UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): March 27, 2024

THE HOME DEPOT, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 1-8207 | 95-3261426 |

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number) | (IRS Employer Identification No.) |

| 2455 Paces Ferry Road, Atlanta, Georgia | 30339 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

(770) 433-8211

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name Of Each Exchange On Which Registered | ||

| Common Stock, $0.05 Par Value Per Share | HD | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01. | Entry into a Material Definitive Agreement. |

On March 27, 2024, The Home Depot, Inc., a Delaware corporation (the “Company”), Star Acquisition Merger Sub Inc., a Delaware corporation and wholly owned subsidiary of the Company (“Merger Sub”), Shingle Acquisition Holdings, Inc., a Delaware corporation (“SRS”), and Shingle Acquisition, LP, a Delaware limited partnership, solely in its capacity as the initial Holder Representative, entered into an Agreement and Plan of Merger (the “Merger Agreement”), pursuant to which Merger Sub will be merged with and into SRS (the “Merger”), with SRS surviving the Merger as the surviving corporation and a wholly owned subsidiary of the Company.

Pursuant to the Merger Agreement, the Company will pay aggregate consideration of $18,250,000,000, subject to customary adjustments for SRS’s debt, cash, transaction expenses and net working capital (the “Merger Consideration”).

At the effective time of the Merger (i) each share of SRS class A common stock and each share of SRS class B common stock (collectively, the “SRS Common Stock”, and each share, a “SRS Common Share”) that is issued and outstanding (other than any dissenting shares and SRS Common Shares, if any, held in treasury), will be converted into the right to receive the applicable portion of the estimated Merger Consideration and (ii) each option to purchase SRS Common Shares (each option, a “SRS Option”) that is in-the-money will be canceled and converted into the right to receive the applicable portion of the estimated Merger Consideration less the applicable exercise price with respect to such option. Out-of-the-money options will terminate and be forfeited for no consideration.

In connection with the Merger, certain members of SRS’s management team have agreed to reinvest a portion of their respective after-tax proceeds from the Merger Consideration into shares of the Company’s common stock. A portion of such shares of Company common stock will be subject to service-based vesting conditions, and all such shares will be subject to transfer restrictions of various durations.

The Merger Agreement contains representations and warranties of the parties customary for a transaction of this type. The Merger Agreement also contains customary covenants and agreements, including, among others: (i) certain limitations on the conduct of business of SRS between the date of the signing of the Merger Agreement and the closing date of the Merger; (ii) regulatory matters, including the parties’ efforts to consummate the closing and obtain approvals from governmental agencies; (iii) SRS’s obligation to deliver the required approval of SRS’s stockholders promptly following execution of the Merger Agreement; (iv) certain cooperation commitments by the Company with respect to the termination of SRS’s outstanding notes and SRS with respect to the Company’s transaction financing efforts; and (v) certain commitments by the Company with respect to the compensation and benefits provided to SRS employees post-closing.

The parties’ obligations to consummate the transactions contemplated by the Merger Agreement are subject to the satisfaction or waiver of customary conditions set forth in the Merger Agreement, including, among others: (i) the expiration of the waiting period applicable to the transactions contemplated by the Merger Agreement under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended; (ii) the absence of any law or governmental order prohibiting the transactions contemplated by the Merger Agreement; (iii) no material adverse effect having occurred since the signing of the Merger Agreement; (iv) receipt of SRS’s stockholder approval; and (v) certain other customary conditions relating to the parties’ representations and warranties in the Merger Agreement and the performance of their respective obligations under the Merger Agreement.

The Merger Agreement also provides for certain customary termination rights for the parties, including: (i) by mutual written consent of the Company and SRS; (ii) by either party, if the Closing has not occurred on or before the twelve-month anniversary of the date of the Merger Agreement (the “Initial Termination Date”), provided, that the Initial Termination Date will automatically be extended up to two times, for a period of six months in the first extension and three months in the second extension, in each case, if only the regulatory closing conditions relating to the antitrust laws remain unsatisfied (such date, as so extended beyond the Initial Termination Date, the “Termination Date”); (iii) by written notice to SRS from the Company if SRS’s stockholder approval is not obtained within two business days following execution of the Merger Agreement; (iv) by either party, if any governmental authority issues an order or permanently enjoins the transaction and such order or other action becomes final and non-appealable; and (v) if the other party has breached any of its representations and warranties or failed to perform any of its covenants or agreements such that any of the conditions to closing would not be satisfied and the party has not cured any such breaches within 30 days following delivery of written notice.

The Company will be obligated to pay a termination fee of $894,250,000 (i) in the event SRS or the Company terminates the Merger Agreement due to an antitrust-related governmental prohibition on the transactions or (ii) if the closing has not occurred on or before the Termination Date, as described above, and, in either case, all closing conditions (other than (a) regulatory closing conditions relating to antitrust laws or (b) conditions which by their terms are to be satisfied at the closing, each of which is capable of being satisfied at the closing) are otherwise satisfied.

The Merger Agreement will be filed to provide investors and stockholders with information regarding its terms and is not intended to provide any factual information about the Company, SRS or Merger Sub. The representations, warranties and covenants contained in the Merger Agreement have been made solely for the purposes of the Merger Agreement and as of specific dates; were solely for the benefit of the parties to the Merger Agreement; are not intended as statements of fact to be relied upon by the Company’s stockholders or other security holders, but rather as a way of allocating the risk between the parties to the Merger Agreement in the event the statements therein prove to be inaccurate; have been modified or qualified by certain confidential disclosures that were made between the parties in connection with the negotiation of the Merger Agreement, which disclosures are not reflected in the Merger Agreement itself; may no longer be true as of a given date; and may apply standards of materiality in a way that is different from what may be viewed as material by the Company’s stockholders or other security holders. The Company’s stockholders or other security holders should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or circumstances of the Company, SRS or Merger Sub. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in the Company’s public disclosures.

| Item 7.01. | Regulation FD Disclosure. |

On March 28, 2024, the Company issued a press release regarding the matters described in Item 1.01 of this Current Report on Form 8-K, a copy of which is filed as Exhibit 99.1 and is incorporated herein by reference.

Attached as Exhibit 99.2 and incorporated by reference herein is an investor presentation dated March 28, 2024, that will be used by the Company with respect to the matters described in Item 1.01 of this Current Report on Form 8-K.

