Document

News Release

22 West Washington Street Telephone: +1 312 696-6000

Chicago Facsimile: +1 312 696-6009

Illinois 60602

FOR IMMEDIATE RELEASE

Morningstar, Inc. Reports Third-Quarter 2025 Financial Results

CHICAGO, Oct. 29, 2025 - Morningstar, Inc. (Nasdaq: MORN), a leading provider of independent investment insights, reported third-quarter revenue growth with increases in operating and adjusted operating income and margins.

“Morningstar Credit delivered a standout quarter driven by strong performance across asset classes and regions, while Morningstar Direct Platform and PitchBook also contributed meaningfully to consolidated growth," said Kunal Kapoor, Morningstar's chief executive officer. "We continue to lay the foundation for durable growth with our planned acquisition of the Center for Research in Security Prices, which will position us as one of the largest index providers for public US equity index funds and provide scale for Morningstar Indexes. Other recent highlights included the introduction of our first medalist ratings on semiliquid funds, the launch of the Morningstar PitchBook US Modern Market 100 Index, and new collaborations to integrate our trusted data with leading generative AI platforms."

The Company completed its $500 million share repurchase program in October, bringing total shares repurchased for the year-to-date through Oct. 28 to 1,873,729 shares for $487.0 million, equivalent to approximately 4% of its outstanding shares as of Dec. 31, 2024. Its Board of Directors approved a new three-year program that authorizes the Company to repurchase up to $1 billion in shares of its outstanding common stock effective Oct. 31.

The Company's quarterly shareholder letter provides more context on its quarterly results and business performance and can be found at shareholders.morningstar.com.

Third-Quarter 2025 Financial Highlights

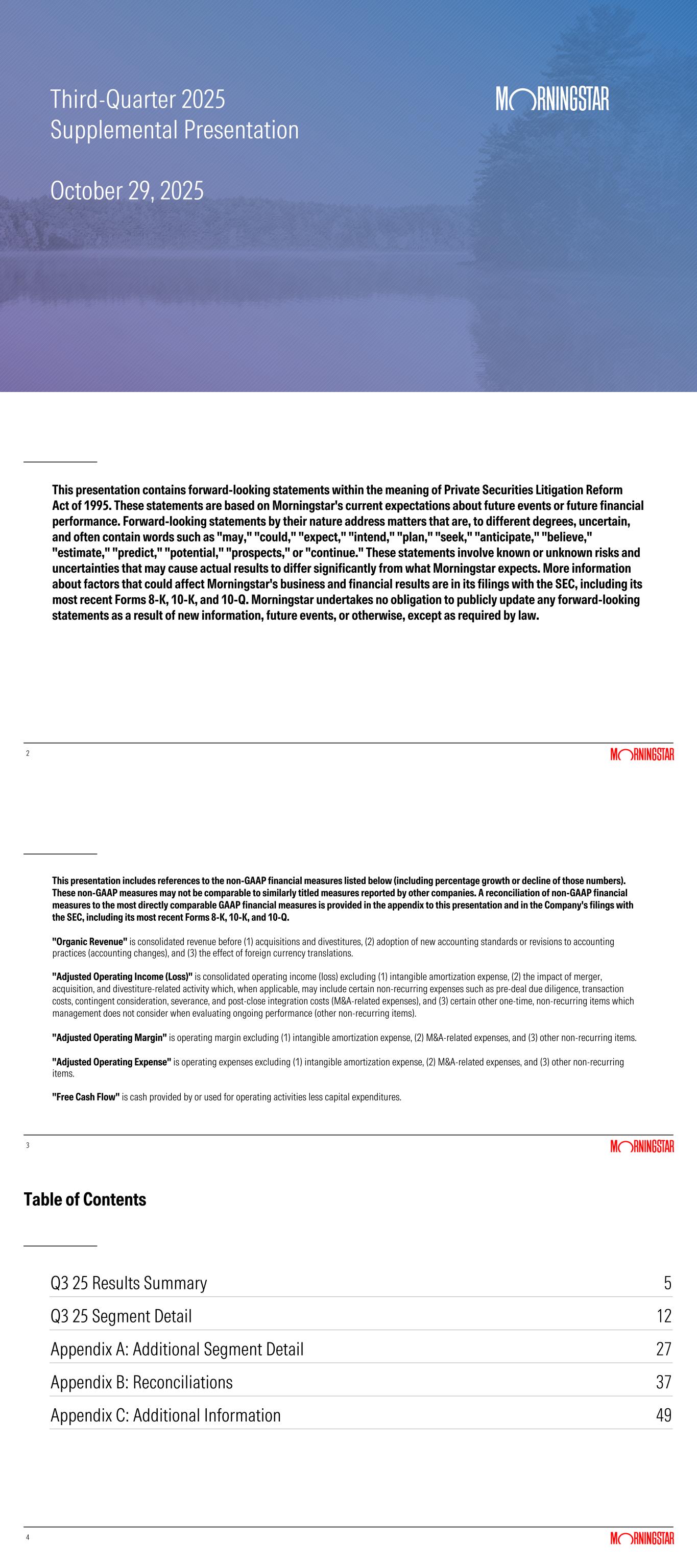

•Reported revenue increased 8.4% to $617.4 million compared to the prior-year period; organic revenue increased 9.0%.

•Reported operating income increased 10.6% to $127.8 million; adjusted operating income increased 15.6%.

•Diluted net income per share decreased 21.7% to $2.17; adjusted diluted net income per share increased 27.5% to $2.55. In the prior-year period, the gain related to the Company's sale of its Commodity and Energy Data business had a $1.05 impact on diluted net income per share.

•Cash provided by operating activities increased 2.0% to $195.7 million; free cash flow increased 2.8% to $160.1 million.

•Share repurchases settled totaled 686,512 shares for $170.1 million.

Year-To-Date Financial Highlights

•Reported revenue increased 7.1% to $1.8 billion compared to the prior-year period; organic revenue increased 8.0%.

•Reported operating income increased 15.9% to $367.0 million; adjusted operating income increased 15.4%.

•Diluted net income per share increased 3.6% to $6.08; adjusted diluted net income per share increased 24.7% to $7.18. In the prior-year period, the gain related to the Company's sale of its Commodity and Energy Data business had a $1.05 impact on diluted net income per share.

•Cash provided by operating activities decreased 12.0% to $385.7 million; free cash flow decreased 16.3% to $281.3 million. The decline in cash provided by operating activities and free cash flow was primarily driven by higher income tax and bonus payments compared to the prior-year period.

•Share repurchases settled totaled 1,453,153 shares for $391.7 million through Sept. 30; through Oct. 28, the Company settled an additional 420,576 share repurchases for $95.3 million bringing the total to 1,873,729 shares for $487.0 million.

