Document

eHealth, Inc. Announces Third Quarter 2025 Results

Raises 2025 annual earnings guidance to reflect strong YTD performance

Comments on strong start to the Annual Enrollment Period

Completed extension of term loan maturity providing additional financial flexibility

AUSTIN, Texas — November 5, 2025 — eHealth, Inc. (Nasdaq: EHTH), a leading private online health insurance marketplace, today announced its financial results for the third quarter ended September 30, 2025.

|

|

|

|

|

|

|

|

|

| CEO Comments |

|

|

|

|

|

|

“As a new CEO, my immediate priority is clear: deliver a strong AEP performance. We entered the enrollment season exceptionally well prepared—with a more experienced advisor force, a trusted and growing brand, and one of the broadest plan selections in the industry. In a period marked by significant disruption in the Medicare Advantage market, our breadth of offerings is a true differentiator, allowing us to support consumers as their coverage and needs evolve.

Early AEP indicators are encouraging: consumer demand is strong, and our branded messages resonate even stronger than a year ago. Our team is approaching AEP with flexibility and focus, ready to lean in where we see an opportunity to drive incremental growth at attractive economics.” – Derrick Duke, Chief Executive Officer

|

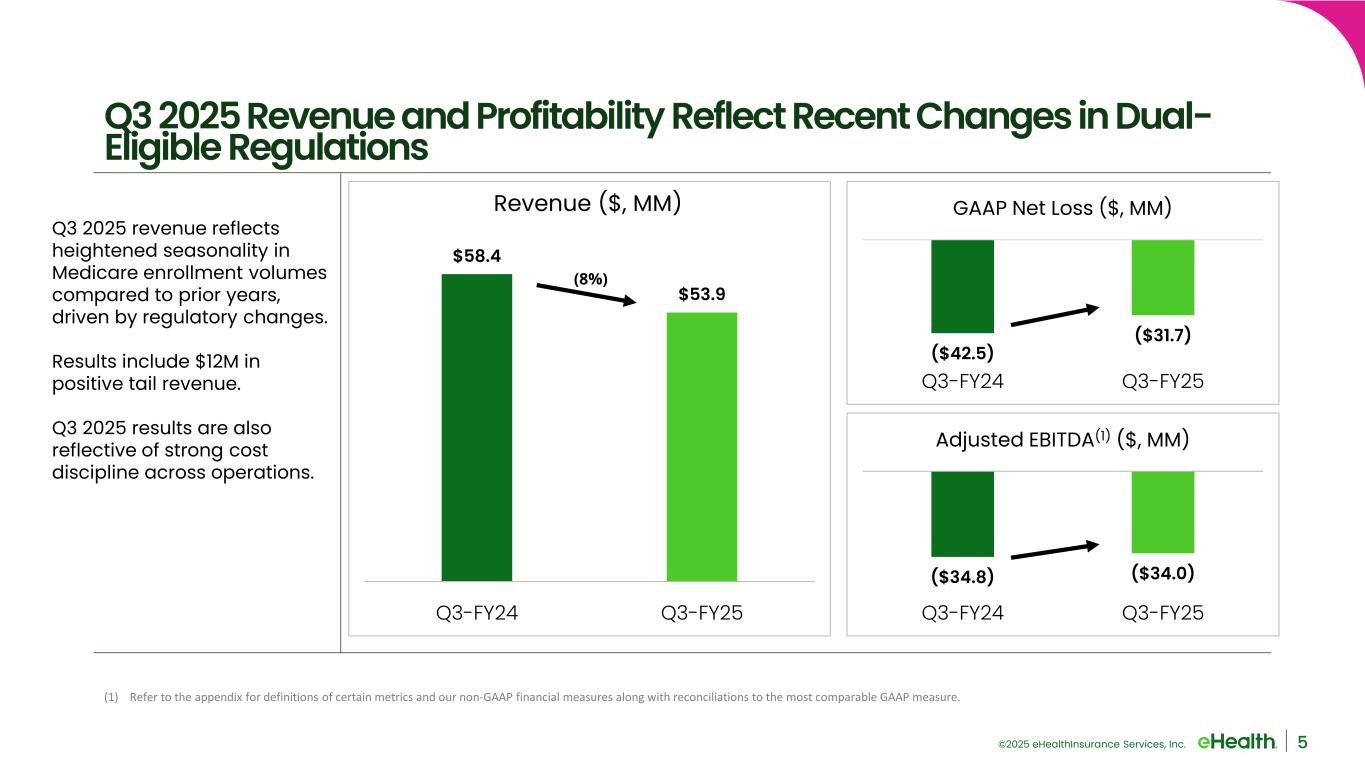

■Q3 2025 total revenue of $53.9 million decreased 8% compared to Q3 2024 total revenue of $58.4 million.

■Lower Medicare Advantage (“MA”) approved members as a result of the recent regulatory changes that limit dual-eligible beneficiaries from switching plans outside of the main enrollment periods.

■Q3 2025 MA constrained lifetime value (“LTV”) of commissions decreased 2% compared to Q3 2024.

■Q3 2025 Medicare Supplement constrained LTV increased 33% compared to Q3 2024.

■Q3 2025 positive net adjustment revenue of $12.2 million compared to $1.2 million in Q3 2024.

■Q3 2025 total operating costs and expenses decreased 6% to $95.4 million compared to $101.6 million in Q3 2024.

■25% reduction in consolidated and Medicare segment variable marketing spend in Q3 2025 compared to Q3 2024, reflecting proactive cost management strategies.

■Q3 2025 customer care and enrollment expenses declined $2.5 million, or 6%, compared to Q3 2024, primarily reflecting execution of our flexible staffing strategy within our telesales organization, partially offset by costs associated with a more tenured benefit advisor group and increased number of retention advisors year-over-year.

■Q3 2025 GAAP net loss of $31.7 million improved $10.8 million, compared to Q3 2024 GAAP net loss of $42.5 million.

■Q3 2025 adjusted EBITDA(1) of $(34.0) million compared to Q3 2024 adjusted EBITDA(1) of $(34.8) million.

■Cash, cash equivalents and marketable securities of $75.3 million as of September 30, 2025.

■Commissions receivable balance of $907.7 million as of September 30, 2025.

■Successfully completed our AEP preparations: achieved our benefit advisor hiring and training targets, continued to strengthen and expand our brand-driven marketing strategy, and completed further enhancements to our omni-channel platform.

■Amended term loan credit agreement to extend maturity date to January 2027 providing additional financial flexibility.

__________

Note: See the tables at the end of this press release for a reconciliation of our GAAP financial measures to our non-GAAP financial measures for the relevant periods and footnote (1) on page

14 at the end of this press release for definitions of our non-GAAP financial measures. Additionally, see accompanying footnotes on page

14 for additional definitions.

