UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 22, 2024

First United Corporation

(Exact name of registrant as specified in its charter)

| Maryland | 0-14237 | 52-1380770 | ||

| (State or other jurisdiction of | (Commission file number) | (IRS Employer | ||

| incorporation or organization) | Identification No.) |

19 South Second Street, Oakland, Maryland 21550

(Address of principal executive offices) (Zip Code)

(301) 334-9471

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbols | Name of each exchange on which registered |

| Common Stock | FUNC | Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

INFORMATION TO BE INCLUDED IN THE REPORT

Item 2.02. Results of Operation and Financial Condition.

On July 22, 2024, First United Corporation (the “Corporation”) issued a press release describing its financial results for the three- and six-month periods ended June 30, 2024. A copy of the press release is furnished herewith as Exhibit 99.1.

The information contained in this Item 2.02 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 7.01. Regulation FD Disclosure.

On July 22, 2024, the Corporation published an investor presentation that discusses certain aspects of its financial results for the three- and six-month periods ended June 30, 2024. A copy of the presentation is furnished herewith as Exhibit 99.2.

The information contained in this Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The exhibits filed or furnished with this report are listed in the following Exhibit Index:

| Exhibit No. | Description | |

| 99.1 | Press release dated July 22, 2024 (furnished herewith) | |

| 99.2 | Investor presentation dated July 22, 2024 (furnished herewith) | |

| 104 | Cover page interactive data file (embedded within the iXBRL document) |

-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| FIRST UNITED CORPORATION | ||

| Dated: July 22, 2024 | By: | /s/ Tonya K. Sturm |

| Tonya K. Sturm | ||

| Senior Vice President & CFO | ||

-

Exhibit 99.1

FIRST UNITED CORPORATION ANNOUNCES

SECOND QUARTER 2024 FINANCIAL RESULTS

OAKLAND, MARYLAND— July 22, 2024: First United Corporation (the “Corporation, “we”, “us”, and “our”) (NASDAQ: FUNC), a bank holding company and the parent company of First United Bank & Trust (the “Bank”), today announced financial results for the three- and six-month periods ended June 30, 2024. Consolidated net income was $4.9 million, or $0.75 per diluted share, for the second quarter of 2024, compared to $4.4 million, or $0.66 per diluted share, for the second quarter of 2023 and $3.7 million, or $0.56 per diluted share, for the first quarter of 2024. Year to date income was $8.6 million, or $1.31 per diluted share, compared to $8.8 million, or $1.31 per diluted share, for the six months ended June 30, 2023.

According to Carissa Rodeheaver, Chairman, President and CEO, “Net interest income improved as we experienced higher repricing of loans and saw stabilization of deposit expense as we remained disciplined in our pricing. Non-interest expenses declined, and loan and wealth production were solid, all resulting in solid core earnings for the quarter offset slightly by increased provision expense. We also took advantage of the lower stock price and improved shareholder position by repurchasing common stock. We believe the environment will continue to be challenging due to the higher interest rates, but we are well positioned to continue to post solid earnings the remainder of the year.”

Financial Highlights:

| · | Deposits decreased due to consumer and commercial spending and runoff of retail certificates of deposit due to competitive pricing |

| · | Repaid $15.0 million of higher cost brokered certificates of deposit |

| · | Shifted $15.0 million of municipal customer balances from overnight investment sweep products to fully insured Intrafi Cash Service (“ICS”) products to release pledging of investment securities and increase available liquidity |

| · | Loan production ramped up with $36.9 million in commercial and $19.1 million in residential mortgage originations |

| · | Purchased and retired 201,800 shares of First United Corporation common stock |

| · | Paid $0.20 per share quarterly dividend to common shareholders |

| · | Net interest margin, on a non-GAAP, fully tax equivalent (“FTE”) basis, was 3.49% for the second quarter of 2024 |

| · | Provision expense increased due to a $1.1 million charge-off on a non-accrual commercial and industrial credit |

| · | Non-interest income, including net gains, remained stable |

| · | Non-interest expense normalized and remains a focus for management |

Income Statement Overview

On a GAAP basis, net income for the second quarter of 2024 was $4.9 million. This compares to GAAP net income of $3.7 million for the first quarter of 2024, inclusive of $0.4 million, net of tax, in accelerated depreciation expense related to branch closures. GAAP net income was $4.4 million for the second quarter of 2023.

| Q2 2024 | Q1 2024 | Q2 2023 | ||||||||||

| Net Income, non-GAAP (millions) | $ | 4.9 | $ | 4.1 | $ | 4.4 | ||||||

| Net Income, GAAP (millions) | $ | 4.9 | $ | 3.7 | $ | 4.4 | ||||||

| Basic and diluted net income per share, non-GAAP | $ | 0.75 | $ | 0.62 | $ | 0.66 | ||||||

| Basic and diluted net income per share, GAAP | $ | 0.75 | $ | 0.56 | $ | 0.66 | ||||||

The $0.5 million increase in quarterly net income year-over-year was primarily driven by a $1.1 million increase in net interest income, which was offset by an increase of $0.8 million in provision expense. The increase in net interest income was primarily related to the $3.4 million increase in interest on loans due to new loans being booked at higher rates and the repricing of adjustable-rate loans. This increase was partially offset by the $2.0 million increase in interest paid on deposits due to continued competitive pricing pressures. An increase of $0.5 million in interest paid on short-term borrowings related to the Bank Term Funding Program (“BTFP”) was offset by the reduction in long-term borrowings related to the repayment of the $40.0 million Federal Home Loan Bank (“FHLB”) advance in the first quarter of 2024. The year-over-year increase in provision for credit losses was primarily driven by increased charge-offs in the commercial and industrial portfolio related to one non-accrual credit where collateral was sold through a liquidation auction at depressed prices. The charge-off was partially offset by continued improvement of qualitative factors. Other activity comparing the second quarter of 2024 to the same period in 2023 was a $0.3 million increase in wealth management income due to improving market conditions and growth of new relationships and a decrease in operating expenses of $0.1 million. The provision for income tax was up $0.2 million when comparing the two quarters due to increased net income before tax.

Compared to the linked quarter, net income increased by $1.2 million due primarily to a $1.4 million increase in net interest income during the second quarter of 2024. The increase in net interest income was primarily related to a $1.0 million increase in interest on loans as new loans continue to be booked at higher interest rates and adjustable-rate loans reprice to higher rates. Additionally, in the first quarter of 2024, two large commercial relationships with combined loan balances of $12.1 million were moved to non-accrual status, which resulted in a reversal of $0.4 million in accrued interest income and fees during the quarter. Equipment and occupancy expenses decreased by $0.6 million due to accelerated depreciation expenses recognized in the first quarter of 2024 related to branch closures. The increased income was partially offset by a $0.2 million increase in provision for credit losses. Provision for income taxes was up $0.4 million when comparing the two quarters due to increased net income in the second quarter over the first quarter 2024.

Year to date net income for the first six months of 2024 was $8.6 million compared to $8.8 million for the same period in 2023. Provision for credit losses increased by $1.2 million related primarily to an increase of $1.1 million in net charge-offs in 2024 due primarily to charge-offs of $1.1 million related to commercial and industrial loans of one relationship in 2024. The increase in provision for credit losses was partially offset by the year over year increase of $0.4 million in net interest income driven by strong growth in our loan portfolio, new loans booked at higher rates, and adjustable-rate loans repricing to higher rates. Wealth management income increased $0.8 million in the first six months of 2024 when compared to the same time period of 2023.

Net Interest Income and Net Interest Margin

Net interest income, on a non-GAAP, fully-tax equivalent (“FTE”) basis, increased by $0.9 million for the second quarter of 2024 when compared to the second quarter of 2023. This increase was driven by a $3.0 million increase in interest income. Interest income on loans increased by $3.4 million due to the increase in average balances of $97.6 million and a 64 basis point increase in the overall yield on the loan portfolio as new loans were booked at higher rates as well as adjustable-rate loans repricing in correlation to the rising rate environment. Investment income decreased by $0.5 million due to a decrease of $86.8 million in average balances related to the balance sheet restructuring of our investment portfolio in the fourth quarter of 2023 and the maturity of $37.5 million in U.S. Treasury bonds in the first four months of 2024. The overall yield on the investment portfolio increased by 12 basis points primarily driven by the increased rate on the trust preferred portfolio and the maturity and sale of lower rate investments. Interest expense increased by $2.1 million year over year due to an increase of 70 basis points on interest paid on deposit accounts. The average deposit balances increased by $24.5 million when compared to the second quarter of 2023 due primarily to the increase of $96.4 million in money market account, which was partially offset by a decrease of $43.2 million and $20.9 million in average savings and time deposits, respectively.

Comparing the second quarter of 2024 to the first quarter of 2024, net interest income, on a non-GAAP, FTE basis, increased by $1.4 million driven by an increase of $1.2 million in interest income and a decrease of $0.2 million in interest expense. Interest income on loans increased by $1.0 million related to the overall increase of 26 basis points in yield and $7.5 million increase in average balances during the second quarter as well as the reversal of $0.4 million in accrued interest and loan fees related to the non-accrual loans in the first quarter of 2024. Interest expense on deposits increased slightly by $0.1 million primarily driven by an increase in average balances of $77.8 million in money market accounts. Interest expense on long-term borrowings decreased by $0.4 million due to the maturity and repayment of $40.0 million in FHLB borrowings during the first quarter of 2024.

Comparing the six months ended June 30, 2024 to the six months ended June 30, 2023, net interest income, on a non-GAAP, FTE basis, was stable. Interest income increased by $6.9 million. Average loan balances increased by $112.9 million and the overall yield increased by 61 basis points in correlation with the rising rate environment and new loans booked at higher rates as well as the repricing of adjustable-rate loans. Interest expense on deposits increased by $5.6 million while the average deposit balances increased by $42.5 million, driven by increases of $77.9 million in money market balances and $27.4 million in retail time deposits, partially offset by decreases in savings balances of $50.1 million. Interest expense on short-term borrowings increased by $0.9 million due to the Bank’s utilization of the BTFP program in January 2024. The increased interest expense resulted in an overall increase of 99 basis points on interest bearing liabilities. The net interest margin for the six months ended June 30, 2024 was 3.31% compared to 3.39% for the six months ended June 30, 2023.

Non-Interest Income

Other operating income, including net gains, for the second quarter of 2024 increased by $0.3 million when compared to the same period of 2023. The growth was driven by an increase of $0.3 million in wealth management income due to improving market conditions, increased annuity sales and growth in new and existing customer relationships. Gains on sales of mortgages declined slightly when comparing the second quarter of 2024 to the same time period of 2023 primarily due to reduced activity in the elevated interest rate environment. Other operating income on service charges and debit card income remained stable.

