UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

March 28, 2024

Date of Report (Date of earliest event reported)

AGBA GROUP HOLDING LIMITED

(Exact Name of Registrant as Specified in its Charter)

| British Virgin Islands | 001-38909 | N/A | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (I.R.S. Employer Identification No.) |

| AGBA Tower 68 Johnston Road Wan Chai, Hong Kong SAR |

N/A | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: +852 3601 8363

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Ordinary Shares, $0.001 par value | AGBA | NASDAQ Capital Market | ||

| Warrants, each warrant exercisable for one-half of one Ordinary Share for $11.50 per full share | AGBAW | NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On March 28, 2024, AGBA Group Holding Limited (“AGBA” or the “Company”) issued a press release and an investor presentation regarding financial results for the fourth quarter ended December 31, 2023. A copy of the press release and the investor presentation is attached to this Current Report as Exhibit 99.1 and 99.2, respectively, and the information in Exhibit 99.1 and 99.2 is incorporated herein by reference.

The information in Item 2.02, Exhibit 99.1, and Exhibit 99.2 in this Current Report on Form 8-K shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| Exhibit No. | Exhibit Description | |

| 99.1 | Press release dated March 28, 2024 | |

| 99.2 | Investor Presentation dated March 28, 2024 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| AGBA GROUP HOLDING LIMITED | |||

| By: | /s/ Shu Pei Huang, Desmond | ||

| Name: | Shu Pei Huang, Desmond | ||

| Title: | Acting Group Chief Financial Officer | ||

Dated: March 28, 2024

2

Exhibit 99.1

【For Immediate Release】

AGBA Announces Fourth Quarter 2023 Earnings, Amid Challenging Macro Environment.

HONG KONG (28 March 2024) - NASDAQ-listed, AGBA Group Holding Limited (“AGBA” or “the Company”) the leading one-stop financial supermarket in Hong Kong released its financial results for the fourth quarter of 2023.

The Company generated $48.9 million in commissions from its Distribution Business during the fourth quarter of 2023, which is double the figure generated during the same period in 2022. This substantial improvement reflects the company’s progress. However, the company believes that this is only a small portion of what the salesforce is capable of as the Hong Kong economy continues to recover and rebound.

On the Platform Business side, our unique OnePlatform now encompasses 90 insurance providers offering 1,152 insurance products and 53 fund houses providing access to 1,137 investment products. We are constantly introducing new products to cater to the needs of our individual and commercial customers, including innovative insurance and investment solutions.

Simultaneously, we are dedicated to transforming our Healthcare Business, Dr. Jones Fok & Associates Medical Scheme Management Limited (“JFA”) brand, into Asia’s foremost medical care institution by 2025. Our goal is to redefine industry standards by delivering market-leading customer care and infrastructure, supported by the power of data analytics.

A significant milestone achieved recently was the successful completion of a private placement, involving ordinary shares and warrants. This placement included the participation of an institutional investor as well as AGBA’s senior management. The placement was completed at a substantial premium to the current market price, demonstrating confidence in the Company’s current business and business outlook, strengthening the Company’s financial position and supporting its growth initiatives.

AGBA has thrived despite macroeconomic challenges, adapting its business model and positioning itself for continued growth. New product launches, strategic partnerships, and platform achievements have all solidified the Company’s market presence. As the Hong Kong market shows signs of recovery, as evidenced by increased spending on financial products and services during the Chinese New Year, AGBA is well-positioned to seize promising opportunities both in its home market and beyond.

Mr. Wing-Fai Ng, Group President of AGBA Group Holding Limited stated, “Over the past 12-18 months, we have diligently worked on refining our business model and positioning ourselves to capitalize on growth opportunities in our core industries. We hold an optimistic outlook on the macroeconomic environment, as well as the fundamental factors that drive growth in the financial services and healthcare industries. With our strong market position in Hong Kong, the Greater Bay Area (GBA), and our upcoming presence in Singapore, we are genuinely excited about the future. Our dedicated team is fully committed to delivering exceptional results and creating value for our stakeholders in 2024 and beyond.”

To view a detailed analysis of our Q4 financial results and future outlook, please visit www.agba.com/ir. For more details, please refer to the company’s report on Form 10-K filed with the Securities and Exchange Commission on 28 March 2024.

# # #

About AGBA Group:

Established in 1993, AGBA Group Holding Limited (NASDAQ: “AGBA”) is a leading one-stop financial supermarket based in Hong Kong offering the broadest set of financial services and healthcare products in the Guangdong-Hong Kong-Macao Greater Bay Area (GBA) through a tech-led ecosystem, enabling clients to unlock the choices that best suit their needs. Trusted by over 400,000 individual and corporate customers, the Group is organized into four market-leading businesses: Platform Business, Distribution Business, Healthcare Business, and Fintech Business.

