Diversified Healthcare Trust Fourth Quarter 2024 Financial Results and Supplemental Information February 25, 2025 Overture at Plano 500 Coit Road Plano, TX Exhibit 99.2

Q4 2024 2 FINANCIAL RESULTS Diversified Healthcare Trust Announces Fourth Quarter 2024 Financial Results .......................................................................................... 3 Fourth Quarter 2024 Highlights.............................................................................................................................................................................. 4 Fourth Quarter 2024 Results ................................................................................................................................................................................... 5 FINANCIALS Key Financial Data ..................................................................................................................................................................................................... 6 Condensed Consolidated Balance Sheets ............................................................................................................................................................ 7 Consolidated Statements of Income (Loss) .......................................................................................................................................................... 8 DEBT AND LEVERAGE Debt Summary ........................................................................................................................................................................................................... 9 Debt Maturity Schedule ........................................................................................................................................................................................... 10 Leverage Ratios, Coverage Ratios and Bond Covenants ................................................................................................................................... 11 INVESTMENTS Summary of Capital Expenditures .......................................................................................................................................................................... 12 Redevelopment Information .................................................................................................................................................................................... 13 Property Dispositions Information Since January 1, 2024 ................................................................................................................................. 14 Investments in Unconsolidated Joint Ventures .................................................................................................................................................... 15 PORTFOLIO INFORMATION Portfolio Summary by Geographic Diversification and Property Type ........................................................................................................... 17 Portfolio Summary ..................................................................................................................................................................................................... 18 SHOP Units by Operator .......................................................................................................................................................................................... 19 SHOP Segment and Same Property - Results of Operations ............................................................................................................................ 20 SHOP Segment and Same Property - Five Star and Other Operator Managed Communities Results of Operations .......................... 21 Senior Living NOI by Manager ................................................................................................................................................................................ 22 Senior Living Results of Operations by Location ................................................................................................................................................. 23 Medical Office and Life Science Portfolio and Same Property - Results of Operations .............................................................................. 24 Portfolio Leasing Summary ...................................................................................................................................................................................... 26 Tenants Representing 1% or More of Total Annualized Rental Income ......................................................................................................... 27 Medical Office and Life Science Portfolio Lease Expiration Schedule ............................................................................................................ 28 All Other Lease Expiration Schedule ..................................................................................................................................................................... 29 APPENDIX Company Profile and Research Coverage ............................................................................................................................................................ 30 Governance Information........................................................................................................................................................................................... 31 Calculation and Reconciliation of NOI and Cash Basis NOI .............................................................................................................................. 32 Calculation and Reconciliation of NOI, Cash Basis NOI, Same Property NOI and Same Property Cash Basis NOI by Segment ....... 33 Calculation and Reconciliation of EBITDA, EBITDAre and Adjusted EBITDAre ............................................................................................ 34 Calculation and Reconciliation of FFO, Normalized FFO and CAD ................................................................................................................. 35 Non-GAAP Financial Measures and Certain Definitions .................................................................................................................................... 37 WARNING CONCERNING FORWARD-LOOKING STATEMENTS ........................................................................................................................................................................ 42 Table of Contents All amounts in this presentation are unaudited. Please refer to Non-GAAP Financial Measures and Certain Definitions for terms used throughout this document. Trading Symbols: Common Shares: DHC Senior Unsecured Notes due 2042: DHCNI Senior Unsecured Notes due 2046: DHCNL Investor Relations Contact: Bryan Maher, Senior Vice President (617) 796-8234 ir@dhcreit.com Corporate Headquarters: Two Newton Place 255 Washington Street, Suite 300 Newton, MA 02458-1634

Q4 2024 3 "DHC ended the fourth quarter by reaching 80% SHOP occupancy for the first time since the first quarter of 2020. On a year-over-year basis, DHC achieved a 56% improvement in SHOP NOI, a 7.3% increase in SHOP revenues and a 6.7% improvement in average monthly rate, resulting in margin expansion of 250 basis points. We are pleased with the results achieved and remain bullish on the outlook within the sector and our SHOP portfolio going into 2025. Over the recent quarters, we have advanced several initiatives to effectively manage our upcoming debt maturities due in 2025 and 2026. These efforts are bolstered by $340 million in anticipated mortgage loan proceeds primarily from signed term sheets, progress on our disposition strategy, with $26 million in proceeds from sales of unencumbered assets since October 1st, and $77 million of potential proceeds from sales of additional unencumbered assets currently under agreements or letters of intent. Furthermore, our cash balance was $145 million at year end. We have also started to address our January 2026 debt maturities by generating $159 million in proceeds from the January 2025 sale of MUSE and $142 million in proceeds from 19 properties which are under agreements to sell and expected to close in the first quarter. These sales represent an expected 25% premium over the allocated fair values of these properties." Christopher Bilotto, President and Chief Executive Officer Diversified Healthcare Trust Announces Fourth Quarter 2024 Financial Results RETURN TO TABLE OF CONTENTS Newton, MA (February 25, 2025): Diversified Healthcare Trust (Nasdaq: DHC) today announced its financial results for the quarter ended December 31, 2024. Distribution On January 16, 2025, DHC declared a quarterly distribution on its common shares of $0.01 per share to shareholders of record as of the close of business on January 27, 2025, and DHC paid this distribution on February 20, 2025. Conference Call A conference call to discuss DHC's fourth quarter 2024 financial results will be held on Wednesday, February 26, 2025 at 10:00 a.m. Eastern Time. The conference call may be accessed by dialing (877) 329-4297 or (412) 317-5435 (if calling from outside the United States and Canada); a pass code is not required. A replay will be available for one week by dialing (877) 344-7529; the replay pass code is 8448634. A live audio webcast of the conference call will also be available in a listen-only mode on DHC's website, at www.dhcreit.com. The archived webcast will be available for replay on DHC's website after the call. The transcription, recording and retransmission in any way of DHC's fourth quarter conference call are strictly prohibited without the prior written consent of DHC. About Diversified Healthcare Trust DHC is a real estate investment trust, or REIT, focused on owning high-quality healthcare properties located throughout the United States. DHC seeks diversification across the health services spectrum by care delivery and practice type, by scientific research disciplines and by property type and location. As of December 31, 2024, DHC’s approximately $7.2 billion portfolio included 367 properties in 36 states and Washington, D.C., occupied by approximately 450 tenants, and totaling approximately 8.0 million square feet of medical office and life science properties and more than 27,000 senior living units. DHC is managed by The RMR Group (Nasdaq: RMR), a leading U.S. alternative asset management company with over $40 billion in assets under management as of December 31, 2024 and more than 35 years of institutional experience in buying, selling, financing and operating commercial real estate. DHC is headquartered in Newton, MA. For more information, visit www.dhcreit.com.

Q4 2024 4 Financial Results Fourth Quarter 2024 Highlights RETURN TO TABLE OF CONTENTS Operating Update Liquidity, Financing and Investing Activities • Net loss of $87.4 million, or $0.36 per share. • Normalized FFO of $5.3 million, or $0.02 per share. • Year over year fourth quarter SHOP occupancy increased 70 basis points to 80.0% and average monthly rates increased by 6.7%, resulting in a 7.3% increase in SHOP revenues. • Consolidated SHOP NOI increased 56.0% year over year to $24.9 million, including a margin increase of 250 basis points. • Leased 111,812 square feet in DHC's Medical Office and Life Science Portfolio at weighted average rents that were 6.9% higher than prior rents for the same space. • Approximately $149.9 million of cash and cash equivalents and restricted cash. • As of February 21, 2025, DHC has executed term sheets with various lenders for anticipated aggregate loan proceeds of approximately $276.0 million and is in active negotiations with an additional lender for expected proceeds of $64.0 million. • On February 14, 2025, DHC received a cash dividend from AlerisLife of $17.0 million. • In November 2024, DHC used $60.0 million of cash to partially redeem its then outstanding $440.0 million senior unsecured notes due June 2025. DHC expects to use its loan proceeds, its proceeds from unencumbered property sales and cash on hand to redeem the remaining $380.0 million of these outstanding senior notes. • DHC sold one unencumbered property in November 2024 for $6.6 million and two additional unencumbered properties in January and February 2025 for an aggregate $19.7 million. As of February 24, 2025, DHC is under agreements or letters of intent to sell seven unencumbered properties for $77.5 million. • In January 2025, DHC sold three of the properties that secure its senior secured notes due 2026 for a sales price of $159.0 million, excluding closing costs. DHC also has 19 properties that secure these senior notes under agreements to sell for an aggregate sales price of $142.1 million, excluding closing costs. The net proceeds from these sales will be used to partially redeem these senior secured notes. Same Property Cash Basis NOI For the Three Months Ended (dollars in thousands) December 31, 2024 September 30, 2024 % Change December 31, 2023 % Change SHOP $ 28,761 $ 30,685 (6.3) % $ 19,843 44.9 % Medical Office and Life Science Portfolio 27,186 27,570 (1.4) % 27,077 0.4 % All Other 7,746 6,365 21.7 % 6,724 15.2 % Consolidated $ 63,693 $ 64,620 (1.4) % $ 53,644 18.7 % As of and for the three months ended December 31, 2024, unless otherwise noted

Q4 2024 5 Fourth Quarter 2024 Results RETURN TO TABLE OF CONTENTS For the Three Months Ended Financial Results December 31, 2024 September 30, 2024 % Change December 31, 2023 % Change Net loss $ (87,446) $ (98,689) 11.4 % $ (102,564) 14.7 % Net loss per share $ (0.36) $ (0.41) 12.2 % $ (0.43) 16.3 % Normalized FFO $ 5,290 $ 4,026 31.4 % $ 8,079 (34.5) % Normalized FFO per share $ 0.02 $ 0.02 — % $ 0.03 (33.3) % Adjusted EBITDAre $ 67,049 $ 66,817 0.3 % $ 59,189 13.3 % As of and For the Three Months Ended December 31, 2024 September 30, 2024 Basis Point Change December 31, 2023 Basis Point Change Occupancy SHOP 80.0% 79.4% 60 79.3% 70 Medical Office and Life Science Portfolio 82.2% 80.8% 140 86.9% (470) Same Property Occupancy SHOP 80.9% 80.3% 60 79.9% 100 Medical Office and Life Science Portfolio 90.2% 90.4% (20) 92.5% (230) (dollars in thousands, except per share data)

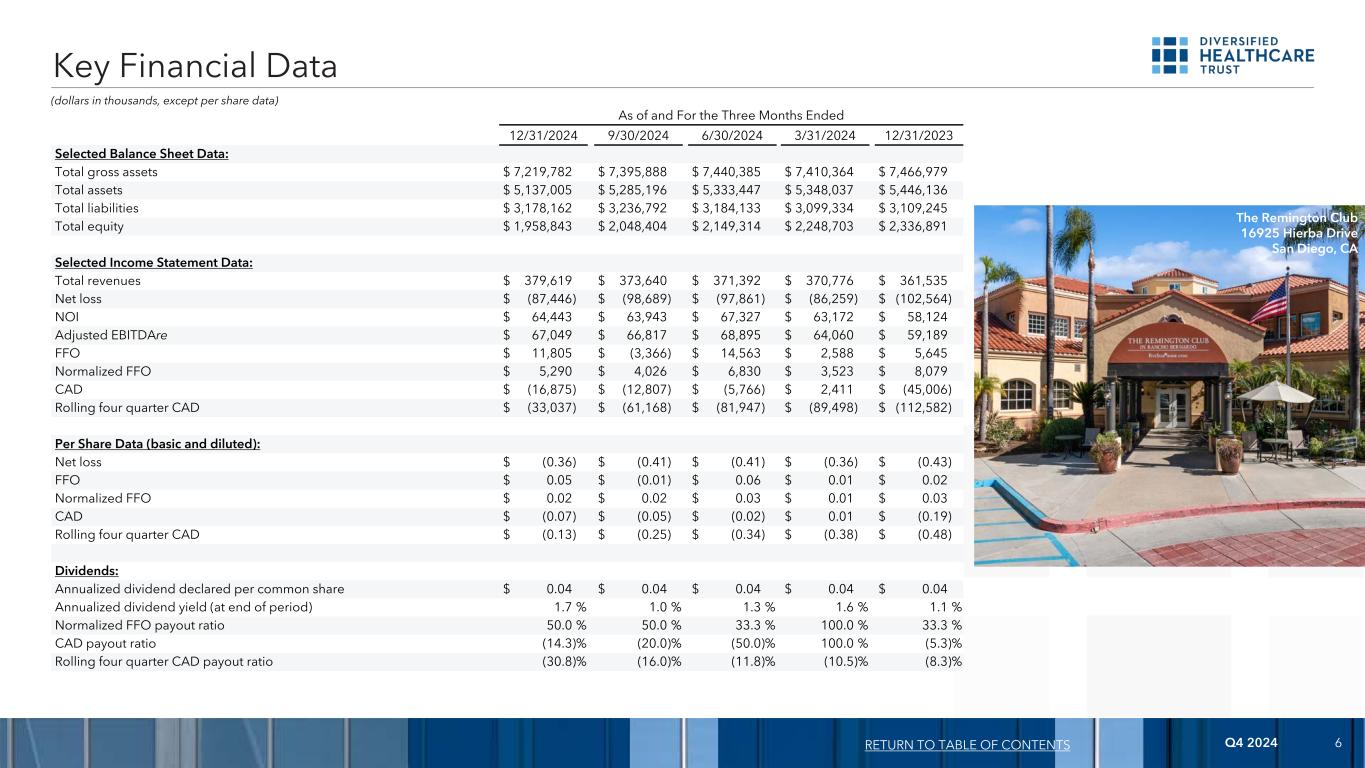

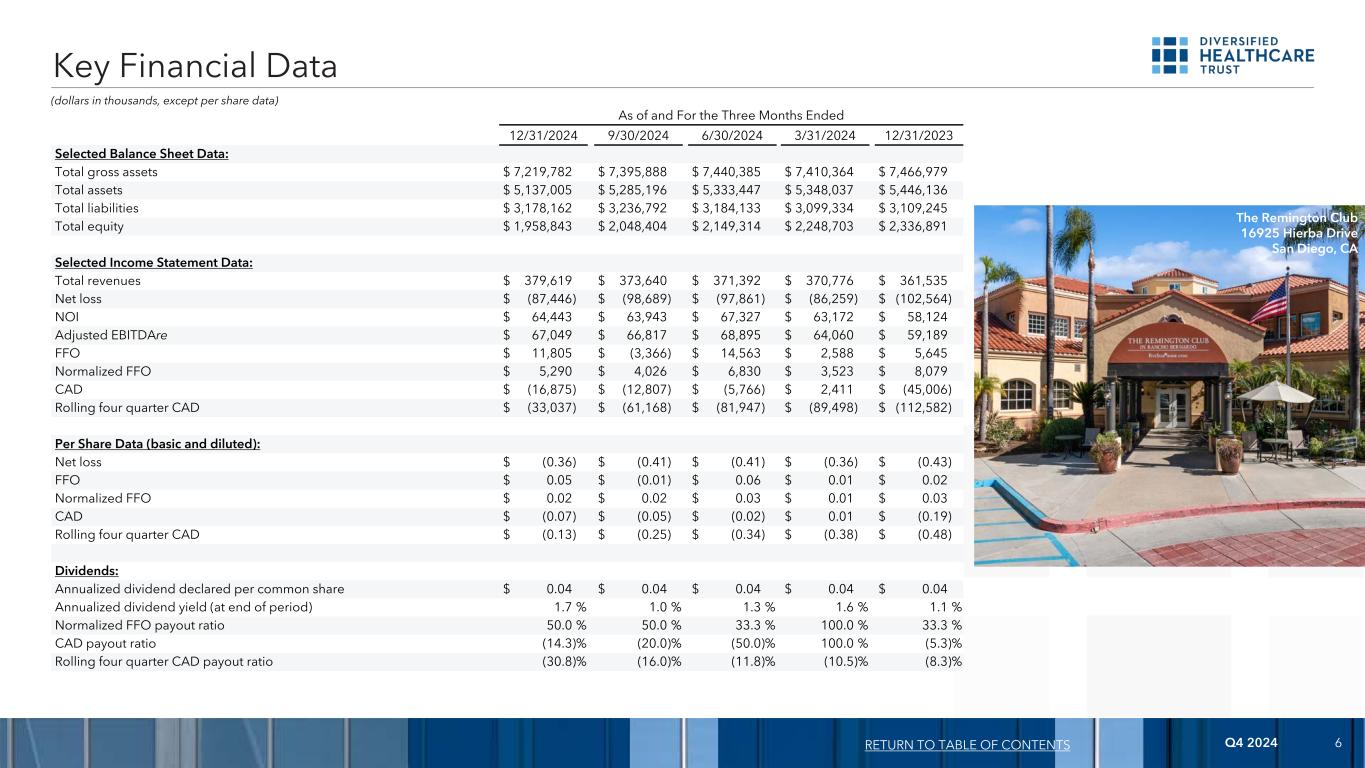

Q4 2024 6 Key Financial Data RETURN TO TABLE OF CONTENTS As of and For the Three Months Ended 12/31/2024 9/30/2024 6/30/2024 3/31/2024 12/31/2023 Selected Balance Sheet Data: Total gross assets $ 7,219,782 $ 7,395,888 $ 7,440,385 $ 7,410,364 $ 7,466,979 Total assets $ 5,137,005 $ 5,285,196 $ 5,333,447 $ 5,348,037 $ 5,446,136 Total liabilities $ 3,178,162 $ 3,236,792 $ 3,184,133 $ 3,099,334 $ 3,109,245 Total equity $ 1,958,843 $ 2,048,404 $ 2,149,314 $ 2,248,703 $ 2,336,891 Selected Income Statement Data: Total revenues $ 379,619 $ 373,640 $ 371,392 $ 370,776 $ 361,535 Net loss $ (87,446) $ (98,689) $ (97,861) $ (86,259) $ (102,564) NOI $ 64,443 $ 63,943 $ 67,327 $ 63,172 $ 58,124 Adjusted EBITDAre $ 67,049 $ 66,817 $ 68,895 $ 64,060 $ 59,189 FFO $ 11,805 $ (3,366) $ 14,563 $ 2,588 $ 5,645 Normalized FFO $ 5,290 $ 4,026 $ 6,830 $ 3,523 $ 8,079 CAD $ (16,875) $ (12,807) $ (5,766) $ 2,411 $ (45,006) Rolling four quarter CAD $ (33,037) $ (61,168) $ (81,947) $ (89,498) $ (112,582) Per Share Data (basic and diluted): Net loss $ (0.36) $ (0.41) $ (0.41) $ (0.36) $ (0.43) FFO $ 0.05 $ (0.01) $ 0.06 $ 0.01 $ 0.02 Normalized FFO $ 0.02 $ 0.02 $ 0.03 $ 0.01 $ 0.03 CAD $ (0.07) $ (0.05) $ (0.02) $ 0.01 $ (0.19) Rolling four quarter CAD $ (0.13) $ (0.25) $ (0.34) $ (0.38) $ (0.48) Dividends: Annualized dividend declared per common share $ 0.04 $ 0.04 $ 0.04 $ 0.04 $ 0.04 Annualized dividend yield (at end of period) 1.7 % 1.0 % 1.3 % 1.6 % 1.1 % Normalized FFO payout ratio 50.0 % 50.0 % 33.3 % 100.0 % 33.3 % CAD payout ratio (14.3) % (20.0) % (50.0) % 100.0 % (5.3) % Rolling four quarter CAD payout ratio (30.8) % (16.0) % (11.8) % (10.5) % (8.3) % (dollars in thousands, except per share data) The Remington Club 16925 Hierba Drive San Diego, CA

Q4 2024 7 December 31, 2024 December 31, 2023 Assets Real estate properties: Land $ 605,973 $ 652,977 Buildings and improvements 5,817,279 6,165,490 Total real estate properties, gross 6,423,252 6,818,467 Accumulated depreciation (2,082,777) (2,020,843) Total real estate properties, net 4,340,475 4,797,624 Investments in unconsolidated joint ventures 126,859 129,916 Assets of properties held for sale 276,270 9,447 Cash and cash equivalents 144,584 245,939 Restricted cash 5,270 1,022 Equity method investment 24,590 — Acquired real estate leases and other intangible assets, net 26,300 33,948 Other assets, net 192,657 228,240 Total assets $ 5,137,005 $ 5,446,136 Liabilities and Shareholders' Equity Senior secured notes, net $ 826,974 $ 731,211 Senior unsecured notes, net 1,957,319 2,072,618 Secured debt and finance leases, net 126,611 13,020 Liabilities of properties held for sale 6,024 32 Accrued interest 23,092 22,847 Other liabilities 238,142 269,517 Total liabilities 3,178,162 3,109,245 Commitments and contingencies Shareholders' equity: Common shares of beneficial interest, $.01 par value: 300,000,000 shares authorized, 241,271,703 and 240,423,898 shares issued and outstanding, respectively 2,413 2,405 Additional paid in capital 4,620,313 4,618,470 Cumulative net income 1,408,023 1,778,278 Cumulative other comprehensive loss (17) — Cumulative distributions (4,071,889) (4,062,262) Total shareholders' equity 1,958,843 2,336,891 Total liabilities and shareholders' equity $ 5,137,005 $ 5,446,136 Condensed Consolidated Balance Sheets (dollars in thousands, except share data) RETURN TO TABLE OF CONTENTS 28515 Westinghouse Place Valencia, CA

Q4 2024 8 For the Three Months Ended December 31, For the Year Ended December 31, 2024 2023 2024 2023 Revenues: Rental income $ 63,883 $ 67,199 $ 251,038 $ 258,400 Residents fees and services 315,736 294,336 1,244,389 1,151,908 Total revenues 379,619 361,535 1,495,427 1,410,308 Expenses: Property operating expenses 315,176 303,411 1,236,542 1,174,151 Depreciation and amortization 77,508 83,653 284,957 284,083 General and administrative (1) (1,245) 6,020 26,518 26,131 Acquisition and certain other transaction related costs 267 1,041 2,510 10,853 Impairment of assets 29,016 — 70,734 18,380 Total expenses 420,722 394,125 1,621,261 1,513,598 Gain (loss) on sale of properties 38 (28) (18,938) 1,205 Gains on equity securities, net — — — 8,126 Interest and other income 1,735 2,964 8,950 15,536 Interest expense (including net amortization of debt discounts, premiums and issuance costs of $26,795, $5,195, $103,437 and $11,811, respectively) (59,518) (48,853) (235,239) (191,775) Loss on modification or early extinguishment of debt (115) (1,393) (324) (2,468) Loss before income taxes and equity in net earnings (losses) of investees (98,963) (79,900) (371,385) (272,666) Income tax benefit (expense) 38 (66) (467) (445) Equity in net earnings (losses) of investees 11,479 (22,598) 1,597 (20,461) Net loss $ (87,446) $ (102,564) $ (370,255) $ (293,572) Weighted average common shares outstanding (basic and diluted) 239,949 239,175 239,535 238,836 Per common share data (basic and diluted): Net loss $ (0.36) $ (0.43) $ (1.55) $ (1.23) Consolidated Statements of Income (Loss) RETURN TO TABLE OF CONTENTS (amounts in thousands, except per share data) (1) During the three months ended December 31, 2024, DHC reversed $6,934 of business management incentive fees. DHC did not recognize a business management incentive fee for the year ended December 31, 2024.

