| Maryland | 001-13145 | 36-4150422 | ||||||||||||

| (State or other jurisdiction | (Commission File Number) | (I.R.S. Employer | ||||||||||||

| of incorporation or organization) | Identification No.) | |||||||||||||

| 200 East Randolph Drive, | Chicago, | IL | 60601 | |||||||||||||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||||||||||||||

| Registrant's telephone number, including area code: | (312) | 782-5800 | ||||||||||||||||||||||||

Former name or former address, if changed since last report: Not Applicable |

||||||||||||||||||||||||||

| ☐ | Written communications pursuant to Rule 425 under Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||||||||

| Common Stock, par value $0.01 | JLL | The New York Stock Exchange | ||||||||||||

| News release issued by Jones Lang LaSalle Incorporated on November 6, 2024 announcing its | |||||

| financial results for the third quarter ended September 30, 2024. | |||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | ||||

| Dated: November 6, 2024 | |||||||||||

| Jones Lang LaSalle Incorporated | |||||||||||

| By: /s/ Karen Brennan | |||||||||||

| Name: Karen Brennan | |||||||||||

| Title: Chief Financial Officer | |||||||||||

| News Release |  |

|||||||||||||

|

Summary Financial Results

($ in millions, except per share data, “LC” = local currency)

|

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||||||||||

| 2024 | 2023 | % Change in USD | % Change in LC | 2024 | 2023 | % Change in USD | % Change in LC | ||||||||||||||||||||||||||||

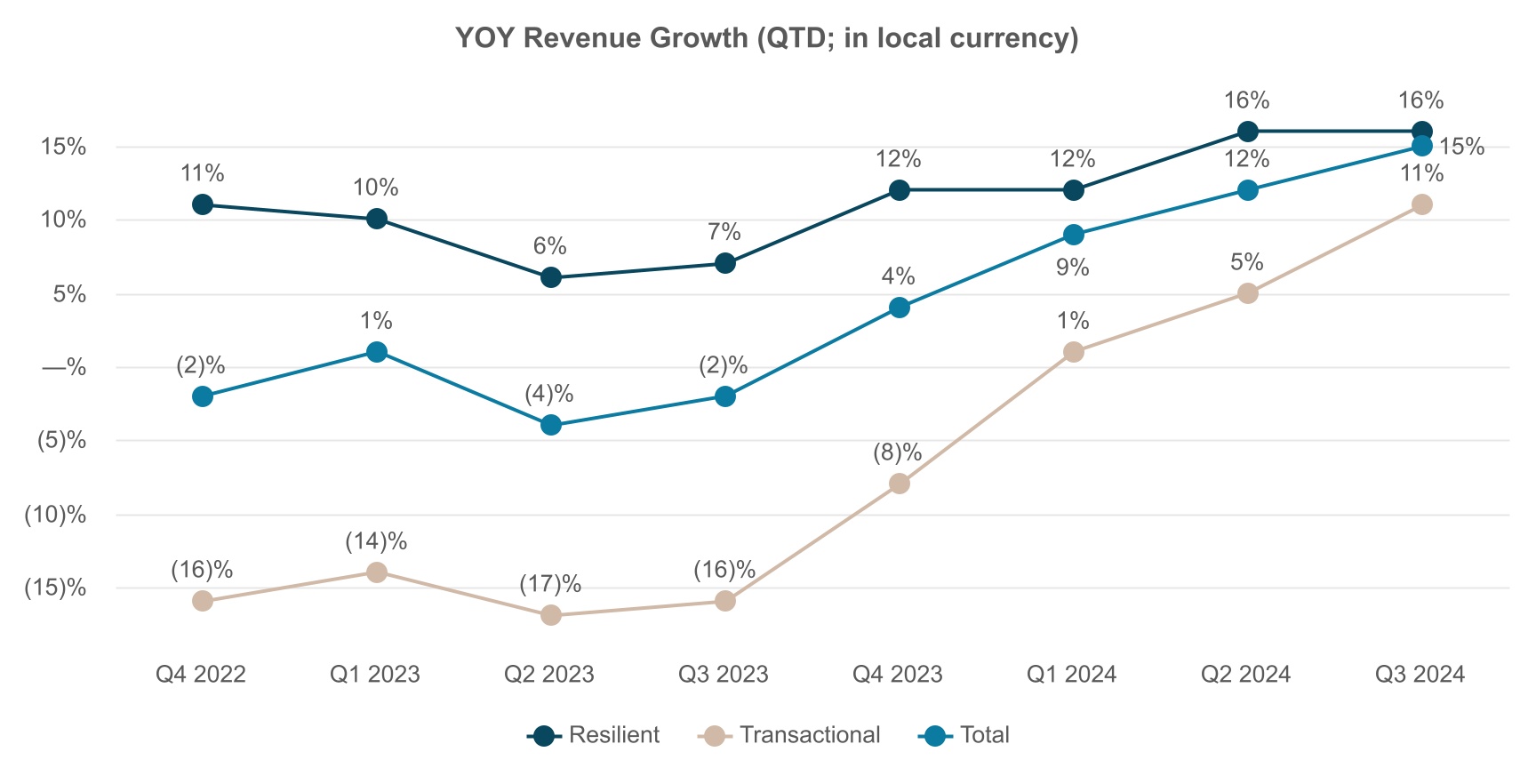

| Revenue | $ | 5,868.8 | $ | 5,111.4 | 15 | % | 15 | % | $ | 16,622.0 | $ | 14,879.4 | 12 | % | 12 | % | |||||||||||||||||||

| Net income attributable to common shareholders | $ | 155.1 | $ | 59.7 | 160 | % | 161 | % | $ | 305.6 | $ | 53.0 | 477 | % | 492 | % | |||||||||||||||||||

Adjusted net income attributable to common shareholders1 |

170.0 | 106.3 | 60 | 60 | 379.2 | 242.7 | 56 | 60 | |||||||||||||||||||||||||||

| Diluted earnings per share | $ | 3.20 | $ | 1.23 | 160 | % | 160 | % | $ | 6.32 | $ | 1.10 | 475 | % | 492 | % | |||||||||||||||||||

