Document

Exhibit 99.1(a)

Second Quarter 2023 Earnings Prepared Comments

Brandon Ayache, Celanese Corporation, Vice President, Investor Relations

This is the Celanese Corporation second quarter 2023 earnings prepared comments. The Celanese Corporation second quarter 2023 earnings release was distributed via Business Wire this afternoon and posted on our investor relations website, investors.celanese.com. As a reminder, some of the matters discussed below may include forward-looking statements concerning, for example, our future objectives and plans. Please note the cautionary language contained at the end of these comments. Also, some of the matters discussed include references to non-GAAP financial measures. Explanations of these measures and reconciliations to the comparable GAAP measures are included on our investor relations website under Financial Information/Non-GAAP Financial Measures. The earnings release and non-GAAP information and the reconciliations are being furnished to the SEC in a Current Report on Form 8-K. These prepared comments are also being furnished to the SEC in a separate Current Report on Form 8-K.

On the earnings conference call tomorrow morning, management will be available to answer questions.

Lori Ryerkerk, Celanese Corporation, Chair of the Board and Chief Executive Officer

Today we reported second quarter 2023 free cash flow of $611 million and adjusted earnings per share of $2.17 (inclusive of approximately $0.30 per share of Mobility & Materials (M&M) transaction amortization1). In a very challenging environment, our teams worked numerous actions to deliver record free cash flow in the quarter as well as a sequential lift in earnings. We are initiating further controllable actions across the remainder of 2023 to support earnings growth in the second half amid a backdrop that remains unpredictable.

The business conditions we see across the globe remain complex and uneven. Current demand levels vary dramatically across our end-markets with resilience in medical, auto, and packaging countering poor conditions in consumer electronics, construction, industrial, and distribution. Volatility in underlying demand in the second quarter was amplified by continued destocking in certain end-markets, particularly

1 Calculated as intangible amortization from the M&M transaction divided by diluted weighted average shares outstanding

in Engineered Materials (EM). This destocking cycle has persisted longer than what our businesses have experienced in the past. I believe this is due to the combination of soft demand and falling raw material pricing across all regions which continues to spur inventory reductions and order deferrals by our customers. As a result of these conditions, sequential volumes across Celanese increased by 2 percent in what is typically a seasonally strong quarter. Amid demand softness across the industry, we are seeing heightened competitive dynamics across all regions. Our teams have been vigilant in assessing real-time pricing pressures to protect certain commercial positions.

The visibility we have within our order book is increasingly limited as lead times are shortening and customers are increasingly changing orders due to volatile demand signals and channel corrections. The demand volatility we are experiencing across 2023 has, in some ways, been the downstream equivalent of the raw material and logistics supply chain volatility we saw in 2021. We are again seeing significant shifts in product mix as we did then, which impact our sequential pricing and margin as we pivot to meet demand where it is.

In this environment our focus remains on our own incremental controllable actions to support an increase in second half earnings and strong 2023 free cash flow.

These actions start with our commercial teams who are navigating a very fluid sales environment. We are rapidly assessing conditions across regions and end-markets to ensure we are preserving maximum value.

•We have identified those customer positions across our businesses which are strategic long-term and for which we must proactively monitor and respond to market conditions.

•We have prioritized certain products where industry supply and demand dynamics support potential spot transactions in the second half of the year. Our teams are positioned to capture potential opportunities in several products including acetate tow, redispersible powders, and GUR.

•We are moving from exclusive distribution arrangements for EM in the West to a dual or multi distribution approach to maximize customer coverage for a larger EM product portfolio. Changes will be implemented over the next two quarters, depending on existing contract terms.

•In EM, we have further aligned compensation with our current strategic priorities by temporarily modifying our project pipeline compensation metrics and the drivers of the 2023 annual bonus program for the commercial team, subject to consent of works council or individual employees where required.

Our commercial and manufacturing teams are committed to aligning our production and inventory levels with demand. As a result, we are taking a series of difficult but necessary actions.

•In EM, we will idle certain production units or lines within the second half at two legacy EM facilities as well as six legacy M&M facilities. We will run at reduced rates within the second half across many more EM facilities.