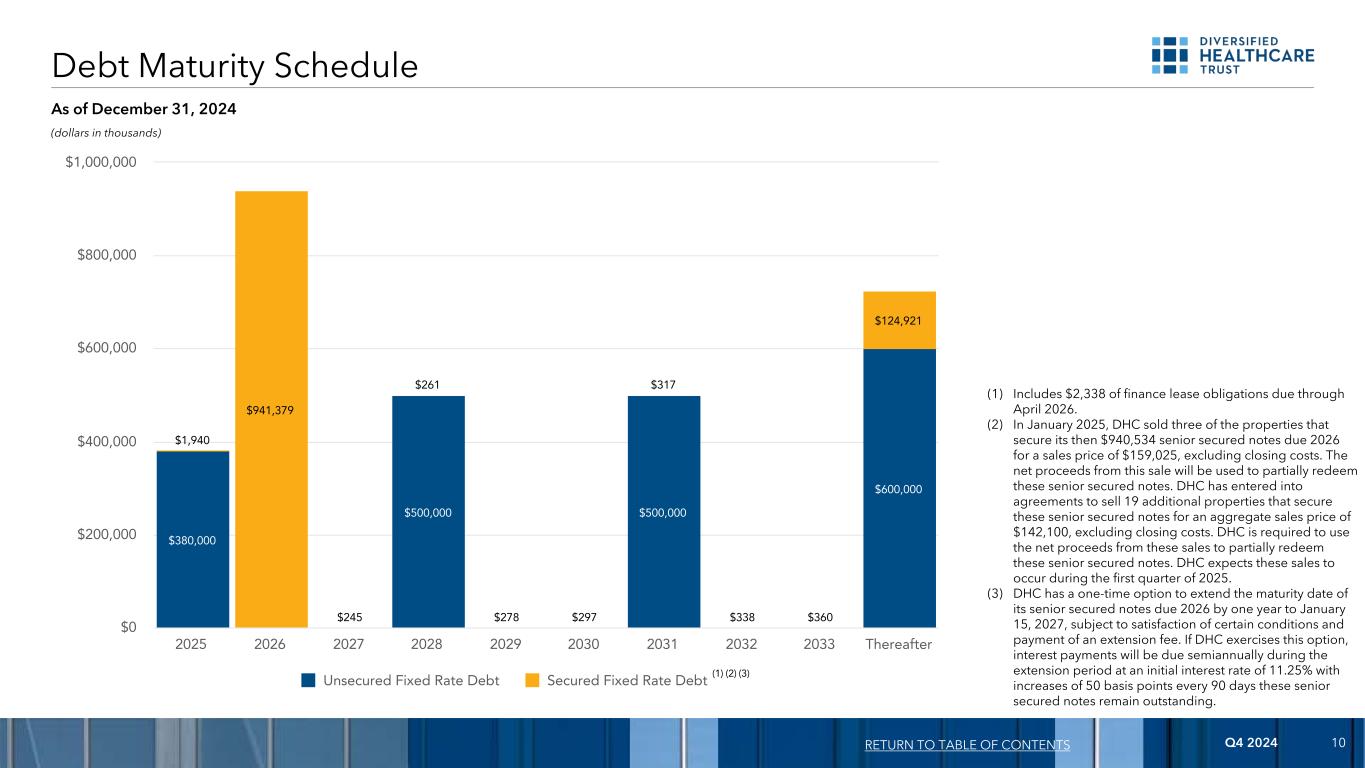

Q4 2024 9 Coupon Interest Principal Maturity Due at Years to Rate Rate Balance Date Maturity Maturity Unsecured Fixed Rate Debt: Senior unsecured notes due 2025 (1) (2) 9.750% 9.750% $ 380,000 6/15/2025 $ 380,000 0.5 Senior unsecured notes due 2028 4.750% 4.966% 500,000 2/15/2028 500,000 3.1 Senior unsecured notes due 2031 (2) 4.375% 4.375% 500,000 3/1/2031 500,000 6.2 Senior unsecured notes due 2042 5.625% 5.625% 350,000 8/1/2042 350,000 17.6 Senior unsecured notes due 2046 6.250% 6.250% 250,000 2/1/2046 250,000 21.1 Weighted average rate / total unsecured fixed rate debt 5.959% 6.014% 1,980,000 1,980,000 8.2 Secured Fixed Rate Debt: Senior secured notes due 2026 (2) (3) (4) (5) (6) 0.000% 0.000% 940,534 1/15/2026 940,534 1.0 Finance leases - 2 properties 7.700% 7.700% 2,338 4/30/2026 155 1.3 Mortgage - secured by eight properties 6.864% 6.864% 120,000 6/11/2034 120,000 9.4 Mortgage - secured by one property 6.444% 6.444% 7,464 7/6/2043 57 18.5 Weighted average rate / total secured fixed rate debt 0.831% 0.831% 1,070,336 1,060,746 2.1 Weighted average rate / total debt 4.160% 4.195% $ 3,050,336 $ 3,040,746 6.1 Debt Summary (dollars and sq. ft. in thousands) RETURN TO TABLE OF CONTENTS As of December 31, 2024 (1) DHC has the option to redeem all or a portion of its senior unsecured notes due 2025 at any time at a set redemption price equal to 100% of the principal amount to be redeemed. (2) As of December 31, 2024, all of DHC's senior unsecured notes due 2025 and senior unsecured notes due 2031 were fully and unconditionally guaranteed, on a joint, several and senior unsecured basis, by all of DHC's subsidiaries except certain excluded subsidiaries, and all of DHC's senior secured notes due 2026 were fully and unconditionally guaranteed, on a joint, several and senior secured basis, by certain of DHC's subsidiaries, and on a joint, several and unsecured basis, by DHC's other subsidiaries, except for certain excluded subsidiaries. The senior secured notes and the related guarantees on a senior secured basis are secured by a first priority lien and security interest in each of the collateral properties and 100% of the equity interests in each of the collateral guarantors. The notes and the guarantees (other than the senior secured notes and the related guarantees on a senior secured basis) are effectively subordinated to all of DHC's and the subsidiary guarantors' secured indebtedness, respectively, to the extent of the value of the applicable collateral, and the notes and the related guarantees are structurally subordinated to all indebtedness and other liabilities and any preferred equity of DHC's subsidiaries that do not guarantee the notes. (3) No cash interest will accrue on these senior secured notes prior to maturity. The accreted value of these senior secured notes will increase at a rate of 11.25% per annum compounded semiannually on January 15 and July 15 of each year, such that the accreted value will equal the principal amount at maturity. (4) Summary information of the properties securing these senior notes are as follows as of December 31, 2024: • Properties: 95 (63 Medical Office/Life Science; 22 triple net leased senior living; 10 triple net leased wellness centers) • Sq. Ft. / Units: 5,788 sq. ft. / 1,529 units • Q4 2024 NOI: $30,733 • Gross book value of real estate assets: $1,621,446 • Occupancy (Medical Office and Life Science Portfolio): 90.1% • Rent coverage (triple net senior living and wellness centers): 2.16x • Weighted average lease term: 6.4 years (5) In January 2025, DHC sold three of the properties that secure its senior secured notes due 2026 for a sales price of $159,025, excluding closing costs. The net proceeds from this sale will be used to partially redeem these senior secured notes. DHC has entered into agreements to sell 19 additional properties that secure these senior secured notes for an aggregate sales price of $142,100, excluding closing costs. DHC is required to use the net proceeds from these sales to partially redeem these senior secured notes. DHC expects these sales to occur during the first quarter of 2025. (6) DHC has a one-time option to extend the maturity date of these senior secured notes by one year, to January 15, 2027, subject to satisfaction of certain conditions and payment of an extension fee. If DHC exercises this option, interest payments will be due semiannually during the extension period at an initial interest rate of 11.25% with increases of 50 basis points every 90 days these senior secured notes remain outstanding.

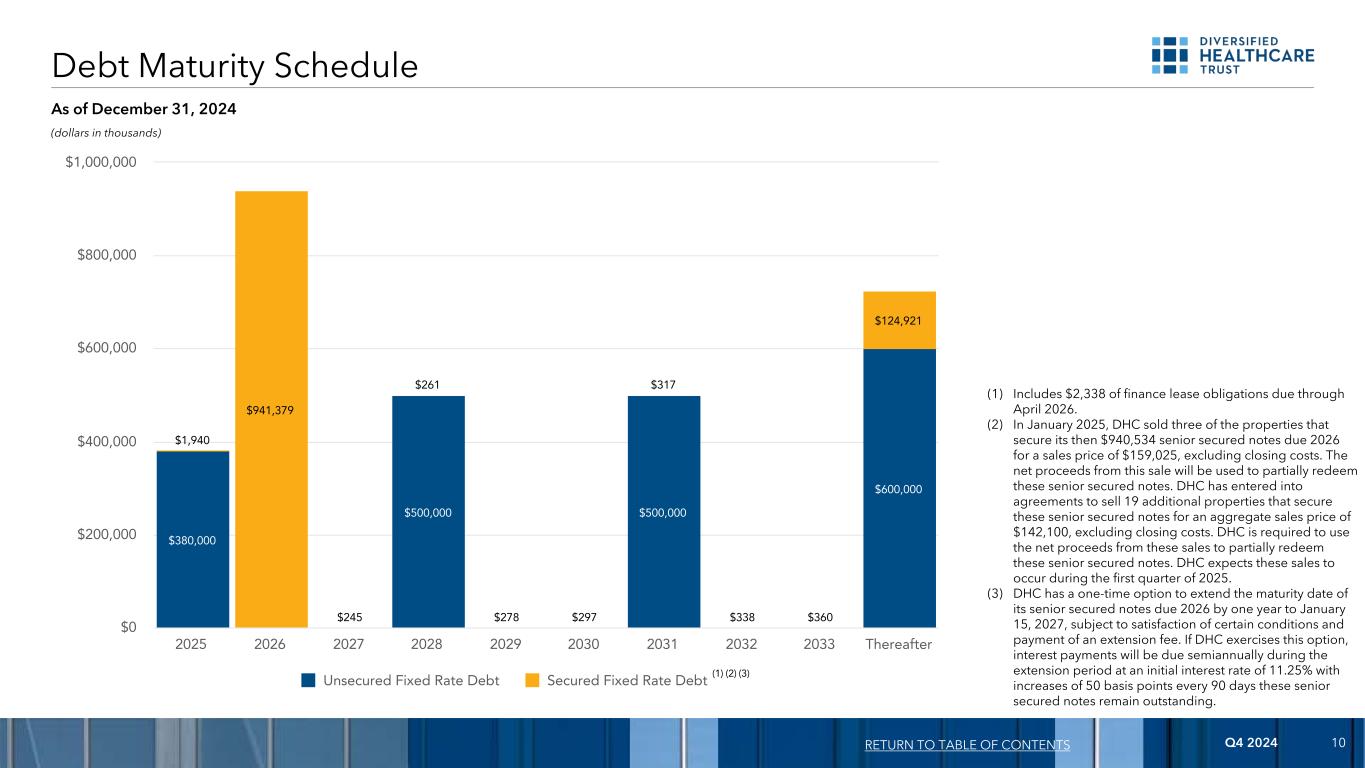

Q4 2024 10 $380,000 $500,000 $500,000 $600,000 $1,940 $941,379 $245 $261 $278 $297 $317 $338 $360 $124,921 Unsecured Fixed Rate Debt Secured Fixed Rate Debt 2025 2026 2027 2028 2029 2030 2031 2032 2033 Thereafter $0 $200,000 $400,000 $600,000 $800,000 $1,000,000 Debt Maturity Schedule (1) RETURN TO TABLE OF CONTENTS (dollars in thousands) As of December 31, 2024 (1) Includes $2,338 of finance lease obligations due through April 2026. (2) In January 2025, DHC sold three of the properties that secure its then $940,534 senior secured notes due 2026 for a sales price of $159,025, excluding closing costs. The net proceeds from this sale will be used to partially redeem these senior secured notes. DHC has entered into agreements to sell 19 additional properties that secure these senior secured notes for an aggregate sales price of $142,100, excluding closing costs. DHC is required to use the net proceeds from these sales to partially redeem these senior secured notes. DHC expects these sales to occur during the first quarter of 2025. (3) DHC has a one-time option to extend the maturity date of its senior secured notes due 2026 by one year to January 15, 2027, subject to satisfaction of certain conditions and payment of an extension fee. If DHC exercises this option, interest payments will be due semiannually during the extension period at an initial interest rate of 11.25% with increases of 50 basis points every 90 days these senior secured notes remain outstanding. (2) (3)

Q4 2024 11 Leverage Ratios, Coverage Ratios and Bond Covenants RETURN TO TABLE OF CONTENTS As of and For the Three Months Ended 12/31/2024 9/30/2024 6/30/2024 3/31/2024 12/31/2023 Leverage Ratios: Net debt / total gross assets 40.2% 38.6% 38.3% 38.4% 37.6% Net debt / gross book value of real estate assets 40.5% 39.8% 39.5% 39.5% 38.9% Secured debt / total assets 20.8% 20.3% 20.1% 17.8% 17.5% Variable rate debt / net debt —% —% —% —% —% Coverage Ratios: Net debt / annualized Adjusted EBITDAre 11.2x 10.6x 10.2x 10.8x 12.3x Adjusted EBITDAre / interest expense 1.1x 1.1x 1.2x 1.1x 1.2x As of and For the Trailing Twelve Months Ended 12/31/2024 9/30/2024 6/30/2024 3/31/2024 12/31/2023 Bond Covenants: Maintenance Covenant Total unencumbered assets / unsecured debt - required minimum 150.0% 262.2% 264.7% 267.5% 271.2% 274.5% Incurrence Covenants Total debt / adjusted total assets - allowable maximum 60.0% 41.7% 41.4% 41.2% 40.6% 40.3% Secured debt / adjusted total assets - allowable maximum 40.0% 14.6% 14.3% 14.2% 12.7% 12.6% Consolidated income available for debt service / debt service - required minimum 1.50x 1.95x 1.76x 1.76x 1.64x 1.64x 7809 W. 38th Avenue Wheat Ridge, CO

Q4 2024 12 (dollars and sq. ft. in thousands, except per sq. ft. and unit data) Summary of Capital Expenditures RETURN TO TABLE OF CONTENTS For the Three Months Ended For the Year Ended 12/31/2024 9/30/2024 6/30/2024 3/31/2024 12/31/2023 12/31/2024 12/31/2023 Medical Office and Life Science Portfolio: Lease related costs $ 5,347 $ 3,504 $ 6,409 $ 6,029 $ 13,349 $ 21,289 $ 38,070 Building improvements 1,872 1,359 1,852 919 5,531 6,002 12,984 Subtotal Medical Office and Life Science Portfolio 7,219 4,863 8,261 6,948 18,880 27,291 51,054 SHOP fixed assets and capital improvements 33,406 27,923 21,623 10,091 32,952 93,043 100,981 Wellness centers lease related costs 3,616 5,488 4,591 6,923 4,928 20,618 9,721 Total recurring capital expenditures $ 44,241 $ 38,274 $ 34,475 $ 23,962 $ 56,760 $ 140,952 $ 161,756 Medical Office and Life Science Portfolio avg. sq. ft. during period 8,073 8,294 8,442 8,710 8,710 8,282 8,711 SHOP avg. units managed during period 25,065 25,191 25,225 25,256 25,256 25,093 25,277 Medical Office and Life Science Portfolio building improvements per avg. sq. ft. during period $ 0.23 $ 0.16 $ 0.22 $ 0.11 $ 0.64 $ 0.72 $ 1.49 SHOP fixed assets and capital improvements per avg. unit managed during period $ 1,333 $ 1,108 $ 857 $ 400 $ 1,305 $ 3,708 $ 3,995 Development, redevelopment and other activities - Medical Office and Life Science Portfolio $ 650 $ 537 $ 1,112 $ 713 $ 120 $ 3,012 $ 9,244 Development, redevelopment and other activities - SHOP 27,950 11,714 5,705 1,189 22,559 46,558 82,207 Total development, redevelopment and other activities $ 28,600 $ 12,251 $ 6,817 $ 1,902 $ 22,679 $ 49,570 $ 91,451 Capital expenditures by segment: Medical Office and Life Science Portfolio $ 7,869 $ 5,400 $ 9,373 $ 7,661 $ 19,000 $ 30,303 $ 60,298 SHOP 61,356 39,637 27,328 11,280 55,511 139,601 183,188 Wellness centers 3,616 5,488 4,591 6,923 4,928 20,618 9,721 Total capital expenditures $ 72,841 $ 50,525 $ 41,292 $ 25,864 $ 79,439 $ 190,522 $ 253,207

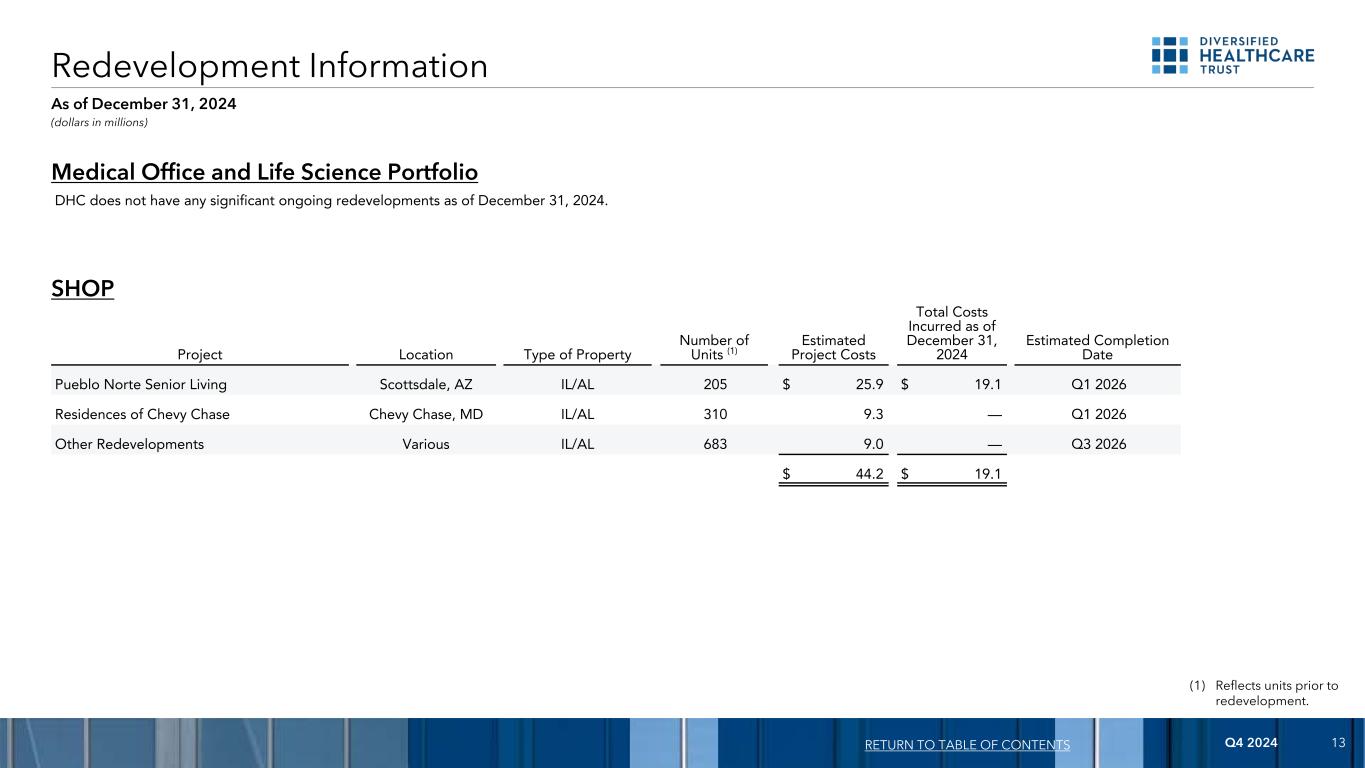

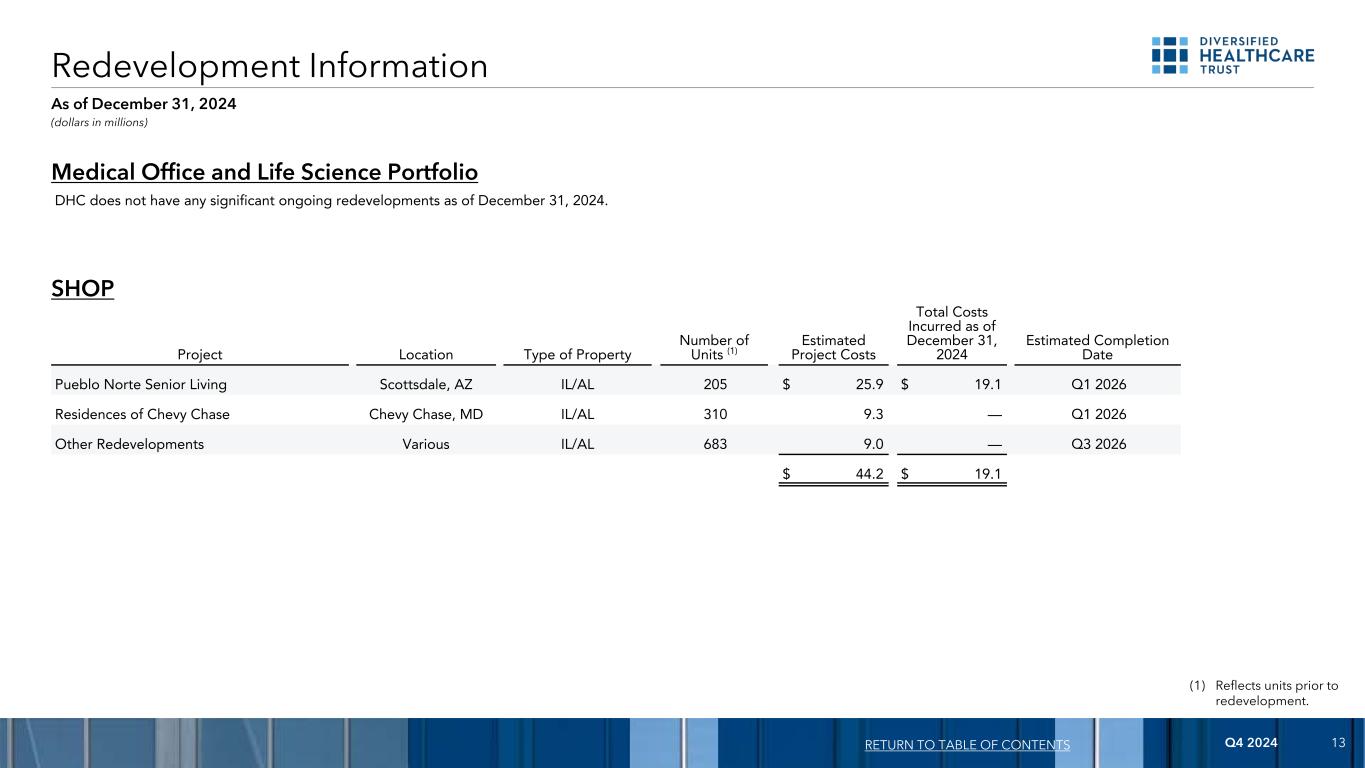

Q4 2024 13 DHC does not have any significant ongoing redevelopments as of December 31, 2024. (1) Reflects units prior to redevelopment. Redevelopment Information (dollars in millions) RETURN TO TABLE OF CONTENTS Medical Office and Life Science Portfolio As of December 31, 2024 Project Location Type of Property Number of Units (1) Estimated Project Costs Total Costs Incurred as of December 31, 2024 Estimated Completion Date Pueblo Norte Senior Living Scottsdale, AZ IL/AL 205 $ 25.9 $ 19.1 Q1 2026 Residences of Chevy Chase Chevy Chase, MD IL/AL 310 9.3 — Q1 2026 Other Redevelopments Various IL/AL 683 9.0 — Q3 2026 $ 44.2 $ 19.1 SHOP

Q4 2024 14 Property Dispositions Information Since January 1, 2024 Dispositions: Date Sold Location Segment Number of Properties Gross Sales Price Gross Sales Price Per Square Foot or Unit (1) Occupancy (2) 3/28/2024 Phoenix, AZ Medical Office and Life Science Portfolio 1 $ 3,600 $ 28.55 100.0 % 6/3/2024 Irving, TX Medical Office and Life Science Portfolio 1 4,200 $ 44.62 0.0 % 7/22/2024 Buffalo Grove, IL Medical Office and Life Science Portfolio 1 6,175 $ 95.21 47.9 % 7/31/2024 Eagan, MN Medical Office and Life Science Portfolio 1 15,100 $ 107.23 65.4 % 11/1/2024 Overland Park, KS Medical Office and Life Science Portfolio 1 6,600 $ 27.57 26.1 % 1/21/2025 Wilmington, DE SHOP 1 2,900 $ 28,431 0.0 % 1/31/2025 San Diego, CA Medical Office and Life Science Portfolio (3) 3 159,025 $ 855.07 49.2 % 2/24/2025 Tempe, AZ Medical Office and Life Science Portfolio 1 16,800 $ 204.22 0.0 % Total Dispositions 10 $ 214,400 RETURN TO TABLE OF CONTENTS (dollars in thousands, except gross sales price per square foot or unit) (1) Represents gross sales price per square foot for the Medical Office and Life Science Portfolio and gross sales price per unit for both the SHOP and All Other segments. (2) Occupancy is presented as of the month end prior to the date of sale for the Medical Office and Life Science Portfolio and for the one month ended prior to the date of sale for the SHOP segment. (3) The net proceeds from the sale of these properties are required to be used to partially redeem DHC's senior secured notes due 2026. (4) The net proceeds from the sale of 19 of these properties are required to be used to partially redeem DHC's senior secured notes due 2026. DHC expects to sell these properties during the first quarter of 2025 for an aggregate sales price of $142,100, excluding closing costs. (5) Occupancy is presented as of December 31, 2024 for the Medical Office and Life Science Portfolio and All Other properties and for the three months ended December 31, 2024 for DHC's SHOP segment. Under Agreement or Letter of Intent as of February 24, 2025: Segment Number of Properties Estimated Gross Sales Price Gross Sales Price Per Square Foot or Unit (1) Occupancy (5) Medical Office and Life Science Portfolio (4) 2 $ 12,600 $ 80.27 41.3 % SHOP 5 68,480 $ 95,509 80.2 % All Other (4) 19 138,500 $ 142,343 89.3 % Total Under Agreement or Letter of Intent 26 $ 219,580

