UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2023

SUMMIT HOTEL PROPERTIES, INC.

(Exact Name of Registrant as Specified in its Charter)

| Maryland | 001-35074 | 27-2962512 |

(State

or Other Jurisdiction |

(Commission File Number) | (I.R.S. Employer Identification No.) |

13215 Bee Cave Parkway, Suite B-300

Austin, Texas 78738

(Address of Principal Executive Offices) (Zip Code)

(512) 538-2300

(Registrants’ telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Securities registered pursuant to Section 12(b) of the Act: | ||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | INN | New York Stock Exchange |

| Series E Cumulative Redeemable Preferred Stock, $0.01 par value | INN-PE | New York Stock Exchange |

| Series F Cumulative Redeemable Preferred Stock, $0.01 par value | INN-PF | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| ¨ | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02. | Results of Operations and Financial Condition. |

On February 27, 2023, Summit Hotel Properties, Inc. (the “Company”) issued a press release announcing the operating results of the Company and its subsidiaries for the fourth quarter and year ended December 31, 2022. The press release referred to supplemental financial information for the fourth quarter and full year 2022 that is available on the Company’s website at www.shpreit.com. A copy of the press release and the supplemental financial information are furnished as Exhibit 99.1 and Exhibit 99.2, respectively, to this Report.

The information in this Report, including the exhibits, is provided under Item 2.02 of Form 8-K and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section. Furthermore, the information in this Report, including the exhibits, shall not be deemed to be incorporated by reference into the filings of the registrant under the Securities Act of 1933 regardless of any general incorporation language in such filings.

| Item 9.01. | Financial Statements and Exhibits. |

| (d) | Exhibits | |

| 99.1 | Press release issued on February 27, 2023 | |

| 99.2 | Fourth Quarter and Full Year 2022 Supplemental Data | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| SUMMIT HOTEL PROPERTIES, INC. | ||

| By: | /s/ Christopher R. Eng | |

| Christopher R. Eng | ||

| Dated: February 27, 2023 | Executive Vice President, General Counsel, Chief Risk Officer and Secretary | |

Exhibit 99.1

|

13215 Bee Cave Pkwy, Suite B-300, Austin, TX 78738 Telephone: 512-538-2300 Fax: 512-538-2333 www.shpreit.com |

NEWS RELEASE

SUMMIT HOTEL PROPERTIES REPORTS FOURTH QUARTER AND FULL YEAR 2022 RESULTS

Fourth Quarter 2022 RevPAR Recapture Reaches New High

Operating Income Triples Driving Adjusted EBITDAre Growth of 100% to $180.8 Million in 2022

Nearly $1 Billion of Strategic Acquisitions Completed in 2022

Austin, Texas, February 27, 2023 - - - Summit Hotel Properties, Inc. (NYSE: INN) (the “Company”), today announced results for the fourth quarter and full year ended December 31, 2022.

“We are pleased with the continued improvement of our operating results during the fourth quarter which drove 2019 RevPAR recapture to a new quarterly high of 97% highlighted by December results that exceeded pre-pandemic levels for the first time in our pro forma portfolio. The strong fourth quarter capped off another active year for the Company as we completed nearly $1 billion of strategic transactions, reinstated our common dividend, and made our initial investment in the rapidly growing glamping segment of the hospitality space. Operating trends have remained stable across our portfolio in early 2023 as January results were in-line with expectations and pace for February and March is accelerating,” said Jonathan P. Stanner, the Company’s President and Chief Executive Officer. “Prudent capital allocation continues to be foundational to our investment strategy and subsequent to year-end we have entered into contracts to sell six hotels and a vacant land parcel for approximately $80 million. Combined with our previously completed asset sale in 2022, we have signed or closed sales totaling $155 million at a blended capitalization rate of 2.3% based on trailing twelve-month net operating income and eliminated nearly $44 million of near-term required capital expenditures. These sales will further enhance our balance sheet reducing net leverage, increasing our liquidity to nearly $500 million, and resulting in no maturities until the fourth quarter of 2024,” commented Mr. Stanner.

Fourth Quarter 2022 Summary

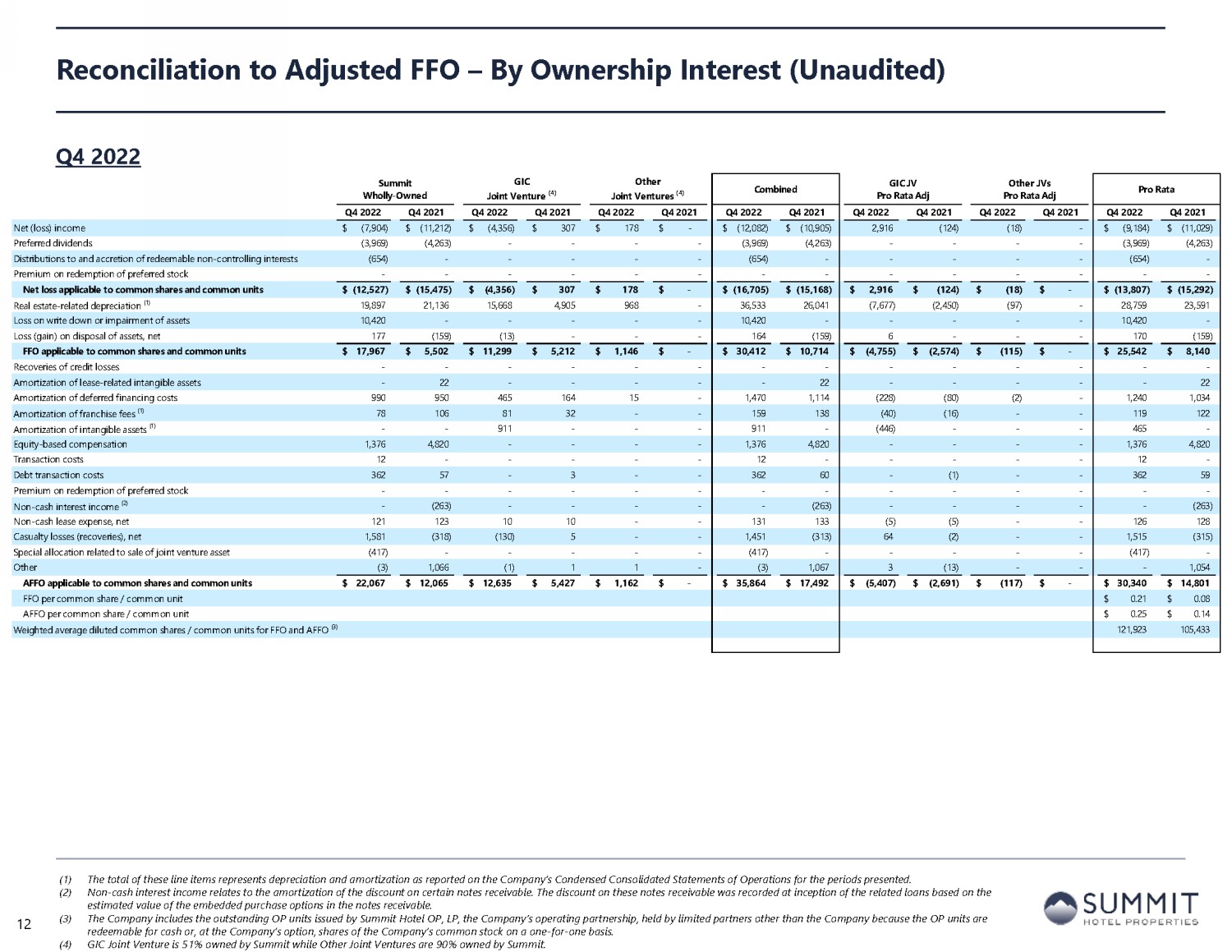

| · | Net Loss: Net loss attributable to common stockholders was $12.0 million, or $0.11 per diluted share, compared to a net loss of $15.3 million, or $0.15 per diluted share, for the fourth quarter of 2021. |

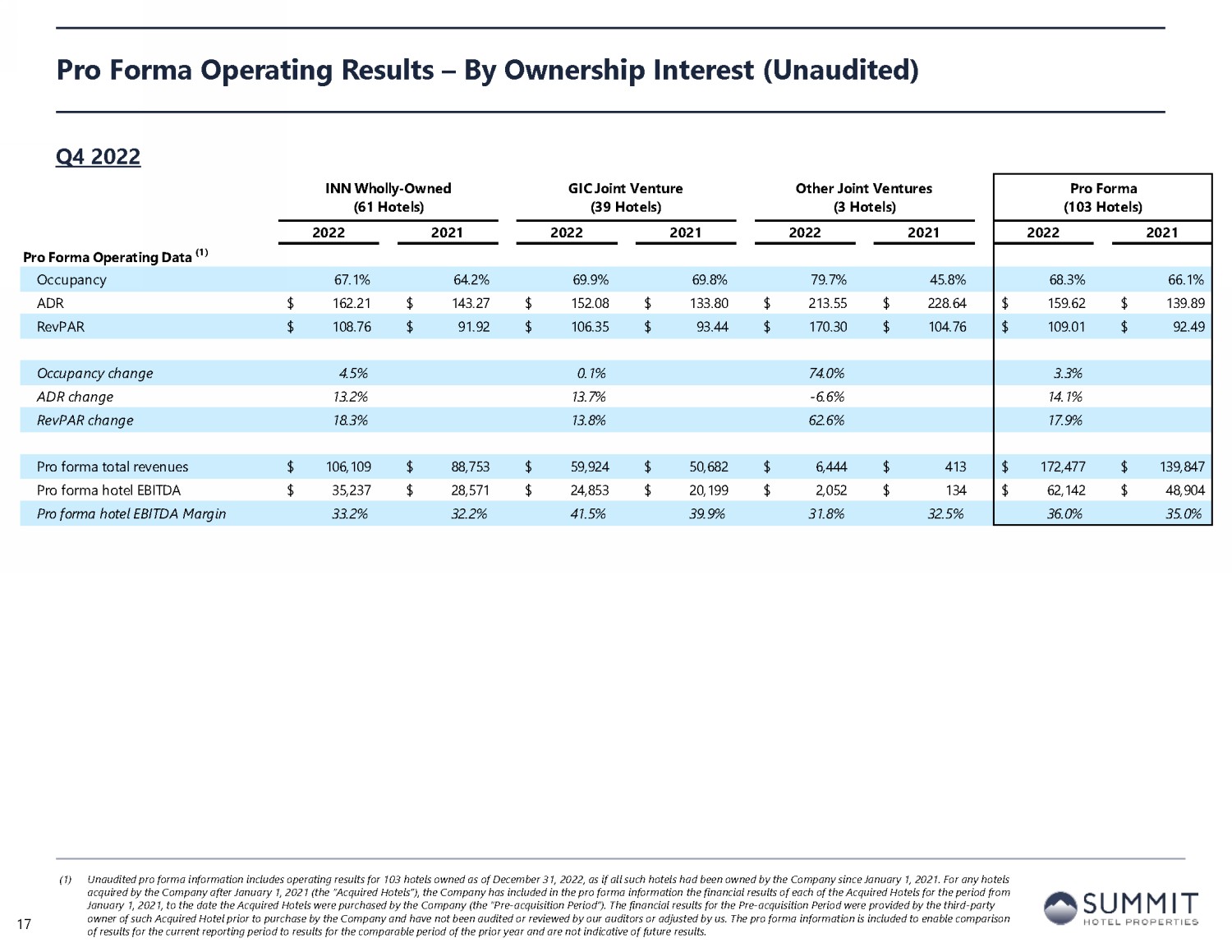

| · | Pro forma RevPAR: Pro forma RevPAR increased 17.9 percent to $109.01 compared to the fourth quarter of 2021. Pro forma ADR increased 14.1 percent to $159.62 compared to the same period in 2021, and pro forma occupancy increased 3.3 percent to 68.3 percent. |

