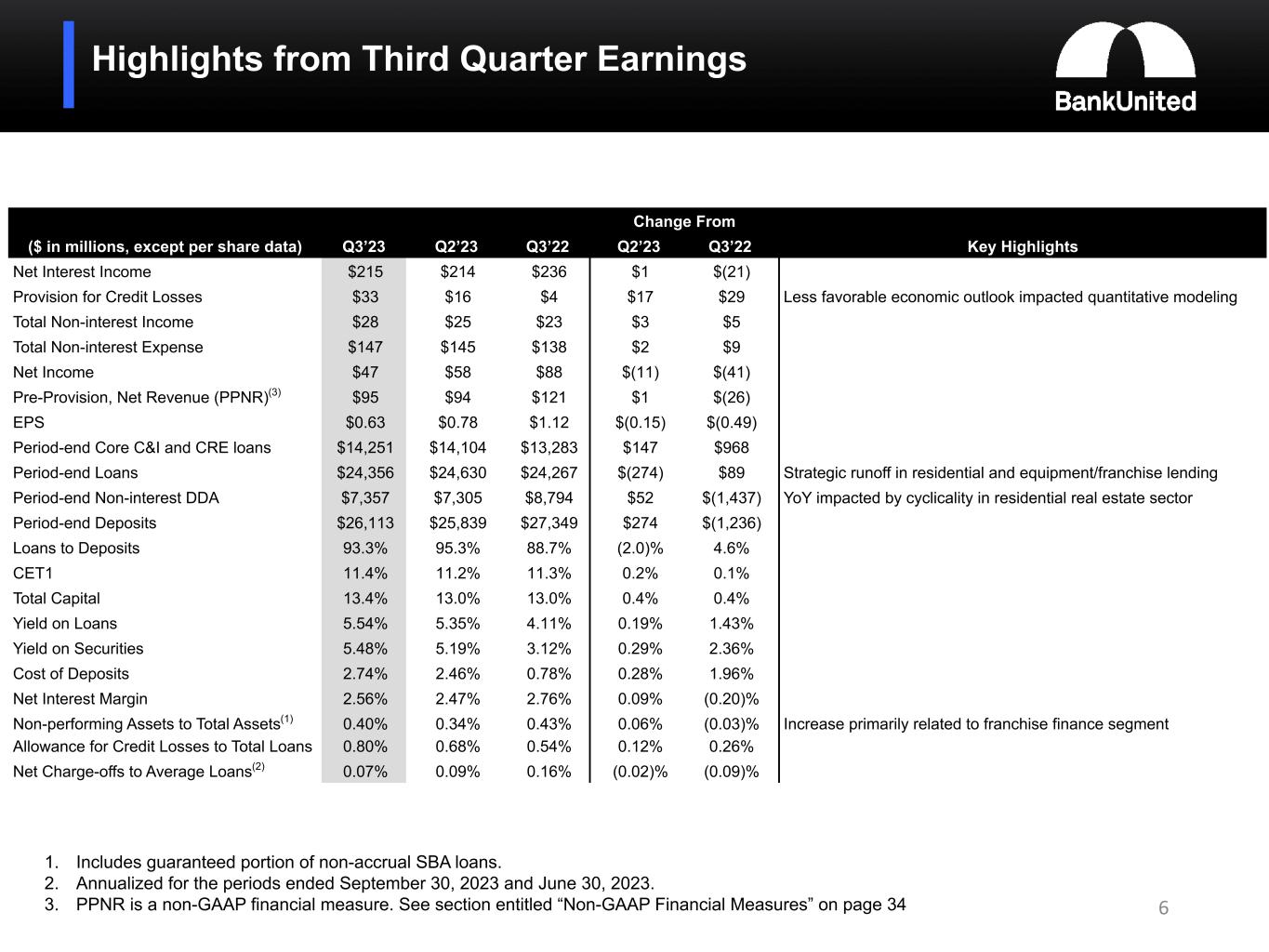

For the quarter ended September 30, 2023, the Company reported net income of $47.0 million, or $0.63 per diluted share, compared to $58.0 million, or $0.78 per diluted share for the immediately preceding quarter ended June 30, 2023 and $87.9 million, or $1.12 per diluted share, for the quarter ended September 30, 2022. Earnings for the quarter ended September 30, 2023 were impacted by an increase in the provision for credit losses, the most significant driver of which was the impact of a less favorable economic forecast, while annualized net charge-offs remained low at 0.07%. For the nine months ended September 30, 2023, the Company reported net income of $157.9 million or $2.11 per diluted share compared to $220.8 million or $2.71 per diluted share for the nine months ended September 30, 2022.

Quarterly Highlights

•We gained momentum executing on near-term strategic priorities this quarter:

◦The net interest margin, calculated on a tax-equivalent basis, expanded this quarter to 2.56% from 2.47% for the immediately preceding quarter.

◦Non-brokered deposits grew by $484 million for the quarter ended September 30, 2023. Total deposits grew by $274 million.

◦Non-interest bearing deposits grew by $52 million for the quarter, remaining consistent at 28% of total deposits at both September 30, 2023 and June 30, 2023.

◦Residential loans declined by $225 million and securities declined by $257 million for the quarter, while our core C&I and commercial real estate portfolios grew by a net $147 million.

◦FHLB advances declined by $810 million for the quarter, as consistent with our strategy to re-position the balance sheet, cash flows from the residential and securities portfolios were used to pay down wholesale funding.

◦The loans to deposits ratio declined to 93.3% at September 30, 2023, from 95.3% at June 30, 2023.

◦We have maintained ample liquidity. Total same day available liquidity was $14.4 billion, the available liquidity to uninsured, uncollateralized deposits ratio was 161% and an estimated 66% of our deposits were insured or collateralized at September 30, 2023.

◦Our capital position remains robust. At September 30, 2023, CET1 increased to 11.4% at the holding company and 13.2% at the Bank. Pro-forma CET1 at the holding company and the Bank, including accumulated other comprehensive income, were 9.8% and 11.5%, respectively at September 30, 2023.

•For the quarter ended September 30, 2023, the provision for credit losses was $33.0 million. The ratio of the ACL to total loans increased to 0.80%, at September 30, 2023 from 0.68% at June 30, 2023. The largest driver of the provision for credit losses and increase in the ACL for the quarter was a less favorable economic forecast.

•The annualized net charge-off ratio for the nine months ended September 30, 2023 was 0.07%. NPAs remained low, totaling $140.5 million at September 30, 2023 compared to $120.8 million at June 30, 2023. Most of the increase was in the franchise finance portfolio. The NPA ratio at September 30, 2023 was 0.40%, including 0.11% related to the guaranteed portion of non-performing SBA loans. At June 30, 2023 the NPA ratio was 0.34%, including 0.10% related to the guaranteed portion of non-performing SBA loans.

•Total loans declined by $274 million quarter-over-quarter. As expected, most of the decline was attributable to residential which was down by $225 million.