For more information about AGBA, please visit www.agba.com

Investor Relations and Media Contact:

|

Ms. Bethany Lai media@agba.com/ ir@agba.com +852 5529 4500 |

|

Social Media Channels: agbagroup LinkedIn | X | Instagram | Facebook | YouTube |

Safe Harbor Statement

This press release contains forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements that are other than statements of historical facts. When the Company uses words such as “may,” “will,” “intend,” “should,” “believe,” “expect,” “anticipate,” “project,” “estimate” or similar expressions that do not relate solely to historical matters, it is making forward-looking statements. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that may cause the actual results to differ materially from the Company’s expectations discussed in the forward-looking statements. These statements are subject to uncertainties and risks including, but not limited to, the following: the Company’s goals and strategies; the Company’s future business development; product and service demand and acceptance; changes in technology; economic conditions; the outcome of any legal proceedings that may be instituted against us following the consummation of the business combination; expectations regarding our strategies and future financial performance, including its future business plans or objectives, prospective performance and opportunities and competitors, revenues, products, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and our ability to invest in growth initiatives and pursue acquisition opportunities; reputation and brand; the impact of competition and pricing; government regulations; fluctuations in general economic and business conditions in Hong Kong and the international markets the Company plans to serve and assumptions underlying or related to any of the foregoing and other risks contained in reports filed by the Company with the SEC, the length and severity of the recent coronavirus outbreak, including its impacts across our business and operations. For these reasons, among others, investors are cautioned not to place undue reliance upon any forward-looking statements in this press release. Additional factors are discussed in the Company’s filings with the SEC, which are available for review at www.sec.gov. The Company undertakes no obligation to publicly revise these forward–looking statements to reflect events or circumstances that arise after the date hereof.

Exhibit 99.2

#1 Wealth and Health Group in Greater Bay Area, China INVESTOR PRESENTATION Q4 2023 Financial Results March 2024 2 Disclaimer and Confidentiality 2 About This Presentation In this presentation, the “Group”, “we”, “us” and “our” mean AGBA Group Holding Limited (the “Group” or “AGBA”) and its subsidiaries . All amounts are in U . S . dollars unless otherwise indicated . The information contained herein does not purport to contain all of the information about the Group or AGBA . AGBA or its respective affiliates or representatives does not make any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation . Forward Looking Statements This presentation contains forward - looking statements with respect to the Group . These forward - looking statements, by their nature, require the Group to make certain assumptions and necessarily involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward - looking statements, including without limitation the successful and timely completion and the commercialization of the products referred to herein . Forward - looking statements are not guarantees of performance . These forward - looking statements, including financial outlooks and strategies or deliverables stated herein, may involve, but are not limited to, comments with respect to the Group’s business or financial objectives, its strategies or future actions, its projections, targets, expectations for financial condition or outlook for operations . Words such as “may”, “will”, “would”, “could”, “expect”, “believe”, “plan”, “anticipate”, “intend”, “estimate”, “continue”, or the negative or comparable terminology, as well as terms usually used in the future and conditional, are intended to identify forward - looking statements . Information contained in forward - looking statements is based upon certain material assumptions that were applied in drawing a conclusion or making a forecast or projection, including perceptions of historical trends, current conditions and expected future developments, as well as other considerations that are believed to be appropriate in the circumstances . These assumptions are considered to be reasonable based on currently available information, but the reader is cautioned that these assumptions regarding future events, many of which are beyond its control, may ultimately prove to be incorrect since they are subject to risks and uncertainties that affect the Group and its business . The forward - looking information set forth herein reflects expectations as of the date hereof and is subject to change thereafter . The Group disclaims any intention or obligation to update or revise any forward - looking statements, whether as a result of new information, future events or otherwise . Undue reliance should not be placed on forward - looking statements . The forward - looking statements contained in this presentation are expressly qualified by this cautionary statement . This presentation is not intended to form the basis of any investment decision and there can be no assurance that any transaction will be undertaken or completed in whole or in part . The delivery of this presentation shall not be taken as any form of commitment on the part of the Group or its shareholders to proceed with any transaction, and no offers will subject the Group or its shareholders to any contractual obligations before definitive documentation has been executed . This presentation does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any security of AGBA, the Group, or any of their respective affiliates . This presentation includes certain financial measures not presented in accordance with GAAP including, but not limited to, Adjusted EBITDA . These non - GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing the Group’s financial results . Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP . You should be aware that the Group’s presentation of these measures may not be comparable to similarly - titled measures used by other companies . The Group believes these non - GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the Group’s financial condition and results of operations . The Group believes that the use of these non - GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends in and in comparing the Group’s financial measures with other similar companies . These non - GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income items are excluded or included in determining these non - GAAP financial measures . Industry and Market Data In this Presentation, AGBA relies on and refers to certain information and statistics obtained from third - party sources which they believe to be reliable . AGBA has not independently verified the accuracy or completeness of any such third - party information . Some data is also based on the good faith estimates of the Company which are derived from their respective reviews of internal sources as well as the independent sources described above . This Presentation contains preliminary information only, is subject to change at any time and, is not, and should not be assumed to be, complete or to constitute all the information necessary to adequately make an informed decision regarding your engagement with the Company . 2 3 ▪ Revenue Growth - 2023 revenue approximately 1 . 7 x 2022 . ▪ Persistent (China) Macro Challenges. ▪ But also, increasing level of integration with and support from China. ▪ Successful launch of various new products and supporting tools . ▪ Continued Investor Engagement through weekly FAQs . ▪ Strong Outlook for 2024 . ▪ Near closing of PIPE ( USD 6 . 2 million) . 3 2023 Forth - Quarter Financial Results Key Highlights