Adjusted diluted earnings per share1 |

3.50 | 2.19 | 60 | 60 | 7.84 | 5.02 | 56 | 59 | |||||||||||||||||||||||||||

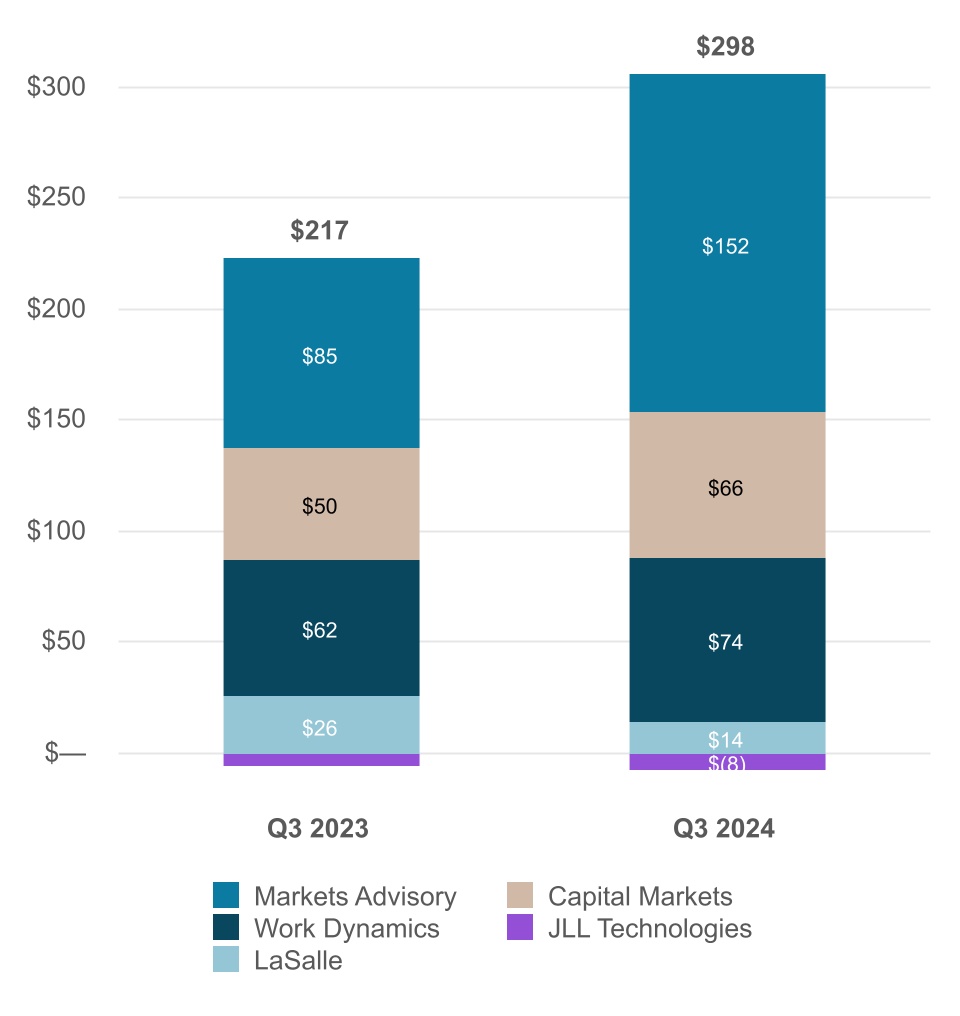

Adjusted EBITDA1 |

$ | 298.1 | $ | 217.3 | 37 | % | 37 | % | $ | 731.5 | $ | 555.3 | 32 | % | 33 | % | |||||||||||||||||||

| Cash flows from operating activities | $ | 261.6 | $ | 325.7 | (20) | % | n/a | $ | (142.0) | $ | (153.6) | 8 | % | n/a | |||||||||||||||||||||

Free Cash Flow5 |

216.7 | 276.2 | (22) | % | n/a | (268.3) | (291.3) | 8 | % | n/a | |||||||||||||||||||||||||

|

Consolidated

($ in millions, “LC” = local currency) |

Three Months Ended September 30, | % Change in USD | % Change in LC | Nine Months Ended September 30, | % Change in USD | % Change in LC | |||||||||||||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||||||||||||||

| Markets Advisory | $ | 1,143.8 | $ | 992.4 | 15 | % | 15 | % | $ | 3,172.7 | $ | 2,924.2 | 8 | % | 9 | % | |||||||||||||||||||||||||||||||

| Capital Markets | 498.8 | 435.8 | 14 | 14 | 1,334.0 | 1,240.9 | 8 | 8 | |||||||||||||||||||||||||||||||||||||||

| Work Dynamics | 4,068.2 | 3,514.2 | 16 | 16 | 11,641.0 | 10,165.0 | 15 | 15 | |||||||||||||||||||||||||||||||||||||||

| JLL Technologies | 56.7 | 58.9 | (4) | (4) | 167.0 | 180.9 | (8) | (8) | |||||||||||||||||||||||||||||||||||||||

| LaSalle | 101.3 | 110.1 | (8) | (8) | 307.3 | 368.4 | (17) | (16) | |||||||||||||||||||||||||||||||||||||||

| Total revenue | $ | 5,868.8 | $ | 5,111.4 | 15 | % | 15 | % | $ | 16,622.0 | $ | 14,879.4 | 12 | % | 12 | % | |||||||||||||||||||||||||||||||

Gross contract costs5 |

$ | 3,861.8 | $ | 3,327.1 | 16 | % | 16 | % | $ | 11,107.9 | $ | 9,666.2 | 15 | % | 15 | % | |||||||||||||||||||||||||||||||

| Platform operating expenses | 1,787.5 | 1,633.6 | 9 | 9 | 5,014.8 | 4,848.0 | 3 | 3 | |||||||||||||||||||||||||||||||||||||||

Restructuring and acquisition charges4 |

(8.8) | 31.6 | (128) | (128) | 4.4 | 79.1 | (94) | (95) | |||||||||||||||||||||||||||||||||||||||

| Total operating expenses | $ | 5,640.5 | $ | 4,992.3 | 13 | % | 13 | % | $ | 16,127.1 | $ | 14,593.3 | 11 | % | 11 | % | |||||||||||||||||||||||||||||||

Net non-cash MSR and mortgage banking derivative activity1 |

$ | (5.1) | $ | (7.1) | 28 | % | 29 | % | $ | (25.9) | $ | (9.5) | (173) | % | (172) | % | |||||||||||||||||||||||||||||||

Adjusted EBITDA1 |

$ | 298.1 | $ | 217.3 | 37 | % | 37 | % | $ | 731.5 | $ | 555.3 | 32 | % | 33 | % | |||||||||||||||||||||||||||||||

Note: For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Performance Highlights below are calculated and presented on a local currency basis, unless otherwise noted. | |||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, 2024 | ||||||||||||||||

| ($ in millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Total number of shares repurchased (in 000's) | 83.5 | 123.2 | 297.9 | 262.5 | |||||||||||||

| Total paid for shares repurchased | $ | 20.1 | 20.1 | $ | 60.3 | 40.1 | |||||||||||

| September 30, 2024 | June 30, 2024 | September 30, 2023 | |||||||||||||||

| Total Net Debt (in millions) | $ | 1,597.3 | 1,752.0 | 1,698.6 | |||||||||||||

| Net Leverage Ratio | 1.4x | 1.7x | 1.9x | ||||||||||||||

| Corporate Liquidity (in millions) | $ | 3,392.8 | 2,449.4 | 2,139.5 | |||||||||||||

|

Markets Advisory

($ in millions, “LC” = local currency) |

Three Months Ended September 30, | % Change in USD | % Change in LC | Nine Months Ended September 30, | % Change in USD | % Change in LC | |||||||||||||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||||||||||||||

| Revenue | $ | 1,143.8 | $ | 992.4 | 15 | % | 15 | % | $ | 3,172.7 | $ | 2,924.2 | 8 | % | 9 | % | |||||||||||||||||||||||||||||||

| Leasing | 665.4 | 547.7 | 21 | 21 | 1,781.8 | 1,626.1 | 10 | 10 | |||||||||||||||||||||||||||||||||||||||

| Property Management | 452.3 | 419.2 | 8 | 8 | 1,318.6 | 1,229.3 | 7 | 8 | |||||||||||||||||||||||||||||||||||||||

| Advisory, Consulting and Other | 26.1 | 25.5 | 2 | 2 | 72.3 | 68.8 | 5 | 5 | |||||||||||||||||||||||||||||||||||||||

| Segment operating expenses | $ | 1,008.4 | $ | 923.0 | 9 | % | 9 | % | $ | 2,845.7 | $ | 2,715.2 | 5 | % | 5 | % | |||||||||||||||||||||||||||||||

| Segment platform operating expenses | 687.5 | 634.6 | 8 | 8 | 1,907.2 | 1,863.4 | 2 | 3 | |||||||||||||||||||||||||||||||||||||||