On a linked quarter basis, other operating income, including net gains, remained stable. Debt card income increased by $0.1 million, which was offset by a $0.1 million decrease in wealth management income.

Other operating income for the six months ended June 30, 2024 increased by $0.8 million when compared to the same period of 2023. This increase was primarily due to the $0.8 million increase in wealth management income due to improving market conditions, increased annuity sales and growth in new and existing customer relationships. Service charge and debit card income were both stable when comparing the six months of 2024 to the six months of 2023.

Non-Interest Expense

Operating expenses decreased by $0.1 million in the second quarter of 2024 when compared to the second quarter of 2023. The decrease was related to a $0.2 million decrease in equipment and occupancy expenses resulting from branch closures in late 2023 and a $0.2 million decrease in check fraud related expenses. These decreases were partially offset by a $0.4 million increase in salaries related to increased health insurance claims, higher salaries and benefits associated with normal merit increases effective April 1, 2024, and reduced loan origination costs due to lower loan production. Other increases in data processing and marketing expenses were offset by decreases in professional services, contract labor, telephone and other miscellaneous expenses.

Non-interest expense decreased by $0.5 million when compared to the linked quarter. This decrease was primarily due to the $0.6 million decrease in equipment and occupancy expenses related to accelerated depreciation expense recognized in the first quarter of 2024 related to branch closures, partially offset by a $0.1 million increase in salaries and employee benefits associated with normal merit increases effective April 1, 2024.

For the six months ended June 30, 2024, non-interest expenses increased by $0.1 million when compared to the six months ended June 30, 2023. Increases in salaries and employee benefits of $0.2 million due to normal merit increases effective April 1, 2024, and increases in FDIC premiums, data processing, equipment and occupancy were offset by decreases in professional services, contract labor, investor relations and other miscellaneous expenses such as pension related expenses, check fraud and membership dues and licenses.

The effective income tax rates as a percentage of income for the six months ended June 30, 2024 and June 30, 2023 were 24.3% and 24.0%, respectively.

Balance Sheet Overview

Total assets at June 30, 2024 were $1.9 billion, representing a $37.3 million decrease since December 31, 2023. During the first six months of 2024, cash and interest-bearing deposits in other banks decreased by $4.7 million. The investment portfolio decreased by $44.3 million due to the maturities of $37.5 million of U.S. Treasury bonds during the year and normal principal amortization of our mortgage-backed securities (“MBS”) portfolio. Gross loans increased by $16.3 million and other real estate owned (“OREO”) decreased by $1.5 million due to sales of OREO properties. Other assets, including deferred taxes, premises and equipment, and accrued interest receivable, decreased by $2.7 million.

Total liabilities at June 30, 2024 were $1.7 billion, representing a $39.6 million decrease since December 31, 2023. Total deposits decreased by $13.9 million when compared to December 31, 2023. The decrease in deposits was attributable to decreases in savings deposits of $11.2 million, retail time deposits of $22.1 million and the repayment of $15.0 million in brokered certificates of deposits, partially offset by increases in demand deposits of $22.2 million and money markets of $16.0 million. Short-term borrowings increased by $17.1 million since December 31, 2023 due to the Bank’s utilization of the BTFP to obtain $40.0 million in borrowings during January 2024 at a rate of 4.87% with a one-year maturity. The increase from the BTFP funding was partially offset by the shift of approximately $22.0 million in overnight investment sweep balances to the ICS product as a result of management’s strategy to release pledging of investment securities for municipalities to increase available liquidity. Long-term borrowings decreased by $40.0 million in the first six month of 2024 when compared to December 31, 2023 due to the repayment of $40.0 million in FHLB borrowings at its maturity in the first quarter of 2024.

Total available for sale and held to maturity securities totaled $267.2 million at June 30, 2024, representing a $44.3 million decrease when compared to December 31, 2023. In the first six months of 2024, $37.5 million in U.S. Treasury bonds matured and the proceeds were used to repay the $40.0 million maturing FHLB advance. Additionally, there were $5.0 million of other principal amortizations in our MBS portfolio year to date.

Outstanding loans of $1.4 billion at June 30, 2024 reflected growth of $16.3 million for the first six months of 2024.

| Loan Type (in millions) |

Change since March 31, 2024 |

Change since December 31, 2023 |

||||||

| Commercial | $ | 3.7 | $ | 9.3 | ||||

| 1 to 4 Family Mortgages | $ | 9.3 | $ | 11.5 | ||||

| Consumer | $ | (2.4 | ) | $ | (4.5 | ) | ||

| Gross Loans | $ | 10.6 | $ | 16.3 | ||||

Since December 31, 2023, commercial real estate loans increased by $12.6 million, and acquisition and development loans increased by $11.2 million. Commercial and industrial loans decreased by $14.4 million, driven by the repayment of $5.5 million of a non-accrual loan late in second quarter and the $1.1 million charge-off of a non-accrual equipment loan. Residential mortgage loans increased by $11.5 million and consumer loans decreased by $4.5 million.

New commercial loan production for the three months ended June 30, 2024 was approximately $36.9 million. The $64.9 million in the pipeline of commercial loans was robust as of June 30, 2024. At June 30, 2024, unfunded, committed commercial construction loans totaled approximately $12.6 million. Commercial amortization and payoffs were approximately $51.6 million through June 30, 2024, due primarily to pay-offs of short-term commercial loans as well as normal amortizations of the commercial loan portfolio.

New consumer mortgage loan production for the second quarter of 2024 was approximately $19.1 million, with most of this production comprised of portfolio mortgages. The pipeline of in-house, portfolio loans as of June 30, 2024 was $19.4 million. The residential mortgage production level increased in the second quarter of 2024 due to the seasonality of this line of business, particularly construction lending. Unfunded commitments related to residential construction loans totaled $13.5 million at June 30, 2024.

Total deposits at June 30, 2024 decreased by $13.9 million when compared to December 31, 2023.

| Deposit Type (in millions) |

Change since March 31, 2024 |

Change since December 31, 2023 |

||||||

| Non-Interest-Bearing | $ | 1.2 | $ | (3.7 | ) | |||

| Interest-Bearing Demand | $ | (4.7 | ) | $ | 22.2 | |||

| Savings and Money Market | $ | (0.1 | ) | $ | 4.7 | |||

| Time Deposits | $ | (22.8 | ) | $ | (37.1 | ) | ||

| Total Deposits | $ | (26.4 | ) | $ | (13.9 | ) | ||

Interest-bearing demand deposits increased by $22.2 million, primarily related to the shift of approximately $22.0 million in overnight investment sweep balances into the ICS product due to management’s strategy to release pledging of investment securities for municipalities to increase available liquidity. Money market accounts increased by $16.0 million due primarily to the expansion of current relationships and new relationships during the first six months. Traditional savings accounts decreased by $11.3 million and time deposits decreased by $37.1 million. The decrease in time deposits was due to a decrease of $22.1 million in retail Certificates of Deposit (“CDs”) related to maturities of a nine-month special CD promotion in 2023 and the maturity and repayment of a $15.0 million brokered CD. The Bank has worked closely with customers as these CDs mature to transition them to other deposit and wealth management products offered by the Bank.

Short-term borrowings increased by $17.1 million as the Bank borrowed $40.0 million from the BTFP in January 2024, partially offset by a decrease of approximately $22.0 million in other short-term borrowings due primarily to management’s strategic decision to shift municipal customers into the ICS deposit product. Long-term borrowings decreased by $40.0 million as a $40.0 million FHLB advance matured in March 2024 and was fully repaid utilizing proceeds from lower yielding investment maturities.

The book value of the Corporation’s common stock was $25.39 per share at June 30, 2024 compared to $24.38 per share at December 31, 2023. At June 30, 2024, there were 6,465,601 of basic outstanding shares and 6,479,624 of diluted outstanding shares of common stock. During the first six months of 2024, the Company purchased and retired 201,800 shares of First United Corporation stock as part of its previously announced stock repurchase plan at an average price of $19.99 per share. The increase in the book value at June 30, 2024 was due to the undistributed net income of $6.0 million for the first six months of 2024.

Asset Quality

The allowance for credit losses (“ACL”) was $17.9 million at June 30, 2024 compared to $16.9 million recorded at June 30, 2023 and $17.5 million at December 31, 2023. The provision for credit losses was $1.2 million for the quarter ended June 30, 2024 compared to $0.4 million for the quarter ended June 30, 2023 and $0.9 million for the first quarter of 2024. The increased provision expense recorded in 2024 was primarily related to $1.1 million in charge-offs related to one non-accrual commercial and industrial loan relationship and was partially offset by improving qualitative risk factors of our loan portfolio. Net charge-offs of $1.3 million were recorded for the quarter ended June 30, 2024 compared to net charge-offs of $0.4 million for the quarter ended June 30, 2023. The ratio of the ACL to loans outstanding was 1.26% at June 30, 2024 compared to 1.27% at March 31, 2024 and 1.25% at June 30, 2023.

The ratio of year-to-date net charge offs to average loans was 0.25% for the six-month period ended June 30, 2024 and 0.10% for the six-month period ended June 30, 2023. The commercial and industrial portfolio had net charge offs of 0.89% for the six-month period ended June 30, 2024 compared to a net charge offs of 0.13% for the six-month period ended June 30, 2023. This shift was due primarily to charge offs of equipment loan balances on one non-accrual commercial relationship during 2024. The consumer portfolio had net charge offs of 2.02% for the six-month period ended June 30, 2024 compared to net charge offs of 1.40% for the six month period ended June 30, 2023. The increase in net charge offs in consumer loans in 2024 was primarily driven by approximately $0.4 million in charge offs of overdrawn demand deposit balances during the first quarter of 2024 and student loan accounts in the second quarter. Details of the ratios, by loan type, are shown below. Our special assets team continues to actively collect on charged-off loans, resulting in overall low net charge-off ratios.

| Ratio of Net (Charge Offs)/Recoveries to Average Loans | ||||||||

| Loan Type |

6/30/2024 (Charge Off) / Recovery |

6/30/2023 (Charge Off) / Recovery |

||||||

| Commercial Real Estate | 0.01 | % | (0.04 | )% | ||||

| Acquisition & Development | 0.01 | % | 0.02 | % | ||||

| Commercial & Industrial | (0.89 | )% | (0.13 | )% | ||||

| Residential Mortgage | (0.01 | )% | 0.01 | % | ||||

| Consumer | (2.02 | )% | (1.40 | )% | ||||

| Total Net (Charge Offs)/Recoveries | (0.25 | )% | (0.10 | )% | ||||

Non-accrual loans totaled $9.4 million at June 30, 2024 compared to $4.0 million at December 31, 2023. The increase in non-accrual balances at June 30, 2024 was related to two commercial and industrial loan relationships totaling $12.1 million that were moved to non-accrual during the first quarter of 2024. The reduction in non-accrual balances during the second quarter of 2024 is related to a borrower’s decision to sell a piece of collateral and reduce outstanding balances by approximately $5.5 million and the charge-off of $1.1 million on another commercial and industrial credit.