2025 Guidance

Said John Dolan, Chief Financial Officer: “We continue to execute with discipline and agility in a dynamic environment. Our Q3 performance reflects strong operational focus on prudent cost management. Our performance through the end of September enabled us to raise our GAAP net income and adjusted EBITDA guidance ranges. The increase reflects the positive impact of net adjustment revenue and favorable operating costs relative to our internal expectations.”

Based on information available as of November 5, 2025, we are revising our guidance for the full year ending December 31, 2025. These expectations are forward-looking statements and we assume no obligation to update these statements. Actual results may be materially different and are affected by the risk factors and uncertainties identified in this press release and in eHealth’s annual and quarterly reports filed with the Securities and Exchange Commission.

The following guidance is for the full year ending December 31, 2025:

•Total revenue is expected to be in the range of $525.0 million to $565.0 million, consistent with our previously issued guidance.

•GAAP net income is expected to be in the range of $9.0 million to $30.0 million compared to our prior guidance range of GAAP net income of $5.0 million to $26.0 million.

•Adjusted EBITDA(1) is expected to be in the range of $60.0 million to $80.0 million compared to our prior guidance range of $55.0 million to $75.0 million.

•Operating cash flow is expected to be in the range of $(25.0) million to $10.0 million, consistent with our previously issued guidance.

The above guidance includes the expected impact of positive net adjustment revenue which has been updated to be in the range of $40 million to $43 million to reflect the Q3 2025 positive net adjustment revenue, compared to the previous range of $29 million to $32 million.

__________

Note: See accompanying footnotes on page

14.

Webcast and Conference Call Information

A webcast and conference call will be held today, Wednesday, November 5, 2025 at 5:00 p.m. Eastern Time / 4:00 p.m. Central Time. Individuals interested in listening to the conference call may do so by dialing (800) 549-8228. The participant passcode is 47090. The live and archived webcast of the call will also be available under “Events & Presentations” on the Investor Relations page of our website at https://ir.ehealthinsurance.com.

About eHealth, Inc.

We’re Matchmakers. For over 25 years, eHealth has helped millions of Americans find the healthcare coverage that fits their needs at a price they can afford. As a leading independent licensed insurance agency and advisor, eHealth offers access to over 180 health insurers, including national and regional companies.

For more information, visit eHealth.com or follow us on LinkedIn, Facebook, Instagram, and X. Open positions can be found on our career page.

Forward-Looking Statements

This press release contains statements that are forward-looking statements as defined within the Private Securities Litigation Reform Act of 1995. These include statements regarding our expectations regarding our business, financial condition, operations and strategy; our estimates regarding approved members and estimated memberships, in the aggregate and by product category; our estimates regarding constrained lifetime values of commissions per approved member by product category; our estimates regarding costs per approved member; our 2025 annual guidance for total revenue, GAAP net income (loss), adjusted EBITDA and operating cash flow; our estimates for positive net adjustment revenue and its expected impact on our 2025 annual guidance; the expected impact of our efforts to prepare for the annual enrollment period, including our benefit advisor hiring and training targets and branding efforts; our expectations regarding market opportunity, consumer demand and our competitive advantage; and other statements regarding our future operations, financial condition, prospects and business strategies.

These forward-looking statements are inherently subject to various risks and uncertainties that could cause actual results to differ materially from the statements made. In particular, we are required by Accounting Standards Codification 606 — Revenue from Contracts with Customers to make numerous assumptions that are based on historical trends and our management’s judgment. These assumptions may change over time and have a material impact on our revenue recognition, guidance, and results of operations. Please review the assumptions stated in this press release carefully.

The risks and uncertainties that could cause our results to differ materially from those expressed or implied by such forward-looking statements include, but are not limited to, our ability to retain existing members and enroll new members during the annual healthcare open enrollment period, the Medicare annual enrollment period, the Medicare Advantage open enrollment period and other special enrollment periods; changes in laws, regulations and guidelines, including in connection with healthcare reform or with respect to the marketing and sale of Medicare plans; competition, including competition from government-run health insurance exchanges marketplaces, and other sources; the seasonality of our business and the fluctuation of our operating results; our ability to accurately estimate membership, lifetime value of commissions and commissions receivable; changes in product offerings among carriers on our ecommerce platform and changes in our estimated conversion rate of an approved member to a paying member and the resulting impact of each on our commission revenue; the concentration of our revenue with a small number of health insurance carriers; our ability to execute on our growth strategy and other business initiatives; changes in our senior management or other key employees; our ability to recruit, train, retain and ensure the productivity of licensed insurance agents, or benefit advisors, and other personnel; exposure to security risks and our ability to safeguard the security and privacy of confidential data; our relationships with health insurance carriers; the success of our carrier advertising and sponsorship program; our success in marketing and selling health insurance plans and our unit cost of acquisition; our ability to effectively manage our operations as our business evolves and execute on our business plan and other strategic initiatives; the need for health insurance carrier and regulatory approvals in connection with the marketing of Medicare-related insurance products; changes in the market for private health insurance; consumer satisfaction of our service and actions we take to improve the quality of enrollments; changes in member conversion rates; changes in commission rates; our ability to sell qualified health insurance plans to subsidy-eligible individuals and to enroll subsidy-eligible individuals through government-run health insurance exchanges and marketplaces; our ability to derive desired benefits from investments in our business, including membership growth and retention initiatives; our reliance on marketing partners; the success and cost of our marketing efforts, including branding, online advertising, direct-to-consumer mail, email, social media, telephone, SMS text, television, radio and other marketing efforts; timing of receipt and accuracy of commission reports; payment practices of health insurance carriers; dependence on our operations in China; the restrictions in our debt obligations; the restrictions in our investment agreement with our convertible preferred stock investor; our ability to raise additional capital, including debt or equity financings, on terms acceptable to us or at all; compliance with insurance, privacy, cybersecurity and other laws and regulations; the outcome of litigation, government enforcement actions or regulatory inquiries in which we are or may from time to time be involved, including the complaint filed against us and certain defendants by the U.S. Attorney’s Office for the District of Massachusetts on May 1, 2025 alleging the violation of the Federal False Claims Act; the performance, reliability and availability of our information technology systems, ecommerce platform and underlying network infrastructure, including any new systems we may implement; our ability to deploy new and evolving technologies, such as artificial intelligence; public health crises, pandemics, natural disasters and other extreme events; general economic and macroeconomic conditions, including the risks of potential delays, reductions or disruptions in payments from a prolonged government shutdown, inflation, recession, political events, instability or geopolitical tensions, tariffs and trade tensions or other international disputes, financial, banking and credit market disruptions; our ability to effectively administer our self-insurance program; and other risks and uncertainties related to our business. Other factors that could cause our operating, financial and other results to differ are described in our most recent Quarterly Report on Form 10-Q or Annual Report on Form 10-K filed with the Securities and Exchange Commission and available on the Investor Relations page of our website at https://ir.ehealthinsurance.com and on the Securities and Exchange Commission’s website at www.sec.gov.

