| Maryland | 001-13561 | 43-1790877 | ||||||||||||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

||||||||||||

| 909 Walnut Street, | Suite 200 | |||||||||||||

| Kansas City, | Missouri | 64106 | ||||||||||||

| (Address of principal executive offices) (Zip Code) | ||||||||||||||

| (816) | 472-1700 | ||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common shares, par value $0.01 per share | EPR | New York Stock Exchange | ||||||||||||

| 5.75% Series C cumulative convertible preferred shares, par value $0.01 per share | EPR PrC | New York Stock Exchange | ||||||||||||

| 9.00% Series E cumulative convertible preferred shares, par value $0.01 per share | EPR PrE | New York Stock Exchange | ||||||||||||

| 5.75% Series G cumulative redeemable preferred shares, par value $0.01 per share | EPR PrG | New York Stock Exchange | ||||||||||||

| Exhibit No. |

Description | |||||||

Press Release dated October 30, 2024 issued by EPR Properties announcing its results of operations and financial condition for the third quarter and nine months ended September 30, 2024. |

||||||||

Investor slide presentation for the third quarter and nine months ended September 30, 2024, made available by EPR Properties on October 30, 2024. |

||||||||

Supplemental Operating and Financial Data for the third quarter and nine months ended September 30, 2024, made available by EPR Properties on October 30, 2024. |

||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

| EPR PROPERTIES | |||||||||||

| By: | /s/ Mark A. Peterson | ||||||||||

| Mark A. Peterson | |||||||||||

| Executive Vice President, Treasurer and Chief Financial Officer |

|||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2024 | 2023 (2) | 2024 | 2023 (2) | ||||||||||||||||||||

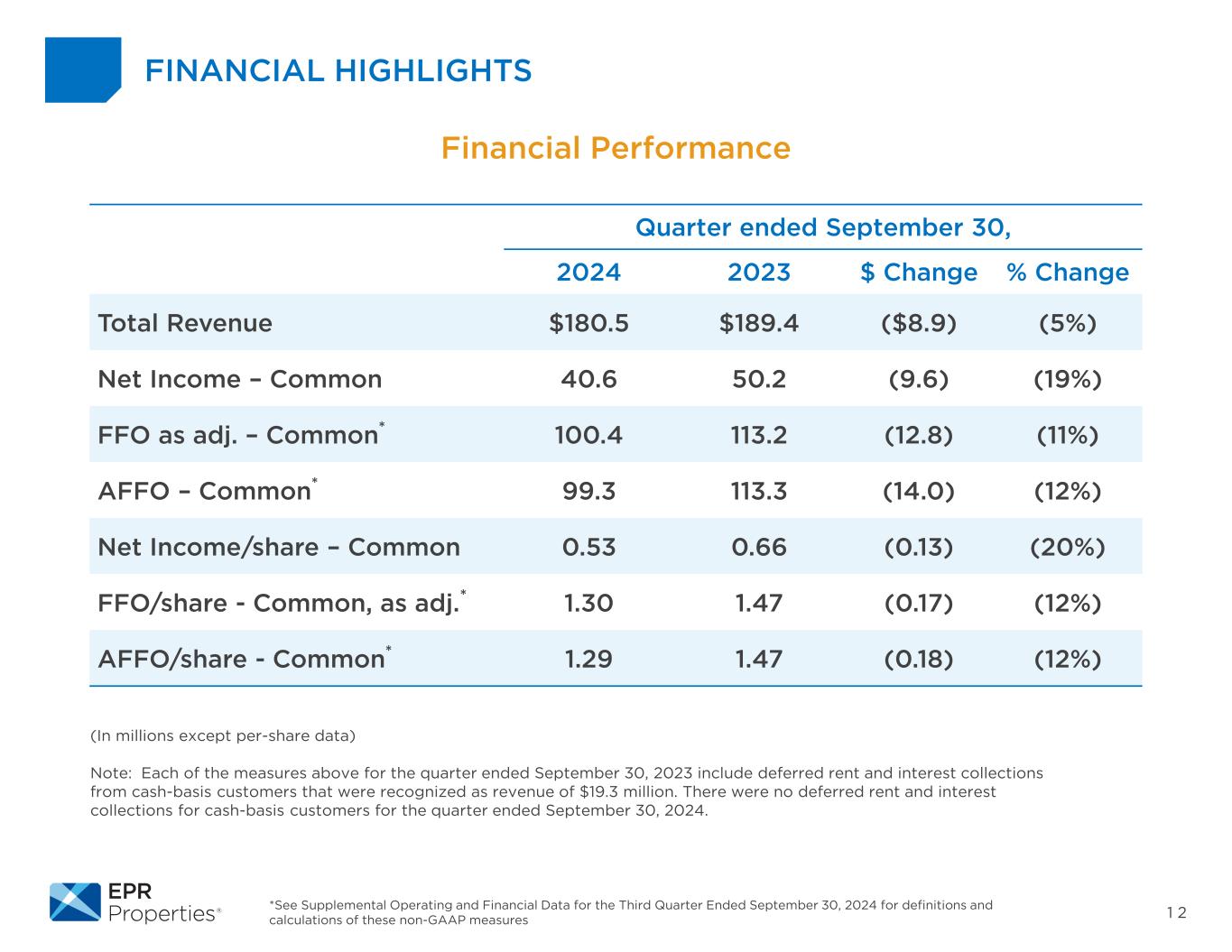

| Total revenue | $ | 180,507 | $ | 189,384 | $ | 520,834 | $ | 533,687 | |||||||||||||||

| Net income available to common shareholders | 40,618 | 50,228 | 136,357 | 109,412 | |||||||||||||||||||

| Net income available to common shareholders per diluted common share | 0.53 | 0.66 | 1.80 | 1.45 | |||||||||||||||||||

| Funds From Operations as adjusted (FFOAA)(1) | 100,382 | 113,156 | 279,620 | 306,954 | |||||||||||||||||||

| FFOAA per diluted common share (1) | 1.30 | 1.47 | 3.64 | 4.00 | |||||||||||||||||||

| Adjusted Funds From Operations (AFFO)(1) | 99,309 | 113,333 | 277,270 | 312,168 | |||||||||||||||||||

| AFFO per diluted common share (1) | 1.29 | 1.47 | 3.61 | 4.07 | |||||||||||||||||||

| Note: Each of the measures above include deferred rent and interest collections from cash basis customers that were recognized as revenue of $19.3 million for the three months ended September 30, 2023 and $0.6 million and $35.7 million for the nine months ended September 30, 2024 and 2023, respectively. | |||||||||||||||||||||||

| (1) A non-GAAP financial measure. | |||||||||||||||||||||||

| (2) Each measure for 2023, except for AFFO and AFFO per diluted share, includes $2.1 million of additional straight-line rent revenue related primarily to recording a straight-line rent receivable for Regal ground leases in connection with reestablishing accrual basis accounting for Regal at August 1, 2023. | |||||||||||||||||||||||

| Current | Prior | |||||||||||||||||||||||||

| Net income available to common shareholders per diluted common share | $ | 2.40 | to | $ | 2.52 | $ | 2.58 | to | $ | 2.78 | ||||||||||||||||

| FFOAA per diluted common share | $ | 4.80 | to | $ | 4.92 | $ | 4.76 | to | $ | 4.96 | ||||||||||||||||

| Investment spending | $ | 225.0 | to | $ | 275.0 | $ | 200.0 | to | $ | 300.0 | ||||||||||||||||

| Disposition proceeds | $ | 70.0 | to | $ | 100.0 | $ | 60.0 | to | $ | 75.0 | ||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Rental revenue | $ | 148,677 | $ | 163,940 | $ | 436,051 | $ | 467,401 | |||||||||||||||

| Other income | 17,419 | 14,422 | 43,874 | 33,879 | |||||||||||||||||||

| Mortgage and other financing income | 14,411 | 11,022 | 40,909 | 32,407 | |||||||||||||||||||

| Total revenue | 180,507 | 189,384 | 520,834 | 533,687 | |||||||||||||||||||

| Property operating expense | 14,611 | 14,592 | 43,958 | 42,719 | |||||||||||||||||||

| Other expense | 15,631 | 13,124 | 43,440 | 31,235 | |||||||||||||||||||

| General and administrative expense | 11,935 | 13,464 | 37,863 | 42,677 | |||||||||||||||||||

| Retirement and severance expense | — | — | 1,836 | 547 | |||||||||||||||||||

| Transaction costs | 175 | 847 | 375 | 1,153 | |||||||||||||||||||

| Provision (benefit) for credit losses, net | (770) | (719) | 2,371 | (407) | |||||||||||||||||||

| Impairment charges | — | 20,887 | 11,812 | 64,672 | |||||||||||||||||||

| Depreciation and amortization | 42,795 | 42,432 | 124,738 | 127,341 | |||||||||||||||||||

| Total operating expenses | 84,377 | 104,627 | 266,393 | 309,937 | |||||||||||||||||||

| (Loss) gain on sale of real estate | (3,419) | 2,550 | 15,989 | 1,415 | |||||||||||||||||||

| Income from operations | 92,711 | 87,307 | 270,430 | 225,165 | |||||||||||||||||||

| Costs associated with loan refinancing or payoff | 337 | — | 337 | — | |||||||||||||||||||

| Interest expense, net | 32,867 | 31,208 | 97,338 | 94,521 | |||||||||||||||||||

| Equity in loss (income) from joint ventures | 851 | (533) | 5,384 | 2,067 | |||||||||||||||||||

| Impairment charges on joint ventures | 12,130 | — | 12,130 | — | |||||||||||||||||||

| Income before income taxes | 46,526 | 56,632 | 155,241 | 128,577 | |||||||||||||||||||

| Income tax (benefit) expense | (124) | 372 | 780 | 1,060 | |||||||||||||||||||

| Net income | $ | 46,650 | $ | 56,260 | $ | 154,461 | $ | 127,517 | |||||||||||||||

| Preferred dividend requirements | 6,032 | 6,032 | 18,104 | 18,105 | |||||||||||||||||||

| Net income available to common shareholders of EPR Properties | $ | 40,618 | $ | 50,228 | $ | 136,357 | $ | 109,412 | |||||||||||||||

| Net income available to common shareholders of EPR Properties per share: | |||||||||||||||||||||||

| Basic | $ | 0.54 | $ | 0.67 | $ | 1.80 | $ | 1.45 | |||||||||||||||

| Diluted | $ | 0.53 | $ | 0.66 | $ | 1.80 | $ | 1.45 | |||||||||||||||

| Shares used for computation (in thousands): | |||||||||||||||||||||||

| Basic | 75,723 | 75,325 | 75,604 | 75,236 | |||||||||||||||||||

| Diluted | 76,108 | 75,816 | 75,945 | 75,655 | |||||||||||||||||||

| September 30, 2024 | December 31, 2023 | ||||||||||

| Assets | |||||||||||

Real estate investments, net of accumulated depreciation of $1,546,509 and $1,435,683 at September 30, 2024 and December 31, 2023, respectively |

