| Allegiant Travel Company | ||||||||||||||||||||||||||||||||

| (Exact name of registrant as specified in its charter) | ||||||||||||||||||||||||||||||||

| Nevada | 001-33166 | 20-4745737 | ||||||||||||||||||||||||||||||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||||||||||||||||||||||||||||||

| 1201 North Town Center Drive | ||||||||||||||||||||||||||||||||

Las Vegas, NV |

89144 | |||||||||||||||||||||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||||||||||||||||||||

| N/A | ||||||||||||||||||||||||||||||||

| (Former name or former address, if changed since last report.) | ||||||||||||||||||||||||||||||||

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||||||||

Common stock, par value $0.001 |

ALGT |

NASDAQ Global Select Market |

||||||||||||

| Exhibit No. | Description of Document | ||||

| Date: August 4, 2025 | ALLEGIANT TRAVEL COMPANY | ||||||||||

| By: | /s/ Robert J. Neal | ||||||||||

| Name: | Robert J. Neal | ||||||||||

| Title: | Executive Vice President and Chief Financial Officer | ||||||||||

| Exhibit No. | Description of Document | ||||

| Consolidated | Three Months Ended June 30, | Percent Change | |||||||||||||||

| (unaudited) (in millions, except per share amounts) | 2025 | 2024 | YoY | ||||||||||||||

| Total operating revenue | $ | 689.4 | $ | 666.3 | 3.5 | % | |||||||||||

| Total operating expense | 756.9 | 631.4 | 19.9 | % | |||||||||||||

| Operating income (loss) | (67.5) | 34.9 | NM | ||||||||||||||

| Income (loss) before income taxes | (88.6) | 18.0 | NM | ||||||||||||||

| Net income (loss) | (65.2) | 13.7 | NM | ||||||||||||||

| Diluted earnings (loss) per share | (3.62) | 0.75 | NM | ||||||||||||||

Sunseeker special charges, net(2) |

103.3 | (2.0) | NM | ||||||||||||||

Airline special charges(2) |

14.6 | 20.1 | (27.4) | % | |||||||||||||

Adjusted income before income taxes(1)(2) |

29.4 | 36.1 | (18.6) | % | |||||||||||||

Adjusted net income(1)(2) |

22.7 | 32.5 | (30.2) | % | |||||||||||||

Adjusted diluted earnings per share(1)(2) |

1.23 | 1.77 | (30.5) | % | |||||||||||||

| Airline only | Three Months Ended June 30, | Percent Change(4) |

|||||||||||||||

| (unaudited) (in millions, except per share amounts) | 2025 | 2024 | YoY | ||||||||||||||

Airline operating revenue |

$ | 668.8 | $ | 649.5 | 3.0 | % | |||||||||||

Airline operating expense |

625.6 | 602.5 | 3.8 | % | |||||||||||||

Airline operating income |

43.2 | 47.0 | (8.1) | % | |||||||||||||

Airline income before income taxes |

29.7 | 35.5 | (16.3) | % | |||||||||||||

Airline special charges(2) |

14.6 | 20.1 | (27.4) | % | |||||||||||||

Adjusted airline-only net income(1)(2) |

34.3 | 41.0 | (16.3) | % | |||||||||||||

Adjusted airline-only operating margin(1)(2) |

8.6 | % | 10.3 | % | (1.7) | ||||||||||||

Adjusted airline-only diluted earnings per share(1)(2) |

1.86 | 2.24 | (17.0) | % | |||||||||||||

| Consolidated | Six Months Ended June 30, | Percent Change | |||||||||||||||

| (unaudited) (in millions, except per share amounts) | 2025 | 2024 | YoY | ||||||||||||||

| Total operating revenue | $ | 1,388.5 | $ | 1,322.7 | 5.0 | % | |||||||||||

| Total operating expense | 1,390.9 | 1,272.3 | 9.3 | % | |||||||||||||

| Operating income (loss) | (2.5) | 50.3 | NM | ||||||||||||||

| Income (loss) before income taxes | (46.6) | 16.7 | NM | ||||||||||||||

| Net income (loss) | (33.1) | 12.8 | NM | ||||||||||||||

| Diluted earnings (loss) per share | (1.84) | 0.68 | NM | ||||||||||||||

Sunseeker special charges, net(2) |

100.4 | (3.8) | NM | ||||||||||||||

Airline special charges(2) |

16.0 | 35.0 | (54.3) | % | |||||||||||||

Adjusted income before income taxes(1)(2)(3) |

73.2 | 47.9 | 52.8 | % | |||||||||||||

Adjusted net income(1)(2)(3) |

56.2 | 42.9 | 31.0 | % | |||||||||||||

Adjusted diluted earnings per share(1)(2)(3) |

3.03 | 2.34 | 29.5 | % | |||||||||||||

| Airline only | Six Months Ended June 30, | Percent Change(4) |

|||||||||||||||

| (unaudited) (in millions, except per share amounts) | 2025 | 2024 | YoY | ||||||||||||||