•In the Acetyl Chain (AC), we have again idled our Frankfurt VAM unit through at least the remainder of the third quarter. We will run both Nanjing and Singapore acetic acid at reduced rates within the second half. In downstream products, we will run block operations across a handful of production units across the globe within the second half.

•We are significantly modifying our 2023 and 2024 turnaround schedule in light of recent production decisions. With reduced demand across our global production networks, we have greater flexibility to defer certain turnarounds or execute them at a more cost-effective pace.

•In the second quarter, we significantly expanded our inventory reduction initiative and lowered inventory by $235 million, driven by sequential inventory reductions in EM and AC of 10 percent and 5 percent, respectively. We are expanding our 2023 inventory reduction initiative to achieve a reduction of $400 to $450 million (previously $300 million) across the year.

•We have extended our capex reduction plan into next year and anticipate 2024 capex of approximately $400 million. We have aligned the timing of certain projects to the current demand outlook and maintained flexibility to restore original project timing as demand justifies.

•For the few products which are sold-out, we are assessing near-term opportunities to expand our capacity through repurposing assets and product swaps. We recently secured additional production time to manufacture Vamac®, a sold-out product that is made on a shared asset.

We are exercising certain portions of the playbook we created during COVID and taking incremental cost cutting measures across Celanese. Among other measures:

•We are significantly reducing our use of contractors across the company and overtime work. The reduced demand on our production network allows us to complete most work in-house.

•All travel outside of sales, procurement, and keeping our plants operating safely has been suspended. All international travel is being approved by my direct reports.

•We have actioned a significant reduction in marketing and promotional spend.

•At the end of July, we eliminated certain additional roles across Celanese in response to current macro conditions. We will continue to right-size the organization in line with our synergy plan and in response to macro conditions.

Our actions support our first priority to maximize cash generation in this environment. This is consistent with our strategy under challenging macro backdrops of the past. In the second quarter, our teams delivered free cash flow of $611 million, $91 million above our prior record set in the third quarter of 2021 when we had double the earnings in a favorable backdrop. Strong anticipated 2023 free cash flow of approximately $1.3 billion and anticipated Food Ingredients transaction net proceeds of $450 million give me strong confidence in our ability to meaningfully exceed the 2023 deleveraging commitments we made when we announced the M&M transaction.

I am also confident in our ability to deliver further earnings improvement in the second half despite an uncertain macro environment. The series of incremental cost actions I outlined above are expected to contribute between $60 and $80 million in savings within the second half of 2023.

With second half earnings growth driven by incremental controllable actions, continued M&M synergies, and diminishing destocking as we progress through the year, we anticipate 2023 adjusted earnings of approximately $9 to $10 per share, inclusive of approximately $1.20 per share of M&M transaction amortization. While we do have views on individual regions and end-markets, the reality remains that the backdrop is complex and volatile. Our guidance does not factor in any material improvement in demand conditions beyond a reduction in destocking across the second half, and such improvement would have an incremental positive impact on our earnings.

With the focus on what we can control, let me now highlight our second quarter performance and actions underway in a familiar framework.

The Acetyl Chain (AC) generated second quarter adjusted EBIT of $332 million and operating EBITDA of $386 million at margins of 27 and 31 percent, respectively. Across the first half of the year, our AC team delivered performance entirely consistent with foundational adjusted EBIT of $1.3 billion a year, despite a macro environment that remains sub-foundational.

I thank our team for delivering against their second quarter forecast despite conditions that deteriorated from what we saw in April. Anticipated normal seasonal demand recovery and rising China acetic acid pricing in April alluded to tightening industry dynamics ahead of scheduled industry turnarounds. Shortly after providing our second quarter outlook which factored in these dynamics, we saw an unexpected and rapid decrease in China acetic acid pricing from above $400 per ton to below $350 per ton, the lowest since October 2020. This was primarily due to an abnormally soft seasonal rebound in demand following Chinese New Year.