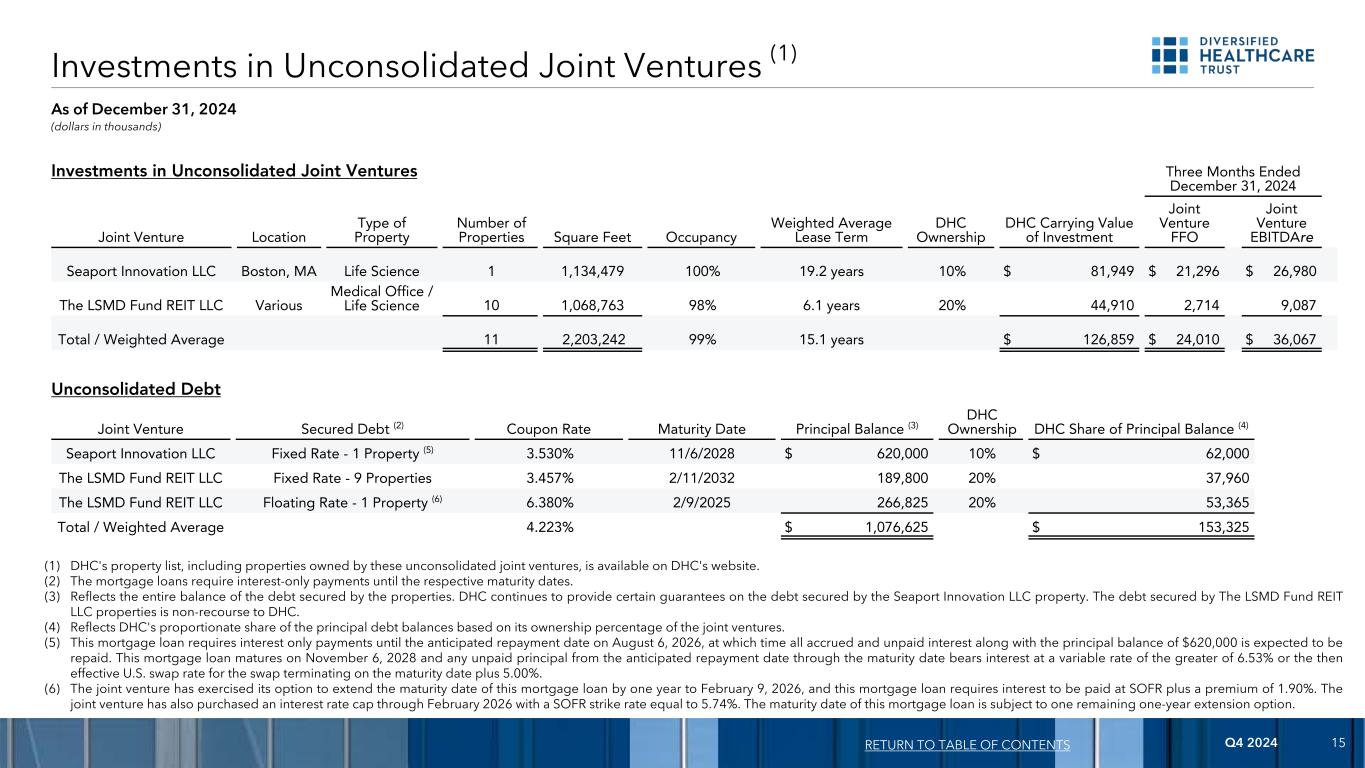

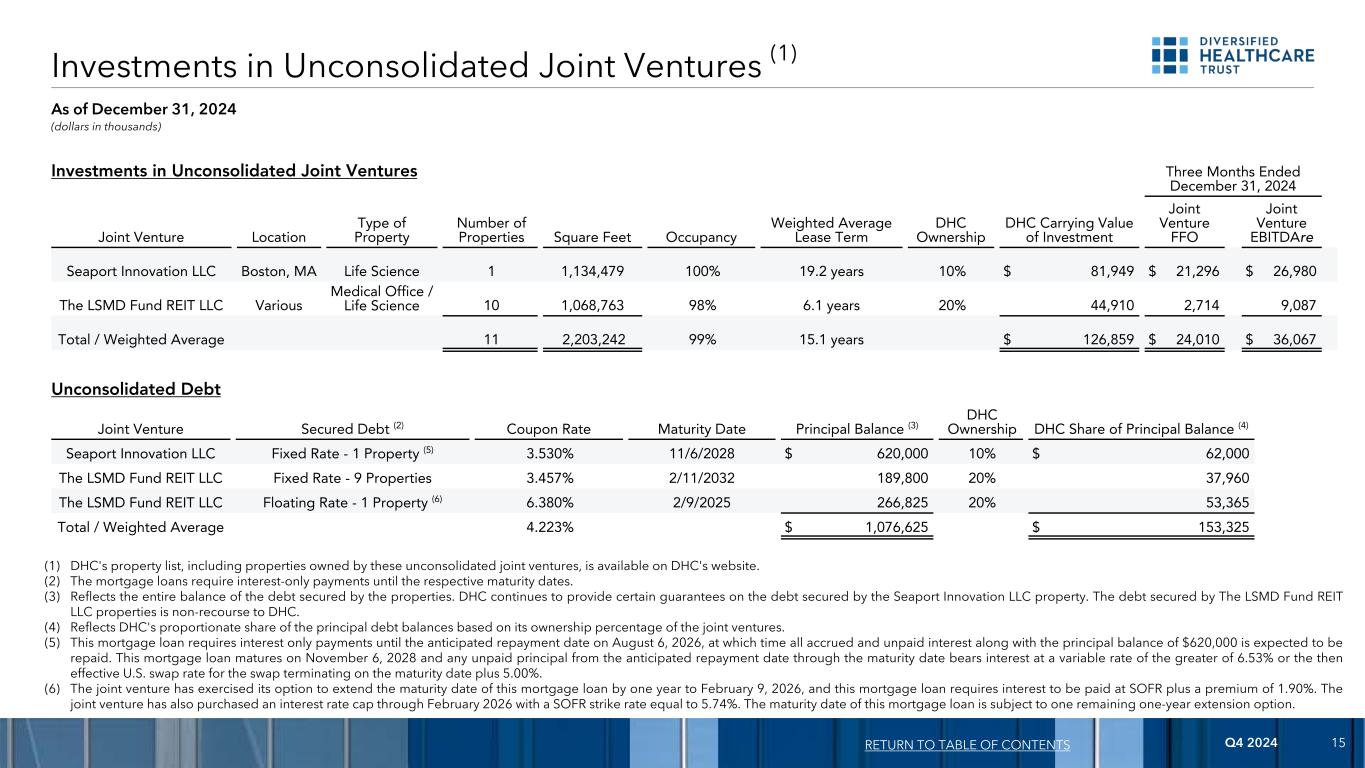

Q4 2024 15 Investments in Unconsolidated Joint Ventures (1) (dollars in thousands) RETURN TO TABLE OF CONTENTS As of December 31, 2024 Three Months Ended December 31, 2024 Joint Venture Location Type of Property Number of Properties Square Feet Occupancy Weighted Average Lease Term DHC Ownership DHC Carrying Value of Investment Joint Venture FFO Joint Venture EBITDAre Seaport Innovation LLC Boston, MA Life Science 1 1,134,479 100% 19.2 years 10% $ 81,949 $ 21,296 $ 26,980 The LSMD Fund REIT LLC Various Medical Office / Life Science 10 1,068,763 98% 6.1 years 20% 44,910 2,714 9,087 Total / Weighted Average 11 2,203,242 99% 15.1 years $ 126,859 $ 24,010 $ 36,067 Investments in Unconsolidated Joint Ventures Unconsolidated Debt Joint Venture Secured Debt (2) Coupon Rate Maturity Date Principal Balance (3) DHC Ownership DHC Share of Principal Balance (4) Seaport Innovation LLC Fixed Rate - 1 Property (5) 3.530% 11/6/2028 $ 620,000 10% $ 62,000 The LSMD Fund REIT LLC Fixed Rate - 9 Properties 3.457% 2/11/2032 189,800 20% 37,960 The LSMD Fund REIT LLC Floating Rate - 1 Property (6) 6.380% 2/9/2025 266,825 20% 53,365 Total / Weighted Average 4.223% $ 1,076,625 $ 153,325 (1) DHC's property list, including properties owned by these unconsolidated joint ventures, is available on DHC's website. (2) The mortgage loans require interest-only payments until the respective maturity dates. (3) Reflects the entire balance of the debt secured by the properties. DHC continues to provide certain guarantees on the debt secured by the Seaport Innovation LLC property. The debt secured by The LSMD Fund REIT LLC properties is non-recourse to DHC. (4) Reflects DHC's proportionate share of the principal debt balances based on its ownership percentage of the joint ventures. (5) This mortgage loan requires interest only payments until the anticipated repayment date on August 6, 2026, at which time all accrued and unpaid interest along with the principal balance of $620,000 is expected to be repaid. This mortgage loan matures on November 6, 2028 and any unpaid principal from the anticipated repayment date through the maturity date bears interest at a variable rate of the greater of 6.53% or the then effective U.S. swap rate for the swap terminating on the maturity date plus 5.00%. (6) The joint venture has exercised its option to extend the maturity date of this mortgage loan by one year to February 9, 2026, and this mortgage loan requires interest to be paid at SOFR plus a premium of 1.90%. The joint venture has also purchased an interest rate cap through February 2026 with a SOFR strike rate equal to 5.74%. The maturity date of this mortgage loan is subject to one remaining one-year extension option.

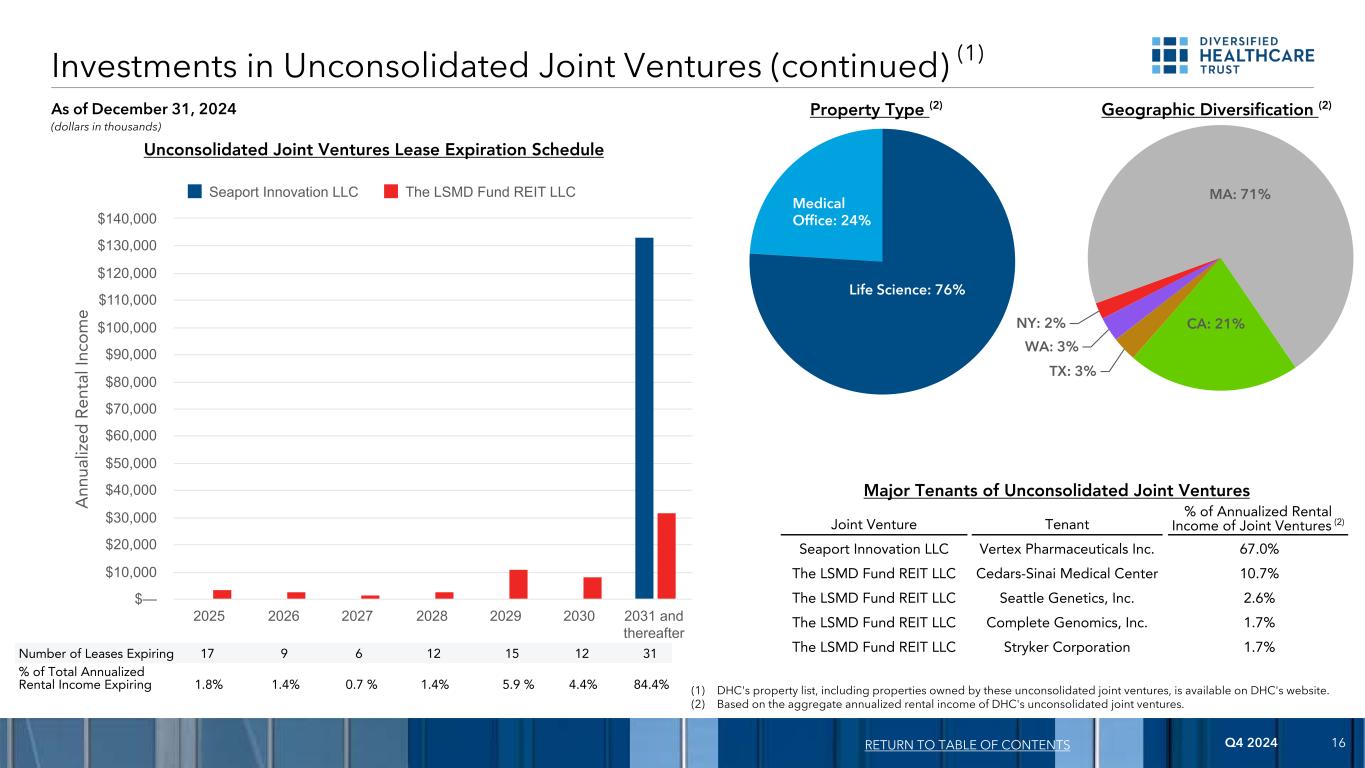

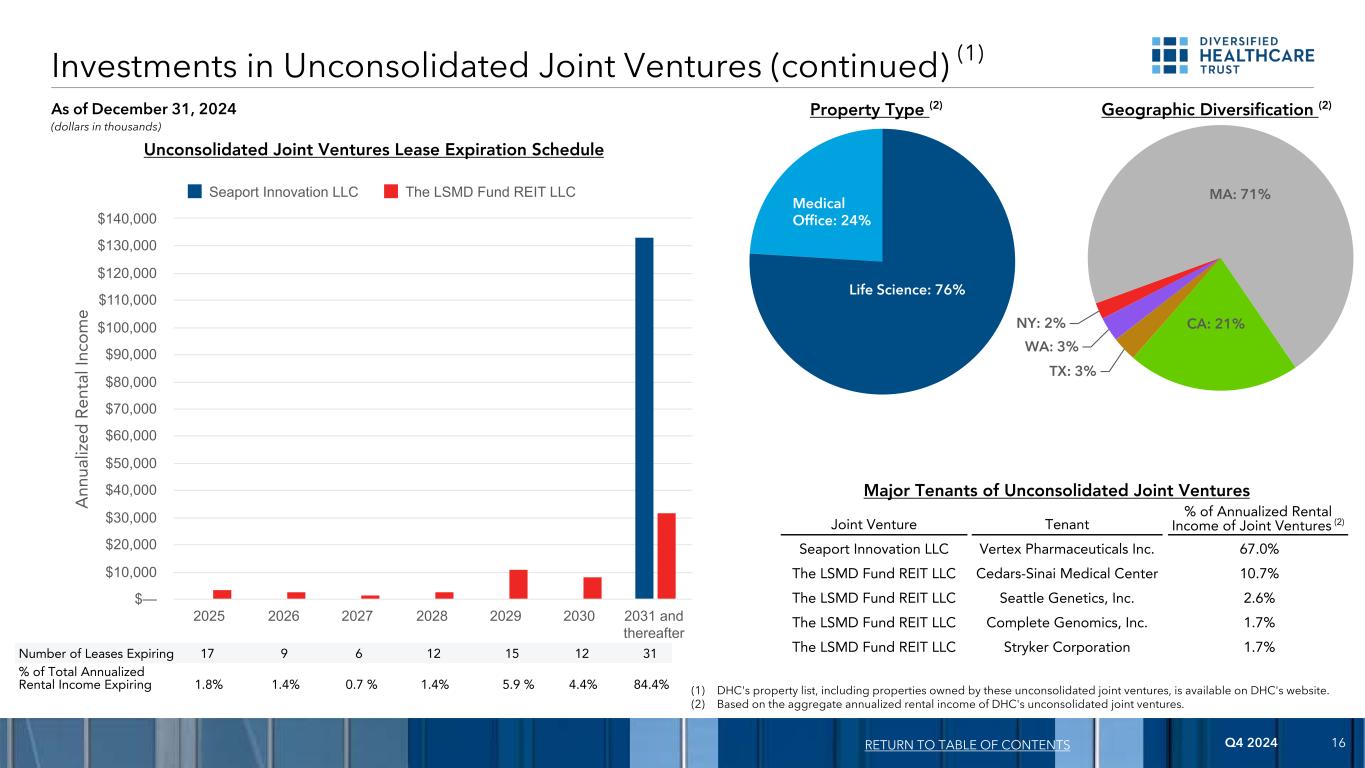

Q4 2024 16 Investments in Unconsolidated Joint Ventures (continued) (1) (dollars in thousands) RETURN TO TABLE OF CONTENTS As of December 31, 2024 (1) DHC's property list, including properties owned by these unconsolidated joint ventures, is available on DHC's website. (2) Based on the aggregate annualized rental income of DHC's unconsolidated joint ventures. A nn ua liz ed R en ta l I nc om e Seaport Innovation LLC The LSMD Fund REIT LLC 2025 2026 2027 2028 2029 2030 2031 and thereafter $— $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 $90,000 $100,000 $110,000 $120,000 $130,000 $140,000 Unconsolidated Joint Ventures Lease Expiration Schedule Number of Leases Expiring 17 9 6 12 15 12 31 % of Total Annualized Rental Income Expiring 1.8% 1.4% 0.7 % 1.4% 5.9 % 4.4% 84.4% Major Tenants of Unconsolidated Joint Ventures Joint Venture Tenant % of Annualized Rental Income of Joint Ventures (2) Seaport Innovation LLC Vertex Pharmaceuticals Inc. 67.0% The LSMD Fund REIT LLC Cedars-Sinai Medical Center 10.7% The LSMD Fund REIT LLC Seattle Genetics, Inc. 2.6% The LSMD Fund REIT LLC Complete Genomics, Inc. 1.7% The LSMD Fund REIT LLC Stryker Corporation 1.7% Life Science: 76% Medical Office: 24% Property Type (2) MA: 71% CA: 21% TX: 3% WA: 3% NY: 2% Geographic Diversification (2)

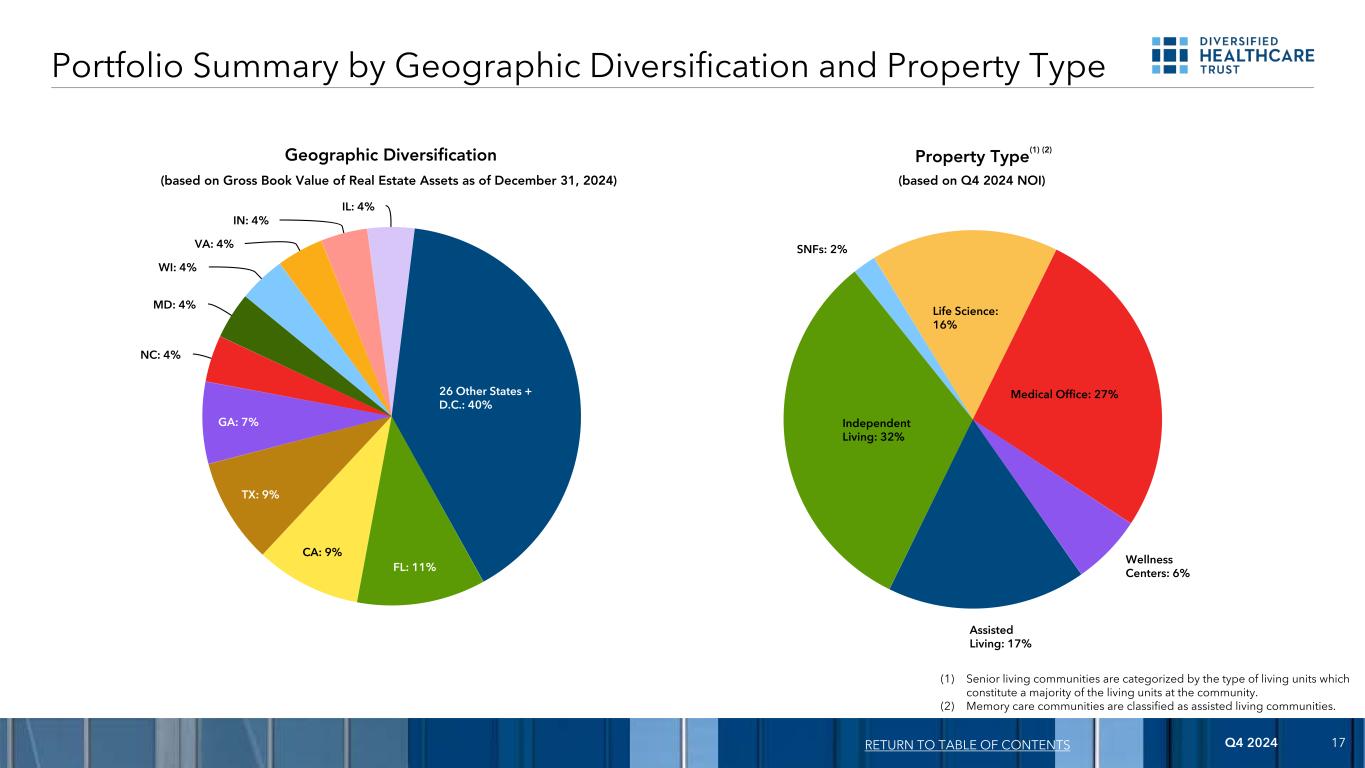

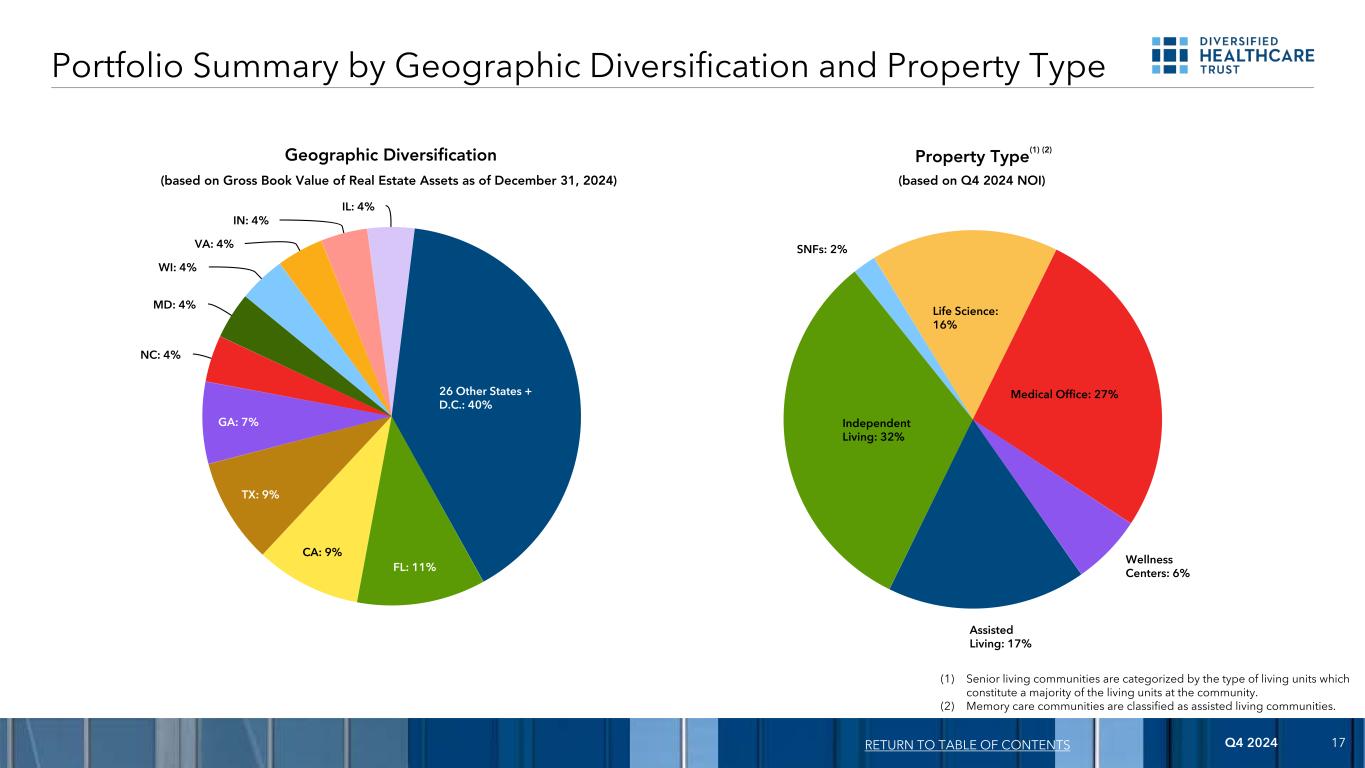

Q4 2024 17 FL: 11% CA: 9% TX: 9% GA: 7% NC: 4% MD: 4% WI: 4% VA: 4% IN: 4% IL: 4% 26 Other States + D.C.: 40% (based on Gross Book Value of Real Estate Assets as of December 31, 2024) (1) Senior living communities are categorized by the type of living units which constitute a majority of the living units at the community. (2) Memory care communities are classified as assisted living communities. Portfolio Summary by Geographic Diversification and Property Type Geographic Diversification RETURN TO TABLE OF CONTENTS Assisted Living: 17% Independent Living: 32% SNFs: 2% Life Science: 16% Medical Office: 27% Wellness Centers: 6% Property Type(1) (2) (based on Q4 2024 NOI)

Q4 2024 18 Portfolio Summary RETURN TO TABLE OF CONTENTS (dollars in thousands, except investment per square foot or unit) As of December 31, 2024 Number of Properties Square Feet or Number of Units Gross Book Value of Real Estate Assets % of Total Gross Book Value of Real Estate Assets Investment Per Square Foot or Unit % of Q4 2024 Total Revenues % of Q4 2024 Total NOI Q4 2024 Q4 2024 Revenues NOI Medical office 76 5,629,613 $ 1,397,457 19.5 % $ 248 $ 34,756 9.2 % $ 17,349 26.9 % Life science 22 2,323,098 738,929 10.3 % $ 318 16,959 4.4 % 9,982 15.5 % Subtotal Medical Office and Life Science Portfolio 98 7,952,711 sq. ft. 2,136,386 29.8 % $ 269 51,715 13.6 % 27,331 42.4 % SHOP 232 24,978 units 4,628,144 64.5 % $ 185,289 315,736 83.2 % 24,933 38.7 % Triple net leased senior living communities 27 2,062 units 201,287 2.8 % $ 97,617 8,654 2.3 % 8,654 13.4 % Wellness centers 10 812,246 sq. ft. 208,110 2.9 % $ 256 3,514 0.9 % 3,525 5.5 % Total 367 $ 7,173,927 100.0 % $ 379,619 100.0 % $ 64,443 100.0 %

