| Maryland | 000-54691 | 27-1106076 | ||||||||||||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

||||||||||||

|

11501 Northlake Drive

Cincinnati, Ohio

|

45249 | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||

(513) 554-1110 | ||

| (Registrant’s telephone number, including area code) | ||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common Stock $0.01 par value per share |

PECO | The Nasdaq Global Select Market | ||||||||||||

| Exhibit Number | Description of Exhibit | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File (formatted as inline XBRL) | |||||||

| PHILLIPS EDISON & COMPANY, INC. | ||||||||

| Dated: April 25, 2024 | By: | /s/ Jennifer L. Robison | ||||||

| Jennifer L. Robison | ||||||||

| Chief Accounting Officer and Senior Vice President (Principal Accounting Officer) |

||||||||

| (in thousands, except per share amounts) | Q1 YTD |

Updated Full Year

2024 Guidance

|

Previous Full Year

2024 Guidance

|

||||||||||||||

| Net income per share | $0.14 | $0.51 - $0.55 | $0.53 - $0.58 | ||||||||||||||

| Nareit FFO per share | $0.59 | $2.34 - $2.41 | $2.34 - $2.41 | ||||||||||||||

| Core FFO per share | $0.60 | $2.37 - $2.45 | $2.37 - $2.45 | ||||||||||||||

| Same-Center NOI growth | 3.7% | 3.25% - 4.25% | 3.25% - 4.25% | ||||||||||||||

| Portfolio Activity: | |||||||||||||||||

| Acquisitions, net | $55,902 | $200,000 - $300,000 | $200,000 - $300,000 | ||||||||||||||

| Other: | |||||||||||||||||

| Interest expense, net | $23,335 | $98,000 - $106,000 | $95,000 - $105,000 | ||||||||||||||

| G&A expense | $11,813 | $45,000 - $49,000 | $45,000 - $49,000 | ||||||||||||||

Non-cash revenue items(1) |

$3,785 | $14,500 - $18,500 | $14,500 - $18,500 | ||||||||||||||

| Adjustments for collectibility | $1,837 | $4,000 - 5,000 | $4,000 - 5,000 | ||||||||||||||

| (Unaudited) | Low End | High End | |||||||||

| Net income per share | $ | 0.51 | $ | 0.55 | |||||||

| Depreciation and amortization of real estate assets | 1.81 | 1.83 | |||||||||

| Gain on sale of real estate assets | — | — | |||||||||

| Adjustments related to unconsolidated joint ventures | 0.02 | 0.03 | |||||||||

| Nareit FFO per share | $ | 2.34 | $ | 2.41 | |||||||

| Depreciation and amortization of corporate assets | 0.01 | 0.01 | |||||||||

| Transaction costs and other | 0.02 | 0.03 | |||||||||

| Core FFO per share | $ | 2.37 | $ | 2.45 | |||||||

| March 31, 2024 | December 31, 2023 | ||||||||||

| ASSETS | |||||||||||

| Investment in real estate: | |||||||||||

| Land and improvements | $ | 1,789,539 | $ | 1,768,487 | |||||||

| Building and improvements | 3,860,003 | 3,818,184 | |||||||||

| In-place lease assets | 500,918 | 495,525 | |||||||||

| Above-market lease assets | 74,499 | 74,446 | |||||||||

| Total investment in real estate assets | 6,224,959 | 6,156,642 | |||||||||

| Accumulated depreciation and amortization | (1,598,743) | (1,540,551) | |||||||||

| Net investment in real estate assets | 4,626,216 | 4,616,091 | |||||||||

| Investment in unconsolidated joint ventures | 24,656 | 25,220 | |||||||||

| Total investment in real estate assets, net | 4,650,872 | 4,641,311 | |||||||||

| Cash and cash equivalents | 5,631 | 4,872 | |||||||||

| Restricted cash | 4,466 | 4,006 | |||||||||

| Goodwill | 29,066 | 29,066 | |||||||||

| Other assets, net | 196,474 | 186,411 | |||||||||

| Total assets | $ | 4,886,509 | $ | 4,865,666 | |||||||

| LIABILITIES AND EQUITY | |||||||||||

| Liabilities: | |||||||||||

| Debt obligations, net | $ | 2,015,554 | $ | 1,969,272 | |||||||

| Below-market lease liabilities, net | 110,774 | 108,223 | |||||||||

| Accounts payable and other liabilities | 102,162 | 116,461 | |||||||||

| Deferred income | 20,621 | 18,359 | |||||||||

| Total liabilities | 2,249,111 | 2,212,315 | |||||||||

| Equity: | |||||||||||

Preferred stock, $0.01 par value per share, 10,000 shares authorized, zero shares issued and outstanding at March 31, 2024 and December 31, 2023 |

— | — | |||||||||

Common stock, $0.01 par value per share, 1,000,000 shares authorized, 122,323 and 122,024 shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively |

1,223 | 1,220 | |||||||||

| Additional paid-in capital | 3,551,678 | 3,546,838 | |||||||||

| Accumulated other comprehensive income | 13,144 | 10,523 | |||||||||

| Accumulated deficit | (1,266,541) | (1,248,273) | |||||||||

| Total stockholders’ equity | 2,299,504 | 2,310,308 | |||||||||

| Noncontrolling interests | 337,894 | 343,043 | |||||||||

| Total equity | 2,637,398 | 2,653,351 | |||||||||

| Total liabilities and equity | $ | 4,886,509 | $ | 4,865,666 | |||||||

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Revenues: | |||||||||||

| Rental income | $ | 158,068 | $ | 147,728 | |||||||

| Fees and management income | 2,565 | 2,478 | |||||||||

| Other property income | 669 | 858 | |||||||||

| Total revenues | 161,302 | 151,064 | |||||||||

| Operating Expenses: | |||||||||||

| Property operating | 26,534 | 25,062 | |||||||||

| Real estate taxes | 18,854 | 18,056 | |||||||||

| General and administrative | 11,813 | 11,533 | |||||||||

| Depreciation and amortization | 60,206 | 58,498 | |||||||||

| Total operating expenses | 117,407 | 113,149 | |||||||||

| Other: | |||||||||||

| Interest expense, net | (23,335) | (19,466) | |||||||||

| (Loss) gain on disposal of property, net | (5) | 942 | |||||||||

| Other expense, net | (929) | (755) | |||||||||

| Net income | 19,626 | 18,636 | |||||||||

| Net income attributable to noncontrolling interests | (1,956) | (2,017) | |||||||||

| Net income attributable to stockholders | $ | 17,670 | $ | 16,619 | |||||||

| Earnings per share of common stock: | |||||||||||

Net income per share attributable to stockholders - basic and diluted |

$ | 0.14 | $ | 0.14 | |||||||

| Three Months Ended March 31, | Favorable (Unfavorable) | ||||||||||||||||||||||

| 2024 | 2023 | $ Change | % Change | ||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||

Rental income(1) |

$ | 112,756 | $ | 108,122 | $ | 4,634 | |||||||||||||||||

| Tenant recovery income | 36,097 | 35,486 | 611 | ||||||||||||||||||||

Reserves for uncollectibility(2) |

(1,772) | (906) | (866) | ||||||||||||||||||||

| Other property income | 603 | 848 | (245) | ||||||||||||||||||||

| Total revenues | 147,684 | 143,550 | 4,134 | 2.9 | % | ||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||

| Property operating expenses | 23,188 | 22,421 | (767) | ||||||||||||||||||||

| Real estate taxes | 17,753 | 18,241 | 488 | ||||||||||||||||||||

| Total operating expenses | 40,941 | 40,662 | (279) | (0.7) | % | ||||||||||||||||||

| Total Same-Center NOI | $ | 106,743 | $ | 102,888 | $ | 3,855 | 3.7 | % | |||||||||||||||

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

Net income |

$ | 19,626 | $ | 18,636 | |||||||

| Adjusted to exclude: | |||||||||||

| Fees and management income | (2,565) | (2,478) | |||||||||

Straight-line rental income(1) |

(2,365) | (2,580) | |||||||||

| Net amortization of above- and below- market leases | (1,419) | (1,228) | |||||||||

| Lease buyout income | (246) | (355) | |||||||||

| General and administrative expenses | 11,813 | 11,533 | |||||||||

| Depreciation and amortization | 60,206 | 58,498 | |||||||||

| Interest expense, net | 23,335 | 19,466 | |||||||||

| Loss (gain) on disposal of property, net | 5 | (942) | |||||||||

| Other expense, net | 929 | 755 | |||||||||

| Property operating expenses related to fees and management income | 1,026 | 315 | |||||||||

| NOI for real estate investments | 110,345 | 101,620 | |||||||||

Less: Non-same-center NOI(2) |

(3,602) | 1,268 | |||||||||

| Total Same-Center NOI | $ | 106,743 | $ | 102,888 | |||||||

| Period-end Same-Center Leased Occupancy % | 97.5 | % | 97.6 | % | |||||||

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Calculation of Nareit FFO Attributable to Stockholders and OP Unit Holders | |||||||||||

Net income |

$ | 19,626 | $ | 18,636 | |||||||

| Adjustments: | |||||||||||

| Depreciation and amortization of real estate assets | 59,776 | 57,953 | |||||||||

| Loss (gain) on disposal of property, net | 5 | (942) | |||||||||

| Adjustments related to unconsolidated joint ventures | 649 | 698 | |||||||||

| Nareit FFO attributable to stockholders and OP unit holders | $ | 80,056 | $ | 76,345 | |||||||

| Calculation of Core FFO Attributable to Stockholders and OP Unit Holders | |||||||||||

| Nareit FFO attributable to stockholders and OP unit holders | $ | 80,056 | $ | 76,345 | |||||||

| Adjustments: | |||||||||||

| Depreciation and amortization of corporate assets | 430 | 545 | |||||||||

| Transaction and acquisition expenses | 1,174 | 1,338 | |||||||||

| Amortization of unconsolidated joint venture basis differences | 3 | 1 | |||||||||

Realized performance income(1) |

— | (75) | |||||||||

| Core FFO attributable to stockholders and OP unit holders | $ | 81,663 | $ | 78,154 | |||||||

| Nareit FFO/Core FFO Attributable to Stockholders and OP Unit Holders per Diluted Share | |||||||||||

| Weighted-average shares of common stock outstanding - diluted | 136,404 | 131,943 | |||||||||

| Nareit FFO attributable to stockholders and OP unit holders per share - diluted | $ | 0.59 | $ | 0.58 | |||||||

| Core FFO attributable to stockholders and OP unit holders per share - diluted | $ | 0.60 | $ | 0.59 | |||||||

| Three Months Ended March 31, |

Year Ended December 31, | ||||||||||||||||

| 2024 | 2023 | 2023 | |||||||||||||||

Calculation of EBITDAre |

|||||||||||||||||

Net income |

$ | 19,626 | $ | 18,636 | $ | 63,762 | |||||||||||

| Adjustments: | |||||||||||||||||

| Depreciation and amortization | 60,206 | 58,498 | 236,443 | ||||||||||||||

| Interest expense, net | 23,335 | 19,466 | 84,232 | ||||||||||||||

| Loss (gain) on disposal of property, net | 5 | (942) | (1,110) | ||||||||||||||

| Federal, state, and local tax expense | 137 | 118 | 438 | ||||||||||||||

| Adjustments related to unconsolidated joint ventures | 928 | 966 | 3,721 | ||||||||||||||

EBITDAre |

$ | 104,237 | $ | 96,742 | $ | 387,486 | |||||||||||

Calculation of Adjusted EBITDAre |

|||||||||||||||||

EBITDAre |

$ | 104,237 | $ | 96,742 | $ | 387,486 | |||||||||||

| Adjustments: | |||||||||||||||||

| Impairment of investment in third parties | — | — | 3,000 | ||||||||||||||

| Transaction and acquisition expenses | 1,174 | 1,338 | 5,675 | ||||||||||||||

| Amortization of unconsolidated joint venture basis differences | 3 | 1 | 17 | ||||||||||||||

