UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13

or 15(d) of the

Securities Exchange Act of 1934

March 19, 2024

Date of Report (Date of earliest event reported)

FEUTUNE LIGHT ACQUISITION CORPORATION

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 001-41424 | 87-4620515 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

48 Bridge Street, Building A Metuchen, New Jersey |

08840 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: 909-214-2482

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act: None.

| Title of each class | Trading Symbol |

Name of each exchange on which registered |

||

| Units, each consisting of one share of Class A Common Stock, one Warrant and one Right | FLFVU | The Nasdaq Stock Market LLC | ||

| Class A Common Stock, par value $0.0001 per share | FLFV | The Nasdaq Stock Market LLC | ||

| Warrants, each warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 | FLFVW | The Nasdaq Stock Market LLC | ||

| Rights, each right exchangeable for one-tenth (1/10) of one share of Class A Common Stock at the closing of a business combination | FLFVR | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

As previous announced, on October 26, 2023, Feutune Light Acquisition Corporation (“FLFV”, or “PubCo” upon and following the Merger, as defined in the Merger Agreement noted below) entered into an Agreement and Plan of Merger (as the same may be amended, restated or supplemented, the “Merger Agreement”) with Thunder Power Holdings Limited, a British Virgin Islands company (“TPH”) and Feutune Light Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of FLFV (“Merger Sub”). The transactions contemplated in the Merger Agreement shall be collectively referred in this Report as the “Business Combination”.

Pursuant to Section 7.5 of the Merger Agreement, in the case that FLFV seeks to extend the deadline by which it must consummate the Business Combination (the “Combination Deadline”) with such number of additional one-month period (“Existing Monthly Extension”) pursuant to its certificate of incorporation effectively at the time by the 21st of each month, TPH agreed to provide such number of extension loan, in the amount of $100,000 (each a “Existing Monthly Extension Payment”) for each Existing Monthly Extension and deposit such amount into the trust account (the “Trust Account”) of FLFV, created for the benefits of the public stockholders of FLFV. In exchange for each Existing Monthly Extension Payment, FLFV shall issue a promissory note in the amount of $100,000, which shall provide for repayment upon the Business Combination or the conversion into 10,000 private placement units of FLFV. Each such note shall also entitle TPH to have senior ranking on repayments of the Existing Monthly Extension Payments provided by the sponsor of FLFV or its other designees, in the event of liquidation of FLFV.

Section 7.5 further provides that in the event that the Business Combination has not been consummated by March 21, 2024, after FLFV sought and secured all nine Existing Monthly Extensions provided in the certificate of incorporation effectively at the time, TPH, in its sole discretion determines that the parties are acting in good faith to consummate the Business Combination and the Business Combination is reasonably expected to be consummated, may agree on the same or different terms and conditions to provide additional loans in support of further extension of the Combination Deadline.

On March 18, 2024, the stockholders of FLFV approved in the Special Meeting (as defined below) to amend the certificate of incorporation of FLFV effective at the time, to provide that FLFV has until March 21, 2024 to consummate an initial business combination and may elect to extend the Combination Deadline for up to nine times, each by an additional New Monthly Extension (as defined below), for a total of up to nine months to December 21, 2024, if FLFV seeks to extend the Combination Deadline by the 21st of each month and that a New Monthly Extension Payment (as defined below) of $60,000 is deposited into the Trust Account.

On March 19, 2024, FLFV consulted and agreed with TPH to amend (the “Merger Agreement Amendment”) the Merger Agreement to provide that TPH shall continue to provide such number of additional New Monthly Extension Payments for each New Monthly Extension FLFV seeks to consummate the Business Combination, up to June 21, 2024. In exchange for each New Monthly Extension Payment, FLFV shall issue a New Monthly Extension Note (as defined below) in the amount of $60,000, which shall provide for repayment upon the Business Combination or the conversion into 6,000 private placement units of FLFV. Each such New Monthly Extension Note shall also continue to entitle TPH to have senior ranking on repayments of the Existing Monthly Extension Payments provided by the sponsor of FLFV or its other designees, in the event of liquidation of FLFV.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

On March 18, 2024, FLFV held a special meeting of the stockholders (the “Special Meeting”), where the stockholders of FLFV approved the proposal to amend FLFV’s Amended and Restated Certificate of Incorporation (the “Charter”) to allow FLFV until March 21, 2024 to consummate an initial business combination and may elect to extend the Combination Deadline up to nine times, each by an additional one-month period (each, a “New Monthly Extension”), for a total of up to nine months to December 21, 2024, by depositing to Trust Account the lesser (the “New Monthly Extension Payment”) of (i) $60,000 for all public shares and (ii) $0.035 for each public share for each one-month extension. On March 18, 2024, a certificate of amendment to the Charter (the “Charter Amendment”) was filed with the State of Delaware, effective on the same date.

On March 19, 2024, $60,000 (the “March New Monthly Extension Payment”) was deposited into the Trust Account for the public stockholders, which enables FLFV to extend the period of time it has to consummate its initial business combination by one month from March 21, 2024 to April 21, 2024 (the “March New Monthly Extension”). The March New Monthly Extension is the first of the up to nine New Monthly Extensions permitted under the amended Charter.

In connection with the March New Monthly Extension Payment, FLFV issued an unsecured promissory note of $60,000 (the “New Monthly Extension Note”) to TPH, to evidence the payments made by TPH for the March New Monthly Extension Payment, pursuant to the Merger Agreement Amendment.

