| 1-13199 | 13-3956775 | ||||

| (Commission File Number) | (I.R.S. employer identification number) | ||||

| One Vanderbilt Avenue | 10017 | |||||||

| New York, | New York | (Zip Code) | ||||||

| Registrant | Trading Symbol | Title of Each Class | Name of Each Exchange on Which Registered | |||||||||||||||||

| SL Green Realty Corp. | SLG | Common Stock, $0.01 par value | New York Stock Exchange | |||||||||||||||||

| SL Green Realty Corp. | SLG.PRI | 6.500% Series I Cumulative Redeemable Preferred Stock, $0.01 par value | New York Stock Exchange | |||||||||||||||||

| Year Ending | |||||||||||

| December 31, | |||||||||||

| 2024 | 2024 | ||||||||||

| Net income per share attributable to SL Green stockholders (diluted) | $ | 2.73 | $ | 3.03 | |||||||

| Add: | |||||||||||

| Depreciation and amortization | 2.32 | 2.32 | |||||||||

| Joint ventures depreciation and noncontrolling interests adjustments | 3.71 | 3.71 | |||||||||

| Net loss attributable to noncontrolling interests | (0.08) | (0.08) | |||||||||

| Depreciable real estate reserve | 0.74 | 0.74 | |||||||||

| Less: | |||||||||||

| Gain on sale of real estate and discontinued operations, net | 2.44 | 2.44 | |||||||||

| Equity in net gain on sale of interest in unconsolidated joint venture / real estate | 0.38 | 0.38 | |||||||||

| Purchase price and other fair value adjustments | (0.79) | (0.79) | |||||||||

| Depreciation on non-real estate assets | 0.04 | 0.04 | |||||||||

| Funds From Operations per share attributable to SL Green common stockholders and noncontrolling interests (diluted) | $ | 7.35 | $ | 7.65 | |||||||

| SL GREEN REALTY CORP. | |||||

| /s/ Matthew J. DiLiberto | |||||

| Matthew J. DiLiberto | |||||

| Chief Financial Officer | |||||

| Date: April 18, 2024 | |||||

| Three Months Ended | |||||||||||

| March 31, | |||||||||||

| Revenues: | 2024 | 2023 | |||||||||

| Rental revenue, net | $ | 128,203 | $ | 174,592 | |||||||

| Escalation and reimbursement revenues | 13,301 | 20,450 | |||||||||

| SUMMIT Operator revenue | 25,604 | 19,771 | |||||||||

| Investment income | 7,403 | 9,057 | |||||||||

| Other income | 13,371 | 21,894 | |||||||||

| Total revenues | 187,882 | 245,764 | |||||||||

| Expenses: | |||||||||||

Operating expenses, including related party expenses of $0 in 2024 and $1 in 2023 |

43,608 | 52,064 | |||||||||

| Real estate taxes | 31,606 | 41,383 | |||||||||

| Operating lease rent | 6,405 | 6,301 | |||||||||

| SUMMIT Operator expenses | 21,858 | 20,688 | |||||||||

| Interest expense, net of interest income | 31,173 | 41,653 | |||||||||

| Amortization of deferred financing costs | 1,539 | 2,021 | |||||||||

| SUMMIT Operator tax expense | (1,295) | 1,267 | |||||||||

| Depreciation and amortization | 48,584 | 78,782 | |||||||||

| Loan loss and other investment reserves, net of recoveries | — | 6,890 | |||||||||

| Transaction related costs | 16 | 884 | |||||||||

| Marketing, general and administrative | 21,313 | 23,285 | |||||||||

| Total expenses | 204,807 | 275,218 | |||||||||

| Equity in net income (loss) from unconsolidated joint ventures | 111,160 | (7,412) | |||||||||

| Equity in net gain (loss) on sale of interest in unconsolidated joint venture/real estate | 26,764 | (79) | |||||||||

| Purchase price and other fair value adjustments | (50,492) | 239 | |||||||||

| Loss on sale of real estate, net | — | (1,651) | |||||||||

| Depreciable real estate reserves | (52,118) | — | |||||||||

| Net income (loss) | 18,389 | (38,357) | |||||||||

| Net loss attributable to noncontrolling interests: | |||||||||||

| Noncontrolling interests in the Operating Partnership | (901) | 2,337 | |||||||||

| Noncontrolling interests in other partnerships | 1,294 | 1,625 | |||||||||

| Preferred units distributions | (1,903) | (1,598) | |||||||||

| Net income (loss) attributable to SL Green | 16,879 | (35,993) | |||||||||

| Perpetual preferred stock dividends | (3,738) | (3,738) | |||||||||

| Net income (loss) attributable to SL Green common stockholders | $ | 13,141 | $ | (39,731) | |||||||

| Earnings Per Share (EPS) | |||||||||||

| Basic earnings (loss) per share | $ | 0.20 | $ | (0.63) | |||||||

| Diluted earnings (loss) per share | $ | 0.20 | $ | (0.63) | |||||||

| Funds From Operations (FFO) | |||||||||||

| Basic FFO per share | $ | 3.11 | $ | 1.54 | |||||||

| Diluted FFO per share | $ | 3.07 | $ | 1.53 | |||||||

| Basic ownership interest | |||||||||||

| Weighted average REIT common shares for net income per share | 64,328 | 64,079 | |||||||||

| Weighted average partnership units held by noncontrolling interests | 4,439 | 4,103 | |||||||||

| Basic weighted average shares and units outstanding | 68,767 | 68,182 | |||||||||

| Diluted ownership interest | |||||||||||

| Weighted average REIT common share and common share equivalents | 65,656 | 64,671 | |||||||||

| Weighted average partnership units held by noncontrolling interests | 4,439 | 4,103 | |||||||||

| Diluted weighted average shares and units outstanding | 70,095 | 68,774 | |||||||||

| March 31, | December 31, | ||||||||||

| 2024 | 2023 | ||||||||||

| Assets | (Unaudited) | ||||||||||

| Commercial real estate properties, at cost: | |||||||||||

| Land and land interests | $ | 1,150,681 | $ | 1,092,671 | |||||||

| Building and improvements | 3,729,884 | 3,655,624 | |||||||||

| Building leasehold and improvements | 1,358,851 | 1,354,569 | |||||||||

| Right of use asset - operating leases | 953,236 | 953,236 | |||||||||

| 7,192,652 | 7,056,100 | ||||||||||

| Less: accumulated depreciation | (2,078,203) | (2,035,311) | |||||||||

| 5,114,449 | 5,020,789 | ||||||||||

| Assets held for sale | 21,586 | — | |||||||||

| Cash and cash equivalents | 196,035 | 221,823 | |||||||||

| Restricted cash | 122,461 | 113,696 | |||||||||

| Investment in marketable securities | 10,673 | 9,591 | |||||||||

| Tenant and other receivables | 38,659 | 33,270 | |||||||||

| Related party receivables | 12,229 | 12,168 | |||||||||

| Deferred rents receivable | 267,969 | 264,653 | |||||||||

Debt and preferred equity investments, net of discounts and deferred origination fees of $1,623 and $1,630 in 2024 and 2023, respectively, and allowances of $13,520 and $13,520 in 2024 and 2023, respectively |

352,347 | 346,745 | |||||||||

| Investments in unconsolidated joint ventures | 2,984,786 | 2,983,313 | |||||||||

| Deferred costs, net | 109,296 | 111,463 | |||||||||

| Other assets | 533,802 | 413,670 | |||||||||

| Total assets | $ | 9,764,292 | $ | 9,531,181 | |||||||

| Liabilities | |||||||||||

| Mortgages and other loans payable | $ | 1,701,378 | $ | 1,497,386 | |||||||

| Revolving credit facility | 650,000 | 560,000 | |||||||||

| Unsecured term loan | 1,250,000 | 1,250,000 | |||||||||

| Unsecured notes | 100,000 | 100,000 | |||||||||

| Deferred financing costs, net | (15,875) | (16,639) | |||||||||

| Total debt, net of deferred financing costs | 3,685,503 | 3,390,747 | |||||||||

| Accrued interest payable | 23,217 | 17,930 | |||||||||

| Accounts payable and accrued expenses | 101,495 | 153,164 | |||||||||

| Deferred revenue | 157,756 | 134,053 | |||||||||

| Lease liability - financing leases | 105,859 | 105,531 | |||||||||

| Lease liability - operating leases | 823,594 | 827,692 | |||||||||

| Dividend and distributions payable | 20,135 | 20,280 | |||||||||

| Security deposits | 56,398 | 49,906 | |||||||||

| Liabilities related to assets held for sale | 10,649 | — | |||||||||

| Junior subordinate deferrable interest debentures held by trusts that issued trust preferred securities | 100,000 | 100,000 | |||||||||

| Other liabilities | 437,302 | 471,401 | |||||||||

| Total liabilities | 5,521,908 | 5,270,704 | |||||||||

| Commitments and contingencies | — | — | |||||||||

| Noncontrolling interests in Operating Partnership | 272,235 | 238,051 | |||||||||

| Preferred units | 166,501 | 166,501 | |||||||||

| Equity | |||||||||||

| SL Green stockholders' equity: | |||||||||||

Series I Preferred Stock, $0.01 par value, $25.00 liquidation preference, 9,200 issued and outstanding at both March 31, 2024 and December 31, 2023 |

221,932 | 221,932 | |||||||||

Common stock, $0.01 par value 160,000 shares authorized, 65,866 and 65,786 issued and outstanding (including 1,060 and 1,060 held in Treasury) at March 31, 2024 and December 31, 2023, respectively |

660 | 660 | |||||||||

| Additional paid-in capital | 3,831,130 | 3,826,452 | |||||||||

| Treasury stock at cost | (128,655) | (128,655) | |||||||||

| Accumulated other comprehensive income | 40,151 | 17,477 | |||||||||

| Retained deficit | (229,607) | (151,551) | |||||||||

| Total SL Green Realty Corp. stockholders’ equity | 3,735,611 | 3,786,315 | |||||||||

| Noncontrolling interests in other partnerships | 68,037 | 69,610 | |||||||||

| Total equity | 3,803,648 | 3,855,925 | |||||||||

| Total liabilities and equity | $ | 9,764,292 | $ | 9,531,181 | |||||||

| Three Months Ended | |||||||||||

| March 31, | |||||||||||

| Funds From Operations (FFO) Reconciliation: | 2024 | 2023 | |||||||||

| Net income (loss) attributable to SL Green common stockholders | $ | 13,141 | $ | (39,731) | |||||||

| Add: | |||||||||||

| Depreciation and amortization | 48,584 | 78,782 | |||||||||

| Joint venture depreciation and noncontrolling interest adjustments | 74,258 | 69,534 | |||||||||

| Net loss attributable to noncontrolling interests | (393) | (3,962) | |||||||||

| Less: | |||||||||||

| Equity in net gain (loss) on sale of interest in unconsolidated joint venture/real estate | 26,764 | (79) | |||||||||

| Purchase price and other fair value adjustments | (55,652) | — | |||||||||

| Loss on sale of real estate, net | — | (1,651) | |||||||||

| Depreciable real estate reserves | (52,118) | — | |||||||||

| Depreciation on non-rental real estate assets | 1,153 | 868 | |||||||||

| FFO attributable to SL Green common stockholders and unit holders | $ | 215,443 | $ | 105,485 | |||||||

| Three Months Ended | |||||||||||

| March 31, | |||||||||||

| Operating income and Same-store NOI Reconciliation: | 2024 | 2023 | |||||||||

| Net income (loss) | $ | 18,389 | $ | (38,357) | |||||||

| Depreciable real estate reserves | 52,118 | — | |||||||||

| Loss on sale of real estate, net | — | 1,651 | |||||||||

| Purchase price and other fair value adjustments | 50,492 | (239) | |||||||||

| Equity in net (gain) loss on sale of interest in unconsolidated joint venture/real estate | (26,764) | 79 | |||||||||