All forward-looking statements in this press release are based on information available to us as of the date hereof, and we do not assume any obligation to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date on which they were made, except as required by law.

Investor Relations Contact

Kate Sidorovich, CFA

Senior Vice President, Investor Relations & Corporate Development

investors@ehealth.com

https://ir.ehealthinsurance.com

EHEALTH, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2025 |

|

December 31, 2024 |

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

63,089 |

|

|

$ |

39,197 |

|

| Short-term marketable securities |

12,212 |

|

|

43,043 |

|

| Accounts receivable |

1,852 |

|

|

16,807 |

|

| Contract assets – commissions receivable – current |

208,426 |

|

|

242,467 |

|

| Prepaid expenses and other current assets |

17,288 |

|

|

12,961 |

|

| Total current assets |

302,867 |

|

|

354,475 |

|

| Contract assets – commissions receivable – non-current |

699,299 |

|

|

757,523 |

|

| Property and equipment, net |

4,939 |

|

|

4,437 |

|

|

|

|

|

| Operating lease right-of-use assets |

9,182 |

|

|

12,081 |

|

| Restricted cash |

3,090 |

|

|

3,090 |

|

| Other assets |

28,038 |

|

|

23,819 |

|

|

|

|

|

|

|

|

|

| Total assets |

$ |

1,047,415 |

|

|

$ |

1,155,425 |

|

|

|

|

|

| Liabilities, convertible preferred stock and stockholders’ equity |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

6,215 |

|

|

$ |

23,448 |

|

| Accrued compensation and benefits |

24,266 |

|

|

43,888 |

|

| Accrued marketing expenses |

5,558 |

|

|

16,612 |

|

|

|

|

|

|

|

|

|

| Lease liabilities – current |

7,769 |

|

|

7,732 |

|

|

|

|

|

| Other current liabilities |

7,430 |

|

|

4,331 |

|

| Total current liabilities |

51,238 |

|

|

96,011 |

|

| Long-term debt |

69,423 |

|

|

68,458 |

|

|

|

|

|

| Deferred income taxes – non-current |

21,860 |

|

|

38,870 |

|

| Lease liabilities – non-current |

15,540 |

|

|

20,731 |

|

| Other non-current liabilities |

4,885 |

|

|

5,418 |

|

| Total liabilities |

162,946 |

|

|

229,488 |

|

| Convertible preferred stock |

370,303 |

|

|

337,509 |

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

| Common stock |

44 |

|

|

43 |

|

| Additional paid-in capital |

758,113 |

|

|

773,371 |

|

| Treasury stock, at cost |

(199,998) |

|

|

(199,998) |

|

| Retained earnings (accumulated deficit) |

(43,815) |

|

|

15,246 |

|

| Accumulated other comprehensive loss |

(178) |

|

|

(234) |

|

| Total stockholders’ equity |

514,166 |

|

|

588,428 |

|

| Total liabilities, convertible preferred stock and stockholders’ equity |

$ |

1,047,415 |

|

|

$ |

1,155,425 |

|

EHEALTH, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

|

Nine Months Ended

September 30, |

|

|

|

2025 |

|

2024 |

|

% Change |

|

2025 |

|

2024 |

|

% Change |

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

| Commission |

$ |

47,223 |

|

$ |

48,222 |

|

(2) |

% |

|

$ |

200,900 |

|

$ |

185,996 |

|

8 |

% |

| Other |

6,646 |

|

10,187 |

|

(35) |

% |

|

26,870 |

|

31,233 |

|

(14) |

% |

| Total revenue |

53,869 |

|

58,409 |

|

(8) |

% |

|

227,770 |

|

217,229 |

|

5 |

% |

Operating costs and expenses(a): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketing and advertising |

24,395 |

|

29,665 |

|

(18) |

% |

|

87,009 |

|

95,185 |

|

(9) |

% |

Customer care and enrollment |

36,814 |

|

39,321 |

|

(6) |

% |

|

101,945 |

|

100,773 |

|

1 |

% |

Technology and content |

11,805 |

|

12,264 |

|

(4) |

% |

|

35,760 |

|

38,613 |

|

(7) |

% |

General and administrative |

21,925 |

|

20,297 |

|

8 |

% |

|

60,817 |

|

62,318 |

|

(2) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Impairment, restructuring and other charges |

455 |

|

61 |

|

646 |

% |

|

2,010 |

|

9,409 |

|

(79) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating costs and expenses |

95,394 |

|

101,608 |

|

(6) |

% |

|

287,541 |

|

306,298 |

|

(6) |

% |

| Loss from operations |

(41,525) |

|

(43,199) |

|

4 |

% |

|

(59,771) |

|

(89,069) |

|

33 |

% |

| Interest expense |

(2,384) |

|

(2,859) |

|

17 |

% |

|

(7,380) |

|

(8,517) |

|

13 |

% |

| Other income, net |

978 |

|

1,699 |

|

(42) |

% |

|

3,894 |

|

6,425 |

|

(39) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before income taxes |

(42,931) |

|

(44,359) |

|

3 |

% |

|

(63,257) |

|

(91,161) |

|

31 |

% |

| Benefit from income taxes |

(11,240) |

|

(1,886) |

|

|

|

(16,118) |

|

(3,736) |

|

|

| Net loss |

(31,691) |

|

(42,473) |

|

25 |

% |

|

(47,139) |

|

(87,425) |

|

46 |

% |

| Preferred stock dividends |

(5,987) |

|

(5,643) |

|

|

|

(17,614) |

|

(16,603) |

|

|

| Change in preferred stock redemption value |

(6,903) |

|

(5,832) |

|

|

|

(19,583) |

|

(16,619) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to common stockholders |

$ |

(44,581) |

|

$ |

(53,948) |

|

17 |

% |

|

$ |

(84,336) |

|

$ |

(120,647) |

|

30 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share attributable to common stockholders: |

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

$ |

(1.46) |

|

$ |

(1.83) |

|

20 |

% |

|

$ |

(2.78) |

|

$ |

(4.13) |

|

33 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average number of shares used in per share: |

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

30,633 |

|

29,485 |

|

4 |

% |

|

30,347 |

|

29,211 |

|

4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

_____________________________

(a) Includes stock-based compensation expense as follows:

|

| Marketing and advertising |

$ |

609 |

|

$ |

437 |

|

|

|

$ |

1,691 |

|

$ |

1,792 |

|

|

| Customer care and enrollment |

339 |

|

452 |

|

|

|

935 |

|

1,487 |

|

|

| Technology and content |

666 |

|

845 |

|

|

|

2,034 |

|

2,598 |

|

|

| General and administrative |

2,308 |

|

2,745 |

|

|

|

6,927 |

|

9,248 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total stock-based compensation expense |

$ |

3,922 |

|

$ |

4,479 |

|

(12) |

% |

|

$ |

11,587 |

|

$ |

15,125 |

|

(23) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Results(1): |

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA(1) |

$ |

(34,007) |

|

$ |

(34,832) |

|

2 |

% |

|

$ |

(35,628) |

|

$ |

(52,024) |

|

32 |

% |

Adjusted EBITDA margin(1) |

(63) |

% |

|

(60) |

% |

|

|

|

(16) |

% |

|

(24) |

% |

|

|

__________

Note: See accompanying footnotes on page

14.

