Q3 2025Quarterly Supplemental Information EX-99.2

Table of Contents 2 Section Page Company Overview 3 Quarterly Highlights 4 Income Statement 5 Balance Sheet 6 GAAP Reconciliation to FFO and AFFO 7 GAAP Reconciliation to Adjusted EBITDAre and Cash NOI 8 Net Asset Value Components 9 Capital Structure and Liquidity 10 Net Debt Metrics, Fixed Charge Coverage and Covenants 11 Capital Deployment Activity 13 Disposition Activity 14 Diversification: Top 60 Tenant Concepts 16 Diversification: Tenant Industry 17 Diversification: Property Map & Geography 18 Lease Expirations, Occupancy and Escalations 19 Non-GAAP Definitions and Explanations 21 Other Definitions and Explanations 22 – 23 Forward-Looking and Cautionary Statements 24

FrontView is an internally-managed net-lease REIT that acquires, owns and manages primarily properties with frontage that are net leased to a diversified group of tenants. FrontView is differentiated by an investment approach focused on properties that are in prominent locations with frontage on high-traffic roads that are highly visible to consumers. 3 Company Overview Company Contact Information Pierre Revol Chief Financial Officer prevol@frontviewreit.com The Company is differentiated by an investment approach focused on properties that are in prominent locations with direct frontage on high-traffic roads that are highly visible to consumers. As of September 30, 2025, the Company owned a well-diversified portfolio of 307 properties with direct frontage across 37 U.S. states. The Company's tenants include service-oriented businesses, such as: Medical and Dental Providers Quick Service Restaurants Casual Dining Financial Institutions Other – Service Cellular Stores Fitness Operators Automotive Stores Discount Retail Automotive Dealers Convenience Stores and Gas Stations Car Washes Home Improvement Stores Pharmacies Other – Necessity Professional Services Executive Team Stephen Preston Chairman of the Board Robert Green Director Elizabeth Frank Independent Director Daniel Swanstrom Independent Director Noelle LeVeaux Independent Director Ernesto Perez Independent Director Stephen Preston Chairman of the Board,President and Chief Executive Officer Pierre Revol Chief Financial Officer Drew Ireland Chief Operating Officer Sean Fukumura Chief Accounting Officer Board of Directors

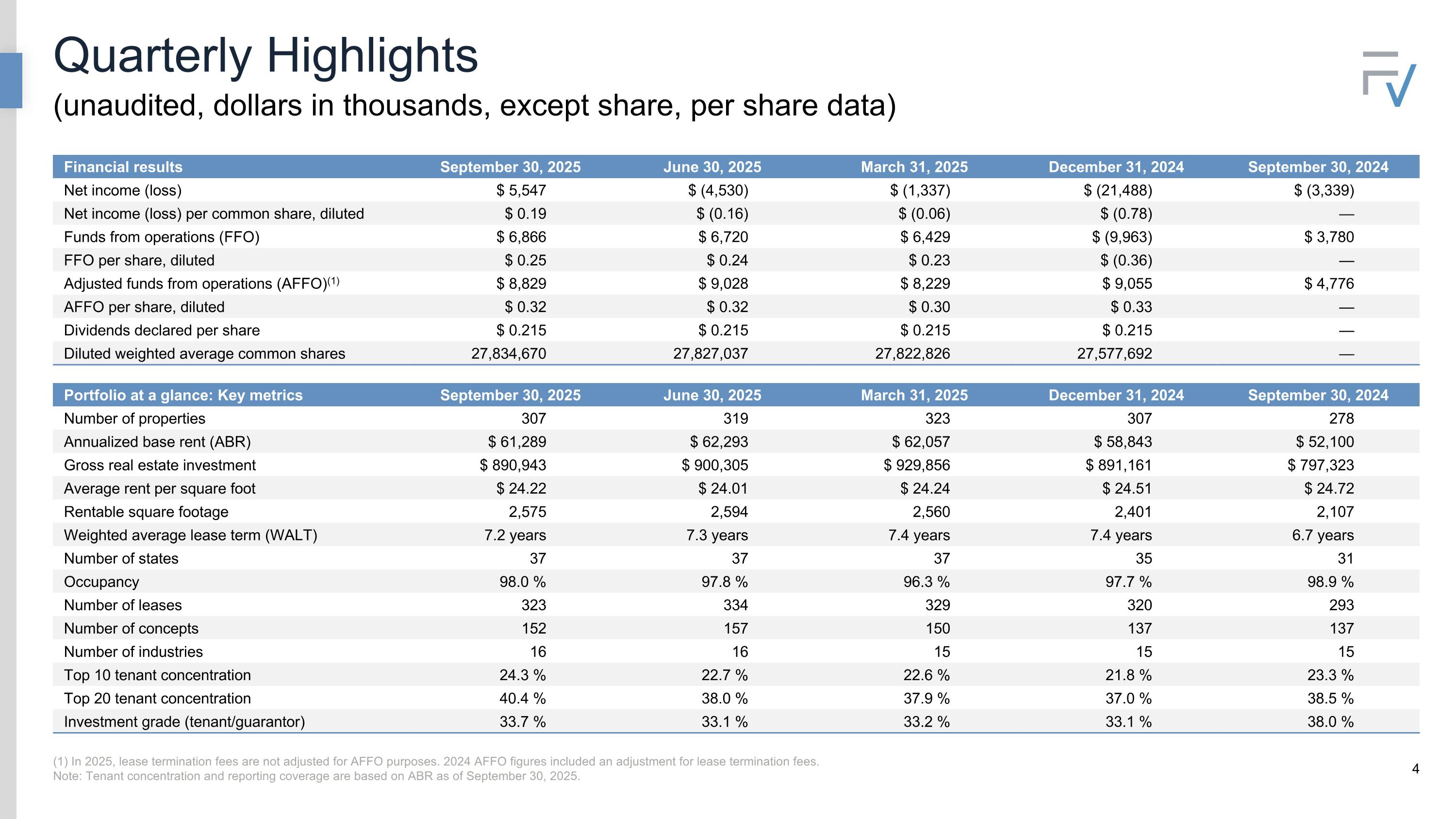

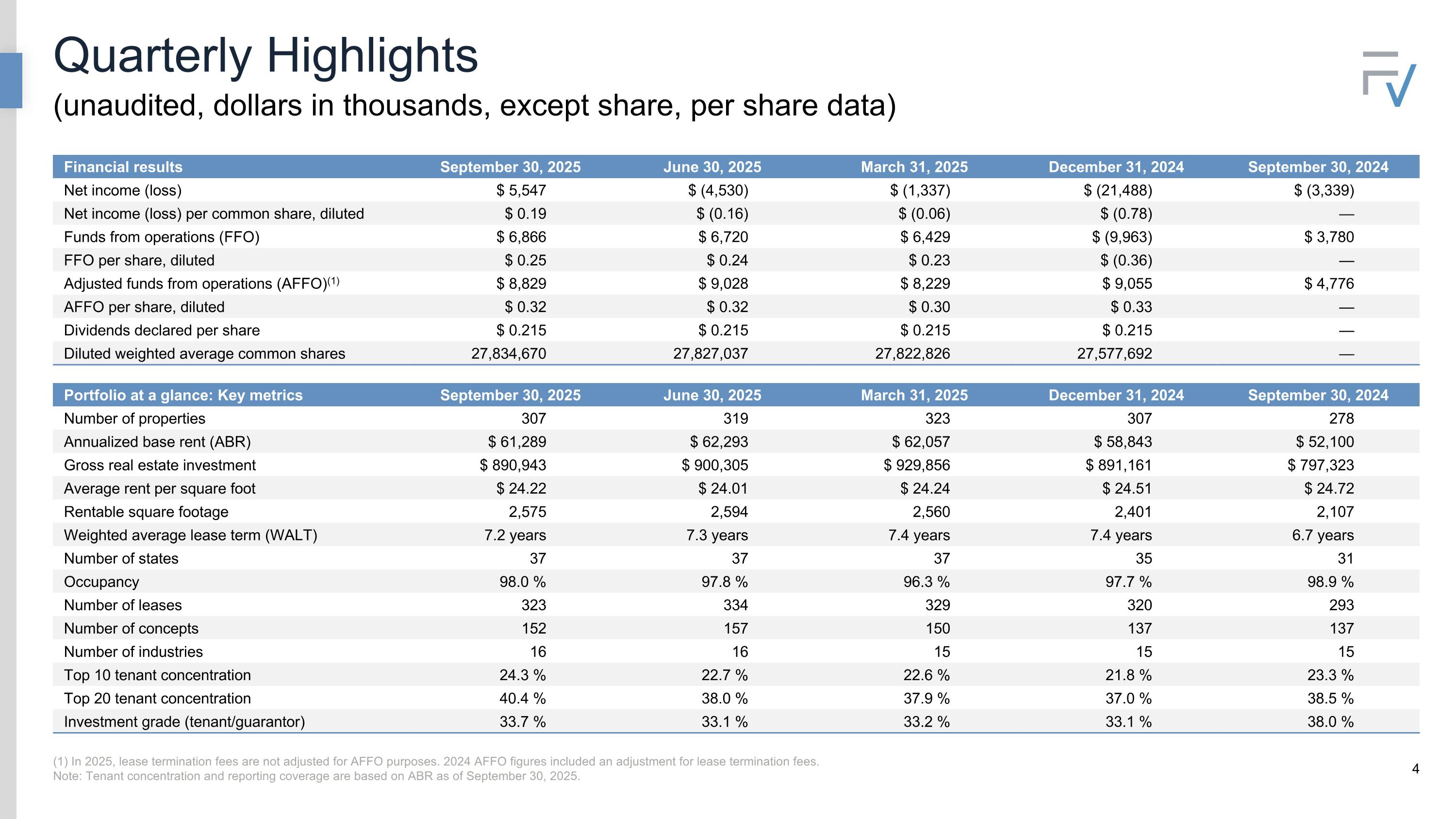

Quarterly Highlights (unaudited, dollars in thousands, except share, per share data) Financial results September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Net income (loss) $ 5,547 $ (4,530) $ (1,337) $ (21,488) $ (3,339) Net income (loss) per common share, diluted $ 0.19 $ (0.16) $ (0.06) $ (0.78) — Funds from operations (FFO) $ 6,866 $ 6,720 $ 6,429 $ (9,963) $ 3,780 FFO per share, diluted $ 0.25 $ 0.24 $ 0.23 $ (0.36) — Adjusted funds from operations (AFFO)(1) $ 8,829 $ 9,028 $ 8,229 $ 9,055 $ 4,776 AFFO per share, diluted $ 0.32 $ 0.32 $ 0.30 $ 0.33 — Dividends declared per share $ 0.215 $ 0.215 $ 0.215 $ 0.215 — Diluted weighted average common shares 27,834,670 27,827,037 27,822,826 27,577,692 — Portfolio at a glance: Key metrics September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Number of properties 307 319 323 307 278 Annualized base rent (ABR) $ 61,289 $ 62,293 $ 62,057 $ 58,843 $ 52,100 Gross real estate investment $ 890,943 $ 900,305 $ 929,856 $ 891,161 $ 797,323 Average rent per square foot $ 24.22 $ 24.01 $ 24.24 $ 24.51 $ 24.72 Rentable square footage 2,575 2,594 2,560 2,401 2,107 Weighted average lease term (WALT) 7.2 years 7.3 years 7.4 years 7.4 years 6.7 years Number of states 37 37 37 35 31 Occupancy 98.0 % 97.8 % 96.3 % 97.7 % 98.9 % Number of leases 323 334 329 320 293 Number of concepts 152 157 150 137 137 Number of industries 16 16 15 15 15 Top 10 tenant concentration 24.3 % 22.7 % 22.6 % 21.8 % 23.3 % Top 20 tenant concentration 40.4 % 38.0 % 37.9 % 37.0 % 38.5 % Investment grade (tenant/guarantor) 33.7 % 33.1 % 33.2 % 33.1 % 38.0 % (1) In 2025, lease termination fees are not adjusted for AFFO purposes. 2024 AFFO figures included an adjustment for lease termination fees. Note: Tenant concentration and reporting coverage are based on ABR as of September 30, 2025.