| Depreciation and amortization | 48,584 | 78,782 | |||||||||

| SUMMIT Operator tax expense | (1,295) | 1,267 | |||||||||

| Amortization of deferred financing costs | 1,539 | 2,021 | |||||||||

| Interest expense, net of interest income | 31,173 | 41,653 | |||||||||

| Operating income | 174,236 | 86,857 | |||||||||

| Equity in net (income) loss from unconsolidated joint ventures | (111,160) | 7,412 | |||||||||

| Marketing, general and administrative expense | 21,313 | 23,285 | |||||||||

| Transaction related costs | 16 | 884 | |||||||||

| Loan loss and other investment reserves, net of recoveries | — | 6,890 | |||||||||

| SUMMIT Operator expenses | 21,858 | 20,688 | |||||||||

| Investment income | (7,403) | (9,057) | |||||||||

| SUMMIT Operator revenue | (25,604) | (19,771) | |||||||||

| Non-building revenue | (5,049) | (6,806) | |||||||||

| Net operating income (NOI) | 68,207 | 110,382 | |||||||||

| Equity in net income (loss) from unconsolidated joint ventures | 111,160 | (7,412) | |||||||||

| SLG share of unconsolidated JV depreciation and amortization | 69,446 | 64,723 | |||||||||

| SLG share of unconsolidated JV amortization of deferred financing costs | 3,095 | 3,062 | |||||||||

| SLG share of unconsolidated JV interest expense, net of interest income | 72,803 | 63,146 | |||||||||

| SLG share of unconsolidated JV loss on early extinguishment of debt | (141,664) | — | |||||||||

| SLG share of unconsolidated JV investment income | — | (313) | |||||||||

| SLG share of unconsolidated JV non-building revenue | (501) | (2,298) | |||||||||

| NOI including SLG share of unconsolidated JVs | 182,546 | 231,290 | |||||||||

| NOI from other properties/affiliates | (24,930) | (66,596) | |||||||||

| Same-Store NOI | 157,616 | 164,694 | |||||||||

| Straight-line and free rent | (3,187) | (5,187) | |||||||||

| Amortization of acquired above and below-market leases, net | 49 | 166 | |||||||||

| Operating lease straight-line adjustment | 204 | 204 | |||||||||

| SLG share of unconsolidated JV straight-line and free rent | (1,737) | (8,888) | |||||||||

| SLG share of unconsolidated JV amortization of acquired above and below-market leases, net | (4,407) | (4,225) | |||||||||

| SLG share of unconsolidated JV operating lease straight-line adjustment | — | (19) | |||||||||

| Same-store cash NOI | $ | 148,538 | $ | 146,745 | |||||||

| Lease termination income | (1,163) | (511) | |||||||||

| SLG share of unconsolidated JV lease termination income | (3,286) | (443) | |||||||||

| Same-store cash NOI excluding lease termination income | $ | 144,089 | $ | 145,791 | |||||||

|

||||||||

| Supplemental Information | 2 |

First Quarter 2024 |

||||||

| TABLE OF CONTENTS |  |

|||||||

| Definitions | |||||||||||

| Highlights | - | ||||||||||

| Comparative Balance Sheets | |||||||||||

| Comparative Statements of Operations | |||||||||||

| Comparative Computation of FFO and FAD | |||||||||||

| Consolidated Statement of Equity | |||||||||||

| Joint Venture Statements | - | ||||||||||

| Selected Financial Data | - | ||||||||||

| Debt Summary Schedule | - | ||||||||||

| Derivative Summary Schedule | |||||||||||

| Lease Liability Schedule | |||||||||||

| Debt and Preferred Equity Investments | - | ||||||||||

| Selected Property Data | |||||||||||

| Property Portfolio | - | ||||||||||

| Largest Tenants | |||||||||||

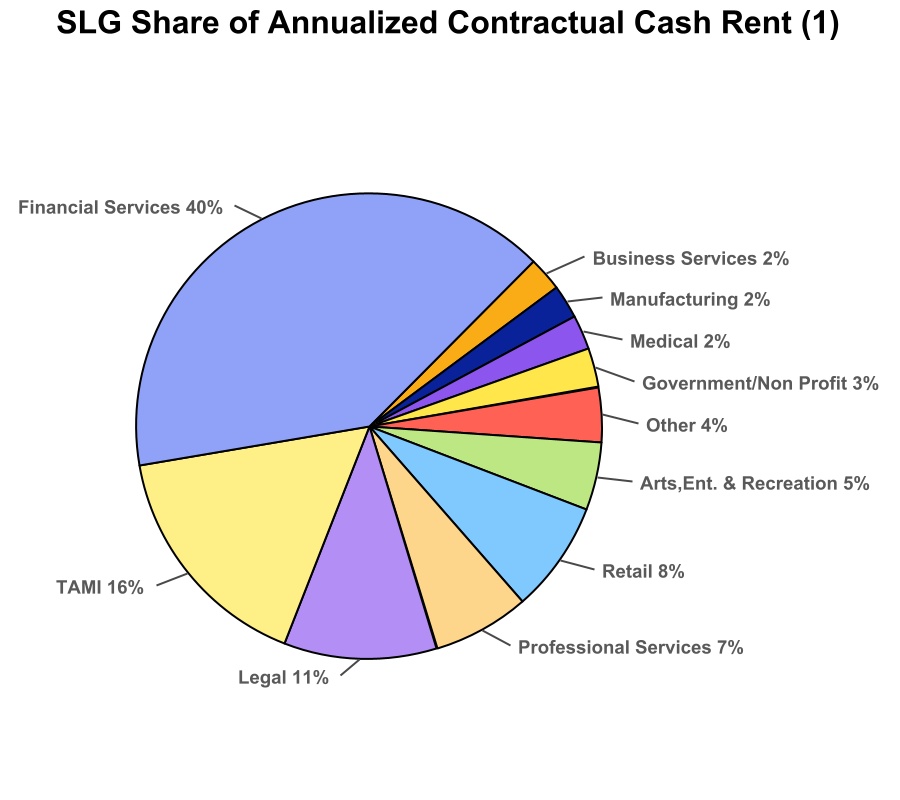

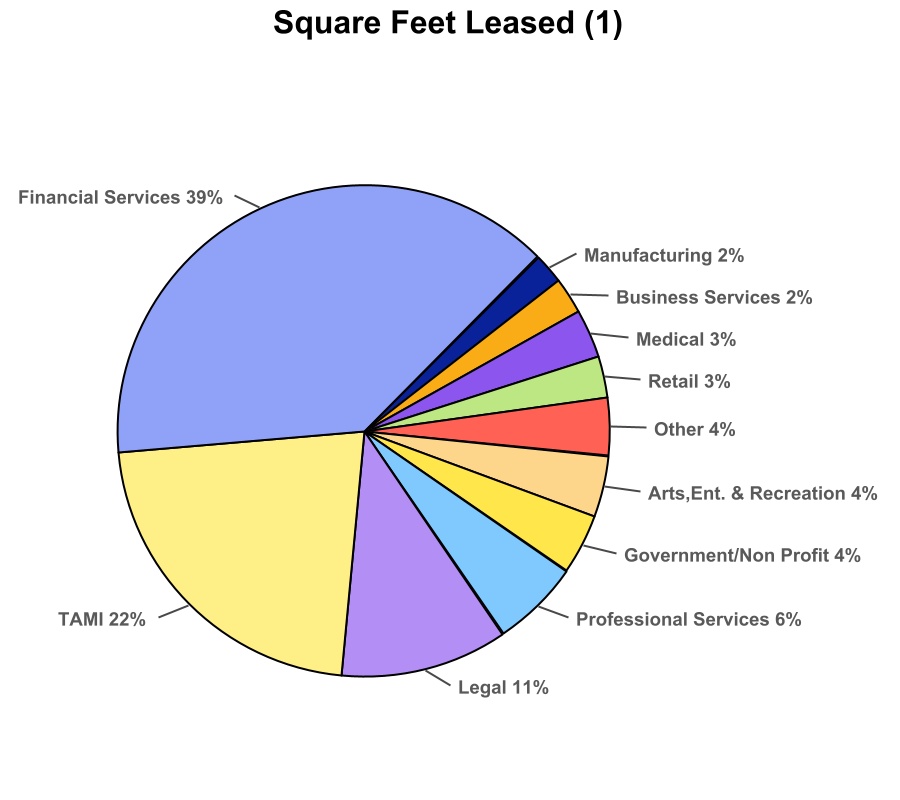

| Tenant Diversification | |||||||||||

| Leasing Activity | - | ||||||||||

| Lease Expirations | - | ||||||||||

| Summary of Real Estate Acquisition/Disposition Activity | - | ||||||||||

| Non-GAAP Disclosures and Reconciliations | |||||||||||

| Analyst Coverage | |||||||||||

| Executive Management | |||||||||||

| Supplemental Information | 3 |

First Quarter 2024 |

||||||

|

DEFINITIONS

|

|

|||||||

| Supplemental Information | 4 |

First Quarter 2024 |

||||||

|

DEFINITIONS

|

|

|||||||

| Added to Same-Store in 2024: | Removed from Same-Store in 2024: | ||||

| 885 Third Avenue | 717 Fifth Avenue (disposed) | ||||

| 450 Park Avenue | 719 Seventh Avenue (ASP) | ||||

| Worldwide Plaza (ASP) | |||||

| 115 Spring Street (ASP) | |||||

| 11 West 34th Street (ASP) | |||||

| 650 Fifth Avenue (ASP) | |||||

| 1552-1560 Broadway (ASP) | |||||

| Supplemental Information | 5 |

First Quarter 2024 |

||||||

|

FIRST QUARTER 2024 HIGHLIGHTS

Unaudited

|

|

|||||||

| Supplemental Information | 6 |

First Quarter 2024 |

||||||

|

FIRST QUARTER 2024 HIGHLIGHTS

Unaudited

|

|

|||||||

| Supplemental Information | 7 |

First Quarter 2024 |

||||||

|

FIRST QUARTER 2024 HIGHLIGHTS

Unaudited

|

|

|||||||

| Supplemental Information | 8 |

First Quarter 2024 |

||||||

|

KEY FINANCIAL DATA

Unaudited

(Dollars in Thousands Except Per Share)

|

|

|||||||

| As of or for the three months ended | |||||||||||||||||||||||||||||

| 3/31/2024 | 12/31/2023 | 9/30/2023 | 6/30/2023 | 3/31/2023 | |||||||||||||||||||||||||

| Earnings Per Share | |||||||||||||||||||||||||||||

| Net income (loss) available to common stockholders (EPS) - diluted | $ | 0.20 | $ | (2.45) | $ | (0.38) | $ | (5.63) | $ | (0.63) | |||||||||||||||||||

| Funds from operations (FFO) available to common stockholders - diluted | $ | 3.07 | $ | 0.72 | $ | 1.27 | $ | 1.43 | $ | 1.53 | |||||||||||||||||||

| Common Share Price & Dividends | |||||||||||||||||||||||||||||

| Closing price at the end of the period | $ | 55.13 | $ | 45.17 | $ | 37.30 | $ | 30.05 | $ | 23.52 | |||||||||||||||||||

| Closing high price during period | $ | 55.13 | $ | 48.00 | $ | 41.47 | $ | 30.72 | $ | 43.97 | |||||||||||||||||||