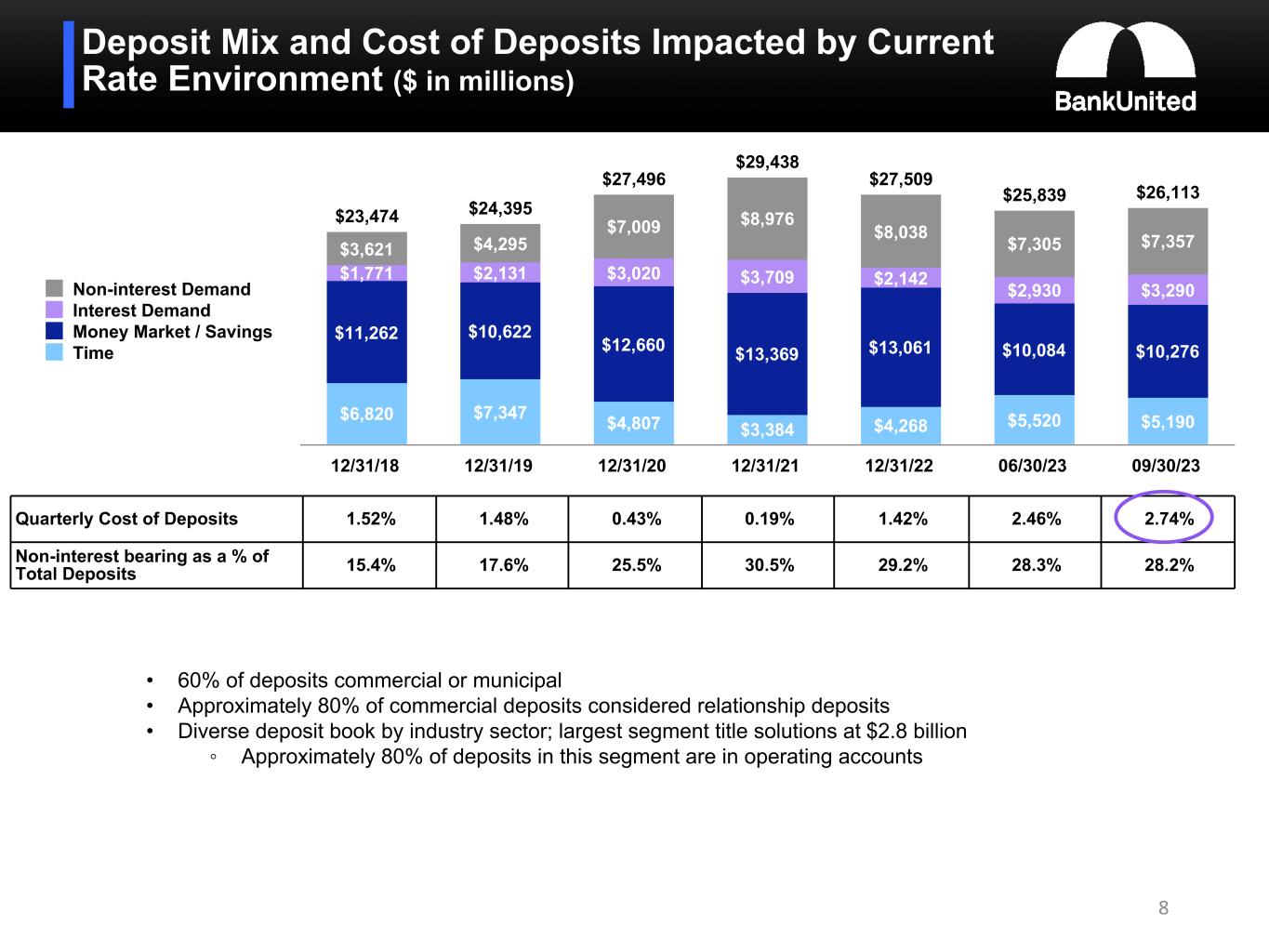

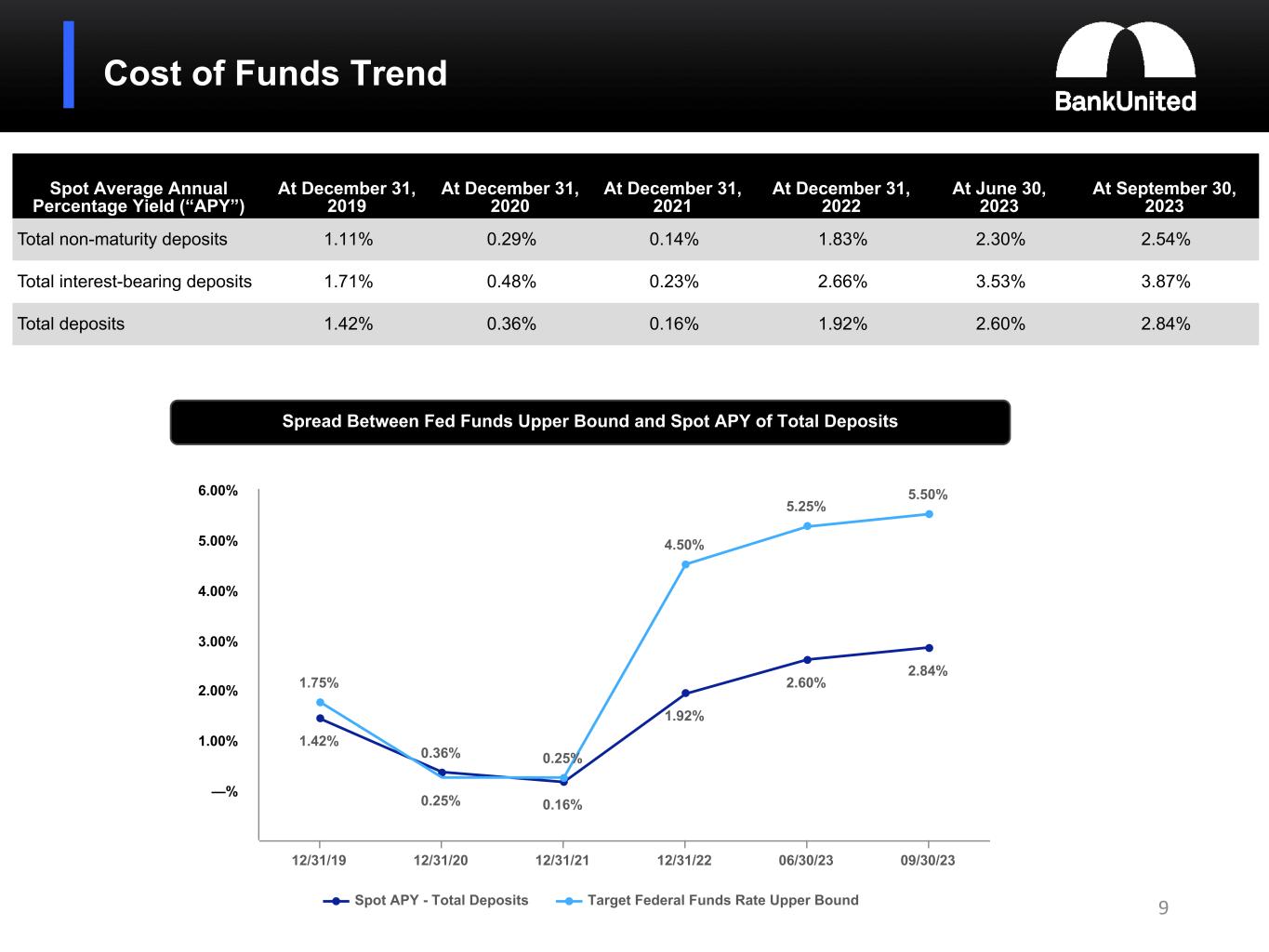

•Consistent with industry trends, rising interest rates and restrictive monetary policy contributed to an increase in the average cost of total deposits to 2.74% for the quarter ended September 30, 2023 from 2.46% for the immediately preceding quarter. This increase of 0.28% was smaller than the 0.41% increase in the cost of deposits for the quarter ended June 30, 2023, continuing the trend of a declining rate of increase in deposit costs. The yield on average interest earning assets increased to 5.52% for the quarter ended September 30, 2023 from 5.30% for the immediately preceding quarter.

•Commercial real estate exposure is modest. Commercial real estate loans totaled 23.5% of loans at September 30, 2023, representing 168% of the Bank's total risk based capital. At September 30, 2023, the weighted average LTV of the CRE portfolio was 55.8% and the weighted average DSCR was 1.80. 58% of the portfolio was secured by collateral properties located in Florida and 25% was secured by properties in the New York tri-state area.

•We remain committed to keeping the duration of our securities portfolio short; the duration of the available for sale securities portfolio was 2.02 at September 30, 2023. Held to maturity securities were not significant.

•Book value and tangible book value per common share were $33.92 and $32.88, respectively, at September 30, 2023, compared to $33.94 and $32.90, respectively at June 30, 2023.

•In October 2023, BankUnited was named #1 on the list of the healthiest 100 workplaces in America published by Healthiest Employers/Springbuk, highlighting our commitment to employee wellness initiatives and programs.

Deposits and Funding

Total deposits grew by $274 million during the quarter ended September 30, 2023. Non-interest bearing demand deposits grew by $52 million, interest-bearing non-maturity deposits grew by $552 million and time deposits declined by $330 million.

Consistent with the current interest rate environment and restrictive monetary policy, the cost of total deposits increased to 2.74% from 2.46% for the immediately preceding quarter, while the cost of interest bearing deposits increased to 3.76% for the quarter ended September 30, 2023 from 3.39% for the preceding quarter.

FHLB advances declined by $810 million for the quarter, as we used cash flows from the residential and securities portfolios to reduce wholesale funding levels and allow for future re-deployment of capital into higher yielding assets.

Loans

A comparison of loan portfolio composition at the dates indicated follows (dollars in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2023 |

|

June 30, 2023 |

|

|

|

December 31, 2022 |

| Residential |

$ |

8,380,568 |

|

|

34.4 |

% |

|

$ |

8,605,838 |

|

|

34.9 |

% |

|

|

|

|

|

$ |

8,900,714 |

|

|

35.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-owner occupied commercial real estate |

5,296,784 |

|

|

21.7 |

% |

|

5,302,523 |

|

|

21.5 |

% |

|

|

|

|

|

5,405,597 |

|

|

21.7 |

% |

| Construction and land |

445,273 |

|

|

1.8 |

% |

|

393,464 |

|

|

1.6 |

% |

|

|

|

|

|

294,360 |

|

|

1.2 |

% |

