UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 11, 2023

authID Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-40747 | 46-2069547 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) | (IRS Employer Identification Number) |

1385 S. Colorado Blvd., Building A, Suite 322, Denver, Colorado 80222

(Address of principal executive offices) (zip code)

516-274-8700

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

| Common Stock par value $0.0001 per share | AUID | The Nasdaq Stock Market, LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth Company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒ Item 2.02 Results of Operations and Financial Condition

On May 11, 2023, authID Inc. (the “Company”) issued a press release regarding its financial results for the fiscal quarter ended March 31, 2023. The full text of the press release issued in connection with the announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The Company also published a presentation used in connection with a conference call hosted on May 11, 2023. The full text of the presentation published in connection with the announcement is furnished as Exhibit 99.2 to this Current Report on Form 8-K.

The information contained in this Item 2.02 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Agreements of Certain Officers

On May 11, 2023, the Company and Ms. Annie Pham, the CFO of the Company, entered a Retention Agreement, pursuant to which the Company agreed to provide specified retention bonus amounts subject to certain performance conditions in the aggregate amount of up to $240,625 and to accelerate the vesting on her equity awards upon termination. This Agreement replaces the previous Executive Retention Agreement dated April 25, 2022, which was terminated and a release granted in relation thereto.

The foregoing is only a summary of the material terms of the Retention Agreement and does not purport to be a complete description of the rights and obligations of the parties thereunder. The summary of the Retention Agreement is qualified in its entirety by reference to the form of such Agreement, which is filed as an exhibit to this Current Report and is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits

(d) Index of Exhibits

| Exhibit Number |

Description | |

| 10.1 | Retention Agreement dated May 11, 2023 between Annie Pham and the Company | |

| 99.1 | Press Release dated May 11, 2023 | |

| 99.2 | Presentation dated May 11, 2023 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| authID Inc. | ||

| Date: May 16, 2023 | By: | /s/ Hang Thi Bich Pham |

| Name: | Hang Thi Bich Pham | |

| Title: | Chief Financial Officer | |

2

Exhibit 10.1

RETENTION AGREEMENT

This Retention Agreement (the “Agreement”) is made and entered into as of May 11, 2023 by and between authID INC., a Delaware corporation (the “Company”), and HANG THI BICH PHAM (the “Executive”) (collectively, the “Parties”).

WHEREAS, Executive is employed by the Company as Chief Financial Officer (“CFO”) pursuant to an Offer Letter dated April 25, 2022 (“Offer Letter”) and entered into an Executive Retention Agreement dated as of April 25, 2022 (“Original Retention Agreement”) as well as an Indemnification Agreement dated as of April, 2022 (“Indemnification Agreement”); and

WHEREAS, the Company and the Executive desire to enter into this Agreement to encourage the Executive to continue to devote the Executive’s full attention and dedication to the success of the Company, and to provide specified compensation and benefits to the Executive.

NOW, THEREFORE, in consideration of the execution of this Agreement and for other good and valuable consideration, the Parties agree as follows:

1. Retention Benefits. In consideration for the release and other covenants in this Agreement, the Company shall provide the following:

(a) The Company agrees to make payment to Executive of the amounts and subject to the conditions set forth below, in addition to Executive’s base salary and benefits payable during the term of her employment (less all applicable deductions required by law) (the “Bonus Payments”), as follows:

(i) Executive will complete all necessary steps and sign as CFO and cause to be delivered and filed all necessary documents in order for the Company to timely file with the Securites & Exchange Commission (“SEC”) the Form 10-Q for the quarter ended March 31, 2023 (“Q1 10-Q”). Company shall pay the sum of $68,750.00 to Executive on or within seven (7) days after the filing of the Q1 10-Q;

(ii) Company shall pay the sum of $68,750.00 to Executive upon the earlier of June 30, 2023 or within seven (7) days after the closing of the Company’s current fund raising offering;

(iii) Executive will complete all necessary steps and sign as CFO and cause to be delivered and filed all necessary documents in order for the Company to timely file with the SEC the Form 10-Q for the quarter ending June 30, 2023 (“Q2 10-Q”). Company shall pay the sum of $68,750.00 to Executive on or within seven (7) days after August 15, 2023. Provided that notwithstanding the foregoing, Company shall not be obligated to make such payment if prior to August 15, 2023 Executive resigns voluntarily, or if the Company terminates Executive’s employment for work related misconduct;

(iv) Company shall pay the sum of $34,375.00 to Executive on or within seven (7) days after September 30, 2023;

and in each case no interest shall accrue on such amount.

