Document

Axos Financial, Inc. Reports Third Quarter Fiscal 2024 Results

LAS VEGAS, NV – (BUSINESS WIRE) – April 30, 2024 – Axos Financial, Inc. (NYSE: AX) (“Axos” or the “Company”) today announced unaudited financial results for the third fiscal quarter ended March 31, 2024. Net income was $110.7 million, an increase of 38.7% from $79.9 million for the quarter ended March 31, 2023. Diluted earnings per share (“EPS”) was $1.91, an increase of $0.59, or 44.7%, as compared to diluted earnings per share of $1.32 for the quarter ended March 31, 2023.

Adjusted earnings and adjusted earnings per diluted common share (“Adjusted EPS”), non-GAAP measures described further below, increased $30.8 million to $112.7 million and increased $0.59 to $1.94, respectively, for the quarter ended March 31, 2024, compared to $81.8 million and $1.35, respectively, for the quarter ended March 31, 2023.

Third Quarter Fiscal 2024 Financial Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

| (Dollars in thousands, except per share data) |

2024 |

|

2023 |

|

% Change |

| Net interest income |

$ |

261,606 |

|

|

$ |

198,982 |

|

|

31.5 |

% |

| Non-interest income |

$ |

33,163 |

|

|

$ |

32,246 |

|

|

2.8 |

% |

| Net income |

$ |

110,720 |

|

|

$ |

79,850 |

|

|

38.7 |

% |

Adjusted earnings (Non-GAAP)1 |

$ |

112,655 |

|

|

$ |

81,832 |

|

|

37.7 |

% |

| Diluted EPS |

$ |

1.91 |

|

|

$ |

1.32 |

|

|

44.7 |

% |

Adjusted EPS (Non-GAAP)1 |

$ |

1.94 |

|

|

$ |

1.35 |

|

|

43.7 |

% |

1 See “Use of Non-GAAP Financial Measures” |

|

|

|

|

|

For the nine months ended March 31, 2024, net income was $345.1 million, an increase of 57.0% from net income of $219.8 million for the nine months ended March 31, 2023. Diluted earnings per share were $5.88 for the nine months ended March 31, 2024, an increase of $2.25, or 62.0%, as compared to diluted earnings per share of $3.63 for the nine months ended March 31, 2023.

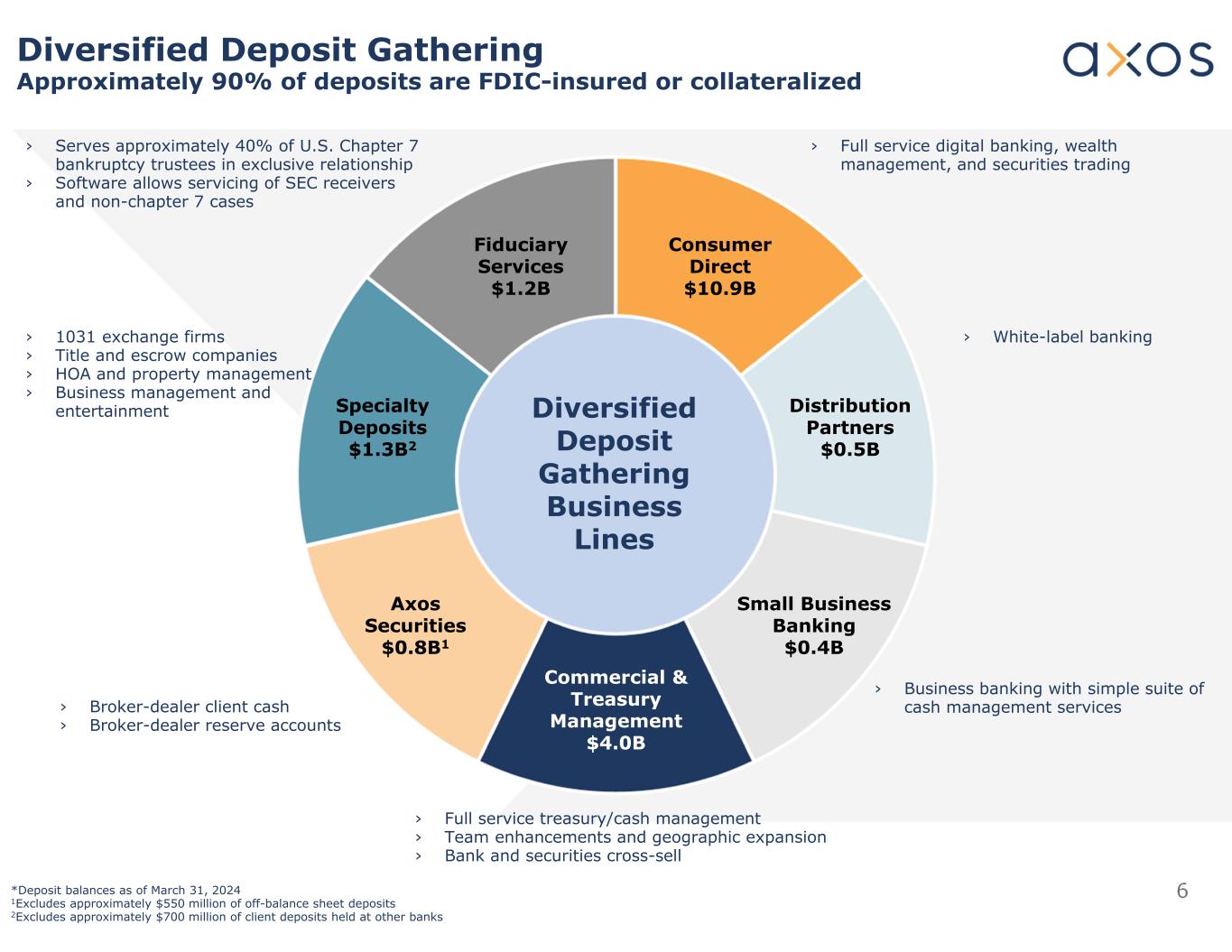

“We delivered strong earnings per share and book value per share growth, driven by a 14% sequential increase in net interest income and a 5% sequential increase in non-interest income, ex-last quarter’s one-time gain on the FDIC Loan Purchase” stated Greg Garrabrants, President and Chief Executive Officer of Axos. “We generated double-digit deposit growth year-over-year and linked-quarter annualized as a result of our diversified channels across consumer and commercial banking. Despite continued cash sorting declines in our custody business, average non-interest bearing deposit balances increased 2.6% linked quarter, driven by a 7% sequential increase in the number of non-interest bearing deposit accounts.”