Third-Quarter 2025 Results

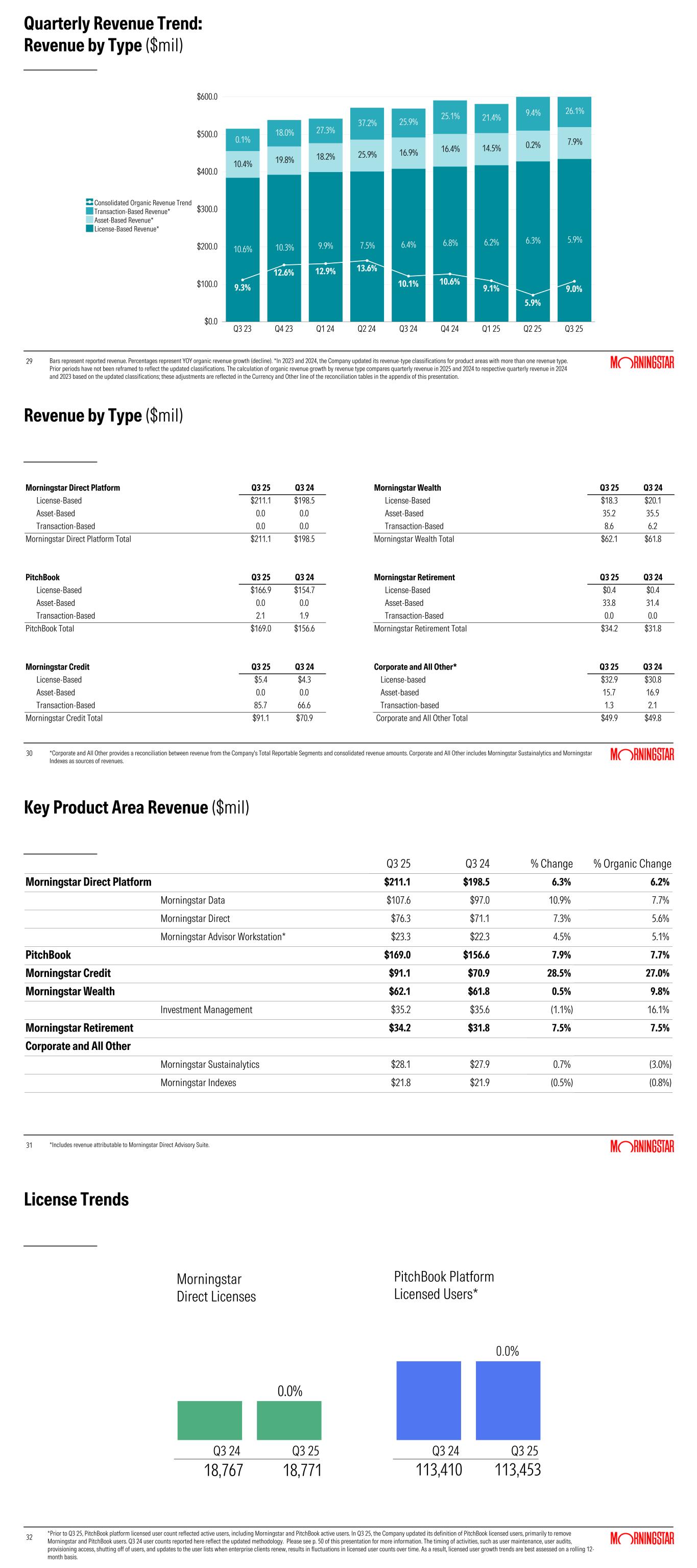

Revenue increased 8.4% to $617.4 million on a reported basis and 9.0% on an organic basis versus the prior-year period. Morningstar Credit, Morningstar Direct Platform, and PitchBook were the largest contributors to reported and organic revenue growth.

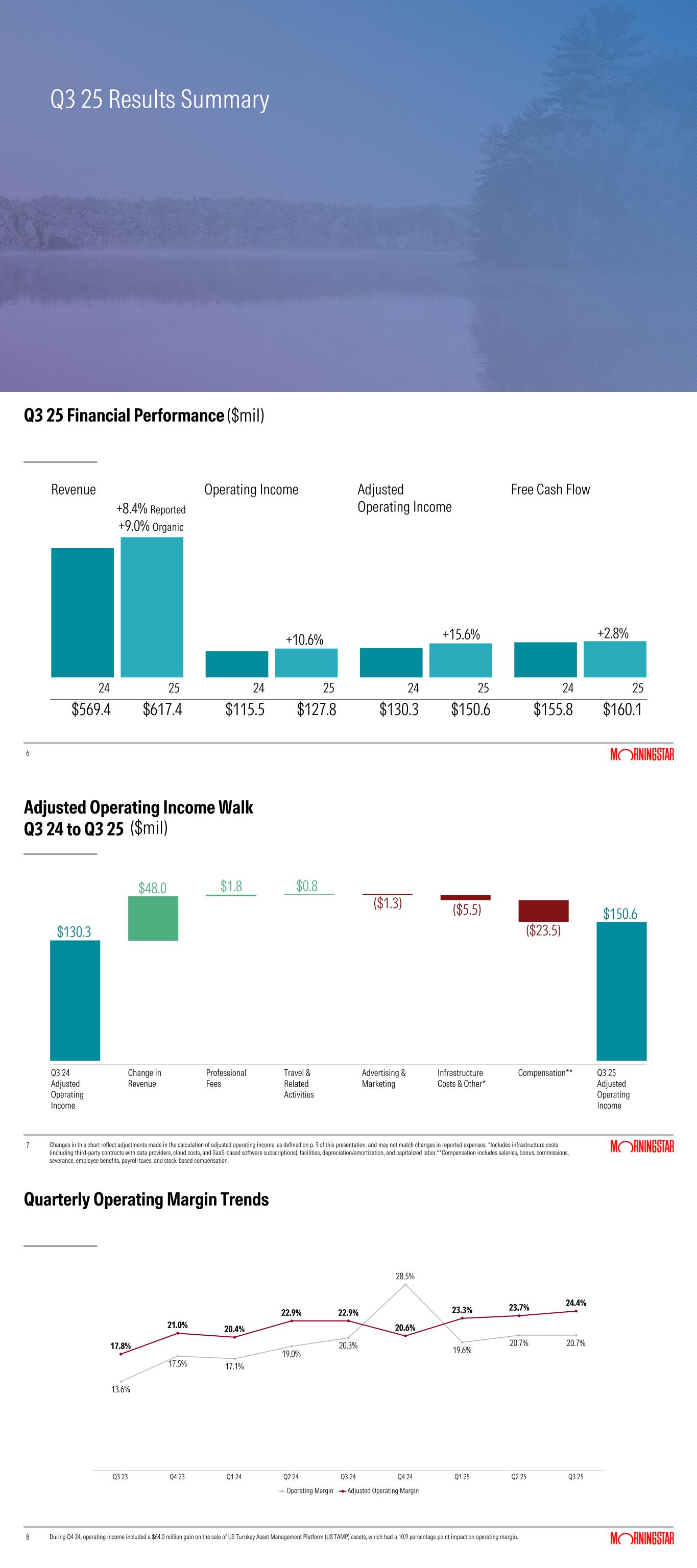

Operating expense increased 8.0% to $490.1 million versus the prior-year period. Excluding the impact of intangible amortization and M&A-related expenses, operating expense increased 6.3%.

Higher operating expense was largely driven by an increase of $29.3 million in compensation costs. In addition to higher salaries and benefits, the increase was driven by higher bonus and stock-based compensation, reflecting strong results relative to targets. Higher compensation costs also included $4.4 million in commissions and retention payments excluded from adjusted operating income related to the ongoing wind-down of Morningstar Office and the sunsetting of Morningstar Wealth's US Turnkey Asset Management Platform (US TAMP).

