| Illinois | 001-35272 | 37-1233196 | ||||||||||||

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||||||||||||

1201 Network Centre Drive | ||

Effingham, Illinois 62401 | ||

| (Address of Principal Executive Offices) (Zip Code) | ||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock, $0.01 par value | MSBI | The Nasdaq Market LLC | ||||||

| Depositary Shares, each representing a 1/40th interest in a share of 7.75% fixed rate reset non-cumulative perpetual preferred stock, Series A, $2.00 par value | MSBIP | The Nasdaq Market LLC | ||||||

| Exhibit No. | Description | ||||||||||

Press Release of Midland States Bancorp, Inc., dated January 25, 2024 |

|||||||||||

Slide Presentation of Midland States Bancorp, Inc. regarding fourth quarter 2023 financial results |

|||||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | ||||||||||

Date: January 25, 2024 |

By: | /s/ Eric T. Lemke | ||||||

| Eric T. Lemke | ||||||||

| Chief Financial Officer | ||||||||

| As of | ||||||||||||||||||||||||||||||||

| December 31, | September 30, | June 30, | March 31, | December 31, | ||||||||||||||||||||||||||||

| (in thousands) | 2023 | 2023 | 2023 | 2023 | 2022 | |||||||||||||||||||||||||||

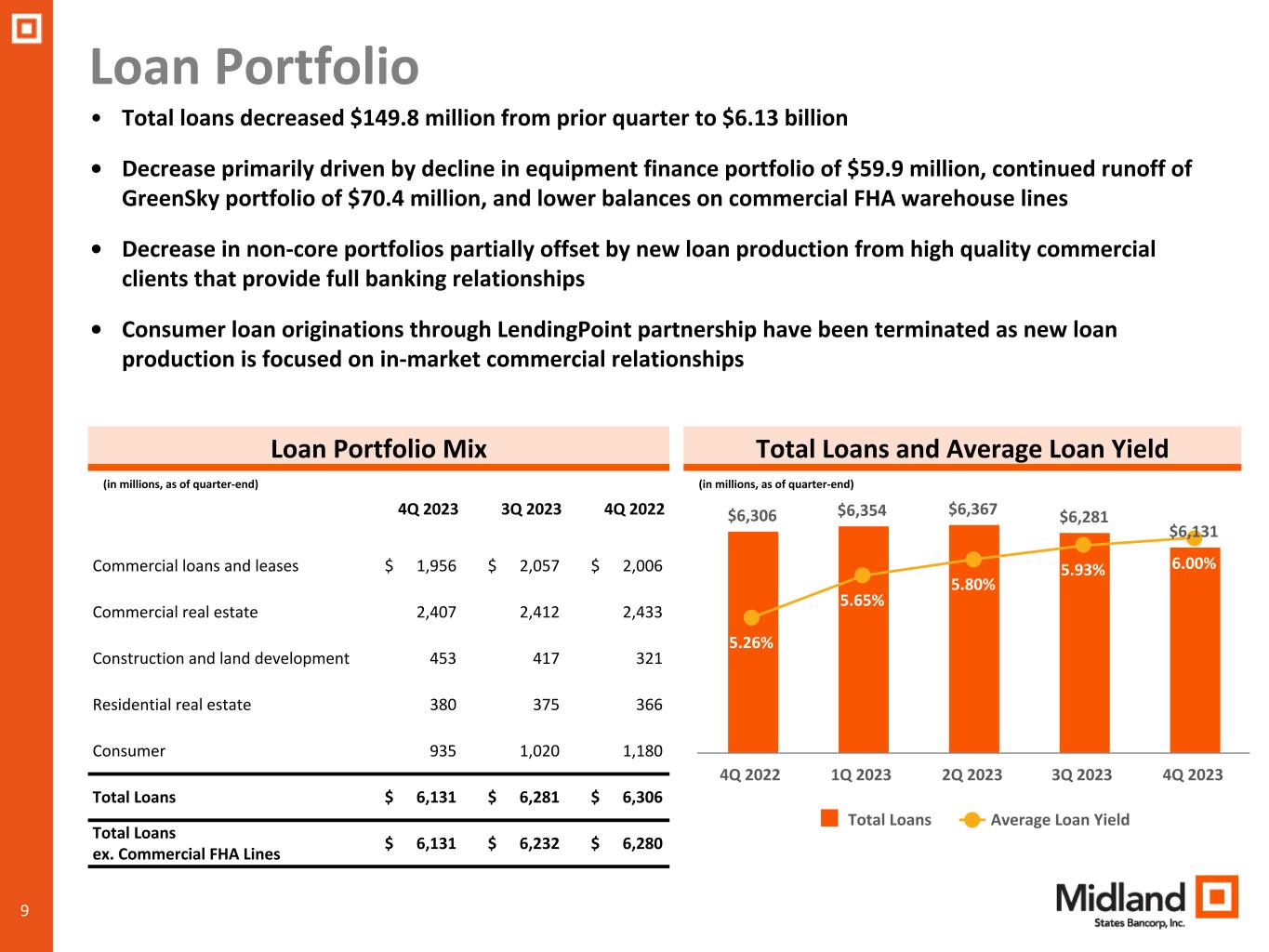

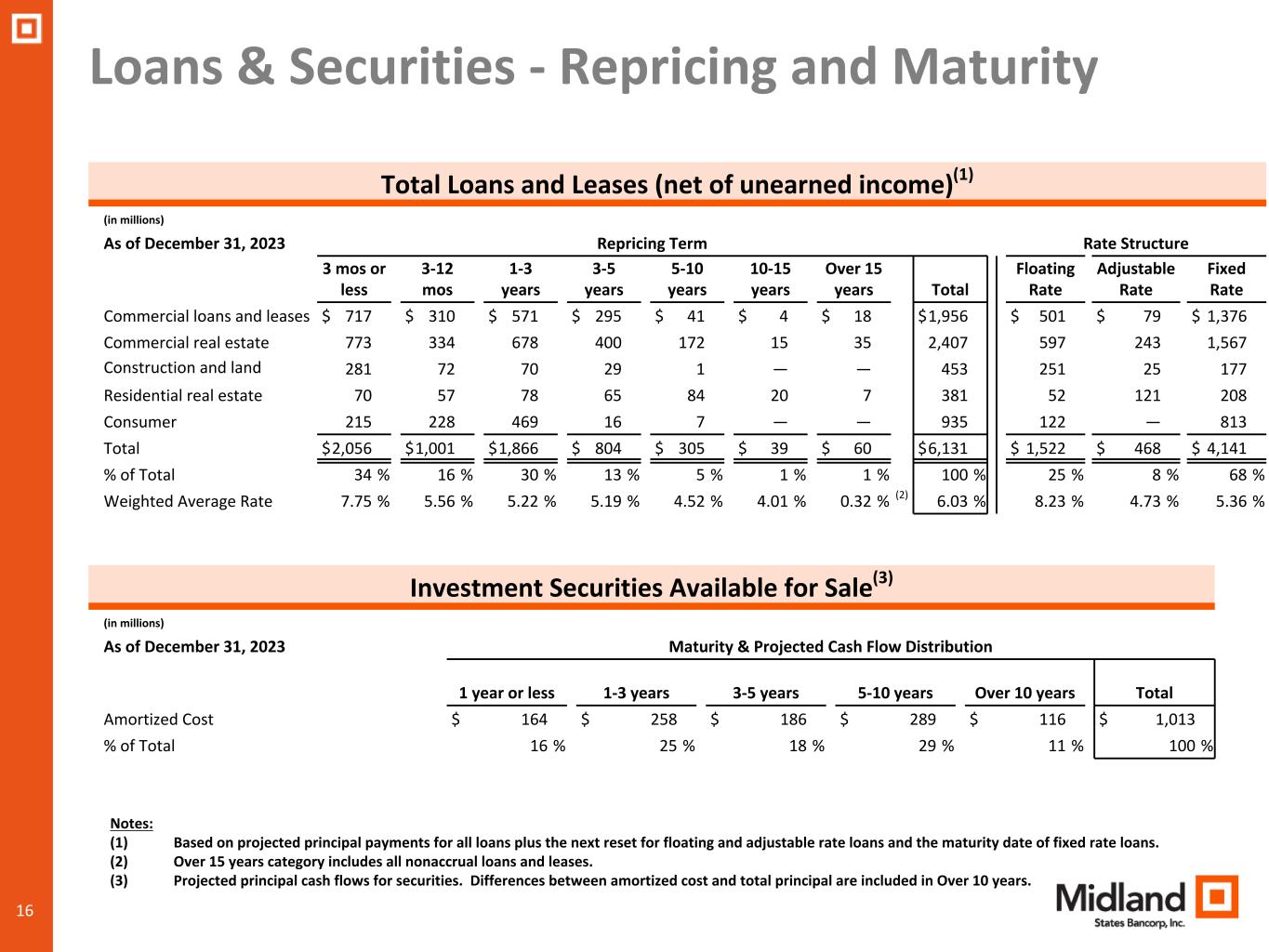

| Loan Portfolio | ||||||||||||||||||||||||||||||||

| Commercial loans | $ | 951,387 | $ | 943,761 | $ | 962,756 | $ | 937,920 | $ | 872,794 | ||||||||||||||||||||||

| Equipment finance loans | 531,143 | 578,931 | 614,633 | 632,205 | 616,751 | |||||||||||||||||||||||||||

| Equipment finance leases | 473,350 | 485,460 | 500,485 | 510,029 | 491,744 | |||||||||||||||||||||||||||

| Commercial FHA warehouse lines | — | 48,547 | 30,522 | 10,275 | 25,029 | |||||||||||||||||||||||||||

| Total commercial loans and leases | 1,955,880 | 2,056,699 | 2,108,396 | 2,090,429 | 2,006,318 | |||||||||||||||||||||||||||

| Commercial real estate | 2,406,845 | 2,412,164 | 2,443,995 | 2,448,158 | 2,433,159 | |||||||||||||||||||||||||||

| Construction and land development | 452,593 | 416,801 | 366,631 | 326,836 | 320,882 | |||||||||||||||||||||||||||

| Residential real estate | 380,583 | 375,211 | 371,486 | 369,910 | 366,094 | |||||||||||||||||||||||||||

| Consumer | 935,178 | 1,020,008 | 1,076,836 | 1,118,938 | 1,180,014 | |||||||||||||||||||||||||||

| Total loans | $ | 6,131,079 | $ | 6,280,883 | $ | 6,367,344 | $ | 6,354,271 | $ | 6,306,467 | ||||||||||||||||||||||