The information in this Item 7.01, including Exhibits 99.1 and 99.2, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933 or the Exchange Act, regardless of any general incorporation language in such filings.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| 99.1 | Press Release, dated March 28, 2024 |

| 99.2 | Investor Presentation, dated March 28, 2024 |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained herein constitute "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements may relate to, among other things, the proposed acquisition of SRS, which involves substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements (the “potential acquisition”); statements about the potential benefits of the potential acquisition; the anticipated timing of closing of the potential acquisition (including failure to obtain necessary regulatory approvals) and the possibility that the potential acquisition does not close; risks related to the ability to realize the anticipated benefits of the potential acquisition, including the possibility that the expected benefits from the proposed transaction will not be realized or will not be realized within the expected time period; the risk that the businesses will not be integrated successfully; disruption from the potential acquisition making it more difficult to maintain business and operational relationships; negative effects of announcing the potential acquisition or the consummation of the potential acquisition on the market price of our common stock, credit ratings or operating results; significant costs associated with the potential acquisition; unknown liabilities; the risk of litigation and/or regulatory actions related to the potential acquisition; the demand for our products and services, including as a result of macroeconomic conditions; net sales growth; comparable sales; the effects of competition; our brand and reputation; implementation of interconnected retail, store, supply chain and technology initiatives; inventory and in-stock positions; the state of the economy; the state of the housing and home improvement markets; the state of the credit markets, including mortgages, home equity loans and consumer credit; the impact of tariffs; issues related to the payment methods we accept; demand for credit offerings; management of relationships with our associates, potential associates, suppliers and service providers; cost and availability of labor; costs of fuel and other energy sources; events that could disrupt our business, supply chain, technology infrastructure or demand for our products and services, such as international trade disputes, natural disasters, climate change, public health issues, cybersecurity events, geopolitical conflicts, military conflicts or acts of war; our ability to maintain a safe and secure store environment; our ability to address expectations regarding environmental, social and governance matters and meet related goals; continuation or suspension of share repurchases; net earnings performance; earnings per share; future dividends; capital allocation and expenditures; liquidity; return on invested capital; expense leverage; changes in interest rates; changes in foreign currency exchange rates; commodity or other price inflation and deflation; our ability to issue debt on terms and at rates acceptable to us; the impact and expected outcome of investigations, inquiries, claims and litigation, including compliance with related settlements; the challenges of operating in international markets; the adequacy of insurance coverage; the effect of accounting charges; the effect of adopting certain accounting standards; the impact of legal and regulatory changes, including changes to tax laws and regulations; store openings and closures; guidance for fiscal 2024 and beyond; financial outlook; and the impact of acquired companies on our organization and the ability to recognize the anticipated benefits of any acquisitions.

Forward-looking statements are based on currently available information and our current assumptions, expectations and projections about future events. You should not rely on our forward-looking statements. These statements are not guarantees of future performance and are subject to future events, risks and uncertainties – many of which are beyond our control, dependent on the actions of third parties, or currently unknown to us – as well as potentially inaccurate assumptions that could cause actual results to differ materially from our historical experience and our expectations and projections. These risks and uncertainties include, but are not limited to, those described in Part I, Item 1A, "Risk Factors," and elsewhere in our Annual Report on Form 10-K for our fiscal year ended January 28, 2024 and also as may be described from time to time in future reports we file with the Securities and Exchange Commission. There also may be other factors that we cannot anticipate or that are not described herein, generally because we do not currently perceive them to be material. Such factors could cause results to differ materially from our expectations. Forward-looking statements speak only as of the date they are made, and we do not undertake to update these statements other than as required by law. You are advised, however, to review any further disclosures we make on related subjects in our filings with the Securities and Exchange Commission and in our other public statements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| THE HOME DEPOT, INC. | ||

| By: | /s/ Richard V. McPhail | |

| Name: | Richard V. McPhail | |

| Title: | Executive Vice President and Chief Financial Officer | |

Date: March 28, 2024

Exhibit 99.1

The Home Depot Announces Agreement to Acquire SRS Distribution, a

Leading Specialty Trade Distributor Across Multiple Verticals;

Expands Offering and Capabilities for Pro Customers;

Increases Total Addressable Pro Market by Approximately $50 Billion

ATLANTA, MARCH 28, 2024 -- The Home Depot®, the world's largest home improvement retailer, has entered into a definitive agreement to acquire SRS Distribution Inc. (“SRS"), a leading residential specialty trade distribution company across several verticals serving the professional roofer, landscaper and pool contractor.

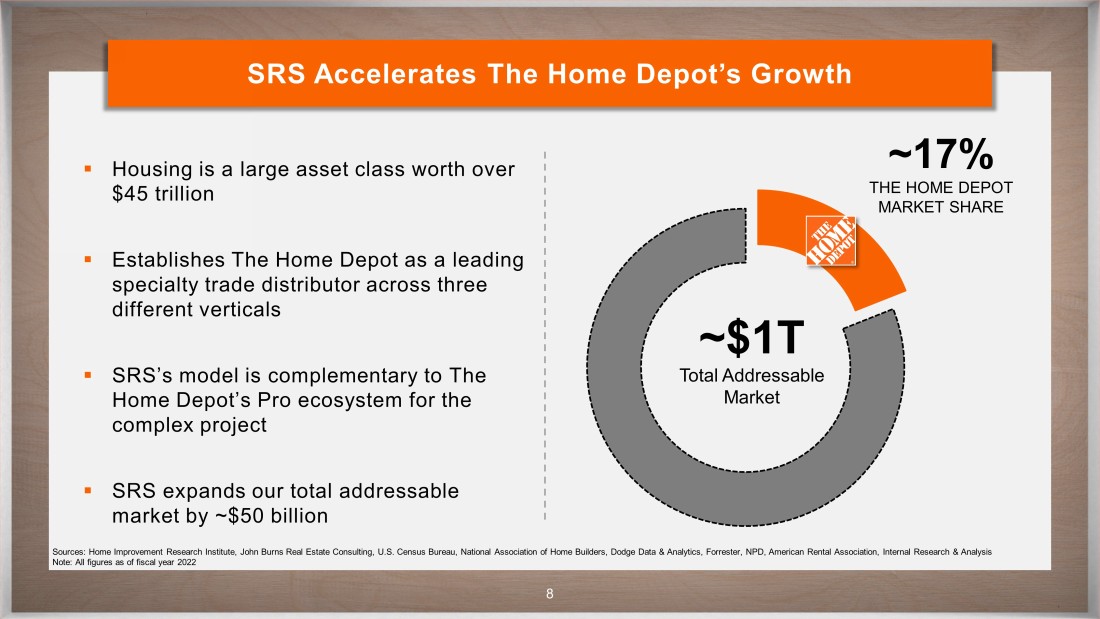

SRS will accelerate The Home Depot’s growth with the residential professional customer. SRS complements The Home Depot’s capabilities and will enable the company to better serve complex project purchase occasions with the renovator/remodeler, while also establishing The Home Depot as a leading specialty trade distributor across multiple verticals.

