| Delaware | 001-31792 | 75-3108137 | ||||||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) | (I.R.S. Employer Identification No.) |

||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||||||||

| Common Stock, par value $0.01 per share | CNO | New York Stock Exchange | ||||||||||||

| Rights to purchase Series F Junior Participating Preferred Stock | New York Stock Exchange | |||||||||||||

| 5.125% Subordinated Debentures due 2060 | CNOpA | New York Stock Exchange | ||||||||||||

| Item 2.02. | Results of Operations and Financial Condition. | ||||

| Item 9.01(d). | Financial Statements and Exhibits. | ||||

| 99.1 | |||||

| 99.2 | |||||

| 99.3 | |||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | ||||

| CNO Financial Group, Inc. | |||||||||||

Date: April 28, 2025 |

|||||||||||

| By: | /s/ Joel T. Koehneman |

||||||||||

Joel T. Koehneman |

|||||||||||

|

Senior Vice President and

Chief Accounting Officer

|

|||||||||||

News

News| Per diluted share | |||||||||||||||||||||||||||||||||||||||||

| Quarter ended | Quarter ended | ||||||||||||||||||||||||||||||||||||||||

| March 31, | March 31, | ||||||||||||||||||||||||||||||||||||||||

| 2025 | 2024 | % change | 2025 | 2024 | % change | ||||||||||||||||||||||||||||||||||||

Income from insurance products (b) |

0.85 | $ | 0.61 | 39 | $ | 87.7 | $ | 68.0 | 29 | ||||||||||||||||||||||||||||||||

| Fee income | (0.01) | 0.10 | (110) | (0.8) | 11.3 | (107) | |||||||||||||||||||||||||||||||||||

Investment income not allocated to product lines (c) |

0.37 | 0.11 | 236 | 38.0 | 12.3 | 209 | |||||||||||||||||||||||||||||||||||

| Expenses not allocated to product lines | (0.20) | (0.15) | 33 | (20.3) | (16.8) | 21 | |||||||||||||||||||||||||||||||||||

| Operating earnings before taxes | 1.01 | 0.67 | 104.6 | 74.8 | |||||||||||||||||||||||||||||||||||||

| Income tax expense on operating income | (0.23) | (0.15) | 53 | (23.5) | (17.3) | 36 | |||||||||||||||||||||||||||||||||||

| Net operating income (1) | 0.79 | 0.52 | 52 | 81.1 | 57.5 | 41 | |||||||||||||||||||||||||||||||||||

| Net realized investment losses from sales, impairments and change in allowance for credit losses | (0.13) | (0.04) | (13.2) | (4.6) | |||||||||||||||||||||||||||||||||||||

| Net change in market value of investments recognized in earnings | 0.06 | 0.11 | 6.4 | 12.4 | |||||||||||||||||||||||||||||||||||||

| Changes in fair value of embedded derivative liabilities and market risk benefits | (0.77) | 0.57 | (79.7) | 64.0 | |||||||||||||||||||||||||||||||||||||

| Other | — | — | (0.4) | (0.4) | |||||||||||||||||||||||||||||||||||||

| Non-operating income (loss) before taxes | (0.84) | 0.64 | (86.9) | 71.4 | |||||||||||||||||||||||||||||||||||||

| Income tax benefit (expense) on non-operating income | 0.19 | (0.15) | 19.5 | (16.6) | |||||||||||||||||||||||||||||||||||||

| Net non-operating income (loss) | (0.65) | 0.49 | (67.4) | 54.8 | |||||||||||||||||||||||||||||||||||||

| Net income | $ | 0.13 | $ | 1.01 | $ | 13.7 | $ | 112.3 | |||||||||||||||||||||||||||||||||

| Weighted average diluted shares outstanding | 103.1 | 110.8 | |||||||||||||||||||||||||||||||||||||||

| Quarter ended | |||||||||||

| March 31, | |||||||||||

| 2025 | 2024 | ||||||||||

Trailing four quarters: |

|||||||||||

| Net Income | $ | 305.4 | $ | 389.6 | |||||||

| Net operating income (a non-GAAP financial measure) | 452.9 | 355.0 | |||||||||

| Net operating income, excluding significant items | 428.8 | 311.7 | |||||||||

Average of each of the trailing four quarters average: |

|||||||||||

| Shareholders’ equity | $ | 2,516.0 | $ | 2,075.3 | |||||||

| Accumulated other comprehensive loss | 1,327.9 | 1,709.8 | |||||||||

| Shareholders’ equity, excluding accumulated other comprehensive loss | 3,843.9 | 3,785.1 | |||||||||

| Net operating loss carryforwards | (237.6) | (135.1) | |||||||||

| Shareholders' equity, excluding accumulated other comprehensive loss and net operating loss carryforwards | $ | 3,606.3 | $ | 3,650.0 | |||||||

Ratios: |

|||||||||||

| Return on equity | 12.1 | % | 18.8 | % | |||||||

Operating return on equity (a non-GAAP financial measure) (5) |

12.6 | % | 9.7 | % | |||||||

Operating return on equity, excluding significant items (a non-GAAP financial measure) (5) |

11.9 | % | 8.5 | % | |||||||

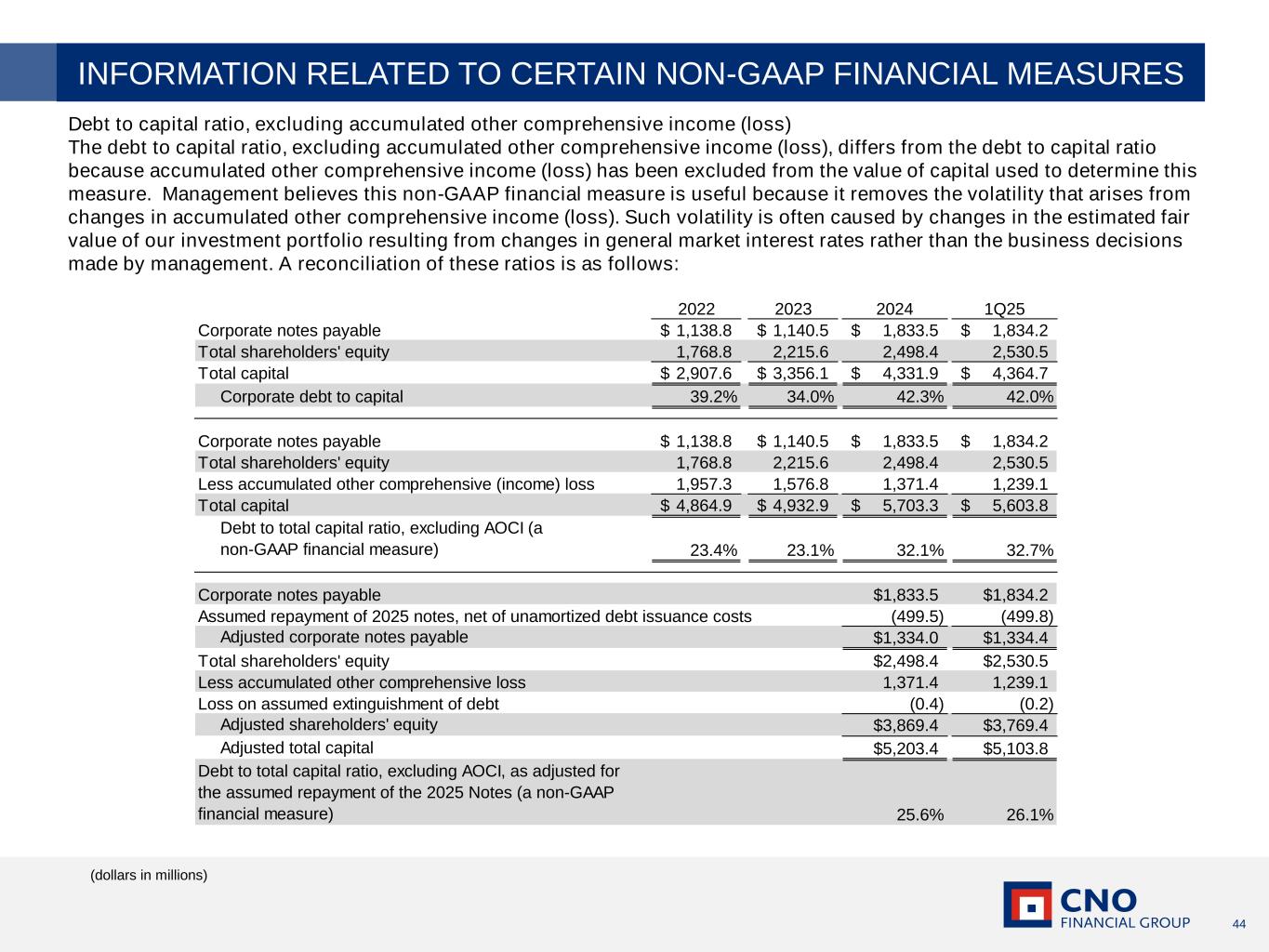

| Shareholders’ equity | $ | 2,530.5 | $ | 2,367.7 | |||||||

| Accumulated other comprehensive loss | 1,239.1 | 1,480.3 | |||||||||

| Shareholders’ equity, excluding accumulated other comprehensive loss | 3,769.6 | 3,848.0 | |||||||||

| Basic shares outstanding | 99,893,923 | 108,568,594 | |||||||||

| Diluted shares outstanding | 101,796,131 | 110,036,495 | |||||||||

| Book value per share | $ | 25.33 | $ | 21.81 | |||||||

| Book value per diluted share | $ | 24.86 | $ | 21.52 | |||||||

Accumulated other comprehensive loss per diluted share |

12.17 | 13.45 | |||||||||

Book value per diluted share, excluding accumulated other comprehensive loss (a non-GAAP financial measure) (2) |

$ | 37.03 | $ | 34.97 | |||||||

| Investment grade | Below investment grade | Total | |||||||||||||||

| Corporate securities | 13,299.1 | $ | 642.9 | $ | 13,942.0 | ||||||||||||

| Certificates of deposit | 470.0 | — | 470.0 | ||||||||||||||

| United States Treasury securities and obligations of the United States government and agencies | 216.3 | — | 216.3 | ||||||||||||||

| States and political subdivisions | 3,274.1 | 23.5 | 3,297.6 | ||||||||||||||

| Foreign governments | 109.0 | — | 109.0 | ||||||||||||||

| Asset-backed securities | 1,524.5 | 101.2 | 1,625.7 | ||||||||||||||

| Agency residential mortgage-backed securities | 812.1 | — | 812.1 | ||||||||||||||

| Non-agency residential mortgage-backed securities | 1,296.6 | 368.4 | (a) | 1,665.0 | |||||||||||||

| Collateralized loan obligations | 1,009.2 | — | 1,009.2 | ||||||||||||||

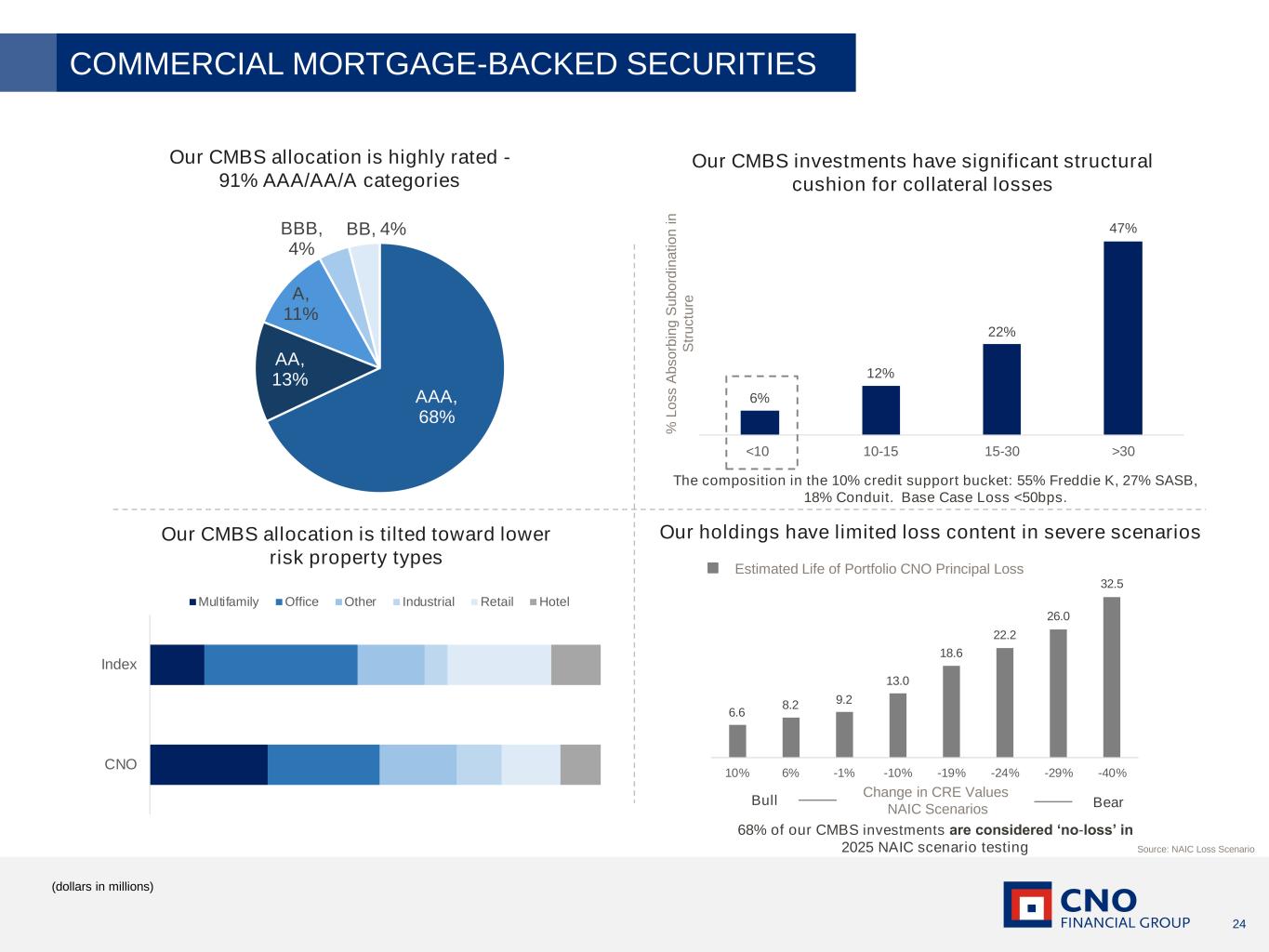

| Commercial mortgage-backed securities | 2,230.0 | 94.2 | 2,324.2 | ||||||||||||||