(b) Equity. The Exercise Period with respect to vested Shares, under the Executive’s stock options granted by the Company, set forth in the table below, shall be extended so as to expire four (4) years from the last day of Executive’s employment by the Company (“Separation Date”) or the remaining term of the relevant equity award, whichever is the lesser. All unvested Shares under any such grants or other equity awards shall become vested and be exercisable as of the Separation Date.

| Date of Grant | No. of Shares |

Exercise Price |

||||||

| 21-Jun-2022 | 350,000 | $ | 2.41 | |||||

| 19-Dec-2022 | 60,000 | $ | 0.79 | |||||

(c) COBRA With effect from the Separation Date, the Company will reimburse Executive for the cost of continuation of health coverage for Executive and Executive’s eligible dependents pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended (“COBRA”) until the earlier of (i) 12 months following the Separation Date, (ii) the date Executive is eligible for health coverage for Executive and Executive’s eligible dependents from a new employer or (iii) the date Executive and Executive’s eligible dependents are no longer eligible for COBRA; provided, however, if, at the time of the Separation Date, the Company determines that providing the COBRA reimbursement in this paragraph would result in a violation of law or an excise tax to the Company, then the Company instead will pay a lump sum payment equal to 150% of 12 months of Executive’s estimated COBRA premiums, less applicable withholdings, within 10 days following the Termination Date.

2. Executive’s Service. Executive agrees to carry out her duties as CFO in accordance with the terms of the Offer Letter and this Agreement for so long as she is employed by the Company.

3. Adequacy of Consideration. Executive understands and agrees that the sums that the Company has agreed to pay and the actions that it has agreed to take or refrain from taking pursuant to this Agreement are a result of the Parties’ negotiations, have not been established to be required of the Company in the absence of this Agreement, do not constitute an admission of liability, and constitute adequate and reasonable consideration for the Agreement.

4. Release of Claims.

(a) Release. The Executive and each of the Executive’s respective heirs, executors, administrators, representatives, agents, successors and assigns (collectively, the “Releasors”) hereby irrevocably and unconditionally release and forever discharge the Company and each of its subsidiaries and affiliates and each of their respective officers, employees, directors, managers, shareholders and agents (“Releasees”) from any and all claims, actions, causes of action, rights, judgments, obligations, damages, demands, accountings or liabilities of whatever kind or character (collectively, “Claims”), including, without limitation, any Claims under any federal, state, local or foreign law, that the Releasors may have or in the future may possess, arising out (i) of the Executive’s employment relationship with and service as an employee, officer, manager or director of the Company, and the termination of such relationship or service, including but not limited to the Offer Letter and the Original Retention Agreement and (ii) any event, condition, circumstance or obligation that occurred, existed or arose on or prior to the date hereof; provided, however, that notwithstanding anything else herein to the contrary, this Agreement shall not affect: (1) the obligations of the Company to pay the amounts due and owing to Executive hereunder or under the Offer Letter, or other obligations that, in each case, by the terms hereof, are to be performed after the date hereof by the Company; (2) any indemnification or similar rights the Executive has pursuant to the Indemnification Agreement, or as a current or former officer, manager or director of the Company, including, without limitation, any and all rights thereto referenced in the Company’s governance documents or any rights with respect to “directors’ and officers’” insurance policies; and (3) Executive’s rights as an option holder, or stockholder of the Company.

(b) Specific Release of ADEA Claims. The Releasors hereby unconditionally release and forever discharge the Releasees from any and all Claims that the Releasors may have as of the date the Executive signs this Agreement and as of the Separation Dte, arising under the Federal Age Discrimination in Employment Act of 1967, as amended, and the applicable rules and regulations promulgated thereunder (“ADEA”). By signing this Agreement, the Executive hereby acknowledges and confirms the following: (i) the Executive was advised by the Company in connection with this Agreement to consult with an attorney of her choice prior to signing this Agreement and to have such attorney explain to the Executive the terms of this Agreement, including, without limitation, the terms relating to the Executive’s release of claims arising under ADEA, and the Executive has in fact consulted with an attorney; and (ii) the Executive knowingly and voluntarily accepts the terms of this Agreement.

(c) Release of All Claims. The Executive acknowledges, understands and agrees that she may later discover Claims or facts in addition to or different from those which she now knows or believes to be true with respect to the subject matters of this Agreement, but that it is nevertheless her intention by signing this Agreement to fully, finally and forever release any and all Claims whether now known or unknown, suspected or unsuspected, which now exist, may exist, or previously have existed as set forth herein.

(d) Executive agrees and acknowledges that the released claims extend to and include unknown and unsuspected claims. In furtherance of the Executive’s intent, the release in this Agreement shall remain in full and complete effect notwithstanding the discovery or existence of any additional, contrary, or different facts.

(e) No Assignment. The Executive represents and warrants that she has not assigned any of the Claims being released under this Agreement.

(f) Proceedings. The Executive has not filed, and agrees not to initiate or cause to be initiated on her behalf, any complaint, charge, claim or proceeding against the Releasees before any local, state or federal agency, court or other body, with respect to any matter which is the subject of the release herein (each, individually, a “Proceeding”), and agrees not to participate voluntarily in any Proceeding. The Executive waives any right she may have to benefit in any manner from any relief (whether monetary or otherwise) arising out of any Proceeding.