| Airline operating revenue | $ | 1,337.1 | $ | 1,282.0 | 4.3 | % | |||||||||||

| Airline operating expense | 1,233.1 | 1,210.8 | 1.8 | % | |||||||||||||

| Airline operating income | 104.0 | 71.2 | 46.1 | % | |||||||||||||

| Airline income before income taxes | 79.3 | 48.0 | 65.2 | % | |||||||||||||

Airline special charges(2) |

16.0 | 35.0 | (54.3) | % | |||||||||||||

Adjusted airline-only net income(1)(2) |

73.3 | 60.8 | 20.6 | % | |||||||||||||

Adjusted airline-only operating margin(1)(2) |

9.0 | % | 8.3 | % | 0.7 | ||||||||||||

Adjusted airline-only diluted earnings per share(1)(2) |

3.96 | 3.31 | 19.6 | % | |||||||||||||

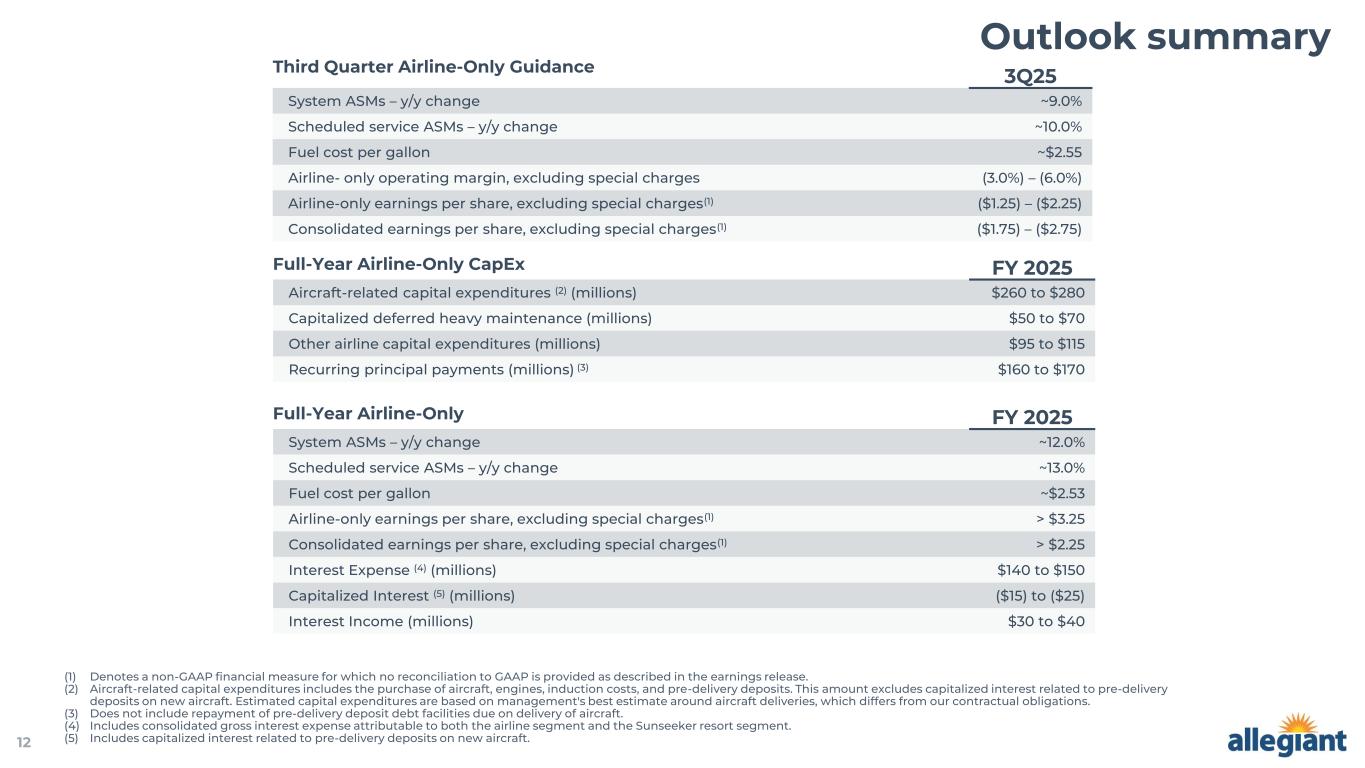

| Third quarter 2025 airline-only guidance | |||||||||||

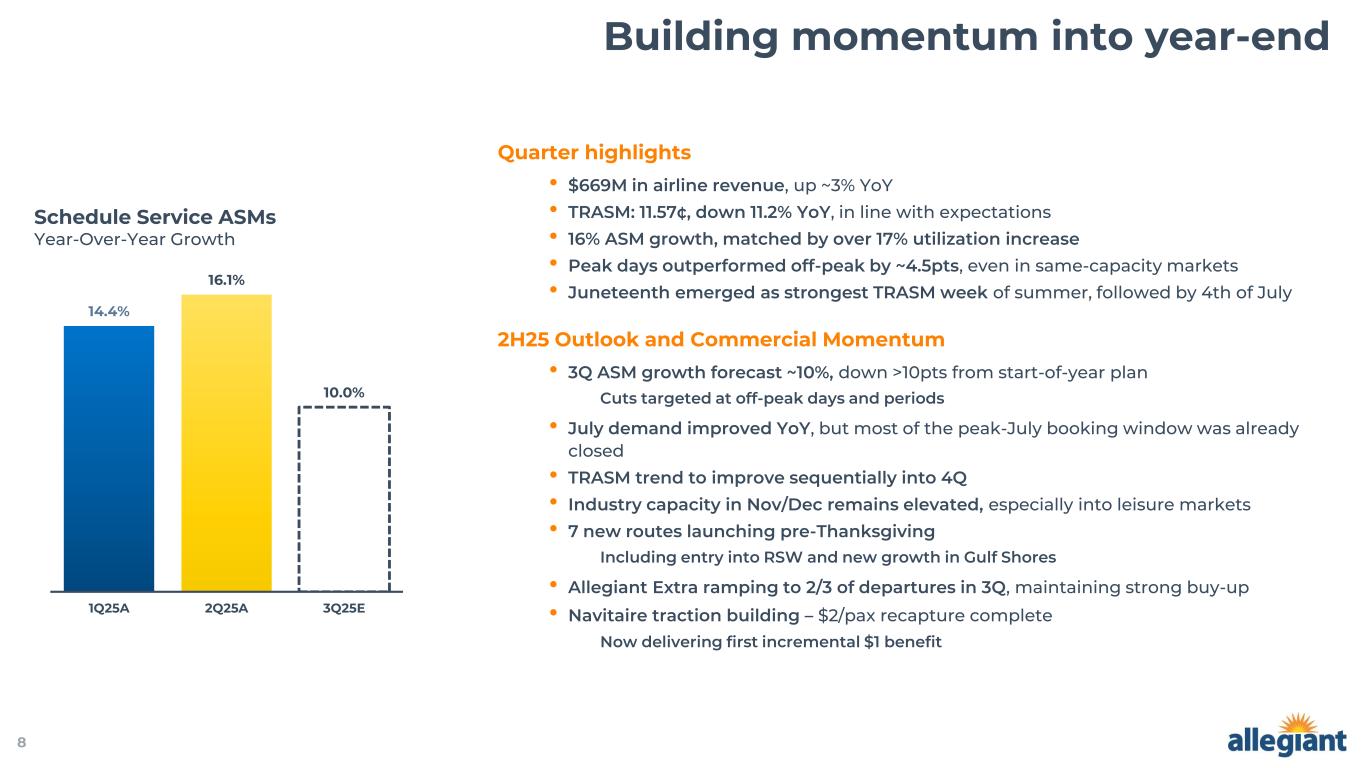

| System ASMs - year over year change | ~9.0% | ||||||||||

| Scheduled service ASMs - year over year change | ~10.0% | ||||||||||

| Fuel cost per gallon | $ | 2.55 | |||||||||

Adjusted airline-only operating margin (1) |

(3.0%) to (6.0%) | ||||||||||

Adjusted airline-only earnings per share(1) |

($1.25) to ($2.25) | ||||||||||

Adjusted consolidated earnings per share(1) |

($1.75) to ($2.75) | ||||||||||

| Full-year 2025 guidance | |||||||||||

| System ASMs - year over year change | ~12.0% | ||||||||||

| Scheduled service ASMs - year over year change | ~13.0% | ||||||||||

| Fuel cost per gallon | ~2.53 | ||||||||||

Adjusted airline-only earnings per share(1) |

> $3.25 | ||||||||||

Adjusted consolidated earnings per share(1) |

> $2.25 | ||||||||||

Interest expense(2) (millions) |

$140 to $150 | ||||||||||

Capitalized interest(3) (millions) |

($15) to ($25) | ||||||||||

| Interest income (millions) | $30 to $40 | ||||||||||

| Airline full-year CAPEX | |||||||||||

Aircraft-related capital expenditures(4) (millions) |

$260 to $280 | ||||||||||

| Capitalized deferred heavy maintenance (millions) | $50 to $70 | ||||||||||

| Other airline capital expenditures (millions) | $95 to $115 | ||||||||||

Recurring principal payments(5) (millions) (full year) |

$160 to $170 | ||||||||||

| Aircraft - (seats per AC) | 2Q25 | 3Q25 | YE25 | ||||||||

| Boeing 737-8200 (190 seats) | 9 | 10 | 16 | ||||||||

| Airbus A320 (180 seats) | 67 | 74 | 71 | ||||||||

| Airbus A320 (186 seats) | 8 | — | — | ||||||||

| Airbus A320 (177 seats) | 10 | 8 | 7 | ||||||||

| Airbus A319 (156 seats) | 32 | 30 | 28 | ||||||||

| Total | 126 | 122 | 122 | ||||||||

| Three Months Ended June 30, | Percent Change | ||||||||||||||||

| 2025 | 2024 | YoY | |||||||||||||||

| OPERATING REVENUES: | |||||||||||||||||

| Passenger | $ | 617,908 | $ | 594,499 | 3.9 | % | |||||||||||

| Third party products | 33,649 | 37,102 | (9.3) | ||||||||||||||

| Fixed fee contracts | 17,019 | 17,699 | (3.8) | ||||||||||||||

| Resort and other | 20,808 | 16,983 | 22.5 | ||||||||||||||

| Total operating revenues | 689,384 | 666,283 | 3.5 | ||||||||||||||

| OPERATING EXPENSES: | |||||||||||||||||

| Salaries and benefits | 214,102 | 209,942 | 2.0 | ||||||||||||||

| Aircraft fuel | 165,752 | 170,060 | (2.5) | ||||||||||||||

| Station operations | 75,248 | 69,798 | 7.8 | ||||||||||||||

| Depreciation and amortization | 68,519 | 65,361 | 4.8 | ||||||||||||||

| Maintenance and repairs | 36,379 | 30,730 | 18.4 | ||||||||||||||

| Sales and marketing | 26,837 | 27,498 | (2.4) | ||||||||||||||

| Aircraft lease rentals | 11,023 | 5,749 | 91.7 | ||||||||||||||

| Other | 41,089 | 34,134 | 20.4 | ||||||||||||||

| Special charges, net of recoveries | 117,924 | 18,114 | NM | ||||||||||||||

| Total operating expenses | 756,873 | 631,386 | 19.9 | ||||||||||||||

| OPERATING INCOME (LOSS) | (67,489) | 34,897 | NM | ||||||||||||||

| OTHER (INCOME) EXPENSES: | |||||||||||||||||

| Interest income | (10,359) | (11,130) | (6.9) | ||||||||||||||

| Interest expense | 35,756 | 39,544 | (9.6) | ||||||||||||||

| Capitalized interest | (4,562) | (11,609) | (60.7) | ||||||||||||||

| Other, net | 240 | 67 | NM | ||||||||||||||

| Total other expenses | 21,075 | 16,872 | 24.9 | ||||||||||||||

| INCOME (LOSS) BEFORE INCOME TAXES | (88,564) | 18,025 | NM | ||||||||||||||

| INCOME TAX PROVISION (BENEFIT) | (23,398) | 4,326 | NM | ||||||||||||||

| NET INCOME (LOSS) | $ | (65,166) | $ | 13,699 | NM | ||||||||||||

| Earnings (loss) per share to common shareholders: | |||||||||||||||||

| Basic | ($3.62) | $0.75 | NM | ||||||||||||||

| Diluted | ($3.62) | $0.75 | NM | ||||||||||||||

Shares used for computation(1): |

|||||||||||||||||

| Basic | 17,995 | 17,828 | 0.9 | ||||||||||||||

| Diluted | 17,995 | 17,869 | 0.7 | ||||||||||||||

| Three Months Ended June 30, 2025 | Three Months Ended June 30, 2024 | ||||||||||||||||||||||||||||||||||