$ | 4,534,450 | $ | 4,537,359 | |||||||

| Land held for development | 20,168 | 20,168 | |||||||||

| Property under development | 76,913 | 131,265 | |||||||||

| Operating lease right-of-use assets | 175,451 | 186,628 | |||||||||

| Mortgage notes and related accrued interest receivable, net | 657,636 | 569,768 | |||||||||

| Investment in joint ventures | 32,426 | 49,754 | |||||||||

| Cash and cash equivalents | 35,328 | 78,079 | |||||||||

| Restricted cash | 2,992 | 2,902 | |||||||||

| Accounts receivable | 79,726 | 63,655 | |||||||||

| Other assets | 74,072 | 61,307 | |||||||||

| Total assets | $ | 5,689,162 | $ | 5,700,885 | |||||||

| Liabilities and Equity | |||||||||||

| Accounts payable and accrued liabilities | $ | 99,334 | $ | 94,927 | |||||||

| Operating lease liabilities | 214,809 | 226,961 | |||||||||

| Dividends payable | 29,843 | 31,307 | |||||||||

| Unearned rents and interest | 88,503 | 77,440 | |||||||||

| Debt | 2,852,970 | 2,816,095 | |||||||||

| Total liabilities | 3,285,459 | 3,246,730 | |||||||||

| Total equity | $ | 2,403,703 | $ | 2,454,155 | |||||||

| Total liabilities and equity | $ | 5,689,162 | $ | 5,700,885 | |||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||

| FFO: | ||||||||||||||||||||||||||

| Net income available to common shareholders of EPR Properties | $ | 40,618 | $ | 50,228 | $ | 136,357 | $ | 109,412 | ||||||||||||||||||

| Loss (gain) on sale of real estate | 3,419 | (2,550) | (15,989) | (1,415) | ||||||||||||||||||||||

| Impairment of real estate investments, net | — | 20,887 | 11,812 | 64,672 | ||||||||||||||||||||||

| Real estate depreciation and amortization | 42,620 | 42,224 | 124,191 | 126,718 | ||||||||||||||||||||||

| Allocated share of joint venture depreciation | 2,581 | 2,315 | 7,454 | 6,532 | ||||||||||||||||||||||

| Impairment charges on joint ventures | 12,130 | — | 12,130 | — | ||||||||||||||||||||||

| FFO available to common shareholders of EPR Properties | $ | 101,368 | $ | 113,104 | $ | 275,955 | $ | 305,919 | ||||||||||||||||||

| FFO available to common shareholders of EPR Properties | $ | 101,368 | $ | 113,104 | $ | 275,955 | $ | 305,919 | ||||||||||||||||||

| Add: Preferred dividends for Series C preferred shares | 1,938 | 1,938 | 5,814 | 5,814 | ||||||||||||||||||||||

| Add: Preferred dividends for Series E preferred shares | 1,938 | 1,938 | 5,814 | 5,814 | ||||||||||||||||||||||

| Diluted FFO available to common shareholders of EPR Properties | $ | 105,244 | $ | 116,980 | $ | 287,583 | $ | 317,547 | ||||||||||||||||||

| FFOAA: | ||||||||||||||||||||||||||

| FFO available to common shareholders of EPR Properties | $ | 101,368 | $ | 113,104 | $ | 275,955 | $ | 305,919 | ||||||||||||||||||

| Retirement and severance expense | — | — | 1,836 | 547 | ||||||||||||||||||||||

| Transaction costs | 175 | 847 | 375 | 1,153 | ||||||||||||||||||||||

| Provision (benefit) for credit losses, net | (770) | (719) | 2,371 | (407) | ||||||||||||||||||||||

| Costs associated with loan refinancing or payoff | 337 | — | 337 | — | ||||||||||||||||||||||

| Deferred income tax benefit | (728) | (76) | (1,254) | (258) | ||||||||||||||||||||||

| FFOAA available to common shareholders of EPR Properties | $ | 100,382 | $ | 113,156 | $ | 279,620 | $ | 306,954 | ||||||||||||||||||

| FFOAA available to common shareholders of EPR Properties | $ | 100,382 | $ | 113,156 | $ | 279,620 | $ | 306,954 | ||||||||||||||||||

| Add: Preferred dividends for Series C preferred shares | 1,938 | 1,938 | 5,814 | 5,814 | ||||||||||||||||||||||

| Add: Preferred dividends for Series E preferred shares | 1,938 | 1,938 | 5,814 | 5,814 | ||||||||||||||||||||||

| Diluted FFOAA available to common shareholders of EPR Properties | $ | 104,258 | $ | 117,032 | $ | 291,248 | $ | 318,582 | ||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||||

| AFFO: | ||||||||||||||||||||||||||

| FFOAA available to common shareholders of EPR Properties | $ | 100,382 | $ | 113,156 | $ | 279,620 | $ | 306,954 | ||||||||||||||||||

| Non-real estate depreciation and amortization | 175 | 208 | 547 | 623 | ||||||||||||||||||||||

| Deferred financing fees amortization | 2,211 | 2,170 | 6,657 | 6,449 | ||||||||||||||||||||||

| Share-based compensation expense to management and trustees | 3,264 | 4,354 | 10,494 | 13,153 | ||||||||||||||||||||||

| Amortization of above and below market leases, net and tenant allowances | (84) | (182) | (252) | (456) | ||||||||||||||||||||||

| Maintenance capital expenditures (1) | (2,561) | (1,753) | (5,437) | (7,384) | ||||||||||||||||||||||

| Straight-lined rental revenue | (4,414) | (4,407) | (13,335) | (7,661) | ||||||||||||||||||||||

| Straight-lined ground sublease expense | 20 | 77 | 77 | 1,043 | ||||||||||||||||||||||

| Non-cash portion of mortgage and other financing income | (396) | (290) | (1,813) | (553) | ||||||||||||||||||||||

| Allocated share of joint venture non-cash items | 712 | — | 712 | — | ||||||||||||||||||||||

| AFFO available to common shareholders of EPR Properties | $ | 99,309 | $ | 113,333 | $ | 277,270 | $ | 312,168 | ||||||||||||||||||

| AFFO available to common shareholders of EPR Properties | $ | 99,309 | $ | 113,333 | $ | 277,270 | $ | 312,168 | ||||||||||||||||||

| Add: Preferred dividends for Series C preferred shares | 1,938 | 1,938 | 5,814 | 5,814 | ||||||||||||||||||||||

| Add: Preferred dividends for Series E preferred shares | 1,938 | 1,938 | 5,814 | 5,814 | ||||||||||||||||||||||

| Diluted AFFO available to common shareholders of EPR Properties | $ | 103,185 | $ | 117,209 | $ | 288,898 | $ | 323,796 | ||||||||||||||||||

| FFO per common share: | ||||||||||||||||||||||||||

| Basic | $ | 1.34 | $ | 1.50 | $ | 3.65 | $ | 4.07 | ||||||||||||||||||

| Diluted | 1.31 | 1.47 | 3.60 | 3.99 | ||||||||||||||||||||||

| FFOAA per common share: | ||||||||||||||||||||||||||

| Basic | $ | 1.33 | $ | 1.50 | $ | 3.70 | $ | 4.08 | ||||||||||||||||||

| Diluted | 1.30 | 1.47 | 3.64 | 4.00 | ||||||||||||||||||||||

| AFFO per common share: | ||||||||||||||||||||||||||

| Basic | $ | 1.31 | $ | 1.50 | $ | 3.67 | $ | 4.15 | ||||||||||||||||||

| Diluted | 1.29 | 1.47 | 3.61 | 4.07 | ||||||||||||||||||||||

| Shares used for computation (in thousands): | ||||||||||||||||||||||||||

| Basic | 75,723 | 75,325 | 75,604 | 75,236 | ||||||||||||||||||||||

| Diluted | 76,108 | 75,816 | 75,945 | 75,655 | ||||||||||||||||||||||

| Weighted average shares outstanding-diluted EPS | 76,108 | 75,816 | 75,945 | 75,655 | ||||||||||||||||||||||

| Effect of dilutive Series C preferred shares | 2,319 | 2,287 | 2,310 | 2,279 | ||||||||||||||||||||||

| Effect of dilutive Series E preferred shares | 1,664 | 1,663 | 1,664 | 1,663 | ||||||||||||||||||||||

| Adjusted weighted average shares outstanding-diluted Series C and Series E | 80,091 | 79,766 | 79,919 | 79,597 | ||||||||||||||||||||||

| Other financial information: | ||||||||||||||||||||||||||

| Dividends per common share | $ | 0.855 | $ | 0.825 | $ | 2.545 | $ | 2.475 | ||||||||||||||||||

| September 30, | |||||||||||

| 2024 | 2023 | ||||||||||

| Net Debt: | |||||||||||

| Debt | $ | 2,852,970 | $ | 2,814,497 | |||||||

| Deferred financing costs, net | 20,622 | 26,732 | |||||||||

| Cash and cash equivalents | (35,328) | (172,953) | |||||||||

| Net Debt | $ | 2,838,264 | $ | 2,668,276 | |||||||

| Gross Assets: | |||||||||||

| Total Assets | $ | 5,689,162 | $ | 5,719,377 | |||||||

| Accumulated depreciation | 1,546,509 | 1,400,642 | |||||||||

| Cash and cash equivalents | (35,328) | (172,953) | |||||||||

| Gross Assets | $ | 7,200,343 | $ | 6,947,066 | |||||||

| Debt to Total Assets Ratio | 50 | % | 49 | % | |||||||

| Net Debt to Gross Assets Ratio | 39 | % | 38 | % | |||||||

| Three Months Ended September 30, | |||||||||||

| 2024 | 2023 | ||||||||||

| EBITDAre and Adjusted EBITDAre: | |||||||||||

| Net income | $ | 46,650 | $ | 56,260 | |||||||

| Interest expense, net | 32,867 | 31,208 | |||||||||

| Income tax (benefit) expense | (124) | 372 | |||||||||

| Depreciation and amortization | 42,795 | 42,432 | |||||||||

| Loss (gain) on sale of real estate | 3,419 | (2,550) | |||||||||

| Impairment of real estate investments, net | — | 20,887 | |||||||||

| Costs associated with loan refinancing or payoff | 337 | — | |||||||||

| Allocated share of joint venture depreciation | 2,581 | 2,315 | |||||||||

| Allocated share of joint venture interest expense | 2,587 | 2,164 | |||||||||

| Impairment charges on joint ventures | 12,130 | — | |||||||||

| EBITDAre | $ | 143,242 | $ | 153,088 | |||||||

| Transaction costs | 175 | 847 | |||||||||

| Provision (benefit) for credit losses, net | (770) | (719) | |||||||||

| Adjusted EBITDAre | $ | 142,647 | $ | 153,216 | |||||||

| Adjusted EBITDAre (annualized) (1) | $ | 570,588 | $ | 612,864 | |||||||

| Net Debt/Adjusted EBITDAre Ratio | 5.0 | 4.4 | |||||||||

| (1) Adjusted EBITDA for the quarter is multiplied by four to calculate an annualized amount but does not include the annualization of investments put in service, acquired or disposed of during the quarter, as well as the potential earnings on property under development, the annualization of percentage rent and participating interest and adjustments for other items. See detailed calculation and reconciliation of Annualized Adjusted EBITDAre and Net Debt/Annualized EBITDAre ratio that includes these adjustments in the Company's Supplemental Operating and Financial Data for the quarter and nine months ended September 30, 2024. | |||||||||||

| September 30, 2024 | December 31, 2023 | ||||||||||

| Total assets | $ | 5,689,162 | $ | 5,700,885 | |||||||

| Operating lease right-of-use assets | (175,451) | (186,628) | |||||||||

| Cash and cash equivalents | (35,328) | (78,079) | |||||||||

| Restricted cash | (2,992) | (2,902) | |||||||||

| Accounts receivable | (79,726) | (63,655) | |||||||||

| Add: accumulated depreciation on real estate investments | 1,546,509 | 1,435,683 | |||||||||

| Add: accumulated amortization on intangible assets (1) | 31,545 | 30,589 | |||||||||

| Prepaid expenses and other current assets (1) | (37,630) | (22,718) | |||||||||

| Total investments | $ | 6,936,089 | $ | 6,813,175 | |||||||

| Total Investments: | |||||||||||

| Real estate investments, net of accumulated depreciation | $ | 4,534,450 | $ | 4,537,359 | |||||||

| Add back accumulated depreciation on real estate investments | 1,546,509 | 1,435,683 | |||||||||

| Land held for development | 20,168 | 20,168 | |||||||||

| Property under development | 76,913 | 131,265 | |||||||||

| Mortgage notes and related accrued interest receivable, net | 657,636 | 569,768 | |||||||||

| Investment in joint ventures | 32,426 | 49,754 | |||||||||

| Intangible assets, gross (1) | 64,544 | 65,299 | |||||||||

| Notes receivable and related accrued interest receivable, net (1) | 3,443 | 3,879 | |||||||||

| Total investments | $ | 6,936,089 | $ | 6,813,175 | |||||||

| (1) Included in other assets in the accompanying consolidated balance sheet. Other assets include the following: | |||||||||||

