Exhibit 99.2

This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements reflect the current views of the management of Equity Bancshares, Inc. (“Equity,” “we,” “us,” “our,” “the company”) with respect to, among other things, future events and Equity’s financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “project,” “forecast,” “goal,” “target,” “would” and “outlook,” or the negative variations of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about Equity’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond Equity’s control. Accordingly, Equity cautions you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although Equity believes that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Factors that could cause actual results to differ materially from Equity’s expectations include competition from other financial institutions and bank holding companies; the effects of and changes in trade, monetary and fiscal policies and laws, including interest rate policies of the Federal Reserve Board; changes in the demand for loans; fluctuations in value of collateral and loan reserves; inflation, interest rate, market and monetary fluctuations; changes in consumer spending, borrowing and savings habits; the possibility that the expected benefits related to the proposed transaction with NBC Corp. of Oklahoma (“NBC”) may not materialize as expected; the proposed transaction not being timely completed, if completed at all; prior to the completion of the proposed transaction, the business of NBC experiencing disruptions due to transaction-related uncertainty or other factors making it more difficult to maintain relationships with employees, customers, other business partners or governmental entities, difficulty retaining key employees; the ability to obtain regulatory approval of the NBC transactions; and the ability to successfully implement integration strategies or to achieve expected synergies and operating efficiencies within the expected time-frames or at all; and similar variables. The foregoing list of factors is not exhaustive. For discussion of these and other risks that may cause actual results to differ from expectations, please refer to “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in Equity’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 7, 2025, and any updates to those risk factors set forth in Equity’s subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. If one or more events related to these or other risks or uncertainties materialize, or if Equity’s underlying assumptions prove to be incorrect, actual results may differ materially from what Equity anticipates. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and Equity does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. New risks and uncertainties arise from time to time and it is not possible for us to predict those events or how they may affect us. In addition, Equity cannot assess the impact of each factor on Equity’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements, expressed or implied, included in this press release are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Equity or persons acting on Equity’s behalf may issue. NON-GAAP FINANCIAL MEASURES This presentation contains certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided at the end of this presentation. Numbers in the presentation may not sum due to rounding. Forward Looking Statements