With this acquisition, The Home Depot now believes its total addressable market is approximately $1 trillion, an increase of approximately $50 billion.

“SRS is an industry leader with a proven track record of profitable growth across verticals,” said Ted Decker, chair, president, and CEO. “SRS’s ability to build leadership positions in each of its trade verticals while generating significant revenue growth is a testament to its strong vision, leadership, culture and execution. SRS has built a robust and successful platform that will accelerate our growth with the residential professional customer while presenting future opportunities with the specialty trade pro.”

Decker continued, “SRS’s branch network, coupled with The Home Depot’s 2,000+ U.S. stores and distribution centers, comprehensive product offering, and extensive pro brands, provides the residential pro customer with more fulfillment and service options than ever before. I look forward to welcoming the entire SRS team to The Home Depot and capturing the exciting opportunity ahead.”

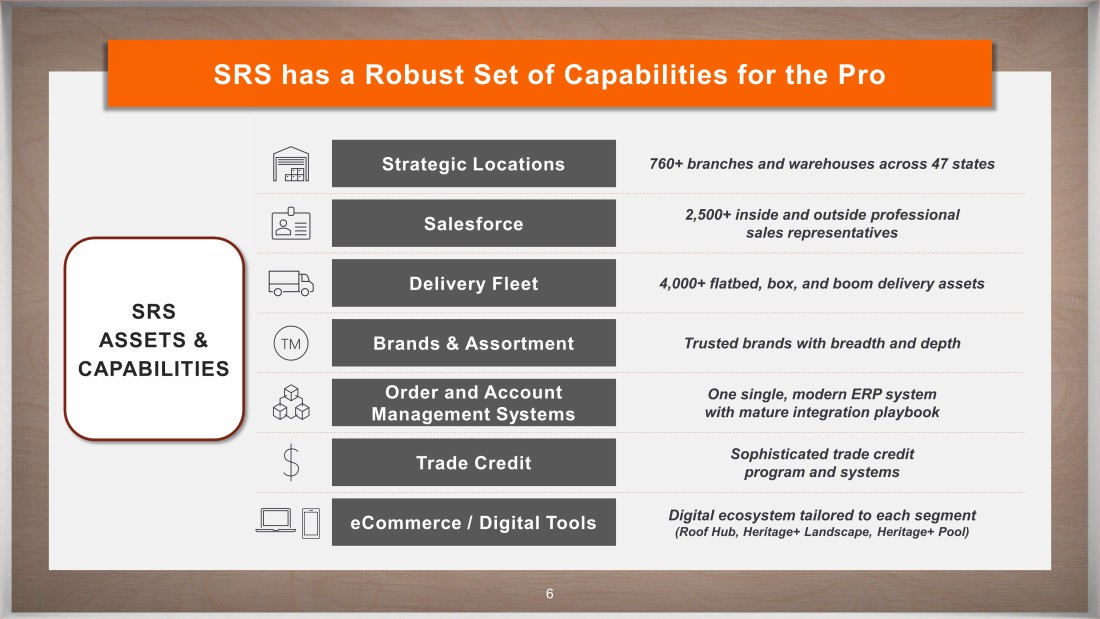

SRS’s 2,500-plus professional sales force and 760-plus branch network across 47 states, together with its 4,000-plus truck fleet and jobsite delivery capabilities, will enable The Home Depot to extend its offering to residential specialty trade pros while better serving renovator/remodelers.

“Our team is thrilled to join The Home Depot,” said Dan Tinker, SRS’s president and CEO. “We are looking forward to combining our differentiated assets and capabilities, including our extensive branch network, experienced sales team, robust trade credit offering, and order management system, geared at serving the complex project purchase occasion, with The Home Depot’s competitive advantages. We believe this will enable us to better serve pros and continue growing in our large and highly fragmented market.”

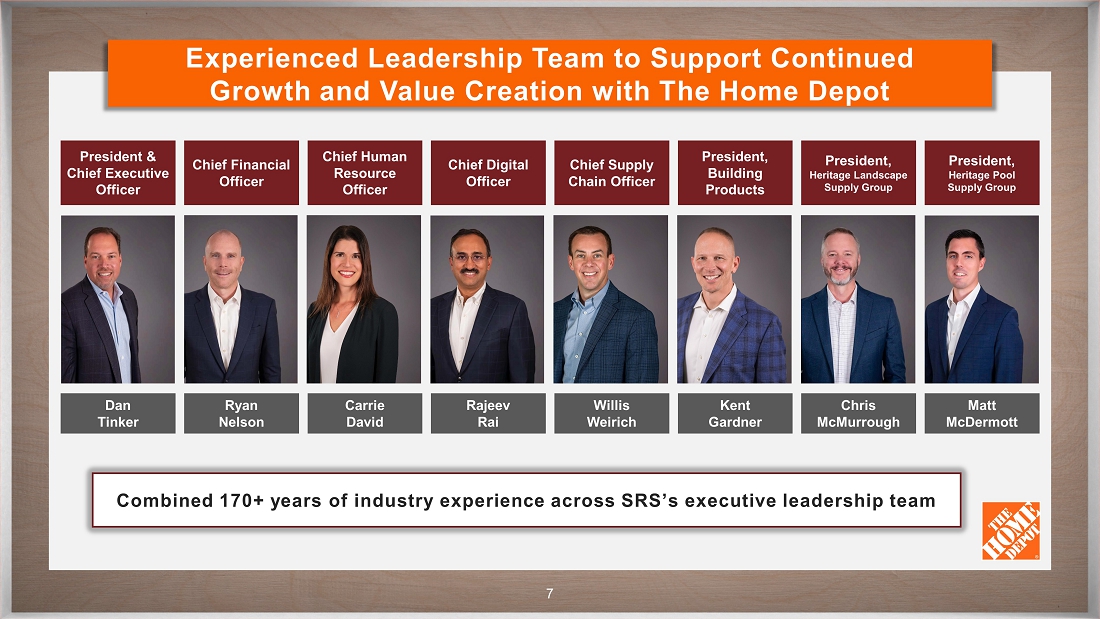

Tinker, as well as his senior leadership team, will continue to lead SRS. Tinker and team will work closely with The Home Depot to deliver the best value proposition for all pro customers.