Non-accrual loans that have been subject to partial charge-offs totaling $1.0 million at June 30, 2024 and $0.1 million at December 31, 2023. Loans secured by 1-4 family residential real estate properties in the process of foreclosure totaled $1.5 million at June 30, 2024 and $1.8 million at December 31, 2023. As a percentage of the loan portfolio, accruing loans past due 30 days or more was 0.26% at June 30, 2024 compared to 0.24% at December 31, 2023 and 0.18% as of June 30, 2023.

ABOUT FIRST UNITED CORPORATION

First United Corporation is a Maryland corporation chartered in 1985 and a financial holding company registered with the Board of Governors of the Federal Reserve System under the Bank Holding Company Act of 1956, as amended, that elected financial holding company status in 2021. The Corporation’s primary business is serving as the parent company of the Bank, First United Statutory Trust I (“Trust I”) and First United Statutory Trust II (“Trust II” and together with Trust I, “the Trusts”), both Connecticut statutory business trusts. The Trusts were formed for the purpose of selling trust preferred securities that qualified as Tier 1 capital. The Bank has two consumer finance company subsidiaries- Oak First Loan Center, Inc., a West Virginia corporation, and OakFirst Loan Center, LLC, a Maryland limited liability company – and two subsidiaries that it uses to hold real estate acquired through foreclosure or by deed in lieu of foreclosure – First OREO Trust, a Maryland statutory trust, and FUBT OREO I, LLC, a Maryland limited liability company. In addition, the Bank owns 99.9% of the limited partnership interests in Liberty Mews Limited Partnership, a Maryland limited partnership formed for the purpose of acquiring, developing and operating low-income housing units in Garrett County, Maryland, and a 99.9% non-voting membership interest in MCC FUBT Fund, LLC, an Ohio limited liability company formed for the purpose of acquiring, developing and operating low-income housing units in Allegany County, Maryland (the “MCC Fund”). The Corporation’s website is www.mybank.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements do not represent historical facts, but are statements about management's beliefs, plans and objectives about the future, as well as its assumptions and judgments concerning such beliefs, plans and objectives. These statements are evidenced by terms such as "anticipate," "estimate," "should," "expect," "believe," "intend," and similar expressions. Although these statements reflect management's good faith beliefs and projections, they are not guarantees of future performance and they may not prove true. The beliefs, plans and objectives on which forward-looking statements are based involve risks and uncertainties that could cause actual results to differ materially from those addressed in the forward-looking statements. For a discussion of these risks and uncertainties, see the section of the periodic reports that First United Corporation files with the Securities and Exchange Commission entitled "Risk Factors". In addition, investors should understand that the Corporation is required under generally accepted accounting principles to evaluate subsequent events through the filing of the consolidated financial statements included in its Quarterly Report on Form 10-Q for the quarter ended June 30, 2024 and the impact that any such events have on our critical accounting assumptions and estimates made as of June 30, 2024, which could require us to make adjustments to the amounts reflected in this press release.

FIRST UNITED CORPORATION

Oakland, MD

Stock Symbol : FUNC

Financial Highlights - Unaudited

| (Dollars in thousands, except per share data) |

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, | June 30, | June 30, | June 30, | |||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Results of Operations: | ||||||||||||||||

| Interest income | $ | 23,113 | $ | 19,972 | $ | 45,011 | $ | 37,801 | ||||||||

| Interest expense | 7,875 | 5,798 | 15,961 | 9,109 | ||||||||||||

| Net interest income | 15,238 | 14,174 | 29,050 | 28,692 | ||||||||||||

| Provision for credit losses | 1,194 | 395 | 2,140 | 938 | ||||||||||||

| Other operating income | 4,782 | 4,483 | 9,575 | 8,822 | ||||||||||||

| Net gains | 59 | 86 | 141 | 140 | ||||||||||||

| Other operating expense | 12,364 | 12,511 | 25,245 | 25,149 | ||||||||||||

| Income before taxes | $ | 6,521 | $ | 5,837 | $ | 11,381 | $ | 11,567 | ||||||||

| Income tax expense | 1,607 | 1,423 | 2,769 | 2,778 | ||||||||||||

| Net income | $ | 4,914 | $ | 4,414 | $ | 8,612 | $ | 8,789 | ||||||||

| Per share data: | ||||||||||||||||

| Basic net income per share | $ | 0.75 | $ | 0.66 | $ | 1.31 | $ | 1.32 | ||||||||

| Diluted net income per share | $ | 0.75 | $ | 0.66 | $ | 1.31 | $ | 1.31 | ||||||||

| Adjusted Basic net income (1) | $ | 0.75 | $ | 0.66 | $ | 1.37 | $ | 1.32 | ||||||||

| Adjusted Diluted net income (1) | $ | 0.75 | $ | 0.66 | $ | 1.37 | $ | 1.31 | ||||||||

| Dividends declared per share | $ | 0.20 | $ | 0.20 | $ | 0.40 | $ | 0.40 | ||||||||

| Book value | $ | 25.39 | $ | 23.12 | ||||||||||||

| Diluted book value | $ | 25.34 | $ | 23.07 | ||||||||||||

| Tangible book value per share | $ | 23.55 | $ | 21.29 | ||||||||||||

| Diluted Tangible book value per share | $ | 23.49 | $ | 21.25 | ||||||||||||

| Closing market value | $ | 20.42 | $ | 14.26 | ||||||||||||

| Market Range: | ||||||||||||||||

| High | $ | 22.88 | $ | 17.01 | ||||||||||||

| Low | $ | 19.40 | $ | 12.56 | ||||||||||||

| Shares outstanding at period end: Basic | 6,465,601 | 6,711,422 | ||||||||||||||

| Shares outstanding at period end: Diluted | 6,479,624 | 6,724,734 | ||||||||||||||

| Performance ratios: (Year to Date Period End, annualized) | ||||||||||||||||

| Return on average assets | 0.89 | % | 0.95 | % | ||||||||||||

| Adjusted return on average assets (1) | 0.98 | % | 0.95 | % | ||||||||||||

| Return on average shareholders' equity | 10.48 | % | 11.43 | % | ||||||||||||

| Adjusted return on average shareholders' equity (1) | 11.52 | % | 11.43 | % | ||||||||||||

| Net interest margin (Non-GAAP), includes tax exempt income of $116 and $452 | 3.31 | % | 3.39 | % | ||||||||||||

| Net interest margin GAAP | 3.29 | % | 3.34 | % | ||||||||||||

| Efficiency ratio - non-GAAP (1) | 63.48 | % | 66.00 | % | ||||||||||||

(1) Efficiency ratio is a non-GAAP measure calculated by dividing total operating expenses by the sum of tax equivalent net interest income and other operating income, less gains/(losses) on sales of securities and/or fixed assets.

| June 30, | December 31 | |||||||

| 2024 | 2023 | |||||||

| Financial Condition at period end: | ||||||||

| Assets | $ | 1,868,599 | $ | 1,905,860 | ||||

| Earning assets | $ | 1,695,425 | $ | 1,725,236 | ||||

| Gross loans | $ | 1,422,975 | $ | 1,406,667 | ||||

| Commercial Real Estate | $ | 506,273 | $ | 493,703 | ||||

| Acquisition and Development | $ | 88,215 | $ | 77,060 | ||||

| Commercial and Industrial | $ | 260,168 | $ | 274,604 | ||||

| Residential Mortgage | $ | 511,354 | $ | 499,871 | ||||

| Consumer | $ | 56,965 | $ | 61,429 | ||||

| Investment securities | $ | 267,151 | $ | 311,466 | ||||

| Total deposits | $ | 1,537,071 | $ | 1,550,977 | ||||

| Noninterest bearing | $ | 423,970 | $ | 427,670 | ||||

| Interest bearing | $ | 1,113,101 | $ | 1,123,307 | ||||

| Shareholders' equity | $ | 164,177 | $ | 161,873 | ||||

| Capital ratios: | ||||||||

| Tier 1 to risk weighted assets | 14.51 | % | 14.42 | % | ||||

| Common Equity Tier 1 to risk weighted assets | 12.54 | % | 12.44 | % | ||||

| Tier 1 Leverage | 11.69 | % | 11.30 | % | ||||

| Total risk based capital | 15.75 | % | 15.64 | % | ||||

| Asset quality: | ||||||||

| Net charge-offs for the quarter | $ | (1,309 | ) | $ | (195 | ) | ||

| Nonperforming assets: (Period End) | ||||||||

| Nonaccrual loans | $ | 9,438 | $ | 3,956 | ||||

| Loans 90 days past due and accruing | 526 | 543 | ||||||

| Total nonperforming loans and 90 day past due | $ | 9,964 | $ | 4,499 | ||||

| Other real estate owned | $ | 2,978 | $ | 4,493 | ||||

| Allowance for credit losses to gross loans | 1.26 | % | 1.24 | % | ||||

| Allowance for credit losses to non-accrual loans | 189.90 | % | 441.86 | % | ||||

| Allowance for credit losses to non-performing assets | 138.49 | % | 194.40 | % | ||||

| Non-performing and 90 day past due loans to total loans | 0.70 | % | 0.32 | % | ||||

| Non-performing loans and 90 day past due loans to total assets | 0.53 | % | 0.24 | % | ||||

| Non-accrual loans to total loans | 0.66 | % | 0.28 | % | ||||

| Non-performing assets to total assets | 0.69 | % | 0.47 | % | ||||

FIRST UNITED CORPORATION

Oakland, MD

Stock Symbol : FUNC

Financial Highlights - Unaudited

| June 30, | March 31, | December 31, | September 30, | June 30, | March 31, | |||||||||||||||||||

| (Dollars in thousands, except per share data) | 2024 | 2024 | 2023 | 2023 | 2023 | 2023 | ||||||||||||||||||

| Results of Operations: | ||||||||||||||||||||||||

| Interest income | $ | 23,113 | $ | 21,898 | $ | 22,191 | $ | 21,164 | $ | 19,972 | $ | 17,829 | ||||||||||||

| Interest expense | 7,875 | 8,086 | 7,997 | 7,180 | 5,798 | 3,311 | ||||||||||||||||||

| Net interest income | 15,238 | 13,812 | 14,194 | 13,984 | 14,174 | 14,518 | ||||||||||||||||||

| Provision for credit losses | 1,194 | 946 | 419 | 263 | 395 | 543 | ||||||||||||||||||

| Other operating income | 4,782 | 4,793 | 4,793 | 4,716 | 4,483 | 4,339 | ||||||||||||||||||