| Owner occupied commercial real estate |

1,851,246 |

|

|

7.6 |

% |

|

1,832,586 |

|

|

7.4 |

% |

|

|

|

|

|

1,890,813 |

|

|

7.6 |

% |

| Commercial and industrial |

6,658,010 |

|

|

27.4 |

% |

|

6,575,368 |

|

|

26.8 |

% |

|

|

|

|

|

6,417,721 |

|

|

25.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pinnacle - municipal finance |

900,199 |

|

|

3.7 |

% |

|

951,529 |

|

|

3.9 |

% |

|

|

|

|

|

912,122 |

|

|

3.7 |

% |

| Franchise finance |

196,745 |

|

|

0.8 |

% |

|

207,783 |

|

|

0.8 |

% |

|

|

|

|

|

253,774 |

|

|

1.0 |

% |

| Equipment finance |

219,874 |

|

|

0.9 |

% |

|

237,816 |

|

|

1.0 |

% |

|

|

|

|

|

286,147 |

|

|

1.1 |

% |

| Mortgage warehouse lending ("MWL") |

407,577 |

|

|

1.7 |

% |

|

523,083 |

|

|

2.1 |

% |

|

|

|

|

|

524,740 |

|

|

2.1 |

% |

|

$ |

24,356,276 |

|

|

100.0 |

% |

|

$ |

24,629,990 |

|

|

100.0 |

% |

|

|

|

|

|

$ |

24,885,988 |

|

|

100.0 |

% |

Consistent with our balance sheet strategy, for the quarter ended September 30, 2023, residential loans declined by $225 million while C&I grew by $101 million and CRE grew by $46 million. Franchise and equipment finance declined by $29 million in aggregate, MWL declined by $116 million, primarily due to low levels of activity in the residential real estate sector, and municipal finance declined by $51 million. As we continue to emphasize high quality relationship based lending, we chose to exit approximately $297 million of commercial loans during the quarter due to lower profitability, the lack of deposit relationships or, in some cases, to take advantage of opportunities to reduce criticized and classified assets.

Asset Quality and the Allowance for Credit Losses ("ACL")

The following table presents the ACL and related ACL coverage ratios at the dates indicated and net charge-off rates for the periods ended September 30, 2023, June 30, 2023 and December 31, 2022 (dollars in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ACL |

|

ACL to Total Loans |

|

ACL to Non-Performing Loans |

|

Net Charge-offs to Average Loans (1) |

| December 31, 2022 |

$ |

147,946 |

|

|

0.59 |

% |

|

140.88 |

% |

|

0.22 |

% |

| June 30, 2023 |

$ |

166,833 |

|

|

0.68 |

% |

|

140.52 |

% |

|

0.09 |

% |

| September 30, 2023 |

$ |

196,063 |

|

|

0.80 |

% |

|

143.22 |

% |

|

0.07 |

% |

(1) Annualized for the six months ended June 30, 2023 and the nine months ended September 30, 2023.

The ACL at September 30, 2023 represents management's estimate of lifetime expected credit losses given an assessment of historical data, current conditions, and a reasonable and supportable economic forecast as of the balance sheet date. For the quarter ended September 30, 2023, the provision for credit losses was $33.0 million, including $30.9 million related to funded loans. The most significant factor impacting the provision for credit losses and increase in the ACL for the quarter ended September 30, 2023 was the impact on quantitative modeling of a less favorable economic forecast. Changes in portfolio composition as well as risk rating migration and increases in certain specific reserves also had an impact.

