Document

ABERCROMBIE & FITCH CO. REPORTS FIRST QUARTER FISCAL 2025 RESULTS

•Record first quarter net sales of $1.1 billion, up 8% from last year, exceeding outlook

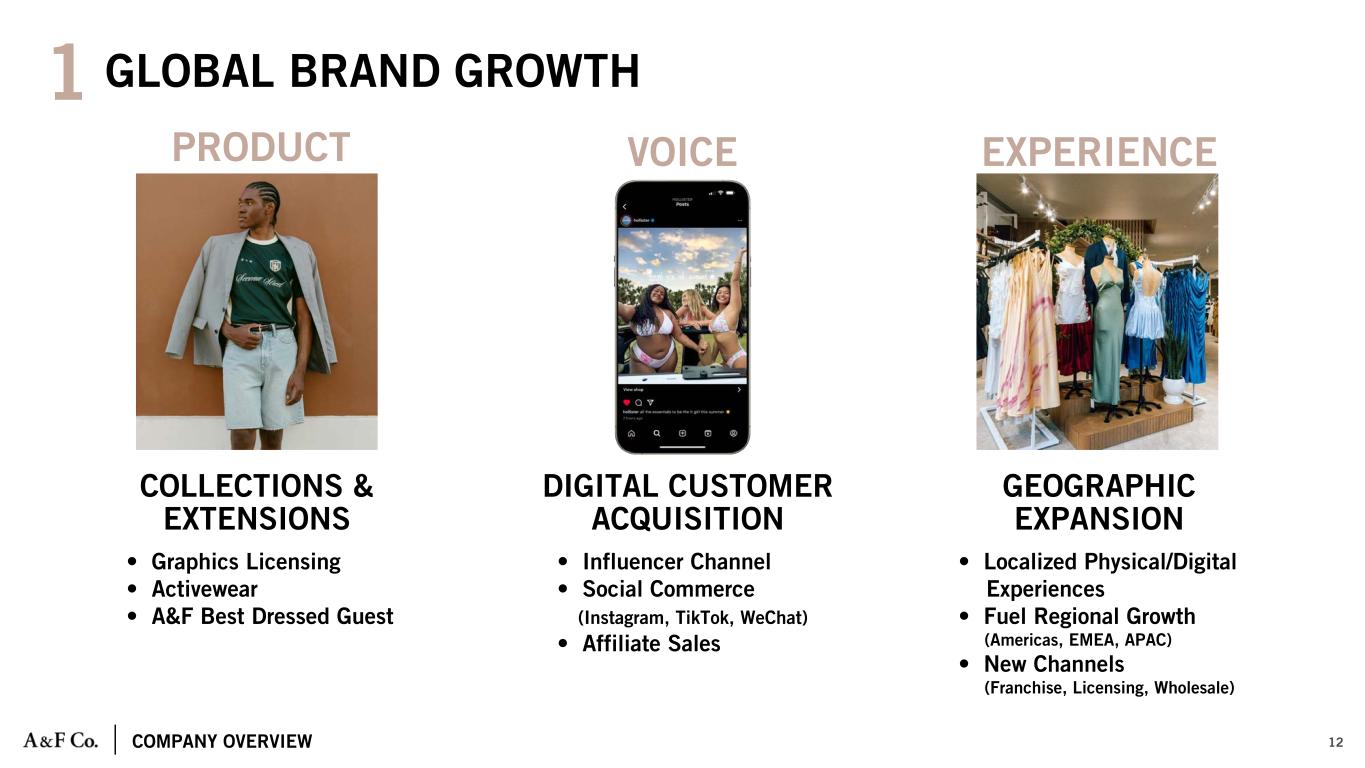

•Net sales growth across regions, with Americas up 7%, EMEA up 12% and APAC up 5%

•Brand performance led by Hollister brands’ growth of 22% with Abercrombie brands down 4% compared to last year

•Profitability exceeds company outlook with operating margin of 9.3%, earnings per share of $1.59

•Repurchased 2.6 million shares for $200 million, representing 5% of shares outstanding at February 1, 2025

New Albany, Ohio, May 28, 2025: Abercrombie & Fitch Co. (NYSE: ANF) today announced results for the first quarter ended May 3, 2025. These compare to results for the first quarter ended May 4, 2024. Descriptions of the use of non-GAAP financial measures and reconciliations of GAAP and non-GAAP financial measures accompany this release.

Fran Horowitz, Chief Executive Officer, said, “We delivered record first quarter net sales with 8% growth to last year. This was above our expectations and was supported by broad-based growth across our three regions. Hollister brands led the performance with growth of 22%, achieving its best ever first quarter net sales, while Abercrombie brands net sales were down 4% against 31% sales growth in 2024. We exceeded our expectations on the bottom line as well, with operating margin of 9.3% and earnings per share of $1.59. We also returned excess cash to shareholders through share repurchases totaling $200 million in the quarter, marking our fifth consecutive quarter of share repurchases.