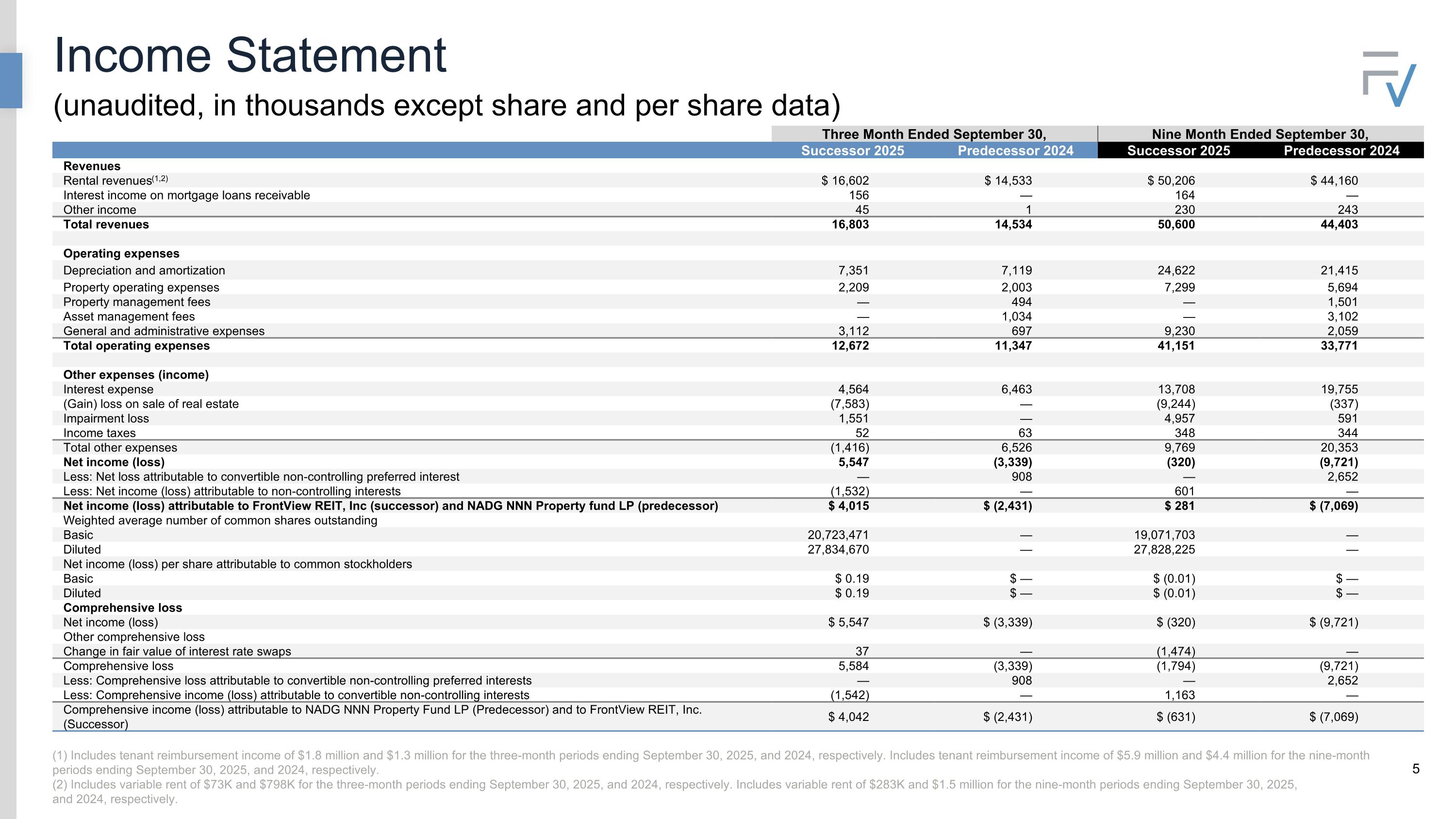

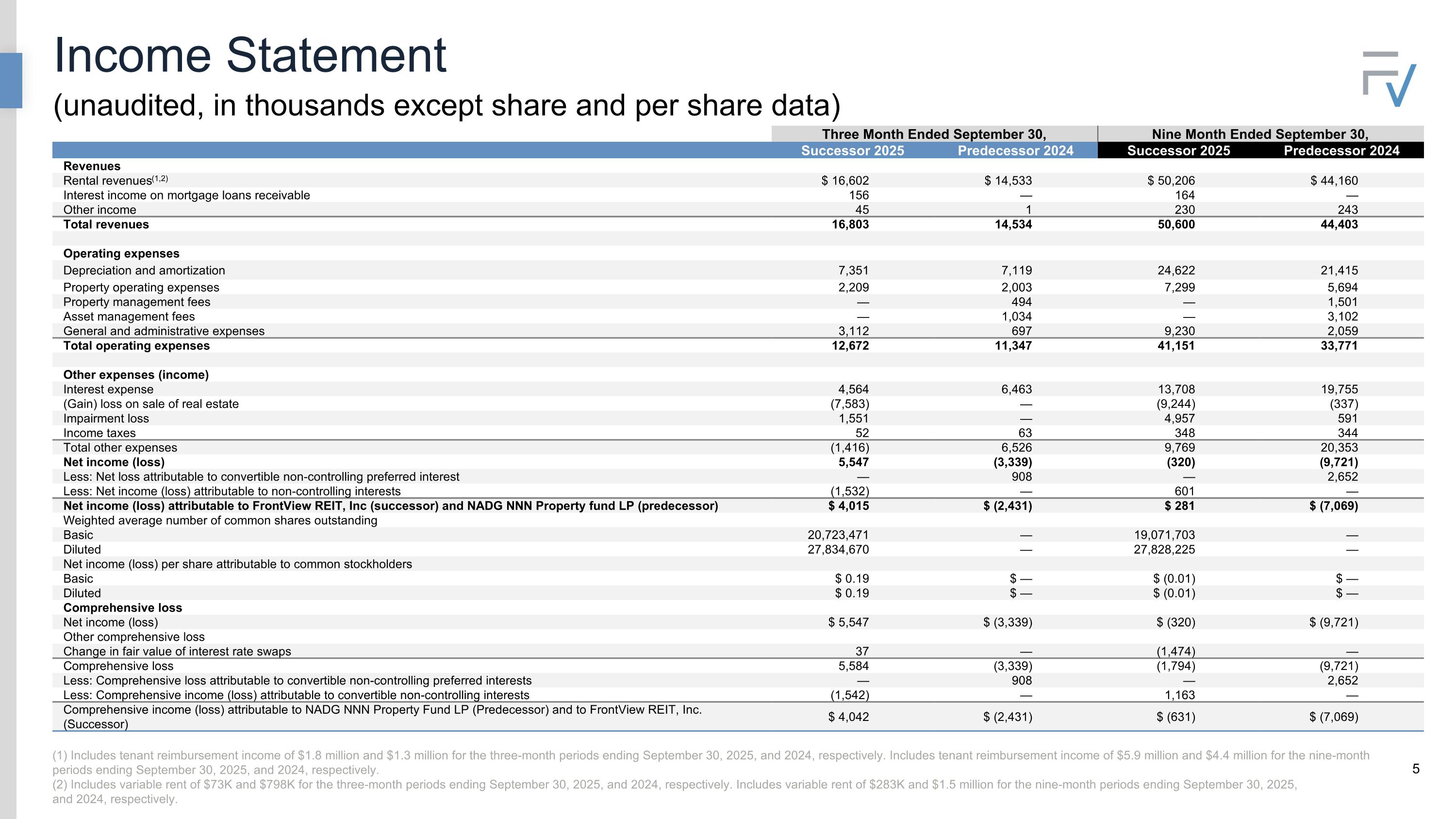

Income Statement (unaudited, in thousands except share and per share data) Three Month Ended September 30, Nine Month Ended September 30, Successor 2025 Predecessor 2024 Successor 2025 Predecessor 2024 Revenues Rental revenues(1,2) $ 16,602 $ 14,533 $ 50,206 $ 44,160 Interest income on mortgage loans receivable 156 — 164 — Other income 45 1 230 243 Total revenues 16,803 14,534 50,600 44,403 Operating expenses Depreciation and amortization 7,351 7,119 24,622 21,415 Property operating expenses 2,209 2,003 7,299 5,694 Property management fees — 494 — 1,501 Asset management fees — 1,034 — 3,102 General and administrative expenses 3,112 697 9,230 2,059 Total operating expenses 12,672 11,347 41,151 33,771 Other expenses (income) Interest expense 4,564 6,463 13,708 19,755 (Gain) loss on sale of real estate (7,583) — (9,244) (337) Impairment loss 1,551 — 4,957 591 Income taxes 52 63 348 344 Total other expenses (1,416) 6,526 9,769 20,353 Net income (loss) 5,547 (3,339) (320) (9,721) Less: Net loss attributable to convertible non-controlling preferred interest — 908 — 2,652 Less: Net income (loss) attributable to non-controlling interests (1,532) — 601 — Net income (loss) attributable to FrontView REIT, Inc (successor) and NADG NNN Property fund LP (predecessor) $ 4,015 $ (2,431) $ 281 $ (7,069) Weighted average number of common shares outstanding Basic 20,723,471 — 19,071,703 — Diluted 27,834,670 — 27,828,225 — Net income (loss) per share attributable to common stockholders Basic $ 0.19 $ — $ (0.01) $ — Diluted $ 0.19 $ — $ (0.01) $ — Comprehensive loss Net income (loss) $ 5,547 $ (3,339) $ (320) $ (9,721) Other comprehensive loss Change in fair value of interest rate swaps 37 — (1,474) — Comprehensive loss 5,584 (3,339) (1,794) (9,721) Less: Comprehensive loss attributable to convertible non-controlling preferred interests — 908 — 2,652 Less: Comprehensive income (loss) attributable to convertible non-controlling interests (1,542) — 1,163 — Comprehensive income (loss) attributable to NADG NNN Property Fund LP (Predecessor) and to FrontView REIT, Inc. (Successor) $ 4,042 $ (2,431) $ (631) $ (7,069) (1) Includes tenant reimbursement income of $1.8 million and $1.3 million for the three-month periods ending September 30, 2025, and 2024, respectively. Includes tenant reimbursement income of $5.9 million and $4.4 million for the nine-month periods ending September 30, 2025, and 2024, respectively. (2) Includes variable rent of $73K and $798K for the three-month periods ending September 30, 2025, and 2024, respectively. Includes variable rent of $283K and $1.5 million for the nine-month periods ending September 30, 2025, and 2024, respectively.

Balance Sheet (unaudited, in thousands) Assets September 30, 2025 December 31, 2024 Assets Real estate held for investment, at cost Land $ 325,699 $ 332,944 Buildings and improvements 399,052 386,462 Total real estate held for investment, at cost 724,751 719,406 Less accumulated depreciation (45,065) (40,398) Real estate held for investment, net 679,686 679,008 Assets held for sale 17,667 5,898 Mortgage loans receivable 10,274 — Cash and cash equivalents 19,595 5,094 Intangible lease assets, net 101,685 114,868 Other assets 17,883 16,941 Total assets $ 846,790 $ 821,809 Liabilities and equity Liabilities Debt, net $ 307,071 $ 266,538 Intangible lease liabilities, net 14,050 14,735 Accounts payable and accrued liabilities 21,518 17,858 Total liabilities 342,639 299,131 Equity Common stock, par value $0.01 per share 212 173 Additional paid-in capital 405,222 331,482 Accumulated deficit (19,285) ( 6,834) Accumulated other comprehensive loss (938) — Total FrontView REIT, Inc. equity 385,211 324,821 Non-controlling interests in the OP 118,940 197,857 Total equity 504,151 522,678 Total liabilities and equity $ 846,790 $ 821,809

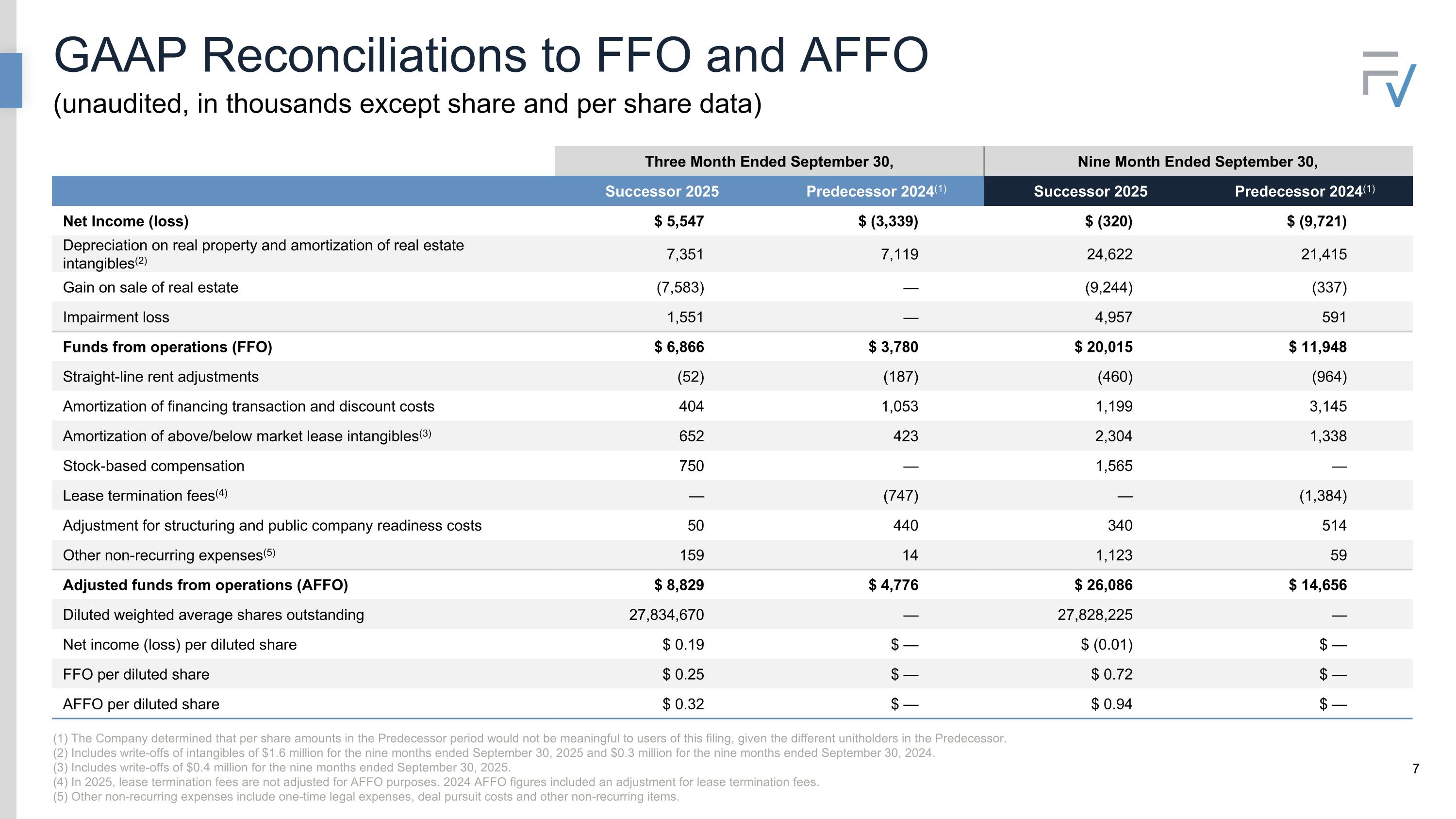

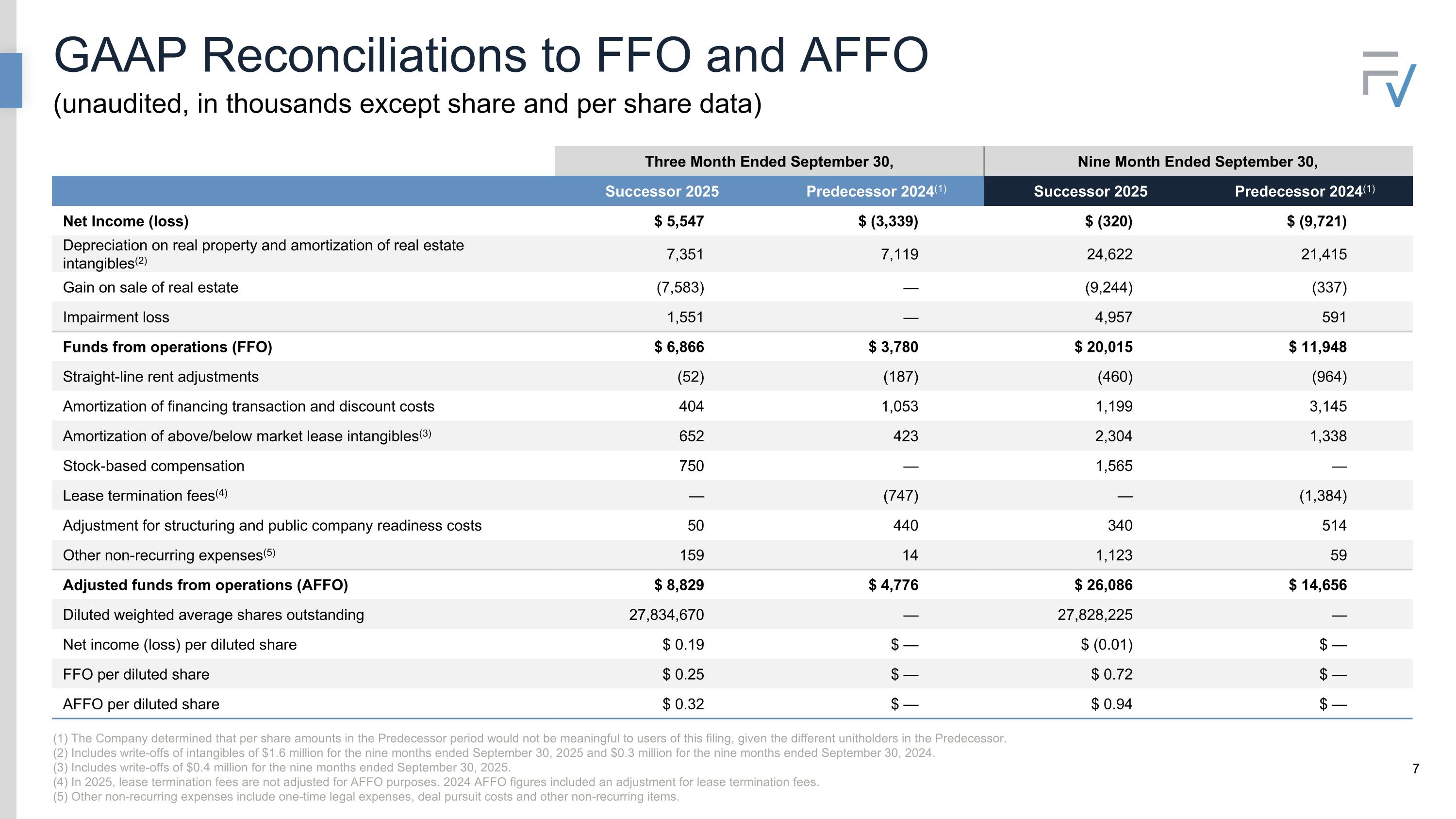

GAAP Reconciliations to FFO and AFFO (unaudited, in thousands except share and per share data) Three Month Ended September 30, Nine Month Ended September 30, Successor 2025 Predecessor 2024(1) Successor 2025 Predecessor 2024(1) Net Income (loss) $ 5,547 $ (3,339) $ (320) $ (9,721) Depreciation on real property and amortization of real estate intangibles(2) 7,351 7,119 24,622 21,415 Gain on sale of real estate (7,583) — (9,244) (337) Impairment loss 1,551 — 4,957 591 Funds from operations (FFO) $ 6,866 $ 3,780 $ 20,015 $ 11,948 Straight-line rent adjustments (52) (187) (460) (964) Amortization of financing transaction and discount costs 404 1,053 1,199 3,145 Amortization of above/below market lease intangibles(3) 652 423 2,304 1,338 Stock-based compensation 750 — 1,565 — Lease termination fees(4) — (747) — (1,384) Adjustment for structuring and public company readiness costs 50 440 340 514 Other non-recurring expenses(5) 159 14 1,123 59 Adjusted funds from operations (AFFO) $ 8,829 $ 4,776 $ 26,086 $ 14,656 Diluted weighted average shares outstanding 27,834,670 — 27,828,225 — Net income (loss) per diluted share $ 0.19 $ — $ (0.01) $ — FFO per diluted share $ 0.25 $ — $ 0.72 $ — AFFO per diluted share $ 0.32 $ — $ 0.94 $ — (1) The Company determined that per share amounts in the Predecessor period would not be meaningful to users of this filing, given the different unitholders in the Predecessor. (2) Includes write-offs of intangibles of $1.6 million for the nine months ended September 30, 2025 and $0.3 million for the nine months ended September 30, 2024. (3) Includes write-offs of $0.4 million for the nine months ended September 30, 2025. (4) In 2025, lease termination fees are not adjusted for AFFO purposes. 2024 AFFO figures included an adjustment for lease termination fees. (5) Other non-recurring expenses include one-time legal expenses, deal pursuit costs and other non-recurring items.