| Airline | Sunseeker | Consolidated | Airline | Sunseeker | Consolidated | ||||||||||||||||||||||||||||||

| REVENUES FROM EXTERNAL CUSTOMERS | $ | 668,750 | $ | 20,634 | $ | 689,384 | $ | 649,472 | $ | 16,811 | $ | 666,283 | |||||||||||||||||||||||

| OPERATING EXPENSES: | |||||||||||||||||||||||||||||||||||

| Salaries and benefits | 203,485 | 10,617 | 214,102 | 197,417 | 12,525 | 209,942 | |||||||||||||||||||||||||||||

| Aircraft fuel | 165,752 | — | 165,752 | 170,060 | — | 170,060 | |||||||||||||||||||||||||||||

| Station operations | 75,248 | — | 75,248 | 69,798 | — | 69,798 | |||||||||||||||||||||||||||||

| Depreciation and amortization | 64,961 | 3,558 | 68,519 | 59,345 | 6,016 | 65,361 | |||||||||||||||||||||||||||||

| Maintenance and repairs | 36,379 | — | 36,379 | 30,730 | — | 30,730 | |||||||||||||||||||||||||||||

| Sales and marketing | 25,119 | 1,718 | 26,837 | 25,918 | 1,580 | 27,498 | |||||||||||||||||||||||||||||

| Aircraft lease rentals | 11,023 | — | 11,023 | 5,749 | — | 5,749 | |||||||||||||||||||||||||||||

| Other operating expenses | 29,031 | 12,058 | 41,089 | 23,426 | 10,708 | 34,134 | |||||||||||||||||||||||||||||

| Special charges, net of recoveries | 14,595 | 103,329 | 117,924 | 20,073 | (1,959) | 18,114 | |||||||||||||||||||||||||||||

| Total operating expenses | 625,593 | 131,280 | 756,873 | 602,516 | 28,870 | 631,386 | |||||||||||||||||||||||||||||

| OPERATING INCOME (LOSS) | 43,157 | (110,646) | (67,489) | 46,956 | (12,059) | 34,897 | |||||||||||||||||||||||||||||

| OTHER (INCOME) EXPENSES: | |||||||||||||||||||||||||||||||||||

| Interest income | (10,359) | — | (10,359) | (11,130) | — | (11,130) | |||||||||||||||||||||||||||||

| Interest expense | 28,121 | 7,635 | 35,756 | 34,121 | 5,423 | 39,544 | |||||||||||||||||||||||||||||

| Capitalized interest | (4,562) | — | (4,562) | (11,609) | — | (11,609) | |||||||||||||||||||||||||||||

| Other non-operating expenses | 240 | — | 240 | 67 | — | 67 | |||||||||||||||||||||||||||||

| Total other expenses | 13,440 | 7,635 | 21,075 | 11,449 | 5,423 | 16,872 | |||||||||||||||||||||||||||||

| INCOME (LOSS) BEFORE INCOME TAXES | $ | 29,717 | $ | (118,281) | $ | (88,564) | $ | 35,507 | $ | (17,482) | $ | 18,025 | |||||||||||||||||||||||

| Three Months Ended June 30, | Percent Change(1) |

||||||||||||||||

| 2025 | 2024 | YoY | |||||||||||||||

| AIRLINE OPERATING STATISTICS | |||||||||||||||||

| Total system statistics: | |||||||||||||||||

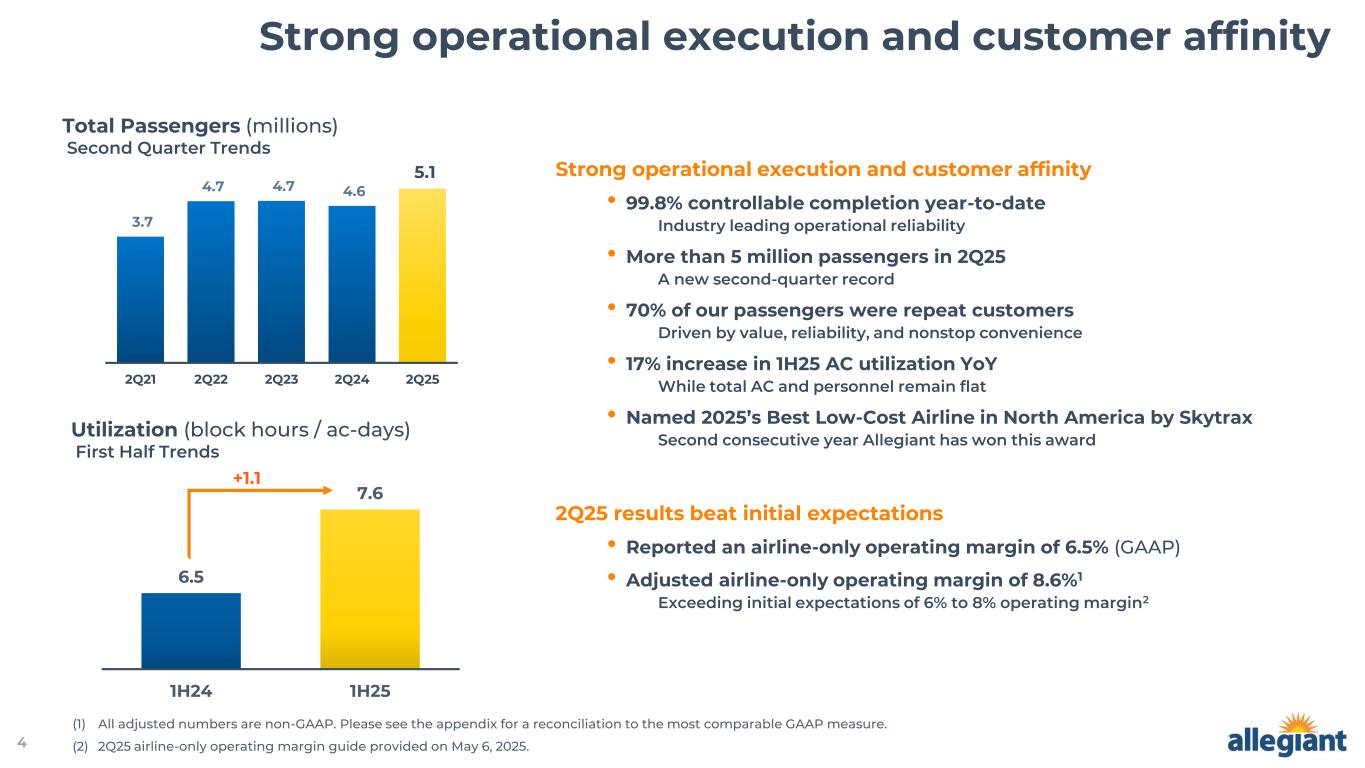

| Passengers | 5,127,025 | 4,621,848 | 10.9 | % | |||||||||||||

| Available seat miles (ASMs) (thousands) | 5,799,409 | 5,013,209 | 15.7 | ||||||||||||||

| Airline operating expense per ASM (CASM) (cents) | 10.79 | ¢ | 12.02 | ¢ | (10.2) | ||||||||||||

| Fuel expense per ASM (cents) | 2.86 | ¢ | 3.39 | ¢ | (15.6) | ||||||||||||

| Airline special charges per ASM (cents) | 0.25 | ¢ | 0.40 | ¢ | (37.5) | ||||||||||||

| Airline operating CASM, excluding fuel and special charges (cents) | 7.68 | ¢ | 8.23 | ¢ | (6.7) | ||||||||||||

| Departures | 37,314 | 32,252 | 15.7 | ||||||||||||||

| Block hours | 88,749 | 75,759 | 17.1 | ||||||||||||||

| Average stage length (miles) | 886 | 883 | 0.3 | ||||||||||||||

| Average number of operating aircraft during period | 126.6 | 125.3 | 1.0 | ||||||||||||||

| Average block hours per aircraft per day | 7.7 | 6.6 | 16.7 | ||||||||||||||

| Full-time equivalent employees at end of period | 5,980 | 5,993 | (0.2) | ||||||||||||||

| Fuel gallons consumed (thousands) | 68,452 | 60,142 | 13.8 | ||||||||||||||

| ASMs per gallon of fuel | 84.7 | 83.4 | 1.6 | ||||||||||||||

| Average fuel cost per gallon | $ | 2.42 | $ | 2.83 | (14.5) | ||||||||||||

| Scheduled service statistics: | |||||||||||||||||

| Passengers | 5,077,788 | 4,572,769 | 11.0 | ||||||||||||||

| Revenue passenger miles (RPMs) (thousands) | 4,610,321 | 4,108,288 | 12.2 | ||||||||||||||

| Available seat miles (ASMs) (thousands) | 5,629,040 | 4,848,017 | 16.1 | ||||||||||||||

