UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 20, 2025

TELA Bio, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-39130 | 45-5320061 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

1 Great Valley Parkway, Suite 24 Malvern, Pennsylvania |

19355 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (484) 320-2930

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.001 per share | TELA | Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition. |

On March 20, 2025, TELA Bio, Inc. (the “Company”) issued a press release announcing its financial results for the fourth quarter of 2024 and the fiscal year ended December 31, 2024. A copy of this press release is furnished as Exhibit 99.1 hereto.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing.

| Item 7.01 | Regulation FD Disclosure. |

On March 20, 2025, the Company updated information reflected in a corporate slide deck, which representatives of the Company will use in various meetings with investors from time to time. A copy of the presentation is attached hereto as Exhibit 99.2, and incorporated herein by reference.

The information furnished pursuant to Item 7.01, including Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

The following exhibits are being furnished herewith:

|

Exhibit No. |

Document |

|

| 99.1 | Press Release of TELA Bio, Inc., dated March 20, 2025. | |

| 99.2 | Corporate Slide Deck, dated March 20, 2025. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| TELA BIO, INC. | ||

| By: | /s/ Antony Koblish | |

| Name: | Antony Koblish | |

| Title: | President, Chief Executive Officer and Director | |

Date: March 20, 2025

Exhibit 99.1

TELA Bio Reports Fourth Quarter and Full Year 2024 Financial Results

MALVERN, PA, March 20, 2025 -- TELA Bio, Inc. ("TELA Bio"), a commercial-stage medical technology company focused on providing innovative soft-tissue reconstruction solutions, today reported financial results for the fourth quarter and full year ended December 31, 2024.

Recent Highlights

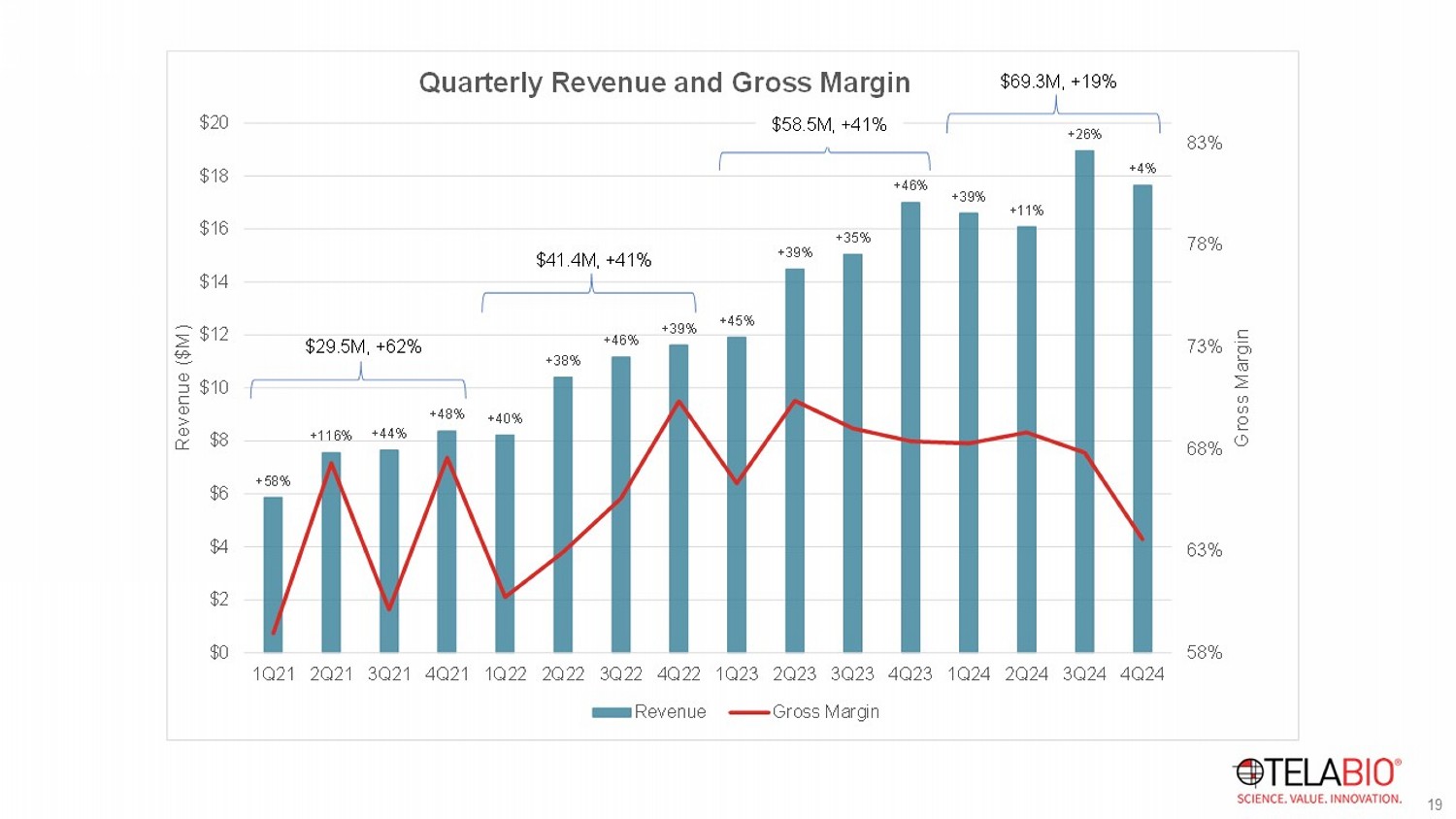

| · | Delivered revenue of $17.6 million in the fourth quarter and $69.3 million for the full year 2024, representing growth of 4% and 19%, respectively, over the corresponding periods of 2023; |

| · | Increased demand for OviTex® and OviTex PRS Reinforced Tissue Matrix products during the full year 2024, resulting in growth in unit sales volume for each product of approximately 33% and 31%, respectively; |

| · | Drove expanded adoption of Company products in hernia procedures with the launch of OviTex IHR Reinforced Tissue Matrix, specifically engineered for laparoscopic and robotic-assisted inguinal hernia repair, selling over 1,200 units in 2024 from its launch in mid-April 2024; |

| · | Implemented cost reduction efforts with a meaningful sequential step down in OpEx from the third to the fourth quarter, with the goal to offset additional investments into our commercial organization and keep 2025 OpEx remaining at the same level as in 2024; and |

| · | Provided full year 2025 revenue guidance of $85.0 million to $88.0 million, representing 23% to 27% year-over-year growth. |

“Our team delivered 19% revenue growth in 2024, and we saw multiple record-high sales months throughout the year. Our fourth quarter results fell short of our expectations due to a confluence of disruptions, some of which we believe are transient and others that have already been redressed. Despite these challenges, the overall opportunity for substantial value creation from current levels remains intact.” said Antony Koblish, co-founder, President, and Chief Executive Officer of TELA Bio. “We believe our OviTex and OviTex PRS products remain well-positioned to benefit from several long-term tailwinds, most significantly an ongoing shift in the hernia repair market away from permanent synthetic mesh and increasing interest among surgeons in device alternatives to cadaveric tissue in plastic and reconstructive surgery. We are optimistic about TELA’s outlook moving forward and believe we have taken necessary steps to drive additional market share capture in our primary indications, restore topline growth more consistent with our historical precedent, and continue our steady path towards profitability.”

Fourth Quarter 2024 Financial Results

Revenue was $17.6 million in the fourth quarter of 2024, an increase of 4% compared to the same period in 2023. The increase was due to an increase in unit sales of our products resulting from the addition of new customers and growing international sales. This growth was partially offset by a decrease in average selling prices caused by product mix as the share of smaller-sized units increased following the introduction of robotically compatible OviTex IHR and our increased focus in growing market share in high-volume minimally invasive and robotic procedures.

Gross profit was $11.2 million in the fourth quarter of 2024, or 64% of revenue, compared to $11.6 million, or 68% of revenue, in the same period in 2023. The decrease in gross margin was primarily due to higher expense recognized for excess and obsolete inventory adjustments due to the introduction of newer generation products.

Operating expenses were $19.6 million in the fourth quarter of 2024, compared to $23.9 million in the same period in 2023. The decrease was due to lower compensation costs resulting from efficiency efforts initiated in the third quarter of 2024, as well as decreased travel, consulting and professional fees.

Loss from operations was $8.4 million in the fourth quarter of 2024, compared to a loss from operations of $12.3 million in the same period in 2023.

Net loss was $9.2 million in the fourth quarter of 2024, compared to a net loss of $12.9 million in the same period in 2023.

Full Year 2024 Financial Results

Revenue was $69.3 million for the full year 2024, an increase of 19% compared to the same period in 2023. The increase was primarily due to an increase in unit sales of our products resulting from the addition of new customers and growing international sales. This growth was partially offset by a decrease in average selling prices caused by product mix as the share of smaller-sized units increased following the introduction of robotically compatible OviTex IHR and our increased focus in growing market share in high-volume minimally invasive and robotic procedures.

Gross profit was $46.5 million in the full year 2024, or 67% of revenue, compared to $40.1 million, or 69% of revenue, in 2023. The decrease in gross margin was primarily due to higher expense recognized for excess and obsolete inventory adjustments due to the introduction of newer generation products.

Operating expenses were $88.2 million in the full year 2024, compared to $84.2 million in 2023. The increase was due to higher compensation costs and employee-related expenses primarily from commissions on an increased revenue base and severance costs, as well as increased travel, consulting and additional selling related expenses related to product sampling and meeting expenses.

Loss from operations was $34.1 million in the full year 2024, compared to a loss from operations of $44.1 million in 2023.

Net loss was $37.8 million in the full year 2024, compared to a net loss of $46.7 million in 2023.

Cash and cash equivalents on December 31, 2024 totaled $52.7 million.

2025 Financial Guidance

| · | Full year 2025 revenue is projected to range from $85.0 million to $88.0 million, representing growth of 23% to 27% over full year 2024. |

| · | First quarter 2025 revenue is projected to range from $17.0 million to $18.0 million, representing growth of 2% to 8% over the first quarter of 2024. | |

| · | 2025 operating expenses are expected to be flat to 2024. |

Conference Call

TELA Bio will host a conference call at 4:30 p.m. Eastern Time on Thursday, March 20, 2025 to discuss its fourth quarter and full year 2024 financial results. Investors interested in listening to the conference call should register online. Participants are required to register a day in advance or at minimum 15 minutes before the start of the call. A replay of the webcast can be accessed via the Events & Presentations page of the investor section of TELA Bio's website.

About TELA Bio, Inc.

TELA Bio, Inc. (NASDAQ: TELA) is a commercial-stage medical technology company focused on providing innovative technologies that optimize clinical outcomes by prioritizing the preservation and restoration of the patient's own anatomy. The Company is committed to providing surgeons with advanced, economically effective soft-tissue reconstruction solutions that leverage the patient's natural healing response while minimizing long-term exposure to permanent synthetic materials. For more information, visit www.telabio.com.