| Total | $ | 24,240.9 | $ | 1,230.2 | $ | 25,471.1 | |||||||||||

| Three months ended | |||||||||||

| March 31, | |||||||||||

| 2025 | 2024 | ||||||||||

| Revenues: | |||||||||||

| Insurance policy income | $ | 650.7 | $ | 628.4 | |||||||

| Net investment income: | |||||||||||

| General account assets | 375.1 | 301.9 | |||||||||

| Policyholder and other special-purpose portfolios | (63.6) | 167.3 | |||||||||

| Investment gains (losses): | |||||||||||

| Realized investment losses | (3.8) | (10.0) | |||||||||

| Other investment gains (losses) | (3.0) | 17.8 | |||||||||

| Total investment gains (losses) | (6.8) | 7.8 | |||||||||

| Fee revenue and other income | 48.7 | 51.1 | |||||||||

| Total revenues | 1,004.1 | 1,156.5 | |||||||||

| Benefits and expenses: | |||||||||||

| Insurance policy benefits | 580.1 | 636.6 | |||||||||

| Liability for future policy benefits remeasurement (gain) loss | (12.2) | (6.4) | |||||||||

| Change in fair value of market risk benefits | 15.3 | (18.9) | |||||||||

| Interest expense | 62.0 | 60.2 | |||||||||

| Amortization of deferred acquisition costs and present value of future profits | 67.4 | 60.5 | |||||||||

| Loss on extinguishment of borrowings related to variable interest entities | (1.5) | — | |||||||||

| Other operating costs and expenses | 275.3 | 278.3 | |||||||||

| Total benefits and expenses | 986.4 | 1,010.3 | |||||||||

| Income before income taxes | 17.7 | 146.2 | |||||||||

| Income tax expense | 4.0 | 33.9 | |||||||||

| Net income | $ | 13.7 | $ | 112.3 | |||||||

| Earnings per common share: | |||||||||||

| Basic: | |||||||||||

| Weighted average shares outstanding | 100,743,000 | 108,964,000 | |||||||||

| Net income | $ | 0.14 | $ | 1.03 | |||||||

| Diluted: | |||||||||||

| Weighted average shares outstanding | 103,070,000 | 110,845,000 | |||||||||

| Net income | $ | 0.13 | $ | 1.01 | |||||||

| Net operating | ||||||||||||||||||||||||||||||||||||||

| Net operating | income, | |||||||||||||||||||||||||||||||||||||

| income, | excluding | Net | ||||||||||||||||||||||||||||||||||||

| excluding | significant | income - | ||||||||||||||||||||||||||||||||||||

| Net operating | Significant | significant | items - trailing | Net | trailing | |||||||||||||||||||||||||||||||||

| income | items | items (a) | four quarters | income (loss) | four quarters | |||||||||||||||||||||||||||||||||

| 2Q23 | $ | 62.3 | $ | — | $ | 62.3 | $ | 281.2 | $ | 73.7 | $ | 286.8 | ||||||||||||||||||||||||||

| 3Q23 | 101.3 | (16.9) | (b) | 84.4 | 287.7 | 167.3 | 278.2 | |||||||||||||||||||||||||||||||

| 4Q23 | 133.9 | (26.4) | (c) | 107.5 | 312.8 | 36.3 | 276.5 | |||||||||||||||||||||||||||||||

| 1Q24 | 57.5 | — | 57.5 | 311.7 | 112.3 | 389.6 | ||||||||||||||||||||||||||||||||

| 2Q24 | 114.6 | — | 114.6 | 364.0 | 116.3 | 432.2 | ||||||||||||||||||||||||||||||||

| 3Q24 | 119.2 | (21.9) | (d) | 97.3 | 376.9 | 9.3 | 274.2 | |||||||||||||||||||||||||||||||

| 4Q24 | 138.0 | 3.1 | (e) | 141.1 | 410.5 | 166.1 | 404.0 | |||||||||||||||||||||||||||||||

| 1Q25 | 81.1 | (5.3) | (f) |

75.8 | 428.8 | 13.7 | 305.4 | |||||||||||||||||||||||||||||||

| (a) See note (6) for additional information. | ||||||||||||||||||||||||||||||||||||||

| (b) Comprised of $21.7 million of legal recoveries, net of expenses and increased legal accruals, net of tax expense of $4.8 million. | ||||||||||||||||||||||||||||||||||||||

| (c) Comprised of $33.9 million of the net favorable impact arising from our comprehensive annual actuarial review, net of tax expense of $7.5 million. | ||||||||||||||||||||||||||||||||||||||

| (d) Comprised of $31.2 million of the net favorable impact arising from our comprehensive annual actuarial review and $2.9 million of the unfavorable impact related to a fixed asset impairment, net of tax expense of $6.4 million. | ||||||||||||||||||||||||||||||||||||||

| (e) Comprised of $3.9 million of the unfavorable impact arising from our comprehensive annual actuarial review, net of tax expense of $0.8 million. | ||||||||||||||||||||||||||||||||||||||

(f) Comprised of $6.8 million of the favorable impact of an out-of-period adjustment which decreased reserves, net of tax expense of $1.5 million. | ||||||||||||||||||||||||||||||||||||||

Trailing four quarters |

|||||||||||||||||

| 1Q25 | 1Q24 | ||||||||||||||||

| Pre-tax operating earnings (a non-GAAP financial measure) | $ | 580.6 | $ | 457.9 | |||||||||||||

| Income tax expense | (127.7) | (102.9) | |||||||||||||||

| Net operating income | 452.9 | 355.0 | |||||||||||||||

| Non-operating items: | |||||||||||||||||

| Net realized investment losses from sales, impairments and change in allowance for credit losses | (81.3) | (54.6) | |||||||||||||||

| Net change in market value of investments recognized in earnings | 16.8 | 8.0 | |||||||||||||||

| Changes in fair value of embedded derivative liabilities and market risk benefits | (119.0) | 99.2 | |||||||||||||||

| Fair value changes related to the agent deferred compensation plan | 6.6 | (3.5) | |||||||||||||||

| Other | (13.9) | (3.0) | |||||||||||||||

| Non-operating loss before taxes | (190.8) | 46.1 | |||||||||||||||

| Income tax benefit on non-operating loss | 43.3 | (11.5) | |||||||||||||||

| Net non-operating loss | (147.5) | 34.6 | |||||||||||||||

| Net income | $ | 305.4 | $ | 389.6 | |||||||||||||

| 1Q23 | 2Q23 | 3Q23 | 4Q23 | ||||||||||||||||||||||||||

| Consolidated capital, excluding accumulated other comprehensive | |||||||||||||||||||||||||||||

| income (loss) and net operating loss carryforwards | |||||||||||||||||||||||||||||

| (a non-GAAP financial measure) | $ | 3,543.8 | $ | 3,603.0 | $ | 3,744.2 | $ | 3,712.8 | |||||||||||||||||||||

| Net operating loss carryforwards | 152.4 | 126.3 | 102.6 | 79.6 | |||||||||||||||||||||||||

| Accumulated other comprehensive loss | (1,664.4) | (1,733.5) | (1,956.7) | (1,576.8) | |||||||||||||||||||||||||

| Common shareholders' equity | $ | 2,031.8 | $ | 1,995.8 | $ | 1,890.1 | $ | 2,215.6 | |||||||||||||||||||||

| 1Q24 | 2Q24 | 3Q24 | 4Q24 | ||||||||||||||||||||||||||

| Consolidated capital, excluding accumulated other comprehensive | |||||||||||||||||||||||||||||

| income (loss) and net operating loss carryforwards | |||||||||||||||||||||||||||||

| (a non-GAAP financial measure) | $ | 3,536.8 | $ | 3,596.7 | $ | 3,529.9 | $ | 3,793.2 | |||||||||||||||||||||

| Net operating loss carryforwards | 311.2 | 296.5 | 273.9 | 76.6 | |||||||||||||||||||||||||

| Accumulated other comprehensive loss | (1,480.3) | (1,464.3) | (1,116.0) | (1,371.4) | |||||||||||||||||||||||||

| Common shareholders' equity | $ | 2,367.7 | $ | 2,428.9 | $ | 2,687.8 | $ | 2,498.4 | |||||||||||||||||||||

| 1Q25 | |||||||||||||||||||||||||||||

| Consolidated capital, excluding accumulated other comprehensive | |||||||||||||||||||||||||||||

| income (loss) and net operating loss carryforwards | |||||||||||||||||||||||||||||

| (a non-GAAP financial measure) | $ | 3,474.3 | |||||||||||||||||||||||||||

| Net operating loss carryforwards | 295.3 | ||||||||||||||||||||||||||||

| Accumulated other comprehensive loss | (1,239.1) | ||||||||||||||||||||||||||||

| Common shareholders' equity | $ | 2,530.5 | |||||||||||||||||||||||||||

| Trailing four quarter average | |||||||||||||||||

| 1Q25 | 1Q24 | ||||||||||||||||

| Consolidated capital, excluding accumulated other comprehensive | |||||||||||||||||

| income (loss) and net operating loss carryforwards | |||||||||||||||||

| (a non-GAAP financial measure) | $ | 3,606.3 | $ | 3,650.0 | |||||||||||||

| Net operating loss carryforwards | 237.6 | 135.1 | |||||||||||||||

| Accumulated other comprehensive loss | (1,327.9) | (1,709.8) | |||||||||||||||

| Common shareholders' equity | $ | 2,516.0 | $ | 2,075.3 | |||||||||||||

Three months ended |

||||||||||||||||||||

| March 31, 2025 | ||||||||||||||||||||

| Actual results | Significant items | Excluding significant items |

||||||||||||||||||

Insurance product margin |

||||||||||||||||||||

| Annuity margin | $ | 54.5 | $ | — | $ | 54.5 | ||||||||||||||

| Health margin | 126.2 | — | 126.2 | |||||||||||||||||

| Life margin | 68.2 | (6.8) | (a) | 61.4 | ||||||||||||||||

| Total insurance product margin | 248.9 | (6.8) | 242.1 | |||||||||||||||||

| Allocated expenses | (161.2) | — | (161.2) | |||||||||||||||||

Income from insurance products |

87.7 | (6.8) | 80.9 | |||||||||||||||||

| Fee income | (0.8) | — | (0.8) | |||||||||||||||||

Investment income not allocated to product lines |

38.0 | — | 38.0 | |||||||||||||||||

| Expenses not allocated to product lines | (20.3) | — | (20.3) | |||||||||||||||||

| Operating earnings before taxes | 104.6 | (6.8) | 97.8 | |||||||||||||||||

| Income tax (expense) benefit on operating income | (23.5) | 1.5 | (22.0) | |||||||||||||||||

Net operating income |

$ | 81.1 | $ | (5.3) | $ | 75.8 | ||||||||||||||

| Net operating income per diluted share | $ | 0.79 | $ | (0.05) | $ | 0.74 | ||||||||||||||

| Three months ended | ||||||||||||||||||||

| December 31, 2024 | ||||||||||||||||||||

| Actual results | Significant items | Excluding significant items |

||||||||||||||||||

| Insurance product margin | ||||||||||||||||||||

| Annuity margin | $ | 55.0 | $ | — | $ | 55.0 | ||||||||||||||

| Health margin | 130.1 | 3.9 | (a) | 134.0 | ||||||||||||||||

| Life margin | 68.0 | — | 68.0 | |||||||||||||||||

| Total insurance product margin | 253.1 | 3.9 | 257.0 | |||||||||||||||||

| Allocated expenses | (146.1) | — | (146.1) | |||||||||||||||||

| Income from insurance products | 107.0 | 3.9 | 110.9 | |||||||||||||||||

| Fee income | 20.6 | — | 20.6 | |||||||||||||||||

| Investment income not allocated to product lines | 65.3 | — | 65.3 | |||||||||||||||||

| Expenses not allocated to product lines | (19.0) | — | (19.0) | |||||||||||||||||

| Operating earnings before taxes | 173.9 | 3.9 | 177.8 | |||||||||||||||||

| Income tax (expense) benefit on operating income | (35.9) | (0.8) | (36.7) | |||||||||||||||||

| Net operating income | $ | 138.0 | $ | 3.1 | $ | 141.1 | ||||||||||||||

| Net operating income per diluted share | $ | 1.31 | $ | 0.03 | $ | 1.34 | ||||||||||||||