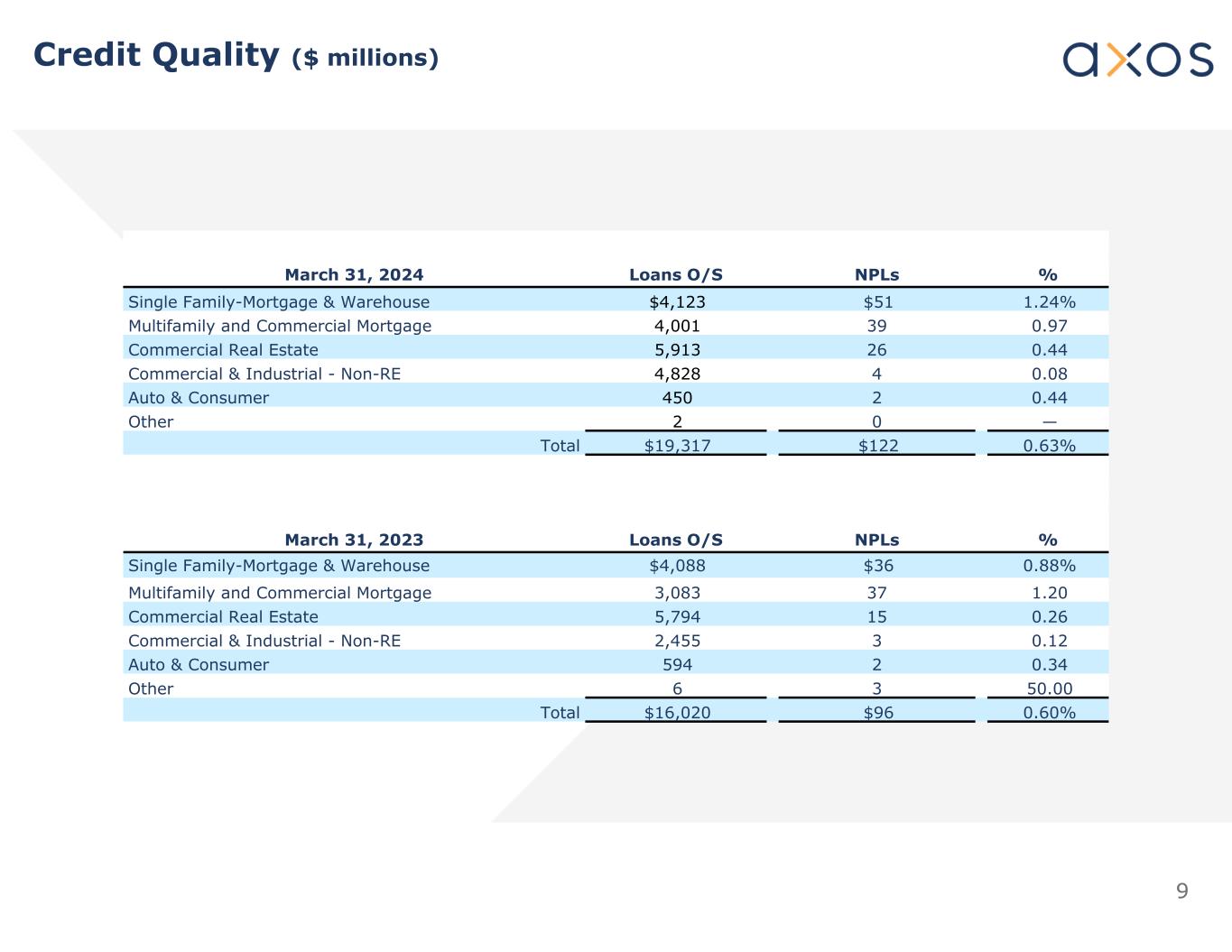

“Our asset-based lending at low loan-to-values credit philosophy continues to serve us well, with non-performing assets remaining relatively stable” stated Derrick Walsh, Executive Vice President and Chief Financial Officer of Axos. “We continue to generate excess capital due to our strong returns and net interest margin, with a return on average common stockholders’ equity of 20.71% and a return on average assets of 1.98% in the three months ended March 31, 2024. Our strong capital position allows us to balance organic growth and opportunistic asset, business and talent acquisition with common share repurchases.”

Other Highlights

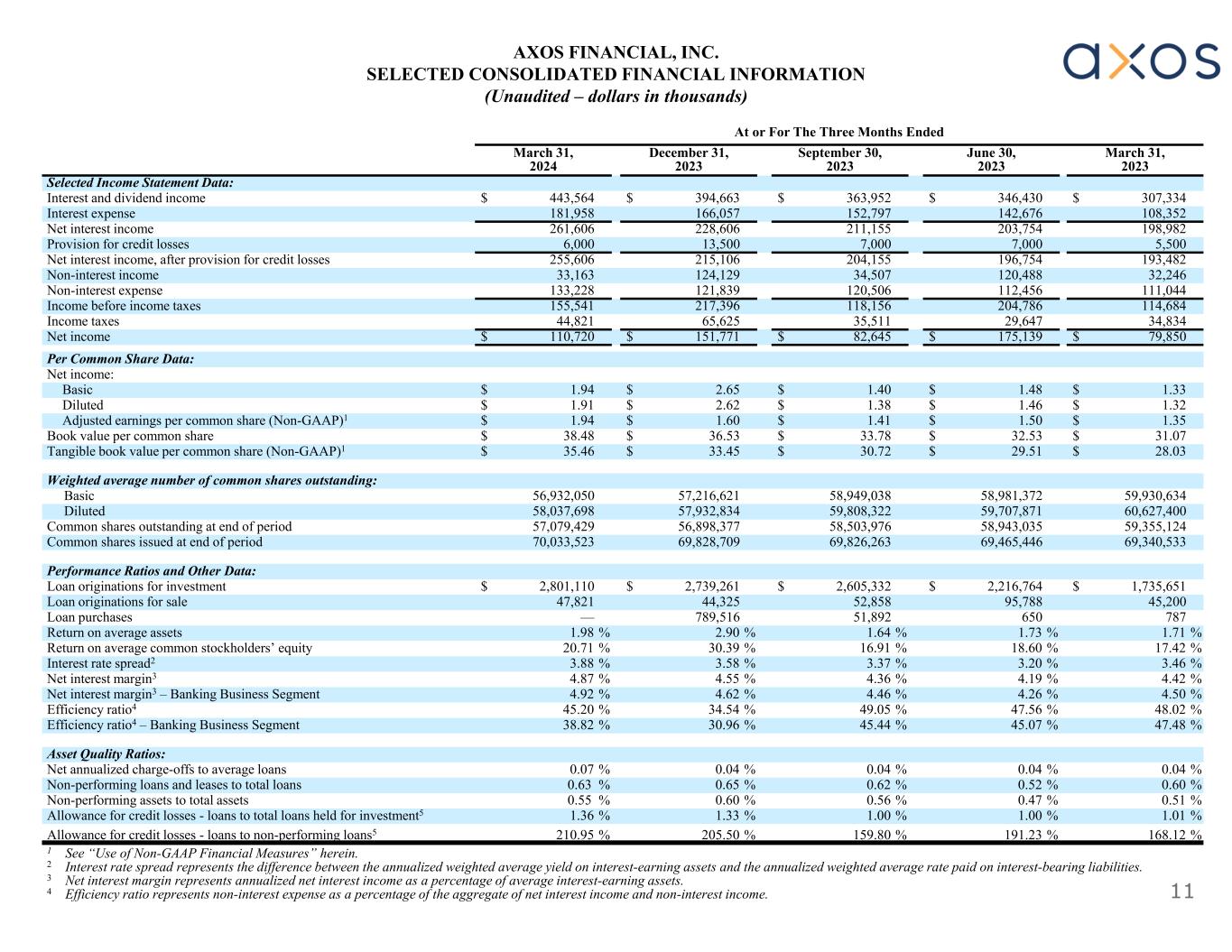

•Net interest margin was 4.87% for the quarter ended March 31, 2024 compared to 4.42% for the quarter ended March 31, 2023