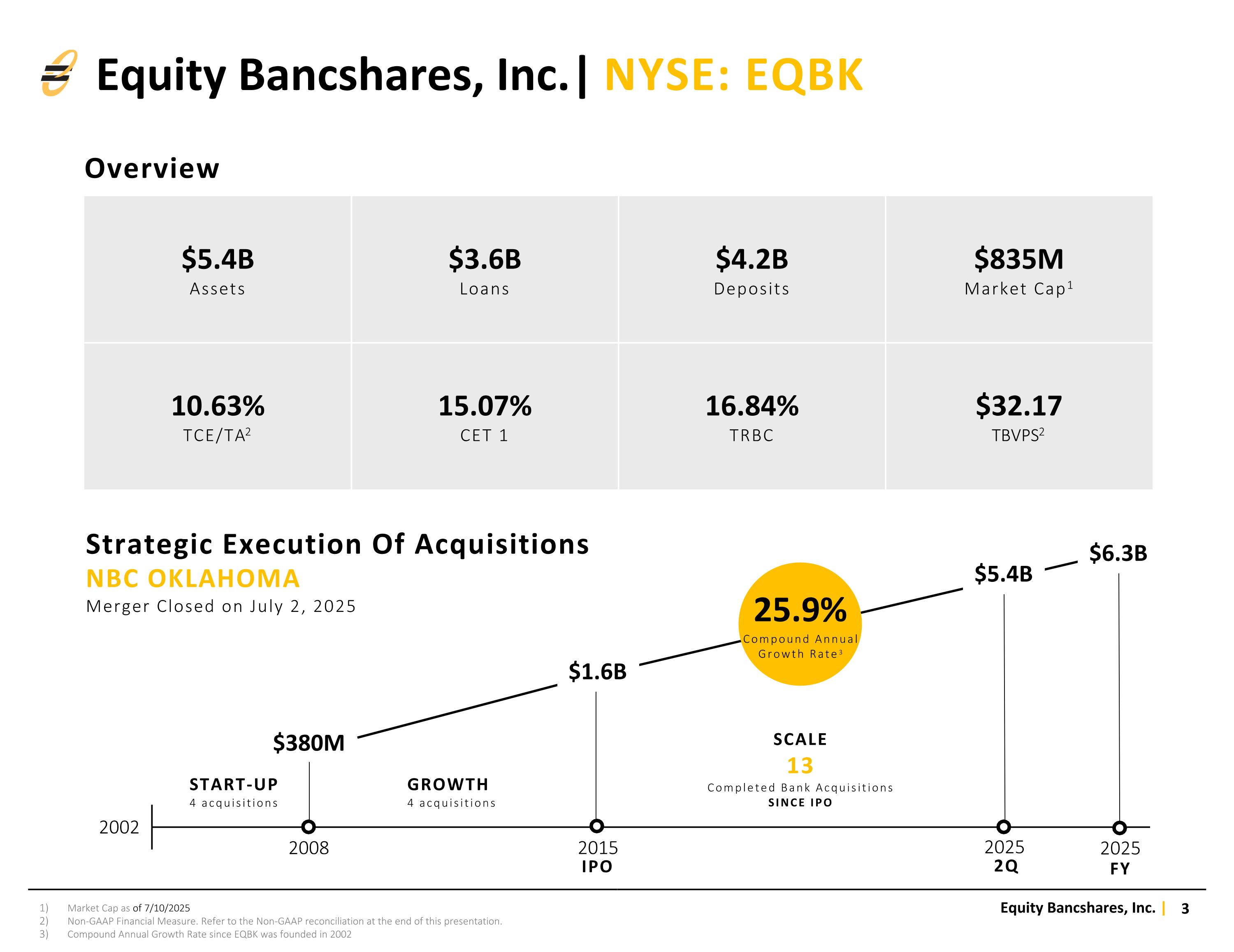

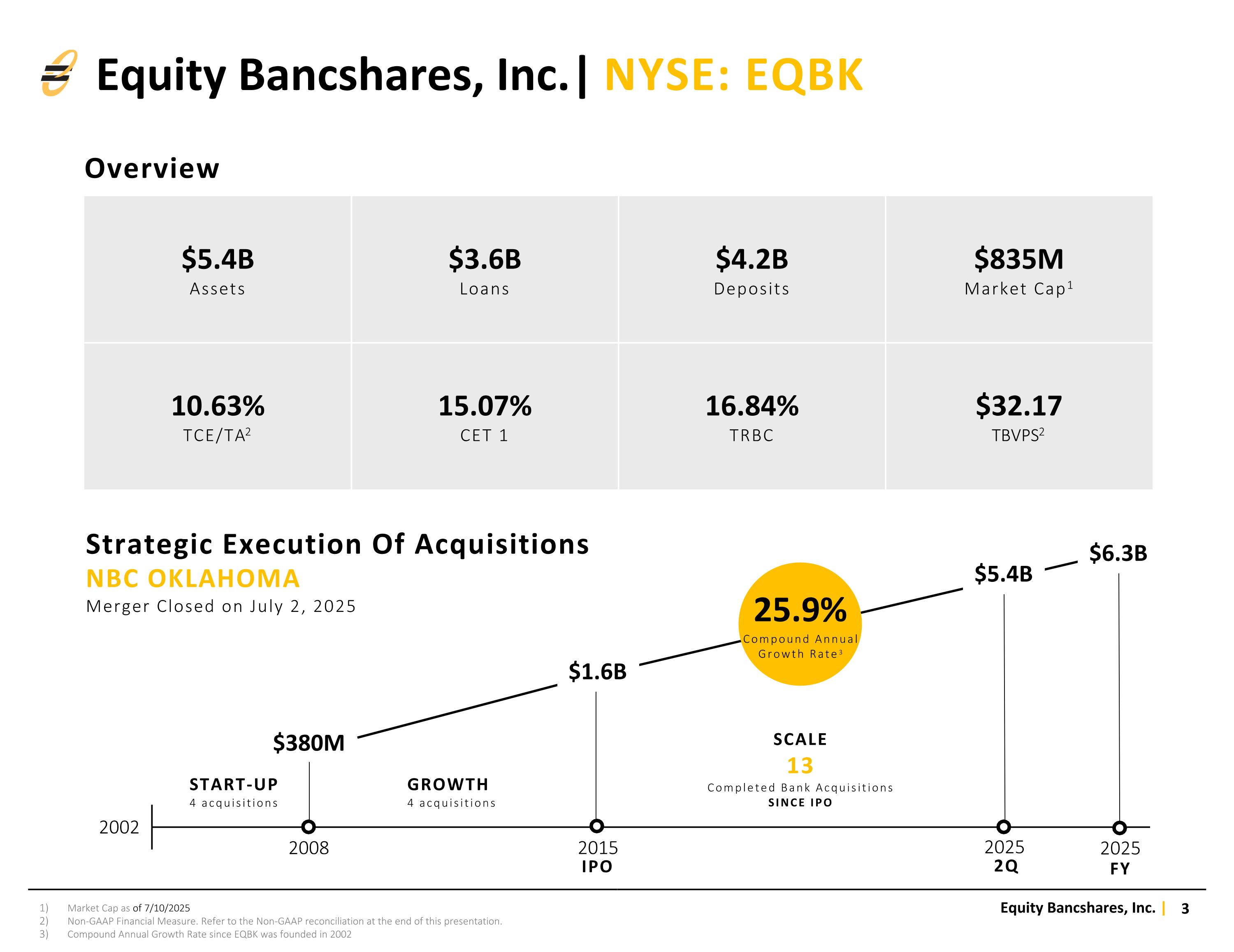

Equity Bancshares, Inc.| NYSE: EQBK Market Cap as of 7/10/2025 Non-GAAP Financial Measure. Refer to the Non-GAAP reconciliation at the end of this presentation. Compound Annual Growth Rate since EQBK was founded in 2002 Strategic Execution Of Acquisitions SCALE 13 Completed Bank Acquisitions SINCE IPO 2002 2008 2015 2025 START-UP 4 acquisitions GROWTH 4 acquisitions IPO $380M $5.4B 25.9% Compound Annual Growth Rate3 Overview $5.4B Assets $3.6B Loans $4.2B Deposits $835M Market Cap1 10.63% TCE/TA2 15.07% CET 1 16.84% TRBC $32.17 TBVPS2 $1.6B $6.3B 2025 2Q FY NBC OKLAHOMA Merger Closed on July 2, 2025

Leadership Team Brad Elliott Equity Bancshares, Inc. Chairman & CEO Years in Banking: 36 Founded Equity Bank in 2002 2018 EY Entrepreneur of the Year National Finalist 2014 Most Influential CEO, Wichita Business Journal Chris Navratil Chief Financial Officer Years in Banking: 14 Promoted to Chief Financial Officer in August 2023. Previously served as Bank CFO and prior to Equity, spent 7 years within the Financial Institution Audit Practice with Crowe LLP Brett Reber General Counsel Years in Law: 37 Prior to joining Equity Bank, he served as Managing Member of the Wise & Reber, L.C. law firm. Brett has practiced corporate and business law for over 30 years. David Pass Chief Information Officer Years in Banking: 24 Previously served in IT leadership positions at UMB Financial Corporation and CoBiz Financial. Rick Sems Equity Bank CEO Years in Banking: 25 Announced as Equity Bank CEO in May 2024. Joined Equity Bank as President in May 2023. Prior to joining, Rick served as Chief Banking Officer of First Bank in St. Louis and President & CEO of Reliance Bank Julie Huber Chief Operating Officer Years in Banking: 35 Announced as Chief Operating Officer in May 2024. Served in variety of leadership roles in her time at Equity Bank including overseeing our operations, HR, compliance functions and sales and training, and as managed the integration process for each acquisition. Kryzsztof Slupkowski Chief Credit Officer Years in Banking: 12 Promoted to Chief Credit Officer in September 2023. Served as Metro Market CCO since 2018, previously served in various credit function at Commerce Bancshares. Ann Knutson Chief Human Resources Officer Years in Banking: 17 Previously served in human resource leadership positions at Bank Five Nine and Summit Credit Union