| September 30, 2024 | December 31, 2023 | ||||||||||

| Intangible assets, gross | $ | 64,544 | $ | 65,299 | |||||||

| Less: accumulated amortization on intangible assets | (31,545) | (30,589) | |||||||||

| Notes receivable and related accrued interest receivable, net | 3,443 | 3,879 | |||||||||

| Prepaid expenses and other current assets | 37,630 | 22,718 | |||||||||

| Total other assets | $ | 74,072 | $ | 61,307 | |||||||

| TABLE OF CONTENTS | ||||||||||||||||||||||||||

| SECTION | PAGE | |||||||||||||||||||||||||

| Company Profile | ||||||||||||||||||||||||||

| Investor Information | ||||||||||||||||||||||||||

| Selected Financial Information | ||||||||||||||||||||||||||

| Selected Balance Sheet Information | ||||||||||||||||||||||||||

| Selected Operating Data | ||||||||||||||||||||||||||

| Funds From Operations and Funds From Operations as Adjusted | ||||||||||||||||||||||||||

| Adjusted Funds From Operations | ||||||||||||||||||||||||||

| Capital Structure | ||||||||||||||||||||||||||

| Summary of Ratios | ||||||||||||||||||||||||||

| Summary of Mortgage Notes Receivable | ||||||||||||||||||||||||||

| Summary of Unconsolidated Joint Ventures | ||||||||||||||||||||||||||

| Investment Spending and Disposition Summaries | ||||||||||||||||||||||||||

| Property Under Development - Investment Spending Estimates | ||||||||||||||||||||||||||

| Portfolio Detail | ||||||||||||||||||||||||||

| Lease Expirations | ||||||||||||||||||||||||||

| Top Ten Customers by Total Revenue | ||||||||||||||||||||||||||

| Guidance | ||||||||||||||||||||||||||

| Definitions-Non-GAAP Financial Measures | ||||||||||||||||||||||||||

| Appendix-Reconciliation of Certain Non-GAAP Financial Measures | ||||||||||||||||||||||||||

|

||||||||

| Q3 2024 Supplemental | Page 2 |

|||||||

| CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS | ||||||||||||||

|

||||||||

| Q3 2024 Supplemental | Page 3 |

|||||||

| COMPANY PROFILE | ||||||||||||||

| THE COMPANY | COMPANY STRATEGY | |||||||

| EPR Properties ("we," "us," "our," "EPR" or the "Company") is a self-administered and self-managed real estate investment trust. EPR was formed in August 1997 as a Maryland real estate investment trust ("REIT"), and an initial public offering was completed on November 18, 1997. | Our primary business objective is to enhance shareholder value by achieving predictable growth in Funds from Operations As Adjusted ("FFOAA") and dividends per share. | |||||||

| Our strategic growth is focused on acquiring or developing a diversified portfolio of experiential real estate venues which create value by facilitating out of home congregate entertainment, recreation and leisure experiences where consumers choose to spend their discretionary time and money. This strategy is driven by the long-term trends of the growing experience economy. | ||||||||

| Since that time, the Company has been a leading Experiential net lease REIT, specializing in select enduring experiential properties. We are focused on growing our Experiential portfolio with properties that offer a variety of enduring, congregate entertainment, recreation and leisure activities. Separately, our Education portfolio is a legacy investment that provides additional geographic and operator diversity. | ||||||||

| This focus is consistent with our depth of knowledge across each of our property types, creating a competitive advantage that allows us to more quickly identify key market trends. We deliberately apply information and our ingenuity to target properties that represent logical extensions within each of our existing property types or potential future investments. | ||||||||

|

||||||||

| As part of our strategic planning and portfolio management process we assess new opportunities against the following underwriting principles: | ||||||||

|

||||||||

| BUILDING THE PREMIER EXPERIENTIAL REAL ESTATE PORTFOLIO | ||||||||||||||||||||

|

|

|

|

|||||||||||||||||

|

||||||||

| Q3 2024 Supplemental | Page 4 |

|||||||

| INVESTOR INFORMATION | ||||||||

| SENIOR MANAGEMENT | ||||||||

| Greg Silvers | Mark Peterson | |||||||

| Chairman and Chief Executive Officer | Executive Vice President and Chief Financial Officer | |||||||

| Tonya Mater | Greg Zimmerman | |||||||

| Senior Vice President and Chief Accounting Officer | Executive Vice President and Chief Investment Officer | |||||||

| Paul Turvey | Elizabeth Grace | |||||||

| Senior Vice President, General Counsel and Secretary | Senior Vice President - Human Resources and Administration | |||||||

| Brian Moriarty | Gwen Johnson | |||||||

| Senior Vice President - Corporate Communications | Senior Vice President - Asset Management | |||||||

| COMPANY INFORMATION | ||||||||

| CORPORATE HEADQUARTERS | TRADING SYMBOLS | |||||||

| 909 Walnut Street, Suite 200 | Common Stock: | |||||||

| Kansas City, MO 64106 | EPR | |||||||

| 816-472-1700 | Preferred Stock: | |||||||

| www.eprkc.com | EPR-PrC | |||||||

| STOCK EXCHANGE LISTING | EPR-PrE | |||||||

| New York Stock Exchange | EPR-PrG | |||||||

| EQUITY RESEARCH COVERAGE | ||||||||

| Bank of America Merrill Lynch | Jeffrey Spector/Joshua Dennerlein | 646-855-1363 | ||||||

| Citi Global Markets | Nick Joseph/Smedes Rose | 212-816-6243 | ||||||

| Janney Montgomery Scott | Rob Stevenson | 646-840-3217 | ||||||

| J.P. Morgan | Anthony Paolone | 212-622-6682 | ||||||

| JMP Securities | Mitch Germain | 212-906-3537 | ||||||

| Kansas City Capital Associates | Jonathan Braatz | 816-932-8019 | ||||||

| Keybanc Capital Markets | Todd Thomas | 917-368-2286 | ||||||

| Raymond James & Associates | RJ Milligan | 727-567-2585 | ||||||

| RBC Capital Markets | Michael Carroll | 440-715-2649 | ||||||

| Stifel | Simon Yarmak | 443-224-1345 | ||||||

| Truist | Ki Bin Kim | 212-303-4124 | ||||||

| Wells Fargo | James Feldman | 212-214-5328 | ||||||

|

||||||||

| Q3 2024 Supplemental | Page 5 |

|||||||

| SELECTED FINANCIAL INFORMATION | |||||||||||||||||||||||

| (UNAUDITED, DOLLARS AND SHARES IN THOUSANDS) | |||||||||||||||||||||||

| THREE MONTHS ENDED SEPTEMBER 30, | NINE MONTHS ENDED SEPTEMBER 30, | ||||||||||||||||||||||

| OPERATING INFORMATION: | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Revenue | $ | 180,507 | $ | 189,384 | $ | 520,834 | $ | 533,687 | |||||||||||||||

| Net income available to common shareholders of EPR Properties | 40,618 | 50,228 | 136,357 | 109,412 | |||||||||||||||||||

| EBITDAre (1) | 143,242 | 153,088 | 400,089 | 426,647 | |||||||||||||||||||

| Adjusted EBITDAre (1) | 142,647 | 153,216 | 404,671 | 427,940 | |||||||||||||||||||

| Interest expense, net | 32,867 | 31,208 | 97,338 | 94,521 | |||||||||||||||||||

| Capitalized interest | 878 | 857 | 2,307 | 2,486 | |||||||||||||||||||

| Straight-lined rental revenue | 4,414 | 4,407 | 13,335 | 7,661 | |||||||||||||||||||

| Percentage rent | 5,944 | 2,096 | 9,817 | 6,032 | |||||||||||||||||||

| Dividends declared on preferred shares | 6,032 | 6,032 | 18,104 | 18,105 | |||||||||||||||||||

| Dividends declared on common shares | 64,745 | 62,144 | 192,229 | 186,382 | |||||||||||||||||||

| General and administrative expense | 11,935 | 13,464 | 37,863 | 42,677 | |||||||||||||||||||

| SEPTEMBER 30, | |||||||||||||||||||||||

| BALANCE SHEET INFORMATION: | 2024 | 2023 | |||||||||||||||||||||

| Total assets | $ | 5,689,162 | $ | 5,719,377 | |||||||||||||||||||

| Accumulated depreciation | 1,546,509 | 1,400,642 | |||||||||||||||||||||

| Cash and cash equivalents | 35,328 | 172,953 | |||||||||||||||||||||

| Total assets before accumulated depreciation less cash and cash equivalents (gross assets) | 7,200,343 | 6,947,066 | |||||||||||||||||||||

| Debt | 2,852,970 | 2,814,497 | |||||||||||||||||||||

| Deferred financing costs, net | 20,622 | 26,732 | |||||||||||||||||||||

| Net debt (1) | 2,838,264 | 2,668,276 | |||||||||||||||||||||

| Equity | 2,403,703 | 2,473,797 | |||||||||||||||||||||

| Common shares outstanding | 75,729 | 75,328 | |||||||||||||||||||||

| Total market capitalization (using EOP closing price and liquidation values)(2) | 6,922,992 | 6,168,364 | |||||||||||||||||||||

| Net debt/total market capitalization ratio (1) | 41 | % | 43 | % | |||||||||||||||||||

| Debt to total assets ratio | 50 | % | 49 | % | |||||||||||||||||||

| Net debt/gross assets ratio (1) | 39 | % | 38 | % | |||||||||||||||||||

| Net debt/Adjusted EBITDAre ratio (1) (3) | 5.0 | 4.4 | |||||||||||||||||||||

| Net debt/Annualized adjusted EBITDAre ratio (1) (4) | 5.2 | 5.1 | |||||||||||||||||||||

(1) See pages 25 through 27 for definitions. See calculation on page 31 as applicable. | |||||||||||||||||||||||

| (2) See calculation on page 15. | |||||||||||||||||||||||

(3) Adjusted EBITDAre in this calculation is for the three-month period multiplied times four. See pages 25 through 27 for definitions. See calculation on page 31. | |||||||||||||||||||||||

(4) Annualized adjusted EBITDAre is adjusted EBITDAre for the quarter further adjusted for in-service and disposed projects, percentage rent and participating interest and other items which is then multiplied times four. These calculations can be found on page 31 under the reconciliation of Adjusted EBITDAre and Annualized Adjusted EBITDAre. See pages 25 through 27 for definitions. | |||||||||||||||||||||||

|

||||||||

| Q3 2024 Supplemental | Page 6 |

|||||||

| SELECTED BALANCE SHEET INFORMATION | ||||||||||||||||||||||||||||||||||||||

| (UNAUDITED, DOLLARS IN THOUSANDS) | ||||||||||||||||||||||||||||||||||||||

| ASSETS | 3RD QUARTER 2024 | 2ND QUARTER 2024 | 1ST QUARTER 2024 | 4TH QUARTER 2023 | 3RD QUARTER 2023 | 2ND QUARTER 2023 | ||||||||||||||||||||||||||||||||

| Real estate investments | $ | 6,080,959 | $ | 6,070,909 | $ | 6,100,366 | $ | 5,973,042 | $ | 5,972,156 | $ | 6,029,468 | ||||||||||||||||||||||||||

| Less: accumulated depreciation | (1,546,509) | (1,504,427) | (1,470,507) | (1,435,683) | (1,400,642) | (1,369,790) | ||||||||||||||||||||||||||||||||

| Land held for development | 20,168 | 20,168 | 20,168 | 20,168 | 20,168 | 20,168 | ||||||||||||||||||||||||||||||||

| Property under development | 76,913 | 59,092 | 36,138 | 131,265 | 101,313 | 80,650 | ||||||||||||||||||||||||||||||||

| Operating lease right-of-use assets | 175,451 | 179,260 | 183,031 | 186,628 | 190,309 | 192,325 | ||||||||||||||||||||||||||||||||

| Mortgage notes and related accrued interest receivable, net | 657,636 | 593,084 | 578,915 | 569,768 | 477,243 | 466,459 | ||||||||||||||||||||||||||||||||

| Investment in joint ventures | 32,426 | 45,406 | 46,127 | 49,754 | 53,855 | 53,763 | ||||||||||||||||||||||||||||||||