EHEALTH, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

|

| |

2025 |

|

2024 |

|

2025 |

|

2024 |

|

|

|

|

| Operating activities: |

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

$ |

(31,691) |

|

|

$ |

(42,473) |

|

|

$ |

(47,139) |

|

|

$ |

(87,425) |

|

|

|

|

|

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

447 |

|

|

473 |

|

|

1,384 |

|

|

1,481 |

|

|

|

|

|

| Amortization of internally developed software |

2,694 |

|

|

3,354 |

|

|

9,162 |

|

|

11,030 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation expense |

3,922 |

|

|

4,479 |

|

|

11,587 |

|

|

15,125 |

|

|

|

|

|

| Deferred income taxes |

(11,815) |

|

|

(1,709) |

|

|

(17,010) |

|

|

(4,340) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Impairment charges |

455 |

|

|

— |

|

|

868 |

|

|

7,413 |

|

|

|

|

|

| Other non-cash items |

41 |

|

|

74 |

|

|

(596) |

|

|

(43) |

|

|

|

|

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

| Accounts receivable |

3 |

|

|

(4,681) |

|

|

14,955 |

|

|

(1,871) |

|

|

|

|

|

| Contract assets – commissions receivable |

9,325 |

|

|

17,885 |

|

|

92,811 |

|

|

104,582 |

|

|

|

|

|

| Prepaid expenses and other assets |

(7,147) |

|

|

(11,327) |

|

|

(7,661) |

|

|

(9,896) |

|

|

|

|

|

| Accounts payable |

516 |

|

|

509 |

|

|

(17,111) |

|

|

(1,965) |

|

|

|

|

|

| Accrued compensation and benefits |

7,213 |

|

|

6,195 |

|

|

(19,621) |

|

|

(14,593) |

|

|

|

|

|

| Accrued marketing expenses |

1,511 |

|

|

1,366 |

|

|

(11,054) |

|

|

(11,132) |

|

|

|

|

|

| Deferred revenue |

(1,200) |

|

|

(1,173) |

|

|

(872) |

|

|

861 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accrued expenses and other liabilities |

413 |

|

|

(2,255) |

|

|

901 |

|

|

69 |

|

|

|

|

|

| Net cash provided by (used in) operating activities |

(25,313) |

|

|

(29,283) |

|

|

10,604 |

|

|

9,296 |

|

|

|

|

|

| Investing activities: |

|

|

|

|

|

|

|

|

|

|

|

| Capitalized internal-use software and website development costs |

(3,409) |

|

|

(3,191) |

|

|

(10,785) |

|

|

(8,070) |

|

|

|

|

|

| Purchases of property and equipment and other assets |

(214) |

|

|

(998) |

|

|

(2,107) |

|

|

(1,463) |

|

|

|

|

|

| Purchases of marketable securities |

(12,132) |

|

|

(48,489) |

|

|

(74,010) |

|

|

(85,880) |

|

|

|

|

|

| Proceeds from redemption and maturities of marketable securities |

39,450 |

|

|

20,000 |

|

|

105,950 |

|

|

39,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in) investing activities |

23,695 |

|

|

(32,678) |

|

|

19,048 |

|

|

(56,413) |

|

|

|

|

|

| Financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Payment of deferred financing costs |

(1,000) |

|

|

— |

|

|

(1,000) |

|

|

— |

|

|

|

|

|

| Net proceeds from exercise of common stock options and employee stock purchases |

— |

|

|

— |

|

|

189 |

|

|

354 |

|

|

|

|

|

| Repurchase of shares to satisfy employee tax withholding obligations |

(276) |

|

|

(450) |

|

|

(2,102) |

|

|

(2,301) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Principal payments in connection with leases |

— |

|

|

— |

|

|

— |

|

|

(4) |

|

|

|

|

|

| Payments of preferred stock dividends |

— |

|

|

— |

|

|

(2,906) |

|

|

(2,740) |

|

|

|

|

|

| Net cash used in financing activities |

(1,276) |

|

|

(450) |

|

|

(5,819) |

|

|

(4,691) |

|

|

|

|

|

| Effect of exchange rate changes on cash, cash equivalents and restricted cash |

63 |

|

|

99 |

|

|

59 |

|

|

118 |

|

|

|

|

|

Net increase (decrease) in cash, cash equivalents and restricted cash |

(2,831) |

|

|

(62,312) |

|

|

23,892 |

|

|

(51,690) |

|

|

|

|

|

| Cash, cash equivalents and restricted cash at beginning of period |

69,010 |

|

|

129,434 |

|

|

42,287 |

|

|

118,812 |

|

|

|

|

|

| Cash, cash equivalents and restricted cash at end of period |

$ |

66,179 |

|

|

$ |

67,122 |

|

|

$ |

66,179 |

|

|

$ |

67,122 |

|

|

|

|

|

EHEALTH, INC.

SEGMENT INFORMATION

(in thousands, unaudited)

We evaluate our business performance and manage our operations as two distinct reporting segments: Medicare and Employer and Individual (“E&I”). The Medicare segment consists primarily of commissions earned as the broker of record from our sale of Medicare-related health insurance plans, including Medicare Advantage, Medicare Supplement and Medicare Part D prescription drug plans, and to a lesser extent, ancillary products sold to our Medicare-eligible beneficiaries, including but not limited to, dental and vision insurance. Our commissions may include certain bonus payments, which are generally based on attaining predetermined target sales levels or other objectives, as determined by the health insurance carriers. The Medicare segment also consists of amounts earned in connection with our advertising program for marketing and other services as well as amounts earned from our non-broker of record fee-based arrangements and our performance of various post-enrollment services for members. The E&I segment consists primarily of commissions earned from our sale of individual and family plans (“IFP”), including qualified and non-qualified plans, small business health insurance plans and ancillary products sold to our non-Medicare-eligible consumers, including but not limited to, dental, vision and short-term insurance. To a lesser extent, the E&I segment includes amounts earned from our online sponsorship program that allows carriers to purchase advertising space in specific markets on our website as well as our technology licensing activities.