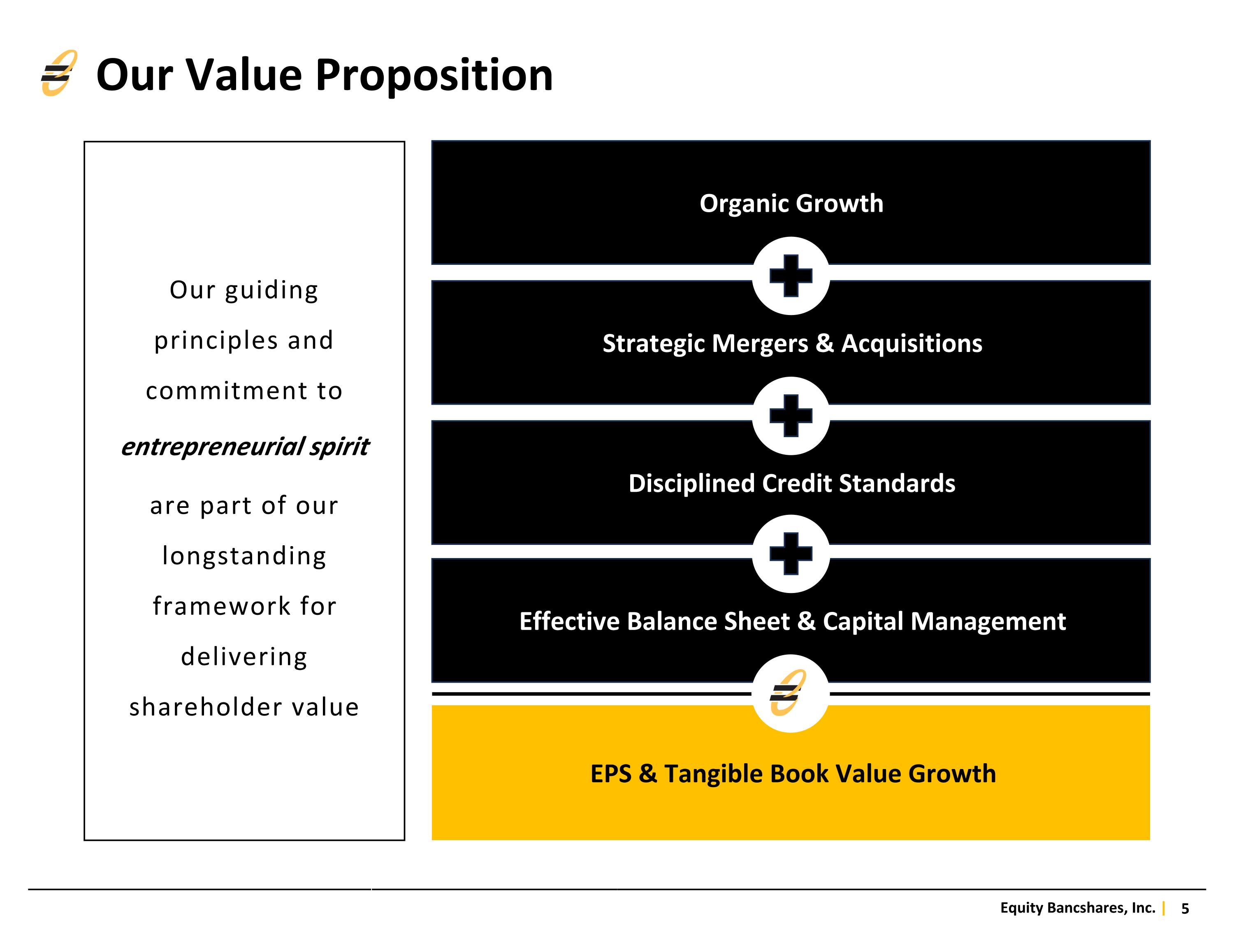

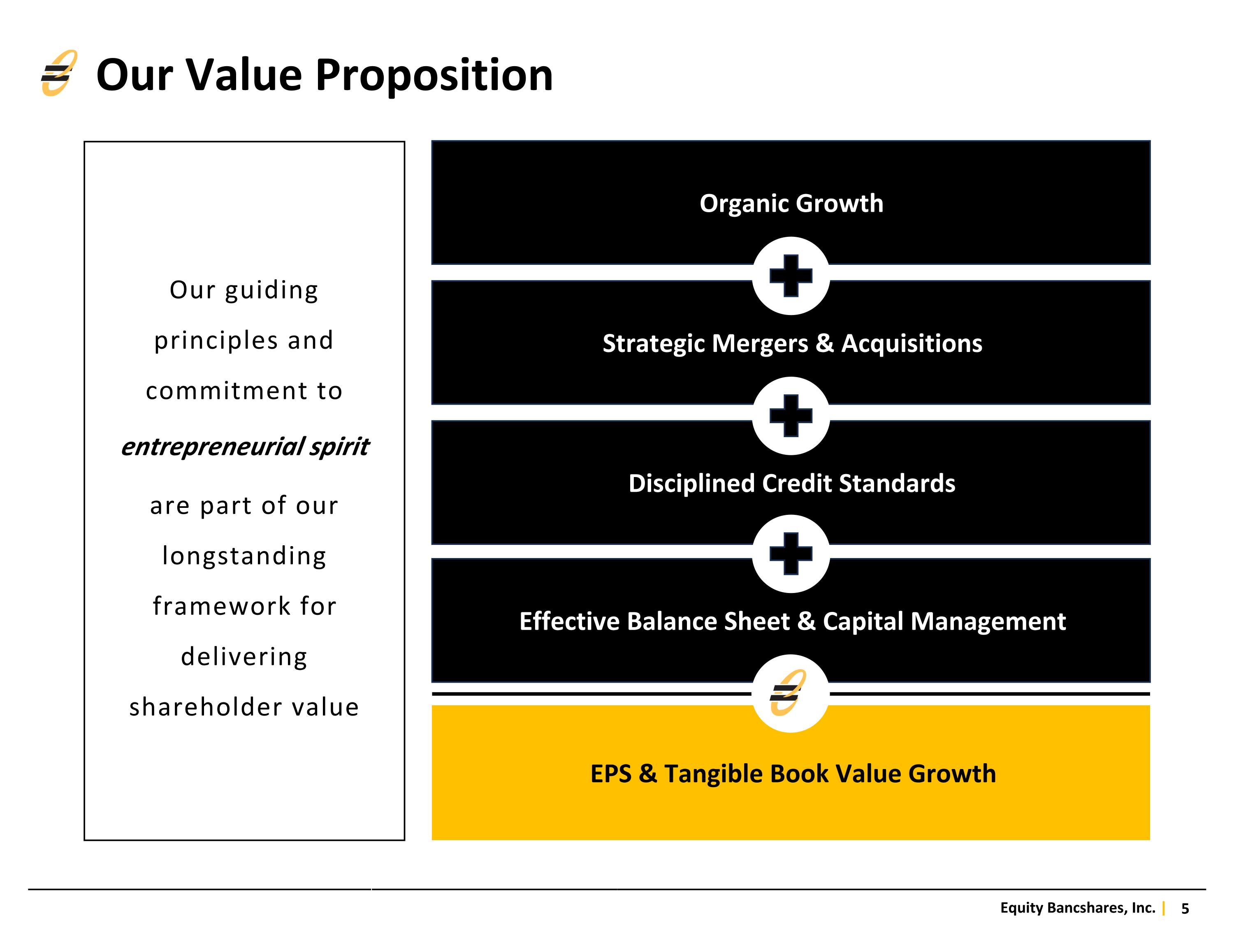

Organic Growth Strategic Mergers & Acquisitions Disciplined Credit Standards Effective Balance Sheet & Capital Management EPS & Tangible Book Value Growth Our guiding principles and commitment to entrepreneurial spirit are part of our longstanding framework for delivering shareholder value Our Value Proposition