The New Monthly Extension Note bears no interest and is payable in full upon the earlier to occur of (i) the consummation of the Business Combination or (ii) the date of expiry of the term of FLFV (the “Maturity Date”). The following shall constitute an event of default: (i) a failure to pay the principal within five business days of the Maturity Date; (ii) the commencement of a voluntary or involuntary bankruptcy action, (iii) the breach of FLFV’s obligations thereunder; (iv) any cross defaults; (v) an enforcement proceedings against FLFV; and (vi) any unlawfulness and invalidity in connection with the performance of the obligations thereunder, in which case the Note may be accelerated. The New Monthly Extension Note also provide that the New Monthly Extension Note is more senior in ranking on repayments of the Existing Monthly Extension Payments provided by the sponsor of FLFV or its other designees, in the event of liquidation of FLFV.

The payees of the New Monthly Extension Note, TPH, has the right, but not the obligation, to convert the New Monthly Extension Note, in whole or in part, respectively, into private placement units (the “Units”) of FLFV, that are identical to public units of FLFV, subject to certain exceptions, as described in the final prospectus of FLFV filed with the SEC on June 17, 2022 (File Number: 333-264221), by providing FLFV with written notice of the intention to convert at least two business days prior to the closing of the Business Combination. The number of Units to be received by TPH in connection with such conversion shall be an amount determined by dividing (x) the sum of the outstanding principal amount payable to TPH by (y) $10.00.

The issuance of the Note was made pursuant to the exemption from registration contained in Section 4(a)(2) of the Securities Act of 1933, as amended.]

A copy of the New Monthly Extension Note is attached as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference. The disclosures set forth in this Item 2.03 are intended to be summaries only and are qualified in their entirety by reference to the New Monthly Extension Note.

The information disclosed under Item1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03 to the extent required herein.

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On March18, 2024, FLFV received a written notice (the “Notice”) from the listing qualifications department staff of The Nasdaq Stock Market (“Nasdaq”) notifying FLFV that the FLFV was not in compliance with Listing Rule 5450(a)(2) (the “Minimum Holders Rule”), which requires FLFV to have at least 400 total holders for continued listing on the Nasdaq Global Market. The Notice is only a notification of deficiency, not of imminent delisting, and has no current effect on the listing or trading of the FLFV’s securities on the Nasdaq Global Market.

The Notice states that FLFV has 45 calendar days to submit a plan to regain compliance with the Minimum Holders Rule. FLFV intends to submit a plan to regain compliance with the Minimum Holders Rule within the required timeframe. If Nasdaq accepts FLFV’s plan, Nasdaq may grant FLFV an extension of up to 180 calendar days from the date of the Notice to evidence compliance with the Minimum Holders Rule. If Nasdaq does not accept FLFV’s plan, FLFV will have the opportunity to appeal the decision in front of a Nasdaq Hearings Panel.

Item 3.02 Unregistered Sales of Equity Securities.

The information disclosed under Item 2.03 of this Current Report on Form 8-K is incorporated by reference into this Item 3.02 to the extent required herein. The Units (and the underlying securities) issuable upon conversion of the Note, if any, (1) may not, subject to certain limited exceptions, be transferable or salable by TPH until 30 days after the completion of the Business Combination and (2) are entitled to registration rights.

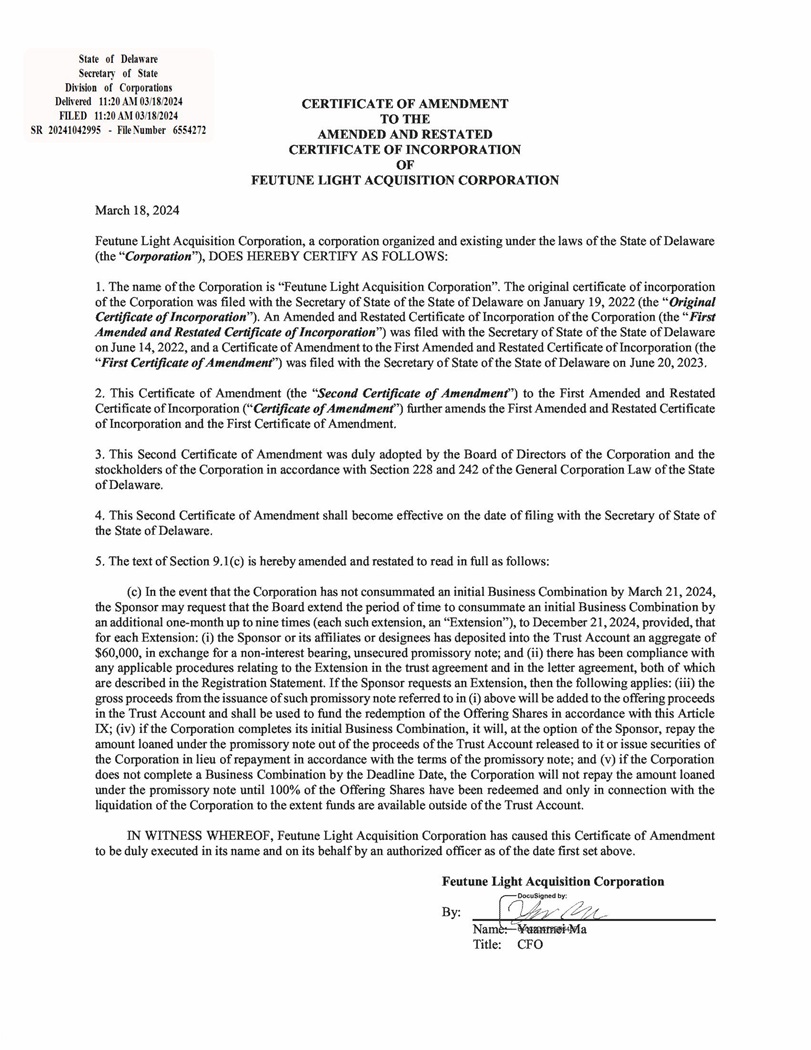

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

At the Special Meeting, the stockholders of FLFV approved the proposal to amend the Charter to allow FLFV until March 21, 2024 to consummate an initial business combination and may elect to extend Combination Deadline up to nine times, each by an additional New Monthly Extension, for a total of up to nine months to December 21, 2024, by depositing to the Trust Account the New Monthly Extension Payment. On March 18, 2024, the Charter Amendment was filed with the State of Delaware, effective on the same date.