Unusually poor seasonal recovery extended to the West, particularly in Europe, where soft underlying demand and continued destocking across multiple applications drove a 10 percent sequential decline in our volume. Sequential pricing deterioration across all three regions drove the sixth consecutive quarter of contraction in global acetic acid variable margin per ton despite moderation in raw material pricing.

As a result, variable margin from external sales of acetic acid in the second quarter represented the lowest percentage of total AC since the first quarter of 2016, a quarter in which our AC adjusted EBIT was lower by more than $75 million. Our team continues to demonstrate the ongoing lift in the foundational earnings power of AC and our ability to exercise our commercial and supply chain optionality.

The business identified and pivoted to capture additional sequential volume and earnings contributions from downstream derivatives including redispersible powders (RDP) and acetate tow. Our team also took decisive actions within the quarter to align our production with demand. As a result, within the quarter we lowered operating rates at some of our highest cost global facilities including Nanjing acetic acid and Frankfurt VAM. For our more regional products, such as European emulsions, we optimized across our four plants in the regional network by moving production from our highest to lowest cost facilities.

As we look to the third quarter, external conditions remain volatile. In the first half of July, acetic acid and VAM pricing recovered off of floors in China as a result of modestly improving demand and industry outages. China pricing has reversed course over the last few weeks despite ongoing industry outages. We are capturing a disproportionate share of demand as industry outages and turnarounds continue with AC July volume in China that was approximately 10 percent higher than any month year to date. We anticipate moderation in our August and September volumes as competitor capacity returns.

We will continue to take actions to align production to demand and to produce cost effectively within our global network. At the end of July we idled our Frankfurt VAM facility, currently the highest cost unit within our five-plant VAM network, and anticipate it will remain idle through at least the third quarter. We will restart Frankfurt VAM when global demand recovers sufficiently. In September we will also carry out a major turnaround at our Singapore acetic acid unit that will extend over a month and will contribute to an incremental $5 to $10 million in sequential turnaround expense.

Inclusive of these manufacturing actions as well as the cost actions I highlighted earlier, we anticipate third quarter AC adjusted EBIT of $310 to $350 million. Also included in this guidance is a sequential headwind of approximately $15 million due to lower sequential margin on certain contract pricing formulas that have a raw material lag, including acetate tow.

Our second half earnings forecast for AC no longer includes a $25 million contribution from the Clear Lake acetic acid expansion, including a previously anticipated $5 to $10 million third quarter contribution. After mechanical completion of the unit and during our commissioning process, our team identified defects in certain high-metallurgy components from the supplier's manufacturing process. These parts must be replaced before start-up. The recasting and quality control of new parts, shipment, installation, and restarted commissioning process will push the initial earnings contribution from the new Clear Lake acid unit into early 2024.

Despite a number of external challenges, we expect to deliver foundational adjusted EBIT of $1.3 billion in AC in 2023. The continued resilience of our earnings power in AC is demonstrated by average quarterly operating EBITDA margins of over 30 percent over the last 5 years, with margins greater than 25 percent in every quarter, including during COVID.

Engineered Materials (EM) delivered second quarter adjusted EBIT of $205 million and operating EBITDA of $317 million at margins of 13 and 20 percent, respectively. These results were inclusive of M&M contributions of $64 million and $132 million, respectively.

Second quarter profitability in EM was negatively impacted by soft demand and continued destocking across several end-markets which resulted in elevated competitive dynamics, pricing pressure, and unfavorable product mix. Earnings performance was also negatively impacted by a decision to more significantly reduce inventory and drive free cash flow in the quarter. Regardless of the drivers, this performance is very disappointing relative to our expectations earlier in the quarter.

EM second quarter volume increased by 2 percent sequentially as a result of a 7 percent increase in M&M and a 2 percent decrease in legacy EM. We did not see a typical seasonal lift in demand and our M&M volume recapture efforts were challenged by weak demand conditions and destocking. In legacy EM the poor underlying demand conditions were most acute in Europe and the Americas and across the industrial, and electrical and electronics (E&E) end-markets.