| Net gains/(losses) | 59 | 82 | (4,184 | ) | 182 | 86 | 54 | |||||||||||||||||

| Other operating expense | 12,364 | 12,881 | 12,309 | 12,785 | 12,511 | 12,638 | ||||||||||||||||||

| Income before taxes | $ | 6,521 | $ | 4,860 | $ | 2,075 | $ | 5,834 | $ | 5,837 | $ | 5,730 | ||||||||||||

| Income tax expense | 1,607 | 1,162 | 317 | 1,321 | 1,423 | 1,355 | ||||||||||||||||||

| Net income | $ | 4,914 | $ | 3,698 | $ | 1,758 | $ | 4,513 | $ | 4,414 | $ | 4,375 | ||||||||||||

| Per share data: | ||||||||||||||||||||||||

| Basic net income per share | $ | 0.75 | $ | 0.56 | $ | 0.26 | $ | 0.67 | $ | 0.66 | $ | 0.66 | ||||||||||||

| Diluted net income per share | $ | 0.75 | $ | 0.56 | $ | 0.26 | $ | 0.67 | $ | 0.66 | $ | 0.65 | ||||||||||||

| Adjusted basic net income (1) | $ | 0.75 | $ | 0.62 | $ | 0.82 | $ | 0.67 | $ | 0.66 | $ | 0.66 | ||||||||||||

| Adjusted diluted net income (1) | $ | 0.75 | $ | 0.62 | $ | 0.82 | $ | 0.67 | $ | 0.66 | $ | 0.65 | ||||||||||||

| Dividends declared per share | $ | 0.20 | $ | 0.20 | $ | 0.20 | $ | 0.20 | $ | 0.20 | $ | 0.20 | ||||||||||||

| Book value | $ | 25.39 | $ | 24.89 | $ | 24.38 | $ | 23.08 | $ | 23.12 | $ | 22.85 | ||||||||||||

| Diluted book value | $ | 25.34 | $ | 24.86 | $ | 24.33 | $ | 23.03 | $ | 23.07 | $ | 22.81 | ||||||||||||

| Tangible book value per share | $ | 23.55 | $ | 23.08 | $ | 22.56 | $ | 21.27 | $ | 21.29 | $ | 21.01 | ||||||||||||

| Diluted Tangible book value per share | $ | 23.49 | $ | 23.05 | $ | 22.51 | $ | 21.22 | $ | 21.25 | $ | 20.96 | ||||||||||||

| Closing market value | $ | 20.42 | $ | 22.91 | $ | 23.51 | $ | 16.23 | $ | 14.26 | $ | 16.89 | ||||||||||||

| Market Range: | ||||||||||||||||||||||||

| High | $ | 22.88 | $ | 23.85 | $ | 23.51 | $ | 17.34 | $ | 17.01 | $ | 20.41 | ||||||||||||

| Low | $ | 19.40 | $ | 21.21 | $ | 16.12 | $ | 13.70 | $ | 12.56 | $ | 16.75 | ||||||||||||

| Shares outstanding at period end: Basic | 6,465,601 | 6,648,645 | 6,639,888 | 6,715,170 | 6,711,422 | 6,688,710 | ||||||||||||||||||

| Shares outstanding at period end: Diluted | 6,479,624 | 6,657,239 | 6,653,200 | 6,728,482 | 6,724,734 | 6,703,252 | ||||||||||||||||||

| Performance ratios: (Year to Date Period End, annualized) | ||||||||||||||||||||||||

| Return on average assets | 0.89 | % | 0.76 | % | 0.78 | % | 0.93 | % | 0.95 | % | 0.94 | % | ||||||||||||

| Adjusted return on average assets (1) | 0.98 | % | 0.85 | % | 0.94 | % | 0.93 | % | 0.95 | % | 0.94 | % | ||||||||||||

| Return on average shareholders' equity | 10.48 | % | 9.07 | % | 9.68 | % | 11.44 | % | 11.43 | % | 11.87 | % | ||||||||||||

| Adjusted return on average shareholders' equity (1) | 11.52 | % | 10.11 | % | 11.87 | % | 11.44 | % | 11.43 | % | 11.87 | % | ||||||||||||

| Net interest margin (Non-GAAP), includes tax exempt income of $116 and $452 | 3.31 | % | 3.12 | % | 3.26 | % | 3.30 | % | 3.39 | % | 3.53 | % | ||||||||||||

| Net interest margin GAAP | 3.29 | % | 3.10 | % | 3.22 | % | 3.25 | % | 3.34 | % | 3.48 | % | ||||||||||||

| Efficiency ratio - non-GAAP (1) | 63.48 | % | 65.71 | % | 65.12 | % | 66.41 | % | 66.00 | % | 67.02 | % | ||||||||||||

(1) Efficiency ratio is a non-GAAP measure calculated by dividing total operating expenses by the sum of tax equivalent net interest income and other operating income, less gains/(losses) on sales of securities and/or fixed assets.

| June 30, | March 31, | December 31, | September 30, | June 30, | March 31, | |||||||||||||||||||

| 2024 | 2024 | 2023 | 2023 | 2023 | 2023 | |||||||||||||||||||

| Financial Condition at period end: | ||||||||||||||||||||||||

| Assets | $ | 1,868,599 | $ | 1,912,953 | $ | 1,905,860 | $ | 1,928,201 | $ | 1,928,393 | $ | 1,937,442 | ||||||||||||

| Earning assets | $ | 1,695,425 | $ | 1,695,962 | $ | 1,725,236 | $ | 1,717,244 | $ | 1,707,522 | $ | 1,652,688 | ||||||||||||

| Gross loans | $ | 1,422,975 | $ | 1,412,327 | $ | 1,406,667 | $ | 1,380,019 | $ | 1,350,038 | $ | 1,289,080 | ||||||||||||

| Commercial Real Estate | $ | 506,273 | $ | 492,819 | $ | 493,703 | $ | 491,284 | $ | 483,485 | $ | 453,356 | ||||||||||||

| Acquisition and Development | $ | 88,215 | $ | 83,424 | $ | 77,060 | $ | 79,796 | $ | 79,003 | $ | 76,980 | ||||||||||||

| Commercial and Industrial | $ | 260,168 | $ | 274,722 | $ | 274,604 | $ | 254,650 | $ | 249,683 | $ | 241,959 | ||||||||||||

| Residential Mortgage | $ | 511,354 | $ | 501,990 | $ | 499,871 | $ | 491,686 | $ | 475,540 | $ | 456,198 | ||||||||||||

| Consumer | $ | 56,965 | $ | 59,372 | $ | 61,429 | $ | 62,603 | $ | 62,327 | $ | 60,587 | ||||||||||||

| Investment securities | $ | 267,151 | $ | 278,716 | $ | 311,466 | $ | 330,053 | $ | 350,844 | $ | 357,061 | ||||||||||||

| Total deposits | $ | 1,537,071 | $ | 1,563,453 | $ | 1,550,977 | $ | 1,575,069 | $ | 1,579,959 | $ | 1,591,285 | ||||||||||||

| Noninterest bearing | $ | 423,970 | $ | 422,759 | $ | 427,670 | $ | 429,691 | $ | 466,628 | $ | 468,554 | ||||||||||||

| Interest bearing | $ | 1,113,101 | $ | 1,140,694 | $ | 1,123,307 | $ | 1,145,378 | $ | 1,113,331 | $ | 1,122,731 | ||||||||||||

| Shareholders' equity | $ | 164,177 | $ | 165,481 | $ | 161,873 | $ | 154,990 | $ | 155,156 | $ | 152,868 | ||||||||||||

| Capital ratios: | ||||||||||||||||||||||||

| Tier 1 to risk weighted assets | 14.51 | % | 14.58 | % | 14.42 | % | 14.60 | % | 14.40 | % | 14.90 | % | ||||||||||||

| Common Equity Tier 1 to risk weighted assets | 12.54 | % | 12.60 | % | 12.44 | % | 12.60 | % | 12.40 | % | 12.82 | % | ||||||||||||

| Tier 1 Leverage | 11.69 | % | 11.48 | % | 11.30 | % | 11.25 | % | 11.25 | % | 11.47 | % | ||||||||||||

| Total risk based capital | 15.75 | % | 15.83 | % | 15.64 | % | 15.81 | % | 15.60 | % | 16.15 | % | ||||||||||||

| Asset quality: | ||||||||||||||||||||||||

| Net (charge-offs)/recoveries for the quarter | $ | (1,309 | ) | $ | (459 | ) | $ | (195 | ) | $ | (83 | ) | $ | (398 | ) | $ | (245 | ) | ||||||

| Nonperforming assets: (Period End) | ||||||||||||||||||||||||

| Nonaccrual loans | $ | 9,438 | $ | 16,007 | $ | 3,956 | $ | 3,479 | $ | 2,972 | $ | 3,258 | ||||||||||||

| Loans 90 days past due and accruing | 526 | 120 | 543 | 145 | 160 | 87 | ||||||||||||||||||

| Total nonperforming loans and 90 day past due | $ | 9,964 | $ | 16,127 | $ | 4,499 | $ | 3,624 | $ | 3,132 | $ | 3,345 | ||||||||||||

| Modified/restructured loans | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||

| Other real estate owned | $ | 2,978 | $ | 4,402 | $ | 4,493 | $ | 4,878 | $ | 4,482 | $ | 4,598 | ||||||||||||

| Allowance for credit losses to gross loans | 1.26 | % | 1.27 | % | 1.24 | % | 1.24 | % | 1.25 | % | 1.31 | % | ||||||||||||

| Allowance for credit losses to non-accrual loans | 189.90 | % | 112.34 | % | 441.86 | % | 492.84 | % | 568.81 | % | 517.83 | % | ||||||||||||

| Allowance for credit losses to non-performing assets | 138.49 | % | 87.59 | % | 194.40 | % | 473.12 | % | 539.79 | % | 212.40 | % | ||||||||||||

| Non-performing and 90 day past due loans to total loans | 0.70 | % | 1.14 | % | 0.32 | % | 0.26 | % | 0.23 | % | 0.26 | % | ||||||||||||

| Non-performing loans and 90 day past due loans to total assets | 0.53 | % | 0.84 | % | 0.24 | % | 0.19 | % | 0.16 | % | 0.17 | % | ||||||||||||

| Non-accrual loans to total loans | 0.66 | % | 1.13 | % | 0.28 | % | 0.25 | % | 0.22 | % | 0.25 | % | ||||||||||||

| Non-performing assets to total assets | 0.69 | % | 1.07 | % | 0.47 | % | 0.44 | % | 0.39 | % | 0.41 | % | ||||||||||||

| (Dollars in thousands - Unaudited) | June 30, 2024 | March 31, 2024 | December 31, 2023 | |||||||||