A copy of the Charter Amendment is attached to this Current Report on Form 8-K as Exhibit 3.1 and is incorporated herein by reference.

Item 5.07. Submission of Matters to a Vote of Security Holders.

On March 18, 2024, the record date of the Special Meeting, there were 7,986,118 issued and outstanding shares of common stock, including 5,542,368 shares of Class A common stock and 2,443,750 shares of Class B common stock, approximately 76.96% of which were represented in person or by proxy at the Special Meeting.

The final results for the matter submitted to a vote of FLFV’s stockholders at the Special Meeting are as follows:

1. The Charter Amendment Proposal

The stockholders approved the proposal to amend FLFV’s Charter to allow FLFV until March 21, 2024 to consummate an initial business combination and may elect to extend the period to consummate an initial business combination up to nine times, each by an additional one-month period, for a total of up to nine months to December 21, 2024, by depositing to the Trust Account the lesser of (i) $60,000 for all public shares and (ii) $0.035 for each public share for each one-month extension. The voting results were as follows:

| FOR | AGAINT | ABSTAIN | ||

| 5,921,294 | 224,438 | 0 |

Item 7.01 Regulation FD Disclosure.

On March 19, 2024, FLFV issued a press release (the “Press Release”) announcing the approval of the Charter Amendment by its stockholders, and the execution of the Merger Agreement Amendment. A copy of the Press Release is furnished as Exhibit 99.1 hereto. The information in this Item 7.01 and the Press Release hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 8.01. Other Events.

In connection with the votes to approve the Charter Amendment Proposal, 2,738,699 shares of Class A common stock of FLFV were tendered for redemption. Once the redemption processes are completed and 2,738,699 shares of Class A common stock are cancelled accordingly, FLFV will have 2,803,669 shares of Class A common stock (including 498,875 shares underlying the private placement units sold simultaneously with the IPO of FLV held by certain affiliates of FLFV), and 2,443,750 shares of Class B common stock issued and outstanding.

Additional Information and Where to Find It

As previously disclosed, on October 26, 2023, FLFV entered into that the Merger Agreement (as may be amended from time to time, the “Merger Agreement”), by and between the by and among FLFV, Merger Sub, and TPH, pursuant to which TPH will merge with and into Merger Sub, with Merger Sub surviving as a wholly-owned subsidiary of FLFV (the “Merger”); (ii) each Additional Agreement (as defined in the Merger Agreement); and (iii) the Business Combination. This Report does not contain all the information that should be considered concerning the proposed Business Combination and is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination. FLFV’s stockholders and other interested persons are advised to read, the proxy statement/prospectus on Form S-4, as amended (the “S-4”), filed on December 7, 2023 with the U.S. Securities & Exchange Commission (File No. 333-275933) (“SEC”) and other documents filed in connection with the proposed Business Combination, as these materials will contain important information about FLFV, Merger Sub or TPH, and the proposed Business Combination. The S-4 and other relevant materials for the proposed Business Combination will be mailed to stockholders of FLFV as of a record date to be established for voting on the proposed Business Combination. Such stockholders will also be able to obtain copies of the S-4 and other documents filed with the SEC, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to FLFV’s principal office at 48 Bridge Street, Building A, Metuchen, New Jersey 08840.

Forward-Looking Statements

This Report contains certain “forward-looking statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, both as amended. Statements that are not historical facts, including statements about the pending transactions described herein, and the parties’ perspectives and expectations, are forward-looking statements. Such statements include, but are not limited to, statements regarding the proposed Business Combination, including the anticipated initial enterprise value and post-closing equity value, the benefits of the proposed Business Combination, integration plans, expected synergies and revenue opportunities, anticipated future financial and operating performance and results, including estimates for growth, the expected management and governance of the combined company, and the expected timing of the transactions. The words “expect,” “believe,” “estimate,” “intend,” “plan” and similar expressions indicate forward-looking statements. These forward-looking statements are not guarantees of future performance and are subject to various risks and uncertainties, assumptions (including assumptions about general economic, market, industry and operational factors), known or unknown, which could cause the actual results to vary materially from those indicated or anticipated.

Such risks and uncertainties include, but are not limited to: (i) risks related to the expected timing and likelihood of completion of the pending Business Combination, including the risk that the transaction may not close due to one or more closing conditions to the Business Combination not being satisfied or waived, such as regulatory approvals not being obtained, on a timely basis or otherwise, or that a governmental entity prohibited, delayed or refused to grant approval for the consummation of the Business Combination or required certain conditions, limitations or restrictions in connection with such approvals; (ii) risks related to the ability of FLFV and TPH to successfully integrate the businesses; (iii) the occurrence of any event, change or other circumstances that could give rise to the termination of the applicable transaction agreements; (iv) the risk that there may be a material adverse change with respect to the financial position, performance, operations or prospects of FLFV or TPH; (v) risks related to disruption of management time from ongoing business operations due to the proposed Business Combination; (vi) the risk that any announcements relating to the proposed Business Combination could have adverse effects on the market price of FLFV’s securities; (vii) the risk that the proposed Business Combination and its announcement could have an adverse effect on the ability of TPH to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers and on their operating results and businesses generally; (viii): risks relating to the automotive industry, including but not limited to governmental regulatory and enforcement changes, market competitions, competitive product and pricing activity; and (ix) risks relating to the combined company’s ability to enhance its products and services, execute its business strategy, expand its customer base and maintain stable relationship with its business partners.