| Closing low price during period | $ | 42.45 | $ | 29.25 | $ | 29.79 | $ | 20.60 | $ | 19.96 | |||||||||||||||||||

| Annual dividend per common share | $ | 3.00 | $ | 3.00 | $ | 3.25 | $ | 3.25 | $ | 3.25 | |||||||||||||||||||

| FFO payout ratio (trailing 12 months) | 48.8% | 65.2% | 57.1% | 55.5% | 53.6% | ||||||||||||||||||||||||

| Funds available for distribution (FAD) payout ratio (trailing 12 months) | 63.8% | 97.3% | 89.4% | 90.4% | 79.0% | ||||||||||||||||||||||||

| Common Shares & Units | |||||||||||||||||||||||||||||

| Common shares outstanding | 64,806 | 64,726 | 64,398 | 64,387 | 64,373 | ||||||||||||||||||||||||

| Units outstanding | 4,417 | 3,949 | 4,139 | 4,238 | 4,239 | ||||||||||||||||||||||||

| Total common shares and units outstanding | 69,223 | 68,675 | 68,537 | 68,625 | 68,612 | ||||||||||||||||||||||||

| Weighted average common shares and units outstanding - basic | 68,767 | 68,014 | 68,296 | 68,341 | 68,182 | ||||||||||||||||||||||||

| Weighted average common shares and units outstanding - diluted | 70,095 | 69,300 | 69,105 | 68,933 | 68,774 | ||||||||||||||||||||||||

| Market Capitalization | |||||||||||||||||||||||||||||

| Market value of common equity | $ | 3,816,264 | $ | 3,102,050 | $ | 2,556,430 | $ | 2,062,181 | $ | 1,613,754 | |||||||||||||||||||

| Liquidation value of preferred equity/units | 396,500 | 396,500 | 396,500 | 396,500 | 407,943 | ||||||||||||||||||||||||

| Consolidated debt | 3,801,378 | 3,507,386 | 3,368,872 | 3,825,313 | 5,599,489 | ||||||||||||||||||||||||

| Consolidated market capitalization | $ | 8,014,142 | $ | 7,005,936 | $ | 6,321,802 | $ | 6,283,994 | $ | 7,621,186 | |||||||||||||||||||

| SLG share of unconsolidated JV debt | 7,087,348 | 7,352,275 | 7,345,740 | 7,113,281 | 6,196,174 | ||||||||||||||||||||||||

| Market capitalization including SLG share of unconsolidated JVs | $ | 15,101,490 | $ | 14,358,211 | $ | 13,667,542 | $ | 13,397,275 | $ | 13,817,360 | |||||||||||||||||||

| Consolidated debt service coverage (trailing 12 months) | 2.82x | 2.27x | 2.31x | 2.50x | 2.93x | ||||||||||||||||||||||||

| Consolidated fixed charge coverage (trailing 12 months) | 2.32x | 1.88x | 1.94x | 2.09x | 2.39x | ||||||||||||||||||||||||

| Debt service coverage, including SLG share of unconsolidated JVs (trailing 12 months) | 1.59x | 1.41x | 1.49x | 1.61x | 1.78x | ||||||||||||||||||||||||

| Fixed charge coverage, including SLG share of unconsolidated JVs (trailing 12 months) | 1.44x | 1.28x | 1.35x | 1.44x | 1.58x | ||||||||||||||||||||||||

| Supplemental Information | 9 |

First Quarter 2024 |

||||||

|

KEY FINANCIAL DATA

Unaudited

(Dollars in Thousands Except Per Share)

|

|

|||||||

| As of or for the three months ended | |||||||||||||||||||||||||||||

| 3/31/2024 | 12/31/2023 | 9/30/2023 | 6/30/2023 | 3/31/2023 | |||||||||||||||||||||||||

| Selected Balance Sheet Data | |||||||||||||||||||||||||||||

| Real estate assets before depreciation | $ | 7,214,191 | (1) |

$ | 7,056,100 | $ | 6,992,239 | $ | 6,917,131 | $ | 9,243,706 | ||||||||||||||||||

| Investments in unconsolidated joint ventures | $ | 2,984,786 | $ | 2,983,313 | $ | 3,152,752 | $ | 3,228,663 | $ | 3,164,729 | |||||||||||||||||||

| Debt and preferred equity investments | $ | 352,347 | $ | 346,745 | $ | 334,327 | $ | 636,476 | $ | 626,803 | |||||||||||||||||||

| Cash and cash equivalents | $ | 196,035 | $ | 221,823 | $ | 189,750 | $ | 191,979 | $ | 158,937 | |||||||||||||||||||

| Investment in marketable securities | $ | 10,673 | $ | 9,591 | $ | 9,616 | $ | 9,797 | $ | 10,273 | |||||||||||||||||||

| Total assets | $ | 9,764,292 | $ | 9,531,181 | $ | 9,690,582 | $ | 10,041,288 | $ | 12,342,119 | |||||||||||||||||||

| Consolidated fixed rate & hedged debt | $ | 3,040,885 | $ | 3,237,386 | $ | 3,248,724 | $ | 3,250,165 | $ | 4,964,341 | |||||||||||||||||||

| Consolidated variable rate debt | 650,000 | 160,000 | 10,148 | 465,148 | 525,148 | ||||||||||||||||||||||||

| Consolidated ASP debt | 110,493 | 110,000 | 110,000 | 110,000 | 110,000 | ||||||||||||||||||||||||

| Total consolidated debt | $ | 3,801,378 | $ | 3,507,386 | $ | 3,368,872 | $ | 3,825,313 | $ | 5,599,489 | |||||||||||||||||||

| Deferred financing costs, net of amortization | (15,875) | (16,639) | (18,340) | (20,394) | (22,275) | ||||||||||||||||||||||||

| Total consolidated debt, net | $ | 3,785,503 | $ | 3,490,747 | $ | 3,350,532 | $ | 3,804,919 | $ | 5,577,214 | |||||||||||||||||||

| Total liabilities | $ | 5,521,908 | $ | 5,270,704 | $ | 5,168,616 | $ | 5,460,520 | $ | 7,361,827 | |||||||||||||||||||

| Fixed rate & hedged debt, including SLG share of unconsolidated JV debt | $ | 8,418,284 | $ | 8,703,587 | $ | 8,719,794 | $ | 9,108,034 | $ | 9,923,079 | |||||||||||||||||||

Variable rate debt, including SLG share of unconsolidated JV debt (2) |

1,429,640 | 964,467 | 818,474 | 670,731 | 727,965 | ||||||||||||||||||||||||

| ASP debt, including SLG share of unconsolidated ASP JV debt | 1,040,802 | 1,191,607 | 1,176,344 | 1,159,829 | 1,144,619 | ||||||||||||||||||||||||

| Total debt, including SLG share of unconsolidated JV debt | $ | 10,888,726 | $ | 10,859,661 | $ | 10,714,612 | $ | 10,938,594 | $ | 11,795,663 | |||||||||||||||||||

| Selected Operating Data | |||||||||||||||||||||||||||||

| Property operating revenues | $ | 141,504 | $ | 151,357 | $ | 150,991 | $ | 185,945 | $ | 195,042 | |||||||||||||||||||

| Property operating expenses | (81,619) | (86,467) | (88,033) | (93,497) | (99,748) | ||||||||||||||||||||||||

| Property NOI | $ | 59,885 | $ | 64,890 | $ | 62,958 | $ | 92,448 | $ | 95,294 | |||||||||||||||||||

| SLG share of unconsolidated JV Property NOI | 116,741 | 119,506 | 126,661 | 106,566 | 129,739 | ||||||||||||||||||||||||

| Property NOI, including SLG share of unconsolidated JV Property NOI | $ | 176,626 | $ | 184,396 | $ | 189,619 | $ | 199,014 | $ | 225,033 | |||||||||||||||||||

| SUMMIT Operator revenue | 25,604 | 35,240 | 35,069 | 28,180 | 19,771 | ||||||||||||||||||||||||

| Investment income, including SLG share of unconsolidated JV | 7,403 | 7,176 | 10,010 | 9,420 | 9,370 | ||||||||||||||||||||||||

| Other income, including SLG share of unconsolidated JV | 17,162 | 17,983 | 25,746 | 27,994 | 24,652 | ||||||||||||||||||||||||

| Loss on early extinguishment of debt | — | (870) | — | — | — | ||||||||||||||||||||||||

| SUMMIT Operator expenses | (21,858) | (24,887) | (32,801) | (22,835) | (20,688) | ||||||||||||||||||||||||

| Loan loss and other investment reserves, net of recoveries | — | — | — | — | (6,890) | ||||||||||||||||||||||||

| Transaction costs, including SLG share of unconsolidated JVs | (16) | (16) | (166) | (33) | (884) | ||||||||||||||||||||||||

| Marketing general & administrative expenses | (21,313) | (42,257) | (22,873) | (22,974) | (23,285) | ||||||||||||||||||||||||

| SUMMIT Operator tax expense | 1,295 | (2,320) | (3,735) | (1,879) | (1,267) | ||||||||||||||||||||||||

| Income taxes | 707 | 737 | (544) | 802 | 564 | ||||||||||||||||||||||||

| EBITDAre | $ | 185,610 | $ | 175,182 | $ | 200,325 | $ | 217,689 | $ | 226,376 | |||||||||||||||||||

(1) Includes $21.5 million attributable to Palisades Premier Conference Center, which was held for sale as of March 31, 2024. | |||||||||||||||||||||||||||||

| (2) Does not reflect floating rate debt and preferred equity investments that provide a hedge against floating rate debt. | |||||||||||||||||||||||||||||

| Supplemental Information | 10 |

First Quarter 2024 |

||||||

|

KEY FINANCIAL DATA

Manhattan Properties (1)

Unaudited

(Dollars in Thousands Except Per Share)

|

|

|||||||

| As of or for the three months ended | |||||||||||||||||||||||||||||

| 3/31/2024 | 12/31/2023 | 9/30/2023 | 6/30/2023 | 3/31/2023 | |||||||||||||||||||||||||

| Selected Operating Data | |||||||||||||||||||||||||||||

| Property operating revenues | $ | 136,869 | $ | 145,542 | $ | 145,547 | $ | 181,045 | $ | 190,215 | |||||||||||||||||||

| Property operating expenses | 70,223 | 73,799 | 78,271 | 83,135 | 88,279 | ||||||||||||||||||||||||

| Property NOI | $ | 66,646 | $ | 71,743 | $ | 67,276 | $ | 97,910 | $ | 101,936 | |||||||||||||||||||

| Other income - consolidated | $ | 2,136 | $ | 2,190 | $ | 3,285 | $ | 1,157 | $ | 7,959 | |||||||||||||||||||

| SLG share of property NOI from unconsolidated JVs | $ | 116,617 | $ | 120,572 | $ | 126,531 | $ | 106,445 | $ | 129,617 | |||||||||||||||||||

| Office Portfolio Statistics (Manhattan Operating Properties) | |||||||||||||||||||||||||||||

| Consolidated office buildings in service | 14 | 13 | 13 | 13 | 14 | ||||||||||||||||||||||||

| Unconsolidated office buildings in service | 10 | 12 | 12 | 12 | 11 | ||||||||||||||||||||||||

| 24 | 25 | 25 | 25 | 25 | |||||||||||||||||||||||||

| Consolidated office buildings in service - square footage | 8,753,441 | 8,399,141 | 8,399,141 | 8,399,141 | 10,181,934 | ||||||||||||||||||||||||

| Unconsolidated office buildings in service - square footage | 13,009,149 | 15,412,174 | 15,412,174 | 15,412,174 | 13,629,381 | ||||||||||||||||||||||||

| 21,762,590 | 23,811,315 | 23,811,315 | 23,811,315 | 23,811,315 | |||||||||||||||||||||||||

| Same-Store office occupancy inclusive of leases signed not yet commenced | 89.2% | 89.8% | 89.9% | 89.8% | 90.2% | ||||||||||||||||||||||||

| Office Leasing Statistics (Manhattan Operating Properties) | |||||||||||||||||||||||||||||

| New leases commenced | 31 | 20 | 21 | 21 | 20 | ||||||||||||||||||||||||

| Renewal leases commenced | 19 | 6 | 22 | 11 | 15 | ||||||||||||||||||||||||

| Total office leases commenced | 50 | 26 | 43 | 32 | 35 | ||||||||||||||||||||||||

| Commenced office square footage filling vacancy | 109,576 | 37,718 | 80,485 | 44,346 | 80,072 | ||||||||||||||||||||||||