| Load factor | 81.9 | % | 84.7 | % | (2.8) | ||||||||||||

| Departures | 36,056 | 31,128 | 15.8 | ||||||||||||||

| Block hours | 85,980 | 73,198 | 17.5 | ||||||||||||||

| Average seats per departure | 175.1 | 176.1 | (0.6) | ||||||||||||||

Yield (cents)(2) |

5.75 | ¢ | 6.99 | ¢ | (17.7) | ||||||||||||

Total passenger revenue per ASM (TRASM) (cents)(3) |

11.57 | ¢ | 13.03 | ¢ | (11.2) | ||||||||||||

Average fare - scheduled service(4) |

$ | 52.20 | $ | 62.79 | (16.9) | ||||||||||||

Average fare - air-related charges(4) |

$ | 69.49 | $ | 67.22 | 3.4 | ||||||||||||

| Average fare - third party products | $ | 6.63 | $ | 8.11 | (18.2) | ||||||||||||

| Average fare - total | $ | 128.32 | $ | 138.12 | (7.1) | ||||||||||||

| Average stage length (miles) | 891 | 885 | 0.7 | ||||||||||||||

| Fuel gallons consumed (thousands) | 66,419 | 58,169 | 14.2 | ||||||||||||||

| Average fuel cost per gallon | $ | 2.43 | $ | 2.83 | (14.1) | ||||||||||||

| Percent of sales through website during period | 92.4 | % | 93.1 | % | (0.7) | ||||||||||||

| Other data: | |||||||||||||||||

| Rental car days sold | 380,176 | 371,405 | 2.4 | ||||||||||||||

| Hotel room nights sold | 37,538 | 61,837 | (39.3) | ||||||||||||||

| Six Months Ended June 30, | Percent Change | ||||||||||||||||

| 2025 | 2024 | YoY | |||||||||||||||

| OPERATING REVENUES: | |||||||||||||||||

| Passenger | $ | 1,234,658 | $ | 1,174,434 | 5.1 | % | |||||||||||

| Third party products | 68,852 | 70,501 | (2.3) | ||||||||||||||

| Fixed fee contracts | 33,271 | 36,560 | (9.0) | ||||||||||||||

| Resort and other | 51,677 | 41,193 | 25.5 | ||||||||||||||

| Total operating revenues | 1,388,458 | 1,322,688 | 5.0 | ||||||||||||||

| OPERATING EXPENSES: | |||||||||||||||||

| Salaries and benefits | 445,541 | 423,269 | 5.3 | ||||||||||||||

| Aircraft fuel | 332,085 | 340,147 | (2.4) | ||||||||||||||

| Station operations | 148,753 | 136,266 | 9.2 | ||||||||||||||

| Depreciation and amortization | 131,830 | 129,205 | 2.0 | ||||||||||||||

| Maintenance and repairs | 71,233 | 61,008 | 16.8 | ||||||||||||||

| Sales and marketing | 51,933 | 58,398 | (11.1) | ||||||||||||||

| Aircraft lease rentals | 16,942 | 11,734 | 44.4 | ||||||||||||||

| Other | 76,259 | 81,105 | (6.0) | ||||||||||||||

| Special charges, net of recoveries | 116,369 | 31,212 | NM | ||||||||||||||

| Total operating expenses | 1,390,945 | 1,272,344 | 9.3 | ||||||||||||||

| OPERATING INCOME (LOSS) | (2,487) | 50,344 | NM | ||||||||||||||

| OTHER (INCOME) EXPENSES: | |||||||||||||||||

| Interest income | (22,294) | (23,371) | (4.6) | ||||||||||||||

| Interest expense | 76,540 | 79,704 | (4.0) | ||||||||||||||

| Capitalized interest | (11,050) | (22,794) | (51.5) | ||||||||||||||

| Other, net | 941 | 117 | NM | ||||||||||||||

| Total other expenses | 44,137 | 33,656 | 31.1 | ||||||||||||||

| INCOME (LOSS) BEFORE INCOME TAXES | (46,624) | 16,688 | NM | ||||||||||||||

| INCOME TAX PROVISION (BENEFIT) | (13,560) | 3,908 | NM | ||||||||||||||

| NET INCOME (LOSS) | $ | (33,064) | $ | 12,780 | NM | ||||||||||||

| Earnings (loss) per share to common shareholders: | |||||||||||||||||

| Basic | ($1.84) | $0.69 | NM | ||||||||||||||

| Diluted | ($1.84) | $0.68 | NM | ||||||||||||||

Shares used for computation(1): |

|||||||||||||||||

| Basic | 17,989 | 17,746 | 1.4 | ||||||||||||||

| Diluted | 17,989 | 17,836 | 0.9 | ||||||||||||||

| Six Months Ended June 30, 2025 | Six Months Ended June 30, 2024 | ||||||||||||||||||||||||||||||||||

| Airline | Sunseeker | Consolidated | Airline | Sunseeker | Consolidated | ||||||||||||||||||||||||||||||

| REVENUE FROM EXTERNAL CUSTOMERS | $ | 1,337,136 | $ | 51,322 | $ | 1,388,458 | $ | 1,281,990 | $ | 40,698 | $ | 1,322,688 | |||||||||||||||||||||||

| OPERATING EXPENSES: | |||||||||||||||||||||||||||||||||||

| Salaries and benefits | 423,859 | 21,682 | 445,541 | 396,926 | 26,343 | 423,269 | |||||||||||||||||||||||||||||

| Aircraft fuel | 332,085 | — | 332,085 | 340,147 | — | 340,147 | |||||||||||||||||||||||||||||

| Station operations | 148,753 | — | 148,753 | 136,266 | — | 136,266 | |||||||||||||||||||||||||||||

| Depreciation and amortization | 124,672 | 7,158 | 131,830 | 117,212 | 11,993 | 129,205 | |||||||||||||||||||||||||||||

| Maintenance and repairs | 71,233 | — | 71,233 | 61,008 | — | 61,008 | |||||||||||||||||||||||||||||

| Sales and marketing | 48,489 | 3,444 | 51,933 | 54,796 | 3,602 | 58,398 | |||||||||||||||||||||||||||||

| Aircraft lease rentals | 16,942 | — | 16,942 | 11,734 | — | 11,734 | |||||||||||||||||||||||||||||

Other operating expenses |

51,107 | 25,152 | 76,259 | 57,742 | 23,363 | 81,105 | |||||||||||||||||||||||||||||

| Special charges, net of recoveries | 15,987 | 100,382 | 116,369 | 34,987 | (3,775) | 31,212 | |||||||||||||||||||||||||||||

| Total operating expenses | 1,233,127 | 157,818 | 1,390,945 | 1,210,818 | 61,526 | 1,272,344 | |||||||||||||||||||||||||||||

| OPERATING INCOME (LOSS) | 104,009 | (106,496) | (2,487) | 71,172 | (20,828) | 50,344 | |||||||||||||||||||||||||||||

| OTHER (INCOME) EXPENSES: | |||||||||||||||||||||||||||||||||||

| Interest income | (22,294) | — | (22,294) | (23,371) | — | (23,371) | |||||||||||||||||||||||||||||

| Interest expense | 57,070 | 19,470 | 76,540 | 68,858 | 10,846 | 79,704 | |||||||||||||||||||||||||||||

| Capitalized interest | (11,050) | — | (11,050) | (22,468) | (326) | (22,794) | |||||||||||||||||||||||||||||

| Other non-operating expenses | 941 | — | 941 | 117 | — | 117 | |||||||||||||||||||||||||||||

| Total other expenses | 24,667 | 19,470 | 44,137 | 23,136 | 10,520 | 33,656 | |||||||||||||||||||||||||||||

| INCOME (LOSS) BEFORE INCOME TAXES | $ | 79,342 | $ | (125,966) | $ | (46,624) | $ | 48,036 | $ | (31,348) | $ | 16,688 | |||||||||||||||||||||||

| Six Months Ended June 30, | Percent Change(1) |

||||||||||||||||

| 2025 | 2024 | YoY | |||||||||||||||

| AIRLINE OPERATING STATISTICS | |||||||||||||||||

| Total system statistics: | |||||||||||||||||

| Passengers | 9,578,331 | 8,726,708 | 9.8 | % | |||||||||||||

| Available seat miles (ASMs) (thousands) | 11,250,993 | 9,785,180 | 15.0 | ||||||||||||||

| Airline operating expense per ASM (CASM) (cents) | 10.96 | ¢ | 12.38 | ¢ | (11.5) | ||||||||||||

| Fuel expense per ASM (cents) | 2.95 | ¢ | 3.48 | ¢ | (15.2) | ||||||||||||

| Airline special charges per ASM (cents) | 0.14 | ¢ | 0.36 | ¢ | (61.1) | ||||||||||||

| Airline operating CASM, excluding fuel and special charges (cents) | 7.87 | ¢ | 8.54 | ¢ | (7.8) | ||||||||||||

