UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 10, 2025

Rumble Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-40079 | 80-0984597 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (I.R.S. Employer Identification Number) |

444 Gulf of Mexico Dr

Longboat Key, FL 34228

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (941) 210-0196

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Class A common stock, par value $0.0001 per share | RUM | The Nasdaq Global Market | ||

| Redeemable warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share | RUMBW | The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 10, 2025, Rumble Inc. (“Rumble”) issued a press release announcing its financial results for the quarter ended September 30, 2025, a copy of which is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

The information included in this Item 2.02, including the accompanying exhibits, is being furnished and shall not be deemed “filed” for any purpose, including for the purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that Section, nor shall such information be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 7.01. Regulation FD Disclosure.

On November 10, 2025, Rumble issued a press release announcing that it had signed a business combination agreement with Northern Data AG (“Northern Data”), a leader in AI and high-performance-computing (HPC) infrastructure. Subject to the terms and conditions of the agreement, Rumble will submit a voluntary public exchange offer to all shareholders of Northern Data (the “Offer”). In connection with the announcement, Rumble made available an investor presentation relating to the Offer. A copy of the press release and the investor presentation are furnished as Exhibit 99.2 and 99.3, respectively, to this Current Report on Form 8-K and are incorporated into this Item 7.01 by reference. In addition, Rumble issued two other press release in connection with the announcement, copies of which are furnished as Exhibit 99.4 and 99.5, respectively, to this Current Report on Form 8-K and are incorporated into this Item 7.01 by reference.

Investors and others should note that we announce material financial and operational information to our investors using our investor relations website (investors.rumble.com), press releases, SEC filings and public conference calls and webcasts. We also intend to use certain social media accounts as a means of disclosing information about us and our services and to comply with our disclosure obligations under Regulation FD: the @rumblevideo X (formerly Twitter) account (x.com/rumblevideo), the @rumble TRUTH Social account (truthsocial.com/@rumble), the @chrispavlovski X (formerly Twitter) account (x.com/chrispavlovski), and the @chris TRUTH Social account (truthsocial.com/@chris), which Chris Pavlovski, our founder and Chief Executive Officer, also uses as a means for personal communications and observations. The information we post through these social media channels may be deemed material. Accordingly, investors should monitor these social media channels in addition to following our press releases, SEC filings and public conference calls and webcasts. The social media channels that we intend to use as a means of disclosing the information described above may be updated from time to time, as listed on our investor relations website.

Rumble is furnishing the information in this Item 7.01 and in Exhibits 99.1, 99.2 and 99.3 to comply with Regulation FD. The information contained in this Item 7.01, including Exhibits 99.1, 99.2 and 99.3, shall not be deemed “filed” for any purpose, including for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that Section, nor shall such information be deemed incorporated by reference into any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Important Information for Investors and Stockholders

This communication does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be commenced except by means of a prospectus meeting the requirements of the Securities Act.

When the Offer is launched in accordance with the definitive agreements for the transaction, such Offer will only be made pursuant to a Registration Statement on Form S-4 and related information statement and other relevant documents to be filed by Rumble with the Securities and Exchange Commission (“SEC”). Before making any voting or investment decision, investors and security holders of Northern Data are strongly advised to read the registration statement and related information statement and all other relevant documents filed or that will be filed with the SEC in connection with the Offer, when launched, as they become available because they will contain important information about the transaction. Holders of Northern Data shares will need to make their own decision whether to tender shares in the Offer, when launched. Investors and security holders of Northern Data will be able to obtain free copies of the registration statement and related information statement and all other relevant documents filed or that will be filed with the SEC by Rumble through the website maintained by the SEC at www.sec.gov.

Neither the SEC nor any U.S. state securities commission has passed any comment upon the adequacy, accuracy or completeness of the disclosure in this Form 8-K and the exhibits hereto. Any representation to the contrary is a criminal offence in the United States.

-

Certain Information Regarding Participants

Rumble and its directors, executive officers and other members of its management and employees may be deemed under SEC rules to be participants in the solicitation of proxies of Rumble’s stockholders in connection with the proposed transactions. Information concerning the interests of Rumble’s participants in any such solicitation, if applicable, which may, in some cases, be different from those of Rumble’s stockholders generally. Information regarding the directors and executive officers of Rumble is contained in Rumble’s Annual Report on Form 10-K for the year ended December 31, 2024, and its Proxy Statement on Schedule 14A, dated April 25, 2025, which are filed with the SEC and can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the information statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when they become available.

Cautionary Statement Regarding Forward-Looking Statements

This Form 8-K and the exhibits hereto contain forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended. Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events or results of operations, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Investors should read statements that contain these words carefully because they discuss future expectations, contain projections of future results of operations or financial condition; or state other “forward-looking” information. These forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Rumble’s and Northern Data’s control.

These forward-looking statements include, but are not limited to, statements regarding benefits of the proposed transaction, integration plans and expected synergies, and anticipated future growth, financial and operating performance and results. Forward-looking statements involve risks and uncertainties that may cause actual results to be materially different from the results predicted or expected. No assurance can be given that these forward-looking statements will prove accurate and correct, or that projected or anticipated future results will be achieved. Factors that could cause actual results to differ materially from those indicated in any forward-looking statement include, but are not limited to: the expected timing and likelihood of the completion of the contemplated transaction, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the contemplated transaction that could reduce anticipated benefits or cause the parties to abandon the transaction; risks that the condition to the publication of the offer document relating to the outcome of an independent investigation to be conducted by Northern Data into certain VAT tax-related allegations is not satisfied; the occurrence of any event, change or other circumstances that could give rise to the termination of the transaction; the ability to successfully complete the proposed transaction; regulatory or other limitations imposed as a result of the proposed transaction; the success of the business following the proposed transaction; the ability to successfully integrate Rumble’s and Northern Data’s businesses; the possibility that the requisite number of Northern Data’s shares may not be tendered in the exchange offer; the risk that the parties may not be able to satisfy the conditions to closing of the proposed transaction in a timely manner or at all; risks related to disruption of management time from ongoing business operations due to the proposed transaction; the risk that the announcement or consummation of the proposed transaction could have adverse effects on the market price of Rumble’s Class A common stock or Northern Data’s capital stock or the ability of Rumble and Northern Data to retain customers, retain or hire key personnel, maintain relationships with their respective suppliers and customers, and on their operating results and businesses generally; the risk that the combined business may be unable to achieve expected synergies or that it may take longer or be more costly than expected to achieve those synergies; the risk of fluctuations in revenue due to lengthy sales and approval process required by major and other service providers for new products; the risk posed by potential breaches of information systems and cyber-attacks; the risks that Rumble, Northern Data or the post-combination company may not be able to effectively compete, including through product improvements and development; and such other factors as are set forth in Northern Data’s annual and interim financial reports made publicly available and Rumble’s public filings made with the SEC from time to time, including but not limited to those described under the headings “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in Rumble’s Form 10-K for the fiscal year ended December 31, 2024 and Rumble’s Form 10-Q for the quarterly period ended September 30, 2025, which are available via the SEC’s website at www.sec.gov. The foregoing list of risk factors is not exhaustive. These risks, as well as other risks associated with the contemplated transaction, will be more fully discussed in the proxy statement/prospectus and the offering prospectus that will be included in the registration statement that will be filed with the SEC and in an offering document and/or any prospectuses or supplements to be filed with the German Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht) in connection with the contemplated transaction. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than Rumble or Northern Data has described. All such factors are difficult to predict and beyond our control. All forward-looking statements included in this document are based upon information available to Rumble on the date hereof, and Rumble disclaims and does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

No assurances can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do occur, what impact they will have on the results of operations, financial condition or cash flows of Rumble or Northern Data. Should any risks and uncertainties develop into actual events, these developments could have a material adverse effect on the proposed transaction or Rumble’s or Northern Data’s ability to successfully complete the proposed transaction or realize the expected benefits from the proposed transaction. You are cautioned not to rely on Rumble’s and Northern Data’s forward-looking statements. These forward-looking statements are and will be based upon management’s then-current views and assumptions regarding future events and operating performance, and are applicable only as of the dates of such statements. Rumble does not assume any duty to update or revise forward-looking statements herein, whether as a result of new information, future events or otherwise, as of any future date.

-

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. | Description | |

| 99.1 | Earnings Press Release of Rumble Inc. dated November 10, 2025 | |

| 99.2 | Press Release of Rumble Inc. dated November 10, 2025 | |

| 99.3 | Investor presentation, dated November 10, 2025 | |

| 99.4 | Press Release of Rumble Inc. dated November 10, 2025 | |

| 99.5 | Press Release of Rumble Inc. dated November 10, 2025 | |

| 104 | The cover page of this Current Report on Form 8-K, formatted in Inline XBRL |

-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Rumble Inc. | ||

| Date: November 10, 2025 | By: | /s/ Brandon Alexandroff |

| Name: | Brandon Alexandroff | |

| Title: | Chief Financial Officer | |

- 4 -

Exhibit 99.1

Rumble Reports Third Quarter 2025 Results

~ ARPU of $0.45, Up 7% from Prior Quarter ~

~ Company Retains Robust Balance Sheet with More Than $290 Million of Liquidity ~

LONGBOAT KEY, Fla., November 10, 2025 (GLOBE NEWSWIRE) -- Rumble Inc. (Nasdaq: RUM) (“Rumble” or the “Company”), the video-sharing platform and cloud services provider, today announced financial results for the fiscal quarter ended September 30, 2025.