Commenced office square footage on previously occupied space (M-T-M leasing) (2) |

280,879 | 235,703 | 218,964 | 369,906 | 384,041 | ||||||||||||||||||||||||

| Total office square footage commenced | 390,455 | 273,421 | 299,449 | 414,252 | 464,113 | ||||||||||||||||||||||||

| Average starting cash rent psf - office leases commenced | $ | 75.11 | $ | 107.62 | $ | 82.96 | $ | 78.88 | $ | 66.44 | |||||||||||||||||||

Previous escalated cash rent psf - office leases commenced (3) |

$ | 76.02 | $ | 102.55 | $ | 86.10 | $ | 78.00 | $ | 62.76 | |||||||||||||||||||

(Decrease) increase in new cash rent over previously escalated cash rent (2) (3) |

(1.2)% | 4.9% | (3.6)% | 1.1% | 5.9% | ||||||||||||||||||||||||

| Average lease term | 7.0 | 11.5 | 4.9 | 5.6 | 6.2 | ||||||||||||||||||||||||

| Tenant concession packages psf | $ | 52.48 | $ | 102.43 | $ | 33.25 | $ | 49.43 | $ | 46.86 | |||||||||||||||||||

| Free rent months | 7.3 | 10.3 | 5.0 | 7.2 | 4.8 | ||||||||||||||||||||||||

| (1) Property data for operating buildings only. | |||||||||||||||||||||||||||||

| (2) Calculated on space that was occupied within the previous 12 months. | |||||||||||||||||||||||||||||

| (3) Previously escalated cash rent includes base rent plus all additional amounts paid by the previous tenant in the form of real estate taxes, operating expenses, porters wage or a consumer price index (CPI) adjustment. | |||||||||||||||||||||||||||||

| Supplemental Information | 11 |

First Quarter 2024 |

||||||

|

COMPARATIVE BALANCE SHEETS

Unaudited

(Dollars in Thousands)

|

|

|||||||

| As of | |||||||||||||||||||||||||||||

| 3/31/2024 | 12/31/2023 | 9/30/2023 | 6/30/2023 | 3/31/2023 | |||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||

| Commercial real estate properties, at cost: | |||||||||||||||||||||||||||||

| Land and land interests | $ | 1,150,681 | $ | 1,092,671 | $ | 1,090,370 | $ | 1,071,469 | $ | 1,576,927 | |||||||||||||||||||

| Building and improvements | 3,729,884 | 3,655,624 | 3,605,247 | 3,494,853 | 4,940,138 | ||||||||||||||||||||||||

| Building leasehold and improvements | 1,358,851 | 1,354,569 | 1,343,386 | 1,397,573 | 1,700,376 | ||||||||||||||||||||||||

| Right of use asset - operating leases | 953,236 | 953,236 | 953,236 | 953,236 | 1,026,265 | ||||||||||||||||||||||||

| 7,192,652 | 7,056,100 | 6,992,239 | 6,917,131 | 9,243,706 | |||||||||||||||||||||||||

| Less: accumulated depreciation | (2,078,203) | (2,035,311) | (1,997,942) | (1,950,028) | (2,100,804) | ||||||||||||||||||||||||

| Net real estate | 5,114,449 | 5,020,789 | 4,994,297 | 4,967,103 | 7,142,902 | ||||||||||||||||||||||||

| Other real estate investments: | |||||||||||||||||||||||||||||

| Debt and preferred equity investments, net | 352,347 | 346,745 | 334,327 | 636,476 | 626,803 | ||||||||||||||||||||||||

| Investment in unconsolidated joint ventures | 2,984,786 | 2,983,313 | 3,152,752 | 3,228,663 | 3,164,729 | ||||||||||||||||||||||||

| Assets held for sale, net | 21,586 | (1) |

— | — | — | — | |||||||||||||||||||||||

| Cash and cash equivalents | 196,035 | 221,823 | 189,750 | 191,979 | 158,937 | ||||||||||||||||||||||||

| Restricted cash | 122,461 | 113,696 | 119,573 | 119,080 | 198,325 | ||||||||||||||||||||||||

| Investment in marketable securities | 10,673 | 9,591 | 9,616 | 9,797 | 10,273 | ||||||||||||||||||||||||

| Tenant and other receivables | 38,659 | 33,270 | 37,295 | 36,657 | 36,289 | ||||||||||||||||||||||||

| Related party receivables | 12,229 | 12,168 | 9,723 | 28,955 | 26,794 | ||||||||||||||||||||||||

| Deferred rents receivable | 267,969 | 264,653 | 262,808 | 260,625 | 266,567 | ||||||||||||||||||||||||

| Deferred costs, net | 109,296 | 111,463 | 108,370 | 112,347 | 117,602 | ||||||||||||||||||||||||

| Other assets | 533,802 | 413,670 | 472,071 | 449,606 | 592,898 | ||||||||||||||||||||||||

| Total Assets | $ | 9,764,292 | $ | 9,531,181 | $ | 9,690,582 | $ | 10,041,288 | $ | 12,342,119 | |||||||||||||||||||

| (1) Includes Palisades Premier Conference Center. | |||||||||||||||||||||||||||||

| Supplemental Information | 12 |

First Quarter 2024 |

||||||

|

COMPARATIVE BALANCE SHEETS

Unaudited

(Dollars in Thousands)

|

|

|||||||

| As of | |||||||||||||||||||||||||||||

| 3/31/2024 | 12/31/2023 | 9/30/2023 | 6/30/2023 | 3/31/2023 | |||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||

| Mortgages and other loans payable | $ | 1,701,378 | $ | 1,497,386 | $ | 1,518,872 | $ | 1,520,313 | $ | 3,234,489 | |||||||||||||||||||

| Unsecured term loans | 1,250,000 | 1,250,000 | 1,250,000 | 1,675,000 | 1,675,000 | ||||||||||||||||||||||||

| Unsecured notes | 100,000 | 100,000 | 100,000 | 100,000 | 100,000 | ||||||||||||||||||||||||

| Revolving credit facility | 650,000 | 560,000 | 400,000 | 430,000 | 490,000 | ||||||||||||||||||||||||

| Deferred financing costs | (15,875) | (16,639) | (18,340) | (20,394) | (22,275) | ||||||||||||||||||||||||

| Total debt, net of deferred financing costs | 3,685,503 | 3,390,747 | 3,250,532 | 3,704,919 | 5,477,214 | ||||||||||||||||||||||||

| Accrued interest payable | 23,217 | 17,930 | 17,934 | 15,711 | 16,049 | ||||||||||||||||||||||||

| Accounts payable and accrued expenses | 101,495 | 153,164 | 146,332 | 116,700 | 150,873 | ||||||||||||||||||||||||

| Deferred revenue | 157,756 | 134,053 | 136,063 | 125,589 | 264,852 | ||||||||||||||||||||||||

| Lease liability - financing leases | 105,859 | 105,531 | 105,198 | 104,870 | 104,544 | ||||||||||||||||||||||||

| Lease liability - operating leases | 823,594 | 827,692 | 887,412 | 890,305 | 892,984 | ||||||||||||||||||||||||

| Dividends and distributions payable | 20,135 | 20,280 | 21,725 | 21,750 | 21,768 | ||||||||||||||||||||||||

| Security deposits | 56,398 | 49,906 | 50,071 | 49,877 | 50,585 | ||||||||||||||||||||||||

| Liabilities related to assets held for sale | 10,649 | (1) |

— | — | — | — | |||||||||||||||||||||||

| Junior subordinated deferrable interest debentures | 100,000 | 100,000 | 100,000 | 100,000 | 100,000 | ||||||||||||||||||||||||

| Other liabilities | 437,302 | 471,401 | 453,349 | 330,799 | 282,958 | ||||||||||||||||||||||||

| Total Liabilities | 5,521,908 | 5,270,704 | 5,168,616 | 5,460,520 | 7,361,827 | ||||||||||||||||||||||||

| Noncontrolling interests in Operating Partnership | |||||||||||||||||||||||||||||

(4,417 units outstanding at 3/31/2024) |

272,235 | 238,051 | 248,222 | 254,434 | 273,175 | ||||||||||||||||||||||||

| Preferred units | 166,501 | 166,501 | 166,501 | 166,501 | 177,943 | ||||||||||||||||||||||||

| Equity | |||||||||||||||||||||||||||||

| SL Green stockholders' equity: | |||||||||||||||||||||||||||||

| Series I Preferred Stock | 221,932 | 221,932 | 221,932 | 221,932 | 221,932 | ||||||||||||||||||||||||

Common stock, $0.01 par value, 160,000 shares authorized, 65,866 |

|||||||||||||||||||||||||||||

issued and outstanding at 3/31/2024, including 1,060 shares held in treasury |

660 | 660 | 656 | 656 | 656 | ||||||||||||||||||||||||

| Additional paid–in capital | 3,831,130 | 3,826,452 | 3,813,758 | 3,805,704 | 3,798,101 | ||||||||||||||||||||||||

| Treasury stock at cost | (128,655) | (128,655) | (128,655) | (128,655) | (128,655) | ||||||||||||||||||||||||

| Accumulated other comprehensive income | 40,151 | 17,477 | 69,616 | 57,769 | 19,428 | ||||||||||||||||||||||||

| Retained (deficit) earnings | (229,607) | (151,551) | 62,406 | 135,518 | 549,024 | ||||||||||||||||||||||||

| Total SL Green Realty Corp. stockholders' equity | 3,735,611 | 3,786,315 | 4,039,713 | 4,092,924 | 4,460,486 | ||||||||||||||||||||||||

| Noncontrolling interests in other partnerships | 68,037 | 69,610 | 67,530 | 66,909 | 68,688 | ||||||||||||||||||||||||

| Total Equity | 3,803,648 | 3,855,925 | 4,107,243 | 4,159,833 | 4,529,174 | ||||||||||||||||||||||||

| Total Liabilities and Equity | $ | 9,764,292 | $ | 9,531,181 | $ | 9,690,582 | $ | 10,041,288 | $ | 12,342,119 | |||||||||||||||||||

| (1) Includes Palisades Premier Conference Center. | |||||||||||||||||||||||||||||

| Supplemental Information | 13 |

First Quarter 2024 |

||||||

|

COMPARATIVE STATEMENT OF OPERATIONS

Unaudited

(Dollars in Thousands Except Per Share)

|

|

|||||||

| Three Months Ended | |||||||||||||||||||||||

| March 31, | March 31, | December 31, | September 30, | ||||||||||||||||||||

| 2024 | 2023 | 2023 | 2023 | ||||||||||||||||||||

| Revenues | |||||||||||||||||||||||

| Rental revenue, net | $ | 128,203 | $ | 174,592 | $ | 131,927 | $ | 131,524 | |||||||||||||||