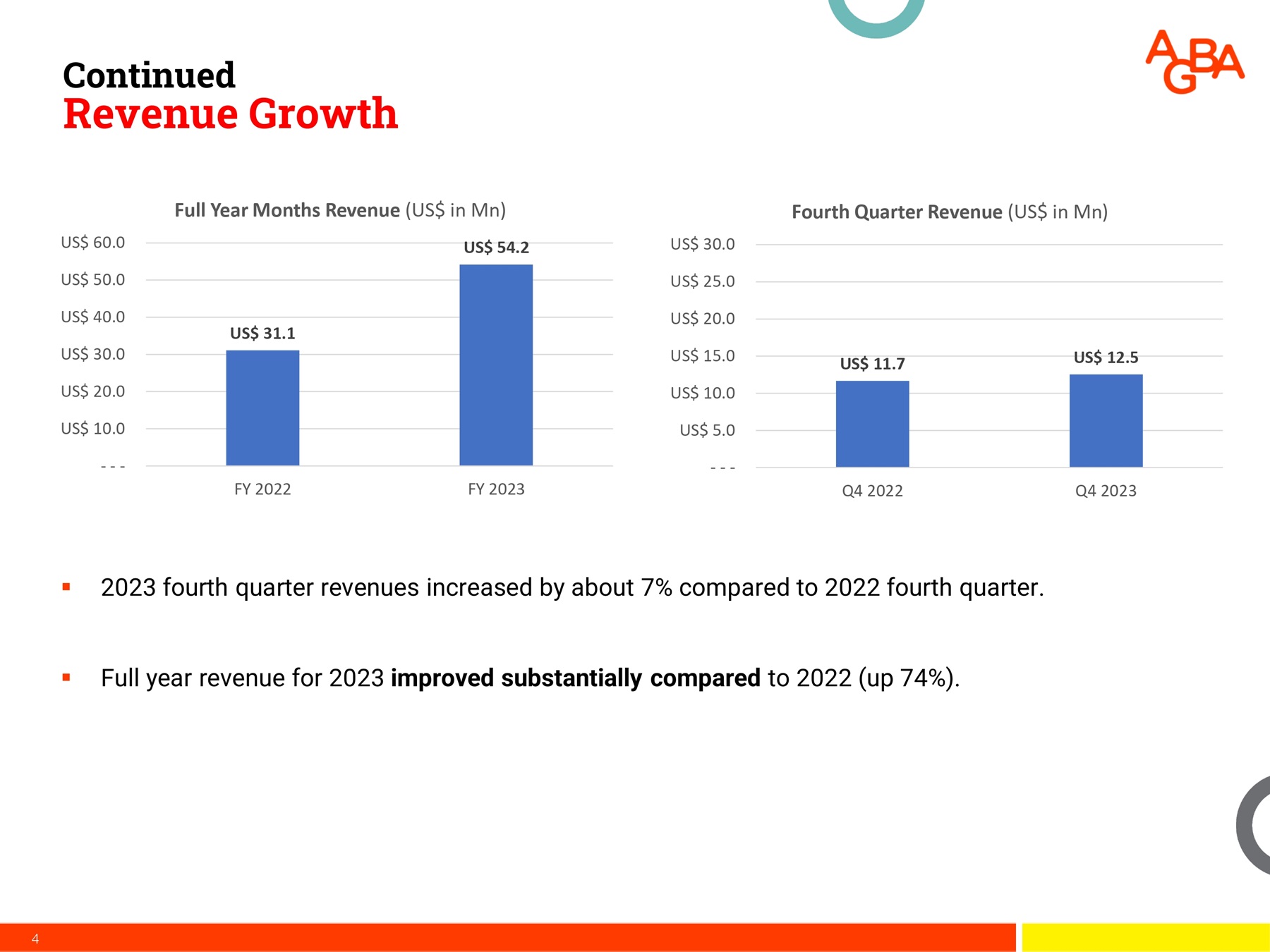

4 ▪ 2023 fourth quarter revenues increased by about 7 % compared to 2022 fourth quarter . ▪ Full year revenue for 2023 improved substantially compared to 2022 (up 74 % ) . 4 Continued Revenue Growth US$ 31.1 US$ 54.2 - - - US$ 10.0 US$ 20.0 US$ 30.0 US$ 40.0 US$ 50.0 US$ 60.0 FY 2022 FY 2023 Full Year Months Revenue (US$ in Mn) US$ 11.7 US$ 12.5 - - - US$ 5.0 US$ 10.0 US$ 15.0 US$ 20.0 US$ 25.0 US$ 30.0 Q4 2022 Q4 2023 Fourth Quarter Revenue (US$ in Mn)

