Document

Exhibit 99.1

Castle Biosciences Reports First Quarter 2025 Results

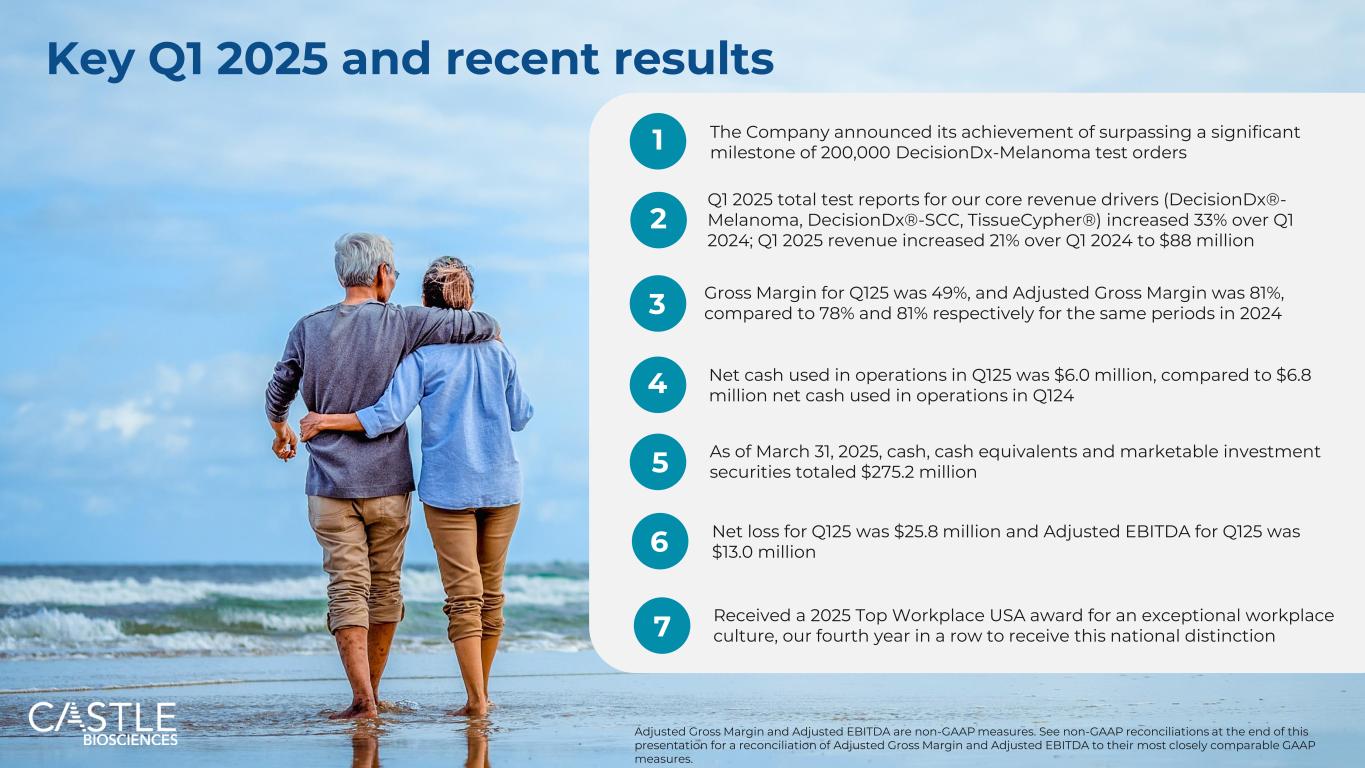

Q1 2025 revenue increased 21% over Q1 2024 to $88 million

Q1 2025 total test reports for our core revenue drivers (DecisionDx®-Melanoma, DecisionDx®-SCC, TissueCypher®) increased 33% over Q1 2024

Raising full-year 2025 revenue guidance to $287-297 million from $280-295 million

Conference call and webcast today at 4:30 p.m. ET

FRIENDSWOOD, Texas - May 5, 2025--Castle Biosciences, Inc. (Nasdaq: CSTL), a company improving health through innovative tests that guide patient care, today announced its financial results for the first quarter ended March 31, 2025.

“We are pleased with the exceptional start to the year, marked by continued growth in test report volume and revenue in the first quarter,” said Derek Maetzold, president and chief executive officer of Castle Biosciences. “We believe our ongoing success reflects both the high clinical value that our clinicians receive from our tests coupled with consistent execution and teamwork across our therapeutic areas.

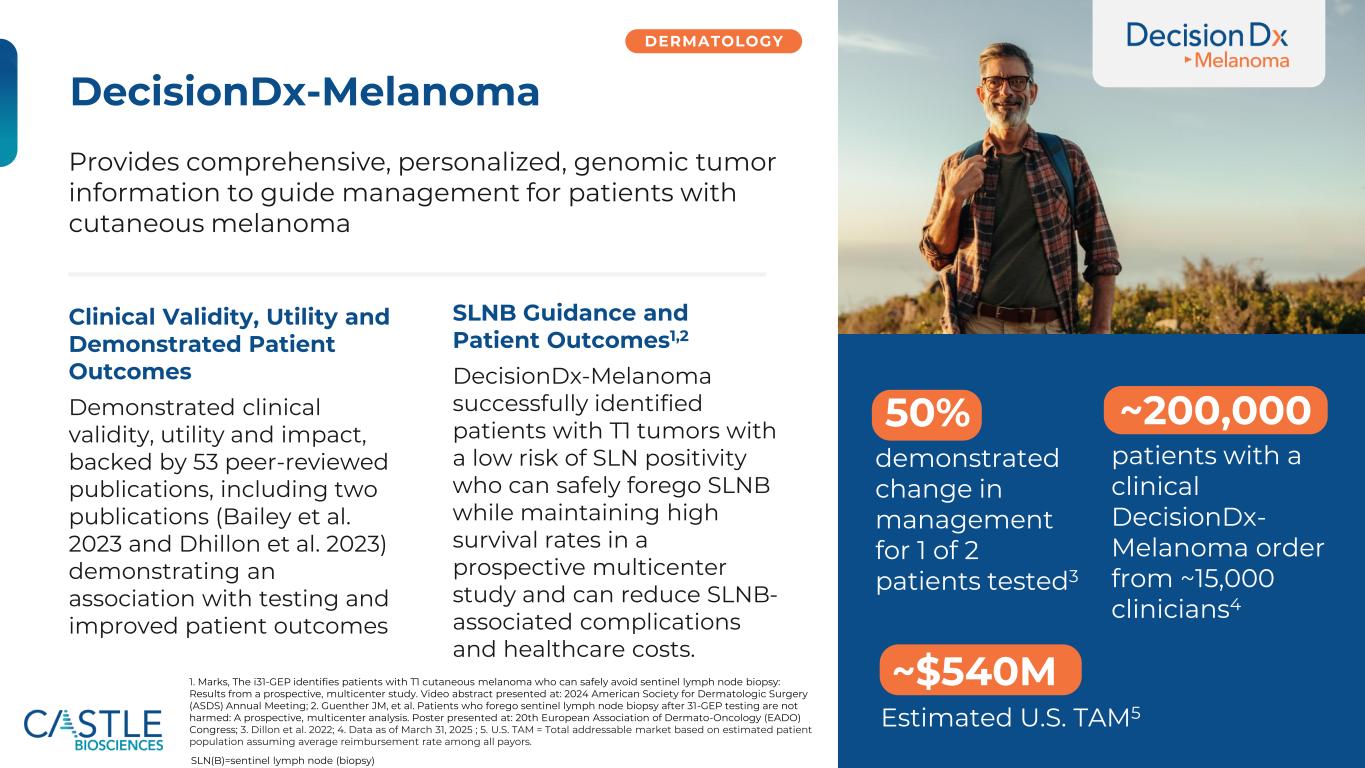

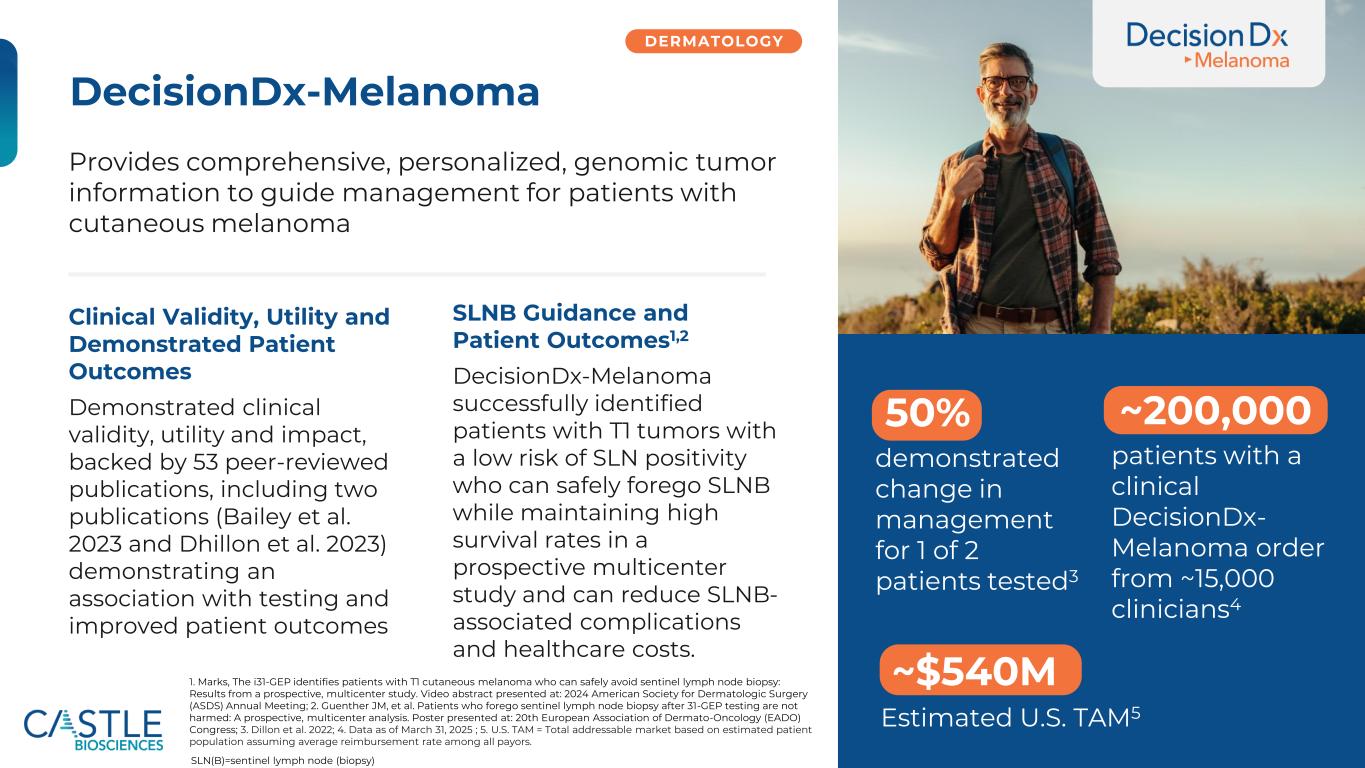

“We saw strong overall growth in our core revenue drivers. And in this month of May, Skin Cancer Awareness Month, I’m especially pleased DecisionDx-Melanoma recently achieved a significant milestone, surpassing 200,000 test orders since the launch of the test. This milestone is certainly expected, given the highly compelling data demonstrating DecisionDx-Melanoma is shown to be associated with improved patient survival, and I am extremely proud of the entire Castle team. We are grateful to the clinicians and patients who achieved this milestone with us.

“We believe our first-quarter results demonstrate our leadership across our proprietary, first-to-market test portfolio and unwavering commitment to impacting patient outcomes. Looking ahead, as we continue to drive forward our growth initiatives, we are raising our 2025 total revenue guidance to $287-297 million, compared to the previous guidance of $280-295 million.”

First Quarter Ended March 31, 2025, Financial and Operational Highlights

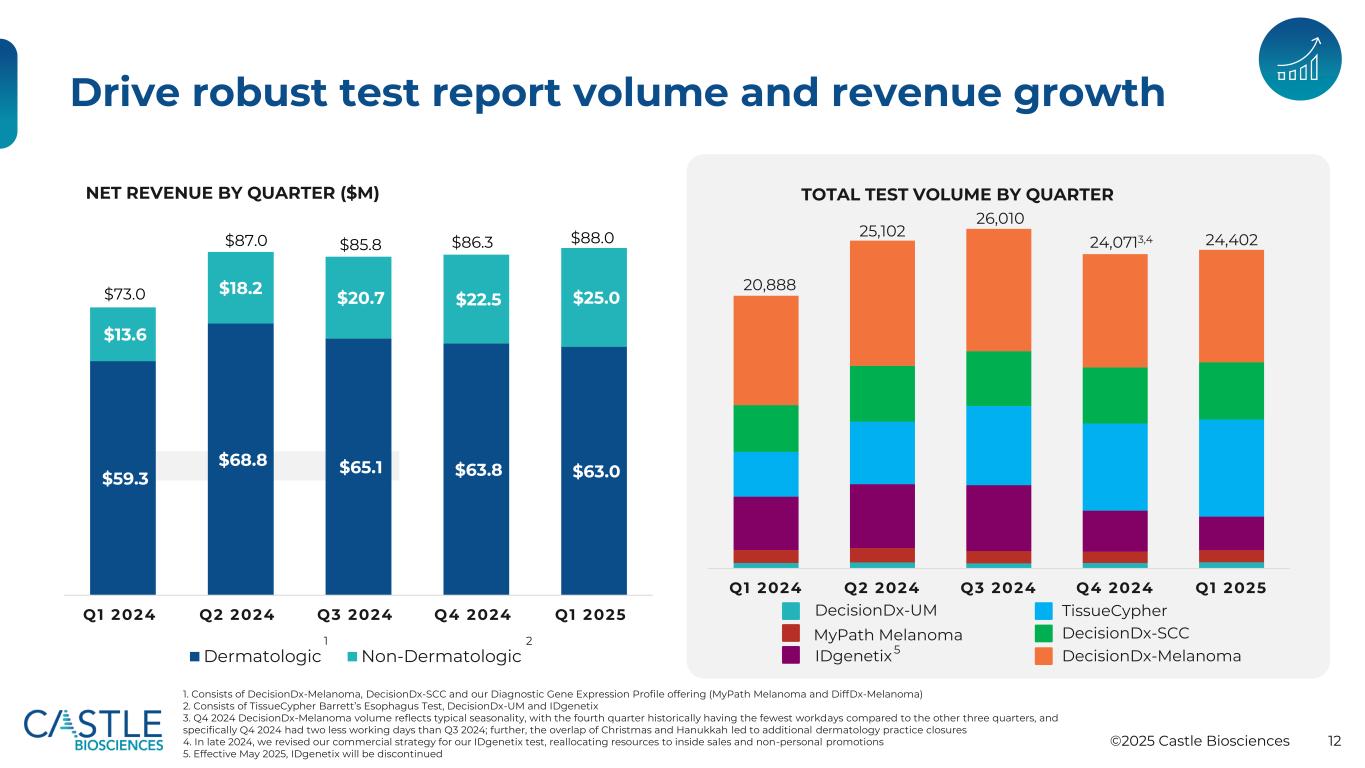

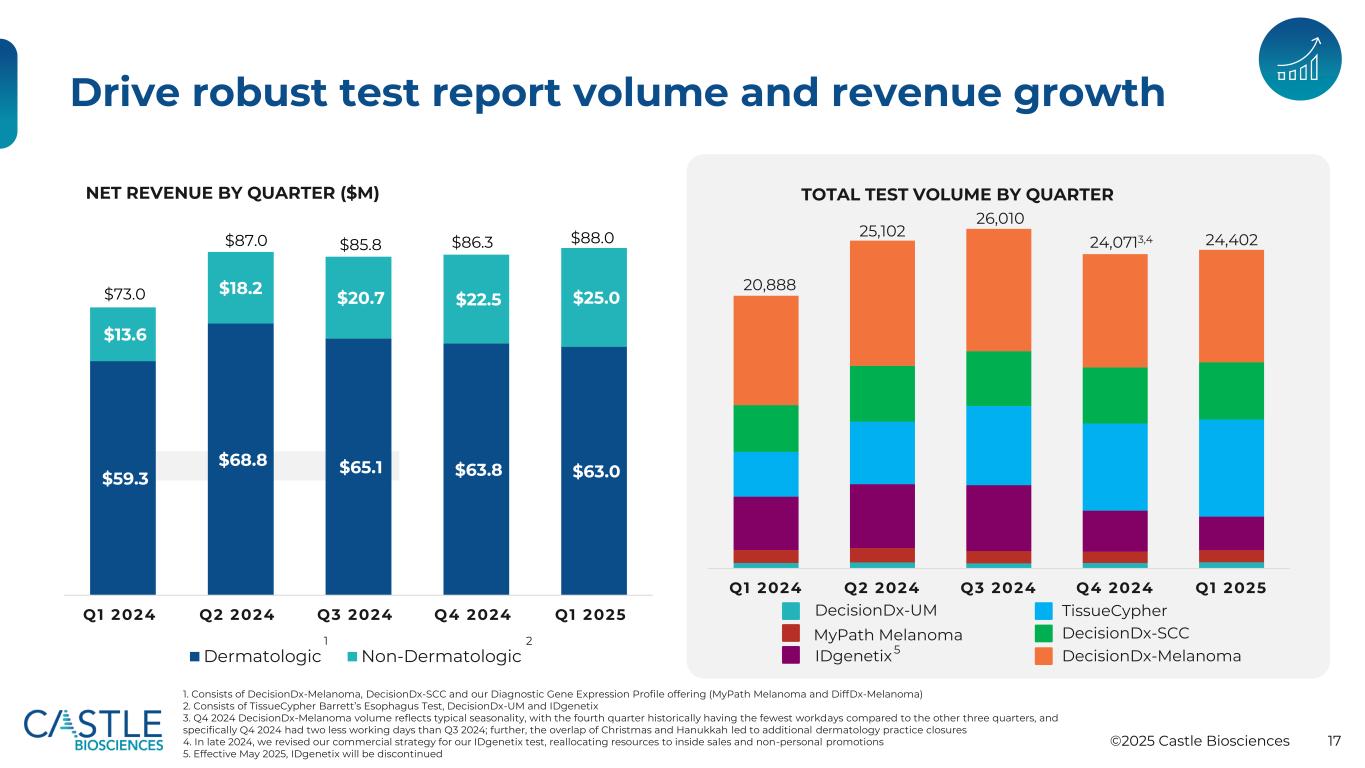

•Revenues were $88.0 million, a 21% increase compared to $73.0 million in the first quarter of 2024.

•Adjusted Revenues, which exclude the effects of revenue adjustments related to tests delivered in prior periods, were $87.2 million, a 22% increase compared to $71.3 million for the same period in 2024.