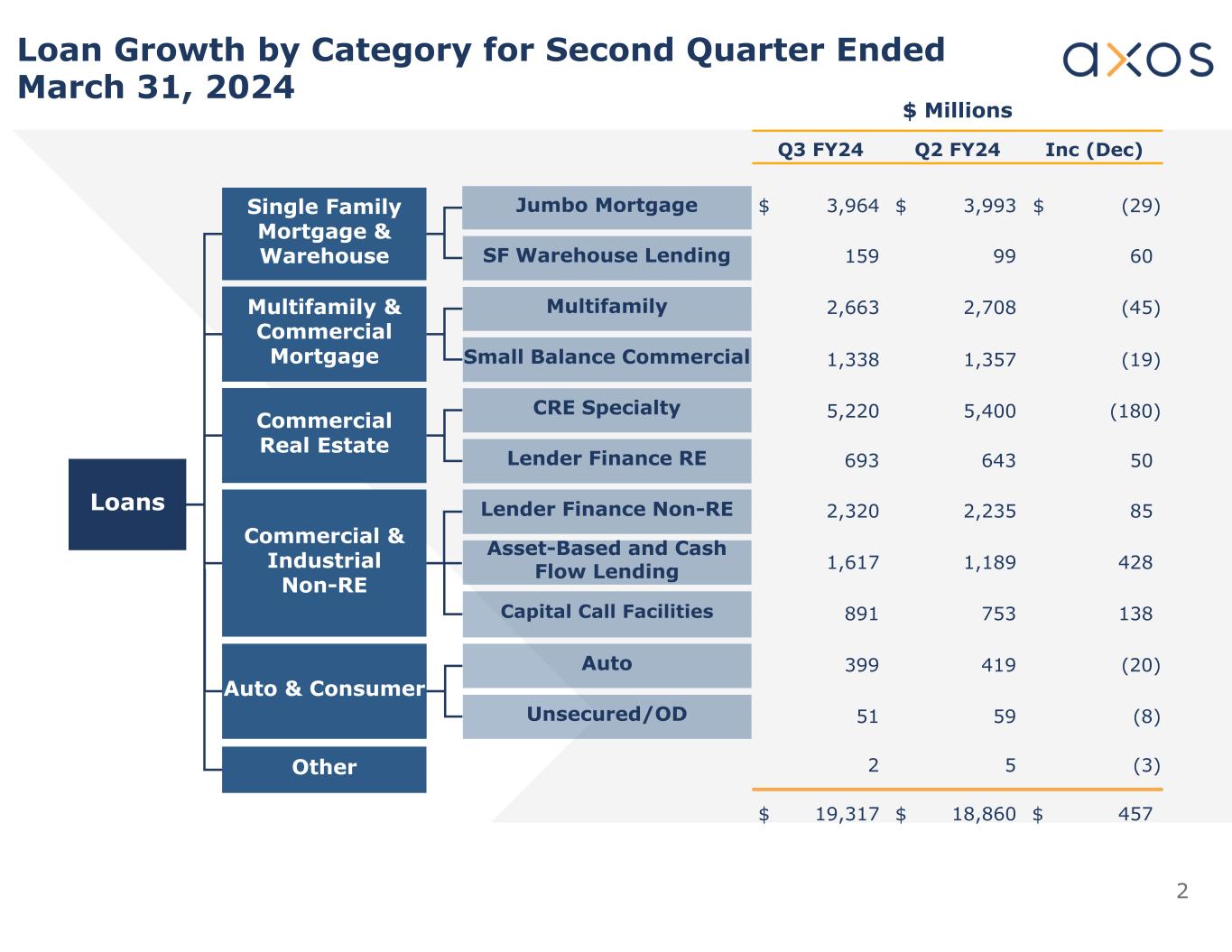

•Net loans for investment totaled $18.7 billion at March 31, 2024, an increase of $0.5 billion, or 10.3% annualized, from $18.3 billion at December 31, 2023

•Total deposits were $19.1 billion at March 31, 2024, an increase of $2.0 billion, or 15.4% annualized, from $17.1 billion at June 30, 2023; total savings, checking and other demand deposits were $18.1 billion at March 31, 2024, up from $14.9 billion at March 31, 2023

•Approximately 90% of total deposits were FDIC-insured or collateralized at March 31, 2024

•Total capital to risk-weighted assets was 13.49% for Axos Bank at March 31, 2024, up from 12.50% at June 30, 2023

•Book value increased to $38.48 per share, from $31.07 at March 31, 2023, an increase of 23.8%

Third Quarter Fiscal 2024 Income Statement Summary

Net income was $110.7 million and earnings per diluted common share was $1.91 for the three months ended March 31, 2024, compared to net income of $79.9 million and earnings per diluted common share of $1.32 for the three months ended March 31, 2023. Net interest income increased $62.6 million or 31.5% for the three months ended March 31, 2024 compared to the three months ended March 31, 2023, primarily due to an increase in interest income from loans attributable to higher rates earned and higher average balances, partially offset by higher rates paid and higher average interest-bearing deposit balances.