We saw demand softness across highly-differentiated applications impacting our mix for larger products including POM and PA66. Our commercial teams pivoted sales of these products to more standard applications where demand could be found. Such dynamics across these products and others resulted in significant unfavorable changes in sequential sales mix across total EM. We estimate that the total impact of this temporary shift to more standard business in the second quarter resulted in an unfavorable mix impact to earnings of approximately $35 million.

The impact of these demand conditions on competitive pricing pressure has been amplified by a falling raw material environment. What we are seeing currently in POM, for example, is representative of certain other products. Historically, POM global capacity utilization has been in the low to mid 80's and approached 90 percent post-COVID. Across the first half of 2023, we estimate global POM utilization in the low 70's, almost entirely driven by demand. We previously discussed how Asian-produced POM, which historically was consumed locally, is being temporarily exported to Europe at elevated levels. In the first quarter of 2023, combined POM exports from China, Malaysia, and Japan to Europe increased 5x (+12 kt) from the same quarter of 2019. Heightened competitive dynamics across POM and other products require our commercial teams to be more responsive in pricing, which contributed to a 5 percent sequential decline in EM pricing.

We continue to leverage our leading positions in medical and auto where we see demand resilience. For legacy EM, global auto volume was flat sequentially and slightly trailed global auto builds. This was largely due to some of the accelerated buying at the end of the first quarter that we previously discussed. In Asia, where our sequential auto build growth was strongest, our legacy EM sequential volume growth into auto exceeded builds.

Beyond our commercial efforts to find demand where it is and price competitively, we took meaningful actions to align our production and inventory with global demand. In the second quarter, we reduced EM inventory by over $200 million, more than double our original target for the quarter. Due to the definitive agreement to form the Nutrinova JV, $28 million of the inventory reduction in EM was the result of reclassifying the Food Ingredients inventory on the balance sheet as assets held for sale. Our team pushed particularly hard to expand our raw material and work in process inventory reduction. As a result of these efforts, despite a significantly larger reduction in total inventory, we were able to limit the unfavorable sequential earnings impact to roughly in line with the $30 to $35 million impact we forecasted previously.

External market conditions in EM remain challenging in the third quarter. We will continue to take cost actions, convert additional inventory to cash, and take the temporary production actions I described earlier. We anticipate third quarter EM volume will increase modestly versus the second quarter due to reduced destocking as well as share recovery efforts in M&M. Competitive dynamics will remain heightened across the quarter and we expect some degree of sequential pricing compression in order to maintain certain positions and to reduce inventory. EM inventory reductions across the third quarter will remain a sequential earnings headwind as our inventory reduction across the portfolio will be partially offset by a Vamac® production campaign. Contemplating these dynamics, we anticipate EM third quarter adjusted EBIT of $210 to $235 million.

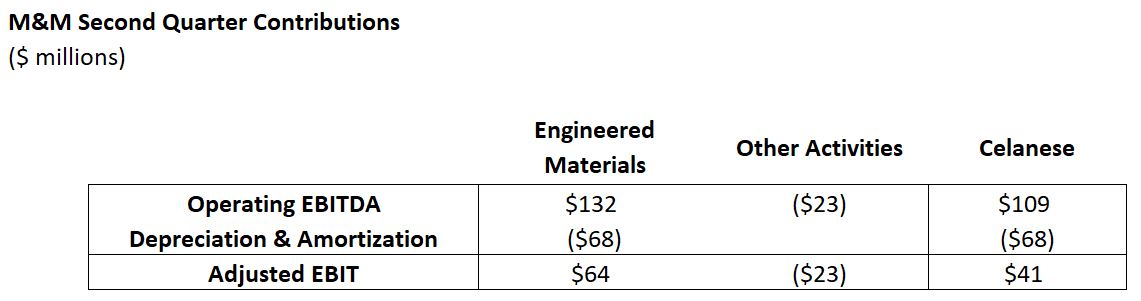

Transitioning to our acquisitions, the M&M business contributed $109 million to Celanese operating EBITDA in the second quarter, which was reflected in our reporting segments as a $132 million contribution to EM operating EBITDA and an alignment of $23 million in costs to Other Activities. The M&M business contributed $64 million to EM adjusted EBIT in the second quarter, inclusive of depreciation and approximately $30 million in quarterly transaction amortization.