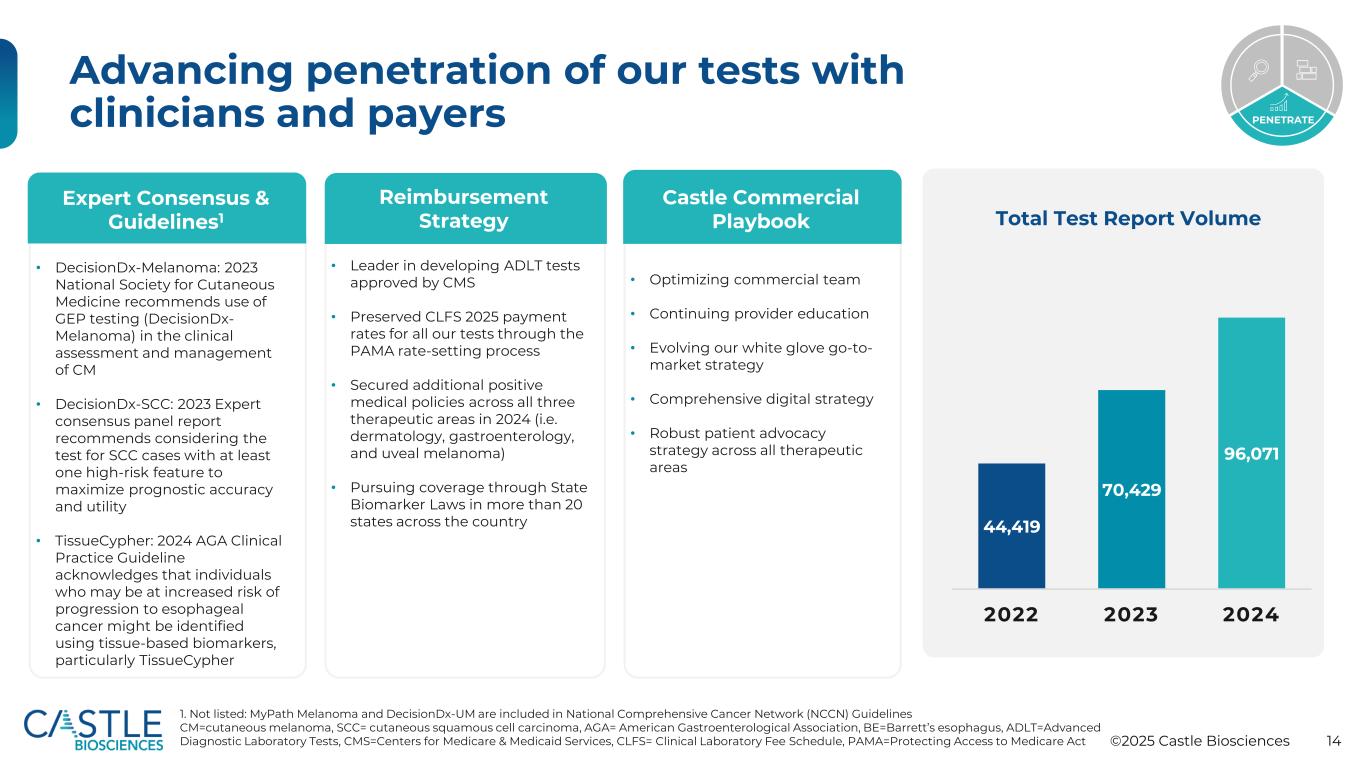

•Delivered 24,402 total test reports in the first quarter of 2025, an increase of 17% compared to 20,888 in the same period of 2024:

◦DecisionDx-Melanoma test reports delivered in the quarter were 8,621, compared to 8,384 in the first quarter of 2024.

◦DecisionDx-SCC test reports delivered in the quarter were 4,375, compared to 3,577 in the first quarter of 2024.

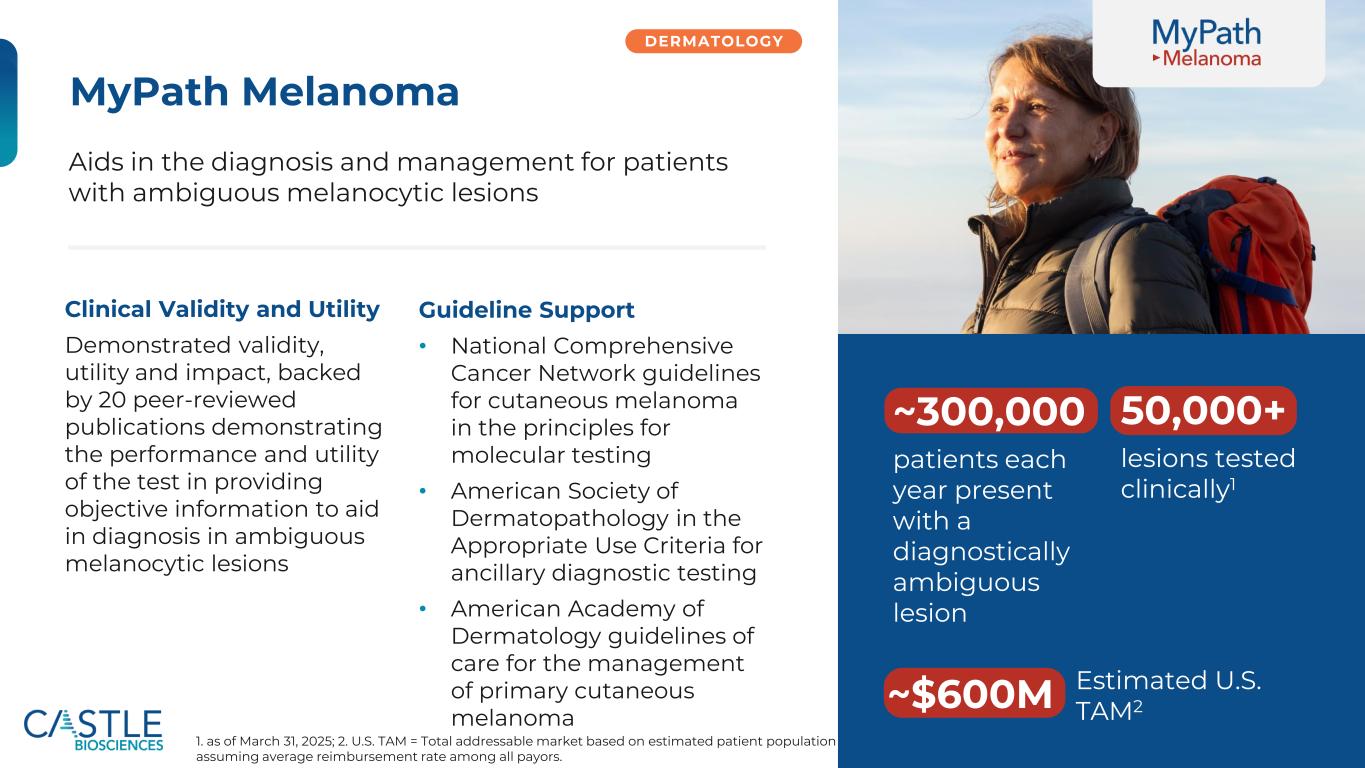

◦MyPath® Melanoma test reports delivered in the quarter were 926, compared to 998 in the first quarter of 2024.

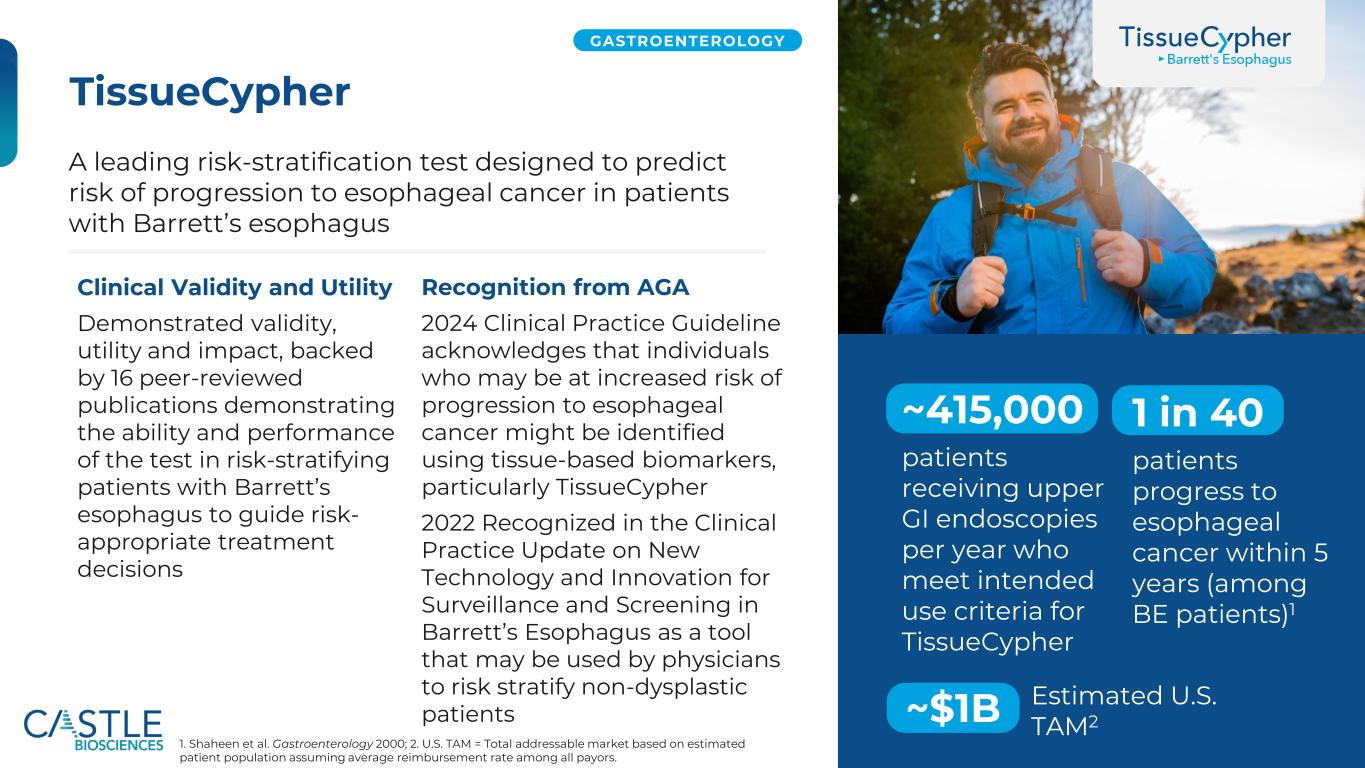

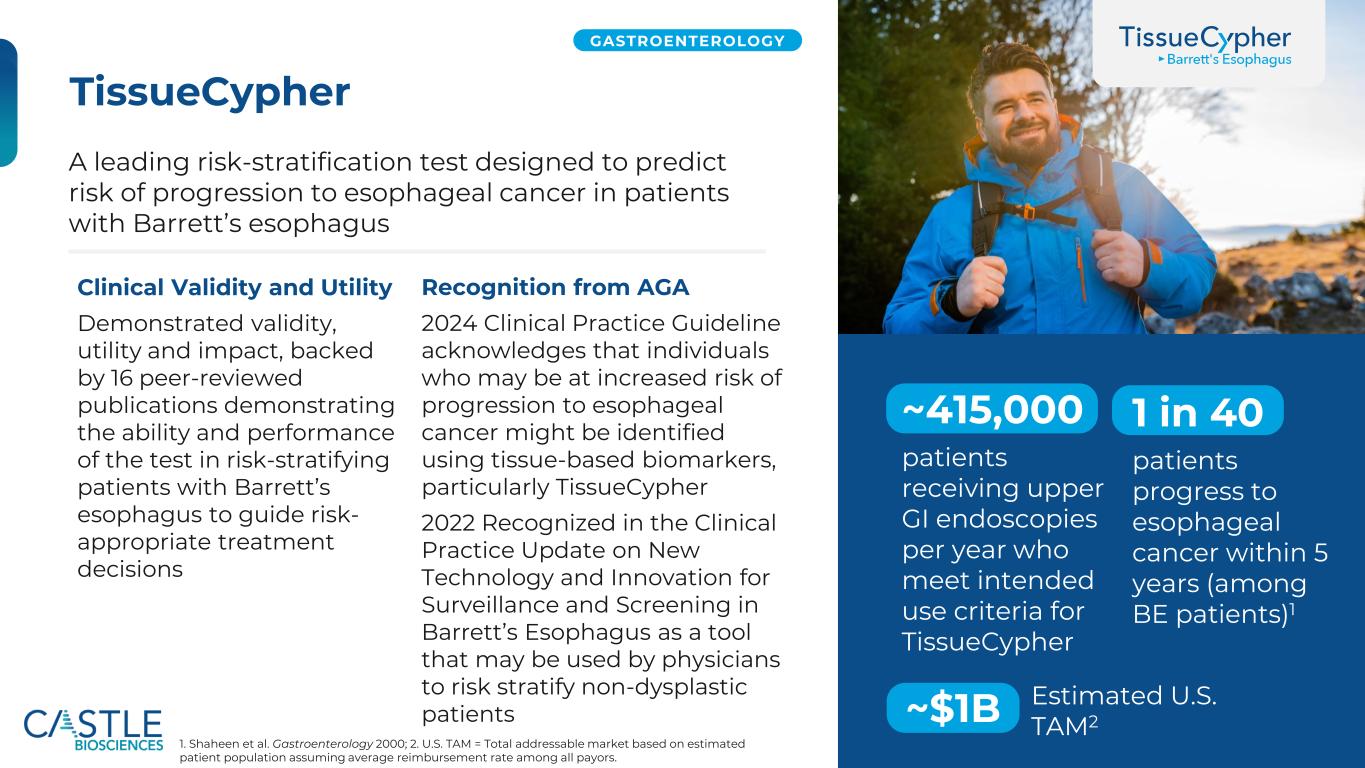

◦TissueCypher Barrett’s Esophagus test reports delivered in the quarter were 7,432, compared to 3,429 in the first quarter of 2024.

◦IDgenetix® test reports delivered in the quarter were 2,578, compared to 4,078 in the first quarter of 2024.

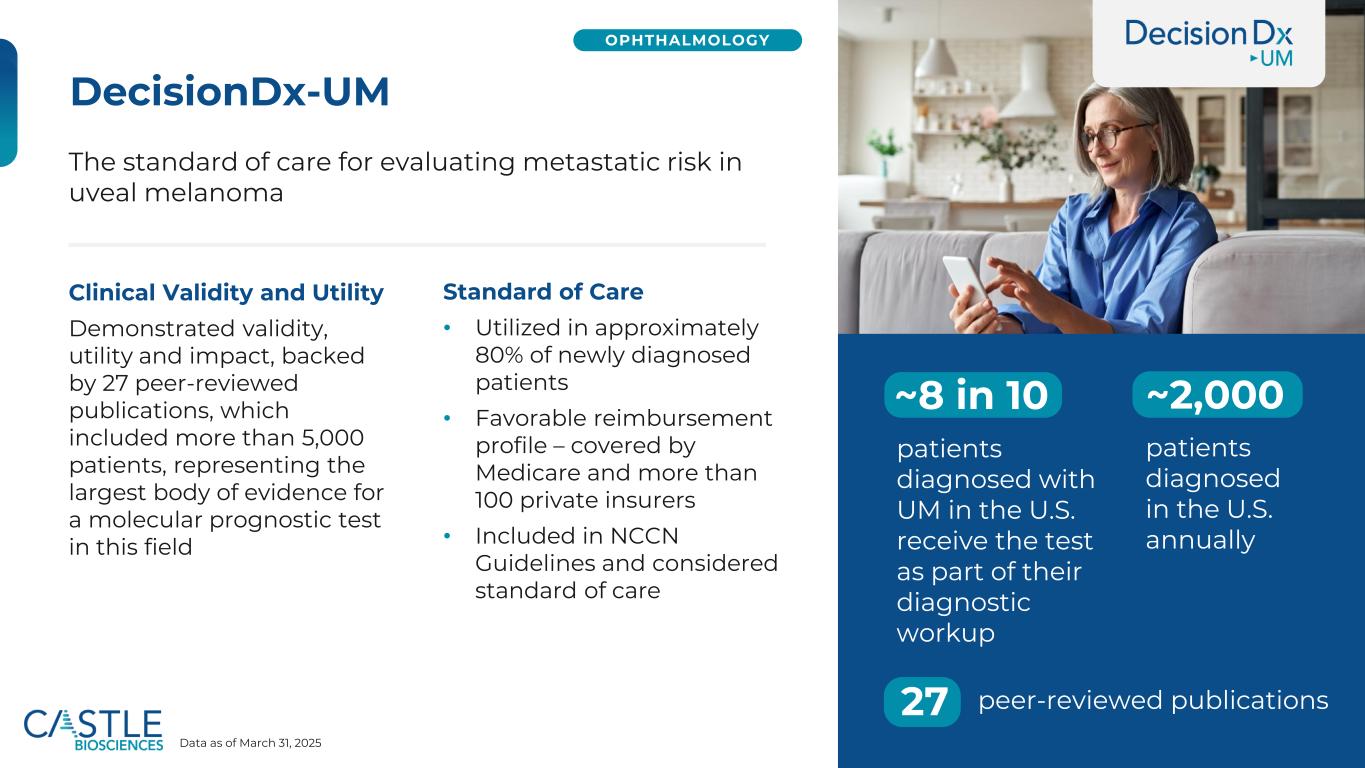

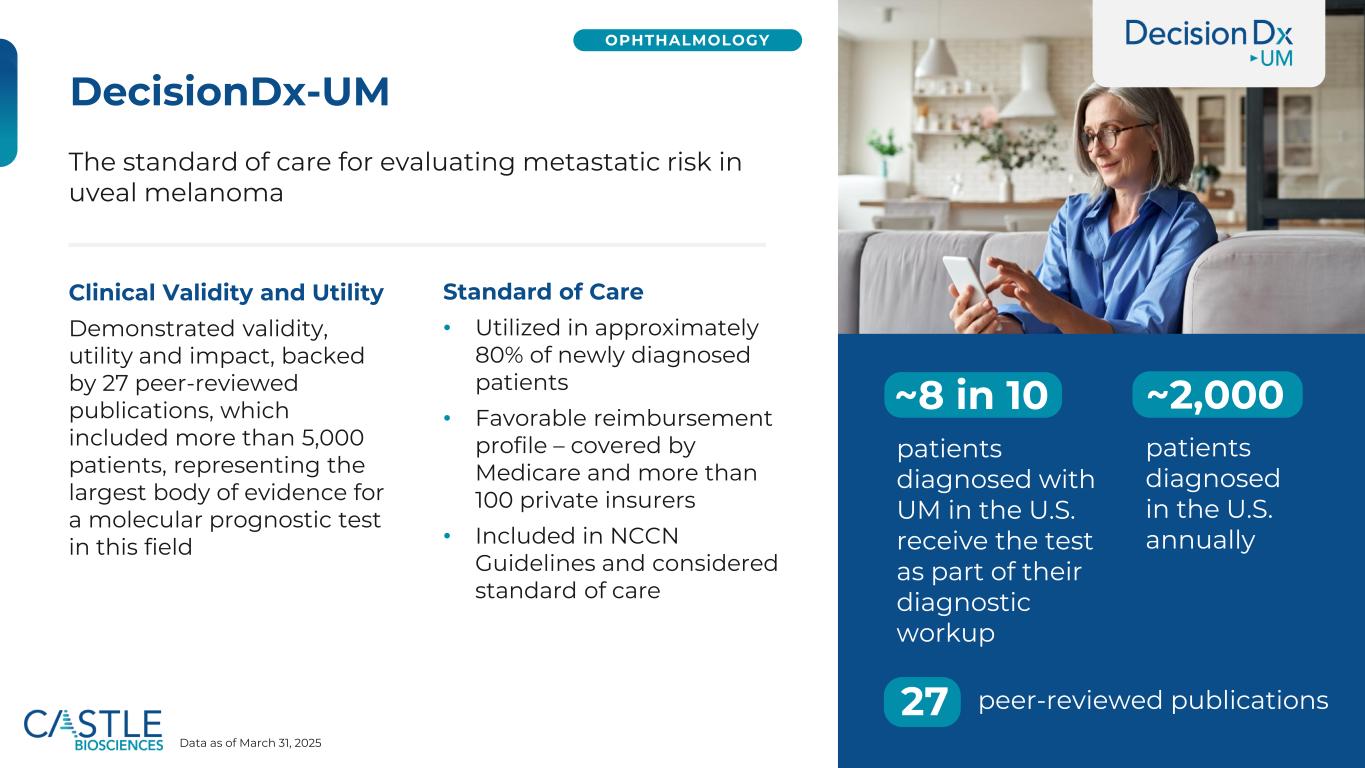

◦DecisionDx®-UM test reports delivered in the quarter were 470, compared to 422 in the first quarter of 2024.