| · | Pro Forma Hotel EBITDA: Pro forma hotel EBITDA increased 27.1 percent to $62.1 million from $48.9 million in the same period in 2021. Pro forma hotel EBITDA margin expanded 106 basis points to 36.0 percent from 35.0 percent in the same period of 2021. |

| · | Adjusted EBITDAre: Adjusted EBITDAre increased 61.6 percent to $46.1 million from $28.5 million in the fourth quarter of 2021. |

| · | Adjusted FFO: Adjusted FFO was $30.3 million, or $0.25 per diluted share, compared to $14.8 million, or $0.14 per diluted share, in the fourth quarter of 2021. |

| · | Capital Improvements: The Company invested $27.7 million in capital improvements during the fourth quarter and $22.2 million on a pro rata basis after consideration of joint ventures. |

|

|

The Company’s results for the three months and years ended December 31, 2022, and 2021 are as follows (in thousands, except per share amounts):

| For the Three Months Ended December 31, |

For the Years Ended December 31, |

|||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| (unaudited) | ||||||||||||||||

| Net loss attributable to common stockholders | $ | (11,975 | ) | $ | (15,275 | ) | $ | (16,929 | ) | $ | (83,714 | ) | ||||

| Net loss per diluted share | $ | (0.11 | ) | $ | (0.15 | ) | $ | (0.16 | ) | $ | (0.80 | ) | ||||

| Total revenues | $ | 172,326 | $ | 106,862 | $ | 675,695 | $ | 361,926 | ||||||||

| EBITDAre (1) | $ | 54,498 | $ | 26,312 | $ | 210,609 | $ | 86,325 | ||||||||

| Adjusted EBITDAre (1) | $ | 46,084 | $ | 28,513 | $ | 180,815 | $ | 90,495 | ||||||||

| FFO (1) | $ | 25,542 | $ | 8,140 | $ | 95,253 | $ | 17,300 | ||||||||

| Adjusted FFO (1) | $ | 30,340 | $ | 14,801 | $ | 113,970 | $ | 36,782 | ||||||||

| FFO per diluted share and unit (1) | $ | 0.21 | $ | 0.08 | $ | 0.79 | $ | 0.16 | ||||||||

| Adjusted FFO per diluted share and unit (1) | $ | 0.25 | $ | 0.14 | $ | 0.94 | $ | 0.35 | ||||||||

| Pro Forma (103 Lodging Assets) (2) | ||||||||||||||||

| RevPAR | $ | 109.01 | $ | 92.49 | $ | 110.91 | $ | 80.42 | ||||||||

| RevPAR Growth | 17.9 | % | 37.9 | % | ||||||||||||

| Hotel EBITDA | $ | 62,142 | $ | 48,904 | $ | 243,940 | $ | 149,678 | ||||||||

| Hotel EBITDA margin | 36.0 | % | 35.0 | % | 35.4 | % | 31.4 | % | ||||||||

| Hotel EBITDA margin growth | 106 bps | 401 bps | ||||||||||||||

| Same Store (71 Lodging Assets) (3) | ||||||||||||||||

| RevPAR | $ | 110.74 | $ | 93.78 | $ | 114.61 | $ | 80.80 | ||||||||

| RevPAR Growth | 18.1 | % | 41.8 | % | ||||||||||||

| Hotel EBITDA | $ | 42,817 | $ | 34,785 | $ | 179,563 | $ | 105,658 | ||||||||

| Hotel EBITDA margin | 34.5 | % | 33.5 | % | 35.5 | % | 29.8 | % | ||||||||

| Hotel EBITDA margin growth | 109 bps | 576 bps | ||||||||||||||

| (1) | See tables later in this press release for a discussion and reconciliation of net loss to non-GAAP financial measures, including earnings before interest, taxes, depreciation, and amortization (“EBITDA”), EBITDAre, adjusted EBITDAre, funds from operations (“FFO”), FFO per diluted share and unit, adjusted FFO (“AFFO”), and AFFO per diluted share and unit, as well as a reconciliation of operating loss to hotel EBITDA. See “Non-GAAP Financial Measures” at the end of this release. |

| (2) | Unless stated otherwise in this release, all pro forma information includes operating and financial results for 103 lodging assets owned as of December 31, 2022, as if each had been owned by the Company since January 1, 2021 and remained open for the entirety of the measurement period. As a result, all pro forma information includes operating and financial results for lodging assets acquired since January 1, 2021, which may include periods prior to the Company’s ownership. Pro forma and non-GAAP measures are unaudited. |

| (3) | All same store information includes operating and financial results for 71 lodging assets owned as of December 31, 2022, and at all times during the three months and year ended December 31, 2022, and 2021. |

|

|

Full Year 2022 Summary

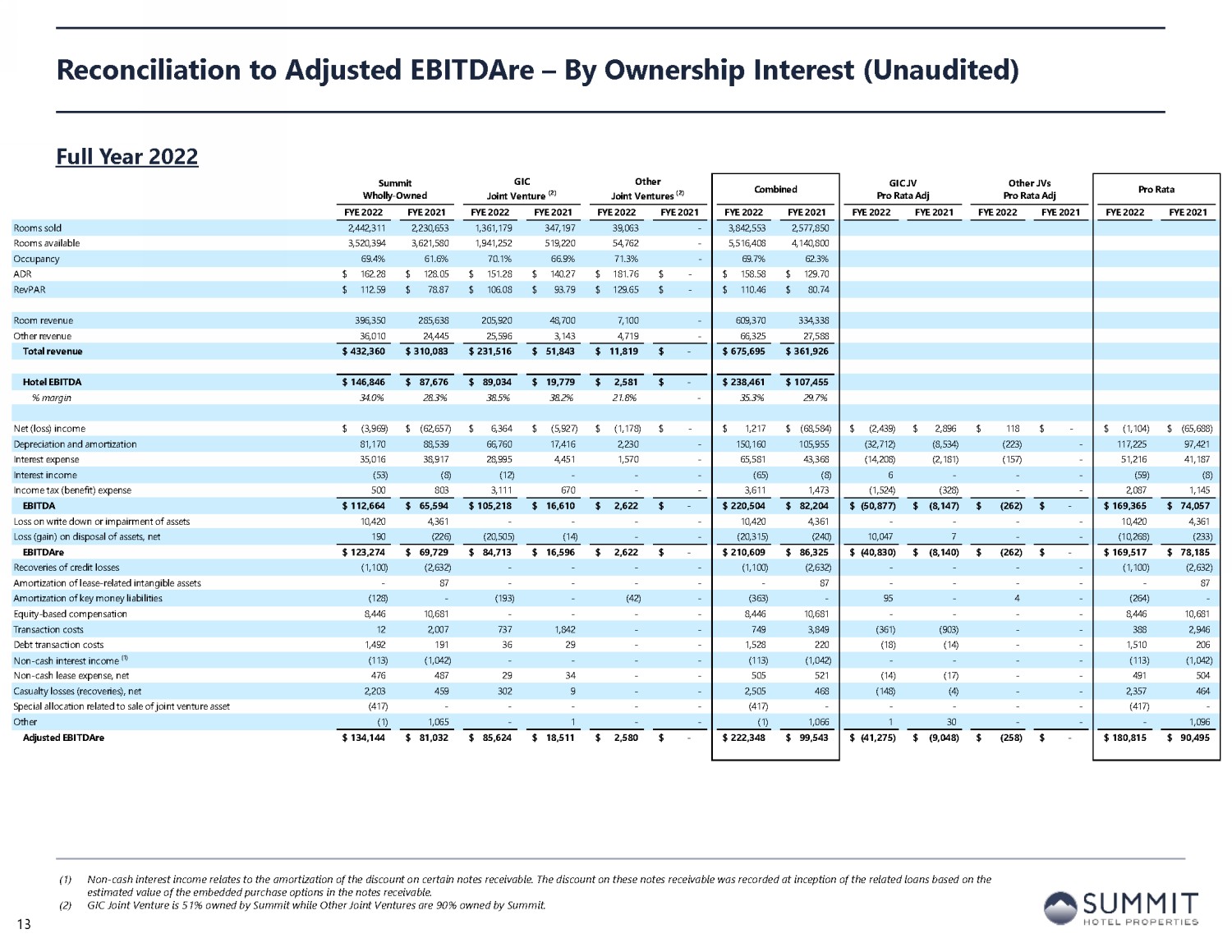

| · | Net Loss: Net loss attributable to common stockholders was $16.9 million, or $0.16 per diluted share, compared to a net loss of $83.7 million, or $0.80 per diluted share, for the year ended 2021. |

| · | Pro Forma RevPAR: Pro forma revenue per available room (“RevPAR”) increased 37.9 percent from 2021 to $110.91. Pro forma average daily rate (“ADR”) increased 25.9 percent from 2021 to $159.30, and pro forma occupancy increased 9.5 percent to 69.6 percent. |

| · | Pro Forma Hotel EBITDA: Pro forma hotel EBITDA increased 63.0 percent to $243.9 million from $149.7 million in 2021. Pro forma hotel EBITDA margin expanded 401 basis points to 35.4 percent from 31.4 percent in 2021. |

| · | Adjusted EBITDAre: Adjusted EBITDAre increased 99.8 percent to $180.8 million from $90.5 million for the year ended 2021. |

| · | Adjusted FFO: Adjusted FFO was $114.0 million, or $0.94 per diluted share, compared to $36.8 million, or $0.35 per diluted share, for the year ended 2021. |

| · | Capital Improvements: The Company invested $76.5 million in capital improvements during 2022 and $63.6 million on a pro rata basis after consideration of joint ventures. |

Onera Partnership Update

Onera Fredericksburg Acquisition and Expansion

On October 26, 2022, the Company acquired a 90 percent equity interest in the entity (the “Onera Joint Venture”) that owns Onera Fredericksburg, an 11-unit premium glamping asset located in Fredericksburg, Texas, for $4.5 million, based on a total valuation of $5.0 million, and an adjacent 6.4-acre land parcel for future expansion for $0.7 million, based on a total valuation of $0.8 million.

Onera Fredericksburg achieved 2022 RevPAR of $440, hotel EBITDA margin of more than 60%, and a net operating income yield of 17% on the Onera Joint Venture’s $5.0 million acquisition price. The Onera Joint Venture will pay a one-time incentive payment of up to $2.0 million if the property meets a certain unlevered yield threshold for the twelve-month period ending July 31, 2023. Additionally, the Onera Joint Venture expects to begin construction on the adjacent 6.4-acre vacant land parcel in 2023, which will add an additional 15-20 premium units that are expected to achieve a mid-teens stabilized net operating income yield.

Onera Development Project Financed Utilizing Mezzanine Loan Program

Subsequent to year-end, the Company utilized its mezzanine lending platform to enter into an agreement with affiliates of Onera to provide mezzanine financing of up to $4.6 million for the future development of a high-end glamping asset. The loan has a fixed interest rate of 12% that will be paid monthly. The Company has an option to purchase 90% of the development upon its expected completion in mid-2024 at a pre-negotiated price.

Upon completion of the two development projects, the Onera Joint Venture will have invested approximately $40 to $45 million in high-end glamping projects that are estimated to achieve blended stabilized net operating income yields in the mid-teens.

|

|

Pending Transaction Activity

The Company entered into three separate contracts subsequent to year end to dispose of an aggregate of six hotels totaling 750 guestrooms and a vacant land parcel. The aggregate gross sales price for the pending disposition activity is $79.9 million and the hotel transactions are expected to close in the second quarter of 2023 with the vacant land sale closing expected in the second half of 2023. The sales price for all transactions represents a 3.9% capitalization rate based on net operating income after a 4% FF&E reserve for the year ended December 31, 2022. The Company expects to forego between $33 million and $38 million of future near-term required capital expenditures at the six hotels as a result of the sales which would reduce the all-in capitalization rate to approximately 2.6%. All of the pending dispositions are wholly owned assets and net proceeds will be used to repay outstanding debt, enhance the Company’s liquidity profile, and reduce overall balance sheet leverage.