The following table summarizes the activity in the ACL for the periods indicated (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

Nine Months Ended |

| |

September 30, 2023 |

|

June 30, 2023 |

|

September 30, 2022 |

|

|

|

|

|

September 30, 2023 |

|

September 30, 2022 |

| Beginning balance |

$ |

166,833 |

|

|

$ |

158,792 |

|

|

$ |

130,239 |

|

|

|

|

|

|

$ |

147,946 |

|

|

$ |

126,457 |

|

| Impact of adoption of new accounting pronouncement (ASU 2022-02) |

N/A |

|

N/A |

|

N/A |

|

|

|

|

|

(1,794) |

|

|

N/A |

| Balance after impact of adoption of new accounting pronouncement (ASU 2022-02) |

166,833 |

|

|

158,792 |

|

|

130,239 |

|

|

|

|

|

|

146,152 |

|

|

126,457 |

|

| Provision |

30,877 |

|

|

14,195 |

|

|

2,753 |

|

|

|

|

|

|

62,667 |

|

|

33,406 |

|

| Net charge-offs |

(1,647) |

|

|

(6,154) |

|

|

(2,321) |

|

|

|

|

|

|

(12,756) |

|

|

(29,192) |

|

| Ending balance |

$ |

196,063 |

|

|

$ |

166,833 |

|

|

$ |

130,671 |

|

|

|

|

|

|

$ |

196,063 |

|

|

$ |

130,671 |

|

Non-performing loans totaled $136.9 million or 0.56% of total loans at September 30, 2023, compared to $118.7 million or 0.48% of total loans at June 30, 2023. Non-performing loans included $37.8 million and $35.9 million of the guaranteed portion of SBA loans on non-accrual status, representing 0.16% and 0.15% of total loans at September 30, 2023 and June 30, 2023, respectively.

The following table presents criticized and classified commercial loans at the dates indicated (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2023 |

|

June 30, 2023 |

|

December 31, 2022 |

|

|

|

|

| Special mention |

$ |

341,999 |

|

|

$ |

233,004 |

|

|

$ |

51,433 |

|

|

|

|

|

| Substandard - accruing |

534,336 |

|

|

525,643 |

|

|

605,965 |

|

|

|

|

|

| Substandard - non-accruing |

96,248 |

|

|

80,642 |

|

|

75,125 |

|

|

|

|

|

| Doubtful |

19,344 |

|

|

14,954 |

|

|

7,990 |

|

|

|

|

|

| Total |

$ |

991,927 |

|

|

$ |

854,243 |

|

|

$ |

740,513 |

|

|

|

|

|

Net Interest Income

Net interest income for the quarter ended September 30, 2023 was $214.8 million, compared to $213.9 million for the immediately preceding quarter ended June 30, 2023 and $235.8 million for the quarter ended September 30, 2022. Interest income increased by $7.1 million for the quarter ended September 30, 2023 compared to the immediately preceding quarter while interest expense increased by $6.2 million.

The Company’s net interest margin, calculated on a tax-equivalent basis, increased by 0.09% to 2.56% for the quarter ended September 30, 2023, from 2.47% for the immediately preceding quarter ended June 30, 2023. Factors impacting the net interest margin for the quarter ended September 30, 2023 were:

•The tax-equivalent yield on loans increased to 5.54% for the quarter ended September 30, 2023, from 5.35% for the quarter ended June 30, 2023. The resetting of variable rate loans to higher coupon rates, paydown of lower rate residential loans and origination of new loans at higher rates contributed to the increase.

•The tax-equivalent yield on investment securities increased to 5.48% for the quarter ended September 30, 2023, from 5.19% for the quarter ended June 30, 2023. This increase resulted primarily from the reset of coupon rates on variable rate securities.

•The average cost of interest bearing deposits increased to 3.76% for the quarter ended September 30, 2023 from 3.39% for the quarter ended June 30, 2023, in response to the interest rate environment.

•The average rate paid on FHLB advances decreased to 4.57% for the quarter ended September 30, 2023, from 4.59% for the quarter ended June 30, 2023, primarily due to repayment of higher rate advances.

•The reduction in the proportion of total funding comprised of more expensive wholesale funding also contributed to the increase in the net interest margin.

Earnings Conference Call and Presentation

A conference call to discuss quarterly results will be held at 9:00 a.m. ET on Thursday, October 19, 2023 with Chairman, President and Chief Executive Officer, Rajinder P. Singh, Chief Financial Officer, Leslie N. Lunak and Chief Operating Officer, Thomas M. Cornish.

The earnings release and slides with supplemental information relating to the release will be available on the Investor Relations page under About Us on www.bankunited.com prior to the call. Due to recent demand for conference call services, participants are encouraged to listen to the call via a live Internet webcast at https://ir.bankunited.com. To participate by telephone, participants will receive dial-in information and a unique PIN number upon completion of registration at https://register.vevent.com/register/BI8dd0dafa7e284086a3d06fd4752fdebf. For those unable to join the live event, an archived webcast will be available in the Investor Relations page at https://ir.bankunited.com approximately two hours following the live webcast.

About BankUnited, Inc.

BankUnited, Inc., with total assets of $35.4 billion at September 30, 2023, is the bank holding company of BankUnited, N.A., a national bank headquartered in Miami Lakes, Florida that provides a full range of banking and related services to individual and corporate customers through banking centers located in the state of Florida, the New York metropolitan area and Dallas, Texas, and a comprehensive suite of wholesale products to customers through an Atlanta office focused on the Southeast region. BankUnited also offers certain commercial lending and deposit products through national platforms. For additional information, call (877) 779-2265 or visit www.BankUnited.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect the Company’s current views with respect to, among other things, future events and financial performance.

The Company generally identifies forward-looking statements by terminology such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “could,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” "forecasts" or the negative version of those words or other comparable words. Any forward-looking statements contained in this press release are based on the historical performance of the Company and its subsidiaries or on the Company’s current plans, estimates and expectations. The inclusion of this forward-looking information should not be regarded as a representation by the Company that the future plans, estimates or expectations contemplated by the Company will be achieved. Such forward-looking statements are subject to various risks and uncertainties and assumptions, including (without limitation) those relating to the Company’s operations, financial results, financial condition, business prospects, growth strategy and liquidity, including as impacted by external circumstances outside the Company's direct control, such as but not limited to adverse events or conditions impacting the financial services industry. If one or more of these or other risks or uncertainties materialize, or if the Company’s underlying assumptions prove to be incorrect, the Company’s actual results may vary materially from those indicated in these statements. These factors should not be construed as exhaustive. The Company does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. A number of important factors could cause actual results to differ materially from those indicated by the forward-looking statements. Information on these factors can be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K, which are available at the SEC’s website (www.sec.gov).