| Cash and cash equivalents | 35,328 | 33,731 | 59,476 | 78,079 | 172,953 | 99,711 | ||||||||||||||||||||||||||||||||

| Restricted cash | 2,992 | 2,958 | 2,929 | 2,902 | 2,868 | 2,623 | ||||||||||||||||||||||||||||||||

| Accounts receivable | 79,726 | 75,493 | 69,414 | 63,655 | 54,826 | 53,305 | ||||||||||||||||||||||||||||||||

| Other assets | 74,072 | 69,693 | 67,979 | 61,307 | 74,328 | 74,882 | ||||||||||||||||||||||||||||||||

| Total assets | $ | 5,689,162 | $ | 5,645,367 | $ | 5,694,036 | $ | 5,700,885 | $ | 5,719,377 | $ | 5,703,564 | ||||||||||||||||||||||||||

| LIABILITIES AND EQUITY | ||||||||||||||||||||||||||||||||||||||

| Liabilities: | ||||||||||||||||||||||||||||||||||||||

| Accounts payable and accrued liabilities | $ | 99,334 | $ | 63,441 | $ | 84,153 | $ | 94,927 | $ | 82,804 | $ | 74,493 | ||||||||||||||||||||||||||

| Operating lease liabilities | 214,809 | 219,004 | 223,077 | 226,961 | 230,922 | 233,126 | ||||||||||||||||||||||||||||||||

| Common dividends payable | 23,811 | 23,365 | 22,918 | 25,275 | 22,795 | 22,289 | ||||||||||||||||||||||||||||||||

| Preferred dividends payable | 6,032 | 6,032 | 6,032 | 6,032 | 6,032 | 6,032 | ||||||||||||||||||||||||||||||||

| Unearned rents and interest | 88,503 | 89,700 | 91,829 | 77,440 | 88,530 | 71,746 | ||||||||||||||||||||||||||||||||

| Line of credit | 169,000 | — | — | — | — | — | ||||||||||||||||||||||||||||||||

| Deferred financing costs, net | (20,622) | (22,200) | (23,519) | (25,134) | (26,732) | (28,222) | ||||||||||||||||||||||||||||||||

| Other debt | 2,704,592 | 2,841,229 | 2,841,229 | 2,841,229 | 2,841,229 | 2,841,229 | ||||||||||||||||||||||||||||||||

| Total liabilities | 3,285,459 | 3,220,571 | 3,245,719 | 3,246,730 | 3,245,580 | 3,220,693 | ||||||||||||||||||||||||||||||||

| Equity: | ||||||||||||||||||||||||||||||||||||||

| Common stock and additional paid-in-capital | 3,947,470 | 3,943,925 | 3,940,077 | 3,925,296 | 3,920,714 | 3,916,102 | ||||||||||||||||||||||||||||||||

| Preferred stock at par value | 148 | 148 | 148 | 148 | 148 | 148 | ||||||||||||||||||||||||||||||||

| Treasury stock | (285,413) | (285,413) | (285,413) | (274,038) | (274,035) | (274,001) | ||||||||||||||||||||||||||||||||

| Accumulated other comprehensive (loss) income | (609) | (541) | 1,119 | 3,296 | 2,378 | 3,610 | ||||||||||||||||||||||||||||||||

| Distributions in excess of net income | (1,257,893) | (1,233,323) | (1,207,614) | (1,200,547) | (1,175,408) | (1,162,988) | ||||||||||||||||||||||||||||||||

| Total equity | 2,403,703 | 2,424,796 | 2,448,317 | 2,454,155 | 2,473,797 | 2,482,871 | ||||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 5,689,162 | $ | 5,645,367 | $ | 5,694,036 | $ | 5,700,885 | $ | 5,719,377 | $ | 5,703,564 | ||||||||||||||||||||||||||

|

||||||||

| Q3 2024 Supplemental | Page 7 |

|||||||

| SELECTED OPERATING DATA | |||||||||||||||||||||||||||||||||||

| (UNAUDITED, DOLLARS IN THOUSANDS) | |||||||||||||||||||||||||||||||||||

| 3RD QUARTER 2024 | 2ND QUARTER 2024 | 1ST QUARTER 2024 | 4TH QUARTER 2023 | 3RD QUARTER 2023 | 2ND QUARTER 2023 | ||||||||||||||||||||||||||||||

| Rental revenue | $ | 148,677 | $ | 145,093 | $ | 142,281 | $ | 148,738 | $ | 163,940 | $ | 151,870 | |||||||||||||||||||||||

| Other income (1) | 17,419 | 14,418 | 12,037 | 12,068 | 14,422 | 10,124 | |||||||||||||||||||||||||||||

| Mortgage and other financing income | 14,411 | 13,584 | 12,914 | 11,175 | 11,022 | 10,913 | |||||||||||||||||||||||||||||

| Total revenue | 180,507 | 173,095 | 167,232 | 171,981 | 189,384 | 172,907 | |||||||||||||||||||||||||||||

| Property operating expense | 14,611 | 14,427 | 14,920 | 14,759 | 14,592 | 13,972 | |||||||||||||||||||||||||||||

| Other expense (1) | 15,631 | 14,833 | 12,976 | 13,539 | 13,124 | 9,161 | |||||||||||||||||||||||||||||

| General and administrative expense | 11,935 | 12,020 | 13,908 | 13,765 | 13,464 | 15,248 | |||||||||||||||||||||||||||||

| Retirement and severance expense | — | — | 1,836 | — | — | 547 | |||||||||||||||||||||||||||||

| Transaction costs | 175 | 199 | 1 | 401 | 847 | 36 | |||||||||||||||||||||||||||||

| Provision (benefit) for credit losses, net | (770) | 404 | 2,737 | 1,285 | (719) | (275) | |||||||||||||||||||||||||||||

| Impairment charges | — | 11,812 | — | 2,694 | 20,887 | 43,785 | |||||||||||||||||||||||||||||

| Depreciation and amortization | 42,795 | 41,474 | 40,469 | 40,692 | 42,432 | 43,705 | |||||||||||||||||||||||||||||

| Total operating expenses | 84,377 | 95,169 | 86,847 | 87,135 | 104,627 | 126,179 | |||||||||||||||||||||||||||||

| (Loss) gain on sale of real estate | (3,419) | 1,459 | 17,949 | (3,612) | 2,550 | (575) | |||||||||||||||||||||||||||||

| Income from operations | 92,711 | 79,385 | 98,334 | 81,234 | 87,307 | 46,153 | |||||||||||||||||||||||||||||

| Costs associated with loan refinancing or payoff | 337 | — | — | — | — | — | |||||||||||||||||||||||||||||

| Interest expense, net | 32,867 | 32,820 | 31,651 | 30,337 | 31,208 | 31,591 | |||||||||||||||||||||||||||||

| Equity in loss (income) from joint ventures | 851 | 906 | 3,627 | 4,701 | (533) | 615 | |||||||||||||||||||||||||||||

| Impairment charges on joint ventures | 12,130 | — | — | — | — | — | |||||||||||||||||||||||||||||

| Income before income taxes | 46,526 | 45,659 | 63,056 | 46,196 | 56,632 | 13,947 | |||||||||||||||||||||||||||||

| Income tax (benefit) expense | (124) | 557 | 347 | 667 | 372 | 347 | |||||||||||||||||||||||||||||

| Net income | 46,650 | 45,102 | 62,709 | 45,529 | 56,260 | 13,600 | |||||||||||||||||||||||||||||

| Preferred dividend requirements | 6,032 | 6,040 | 6,032 | 6,040 | 6,032 | 6,040 | |||||||||||||||||||||||||||||

| Net income available to common shareholders of EPR Properties | $ | 40,618 | $ | 39,062 | $ | 56,677 | $ | 39,489 | $ | 50,228 | $ | 7,560 | |||||||||||||||||||||||

| (1) Other income and other expense consist primarily of results from the Company's properties operated through third-party managers. | |||||||||||||||||||||||||||||||||||

|

||||||||

| Q3 2024 Supplemental | Page 8 |

|||||||

| FUNDS FROM OPERATIONS AND FUNDS FROM OPERATIONS AS ADJUSTED | |||||||||||||||||||||||||||||||||||

| (UNAUDITED, DOLLARS IN THOUSANDS EXCEPT PER SHARE INFORMATION) | |||||||||||||||||||||||||||||||||||

| FUNDS FROM OPERATIONS ("FFO") (1): | 3RD QUARTER 2024 | 2ND QUARTER 2024 | 1ST QUARTER 2024 | 4TH QUARTER 2023 | 3RD QUARTER 2023 | 2ND QUARTER 2023 | |||||||||||||||||||||||||||||

| Net income available to common shareholders of EPR Properties | $ | 40,618 | $ | 39,062 | $ | 56,677 | $ | 39,489 | $ | 50,228 | $ | 7,560 | |||||||||||||||||||||||

| Loss (gain) on sale of real estate | 3,419 | (1,459) | (17,949) | 3,612 | (2,550) | 575 | |||||||||||||||||||||||||||||

| Impairment of real estate investments, net | — | 11,812 | — | 2,694 | 20,887 | 43,785 | |||||||||||||||||||||||||||||

| Real estate depreciation and amortization | 42,620 | 41,289 | 40,282 | 40,501 | 42,224 | 43,494 | |||||||||||||||||||||||||||||

| Allocated share of joint venture depreciation | 2,581 | 2,457 | 2,416 | 2,344 | 2,315 | 2,162 | |||||||||||||||||||||||||||||

| Impairment charges on joint ventures | 12,130 | — | — | — | — | — | |||||||||||||||||||||||||||||

| FFO available to common shareholders of EPR Properties | $ | 101,368 | $ | 93,161 | $ | 81,426 | $ | 88,640 | $ | 113,104 | $ | 97,576 | |||||||||||||||||||||||

| FFO available to common shareholders of EPR Properties | $ | 101,368 | $ | 93,161 | $ | 81,426 | $ | 88,640 | $ | 113,104 | $ | 97,576 | |||||||||||||||||||||||

| Add: Preferred dividends for Series C preferred shares | 1,938 | 1,938 | 1,938 | 1,938 | 1,938 | 1,938 | |||||||||||||||||||||||||||||

| Add: Preferred dividends for Series E preferred shares | 1,938 | 1,938 | 1,938 | 1,938 | 1,938 | 1,938 | |||||||||||||||||||||||||||||

| Diluted FFO available to common shareholders of EPR Properties | $ | 105,244 | $ | 97,037 | $ | 85,302 | $ | 92,516 | $ | 116,980 | $ | 101,452 | |||||||||||||||||||||||

| FUNDS FROM OPERATIONS AS ADJUSTED ("FFOAA") (1): | |||||||||||||||||||||||||||||||||||

| FFO available to common shareholders of EPR Properties | $ | 101,368 | $ | 93,161 | $ | 81,426 | $ | 88,640 | $ | 113,104 | $ | 97,576 | |||||||||||||||||||||||

| Retirement and severance expense | — | — | 1,836 | — | — | 547 | |||||||||||||||||||||||||||||

| Transaction costs | 175 | 199 | 1 | 401 | 847 | 36 | |||||||||||||||||||||||||||||

| Provision (benefit) for credit losses, net | (770) | 404 | 2,737 | 1,285 | (719) | (275) | |||||||||||||||||||||||||||||

| Costs associated with loan refinancing or payoff | 337 | — | — | — | — | — | |||||||||||||||||||||||||||||

| Deferred income tax benefit | (728) | (249) | (277) | (86) | (76) | (92) | |||||||||||||||||||||||||||||

| FFO as adjusted available to common shareholders of EPR Properties | $ | 100,382 | $ | 93,515 | $ | 85,723 | $ | 90,240 | $ | 113,156 | $ | 97,792 | |||||||||||||||||||||||

| FFO as adjusted available to common shareholders of EPR Properties | $ | 100,382 | $ | 93,515 | $ | 85,723 | $ | 90,240 | $ | 113,156 | $ | 97,792 | |||||||||||||||||||||||