Financial Overview

Under the terms of the merger agreement, a subsidiary of The Home Depot will acquire SRS for a total enterprise value (including net debt) of approximately $18.25 billion. The closing of the acquisition is subject to customary closing conditions, including regulatory approvals, and is expected to be completed by the end of fiscal 2024. The transaction is expected to be funded through cash on hand and debt.

"We plan to access the debt capital markets to raise incremental indebtedness in support of this acquisition. We expect the acquisition to create significant shareholder value over the long term," said Richard McPhail, executive vice president and CFO.

This transaction is expected to be dilutive to earnings-per-share (EPS) from a GAAP perspective due to amortization expense, but accretive from a cash EPS perspective in the first year, post-closing, excluding synergies.

The Company intends to maintain its current credit ratings.

Conference Call

The Home Depot will conduct a conference call today at 9 a.m. ET to discuss information included in this news release and a slide presentation that will be made available at 8:30 a.m. ET on its investor relations webpage at ir.homedepot.com/events-and-presentations. The conference call will be available in its entirety through a webcast and replay at ir.homedepot.com/events-and-presentations.

Advisors

J.P. Morgan Securities LLC served as exclusive financial advisor and Weil, Gotshal & Manges LLP served as legal counsel

to The Home Depot in connection with the transaction.

About The Home Depot

The Home Depot is the world's largest home improvement specialty retailer. At the end of fiscal year 2023, the company operated a total of 2,335 retail stores in all 50 states, the District of Columbia, Puerto Rico, the U.S. Virgin Islands, Guam, 10 Canadian provinces and Mexico. The company employs approximately 465,000 associates. The Home Depot's stock is traded on the New York Stock Exchange (NYSE: HD) and is included in the Dow Jones industrial average and Standard & Poor's 500 index.

About SRS Distribution

Founded in 2008 and headquartered in McKinney, Texas, SRS has grown to become one of the fastest growing building products

distributors in the United States. Since the Company’s inception, it has established a differentiated growth strategy and entrepreneurial

culture that is focused on serving customers, partnering with suppliers, and attracting the industry’s best talent. SRS currently

operates under a family of distinct local brands encompassing more than 760 locations across 47 states. For more information, visit www.srsdistribution.com.

###

Certain statements contained herein constitute "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements may relate to, among other things, the proposed acquisition of SRS Distribution Inc., which involves substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements (the “potential acquisition”); statements about the potential benefits of the potential acquisition; the anticipated timing of closing of the potential acquisition (including failure to obtain necessary regulatory approvals) and the possibility that the potential acquisition does not close; risks related to the ability to realize the anticipated benefits of the potential acquisition, including the possibility that the expected benefits from the proposed transaction will not be realized or will not be realized within the expected time period; the risk that the businesses will not be integrated successfully; disruption from the potential acquisition making it more difficult to maintain business and operational relationships; negative effects of announcing the potential acquisition or the consummation of the potential acquisition on the market price of our common stock, credit ratings or operating results; significant costs associated with the potential acquisition; unknown liabilities; the risk of litigation and/or regulatory actions related to the potential acquisition; the demand for our products and services, including as a result of macroeconomic conditions; net sales growth; comparable sales; the effects of competition; our brand and reputation; implementation of interconnected retail, store, supply chain and technology initiatives; inventory and in-stock positions; the state of the economy; the state of the housing and home improvement markets; the state of the credit markets, including mortgages, home equity loans, and consumer credit; the impact of tariffs; issues related to the payment methods we accept; demand for credit offerings; management of relationships with our associates, potential associates, suppliers and service providers; cost and availability of labor; costs of fuel and other energy sources; events that could disrupt our business, supply chain, technology infrastructure, or demand for our products and services, such as international trade disputes, natural disasters, climate change, public health issues, cybersecurity events, geopolitical conflicts, military conflicts, or acts of war; our ability to maintain a safe and secure store environment; our ability to address expectations regarding environmental, social and governance matters and meet related goals; continuation or suspension of share repurchases; net earnings performance; earnings per share; future dividends; capital allocation and expenditures; liquidity; return on invested capital; expense leverage; changes in interest rates; changes in foreign currency exchange rates; commodity or other price inflation and deflation; our ability to issue debt on terms and at rates acceptable to us; the impact and expected outcome of investigations, inquiries, claims, and litigation, including compliance with related settlements; the challenges of operating in international markets; the adequacy of insurance coverage; the effect of accounting charges; the effect of adopting certain accounting standards; the impact of legal and regulatory changes, including changes to tax laws and regulations; store openings and closures; guidance for fiscal 2024 and beyond; financial outlook; and the impact of acquired companies on our organization and the ability to recognize the anticipated benefits of any acquisitions.

Forward-looking statements are based on currently available information and our current assumptions, expectations and projections about future events. You should not rely on our forward-looking statements. These statements are not guarantees of future performance and are subject to future events, risks and uncertainties – many of which are beyond our control, dependent on the actions of third parties, or currently unknown to us – as well as potentially inaccurate assumptions that could cause actual results to differ materially from our historical experience and our expectations and projections. These risks and uncertainties include, but are not limited to, those described in Part I, Item 1A, "Risk Factors," and elsewhere in our Annual Report on Form 10-K for our fiscal year ended January 28, 2024 and also as may be described from time to time in future reports we file with the Securities and Exchange Commission. There also may be other factors that we cannot anticipate or that are not described herein, generally because we do not currently perceive them to be material. Such factors could cause results to differ materially from our expectations. Forward-looking statements speak only as of the date they are made, and we do not undertake to update these statements other than as required by law. You are advised, however, to review any further disclosures we make on related subjects in our filings with the Securities and Exchange Commission and in our other public statements.