| As of and for the Three Months Ended | ||||||||||||||||||||||||||||||||

| (in thousands) | December 31, | September 30, | June 30, | March 31, | December 31, | |||||||||||||||||||||||||||

| 2023 | 2023 | 2023 | 2023 | 2022 | ||||||||||||||||||||||||||||

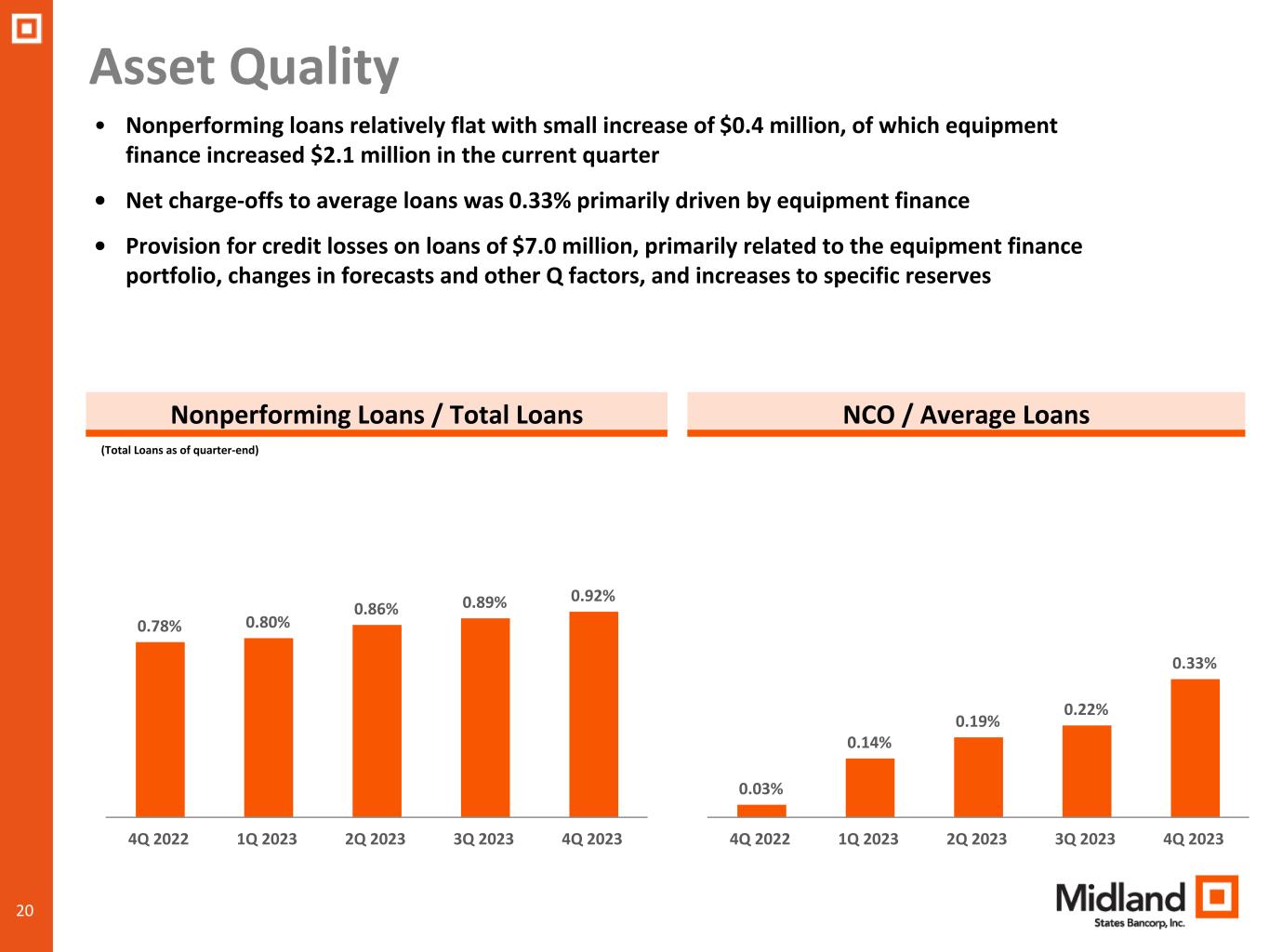

| Asset Quality | ||||||||||||||||||||||||||||||||

| Loans 30-89 days past due | $ | 82,778 | $ | 46,608 | $ | 44,161 | $ | 30,895 | $ | 32,372 | ||||||||||||||||||||||

| Nonperforming loans | 56,351 | 55,981 | 54,844 | 50,713 | 49,423 | |||||||||||||||||||||||||||

| Nonperforming assets | 67,701 | 58,677 | 57,688 | 58,806 | 57,824 | |||||||||||||||||||||||||||

| Substandard loans | 184,224 | 143,793 | 130,707 | 99,819 | 101,044 | |||||||||||||||||||||||||||

| Net charge-offs | 5,117 | 3,449 | 2,996 | 2,119 | 538 | |||||||||||||||||||||||||||

| Loans 30-89 days past due to total loans | 1.35 | % | 0.74 | % | 0.69 | % | 0.49 | % | 0.51 | % | ||||||||||||||||||||||

| Nonperforming loans to total loans | 0.92 | % | 0.89 | % | 0.86 | % | 0.80 | % | 0.78 | % | ||||||||||||||||||||||

| Nonperforming assets to total assets | 0.86 | % | 0.74 | % | 0.72 | % | 0.74 | % | 0.74 | % | ||||||||||||||||||||||

| Allowance for credit losses to total loans | 1.12 | % | 1.06 | % | 1.02 | % | 0.98 | % | 0.97 | % | ||||||||||||||||||||||

| Allowance for credit losses to nonperforming loans | 121.56 | % | 119.09 | % | 118.43 | % | 122.39 | % | 123.53 | % | ||||||||||||||||||||||

| Net charge-offs to average loans | 0.33 | % | 0.22 | % | 0.19 | % | 0.14 | % | 0.03 | % | ||||||||||||||||||||||

| As of | ||||||||||||||||||||||||||||||||

| December 31, | September 30, | June 30, | March 31, | December 31, | ||||||||||||||||||||||||||||

| (in thousands) | 2023 | 2023 | 2023 | 2023 | 2022 | |||||||||||||||||||||||||||

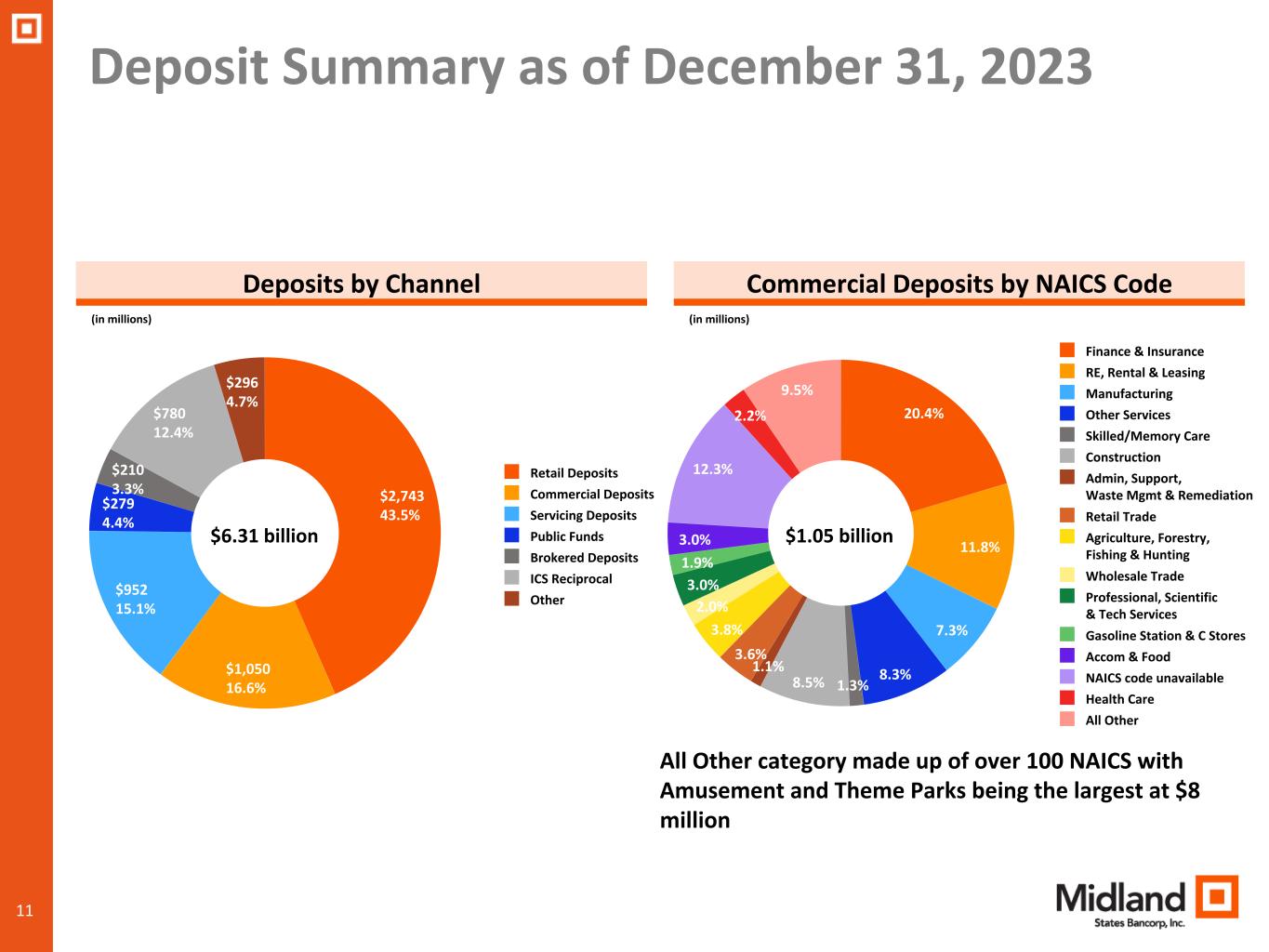

| Deposit Portfolio | ||||||||||||||||||||||||||||||||

| Noninterest-bearing demand | $ | 1,145,395 | $ | 1,154,515 | $ | 1,162,909 | $ | 1,215,758 | $ | 1,362,158 | ||||||||||||||||||||||

| Interest-bearing: | ||||||||||||||||||||||||||||||||

| Checking | 2,511,840 | 2,572,224 | 2,499,693 | 2,502,827 | 2,494,073 | |||||||||||||||||||||||||||

| Money market | 1,135,629 | 1,090,962 | 1,226,470 | 1,263,813 | 1,184,101 | |||||||||||||||||||||||||||

| Savings | 559,267 | 582,359 | 624,005 | 636,832 | 661,932 | |||||||||||||||||||||||||||

| Time | 862,865 | 885,858 | 840,734 | 766,884 | 649,552 | |||||||||||||||||||||||||||

| Brokered time | 94,533 | 119,084 | 72,737 | 39,087 | 12,836 | |||||||||||||||||||||||||||

| Total deposits | $ | 6,309,529 | $ | 6,405,002 | $ | 6,426,548 | $ | 6,425,201 | $ | 6,364,652 | ||||||||||||||||||||||

| For the Three Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, | September 30, | December 31, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | 2023 | 2023 | 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets | Average Balance | Interest & Fees | Yield/Rate | Average Balance | Interest & Fees | Yield/Rate | Average Balance | Interest & Fees | Yield/Rate | |||||||||||||||||||||||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 77,363 | $ | 1,054 | 5.41 | % | $ | 78,391 | $ | 1,036 | 5.24 | % | $ | 220,938 | $ | 2,143 | 3.85 | % | ||||||||||||||||||||||||||||||||||||||