Two-Hotel Portfolio Sale

The Company is under contract to sell two hotels totaling 283 guestrooms for a gross sales price of $50.5 million. The sales price represents a 3.9% capitalization rate based on the portfolio’s net operating income after a 4% FF&E reserve for the year ended December 31, 2022. The hotels for sale are:

| · | 160-guestroom – Residence Atlanta Midtown/Peachtree at 17th |

| · | 123-guestroom – Courtyard Kansas City Country Club Plaza |

Four-Hotel Portfolio Sale

The Company is separately under contract to sell four hotels totaling 467 guestrooms for a gross sales price of $28.1 million. The sales price represents a 4.2% capitalization rate based on the portfolio’s net operating income after a 4% FF&E reserve for the year ended December 31, 2022. The hotels for sale are:

| · | 151-guestroom – Hyatt Place Chicago/Lombard/Oak Brook |

| · | 126-guestroom – Hyatt Place Chicago/Hoffman Estates |

| · | 97-guestroom – Hilton Garden Inn Minneapolis/Eden Prairie |

| · | 93-guestroom – Holiday Inn Express & Suites Eden Prairie – Minnetonka |

The Company can make no assurances that it will be able to complete the sale transactions based on the current contractual terms or at all.

Capital Markets & Balance Sheet

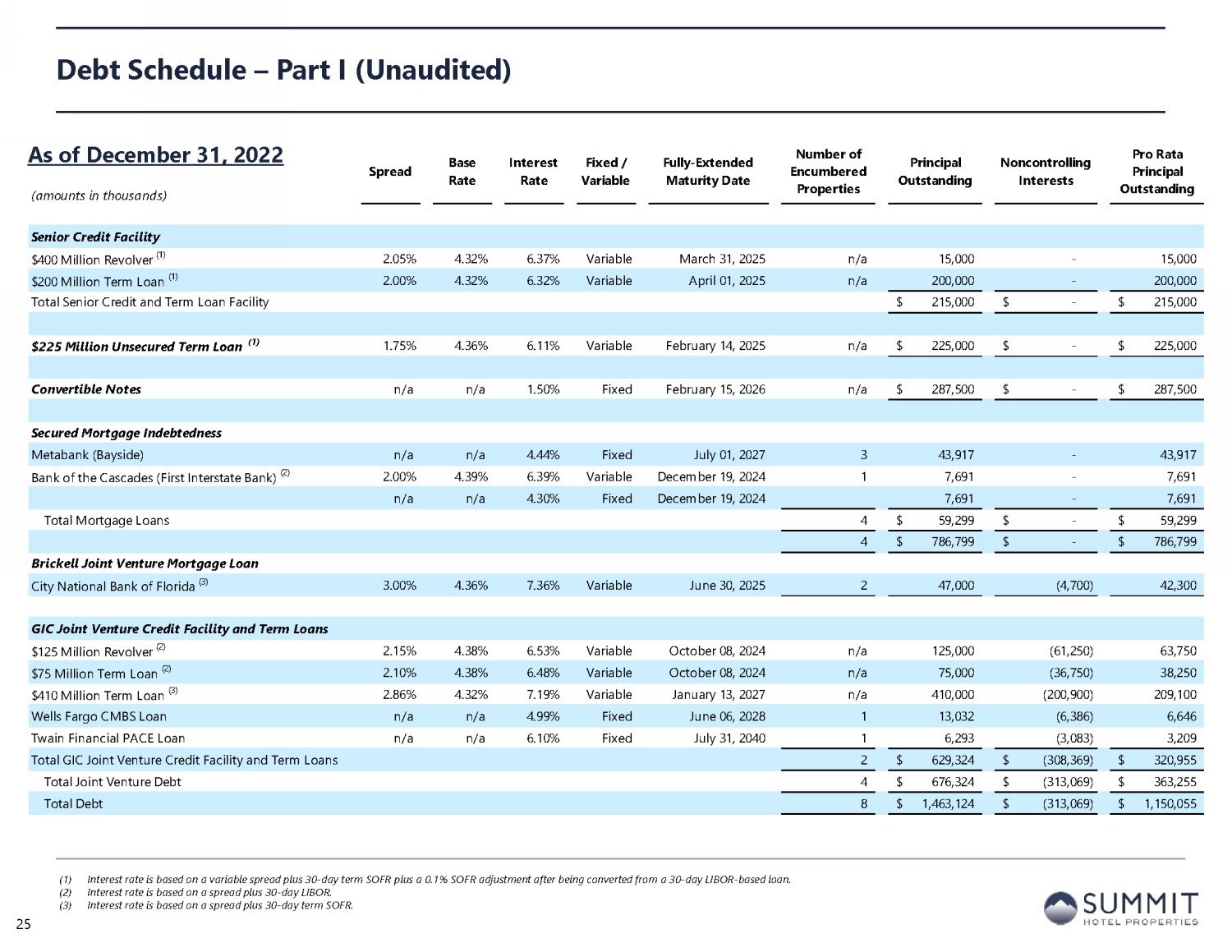

On December 31, 2022, inclusive of its pro rata share of the GIC Joint Venture credit facility, the Company had the following:

| · | Outstanding debt of $1.2 billion with a weighted average interest rate of 4.53 percent. After giving effect to interest rate derivative agreements, $749.0 million, or 65 percent, of our outstanding debt had an average fixed interest rate, and $401.1 million, or 35 percent, had a variable interest rate. |

| · | Unrestricted cash and cash equivalents of $38.1 million. |

|

|

| · | Revolving credit facility availability of $385.0 million on its $400.0 million credit facility. |

| · | Total liquidity of $423.1 million, including unrestricted cash and cash equivalents and revolving credit facility availability. |

On February 10, 2023, inclusive of the recent transaction activity and its pro rata share of the GIC Joint Venture credit facility but exclusive of pending disposition activity, the Company had the following:

| · | Outstanding debt of $1.1 billion with a weighted average interest rate of 4.70 percent. After giving effect to interest rate derivative agreements, $748.7 million, or 65 percent, of our outstanding debt had an average fixed interest rate, and $401.0 million, or 35 percent, had a variable interest rate. |

| · | Unrestricted cash and cash equivalents of $38.5 million. |

| · | Revolving credit facility availability of $382.0 million on its $400.0 million credit facility. |

| · | Total liquidity of $420.5 million including unrestricted cash and cash equivalents and revolving credit facility availability. |

| · | Adjusted for pending disposition activity, an estimated total liquidity of $500 million, including unrestricted cash equivalents and revolving credit facility availability. |

The Company notified lenders of its intent to exercise the first of four available maturity date extension options on its $400 million senior revolving credit facility during the fourth quarter. The extended maturity date of September 30, 2023, is expected to become effective in March of this year and the Company will have three remaining six-month extension options at the Company’s sole discretion available that result in a fully extended maturity date of March 31, 2025.

The Company also defeased its final 2023 debt maturity for $32.3 million in the fourth quarter of 2022, resulting in $6.7 million of restricted cash being returned to the Company. The Company does not have any remaining debt maturities after consideration of extension options until the fourth quarter of 2024.

Dividends

On January 26, 2023, the Company declared a quarterly cash dividend of $0.04 per share on its common stock and per common unit of limited partnership interest in Summit Hotel OP, LP.

In addition, the Board of Directors declared a quarterly cash dividend of:

| · | $0.390625 per share on its 6.25% Series E Cumulative Redeemable Preferred Stock |

| · | $0.3671875 per share on its 5.875% Series F Cumulative Redeemable Preferred Stock. |

| · | $0.328125 per unit on its 5.25% Series Z Cumulative Perpetual Preferred Units |

The common and preferred dividends are payable on February 28, 2023, to holders of record as of February 14, 2023.

|

|

2023 Outlook

The Company is providing its outlook for the full year 2023 based on 103 lodging assets, 61 of which were wholly owned as of February 27, 2023. There are no pending acquisitions, dispositions, or additional capital markets activities assumed in the Company’s full year 2023 outlook.

| FYE 2023 Outlook | ||||||||

| Low | High | |||||||

| Pro Forma RevPAR (103 Lodging Assets) (1) | $ | 117.50 | $ | 123.00 | ||||

| Pro Forma RevPAR Growth | 6.00 | % | 11.00 | % | ||||

| Adjusted EBITDAre | $ | 190,400 | $ | 205,900 | ||||

| Adjusted FFO | $ | 112,100 | $ | 128,100 | ||||

| Adjusted FFO per Diluted Unit | $ | 0.92 | $ | 1.05 | ||||

| Capital Expenditures, Pro Rata | $ | 60,000 | $ | 80,000 | ||||

| (1) | All pro forma information includes operating and financial results for 103 lodging assets owned as of December 31, 2022, as if each property had been owned by the Company since January 1, 2022 and will continue to be owned through the entire year ending December 31, 2023. As a result, the pro forma information includes operating and financial results for lodging assets acquired since January 1, 2022, which may include periods prior to the Company’s ownership. Pro forma and non-GAAP financial measures are unaudited. |

Fourth Quarter and Full Year 2022 Earnings Conference Call

The Company will conduct its quarterly conference call on Tuesday, February 28, 2023, at 9:00 AM ET. To participate in the conference call, please follow the steps below:

| 1. | To access the conference call, please pre-register using this link. Registrants will receive a confirmation with dial-in details. |

| 2. | A live webcast of the conference call can be accessed using this link. A replay of the webcast will be available in the Investors section of the Company’s website, www.shpreit.com, until April 30, 2023. |

Supplemental Disclosures

In conjunction with this press release, the Company has furnished a financial supplement with additional disclosures on its website. Visit www.shpreit.com for more information. The Company has no obligation to update any of the information provided to conform to actual results or changes in portfolio, capital structure or future expectations.

About Summit Hotel Properties

Summit Hotel Properties, Inc. is a publicly traded real estate investment trust focused on owning premium-branded lodging assets with efficient operating models primarily in the upscale segment of the lodging industry. As of February 27, 2023, the Company’s portfolio consisted of 103 lodging assets, 61 of which are wholly owned, with a total of 15,334 guestrooms located in 24 states.

For additional information, please visit the Company’s website, www.shpreit.com, and follow on Twitter at @SummitHotel_INN and on Facebook at facebook.com/SummitHotelProperties.

|

|

Contact:

Adam Wudel

SVP – Finance & Capital Markets

Summit Hotel Properties, Inc.

(512) 538-2325

Forward-Looking Statements

This press release contains statements that are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “seek,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” “forecast,” “continue,” “plan,” “likely,” “would” or other similar words or expressions. Forward-looking statements are based on certain assumptions and can include future expectations, future plans and strategies, financial and operating projections, or other forward-looking information. Examples of forward-looking statements include the following: the Company’s ability to realize growth from the deployment of renovation capital; projections of the Company’s revenues and expenses, capital expenditures or other financial items; descriptions of the Company’s plans or objectives for future operations, acquisitions, dispositions, financings, redemptions or services; forecasts of the Company’s future financial performance and potential increases in average daily rate, occupancy, RevPAR, room supply and demand, EBITDAre, Adjusted EBITDAre, FFO and AFFO; the Company’s outlook with respect to pro forma RevPAR, pro forma RevPAR growth, RevPAR, RevPAR growth, AFFO, AFFO per diluted share and unit and renovation capital deployed; and descriptions of assumptions underlying or relating to any of the foregoing expectations regarding the timing of their occurrence. These forward-looking statements are subject to various risks and uncertainties, not all of which are known to the Company and many of which are beyond the Company’s control, which could cause actual results to differ materially from such statements. These risks and uncertainties include, but are not limited to, the state of the U.S. economy, supply and demand in the hotel industry, and other factors as are described in greater detail in the Company’s filings with the Securities and Exchange Commission (“SEC”). Unless legally required, the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events, or otherwise.