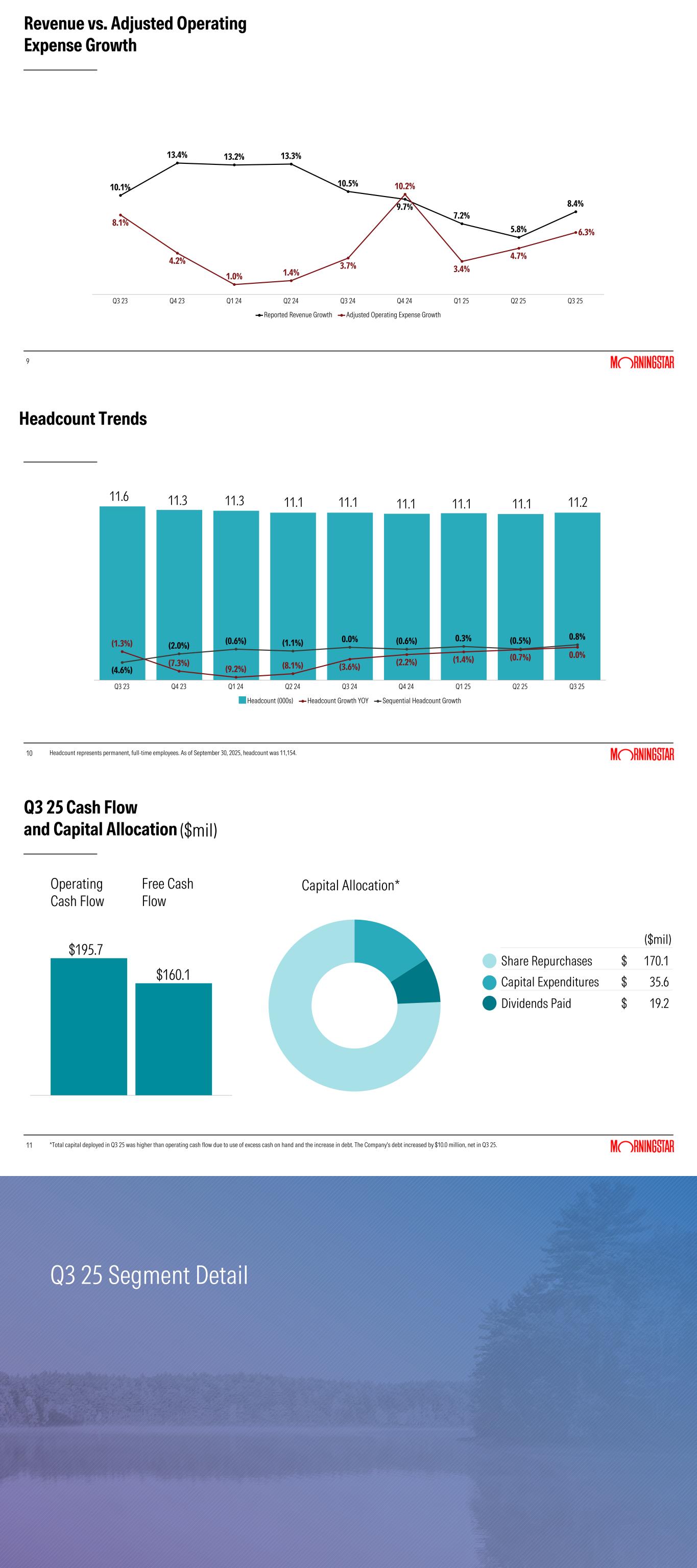

Third-quarter operating income increased 10.6% to $127.8 million. Adjusted operating income was $150.6 million, an increase of 15.6%. Third-quarter operating margin was 20.7%, compared with 20.3% in the prior-year period. Adjusted operating margin was 24.4% in the third quarter of 2025, versus 22.9% in the prior-year period.

Net income in the third quarter of 2025 was $91.6 million, or $2.17 per diluted share, compared with net income of $119.7 million, or $2.77 per diluted share, in the third quarter of 2024, a decrease of 21.7% on a per diluted share basis. In the prior-year period, the gain related to the Company's sale of its Commodity and Energy Data business had a $1.05 impact on diluted net income per share. Adjusted diluted net income per share increased 27.5% to $2.55 in the third quarter of 2025, compared with $2.00 in the prior-year period.

The Company's effective tax rate was 25.5% in the third quarter of 2025 compared to 19.8% in the prior-year period. The increase is primarily attributable to the book gain in excess of taxable gain on the sale of our Commodity and Energy Data business in the prior-year period.

Segment Highlights

Morningstar Direct Platform

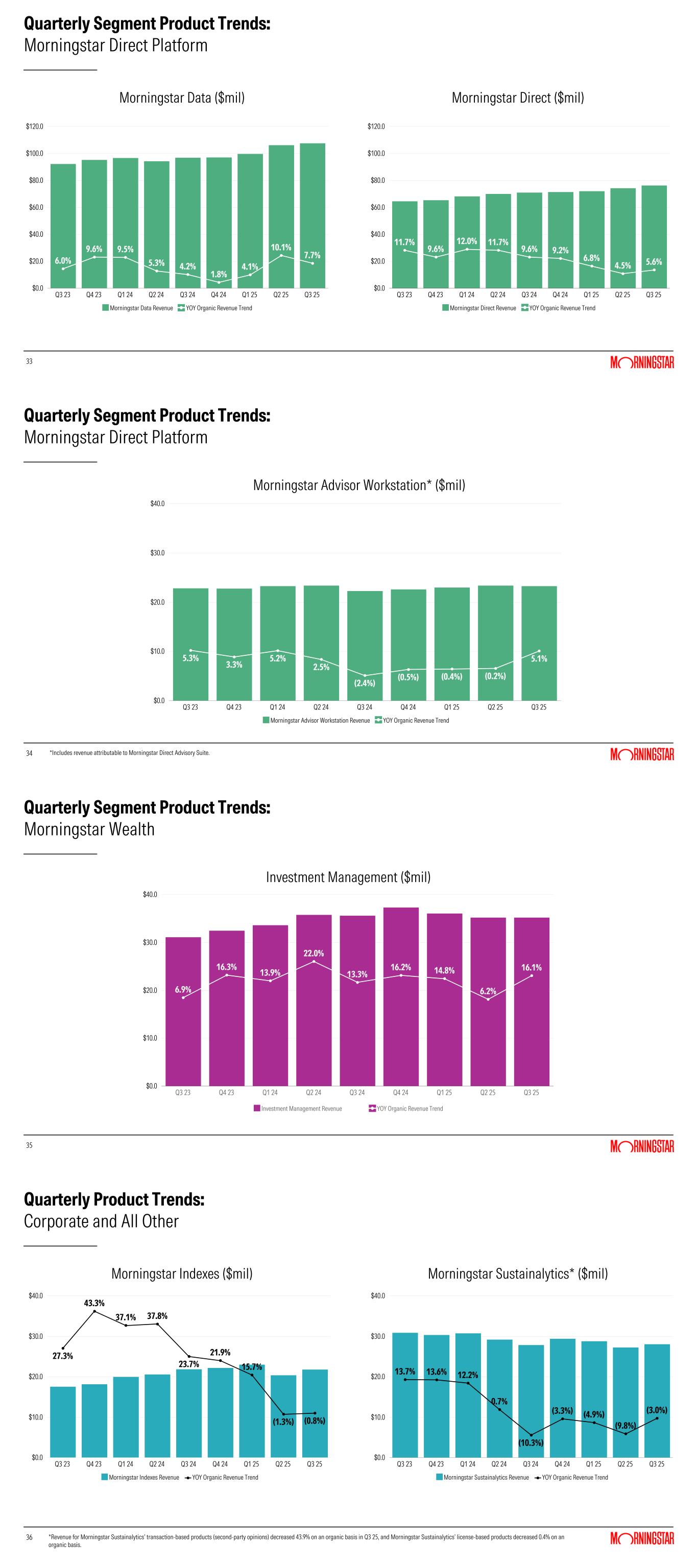

Morningstar Direct Platform contributed $211.1 million to consolidated revenue and $12.6 million to consolidated revenue growth, with revenue increasing 6.3% compared to the prior-year period, or 6.2% on an organic basis. Organic revenue growth excludes revenue associated with the divested Commodity and Energy Data business from the prior-year period and foreign currency impact. Higher revenue was primarily driven by Morningstar Data, supported by higher managed investment data revenue. Morningstar Direct also contributed to higher revenue with growth across geographies. The Morningstar Direct license count was flat compared to the prior-year period.

Morningstar Direct Platform adjusted operating income increased 2.5% to $93.7 million, and adjusted operating margin decreased 1.6 percentage points to 44.4%. The decline in adjusted operating margin reflected higher compensation costs, primarily driven by the annual merit increase and higher bonus expense reflecting outperformance relative to targets; the impact of the sale of the Company's Commodity and Energy Data business; and increased depreciation primarily driven by higher capitalized software costs for product enhancements in prior periods.