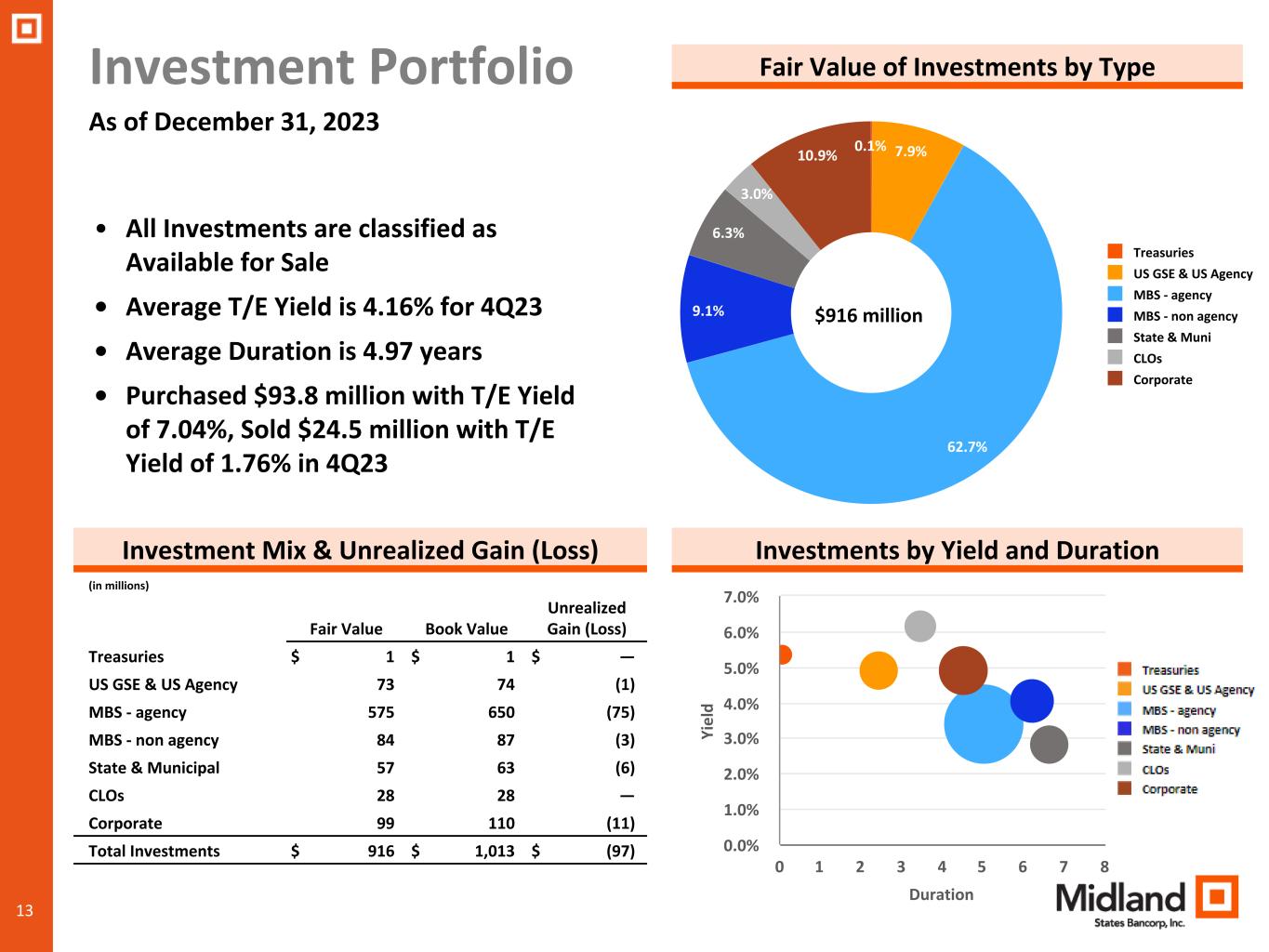

| Investment securities | 883,153 | 9,257 | 4.16 | 862,998 | 7,822 | 3.60 | 736,579 | 4,824 | 2.62 | |||||||||||||||||||||||||||||||||||||||||||||||

| Loans | 6,196,362 | 93,757 | 6.00 | 6,297,568 | 94,118 | 5.93 | 6,240,277 | 82,810 | 5.26 | |||||||||||||||||||||||||||||||||||||||||||||||

| Loans held for sale | 4,429 | 81 | 7.26 | 6,078 | 104 | 6.80 | 3,883 | 47 | 4.86 | |||||||||||||||||||||||||||||||||||||||||||||||

| Nonmarketable equity securities | 41,192 | 715 | 6.89 | 39,347 | 710 | 7.16 | 43,618 | 677 | 6.16 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | $ | 7,202,499 | $ | 104,864 | 5.78 | % | $ | 7,284,382 | $ | 103,790 | 5.65 | % | $ | 7,245,295 | $ | 90,501 | 4.96 | % | ||||||||||||||||||||||||||||||||||||||

| Noninterest-earning assets | 695,293 | 622,969 | 609,866 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 7,897,792 | $ | 7,907,351 | $ | 7,855,161 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-Bearing Liabilities | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits | $ | 5,295,296 | $ | 39,156 | 2.93 | % | $ | 5,354,356 | $ | 37,769 | 2.80 | % | $ | 5,053,158 | $ | 19,841 | 1.56 | % | ||||||||||||||||||||||||||||||||||||||

| Short-term borrowings | 13,139 | 15 | 0.47 | 20,127 | 14 | 0.28 | 47,391 | 31 | 0.26 | |||||||||||||||||||||||||||||||||||||||||||||||

| FHLB advances & other borrowings | 430,207 | 4,750 | 4.38 | 402,500 | 4,557 | 4.49 | 460,598 | 4,264 | 3.67 | |||||||||||||||||||||||||||||||||||||||||||||||

| Subordinated debt | 93,512 | 1,281 | 5.43 | 93,441 | 1,280 | 5.43 | 107,374 | 1,463 | 5.45 | |||||||||||||||||||||||||||||||||||||||||||||||

| Trust preferred debentures | 50,541 | 1,402 | 11.00 | 50,379 | 1,369 | 10.78 | 49,902 | 1,066 | 8.47 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | $ | 5,882,695 | $ | 46,604 | 3.14 | % | $ | 5,920,803 | $ | 44,989 | 3.01 | % | $ | 5,718,423 | $ | 26,665 | 1.85 | % | ||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | 1,142,062 | 1,116,988 | 1,336,620 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other noninterest-bearing liabilities | 108,245 | 97,935 | 50,935 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholders’ equity | 764,790 | 771,625 | 749,183 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and shareholder’s equity | $ | 7,897,792 | $ | 7,907,351 | $ | 7,855,161 | ||||||||||||||||||||||||||||||||||||||||||||||||||