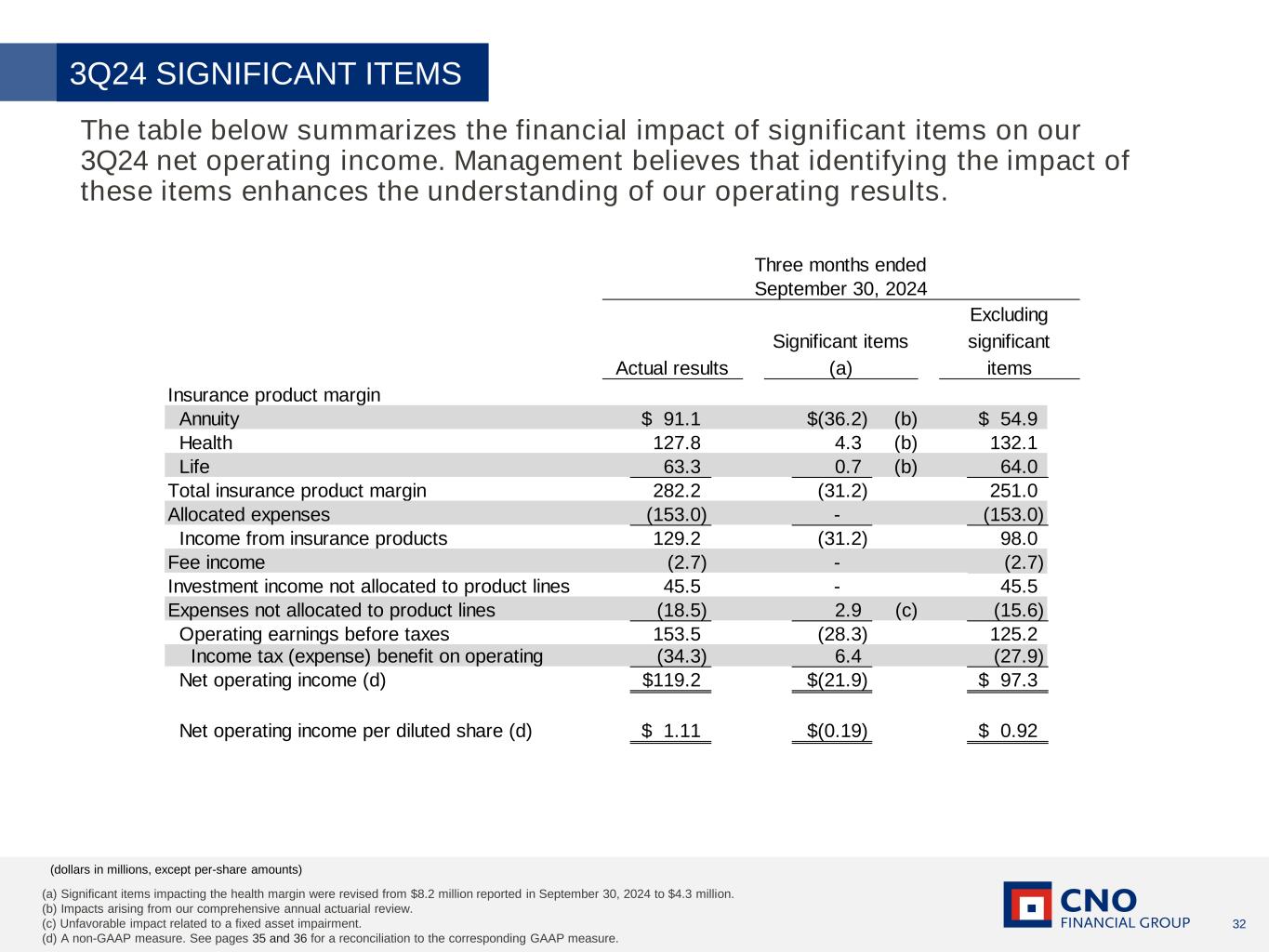

| Three months ended | ||||||||||||||||||||

| September 30, 2024 | ||||||||||||||||||||

| Actual results | Significant items (a) | Excluding significant items |

||||||||||||||||||

| Insurance product margin | ||||||||||||||||||||

| Annuity margin | $ | 91.1 | $ | (36.2) | (b) | $ | 54.9 | |||||||||||||

| Health margin | 127.8 | 4.3 | (b) | 132.1 | ||||||||||||||||

| Life margin | 63.3 | 0.7 | (b) | 64.0 | ||||||||||||||||

| Total insurance product margin | 282.2 | (31.2) | 251.0 | |||||||||||||||||

| Allocated expenses | (153.0) | — | (153.0) | |||||||||||||||||

| Income from insurance products | 129.2 | (31.2) | 98.0 | |||||||||||||||||

| Fee income | (2.7) | — | (2.7) | |||||||||||||||||

| Investment income not allocated to product lines | 45.5 | — | 45.5 | |||||||||||||||||

| Expenses not allocated to product lines | (18.5) | 2.9 | (c) | (15.6) | ||||||||||||||||

| Operating earnings before taxes | 153.5 | (28.3) | 125.2 | |||||||||||||||||

| Income tax (expense) benefit on operating income | (34.3) | 6.4 | (27.9) | |||||||||||||||||

| Net operating income | $ | 119.2 | $ | (21.9) | $ | 97.3 | ||||||||||||||

| Net operating income per diluted share | $ | 1.11 | $ | (0.19) | $ | 0.92 | ||||||||||||||

| Quarterly Financial Supplement - 1Q2025 | |||||||||||||||||

| April 28, 2025 | |||||||||||||||||

| Table of Contents | Page | |||||||||||||

| Consolidated balance sheet | 3 | |||||||||||||

| Consolidated statement of operations | 4 | |||||||||||||

| Financial summary | 5 | |||||||||||||

| Insurance operations | 6 | |||||||||||||

| Margin from insurance products | 7-9 | |||||||||||||

| Collected premiums and insurance policy income | 10 | |||||||||||||

| Health and life new annualized premiums | 11 | |||||||||||||

| Computation of weighted average shares outstanding | 12 | |||||||||||||

| Annuities - account value rollforwards | 13 | |||||||||||||

| Consolidated statutory information of U.S. based insurance subsidiaries | 14 | |||||||||||||

| Investment income not allocated to product lines and investment income allocated to product lines | 15-18 | |||||||||||||

| Other investment data | 18 | |||||||||||||

| Significant items | 19-20 | |||||||||||||

| Notes | 20-21 | |||||||||||||

| Mar-24 | Jun-24 | Sep-24 | Dec-24 | Mar-25 | |||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||

| Investments: | |||||||||||||||||||||||||||||

| Fixed maturities, available for sale, at fair value | $ | 21,648.1 | $ | 22,617.9 | $ | 23,724.7 | $ | 22,840.5 | $ | 23,283.0 | |||||||||||||||||||

| Equity securities at fair value | 118.4 | 117.7 | 120.5 | 162.0 | 349.1 | ||||||||||||||||||||||||

| Mortgage loans | 2,087.1 | 2,176.0 | 2,372.7 | 2,506.3 | 2,601.2 | ||||||||||||||||||||||||

| Policy loans | 130.3 | 131.3 | 133.3 | 135.3 | 136.4 | ||||||||||||||||||||||||

| Trading securities | 222.8 | 207.8 | 217.4 | 304.2 | 308.0 | ||||||||||||||||||||||||

| Investments held by variable interest entities | 533.4 | 425.5 | 250.1 | 432.3 | 380.2 | ||||||||||||||||||||||||

| Other invested assets | 1,471.3 | 1,554.0 | 1,595.5 | 1,491.5 | 1,386.7 | ||||||||||||||||||||||||

| Total investments | 26,211.4 | 27,230.2 | 28,414.2 | 27,872.1 | 28,444.6 | ||||||||||||||||||||||||

| Cash and cash equivalents - unrestricted | 566.3 | 878.8 | 1,164.7 | 1,656.7 | 928.2 | ||||||||||||||||||||||||

| Cash and cash equivalents held by variable interest entities | 83.5 | 113.3 | 80.6 | 341.0 | 96.6 | ||||||||||||||||||||||||

| Accrued investment income | 252.0 | 262.5 | 276.2 | 286.4 | 289.6 | ||||||||||||||||||||||||

| Present value of future profits | 175.5 | 170.4 | 165.7 | 161.0 | 156.5 | ||||||||||||||||||||||||

| Deferred acquisition costs | 1,992.3 | 2,047.2 | 2,100.9 | 2,158.6 | 2,209.9 | ||||||||||||||||||||||||

| Reinsurance receivables | 3,969.0 | 3,910.9 | 3,906.7 | 3,854.7 | 3,804.3 | ||||||||||||||||||||||||

| Income tax assets, net | 886.1 | 882.8 | 788.7 | 818.9 | 775.1 | ||||||||||||||||||||||||

| Assets held in separate accounts | 3.3 | 3.2 | 3.3 | 3.3 | 3.1 | ||||||||||||||||||||||||

| Other assets | 716.2 | 706.4 | 648.0 | 699.9 | 728.4 | ||||||||||||||||||||||||

| Total assets | $ | 34,855.6 | $ | 36,205.7 | $ | 37,549.0 | $ | 37,852.6 | $ | 37,436.3 | |||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||

| Liabilities for insurance products: | |||||||||||||||||||||||||||||

| Policyholder account balances | $ | 15,361.1 | $ | 16,247.9 | $ | 16,992.4 | $ | 17,615.8 | $ | 17,346.0 | |||||||||||||||||||

| Future policy benefits | 11,932.2 | 11,695.1 | 12,258.2 | 11,705.5 | 11,773.0 | ||||||||||||||||||||||||

| Market risk benefit liability | 99.6 | 93.0 | 74.1 | 60.0 | 73.6 | ||||||||||||||||||||||||

| Liability for life insurance policy claims | 65.1 | 59.6 | 59.9 | 61.1 | 63.5 | ||||||||||||||||||||||||

| Unearned and advanced premiums | 226.0 | 220.9 | 217.4 | 226.8 | 221.5 | ||||||||||||||||||||||||

| Liabilities related to separate accounts | 3.3 | 3.2 | 3.3 | 3.3 | 3.1 | ||||||||||||||||||||||||

| Other liabilities | 905.0 | 934.4 | 951.0 | 1,161.8 | 1,027.2 | ||||||||||||||||||||||||

| Investment borrowings | 2,189.1 | 2,189.0 | 2,188.9 | 2,188.8 | 2,188.6 | ||||||||||||||||||||||||

| Borrowings related to variable interest entities | 565.5 | 501.4 | 283.1 | 497.6 | 375.1 | ||||||||||||||||||||||||

| Notes payable - direct corporate obligations | 1,141.0 | 1,832.3 | 1,832.9 | 1,833.5 | 1,834.2 | ||||||||||||||||||||||||

| Total liabilities | 32,487.9 | 33,776.8 | 34,861.2 | 35,354.2 | 34,905.8 | ||||||||||||||||||||||||

| Shareholders' equity | |||||||||||||||||||||||||||||

| Common stock | 1.1 | 1.1 | 1.0 | 1.0 | 1.0 | ||||||||||||||||||||||||

| Additional paid-in capital | 1,851.2 | 1,797.6 | 1,715.9 | 1,632.5 | 1,535.0 | ||||||||||||||||||||||||

| Retained earnings | 1,995.7 | 2,094.5 | 2,086.9 | 2,236.3 | 2,233.6 | ||||||||||||||||||||||||

| Total shareholders' equity before accumulated other comprehensive loss | 3,848.0 | 3,893.2 | 3,803.8 | 3,869.8 | 3,769.6 | ||||||||||||||||||||||||

| Accumulated other comprehensive loss | (1,480.3) | (1,464.3) | (1,116.0) | (1,371.4) | (1,239.1) | ||||||||||||||||||||||||

| Total shareholders' equity | 2,367.7 | 2,428.9 | 2,687.8 | 2,498.4 | 2,530.5 | ||||||||||||||||||||||||

| Total liabilities and shareholders' equity | $ | 34,855.6 | $ | 36,205.7 | $ | 37,549.0 | $ | 37,852.6 | $ | 37,436.3 | |||||||||||||||||||

| Mar-24 | Jun-24 | Sep-24 | Dec-24 | Mar-25 | |||||||||||||||||||||||||

| Book value per common share | $ | 21.81 | $ | 22.80 | $ | 25.86 | $ | 24.59 | $ | 25.33 | |||||||||||||||||||

| Book value per common share, excluding accumulated other comprehensive loss (1) (2) | $ | 35.44 | $ | 36.55 | $ | 36.60 | $ | 38.08 | $ | 37.74 | |||||||||||||||||||

Book value per diluted share, excluding accumulated other comprehensive loss (1) (3) |