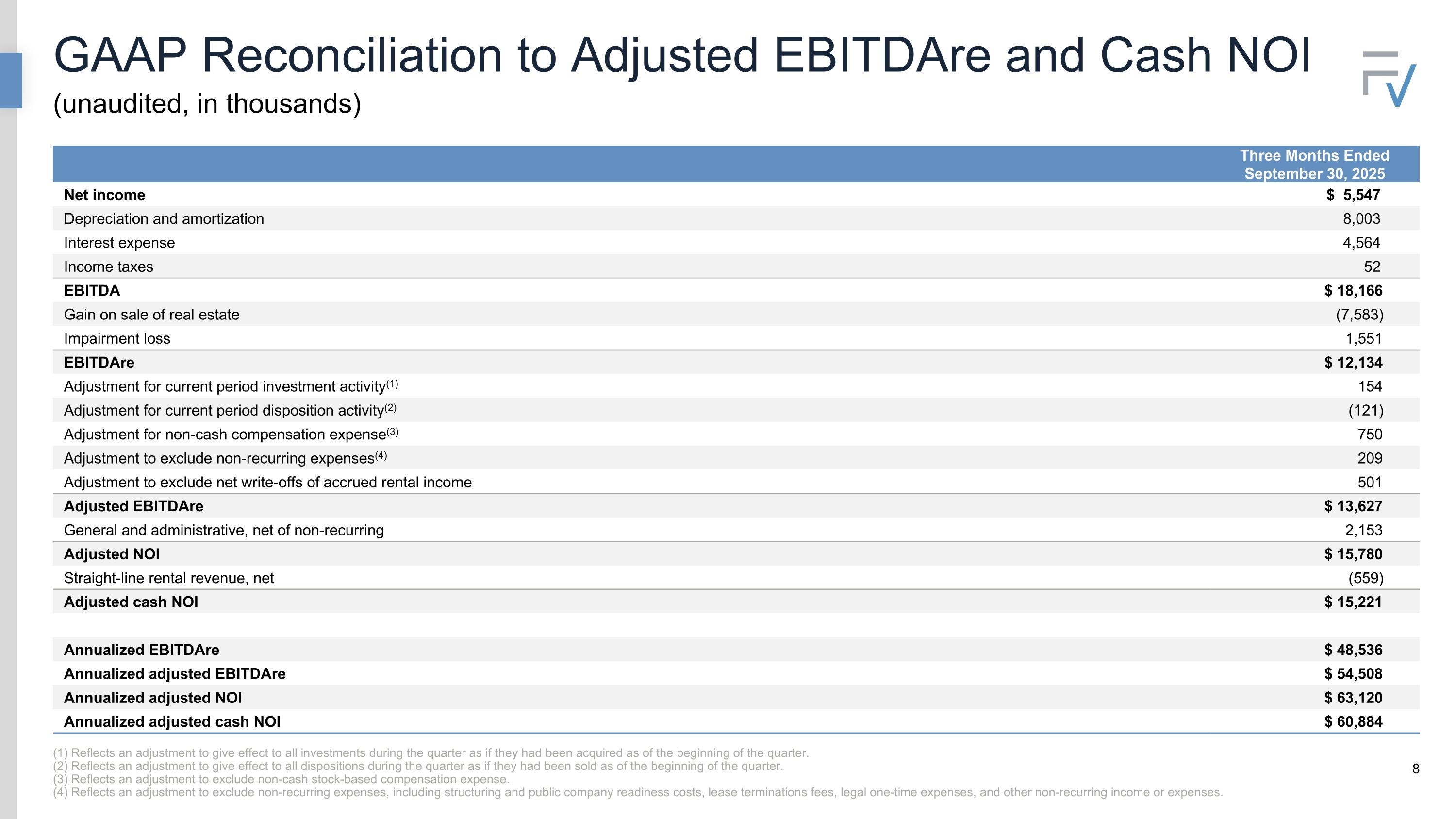

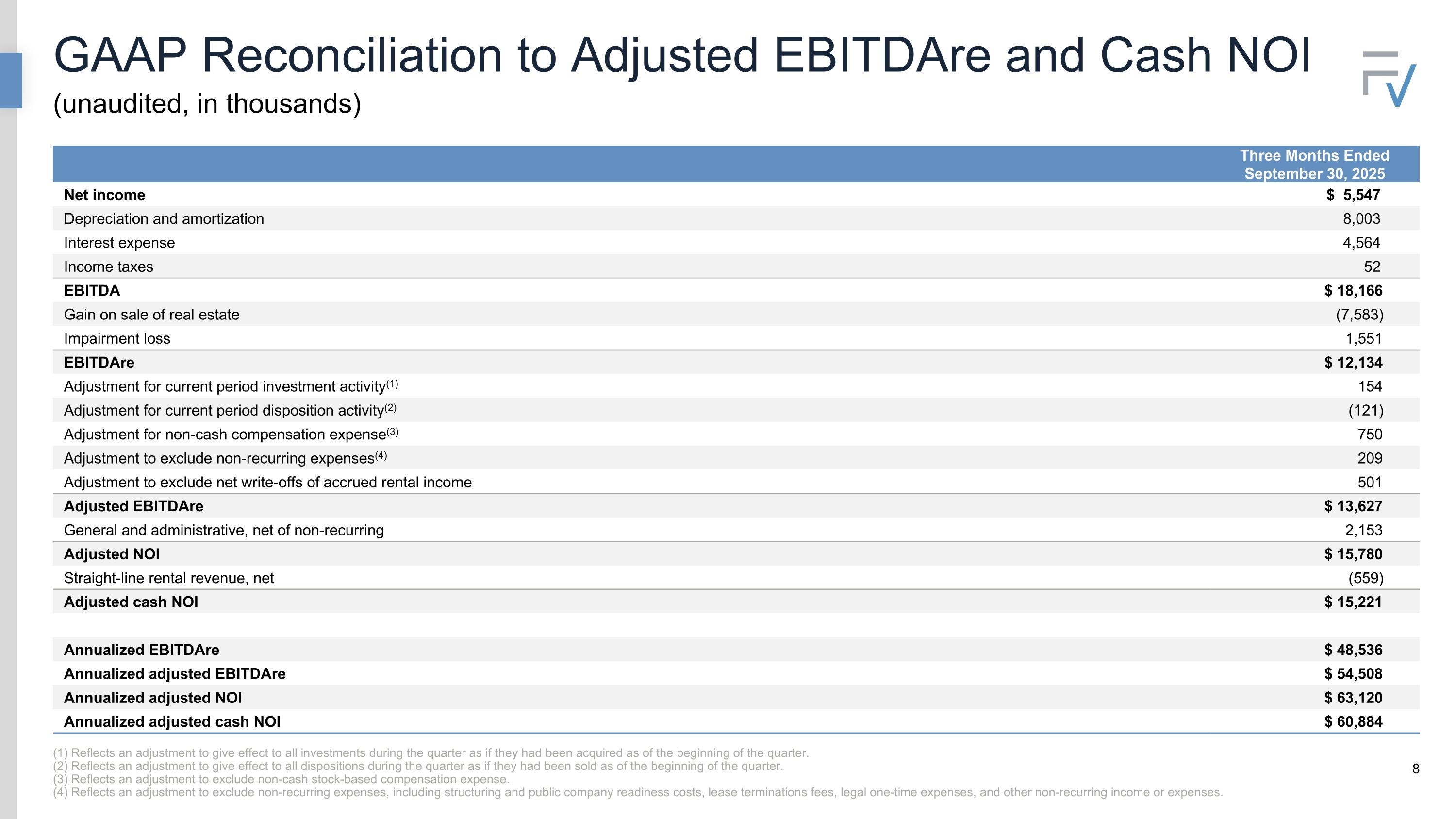

GAAP Reconciliation to Adjusted EBITDAre and Cash NOI (unaudited, in thousands) (1) Reflects an adjustment to give effect to all investments during the quarter as if they had been acquired as of the beginning of the quarter. (2) Reflects an adjustment to give effect to all dispositions during the quarter as if they had been sold as of the beginning of the quarter. (3) Reflects an adjustment to exclude non-cash stock-based compensation expense. (4) Reflects an adjustment to exclude non-recurring expenses, including structuring and public company readiness costs, lease terminations fees, legal one-time expenses, and other non-recurring income or expenses. Three Months Ended September 30, 2025 Net income $ 5,547 Depreciation and amortization 8,003 Interest expense 4,564 Income taxes 52 EBITDA $ 18,166 Gain on sale of real estate (7,583) Impairment loss 1,551 EBITDAre $ 12,134 Adjustment for current period investment activity(1) 154 Adjustment for current period disposition activity(2) (121) Adjustment for non-cash compensation expense(3) 750 Adjustment to exclude non-recurring expenses(4) 209 Adjustment to exclude net write-offs of accrued rental income 501 Adjusted EBITDAre $ 13,627 General and administrative, net of non-recurring 2,153 Adjusted NOI $ 15,780 Straight-line rental revenue, net (559) Adjusted cash NOI $ 15,221 Annualized EBITDAre $ 48,536 Annualized adjusted EBITDAre $ 54,508 Annualized adjusted NOI $ 63,120 Annualized adjusted cash NOI $ 60,884