(g) Remedies. The Executive understands that by entering into this Agreement she will be limiting the availability of certain remedies that he may have against the Company and limiting also her ability to pursue certain claims against the Company.

(h) Severability Clause. In the event any provision or part of this Agreement is found to be invalid or unenforceable, only that particular provision or part so found, and not the entire Agreement, will be inoperative.

5. No Admission of Liability: This Agreement is not and shall not be construed or contended by either party to be an admission or evidence of any wrongdoing or liability on the part of the Parties or the respective Releasees.

6. Entire Agreement, Modification and Severability. This Agreement (including the Recitals) sets forth the entire agreement between the Parties and fully supersedes the Original Retention Agreement and any and all prior agreements or understandings, written or oral, between the Parties pertaining to its subject matter, except as expressly noted or referenced herein and except for the Offer Letter, Indemnification Agreement and the Invention Assignment Agreement which shall continue in full force and effect.7.

7. Controlling Law. This Agreement shall be governed by and construed in accordance with the substantive and procedural laws of the State of Texas, without giving effect to principles of conflicts or choice of laws thereof. This Agreement shall be interpreted as neutral as between the Parties, without regard to any presumptions, inferences or rules of construction based on the authorship of the Agreement.

8. Voluntary Execution. Executive explicitly and unconditionally acknowledges and agrees that they:

(a) have carefully read and fully understand all of the terms of this Agreement;

(b) understand that by signing this Agreement, and in consideration of the benefits payable by the Company hereunder they are waiving their rights to all claims described in Paragraph 4 of this Agreement, including any and all claims arising under the Age Discrimination in Employment Act of 1967 (29 U.S.C. § 621 et seq.), including certain rights arising after the date that this Agreement is signed;

(c) knowingly and voluntarily agree to all of the terms set forth in this Agreement;

(d) knowingly and voluntarily intend to be legally bound by this Agreement;

(e) are receiving consideration (i.e. payment, resolution of a dispute without the risks and burdens of arbitration, a release, and a promise of confidentiality) in addition to anything of value to which they are already entitled;

(f) have consulted with an attorney prior to signing this Agreement;

(g) have not been coerced, threatened, or intimidated in any way into signing this Agreement.

9. Notices. All notices to be provided pursuant to this Agreement (and any consents permitted by the terms of this Agreement) shall be in writing and delivered by hand or courier, or sent by e-mail transmission, or other electronic means, to their respective addresses as set forth below to:

| (a) | Executive: E-mail: _________________ |

| (b) | authID: | 1624 Market St. Ste 226, Unit 51767, | |

| Denver, Colorado 80202-1559 | |||

| Attn: General Counsel | |||

| E-mail: Legal@authid.ai |

All such notices delivered by hand or by courier shall be deemed served upon receipt or refusal of receipt by the addressee. All notices given electronically shall be deemed served upon the next business day after transmission, provided no error message was received.

10. Arbitration

(a) Disputes Subject to Arbitration. Any claim, dispute or controversy arising out of this Agreement (other than claims relating to misuse or misappropriation of the intellectual property of the Company), the interpretation, validity or enforceability of this Agreement or the alleged breach thereof shall be submitted by the parties to binding arbitration by a sole arbitrator under the rules of the American Arbitration Association; provided, however, that (a) the arbitrator shall have no authority to make any ruling or judgment that would confer any rights with respect to the trade secrets, confidential and proprietary information or other intellectual property of the Company upon the Executive or any third party; and (b) this arbitration provision shall not preclude the Company from seeking legal and equitable relief from any court having jurisdiction with respect to any disputes or claims relating to or arising out of the misuse or misappropriation of the Company’s intellectual property. Judgment may be entered on the award of the arbitrator in any court having jurisdiction.

(b) Costs of Arbitration. All costs of arbitration, including reasonable attorney’s fees of the Executive, will be borne by the Company, except that if the Executive initiates arbitration and the arbitrator finds the Executive’s claims to be frivolous the Executive shall be responsible for their own costs and attorneys’ fees.

(c) Site of Arbitration. The site of the arbitration proceeding shall be in Austin, Texas.

THE EMPLOYEE ACKNOWLEDGES THAT SHE HAS READ THIS RELEASE AND THAT SHE FULLY KNOWS, UNDERSTANDS AND APPRECIATES ITS CONTENTS, AND THAT SHE HEREBY EXECUTES THE SAME AND MAKES THIS AGREEMENT AND THE RELEASE AND AGREEMENTS PROVIDED FOR HEREIN VOLUNTARILY AND OF HER OWN FREE WILL.

NOW, THEREFORE, by signing below, the Parties have executed this Agreement and General Release, freely and voluntarily.