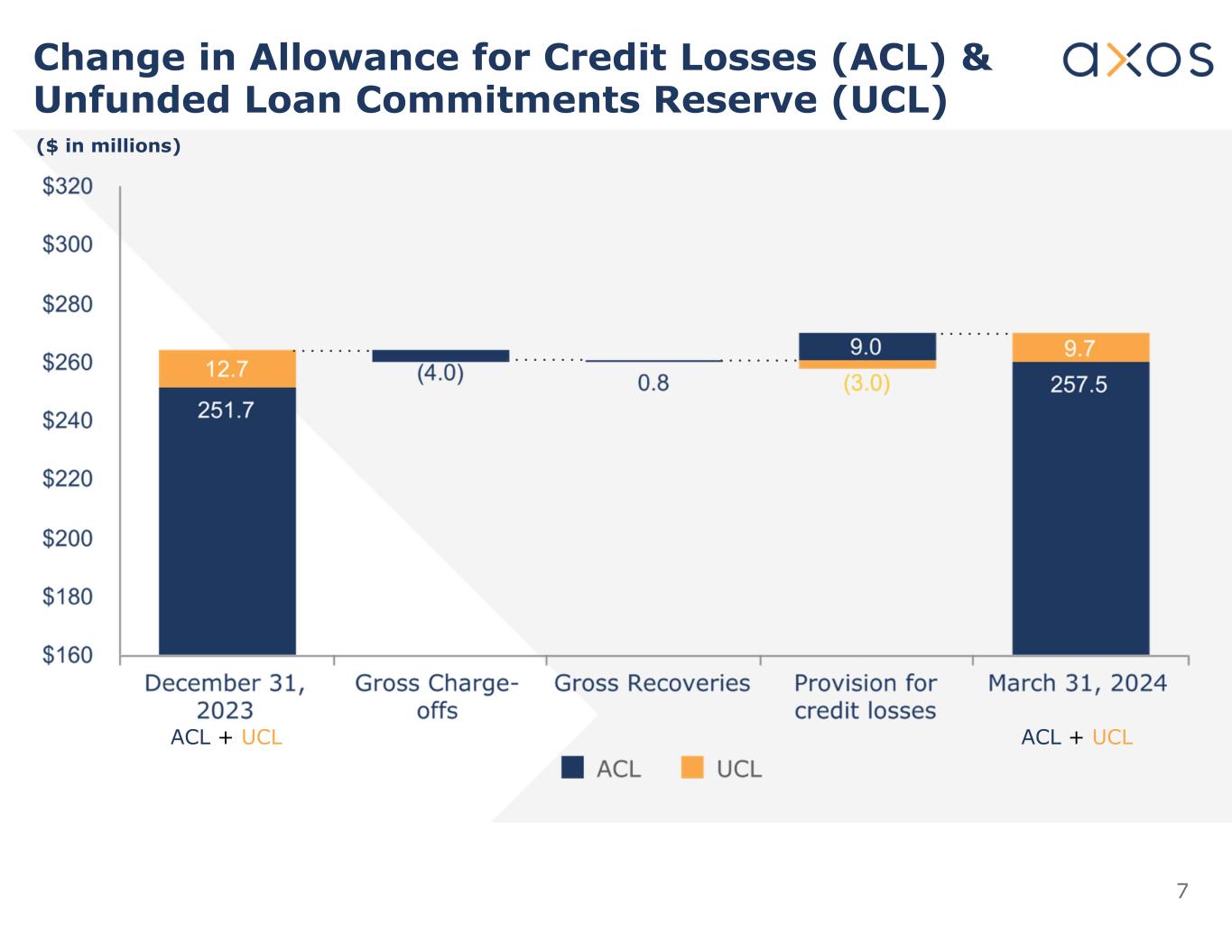

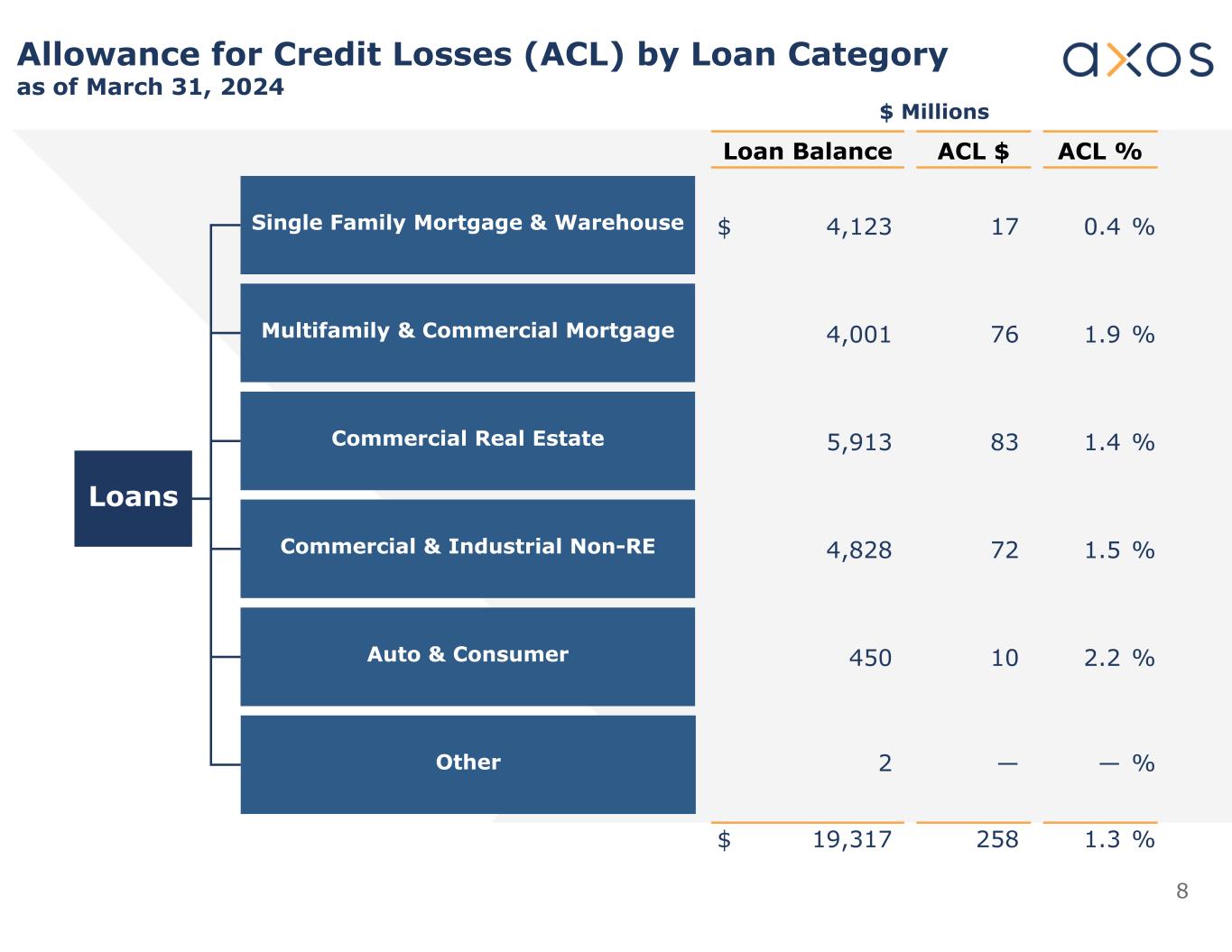

The provision for credit losses was $6.0 million for the three months ended March 31, 2024, compared to $5.5 million for the three months ended March 31, 2023. The provision for credit losses for the three months ended March 31, 2024, was primarily due to loan growth in the Commercial & Industrial - Non-RE portfolio and an increase in the Commercial Real Estate portfolio reflecting changes in the underlying macroeconomic variables.