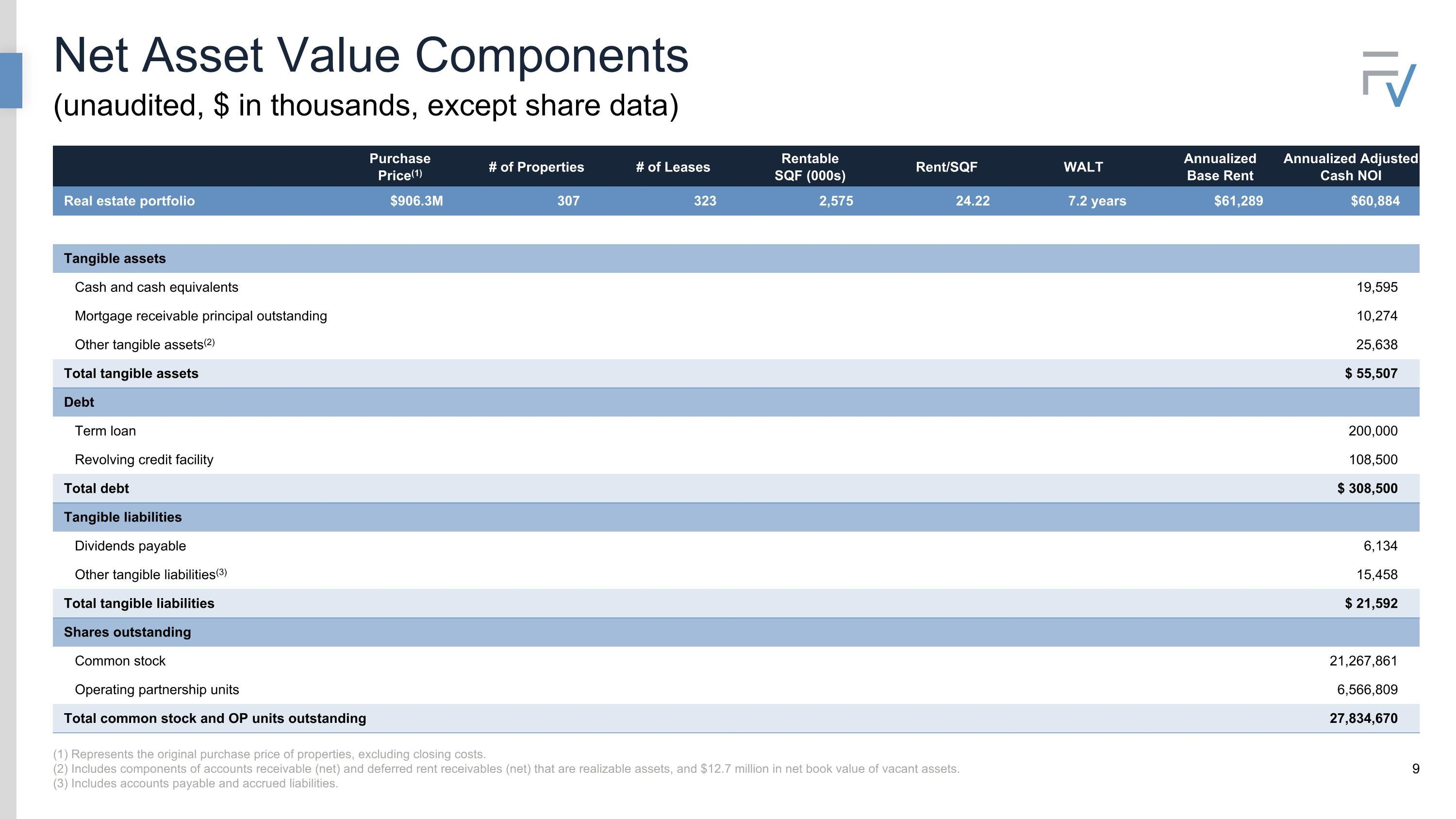

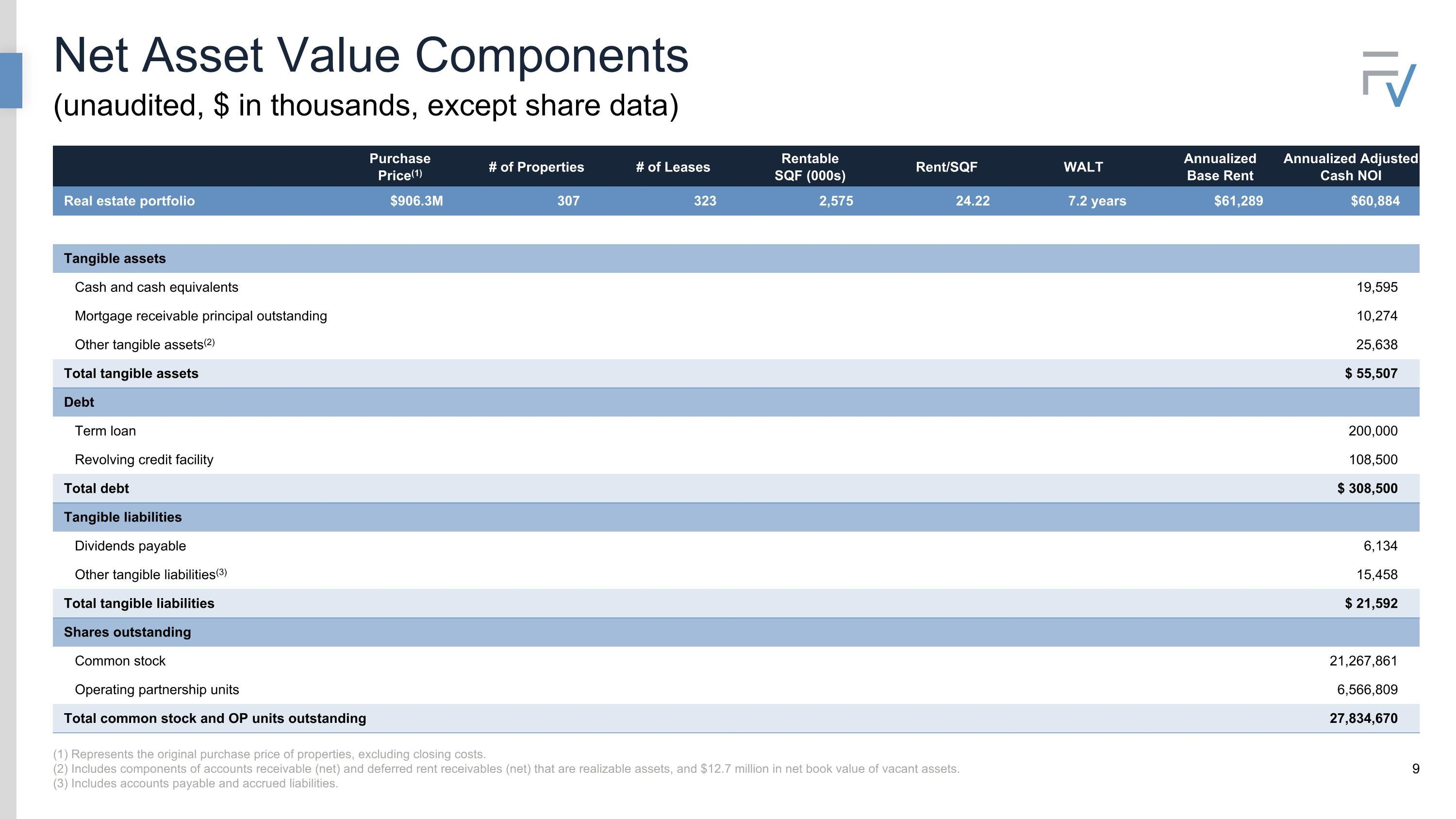

Net Asset Value Components (unaudited, $ in thousands, except share data) (1) Represents the original purchase price of properties, excluding closing costs. (2) Includes components of accounts receivable (net) and deferred rent receivables (net) that are realizable assets, and $12.7 million in net book value of vacant assets. (3) Includes accounts payable and accrued liabilities. PurchasePrice(1) # of Properties # of Leases RentableSQF (000s) Rent/SQF WALT AnnualizedBase Rent Annualized AdjustedCash NOI Real estate portfolio $906.3M 307 323 2,575 24.22 7.2 years $61,289 $60,884 Tangible assets Cash and cash equivalents 19,595 Mortgage receivable principal outstanding 10,274 Other tangible assets(2) 25,638 Total tangible assets $ 55,507 Debt Term loan 200,000 Revolving credit facility 108,500 Total debt $ 308,500 Tangible liabilities Dividends payable 6,134 Other tangible liabilities(3) 15,458 Total tangible liabilities $ 21,592 Shares outstanding Common stock 21,267,861 Operating partnership units 6,566,809 Total common stock and OP units outstanding 27,834,670

Q3 2025 Capital Structure Overview Ample Liquidity and Lowest Leverage Since IPO Note: Metrics as of September 30, 2025. (1) Equity value as of September 30, 2025, was $13.71. (2) During the quarter, the company hedged $100M of 1-month SOFR through March 2028. (3) Both facilities have two 12-month extension options. (4) Excludes non-cash stock-based compensation expense and non-recurring expenses, including lease termination fees. (5) The company entered an amendment post-quarter, reducing the spread to 1.15%, so long as LTV remains below 35%. (6) Including the delayed-draw Convertible Perpetual Preferred, which closed on November 12, 2025, liquidity increases to $236.1 million. Debt, Net Debt and Net Debt to Annualized Adjusted EBIDTAre Interest Rate Interest rate Maturity September 30, 2025 (000s) Revolving Credit Facility SOFR + 1.20%(2, 5) Adj. SOFR + 1.20% 10/3/2027(3) $108,500 Term Loan SOFR + 1.20%(5) Adj. SOFR + 1.2%( 10/3/2027(3) 200,000 Gross Debt $308,500 Cash and Cash Equivalents (19,595) Net Debt $288,905 Annualized Adjusted EBITDAre(4) $54,508 Net Debt to Annualized Adjusted EBITDAre 5.3 x Fixed Charge Coverage Ratio Interest Expense $4,564 Less: Non-Cash Interest (404) Fixed Charges $4,160 Annualized Fixed Charges $16,640 Annualized Adjusted EBITDAre/Annualized Fixed Charges 3.3 x Liquidity Undrawn Revolver Capacity $141,500 Cash and Cash Equivalents 19,595 Total Liquidity(6) $161,095 Capital Structure Total Capitalization $690M Common Stock(1) 42.3% OP Units(1) 13.0%

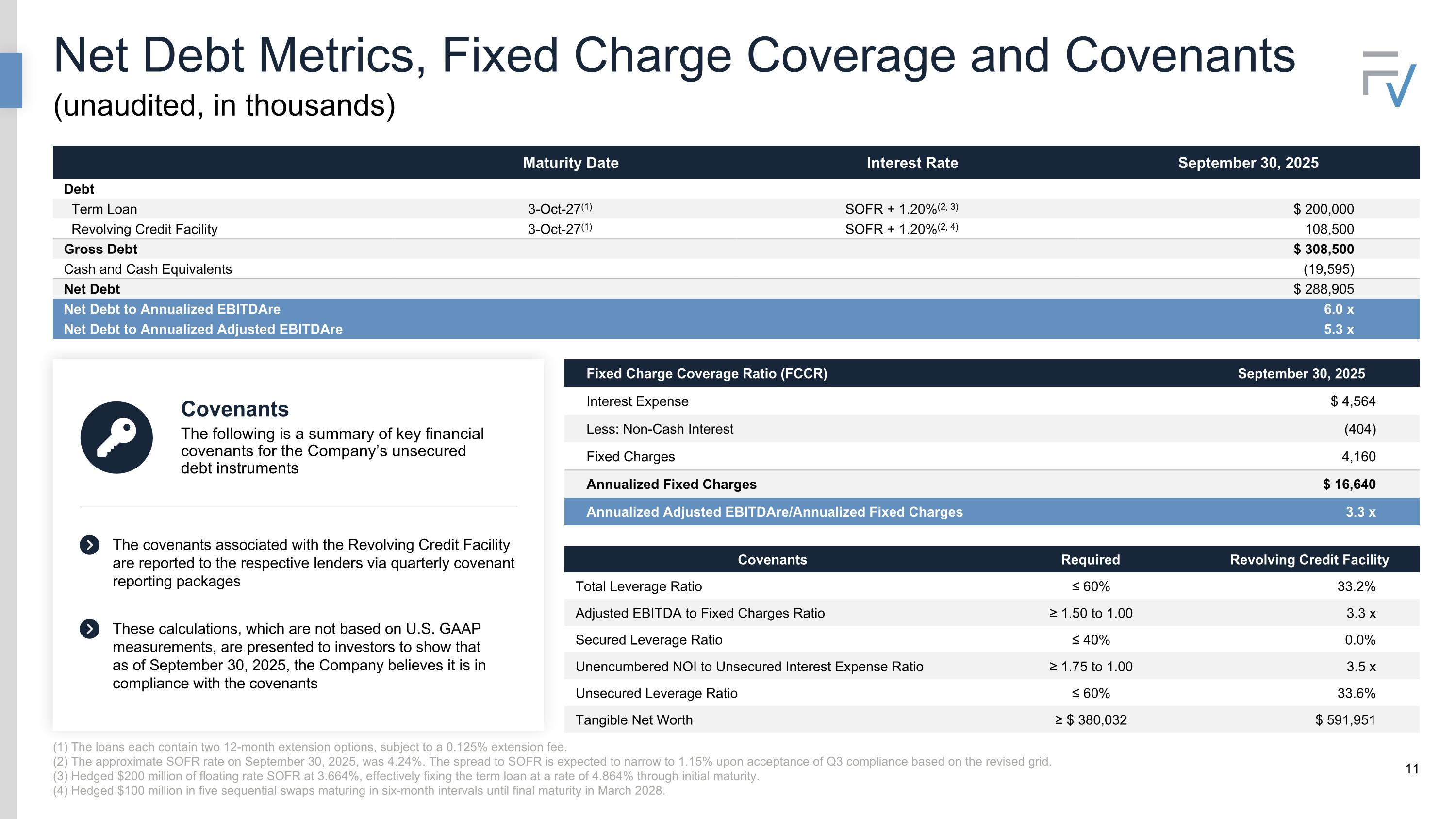

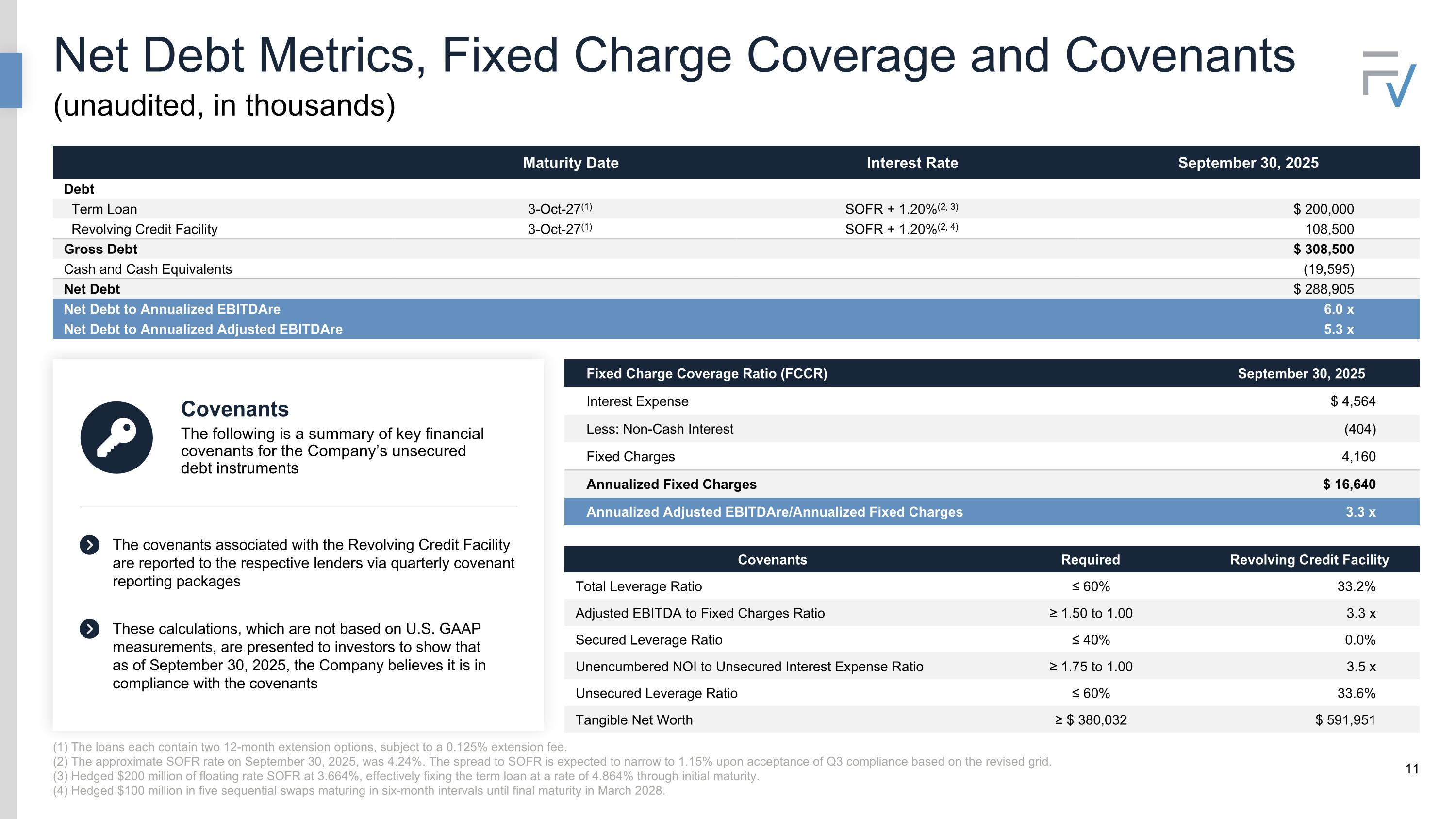

Net Debt Metrics, Fixed Charge Coverage and Covenants (unaudited, in thousands) (1) The loans each contain two 12-month extension options, subject to a 0.125% extension fee. (2) The approximate SOFR rate on September 30, 2025, was 4.24%. The spread to SOFR is expected to narrow to 1.15% upon acceptance of Q3 compliance based on the revised grid. (3) Hedged $200 million of floating rate SOFR at 3.664%, effectively fixing the term loan at a rate of 4.864% through initial maturity. (4) Hedged $100 million in five sequential swaps maturing in six-month intervals until final maturity in March 2028. Maturity Date Interest Rate September 30, 2025 Debt Term Loan 3-Oct-27(1) SOFR + 1.20%(2, 3) $ 200,000 Revolving Credit Facility 3-Oct-27(1) SOFR + 1.20%(2, 4) 108,500 Gross Debt $ 308,500 Cash and Cash Equivalents (19,595) Net Debt $ 288,905 Net Debt to Annualized EBITDAre 6.0 x Net Debt to Annualized Adjusted EBITDAre 5.3 x Covenants Required Revolving Credit Facility Total Leverage Ratio ≤ 60% 33.2% Adjusted EBITDA to Fixed Charges Ratio ≥ 1.50 to 1.00 3.3 x Secured Leverage Ratio ≤ 40% 0.0% Unencumbered NOI to Unsecured Interest Expense Ratio ≥ 1.75 to 1.00 3.5 x Unsecured Leverage Ratio ≤ 60% 33.6% Tangible Net Worth ≥ $ 380,032 $ 591,951 Fixed Charge Coverage Ratio (FCCR) September 30, 2025 Interest Expense $ 4,564 Less: Non-Cash Interest (404) Fixed Charges 4,160 Annualized Fixed Charges $ 16,640 Annualized Adjusted EBITDAre/Annualized Fixed Charges 3.3 x The covenants associated with the Revolving Credit Facility are reported to the respective lenders via quarterly covenant reporting packages These calculations, which are not based on U.S. GAAP measurements, are presented to investors to show that as of September 30, 2025, the Company believes it is in compliance with the covenants Covenants The following is a summary of key financial covenants for the Company’s unsecured debt instruments