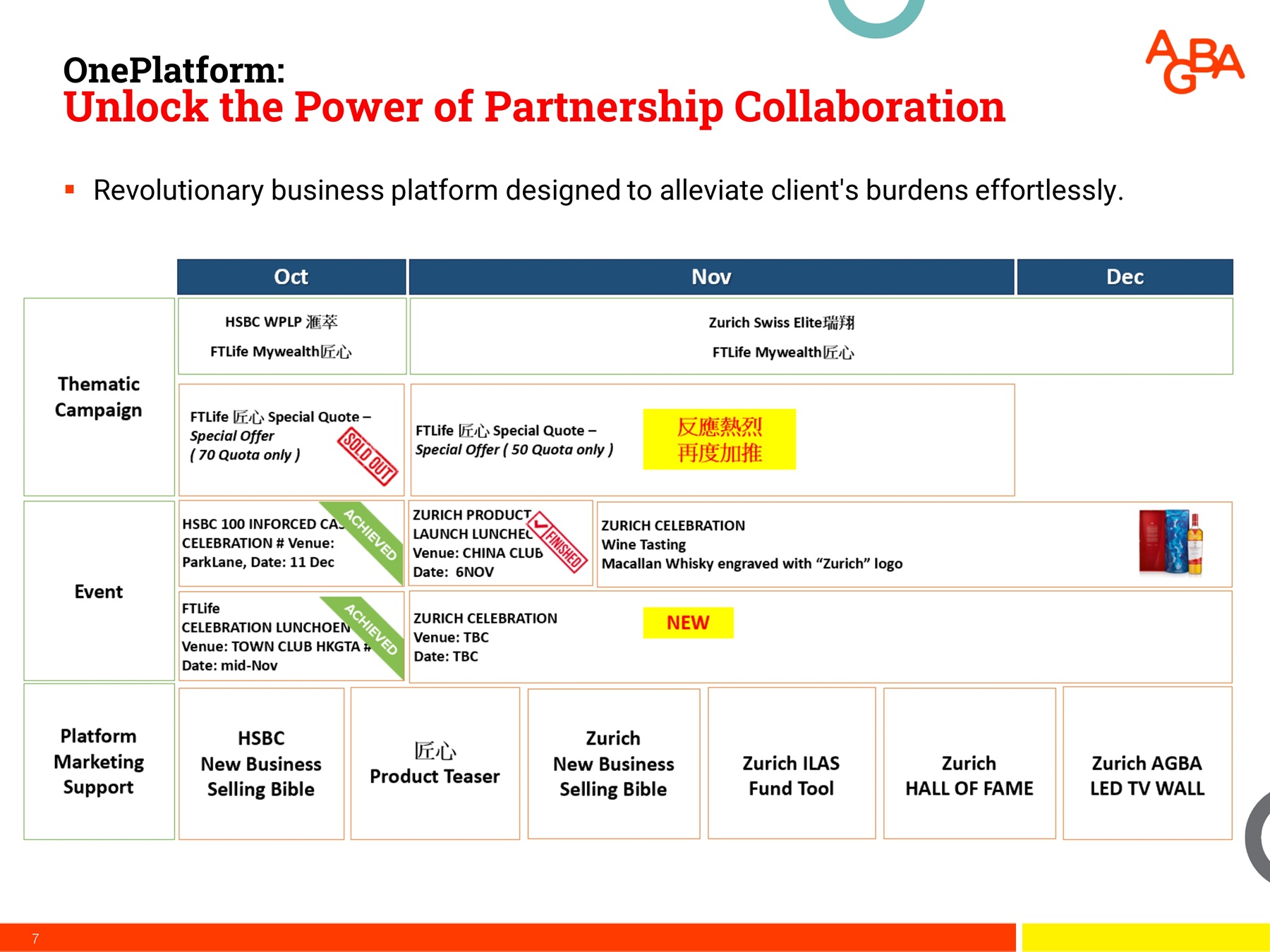

5 5 5 We are Leaner, Stronger and more Resilient Looking Forward to 2024 5 Encouragin g Macro Environment AGBA Is Wel l Positioned For Growth Substantial Share Value to be Unlocked ▪ 2023 was a tough year for Hong Kong and China . ▪ Current macro environment bolstered by emerging signs of a China recovery . ▪ Plus, support from structural growth from demographics, GBA . ▪ Response to external challenges : simplify business model and material cost cuts . ▪ Raised substantial funds for growth (equity private placement, asset sales) . ▪ Exciting and successful new partnerships . ▪ Various (technical) factors combined to drive our share price decline . ▪ Disconnect between share price and underlying business value . ▪ Opens up substantial valuation gap / upside . 3 2 1 7 OnePlatform: Unlock the Power of Partnership Collaboration ▪ Revolutionary business platform designed to alleviate client's burdens effortlessly . 7