For information about the Company’s business and financial results, please refer to the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” sections of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC, and its quarterly and other periodic filings with the SEC. The Company undertakes no duty to update the statements in this release to conform the statements to actual results or changes in the Company’s expectations.

|

|

Summit Hotel Properties, Inc.

Condensed Consolidated Balance Sheets

(in thousands)

| December 31, 2022 |

December 31, 2021 |

|||||||

| ASSETS | ||||||||

| Investments in lodging property, net | $ | 2,792,552 | $ | 2,091,973 | ||||

| Undeveloped land | - | 1,500 | ||||||

| Assets held for sale, net | 78,576 | 425 | ||||||

| Cash and cash equivalents | 51,255 | 64,485 | ||||||

| Restricted cash | 10,553 | 32,459 | ||||||

| Right-of-use assets, net | 35,023 | 26,942 | ||||||

| Trade receivables, net | 21,015 | 14,476 | ||||||

| Prepaid expenses and other | 8,378 | 24,496 | ||||||

| Deferred charges, net | 7,074 | 4,347 | ||||||

| Other assets | 17,844 | 3,799 | ||||||

| Total assets | $ | 3,022,270 | $ | 2,264,902 | ||||

| LIABILITIES, REDEEMABLE NON-CONTROLLING INTERESTS AND EQUITY |

||||||||

| Liabilities: | ||||||||

| Debt, net of debt issuance costs | $ | 1,451,796 | $ | 1,069,797 | ||||

| Lease liabilities, net | 25,484 | 17,232 | ||||||

| Accounts payable | 5,517 | 4,462 | ||||||

| Accrued expenses and other | 81,304 | 66,219 | ||||||

| Total liabilities | 1,564,101 | 1,157,710 | ||||||

| Redeemable non-controlling interests | 50,219 | - | ||||||

| Total stockholders' equity | 959,813 | 948,073 | ||||||

| Non-controlling interests | 448,137 | 159,119 | ||||||

| Total equity | 1,407,950 | 1,107,192 | ||||||

| Total liabilities, redeemable non-controlling interests and equity | $ | 3,022,270 | $ | 2,264,902 | ||||

|

|

Summit Hotel Properties, Inc.

Condensed Consolidated Statements of Operations

(in thousands, except per share amounts)

| For the Three Months Ended December 31, |

For the Years Ended December 31, |

|||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| (Unaudited) | ||||||||||||||||

| Revenues: | ||||||||||||||||

| Room | $ | 153,623 | $ | 98,577 | $ | 609,370 | $ | 334,338 | ||||||||

| Food and beverage | 9,937 | 2,643 | 32,117 | 7,299 | ||||||||||||

| Other | 8,766 | 5,642 | 34,208 | 20,289 | ||||||||||||

| Total revenues | 172,326 | 106,862 | 675,695 | 361,926 | ||||||||||||

| Expenses: | ||||||||||||||||

| Room expense | 35,281 | 22,461 | 136,999 | 74,781 | ||||||||||||

| Food and beverage expense | 7,710 | 1,856 | 24,897 | 4,856 | ||||||||||||

| Other hotel operating expenses | 53,104 | 34,954 | 207,975 | 123,626 | ||||||||||||

| Property taxes, insurance and other | 9,885 | 8,777 | 49,921 | 41,350 | ||||||||||||

| Management fees | 4,297 | 3,101 | 17,442 | 9,858 | ||||||||||||

| Depreciation and amortization | 37,698 | 26,179 | 150,160 | 105,955 | ||||||||||||

| Corporate general and administrative | 7,022 | 11,145 | 30,765 | 29,428 | ||||||||||||

| Transaction costs | 12 | - | 749 | 3,849 | ||||||||||||

| Recoveries of credit losses | - | - | (1,100 | ) | (2,632 | ) | ||||||||||

| Loss on write-down or impairment of assets | 10,420 | - | 10,420 | 4,361 | ||||||||||||

| Total expenses | 165,429 | 108,473 | 628,228 | 395,432 | ||||||||||||

| (Loss) gain on disposal of assets, net | (164 | ) | 159 | 20,315 | 240 | |||||||||||

| Operating income (loss) | 6,733 | (1,452 | ) | 67,782 | (33,266 | ) | ||||||||||

| Other income (expense): | ||||||||||||||||

| Interest expense | (19,379 | ) | (10,801 | ) | (65,581 | ) | (43,368 | ) | ||||||||

| Other (expense) income, net | (472 | ) | 1,746 | 2,627 | 9,523 | |||||||||||

| Total other expense | (19,851 | ) | (9,055 | ) | (62,954 | ) | (33,845 | ) | ||||||||

| (Loss) income from continuing operations before income taxes | (13,118 | ) | (10,507 | ) | 4,828 | (67,111 | ) | |||||||||

| Income tax benefit (expense) | 1,036 | (398 | ) | (3,611 | ) | (1,473 | ) | |||||||||

| Net (loss) income | (12,082 | ) | (10,905 | ) | 1,217 | (68,584 | ) | |||||||||

| Loss (income) loss attributable to non-controlling interests | 4,730 | (107 | ) | 249 | 3,011 | |||||||||||

| Net (loss) income attributable to Summit Hotel Properties, Inc. | (7,352 | ) | (11,012 | ) | 1,466 | (65,573 | ) | |||||||||

| Distributions to and accretion of redeemable non-controlling interests | (654 | ) | - | (2,520 | ) | - | ||||||||||

| Preferred dividends | (3,969 | ) | (4,263 | ) | (15,875 | ) | (15,431 | ) | ||||||||

| Premium on redemption of preferred stock | - | - | - | (2,710 | ) | |||||||||||

| Net loss attributable to common stockholders | $ | (11,975 | ) | $ | (15,275 | ) | $ | (16,929 | ) | $ | (83,714 | ) | ||||

| Loss per share: | ||||||||||||||||

| Basic and diluted | $ | (0.11 | ) | $ | (0.15 | ) | $ | (0.16 | ) | $ | (0.80 | ) | ||||

| Weighted average common shares outstanding: | ||||||||||||||||

| Basic and diluted | 105,235 | 104,559 | 105,142 | 104,471 | ||||||||||||

|

|

Summit Hotel Properties, Inc.

Reconciliation of Net Income (Loss) to Non-GAAP Measures – Funds From Operations

(in thousands, except per share and unit amounts)

(Unaudited)

| For the Three Months Ended December 31, |

For the Year Ended December 31, |

|||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| Net (loss) income | $ | (12,082 | ) | $ | (10,905 | ) | $ | 1,217 | $ | (68,584 | ) | |||||

| Preferred dividends | (3,969 | ) | (4,263 | ) | (15,875 | ) | (15,431 | ) | ||||||||

| Distributions to and accretion of redeemable non-controlling interests | (654 | ) | - | (2,520 | ) | - | ||||||||||

| Premium on redemption of preferred stock | - | - | - | (2,710 | ) | |||||||||||

| Loss (income) related to non-controlling interests in consolidated joint ventures | 2,898 | (124 | ) | (2,321 | ) | 2,896 | ||||||||||

| Net loss applicable to common shares and common units | (13,807 | ) | (15,292 | ) | (19,499 | ) | (83,829 | ) | ||||||||

| Real estate-related depreciation (1) | 36,533 | 26,041 | 145,492 | 105,462 | ||||||||||||

| Loss on write down or impairment of assets | 10,420 | - | 10,420 | 4,361 | ||||||||||||

| Loss (gain) on disposal of assets, net | 164 | (159 | ) | (20,315 | ) | (240 | ) | |||||||||

| Adjustments related to non-controlling interests in consolidated joint ventures | (7,768 | ) | (2,450 | ) | (20,845 | ) | (8,454 | ) | ||||||||

| FFO applicable to common shares and common units | 25,542 | 8,140 | 95,253 | 17,300 | ||||||||||||

| Recoveries of credit losses | - | - | (1,100 | ) | (2,632 | ) | ||||||||||

| Amortization of lease-related intangible assets | - | 22 | - | 87 | ||||||||||||

| Amortization of deferred financing costs | 1,470 | 1,114 | 5,708 | 4,353 | ||||||||||||

| Amortization of franchise fees (1) | 159 | 138 | 663 | 493 | ||||||||||||

| Amortization of intangible assets (1) | 911 | - | 3,643 | - | ||||||||||||

| Equity-based compensation | 1,376 | 4,820 | 8,446 | 10,681 | ||||||||||||

| Executive transition costs | - | 1,065 | - | 1,065 | ||||||||||||

| Transaction costs | 12 | - | 749 | 3,849 | ||||||||||||

| Debt transaction costs | 362 | 60 | 1,528 | 220 | ||||||||||||

| Premium on redemption of preferred stock | - | - | - | 2,710 | ||||||||||||

| Non-cash interest income (2) | - | (263 | ) | (113 | ) | (1,042 | ) | |||||||||

| Non-cash lease expense, net | 131 | 133 | 505 | 521 | ||||||||||||

| Casualty losses (recoveries), net | 1,451 | (313 | ) | 2,505 | 468 | |||||||||||

| Adjustments related to non-controlling interests in consolidated joint ventures | (657 | ) | (115 | ) | (3,400 | ) | (1,291 | ) | ||||||||

| Special allocation related to sale of joint venture asset | (417 | ) | - | (417 | ) | - | ||||||||||

| AFFO applicable to common shares and common units | $ | 30,340 | $ | 14,801 | $ | 113,970 | $ | 36,782 | ||||||||

| FFO per common share / common unit | $ | 0.21 | $ | 0.08 | $ | 0.79 | $ | 0.16 | ||||||||

| AFFO per common share / common unit | $ | 0.25 | $ | 0.14 | $ | 0.94 | $ | 0.35 | ||||||||

| Weighted average diluted common shares/common units for FFO and AFFO (3) | 121,923 | 105,433 | 121,163 | 105,455 | ||||||||||||

| (1) | The total of these line items represents depreciation and amortization as reported on the Company’s Condensed Consolidated Statements of Operations for the periods presented. |

| (2) | Non-cash interest income relates to the amortization of the discount on certain notes receivable. The discount on these notes receivable was recorded at inception of the related loans based on the estimated value of the embedded purchase options in the notes receivable. |

| (3) | The Company includes the outstanding OP units issued by Summit Hotel OP, LP, the Company’s operating partnership, held by limited partners other than the Company because the OP units are redeemable for cash or, at the Company’s option, shares of the Company’s common stock on a one-for-one basis. |

|

|

Summit Hotel Properties, Inc.

Reconciliation of Weighted Average Diluted Common Shares

(in thousands)

(Unaudited)

| For the Three Months Ended December 31, |

For the Year Ended December 31, |

|||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| Weighted average dilutive common shares outstanding | 105,235 | 104,559 | 105,142 | 104,471 | ||||||||||||

| Dilutive effect of restricted stock awards | 105 | 381 | 221 | 402 | ||||||||||||

| Dilutive effect of performance stock awards | 52 | - | 7 | - | ||||||||||||

| Dilutive effect of shares issuable upon conversion of convertible debt | 24,193 | 23,978 | 24,193 | 23,256 | ||||||||||||

| Adjusted weighted average dilutive common shares outstanding | 129,585 | 128,918 | 129,563 | 128,129 | ||||||||||||

| Non-GAAP adjustment for dilutive effect of common units | 15,981 | 125 | 15,360 | 144 | ||||||||||||

| Non-GAAP adjustment for dilutive effect of restricted stock awards | 550 | 368 | 433 | 438 | ||||||||||||

| Non-GAAP adjustment for dilutive effect of shares issuable upon conversion of convertible debt | (24,193 | ) | (23,978 | ) | (24,193 | ) | (23,256 | ) | ||||||||

| Non-GAAP weighted dilutive common shares/units outstanding – FFO and AFFO | 121,923 | 105,433 | 121,163 | 105,455 | ||||||||||||

|

|

Summit Hotel Properties, Inc.