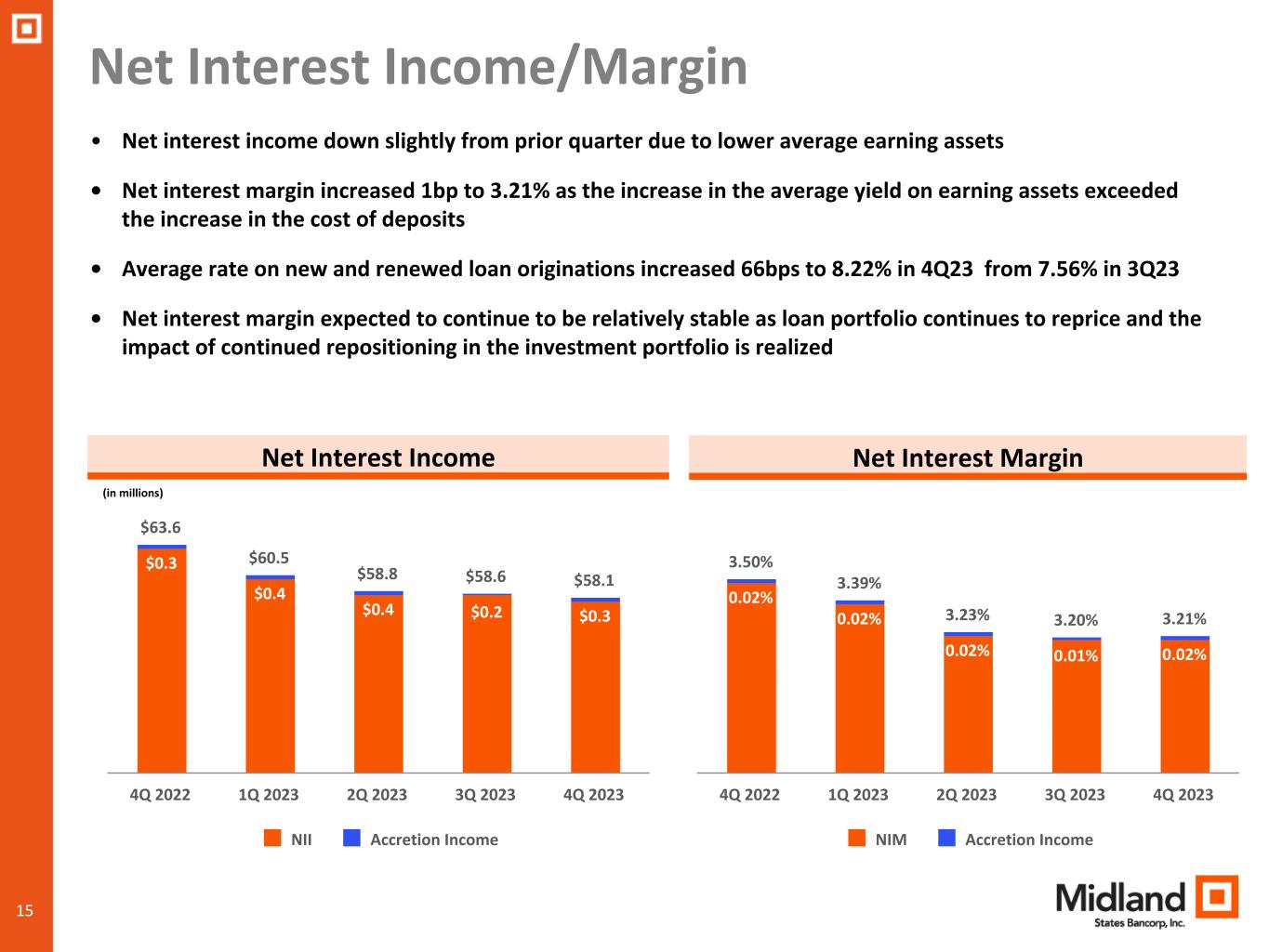

| Net Interest Margin | $ | 58,260 | 3.21 | % | $ | 58,801 | 3.20 | % | $ | 63,836 | 3.50 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Cost of Deposits | 2.41 | % | 2.32 | % | 1.23 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| For the Years Ended | ||||||||||||||||||||||||||||||||||||||

| December 31, | December 31, | |||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | 2023 | 2022 | ||||||||||||||||||||||||||||||||||||

| Interest-earning assets | Average Balance | Interest & Fees | Yield/Rate | Average Balance | Interest & Fees | Yield/Rate | ||||||||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 77,046 | $ | 3,922 | 5.09 | % | $ | 256,221 | $ | 3,907 | 1.52 | % | ||||||||||||||||||||||||||

| Investment securities | 854,576 | 30,361 | 3.55 | 799,218 | 19,277 | 2.41 | ||||||||||||||||||||||||||||||||

| Loans | 6,292,260 | 367,762 | 5.84 | 5,811,403 | 277,252 | 4.77 | ||||||||||||||||||||||||||||||||

| Loans held for sale | 4,034 | 260 | 6.45 | 12,669 | 404 | 3.19 | ||||||||||||||||||||||||||||||||

| Nonmarketable equity securities | 43,318 | 2,819 | 6.51 | 38,543 | 2,198 | 5.70 | ||||||||||||||||||||||||||||||||

| Total interest-earning assets | $ | 7,271,234 | $ | 405,124 | 5.57 | % | $ | 6,918,054 | $ | 303,038 | 4.38 | % | ||||||||||||||||||||||||||

| Noninterest-earning assets | 635,490 | 618,593 | ||||||||||||||||||||||||||||||||||||

| Total assets | $ | 7,906,724 | $ | 7,536,647 | ||||||||||||||||||||||||||||||||||

| Interest-Bearing Liabilities | ||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits | $ | 5,241,723 | $ | 136,947 | 2.61 | % | $ | 4,802,130 | $ | 36,061 | 0.75 | % | ||||||||||||||||||||||||||

| Short-term borrowings | 23,406 | 68 | 0.29 | 58,688 | 104 | 0.18 | ||||||||||||||||||||||||||||||||

| FHLB advances & other borrowings | 460,781 | 20,709 | 4.49 | 355,282 | 9,335 | 2.63 | ||||||||||||||||||||||||||||||||

| Subordinated debt | 95,986 | 5,266 | 5.49 | 131,203 | 7,495 | 5.71 | ||||||||||||||||||||||||||||||||

| Trust preferred debentures | 50,298 | 5,289 | 10.52 | 49,678 | 3,025 | 6.09 | ||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | $ | 5,872,194 | $ | 168,279 | 2.87 | % | $ | 5,396,981 | $ | 56,020 | 1.04 | % | ||||||||||||||||||||||||||

| Noninterest-bearing deposits | 1,173,873 | 1,386,251 | ||||||||||||||||||||||||||||||||||||

| Other noninterest-bearing liabilities | 90,562 | 65,539 | ||||||||||||||||||||||||||||||||||||

| Shareholders’ equity | 770,095 | 687,876 | ||||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 7,906,724 | $ | 7,536,647 | ||||||||||||||||||||||||||||||||||

| Net Interest Margin | $ | 236,845 | 3.26 | % | $ | 247,018 | 3.57 | % | ||||||||||||||||||||||||||||||

| Cost of Deposits | 2.13 | % | 0.58 | % | ||||||||||||||||||||||||||||||||||

| For the Three Months Ended | For the Years Ended | |||||||||||||||||||||||||||||||

| December 31, | September 30, | December 31, | December 31, | December 31, | ||||||||||||||||||||||||||||

| (in thousands) | 2023 | 2023(1) |

2022 | 2023 | 2022 | |||||||||||||||||||||||||||

| Noninterest income | ||||||||||||||||||||||||||||||||

| Wealth management revenue | $ | 6,604 | $ | 6,288 | $ | 6,227 | $ | 25,572 | $ | 25,708 | ||||||||||||||||||||||

| Residential mortgage banking revenue | 451 | 507 | 316 | 1,903 | 1,509 | |||||||||||||||||||||||||||

| Service charges on deposit accounts | 3,246 | 3,149 | 2,879 | 11,990 | 10,237 | |||||||||||||||||||||||||||

| Interchange revenue | 3,585 | 3,609 | 3,478 | 14,302 | 13,879 | |||||||||||||||||||||||||||

| Income on company-owned life insurance | 1,753 | 918 | 796 | 4,439 | 3,584 | |||||||||||||||||||||||||||

| Loss on sales of investment securities, net | (2,894) | (4,961) | — | (9,372) | (230) | |||||||||||||||||||||||||||

| Gain (loss) on sales of other real estate owned, net | 6 | — | — | 825 | (118) | |||||||||||||||||||||||||||

| Gain on termination of hedged interest rate swaps | — | — | 17,531 | — | 17,531 | |||||||||||||||||||||||||||

| Gain on repurchase of subordinated debt, net | — | — | — | 676 | — | |||||||||||||||||||||||||||

| Impairment on commercial mortgage servicing rights | — | — | — | — | (1,263) | |||||||||||||||||||||||||||

| Other income | 7,762 | 2,035 | 2,612 | 16,255 | 9,054 | |||||||||||||||||||||||||||

| Total noninterest income | $ | 20,513 | $ | 11,545 | $ | 33,839 | $ | 66,590 | $ | 79,891 | ||||||||||||||||||||||

| For the Three Months Ended | For the Years Ended | |||||||||||||||||||||||||||||||

| December 31, | September 30, | December 31, | December 31, | December 31, | ||||||||||||||||||||||||||||

| (in thousands) | 2023 | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||||||||||

| Noninterest expense | ||||||||||||||||||||||||||||||||

| Salaries and employee benefits | $ | 24,031 | $ | 22,307 | $ | 22,901 | $ | 93,438 | $ | 90,305 | ||||||||||||||||||||||

| Occupancy and equipment | 3,934 | 3,730 | 3,748 | 15,986 | 14,842 | |||||||||||||||||||||||||||

| Data processing | 6,963 | 6,468 | 6,302 | 26,286 | 24,350 | |||||||||||||||||||||||||||

| Professional | 2,072 | 1,554 | 1,726 | 7,049 | 6,907 | |||||||||||||||||||||||||||

| Amortization of intangible assets | 1,130 | 1,129 | 1,333 | 4,758 | 5,410 | |||||||||||||||||||||||||||

| Other real estate owned | 8 | — | 3,779 | 333 | 5,188 | |||||||||||||||||||||||||||

Loss on mortgage servicing rights held for sale |

— | — | 3,250 | — | 3,250 | |||||||||||||||||||||||||||

| FDIC insurance | 1,147 | 1,107 | 703 | 4,779 | 3,336 | |||||||||||||||||||||||||||

| Other expense | 5,203 | 5,743 | 6,201 | 21,273 | 22,074 | |||||||||||||||||||||||||||

| Total noninterest expense | $ | 44,488 | $ | 42,038 | $ | 49,943 | $ | 173,902 | $ | 175,662 | ||||||||||||||||||||||

As of December 31, 2023 |

|||||||||||||||||

| Midland States Bank | Midland States Bancorp, Inc. | Minimum Regulatory Requirements (2) |

|||||||||||||||

| Total capital to risk-weighted assets | 12.40% | 13.20% | 10.50% | ||||||||||||||

| Tier 1 capital to risk-weighted assets | 11.44% | 10.91% | 8.50% | ||||||||||||||

| Tier 1 leverage ratio | 10.18% | 9.71% | 4.00% | ||||||||||||||

| Common equity Tier 1 capital | 11.44% | 8.40% | 7.00% | ||||||||||||||

Tangible common equity to tangible assets (1) |

N/A | 6.55% | N/A | ||||||||||||||

| MIDLAND STATES BANCORP, INC. | ||||||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL SUMMARY (unaudited) | ||||||||||||||||||||||||||||||||

| As of and for the Three Months Ended |

As of and

for the Years Ended

|

|||||||||||||||||||||||||||||||

| December 31, | September 30, | December 31, | December 31, | December 31, | ||||||||||||||||||||||||||||

| (dollars in thousands, except per share data) | 2023 | 2023(2) |

2022 | 2023 | 2022 | |||||||||||||||||||||||||||

| Earnings Summary | ||||||||||||||||||||||||||||||||

| Net interest income | $ | 58,077 | $ | 58,596 | $ | 63,550 | $ | 236,017 | $ | 245,735 | ||||||||||||||||||||||

| Provision for credit losses | 6,950 | 5,168 | 3,544 | 21,132 | 20,126 | |||||||||||||||||||||||||||

| Noninterest income | 20,513 | 11,545 | 33,839 | 66,590 | 79,891 | |||||||||||||||||||||||||||

| Noninterest expense | 44,488 | 42,038 | 49,943 | 173,902 | 175,662 | |||||||||||||||||||||||||||

| Income before income taxes | 27,152 | 22,935 | 43,902 | 107,573 | 129,838 | |||||||||||||||||||||||||||

| Income taxes | 6,441 | 11,533 | 11,030 | 32,113 | 30,813 | |||||||||||||||||||||||||||

| Net income | 20,711 | 11,402 | 32,872 | 75,460 | 99,025 | |||||||||||||||||||||||||||

| Preferred dividends | 2,228 | 2,229 | 3,169 | 8,913 | 3,169 | |||||||||||||||||||||||||||

| Net income available to common shareholders | $ | 18,483 | $ | 9,173 | $ | 29,703 | $ | 66,547 | $ | 95,856 | ||||||||||||||||||||||

| Diluted earnings per common share | $ | 0.84 | $ | 0.41 | $ | 1.30 | $ | 2.97 | $ | 4.23 | ||||||||||||||||||||||

| Weighted average common shares outstanding - diluted | 21,822,328 | 21,977,196 | 22,503,611 | 22,124,402 | 22,395,698 | |||||||||||||||||||||||||||

| Return on average assets | 1.04 | % | 0.57 | % | 1.66 | % | 0.95 | % | 1.31 | % | ||||||||||||||||||||||

| Return on average shareholders' equity | 10.74 | % | 5.86 | % | 17.41 | % | 9.80 | % | 14.40 | % | ||||||||||||||||||||||