Q3 2025 Key Highlights and Key Items

| ● | Revenue for the third quarter was $24.8 million, compared to $25.1 million in the third quarter of 2024. |

| ● | MAUs were 47 million in the third quarter of 2025, compared to 51 million in the second quarter of 2025. The decrease continues to be in part the result of a slowdown of news and political commentary outside of a U.S. election cycle, combined with seasonality related to content creators who produce less content during the summer months. |

| ● | Average Revenue Per User (“ARPU”) for the third quarter of 2025 was $0.45, representing a 7% increase from the second quarter of 2025. The increase is attributable to similar audience monetization revenue that came from fewer MAUs. |

| ● | Net loss for the third quarter of 2025 was $16.3 million, compared to a loss of $31.5 million in the third quarter of 2024. |

| ● | Adjusted EBITDA, a non-GAAP financial measure, was a loss of $15.1 million in the third quarter of 2025, an improvement of $8.4 million compared to the third quarter of 2024. |

| ● | As of September 30, 2025, Rumble had total liquidity of $293.8 million, consisting of $269.8 million in cash and cash equivalents and 210.82 Bitcoin, valued at $24.0 million. As of 4pm ET on November 7, 2025, the Company’s Bitcoin holdings are valued at $21.8 million. |

| ● | On August 5, 2025, Rumble announced a multi-pronged strategic partnership with Cumulus Media, one of the largest audio creators and distributors, to expand distribution and monetization opportunities across Cumulus Media radio stations, Westwood One, the Cumulus Podcast Network, and Rumble.com. |

Subsequent Events

| ● | On October 2, 2025, Rumble announced a partnership with Perplexity, integrating Perplexity AI’s search capabilities to expand the discoverability of Rumble videos and creators across AI-driven platforms. |

| ● | On October 14, 2025, Rumble announced that its platform had been fully restored in France following a favorable court ruling that determined a 2022 email from a French government official was not an enforceable order. |

| ● | On October 15, 2025, Rumble and Perplexity launched a subscription bundle combining Rumble Premium and Perplexity Pro for $19.99 per month, a limited time offer available through December 31, 2025. The bundle builds on the companies’ previously announced partnership, which integrates Perplexity’s AI-powered search tools to enhance discoverability on Rumble.com. |

Q3 Financial Summary (Unaudited)

| For the three months ended September 30, | 2025 | 2024 | Variance ($) | Variance (%) | ||||||||||||

| Revenues | $ | 24,762,445 | $ | 25,056,904 | $ | (294,459 | ) | (1 | )% | |||||||

| Expenses | ||||||||||||||||

| Cost of services (content, hosting and other) | $ | 25,219,331 | $ | 36,428,951 | $ | (11,209,620 | ) | (31 | )% | |||||||

| General and administrative | 10,492,008 | 9,710,935 | 781,073 | 8 | % | |||||||||||

| Research and development | 4,455,354 | 4,650,688 | (195,334 | ) | (4 | )% | ||||||||||

| Sales and marketing | 5,076,937 | 3,955,552 | 1,121,385 | 28 | % | |||||||||||

Revenues decreased by $0.3 million to $24.8 million in the three months ended September 30, 2025 compared to the three months ended September 30, 2024, of which $0.5 million was attributable to a reduction in Audience Monetization revenues, offset by a $0.2 million increase in Other Initiatives revenues. The decrease in Audience Monetization revenues was due to a $4.9 million reduction in advertising revenue, offset by a $3.7 million increase in subscription fees, as well as $0.7 million from licensing, tipping fees, and platform hosting fees. We are continuing to see progress in the uptake of new brands, but we are still at the early stages of that process. The increase in Other Initiatives revenue was due to a $0.1 million increase in cloud services offered and a $0.1 million increase in advertising inventory being monetized by our publisher network.

Cost of services decreased by $11.2 million to $25.2 million in the three months ended September 30, 2025 compared to the three months ended September 30, 2024. The decrease was due to a reduction in programming and content costs of $11.9 million, offset by an increase in other costs of services of $0.7 million.

General and administrative expenses increased by $0.8 million to $10.5 million in the three months ended September 30, 2025 compared to the three months ended September 30, 2024. The increase was driven by a $1.2 million rise in administrative expenses, reflecting higher professional fees and other administrative services, offset by a decrease in payroll and related expenses of $0.4 million.

Research and development expenses decreased by $0.2 million to $4.5 million in the three months ended September 30, 2025 compared to the three months ended September 30, 2024. The decrease resulted from a $0.2 million decrease in costs associated with computer software, hardware, and other expenditures used in research and development-related activities.

Sales and marketing expenses increased by $1.1 million to $5.1 million in the three months ended September 30, 2025 compared to the three months ended September 30, 2024. The increase was due to a rise in marketing and public relations activities of $0.9 million and an increase in payroll and related expenses of $0.2 million.

-

Notes on KPIs

Monthly Active Users (“MAUs”).

We use MAUs as a measure of audience engagement to help us understand the volume of users engaged with our content on a monthly basis. MAUs represent the total web, mobile app, and connected TV users of Rumble for each month, which allows us to measure our total user base calculated from data provided by Google, a third-party analytics provider. Google defines “active users” as the “[n]umber of distinct users who visited your website or application.”1 We have used the Google analytics systems since we first began publicly reporting MAU statistics, and the resulting data have not been independently verified.

As of July 1, 2023, Universal Analytics (“UA”), Google’s analytics platform on which we historically relied for calculating MAUs using company-set parameters, was phased out by Google and ceased processing data. At that time, Google Analytics 4 (“GA4”) succeeded UA as Google’s next-generation analytics platform, which has been used to determine MAUs since the third quarter of 2023 and which we expect to continue to use to determine MAUs in future periods. Although Google has disclosed certain information regarding the transition to GA4, Google does not currently make available sufficient information relating to its new GA4 algorithm for us to determine the full effect of the switch from UA to GA4 on our reported MAUs. Because Google has publicly stated that metrics in UA “may be more or less similar” to metrics in GA4, and that “[i]t is not unusual for there to be apparent discrepancies” between the two systems, we are unable to determine whether the transition from UA to GA4 has had a positive or negative effect, or the magnitude of such effect, if any, on our reported MAUs. It is therefore possible that MAUs that we reported based on the UA methodology (“MAUs (UA)”) for periods prior to July 1, 2023, cannot be meaningfully compared to MAUs based on the GA4 methodology (“MAUs (GA4)”) in subsequent periods.

Average Revenue Per User (“ARPU”)

We use ARPU as a measure of our ability to monetize our user base. Quarterly ARPU is calculated as quarterly Audience Monetization revenue divided by MAUs for the relevant quarter (as reported by Google Analytics). ARPU does not include Other Initiatives revenue.

About Rumble

Rumble is a Freedom-First technology platform with a mission to protect a free and open internet. The platform spans cloud, AI, and digital media, including its namesake video service, and is built on a foundation of customer independence and free speech. For more information, visit: corp.rumble.com.

Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use certain non-GAAP financial measures, as described below, to understand and evaluate our core operating performance. These non-GAAP financial measures, which may be different than similarly titled measures used by other companies, are presented to enhance investors’ overall understanding of our financial performance and should not be considered a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. We use the non-GAAP financial measure of Adjusted EBITDA, which is defined as net income (loss) excluding interest income (expense), net, other income (expense), net, provision for income taxes, depreciation and amortization, share-based compensation expense, acquisition-related transaction costs, change in fair value of warrants, change in fair value of digital assets, change in fair value of contingent consideration, and change in the fair value of derivative. The Company’s management believes that it is important to consider Adjusted EBITDA, in addition to net income (loss), as it helps identify trends in our business that could otherwise be masked by the effect of the gains and losses that are included in net income (loss) but excluded from Adjusted EBITDA.

Adjusted EBITDA should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. There are a number of limitations related to the use of Adjusted EBITDA rather than net income (loss), the nearest GAAP equivalent. As a result of these limitations, you should consider Adjusted EBITDA alongside other financial performance measures, including net income (loss) and our other financial results presented in accordance with GAAP.

-

Forward-Looking Statements

Certain statements in this press release and the associated conference call constitute “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Statements contained in this press release that are not historical facts are forward-looking statements and include, for example, results of operations, financial condition and cash flows (including revenues, operating expenses, and net income (loss)); our ability to meet working capital needs and cash requirements over the next 12 months; and our expectations regarding future results and certain key performance indicators. Certain of these forward-looking statements can be identified by using words such as “anticipates,” “believes,” “intends,” “estimates,” “targets,” “expects,” “endeavors,” “forecasts,” “could,” “will,” “may,” “future,” “likely,” “on track to deliver,” “continues to,” “looks forward to,” “is primed to,” “plans,” “projects,” “assumes,” “should” or other similar expressions. Such forward-looking statements involve known and unknown risks and uncertainties, and our actual results could differ materially from future results expressed or implied in these forward-looking statements. The forward-looking statements included in this release are based on our current beliefs and expectations of our management as of the date of this release. These statements are not guarantees or indicative of future performance. Important assumptions and other important factors that could cause actual results to differ materially from those forward-looking statements include our ability to grow and manage future growth profitably over time, maintain relationships with customers, compete within our industry and retain key employees; the possibility that we may be adversely impacted by economic, business, and/or competitive factors; our limited operating history makes it difficult to evaluate our business and prospects; our recent and rapid growth may not be indicative of future performance; we may not continue to grow or maintain our active user base, and may not be able to achieve or maintain profitability; risks relating to our ability to attract new advertisers, or the potential loss of existing advertisers or the reduction of or failure by existing advertisers to maintain or increase their advertising budgets; our cloud business may not achieve success, and, as a result, our business, financial condition and results of operations could be adversely affected; negative media campaigns may adversely impact our financial performance, results of operations, and relationships with our business partners, including content creators and advertisers; prolonged or escalating trade disputes could materially and adversely impact our business; spam activity, including inauthentic and fraudulent user activity, if undetected, may contribute, from time to time, to some amount of overstatement of our performance indicators; we collect, store, and process large amounts of user video content and personal information of our users and subscribers and, if our security measures are breached, our sites and applications may be perceived as not being secure, traffic and advertisers may curtail or stop viewing our content or using our services, our business and operating results could be harmed, and we could face governmental investigations and legal claims from users and subscribers; our Bitcoin treasury strategy exposes us to various risks associated with holding Bitcoin; the operation of our crypto wallet exposes us to significant regulatory, operational, security, and market risks that could adversely affect our business, financial condition, results of operations, and reputation; we may fail to comply with applicable privacy laws, subjecting us to liability and damages; we are exposed to significant regulatory, operational, compliance, privacy, and legal risks related to age verification and child online safety laws implemented in various U.S states and foreign jurisdictions; our cloud services business operates in a highly regulated environment, subject to a complex and rapidly evolving array of domestic and international laws, regulations, and industry standards governing data privacy, cybersecurity, data localization, and cross-border data transfers; we are subject to cybersecurity risks and interruptions or failures in our information technology systems and as we grow and gain recognition, we will likely need to expend additional resources to enhance our protection from such risks, although notwithstanding our efforts, a cyber incident could occur and result in information theft, data corruption, operational disruption and/or financial loss; we may be found to have infringed on the intellectual property of others, which could expose us to substantial losses or restrict our operations; we may face liability for hosting a variety of tortious or unlawful materials uploaded by third parties, notwithstanding the liability protections of Section 230 of the Communications Decency Act of 1996; we may face negative publicity for removing, or declining to remove, certain content, regardless of whether such content violated any law; paid endorsements by our content creators may expose us to regulatory risk, liability, and compliance costs, and, as a result, may adversely affect our business, financial condition and results of operations; our traffic growth, engagement, and monetization depend upon effective operation within and compatibility with operating systems, networks, devices, web browsers and standards, including mobile operating systems, networks, and standards that we do not control; our business depends on continued and unimpeded access to our content and services on the internet and, if we or those who engage with our content experience disruptions in internet service, or if internet service providers are able to block, degrade or charge for access to our content and services, we could incur additional expenses and the loss of traffic and advertisers; we face significant market competition, and if we are unable to compete effectively with our competitors for traffic and advertising spend, our business and operating results could be harmed; we rely on data from third parties to calculate certain of our performance metrics and real or perceived inaccuracies in such metrics may harm our reputation and negatively affect our business; changes to our existing content and services could fail to attract traffic and advertisers or fail to generate revenue; we derive the majority of our revenue from advertising and the failure to attract new advertisers, the loss of existing advertisers, or the reduction of or failure by existing advertisers to maintain or increase their advertising budgets would adversely affect our business; we depend on third-party vendors, including internet service providers, advertising networks, and data centers, to provide core services; hosting and delivery costs may increase unexpectedly; we have offered and intend to continue to offer incentives, including economic incentives, to content creators to join our platform, and these arrangements may involve fixed payment obligations that are not contingent on actual revenue or performance metrics generated by the applicable content creator but rather are based on our modeled financial projections for that creator, which if not satisfied may adversely impact our financial performance, results of operations and liquidity; we may be unable to develop or maintain effective internal controls; we have identified a material weakness in our internal control over financial reporting as of December 31, 2024, and if we are unable to remediate this material weakness, we may not be able to accurately or timely report our financial condition or results of operations; potential diversion of management’s attention and consumption of resources as a result of acquisitions of other companies and success in integrating and otherwise achieving the benefits of recent and potential acquisitions; we may fail to maintain adequate operational and financial resources or raise additional capital or generate sufficient cash flows; changes in tax rates, changes in tax treatment of companies engaged in e-commerce, the adoption of new tax legislation, or exposure to additional tax liabilities may adversely impact our financial results; compliance obligations imposed by new privacy laws, laws regulating online video sharing platforms, other online platforms, and online speech in certain jurisdictions in which we operate, or industry practices may adversely affect our business; and those additional risks, uncertainties and factors described in more detail under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024, and in our other filings with the Securities and Exchange Commission. We do not intend, and, except as required by law, we undertake no obligation, to update any of our forward-looking statements after the issuance of this release to reflect any future events or circumstances. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