| Departures | 70,549 | 61,477 | 14.8 | ||||||||||||||

| Block hours | 172,620 | 148,391 | 16.3 | ||||||||||||||

| Average stage length (miles) | 909 | 900 | 1.0 | ||||||||||||||

| Average number of operating aircraft during period | 125.8 | 125.6 | 0.2 | ||||||||||||||

| Average block hours per aircraft per day | 7.6 | 6.5 | 16.9 | ||||||||||||||

| Full-time equivalent employees at end of period | 5,980 | 5,993 | (0.2) | ||||||||||||||

| Fuel gallons consumed (thousands) | 132,089 | 116,366 | 13.5 | ||||||||||||||

| ASMs per gallon of fuel | 85.2 | 84.1 | 1.3 | ||||||||||||||

| Average fuel cost per gallon | $ | 2.51 | $ | 2.92 | (14.0) | ||||||||||||

| Scheduled service statistics: | |||||||||||||||||

| Passengers | 9,498,599 | 8,642,288 | 9.9 | ||||||||||||||

| Revenue passenger miles (RPMs) (thousands) | 8,881,650 | 7,992,097 | 11.1 | ||||||||||||||

| Available seat miles (ASMs) (thousands) | 10,934,232 | 9,484,939 | 15.3 | ||||||||||||||

| Load factor | 81.2 | % | 84.3 | % | (3.1) | ||||||||||||

| Departures | 68,189 | 59,305 | 15.0 | ||||||||||||||

| Block hours | 167,394 | 143,563 | 16.6 | ||||||||||||||

| Average seats per departure | 175.0 | 176.7 | (1.0) | ||||||||||||||

Yield (cents)(2) |

6.38 | ¢ | 7.41 | ¢ | (13.9) | ||||||||||||

Total passenger revenue per ASM (TRASM) (cents)(3) |

11.92 | ¢ | 13.13 | ¢ | (9.2) | ||||||||||||

Average fare - scheduled service(4) |

$ | 59.64 | $ | 68.53 | (13.0) | ||||||||||||

Average fare - air-related charges(4) |

$ | 70.34 | $ | 67.36 | 4.4 | ||||||||||||

| Average fare - third party products | $ | 7.25 | $ | 8.16 | (11.2) | ||||||||||||

| Average fare - total | $ | 137.23 | $ | 144.05 | (4.7) | ||||||||||||

| Average stage length (miles) | 914 | 905 | 1.0 | ||||||||||||||

| Fuel gallons consumed (thousands) | 128,245 | 112,735 | 13.8 | ||||||||||||||

| Average fuel cost per gallon | $ | 2.52 | $ | 2.92 | (13.7) | ||||||||||||

| Percent of sales through website during period | 92.4 | % | 94.8 | % | (2.4) | ||||||||||||

| Other data: | |||||||||||||||||

| Rental car days sold | 741,066 | 729,349 | 1.6 | ||||||||||||||

| Hotel room nights sold | 77,478 | 123,131 | (37.1) | ||||||||||||||

| (in millions) | June 30, 2025 (unaudited) |

December 31, 2024 | Percent Change | ||||||||||||||

| Unrestricted cash and investments | |||||||||||||||||

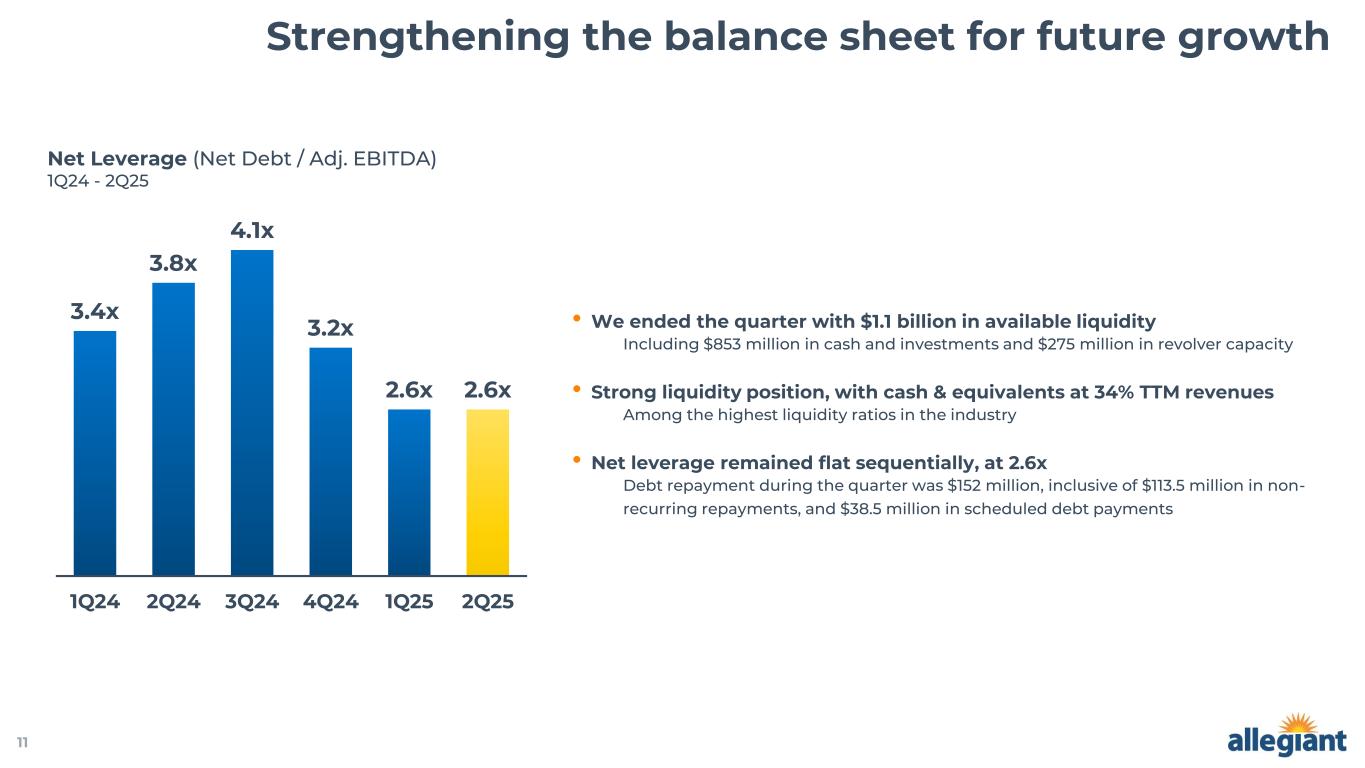

| Cash and cash equivalents | $ | 209.9 | $ | 285.9 | (26.6) | % | |||||||||||

| Short-term investments | 632.9 | 495.2 | 27.8 | ||||||||||||||

| Long-term investments | 9.9 | 51.7 | (80.9) | ||||||||||||||

| Total unrestricted cash and investments | 852.7 | 832.8 | 2.4 | ||||||||||||||

| Debt | |||||||||||||||||

| Current maturities of long-term debt and finance lease obligations, net of related costs | 183.1 | 454.8 | (59.7) | ||||||||||||||

| Long-term debt and finance lease obligations, net of current maturities and related costs | 1,778.9 | 1,611.7 | 10.4 | ||||||||||||||

| Total debt | 1,962.0 | 2,066.5 | (5.1) | ||||||||||||||

| Debt, net of unrestricted cash and investments | 1,109.3 | 1,233.7 | (10.1) | ||||||||||||||

| Total Allegiant Travel Company shareholders’ equity | 1,055.9 | 1,089.4 | (3.1) | ||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

| Basic: | |||||||||||||||||||||||

| Net income (loss) | $ | (65,166) | $ | 13,699 | $ | (33,064) | $ | 12,780 | |||||||||||||||

| Less income allocated to participating securities | — | (333) | — | (618) | |||||||||||||||||||

| Net income (loss) attributable to common stock | $ | (65,166) | $ | 13,366 | $ | (33,064) | $ | 12,162 | |||||||||||||||

| Earnings (loss) per share, basic | $ | (3.62) | $ | 0.75 | $ | (1.84) | $ | 0.69 | |||||||||||||||

| Weighted-average shares outstanding | 17,995 | 17,828 | 17,989 | 17,746 | |||||||||||||||||||

| Diluted: | |||||||||||||||||||||||

| Net income (loss) | $ | (65,166) | $ | 13,699 | $ | (33,064) | $ | 12,780 | |||||||||||||||

| Less income allocated to participating securities | — | (333) | — | (618) | |||||||||||||||||||

| Net income (loss) attributable to common stock | $ | (65,166) | $ | 13,366 | $ | (33,064) | $ | 12,162 | |||||||||||||||

| Earnings (loss) per share, diluted | $ | (3.62) | $ | 0.75 | $ | (1.84) | $ | 0.68 | |||||||||||||||