Contact

BankUnited, Inc.

Investor Relations:

Leslie N. Lunak, 786-313-1698

llunak@bankunited.com

Source: BankUnited, Inc.

BANKUNITED, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS - UNAUDITED

(In thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

2023 |

|

June 30,

2023 |

|

December 31,

2022 |

| ASSETS |

|

|

|

|

|

| Cash and due from banks: |

|

|

|

|

|

| Non-interest bearing |

$ |

12,391 |

|

|

$ |

18,355 |

|

|

$ |

16,068 |

|

| Interest bearing |

379,494 |

|

|

282,814 |

|

|

556,579 |

|

| Cash and cash equivalents |

391,885 |

|

|

301,169 |

|

|

572,647 |

|

Investment securities (including securities reported at fair value of $8,876,484, $9,133,937 and $9,745,327) |

8,886,484 |

|

|

9,143,937 |

|

|

9,755,327 |

|

| Non-marketable equity securities |

312,159 |

|

|

317,759 |

|

|

294,172 |

|

|

|

|

|

|

|

| Loans |

24,356,276 |

|

|

24,629,990 |

|

|

24,885,988 |

|

| Allowance for credit losses |

(196,063) |

|

|

(166,833) |

|

|

(147,946) |

|

| Loans, net |

24,160,213 |

|

|

24,463,157 |

|

|

24,738,042 |

|

| Bank owned life insurance |

319,808 |

|

|

318,935 |

|

|

308,212 |

|

| Operating lease equipment, net |

460,146 |

|

|

514,734 |

|

|

539,799 |

|

|

|

|

|

|

|

| Goodwill |

77,637 |

|

|

77,637 |

|

|

77,637 |

|

| Other assets |

781,332 |

|

|

734,151 |

|

|

740,876 |

|

| Total assets |

$ |

35,389,664 |

|

|

$ |

35,871,479 |

|

|

$ |

37,026,712 |

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

| Liabilities: |

|

|

|

|

|

| Demand deposits: |

|

|

|

|

|

| Non-interest bearing |

$ |

7,356,523 |

|

|

$ |

7,304,735 |

|

|

$ |

8,037,848 |

|

| Interest bearing |

3,290,391 |

|

|

2,929,870 |

|

|

2,142,067 |

|

| Savings and money market |

10,276,071 |

|

|

10,084,276 |

|

|

13,061,341 |

|

| Time |

5,189,681 |

|

|

5,519,771 |

|

|

4,268,078 |

|

| Total deposits |

26,112,666 |

|

|

25,838,652 |

|

|

27,509,334 |

|

| Federal funds purchased |

— |

|

|

— |

|

|

190,000 |

|

| FHLB advances |

5,165,000 |

|

|

5,975,000 |

|

|

5,420,000 |

|

| Notes and other borrowings |

715,197 |

|

|

715,302 |

|

|

720,923 |

|

| Other liabilities |

872,731 |

|

|

816,215 |

|

|

750,474 |

|

| Total liabilities |

32,865,594 |

|

|

33,345,169 |

|

|

34,590,731 |

|

|

|

|

|

|

|

| Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

| Stockholders' equity: |

|

|

|

|

|

Common stock, par value $0.01 per share, 400,000,000 shares authorized; 74,413,059, 74,429,948 and 75,674,587 shares issued and outstanding |

744 |

|

|

744 |

|

|

757 |

|

| Paid-in capital |

279,672 |

|

|

274,202 |

|

|

321,729 |

|

| Retained earnings |

2,650,850 |

|

|

2,623,926 |

|

|

2,551,400 |

|

| Accumulated other comprehensive loss |

(407,196) |

|

|

(372,562) |

|

|

(437,905) |

|

| Total stockholders' equity |

2,524,070 |

|

|

2,526,310 |

|

|

2,435,981 |

|

| Total liabilities and stockholders' equity |

$ |

35,389,664 |

|

|

$ |

35,871,479 |

|

|

$ |

37,026,712 |

|

BANKUNITED, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME - UNAUDITED

(In thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

| |

September 30, |

|

June 30, |

|

September 30, |

|

September 30, |

|

September 30, |

|

|

|

|

| |

2023 |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

|

| Interest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans |

$ |

337,014 |

|

|

$ |

326,153 |

|

|

$ |

244,884 |

|

|

$ |

971,962 |

|

|

$ |

645,669 |

|

|

|

|

|

| Investment securities |

122,857 |

|

|

120,604 |

|

|

77,109 |

|

|

362,219 |

|

|

174,928 |

|

|

|

|

|

| Other |

10,668 |

|

|

16,664 |

|

|

4,031 |

|

|

40,195 |

|

|

8,364 |

|

|

|

|

|

| Total interest income |

470,539 |

|

|

463,421 |

|

|

326,024 |

|

|

1,374,376 |

|

|

828,961 |

|

|

|

|

|

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits |

176,974 |

|

|

156,868 |

|

|

53,206 |

|

|

467,472 |

|

|

85,569 |

|

|

|

|

|

| Borrowings |

78,723 |

|

|

92,675 |

|

|

36,982 |

|

|

250,310 |

|

|

73,498 |

|

|

|

|

|

| Total interest expense |

255,697 |

|

|

249,543 |

|

|

90,188 |

|

|

717,782 |

|

|

159,067 |

|

|

|

|

|

| Net interest income before provision for credit losses |

214,842 |

|

|

213,878 |

|

|

235,836 |

|

|

656,594 |

|

|

669,894 |

|

|

|

|

|

| Provision for credit losses |

33,049 |

|

|

15,517 |

|

|

3,720 |

|

|

68,354 |

|

|

35,546 |

|

|

|

|

|

| Net interest income after provision for credit losses |

181,793 |

|

|

198,361 |

|

|

232,116 |

|

|

588,240 |

|

|

634,348 |

|

|

|

|

|

| Non-interest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposit service charges and fees |

5,402 |

|

|

5,349 |

|

|

6,064 |

|

|

16,296 |

|

|

17,920 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gain (loss) on investment securities, net |

887 |

|

|

993 |

|

|

135 |

|

|

(10,669) |

|

|

(16,125) |

|

|

|

|

|

| Lease financing |

16,531 |

|

|

12,519 |

|

|

13,180 |

|

|

42,159 |

|

|

39,958 |

|

|

|

|

|

| Other non-interest income |

4,904 |

|

|

6,626 |

|

|

3,693 |

|

|

21,960 |

|

|

9,070 |

|

|

|

|

|

| Total non-interest income |

27,724 |

|

|

25,487 |

|

|

23,072 |

|

|

69,746 |

|

|

50,823 |

|

|

|

|

|

| Non-interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Employee compensation and benefits |