While our team delivered a 14 percent sequential increase in the M&M operating EBITDA contribution in a difficult environment, these results came in below our expectations.

The sequential lift in earnings was unfavorably impacted by (1) our decision to more significantly reduce M&M inventory and (2) a challenging demand and competitive backdrop that diluted the immediate contributions from our commercial and synergy initiatives in the quarter.

Our intentional decision to more significantly drive inventory reduction in M&M resulted in stronger second quarter free cash flow and an approximately $10 million sequential earnings headwind in M&M. This included impacts from inventory fixed cost accounting as well as sales of certain older and higher-cost inventory at positive cash, negative EBIT.

Our team delivered an incremental $11 million in sequential synergies in the second quarter. These savings were realized from the actions we took to right-size our commercial and technical organizations in April as well as real estate, PA66 insourcing, procurement, and functional spend synergies. Second quarter synergies came in at the low-end of our expected range as demand conditions and inventory actions muted the impact of volume-correlated synergies in procurement, PA66 insourcing, logistics, and tax.

Looking forward, we expect a $25 to $35 million sequential lift in the third quarter operating EBITDA contribution from M&M. This sequential increase reflects an additional $10 to $15 million in synergies, incremental controllable cost and manufacturing actions, and modest volume growth due to volume recapture efforts and reduced destocking. We will continue to reduce inventory across the third quarter which will likely result in an earnings headwind roughly consistent with the second quarter.

To sum up the company-wide outlook for the third quarter, we expect contributions from controllable actions, reduced destocking, and continued improvement in M&M earnings to offset broad pricing pressure, unfavorable mix, and the impact of inventory reductions on earnings. We anticipate third quarter earnings of $2.00 to $2.50 per share, inclusive of approximately $0.30 per share of Mobility & Materials (M&M) transaction amortization. This guidance is also inclusive of anticipated third quarter net expenses of approximately $100 million in Other Activities.

Scott Richardson, Celanese Corporation, Chief Financial Officer

I thank our teams for executing against our cash generation initiatives across the second quarter to deliver $611 million in free cash flow. They reduced our second quarter inventory balances by $235 million in a tough demand environment, and despite the associated earnings headwind, delivered a sequential increase in adjusted earnings per share.

As a result, in the second quarter we reduced net debt by $515 million, including $386 million of debt retirement and a $129 million sequential increase in cash on hand. We repaid $370 million of the U.S. term loan which will mature later this year. We expect to pay off the remaining $130 million of that term loan very shortly using free cash flow.

We are at a critical inflection point as we come off of the peak in our leverage in the middle of this year and drive significant deleveraging across the back half of 2023. We expect our leverage metrics to improve across the second half on both net debt reduction as well as year over year EBITDA growth. We continue to progress rapidly on a number of initiatives that will support our deleveraging.

•We are preparing to close our Food Ingredients JV, Nutrinova, in the third quarter, subject to receiving regulatory approvals. We have filed for such approvals in five jurisdictions and qualified for simplified, fast track, or short-form review treatment where available. Once closed, we will immediately deploy approximately $450 million in transaction net proceeds to pay down debt.

•We have already reduced inventory balances by nearly $300 million across the first half of the year. This inventory initiative has added resilience to our 2023 free cash flow outlook despite macro instability.

•We continue to progress on the effective redomiciling of a portion of our U.S. terms loans by obtaining up to $700 million in new debt in China and repaying U.S. debt. When complete in the second half, we expect to capture the interest rate savings due to the difference in U.S. and China benchmark rates, which equates to around 300 basis points in savings.

•We are progressing on our restructuring work which should allow us to convert a portion of our U.S. dollar debt into Japanese yen in the second half to lower our blended borrowing rate and align our underlying business currency exposure to our debt mix.

•We continue to evaluate potential opportunistic divestitures which could accelerate our deleveraging.