Weighted-average shares outstanding(1) |

17,995 | 17,828 | 17,989 | 17,746 | |||||||||||||||||||

| Dilutive effect of restricted stock | — | 78 | — | 195 | |||||||||||||||||||

| Adjusted weighted-average shares outstanding under treasury stock method | 17,995 | 17,906 | 17,989 | 17,941 | |||||||||||||||||||

| Participating securities excluded under two-class method | — | (37) | — | (105) | |||||||||||||||||||

| Adjusted weighted-average shares outstanding under two-class method | 17,995 | 17,869 | 17,989 | 17,836 | |||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

| Special Charges (millions) | |||||||||||||||||||||||

| Accelerated depreciation on airframes identified for early retirement | $ | 2.5 | $ | 9.3 | $ | 3.9 | $ | 24.2 | |||||||||||||||

| Flight attendant ratification bonus | — | 10.8 | — | 10.8 | |||||||||||||||||||

| Organizational restructuring | 12.1 | — | 12.1 | — | |||||||||||||||||||

Airline special charges(2) |

14.6 | 20.1 | 16.0 | 35.0 | |||||||||||||||||||

Sunseeker special charges, net of recoveries(2) |

103.3 | (2.0) | 100.4 | (3.8) | |||||||||||||||||||

Consolidated special charges, net of recoveries(2) |

$ | 117.9 | $ | 18.1 | $ | 116.4 | $ | 31.2 | |||||||||||||||

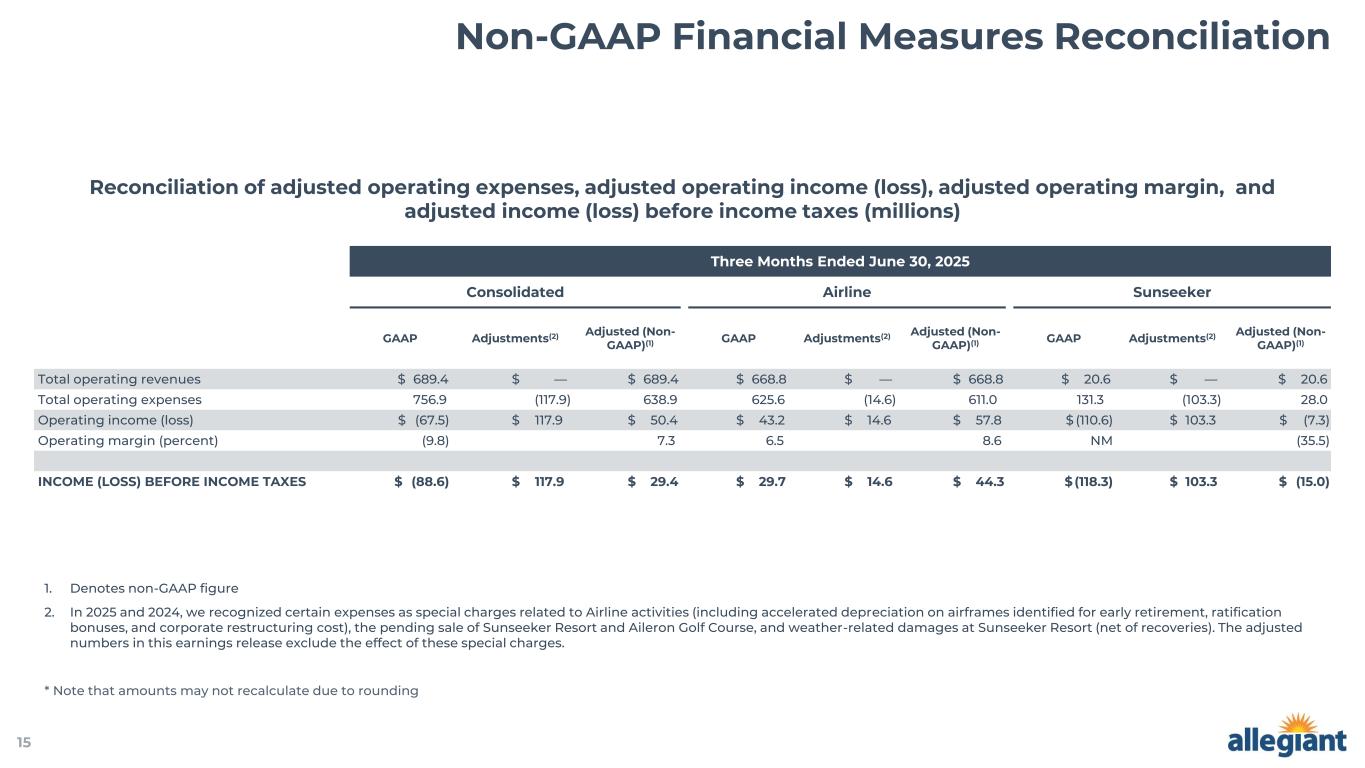

| Three Months Ended June 30, 2025 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidated | Airline | Sunseeker | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Reconciliation of adjusted operating expenses, adjusted operating income (loss), adjusted operating margin, and adjusted income (loss) before income taxes (millions) | GAAP | Adjustments(2) |

Adjusted (Non-GAAP)(1) |

GAAP | Adjustments(2) |

Adjusted (Non-GAAP)(1) |

GAAP | Adjustments(2) |

Adjusted (Non-GAAP)(1) |

||||||||||||||||||||||||||||||||||||||||||||

| Total operating revenues | $ | 689.4 | $ | — | $ | 689.4 | $ | 668.8 | $ | — | $ | 668.8 | $ | 20.6 | $ | — | $ | 20.6 | |||||||||||||||||||||||||||||||||||

| Total operating expenses | 756.9 | (117.9) | 638.9 | 625.6 | (14.6) | 611.0 | 131.3 | (103.3) | 28.0 | ||||||||||||||||||||||||||||||||||||||||||||

| Operating income (loss) | $ | (67.5) | $ | 117.9 | $ | 50.4 | $ | 43.2 | $ | 14.6 | $ | 57.8 | $ | (110.6) | $ | 103.3 | $ | (7.3) | |||||||||||||||||||||||||||||||||||

| Operating margin (percent) | (9.8) | 7.3 | 6.5 | 8.6 | NM | (35.5) | |||||||||||||||||||||||||||||||||||||||||||||||

| INCOME (LOSS) BEFORE INCOME TAXES | $ | (88.6) | $ | 117.9 | $ | 29.4 | $ | 29.7 | $ | 14.6 | $ | 44.3 | $ | (118.3) | $ | 103.3 | $ | (15.0) | |||||||||||||||||||||||||||||||||||

| Three Months Ended June 30, 2024 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidated | Airline | Sunseeker | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Reconciliation of adjusted operating expenses, adjusted operating income (loss), adjusted operating margin, and adjusted income (loss) before income taxes (millions) | GAAP | Adjustments(2) |

Adjusted (Non-GAAP)(1) |

GAAP | Adjustments(2) |

Adjusted (Non-GAAP)(1) |

GAAP | Adjustments(2) |

Adjusted (Non-GAAP)(1) |

||||||||||||||||||||||||||||||||||||||||||||

| Total operating revenues | $ | 666.3 | $ | — | $ | 666.3 | $ | 649.5 | $ | — | $ | 649.5 | $ | 16.8 | $ | — | $ | 16.8 | |||||||||||||||||||||||||||||||||||

| Total operating expenses | 631.4 | (18.1) | 613.3 | 602.5 | (20.1) | 582.4 | 28.9 | 2.0 | 30.8 | ||||||||||||||||||||||||||||||||||||||||||||

| Operating income (loss) | $ | 34.9 | $ | 18.1 | $ | 53.0 | $ | 47.0 | $ | 20.1 | $ | 67.0 | $ | (12.1) | $ | (2.0) | $ | (14.0) | |||||||||||||||||||||||||||||||||||

| Operating margin (percent) | 5.2 | 8.0 | 7.2 | 10.3 | (71.7) | (83.4) | |||||||||||||||||||||||||||||||||||||||||||||||

| INCOME (LOSS) BEFORE INCOME TAXES | $ | 18.0 | $ | 18.1 | $ | 36.1 | $ | 35.5 | $ | 20.1 | $ | 55.6 | $ | (17.5) | $ | (2.0) | $ | (19.4) | |||||||||||||||||||||||||||||||||||

| Six Months Ended June 30, 2025 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidated | Airline | Sunseeker | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Reconciliation of adjusted operating expenses, adjusted operating income (loss), adjusted operating margin, adjusted interest expense, and adjusted income (loss) before income taxes (millions) | GAAP | Adjustments(2)(3) |