For more information, contact:

| Financial Community | News Media |

| Isabel Janci | Sara Gorman |

| Vice President of Investor Relations and Treasurer | Senior Director of Corporate Communications |

| 770-384-2666 | 770-384-2852 |

| isabel_janci@homedepot.com | sara_gorman@homedepot.com |

Exhibit 99.2

The Home Depot to Acquire SRS Distribution March 28, 2024

CONFIDENTIAL Forward Looking Statements and Non - GAAP Financial Measures Certain statements contained herein constitute "forward - looking statements" as defined in the Private Securities Litigation Reform Act of 1995 . Forward - looking statements may relate to, among other things, the proposed acquisition of SRS Distribution Inc . , which involves substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements (the “potential acquisition”) ; statements about the potential benefits of the potential acquisition ; the anticipated timing of closing of the potential acquisition (including failure to obtain necessary regulatory approvals) and the possibility that the potential acquisition does not close ; risks related to the ability to realize the anticipated benefits of the potential acquisition, including the possibility that the expected benefits from the proposed transaction will not be realized or will not be realized within the expected time period ; the risk that the businesses will not be integrated successfully ; disruption from the potential acquisition making it more difficult to maintain business and operational relationships ; negative effects of announcing the potential acquisition or the consummation of the potential acquisition on the market price of our common stock, credit ratings or operating results ; significant costs associated with the potential acquisition ; unknown liabilities ; the risk of litigation and/or regulatory actions related to the potential acquisition ; the demand for our products and services, including as a result of macroeconomic conditions ; net sales growth ; comparable sales ; the effects of competition ; our brand and reputation ; implementation of interconnected retail, store, supply chain and technology initiatives ; inventory and in - stock positions ; the state of the economy ; the state of the housing and home improvement markets ; the state of the credit markets, including mortgages, home equity loans, and consumer credit ; the impact of tariffs ; issues related to the payment methods we accept ; demand for credit offerings ; management of relationships with our associates, potential associates, suppliers and service providers ; cost and availability of labor ; costs of fuel and other energy sources ; events that could disrupt our business, supply chain, technology infrastructure, or demand for our products and services, such as international trade disputes, natural disasters, climate change, public health issues, cybersecurity events, geopolitical conflicts, military conflicts, or acts of war ; our ability to maintain a safe and secure store environment ; our ability to address expectations regarding environmental, social and governance matters and meet related goals ; continuation or suspension of share repurchases ; net earnings performance ; earnings per share ; future dividends ; capital allocation and expenditures ; liquidity ; return on invested capital ; expense leverage ; changes in interest rates ; changes in foreign currency exchange rates ; commodity or other price inflation and deflation ; our ability to issue debt on terms and at rates acceptable to us ; the impact and expected outcome of investigations, inquiries, claims, and litigation, including compliance with related settlements ; the challenges of operating in international markets ; the adequacy of insurance coverage ; the effect of accounting charges ; the effect of adopting certain accounting standards ; the impact of legal and regulatory changes, including changes to tax laws and regulations ; store openings and closures ; guidance for fiscal 2024 and beyond ; financial outlook ; and the impact of acquired companies on our organization and the ability to recognize the anticipated benefits of any acquisitions . Forward - looking statements are based on currently available information and our current assumptions, expectations and projections about future events . You should not rely on our forward - looking statements . These statements are not guarantees of future performance and are subject to future events, risks and uncertainties – many of which are beyond our control, dependent on the actions of third parties, or currently unknown to us – as well as potentially inaccurate assumptions that could cause actual results to differ materially from our historical experience and our expectations and projections . These risks and uncertainties include, but are not limited to, those described in Part I, Item 1 A, "Risk Factors," and elsewhere in our Annual Report on Form 10 - K for our fiscal year ended January 28 , 2024 and also as may be described from time to time in future reports we file with the Securities and Exchange Commission . There also may be other factors that we cannot anticipate or that are not described herein, generally because we do not currently perceive them to be material . Such factors could cause results to differ materially from our expectations . Forward - looking statements speak only as of the date they are made, and we do not undertake to update these statements other than as required by law . You are advised, however, to review any further disclosures we make on related subjects in our filings with the Securities and Exchange Commission and in our other public statements . Today’s presentations are also supplemented with certain non - GAAP financial measures . We believe these non - GAAP financial measures better enable management and investors to understand and analyze our performance . However, this supplemental information should not be considered in isolation or as a substitute for the related GAAP measures . Reconciliations of the supplemental information to the comparable GAAP measures can be found in the Appendix of this presentation and on our Investor Relations website at ir . homedepot . com . 2 CONFIDENTIAL 3 The Home Depot Strategy Objectives Strategies Grow Market Share with Pros and Consumers Create Exceptional Shareholder Value DELIVER THE BEST CUSTOMER EXPERIENCE DEVELOP DIFFERENTIATED CAPABILITIES EXTEND OUR LOW - COST PROVIDER POSITION

CONFIDENTIAL 4 Key Growth Opportunities INTERCONNECTED CUSTOMER EXPERIENCE PRO ECOSYSTEM NEW STORES SRS expands our Pro Ecosystem CONFIDENTIAL SRS’s Strong Performance and Track Record of Growth Notes : 2023 revenue and adjusted EBITDA are unaudited for fiscal year end 12/31/23.

Adjusted EBITDA includes full year impact of acquisitions.