| Escalation and reimbursement revenues | 13,301 | 20,450 | 19,430 | 19,467 | |||||||||||||||||||

| SUMMIT Operator revenue | 25,604 | 19,771 | 35,240 | 35,069 | |||||||||||||||||||

| Investment income | 7,403 | 9,057 | 6,856 | 9,689 | |||||||||||||||||||

| Other income | 13,371 | 21,894 | 18,271 | 14,437 | |||||||||||||||||||

| Total Revenues | 187,882 | 245,764 | 211,724 | 210,186 | |||||||||||||||||||

| Loss on early extinguishment of debt | — | — | (870) | — | |||||||||||||||||||

| Expenses | |||||||||||||||||||||||

| Operating expenses | 43,608 | 52,064 | 48,090 | 49,585 | |||||||||||||||||||

| Real estate taxes | 31,606 | 41,383 | 31,294 | 31,195 | |||||||||||||||||||

| Operating lease rent | 6,405 | 6,301 | 7,083 | 7,253 | |||||||||||||||||||

| SUMMIT Operator expenses | 21,858 | 20,688 | 24,887 | 32,801 | |||||||||||||||||||

| Loan loss and other investment reserves, net of recoveries | — | 6,890 | — | — | |||||||||||||||||||

| Transaction related costs | 16 | 884 | 16 | 166 | |||||||||||||||||||

| Marketing, general and administrative | 21,313 | 23,285 | 42,257 | 22,873 | |||||||||||||||||||

| Total Operating Expenses | 124,806 | 151,495 | 153,627 | 143,873 | |||||||||||||||||||

| Equity in net income (loss) from unconsolidated joint ventures | 111,160 | (7,412) | (32,039) | (15,126) | |||||||||||||||||||

| Operating Income | 174,236 | 86,857 | 25,188 | 51,187 | |||||||||||||||||||

| Interest expense, net of interest income | 31,173 | 41,653 | 27,400 | 27,440 | |||||||||||||||||||

| Amortization of deferred financing costs | 1,539 | 2,021 | 1,510 | 2,152 | |||||||||||||||||||

| SUMMIT Operator tax expense | (1,295) | 1,267 | 2,320 | 3,735 | |||||||||||||||||||

| Depreciation and amortization | 48,584 | 78,782 | 49,050 | 50,642 | |||||||||||||||||||

Income (Loss) from Continuing Operations (1) |

94,235 | (36,866) | (55,092) | (32,782) | |||||||||||||||||||

| Equity in net gain (loss) on sale of interest in unconsolidated joint venture/real estate | 26,764 | (79) | (13,289) | — | |||||||||||||||||||

| Purchase price and other fair value adjustments | (50,492) | 239 | (10,273) | 10,183 | |||||||||||||||||||

| (Loss) gain on sale of real estate, net | — | (1,651) | (4,557) | 516 | |||||||||||||||||||

| Depreciable real estate reserves | (52,118) | — | (76,847) | 389 | |||||||||||||||||||

| Net Income (Loss) | 18,389 | (38,357) | (160,058) | (21,694) | |||||||||||||||||||

| Net loss attributable to noncontrolling interests | 393 | 3,962 | 10,081 | 3,368 | |||||||||||||||||||

| Preferred units distributions | (1,903) | (1,598) | (1,903) | (1,903) | |||||||||||||||||||

| Net Income (Loss) attributable to SL Green | 16,879 | (35,993) | (151,880) | (20,229) | |||||||||||||||||||

| Perpetual preferred stock dividends | (3,738) | (3,738) | (3,737) | (3,738) | |||||||||||||||||||

| Net Income (Loss) attributable to SL Green common stockholders | $ | 13,141 | $ | (39,731) | $ | (155,617) | $ | (23,967) | |||||||||||||||

| Basic earnings (loss) per share | $ | 0.20 | $ | (0.63) | $ | (2.45) | $ | (0.38) | |||||||||||||||

| Diluted earnings (loss) per share | $ | 0.20 | $ | (0.63) | $ | (2.45) | $ | (0.38) | |||||||||||||||

| (1) Before equity in net gain (loss), purchase price and other fair value adjustments, (loss) gain on sale and depreciable real estate reserves shown below. | |||||||||||||||||||||||

| Supplemental Information | 14 |

First Quarter 2024 |

||||||

|

COMPARATIVE COMPUTATION OF FFO AND FAD

Unaudited

(Dollars in Thousands Except Per Share)

|

|

|||||||

| Three Months Ended | ||||||||||||||||||||||||||

| March 31, | March 31, | December 31, | September 30, | |||||||||||||||||||||||

| 2024 | 2023 | 2023 | 2023 | |||||||||||||||||||||||

| Funds from Operations | ||||||||||||||||||||||||||

| Net Income (Loss) attributable to SL Green common stockholders | $ | 13,141 | $ | (39,731) | $ | (155,617) | $ | (23,967) | ||||||||||||||||||

| Depreciation and amortization | 48,584 | 78,782 | 49,050 | 50,642 | ||||||||||||||||||||||

| Joint ventures depreciation and noncontrolling interests adjustments | 74,258 | 69,534 | 73,062 | 76,539 | ||||||||||||||||||||||

| Net loss attributable to noncontrolling interests | (393) | (3,962) | (10,081) | (3,368) | ||||||||||||||||||||||

| Equity in net (gain) loss on sale of interest in unconsolidated joint venture/real estate | (26,764) | 79 | 13,289 | — | ||||||||||||||||||||||

| Purchase price and other fair value adjustments | 55,652 | — | — | (10,200) | ||||||||||||||||||||||

| Loss (gain) on sale of real estate, net | — | 1,651 | 4,557 | (516) | ||||||||||||||||||||||

| Depreciable real estate reserves | 52,118 | — | 76,847 | (389) | ||||||||||||||||||||||

| Depreciation on non-rental real estate assets | (1,153) | (868) | (1,414) | (1,002) | ||||||||||||||||||||||

| Funds From Operations | $ | 215,443 | $ | 105,485 | $ | 49,693 | $ | 87,739 | ||||||||||||||||||

| Funds From Operations - Basic per Share | $ | 3.11 | $ | 1.54 | $ | 0.72 | $ | 1.28 | ||||||||||||||||||

| Funds From Operations - Diluted per Share | $ | 3.07 | $ | 1.53 | $ | 0.72 | $ | 1.27 | ||||||||||||||||||

| Funds Available for Distribution | ||||||||||||||||||||||||||

| FFO | $ | 215,443 | $ | 105,485 | $ | 49,693 | $ | 87,739 | ||||||||||||||||||

| Non real estate depreciation and amortization | 1,153 | 868 | 1,414 | 1,002 | ||||||||||||||||||||||

| Amortization of deferred financing costs | 1,539 | 2,021 | 1,510 | 2,152 | ||||||||||||||||||||||

| Non-cash deferred compensation | 10,780 | 13,947 | 23,398 | 12,771 | ||||||||||||||||||||||

| FAD adjustment for joint ventures | (11,381) | (20,838) | (20,641) | (17,820) | ||||||||||||||||||||||

| Straight-line rental income and other non-cash adjustments | (3,067) | (15,326) | (1,484) | (2,454) | ||||||||||||||||||||||

| Non-cash fair value adjustments on mark-to-market derivatives | (5,160) | (239) | 10,273 | 17 | ||||||||||||||||||||||

| Second cycle tenant improvements | (13,479) | (5,641) | (15,355) | (16,045) | ||||||||||||||||||||||

| Second cycle leasing commissions | (3,487) | (3,569) | (2,705) | (1,821) | ||||||||||||||||||||||

| Revenue enhancing recurring CAPEX | (19) | (103) | (841) | (379) | ||||||||||||||||||||||

| Non-revenue enhancing recurring CAPEX | (2,375) | (3,044) | (8,326) | (5,880) | ||||||||||||||||||||||

| Reported Funds Available for Distribution | $ | 189,947 | $ | 73,561 | $ | 36,936 | $ | 59,282 | ||||||||||||||||||

| First cycle tenant improvements | $ | 461 | $ | 22 | $ | 516 | $ | 879 | ||||||||||||||||||

| First cycle leasing commissions | $ | — | $ | 103 | $ | 9 | $ | 271 | ||||||||||||||||||

| Development costs | $ | 15,697 | $ | 7,808 | $ | 19,361 | $ | 18,019 | ||||||||||||||||||

| Redevelopment costs | $ | 1,654 | $ | 4,693 | $ | 6,372 | $ | 1,804 | ||||||||||||||||||

| Capitalized interest | $ | 17,949 | $ | 25,464 | $ | 18,064 | $ | 25,483 | ||||||||||||||||||

| Supplemental Information | 15 |

First Quarter 2024 |

||||||

|

CONSOLIDATED STATEMENT OF EQUITY

Unaudited

(Dollars in Thousands)

|

|

|||||||

| Accumulated | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Series I | Other | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred | Common | Additional | Treasury | Retained | Noncontrolling | Comprehensive | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock | Stock | Paid-In Capital | Stock | Deficit | Interests | Income | Total | |||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2023 | $ | 221,932 | $ | 660 | $ | 3,826,452 | $ | (128,655) | $ | (151,551) | $ | 69,610 | $ | 17,477 | $ | 3,855,925 | ||||||||||||||||||||||||||||||||||||||||

| Net income | 16,879 | (1,294) | 15,585 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Acquisition of subsidiary interest from noncontrolling interest | (5,674) | (5,674) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income - net unrealized loss on derivative instruments | 19,928 | 19,928 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income - SLG share of unconsolidated joint venture net unrealized loss on derivative instruments | 1,727 | 1,727 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income - net unrealized loss on marketable securities | 1,019 | 1,019 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Perpetual preferred stock dividends | (3,738) | (3,738) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DRSPP proceeds | 77 | 77 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reallocation of noncontrolling interest in the Operating Partnership | (42,841) | (42,841) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deferred compensation plan and stock awards, net of forfeitures and tax withholdings | 4,601 | 4,601 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidation of partially owned entity | 6,678 | 6,678 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash distributions to noncontrolling interests | (1,283) | (1,283) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Cash distributions declared ($0.7500 per common share, none of which represented a return of capital for federal income tax purposes) |

(48,356) | (48,356) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at March 31, 2024 | $ | 221,932 | $ | 660 | $ | 3,831,130 | $ | (128,655) | $ | (229,607) | $ | 68,037 | $ | 40,151 | $ | 3,803,648 | ||||||||||||||||||||||||||||||||||||||||

| RECONCILIATION OF SHARES AND UNITS OUTSTANDING, AND DILUTION COMPUTATION | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Stock | OP Units | Stock-Based Compensation | Diluted Shares | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Share Count at December 31, 2023 | 64,726,253 | 3,949,448 | — | 68,675,701 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| YTD share activity | 79,257 | 467,799 | — | 547,056 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Share Count at March 31, 2024 | 64,805,510 | 4,417,247 | — | 69,222,757 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Weighting factor | (24,277) | 22,011 | 874,080 | 871,814 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Weighted Average Share Count at March 31, 2024 - Diluted | 64,781,233 | 4,439,258 | 874,080 | 70,094,571 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Supplemental Information | 16 |