| Add: Preferred dividends for Series C preferred shares | 1,938 | 1,938 | 1,938 | 1,938 | 1,938 | 1,938 | |||||||||||||||||||||||||||||

| Add: Preferred dividends for Series E preferred shares | 1,938 | 1,938 | 1,938 | 1,938 | 1,938 | 1,938 | |||||||||||||||||||||||||||||

| Diluted FFO as adjusted available to common shareholders of EPR Properties | $ | 104,258 | $ | 97,391 | $ | 89,599 | $ | 94,116 | $ | 117,032 | $ | 101,668 | |||||||||||||||||||||||

| FFO per common share: | |||||||||||||||||||||||||||||||||||

| Basic | $ | 1.34 | $ | 1.23 | $ | 1.08 | $ | 1.18 | $ | 1.50 | $ | 1.30 | |||||||||||||||||||||||

| Diluted | 1.31 | 1.21 | 1.07 | 1.16 | 1.47 | 1.27 | |||||||||||||||||||||||||||||

| FFO as adjusted per common share: | |||||||||||||||||||||||||||||||||||

| Basic | $ | 1.33 | $ | 1.24 | $ | 1.14 | $ | 1.20 | $ | 1.50 | $ | 1.30 | |||||||||||||||||||||||

| Diluted | 1.30 | 1.22 | 1.13 | 1.18 | 1.47 | 1.28 | |||||||||||||||||||||||||||||

| Shares used for computation (in thousands): | |||||||||||||||||||||||||||||||||||

| Basic | 75,723 | 75,689 | 75,398 | 75,330 | 75,325 | 75,297 | |||||||||||||||||||||||||||||

| Diluted | 76,108 | 76,022 | 75,705 | 75,883 | 75,816 | 75,715 | |||||||||||||||||||||||||||||

| Effect of dilutive Series C preferred shares | 2,319 | 2,310 | 2,301 | 2,293 | 2,287 | 2,279 | |||||||||||||||||||||||||||||

| Effect of dilutive Series E preferred shares | 1,664 | 1,664 | 1,663 | 1,663 | 1,663 | 1,663 | |||||||||||||||||||||||||||||

| Adjusted weighted-average shares outstanding-diluted Series C and Series E | 80,091 | 79,996 | 79,669 | 79,839 | 79,766 | 79,657 | |||||||||||||||||||||||||||||

(1) See pages 25 through 27 for definitions. |

|||||||||||||||||||||||||||||||||||

|

||||||||

| Q3 2024 Supplemental | Page 9 |

|||||||

| ADJUSTED FUNDS FROM OPERATIONS | ||||||||||||||||||||||||||||||||||||||

| (UNAUDITED, DOLLARS IN THOUSANDS EXCEPT PER SHARE INFORMATION) | ||||||||||||||||||||||||||||||||||||||

| ADJUSTED FUNDS FROM OPERATIONS ("AFFO") (1): | 3RD QUARTER 2024 | 2ND QUARTER 2024 | 1ST QUARTER 2024 | 4TH QUARTER 2023 | 3RD QUARTER 2023 | 2ND QUARTER 2023 | ||||||||||||||||||||||||||||||||

FFO available to common shareholders of EPR Properties |

$ | 101,368 | $ | 93,161 | $ | 81,426 | $ | 88,640 | $ | 113,104 | $ | 97,576 | ||||||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||||||||

| Retirement and severance expense | — | — | 1,836 | — | — | 547 | ||||||||||||||||||||||||||||||||

| Transaction costs | 175 | 199 | 1 | 401 | 847 | 36 | ||||||||||||||||||||||||||||||||

| Provision (benefit) for credit losses, net | (770) | 404 | 2,737 | 1,285 | (719) | (275) | ||||||||||||||||||||||||||||||||

Costs associated with loan refinancing or payoff |

337 | — | — | — | — | — | ||||||||||||||||||||||||||||||||

| Deferred income tax benefit | (728) | (249) | (277) | (86) | (76) | (92) | ||||||||||||||||||||||||||||||||

| Non-real estate depreciation and amortization | 175 | 185 | 187 | 191 | 208 | 211 | ||||||||||||||||||||||||||||||||

| Deferred financing fees amortization | 2,211 | 2,234 | 2,212 | 2,188 | 2,170 | 2,150 | ||||||||||||||||||||||||||||||||

Share-based compensation expense to management and trustees |

3,264 | 3,538 | 3,692 | 4,359 | 4,354 | 4,477 | ||||||||||||||||||||||||||||||||

| Amortization of above/below market leases, net and tenant allowances | (84) | (84) | (84) | (79) | (182) | (185) | ||||||||||||||||||||||||||||||||

| Maintenance capital expenditures (2) | (2,561) | (1,321) | (1,555) | (5,015) | (1,753) | (3,455) | ||||||||||||||||||||||||||||||||

| Straight-lined rental revenue | (4,414) | (5,251) | (3,670) | (2,930) | (4,407) | (1,149) | ||||||||||||||||||||||||||||||||

| Straight-lined ground sublease expense | 20 | 25 | 32 | 56 | 77 | 401 | ||||||||||||||||||||||||||||||||

Non-cash portion of mortgage and other financing income |

(396) | (555) | (862) | (535) | (290) | (141) | ||||||||||||||||||||||||||||||||

| Allocated share of joint venture non-cash items | 712 | — | — | — | — | — | ||||||||||||||||||||||||||||||||

| AFFO available to common shareholders of EPR Properties | $ | 99,309 | $ | 92,286 | $ | 85,675 | $ | 88,475 | $ | 113,333 | $ | 100,101 | ||||||||||||||||||||||||||

| AFFO available to common shareholders of EPR Properties | $ | 99,309 | $ | 92,286 | $ | 85,675 | $ | 88,475 | $ | 113,333 | $ | 100,101 | ||||||||||||||||||||||||||

| Add: Preferred dividends for Series C preferred shares | 1,938 | 1,938 | 1,938 | 1,938 | 1,938 | 1,938 | ||||||||||||||||||||||||||||||||

| Add: Preferred dividends for Series E preferred shares | 1,938 | 1,938 | 1,938 | 1,938 | 1,938 | 1,938 | ||||||||||||||||||||||||||||||||

| Diluted AFFO available to common shareholders of EPR Properties | $ | 103,185 | $ | 96,162 | $ | 89,551 | $ | 92,351 | $ | 117,209 | $ | 103,977 | ||||||||||||||||||||||||||

Weighted average diluted shares outstanding (in thousands) |

76,108 | 76,022 | 75,705 | 75,883 | 75,816 | 75,715 | ||||||||||||||||||||||||||||||||

| Effect of dilutive Series C preferred shares | 2,319 | 2,310 | 2,301 | 2,293 | 2,287 | 2,279 | ||||||||||||||||||||||||||||||||

| Effect of dilutive Series E preferred shares | 1,664 | 1,664 | 1,663 | 1,663 | 1,663 | 1,663 | ||||||||||||||||||||||||||||||||

| Adjusted weighted-average shares outstanding-diluted | 80,091 | 79,996 | 79,669 | 79,839 | 79,766 | 79,657 | ||||||||||||||||||||||||||||||||

| AFFO per diluted common share | $ | 1.29 | $ | 1.20 | $ | 1.12 | $ | 1.16 | $ | 1.47 | $ | 1.31 | ||||||||||||||||||||||||||

| Dividends declared per common share | $ | 0.855 | $ | 0.855 | $ | 0.835 | $ | 0.825 | $ | 0.825 | $ | 0.825 | ||||||||||||||||||||||||||

| AFFO payout ratio (3) | 66 | % | 71 | % | 75 | % | 71 | % | 56 | % | 63 | % | ||||||||||||||||||||||||||

(1) See pages 25 through 27 for definitions. | ||||||||||||||||||||||||||||||||||||||

| (2) Includes maintenance capital expenditures and certain second generation tenant improvements and leasing commissions. | ||||||||||||||||||||||||||||||||||||||

| (3) AFFO payout ratio is calculated by dividing dividends declared per common share by AFFO per diluted common share. | ||||||||||||||||||||||||||||||||||||||

|

||||||||

| Q3 2024 Supplemental | Page 10 |

|||||||

CAPITAL STRUCTURE AS OF SEPTEMBER 30, 2024 | |||||||||||||||||||||||||||||||||||

| (UNAUDITED, DOLLARS IN THOUSANDS) | |||||||||||||||||||||||||||||||||||

| CONSOLIDATED DEBT | |||||||||||||||||||||||||||||||||||

| PRINCIPAL PAYMENTS DUE ON DEBT: | |||||||||||||||||||||||||||||||||||

| BONDS/TERM LOAN/OTHER (1) | UNSECURED CREDIT FACILITY (2) | UNSECURED SENIOR NOTES | TOTAL | WEIGHTED AVG INTEREST RATE | |||||||||||||||||||||||||||||||

| YEAR | |||||||||||||||||||||||||||||||||||

| 2024 | $ | — | $ | — | $ | — | $ | — | —% | ||||||||||||||||||||||||||

| 2025 | — | — | 300,000 | 300,000 | 4.50% | ||||||||||||||||||||||||||||||

| 2026 | — | — | 629,597 | 629,597 | 4.70% | ||||||||||||||||||||||||||||||

| 2027 | — | — | 450,000 | 450,000 | 4.50% | ||||||||||||||||||||||||||||||

| 2028 | — | 169,000 | 400,000 | 569,000 | 5.26% | ||||||||||||||||||||||||||||||

| 2029 | — | — | 500,000 | 500,000 | 3.75% | ||||||||||||||||||||||||||||||

| 2030 | — | — | — | — | —% | ||||||||||||||||||||||||||||||

| 2031 | — | — | 400,000 | 400,000 | 3.60% | ||||||||||||||||||||||||||||||

| 2032 | — | — | — | — | —% | ||||||||||||||||||||||||||||||

| 2033 | — | — | — | — | —% | ||||||||||||||||||||||||||||||

| 2034 | — | — | — | — | —% | ||||||||||||||||||||||||||||||

| Thereafter | 24,995 | — | — | 24,995 | 2.53% | ||||||||||||||||||||||||||||||

| Less: deferred financing costs, net | — | — | — | (20,622) | —% | ||||||||||||||||||||||||||||||

| $ | 24,995 | $ | 169,000 | $ | 2,679,597 | $ | 2,852,970 | 4.42% | |||||||||||||||||||||||||||

| BALANCE | WEIGHTED AVG INTEREST RATE | WEIGHTED AVG MATURITY | |||||||||||||||||||||||||||||||||

| Fixed rate unsecured debt | $ | 2,679,597 | 4.34 | % | 3.47 | ||||||||||||||||||||||||||||||

| Fixed rate secured debt (1) | 24,995 | 2.53 | % | 22.84 | |||||||||||||||||||||||||||||||

| Variable rate unsecured debt | 169,000 | 5.98 | % | 4.02 | |||||||||||||||||||||||||||||||

| Less: deferred financing costs, net | (20,622) | — | % | — | |||||||||||||||||||||||||||||||

| Total | $ | 2,852,970 | 4.42 | % | 3.70 | ||||||||||||||||||||||||||||||

| (1) Includes $25 million of secured bonds that have been fixed through interest rate swaps through September 30, 2026. | |||||||||||||||||||||||||||||||||||

| (2) Unsecured Revolving Credit Facility Summary: | |||||||||||||||||||||||||||||||||||

| BALANCE | RATE | ||||||||||||||||||||||||||||||||||

| COMMITMENT | AT 9/30/2024 |

MATURITY | AT 9/30/2024 |

||||||||||||||||||||||||||||||||

| $1,000,000 | $169,000 | October 2, 2028 | 5.98% | ||||||||||||||||||||||||||||||||