As we navigate the current environment, we have the team and proven capabilities in place to read, react and adapt, while continuing to deliver for customers globally. Importantly, with a strong foundation, we remain on offense and focused on top-line growth, store expansion, and investments in digital and technology that will enable sustainable long-term success.”

Details related to reported net income per diluted share and adjusted net income per diluted share for the first quarter are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2025 |

|

2024 |

| GAAP |

|

$ |

1.59 |

|

|

$ |

2.14 |

|

|

|

|

|

|

|

|

|

|

|

Impact from changes in foreign currency exchange rates (1) |

|

— |

|

|

(0.08) |

|

| Adjusted non-GAAP constant currency |

|

$ |

1.59 |

|

|

$ |

2.06 |

|

(1)The estimated impact from foreign currency is calculated by applying current period exchange rates to prior year results using a 26% tax rate.

A summary of results for the first quarter ended May 3, 2025 as compared to the first quarter ended May 4, 2024:

•Net sales of $1.1 billion, up 8% as compared to last year, with comparable sales of 4%.

•Operating income of $102 million as compared to operating income last year of $130 million.

•Operating margin as a percent of sales decreased to 9.3% from 12.7% last year.

•Net income per diluted share of $1.59 as compared to net income per diluted share last year of $2.14.

Net sales by segment and brand for the first quarter are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in thousands) |

2025 |

|

2024 |

|

1 YR % Change |

|

Comparable sales (2) |

Net sales by segment: (1) |

|

|

|

|

|

|

|

|

|

Americas (3) |

$ |

874,804 |

|

|

|

$ |

820,121 |

|

|

|

7% |

|

4% |

EMEA (4) |

185,036 |

|

|

|

164,778 |

|

|

|

12% |

|

6% |

APAC (5) |

37,471 |

|

|

|

35,831 |

|

|

|

5% |

|

2% |

| Total company |

$ |

1,097,311 |

|

|

|

$ |

1,020,730 |

|

|

|

8% |

|

4% |

|

|

|

|

|

|

|

|

|

|

|

2025 |

|

2024 |

|

1 YR % Change |

|

Comparable sales (2) |

Net sales by brand family: |

|

|

|

|

|

|

|

|

|

Abercrombie |

$ |

547,947 |

|

|

|

$ |

571,513 |

|

|

|

(4)% |

|

(10)% |

Hollister |

549,364 |

|

|

|

449,217 |

|

|

|

22% |

|

23% |

| Total company |

$ |

1,097,311 |

|

|

|

$ |

1,020,730 |

|

|

|

8% |

|

4% |

(1) Net sales by segment are presented by attributing revenues to a physical store location or geographical region that fulfills the order.

(2) Comparable sales are calculated on a constant currency basis. Refer to "REPORTING AND USE OF GAAP AND NON-GAAP MEASURES," for further discussion.

(3) The Americas segment includes the results of operations in North America and South America.

(4) The EMEA segment includes the results of operations in Europe, the Middle East and Africa.

(5) The APAC segment includes the results of operations in the Asia-Pacific region, including Asia and Oceania.

