Document

Exhibit 99.1(a)

Fourth Quarter 2023 Earnings Prepared Comments

Brandon Ayache, Celanese Corporation, Vice President, Investor Relations

This is the Celanese Corporation fourth quarter 2023 earnings prepared comments. The Celanese Corporation fourth quarter 2023 earnings release was distributed via Business Wire this afternoon and posted on our investor relations website, investors.celanese.com. As a reminder, some of the matters discussed below may include forward-looking statements concerning, for example, our future objectives and plans. Please note the cautionary language contained at the end of these comments. Also, some of the matters discussed include references to non-GAAP financial measures. Explanations of these measures and reconciliations to the comparable GAAP measures are included on our investor relations website under Financial Information/Non-GAAP Financial Measures. The earnings release and non-GAAP information and the reconciliations are being furnished to the SEC in a Current Report on Form 8-K. These prepared comments are also being furnished to the SEC in a separate Current Report on Form 8-K.

On the earnings conference call tomorrow morning, management will be available to answer questions.

Lori Ryerkerk, Celanese Corporation, Chair of the Board and Chief Executive Officer

Today we reported full year 2023 adjusted earnings of $8.92 per share (inclusive of approximately $1.20 per share of Mobility & Materials (M&M) transaction amortization1) and record free cash flow of $1.3 billion. I sincerely thank our teams for persevering across what was a very challenging year to deliver this performance.

Our teams managed the unfavorable and compounding dynamics in a global commercial backdrop across 2023 that challenged both of our businesses. We are still navigating cyclical demand downturns for most durable goods (electronics, appliances, furniture, etc.) and remodel/renovation activity that spanned 2023 as a result of persistent inflation and the follow-on effects of COVID-19 spending patterns. This spurred a wave of prolonged destocking across most of the supply chains into which we sell. Unpredictable demand

1 Calculated as intangible amortization from the M&M transaction divided by diluted weighted average shares outstanding

across the year drove producers to chase volume where it could be found and fueled elevated competitive pricing pressures.

These challenges were masked by the addition of M&M, resulting in a reported 2023 volume increase of 23 percent year over year. When excluding the impact of M&M, our 2023 volume decreased by 2 percent across Celanese. Even so, this metric alone does not accurately convey the severity of demand challenges as our commercial team successfully pivoted and pursued volume offsets in alternative end-markets across the year to support our results. Significant competitive pricing pressures, raw material deflation, and meaningful shifts in our sales mix resulted in a 10 percent year over year decline in our pricing. The commercial actions to secure alternative business bolstered our financial results in 2023.

Today we also reported fourth quarter adjusted earnings of $2.24 per share (inclusive of approximately $0.30 of M&M transaction amortization) and record free cash flow of $702 million in the quarter despite continued commercial challenges that resulted in sequentially lower volume and pricing.

We believe these unfavorable commercial dynamics will turn. I wish I could say that we are back to normal demand patterns in 2024, but we are not seeing that yet. As always, our team continues to act on what we can control and to prepare us for demand recovery when it comes.

While working to optimize our near-term performance, our team has remained focused on laying the groundwork for future value creation. The first quarter of 2024 is a particularly exciting one for us, as we will complete a series of significant value creation projects.

•On February 1, we successfully went live with M&M on our upgraded SAP S/4HANA ERP system. This was the final step in our strategy to fold the organization onto one upgraded ERP system. I thank our IT, finance, manufacturing, commercial, and supply chain teams for this momentous achievement of integrating a large and complex M&M business onto a new ERP just 15 months after closing the acquisition. This will allow us to completely exit the IT transition services agreement with DuPont in phases over the next few months and support meaningful synergies within the associated functions across 2024. It also allows us to analyze, operate, and report on legacy Engineered Materials (EM) and M&M as one fully integrated business. Starting with the first quarter of 2024, we will talk about one EM, both internally and externally.

•We completed the previously announced closure of our nylon 66 (PA66) and certain high-performance nylons (HPN) polymerization units at Uentrop, Germany. Because polymerization costs at this site were the highest in our global nylon network, this closure will be a meaningful contributor to our synergy realization across the year and helps to further reduce our global fixed cost base.