Realized performance income(1) |

— | (75) | (75) | ||||||||||||||

Adjusted EBITDAre |

$ | 105,414 | $ | 98,006 | $ | 396,103 | |||||||||||

| March 31, 2024 | December 31, 2023 | ||||||||||

| Net debt: | |||||||||||

| Total debt, excluding discounts, market adjustments, and deferred financing expenses | $ | 2,056,059 | $ | 2,011,093 | |||||||

| Less: Cash and cash equivalents | 5,813 | 5,074 | |||||||||

| Total net debt | $ | 2,050,246 | $ | 2,006,019 | |||||||

| Enterprise value: | |||||||||||

| Net debt | $ | 2,050,246 | $ | 2,006,019 | |||||||

Total equity market capitalization(1)(2) |

4,880,652 | 4,955,480 | |||||||||

| Total enterprise value | $ | 6,930,898 | $ | 6,961,499 | |||||||

| March 31, 2024 | December 31, 2023 | ||||||||||

Net debt to Adjusted EBITDAre - annualized: |

|||||||||||

| Net debt | $ | 2,050,246 | $ | 2,006,019 | |||||||

Adjusted EBITDAre - annualized(1) |

403,511 | 396,103 | |||||||||

Net debt to Adjusted EBITDAre - annualized |

5.1x | 5.1x | |||||||||

| Net debt to total enterprise value: | |||||||||||

| Net debt | $ | 2,050,246 | $ | 2,006,019 | |||||||

| Total enterprise value | 6,930,898 | 6,961,499 | |||||||||

| Net debt to total enterprise value | 29.6% | 28.8% | |||||||||

| Table of Contents | |||||

Earnings Release |

|||||

Consolidated Statements of Operations (Quarterly) |

|||||

Nareit FFO, Core FFO, and Adjusted FFO (Quarterly) |

|||||

Joint Venture Summary and Financials |

|||||

Summary of Outstanding Debt

|

|||||

Covenant Disclosures |

|||||

| INVESTOR INFORMATION | |||||

| Phillips Edison & Company |

2

|

|||||||

| Introductory Notes | ||||||||

SUPPLEMENTAL INFORMATION | ||

| CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS | ||

| NOTICE REGARDING NON-GAAP FINANCIAL MEASURES | ||

| Phillips Edison & Company |

3

|

|||||||

| Introductory Notes | ||||||||

PRO RATA FINANCIAL INFORMATION | ||

| Phillips Edison & Company |

4

|

|||||||

| FINANCIAL RESULTS | ||

Quarter Ended March 31, 2024 | ||

|

Earnings Release

Unaudited

| ||||||||

| Phillips Edison & Company |

6

|

|||||||

|

Earnings Release

Unaudited

| ||||||||

| Phillips Edison & Company |

7

|

|||||||

|

Earnings Release

Unaudited

| ||||||||

| (in thousands, except per share amounts) | Q1 YTD |

Updated Full Year

2024 Guidance

|

Previous Full Year

2024 Guidance

|

||||||||||||||

| Net income per share | $0.14 | $0.51 - $0.55 | $0.53 - $0.58 | ||||||||||||||

| Nareit FFO per share | $0.59 | $2.34 - $2.41 | $2.34 - $2.41 | ||||||||||||||

| Core FFO per share | $0.60 | $2.37 - $2.45 | $2.37 - $2.45 | ||||||||||||||

| Same-Center NOI growth | 3.7% | 3.25% - 4.25% | 3.25% - 4.25% | ||||||||||||||

| Portfolio Activity: | |||||||||||||||||

| Acquisitions, net | $55,902 | $200,000 - $300,000 | $200,000 - $300,000 | ||||||||||||||

| Other: | |||||||||||||||||

| Interest expense, net | $23,335 | $98,000 - $106,000 | $95,000 - $105,000 | ||||||||||||||

| G&A expense | $11,813 | $45,000 - $49,000 | $45,000 - $49,000 | ||||||||||||||

Non-cash revenue items(1) |

$3,785 | $14,500 - $18,500 | $14,500 - $18,500 | ||||||||||||||

| Adjustments for collectibility | $1,837 | $4,000 - 5,000 | $4,000 - 5,000 | ||||||||||||||

| (Unaudited) | Low End | High End | |||||||||

| Net income per share | $ | 0.51 | $ | 0.55 | |||||||

| Depreciation and amortization of real estate assets | 1.81 | 1.83 | |||||||||

| Gain on sale of real estate assets | — | — | |||||||||

| Adjustments related to unconsolidated joint ventures | 0.02 | 0.03 | |||||||||

| Nareit FFO per share | $ | 2.34 | $ | 2.41 | |||||||

| Depreciation and amortization of corporate assets | 0.01 | 0.01 | |||||||||

| Transaction costs and other | 0.02 | 0.03 | |||||||||

| Core FFO per share | $ | 2.37 | $ | 2.45 | |||||||

| Phillips Edison & Company |

8

|

|||||||

|

Earnings Release

Unaudited

| ||||||||

| Phillips Edison & Company |

9

|

|||||||

|

Overview of Results

Unaudited, in thousands (excluding per share and per square foot amounts)

| |||||||||||

| Three Months Ended March 31, |

|||||||||||

| 2024 | 2023 | ||||||||||

| SUMMARY FINANCIAL RESULTS | |||||||||||

Total revenues (page 13) |

$ | 161,302 | $ | 151,064 | |||||||

Net income attributable to stockholders (page 13) |

17,670 | 16,619 | |||||||||

Net income per share - basic and diluted (page 13) |

$ | 0.14 | $ | 0.14 | |||||||

Same-Center NOI (page 19) |

106,743 | 102,888 | |||||||||

Adjusted EBITDAre (page 17) |

105,414 | 98,006 | |||||||||

Nareit FFO (page 15) |

80,056 | 76,345 | |||||||||

Nareit FFO per share - diluted (page 15) |

$ | 0.59 | $ | 0.58 | |||||||

Core FFO (page 15) |

81,663 | 78,154 | |||||||||

Core FFO per share - diluted (page 15) |

$ | 0.60 | $ | 0.59 | |||||||

| SUMMARY OF FINANCIAL AND OPERATING RATIOS | |||||||||||

Same-Center NOI margin (page 19) |

72.3 | % | 71.7 | % | |||||||

Same-Center NOI change (page 19)(1) |

3.7 | % | 4.9 | % | |||||||

| LEASING RESULTS | |||||||||||

Comparable rent spreads - new leases (page 39)(2) |

29.1 | % | 27.4 | % | |||||||

Comparable rent spreads - renewals (page 39)(2) |

16.9 | % | 16.1 | % | |||||||

Portfolio retention rate (page 33)(2) |

87.9 | % | 94.7 | % | |||||||

| As of March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| OUTSTANDING STOCK AND PARTNERSHIP UNITS | |||||||||||

| Common stock outstanding | 122,323 | 117,259 | |||||||||

| Operating Partnership (OP) units outstanding | 13,742 | 14,298 | |||||||||

SUMMARY PORTFOLIO STATISTICS(2) |

|||||||||||

| Number of properties | 284 | 275 | |||||||||

GLA (page 33) |

32,350 | 31,456 | |||||||||

Leased occupancy (page 35) |

97.2 | % | 97.5 | % | |||||||

Economic occupancy (page 35) |

96.8 | % | 96.7 | % | |||||||

Leased ABR PSF (page 35) |

$ | 15.24 | $ | 14.52 | |||||||

Leased Anchor ABR PSF (page 35) |

$ | 10.20 | $ | 9.95 | |||||||

Leased Inline ABR PSF (page 35) |

$ | 24.99 | $ | 23.66 | |||||||

Same-Center leased occupancy (page 35) |

97.5 | % | 97.6 | % | |||||||

Same-Center economic occupancy (page 35) |

97.0 | % | 96.7 | % | |||||||

| Phillips Edison & Company |

10

|

|||||||

| FINANCIAL SUMMARY | ||

Quarter Ended March 31, 2024 | ||

|

Consolidated Balance Sheets

Condensed and Unaudited, in thousands (excluding per share amounts)

| |||||||||||

| March 31, 2024 | December 31, 2023 | ||||||||||

| ASSETS | |||||||||||

| Investment in real estate: | |||||||||||

| Land and improvements | $ | 1,789,539 | $ | 1,768,487 | |||||||

| Building and improvements | 3,860,003 | 3,818,184 | |||||||||

| In-place lease assets | 500,918 | 495,525 | |||||||||

| Above-market lease assets | 74,499 | 74,446 | |||||||||

| Total investment in real estate assets | 6,224,959 | 6,156,642 | |||||||||

| Accumulated depreciation and amortization | (1,598,743) | (1,540,551) | |||||||||

| Net investment in real estate assets | 4,626,216 | 4,616,091 | |||||||||

| Investment in unconsolidated joint ventures | 24,656 | 25,220 | |||||||||

| Total investment in real estate assets, net | 4,650,872 | 4,641,311 | |||||||||

| Cash and cash equivalents | 5,631 | 4,872 | |||||||||

| Restricted cash | 4,466 | 4,006 | |||||||||

| Goodwill | 29,066 | 29,066 | |||||||||

| Other assets, net | 196,474 | 186,411 | |||||||||

| Total assets | $ | 4,886,509 | $ | 4,865,666 | |||||||

| LIABILITIES AND EQUITY | |||||||||||

| Liabilities: | |||||||||||

| Debt obligations, net | $ | 2,015,554 | $ | 1,969,272 | |||||||

| Below-market lease liabilities, net | 110,774 | 108,223 | |||||||||

| Accounts payable and other liabilities | 102,162 | 116,461 | |||||||||

| Deferred income | 20,621 | 18,359 | |||||||||

| Total liabilities | 2,249,111 | 2,212,315 | |||||||||

| Equity: | |||||||||||

Preferred stock, $0.01 par value per share, 10,000 shares authorized, zero shares issued and outstanding at March 31, 2024 and December 31, 2023 |

— | — | |||||||||

Common stock, $0.01 par value per share, 1,000,000 shares authorized, 122,323 and 122,024 shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively |

1,223 | 1,220 | |||||||||

| Additional paid-in capital | 3,551,678 | 3,546,838 | |||||||||

| Accumulated other comprehensive income | 13,144 | 10,523 | |||||||||

| Accumulated deficit | (1,266,541) | (1,248,273) | |||||||||

| Total stockholders’ equity | 2,299,504 | 2,310,308 | |||||||||

| Noncontrolling interests | 337,894 | 343,043 | |||||||||

| Total equity | 2,637,398 | 2,653,351 | |||||||||

| Total liabilities and equity | $ | 4,886,509 | $ | 4,865,666 | |||||||

| Phillips Edison & Company |

12

|

|||||||

|

Consolidated Statements of Operations

Condensed and Unaudited, in thousands (excluding per share amounts)

| |||||||||||

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| REVENUES | |||||||||||

| Rental income | $ | 158,068 | $ | 147,728 | |||||||

| Fees and management income | 2,565 | 2,478 | |||||||||

| Other property income | 669 | 858 | |||||||||

| Total revenues | 161,302 | 151,064 | |||||||||

| OPERATING EXPENSES | |||||||||||

| Property operating | 26,534 | 25,062 | |||||||||

| Real estate taxes | 18,854 | 18,056 | |||||||||

| General and administrative | 11,813 | 11,533 | |||||||||

| Depreciation and amortization | 60,206 | 58,498 | |||||||||

| Total operating expenses | 117,407 | 113,149 | |||||||||

| OTHER | |||||||||||

| Interest expense, net | (23,335) | (19,466) | |||||||||

| (Loss) gain on disposal of property, net | (5) | 942 | |||||||||

Other expense, net |

(929) | (755) | |||||||||

Net income |

19,626 | 18,636 | |||||||||

Net income attributable to noncontrolling interests |

(1,956) | (2,017) | |||||||||

Net income attributable to stockholders |

$ | 17,670 | $ | 16,619 | |||||||

| EARNINGS PER SHARE OF COMMON STOCK | |||||||||||

Net income per share attributable to stockholders - basic and diluted |

$ | 0.14 | $ | 0.14 | |||||||

| Phillips Edison & Company |

13

|

|||||||

|

Consolidated Statements of Operations

Condensed and Unaudited, in thousands (excluding per share amounts)