Return on average tangible common equity (1) |

15.41 | % | 7.56 | % | 25.89 | % | 13.89 | % | 20.76 | % | ||||||||||||||||||||||

| Net interest margin | 3.21 | % | 3.20 | % | 3.50 | % | 3.26 | % | 3.57 | % | ||||||||||||||||||||||

Efficiency ratio (1) |

55.22 | % | 55.82 | % | 58.26 | % | 55.91 | % | 55.35 | % | ||||||||||||||||||||||

Adjusted Earnings Performance Summary (1) |

||||||||||||||||||||||||||||||||

| Adjusted earnings available to common shareholders | $ | 19,793 | $ | 17,278 | $ | 19,278 | $ | 76,576 | $ | 85,852 | ||||||||||||||||||||||

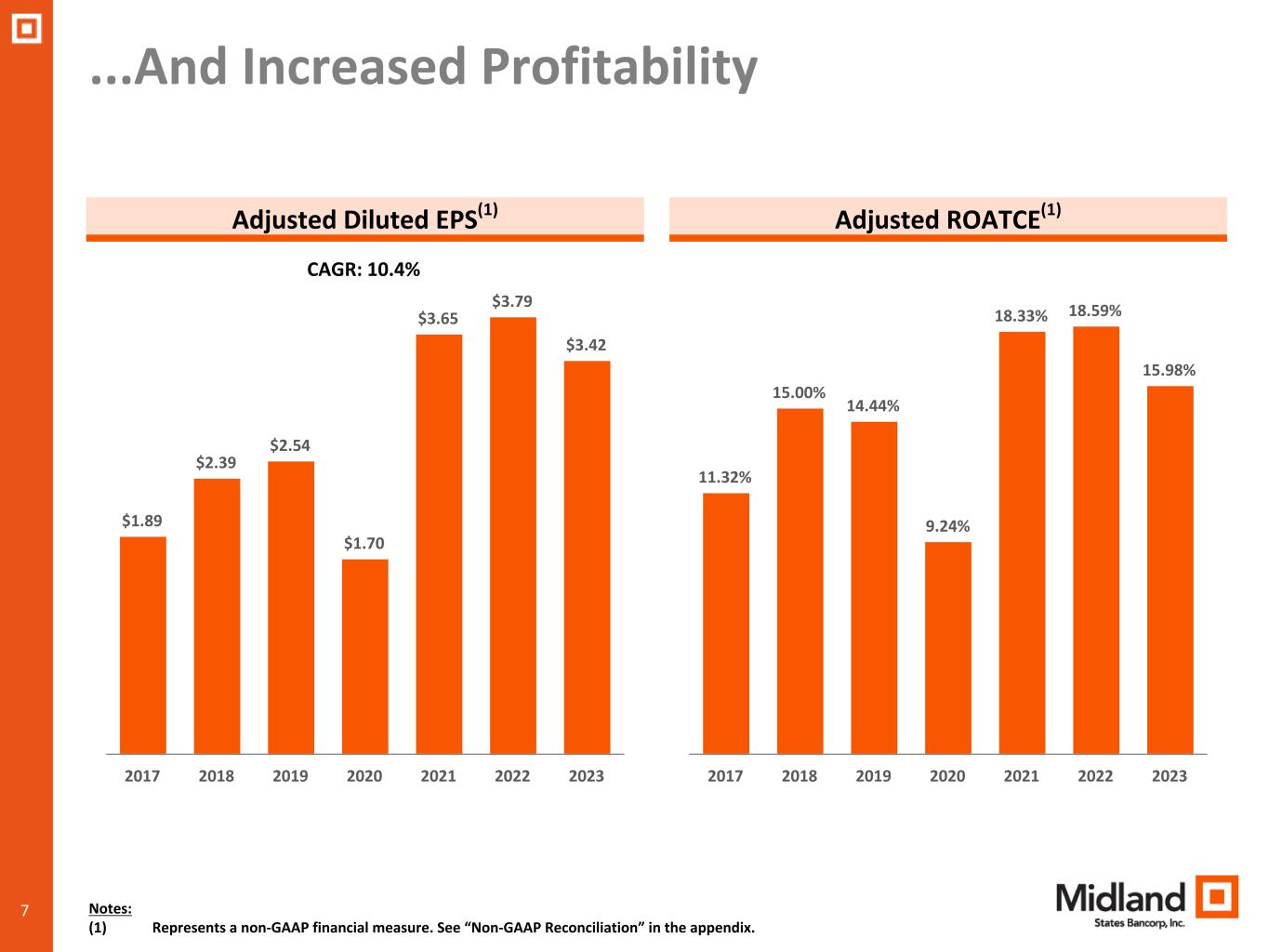

| Adjusted diluted earnings per common share | $ | 0.89 | $ | 0.78 | $ | 0.85 | $ | 3.42 | $ | 3.79 | ||||||||||||||||||||||

| Adjusted return on average assets | 1.11 | % | 0.98 | % | 1.13 | % | 1.08 | % | 1.18 | % | ||||||||||||||||||||||

| Adjusted return on average shareholders' equity | 11.42 | % | 10.03 | % | 11.89 | % | 11.10 | % | 12.94 | % | ||||||||||||||||||||||

| Adjusted return on average tangible common equity | 16.51 | % | 14.24 | % | 16.80 | % | 15.98 | % | 18.59 | % | ||||||||||||||||||||||

| Adjusted pre-tax, pre-provision earnings | $ | 35,898 | $ | 33,064 | $ | 33,165 | $ | 136,303 | $ | 137,523 | ||||||||||||||||||||||

| Adjusted pre-tax, pre-provision return on average assets | 1.80 | % | 1.66 | % | 1.68 | % | 1.72 | % | 1.82 | % | ||||||||||||||||||||||

| Market Data | ||||||||||||||||||||||||||||||||

| Book value per share at period end | $ | 31.61 | $ | 29.96 | $ | 29.17 | ||||||||||||||||||||||||||

Tangible book value per share at period end (1) |

$ | 23.35 | $ | 21.67 | $ | 20.94 | ||||||||||||||||||||||||||

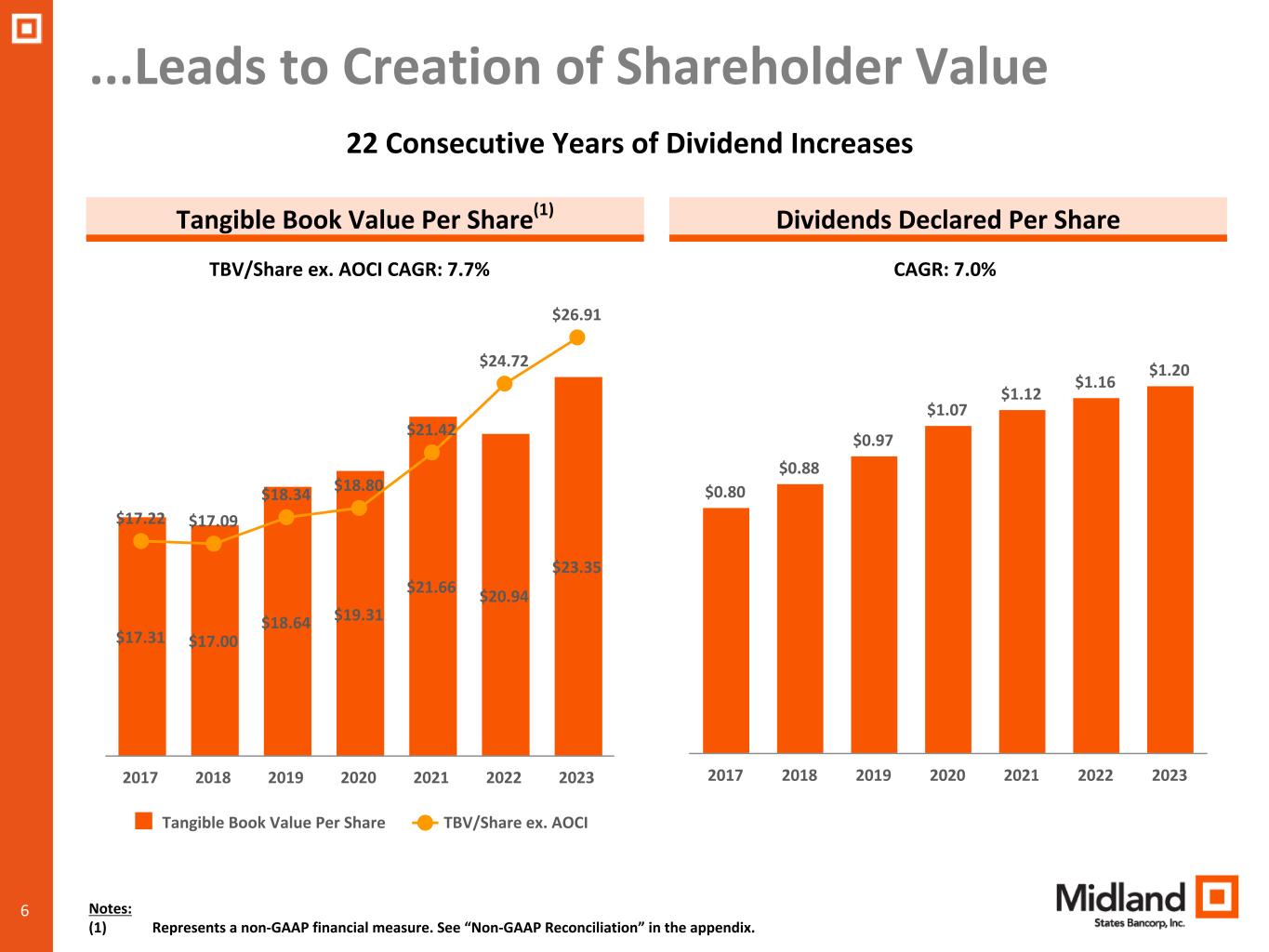

Tangible book value per share excluding accumulated other comprehensive income at period end (1) |