We report segment information based on how our chief executive officer, who is our chief operating decision maker (“CODM”), regularly reviews our operating results, allocates resources and makes decisions regarding our business operation in the annual budget and forecasting process along with evaluation of actual performance. Our CODM considers budget-to-actual variances on a monthly basis for our segment performance measures when making decisions about allocating capital and personnel to our segments. These performance measures include total segment revenue and segment gross profit (loss). Prior to the fourth quarter of 2024, we reported our measure of segment profitability as segment profit (loss). Accordingly, prior period amounts have been reclassified to conform to the current period presentation, in all material respects.

Segment gross profit (loss) is calculated as total revenue for the applicable segment less variable marketing and advertising expenses, segment customer care and enrollment expenses (“CC&E”) and cost of revenue for the applicable segment. Variable marketing and advertising expenses represent costs incurred in member acquisition from our direct marketing and marketing partner channels and exclude fixed overhead costs, such as personnel related costs, consulting expenses and other operating costs allocated to the marketing and advertising department. Segment CC&E expenses include expenses we incur in assisting applicants during the enrollment process and exclude operating costs allocated to the CC&E department.

The results of our reportable segments are summarized for the periods presented below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

|

Nine Months Ended

September 30, |

|

|

|

|

| |

2025 |

|

2024 |

|

% Change |

|

2025 |

|

2024 |

|

% Change |

|

|

| Medicare: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

$ |

49,932 |

|

|

$ |

53,221 |

|

|

(6) |

% |

|

$ |

211,660 |

|

|

$ |

194,857 |

|

|

9 |

% |

|

|

Variable marketing and advertising |

(16,930) |

|

|

(22,512) |

|

|

25 |

% |

|

(64,483) |

|

|

(71,030) |

|

|

9 |

% |

|

|

| Medicare CC&E |

(34,049) |

|

|

(36,320) |

|

|

6 |

% |

|

(93,596) |

|

|

(91,954) |

|

|

(2) |

% |

|

|

Cost of revenue |

(106) |

|

|

(13) |

|

|

* |

|

158 |

|

|

(245) |

|

|

164 |

% |

|

|

| Medicare segment gross profit (loss) |

$ |

(1,153) |

|

|

$ |

(5,624) |

|

|

79 |

% |

|

$ |

53,739 |

|

|

$ |

31,628 |

|

|

70 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

|

Nine Months Ended

September 30, |

|

|

|

|

| |

2025 |

|

2024 |

|

% Change |

|

2025 |

|

2024 |

|

% Change |

|

|

| Employer and Individual: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

$ |

3,937 |

|

|

$ |

5,188 |

|

|

(24) |

% |

|

$ |

16,110 |

|

|

$ |

22,372 |

|

|

(28) |

% |

|

|

Variable marketing and advertising |

(723) |

|

|

(936) |

|

|

23 |

% |

|

(2,630) |

|

|

(2,410) |

|

|

(9) |

% |

|

|

| E&I CC&E |

(2,154) |

|

|

(2,320) |

|

|

7 |

% |

|

(6,535) |

|

|

(6,732) |

|

|

3 |

% |

|

|

Cost of revenue |

(87) |

|

|

(89) |

|

|

2 |

% |

|

(241) |

|

|

(300) |

|

|

20 |

% |

|

|

| E&I segment gross profit |

$ |

973 |

|

|

$ |

1,843 |

|

|

(47) |

% |

|

$ |

6,704 |

|

|

$ |

12,930 |

|

|

(48) |

% |

|

|

__________

* Percentage calculated is not meaningful.

EHEALTH, INC.

SEGMENT INFORMATION

(in thousands, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

|

Nine Months Ended

September 30, |

|

|

|

|

| |

2025 |

|

2024 |

|

% Change |

|

2025 |

|

2024 |

|

% Change |

|

|

| Consolidated: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

$ |

53,869 |

|

|

$ |

58,409 |

|

|

(8) |

% |

|

$ |

227,770 |

|

|

$ |

217,229 |

|

|

5 |

% |

|

|

Variable marketing and advertising |

(17,653) |

|

|

(23,448) |

|

|

25 |

% |

|

(67,113) |

|

|

(73,440) |

|

|

9 |

% |

|

|

Segment CC&E |

(36,203) |

|

|

(38,640) |

|

|

6 |

% |

|

(100,131) |

|

|

(98,686) |

|

|

(1) |

% |

|

|

Cost of revenue |

(193) |

|

|

(102) |

|

|

(89) |

% |

|

(83) |

|

|

(545) |

|

|

85 |

% |

|

|

| Total segment gross profit (loss) |

$ |

(180) |

|

|

$ |

(3,781) |

|

|

95 |

% |

|

$ |

60,443 |

|

|

$ |

44,558 |

|

|

36 |

% |

|

|

A reconciliation of our segment gross profit (loss) to the Condensed Consolidated Statements of Operations for the periods presented is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

|

Nine Months Ended

September 30, |

|

|

|

|

| |

2025 |

|

2024 |

|

% Change |

|

2025 |

|

2024 |

|

% Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total segment gross profit (loss) |

$ |

(180) |

|

|

$ |

(3,781) |

|

|

95 |

% |

|

$ |

60,443 |

|

|

$ |

44,558 |

|

|

36 |

% |

|

|

Other marketing and advertising(a) |

(6,549) |

|

|

(6,115) |

|

|

(7) |

% |

|

(19,813) |

|

|

(21,200) |

|

|

7 |

% |

|

|

Other CC&E(b) |

(611) |

|

|

(681) |

|

|

10 |

% |

|

(1,814) |

|

|

(2,087) |

|

|

13 |

% |

|

|

| Technology and content |

(11,805) |

|

|

(12,264) |

|

|

4 |

% |

|

(35,760) |

|

|

(38,613) |

|

|

7 |

% |

|

|

| General and administrative |

(21,925) |

|

|

(20,297) |

|

|

(8) |

% |

|

(60,817) |

|

|

(62,318) |

|

|

2 |

% |

|

|

| Impairment, restructuring and other charges |

(455) |

|

|

(61) |

|

|

(646) |

% |

|

(2,010) |

|

|

(9,409) |

|

|

79 |

% |

|

|

| Interest expense |

(2,384) |

|

|

(2,859) |

|

|

17 |

% |

|

(7,380) |

|

|

(8,517) |

|

|

13 |

% |

|

|

| Other income, net |

978 |

|

|

1,699 |

|

|

(42) |

% |

|

3,894 |

|

|

6,425 |

|

|

(39) |

% |

|

|

| Loss before income taxes |

$ |

(42,931) |

|

|

$ |

(44,359) |

|

|

3 |

% |

|

$ |

(63,257) |

|

|

$ |

(91,161) |

|

|

31 |

% |

|

|

__________

(a)Other marketing and advertising costs consist of fixed marketing and advertising, previously capitalized labor, depreciation and share-based compensation costs.