Capital Deployment YTD Investment Activity and Dispositions

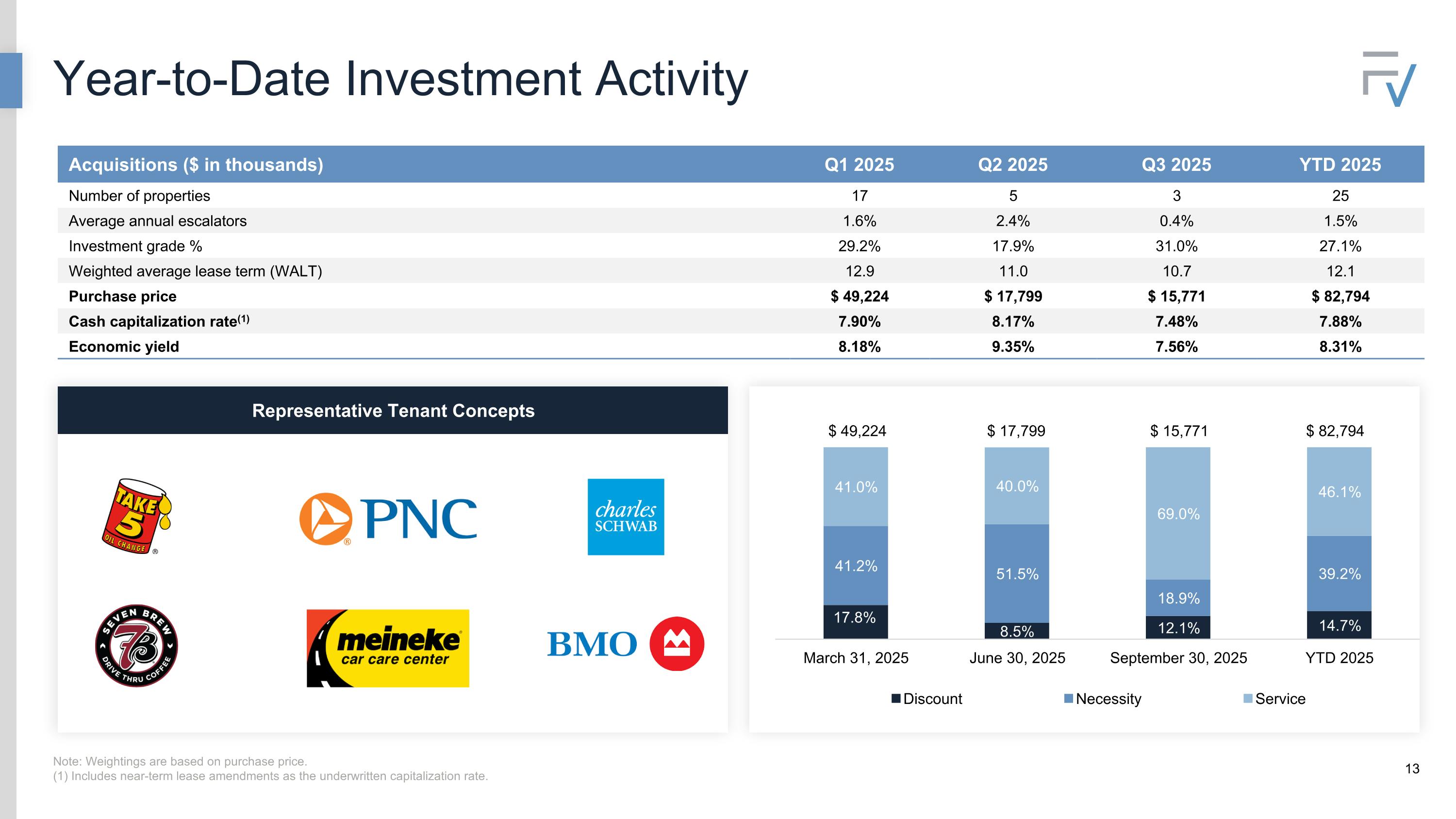

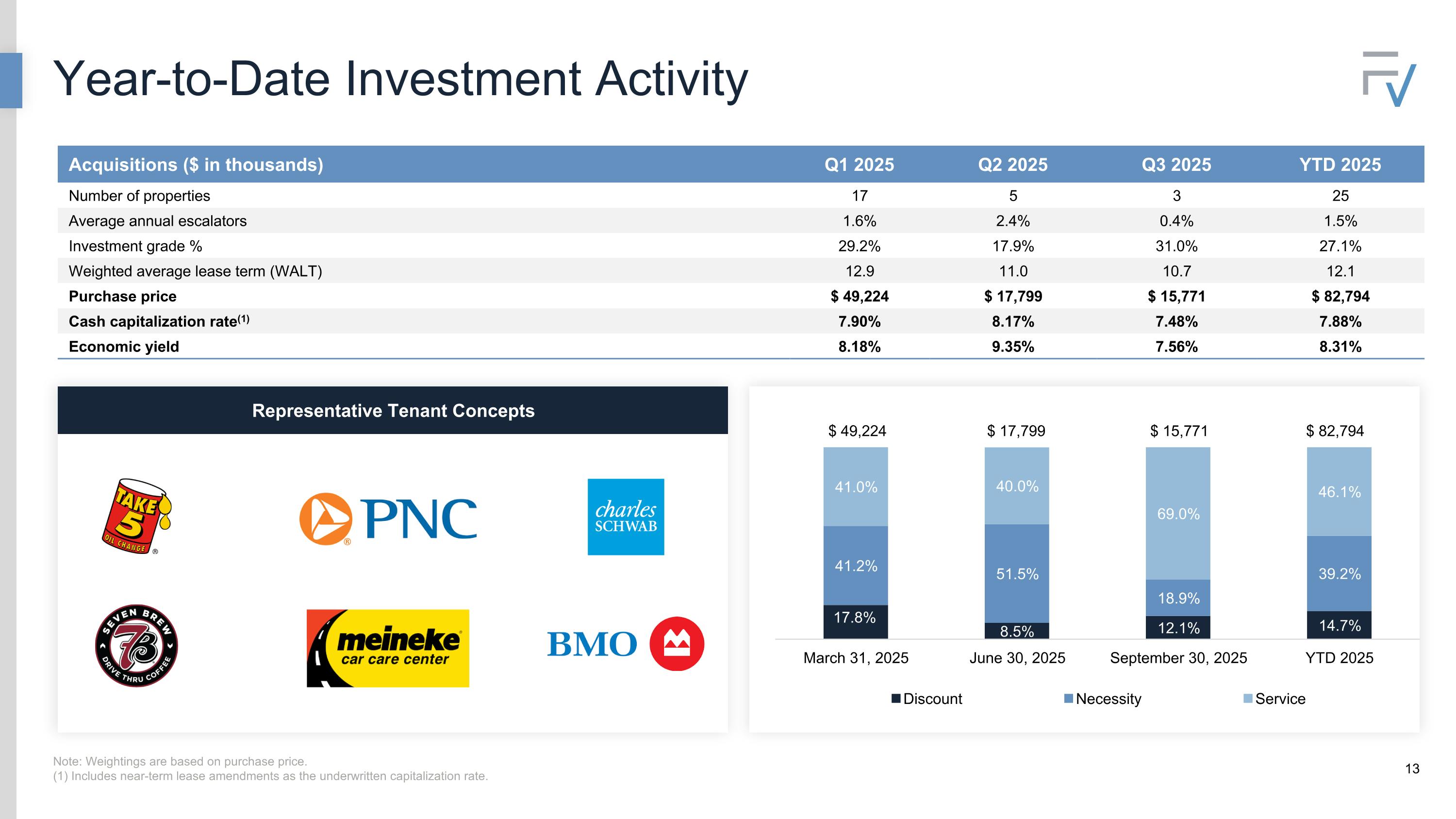

Acquisitions ($ in thousands) Q1 2025 Q2 2025 Q3 2025 YTD 2025 Number of properties 17 5 3 25 Average annual escalators 1.6% 2.4% 0.4% 1.5% Investment grade % 29.2% 17.9% 31.0% 27.1% Weighted average lease term (WALT) 12.9 11.0 10.7 12.1 Purchase price $ 49,224 $ 17,799 $ 15,771 $ 82,794 Cash capitalization rate(1) 7.90% 8.17% 7.48% 7.88% Economic yield 8.18% 9.35% 7.56% 8.31% $ 49,224 $ 17,799 $ 15,771 Representative Tenant Concepts Note: Weightings are based on purchase price. (1) Includes near-term lease amendments as the underwritten capitalization rate. $ 82,794 Year-to-Date Investment Activity

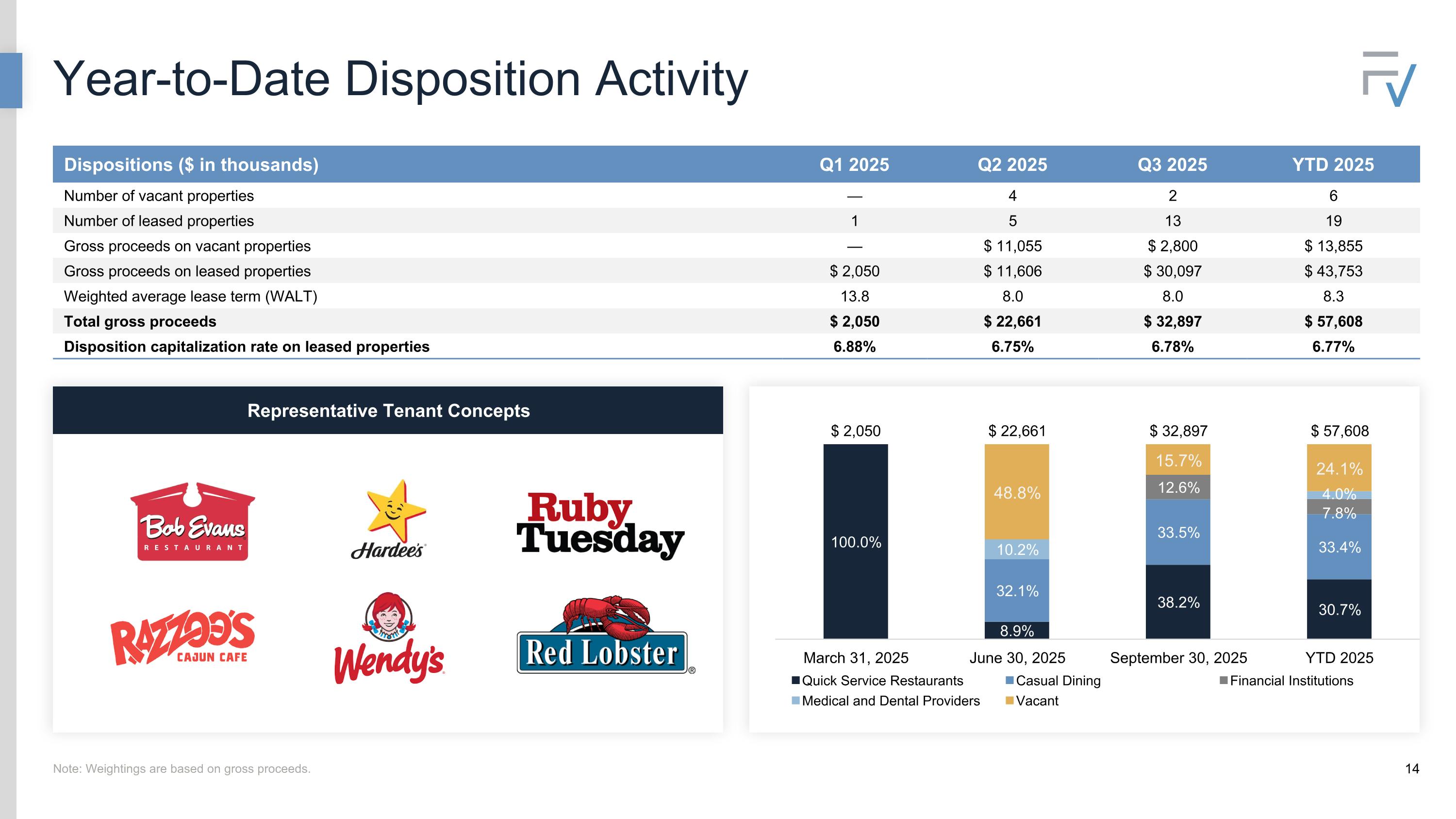

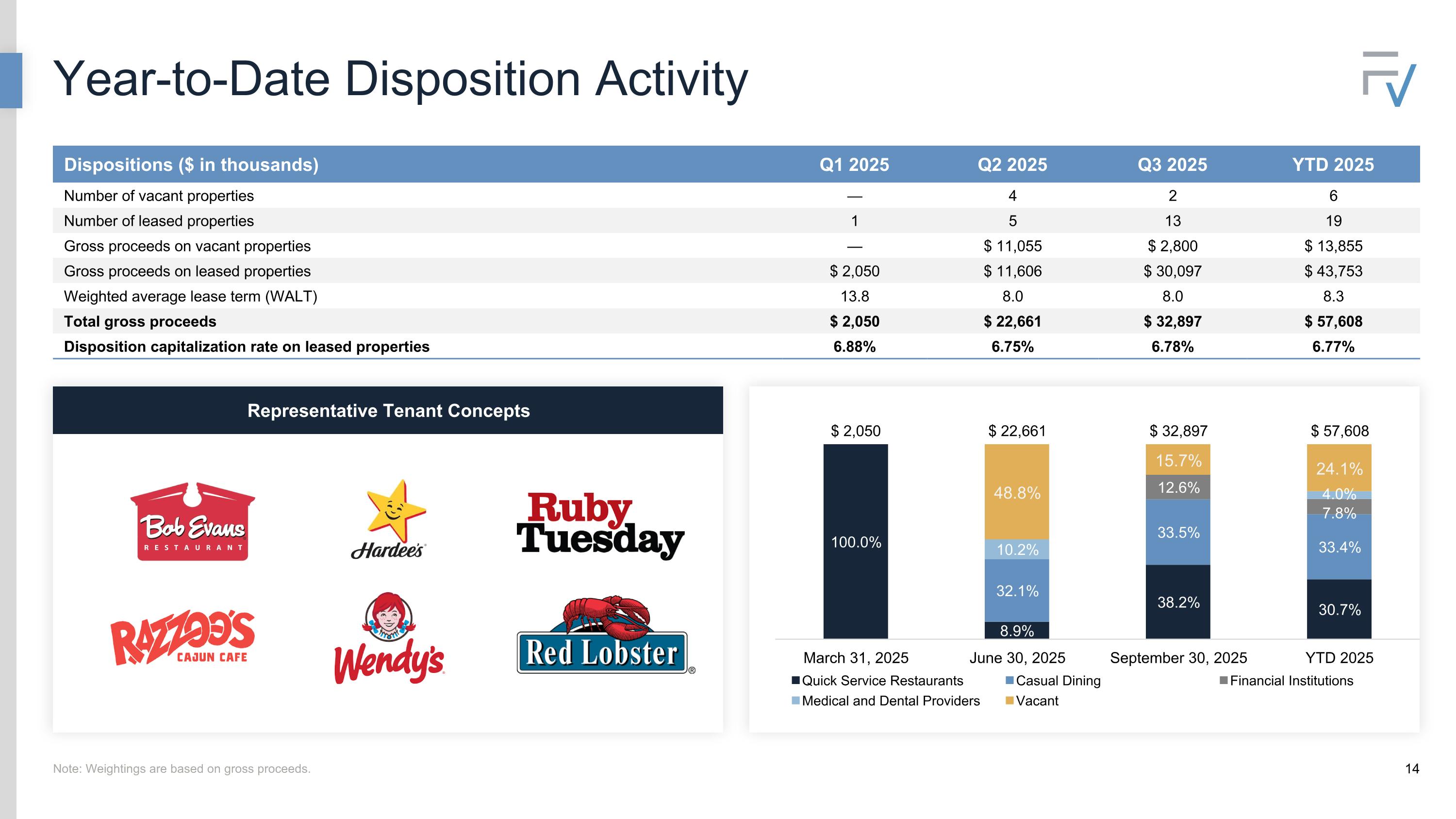

Dispositions ($ in thousands) Q1 2025 Q2 2025 Q3 2025 YTD 2025 Number of vacant properties — 4 2 6 Number of leased properties 1 5 13 19 Gross proceeds on vacant properties — $ 11,055 $ 2,800 $ 13,855 Gross proceeds on leased properties $ 2,050 $ 11,606 $ 30,097 $ 43,753 Weighted average lease term (WALT) 13.8 8.0 8.0 8.3 Total gross proceeds $ 2,050 $ 22,661 $ 32,897 $ 57,608 Disposition capitalization rate on leased properties 6.88% 6.75% 6.78% 6.77% $ 2,050 $ 22,661 Representative Tenant Concepts Note: Weightings are based on gross proceeds. $ 32,897 $ 57,608 Year-to-Date Disposition Activity