THIS IS A LEGAL AGREEMENT AND RELEASE/WAIVER OF CLAIMS

READ CAREFULLY BEFORE SIGNING

| /s/ Hang Thi Bich Pham | Dated: May 11, 2023 | ||

| Name: | Hang Thi Bich Pham | ||

AUTHID INC.

| By: | /s/ Rhoniel A. Daguro | Dated: May 11, 2023 | ||

| Name: | Rhoniel A. Daguro | |||

| Title: | CEO | |||

5

Exhibit 99.1

authID Reports Financial and Operating Results for the Quarter Ended March 31, 2023

Management to Host Conference Call Today at 5:30 p.m. EDT

DENVER, May 11, 2023 (GLOBE NEWSWIRE) -- authID® [Nasdaq: AUID] a leading provider of secure identity authentication solutions today reported financial and operating results for the quarter ended March 31, 2023.

“Balancing uncompromised cybersecurity with an easy user experience, authID’s biometric identity technology delivers the enhanced, non-repudiable authentication needed to protect both workforce and consumer applications against identity fraud and cyberattacks associated with compromised credentials,” said CEO Rhon Daguro.

“With exponential growth predicted for digital transactions, the authID team is focused on achieving market momentum by delivering the faster, frictionless, and accurate user identity solutions on which highly secure enterprises and digital commerce will be built,” concluded Daguro.

Financial Results for the First Quarter Ended March 31, 2023:

The following highlights comprise results from continuing operations.

| ● | Total revenue was $0.04 million for the first quarter ended March 31, 2023, compared with $0.2 million for the first quarter of 2022. The reduction was primarily attributed to revenue from a legacy authentication product that was discontinued in April 2022. |

| ● | Loss for the three-month period in 2023 was $5.2 million, of which non-cash and one-time severance charges were $3.0 million, compared with a loss of $5.1 million, of which non-cash and one-time severance charges were $2.3 million, for the comparable period in 2022. |

| ● | Net loss per share was $0.21 for the first quarter ended March 31, 2023, compared with net loss per share of $0.22 for the first quarter of 2022. |

| ● | Adjusted EBITDA loss improved to $2.2 million for the first quarter ended March 31, 2023, compared with an Adjusted EBITDA loss of $2.8 million for the first quarter of 2022, primarily due to cost savings from the restructuring plan executed in the first quarter of 2023. |

| ● | In March, the Company secured financing of up to $3.6 million under a facility agreement with Stephen J. Garchik, and completed a $0.9 million initial drawdown before fees, and expenses. |

Please refer to Table 1 for reconciliation of net loss to Adjusted EBITDA (a non-GAAP measure).

Operational Highlights for the First Quarter of 2023:

| ● | Appointed Rhon Daguro as Chief Executive Officer and Joe Trelin as Chairman of the Board. |

| ● | Appointed four new directors to the authID Board including Rhon Daguro, Ken Jisser, Thomas Szoke and Michael Thompson, joining Directors Michael Koehneman and Jacqueline White. |

| ● | Named for the second year in a row “Best ID Management Platform” by Fintech Breakthrough Awards. |

| ● | Expanded the reach of its Verified CloudConnect ecosystem with the Okta Workforce Identity Cloud and Okta/Auth0 Customer Identity Cloud, and BeyondTrust’s Privilege Management for Windows & Mac solution. Through these OpenID Connect pre-integrations with key Identity Access providers, authID’s solutions are now easily available through low-code integration by a larger group of organizations needing to secure workforce and consumer applications. |

About authID Inc.

At authID (Nasdaq: AUID), We Are Digital Identity®. authID provides secure identity verification and authentication through Verified™, an easy-to-integrate strong authentication platform. Verified combines document-based identity verification with strong FIDO2 passwordless device authentication and cloud biometrics to deliver identity-first cybersecurity for both workforce and consumer applications. Powered by sophisticated biometric and artificial intelligence technologies, authID establishes trusted digital identities, binds an identity to provisioned devices, and eliminates the risks of passwords to deliver the faster, frictionless, and accurate user identity solutions demanded by today’s digital ecosystem. For more information, go to www.authID.ai.

authID Media Contact

Graham

N. Arad

General Counsel

InvestorRelations@authid.ai

Forward-Looking Statements

This Press Release includes “forward-looking statements.” All statements other than statements of historical facts included herein, including, without limitation, those regarding the future results of operations, cash flow, cash position and financial position, business strategy, plans and objectives of management for future operations of both authID Inc. and its business partners, are forward-looking statements. Such forward-looking statements are based on a number of assumptions regarding authID’s present and future business strategies, and the environment in which authID expects to operate in the future, which assumptions may or may not be fulfilled in practice. Actual results may vary materially from the results anticipated by these forward-looking statements as a result of a variety of risk factors, including the Company’s ability to successfully implement its cost-saving initiatives; the Company’s ability to realize the anticipated benefits of changes to its operations; the terms that its lender may require for any drawdowns under the Facility Agreement; the Company’s ability to attract and retain customers; the Company’s ability to compete effectively; changes in laws, regulations and practices; changes in domestic and international economic and political conditions, the as yet uncertain impact of the war in Ukraine, the Covid-19 pandemic, inflationary pressures, rising energy prices, increases in interest rates, and others. See the Company’s Annual Report on Form 10-K for the Fiscal Year ended December 31, 2022 filed at www.sec.gov and other documents filed with the SEC for other risk factors which investors should consider. These forward-looking statements speak only as to the date of this release and cannot be relied upon as a guide to future performance. authID expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained in this release to reflect any changes in its expectations with regard thereto or any change in events, conditions, or circumstances on which any statement is based.