MULTI - FACETED GROWTH APPROACH Same - Store Sales Greenfields M&A Digital NOW OPEN ~ $1.1B 2023 ADJUSTED EBITDA ~ $10B 2023 REVENUE Entered in 2008 Entered in 2019 Entered in 2021 ROOFING & BUILDING PRODUCTS LANDSCAPE POOL 5 CONFIDENTIAL 6 SRS has a Robust Set of Capabilities for the Pro Salesforce Strategic Locations Order and Account Management Systems Delivery Fleet Trade Credit Brands & Assortment eCommerce / Digital Tools 760+ branches and warehouses across 47 states 2,500+ inside and outside professional sales representatives 4,000+ flatbed, box, and boom delivery assets Trusted brands with breadth and depth One single, modern ERP system with mature integration playbook Sophisticated trade credit program and systems Digital ecosystem tailored to each segment (Roof Hub, Heritage+ Landscape, Heritage+ Pool) SRS ASSETS & CAPABILITIES CONFIDENTIAL 7 Experienced Leadership Team to Support Continued Growth and Value Creation with The Home Depot President & Chief Executive Officer Chief Financial Officer Chief Human Resource Officer Chief Digital Officer Chief Supply Chain Officer President, Building Products President, Heritage Landscape Supply Group President, Heritage Landscape Supply Group Dan Tinker Combined 170+ years of industry experience across SRS’s executive leadership team Ryan Nelson Willis Weirich Rajeev Rai Carrie David Kent Gardner Chris McMurrough Matt McDermott

CONFIDENTIAL 8 SRS Accelerates The Home Depot’s Growth ~$1T Total Addressable Market ~17% THE HOME DEPOT MARKET SHARE Sources: Home Improvement Research Institute, John Burns Real Estate Consulting, U.S.

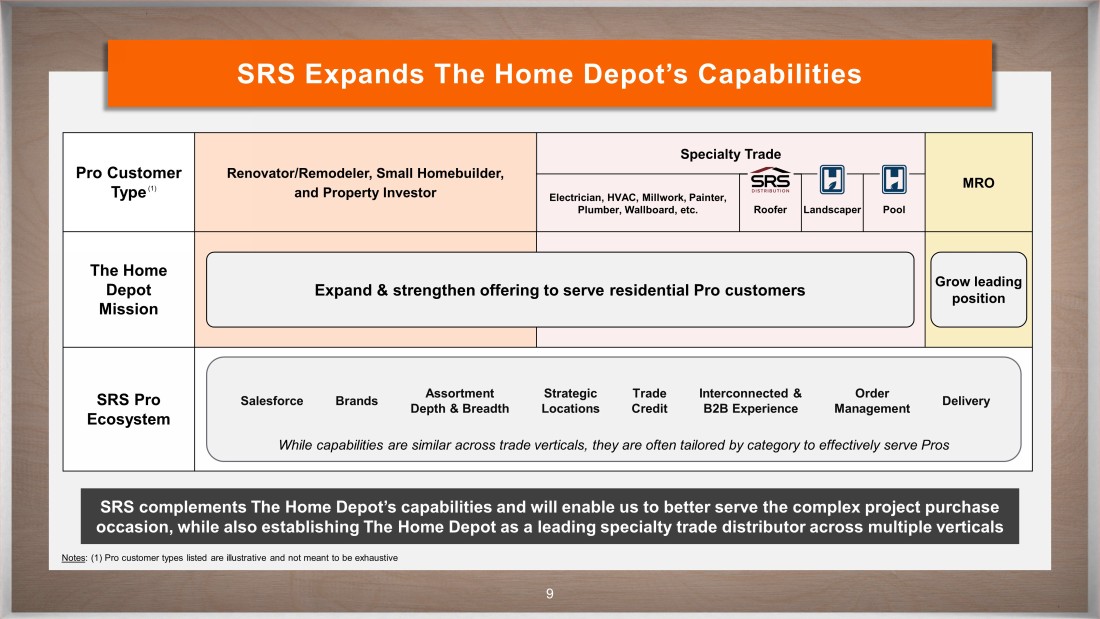

Census Bureau, National Association of Home Buil der s, Dodge Data & Analytics, Forrester, NPD, American Rental Association, Internal Research & Analysis Note: All figures as of fiscal year 2022 ▪ Housing is a l arge asset class worth over $45 trillion ▪ Establishes The Home Depot as a leading specialty trade distributor across three different verticals ▪ SRS’s model is complementary to The Home Depot’s Pro ecosystem for the complex project ▪ SRS expands our total addressable market by ~$50 billion CONFIDENTIAL 9 SRS Expands The Home Depot’s Capabilities SRS complements The Home Depot’s capabilities and will enable us to better serve the complex project purchase occasion, while also establishing The Home Depot as a leading specialty trade distributor across multiple verticals Notes : (1) Pro customer types listed are illustrative and not meant to be exhaustive Pro Customer Type Renovator/Remodeler, Small Homebuilder, and Property Investor Specialty Trade MRO Electrician, HVAC, Millwork, Painter, Plumber, Wallboard, etc. Roofer Landscaper Pool The Home Depot Mission SRS Pro Ecosystem Expand & strengthen offering to serve residential Pro customers Grow leading position While capabilities are similar across trade verticals, they are often tailored by category to effectively serve Pros Salesforce Brands Assortment Depth & Breadth Strategic Locations Trade Credit Interconnected & B2B Experience Order Management Delivery (1)