$ | 34.97 | $ | 36.00 | $ | 35.84 | $ | 37.19 | $ | 37.03 | |||||||||||||||||||

| 1Q | 2Q | 3Q | 4Q | YTD | 1Q | ||||||||||||||||||||||||||||||

| 2024 | 2024 | 2024 | 2024 | 2024 | 2025 | ||||||||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||||||||

| Insurance policy income | $ | 628.4 | $ | 641.5 | $ | 645.0 | $ | 643.6 | $ | 2,558.5 | $ | 650.7 | |||||||||||||||||||||||

| Net investment income: | |||||||||||||||||||||||||||||||||||

| General account assets | 301.9 | 351.7 | 366.3 | 399.5 | 1,419.4 | 375.1 | |||||||||||||||||||||||||||||

| Policyholder and other special-purpose portfolios | 167.3 | 57.4 | 87.6 | 17.1 | 329.4 | (63.6) | |||||||||||||||||||||||||||||

| Investment gains (losses): | |||||||||||||||||||||||||||||||||||

| Realized investment losses | (10.0) | (26.3) | (13.1) | (26.2) | (75.6) | (3.8) | |||||||||||||||||||||||||||||

| Other investment gains (losses) | 17.8 | 9.1 | 14.3 | (15.5) | 25.7 | (3.0) | |||||||||||||||||||||||||||||

| Total investment gains (losses) | 7.8 | (17.2) | 1.2 | (41.7) | (49.9) | (6.8) | |||||||||||||||||||||||||||||

| Fee revenue and other income | 51.1 | 32.8 | 29.5 | 78.7 | 192.1 | 48.7 | |||||||||||||||||||||||||||||

| Total revenues | 1,156.5 | 1,066.2 | 1,129.6 | 1,097.2 | 4,449.5 | 1,004.1 | |||||||||||||||||||||||||||||

| Benefits and expenses | |||||||||||||||||||||||||||||||||||

| Insurance policy benefits | 636.6 | 574.4 | 731.0 | 529.9 | 2,471.9 | 580.1 | |||||||||||||||||||||||||||||

| Liability for future policy benefits remeasurement (gain) loss | (6.4) | (30.0) | 7.3 | (12.0) | (41.1) | (12.2) | |||||||||||||||||||||||||||||

| Change in fair value of market risk benefits | (18.9) | (5.8) | (20.9) | (14.9) | (60.5) | 15.3 | |||||||||||||||||||||||||||||

| Interest expense | 60.2 | 64.2 | 68.0 | 62.0 | 254.4 | 62.0 | |||||||||||||||||||||||||||||

| Amortization of deferred acquisition costs and present value of future profits | 60.5 | 61.4 | 64.0 | 65.3 | 251.2 | 67.4 | |||||||||||||||||||||||||||||

| Loss on extinguishment of borrowings related to variable interest entities | — | — | — | — | — | (1.5) | |||||||||||||||||||||||||||||

| Other operating costs and expenses | 278.3 | 251.4 | 269.2 | 256.4 | 1,055.3 | 275.3 | |||||||||||||||||||||||||||||

| Total benefits and expenses | 1,010.3 | 915.6 | 1,118.6 | 886.7 | 3,931.2 | 986.4 | |||||||||||||||||||||||||||||

Income before income taxes |

146.2 | 150.6 | 11.0 | 210.5 | 518.3 | 17.7 | |||||||||||||||||||||||||||||

Income tax expense on period income |

33.9 | 34.3 | 1.7 | 44.4 | 114.3 | 4.0 | |||||||||||||||||||||||||||||

Net income |

$ | 112.3 | $ | 116.3 | $ | 9.3 | $ | 166.1 | $ | 404.0 | $ | 13.7 | |||||||||||||||||||||||

| 1Q | 2Q | 3Q | 4Q | YTD | 1Q | ||||||||||||||||||||||||||||||

| 2024 | 2024 | 2024 | 2024 | 2024 | 2025 | ||||||||||||||||||||||||||||||

| Insurance product margin (4) | |||||||||||||||||||||||||||||||||||

| Annuity margin | $ | 52.0 | $ | 76.1 | $ | 91.1 | $ | 55.0 | $ | 274.2 | $ | 54.5 | |||||||||||||||||||||||

| Health margin | 123.0 | 135.9 | 127.8 | 130.1 | 516.8 | 126.2 | |||||||||||||||||||||||||||||

| Life margin | 54.6 | 63.1 | 63.3 | 68.0 | 249.0 | 68.2 | |||||||||||||||||||||||||||||

| Total insurance product margin | 229.6 | 275.1 | 282.2 | 253.1 | 1,040.0 | 248.9 | |||||||||||||||||||||||||||||

| Allocated expenses | (161.6) | (154.6) | (153.0) | (146.1) | (615.3) | (161.2) | |||||||||||||||||||||||||||||

| Income from insurance products (8) | 68.0 | 120.5 | 129.2 | 107.0 | 424.7 | 87.7 | |||||||||||||||||||||||||||||

| Fee income | 11.3 | 0.8 | (2.7) | 20.6 | 30.0 | (0.8) | |||||||||||||||||||||||||||||

| Investment income not allocated to product lines (9) | 12.3 | 44.8 | 45.5 | 65.3 | 167.9 | 38.0 | |||||||||||||||||||||||||||||

| Expenses not allocated to product lines | (16.8) | (17.5) | (18.5) | (19.0) | (71.8) | (20.3) | |||||||||||||||||||||||||||||

| Operating earnings before taxes | 74.8 | 148.6 | 153.5 | 173.9 | 550.8 | 104.6 | |||||||||||||||||||||||||||||

| Income tax expense on operating income | (17.3) | (34.0) | (34.3) | (35.9) | (121.5) | (23.5) | |||||||||||||||||||||||||||||

| Net operating income (10) | 57.5 | 114.6 | 119.2 | 138.0 | 429.3 | 81.1 | |||||||||||||||||||||||||||||

Net realized investment losses from sales, impairments and change in allowance for credit losses |

(4.6) | (21.9) | (11.1) | (35.1) | (72.7) | (13.2) | |||||||||||||||||||||||||||||

| Net change in market value of investments recognized in earnings | 12.4 | 4.7 | 12.3 | (6.6) | 22.8 | 6.4 | |||||||||||||||||||||||||||||

| Fair value changes related to agent deferred compensation plan | — | 3.5 | (3.5) | 6.6 | 6.6 | — | |||||||||||||||||||||||||||||

| Changes in fair value of embedded derivative liabilities and market risk benefits | 64.0 | 16.8 | (127.1) | 71.0 | 24.7 | (79.7) | |||||||||||||||||||||||||||||

| Other | (0.4) | (1.1) | (13.1) | 0.7 | (13.9) | (0.4) | |||||||||||||||||||||||||||||

| Net non-operating income (loss) before taxes | 71.4 | 2.0 | (142.5) | 36.6 | (32.5) | (86.9) | |||||||||||||||||||||||||||||

| Income tax (expense) benefit on non-operating income (loss) | (16.6) | (0.3) | 32.6 | (8.5) | 7.2 | 19.5 | |||||||||||||||||||||||||||||

| Net non-operating income (loss) | 54.8 | 1.7 | (109.9) | 28.1 | (25.3) | (67.4) | |||||||||||||||||||||||||||||

Net income |

$ | 112.3 | $ | 116.3 | $ | 9.3 | $ | 166.1 | $ | 404.0 | $ | 13.7 | |||||||||||||||||||||||

| Per diluted share | |||||||||||||||||||||||||||||||||||

| Net operating income | $ | 0.52 | $ | 1.05 | $ | 1.11 | $ | 1.31 | $ | 3.97 | $ | 0.79 | |||||||||||||||||||||||

| Net non-operating income (loss) | 0.49 | 0.01 | (1.02) | 0.27 | (0.23) | (0.66) | |||||||||||||||||||||||||||||

Net income |

$ | 1.01 | $ | 1.06 | $ | 0.09 | $ | 1.58 | $ | 3.74 | $ | 0.13 | |||||||||||||||||||||||

| 1Q | 2Q | 3Q | 4Q | YTD | 1Q | ||||||||||||||||||||||||||||||

| 2024 | 2024 | 2024 | 2024 | 2024 | 2025 | ||||||||||||||||||||||||||||||

| Insurance product margin (4) | |||||||||||||||||||||||||||||||||||

| Annuity: | |||||||||||||||||||||||||||||||||||

| Insurance policy income | $ | 7.3 | $ | 9.3 | $ | 11.2 | $ | 7.7 | $ | 35.5 | $ | 9.8 | |||||||||||||||||||||||

| Net investment income (5) (6) | 134.5 | 140.5 | 142.2 | 147.8 | 565.0 | 148.0 | |||||||||||||||||||||||||||||

| Insurance policy benefits | (11.3) | 8.4 | 25.9 | (7.8) | 15.2 | (10.3) | |||||||||||||||||||||||||||||

| Interest credited (6) | (58.3) | (61.2) | (65.2) | (69.1) | (253.8) | (68.3) | |||||||||||||||||||||||||||||

| Amortization and non-deferred commissions | (20.2) | (20.9) | (23.0) | (23.6) | (87.7) | (24.7) | |||||||||||||||||||||||||||||

| Annuity margin | 52.0 | 76.1 | 91.1 | 55.0 | 274.2 | 54.5 | |||||||||||||||||||||||||||||

| Health: | |||||||||||||||||||||||||||||||||||

| Insurance policy income | 398.4 | 403.6 | 406.9 | 409.4 | 1,618.3 | 412.0 | |||||||||||||||||||||||||||||

| Net investment income (5) | 74.3 | 75.1 | 75.0 | 75.2 | 299.6 | 75.1 | |||||||||||||||||||||||||||||

| Insurance policy benefits | (308.5) | (302.3) | (314.1) | (314.7) | (1,239.6) | (320.3) | |||||||||||||||||||||||||||||

| Amortization and non-deferred commissions | (41.2) | (40.5) | (40.0) | (39.8) | (161.5) | (40.6) | |||||||||||||||||||||||||||||

| Health margin | 123.0 | 135.9 | 127.8 | 130.1 | 516.8 | 126.2 | |||||||||||||||||||||||||||||

| Life: | |||||||||||||||||||||||||||||||||||

| Insurance policy income | 222.7 | 228.6 | 226.9 | 226.5 | 904.7 | 228.9 | |||||||||||||||||||||||||||||

| Net investment income (5) (7) | 36.5 | 36.7 | 36.8 | 37.1 | 147.1 | 37.6 | |||||||||||||||||||||||||||||

| Insurance policy benefits | (144.0) | (144.6) | (143.5) | (143.9) | (576.0) | (138.1) | |||||||||||||||||||||||||||||

| Interest credited (7) | (12.5) | (12.4) | (13.3) | (13.3) | (51.5) | (13.0) | |||||||||||||||||||||||||||||

| Amortization and non-deferred commissions | (23.5) | (24.3) | (25.1) | (25.1) | (98.0) | (26.0) | |||||||||||||||||||||||||||||

| Advertising expense | (24.6) | (20.9) | (18.5) | (13.3) | (77.3) | (21.2) | |||||||||||||||||||||||||||||

| Life margin | 54.6 | 63.1 | 63.3 | 68.0 | 249.0 | 68.2 | |||||||||||||||||||||||||||||

| Total insurance product margin | 229.6 | 275.1 | 282.2 | 253.1 | 1,040.0 | 248.9 | |||||||||||||||||||||||||||||

| Allocated expenses: | |||||||||||||||||||||||||||||||||||

| Branch office expenses | (19.8) | (16.2) | (16.7) | (13.0) | (65.7) | (20.7) | |||||||||||||||||||||||||||||

| Other allocated expenses | (141.8) | (138.4) | (136.3) | (133.1) | (549.6) | (140.5) | |||||||||||||||||||||||||||||

| Income from insurance products (8) | 68.0 | 120.5 | 129.2 | 107.0 | 424.7 | 87.7 | |||||||||||||||||||||||||||||

| Fee income | 11.3 | 0.8 | (2.7) | 20.6 | 30.0 | (0.8) | |||||||||||||||||||||||||||||

| Investment income not allocated to product lines (9) | 12.3 | 44.8 | 45.5 | 65.3 | 167.9 | 38.0 | |||||||||||||||||||||||||||||

| Expenses not allocated to product lines | (16.8) | (17.5) | (18.5) | (19.0) | (71.8) | (20.3) | |||||||||||||||||||||||||||||

| Operating earnings before taxes | 74.8 | 148.6 | 153.5 | 173.9 | 550.8 | 104.6 | |||||||||||||||||||||||||||||

| Income tax expense on operating income | (17.3) | (34.0) | (34.3) | (35.9) | (121.5) | (23.5) | |||||||||||||||||||||||||||||

| Net operating income (10) | $ | 57.5 | $ | 114.6 | $ | 119.2 | $ | 138.0 | $ | 429.3 | $ | 81.1 | |||||||||||||||||||||||

| 1Q | 2Q | 3Q | 4Q | YTD | 1Q | ||||||||||||||||||||||||||||||

| 2024 | 2024 | 2024 | 2024 | 2024 | 2025 | ||||||||||||||||||||||||||||||

| Annuity margin (4): | |||||||||||||||||||||||||||||||||||

| Fixed indexed annuities | |||||||||||||||||||||||||||||||||||

| Insurance policy income | $ | 6.0 | $ | 7.2 | $ | 8.7 | $ | 6.1 | $ | 28.0 | $ | 7.2 | |||||||||||||||||||||||

| Net investment income (5) (6) | 108.4 | 113.8 | 115.9 | 120.6 | 458.7 | 120.9 | |||||||||||||||||||||||||||||

| Insurance policy benefits | (5.8) | (2.6) | 28.7 | (6.1) | 14.2 | (5.5) | |||||||||||||||||||||||||||||

| Interest credited (6) | (46.7) | (49.4) | (53.3) | (55.7) | (205.1) | (55.7) | |||||||||||||||||||||||||||||

| Amortization and non-deferred commissions | (18.5) | (19.1) | (21.0) | (21.4) | (80.0) | (22.4) | |||||||||||||||||||||||||||||

| Margin from fixed indexed annuities | $ | 43.4 | $ | 49.9 | $ | 79.0 | $ | 43.5 | $ | 215.8 | $ | 44.5 | |||||||||||||||||||||||

| Average net insurance liabilities (11) | $ | 9,636.3 | $ | 9,758.1 | $ | 9,899.4 | $ | 10,101.6 | $ | 9,848.9 | $ | 10,085.7 | |||||||||||||||||||||||

| Margin/average net insurance liabilities (12) | 1.80 | % | 2.05 | % | 3.19 | % | 1.72 | % | 2.19 | % | 1.76 | % | |||||||||||||||||||||||

| Fixed interest annuities | |||||||||||||||||||||||||||||||||||

| Insurance policy income | $ | 0.1 | $ | 0.4 | $ | 0.1 | $ | 0.6 | $ | 1.2 | $ | 0.5 | |||||||||||||||||||||||