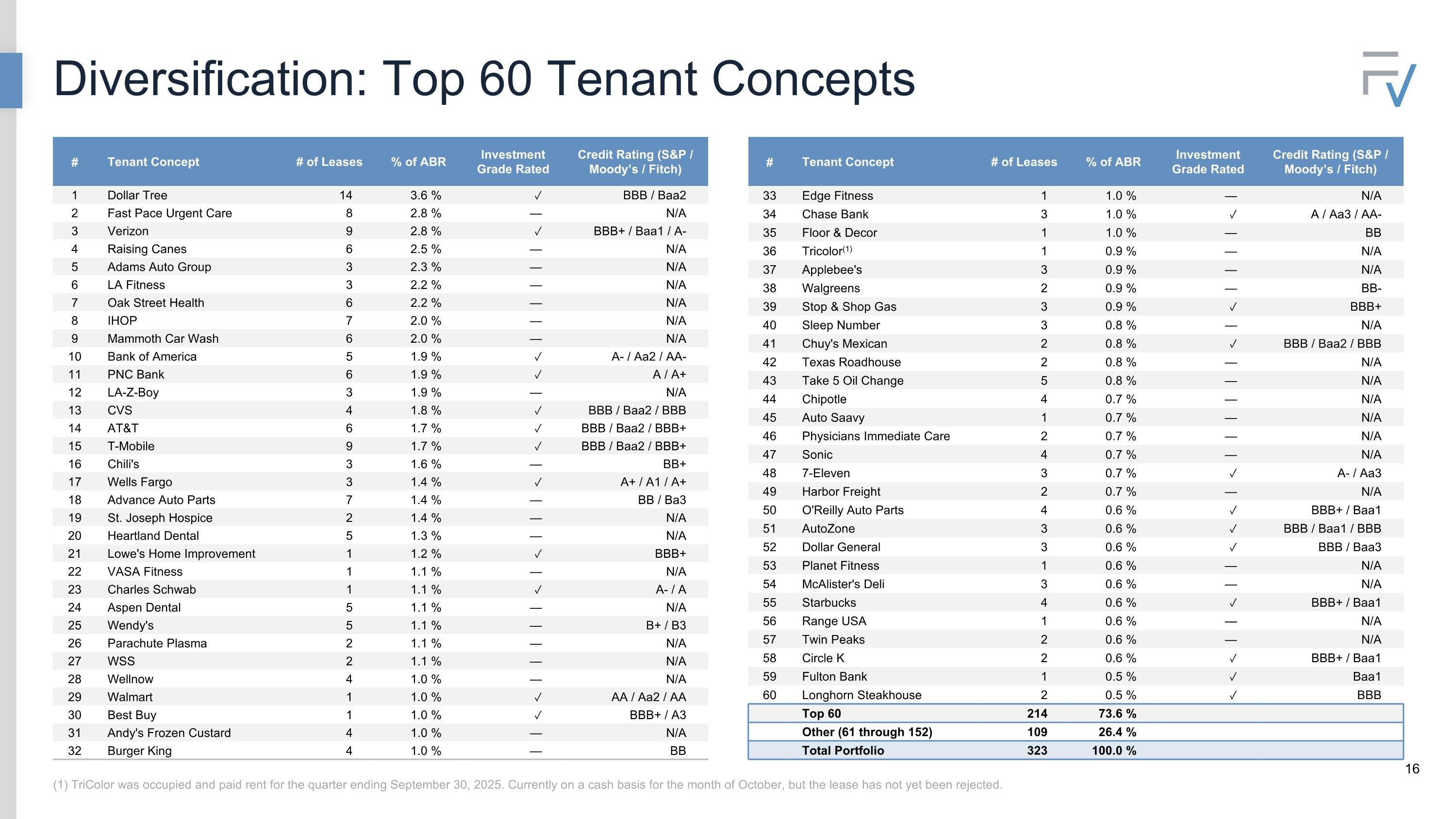

Portfolio Detail Top 60 Tenant Concepts, Industry and Geographic Mix

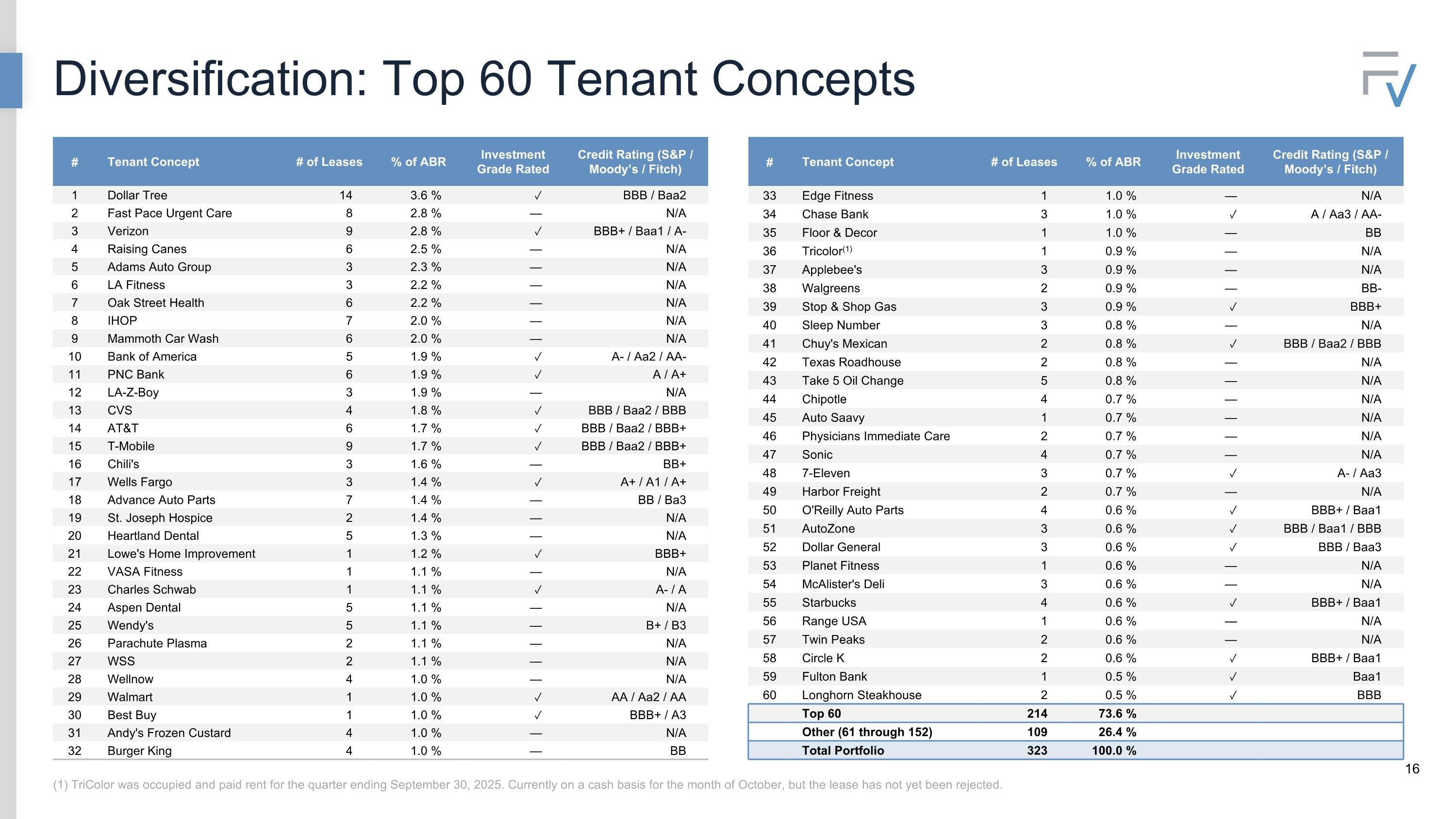

# Tenant Concept # of Leases % of ABR Investment Grade Rated Credit Rating (S&P / Moody’s / Fitch) 1 Dollar Tree 14 3.6 % ✓ BBB / Baa2 2 Fast Pace Urgent Care 8 2.8 % — N/A 3 Verizon 9 2.8 % ✓ BBB+ / Baa1 / A- 4 Raising Canes 6 2.5 % — N/A 5 Adams Auto Group 3 2.3 % — N/A 6 LA Fitness 3 2.2 % — N/A 7 Oak Street Health 6 2.2 % — N/A 8 IHOP 7 2.0 % — N/A 9 Mammoth Car Wash 6 2.0 % — N/A 10 Bank of America 5 1.9 % ✓ A- / Aa2 / AA- 11 PNC Bank 6 1.9 % ✓ A / A+ 12 LA-Z-Boy 3 1.9 % — N/A 13 CVS 4 1.8 % ✓ BBB / Baa2 / BBB 14 AT&T 6 1.7 % ✓ BBB / Baa2 / BBB+ 15 T-Mobile 9 1.7 % ✓ BBB / Baa2 / BBB+ 16 Chili's 3 1.6 % — BB+ 17 Wells Fargo 3 1.4 % ✓ A+ / A1 / A+ 18 Advance Auto Parts 7 1.4 % — BB / Ba3 19 St. Joseph Hospice 2 1.4 % — N/A 20 Heartland Dental 5 1.3 % — N/A 21 Lowe's Home Improvement 1 1.2 % ✓ BBB+ 22 VASA Fitness 1 1.1 % — N/A 23 Charles Schwab 1 1.1 % ✓ A- / A 24 Aspen Dental 5 1.1 % — N/A 25 Wendy's 5 1.1 % — B+ / B3 26 Parachute Plasma 2 1.1 % — N/A 27 WSS 2 1.1 % — N/A 28 Wellnow 4 1.0 % — N/A 29 Walmart 1 1.0 % ✓ AA / Aa2 / AA 30 Best Buy 1 1.0 % ✓ BBB+ / A3 31 Andy's Frozen Custard 4 1.0 % — N/A 32 Burger King 4 1.0 % — BB # Tenant Concept # of Leases % of ABR Investment Grade Rated Credit Rating (S&P / Moody’s / Fitch) 33 Edge Fitness 1 1.0 % — N/A 34 Chase Bank 3 1.0 % ✓ A / Aa3 / AA- 35 Floor & Decor 1 1.0 % — BB 36 Tricolor(1) 1 0.9 % — N/A 37 Applebee's 3 0.9 % — N/A 38 Walgreens 2 0.9 % — BB- 39 Stop & Shop Gas 3 0.9 % ✓ BBB+ 40 Sleep Number 3 0.8 % — N/A 41 Chuy's Mexican 2 0.8 % ✓ BBB / Baa2 / BBB 42 Texas Roadhouse 2 0.8 % — N/A 43 Take 5 Oil Change 5 0.8 % — N/A 44 Chipotle 4 0.7 % — N/A 45 Auto Saavy 1 0.7 % — N/A 46 Physicians Immediate Care 2 0.7 % — N/A 47 Sonic 4 0.7 % — N/A 48 7-Eleven 3 0.7 % ✓ A- / Aa3 49 Harbor Freight 2 0.7 % — N/A 50 O'Reilly Auto Parts 4 0.6 % ✓ BBB+ / Baa1 51 AutoZone 3 0.6 % ✓ BBB / Baa1 / BBB 52 Dollar General 3 0.6 % ✓ BBB / Baa3 53 Planet Fitness 1 0.6 % — N/A 54 McAlister's Deli 3 0.6 % — N/A 55 Starbucks 4 0.6 % ✓ BBB+ / Baa1 56 Range USA 1 0.6 % — N/A 57 Twin Peaks 2 0.6 % — N/A 58 Circle K 2 0.6 % ✓ BBB+ / Baa1 59 Fulton Bank 1 0.5 % ✓ Baa1 60 Longhorn Steakhouse 2 0.5 % ✓ BBB Top 60 214 73.6 % Other (61 through 152) 109 26.4 % Total Portfolio 323 100.0 % (1) TriColor was occupied and paid rent for the quarter ending September 30, 2025. Currently on a cash basis for the month of October, but the lease has not yet been rejected. Diversification: Top 60 Tenant Concepts