| Assets | ||||||||||||

| Cash and due from banks | $ | 43,635 | $ | 85,578 | $ | 48,343 | ||||||

| Interest bearing deposits in banks | 1,457 | 1,354 | 1,410 | |||||||||

| Cash and cash equivalents | 45,092 | 86,932 | 49,753 | |||||||||

| Investment securities – available for sale (at fair value) | 92,954 | 95,580 | 97,169 | |||||||||

| Investment securities – held to maturity (at cost) | 174,197 | 183,136 | 214,297 | |||||||||

| Restricted investment in bank stock, at cost | 3,395 | 3,390 | 5,250 | |||||||||

| Loans held for sale | 447 | 175 | 443 | |||||||||

| Loans | 1,422,975 | 1,412,327 | 1,406,667 | |||||||||

| Unearned fees | (306 | ) | (314 | ) | (340 | ) | ||||||

| Allowance for credit losses | (17,923 | ) | (17,982 | ) | (17,480 | ) | ||||||

| Net loans | 1,404,746 | 1,394,031 | 1,388,847 | |||||||||

| Premises and equipment, net | 29,688 | 30,268 | 31,459 | |||||||||

| Goodwill and other intangible assets | 11,938 | 12,021 | 12,103 | |||||||||

| Bank owned life insurance | 48,267 | 47,933 | 47,607 | |||||||||

| Deferred tax assets | 11,214 | 10,736 | 11,948 | |||||||||

| Other real estate owned, net | 2,978 | 4,402 | 4,493 | |||||||||

| Operating lease asset | 1,230 | 1,299 | 1,367 | |||||||||

| Accrued interest receivable and other assets | 42,453 | 43,050 | 41,124 | |||||||||

| Total Assets | $ | 1,868,599 | $ | 1,912,953 | $ | 1,905,860 | ||||||

| Liabilities and Shareholders’ Equity | ||||||||||||

| Liabilities: | ||||||||||||

| Non-interest bearing deposits | $ | 423,970 | $ | 422,759 | $ | 427,670 | ||||||

| Interest bearing deposits | 1,113,101 | 1,140,694 | 1,123,307 | |||||||||

| Total deposits | 1,537,071 | 1,563,453 | 1,550,977 | |||||||||

| Short-term borrowings | 62,564 | 79,494 | 45,418 | |||||||||

| Long-term borrowings | 70,929 | 70,929 | 110,929 | |||||||||

| Operating lease liability | 1,412 | 1,484 | 1,556 | |||||||||

| Allowance for credit loss on off balance sheet exposures | 801 | 858 | 873 | |||||||||

| Accrued interest payable and other liabilities | 30,352 | 29,925 | 32,904 | |||||||||

| Dividends payable | 1,293 | 1,329 | 1,330 | |||||||||

| Total Liabilities | 1,704,422 | $ | 1,747,472 | 1,743,987 | ||||||||

| Shareholders’ Equity: | ||||||||||||

| Common Stock – par value $0.01 per share; Authorized 25,000,000 shares; issued and outstanding 6,465,601 shares at June 30, 2024 and 6,639,888 at December 31, 2023 | 65 | 66 | 66 | |||||||||

| Surplus | 20,280 | 23,865 | 23,734 | |||||||||

| Retained earnings | 179,892 | 176,272 | 173,900 | |||||||||

| Accumulated other comprehensive loss | (36,060 | ) | (34,722 | ) | (35,827 | ) | ||||||

| Total Shareholders’ Equity | 164,177 | 165,481 | 161,873 | |||||||||

| Total Liabilities and Shareholders’ Equity | $ | 1,868,599 | $ | 1,912,953 | $ | 1,905,860 | ||||||

| 2024 | 2023 | |||||||||||||||||||||||

| Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | |||||||||||||||||||

| In thousands | (Unaudited) | |||||||||||||||||||||||

| Interest income | ||||||||||||||||||||||||

| Interest and fees on loans | $ | 20,221 | $ | 19,218 | $ | 19,290 | $ | 18,055 | $ | 16,780 | $ | 15,444 | ||||||||||||

| Interest on investment securities | ||||||||||||||||||||||||

| Taxable | 1,697 | 1,744 | 1,834 | 1,792 | 1,779 | 1,768 | ||||||||||||||||||

| Exempt from federal income tax | 53 | 53 | 53 | 123 | 268 | 270 | ||||||||||||||||||

| Total investment income | 1,750 | 1,797 | 1,887 | 1,915 | 2,047 | 2,038 | ||||||||||||||||||

| Other | 1,142 | 883 | 1,014 | 1,194 | 1,145 | 347 | ||||||||||||||||||

| Total interest income | 23,113 | 21,898 | 22,191 | 21,164 | 19,972 | 17,829 | ||||||||||||||||||

| Interest expense | ||||||||||||||||||||||||

| Interest on deposits | 6,398 | 6,266 | 6,498 | 5,672 | 4,350 | 2,678 | ||||||||||||||||||

| Interest on short-term borrowings | 509 | 461 | 54 | 33 | 29 | 31 | ||||||||||||||||||

| Interest on long-term borrowings | 968 | 1,359 | 1,445 | 1,475 | 1,419 | 602 | ||||||||||||||||||

| Total interest expense | 7,875 | 8,086 | 7,997 | 7,180 | 5,798 | 3,311 | ||||||||||||||||||

| Net interest income | 15,238 | 13,812 | 14,194 | 13,984 | 14,174 | 14,518 | ||||||||||||||||||

| Credit loss expense/(credit) | ||||||||||||||||||||||||

| Loans | 1,251 | 961 | 530 | 322 | 434 | 414 | ||||||||||||||||||

| Debt securities held to maturity | — | — | — | 45 | — | — | ||||||||||||||||||

| Off balance sheet credit exposures | (57 | ) | (15 | ) | (111 | ) | (104 | ) | (39 | ) | 129 | |||||||||||||

| Provision for credit losses | 1,194 | 946 | 419 | 263 | 395 | 543 | ||||||||||||||||||

| Net interest income after provision for credit losses | 14,044 | 12,866 | 13,775 | 13,721 | 13,779 | 13,975 | ||||||||||||||||||

| Other operating income | ||||||||||||||||||||||||

| Net losses on investments, available for sale | — | — | (4,214 | ) | — | — | — | |||||||||||||||||

| Gains on sale of residential mortgage loans | 59 | 82 | 59 | 182 | 86 | 54 | ||||||||||||||||||

| Losses on disposal of fixed assets | — | — | (29 | ) | — | — | — | |||||||||||||||||

| Net gains/(losses) | 59 | 82 | (4,184 | ) | 182 | 86 | 54 | |||||||||||||||||

| Other Income | ||||||||||||||||||||||||

| Service charges on deposit accounts | 556 | 556 | 567 | 569 | 546 | 516 | ||||||||||||||||||

| Other service charges | 225 | 215 | 223 | 230 | 244 | 232 | ||||||||||||||||||

| Trust department | 2,255 | 2,188 | 2,148 | 2,139 | 2,025 | 1,970 | ||||||||||||||||||

| Debit card income | 999 | 932 | 1,120 | 995 | 1,031 | 955 | ||||||||||||||||||

| Bank owned life insurance | 334 | 326 | 325 | 320 | 311 | 305 | ||||||||||||||||||

| Brokerage commissions | 362 | 495 | 360 | 245 | 258 | 297 | ||||||||||||||||||

| Other | 51 | 81 | 50 | 218 | 68 | 64 | ||||||||||||||||||

| Total other income | 4,782 | 4,793 | 4,793 | 4,716 | 4,483 | 4,339 | ||||||||||||||||||

| Total other operating income | 4,841 | 4,875 | 609 | 4,898 | 4,569 | 4,393 | ||||||||||||||||||

| Other operating expenses | ||||||||||||||||||||||||

| Salaries and employee benefits | 7,256 | 7,157 | 6,390 | 6,964 | 6,870 | 7,296 | ||||||||||||||||||

| FDIC premiums | 285 | 269 | 268 | 254 | 277 | 193 | ||||||||||||||||||

| Equipment | 635 | 923 | 912 | 718 | 747 | 780 | ||||||||||||||||||

| Occupancy | 652 | 954 | 1,169 | 745 | 742 | 785 | ||||||||||||||||||

| Data processing | 1,422 | 1,318 | 1,384 | 1,388 | 1,306 | 1,306 | ||||||||||||||||||

| Marketing | 184 | 134 | 311 | 242 | 160 | 120 | ||||||||||||||||||

| Professional services | 449 | 486 | 631 | 488 | 520 | 494 | ||||||||||||||||||

| Contract labor | 84 | 183 | 170 | 155 | 157 | 134 | ||||||||||||||||||

| Telephone | 103 | 109 | 125 | 115 | 116 | 110 | ||||||||||||||||||

| Other real estate owned | 14 | 86 | (370 | ) | 139 | 18 | 124 | |||||||||||||||||

| Investor relations | 91 | 53 | 65 | 74 | 123 | 83 | ||||||||||||||||||

| Contributions | 66 | 50 | 12 | 74 | 79 | 64 | ||||||||||||||||||

| Other | 1,123 | 1,159 | 1,242 | 1,429 | 1,396 | 1,149 | ||||||||||||||||||

| Total other operating expenses | 12,364 | 12,881 | 12,309 | 12,785 | 12,511 | 12,638 | ||||||||||||||||||

| Income before income tax expense | 6,521 | 4,860 | 2,075 | 5,834 | 5,837 | 5,730 | ||||||||||||||||||

| Provision for income tax expense | 1,607 | 1,162 | 317 | 1,321 | 1,423 | 1,355 | ||||||||||||||||||

| Net Income | $ | 4,914 | $ | 3,698 | $ | 1,758 | $ | 4,513 | $ | 4,414 | $ | 4,375 | ||||||||||||

| Basic net income per common share | $ | 0.75 | $ | 0.56 | $ | 0.26 | $ | 0.67 | $ | 0.66 | $ | 0.66 | ||||||||||||

| Diluted net income per common share | $ | 0.75 | $ | 0.56 | $ | 0.26 | $ | 0.67 | $ | 0.66 | $ | 0.65 | ||||||||||||

| Weighted average number of basic shares outstanding | 6,527 | 6,642 | 6,649 | 6,714 | 6,704 | 6,675 | ||||||||||||||||||

| Weighted average number of diluted shares outstanding | 6,537 | 6,655 | 6,663 | 6,728 | 6,718 | 6,697 | ||||||||||||||||||

| Dividends declared per common share | $ | 0.20 | $ | 0.20 | $ | 0.20 | $ | 0.20 | $ | 0.20 | $ | 0.20 | ||||||||||||

Non-GAAP Financial Measures (unaudited)

Reconciliation of as reported (GAAP) and non-GAAP financial measures

The following tables below provide a reconciliation of certain financial measures calculated under generally accepted accounting principles ("GAAP") (as reported) and non-GAAP. A non-GAAP financial measure is a numerical measure of historical or future financial performance, financial position or cash flows that excludes or includes amounts that are required to be disclosed in the most directly comparable measure calculated and presented in accordance with GAAP in the United States. The Company’s management believes the presentation of non-GAAP financial measures provide investors with a greater understanding of the Company’s operating results in addition to the results measured in accordance with GAAP. While management uses these non-GAAP measures in its analysis of the Company’s performance, this information should not be viewed as a substitute for financial results determined in accordance with GAAP or considered to be more important than financial results determined in accordance with GAAP.