Gross contract costs5 |

320.9 | 288.4 | 11 | 11 | 938.5 | 851.8 | 10 | 11 | |||||||||||||||||||||||||||||||||||||||

Adjusted EBITDA1 |

$ | 151.9 | $ | 85.1 | 78 | % | 77 | % | $ | 376.8 | $ | 256.1 | 47 | % | 46 | % | |||||||||||||||||||||||||||||||

| Note: For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Performance Highlights below are calculated and presented on a local currency basis, unless otherwise noted. | |||||||||||||||||||||||||||||||||||||||||||||||

|

Capital Markets

($ in millions, “LC” = local currency) |

Three Months Ended September 30, | % Change in USD | % Change in LC | Nine Months Ended September 30, | % Change in USD | % Change in LC | |||||||||||||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||||||||||||||

| Revenue | $ | 498.8 | $ | 435.8 | 14 | % | 14 | % | $ | 1,334.0 | $ | 1,240.9 | 8 | % | 8 | % | |||||||||||||||||||||||||||||||

Investment Sales, Debt/Equity Advisory and Other, excluding Net non-cash MSR(a) |

376.9 | 317.3 | 19 | 18 | 976.7 | 879.8 | 11 | 11 | |||||||||||||||||||||||||||||||||||||||

Net non-cash MSR and mortgage banking derivative activity (a) |

(5.1) | (7.1) | 28 | 29 | (25.9) | (9.5) | (173) | (172) | |||||||||||||||||||||||||||||||||||||||

| Value and Risk Advisory | 86.0 | 87.5 | (2) | (3) | 262.0 | 256.1 | 2 | 2 | |||||||||||||||||||||||||||||||||||||||

| Loan Servicing | 41.0 | 38.1 | 8 | 8 | 121.2 | 114.5 | 6 | 6 | |||||||||||||||||||||||||||||||||||||||

| Segment operating expenses | $ | 455.9 | $ | 410.0 | 11 | % | 11 | % | $ | 1,287.8 | $ | 1,209.1 | 7 | % | 7 | % | |||||||||||||||||||||||||||||||

| Segment platform operating expenses | 444.4 | 398.5 | 12 | 11 | 1,250.9 | 1,175.2 | 6 | 6 | |||||||||||||||||||||||||||||||||||||||

Gross contract costs5 |

11.5 | 11.5 | — | (1) | 36.9 | 33.9 | 9 | 10 | |||||||||||||||||||||||||||||||||||||||

| Equity earnings | $ | 0.2 | $ | 0.7 | (71) | % | (67) | % | $ | 0.8 | $ | 6.1 | (87) | % | (86) | % | |||||||||||||||||||||||||||||||

Adjusted EBITDA1 |

$ | 65.7 | $ | 50.3 | 31 | % | 30 | % | $ | 124.5 | $ | 97.0 | 28 | % | 29 | % | |||||||||||||||||||||||||||||||

| Note: For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Performance Highlights below are calculated and presented on a local currency basis, unless otherwise noted. | |||||||||||||||||||||||||||||||||||||||||||||||

| (a) Historically, net non-cash MSR and mortgage banking derivative activity was included in the Investment Sales, Debt/Equity Advisory and Other caption. Effective beginning Q2 2024, the net non-cash MSR and mortgage banking derivative activity revenue is separately presented in the above table and prior period financial information recast to conform with this presentation. | |||||||||||||||||||||||||||||||||||||||||||||||

|

Work Dynamics

($ in millions, “LC” = local currency) |

Three Months Ended September 30, | % Change in USD | % Change in LC | Nine Months Ended September 30, | % Change in USD | % Change in LC | |||||||||||||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||||||||||||||

| Revenue | $ | 4,068.2 | $ | 3,514.2 | 16 | % | 16 | % | $ | 11,641.0 | $ | 10,165.0 | 15 | % | 15 | % | |||||||||||||||||||||||||||||||

| Workplace Management | 3,164.6 | 2,637.1 | 20 | 20 | 9,057.4 | 7,687.7 | 18 | 18 | |||||||||||||||||||||||||||||||||||||||

| Project Management | 771.3 | 747.0 | 3 | 3 | 2,215.8 | 2,126.5 | 4 | 4 | |||||||||||||||||||||||||||||||||||||||

| Portfolio Services and Other | 132.3 | 130.1 | 2 | 1 | 367.8 | 350.8 | 5 | 4 | |||||||||||||||||||||||||||||||||||||||

| Segment operating expenses | $ | 4,019.6 | $ | 3,472.4 | 16 | % | 16 | % | $ | 11,513.3 | $ | 10,081.3 | 14 | % | 14 | % | |||||||||||||||||||||||||||||||

| Segment platform operating expenses | 500.9 | 455.9 | 10 | 10 | 1,411.3 | 1,333.8 | 6 | 6 | |||||||||||||||||||||||||||||||||||||||

Gross contract costs5 |

3,518.7 | 3,016.5 | 17 | 17 | 10,102.0 | 8,747.5 | 15 | 16 | |||||||||||||||||||||||||||||||||||||||

Adjusted EBITDA1 |

$ | 74.3 | $ | 61.6 | 21 | % | 20 | % | $ | 196.3 | $ | 143.5 | 37 | % | 37 | % | |||||||||||||||||||||||||||||||

| Note: For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Performance Highlights below are calculated and presented on a local currency basis, unless otherwise noted. | |||||||||||||||||||||||||||||||||||||||||||||||

|

JLL Technologies

($ in millions, “LC” = local currency) |

Three Months Ended September 30, | % Change in USD | % Change in LC | Nine Months Ended September 30, | % Change in USD | % Change in LC | |||||||||||||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||||||||||||||

| Revenue | $ | 56.7 | $ | 58.9 | (4) | % | (4) | % | $ | 167.0 | $ | 180.9 | (8) | % | (8) | % | |||||||||||||||||||||||||||||||

| Segment operating expenses | $ | 75.7 | $ | 68.5 | 11 | % | 10 | % | $ | 211.3 | $ | 218.0 | (3) | % | (3) | % | |||||||||||||||||||||||||||||||

Segment platform operating expenses(a) |

74.3 | 65.2 | 14 | 14 | 207.3 | 207.0 | — | — | |||||||||||||||||||||||||||||||||||||||

Gross contract costs5 |

1.4 | 3.3 | (58) | (59) | 4.0 | 11.0 | (64) | (64) | |||||||||||||||||||||||||||||||||||||||

Adjusted EBITDA1 |

$ | (7.8) | $ | (5.7) | (37) | % | (39) | % | $ | (23.8) | $ | (25.2) | 6 | % | 6 | % | |||||||||||||||||||||||||||||||

| Note: For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Performance Highlights below are calculated and presented on a local currency basis, unless otherwise noted. | |||||||||||||||||||||||||||||||||||||||||||||||