Key Initiatives in Q4

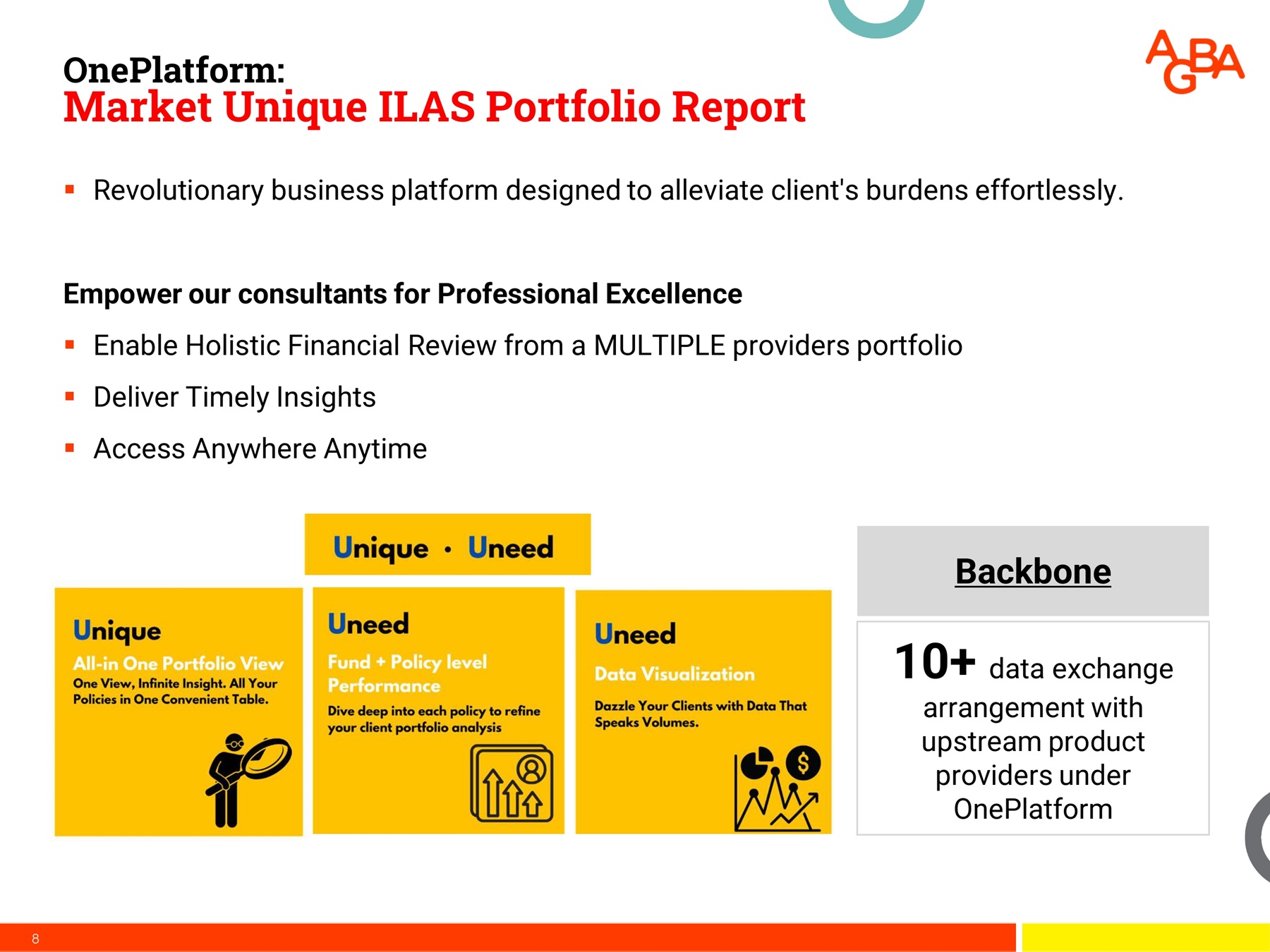

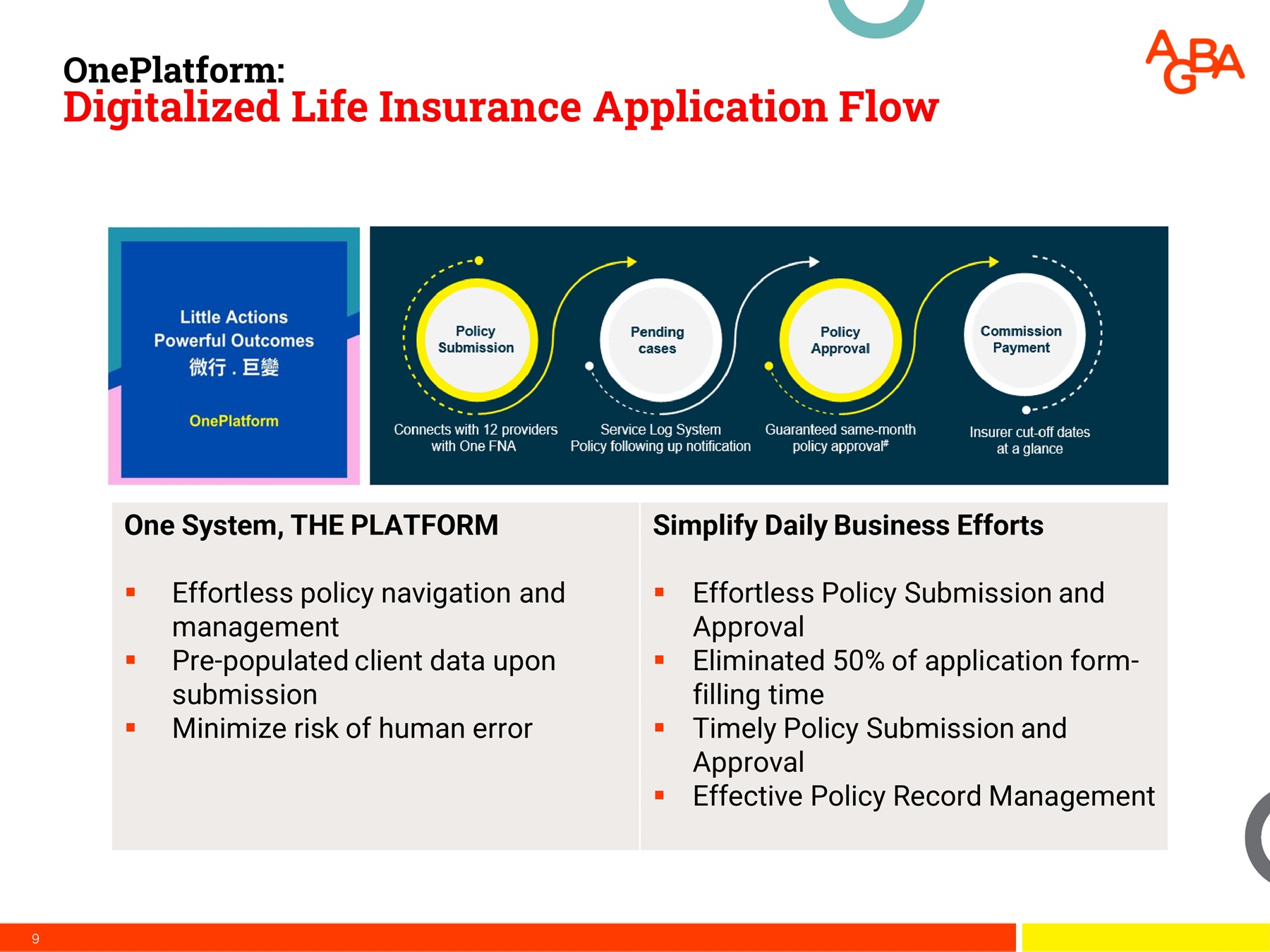

8 OnePlatform: Market Unique ILAS Portfolio Report ▪ Revolutionary business platform designed to alleviate client's burdens effortlessly . Empower our consultants for Professional Excellence ▪ Enable Holistic Financial Review from a MULTIPLE providers portfolio ▪ Deliver Timely Insights ▪ Access Anywhere Anytime Backbone 10+ data exchange arrangement with upstream product providers under OnePlatform 8 OnePlatform: Digitalized Life Insurance Application Flow Simplify Daily Business Efforts ▪ Effortless Policy Submission and Approval ▪ Eliminated 50% of application form - filling time ▪ Timely Policy Submission and Approval ▪ Effective Policy Record Management One System, THE PLATFORM ▪ Effortless policy navigation and management ▪ Pre - populated client data upon submission ▪ Minimize risk of human error 9

10 Asset Management: New Product Expansion and Solutions Launch ▪ Over 900 + new fund products were launched during the fourth quarter in 2023 , with new funds being added to the product lineup each month . ▪ We are continuously adding new products in 2024 Q 1 , including equity funds, bond funds, and multi - asset funds, to diversify our offering and meet clients' needs . ▪ Our GPS Solution Brings Outstanding Returns : Our customized fund portfolios solution yielded up to an 11 . 2 % annualized return by the end of Q 4 . 10 Asset Management: New Structured Products Launched to Capture Exponential New Market Potential Launch Structured Products to Capture Exponential New Market Potential : ▪ OAM will distribute structured products designed to provide customers with a range of options to meet their financial goals, whether they are looking for diversification , tailored solutions , regular income , principal protection , or enhanced returns . ▪ We are the one - stop investment hub for our customers to achieve their investment objectives . 11

Asset Management: Amplification for Investment Business Growth ▪ Partnership Collaboration : Engaged with our financial advisors, we foster collaboration with fund houses, providing market insights and opportunities. ▪ Marketing Amplification : Content marketing to drive brand preference via social networks. ▪ Education and Empowerment : Regular webinars and briefing to ignite our sales engines.