-

Rumble on Social Media

Investors and others should note that we announce material financial and operational information to our investors using our investor relations website (investors.rumble.com), press releases, SEC filings and public conference calls and webcasts. We also intend to use certain social media accounts as a means of disclosing information about us and our services and to comply with our disclosure obligations under Regulation FD: the @rumblevideo X (formerly Twitter) account (x.com/rumblevideo), the @rumble TRUTH Social account (truthsocial.com/@rumble), the @chrispavlovski X (formerly Twitter) account (x.com/chrispavlovski), and the @chris TRUTH Social account (truthsocial.com/@chris), which Chris Pavlovski, our Chairman and Chief Executive Officer, also uses as a means for personal communications and observations. The information we post through these social media channels may be deemed material. Accordingly, investors should monitor these social media channels in addition to following our press releases, SEC filings and public conference calls and webcasts. The social media channels that we intend to use as a means of disclosing the information described above may be updated from time to time, as listed on our investor relations website.

For investor inquiries, please contact:

Shannon Devine

MZ Group, MZ North America

203-741-8811

investors@rumble.com

Source: Rumble Inc.

-

Condensed Consolidated Interim Statements of Operations (Unaudited)

| Three months ended September 30, |

Nine months ended September 30, |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Revenues | $ | 24,762,445 | $ | 25,056,904 | $ | 73,553,866 | $ | 65,259,903 | ||||||||

| Expenses | ||||||||||||||||

| Cost of services (content, hosting, and other) | $ | 25,219,331 | $ | 36,428,951 | $ | 81,797,812 | $ | 103,949,438 | ||||||||

| General and administrative | 10,492,008 | 9,710,935 | 38,792,062 | 29,448,330 | ||||||||||||

| Research and development | 4,455,354 | 4,650,688 | 14,070,349 | 14,497,709 | ||||||||||||

| Sales and marketing | 5,076,937 | 3,955,552 | 16,607,389 | 13,527,043 | ||||||||||||

| Acquisition-related transaction costs | 5,236,796 | - | 7,624,901 | - | ||||||||||||

| Amortization and depreciation | 3,880,492 | 3,128,242 | 10,775,361 | 9,118,603 | ||||||||||||

| Changes in fair value of digital assets | (1,456,388 | ) | - | (4,949,413 | ) | - | ||||||||||

| Changes in fair value of contingent consideration | - | - | - | 1,354,357 | ||||||||||||

| Total expenses | 52,904,530 | 57,874,368 | 164,718,461 | 171,895,480 | ||||||||||||

| Loss from operations | (28,142,085 | ) | (32,817,464 | ) | (91,164,595 | ) | (106,635,577 | ) | ||||||||

| Interest income | 2,896,649 | 1,949,898 | 7,979,880 | 6,646,015 | ||||||||||||

| Other income (expense) | 46,901 | (304 | ) | (476 | ) | (73,881 | ) | |||||||||

| Changes in fair value of derivative | - | - | 9,700,000 | - | ||||||||||||

| Changes in fair value of warrant liability | 8,936,773 | (756,700 | ) | 24,379,616 | (1,480,395 | ) | ||||||||||

| Loss before income taxes | (16,261,762 | ) | (31,624,570 | ) | (49,105,575 | ) | (101,543,838 | ) | ||||||||

| Income tax benefit (expense) | - | 85,157 | (31,310 | ) | (66,315 | ) | ||||||||||

| Net loss | $ | (16,261,762 | ) | $ | (31,539,413 | ) | $ | (49,136,885 | ) | $ | (101,610,153 | ) | ||||

| Loss per share – basic and diluted | $ | (0.06 | ) | $ | (0.15 | ) | $ | (0.19 | ) | $ | (0.50 | ) | ||||

| Weighted-average number of common shares used in computing net loss per | ||||||||||||||||

| share - basic and diluted | 260,529,688 | 204,972,162 | 252,722,453 | 203,660,885 | ||||||||||||

| Share-based compensation expense included in expenses: | ||||||||||||||||

| Cost of services (content, hosting, and other) | $ | 971,476 | $ | 2,405,375 | $ | 3,534,489 | $ | 5,332,489 | ||||||||

| General and administrative | 3,020,892 | 3,139,578 | 12,256,088 | 10,176,965 | ||||||||||||

| Research and development | 909,444 | 361,752 | 2,450,885 | 1,299,092 | ||||||||||||

| Sales and marketing | 481,879 | 251,060 | 1,206,326 | 669,495 | ||||||||||||

| Total share-based compensation expense | $ | 5,383,691 | $ | 6,157,765 | $ | 19,447,788 | $ | 17,478,041 | ||||||||

-

Condensed Consolidated Interim Balance Sheets (Unaudited)

| September 30, 2025 |

December 31, 2024 |

|||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 269,757,150 | $ | 114,018,900 | ||||

| Accounts receivable, net | 12,576,138 | 9,778,941 | ||||||

| Prepaid expenses and other | 4,748,926 | 12,329,789 | ||||||

| 287,082,214 | 136,127,630 | |||||||

| Other non-current assets | 1,289,830 | 402,475 | ||||||

| Digital assets | 24,049,413 | - | ||||||

| Property and equipment, net | 16,719,825 | 17,068,076 | ||||||

| Right-of-use assets, net | 2,199,418 | 1,753,100 | ||||||

| Intangible assets, net | 25,178,209 | 29,306,135 | ||||||

| Goodwill | 10,655,391 | 10,655,391 | ||||||

| $ | 367,174,300 | $ | 195,312,807 | |||||

| Liabilities and Shareholders’ Equity (Deficit) | ||||||||

| Current liabilities | ||||||||

| Accounts payable and accrued liabilities | $ | 30,545,284 | $ | 18,223,372 | ||||

| Deferred revenue | 15,641,367 | 12,812,984 | ||||||

| Lease liabilities | 1,325,202 | 1,000,643 | ||||||

| Derivative liability | - | 184,699,998 | ||||||

| 45,511,853 | 216,736,997 | |||||||

| Lease liabilities, net of current portion | 920,130 | 799,910 | ||||||

| Warrant liability | 16,011,686 | 40,391,302 | ||||||

| Other liability | 500,000 | 500,000 | ||||||

| 64,943,669 | 258,428,209 | |||||||

| Commitments and contingencies (Note 14) | ||||||||

| Shareholders’ equity (deficit) | ||||||||

| Preferred shares ($0.0001 par value per share, 20,000,000 shares authorized, no shares issued or outstanding) |

- | - | ||||||

| Common shares ($0.0001 par value per share, 700,000,000 Class A shares authorized, 215,380,893 and 118,808,857 shares issued and outstanding, as of September 30, 2025 and December 31, 2024, respectively; 170,000,000 Class C shares (and corresponding ExchangeCo Share) authorized, 123,690,470 and 165,153,621 shares issued and outstanding, as of September 30, 2025 and December 31, 2024, respectively; 110,000,000 Class D shares authorized, 95,791,120 and 105,782,403 shares issued and outstanding, as of September 30, 2025 and December 31, 2024, respectively) |