Caution Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Words such as "may," "might," "will," "should," "believe," "expect," "anticipate," "estimate," "continue," "predict," "forecast," "project," "plan," "intend" or similar expressions, or statements regarding intent, belief, or current expectations are forward-looking statements and reflect the current beliefs of TELA Bio's management. Such forward-looking statements include statements relating to our expected revenue and revenue growth for the full year 2025 and reduction in operating expenses throughout the full year 2025 compared to prior periods. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors that could cause actual results and events to differ materially and adversely from those indicated by such forward-looking statements including, among others: the impact to our business from macroeconomic conditions, including recessionary concerns, banking instability, increasing market interest rates, monetary policy changes, changes in trade policies, including tariffs, and inflationary pressures, potentially impacting our ability to market our products; demand for our products related to changes in volumes or frequency of surgical procedures, including due to outbreak of illness or disease, cybersecurity events impacting hospital operations, labor and hospital staffing shortages, supply chain disruptions to critical surgical and hospital supplies, pricing pressures or any other applicable adverse healthcare economic factors; our ability to achieve or sustain profitability; our ability to gain market acceptance for our products and to accurately forecast and meet customer demand; our ability to compete successfully; that data from earlier studies related to our products and interim data from ongoing studies may not be replicated in later studies or indicative of future data; that data obtained from clinical studies using our product may not be indicative of outcomes in other surgical settings; our ability to enhance our product offerings; product development and manufacturing problems; capacity constraints or delays in production of our products; maintenance of coverage and adequate reimbursement for procedures using our products; and product defects or failures. These risks and uncertainties are described more fully in the "Risk Factors" section and elsewhere in our filings with the Securities and Exchange Commission and available at www.sec.gov, including in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Any forward-looking statements that we make in this announcement speak only as of the date of this press release, and TELA Bio assumes no obligation to update forward-looking statements whether as a result of new information, future events or otherwise after the date of this press release, except as required under applicable law.

Investor

Contact

Louisa Smith

ir@telabio.com

TELA Bio, Inc.

Consolidated Balance Sheets

(In thousands, except share and per share amounts)

(Unaudited)

| December 31, | ||||||||

| 2024 | 2023 | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 52,670 | $ | 46,729 | ||||

| Accounts receivable, net of allowances of $275 and $416 | 10,098 | 9,737 | ||||||

| Inventory | 12,781 | 13,162 | ||||||

| Prepaid expenses and other current assets | 2,522 | 2,098 | ||||||

| Total current assets | 78,071 | 71,726 | ||||||

| Property and equipment, net | 2,341 | 1,984 | ||||||

| Intangible assets, net | 1,739 | 2,119 | ||||||

| Right-of-use assets | 1,738 | 1,954 | ||||||

| Other long-term assets | 2,276 | — | ||||||

| Deferred tax asset, net | 140 | — | ||||||

| Restricted cash | 265 | 265 | ||||||

| Total assets | $ | 86,570 | $ | 78,048 | ||||

| Liabilities and stockholders’ equity | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 2,147 | $ | 1,667 | ||||

| Accrued expenses and other current liabilities | 13,451 | 15,300 | ||||||

| Total current liabilities | 15,598 | 16,967 | ||||||

| Long-term debt | 41,124 | 40,515 | ||||||

| Other long-term liabilities | 1,390 | 1,685 | ||||||

| Total liabilities | 58,112 | 59,167 | ||||||

| Stockholders’ equity: | ||||||||

| Preferred stock; $0.001 par value: 10,000,000 shares authorized; no shares issued and outstanding | — | — | ||||||

| Common stock; $0.001 par value: 200,000,000 shares authorized; 39,395,712 and 24,494,675 shares issued and outstanding at December 31, 2024 and December 31, 2023, respectively | 39 | 24 | ||||||

| Additional paid-in capital | 387,059 | 339,655 | ||||||

| Accumulated other comprehensive income | 90 | 91 | ||||||

| Accumulated deficit | (358,730 | ) | (320,889 | ) | ||||

| Total stockholders’ equity | 28,458 | 18,881 | ||||||

| Total liabilities and stockholders’ equity | $ | 86,570 | $ | 78,048 | ||||

TELA Bio, Inc.

Consolidated Statements of Operations and Comprehensive Loss

(In thousands, except share and per share amounts)

(Unaudited)

| Three Months Ended December 31, | Year Ended December 31, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenue | $ | 17,649 | $ | 16,998 | $ | 69,300 | $ | 58,453 | ||||||||

| Cost of revenue (excluding amortization of intangible assets) | 6,333 | 5,279 | 22,432 | 17,961 | ||||||||||||

| Amortization of intangible assets | 95 | 95 | 380 | 380 | ||||||||||||

| Gross profit | 11,221 | 11,624 | 46,488 | 40,112 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| Sales and marketing | 13,957 | 17,164 | 64,648 | 59,681 | ||||||||||||

| General and administrative | 3,589 | 4,053 | 14,722 | 14,887 | ||||||||||||

| Research and development | 2,029 | 2,685 | 8,813 | 9,619 | ||||||||||||

| Total operating expenses | 19,575 | 23,902 | 88,183 | 84,187 | ||||||||||||

| Other operating income: | ||||||||||||||||

| Gain on sale of product line | — | — | 7,580 | — | ||||||||||||

| Loss from operations | (8,354 | ) | (12,278 | ) | (34,115 | ) | (44,075 | ) | ||||||||

| Other (expense) income: | ||||||||||||||||

| Interest expense | (1,283 | ) | (1,345 | ) | (5,290 | ) | (5,223 | ) | ||||||||

| Other income | 285 | 733 | 1,420 | 2,634 | ||||||||||||

| Total other expense | (998 | ) | (612 | ) | (3,870 | ) | (2,589 | ) | ||||||||

| Loss before income tax benefit | (9,352 | ) | (12,890 | ) | (37,985 | ) | (46,664 | ) | ||||||||

| Income tax benefit | 144 | — | 144 | — | ||||||||||||

| Net loss | $ | (9,208 | ) | $ | (12,890 | ) | $ | (37,841 | ) | $ | (46,664 | ) | ||||

| Net loss per common share, basic and diluted | $ | (0.23 | ) | $ | (0.53 | ) | $ | (1.33 | ) | $ | (2.04 | ) | ||||

| Weighted average common shares outstanding, basic and diluted | 40,074,672 | 24,490,066 | 28,526,441 | 22,868,663 | ||||||||||||

| Comprehensive loss: | ||||||||||||||||

| Net loss | $ | (9,208 | ) | $ | (12,890 | ) | $ | (37,841 | ) | $ | (46,664 | ) | ||||

| Foreign currency translation adjustment | (59 | ) | (44 | ) | (1 | ) | (59 | ) | ||||||||

| Comprehensive loss | $ | (9,267 | ) | $ | (12,934 | ) | $ | (37,842 | ) | $ | (46,723 | ) | ||||

Exhibit 99.2

INVESTOR PRESENTATION March 2025

This presentation contains forward - looking statements within the meaning of The Private Securities Litigation Reform Act of 1995 . All statements other than statements of historical facts contained in this document, including but not limited to statements regarding possible or assu med future results of operations, business strategies, development plans, regulatory activities, market opportunity competitive position, potential growth oppo rtu nities, and the effects of competition, are forward - looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause the actual results, performance or achievements of TELA Bio, Inc. (the “Company”) to be materially different from any future res ults, performance or achievements expressed or implied by the forward - looking statements. In some cases, you can identify forward - looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “aim,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “e sti mate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. The forward - looking statements in this presentation are only predictio ns. The Company has based these forward - looking statements largely on its current expectations and projections about future events and financial trends th at it believes may affect the Company’s business, financial condition, and results of operations. These forward - looking statements speak only as of the date o f this presentation and are subject to a number of risks, uncertainties and assumptions, some of which cannot be predicted or quantified and some of whic h a re beyond the Company’s control, including, among others: the impact to our business from macroeconomic conditions, including recessionary concerns, ban king instability, increasing market interest rates, monetary policy changes, changes in trade policies, including tariffs, and inflationary pressures, pot ent ially impacting our ability to market our products; demand for our products related to changes in volumes or frequency of surgical procedures, including due to outbreak of illness or disease, cybersecurity events impacting hospital operations, labor and hospital staffing shortages, supply chain disruptions to critical surgical and hospital supplies, pricing pressures or any other applicable adverse healthcare economic factors; our ability to achieve or sustain pr ofi tability; our ability to gain market acceptance for our products and to accurately forecast and meet customer demand; our ability to compete successfully; that da ta from earlier studies related to our products and interim data from ongoing studies may not be replicated in later studies or indicative of future data; th at data obtained from clinical studies using our product may not be indicative of outcomes in other surgical settings; our ability to enhance our product offerings; pr oduct development and manufacturing problems; capacity constraints or delays in production of our products; maintenance of coverage and adequate re imb ursement for procedures using our products; and product defects or failures. These and other risks and uncertainties are described more fully in the "Ri sk Factors" section and elsewhere in the Company's filings with the U.S. Securities and Exchange Commission (the “SEC”) and available at www.sec.gov. Yo u should not rely on these forward - looking statements as predictions of future events. The events and circumstances reflected in the Company’s forwar d - looking statements may not be achieved or occur, and actual results could differ materially from those projected in the forward - looking statements. Mor eover, the Company operates in a dynamic industry and economy. New risk factors and uncertainties may emerge from time to time, and it is not possible fo r m anagement to predict all risk factors and uncertainties that the Company may face. Except as required by applicable law, we do not plan to publicly update or revise any forward - looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. 2 Forward Looking Statements We provide innovative soft - tissue reconstruction solutions that optimize clinical outcomes by prioritizing the Preservation and Restoration of the patient’s own anatomy.

3 Our Mission

TELA Bio, Inc. Advanced reinforced tissue matrix portfolio supported by compelling clinical evidence $2.6B US market opportunity 1 – still in early stages of growth Driving commercial adoption with targeted direct - sales approach Recent product launches in growing markets: robotic hernia surgery, plastic and reconstructive surgery Broad intellectual property portfolio Established DRG - based reimbursement pathway for hernia repair and robust GPO access Highly accomplished executive team with proven track record Redefining soft tissue preservation and restoration with a differentiated category of tissue reinforcement materials and supportive products 4 1. Management estimate. $2.6B total includes $1.8B hernia & abdominal wall reconstruction, $0.8B plastic reconstructive surgery.