|

|

|

| Financial Position and Liquidity |

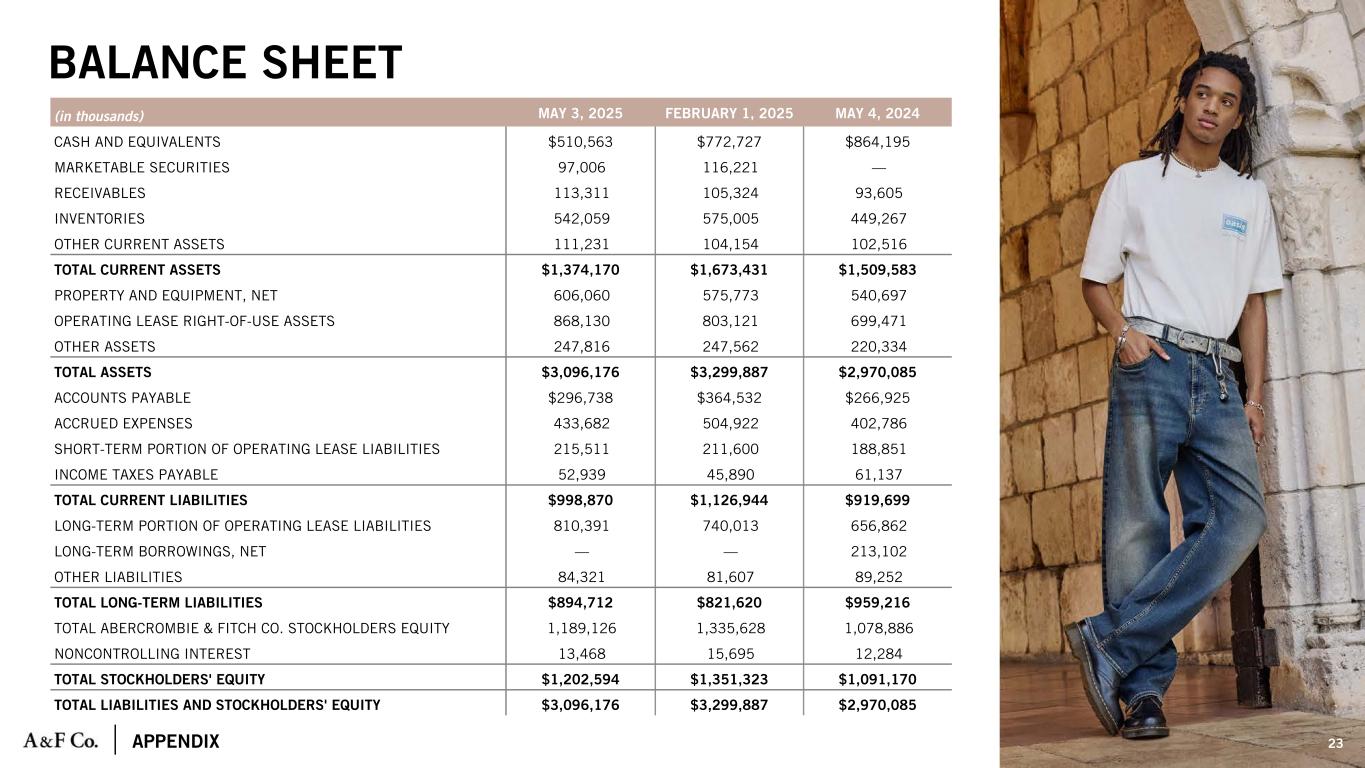

As of May 3, 2025 the company had:

•Cash and equivalents of $511 million compared to cash and equivalents of $773 million and $864 million as of February 1, 2025 and May 4, 2024, respectively.

•Marketable securities of $97 million and $116 million as of May 3, 2025 and February 1, 2025, respectively.

•Inventories of $542 million compared to inventories of $575 million and $449 million as of February 1, 2025 and May 4, 2024, respectively.

•Borrowing capacity of $477 million under the senior-secured asset-based revolving credit facility (the “ABL Facility”) with net borrowing available of $429 million after minimum excess availability requirement.

•Liquidity, comprised of cash and equivalents and borrowing available under the ABL Facility, of approximately $940 million as of May 3, 2025. This compares to liquidity of $1.2 billion and $1.2 billion as of February 1, 2025 and May 4, 2024, respectively.

|

|

|

Cash Flow and Capital Allocation |

Details related to the company’s cash flows for the year-to-date period ended May 3, 2025 are as follows:

•Net cash used for operating activities of $4 million.

•Net cash used for investing activities of $31 million, primarily reflecting capital expenditures, partially offset by maturities of marketable securities.

•Net cash used for financing activities of $235 million, primarily reflecting share repurchases.

During the first quarter of 2025, the company repurchased 2.6 million shares for approximately $200 million, representing a 5% reduction in shares outstanding prior to the vesting impact of stock compensation. The company has $1.1 billion remaining on the share repurchase authorization established in March 2025.

Depreciation and amortization was $39 million for the year-to-date period ended May 3, 2025.

|

|

|

|

|

|

|

|

|

The following outlook replaces all previous full year guidance. For fiscal 2025, the company now expects: |

|

Current Full Year Outlook (1) |

Previous Full Year Outlook (2) |

Net sales |

Growth In The Range of 3% to 6% |

Growth In The Range of 3% to 5% |

Operating margin |

In The Range of 12.5% to 13.5% |

In The Range of 14% to 15% |

Effective tax rate (3) |

Around 27% |

Around 26% |

Net income per diluted share (4) (5) |

In The Range of $9.50 to $10.50 |

In The Range of $10.40 to $11.40 |

Share repurchases (5) |

$400 million |

$400 million |

Diluted weighted average shares (4) (5) |

Around 49 million |

Around 51 million |

Capital expenditures |

~$200 million |

~$200 million |

|

Real estate activity

(all approximate)

|

~40 Net Store Openings |

~40 Net Store Openings |

60 Openings, 20 Closures |

60 Openings, 20 Closures |

40 Remodels And Right-Sizes |

40 Remodels And Right-Sizes |

|

|

|

|

|

Second Quarter Outlook (1) |

|

Net sales |

Growth In The Range of 3% to 5% |

|

Operating margin |

In The Range of 12% to 13% |

|

Effective tax rate (3) |

Around 28% |

|

Net income per diluted share (4) (5) |

In The Range of $2.10 to $2.30 |

|

Share repurchases (5) |

$50 million |

|

Diluted weighted average shares (4) (5) |

Around 49 million |

|

(1) Includes the estimated impact from the tariffs on goods imported into the United States in accordance with trade policies currently in effect. This includes a 30% tariff on imports from China, and a 10% tariff on all other global imports, but excludes other currently-paused tariffs and any other potential future trade policy changes imposed by the United States or other countries. Net of planned mitigation efforts, the full year outlook assumes approximately $50 million of tariff expense, or 100 basis points as a percent of net sales.