(a) Included in Segment platform operating expenses is carried interest expense of $2.2 million and $4.3 million for the three and nine months ended September 30, 2024, and a carried interest benefit of $0.1 million and $9.4 million for the three and nine months ended September 30, 2023, related to Equity earnings (losses) of the segment. | |||||||||||||||||||||||||||||||||||||||||||||||

|

LaSalle

($ in millions, “LC” = local currency) |

Three Months Ended September 30, | % Change in USD | % Change in LC | Nine Months Ended September 30, | % Change in USD | % Change in LC | |||||||||||||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||||||||||||||

| Revenue | $ | 101.3 | $ | 110.1 | (8) | % | (8) | % | $ | 307.3 | $ | 368.4 | (17) | % | (16) | % | |||||||||||||||||||||||||||||||

| Advisory fees | 92.7 | 102.7 | (10) | (10) | 278.1 | 306.3 | (9) | (8) | |||||||||||||||||||||||||||||||||||||||

| Transaction fees and other | 8.6 | 7.4 | 16 | 17 | 24.4 | 22.8 | 7 | 10 | |||||||||||||||||||||||||||||||||||||||

| Incentive fees | — | — | n.m. | n.m. | 4.8 | 39.3 | (88) | (87) | |||||||||||||||||||||||||||||||||||||||

| Segment operating expenses | $ | 89.7 | $ | 86.8 | 3 | % | 3 | % | $ | 264.6 | $ | 290.6 | (9) | % | (9) | % | |||||||||||||||||||||||||||||||

| Segment platform operating expenses | 80.4 | 79.4 | 1 | 1 | 238.1 | 268.6 | (11) | (11) | |||||||||||||||||||||||||||||||||||||||

Gross contract costs5 |

9.3 | 7.4 | 26 | 26 | 26.5 | 22.0 | 20 | 21 | |||||||||||||||||||||||||||||||||||||||

Adjusted EBITDA1 |

$ | 14.0 | $ | 26.0 | (46) | % | (45) | % | $ | 57.7 | $ | 83.9 | (31) | % | (28) | % | |||||||||||||||||||||||||||||||

| Note: For discussion and reconciliation of non-GAAP financial measures, see the Notes following the Financial Statements in this news release. Percentage variances in the Performance Highlights below are calculated and presented on a local currency basis, unless otherwise noted. | |||||||||||||||||||||||||||||||||||||||||||||||

| Connect with us |

|

||||

| Live Webcast | Conference Call | ||||||||||

|

Management will offer a live webcast for shareholders, analysts and investment professionals on Wednesday, November 6, 2024, at 9:00 a.m. Eastern. Following the live broadcast, an audio replay will be available.

The link to the live webcast and audio replay can be accessed at the Investor Relations website: ir.jll.com.

|

The conference call can be accessed live over the phone by dialing (888) 660-6392; the conference ID number is 5398158. Listeners are asked to please dial in 10 minutes prior to the call start time and provide the conference ID number to be connected. |

||||||||||

| Supplemental Information | Contact | ||||||||||

Supplemental information regarding the third quarter 2024 earnings call has been posted to the Investor Relations section of JLL's website: ir.jll.com. |

If you have any questions, please contact Brian Hogan, Interim Head of Investor Relations. |

||||||||||

Phone: |

+1 312 252 8943 | ||||||||||

Email: |

JLLInvestorRelations@jll.com

|

||||||||||

| JONES LANG LASALLE INCORPORATED | |||||||||||||||||||||||

| Consolidated Statements of Operations (Unaudited) | |||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| (in millions, except share and per share data) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Revenue | $ | 5,868.8 | $ | 5,111.4 | $ | 16,622.0 | $ | 14,879.4 | |||||||||||||||

| Operating expenses: | |||||||||||||||||||||||

| Compensation and benefits | $ | 2,854.6 | $ | 2,434.6 | $ | 7,869.4 | $ | 7,104.6 | |||||||||||||||

| Operating, administrative and other | 2,729.2 | 2,467.0 | 8,064.5 | 7,233.1 | |||||||||||||||||||

| Depreciation and amortization | 65.5 | 59.1 | 188.8 | 176.5 | |||||||||||||||||||

Restructuring and acquisition charges4 |

(8.8) | 31.6 | 4.4 | 79.1 | |||||||||||||||||||

| Total operating expenses | $ | 5,640.5 | $ | 4,992.3 | $ | 16,127.1 | $ | 14,593.3 | |||||||||||||||

| Operating income | $ | 228.3 | $ | 119.1 | $ | 494.9 | $ | 286.1 | |||||||||||||||

| Interest expense, net of interest income | 38.1 | 37.1 | 110.3 | 103.9 | |||||||||||||||||||

| Equity losses | (0.9) | (11.2) | (20.0) | (117.3) | |||||||||||||||||||

| Other income | 2.9 | 3.0 | 14.1 | 1.9 | |||||||||||||||||||

| Income before income taxes and noncontrolling interest | 192.2 | 73.8 | 378.7 | 66.8 | |||||||||||||||||||

| Income tax provision | 37.4 | 14.5 | 73.8 | 13.0 | |||||||||||||||||||

| Net income | 154.8 | 59.3 | 304.9 | 53.8 | |||||||||||||||||||

Net (loss) income attributable to noncontrolling interest |

(0.3) | (0.4) | (0.7) | 0.8 | |||||||||||||||||||

| Net income attributable to common shareholders | $ | 155.1 | $ | 59.7 | $ | 305.6 | $ | 53.0 | |||||||||||||||

| Basic earnings per common share | $ | 3.26 | $ | 1.25 | $ | 6.43 | $ | 1.11 | |||||||||||||||

| Basic weighted average shares outstanding (in 000's) | 47,505 | 47,662 | 47,506 | 47,655 | |||||||||||||||||||

| Diluted earnings per common share | $ | 3.20 | $ | 1.23 | $ | 6.32 | $ | 1.10 | |||||||||||||||

| Diluted weighted average shares outstanding (in 000's) | 48,497 | 48,394 | 48,355 | 48,317 | |||||||||||||||||||

| Please reference accompanying financial statement notes. | |||||||||||||||||||||||

| JONES LANG LASALLE INCORPORATED | |||||||||||||||||||||||

| Selected Segment Financial Data (Unaudited) | |||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| (in millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| MARKETS ADVISORY | |||||||||||||||||||||||

| Revenue | $ | 1,143.8 | $ | 992.4 | $ | 3,172.7 | $ | 2,924.2 | |||||||||||||||

| Platform compensation and benefits | $ | 582.5 | $ | 531.2 | $ | 1,588.4 | $ | 1,538.6 | |||||||||||||||

| Platform operating, administrative and other | 87.7 | 86.5 | 266.7 | 273.4 | |||||||||||||||||||

| Depreciation and amortization | 17.3 | 16.9 | 52.1 | 51.4 | |||||||||||||||||||

| Segment platform operating expenses | 687.5 | 634.6 | 1,907.2 | 1,863.4 | |||||||||||||||||||

Gross contract costs5 |

320.9 | 288.4 | 938.5 | 851.8 | |||||||||||||||||||

| Segment operating expenses | $ | 1,008.4 | $ | 923.0 | $ | 2,845.7 | $ | 2,715.2 | |||||||||||||||

| Segment operating income | $ | 135.4 | $ | 69.4 | $ | 327.0 | $ | 209.0 | |||||||||||||||

| Add: | |||||||||||||||||||||||

| Equity earnings | 0.1 | 0.1 | 0.5 | 0.3 | |||||||||||||||||||

Depreciation and amortization(a) |

16.3 | 15.9 | 49.2 | 48.5 | |||||||||||||||||||

| Other income | 1.4 | 1.8 | 3.0 | 0.5 | |||||||||||||||||||

| Net income attributable to noncontrolling interest | (0.2) | (0.2) | (0.5) | (0.8) | |||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Net (gain) loss on disposition | — | (0.9) | — | 0.9 | |||||||||||||||||||

| Interest on employee loans, net of forgiveness | (1.1) | (1.0) | (2.4) | (2.3) | |||||||||||||||||||