Non-interest income increased to $33.2 million for the three months ended March 31, 2024, compared to $32.2 million for the three months ended March 31, 2023. The increase was primarily due to higher advisory fee income and higher mortgage banking and servicing rights income, partially offset by a decrease in broker-dealer fee income.

Non-interest expense, comprised of various operating expenses, increased $22.2 million to $133.2 million for the three months ended March 31, 2024 from $111.0 million for the three months ended March 31, 2023. The increase was primarily due to higher salaries and related costs, higher data and operational processing expenses and increased professional services expense, partially offset by a decrease in advertising and promotional expenses.

Balance Sheet Summary

Axos’ total assets increased by $2.3 billion, or 11.3%, to $22.6 billion, at March 31, 2024, from $20.3 billion at June 30, 2023, primarily due to an increase in loans. Total liabilities increased by $2.0 billion, or 10.9%, to $20.4 billion at March 31, 2024, from $18.4 billion at June 30, 2023, primarily due to an increase in deposits. Stockholders’ equity increased by $279.1 million, or 14.6%, to $2.2 billion at March 31, 2024 from $1.9 billion at June 30, 2023, primarily due to net income of $345.1 million, partially offset by purchases of common stock of $83.8 million under the share repurchase program.

Conference Call

A conference call and webcast will be held on Tuesday, April 30, 2024 at 5:00 PM Eastern / 2:00 PM Pacific. Analysts and investors may dial in and participate in the question/answer session. To access the call, please dial: 877-407-8293. The conference call will be webcast live, and both the webcast and the earnings supplement may be accessed at Axos’ website, investors.axosfinancial.com. For those unable to listen to the live broadcast, a replay will be available until May 30, 2024, at Axos’ website and telephonically by dialing toll-free number 877-660-6853, passcode 13745514.

About Axos Financial, Inc. and Subsidiaries

Axos Financial, Inc., with approximately $22.6 billion in consolidated assets as of March 31, 2024, is the holding company for Axos Bank, Axos Clearing LLC and Axos Invest, Inc. Axos Bank provides consumer and business banking products nationwide through its low-cost distribution channels and affinity partners. Axos Clearing LLC (including its business division Axos Advisor Services), with approximately $35.0 billion of assets under custody and/or administration as of March 31, 2024, and Axos Invest, Inc., provide comprehensive securities clearing services to introducing broker-dealers and registered investment advisor correspondents, and digital investment advisory services to retail investors, respectively. Axos Financial, Inc.’s common stock is listed on the NYSE under the symbol “AX” and is a component of the Russell 2000® Index, the S&P SmallCap 600® Index, the KBW Nasdaq Financial Technology Index, and the Travillian Tech-Forward Bank Index. For more information on Axos Financial, Inc., please visit http://investors.axosfinancial.com.

Segment Reporting

The Company operates through two segments: Banking Business and Securities Business. In order to reconcile the two segments to the consolidated totals, the Company includes parent-only activities and intercompany eliminations. Inter-segment transactions are eliminated in consolidation and primarily include non-interest income earned by the Securities Business segment and non-interest expense incurred by the Banking Business segment for cash sorting fees related to deposits sourced from Securities Business segment customers, as well as interest expense paid by the Banking Business segment to each of the wholly-owned subsidiaries of the Company and to the Company itself for their operating cash held on deposit with the Business Banking segment.

The following tables present the operating results of the segments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended March 31, 2024 |