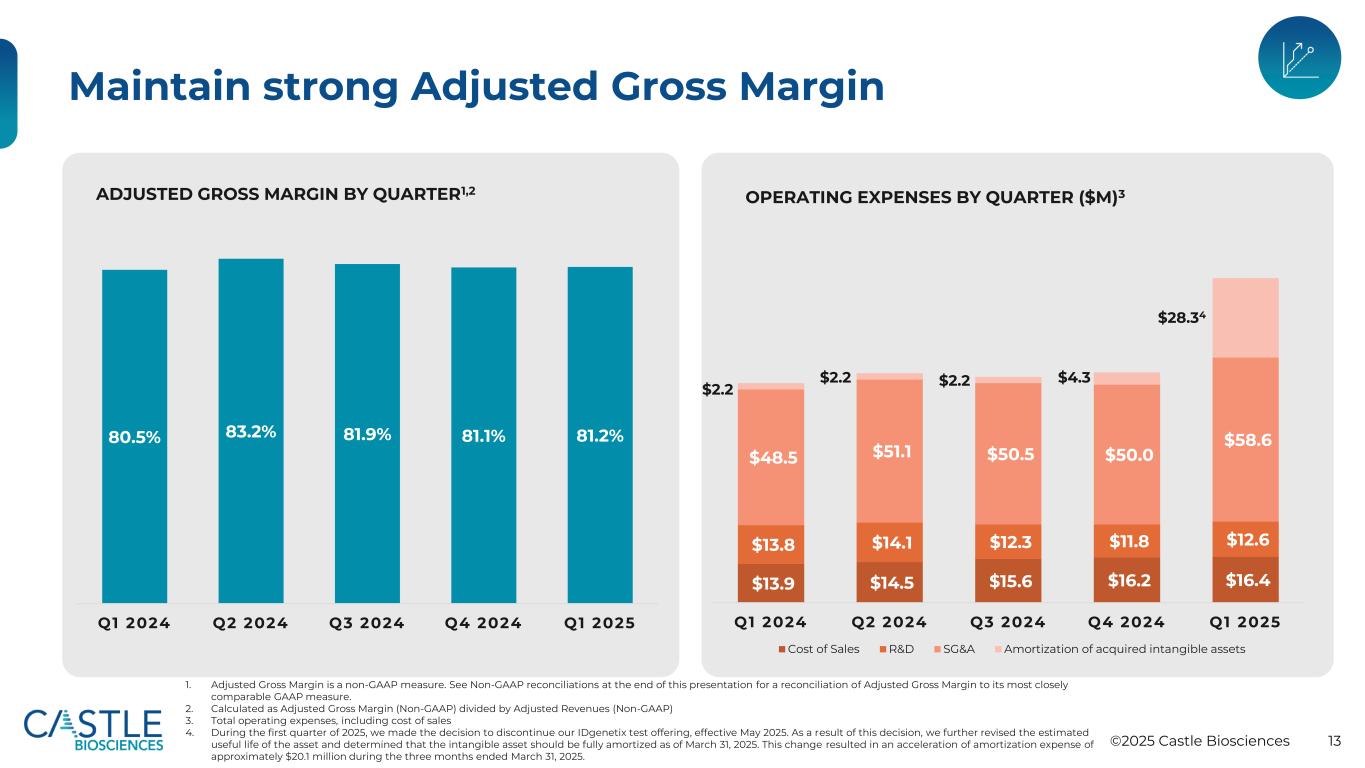

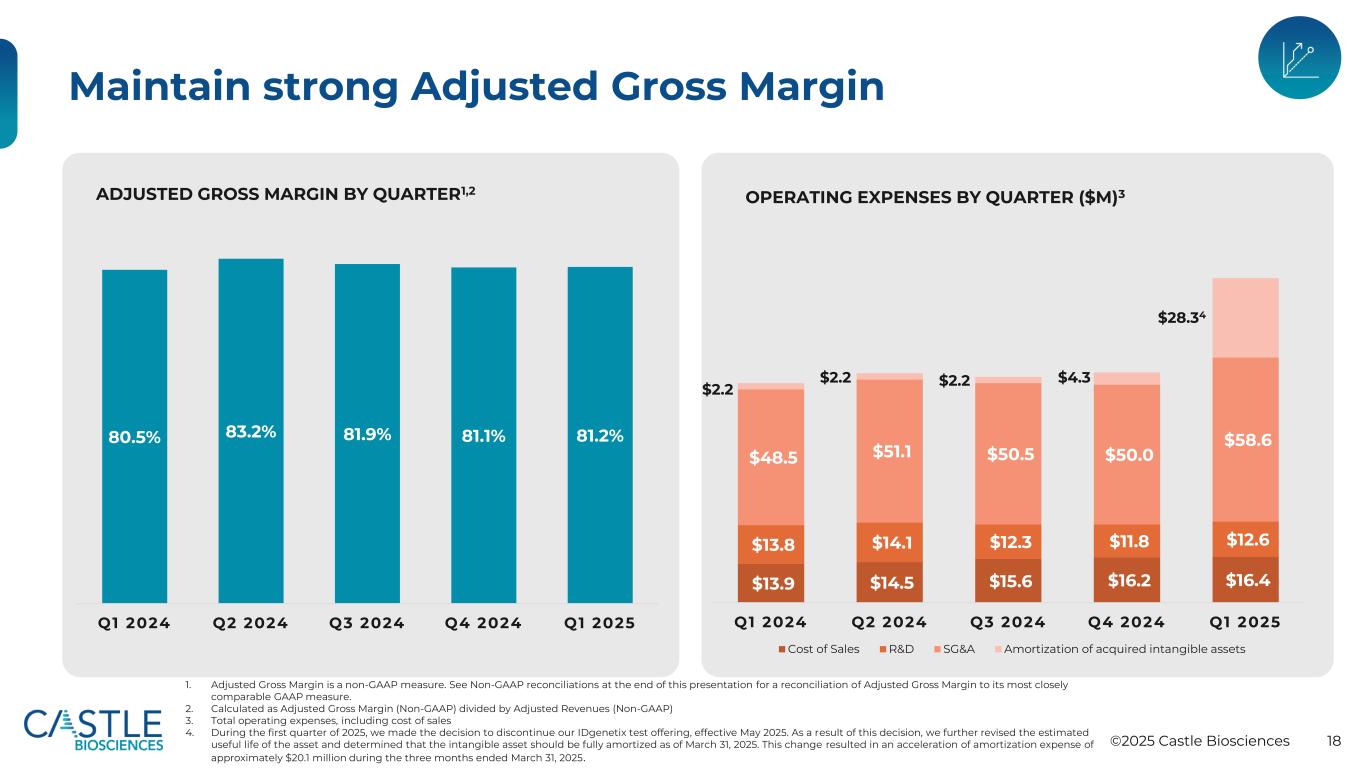

•Gross margin was 49%, and Adjusted Gross Margin was 81%, compared to 78% and 81%, respectively, for the same periods in 2024. Gross margin for the first quarter 2025 was impacted in large part due to the one-time adjustment of an acceleration of amortization expense of approximately $20.1 million during the three months ended March 31, 2025. During the first quarter of 2025, we made the decision to discontinue the IDgenetix test offering, effective May 2025. This change resulted in a change in estimated remaining useful life of IDgenetix.

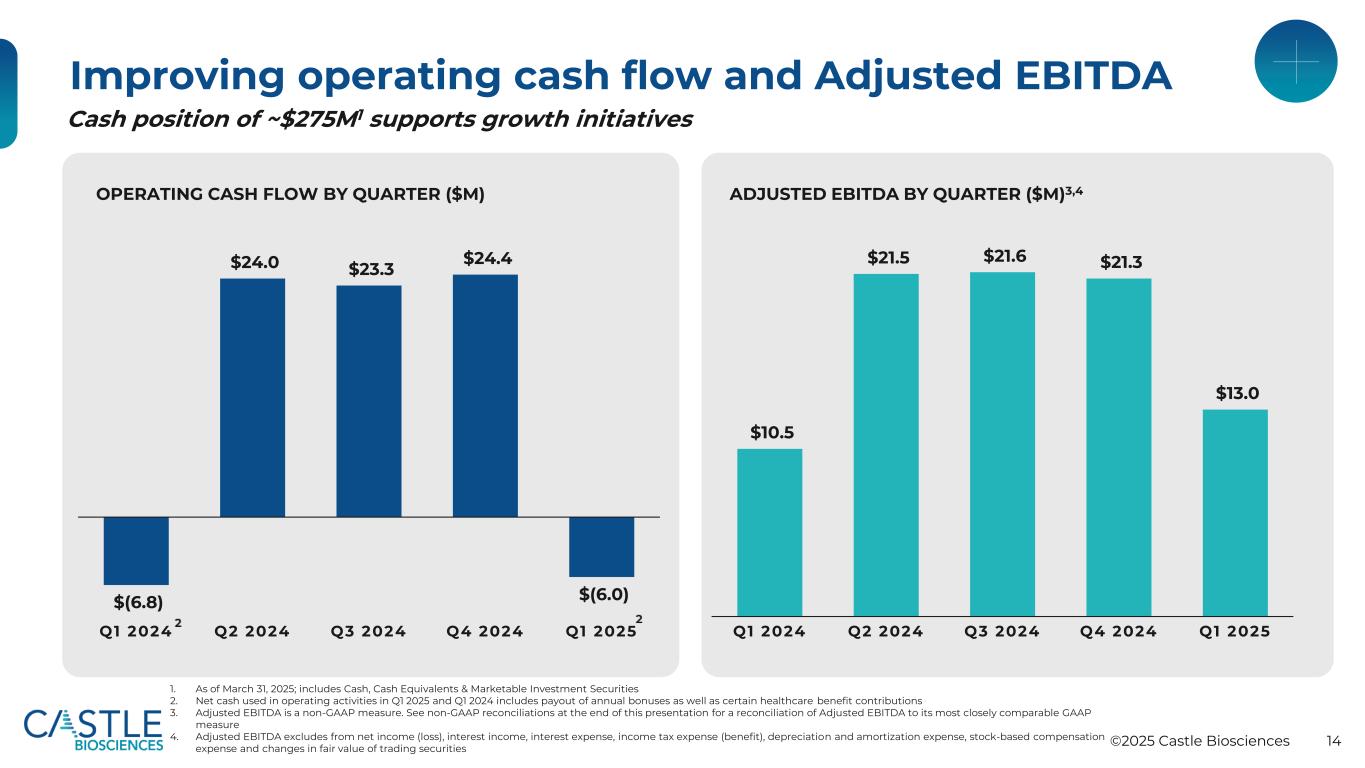

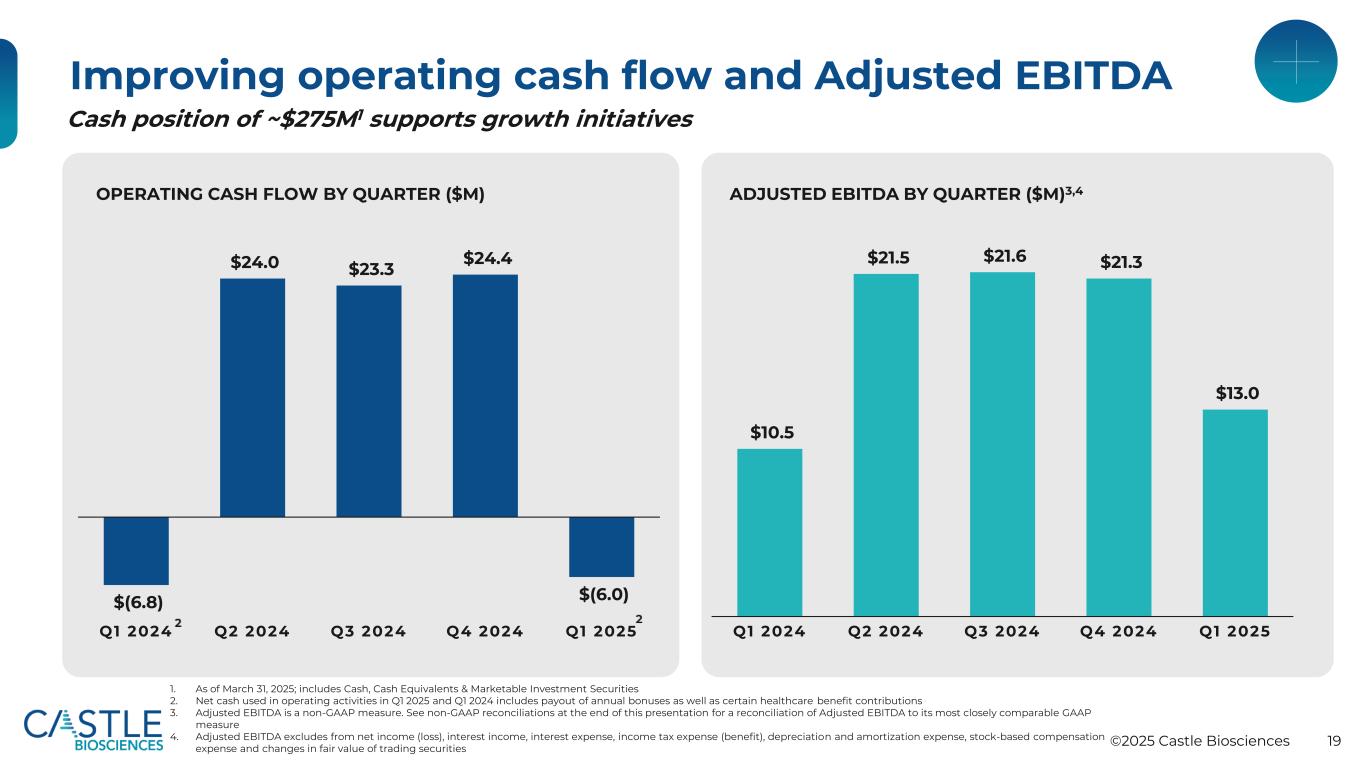

•Net cash used in operations was $6.0 million, compared to net cash used in operations of $6.8 million for the same period in 2024.

•Net loss, which includes non-cash stock-based compensation expense of $11.2 million, was $25.8 million, compared to a net loss of $2.5 million for the same period in 2024.

•Net loss per share, basic and diluted, was $(0.90) and Adjusted Net Loss per Share, Basic and Diluted, was $(0.20) compared, in each case, to $(0.09), for the same periods in 2024.

•Adjusted EBITDA was $13.0 million, compared to $10.5 million for the same period in 2024.

Cash, Cash Equivalents and Marketable Investment Securities

As of March 31, 2025, the Company’s cash, cash equivalents and marketable investment securities totaled $275.2 million.

2025 Outlook

Castle Biosciences is raising its guidance for anticipated total revenue in 2025. The Company now anticipates generating between $287-297 million in total revenue in 2025, compared to the previously provided guidance of between $280-295 million.

First Quarter and Recent Accomplishments and Highlights

Dermatology

•DecisionDx-Melanoma: The Company announced its achievement of surpassing a significant milestone of 200,000 DecisionDx-Melanoma test orders. See the Company’s news release from April 28, 2025, for more information.