773,404 | 768,892 | ||||||

| Accumulated deficit | (532,702,827 | ) | (483,565,942 | ) | ||||

| Additional paid-in capital | 834,160,054 | 419,681,648 | ||||||

| 302,230,631 | (63,115,402 | ) | ||||||

| $ | 367,174,300 | $ | 195,312,807 | |||||

-

Condensed Consolidated Interim Statements of Cash Flows (Unaudited)

| For the nine months ended September 30, | 2025 | 2024 | ||||||

| Cash flows provided by (used in) | ||||||||

| Operating activities | ||||||||

| Net loss for the period | $ | (49,136,885 | ) | $ | (101,610,153 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Amortization and depreciation | 10,775,361 | 9,118,603 | ||||||

| Share-based compensation | 19,447,788 | 14,666,835 | ||||||

| Non-cash lease expense | 864,361 | 805,679 | ||||||

| Net trade and barter revenue and expense | 1,310,795 | 1,327,605 | ||||||

| Change in fair value of derivative | (9,700,000 | ) | - | |||||

| Change in fair value of warrants | (24,379,616 | ) | 1,480,395 | |||||

| Change in fair value of contingent consideration | - | 1,354,357 | ||||||

| Change in fair value of digital assets | (4,949,413 | ) | - | |||||

| Loss on disposal of property and equipment | 6,627 | - | ||||||

| Loss on lease termination | 925 | - | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | (2,797,197 | ) | (5,864,270 | ) | ||||

| Prepaid expenses and other | 6,642,470 | (1,384,211 | ) | |||||

| Accounts payable and accrued liabilities | 10,208,952 | 976,194 | ||||||

| Deferred revenue | 1,517,588 | 4,263,094 | ||||||

| Deferred tax liability | - | 1,030,757 | ||||||

| Operating lease liabilities | (815,788 | ) | (817,540 | ) | ||||

| Net cash used in operating activities | (41,004,032 | ) | (74,652,655 | ) | ||||

| Investing activities | ||||||||

| Purchase of property and equipment | (1,774,932 | ) | (2,654,913 | ) | ||||

| Purchase of intangible assets | (2,019,595 | ) | (4,700,559 | ) | ||||

| Purchase of marketable securities | - | (1,202,290 | ) | |||||

| Sale and maturities of marketable securities | - | 1,135,200 | ||||||

| Purchase of digital assets | (19,100,000 | ) | - | |||||

| Cash paid to non-accredited investors in connection with Callin acquisition | - | (204,846 | ) | |||||

| Cash paid in connection with North River acquisition | - | (3,654,500 | ) | |||||

| Net cash used in investing activities | (22,894,527 | ) | (11,281,908 | ) | ||||

| Financing activities | ||||||||

| Taxes paid from net share settlement for share-based compensation | (3,260,193 | ) | (1,915,138 | ) | ||||

| Proceeds from the exercise of warrants and stock options | 2,197,419 | 295,726 | ||||||

| Proceeds from issuance of Class A Common Stock under ESPP | 129,374 | - | ||||||

| Proceeds from issuance of Class A Common Stock | 775,000,000 | - | ||||||

| Repurchase of Class A Common Stock | (525,000,000 | ) | - | |||||

| Share issuance costs | (29,429,791 | ) | - | |||||

| Net cash provided by (used in) financing activities | 219,636,809 | (1,619,412 | ) | |||||

| Increase/ (decrease) in cash and cash equivalents during the period | 155,738,250 | (87,553,975 | ) | |||||

| Cash and cash equivalents, beginning of period | 114,018,900 | 218,338,658 | ||||||

| Cash and cash equivalents, end of period | $ | 269,757,150 | $ | 130,784,683 | ||||

| Supplemental cash flow information | ||||||||

| Cash paid for income taxes | $ | 33,755 | $ | 71,864 | ||||

| Cash paid for interest | - | 278 | ||||||

| Cash paid for lease liabilities | 805,308 | 945,354 | ||||||

| Non-cash investing and financing activities: | ||||||||

| Class A Common Stock issued to settle contingent consideration liability | - | 1,404,753 | ||||||

| Property and equipment in accounts payable and accrued liabilities | 2,112,958 | 49,343 | ||||||

| Recognition of operating right-of-use assets in exchange of operating lease Liabilities, net of derecognition of terminated leases | 1,119,786 | 317,003 | ||||||

| Share-based compensation capitalized related to intangible assets | 398,323 | 342,374 | ||||||

-

Reconciliation of GAAP to Non-GAAP Financial Measures

Reconciliation of Adjusted EBITDA (Unaudited)

| Three months ended September 30, |

Nine months ended September 30, |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Net loss | $ | (16,261,762 | ) | $ | (31,539,413 | ) | $ | (49,136,885 | ) | $ | (101,610,153 | ) | ||||

| Adjustments: | ||||||||||||||||

| Amortization and depreciation | 3,880,492 | 3,128,242 | 10,775,361 | 9,118,603 | ||||||||||||

| Share-based compensation expense | 5,383,691 | 6,157,765 | 19,447,788 | 17,478,041 | ||||||||||||

| Interest income | (2,896,649 | ) | (1,949,898 | ) | (7,979,880 | ) | (6,646,015 | ) | ||||||||

| Other (income) expense | (46,901 | ) | 304 | 476 | 73,881 | |||||||||||

| Income tax (benefit) expense | - | (85,157 | ) | 31,310 | 66,315 | |||||||||||

| Change in fair value of warrants liability | (8,936,773 | ) | 756,700 | (24,379,616 | ) | 1,480,395 | ||||||||||

| Change in fair value of digital assets | (1,456,388 | ) | - | (4,949,413 | ) | - | ||||||||||

| Change in fair value of contingent consideration | - | - | - | 1,354,357 | ||||||||||||

| Change in fair value of derivative | - | - | (9,700,000 | ) | - | |||||||||||

| Acquisition-related transaction costs | 5,236,796 | - | 7,624,901 | - | ||||||||||||

| Adjusted EBITDA | $ | (15,097,494 | ) | $ | (23,531,457 | ) | $ | (58,265,958 | ) | $ | (78,684,576 | ) | ||||

-

Exhibit 99.2

Rumble to Acquire AI Infrastructure Company Northern Data

Rumble and Northern Data sign business combination agreement and agree on exchange offer

Transaction will bolster Rumble Cloud’s

portfolio with the addition of approximately 22K Nvidia GPUs

and globally distributed network of energized data center locations

Transaction marks a transformational step in

Rumble’s vision of a Freedom-First technology platform,

a new way forward for tech rooted in freedom, privacy, independence and

resilience

Northern Data will delist after completion of offer

Rumble to host call to review transaction, Monday, November 10th at 9am ET

LONGBOAT KEY, Fla., November 10, 2025 – Rumble Inc. (NASDAQ: RUM) (“Rumble” or the “Company”), the Freedom-First technology platform, today signed a business combination agreement with Northern Data AG (ETR: NB2) (“Northern Data”), a leader in AI and high-performance-computing (HPC) infrastructure. Under the agreement, Rumble will submit a voluntary public exchange offer to all shareholders of Northern Data. This follows the announcement on August 10, 2025, that Rumble was exploring a potential transaction with Northern Data.

Once completed, the transaction will enable Rumble to scale and expand its cloud business with the addition of one of the largest estates of GPUs in Europe along with a data center business. In addition, the transaction will accelerate Rumble’s international expansion strategy, provide a significant revenue growth opportunity, and enable an acceleration of Rumble’s creator, video and advertising AI roadmap.

Freedom-First

In February this year, Rumble announced Tether’s $775 million strategic investment into the Company, and since then, the partnership has flourished with the build out of Rumble Wallet and Tether’s support for the exchange offer for Northern Data. This transaction marks a transformational step in Rumble’s vision of building a Freedom-First ecosystem, which represents a new way forward for tech rooted in freedom, privacy, independence and resilience.

As AI’s profound impact on society accelerates, it becomes clear that it is a major risk to have all data and infrastructure controlled by a small handful of big tech companies who have a checkered past with respect to privacy, abuse of data, and control. For AI to thrive, there must be scaled infrastructure rooted in freedom, privacy, independence and resilience. With this massive market opportunity, Rumble has positioned itself to become a leader AI with its Freedom-First Technology.

“Northern Data. Tether. Rumble. This is how we build the AI ecosystem for the future, from the ground up,” said Chris Pavlovski, Chairman and Chief Executive Officer of Rumble. “Freedom-First is the new way forward for tech. Unlike Big Tech, it represents a future where technology empowers rather than controls. Built on the principles of free speech, privacy, independence, and resilience, Freedom-First seeks to ensure that people—not unaccountable digital gatekeepers—are in charge,” he continued. “The addition of GPUs and data centers to our existing video and cloud portfolio would just be the start. Our vision is to continue building out this ecosystem with the addition of new verticals, including financial services like Rumble Wallet, AI chatbots and agents, productivity suite with email and storage, and new web navigation solutions all in the name of freedom, privacy, independence and resilience.”

John Hoffman, co-CEO of Northern Data added, “The AI revolution requires a complete redesign of compute architecture, one that is underpinned not only by large scale GPU deployments and access to energy but a foundational commitment to individual control, customer enablement and scaled access to capital. Rumble’s Freedom-First initiative combined with Tether’s vision alongside Northern Data’s robust asset base creates a highly disruptive force in the Ai infrastructure market.”