PitchBook

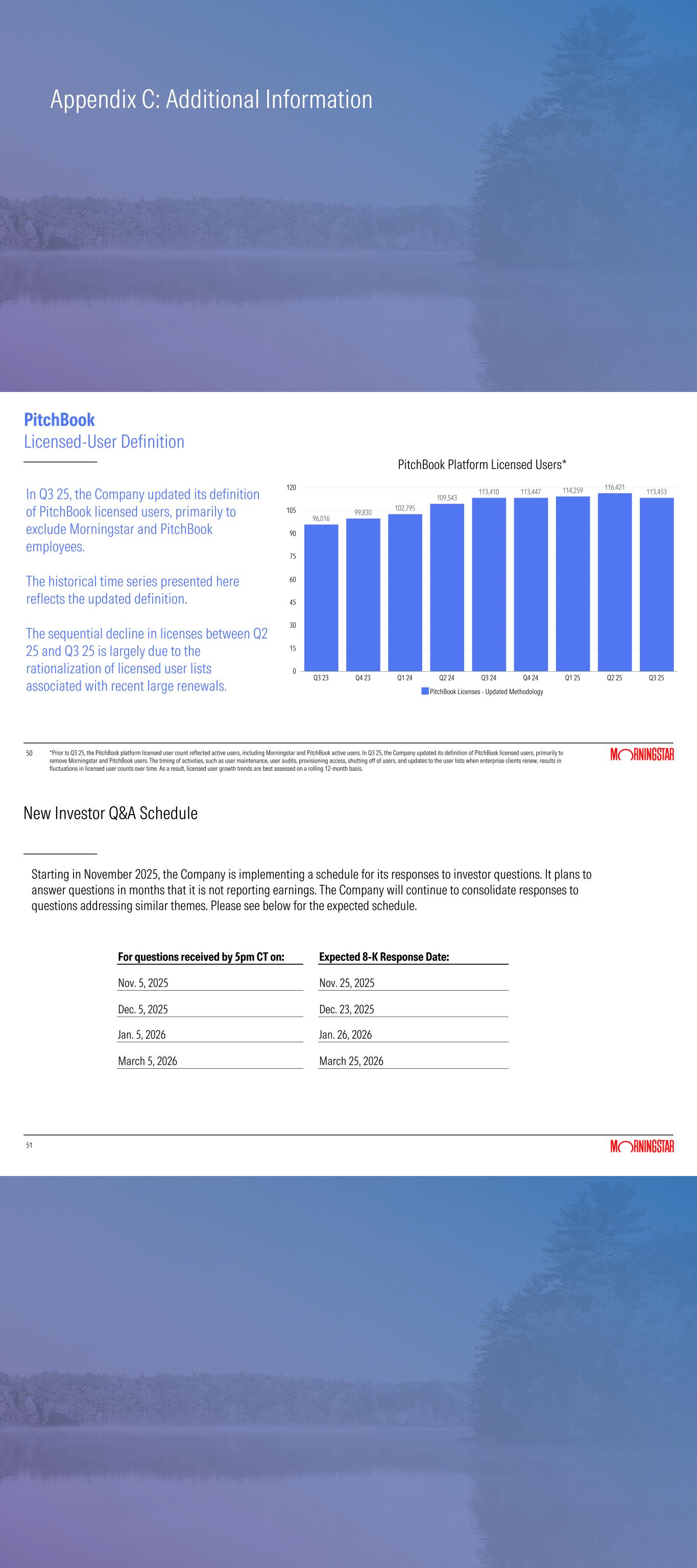

PitchBook contributed $169.0 million to consolidated revenue and $12.4 million to consolidated revenue growth, with revenue increasing 7.9% on a reported and 7.7% on an organic basis. Revenue growth was primarily driven by the PitchBook platform with contributions from the small-but-growing direct data business. PitchBook platform growth drivers were consistent with recent quarters with increased revenue driven by PitchBook's core investor and advisor client segments, including private equity, credit, and investment banks, partially offset by continued softness in the corporate client segment, especially among smaller firms with more limited use cases during periods of slower deal activity.

Licensed user counts were flat compared to the prior-year period, reflecting the addition of new logos offset by churn and including the impact of the rationalization of user lists associated with recent large enterprise renewals. In the quarter, the Company updated its definition of licensed user counts, primarily to exclude Morningstar and PitchBook employees. The change is discussed in more detail on p. 50 of the quarterly supplemental deck.

PitchBook adjusted operating income increased 5.0% to $52.9 million, and adjusted operating margin decreased 0.9 percentage points to 31.3%. The decline in adjusted operating margin was primarily due to higher compensation costs, which included the impact of increased headcount in product development and technology, as well as higher health care costs.

Morningstar Credit

Morningstar Credit contributed $91.1 million to consolidated revenue and $20.2 million to consolidated revenue growth, with revenue increasing 28.5% on a reported and 27.0% on an organic basis, supported by a robust issuance market. Revenue grew across asset classes and geographies, with particular strength in US commercial mortgage- and asset-backed securities ratings revenue and Canadian and European corporate ratings revenue. Organic revenue growth excludes revenue associated with DealX, which was acquired in the first quarter of 2025, and foreign currency impact.

Morningstar Credit adjusted operating income increased 84.9% to $28.1 million, and adjusted operating margin increased 9.4 percentage points to 30.8%. The increase in adjusted operating income and margin reflected higher revenue, partially offset by higher compensation costs. The increase in compensation was primarily driven by higher salaries and benefits due to increased headcount to support growth and higher bonus expense, reflecting strong performance relative to targets.

Morningstar Wealth

Morningstar Wealth contributed $62.1 million to consolidated revenue and $0.3 million to consolidated revenue growth, with revenue increasing 0.5% compared to the prior-year period, or 9.8% on an organic basis. Organic growth was primarily driven by Investment Management and increased advertising sales. Organic revenue growth excludes platform revenue associated with US TAMP assets sold to AssetMark from the prior-year period and foreign currency impact. Reported and organic growth included a $1.5 million negative impact from the ongoing sunsetting of Morningstar Office.

Reported assets under management and advisement (AUMA) increased 11.1% to $70.8 billion compared with the prior-year period. Growth was primarily driven by market performance, which contributed to higher asset values, and positive net flows to Morningstar Model Portfolios offered on third-party platforms and to the International Wealth Platform, partially offset by net outflows related to the sale of US TAMP assets to AssetMark.

Morningstar Wealth adjusted operating income was $3.1 million compared to a $0.7 million loss in the prior-year period, and adjusted operating margin was 5.0% compared with negative 1.1% in the prior-year period.

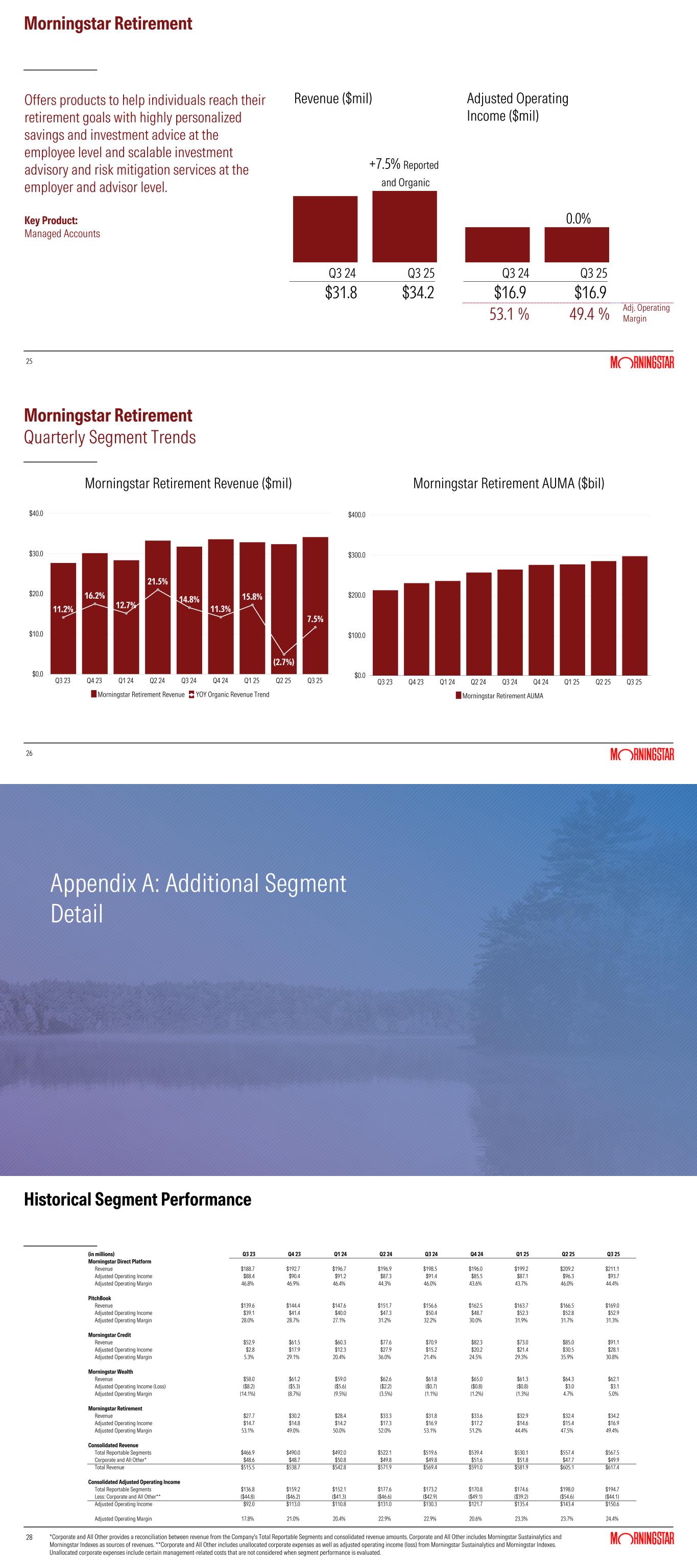

Morningstar Retirement

Morningstar Retirement contributed $34.2 million to consolidated revenue and $2.4 million to consolidated revenue growth. Revenue increased 7.5% on a reported and organic basis. AUMA increased 12.6% to $297.8 billion compared with the prior-year period, primarily due to market gains. Net inflows also contributed to higher AUMA, supported by strong growth in traditional and Advisor Managed Accounts.