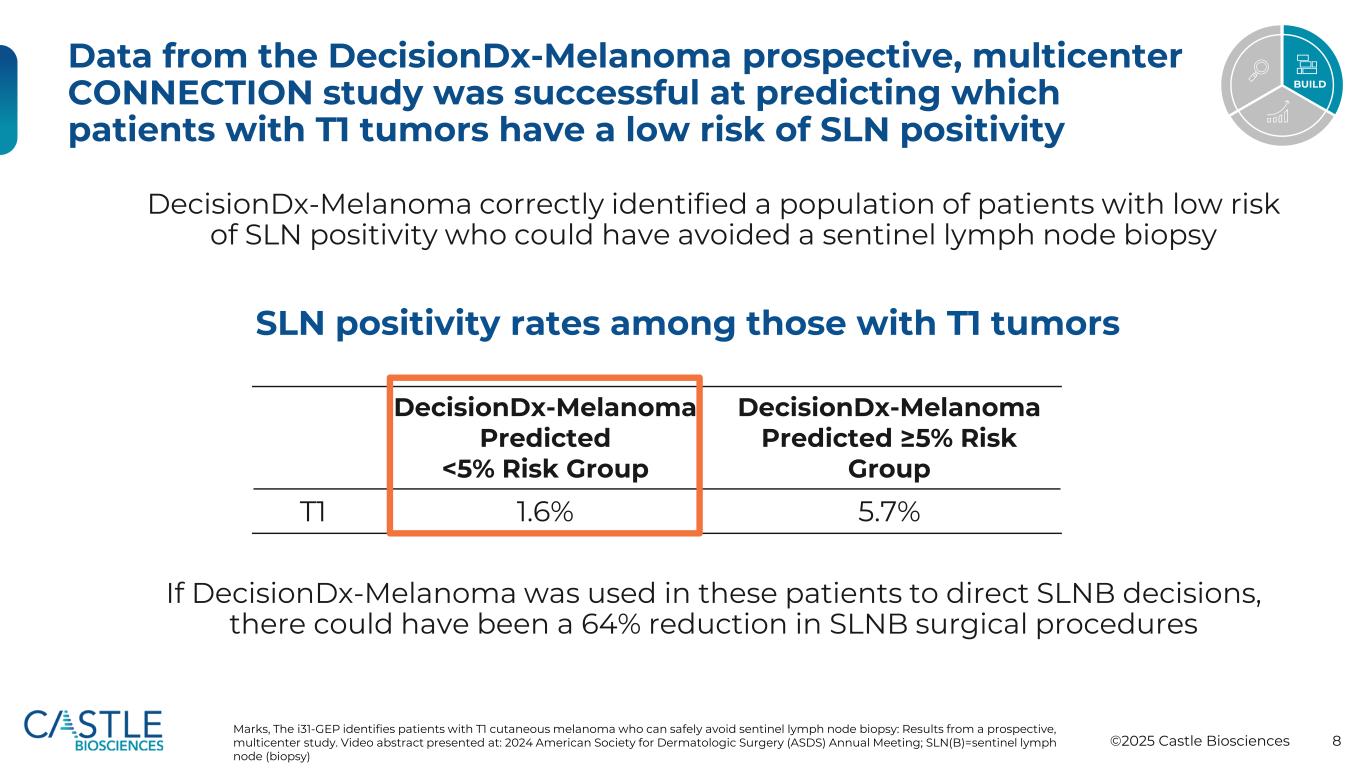

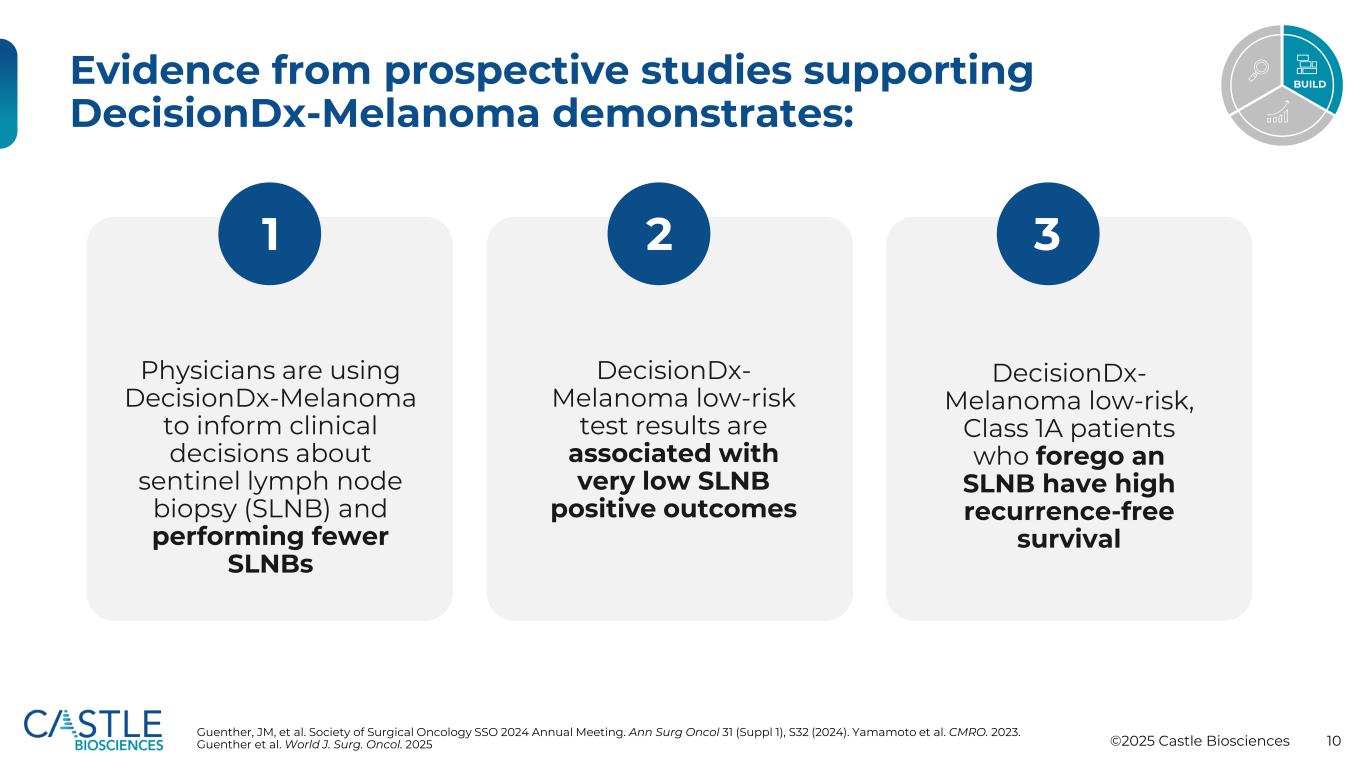

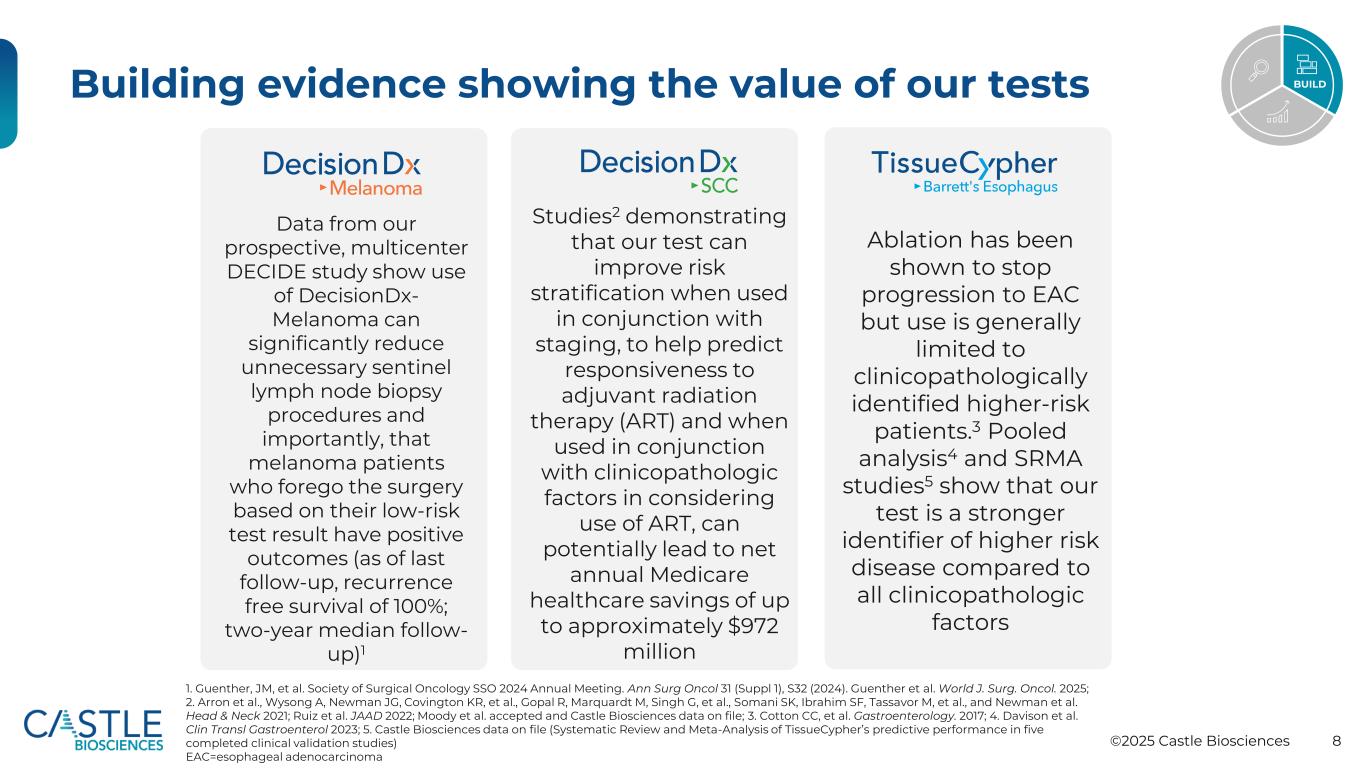

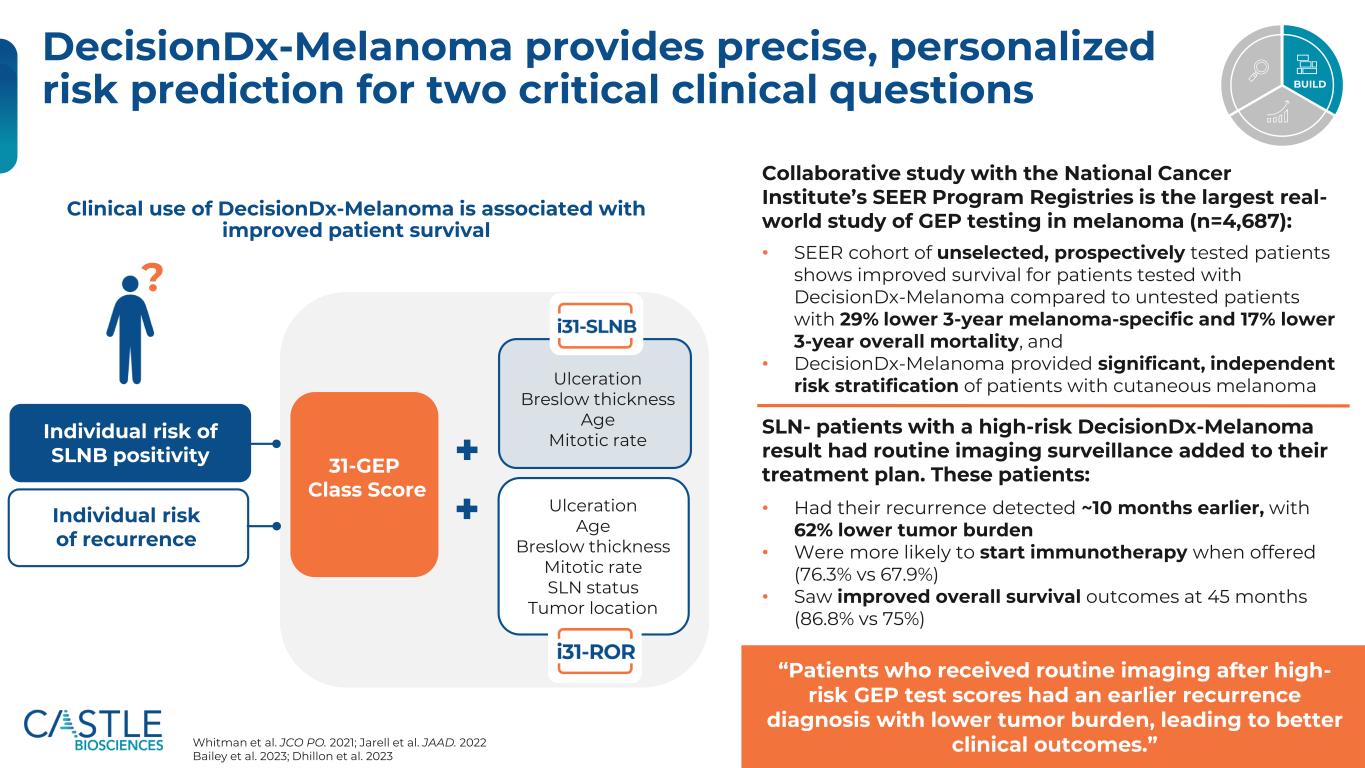

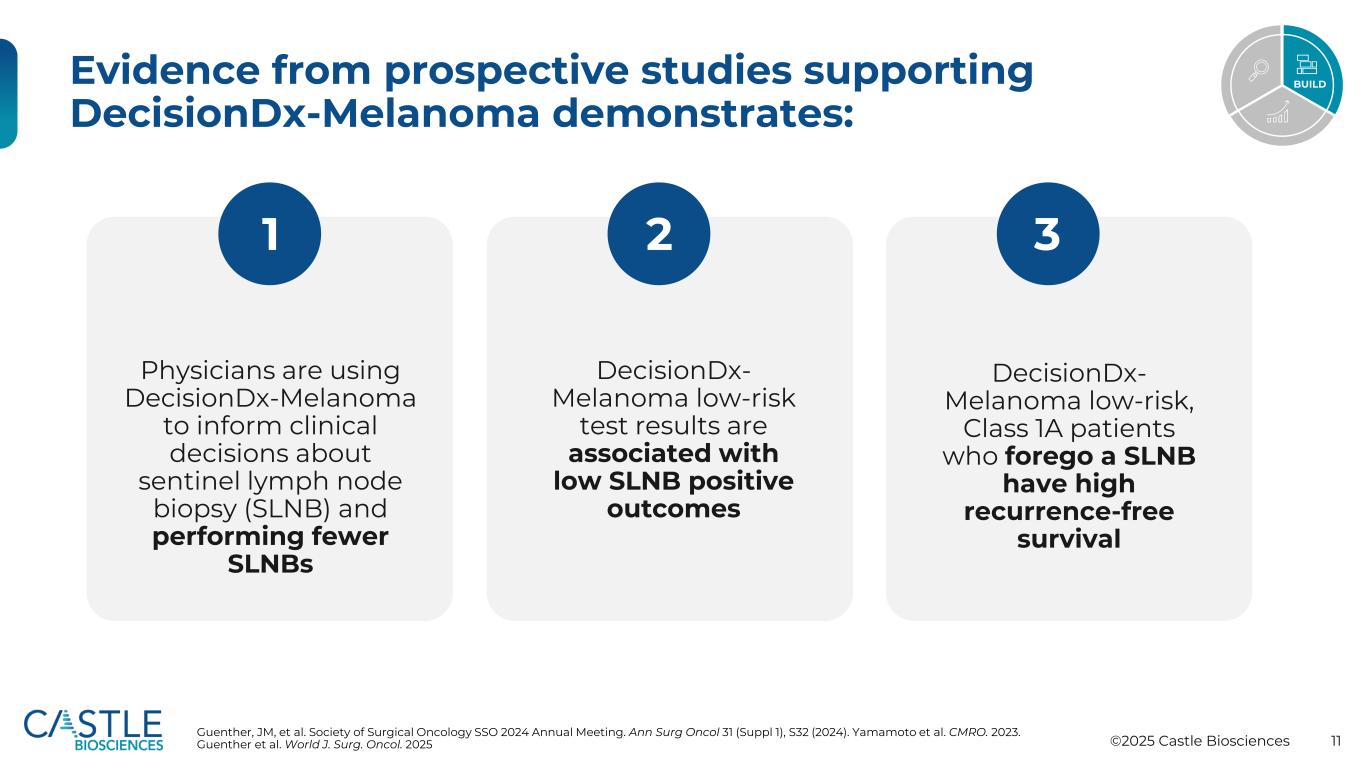

•DecisionDx-Melanoma: The Company announced the publication of a new study in Cancer Diagnosis & Prognosis demonstrating that DecisionDx-Melanoma outperforms both American Joint Committee on Cancer (AJCC) staging and the clinicopathologic and gene expression (CP-GEP) test in identifying patients at low risk of sentinel lymph node (SLN) positivity who may consider forgoing sentinel lymph node biopsy (SLNB) surgery. The new study provides an analysis of the accuracy of CP-GEP and DecisionDx-Melanoma in identifying patients with less than a 5% risk of SLN positivity, in T1-T2 tumors specifically, across five CP-GEP and four DecisionDx-Melanoma validation studies. Using a weighted average across all studies, patients classified as low risk by CP-GEP had an SLN positivity rate of 6.2%, exceeding the 5% NCCN threshold for ruling out SLNB. In contrast, patients identified as low risk by DecisionDx-Melanoma had a 2.8% SLN positivity rate, a significant improvement over AJCC staging. Overall, CP-GEP did not perform as well as staging alone, while DecisionDx-Melanoma outperformed staging, further demonstrating its ability to improve clinical decision-making and, ultimately, outcomes. See our press release from April 30, 2025, for more information.

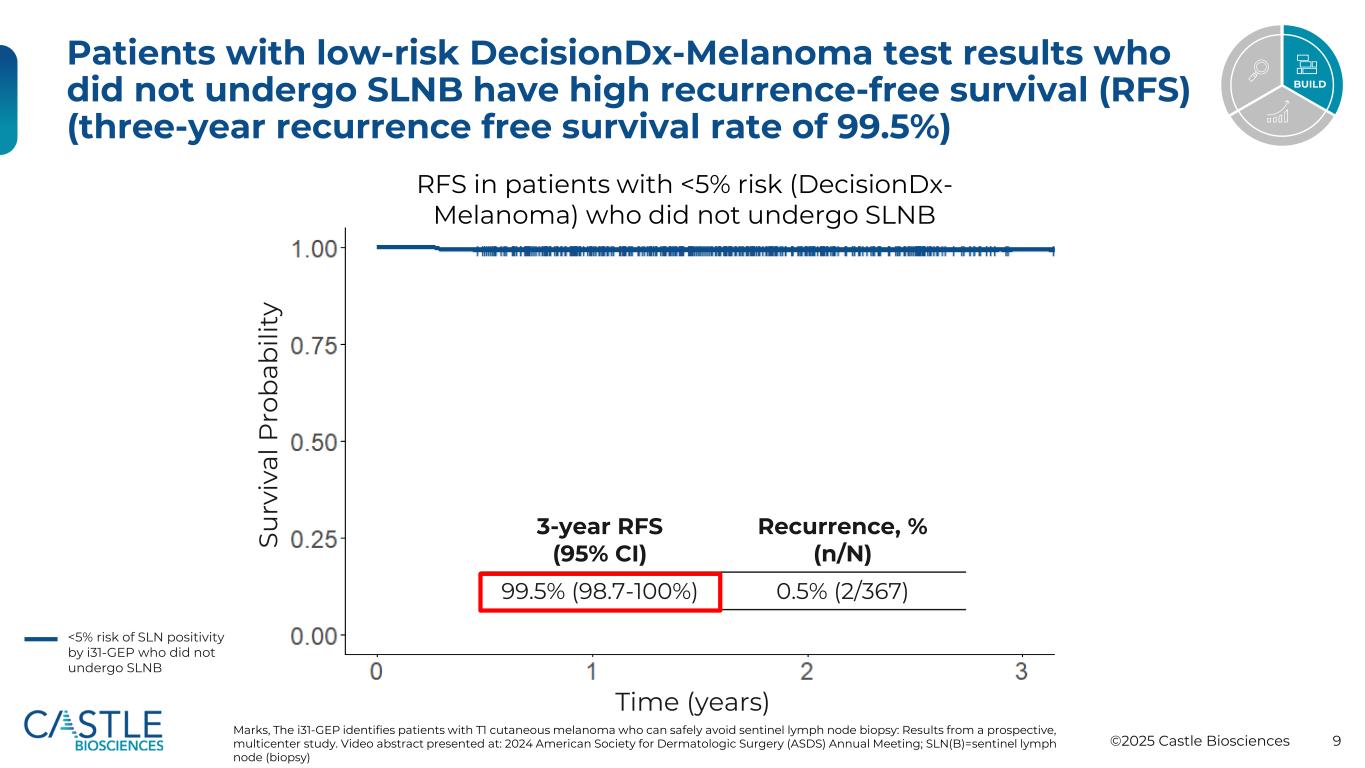

•DecisionDx-Melanoma: The Company announced the recent publication of two papers in the World Journal of Surgical Oncology and Cancer Medicine sharing reports from the prospective, multicenter DECIDE study demonstrating the significant impact of the Company’s DecisionDx-Melanoma test on SLNB decision-making for patients with melanoma. Consistent with prior studies, published results from Castle’s DECIDE study support that DecisionDx-Melanoma can accurately identify patients with less than 5% risk of sentinel lymph node (SLN) positivity, who can safely consider forgoing the SLNB surgical procedure, and who are also unlikely to experience disease progression. See the Company’s news release from April 3, 2025, for more information.