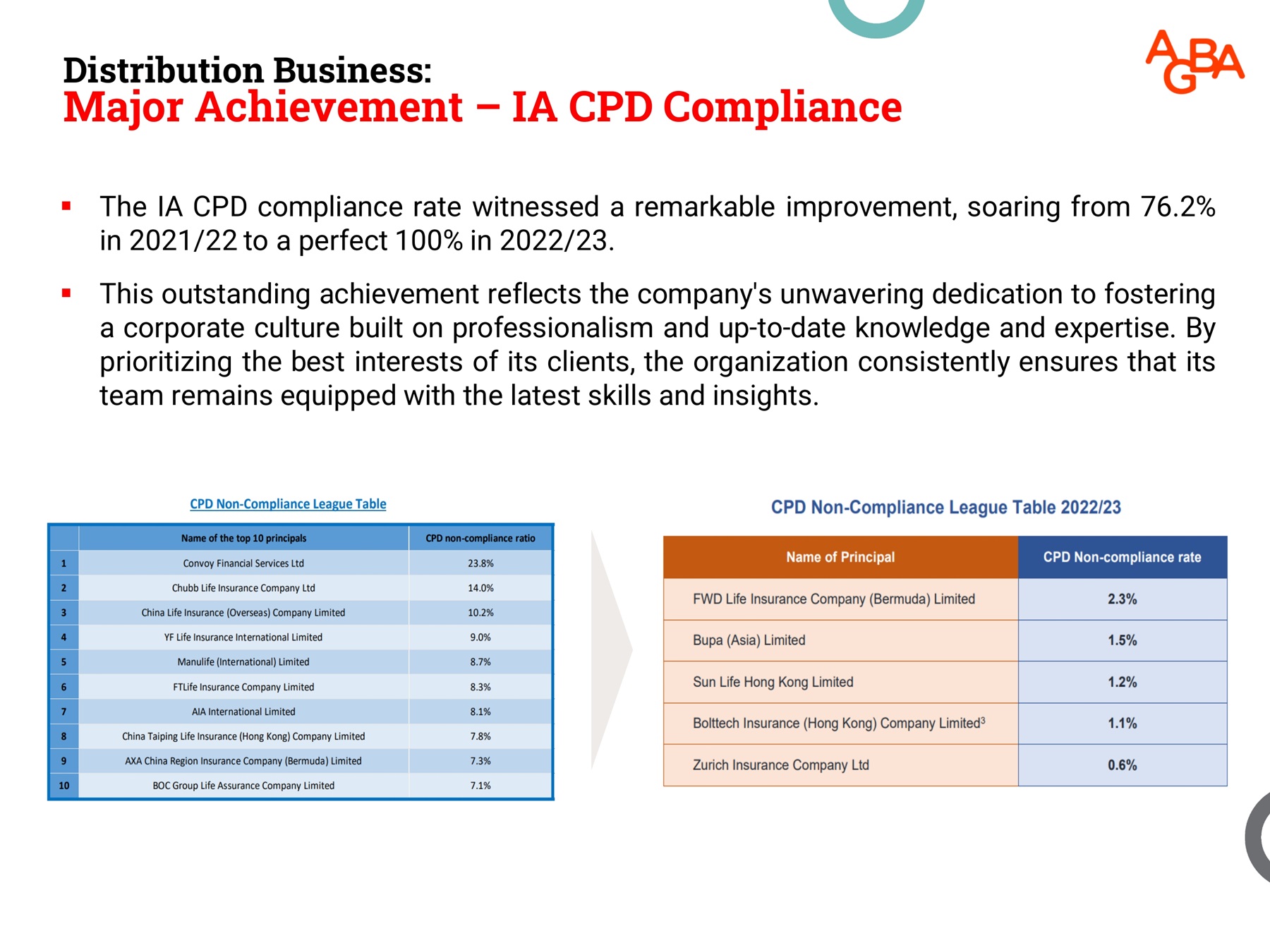

▪ The IA CPD compliance rate witnessed a remarkable improvement, soaring from 76 . 2 % in 2021 / 22 to a perfect 100 % in 2022 / 23 . ▪ This outstanding achievement reflects the company's unwavering dedication to fostering a corporate culture built on professionalism and up - to - date knowledge and expertise . By prioritizing the best interests of its clients, the organization consistently ensures that its team remains equipped with the latest skills and insights .

Distribution Business: Major Achievement – IA CPD Compliance ▪ Over 100 + of our dedicated consultants have accomplished the prestigious 2024 MDRT Qualification, also known as the Million Dollar Round Table . This remarkable achievement highlights their exceptional expertise and unwavering dedication to excellence in the field . ▪ Our team's commitment to the company is further exemplified by the overall productivity growth of 10 % when comparing the years 2022 and 2023 . ▪ Despite facing challenging macroeconomic conditions, our team remained resilient and focused, consistently delivering outstanding results . This productivity boost is a testament to their unwavering commitment, adaptability, and determination to succeed, driving the company forward even in the face of adversity .