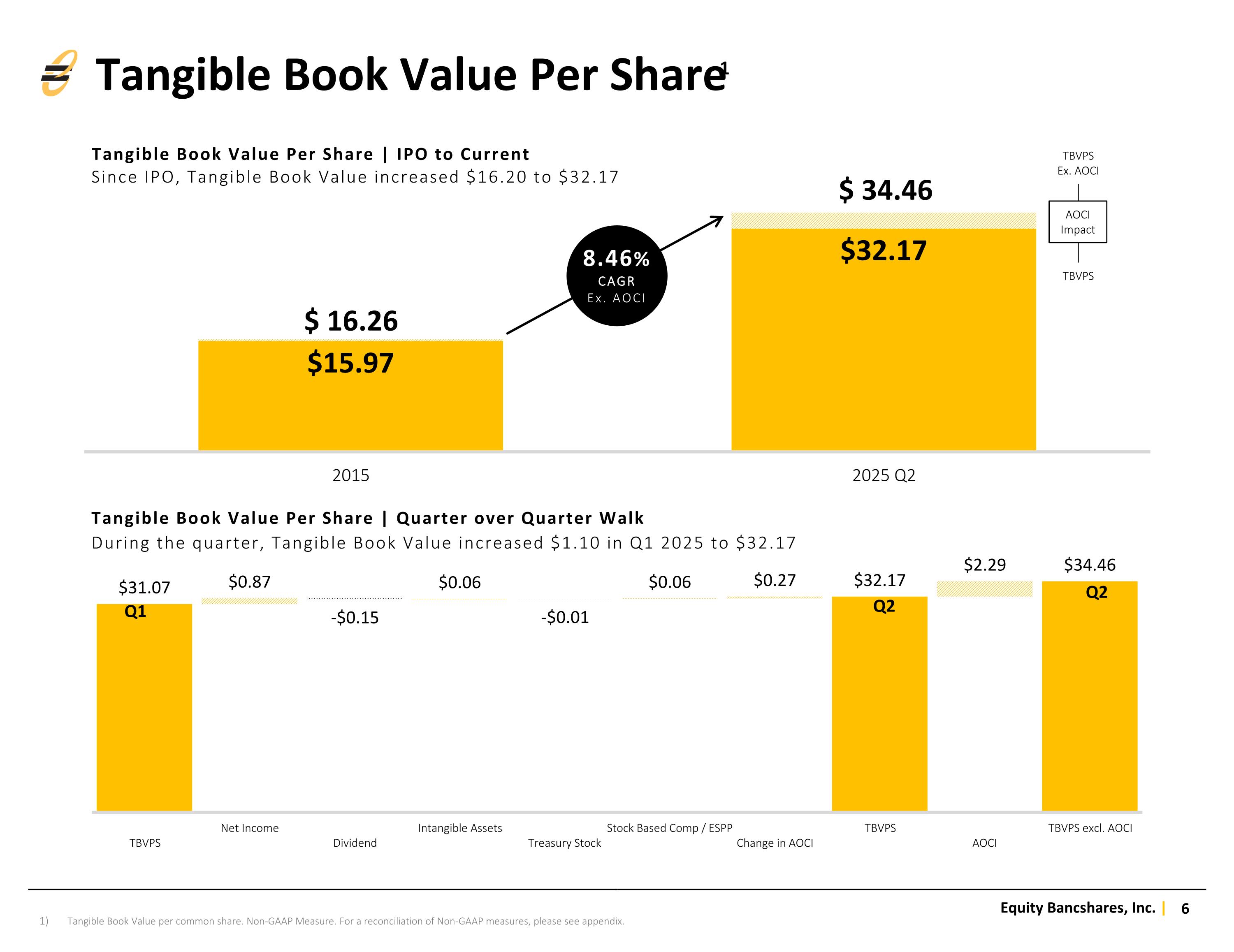

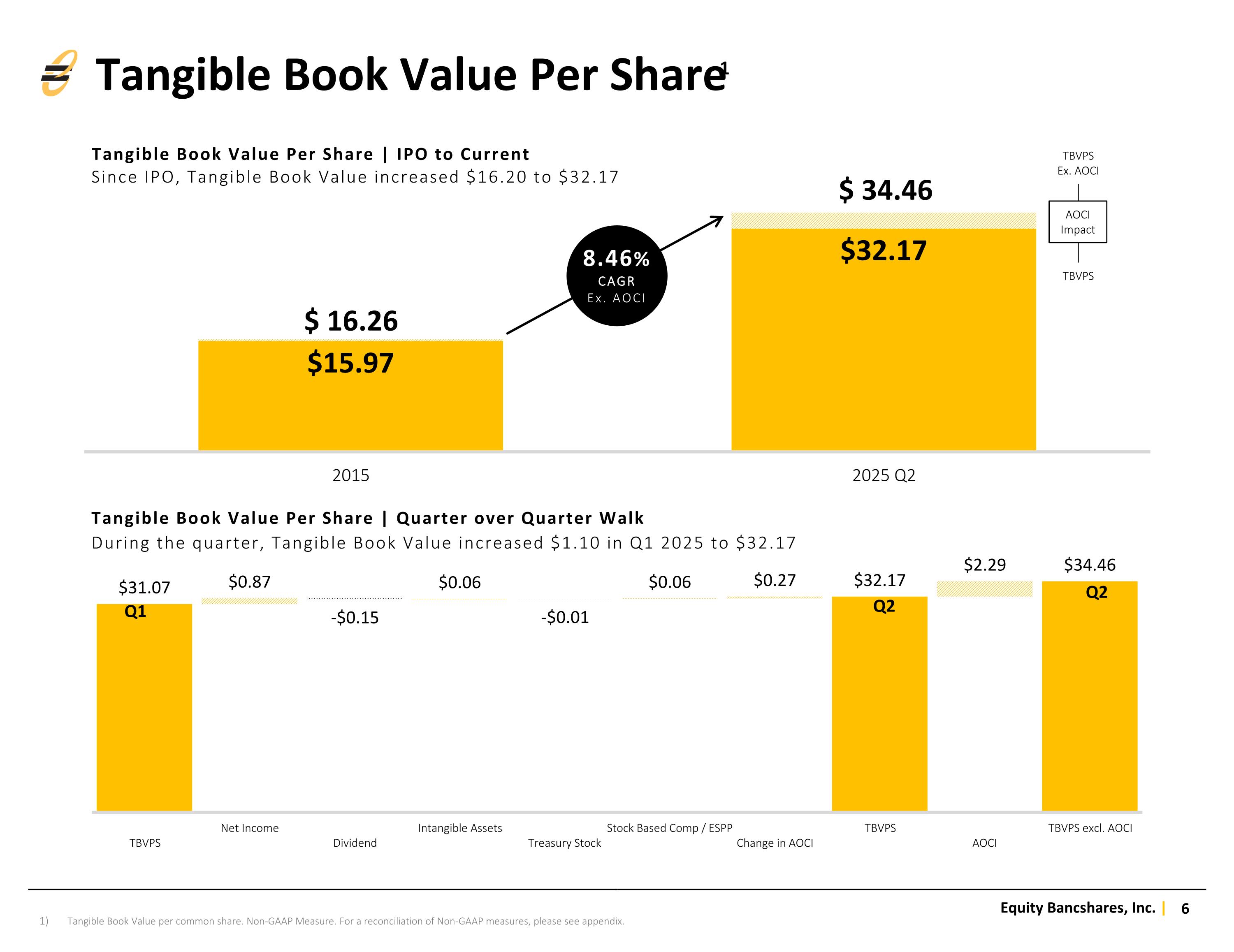

Tangible Book Value per common share. Non-GAAP Measure. For a reconciliation of Non-GAAP measures, please see appendix. AOCI Impact TBVPS TBVPS Ex. AOCI Tangible Book Value Per Share | IPO to Current Tangible Book Value Per Share | Quarter over Quarter Walk 8.46% CAGR Ex. AOCI During the quarter, Tangible Book Value increased $1.10 in Q1 2025 to $32.17 Since IPO, Tangible Book Value increased $16.20 to $32.17 Tangible Book Value Per Share1 Q1 Q2 Q2

2nd Quarter 2025 | Financial Highlights Non-GAAP Financial Measure. Refer to the Non-GAAP reconciliation at the end of this presentation. 2025 2025 2024 Earnings & Profitability Q2 Q1 Q4 Earnings Per Share | Core Earnings Per Share1 $0.87 | $0.99 $0.86 | $0.90 $1.06 | $1.10 Book Value Per Share | TBV Per Share1 $36.27 | $32.17 $35.23 | $31.07 $34.04 | $30.07 Net Income | Core Net Income1 $15.3M | $17.5M $15.0M | $16.0M $17.0M | $17.8M Net Interest Margin 4.17% 4.27% 4.17% Efficiency Ratio1 63.62% 62.43% 63.02% ROAA | Core ROAA 1 1.18% | 1.35% 1.17% | 1.24% 1.31% |1.37% ROAE | Core ROATCE 1 9.76% | 12.64% 10.07% | 12.14% 12.67% | 15.29% Balance Sheet & Capital Total Loans $3.6B $3.6B $3.5B Total Deposits $4.2B $4.4B $4.4B Total Equity / Total Assets | TCE / TA1 11.83% | 10.63% 11.34% |10.13% 11.12% | 9.95% CET 1 Capital Ratio 15.07% 14.70% 14.51% Total Risk-based Capital Ratio 16.84% 18.32% 18.07% Asset Quality Provision for Credit Losses $0.0M $2.7M $0.0M NCOs / Avg. Loans 0.06% 0.02% 0.04% NPAs / Total Assets 0.85% 0.51% 0.65% Classified Assets / Regulatory Capital 11.39% 10.24% 12.00% $17.5M Core Net Income1 $0.99 Core Earnings Per Share1 $4.2B Total Deposits $3.6B Gross Loans