Reconciliation of Net (Loss) Income to Non-GAAP Measures – EBITDAre

(in thousands)

(Unaudited)

| For the Three Months Ended December 31, |

For the Year Ended December 31, |

|||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| Net (loss) income | $ | (12,082 | ) | $ | (10,905 | ) | $ | 1,217 | $ | (68,584 | ) | |||||

| Depreciation and amortization | 37,698 | 26,179 | 150,160 | 105,955 | ||||||||||||

| Interest expense | 19,379 | 10,801 | 65,581 | 43,368 | ||||||||||||

| Interest income | (45 | ) | (2 | ) | (65 | ) | (8 | ) | ||||||||

| Income tax (benefit) expense | (1,036 | ) | 398 | 3,611 | 1,473 | |||||||||||

| EBITDA | 43,914 | 26,471 | 220,504 | 82,204 | ||||||||||||

| Loss on write down or impairment of assets | 10,420 | - | 10,420 | 4,361 | ||||||||||||

| Loss (gain) on disposal of assets, net | 164 | (159 | ) | (20,315 | ) | (240 | ) | |||||||||

| EBITDAre | 54,498 | 26,312 | 210,609 | 86,325 | ||||||||||||

| Recoveries of credit losses | - | - | (1,100 | ) | (2,632 | ) | ||||||||||

| Amortization of lease-related intangible assets | - | 22 | - | 87 | ||||||||||||

| Amortization of key money liabilities | (96 | ) | - | (363 | ) | - | ||||||||||

| Equity-based compensation | 1,376 | 4,820 | 8,446 | 10,681 | ||||||||||||

| Executive transition costs | - | 1,065 | - | 1,065 | ||||||||||||

| Transaction costs | 12 | - | 749 | 3,849 | ||||||||||||

| Debt transaction costs | 362 | 60 | 1,528 | 220 | ||||||||||||

| Non-cash interest income (1) | - | (263 | ) | (113 | ) | (1,042 | ) | |||||||||

| Non-cash lease expense, net | 131 | 133 | 505 | 521 | ||||||||||||

| Casualty losses (recoveries), net | 1,451 | (313 | ) | 2,505 | 468 | |||||||||||

| Loss (income) related to non-controlling interests in consolidated joint ventures | 2,898 | (124 | ) | (2,321 | ) | 2,896 | ||||||||||

| Adjustments related to non-controlling interests in consolidated joint ventures | (14,131 | ) | (3,199 | ) | (39,213 | ) | (11,943 | ) | ||||||||

| Special allocation related to sale of joint venture asset | (417 | ) | - | (417 | ) | - | ||||||||||

| Adjusted EBITDAre | $ | 46,084 | $ | 28,513 | $ | 180,815 | $ | 90,495 | ||||||||

| (1) | Non-cash interest income relates to the amortization of the discount on certain notes receivable. The discount on these notes receivable was recorded at inception of the related loans based on the estimated value of the embedded purchase options in the notes receivable. |

|

|

Summit Hotel Properties, Inc.

Pro Forma Hotel Operating Data

(in thousands)

(Unaudited)

| For the Three Months Ended December 31, |

For the Years Ended December 31, |

|||||||||||||||

| Pro Forma Operating Data (1,2) | 2022 | 2021 | 2022 | 2021 | ||||||||||||

| Pro forma room revenue | $ | 153,767 | $ | 127,208 | $ | 619,051 | $ | 436,048 | ||||||||

| Pro forma other hotel operations revenue | 18,710 | 12,639 | 70,131 | 40,856 | ||||||||||||

| Pro forma total revenues | 172,477 | 139,847 | 689,182 | 476,904 | ||||||||||||

| Pro forma total hotel operating expenses | 110,335 | 90,943 | 445,242 | 327,226 | ||||||||||||

| Pro forma hotel EBITDA | $ | 62,142 | $ | 48,904 | $ | 243,940 | $ | 149,678 | ||||||||

| Pro forma hotel EBITDA Margin | 36.0 | % | 35.0 | % | 35.4 | % | 31.4 | % | ||||||||

| Reconciliations of Non-GAAP financial measures to comparable GAAP financial measures | ||||||||||||||||

| Revenue: | ||||||||||||||||

| Total revenues | $ | 172,326 | $ | 106,862 | $ | 675,695 | $ | 361,926 | ||||||||

| Total revenues - acquisitions (1) | 151 | 34,260 | 15,329 | 118,864 | ||||||||||||

| Total revenues - dispositions (2) | - | (1,275 | ) | (1,842 | ) | (3,886 | ) | |||||||||

| Pro forma total revenues | 172,477 | 139,847 | 689,182 | 476,904 | ||||||||||||

| Hotel Operating Expenses: | ||||||||||||||||

| Total hotel operating expenses | 110,277 | 71,149 | 437,234 | 254,471 | ||||||||||||

| Hotel operating expenses - acquisitions (1) | 58 | 20,826 | 9,593 | 76,272 | ||||||||||||

| Hotel operating expenses - dispositions (2) | - | (1,032 | ) | (1,585 | ) | (3,517 | ) | |||||||||

| Pro forma hotel operating expenses | 110,335 | 90,943 | 445,242 | 327,226 | ||||||||||||

| Hotel EBITDA: | ||||||||||||||||

| Operating income (loss) | 6,733 | (1,452 | ) | 67,782 | (33,266 | ) | ||||||||||

| Loss (gain) on disposal of assets, net | 164 | (159 | ) | (20,315 | ) | (240 | ) | |||||||||

| Loss on write down or impairment of assets | 10,420 | - | 10,420 | 4,361 | ||||||||||||

| Recoveries of credit losses | - | - | (1,100 | ) | (2,632 | ) | ||||||||||

| Transaction costs | 12 | - | 749 | 3,849 | ||||||||||||

| Corporate general and administrative | 7,022 | 11,145 | 30,765 | 29,428 | ||||||||||||

| Depreciation and amortization | 37,698 | 26,179 | 150,160 | 105,955 | ||||||||||||

| Hotel EBITDA | 62,049 | 35,713 | 238,461 | 107,455 | ||||||||||||

| Hotel EBITDA - acquisitions (1) | (19,232 | ) | (685 | ) | (58,641 | ) | (1,428 | ) | ||||||||

| Hotel EBITDA - dispositions (2) | - | (243 | ) | (257 | ) | (369 | ) | |||||||||

| Same store hotel EBITDA | $ | 42,817 | $ | 34,785 | $ | 179,563 | $ | 105,658 | ||||||||

| Hotel EBITDA - acquisitions (3) | 19,325 | 14,119 | 64,377 | 44,020 | ||||||||||||

| Pro forma hotel EBITDA | $ | 62,142 | $ | 48,904 | $ | 243,940 | $ | 149,678 | ||||||||

| (1) | For any hotels acquired by the Company after January 1, 2021 (the “Acquired Hotels”), the Company has excluded the financial results of each of the Acquired Hotels for the period the Acquired Hotels were purchased by the Company to December 31, 2022 (the “Acquisition Period”) in determining same-store hotel EBITDA. |

| (2) | For hotels sold by the Company between January 1, 2021, and December 31, 2022 (the “Disposed Hotels”), the Company has excluded the financial results of each of the Disposed Hotels for the period beginning on January 1, 2020 and ending on the date the Disposed Hotels were sold by the Company (the “Disposition Period”) in determining same-store hotel EBITDA. |

| (3) | Unaudited pro forma information includes operating results for 103 hotels owned as of December 31, 2022, as if all such hotels had been owned by the Company since January 1, 2021. For hotels acquired by the Company after January 1, 2021 (the “Acquired Hotels”), the Company has included in the pro forma information the financial results of each of the Acquired Hotels for the period from January 1, 2021, to December 31, 2022. The financial results for the Acquired Hotels include information provided by the third-party owner of such Acquired Hotel prior to purchase by the Company and have not been audited or reviewed by our auditors or adjusted by us. The pro forma information is included to enable comparison of results for the current reporting period to results for the comparable period of the prior year and are not indicative of future results. |

|

|

Summit Hotel Properties, Inc.

Pro Forma Hotel Operating Data

(in thousands, except operating statistics)

(Unaudited)

| 2022 | ||||||||||||||||||||

| Pro Forma Operating Data (1,2) | Q1 | Q2 | Q3 | Q4 | Year Ended 12/31/2022 |

|||||||||||||||

| Pro forma room revenue | $ | 135,262 | $ | 169,519 | $ | 160,503 | $ | 153,767 | $ | 619,051 | ||||||||||

| Pro forma other hotel operations revenue | 15,024 | 18,263 | 18,134 | 18,710 | 70,131 | |||||||||||||||

| Pro forma total revenues | 150,286 | 187,782 | 178,637 | 172,477 | 689,182 | |||||||||||||||

| Pro forma total hotel operating expenses | 100,696 | 116,910 | 117,301 | 110,335 | 445,242 | |||||||||||||||

| Pro forma hotel EBITDA | $ | 49,590 | $ | 70,872 | $ | 61,336 | $ | 62,142 | $ | 243,940 | ||||||||||

| Pro forma hotel EBITDA Margin | 33.0 | % | 37.7 | % | 34.3 | % | 36.0 | % | 35.4 | % | ||||||||||

| Pro Forma Statistics (1,2) | ||||||||||||||||||||

| Rooms sold | 876,489 | 1,034,603 | 1,011,675 | 963,342 | 3,886,109 | |||||||||||||||

| Rooms available | 1,365,325 | 1,395,182 | 1,410,544 | 1,410,583 | 5,581,634 | |||||||||||||||

| Occupancy | 64.2 | % | 74.2 | % | 71.7 | % | 68.3 | % | 69.6 | % | ||||||||||

| ADR | $ | 154.32 | $ | 163.85 | $ | 158.65 | $ | 159.62 | $ | 159.30 | ||||||||||

| RevPAR | $ | 99.07 | $ | 121.50 | $ | 113.79 | $ | 109.01 | $ | 110.91 | ||||||||||

| Actual Statistics | ||||||||||||||||||||

| Rooms sold | 843,066 | 1,025,340 | 1,010,996 | 963,151 | 3,842,553 | |||||||||||||||

| Rooms available | 1,313,661 | 1,382,673 | 1,409,716 | 1,410,358 | 5,516,408 | |||||||||||||||

| Occupancy | 64.2 | % | 74.2 | % | 71.7 | % | 68.3 | % | 69.7 | % | ||||||||||

| ADR | $ | 152.79 | $ | 162.68 | $ | 158.39 | $ | 159.50 | $ | 158.58 | ||||||||||

| RevPAR | $ | 98.05 | $ | 120.64 | $ | 113.59 | $ | 108.92 | $ | 110.46 | ||||||||||

| Reconciliations of Non-GAAP financial measures to comparable GAAP financial measures | ||||||||||||||||||||

| Revenue: | ||||||||||||||||||||

| Total revenues | $ | 141,869 | $ | 183,248 | $ | 178,252 | $ | 172,326 | $ | 675,695 | ||||||||||

| Total revenues from acquisitions (1) | 9,551 | 5,242 | 385 | 151 | 15,329 | |||||||||||||||

| Total revenues from dispositions (2) | (1,134 | ) | (708 | ) | - | - | (1,842 | ) | ||||||||||||

| Pro forma total revenues | 150,286 | 187,782 | 178,637 | 172,477 | 689,182 | |||||||||||||||

| Hotel Operating Expenses: | ||||||||||||||||||||

| Total hotel operating expenses | 95,734 | 114,074 | 117,149 | 110,277 | 437,234 | |||||||||||||||