| (Dollars in thousands) |

Banking

Business |

|

Securities Business |

|

Corporate/Eliminations |

|

Axos Consolidated |

| Net interest income |

$ |

258,435 |

|

|

$ |

7,133 |

|

|

$ |

(3,962) |

|

|

$ |

261,606 |

|

| Provision for credit losses |

6,000 |

|

|

— |

|

|

— |

|

|

6,000 |

|

| Non-interest income |

11,908 |

|

|

32,746 |

|

|

(11,491) |

|

|

33,163 |

|

| Non-interest expense |

104,959 |

|

|

32,488 |

|

|

(4,219) |

|

|

133,228 |

|

| Income before income taxes |

$ |

159,384 |

|

|

$ |

7,391 |

|

|

$ |

(11,234) |

|

|

$ |

155,541 |

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended March 31, 2023 |

| (Dollars in thousands) |

Banking

Business |

|

Securities Business |

|

Corporate/Eliminations |

|

Axos Consolidated |

| Net interest income |

$ |

196,249 |

|

|

$ |

6,335 |

|

|

$ |

(3,602) |

|

|

$ |

198,982 |

|

| Provision for credit losses |

5,500 |

|

|

— |

|

|

— |

|

|

5,500 |

|

| Non-interest income |

10,685 |

|

|

38,298 |

|

|

(16,737) |

|

|

32,246 |

|

| Non-interest expense |

98,252 |

|

|

25,138 |

|

|

(12,346) |

|

|

111,044 |

|

| Income before income taxes |

$ |

103,182 |

|

|

$ |

19,495 |

|

|

$ |

(7,993) |

|

|

$ |

114,684 |

|

|

|

|

|

|

|

|

|

|

For the Nine Months Ended March 31, 2024 |

| (Dollars in thousands) |

Banking

Business |

|

Securities Business |

|

Corporate/Eliminations |

|

Axos Consolidated |

| Net interest income |

$ |

694,289 |

|

|

$ |

18,755 |

|

|

$ |

(11,677) |

|

|

$ |

701,367 |

|

| Provision for credit losses |

26,500 |

|

|

— |

|

|

— |

|

|

26,500 |

|

| Non-interest income |

128,244 |

|

|

99,942 |

|

|

(36,387) |

|

|

191,799 |

|

| Non-interest expense |

308,027 |

|

|

87,979 |

|

|

(20,433) |

|

|

375,573 |

|

| Income before income taxes |

$ |

488,006 |

|

|

$ |

30,718 |

|

|

$ |

(27,631) |

|

|

$ |

491,093 |

|

|

|

|

|

|

|

|

|

|

For the Nine Months Ended March 31, 2023 |

| (Dollars in thousands) |

Banking

Business |

|

Securities Business |

|

Corporate/Eliminations |

|

Axos Consolidated |

| Net interest income |

$ |

574,524 |

|

|

$ |

15,486 |

|

|

$ |

(10,643) |

|

|

$ |

579,367 |

|

| Provision for credit losses |

17,251 |

|

|

— |

|

|

— |

|

|

17,251 |

|

| Non-interest income |

31,954 |

|

|

103,467 |

|

|

(47,638) |

|

|

87,783 |

|

| Non-interest expense |

295,831 |

|

|

74,924 |

|

|

(35,597) |

|

|

335,158 |

|

| Income before income taxes |

$ |

293,396 |

|

|

$ |

44,029 |

|

|

$ |

(22,684) |

|

|

$ |

314,741 |

|

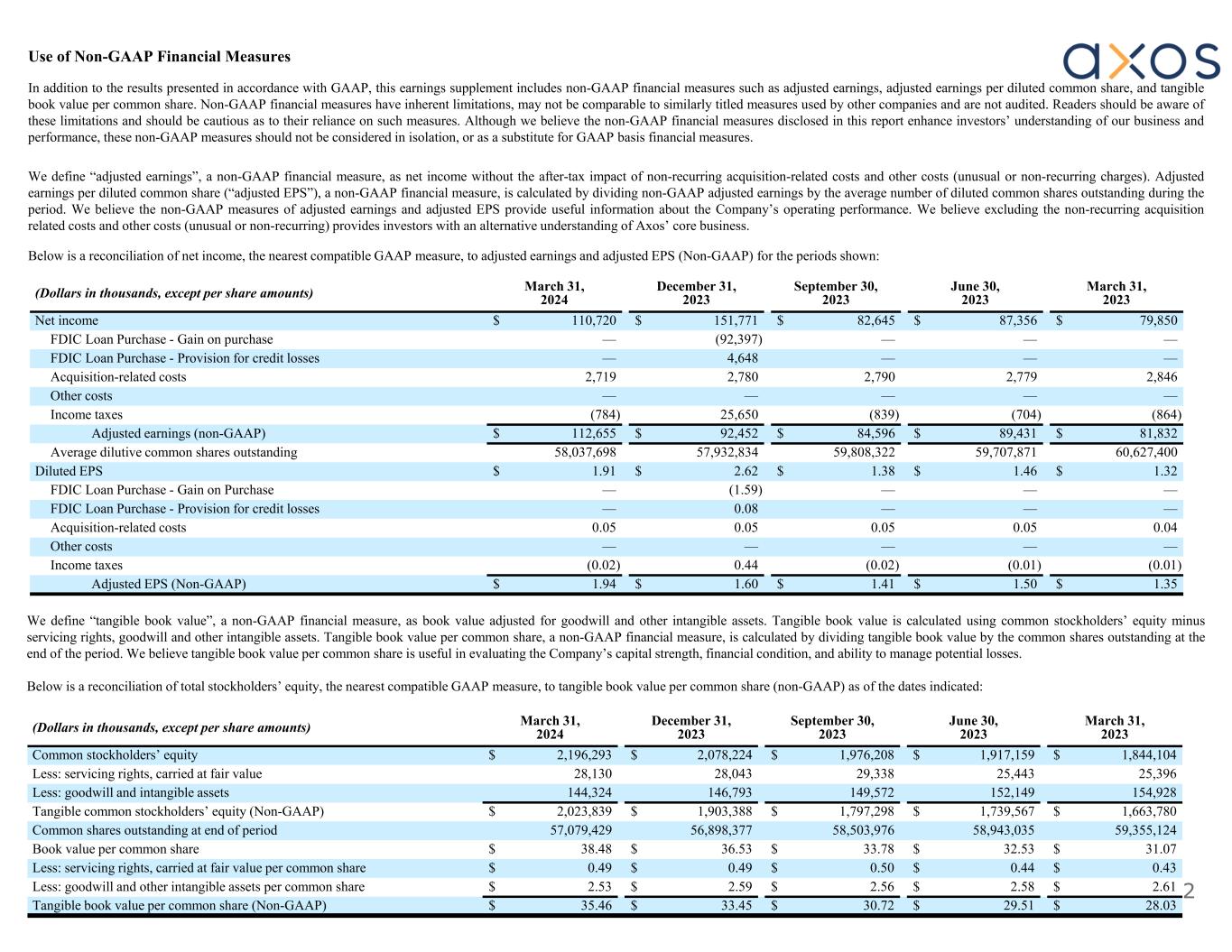

Use of Non-GAAP Financial Measures

In addition to the results presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”), this release includes non-GAAP financial measures such as adjusted earnings, adjusted earnings per diluted common share, and tangible book value per common share. Non-GAAP financial measures have inherent limitations, may not be comparable to similarly titled measures used by other companies and are not audited. Readers should be aware of these limitations and should be cautious as to their reliance on such measures. Although we believe the non-GAAP financial measures disclosed in this release enhance investors’ understanding of our business and performance, these non-GAAP measures should not be considered in isolation, or as a substitute for GAAP basis financial measures.

We define “adjusted earnings”, a non-GAAP financial measure, as net income without the after-tax impact of non-recurring acquisition-related items (including amortization of intangible assets related to acquisitions and certain gains and provisions resulting from the Company’s FDIC Loan Purchase) and other costs (unusual or non-recurring charges). Adjusted EPS, a non-GAAP financial measure, is calculated by dividing non-GAAP adjusted earnings by the average number of diluted common shares outstanding during the period. We believe the non-GAAP measures of adjusted earnings and Adjusted EPS provide useful information about Axos’ operating performance. We believe excluding the non-recurring acquisition-related costs, and other costs provides investors with an alternative understanding of Axos’ core business.

Below is a reconciliation of net income, the nearest compatible GAAP measure, to adjusted earnings and adjusted EPS (Non-GAAP) for the periods shown:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

March 31, |

|

March 31, |

| (Dollars in thousands, except per share amounts) |

2024 |

|

2023 |

|

2024 |

|

2023 |

| Net income |

$ |

110,720 |

|

|

$ |

79,850 |

|

|

$ |

345,136 |

|

|

$ |

219,809 |

|

FDIC Loan Purchase - Gain on purchase1 |

— |

|

|

— |

|

|

(92,397) |

|

|

— |

|

FDIC Loan Purchase - Provision for credit losses1 |

— |

|

|

— |

|

|

4,648 |

|

|

— |

|

| Acquisition-related costs |

2,719 |

|

|

2,846 |

|

|

8,289 |

|

|

8,169 |

|

Other costs2 |

— |

|

|

— |

|

|

— |

|

|

16,000 |

|

| Income tax effect |

(784) |

|

|

(864) |

|

|

23,616 |

|

|

(7,290) |

|

| Adjusted earnings (Non-GAAP) |

$ |

112,655 |

|

|

$ |

81,832 |

|

|

$ |

289,292 |

|

|

$ |

236,688 |

|

|

|

|

|

|

|

|

|

| Average dilutive common shares outstanding |

58,037,698 |

|

|

60,627,400 |

|

|

58,707,815 |

|

|

60,595,414 |

|

|

|

|

|

|

|

|

|

| Diluted EPS |

$ |

1.91 |

|

|

$ |

1.32 |

|

|

$ |

5.88 |

|

|

$ |

3.63 |

|

FDIC Loan Purchase - Gain on purchase1 |

— |

|

|

— |

|

|

(1.57) |

|

|

— |

|

FDIC Loan Purchase - Provision for credit losses1 |

— |

|

|

— |

|

|

0.08 |

|

|

— |

|

| Acquisition-related costs |

0.05 |

|

|

0.04 |

|

|

0.14 |

|

|

0.13 |

|

Other costs2 |

— |

|

|

— |

|

|

— |

|

|

0.26 |

|

| Income tax effect |

(0.02) |

|

|

(0.01) |

|

|

0.40 |

|

|

(0.11) |

|

| Adjusted EPS (Non-GAAP) |

$ |

1.94 |

|

|

$ |

1.35 |

|

|

$ |

4.93 |

|

|

$ |

3.91 |

|

1 During the nine months ended March 31, 2024, the Company completed the purchase from the Federal Deposit Insurance Corporation (“FDIC”) of two performing commercial real estate and multi-family loan pools with a combined unpaid principal balance of approximately $1.25 billion at 63% of par value (the “FDIC Loan Purchase”). |