In addition to these deleveraging and borrowing cost initiatives, we are also looking closely at opportunities to very cost effectively extend our debt maturity profile and effectively eliminate any further need to refinance for the next several years. As we have said previously, when we secured financing for the M&M acquisition last summer, we intentionally built a shorter-term debt maturity profile to avoid locking in abnormally wider spreads on longer-term debt and maintain flexibility to opportunistically refinance in the future. We believe current market conditions, including changes to the yield curve and improvement in credit spreads, potentially present an opportunity to extend our debt maturity profile without adding material incremental cost. We are prepared to move quickly on the right opportunities while maintaining ample flexibility in the debt profile to aggressively pay down debt and execute our deleveraging plan.

We remain committed to maintaining our investment grade credit rating. With expected 2023 free cash flow of approximately $1.3 billion and anticipated net proceeds of approximately $450 million from the Food Ingredients joint venture, I am fully confident that we will meaningfully exceed our full year deleveraging objective to reduce net debt by $1 billion in 2023.

We remain committed to executing against our earnings, cash generation, and deleveraging objectives. This concludes our prepared remarks. We look forward to discussing our second quarter results and addressing your questions.

Forward-Looking Statements

These prepared comments may contain "forward-looking statements," which include information concerning the Company's plans, objectives, goals, strategies, future revenues, cash flow, financial performance, synergies, capital expenditures, financing needs and other information that is not historical information. All forward-looking statements are based upon current expectations and beliefs and various assumptions. There can be no assurance that the Company will realize these expectations or that these beliefs will prove correct. There are a number of risks and uncertainties that could cause actual results to differ materially from the results expressed or implied in the forward-looking statements contained in these comments. These risks and uncertainties include, among other things: changes in general economic, business, political and regulatory conditions in the countries or regions in which we operate; volatility or changes in the price and availability of raw materials and energy, particularly changes in the demand for, supply of, and market prices of ethylene, methanol, natural gas, wood pulp and fuel oil and the prices for electricity and other energy sources; the length and depth of product and industry business cycles, particularly in the automotive, electrical, mobility, textiles, medical, electronics and construction industries; the ability to pass increases in raw material prices, logistics costs and other costs on to customers or otherwise improve margins through price increases; the accuracy or inaccuracy of our beliefs or assumptions regarding anticipated benefits of the acquisition (the "M&M Acquisition") by us of the majority of the Mobility & Materials business (the "M&M Business") of DuPont de Nemours, Inc.; the possibility that we will not be able to realize all of the anticipated improvements in the M&M Business's financial performance — including optimizing pricing, currency mix and inventory — or realize all of the anticipated benefits of the M&M Acquisition, including synergies and growth opportunities, within the anticipated timeframe, or at all, whether as a result of difficulties arising from the operation or integration of the M&M Business or other unanticipated delays, costs, inefficiencies or liabilities; increased commercial, legal or regulatory complexity of entering into, or expanding our exposure to, certain end markets and geographies; risks in the global economy and equity and credit markets and their potential impact on our ability to pay down debt in the future and/or refinance at suitable rates, in a timely manner, or at all; diversion of management's attention from ongoing business operations and opportunities and other disruption caused by the M&M Acquisition and the integration processes and their impact on our existing business and relationships; risks and costs associated with increased leverage from the M&M Acquisition, including increased interest expense and potential reduction of business and strategic flexibility; the ability to maintain plant utilization rates and to implement planned capacity additions, expansions and maintenance; the ability to reduce or maintain their current levels of production costs and to improve productivity by implementing technological improvements to existing plants; increased price competition and the introduction of competing products by other companies; the ability to identify desirable potential acquisition or divestiture opportunities and to complete such transactions, including obtaining regulatory approvals, consistent with the Company's strategy; market acceptance of our products and technology; compliance and other costs and potential disruption or interruption of production or operations due to accidents, interruptions in sources of raw materials, transportation, logistics or supply chain disruptions, cybersecurity incidents, terrorism or political unrest, public health crises (including, but not limited to, the COVID-19 pandemic), or other unforeseen events or delays in construction or operation of facilities, including as a result of geopolitical conditions, the occurrence of acts of war (such as the Russia-Ukraine conflict) or terrorist incidents or as a result of weather, natural disasters, or other crises; the ability to obtain governmental approvals and to construct facilities on terms and schedules acceptable to the Company; changes in applicable tariffs, duties and trade agreements, tax rates or legislation throughout the world including, but not limited to, adjustments, changes in estimates or interpretations or the resolution of tax examinations or audits that may impact recorded or future tax impacts and potential regulatory and legislative tax developments in the United States and other jurisdictions; changes in the degree of intellectual property and other legal protection afforded to our products or technologies, or the theft of such intellectual property; potential liability for remedial actions and increased costs under existing or future environmental, health and safety regulations, including those relating to climate change or other sustainability matters; potential liability resulting from pending or future claims or litigation, including investigations or enforcement actions, or from changes in the laws, regulations or policies of governments or other governmental activities in the countries in which we operate; changes in currency exchange rates and interest rates; our level of indebtedness, which could diminish our ability to raise additional capital to fund operations or limit our ability to react to changes in the economy or the chemicals industry; tax rates and changes thereto; our ability to obtain regulatory approval for, and satisfy closing conditions to, any transactions described herein that have not closed; and various other factors discussed from time to time in the Company's filings with the Securities and Exchange Commission.