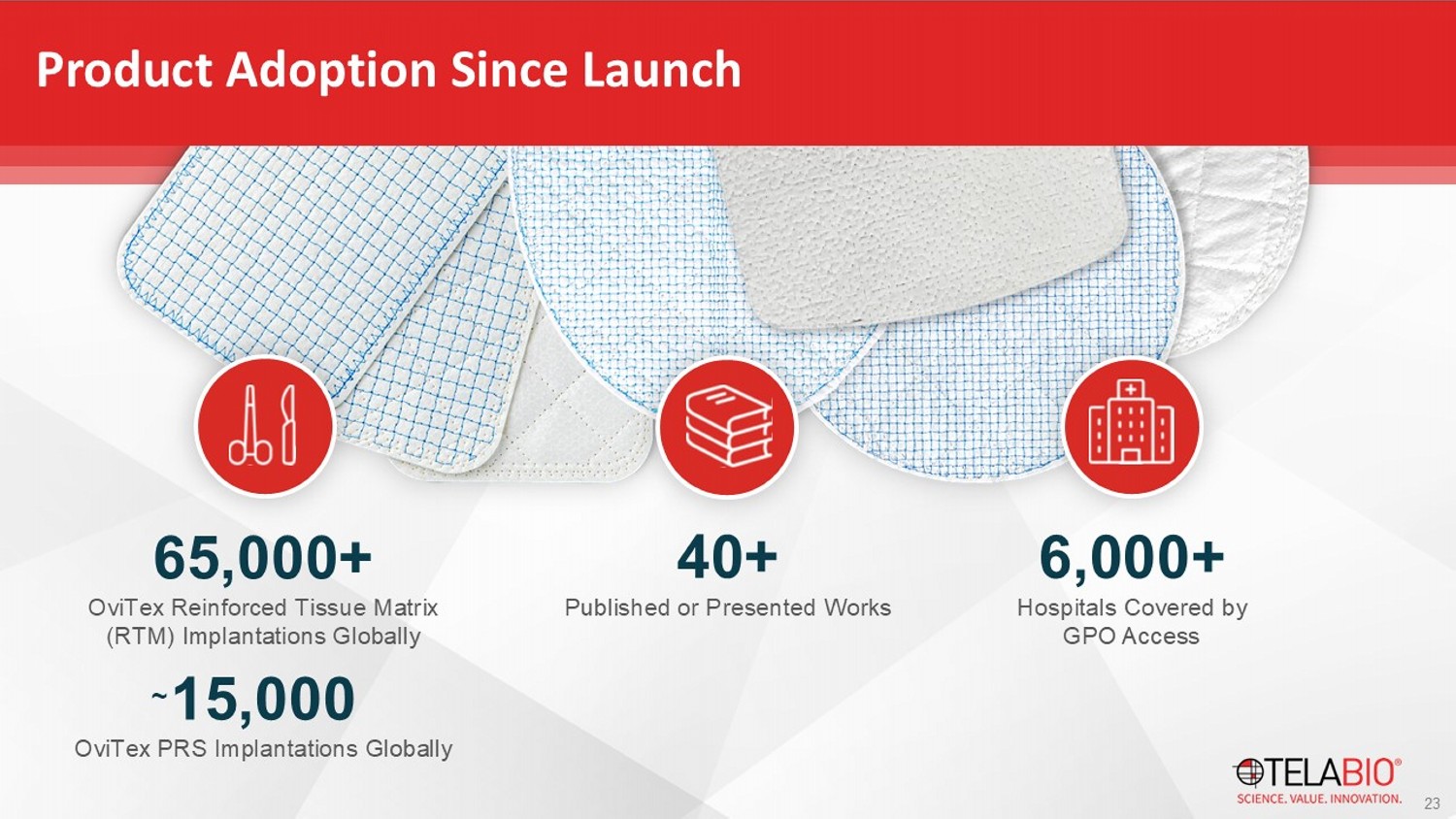

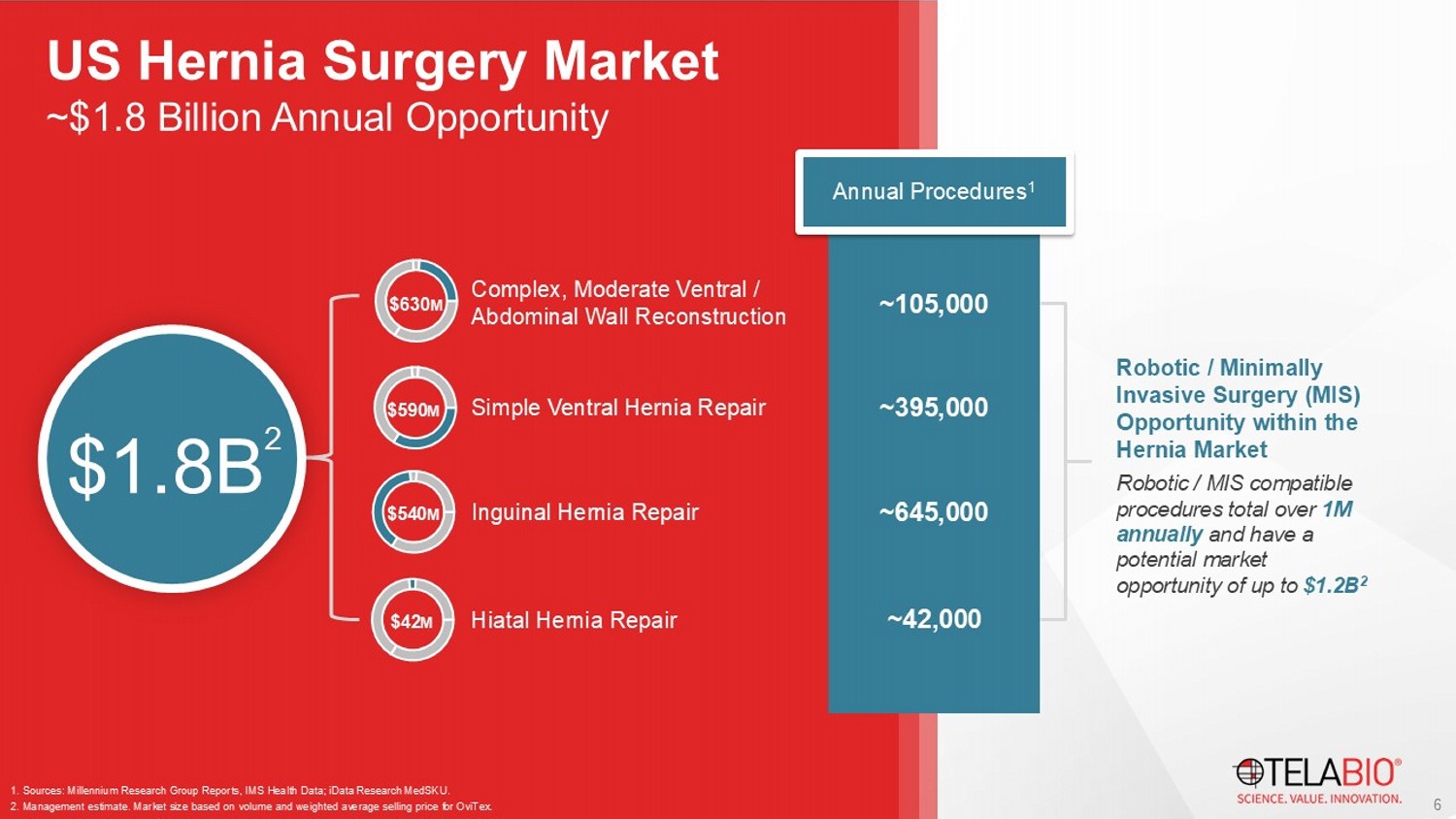

Product Adoption Since Launch 65,000+ OviTex Reinforced Tissue Matrix (RTM) Implantations Globally 23 40+ Published or Presented Works 6,000+ Hospitals Covered by GPO Access 15,000 OviTex PRS Implantations Globally ~ Complex, Moderate Ventral / Abdominal Wall Reconstruction Simple Ventral Hernia Repair Inguinal Hernia Repair Hiatal Hernia Repair ~105,000 ~395,000 ~645,000 ~42,000 $630 M $590 M $ 54 0 M $42 M 1.

5

Sources: Millennium Research Group Reports, IMS Health Data; iData Research MedSKU . 2. Management estimate. Market size based on volume and weighted average selling price for OviTex . Annual Procedures 1 $1.8B 2 Robotic / Minimally Invasive Surgery (MIS) Opportunity within the Hernia Market Robotic / MIS compatible procedures total over 1M annually and have a potential market opportunity of up to $1.2B 2 6 ~$1.8 Billion Annual Opportunity US Hernia Surgery Market OviTex Core 4 - layer device No smooth sides Robot Compatible 1 : Yes OviTex Core is designed to reinforce primary hernia repairs where the device will not come into contact with viscera.

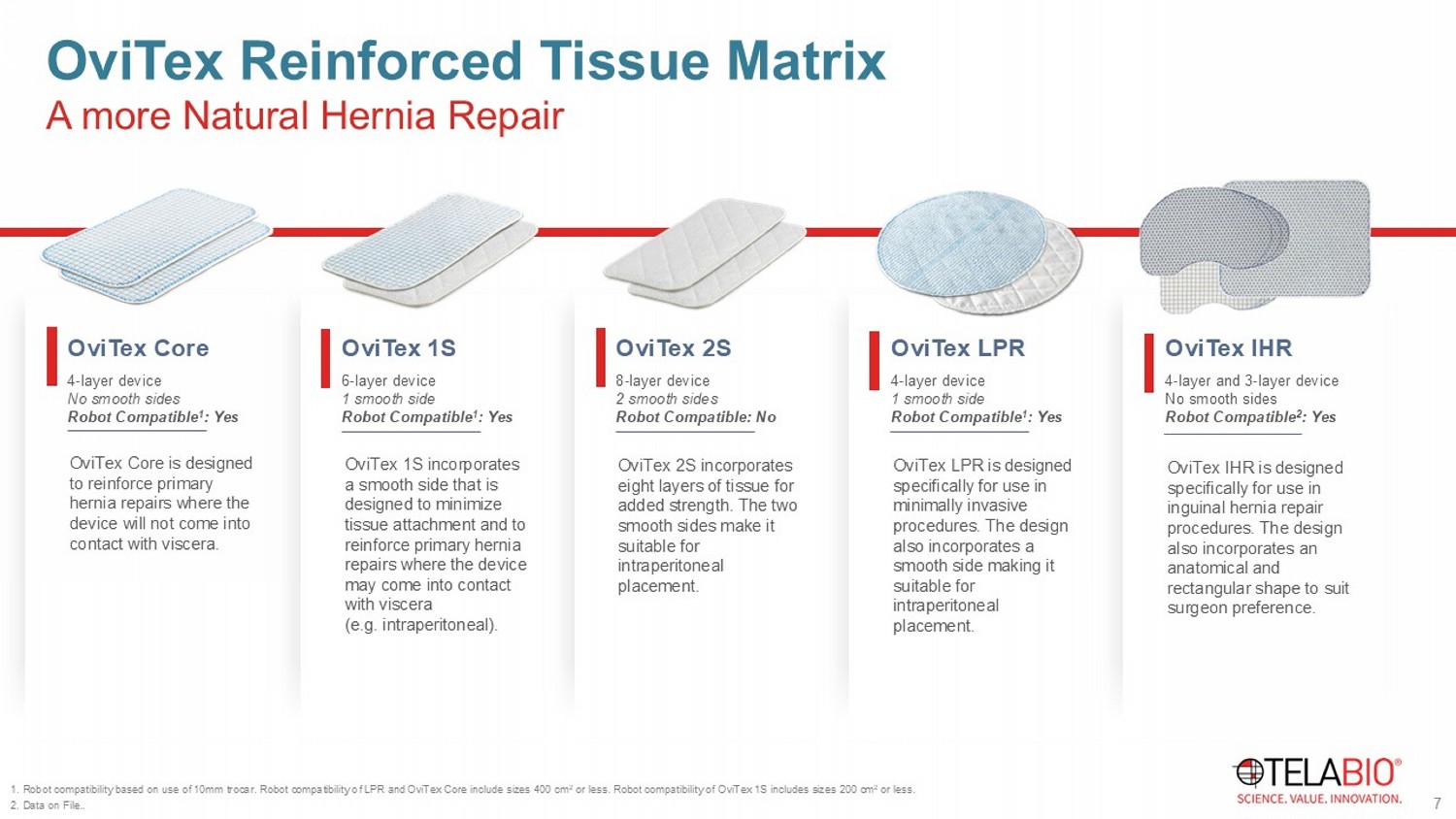

A more Natural Hernia Repair OviTex Reinforced Tissue Matrix OviTex 1S 6 - layer device 1 smooth side Robot Compatible 1 : Yes OviTex 1S incorporates a smooth side that is designed to minimize tissue attachment and to reinforce primary hernia repairs where the device may come into contact with viscera (e.g. intraperitoneal). OviTex 2S 8 - layer device 2 smooth sides Robot Compatible: No OviTex 2S incorporates eight layers of tissue for added strength. The two smooth sides make it suitable for intraperitoneal placement. OviTex LPR 4 - layer device 1 smooth side Robot Compatible 1 : Yes OviTex LPR is designed specifically for use in minimally invasive procedures. The design also incorporates a smooth side making it suitable for intraperitoneal placement. OviTex IHR 4 - layer and 3 - layer device No smooth sides Robot Compatible 2 : Yes OviTex IHR is designed specifically for use in inguinal hernia repair procedures. The design also incorporates an anatomical and rectangular shape to suit surgeon preference. 7 1. Robot compatibility based on use of 10mm trocar. Robot compatibility of LPR and OviTex Core include sizes 400 cm 2 or less. Robot compatibility of OviTex 1S includes sizes 200 cm 2 or less. 2. Data on File..