2 Other costs for the nine months ended March 31, 2023 reflect an accrual recorded in the first quarter of fiscal year 2024 as a result of an adverse legal judgement that has not been finalized. |

We define “tangible book value”, a non-GAAP financial measure, as book value adjusted for goodwill and other intangible assets. Tangible book value is calculated using common stockholders’ equity minus servicing rights, goodwill and other intangible assets. Tangible book value per common share, a non-GAAP financial measure, is calculated by dividing tangible book value by the common shares outstanding at the end of the period. We believe tangible book value per common share is useful in evaluating the Company’s capital strength, financial condition, and ability to manage potential losses.

Below is a reconciliation of total stockholders’ equity, the nearest compatible GAAP measure, to tangible book value per common share (non-GAAP) as of the dates indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, |

| (Dollars in thousands, except per share amounts) |

2024 |

|

2023 |

| Common stockholders’ equity |

$ |

2,196,293 |

|

|

$ |

1,844,104 |

|

| Less: servicing rights, carried at fair value |

28,130 |

|

|

25,396 |

|

| Less: goodwill and intangible assets—net |

144,324 |

|

|

154,928 |

|

| Tangible common stockholders’ equity (Non-GAAP) |

$ |

2,023,839 |

|

|

$ |

1,663,780 |

|

|

|

|

|

| Common shares outstanding at end of period |

57,079,429 |

|

|

59,355,124 |

|

|

|

|

|

| Book value per common share |

38.48 |

|

|

31.07 |

|

| Less: servicing rights, carried at fair value per common share |

0.49 |

|

|

0.43 |

|

| Less: goodwill and other intangible assets—net per common share |

2.53 |

|

|

2.61 |

|

| Tangible book value per common share (Non-GAAP) |

$ |

35.46 |

|

|

$ |

28.03 |

|

Forward-Looking Safe Harbor Statement

This press release contains forward-looking statements that involve risks and uncertainties, including without limitation statements relating to Axos’ financial prospects and other projections of its performance and asset quality, Axos’ deposit balances and capital ratios, Axos’ ability to continue to grow profitably and increase its business, Axos’ ability to continue to diversify its lending and deposit franchises, the anticipated timing and financial performance of other offerings, initiatives, and acquisitions, expectations of the environment in which Axos operates and projections of future performance. These forward-looking statements are made on the basis of the views and assumptions of management regarding future events and performance as of the date of this press release. Actual results and the timing of events could differ materially from those expressed or implied in such forward-looking statements as a result of risks and uncertainties, including without limitation Axos’ ability to successfully integrate acquisitions and realize the anticipated benefits of the transactions, changes in the interest rate environment, monetary policy, inflation, government regulation, general economic conditions, changes in the competitive marketplace, conditions in the real estate markets in which we operate, risks associated with credit quality, our ability to attract and retain deposits and access other sources of liquidity, and the outcome and effects of litigation and other factors beyond our control. These and other risks and uncertainties detailed in Axos’ periodic reports filed with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended June 30, 2023, could cause actual results to differ materially from those expressed or implied in any forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Axos undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. All written and oral forward-looking statements made in connection with this press release, which are attributable to us or persons acting on Axos’ behalf are expressly qualified in their entirety by the foregoing information.

Investor Relations Contact:

Johnny Lai, CFA

SVP, Corporate Development & Investor Relations

858-649-2218

jlai@axosfinancial.com

AXOS FINANCIAL, INC.