Adjusted EBITDA1 |

$ | 151.9 | $ | 85.1 | $ | 376.8 | $ | 256.1 | |||||||||||||||

| (a) This adjustment excludes the noncontrolling interest portion of amortization of acquisition-related intangibles which is not attributable to common shareholders. | |||||||||||||||||||||||

| JONES LANG LASALLE INCORPORATED | |||||||||||||||||||||||

| Selected Segment Financial Data (Unaudited) Continued | |||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| (in millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| CAPITAL MARKETS | |||||||||||||||||||||||

| Revenue | $ | 498.8 | $ | 435.8 | $ | 1,334.0 | $ | 1,240.9 | |||||||||||||||

| Platform compensation and benefits | $ | 365.5 | $ | 323.8 | $ | 994.2 | $ | 943.1 | |||||||||||||||

| Platform operating, administrative and other | 62.3 | 58.3 | 206.4 | 183.6 | |||||||||||||||||||

| Depreciation and amortization | 16.6 | 16.4 | 50.3 | 48.5 | |||||||||||||||||||

| Segment platform operating expenses | 444.4 | 398.5 | 1,250.9 | 1,175.2 | |||||||||||||||||||

Gross contract costs5 |

11.5 | 11.5 | 36.9 | 33.9 | |||||||||||||||||||

| Segment operating expenses | $ | 455.9 | $ | 410.0 | $ | 1,287.8 | $ | 1,209.1 | |||||||||||||||

| Segment operating income | $ | 42.9 | $ | 25.8 | $ | 46.2 | $ | 31.8 | |||||||||||||||

| Add: | |||||||||||||||||||||||

| Equity earnings | 0.2 | 0.7 | 0.8 | 6.1 | |||||||||||||||||||

| Depreciation and amortization | 16.6 | 16.4 | 50.3 | 48.5 | |||||||||||||||||||

| Other income | 1.6 | 1.3 | 3.0 | 1.5 | |||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Net non-cash MSR and mortgage banking derivative activity | 5.1 | 7.1 | 25.9 | 9.5 | |||||||||||||||||||

| Interest on employee loans, net of forgiveness | (0.7) | (0.6) | (1.7) | — | |||||||||||||||||||

| Gain on disposition | — | (0.4) | — | (0.4) | |||||||||||||||||||

Adjusted EBITDA1 |

$ | 65.7 | $ | 50.3 | $ | 124.5 | $ | 97.0 | |||||||||||||||

| JONES LANG LASALLE INCORPORATED | |||||||||||||||||||||||

| Selected Segment Financial Data (Unaudited) Continued | |||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| (in millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| WORK DYNAMICS | |||||||||||||||||||||||

| Revenue | $ | 4,068.2 | $ | 3,514.2 | $ | 11,641.0 | $ | 10,165.0 | |||||||||||||||

| Platform compensation and benefits | $ | 348.8 | $ | 332.9 | $ | 1,002.4 | $ | 958.9 | |||||||||||||||

| Platform operating, administrative and other | 127.3 | 103.3 | 342.6 | 316.0 | |||||||||||||||||||

| Depreciation and amortization | 24.8 | 19.7 | 66.3 | 58.9 | |||||||||||||||||||

| Segment platform operating expenses | 500.9 | 455.9 | 1,411.3 | 1,333.8 | |||||||||||||||||||

Gross contract costs5 |

3,518.7 | 3,016.5 | 10,102.0 | 8,747.5 | |||||||||||||||||||

| Segment operating expenses | $ | 4,019.6 | $ | 3,472.4 | $ | 11,513.3 | $ | 10,081.3 | |||||||||||||||

| Segment operating income | $ | 48.6 | $ | 41.8 | $ | 127.7 | $ | 83.7 | |||||||||||||||

| Add: | |||||||||||||||||||||||

| Equity earnings | 1.0 | 0.1 | 2.1 | 1.3 | |||||||||||||||||||

| Depreciation and amortization | 24.8 | 19.7 | 66.3 | 58.9 | |||||||||||||||||||

| Net (income) loss attributable to noncontrolling interest | (0.1) | — | 0.2 | (0.4) | |||||||||||||||||||

Adjusted EBITDA1 |

$ | 74.3 | $ | 61.6 | $ | 196.3 | $ | 143.5 | |||||||||||||||

| JONES LANG LASALLE INCORPORATED | |||||||||||||||||||||||

| Selected Segment Financial Data (Unaudited) Continued | |||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| (in millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| JLL TECHNOLOGIES | |||||||||||||||||||||||

| Revenue | $ | 56.7 | $ | 58.9 | $ | 167.0 | $ | 180.9 | |||||||||||||||

Platform compensation and benefits(a) |

$ | 50.3 | $ | 48.7 | $ | 151.1 | $ | 155.3 | |||||||||||||||

| Platform operating, administrative and other | 19.1 | 12.6 | 42.0 | 39.8 | |||||||||||||||||||

| Depreciation and amortization | 4.9 | 3.9 | 14.2 | 11.9 | |||||||||||||||||||

| Segment platform operating expenses | 74.3 | 65.2 | 207.3 | 207.0 | |||||||||||||||||||

Gross contract costs5 |

1.4 | 3.3 | 4.0 | 11.0 | |||||||||||||||||||

| Segment operating expenses | $ | 75.7 | $ | 68.5 | $ | 211.3 | $ | 218.0 | |||||||||||||||

| Segment operating loss | $ | (19.0) | $ | (9.6) | $ | (44.3) | $ | (37.1) | |||||||||||||||

| Add: | |||||||||||||||||||||||

| Depreciation and amortization | 4.9 | 3.9 | 14.2 | 11.9 | |||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Credit losses on convertible note investments | 6.3 | — | 6.3 | — | |||||||||||||||||||

Adjusted EBITDA1 |

$ | (7.8) | $ | (5.7) | $ | (23.8) | $ | (25.2) | |||||||||||||||

| Equity earnings (losses) | $ | 11.6 | $ | (3.0) | $ | 1.6 | $ | (102.0) | |||||||||||||||

(a) Included in Platform compensation and benefits is carried interest expense of $2.2 million and $4.3 million for the three and nine months ended September 30, 2024 and a carried interest benefit of $0.1 million and $9.4 million for the three and nine months ended September 30, 2023, related to Equity earnings (losses) of the segment. | |||||||||||||||||||||||

| JONES LANG LASALLE INCORPORATED | |||||||||||||||||||||||

| Selected Segment Financial Data (Unaudited) Continued | |||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| (in millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| LASALLE | |||||||||||||||||||||||

| Revenue | $ | 101.3 | $ | 110.1 | $ | 307.3 | $ | 368.4 | |||||||||||||||

| Platform compensation and benefits | $ | 59.8 | $ | 63.2 | $ | 180.1 | $ | 216.5 | |||||||||||||||

| Platform operating, administrative and other | 18.7 | 14.0 | 52.1 | 46.3 | |||||||||||||||||||

| Depreciation and amortization | 1.9 | 2.2 | 5.9 | 5.8 | |||||||||||||||||||

| Segment platform operating expenses | 80.4 | 79.4 | 238.1 | 268.6 | |||||||||||||||||||