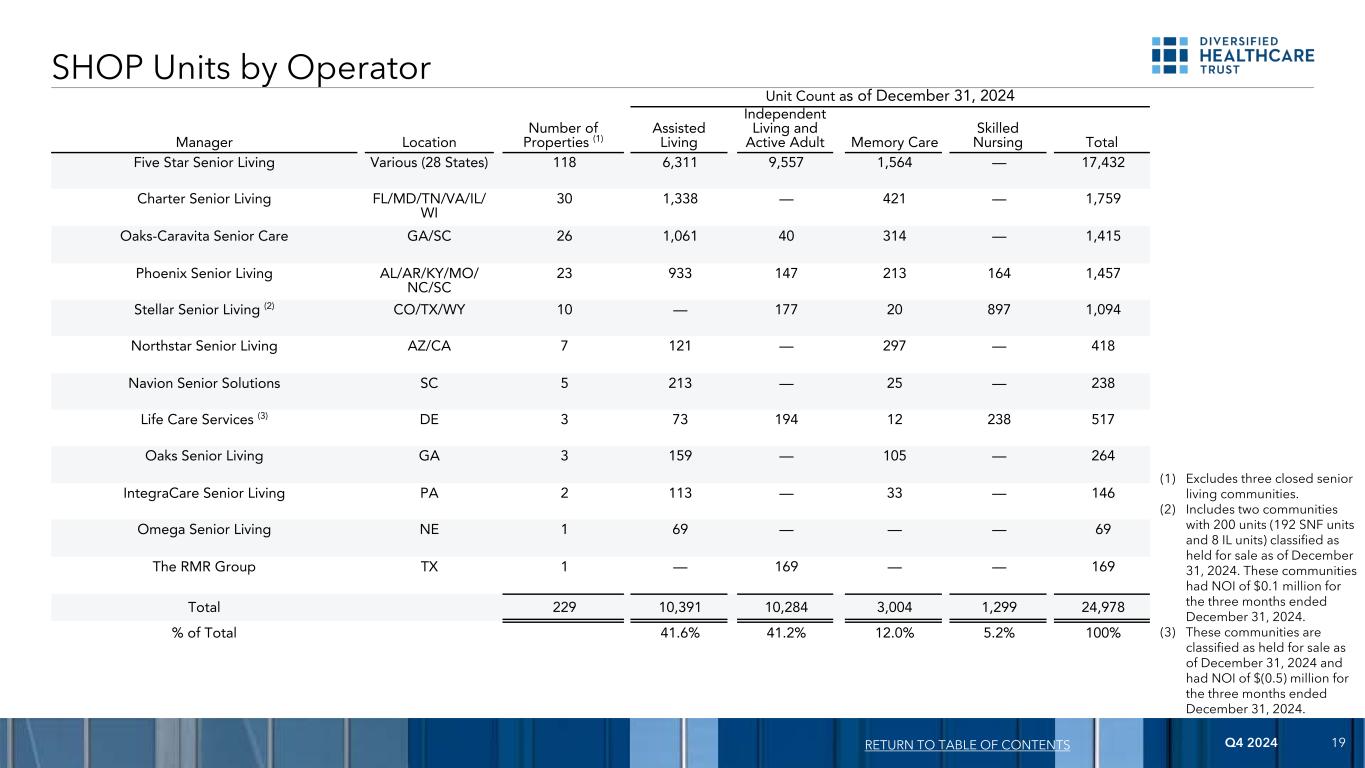

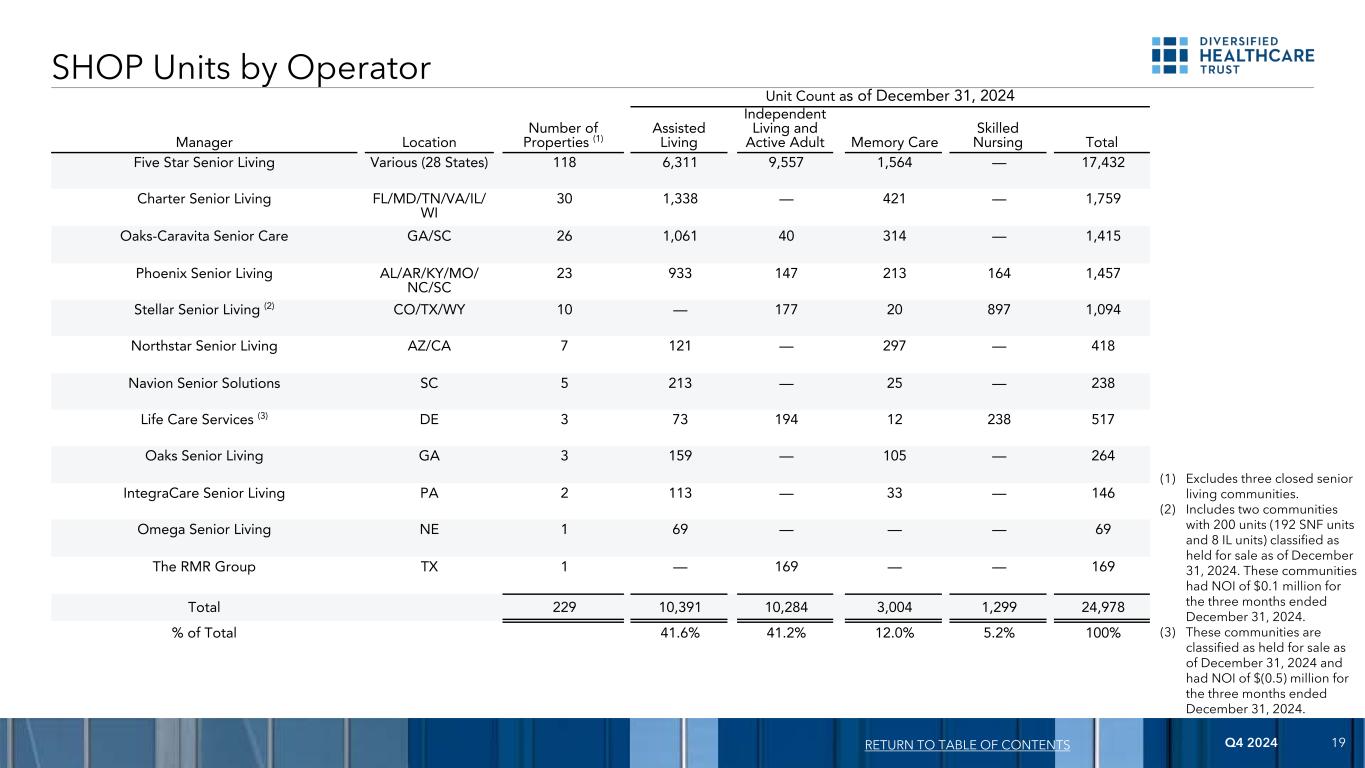

Q4 2024 19 SHOP Units by Operator RETURN TO TABLE OF CONTENTS Unit Count as of December 31, 2024 Manager Location Number of Properties (1) Assisted Living Independent Living and Active Adult Memory Care Skilled Nursing Total Five Star Senior Living Various (28 States) 118 6,311 9,557 1,564 — 17,432 Charter Senior Living FL/MD/TN/VA/IL/ WI 30 1,338 — 421 — 1,759 Oaks-Caravita Senior Care GA/SC 26 1,061 40 314 — 1,415 Phoenix Senior Living AL/AR/KY/MO/ NC/SC 23 933 147 213 164 1,457 Stellar Senior Living (2) CO/TX/WY 10 — 177 20 897 1,094 Northstar Senior Living AZ/CA 7 121 — 297 — 418 Navion Senior Solutions SC 5 213 — 25 — 238 Life Care Services (3) DE 3 73 194 12 238 517 Oaks Senior Living GA 3 159 — 105 — 264 IntegraCare Senior Living PA 2 113 — 33 — 146 Omega Senior Living NE 1 69 — — — 69 The RMR Group TX 1 — 169 — — 169 Total 229 10,391 10,284 3,004 1,299 24,978 % of Total 41.6% 41.2% 12.0% 5.2% 100% (1) Excludes three closed senior living communities. (2) Includes two communities with 200 units (192 SNF units and 8 IL units) classified as held for sale as of December 31, 2024. These communities had NOI of $0.1 million for the three months ended December 31, 2024. (3) These communities are classified as held for sale as of December 31, 2024 and had NOI of $(0.5) million for the three months ended December 31, 2024.

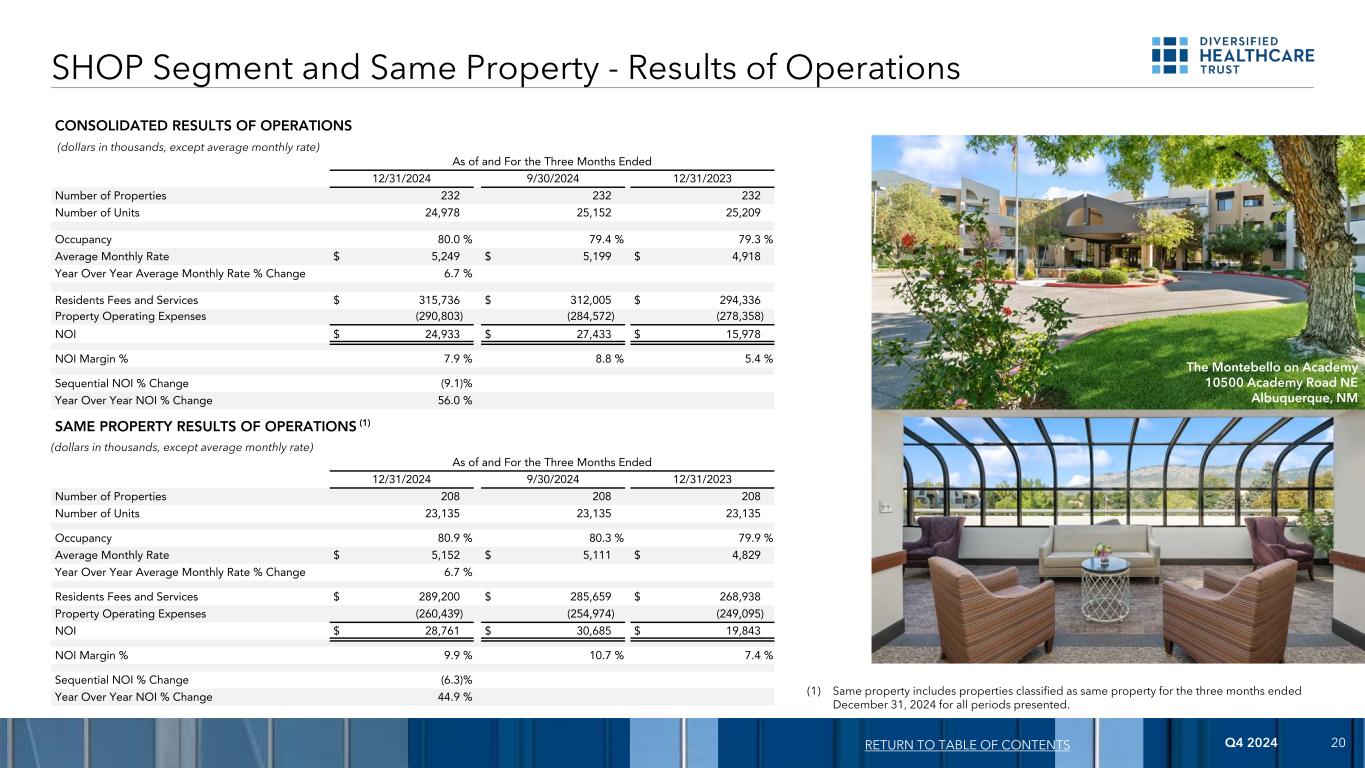

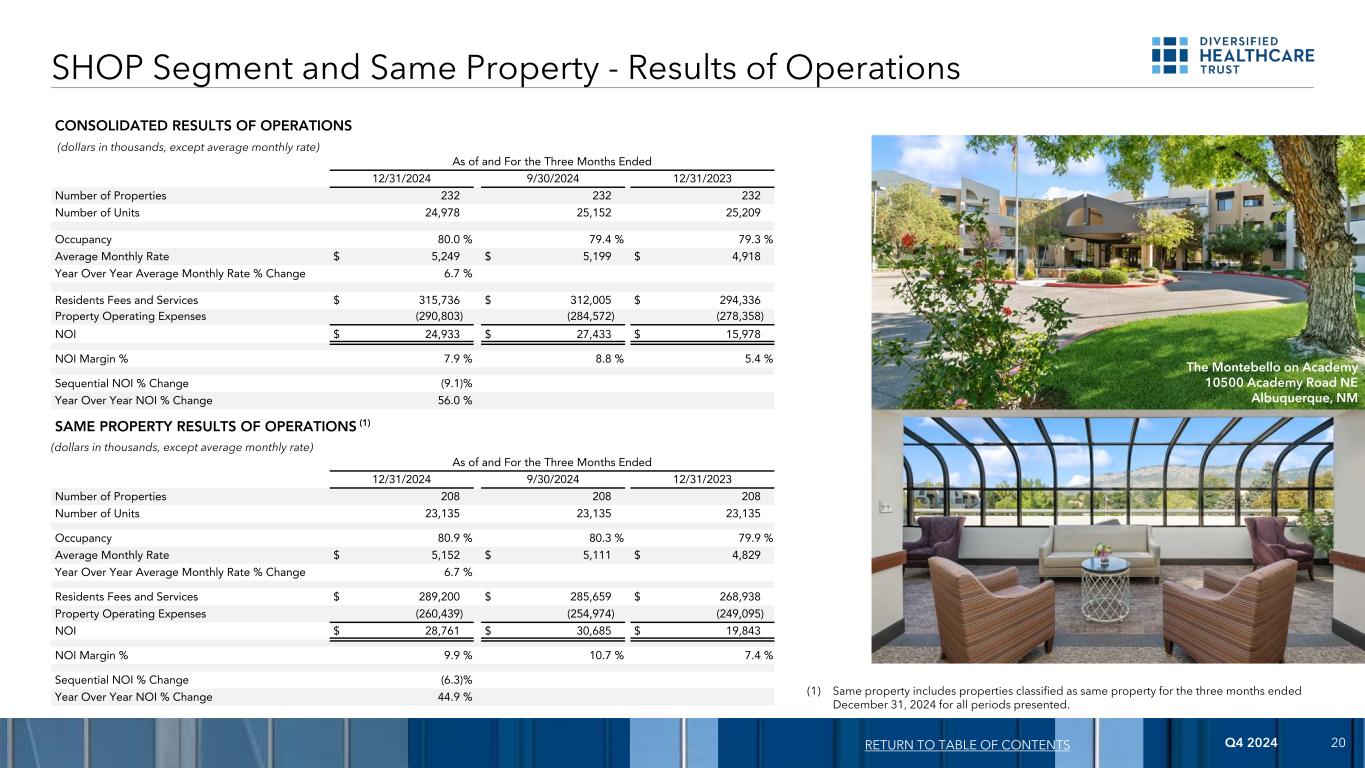

Q4 2024 20 SHOP Segment and Same Property - Results of Operations RETURN TO TABLE OF CONTENTS CONSOLIDATED RESULTS OF OPERATIONS As of and For the Three Months Ended 12/31/2024 9/30/2024 12/31/2023 Number of Properties 232 232 232 Number of Units 24,978 25,152 25,209 Occupancy 80.0 % 79.4 % 79.3 % Average Monthly Rate $ 5,249 $ 5,199 $ 4,918 Year Over Year Average Monthly Rate % Change 6.7 % Residents Fees and Services $ 315,736 $ 312,005 $ 294,336 Property Operating Expenses (290,803) (284,572) (278,358) NOI $ 24,933 $ 27,433 $ 15,978 NOI Margin % 7.9 % 8.8 % 5.4 % Sequential NOI % Change (9.1) % Year Over Year NOI % Change 56.0 % SAME PROPERTY RESULTS OF OPERATIONS (1) As of and For the Three Months Ended 12/31/2024 9/30/2024 12/31/2023 Number of Properties 208 208 208 Number of Units 23,135 23,135 23,135 Occupancy 80.9 % 80.3 % 79.9 % Average Monthly Rate $ 5,152 $ 5,111 $ 4,829 Year Over Year Average Monthly Rate % Change 6.7 % Residents Fees and Services $ 289,200 $ 285,659 $ 268,938 Property Operating Expenses (260,439) (254,974) (249,095) NOI $ 28,761 $ 30,685 $ 19,843 NOI Margin % 9.9 % 10.7 % 7.4 % Sequential NOI % Change (6.3) % Year Over Year NOI % Change 44.9 % (1) Same property includes properties classified as same property for the three months ended December 31, 2024 for all periods presented. (dollars in thousands, except average monthly rate) (dollars in thousands, except average monthly rate) The Montebello on Academy 10500 Academy Road NE Albuquerque, NM

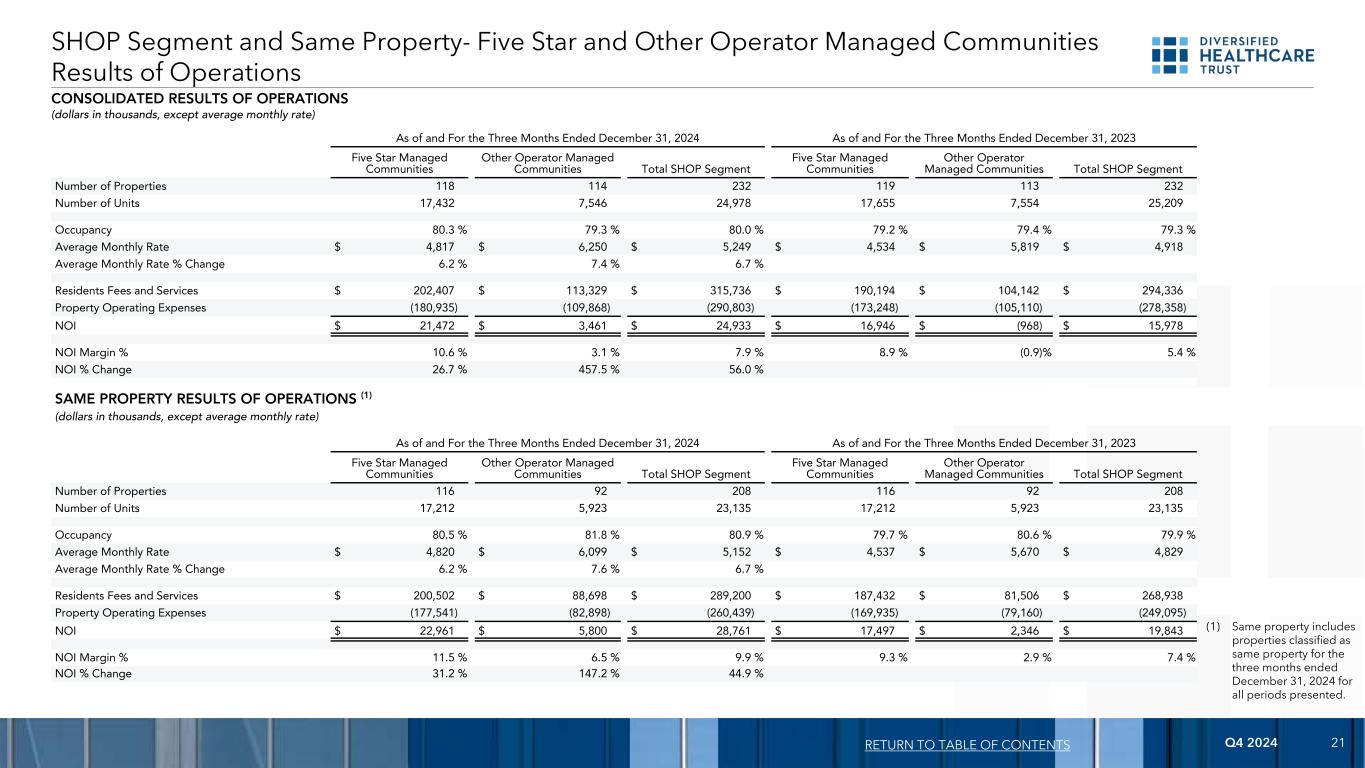

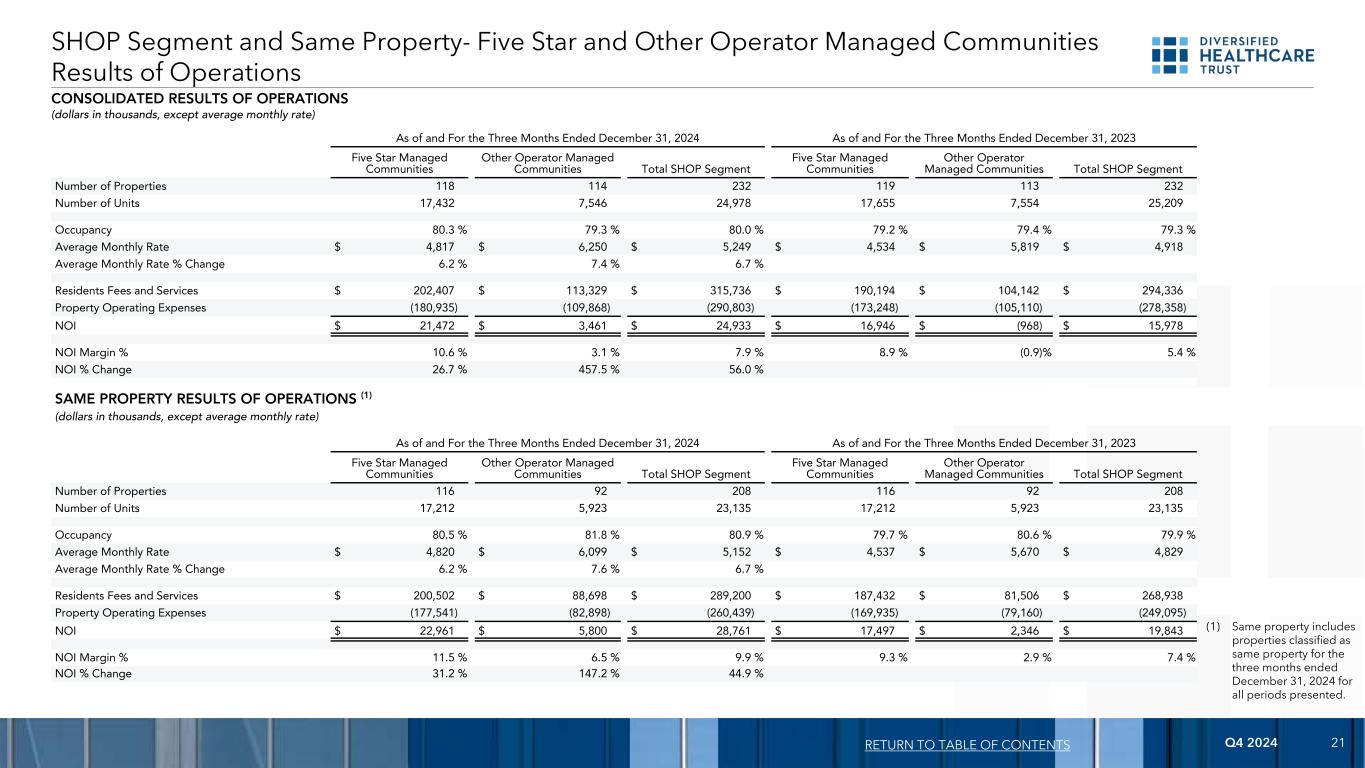

Q4 2024 21RETURN TO TABLE OF CONTENTS As of and For the Three Months Ended December 31, 2024 As of and For the Three Months Ended December 31, 2023 Five Star Managed Communities Other Operator Managed Communities Total SHOP Segment Five Star Managed Communities Other Operator Managed Communities Total SHOP Segment Number of Properties 118 114 232 119 113 232 Number of Units 17,432 7,546 24,978 17,655 7,554 25,209 Occupancy 80.3 % 79.3 % 80.0 % 79.2 % 79.4 % 79.3 % Average Monthly Rate $ 4,817 $ 6,250 $ 5,249 $ 4,534 $ 5,819 $ 4,918 Average Monthly Rate % Change 6.2 % 7.4 % 6.7 % Residents Fees and Services $ 202,407 $ 113,329 $ 315,736 $ 190,194 $ 104,142 $ 294,336 Property Operating Expenses (180,935) (109,868) (290,803) (173,248) (105,110) (278,358) NOI $ 21,472 $ 3,461 $ 24,933 $ 16,946 $ (968) $ 15,978 NOI Margin % 10.6 % 3.1 % 7.9 % 8.9 % (0.9) % 5.4 % NOI % Change 26.7 % 457.5 % 56.0 % SAME PROPERTY RESULTS OF OPERATIONS (1) (dollars in thousands, except average monthly rate) As of and For the Three Months Ended December 31, 2024 As of and For the Three Months Ended December 31, 2023 Five Star Managed Communities Other Operator Managed Communities Total SHOP Segment Five Star Managed Communities Other Operator Managed Communities Total SHOP Segment Number of Properties 116 92 208 116 92 208 Number of Units 17,212 5,923 23,135 17,212 5,923 23,135 Occupancy 80.5 % 81.8 % 80.9 % 79.7 % 80.6 % 79.9 % Average Monthly Rate $ 4,820 $ 6,099 $ 5,152 $ 4,537 $ 5,670 $ 4,829 Average Monthly Rate % Change 6.2 % 7.6 % 6.7 % Residents Fees and Services $ 200,502 $ 88,698 $ 289,200 $ 187,432 $ 81,506 $ 268,938 Property Operating Expenses (177,541) (82,898) (260,439) (169,935) (79,160) (249,095) NOI $ 22,961 $ 5,800 $ 28,761 $ 17,497 $ 2,346 $ 19,843 NOI Margin % 11.5 % 6.5 % 9.9 % 9.3 % 2.9 % 7.4 % NOI % Change 31.2 % 147.2 % 44.9 % SHOP Segment and Same Property- Five Star and Other Operator Managed Communities Results of Operations CONSOLIDATED RESULTS OF OPERATIONS (dollars in thousands, except average monthly rate) (1) Same property includes properties classified as same property for the three months ended December 31, 2024 for all periods presented.

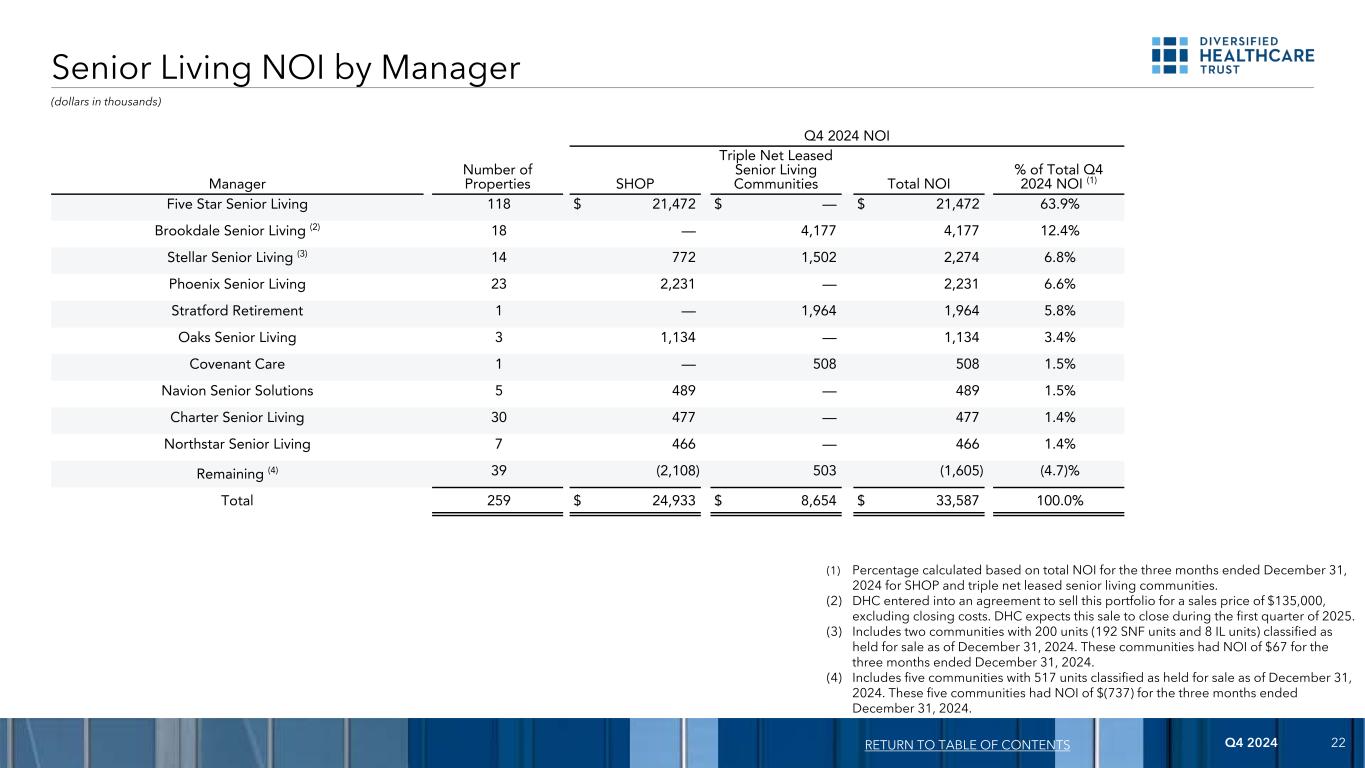

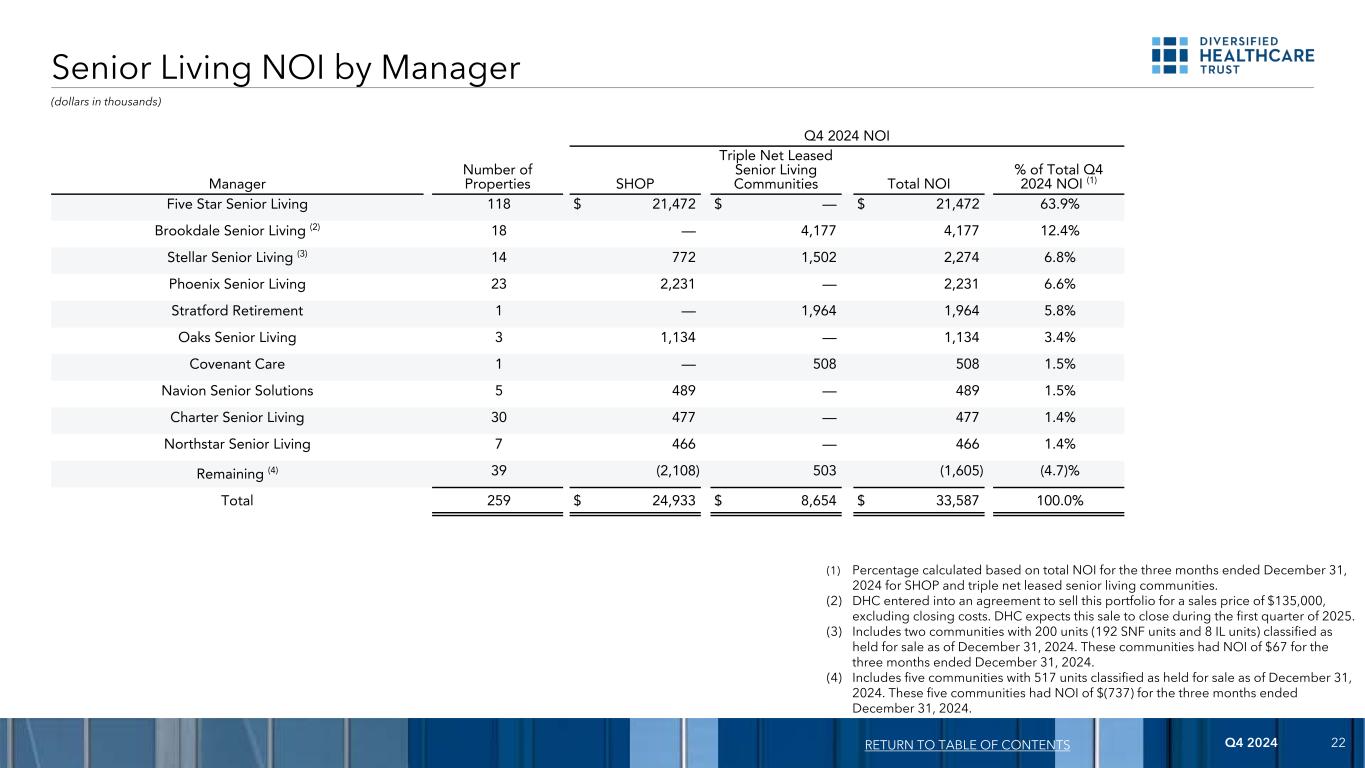

Q4 2024 22 Senior Living NOI by Manager RETURN TO TABLE OF CONTENTS Q4 2024 NOI Manager Number of Properties SHOP Triple Net Leased Senior Living Communities Total NOI % of Total Q4 2024 NOI (1) Five Star Senior Living 118 $ 21,472 $ — $ 21,472 63.9% Brookdale Senior Living (2) 18 — 4,177 4,177 12.4% Stellar Senior Living (3) 14 772 1,502 2,274 6.8% Phoenix Senior Living 23 2,231 — 2,231 6.6% Stratford Retirement 1 — 1,964 1,964 5.8% Oaks Senior Living 3 1,134 — 1,134 3.4% Covenant Care 1 — 508 508 1.5% Navion Senior Solutions 5 489 — 489 1.5% Charter Senior Living 30 477 — 477 1.4% Northstar Senior Living 7 466 — 466 1.4% Remaining (4) 39 (2,108) 503 (1,605) (4.7)% Total 259 $ 24,933 $ 8,654 $ 33,587 100.0% (1) Percentage calculated based on total NOI for the three months ended December 31, 2024 for SHOP and triple net leased senior living communities. (2) DHC entered into an agreement to sell this portfolio for a sales price of $135,000, excluding closing costs. DHC expects this sale to close during the first quarter of 2025. (3) Includes two communities with 200 units (192 SNF units and 8 IL units) classified as held for sale as of December 31, 2024. These communities had NOI of $67 for the three months ended December 31, 2024. (4) Includes five communities with 517 units classified as held for sale as of December 31, 2024. These five communities had NOI of $(737) for the three months ended December 31, 2024. (dollars in thousands)

