UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) November 10, 2025

Fermi Inc.

(Exact name of registrant as specified in its charter)

| Texas | 001-42888 | 33-3560468 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 620 S. Taylor St., Suite 301 Amarillo, TX |

79101 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (214) 894-7855

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, $0.001 par value | FRMI | The Nasdaq Stock Market LLC | ||

| Common Stock, $0.001 par value | FRMI | The London Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

Item 2.02. Results of Operations and Financial Condition.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒ On November 10, 2025, Fermi Inc. (the “Company”) issued its shareholder letter (the “Shareholder Letter”) announcing its financial results for the third quarter ended September 30, 2025. The full text of the Shareholder Letter is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference. The Company is hosting a conference call on November 11, 2025 at 8:00 am CT / 9:00 am ET to discuss its financial results for the third quarter ended September 30, 2025.

The information in this Item 2.02, including Exhibit 99.1, shall be deemed “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities such section, nor shall it be deemed incorporated by reference into any registration statement or other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 7.01. Regulation FD Disclosure.

In conjunction with the Press Release, the Company also made available an investor presentation (the “Investor Presentation”). The Investor Presentation, which is available under the “Investor Relations” section of the Company’s corporate website, located at investor.fermiamerica.com, is furnished as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated by reference herein. Information on the Company’s corporate website is not, and will not be deemed to be, a part of this Current Report on Form 8-K or incorporated into any other filings the Company may make with the U.S. Securities and Exchange Commission.

The information in this Item 7.01, including Exhibit 99.2, shall be deemed “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities such section, nor shall it be deemed incorporated by reference into any registration statement or other filing under the Securities Act, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. | Description | |

| 99.1 | Shareholder Letter, dated November 10, 2025 | |

| 99.2 | Investor Presentation, dated November 10, 2025 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| FERMI INC. | ||

| Date: November 10, 2025 | By: | /s/ Miles Everson |

| Name: | Miles Everson | |

| Title: | Chief Financial Officer | |

3

Exhibit 99.1

Q3 2025 Shareholder Letter

Key Highlights 620 S.

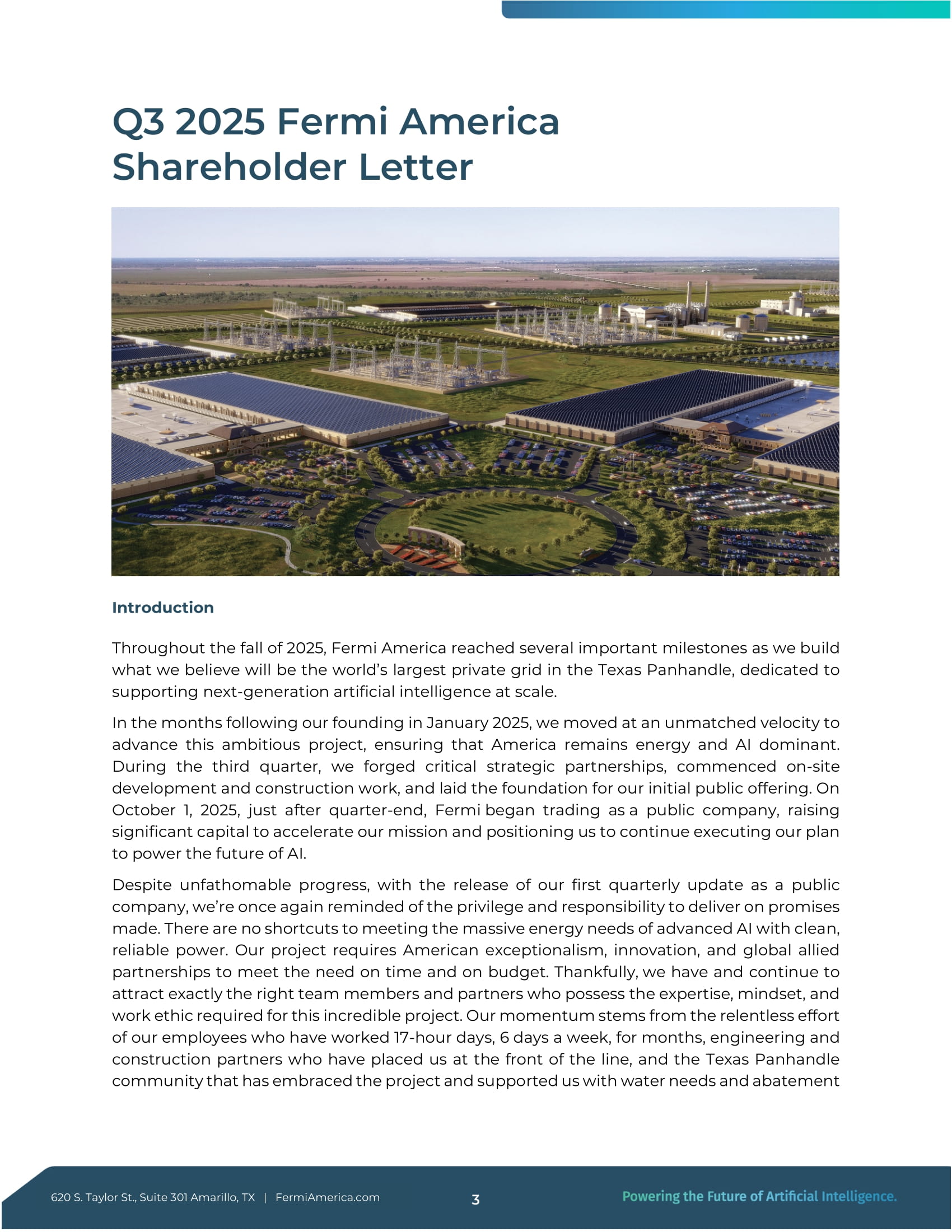

Taylor St., Suite 301 Amarillo, TX | FermiAmerica.com 2 1.1 Gigawatts Target for first power delivery from Project Matador’s hybrid grid in 2026 11 Gigawatts Planned total generation capacity at Project Matador 5,263 Acres 99 - year campus lease with Texas Tech University commenced in September 2.2 Gigawatts Gas - fired generation equipment secured or under LOI - surpassing initial 2026 target 300K MMBtu/day of Natural Gas Secured $1.6Bn Capital raised year - to - date through private financing and IPO Q3 2025 Fermi America Shareholder Letter Introduction Throughout the fall of 2025 , Fermi America reached several important milestones as we build what we believe will be the world’s largest private grid in the Texas Panhandle, dedicated to supporting next - generation artificial intelligence at scale . In the months following our founding in January 2025 , we moved at an unmatched velocity to advance this ambitious project, ensuring that America remains energy and AI dominant . During the third quarter, we forged critical strategic partnerships, commenced on - site development and construction work, and laid the foundation for our initial public offering . On October 1 , 2025 , just after quarter - end, Fermi began trading as a public company, raising significant capital to accelerate our mission and positioning us to continue executing our plan to power the future of AI . Despite unfathomable progress, with the release of our first quarterly update as a public company, we’re once again reminded of the privilege and responsibility to deliver on promises made . There are no shortcuts to meeting the massive energy needs of advanced AI with clean, reliable power . Our project requires American exceptionalism, innovation, and global allied partnerships to meet the need on time and on budget . Thankfully, we have and continue to attract exactly the right team members and partners who possess the expertise, mindset, and work ethic required for this incredible project . Our momentum stems from the relentless effort of our employees who have worked 17 - hour days, 6 days a week, for months, engineering and construction partners who have placed us at the front of the line, and the Texas Panhandle community that has embraced the project and supported us with water needs and abatement 620 S.

Taylor St., Suite 301 Amarillo, TX | FermiAmerica.com 3 incentives . Of course, none of this would have been possible without you, our valued shareholders, who have stood behind us throughout the journey . During this extraordinary time, we are humbled to partner with you on the Manhattan Project of our generation . Together, we are answering the call to defend our country and Western Civilization against the national security threat of our time, securing America's energy and AI dominance, and preserving the American way of life for the benefit of our children and grandchildren . Our Purpose and Vision Not all enemies wear uniforms, but make no mistake, America is at war . Today’s superpowers must possess three assets : nuclear - powered submarines, nuclear - powered aircraft carriers, and nuclear - powered artificial intelligence . China is building 33 nuclear reactors today, whereas Fermi is the only American company with an accepted COL permit under review to build new clean nuclear power . Artificial intelligence demands enormous amounts of redundant, reliable electricity as well as dependable infrastructure . Co - founded by former U . S . Energy Secretary Rick Perry and Toby Neugebauer, co - founder and co - managing partner of Quantum Energy, Fermi exists to meet this need, ensuring America controls the future of AI . Our purpose is to pioneer next - generation private electric grids that deliver highly redundant, gigawatt - scale power for AI and high - performance computing, while leveraging low - carbon, clean energy sources . In practice, this means building a first - of - its - kind behind - the - meter campus that integrates multiple power technologies on one HyperGrid site, essentially creating a self - contained, clean energy private grid dedicated to AI computing . Our flagship “Project Matador” campus in the Texas Panhandle will be one of the largest such complexes ever built . Spanning over 5 , 200 acres, the site plans to deliver up to 11 gigawatts (GW) of power, supporting 15 million square feet of AI capacity . Once completed, the private campus would incorporate one of the largest nuclear power complexes in the U . S . and the nation’s biggest combined - cycle natural gas plant, alongside significant solar and battery installations . The result will be a platform capable of meeting the voracious appetite of artificial intelligence without overburdening public utilities or increasing consumer electricity bills . Industry observers have noted that Fermi America’s distinctive strategy and ability to tap into near - term power solutions position us well to achieve this mission at lightning speed . In short, our vision is to protect our national security by powering tomorrow’s intelligence, while setting a new standard for resilient, carbon - neutral infrastructure . Q 3 2025 Highlights During the third quarter of 2025 (July 1 – September 30 ), Fermi America transformed ambition into execution – achieving major milestones that accelerated Project Matador’s development 620 S.