Adjusted (Non-GAAP)(1) |

GAAP | Adjustments(2) |

Adjusted (Non-GAAP)(1) |

GAAP | Adjustments(2)(3) |

Adjusted (Non-GAAP)(1) |

||||||||||||||||||||||||||||||||||||||||||||

| Total operating revenues | $ | 1,388.5 | $ | — | $ | 1,388.5 | $ | 1,337.1 | $ | — | $ | 1,337.1 | $ | 51.3 | $ | — | $ | 51.3 | |||||||||||||||||||||||||||||||||||

| Total operating expenses | 1,390.9 | (116.4) | 1,274.6 | 1,233.1 | (16.0) | 1,217.1 | 157.8 | (100.4) | 57.4 | ||||||||||||||||||||||||||||||||||||||||||||

| Operating income (loss) | $ | (2.5) | $ | 116.4 | $ | 113.9 | $ | 104.0 | $ | 16.0 | $ | 120.0 | $ | (106.5) | $ | 100.4 | $ | (6.1) | |||||||||||||||||||||||||||||||||||

| Operating margin (percent) | (0.2) | 8.2 | 7.8 | 9.0 | NM | (11.9) | |||||||||||||||||||||||||||||||||||||||||||||||

| Interest expense | $ | 76.5 | $ | (3.4) | $ | 73.1 | $ | 57.1 | $ | — | $ | 57.1 | $ | 19.5 | $ | (3.4) | $ | 16.1 | |||||||||||||||||||||||||||||||||||

| INCOME (LOSS) BEFORE INCOME TAXES | $ | (46.6) | $ | 119.8 | $ | 73.2 | $ | 79.3 | $ | 16.0 | $ | 95.3 | $ | (126.0) | $ | 103.8 | $ | (22.2) | |||||||||||||||||||||||||||||||||||

| Six Months Ended June 30, 2024 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidated | Airline | Sunseeker | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Reconciliation of adjusted operating expenses, adjusted operating income (loss), adjusted operating margin, and adjusted income (loss) before income taxes (millions) | GAAP | Adjustments(2) |

Adjusted (Non-GAAP)(1) |

GAAP | Adjustments(2) |

Adjusted (Non-GAAP)(1) |

GAAP | Adjustments(2) |

Adjusted (Non-GAAP)(1) |

||||||||||||||||||||||||||||||||||||||||||||

| Total operating revenues | $ | 1,322.7 | $ | — | $ | 1,322.7 | $ | 1,282.0 | $ | — | $ | 1,282.0 | $ | 40.7 | $ | — | $ | 40.7 | |||||||||||||||||||||||||||||||||||

| Total operating expenses | 1,272.3 | (31.2) | 1,241.1 | 1,210.8 | (35.0) | 1,175.8 | 61.5 | 3.8 | 65.3 | ||||||||||||||||||||||||||||||||||||||||||||

| Operating income (loss) | $ | 50.3 | $ | 31.2 | $ | 81.6 | $ | 71.2 | $ | 35.0 | $ | 106.2 | $ | (20.8) | $ | (3.8) | $ | (24.6) | |||||||||||||||||||||||||||||||||||

| Operating margin (percent) | 3.8 | 6.2 | 5.6 | 8.3 | (51.2) | (60.5) | |||||||||||||||||||||||||||||||||||||||||||||||

| Interest expense | $ | 79.7 | $ | — | $ | 79.7 | $ | 68.9 | $ | — | $ | 68.9 | $ | 10.8 | $ | — | $ | 10.8 | |||||||||||||||||||||||||||||||||||

| INCOME (LOSS) BEFORE INCOME TAXES | $ | 16.7 | $ | 31.2 | $ | 47.9 | $ | 48.0 | $ | 35.0 | $ | 83.0 | $ | (31.3) | $ | (3.8) | $ | (35.1) | |||||||||||||||||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

| Consolidated EBITDA and adjusted consolidated EBITDA (millions) | |||||||||||||||||||||||

| Net income (loss) as reported (GAAP) | $ | (65.2) | $ | 13.7 | $ | (33.1) | $ | 12.8 | |||||||||||||||

| Interest expense, net | 20.8 | 16.8 | 43.2 | 33.5 | |||||||||||||||||||

| Income tax expense (benefit) | (23.4) | 4.3 | (13.6) | 3.9 | |||||||||||||||||||

| Depreciation and amortization | 68.5 | 65.4 | 131.8 | 129.2 | |||||||||||||||||||

Consolidated EBITDA(1) |

$ | 0.8 | $ | 100.2 | $ | 128.4 | $ | 179.4 | |||||||||||||||

Special charges(2) |

117.9 | 18.1 | 116.4 | 31.2 | |||||||||||||||||||

Adjusted consolidated EBITDA(1)(2) |

$ | 118.7 | $ | 118.3 | $ | 244.8 | $ | 210.6 | |||||||||||||||

| Adjusted airline-only EBITDA (millions) | |||||||||||||||||||||||

| Airline income before income taxes as reported (GAAP) | $ | 29.7 | $ | 35.5 | $ | 79.3 | $ | 48.0 | |||||||||||||||

Airline special charges(2) |

14.6 | 20.1 | 16.0 | 35.0 | |||||||||||||||||||

| Airline interest expense, net | 13.2 | 11.4 | 23.7 | 23.0 | |||||||||||||||||||

| Airline depreciation and amortization | 65.0 | 59.3 | 124.7 | 117.2 | |||||||||||||||||||

Adjusted airline-only EBITDA(1)(2) |

$ | 122.5 | $ | 126.3 | $ | 243.7 | $ | 223.3 | |||||||||||||||

| Three Months Ended June 30, 2025 | Three Months Ended June 30, 2024 | |||||||||||||||||||||||||

| Amount | Per Share | Amount | Per Share | |||||||||||||||||||||||

| Reconciliation of adjusted consolidated earnings per share and adjusted consolidated net income (millions except share and per share amounts) | ||||||||||||||||||||||||||

| Net income (loss) as reported (GAAP) | $ | (65.2) | $ | 13.7 | ||||||||||||||||||||||

| Less: Net income allocated to participating securities | — | (0.3) | ||||||||||||||||||||||||

| Net income attributable to common stock (GAAP) | $ | (65.2) | $ | (3.62) | $ | 13.4 | $ | 0.75 | ||||||||||||||||||

| Plus: Net income allocated to participating securities | — | — | 0.3 | 0.02 | ||||||||||||||||||||||

Plus: Special charges, net of recoveries(2) |

117.9 | 6.55 | 18.1 | 1.01 | ||||||||||||||||||||||

| Plus (Minus): Income tax effect of adjustments above | (30.0) | (1.67) | 0.7 | 0.04 | ||||||||||||||||||||||

Adjusted net income(1) |

$ | 22.7 | $ | 32.5 | ||||||||||||||||||||||

| Less: Adjusted consolidated net income allocated to participating securities | (0.5) | (0.03) | (0.8) | (0.05) | ||||||||||||||||||||||

| Effect of dilutive securities | — | — | ||||||||||||||||||||||||

Adjusted net income attributable to common stock(1) |

$ | 22.2 | $ | 1.23 | $ | 31.7 | $ | 1.77 | ||||||||||||||||||

| Shares used for diluted computation (GAAP) (thousands) | 17,995 | 17,869 | ||||||||||||||||||||||||

| Shares used for diluted computation (adjusted) (thousands) | 18,027 | 17,869 | ||||||||||||||||||||||||

| Three Months Ended June 30, 2025 | Three Months Ended June 30, 2024 | |||||||||||||||||||||||||