•We have received, inspected, and installed replacement high-metallurgy components at our new acetic acid unit in Clear Lake. We are finalizing the commissioning process and expect the unit to be operational by the end of the first quarter. Once complete, we believe this new 1.3 million ton unit will be the lowest-cost and lowest-carbon footprint acetic acid unit in the world2 and it is expected to drive approximately $100 million in incremental productivity within our global Acetyl Chain (AC) network on a full year basis.

•In late 2023, we commenced an initiative to consolidate our European regional management activities from our legacy Celanese regional headquarters in Amsterdam to the legacy M&M regional headquarters in Meyrin, Switzerland. Among other reasons for this decision, the Meyrin site is already a significant office site with a technology and innovation center, is a facility we own with room to grow, and is centrally located to our manufacturing and commercial footprint in the region. We informed our European team in early 2024, have already relocated certain regional leaders, and will largely complete that process throughout 2024.

We are starting off 2024 with significant milestones in our value creation journey and there will be more throughout the year. It is a great privilege for me to work with individuals at Celanese who diligently search for value creation opportunities and pursue them with great vigor and urgency. In my closing comments, I will revisit the impact of some these milestones and summarize the growth we expect across 2024.

With that, let me pass it to Scott and Chuck to further discuss our fourth quarter business and financial performance using a familiar framework.

2 Based on internal estimates

Scott Richardson, Celanese Corporation, Executive Vice President and Chief Operating Officer

The Acetyl Chain (AC) delivered fourth quarter adjusted EBIT of $300 million and operating EBITDA of $354 million, at margins of 25 and 30 percent, respectively. Our fourth quarter AC adjusted EBIT was the second highest fourth quarter in our history, behind only the fourth quarter of 2021, a year in which we reported over $2 billion in adjusted EBIT3 due to elevated industry pricing. I commend our team for delivering this performance despite unanticipated challenges impacting the quarter including China pricing that declined more quickly in the quarter than we anticipated and operational disruptions to our U.S. Gulf Coast network.

We had a series of unanticipated operational challenges at our Clear Lake and Bay City plants including unscheduled maintenance and supplier disruptions. These challenges reduced our anticipated production by over 50 kt in the quarter at these cost advantaged facilities within our global network. However, our team successfully maintained reliability of supply to our customers by utilizing higher cost facilities in our global network, leveraging our global logistics, and in some cases, securing third-party product. These actions added nearly $15 million in unanticipated costs in the fourth quarter. The unfavorable impact would have been significantly reduced if our Clear Lake acetic acid expansion was operational, providing us with redundancy and excess make-up capacity at the lowest cost site in our network.

Our 2023 AC adjusted EBIT of $1.3 billion and operating EBITDA of $1.5 billion demonstrated the resilience of our foundational earnings. Despite consistent year over year volumes, AC faced a 17 percent decline in pricing from 2022 levels, which created an almost $1 billion headwind to our performance. Variable margin contributions in 2023 compressed year over year across virtually every product, led by acetic acid and VAM where the combined variable margin contributions declined by approximately 50 percent globally. To elaborate, the variable margin contributions from acetic acid and VAM in 2023 made up the lowest percentage of our total AC variable margin since 2016, a year in which our reported adjusted EBIT was approximately 35 percent lower than 2023. Differentiated results in 2023 were the result of work over the last decade to reduce our fixed cost base and build optionality within the chain. In 2023, we heavily leveraged our downstream optionality to place incremental volume in acetate tow and redispersible powders, the most recent downstream extensions to our chain optionality. As a result of this and other actions, we successfully offset two-thirds of the nearly $1 billion pricing headwind to deliver

3 Inclusive of former Acetate Tow reporting segment

foundational earnings of $1.3 billion across the year. Full year adjusted EBIT margin compressed only 220 basis points to 26 percent.

We continuously look for ways to further enhance the optionality of AC. In the fourth quarter we commissioned our latest AC enhancement via the expansion of our methanol production at Clear Lake, a carbon capture and utilization (CCU) project that increases our JV methanol capacity by 130 kt. We have successfully produced low-carbon methanol and are partnering with customers to direct that methanol into a variety of low-carbon AC and EM downstream products, marketed as ECO-CC, for a wide range of consumer applications.