Non-GAAP Financial Measure. Refer to the Non-GAAP reconciliation at the end of this presentation. Return On Average Tangible Common Equity - Core1 Return on Average Assets - Core1 Efficiency Ratio1 TCE / TA Excluding AOCI1 Performance Metrics

Net Interest Income Noninterest Income Rate Protection Noninterest Expense Net interest income was $49.8 million for the period, as compared to $50.3 million for previous quarter. Adjusting the stated number for non-recurring nonaccrual reversals and excess prepayment fee realization of $2.3 million in the prior quarter, net interest income was up $1.8 million in Q2. Increased coupon yield and a larger balance sheet drove the outperformance to Q1. Total non-interest income was $8.6 million for the quarter, as compared to $10.3 million linked quarter. Q1 includes a $2.2 million comparative improvement in benefit from Bank Owned Life Insurance as we realized a death benefit during the period. Excluding this periodic change Noninterest income was up $0.5 million linked quarter due to growth in our Wealth Management, Insurance, and Mortgage services. Proactive effort to book variable rate assets subject to floor levels. Total non-interest expense for the quarter was $40.0 million as compared to $39.0 million for the previous quarter. Adjusting for the non-recurring $1.7 million loss on debt extinguishment and merger expenses, non-interest expense decreased $0.7 million QoQ. The comparative decrease during the period was driven by beginning of the year payroll dynamics as well as savings in maintenance and professional fees. Quarter over Quarter Walk Q1 Q2 Net Income Non-GAAP Financial Measure. Refer to the Non-GAAP reconciliation at the end of this presentation. 1 Q2 1