Strategic Benefits of Rumble’s Exchange Offer for Northern Data

Immediate Scale in the Cloud & Data Center Business

| ● | The exchange offer marks a significant step to building a full-stack cloud platform — from power to GPUs-as-a-service and beyond — backed by a mission to protect a free and open internet. |

| ● | Once the exchange offer is completed, Rumble will gain one of the largest GPU fleets, with 22.4K NVIDIA GPUs, including 20.4K Nvidia H100s and 2K Nvidia H200s.1 |

| ● | Rumble will also gain access to a globally distributed network of data center locations and several strategically co-located sites. |

| ● | 4 owned data center locations anchored by Northern Data’s site in Maysville, Georgia which, upon completion, is anticipated to deliver up 180MW of capacity. |

Expanding International Footprint

| ● | Northern Data has a prominent presence in Europe, with locations across Germany, Sweden, Norway, Portugal, Netherlands, and the United Kingdom, in addition to a growing footprint in the United States. |

| ● | With Northern Data owning one of the largest GPU clusters in Europe and Rumble’s strong US-brand position, the exchange offer, once completed, will open up significant opportunities for the combined group: Investing in Europe data capacities, expanding globally, and strengthening investment in America to penetrate the high-growth AI-market worldwide. |

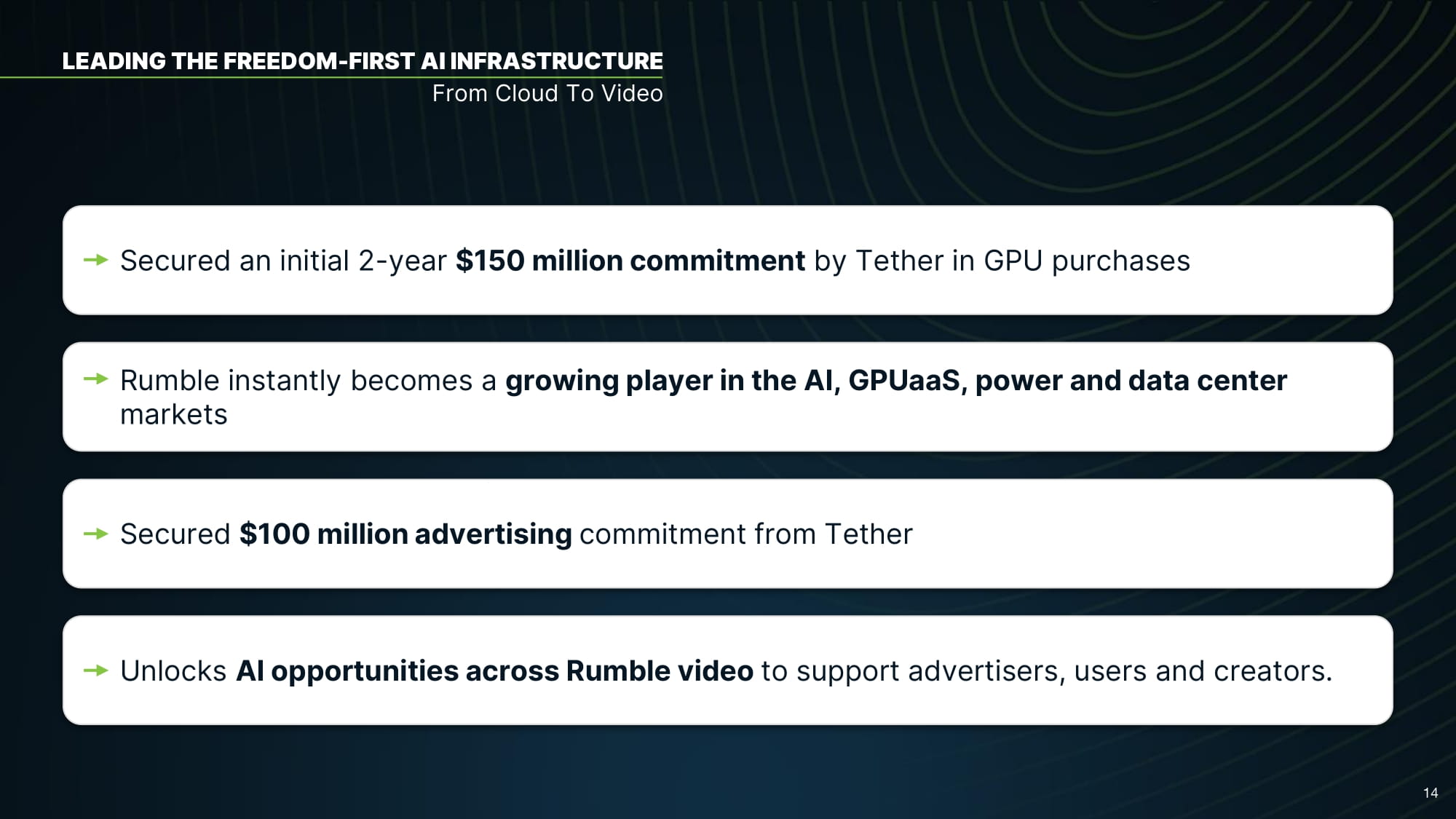

Tether Committed as a Customer at Closing

| ● | Tether has agreed to become an important anchor customer of the combined group following closing. The details of this commitment will be announced later today. |

Accelerating Creator, Video & Advertising AI Innovation

| ● | With a scaled GPU estate and new AI competencies, Rumble will be in position to accelerate innovation to its video business. |

| 1 | Data center and GPU information included in this press release is based on information provided by Northern Data. |

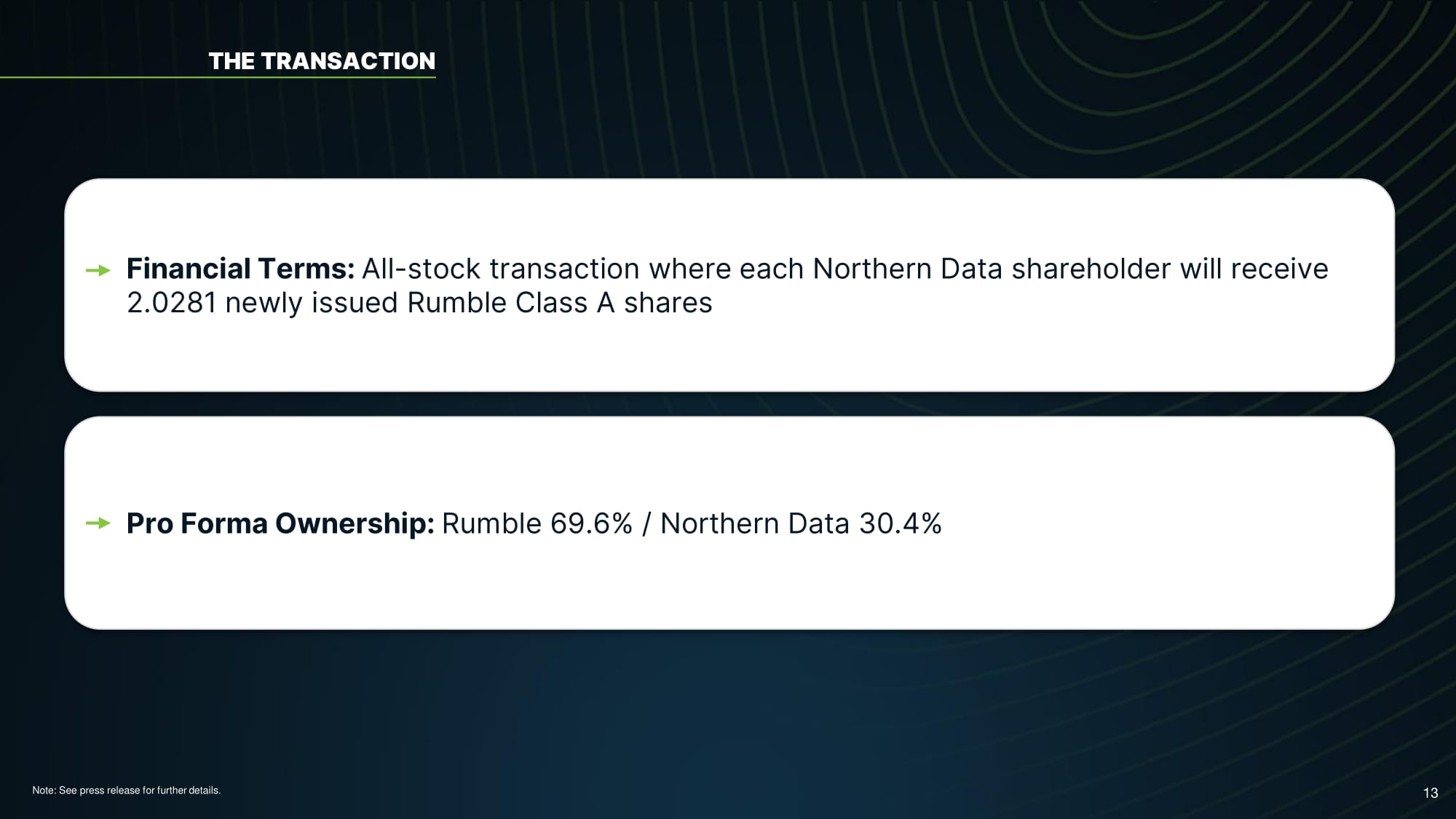

Transaction Details

Under the terms of the business combination agreement, which has been approved by the board of directors of Rumble as well as Northern Data’s management and supervisory boards, Rumble will submit a voluntary public exchange offer to all Northern Data shareholders. Each Northern Data shareholder that tenders will receive 2.0281 newly issued Class A Rumble shares in exchange for each Northern Data share (with customary settlement mechanisms for fractional shares).The transaction would result in approximately 30.4% total pro forma ownership in Rumble for Northern Data shareholders, assuming all outstanding Northern Data shares are tendered.2

Whilst the offer is subject to closing conditions, including customary regulatory approvals, there will be no minimum acceptance rate. Tether, along with shareholders affiliated with Northern Data’s co-CEO, Aroosh Thillainathan, and another significant shareholder, collectively representing approximately 72% of the outstanding shares of Northern Data, have committed to sell their Northern Data shares to Rumble at the same exchange ratio that applies to the exchange offer. These sales will depend on closing of the exchange offer and be settled around the same time as the offer.

The offer also provides for a potential cash payment to Northern Data shareholders who accept the offer as well as the other shareholders who have agreed to sell their shares to Rumble in an aggregate amount of up to $200 million (the “Cash Consideration Amount”). The Cash Consideration Amount will be due solely in the event there is a successful sale and/or the achievement of certain commercialization milestones of Northern Data’s previously owned Corpus Christi location to a leading global infrastructure asset management firm, who is currently evaluating the location for HPC purposes under an exclusivity agreement. The Cash Consideration Amount payable, if any, will be calculated based on actual net after-tax proceeds received by Northern Data from such transaction prior to the closing of the offer. There is no assurance that any Cash Consideration Amount will be payable in the offer.

Rumble and Northern Data have agreed not to enter into a domination and/or profit and loss transfer agreement for a period of at least three years from the date hereof. The parties have agreed that the management board of Northern Data will terminate the inclusion of the Northern Data shares in the trading on the open market shortly after the closing of the exchange offer. A separate delisting offer will not be required since the Northern Data shares are not listed on a regulated market.