First Quarter 2024 |

||||||

|

JOINT VENTURE STATEMENTS

Balance Sheet for Unconsolidated Joint Ventures

Unaudited

(Dollars in Thousands)

|

|

|||||||

| As of | |||||||||||||||||||||||||||||||||||

| March 31, 2024 | December 31, 2023 | September 30, 2023 | |||||||||||||||||||||||||||||||||

| Total | SLG Share | Total | SLG Share | Total | SLG Share | ||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||

| Commercial real estate properties, at cost: | |||||||||||||||||||||||||||||||||||

| Land and land interests | $ | 4,852,319 | $ | 2,679,256 | $ | 4,991,534 | $ | 2,732,409 | $ | 5,016,088 | $ | 2,737,095 | |||||||||||||||||||||||

| Building and improvements | 13,994,777 | 7,049,600 | 14,428,029 | 7,194,972 | 14,343,942 | 7,166,888 | |||||||||||||||||||||||||||||

| Building leasehold and improvements | 995,651 | 402,349 | 984,811 | 346,818 | 1,150,997 | 433,675 | |||||||||||||||||||||||||||||

| Right of use asset - financing leases | 740,832 | 541,405 | 740,832 | 345,489 | 740,832 | 345,489 | |||||||||||||||||||||||||||||

| Right of use asset - operating leases | 274,053 | 130,054 | 274,053 | 130,054 | 274,053 | 130,054 | |||||||||||||||||||||||||||||

| 20,857,632 | 10,802,664 | 21,419,259 | 10,749,742 | 21,525,912 | 10,813,201 | ||||||||||||||||||||||||||||||

| Less: accumulated depreciation | (2,832,990) | (1,444,601) | (2,951,919) | (1,438,010) | (2,858,578) | (1,386,826) | |||||||||||||||||||||||||||||

| Net real estate | 18,024,642 | 9,358,063 | 18,467,340 | 9,311,732 | 18,667,334 | 9,426,375 | |||||||||||||||||||||||||||||

| Cash and cash equivalents | 258,238 | 124,307 | 334,197 | 161,856 | 333,119 | 165,830 | |||||||||||||||||||||||||||||

| Restricted cash | 350,224 | 199,439 | 321,841 | 188,373 | 358,155 | 206,166 | |||||||||||||||||||||||||||||

| Tenant and other receivables | 46,850 | 29,773 | 38,539 | 20,865 | 44,706 | 25,763 | |||||||||||||||||||||||||||||

| Deferred rents receivable | 587,963 | 339,523 | 634,993 | 351,054 | 623,431 | 345,478 | |||||||||||||||||||||||||||||

| Deferred costs, net | 335,443 | 182,608 | 339,085 | 179,850 | 314,166 | 169,811 | |||||||||||||||||||||||||||||

| Other assets | 2,203,435 | 927,298 | 2,245,680 | 935,322 | 2,342,447 | 982,168 | |||||||||||||||||||||||||||||

| Total Assets | $ | 21,806,795 | $ | 11,161,011 | $ | 22,381,675 | $ | 11,149,052 | $ | 22,683,358 | $ | 11,321,591 | |||||||||||||||||||||||

| Liabilities and Equity | |||||||||||||||||||||||||||||||||||

|

Mortgage and other loans payable, net of deferred financing costs of

$93,904 at 3/31/2024, of which $50,598 is SLG share

|

$ | 13,824,249 | $ | 7,036,750 | $ | 14,799,277 | $ | 7,297,410 | $ | 14,707,926 | $ | 7,286,949 | |||||||||||||||||||||||

| Accrued interest payable | 54,743 | 25,388 | 55,103 | 23,408 | 50,910 | 21,530 | |||||||||||||||||||||||||||||

| Accounts payable and accrued expenses | 256,658 | 119,696 | 270,788 | 112,455 | 264,761 | 113,809 | |||||||||||||||||||||||||||||

| Deferred revenue | 1,070,740 | 487,183 | 1,108,180 | 498,387 | 1,156,816 | 523,277 | |||||||||||||||||||||||||||||

| Lease liability - financing leases | 745,257 | 534,330 | 745,473 | 346,350 | 745,536 | 346,490 | |||||||||||||||||||||||||||||

| Lease liability - operating leases | 242,042 | 116,937 | 244,803 | 118,248 | 247,505 | 119,530 | |||||||||||||||||||||||||||||

| Security deposits | 40,764 | 20,292 | 43,503 | 22,510 | 41,167 | 21,840 | |||||||||||||||||||||||||||||

| Other liabilities | 78,368 | 48,736 | 78,311 | 49,330 | 87,370 | 53,049 | |||||||||||||||||||||||||||||

| Equity | 5,493,974 | 2,771,699 | 5,036,237 | 2,680,954 | 5,381,367 | 2,835,117 | |||||||||||||||||||||||||||||

| Total Liabilities and Equity | $ | 21,806,795 | $ | 11,161,011 | $ | 22,381,675 | $ | 11,149,052 | $ | 22,683,358 | $ | 11,321,591 | |||||||||||||||||||||||

| Supplemental Information | 17 |

First Quarter 2024 |

||||||

|

JOINT VENTURE STATEMENTS

Statement of Operations for Unconsolidated Joint Ventures

Unaudited

(Dollars in Thousands)

|

|

|||||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||

| March 31, 2024 | March 31, 2023 | December 31, 2023 | |||||||||||||||||||||||||||||||||

| Total | SLG Share | Total | SLG Share | Total | SLG Share | ||||||||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||||||||

| Rental revenue, net | $ | 300,675 | $ | 159,279 | $ | 325,664 | $ | 167,187 | $ | 321,457 | $ | 164,315 | |||||||||||||||||||||||

| Escalation and reimbursement revenues | 58,872 | 33,076 | 57,398 | 31,549 | 61,423 | 33,680 | |||||||||||||||||||||||||||||

| Investment income | 20 | — | 1,236 | 313 | 1,262 | 320 | |||||||||||||||||||||||||||||

| Other income | 5,772 | 3,791 | 5,154 | 2,758 | 13 | (288) | |||||||||||||||||||||||||||||

| Total Revenues | 365,339 | 196,146 | 389,452 | 201,807 | 384,155 | 198,027 | |||||||||||||||||||||||||||||

| Gain on early extinguishment of debt | 172,519 | 141,664 | — | — | — | — | |||||||||||||||||||||||||||||

| Expenses | |||||||||||||||||||||||||||||||||||

| Operating expenses | 65,750 | 34,701 | 61,968 | 32,544 | 69,805 | 36,463 | |||||||||||||||||||||||||||||

| Real estate taxes | 75,632 | 38,785 | 65,740 | 33,115 | 77,034 | 38,649 | |||||||||||||||||||||||||||||

| Operating lease rent | 9,025 | 2,128 | 7,181 | 3,338 | 7,302 | 3,377 | |||||||||||||||||||||||||||||

| Total Operating Expenses | 150,407 | 75,614 | 134,889 | 68,997 | 154,141 | 78,489 | |||||||||||||||||||||||||||||

| Operating Income | 387,451 | 262,196 | 254,563 | 132,810 | 230,014 | 119,538 | |||||||||||||||||||||||||||||

| Interest expense, net of interest income | 149,854 | 72,803 | 129,477 | 63,146 | 152,504 | 73,012 | |||||||||||||||||||||||||||||

| Amortization of deferred financing costs | 6,072 | 3,095 | 7,045 | 3,062 | 7,017 | 2,876 | |||||||||||||||||||||||||||||

| Depreciation and amortization | 134,178 | 69,446 | 125,266 | 64,723 | 135,599 | 69,588 | |||||||||||||||||||||||||||||

| Net Income (Loss) | 97,347 | 116,852 | (7,225) | 1,879 | (65,106) | (25,938) | |||||||||||||||||||||||||||||

| Real estate depreciation | 134,172 | 69,442 | 125,260 | 64,719 | 135,593 | 69,583 | |||||||||||||||||||||||||||||

| FFO Contribution | $ | 231,519 | $ | 186,294 | $ | 118,035 | $ | 66,598 | $ | 70,487 | $ | 43,645 | |||||||||||||||||||||||

| FAD Adjustments: | |||||||||||||||||||||||||||||||||||

| Non real estate depreciation and amortization | $ | 6 | $ | 4 | $ | 6 | $ | 4 | $ | 6 | $ | 5 | |||||||||||||||||||||||

| Amortization of deferred financing costs | 6,072 | 3,095 | 7,045 | 3,062 | 7,017 | 2,876 | |||||||||||||||||||||||||||||

| Straight-line rental income and other non-cash adjustments | (9,519) | (10,841) | (22,417) | (13,786) | (17,634) | (10,027) | |||||||||||||||||||||||||||||

| Second cycle tenant improvements | (4,909) | (2,640) | (14,969) | (7,804) | (8,914) | (4,662) | |||||||||||||||||||||||||||||

| Second cycle leasing commissions | (1,411) | (830) | (706) | (399) | (14,263) | (7,133) | |||||||||||||||||||||||||||||

| Revenue enhancing recurring CAPEX | (41) | (22) | (133) | (73) | (195) | (99) | |||||||||||||||||||||||||||||

| Non-revenue enhancing recurring CAPEX | (357) | (147) | (3,798) | (1,842) | (2,965) | (1,601) | |||||||||||||||||||||||||||||

| Total FAD Adjustments | $ | (10,159) | $ | (11,381) | $ | (34,972) | $ | (20,838) | $ | (36,948) | $ | (20,641) | |||||||||||||||||||||||

| First cycle tenant improvements | $ | 3,081 | $ | 1,027 | $ | 161 | $ | 61 | $ | 8,536 | $ | 2,691 | |||||||||||||||||||||||

| First cycle leasing commissions | $ | 1,735 | $ | 489 | $ | 125 | $ | 32 | $ | 11,756 | $ | 4,953 | |||||||||||||||||||||||

| Development costs | $ | 51,737 | $ | 14,174 | $ | 76,079 | $ | 20,796 | $ | 56,568 | $ | 16,851 | |||||||||||||||||||||||

| Redevelopment costs | $ | 11,489 | $ | 3,848 | $ | 17,414 | $ | 5,528 | $ | 22,560 | $ | 7,287 | |||||||||||||||||||||||

| Capitalized interest | $ | 34,889 | $ | 13,256 | $ | 30,350 | $ | 9,491 | $ | 43,947 | $ | 17,005 | |||||||||||||||||||||||

| Supplemental Information | 18 |

First Quarter 2024 |

||||||

|

SELECTED FINANCIAL DATA

Net Operating Income(1)

Unaudited

(Dollars in Thousands)

|

|

|||||||

| Three Months Ended | |||||||||||||||||||||||

| March 31, | March 31, | December 31, | September 30, | ||||||||||||||||||||

| 2024 | 2023 | 2023 | 2023 | ||||||||||||||||||||

Net Operating Income (1) |

$ | 68,338 | $ | 105,295 | $ | 74,124 | $ | 71,943 | |||||||||||||||

| SLG share of NOI from unconsolidated JVs | 112,990 | 130,214 | 119,999 | 127,784 | |||||||||||||||||||

| NOI, including SLG share of unconsolidated JVs | 181,328 | 235,509 | 194,123 | 199,727 | |||||||||||||||||||

| Partners' share of NOI - consolidated JVs | 88 | 63 | 96 | 142 | |||||||||||||||||||

| NOI - SLG share | $ | 181,416 | $ | 235,572 | $ | 194,219 | $ | 199,869 | |||||||||||||||

| NOI, including SLG share of unconsolidated JVs | $ | 181,328 | $ | 235,509 | $ | 194,123 | $ | 199,727 | |||||||||||||||

| Free rent (net of amortization) | (4,554) | (10,720) | (4,549) | (3,314) | |||||||||||||||||||

| Straight-line revenue adjustment | (5,198) | (6,958) | (1,622) | (4,451) | |||||||||||||||||||

| Amortization of acquired above and below-market leases, net | (6,311) | (12,496) | (6,227) | (6,656) | |||||||||||||||||||

| Operating lease straight-line adjustment | 985 | 547 | 732 | 756 | |||||||||||||||||||

| Straight-line tenant credit loss | 5,841 | (447) | (320) | (361) | |||||||||||||||||||

| Cash NOI, including SLG share of unconsolidated JVs | 172,091 | 205,435 | 182,137 | 185,701 | |||||||||||||||||||

| Partners' share of cash NOI - consolidated JVs | 25 | 63 | 52 | 97 | |||||||||||||||||||

| Cash NOI - SLG share | $ | 172,116 | $ | 205,498 | $ | 182,189 | $ | 185,798 | |||||||||||||||

| (1) Includes SL Green Management Corp. and Emerge 212. Excludes lease termination income. | |||||||||||||||||||||||