| |||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| March 31, 2024 |

December 31, 2023 |

September 30, 2023 | June 30, 2023 |

March 31, 2023 |

|||||||||||||||||||||||||

| REVENUES | |||||||||||||||||||||||||||||

| Rental income | $ | 158,068 | $ | 151,227 | $ | 149,566 | $ | 148,980 | $ | 147,728 | |||||||||||||||||||

| Fees and management income | 2,565 | 2,454 | 2,168 | 2,546 | 2,478 | ||||||||||||||||||||||||

| Other property income | 669 | 768 | 740 | 611 | 858 | ||||||||||||||||||||||||

| Total revenues | 161,302 | 154,449 | 152,474 | 152,137 | 151,064 | ||||||||||||||||||||||||

| OPERATING EXPENSES | |||||||||||||||||||||||||||||

| Property operating | 26,534 | 28,293 | 24,274 | 24,674 | 25,062 | ||||||||||||||||||||||||

| Real estate taxes | 18,854 | 17,335 | 19,028 | 18,397 | 18,056 | ||||||||||||||||||||||||

| General and administrative | 11,813 | 10,762 | 10,385 | 11,686 | 11,533 | ||||||||||||||||||||||||

| Depreciation and amortization | 60,206 | 59,572 | 58,706 | 59,667 | 58,498 | ||||||||||||||||||||||||

| Total operating expenses | 117,407 | 115,962 | 112,393 | 114,424 | 113,149 | ||||||||||||||||||||||||

| OTHER | |||||||||||||||||||||||||||||

| Interest expense, net | (23,335) | (22,569) | (21,522) | (20,675) | (19,466) | ||||||||||||||||||||||||

| (Loss) gain on disposal of property, net | (5) | 40 | 53 | 75 | 942 | ||||||||||||||||||||||||

| Other expense, net | (929) | (770) | (4,883) | (904) | (755) | ||||||||||||||||||||||||

| Net income | 19,626 | 15,188 | 13,729 | 16,209 | 18,636 | ||||||||||||||||||||||||

| Net income attributable to noncontrolling interests | (1,956) | (1,655) | (1,484) | (1,758) | (2,017) | ||||||||||||||||||||||||

| Net income attributable to stockholders | $ | 17,670 | $ | 13,533 | $ | 12,245 | $ | 14,451 | $ | 16,619 | |||||||||||||||||||

| EARNINGS PER SHARE OF COMMON STOCK | |||||||||||||||||||||||||||||

| Net income per share attributable to stockholders - basic and diluted | $ | 0.14 | $ | 0.11 | $ | 0.10 | $ | 0.12 | $ | 0.14 | |||||||||||||||||||

| Phillips Edison & Company |

14

|

|||||||

|

Nareit FFO, Core FFO, and Adjusted FFO

Unaudited, in thousands (excluding per share amounts)

| |||||||||||

| Three Months Ended March 31, |

|||||||||||

| 2024 | 2023 | ||||||||||

| CALCULATION OF NAREIT FFO ATTRIBUTABLE TO STOCKHOLDERS AND OP UNIT HOLDERS | |||||||||||

Net income |

$ | 19,626 | $ | 18,636 | |||||||

| Adjustments: | |||||||||||

| Depreciation and amortization of real estate assets | 59,776 | 57,953 | |||||||||

| Loss (gain) on disposal of property, net | 5 | (942) | |||||||||

| Adjustments related to unconsolidated joint ventures | 649 | 698 | |||||||||

| Nareit FFO attributable to stockholders and OP unit holders | $ | 80,056 | $ | 76,345 | |||||||

| CALCULATION OF CORE FFO ATTRIBUTABLE TO STOCKHOLDERS AND OP UNIT HOLDERS | |||||||||||

| Nareit FFO attributable to stockholders and OP unit holders | $ | 80,056 | $ | 76,345 | |||||||

| Adjustments: | |||||||||||

| Depreciation and amortization of corporate assets | 430 | 545 | |||||||||

| Transaction and acquisition expenses | 1,174 | 1,338 | |||||||||

| Amortization of unconsolidated joint venture basis differences | 3 | 1 | |||||||||

Realized performance income(1) |

— | (75) | |||||||||

| Core FFO attributable to stockholders and OP unit holders | $ | 81,663 | $ | 78,154 | |||||||

| CALCULATION OF ADJUSTED FFO ATTRIBUTABLE TO STOCKHOLDERS AND OP UNIT HOLDERS | |||||||||||

| Core FFO attributable to stockholders and OP unit holders | $ | 81,663 | $ | 78,154 | |||||||

| Adjustments: | |||||||||||

| Straight-line rent and above- and below-market leases and contracts | (3,910) | (3,919) | |||||||||

| Non-cash debt adjustments | 1,901 | 1,563 | |||||||||

Capital expenditures and leasing commissions(2) |

(10,422) | (13,141) | |||||||||

| Non-cash share-based compensation expense | 1,947 | 2,005 | |||||||||

| Adjustments related to unconsolidated joint ventures | (95) | (138) | |||||||||

| Adjusted FFO attributable to stockholders and OP unit holders | $ | 71,084 | $ | 64,524 | |||||||

| NAREIT FFO/CORE FFO ATTRIBUTABLE TO STOCKHOLDERS AND OP UNIT HOLDERS PER DILUTED SHARE | |||||||||||

| Weighted-average shares of common stock outstanding - diluted | 136,404 | 131,943 | |||||||||

| Nareit FFO attributable to stockholders and OP unit holders per share - diluted | $ | 0.59 | $ | 0.58 | |||||||

| Core FFO attributable to stockholders and OP unit holders per share - diluted | $ | 0.60 | $ | 0.59 | |||||||

| Phillips Edison & Company |

15

|

|||||||

|

Nareit FFO, Core FFO, and Adjusted FFO

Unaudited, in thousands (excluding per share amounts)

| |||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

|||||||||||||||||||||||||

| CALCULATION OF NAREIT FFO ATTRIBUTABLE TO STOCKHOLDERS AND OP UNIT HOLDERS | |||||||||||||||||||||||||||||

| Net income | $ | 19,626 | $ | 15,188 | $ | 13,729 | $ | 16,209 | $ | 18,636 | |||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||

| Depreciation and amortization of real estate assets | 59,776 | 59,048 | 58,144 | 59,115 | 57,953 | ||||||||||||||||||||||||

| Loss (gain) on disposal of property, net | 5 | (40) | (53) | (75) | (942) | ||||||||||||||||||||||||

| Adjustments related to unconsolidated joint ventures | 649 | 647 | 646 | 645 | 698 | ||||||||||||||||||||||||

| Nareit FFO attributable to stockholders and OP unit holders | $ | 80,056 | $ | 74,843 | $ | 72,466 | $ | 75,894 | $ | 76,345 | |||||||||||||||||||

| CALCULATION OF CORE FFO ATTRIBUTABLE TO STOCKHOLDERS AND OP UNIT HOLDERS | |||||||||||||||||||||||||||||

| Nareit FFO attributable to stockholders and OP unit holders | $ | 80,056 | $ | 74,843 | $ | 72,466 | $ | 75,894 | $ | 76,345 | |||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||

| Depreciation and amortization of corporate assets | 430 | 524 | 562 | 552 | 545 | ||||||||||||||||||||||||

| Impairment of investment in third parties | — | — | 3,000 | — | — | ||||||||||||||||||||||||

| Transaction and acquisition expenses | 1,174 | 2,496 | 580 | 1,261 | 1,338 | ||||||||||||||||||||||||

| Loss (gain) on extinguishment or modification of debt and other, net | — | 2 | 375 | (9) | — | ||||||||||||||||||||||||

| Amortization of unconsolidated joint venture basis differences | 3 | 5 | 4 | 7 | 1 | ||||||||||||||||||||||||

Realized performance income(1) |

— | — | — | — | (75) | ||||||||||||||||||||||||

| Core FFO attributable to stockholders and OP unit holders | $ | 81,663 | $ | 77,870 | $ | 76,987 | $ | 77,705 | $ | 78,154 | |||||||||||||||||||

| CALCULATION OF ADJUSTED FFO ATTRIBUTABLE TO STOCKHOLDERS AND OP UNIT HOLDERS | |||||||||||||||||||||||||||||

| Core FFO attributable to stockholders and OP unit holders | $ | 81,663 | $ | 77,870 | $ | 76,987 | $ | 77,705 | $ | 78,154 | |||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||

| Straight-line rent and above- and below-market leases and contracts | (3,910) | (3,575) | (3,683) | (4,645) | (3,919) | ||||||||||||||||||||||||

| Non-cash debt adjustments | 1,901 | 1,934 | 1,992 | 1,632 | 1,563 | ||||||||||||||||||||||||

Capital expenditures and leasing commissions(2) |

(10,422) | (12,691) | (18,497) | (15,533) | (13,141) | ||||||||||||||||||||||||

| Non-cash share-based compensation expense | 1,947 | 2,088 | 1,048 | 2,700 | 2,005 | ||||||||||||||||||||||||

| Adjustments related to unconsolidated joint ventures | (95) | (124) | (144) | (256) | (138) | ||||||||||||||||||||||||

| Adjusted FFO attributable to stockholders and OP unit holders | $ | 71,084 | $ | 65,502 | $ | 57,703 | $ | 61,603 | $ | 64,524 | |||||||||||||||||||

| NAREIT FFO/CORE FFO ATTRIBUTABLE TO STOCKHOLDERS AND OP UNIT HOLDERS PER DILUTED SHARE | |||||||||||||||||||||||||||||

| Weighted-average shares of common stock outstanding - diluted | 136,404 | 134,667 | 132,800 | 131,887 | 131,943 | ||||||||||||||||||||||||

| Nareit FFO attributable to stockholders and OP unit holders per share - diluted | $ | 0.59 | $ | 0.56 | $ | 0.55 | $ | 0.58 | $ | 0.58 | |||||||||||||||||||

| Core FFO attributable to stockholders and OP unit holders per share - diluted | $ | 0.60 | $ | 0.58 | $ | 0.58 | $ | 0.59 | $ | 0.59 | |||||||||||||||||||

| Phillips Edison & Company |

16

|

|||||||

|

EBITDAre Metrics

Unaudited, in thousands

| |||||||||||

| Three Months Ended March 31, |

|||||||||||

| 2024 | 2023 | ||||||||||

CALCULATION OF EBITDAre |

|||||||||||

Net income |

$ | 19,626 | $ | 18,636 | |||||||

| Adjustments: | |||||||||||

| Depreciation and amortization | 60,206 | 58,498 | |||||||||

| Interest expense, net | 23,335 | 19,466 | |||||||||

| Loss (gain) on disposal of property, net | 5 | (942) | |||||||||

| Federal, state, and local tax expense | 137 | 118 | |||||||||

| Adjustments related to unconsolidated joint ventures | 928 | 966 | |||||||||

EBITDAre |

$ | 104,237 | $ | 96,742 | |||||||

CALCULATION OF ADJUSTED EBITDAre |

|||||||||||

EBITDAre |

$ | 104,237 | $ | 96,742 | |||||||

| Adjustments: | |||||||||||

| Transaction and acquisition expenses | 1,174 | 1,338 | |||||||||

| Amortization of unconsolidated joint venture basis differences | 3 | 1 | |||||||||