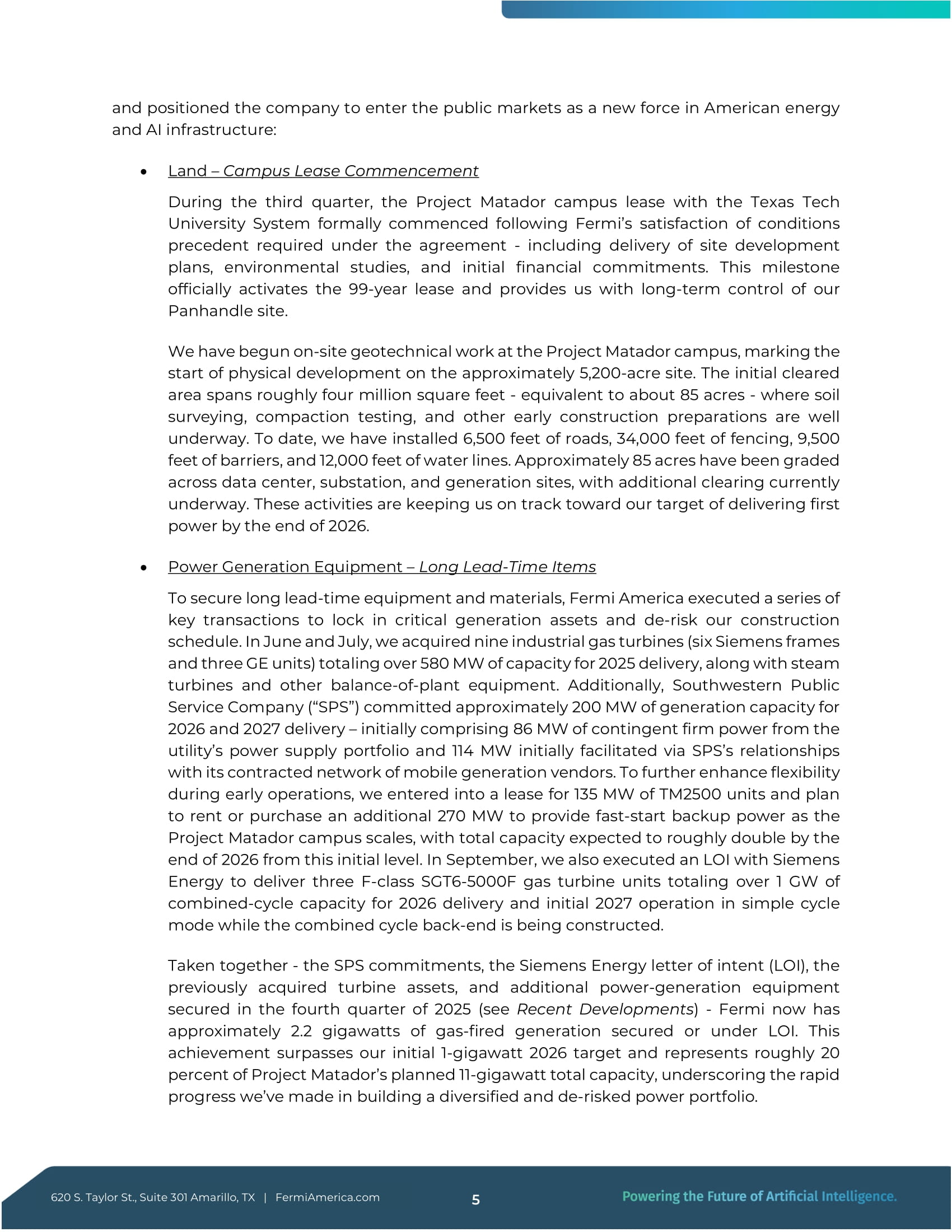

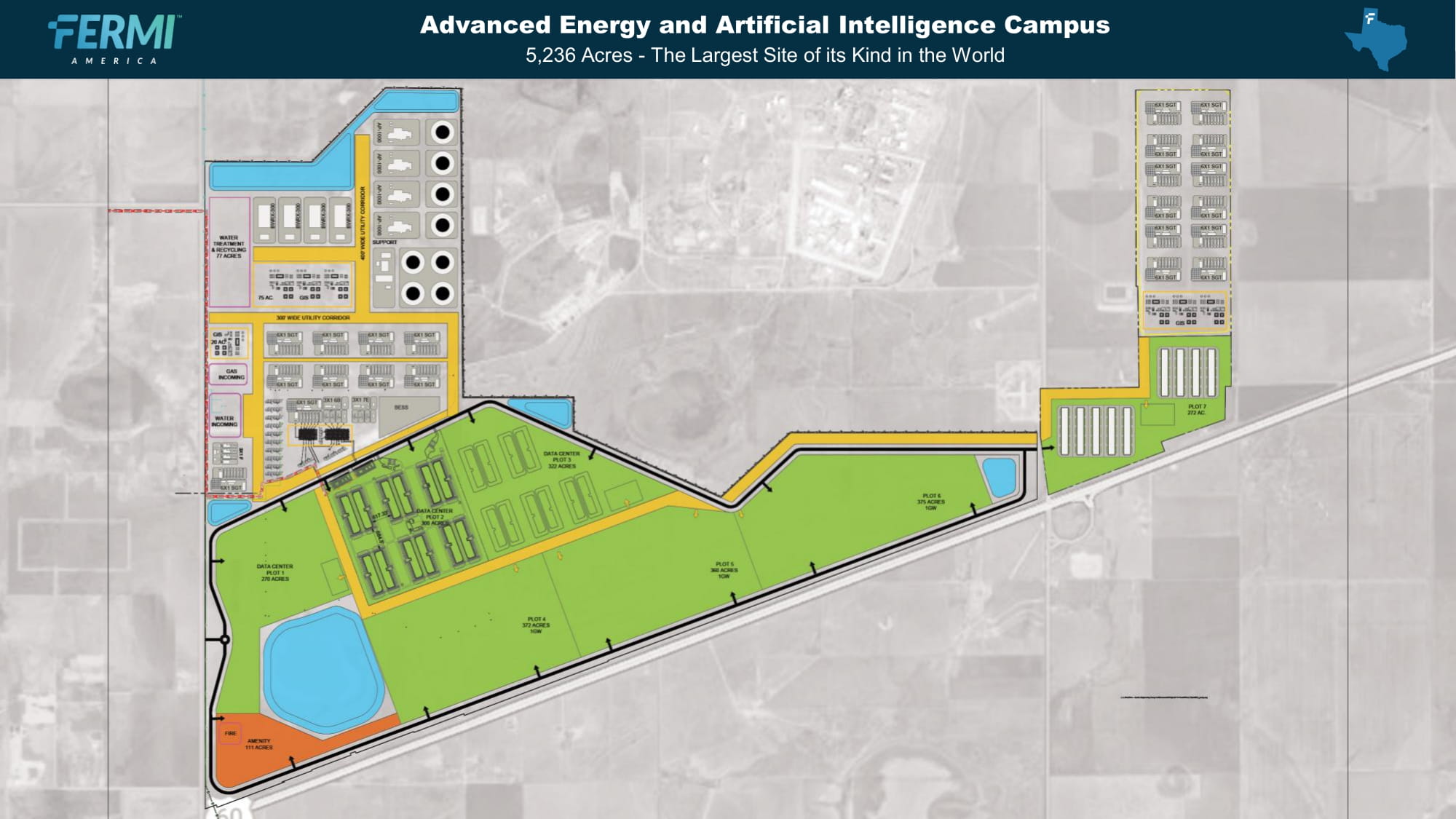

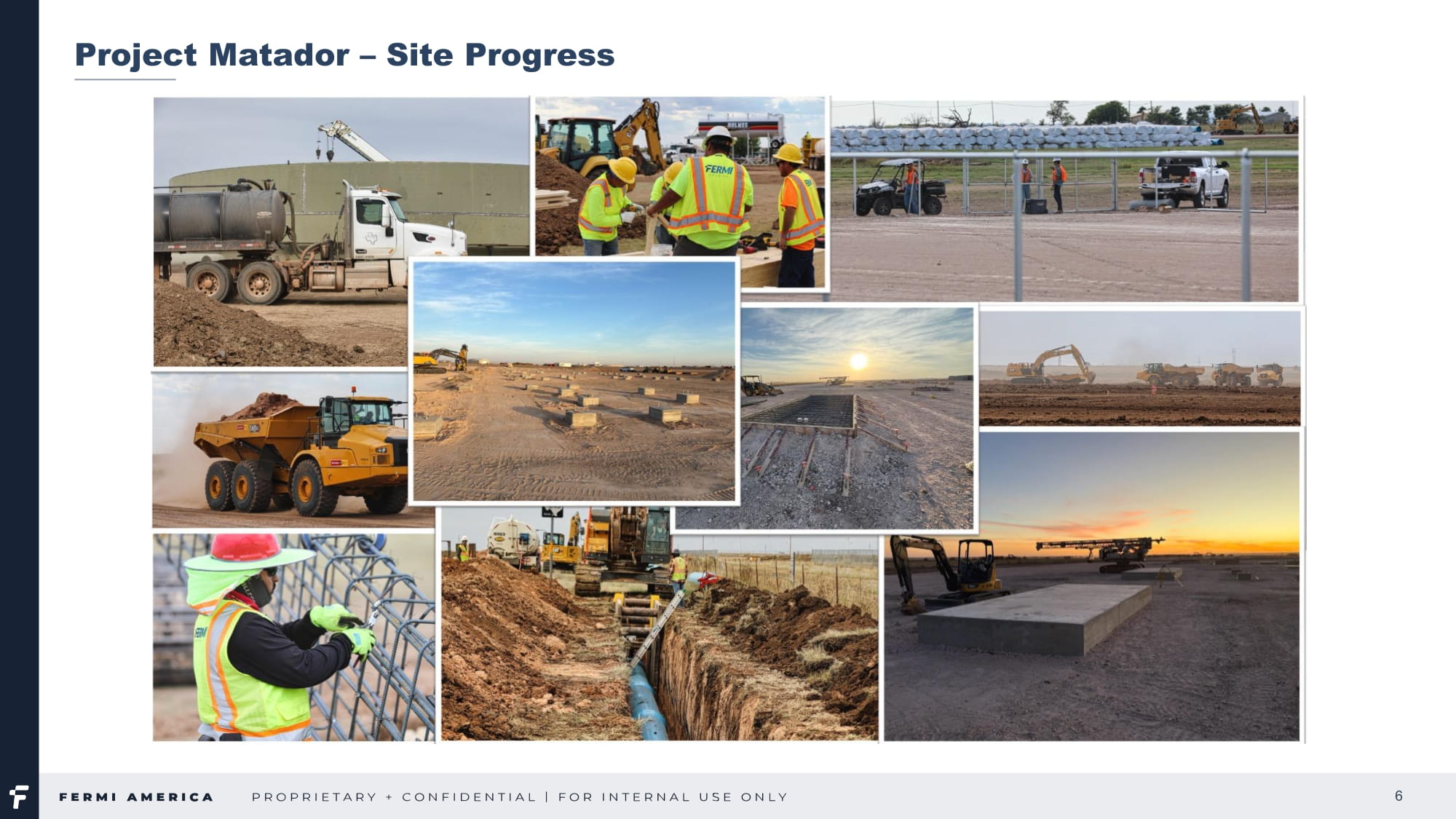

Taylor St., Suite 301 Amarillo, TX | FermiAmerica.com 4 and positioned the company to enter the public markets as a new force in American energy and AI infrastructure: Land – Campus Lease Commencement During the third quarter, the Project Matador campus lease with the Texas Tech University System formally commenced following Fermi’s satisfaction of conditions precedent required under the agreement - including delivery of site development plans, environmental studies, and initial financial commitments . This milestone officially activates the 99 - year lease and provides us with long - term control of our Panhandle site . We have begun on - site geotechnical work at the Project Matador campus, marking the start of physical development on the approximately 5 , 200 - acre site . The initial cleared area spans roughly four million square feet - equivalent to about 85 acres - where soil surveying, compaction testing, and other early construction preparations are well underway . To date, we have installed 6 , 500 feet of roads, 34 , 000 feet of fencing, 9 , 500 feet of barriers, and 12 , 000 feet of water lines . Approximately 85 acres have been graded across data center, substation, and generation sites, with additional clearing currently underway . These activities are keeping us on track toward our target of delivering first power by the end of 2026 . Power Generation Equipment – Long Lead - Time Items To secure long lead - time equipment and materials, Fermi America executed a series of key transactions to lock in critical generation assets and de - risk our construction schedule . In June and July, we acquired nine industrial gas turbines (six Siemens frames and three GE units) totaling over 580 MW of capacity for 2025 delivery, along with steam turbines and other balance - of - plant equipment . Additionally, Southwestern Public Service Company (“SPS”) committed approximately 200 MW of generation capacity for 2026 and 2027 delivery – initially comprising 86 MW of contingent firm power from the utility’s power supply portfolio and 114 MW initially facilitated via SPS’s relationships with its contracted network of mobile generation vendors . To further enhance flexibility during early operations, we entered into a lease for 135 MW of TM 2500 units and plan to rent or purchase an additional 270 MW to provide fast - start backup power as the Project Matador campus scales, with total capacity expected to roughly double by the end of 2026 from this initial level . In September, we also executed an LOI with Siemens Energy to deliver three F - class SGT 6 - 5000 F gas turbine units totaling over 1 GW of combined - cycle capacity for 2026 delivery and initial 2027 operation in simple cycle mode while the combined cycle back - end is being constructed . Taken together - the SPS commitments, the Siemens Energy letter of intent (LOI), the previously acquired turbine assets, and additional power - generation equipment secured in the fourth quarter of 2025 (see Recent Developments ) - Fermi now has approximately 2 . 2 gigawatts of gas - fired generation secured or under LOI . This achievement surpasses our initial 1 - gigawatt 2026 target and represents roughly 20 percent of Project Matador’s planned 11 - gigawatt total capacity, underscoring the rapid progress we’ve made in building a diversified and de - risked power portfolio . 620 S.

Taylor St., Suite 301 Amarillo, TX | FermiAmerica.com 5 Power Generation Equipment – Strategic Nuclear Partnerships In August 2025 , we executed a collaboration agreement with Westinghouse Electric Company to support the licensing and deployment of four AP 1000 ® reactors at the Project Matador campus in the Texas Panhandle . The partnership includes assistance with our Combined Operating License Application and continued support during the U . S . Nuclear Regulatory Commission review process . Westinghouse’s proven Gen III+ reactor design anchors our clean baseload generation strategy and forms the foundation of the Project Matador nuclear program . Also in August 2025 , we signed two LOIs with Siemens Energy to strengthen both the gas and nuclear components of the campus . The first LOI covers the planned delivery of three advanced F - class gas turbines (totaling approximately 1 . 1 gigawatts) by 2026 to accelerate initial power generation . The second LOI establishes a framework for Siemens Energy to potentially supply steam turbines, generators, and related control systems for our future nuclear units . Partnering with a leading global original equipment manufacturer at this stage provides the technology depth and supply assurance needed for a project of this scale . During the same period, we executed a Memorandum of Understanding (MOU) with Samsung C&T Corporation and Korea Hydro & Nuclear Power (KHNP) to participate in the Project Matador campus . The MOU outlines collaboration on Engineering, Procurement, and Construction (EPC) planning for gigawatt - scale nuclear facilities within the site . KHNP brings world - class operational and project management expertise, while Samsung C&T contributes extensive EPC experience from major international nuclear projects such as the Barakah Plant in the United Arab Emirates . Together, these partners enhance our global delivery capability and support the successful execution of our U . S . nuclear expansion . We also entered into a MOU with ASP Isotopes Inc . and its subsidiary, Quantum Leap Energy, in August 2025 to advance the research, development, and commercial production of advanced nuclear fuels, including High - Assay Low - Enriched Uranium (HALEU) and next - generation isotopes . The planned facility will establish a domestic HALEU supply chain and enable on - site fuel research aligned with our future reactor fleet . This collaboration strengthens both supply security and innovation capacity within the Project Matador ecosystem . In September 2025 , we signed an MOU with Hyundai Engineering & Construction to jointly plan and develop the nuclear energy component of our AI - focused private grid project . The MOU defines a framework for project planning, Front - End Engineering Design, and eventual EPC cooperation for our series of Westinghouse AP 1000 ® reactors . Hyundai E&C’s global track record, which includes the construction of more than 20 nuclear units, provides proven expertise that will help ensure timely and cost - efficient project delivery . Also in September 2025 , we entered into an MOU with Doosan Enerbility, a leading global supplier of nuclear plant components, to collaborate on the deployment of large reactors and future small modular reactors at our site . Doosan’s advanced 620 S.