•DecisionDx-Melanoma: The Company presented new data supporting the clinical value of the DecisionDx-Melanoma test in guiding risk-aligned management of patients with melanoma at the 11th World Congress of Melanoma and 21st European Association of Dermato-Oncology (EADO) Congress, which was held April 3-5, 2025, in Athens, Greece. The new study data demonstrated the significant risk stratification provided by DecisionDx-Melanoma in a real-world cohort of patients with stage IIB-IIC cutaneous melanoma (CM) to help guide adjuvant therapy, and the role of the test in prompting use of imaging surveillance in early-stage patients at high risk of metastasis to the central nervous system (CNS). See the Company’s news release from April 1, 2025, for more information.

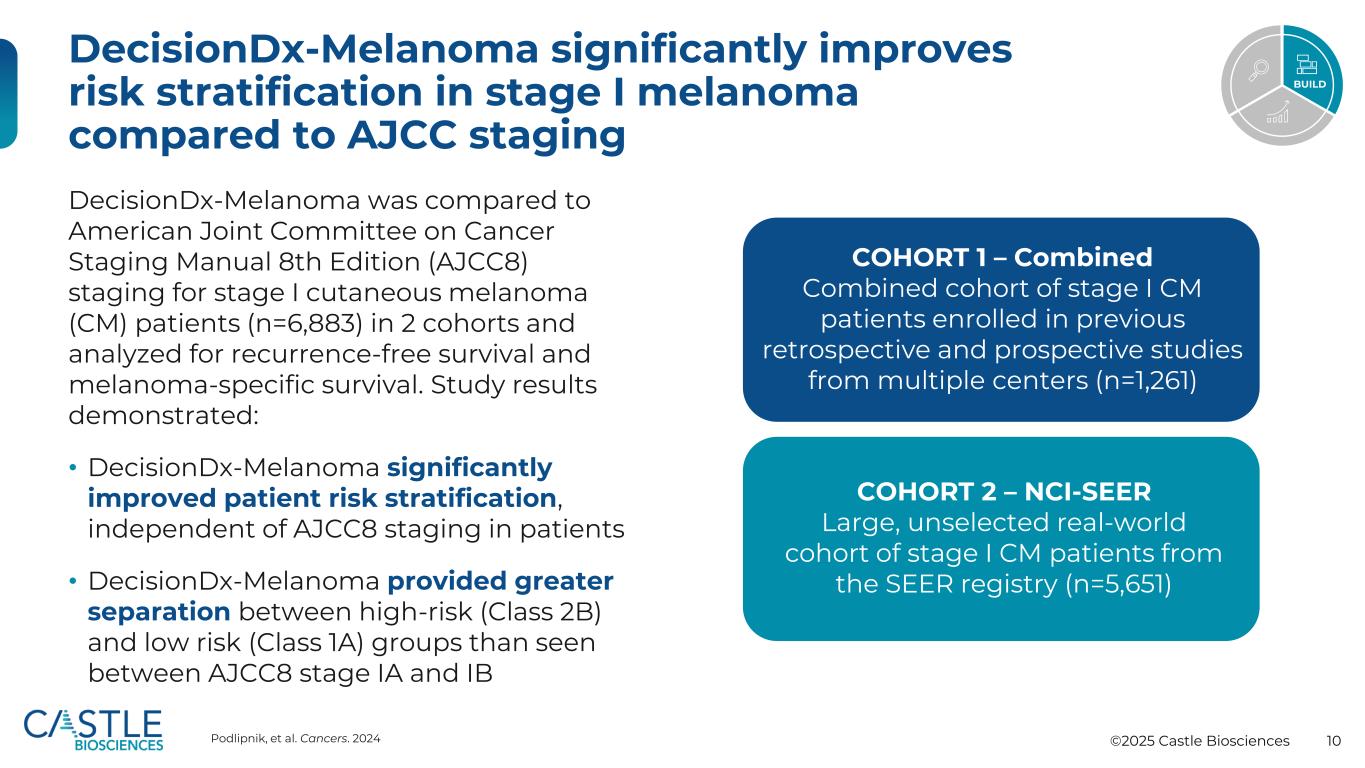

•DecisionDx-Melanoma: The Company also presented new data on its DecisionDx-Melanoma test at the National Comprehensive Cancer Network (NCCN) 2025 Annual Conference, which was held March 28-30 in Orlando, Florida. Specifically, as part of Castle’s ongoing collaboration with the National Cancer Institute’s Surveillance, Epidemiology and End Results (SEER) Program Registries, new data presented new validation of the DecisionDx-Melanoma test’s risk-stratification performance in patients with thin/early-stage CM tumors (stage I-IIA). In a large, unselected real-world cohort of 6,892 patients classified as low risk by the American Joint Committee on Cancer Eighth Edition (AJCC8) staging system, the test identified individuals at higher risk of death. In multivariable analysis that included key AJCC8 staging criteria such as tumor thickness and ulceration as well as age and mitotic rate, the data demonstrated that the DecisionDx-Melanoma test is a significant predictor of both melanoma-specific and overall mortality. These findings highlight the test’s significant, independent risk-stratification capabilities, designed to help identify patients at greater predicted risk than indicated by AJCC8 staging alone who may benefit from enhanced surveillance and management to potentially improve outcomes. See the Company’s news release from March 28, 2025, for more information.

•DecisionDx-Melanoma: Additionally, the Company presented new data on its DecisionDx-Melanoma test for patients with skin cancers at the 2025 AAD Annual Meeting, which took place from March 7-11 in Orlando, Florida. A poster from Castle’s ongoing collaboration with the National Cancer Institute’s SEER Program Registries provided an updated validation of the risk-stratification performance of the DecisionDx-Melanoma test. The study encompassed an additional year’s worth of data and approximately 4,800 more patients than the initial study by Bailey et al. In a large, unselected real-world cohort of nearly 10,000 patients who received the DecisionDx-Melanoma test as part of their clinical care, this study demonstrated the significant independent risk stratification provided by the test, beyond AJCC8 stage, and its association with improved survival relative to matched patients who did not receive testing. See the Company’s news release from March 7, 2025, for more information.