| Net investment income (5) | 20.6 | 21.1 | 20.8 | 21.6 | 84.1 | 21.6 | |||||||||||||||||||||||||||||

| Insurance policy benefits | (0.4) | 0.1 | (0.4) | 0.8 | 0.1 | 0.2 | |||||||||||||||||||||||||||||

| Interest credited | (11.1) | (11.3) | (11.3) | (12.9) | (46.6) | (12.1) | |||||||||||||||||||||||||||||

| Amortization and non-deferred commissions | (1.6) | (1.6) | (1.9) | (2.1) | (7.2) | (2.1) | |||||||||||||||||||||||||||||

| Margin from fixed interest annuities | $ | 7.6 | $ | 8.7 | $ | 7.3 | $ | 8.0 | $ | 31.6 | $ | 8.1 | |||||||||||||||||||||||

| Average net insurance liabilities (11) | $ | 1,588.0 | $ | 1,569.4 | $ | 1,568.2 | $ | 1,587.7 | $ | 1,578.3 | $ | 1,599.5 | |||||||||||||||||||||||

| Margin/average net insurance liabilities (12) | 1.91 | % | 2.22 | % | 1.86 | % | 2.02 | % | 2.00 | % | 2.03 | % | |||||||||||||||||||||||

| Other annuities | |||||||||||||||||||||||||||||||||||

| Insurance policy income | $ | 1.2 | $ | 1.7 | $ | 2.4 | $ | 1.0 | $ | 6.3 | $ | 2.1 | |||||||||||||||||||||||

| Net investment income (5) | 5.5 | 5.6 | 5.5 | 5.6 | 22.2 | 5.5 | |||||||||||||||||||||||||||||

| Insurance policy benefits | (5.1) | 10.9 | (2.4) | (2.5) | 0.9 | (5.0) | |||||||||||||||||||||||||||||

| Interest credited | (0.5) | (0.5) | (0.6) | (0.5) | (2.1) | (0.5) | |||||||||||||||||||||||||||||

| Amortization and non-deferred commissions | (0.1) | (0.2) | (0.1) | (0.1) | (0.5) | (0.2) | |||||||||||||||||||||||||||||

| Margin from other annuities | $ | 1.0 | $ | 17.5 | $ | 4.8 | $ | 3.5 | $ | 26.8 | $ | 1.9 | |||||||||||||||||||||||

| Average net insurance liabilities (11) | $ | 439.9 | $ | 426.4 | $ | 414.4 | $ | 408.6 | $ | 422.3 | $ | 402.2 | |||||||||||||||||||||||

| Margin/average net insurance liabilities (12) | 0.91 | % | 16.42 | % | 4.63 | % | 3.43 | % | 6.35 | % | 1.89 | % | |||||||||||||||||||||||

| Total annuity margin | $ | 52.0 | $ | 76.1 | $ | 91.1 | $ | 55.0 | $ | 274.2 | $ | 54.5 | |||||||||||||||||||||||

| Average net insurance liabilities (11) | $ | 11,664.2 | $ | 11,753.9 | $ | 11,882.0 | $ | 12,097.9 | $ | 11,849.5 | $ | 12,087.4 | |||||||||||||||||||||||

| Margin/average net insurance liabilities (12) | 1.78 | % | 2.59 | % | 3.07 | % | 1.82 | % | 2.31 | % | 1.80 | % | |||||||||||||||||||||||

| 1Q | 2Q | 3Q | 4Q | YTD | 1Q | ||||||||||||||||||||||||||||||

| 2024 | 2024 | 2024 | 2024 | 2024 | 2025 | ||||||||||||||||||||||||||||||

| Health margin (4): | |||||||||||||||||||||||||||||||||||

| Supplemental health | |||||||||||||||||||||||||||||||||||

| Insurance policy income | $ | 179.7 | $ | 180.1 | $ | 182.0 | $ | 183.3 | $ | 725.1 | $ | 185.1 | |||||||||||||||||||||||

| Net investment income (5) | 39.0 | 39.4 | 39.6 | 39.7 | 157.7 | 39.8 | |||||||||||||||||||||||||||||

| Insurance policy benefits | (125.8) | (127.4) | (125.8) | (125.2) | (504.2) | (131.6) | |||||||||||||||||||||||||||||

| Amortization and non-deferred commissions | (27.5) | (27.0) | (27.2) | (27.1) | (108.8) | (27.7) | |||||||||||||||||||||||||||||

| Margin from supplemental health | $ | 65.4 | $ | 65.1 | $ | 68.6 | $ | 70.7 | $ | 269.8 | $ | 65.6 | |||||||||||||||||||||||

| Margin/insurance policy income | 36.39 | % | 36.15 | % | 37.69 | % | 38.57 | % | 37.21 | % | 35.44 | % | |||||||||||||||||||||||

| Medicare supplement | |||||||||||||||||||||||||||||||||||

| Insurance policy income | $ | 151.7 | $ | 155.8 | $ | 156.3 | $ | 156.7 | $ | 620.5 | $ | 156.3 | |||||||||||||||||||||||

| Net investment income (5) | 1.4 | 1.3 | 1.3 | 1.3 | 5.3 | 1.2 | |||||||||||||||||||||||||||||

| Insurance policy benefits | (116.4) | (111.5) | (121.6) | (122.9) | (472.4) | (120.0) | |||||||||||||||||||||||||||||

| Amortization and non-deferred commissions | (10.2) | (10.1) | (9.7) | (9.5) | (39.5) | (9.4) | |||||||||||||||||||||||||||||

| Margin from Medicare supplement | $ | 26.5 | $ | 35.5 | $ | 26.3 | $ | 25.6 | $ | 113.9 | $ | 28.1 | |||||||||||||||||||||||

| Margin/insurance policy income | 17.47 | % | 22.79 | % | 16.83 | % | 16.34 | % | 18.36 | % | 17.98 | % | |||||||||||||||||||||||

| Long-term care | |||||||||||||||||||||||||||||||||||

| Insurance policy income | $ | 67.0 | $ | 67.7 | $ | 68.6 | $ | 69.4 | $ | 272.7 | $ | 70.6 | |||||||||||||||||||||||

| Net investment income (5) | 33.9 | 34.4 | 34.1 | 34.2 | 136.6 | 34.1 | |||||||||||||||||||||||||||||

| Insurance policy benefits | (66.3) | (63.4) | (66.7) | (66.6) | (263.0) | (68.7) | |||||||||||||||||||||||||||||

| Amortization and non-deferred commissions | (3.5) | (3.4) | (3.1) | (3.2) | (13.2) | (3.5) | |||||||||||||||||||||||||||||

| Margin from long-term care | $ | 31.1 | $ | 35.3 | $ | 32.9 | $ | 33.8 | $ | 133.1 | $ | 32.5 | |||||||||||||||||||||||

| Margin/insurance policy income | 46.42 | % | 52.14 | % | 47.96 | % | 48.70 | % | 48.81 | % | 46.03 | % | |||||||||||||||||||||||

| Total health margin | $ | 123.0 | $ | 135.9 | $ | 127.8 | $ | 130.1 | $ | 516.8 | $ | 126.2 | |||||||||||||||||||||||

| Margin/insurance policy income | 30.87 | % | 33.67 | % | 31.41 | % | 31.78 | % | 31.93 | % | 30.63 | % | |||||||||||||||||||||||

| 1Q | 2Q | 3Q | 4Q | YTD | 1Q | ||||||||||||||||||||||||||||||

| 2024 | 2024 | 2024 | 2024 | 2024 | 2025 | ||||||||||||||||||||||||||||||

| Life margin (4): | |||||||||||||||||||||||||||||||||||

| Interest sensitive life | |||||||||||||||||||||||||||||||||||

| Insurance policy income | $ | 46.6 | $ | 46.9 | $ | 47.0 | $ | 47.4 | $ | 187.9 | $ | 48.1 | |||||||||||||||||||||||

| Net investment income (5) (7) | 13.2 | 13.2 | 13.3 | 13.5 | 53.2 | 13.9 | |||||||||||||||||||||||||||||

| Insurance policy benefits | (19.9) | (18.6) | (13.6) | (19.7) | (71.8) | (19.9) | |||||||||||||||||||||||||||||

| Interest credited (7) | (12.3) | (12.3) | (13.2) | (13.1) | (50.9) | (12.9) | |||||||||||||||||||||||||||||

| Amortization and non-deferred commissions | (5.1) | (5.3) | (5.3) | (4.8) | (20.5) | (5.1) | |||||||||||||||||||||||||||||

| Margin from interest sensitive life | $ | 22.5 | $ | 23.9 | $ | 28.2 | $ | 23.3 | $ | 97.9 | $ | 24.1 | |||||||||||||||||||||||

| Average net insurance liabilities (11) | $ | 1,056.1 | $ | 1,063.0 | $ | 1,070.8 | $ | 1,078.7 | $ | 1,067.2 | $ | 1,096.1 | |||||||||||||||||||||||

| Interest margin | $ | 0.9 | $ | 0.9 | $ | 0.1 | $ | 0.4 | $ | 2.3 | $ | 1.0 | |||||||||||||||||||||||

| Interest margin/average net insurance liabilities (12) | 0.34 | % | 0.34 | % | 0.04 | % | 0.15 | % | 0.22 | % | 0.36 | % | |||||||||||||||||||||||

| Underwriting margin | $ | 21.6 | $ | 23.0 | $ | 28.1 | $ | 22.9 | $ | 95.6 | $ | 23.1 | |||||||||||||||||||||||

| Underwriting margin/insurance policy income | 46.35 | % | 49.04 | % | 59.79 | % | 48.31 | % | 50.88 | % | 48.02 | % | |||||||||||||||||||||||

| Traditional life | |||||||||||||||||||||||||||||||||||

| Insurance policy income | $ | 176.1 | $ | 181.7 | $ | 179.9 | $ | 179.1 | $ | 716.8 | $ | 180.8 | |||||||||||||||||||||||

| Net investment income (5) | 23.3 | 23.5 | 23.5 | 23.6 | 93.9 | 23.7 | |||||||||||||||||||||||||||||

| Insurance policy benefits | (124.1) | (126.0) | (129.9) | (124.2) | (504.2) | (118.2) | |||||||||||||||||||||||||||||

| Interest credited | (0.2) | (0.1) | (0.1) | (0.2) | (0.6) | (0.1) | |||||||||||||||||||||||||||||

| Amortization and non-deferred commissions | (18.4) | (19.0) | (19.8) | (20.3) | (77.5) | (20.9) | |||||||||||||||||||||||||||||

| Advertising expense | (24.6) | (20.9) | (18.5) | (13.3) | (77.3) | (21.2) | |||||||||||||||||||||||||||||

| Margin from traditional life | $ | 32.1 | $ | 39.2 | $ | 35.1 | $ | 44.7 | $ | 151.1 | $ | 44.1 | |||||||||||||||||||||||

| Margin/insurance policy income | 18.23 | % | 21.57 | % | 19.51 | % | 24.96 | % | 21.08 | % | 24.39 | % | |||||||||||||||||||||||

| Margin excluding advertising expense/insurance policy income | 32.20 | % | 33.08 | % | 29.79 | % | 32.38 | % | 31.86 | % | 36.12 | % | |||||||||||||||||||||||

| Total life margin | $ | 54.6 | $ | 63.1 | $ | 63.3 | $ | 68.0 | $ | 249.0 | $ | 68.2 | |||||||||||||||||||||||

| 1Q | 2Q | 3Q | 4Q | YTD | 1Q | ||||||||||||||||||||||||||||||

| 2024 | 2024 | 2024 | 2024 | 2024 | 2025 | ||||||||||||||||||||||||||||||

| Collected premiums: | |||||||||||||||||||||||||||||||||||

| Annuity products | |||||||||||||||||||||||||||||||||||

| Fixed indexed annuities | $ | 345.5 | $ | 388.5 | $ | 398.8 | $ | 409.9 | $ | 1,542.7 | $ | 388.0 | |||||||||||||||||||||||

| Fixed interest annuities | 45.9 | 49.1 | 62.9 | 81.2 | 239.1 | 51.7 | |||||||||||||||||||||||||||||

| Other annuities | 1.9 | 1.5 | 3.4 | 2.0 | 8.8 | 2.3 | |||||||||||||||||||||||||||||

| Total annuity collected premiums | 393.3 | 439.1 | 465.1 | 493.1 | 1,790.6 | 442.0 | |||||||||||||||||||||||||||||

| Health products | |||||||||||||||||||||||||||||||||||

| Supplemental health | 181.4 | 179.8 | 181.3 | 183.2 | 725.7 | 184.8 | |||||||||||||||||||||||||||||

| Medicare supplement | 155.7 | 152.4 | 153.1 | 164.5 | 625.7 | 151.1 | |||||||||||||||||||||||||||||

| Long-term care | 67.7 | 67.9 | 68.7 | 71.9 | 276.2 | 69.8 | |||||||||||||||||||||||||||||

| Total health collected premiums | 404.8 | 400.1 | 403.1 | 419.6 | 1,627.6 | 405.7 | |||||||||||||||||||||||||||||

| Life products | |||||||||||||||||||||||||||||||||||

| Interest-sensitive life | 60.5 | 61.3 | 61.0 | 61.3 | 244.1 | 62.9 | |||||||||||||||||||||||||||||

| Traditional life | 176.8 | 181.1 | 180.0 | 178.5 | 716.4 | 181.5 | |||||||||||||||||||||||||||||

| Total life collected premiums | 237.3 | 242.4 | 241.0 | 239.8 | 960.5 | 244.4 | |||||||||||||||||||||||||||||