Note: This facility will mature on October 2, 2028 and has two six-month extensions available at the Company's option and includes an accordion feature pursuant to which the maximum borrowing amount can be increased from $1.0 billion to $2.0 billion, in each case, subject to certain terms and conditions. |

|||||||||||||||||||||||||||||||||||

|

||||||||

| Q3 2024 Supplemental | Page 11 |

|||||||

CAPITAL STRUCTURE AS OF SEPTEMBER 30, 2024 AND DECEMBER 31, 2023 | ||||||||||||||

| (UNAUDITED, DOLLARS IN THOUSANDS) | ||||||||||||||

| CONSOLIDATED DEBT (continued) | ||||||||||||||

| SUMMARY OF DEBT: | September 30, 2024 |

December 31, 2023 |

||||||||||||

| Senior unsecured notes payable, 4.35%, paid in full on August 22, 2024 | $ | — | $ | 136,637 | ||||||||||

| Senior unsecured notes payable, 4.50%, due April 1, 2025 | 300,000 | 300,000 | ||||||||||||

| Senior unsecured notes payable, 4.56%, due August 22, 2026 | 179,597 | 179,597 | ||||||||||||

| Senior unsecured notes payable, 4.75%, due December 15, 2026 | 450,000 | 450,000 | ||||||||||||

| Senior unsecured notes payable, 4.50%, due June 1, 2027 | 450,000 | 450,000 | ||||||||||||

| Senior unsecured notes payable, 4.95%, due April 15, 2028 | 400,000 | 400,000 | ||||||||||||

| Unsecured revolving variable rate credit facility, SOFR + 1.15%, due October 2, 2028 | 169,000 | — | ||||||||||||

| Senior unsecured notes payable, 3.75%, due August 15, 2029 | 500,000 | 500,000 | ||||||||||||

| Senior unsecured notes payable, 3.60%, due November 15, 2031 | 400,000 | 400,000 | ||||||||||||

| Bonds payable, variable rate, fixed at 2.53% through September 30, 2026, due August 1, 2047 | 24,995 | 24,995 | ||||||||||||

| Less: deferred financing costs, net | (20,622) | (25,134) | ||||||||||||

| Total debt | $ | 2,852,970 | $ | 2,816,095 | ||||||||||

|

||||||||

| Q3 2024 Supplemental | Page 12 |

|||||||

| CAPITAL STRUCTURE | |||||||||||||||||||||||

| SENIOR NOTES | |||||||||||||||||||||||

SENIOR DEBT RATINGS AS OF SEPTEMBER 30, 2024 | |||||||||||||||||||||||

| Moody's | Baa3 (stable) | ||||||||||||||||||||||

| Fitch | BBB- (stable) | ||||||||||||||||||||||

| Standard and Poor's | BBB- (stable) | ||||||||||||||||||||||

| SUMMARY OF COVENANTS | |||||||||||||||||||||||

The Company had outstanding public senior unsecured notes with fixed interest rates of 3.60%, 3.75%, 4.50%, 4.75% and 4.95% at September 30, 2024. Interest on these notes is paid semiannually. These public senior unsecured notes contain various covenants, including: (i) a limitation on incurrence of any debt that would cause the Company's debt to adjusted total assets ratio to exceed 60%; (ii) a limitation on incurrence of any secured debt which would cause the Company’s secured debt to adjusted total assets ratio to exceed 40%; (iii) a limitation on incurrence of any debt which would cause the Company’s debt service coverage ratio to be less than 1.5 times; and (iv) the maintenance at all times of total unencumbered assets not less than 150% of the Company’s outstanding unsecured debt. |

|||||||||||||||||||||||

The following is a summary of the key financial covenants for the Company's 3.60%, 3.75%, 4.50%, 4.75% and 4.95% public senior unsecured notes, as defined and calculated per the terms of the notes. These calculations, which are not based on U.S. generally accepted accounting principles ("GAAP") measurements, are presented to investors to show the Company's ability to incur additional debt under the terms of the senior unsecured notes only and are not measures of the Company's liquidity or performance. The actual amounts as of September 30, 2024 and June 30, 2024 are: |

|||||||||||||||||||||||

| Actual | Actual | ||||||||||||||||||||||

| NOTE COVENANTS | Required | 3rd Quarter 2024 (1) | 2nd Quarter 2024 (1) | ||||||||||||||||||||

| Limitation on incurrence of total debt (Total Debt/Total Assets) | ≤ 60% | 40% | 40% | ||||||||||||||||||||

| Limitation on incurrence of secured debt (Secured Debt/Total Assets) | ≤ 40% | —% | —% | ||||||||||||||||||||

| Limitation on incurrence of debt: Debt service coverage (Consolidated Income Available for Debt Service/Annual Debt Service) - trailing twelve months | ≥ 1.5 x | 4.1x | 4.2x | ||||||||||||||||||||

| Maintenance of total unencumbered assets (Unencumbered Assets/Unsecured Debt) | ≥ 150% of unsecured debt | 238% | 238% | ||||||||||||||||||||

| (1) See page 14 for details of calculations. | |||||||||||||||||||||||

|

||||||||

| Q3 2024 Supplemental | Page 13 |

|||||||

| CAPITAL STRUCTURE | |||||||||||||||||||||||||||||

| SENIOR NOTES | |||||||||||||||||||||||||||||

| (UNAUDITED, DOLLARS IN THOUSANDS) | |||||||||||||||||||||||||||||

| COVENANT CALCULATIONS | |||||||||||||||||||||||||||||

| TOTAL ASSETS: | September 30, 2024 | TOTAL DEBT: | September 30, 2024 | ||||||||||||||||||||||||||

| Total Assets per balance sheet | $ | 5,689,162 | Secured debt obligations | $ | 24,995 | ||||||||||||||||||||||||

| Add: accumulated depreciation | 1,546,509 | Unsecured debt obligations: | |||||||||||||||||||||||||||

| Less: intangible assets, net | (32,999) | Unsecured debt | 2,848,597 | ||||||||||||||||||||||||||

| Total Assets | $ | 7,202,672 | Outstanding letters of credit | — | |||||||||||||||||||||||||

| Guarantees | 10,000 | ||||||||||||||||||||||||||||

| TOTAL UNENCUMBERED ASSETS: | September 30, 2024 | Derivatives at fair market value, net, if liability | 1,360 | ||||||||||||||||||||||||||

| Unencumbered real estate assets, gross | $ | 6,677,638 | Total unsecured debt obligations: | $ | 2,859,957 | ||||||||||||||||||||||||

| Cash and cash equivalents | 35,328 | Total Debt | $ | 2,884,952 | |||||||||||||||||||||||||

| Land held for development | 20,168 | ||||||||||||||||||||||||||||

| Property under development | 76,913 | ||||||||||||||||||||||||||||

| Total Unencumbered Assets | $ | 6,810,047 | |||||||||||||||||||||||||||

| CONSOLIDATED INCOME AVAILABLE FOR DEBT SERVICE: | 3RD QUARTER 2024 | 2ND QUARTER 2024 | 1ST QUARTER 2024 | 4TH QUARTER 2023 | TRAILING TWELVE MONTHS | ||||||||||||||||||||||||

| Adjusted EBITDAre | $ | 142,647 | $ | 135,676 | $ | 126,348 | $ | 129,440 | $ | 534,111 | |||||||||||||||||||

| Less: straight-line revenue, net, included in adjusted EBITDAre | (4,414) | (5,251) | (3,670) | (2,930) | (16,265) | ||||||||||||||||||||||||

| CONSOLIDATED INCOME AVAILABLE FOR DEBT SERVICE | $ | 138,233 | $ | 130,425 | $ | 122,678 | $ | 126,510 | $ | 517,846 | |||||||||||||||||||

| ANNUAL DEBT SERVICE: | |||||||||||||||||||||||||||||

| Interest expense, gross | $ | 34,402 | $ | 33,784 | $ | 33,592 | $ | 33,583 | $ | 135,361 | |||||||||||||||||||

| Less: deferred financing fees amortization | (2,211) | (2,234) | (2,212) | (2,188) | (8,845) | ||||||||||||||||||||||||

| ANNUAL DEBT SERVICE | $ | 32,191 | $ | 31,550 | $ | 31,380 | $ | 31,395 | $ | 126,516 | |||||||||||||||||||

| DEBT SERVICE COVERAGE | 4.3 | 4.1 | 3.9 | 4.0 | 4.1 | ||||||||||||||||||||||||

|

||||||||

| Q3 2024 Supplemental | Page 14 |

|||||||

CAPITAL STRUCTURE AS OF SEPTEMBER 30, 2024 | ||||||||||||||||||||||||||||||||||||||||||||

| (UNAUDITED, DOLLARS IN THOUSANDS EXCEPT SHARE INFORMATION) | ||||||||||||||||||||||||||||||||||||||||||||

| EQUITY | ||||||||||||||||||||||||||||||||||||||||||||

| SECURITY | SHARES OUTSTANDING | PRICE PER SHARE AT SEPTEMBER 30, 2024 |

LIQUIDATION PREFERENCE | DIVIDEND RATE | CONVERTIBLE | CONVERSION RATIO AT SEPTEMBER 30, 2024 |

CONVERSION PRICE AT SEPTEMBER 30, 2024 |

|||||||||||||||||||||||||||||||||||||

| Common shares | 75,729,102 | $49.04 | N/A | (1) | N/A | N/A | N/A | |||||||||||||||||||||||||||||||||||||

| Series C | 5,392,916 | $22.41 | $134,823 | 5.750% | Y | 0.4300 | $58.14 | |||||||||||||||||||||||||||||||||||||

| Series E | 3,445,980 | $30.63 | $86,150 | 9.000% | Y | 0.4829 | $51.77 | |||||||||||||||||||||||||||||||||||||

| Series G | 6,000,000 | $22.99 | $150,000 | 5.750% | N | N/A | N/A | |||||||||||||||||||||||||||||||||||||

| CALCULATION OF TOTAL MARKET CAPITALIZATION: | ||||||||||||||||||||||||||||||||||||||||||||

Common shares outstanding at September 30, 2024 multiplied by closing price at September 30, 2024 |

$ | 3,713,755 | ||||||||||||||||||||||||||||||||||||||||||

| Aggregate liquidation value of Series C preferred shares (2) | 134,823 | |||||||||||||||||||||||||||||||||||||||||||

| Aggregate liquidation value of Series E preferred shares (2) | 86,150 | |||||||||||||||||||||||||||||||||||||||||||

| Aggregate liquidation value of Series G preferred shares (2) | 150,000 | |||||||||||||||||||||||||||||||||||||||||||

Net debt at September 30, 2024 (3) |

2,838,264 | |||||||||||||||||||||||||||||||||||||||||||

| Total consolidated market capitalization | $ | 6,922,992 | ||||||||||||||||||||||||||||||||||||||||||

(1) Total monthly dividends declared in the third quarter of 2024 were $0.855 per share. | ||||||||||||||||||||||||||||||||||||||||||||

(2) Excludes accrued unpaid dividends at September 30, 2024. |

||||||||||||||||||||||||||||||||||||||||||||

(3) See pages 25 through 27 for definitions. |

||||||||||||||||||||||||||||||||||||||||||||

|

||||||||

| Q3 2024 Supplemental | Page 15 |

|||||||

| SUMMARY OF RATIOS | |||||||||||||||||||||||||||||||||||

| (UNAUDITED) | |||||||||||||||||||||||||||||||||||

| 3RD QUARTER 2024 | 2ND QUARTER 2024 | 1ST QUARTER 2024 | 4TH QUARTER 2023 | 3RD QUARTER 2023 | 2ND QUARTER 2023 | ||||||||||||||||||||||||||||||

| Debt to total assets ratio | 50% | 50% | 49% | 49% | 49% | 49% | |||||||||||||||||||||||||||||

| Net debt to total market capitalization ratio (1) | 41% | 44% | 44% | 41% | 43% | 41% | |||||||||||||||||||||||||||||

| Net debt to gross assets ratio (1) | 39% | 39% | 39% | 39% | 38% | 39% | |||||||||||||||||||||||||||||

| Net debt/Adjusted EBITDAre ratio (1)(2) | 5.0 | 5.2 | 5.5 | 5.3 | 4.4 | 5.0 | |||||||||||||||||||||||||||||

| Net debt/Annualized adjusted EBITDAre ratio (1)(3) | 5.2 | 5.2 | 5.2 | 5.3 | 5.1 | 5.2 | |||||||||||||||||||||||||||||

| Interest coverage ratio (4) | 4.0 | 3.8 | 3.6 | 3.8 | 4.5 | 4.1 | |||||||||||||||||||||||||||||

| Fixed charge coverage ratio (4) | 3.4 | 3.2 | 3.1 | 3.2 | 3.8 | 3.5 | |||||||||||||||||||||||||||||

| Debt service coverage ratio (4) | 4.0 | 3.8 | 3.6 | 3.8 | 4.5 | 4.1 | |||||||||||||||||||||||||||||

| FFO payout ratio (5) | 65% | 71% | 78% | 71% | 56% | 65% | |||||||||||||||||||||||||||||

| FFO as adjusted payout ratio (6) | 66% | 70% | 74% | 70% | 56% | 64% | |||||||||||||||||||||||||||||

| AFFO payout ratio (7) | 66% | 71% | 75% | 71% | 56% | 63% | |||||||||||||||||||||||||||||