A further list and description of risks and uncertainties can be found in the prospectus filed on June 17, 2022 relating to FLFV’s initial public offering, the annual report of FLFV on Form 10-K for the fiscal year ended on December 31, 2023, filed on March 6, 2024, and in the S-4, and other documents that the parties may file or furnish with the SEC, which you are encouraged to read. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. Accordingly, you are cautioned not to place undue reliance on these forward-looking statements. Forward-looking statements relate only to the date they were made, and FLFV, TPH, and their subsidiaries undertake no obligation to update forward-looking statements to reflect events or circumstances after the date they were made except as required by law or applicable regulation.

No Offer or Solicitation

This Report is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed Business Combination or any other transaction and does not constitute an offer to sell or a solicitation of an offer to buy any securities of FLFV, Merger Sub or TPH, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933.

Participants in the Solicitation

FLFV, Merger Sub, TPH, and their respective directors, executive officers, other members of management, and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of FLFV stockholders in connection with the proposed Business Combination. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of FLFV stockholders in connection with the proposed bus Business Combination as set forth in the S-4.

Item 9.01 Financial Statements and Exhibits.

| Exhibit No. | Description | |

| 1.1 | Merger Agreement Amendment, dated March 19, 2024, by and between FLFV, Merger Sub and TPH. | |

| 3.1 | Certificate of Amendment to the Amended and Restated Certificate of Incorporation, dated March 18, 2024. | |

| 10.1 | Promissory Note, dated March 19, 2024, issued by FLFV to TPH. | |

| 99.1 | Press Release, dated March 19, 2024 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Feutune Light Acquisition Corporation | ||

| Date: March 19, 2024 | By: | /s/ Yuanmei Ma |

| Name: | Yuanmei Ma | |

| Title: | Chief Financial Officer | |

6

Exhibit 1.1

AMENDMENT TO AGREEMENT AND PLAN OF MERGER

This AMENDMENT TO AGREEMENT AND PLAN OF MERGER (the “Amendment”), dated as of March 19, 2024, by and among, Feutune Light Acquisition Corporation, a Delaware corporation (“Parent”), Feutune Light Merger Sub Inc. a Delaware corporation and a wholly-owned subsidiary of Parent (“Merger Sub”), and Thunder Power Holdings Limited, a British Virgin Islands company (the “Company”). Capitalized terms not otherwise defined in this Amendment shall have the meaning given to them in the Merger Agreement (as defined below).

W I T N E S S E T H:

WHEREAS, Parent, Merger Sub, and the Company are parties to a certain Agreement and Plan of Merger dated as of October 26, 2023 (the “Merger Agreement”);

WHEREAS, on March 18, 2024, Parent’s stockholders approved Parent’s amended and restated certificate of incorporation to allow Parent until March 21, 2024 to consummate an initial business combination and may elect to extend the period to consummate an initial business combination up to nine times, each by an additional one-month period, for a total of up to nine months to December 21, 2024, by depositing $60,000, for each one-month period (each, a “New Monthly Extension Payment”) to the Trust Account;

WHEREAS, the Company has agreed to provide loans to Parent to be deposited into the Trust Account as New Monthly Extension Payments to extend the Combination Period until December 21, 2024; and

WHEREAS, in accordance with the terms of Section 11.2 of the Merger Agreement, Parent, Merger Sub and the Company desire to amend the Merger Agreement as set forth herein.

NOW, THEREFORE, in consideration of the foregoing and the respective covenants and agreements set forth below, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Parent, Merger Sub and the Company agree as follows:

Section 1. Amendments to the Merger Agreement.

(a) Article VII, Section 7.5 of the Merger Agreement shall hereby be deleted in its entirety and shall be replaced as follows:

“7.5 Extension Payment Loans. From October 26, 2023 to March 21, 2024, the Company shall provide loans to Parent to be deposited into the Trust Account as Monthly Extension Payments to extend the Combination Period until March 21, 2024, including, for the avoidance of doubt, the Monthly Extension Payment to extend the Combination Period until November 21, 2023. From March 18, 2024, the Company shall provide loans to Parent to be deposited into the Trust Account as New Monthly Extension Payments to extend the Combination Period until June 21, 2024. In the event that the Business Combination has not been consummated by June 21, 2024, the Company, in its sole discretion determines that the parties are acting in good faith to consummate the Business Combination and the Business Combination is reasonably expected to be consummated, may agree on the same or different terms and conditions to provide additional loans in support of further extension of the Combination Period (the loans provided by the Company as Monthly Extension Payments and New Monthly Extension Payments in support of the extension of the Combination Period are collectively referred as “Extension Payment Loans”). The Extension Payment Loans shall be evidenced by promissory notes issued by Parent which shall entitle the Company to have senior ranking on repayments of the Extension Payment Loans in the event of liquidation of Parent.”

(b) In Article I, the following definition shall be added into the Merger Agreement, inserted between the definitions of “Nasdaq” and “Non-Compete Agreement” as follows:

“New Monthly Extension Payment” means the monthly deposit in the amount of $60,000 to be made to the Trust Account by 21st of each month to allow Parent to consummate its initial business combination by June 21, 2024 in accordance with the terms of Section 7.5 hereof.

Section 2. Effectiveness of Amendment. Upon the execution and delivery hereof, the Merger Agreement shall thereupon be deemed to be amended as set forth herein and with the same effect as if the amendments made hereby were originally set forth in the Merger Agreement, and this Amendment and the Merger Agreement shall henceforth respectively be read, taken and construed as one and the same instrument, but such amendments shall not operate so as to render invalid or improper any action heretofore taken under the Merger Agreement. Upon the effectiveness of this Amendment, each reference in the Merger Agreement to “this Agreement,” “hereof,” “hereunder” or words of like import referring to the Merger Agreement shall refer to the Merger Agreement as amended by this Amendment.