Realized performance income(1) |

— | (75) | |||||||||

Adjusted EBITDAre |

$ | 105,414 | $ | 98,006 | |||||||

| Phillips Edison & Company |

17

|

|||||||

|

EBITDAre Metrics

Unaudited, in thousands

| |||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

|||||||||||||||||||||||||

CALCULATION OF EBITDAre |

|||||||||||||||||||||||||||||

| Net income | $ | 19,626 | $ | 15,188 | $ | 13,729 | $ | 16,209 | $ | 18,636 | |||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||

| Depreciation and amortization | 60,206 | 59,572 | 58,706 | 59,667 | 58,498 | ||||||||||||||||||||||||

| Interest expense, net | 23,335 | 22,569 | 21,522 | 20,675 | 19,466 | ||||||||||||||||||||||||

| Loss (gain) on disposal of property, net | 5 | (40) | (53) | (75) | (942) | ||||||||||||||||||||||||

| Federal, state, and local tax expense | 137 | 81 | 120 | 119 | 118 | ||||||||||||||||||||||||

| Adjustments related to unconsolidated joint ventures | 928 | 919 | 918 | 918 | 966 | ||||||||||||||||||||||||

EBITDAre |

$ | 104,237 | $ | 98,289 | $ | 94,942 | $ | 97,513 | $ | 96,742 | |||||||||||||||||||

CALCULATION OF ADJUSTED EBITDAre |

|||||||||||||||||||||||||||||

EBITDAre |

$ | 104,237 | $ | 98,289 | $ | 94,942 | $ | 97,513 | $ | 96,742 | |||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||

| Impairment of investment in third parties | — | — | 3,000 | — | — | ||||||||||||||||||||||||

| Transaction and acquisition expenses | 1,174 | 2,496 | 580 | 1,261 | 1,338 | ||||||||||||||||||||||||

| Amortization of unconsolidated joint venture basis differences | 3 | 5 | 4 | 7 | 1 | ||||||||||||||||||||||||

Realized performance income(1) |

— | — | — | — | (75) | ||||||||||||||||||||||||

Adjusted EBITDAre |

$ | 105,414 | $ | 100,790 | $ | 98,526 | $ | 98,781 | $ | 98,006 | |||||||||||||||||||

| Phillips Edison & Company |

18

|

|||||||

|

Same-Center Net Operating Income

Unaudited, in thousands

| |||||||||||||||||

| Three Months Ended March 31, |

Favorable (Unfavorable) % Change |

||||||||||||||||

| 2024 | 2023 | ||||||||||||||||

SAME-CENTER NOI(1) |

|||||||||||||||||

| Revenues: | |||||||||||||||||

Rental income(2) |

$ | 112,756 | $ | 108,122 | |||||||||||||

| Tenant recovery income | 36,097 | 35,486 | |||||||||||||||

Reserves for uncollectibility(3) |

(1,772) | (906) | |||||||||||||||

| Other property income | 603 | 848 | |||||||||||||||

| Total revenues | 147,684 | 143,550 | 2.9 | % | |||||||||||||

| Operating expenses: | |||||||||||||||||

| Property operating expenses | 23,188 | 22,421 | |||||||||||||||

| Real estate taxes | 17,753 | 18,241 | |||||||||||||||

| Total operating expenses | 40,941 | 40,662 | (0.7) | % | |||||||||||||

| Total Same-Center NOI | $ | 106,743 | $ | 102,888 | 3.7 | % | |||||||||||

| Same-Center NOI margin | 72.3% | 71.7% | |||||||||||||||

|

(1)Same-Center NOI represents the NOI for the 270 properties that were wholly-owned and operational for the entire portion of all comparable reporting periods.

(2)Excludes straight-line rental income, net amortization of above- and below-market leases, and lease buyout income.

(3)Includes billings that will not be recognized as revenue until cash is collected or the Neighbor resumes regular payments and/or we deem it appropriate to resume recording revenue on an accrual basis, rather than on a cash basis.

| |||||||||||||||||

| Three Months Ended March 31, |

|||||||||||

| 2024 | 2023 | ||||||||||

RECONCILIATION OF NET INCOME TO NOI AND SAME-CENTER NOI |

|||||||||||

Net income |

$ | 19,626 | $ | 18,636 | |||||||

| Adjusted to exclude: | |||||||||||

| Fees and management income | (2,565) | (2,478) | |||||||||

Straight-line rental income(1) |

(2,365) | (2,580) | |||||||||

| Net amortization of above- and below-market leases | (1,419) | (1,228) | |||||||||

| Lease buyout income | (246) | (355) | |||||||||

| General and administrative expenses | 11,813 | 11,533 | |||||||||

| Depreciation and amortization | 60,206 | 58,498 | |||||||||

| Interest expense, net | 23,335 | 19,466 | |||||||||

| Loss (gain) on disposal of property, net | 5 | (942) | |||||||||

Other expense, net |

929 | 755 | |||||||||

| Property operating expenses related to fees and management income | 1,026 | 315 | |||||||||

| NOI for real estate investments | 110,345 | 101,620 | |||||||||

Less: Non-same-center NOI(2) |

(3,602) | 1,268 | |||||||||

| Total Same-Center NOI | $ | 106,743 | $ | 102,888 | |||||||

|

(1)Includes straight-line rent adjustments for Neighbors for whom revenue is being recorded on a cash basis.

(2)Includes operating revenues and expenses from non-same-center properties which includes properties acquired or sold and corporate activities.

| |||||||||||

| Phillips Edison & Company |

19

|

|||||||

|

Joint Venture Portfolio and Financial Summary

Unaudited, dollars and square feet in thousands

| |||||||||||||||||||||||||||||||||||

| UNCONSOLIDATED JOINT VENTURE PORTFOLIO SUMMARY | |||||||||||||||||||||||||||||||||||

| As of March 31, 2024 | |||||||||||||||||

| Joint Venture | Investment Partner | Ownership Percentage | Number of Shopping Centers | ABR | GLA | ||||||||||||

| Grocery Retail Partners I LLC ("GRP I") | The Northwestern Mutual Life Insurance Company | 14% | 20 | $31,891 | 2,213 | ||||||||||||

| UNCONSOLIDATED JOINT VENTURE FINANCIAL SUMMARY | |||||||||||||||||||||||||||||||||||

| As of March 31, 2024 | |||||||||||||||||

| GRP I | NRP(1) |

||||||||||||||||

| Total assets | $ | 359,725 | $ | 591 | |||||||||||||

| Gross debt | 174,026 | — | |||||||||||||||

| Pro rata share of debt | 24,358 | — | |||||||||||||||

| Three Months Ended March 31, 2024 |

|||||||||||||||||

| GRP I | NRP(1) |

||||||||||||||||

Pro rata share of Nareit FFO(2) |

$ | 715 | $ | (1) | |||||||||||||

Pro rata share of NOI(2) |

1,044 | — | |||||||||||||||

| Phillips Edison & Company |

20

|

|||||||

|

Supplemental Balance Sheets Detail

Unaudited, in thousands

| |||||||||||

| March 31, 2024 | December 31, 2023 | ||||||||||

| OTHER ASSETS, NET | |||||||||||

| Deferred leasing commissions and costs | $ | 54,001 | $ | 53,379 | |||||||

Deferred financing expenses(1) |

8,984 | 8,984 | |||||||||

| Office equipment, capital lease assets, and other | 24,352 | 24,073 | |||||||||

| Corporate intangible assets | 6,686 | 6,686 | |||||||||

| Total depreciable and amortizable assets | 94,023 | 93,122 | |||||||||

| Accumulated depreciation and amortization | (53,816) | (53,205) | |||||||||

| Net depreciable and amortizable assets | 40,207 | 39,917 | |||||||||

Accounts receivable, net(2) |

49,164 | 44,548 | |||||||||

| Accounts receivable - affiliates | 989 | 803 | |||||||||

Deferred rent receivable, net(3) |

64,658 | 62,288 | |||||||||

| Derivative assets | 15,271 | 12,669 | |||||||||

| Prepaid expenses and other | 10,394 | 10,745 | |||||||||

| Investment in third parties | 6,888 | 6,875 | |||||||||

| Investment in marketable securities | 8,903 | 8,566 | |||||||||

| Total other assets, net | $ | 196,474 | $ | 186,411 | |||||||

| ACCOUNTS PAYABLE AND OTHER LIABILITIES | |||||||||||

| Accounts payable trade and other accruals | $ | 32,600 | $ | 30,682 | |||||||

| Accrued real estate taxes | 28,484 | 33,379 | |||||||||

| Security deposits | 15,888 | 15,426 | |||||||||

| Distribution accrual | 932 | 1,093 | |||||||||

| Accrued compensation | 6,421 | 15,983 | |||||||||

| Accrued interest | 12,038 | 9,684 | |||||||||

| Capital expenditure accrual | 5,263 | 9,892 | |||||||||

| Accrued income taxes and deferred tax liabilities, net | 536 | 322 | |||||||||

| Total accounts payable and other liabilities | $ | 102,162 | $ | 116,461 | |||||||

| Phillips Edison & Company |

21

|

|||||||

|

Supplemental Statements of Operations Detail

Unaudited, in thousands

| |||||||||||

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| REVENUES | |||||||||||

Rental income(1) |

$ | 118,059 | $ | 108,883 | |||||||

Recovery income(1) |

38,201 | 35,744 | |||||||||

| Straight-line rent amortization | 1,993 | 2,443 | |||||||||

| Amortization of lease assets | 1,406 | 1,216 | |||||||||

| Lease buyout income | 246 | 355 | |||||||||

Adjustments for collectibility(2)(3) |

(1,837) | (913) | |||||||||

| Fees and management income | 2,565 | 2,478 | |||||||||

| Other property income | 669 | 858 | |||||||||

| Total revenues | $ | 161,302 | $ | 151,064 | |||||||

|

(1)Includes income related to lease payments before assessing for collectibility.

(2)Includes revenue adjustments for non-creditworthy Neighbors.

(3)Contains general reserves but excludes reserves for straight-line rent amortization; includes recovery of previous revenue reserved.

| |||||||||||

| INTEREST EXPENSE, NET | |||||||||||

| Interest on unsecured term loans and senior notes, net | $ | 13,657 | $ | 11,292 | |||||||

| Interest on secured debt | 4,506 | 4,888 | |||||||||

| Interest on revolving credit facility, net | 3,159 | 1,568 | |||||||||

Non-cash amortization and other(1) |

2,013 | 1,718 | |||||||||

| Total interest expense, net | $ | 23,335 | $ | 19,466 | |||||||

(1)Amortization of debt-related items includes items such as deferred financing expenses, assumed market debt, and derivative adjustments, net. | |||||||||||