Distribution Business: Major Achievement 15 ▪ Education is at the heart of our beliefs . We actively engage with investors frequently, fostering transparency and operating as a transparent company . We recognize the significance of corporate governance, and we make it a priority to continually educate and share our story . ▪ Throughout the year, we proactively participated in Investor Conferences and Roadshows, including the Sidoti Conference, Emerging Growth Conference, Lake Street Big 7 Conference, Maxim Virtual Conference , and roadshows in the US, Dublin, and London . These engagements aim to strengthen investor relationships, showcase growth potential, and expand the Company's network within the investment community . ▪ Visit www . agba . com/ir today to delve into our latest disclosure, Investor Presentation, and research report . Q4 Investor Engagement Update 15 16 16 New Capital At a Premium to Market Price ▪ $5.0m + in new equity capital.

▪ $0.70 per share = 60% Premium at Time of Signing. ▪ From Institutional Investor and AGBA Management. ▪ AGBA Group, Group President contributes for 53% of the Private Placement. ▪ The successful completion of our private placement is an accomplishment that speaks volumes about the strength and potential of our business. ▪ Limited Delisting Risk.

Forward - Looking Plans #1 Focus: Execution 17 1. Capitalize on Hong Kong rebound in 2024 . 2. Profitable by end - 2024 driven by revenue growth and continued cost savings . 3. Expand further into Greater Bay Area and S . E . Asia . 4. Make strategic investments/acquisitions in FinTech and distribution .

THANK YOU For further information, please visit www.agba.com/ir Investor Relation Enquires: agbagroup ir@agba.com +852 5529 4500