SELECTED CONSOLIDATED FINANCIAL INFORMATION

(Unaudited – dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31,

2024 |

|

June 30,

2023 |

|

March 31,

2023 |

| Selected Balance Sheet Data: |

|

|

|

|

|

| Total assets |

$ |

22,642,133 |

|

|

$ |

20,348,469 |

|

|

$ |

19,782,481 |

|

| Loans—net of allowance for credit losses |

18,733,455 |

|

|

16,456,728 |

|

|

15,836,255 |

|

| Loans held for sale, carried at fair value |

16,239 |

|

|

23,203 |

|

|

7,920 |

|

| Loans held for sale, lower of cost or fair value |

— |

|

|

776 |

|

|

303 |

|

| Allowance for credit losses |

257,522 |

|

|

166,680 |

|

|

161,293 |

|

| Trading securities |

592 |

|

|

758 |

|

|

400 |

|

| Available-for-sale securities |

207,582 |

|

|

232,350 |

|

|

279,612 |

|

|

|

|

|

|

|

| Securities borrowed |

105,853 |

|

|

134,339 |

|

|

87,293 |

|

| Customer, broker-dealer and clearing receivables |

292,630 |

|

|

374,074 |

|

|

323,359 |

|

| Total deposits |

19,103,532 |

|

|

17,123,108 |

|

|

16,738,869 |

|

|

|

|

|

|

|

| Advances from the Federal Home Loan Bank |

90,000 |

|

|

90,000 |

|

|

90,000 |

|

| Borrowings, subordinated notes and debentures |

330,389 |

|

|

361,779 |

|

|

334,330 |

|

| Securities loaned |

119,800 |

|

|

159,832 |

|

|

114,613 |

|

| Customer, broker-dealer and clearing payables |

387,176 |

|

|

445,477 |

|

|

406,092 |

|

| Total stockholders’ equity |

2,196,293 |

|

|

1,917,159 |

|

|

1,844,104 |

|

|

|

|

|

|

|

| Capital Ratios: |

|

|

|

|

|

| Equity to assets at end of period |

9.70 |

% |

|

9.42 |

% |

|

9.32 |

% |

| Axos Financial, Inc.: |

|

|

|

|

|

| Tier 1 leverage (to adjusted average assets) |

9.33 |

% |

|

8.96 |

% |

|

9.29 |

% |

| Common equity tier 1 capital (to risk-weighted assets) |

11.47 |

% |

|

10.94 |

% |

|

10.71 |

% |

| Tier 1 capital (to risk-weighted assets) |

11.47 |

% |

|

10.94 |

% |

|

10.71 |

% |

| Total capital (to risk-weighted assets) |

14.26 |

% |

|

13.82 |

% |

|

13.63 |

% |

| Axos Bank: |

|

|

|

|

|

| Tier 1 leverage (to adjusted average assets) |

9.86 |

% |

|

9.68 |

% |

|

10.17 |

% |

| Common equity tier 1 capital (to risk-weighted assets) |

12.47 |

% |

|

11.63 |

% |

|

11.55 |

% |

| Tier 1 capital (to risk-weighted assets) |

12.47 |

% |

|

11.63 |

% |

|

11.55 |

% |

| Total capital (to risk-weighted assets) |

13.49 |

% |

|

12.50 |

% |

|

12.40 |

% |

| Axos Clearing LLC: |

|

|

|

|

|

| Net capital |

$ |

102,963 |

|

|

$ |

35,221 |

|

|

$ |

79,459 |

|

| Excess capital |

$ |

97,646 |

|

|

$ |

29,905 |

|

|

$ |

74,377 |

|

| Net capital as a percentage of aggregate debit items |

38.73 |

% |

|

13.25 |

% |

|

31.27 |

% |

| Net capital in excess of 5% aggregate debit items |

$ |

89,671 |

|

|

$ |

21,930 |

|

|

$ |

66,755 |

|

AXOS FINANCIAL, INC.

SELECTED CONSOLIDATED FINANCIAL INFORMATION

(Unaudited – dollars in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of or for the

Three Months Ended

|

|

As of or for the

Nine Months Ended

|

|

March 31, |

|

March 31, |

| (Dollars in thousands, except per share data) |

2024 |

|

2023 |

|

2024 |

|

2023 |

| Selected Income Statement Data: |

|

|

|

|

|

|

|

| Interest and dividend income |

$ |

443,564 |

|

$ |

307,334 |

|

$ |

1,202,179 |

|

$ |

810,708 |

| Interest expense |

181,958 |

|

108,352 |

|

500,812 |

|

231,341 |

| Net interest income |

261,606 |

|

198,982 |

|

701,367 |

|

579,367 |

| Provision for credit losses |

6,000 |

|

5,500 |

|

26,500 |

|

17,251 |

| Net interest income, after provision for credit losses |

255,606 |

|

193,482 |

|

674,867 |

|

562,116 |

| Non-interest income |

33,163 |

|

32,246 |

|

191,799 |

|

87,783 |

| Non-interest expense |

133,228 |

|

111,044 |

|

375,573 |

|

335,158 |

| Income before income taxes |

155,541 |

|

114,684 |

|

491,093 |

|

314,741 |

| Income tax expense |

44,821 |

|

34,834 |

|

145,957 |

|

94,932 |

| Net income |

$ |

110,720 |

|

$ |

79,850 |

|

$ |

345,136 |

|

$ |

219,809 |

|

|

|

|

|

|

|

|

| Per Common Share Data: |

|

|

|

|

|

|

|

| Net income: |

|

|

|

|

|

|

|

| Basic |

$ |

1.94 |

|

$ |

1.33 |

|

$ |

5.98 |

|

$ |

3.67 |

| Diluted |

$ |

1.91 |

|

$ |

1.32 |

|

$ |

5.88 |

|

$ |

3.63 |

Adjusted earnings per common share (Non-GAAP)1 |

$ |

1.94 |

|

$ |

1.35 |

|

$ |

4.93 |

|

$ |

3.91 |

| Book value per common share |

$ |

38.48 |

|

$ |

31.07 |

|

$ |

38.48 |

|

$ |

31.07 |

Tangible book value per common share (Non-GAAP)1 |

$ |

35.46 |

|

$ |

28.03 |

|

$ |

35.46 |

|

$ |

28.03 |

|

|

|

|

|

|

|

|

| Weighted average number of common shares outstanding: |

|

|

|

|

|

|

|

| Basic |

56,932,050 |

|

59,930,634 |

|

57,699,236 |

|

59,928,263 |

| Diluted |

58,037,698 |

|

60,627,400 |

|

58,707,815 |

|

60,595,414 |

| Common shares outstanding at end of period |

57,079,429 |

|

59,355,124 |

|

57,079,429 |

|

59,355,124 |

| Common shares issued at end of period |

70,033,523 |

|

69,340,533 |

|

70,033,523 |

|

69,340,533 |

|

|

|

|

|

|

|

|

| Performance Ratios and Other Data: |

|

|

|

|

|

|

|

| Loan originations for investment |

$ |

2,801,110 |

|

$ |

1,735,651 |

|

$ |

8,145,703 |

|

$ |

6,235,451 |

| Loan originations for sale |

47,821 |

|

45,200 |

|

144,731 |

|

158,500 |

Loan purchases |

— |

|

787 |

|

841,408 |

|

914 |

| Return on average assets |

1.98 |

% |

|

1.71 |

% |

|

2.18 |

% |

|

1.60 |

% |

| Return on average common stockholders’ equity |

20.71 |

% |

|

17.42 |

% |

|

22.65 |

% |

|

16.73 |

% |

Interest rate spread2 |

3.88 |

% |

|

3.46 |

% |

|

3.62 |

% |

|

3.57 |

% |

Net interest margin3 |

4.87 |

% |

|

4.42 |

% |

|

4.61 |

% |

|

4.41 |

% |

Net interest margin3 – Banking Business Segment |

4.92 |

% |

|

4.50 |

% |

|

4.68 |

% |

|

4.56 |

% |

Efficiency ratio4 |

45.20 |

% |

|

48.02 |

% |

|

42.05 |

% |

|

50.24 |

% |

Efficiency ratio4 – Banking Business Segment |

38.82 |

% |

|

47.48 |

% |

|

37.45 |

% |

|

48.78 |

% |

|

|

|

|

|

|

|

|

| Asset Quality Ratios: |

|

|

|

|

|

|

|

| Net annualized charge-offs to average loans |

0.07 |

% |

|

0.04 |

% |

|

0.05 |

% |

|

0.04 |

% |

| Non-performing loans and leases to total loans |

0.63 |

% |

|

0.60 |

% |

|

0.63 |

% |

|

0.60 |

% |

| Non-performing assets to total assets |

0.54 |

% |

|

0.51 |

% |

|

0.54 |

% |

|

0.51 |

% |

| Allowance for credit losses - loans to total loans held for investment |

1.36 |

% |

|

1.01 |

% |

|

1.36 |

% |

|

1.01 |

% |

| Allowance for credit losses - loans to non-performing loans |

210.95 |

% |

|

168.12 |

% |

|

210.95 |

% |

|

168.12 |

% |

1 See “Use of Non-GAAP Financial Measures” herein.

2 Interest rate spread represents the difference between the annualized weighted average yield on interest-earning assets and the annualized weighted average

rate paid on interest-bearing liabilities.

3 Net interest margin represents annualized net interest income as a percentage of average interest-earning assets.

4 Efficiency ratio represents non-interest expense as a percentage of the aggregate of net interest income and non-interest income.