NOI Summary by Portfolio (1) - SLG Share |

|||||||||||||||||

| Three Months Ended | |||||||||||||||||

| March 31, 2024 | |||||||||||||||||

| NOI | Cash NOI | ||||||||||||||||

| Manhattan Office | $ | 163,435 | $ | 151,417 | |||||||||||||

| Development / Redevelopment | 2,256 | 2,027 | |||||||||||||||

| High Street Retail | 240 | 174 | |||||||||||||||

| Suburban & Residential | 3,315 | 3,590 | |||||||||||||||

| Total Operating and Development | 169,246 | 157,208 | |||||||||||||||

| Alternative Strategy Portfolio | 11,432 | 13,811 | |||||||||||||||

Property Dispositions (2) |

223 | 223 | |||||||||||||||

Other (3) |

515 | 874 | |||||||||||||||

| Total | $ | 181,416 | $ | 172,116 | |||||||||||||

(1) Portfolio composition consistent with the Selected Property Data tables. |

|||||||||||||||||

(2) Includes properties sold or otherwise disposed of during the respective period. |

|||||||||||||||||

(3) Includes SL Green Management Corp., Emerge 212, Belmont Insurance Company and Ticonderoga Insurance Company. |

|||||||||||||||||

| Supplemental Information | 19 |

First Quarter 2024 |

||||||

|

SELECTED FINANCIAL DATA

Same Store Net Operating Income - Wholly Owned and Consolidated JVs

Unaudited

(Dollars in Thousands)

|

|

|||||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||

| March 31, | March 31, | December 31, | September 30, | ||||||||||||||||||||||||||||||||

| 2024 | 2023 | % | 2023 | 2023 | |||||||||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||||||||

| Rental revenue, net | $ | 121,303 | $ | 125,880 | (3.6) | % | $ | 122,258 | $ | 121,072 | |||||||||||||||||||||||||

| Escalation & reimbursement revenues | 13,270 | 16,599 | (20.1) | % | 18,415 | 18,698 | |||||||||||||||||||||||||||||

| Other income | 1,243 | 662 | 87.8 | % | 1,097 | 2,237 | |||||||||||||||||||||||||||||

| Total Revenues | $ | 135,816 | $ | 143,141 | (5.1) | % | $ | 141,770 | $ | 142,007 | |||||||||||||||||||||||||

| Expenses | |||||||||||||||||||||||||||||||||||

| Operating expenses | $ | 34,349 | $ | 36,068 | (4.8) | % | $ | 36,727 | $ | 37,692 | |||||||||||||||||||||||||

| Real estate taxes | 29,963 | 29,719 | 0.8 | % | 29,856 | 29,852 | |||||||||||||||||||||||||||||

| Operating lease rent | 6,106 | 6,106 | 0.0 | % | 6,106 | 6,106 | |||||||||||||||||||||||||||||

| Total Operating Expenses | $ | 70,418 | $ | 71,893 | (2.1) | % | $ | 72,689 | $ | 73,650 | |||||||||||||||||||||||||

| Operating Income | $ | 65,398 | $ | 71,248 | (8.2) | % | $ | 69,081 | $ | 68,357 | |||||||||||||||||||||||||

| Interest expense & amortization of financing costs | $ | 14,945 | $ | 14,927 | 0.1 | % | $ | 15,105 | $ | 15,149 | |||||||||||||||||||||||||

| Depreciation & amortization | 40,880 | 40,324 | 1.4 | % | 41,198 | 40,798 | |||||||||||||||||||||||||||||

| Income before noncontrolling interest | $ | 9,573 | $ | 15,997 | (40.2) | % | $ | 12,778 | $ | 12,410 | |||||||||||||||||||||||||

| Real estate depreciation & amortization | 40,880 | 40,324 | 1.4 | % | 41,198 | 40,798 | |||||||||||||||||||||||||||||

| FFO Contribution | $ | 50,453 | $ | 56,321 | (10.4) | % | $ | 53,976 | $ | 53,208 | |||||||||||||||||||||||||

| Non–building revenue | (62) | (139) | (55.4) | % | (56) | (141) | |||||||||||||||||||||||||||||

| Interest expense & amortization of financing costs | 14,945 | 14,927 | 0.1 | % | 15,105 | 15,149 | |||||||||||||||||||||||||||||

| Non-real estate depreciation | — | — | — | % | — | — | |||||||||||||||||||||||||||||

| NOI | $ | 65,336 | $ | 71,109 | (8.1) | % | $ | 69,025 | $ | 68,216 | |||||||||||||||||||||||||

| Cash Adjustments | |||||||||||||||||||||||||||||||||||

| Free rent (net of amortization) | $ | (5,054) | $ | (4,562) | 10.8 | % | $ | (1,267) | $ | (1,989) | |||||||||||||||||||||||||

| Straight-line revenue adjustment | 1,188 | (291) | (508.2) | % | (120) | 330 | |||||||||||||||||||||||||||||

| Amortization of acquired above and below-market leases, net | 49 | 166 | (70.5) | % | 88 | 140 | |||||||||||||||||||||||||||||

| Operating lease straight-line adjustment | 204 | 204 | — | % | 204 | 204 | |||||||||||||||||||||||||||||

| Straight-line tenant credit loss | 679 | (334) | (303.3) | % | (43) | (345) | |||||||||||||||||||||||||||||

| Cash NOI | $ | 62,402 | $ | 66,292 | (5.9) | % | $ | 67,887 | $ | 66,556 | |||||||||||||||||||||||||

| Lease termination income | (1,163) | (511) | 127.6 | % | (1,023) | (2,082) | |||||||||||||||||||||||||||||

| Cash NOI excluding lease termination income | $ | 61,239 | $ | 65,781 | (6.9) | % | $ | 66,864 | $ | 64,474 | |||||||||||||||||||||||||

| Operating Margins | |||||||||||||||||||||||||||||||||||

| NOI to real estate revenue, net | 48.1 | % | 49.7 | % | 48.7 | % | 48.1 | % | |||||||||||||||||||||||||||

| Cash NOI to real estate revenue, net | 46.0 | % | 46.4 | % | 47.9 | % | 46.9 | % | |||||||||||||||||||||||||||

| NOI before operating lease rent/real estate revenue, net | 52.6 | % | 54.0 | % | 53.0 | % | 52.4 | % | |||||||||||||||||||||||||||

| Cash NOI before operating lease rent/real estate revenue, net | 50.3 | % | 50.5 | % | 52.1 | % | 51.1 | % | |||||||||||||||||||||||||||

| Supplemental Information | 20 |

First Quarter 2024 |

||||||

|

SELECTED FINANCIAL DATA

Same Store Net Operating Income - Unconsolidated JVs

Unaudited

(Dollars in Thousands, SLG Share)

|

|

|||||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||

| March 31, | March 31, | December 31, | September 30, | ||||||||||||||||||||||||||||||||

| 2024 | 2023 | % | 2023 | 2023 | |||||||||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||||||||

| Rental revenue, net | $ | 120,279 | $ | 123,512 | (2.6) | % | $ | 125,835 | $ | 129,004 | |||||||||||||||||||||||||

| Escalation & reimbursement revenues | 29,273 | 28,898 | 1.3 | % | 29,777 | 31,410 | |||||||||||||||||||||||||||||

| Other income | 3,439 | 1,185 | 190.2 | % | (176) | 1,739 | |||||||||||||||||||||||||||||

| Total Revenues | $ | 152,991 | $ | 153,595 | (0.4) | % | $ | 155,436 | $ | 162,153 | |||||||||||||||||||||||||

| Expenses | |||||||||||||||||||||||||||||||||||

| Operating expenses | $ | 29,424 | $ | 29,681 | (0.9) | % | $ | 30,889 | $ | 31,609 | |||||||||||||||||||||||||

| Real estate taxes | 30,842 | 29,314 | 5.2 | % | 30,725 | 30,934 | |||||||||||||||||||||||||||||

| Operating lease rent | 296 | 277 | 6.9 | % | 296 | 296 | |||||||||||||||||||||||||||||

| Total Operating Expenses | $ | 60,562 | $ | 59,272 | 2.2 | % | $ | 61,910 | $ | 62,839 | |||||||||||||||||||||||||

| Operating Income | $ | 92,429 | $ | 94,323 | (2.0) | % | $ | 93,526 | $ | 99,314 | |||||||||||||||||||||||||

| Interest expense & amortization of financing costs | $ | 56,600 | $ | 52,992 | 6.8 | % | $ | 55,995 | $ | 55,993 | |||||||||||||||||||||||||

| Depreciation & amortization | 52,469 | 52,439 | 0.1 | % | 52,119 | 52,683 | |||||||||||||||||||||||||||||

| Loss before noncontrolling interest | $ | (16,640) | $ | (11,108) | 49.8 | % | $ | (14,588) | $ | (9,362) | |||||||||||||||||||||||||

| Real estate depreciation & amortization | 52,465 | 52,435 | 0.1 | % | 52,115 | 52,679 | |||||||||||||||||||||||||||||

| FFO Contribution | $ | 35,825 | $ | 41,327 | (13.3) | % | $ | 37,527 | $ | 43,317 | |||||||||||||||||||||||||

| Non–building revenue | (149) | (738) | (79.8) | % | 590 | (527) | |||||||||||||||||||||||||||||

| Interest expense & amortization of financing costs | 56,600 | 52,992 | 6.8 | % | 55,995 | 55,993 | |||||||||||||||||||||||||||||

| Non-real estate depreciation | 4 | 4 | — | % | 4 | 4 | |||||||||||||||||||||||||||||

| NOI | $ | 92,280 | $ | 93,585 | (1.4) | % | $ | 94,116 | $ | 98,787 | |||||||||||||||||||||||||

| Cash Adjustments | |||||||||||||||||||||||||||||||||||

| Free rent (net of amortization) | $ | 785 | $ | (3,907) | (120.1) | % | $ | (2,898) | $ | 618 | |||||||||||||||||||||||||

| Straight-line revenue adjustment | (2,773) | (4,966) | (44.2) | % | 560 | (3,365) | |||||||||||||||||||||||||||||

| Amortization of acquired above and below-market leases, net | (4,407) | (4,225) | 4.3 | % | (4,407) | (4,318) | |||||||||||||||||||||||||||||

| Operating lease straight-line adjustment | — | (19) | (100.0) | % | — | — | |||||||||||||||||||||||||||||

| Straight-line tenant credit loss | 251 | (15) | (1,773.3) | % | (277) | (16) | |||||||||||||||||||||||||||||

| Cash NOI | $ | 86,136 | $ | 80,453 | 7.1 | % | $ | 87,094 | $ | 91,706 | |||||||||||||||||||||||||

| Lease termination income | (3,286) | (443) | 641.8 | % | (412) | (1,213) | |||||||||||||||||||||||||||||

| Cash NOI excluding lease termination income | $ | 82,850 | $ | 80,010 | 3.5 | % | $ | 86,682 | $ | 90,493 | |||||||||||||||||||||||||

| Operating Margins | |||||||||||||||||||||||||||||||||||

| NOI to real estate revenue, net | 60.4 | % | 61.2 | % | 60.3 | % | 61.1 | % | |||||||||||||||||||||||||||

| Cash NOI to real estate revenue, net | 56.4 | % | 52.6 | % | 55.8 | % | 56.7 | % | |||||||||||||||||||||||||||

| NOI before operating lease rent/real estate revenue, net | 60.6 | % | 61.4 | % | 60.5 | % | 61.3 | % | |||||||||||||||||||||||||||

| Cash NOI before operating lease rent/real estate revenue, net | 56.5 | % | 52.8 | % | 56.0 | % | 56.9 | % | |||||||||||||||||||||||||||

| Supplemental Information | 21 |

First Quarter 2024 |

||||||

|

SELECTED FINANCIAL DATA

Same Store Net Operating Income

Unaudited

(Dollars in Thousands)

|

|

|||||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||

| March 31, | March 31, | December 31, | September 30, | ||||||||||||||||||||||||||||||||

| 2024 | 2023 | % | 2023 | 2023 | |||||||||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||||||||

| Rental revenue, net | $ | 121,303 | $ | 125,880 | (3.6) | % | $ | 122,258 | $ | 121,072 | |||||||||||||||||||||||||

| Escalation & reimbursement revenues | 13,270 | 16,599 | (20.1) | % | 18,415 | 18,698 | |||||||||||||||||||||||||||||

| Other income | 1,243 | 662 | 87.8 | % | 1,097 | 2,237 | |||||||||||||||||||||||||||||

| Total Revenues | $ | 135,816 | $ | 143,141 | (5.1) | % | $ | 141,770 | $ | 142,007 | |||||||||||||||||||||||||