| Total hotel operating expenses from acquisitions (1) | 6,030 | 3,353 | 152 | 58 | 9,593 | |||||||||||||||

| Total hotel operating expenses from dispositions (2) | (1,068 | ) | (517 | ) | - | - | (1,585 | ) | ||||||||||||

| Pro forma total hotel operating expenses | 100,696 | 116,910 | 117,301 | 110,335 | 445,242 | |||||||||||||||

| Hotel EBITDA: | ||||||||||||||||||||

| Operating income | 724 | 43,095 | 17,230 | 6,733 | 67,782 | |||||||||||||||

| (Gain) loss on disposal of assets, net | - | (20,484 | ) | 5 | 164 | (20,315 | ) | |||||||||||||

| Loss on write down or impairment of assets | - | - | - | 10,420 | 10,420 | |||||||||||||||

| Recoveries of credit losses | - | (250 | ) | (850 | ) | - | (1,100 | ) | ||||||||||||

| Transaction costs | - | 681 | 56 | 12 | 749 | |||||||||||||||

| Corporate general and administrative | 9,137 | 8,074 | 6,532 | 7,022 | 30,765 | |||||||||||||||

| Depreciation and amortization | 36,274 | 38,058 | 38,130 | 37,698 | 150,160 | |||||||||||||||

| Hotel EBITDA | 46,135 | 69,174 | 61,103 | 62,049 | 238,461 | |||||||||||||||

| Hotel EBITDA from acquisitions (1) | (12,304 | ) | (14,815 | ) | (12,290 | ) | (19,232 | ) | (58,641 | ) | ||||||||||

| Hotel EBITDA from dispositions (2) | (66 | ) | (191 | ) | - | - | (257 | ) | ||||||||||||

| Same store hotel EBITDA | $ | 33,765 | $ | 54,168 | $ | 48,813 | $ | 42,817 | $ | 179,563 | ||||||||||

| Hotel EBITDA from acquisitions (3) | 15,825 | 16,704 | 12,523 | 19,325 | 64,377 | |||||||||||||||

| Pro forma hotel EBITDA | $ | 49,590 | $ | 70,872 | $ | 61,336 | $ | 62,142 | $ | 243,940 | ||||||||||

| (1) | For any hotels acquired by the Company after January 1, 2022 (the “Acquired Hotels”), the Company has excluded the financial results of each of the Acquired Hotels for the period the Acquired Hotels were purchased by the Company to December 31, 2022 (the “Acquisition Period”) in determining same-store hotel EBITDA. |

| (2) | For hotels sold by the Company between January 1, 2022, and December 31, 2022 (the “Disposed Hotels”), the Company has excluded the financial results of each of the Disposed Hotels for the period beginning on January 1, 2022, and ending on the date the Disposed Hotels were sold by the Company (the “Disposition Period”) in determining same-store hotel EBITDA. |

| (3) | Unaudited pro forma information includes operating results for 103 hotels owned as of December 31, 2022, as if all such hotels had been owned by the Company since January 1, 2022. For hotels acquired by the Company after January 1, 2022 (the “Acquired Hotels”), the Company has included in the pro forma information the financial results of each of the Acquired Hotels for the period from January 1, 2022, to December 31, 2022. The financial results for the Acquired Hotels include information provided by the third-party owner of such Acquired Hotel prior to purchase by the Company and have not been audited or reviewed by our auditors or adjusted by us. The pro forma information is included to enable comparison of results for the current reporting period to results for the comparable period of the prior year and are not indicative of future results. |

|

|

Summit Hotel Properties, Inc.

Reconciliation of Net (Loss) Income to Non-GAAP Measures – EBITDA for Financial Outlook

(in thousands)

(Unaudited)

| FYE 2023 Outlook | ||||||||

| Low | High | |||||||

| Net (loss) income | $ | (9,100 | ) | $ | 10,000 | |||

| Depreciation and amortization | 150,100 | 150,100 | ||||||

| Interest expense | 84,600 | 84,100 | ||||||

| Income tax expense | 3,100 | 3,100 | ||||||

| EBITDA and EBITDAre | $ | 228,700 | $ | 247,300 | ||||

| Equity-based compensation | 7,300 | 7,300 | ||||||

| Debt transaction costs | 300 | 300 | ||||||

| Other non-cash expense | 400 | 400 | ||||||

| Loss related to non-controlling interests in consolidated joint ventures | 12,300 | 9,200 | ||||||

| Adjustments related to non-controlling interests in consolidated joint ventures | (58,600 | ) | (58,600 | ) | ||||

| Adjusted EBITDAre | $ | 190,400 | $ | 205,900 | ||||

|

|

Summit Hotel Properties, Inc.

Reconciliation of Net (Loss) Income to Non-GAAP Measures – Funds From Operations for Financial Outlook

(In thousands except per share and unit)

(Unaudited)

| FYE 2023 Outlook | ||||||||

| Low | High | |||||||

| Net (loss) income | $ | (9,100 | ) | $ | 10,000 | |||

| Preferred dividends | (15,900 | ) | (15,900 | ) | ||||

| Distributions to and accretion of redeemable non-controlling interests | (2,600 | ) | (2,600 | ) | ||||

| Loss related to non-controlling interests in consolidated joint ventures | 12,300 | 9,200 | ||||||

| Net (loss) income applicable to common shares and common units | $ | (15,300 | ) | $ | 700 | |||

| Real estate-related depreciation | 145,800 | 145,800 | ||||||

| Adjustments related to non-controlling interests in consolidated joint ventures | (30,900 | ) | (30,900 | ) | ||||

| FFO applicable to common shares and common units | $ | 99,600 | $ | 115,600 | ||||

| Amortization of deferred financing costs | 3,000 | 3,000 | ||||||

| Amortization of franchise fees | 600 | 600 | ||||||

| Equity-based compensation | 7,300 | 7,300 | ||||||

| Debt transaction costs | 300 | 300 | ||||||

| Other non-cash expense | 4,100 | 4,100 | ||||||

| Adjustments related to non-controlling interests in consolidated joint ventures | (2,800 | ) | (2,800 | ) | ||||

| AFFO applicable to common shares and common units | $ | 112,100 | $ | 128,100 | ||||

| Weighted average diluted common shares / common units for FFO and AFFO | 122,400 | 122,400 | ||||||

| FFO per common share / common unit | $ | 0.81 | $ | 0.94 | ||||

| AFFO per common share / common unit | $ | 0.92 | $ | 1.05 | ||||

|

|

Non-GAAP Financial Measures

We disclose certain “non-GAAP financial measures,” which are measures of our historical financial performance. Non-GAAP financial measures are financial measures not prescribed by Generally Accepted Accounting Principles ("GAAP"). These measures are as follows: (i) Funds From Operations (“FFO”) and Adjusted Funds from Operations ("AFFO"), (ii) Earnings before Interest, Taxes, Depreciation and Amortization ("EBITDA"), Earnings before Interest, Taxes, Depreciation and Amortization for Real Estate ("EBITDAre") and Adjusted EBITDAre, and Hotel EBITDA (as described below). We caution investors that amounts presented in accordance with our definitions of non-GAAP financial measures may not be comparable to similar measures disclosed by other companies, since not all companies calculate these non-GAAP financial measures in the same manner. Our non-GAAP financial measures should be considered along with, but not as alternatives to, net income (loss) as a measure of our operating performance. Our non-GAAP financial measures may include funds that may not be available for our discretionary use due to functional requirements to conserve funds for capital expenditures, property acquisitions, debt service obligations and other commitments and uncertainties. Although we believe that our non-GAAP financial measures can enhance the understanding of our financial condition and results of operations, these non-GAAP financial measures are not necessarily better indicators of any trend as compared to a comparable measure prescribed by GAAP such as net income (loss).

Funds From Operations (“FFO”) and Adjusted FFO (“AFFO”)

As defined by Nareit, FFO represents net income

or loss (computed in accordance with GAAP), excluding preferred dividends, gains (or losses) from sales of real property, impairment losses

on real estate assets, items classified by GAAP as extraordinary, the cumulative effect of changes in accounting principles, plus depreciation

and amortization related to real estate assets, and adjustments for unconsolidated partnerships, and joint ventures. AFFO represents FFO

excluding amortization of deferred financing costs, franchise fees, equity-based compensation expense, transaction costs, debt transaction

costs, premiums on redemption of preferred shares, losses from net casualties, non-cash interest income and non-cash income tax related

adjustments to our deferred tax asset. Unless otherwise indicated, we present FFO and AFFO applicable to our common shares and common

units. We present FFO and AFFO because we consider FFO and AFFO an important supplemental measure of our operational performance and believe

it is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs, many of which present

FFO and AFFO when reporting their results. FFO and AFFO are intended to exclude GAAP historical cost depreciation and amortization, which

assumes that the value of real estate assets diminishes ratably over time. Historically, however, real estate values have risen or fallen

with market conditions. Because FFO and AFFO exclude depreciation and amortization related to real estate assets, gains and losses from

real property dispositions and impairment losses on real estate assets, and certain transaction costs related to lodging property acquisition

activities and debt, FFO and AFFO provide performance measures that, when compared year over year, reflect the effect to operations from

trends in occupancy, guestroom rates, operating costs, development activities and interest costs, providing perspective not immediately

apparent from net income. Our computation of FFO differs slightly from the computation of Nareit-defined FFO related to the reporting

of depreciation and amortization expense on assets at our corporate offices, which is de minimus. Our computation of FFO may also differ

from the methodology for calculating FFO used by other equity REITs and, accordingly, may not be comparable to such other REITs. FFO and

AFFO should not be considered as an alternative to net income (loss) (computed in accordance with GAAP) as an indicator of our liquidity,

nor is it indicative of funds available to fund our cash needs, including our ability to pay dividends or make distributions. Where

indicated in this release, FFO is based on our computation of FFO and not the computation of Nareit-defined FFO unless otherwise noted.

|

|

EBITDA, EBITDAre, Adjusted EBITDAre, and Hotel EBITDA

In September 2017, Nareit proposed a standardized performance measure, called EBITDAre, which is based on EBITDA and is expected to provide additional relevant information about REITs as real estate companies in support of growing interest among generalist investors. The conclusion was reached that, while dedicated REIT investors have long been accustomed to utilizing the industry’s supplemental measures such as FFO and net operating income (“NOI”) to evaluate the investment quality of REITs as real estate companies, it would be helpful to generalist investors for REITs as real estate companies to also present EBITDAre as a more widely known and understood supplemental measure of performance. EBITDAre is intended to be a supplemental non-GAAP performance measure that is independent of a company’s capital structure and will provide a uniform basis for one measurement of the enterprise value of a company compared to other REITs.

EBITDAre, as defined by Nareit, is calculated as EBITDA, excluding: (i) loss and gains on disposition of property and (ii) asset impairments, if any. We believe EBITDAre is useful to an investor in evaluating our operating performance because it provides investors with an indication of our ability to incur and service debt, to satisfy general operating expenses, to make capital expenditures and to fund other cash needs or reinvest cash into our business. We also believe it helps investors meaningfully evaluate and compare the results of our operations from period to period by removing the effect of our asset base (primarily depreciation and amortization) from our operating results.

We make additional adjustments to EBITDAre when evaluating our performance because we believe that the exclusion of certain additional non-recurring or unusual items described below provides useful supplemental information to investors regarding our ongoing operating performance. We believe that the presentation of Adjusted EBITDAre, when combined with the primary GAAP presentation of net income, is useful to an investor in evaluating our operating performance because it provides investors with an indication of our ability to incur and service debt, to satisfy general operating expenses, to make capital expenditures and to fund other cash needs or reinvest cash into our business. We also believe it helps investors meaningfully evaluate and compare the results of our operations from period to period by removing the effect of our asset base (primarily depreciation and amortization) from our operating results.