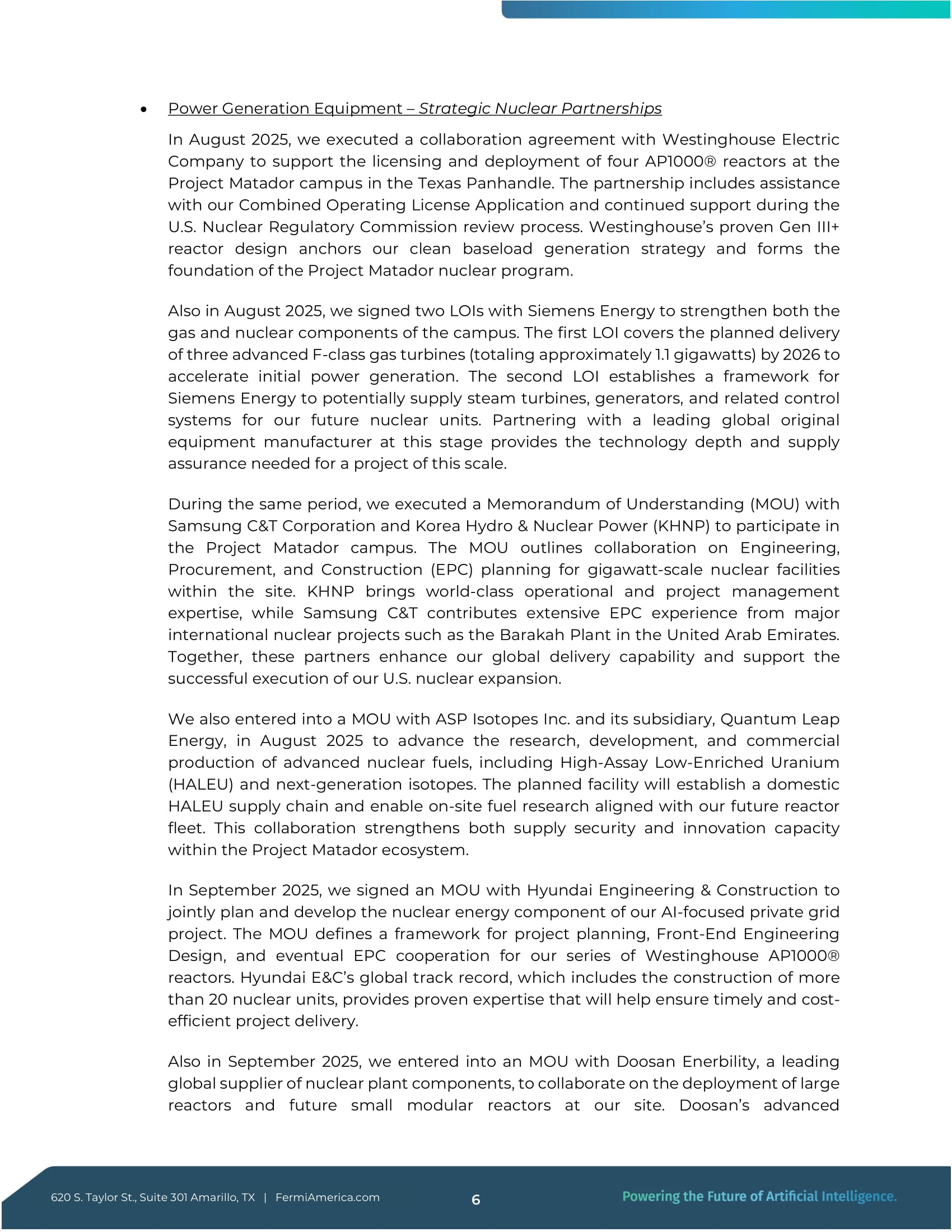

Taylor St., Suite 301 Amarillo, TX | FermiAmerica.com 6 manufacturing capabilities for reactor vessels, steam generators, and other heavy components provide critical supply chain reliability for our nuclear build program . Collectively, these strategic partnerships - spanning engineering, manufacturing, reactor design, and advanced fuel development - position Fermi America and the Project Matador campus at the forefront of next - generation, nuclear - powered infrastructure in the United States . Fuel – Pipeline Interconnect Trenching and laying of the dedicated natural gas pipeline interconnect is now underway, with meter - station foundations and tie - ins progressing to support fuel delivery in early 2026 . Two construction spreads are mobilized ; right - of - way clearing, stringing and welding are in progress with line pipe and mainline valves staged at laydown yards . Hydrostatic testing, pigging, and commissioning windows are coordinated with Energy Transfer, and the meter skid is in fabrication . The line is engineered to serve the first approximately 2 GW with headroom for expansion via looping/compression, keeping gas - in on track for early 2026 . Water – Water Supply Contract As of the third quarter, Fermi entered into an LOI with the City of Amarillo for up to 2 . 5 million gallons per day (MGD) of water supply to support Project Matador . During the quarter, we made significant progress toward finalizing this agreement with the City of Amarillo, advancing negotiations, technical planning, and infrastructure scoping that ultimately laid the groundwork for completion of the deal after quarter - end . Fermi also entered into an MOU with the City of Amarillo to secure scalable water access of up to approximately 10 MGD as additional transmission infrastructure is developed . The water will serve both power generation and data center cooling applications . Permits – Nuclear Regulatory Permits On the regulatory front, in June we submitted our Combined Operating License Application to the U . S . Nuclear Regulatory Commission for our four planned reactors, and in September the NRC formally accepted our application for review . This regulatory milestone is critical, as it keeps the nuclear deployment timeline on schedule . We are committed to maintaining a constructive relationship with regulators and meeting all safety and compliance requirements as we move through the licensing process . Shell Construction – Construction and Infrastructure Partnerships We assembled a world - class design and construction team during the third quarter . We engaged Parkhill, a Texas - based engineering firm, to lead the campus’s infrastructure and architectural design in partnership with specialized consultants . In parallel, we selected Lee Lewis Construction - one of the nation’s top construction management firms based in West Texas with 50 years of workforce relationships - to oversee the build - out of the Project Matador campus . Bringing these experienced 620 S.

Taylor St., Suite 301 Amarillo, TX | FermiAmerica.com 7 partners on board, each with deep regional expertise, ensures we have the right team in place as we transition from planning into full - scale development . Financing – Pre - IPO Financing In August, we strengthened our balance sheet with a significant private funding round led by Macquarie Group . Fermi closed approximately $ 358 million in new financings, consisting of an approximately $ 108 million Series C preferred equity investment and a $ 250 million senior loan facility . Notably, Macquarie not only took the lead equity position but is also providing project debt financing (with $ 100 million drawn at close) to support our equipment procurement and construction efforts . This infusion of capital was a major vote of confidence in our company . It has enabled us to “lock up” vital long - lead items and mobilize our execution team faster . The successful closing of the Macquarie - led funding round was a key milestone in Q 3 , ensuring that we entered our IPO with a strong financial foundation to build upon . Tenants – Investment Grade LOI On September 19 , 2025 , Fermi America executed an LOI with an investment grade - rated tenant to lease a portion of the Project Matador campus on a triple - net basis for an initial term of twenty years, with four additional five - year renewal options . The agreement contemplates the phased delivery of more than one gigawatt of powered shell capacity across twelve separate powered shell facilities to be constructed by the Company . In November, the parties entered into a $ 150 million Advance in Aid of Construction Agreement (see Recent Developments ), which establishes a cost reimbursement framework under which the tenant will fund a portion of shared infrastructure and utility systems in advance of occupancy . While the Tenant LOI remains non - binding and subject to customary conditions, it represents an important step toward securing long - term tenancy for Project Matador and validating market demand for Fermi’s large - scale, energy - integrated AI infrastructure platform . Initial Public Offering (IPO) Just after the quarter’s end, we reached a historic milestone : Fermi America’s initial public offering . On October 1 , 2025 , Fermi America began trading on the Nasdaq Global Select Market under the ticker symbol FRMI, following an IPO in which we raised approximately $ 785 million in gross proceeds, inclusive of the underwriters’ full 15 percent over - allotment option . We priced 32 . 5 million shares at $ 21 each (in the top end of the marketed range), and the offering was significantly oversubscribed - strong investor demand led us to increase the offering size from an initial 25 million shares to 32 . 5 million, with an additional 4 . 875 million shares issued 620 S.

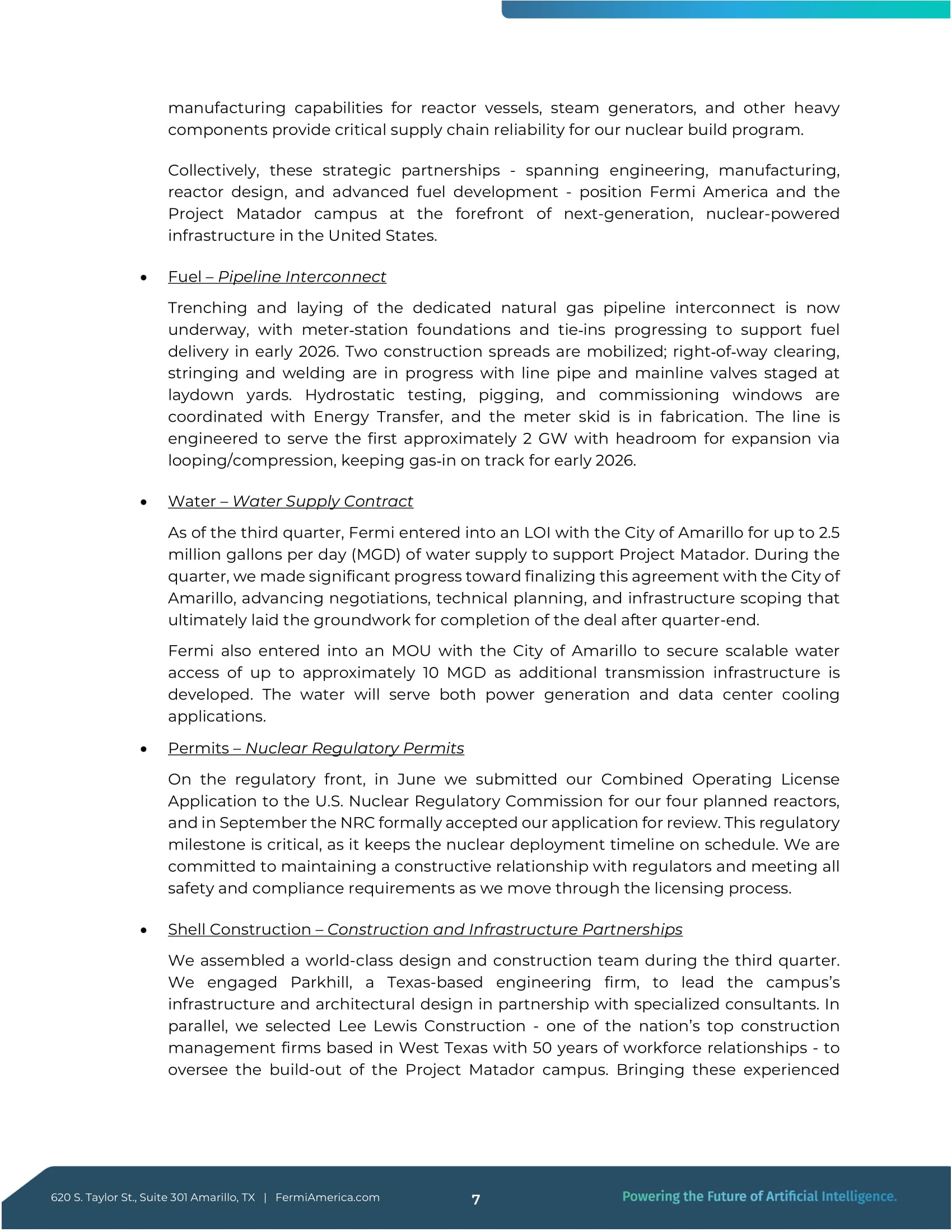

Taylor St., Suite 301 Amarillo, TX | FermiAmerica.com 8 under the greenshoe . We were honored by this enthusiastic reception from the investment community and welcomed multiple new investors to the Fermi America family . Notably, Fermi America’s IPO broke new ground as a simultaneous dual listing on two major exchanges . Our shares debuted on Nasdaq in the U . S . on October 1 and on the London Stock Exchange on October 2 - the first time in decades that a U . S . company has launched an IPO with a concurrent dual listing in London . By tapping into capital markets on both sides of the Atlantic, we broadened our global shareholder base and reflected the international interest in Fermi America’s mission . The IPO valued the company at roughly $ 14 billion on a fully diluted basis, underscoring investor confidence in our strategy . We intend to uphold that confidence through disciplined execution in the coming years . Use of Proceeds : The funds raised in our IPO, combined with existing resources, will enable us to accelerate the build - out of the Project Matador campus and continue to develop our platform . We expect the IPO proceeds to fund our near - term roadmap, including : Construction of Phase One facilities : Building out the initial batch of data center structures and on - site power generation units on our Amarillo campus (the first steps toward our planned 15 million sq . ft . of AI computing facilities) . This includes foundational work for the nuclear reactors and the natural gas plant that will ultimately supply the campus’s first gigawatt of power . Power infrastructure and equipment : Procuring and installing critical equipment (e . g . turbines, transmission hardware) and developing the necessary power and pipeline infrastructure to interconnect our energy assets . This encompasses everything from grid switchyards and cooling systems to gas pipelines and other utilities required to support 24 / 7 operations . Team expansion and execution capacity : Recruiting additional expert talent and contractors to execute project delivery . Building a project of this magnitude requires growing our bench of engineers, construction managers, energy system operators, and other specialists . We are investing in people and capabilities to ensure we meet our aggressive timelines . These investments set the stage for Fermi’s next chapter . We believe that with the IPO capital, we have the resources in place to achieve our initial development goals - bringing 1 GW of capacity online by late 2026 as a first milestone and pushing toward our full 11 GW vision over the following decade . We will continue to exercise prudent financial management as we deploy this capital, keeping a long - term perspective on value creation . Recent Developments Since the start of the fourth quarter, we have continued to drive our ambitious agenda forward, executing with focus and momentum across every dimension of the Project Matador development . We are advancing critical infrastructure, securing long lead - time items, deepening strategic partnerships, and progressing negotiations with our first tenant as we transition from planning to full - scale implementation . The following milestones highlight the 620 S. Taylor St., Suite 301 Amarillo, TX | FermiAmerica.com 9 tangible progress achieved as we position Fermi America for major construction and initial operations in 2026.