(2) Released March 5, 2025.

(3) The current outlook for effective tax rate is sensitive to the jurisdictional mix and level of income and does not include the impact of potential future tax policy or legislative changes.

(4) The current outlook for net income per diluted share and diluted weighted average shares includes the anticipated impact to shares outstanding from potential share repurchase activity in fiscal 2025.

(5) The timing and amount of any such repurchases will be determined based on an evaluation of market conditions, the company’s share price, legal requirements, and other factors.

Today at 8:30 a.m. ET, the company will conduct a conference call and provide additional details around its quarterly results and its outlook for the second quarter. To access the call by phone, participants will need to register at the following URL address to obtain a dial-in number and passcode:

https://register-conf.media-server.com/register/BI9df7c6cf6ffa473fa1a4b41a1fd57141

A presentation of first quarter results will be available in the “Investors” section at corporate.abercrombie.com at approximately 7:30 a.m. ET, today. Important information may be disseminated initially or exclusively via the website; investors should consult the site to access this information.

|

|

|

| Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995 |

This Press Release and related statements by management or spokespeople of Abercrombie & Fitch Co. (A&F) contain forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995). These statements, including, without limitation, statements regarding our second quarter and annual fiscal 2025 results, relate to our current assumptions, projections and expectations about our business and future events. Any such forward-looking statements involve risks and uncertainties and are subject to change based on various important factors, many of which may be beyond the company’s control. The inclusion of such information should not be regarded as a representation by the company, or any other person, that the objectives of the company will be achieved. Words such as “estimate,” “project,” “plan,” “goal,” “believe,” “expect,” “anticipate,” “intend,” “should,” “are confident,” “will,” “could,” “outlook,” and similar expressions may identify forward-looking statements. Except as may be required by applicable law, we assume no obligation to publicly update or revise any forward-looking statements, including any financial targets, estimates, or performance outlooks whether as a result of new information, future events, or otherwise. Factors that may cause results to differ from those expressed in our forward-looking statements include, but are not limited to, the factors disclosed in Part I, Item 1A. “Risk Factors” of the company’s Annual Report on Form 10-K for the fiscal year ended February 1, 2025, and in our subsequent reports and filings with the Securities and Exchange Commission, as well as the following factors: risks related to global trade policy, including the impact of the imposition or threat of imposition of new or increased tariffs by the United States or foreign governments, other changes to and continued uncertainties relating to trade policies and arrangements, or a global trade war; risks related to changes in global economic and financial conditions, including inflation, and the resulting impact on consumer spending and our operating results, financial condition, and expense management; risks related to global operations, including changes in the economic or political conditions where we sell or source our products; risks related to the geopolitical landscape and ongoing armed conflicts, acts of terrorism, mass casualty events, social unrest, civil disturbance or disobedience and the impact of such conflicts or events on international trade, supplier delivery or increased freight costs; risks related to natural disasters and other unforeseen catastrophic events; risks related to our failure to engage our customers, anticipate customer demand, expectations, and changing fashion trends, and manage our inventory and product delivery; risks related to our failure to operate effectively in a highly competitive and constantly evolving industry; risks related to our ability to successfully invest in and execute on our customer, digital and omnichannel initiatives; risks related to our ability to execute on, and maintain the success of, our strategic and growth initiatives; risks related to fluctuations in foreign currency exchange rates; risks related to fluctuations in our tax obligations and effective tax rate, including as a result of earnings and losses generated from our global operations, may result in volatility in our results of operations; risks and uncertainty related to adverse public health developments; risks associated with climate change and other corporate responsibility issues; risks related to reputational harm to the company, its officers, and directors; risks related to actual or threatened litigation; risks related to cybersecurity threats and privacy or data security breaches, and the potential loss or disruption to our information systems, and uncertainties related to future legislation, regulatory reform, policy changes, or interpretive guidance on existing laws and regulations.

This document includes certain adjusted non-GAAP financial measures where management believes it to be helpful in understanding the company's results of operations or financial position. Additional details about non-GAAP financial measures and a reconciliation of GAAP financial measures to non-GAAP financial measures can be found in the "Reporting and Use of GAAP and Non-GAAP Measures" section. Sub-totals and totals may not foot due to rounding. Net income and net income per share financial measures included herein are attributable to Abercrombie & Fitch Co., excluding net income attributable to noncontrolling interests.