The following non-GAAP financial measures exclude accelerated depreciation expenses related to the branch closures.

| Three months ended June 30, | Six months ended June 30, | |||||||||||||||

| (in thousands, except for per share amount) | 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Net income - as reported | $ | 4,914 | $ | 4,414 | $ | 8,612 | $ | 8,789 | ||||||||

| Adjustments: | ||||||||||||||||

| Accelerated depreciation expenses | — | — | 562 | — | ||||||||||||

| Income tax effect of adjustments | — | — | (137 | ) | — | |||||||||||

| Adjusted net income (non-GAAP) | $ | 4,914 | $ | 4,414 | $ | 9,037 | $ | 8,789 | ||||||||

| Diluted earnings per share - as reported | $ | 0.75 | $ | 0.66 | $ | 1.31 | $ | 1.31 | ||||||||

| Adjustments: | ||||||||||||||||

| Accelerated depreciation expenses | — | — | 0.08 | — | ||||||||||||

| Income tax effect of adjustments | — | — | (0.02 | ) | — | |||||||||||

| Adjusted basic and diluted earnings per share (non-GAAP) | $ | 0.75 | $ | 0.66 | $ | 1.37 | $ | 1.31 | ||||||||

| As of or for the three months ended |

As of or for the six months ended |

|||||||||||||||

| June 30, | June 30, | |||||||||||||||

| (in thousands, except per share data) | 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Per Share Data | ||||||||||||||||

| Basic net income per share (1) - as reported | $ | 0.75 | $ | 0.66 | $ | 1.31 | $ | 1.32 | ||||||||

| Basic net income per share (1) - non-GAAP | 0.75 | 0.66 | 1.37 | 1.32 | ||||||||||||

| Diluted net income per share (1) - as reported | $ | 0.75 | $ | 0.66 | $ | 1.31 | $ | 1.31 | ||||||||

| Diluted net income per share (1) - non-GAAP | 0.75 | 0.66 | 1.37 | 1.31 | ||||||||||||

| Basic book value per share | $ | 25.39 | $ | 23.12 | ||||||||||||

| Diluted book value per share | $ | 25.34 | $ | 23.07 | ||||||||||||

| Significant Ratios: | ||||||||||||||||

| As of or for the six months ended |

||||||||||||||||

| June 30, | ||||||||||||||||

| Return on Average Assets (1) - as reported | 0.89 | % | 0.95 | % | ||||||||||||

| Accelerated depreciation expenses | 0.12 | % | — | |||||||||||||

| Income tax effect of adjustments | -0.03 | % | — | |||||||||||||

| Adjusted Return on Average Assets (1) (non-GAAP) | 0.98 | % | 0.95 | % | ||||||||||||

| Return on Average Equity (1) - as reported | 10.48 | % | 11.43 | % | ||||||||||||

| Accelerated depreciation expenses | 1.38 | % | — | |||||||||||||

| Income tax effect of adjustments | (0.34 | %) | — | |||||||||||||

| Adjusted Return on Average Equity (1) (non-GAAP) | 11.52 | % | 11.43 | % | ||||||||||||

(1) See reconcilation of this non-GAAP financial measure provided elsewhere herein.

| Three Months Ended | ||||||||||||||||||||||||

| June 30 | ||||||||||||||||||||||||

| 2024 | 2023 | |||||||||||||||||||||||

| (dollars in thousands) | Average Balance |

Interest | Average Yield/Rate |

Average Balance |

Interest | Average Yield/Rate |

||||||||||||||||||

| Assets | ||||||||||||||||||||||||

| Loans | $ | 1,415,353 | $ | 20,237 | 5.75 | % | $ | 1,317,728 | $ | 16,794 | 5.11 | % | ||||||||||||

| Investment Securities: | ||||||||||||||||||||||||

| Taxable | 268,522 | 1,697 | 2.54 | % | 337,032 | 1,779 | 2.12 | % | ||||||||||||||||

| Non taxable | 7,800 | 95 | 4.90 | % | 26,093 | 479 | 7.36 | % | ||||||||||||||||

| Total | 276,322 | 1,792 | 2.61 | % | 363,125 | 2,258 | 2.49 | % | ||||||||||||||||

| Federal funds sold | 66,658 | 1,037 | 6.26 | % | 84,629 | 1,102 | 5.22 | % | ||||||||||||||||

| Interest-bearing deposits with other banks | 2,194 | 18 | 3.30 | % | 1,735 | 19 | 4.39 | % | ||||||||||||||||

| Other interest earning assets | 3,390 | 87 | 10.32 | % | 4,490 | 24 | 2.23 | % | ||||||||||||||||

| Total earning assets | 1,763,917 | 23,171 | 5.28 | % | 1,771,707 | 20,197 | 4.57 | % | ||||||||||||||||

| Allowance for credit losses | (18,184 | ) | (16,982 | ) | ||||||||||||||||||||

| Non-earning assets | 198,750 | 175,369 | ||||||||||||||||||||||

| Total Assets | $ | 1,944,483 | $ | 1,930,094 | ||||||||||||||||||||

| Liabilities and Shareholders’ Equity | ||||||||||||||||||||||||

| Interest-bearing demand deposits | $ | 369,836 | $ | 1,495 | 1.63 | % | $ | 377,773 | $ | 1,132 | 1.20 | % | ||||||||||||

| Interest-bearing money markets - retail | 400,747 | 3,515 | 3.53 | % | 304,322 | 1,809 | 2.38 | % | ||||||||||||||||

| Interest-bearing money markets - brokered | 111 | 1 | 3.62 | % | — | — | — | % | ||||||||||||||||

| Savings deposits | 182,988 | 46 | 0.10 | % | 226,172 | 56 | 0.10 | % | ||||||||||||||||

| Time deposits - retail | 146,420 | 1,016 | 2.79 | % | 130,634 | 552 | 1.69 | % | ||||||||||||||||

| Time deposits - brokered | 24,396 | 325 | 5.36 | % | 61,081 | 801 | 5.26 | % | ||||||||||||||||

| Short-term borrowings | 71,900 | 509 | 2.85 | % | 47,356 | 29 | 0.25 | % | ||||||||||||||||

| Long-term borrowings | 70,929 | 968 | 5.49 | % | 110,929 | 1,419 | 5.13 | % | ||||||||||||||||

| Total interest-bearing liabilities | 1,267,327 | 7,875 | 2.50 | % | 1,258,267 | 5,798 | 1.85 | % | ||||||||||||||||

| Non-interest-bearing deposits | 479,232 | 484,952 | ||||||||||||||||||||||

| Other liabilities | 32,884 | 31,517 | ||||||||||||||||||||||

| Shareholders’ Equity | 165,040 | 155,358 | ||||||||||||||||||||||

| Total Liabilities and Shareholders’ Equity | $ | 1,944,483 | $ | 1,930,094 | ||||||||||||||||||||

| Net interest income and spread | $ | 15,296 | 2.78 | % | $ | 14,399 | 2.72 | % | ||||||||||||||||

| Net interest margin | 3.49 | % | 3.26 | % | ||||||||||||||||||||

| Six Months Ended | ||||||||||||||||||||||||

| June 30, | ||||||||||||||||||||||||

| 2024 | 2023 | |||||||||||||||||||||||

| (dollars in thousands) | Average Balance |

Interest | Average Yield/Rate |

Average Balance |

Interest | Average Yield/Rate |

||||||||||||||||||

| Assets | ||||||||||||||||||||||||

| Loans | $ | 1,411,620 | $ | 39,471 | 5.62 | % | $ | 1,298,743 | $ | 32,251 | 5.01 | % | ||||||||||||

| Investment Securities: | ||||||||||||||||||||||||

| Taxable | 281,524 | 3,441 | 2.46 | % | 338,817 | 3,547 | 2.11 | % | ||||||||||||||||

| Non taxable | 7,803 | 189 | 4.87 | % | 26,099 | 963 | 7.44 | % | ||||||||||||||||

| Total | 289,327 | 3,630 | 2.52 | % | 364,916 | 4,510 | 2.49 | % | ||||||||||||||||

| Federal funds sold | 65,251 | 1,795 | 5.53 | % | 62,361 | 1,409 | 4.56 | % | ||||||||||||||||

| Interest-bearing deposits with other banks | 1,352 | 49 | 7.29 | % | 3,342 | 45 | 2.72 | % | ||||||||||||||||

| Other interest earning assets | 4,248 | 181 | 8.57 | % | 3,069 | 38 | 2.56 | % | ||||||||||||||||

| Total earning assets | 1,771,798 | 45,126 | 5.12 | % | 1,732,431 | 38,253 | 4.45 | % | ||||||||||||||||

| Allowance for loan losses | (17,940 | ) | (15,905 | ) | ||||||||||||||||||||

| Non-earning assets | 201,872 | 172,461 | ||||||||||||||||||||||

| Total Assets | $ | 1,955,730 | $ | 1,888,987 | ||||||||||||||||||||

| Liabilities and Shareholders’ Equity | ||||||||||||||||||||||||

| Interest-bearing demand deposits | $ | 361,358 | $ | 2,936 | 1.63 | % | $ | 365,491 | $ | 2,021 | 1.11 | % | ||||||||||||

| Interest-bearing money markets - retail | 392,164 | 6,774 | 3.47 | % | 314,246 | 3,107 | 1.99 | % | ||||||||||||||||

| Interest-bearing money markets - brokered | 55 | 1 | 3.66 | % | — | — | — | % | ||||||||||||||||

| Savings deposits | 186,280 | 94 | 0.10 | % | 236,383 | 135 | 0.12 | % | ||||||||||||||||

| Time deposits - retail | 152,049 | 2,134 | 2.82 | % | 124,684 | 832 | 1.35 | % | ||||||||||||||||

| Time deposits - brokered | 27,198 | 724 | 5.35 | % | 35,771 | 933 | 5.26 | % | ||||||||||||||||

| Short-term borrowings | 72,626 | 970 | 2.69 | % | 52,332 | 60 | 0.23 | % | ||||||||||||||||

| Long-term borrowings | 86,973 | 2,327 | 5.38 | % | 77,338 | 2,021 | 5.27 | % | ||||||||||||||||

| Total interest-bearing liabilities | 1,278,703 | 15,960 | 2.51 | % | 1,206,245 | 9,109 | 1.52 | % | ||||||||||||||||