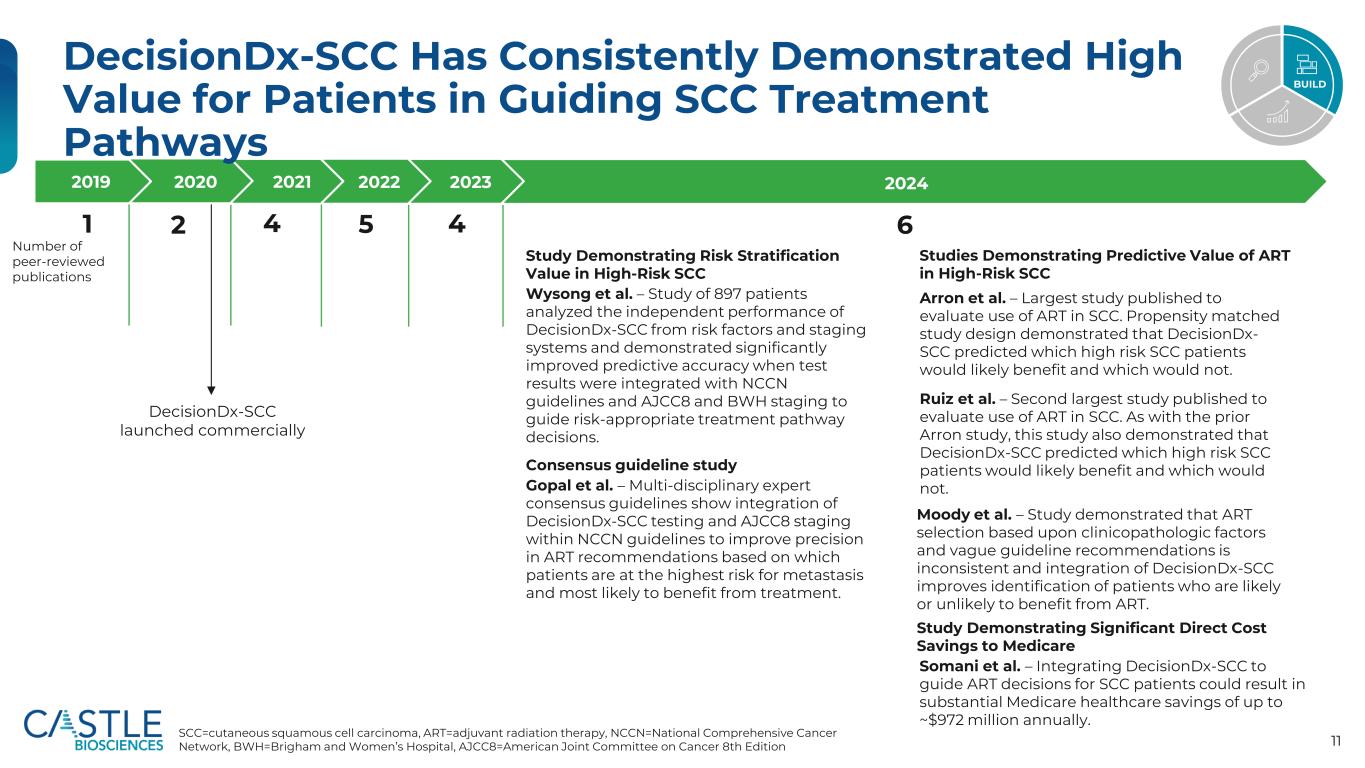

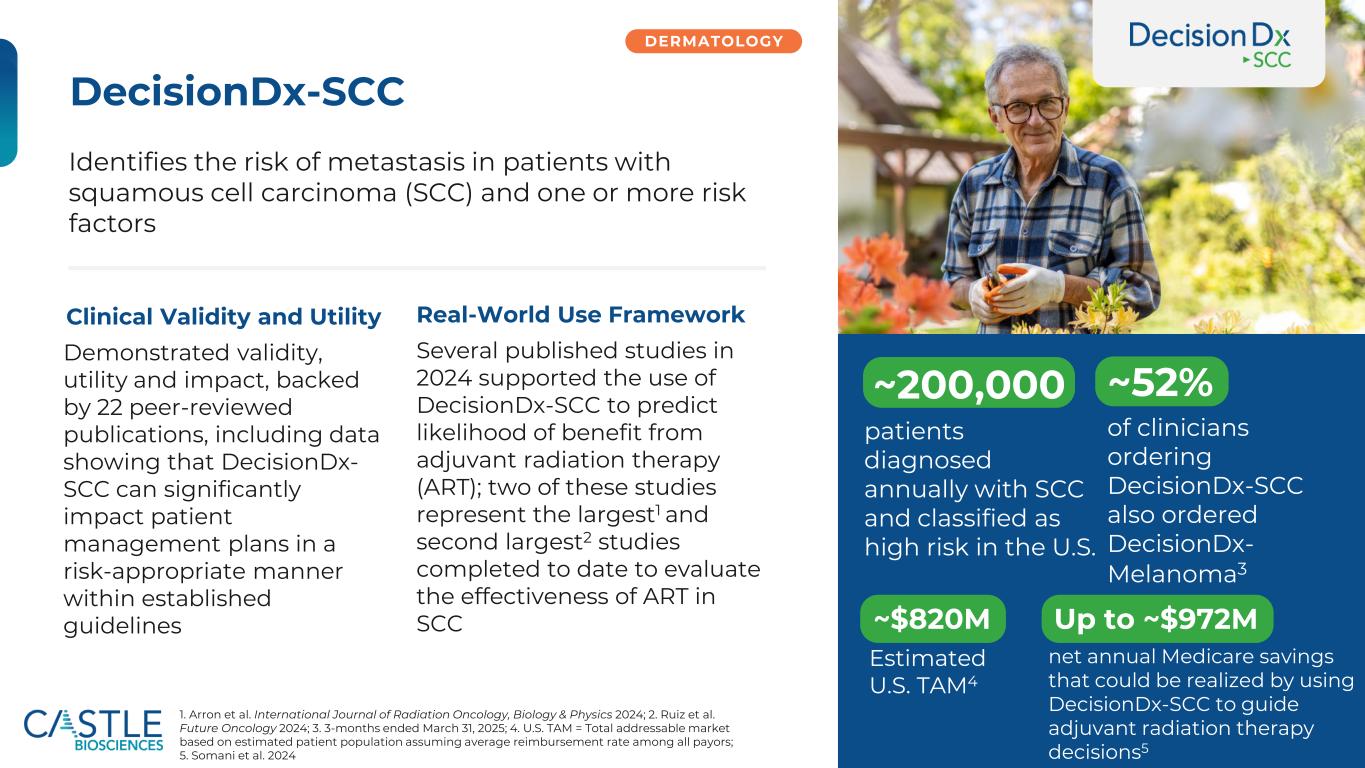

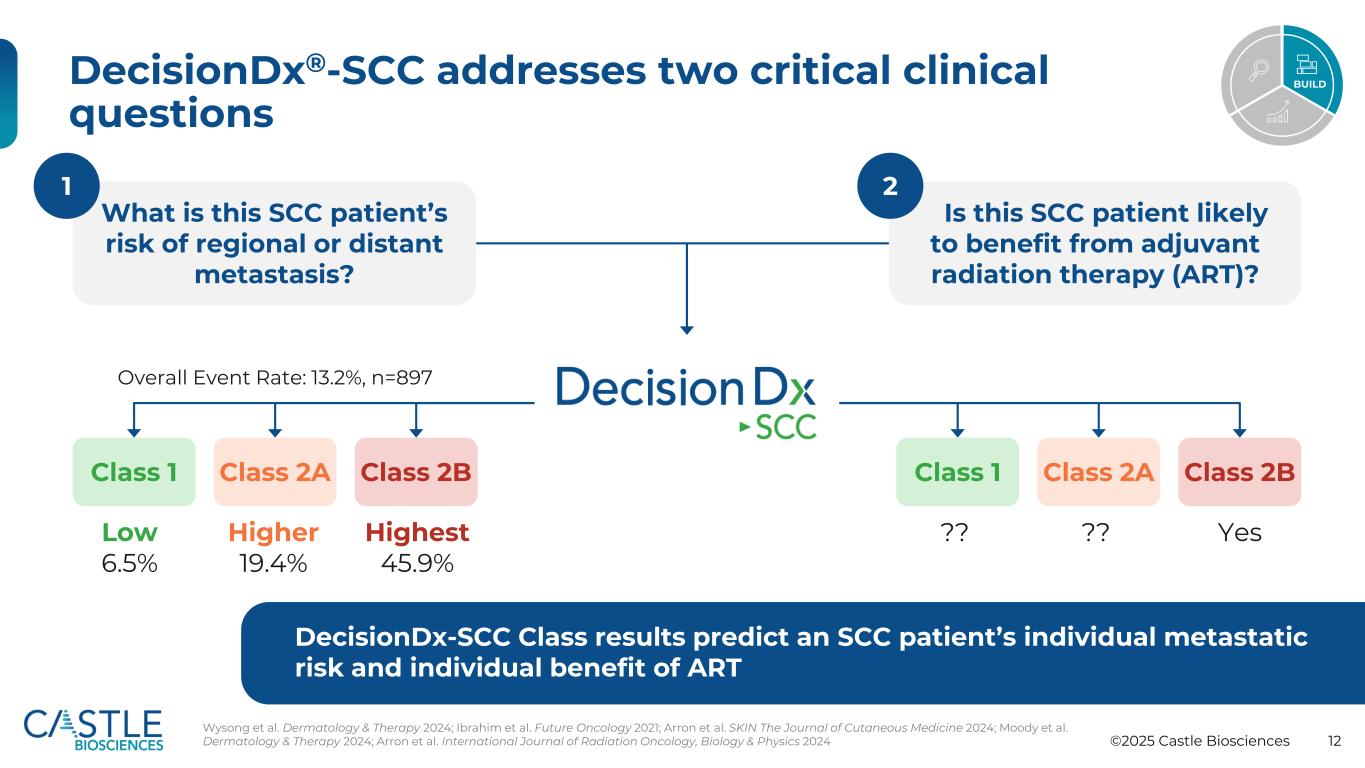

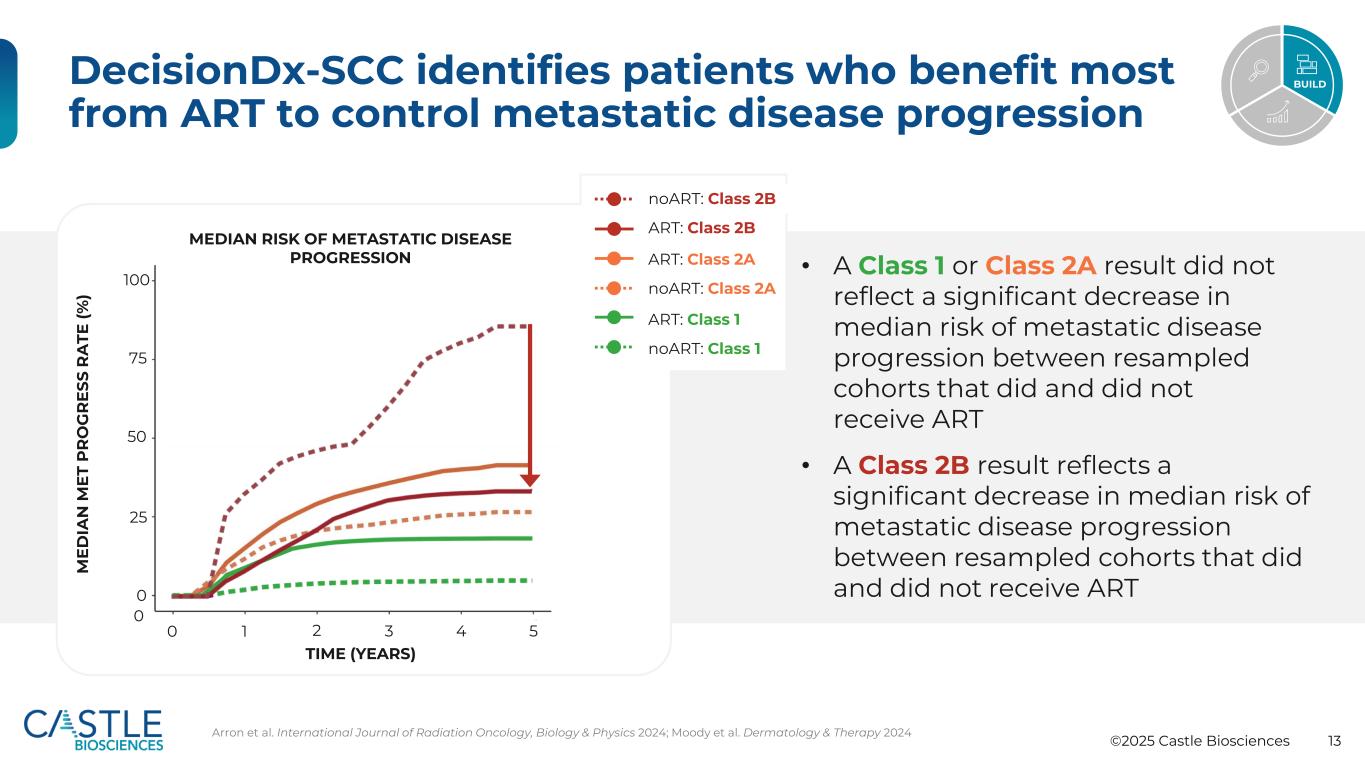

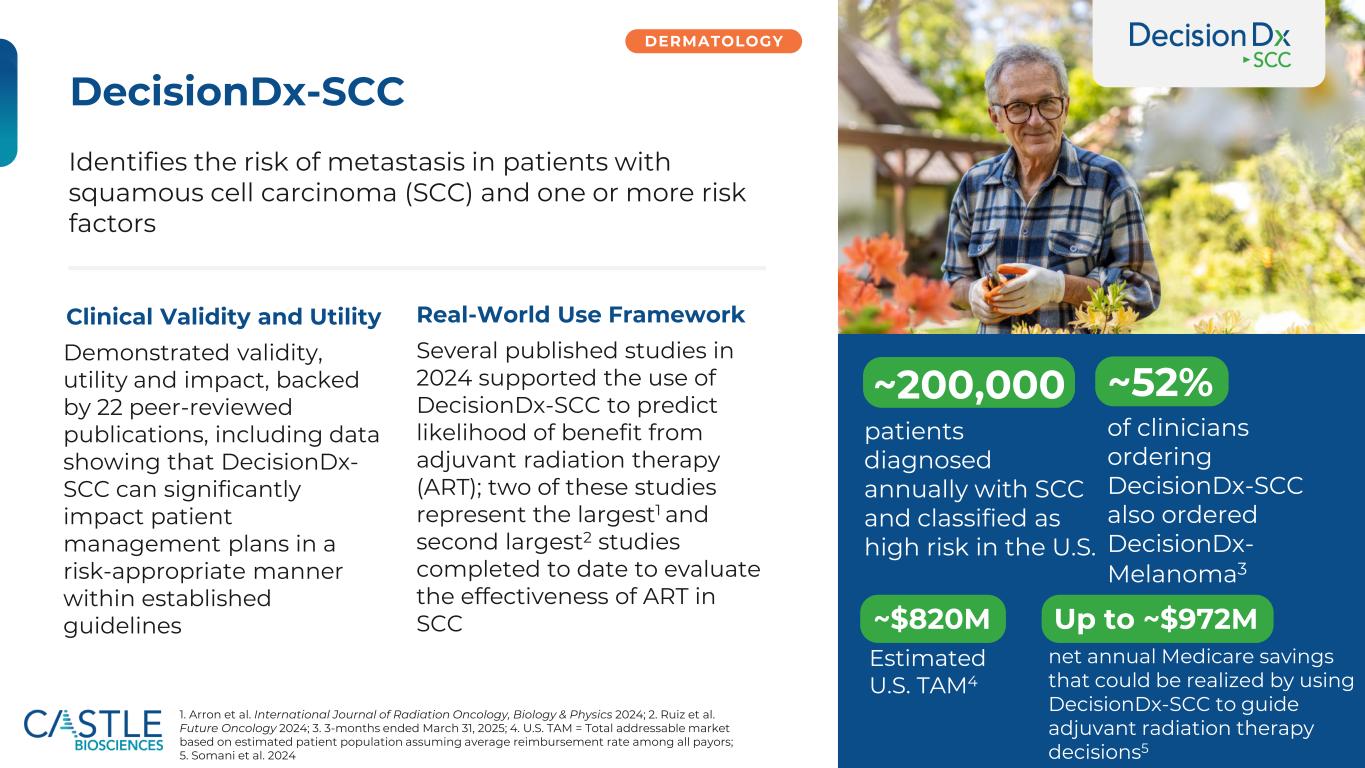

•DecisionDx-SCC: The Company also presented new data on its DecisionDx-SCC test at the NCCN 2025 Annual Conference in Orlando with an abstract that was selected as a Top Five Abstract at the meeting. Specifically, a study assessed how integrating the DecisionDx-SCC test with Brigham & Women's Hospital (BWH) staging within NCCN guidelines can improve prognostic accuracy. An analysis of a new, combined multi-center cohort of 1,412 high-risk SCC patients, with one or more NCCN High-Risk or Very-High-Risk factors, showed that DecisionDx-SCC significantly enhanced metastatic risk stratification in NCCN High- and Very-High-Risk patient populations (p < 0.001). The test significantly improved BWH staging’s risk prediction accuracy (p < 0.001). Compared to the broader NCCN risk stratification, when DecisionDx-SCC was combined with BWH staging, Class 1 (low risk) test results showed a nearly two-fold decrease in metastatic risk and Class 2B (highest risk) results showed more than a five-fold increase in risk in lower-stage (BWH T1/T2a) NCCN High-Risk patients. These findings show that DecisionDx-SCC can significantly refine risk assessment when used with established staging methods, enabling more accurate, personalized treatment decisions based on a patient’s predicted metastatic risk. See the Company’s news release from March 28, 2025, for more information.

•DecisionDx-SCC: Additionally, the Company presented new data on its DecisionDx-SCC test for patients with skin cancer at the 2025 AAD Annual Meeting in Orlando. The study presented provided a validation of the ability of the DecisionDx-SCC test to predict metastatic risk in a novel, independent cohort of patients with high-risk SCC tumors (n=515). In the study, DecisionDx-SCC and BWH staging were both significant predictors of metastasis (p < 0.05). Overall, the study data provided further evidence that DecisionDx-SCC provides significant risk stratification (p < 0.001) of patients at higher risk of SCC metastasis to guide personalized, risk-aligned treatment decisions. See the Company’s news release from March 7, 2025, for more information.

Gastroenterology

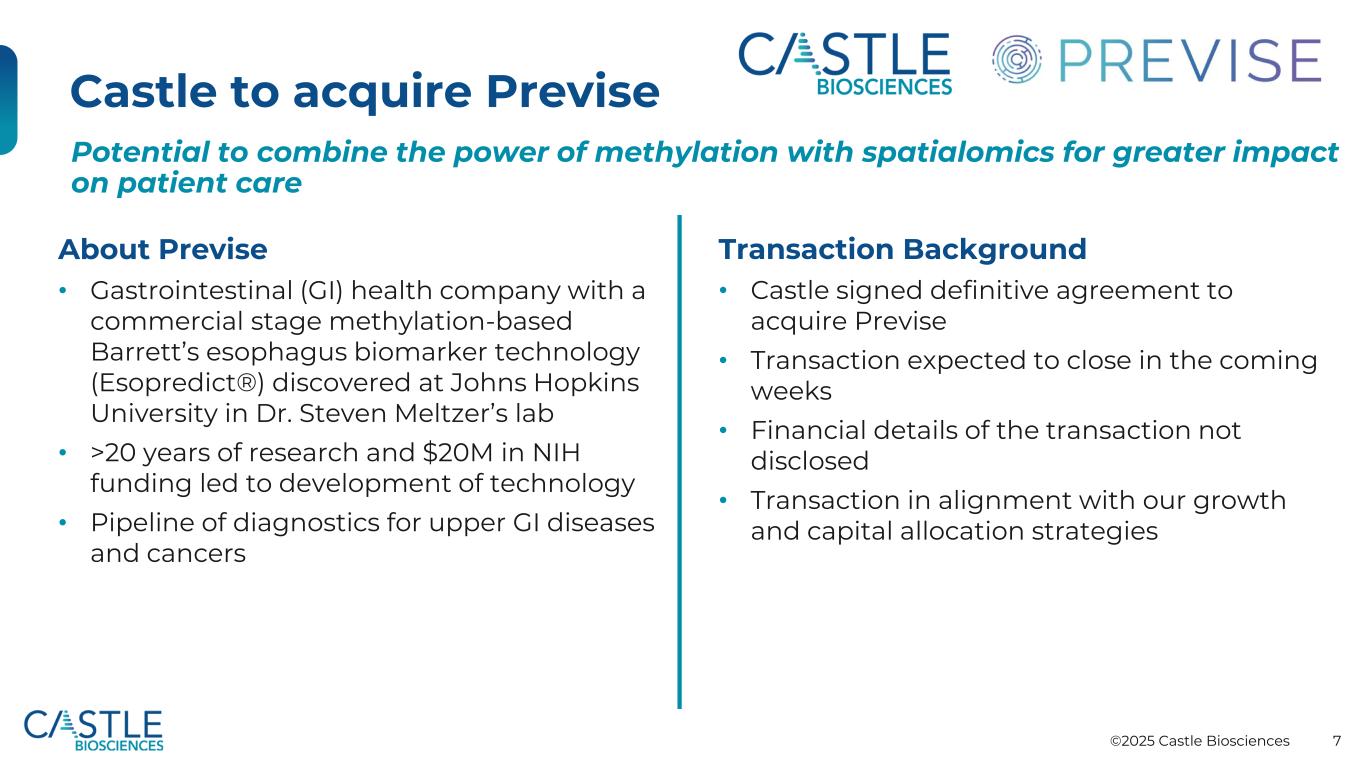

•The Company announced it signed a definitive agreement to acquire Previse. Previse is a gastrointestinal health company with a primary focus on chronic acid reflux related diseases, including esophageal cancer. See the Company’s news release from May 5, 2025, for more information.

•The Company announced supporting key educational programs and initiatives throughout the month of April in recognition of Esophageal Cancer Awareness Month. Castle collaborated with the Esophageal Cancer Action Network (ECAN), the American Foregut Society (AFS) and The Gut Doctor Podcast LLC to promote esophageal cancer prevention, education and advocacy. See the Company’s news release from April 8, 2025, for more information.

Mental Health

•During the first quarter of 2025, the Company made the decision to discontinue its IDgenetix test offering, effective May 2025.

Corporate

•The Company earned a Top Workplace USA award for the fourth year in a row, underscoring Castle’s position as a leader in creating an exemplary workforce culture. See the Company’s news release from April 7, 2025, for more information.

Conference Call and Webcast Details

Castle Biosciences will hold a conference call on Monday, May 5, 2025, at 4:30 p.m. Eastern time to discuss its first quarter 2025 results and provide a corporate update.

A live webcast of the conference call can be accessed here:https://events.q4inc.com/attendee/787806709 or via the webcast link on the Investor Relations page of the Company’s website,

https://ir.castlebiosciences.com/overview/default.aspx. Please access the webcast at least 10 minutes before the conference call start time. An archive of the webcast will be available on the Company’s website until May 26, 2025.

To access the live conference call via phone, please dial 833 470 1428 from the United States, or +1 404 975 4839 internationally, at least 10 minutes prior to the start of the call, using the conference ID 040892.

There will be a brief Question & Answer session following management commentary.

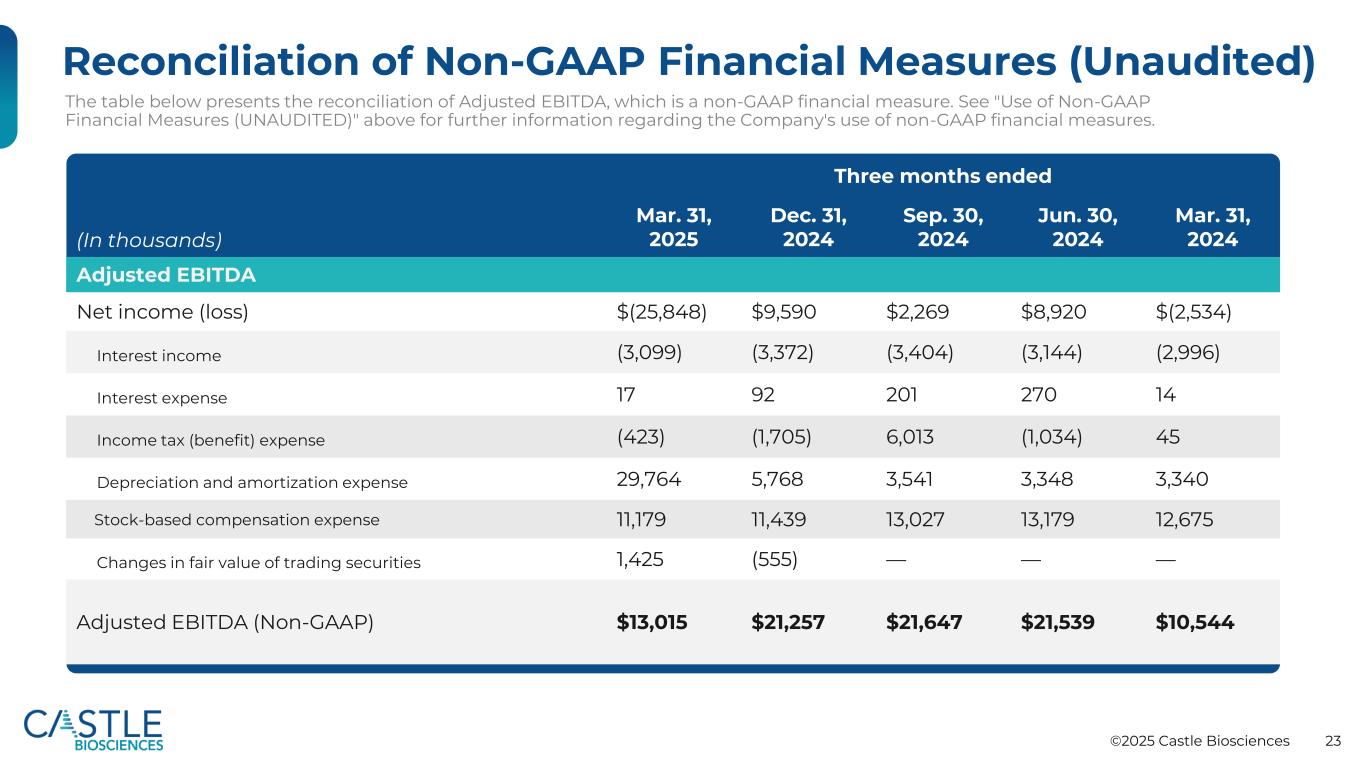

Use of Non-GAAP Financial Measures (UNAUDITED)