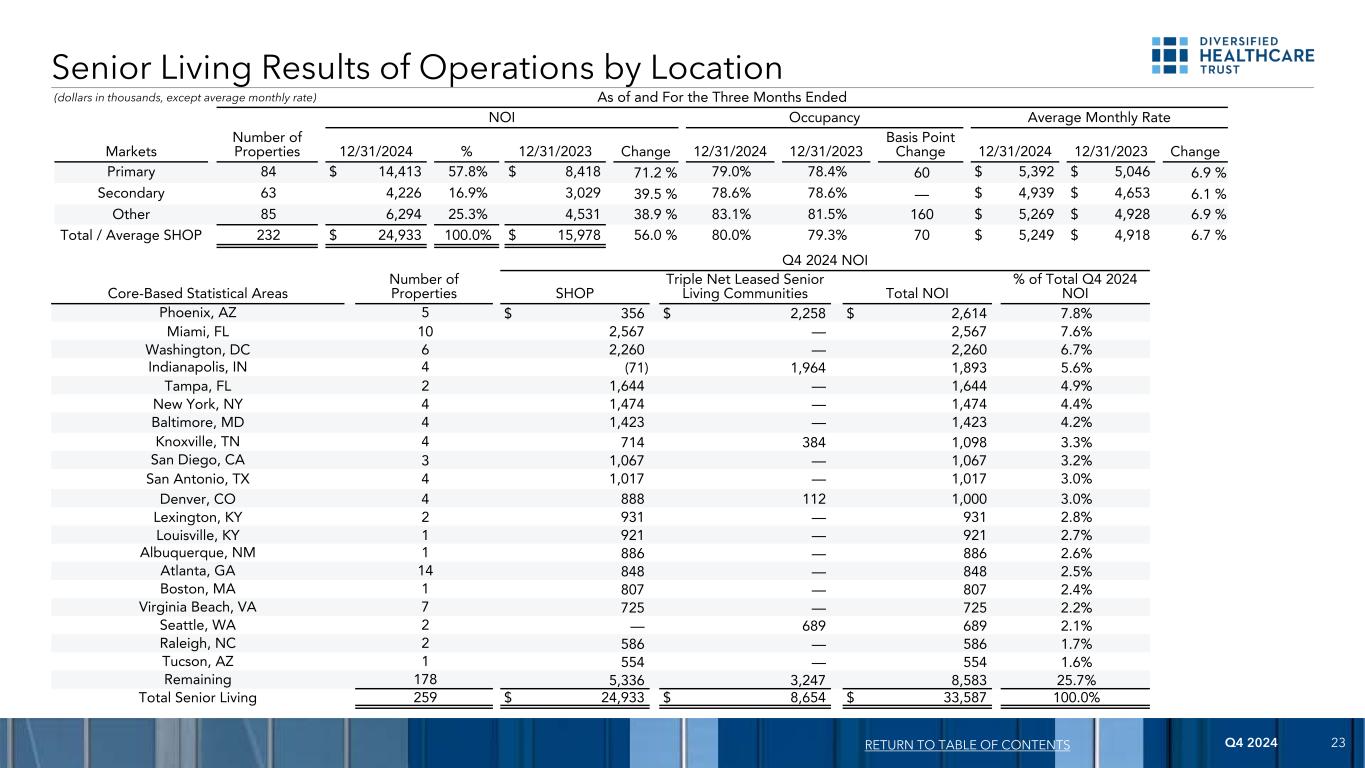

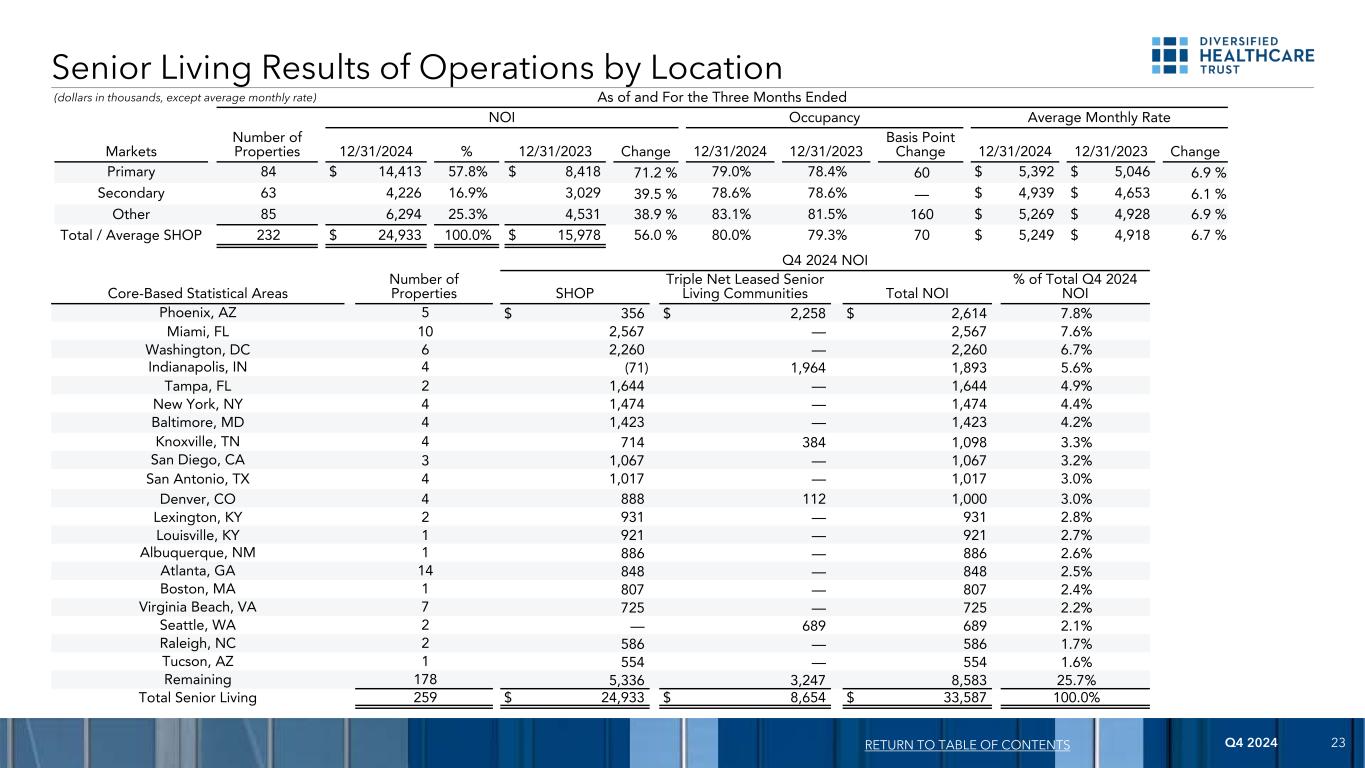

Q4 2024 23 Senior Living Results of Operations by Location RETURN TO TABLE OF CONTENTS Q4 2024 NOI Core-Based Statistical Areas Number of Properties SHOP Triple Net Leased Senior Living Communities Total NOI % of Total Q4 2024 NOI Phoenix, AZ 5 $ 356 $ 2,258 $ 2,614 7.8% Miami, FL 10 2,567 — 2,567 7.6% Washington, DC 6 2,260 — 2,260 6.7% Indianapolis, IN 4 (71) 1,964 1,893 5.6% Tampa, FL 2 1,644 — 1,644 4.9% New York, NY 4 1,474 — 1,474 4.4% Baltimore, MD 4 1,423 — 1,423 4.2% Knoxville, TN 4 714 384 1,098 3.3% San Diego, CA 3 1,067 — 1,067 3.2% San Antonio, TX 4 1,017 — 1,017 3.0% Denver, CO 4 888 112 1,000 3.0% Lexington, KY 2 931 — 931 2.8% Louisville, KY 1 921 — 921 2.7% Albuquerque, NM 1 886 — 886 2.6% Atlanta, GA 14 848 — 848 2.5% Boston, MA 1 807 — 807 2.4% Virginia Beach, VA 7 725 — 725 2.2% Seattle, WA 2 — 689 689 2.1% Raleigh, NC 2 586 — 586 1.7% Tucson, AZ 1 554 — 554 1.6% Remaining 178 5,336 3,247 8,583 25.7% Total Senior Living 259 $ 24,933 $ 8,654 $ 33,587 100.0% As of and For the Three Months Ended NOI Occupancy Average Monthly Rate Markets Number of Properties 12/31/2024 % 12/31/2023 Change 12/31/2024 12/31/2023 Basis Point Change 12/31/2024 12/31/2023 Change Primary 84 $ 14,413 57.8% $ 8,418 71.2 % 79.0% 78.4% 60 $ 5,392 $ 5,046 6.9 % Secondary 63 4,226 16.9% 3,029 39.5 % 78.6% 78.6% — $ 4,939 $ 4,653 6.1 % Other 85 6,294 25.3% 4,531 38.9 % 83.1% 81.5% 160 $ 5,269 $ 4,928 6.9 % Total / Average SHOP 232 $ 24,933 100.0% $ 15,978 56.0 % 80.0% 79.3% 70 $ 5,249 $ 4,918 6.7 % (dollars in thousands, except average monthly rate)

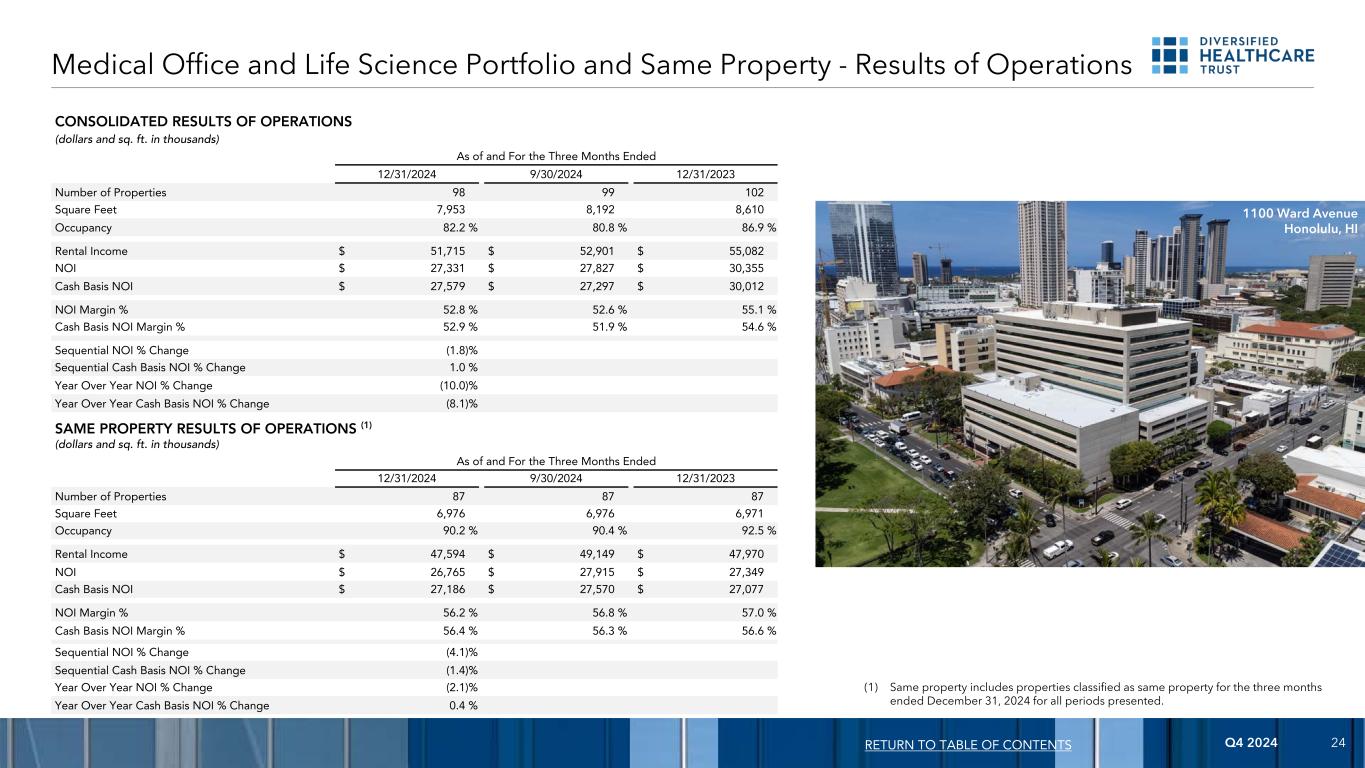

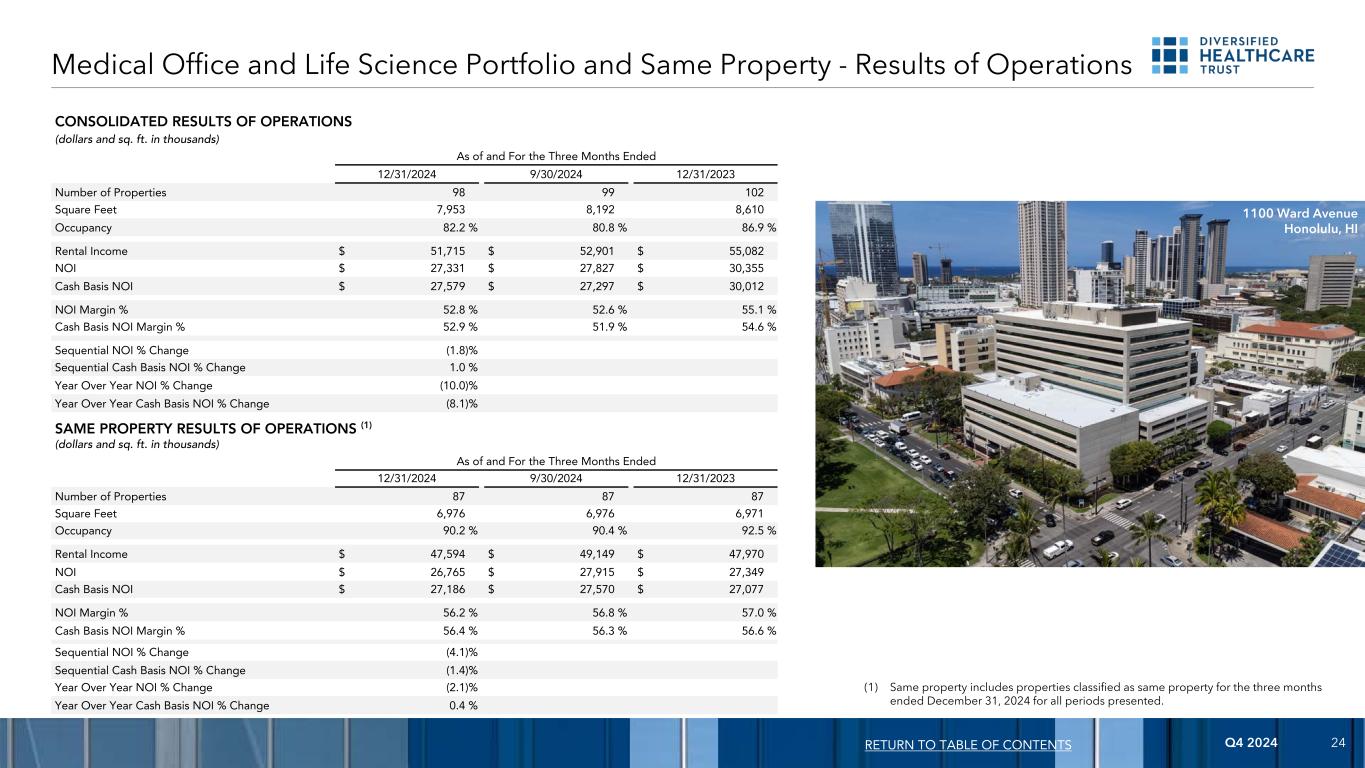

Q4 2024 24 (1) Same property includes properties classified as same property for the three months ended December 31, 2024 for all periods presented. RETURN TO TABLE OF CONTENTS CONSOLIDATED RESULTS OF OPERATIONS (dollars and sq. ft. in thousands) As of and For the Three Months Ended 12/31/2024 9/30/2024 12/31/2023 Number of Properties 98 99 102 Square Feet 7,953 8,192 8,610 Occupancy 82.2 % 80.8 % 86.9 % Rental Income $ 51,715 $ 52,901 $ 55,082 NOI $ 27,331 $ 27,827 $ 30,355 Cash Basis NOI $ 27,579 $ 27,297 $ 30,012 NOI Margin % 52.8 % 52.6 % 55.1 % Cash Basis NOI Margin % 52.9 % 51.9 % 54.6 % Sequential NOI % Change (1.8) % Sequential Cash Basis NOI % Change 1.0 % Year Over Year NOI % Change (10.0) % Year Over Year Cash Basis NOI % Change (8.1) % SAME PROPERTY RESULTS OF OPERATIONS (1) (dollars and sq. ft. in thousands) As of and For the Three Months Ended 12/31/2024 9/30/2024 12/31/2023 Number of Properties 87 87 87 Square Feet 6,976 6,976 6,971 Occupancy 90.2 % 90.4 % 92.5 % Rental Income $ 47,594 $ 49,149 $ 47,970 NOI $ 26,765 $ 27,915 $ 27,349 Cash Basis NOI $ 27,186 $ 27,570 $ 27,077 NOI Margin % 56.2 % 56.8 % 57.0 % Cash Basis NOI Margin % 56.4 % 56.3 % 56.6 % Sequential NOI % Change (4.1) % Sequential Cash Basis NOI % Change (1.4) % Year Over Year NOI % Change (2.1) % Year Over Year Cash Basis NOI % Change 0.4 % Medical Office and Life Science Portfolio and Same Property - Results of Operations 1100 Ward Avenue Honolulu, HI

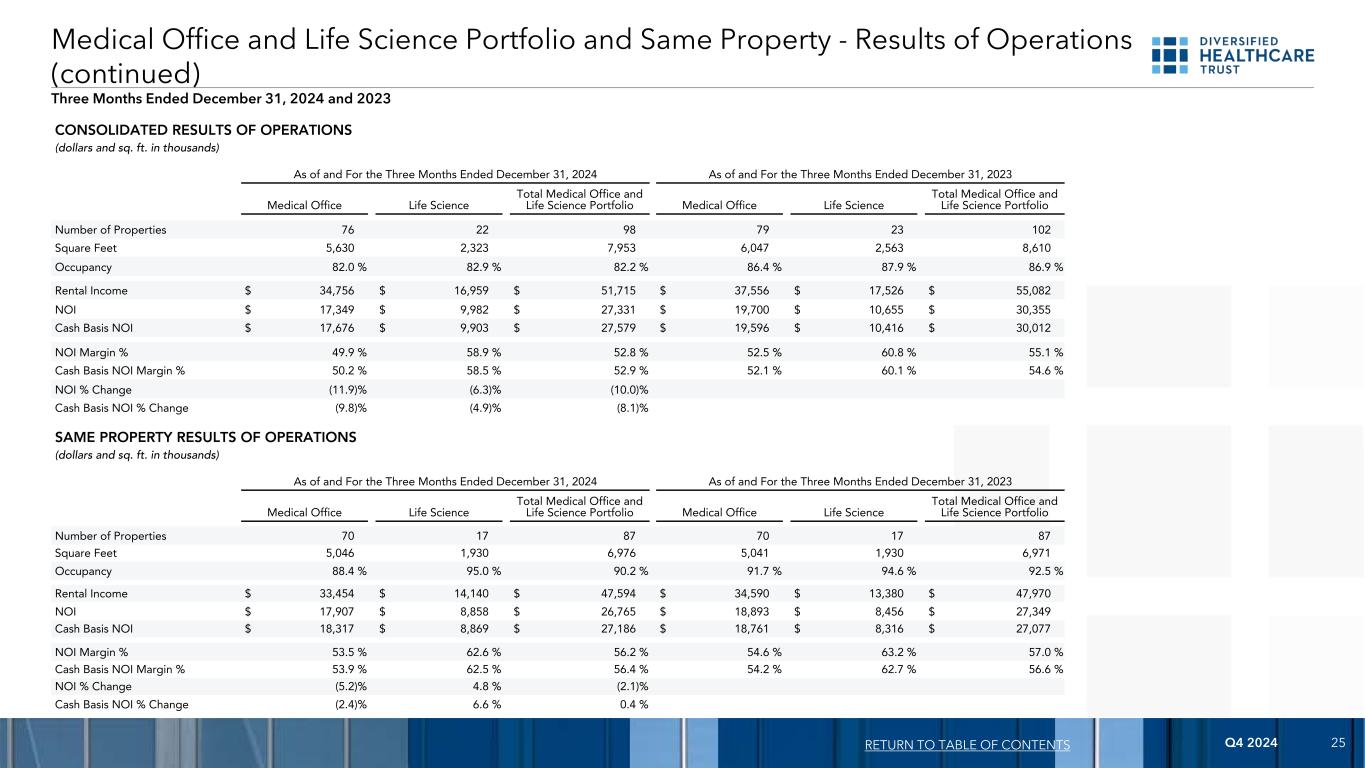

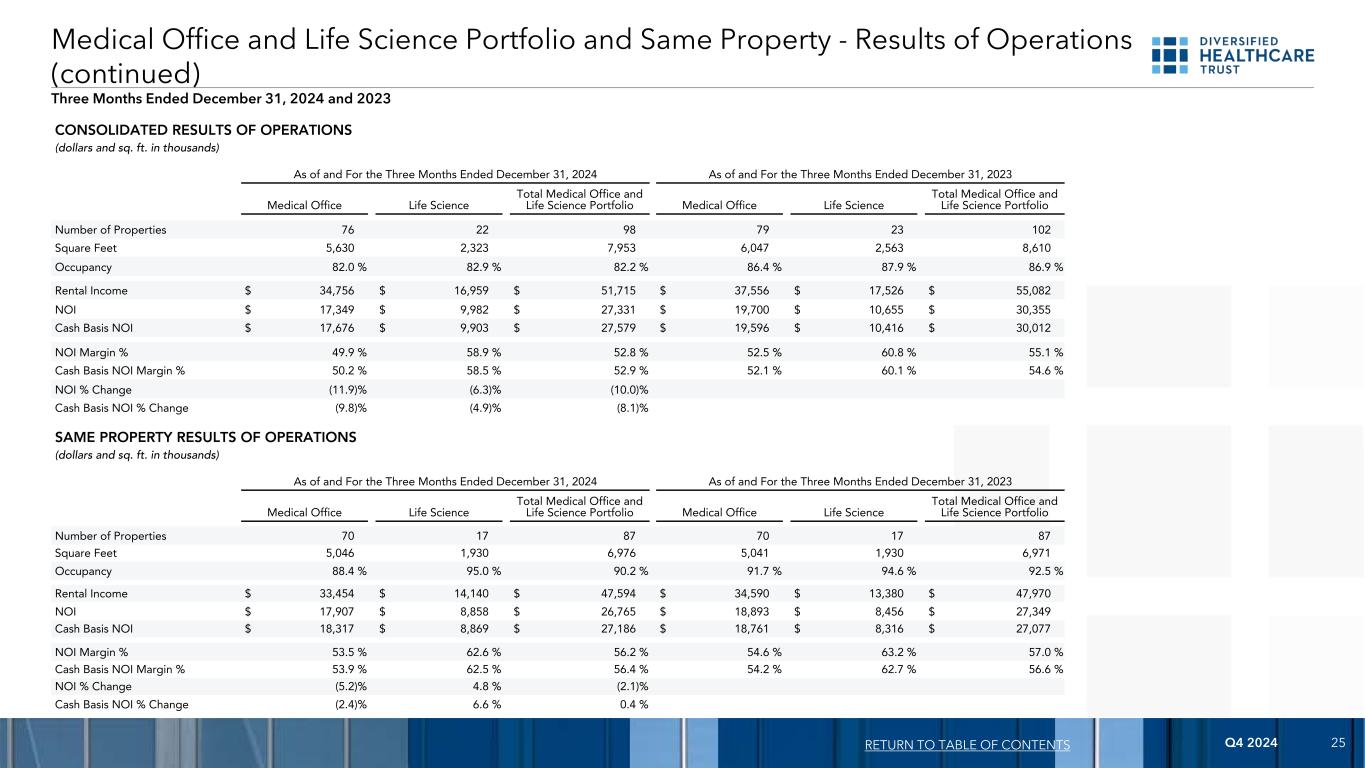

Q4 2024 25RETURN TO TABLE OF CONTENTS CONSOLIDATED RESULTS OF OPERATIONS (dollars and sq. ft. in thousands) As of and For the Three Months Ended December 31, 2024 As of and For the Three Months Ended December 31, 2023 Medical Office Life Science Total Medical Office and Life Science Portfolio Medical Office Life Science Total Medical Office and Life Science Portfolio Number of Properties 76 22 98 79 23 102 Square Feet 5,630 2,323 7,953 6,047 2,563 8,610 Occupancy 82.0 % 82.9 % 82.2 % 86.4 % 87.9 % 86.9 % Rental Income $ 34,756 $ 16,959 $ 51,715 $ 37,556 $ 17,526 $ 55,082 NOI $ 17,349 $ 9,982 $ 27,331 $ 19,700 $ 10,655 $ 30,355 Cash Basis NOI $ 17,676 $ 9,903 $ 27,579 $ 19,596 $ 10,416 $ 30,012 NOI Margin % 49.9 % 58.9 % 52.8 % 52.5 % 60.8 % 55.1 % Cash Basis NOI Margin % 50.2 % 58.5 % 52.9 % 52.1 % 60.1 % 54.6 % NOI % Change (11.9) % (6.3) % (10.0) % Cash Basis NOI % Change (9.8) % (4.9) % (8.1) % SAME PROPERTY RESULTS OF OPERATIONS (dollars and sq. ft. in thousands) As of and For the Three Months Ended December 31, 2024 As of and For the Three Months Ended December 31, 2023 Medical Office Life Science Total Medical Office and Life Science Portfolio Medical Office Life Science Total Medical Office and Life Science Portfolio Number of Properties 70 17 87 70 17 87 Square Feet 5,046 1,930 6,976 5,041 1,930 6,971 Occupancy 88.4 % 95.0 % 90.2 % 91.7 % 94.6 % 92.5 % Rental Income $ 33,454 $ 14,140 $ 47,594 $ 34,590 $ 13,380 $ 47,970 NOI $ 17,907 $ 8,858 $ 26,765 $ 18,893 $ 8,456 $ 27,349 Cash Basis NOI $ 18,317 $ 8,869 $ 27,186 $ 18,761 $ 8,316 $ 27,077 NOI Margin % 53.5 % 62.6 % 56.2 % 54.6 % 63.2 % 57.0 % Cash Basis NOI Margin % 53.9 % 62.5 % 56.4 % 54.2 % 62.7 % 56.6 % NOI % Change (5.2) % 4.8 % (2.1) % Cash Basis NOI % Change (2.4) % 6.6 % 0.4 % Medical Office and Life Science Portfolio and Same Property - Results of Operations (continued) Three Months Ended December 31, 2024 and 2023