Tenants – Advance in Aid of Construction Agreement In November 2025 , Fermi America executed a $ 150 million Advance in Aid of Construction (AIAC) Agreement with its first prospective tenant at Project Matador . The AIAC establishes a cost reimbursement framework under which the tenant will fund a portion of shared infrastructure and utility systems in advance of occupancy . This agreement marks a pivotal milestone in Fermi’s commercial program, strengthening alignment with the prospective tenant and advancing the parties toward execution of a long - term campus lease . Land – Campus Development We have been finalizing critical site infrastructure agreements and permits to prepare the campus for large - scale construction . Working closely with local and regional authorities, we have advanced key arrangements for utilities and road access, ensuring that essential supporting infrastructure will be in place as power generation and data center construction begin . We are also actively exploring options to expand the size of the Project Matador campus through land purchases by an incremental approximately 2 , 000 acres . Power Generation Equipment – GE TM 2500 Turbine Lease and Nuclear Collaboration Agreements In October 2025 , we entered into an agreement with Mobile Power Solutions LLC to lease seven GE TM 2500 Gen 4 mobile gas turbine units for deployment at the Project Matador campus . These leased turbines secure the initial 135 megawatts of the stated 320 megawatts to provide fast - start, dispatchable capacity, serving as a bridge resource to support early - stage power generation while permanent combined - cycle and nuclear facilities are constructed . The agreement enables Fermi to maintain schedule flexibility, ensure continuous power availability during construction and commissioning, and accelerate initial data - center energization ahead of the delivery of long - lead generation assets - bringing Fermi to approximately 2 . 2 gigawatts of gas - fired generation secured or under LOI . In late October 2025 , ahead of President Trump’s visit to Seoul, Fermi America’s wholly owned subsidiary, Fermi Nuclear LLC (Fermi Nuclear), executed two international contracts supporting Project Matador’s AP 1000 ® reactor program . Fermi Nuclear entered into a Front - End Engineering Design (FEED) agreement with Hyundai Engineering & Construction Co . , Ltd . to perform FEED studies and deliverables for the AP 1000 ® scope at Project Matador, including cooling strategy, site layout and constructability, site access and logistics planning, laydown and geotechnical work, civil estimating, schedule development, and interfaces and data management . Fermi Nuclear also executed a Forging Material Production Readiness agreement with Doosan Enerbility Co . , Ltd . to procure forging materials, fabricate and store forging dies, and prepare for production of reactor vessels and steam generators for the planned four - unit AP 1000 ® deployment . Collectively, these agreements secure FEED execution 620 S.

Taylor St., Suite 301 Amarillo, TX | FermiAmerica.com 10 and component production readiness for Project Matador and position the Company to initiate AP 1000 ® deployments and expand its nuclear manufacturing and EPC partnerships across the U . S . and South Korea . Fuel – Gas Supply Agreement We finalized a firm natural gas supply agreement with Energy Transfer to provide pipeline - delivered natural gas to the Project Matador campus via a new Transwestern interconnect south of the site . This dedicated connection, expected to enter service in the first quarter of 2026 , will deliver up to 300 , 000 MMBtu per day – sufficient to support approximately 1 . 5 GW of power generation in combined - cycle mode – and establishes a reliable energy backbone for our hybrid gas - nuclear - renewable grid - secured with minimal capital outlay by Fermi . We are also exploring options for additional capacity from other shippers on the Transwestern pipeline to support future phases . Water – Regional Partnership and Supply Framework In late October 2025 , Fermi America finalized a partnership agreement with the City of Amarillo that established the framework for long - term water supply and local infrastructure cooperation . The Amarillo City Council approved a water - supply agreement allowing the city to sell up to 2 . 5 million gallons per day (MGD) to Project Matador . The agreement also includes a non - binding MOU providing the option to expand supply to 10 MGD in later phases as campus development progresses . Under the agreement, Fermi will fund the necessary water infrastructure and adhere to defined water stewardship standards . These water infrastructure projects – including new wells, pipelines, and pump stations – are expected to be completed by January 2027 . Permits – Tax Abatement, TCEQ Preliminary Clean Air Permit, and Reinvestment Zone In late October, Carson County approved a 10 - year tax abatement per phase and reinvestment zone for the Project Matador campus, establishing a framework that drives local investment, supports regional economic growth, and creates long - term, sustainable jobs while generating new tax revenues for the community . Additionally, the Texas Commission on Environmental Quality (TCEQ) preliminarily approved Fermi’s 6 GW Clean Air Permit for natural gas generation, subject to an ongoing process for public input before final approval . In early November, Panhandle ISD unanimously approved a Foreign Trade Zone Exemption and Revenue Loss Indemnity Agreement and issued a letter of non - objection supporting the establishment of a special purpose Foreign Trade Zone (FTZ) subzone in Carson County . Collectively, these post - quarter milestones enhance the reliability and self - sufficiency of the Project Matador campus, reduce construction and operational risk, and put Fermi America in a stronger position as we enter 2026 with full readiness to commence major development . 620 S.

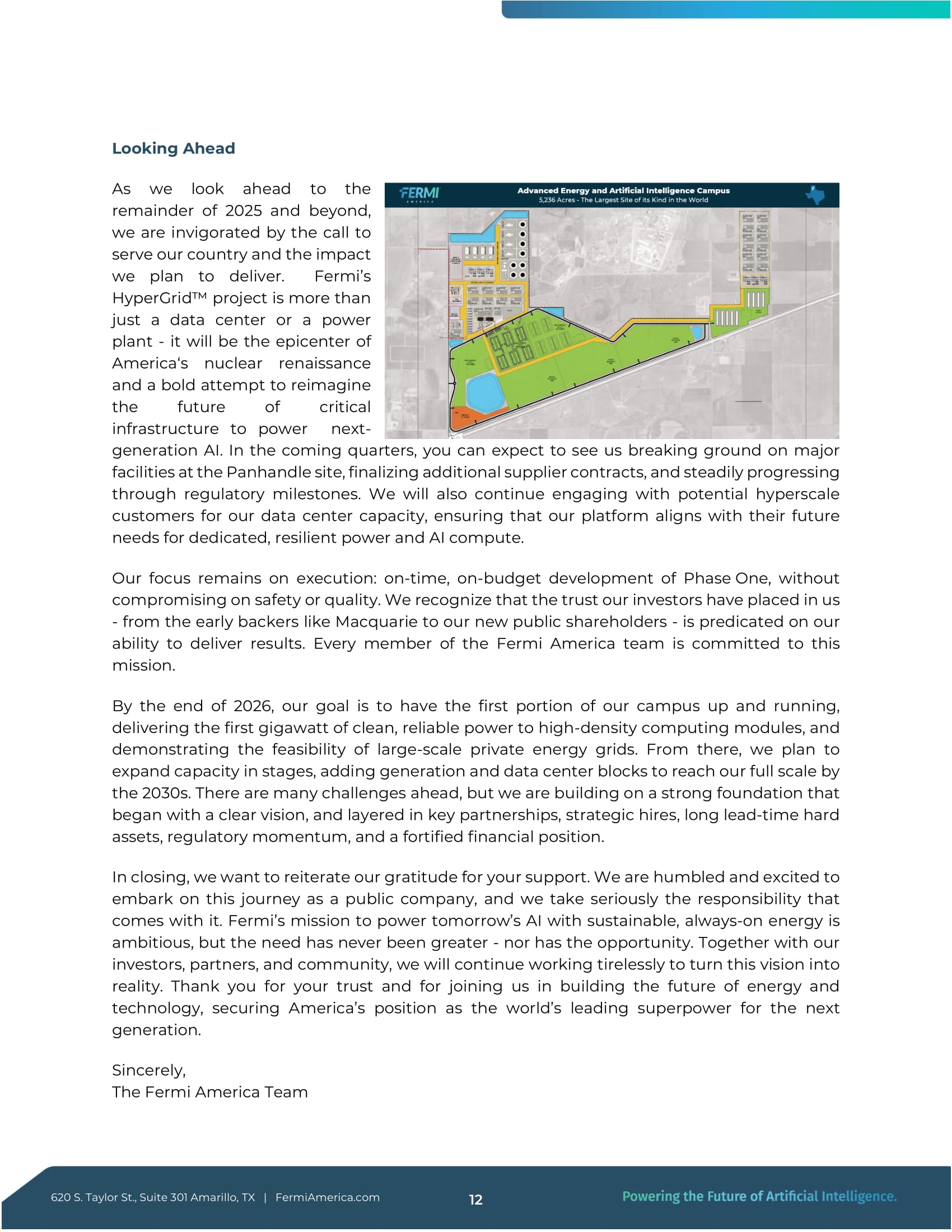

Taylor St., Suite 301 Amarillo, TX | FermiAmerica.com 11 Looking Ahead As we look ahead to the remainder of 2025 and beyond, we are invigorated by the call to serve our country and the impact we plan to deliver . Fermi’s HyperGrid project is more than just a data center or a power plant - it will be the epicenter of America‘s nuclear renaissance and a bold attempt to reimagine the future of critical infrastructure to power next - generation AI . In the coming quarters, you can expect to see us breaking ground on major facilities at the Panhandle site, finalizing additional supplier contracts, and steadily progressing through regulatory milestones . We will also continue engaging with potential hyperscale customers for our data center capacity, ensuring that our platform aligns with their future needs for dedicated, resilient power and AI compute . Our focus remains on execution : on - time, on - budget development of Phase One, without compromising on safety or quality . We recognize that the trust our investors have placed in us - from the early backers like Macquarie to our new public shareholders - is predicated on our ability to deliver results . Every member of the Fermi America team is committed to this mission . By the end of 2026 , our goal is to have the first portion of our campus up and running, delivering the first gigawatt of clean, reliable power to high - density computing modules, and demonstrating the feasibility of large - scale private energy grids . From there, we plan to expand capacity in stages, adding generation and data center blocks to reach our full scale by the 2030 s . There are many challenges ahead, but we are building on a strong foundation that began with a clear vision, and layered in key partnerships, strategic hires, long lead - time hard assets, regulatory momentum, and a fortified financial position . In closing, we want to reiterate our gratitude for your support . We are humbled and excited to embark on this journey as a public company, and we take seriously the responsibility that comes with it . Fermi’s mission to power tomorrow’s AI with sustainable, always - on energy is ambitious, but the need has never been greater - nor has the opportunity . Together with our investors, partners, and community, we will continue working tirelessly to turn this vision into reality . Thank you for your trust and for joining us in building the future of energy and technology, securing America’s position as the world’s leading superpower for the next generation . Sincerely, The Fermi America Team 620 S.