Non-GAAP Financial Information.

The Company provides certain non-GAAP financial measures in this statement. Management believes that Adjusted EBITDA, when viewed with our results under GAAP and the accompanying reconciliations, provides useful information about our period-over-period results. Adjusted EBITDA is presented because management believes it provides additional information with respect to the performance of our fundamental business activities and is also frequently used by securities analysts, investors, and other interested parties in the evaluation of comparable companies. We also rely on Adjusted EBITDA as a primary measure to review and assess the operating performance of our company and our management. These non-GAAP key business indicators, which include Adjusted EBITDA, should not be considered replacements for and should be read in conjunction with the GAAP financial measures.

We define Adjusted EBITDA as GAAP net loss adjusted to exclude: (1) interest expense, (2) interest income, (3) income tax expense, (4) depreciation and amortization, (5) stock-based compensation expense and (6) severance and certain other items management believes affect the comparability of operating results. Please see Table 1 below for a reconciliation of Adjusted EBITDA – continuing operations to net loss – continuing operations, the most directly comparable financial measure calculated and presented in accordance with GAAP.

TABLE 1

Reconciliation of Loss from Continuing Operations to Adjusted EBITDA Continuing Operations.

| Three Months Ended March 31, | ||||||||

| 2023 | 2022 | |||||||

| Loss from continuing operations | $ | (5,220,239 | ) | $ | (5,104,208 | ) | ||

| Addback: | ||||||||

| Interest expense, debt discount and debt issuance costs amortization expense | 800,073 | 32,857 | ||||||

| Other expense (income) | - | (1,456 | ) | |||||

| Severance expenses | 811,041 | 150,000 | ||||||

| Depreciation and amortization | 76,017 | 215,476 | ||||||

| Taxes | - | 4,972 | ||||||

| Non-cash recruiting fees | 492,000 | - | ||||||

| Stock compensation | 840,021 | 1,866,989 | ||||||

| Adjusted EBITDA continuing operations (Non-GAAP) | $ | (2,201,087 | ) | $ | (2,835,370 | ) | ||

AUTHID

INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| Three Months Ended March 31, |

||||||||

| 2023 | 2022 | |||||||

| Revenues: | ||||||||

| Verified software license | $ | 35,778 | $ | 35,493 | ||||

| Legacy authentication services | 2,078 | 129,559 | ||||||

| Total revenues, net | 37,856 | 165,052 | ||||||

| Operating Expenses: | ||||||||

| General and administrative | 3,276,191 | 3,643,909 | ||||||

| Research and development | 1,105,814 | 1,373,502 | ||||||

| Depreciation and amortization | 76,017 | 215,476 | ||||||

| Total operating expenses | 4,458,022 | 5,232,887 | ||||||

| Loss from continuing operations | (4,420,166 | ) | (5,067,835 | ) | ||||

| Other (Expense) Income | ||||||||

| Interest expense including debts issuance costs amortization | (800,073 | ) | (32,857 | ) | ||||

| Other income | - | 1,456 | ||||||

| Other expense, net | (800,073 | ) | (31,401 | ) | ||||

| Loss from continuing operations before income taxes | (5,220,239 | ) | (5,099,236 | ) | ||||

| Income tax expense | - | (4,972 | ) | |||||

| Loss from continuing operations | (5,220,239 | ) | (5,104,208 | ) | ||||

| Loss from discontinued operations | (2,255 | ) | (196,520 | ) | ||||

| Net loss | $ | (5,222,494 | ) | $ | (5,300,728 | ) | ||

| Net Loss Per Share - Basic and Diluted | ||||||||

| Continuing operations | $ | (0.21 | ) | $ | (0.22 | ) | ||

| Discontinued operations | $ | (0.00 | ) | $ | (0.01 | ) | ||

| Weighted Average Shares Outstanding - Basic and Diluted | 25,325,154 | 23,563,852 | ||||||