68,825 |

|

|

67,414 |

|

|

66,097 |

|

|

207,290 |

|

|

195,646 |

|

|

|

|

|

| Occupancy and equipment |

10,890 |

|

|

11,043 |

|

|

11,719 |

|

|

32,735 |

|

|

34,630 |

|

|

|

|

|

| Deposit insurance expense |

7,790 |

|

|

7,597 |

|

|

4,398 |

|

|

23,294 |

|

|

11,794 |

|

|

|

|

|

| Professional fees |

2,696 |

|

|

3,518 |

|

|

3,184 |

|

|

9,132 |

|

|

8,702 |

|

|

|

|

|

| Technology |

19,193 |

|

|

20,437 |

|

|

19,813 |

|

|

61,356 |

|

|

54,715 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation of operating lease equipment |

11,217 |

|

|

11,232 |

|

|

12,646 |

|

|

33,970 |

|

|

37,841 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other non-interest expense |

26,479 |

|

|

23,977 |

|

|

20,248 |

|

|

77,311 |

|

|

48,503 |

|

|

|

|

|

| Total non-interest expense |

147,090 |

|

|

145,218 |

|

|

138,105 |

|

|

445,088 |

|

|

391,831 |

|

|

|

|

|

| Income before income taxes |

62,427 |

|

|

78,630 |

|

|

117,083 |

|

|

212,898 |

|

|

293,340 |

|

|

|

|

|

| Provision for income taxes |

15,446 |

|

|

20,634 |

|

|

29,233 |

|

|

55,039 |

|

|

72,576 |

|

|

|

|

|

| Net income |

$ |

46,981 |

|

|

$ |

57,996 |

|

|

$ |

87,850 |

|

|

$ |

157,859 |

|

|

$ |

220,764 |

|

|

|

|

|

| Earnings per common share, basic |

$ |

0.63 |

|

|

$ |

0.78 |

|

|

$ |

1.13 |

|

|

$ |

2.12 |

|

|

$ |

2.73 |

|

|

|

|

|

| Earnings per common share, diluted |

$ |

0.63 |

|

|

$ |

0.78 |

|

|

$ |

1.12 |

|

|

$ |

2.11 |

|

|

$ |

2.71 |

|

|

|

|

|

BANKUNITED, INC. AND SUBSIDIARIES

AVERAGE BALANCES AND YIELDS

(Dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Three Months Ended June 30, |

|

Three Months Ended September 30, |

|

2023 |

|

2023 |

|

2022 |

|

Average

Balance |

|

Interest (1) |

|

Yield/

Rate (1)(2)

|

|

Average

Balance |

|

Interest (1) |

|

Yield/

Rate (1)(2)

|

|

Average

Balance |

|

Interest (1) |

|

Yield/

Rate (1)(2)

|

| Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans |

$ |

24,417,433 |

|

|

$ |

340,357 |

|

|

5.54 |

% |

|

$ |

24,680,919 |

|

|

$ |

329,494 |

|

|

5.35 |

% |

|

$ |

24,053,742 |

|

|

$ |

248,168 |

|

|

4.11 |

% |

Investment securities (3) |

9,034,116 |

|

|

123,794 |

|

|

5.48 |

% |

|

9,369,019 |

|

|

121,520 |

|

|

5.19 |

% |

|

9,981,486 |

|

|

77,840 |

|

|

3.12 |

% |

| Other interest earning assets |

785,146 |

|

|

10,668 |

|

|

5.39 |

% |

|

1,323,025 |

|

|

16,664 |

|

|

5.05 |

% |

|

596,879 |

|

|

4,031 |

|

|

2.68 |

% |

| Total interest earning assets |

34,236,695 |

|

|

474,819 |

|

|

5.52 |

% |

|

35,372,963 |

|

|

467,678 |

|

|

5.30 |

% |

|

34,632,107 |

|

|

330,039 |

|

|

3.80 |

% |

| Allowance for credit losses |

(173,407) |

|

|

|

|

|

|

(162,463) |

|

|

|

|

|

|

(133,828) |

|

|

|

|

|

| Non-interest earning assets |

1,747,310 |

|

|

|

|

|

|

1,744,693 |

|

|

|

|

|

|

1,703,371 |

|

|

|

|

|

| Total assets |

$ |

35,810,598 |

|

|

|

|

|

|

$ |

36,955,193 |

|

|

|

|

|

|

$ |

36,201,650 |

|

|

|

|

|

| Liabilities and Stockholders' Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest bearing demand deposits |