| Total collected premiums | $ | 1,035.4 | $ | 1,081.6 | $ | 1,109.2 | $ | 1,152.5 | $ | 4,378.7 | $ | 1,092.1 | |||||||||||||||||||||||

| Insurance policy income: | |||||||||||||||||||||||||||||||||||

| Annuity products | |||||||||||||||||||||||||||||||||||

| Fixed indexed annuities | $ | 6.0 | $ | 7.2 | $ | 8.7 | $ | 6.1 | $ | 28.0 | $ | 7.2 | |||||||||||||||||||||||

| Fixed interest annuities | 0.1 | 0.4 | 0.1 | 0.6 | 1.2 | 0.5 | |||||||||||||||||||||||||||||

| Other annuities | 1.2 | 1.7 | 2.4 | 1.0 | 6.3 | 2.1 | |||||||||||||||||||||||||||||

| Total annuity insurance policy income | 7.3 | 9.3 | 11.2 | 7.7 | 35.5 | 9.8 | |||||||||||||||||||||||||||||

| Health products | |||||||||||||||||||||||||||||||||||

| Supplemental health | 179.7 | 180.1 | 182.0 | 183.3 | 725.1 | 185.1 | |||||||||||||||||||||||||||||

| Medicare supplement | 151.7 | 155.8 | 156.3 | 156.7 | 620.5 | 156.3 | |||||||||||||||||||||||||||||

| Long-term care | 67.0 | 67.7 | 68.6 | 69.4 | 272.7 | 70.6 | |||||||||||||||||||||||||||||

| Total health insurance policy income | 398.4 | 403.6 | 406.9 | 409.4 | 1,618.3 | 412.0 | |||||||||||||||||||||||||||||

| Life products | |||||||||||||||||||||||||||||||||||

| Interest-sensitive life | 46.6 | 46.9 | 47.0 | 47.4 | 187.9 | 48.1 | |||||||||||||||||||||||||||||

| Traditional life | 176.1 | 181.7 | 179.9 | 179.1 | 716.8 | 180.8 | |||||||||||||||||||||||||||||

| Total life insurance policy income | 222.7 | 228.6 | 226.9 | 226.5 | 904.7 | 228.9 | |||||||||||||||||||||||||||||

| Total insurance policy income | $ | 628.4 | $ | 641.5 | $ | 645.0 | $ | 643.6 | $ | 2,558.5 | $ | 650.7 | |||||||||||||||||||||||

| 1Q | 2Q | 3Q | 4Q | YTD | 1Q | ||||||||||||||||||||||||||||||

| 2024 | 2024 | 2024 | 2024 | 2024 | 2025 | ||||||||||||||||||||||||||||||

| Consumer Division | |||||||||||||||||||||||||||||||||||

| Health products: | |||||||||||||||||||||||||||||||||||

| Supplemental health | $ | 18.0 | $ | 18.2 | $ | 19.1 | $ | 23.7 | $ | 79.0 | $ | 19.5 | |||||||||||||||||||||||

| Medicare supplement | 9.7 | 10.3 | 10.0 | 16.6 | 46.6 | 12.0 | |||||||||||||||||||||||||||||

| Long-term care | 10.6 | 10.7 | 11.6 | 10.2 | 43.1 | 10.2 | |||||||||||||||||||||||||||||

| Total Consumer Division health NAP | 38.3 | 39.2 | 40.7 | 50.5 | 168.7 | 41.7 | |||||||||||||||||||||||||||||

| Life products: | |||||||||||||||||||||||||||||||||||

| Interest sensitive life | 4.4 | 5.0 | 4.2 | 4.0 | 17.6 | 3.6 | |||||||||||||||||||||||||||||

| Traditional life | 48.8 | 43.2 | 38.6 | 36.5 | 167.1 | 46.0 | |||||||||||||||||||||||||||||

| Total Consumer Division life NAP | 53.2 | 48.2 | 42.8 | 40.5 | 184.7 | 49.6 | |||||||||||||||||||||||||||||

| Total Consumer Division health and life NAP | $ | 91.5 | $ | 87.4 | $ | 83.5 | $ | 91.0 | $ | 353.4 | $ | 91.3 | |||||||||||||||||||||||

| Worksite Division | |||||||||||||||||||||||||||||||||||

| Health products: | |||||||||||||||||||||||||||||||||||

| Supplemental health | $ | 9.5 | $ | 11.4 | $ | 11.4 | $ | 13.0 | $ | 45.3 | $ | 10.3 | |||||||||||||||||||||||

| Life products: | |||||||||||||||||||||||||||||||||||

| Interest sensitive life | 3.5 | 4.1 | 4.5 | 4.6 | 16.7 | 4.1 | |||||||||||||||||||||||||||||

| Total Worksite Division health and life NAP | $ | 13.0 | $ | 15.5 | $ | 15.9 | $ | 17.6 | $ | 62.0 | $ | 14.4 | |||||||||||||||||||||||

| Total NAP (both divisions) | |||||||||||||||||||||||||||||||||||

| Health products: | |||||||||||||||||||||||||||||||||||

| Supplemental health | $ | 27.5 | $ | 29.6 | $ | 30.5 | $ | 36.7 | $ | 124.3 | $ | 29.8 | |||||||||||||||||||||||

| Medicare supplement | 9.7 | 10.3 | 10.0 | 16.6 | 46.6 | 12.0 | |||||||||||||||||||||||||||||

| Long-term care | 10.6 | 10.7 | 11.6 | 10.2 | 43.1 | 10.2 | |||||||||||||||||||||||||||||

| Total health NAP | 47.8 | 50.6 | 52.1 | 63.5 | 214.0 | 52.0 | |||||||||||||||||||||||||||||

| Life products: | |||||||||||||||||||||||||||||||||||

| Interest sensitive life | 7.9 | 9.1 | 8.7 | 8.6 | 34.3 | 7.7 | |||||||||||||||||||||||||||||

| Traditional life | 48.8 | 43.2 | 38.6 | 36.5 | 167.1 | 46.0 | |||||||||||||||||||||||||||||

| Total life NAP | 56.7 | 52.3 | 47.3 | 45.1 | 201.4 | 53.7 | |||||||||||||||||||||||||||||

| Total NAP | $ | 104.5 | $ | 102.9 | $ | 99.4 | $ | 108.6 | $ | 415.4 | $ | 105.7 | |||||||||||||||||||||||

| 1Q | 2Q | 3Q | 4Q | YTD | 1Q | ||||||||||||||||||||||||||||||

| 2024 | 2024 | 2024 | 2024 | 2024 | 2025 | ||||||||||||||||||||||||||||||

| Basic | |||||||||||||||||||||||||||||||||||

| Shares outstanding, beginning of period | 109,357.5 | 108,568.6 | 106,513.6 | 103,923.0 | 109,357.5 | 101,619.0 | |||||||||||||||||||||||||||||

| Weighted average share activity during the period: | |||||||||||||||||||||||||||||||||||

| Shares repurchased | (618.6) | (893.0) | (1,483.9) | (1,233.7) | (3,958.1) | (1,106.8) | |||||||||||||||||||||||||||||

| Amounts related to employee benefit plans | 344.5 | 57.0 | 76.7 | 90.4 | 1,028.3 | 307.9 | |||||||||||||||||||||||||||||

| Shares withheld for the payment of the exercise price and taxes related to employee benefit plans | (119.5) | (1.9) | (4.9) | (1.5) | (284.1) | (77.3) | |||||||||||||||||||||||||||||

| Weighted average basic shares outstanding during the period | 108,963.9 | 107,730.7 | 105,101.5 | 102,778.2 | 106,143.6 | 100,742.8 | |||||||||||||||||||||||||||||

| Basic shares outstanding, end of period | 108,568.6 | 106,513.6 | 103,923.0 | 101,619.0 | 101,619.0 | 99,893.9 | |||||||||||||||||||||||||||||

| Diluted | |||||||||||||||||||||||||||||||||||

| Weighted average basic shares outstanding | 108,963.9 | 107,730.7 | 105,101.5 | 102,778.2 | 106,143.6 | 100,742.8 | |||||||||||||||||||||||||||||

| Common stock equivalent shares related to: | |||||||||||||||||||||||||||||||||||

| Employee benefit plans | 1,881.0 | 1,527.5 | 2,029.5 | 2,452.1 | 1,972.6 | 2,327.1 | |||||||||||||||||||||||||||||

| Weighted average diluted shares outstanding during the period | 110,844.9 | 109,258.2 | 107,131.0 | 105,230.3 | 108,116.2 | 103,069.9 | |||||||||||||||||||||||||||||

| Diluted shares outstanding, end of period | 110,036.5 | 108,140.0 | 106,141.8 | 104,052.8 | 104,052.8 | 101,796.1 | |||||||||||||||||||||||||||||

| 1Q | 2Q | 3Q | 4Q | YTD | 1Q | ||||||||||||||||||||||||||||||

| 2024 | 2024 | 2024 | 2024 | 2024 | 2025 | ||||||||||||||||||||||||||||||

| Fixed indexed annuities | |||||||||||||||||||||||||||||||||||

Policyholder account balances, beginning of period excluding contracts 100% ceded |

$ | 9,999.2 | $ | 10,112.7 | $ | 10,279.1 | $ | 10,468.0 | $ | 9,999.2 | $ | 10,766.3 | |||||||||||||||||||||||

| Issuances (funds collected from new business) | 345.4 | 388.5 | 398.7 | 409.0 | 1,541.6 | 383.7 | |||||||||||||||||||||||||||||

| Premiums received (premiums collected from inforce business) | 0.5 | 0.7 | 0.1 | 1.3 | 2.6 | 4.0 | |||||||||||||||||||||||||||||

| Policy charges | (6.5) | (7.9) | (8.8) | (6.5) | (29.7) | (6.8) | |||||||||||||||||||||||||||||

| Surrenders and withdrawals | (232.2) | (235.2) | (239.1) | (221.1) | (927.6) | (233.3) | |||||||||||||||||||||||||||||

| Benefit payments | (74.4) | (77.6) | (67.5) | (54.9) | (274.4) | (72.7) | |||||||||||||||||||||||||||||

| Interest credited | 68.9 | 84.0 | 91.2 | 155.7 | 399.8 | 96.4 | |||||||||||||||||||||||||||||

| Other | 11.8 | 13.9 | 14.3 | 14.8 | 54.8 | 14.5 | |||||||||||||||||||||||||||||

Policyholder account balances, end of period excluding contracts 100% ceded |

$ | 10,112.7 | $ | 10,279.1 | $ | 10,468.0 | $ | 10,766.3 | $ | 10,766.3 | $ | 10,952.1 | |||||||||||||||||||||||

| Fixed interest annuities | |||||||||||||||||||||||||||||||||||

Policyholder account balances, beginning of period excluding contracts 100% ceded |

$ | 1,636.4 | $ | 1,610.6 | $ | 1,602.6 | $ | 1,612.7 | $ | 1,636.4 | $ | 1,646.6 | |||||||||||||||||||||||

| Issuances (funds collected from new business) | 45.1 | 48.5 | 62.3 | 80.5 | 236.4 | 50.9 | |||||||||||||||||||||||||||||

| Premiums received (premiums collected from inforce business) | 1.0 | 0.5 | 1.0 | 0.4 | 2.9 | 0.7 | |||||||||||||||||||||||||||||

| Policy charges | (0.3) | (0.3) | (0.4) | (0.4) | (1.4) | (0.4) | |||||||||||||||||||||||||||||

| Surrenders and withdrawals | (52.8) | (42.4) | (39.2) | (37.1) | (171.5) | (41.4) | |||||||||||||||||||||||||||||

| Benefit payments | (30.2) | (25.8) | (25.0) | (22.8) | (103.8) | (28.4) | |||||||||||||||||||||||||||||

| Interest credited | 11.4 | 11.6 | 11.7 | 13.3 | 48.0 | 12.7 | |||||||||||||||||||||||||||||

| Other | — | (0.1) | (0.3) | — | (0.4) | — | |||||||||||||||||||||||||||||

Policyholder account balances, end of period excluding contracts 100% ceded |

$ | 1,610.6 | $ | 1,602.6 | $ | 1,612.7 | $ | 1,646.6 | $ | 1,646.6 | $ | 1,640.7 | |||||||||||||||||||||||

| Total annuities | |||||||||||||||||||||||||||||||||||

Policyholder account balances, beginning of period excluding contracts 100% ceded |

$ | 11,635.6 | $ | 11,723.3 | $ | 11,881.7 | $ | 12,080.7 | $ | 11,635.6 | $ | 12,412.9 | |||||||||||||||||||||||

| Issuances (funds collected from new business) | 390.5 | 437.0 | 461.0 | 489.5 | 1,778.0 | 434.6 | |||||||||||||||||||||||||||||

| Premiums received (premiums collected from inforce business) | 1.5 | 1.2 | 1.1 | 1.7 | 5.5 | 4.7 | |||||||||||||||||||||||||||||

| Policy charges | (6.8) | (8.2) | (9.2) | (6.9) | (31.1) | (7.2) | |||||||||||||||||||||||||||||

| Surrenders and withdrawals | (285.0) | (277.6) | (278.3) | (258.2) | (1,099.1) | (274.7) | |||||||||||||||||||||||||||||

| Benefit payments | (104.6) | (103.4) | (92.5) | (77.7) | (378.2) | (101.1) | |||||||||||||||||||||||||||||

| Interest credited | 80.3 | 95.6 | 102.9 | 169.0 | 447.8 | 109.1 | |||||||||||||||||||||||||||||

| Other | 11.8 | 13.8 | 14.0 | 14.8 | 54.4 | 14.5 | |||||||||||||||||||||||||||||