$ | 26.91 | $ | 26.35 | $ | 24.72 | ||||||||||||||||||||||||||

| Market price at period end | $ | 27.56 | $ | 20.54 | $ | 26.62 | ||||||||||||||||||||||||||

| Common shares outstanding at period end | 21,551,402 | 21,594,546 | 22,214,913 | |||||||||||||||||||||||||||||

| Capital | ||||||||||||||||||||||||||||||||

| Total capital to risk-weighted assets | 13.20 | % | 12.76 | % | 12.38 | % | ||||||||||||||||||||||||||

| Tier 1 capital to risk-weighted assets | 10.91 | % | 10.53 | % | 10.21 | % | ||||||||||||||||||||||||||

| Tier 1 common capital to risk-weighted assets | 8.40 | % | 8.07 | % | 7.77 | % | ||||||||||||||||||||||||||

| Tier 1 leverage ratio | 9.71 | % | 9.59 | % | 9.43 | % | ||||||||||||||||||||||||||

Tangible common equity to tangible assets (1) |

6.55 | % | 6.01 | % | 6.06 | % | ||||||||||||||||||||||||||

| Wealth Management | ||||||||||||||||||||||||||||||||

| Trust assets under administration | $ | 3,733,355 | $ | 3,501,225 | $ | 3,505,372 | ||||||||||||||||||||||||||

| MIDLAND STATES BANCORP, INC. | ||||||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL SUMMARY (unaudited) (continued) | ||||||||||||||||||||||||||||||||

| As of | ||||||||||||||||||||||||||||||||

| December 31, | September 30, | June 30, | March 31, | December 31, | ||||||||||||||||||||||||||||

| (in thousands) | 2023 | 2023(1) |

2023 | 2023 | 2022 | |||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||

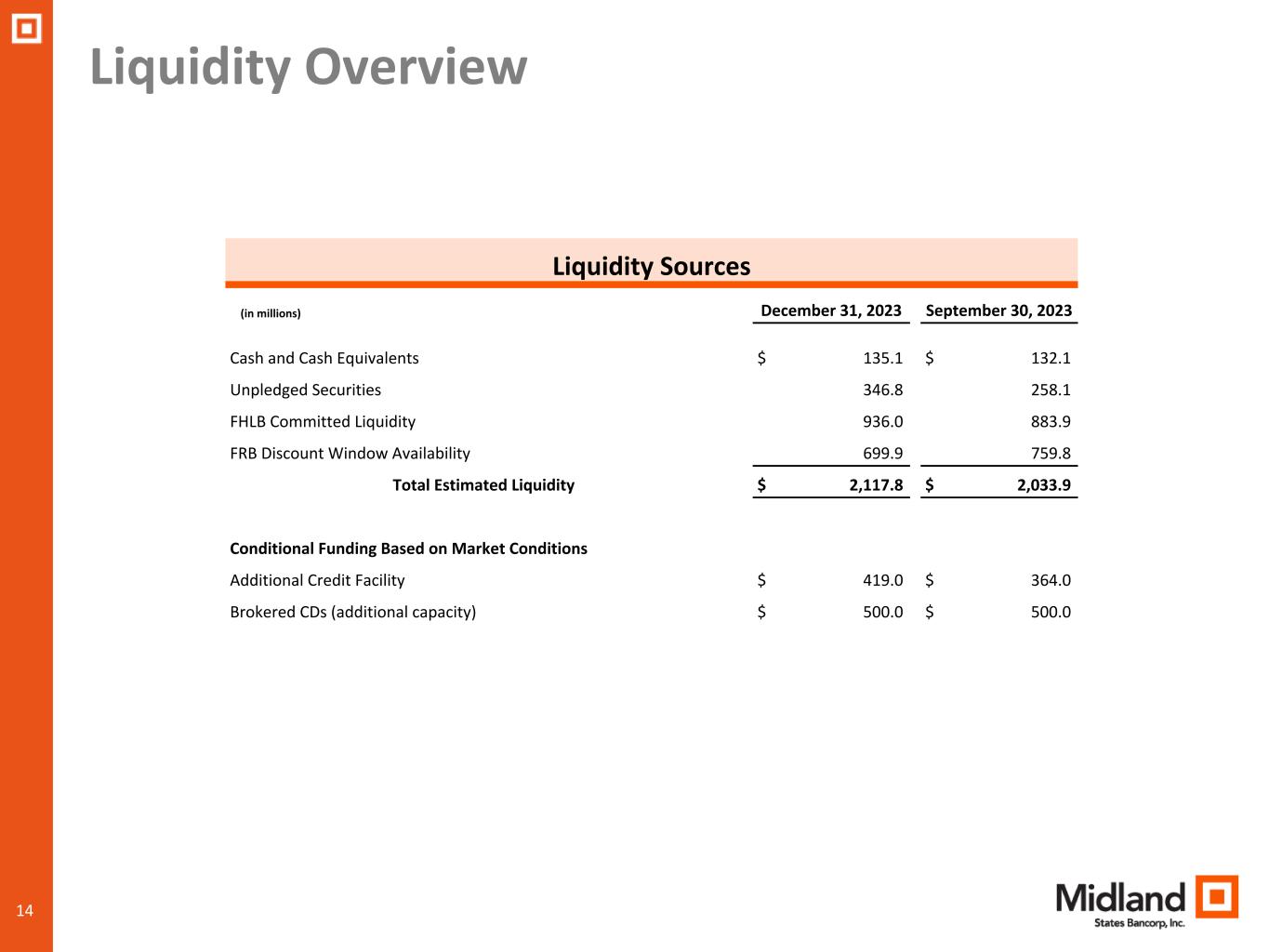

| Cash and cash equivalents | $ | 135,061 | $ | 132,132 | $ | 160,695 | $ | 138,310 | $ | 160,631 | ||||||||||||||||||||||

| Investment securities | 920,396 | 839,344 | 887,003 | 821,005 | 776,860 | |||||||||||||||||||||||||||

| Loans | 6,131,079 | 6,280,883 | 6,367,344 | 6,354,271 | 6,306,467 | |||||||||||||||||||||||||||

| Allowance for credit losses on loans | (68,502) | (66,669) | (64,950) | (62,067) | (61,051) | |||||||||||||||||||||||||||

| Total loans, net | 6,062,577 | 6,214,214 | 6,302,394 | 6,292,204 | 6,245,416 | |||||||||||||||||||||||||||

| Loans held for sale | 3,811 | 6,089 | 5,632 | 2,747 | 1,286 | |||||||||||||||||||||||||||

| Premises and equipment, net | 82,814 | 82,741 | 81,006 | 80,582 | 78,293 | |||||||||||||||||||||||||||

| Other real estate owned | 9,112 | 480 | 202 | 6,729 | 6,729 | |||||||||||||||||||||||||||

| Loan servicing rights, at lower of cost or fair value | 20,253 | 20,933 | 21,611 | 1,117 | 1,205 | |||||||||||||||||||||||||||

| Commercial FHA mortgage loan servicing rights held for sale | — | — | — | 20,745 | 20,745 | |||||||||||||||||||||||||||

| Goodwill | 161,904 | 161,904 | 161,904 | 161,904 | 161,904 | |||||||||||||||||||||||||||

| Other intangible assets, net | 16,108 | 17,238 | 18,367 | 19,575 | 20,866 | |||||||||||||||||||||||||||

| Company-owned life insurance | 203,485 | 201,750 | 152,210 | 151,319 | 150,443 | |||||||||||||||||||||||||||

| Other assets | 251,347 | 292,460 | 243,697 | 233,937 | 231,123 | |||||||||||||||||||||||||||

| Total assets | $ | 7,866,868 | $ | 7,969,285 | $ | 8,034,721 | $ | 7,930,174 | $ | 7,855,501 | ||||||||||||||||||||||

| Liabilities and Shareholders' Equity | ||||||||||||||||||||||||||||||||

| Noninterest-bearing demand deposits | $ | 1,145,395 | $ | 1,154,515 | $ | 1,162,909 | $ | 1,215,758 | $ | 1,362,158 | ||||||||||||||||||||||

| Interest-bearing deposits | 5,164,134 | 5,250,487 | 5,263,639 | 5,209,443 | 5,002,494 | |||||||||||||||||||||||||||

| Total deposits | 6,309,529 | 6,405,002 | 6,426,548 | 6,425,201 | 6,364,652 | |||||||||||||||||||||||||||

| Short-term borrowings | 34,865 | 17,998 | 21,783 | 31,173 | 42,311 | |||||||||||||||||||||||||||

| FHLB advances and other borrowings | 476,000 | 538,000 | 575,000 | 482,000 | 460,000 | |||||||||||||||||||||||||||

| Subordinated debt | 93,546 | 93,475 | 93,404 | 99,849 | 99,772 | |||||||||||||||||||||||||||

| Trust preferred debentures | 50,616 | 50,457 | 50,296 | 50,135 | 49,975 | |||||||||||||||||||||||||||

| Other liabilities | 110,459 | 106,743 | 90,869 | 66,173 | 80,217 | |||||||||||||||||||||||||||

| Total liabilities | 7,075,015 | 7,211,675 | 7,257,900 | 7,154,531 | 7,096,927 | |||||||||||||||||||||||||||

| Total shareholders’ equity | 791,853 | 757,610 | 776,821 | 775,643 | 758,574 | |||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 7,866,868 | $ | 7,969,285 | $ | 8,034,721 | $ | 7,930,174 | $ | 7,855,501 | ||||||||||||||||||||||

| MIDLAND STATES BANCORP, INC. | ||||||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL SUMMARY (unaudited) (continued) | ||||||||||||||||||||||||||||||||

| For the Three Months Ended | For the Years Ended | |||||||||||||||||||||||||||||||

| December 31, | September 30, | December 31, | December 31, | December 31, | ||||||||||||||||||||||||||||

| (in thousands, except per share data) | 2023 | 2023(1) |

2022 | 2023 | 2022 | |||||||||||||||||||||||||||

| Net interest income: | ||||||||||||||||||||||||||||||||

| Interest income | $ | 104,681 | $ | 103,585 | $ | 90,215 | $ | 404,296 | $ | 301,755 | ||||||||||||||||||||||