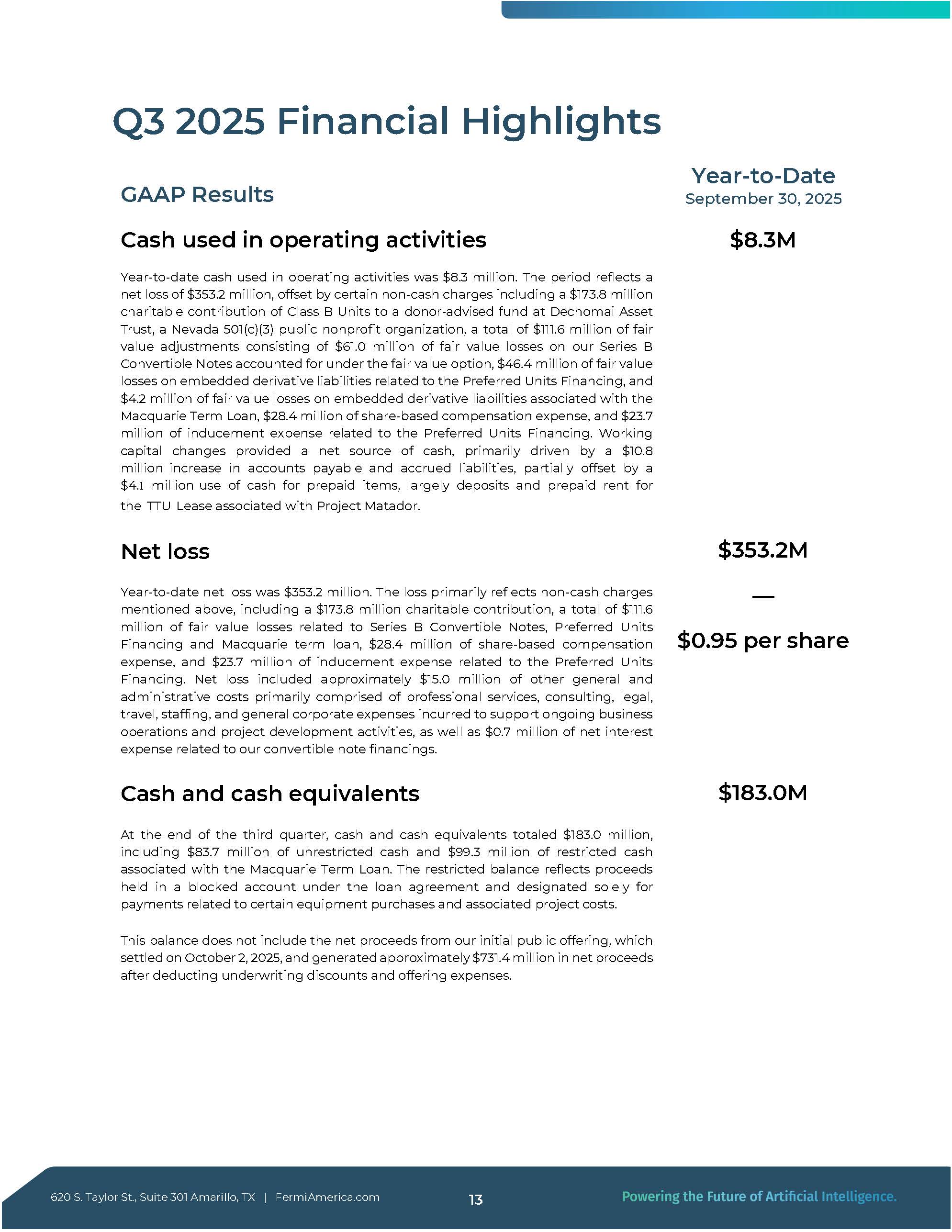

Taylor St., Suite 301 Amarillo, TX | FermiAmerica.com 12 Q3 2025 Financial Highlights 620 S. Taylor St., Suite 301 Amarillo, TX | FermiAmerica.com 13 Year - to - Date September 30, 2025 GAAP Results $8.3M Cash used in operating activities Year - to - date cash used in operating activities was $ 8 . 3 million . The period reflects a net loss of $ 353 . 2 million, offset by certain non - cash charges including a $ 173 . 8 million charitable contribution of Class B Units to a donor - advised fund at Dechomai Asset Trust, a Nevada 501 (c)( 3 ) public nonprofit organization, a total of $ 111 . 6 million of fair value adjustments consisting of $ 61 . 0 million of fair value losses on our Series B Convertible Notes accounted for under the fair value option, $ 46 . 4 million of fair value losses on embedded derivative liabilities related to the Preferred Units Financing, and $ 4 . 2 million of fair value losses on embedded derivative liabilities associated with the Macquarie Term Loan, $ 28 . 4 million of share - based compensation expense, and $ 23 . 7 million of inducement expense related to the Preferred Units Financing . Working capital changes provided a net source of cash, primarily driven by a $ 10 . 8 million increase in accounts payable and accrued liabilities, partially offset by a $ 4 . 5 million use of cash for prepaid items, largely deposits and prepaid rent for the TTU Lease associated with Project Matador . $353.2M – – $0.95 per share Net loss Year - to - date net loss was $ 353 . 2 million . The loss primarily reflects non - cash charges mentioned above, including a $ 173 . 8 million charitable contribution, a total of $ 111 . 6 million of fair value losses related to Series B Convertible Notes, Preferred Units Financing and Macquarie term loan, $ 28 . 4 million of share - based compensation expense, and $ 23 . 7 million of inducement expense related to the Preferred Units Financing . Net loss included approximately $ 15 . 0 million of other general and administrative costs primarily comprised of professional services, consulting, legal, travel, staffing, and general corporate expenses incurred to support ongoing business operations and project development activities, as well as $ 0 . 7 million of net interest expense related to our convertible note financings . $183.0M Cash and cash equivalents At the end of the third quarter, cash and cash equivalents totaled $ 183 . 0 million, including $ 83 . 7 million of unrestricted cash and $ 99 . 3 million of restricted cash associated with the Macquarie Term Loan . The restricted balance reflects proceeds held in a blocked account under the loan agreement and designated solely for payments related to certain equipment purchases and associated project costs . This balance does not include the net proceeds from our initial public offering, which settled on October 2 , 2025 , and generated approximately $ 731 . 4 million in net proceeds after deducting underwriting discounts and offering expenses .

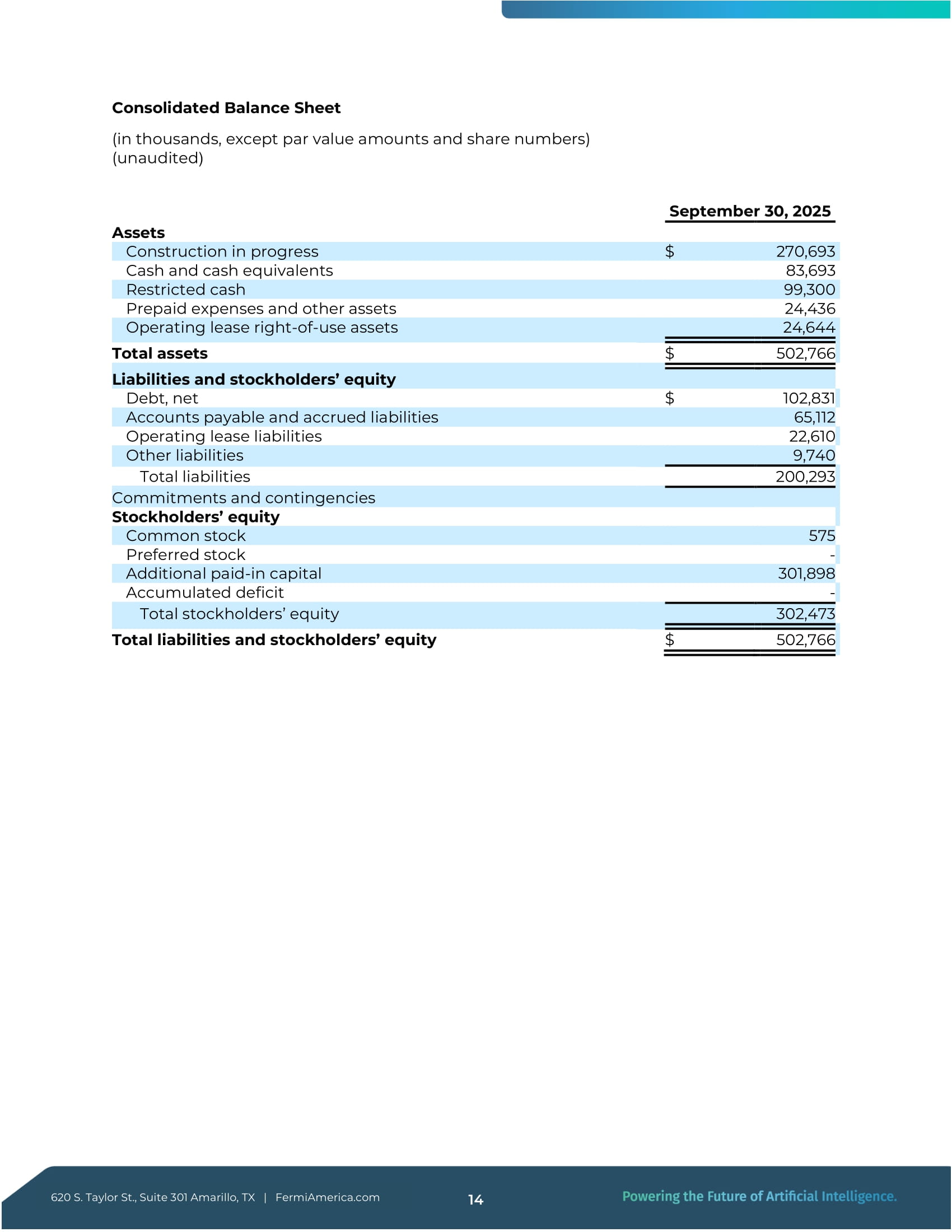

Consolidated Balance Sheet (in thousands, except par value amounts and share numbers) (unaudited ) September 30, 2025 Assets 270,693 $ Construction in progress 83,693 Cash and cash equivalents 99,300 Restricted cash 24,436 Prepaid expenses and other assets 24,644 Operating lease right - of - use assets 502,766 $ Total assets Liabilities and stockholders’ equity 102,831 $ Debt, net 65,112 Accounts payable and accrued liabilities 22,610 Operating lease liabilities 9,740 Other liabilities 200,293 Total liabilities Commitments and contingencies Stockholders’ equity 575 Common stock - Preferred stock 301,898 Additional paid - in capital - Accumulated deficit 302,473 Total stockholders’ equity 502,766 $ Total liabilities and stockholders’ equity 620 S.

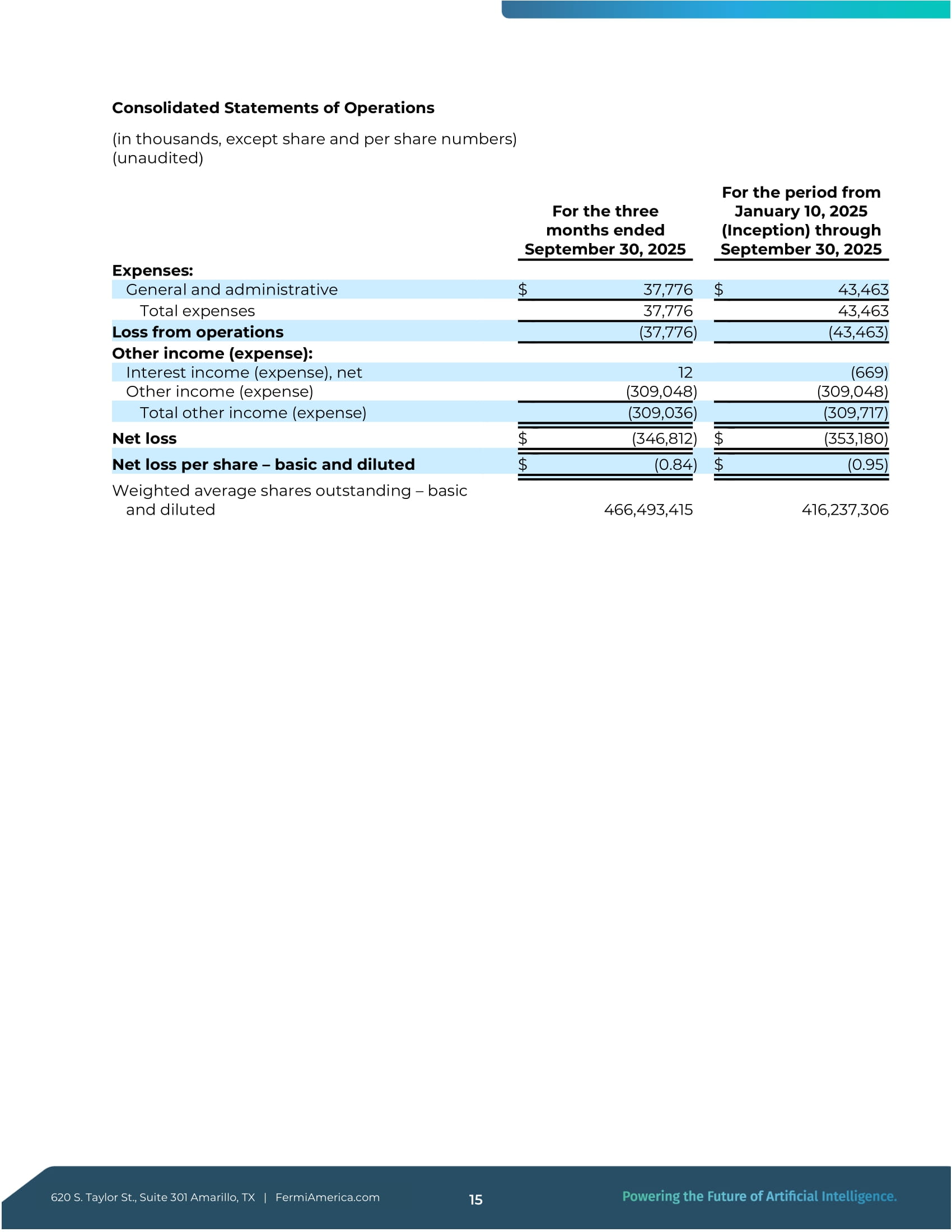

Taylor St., Suite 301 Amarillo, TX | FermiAmerica.com 14 Consolidated Statements of Operations (in thousands, except share and per share numbers) (unaudited ) 620 S.