Section 3. General Provisions.

(a) Miscellaneous. This Amendment may be executed in two or more counterparts, each of which shall be deemed an original but all of which together shall be considered one and the same agreement and shall become effective when counterparts have been signed by each of the parties hereto and delivered to the other parties, it being understood that all parties need not sign the same counterpart. This Amendment may be executed and delivered by facsimile or PDF transmission. The terms of Article XI of the Merger Agreement shall apply to this Amendment, as applicable.

(b) Merger Agreement in Effect. Except as specifically and explicitly provided for in this Amendment, the Merger Agreement shall remain unmodified and in full force and effect.

[Remainder of Page Intentionally Left Blank]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed as of the day and year first above written.

| Parent: | |||

| Feutune Light Acquisition Corporation | |||

| By: | /s/ Yuanmei Ma | ||

| Name: | Yuanmei Ma | ||

| Title: | Chief Financial Officer | ||

| Merger Sub: | |||

| Feutune Light Merger Sub Inc. | |||

| By: | /s/ Yuanmei Ma | ||

| Name: | Yuanmei Ma | ||

| Title: | Sole Director and Chairman | ||

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed as of the day and year first above written.

| The Company: | |||

| Thunder Power Holding Limited | |||

| By: | /s/ Wellen Sham | ||

| Name: | Wellen Sham | ||

| Title: | Chief Executive Officer | ||

Exhibit 3.1

Exhibit 10.1

THIS PROMISSORY NOTE (“NOTE”) HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”). THIS NOTE HAS BEEN ACQUIRED FOR INVESTMENT ONLY AND MAY NOT BE SOLD, TRANSFERRED OR ASSIGNED IN THE ABSENCE OF REGISTRATION OF THE RESALE THEREOF UNDER THE SECURITIES ACT OR AN OPINION OF COUNSEL REASONABLY SATISFACTORY IN FORM, SCOPE AND SUBSTANCE TO THE COMPANY THAT SUCH REGISTRATION IS NOT REQUIRED.

PROMISSORY NOTE

Principal Amount: up to US$60,000

Dated: March 19, 2024

FOR VALUE RECEIVED, Feutune Light Acquisition Corporation (the “Maker” or the “Company”) promises to pay to the order of Thunder Power Holdings Limited, if prior to the Closing Date as such terms are defined in the Merger Agreement (as defined below), or the Surviving Corporation, if after the Closing Date (the “Payee” or “TPH”), for the outstanding principal balance (the “Outstanding Principal Balance”) up to Sixty Thousand US Dollars (US$60,000), on the terms and conditions described below. All payments on this Note shall be made by wire transfer of immediately available funds to such account as the Payee may from time to time designate by written notice in accordance with the provisions of this note (the “Note”). Capitalized terms used and not otherwise defined herein shall have the meanings given such terms in the certain Agreement and Plan of Merger dated October 26, 2023, as amended by that certain Amendment to Agreement and Plan of Merger dated March 19, 2024, by and among the Maker, the Payee and Feutune Light Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of the Maker (as amended, the “Merger Agreement”).

1. Principal. The Outstanding Principal Balance of this Note shall be payable by the Maker to the Payee in full upon the earlier to occur of (i) the date on which the Maker consummates a business combination or merger with the Payee which is a qualified target company (as described in its Prospectus (as defined below)) (the “Business Combination”) pursuant to a merger agreement (the “Merger Agreement”), and (ii) the date of expiry of the term of the Maker (each such date, the “Maturity Date”). The principal balance may be prepaid at any time prior to the Maturity Date without penalty. Under no circumstances shall any individual, including but not limited to any officer, director, employee or stockholder of the Maker, be obligated personally for any obligations or liabilities of the Maker hereunder.

2. Purpose of the Note. This Note is issued pursuant to the Merger Agreement and the proceeds of this Note is for the purpose for the Maker to fund its trust account to extend the date by which the Maker must complete its initial business combination from March 21, 2024 to April 21, 2024.

3. Repayment; Extension. The Payee, in its sole discretion, may determine that the repayment of the Outstanding Principal Balance be in cash, or in conversion pursuant to Section 4, on the Maturity Date. In the event that the Business Combination is being negotiated in good faith and shows a reasonable chance of being consummated, the Payee in its sole discretion may agree on the same or different terms and conditions to further extend the monthly extension payments to the Maker, thereby incurring additional promissory notes from the Maker to the Payee. So long of there is an Outstanding Principal Balance to this Note or any additional promissory note, the Maker and the Payee must mutually agree if to extend the consummation of the Business Combination Period beyond June 21, 2024.

4. Conversion Rights. The Payee has the right, but not the obligation, to convert this Note, in whole or in part, into private units (the “Units”) of the Maker, each consisting of one share of Class A common stock, one warrant and one right to receive one-tenth (1/10) of one share of Class A common stock of the Maker, that are identical to the public units of the Maker, as described in the Prospectus of the Maker (File Number 333-264221) (the “Prospectus”), by providing the Maker with written notice of its intention to convert this Note at least two business days prior to the closing of the Business Combination. The number of Units to be received by the Payee in connection with such conversion shall be an amount determined by dividing (x) the sum of the Outstanding Principal Balance payable to such Payee by (y) $10.00.

a. Fractional Units. No fractional Units will be issued upon conversion of this Note. In lieu of any fractional Shares to which Payee would otherwise be entitled, the Maker will pay to Payee in cash the amount of the unconverted Outstanding Principal Balance of this Note that would otherwise be converted into such fractional Unit.

b. Effect of Conversion. If the Maker timely receives notice of the Payee’s intention to convert this Note at least two business days prior to the closing of the Business Combination, this Note shall be deemed to be converted on such closing date. At its expense, the Maker will, upon receipt of such conversion notice, as soon as practicable after consummation of the Business Combination, issue and deliver to Payee, at Payee’s address as requested by Payee in its conversion notice, a certificate or certificates for the number of Units to which Payee is entitled upon such conversion (bearing such legends as are customary pursuant to applicable state and federal securities laws), including a check payable to Payee for any cash amounts payable as a result of any fractional Units as described herein.