$ |

3,038,870 |

|

|

$ |

25,491 |

|

|

3.33 |

% |

|

$ |

2,772,839 |

|

|

$ |

18,417 |

|

|

2.66 |

% |

|

$ |

2,306,906 |

|

|

$ |

4,104 |

|

|

0.71 |

% |

| Savings and money market deposits |

10,205,765 |

|

|

97,956 |

|

|

3.81 |

% |

|

10,285,494 |

|

|

88,892 |

|

|

3.47 |

% |

|

13,001,566 |

|

|

39,838 |

|

|

1.22 |

% |

| Time deposits |

5,420,522 |

|

|

53,527 |

|

|

3.92 |

% |

|

5,494,631 |

|

|

49,559 |

|

|

3.62 |

% |

|

3,255,869 |

|

|

9,264 |

|

|

1.13 |

% |

| Total interest bearing deposits |

18,665,157 |

|

|

176,974 |

|

|

3.76 |

% |

|

18,552,964 |

|

|

156,868 |

|

|

3.39 |

% |

|

18,564,341 |

|

|

53,206 |

|

|

1.14 |

% |

| Federal funds purchased |

— |

|

|

— |

|

|

— |

% |

|

— |

|

|

— |

|

|

— |

% |

|

153,905 |

|

|

833 |

|

|

2.12 |

% |

| FHLB advances |

6,040,870 |

|

|

69,525 |

|

|

4.57 |

% |

|

7,288,187 |

|

|

83,429 |

|

|

4.59 |

% |

|

4,739,457 |

|

|

26,890 |

|

|

2.25 |

% |

| Notes and other borrowings |

715,307 |

|

|

9,198 |

|

|

5.14 |

% |

|

719,368 |

|

|

9,246 |

|

|

5.14 |

% |

|

721,164 |

|

|

9,259 |

|

|

5.14 |

% |

| Total interest bearing liabilities |

25,421,334 |

|

|

255,697 |

|

|

3.99 |

% |

|

26,560,519 |

|

|

249,543 |

|

|

3.77 |

% |

|

24,178,867 |

|

|

90,188 |

|

|

1.48 |

% |

| Non-interest bearing demand deposits |

6,937,537 |

|

|

|

|

|

|

7,067,053 |

|

|

|

|

|

|

8,749,794 |

|

|

|

|

|

| Other non-interest bearing liabilities |

868,178 |

|

|

|

|

|

|

798,279 |

|

|

|

|

|

|

697,440 |

|

|

|

|

|

| Total liabilities |

33,227,049 |

|

|

|

|

|

|

34,425,851 |

|

|

|

|

|

|

33,626,101 |

|

|

|

|

|

| Stockholders' equity |

2,583,549 |

|

|

|

|

|

|

2,529,342 |

|

|

|

|

|

|

2,575,549 |

|

|

|

|

|

| Total liabilities and stockholders' equity |

$ |

35,810,598 |

|

|

|

|

|

|

$ |

36,955,193 |

|

|

|

|

|

|

$ |

36,201,650 |

|

|

|

|

|

| Net interest income |

|

|

$ |

219,122 |

|

|

|

|

|

|

$ |

218,135 |

|

|

|

|

|

|

$ |

239,851 |

|

|

|

| Interest rate spread |

|

|

|

|

1.53 |

% |

|

|

|

|

|

1.53 |

% |

|

|

|

|

|

2.32 |

% |

| Net interest margin |

|

|

|

|

2.56 |

% |

|

|

|

|

|

2.47 |

% |

|

|

|

|

|

2.76 |

% |

(1) On a tax-equivalent basis where applicable

(2) Annualized

(3) At fair value except for securities held to maturity

BANKUNITED, INC. AND SUBSIDIARIES

AVERAGE BALANCES AND YIELDS

(Dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

| |

2023 |

|

|

|

2022 |

| |

Average

Balance |

|

Interest (1) |

|

Yield/

Rate (1)(2)

|

|

|

|

|

|

|

|

Average

Balance |

|

Interest (1) |

|

Yield/

Rate (1)(2)

|

| Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans |

$ |

24,606,425 |

|

|

$ |

981,976 |

|

|

5.33 |

% |

|

|

|

|

|

|

|

$ |

23,706,606 |

|

|

$ |

655,114 |

|

|

3.69 |

% |

Investment securities (3) |

9,356,211 |

|

|

364,980 |

|

|

5.20 |

% |

|

|

|

|

|

|

|

10,180,351 |

|

|

177,047 |

|

|

2.32 |

% |

| Other interest earning assets |

1,048,313 |

|

|

40,195 |

|

|

5.13 |

% |

|

|

|

|

|

|

|

663,189 |

|

|

8,364 |

|

|

1.69 |

% |

| Total interest earning assets |

35,010,949 |

|

|

1,387,151 |

|

|

5.29 |

% |

|

|

|

|

|

|

|

34,550,146 |

|

|

840,525 |

|

|

3.25 |

% |

| Allowance for credit losses |

(162,395) |

|

|

|

|

|

|

|

|

|

|

|

|

(130,258) |

|

|

|

|

|

| Non-interest earning assets |

1,761,500 |

|

|

|

|

|

|

|

|

|

|

|

|

1,682,618 |

|

|

|

|

|

| Total assets |

$ |

36,610,054 |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

36,102,506 |

|

|

|

|

|

| Liabilities and Stockholders' Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest bearing demand deposits |