Commencement of the acceptance period for the offer and closing are expected to occur in the second quarter of 2026. Further information regarding the transaction terms will be included in a Current Report on Form 8-K that Rumble will file with the Securities and Exchange Commission.

The offer document for the exchange offer and other information relating to the exchange offer will be published on the internet at www.rumble-offer.com.

| 2 | Based on Rumble’s pro forma diluted shares outstanding as of September 30, 2025, using the treasury stock method, and unaffected closing share prices as of August 8, 2025; on a pro forma basis, this would represent approximately 298.5 million pre-transaction Rumble shares outstanding, which number includes approximately 37.8 million dilutive shares using the treasury stock method (with the aforementioned assumptions), plus approximately 130.2 million newly issued Rumble shares issued to Northern Data shareholders. For the avoidance of doubt, pro forma diluted shares excludes any Rumble earnout securities. |

Investor Call

Rumble CEO, Chris Pavlovski and Tether CEO, Paolo Ardoino will host an update to discuss the transaction at 9:00 a.m. Eastern Time, Monday, November 10, 2025. Access to the live webcast and replay of the conference call will be available here and on Rumble’s Investor Relations website at investors.rumble.com ‘News & Events.’ This call will replace the Company’s previously scheduled earnings call, scheduled for Wednesday, November 12, 2025. In conjunction with the update call, Rumble has released an updated investor presentation accessible on the Company’s investor relations website.

About Rumble

Rumble is a Freedom-First technology platform with a mission to protect a free and open internet. The platform spans cloud, AI, and digital media, including its namesake video service, and is built on a foundation of customer independence and free speech.

About Tether

Tether is the creator of the world’s most used stablecoin and a pioneer in building decentralized financial, communication, AI, and energy infrastructure. With a mission to promote financial inclusion and sovereign access to resources, Tether supports projects globally that align with the principles of openness, transparency, and technological independence.

About Northern Data

Northern Data AG (ETR: NB2) is a leading provider of full-stack AI and High Performance Computing (HPC) solutions, leveraging a network of high-density, liquid-cooled, GPU-based technology to enable the world’s most innovative companies. Northern Data has one of the largest GPU clusters in Europe through its Taiga Cloud business, while its Ardent Data Centers business has a network of owned and colocation data centers across the globe. Northern Data enjoys access to cutting-edge chips and hardware for maximum performance and efficiency. To learn more, please visit northerndata.de.

Advisors

Guggenheim Securities, LLC is acting as lead financial advisor, ParkView Partners is acting as financial advisor and Willkie Farr & Gallagher LLP is serving as legal counsel to Rumble. Latham & Watkins LLP and Gleiss Lutz are serving as legal counsel, and Jefferies Financial Group Inc. is acting as financial advisor, to Northern Data. McDermott Will & Schulte LLP is serving as legal counsel to Tether.

General Information

The exchange offer contemplated by this press release (the “Offer”) will be implemented in accordance with the applicable laws of the Federal Republic of Germany and the United States. As the shares of Northern Data are listed in the open market (Freiverkehr), it will not be subject to the German Securities Acquisition and Trading Act (Wertpapiererwerbs- und Übernahmegesetz).

The Offer, if launched, will not be filed, published or publicly advertised pursuant to the laws of any jurisdiction other than the Federal Republic of Germany and the United States of America.

Rumble assumes no responsibility for the publication, dispatch, distribution or dissemination of any documents connected with the Offer outside the Federal Republic of Germany, the Member States of the European Union, the European Economic Area and the United States being compatible with the applicable requirements of jurisdictions other than those of the Federal Republic of Germany and the United States. Furthermore, Rumble assumes no responsibility for the non-compliance of third parties with any laws.

The information is provided in good faith and is intended for informational purposes and to comply with applicable laws and requirements. The information is not intended to constitute, and does not constitute, an offer or part of an offer to sell or otherwise dispose of any securities, or an invitation or solicitation of an offer to purchase or otherwise acquire any securities.

Shareholders of Rumble and Northern Data are strongly advised to read the offer document, the prospectus relating to Rumble shares as well as all other documents related to the Offer, as they will contain important information.

To the extent permissible under applicable law, Rumble may purchase, or conclude agreements to purchase, shares in Northern Data, directly or indirectly, or enter into derivative transactions with respect to the shares in Northern Data, outside of the Offer, before, during or after the period in which the Offer remains open for acceptance. This applies to other securities which are directly convertible into, exchangeable for, or exercisable for shares in Northern Data. These purchases may be completed via the stock exchange at market prices or outside the stock exchange in negotiated transactions. Any information about such purchases will be disclosed as required by law or regulation in Germany, the United States and any other relevant jurisdiction.

Information for Shareholders

Shareholders are advised that the shares in Northern Data are not listed on a U.S. securities exchange and that Northern Data is not subject to the periodic reporting requirements of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), and is not required to, and does not, file any reports with the U.S. Securities and Exchange Commission (the “SEC”) thereunder.

When the Offer is launched in accordance with the definitive agreements for the transaction, it will be launched for the issued and outstanding shares in Northern Data, which is domiciled in Germany, and is subject to German disclosure and procedural requirements. When the Offer is launched, it will be made in the United States pursuant to Section 14(e) and Regulation 14E under the Exchange Act, and otherwise in accordance with the disclosure and procedural requirements of German law, including with respect to the timetable, settlement procedures, withdrawal, waiver of conditions and timing of payments, which may differ different from those of the United States.

Important Information for Investors and Stockholders

This communication does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be commenced except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended (the “Securities Act”).

When the Offer is launched in accordance with the definitive agreements for the transaction, such Offer will only be made pursuant to a Registration Statement on Form S-4 and related information statement and other relevant documents to be filed by Rumble with the SEC. Before making any voting or investment decision, investors and security holders of Northern Data are strongly advised to read the registration statement and related information statement and all other relevant documents filed or that will be filed with the SEC in connection with the Offer, when launched, as they become available because they will contain important information about the transaction. Holders of Northern Data shares will need to make their own decision whether to tender shares in the Offer, when launched. Investors and security holders of Northern Data will be able to obtain free copies of the registration statement and related information statement and all other relevant documents filed or that will be filed with the SEC by Rumble through the website maintained by the SEC at www.sec.gov.

Neither the SEC nor any U.S. state securities commission has passed any comment upon the adequacy, accuracy or completeness of the disclosure in this release. Any representation to the contrary is a criminal offence in the United States.

Certain Information Regarding Participants

Rumble and its directors, executive officers and other members of its management and employees may be deemed under SEC rules to be participants in the solicitation of proxies of Rumble’s stockholders in connection with the proposed transactions. Information concerning the interests of Rumble’s participants in any such solicitation, if applicable, which may, in some cases, be different from those of Rumble’s stockholders generally. Information regarding the directors and executive officers of Rumble is contained in Rumble’s Annual Report on Form 10-K for the year ended December 31, 2024, and its Proxy Statement on Schedule 14A, dated April 25, 2025, which are filed with the SEC and can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the information statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when they become available.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended. Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events or results of operations, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Investors should read statements that contain these words carefully because they discuss future expectations, projections of future results of operations or financial condition; or state other “forward-looking” information. These forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Rumble’s and Northern Data’s control.

These forward-looking statements include, but are not limited to, statements regarding benefits of the proposed transaction, integration plans and expected synergies, and anticipated future growth, financial and operating performance and results. Forward-looking statements involve risks and uncertainties that may cause actual results to be materially different from the results predicted or expected. No assurance can be given that these forward-looking statements will prove accurate and correct, or that projected or anticipated future results will be achieved. Factors that could cause actual results to differ materially from those indicated in any forward-looking statement include, but are not limited to: the expected timing and likelihood of the completion of the contemplated transaction, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the contemplated transaction that could reduce anticipated benefits or cause the parties to abandon the transaction; risks that the condition to the publication of the offer document relating to the outcome of an independent investigation to be conducted by Northern Data into certain VAT tax-related allegations is not satisfied; the occurrence of any event, change or other circumstances that could give rise to the termination of the transaction; the ability to successfully complete the proposed transaction; regulatory or other limitations imposed as a result of the proposed transaction; the success of the business following the proposed transaction; the ability to successfully integrate Rumble’s and Northern Data’s businesses; the possibility that the requisite number of Northern Data’s shares may not be tendered in the exchange offer; the risk that the parties may not be able to satisfy the conditions to closing of the proposed transaction in a timely manner or at all; risks related to disruption of management time from ongoing business operations due to the proposed transaction; the risk that the announcement or consummation of the proposed transaction could have adverse effects on the market price of Rumble’s Class A common stock or Northern Data’s capital stock or the ability of Rumble and Northern Data to retain customers, retain or hire key personnel, maintain relationships with their respective suppliers and customers, and on their operating results and businesses generally; the risk that the combined business may be unable to achieve expected synergies or that it may take longer or be more costly than expected to achieve those synergies; the risk of fluctuations in revenue due to lengthy sales and approval process required by major and other service providers for new products; the risk posed by potential breaches of information systems and cyber-attacks; the risks that Rumble, Northern Data or the post-combination company may not be able to effectively compete, including through product improvements and development; and such other factors as are set forth in Northern Data’s annual and interim financial reports made publicly available and Rumble’s public filings made with the SEC from time to time, including but not limited to those described under the headings “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in Rumble’s Form 10-K for the fiscal year ended December 31, 2024 and Rumble’s Form 10-Q for the quarterly period ended September 30, 2025, which are available via the SEC’s website at www.sec.gov. The foregoing list of risk factors is not exhaustive. These risks, as well as other risks associated with the contemplated transaction, will be more fully discussed in the proxy statement/prospectus and the offering prospectus that will be included in the registration statement that will be filed with the SEC and in an offering document and/or any prospectuses or supplements to be filed with the German Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht) in connection with the contemplated transaction. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than Rumble or Northern Data has described. All such factors are difficult to predict and beyond our control. All forward-looking statements included in this document are based upon information available to Rumble on the date hereof, and Rumble disclaims and does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

No assurances can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do occur, what impact they will have on the results of operations, financial condition or cash flows of Rumble or Northern Data. Should any risks and uncertainties develop into actual events, these developments could have a material adverse effect on the proposed transaction or Rumble’s or Northern Data’s ability to successfully complete the proposed transaction or realize the expected benefits from the proposed transaction. You are cautioned not to rely on Rumble’s and Northern Data’s forward-looking statements. These forward-looking statements are and will be based upon management’s then-current views and assumptions regarding future events and operating performance, and are applicable only as of the dates of such statements. Rumble does not assume any duty to update or revise forward-looking statements herein, whether as a result of new information, future events or otherwise, as of any future date.