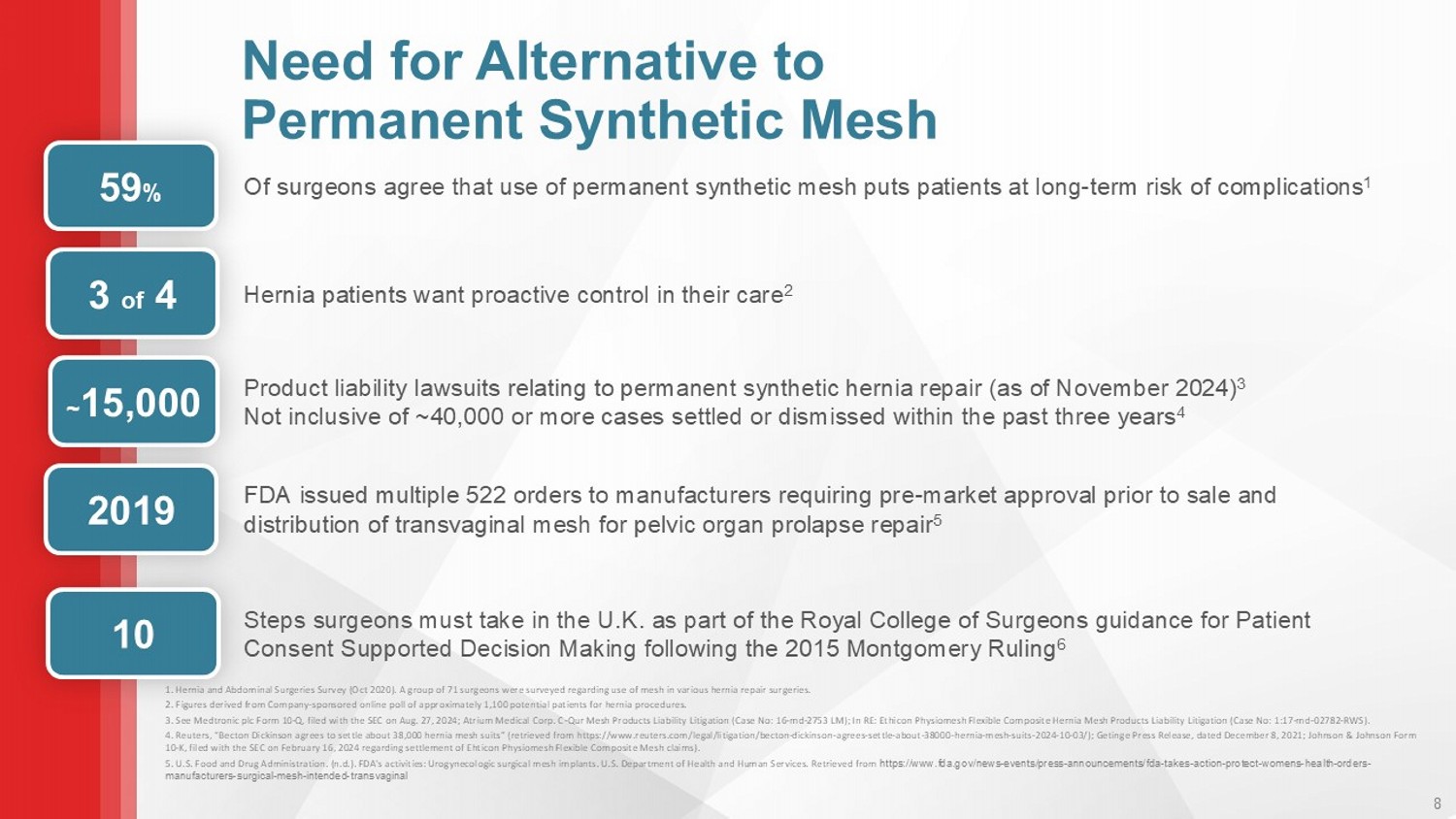

8 1. Hernia and Abdominal Surgeries Survey (Oct 2020). A group of 71 surgeons were surveyed regarding use of mesh in various he rni a repair surgeries. 2. Figures derived from Company - sponsored online poll of approximately 1,100 potential patients for hernia procedures. 3. See Medtronic plc Form 10 - Q, filed with the SEC on Aug. 27, 2024; Atrium Medical Corp. C - Qur Mesh Products Liability Litigation (Case No: 16 - md - 2753 LM); In RE: Ethicon Physiomesh Flexible Composite Hernia Mesh Products Liability Litigation (Case No: 1:17 - md - 02782 - RWS). 4. Reuters, “Becton Dickinson agrees to settle about 38,000 hernia mesh suits” (retrieved from https:// www.reuters.com /legal/litigation/becton - dickinson - agrees - settle - about - 38000 - hernia - mesh - suits - 2024 - 10 - 03/); Getinge Press Release, dated Decemb er 8, 2021; Johnson & Johnson Form 10 - K, filed with the SEC on February 16, 2024 regarding settlement of Ehticon Physiomesh Flexible Composite Mesh claims). 5. U.S. Food and Drug Administration. (n.d.). FDA's activities: Urogynecologic surgical mesh implants. U.S. Department of Health and Human Services. Retrieved from https:// www.fda.gov /news - events/press - announcements/fda - takes - action - protect - womens - health - orders - manufacturers - surgical - mesh - intended - transvaginal O f surgeons agree that use of permanent synthetic mesh puts patients at long - term risk of complications 1 59 % Hernia patients want proactive control in their care 2 3 of 4 Product liability lawsuits relating to permanent synthetic hernia repair (as of November 2024) 3 Not inclusive of ~40,000 or more cases settled or dismissed within the past three years 4 ~ 15,000 FDA issued multiple 522 orders to manufacturers requiring pre - market approval prior to sale and distribution of transvaginal mesh for pelvic organ prolapse repair 5 2019 Steps surgeons must take in the U.K. as part of the Royal College of Surgeons guidance for Patient Consent Supported Decision Making following the 2015 Montgomery Ruling 6 10 Need for Alternative to Permanent Synthetic Mesh Source: Refer to “Clinical References” in this presentation.