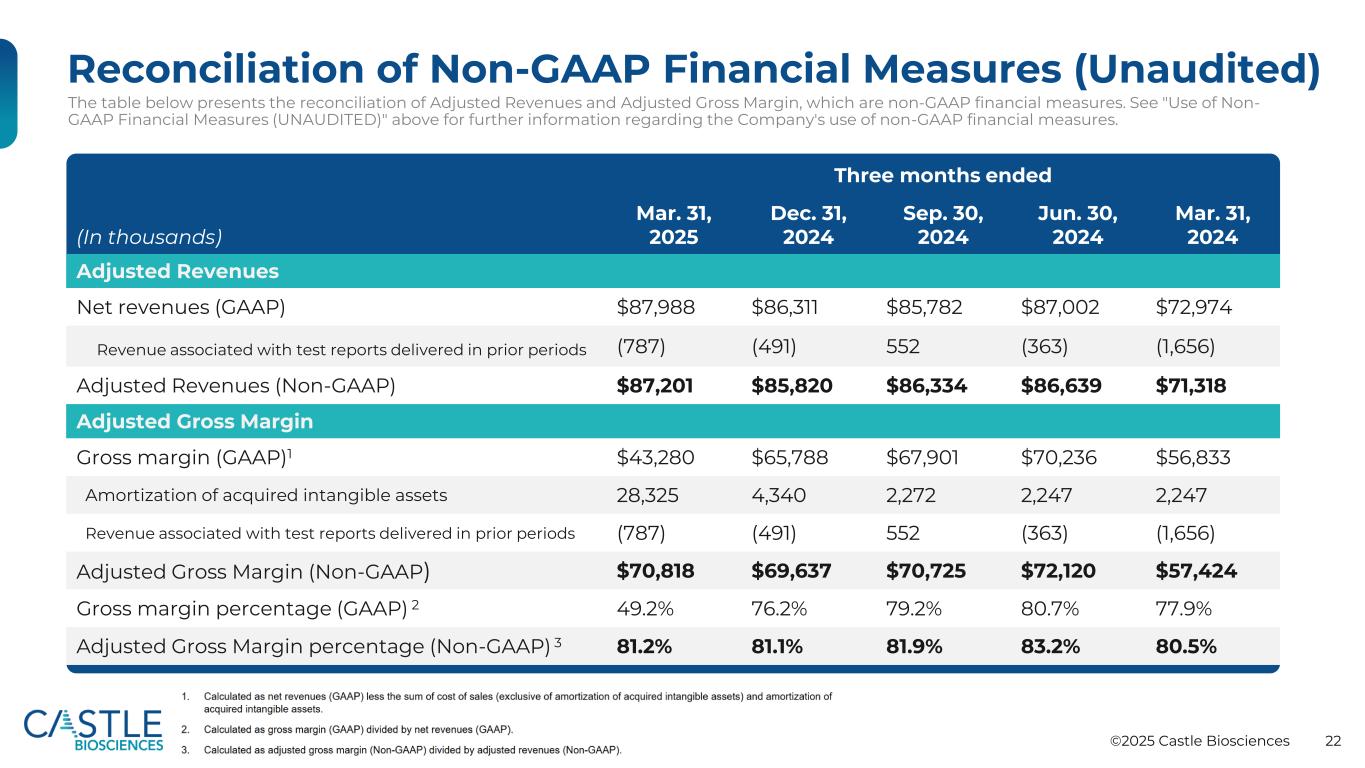

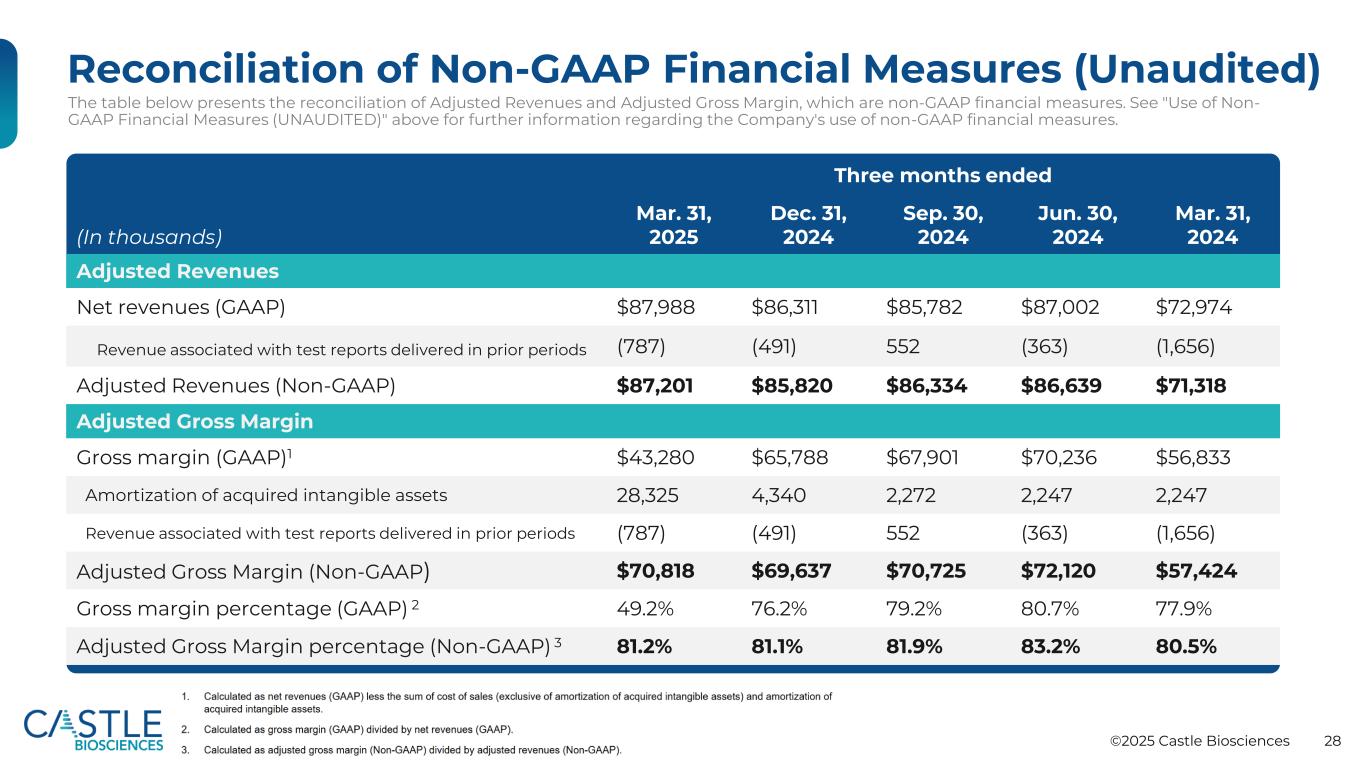

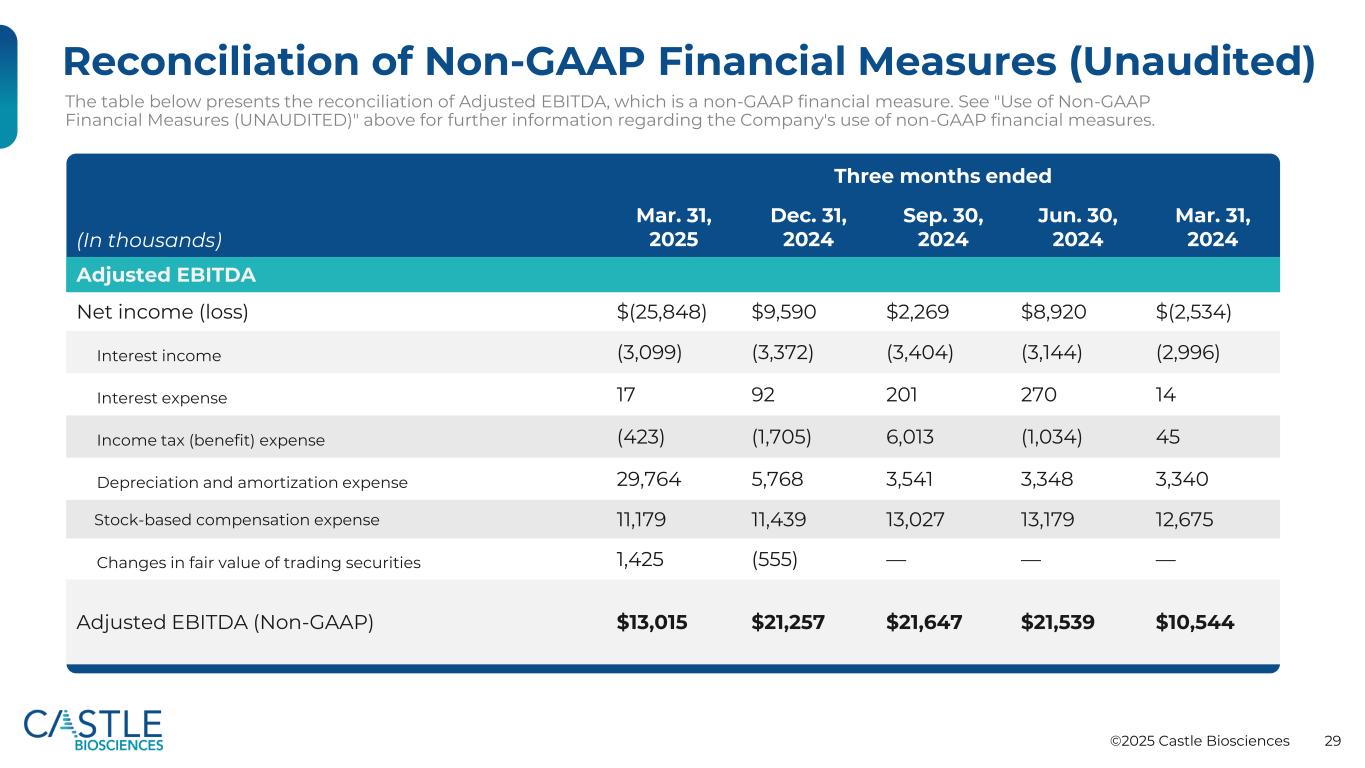

In this release, we use the metrics of Adjusted Revenues, Adjusted Gross Margin, Adjusted EBITDA and Adjusted Net Loss per Share, which are non-GAAP financial measures and are not calculated in accordance with generally accepted accounting principles in the United States (GAAP).

Adjusted Revenues and Adjusted Gross Margin reflect adjustments to GAAP net revenues to exclude net positive and/or net negative revenue adjustments recorded in the current period associated with changes in estimated variable consideration related to test reports delivered in previous periods. Adjusted Gross Margin further excludes acquisition-related intangible asset amortization. Adjusted EBITDA excludes from net income (loss): interest income, interest expense, income tax expense (benefit), depreciation and amortization expense, stock-based compensation expense and changes in fair value of trading securities. Adjusted Net Loss per Share, Basic and Diluted, excludes a one-time adjustment of an acceleration of amortization expense for our IDgenetix test from net loss.

We use Adjusted Revenues, Adjusted Gross Margin, Adjusted EBITDA and Adjusted Net Loss per Share, Basic and Diluted, internally because we believe these metrics provide useful supplemental information in assessing our revenue and operating performance reported in accordance with GAAP, respectively. We believe that Adjusted Revenues, when used in conjunction with our test report volume information, facilitates investors’ analysis of our current-period revenue performance and average selling price performance by excluding the effects of revenue adjustments related to test reports delivered in prior periods, since these adjustments may not be indicative of the current or future performance of our business. We believe that providing Adjusted Revenues may also help facilitate comparisons to our historical periods. Adjusted Gross Margin is calculated using Adjusted Revenues and therefore excludes the impact of revenue adjustments related to test reports delivered in prior periods, which we believe is useful to investors as described above. We further exclude acquisition-related intangible asset amortization in the calculation of Adjusted Gross Margin. We believe that excluding acquisition-related intangible asset amortization may facilitate gross margin comparisons to historical periods and may be useful in assessing current-period performance without regard to the historical accounting valuations of intangible assets, which are applicable only to tests we acquired rather than internally developed. Adjusted Net Loss per Share, Basic and Diluted, is calculated by excluding a one-time adjustment of an acceleration of amortization expense for our IDgenetix test from net loss. We believe that providing Adjusted Net Loss per Share, Basic and Diluted, may also help facilitate comparisons to our historical periods. We believe Adjusted EBITDA may enhance an evaluation of our operating performance because it excludes the impact of prior decisions made about capital investment, financing, investing and certain expenses we believe are not indicative of our ongoing performance. However, these non-GAAP financial measures may be different from non-GAAP financial measures used by other companies, even when the same or similarly titled terms are used to identify such measures, limiting their usefulness for comparative purposes.

These non-GAAP financial measures are not meant to be considered in isolation or used as substitutes for net revenues, gross margin net income (loss) or net income (loss) per share reported in accordance with GAAP; should be considered in conjunction with our financial information presented in accordance with GAAP; have no standardized meaning prescribed by GAAP; are unaudited; and are not prepared under any comprehensive set of accounting rules or principles. In addition, from time to time in the future, there may be other items that we may exclude for purposes of these non-GAAP financial measures, and we may in the future cease to exclude items that we have historically excluded for purposes of these non-GAAP financial measures. Likewise, we may determine to modify the nature of adjustments to arrive at these non-GAAP financial measures. Because of the non-standardized definitions of non-GAAP financial measures, the non-GAAP financial measure as used by us in this press release and the accompanying reconciliation tables have limits in their usefulness to investors and may be calculated differently from, and therefore may not be directly comparable to, similarly titled measures used by other companies. Accordingly, investors should not place undue reliance on non-GAAP financial measures. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are presented in the tables at the end of this release.

About Castle Biosciences

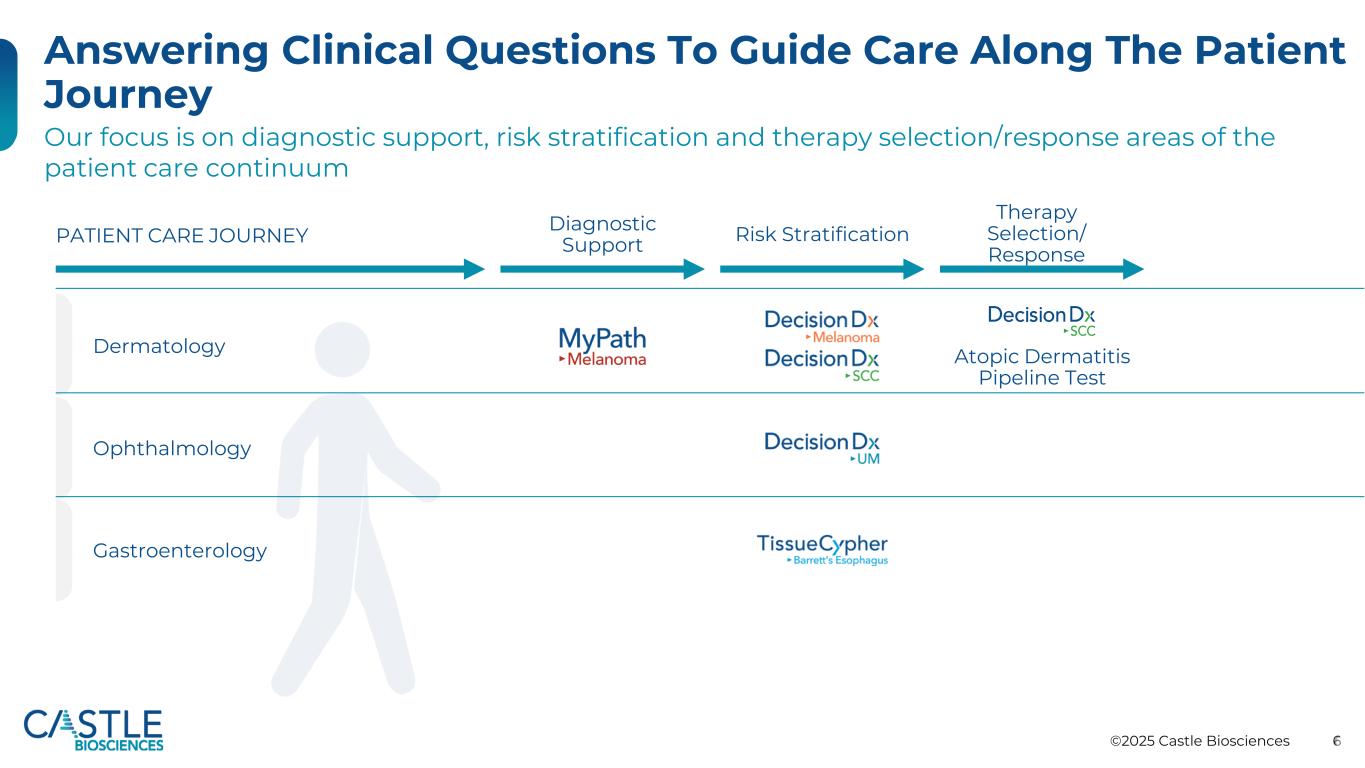

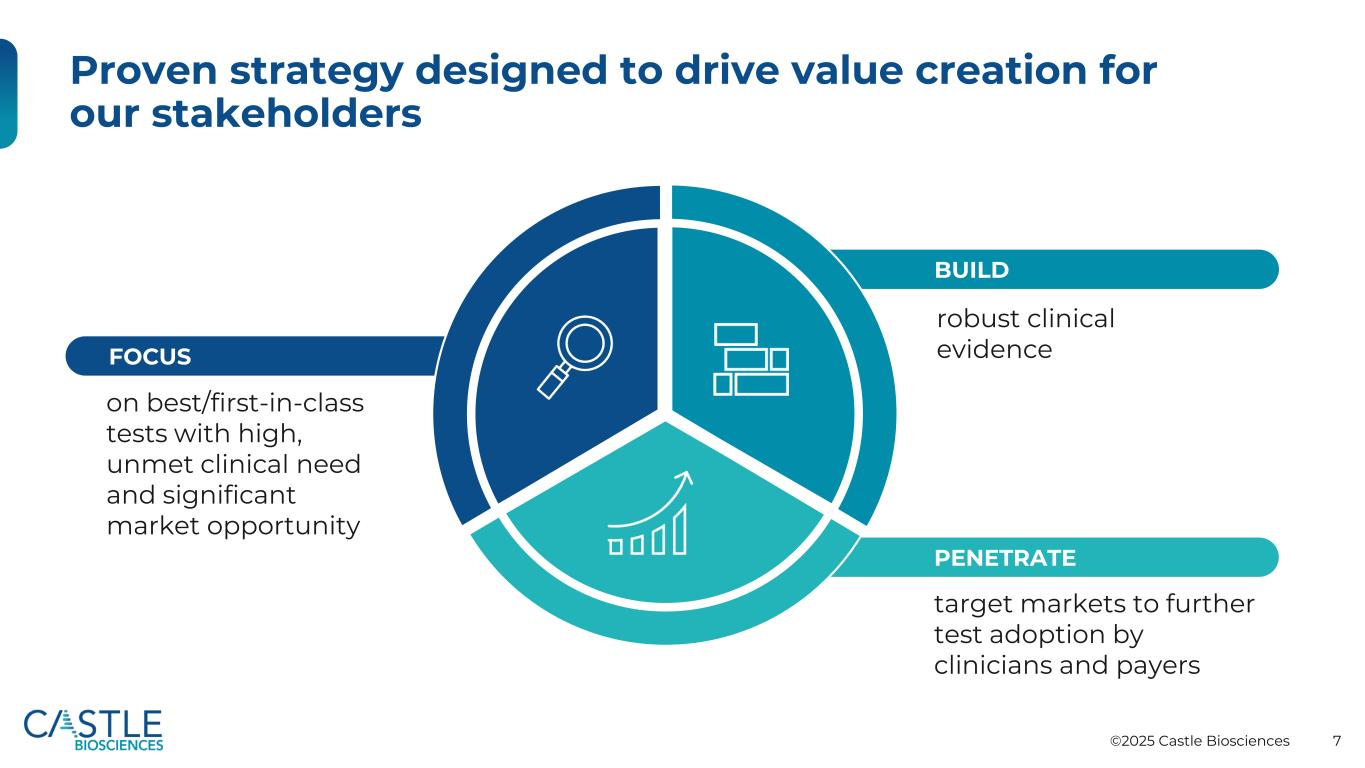

Castle Biosciences (Nasdaq: CSTL) is a leading diagnostics company improving health through innovative tests that guide patient care. The Company aims to transform disease management by keeping people first: patients, clinicians, employees and investors.