5. Interest. This Note does not carry any interest on the Outstanding Principal Balance of this Note, provided, that, any Outstanding Principal Balance not paid on the Maturity Date shall accrue default interest at a rate per annum equal to the interest rate which is the prevailing short term United States Treasury Bill rate, from the Maturity Date until the day on which all Outstanding Principal Balance due are received by the Payee in cash.

6. Application of Payments. All payments shall be applied first to payment in full of any costs incurred in the collection of any sum due under this Note, including but not limited to reasonable attorney’s and auditor’s fees and expenses, then to the payment in full of any late charges, and finally to the reduction of the Outstanding Principal Balance of this Note.

7. Events of Default. The following shall constitute an event of default (each, an “Event of Default”):

a. Failure to Make Required Payments. Failure by the Maker to pay the Outstanding Principal Balance due pursuant to this Note more than 5 business days after the Maturity Date.

b. Voluntary Bankruptcy, etc. The commencement by the Maker of a voluntary case under any applicable bankruptcy, insolvency, reorganization, rehabilitation or other similar law, or the consent by it to the appointment of or taking possession by a receiver, liquidator, assignee, trustee, custodian, sequestrator (or other similar official) of the Maker or for any substantial part of its property, or the making by it of any assignment for the benefit of creditors, or the failure of the Maker generally to pay its debts as such debts become due, or the taking of corporate action by the Maker in furtherance of any of the foregoing.

c. Involuntary Bankruptcy, etc. The entry of a decree or order for relief by a court having jurisdiction in the premises in respect of the Maker in an involuntary case under any applicable bankruptcy, insolvency or other similar law, or appointing a receiver, liquidator, assignee, custodian, trustee, sequestrator (or similar official) of the Maker or for any substantial part of its property, or ordering the winding-up or liquidation of its affairs, and the continuance of any such decree or order unstayed and in effect for a period of 60 consecutive days.

d. Breach of Other Obligations. The Maker fails to perform or comply with any one or more of its obligations under this Note including the application of the proceeds of the Note to fund any other activities of the Maker other than the monthly extension payments.

e. Cross Default. Any present or future indebtedness of the Maker in respect of moneys borrowed or raised becomes (or becomes capable of being declared) due and payable prior to its stated maturity by reason of any event of default, or any such indebtedness is not paid when due or, as the case may be, within any applicable grace period.

f. Enforcement Proceedings. A distress, attachment, execution or other legal process is levied or enforced on or against any assets of the Maker which is not discharged or stayed within 30 days.

g. Unlawfulness and Invalidity. It is or becomes unlawful for the Maker to perform any of its obligations under this Note, or any obligations of the Maker under this Note are not or cease to be legal, valid, binding or enforceable.

8. Remedies.

a. Upon the occurrence of an Event of Default specified in Section 7(a) and 7(d) hereof, the Payee may, by written notice to the Maker, declare this Note to be due immediately and payable, whereupon the Outstanding Principal Balance of this Note, and all other amounts payable hereunder, shall become immediately due and payable without presentment, demand, protest or other notice of any kind, all of which are hereby expressly waived, notwithstanding anything contained herein or in the documents evidencing the same to the contrary.

b. Upon the occurrence of an Event of Default specified in Sections 7(b), 7(c), 7(e), 7(f) and 7(g) hereof, the Outstanding Principal Balance of this Note, and all other sums payable with regard to this Note hereunder, shall automatically and immediately become due and payable, in all cases without any action on the part of the Payee.

9. Taxes. The Maker will pay all amounts due hereunder free and clear of and without reduction for any taxes, levies, imposts, deductions, withholding or charges imposed or levied by any governmental authority or any political subdivision or taxing authority thereof with respect thereto (“Taxes”). The Maker will pay on behalf of the Payee all such Taxes so imposed or levied and any additional amounts as may be necessary so that the net payment of principal and any interest on this Note received by the Payee after payment of all such Taxes shall be not less than the full amount provided hereunder.

10. Waivers. The Maker and all endorsers and guarantors of, and sureties for, this Note waive presentment for payment, demand, notice of dishonor, protest, and notice of protest with regard to the Note, all errors, defects and imperfections in any proceedings instituted by the Payee under the terms of this Note, and all benefits that might accrue to the Maker by virtue of any present or future laws exempting any property, real or personal, or any part of the proceeds arising from any sale of any such property, from attachment, levy or sale under execution, or providing for any stay of execution, exemption from civil process, or extension of time for payment; and the Maker agrees that any real estate that may be levied upon pursuant to a judgment obtained by virtue hereof or any writ of execution issued hereon, may be sold upon any such writ in whole or in part in any order desired by the Payee.

11. Unconditional Liability. The Maker hereby waives all notices in connection with the delivery, acceptance, performance, default, or enforcement of the payment of this Note, and agrees that its liability shall be unconditional, without regard to the liability of any other party, and shall not be affected in any manner by any indulgence, extension of time, renewal, waiver or modification granted or consented to by the Payee, and consents to any and all extensions of time, renewals, waivers, or modifications that may be granted by the Payee with respect to the payment or other provisions of this Note, and agrees that additional makers, endorsers, guarantors, or sureties may become parties hereto without notice to the Maker or affecting the Maker’s liability hereunder. For the purpose of this Note, “business day” shall mean a day (other than a Saturday, Sunday or public holiday) on which banks are open in New York City, New York, the British Virgin Islands, Hong Kong or Taiwan for general banking business.