Looking to 2024, we expect to further lift the foundational earnings power of AC with the Clear Lake acetic acid and methanol expansions. Contributions from those expansions will be negligible in the first quarter, as acetic acid is starting up later in the quarter and methanol is currently undergoing a major scheduled turnaround. We are in the middle of a seven week turnaround of our methanol unit that started in mid-January and will extend until early March. This turnaround is the largest of any single unit in our history as we are replacing catalyst and completing maintenance on numerous pieces of equipment (some for the first time since we commissioned the unit in 2015). We will lose over 100 kt of production and expect to incur approximately $35 million in costs related to this methanol turnaround, approximately $25 million of which will hit AC and $10 million of which will flow to EM. Inclusive of these costs, and largely neutral anticipated sequential volume and pricing conditions, we expect first quarter AC adjusted EBIT of $285 to $300 million.

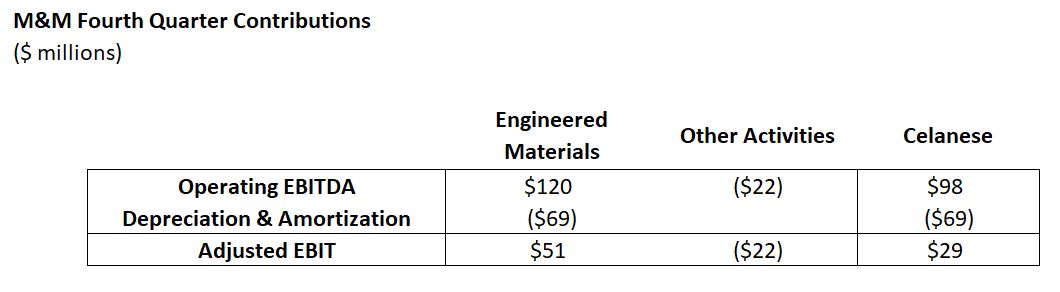

Engineered Materials (EM) delivered fourth quarter adjusted EBIT of $199 million and operating EBITDA of $311 million at margins of 14 and 22 percent, respectively. These results were inclusive of M&M contributions to these earnings metrics of $51 million and $120 million, respectively. Sequential net sales declined by 8 percent, which constituted declines of 5 percent in volume and 3 percent in pricing. The adjusted EBIT outcome was approximately $10 million below our anticipated results and was mainly driven by higher than expected seasonal, year-end destocking within the automotive value chain and product mix headwinds, particularly in M&M. Our legacy EM business delivered an increase in sequential adjusted EBIT4, despite the automotive destocking and continued demand sluggishness in other end-markets.

To focus for a moment on automotive, for most of 2023 we had not seen any material destocking as we had in most other end-markets. Fourth quarter destocking is a common year-end occurrence in automotive, but we anticipated that customer demand and continued strengthening in auto builds would somewhat

4 After accounting for the $13 million in lower sequential consolidated earnings from the Nutrinova JV

interrupt that seasonal cycle. While builds increased in the quarter, the automotive value chain reduced inventories in a more typical fashion. The impact of destocking and the lagging effects of the UAW strike caused our fourth quarter sales into automotive to lag sequential auto builds in both the Americas and Europe, while our sales into Asia were consistent with auto builds. The impact of the destocking in the Western Hemisphere and the UAW strike contributed an approximately $10 million sequential headwind to the quarter across EM. In addition to automotive, year-end destocking was also prevalent throughout the distribution channel.

The resilience of our legacy EM business was evident not only in the EBIT expansion described earlier, but also through volume expansion. When excluding the impact of the Nutrinova JV launch, sequential volumes for legacy EM increased in both Europe and Asia, reinforcing our expectation that the prolonged period of destocking is ending. We saw continued strength in the medical segment, as well as sequential improvement in some industrial segments. We expect this demand stabilization to continue.