| Non-interest-bearing deposits | 478,655 | 497,226 | ||||||||||||||||||||||

| Other liabilities | 33,624 | 30,497 | ||||||||||||||||||||||

| Shareholders’ Equity | 164,748 | 155,019 | ||||||||||||||||||||||

| Total Liabilities and Shareholders’ Equity | $ | 1,955,730 | $ | 1,888,987 | ||||||||||||||||||||

| Net interest income and spread | $ | 29,166 | 2.61 | % | $ | 29,144 | 2.93 | % | ||||||||||||||||

| Net interest margin | 3.31 | % | 3.39 | % | ||||||||||||||||||||

Exhibit 99.2

INVESTOR PRESENTATION Second Quarter 2024 MyBank.com 2 Forward looking statements This presentation contains forward - looking statements as defined by the Private Securities Litigation Reform Act of 1995 . Forward - looking statements do not represent historical facts, but are statements about management's beliefs, plans and objectives about the future, as well as its assumptions and judgments concerning such beliefs, plans and objectives . These statements are evidenced by terms such as "anticipate," "estimate," "should," "expect," "believe," "intend," and similar expressions . Although these statements reflect management's good faith beliefs and projections, they are not guarantees of future performance and they may not prove true . The beliefs, plans and objectives on which forward - looking statements are based involve risks and uncertainties that could cause actual results to differ materially from those addressed in the forward - looking statements . For a discussion of these risks and uncertainties, see the section of the periodic reports that First United Corporation files with the Securities and Exchange Commission entitled "Risk Factors . Whether actual results will conform to expectations and predictions is subject to known and unknown risks and uncertainties . Actual results could be materially different from management’s expectations . This presentation should be read in conjunction with our Annual Report on Form 10 - K, as amended, for the year ended December 31 , 2023 , including the sections of the report entitled “Risk Factors”, as well as the reports and other documents that we subsequently file with the Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www . sec . gov or at our website at www . mybank . com . Except as required by law, we do not intend to publish updates or revisions of any forward - looking statements we make to reflect new information, future events or otherwise .

3 Table of Contents I. II. III. Corporate Overview Financial Performance Appendices Pg. 4 Pg. 9 Pg. 31 4 Our Mission To enrich the lives of our associates, customers, communities and shareholders through uncommon commitment to service and customized financial solutions.

Corporate Overview Founded: 1900 Headquarters: Oakland, MD Locations: 22 branches Business Lines: ▪ Commercial & Retail Banking ▪ Trust Services ▪ Wealth Management Ticker: FUNC (Nasdaq) Website: www.MyBank.com Overview West Virginia Maryland • Pittsburgh, PA • Washington, DC • Columbus, OH • Baltimore, MD • Richmond, VA Morgantown, WV භ • Philadelphia, PA • Harrisburg, PA Winchester, VA භ Star denotes Oakland, Maryland Headquarters 5 West Region Central Region East Region Loans (000s) $322,866 $425,333 $551,787 Deposits (000s) $134,158 $791,482 $492,332 Deposit Market Share (1) (at June 30, 2023) 2% 47% 4% Branches 3 9 10 Note: Out of market loans represent $124 million and are not reflected in this table; Brokered CDs represent $15 million and are not reflected in this table (1) Source: FDIC Market Share Data, most current.