(b)Other CC&E costs consist of previously capitalized labor, depreciation and share-based compensation costs.

EHEALTH, INC.

COMMISSION REVENUE

(in thousands, unaudited)

Our commission revenue results from approval of an application from health insurance carriers, which we define as our customers under Accounting Standards Codification 606 — Revenue from Contracts with Customers (“ASC 606”). Our commission revenue is primarily comprised of commissions from health insurance carriers which is computed using the estimated constrained lifetime values of commission payments that we expect to receive. Our commissions may include certain bonus payments, which are generally based on our attaining predetermined target sales levels or other objectives, as determined by the health insurance carriers.

The following table presents commission revenue by product for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

% Change |

|

Nine Months Ended

September 30, |

|

% Change |

|

2025 |

|

2024 |

|

|

2025 |

|

2024 |

|

| Medicare |

|

|

|

|

|

|

|

|

|

|

|

| Medicare Advantage |

$ |

37,713 |

|

|

$ |

39,463 |

|

|

(4) |

% |

|

$ |

150,963 |

|

|

$ |

143,627 |

|

|

5 |

% |

| Medicare Supplement |

2,309 |

|

|

2,312 |

|

|

— |

% |

|

24,199 |

|

|

11,835 |

|

|

104 |

% |

Medicare Part D |

1,561 |

|

|

843 |

|

|

85 |

% |

|

2,956 |

|

|

6,238 |

|

|

(53) |

% |

| Total Medicare |

41,583 |

|

|

42,618 |

|

|

(2) |

% |

|

178,118 |

|

|

161,700 |

|

|

10 |

% |

Individual and Family |

|

|

|

|

|

|

|

|

|

|

|

Non-Qualified Health Plans(a) |

(125) |

|

|

(199) |

|

|

(37) |

% |

|

359 |

|

|

1,834 |

|

|

(80) |

% |

Qualified Health Plans(a) |

(64) |

|

|

602 |

|

|

(111) |

% |

|

1,299 |

|

|

3,358 |

|

|

(61) |

% |

Total Individual and Family |

(189) |

|

|

403 |

|

|

(147) |

% |

|

1,658 |

|

|

5,192 |

|

|

(68) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ancillary |

3,274 |

|

|

2,036 |

|

|

61 |

% |

|

11,355 |

|

|

7,279 |

|

|

56 |

% |

| Small Business |

2,251 |

|

|

2,268 |

|

|

(1) |

% |

|

7,982 |

|

|

8,447 |

|

|

(6) |

% |

| Commission Bonus and Other |

304 |

|

|

897 |

|

|

(66) |

% |

|

1,787 |

|

|

3,378 |

|

|

(47) |

% |

| Total Commission Revenue |

$ |

47,223 |

|

|

$ |

48,222 |

|

|

(2) |

% |

|

$ |

200,900 |

|

|

$ |

185,996 |

|

|

8 |

% |

_____________

(a)Total revenue for non-qualified and qualified health plans was negative due to $(0.5) million and $(0.3) million, respectively, of net commission revenue from members approved in prior periods for the three months ended September 30, 2025. Total revenue for non-qualified health plans was negative due to $(0.6) million of net commission revenue from members approved in prior periods for the three months ended September 30, 2024.

The following table presents a summary of commission revenue by segment for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

|

| |

2025 |

|

2024 |

|

2025 |

|

2024 |

|

| Medicare |

|

|

|

|

|

|

|

|

|

Commission revenue from members approved during the period |

$ |

31,402 |

|

|

$ |

42,324 |

|

|

$ |

146,304 |

|

|

$ |

152,017 |

|

|

|

Net commission revenue from members approved in prior periods(a) |

12,081 |

|

|

1,090 |

|

|

39,135 |

|

|

12,773 |

|

|

|

Total Medicare segment commission revenue |

43,483 |

|

|

43,414 |

|

|

185,439 |

|

|

164,790 |

|

|

|

Employer and Individual |

|

|

|

|

|

|

|

|

|

Commission revenue from members approved during the period |

1,881 |

|

|

2,848 |

|

|

7,659 |

|

|

11,790 |

|

|

|

Commission revenue from renewals of small business members during the period |

1,737 |

|

|

1,852 |

|

|

6,479 |

|

|

7,022 |

|

|

|

Net commission revenue from members approved in prior periods(a) |

122 |

|

|

108 |

|

|

1,323 |

|

|

2,394 |

|

|

|

Total Employer and Individual segment commission revenue |

3,740 |

|

|

4,808 |

|

|

15,461 |

|

|

21,206 |

|

|

|

Total commission revenue |

$ |

47,223 |

|

|

$ |

48,222 |

|

|

$ |

200,900 |

|

|

$ |

185,996 |

|

|

|

_____________

(a)For all existing cohorts approved in prior periods, we reassess assumptions for our constrained lifetime value (“LTV”) of commissions on a quarterly basis and compare to the most current constrained LTV recognized on these cohorts. To the extent there is an indication of a change to expected cash collections for these cohorts, net commission revenue from members approved in prior periods, also referred to as net adjustment revenue, is recorded to adjust revenue previously recognized for the affected cohorts. Net adjustment revenue includes both increases and reductions to revenue; however, adjustments increasing revenue are only recognized when it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur.

EHEALTH, INC.

SUMMARY OF SELECTED METRICS

(unaudited)

Selected Metrics — Third Quarter of 2025

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

% Change |

|

2025 |

|

2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Approved Members(2) |

|

|

|

|

|

| Medicare |

|

|

|

|

|

| Medicare Advantage |

28,645 |

|

40,141 |

|

(29) |

% |

| Medicare Supplement |

1,393 |

|

1,438 |

|

(3) |

% |

| Medicare Part D |

1,129 |

|

1,292 |

|

(13) |

% |

| Total Medicare |

31,167 |

|

42,871 |

|

(27) |

% |

| Individual and Family |

1,872 |

|

2,872 |

|

(35) |

% |

| Ancillary |

12,003 |

|

11,382 |

|

5 |

% |

| Small Business |

1,228 |

|

1,141 |

|

8 |

% |

| Total Approved Members |

46,270 |

|

58,266 |

|

(21) |

% |

|

|

|

|

|

|

Constrained Lifetime Value of Commissions per Approved Member(3) |

|

|

|

|

|

Medicare(a) |

|

|

|

|

|

| Medicare Advantage |

$ |

975 |

|

$ |

990 |

|

(2) |

% |

| Medicare Supplement |

1,467 |

|

1,105 |

|

33 |

% |

| Medicare Part D |

168 |

|

222 |

|

(24) |

% |

| Individual and Family |

|

|

|

|

|

| Non-Qualified Health Plans |

300 |

|

314 |

|

(4) |

% |

| Qualified Health Plans |

268 |

|

311 |

|

(14) |

% |

| Ancillary |

|

|

|

|

|

| Short-term |

110 |

|

144 |

|

(24) |

% |

| Dental |

125 |

|

118 |

|

6 |

% |

| Vision |

78 |

|

78 |

|

— |

% |

| Small Business |

254 |

|

249 |

|

2 |

% |

(a)Constraints for Medicare Advantage, Medicare Supplement and Medicare Part D were 5.5%, 4% and 7%, respectively, for the three months ended September 30, 2025. Constraints for Medicare Advantage, Medicare Supplement and Medicare Part D were 5.5%, 9% and 7%, respectively, for the three months ended September 30, 2024. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expense Metrics per Approved Member(4) |