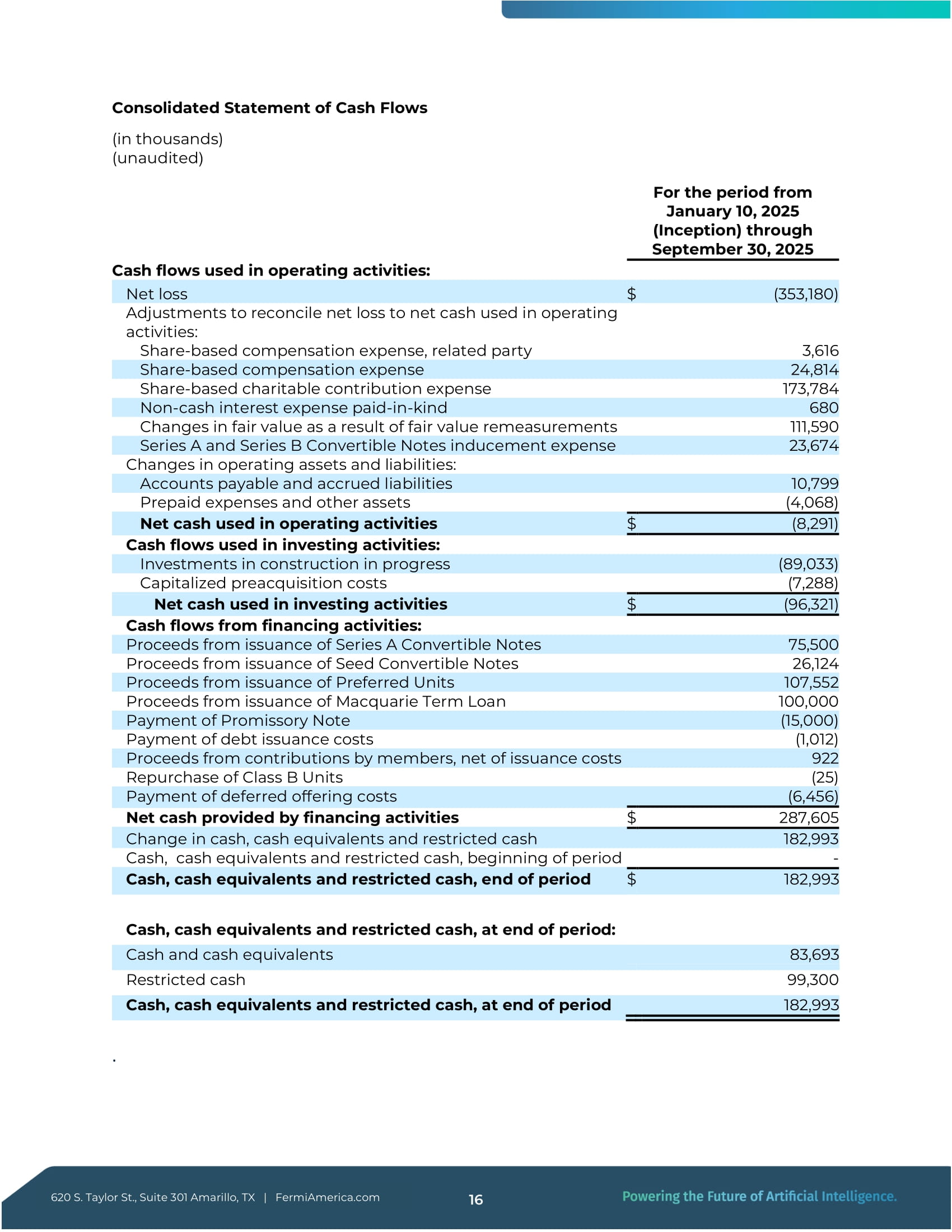

Taylor St., Suite 301 Amarillo, TX | FermiAmerica.com 15 For the period from January 10, 2025 (Inception) through September 30, 2025 For the three months ended September 30, 2025 Expenses: 43,463 $ 37,776 $ General and administrative 43,463 37,776 Total expenses (43,463) ) (37,776 Loss from operations Other income (expense): (669) 12 Interest income (expense), net (309,048) ) (309,048 Other income (expense) (309,717) ) (309,036 Total other income (expense) (353,180) $ ) (346,812 $ Net loss (0.95) $ ) (0.84 $ Net loss per share – basic and diluted 416,237,306 466,493,415 Weighted average shares outstanding – basic and diluted Consolidated Statement of Cash Flows (in thousands) (unaudited ) 620 S. Taylor St., Suite 301 Amarillo, TX | FermiAmerica.com 16 For the period from January 10, 2025 (Inception) through September 30, 2025 Cash flows used in operating activities: (353,180) $ Net loss Adjustments to reconcile net loss to net cash used in operating activities: 3,616 Share - based compensation expense, related party 24,814 Share - based compensation expense 173,784 Share - based charitable contribution expense 680 Non - cash interest expense paid - in - kind 111,590 Changes in fair value as a result of fair value remeasurements 23,674 Series A and Series B Convertible Notes inducement expense Changes in operating assets and liabilities: 10,799 Accounts payable and accrued liabilities (4,068) Prepaid expenses and other assets (8,291) $ Net cash used in operating activities Cash flows used in investing activities: (89,033) Investments in construction in progress (7,288) Capitalized preacquisition costs (96,321) $ Net cash used in investing activities Cash flows from financing activities: 75,500 Proceeds from issuance of Series A Convertible Notes 26,124 Proceeds from issuance of Seed Convertible Notes 107,552 Proceeds from issuance of Preferred Units 100,000 Proceeds from issuance of Macquarie Term Loan (15,000) Payment of Promissory Note (1,012) Payment of debt issuance costs 922 Proceeds from contributions by members, net of issuance costs (25) Repurchase of Class B Units (6,456) Payment of deferred offering costs 287,605 $ Net cash provided by financing activities 182,993 Change in cash, cash equivalents and restricted cash - Cash, cash equivalents and restricted cash, beginning of period 182,993 $ Cash, cash equivalents and restricted cash, end of period Cash, cash equivalents and restricted cash, at end of period: 83,693 Cash and cash equivalents 99,300 Restricted cash 182,993 Cash, cash equivalents and restricted cash, at end of period .

Exhibit 99.2

11 Gigawatt Private Grid Powering Next - Gen AI USHERING IN AMERICAN ENERGY AND AI DOMINANCE 1 3 Quarter 2025 Earnings Release DISCLAIMERS ABOUT THIS PRESENTATION This presentation is provided by Fermi Inc. (“Fermi”) for informational purposes only. The information contained herein does not purport to be all inclusive and no representations or warranties, express or implied, are given in, or in respect of, this pr es entation. To the fullest extent permitted by law, in no circumstances will Fermi or any of its subsidiaries, interest holders, affiliat es, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indire ct or consequential loss or loss of profit arising from the use of this presentation, its contents, its omissions, reliance on the inf ormation contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. NO OFFER OR SOLICITATION This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitati on of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or s ale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. This presentation is not, and unde r n o circumstances is to be construed as, a prospectus, an advertisement or a public offering of the securities described herein in the United States or any other jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the req uir ements of Section 10 of the Securities Act of 1933, as amended, or exemptions therefrom. NO REPRESENTATIONS OR WARRANTIES This presentation is for informational purposes only and does not purport to contain all of the information that may be required to evaluate Fermi . Viewers of this presentation should make their own evaluation of Fermi and of the relevance and adequacy of the information and should make other investigations as they deem necessary . This presentation is not intended to form the basis of any investment decision by any potential investor and does not constitute investment, tax or legal advice . No representations or warranties, express or implied, are or will be given in, or in respect of, this presentation or any other written, oral or other communications transmitted or otherwise made available to any party in the course of its evaluation of an investment in Fermi, and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or misstatements, negligent or otherwise, relating thereto . To the fullest extent permitted by law, in no circumstances will Fermi or any of its subsidiaries, interest holders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith . The information contained in this presentation is preliminary in nature and is subject to change, and any such changes may be material . Fermi disclaims any duty to update the information contained in this presentation . FORWARD - LOOKING STATEMENTS In particular, statements pertaining to our business and growth strategies, investment and development activities and trends in our business, contain forward - looking statements . When used in this presentation, the words “estimate,” “anticipate,” “expect,” “believe,” “intend,” “may,” “will,” “could,” “should,” “would,” “seek,” “position,” “support,” “drive,” “enable,” “optimistic,” “target,” “opportunity,” “approximately” or “plan,” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters are intended to identify forward - looking statements . You can also identify forward - looking statements by discussions of strategy, plans or intentions of management . Forward - looking statements involve numerous risks and uncertainties, and you should not rely on them as predictions of future events . Forward - looking statements depend on assumptions, data or methods that may be incorrect or imprecise and we may not be able to realize them . We do not guarantee that the transactions and events described will happen as described (or that they will happen at all), including with respect to historical environmental conditions at the Project Matador site, which increases site preparation and timelines . The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward - looking statements : our business model is highly dependent on the successful construction, development, leasing, and continued maintenance of Project Matador, our ability to access adequate project financing, commercial borrowings and debt and equity capital markets to fund our significant anticipated capital expenditures, our ability to construct, operate and maintain power generation facilities on schedule and at anticipated costs, either of which may be impacted by supply chain disruptions, including the impact on labor availability, raw materials and input commodity costs and availability, and manufacturing and transportation, the market for generating nuclear power is not yet established and may not achieve the growth potential we expect or may grow more slowly than expected ; general business and economic conditions ; environmental history, remediation, and associated risks ; our ability to obtain and renew leases with our tenants on terms favorable to us, and manage our growth, business, financial results and results of operations ; our ability to respond to price fluctuations and rapidly changing technology ; the impact of tariffs and global trade disruptions on us and our tenants ; changes in political conditions, geopolitical turmoil, political instability, civil disturbances, and restrictive governmental actions ; we and our customers operate in a politically sensitive environment, and the public perception of nuclear energy can affect our customers and us ; the degree and nature of our competition ; our failure to generate sufficient cash flows to service indebtedness ; material negative changes in the creditworthiness and the ability of our tenants to meet their contractual obligations ; increases and volatility in interest rates ; increased power, labor, equipment procurement, shipping, refurbishment or construction costs ; labor shortages or our inability to attract and retain talent ; changes in, or the failure or inability to comply with, government regulation, including regulation of our facilities’ environmental footprint and the project’s electric generation and storage assets ; a failure of our information technology systems, systems conversions and integrations, cybersecurity attacks or a breach of our information security systems, networks or processes ; our inability to obtain and/or maintain necessary government or other required consents or permits ; our failure to qualify as a REIT and maintain our REIT qualification for U . S . federal income tax purposes ; changes in, or the failure or inability to comply with, local, state, federal and applicable international laws and regulations, including related to taxation, real estate and zoning laws, and increases in real property tax rates ; the impact of any financial, accounting, legal or regulatory issues or litigation that may affect us ; and additional factors discussed in the sections entitled “Business and Properties,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our final prospectus filed with the U . S . Securities and Exchange Commission . You are cautioned not to place undue reliance on forward - looking statements, which speak only as of the date hereof . While forward - looking statements reflect our good faith beliefs, they are not guarantees of future performance . We undertake no obligation to publicly release the results of any revisions to these forward - looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, except as required by law . In light of these risks and uncertainties, the forward - looking events discussed in in this presentation might not occur as described, or at all . INDUSTRY AND MARKET DATA In this presentation, Fermi relies on and refers to certain information and statistics regarding the markets and industries i n w hich Fermi competes. Such information and statistics are based on Fermi’s management’s estimates and/or obtained from third p art y sources, including reports by market research firms and company filings. While Fermi believes such third party information is re liable, there can be no assurance as to the accuracy or completeness of the indicated information. Fermi has not independentl y verified the accuracy or completeness of the information provided by the third - party sources.

FERMI AMERICA SALUTES THE BRAVE MEN & WOMEN WHO SERVED WITH HONOR On this Veterans Day and Remembrance Day, we proudly salute all who have worn the uniform, knowing that we are the land of the free because of the brave. Their courage, sacrifice, and devotion have safeguarded the freedom and promise of America. As we remember their service, Fermi America stands united in our mission to fight today's war for the freedom of Western Civilization as we know it, ensuring America controls the future of AI. God bless our veterans and God bless America.

\ AS1 THE WORLD'S LARGEST ADVANCED ENERGY AND ARTIFICIAL INTELLIGENCE CAMPUS Spanning 11 gigawatts of power , comprised of a combination of 5 gigawatts of gas - powered generation and 6 gigawatts of nuclear generation , across 5,200 acres , Project Matador is expected to be the largest advanced energy and data campus in the world. A first - of - its - kind private electric grid combining nuclear, natural gas, and solar power , delivering next - generation artificial intelligence at scale, in partnership with the Texas Tech University System.