OTHER EXPENSE, NET |

|||||||||||

| Transaction and acquisition expenses | $ | (1,174) | $ | (1,338) | |||||||

| Federal, state, and local income tax expense | (137) | (118) | |||||||||

| Equity in net income of unconsolidated investments | 29 | 90 | |||||||||

| Other income | 353 | 611 | |||||||||

Total other expense, net |

$ | (929) | $ | (755) | |||||||

| Phillips Edison & Company |

22

|

|||||||

|

Capital Expenditures

Unaudited, in thousands

| |||||||||||

| Three Months Ended March 31, |

|||||||||||

| 2024 | 2023 | ||||||||||

CAPITAL EXPENDITURES FOR REAL ESTATE(1)(2) |

|||||||||||

| Capital improvements | $ | 1,263 | $ | 3,709 | |||||||

| Tenant improvements | 5,413 | 6,419 | |||||||||

| Redevelopment and development | 3,134 | 11,977 | |||||||||

| Total capital expenditures for real estate | $ | 9,810 | $ | 22,105 | |||||||

| Corporate asset capital expenditures | 186 | 365 | |||||||||

Capitalized indirect costs(3) |

1,011 | 1,214 | |||||||||

| Total capital spending activity | $ | 11,007 | $ | 23,684 | |||||||

| Cash paid for leasing commissions | $ | 2,709 | $ | 1,306 | |||||||

| Phillips Edison & Company |

23

|

|||||||

|

Active Capital Projects

Unaudited, dollars in thousands

| |||||||||||||||||||||||

Project |

Location |

Description |

Target Stabilization Quarter(1) |

Incurred to Date | Future Spend | Total Estimated Costs | Estimated Project Yield (2,3,4) |

||||||||||||||||

GROUND UP EXPANSION DEVELOPMENT |

|||||||||||||||||||||||

| Oak Mill Plaza | Niles, IL | Construction of a 5K SF multi-tenant outparcel 74% leased with Starbucks and Buffalo Wild Wings Go | Q1-2024 | $ | 3,386 | $ | 83 | $ | 3,469 | ||||||||||||||

| Hamilton Ridge | Buford, GA | Construction of a 6K SF multi-tenant outparcel 50% leased with bb.q Chicken and Vitality Bowls | Q3-2024 | 2,873 | 428 | 3,302 | |||||||||||||||||

| Northstar Marketplace | Ramsey, MN | Construction of a 7K SF multi-tenant outparcel | Q3-2024 | 2,433 | 701 | 3,134 | |||||||||||||||||

| Roxborough Marketplace | Littleton, CO | Construction of a 2K SF single tenant outparcel 100% leased with Starbucks | Q4-2024 | 1,338 | 652 | 1,990 | |||||||||||||||||

| The Shoppes at Windmill Place | Batavia, IL | Construction of 2K SF single tenant outparcel 100% leased with Dave's Hot Chicken | Q4-2024 | 340 | 1,533 | 1,873 | |||||||||||||||||

| Total: Ground Up | $ | 10,370 | $ | 3,397 | $ | 13,768 | 6%-8% | ||||||||||||||||

| Phillips Edison & Company |

24

|

|||||||

|

Active Capital Projects

Unaudited, dollars in thousands

| |||||||||||||||||||||||

Project |

Location |

Description |

Target Stabilization Quarter(1) |

Incurred to Date | Future Spend | Total Estimated Costs | Estimated Project Yield (2,3,4) |

||||||||||||||||

REDEVELOPMENT |

|||||||||||||||||||||||

| The Oaks | Hudson, FL | Second phase of Center Repositioning project on multiple units with Skechers, Bealls and multiple inline units | Q3-2024 | $ | 2,677 | $ | 1,565 | $ | 4,242 | ||||||||||||||

| Wheat Ridge Marketplace | Wheat Ridge, CO | Redevelop former Boston Market with Starbucks | Q4-2024 | 254 | 682 | 936 | |||||||||||||||||

| North Pointe Plaza | North Charleston, SC | Anchor Redevelopment with FIT Life Health Clubs | Q1-2025 | 102 | 1,475 | 1,578 | |||||||||||||||||

| Hampton Village | Taylors, SC | Redevelop former Tuesday Morning with Five Below | Q2-2025 | 130 | 1,031 | 1,161 | |||||||||||||||||

| Total: Redevelopment | $ | 3,163 | $ | 4,753 | $ | 7,917 | 11%-19% | ||||||||||||||||

| Active Projects Total | $ | 13,533 | $ | 8,150 | $ | 21,685 | 9%-12% | ||||||||||||||||

2024 STABILIZED PROJECTS (4) |

4 | $16,922 | 14% | ||||||||||||||||||||

| Phillips Edison & Company |

25

|

|||||||

|

Capitalization and Debt Ratios

Unaudited, in thousands (excluding per share amounts and leverage ratios)

| |||||||||||

| March 31, 2024 |

December 31, 2023 |

||||||||||

| EQUITY CAPITALIZATION | |||||||||||

| Common stock outstanding | 122,323 | 122,024 | |||||||||

| OP units outstanding | 13,742 | 13,817 | |||||||||

| Total shares and units outstanding | 136,065 | 135,841 | |||||||||

Share price |

$ | 35.87 | $ | 36.48 | |||||||

| Total equity market capitalization | $ | 4,880,652 | $ | 4,955,480 | |||||||

| DEBT | |||||||||||

| Debt obligations, net | $ | 2,015,554 | $ | 1,969,272 | |||||||

| Add: Discount on notes payable | 6,124 | 6,302 | |||||||||

| Add: Market debt adjustments, net | 630 | 858 | |||||||||

| Add: Deferred financing expenses, net | 9,393 | 10,303 | |||||||||

| Total debt - gross | 2,031,701 | 1,986,735 | |||||||||

| Less: Cash and cash equivalents | 5,631 | 4,872 | |||||||||

| Total net debt - consolidated | 2,026,070 | 1,981,863 | |||||||||

| Add: Prorated share from unconsolidated joint ventures | 24,176 | 24,156 | |||||||||

| Total net debt | $ | 2,050,246 | $ | 2,006,019 | |||||||

| ENTERPRISE VALUE | |||||||||||

| Total net debt | $ | 2,050,246 | $ | 2,006,019 | |||||||

| Total equity market capitalization | 4,880,652 | 4,955,480 | |||||||||

| Total enterprise value | $ | 6,930,898 | $ | 6,961,499 | |||||||

| FINANCIAL LEVERAGE RATIOS | |||||||||||

Net debt to Adjusted EBITDAre - annualized: |

|||||||||||

| Net debt | $ | 2,050,246 | $ | 2,006,019 | |||||||

Adjusted EBITDAre - annualized(1) |

403,511 | 396,103 | |||||||||

Net debt to Adjusted EBITDAre - annualized |

5.1x | 5.1x | |||||||||

| Net debt to total enterprise value: | |||||||||||

| Net debt | $ | 2,050,246 | $ | 2,006,019 | |||||||

| Total enterprise value | 6,930,898 | 6,961,499 | |||||||||

| Net debt to total enterprise value | 29.6% | 28.8% | |||||||||

| Phillips Edison & Company |

26

|

|||||||

|

Summary of Outstanding Debt

Unaudited, dollars in thousands

| |||||||||||||||||

| Outstanding Balance | Contractual Interest Rate |

Maturity Date | Percent of Total Indebtedness | ||||||||||||||

| SECURED DEBT | |||||||||||||||||

| Individual property mortgages | $ | 94,713 | 3.45% - 6.43% | 2024 - 2031 | 5% | ||||||||||||

| Secured pool due 2027 (15 assets) | 195,000 | 3.52% | 2027 | 10% | |||||||||||||

| Secured pool due 2030 (16 assets) | 200,000 | 3.35% | 2030 | 10% | |||||||||||||

| Total secured debt | $ | 489,713 | 24% | ||||||||||||||

| UNSECURED DEBT | |||||||||||||||||

Revolving credit facility(1)(2) |

$ | 227,000 | SOFR + 1.14% | 2026 | 11% | ||||||||||||

Term loan due 2025(1) |

240,000 | SOFR + 1.29% | 2025 | 12% | |||||||||||||

Term loan due 2026(2) |

161,750 | SOFR + 1.35% | 2026 | 8% | |||||||||||||

Term loan due 2026(1) |

240,000 | SOFR + 1.29% | 2026 | 12% | |||||||||||||

| Term loan due 2027 | 158,000 | SOFR + 1.35% | 2027 | 8% | |||||||||||||

| Term loan due 2027 | 165,000 | SOFR + 1.35% | 2027 | 8% | |||||||||||||

| Senior unsecured note due 2031 | 350,000 | 2.63% | 2031 | 17% | |||||||||||||

Total unsecured debt(2) |

$ | 1,541,750 | 76% | ||||||||||||||

| Finance leases, net | 238 | ||||||||||||||||

Total debt obligations(2) |

$ | 2,031,701 | |||||||||||||||

| Assumed market debt adjustments, net | $ | (630) | |||||||||||||||

| Discount on notes payable | (6,124) | ||||||||||||||||

| Deferred financing expenses, net | (9,393) | ||||||||||||||||

| Debt obligations, net | $ | 2,015,554 | |||||||||||||||

| Notional Amount | Fixed Rate | ||||||||||

INTEREST RATE SWAPS(3) |

|||||||||||

| Interest rate swap expiring September 2024 | 200,000 | 2.09 | % | ||||||||

| Interest rate swap expiring October 2024 | 175,000 | 2.07 | % | ||||||||

| Interest rate swap expiring November 2025 | 125,000 | 2.84 | % | ||||||||

| Interest rate swap expiring September 2026 | 200,000 | 3.36 | % | ||||||||

| Total notional amount | $ | 700,000 | |||||||||

| Phillips Edison & Company |

27

|

|||||||

|

Debt Overview and Schedule of Maturities

Unaudited, dollars in thousands

| ||||||||||||||||||||||||||||||||||||||||||||||||||

| Secured Debt | Unsecured Debt(2) |

|||||||||||||||||||||||||||||||||||||||||||||||||

| Maturity Year | Scheduled Mortgage Principal Payments | Mortgage Loans | Secured Portfolio Loans | Unsecured Term Loans | Senior Unsecured Notes | Revolving Line of Credit | Total Consolidated Debt | Pro Rata Share of JV Debt | Total Debt | Weighted-Average Interest Rate(1)(2) |

||||||||||||||||||||||||||||||||||||||||

| 2024 | 2,028 | 25,130 | — | — | — | — | 27,158 | — | 27,158 | 5.1 | % | |||||||||||||||||||||||||||||||||||||||

| 2025 | 1,956 | 35,680 | — | 240,000 | — | — | 277,636 | — | 277,636 | 3.4 | % | |||||||||||||||||||||||||||||||||||||||

| 2026 | 1,908 | — | — | 240,000 | — | — | 241,908 | 24,358 | 266,266 | 3.6 | % | |||||||||||||||||||||||||||||||||||||||

| 2027 | 1,905 | 3,690 | 195,000 | 323,000 | — | 227,000 | 750,595 | — | 750,595 | 5.2 | % | |||||||||||||||||||||||||||||||||||||||

| 2028 | 767 | 16,600 | — | 161,750 | — | — | 179,117 | — | 179,117 | 6.5 | % | |||||||||||||||||||||||||||||||||||||||

| 2029 | 805 | — | — | — | — | — | 805 | — | 805 | — | % | |||||||||||||||||||||||||||||||||||||||

| 2030 | 844 | — | 200,000 | — | — | — | 200,844 | — | 200,844 | 3.4 | % | |||||||||||||||||||||||||||||||||||||||

| 2031 | 560 | 2,840 | — | — | 350,000 | — | 353,400 | — | 353,400 | 2.7 | % | |||||||||||||||||||||||||||||||||||||||

| Net debt market adjustments / discounts / issuance costs | — | — | — | — | — | — | (16,147) | (497) | (16,644) | N/A | ||||||||||||||||||||||||||||||||||||||||

| Finance leases | — | — | — | — | — | — | 238 | — | 238 | N/A | ||||||||||||||||||||||||||||||||||||||||

| Total | $ | 10,773 | $ | 83,940 | $ | 395,000 | $ | 964,750 | $ | 350,000 | $ | 227,000 | $ | 2,015,554 | $ | 23,861 | $ | 2,039,415 | 4.3 | % | ||||||||||||||||||||||||||||||

| Weighted-Average | |||||||||||||||||||||||||||||

| Total Debt | Percent of Total Indebtedness | Effective Interest Rate(1) |

Years to

Maturity(2)

|

||||||||||||||||||||||||||

| Fixed rate debt | $ | 1,539,713 | 74.9% | 3.5% | 5.6 | ||||||||||||||||||||||||

| Variable rate debt | 491,750 | 23.9% | 6.6% | 2.6 | |||||||||||||||||||||||||

| Net debt market adjustments / discounts / issuance costs | (16,147) | N/A | N/A | N/A | |||||||||||||||||||||||||

| Finance leases | 238 | N/A | N/A | N/A | |||||||||||||||||||||||||

| Total consolidated debt | $ | 2,015,554 | 98.8% | 4.3% | 3.8 | ||||||||||||||||||||||||

| Pro rata share of JV Debt | 24,358 | 1.2% | 3.6% | 2.6 | |||||||||||||||||||||||||

| Net debt market adjustments / discounts / issuance costs of JV Debt | (497) | N/A | N/A | N/A | |||||||||||||||||||||||||

| Total consolidated + JV debt | $ | 2,039,415 | 100.0% | 4.3% | 3.8 | ||||||||||||||||||||||||