|

|

|

|

|

Medicare Plans |

|

|

|

|

|

CC&E cost per Medicare Advantage (“MA”)-equivalent approved member |

$ |

930 |

|

$ |

719 |

|

29 |

% |

| Variable marketing cost per MA-equivalent approved member |

559 |

|

537 |

|

4 |

% |

| Total acquisition cost per MA-equivalent approved member |

$ |

1,489 |

|

$ |

1,256 |

|

19 |

% |

Individual and Family Plans (“IFP”) |

|

|

|

|

|

CC&E cost per IFP-equivalent approved member |

$ |

433 |

|

$ |

359 |

|

21 |

% |

| Variable marketing cost per IFP-equivalent approved member |

104 |

|

118 |

|

(12) |

% |

| Total acquisition cost per IFP-equivalent approved member |

$ |

537 |

|

$ |

477 |

|

13 |

% |

__________

Note: See accompanying footnotes on page

14.

EHEALTH, INC.

SUMMARY OF SELECTED METRICS

(unaudited)

Selected Metrics — Nine Months Ended September 30, 2025

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended

September 30, |

|

% Change |

|

2025 |

|

2024 |

|

Approved Members(2) |

|

|

|

|

|

| Medicare |

|

|

|

|

|

| Medicare Advantage |

141,884 |

|

|

143,529 |

|

|

(1) |

% |

| Medicare Supplement |

5,688 |

|

|

9,574 |

|

|

(41) |

% |

| Medicare Part D |

5,149 |

|

|

6,335 |

|

|

(19) |

% |

| Total Medicare |

152,721 |

|

|

159,438 |

|

|

(4) |

% |

| Individual and Family |

9,751 |

|

|

13,540 |

|

|

(28) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ancillary |

41,288 |

|

|

36,410 |

|

|

13 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Small Business |

3,256 |

|

|

3,705 |

|

|

(12) |

% |

| Total Approved Members |

207,016 |

|

|

213,093 |

|

|

(3) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of September 30, |

|

% Change |

|

2025 |

|

2024 |

|

Estimated Membership(5) |

|

|

|

|

|

Medicare(6) |

|

|

|

|

|

| Medicare Advantage |

579,914 |

|

|

583,970 |

|

|

(1) |

% |

| Medicare Supplement |

90,596 |

|

|

95,153 |

|

|

(5) |

% |

| Medicare Part D |

174,970 |

|

|

194,303 |

|

|

(10) |

% |

| Total Medicare |

845,480 |

|

|

873,426 |

|

|

(3) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Individual and Family(6) |

62,678 |

|

|

75,871 |

|

|

(17) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ancillary(6) |

173,835 |

|

|

168,953 |

|

|

3 |

% |

Small Business(7) |

36,528 |

|

|

41,172 |

|

|

(11) |

% |

| Total Estimated Membership |

1,118,521 |

|

|

1,159,422 |

|

|

(4) |

% |

__________

Note: See accompanying footnotes on page

14.

EHEALTH, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(unaudited)

Reconciliation of GAAP Operating Costs and Expenses to Non-GAAP Operating Costs and Expenses(1) (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

GAAP marketing and advertising expense |

$ |

24,395 |

|

|

$ |

29,665 |

|

|

$ |

87,009 |

|

|

$ |

95,185 |

|

Stock-based compensation expense |

(609) |

|

|

(437) |

|

|

(1,691) |

|

|

(1,792) |

|

Non-GAAP marketing and advertising expense(1) |

$ |

23,786 |

|

|

$ |

29,228 |

|

|

$ |

85,318 |

|

|

$ |

93,393 |

|

|

|

|

|

|

|

|

|

GAAP customer care and enrollment expense |

$ |

36,814 |

|

|

$ |

39,321 |

|

|

$ |

101,945 |

|

|

$ |

100,773 |

|

| Stock-based compensation expense |

(339) |

|

|

(452) |

|

|

(935) |

|

|

(1,487) |

|

Non-GAAP customer care and enrollment expense(1) |

$ |

36,475 |

|

|

$ |

38,869 |

|

|

$ |

101,010 |

|

|

$ |

99,286 |

|

|

|

|

|

|

|

|

|

GAAP technology and content expense |

$ |

11,805 |

|

|

$ |

12,264 |

|

|

$ |

35,760 |

|

|

$ |

38,613 |

|

| Stock-based compensation expense |

(666) |

|

|

(845) |

|

|

(2,034) |

|

|

(2,598) |

|

Non-GAAP technology and content expense(1) |

$ |

11,139 |

|

|

$ |

11,419 |

|

|

$ |

33,726 |

|

|

$ |

36,015 |

|

|

|

|

|

|

|

|

|

GAAP general and administrative expense |

$ |

21,925 |

|

|

$ |

20,297 |

|

|

$ |

60,817 |

|

|

$ |

62,318 |

|

| Stock-based compensation expense |

(2,308) |

|

|

(2,745) |

|

|

(6,927) |

|

|

(9,248) |

|

Non-GAAP general and administrative expense(1) |

$ |

19,617 |

|

|

$ |

17,552 |

|

|

$ |

53,890 |

|

|

$ |

53,070 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP operating costs and expenses |

$ |

95,394 |

|

|

$ |

101,608 |

|

|

$ |

287,541 |

|

|

$ |

306,298 |

|

| Stock-based compensation expense |

(3,922) |

|

|

(4,479) |

|

|

(11,587) |

|

|

(15,125) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Impairment, restructuring and other charges |

(455) |

|

|

(61) |

|

|

(2,010) |

|

|

(9,409) |

|

|

|

|

|

|

|

|

|

Non-GAAP operating costs and expenses(1) |

$ |

91,017 |

|

|

$ |

97,068 |

|

|

$ |

273,944 |

|

|

$ |

281,764 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of GAAP Net Loss Attributable to Common Stockholders to Adjusted EBITDA(1) (in thousands) and Adjusted EBITDA Margin(1):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