Policyholder account balances, end of period excluding contracts 100% ceded |

$ | 11,723.3 | $ | 11,881.7 | $ | 12,080.7 | $ | 12,412.9 | $ | 12,412.9 | $ | 12,592.8 | |||||||||||||||||||||||

| 1Q | 2Q | 3Q | 4Q | YTD | 1Q | ||||||||||||||||||||||||||||||

| 2024 | 2024 | 2024 | 2024 | 2024 | 2025 (a) |

||||||||||||||||||||||||||||||

| Net gain from operations before interest expense and federal income taxes | $ | 40.3 | $ | 63.3 | $ | 58.9 | $ | 161.1 | $ | 323.6 | $ | 29.0 | |||||||||||||||||||||||

| Interest expense on surplus debentures held by parent company | 17.6 | 17.5 | 32.9 | 16.4 | 84.4 | 15.5 | |||||||||||||||||||||||||||||

| Net gain from operations before federal income taxes | 22.7 | 45.8 | 26.0 | 144.7 | 239.2 | 13.5 | |||||||||||||||||||||||||||||

| Federal income tax expense (benefit) | 26.7 | 17.7 | 17.6 | (19.7) | 42.3 | — | |||||||||||||||||||||||||||||

| Net gain (loss) from operations before net realized capital gains (losses) | (4.0) | 28.1 | 8.4 | 164.4 | 196.9 | 13.5 | |||||||||||||||||||||||||||||

| Net realized capital gains (losses) | (4.2) | 7.4 | (0.5) | (23.0) | (20.3) | (1.2) | |||||||||||||||||||||||||||||

| Net income (loss) | $ | (8.2) | $ | 35.5 | $ | 7.9 | $ | 141.4 | $ | 176.6 | $ | 12.3 | |||||||||||||||||||||||

| Capital and surplus | $ | 1,487.3 | $ | 1,489.5 | $ | 1,446.6 | $ | 1,458.1 | $ | 1,458.1 | $ | 1,422.3 | |||||||||||||||||||||||

| Asset valuation reserve (AVR) | 351.8 | 369.8 | 393.2 | 407.1 | 407.1 | 428.5 | |||||||||||||||||||||||||||||

| Capital, surplus and AVR | 1,839.1 | 1,859.3 | 1,839.8 | 1,865.2 | 1,865.2 | 1,850.8 | |||||||||||||||||||||||||||||

| Interest maintenance reserve (IMR) | 362.1 | 344.0 | 338.1 | 334.2 | 334.2 | 331.5 | |||||||||||||||||||||||||||||

| Total statutory capital, surplus, AVR & IMR | $ | 2,201.2 | $ | 2,203.3 | $ | 2,177.9 | $ | 2,199.4 | $ | 2,199.4 | $ | 2,182.3 | |||||||||||||||||||||||

| Risk-based capital ratio | 391 | % | 394 | % | 388 | % | 383 | % | 383 | % | 379 | % | |||||||||||||||||||||||

| 1Q | 2Q | 3Q | 4Q | YTD | 1Q | |||||||||||||||||||||||||||||||||

| 2024 | 2024 | 2024 | 2024 | 2024 | 2025 | |||||||||||||||||||||||||||||||||

| Net investment income | $ | 469.2 | $ | 409.1 | $ | 453.9 | $ | 416.6 | $ | 1,748.8 | $ | 311.5 | ||||||||||||||||||||||||||

| Allocated to product lines: | ||||||||||||||||||||||||||||||||||||||

| Annuity | (134.5) | (140.5) | (142.2) | (147.8) | (565.0) | (148.0) | ||||||||||||||||||||||||||||||||

| Health | (74.3) | (75.1) | (75.0) | (75.2) | (299.6) | (75.1) | ||||||||||||||||||||||||||||||||

| Life | (36.5) | (36.7) | (36.8) | (37.1) | (147.1) | (37.6) | ||||||||||||||||||||||||||||||||

| Equity returns credited to policyholder account balances | (139.7) | (38.9) | (67.6) | (7.5) | (253.7) | 70.2 | ||||||||||||||||||||||||||||||||

| Amounts allocated to product lines and credited to policyholder account balances | (385.0) | (291.2) | (321.6) | (267.6) | (1,265.4) | (190.5) | ||||||||||||||||||||||||||||||||

| Impact of annual option forfeitures related to fixed indexed annuity surrenders | 6.2 | 6.0 | 7.4 | 6.4 | 26.0 | 3.5 | ||||||||||||||||||||||||||||||||

| Amount related to variable interest entities and other non-operating items | (12.6) | (9.6) | (5.3) | (6.0) | (33.5) | (7.2) | ||||||||||||||||||||||||||||||||

| Interest expense on debt | (15.7) | (21.8) | (27.2) | (27.1) | (91.8) | (27.2) | ||||||||||||||||||||||||||||||||

| Interest expense on financing arrangements | (1.2) | (1.2) | (1.1) | (1.2) | (4.7) | (1.0) | ||||||||||||||||||||||||||||||||

| Interest expense on investment borrowings from the Federal Home Loan Bank ("FHLB") program | (31.4) | (31.4) | (31.8) | (28.6) | (123.2) | (26.0) | ||||||||||||||||||||||||||||||||

| Expenses related to the funding agreement-backed notes ("FABN") program (a) | (7.6) | (10.9) | (20.6) | (24.9) | (64.0) | (27.9) | ||||||||||||||||||||||||||||||||

| Less amounts credited to deferred compensation plans (offsetting investment income) | (9.6) | (4.2) | (8.2) | (2.3) | (24.3) | 2.8 | ||||||||||||||||||||||||||||||||

| Total adjustments | (71.9) | (73.1) | (86.8) | (83.7) | (315.5) | (83.0) | ||||||||||||||||||||||||||||||||

| Investment income not allocated to product lines | $ | 12.3 | $ | 44.8 | $ | 45.5 | $ | 65.3 | $ | 167.9 | $ | 38.0 | ||||||||||||||||||||||||||

| 1Q | 2Q | 3Q | 4Q | YTD | 1Q | |||||||||||||||||||||||||||||||||

| 2024 | 2024 | 2024 | 2024 | 2024 | 2025 | |||||||||||||||||||||||||||||||||

| Investment income not allocated: | ||||||||||||||||||||||||||||||||||||||

| Excluding variable components: | ||||||||||||||||||||||||||||||||||||||

| From general account assets | $ | 27.1 | $ | 25.0 | $ | 28.2 | $ | 47.6 | $ | 127.9 | $ | 27.3 | ||||||||||||||||||||||||||

| Other investment income | 3.1 | 6.8 | 12.9 | 13.8 | 36.6 | 10.9 | ||||||||||||||||||||||||||||||||

| Spread income: | ||||||||||||||||||||||||||||||||||||||

| FHLB program: | ||||||||||||||||||||||||||||||||||||||

| Investment income on matched assets | 41.7 | 42.4 | 41.0 | 36.1 | 161.2 | 35.4 | ||||||||||||||||||||||||||||||||

| Interest expense | (31.4) | (31.4) | (31.8) | (28.6) | (123.2) | (26.0) | ||||||||||||||||||||||||||||||||

| Net spread income on FHLB program | 10.3 | 11.0 | 9.2 | 7.5 | 38.0 | 9.4 | ||||||||||||||||||||||||||||||||

| FABN program: | ||||||||||||||||||||||||||||||||||||||

| Investment income on matched assets | 14.9 | 19.6 | 28.6 | 33.6 | 96.7 | 34.3 | ||||||||||||||||||||||||||||||||

| Expenses (b) | (7.6) | (10.9) | (20.6) | (24.9) | (64.0) | (27.9) | ||||||||||||||||||||||||||||||||

| Net spread income on FABN program | 7.3 | 8.7 | 8.0 | 8.7 | 32.7 | 6.4 | ||||||||||||||||||||||||||||||||

| Interest expense on corporate debt | (15.7) | (21.8) | (27.2) | (27.1) | (91.8) | (27.2) | ||||||||||||||||||||||||||||||||

| Interest expense on financing arrangements | (1.2) | (1.2) | (1.1) | (1.2) | (4.7) | (1.0) | ||||||||||||||||||||||||||||||||

| Total excluding variable components | 30.9 | 28.5 | 30.0 | 49.3 | 138.7 | 25.8 | ||||||||||||||||||||||||||||||||

| Variable components: | ||||||||||||||||||||||||||||||||||||||

| Net income from Corporate Owned Life Insurance ("COLI") supporting agent deferred compensation plan: | ||||||||||||||||||||||||||||||||||||||

| Change in value of COLI investments | 3.6 | 2.9 | 4.1 | 0.7 | 11.3 | 3.0 | ||||||||||||||||||||||||||||||||

| Increase in liability for agent deferred compensation plan | (1.6) | (1.6) | (1.6) | (1.6) | (6.4) | (1.6) | ||||||||||||||||||||||||||||||||

| Net COLI income (loss) | 2.0 | 1.3 | 2.5 | (0.9) | 4.9 | 1.4 | ||||||||||||||||||||||||||||||||

| Other variable components: | ||||||||||||||||||||||||||||||||||||||

| Alternative investment income (loss): | ||||||||||||||||||||||||||||||||||||||

| Total | (24.3) | 11.9 | 8.9 | 17.1 | 13.6 | 12.9 | ||||||||||||||||||||||||||||||||

| Allocated to product lines | (7.1) | (6.4) | (6.5) | (8.2) | (28.2) | (6.0) | ||||||||||||||||||||||||||||||||

| Allocated to FABN program | — | (0.4) | 0.6 | (0.9) | (0.7) | — | ||||||||||||||||||||||||||||||||

| Excess alternative investment income (loss) | (31.4) | 5.1 | 3.0 | 8.0 | (15.3) | 6.9 | ||||||||||||||||||||||||||||||||

| Trading account | 2.1 | 1.0 | 1.3 | 0.5 | 4.9 | 1.6 | ||||||||||||||||||||||||||||||||

| Hedge variance related to fixed indexed products | 0.5 | — | (0.4) | 2.1 | 2.2 | (0.5) | ||||||||||||||||||||||||||||||||

| Impact of annual option forfeitures related to fixed indexed annuity surrenders | 6.2 | 6.0 | 7.4 | 6.4 | 26.0 | 3.5 | ||||||||||||||||||||||||||||||||

| Other (a) | 2.0 | 2.9 | 1.7 | (0.1) | 6.5 | (0.7) | ||||||||||||||||||||||||||||||||

| Total variable components | (18.6) | 16.3 | 15.5 | 16.0 | 29.2 | 12.2 | ||||||||||||||||||||||||||||||||

| Total investment income not allocated to product lines | $ | 12.3 | $ | 44.8 | $ | 45.5 | $ | 65.3 | $ | 167.9 | $ | 38.0 | ||||||||||||||||||||||||||

| 1Q | 2Q | 3Q | 4Q | YTD | 1Q | |||||||||||||||||||||||||||||||||

| 2024 | 2024 | 2024 | 2024 | 2024 | 2025 | |||||||||||||||||||||||||||||||||

Average net insurance liabilities (11) |

||||||||||||||||||||||||||||||||||||||

| Annuity: | ||||||||||||||||||||||||||||||||||||||

| Fixed indexed annuities | $ | 9,636.3 | $ | 9,758.1 | $ | 9,899.4 | $ | 10,101.6 | $ | 9,848.9 | $ | 10,085.7 | ||||||||||||||||||||||||||

| Fixed interest annuities | 1,588.0 | 1,569.4 | 1,568.2 | 1,587.7 | 1,578.3 | 1,599.5 | ||||||||||||||||||||||||||||||||

| Other annuities | 439.9 | 426.4 | 414.4 | 408.6 | 422.3 | 402.2 | ||||||||||||||||||||||||||||||||

| Total annuity average net insurance liabilities (11) | 11,664.2 | 11,753.9 | 11,882.0 | 12,097.9 | 11,849.5 | 12,087.4 | ||||||||||||||||||||||||||||||||

| Health: | ||||||||||||||||||||||||||||||||||||||

| Supplemental health | 3,346.3 | 3,351.1 | 3,361.1 | 3,372.5 | 3,357.8 | 3,387.4 | ||||||||||||||||||||||||||||||||

| Medicare supplement | 114.8 | 111.6 | 105.8 | 111.9 | 111.0 | 113.1 | ||||||||||||||||||||||||||||||||

| Long-term care | 2,698.7 | 2,696.1 | 2,693.4 | 2,694.3 | 2,695.6 | 2,695.7 | ||||||||||||||||||||||||||||||||

| Total health average net insurance liabilities (11) | 6,159.8 | 6,158.8 | 6,160.3 | 6,178.7 | 6,164.4 | 6,196.2 | ||||||||||||||||||||||||||||||||

| Life: | ||||||||||||||||||||||||||||||||||||||

| Interest sensitive | 1,056.1 | 1,063.0 | 1,070.8 | 1,078.7 | 1,067.2 | 1,096.1 | ||||||||||||||||||||||||||||||||

| Traditional | 1,994.1 | 1,997.3 | 2,007.6 | 2,019.9 | 2,004.7 | 2,020.3 | ||||||||||||||||||||||||||||||||

| Total life average net insurance liabilities (11) | 3,050.2 | 3,060.3 | 3,078.4 | 3,098.6 | 3,071.9 | 3,116.4 | ||||||||||||||||||||||||||||||||

| Total average net insurance liabilities (11) | $ | 20,874.2 | $ | 20,973.0 | $ | 21,120.7 | $ | 21,375.2 | $ | 21,085.8 | $ | 21,400.0 | ||||||||||||||||||||||||||

| Average yield on allocated investments | ||||||||||||||||||||||||||||||||||||||