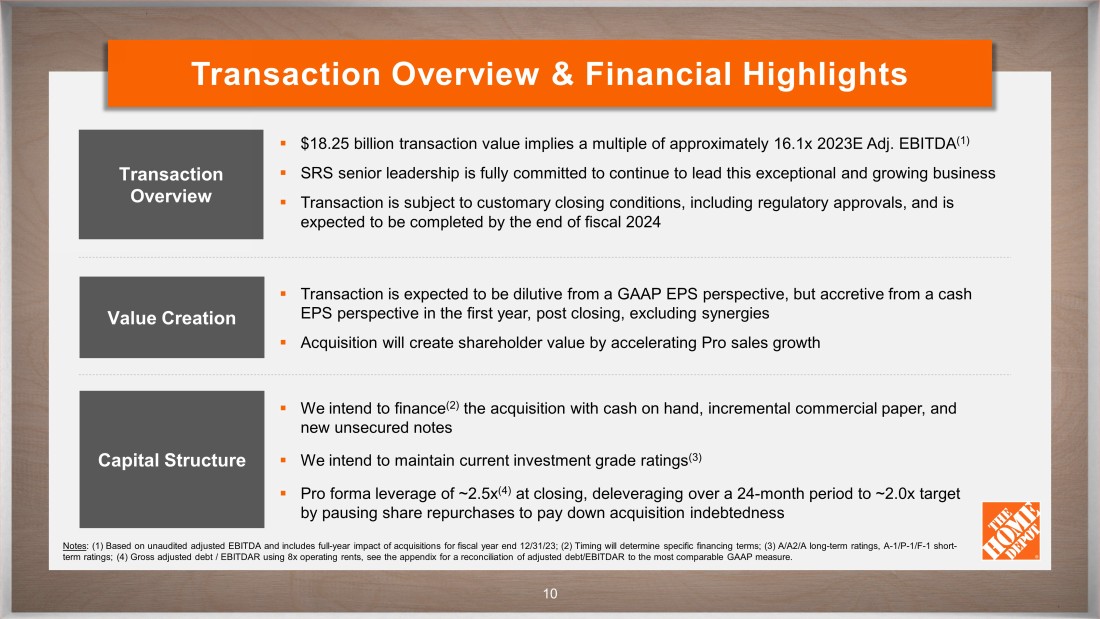

CONFIDENTIAL 10 Transaction Overview & Financial Highlights ▪ $18.25 billion transaction value implies a multiple of approximately 16.1x 2023E Adj. EBITDA (1) ▪ SRS senior leadership is fully committed to continue to lead this exceptional and growing business ▪ Transaction is subject to customary closing conditions, including regulatory approvals, and is expected to be completed by the end of fiscal 2024 Notes : (1) Based on unaudited adjusted EBITDA and includes full - year impact of acquisitions for fiscal year end 12/31/23; (2) Timing will determine specific financing terms; (3) A/A2/A long - term ratings, A - 1/P - 1/F - 1 short - term ratings; (4) Gross adjusted debt / EBITDAR using 8x operating rents, see the appendix for a reconciliation of adjusted d ebt /EBITDAR to the most comparable GAAP measure. Transaction Overview Value Creation Capital Structure ▪ Transaction is expected to be dilutive from a GAAP EPS perspective, but accretive from a cash EPS perspective in the first year, post closing, excluding synergies ▪ Acquisition will create shareholder value by accelerating Pro sales growth ▪ We intend to finance (2) the acquisition with cash on hand, incremental commercial paper, and new unsecured notes ▪ We intend to maintain current investment grade ratings (3) ▪ Pro forma leverage of ~2.5x (4) at closing, deleveraging over a 24 - month period to ~2.0x target by pausing share repurchases to pay down acquisition indebtedness CONFIDENTIAL 11 Creates Significant Long - Term Value OPERATING PROFIT DOLLAR GROWTH GENERATE SUPERIOR RETURNS INCREASE REVENUE WITH THE PRO

CONFIDENTIAL Appendix

CONFIDENTIAL 13 Non - GAAP Measures The Company’s presentation includes the pro forma adjusted debt/EBITDAR ratio at the anticipated closing date of the transact ion and the pro forma adjusted debt/EBITDAR ratio that the Company expects to achieve over a 24 - month period following closing of the transaction. This supplem ental information includes non - GAAP measures that should not be considered in isolation or as a substitute for the related U.S. GAAP measures. Set forth be low is a reconciliation of the pro forma adjusted debt/EBITDAR ratio at the anticipated closing date to the most comparable U.S. GAAP measures. Additionally, the Comp any cannot reconcile the forward - looking adjusted debt/EBTIDAR ratio that it expects to achieve over a 24 - month period following closing of the transaction to th e corresponding U.S. GAAP measures, due to variability and difficulty in making accurate forecasts and projections and/or certain information not being ascertain abl e or accessible, and because not all of the information, such as Net Earnings, EBITDAR, and Adjusted Debt, necessary for a quantitative reconciliation of such forward - looki ng non - GAAP financial measures to the most directly comparable U.S. GAAP financial measures is available to the Company without unreasonable efforts. Adjusted Debt/EBITDAR We believe that our adjusted debt/EBITDAR ratio better enables management and investors to understand and analyze our level o f i ndebtedness in relation to our capital structure. We define adjusted debt/EBITDAR as follows: Adjusted Debt (Page 14 ) We define adjusted debt as long - term debt (including current installments of long - term debt), plus short - term debt, plus eight t imes operating rents for the trailing twelve months. We continue to use the eight times operating rents methodology to calculate adjusted debt post implem ent ation of Accounting Standards Codification Topic 842, Leases , ("Topic 842") as it typically results in a more conservative estimate and is still used by a primary U.S. rating agency. EBITDAR (Page 15 ) We define EBITDAR as net earnings before interest and other, net, income taxes, depreciation and amortization, and operating ren ts calculated on a trailing twelve - month basis. Adjusted Debt/EBITDAR (Page 15 ) We define adjusted debt/EBITDAR as adjusted debt divided by EBITDAR.