Morningstar Retirement adjusted operating income remained flat at $16.9 million, and adjusted operating margin decreased 3.7 percentage points to 49.4%. The decline in adjusted operating margin was primarily driven by higher compensation costs, which included the impact of the annual merit increase and increased commissions, and higher marketing expenses, including costs related to campaign tracking and data management.

Corporate and All Other

Revenue attributable to Corporate and All Other contributed $49.9 million to consolidated revenue and $0.1 million to consolidated revenue growth, with reported revenue increasing 0.2% compared to the prior-year period. Morningstar Indexes revenue declined modestly, reflecting lower investable product revenue driven by outflows and lower AUMA for certain higher margin products. Reported revenue from Morningstar Sustainalytics was relatively flat compared to the prior-year period and declined modestly on an organic basis.

The impact of Corporate and All Other on consolidated adjusted operating income was negative $44.1 million compared with negative $42.9 million in the prior-year period.

Balance Sheet and Capital Allocation

As of Sept. 30, 2025, the Company had cash, cash equivalents, and investments totaling $514.5 million and $848.9 million of debt, compared with $551.0 million and $698.6 million, respectively, as of Dec. 31, 2024.

Cash provided by operating activities increased 2.0% to $195.7 million and free cash flow increased 2.8% to $160.1 million in the third quarter of 2025. The increase in cash provided by operating activities and free cash flow was primarily driven by higher cash earnings, offset by an increase in income tax payments compared to the prior-year period. The Company made income tax payments of $40.3 million during the third quarter of 2025 compared with $21.9 million in the third quarter of 2024. The increase in taxes paid was due in large part to higher US tax installment payments, including the impact of $8.1 million of foreign withholding taxes on cash repatriation from one of the Company's affiliates in the quarter.

During the quarter, the Company increased its debt by $10.0 million, net, repurchased $180.1 million of its shares of which $170.1 million settled, and paid $19.2 million in dividends.

Use of Non-GAAP Financial Measures

Organic revenue, adjusted operating income (loss), adjusted operating margin, adjusted diluted net income per share, and free cash flow are non-GAAP financial measures. The tables at the end of this press release include a reconciliation of the non-GAAP financial measures used by the Company to comparable GAAP measures and an explanation of why the Company uses them.

Investor Communication

Morningstar encourages all interested parties — including securities analysts, current shareholders, potential shareholders, and others — to submit questions in writing. Investors and others may send questions about Morningstar’s business to investors@morningstar.com. Morningstar will make written responses to selected inquiries available to all investors at the same time in Form 8-Ks furnished to the Securities and Exchange Commission (the SEC), on a monthly basis, with the exception of months when it releases earnings.

About Morningstar, Inc.

Morningstar, Inc. is a leading provider of independent investment insights in North America, Europe, Australia, and Asia. The Company offers an extensive line of products and services for individual investors, financial advisors, asset managers and owners, retirement plan providers and sponsors, institutional investors in the debt and private capital markets, and alliances and redistributors. Morningstar provides data and research insights on a wide range of investment offerings, including managed investment products, publicly listed companies, private capital markets, debt securities, and real-time global market data. Morningstar also offers investment management services through its investment advisory subsidiaries, with approximately $369 billion in AUMA as of Sept. 30, 2025. The Company operates through wholly-owned subsidiaries in 32 countries. For more information, visit www.morningstar.com/company. Follow Morningstar on X @MorningstarInc.

Caution Concerning Forward-Looking Statements

This press release contains forward-looking statements as that term is used in the Private Securities Litigation Reform Act of 1995. These statements are based on our current expectations about future events or future financial performance. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, and often contain words such as "aim," "committed," "consider," "estimate," "future," "goal," "is designed to," "maintain," "may," "might," "objective," "ongoing," "could," "expect," "intend," "plan," "possible," "potential," "seek," "anticipate," "believe," "predict," "prospects," "continue," "strategy," "strive," "will," "would," "determine," "evaluate," or the negative thereof, and similar expressions. These statements involve known and unknown risks and uncertainties that may cause the events we discuss not to occur or to differ significantly from what we expect. For us, these risks and uncertainties include, among others, failing to consummate the Center for Research in Security Prices (CRSP) acquisition on a timely basis or at all, failing to achieve the anticipated benefits of the CRSP acquisition; failing to maintain and protect our brand, independence, and reputation; failure to prevent and/or mitigate cybersecurity events and the failure to protect confidential information, including personal information about individuals; changing economic conditions, including prolonged volatility, recessions, or downturns affecting the financial sector and global financial markets, and the impacts of global trade policies, may negatively impact our financial results, including those of our asset-based businesses; compliance failures, regulatory action, or changes in laws applicable to our regulated businesses; failing to innovate our product and service offerings or meet or anticipate our clients’ changing needs; impact of artificial intelligence technologies on our business and reputation, and the legal risks as they are incorporated into our products and tools; failure to detect errors in our products or failure of our products to perform properly due to defects, malfunctions or similar problems; failing to recruit, develop, and retain qualified employees; failing to scale our operations, increase productivity in order to implement our business plans and strategies; liability for any losses that result from errors in our automated advisory tools or errors in the use of the information and data we collect; inadequacy of our operational risk management and business continuity programs to address materially disruptive events; failure of our strategic transactions, acquisitions, divestitures and investments in companies or technologies to yield expected business or financial benefits, negatively impacting our operating results and our ability to deliver long-term value to shareholders; failing to maintain growth across our businesses due to changes in geopolitics and the regulatory landscape; liability relating to the information and data we collect, store, use, create, and distribute or the reports that we publish or are produced by our software products; the potential adverse effect of our indebtedness (and rising interest rates) on our cash flow and financial and operational flexibility; liability, costs and reputational risks relating to environmental, social, and governance considerations; our dependence on third-party service providers in our operations; inadequacy of our insurance coverage; challenges in accounting for tax complexities in the global jurisdictions we operate in could materially affect our tax obligations and tax rates; the potential and impact of vendor consolidation and clients' strategic decisions to replace our products and services with in-house products and services; our ability to build and maintain short-term and long-term shareholder value and pay dividends to our shareholders; our ability to maintain existing business and renewal rates and to gain new business; the impact of recently issued accounting pronouncements on our consolidated financial statements and related disclosure; and failing to protect our intellectual property rights or claims of intellectual property infringement against us. A more complete description of these risks and uncertainties, among others, can be found in our filings with the SEC, including our most recent Reports on Forms 10-K and 10-Q. If any of these risks and uncertainties materialize, our actual future results and other future events may vary significantly from what we expect. We do not undertake to update our forward-looking statements as a result of new information, future events or otherwise, except as may be required by law. You are, however, advised to review any further disclosures we make on related subjects, and about new or additional risks, uncertainties and assumptions in our future filings with the SEC on Forms 10-K, 10-Q, and 8-K.

# # #

Media Relations Contact:

Stephanie Lerdall, +1 312-244-7805, stephanie.lerdall@morningstar.com

Investor Relations Contact:

Sarah Bush, +1 312-384-3754, sarah.bush@morningstar.com

©2025 Morningstar, Inc. All Rights Reserved.