Advanced Energy and Artificial Intelligence Campus 5,236 Acres - The Largest Site of its Kind in the World AS1 Project Matador – Site Progress 6 AS1JD2

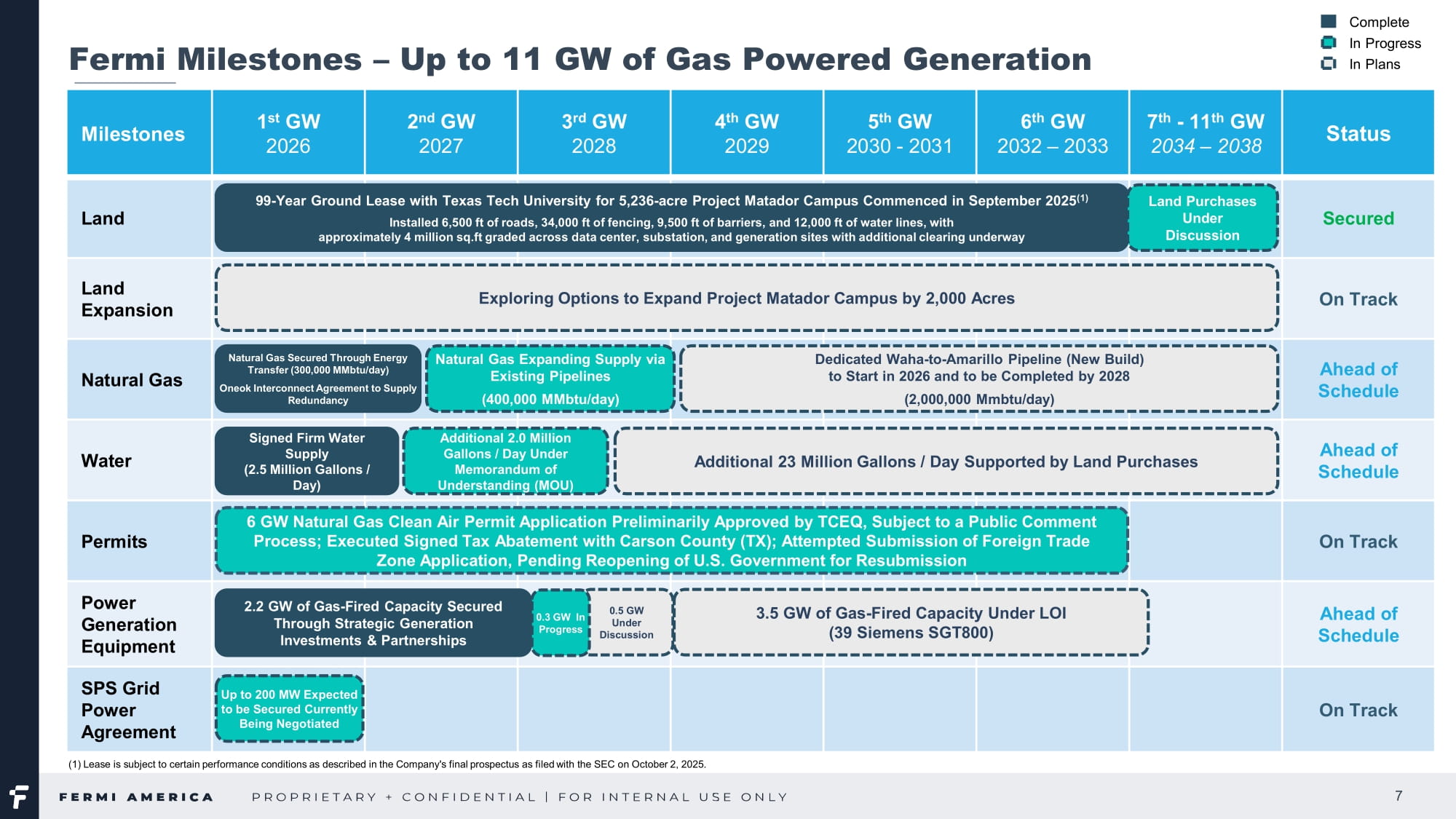

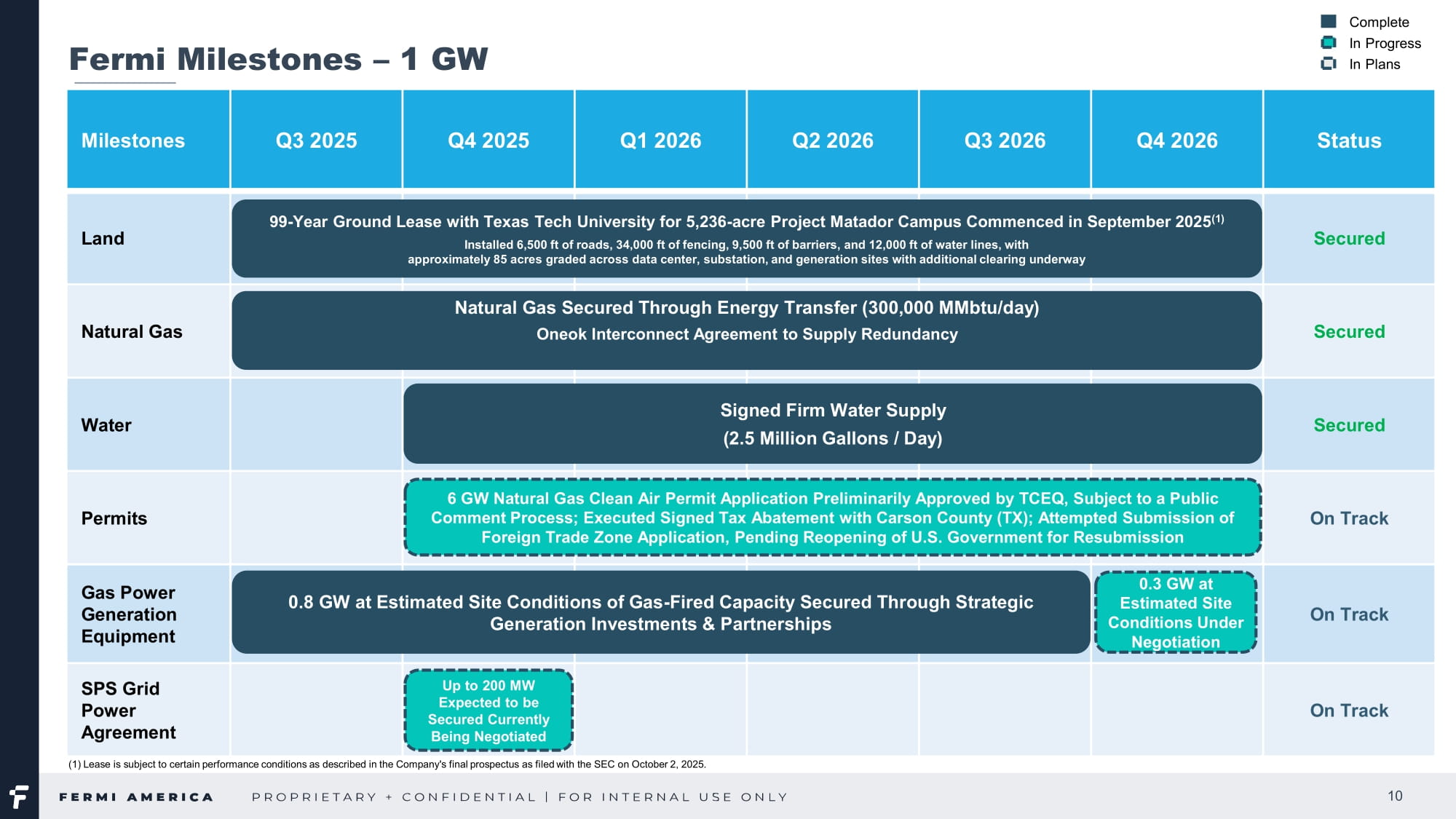

Fermi Milestones – Up to 11 GW of Gas Powered Generation Status 7 th - 11 th GW 2034 – 2038 6 th GW 2032 – 2033 5 th GW 2030 - 2031 4 th GW 2029 3 rd GW 2028 2 nd GW 2027 1 st GW 2026 Milestones Secured Land On Track Land Expansion Ahead of Schedule Natural Gas Ahead of Schedule Water On Track Permits Ahead of Schedule Power Generation Equipment On Track SPS Grid Power Agreement 99 - Year Ground Lease with Texas Tech University for 5,236 - acre Project Matador Campus Commenced in September 2025 (1) Installed 6,500 ft of roads, 34,000 ft of fencing, 9,500 ft of barriers, and 12,000 ft of water lines, with approximately 4 million sq.ft graded across data center, substation, and generation sites with additional clearing underway 6 GW Natural Gas Clean Air Permit Application Preliminarily Approved by TCEQ, Pending Public Comment Period; Executed Signed Tax Abatement with Carson County (TX); Attempted Submission of Foreign Trade Zone Application, Pending Reopening of U.S. Government for Resubmission Signed Firm Water Supply (2.5 Million Gallons / Day) Additional 2.0 Million Gallons / Day Under Memorandum of Understanding (MOU) 7 Dedicated Waha - to - Amarillo Pipeline (New Build) to Start in 2026 and to be Completed by 2028 (2,000,000 Mmbtu /day) 0.5 GW Under Discussion Natural Gas Secured Through Energy Transfer (300,000 MMbtu /day) Natural Gas Expanding Supply via Existing Pipelines (400,000 MMbtu /day) Additional 23 Million Gallons / Day Supported by Land Purchases 3.5 GW of Gas - Fired Capacity Under LOI (39 Siemens SGT800) 2.2 GW of Gas - Fired Capacity Secured Through Strategic Generation Investments & Partnerships Exploring Options to Expand Project Matador Campus by 2,000 Acres Complete In Progress In Plans 0.3 GW Under Negotiation (1) Lease is subject to certain performance conditions as described in the Company's final prospectus as filed with the SEC o n O ctober 2, 2025.