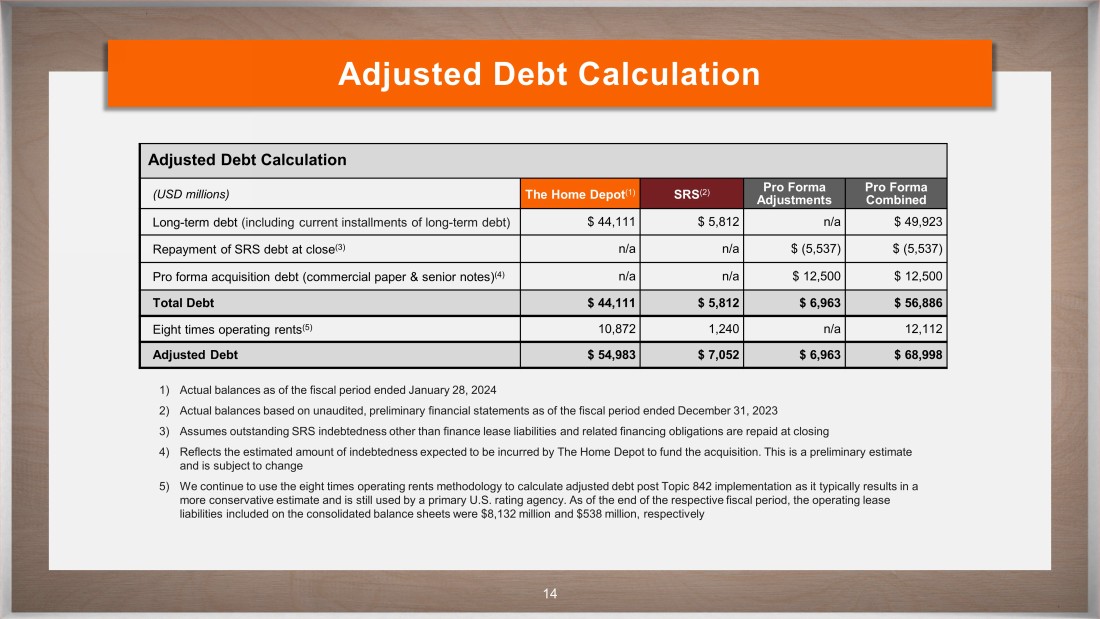

CONFIDENTIAL 14 Adjusted Debt Calculation Adjusted Debt Calculation (USD millions) The Home Depot (1) SRS (2) Pro Forma Adjustments Pro Forma Combined Long - term debt (including current installments of long - term debt) $ 44,111 $ 5,812 n/a $ 49,923 Repayment of SRS debt at close (3) n/a n/a $ (5,537) $ (5,537) Pro forma acquisition debt (commercial paper & senior notes) (4) n/a n/a $ 12,500 $ 12,500 Total D ebt $ 44,111 $ 5,812 $ 6,963 $ 56 , 886 Eight times operating rents (5 ) 10,872 1,240 n/a 12,112 Adjusted D ebt $ 54,983 $ 7,052 $ 6,963 $ 68,998 1) Actual balances as of the fiscal period ended January 28, 2024 2) Actual balances based on unaudited, preliminary financial statements as of the fiscal period ended December 31, 2023 3) Assumes outstanding SRS indebtedness other than finance lease liabilities and related financing obligations are repaid at clo sin g 4) Reflects the estimated amount of indebtedness expected to be incurred by The Home Depot to fund the acquisition. This is a pr eli minary estimate and is subject to change 5) We continue to use the eight times operating rents methodology to calculate adjusted debt post Topic 842 implementation as it ty pically results in a more conservative estimate and is still used by a primary U.S. rating agency.

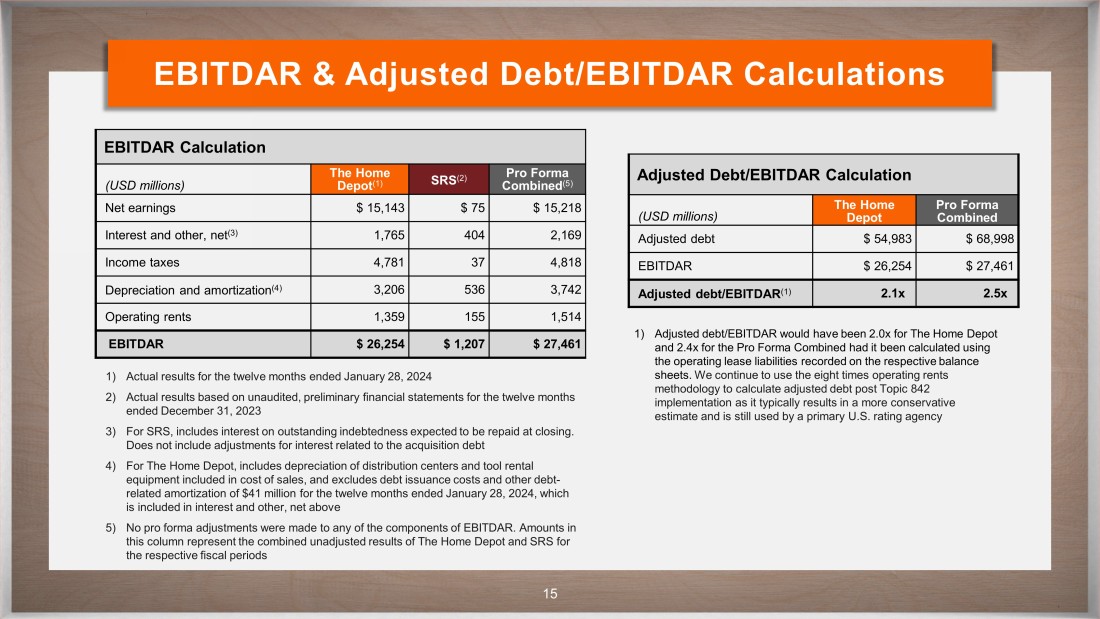

As of the end of the respective fiscal period, the operating lease liabilities included on the consolidated balance sheets were $8,132 million and $538 million, respectively CONFIDENTIAL 15 EBITDAR & Adjusted Debt/EBITDAR Calculations EBITDAR Calculation (USD millions) The Home Depot (1) SRS (2) Pro Forma Combined (5) Net earnings $ 15,143 $ 75 $ 15,218 Interest and other, net (3) 1,765 404 2,169 Income taxes 4,781 37 4,818 Depreciation and amortization (4 ) 3,206 536 3,742 Operating rents 1,359 155 1,514 EBITDAR $ 26,254 $ 1,207 $ 27,461 1) Actual results for the twelve months ended January 28, 2024 2) Actual results based on unaudited, preliminary financial statements for the twelve months ended December 31, 2023 3) For SRS, includes interest on outstanding indebtedness expected to be repaid at closing. Does not include adjustments for interest related to the acquisition debt 4) For The Home Depot, includes depreciation of distribution centers and tool rental equipment included in cost of sales, and excludes debt issuance costs and other debt - related amortization of $41 million for the twelve months ended January 28, 2024, which is included in interest and other, net above 5) No pro forma adjustments were made to any of the components of EBITDAR. Amounts in this column represent the combined unadjusted results of The Home Depot and SRS for the respective fiscal periods Adjusted Debt/EBITDAR Calculation (USD millions) The Home Depot Pro Forma Combined Adjusted debt $ 54,983 $ 68,998 EBITDAR $ 26,254 $ 27,461 Adjusted debt/EBITDAR (1 ) 2.1x 2.5 x 1) Adjusted debt/EBITDAR would have been 2.0x for The Home Depot and 2. 4 x for the Pro Forma Combined had it been calculated using the operating lease liabilities recorded on the respective balance sheet s . We continue to use the eight times operating rents methodology to calculate adjusted debt post Topic 842 implementation as it typically results in a more conservative estimate and is still used by a primary U.S. rating agency