| Phillips Edison & Company |

28

|

|||||||

|

Debt Covenants

Unaudited, dollars in thousands

| |||||||||||||||||

| UNSECURED CREDIT FACILITY AND TERM LOANS DUE 2025, 2026, AND 2027 | |||||||||||||||||

| Covenant | March 31, 2024 |

||||||||||||||||

| LEVERAGE RATIO | |||||||||||||||||

| Total Indebtedness | $2,054,170 | ||||||||||||||||

| Total Asset Value | $6,901,435 | ||||||||||||||||

| Leverage Ratio | =<60% | 29.8% | |||||||||||||||

| SECURED LEVERAGE RATIO | |||||||||||||||||

| Total Secured Indebtedness | $514,309 | ||||||||||||||||

| Total Asset Value | $6,901,435 | ||||||||||||||||

| Secured Leverage Ratio | =<35% | 7.5% | |||||||||||||||

| FIXED CHARGE COVERAGE RATIO | |||||||||||||||||

| Adjusted EBITDA | $381,793 | ||||||||||||||||

| Total Fixed Charges | $86,814 | ||||||||||||||||

| Fixed Charge Coverage Ratio | =>1.5x | 4.40x | |||||||||||||||

| MAXIMUM UNSECURED INDEBTEDNESS TO UNENCUMBERED ASSET VALUE | |||||||||||||||||

| Total Unsecured Indebtedness | $1,555,132 | ||||||||||||||||

| Unencumbered Asset Value | $5,581,160 | ||||||||||||||||

| Unsecured Indebtedness to Unencumbered Asset Value | =<60% | 27.9% | |||||||||||||||

| MINIMUM UNENCUMBERED NOI TO INTEREST EXPENSE | |||||||||||||||||

| Unencumbered NOI | $363,155 | ||||||||||||||||

| Interest Expense for Unsecured Indebtedness | $63,203 | ||||||||||||||||

| Unencumbered NOI to Interest Expense | >=1.75x | 5.75x | |||||||||||||||

| DIVIDEND PAYOUT RATIO | |||||||||||||||||

| Distributions | $154,734 | ||||||||||||||||

| Funds From Operations | $315,895 | ||||||||||||||||

| Dividend Payout Ratio | <95% | 49.0% | |||||||||||||||

| SENIOR UNSECURED NOTES DUE 2031 | |||||||||||||||||

| Covenant | March 31, 2024 |

||||||||||||||||

| AGGREGATE DEBT TEST | |||||||||||||||||

| Total Indebtedness | $2,044,151 | ||||||||||||||||

| Total Asset Value | $6,144,875 | ||||||||||||||||

| Aggregate Debt Test | =<65% | 33.3% | |||||||||||||||

| SECURED DEBT TEST | |||||||||||||||||

| Total Secured Indebtedness | $489,951 | ||||||||||||||||

| Total Asset Value | $6,144,875 | ||||||||||||||||

| Secured Debt Test | =<40% | 8.0% | |||||||||||||||

| DEBT SERVICE TEST | |||||||||||||||||

| Consolidated EBITDA | $401,189 | ||||||||||||||||

| Annual Debt Service Charge | $80,978 | ||||||||||||||||

| Debt Service Test | =>1.5x | 4.95x | |||||||||||||||

| MAINTENANCE OF TOTAL UNENCUMBERED ASSETS | |||||||||||||||||

| Unencumbered Asset Value | $5,121,681 | ||||||||||||||||

| Total Unsecured Indebtedness | $1,554,200 | ||||||||||||||||

| MAINTENANCE OF TOTAL UNENCUMBERED ASSETS | =<150% | 330% | |||||||||||||||

| Note: Calculations are per covenant definitions as set forth in the applicable debt agreements. | |||||||||||||||||

| Phillips Edison & Company |

29

|

|||||||

| TRANSACTIONAL SUMMARY | ||

Quarter Ended March 31, 2024 | ||

|

Acquisition Summary

Unaudited, dollars in thousands

| ||||||||||||||||||||||||||||||||||||||

| Date | Property Name | Location | Total GLA | Contract Price | Leased Occupancy at Acquisition | Grocery Anchor | ||||||||||||||||||||||||||||||||

| 2/14/2024 | Shoppes at Lake Mary | Lake Mary, FL | 74,234 | $26,100 | 95.7% | Publix | ||||||||||||||||||||||||||||||||

| 3/7/2024 | Goolsby Pointe Development Land |

Riverview, FL | N/A | 2,027 | N/A | N/A | ||||||||||||||||||||||||||||||||

| 3/27/2024 | Memorial at Kirkwood | Houston, TX | 104,887 | 27,775 | 97.0% | N/A | ||||||||||||||||||||||||||||||||

| Total acquisitions | 179,121 | $55,902 | ||||||||||||||||||||||||||||||||||||

Weighted-average cap rate(1) |

6.8 | % | ||||||||||||||||||||||||||||||||||||

|

Disposition Summary

Unaudited, dollars in thousands

| ||||||||||||||||||||||||||||||||||||||

| There were no dispositions during the three months ended March 31, 2024. | ||||||||||||||||||||||||||||||||||||||

| Phillips Edison & Company |

31

|

|||||||

| PORTFOLIO SUMMARY | ||

Quarter Ended March 31, 2024 | ||

|

Wholly-Owned Portfolio Summary

Unaudited, dollars and square feet in thousands (excluding per square foot amounts)

| |||||

| As of March 31, 2024 |

|||||

| PORTFOLIO OVERVIEW: | |||||

| Number of shopping centers | 284 | ||||

| Number of states | 31 | ||||

| Total GLA | 32,350 | ||||

| Average shopping center GLA | 114 | ||||

| Total ABR | $ | 479,159 | |||

Total ABR from necessity-based goods and services(1) |

69.9 | % | |||

| Percent of ABR from non-grocery anchors | 13.3 | % | |||

| Percent of ABR from inline spaces | 55.6 | % | |||

| GROCERY METRICS: | |||||

Percent of ABR from omni-channel grocery-anchored shopping centers |

96.8 | % | |||

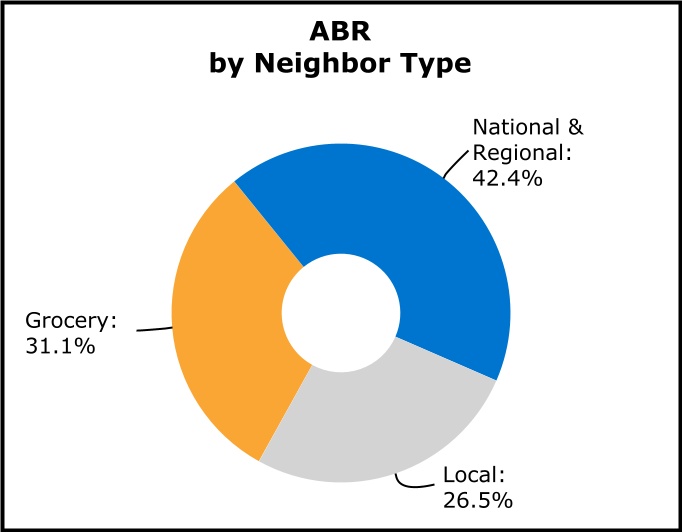

| Percent of ABR from grocery anchors | 31.1 | % | |||

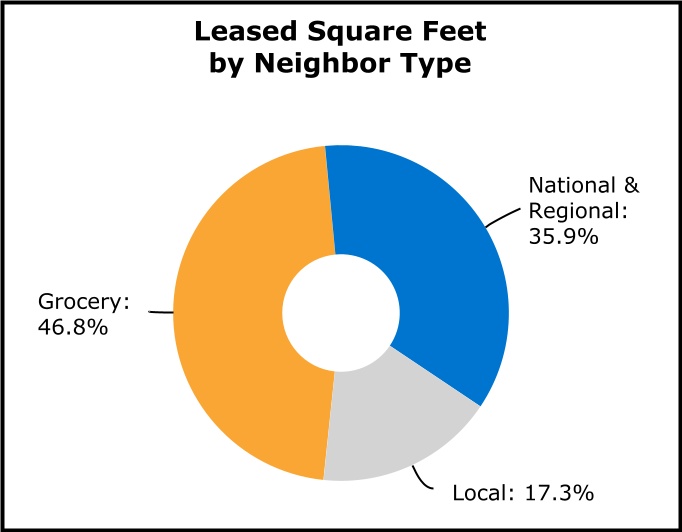

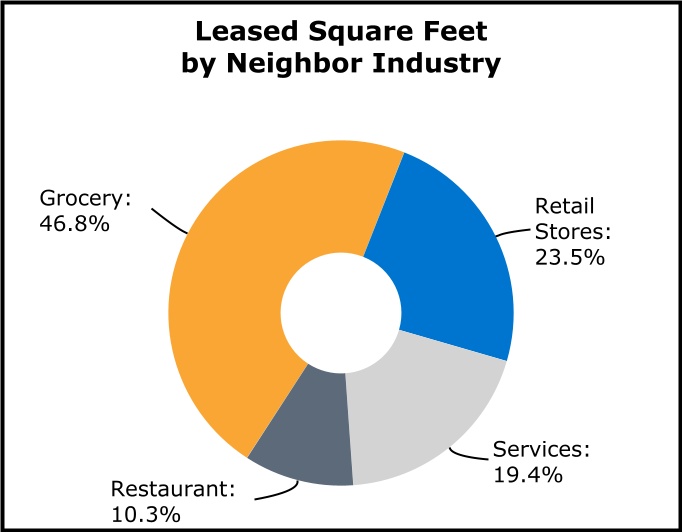

| Percent of occupied GLA leased to grocery Neighbors | 46.8 | % | |||

Grocer health ratio(2) |

2.4 | % | |||

| Percent of ABR from centers with grocery anchors that are #1 or #2 by sales | 85.2 | % | |||