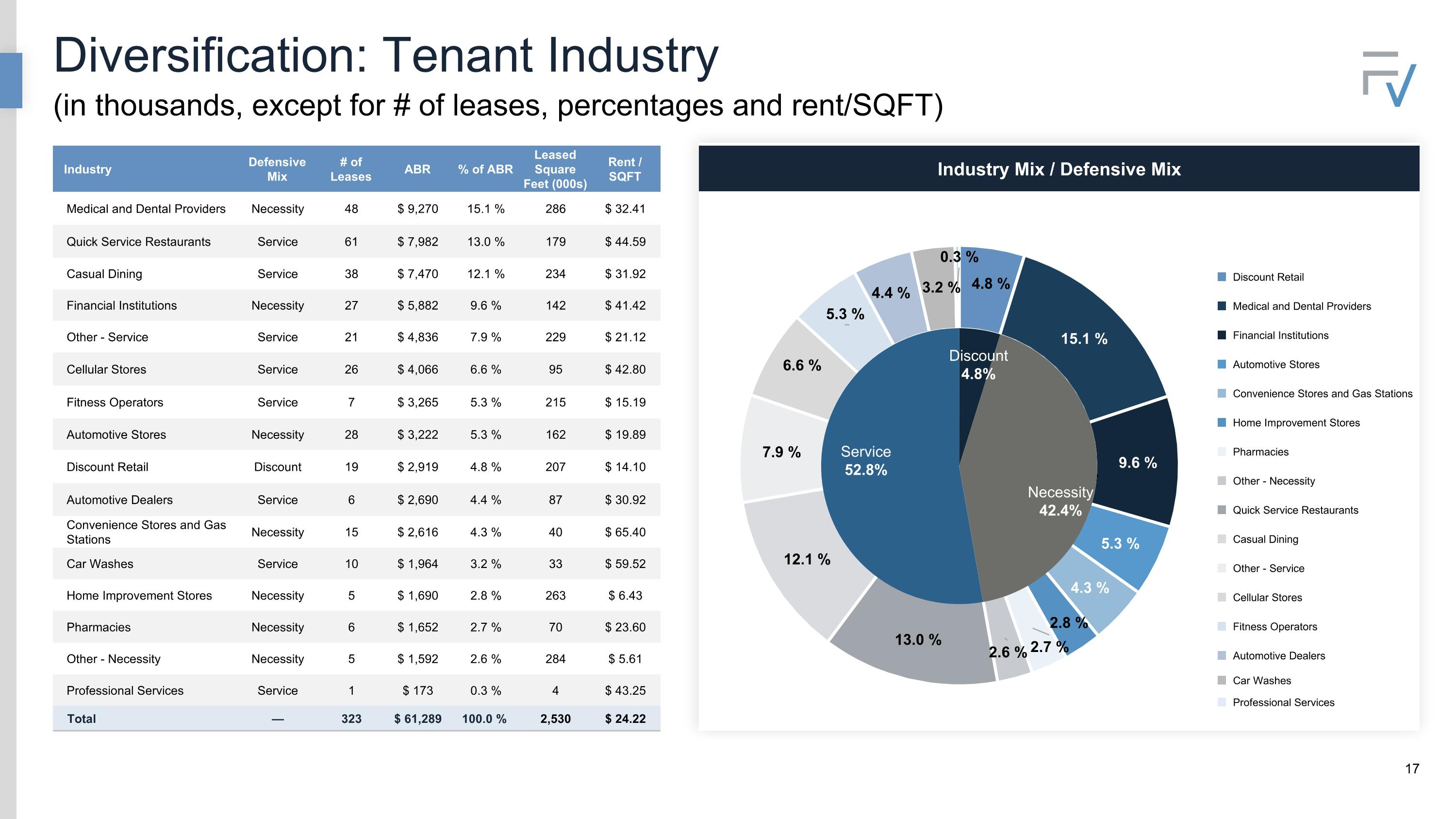

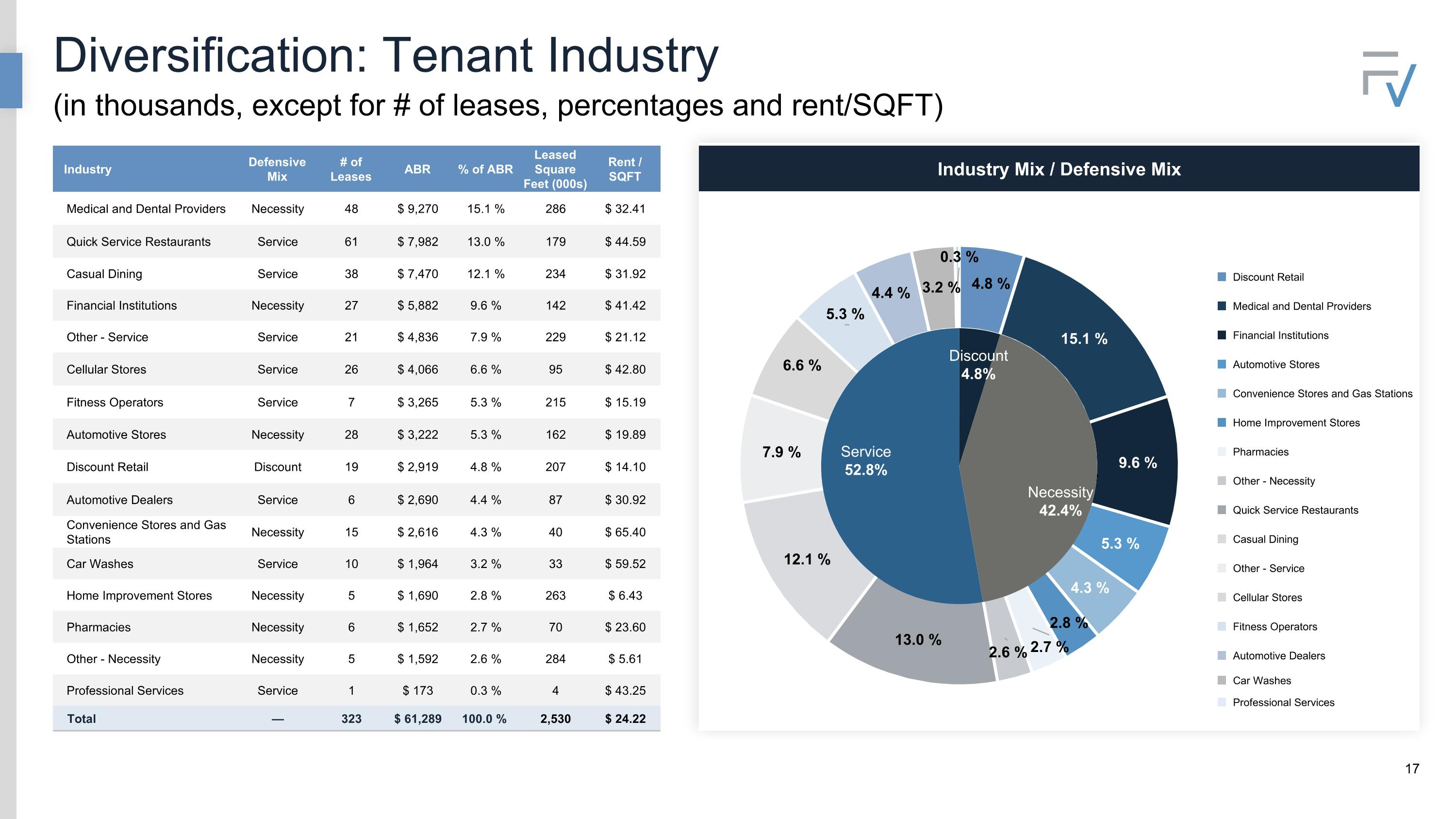

Diversification: Tenant Industry (in thousands, except for # of leases, percentages and rent/SQFT) Industry Defensive Mix # of Leases ABR % of ABR Leased SquareFeet (000s) Rent / SQFT Medical and Dental Providers Necessity 48 $ 9,270 15.1 % 286 $ 32.41 Quick Service Restaurants Service 61 $ 7,982 13.0 % 179 $ 44.59 Casual Dining Service 38 $ 7,470 12.1 % 234 $ 31.92 Financial Institutions Necessity 27 $ 5,882 9.6 % 142 $ 41.42 Other - Service Service 21 $ 4,836 7.9 % 229 $ 21.12 Cellular Stores Service 26 $ 4,066 6.6 % 95 $ 42.80 Fitness Operators Service 7 $ 3,265 5.3 % 215 $ 15.19 Automotive Stores Necessity 28 $ 3,222 5.3 % 162 $ 19.89 Discount Retail Discount 19 $ 2,919 4.8 % 207 $ 14.10 Automotive Dealers Service 6 $ 2,690 4.4 % 87 $ 30.92 Convenience Stores and Gas Stations Necessity 15 $ 2,616 4.3 % 40 $ 65.40 Car Washes Service 10 $ 1,964 3.2 % 33 $ 59.52 Home Improvement Stores Necessity 5 $ 1,690 2.8 % 263 $ 6.43 Pharmacies Necessity 6 $ 1,652 2.7 % 70 $ 23.60 Other - Necessity Necessity 5 $ 1,592 2.6 % 284 $ 5.61 Professional Services Service 1 $ 173 0.3 % 4 $ 43.25 Total — 323 $ 61,289 100.0 % 2,530 $ 24.22 Industry Mix / Defensive Mix Other - Service Discount Retail Medical and Dental Providers Financial Institutions Automotive Stores Convenience Stores and Gas Stations Home Improvement Stores Pharmacies Other - Necessity Quick Service Restaurants Casual Dining Cellular Stores Fitness Operators Automotive Dealers Car Washes Professional Services

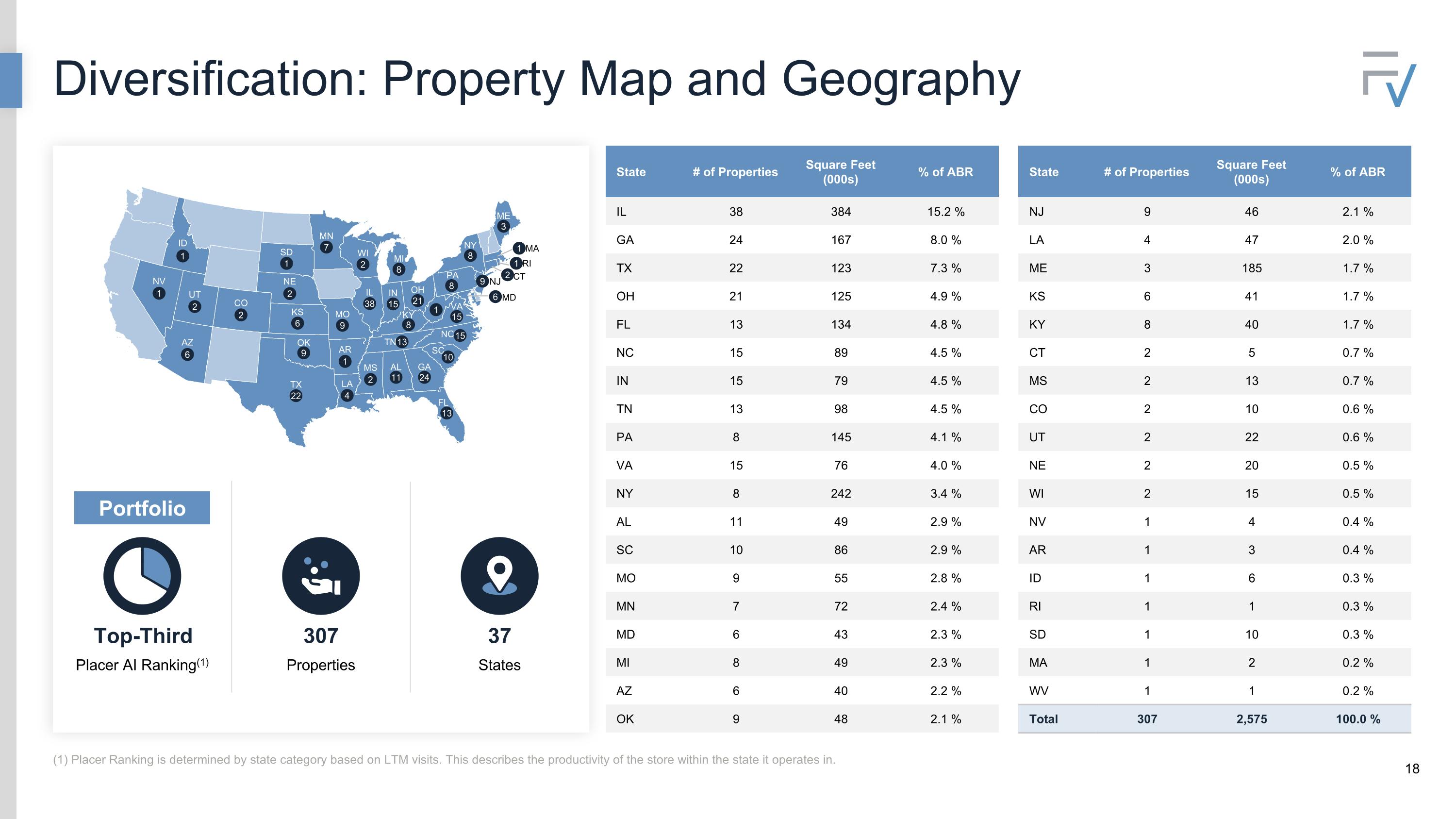

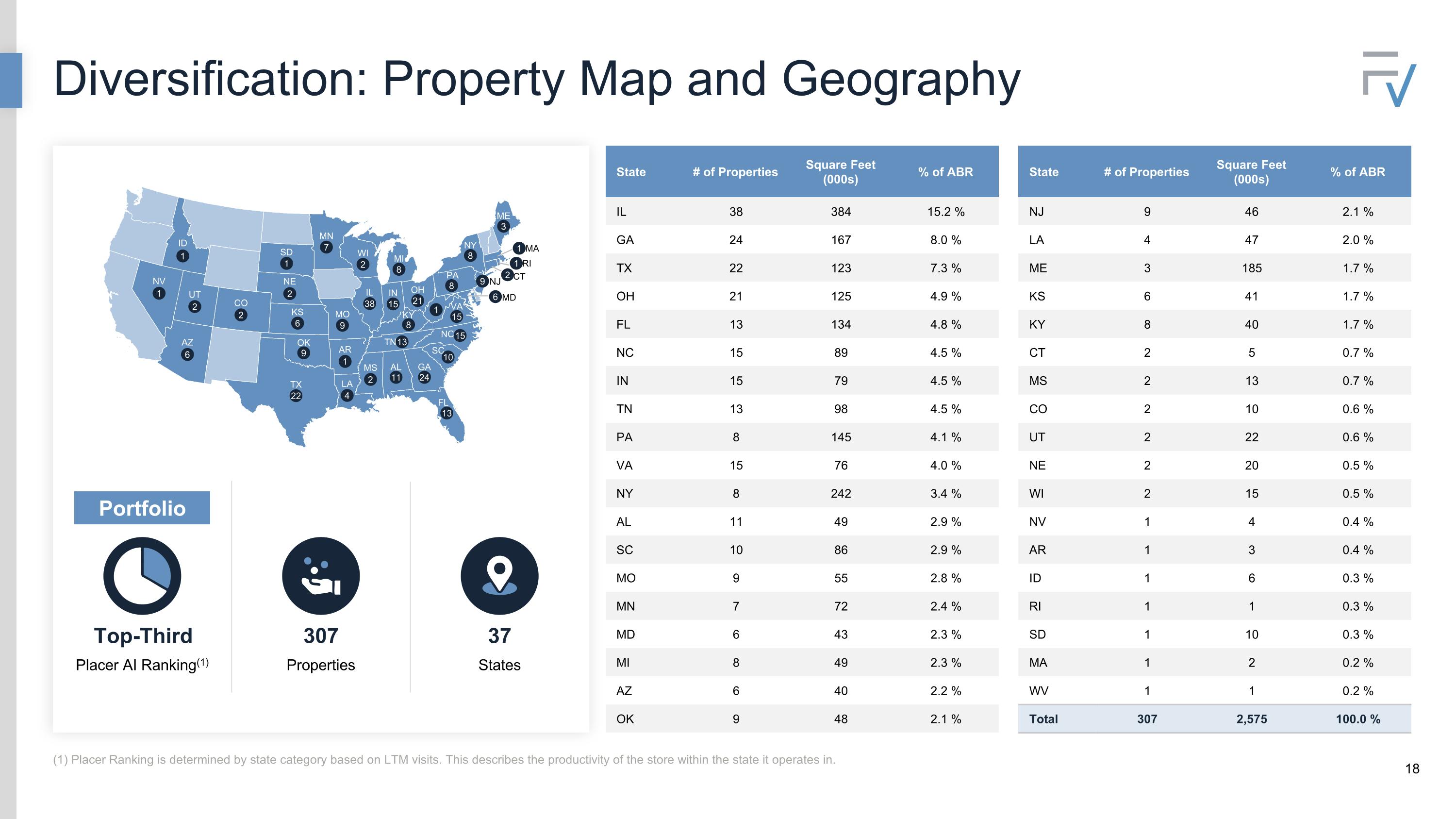

State # of Properties Square Feet (000s) % of ABR IL 38 384 15.2 % GA 24 167 8.0 % TX 22 123 7.3 % OH 21 125 4.9 % FL 13 134 4.8 % NC 15 89 4.5 % IN 15 79 4.5 % TN 13 98 4.5 % PA 8 145 4.1 % VA 15 76 4.0 % NY 8 242 3.4 % AL 11 49 2.9 % SC 10 86 2.9 % MO 9 55 2.8 % MN 7 72 2.4 % MD 6 43 2.3 % MI 8 49 2.3 % AZ 6 40 2.2 % OK 9 48 2.1 % State # of Properties Square Feet (000s) % of ABR NJ 9 46 2.1 % LA 4 47 2.0 % ME 3 185 1.7 % KS 6 41 1.7 % KY 8 40 1.7 % CT 2 5 0.7 % MS 2 13 0.7 % CO 2 10 0.6 % UT 2 22 0.6 % NE 2 20 0.5 % WI 2 15 0.5 % NV 1 4 0.4 % AR 1 3 0.4 % ID 1 6 0.3 % RI 1 1 0.3 % SD 1 10 0.3 % MA 1 2 0.2 % WV 1 1 0.2 % Total 307 2,575 100.0 % MA MN ID AZ CO NV UT AR KS MO OK SD LA TX CT RI AL FL GA MS SC IL IN KY NC OH TN VA WI MD NJ NY PA ME MI 1 1 2 6 2 1 NE 2 6 9 22 4 2 1 9 38 7 2 15 13 8 11 24 10 13 15 15 1 21 8 MI 8 8 6 9 2 1 1 3 Portfolio Top-Third Placer AI Ranking(1) 307 Properties 37 States (1) Placer Ranking is determined by state category based on LTM visits. This describes the productivity of the store within the state it operates in. Diversification: Property Map and Geography