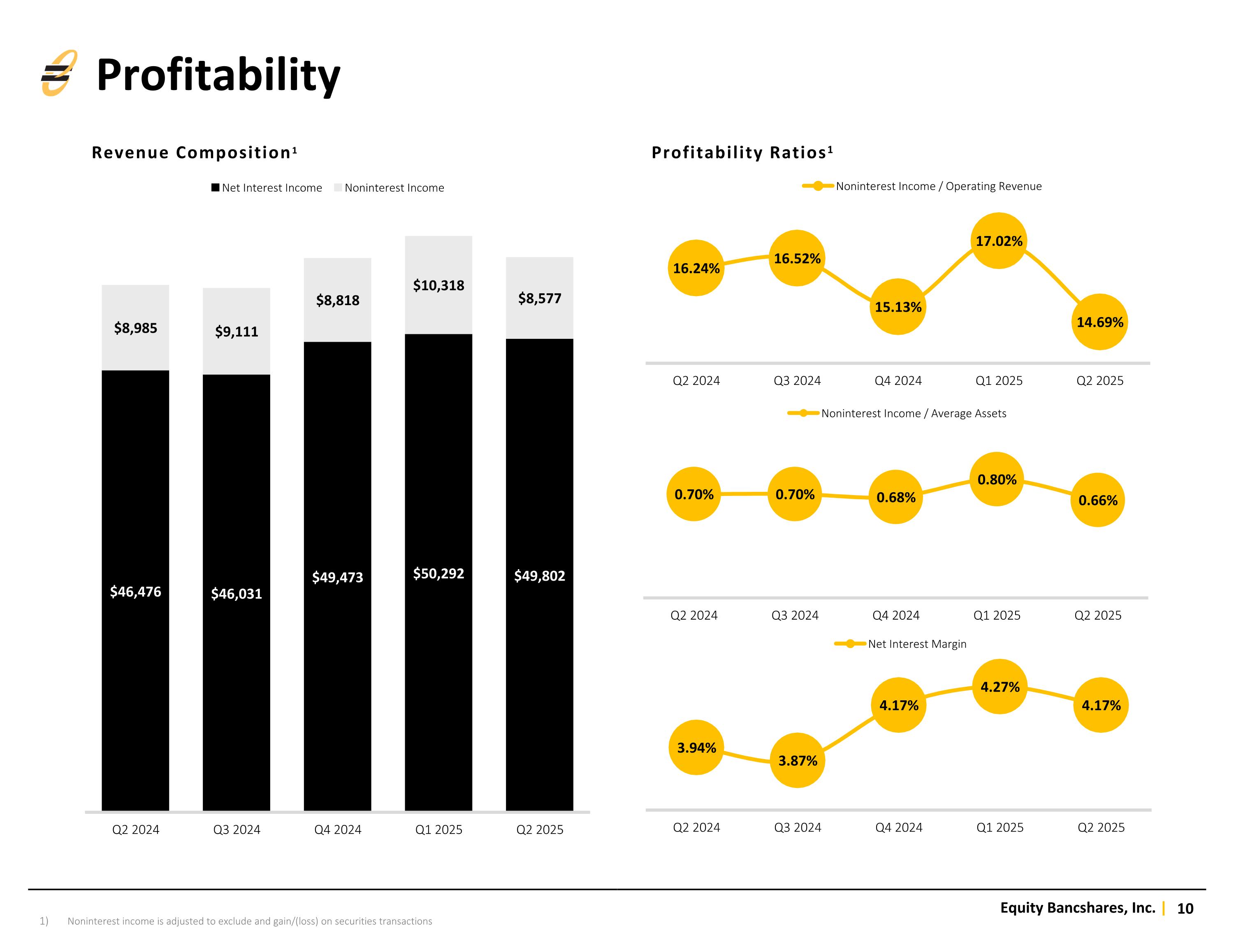

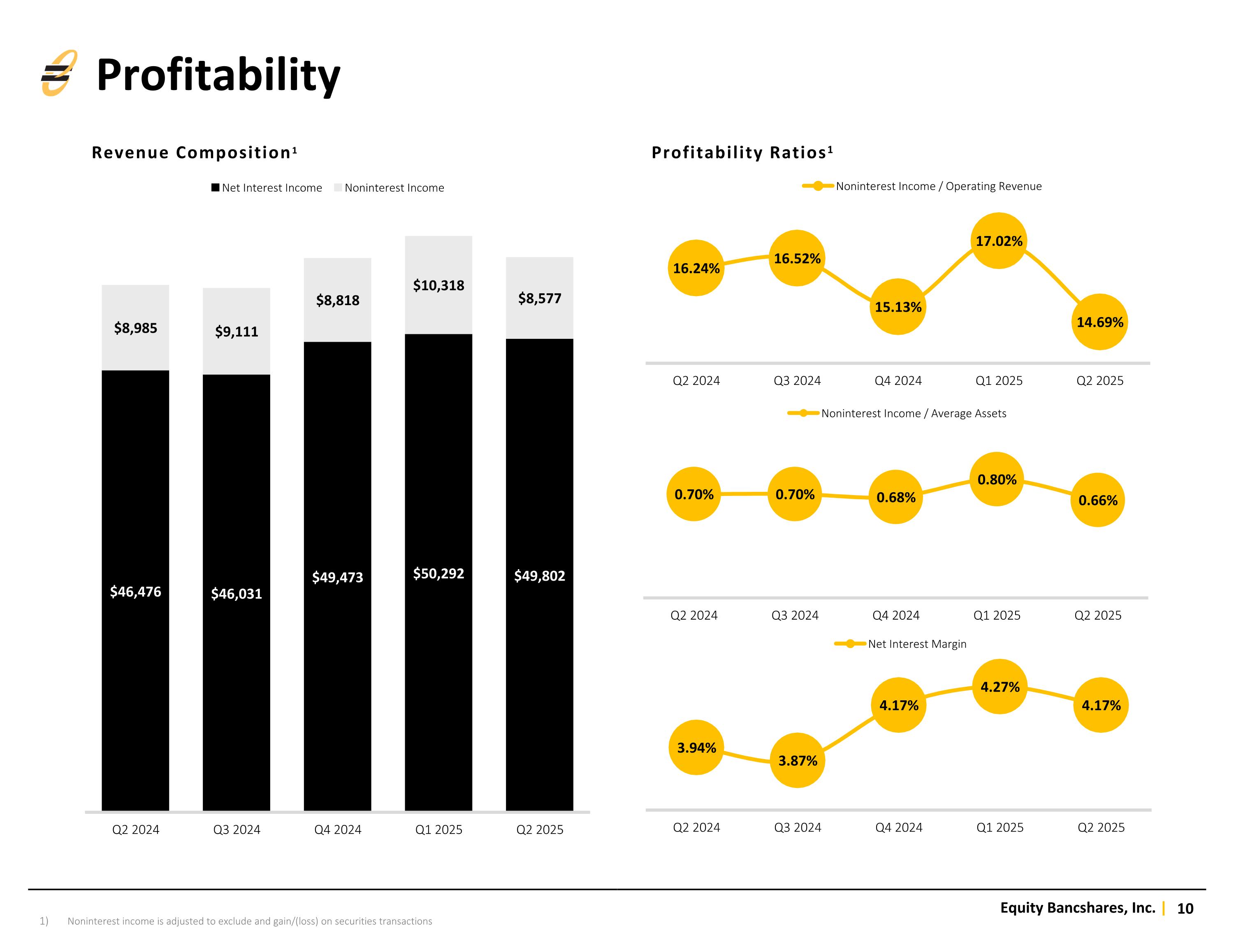

Profitability Noninterest income is adjusted to exclude and gain/(loss) on securities transactions Revenue Composition1 Profitability Ratios1