AUTHID

INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| March 31, | December 31, | |||||||

| 2023 | 2022 | |||||||

| (unaudited) | ||||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash | $ | 1,587,982 | $ | 3,237,106 | ||||

| Accounts receivable, net | 55,391 | 261,809 | ||||||

| Other current assets | 425,024 | 729,342 | ||||||

| Current assets held for sale | 64,671 | 118,459 | ||||||

| Total current assets | 2,133,068 | 4,346,716 | ||||||

| Other Assets | - | 250,383 | ||||||

| Intangible Assets, net | 490,242 | 566,259 | ||||||

| Goodwill | 4,183,232 | 4,183,232 | ||||||

| Non-current assets held for sale | 23,685 | 27,595 | ||||||

| Total assets | $ | 6,830,227 | $ | 9,374,185 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | ||||||||

| Current Liabilities: | ||||||||

| Accounts payable and accrued expenses | $ | 1,871,443 | $ | 1,154,072 | ||||

| Deferred revenue | 73,869 | 81,318 | ||||||

| Current liabilities held for sale | 17,795 | 13,759 | ||||||

| Total current liabilities | 1,963,107 | 1,249,149 | ||||||

| Non-current Liabilities: | ||||||||

| Credit facility, net | 458,800 | - | ||||||

| Convertible debt, net | 7,983,896 | 7,841,500 | ||||||

| Accrued severance liability | 325,000 | - | ||||||

| Total liabilities | 10,730,803 | 9,090,649 | ||||||

| Stockholders’ (Deficit) Equity: | ||||||||

| Common stock, $0.0001 par value, 250,000,000 shares authorized; 25,864,437 and 25,319,095 shares issued and outstanding as of March 31, 2023 and December 31, 2022, respectively | 2,587 | 2,532 | ||||||

| Additional paid in capital | 141,317,627 | 140,255,234 | ||||||

| Accumulated deficit | (145,352,653 | ) | (140,130,159 | ) | ||||

| Accumulated comprehensive income | 131,863 | 155,929 | ||||||

| Total stockholders’ (deficit) equity | (3,900,576 | ) | 283,536 | |||||

| Total liabilities and stockholders’ (deficit) equity | $ | 6,830,227 | $ | 9,374,185 | ||||

4

Exhibit 99.2

Denver, CO NASDAQ : AUID © © 2 2 0 0 2 2 © 2023 authID Inc. All Rights Reserved. 3 authID Inc. All Rights Reserved. Q1 2023 Results Conference Call May 11, 2022 Slides Available @ 5:30pm

• This Presentation and information provided at a webcast or meeting at which it is presented (the “Presentation") has been prepared on the basis of information furnished by the management of authID Inc . (“authID” or the “Company”) and has not been independently verified by any third party . • This Presentation is provided for information purposes only . This Presentation is not an offer to sell nor a solicitation of an offer to buy any securities . • While the Company is not aware of any inaccuracies, no warranty or representation is made by the Company or its employees and representatives as to the completeness or accuracy of the information contained herein . This presentation also contains estimates and other statistical data made by independent parties and us relating to market size and other data about our industry . This data involves a number of assumptions and limitations, and you should not give undue weight to such data and estimates . • Information contained in this Presentation or presented during this meeting may include “forward - looking statements . ” All statements other than statements of historical facts included herein, including, without limitation, those regarding the future results of operations, cash position and cash flow of the Company, financial position, results of operations, business strategy, plans and objectives of management for future operations of both authID and its business partners, future service launches with customers, the outcome of pilots and new initiatives and customer pipeline are forward - looking statements . Such forward - looking statements are based on a number of assumptions regarding authID’s present and future business strategies, and the environment in which authID expects to operate in the future, which assumptions may or may not be fulfilled in practice . Implementation of some or all of the new services referred to is subject to third - party approvals and activities . Actual results may vary materially from the results anticipated by these forward - looking statements as a result of a variety of risk factors, including the risk that implementation, adoption and offering of the service by customers, consumers and others may take longer than anticipated, or may not occur at all ; changes in laws, regulations and practices ; changes in domestic and international economic and political conditions, the impact of the war in Ukraine, pandemic, inflationary pressures, and increases in interest rates and others . See the Company’s Annual Report on Form 10 - K for the Fiscal Year ended December 31 , 2022 and other documents filed at www . sec . gov for other risk factors which anyone considering a transaction with the Company should consider . These forward - looking statements speak only as to the date of this Presentation, webcast or meeting and cannot be relied upon as a guide to future performance . authID expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward - looking statements contained in this Presentation to reflect any changes in its expectations with regard thereto or any change in events, conditions or circumstances on which any statement is based . • This Presentation contains references to the Company’s and other entities’ trademarks . Such trademarks are the property of their respective owner . The Company does not intend its use or the display of other companies’ trade names or trademarks to imply a relationship with or endorsement of the Company by any other entity . • By reading this Presentation or attending a webcast or meeting at which it is presented you accept and agree to these terms, disclaimers and limitations . - 2 - © 2023 authID Inc. All Rights Reserved. Disclaimer & Forward Looking Statements