With respect to hotel EBITDA, we believe that excluding the effect of corporate-level expenses and non-cash items provides a more complete understanding of the operating results over which individual hotels and operators have direct control. We believe the property-level results provide investors with supplemental information on the ongoing operational performance of our hotels and effectiveness of the third-party management companies operating our business on a property-level basis.

We caution investors that amounts presented in accordance with our definitions of EBITDA, EBITDAre, adjusted EBITDAre, and hotel EBITDA may not be comparable to similar measures disclosed by other companies, since not all companies calculate these non-GAAP measures in the same manner. EBITDA, EBITDAre, adjusted EBITDAre, and hotel EBITDA should not be considered as an alternative measure of our net income (loss) or operating performance. EBITDA, EBITDAre, adjusted EBITDAre, and hotel EBITDA may include funds that may not be available for our discretionary use due to functional requirements to conserve funds for capital expenditures and property acquisitions and other commitments and uncertainties. Although we believe that EBITDA, EBITDAre, adjusted EBITDAre, and hotel EBITDA can enhance your understanding of our financial condition and results of operations, these non-GAAP financial measures are not necessarily a better indicator of any trend as compared to a comparable GAAP measure such as net income (loss). Above, we include a quantitative reconciliation of EBITDA, EBITDAre, adjusted EBITDAre and hotel EBITDA to the most directly comparable GAAP financial performance measure, which is net income (loss) and operating income (loss).

|

|

Exhibit 99.2

E ARNINGS R ELEASE S UPPLEMENT F OURTH Q UARTER 2022 F EBRUARY 27, 2022

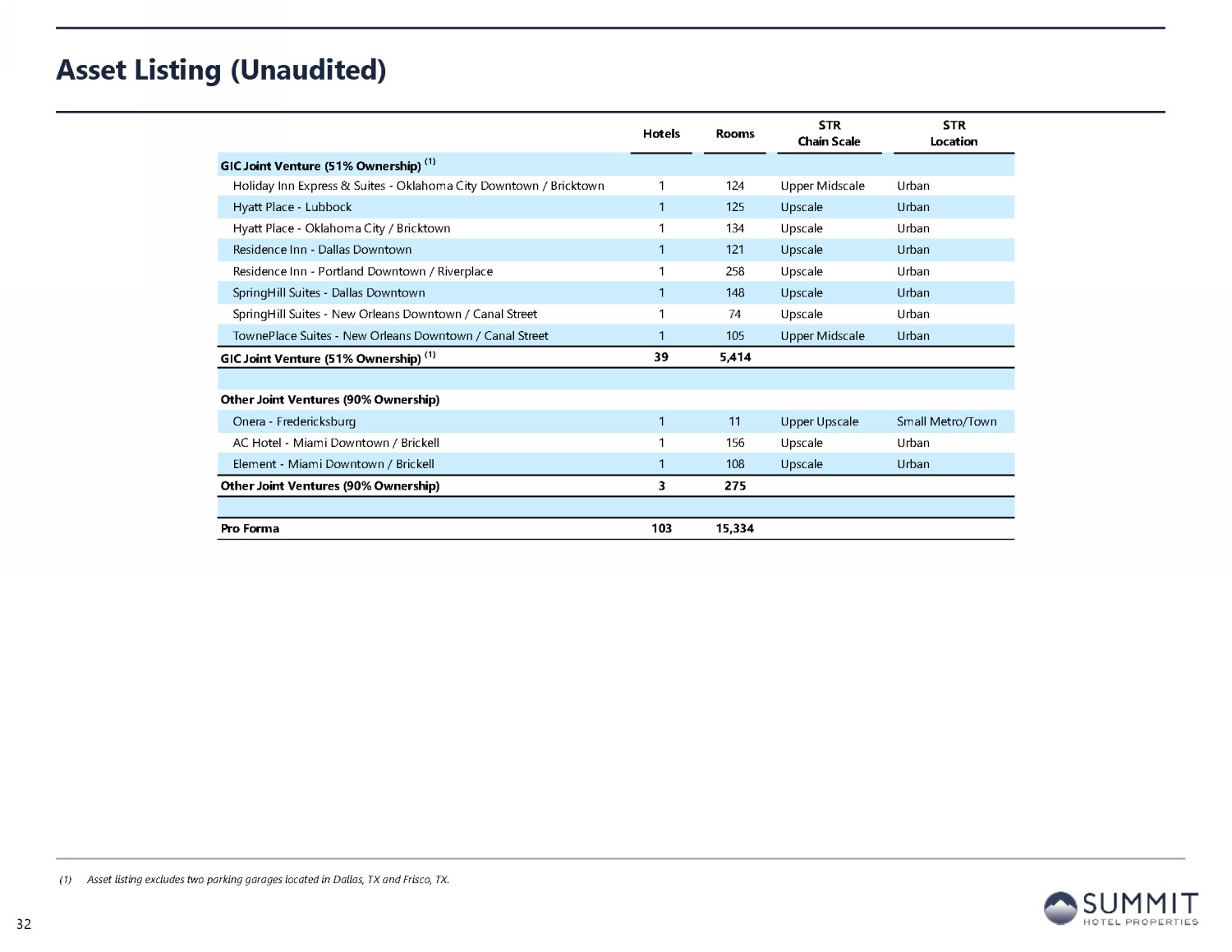

Table of Contents Section I Forward - Looking Statements and Non - GAAP Financial Measure Disclosures Section II Corporate Financial Schedules Section III Operating & Property - Level Schedules Section IV Capitalization and Debt Schedules Section VI Asset Listing 2 Forward - Looking Statements We make forward - looking statements in this presentation that are subject to risks and uncertainties . These forward - looking statements include information about possible or assumed future results of our business, financial condition, liquidity, results of operations, plans, and objectives . When we use the words “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “may,” or similar expressions, we intend to identify forward - looking statements . Statements regarding the following subjects, among others, may be forward - looking by their nature : • our ability to increase our dividend per share of common stock ; • the state of the U . S . economy generally or in specific geographic regions in which we operate, and the effect of general economic conditions on the lodging industry and our business in particular ; • market trends in our industry, interest rates, real estate values and the capital markets ; • our business and investment strategy and, particularly, our ability to identify and complete hotel acquisitions and dispositions ; • our projected operating results ; • actions and initiatives of the U . S . government and changes to U . S . government policies and the execution and impact of such actions, initiatives and policies ; • our ability to manage our relationships with our management companies and franchisors ; • our ability to maintain our existing and future financing arrangements ; • changes in the value of our properties ; • the impact of and changes in governmental regulations, tax law and rates, accounting guidance and similar matters ; • our ability to satisfy the requirements for qualification as a REIT under the U . S . Tax Code ; • our ability to repay or refinance our indebtedness as it matures or becomes callable by lenders ; • the availability of qualified personnel ; • our ability to make distributions to our stockholders in the future ; • the general volatility of the market price of our securities ; and • the degree and nature of our competition . Forward - looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account information currently available to us . You should not place undue reliance on these forward - looking statements . These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us . These factors are discussed under “Item 1 A . Risk Factors” in our Annual Report on Form 10 - K for the year ended December 31 , 2022 , and in other documents we have filed with the Securities and Exchange Commission . If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward - looking statements . Any forward - looking statement is effective only as of the date on which it is made . New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us . Except as required by law we are not obligated to, and do not intend to, publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise . Additionally, this presentation contains certain unaudited historical and pro forma information and metrics which are based or calculated from historical data that is maintained or produced by Summit or third parties . This presentation contain statistics and other data that may have been obtained from, or compiled from, information made available by third - parties . 3 Non - GAAP Financial Measures We disclose certain “non - GAAP financial measures,” which are measures of our historical financial performance . Non - GAAP financial measures are financial measures not prescribed by Generally Accepted Accounting Principles ("GAAP") . These measures are as follows : (i) Funds From Operations (“FFO”) and Adjusted Funds from Operations ("AFFO"), (ii) Earnings before Interest, Taxes, Depreciation and Amortization ("EBITDA"), Earnings before Interest, Taxes, Depreciation and Amortization for Real Estate (" EBITDA re ") and Adjusted EBITDA re (as described below) . We caution investors that amounts presented in accordance with our definitions of non - GAAP financial measures may not be comparable to similar measures disclosed by other companies, since not all companies calculate these non - GAAP financial measures in the same manner . Our non - GAAP financial measures should be considered along with, but not as alternatives to, net income (loss) as a measure of our operating performance . Our non - GAAP financial measures may include funds that may not be available for our discretionary use due to functional requirements to conserve funds for capital expenditures, property acquisitions, debt service obligations and other commitments and uncertainties . Although we believe that our non - GAAP financial measures can enhance the understanding of our financial condition and results of operations, these non - GAAP financial measures are not necessarily better indicators of any trend as compared to a comparable measure prescribed by GAAP such as net income (loss) . FFO and AFFO As defined by Nareit, FFO represents net income or loss (computed in accordance with GAAP), excluding preferred dividends, gains (or losses) from sales of real property, impairment losses on real estate assets, items classified by GAAP as extraordinary, the cumulative effect of changes in accounting principles, plus depreciation and amortization related to real estate assets, and adjustments for unconsolidated partnerships, and joint ventures . AFFO represents FFO excluding amortization of deferred financing costs, franchise fees, equity - based compensation expense, transaction costs, debt transaction costs, premiums on redemption of preferred shares, losses from net casualties, non - cash interest income and non - cash income tax related adjustments to our deferred tax asset . Unless otherwise indicated, we present FFO and AFFO applicable to our common shares and common units . We present FFO and AFFO because we consider FFO and AFFO an important supplemental measure of our operational performance and believe it is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs, many of which present FFO and AFFO when reporting their results . FFO and AFFO are intended to exclude GAAP historical cost depreciation and amortization, which assumes that the value of real estate assets diminishes ratably over time . Historically, however, real estate values have risen or fallen with market conditions . Because FFO and AFFO exclude depreciation and amortization related to real estate assets, gains and losses from real property dispositions and impairment losses on real estate assets, and certain transaction costs related to lodging property acquisition activities and debt, FFO and AFFO provide performance measures that, when compared year over year, reflect the effect to operations from trends in occupancy, guestroom rates, operating costs, development activities and interest costs, providing perspective not immediately apparent from net income . Our computation of FFO differs slightly from the computation of Nareit - defined FFO related to the reporting of depreciation and amortization expense on assets at our corporate offices, which is de minimus . Our computation of FFO may also differ from the methodology for calculating FFO used by other equity REITs and, accordingly, may not be comparable to such other REITs . FFO and AFFO should not be considered as an alternative to net income (loss) (computed in accordance with GAAP) as an indicator of our liquidity, nor is it indicative of funds available to fund our cash needs, including our ability to pay dividends or make distributions . Where indicated in this Annual Report on Form 10 - K, FFO is based on our computation of FFO and not the computation of Nareit - defined FFO unless otherwise noted . 4 Non - GAAP Financial Measures (cont.) EBITDAre and Adjusted EBITDAre In September 2017 , Nareit proposed a standardized performance measure, called EBITDA re , which is based on EBITDA and is expected to provide additional relevant information about REITs as real estate companies in support of growing interest among generalist investors . The conclusion was reached that, while dedicated REIT investors have long been accustomed to utilizing the industry’s supplemental measures such as FFO and net operating income (“NOI”) to evaluate the investment quality of REITs as real estate companies, it would be helpful to generalist investors for REITs as real estate companies to also present EBITDA re as a more widely known and understood supplemental measure of performance . EBITDA re is intended to be a supplemental non - GAAP performance measure that is independent of a company’s capital structure and will provide a uniform basis for one measurement of the enterprise value of a company compared to other REITs . EBITDA re , as defined by Nareit, is calculated as EBITDA, excluding : (i) loss and gains on disposition of property and (ii) asset impairments, if any . We believe EBITDA re is useful to an investor in evaluating our operating performance because it provides investors with an indication of our ability to incur and service debt, to satisfy general operating expenses, to make capital expenditures and to fund other cash needs or reinvest cash into our business . We also believe it helps investors meaningfully evaluate and compare the results of our operations from period to period by removing the effect of our asset base (primarily depreciation and amortization) from our operating results . We make additional adjustments to EBITDA re when evaluating our performance because we believe that the exclusion of certain additional non - recurring or unusual items described below provides useful supplemental information to investors regarding our ongoing operating performance . We believe that the presentation of Adjusted EBITDA re , when combined with the primary GAAP presentation of net income, is useful to an investor in evaluating our operating performance because it provides investors with an indication of our ability to incur and service debt, to satisfy general operating expenses, to make capital expenditures and to fund other cash needs or reinvest cash into our business . We also believe it helps investors meaningfully evaluate and compare the results of our operations from period to period by removing the effect of our asset base (primarily depreciation and amortization) from our operating results . 5

Table of Contents Section I Forward - Looking Statements and Non - GAAP Financial Measure Disclosures Section II Corporate Financial Schedules Section III Operating & Property - Level Schedules Section IV Capitalization and Debt Schedules Section VI Asset Listing 6 Summary Financial Results (1) See tables later in this presentation for a discussion and reconciliation of net loss to non - GAAP financial measures, including earnings before interest, taxes, depreciation, and amortization (“EBITDA”), EBITDAre, adjusted EBITDAre, funds from operations (“FFO”), FFO per diluted share and unit, adjusted FFO (“AFFO”), and AFFO p er diluted share and unit, as well as a reconciliation of operating income ( loss) to hotel EBITDA.