As used in this document, references to “Americas” includes North America and South America, “EMEA” includes Europe, the Middle East and Africa and “APAC” includes the Asia-Pacific region, including Asia and Oceania.

|

|

|

| About Abercrombie & Fitch Co. |

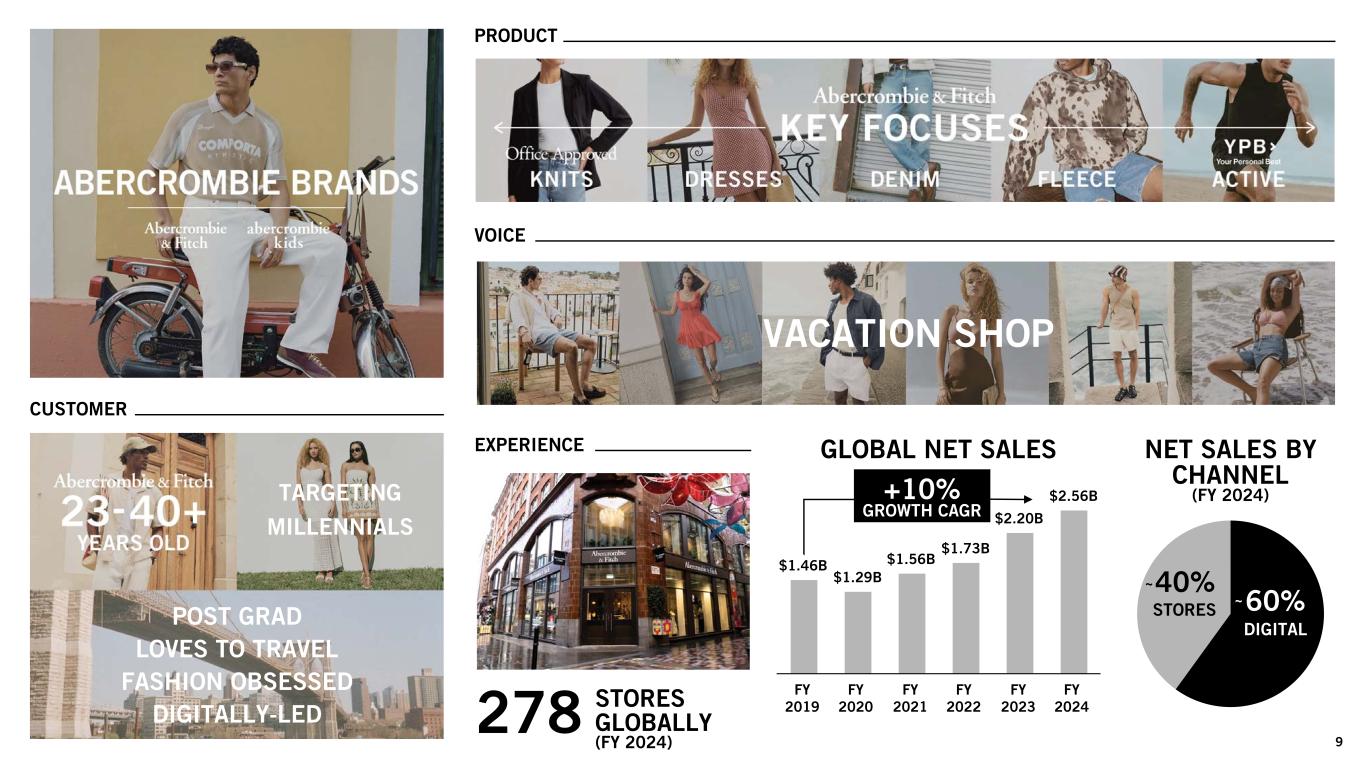

Abercrombie & Fitch Co. (NYSE: ANF) is a global, digitally led, omnichannel specialty retailer of apparel and accessories catering to kids through millennials with assortments curated for their specific lifestyle needs.

The company operates a family of brands, including Abercrombie brands and Hollister brands, each sharing a commitment to offer products of enduring quality and exceptional comfort that support global customers on their journey to being and becoming who they are. Abercrombie & Fitch Co. operates approximately 790 stores under these brands across North America, Europe, Asia and the Middle East, as well as the e-commerce sites abercrombie.com, abercrombiekids.com, and HollisterCo.com.

|

|

|

|

|

|

|

|

|

| Investor Contact: |

|

Media Contact: |

|

|

|

| Mo Gupta |

|

Kate Wagner |

| Abercrombie & Fitch Co. |

|

Abercrombie & Fitch Co. |

| (614) 283-6751 |

|

(614) 283-6192 |

| Investor_Relations@anfcorp.com |

|

Public_Relations@anfcorp.com |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Abercrombie & Fitch Co. |

| Condensed Consolidated Statements of Operations |

| (in thousands, except per share data) |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