• Total Revenue was $0.04M for Q1 23, compared with $0.2M a year ago • Operating Expenses were $4.5M for Q1 23, compared with $5.2M a year ago • Loss was $5.2M for Q1 23, including non - cash & one - time severance charges of $3.0M, compared with a loss of $5.1M , including non - cash & one - time severance charges of $2.3M, a year ago • Loss per Share was $0.21 for Q1 23, compared with $0.22 a year ago • Adjusted EBITDA Loss was $2.2M for Q1 23, compared with $2.8M a year ago, primarily due to cost savings from the restructuring plan executed in the first quarter of 2023. • In March, the Company secured financing of up to $3.6M under a facility agreement with Stephen J. Garchik, and completed an initial drawdown of $0.9M before fees and expenses. - 3 - © 2023 authID Inc. All Rights Reserved. Financial Results for Q1 2023

Denver, CO NASDAQ : AUID © © 2 2 0 0 2 2 © 2023 authID Inc. All Rights Reserved. 3 authID Inc. All Rights Reserved. Our Path Forward

New Executive Leadership - 5 - Joe Trelin Chairman Ken Jisser Director Rhon Daguro CEO & Director Thomas Szoke Director Michael Thompson Director © 2023 authID Inc. All Rights Reserved. Michael Koehneman Director Jacqueline White Director

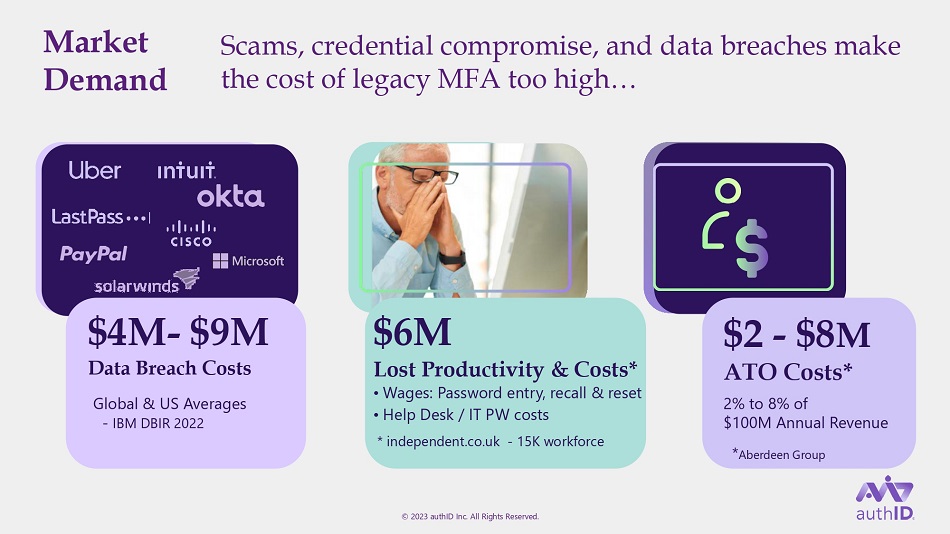

Market Demand $4M - $9M Data Breach Costs Global & US Averages - IBM DBIR 2022 Scams, credential compromise, and data breaches make the cost of legacy MFA too high… $6M Lost Productivity & Costs* • Wages: Password entry, recall & reset • Help Desk / IT PW costs * independent.co.uk - 15K workforce $2 - $8 M ATO Costs* 2% to 8% of $100M Annual Revenue * Aberdeen Group © 2023 authID Inc. All Rights Reserved.

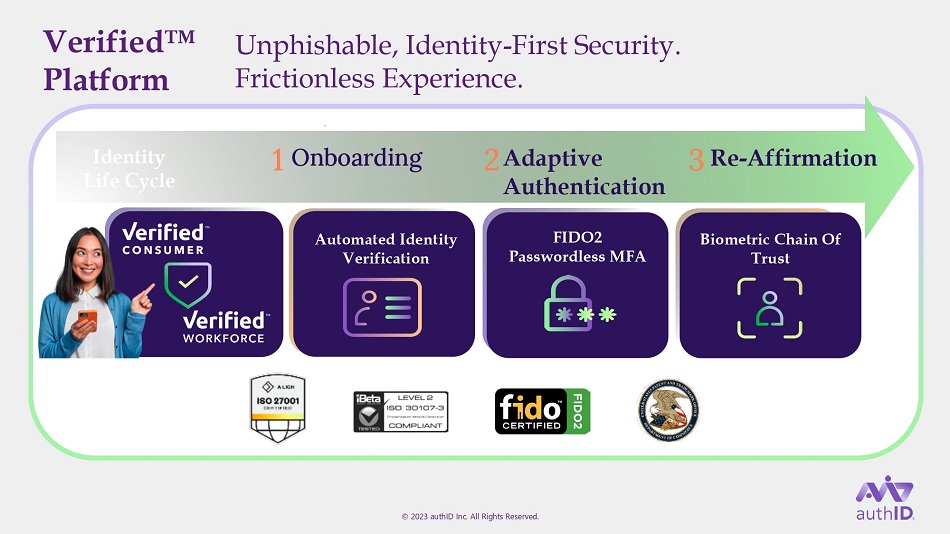

Identity Life Cycle 1 Onboarding 2 Adaptive Authentication 3 Re - Affirmation Verified ̻ Platform Biometric Chain Of Trust FIDO2 Passwordless MFA Automated Identity Verification Unphishable, Identity - First Security. Frictionless Experience. © 2023 authID Inc. All Rights Reserved.