Another indicator of stabilization is the trend of trade flows from Asian producers into the Western Hemisphere. We discussed previously how these exports negatively impacted pricing and mix, particularly in Europe. Since peaking in March, POM exports from China, Malaysia, and Japan have fallen in both the second and third quarters of 2023. While not yet back to normalized levels, the combined third quarter exports to Europe from these three countries has fallen by 38 percent. This is an indication of progressing demand recovery in Asia and the transitory nature of the export spike, bringing near-term benefit in Asia and anticipated future improvement in Europe.

As we look to the first quarter of 2024, we anticipate commercial conditions to be similar to the fourth quarter. We expect modest volume recovery to be largely offset by price compression due to continued competitive dynamics. Costs related to a two-week planned outage at our Frankfurt POM facility will be approximately $20 million in the quarter. We expect affiliate earnings to decline by approximately $10 million sequentially, largely driven by Ibn Sina. We expect these impacts will be largely offset by meaningful recovery in M&M, where we expect to deliver the highest quarterly earnings since the acquisition closed. As we consider these dynamics, we anticipate EM first quarter adjusted EBIT of $190 to $200 million.

The M&M business contributed $98 million to Celanese operating EBITDA in the fourth quarter, which was reflected in our reporting segments as $120 million contribution to EM operating EBITDA and an alignment of $22 million in costs to Other Activities. The M&M business contributed $51 million to EM adjusted EBIT in the fourth quarter, inclusive of depreciation and approximately $30 million in quarterly transaction amortization.

While the M&M performance did not meet our expectations, the drivers behind the results are transitory and we expect recovery in the first quarter. The impact of the automotive headwinds discussed earlier were amplified in M&M, given that over 50 percent of net sales of its products go into auto. Additionally, results were also adversely affected by restocking across the middle of the year in our Vamac® product line that also is primarily sold into auto.

To focus on the headwinds in Vamac®, M&M had experienced supply constraints within the product line in past years. Our manufacturing and supply chain teams focused on addressing these supply constraints to improve supply reliability. Thanks to these efforts, our last production campaign was one of the most successful in the history of the product and led to heavier restocking by customers that had been impacted by shortfalls in their supply in the past. This caused lower volumes in the fourth quarter and had a negative sequential mix impact of $15 million. As Vamac® supply continues to improve, we expect a return to a more normalized demand pattern.

During the fourth quarter, we started to realize the benefit of lower raw material costs flowing through inventory, particularly in nylon. While sluggish demand and year-end destocking slowed the realization of these gains, variable margin for nylon bottomed in the fourth quarter and is improving in January.

We anticipate meaningful earnings improvements in the M&M business due to automotive volume recovery and continued realization of lower costs flowing through inventory. We have recently completed the previously announced closure of nylon 66 (PA66) and high-performance nylons (HPN) polymerization units at Uentrop, which will lower our fixed cost base while increasing flexibility. We will continue to operate compounding at Uentrop, in addition to polymerization of certain HPN grades, to maintain a localized production presence and allow us to meet our customer demand. We expect these types of strategic actions and continued realization of synergies will drive further business recovery as lower costs increasingly flow through inventory.

Chuck Kyrish, Celanese Corporation, Senior Vice President and Chief Financial Officer

In my comments I want to provide some added context for our reported earnings, free cash flow, and deleveraging performance across the fourth quarter.

Let me start by addressing the impact of Other Activities on our fourth quarter earnings. In the quarter we reported a net expense of $65 million in Other Activities adjusted EBIT, a sequential expense reduction of $23 million. This sequential reduction was due to certain non-cash foreign exchange gains5 resulting from significant internal restructuring, primarily related to consolidation of our European management activities into Switzerland. While we anticipated potential gains in the quarter from this activity, the actual amount was more significant due to movement in certain foreign currencies and the scale and timing of the intercompany transactions. Going forward, we do not expect to have this level of foreign exchange gains or losses resulting from restructuring activity.

In the first quarter, we expect Other Activities adjusted EBIT to reflect a net expense more in line with the 2023 quarterly run-rate before accounting for the fourth quarter foreign exchange gain just discussed. As we move through 2024, we expect to see a sustainable reduction in our Other Activities expenses following the SAP integration and pursuit of related synergy opportunities.