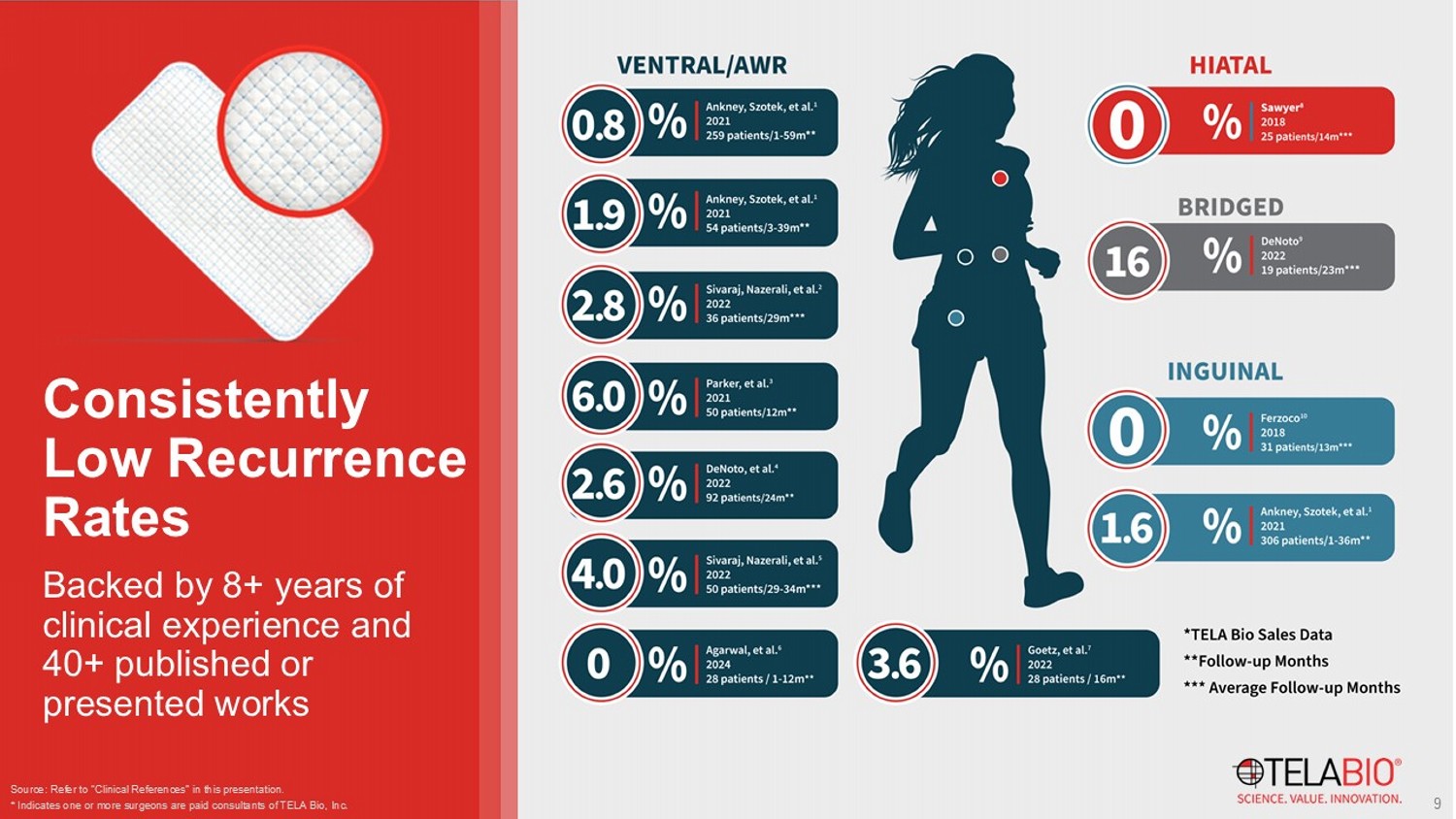

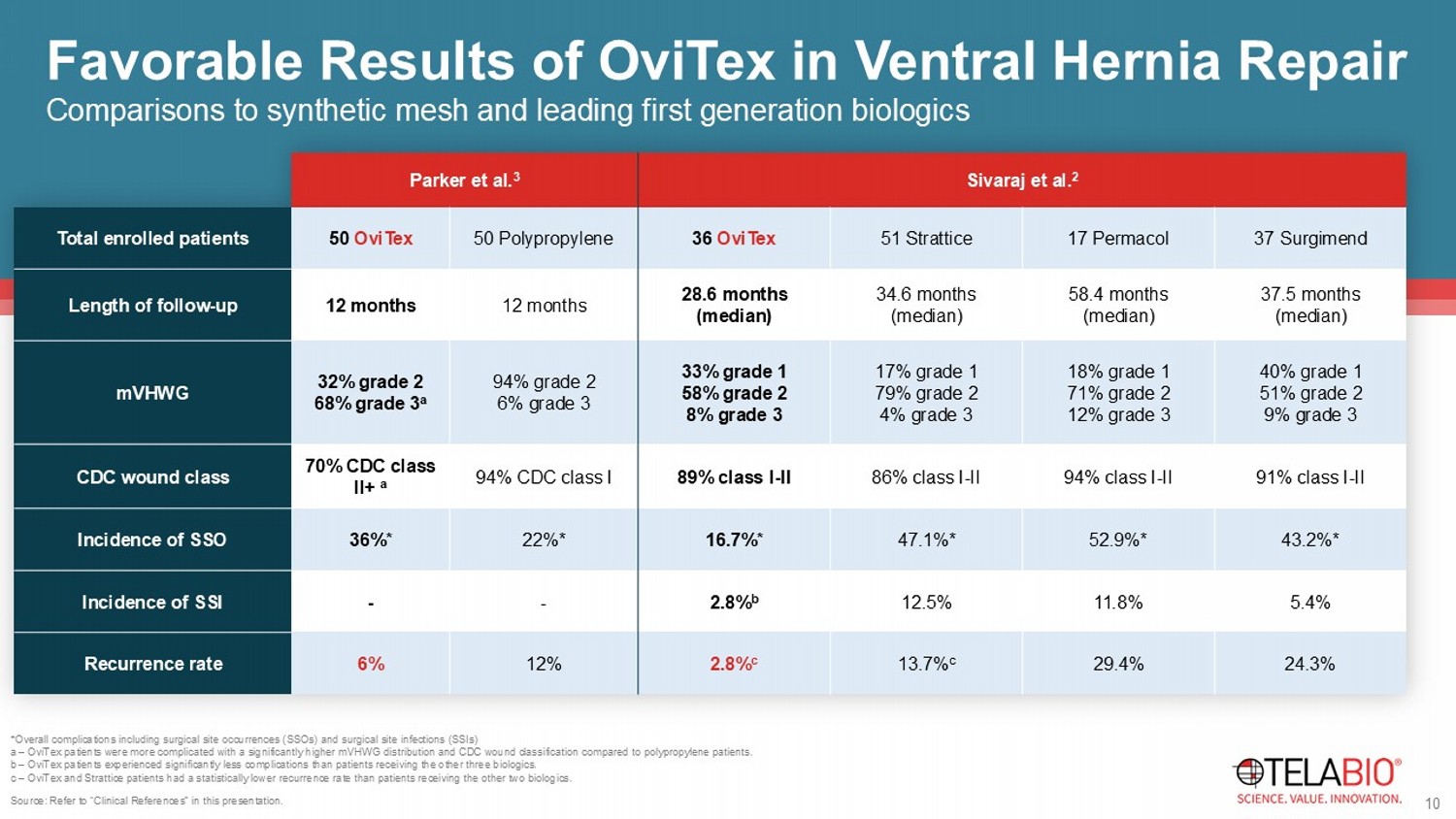

* Indicates one or more surgeons are paid consultants of TELA Bio, Inc. 9 Backed by 8+ years of clinical experience and 40+ published or presented works Consistently Low Recurrence Rates *Overall complications including surgical site occurrences (SSOs) and surgical site infections (SSIs) a – OviTex patients were more complicated with a significantly higher mVHWG distribution and CDC wound classification compared to polypropylene patients.

b – OviTex patients experienced significantly less complications than patients receiving the other three biologics. c – OviTex and Strattice patients had a statistically lower recurrence rate than patients receiving the other two biologics. Source: Refer to “Clinical References” in this presentation. Sivaraj et al. 2 Parker et al. 3 37 Surgimend 17 Permacol 51 Strattice 36 OviTex 50 Polypropylene 50 OviTex Total enrolled patients 37.5 months (median) 58.4 months (median) 34.6 months (median) 28.6 months (median) 12 months 12 months Length of follow - up 40% grade 1 51% grade 2 9% grade 3 18% grade 1 71% grade 2 12% grade 3 17% grade 1 79% grade 2 4% grade 3 33% grade 1 58% grade 2 8% grade 3 94% grade 2 6% grade 3 32% grade 2 68% grade 3 a mVHWG 91% class I - II 94% class I - II 86% class I - II 89% class I - II 94% CDC class I 70% CDC class II+ a CDC wound class 43.2%* 52.9%* 47.1%* 16.7%* 22%* 36%* Incidence of SSO 5.4% 11.8% 12.5% 2.8% b - - Incidence of SSI 24.3% 29.4% 13.7% c 2.8% c 12% 6% Recurrence rate 10 Comparisons to synthetic mesh and leading first generation biologics Favorable Results of OviTex in Ventral Hernia Repair * Kaplan - Meier survival estimate **No head - to - head clinical studies have been conducted.

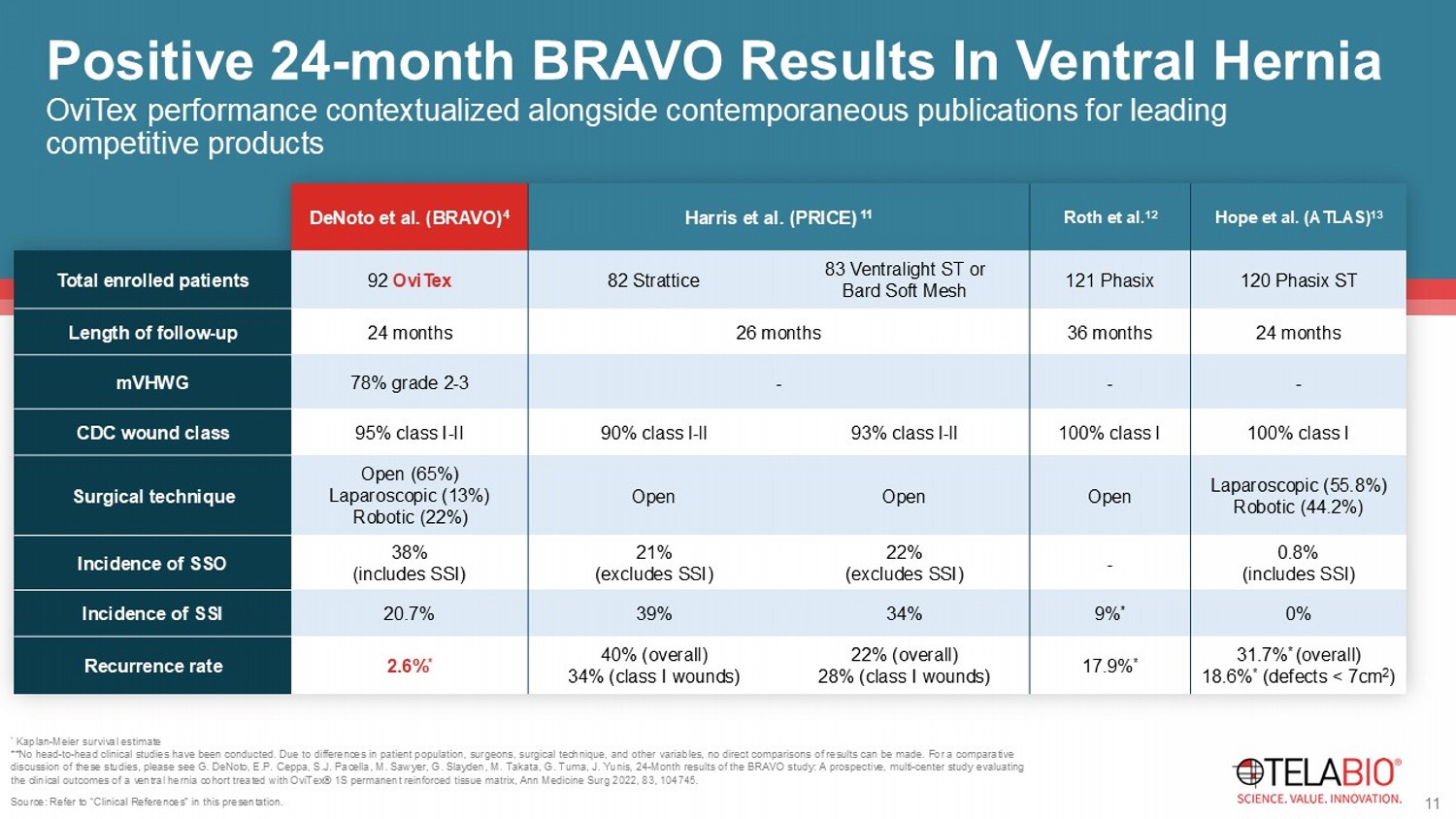

Due to differences in patient population, surgeons, surgical technique, and other variables, no direct comparisons of results can be made. For a comparative discussion of these studies, please see G. DeNoto , E.P. Ceppa , S.J. Pacella, M. Sawyer, G. Slayden , M. Takata, G. Tuma, J. Yunis, 24 - Month results of the BRAVO study: A prospective, multi - center study evaluating the clinical outcomes of a ventral hernia cohort treated with OviTex ® 1S permanent reinforced tissue matrix, Ann Medicine Surg 2022, 83, 104745 . Hope et al. (ATLAS) 13 Roth et al. 12 Harris et al. (PRICE) 11 DeNoto et al. (BRAVO) 4 120 Phasix ST 121 Phasix 83 Ventralight ST or Bard Soft Mesh 82 Strattice 92 OviTex Total enrolled patients 24 months 36 months 26 months 24 months Length of follow - up - - - 78% grade 2 - 3 mVHWG 100% class I 100% class I 93% class l - ll 90% class l - ll 95% class I - II CDC wound class Laparoscopic (55.8%) Robotic (44.2%) Open Open Open Open (65%) Laparoscopic (13%) Robotic (22%) Surgical technique 0.8% (includes SSI) - 22% (excludes SSI) 21% (excludes SSI) 38% (includes SSI) Incidence of SSO 0% 9% * 34% 39% 20.7% Incidence of SSI 31.7% * (overall) 18.6% * (defects < 7cm 2 ) 17.9% * 22% (overall) 28% (class I wounds) 40% (overall) 34% (class I wounds) 2.6% * Recurrence rate Source: Refer to “Clinical References” in this presentation.