Thirteen Weeks Ended |

|

Thirteen Weeks Ended |

|

May 3, 2025 |

|

% of

Net Sales |

|

May 4, 2024 |

|

% of

Net Sales |

| Net sales |

$ |

1,097,311 |

|

|

100.0 |

% |

|

$ |

1,020,730 |

|

|

100.0 |

% |

| Cost of sales, exclusive of depreciation and amortization |

417,133 |

|

|

38.0 |

% |

|

343,273 |

|

|

33.6 |

% |

|

|

|

|

|

|

|

|

| Selling expense |

399,937 |

|

|

36.4 |

% |

|

360,018 |

|

|

35.3 |

% |

| General and administrative expense |

174,925 |

|

|

15.9 |

% |

|

189,548 |

|

|

18.6 |

% |

| Other operating loss (income), net |

3,783 |

|

|

0.3 |

% |

|

(1,958) |

|

|

(0.2) |

% |

| Operating income |

101,533 |

|

|

9.3 |

% |

|

129,849 |

|

|

12.7 |

% |

| Interest expense |

661 |

|

|

0.1 |

% |

|

5,780 |

|

|

0.6 |

% |

| Interest income |

(7,444) |

|

|

(0.7) |

% |

|

(10,803) |

|

|

(1.1) |

% |

| Interest income, net |

(6,783) |

|

|

(0.6) |

% |

|

(5,023) |

|

|

(0.5) |

% |

| Income before income taxes |

108,316 |

|

|

9.9 |

% |

|

134,872 |

|

|

13.2 |

% |

| Income tax expense |

26,577 |

|

|

2.4 |

% |

|

19,794 |

|

|

1.9 |

% |

| Net income |

81,739 |

|

|

7.4 |

% |

|

115,078 |

|

|

11.3 |

% |

| Less: Net income attributable to noncontrolling interests |

1,326 |

|

|

0.1 |

% |

|

1,228 |

|

|

0.1 |

% |

| Net income attributable to A&F |

$ |

80,413 |

|

|

7.3 |

% |

|

$ |

113,850 |

|

|

11.2 |

% |

|

|

|

|

|

|

|

|

| Net income per share attributable to A&F |

|

|

|

|

|

|

|

| Basic |

$ |

1.63 |

|

|

|

|

$ |

2.24 |

|

|

|

| Diluted |

$ |

1.59 |

|

|

|

|

$ |

2.14 |

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average shares outstanding: |