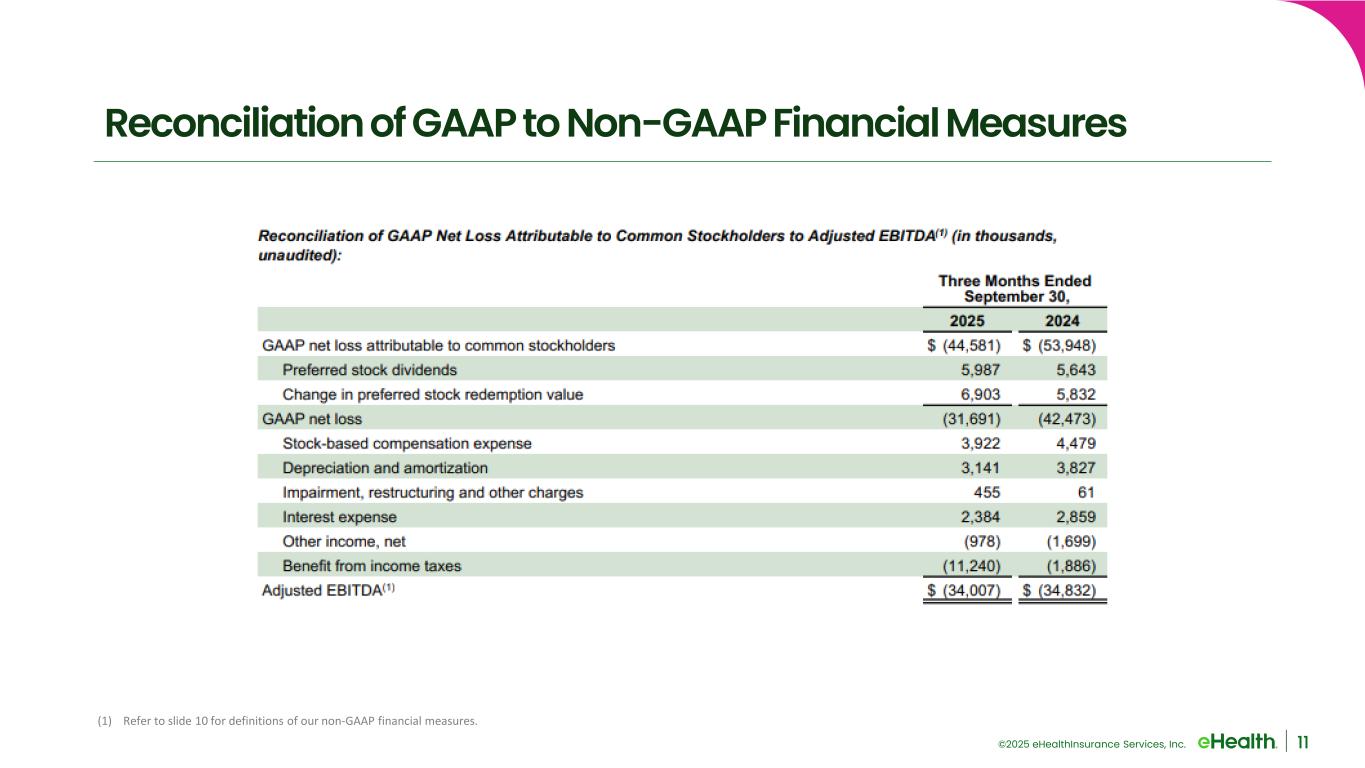

GAAP net loss attributable to common stockholders |

$ |

(44,581) |

|

$ |

(53,948) |

|

$ |

(84,336) |

|

$ |

(120,647) |

| Preferred stock dividends |

5,987 |

|

5,643 |

|

17,614 |

|

16,603 |

| Change in preferred stock redemption value |

6,903 |

|

5,832 |

|

19,583 |

|

16,619 |

GAAP net loss |

(31,691) |

|

(42,473) |

|

(47,139) |

|

(87,425) |

| Stock-based compensation expense |

3,922 |

|

4,479 |

|

11,587 |

|

15,125 |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

3,141 |

|

3,827 |

|

10,546 |

|

12,511 |

|

|

|

|

|

|

|

|

| Impairment, restructuring and other charges |

455 |

|

61 |

|

2,010 |

|

9,409 |

|

|

|

|

|

|

|

|

| Interest expense |

2,384 |

|

2,859 |

|

7,380 |

|

8,517 |

| Other income, net |

(978) |

|

(1,699) |

|

(3,894) |

|

(6,425) |

Benefit from income taxes |

(11,240) |

|

(1,886) |

|

(16,118) |

|

(3,736) |

Adjusted EBITDA(1) |

$ |

(34,007) |

|

$ |

(34,832) |

|

$ |

(35,628) |

|

$ |

(52,024) |

Net loss margin |

(59) |

% |

|

(73) |

% |

|

(21) |

% |

|

(40) |

% |

Adjusted EBITDA margin(1) |

(63) |

% |

|

(60) |

% |

|

(16) |

% |

|

(24) |

% |

__________

Note: See accompanying footnotes on page

14.

EHEALTH, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(unaudited)

Reconciliation of Guidance GAAP Net Loss Attributable to Common Stockholders to Adjusted EBITDA(1) (in millions):

|

|

|

|

|

|

|

|

|

|

|

|

|

Full Year 2025 Guidance |

|

Low |

|

High |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP net loss attributable to common stockholders |

$ |

(41.0) |

|

|

$ |

(20.0) |

|

| Impact from preferred stock |

50.0 |

|

|

50.0 |

|

| GAAP net income |

9.0 |

|

|

30.0 |

|

| Stock-based compensation expense |

15.0 |

|

|

12.0 |

|

| Depreciation and amortization |

18.0 |

|

|

17.0 |

|

|

|

|

|

|

|

|

|

| Interest expense |

11.0 |

|

|

10.0 |

|

| Other income, net |

(3.0) |

|

|

(3.0) |

|

| Provision for income taxes |

10.0 |

|

|

14.0 |

|

Adjusted EBITDA(1) |

$ |

60.0 |

|

|

$ |

80.0 |

|

__________

Note: See accompanying footnotes on page

14.

EHEALTH, INC.

Footnotes to Preceding Financial Statements and Metrics

(1)Non-GAAP Financial Information

This press release includes financial measures that are not calculated in accordance with U.S. generally accepted accounting principles (GAAP). To supplement eHealth’s condensed consolidated financial statements presented in accordance with GAAP, eHealth presents investors with non-GAAP financial measures, including non-GAAP operating costs and expenses, adjusted EBITDA and adjusted EBITDA margin.