Gross contract costs5 |

9.3 | 7.4 | 26.5 | 22.0 | |||||||||||||||||||

| Segment operating expenses | $ | 89.7 | $ | 86.8 | $ | 264.6 | $ | 290.6 | |||||||||||||||

| Segment operating income | $ | 11.6 | $ | 23.3 | $ | 42.7 | $ | 77.8 | |||||||||||||||

| Add: | |||||||||||||||||||||||

| Depreciation and amortization | 1.9 | 2.2 | 5.9 | 5.8 | |||||||||||||||||||

| Other (expense) income | (0.1) | (0.1) | 8.1 | (0.1) | |||||||||||||||||||

| Net loss attributable to noncontrolling interest | 0.6 | 0.6 | 1.0 | 0.4 | |||||||||||||||||||

Adjusted EBITDA1 |

$ | 14.0 | $ | 26.0 | $ | 57.7 | $ | 83.9 | |||||||||||||||

| Equity losses | $ | (13.8) | $ | (9.1) | $ | (25.0) | $ | (23.0) | |||||||||||||||

| JONES LANG LASALLE INCORPORATED | ||||||||||||||||||||||||||

| Consolidated Statement of Cash Flows (Unaudited) | ||||||||||||||||||||||||||

| Nine Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| (in millions) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||

Cash flows from operating activities7: |

Cash flows from investing activities: | |||||||||||||||||||||||||

| Net income | $ | 304.9 | $ | 53.8 | Net capital additions – property and equipment | $ | (126.3) | $ | (137.7) | |||||||||||||||||

| Reconciliation of net income to net cash used in operating activities: | Business acquisitions, net of cash acquired | (40.8) | (13.6) | |||||||||||||||||||||||

| Depreciation and amortization | 188.8 | 176.5 | Capital contributions to investments | (69.2) | (86.8) | |||||||||||||||||||||

| Equity losses | 20.0 | 117.3 | Distributions of capital from investments | 14.3 | 21.5 | |||||||||||||||||||||

| Net loss on dispositions | — | 0.5 | Acquisition of controlling interest, net of cash acquired | 3.7 | — | |||||||||||||||||||||

| Distributions of earnings from investments | 10.7 | 8.2 | Other, net | (0.7) | (3.8) | |||||||||||||||||||||

| Provision for loss on receivables and other assets | 34.7 | 21.7 | Net cash used in investing activities | (219.0) | (220.4) | |||||||||||||||||||||

| Amortization of stock-based compensation | 78.9 | 59.5 | Cash flows from financing activities: | |||||||||||||||||||||||

| Net non-cash mortgage servicing rights and mortgage banking derivative activity | 25.9 | 9.5 | Proceeds from borrowings under credit facility | 6,029.0 | 5,969.0 | |||||||||||||||||||||

| Accretion of interest and amortization of debt issuance costs | 4.1 | 3.1 | Repayments of borrowings under credit facility | (6,309.0) | (5,594.0) | |||||||||||||||||||||

| Other, net | (5.2) | 15.4 | Proceeds from issuance of commercial paper | 800.0 | — | |||||||||||||||||||||

| Change in: | Net repayments of short-term borrowings | (73.0) | (46.4) | |||||||||||||||||||||||

| Receivables | 59.7 | 158.1 | Payments of deferred business acquisition obligations and earn-outs | (5.1) | (22.6) | |||||||||||||||||||||

| Reimbursable receivables and reimbursable payables | (160.0) | (110.7) | Repurchase of common stock | (60.4) | (39.4) | |||||||||||||||||||||

| Prepaid expenses and other assets | (105.0) | (32.0) | Noncontrolling interest contributions (distributions), net | 2.1 | (4.2) | |||||||||||||||||||||

| Income taxes receivable, payable and deferred | (172.0) | (114.0) | Other, net | (34.6) | (31.2) | |||||||||||||||||||||

| Accounts payable, accrued liabilities and other liabilities | (100.1) | (91.7) | Net cash provided by financing activities | 349.0 | 231.2 | |||||||||||||||||||||

| Accrued compensation (including net deferred compensation) | (327.4) | (428.8) | Effect of currency exchange rate changes on cash, cash equivalents and restricted cash | (1.8) | (9.6) | |||||||||||||||||||||

| Net cash used in operating activities | $ | (142.0) | $ | (153.6) | Net change in cash, cash equivalents and restricted cash | $ | (13.8) | $ | (152.4) | |||||||||||||||||

| Cash, cash equivalents and restricted cash, beginning of the period | 663.4 | 746.0 | ||||||||||||||||||||||||

| Cash, cash equivalents and restricted cash, end of the period | $ | 649.6 | $ | 593.6 | ||||||||||||||||||||||

| Please reference accompanying financial statement notes. | ||||||||||||||||||||||||||

| JONES LANG LASALLE INCORPORATED | ||||||||||||||||||||||||||||||||||||||

| Consolidated Balance Sheets | ||||||||||||||||||||||||||||||||||||||

| September 30, | December 31, | September 30, | December 31, | |||||||||||||||||||||||||||||||||||

| (in millions, except share and per share data) | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||||

| ASSETS | (Unaudited) | LIABILITIES AND EQUITY | (Unaudited) | |||||||||||||||||||||||||||||||||||

| Current assets: | Current liabilities: | |||||||||||||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 437.8 | $ | 410.0 | Accounts payable and accrued liabilities | $ | 1,162.0 | $ | 1,406.7 | |||||||||||||||||||||||||||||

| Trade receivables, net of allowance | 1,998.5 | 2,095.8 | Reimbursable payables | 1,846.8 | 1,796.9 | |||||||||||||||||||||||||||||||||

| Notes and other receivables | 414.6 | 446.4 | Accrued compensation and benefits | 1,366.4 | 1,698.3 | |||||||||||||||||||||||||||||||||

| Reimbursable receivables | 2,535.4 | 2,321.7 | Short-term borrowings | 99.6 | 147.9 | |||||||||||||||||||||||||||||||||

| Warehouse receivables | 2,055.9 | 677.4 | Commercial paper, net of debt issuance costs | 798.0 | — | |||||||||||||||||||||||||||||||||

| Short-term contract assets, net of allowance | 327.3 | 338.3 | Short-term contract liability and deferred income | 200.1 | 226.4 | |||||||||||||||||||||||||||||||||

| Prepaid and other | 637.2 | 567.4 | Warehouse facilities | 2,053.1 | 662.7 | |||||||||||||||||||||||||||||||||

| Total current assets | 8,406.7 | 6,857.0 | Short-term operating lease liability | 162.8 | 161.9 | |||||||||||||||||||||||||||||||||

| Property and equipment, net of accumulated depreciation | 599.3 | 613.9 | Other | 339.2 | 345.3 | |||||||||||||||||||||||||||||||||

| Operating lease right-of-use asset | 746.8 | 730.9 | Total current liabilities | 8,028.0 | 6,446.1 | |||||||||||||||||||||||||||||||||

| Goodwill | 4,667.2 | 4,587.4 | Noncurrent liabilities: | |||||||||||||||||||||||||||||||||||

| Identified intangibles, net of accumulated amortization | 721.1 | 785.0 | Credit facility, net of debt issuance costs | 332.8 | 610.6 | |||||||||||||||||||||||||||||||||

| Investments | 866.5 | 816.6 | Long-term debt, net of debt issuance costs | 783.7 | 779.3 | |||||||||||||||||||||||||||||||||