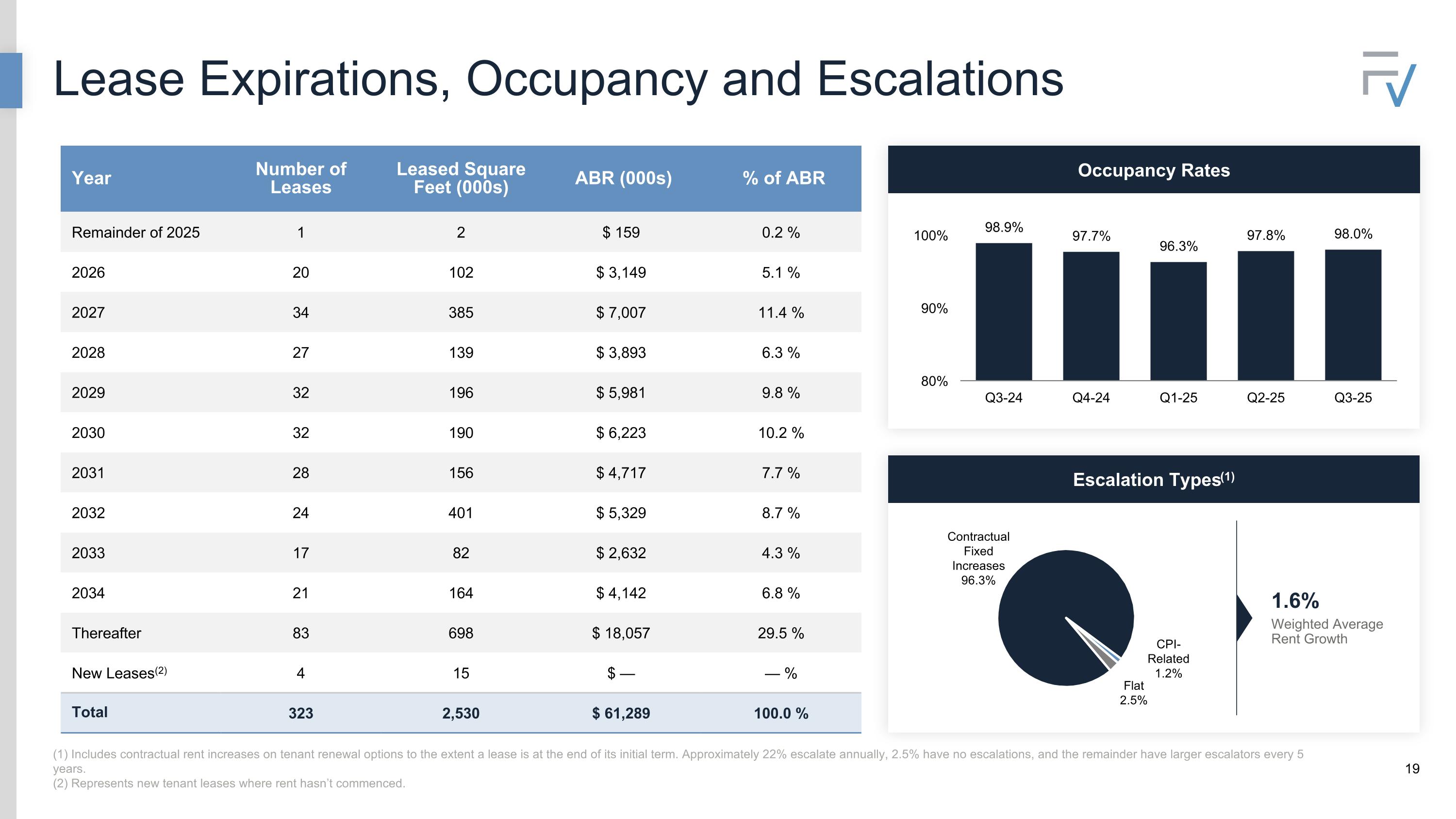

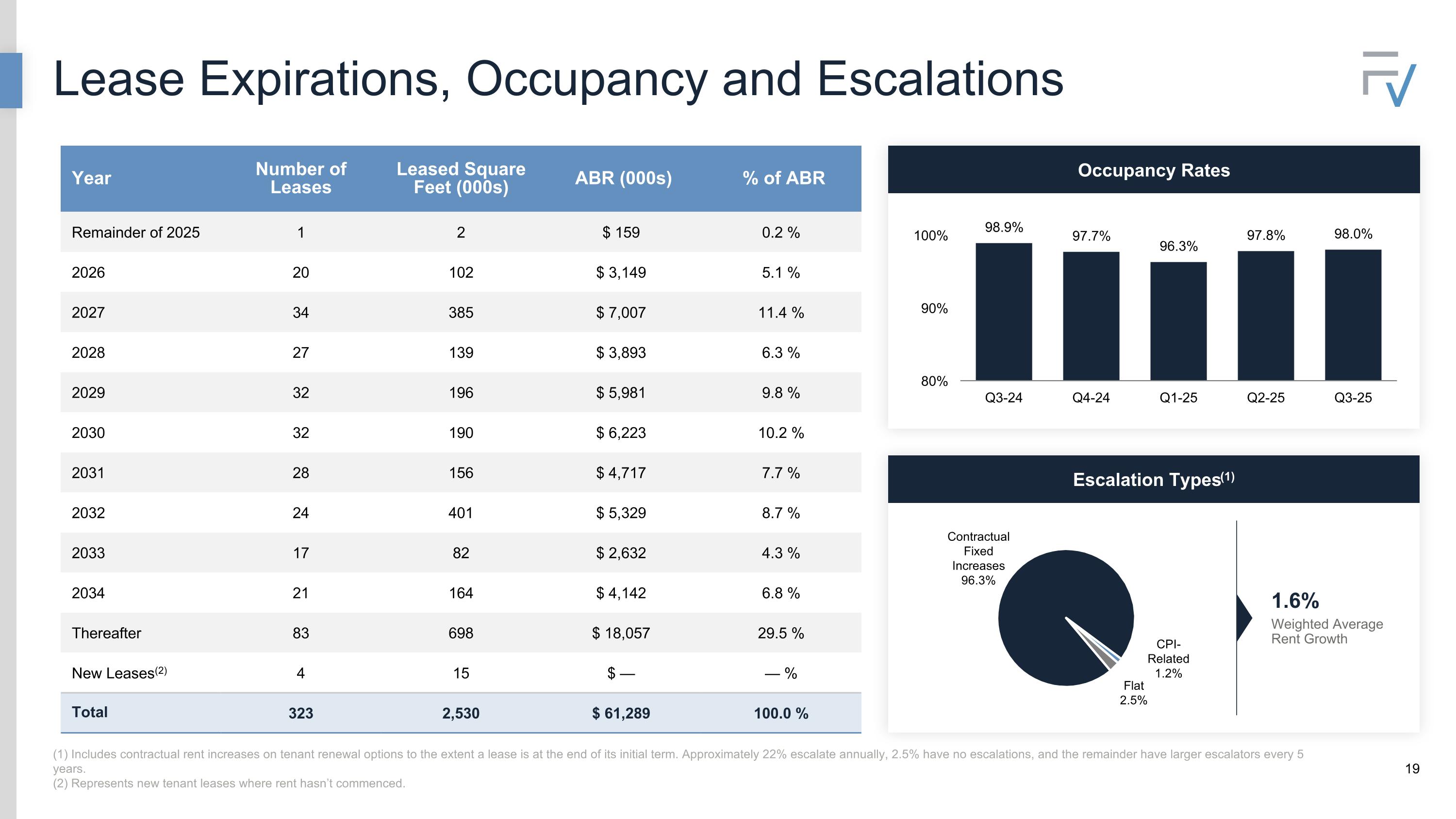

Occupancy Rates Year Number ofLeases Leased Square Feet (000s) ABR (000s) % of ABR Remainder of 2025 1 2 $ 159 0.2 % 2026 20 102 $ 3,149 5.1 % 2027 34 385 $ 7,007 11.4 % 2028 27 139 $ 3,893 6.3 % 2029 32 196 $ 5,981 9.8 % 2030 32 190 $ 6,223 10.2 % 2031 28 156 $ 4,717 7.7 % 2032 24 401 $ 5,329 8.7 % 2033 17 82 $ 2,632 4.3 % 2034 21 164 $ 4,142 6.8 % Thereafter 83 698 $ 18,057 29.5 % New Leases(2) 4 15 $ — — % Total 323 2,530 $ 61,289 100.0 % Escalation Types(1) 19 1.6% Weighted Average Rent Growth (1) Includes contractual rent increases on tenant renewal options to the extent a lease is at the end of its initial term. Approximately 22% escalate annually, 2.5% have no escalations, and the remainder have larger escalators every 5 years. (2) Represents new tenant leases where rent hasn’t commenced. Lease Expirations, Occupancy and Escalations

Appendix Definitions and Forward-Looking Statements

Non-GAAP Definitions and Explanations EBITDA, EBITDAre, Adjusted EBITDAre, and Annualized Adjusted EBITDAre: EBITDA, EBITDAre, Adjusted EBITDAre, and Annualized Adjusted EBITDAre are non-GAAP financial measures. We compute EBITDA as earnings before interest, income taxes and depreciation and amortization. EBITDA is a measure commonly used in our industry. We believe that this ratio provides investors and analysts with a measure of our leverage that includes our operating results unaffected by the differences in capital structures, capital investment cycles and useful life of related assets compared to other companies in our industry. In 2017, Nareit issued a white paper recommending that companies that report EBITDA also report EBITDAre in financial reports. We compute EBITDAre in accordance with the definition adopted by Nareit. Nareit defines EBITDAre as EBITDA (as defined above) excluding gains (loss) from the sales of depreciable property and provisions for impairment on investment in real estate. We believe EBITDA and EBITDAre are useful to investors and analysts because they provide important supplemental information about our operating performance exclusive of certain non-cash and other costs. We compute adjusted EBITDAre as EBITDAre for the applicable quarter, as adjusted to (i) reflect all investment and disposition activity that took place during the applicable quarter as if each transaction had been completed on the first day of the quarter, (ii) exclude certain GAAP income and expense amounts that we believe are infrequent and unusual in nature because they relate to unique circumstances or transactions that had not previously occurred and which we do not anticipate occurring in the future, (iii) eliminate the impact of lease termination fees from certain of our tenants, and (iv) exclude non-cash stock-based compensation expense. Annualized adjusted EBITDAre is calculated by multiplying adjusted EBITDAre for the applicable quarter by four, which we believe provides a meaningful estimate of our current run rate for all of our investments as of the end of the most recently completed quarter given the contractual nature of our long-term net leases. You should not unduly rely on this measure as it is based on assumptions and estimates that may prove to be inaccurate. Our actual reported EBITDAre for future periods may be significantly different from our annualized adjusted EBITDAre. Our reported EBITDA, EBITDAre, Adjusted EBITDAre, and Annualized Adjusted EBITDAre may not be comparable to similarly titled measures of other companies. You should not consider these measures as alternatives to net income or cash flows from operating activities determined in accordance with GAAP. Funds From Operations (FFO) and Adjusted Funds From Operations (AFFO): FFO and AFFO are non-GAAP measures. We believe the use of FFO and AFFO are useful to investors because they are widely accepted industry measures used by analysts and investors to compare the operating performance of REITs. FFO and AFFO should not be considered alternatives to net income as a performance measure or to cash flows from operations, as reported on our statement of cash flows, or as a liquidity measure and should be considered in addition to, and not in lieu of, GAAP financial measures. We compute FFO in accordance with the standards established by the Board of Governors of Nareit. Nareit defines FFO as GAAP net income or loss adjusted to exclude net gains (losses) from sales of certain depreciated real estate assets, depreciation and amortization expense from real estate assets, gains and losses from change in control, and impairment charges related to certain previously depreciated real estate assets. To derive AFFO, we modify the Nareit computation of FFO to include other adjustments to GAAP net income related to certain non-cash or non-recurring revenues and expenses, including straight-line rents, cost of debt extinguishments, amortization of lease intangibles, amortization of debt issuance costs, amortization of net mortgage premiums, (gain) loss on interest rate swaps and other non-cash interest expense, realized gains or losses on foreign currency transactions, Internalization expenses, structuring and public company readiness costs, extraordinary items, and other specified non-cash items. We believe that such items are not a result of normal operations and thus we believe excluding such items assists management and investors in distinguishing whether changes in our operations are due to growth or decline of operations at our properties or from other factors. Adjusted NOI, Annualized Adjusted NOI, and Cash NOI: Adjusted NOI, Annualized Adjusted NOI, Cash NOI, and GAAP NOI are non-GAAP financial measures which we use to assess our operating results. We compute Adjusted NOI as Adjusted EBITDAre and exclude general and administration expenses. We further adjust Adjusted NOI for non-cash revenue components of straight-line rent and other amortization expense to derive Adjusted Cash NOI. We believe Adjusted NOI and Adjusted Cash NOI provide useful and relevant information because they reflect only those income and expense items that are incurred at the property level. Adjusted NOI and Adjusted Cash NOI are not measurements of financial performance under GAAP and may not be comparable to similarly titled measures of other companies. You should not consider our measures as alternatives to net income or cash flows from operating activities determined in accordance with GAAP. Annualized Adjusted NOI is calculated by multiplying Adjusted NOI for the applicable quarter by four and Annualized Adjusted Cash NOI is calculated by multiplying Adjusted Cash NOI for the applicable quarter by four. We believe these annualized figures provide a meaningful estimate of our current run rate for all of our investments as of the end of the most recently completed quarter given the contractual nature of our long-term net leases. You should not unduly rely on these measures as they are based on assumptions and estimates that may prove to be inaccurate. Our actual reported NOI for future periods may be significantly different from our Annualized Adjusted NOI and Annualized Adjusted Cash NOI. Fixed Charge Coverage Ratio (FCCR): The adjusted EBITDA to fixed charge ratio is the ratio of adjusted EBITDA to fixed charges as of the last day of any fiscal quarter. Adjusted EBITDA is computed as net income adjusted for depreciation and amortization, interest expense, income tax expense, extraordinary or nonrecurring items, fees in connection with debt financing, acquisitions and dispositions and capital markets transactions, non-cash items and equity in net income of unconsolidated subsidiaries minus a reserve for replacements with respect to certain properties. Fixed charges are computed on a consolidated basis as interest expense (excluding amortization of fees paid in cash and discounts and premiums on debt), plus regularly scheduled principal repayments of debt (excluding any balloon or similar payments), plus any preferred dividends payable in cash.

Other Definitions and Explanations Economic Yield: Economic Yield is calculated by dividing contractual cash rent, inclusive of fixed rent increases and escalators determined by CPI, by the existing lease term, expressed as a percentage of the purchase price. Cash Capitalization Rate: Cash Capitalization Rate is calculated by measuring the annualized contractual cash rent at the time of closing, divided by the purchase price of the related property. Concept: Represents the brand or trade name the tenant operates. Disposition Capitalization Rate: Disposition Capitalization Rate is calculated by the ABR on the date of the related disposition divided by the gross sale price. Defensive Mix: Defensive Mix is a term used by us to categorize tenants determined by their area of focus: (1) Necessity, which represents tenants providing essential services or selling essential goods to consumers and includes Medical and Dental Providers, Financial Institutions, Automotive Stores, Convenience & Gas Stores, Pharmacies, and Home Improvement Stores, (2) Service, which represents tenants who provide specific services to consumers and includes Quick Service Restaurants, Casual Diners, Automotive Dealers, Fitness Operators, Car Washed, and Professional Service, and (3) Discount, which represents tenants that sell merchandise and goods a significant discount compared to traditional retailers. Annualized Base Rent (ABR): We define ABR as the annualized contractual cash rent due for the last month of the reporting period and adjusted to remove rent from properties sold during the month and to include a full month of contractual cash rent for properties acquired during the last month of the reporting period. GAAP: GAAP is the Generally Accepted Accounting Principles in the United States.

Other Definitions and Explanations (Continued) WALT: WALT represents the remaining average lease term of our leases, weighted by rent, and excluding lease renewal options and investments in mortgage loans. Purchase Price: Purchase Price is represented by the contractual acquisition price of the related property, excluding any transaction costs or other capital expenditures. Tenant: Tenant represents the legal entity responsible for fulfilling obligations under the lease agreement. Gross Debt: We define Gross Debt as total debt, net plus debt issuance costs and original issuance discount. Net Debt: Net Debt is a non-GAAP financial measure. We define Net Debt as our Debt less cash and cash equivalents. Occupancy: Occupancy or a specified percentage of our portfolio that is “occupied” or “leased” means as of a specified date (i) the number of properties that are subject to a signed lease divided by (ii) the total number of properties in our portfolio. Secured Overnight Financing Rate (SOFR): We define SOFR as the current one-month term SOFR.

Forward-Looking and Cautionary Statements IP Disclaimer This document contains references to copyrights, trademarks, trade names, and service marks that belong to other companies. FrontView REIT, Inc. is not affiliated or associated with, and is not endorsed by and does not endorse, such companies or their products or services. Information set forth herein contains forward-looking statements, which reflect our current views regarding our business, financial performance, growth prospects and strategies, market opportunities, and market trends. Forward-looking statements include all statements that are not historical facts. In some cases, you can identify these forward-looking statements by the use of words such as “outlook, ” “believes, ” “expects, ” “potential, ” “continues, ” “may, ” “will, ” “should, ” “could, ” “would be, ” “seeks, ” “approximately, ” “projects, ” “predicts, ” “intends, ” “plans, ” “estimates, ” “anticipates, ” or the negative version of these words or other comparable words. All of the forward-looking statements herein are subject to various risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions, and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results, performance, and achievements could differ materially from those expressed in or by the forward-looking statements and may be affected by a variety of risks and other factors. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from such forward-looking statements. These factors include, but are not limited to, risks and uncertainties related to general economic conditions, including but not limited to increases in the rate of inflation and/or interest rates, local real estate conditions, tenant financial health, and property acquisitions and the timing of these investments and acquisitions. These and other risks, assumptions, and uncertainties are described in our filings with the SEC, which are available on the SEC’s website at www.sec.gov. You are cautioned not to place undue reliance on any forward-looking statements included herein. All forward-looking statements are made as of the date of this document and the risk that actual results, performance, and achievements will differ materially from the expectations expressed or referenced herein will increase with the passage of time. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as required by law. Forward Looking Statements This data and other information described herein are as of and for the three months ended September 30, 2025, unless otherwise indicated. Future performance may not be consistent with past performance and is subject to change, involving inherent risks and uncertainties. This information should be read in conjunction with FrontView’s Quarterly Report on Form 10-Q as of and for the period ended September 30, 2025, including the financial statements and the management’s discussion and analysis of financial condition and results of operations sections. About the Data