| Average annual sales per square foot of reporting grocers | $ | 705 | |||

| LEASED OCCUPANCY AS A PERCENTAGE OF RENTABLE SQUARE FEET: | |||||

| Total portfolio | 97.2 | % | |||

| Anchor spaces | 98.4 | % | |||

| Inline spaces | 94.8 | % | |||

AVERAGE REMAINING LEASE TERM (IN YEARS):(3) |

|||||

| Total portfolio | 4.3 | ||||

| Grocery anchor spaces | 4.4 | ||||

| Non-grocery anchor spaces | 4.9 | ||||

| Inline spaces | 4.0 | ||||

PORTFOLIO RETENTION RATE:(4) |

|||||

| Total portfolio | 87.9 | % | |||

| Anchor spaces | 89.4 | % | |||

| Inline spaces | 83.3 | % | |||

| AVERAGE ABR PER SQUARE FOOT: | |||||

| Total portfolio | $ | 15.24 | |||

| Anchor spaces | $ | 10.20 | |||

| Inline spaces | $ | 24.99 | |||

| Phillips Edison & Company |

33

|

|||||||

|

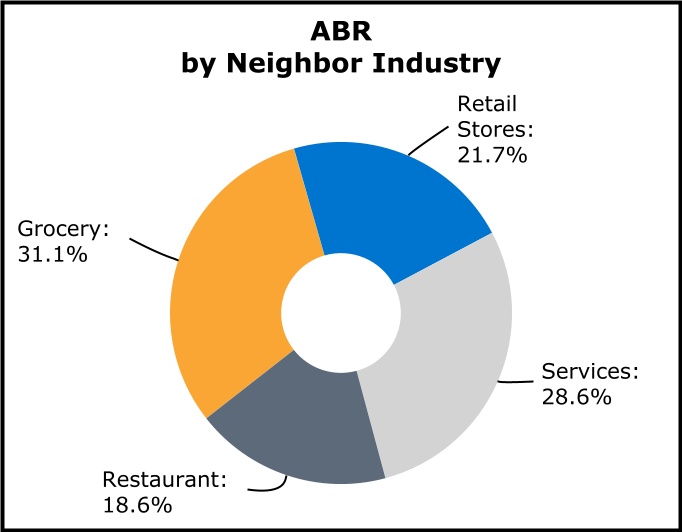

ABR by Neighbor Category

Unaudited

| |||||

| As of March 31, 2024 | |||||

| NECESSITY RETAIL AND SERVICES | |||||

| Grocery | 31.1 | % | |||

| Quick service - Restaurant | 11.2 | % | |||

| Medical | 6.3 | % | |||

| Beauty & Hair Care | 5.2 | % | |||

| Banks, insurance, and government services | 3.6 | % | |||

| Pet Supply | 2.4 | % | |||

| Dollar Stores | 1.8 | % | |||

| Education & Training | 1.6 | % | |||

| Hardware/automotive | 1.4 | % | |||

| Telecommunications/cell phone services | 1.4 | % | |||

| Wine, Beer, & Liquor | 1.3 | % | |||

| Pharmacy | 0.7 | % | |||

| Other Necessity-based | 1.9 | % | |||

| Total ABR from Necessity-based goods and services | 69.9 | % | |||

| OTHER RETAIL STORES | |||||

Soft goods(1) |

13.1 | % | |||

| Full service - restaurant | 7.4 | % | |||

Fitness and lifestyle services(2) |

6.0 | % | |||

Other retail(3) |

3.6 | % | |||

| Total ABR from other retail stores | 30.1 | % | |||

| Total ABR | 100.0 | % | |||

| Phillips Edison & Company |

34

|

|||||||

|

Wholly-Owned Occupancy and ABR

Unaudited

| |||||||||||||||||||||||||||||

| Quarter Ended | |||||||||||||||||||||||||||||

| March 31, 2024 |

December 31, 2023 |

September 30, 2023 |

June 30, 2023 |

March 31, 2023 |

|||||||||||||||||||||||||

| OCCUPANCY | |||||||||||||||||||||||||||||

| Leased Basis | |||||||||||||||||||||||||||||

| Anchor | 98.4 | % | 98.9 | % | 99.3 | % | 99.4 | % | 99.3 | % | |||||||||||||||||||

| Inline | 94.8 | % | 94.7 | % | 94.9 | % | 94.8 | % | 94.3 | % | |||||||||||||||||||

| Total leased occupancy | 97.2 | % | 97.4 | % | 97.8 | % | 97.8 | % | 97.5 | % | |||||||||||||||||||

| Economic Basis | |||||||||||||||||||||||||||||

| Anchor | 98.1 | % | 98.5 | % | 99.3 | % | 99.0 | % | 98.4 | % | |||||||||||||||||||

| Inline | 94.3 | % | 94.2 | % | 94.4 | % | 93.8 | % | 93.5 | % | |||||||||||||||||||

| Total economic occupancy | 96.8 | % | 97.0 | % | 97.6 | % | 97.2 | % | 96.7 | % | |||||||||||||||||||

| ABR | |||||||||||||||||||||||||||||

| Leased Basis - $ | |||||||||||||||||||||||||||||

| Anchor | $ | 211,286 | $ | 209,985 | $ | 203,904 | $ | 203,645 | $ | 203,525 | |||||||||||||||||||

| Inline | 267,873 | 260,834 | 249,124 | 245,669 | 242,086 | ||||||||||||||||||||||||

| Total ABR | $ | 479,159 | $ | 470,819 | $ | 453,028 | $ | 449,314 | $ | 445,611 | |||||||||||||||||||

| Leased Basis - PSF | |||||||||||||||||||||||||||||

| Anchor | $ | 10.20 | $ | 10.12 | $ | 9.98 | $ | 9.97 | $ | 9.95 | |||||||||||||||||||

| Inline | $ | 24.99 | $ | 24.66 | $ | 24.19 | $ | 23.95 | $ | 23.66 | |||||||||||||||||||

| Total ABR PSF | $ | 15.24 | $ | 15.03 | $ | 14.74 | $ | 14.64 | $ | 14.52 | |||||||||||||||||||

| SAME-CENTER | |||||||||||||||||||||||||||||

| Same-Center Leased Basis | |||||||||||||||||||||||||||||

| Anchor | 98.8 | % | 99.3 | % | 99.3 | % | 99.4 | % | 99.3 | % | |||||||||||||||||||

| Inline | 94.9 | % | 94.9 | % | 95.0 | % | 94.9 | % | 94.4 | % | |||||||||||||||||||

| Total same-center leased occupancy | 97.5 | % | 97.8 | % | 97.8 | % | 97.9 | % | 97.6 | % | |||||||||||||||||||

| Same-Center Economic Basis | |||||||||||||||||||||||||||||

| Anchor | 98.4 | % | 99.0 | % | 99.3 | % | 99.1 | % | 98.4 | % | |||||||||||||||||||

| Inline | 94.3 | % | 94.5 | % | 94.5 | % | 94.0 | % | 93.6 | % | |||||||||||||||||||

| Total same-center economic occupancy | 97.0 | % | 97.4 | % | 97.7 | % | 97.3 | % | 96.7 | % | |||||||||||||||||||

| Phillips Edison & Company |

35

|

|||||||

|

Top 25 Neighbors by ABR

Dollars and square footage amounts in thousands

| |||||||||||||||||||||||

| Number of Locations | |||||||||||||||||||||||

| Neighbor | Banners Leased at PECO Centers | Wholly-Owned | Joint Ventures | ABR(1) |

% ABR(1) |

Leased SF(1) |

|||||||||||||||||

| 1 | Kroger | Kroger, Fry's Food Stores, King Soopers, Pick 'n Save, Smith's, Harris Teeter, Quality Food Centers, Ralphs, Mariano's, Food 4 Less, Metro Market | 57 | 6 | $ | 28,495 | 5.9 | % | 3,474 | ||||||||||||||

| 2 | Publix | Publix | 52 | 9 | 26,572 | 5.5 | % | 2,519 | |||||||||||||||

| 3 | Albertsons | Safeway, Market Street United, Randalls, Tom Thumb, Jewel-Osco, Vons, United Supermarkets, Shaw's Supermarket, Albertsons | 30 | 2 | 19,470 | 4.0 | % | 1,777 | |||||||||||||||

| 4 | Ahold Delhaize | Martin's, Giant, Stop & Shop, Food Lion | 23 | — | 17,829 | 3.7 | % | 1,249 | |||||||||||||||

| 5 | Walmart | Walmart Neighborhood Market, Walmart | 13 | — | 8,952 | 1.9 | % | 1,770 | |||||||||||||||

| 6 | Giant Eagle | Giant Eagle | 9 | 1 | 7,390 | 1.5 | % | 759 | |||||||||||||||

| 7 | Sprouts Farmers Market | Sprouts Farmers Market | 14 | — | 6,715 | 1.3 | % | 421 | |||||||||||||||

| 8 | TJX Companies | Sierra Trading Co., HomeGoods, T.J.Maxx, Marshalls | 17 | — | 6,045 | 1.2 | % | 492 | |||||||||||||||

| 9 | Raley's | Raley's | 5 | — | 4,599 | 1.0 | % | 288 | |||||||||||||||

| 10 | Dollar Tree | Dollar Tree, Family Dollar, Dollar Tree Family Dollar | 35 | 4 | 4,034 | 0.8 | % | 386 | |||||||||||||||

| 11 | UNFI (SuperValu) | Cub Foods | 5 | — | 3,476 | 0.7 | % | 336 | |||||||||||||||

| 12 | Starbucks Corporation | Starbucks | 35 | — | 3,280 | 0.7 | % | 70 | |||||||||||||||

| 13 | Trader Joe's | Trader Joe's | 9 | — | 2,727 | 0.6 | % | 122 | |||||||||||||||

| 14 | H-E-B | H-E-B | 2 | — | 2,492 | 0.5 | % | 164 | |||||||||||||||

| 15 | Lowe's | Lowe's | 3 | 1 | 2,469 | 0.5 | % | 369 | |||||||||||||||

| 16 | Subway Group | Subway | 58 | 2 | 2,442 | 0.5 | % | 87 | |||||||||||||||

| 17 | Pet Supplies Plus | Pet Supplies Plus | 20 | — | 2,423 | 0.5 | % | 156 | |||||||||||||||

| 18 | United Parcel Service | The UPS Store, WeShip Store | 58 | 8 | 2,354 | 0.5 | % | 83 | |||||||||||||||

| 19 | Anytime Fitness, Inc. | Anytime Fitness | 26 | 2 | 2,351 | 0.5 | % | 136 | |||||||||||||||

| 20 | Food 4 Less (PAQ) | Food 4 Less | 2 | — | 2,305 | 0.5 | % | 118 | |||||||||||||||

| 21 | H&R Block, Inc. | H&R Block | 54 | 2 | 2,283 | 0.5 | % | 96 | |||||||||||||||

| 22 | Office Depot | Office Depot, OfficeMax | 8 | — | 2,275 | 0.5 | % | 179 | |||||||||||||||

| 23 | Great Clips, Inc. | Great Clips | 63 | 7 | 2,248 | 0.5 | % | 80 | |||||||||||||||

| 24 | Kohl's Corporation | Kohl's | 4 | — | 2,241 | 0.5 | % | 365 | |||||||||||||||

| 25 | Inspire Brands - Roark Capital | Arby's, Baskin Robbins, Jimmy John's, Buffalo Wild Wings, Buffalo Wild Wings Go, Dunkin' | 34 | 2 | 2,208 | 0.4 | % | 86 | |||||||||||||||

| Total | 636 | 46 | $ | 167,675 | 34.7 | % | 15,582 | ||||||||||||||||

| Phillips Edison & Company |

36

|

|||||||

|

Neighbors by Type and Industry(1)(2)

Unaudited

| ||

| Phillips Edison & Company |

37

|

|||||||

|

Properties by State(1)

Dollars and square footage amounts in thousands (excluding per square foot amounts)

| |||||||||||||||||||||||

| State | ABR | % ABR | ABR / Leased SF | GLA | % GLA | % Leased | Number of Properties | ||||||||||||||||

| Florida | $ | 61,040 | 12.6 | % | $ | 15.00 | 4,163 | 12.7 | % | 97.8 | % | 53 | |||||||||||

| California | 52,477 | 10.9 | % | 21.78 | 2,505 | 7.7 | % | 96.2 | % | 26 | |||||||||||||

| Texas | 45,043 | 9.3 | % | 18.35 | 2,578 | 7.9 | % | 95.2 | % | 21 | |||||||||||||

| Georgia | 41,816 | 8.6 | % | 13.95 | 3,035 | 9.3 | % | 98.7 | % | 31 | |||||||||||||

| Illinois | 28,631 | 5.9 | % | 16.87 | 1,812 | 5.6 | % | 93.6 | % | 16 | |||||||||||||

| Ohio | 25,446 | 5.3 | % | 11.08 | 2,336 | 7.2 | % | 98.3 | % | 19 | |||||||||||||

| Colorado | 25,358 | 5.3 | % | 18.74 | 1,403 | 4.3 | % | 96.5 | % | 12 | |||||||||||||

| Virginia | 22,723 | 4.7 | % | 17.39 | 1,359 | 4.2 | % | 96.1 | % | 13 | |||||||||||||

| Minnesota | 19,785 | 4.1 | % | 15.64 | 1,329 | 4.1 | % | 95.1 | % | 13 | |||||||||||||

| Massachusetts | 17,049 | 3.5 | % | 15.30 | 1,149 | 3.5 | % | 97.0 | % | 9 | |||||||||||||

| Nevada | 15,006 | 3.1 | % | 24.69 | 623 | 1.9 | % | 97.5 | % | 5 | |||||||||||||

| Pennsylvania | 12,262 | 2.6 | % | 12.56 | 1,000 | 3.1 | % | 97.6 | % | 6 | |||||||||||||

| Wisconsin | 12,069 | 2.5 | % | 11.57 | 1,057 | 3.2 | % | 98.7 | % | 9 | |||||||||||||

| Arizona | 10,861 | 2.3 | % | 14.91 | 735 | 2.3 | % | 99.1 | % | 6 | |||||||||||||