Equity in net income (loss) from unconsolidated joint ventures (1) |

$ | (16,640) | $ | (11,108) | 49.8 | % | $ | (14,588) | $ | (9,362) | |||||||||||||||||||||||||

| Expenses | |||||||||||||||||||||||||||||||||||

| Operating expenses | $ | 34,349 | $ | 36,068 | (4.8) | % | $ | 36,727 | $ | 37,692 | |||||||||||||||||||||||||

| Real estate taxes | 29,963 | 29,719 | 0.8 | % | 29,856 | 29,852 | |||||||||||||||||||||||||||||

| Operating lease rent | 6,106 | 6,106 | 0.0 | % | 6,106 | 6,106 | |||||||||||||||||||||||||||||

| Total Operating Expenses | $ | 70,418 | $ | 71,893 | (2.1) | % | $ | 72,689 | $ | 73,650 | |||||||||||||||||||||||||

| Operating Income | $ | 48,758 | $ | 60,140 | (18.9) | % | $ | 54,493 | $ | 58,995 | |||||||||||||||||||||||||

| Interest expense & amortization of financing costs | $ | 14,945 | $ | 14,927 | 0.1 | % | $ | 15,105 | $ | 15,149 | |||||||||||||||||||||||||

| Depreciation & amortization | 40,880 | 40,324 | 1.4 | % | 41,198 | 40,798 | |||||||||||||||||||||||||||||

| (Loss) income before noncontrolling interest | $ | (7,067) | $ | 4,889 | (244.5) | % | $ | (1,810) | $ | 3,048 | |||||||||||||||||||||||||

| Real estate depreciation & amortization | 40,880 | 40,324 | 1.4 | % | 41,198 | 40,798 | |||||||||||||||||||||||||||||

Joint Ventures Real estate depreciation & amortization (1) |

52,465 | 52,435 | 0.1 | % | 52,115 | 52,679 | |||||||||||||||||||||||||||||

| FFO Contribution | $ | 86,278 | $ | 97,648 | (11.6) | % | $ | 91,503 | $ | 96,525 | |||||||||||||||||||||||||

| Non–building revenue | (62) | (139) | (55.4) | % | (56) | (141) | |||||||||||||||||||||||||||||

Joint Ventures Non–building revenue (1) |

(149) | (738) | (79.8) | % | 590 | (527) | |||||||||||||||||||||||||||||

| Interest expense & amortization of financing costs | 14,945 | 14,927 | 0.1 | % | 15,105 | 15,149 | |||||||||||||||||||||||||||||

Joint Ventures Interest expense & amortization of financing costs (1) |

56,600 | 52,992 | 6.8 | % | 55,995 | 55,993 | |||||||||||||||||||||||||||||

| Non-real estate depreciation | — | — | — | % | — | — | |||||||||||||||||||||||||||||

Joint Ventures Non-real estate depreciation (1) |

4 | 4 | 0.0 | % | 4 | 4 | |||||||||||||||||||||||||||||

| NOI | $ | 157,616 | $ | 164,694 | (4.3) | % | $ | 163,141 | $ | 167,003 | |||||||||||||||||||||||||

| Cash Adjustments | |||||||||||||||||||||||||||||||||||

| Non-cash adjustments | $ | (2,934) | $ | (4,817) | (39.1) | % | $ | (1,138) | $ | (1,660) | |||||||||||||||||||||||||

Joint Ventures non-cash adjustments (1) |

(6,144) | (13,132) | (53.2) | % | (7,022) | (7,081) | |||||||||||||||||||||||||||||

| Cash NOI | $ | 148,538 | $ | 146,745 | 1.2 | % | $ | 154,981 | $ | 158,262 | |||||||||||||||||||||||||

| Lease termination income | $ | (1,163) | $ | (511) | 127.6 | % | $ | (1,023) | $ | (2,082) | |||||||||||||||||||||||||

Joint Ventures lease termination income (1) |

(3,286) | (443) | 641.8 | % | (412) | (1,213) | |||||||||||||||||||||||||||||

| Cash NOI excluding lease termination income | $ | 144,089 | $ | 145,791 | (1.2) | % | $ | 153,546 | $ | 154,967 | |||||||||||||||||||||||||

| Operating Margins | |||||||||||||||||||||||||||||||||||

| NOI to real estate revenue, net | 54.6 | % | 55.7 | % | 54.8 | % | 55.0 | % | |||||||||||||||||||||||||||

| Cash NOI to real estate revenue, net | 51.5 | % | 49.6 | % | 52.1 | % | 52.1 | % | |||||||||||||||||||||||||||

| NOI before operating lease rent/real estate revenue, net | 56.8 | % | 57.8 | % | 56.9 | % | 57.1 | % | |||||||||||||||||||||||||||

| Cash NOI before operating lease rent/real estate revenue, net | 53.6 | % | 51.7 | % | 54.1 | % | 54.2 | % | |||||||||||||||||||||||||||

(1) The amount represents the Company's share of same-store unconsolidated joint venture activity. The Company does not control investments in unconsolidated joint ventures. |

|||||||||||||||||||||||||||||||||||

| Supplemental Information | 22 |

First Quarter 2024 |

||||||

|

DEBT SUMMARY SCHEDULE

Consolidated

Unaudited

(Dollars in Thousands)

|

|

|||||||

| Principal | 2024 | Current | Final | Principal | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ownership | Outstanding | Principal | Maturity | Maturity | Due at | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Fixed rate debt | Interest (%) | 3/31/2024 | Coupon (1) | Amortization | Date | Date (2) | Maturity | |||||||||||||||||||||||||||||||||||||||||||||||||

| Secured fixed rate debt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 420 Lexington Avenue | 100.0 | $ | 275,737 | 3.99% | $ | 4,488 | Oct-24 | Oct-40 | $ | 272,750 | ||||||||||||||||||||||||||||||||||||||||||||||

| 10 East 53rd Street (capped) | 55.0 | 205,000 | 5.45% | — | May-25 | May-28 | (3) | 205,000 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 100 Church Street (swapped) | 100.0 | 370,000 | 5.89% | — | Jun-25 | Jun-27 | 370,000 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 185 Broadway / 7 Dey | 100.0 | 190,148 | 6.65% | — | Nov-25 | Nov-26 | (3) | 190,148 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Landmark Square | 100.0 | 100,000 | 4.90% | — | Jan-27 | Jan-27 | 100,000 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 485 Lexington Avenue | 100.0 | 450,000 | 4.25% | — | Feb-27 | Feb-27 | 450,000 | |||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 1,590,885 | 5.07% | $ | 4,488 | $ | 1,587,898 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Unsecured fixed rate debt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Term Loan B (swapped) | $ | 200,000 | 4.41% | $ | — | Nov-24 | Nov-24 | $ | 200,000 | |||||||||||||||||||||||||||||||||||||||||||||||

| Unsecured notes | 100,000 | 4.27% | — | Dec-25 | Dec-25 | 100,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Term Loan A (swapped) | 1,050,000 | 4.54% | (4) | — | May-27 | May-27 | 1,050,000 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Junior subordinated deferrable interest debentures (swapped) | 100,000 | 5.27% | — | Jul-35 | Jul-35 | 100,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 1,450,000 | 4.56% | $ | — | $ | 1,450,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Fixed Rate Debt | $ | 3,040,885 | 4.82% | $ | 4,488 | $ | 3,037,898 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Floating rate debt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alternative strategy portfolio | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 690 Madison (SOFR + 50 bps) | 100.0 | $ | 60,493 | 5.83% | $ | — | Jul-24 | Jul-25 | $ | 60,493 | ||||||||||||||||||||||||||||||||||||||||||||||

| 719 Seventh Avenue (SOFR+ 131 bps) (5)(6) | 100.0 | 50,000 | 6.64% | — | Dec-24 | Dec-24 | 50,000 | |||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 110,493 | 6.20% | $ | — | $ | 110,493 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Unsecured floating rate debt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revolving credit facility (SOFR+ 150 bps) (5) | 100.0 | $ | 650,000 | 6.83% | $ | — | May-26 | May-27 | (3) | $ | 650,000 | |||||||||||||||||||||||||||||||||||||||||||||

| $ | 650,000 | 6.83% | $ | — | $ | 650,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Floating Rate Debt | $ | 760,493 | 6.74% | $ | — | $ | 760,493 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidated Debt | $ | 3,690,885 | 5.18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alternative Strategy Portfolio Debt | $ | 110,493 | 6.20% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Debt - Consolidated | $ | 3,801,378 | 5.21% | $ | 4,488 | $ | 3,798,391 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Deferred financing costs | (15,875) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Debt - Consolidated, net | $ | 3,785,503 | 5.21% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Debt - Unconsolidated JV, net | $ | 7,036,750 | 4.64% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Debt including SLG share of JV Debt | $ | 9,847,924 | 4.62% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alternative Strategy Portfolio Debt including SLG share of JV Debt | $ | 1,040,802 | 6.87% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Debt including SLG share of JV Debt | $ | 10,888,726 | 4.84% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Weighted Average Balance & Interest Rate for the quarter, including SLG share of JV Debt | $ | 10,866,572 | 4.80% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (1) Coupon for floating rate debt determined using the effective Term SOFR rate at the end of the quarter of 5.33%. Coupon for loans that are subject to SOFR floors, interest rate caps or interest rate swaps were determined using the SOFR floors, interest rate cap strike rate, or swapped interest rate plus the applicable loan spread. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) Reflects exercise of all available extension options, which may be subject to conditions and result in adjusted terms. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (3) As-of-right extension. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (4) Represents a blended swapped rate inclusive of the effect of multiple swaps. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (5) Spread includes applicable Term SOFR adjustment. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (6) In connection with the sale of 719 Seventh Avenue, the Company will repay the existing $50.0 million mortgage for $32.0 million. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Supplemental Information | 23 |

First Quarter 2024 |

||||||

|

DEBT SUMMARY SCHEDULE

Unconsolidated JVs

Unaudited