Any forward-looking statement speaks only as of the date on which it is made, and the Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances.

Results Unaudited

The results in this document, together with the adjustments made to present the results on a comparable basis, have not been audited and are based on internal financial data furnished to management. Quarterly results should not be taken as an indication of the results of operations to be reported for any subsequent period or for the full fiscal year.

Non-GAAP Financial Measures

These prepared comments, and statements made in connection with these prepared comments, refer to non-GAAP financial measures. For more information on the non-GAAP financial measures used by the Company, including the most directly comparable GAAP financial measure for each non-GAAP financial measure used, including definitions and reconciliations of the differences between such non-GAAP financial measures and the comparable GAAP financial measures, please refer to the Non-US GAAP Financial Measures and Supplemental Information document available on our website, investors.celanese.com, under Financial Information/Financial Document Library.

The Acetyl Chain (AC) generated second quarter adjusted EBIT of $332 million and operating EBITDA of $386 million at margins of 27 and 31 percent, respectively. Across the first half of the year, our AC team delivered performance entirely consistent with foundational adjusted EBIT of $1.3 billion a year, despite a macro environment that remains sub-foundational.

The Acetyl Chain (AC) generated second quarter adjusted EBIT of $332 million and operating EBITDA of $386 million at margins of 27 and 31 percent, respectively. Across the first half of the year, our AC team delivered performance entirely consistent with foundational adjusted EBIT of $1.3 billion a year, despite a macro environment that remains sub-foundational.  Transitioning to our acquisitions, the M&M business contributed $109 million to Celanese operating EBITDA in the second quarter, which was reflected in our reporting segments as a $132 million contribution to EM operating EBITDA and an alignment of $23 million in costs to Other Activities. The M&M business contributed $64 million to EM adjusted EBIT in the second quarter, inclusive of depreciation and approximately $30 million in quarterly transaction amortization.

Transitioning to our acquisitions, the M&M business contributed $109 million to Celanese operating EBITDA in the second quarter, which was reflected in our reporting segments as a $132 million contribution to EM operating EBITDA and an alignment of $23 million in costs to Other Activities. The M&M business contributed $64 million to EM adjusted EBIT in the second quarter, inclusive of depreciation and approximately $30 million in quarterly transaction amortization.

I thank our teams for executing against our cash generation initiatives across the second quarter to deliver $611 million in free cash flow. They reduced our second quarter inventory balances by $235 million in a tough demand environment, and despite the associated earnings headwind, delivered a sequential increase in adjusted earnings per share.

I thank our teams for executing against our cash generation initiatives across the second quarter to deliver $611 million in free cash flow. They reduced our second quarter inventory balances by $235 million in a tough demand environment, and despite the associated earnings headwind, delivered a sequential increase in adjusted earnings per share.