Lastly, related to earnings, the tax rate for U.S. GAAP purposes was a benefit of 67 percent for full year 2023 due to deferred tax benefits of non-recurring internal reorganization transactions, the integration of the European headquarters to Switzerland, the release of valuation allowances on U.S. foreign tax credit carryforwards, and excess of U.S. GAAP book gains over tax gains related to the formation of the Nutrinova JV. The effective tax rate for adjusted earnings was 9 percent for 2023 as certain benefits of the internal restructuring will be realized in future periods. At this stage, we anticipate an effective tax rate for adjusted earnings in 2024 that is similar to 2023.

Turning to cash generation, I would like to congratulate and thank our team for delivering record quarterly free cash flow of $702 million in the fourth quarter and record annual free cash flow of $1.3 billion across 2023. This achievement was the result of countless Celanese employees working to achieve our shared objective of maximizing and accelerating our cash generation.

Across 2023 we bolstered our free cash flow by delivering a net reduction of approximately $580 million in our working capital balances. The majority of this reduction came from a $451 million reduction in

5 Reflected in the income statement as Foreign exchange gain (loss), net as well as a portion of Other income (expense), net

inventory balances across 2023, exceeding our full year inventory reduction objective. Our team delivered reductions across raw material, work in progress, and finished goods inventory with over 80 percent of the total reduction coming from EM. These efforts continue today.

The record free cash flow we generated in 2023 was delivered following $568 million in capital expenditures, approximately $700 million in net interest, and additional cash costs to integrate and synergize M&M across the year. The reported free cash flow excludes approximately $500 million in cash proceeds from the Nutrinova JV completed in the third quarter.

As a result of our cash generation across the year and proceeds from the Nutrinova JV, we delivered a total net debt reduction of $1.3 billion in 2023. I congratulate our team for meaningfully exceeding our full year objective to reduce net debt by $1 billion in 2023.

As disclosed in an 8-K filing today, we executed an amendment to our U.S. term loan and revolving credit facility, which increased the permitted net debt to EBITDA level through the first quarter of 2026. While this amendment was not necessary for us at this time, we decided to capitalize on an improved credit market backdrop and supportive banking partners to improve the terms and extend the covenant relief period beyond what we believe we will need. The revision in the leverage covenant required no concessions on our part.

Looking forward, our deleveraging objective is very simple - achieve our targeted leverage ratio of 3x net debt to EBITDA as rapidly as possible. What may appear as an urgency to simply reduce leverage is, for us, better described as eagerness to deploy our very strong and growing free cash flow with full flexibility to accelerate our value creation under a balanced capital allocation strategy that would again include share repurchases.

We moved past peak leverage in the second quarter of 2023 and drove our leverage down across each of the last two quarters as a result of both net debt reduction and year over year growth in EBITDA. Across 2024, we expect to make further progress towards 3x leverage from EBITDA growth across the year as well as net debt reduction. This progress will begin in the second quarter, as a result of some of the unique turnaround-related expenses in the first quarter that Scott highlighted as well as first quarter cash flow considerations including normal working capital seasonality and a heavy cash interest burden in the quarter. As a result of these dynamics, we expect negative free cash flow in the first quarter of this year and to maintain similar sequential leverage levels at the end of the first quarter.

We remain committed to aggressively executing against our deleveraging plan and are excited about the opportunities we see across 2024 to deliver earnings and cash flow growth to support this objective.

Lori Ryerkerk, Celanese Corporation, Chair of the Board and Chief Executive Officer

To summarize our comments, 2023 was characterized by poor demand conditions and elevated competitive pressures that challenged our volumes, pricing, and the quality of our sales mix.

Across the first six weeks of 2024, we are seeing certain combinations of product, end-market, and geography where demand and competitive challenges are easing, but we do not anticipate meaningful sequential improvement in total volume or pricing in the first quarter. Inclusive of these dynamics and over $50 million in expenses related to planned outages in the first quarter, we anticipate first quarter adjusted earnings per share of $1.75 to $2.00.