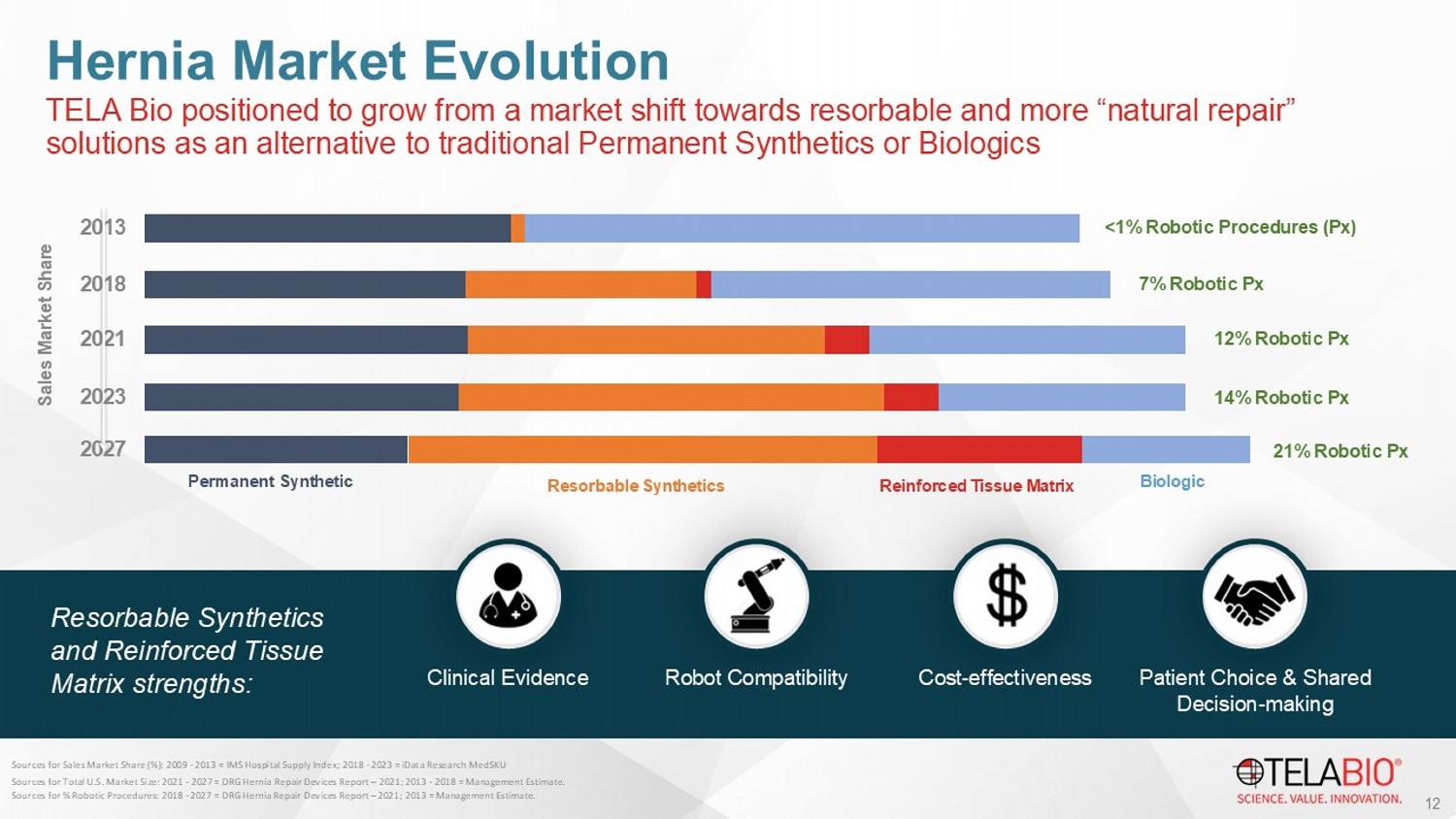

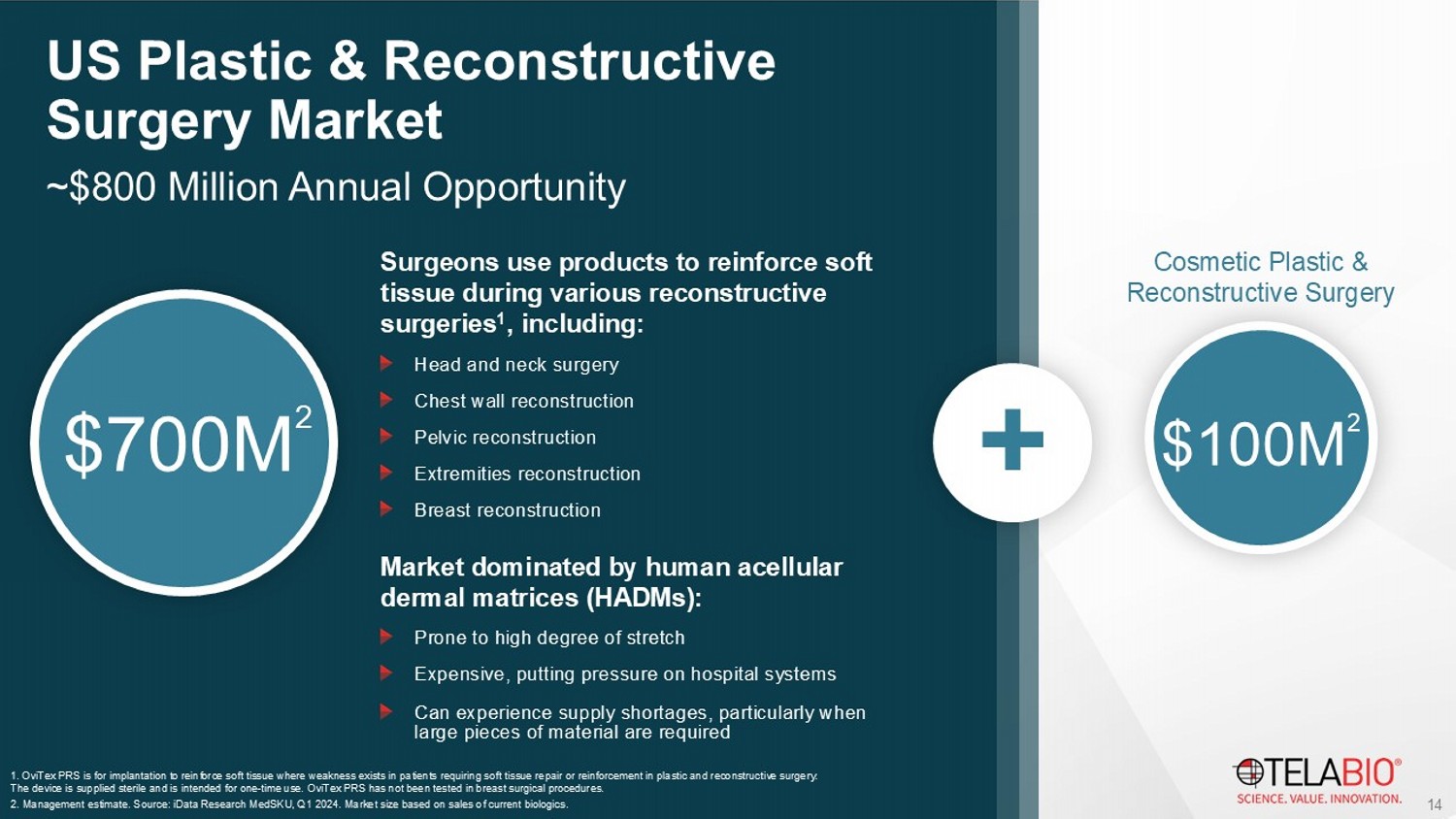

11 OviTex performance contextualized alongside contemporaneous publications for leading competitive products Positive 24 - month BRAVO Results In Ventral Hernia TELA Bio positioned to grow from a market shift towards resorbable and more “natural repair” solutions as an alternative to traditional Permanent Synthetics or Biologics Hernia Market Evolution 2027 2021 2018 2013 Permanent Synthetic Biologic Sales Market Share <1% Robotic Procedures ( Px ) 7% Robotic Px 12% Robotic Px 202 3 1 4 % Robotic Px Resorbable Synthetics Reinforced Tissue Matrix 21% Robotic Px Resorbable Synthetics and Reinforced Tissue Matrix strengths: 12 Sources for Sales Market Share (%): 2009 - 2013 = IMS Hospital Supply Index; 2018 - 2023 = iData Research MedSKU Sources for Total U.S. Market Size: 2021 - 202 7 = DRG Hernia Repair Devices Report – 2021; 2013 - 2018 = Management Estimate. Sources for % Robotic Procedures: 2018 - 2027 = DRG Hernia Repair Devices Report – 2021; 2013 = Management Estimate. Clinical Evidence Robot Compatibility Cost - effectiveness Patient Choice & Shared Decision - making 14 ~$800 Million Annual Opportunity US Plastic & Reconstructive Surgery Market $700M 2 1.

13

OviTex PRS is for implantation to reinforce soft tissue where weakness exists in patients requiring soft tissue repair or reinforcem en t in plastic and reconstructive surgery. The device is supplied sterile and is intended for one - time use. OviTex PRS has not been tested in breast surgical procedures. 2. Management estimate. Source: iData Research MedSKU , Q1 2024. Market size based on sales of current biologics.