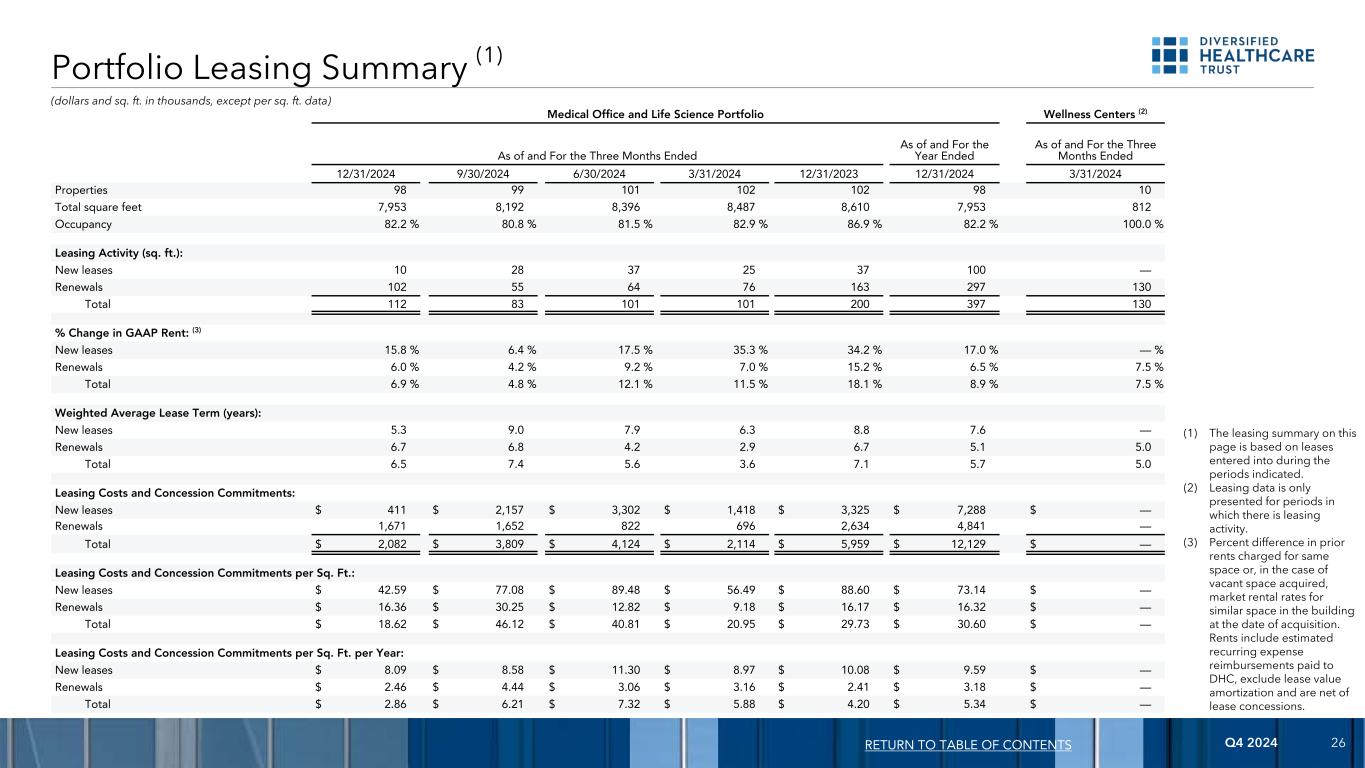

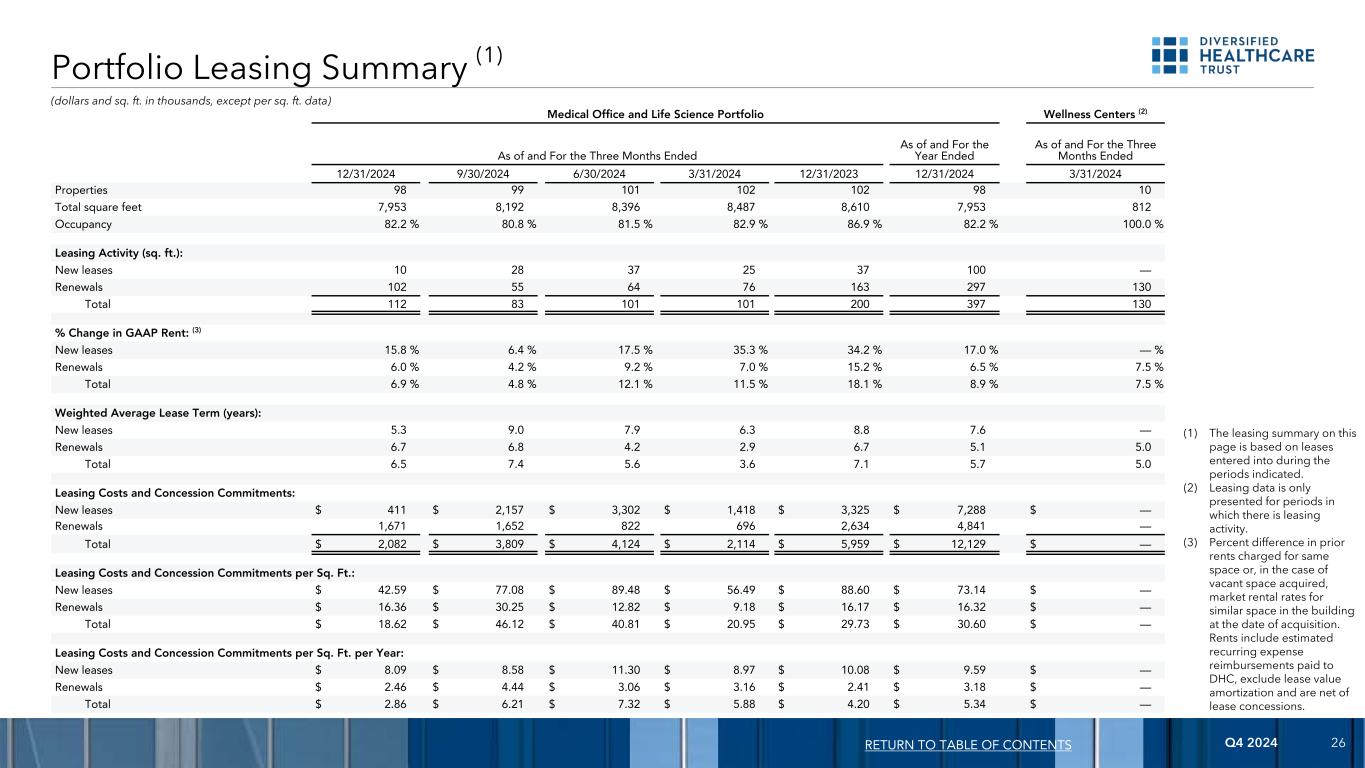

Q4 2024 26 Portfolio Leasing Summary (1) (1) The leasing summary on this page is based on leases entered into during the periods indicated. (2) Leasing data is only presented for periods in which there is leasing activity. (3) Percent difference in prior rents charged for same space or, in the case of vacant space acquired, market rental rates for similar space in the building at the date of acquisition. Rents include estimated recurring expense reimbursements paid to DHC, exclude lease value amortization and are net of lease concessions. RETURN TO TABLE OF CONTENTS Medical Office and Life Science Portfolio Wellness Centers (2) As of and For the Three Months Ended As of and For the Year Ended As of and For the Three Months Ended 12/31/2024 9/30/2024 6/30/2024 3/31/2024 12/31/2023 12/31/2024 3/31/2024 Properties 98 99 101 102 102 98 10 Total square feet 7,953 8,192 8,396 8,487 8,610 7,953 812 Occupancy 82.2 % 80.8 % 81.5 % 82.9 % 86.9 % 82.2 % 100.0 % Leasing Activity (sq. ft.): New leases 10 28 37 25 37 100 — Renewals 102 55 64 76 163 297 130 Total 112 83 101 101 200 397 130 % Change in GAAP Rent: (3) New leases 15.8 % 6.4 % 17.5 % 35.3 % 34.2 % 17.0 % — % Renewals 6.0 % 4.2 % 9.2 % 7.0 % 15.2 % 6.5 % 7.5 % Total 6.9 % 4.8 % 12.1 % 11.5 % 18.1 % 8.9 % 7.5 % Weighted Average Lease Term (years): New leases 5.3 9.0 7.9 6.3 8.8 7.6 — Renewals 6.7 6.8 4.2 2.9 6.7 5.1 5.0 Total 6.5 7.4 5.6 3.6 7.1 5.7 5.0 Leasing Costs and Concession Commitments: New leases $ 411 $ 2,157 $ 3,302 $ 1,418 $ 3,325 $ 7,288 $ — Renewals 1,671 1,652 822 696 2,634 4,841 — Total $ 2,082 $ 3,809 $ 4,124 $ 2,114 $ 5,959 $ 12,129 $ — Leasing Costs and Concession Commitments per Sq. Ft.: New leases $ 42.59 $ 77.08 $ 89.48 $ 56.49 $ 88.60 $ 73.14 $ — Renewals $ 16.36 $ 30.25 $ 12.82 $ 9.18 $ 16.17 $ 16.32 $ — Total $ 18.62 $ 46.12 $ 40.81 $ 20.95 $ 29.73 $ 30.60 $ — Leasing Costs and Concession Commitments per Sq. Ft. per Year: New leases $ 8.09 $ 8.58 $ 11.30 $ 8.97 $ 10.08 $ 9.59 $ — Renewals $ 2.46 $ 4.44 $ 3.06 $ 3.16 $ 2.41 $ 3.18 $ — Total $ 2.86 $ 6.21 $ 7.32 $ 5.88 $ 4.20 $ 5.34 $ — (dollars and sq. ft. in thousands, except per sq. ft. data)

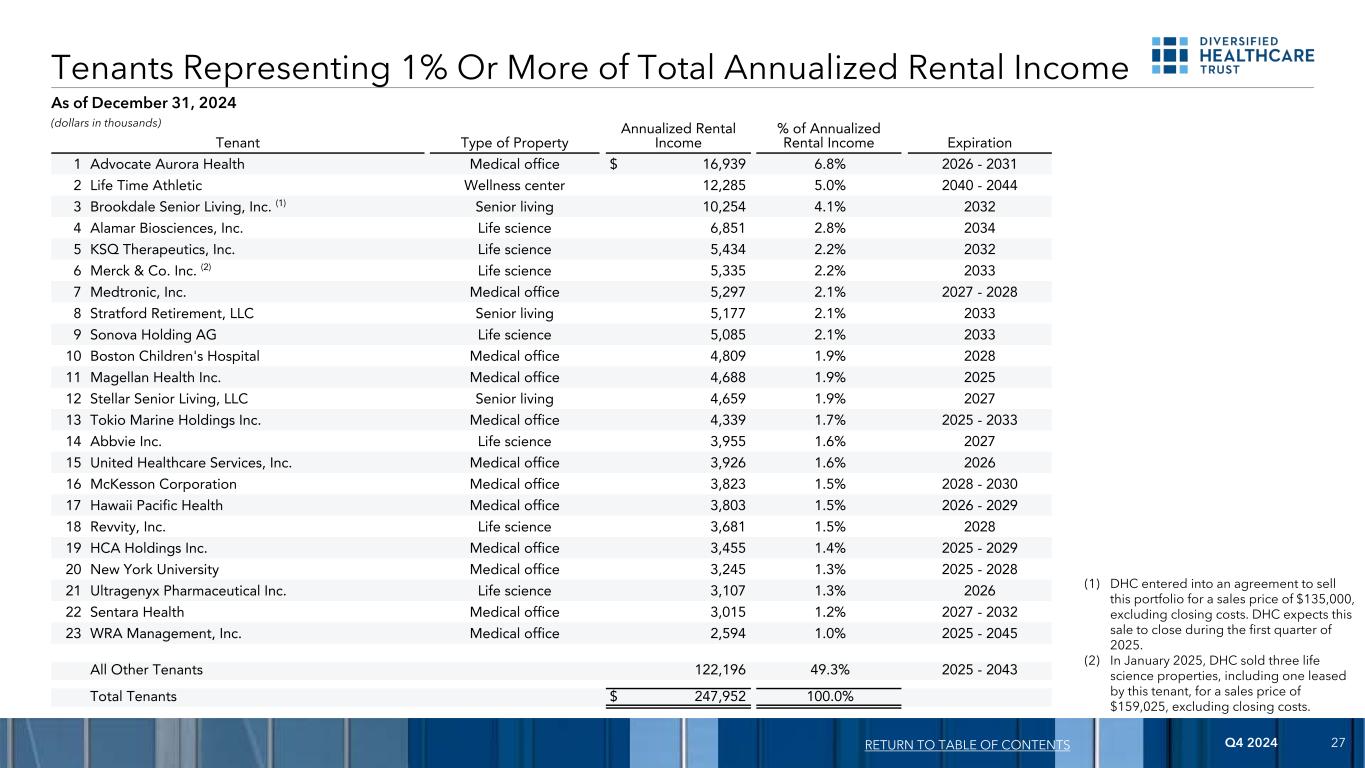

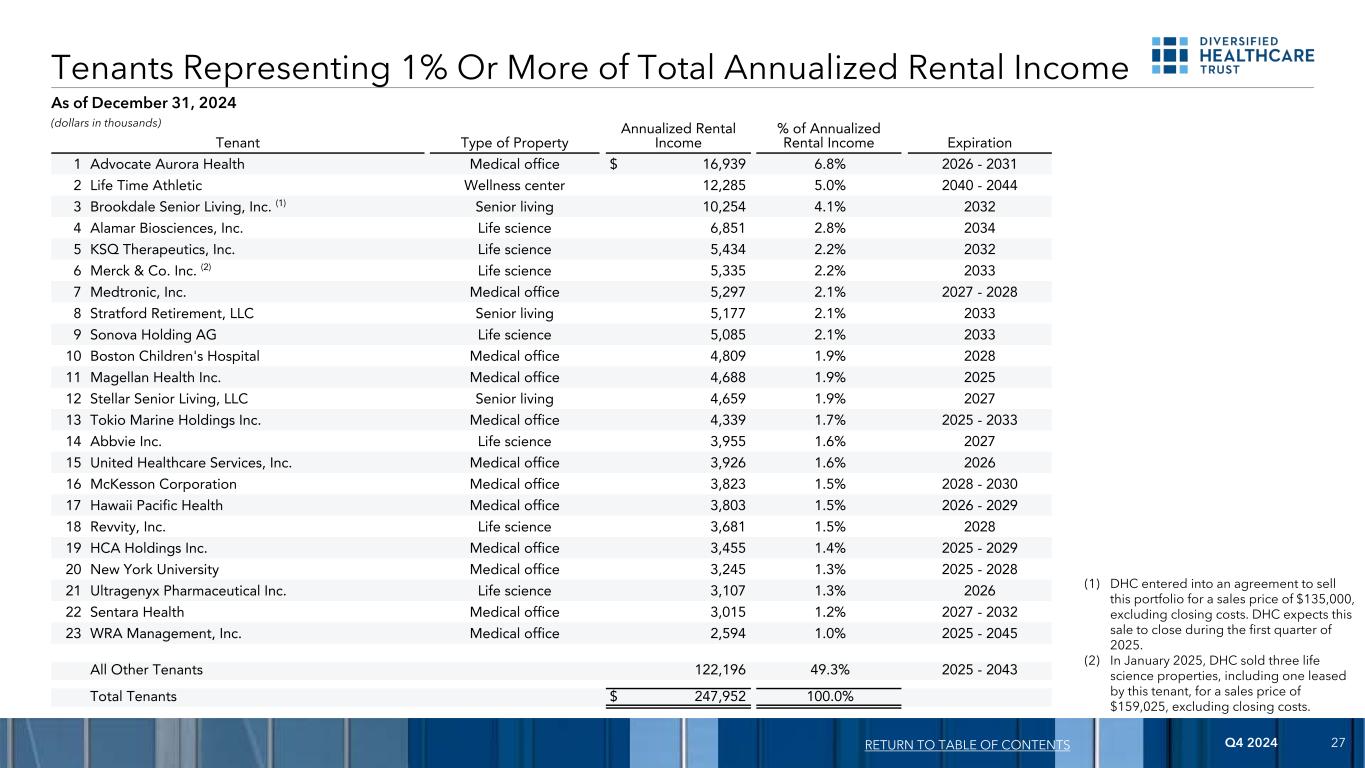

Q4 2024 27 As of December 31, 2024 Tenants Representing 1% Or More of Total Annualized Rental Income RETURN TO TABLE OF CONTENTS (dollars in thousands) Tenant Type of Property Annualized Rental Income % of Annualized Rental Income Expiration 1 Advocate Aurora Health Medical office $ 16,939 6.8% 2026 - 2031 2 Life Time Athletic Wellness center 12,285 5.0% 2040 - 2044 3 Brookdale Senior Living, Inc. (1) Senior living 10,254 4.1% 2032 4 Alamar Biosciences, Inc. Life science 6,851 2.8% 2034 5 KSQ Therapeutics, Inc. Life science 5,434 2.2% 2032 6 Merck & Co. Inc. (2) Life science 5,335 2.2% 2033 7 Medtronic, Inc. Medical office 5,297 2.1% 2027 - 2028 8 Stratford Retirement, LLC Senior living 5,177 2.1% 2033 9 Sonova Holding AG Life science 5,085 2.1% 2033 10 Boston Children's Hospital Medical office 4,809 1.9% 2028 11 Magellan Health Inc. Medical office 4,688 1.9% 2025 12 Stellar Senior Living, LLC Senior living 4,659 1.9% 2027 13 Tokio Marine Holdings Inc. Medical office 4,339 1.7% 2025 - 2033 14 Abbvie Inc. Life science 3,955 1.6% 2027 15 United Healthcare Services, Inc. Medical office 3,926 1.6% 2026 16 McKesson Corporation Medical office 3,823 1.5% 2028 - 2030 17 Hawaii Pacific Health Medical office 3,803 1.5% 2026 - 2029 18 Revvity, Inc. Life science 3,681 1.5% 2028 19 HCA Holdings Inc. Medical office 3,455 1.4% 2025 - 2029 20 New York University Medical office 3,245 1.3% 2025 - 2028 21 Ultragenyx Pharmaceutical Inc. Life science 3,107 1.3% 2026 22 Sentara Health Medical office 3,015 1.2% 2027 - 2032 23 WRA Management, Inc. Medical office 2,594 1.0% 2025 - 2045 All Other Tenants 122,196 49.3% 2025 - 2043 Total Tenants $ 247,952 100.0% (1) DHC entered into an agreement to sell this portfolio for a sales price of $135,000, excluding closing costs. DHC expects this sale to close during the first quarter of 2025. (2) In January 2025, DHC sold three life science properties, including one leased by this tenant, for a sales price of $159,025, excluding closing costs.

Q4 2024 28 Medical Office and Life Science Portfolio Lease Expiration Schedule RETURN TO TABLE OF CONTENTS (dollars in thousands) As of December 31, 2024 Annualized Rental Income Expiring (1) Year Annualized Rental Income Expiring % of Total Annualized Rental Income Expiring Cumulative % of Total Annualized Rental Income Expiring 2025 $ 16,431 7.9% 7.9% 2026 22,215 10.7% 18.6% 2027 22,564 10.8% 29.4% 2028 35,184 16.9% 46.3% 2029 18,770 9.0% 55.3% 2030 10,629 5.1% 60.4% 2031 25,413 12.2% 72.6% 2032 13,849 6.7% 79.3% 2033 20,174 9.7% 89.0% 2034 and thereafter 22,972 11.0% 100.0% Total $ 208,201 100.0% Average remaining lease term (weighted by annualized rental income): 5.2 years Square Feet with Leases Expiring (1) Year Leased Square Feet Expiring % of Total Leased Square Feet Expiring Cumulative % of Total Leased Square Feet Expiring 2025 574,073 8.8% 8.8% 2026 689,307 10.5% 19.3% 2027 895,918 13.7% 33.0% 2028 1,175,592 18.0% 51.0% 2029 636,587 9.7% 60.7% 2030 375,124 5.7% 66.4% 2031 835,058 12.8% 79.2% 2032 358,303 5.5% 84.7% 2033 416,410 6.4% 91.1% 2034 and thereafter 582,700 8.9% 100.0% Total 6,539,072 100.0% 4 Maguire Road Lexington, MA (1) Excludes leases that expired on December 31, 2024.