$ |

2,728,287 |

|

|

$ |

54,781 |

|

|

2.68 |

% |

|

|

|

|

|

|

|

$ |

2,658,558 |

|

|

$ |

7,215 |

|

|

0.36 |

% |

| Savings and money market deposits |

10,844,838 |

|

|

278,243 |

|

|

3.43 |

% |

|

|

|

|

|

|

|

13,150,357 |

|

|

62,704 |

|

|

0.64 |

% |

| Time deposits |

5,150,486 |

|

|

134,448 |

|

|

3.49 |

% |

|

|

|

|

|

|

|

3,129,247 |

|

|

15,650 |

|

|

0.67 |

% |

| Total interest bearing deposits |

18,723,611 |

|

|

467,472 |

|

|

3.34 |

% |

|

|

|

|

|

|

|

18,938,162 |

|

|

85,569 |

|

|

0.60 |

% |

| Federal funds purchased |

47,334 |

|

|

1,611 |

|

|

4.54 |

% |

|

|

|

|

|

|

|

152,028 |

|

|

1,046 |

|

|

0.92 |

% |

| FHLB advances |

6,596,465 |

|

|

220,993 |

|

|

4.48 |

% |

|

|

|

|

|

|

|

3,796,484 |

|

|

44,680 |

|

|

1.57 |

% |

| Notes and other borrowings |

718,507 |

|

|

27,706 |

|

|

5.14 |

% |

|

|

|

|

|

|

|

721,283 |

|

|

27,772 |

|

|

5.13 |

% |

| Total interest bearing liabilities |

26,085,917 |

|

|

717,782 |

|

|

3.68 |

% |

|

|

|

|

|

|

|

23,607,957 |

|

|

159,067 |

|

|

0.90 |

% |

| Non-interest bearing demand deposits |

7,152,362 |

|

|

|

|

|

|

|

|

|

|

|

|

9,071,135 |

|

|

|

|

|

| Other non-interest bearing liabilities |

829,464 |

|

|

|

|

|

|

|

|

|

|

|

|

650,936 |

|

|

|

|

|

| Total liabilities |

34,067,743 |

|

|

|

|

|

|

|

|

|

|

|

|

33,330,028 |

|

|

|

|

|

| Stockholders' equity |

2,542,311 |

|

|

|

|

|

|

|

|

|

|

|

|

2,772,478 |

|

|

|

|

|

| Total liabilities and stockholders' equity |

$ |

36,610,054 |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

36,102,506 |

|

|

|

|

|

| Net interest income |

|

|

$ |

669,369 |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

681,458 |

|

|

|

| Interest rate spread |

|

|

|

|

1.61 |

% |

|

|

|

|

|

|

|

|

|

|

|

2.35 |

% |

| Net interest margin |

|

|

|

|

2.55 |

% |

|

|

|

|

|

|

|

|

|

|

|

2.63 |

% |

(1) On a tax-equivalent basis where applicable

(2) Annualized

(3) At fair value except for securities held to maturity

BANKUNITED, INC. AND SUBSIDIARIES

EARNINGS PER COMMON SHARE

(In thousands except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

| c |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

|

| Basic earnings per common share: |

|

|

|

|

|

|

|

|

|

|

|

| Numerator: |

|

|

|

|

|

|

|

|

|

|

|

| Net income |

$ |

46,981 |

|

|

$ |

87,850 |

|

|

$ |

157,859 |

|

|

$ |

220,764 |

|

|

|

|

|

Distributed and undistributed earnings allocated to participating securities |

(700) |

|

|

(1,343) |

|

|

(2,378) |

|

|

(3,258) |

|

|

|

|

|

| Income allocated to common stockholders for basic earnings per common share |

$ |

46,281 |

|

|

$ |

86,507 |

|

|

$ |

155,481 |

|

|

$ |

217,506 |

|

|

|

|

|

| Denominator: |

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding |

74,416,698 |

|

|

77,912,320 |

|

|

74,530,871 |

|

|

81,039,561 |

|

|

|

|

|

| Less average unvested stock awards |

(1,165,105) |

|

|

(1,221,971) |

|

|

(1,180,570) |

|

|

(1,230,396) |

|

|

|

|

|

| Weighted average shares for basic earnings per common share |

73,251,593 |

|

|

76,690,349 |

|

|

73,350,301 |

|

|

79,809,165 |

|

|

|

|

|

| Basic earnings per common share |

$ |

0.63 |

|

|

$ |

1.13 |

|

|

$ |

2.12 |

|

|

$ |

2.73 |

|

|

|

|

|

| Diluted earnings per common share: |

|

|

|

|

|

|

|

|

|

|

|

| Numerator: |

|

|

|

|

|

|

|

|

|

|

|

| Income allocated to common stockholders for basic earnings per common share |

$ |

46,281 |

|

|

$ |

86,507 |

|

|

$ |

155,481 |

|

|

$ |

217,506 |

|

|

|

|

|

Adjustment for earnings reallocated from participating securities |

3 |

|

|

6 |

|

|

8 |

|

|

9 |

|

|

|

|

|

| Income used in calculating diluted earnings per common share |

$ |

46,284 |

|

|

$ |

86,513 |

|

|

$ |

155,489 |

|

|

$ |

217,515 |

|

|

|

|

|

| Denominator: |

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares for basic earnings per common share |

73,251,593 |

|

|

76,690,349 |

|

|

73,350,301 |

|

|

79,809,165 |

|

|

|

|

|

| Dilutive effect of certain share-based awards |

537,230 |

|

|

433,472 |

|

|

388,372 |

|

|

308,608 |

|

|

|

|

|

Weighted average shares for diluted earnings per common share |

73,788,823 |

|

|

77,123,821 |

|

|

73,738,673 |

|

|

80,117,773 |

|

|

|

|

|

| Diluted earnings per common share |

$ |

0.63 |

|

|

$ |

1.12 |

|

|

$ |

2.11 |

|

|

$ |

2.71 |

|

|

|

|

|

BANKUNITED, INC. AND SUBSIDIARIES

SELECTED RATIOS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

At or for the Three Months Ended |

|

|

|

Nine Months Ended September 30, |

| |

September 30, 2023 |

|

June 30, 2023 |

|

September 30, 2022 |

|

|

|

|

|

2023 |

|

2022 |

Financial ratios (4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets |

0.52 |

% |

|

0.63 |

% |

|

0.96 |

% |

|

|

|

|

|

0.58 |

% |

|

0.82 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average stockholders’ equity |

7.2 |

% |

|

9.2 |

% |

|

13.5 |

% |

|

|

|

|

|

8.3 |

% |

|

10.6 |

% |

Net interest margin (3) |

2.56 |

% |

|

2.47 |

% |

|

2.76 |

% |

|

|

|

|

|

2.55 |

% |

|

2.63 |

% |

| Loans to deposits |

93.3 |

% |

|

95.3 |

% |

|

88.7 |

% |

|

|

|

|

|

|

|

|

| Tangible book value per common share |

$ |

32.88 |

|

|

$ |

32.90 |

|

|

$ |

30.97 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

September 30, 2023 |

|

June 30, 2023 |

|

December 31, 2022 |

|

|

|

|

|

|

| Asset quality ratios |

|

|

|

|

|

Non-performing loans to total loans (1)(5) |

0.56 |

% |

|

0.48 |

% |

|

0.42 |

% |

Non-performing assets to total assets (2)(5) |

0.40 |

% |

|

0.34 |

% |

|

0.29 |

% |

| Allowance for credit losses to total loans |

0.80 |

% |

|

0.68 |

% |

|

0.59 |

% |

Allowance for credit losses to non-performing loans (1)(5) |

143.22 |

% |

|

140.52 |

% |

|

140.88 |

% |

|

|

|

|

|

|

Net charge-offs to average loans (4) |

0.07 |

% |

|

0.09 |

% |

|

0.22 |

% |

(1) We define non-performing loans to include non-accrual loans and loans other than purchased credit deteriorated and government insured residential loans that are past due 90 days or more and still accruing. Contractually delinquent purchased credit deteriorated and government insured residential loans on which interest continues to be accrued are excluded from non-performing loans.

(2) Non-performing assets include non-performing loans, OREO and other repossessed assets.

(3) On a tax-equivalent basis.

(4) Annualized as applicable

(5) Non-performing loans and assets include the guaranteed portion of non-accrual SBA loans totaling $37.8 million or 0.16% of total loans and 0.11% of total assets at September 30, 2023, $35.9 million or 0.15% of total loans and 0.10% of total assets at June 30, 2023 and $40.3 million or 0.16% of total loans and 0.11% of total assets at December 31, 2022.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2023 |

|

June 30, 2023 |

|

December 31, 2022 |

|

Required to be Considered Well Capitalized |

|

BankUnited, Inc. |

|

BankUnited, N.A. |

|

BankUnited, Inc. |

|

BankUnited, N.A. |

|

BankUnited, Inc. |

|

BankUnited, N.A. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tier 1 leverage |

7.9 |

% |

|

9.1 |

% |

|

7.6 |

% |

|

8.8 |

% |

|

7.5 |

% |

|

8.4 |

% |

|

5.0 |

% |

| Common Equity Tier 1 ("CET1") risk-based capital |

11.4 |

% |

|

13.2 |

% |

|

11.2 |

% |

|

13.0 |

% |

|

11.0 |

% |

|

12.4 |

% |

|

6.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total risk-based capital |

13.4 |

% |

|

13.9 |

% |

|

13.0 |

% |

|

13.6 |

% |

|

12.7 |

% |

|

12.9 |

% |

|

10.0 |

% |

| Tangible Common Equity/Tangible Assets |

6.9 |

% |

|

N/A |

|

6.8 |

% |

|

N/A |

|

6.4 |

% |

|

N/A |

|

N/A |

Non-GAAP Financial Measures

Tangible book value per common share is a non-GAAP financial measure. Management believes this measure is relevant to understanding the capital position and performance of the Company. Disclosure of this non-GAAP financial measure also provides a meaningful basis for comparison to other financial institutions as it is a metric commonly used in the banking industry. The following table reconciles the non-GAAP financial measurement of tangible book value per common share to the comparable GAAP financial measurement of book value per common share at the dates indicated (in thousands except share and per share data):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2023 |

|

June 30, 2023 |

|

September 30, 2022 |

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

$ |

2,524,070 |

|

|

$ |

2,526,310 |

|

|

$ |

2,480,985 |

|

|

|

|

|

|

|

|

|

| Less: goodwill and other intangible assets |

77,637 |

|

|

77,637 |

|

|

77,637 |

|

|

|

|

|

|

|

|

|

| Tangible stockholders’ equity |

$ |

2,446,433 |

|

|

$ |

2,448,673 |

|

|

$ |

2,403,348 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common shares issued and outstanding |

74,413,059 |

|

|

74,429,948 |

|

|

77,599,408 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Book value per common share |

$ |

33.92 |

|

|

$ |

33.94 |

|

|

$ |

31.97 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tangible book value per common share |

$ |

32.88 |

|

|

$ |

32.90 |

|

|

$ |

30.97 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|