| Amount | Per Share | Amount | Per Share | |||||||||||||||||||||||

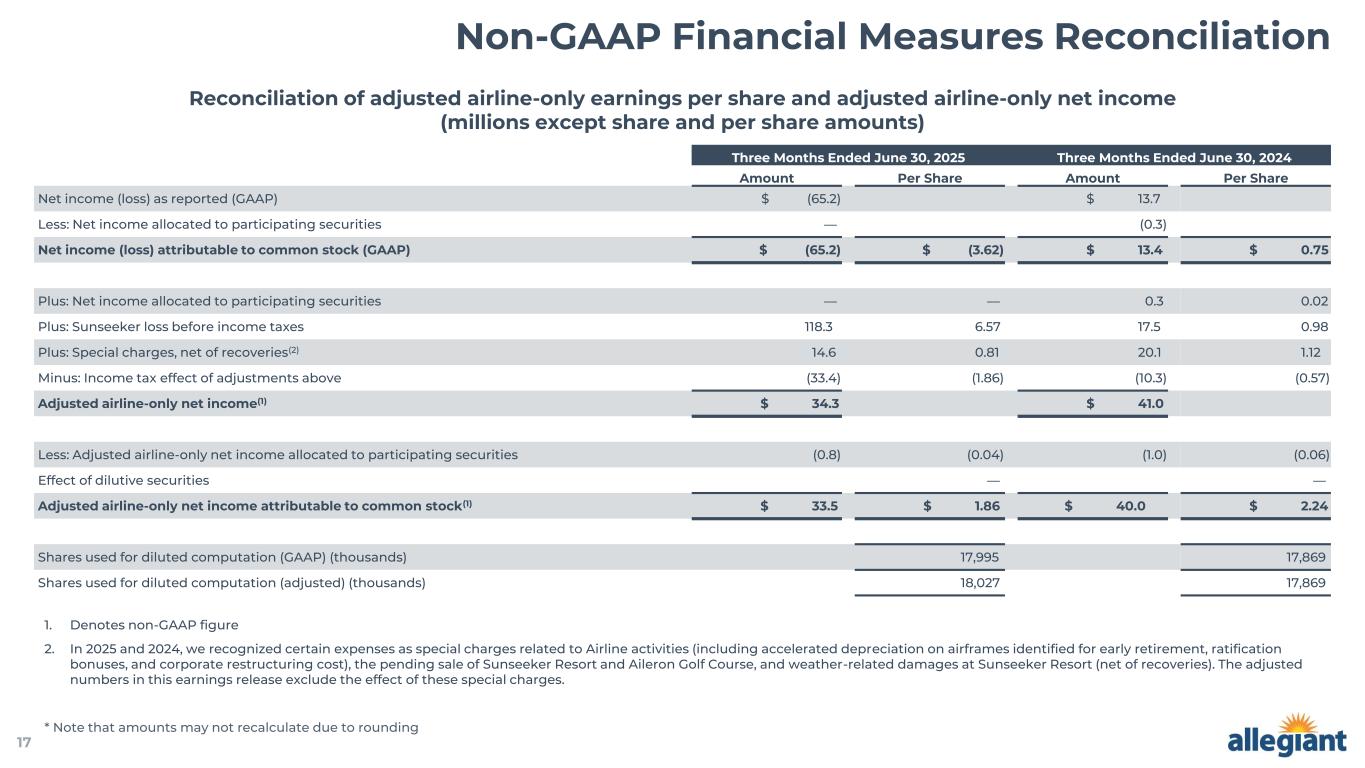

| Reconciliation of adjusted airline-only earnings per share and adjusted airline-only net income (millions except share and per share amounts) | ||||||||||||||||||||||||||

| Net income (loss) as reported (GAAP) | $ | (65.2) | $ | 13.7 | ||||||||||||||||||||||

| Less: Net income allocated to participating securities | — | (0.3) | ||||||||||||||||||||||||

| Net income (loss) attributable to common stock (GAAP) | $ | (65.2) | $ | (3.62) | $ | 13.4 | $ | 0.75 | ||||||||||||||||||

| Plus: Net income allocated to participating securities | — | — | 0.3 | 0.02 | ||||||||||||||||||||||

| Plus: Sunseeker loss before income taxes | 118.3 | 6.57 | 17.5 | 0.98 | ||||||||||||||||||||||

Plus: Special charges, net of recoveries(2) |

14.6 | 0.81 | 20.1 | 1.12 | ||||||||||||||||||||||

| Minus: Income tax effect of adjustments above | (33.4) | (1.86) | (10.3) | (0.57) | ||||||||||||||||||||||

Adjusted airline-only net income(1) |

$ | 34.3 | $ | 41.0 | ||||||||||||||||||||||

| Less: Adjusted airline-only net income allocated to participating securities | (0.8) | (0.04) | (1.0) | (0.06) | ||||||||||||||||||||||

| Effect of dilutive securities | — | — | ||||||||||||||||||||||||

Adjusted airline-only net income attributable to common stock(1) |

$ | 33.5 | $ | 1.86 | $ | 40.0 | $ | 2.24 | ||||||||||||||||||

| Shares used for diluted computation (GAAP) (thousands) | 17,995 | 17,869 | ||||||||||||||||||||||||

| Shares used for diluted computation (adjusted) (thousands) | 18,027 | 17,869 | ||||||||||||||||||||||||

| Six Months Ended June 30, 2025 | Six Months Ended June 30, 2024 | |||||||||||||||||||||||||

| Amount | Per Share | Amount | Per Share | |||||||||||||||||||||||

| Reconciliation of adjusted consolidated earnings per share and adjusted consolidated net income (millions except share and per share amounts) | ||||||||||||||||||||||||||

| Net income (loss) as reported (GAAP) | $ | (33.1) | $ | 12.8 | ||||||||||||||||||||||

| Less: Net income allocated to participating securities | — | (0.6) | ||||||||||||||||||||||||

| Net income (loss) attributable to common stock (GAAP) | $ | (33.1) | $ | (1.84) | $ | 12.2 | $ | 0.68 | ||||||||||||||||||

| Plus: Net income allocated to participating securities | — | — | 0.6 | 0.04 | ||||||||||||||||||||||

Plus: Loss on extinguishment of debt(3) |

3.4 | 0.19 | — | — | ||||||||||||||||||||||

Plus: Special charges, net of recoveries(2) |

116.4 | 6.47 | 31.2 | 1.75 | ||||||||||||||||||||||

| Minus: Income tax effect of adjustments above | (30.5) | (1.70) | (1.1) | (0.06) | ||||||||||||||||||||||

Adjusted net income(1) |

$ | 56.2 | $ | 42.9 | ||||||||||||||||||||||

| Less: Adjusted consolidated net income allocated to participating securities | (1.4) | (0.08) | (1.2) | (0.07) | ||||||||||||||||||||||

| Effect of dilutive securities | (0.01) | — | ||||||||||||||||||||||||

Adjusted net income attributable to common stock(1) |

$ | 54.8 | $ | 3.03 | $ | 41.7 | $ | 2.34 | ||||||||||||||||||

| Shares used for diluted computation (GAAP) (thousands) | 17,989 | 17,836 | ||||||||||||||||||||||||

| Shares used for diluted computation (adjusted) (thousands) | 18,076 | 17,836 | ||||||||||||||||||||||||

| Six Months Ended June 30, 2025 | Six Months Ended June 30, 2024 | |||||||||||||||||||||||||

| Amount | Per Share | Amount | Per Share | |||||||||||||||||||||||

| Reconciliation of adjusted airline-only earnings per share and adjusted airline-only net income (millions except share and per share amounts) | ||||||||||||||||||||||||||

| Net income (loss) as reported (GAAP) | $ | (33.1) | $ | 12.8 | ||||||||||||||||||||||

| Less: Net income allocated to participating securities | — | (0.6) | ||||||||||||||||||||||||

| Net income (loss) attributable to common stock (GAAP) | $ | (33.1) | $ | (1.84) | $ | 12.2 | $ | 0.68 | ||||||||||||||||||

| Plus: Net income allocated to participating securities | — | — | 0.6 | 0.04 | ||||||||||||||||||||||

| Plus: Sunseeker loss before income taxes | 126.0 | 7.00 | 31.3 | 1.76 | ||||||||||||||||||||||

Plus: Special charges, net of recoveries(2) |

16.0 | 0.89 | 35.0 | 1.96 | ||||||||||||||||||||||

| Minus: Income tax effect of adjustments above | (35.6) | (1.98) | (18.3) | (1.03) | ||||||||||||||||||||||

Adjusted airline-only net income(1) |

$ | 73.3 | $ | 60.8 | ||||||||||||||||||||||

| Less: Adjusted airline-only net income allocated to participating securities | (1.8) | (0.10) | (1.8) | (0.10) | ||||||||||||||||||||||

| Effect of dilutive securities | (0.01) | — | ||||||||||||||||||||||||

Adjusted airline-only net income attributable to common stock(1) |

$ | 71.5 | $ | 3.96 | $ | 59.0 | $ | 3.31 | ||||||||||||||||||

| Shares used for diluted computation (GAAP) (thousands) | 17,989 | 17,836 | ||||||||||||||||||||||||

| Shares used for diluted computation (adjusted) (thousands) | 18,076 | 17,836 | ||||||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

| Reconciliation of adjusted airline-only operating CASM excluding fuel and special charges (millions) | |||||||||||||||||||||||

| Consolidated operating expenses (GAAP) | $ | 756.9 | $ | 631.4 | $ | 1,390.9 | $ | 1,272.3 | |||||||||||||||

| Minus: Sunseeker operating expenses | 131.3 | 28.9 | 157.8 | 61.5 | |||||||||||||||||||

| Airline-only operating expenses | 625.6 | 602.5 | 1,233.1 | 1,210.8 | |||||||||||||||||||

Minus: airline special charges(2) |

14.6 | 20.1 | 16.0 | 35.0 | |||||||||||||||||||

| Minus: fuel expenses | 165.8 | 170.1 | 332.1 | 340.1 | |||||||||||||||||||

Adjusted airline-only operating expenses, excluding fuel and special charges(1) |

$ | 445.2 | $ | 412.3 | $ | 885.0 | $ | 835.7 | |||||||||||||||

| System available seat miles (millions) | 5,799.4 | 5,013.2 | 11,251.0 | 9,785.2 | |||||||||||||||||||

| Airline-only cost per available seat mile (cents) | 10.79 | 12.02 | 10.96 | 12.38 | |||||||||||||||||||

| Adjusted airline-only cost per available seat mile excluding fuel and special charges (cents) | 7.68 | 8.23 | 7.87 | 8.54 | |||||||||||||||||||