MORN-E

Morningstar, Inc. and Subsidiaries

Unaudited Condensed Consolidated Statements of Income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

| (in millions, except per share amounts) |

|

2025 |

|

2024 |

|

Change |

|

2025 |

|

2024 |

|

Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

617.4 |

|

|

$ |

569.4 |

|

|

8.4 |

% |

|

$ |

1,804.4 |

|

|

$ |

1,684.1 |

|

|

7.1 |

% |

| Operating expense: |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenue |

|

241.7 |

|

|

222.7 |

|

|

8.5 |

% |

|

703.7 |

|

|

663.5 |

|

|

6.1 |

% |

| Sales and marketing |

|

115.5 |

|

|

107.9 |

|

|

7.0 |

% |

|

347.8 |

|

|

323.8 |

|

|

7.4 |

% |

| General and administrative |

|

85.9 |

|

|

77.6 |

|

|

10.7 |

% |

|

244.4 |

|

|

238.2 |

|

|

2.6 |

% |

| Depreciation and amortization |

|

47.0 |

|

|

45.7 |

|

|

2.8 |

% |

|

142.8 |

|

|

142.0 |

|

|

0.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expense |

|

490.1 |

|

|

453.9 |

|

|

8.0 |

% |

|

1,438.7 |

|

|

1,367.5 |

|

|

5.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other operating income |

|

0.5 |

|

|

— |

|

|

NMF |

|

1.3 |

|

|

— |

|

|

NMF |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

127.8 |

|

|

115.5 |

|

|

10.6 |

% |

|

367.0 |

|

|

316.6 |

|

|

15.9 |

% |

| Operating margin |

|

20.7 |

% |

|

20.3 |

% |

|

0.4 pp |

|

20.3 |

% |

|

18.8 |

% |

|

1.5 pp |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-operating income (expense), net: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

(7.0) |

|

|

(8.9) |

|

|

(21.3) |

% |

|

(19.8) |

|

|

(30.7) |

|

|

(35.5) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gain on sale of business |

|

— |

|

|

45.3 |

|

|

NMF |

|

— |

|

|

45.3 |

|

|

NMF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense), net |

|

2.3 |

|

|

— |

|

|

NMF |

|

0.9 |

|

|

(2.8) |

|

|

NMF |

Non-operating income (expense), net |

|

(4.7) |

|

|

36.4 |

|

|

NMF |

|

(18.9) |

|

|

11.8 |

|

|

NMF |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes and equity in investments of unconsolidated entities |

|

123.1 |

|

|

151.9 |

|

|

(19.0) |

% |

|

348.1 |

|

|

328.4 |

|

|

6.0 |

% |

Equity in investments of unconsolidated entities |

|

(0.1) |

|

|

(2.6) |

|

|

(96.2) |

% |

|

(3.9) |

|

|

(5.3) |

|

|

(26.4) |

% |

Income tax expense |

|

31.4 |

|

|

29.6 |

|

|

6.1 |

% |

|

85.1 |

|

|

70.1 |

|

|

21.4 |

% |

Consolidated net income |

|

$ |

91.6 |

|

|

$ |

119.7 |

|

|

(23.5) |

% |

|

$ |

259.1 |

|

|

$ |

253.0 |

|

|

2.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

2.18 |

|

|

$ |

2.79 |

|

|

(21.9) |

% |

|

$ |

6.12 |

|

|

$ |

5.91 |

|

|

3.6 |

% |

| Diluted |

|

$ |

2.17 |

|

|

$ |

2.77 |

|

|

(21.7) |

% |

|

$ |

6.08 |

|

|

$ |

5.87 |

|

|

3.6 |

% |

| Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

42.1 |

|

|

42.9 |

|

|

|

|

42.4 |

|

|

42.8 |

|

|

|

| Diluted |

|

42.3 |

|

|

43.2 |

|

|

|

|

42.6 |

|

|

43.1 |

|

|

|

___________________________________________________________________________________________________________________________________________________________________

NMF - Not meaningful, pp - percentage points

Morningstar, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

|

As of September 30, 2025

(unaudited) |

|

As of December 31, 2024 |

| |

|

|

|

|

| Assets |

|

|

|

|

| Current assets: |

|

|

|

|

| Cash and cash equivalents |

|

$ |

474.2 |

|

|

$ |

502.7 |

|

| Investments |

|

40.3 |

|

|

48.3 |

|

| Accounts receivable, net |

|

363.9 |

|

|

358.1 |

|

|

|

|

|

|

Income tax receivable |

|

12.9 |

|

|

12.4 |

|

| Other current assets |

|

87.9 |

|

|

92.6 |

|

| Total current assets |

|

979.2 |

|

|

1,014.1 |

|

| |

|

|

|

|

| Goodwill |

|

1,614.7 |

|

|

1,562.0 |

|

| Intangible assets, net |

|

396.0 |

|

|

408.8 |

|

| Property, equipment, and capitalized software, net |

|

225.9 |

|

|

218.9 |

|

| Operating lease assets |

|

164.4 |

|

|

181.2 |

|

| Investments in unconsolidated entities |

|

71.8 |

|

|

85.3 |

|

Deferred tax assets |

|

65.7 |

|

|

43.2 |

|

| Other assets |

|

39.9 |

|

|

35.4 |

|

| Total assets |

|

$ |

3,557.6 |

|

|

$ |

3,548.9 |

|

| |

|

|

|

|

| Liabilities and equity |

|

|

|

|

| Current liabilities: |

|

|

|

|

| Deferred revenue |

|

$ |

563.9 |

|

|

$ |

540.8 |

|

| Accrued compensation |

|

231.0 |

|

|

272.2 |

|

| Accounts payable and accrued liabilities |

|

90.4 |

|

|

87.3 |

|

|

|

|

|

|

| Operating lease liabilities |

|

39.9 |

|

|

35.1 |

|

|

|

|

|

|

|

|

|

|

|

Income tax payable |

|

9.6 |

|

|

30.5 |

|

| Other current liabilities |

|

10.7 |

|

|

1.4 |

|

| Total current liabilities |

|

945.5 |

|

|

967.3 |

|

| |

|

|

|

|

Operating lease liabilities |

|

153.8 |

|

|

170.3 |

|

| Accrued compensation |

|

20.0 |

|

|

21.0 |

|

Deferred tax liabilities |

|

27.2 |

|

|

27.6 |

|

| Long-term debt |

|

848.9 |

|

|

698.6 |

|

Income tax payable |

|

13.5 |

|

|

11.7 |

|

| Other long-term liabilities |

|

34.7 |

|

|

33.8 |

|

| Total liabilities |

|

2,043.6 |

|

|

1,930.3 |

|

| Total equity |

|

1,514.0 |

|

|

1,618.6 |

|

| Total liabilities and equity |

|

$ |

3,557.6 |

|

|

$ |

3,548.9 |

|

Morningstar, Inc. and Subsidiaries

Unaudited Condensed Consolidated Statements of Cash Flows

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

| (in millions) |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

|

| Operating activities |

|

|

|

|

|

|

|

|

|

|

Consolidated net income |

|

$ |

91.6 |

|

|

$ |

119.7 |

|

|

$ |

259.1 |

|

|

$ |

253.0 |

|

|

|

Adjustments to reconcile consolidated net income to net cash flows from operating activities |

|

47.8 |

|

|

12.2 |

|

|

162.0 |

|

|

128.9 |

|

|

|

| Changes in operating assets and liabilities, net |

|

56.3 |

|

|

60.0 |

|

|

(35.4) |

|

|

56.3 |

|

|

|

| Cash provided by operating activities |

|

195.7 |

|

|

191.9 |

|

|

385.7 |

|

|

438.2 |

|

|

|

| Investing activities |

|

|

|

|

|

|

|

|

|

|

| Capital expenditures |

|

(35.6) |

|

|

(36.1) |

|

|

(104.4) |

|

|

(102.1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Acquisitions, net of cash acquired |

|

— |

|

|

— |

|

|

(39.1) |

|

|

— |

|

|

|

Proceeds from sale of business |

|

— |

|

|

52.2 |

|

|

— |

|

|

52.2 |

|

|

|

| Purchases of investments in unconsolidated entities |

|

(0.8) |

|

|

(3.2) |

|

|

(3.3) |

|

|

(6.8) |

|

|

|

| Other, net |

|

3.4 |

|

|

1.2 |

|

|

19.2 |

|

|

11.3 |

|

|

|

Cash provided by (used for) investing activities |

|

(33.0) |

|

|

14.1 |

|

|

(127.6) |

|

|

(45.4) |

|

|

|

| Financing activities |

|

|

|

|

|

|

|

|

|

|

| Common shares repurchased |

|

(170.1) |

|

|

— |

|

|

(391.7) |

|

|

— |

|

|

|

| Dividends paid |

|

(19.2) |

|

|

(17.4) |

|

|

(58.0) |

|

|

(52.0) |

|

|

|

Repayments of debt |

|

(95.0) |

|

|

(35.0) |

|

|

(220.0) |

|

|

(198.1) |

|

|

|

Proceeds from debt |

|

105.0 |

|

|

— |

|

|

370.0 |

|

|

90.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other, net |

|

(8.8) |

|

|

(7.8) |

|

|

(21.0) |

|

|

(25.2) |

|

|

|

Cash used for financing activities |

|

(188.1) |

|

|

(60.2) |

|

|

(320.7) |

|

|

(185.3) |

|

|

|

| Effect of exchange rate changes on cash and cash equivalents |

|

(3.9) |

|

|

15.9 |

|

|

34.1 |

|

|

7.5 |

|

|

|

Net increase (decrease) in cash and cash equivalents |

|

(29.3) |

|

|

161.7 |

|

|

(28.5) |

|

|

215.0 |

|

|

|

| Cash and cash equivalents-beginning of period |

|

503.5 |

|

|

391.2 |

|

|

502.7 |

|

|

337.9 |

|

|

|

| Cash and cash equivalents-end of period |

|

$ |

474.2 |

|

|

$ |

552.9 |

|

|

$ |

474.2 |

|

|

$ |

552.9 |

|

|

|

Morningstar, Inc. and Subsidiaries

Supplemental Data (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

| (in millions) |

|

2025 |

|

2024 |

|

Change |

|

Organic |

|

2025 |

|

2024 |

|

Change |

|

Organic |

|

| Morningstar Direct Platform |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