|

|

|

|

|

|

|

| Basic |

49,214 |

|

|

|

|

50,893 |

|

|

|

| Diluted |

50,634 |

|

|

|

|

53,276 |

|

|

|

|

|

|

|

|

|

|

|

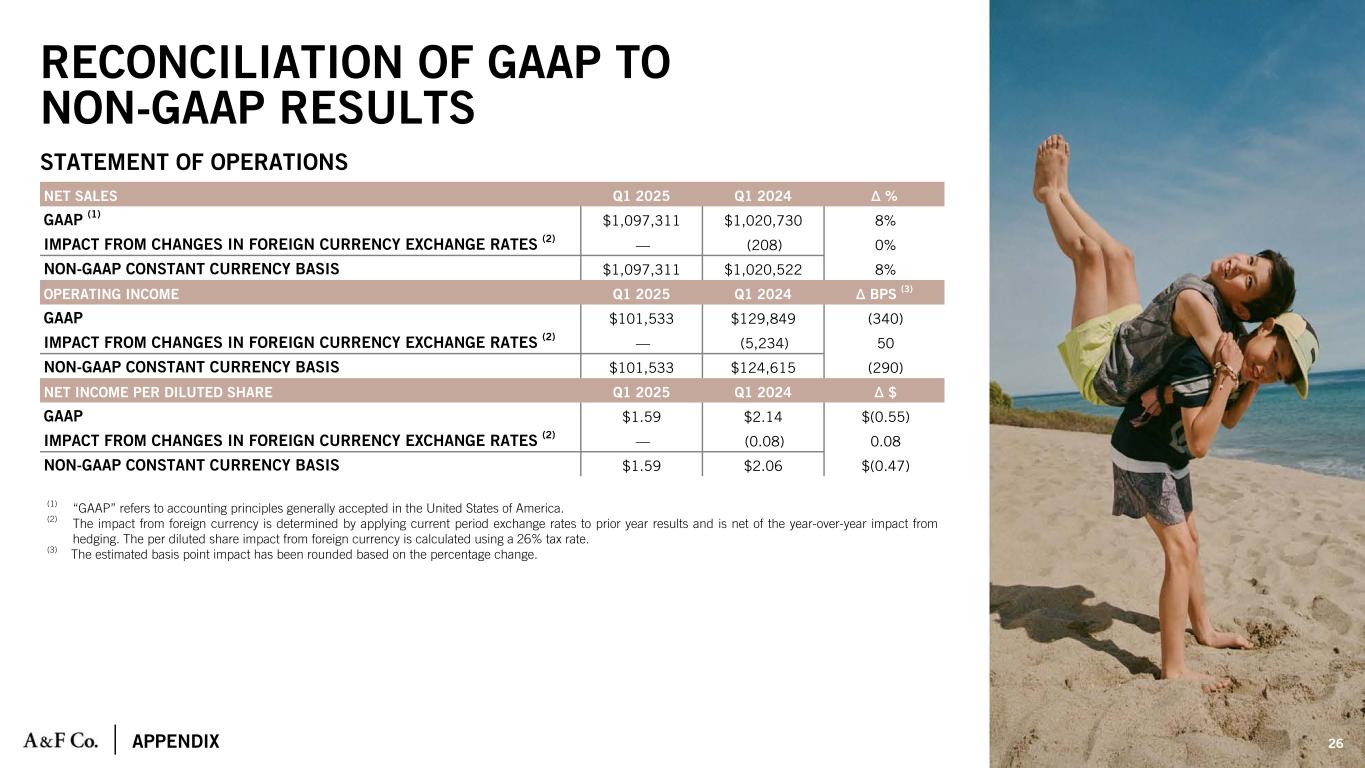

Reporting and Use of GAAP and Non-GAAP Measures

The company believes that each of the non-GAAP financial measures presented are useful to investors as they provide a measure of the company’s operating performance excluding the effect of certain items which the company believes do not reflect its future operating outlook, such as asset impairment charges, therefore supplementing investors’ understanding of comparability of operations across periods. Management used these non-GAAP financial measures during the periods presented to assess the company’s performance and to develop expectations for future operating performance. Non-GAAP financial measures should be used supplemental to, and not as an alternative to, the company’s GAAP financial results, and may not be calculated in the same manner as similar measures presented by other companies.

The company provides comparable sales, defined as the percentage year-over-year change in the aggregate of: (1) sales for stores that have been open as the same brand at least one year and whose square footage has not been expanded or reduced by more than 20% within the past year, with prior year’s net sales converted at the current year’s foreign currency exchange rate to remove the impact of foreign currency rate fluctuation, and (2) digital net sales with prior year’s net sales converted at the current year’s foreign currency exchange rate to remove the impact of foreign currency rate fluctuation.

The company also provides certain financial information on a constant currency basis to enhance investors’ understanding of underlying business trends and operating performance, by removing the impact of foreign currency exchange rate fluctuations. The effect from foreign currency, calculated on a constant currency basis, is determined by applying current year average exchange rates to prior year results and is net of the year-over-year impact from hedging. The per diluted share effect from foreign currency is calculated using a 26% tax rate.

In addition, the company provides EBITDA as a supplemental measure used by the company's executive management to assess the company's performance. We also believe these supplemental performance measures are meaningful information for investors and other interested parties to use in computing the company's core financial performance over multiple periods and with other companies by excluding the impact of differences in tax jurisdictions, debt service levels and capital investment.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Abercrombie & Fitch Co. |

| Reconciliation of Constant Currency Financial Measures |

Thirteen Weeks Ended May 3, 2025 and May 4, 2024 |

| (in thousands, except percentage and basis point changes and per share data) |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

2025 |

|

2024 |

|

|

|

% Change |

| Net sales |

|

|

|

|

|

|

|

GAAP (1) |

$ |

1,097,311 |

|

|

$ |

1,020,730 |

|

|

|

|

8% |

Impact from changes in foreign currency exchange rates (2) |

— |

|

|

(208) |

|

|

|

|

— |

| Net sales on a constant currency basis |

$ |

1,097,311 |

|

|

$ |

1,020,522 |

|

|

|

|

8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

2025 |

|

2024 |

|

|

|

BPS Change (3) |

GAAP (1) |

$ |

101,533 |

|

|

$ |

129,849 |

|

|

|

|

(340) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Impact from changes in foreign currency exchange rates (2) |

— |

|

|

(5,234) |

|

|

|

|

50 |

Non-GAAP constant currency basis |

$ |

101,533 |

|

|

$ |

124,615 |

|

|

|

|

(290) |

|

|

|

|

|

|

|

|

| Net income attributable to A&F |

2025 |

|

2024 |

|

|

|

$ Change |

GAAP (1) |

$ |

1.59 |

|

|

$ |

2.14 |

|

|

|

|

$(0.55) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Impact from changes in foreign currency exchange rates (2) |

— |

|

|

(0.08) |

|

|

|

|

0.08 |

Non-GAAP constant currency basis |

$ |

1.59 |

|

|

$ |

2.06 |

|

|

|

|

$(0.47) |

(1) “GAAP” refers to accounting principles generally accepted in the United States of America.

(2) The estimated impact from foreign currency is determined by applying current period exchange rates to prior year results and is net of the year-over-year impact from hedging. The per diluted share estimated impact from foreign currency is calculated using a 26% tax rate.

(3) The estimated basis point change has been rounded based on the percentage change.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Abercrombie & Fitch Co. |

Reconciliation of EBITDA |

Thirteen Weeks Ended May 3, 2025 and May 4, 2024 |

| (in thousands) |

| (Unaudited) |

|

|

|

|

|

|

|

|

2025 |

|

% of

Net Sales |

2024 |

|

% of

Net Sales |

| Net income |

$ |

81,739 |

|

|

7.4 |

% |

$ |

115,078 |

|

|

11.3 |

% |

| Income tax expense |

26,577 |

|

|

2.4 |

|

19,794 |

|

|

1.9 |

|

Interest income, net |

(6,783) |

|

|

(0.6) |

|

(5,023) |

|

|

(0.5) |

|

Depreciation and amortization |

38,576 |

|

|

3.6 |

|

37,689 |

|

|

3.7 |

|

EBITDA (1) |

$ |

140,109 |

|

|

12.8 |

% |

$ |

167,538 |

|

|

16.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)EBITDA is a supplemental financial measure that is not defined or prepared in accordance with GAAP. EBITDA is defined as net income before interest, income taxes and depreciation and amortization.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Abercrombie & Fitch Co. |