| Long-term receivables | 390.9 | 363.8 | Long-term deferred tax liabilities, net | 41.6 | 44.8 | |||||||||||||||||||||||||||||||||

| Deferred tax assets, net | 525.9 | 497.4 | Deferred compensation | 653.0 | 580.0 | |||||||||||||||||||||||||||||||||

| Deferred compensation plans | 672.2 | 604.3 | Long-term operating lease liability | 783.1 | 754.5 | |||||||||||||||||||||||||||||||||

| Other | 220.6 | 208.5 | Other | 426.0 | 439.6 | |||||||||||||||||||||||||||||||||

| Total assets | $ | 17,817.2 | $ | 16,064.8 | Total liabilities | $ | 11,048.2 | $ | 9,654.9 | |||||||||||||||||||||||||||||

| Company shareholders' equity | ||||||||||||||||||||||||||||||||||||||

| Common stock | 0.5 | 0.5 | ||||||||||||||||||||||||||||||||||||

| Additional paid-in capital | 2,020.8 | 2,019.7 | ||||||||||||||||||||||||||||||||||||

| Retained earnings | 6,094.6 | 5,795.6 | ||||||||||||||||||||||||||||||||||||

| Treasury stock | (921.8) | (920.1) | ||||||||||||||||||||||||||||||||||||

| Shares held in trust | (12.1) | (10.4) | ||||||||||||||||||||||||||||||||||||

| Accumulated other comprehensive loss | (535.1) | (591.5) | ||||||||||||||||||||||||||||||||||||

| Total company shareholders' equity | 6,646.9 | 6,293.8 | ||||||||||||||||||||||||||||||||||||

| Noncontrolling interest | 122.1 | 116.1 | ||||||||||||||||||||||||||||||||||||

| Total equity | 6,769.0 | 6,409.9 | ||||||||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 17,817.2 | $ | 16,064.8 | ||||||||||||||||||||||||||||||||||

| Please reference accompanying financial statement notes. | ||||||||||||||||||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| (in millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Net income attributable to common shareholders | $ | 155.1 | $ | 59.7 | $ | 305.6 | $ | 53.0 | |||||||||||||||

| Add: | |||||||||||||||||||||||

| Interest expense, net of interest income | 38.1 | 37.1 | 110.3 | 103.9 | |||||||||||||||||||

| Income tax provision | 37.4 | 14.5 | 73.8 | 13.0 | |||||||||||||||||||

Depreciation and amortization(a) |

64.5 | 58.1 | 185.9 | 173.6 | |||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||

Restructuring and acquisition charges4 |

(8.8) | 31.6 | 4.4 | 79.1 | |||||||||||||||||||

| Net (gain) loss on disposition | — | (1.3) | — | 0.5 | |||||||||||||||||||

| Net non-cash MSR and mortgage banking derivative activity | 5.1 | 7.1 | 25.9 | 9.5 | |||||||||||||||||||

| Interest on employee loans, net of forgiveness | (1.8) | (1.6) | (4.1) | (2.3) | |||||||||||||||||||

| Equity losses - JLL Technologies and LaSalle | 2.2 | 12.1 | 23.4 | 125.0 | |||||||||||||||||||

| Credit losses on convertible note investments | 6.3 | — | 6.3 | — | |||||||||||||||||||

| Adjusted EBITDA | $ | 298.1 | $ | 217.3 | $ | 731.5 | $ | 555.3 | |||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| (In millions, except share and per share data) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Net income attributable to common shareholders | $ | 155.1 | $ | 59.7 | $ | 305.6 | $ | 53.0 | |||||||||||||||

| Diluted shares (in thousands) | 48,497 | 48,394 | 48,355 | 48,317 | |||||||||||||||||||

| Diluted earnings per share | $ | 3.20 | $ | 1.23 | $ | 6.32 | $ | 1.10 | |||||||||||||||

| Net income attributable to common shareholders | $ | 155.1 | $ | 59.7 | $ | 305.6 | $ | 53.0 | |||||||||||||||

| Adjustments: | |||||||||||||||||||||||

Restructuring and acquisition charges4 |

(8.8) | 31.6 | 4.4 | 79.1 | |||||||||||||||||||

| Net non-cash MSR and mortgage banking derivative activity | 5.1 | 7.1 | 25.9 | 9.5 | |||||||||||||||||||

Amortization of acquisition-related intangibles(a) |

15.6 | 16.2 | 46.6 | 49.9 | |||||||||||||||||||

| Net (gain) loss on disposition | — | (1.3) | — | 0.5 | |||||||||||||||||||

| Interest on employee loans, net of forgiveness | (1.8) | (1.6) | (4.1) | (2.3) | |||||||||||||||||||

| Equity losses - JLL Technologies and LaSalle | 2.2 | 12.1 | 23.4 | 125.0 | |||||||||||||||||||

| Credit losses on convertible note investments | 6.3 | — | 6.3 | — | |||||||||||||||||||

Tax impact of adjusted items(b) |

(3.7) | (17.5) | (28.9) | (72.0) | |||||||||||||||||||

| Adjusted net income attributable to common shareholders | $ | 170.0 | $ | 106.3 | $ | 379.2 | $ | 242.7 | |||||||||||||||

| Diluted shares (in thousands) | 48,497 | 48,394 | 48,355 | 48,317 | |||||||||||||||||||

| Adjusted diluted earnings per share | $ | 3.50 | $ | 2.19 | $ | 7.84 | $ | 5.02 | |||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| ($ in millions) | 2024 | % Change | 2024 | % Change | |||||||||||||||||||

| Revenue: | |||||||||||||||||||||||

| At current period exchange rates | $ | 5,868.8 | 15 | % | $ | 16,622.0 | 12 | % | |||||||||||||||

| Impact of change in exchange rates | (8.5) | n/a | 29.5 | n/a | |||||||||||||||||||

| At comparative period exchange rates | $ | 5,860.3 | 15 | % | $ | 16,651.5 | 12 | % | |||||||||||||||

| Operating income: | |||||||||||||||||||||||

| At current period exchange rates | $ | 228.3 | 92 | % | $ | 494.9 | 73 | % | |||||||||||||||

| Impact of change in exchange rates | 0.2 | n/a | 8.3 | n/a | |||||||||||||||||||

| At comparative period exchange rates | $ | 228.5 | 92 | % | $ | 503.2 | 76 | % | |||||||||||||||

| Adjusted EBITDA: | |||||||||||||||||||||||

| At current period exchange rates | $ | 298.1 | 37 | % | $ | 731.5 | 32 | % | |||||||||||||||

| Impact of change in exchange rates | (0.1) | n/a | 7.9 | n/a | |||||||||||||||||||

| At comparative period exchange rates | $ | 298.0 | 37 | % | $ | 739.4 | 33 | % | |||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| (in millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Severance and other employment-related charges | $ | 6.1 | $ | 16.4 | $ | 17.8 | $ | 47.9 | |||||||||||||||

| Restructuring, pre-acquisition and post-acquisition charges | 6.0 | 15.1 | 20.1 | 31.7 | |||||||||||||||||||

| Fair value adjustments that resulted in a net (decrease) increase to earn-out liabilities from prior-period acquisition activity | (20.9) | 0.1 | (33.5) | (0.5) | |||||||||||||||||||

| Total Restructuring and acquisition charges | $ | (8.8) | $ | 31.6 | $ | 4.4 | $ | 79.1 | |||||||||||||||