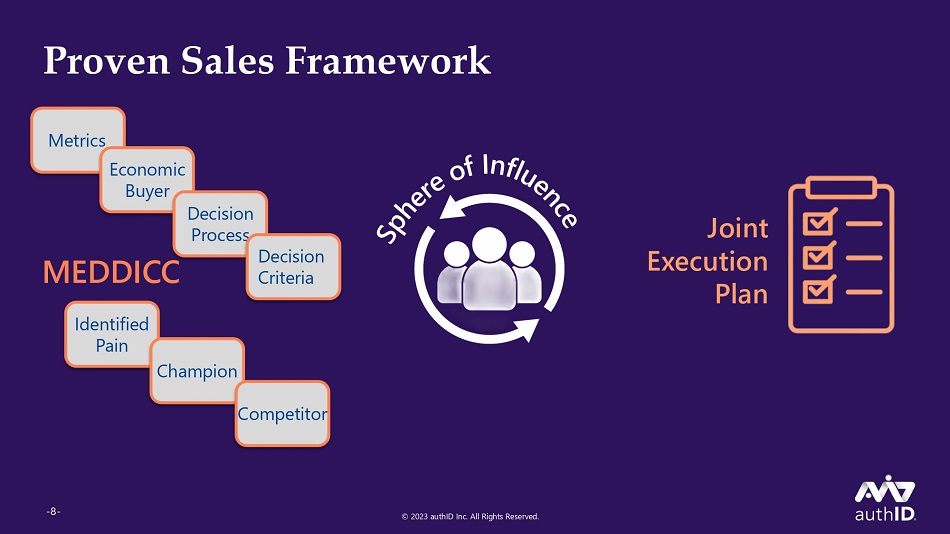

Proven Sales Framework Metrics Economic Buyer Decision Process Decision Criteria Competitor MEDDICC Identified Pain Champion Joint Execution Plan - 8 - © 2023 authID Inc. All Rights Reserved.

High Performance Sales Culture authID University - 9 - © 2023 authID Inc. All Rights Reserved. Customer Focused Compete To Win

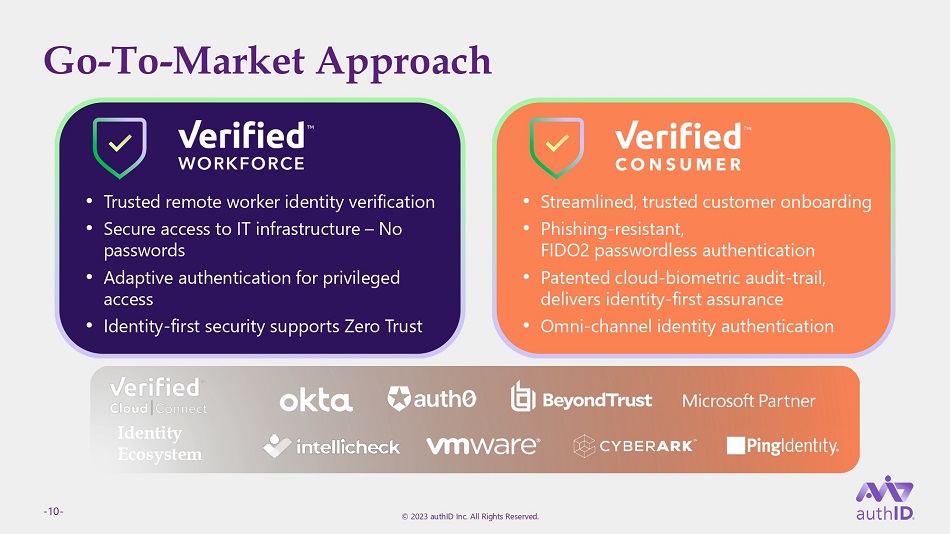

Go - To - Market Approach • Trusted remote worker identity verification • Secure access to IT infrastructure – No passwords • Adaptive authentication for privileged access • Identity - first security supports Zero Trust • Streamlined, trusted customer onboarding • Phishing - resistant, FIDO2 passwordless authentication • Patented cloud - biometric audit - trail, delivers identity - first assurance • Omni - channel identity authentication Identity Ecosystem - 10 - © 2023 authID Inc. All Rights Reserved.

Current Sales Activity Revisit Past 600 Prospects Top 200 Targets Strategic 100 and Tactical 100 20+ Active Opportunities - 11 - © 2023 authID Inc. All Rights Reserved.

© © 2 2 0 0 2 2 © 2023 authID Inc. All Rights Reserved. 3 authID Inc. All Rights Reserved. Q&A Denver, CO NASD - A 1 2 Q - : AUID