For investor inquiries, please contact:

Shannon Devine

MZ Group, MZ North America

203-741-8811

investors@rumble.com

Source: Rumble Inc.

Exhibit 99.3

Leading Freedom - First AI Infrastructure from Video to Cloud November 10, 2025

Christopher Pavlovski Founder, Chairman & CEO | Rumble Paolo Ardoino CEO | Tether Today we are announcing the combination of two assets that will form a major accelerant towards the goals of building a Freedom - First Ecosystem “ TW O COMPANIES, ONE MISSION “ Today we ’re unve iling the Freedom - Firs t ecos ys tem, which repres ents a new way forward for te ch roote d in fre e dom, privacy, independence and res ilience . The as p ira t ion is to be a fie rce compe t ito r to a ll of Big Te ch . In a world that goes darker, a Stable Society requires equipotent and independent access to technology and financial tools . Decentralization of these makes society resilient to failures and control . 2 Freedom.

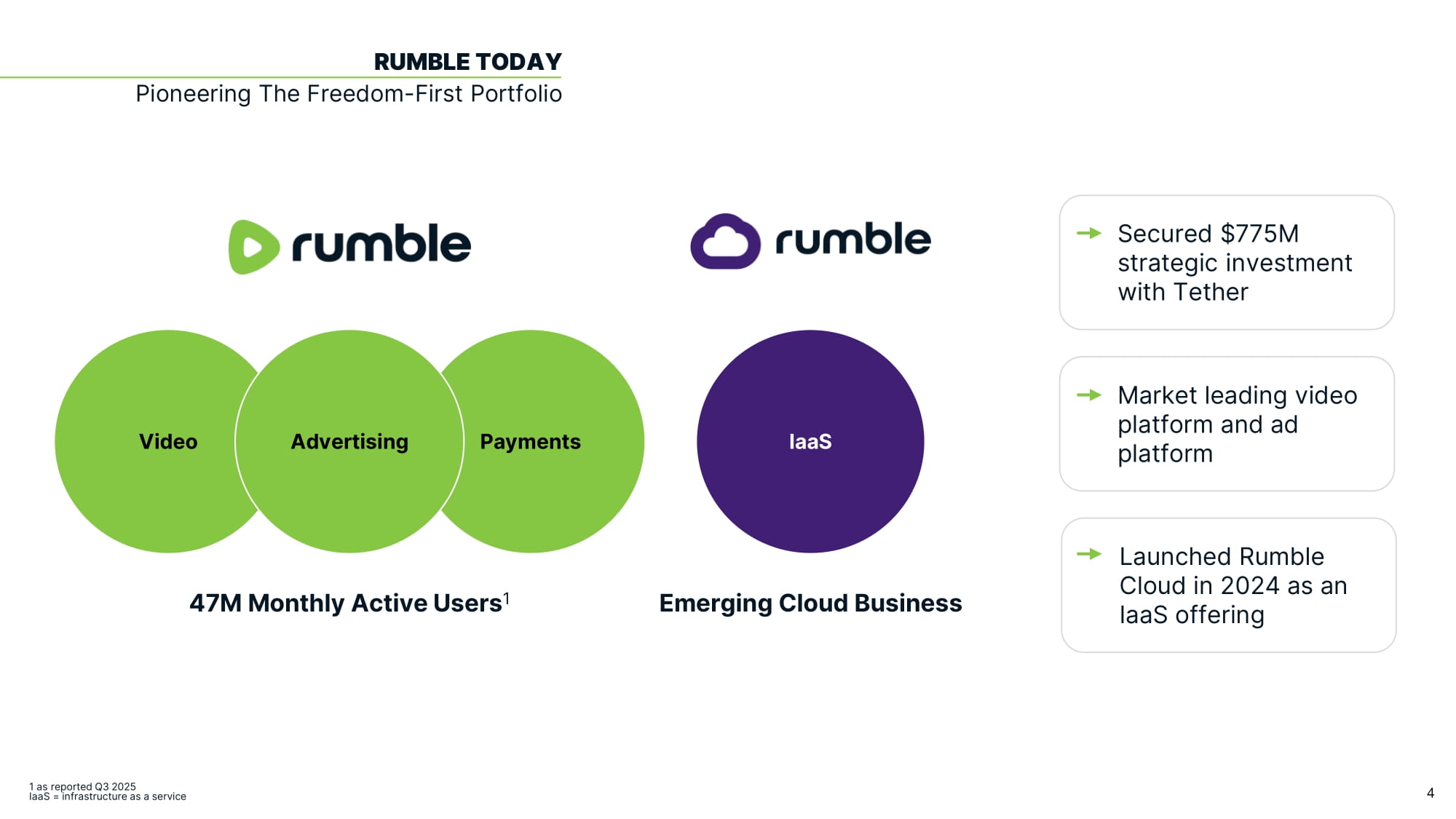

Privacy. Independence. Resilience. Censored . Controlled . Locked - In . Biased. FREEDOM - FIRST IS A NEW W AY FORW ARD FOR TECH Which Internet Highway Would You Pick? VS. 3 Payments 4 Video Advertising IaaS 47M Monthly Active Users 1 Emerging Cloud Business Secured $775M strategic investment with Tether Market leading video platform and ad platform 1 as reported Q3 2025 IaaS = infrastructure as a service Launched Rumble Cloud in 2024 as an IaaS offering RUMBLE TODAY Pionee ring The Freedom - Firs t Portfo lio

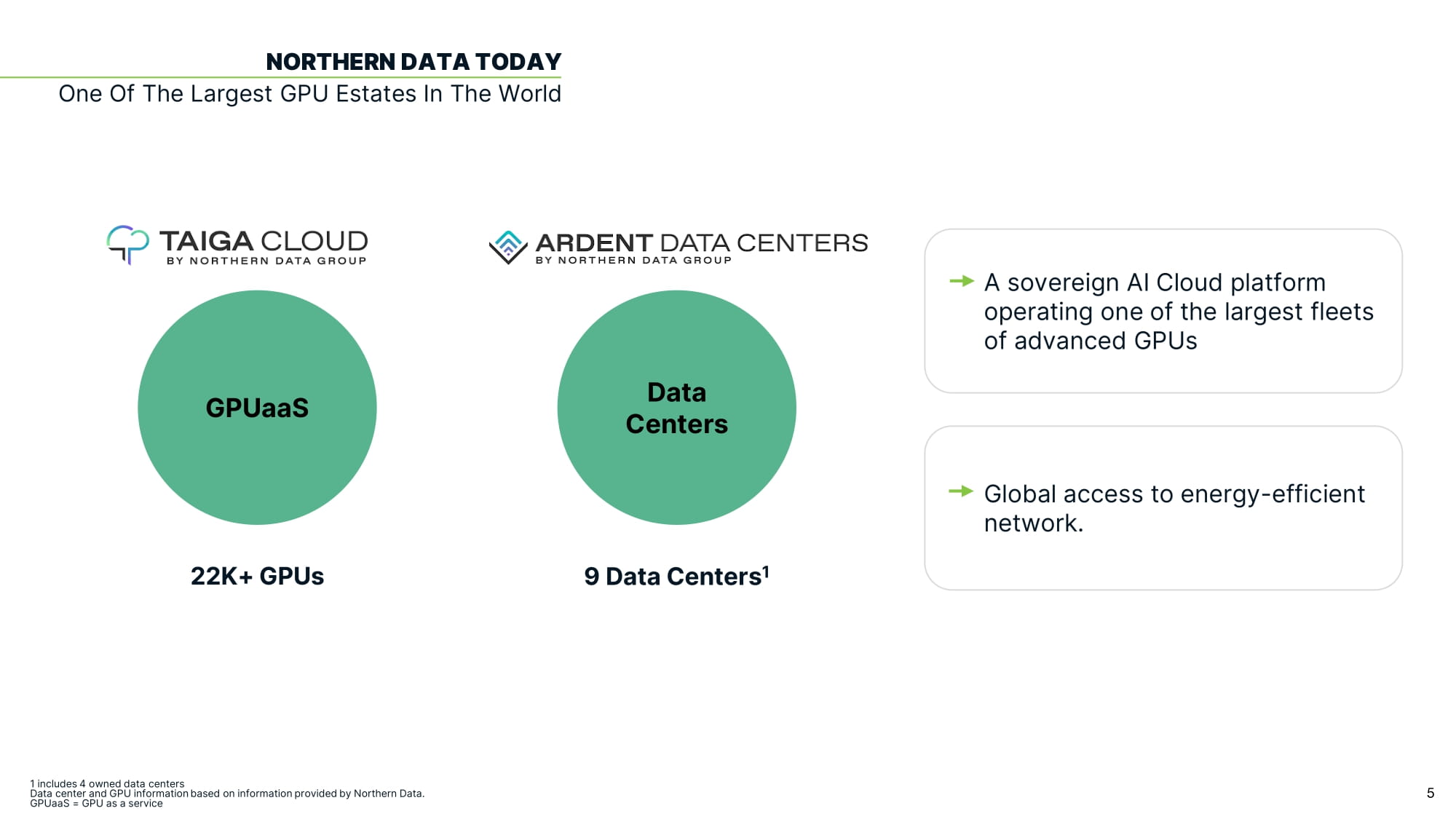

5 Data Centers 22K+ GPUs 9 Data Centers 1 GPUaaS A sovereign AI Cloud platform operating one of the largest fleets of advanced GPUs - efficient Global access to energy network. NORTHERN DATA TODAY One Of The Larges t GPU Es ta tes In The World 1 include s 4 owne d da ta ce nte rs Da ta ce nte r a nd GPU informa tion ba s e d on informa tion provide d by Northe rn Da ta .