(1) See pages 25 through 27 for definitions. See prior period supplementals for detailed calculations as applicable. | |||||||||||||||||||||||||||||||||||

(2) Adjusted EBITDAre is for the quarter multiplied times four. See calculation on page 31. | |||||||||||||||||||||||||||||||||||

(3) Annualized adjusted EBITDAre is adjusted EBITDAre for the quarter further adjusted for in-service and disposed projects, percentage rent and participating interest and other items which is then multiplied times four. These calculations can be found on page 31 under the reconciliation of Adjusted EBITDAre and Annualized Adjusted EBITDAre. See pages 25 through 27 for definitions. | |||||||||||||||||||||||||||||||||||

(4) See page 29 for detailed calculation. | |||||||||||||||||||||||||||||||||||

| (5) FFO payout ratio is calculated by dividing dividends declared per common share by FFO per diluted common share. | |||||||||||||||||||||||||||||||||||

| (6) FFO as adjusted payout ratio is calculated by dividing dividends declared per common share by FFO as adjusted per diluted common share. | |||||||||||||||||||||||||||||||||||

| (7) AFFO payout ratio is calculated by dividing dividends declared per common share by AFFO per diluted common share. | |||||||||||||||||||||||||||||||||||

|

||||||||

| Q3 2024 Supplemental | Page 16 |

|||||||

| SUMMARY OF MORTGAGE NOTES RECEIVABLE | |||||||||||||||||||||||

| (UNAUDITED, DOLLARS IN THOUSANDS) | |||||||||||||||||||||||

| CARRYING AMOUNT AS OF (1) | |||||||||||||||||||||||

| DESCRIPTION | INTEREST RATE | PAYOFF DATE/MATURITY DATE | OUTSTANDING PRINCIPAL AMOUNT OF MORTGAGE | SEPTEMBER 30, 2024 | DECEMBER 31, 2023 | ||||||||||||||||||

| Eat & play property Schaumburg, Illinois | 6.50 | % | 12/31/2024 | $ | 5,965 | $ | 5,958 | $ | — | ||||||||||||||

| Attraction property Powells Point, North Carolina | 7.75 | % | 6/30/2025 | 29,378 | 29,092 | 29,200 | |||||||||||||||||

| Eat & play property Eugene, Oregon | 8.13 | % | 12/31/2025 | 10,750 | 10,417 | 10,417 | |||||||||||||||||

| Fitness & wellness property Merriam, Kansas | 8.15 | % | 7/31/2029 | 9,090 | 9,245 | 9,223 | |||||||||||||||||

| Fitness & wellness property Omaha, Nebraska | 9.25 | % | 6/30/2030 | 10,905 | 10,978 | 10,951 | |||||||||||||||||

| Fitness & wellness property Omaha, Nebraska | 9.25 | % | 6/30/2030 | 10,539 | 10,643 | 10,615 | |||||||||||||||||

| Experiential lodging property Nashville, Tennessee | 6.99 | % | 9/30/2031 | 70,000 | 71,184 | 71,187 | |||||||||||||||||

| Ski property Girdwood, Alaska | 8.79 | % | 7/31/2032 | 79,830 | 79,340 | 78,062 | |||||||||||||||||

| Fitness & wellness properties Colorado and California | 7.15 | % | 1/10/2033 | 62,506 | 62,488 | 59,207 | |||||||||||||||||

| Eat & play property Austin, Texas | 11.31 | % | 6/1/2033 | 9,244 | 9,244 | 9,701 | |||||||||||||||||

| Eat & play property Dallas, Texas | 10.25 | % | 6/9/2033 | 5,325 | 5,315 | 1,105 | |||||||||||||||||

| Experiential lodging property Breaux Bridge, Louisiana | 7.25 | % | 3/8/2034 | 11,305 | 11,373 | 11,373 | |||||||||||||||||

| Fitness & wellness property Glenwood Springs, Colorado | 8.45 | % | 8/16/2034 | 52,000 | 51,878 | — | |||||||||||||||||

| Ski property West Dover and Wilmington, Vermont | 12.50 | % | 12/1/2034 | 51,050 | 51,049 | 51,049 | |||||||||||||||||

| Four ski properties Ohio and Pennsylvania | 11.41 | % | 12/1/2034 | 37,562 | 37,447 | 37,495 | |||||||||||||||||

| Ski property Chesterland, Ohio | 11.90 | % | 12/1/2034 | 4,550 | 4,405 | 4,508 | |||||||||||||||||

| Ski property Hunter, New York | 9.19 | % | 1/5/2036 | 21,000 | 21,000 | 21,000 | |||||||||||||||||

| Eat & play property Midvale, Utah | 10.25 | % | 5/31/2036 | 17,505 | 17,505 | 17,505 | |||||||||||||||||

| Eat & play property West Chester, Ohio | 9.75 | % | 8/1/2036 | 18,068 | 18,068 | 18,067 | |||||||||||||||||

| Fitness & wellness property Fort Collins, Colorado | 8.00 | % | 1/31/2038 | 10,292 | 9,850 | 10,070 | |||||||||||||||||

| Early childhood education center Lake Mary, Florida | 8.35 | % | 5/9/2039 | 4,200 | 4,405 | 4,387 | |||||||||||||||||

| Early childhood education center Lithia, Florida | 8.93 | % | 10/31/2039 | 3,959 | 4,090 | 4,018 | |||||||||||||||||

| Attraction property Frankenmuth, Michigan | 8.25 | % | 10/14/2042 | 46,912 | 46,059 | 24,375 | |||||||||||||||||

| Fitness & wellness properties Massachusetts and New York | 8.30 | % | 1/10/2044 | 77,000 | 76,603 | 76,253 | |||||||||||||||||

| Total | $ | 658,935 | $ | 657,636 | $ | 569,768 | |||||||||||||||||

|

||||||||

| Q3 2024 Supplemental | Page 17 |

|||||||

| SUMMARY OF UNCONSOLIDATED JOINT VENTURES | ||||||||||||||||||||

| (UNAUDITED, DOLLARS IN THOUSANDS) | ||||||||||||||||||||

| PROPERTY | ACQUISITION DATE | PROPERTY TYPE | LOCATION | CARRYING VALUE AT SEPTEMBER 30, 2024 |

OWNERSHIP INTEREST | |||||||||||||||

| Bellwether Beach Resort & Beachcomber Beach Resort Hotel (1) | 12/2018 | Experiential lodging | St. Pete Beach, Florida | $ | — | 65 | % | |||||||||||||

| Jellystone Park Warrens | 8/2021 | Experiential lodging | Warrens, Wisconsin | 10,271 | 95 | % | ||||||||||||||

| Camp Margaritaville Breaux Bridge | 5/2022 | Experiential lodging | Breaux Bridge, Louisiana | 16,530 | 85 | % | ||||||||||||||

| Jellystone Kozy Rest | 11/2022 | Experiential lodging | Harrisville, Pennsylvania | 5,625 | 62 | % | ||||||||||||||

AS OF SEPTEMBER 30, 2024 |

|||||||||||||||||

| TOTAL | EPR PORTION (3) | ||||||||||||||||

| Total assets | $ | 265,810 | $ | 196,229 | |||||||||||||

| Mortgage notes payable due to third parties | 186,260 | 135,321 | |||||||||||||||

| Mortgage note payable due to EPR (2) | 11,305 | 9,609 | |||||||||||||||

THREE MONTHS ENDED SEPTEMBER 30, 2024 |

NINE MONTHS ENDED SEPTEMBER 30, 2024 |

||||||||||||||||

| TOTAL | EPR PORTION (3) | TOTAL | EPR PORTION (3) | ||||||||||||||

| Revenue and other income | $ | 23,691 | $ | 18,222 | $ | 61,729 | $ | 45,084 | |||||||||

| Operating expenses | 22,111 | 16,486 | 59,273 | 43,439 | |||||||||||||

| Net operating (loss) income | $ | 1,580 | $ | 1,736 | $ | 2,456 | $ | 1,645 | |||||||||

| Interest expense | 3,700 | 2,587 | 9,972 | 7,029 | |||||||||||||

| Net loss | $ | (2,120) | $ | (851) | $ | (7,516) | $ | (5,384) | |||||||||

| Allocated share of joint venture depreciation (3) | n/a | 2,581 | n/a | 7,454 | |||||||||||||

| FFOAA (3) | n/a | $ | 1,730 | n/a | $ | 2,070 | |||||||||||

| (1) As a result of the significant damage to these properties from Hurricanes Helene and Milton during September and October of 2024, we determined that our investment in these joint ventures had no fair value and was not recoverable at September 30, 2024. Accordingly, during the nine months ending September 30, 2024, we recognized $12.1 million in other-than-temporary impairment charges on joint ventures related to these equity investments. | |||||||||||||||||

| (2) Mortgage note payable to EPR matures on March 8, 2034, with an interest rate of 7.25% through the sixth anniversary and SOFR plus 7.20%, with a cap of 8.00%, thereafter through maturity. | |||||||||||||||||

(3) Non-GAAP financial measure. See pages 25 through 27 for definitions. | |||||||||||||||||

| SUMMARY OF UNCONSOLIDATED MORTGAGE NOTES PAYABLE DUE TO THIRD PARTIES (4) | |||||||||||||||||

SEPTEMBER 30, 2024 |

|||||||||||||||||

| PROPERTY | MATURITY | EXTENSIONS | INTEREST RATE | TOTAL | EPR PORTION (3) | ||||||||||||

| Bellwether Beach Resort & Beachcomber Beach Resort Hotel | May 18, 2025 | Two additional one-year extensions | SOFR plus 3.65%, with SOFR capped at 3.50% through December 1, 2024 | $ | 105,000 | $ | 68,250 | ||||||||||

| Jellystone Park Warrens | September 15, 2031 | n/a | 4.00% | 23,741 | 22,554 | ||||||||||||

| Camp Margaritaville Breaux Bridge | March 8, 2034 | n/a | 3.85% through April 7, 2025; 4.25% April 8, 2025 through maturity | 38,500 | 32,725 | ||||||||||||

| Jellystone Kozy Rest | November 1, 2029 | n/a | 6.38% | 19,019 | 11,792 | ||||||||||||

| Total mortgage notes payable due to third parties | $ | 186,260 | $ | 135,321 | |||||||||||||

| (4) All unconsolidated mortgage notes payable are non-recourse debt instruments with the exception of Jellystone Kozy Rest, which has a limited guarantee by the Company. See Footnote 9 in the Company's most recent Quarterly Report on Form 10-Q for additional details. | |||||||||||||||||

|

||||||||

| Q3 2024 Supplemental | Page 18 |

|||||||

| INVESTMENT SPENDING AND DISPOSITION SUMMARIES | |||||||||||||||||||||||

| (UNAUDITED, DOLLARS IN THOUSANDS) | |||||||||||||||||||||||

INVESTMENT SPENDING THREE MONTHS ENDED SEPTEMBER 30, 2024 | |||||||||||||||||||||||

| INVESTMENT TYPE | TOTAL INVESTMENT SPENDING | NEW DEVELOPMENT | RE-DEVELOPMENT | ASSET ACQUISITION | MORTGAGE NOTES OR NOTES RECEIVABLE | INVESTMENT IN JOINT VENTURES | |||||||||||||||||

| Theatres | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | |||||||||||

| Eat & Play | 6,128 | 5,251 | 41 | — | 836 | — | |||||||||||||||||

| Attractions | 9,972 | — | — | — | 9,972 | — | |||||||||||||||||

| Ski | 80 | — | — | — | 80 | — | |||||||||||||||||

| Experiential Lodging | 521 | — | — | — | — | 521 | |||||||||||||||||

| Fitness & Wellness | 65,130 | 125 | 11,358 | — | 53,647 | — | |||||||||||||||||

| Cultural | 139 | — | 139 | — | — | — | |||||||||||||||||

| Total Experiential | 81,970 | 5,376 | 11,538 | — | 64,535 | 521 | |||||||||||||||||

| Total Investment Spending | $ | 81,970 | $ | 5,376 | $ | 11,538 | $ | — | $ | 64,535 | $ | 521 | |||||||||||