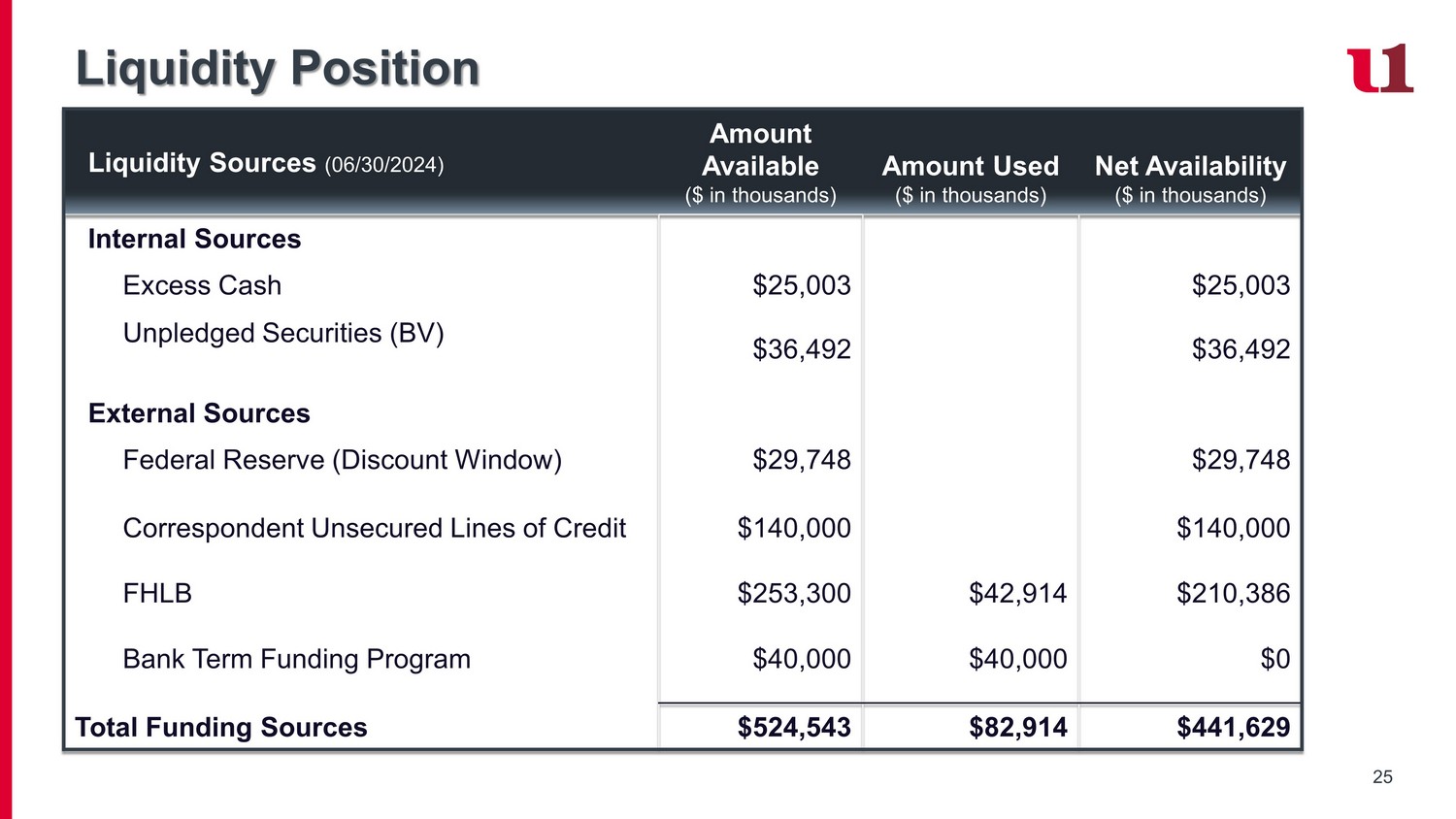

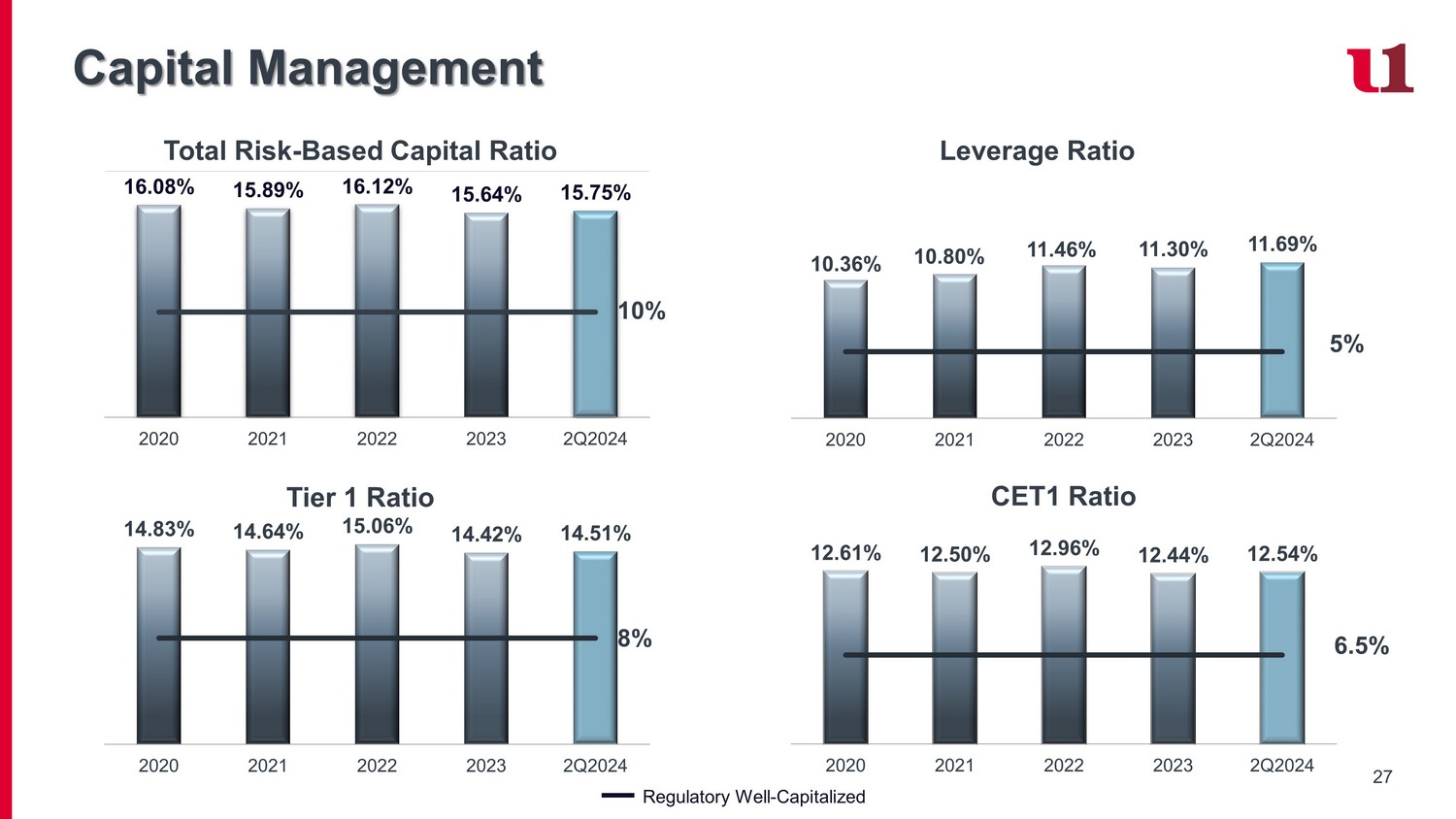

Deposit market share for each region includes the following counties: West : Monongalia, WV Central: Garrett, MD; Allegany, MD; Mineral, WV East: Washington, MD; Frederick, MD; Berkeley, WV Core Markets 6 6 Core Strengths ▪ Diversified revenue stream driven by trust and brokerage fee income provides protection during times of low interest rates Diversified Revenue Stream ▪ Stable legacy markets produce steady low - cost funding ▪ Technology and business relationships drive growth Core Deposit Franchise ▪ Diverse and experienced Board with the skills to oversee risks, strategic initiatives and governance best practices ▪ Ongoing Board succession strategy Engaged & Diverse Leadership ▪ Supporting local causes with financial education, consultation and robust products and services ▪ Knowledgeable associates committed to helping clients & the communities we serve Culture of Engagement ▪ Well - established operational infrastructure will support future growth ▪ Expense management focus, hybrid work environment and technology drive cost savings Expense Structure ▪ Strong underwriting guidelines and risk management framework ▪ Focus on risk mitigation, loan concentration management and information security Robust Enterprise Risk Management ▪ Innovative and dynamic approach to attracting and retaining clients ▪ Investment in FinTech funds provides early exposure to new technology Forward - Thinking Approach ▪ Regulatory capital ratios significantly above regulatory requirements ▪ Significant access to liquidity sources Financial Strength 7 Risk Management, Monitoring & Mitigation Underlies all Strategic Priorities ▪ Low net charge - offs and strong asset quality resulting from conservative and proactive credit culture ▪ ACL level of 1.26%; future provisioning based on loan growth, economic environment and asset quality changes ▪ Diversified commercial loan portfolio and geographic footprint ▪ Disciplined loan growth strategy, concentration management, stress testing and exception tracking and monitoring ▪ Well - defined loan approval levels ▪ Centralized risk rating and monitoring of risk rating migration and delinquency trends ▪ Robust annual third - party loan review ▪ Maintaining a slightly asset sensitive balance sheet and positioning for down rate environment ▪ Limiting longer - term investment exposure and actively managing loan and deposit terms ▪ Focused on capturing core, low - cost deposits ▪ Monitoring dynamic and static rate ramp scenarios ▪ Board regularly briefed on cyber - security matters ▪ Robust information security training programs for associates and Board ▪ Regular third - party review and testing of information security, compliance processes and cybersecurity controls ▪ No security breaches to - date ▪ Adaptive fraud detection and management ▪ Strong capital levels well above regulatory “well - capitalized” definition ▪ Conservative dividend payout policy to improve TCE and maintain capital during turbulent economic environment ▪ Capital stress tests indicate Bank is well positioned to absorb potential losses ▪ Stock repurchase program approved by board ▪ Loan to deposit ratio of 93% ▪ Liquidity contingency plan in place and funds position monitored daily ▪ Liquidity stress testing performed quarterly with strong liquidity under various scenarios ▪ Available borrowing capacity of $380 million through correspondent lines of credit, FHLB and the Federal Reserve ▪ Strong, stable low - cost core deposit franchise of 90% of total deposit portfolio Cyber - Security & Fraud Monitoring Asset Quality Capital Liquidity Management Interest Rate Sensitivity 8 Strategic Pillars & Key Objectives Culture & Human Capital ▪ Attract and hire passionate, diverse talent to engage with clients and prospects across broader geographics.

▪ Drive associate retention and foster career development through mentoring initiatives, leadership programs, and educational opportunities. ▪ Expand associate engagement , cross - functional collaboration , and communication . ▪ Enhance succession plan by fostering forward - thinking strategies that promote innovation and long - term growth. Product & Service Revenue Diversification ▪ Increase non - interest income as a percentage of revenue to reduce dependence on net interest margin. ▪ Expand business development training and outreach efforts to drive strategic sales growth and deepen community - oriented business owner relationships . ▪ Revamp customer segmentation to focus on expanding product and service utilization by the existing customer base. ▪ Improve brand awareness in growth markets. Resource Optimization ▪ Optimize balance sheet mix to maximize profitability. ▪ Expand net interest margin through a disciplined approach to loan and deposit portfolio repricing. ▪ Effectively manage Capital through repurchase opportunities and effective investor communication . ▪ Improve efficiency by utilizing technology, leveraging data, artificial intelligence, and digital alternatives. ▪ Reduce monetary loss and administrative costs associated with cyber security and fraud. ▪ Allocate resources to enhance market share and execute tactics to optimize geographic presence. ▪ Cultivate relationships for potential future bank and wealth expansion. Effective use of technology, marketing and communications, and an environmental focus underlies all strategic priorities.

9 Second Quarter Financial Highlights $4.9 Million Net Income (1) $0.75 Diluted EPS (1) 1.02% * ROAA (1) 12.91 * ROATCE (1) 3.49% NIM ▪ Total assets declined $22.3 million compared to March 31, 2024 ▪ Consolidated net income (1) of $4.9 million in 2Q24 compared to $4.4 million in 2Q23 and $3.7 million in linked quarter; pre - provision net revenue of $7.7 million compared to $6.2 million and $6.4, respectively ▪ Net interest income, on a non - GAAP, FTE basis* increased by 10.29% in 2Q24 compared to 1Q24, driven by a 14.72% increase in interest income partially offset by a 35.82% increase in interest expense, driven by the competitive deposit landscape ▪ Asset quality remains strong with the ratio of the allowance for credit losses (“ACL”) to loans outstanding at 1.26% in 2Q24 and 1.27% in the linked quarter ▪ Efficiency ratio of 61.39% (1) for the second quarter of 2024 compared to 65.71% for the linked quarter; decrease primarily attributable to the increase in net interest income and reduced expenses for accelerated depreciation on the branch closures recognized in the first quarter (1) See Appendix for a reconciliation of these non - GAAP financial measure * 2Q2024 Annualized 10 Year to Date Financial Highlights $8.6 Million Net Income (1) $1.37 Diluted EPS (1) 0.98% * ROAA (1) 12.38 * ROATCE (1) 3.31% NIM ▪ Total assets declined $37.3 million compared to December 31, 2023 ▪ Consolidated net income (1) of $8.6 million as of June 30, 2024 compared to $8.8 million as of June 30, 2023; pre - provision net revenue of $14.1 million as of June 30, 2024 compared to $12.5 million as of June 30, 2023 ▪ Net interest income, on a non - GAAP, FTE basis* was stable for the six months ended June 30, 2024 compared to the six months ended June 30, 2023; increased interest income was o ffset by an increase in interest expense due to the continued competitive deposit landscape ▪ Asset quality remains strong with the ratio of the allowance for credit losses (“ACL”) to loans outstanding at 1.26% at June 30, 2024 ▪ Efficiency ratio of 63.47% (1) as of June 30, 2024 compared to 65.71% for the first quarter; decrease primarily attributable to the increase in net interest income and reduced expenses for accelerated depreciation on the branch closures recognized in the first quarter (1) See Appendix for a reconciliation of these non - GAAP financial measure * 2Q2024 Annualized

11 Long - Term Growth Pre - Provision Net Revenue ($ in millions) (1) $23.2 $30.8 $32.5 $25.9 $14.1 2020 2021 2022 2023 2Q2024 (1) See Appendix for a reconciliation of these non - GAAP financial measures $1.97 $3.54 $3.76 $2.80 $1.37 2020 2021 2022 2023 2Q2024 Diluted Earnings per Share (1) Total Deposits ($ in millions) $1,422 $1,469 $1,571 $1,551 $1,537 2020 2021 2022 2023 2Q2024 Total Gross Loans, including PPP ($ in millions) $1,168 $1,154 $1,279 $1,407 $1,423 2020 2021 2022 2023 2Q2024 $114 PPP $8 PPP 12 Solid Profitability (1) See Appendix for a reconciliation of these non - GAAP financial measures Long - term Strategic Target 13% - 15% Long - term Strategic Target 1.25% - 1.60% Core ROAA (non - GAAP (1) ) Core ROATCE (non - GAAP (1) ) 0.86% 1.35% 1.39% 0.97% 0.98% 2020 2021 2022 2023 2Q2024 11.92% 19.78% 19.94% 12.92% 12.38% 2020 2021 2022 2023 2Q2024

13 Total 1 - 4 Family 36% CRE - NOO 21% C&I 19% CRE - OO 11% C&D 6% Consumer 4% Multi - family 3% Loan Diversification Loan Portfolio Mix (06/30/2024) RE/Rental/Leasing NOO 23% RE/Rental/ Leasing OO, C&I 20% All Other 17% Accommodations 12% Services 7% RE/Rental/Leasing Multifamily 5% Trade 3% Construction - Developers 1% Health Care / Social Assistance 4% RE/Rental/Leasing - Developers 5% Construction - All Other 3% Commercial Loan Mix (06/30/2024)

14 Commercial Industry Mix by Origination Year Commercial Industry Mix by Origination Prior to 2000 2000 - 2005 2006 - 2010 2011 - 2015 2016 - 2020 2021 - Current Total RE / Rental / Leasing - NOO -$ 4,326,148$ 3,027,534$ 10,173,744$ 85,130,566$ 105,491,967$ 208,149,959$ RE / Rental / Leasing - OO, C&I 14,394 35,617 1,241,290 8,828,717 48,642,770 121,466,297 180,229,085 RE / Rental / Leasing - Multifamily - 55,028 2,121,878 9,701,770 14,929,878 22,404,518 49,213,072 RE / Rental / Leasing - Developers - 61,167 77,396 - 2,299,635 38,709,056 41,147,254 Construction - All Other 40,000 77,143 113,983 1,816,431 7,567,381 17,403,180 27,018,117 Construction - Developers - - 2,242,926 78,613 382,524 7,568,366 10,272,429 Accommodations - 1,434,260 3,766,224 10,651,241 47,595,664 22,854,741 86,302,129 Services - 2,185,455 358,501 9,466,125 14,046,610 37,533,443 63,590,133 Health Care / Social Assistance - 1,914,511 4,934,612 8,321,060 21,903,848 37,074,031 Trade - 334,726 207,492 1,269,874 9,473,115 14,069,345 25,354,552 All Other 39,178 320,590 1,395,451 1,000,600 30,928,427 109,291,622 142,975,869 Totals 93,571$ 8,830,135$ 16,467,185$ 57,921,727$ 269,317,629$ 518,696,383$ 871,326,630$ 15 Commercial Real Estate Focus on risk mitigation and managing of concentrations ▪ CRE / Total Capital: 234% ▪ ADC / Total Capital: 41% * There are no office buildings located in metropolitan markets or over four stories.