| South Carolina | 10,397 | 2.1 | % | 12.09 | 863 | 2.6 | % | 99.7 | % | 8 | |||||||||||||

| Maryland | 9,786 | 2.0 | % | 21.26 | 463 | 1.4 | % | 99.5 | % | 4 | |||||||||||||

| North Carolina | 8,352 | 1.7 | % | 13.07 | 659 | 2.0 | % | 97.0 | % | 10 | |||||||||||||

| Tennessee | 8,190 | 1.7 | % | 10.25 | 802 | 2.5 | % | 99.6 | % | 5 | |||||||||||||

| Indiana | 7,283 | 1.5 | % | 8.91 | 832 | 2.5 | % | 98.2 | % | 5 | |||||||||||||

| Kentucky | 6,914 | 1.4 | % | 11.26 | 616 | 1.9 | % | 99.7 | % | 4 | |||||||||||||

| Michigan | 6,813 | 1.4 | % | 9.81 | 723 | 2.2 | % | 96.0 | % | 5 | |||||||||||||

| New Mexico | 5,929 | 1.2 | % | 14.87 | 404 | 1.2 | % | 98.8 | % | 3 | |||||||||||||

| Connecticut | 5,876 | 1.2 | % | 15.24 | 421 | 1.3 | % | 91.6 | % | 4 | |||||||||||||

| Oregon | 5,060 | 1.0 | % | 16.71 | 316 | 1.0 | % | 95.8 | % | 4 | |||||||||||||

| Kansas | 4,704 | 1.0 | % | 12.63 | 374 | 1.1 | % | 99.6 | % | 3 | |||||||||||||

| New Jersey | 4,256 | 0.9 | % | 25.11 | 169 | 0.5 | % | 100.0 | % | 1 | |||||||||||||

| Washington | 2,890 | 0.6 | % | 16.71 | 173 | 0.5 | % | 100.0 | % | 2 | |||||||||||||

| Iowa | 2,836 | 0.6 | % | 8.06 | 360 | 1.1 | % | 97.9 | % | 3 | |||||||||||||

| Missouri | 2,599 | 0.5 | % | 11.94 | 222 | 0.7 | % | 98.2 | % | 2 | |||||||||||||

| New York | 1,711 | 0.4 | % | 11.69 | 163 | 0.5 | % | 89.6 | % | 1 | |||||||||||||

| Utah | 461 | 0.1 | % | 31.70 | 15 | — | % | 100.0 | % | 1 | |||||||||||||

| Total | $ | 483,623 | 100.0 | % | $ | 15.24 | 32,659 | 100.0 | % | 97.2 | % | 304 | |||||||||||

| Phillips Edison & Company |

38

|

|||||||

|

New, Renewal, and Option Lease Summary

Unaudited, dollars and square footage amounts in thousands (excluding per square foot amounts)

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Comparable Only | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of Leases Signed | GLA | ABR | ABR PSF(1) |

Weighted-Average Lease Term (Years) | Cost of TI/TIA PSF(2) |

Number of Leases | Increase in ABR PSF | Rent Spread % | ||||||||||||||||||||||||||||||||||||||||||||||||

TOTAL - NEW, RENEWAL, AND OPTION LEASES |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Q1 2024 | 245 | 1,307 | $ | 23,585 | $ | 18.05 | 5.5 | $ | 4.86 | 203 | $ | 1.97 | 12.9 | % | ||||||||||||||||||||||||||||||||||||||||||

| Q4 2023 | 217 | 1,146 | 19,391 | 16.92 | 5.9 | 7.62 | 174 | 1.77 | 12.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Q3 2023 | 231 | 939 | 18,333 | 19.52 | 6.3 | 6.76 | 192 | 2.37 | 13.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Q2 2023 | 285 | 1,568 | 24,160 | 15.40 | 5.3 | 4.16 | 224 | 1.54 | 11.5 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Total | 978 | 4,960 | $ | 85,469 | $ | 17.23 | 5.7 | $ | 5.64 | 793 | $ | 1.86 | 12.6 | % | ||||||||||||||||||||||||||||||||||||||||||

NEW LEASES |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Q1 2024 | 84 | 255 | $ | 6,443 | $ | 25.24 | 8.5 | $ | 24.08 | 43 | $ | 5.78 | 29.1 | % | ||||||||||||||||||||||||||||||||||||||||||

| Q4 2023 | 74 | 248 | 5,882 | 23.73 | 7.9 | 32.94 | 31 | 5.41 | 21.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Q3 2023 | 82 | 279 | 5,676 | 20.36 | 10.3 | 21.93 | 43 | 4.32 | 26.3 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Q2 2023 | 94 | 286 | 5,709 | 19.98 | 6.8 | 21.02 | 33 | 4.71 | 25.1 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Total | 334 | 1,068 | $ | 23,710 | $ | 22.20 | 8.4 | $ | 24.76 | 150 | $ | 5.02 | 26.2 | % | ||||||||||||||||||||||||||||||||||||||||||

RENEWAL LEASES |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Q1 2024 | 118 | 381 | $ | 8,935 | $ | 23.47 | 4.8 | $ | 0.54 | 117 | $ | 3.40 | 16.9 | % | ||||||||||||||||||||||||||||||||||||||||||

| Q4 2023 | 107 | 488 | 8,962 | 18.37 | 5.8 | 1.17 | 107 | 2.28 | 14.2 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Q3 2023 | 109 | 266 | 6,878 | 25.87 | 3.9 | 0.88 | 109 | 3.75 | 16.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Q2 2023 | 143 | 382 | 8,824 | 23.12 | 4.5 | 1.35 | 143 | 3.48 | 17.7 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Total | 477 | 1,517 | $ | 33,599 | $ | 22.15 | 4.9 | $ | 1.01 | 476 | $ | 3.12 | 16.4 | % | ||||||||||||||||||||||||||||||||||||||||||

OPTION LEASES |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Q1 2024 | 43 | 671 | $ | 8,207 | $ | 12.23 | 4.9 | $ | — | 43 | $ | 0.42 | 3.6 | % | ||||||||||||||||||||||||||||||||||||||||||

| Q4 2023 | 36 | 410 | 4,547 | 11.08 | 4.9 | — | 36 | 0.63 | 6.0 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Q3 2023 | 40 | 394 | 5,779 | 14.65 | 5.0 | — | 40 | 0.75 | 5.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Q2 2023 | 48 | 901 | 9,627 | 10.69 | 5.2 | — | 48 | 0.43 | 4.2 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Total | 167 | 2,376 | $ | 28,160 | $ | 11.85 | 5.0 | $ | — | 167 | $ | 0.51 | 4.5 | % | ||||||||||||||||||||||||||||||||||||||||||

| Phillips Edison & Company |

39

|

|||||||

|

Lease Expirations(1)(2)

Unaudited, square footage amounts in thousands

| |||||||||||||||||||||||||||||

| Number of Leases | GLA Expiring | % of Leased GLA(3) |

ABR PSF | % of ABR | |||||||||||||||||||||||||

| TOTAL LEASES | |||||||||||||||||||||||||||||

| MTM | 68 | 189 | 0.6 | % | $ | 17.96 | 0.7 | % | |||||||||||||||||||||

| 2024 | 475 | 1,750 | 5.5 | % | 15.74 | 5.7 | % | ||||||||||||||||||||||

| 2025 | 774 | 4,585 | 14.4 | % | 13.81 | 13.1 | % | ||||||||||||||||||||||

| 2026 | 915 | 4,721 | 14.9 | % | 15.57 | 15.2 | % | ||||||||||||||||||||||

| 2027 | 865 | 4,375 | 13.8 | % | 15.20 | 13.8 | % | ||||||||||||||||||||||

| 2028 | 823 | 5,018 | 15.8 | % | 15.38 | 16.0 | % | ||||||||||||||||||||||

| 2029 | 553 | 4,041 | 12.7 | % | 14.48 | 12.1 | % | ||||||||||||||||||||||

| 2030 | 202 | 1,452 | 4.6 | % | 16.61 | 5.0 | % | ||||||||||||||||||||||

| 2031 | 233 | 1,349 | 4.3 | % | 17.00 | 4.7 | % | ||||||||||||||||||||||

| 2032 | 188 | 1,474 | 4.6 | % | 14.27 | 4.3 | % | ||||||||||||||||||||||

| 2033 | 174 | 943 | 3.0 | % | 18.20 | 3.5 | % | ||||||||||||||||||||||

| 2034+ | 209 | 1,840 | 5.8 | % | 15.45 | 5.9 | % | ||||||||||||||||||||||

| Total leases | 5,479 | 31,737 | 100.0 | % | $ | 15.24 | 100.0 | % | |||||||||||||||||||||

| ANCHOR LEASES | |||||||||||||||||||||||||||||

| MTM | 5 | 69 | 0.2 | % | $ | 11.04 | 0.2 | % | |||||||||||||||||||||

| 2024 | 20 | 783 | 2.5 | % | 8.70 | 1.4 | % | ||||||||||||||||||||||

| 2025 | 82 | 3,211 | 10.1 | % | 9.51 | 6.3 | % | ||||||||||||||||||||||

| 2026 | 78 | 2,949 | 9.3 | % | 10.14 | 6.2 | % | ||||||||||||||||||||||

| 2027 | 80 | 2,698 | 8.5 | % | 9.40 | 5.2 | % | ||||||||||||||||||||||

| 2028 | 82 | 3,414 | 10.7 | % | 10.21 | 7.2 | % | ||||||||||||||||||||||

| 2029 | 80 | 2,943 | 9.3 | % | 10.44 | 6.3 | % | ||||||||||||||||||||||

| 2030 | 24 | 1,004 | 3.2 | % | 12.81 | 2.7 | % | ||||||||||||||||||||||

| 2031 | 30 | 821 | 2.6 | % | 11.58 | 2.0 | % | ||||||||||||||||||||||

| 2032 | 25 | 1,023 | 3.2 | % | 8.94 | 1.9 | % | ||||||||||||||||||||||

| 2033 | 17 | 563 | 1.8 | % | 12.06 | 1.4 | % | ||||||||||||||||||||||

| 2034+ | 41 | 1,440 | 4.5 | % | 11.18 | 3.3 | % | ||||||||||||||||||||||

| Anchor leases | 564 | 20,918 | 65.9 | % | $ | 10.20 | 44.1 | % | |||||||||||||||||||||

| INLINE LEASES | |||||||||||||||||||||||||||||

| MTM | 63 | 120 | 0.4 | % | $ | 21.95 | 0.5 | % | |||||||||||||||||||||

| 2024 | 455 | 967 | 3.0 | % | 21.43 | 4.3 | % | ||||||||||||||||||||||

| 2025 | 692 | 1,374 | 4.3 | % | 23.86 | 6.8 | % | ||||||||||||||||||||||

| 2026 | 837 | 1,772 | 5.6 | % | 24.62 | 9.0 | % | ||||||||||||||||||||||

| 2027 | 785 | 1,677 | 5.3 | % | 24.53 | 8.6 | % | ||||||||||||||||||||||

| 2028 | 741 | 1,604 | 5.1 | % | 26.38 | 8.8 | % | ||||||||||||||||||||||

| 2029 | 473 | 1,098 | 3.4 | % | 25.32 | 5.8 | % | ||||||||||||||||||||||

| 2030 | 178 | 448 | 1.4 | % | 25.12 | 2.3 | % | ||||||||||||||||||||||

| 2031 | 203 | 528 | 1.7 | % | 25.43 | 2.7 | % | ||||||||||||||||||||||

| 2032 | 163 | 451 | 1.4 | % | 26.36 | 2.4 | % | ||||||||||||||||||||||

| 2033 | 157 | 380 | 1.2 | % | 27.30 | 2.1 | % | ||||||||||||||||||||||

| 2034+ | 168 | 400 | 1.3 | % | 30.85 | 2.6 | % | ||||||||||||||||||||||

| Inline leases | 4,915 | 10,819 | 34.1 | % | $ | 24.98 | 55.9 | % | |||||||||||||||||||||

| Phillips Edison & Company |