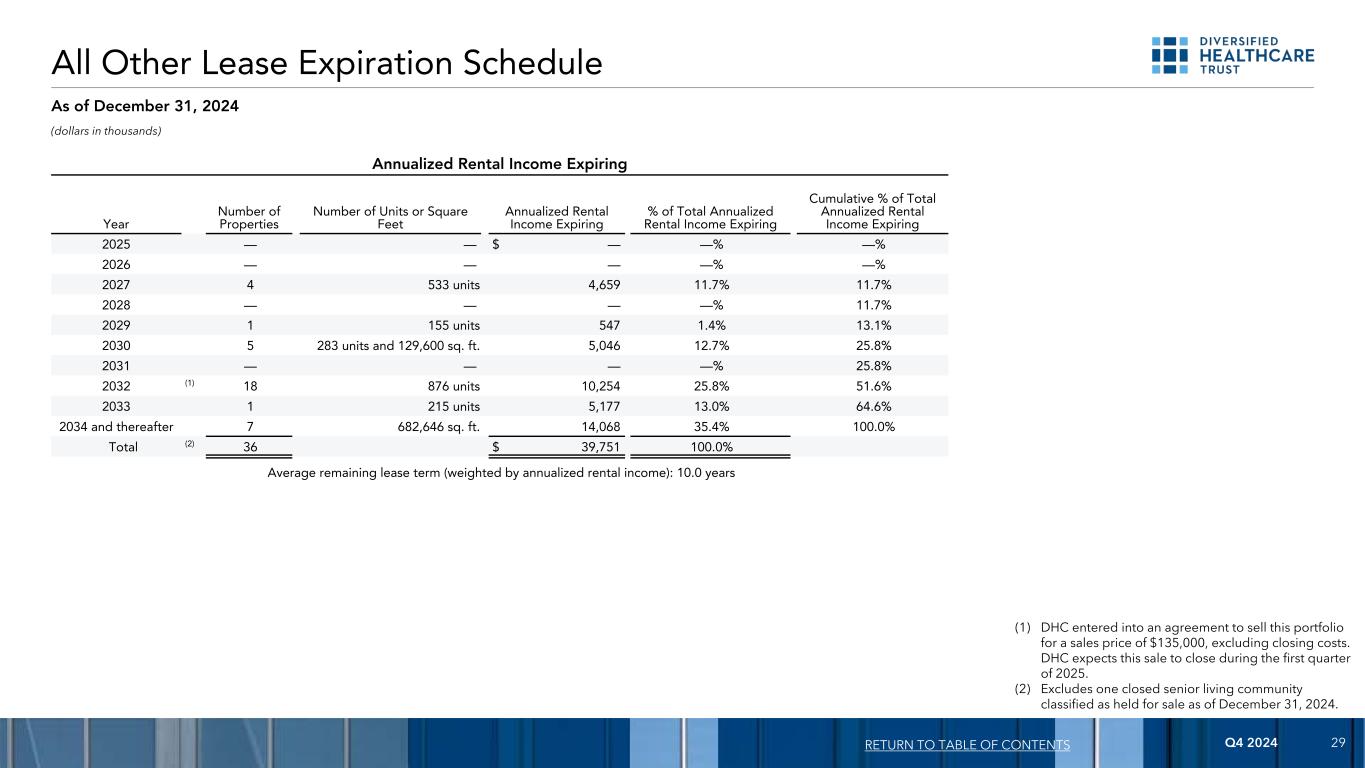

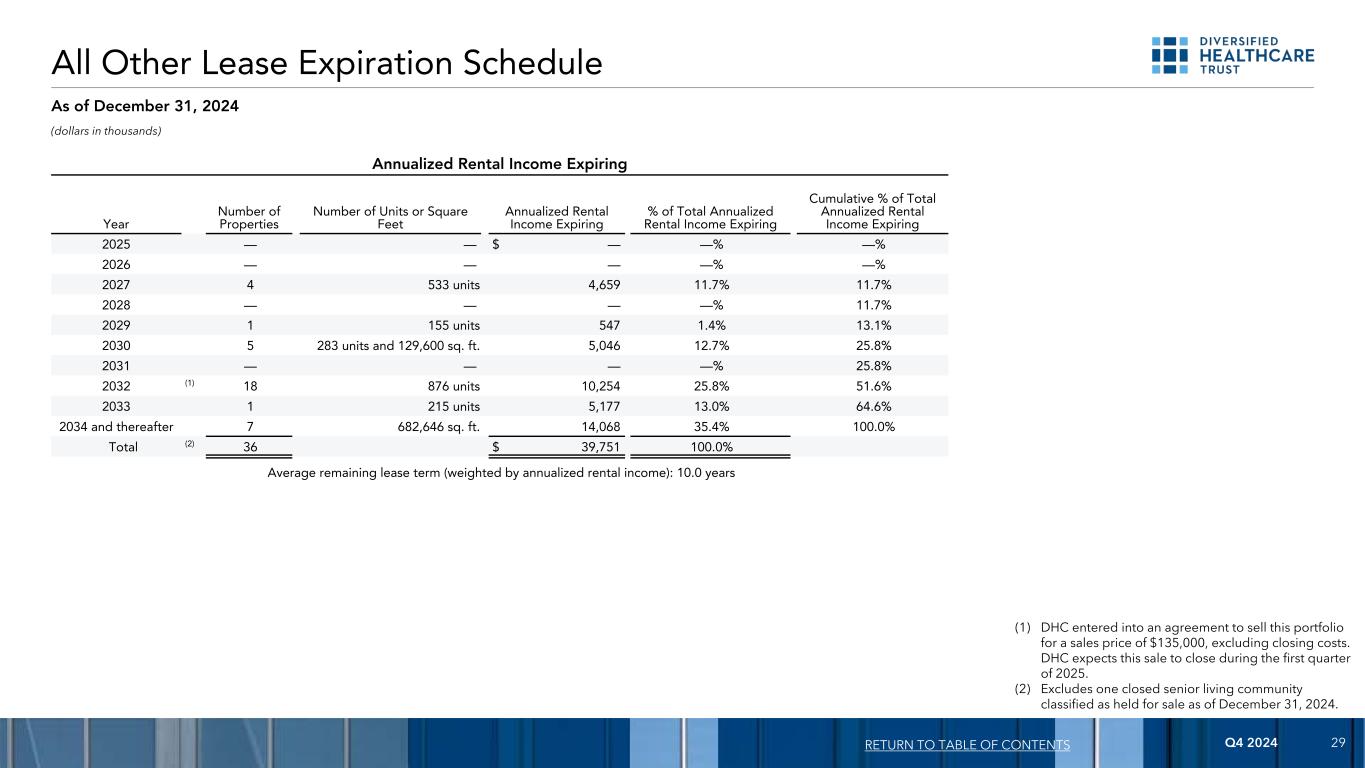

Q4 2024 29 Annualized Rental Income Expiring Year Number of Properties Number of Units or Square Feet Annualized Rental Income Expiring % of Total Annualized Rental Income Expiring Cumulative % of Total Annualized Rental Income Expiring 2025 — — $ — —% —% 2026 — — — —% —% 2027 4 533 units 4,659 11.7% 11.7% 2028 — — — —% 11.7% 2029 1 155 units 547 1.4% 13.1% 2030 5 283 units and 129,600 sq. ft. 5,046 12.7% 25.8% 2031 — — — —% 25.8% 2032 (1) 18 876 units 10,254 25.8% 51.6% 2033 1 215 units 5,177 13.0% 64.6% 2034 and thereafter 7 682,646 sq. ft. 14,068 35.4% 100.0% Total (2) 36 $ 39,751 100.0% Average remaining lease term (weighted by annualized rental income): 10.0 years All Other Lease Expiration Schedule As of December 31, 2024 RETURN TO TABLE OF CONTENTS (1) DHC entered into an agreement to sell this portfolio for a sales price of $135,000, excluding closing costs. DHC expects this sale to close during the first quarter of 2025. (2) Excludes one closed senior living community classified as held for sale as of December 31, 2024. (dollars in thousands)

Q4 2024 30 The Company: DHC is a REIT focused on owning high-quality healthcare properties located throughout the United States. DHC seeks diversification across the health services spectrum by care delivery and practice type, by scientific research disciplines and by property type and location. As of December 31, 2024, DHC’s approximately $7.2 billion portfolio included 367 properties in 36 states and Washington, D.C., occupied by approximately 450 tenants, and totaling approximately 8.0 million square feet of medical office and life science properties and more than 27,000 senior living units. Management: DHC is managed by The RMR Group (Nasdaq: RMR). RMR is an alternative asset management company that is focused on commercial real estate and related businesses. RMR primarily provides management services to publicly traded real estate companies, privately held real estate funds and real estate related operating businesses. As of December 31, 2024, RMR had over $40 billion of real estate assets under management and the combined RMR managed companies had more than $5 billion of annual revenues, approximately 2,000 properties and over 18,000 employees. DHC believes that being managed by RMR is a competitive advantage for DHC because of RMR’s depth of management and experience in the real estate industry. DHC also believes RMR provides management services to it at costs that are lower than DHC would have to pay for similar quality services if DHC were self- managed. Company Profile and Research Coverage RETURN TO TABLE OF CONTENTS Equity Research Coverage JMP Securities RBC Capital Markets Aaron Hecht Michael Carroll (415) 835-3963 (440) 715-2649 ahecht@jmpsecurities.com michael.carroll@rbccm.com Rating Agencies and Issuer Ratings Moody’s Investors Service S & P Global Christian Azzi Alan Zigman (212) 553-9342 (416) 507-2556 christian.azzi@moodys.com alan.zigman@spglobal.com DHC is followed by the equity research analysts and its publicly held debt is rated by the rating agencies listed on this page. Please note that any opinions, estimates or forecasts regarding DHC's performance made by these analysts or agencies do not represent opinions, forecasts or predictions of DHC or its management. DHC does not by its reference on this page imply its endorsement of or concurrence with any information, conclusions or recommendations provided by any of these analysts or agencies.

Q4 2024 31 Board of Trustees Christopher J. Bilotto John L. Harrington Managing Trustee Independent Trustee Lisa Harris Jones Phyllis M. Hollis Lead Independent Trustee Independent Trustee Dawn K. Neher Adam D. Portnoy Independent Trustee Chair of the Board & Managing Trustee Jeffrey P. Somers Independent Trustee Executive Officers Christopher J. Bilotto Matthew C. Brown President and Chief Executive Officer Chief Financial Officer and Treasurer Anthony Paula Vice President Governance Information RETURN TO TABLE OF CONTENTS Five Star Residences of Dayton Place 1950 South Dayton Street Aurora, CO

Q4 2024 32 Calculation and Reconciliation of NOI and Cash Basis NOI (dollars in thousands) RETURN TO TABLE OF CONTENTS For the Three Months Ended For the Year Ended 12/31/2024 9/30/2024 6/30/2024 3/31/2024 12/31/2023 12/31/2024 12/31/2023 Calculation of NOI and Cash Basis NOI: Revenues: Rental income $ 63,883 $ 61,635 $ 62,870 $ 62,650 $ 67,199 $ 251,038 $ 258,400 Residents fees and services 315,736 312,005 308,522 308,126 294,336 1,244,389 1,151,908 Total revenues 379,619 373,640 371,392 370,776 361,535 1,495,427 1,410,308 Property operating expenses (315,176) (309,697) (304,065) (307,604) (303,411) (1,236,542) (1,174,151) NOI 64,443 63,943 67,327 63,172 58,124 258,885 236,157 Non-cash straight line rent adjustments included in rental income 160 (658) (656) (291) (238) (1,445) 1,095 Lease value amortization included in rental income 22 27 29 28 22 106 (242) Lease termination fees included in rental income — — — (203) (419) (203) (3,319) Non-cash amortization included in property operating expenses (201) (199) (199) (199) (201) (798) (798) Cash Basis NOI $ 64,424 $ 63,113 $ 66,501 $ 62,507 $ 57,288 $ 256,545 $ 232,893 Reconciliation of Net Loss to NOI and Cash Basis NOI: Net loss $ (87,446) $ (98,689) $ (97,861) $ (86,259) $ (102,564) $ (370,255) $ (293,572) Equity in net (earnings) losses of investees (11,479) (527) 12,307 (1,898) 22,598 (1,597) 20,461 Income tax (benefit) expense (38) 148 170 187 66 467 445 Loss on modification or early extinguishment of debt 115 — 209 — 1,393 324 2,468 Interest expense 59,518 59,443 58,702 57,576 48,853 235,239 191,775 Interest and other income (1,735) (2,575) (2,403) (2,237) (2,964) (8,950) (15,536) Gains on equity investments, net — — — — — — (8,126) (Gain) loss on sale of properties (38) (111) 13,213 5,874 28 18,938 (1,205) Impairment of assets 29,016 23,031 6,545 12,142 — 70,734 18,380 Acquisition and certain other transaction related costs 267 331 1,826 86 1,041 2,510 10,853 General and administrative (1,245) 13,933 6,262 7,568 6,020 26,518 26,131 Depreciation and amortization 77,508 68,959 68,357 70,133 83,653 284,957 284,083 NOI 64,443 63,943 67,327 63,172 58,124 258,885 236,157 Non-cash straight line rent adjustments included in rental income 160 (658) (656) (291) (238) (1,445) 1,095 Lease value amortization included in rental income 22 27 29 28 22 106 (242) Lease termination fees included in rental income — — — (203) (419) (203) (3,319) Non-cash amortization included in property operating expenses (201) (199) (199) (199) (201) (798) (798) Cash Basis NOI $ 64,424 $ 63,113 $ 66,501 $ 62,507 $ 57,288 $ 256,545 $ 232,893

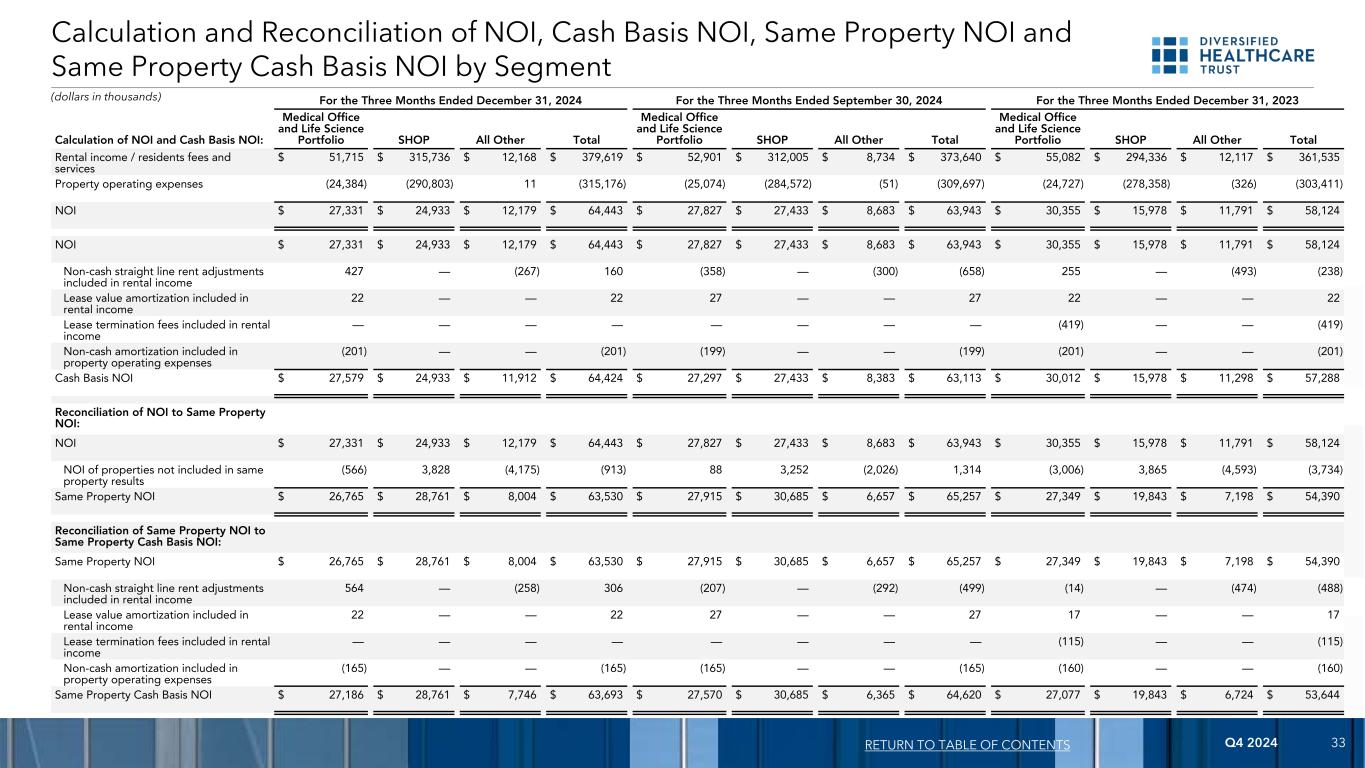

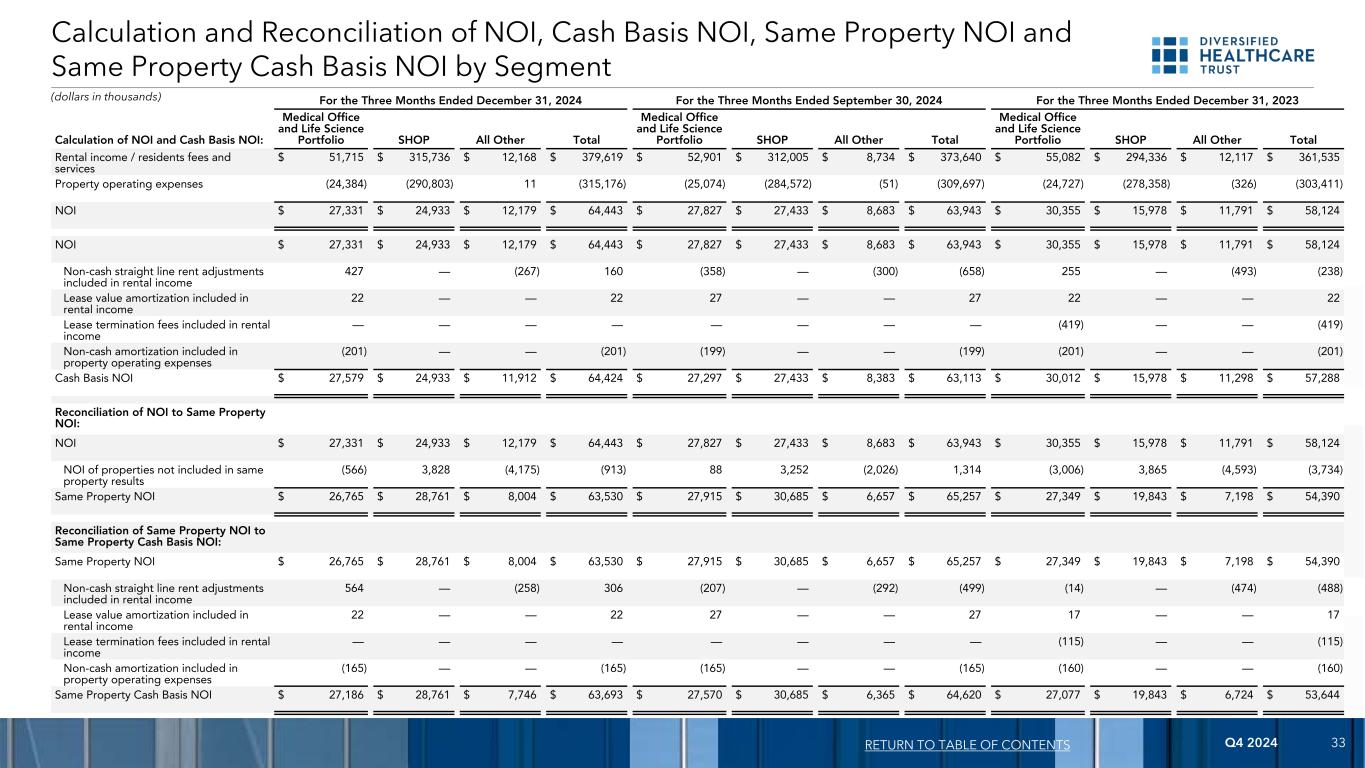

Q4 2024 33 Calculation and Reconciliation of NOI, Cash Basis NOI, Same Property NOI and Same Property Cash Basis NOI by Segment RETURN TO TABLE OF CONTENTS (dollars in thousands) For the Three Months Ended December 31, 2024 For the Three Months Ended September 30, 2024 For the Three Months Ended December 31, 2023 Calculation of NOI and Cash Basis NOI: Medical Office and Life Science Portfolio SHOP All Other Total Medical Office and Life Science Portfolio SHOP All Other Total Medical Office and Life Science Portfolio SHOP All Other Total Rental income / residents fees and services $ 51,715 $ 315,736 $ 12,168 $ 379,619 $ 52,901 $ 312,005 $ 8,734 $ 373,640 $ 55,082 $ 294,336 $ 12,117 $ 361,535 Property operating expenses (24,384) (290,803) 11 (315,176) (25,074) (284,572) (51) (309,697) (24,727) (278,358) (326) (303,411) NOI $ 27,331 $ 24,933 $ 12,179 $ 64,443 $ 27,827 $ 27,433 $ 8,683 $ 63,943 $ 30,355 $ 15,978 $ 11,791 $ 58,124 NOI $ 27,331 $ 24,933 $ 12,179 $ 64,443 $ 27,827 $ 27,433 $ 8,683 $ 63,943 $ 30,355 $ 15,978 $ 11,791 $ 58,124 Non-cash straight line rent adjustments included in rental income 427 — (267) 160 (358) — (300) (658) 255 — (493) (238) Lease value amortization included in rental income 22 — — 22 27 — — 27 22 — — 22 Lease termination fees included in rental income — — — — — — — — (419) — — (419) Non-cash amortization included in property operating expenses (201) — — (201) (199) — — (199) (201) — — (201) Cash Basis NOI $ 27,579 $ 24,933 $ 11,912 $ 64,424 $ 27,297 $ 27,433 $ 8,383 $ 63,113 $ 30,012 $ 15,978 $ 11,298 $ 57,288 Reconciliation of NOI to Same Property NOI: NOI $ 27,331 $ 24,933 $ 12,179 $ 64,443 $ 27,827 $ 27,433 $ 8,683 $ 63,943 $ 30,355 $ 15,978 $ 11,791 $ 58,124 NOI of properties not included in same property results (566) 3,828 (4,175) (913) 88 3,252 (2,026) 1,314 (3,006) 3,865 (4,593) (3,734) Same Property NOI $ 26,765 $ 28,761 $ 8,004 $ 63,530 $ 27,915 $ 30,685 $ 6,657 $ 65,257 $ 27,349 $ 19,843 $ 7,198 $ 54,390 Reconciliation of Same Property NOI to Same Property Cash Basis NOI: Same Property NOI $ 26,765 $ 28,761 $ 8,004 $ 63,530 $ 27,915 $ 30,685 $ 6,657 $ 65,257 $ 27,349 $ 19,843 $ 7,198 $ 54,390 Non-cash straight line rent adjustments included in rental income 564 — (258) 306 (207) — (292) (499) (14) — (474) (488) Lease value amortization included in rental income 22 — — 22 27 — — 27 17 — — 17 Lease termination fees included in rental income — — — — — — — — (115) — — (115) Non-cash amortization included in property operating expenses (165) — — (165) (165) — — (165) (160) — — (160) Same Property Cash Basis NOI $ 27,186 $ 28,761 $ 7,746 $ 63,693 $ 27,570 $ 30,685 $ 6,365 $ 64,620 $ 27,077 $ 19,843 $ 6,724 $ 53,644

Q4 2024 34 Calculation and Reconciliation of EBITDA, EBITDAre and Adjusted EBITDAre (dollars in thousands) For the Three Months Ended For the Year Ended 12/31/2024 9/30/2024 6/30/2024 3/31/2024 12/31/2023 12/31/2024 12/31/2023 Net loss $ (87,446) $ (98,689) $ (97,861) $ (86,259) $ (102,564) $ (370,255) $ (293,572) Interest expense 59,518 59,443 58,702 57,576 48,853 235,239 191,775 Income tax (benefit) expense (38) 148 170 187 66 467 445 Depreciation and amortization 77,508 68,959 68,357 70,133 83,653 284,957 284,083 EBITDA 49,542 29,861 29,368 41,637 30,008 150,408 182,731 (Gain) loss on sale of properties (38) (111) 13,213 5,874 28 18,938 (1,205) Impairment of assets 29,016 23,031 6,545 12,142 — 70,734 18,380 Equity in net (earnings) losses of investees (11,479) (527) 12,307 (1,898) 22,598 (1,597) 20,461 Share of EBITDAre from unconsolidated joint ventures 4,515 4,117 3,872 3,838 3,781 16,342 15,086 Adjustments to reflect DHC's share of EBITDAre attributable to an equity method investment (1) 1,679 2,222 13,282 1,047 — 18,230 (1,117) EBITDAre 73,235 58,593 78,587 62,640 56,415 273,055 234,336 General and administrative expense paid in common shares 324 925 940 558 340 2,747 1,840 Business management incentive fees (2) (6,934) 6,934 (849) 849 — — — Acquisition and certain other transaction related costs 267 331 1,826 86 1,041 2,510 10,853 Loss on modification or early extinguishment of debt 115 — 209 — 1,393 324 2,468 Gains on equity securities, net — — — — — — (8,126) Adjustments to reflect DHC's share of Adjusted EBITDAre attributable to an equity method investment (1) 42 34 (11,818) (73) — (11,815) 1,455 Adjusted EBITDAre $ 67,049 $ 66,817 $ 68,895 $ 64,060 $ 59,189 $ 266,821 $ 242,826 RETURN TO TABLE OF CONTENTS (1) For the three months ended March 31, 2024, represents DHC's 34% pro rata share of AlerisLife's EBITDAre and Adjusted EBITDAre for DHC's period of ownership from February 16, 2024 to March 31, 2024. (2) During the three months ended December 31, 2024, DHC reversed $6,934 of business management incentive fees. DHC did not recognize a business management incentive fee for the year ended December 31, 2024.