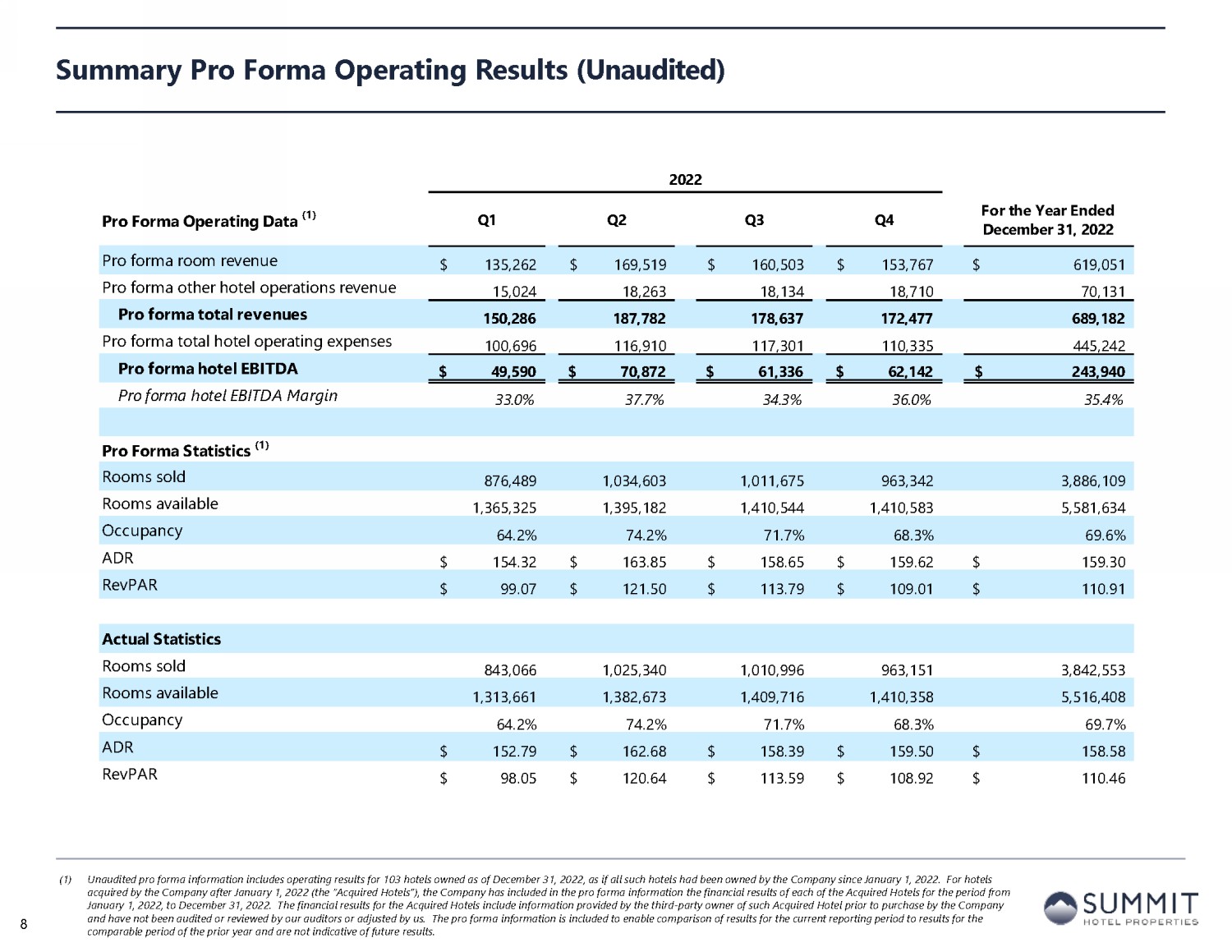

See “Non - GAAP Financial Measures” at the end of this presentation. (2) Unless stated otherwise in this presentation, all pro forma information includes operating and financial results for 103 hote ls owned as of December 31, 2022, as if each hotel had been owned by the Company since January 1, 2021 and remained open for the entirety of the measurement period. As a result, all pro forma inform ati on includes operating and financial results for hotels acquired since January 1, 2021, which may include periods prior to the Company’s ownership. Pro forma and non - GAAP financial measures are unaud ited. (3) All same store information includes 71 hotels owned as of December 31, 2022, with operating and financial results for the twe lve months ended December 31, 2022, 2021, and 2019. (In thousands, except per share metrics) For the Three Months Ended December 31, For the Years Ended December 31, 2022 2021 2022 2021 (unaudited) Net loss attributable to common stockholders (11,975)$ (15,275)$ (16,929)$ (83,714)$ Net loss per diluted share (0.11)$ (0.15)$ (0.16)$ (0.80)$ Total revenues 172,326$ 106,862$ 675,695$ 361,926$ EBITDAre (1) 54,498$ 26,312$ 210,609$ 86,325$ Adjusted EBITDAre (1) 46,084$ 28,513$ 180,815$ 90,495$ FFO (1) 25,542$ 8,140$ 95,253$ 17,300$ Adjusted FFO (1) 30,340$ 14,801$ 113,970$ 36,782$ FFO per diluted share and unit (1) 0.21$ 0.08$ 0.79$ 0.16$ Adjusted FFO per diluted share and unit (1) 0.25$ 0.14$ 0.94$ 0.35$ Pro Forma (2) RevPAR 109.01$ 92.49$ 110.91$ 80.42$ RevPAR Growth 17.9% 37.9% Hotel EBITDA 62,142$ 48,904$ 243,940$ 149,678$ Hotel EBITDA margin 36.0% 35.0% 35.4% 31.4% Hotel EBITDA margin growth 106 bps 401 bps Same Store (3) RevPAR 110.74$ 93.78$ 114.61$ 80.80$ RevPAR Growth 18.1% 41.8% Hotel EBITDA 42,817$ 34,785$ 179,563$ 105,658$ Hotel EBITDA margin 34.5% 33.5% 35.5% 29.8% Hotel EBITDA margin growth 109 bps 576 bps 7 Summary Pro Forma Operating Results (1) Unaudited pro forma information includes operating results for 103 hotels owned as of December 31, 2022, as if all such hotel s h ad been owned by the Company since January 1, 2022.

For hotels acquired by the Company after January 1, 2022 (the “Acquired Hotels”), the Company has included in the pro forma information the financial results of each of the Acquired Hotels for the period from January 1, 2022, to December 31, 2022. The financial results for the Acquired Hotels include information provided by the thi rd - party owner of such Acquired Hotel prior to purchase by the Company and have not been audited or reviewed by our auditors or adjusted by us. The pro forma information is included to enable com par ison of results for the current reporting period to results for the comparable period of the prior year and are not indicative of future results. 2022 Pro Forma Operating Data (1) Q1 Q2 Q3 Q4 Year Ended December 31, 2022 Pro forma room revenue 135,262$ 169,519$ 160,503$ 153,767$ 619,051$ Pro forma other hotel operations revenue 15,024 18,263 18,134 18,710 70,131 Pro forma total revenues 150,286 187,782 178,637 172,477 689,182 Pro forma total hotel operating expenses 100,696 116,910 117,301 110,335 445,242 Pro forma hotel EBITDA 49,590$ 70,872$ 61,336$ 62,142$ 243,940$ Pro forma hotel EBITDA Margin 33.0% 37.7% 34.3% 36.0% 35.4% Pro Forma Statistics (1) Rooms sold 876,489 1,034,603 1,011,675 963,342 3,886,109 Rooms available 1,365,325 1,395,182 1,410,544 1,410,583 5,581,634 Occupancy 64.2% 74.2% 71.7% 68.3% 69.6% ADR 154.32$ 163.85$ 158.65$ 159.62$ 159.30$ RevPAR 99.07$ 121.50$ 113.79$ 109.01$ 110.91$ Actual Statistics Rooms sold 843,066 1,025,340 1,010,996 963,151 3,842,553 Rooms available 1,313,661 1,382,673 1,409,716 1,410,358 5,516,408 Occupancy 64.2% 74.2% 71.7% 68.3% 69.7% ADR 152.79$ 162.68$ 158.39$ 159.50$ 158.58$ RevPAR 98.05$ 120.64$ 113.59$ 108.92$ 110.46$ 8 Adjusted EBITDAre Reconciliation (1) Non - cash interest income relates to the amortization of the discount on certain notes receivable.

The discount on these notes re ceivable was recorded at inception of the related loans based on the estimated value of the embedded purchase options in the notes receivable. 9 For the Three Months Ended December 31, For the Years Ended December 31, 2022 2021 2022 2021 Net (loss) income (12,082)$ (10,905)$ 1,217$ (68,584)$ Depreciation and amortization 37,698 26,179 150,160 105,955 Interest expense 19,379 10,801 65,581 43,368 Interest income (45) (2) (65) (8) Income tax (benefit) expense (1,036) 398 3,611 1,473 EBITDA 43,914$ 26,471$ 220,504$ 82,204$ Loss on write down or impairment of assets 10,420 - 10,420 4,361 Loss (gain) on disposal of assets, net 164 (159) (20,315) (240) EBITDAre 54,498$ 26,312$ 210,609$ 86,325$ Recoveries of credit losses - - (1,100) (2,632) Amortization of lease-related intangible assets - 22 - 87 Amortization of key money liabilities (96) - (363) - Equity-based compensation 1,376 4,820 8,446 10,681 Executive transition costs - 1,065 - 1,065 Transaction costs 12 - 749 3,849 Debt transaction costs 362 60 1,528 220 Non-cash interest income (1) - (263) (113) (1,042) Non-cash lease expense, net 131 133 505 521 Casualty losses (recoveries), net 1,451 (313) 2,505 468 Loss (income) related to non-controlling interests in consolidated joint ventures 2,898 (124) (2,321) 2,896 Adjustments related to non-controlling interests in consolidated joint ventures (14,131) (3,199) (39,213) (11,943) Special allocation related to sale of joint venture asset (417) - (417) - Adjusted EBITDAre 46,084$ 28,513$ 180,815$ 90,495$ Adjusted FFO Reconciliation (1) The total of these line items represents depreciation and amortization as reported on the Company’s Condensed Consolidated St ate ments of Operations for the periods presented.