211.1 |

|

|

$ |

198.5 |

|

|

6.3 |

% |

|

6.2 |

% |

|

$ |

619.5 |

|

|

$ |

592.1 |

|

|

4.6 |

% |

|

5.6 |

% |

|

Adjusted Operating Income |

|

$ |

93.7 |

|

|

$ |

91.4 |

|

|

2.5 |

% |

|

|

|

$ |

277.1 |

|

|

$ |

269.9 |

|

|

2.7 |

% |

|

|

|

Adjusted Operating Margin |

|

44.4 |

% |

|

46.0 |

% |

|

(1.6) pp |

|

|

|

44.7 |

% |

|

45.6 |

% |

|

(0.9) pp |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PitchBook |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

169.0 |

|

|

$ |

156.6 |

|

|

7.9 |

% |

|

7.7 |

% |

|

$ |

499.2 |

|

|

$ |

455.9 |

|

|

9.5 |

% |

|

9.4 |

% |

|

| Adjusted Operating Income |

|

$ |

52.9 |

|

|

$ |

50.4 |

|

|

5.0 |

% |

|

|

|

$ |

158.0 |

|

|

$ |

137.7 |

|

|

14.7 |

% |

|

|

|

| Adjusted Operating Margin |

|

31.3 |

% |

|

32.2 |

% |

|

(0.9) pp |

|

|

|

31.7 |

% |

|

30.2 |

% |

|

1.5 pp |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Morningstar Credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

91.1 |

|

|

$ |

70.9 |

|

|

28.5 |

% |

|

27.0 |

% |

|

$ |

249.1 |

|

|

$ |

208.8 |

|

|

19.3 |

% |

|

19.0 |

% |

|

| Adjusted Operating Income |

|

$ |

28.1 |

|

|

$ |

15.2 |

|

|

84.9 |

% |

|

|

|

$ |

80.0 |

|

|

$ |

55.4 |

|

|

44.4 |

% |

|

|

|

| Adjusted Operating Margin |

|

30.8 |

% |

|

21.4 |

% |

|

9.4 pp |

|

|

|

32.1 |

% |

|

26.5 |

% |

|

5.6 pp |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Morningstar Wealth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

62.1 |

|

|

$ |

61.8 |

|

|

0.5 |

% |

|

9.8 |

% |

|

$ |

187.7 |

|

|

$ |

183.4 |

|

|

2.3 |

% |

|

8.3 |

% |

|

| Adjusted Operating Income (Loss) |

|

$ |

3.1 |

|

|

$ |

(0.7) |

|

|

NMF |

|

|

|

$ |

5.3 |

|

|

$ |

(8.5) |

|

|

NMF |

|

|

|

| Adjusted Operating Margin |

|

5.0 |

% |

|

(1.1) |

% |

|

6.1 pp |

|

|

|

2.8 |

% |

|

(4.6) |

% |

|

7.4 pp |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Morningstar Retirement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

34.2 |

|

|

$ |

31.8 |

|

|

7.5 |

% |

|

7.5 |

% |

|

$ |

99.5 |

|

|

$ |

93.5 |

|

|

6.4 |

% |

|

6.4 |

% |

|

| Adjusted Operating Income |

|

$ |

16.9 |

|

|

$ |

16.9 |

|

|

— |

% |

|

|

|

$ |

46.9 |

|

|

$ |

48.4 |

|

|

(3.1) |

% |

|

|

|

| Adjusted Operating Margin |

|

49.4 |

% |

|

53.1 |

% |

|

(3.7) pp |

|

|

|

47.1 |

% |

|

51.8 |

% |

|

(4.7) pp |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Reportable Segments |

|

$ |

567.5 |

|

|

$ |

519.6 |

|

|

9.2 |

% |

|

|

|

$ |

1,655.0 |

|

|

$ |

1,533.7 |

|

|

7.9 |

% |

|

|

|

Corporate and All Other (1) |

|

49.9 |

|

|

49.8 |

|

|

0.2 |

% |

|

|

|

149.4 |

|

|

150.4 |

|

|

(0.7) |

% |

|

|

|

| Total Revenue |

|

$ |

617.4 |

|

|

$ |

569.4 |

|

|

8.4 |

% |

|

8.9 |

% |

|

$ |

1,804.4 |

|

|

$ |

1,684.1 |

|

|

7.1 |

% |

|

8.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Adjusted Operating Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Reportable Segments |

|

$ |

194.7 |

|

|

$ |

173.2 |

|

|

12.4 |

% |

|

|

|

$ |

567.3 |

|

|

$ |

502.9 |

|

|

12.8 |

% |

|

|

|

Less: Corporate and All Other (2) |

|

(44.1) |

|

|

(42.9) |

|

|

NMF |

|

|

|

(137.9) |

|

|

(130.8) |

|

|

NMF |

|

|

|

| Adjusted Operating Income |

|

$ |

150.6 |

|

|

$ |

130.3 |

|

|

15.6 |

% |

|

|

|

$ |

429.4 |

|

|

$ |

372.1 |

|

|

15.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Operating Margin |

|

24.4 |

% |

|

22.9 |

% |

|

1.5 pp |

|

|

|

23.8 |

% |

|

22.1 |

% |

|

1.7 pp |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

___________________________________________________________________________________________________________________________________________________________________

(1) Corporate and All Other provides a reconciliation between revenue from our Total Reportable Segments and consolidated revenue amounts. Corporate and All Other includes Morningstar Sustainalytics and Morningstar Indexes as sources of revenues. Revenue from Morningstar Sustainalytics was $28.1 million and $27.9 million for the three months ended Sept. 30, 2025 and 2024, respectively, and $84.2 million and $87.9 million for the nine months ended Sept. 30, 2025 and 2024, respectively. Revenue from Morningstar Indexes was $21.8 million and $21.9 million for the three months ended Sept. 30, 2025 and 2024, respectively, and $65.2 million and $62.5 million for the nine months ended Sept. 30, 2025 and 2024, respectively.

(2) Corporate and All Other includes unallocated corporate expenses as well as adjusted operating income (loss) from Morningstar Sustainalytics and Morningstar Indexes. For the third quarter of 2025 and 2024, unallocated corporate expenses were $47.1 million and $43.5 million, respectively. For the first nine months of 2025 and 2024, unallocated corporate expenses were $139.0 million and $130.4 million, respectively. Unallocated corporate expenses include finance, human resources, legal, and other management-related costs that are not considered when segment performance is evaluated.

Morningstar, Inc. and Subsidiaries

Supplemental Data (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of September 30, |

|

|

|

|

|

|

|

AUMA (approximate) ($bil) |

|

2025 |

|

2024 |

|

Change |

|

|

|

|

|

|

|

|

Morningstar Retirement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Managed Accounts |

|

$ |

184.1 |

|

|

$ |

155.1 |

|

|

18.7 |

% |

|

|

|

|

|

|

|

|

Fiduciary Services |

|

68.2 |

|

|

63.0 |

|

|

8.3 |

% |

|

|

|

|

|

|

|

|

Custom Models/CIT |

|

45.5 |

|

|

46.3 |

|

|

(1.7) |

% |

|

|

|

|

|

|

|

|

Morningstar Retirement (total) |

|

$ |

297.8 |

|

|

$ |

264.4 |

|

|

12.6 |

% |

|

|

|

|

|

|

|

|

Investment Management |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Morningstar Model Portfolios (1) |

|

$ |

50.4 |

|

|

$ |

44.6 |

|

|

13.0 |

% |

|

|

|

|

|

|

|

|

Institutional Asset Management |

|

6.0 |

|

|

7.3 |

|

|

(17.8) |

% |

|

|

|

|

|

|

|

|

Asset Allocation Services |

|

14.4 |

|

|

11.8 |

|

|

22.0 |

% |

|

|

|

|

|

|

|

|

Investment Management (total) |

|

$ |

70.8 |

|

|

$ |

63.7 |

|

|

11.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Asset value linked to Morningstar Indexes ($bil) |

|

$ |

237.5 |

|

|

$ |

228.2 |

|

|

4.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

|

|

2025 |

|

2024 |

|

Change |

|

2025 |

|

2024 |

|

Change |

|

Average AUMA ($bil) |

|

$ |

360.4 |

|

|

$ |

322.2 |

|

|

11.9 |

% |

|

$ |

350.1 |

|

|

$ |

306.0 |

|

|

14.4 |

% |

|

____________________________________________________________________________________________________________________________________________________________________________________________________________

(1) Includes AUMA in Morningstar Model Portfolios and assets on the International Wealth Platform invested in third-party model portfolios.