| Annuity: | ||||||||||||||||||||||||||||||||||||||

| Fixed indexed annuities | 4.50 | % | 4.66 | % | 4.68 | % | 4.78 | % | 4.66 | % | 4.79 | % | ||||||||||||||||||||||||||

| Fixed interest annuities | 5.19 | % | 5.38 | % | 5.31 | % | 5.44 | % | 5.33 | % | 5.40 | % | ||||||||||||||||||||||||||

| Other annuities | 5.00 | % | 5.25 | % | 5.31 | % | 5.48 | % | 5.26 | % | 5.47 | % | ||||||||||||||||||||||||||

| Average yield on investments allocated to annuities | 4.61 | % | 4.78 | % | 4.79 | % | 4.89 | % | 4.77 | % | 4.90 | % | ||||||||||||||||||||||||||

| Health: | ||||||||||||||||||||||||||||||||||||||

| Supplemental health | 4.66 | % | 4.70 | % | 4.71 | % | 4.71 | % | 4.70 | % | 4.70 | % | ||||||||||||||||||||||||||

| Medicare supplement | 4.73 | % | 4.89 | % | 4.91 | % | 4.65 | % | 4.77 | % | 4.24 | % | ||||||||||||||||||||||||||

| Long-term care | 5.02 | % | 5.10 | % | 5.06 | % | 5.08 | % | 5.07 | % | 5.06 | % | ||||||||||||||||||||||||||

| Average yield on investments allocated to health products | 4.82 | % | 4.88 | % | 4.87 | % | 4.87 | % | 4.86 | % | 4.85 | % | ||||||||||||||||||||||||||

| Life: | ||||||||||||||||||||||||||||||||||||||

| Interest sensitive | 5.00 | % | 4.97 | % | 4.97 | % | 5.01 | % | 4.99 | % | 5.07 | % | ||||||||||||||||||||||||||

| Traditional | 4.67 | % | 4.71 | % | 4.68 | % | 4.67 | % | 4.68 | % | 4.69 | % | ||||||||||||||||||||||||||

| Average yield on investments allocated to life products | 4.79 | % | 4.80 | % | 4.78 | % | 4.79 | % | 4.79 | % | 4.83 | % | ||||||||||||||||||||||||||

| Total average yield | 4.70 | % | 4.81 | % | 4.81 | % | 4.87 | % | 4.80 | % | 4.87 | % | ||||||||||||||||||||||||||

| Allocated investment income | ||||||||||||||||||||||||||||||||||||||

| Annuity: | ||||||||||||||||||||||||||||||||||||||

| Fixed indexed annuities | $ | 108.4 | $ | 113.8 | $ | 115.9 | $ | 120.6 | $ | 458.7 | $ | 120.9 | ||||||||||||||||||||||||||

| Fixed interest annuities | 20.6 | 21.1 | 20.8 | 21.6 | 84.1 | 21.6 | ||||||||||||||||||||||||||||||||

| Other annuities | 5.5 | 5.6 | 5.5 | 5.6 | 22.2 | 5.5 | ||||||||||||||||||||||||||||||||

| Total investment income allocated to annuities | 134.5 | 140.5 | 142.2 | 147.8 | 565.0 | 148.0 | ||||||||||||||||||||||||||||||||

| Health: | ||||||||||||||||||||||||||||||||||||||

| Supplemental health | 39.0 | 39.4 | 39.6 | 39.7 | 157.7 | 39.8 | ||||||||||||||||||||||||||||||||

| Medicare supplement | 1.4 | 1.3 | 1.3 | 1.3 | 5.3 | 1.2 | ||||||||||||||||||||||||||||||||

| Long-term care | 33.9 | 34.4 | 34.1 | 34.2 | 136.6 | 34.1 | ||||||||||||||||||||||||||||||||

| Total investment income allocated to health products | 74.3 | 75.1 | 75.0 | 75.2 | 299.6 | 75.1 | ||||||||||||||||||||||||||||||||

| Life: | ||||||||||||||||||||||||||||||||||||||

| Interest sensitive | 13.2 | 13.2 | 13.3 | 13.5 | 53.2 | 13.9 | ||||||||||||||||||||||||||||||||

| Traditional | 23.3 | 23.5 | 23.5 | 23.6 | 93.9 | 23.7 | ||||||||||||||||||||||||||||||||

| Total investment income allocated to life products | 36.5 | 36.7 | 36.8 | 37.1 | 147.1 | 37.6 | ||||||||||||||||||||||||||||||||

| Total allocated investment income | $ | 245.3 | $ | 252.3 | $ | 254.0 | $ | 260.1 | $ | 1,011.7 | $ | 260.7 | ||||||||||||||||||||||||||

| 1Q | 2Q | 3Q | 4Q | YTD | 1Q | |||||||||||||||||||||||||||||||||

| 2024 | 2024 | 2024 | 2024 | 2024 | 2025 | |||||||||||||||||||||||||||||||||

| General account assets investment income | $ | 301.9 | $ | 351.7 | $ | 366.3 | $ | 399.5 | $ | 1,419.4 | $ | 375.1 | ||||||||||||||||||||||||||

| Policyholder and other special purpose portfolio investment income (loss) | 167.3 | 57.4 | 87.6 | 17.1 | 329.4 | (63.6) | ||||||||||||||||||||||||||||||||

| Less equity returns credited to policyholders: | ||||||||||||||||||||||||||||||||||||||

| Annuity | (128.6) | (34.9) | (62.1) | (6.2) | (231.8) | 63.5 | ||||||||||||||||||||||||||||||||

| Life | (11.1) | (4.0) | (5.5) | (1.3) | (21.9) | 6.7 | ||||||||||||||||||||||||||||||||

| Less amount related to variable interest entities | (12.6) | (9.6) | (5.3) | (6.0) | (33.5) | (7.2) | ||||||||||||||||||||||||||||||||

| Less amounts credited to deferred compensation plans | (9.6) | (4.2) | (8.2) | (2.3) | (24.3) | 2.8 | ||||||||||||||||||||||||||||||||

| Other special purpose portfolio investment income (loss) | 5.4 | 4.7 | 6.5 | 1.3 | 17.9 | 2.2 | ||||||||||||||||||||||||||||||||

| Adjusted net investment income | 307.3 | 356.4 | 372.8 | 400.8 | 1,437.3 | 377.3 | ||||||||||||||||||||||||||||||||

| Less amounts allocated to product lines | ||||||||||||||||||||||||||||||||||||||

| Annuity | (134.5) | (140.5) | (142.2) | (147.8) | (565.0) | (148.0) | ||||||||||||||||||||||||||||||||

| Health | (74.3) | (75.1) | (75.0) | (75.2) | (299.6) | (75.1) | ||||||||||||||||||||||||||||||||

| Life | (36.5) | (36.7) | (36.8) | (37.1) | (147.1) | (37.6) | ||||||||||||||||||||||||||||||||

| Total investment income allocated to product lines | (245.3) | (252.3) | (254.0) | (260.1) | (1,011.7) | (260.7) | ||||||||||||||||||||||||||||||||

| Impact of annual option forfeitures related to fixed indexed annuity surrenders | 6.2 | 6.0 | 7.4 | 6.4 | 26.0 | 3.5 | ||||||||||||||||||||||||||||||||

| Less interest expense on investment borrowings from FHLB program | (31.4) | (31.4) | (31.8) | (28.6) | (123.2) | (26.0) | ||||||||||||||||||||||||||||||||

| Less expenses related to FABN program | (7.6) | (10.9) | (20.6) | (24.9) | (64.0) | (27.9) | ||||||||||||||||||||||||||||||||

| Less interest expense on debt | (15.7) | (21.8) | (27.2) | (27.1) | (91.8) | (27.2) | ||||||||||||||||||||||||||||||||

| Less interest expense on financing arrangements | (1.2) | (1.2) | (1.1) | (1.2) | (4.7) | (1.0) | ||||||||||||||||||||||||||||||||

| Investment income not allocated to product lines | $ | 12.3 | $ | 44.8 | $ | 45.5 | $ | 65.3 | $ | 167.9 | $ | 38.0 | ||||||||||||||||||||||||||

| 1Q | 2Q | 3Q | 4Q | 1Q | ||||||||||||||||||||||||||||

| 2024 | 2024 | 2024 | 2024 | 2025 | ||||||||||||||||||||||||||||

| Average book value of invested assets and cash | $ | 27,897.0 | $ | 28,577.4 | $ | 29,716.2 | $ | 30,398.9 | $ | 30,755.7 | ||||||||||||||||||||||

| Net investment income from general account investments | 301.9 | 351.7 | 366.3 | 399.5 | 375.1 | |||||||||||||||||||||||||||

| New money rate (14) | 6.17 | % | 6.41 | % | 6.50 | % | 6.72 | % | 6.43 | % | ||||||||||||||||||||||

| Book yield (15) | 4.64 | % | 4.73 | % | 4.78 | % | 4.78 | % | 4.81 | % | ||||||||||||||||||||||

| Earned yield (16) | 4.06 | % | 4.71 | % | 4.71 | % | 5.16 | % | 4.71 | % | ||||||||||||||||||||||

| Alternative investment income (loss) | (24.3) | 11.9 | 8.9 | 17.1 | 12.9 | |||||||||||||||||||||||||||

Three months ended |

||||||||||||||||||||

| March 31, 2025 | ||||||||||||||||||||

| Actual results | Significant items | Excluding significant items |

||||||||||||||||||

| Insurance product margin (4) | ||||||||||||||||||||

| Annuity margin | $ | 54.5 | $ | — | $ | 54.5 | ||||||||||||||

| Health margin | 126.2 | — | 126.2 | |||||||||||||||||

| Life margin | 68.2 | (6.8) | (a) | 61.4 | ||||||||||||||||

| Total insurance product margin | 248.9 | (6.8) | 242.1 | |||||||||||||||||

| Allocated expenses | (161.2) | — | (161.2) | |||||||||||||||||

| Income from insurance products (5) | 87.7 | (6.8) | 80.9 | |||||||||||||||||

| Fee income | (0.8) | — | (0.8) | |||||||||||||||||

| Investment income not allocated to product lines (9) | 38.0 | — | 38.0 | |||||||||||||||||

| Expenses not allocated to product lines | (20.3) | — | (20.3) | |||||||||||||||||

| Operating earnings before taxes | 104.6 | (6.8) | 97.8 | |||||||||||||||||

| Income tax (expense) benefit on operating income | (23.5) | 1.5 | (22.0) | |||||||||||||||||

| Net operating income (10) | $ | 81.1 | $ | (5.3) | $ | 75.8 | ||||||||||||||

| Net operating income per diluted share | $ | 0.79 | $ | (0.05) | $ | 0.74 | ||||||||||||||

| Three months ended | ||||||||||||||||||||

| December 31, 2024 | ||||||||||||||||||||

| Actual results | Significant items | Excluding significant items |

||||||||||||||||||

| Insurance product margin (4) | ||||||||||||||||||||

| Annuity margin | $ | 55.0 | $ | — | $ | 55.0 | ||||||||||||||

| Health margin | 130.1 | 3.9 | (a) | 134.0 | ||||||||||||||||

| Life margin | 68.0 | — | 68.0 | |||||||||||||||||

| Total insurance product margin | 253.1 | 3.9 | 257.0 | |||||||||||||||||

| Allocated expenses | (146.1) | — | (146.1) | |||||||||||||||||

| Income from insurance products (5) | 107.0 | 3.9 | 110.9 | |||||||||||||||||

| Fee income | 20.6 | — | 20.6 | |||||||||||||||||

| Investment income not allocated to product lines (9) | 65.3 | — | 65.3 | |||||||||||||||||

| Expenses not allocated to product lines | (19.0) | — | (19.0) | |||||||||||||||||

| Operating earnings before taxes | 173.9 | 3.9 | 177.8 | |||||||||||||||||

| Income tax (expense) benefit on operating income | (35.9) | (0.8) | (36.7) | |||||||||||||||||

| Net operating income (10) | $ | 138.0 | $ | 3.1 | $ | 141.1 | ||||||||||||||

| Net operating income per diluted share | $ | 1.31 | $ | 0.03 | $ | 1.34 | ||||||||||||||

| Three months ended | ||||||||||||||||||||

| September 30, 2024 | ||||||||||||||||||||

| Actual results | Significant items (a) | Excluding significant items |

||||||||||||||||||

| Insurance product margin (4) | ||||||||||||||||||||

| Annuity margin | $ | 91.1 | $ | (36.2) | (b) | $ | 54.9 | |||||||||||||

| Health margin | 127.8 | 4.3 | (b) | 132.1 | ||||||||||||||||

| Life margin | 63.3 | 0.7 | (b) | 64.0 | ||||||||||||||||

| Total insurance product margin | 282.2 | (31.2) | 251.0 | |||||||||||||||||

| Allocated expenses | (153.0) | (153.0) | ||||||||||||||||||

| Income from insurance products (5) | 129.2 | (31.2) | 98.0 | |||||||||||||||||

| Fee income | (2.7) | — | (2.7) | |||||||||||||||||

| Investment income not allocated to product lines (9) | 45.5 | — | 45.5 | |||||||||||||||||

| Expenses not allocated to product lines | (18.5) | 2.9 | (c) | (15.6) | ||||||||||||||||

| Operating earnings before taxes | 153.5 | (28.3) | 125.2 | |||||||||||||||||

| Income tax (expense) benefit on operating income | (34.3) | 6.4 | (27.9) | |||||||||||||||||

| Net operating income (10) | $ | 119.2 | $ | (21.9) | $ | 97.3 | ||||||||||||||

| Net operating income per diluted share | $ | 1.11 | $ | (0.19) | $ | 0.92 | ||||||||||||||