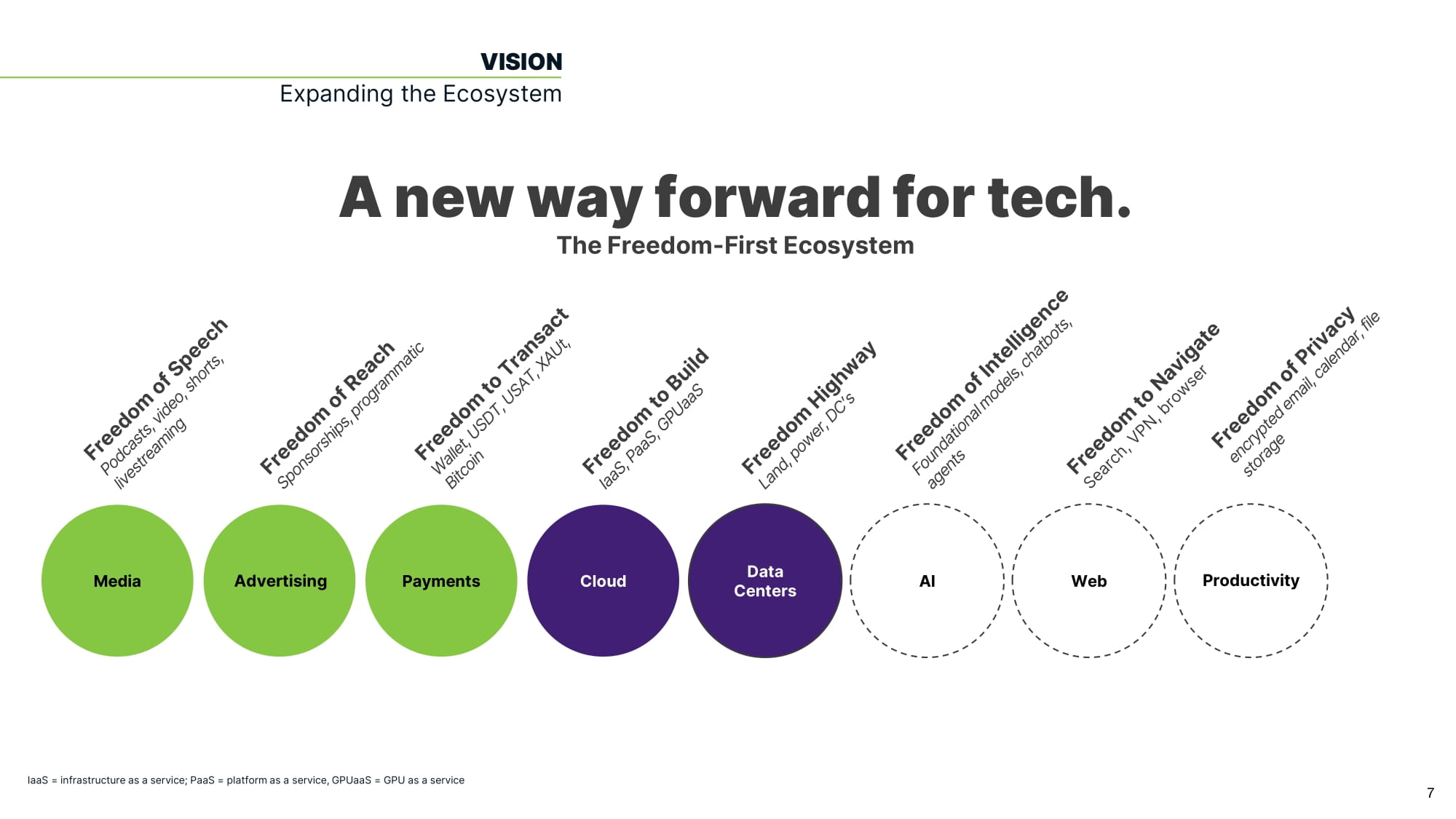

GPUa a S = GPU a s a s e rvice 6 Consumer 47M Monthly Active Users 1 Ente rpris e 22K+ GPUs | 9 Data Centers 2 | >$1B in Capital Deployed 3 Video IaaS Payments Data Centers new GPUaaS 1 a s re porte d Q3 2025; 2 include s 4 owne d da ta ce nte rs 3 Da ta ce nte r a nd GPU informa tion ba s e d on informa tion provide d by Northe rn Da ta . Ia a S = infra s tructure a s a s e rvice ; GPUa a S = GPU a s a s e rvice COMBINED FUTURE The Freedom Firs t Technology Ecos ys tem Advertising Media Cloud Payments IaaS = infrastructure as a service; PaaS = platform as a service, GPUaaS = GPU as a service VIS ION Expanding the Ecos ys te m AI Web A ne w w ay fo rw a rd fo r t e c h.

The Freedom - First Ecosystem 7 Data Centers Advertising Productivity Immediate Scale in Enterprise via GPUaaS & Data Center Business Expanding International Footprint Go To Market Strategy Utilizing Government & Corporate Relationships STRATEGIC RATIONALE Build an Unstoppable Independent Ecosystem Exchange Offer for Northern Data Vision

9 IMMEDIATE SCALE IN CLOUD & DATA CENTERS Strategic Rationale S ig n ific ant s te p to b u ild in g a џ Α ˠˠ ְ ΔР ˗ ȀР ˠ Α ЫȀ ͋ ˠ Δ џ ˾ Ȁ from power to GPUaaS and beyond. 20 K+ Nvidia H100s 2K+ Nvidia H200s >$1B Capital Deployed 9 Data Centers 1 1 include s 4 owne d da ta ce nte rs Da ta ce nte r a nd GPU informa tion ba s e d on informa tion provide d by Northe rn Da ta .

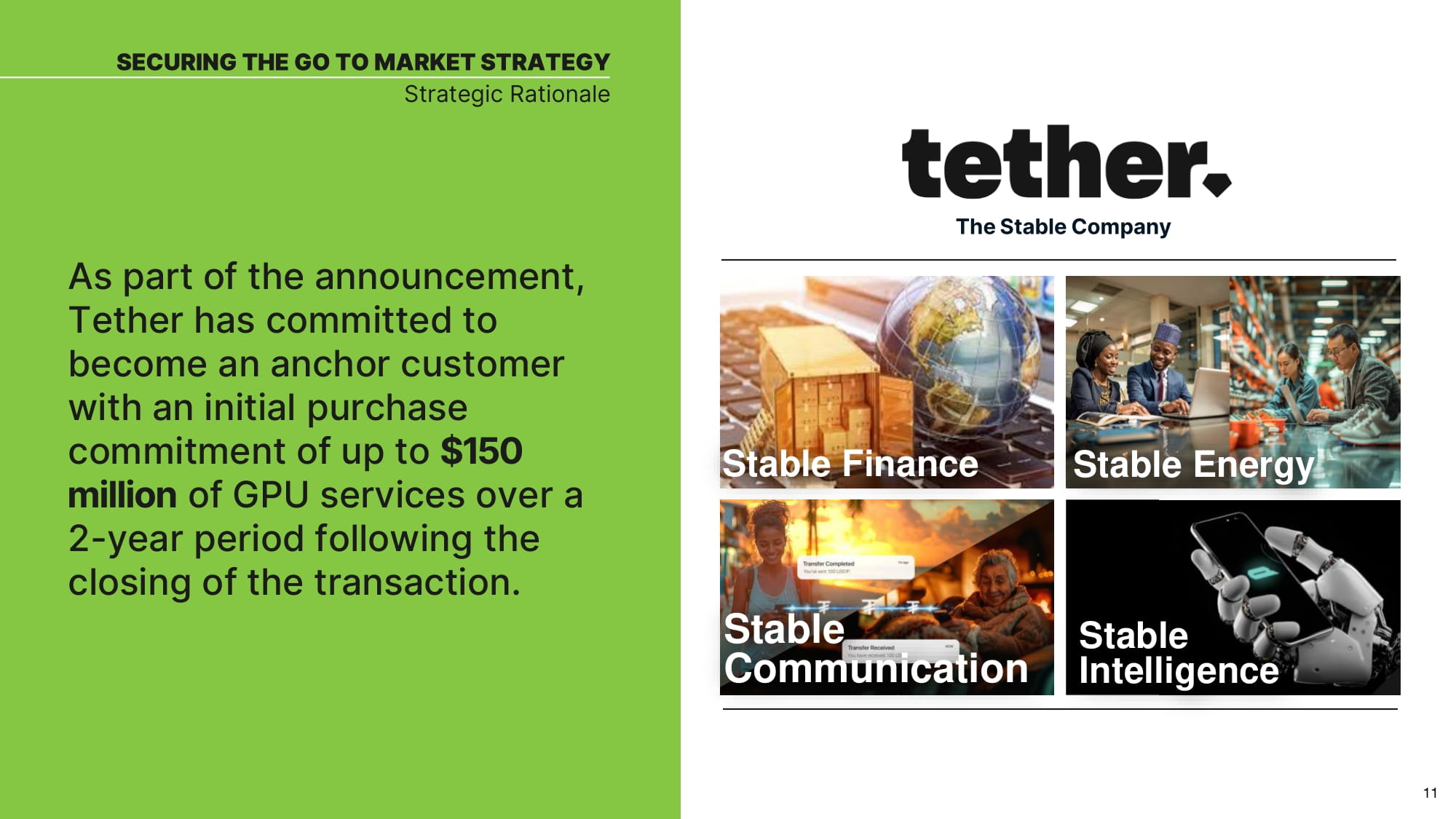

Comb in in g Rumb le and Northe rn Data to b u ild g lo b a lly acce s s ib le computing infras tructure with a us e r - firs t ph ilos ophy. EXPANDING INTERNATIONAL FOOTPRINT Strategic Rationale 10 As part of the announce me nt, Te the r has committe d to b e come an anchor cus tome r w it h an in it ia l purchas e commitme nt of up to $150 million of GPU s e rvices over a 2 - ye a r pe rio d fo llo w in g the c lo s in g of the t rans action.

The Stable Company SECURING THE GO TO MARKET STRATEGY Strategic Rationale Stable Energy Stable Finance Stable Intelligence Stable Communication 11 12 COMBINATION A Growing Player In The High Growth AI, GPU Market GPUs Data Centers Market Cap (As of 11/7/2025) 300 K 33 $55B+ 30K 7 $25B+ 22K+ 1 9 2 $ 3.5 B+ 1 include s 4 owne d da ta ce nte rs 2 Re pre s e nts the combine d ma rke t ca ps for Rumble a nd Northe rn Da ta . Source : Pub lic filing s