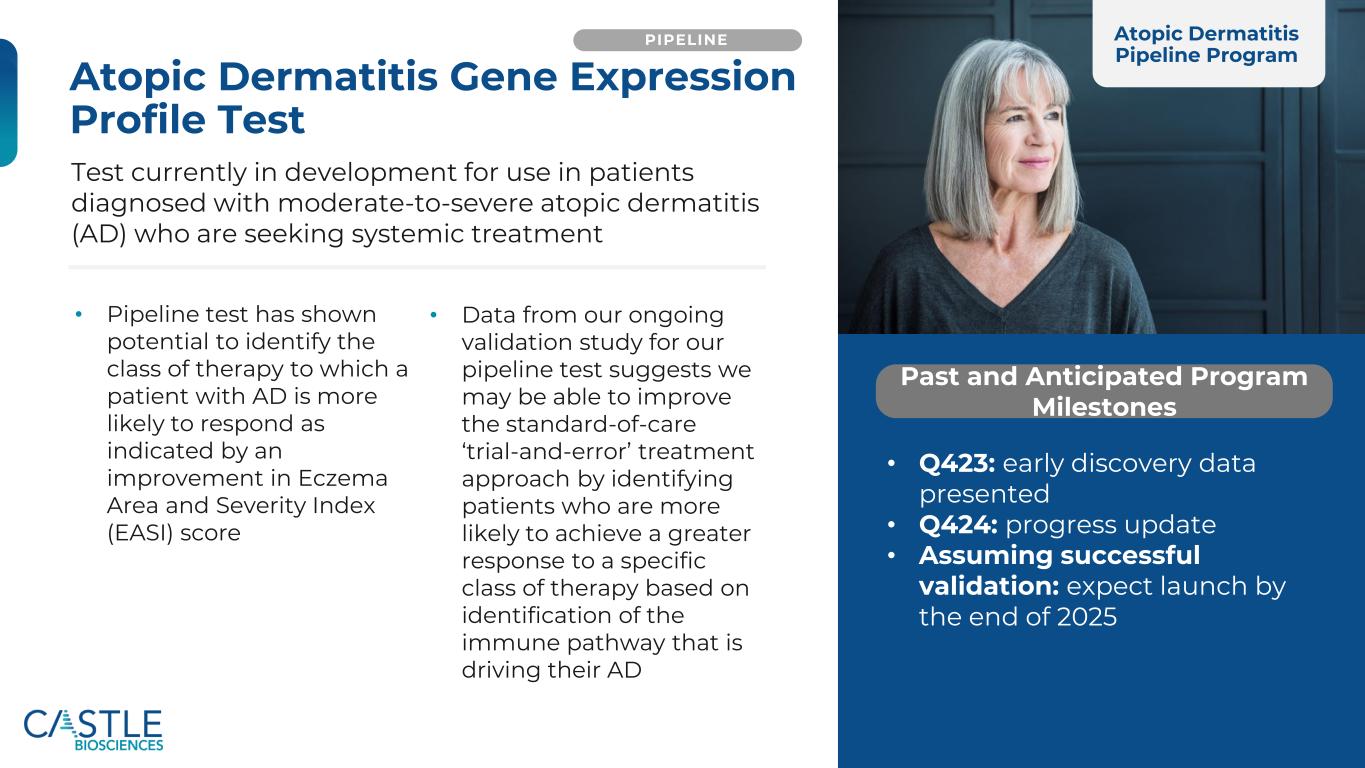

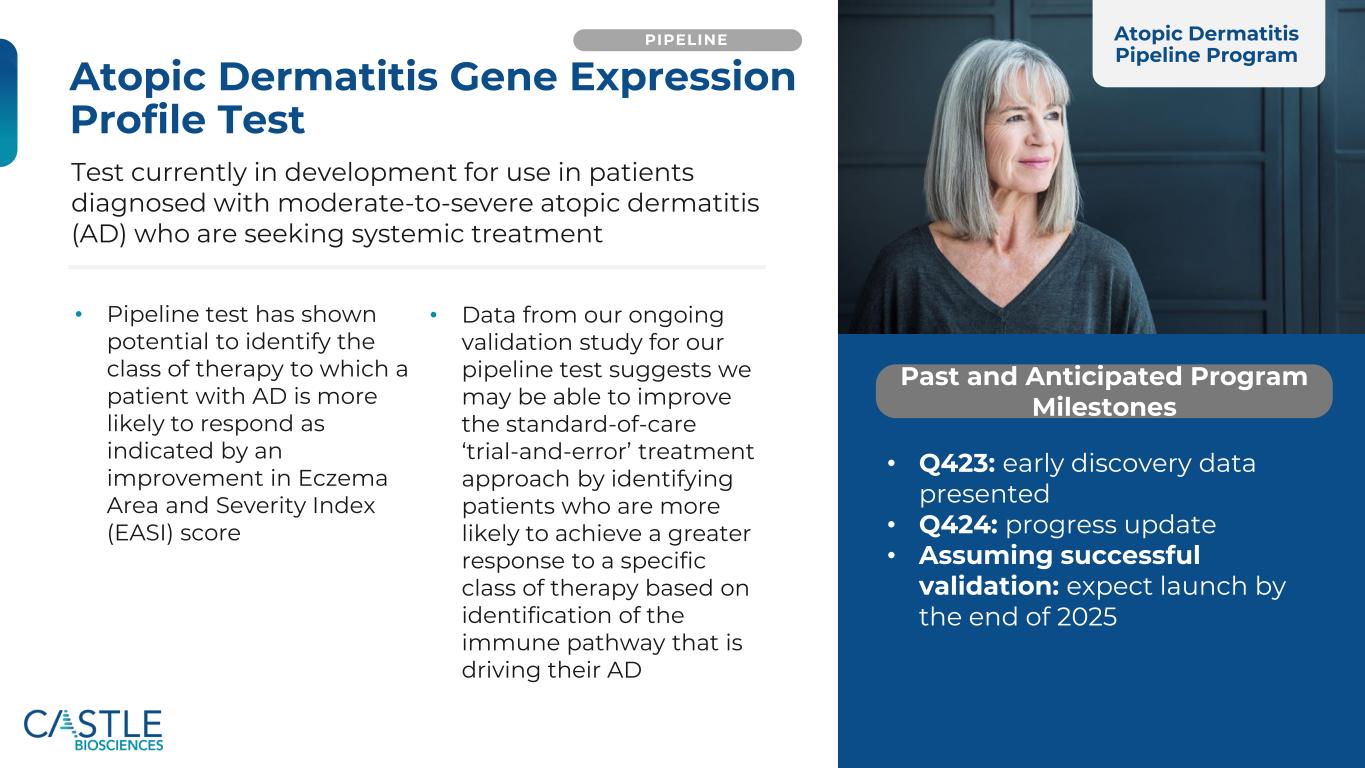

Castle’s current portfolio consists of tests for skin cancers, Barrett’s esophagus, mental health conditions and uveal melanoma. Additionally, the Company has active research and development programs for tests in these and other diseases with high clinical need, including its test in development to help guide systemic therapy selection for patients with moderate-to-severe atopic dermatitis seeking biologic treatment. To learn more, please visit www.CastleBiosciences.com and connect with us on LinkedIn, Facebook, X and Instagram.

DecisionDx-Melanoma, DecisionDx-CMSeq, i31-SLNB, i31-ROR, DecisionDx-SCC, MyPath Melanoma, DiffDx-Melanoma, TissueCypher, IDgenetix, DecisionDx-UM, DecisionDx-PRAME and DecisionDx-UMSeq are trademarks of Castle Biosciences, Inc.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. These forward-looking statements include, but are not limited to, statements concerning our expectations regarding: our 2025 total revenue guidance of $287-297 million; continued growth of test volumes; the ability of DecisionDx-Melanoma and DecisionDx-SCC to bring substantial added value to clinicians and their patients; the significant impact of DecisionDx-Melanoma on SLNB decision-making for patients with melanoma; DecisionDx-Melanoma’s ability to (i) guide adjuvant therapy, (ii) be a significant predictor of both melanoma-specific and overall mortality and (iii) identify patients at greater predicted risk than indicated by AJCC8 staging alone who may benefit from enhanced surveillance and management to improve outcomes; the ability of DecisionDx-SCC to (i) integrate with BWH staging to improve prognostic accuracy, (ii) significantly refine individual patient risk assessment when used with established staging methods, (iii) enable more personalized treatment decisions and (iv) predict metastatic risk and help guide personalized, risk-aligned treatment decisions; Castle’s ability to achieve near- and long-term success and the continued growth of our portfolio; and Castle’s ability to acquire Previse on the anticipated terms or timeline, if at all. The words “anticipate,” “can,” “could,” “expect,” “goal,” “may,” “plan” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. These forward-looking statements involve risks and uncertainties that could cause our actual results to differ materially from those in the forward-looking statements, including, without limitation: our assumptions or expectations regarding continued reimbursement for our DecisionDx-SCC test at the current rate and reimbursement for our other products and subsequent coverage decisions, our estimated total addressable markets for our products and product candidates and the related expenses, capital requirements and potential needs for additional financing, the anticipated cost, timing and success of our product candidates, and our plans to research, develop and commercialize new tests and our ability to successfully integrate new businesses, assets, products or technologies acquired through acquisitions, the effects of macroeconomic events and conditions, including inflation and monetary supply shifts, labor shortages, liquidity concerns at, and failures of, banks and other financial institutions or other disruptions in the banking system or financing markets and recession risks, supply chain disruptions, tariffs, outbreaks of contagious diseases and geopolitical events (such as the ongoing Israel-Hamas War and Ukraine-Russia conflict), among others, on our business and our efforts to address its impact on our business; the possibility that subsequent study or trial results and findings may contradict earlier study or trial results and findings or may not support the results discussed in this press release, including with respect to

the tests discussed in this press release; our planned installation of additional equipment and supporting technology infrastructures and implementation of certain process efficiencies may not enable us to increase the future scalability of our TissueCypher Test; the possibility that actual application of our tests may not provide the aforementioned benefits to patients; the possibility that our newer gastroenterology and mental health franchises may not contribute to the achievement of our long-term financial targets as anticipated; and the risks set forth under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2025, each filed or to be filed with the SEC, and in our other filings with the SEC. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements, except as may be required by law.

Investor Relations Contact:

Camilla Zuckero

czuckero@castlebiosciences.com

281-906-3868

Media Contact:

Allison Marshall

amarshall@castlebiosciences.com

###

CASTLE BIOSCIENCES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

|

|

2025 |

|

2024 |

|

|

|

|

|

|

|

| NET REVENUES |

$ |

87,988 |

|

|

$ |

72,974 |

|

|

|

|

|

|

|

|

| OPERATING EXPENSES |

|

|

|

|

|

|

|

|

|

|

| Cost of sales (exclusive of amortization of acquired intangible assets) |

16,383 |

|

|

13,894 |

|

|

|

|

|

|

|

|

| Research and development |

12,588 |

|

|

13,809 |

|

|

|

|

|

|

|

|

| Selling, general and administrative |

58,620 |

|

|

48,495 |

|

|

|

|

|

|

|

|

| Amortization of acquired intangible assets |

28,325 |

|

|

2,247 |

|

|

|

|

|

|

|

|

| Total operating expenses, net |

115,916 |

|

|

78,445 |

|

|

|

|

|

|

|

|

| Operating loss |

(27,928) |

|

|

(5,471) |

|

|

|

|

|

|

|

|

| Interest income |

3,099 |

|

|

2,996 |

|

|

|

|

|

|

|

|

| Changes in fair value of trading securities |

(1,425) |

|

|

— |

|

|

|

|

|

|

|

|

| Interest expense |

(17) |

|

|

(14) |

|

|

|

|

|

|

|

|

| Loss before income taxes |

(26,271) |

|

|

(2,489) |

|

|

|

|

|

|

|

|

| Income tax (benefit) expense |

(423) |

|

|

45 |

|

|

|

|

|

|

|

|

| Net loss |

$ |

(25,848) |

|

|

$ |

(2,534) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per share, basic and diluted |

$ |

(0.90) |

|

|

$ |

(0.09) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average shares outstanding, basic and diluted |

28,609 |

|

|

27,485 |

|

|

|

|

|

|

|

|

Stock-Based Compensation Expense

Stock-based compensation expense is included in the unaudited condensed consolidated statements of operations as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

|

|

2025 |

|

2024 |

|

|

|

|

|

|

|

| Cost of sales (exclusive of amortization of acquired intangible assets) |

$ |

1,456 |

|

|

$ |

1,314 |

|

|

|

|

|

|

|

|

| Research and development |

1,895 |

|

|

2,629 |

|

|

|

|

|

|

|

|

| Selling, general and administrative |

7,828 |

|

|

8,732 |

|

|

|

|

|

|

|

|

| Total stock-based compensation expense |

$ |

11,179 |

|

|

$ |

12,675 |

|

|

|

|

|

|

|

|

CASTLE BIOSCIENCES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(UNAUDITED)

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

|

|

2025 |

|

2024 |

|

|

|

|

|

|

|

|

| Net loss |

$ |

(25,848) |

|

|

$ |

(2,534) |

|

|

|

|

|

|

|

|

|

| Other comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

| Net unrealized loss on marketable investment securities |

(99) |

|

|

(247) |

|

|

|

|

|

|

|

|

|

| Comprehensive loss |

$ |

(25,947) |

|

|

$ |

(2,781) |

|

|

|

|

|

|

|

|

|

CASTLE BIOSCIENCES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2025 |

|

December 31, 2024 |

| ASSETS |

(unaudited) |

|

|

| Current Assets |

|

|

|

| Cash and cash equivalents |

$ |

89,689 |

|

|

$ |

119,709 |

|

| Marketable investment securities |

185,462 |

|

|

173,421 |

|

| Accounts receivable, net |

56,353 |

|

|

51,218 |

|

| Inventory |

6,849 |

|

|

8,135 |

|

| Prepaid expenses and other current assets |

11,035 |

|

|

7,671 |

|

| Total current assets |

349,388 |

|

|

360,154 |

|

| Long-term marketable investment securities |

5,570 |

|

|

— |

|

| Long-term accounts receivable, net |

1,000 |

|

|

918 |

|

| Property and equipment, net |

55,423 |

|

|

51,122 |

|

| Operating lease assets |

11,164 |

|

|

11,584 |

|

| Goodwill and other intangible assets, net |

77,904 |

|

|

106,229 |

|

| Other assets – long-term |

1,266 |

|

|

1,228 |

|

| Total assets |

$ |

501,715 |

|

|

$ |

531,235 |

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| Current Liabilities |

|

|

|

| Accounts payable |

$ |

8,502 |

|

|

$ |

6,901 |

|

| Accrued compensation |

17,857 |

|

|

32,555 |

|

| Operating lease liabilities |

1,435 |

|

|

1,665 |

|

| Current portion of long-term debt |

1,111 |

|

|

278 |

|

| Other accrued and current liabilities |

8,369 |

|

|

7,993 |

|

| Total current liabilities |

37,274 |

|

|

49,392 |

|

| Long-term debt |

8,921 |

|

|

9,745 |

|

| Noncurrent operating lease liabilities |

14,049 |

|

|

14,345 |

|

| Noncurrent finance lease liabilities |

328 |

|

|

311 |

|

| Deferred tax liability |

837 |

|

|

1,607 |

|

| Total liabilities |

61,409 |

|

|

75,400 |

|

| Stockholders’ Equity |

|

|

|

| Preferred stock |

— |

|

|

— |

|

| Common stock |

29 |

|

|

28 |

|

| Additional paid-in capital |

666,120 |

|

|

655,703 |

|

| Accumulated deficit |

(225,974) |

|

|

(200,126) |

|

| Accumulated other comprehensive income |

131 |

|

|

230 |

|

| Total stockholders’ equity |

440,306 |

|

|

455,835 |

|

| Total liabilities and stockholders’ equity |

$ |

501,715 |

|

|

$ |

531,235 |

|

|

|

|

|

CASTLE BIOSCIENCES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

2025 |

|

2024 |

| OPERATING ACTIVITIES |

|

|

|

| Net loss |

$ |

(25,848) |

|

|

$ |

(2,534) |

|

| Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

| Depreciation and amortization |

29,764 |

|

|

3,340 |

|

| Stock-based compensation expense |

11,179 |

|

|

12,675 |

|

| Change in fair value of trading securities |

1,425 |

|

|

— |

|

| Deferred income taxes |

(770) |

|

|

— |

|

| Accretion of discounts on marketable investment securities |

(1,435) |

|

|

(1,699) |

|

| Other |

30 |

|

|

179 |

|

| Change in operating assets and liabilities: |

|

|

|

| Accounts receivable |

(5,217) |

|

|

(4,262) |

|

| Prepaid expenses and other current assets |

(3,364) |

|

|

(103) |

|

| Inventory |

1,286 |

|

|

297 |

|

| Operating lease assets |

420 |

|

|

338 |

|

| Other assets |

(38) |

|

|

(230) |

|

| Accounts payable |

615 |

|

|

(422) |

|

| Operating lease liabilities |

(526) |

|

|

(250) |

|

| Accrued compensation |

(14,698) |

|

|

(14,237) |

|

| Other accrued and current liabilities |

1,141 |

|

|

73 |

|

| Net cash used in operating activities |

(6,036) |

|

|

(6,835) |

|

|

|

|

|

| INVESTING ACTIVITIES |

|

|

|

| Purchases of marketable investment securities |

(48,431) |

|

|

(60,754) |

|

| Proceeds from maturities of marketable investment securities |

36,300 |

|

|

50,200 |

|

| Purchases of debt securities classified as held-to-maturity |

(5,569) |

|

|

— |

|

| Purchases of property and equipment |

(4,740) |

|

|

(9,152) |

|

| Proceeds from sale of property and equipment |

9 |

|

|

5 |

|

| Net cash used in investing activities |

(22,431) |

|

|

(19,701) |

|

|

|

|

|

| FINANCING ACTIVITIES |

|

|

|

| Proceeds from exercise of common stock options |

18 |

|

|

65 |

|

| Payment of employees’ taxes on vested restricted stock units |

(2,515) |

|

|

(474) |

|

| Proceeds from contributions to the employee stock purchase plan |

970 |

|

|

1,089 |

|

| Repayment of principal portion of finance lease liabilities |

(26) |

|

|

(36) |

|

| Proceeds from issuance of term debt |

— |

|

|

10,000 |

|

| Net cash (used in) provided by financing activities |

(1,553) |

|

|

10,644 |

|

|

|

|

|

| NET CHANGE IN CASH AND CASH EQUIVALENTS |

(30,020) |

|

|

(15,892) |

|

| Beginning of period |

119,709 |

|

|

98,841 |

|

| End of period |

$ |

89,689 |

|

|

$ |

82,949 |

|

CASTLE BIOSCIENCES, INC.

Reconciliation of Non-GAAP Financial Measures (UNAUDITED)

The table below presents the reconciliation of Adjusted Revenues, Adjusted Gross Margin and Adjusted Net Loss Per Share, Basic and Diluted, which are non-GAAP financial measures. See "Use of Non-GAAP Financial Measures (UNAUDITED)" above for further information regarding the Company's use of non-GAAP financial measures.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

|

2025 |

|

2024 |

|

|

|

|

| (in thousands, except per share data) |

|

|

|

|

|

|

|

| Adjusted Revenues |

|

|

|

|

|

|

|

| Net revenues (GAAP) |

$ |

87,988 |

|

$ |

72,974 |

|

|

|

|

| Revenue associated with test reports delivered in prior periods |

(787) |

|

(1,656) |

|

|

|

|

| Adjusted revenues (Non-GAAP) |

$ |

87,201 |

|

$ |

71,318 |

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Gross Margin |

|

|

|

|

|

|

|

Gross margin (GAAP)1 |

$ |

43,280 |

|

$ |

56,833 |

|

|

|

|

| Amortization of acquired intangible assets |

28,325 |

|

2,247 |

|

|

|

|

| Revenue associated with test reports delivered in prior periods |

(787) |

|

(1,656) |

|

|

|

|

| Adjusted Gross Margin (Non-GAAP) |

$ |

70,818 |

|

$ |

57,424 |

|

|

|

|

|

|

|

|

|

|

|

|

Gross Margin percentage (GAAP)2 |

49.2 |

% |

|

77.9 |

% |

|

|

|

|

Adjusted gross margin percentage (Non-GAAP)3 |

81.2 |

% |

|

80.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Loss per Share, Basic and Diluted |

|

|

|

|

|

|

|

| Net loss (GAAP) |

$ |

(25,848) |

|

$ |

(2,534) |

|

|

|

|

Amortization of acquired intangible assets4 |

20,099 |

|

— |

|

|

|

|

| Adjusted Net Loss (Non-GAAP) |

$ |

(5,749) |

|

$ |

(2,534) |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average shares outstanding, basic and diluted: |

28,609 |

|

27,485 |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share, basic and diluted (GAAP)5 |

$ |

(0.90) |

|

$ |

(0.09) |

|

|

|

|

Adjusted Net Loss Per Share, Basic and Diluted (Non-GAAP)6 |

$ |

(0.20) |

|

$ |

(0.09) |

|

|

|

|

1.Calculated as net revenues (GAAP) less the sum of cost of sales (exclusive of amortization of acquired intangible assets) and amortization of acquired intangible assets.

2.Calculated as gross margin (GAAP) divided by net revenues (GAAP).

3.Calculated as Adjusted Gross Margin (Non-GAAP) divided by Adjusted Revenues (Non-GAAP).

4.Represents a one-time adjustment of an acceleration of amortization expense for our IDgenetix test during the three months ended March 31,2025.

5.Calculated as net loss (GAAP) divided by weighted-average shares outstanding, basic and diluted.

6.Calculated as Adjusted Net Loss (Non-GAAP) divided by weighted-average shares outstanding, basic and diluted.

The table below presents the reconciliation of Adjusted EBITDA, which is a non-GAAP financial measure. See "Use of Non-GAAP Financial Measures (UNAUDITED)" above for further information regarding the Company's use of non-GAAP financial measures.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

|

|

|

2025 |

|

2024 |

|

|

|

|

|

|

|

|

| (in thousands) |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

$ |

(25,848) |

|

|

$ |

(2,534) |

|

|

|

|

|

|

|

|

|

| Interest income |

(3,099) |

|

|

(2,996) |

|

|

|

|

|

|

|

|

|

| Interest expense |

17 |

|

|

14 |

|

|

|

|

|

|

|

|

|

| Income tax (benefit) expense |

(423) |

|

|

45 |

|

|

|

|

|

|

|

|

|

| Depreciation and amortization expense |

29,764 |

|

|

3,340 |

|

|

|

|

|

|

|

|

|

| Stock-based compensation expense |

11,179 |

|

|

12,675 |

|

|

|

|

|

|

|

|

|

| Change in fair value of trading securities |

1,425 |

|

|

— |

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA (Non-GAAP) |

$ |

13,015 |

|

|

$ |

10,544 |

|

|

|

|

|

|

|

|

|