INVESTMENT SPENDING NINE MONTHS ENDED SEPTEMBER 30, 2024 | |||||||||||||||||||||||

| INVESTMENT TYPE | TOTAL INVESTMENT SPENDING | NEW DEVELOPMENT | RE-DEVELOPMENT | ASSET ACQUISITION | MORTGAGE NOTES OR NOTES RECEIVABLE | INVESTMENT IN JOINT VENTURES | |||||||||||||||||

| Theatres | $ | 370 | $ | — | $ | 370 | $ | — | $ | — | $ | — | |||||||||||

| Eat & Play | 31,944 | 20,963 | 797 | — | 10,184 | — | |||||||||||||||||

| Attractions | 55,798 | — | 164 | 33,437 | 22,197 | — | |||||||||||||||||

| Ski | 1,729 | — | — | — | 1,729 | — | |||||||||||||||||

| Experiential Lodging | 7,757 | — | — | — | — | 7,757 | |||||||||||||||||

| Fitness & Wellness | 115,171 | 21,756 | 37,944 | — | 55,471 | — | |||||||||||||||||

| Cultural | 1,860 | — | 1,860 | — | — | — | |||||||||||||||||

| Total Experiential | 214,629 | 42,719 | 41,135 | 33,437 | 89,581 | 7,757 | |||||||||||||||||

| Total Investment Spending | $ | 214,629 | $ | 42,719 | $ | 41,135 | $ | 33,437 | $ | 89,581 | $ | 7,757 | |||||||||||

2024 DISPOSITIONS | |||||||||||||||||||||||

THREE MONTHS ENDED SEPTEMBER 30, 2024 |

NINE MONTHS ENDED SEPTEMBER 30, 2024 |

||||||||||||||||||||||

| INVESTMENT TYPE | TOTAL DISPOSITIONS | NET PROCEEDS FROM SALE OF REAL ESTATE | NET PROCEEDS FROM PAYDOWN OF MORTGAGE NOTES | TOTAL DISPOSITIONS | NET PROCEEDS FROM SALE OF REAL ESTATE | NET PROCEEDS FROM PAYDOWN OF MORTGAGE NOTES | |||||||||||||||||

| Theatres | $ | 2,795 | $ | 2,795 | $ | — | $ | 14,386 | $ | 14,386 | $ | — | |||||||||||

| Cultural | — | — | — | 44,902 | 44,902 | — | |||||||||||||||||

| Total Experiential | 2,795 | 2,795 | — | 59,288 | 59,288 | — | |||||||||||||||||

| Total Education | 5,861 | 5,861 | — | 5,861 | 5,861 | — | |||||||||||||||||

| Total Education | 5,861 | 5,861 | — | 5,861 | 5,861 | — | |||||||||||||||||

| Total Dispositions | $ | 8,656 | $ | 8,656 | $ | — | $ | 65,149 | $ | 65,149 | $ | — | |||||||||||

|

||||||||

| Q3 2024 Supplemental | Page 19 |

|||||||

PROPERTY UNDER DEVELOPMENT - INVESTMENT SPENDING ESTIMATES AT SEPTEMBER 30, 2024 (1) | |||||||||||||||||||||||||||||||||||||||||||||||

| (UNAUDITED, DOLLARS IN THOUSANDS) | |||||||||||||||||||||||||||||||||||||||||||||||

| SEPTEMBER 30, 2024 | OWNED BUILD-TO-SUIT SPENDING ESTIMATES | ||||||||||||||||||||||||||||||||||||||||||||||

| PROPERTY UNDER DEVELOPMENT | # OF PROJECTS | 4TH QUARTER 2024 | 1ST QUARTER 2025 | 2ND QUARTER 2025 | 3RD QUARTER 2025 | THEREAFTER | TOTAL EXPECTED COSTS (2) | % LEASED | |||||||||||||||||||||||||||||||||||||||

| Total Build-to-Suit (3) | $ | 69,524 | 5 | $ | 29,479 | $ | 20,637 | $ | 19,220 | $ | 5,840 | $ | — | $ | 144,700 | 100 | % | ||||||||||||||||||||||||||||||

| Non Build-to-Suit Development | 7,389 | ||||||||||||||||||||||||||||||||||||||||||||||

| Total Property Under Development | $ | 76,913 | |||||||||||||||||||||||||||||||||||||||||||||

| SEPTEMBER 30, 2024 | OWNED BUILD-TO-SUIT IN-SERVICE ESTIMATES | ||||||||||||||||||||||||||||||||||||||||||||||

| # OF PROJECTS | 4TH QUARTER 2024 | 1ST QUARTER 2025 | 2ND QUARTER 2025 | 3RD QUARTER 2025 | THEREAFTER | TOTAL IN-SERVICE (2) | ACTUAL IN-SERVICE 3RD QUARTER 2024 | ||||||||||||||||||||||||||||||||||||||||

| Total Build-to-Suit | 5 | $ | 3,891 | $ | 1,631 | $ | 139,178 | $ | — | $ | — | $ | 144,700 | $ | — | ||||||||||||||||||||||||||||||||

| SEPTEMBER 30, 2024 | MORTGAGE BUILD-TO-SUIT SPENDING ESTIMATES | ||||||||||||||||||||||||||||||||||||||||||||||

| MORTGAGE NOTES RECEIVABLE | # OF PROJECTS | 4TH QUARTER 2024 | 1ST QUARTER 2025 | 2ND QUARTER 2025 | 3RD QUARTER 2025 | THEREAFTER | TOTAL EXPECTED COSTS (2) | ||||||||||||||||||||||||||||||||||||||||

| Total Build-to-Suit Mortgage Notes | $ | 269,805 | 5 | $ | 20,151 | $ | 4,531 | $ | 1,710 | $ | — | $ | 48,970 | $ | 345,167 | ||||||||||||||||||||||||||||||||

| Non Build-to-Suit Mortgage Notes | 387,831 | ||||||||||||||||||||||||||||||||||||||||||||||

| Total Mortgage Notes Receivable | $ | 657,636 | |||||||||||||||||||||||||||||||||||||||||||||

(1) This schedule includes only those properties for which the Company has commenced construction as of September 30, 2024. | |||||||||||||||||||||||||||||||||||||||||||||||

| (2) "Total Expected Costs" and "Total In-Service" each reflect the total capital costs expected to be funded by the Company through completion (including capitalized interest or accrued interest as applicable). | |||||||||||||||||||||||||||||||||||||||||||||||

| (3) Total Build-to-Suit excludes property under development related to the Company's real estate joint ventures that own an experiential lodging property in Harrisville, Pennsylvania. The Company's investment spending for these joint ventures is estimated at $1.5 million for the remainder of 2024. | |||||||||||||||||||||||||||||||||||||||||||||||

Note: This schedule includes future estimates for which the Company can give no assurance as to timing or amounts. Development projects have risks. See Item 1A - "Risk Factors" in the Company's most recent Annual Report on Form 10-K and, to the extent applicable, the Company's Quarterly Reports on Form 10-Q. | |||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||

| Q3 2024 Supplemental | Page 20 |

|||||||

PORTFOLIO DETAIL AS OF SEPTEMBER 30, 2024 | ||||||||||||||||||||||||||

| (UNAUDITED) | ||||||||||||||||||||||||||

| PROPERTY TYPE | PROPERTIES | OPERATORS | ANNUALIZED ADJUSTED EBITDAre (1) | STRATEGIC FOCUS | ||||||||||||||||||||||

| Theatres (2) (4) | 159 | 17 | 36 | % | Reduce | |||||||||||||||||||||

| Eat & Play | 58 | 9 | (3) | 24 | % | Grow | ||||||||||||||||||||

| Attractions | 24 | 8 | 12 | % | Grow | |||||||||||||||||||||

| Ski | 11 | 3 | 8 | % | Grow | |||||||||||||||||||||

| Experiential Lodging | 7 | 4 | 2 | % | Grow | |||||||||||||||||||||

| Fitness & Wellness | 22 | 9 | 8 | % | Grow | |||||||||||||||||||||

| Gaming | 1 | 1 | 2 | % | Grow | |||||||||||||||||||||

| Cultural | 1 | 1 | 1 | % | Grow | |||||||||||||||||||||

| EXPERIENTIAL PORTFOLIO | 283 | 52 | 93 | % | ||||||||||||||||||||||

| Early Childhood Education (5) | 60 | 7 | 5 | % | Reduce | |||||||||||||||||||||

| Private schools | 9 | 1 | 2 | % | Reduce | |||||||||||||||||||||

| EDUCATION PORTFOLIO | 69 | 8 | 7 | % | ||||||||||||||||||||||

| TOTAL PORTFOLIO | 352 | 60 | 100 | % | ||||||||||||||||||||||

(1) See pages 25 through 27 for definitions. | ||||||||||||||||||||||||||

| (2) Excludes seven theatres located in Entertainment Districts (included in Eat & Play). | ||||||||||||||||||||||||||

| (3) Excludes non-theatre operators at Entertainment districts. | ||||||||||||||||||||||||||

| (4) Includes seven properties that the Company intends to sell. | ||||||||||||||||||||||||||

(5) Includes two properties that the Company intends to sell. | ||||||||||||||||||||||||||

|

||||||||

| Q3 2024 Supplemental | Page 21 |

|||||||

| LEASE EXPIRATIONS | |||||||||||||||||||||||

AS OF SEPTEMBER 30, 2024 | |||||||||||||||||||||||

| (UNAUDITED, DOLLARS IN THOUSANDS) | |||||||||||||||||||||||

| YEAR | TOTAL NUMBER OF PROPERTIES | RENTAL REVENUE FOR THE TRAILING TWELVE MONTHS ENDED SEPTEMBER 30, 2024 (1) |

% OF TOTAL REVENUE | ||||||||||||||||||||

| 2024 | — | $ | — | — | % | ||||||||||||||||||

| 2025 | 2 | 2,801 | — | % | |||||||||||||||||||

| 2026 | 2 | 2,508 | — | % | |||||||||||||||||||

| 2027 | 4 | 21,223 | 3 | % | |||||||||||||||||||

| 2028 | 9 | 14,865 | 2 | % | |||||||||||||||||||

| 2029 | 14 | 21,438 | 3 | % | |||||||||||||||||||

| 2030 | 18 | 29,902 | 4 | % | |||||||||||||||||||

| 2031 | 4 | 7,381 | 1 | % | |||||||||||||||||||

| 2032 | 8 | 12,003 | 2 | % | |||||||||||||||||||

| 2033 | 7 | 10,756 | 2 | % | |||||||||||||||||||

| 2034 | 36 | 66,098 | 10 | % | |||||||||||||||||||

| 2035 | 29 | 75,277 | 11 | % | |||||||||||||||||||

| 2036 | 40 | 73,209 | 11 | % | |||||||||||||||||||

| 2037 | 29 | 61,823 | 9 | % | |||||||||||||||||||

| 2038 | 41 | 62,926 | 9 | % | |||||||||||||||||||

| 2039 | 9 | 6,337 | 1 | % | |||||||||||||||||||

| 2040 | 4 | 10,220 | 1 | % | |||||||||||||||||||

| 2041 | 30 | 18,608 | 3 | % | |||||||||||||||||||