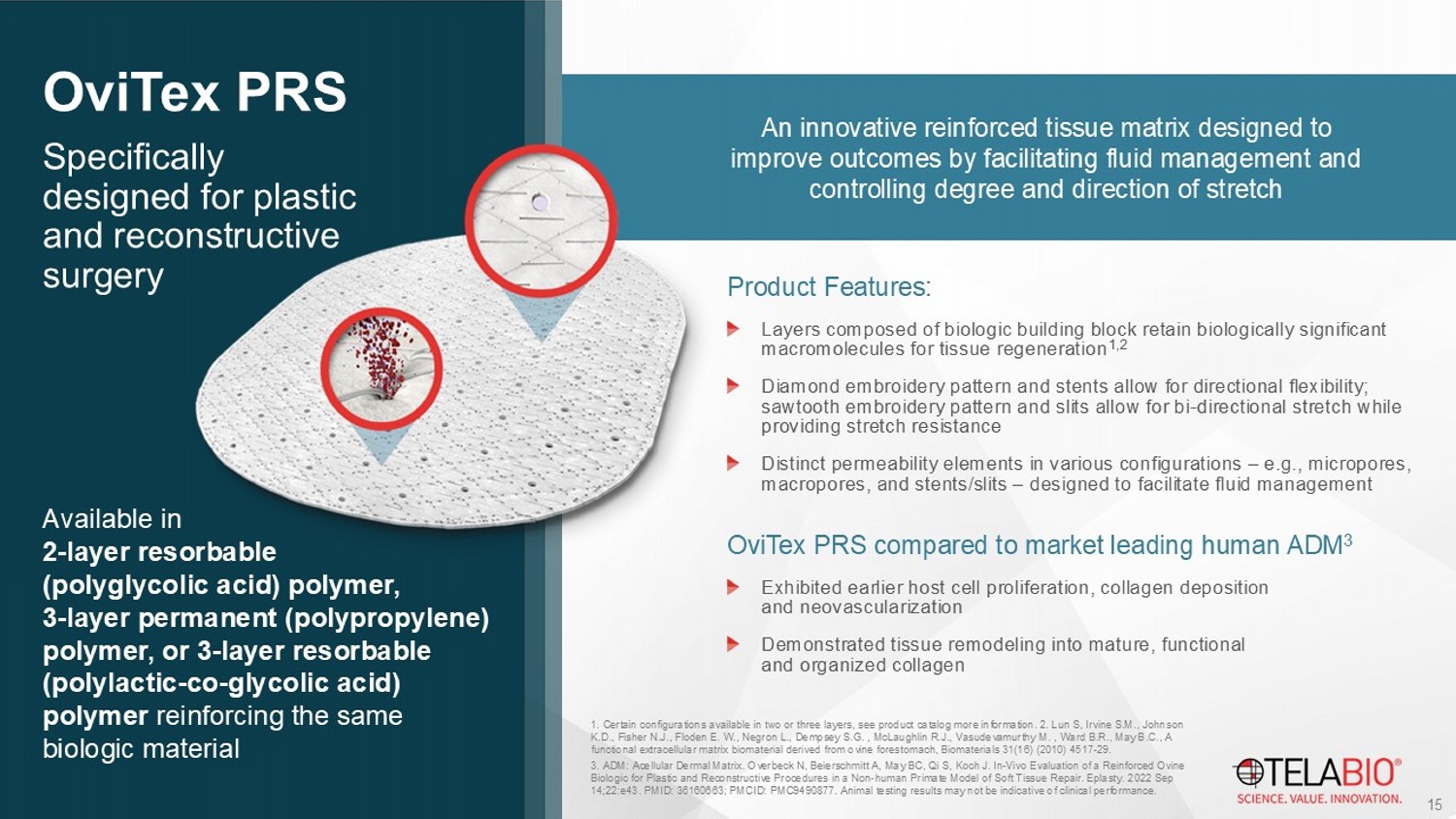

+ $100M 2 Cosmetic Plastic & Reconstructive Surgery Surgeons use products to reinforce soft tissue during various reconstructive surgeries 1 , including: Head and neck surgery Chest wall reconstruction Pelvic reconstruction Extremities reconstruction Breast reconstruction Market dominated by human acellular dermal matrices (HADMs): Prone to high degree of stretch Expensive, putting pressure on hospital systems Can experience supply shortages, particularly when large pieces of material are required Specifically designed for plastic and reconstructive surgery OviTex PRS An innovative reinforced tissue matrix designed to improve outcomes by facilitating fluid management and controlling degree and direction of stretch Product Features: Layers composed of biologic building block retain biologically significant macromolecules for tissue regeneration 1,2 Diamond embroidery pattern and stents allow for directional flexibility; sawtooth embroidery pattern and slits allow for bi - directional stretch while providing stretch resistance Distinct permeability elements in various configurations – e.g., micropores, macropores, and stents/slits – designed to facilitate fluid management OviTex PRS compared to market leading human ADM 3 Exhibited earlier host cell proliferation, collagen deposition and neovascularization Demonstrated tissue remodeling into mature, functional and organized collagen 1. Certain configurations available in two or three layers, see product catalog more information. 2. Lun S, Irvine S.M., John son K.D., Fisher N.J., Floden E. W., Negron L., Dempsey S.G. , McLaughlin R.J., Vasudevamurthy M. , Ward B.R., May B.C., A functional extracellular matrix biomaterial derived from ovine forestomach, Biomaterials 31(16) (2010) 4517 - 29. 3. ADM: Acellular Dermal Matrix. Overbeck N, Beierschmitt A, May BC, Qi S, Koch J. In - Vivo Evaluation of a Reinforced Ovine Biologic for Plastic and Reconstructive Procedures in a Non - human Primate Model of Soft Tissue Repair. Eplasty . 2022 Sep 14;22:e43. PMID: 36160663; PMCID: PMC9490877. Animal testing results may not be indicative of clinical performance. 15 Available in 2 - layer resorbable (polyglycolic acid) polymer, 3 - layer permanent (polypropylene) polymer, or 3 - layer resorbable (polylactic - co - glycolic acid) polymer reinforcing the same biologic material 16 Leading - edge atraumatic hernia mesh fixation devices Designed to minimize complications for patient safety and comfort

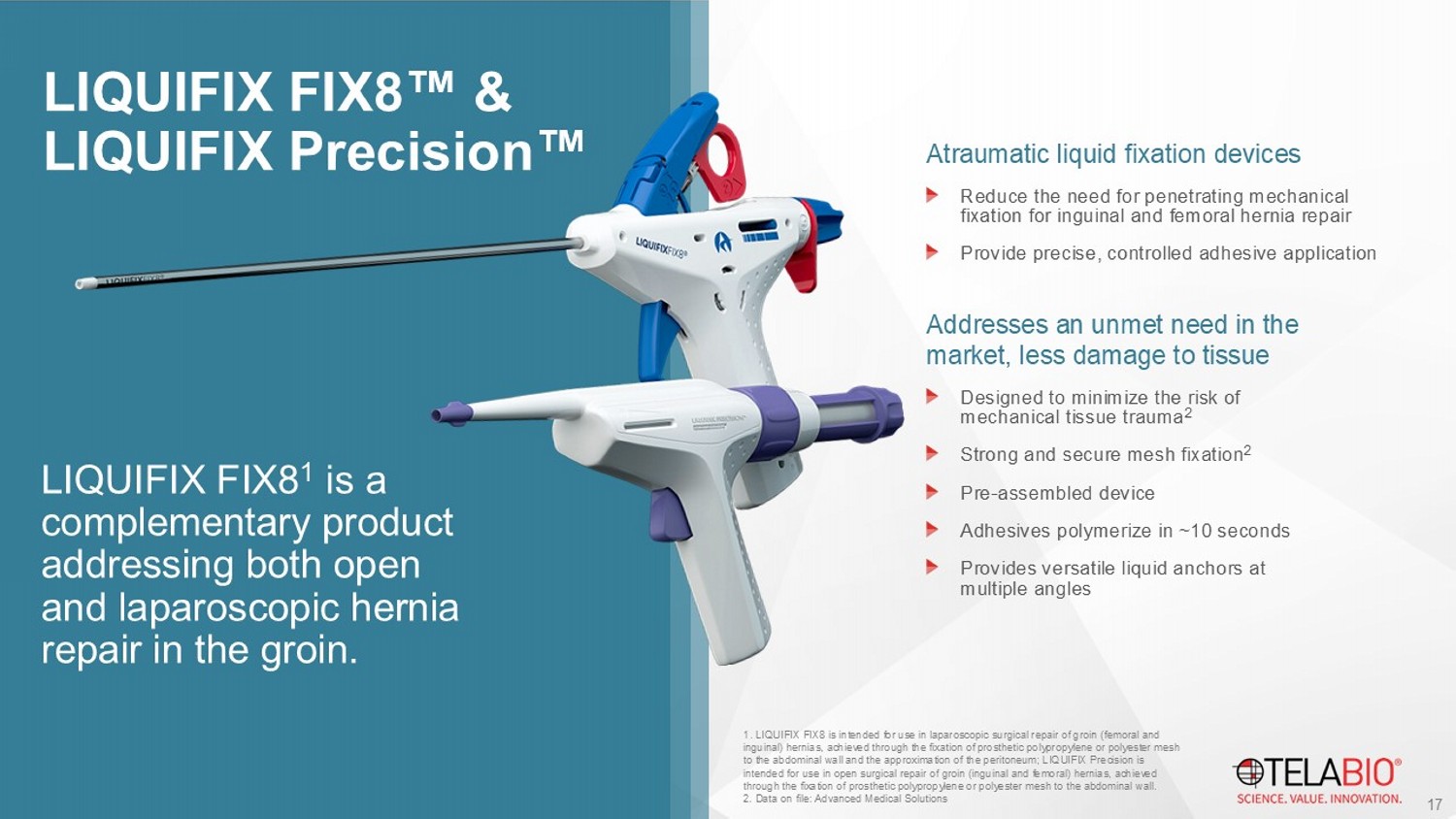

LIQUIFIX FIX8 & LIQUIFIX Precision Atraumatic liquid fixation devices Reduce the need for penetrating mechanical fixation for inguinal and femoral hernia repair Provide precise, controlled adhesive application Addresses an unmet need in the market, less damage to tissue Designed to minimize the risk of mechanical tissue trauma 2 Strong and secure mesh fixation 2 Pre - assembled device Adhesives polymerize in ~10 seconds Provides versatile liquid anchors at multiple angles 1 . LIQUIFIX FIX8 is intended for use in laparoscopic surgical repair of groin (femoral and inguinal) hernias, achieved through the fixation of prosthetic polypropylene or polyester mesh to the abdominal wall and the approximation of the peritoneum; LIQUIFIX Precision is intended for use in open surgical repair of groin (inguinal and femoral) hernias, achieved through the fixation of prosthetic polypropylene or polyester mesh to the abdominal wall. 2. Data on file: Advanced Medical Solutions 17 LIQUIFIX FIX8 1 is a complementary product addressing both open and laparoscopic hernia repair in the groin.