12. Notices. All notices, statements or other documents which are required or contemplated by this Note shall be made in writing and delivered: (i) personally or sent by first class registered or certified mail, overnight courier service to the address most recently provided in writing to such party or such other address as may be designated in writing by such party, (ii) by fax to the number most recently provided to such party or such other fax number as may be designated in writing by such party, or (iii) by email, to the email address most recently provided to such party or such other email address as may be designated in writing by such party. Any notice or other communication so transmitted shall be deemed to have been given on (a) the day of delivery, if delivered personally, (b) only if the receipt is acknowledged, the day after such receipt, if sent by fax or email, (c) the business day after delivery to an overnight courier service, if sent by an overnight courier service, or (d) 5 days after mailing if sent by first class registered or certified mail.

13. Construction. This Note shall be construed and enforced in accordance with the laws of New York, without regard to conflict of law provisions thereof.

14. Severability. Any provision contained in this Note which is prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof, and any such prohibition or unenforceability in any jurisdiction shall not invalidate or render unenforceable such provision in any other jurisdiction. The Payee hereby waives any and all right, title, interest or claim of any kind (“Claim”) in or to any amounts contained in the trust account deriving from the proceeds of the IPO conducted by the Maker, as described in greater detail in the Prospectus filed with the Securities and Exchange Commission in connection with the IPO (the “Trust Account Funds”) set aside for the benefit of the public shareholders of the Maker and the underwriters of the IPO pursuant to the Investment Management Trust Agreement (as defined in the Prospectus), and hereby agrees not to seek recourse, reimbursement, payment or satisfaction for any Claim from such sums in the Trust Account Funds. If Maker does not consummate the Business Combination, this Note shall be repaid from amounts remaining in the Trust Account Funds after the payment of the public shareholders and the underwriters of the IPO, if any, and from the proceeds of the sale of securities in a private placement if any as described in greater detail in Section 7.5 of the Merger Agreement. If Maker consummates any business combination with any target company, this Note shall be repaid from the proceeds of such business combination in the form determined by the Payee in its sole discretion.

15. Amendment; Waiver. Any amendment hereto or waiver of any provision hereof may be made with, and only with, the written consent of the Maker and the Payee.

16. Assignment. This Note shall be binding upon the Maker and its successors and assignees and is for the benefit of the Payee and its successors and assignees, except that the Maker may not assign or otherwise transfer its rights or obligations under this Note. The Payee may at any time without the consent of or notice to the Maker assign to one or more entities all or a portion of its rights under this Note.

[signature page follows]

The Parties, intending to be legally bound hereby, have caused this Note to be duly executed by the undersigned as of the day and year first above written.

MAKER:

Feutune Light Acquisition Corporation, if prior to the Merger Effective Time

or

PubCo, if after the Merger Effective Time

| By: | /s/ Yuanmei Ma | |

| Name: | Yuanmei Ma | |

| Title: | Chief Financial Officer |

PAYEE:

Thunder Power Holdings Limited, if prior to the Closing Date

or

Surviving Corporation, if after the Closing Date

| By: | /s/ Wellen Sham | |

| Name: | Wellen Sham | |

| Title: | Chief Executive Officer of TPH |

[signature page to the promissory note]

Exhibit 99.1

Feutune Light Acquisition Corporation Announces Stockholder Approval for Extending Business Combination Deadline and Merger Agreement Amendment with Thunder Power Holdings Limited

Metuchen, NJ, March 19, 2024 (GLOBE NEWSWIRE) -- Feutune Light Acquisition Corporation (NASDAQ: FLFV) (“FLFV”), a blank check company incorporated in Delaware, today announced it held a special meeting of the stockholders (the “Special Meeting”) and obtained the stockholders’ approval for the proposals to extend the time (the “Combination Deadline”) it has to complete an initial business combination. In addition, FLFV agreed with Thunder Power Holdings Limited (“TPH”) to amend Agreement and Plan of Merger (“Merger Agreement”) to confirm that TPH will continue to provide extension payments for the FLFV to extend its Combination Deadline.

Special Meeting Results

At the Special Meeting, the stockholders of FLFV approved to amend FLFV’s Amended and Restated Certificate of Incorporation (the “Current Charter”) to allow FLFV until March 21, 2024 to consummate an initial business combination and may elect to extend the Combination Deadline up to nine times, each by an additional one-month period (each a “Monthly Extension”), for a total of up to nine months to December 21, 2024, by depositing to FLFV’s trust account (the “Trust Account”) the lesser of (i) $60,000 for all public shares and (ii) $0.035 for each public share for each one-month extension (each such deposit, a “Monthly Extension Payment”). The Special Meeting is the second such meeting since July 2023 to extend the Combination Deadline.

Pursuant to FLFV’s certificate of amendment to the Current Charter to be filed on March 18, 2024, FLFV may extend on monthly basis from March 21, 2024 until December 21, 2024 or such an earlier date as may be determined by its board to complete a business combination by depositing the Monthly Extension Payment for each month into the Trust Account.

Merger Agreement Amendment

Pursuant the current Merger Agreement, TPH agreed to provide loans to FLFV to be deposited into the Trust Account as monthly extension payments to extend the deadline for completing the Business Combination under the Current Charter until March 21, 2024.

To afford more time and flexibility to consummate the Business Combination, on March 19, 2024, FLFV and TPH entered into an amendment to the Merger Agreement, pursuant to which TPH will continue to provide loans to FLFV to be deposited into the Trust Account as Monthly Extension Payments for each Monthly Extension FLFV seeks to consummate the Business Combination, up to June 21, 2024.