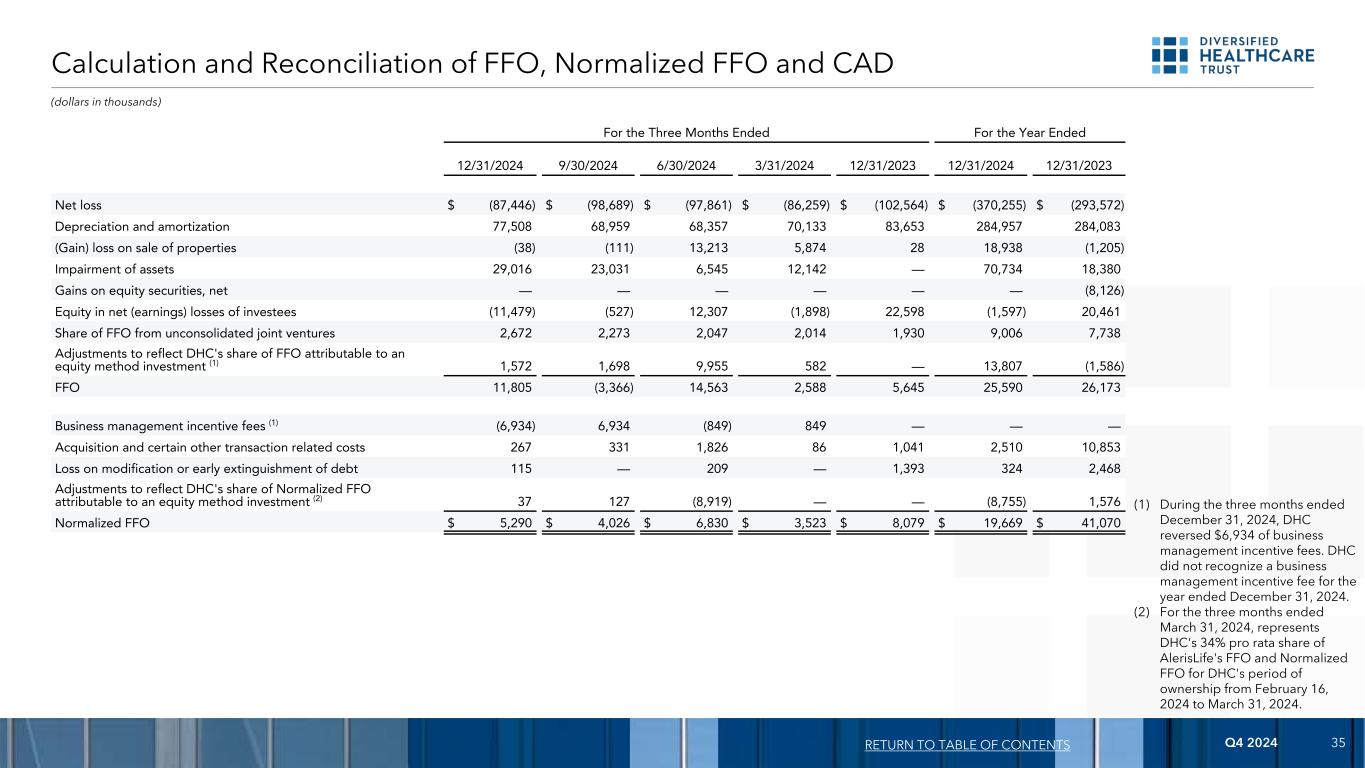

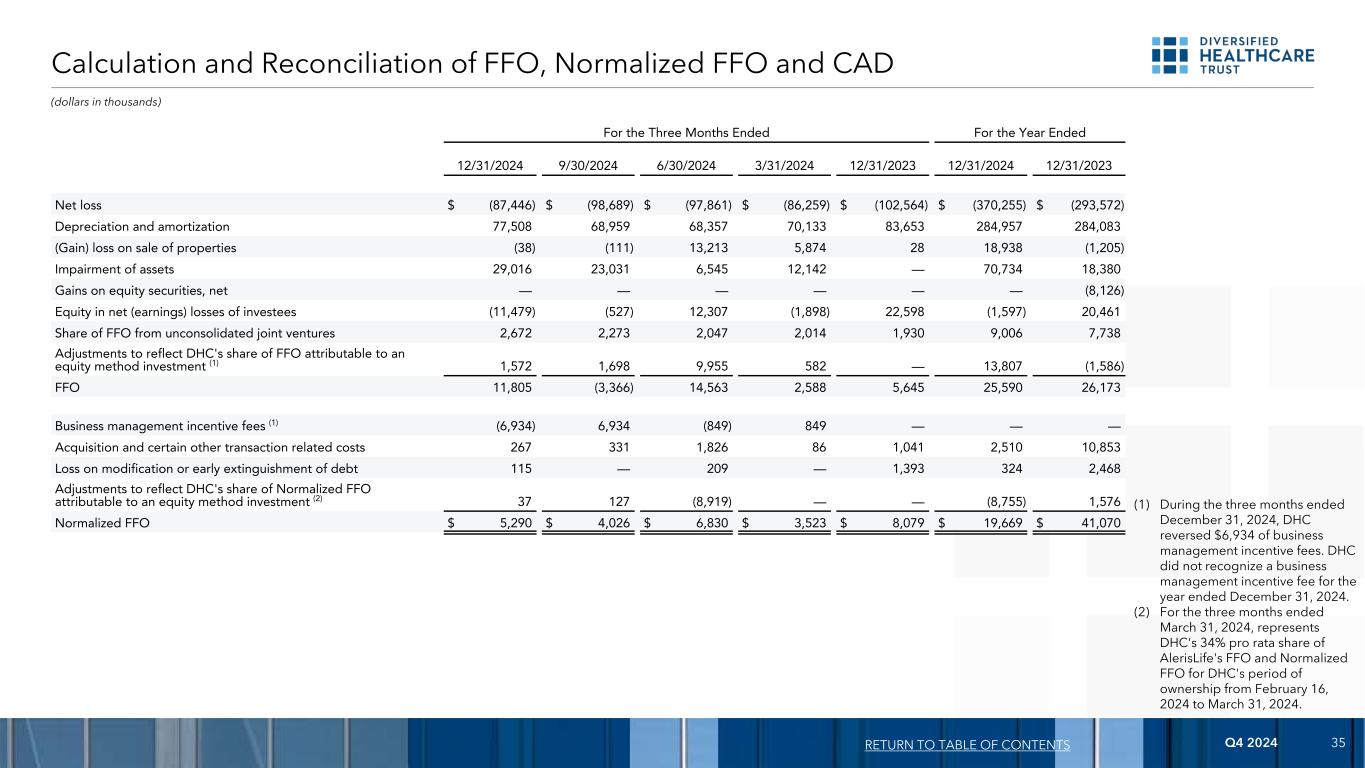

Q4 2024 35 Calculation and Reconciliation of FFO, Normalized FFO and CAD (dollars in thousands) RETURN TO TABLE OF CONTENTS For the Three Months Ended For the Year Ended 12/31/2024 9/30/2024 6/30/2024 3/31/2024 12/31/2023 12/31/2024 12/31/2023 Net loss $ (87,446) $ (98,689) $ (97,861) $ (86,259) $ (102,564) $ (370,255) $ (293,572) Depreciation and amortization 77,508 68,959 68,357 70,133 83,653 284,957 284,083 (Gain) loss on sale of properties (38) (111) 13,213 5,874 28 18,938 (1,205) Impairment of assets 29,016 23,031 6,545 12,142 — 70,734 18,380 Gains on equity securities, net — — — — — — (8,126) Equity in net (earnings) losses of investees (11,479) (527) 12,307 (1,898) 22,598 (1,597) 20,461 Share of FFO from unconsolidated joint ventures 2,672 2,273 2,047 2,014 1,930 9,006 7,738 Adjustments to reflect DHC's share of FFO attributable to an equity method investment (1) 1,572 1,698 9,955 582 — 13,807 (1,586) FFO 11,805 (3,366) 14,563 2,588 5,645 25,590 26,173 Business management incentive fees (1) (6,934) 6,934 (849) 849 — — — Acquisition and certain other transaction related costs 267 331 1,826 86 1,041 2,510 10,853 Loss on modification or early extinguishment of debt 115 — 209 — 1,393 324 2,468 Adjustments to reflect DHC's share of Normalized FFO attributable to an equity method investment (2) 37 127 (8,919) — — (8,755) 1,576 Normalized FFO $ 5,290 $ 4,026 $ 6,830 $ 3,523 $ 8,079 $ 19,669 $ 41,070 (1) During the three months ended December 31, 2024, DHC reversed $6,934 of business management incentive fees. DHC did not recognize a business management incentive fee for the year ended December 31, 2024. (2) For the three months ended March 31, 2024, represents DHC's 34% pro rata share of AlerisLife's FFO and Normalized FFO for DHC's period of ownership from February 16, 2024 to March 31, 2024.

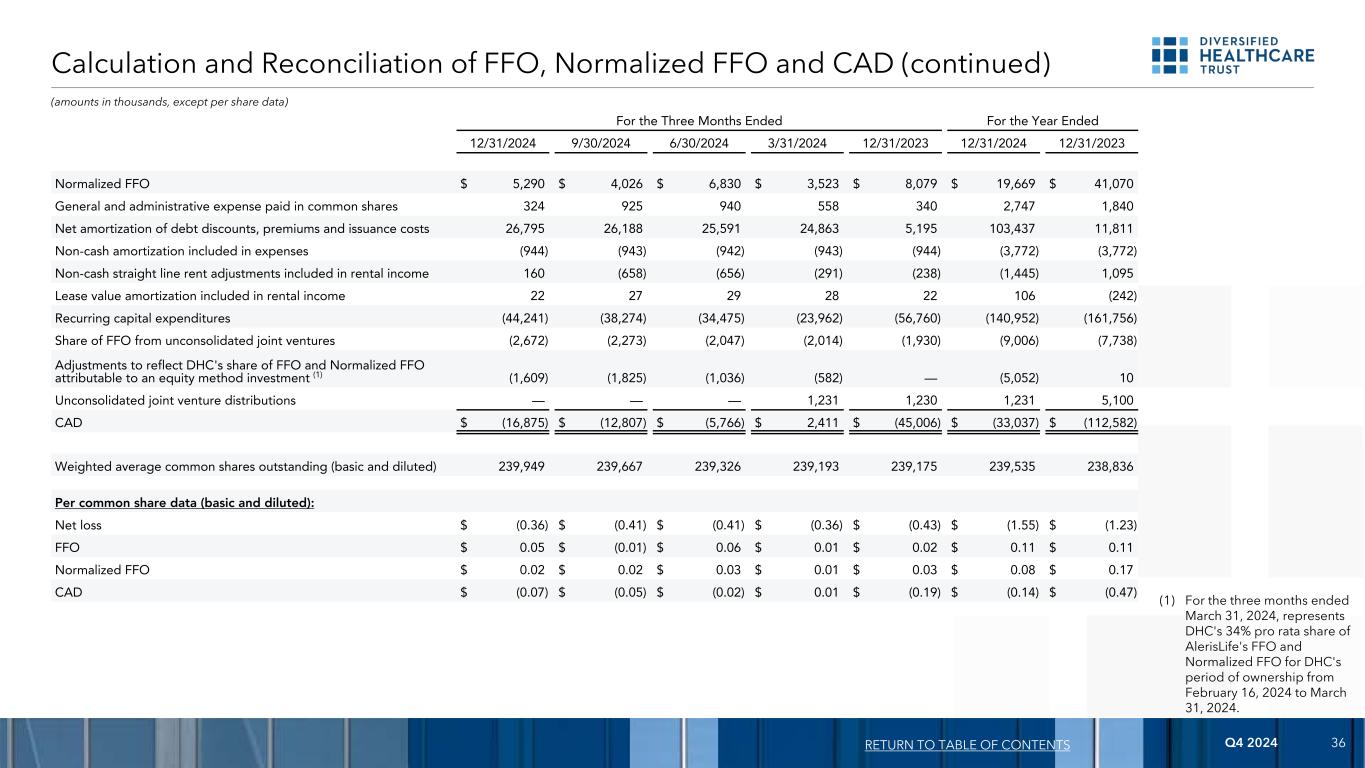

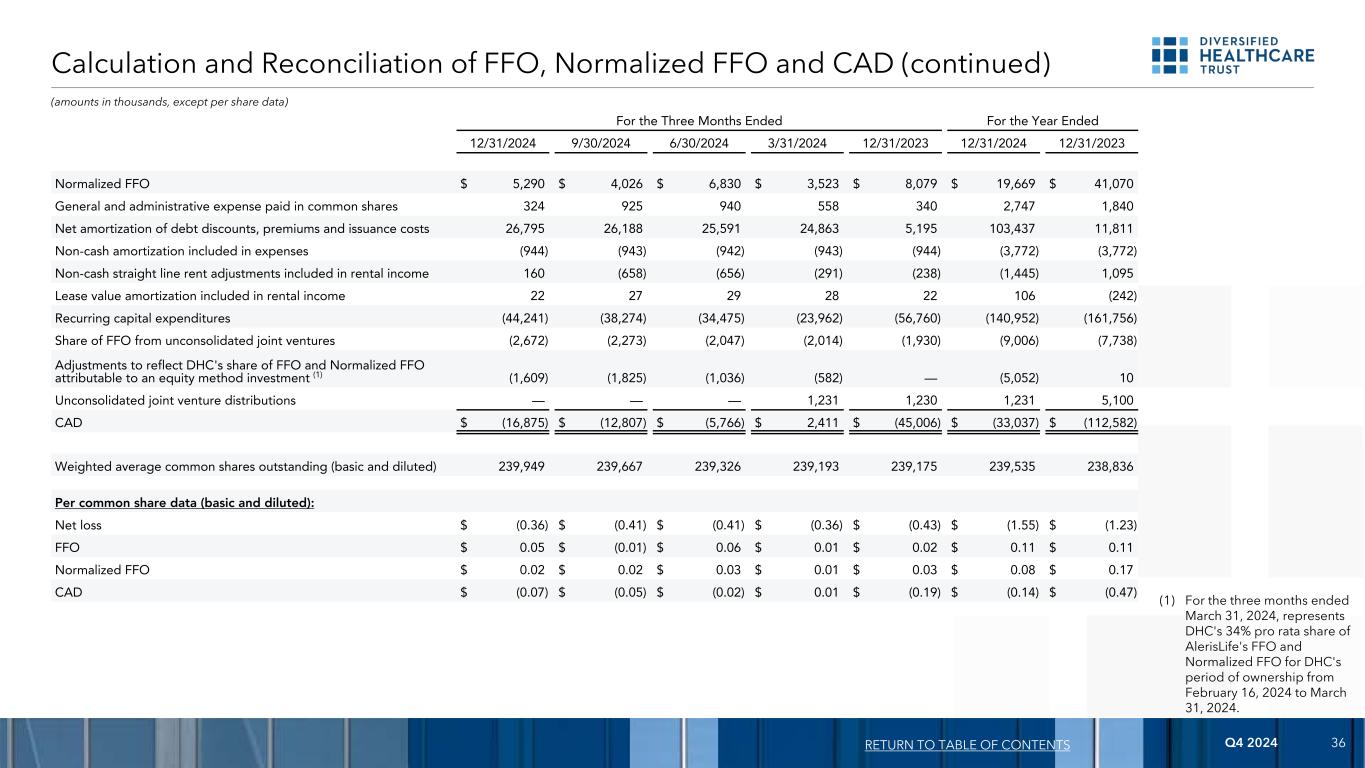

Q4 2024 36 Calculation and Reconciliation of FFO, Normalized FFO and CAD (continued) (amounts in thousands, except per share data) RETURN TO TABLE OF CONTENTS For the Three Months Ended For the Year Ended 12/31/2024 9/30/2024 6/30/2024 3/31/2024 12/31/2023 12/31/2024 12/31/2023 Normalized FFO $ 5,290 $ 4,026 $ 6,830 $ 3,523 $ 8,079 $ 19,669 $ 41,070 General and administrative expense paid in common shares 324 925 940 558 340 2,747 1,840 Net amortization of debt discounts, premiums and issuance costs 26,795 26,188 25,591 24,863 5,195 103,437 11,811 Non-cash amortization included in expenses (944) (943) (942) (943) (944) (3,772) (3,772) Non-cash straight line rent adjustments included in rental income 160 (658) (656) (291) (238) (1,445) 1,095 Lease value amortization included in rental income 22 27 29 28 22 106 (242) Recurring capital expenditures (44,241) (38,274) (34,475) (23,962) (56,760) (140,952) (161,756) Share of FFO from unconsolidated joint ventures (2,672) (2,273) (2,047) (2,014) (1,930) (9,006) (7,738) Adjustments to reflect DHC's share of FFO and Normalized FFO attributable to an equity method investment (1) (1,609) (1,825) (1,036) (582) — (5,052) 10 Unconsolidated joint venture distributions — — — 1,231 1,230 1,231 5,100 CAD $ (16,875) $ (12,807) $ (5,766) $ 2,411 $ (45,006) $ (33,037) $ (112,582) Weighted average common shares outstanding (basic and diluted) 239,949 239,667 239,326 239,193 239,175 239,535 238,836 Per common share data (basic and diluted): Net loss $ (0.36) $ (0.41) $ (0.41) $ (0.36) $ (0.43) $ (1.55) $ (1.23) FFO $ 0.05 $ (0.01) $ 0.06 $ 0.01 $ 0.02 $ 0.11 $ 0.11 Normalized FFO $ 0.02 $ 0.02 $ 0.03 $ 0.01 $ 0.03 $ 0.08 $ 0.17 CAD $ (0.07) $ (0.05) $ (0.02) $ 0.01 $ (0.19) $ (0.14) $ (0.47) (1) For the three months ended March 31, 2024, represents DHC's 34% pro rata share of AlerisLife's FFO and Normalized FFO for DHC's period of ownership from February 16, 2024 to March 31, 2024.

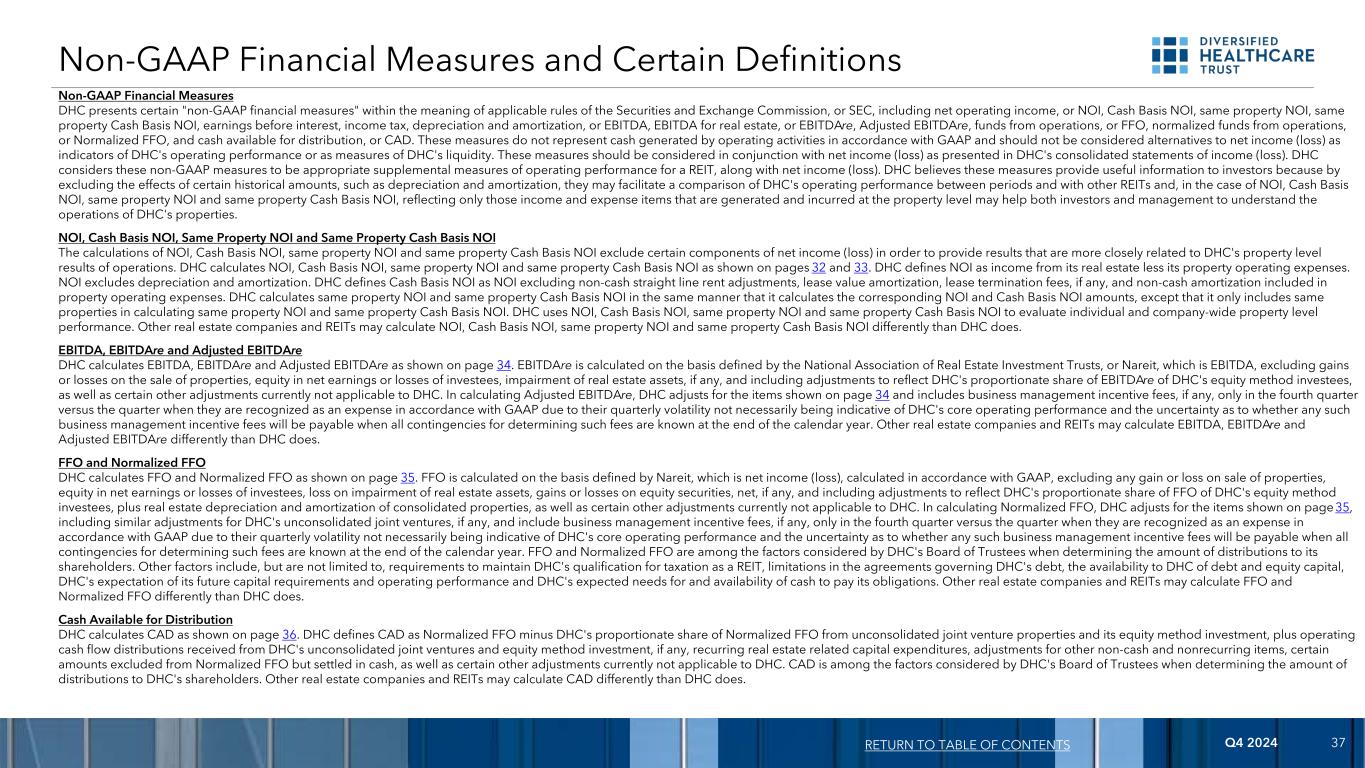

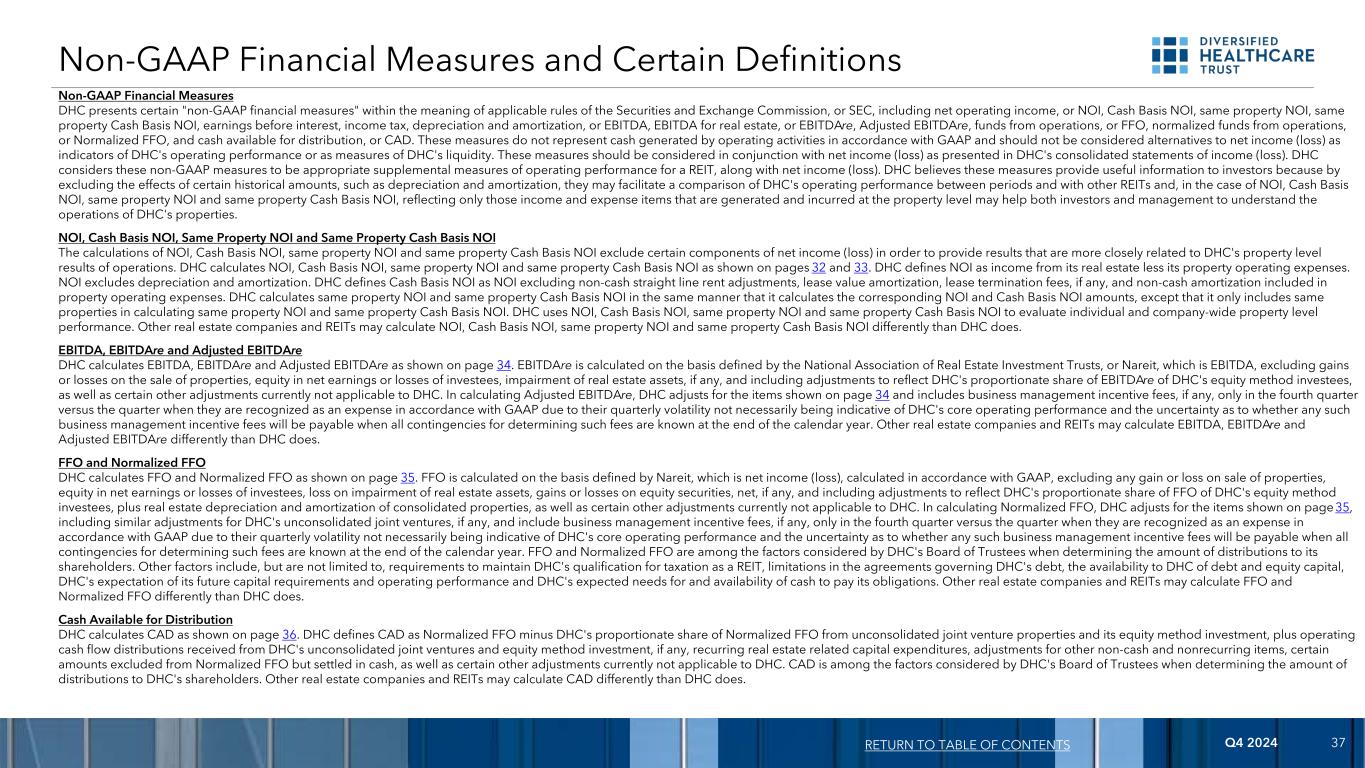

Q4 2024 37 Non-GAAP Financial Measures DHC presents certain "non-GAAP financial measures" within the meaning of applicable rules of the Securities and Exchange Commission, or SEC, including net operating income, or NOI, Cash Basis NOI, same property NOI, same property Cash Basis NOI, earnings before interest, income tax, depreciation and amortization, or EBITDA, EBITDA for real estate, or EBITDAre, Adjusted EBITDAre, funds from operations, or FFO, normalized funds from operations, or Normalized FFO, and cash available for distribution, or CAD. These measures do not represent cash generated by operating activities in accordance with GAAP and should not be considered alternatives to net income (loss) as indicators of DHC's operating performance or as measures of DHC's liquidity. These measures should be considered in conjunction with net income (loss) as presented in DHC's consolidated statements of income (loss). DHC considers these non-GAAP measures to be appropriate supplemental measures of operating performance for a REIT, along with net income (loss). DHC believes these measures provide useful information to investors because by excluding the effects of certain historical amounts, such as depreciation and amortization, they may facilitate a comparison of DHC's operating performance between periods and with other REITs and, in the case of NOI, Cash Basis NOI, same property NOI and same property Cash Basis NOI, reflecting only those income and expense items that are generated and incurred at the property level may help both investors and management to understand the operations of DHC's properties. NOI, Cash Basis NOI, Same Property NOI and Same Property Cash Basis NOI The calculations of NOI, Cash Basis NOI, same property NOI and same property Cash Basis NOI exclude certain components of net income (loss) in order to provide results that are more closely related to DHC's property level results of operations. DHC calculates NOI, Cash Basis NOI, same property NOI and same property Cash Basis NOI as shown on pages 32 and 33. DHC defines NOI as income from its real estate less its property operating expenses. NOI excludes depreciation and amortization. DHC defines Cash Basis NOI as NOI excluding non-cash straight line rent adjustments, lease value amortization, lease termination fees, if any, and non-cash amortization included in property operating expenses. DHC calculates same property NOI and same property Cash Basis NOI in the same manner that it calculates the corresponding NOI and Cash Basis NOI amounts, except that it only includes same properties in calculating same property NOI and same property Cash Basis NOI. DHC uses NOI, Cash Basis NOI, same property NOI and same property Cash Basis NOI to evaluate individual and company-wide property level performance. Other real estate companies and REITs may calculate NOI, Cash Basis NOI, same property NOI and same property Cash Basis NOI differently than DHC does. EBITDA, EBITDAre and Adjusted EBITDAre DHC calculates EBITDA, EBITDAre and Adjusted EBITDAre as shown on page 34. EBITDAre is calculated on the basis defined by the National Association of Real Estate Investment Trusts, or Nareit, which is EBITDA, excluding gains or losses on the sale of properties, equity in net earnings or losses of investees, impairment of real estate assets, if any, and including adjustments to reflect DHC's proportionate share of EBITDAre of DHC's equity method investees, as well as certain other adjustments currently not applicable to DHC. In calculating Adjusted EBITDAre, DHC adjusts for the items shown on page 34 and includes business management incentive fees, if any, only in the fourth quarter versus the quarter when they are recognized as an expense in accordance with GAAP due to their quarterly volatility not necessarily being indicative of DHC's core operating performance and the uncertainty as to whether any such business management incentive fees will be payable when all contingencies for determining such fees are known at the end of the calendar year. Other real estate companies and REITs may calculate EBITDA, EBITDAre and Adjusted EBITDAre differently than DHC does. FFO and Normalized FFO DHC calculates FFO and Normalized FFO as shown on page 35. FFO is calculated on the basis defined by Nareit, which is net income (loss), calculated in accordance with GAAP, excluding any gain or loss on sale of properties, equity in net earnings or losses of investees, loss on impairment of real estate assets, gains or losses on equity securities, net, if any, and including adjustments to reflect DHC's proportionate share of FFO of DHC's equity method investees, plus real estate depreciation and amortization of consolidated properties, as well as certain other adjustments currently not applicable to DHC. In calculating Normalized FFO, DHC adjusts for the items shown on page 35, including similar adjustments for DHC's unconsolidated joint ventures, if any, and include business management incentive fees, if any, only in the fourth quarter versus the quarter when they are recognized as an expense in accordance with GAAP due to their quarterly volatility not necessarily being indicative of DHC's core operating performance and the uncertainty as to whether any such business management incentive fees will be payable when all contingencies for determining such fees are known at the end of the calendar year. FFO and Normalized FFO are among the factors considered by DHC's Board of Trustees when determining the amount of distributions to its shareholders. Other factors include, but are not limited to, requirements to maintain DHC's qualification for taxation as a REIT, limitations in the agreements governing DHC's debt, the availability to DHC of debt and equity capital, DHC's expectation of its future capital requirements and operating performance and DHC's expected needs for and availability of cash to pay its obligations. Other real estate companies and REITs may calculate FFO and Normalized FFO differently than DHC does. Cash Available for Distribution DHC calculates CAD as shown on page 36. DHC defines CAD as Normalized FFO minus DHC's proportionate share of Normalized FFO from unconsolidated joint venture properties and its equity method investment, plus operating cash flow distributions received from DHC's unconsolidated joint ventures and equity method investment, if any, recurring real estate related capital expenditures, adjustments for other non-cash and nonrecurring items, certain amounts excluded from Normalized FFO but settled in cash, as well as certain other adjustments currently not applicable to DHC. CAD is among the factors considered by DHC's Board of Trustees when determining the amount of distributions to DHC's shareholders. Other real estate companies and REITs may calculate CAD differently than DHC does. Non-GAAP Financial Measures and Certain Definitions RETURN TO TABLE OF CONTENTS