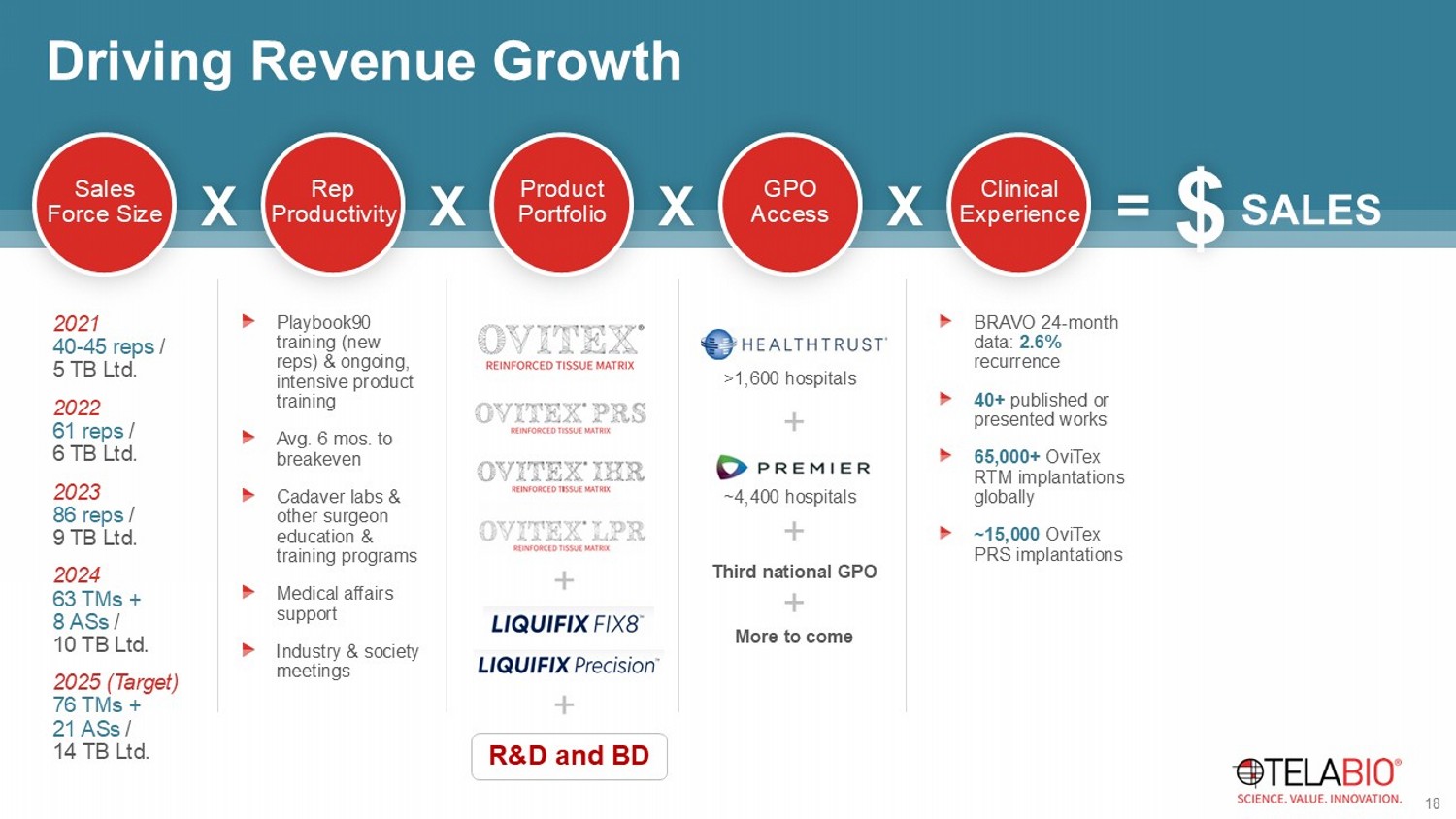

Driving Revenue Growth Sales Force Size Rep Productivity Product Portfolio GPO Access Clinical Experience X X X X = SALES $ 2021 40 - 45 reps / 5 TB Ltd. 2022 61 reps / 6 TB Ltd. 2023 86 reps / 9 TB Ltd. 2024 63 TMs + 8 ASs / 10 TB Ltd. 2025 (Target) 76 TMs + 21 ASs / 14 TB Ltd. Playbook90 training (new reps) & ongoing, intensive product training Avg. 6 mos. to breakeven Cadaver labs & other surgeon education & training programs Medical affairs support Industry & society meetings R&D and BD + + >1,600 hospitals ~4,400 hospitals Third national GPO More to come + + + BRAVO 24 - month data: 2.6% recurrence 40+ published or presented works 65,000+ OviTex RTM implantations globally ~15,000 OviTex PRS implantations 18 19 19 +58% +116% +44% +48% +40% +38% +46% +39% +45% +39% +35% +46% +39% +11% +26% +4% 58% 63% 68% 73% 78% 83% $0 $2 $4 $6 $8 $10 $12 $14 $16 $18 $20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 Gross Margin Revenue ($M) Quarterly Revenue and Gross Margin Revenue Gross Margin $29.5M, +62% $41.4M, +41% $58.5M, +41% $69.3M, +19%

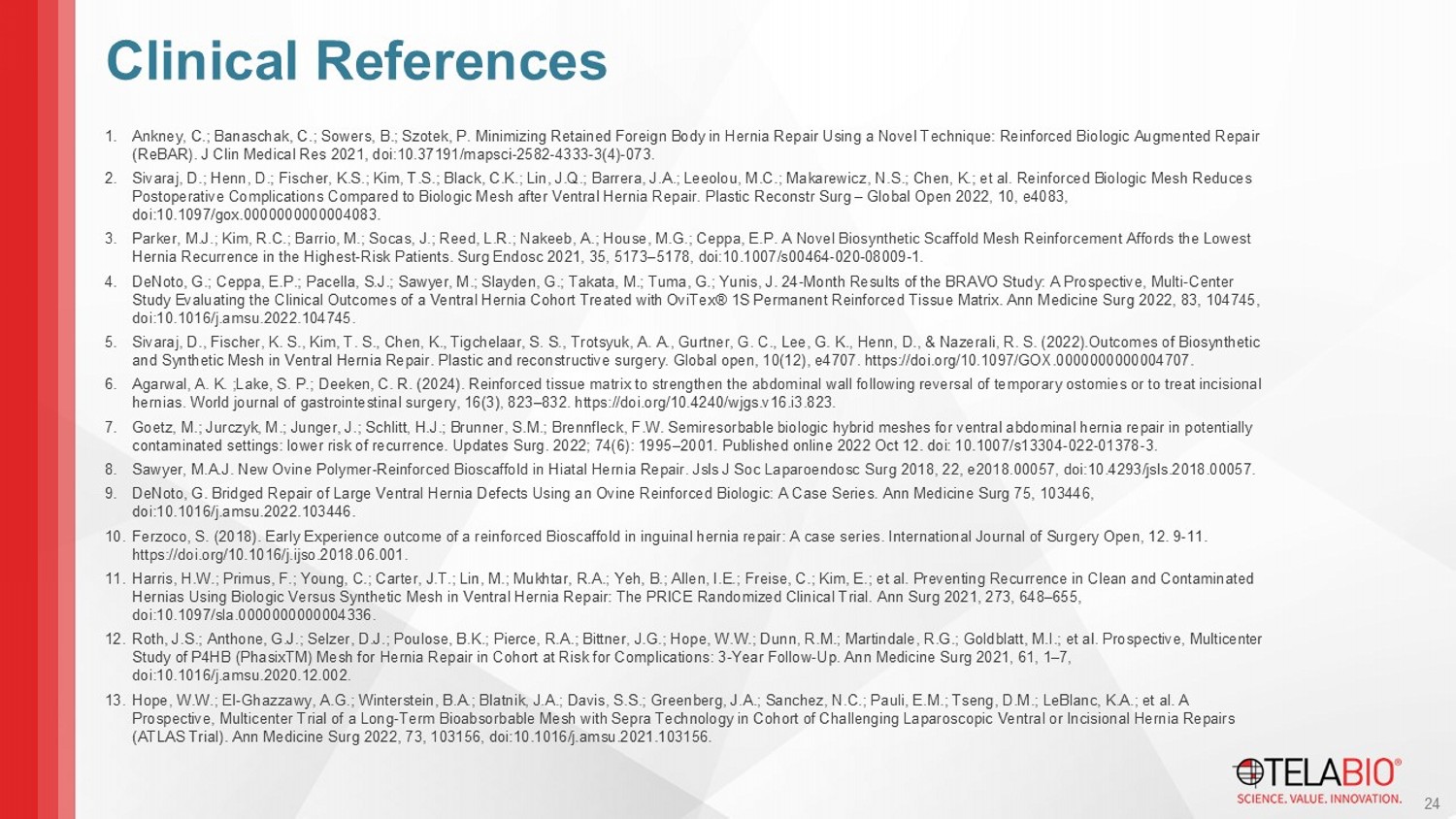

19 Delivering Revenue Growth and Strong Margin with Continuing Improvement Potential $18M Quarterly revenue of $17.6M, growing 4% over corresponding period of 2023 $52.7M Cash and Cash Equivalents at December 31, 2024 64% Gross Margin The Company implemented cost - cutting measures in Q3, which are expected to result in 2025 operating expenses remaining flat to those in 2024 Q4 2024 Performance 20 1. Ankney, C.; Banaschak , C.; Sowers, B.; Szotek , P. Minimizing Retained Foreign Body in Hernia Repair Using a Novel Technique: Reinforced Biologic Augmented Repair ( ReBAR ). J Clin Medical Res 2021, doi:10.37191/mapsci - 2582 - 4333 - 3(4) - 073. 2. Sivaraj , D.; Henn, D.; Fischer, K.S.; Kim, T.S.; Black, C.K.; Lin, J.Q.; Barrera, J.A.; Leeolou , M.C.; Makarewicz , N.S.; Chen, K.; et al. Reinforced Biologic Mesh Reduces Postoperative Complications Compared to Biologic Mesh after Ventral Hernia Repair. Plastic Reconstr Surg – Global Open 2022, 10, e4083, doi:10.1097/gox.0000000000004083. 3. Parker, M.J.; Kim, R.C.; Barrio, M.; Socas, J.; Reed, L.R.; Nakeeb , A.; House, M.G.; Ceppa , E.P. A Novel Biosynthetic Scaffold Mesh Reinforcement Affords the Lowest Hernia Recurrence in the Highest - Risk Patients. Surg Endosc 2021, 35, 5173 – 5178, doi:10.1007/s00464 - 020 - 08009 - 1. 4. DeNoto , G.; Ceppa , E.P.; Pacella, S.J.; Sawyer, M.; Slayden , G.; Takata, M.; Tuma, G.; Yunis, J. 24 - Month Results of the BRAVO Study: A Prospective, Multi - Center Study Evaluating the Clinical Outcomes of a Ventral Hernia Cohort Treated with OviTex ® 1S Permanent Reinforced Tissue Matrix. Ann Medicine Surg 2022, 83, 104745, doi:10.1016/j.amsu.2022.104745. 5. Sivaraj , D., Fischer, K. S., Kim, T. S., Chen, K., Tigchelaar , S. S., Trotsyuk , A. A., Gurtner , G. C., Lee, G. K., Henn, D., & Nazerali, R. S. (2022).Outcomes of Biosynthetic and Synthetic Mesh in Ventral Hernia Repair. Plastic and reconstructive surgery. Global open, 10(12), e4707. https:// doi.org /10.1097/GOX.0000000000004707. 6. Agarwal, A. K. ;Lake, S. P.; Deeken , C. R. (2024). Reinforced tissue matrix to strengthen the abdominal wall following reversal of temporary ostomies or to trea t i ncisional hernias. World journal of gastrointestinal surgery, 16(3), 823 – 832. https:// doi.org /10.4240/wjgs.v16.i3.823. 7. Goetz, M.; Jurczyk , M.; Junger, J.; Schlitt, H.J.; Brunner, S.M.; Brennfleck , F.W. Semiresorbable biologic hybrid meshes for ventral abdominal hernia repair in potentially contaminated settings: lower risk of recurrence. Updates Surg. 2022; 74(6): 1995 – 2001. Published online 2022 Oct 12. doi : 10.1007/s13304 - 022 - 01378 - 3. 8. Sawyer, M.A.J. New Ovine Polymer - Reinforced Bioscaffold in Hiatal Hernia Repair. Jsls J Soc Laparoendosc Surg 2018, 22, e2018.00057, doi:10.4293/jsls.2018.00057. 9. DeNoto , G. Bridged Repair of Large Ventral Hernia Defects Using an Ovine Reinforced Biologic: A Case Series. Ann Medicine Surg 75, 103 446, doi:10.1016/j.amsu.2022.103446. 10. Ferzoco , S. (2018). Early Experience outcome of a reinforced Bioscaffold in inguinal hernia repair: A case series. International Journal of Surgery Open, 12. 9 - 11. https:// doi.org /10.1016/j.ijso.2018.06.001. 11. Harris, H.W.; Primus, F.; Young, C.; Carter, J.T.; Lin, M.; Mukhtar, R.A.; Yeh, B.; Allen, I.E.; Freise , C.; Kim, E.; et al. Preventing Recurrence in Clean and Contaminated Hernias Using Biologic Versus Synthetic Mesh in Ventral Hernia Repair: The PRICE Randomized Clinical Trial. Ann Surg 2021, 27 3, 648 – 655, doi:10.1097/sla.0000000000004336. 12. Roth, J.S.; Anthone , G.J.; Selzer, D.J.; Poulose , B.K.; Pierce, R.A.; Bittner, J.G.; Hope, W.W.; Dunn, R.M.; Martindale, R.G.; Goldblatt, M.I.; et al. Prospective, Multicent er Study of P4HB ( PhasixTM ) Mesh for Hernia Repair in Cohort at Risk for Complications: 3 - Year Follow - Up. Ann Medicine Surg 2021, 61, 1 – 7, doi:10.1016/j.amsu.2020.12.002. 13. Hope, W.W.; El - Ghazzawy , A.G.; Winterstein, B.A.; Blatnik, J.A.; Davis, S.S.; Greenberg, J.A.; Sanchez, N.C.; Pauli, E.M.; Tseng, D.M.; LeBlanc, K.A .; et al. A Prospective, Multicenter Trial of a Long - Term Bioabsorbable Mesh with Sepra Technology in Cohort of Challenging Laparoscopic Ventral or Incisional Hernia Repairs (ATLAS Trial). Ann Medicine Surg 2022, 73, 103156, doi:10.1016/j.amsu.2021.103156. 24 Clinical References