In order to extend the Combination Deadline from March 21, 2024 to April 21, 2024, an aggregate of $60,000 Monthly Extension Payment was deposited into the Trust Account on March 19, 2024.

About Feutune Light Acquisition Corporation

Feutune Light Acquisition Corporation is a blank check company formed as a Delaware corporation for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or similar business combination with one or more businesses. The Company is actively searching and identifying suitable business combination targets but has not selected any business combination target. The company’s efforts to identify a prospective target business are not be limited to a particular industry or geographic region, although the Company is prohibited from undertaking initial business combination with any entity that is based in or have the majority of its operations in China (including Hong Kong and Macau).

Additional Information and Where to Find It

As previously disclosed, on October 26, 2023, FLFV entered into that certain Agreement and Plan of Merger (as may be amended, supplemented or otherwise modified from time to time, the “Merger Agreement”), by and between the by and among FLFV, Feutune Light Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of FLFV (“Merger Sub”), and Thunder Power Holdings Limited, a British Virgin Islands company (“TPH”), pursuant to which TPH will merge with and into Merger Sub, with Merger Sub surviving as a wholly-owned subsidiary of FLFV (the “Merger”); (ii) each Additional Agreement (as defined in the Merger Agreement); and (iii) the Merger and other transactions contemplated therein (collectively, the “Business Combination” or “Transactions”). This press release does not contain all the information that should be considered concerning the proposed Business Combination and is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination. FLFV’s stockholders and other interested persons are advised to read, the proxy statement/prospectus on Form S-4, as amended (the “S-4”), filed on December 7, 2023 with the U.S. Securities & Exchange Commission (File No. 333-275933) (“SEC”) and other documents filed in connection with the proposed Business Combination, as these materials will contain important information about FLFV, Merger Sub or TPH, and the proposed Business Combination. The S-4 and other relevant materials for the proposed Business Combination will be mailed to stockholders of FLFV as of a record date to be established for voting on the proposed Business Combination. Such stockholders will also be able to obtain copies of the S-4 and other documents filed with the SEC, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to FLFV’s principal office at 48 Bridge Street, Building A, Metuchen, New Jersey 08840.

Forward-Looking Statements

This press release contains certain “forward-looking statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, both as amended. Statements that are not historical facts, including statements about the pending transactions described herein, and the parties’ perspectives and expectations, are forward-looking statements. Such statements include, but are not limited to, statements regarding the proposed Business Combination, including the anticipated initial enterprise value and post-closing equity value, the benefits of the proposed Business Combination, integration plans, expected synergies and revenue opportunities, anticipated future financial and operating performance and results, including estimates for growth, the expected management and governance of the combined company, and the expected timing of the transactions. The words “expect,” “believe,” “estimate,” “intend,” “plan” and similar expressions indicate forward-looking statements. These forward-looking statements are not guarantees of future performance and are subject to various risks and uncertainties, assumptions (including assumptions about general economic, market, industry and operational factors), known or unknown, which could cause the actual results to vary materially from those indicated or anticipated.

Such risks and uncertainties include, but are not limited to: (i) risks related to the expected timing and likelihood of completion of the pending Business Combination, including the risk that the transaction may not close due to one or more closing conditions to the Business Combination not being satisfied or waived, such as regulatory approvals not being obtained, on a timely basis or otherwise, or that a governmental entity prohibited, delayed or refused to grant approval for the consummation of the Business Combination or required certain conditions, limitations or restrictions in connection with such approvals; (ii) risks related to the ability of FLFV and TPH to successfully integrate the businesses; (iii) the occurrence of any event, change or other circumstances that could give rise to the termination of the applicable transaction agreements; (iv) the risk that there may be a material adverse change with respect to the financial position, performance, operations or prospects of FLFV or TPH; (v) risks related to disruption of management time from ongoing business operations due to the proposed Business Combination; (vi) the risk that any announcements relating to the proposed Business Combination could have adverse effects on the market price of FLFV’s securities; (vii) the risk that the proposed Business Combination and its announcement could have an adverse effect on the ability of TPH to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers and on their operating results and businesses generally; (viii): risks relating to the automotive industry, including but not limited to governmental regulatory and enforcement changes, market competitions, competitive product and pricing activity; and (ix) risks relating to the combined company’s ability to enhance its products and services, execute its business strategy, expand its customer base and maintain stable relationship with its business partners.

A further list and description of risks and uncertainties can be found in the prospectus filed on June 17, 2022 relating to FLFV’s initial public offering, the annual report of FLFV on Form 10-K for the fiscal year ended on December 31, 2023, filed on March 6, 2024, and in the S-4, and other documents that the parties may file or furnish with the SEC, which you are encouraged to read. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. Accordingly, you are cautioned not to place undue reliance on these forward-looking statements. Forward-looking statements relate only to the date they were made, and FLFV, TPH, and their subsidiaries undertake no obligation to update forward-looking statements to reflect events or circumstances after the date they were made except as required by law or applicable regulation.

No Offer or Solicitation

This press release is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed Business Combination or any other transaction and does not constitute an offer to sell or a solicitation of an offer to buy any securities of FLFV, Merger Sub or TPH, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933.

Participants in the Solicitation

FLFV, Merger Sub, TPH, and their respective directors, executive officers, other members of management, and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of FLFV stockholders in connection with the proposed Business Combination. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of FLFV stockholders in connection with the proposed bus Business Combination as set forth in the S-4.

Contact Information:

Feutune Light Acquisition Corporation

Yuanmei Ma

Chief Financial Officer

48 Bridge Street, Building A

Metuchen, New Jersey 08840

(909)-214-2482

3