| Interest expense | 46,604 | 44,989 | 26,665 | 168,279 | 56,020 | |||||||||||||||||||||||||||

| Net interest income | 58,077 | 58,596 | 63,550 | 236,017 | 245,735 | |||||||||||||||||||||||||||

| Provision for credit losses: | ||||||||||||||||||||||||||||||||

| Provision for credit losses on loans | 6,950 | 5,168 | 2,950 | 21,132 | 18,797 | |||||||||||||||||||||||||||

| Provision for credit losses on unfunded commitments | — | — | 594 | — | 1,550 | |||||||||||||||||||||||||||

| Provision for other credit losses | — | — | — | — | (221) | |||||||||||||||||||||||||||

| Total provision for credit losses | 6,950 | 5,168 | 3,544 | 21,132 | 20,126 | |||||||||||||||||||||||||||

| Net interest income after provision for credit losses | 51,127 | 53,428 | 60,006 | 214,885 | 225,609 | |||||||||||||||||||||||||||

| Noninterest income: | ||||||||||||||||||||||||||||||||

| Wealth management revenue | 6,604 | 6,288 | 6,227 | 25,572 | 25,708 | |||||||||||||||||||||||||||

| Residential mortgage banking revenue | 451 | 507 | 316 | 1,903 | 1,509 | |||||||||||||||||||||||||||

| Service charges on deposit accounts | 3,246 | 3,149 | 2,879 | 11,990 | 10,237 | |||||||||||||||||||||||||||

| Interchange revenue | 3,585 | 3,609 | 3,478 | 14,302 | 13,879 | |||||||||||||||||||||||||||

| Income on company-owned life insurance | 1,753 | 918 | 796 | 4,439 | 3,584 | |||||||||||||||||||||||||||

| Loss on sales of investment securities, net | (2,894) | (4,961) | — | (9,372) | (230) | |||||||||||||||||||||||||||

| Gain (loss) on sales of other real estate owned, net | 6 | — | — | 825 | (118) | |||||||||||||||||||||||||||

| Gain on termination of hedged interest rate swaps | — | — | 17,531 | — | 17,531 | |||||||||||||||||||||||||||

| Gain on repurchase of subordinated debt, net | — | — | — | 676 | — | |||||||||||||||||||||||||||

| Impairment on commercial mortgage servicing rights | — | — | — | — | (1,263) | |||||||||||||||||||||||||||

| Other income | 7,762 | 2,035 | 2,612 | 16,255 | 9,054 | |||||||||||||||||||||||||||

| Total noninterest income | 20,513 | 11,545 | 33,839 | 66,590 | 79,891 | |||||||||||||||||||||||||||

| Noninterest expense: | ||||||||||||||||||||||||||||||||

| Salaries and employee benefits | 24,031 | 22,307 | 22,901 | 93,438 | 90,305 | |||||||||||||||||||||||||||

| Occupancy and equipment | 3,934 | 3,730 | 3,748 | 15,986 | 14,842 | |||||||||||||||||||||||||||

| Data processing | 6,963 | 6,468 | 6,302 | 26,286 | 24,350 | |||||||||||||||||||||||||||

| Professional | 2,072 | 1,554 | 1,726 | 7,049 | 6,907 | |||||||||||||||||||||||||||

| Amortization of intangible assets | 1,130 | 1,129 | 1,333 | 4,758 | 5,410 | |||||||||||||||||||||||||||

| Other real estate owned | 8 | — | 3,779 | 333 | 5,188 | |||||||||||||||||||||||||||

| Loss on mortgage servicing rights held for sale | — | — | 3,250 | — | 3,250 | |||||||||||||||||||||||||||

| FDIC insurance | 1,147 | 1,107 | 703 | 4,779 | 3,336 | |||||||||||||||||||||||||||

| Other expense | 5,203 | 5,743 | 6,201 | 21,273 | 22,074 | |||||||||||||||||||||||||||

| Total noninterest expense | 44,488 | 42,038 | 49,943 | 173,902 | 175,662 | |||||||||||||||||||||||||||

| Income before income taxes | 27,152 | 22,935 | 43,902 | 107,573 | 129,838 | |||||||||||||||||||||||||||

| Income taxes | 6,441 | 11,533 | 11,030 | 32,113 | 30,813 | |||||||||||||||||||||||||||

| Net income | 20,711 | 11,402 | 32,872 | 75,460 | 99,025 | |||||||||||||||||||||||||||

| Preferred stock dividends | 2,228 | 2,229 | 3,169 | 8,913 | 3,169 | |||||||||||||||||||||||||||

| Net income available to common shareholders | $ | 18,483 | $ | 9,173 | $ | 29,703 | $ | 66,547 | $ | 95,856 | ||||||||||||||||||||||

| Basic earnings per common share | $ | 0.84 | $ | 0.41 | $ | 1.31 | $ | 2.97 | $ | 4.24 | ||||||||||||||||||||||

| Diluted earnings per common share | $ | 0.84 | $ | 0.41 | $ | 1.30 | $ | 2.97 | $ | 4.23 | ||||||||||||||||||||||

| MIDLAND STATES BANCORP, INC. | ||||||||||||||||||||||||||||||||

| RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES (unaudited) | ||||||||||||||||||||||||||||||||

| Adjusted Earnings Reconciliation | ||||||||||||||||||||||||||||||||

| For the Three Months Ended | For the Years Ended | |||||||||||||||||||||||||||||||

| December 31, | September 30, | December 31, | December 31, | December 31, | ||||||||||||||||||||||||||||

| (dollars in thousands, except per share data) | 2023 | 2023(1) |

2022 | 2023 | 2022 | |||||||||||||||||||||||||||

| Income before income taxes - GAAP | $ | 27,152 | $ | 22,935 | $ | 43,902 | $ | 107,573 | $ | 129,838 | ||||||||||||||||||||||

| Adjustments to noninterest income: | ||||||||||||||||||||||||||||||||

| Loss on sales of investment securities, net | 2,894 | 4,961 | — | 9,372 | 230 | |||||||||||||||||||||||||||

| (Gain) on termination of hedged interest rate swaps | — | — | (17,531) | — | (17,531) | |||||||||||||||||||||||||||

| (Gain) on sale of Visa B shares | (1,098) | — | — | (1,098) | — | |||||||||||||||||||||||||||

| (Gain) on repurchase of subordinated debt | — | — | — | (676) | — | |||||||||||||||||||||||||||

| Total adjustments to noninterest income | 1,796 | 4,961 | (17,531) | 7,598 | (17,301) | |||||||||||||||||||||||||||

| Adjustments to noninterest expense: | ||||||||||||||||||||||||||||||||

| (Loss) on mortgage servicing rights held for sale | — | — | (3,250) | — | (3,250) | |||||||||||||||||||||||||||

| Integration and acquisition expenses | — | — | — | — | (347) | |||||||||||||||||||||||||||

| Total adjustments to noninterest expense | — | — | (3,250) | — | (3,597) | |||||||||||||||||||||||||||

| Adjusted earnings pre tax - non-GAAP | 28,948 | 27,896 | 29,621 | 115,171 | 116,134 | |||||||||||||||||||||||||||

| Adjusted earnings tax | 6,927 | 8,389 | 7,174 | 29,682 | 27,113 | |||||||||||||||||||||||||||

| Adjusted earnings - non-GAAP | 22,021 | 19,507 | 22,447 | 85,489 | 89,021 | |||||||||||||||||||||||||||

| Preferred stock dividends | 2,228 | 2,229 | 3,169 | 8,913 | 3,169 | |||||||||||||||||||||||||||

| Adjusted earnings available to common shareholders | $ | 19,793 | $ | 17,278 | $ | 19,278 | $ | 76,576 | $ | 85,852 | ||||||||||||||||||||||

| Adjusted diluted earnings per common share | $ | 0.89 | $ | 0.78 | $ | 0.85 | $ | 3.42 | $ | 3.79 | ||||||||||||||||||||||

| Adjusted return on average assets | 1.11 | % | 0.98 | % | 1.13 | % | 1.08 | % | 1.18 | % | ||||||||||||||||||||||

| Adjusted return on average shareholders' equity | 11.42 | % | 10.03 | % | 11.89 | % | 11.10 | % | 12.94 | % | ||||||||||||||||||||||

| Adjusted return on average tangible common equity | 16.51 | % | 14.24 | % | 16.80 | % | 15.98 | % | 18.59 | % | ||||||||||||||||||||||

| (1) September 30, 2023 amounts include the impact of the revision previously mentioned in this earnings release. | ||||||||||||||||||||||||||||||||

| Adjusted Pre-Tax, Pre-Provision Earnings Reconciliation | ||||||||||||||||||||||||||||||||

| For the Three Months Ended | For the Years Ended | |||||||||||||||||||||||||||||||

| December 31, | September 30, | December 31, | December 31, | December 31, | ||||||||||||||||||||||||||||

| (dollars in thousands) | 2023 | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||||||||||

| Adjusted earnings pre tax - non-GAAP | $ | 28,948 | $ | 27,896 | $ | 29,621 | $ | 115,171 | $ | 116,134 | ||||||||||||||||||||||

| Provision for credit losses | 6,950 | 5,168 | 3,544 | 21,132 | 20,126 | |||||||||||||||||||||||||||

| Impairment on commercial mortgage servicing rights | — | — | — | — | 1,263 | |||||||||||||||||||||||||||

| Adjusted pre-tax, pre-provision earnings - non-GAAP | $ | 35,898 | $ | 33,064 | $ | 33,165 | $ | 136,303 | $ | 137,523 | ||||||||||||||||||||||

| Adjusted pre-tax, pre-provision return on average assets | 1.80 | % | 1.66 | % | 1.68 | % | 1.72 | % | 1.82 | % | ||||||||||||||||||||||

| MIDLAND STATES BANCORP, INC. | ||||||||||||||||||||||||||||||||

| RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES (unaudited) (continued) | ||||||||||||||||||||||||||||||||

| Efficiency Ratio Reconciliation | ||||||||||||||||||||||||||||||||

| For the Three Months Ended | For the Years Ended | |||||||||||||||||||||||||||||||

| December 31, | September 30, | December 31, | December 31, | December 31, | ||||||||||||||||||||||||||||

| (dollars in thousands) | 2023 | 2023(1) |

2022 | 2023 | 2022 | |||||||||||||||||||||||||||

| Noninterest expense - GAAP | $ | 44,488 | $ | 42,038 | $ | 49,943 | $ | 173,902 | $ | 175,662 | ||||||||||||||||||||||