I am confident that we will deliver a significant ramp in earnings coming off of the first quarter and across 2024. The cadence of anticipated 2024 earnings is tied to the timing of major contributors (as well as headwinds) to our year over year growth.

•We anticipate incremental M&M synergies of $150 million or more across the year. The vast majority of these synergies will be delivered across the last three quarters of the year, spurred in part by the completion of the SAP integration and the shutdown of Uentrop polymerization in the first quarter. We continue to take actions to accelerate our synergy capture.

•We expect approximately $100 million in additional earnings contribution from Clear Lake in 2024 due to the new expansions of acetic acid and carbon capture and utilization (CCU) methanol.

•We expect the total annual cost of servicing our debt will decrease by approximately $50 million6 from 2023 as a result of debt paydown and debt optimization efforts.

•We expect that lower raw material costs and lower fixed costs, as a result of actions we took in 2023, will increasingly flow to the income statement across the year as we flush higher cost inventory and improve production utilization rates. We still believe this has the potential to be the highest year over year earnings contributor depending on the future trajectory of pricing and demand conditions, though the net contribution is limited in the first quarter.

•We expect over $50 million in higher expenses year over year related to planned outages.

6 Lower interest due to cross-currency swaps will be reflected in the income statement as Other income (expense), net

•We expect an unfavorable impact of $50 to $75 million year over year from one-time contributions to 2023 earnings that are unlikely to repeat including certain one-time cost avoidance actions and the foreign currency impacts from restructuring activities that Chuck highlighted.

The first quarter of 2024 will not reflect any material benefit from these year over year contributors as a result of the timing of major projects and demand conditions to start the year. Additionally, the first quarter will bear a disproportionate share of the burden of the year over year headwinds as half or more of the 2024 outage-related expense will hit in the first quarter.

At this stage, we do not yet have visibility in our order books or otherwise, to enough green shoots to meaningfully lift our perspective on the underlying demand backdrop. Consequently, the bases for our full year 2024 outlook are the earnings contributors I highlighted above. Inclusive of our first quarter guidance and an anticipated ramp in earnings across 2024 from those contributors, we expect 2024 earnings of $11 to $12 per share.

We remain focused on executing against the significant value creation opportunities in front of us, particularly in the first quarter, that will support meaningful earnings and cash generation growth across 2024 and beyond.