Morningstar, Inc. and Subsidiaries

Reconciliations of Non-GAAP Measures with the Nearest Comparable GAAP Measures (Unaudited)

To supplement Morningstar’s condensed consolidated financial statements presented in accordance with US Generally Accepted Accounting Principles (GAAP), Morningstar uses the following measures considered as non-GAAP by the SEC, including:

•"Organic Revenue" is consolidated revenue before (1) acquisitions and divestitures, (2) adoption of new accounting standards or revisions to accounting practices (accounting changes), and (3) the effect of foreign currency translations.

•"Adjusted Operating Income (Loss)" is consolidated operating income (loss) excluding (1) intangible amortization expense, (2) the impact of merger, acquisition, and divestiture-related activity which, when applicable, may include certain non-recurring expenses such as pre-deal due diligence, transaction costs, contingent consideration, severance, and post-close integration costs (M&A-related expenses), and (3) certain other one-time, non-recurring items which management does not consider when evaluating ongoing performance (other non-recurring items).

•"Adjusted Operating Margin" is operating margin excluding (1) intangible amortization expense, (2) M&A-related expenses, and (3) other non-recurring items.

•"Adjusted Diluted Net Income Per Share" is consolidated diluted net income per share excluding (1) intangible amortization expense, (2) M&A-related expenses, (3) other non-recurring items, and (4) non-operating gains and losses.

•"Free Cash Flow" is cash provided by or used for operating activities less capital expenditures.

These non-GAAP measures may not be comparable to similarly titled measures reported by other companies and should not be considered an alternative to any measure of performance promulgated under GAAP.

Morningstar presents organic revenue because the Company believes this non-GAAP measure helps investors better compare period-over-period results. Morningstar excludes revenue from acquired businesses from its organic revenue growth calculation for a period of 12 months after it completes the acquisition. For divestitures (including sale of assets), Morningstar excludes revenue in the prior-year period for which there is no comparable revenue in the current period.

Morningstar presents adjusted operating income (loss), adjusted operating margin, and adjusted diluted net income per share to better reflect period-over-period comparisons, and improve overall understanding of the underlying performance of the business absent the impact of intangible amortization expense, M&A-related expenses and certain other one-time, non-recurring items.

In addition, Morningstar presents free cash flow as a supplemental disclosure to help investors better understand how much cash is available after making capital expenditures. Morningstar's management team uses free cash flow to evaluate the health of its business.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

| (in millions) |

|

2025 |

|

2024 |

|

Change |

|

2025 |

|

2024 |

|

Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation from consolidated revenue to organic revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated revenue |

|

$ |

617.4 |

|

|

$ |

569.4 |

|

|

8.4 |

% |

|

$ |

1,804.4 |

|

|

$ |

1,684.1 |

|

|

7.1 |

% |

|

Acquisitions |

|

(1.0) |

|

|

— |

|

|

NMF |

|

(2.3) |

|

|

— |

|

|

NMF |

|

| Divestitures |

|

(2.1) |

|

|

(9.9) |

|

|

(78.8) |

% |

|

(8.8) |

|

|

(27.9) |

|

|

(68.5) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Effect of foreign currency translations |

|

(4.5) |

|

|

— |

|

|

NMF |

|

(5.0) |

|

|

— |

|

|

NMF |

|

| Organic revenue |

|

$ |

609.8 |

|

|

$ |

559.5 |

|

|

9.0 |

% |

|

$ |

1,788.3 |

|

|

$ |

1,656.2 |

|

|

8.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation from consolidated operating income to adjusted operating income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated operating income |

|

$ |

127.8 |

|

|

$ |

115.5 |

|

|

10.6 |

% |

|

$ |

367.0 |

|

|

$ |

316.6 |

|

|

15.9 |

% |

|

Intangible amortization expense |

|

15.1 |

|

|

14.7 |

|

|

2.7 |

% |

|

44.8 |

|

|

49.9 |

|

|

(10.2) |

% |

|

M&A-related expenses |

|

8.2 |

|

|

0.1 |

|

|

NMF |

|

18.9 |

|

|

5.6 |

|

|

237.5 |

% |

|

Other non-recurring items |

|

(0.5) |

|

|

— |

|

|

NMF |

|

(1.3) |

|

|

— |

|

|

NMF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted operating income |

|

$ |

150.6 |

|

|

$ |

130.3 |

|

|

15.6 |

% |

|

$ |

429.4 |

|

|

$ |

372.1 |

|

|

15.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation from consolidated operating margin to adjusted operating margin: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated operating margin |

|

20.7 |

% |

|

20.3 |

% |

|

0.4 pp |

|

20.3 |

% |

|

18.8 |

% |

|

1.5 pp |

|

| Intangible amortization expense |

|

2.5 |

% |

|

2.6 |

% |

|

(0.1) pp |

|

2.6 |

% |

|

3.0 |

% |

|

(0.4) pp |

|

| M&A-related expenses |

|

1.3 |

% |

|

— |

% |

|

1.3 pp |

|

1.0 |

% |

|

0.3 |

% |

|

0.7 pp |

|

| Other non-recurring items |

|

(0.1) |

% |

|

— |

% |

|

(0.1) pp |

|

(0.1) |

% |

|

— |

% |

|

(0.1) pp |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted operating margin |

|

24.4 |

% |

|

22.9 |

% |

|

1.5 pp |

|

23.8 |

% |

|

22.1 |

% |

|

1.7 pp |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation from consolidated diluted net income per share to adjusted diluted net income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated diluted net income per share |

|

$ |

2.17 |

|

|

$ |

2.77 |

|

|

(21.7) |

% |

|

$ |

6.08 |

|

|

$ |

5.87 |

|

|

3.6 |

% |

|

| Intangible amortization expense |

|

0.27 |

|

|

0.25 |

|

|

8.0 |

% |

|

0.78 |

|

|

0.86 |

|

|

(9.3) |

% |

|

| M&A-related expenses |

|

0.14 |

|

|

— |

|

|

NMF |

|

0.33 |

|

|

0.10 |

|

|

230.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

| (in millions) |

|

2025 |

|

2024 |

|

Change |

|

2025 |

|

2024 |

|

Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other non-recurring items |

|

(0.01) |

|

|

— |

|

|

NMF |

|

(0.02) |

|

|

— |

|

|

NMF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-operating (gains) losses |

|

(0.02) |

|

|

(1.02) |

|

|

(98.0) |

% |

|

0.01 |

|

|

(1.07) |

|

|

NMF |

|

Adjusted diluted net income per share |

|

$ |

2.55 |

|

|

$ |

2.00 |

|

|

27.5 |

% |

|

$ |

7.18 |

|

|

$ |

5.76 |

|

|

24.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation from cash provided by operating activities to free cash flow: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash provided by operating activities |

|

$ |

195.7 |

|

|

$ |

191.9 |

|

|

2.0 |

% |

|

$ |

385.7 |

|

|

$ |

438.2 |

|

|

(12.0) |

% |

|

| Capital expenditures |

|

(35.6) |

|

|

(36.1) |

|

|

(1.4) |

% |

|

(104.4) |

|

|

(102.1) |

|

|

2.3 |

% |

|

| Free cash flow |

|

$ |

160.1 |

|

|

$ |

155.8 |

|

|

2.8 |

% |

|

$ |

281.3 |

|

|

$ |

336.1 |

|

|

(16.3) |

% |

|

_____________________________________________________________________________________________________________________________________________________________________________________

NMF - Not meaningful, pp - percentage points

News Release

News Release