| ($ in millions) | September 30, 2024 | June 30, 2024 | September 30, 2023 | ||||||||||||||

| Total debt | $ | 2,035.1 | $ | 2,176.4 | $ | 2,088.1 | |||||||||||

| Less: Cash and cash equivalents | 437.8 | 424.4 | 389.5 | ||||||||||||||

| Net Debt | $ | 1,597.3 | $ | 1,752.0 | $ | 1,698.6 | |||||||||||

| Divided by: Trailing twelve-month Adjusted EBITDA | $ | 1,114.6 | $ | 1,033.8 | $ | 915.3 | |||||||||||

| Net Leverage Ratio | 1.4x | 1.7x | 1.9x | ||||||||||||||

| Nine Months Ended September 30, | |||||||||||

| (in millions) | 2024 | 2023 | |||||||||

| Net cash used in operating activities | $ | (142.0) | $ | (153.6) | |||||||

| Net capital additions - property and equipment | (126.3) | (137.7) | |||||||||

| Free Cash Flow | $ | (268.3) | $ | (291.3) | |||||||

| Three Months Ended September 30, 2024 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in millions) | Markets Advisory | Capital Markets | Work Dynamics | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Leasing | Property Mgmt | Advisory, Consulting and Other | Total Markets Advisory | Invt Sales, Debt/Equity Advisory and Other | Value and Risk Advisory | Loan Servicing | Total Capital Markets | Workplace Mgmt | Project Mgmt | Portfolio Services and Other | Total Work Dynamics | JLLT | LaSalle | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Revenue(a) |

$ | 665.4 | 452.3 | 26.1 | $ | 1,143.8 | $ | 371.8 | 86.0 | 41.0 | $ | 498.8 | $ | 3,164.6 | 771.3 | 132.3 | $ | 4,068.2 | $ | 56.7 | $ | 101.3 | $ | 5,868.8 | |||||||||||||||||||||||||||||||||||||||||||||||

Gross contract costs5 |

$ | 5.1 | 311.2 | 4.6 | $ | 320.9 | $ | 7.9 | 3.6 | — | $ | 11.5 | $ | 2,928.0 | 528.5 | 62.2 | $ | 3,518.7 | $ | 1.4 | $ | 9.3 | $ | 3,861.8 | |||||||||||||||||||||||||||||||||||||||||||||||

| Platform operating expenses | $ | 687.5 | $ | 444.4 | $ | 500.9 | $ | 74.3 | $ | 80.4 | $ | 1,787.5 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Adjusted EBITDA1 |

$ | 151.9 | $ | 65.7 | $ | 74.3 | $ | (7.8) | $ | 14.0 | $ | 298.1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended September 30, 2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in millions) | Markets Advisory | Capital Markets | Work Dynamics | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Leasing | Property Mgmt | Advisory, Consulting and Other | Total Markets Advisory | Invt Sales, Debt/Equity Advisory and Other | Value and Risk Advisory | Loan Servicing | Total Capital Markets | Workplace Mgmt | Project Mgmt | Portfolio Services and Other | Total Work Dynamics | JLLT | LaSalle | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revenue | $ | 547.7 | 419.2 | 25.5 | $ | 992.4 | $ | 310.2 | 87.5 | 38.1 | $ | 435.8 | $ | 2,637.1 | 747.0 | 130.1 | $ | 3,514.2 | $ | 58.9 | $ | 110.1 | $ | 5,111.4 | |||||||||||||||||||||||||||||||||||||||||||||||

Gross contract costs5 |

$ | 5.2 | 280.8 | 2.4 | $ | 288.4 | $ | 8.4 | 3.1 | — | $ | 11.5 | $ | 2,442.0 | 517.4 | 57.1 | $ | 3,016.5 | $ | 3.3 | $ | 7.4 | $ | 3,327.1 | |||||||||||||||||||||||||||||||||||||||||||||||

| Platform operating expenses | $ | 634.6 | $ | 398.5 | $ | 455.9 | $ | 65.2 | $ | 79.4 | $ | 1,633.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Adjusted EBITDA1 |

$ | 85.1 | $ | 50.3 | $ | 61.6 | $ | (5.7) | $ | 26.0 | $ | 217.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nine Months Ended September 30, 2024 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in millions) | Markets Advisory | Capital Markets | Work Dynamics | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Leasing | Property Mgmt | Advisory, Consulting and Other | Total Markets Advisory | Invt Sales, Debt/Equity Advisory and Other | Value and Risk Advisory | Loan Servicing | Total Capital Markets | Workplace Mgmt | Project Mgmt | Portfolio Services and Other | Total Work Dynamics | JLLT | LaSalle | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Revenue(a) |

$ | 1,781.8 | 1,318.6 | 72.3 | $ | 3,172.7 | $ | 950.8 | 262.0 | 121.2 | $ | 1,334.0 | $ | 9,057.4 | 2,215.8 | 367.8 | $ | 11,641.0 | $ | 167.0 | $ | 307.3 | $ | 16,622.0 | |||||||||||||||||||||||||||||||||||||||||||||||

Gross contract costs5 |

$ | 15.2 | 914.1 | 9.2 | $ | 938.5 | $ | 27.6 | 9.3 | — | $ | 36.9 | $ | 8,384.5 | 1,529.6 | 187.9 | $ | 10,102.0 | $ | 4.0 | $ | 26.5 | $ | 11,107.9 | |||||||||||||||||||||||||||||||||||||||||||||||

| Platform operating expenses | $ | 1,907.2 | $ | 1,250.9 | $ | 1,411.3 | $ | 207.3 | $ | 238.1 | $ | 5,014.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Adjusted EBITDA1 |

$ | 376.8 | $ | 124.5 | $ | 196.3 | $ | (23.8) | $ | 57.7 | $ | 731.5 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nine Months Ended September 30, 2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in millions) | Markets Advisory | Capital Markets | Work Dynamics | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Leasing | Property Mgmt | Advisory, Consulting and Other | Total Markets Advisory | Invt Sales, Debt/Equity Advisory and Other | Value and Risk Advisory | Loan Servicing | Total Capital Markets | Workplace Mgmt | Project Mgmt | Portfolio Services and Other | Total Work Dynamics | JLLT | LaSalle | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Revenue(a) |

$ | 1,626.1 | 1,229.3 | 68.8 | $ | 2,924.2 | $ | 870.3 | 256.1 | 114.5 | $ | 1,240.9 | $ | 7,687.7 | 2,126.5 | 350.8 | $ | 10,165.0 | $ | 180.9 | $ | 368.4 | $ | 14,879.4 | |||||||||||||||||||||||||||||||||||||||||||||||

Gross contract costs5 |

$ | 13.1 | 832.8 | 5.9 | $ | 851.8 | $ | 25.8 | 8.1 | — | $ | 33.9 | $ | 7,121.2 | 1,456.3 | 170.0 | $ | 8,747.5 | $ | 11.0 | $ | 22.0 | $ | 9,666.2 | |||||||||||||||||||||||||||||||||||||||||||||||

| Platform operating expenses | $ | 1,863.4 | $ | 1,175.2 | $ | 1,333.8 | $ | 207.0 | $ | 268.6 | $ | 4,848.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Adjusted EBITDA1 |

$ | 256.1 | $ | 97.0 | $ | 143.5 | $ | (25.2) | $ | 83.9 | $ | 555.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||