Forward-Looking Statements

These prepared comments may contain "forward-looking statements," which include information concerning the Company's plans, objectives, goals, strategies, future revenues, cash flow, financial performance, synergies, capital expenditures, financing needs and other information that is not historical information. All forward-looking statements are based upon current expectations and beliefs and various assumptions. There can be no assurance that the Company will realize these expectations or that these beliefs will prove correct. There are a number of risks and uncertainties that could cause actual results to differ materially from the results expressed or implied in the forward-looking statements contained in these comments. These risks and uncertainties include, among other things: changes in general economic, business, political and regulatory conditions in the countries or regions in which we operate; the length and depth of product and industry business cycles, particularly in the automotive, electrical, textiles, electronics and construction industries; volatility or changes in the price and availability of raw materials and energy, particularly changes in the demand for, supply of, and market prices of ethylene, methanol, natural gas, wood pulp and fuel oil and the prices for electricity and other energy sources; the ability to pass increases in raw material prices, logistics costs and other costs on to customers or otherwise improve margins through price increases; the possibility that we will not be able to timely or effectively continue to integrate the Mobility & Materials business (the "M&M Business") we acquired from DuPont de Nemours, Inc. (the "M&M Acquisition") in order to realize the anticipated benefits of the M&M Acquisition, including synergies and growth opportunities, whether as a result of difficulties arising from the operation of the M&M Business or other unanticipated delays, costs, inefficiencies or liabilities; increased commercial, legal or regulatory complexity of entering into, or expanding our exposure to, certain end markets and geographies; risks in the global economy and equity and credit markets and their potential impact on our ability to pay down debt in the future and/or refinance at suitable rates, in a timely manner, or at all; risks and costs associated with increased leverage from the M&M Acquisition, including increased interest expense and potential reduction of business and strategic flexibility; the ability to maintain plant utilization rates and to implement planned capacity additions, expansions and maintenance; the ability to reduce or maintain current levels of production costs and to improve productivity by implementing technological improvements to existing plants; increased price competition and the introduction of competing products by other companies; the ability to identify desirable potential acquisition or divestiture opportunities and to complete such transactions, including obtaining regulatory approvals, consistent with the Company's strategy; market acceptance of our products and technology; compliance and other costs and potential disruption or interruption of production or operations due to accidents, interruptions in sources of raw materials, transportation, logistics or supply chain disruptions, cybersecurity incidents, terrorism or political unrest, public health crises (including, but not limited to, the COVID-19 pandemic), or other unforeseen events or delays in construction or operation of facilities, including as a result of geopolitical conditions, the direct or indirect consequences of acts of war or conflict (such as the Russia-Ukraine conflict or the Israel-Hamas conflict) or terrorist incidents or as a result of weather, natural disasters, or other crises; the ability to obtain governmental approvals and to construct facilities on terms and schedules acceptable to the Company; changes in applicable tariffs, duties and trade agreements, tax rates or legislation throughout the world including, but not limited to, adjustments, changes in estimates or interpretations or the resolution of tax examinations or audits that may impact recorded or future tax impacts and potential regulatory and legislative tax developments in the United States and other jurisdictions; changes in the degree of intellectual property and other legal protection afforded to our products or technologies, or the theft of such intellectual property; potential liability for remedial actions and increased costs under existing or future environmental, health and safety regulations, including those relating to climate change or other sustainability matters; potential liability resulting from pending or future claims or litigation, including investigations or enforcement actions, or from changes in the laws, regulations or policies of governments or other governmental activities in the countries in which we operate; changes in currency exchange rates and interest rates; our level of indebtedness, which could diminish our ability to raise additional capital to fund operations or limit our ability to react to changes in the economy or the chemicals industry; tax rates and changes thereto; and various other factors discussed from time to time in the Company's filings with the Securities and Exchange Commission.

Any forward-looking statement speaks only as of the date on which it is made, and the Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances.

Results Unaudited

The results in this document, together with the adjustments made to present the results on a comparable basis, have not been audited and are based on internal financial data furnished to management. Quarterly results should not be taken as an indication of the results of operations to be reported for any subsequent period or for the full fiscal year.

Non-GAAP Financial Measures

These prepared comments, and statements made in connection with these prepared comments, refer to non-GAAP financial measures. For more information on the non-GAAP financial measures used by the Company, including the most directly comparable GAAP financial measure for each non-GAAP financial measure used, including definitions and reconciliations of the differences between such non-GAAP financial measures and the comparable GAAP financial measures, please refer to the Non-US GAAP Financial Measures and Supplemental Information document available on our website, investors.celanese.com, under Financial Information/Financial Document Library.

The Acetyl Chain (AC) delivered fourth quarter adjusted EBIT of $300 million and operating EBITDA of $354 million, at margins of 25 and 30 percent, respectively. Our fourth quarter AC adjusted EBIT was the second highest fourth quarter in our history, behind only the fourth quarter of 2021, a year in which we reported over $2 billion in adjusted EBIT3 due to elevated industry pricing. I commend our team for delivering this performance despite unanticipated challenges impacting the quarter including China pricing that declined more quickly in the quarter than we anticipated and operational disruptions to our U.S. Gulf Coast network.

The Acetyl Chain (AC) delivered fourth quarter adjusted EBIT of $300 million and operating EBITDA of $354 million, at margins of 25 and 30 percent, respectively. Our fourth quarter AC adjusted EBIT was the second highest fourth quarter in our history, behind only the fourth quarter of 2021, a year in which we reported over $2 billion in adjusted EBIT3 due to elevated industry pricing. I commend our team for delivering this performance despite unanticipated challenges impacting the quarter including China pricing that declined more quickly in the quarter than we anticipated and operational disruptions to our U.S. Gulf Coast network.

In my comments I want to provide some added context for our reported earnings, free cash flow, and deleveraging performance across the fourth quarter.

In my comments I want to provide some added context for our reported earnings, free cash flow, and deleveraging performance across the fourth quarter.