| Condensed Consolidated Balance Sheets |

| (in thousands) |

| (Unaudited) |

|

|

|

|

|

|

|

May 3, 2025 |

|

February 1, 2025 |

|

May 4, 2024 |

| Assets |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

| Cash and equivalents |

$ |

510,563 |

|

|

$ |

772,727 |

|

|

$ |

864,195 |

|

| Marketable securities |

97,006 |

|

|

116,221 |

|

|

— |

|

| Receivables |

113,311 |

|

|

105,324 |

|

|

93,605 |

|

| Inventories |

542,059 |

|

|

575,005 |

|

|

449,267 |

|

| Other current assets |

111,231 |

|

|

104,154 |

|

|

102,516 |

|

| Total current assets |

1,374,170 |

|

|

1,673,431 |

|

|

1,509,583 |

|

| Property and equipment, net |

606,060 |

|

|

575,773 |

|

|

540,697 |

|

| Operating lease right-of-use assets |

868,130 |

|

|

803,121 |

|

|

699,471 |

|

| Other assets |

247,816 |

|

|

247,562 |

|

|

220,334 |

|

| Total assets |

$ |

3,096,176 |

|

|

$ |

3,299,887 |

|

|

$ |

2,970,085 |

|

|

|

|

|

|

|

| Liabilities and stockholders’ equity |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

| Accounts payable |

$ |

296,738 |

|

|

$ |

364,532 |

|

|

$ |

266,925 |

|

| Accrued expenses |

433,682 |

|

|

504,922 |

|

|

402,786 |

|

| Short-term portion of operating lease liabilities |

215,511 |

|

|

211,600 |

|

|

188,851 |

|

|

|

|

|

|

|

| Income taxes payable |

52,939 |

|

|

45,890 |

|

|

61,137 |

|

| Total current liabilities |

998,870 |

|

|

1,126,944 |

|

|

919,699 |

|

| Long-term liabilities: |

|

|

|

|

|

| Long-term portion of operating lease liabilities |

$ |

810,391 |

|

|

$ |

740,013 |

|

|

$ |

656,862 |

|

| Long-term borrowings, net |

— |

|

|

— |

|

|

213,102 |

|

| Other liabilities |

84,321 |

|

|

81,607 |

|

|

89,252 |

|

| Total long-term liabilities |

894,712 |

|

|

821,620 |

|

|

959,216 |

|

| Total Abercrombie & Fitch Co. stockholders’ equity |

1,189,126 |

|

|

1,335,628 |

|

|

1,078,886 |

|

| Noncontrolling interests |

13,468 |

|

|

15,695 |

|

|

12,284 |

|

| Total stockholders’ equity |

1,202,594 |

|

|

1,351,323 |

|

|

1,091,170 |

|

| Total liabilities and stockholders’ equity |

$ |

3,096,176 |

|

|

$ |

3,299,887 |

|

|

$ |

2,970,085 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Abercrombie & Fitch Co. |

| Condensed Consolidated Statements of Cash Flows |

| (in thousands, except per share data) |

| (Unaudited) |

|

|

|

|

|

|

|

|

| |

Thirteen Weeks Ended |

| |

May 3, 2025 |

|

May 4, 2024 |

| Operating activities |

|

|

|

| Net cash (used for) provided by operating activities |

$ |

(4,000) |

|

|

$ |

95,010 |

|

|

|

|

|

| Investing activities |

|

|

|

|

|

|

|

Proceeds from maturities of marketable securities |

20,000 |

|

|

— |

|

| Purchases of property and equipment |

(50,764) |

|

|

(38,886) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash used for investing activities |

$ |

(30,764) |

|

|

$ |

(38,886) |

|

|

|

|

|

| Financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Redemption of senior secured notes |

— |

|

|

(9,425) |

|

|

|

|

|

| Purchases of common stock |

(200,000) |

|

|

(15,000) |

|

|

|

|

|

| Acquisition of common stock for tax withholding obligations |

(34,062) |

|

|

(65,173) |

|

| Other financing activities |

(451) |

|

|

(3,353) |

|

| Net cash used for financing activities |

$ |

(234,513) |

|

|

$ |

(92,951) |

|

|

|

|

|

| Effect of foreign currency exchange rates on cash |

$ |

7,407 |

|

|

$ |

(857) |

|

| Net decrease in cash and equivalents, and restricted cash and equivalents |

$ |

(261,870) |

|

|

$ |

(37,684) |

|

| Cash and equivalents, and restricted cash and equivalents, beginning of period |

$ |

780,395 |

|

|

$ |

909,685 |

|

| Cash and equivalents, and restricted cash and equivalents, end of period |

$ |

518,525 |

|

|

$ |

872,001 |

|