| Loss on mortgage servicing rights held for sale | — | — | (3,250) | — | (3,250) | |||||||||||||||||||||||||||

| Integration and acquisition expenses | — | — | — | — | (347) | |||||||||||||||||||||||||||

| Adjusted noninterest expense | $ | 44,488 | $ | 42,038 | $ | 46,693 | $ | 173,902 | $ | 172,065 | ||||||||||||||||||||||

| Net interest income - GAAP | $ | 58,077 | $ | 58,596 | $ | 63,550 | $ | 236,017 | $ | 245,735 | ||||||||||||||||||||||

| Effect of tax-exempt income | 183 | 205 | 286 | 828 | 1,283 | |||||||||||||||||||||||||||

| Adjusted net interest income | 58,260 | 58,801 | 63,836 | 236,845 | 247,018 | |||||||||||||||||||||||||||

| Noninterest income - GAAP | 20,513 | 11,545 | 33,839 | 66,590 | 79,891 | |||||||||||||||||||||||||||

| Impairment on commercial mortgage servicing rights | — | — | — | — | 1,263 | |||||||||||||||||||||||||||

| Loss on sales of investment securities, net | 2,894 | 4,961 | — | 9,372 | 230 | |||||||||||||||||||||||||||

| (Gain) on termination of hedged interest rate swaps | — | — | (17,531) | — | (17,531) | |||||||||||||||||||||||||||

| (Gain) on repurchase of subordinated debt | — | — | — | (676) | — | |||||||||||||||||||||||||||

| (Gain) on sale of Visa B shares | (1,098) | — | — | (1,098) | — | |||||||||||||||||||||||||||

| Adjusted noninterest income | 22,309 | 16,506 | 16,308 | 74,188 | 63,853 | |||||||||||||||||||||||||||

| Adjusted total revenue | $ | 80,569 | $ | 75,307 | $ | 80,144 | $ | 311,033 | $ | 310,871 | ||||||||||||||||||||||

| Efficiency ratio | 55.22 | % | 55.82 | % | 58.26 | % | 55.91 | % | 55.35 | % | ||||||||||||||||||||||

| Return on Average Tangible Common Equity (ROATCE) | ||||||||||||||||||||||||||||||||

| For the Three Months Ended | For the Years Ended | |||||||||||||||||||||||||||||||

| December 31, | September 30, | December 31, | December 31, | December 31, | ||||||||||||||||||||||||||||

| (dollars in thousands) | 2023 | 2023(1) |

2022 | 2023 | 2022 | |||||||||||||||||||||||||||

| Net income available to common shareholders | $ | 18,483 | $ | 9,173 | $ | 29,703 | $ | 66,547 | $ | 95,856 | ||||||||||||||||||||||

| Average total shareholders' equity—GAAP | $ | 764,790 | $ | 771,625 | $ | 749,183 | $ | 770,095 | $ | 687,876 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Preferred Stock | (110,548) | (110,548) | (110,548) | (110,548) | (41,493) | |||||||||||||||||||||||||||

| Goodwill | (161,904) | (161,904) | (161,904) | (161,904) | (161,904) | |||||||||||||||||||||||||||

| Other intangible assets, net | (16,644) | (17,782) | (22,859) | (18,376) | (22,637) | |||||||||||||||||||||||||||

| Average tangible common equity | $ | 475,694 | $ | 481,391 | $ | 453,872 | $ | 479,267 | $ | 461,842 | ||||||||||||||||||||||

| ROATCE | 15.41 | % | 7.56 | % | 25.89 | % | 13.89 | % | 20.76 | % | ||||||||||||||||||||||

| MIDLAND STATES BANCORP, INC. | ||||||||||||||||||||||||||||||||

| RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES (unaudited) (continued) | ||||||||||||||||||||||||||||||||

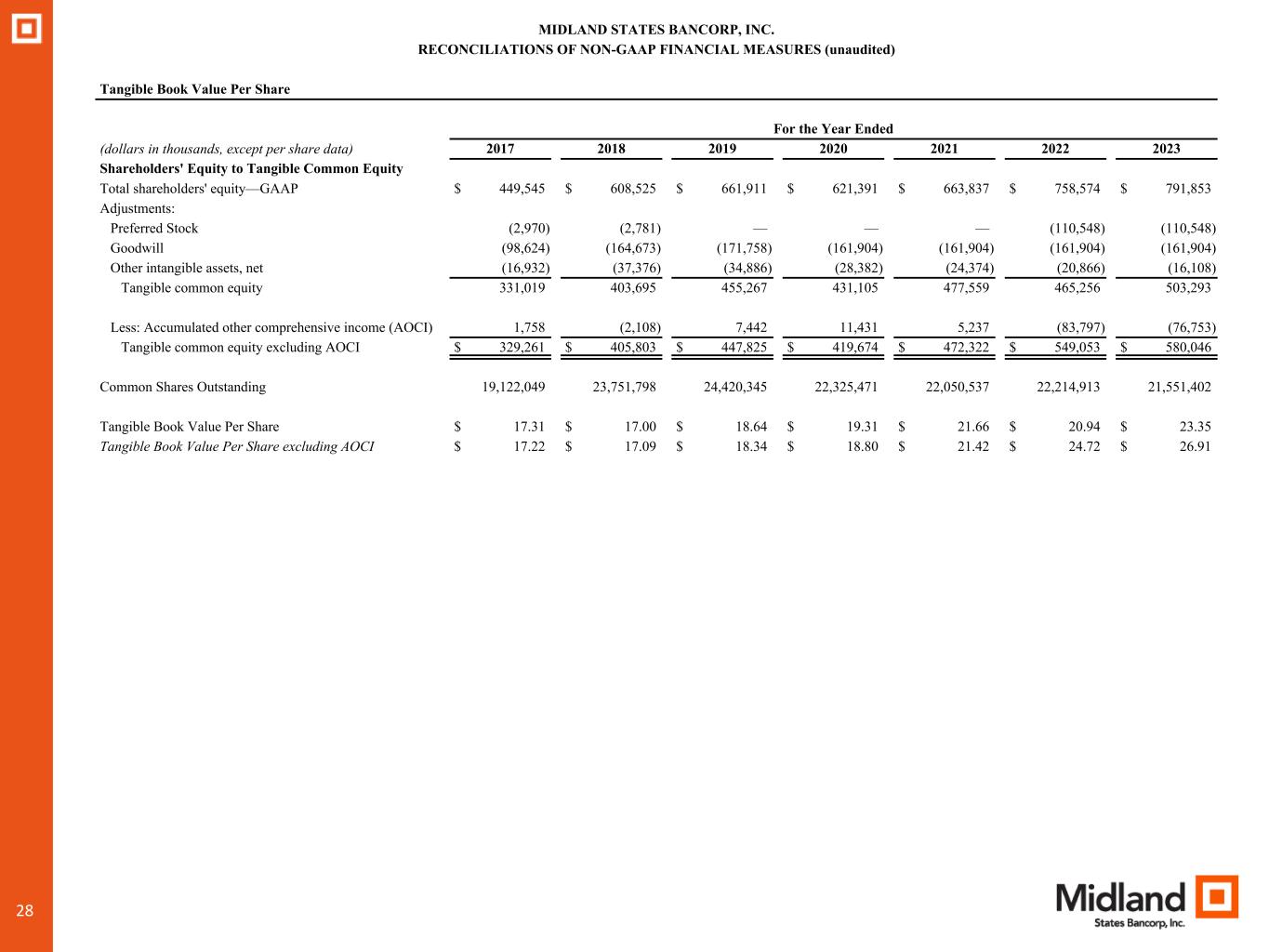

| Tangible Common Equity to Tangible Assets Ratio and Tangible Book Value Per Share | ||||||||||||||||||||||||||||||||

| As of | ||||||||||||||||||||||||||||||||

| December 31, | September 30, | June 30, | March 31, | December 31, | ||||||||||||||||||||||||||||

| (dollars in thousands, except per share data) | 2023 | 2023(1) |

2023 | 2023 | 2022 | |||||||||||||||||||||||||||

| Shareholders' Equity to Tangible Common Equity | ||||||||||||||||||||||||||||||||

| Total shareholders' equity—GAAP | $ | 791,853 | $ | 757,610 | $ | 776,821 | $ | 775,643 | $ | 758,574 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Preferred Stock | (110,548) | (110,548) | (110,548) | (110,548) | (110,548) | |||||||||||||||||||||||||||

| Goodwill | (161,904) | (161,904) | (161,904) | (161,904) | (161,904) | |||||||||||||||||||||||||||

| Other intangible assets, net | (16,108) | (17,238) | (18,367) | (19,575) | (20,866) | |||||||||||||||||||||||||||

| Tangible common equity | 503,293 | 467,920 | 486,002 | 483,616 | 465,256 | |||||||||||||||||||||||||||

| Less: Accumulated other comprehensive income (AOCI) | (76,753) | (101,181) | (84,719) | (77,797) | (83,797) | |||||||||||||||||||||||||||

| Tangible common equity excluding AOCI | $ | 580,046 | $ | 569,101 | $ | 570,721 | $ | 561,413 | $ | 549,053 | ||||||||||||||||||||||

| Total Assets to Tangible Assets: | ||||||||||||||||||||||||||||||||

| Total assets—GAAP | $ | 7,866,868 | $ | 7,969,285 | $ | 8,034,721 | $ | 7,930,174 | $ | 7,855,501 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Goodwill | (161,904) | (161,904) | (161,904) | (161,904) | (161,904) | |||||||||||||||||||||||||||

| Other intangible assets, net | (16,108) | (17,238) | (18,367) | (19,575) | (20,866) | |||||||||||||||||||||||||||

| Tangible assets | $ | 7,688,856 | $ | 7,790,143 | $ | 7,854,450 | $ | 7,748,695 | $ | 7,672,731 | ||||||||||||||||||||||

| Common Shares Outstanding | 21,551,402 | 21,594,546 | 21,854,800 | 22,111,454 | 22,214,913 | |||||||||||||||||||||||||||

| Tangible Common Equity to Tangible Assets | 6.55 | % | 6.01 | % | 6.19 | % | 6.24 | % | 6.06 | % | ||||||||||||||||||||||

| Tangible Book Value Per Share | $ | 23.35 | $ | 21.67 | $ | 22.24 | $ | 21.87 | $ | 20.94 | ||||||||||||||||||||||

| Tangible Book Value Per Share, excluding AOCI | $ | 26.91 | $ | 26.35 | $ | 26.11 | $ | 25.39 | $ | 24.72 | ||||||||||||||||||||||