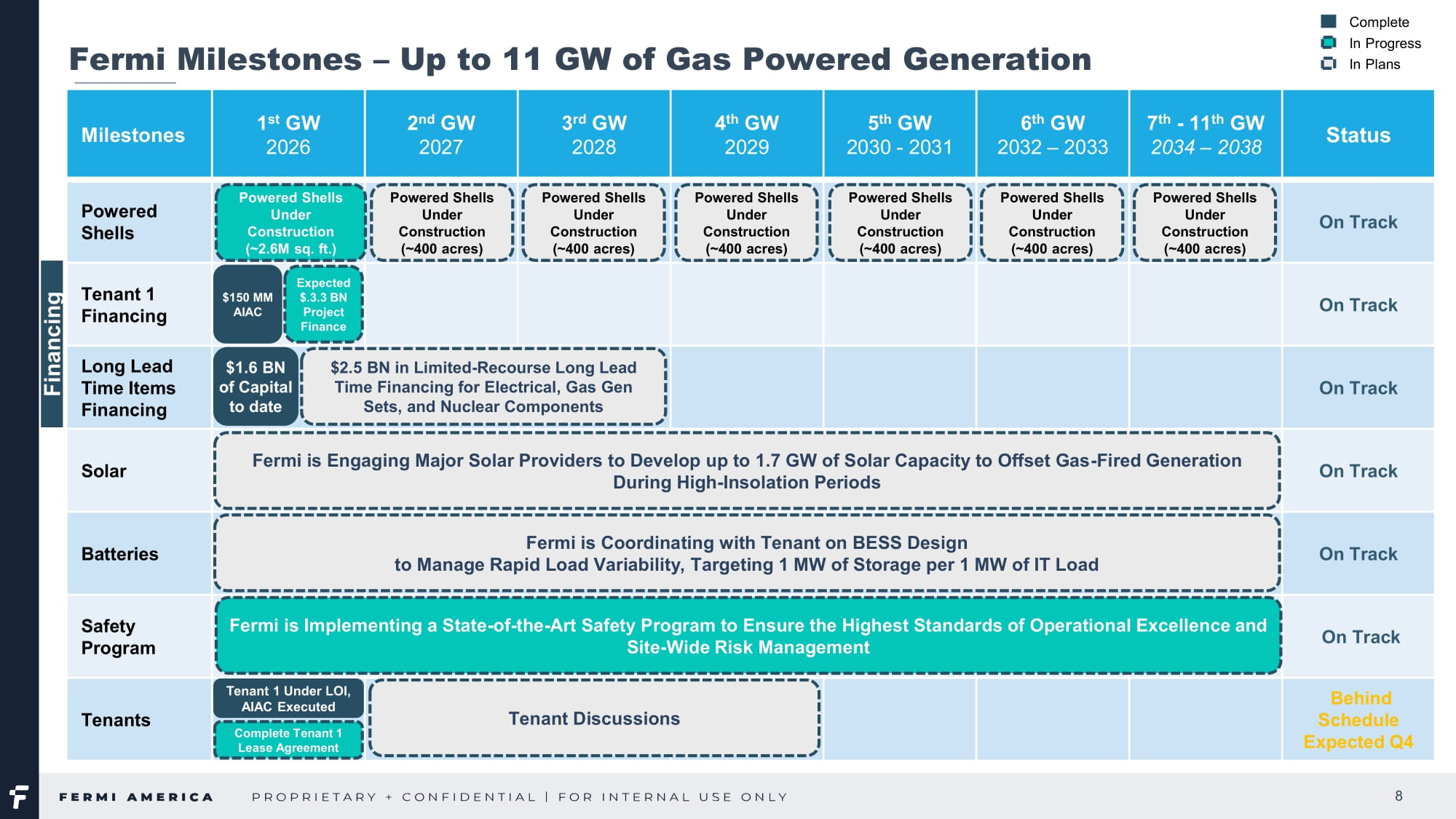

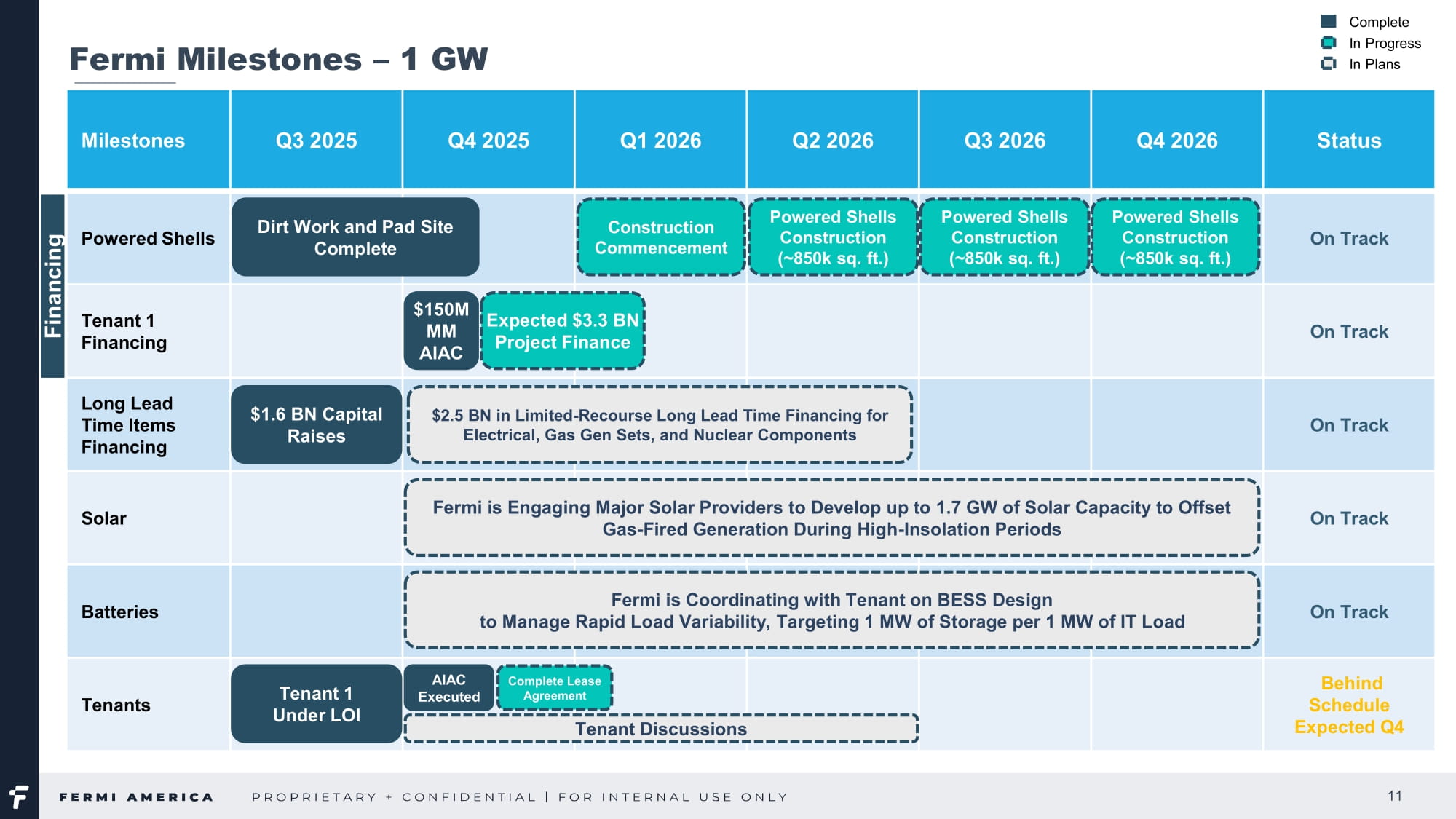

Land Purchases Under Discussion Up to 200 MW Expected to be Secured Currently Being Negotiated Fermi Milestones – Up to 11 GW of Gas Powered Generation Status 7 th - 11 th GW 2034 – 2038 6 th GW 2032 – 2033 5 th GW 2030 - 2031 4 th GW 2029 3 rd GW 2028 2 nd GW 2027 1 st GW 2026 Milestones On Track Powered Shells On Track Tenant 1 Financing On Track Long Lead Time Items Financing On Track Solar On Track Batteries On Track Safety Program Behind Schedule Expected Q4 Tenants 8 Fermi is Coordinating with Tenant on BESS Design to Manage Rapid Load Variability, Targeting 1 MW of Storage per 1 MW of IT Load Fermi is Engaging Major Solar Providers to Develop up to 1.7 GW of Solar Capacity to Offset Gas - Fired Generation During High - Insolation Periods Expected $.3.3 BN Project Finance Tenant 1 Under LOI, AIAC Executed Tenant Discussions Financing $2.5 BN in Non - Recourse Long Lead Time Financing for Electrical, Gas Gen Sets, and Nuclear Components $1.6 BN of Capital to date $150 MM AIAC Complete Tenant 1 Lease Agreement Powered Shells Under Construction (~2.6M sq.

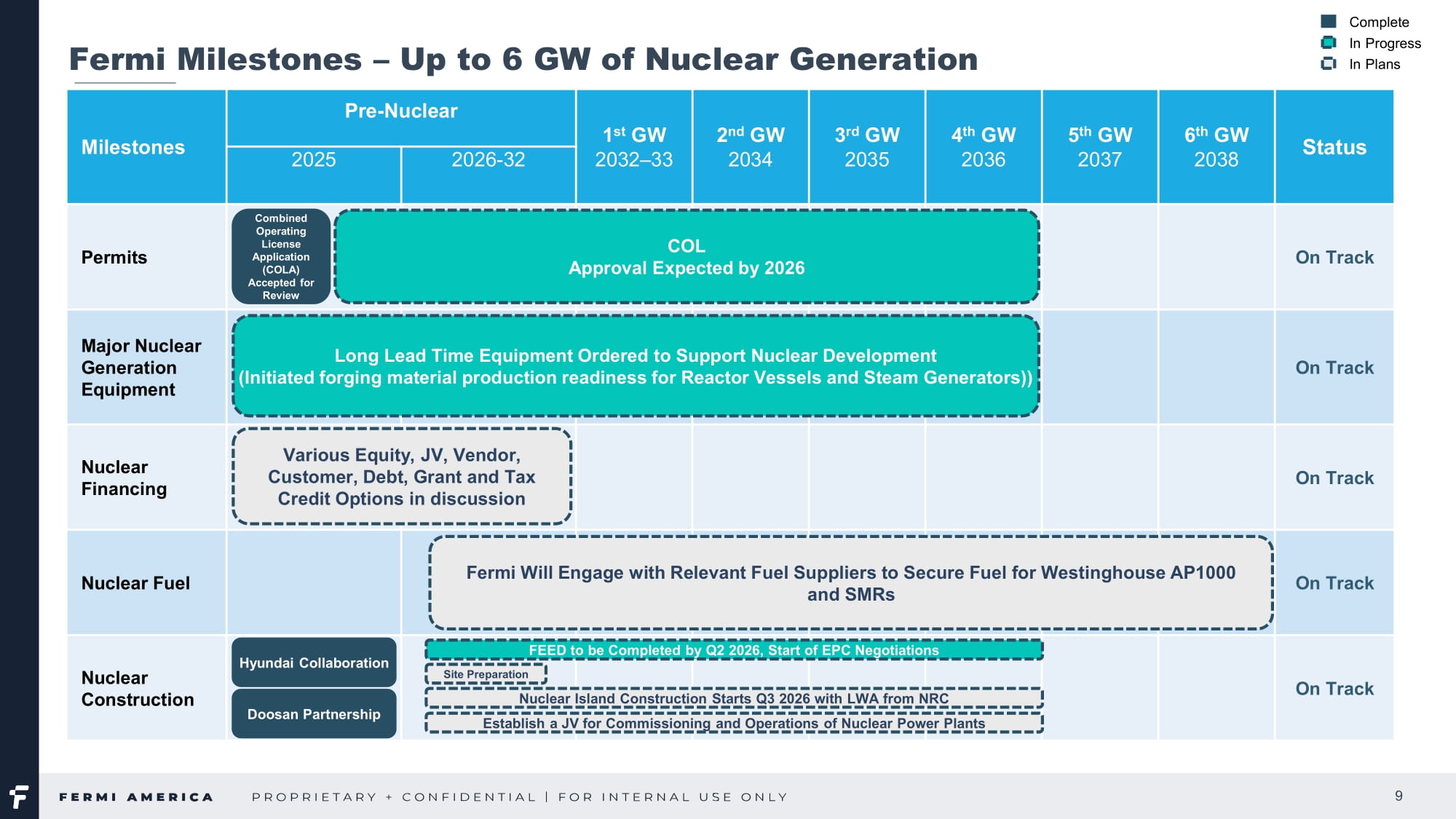

ft.) Powered Shells Under Construction (~400 acres) Powered Shells Under Construction (~400 acres) Powered Shells Under Construction (~400 acres) Powered Shells Under Construction (~400 acres) Powered Shells Under Construction (~400 acres) Powered Shells Under Construction (~400 acres) Complete In Progress In Plans Fermi is Implementing a State - of - the - Art Safety Program to Ensure the Highest Standards of Operational Excellence and Site - Wide Risk Management Fermi Milestones – Up to 6 GW of Nuclear Generation Status 6 th GW 2038 5 th GW 2037 4 th GW 2036 3 rd GW 2035 2 nd GW 2034 1 st GW 2032 – 33 Pre - Nuclear Milestones 2026 - 32 2025 On Track Permits On Track Major Nuclear Generation Equipment On Track Nuclear Financing On Track Nuclear Fuel On Track Nuclear Construction Fermi Will Engage with Relevant Fuel Suppliers to Secure Fuel for Westinghouse AP1000 and SMRs Combined Operating License Application (COLA) Accepted for Review Various Financing Options Being Discussed 9 Long Lead Time Equipment Ordered to Support Nuclear Development (Reactor Vessels and Steam Generators) COL Approval Expected by 2026 Hyundai Collaboration Doosan Partnership FEED to be Completed by Q2 2026, Start of EPC Negotiations Site Preparation Nuclear Island Construction Starts Q3 2026 with LWA from NRC Establish a JV for Commissioning and Operations of Nuclear Power Plants Complete In Progress In Plans MU1 Fermi Milestones – 1 GW Status Q4 2026 Q3 2026 Q2 2026 Q1 2026 Q4 2025 Q3 2025 Milestones Secured Land Secured Natural Gas Secured Water On Track Permits On Track Gas Power Generation Equipment On Track SPS Grid Power Agreement 99 - Year Ground Lease with Texas Tech University for 5,236 - acre Project Matador Campus Commenced in September 2025 (1) Installed 6,500 ft of roads, 34,000 ft of fencing, 9,500 ft of barriers, and 12,000 ft of water lines, with approximately 85 acres graded across data center, substation, and generation sites with additional clearing underway 0.8 GW at Estimated Site Conditions of Gas - Fired Capacity Secured Through Strategic Generation Investments & Partnerships 6 GW Natural Gas Clean Air Permit Application Preliminarily Approved by TCEQ, Pending Public Comment Period; Executed Signed Tax Abatement with Carson County (TX); Attempted Submission of Foreign Trade Zone Application, Pending Reopening of U.S. Government for Resubmission Signed Firm Water Supply (2.5 Million Gallons / Day) 10 Natural Gas Secured Through Energy Transfer (300,000 MMbtu /day) Complete In Progress In Plans 0.3 GW at Estimated Site Conditions Under Negotiation (1) Lease is subject to certain performance conditions as described in the Company's final prospectus as filed with the SEC o n O ctober 2, 2025. Up to 200 MW Expected to be Secured Currently Being Negotiated

Fermi Milestones – 1 GW Status Q4 2026 Q3 2026 Q2 2026 Q1 2026 Q4 2025 Q3 2025 Milestones On Track Powered Shells On Track Tenant 1 Financing On Track Long Lead Time Items Financing On Track Solar On Track Batteries Behind Schedule Expected Q4 Tenants 11 Fermi is Coordinating with Tenant on BESS Design to Manage Rapid Load Variability, Targeting 1 MW of Storage per 1 MW of IT Load Fermi is Engaging Major Solar Providers to Develop up to 1.7 GW of Solar Capacity to Offset Gas - Fired Generation During High - Insolation Periods Expected $3.0 BN Project Finance Tenant 1 Under LOI Financing Complete Lease Agreement AIAC Executed Tenant Discussions $1.3 BN Capital Raises $150M MM AIAC $2.5 BN in Non - Recourse Long Lead Time Financing for Electrical, Gas Gen Sets, and Nuclear Components Complete In Progress In Plans Powered Shells Construction (~850k sq. ft.) Powered Shells Construction (~850k sq. ft.) Powered Shells Construction (~850k sq. ft.) Dirt Work and Pad Site Complete Construction Commencement