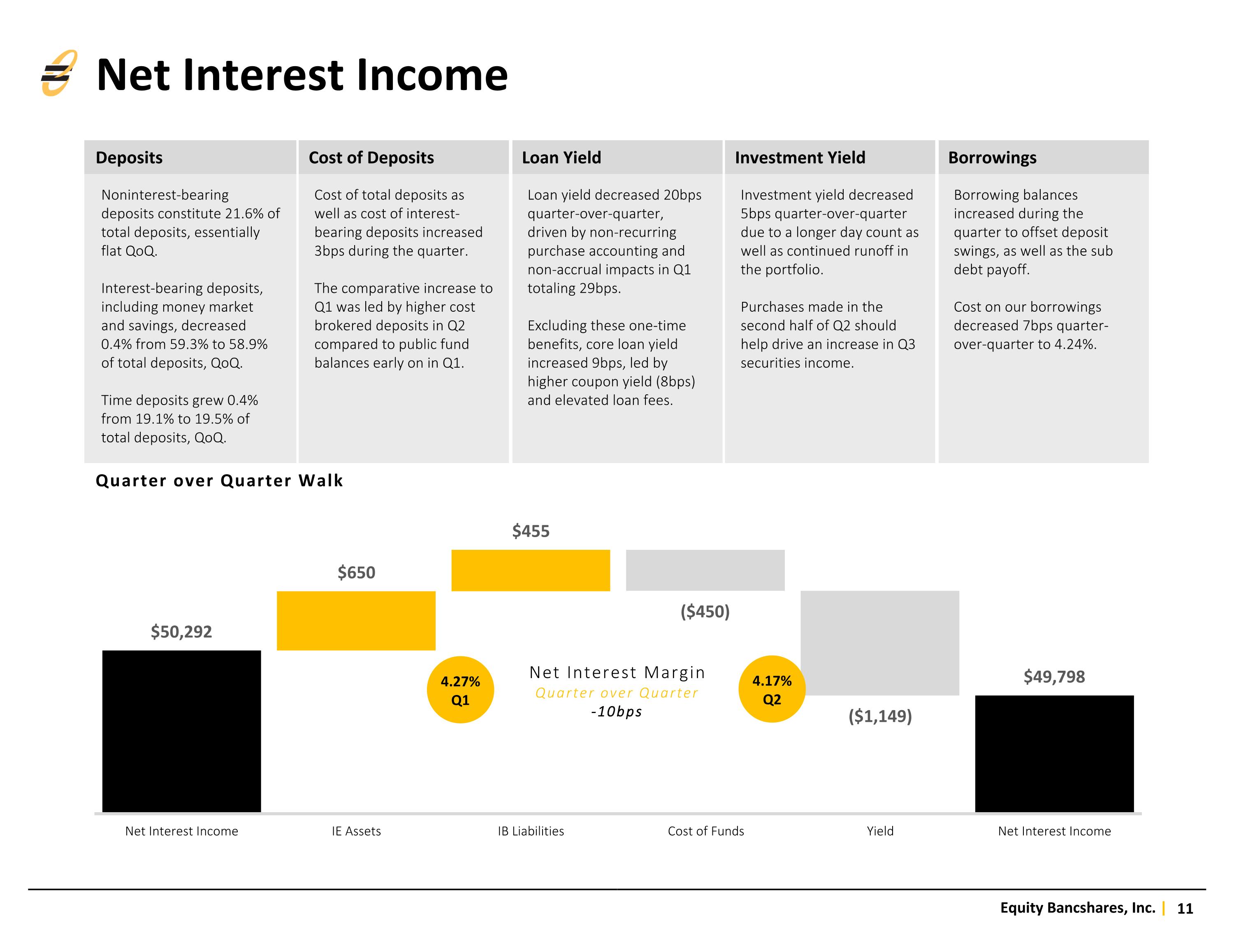

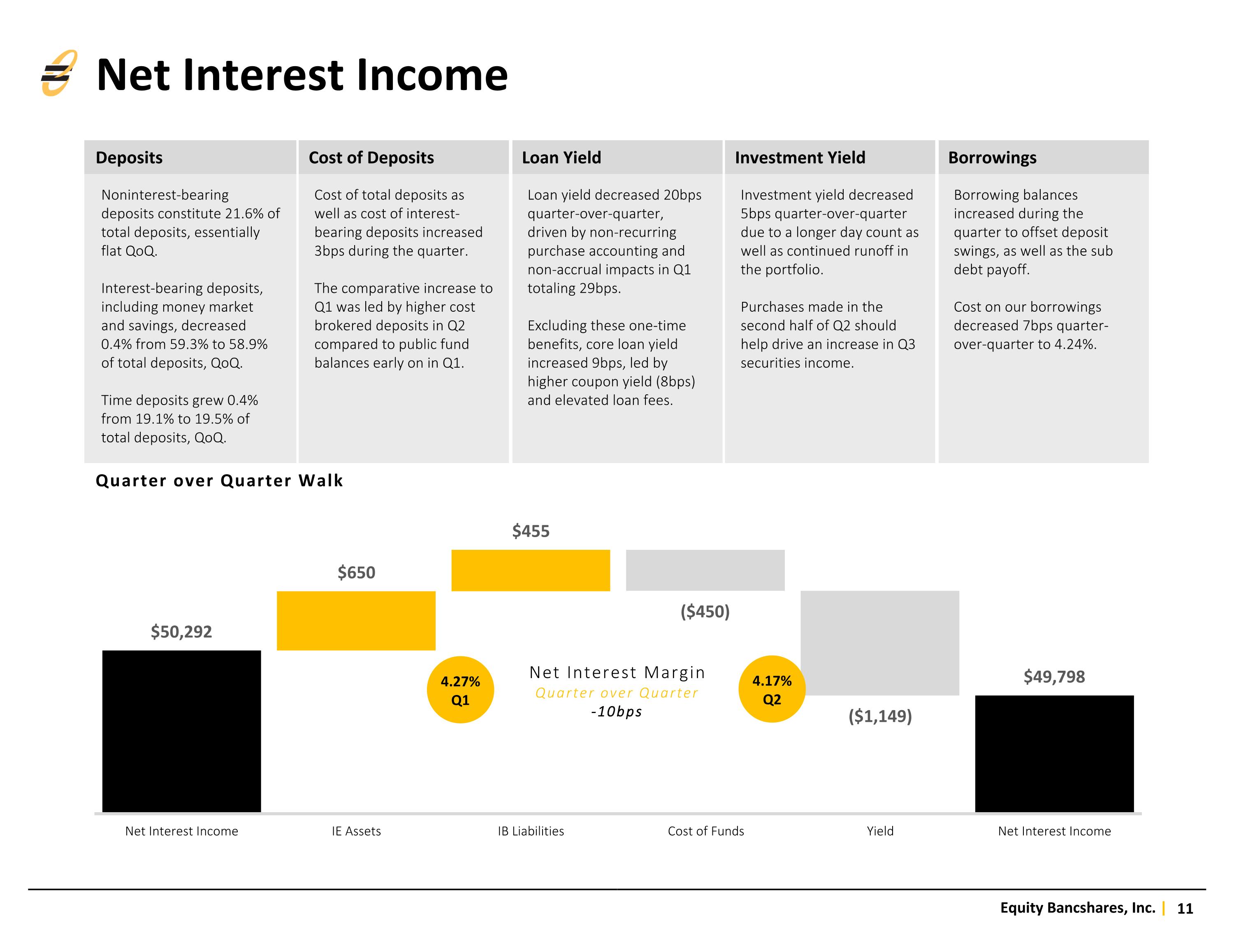

Deposits Cost of Deposits Loan Yield Investment Yield Borrowings Noninterest-bearing deposits constitute 21.6% of total deposits, essentially flat QoQ. Interest-bearing deposits, including money market and savings, decreased 0.4% from 59.3% to 58.9% of total deposits, QoQ. Time deposits grew 0.4% from 19.1% to 19.5% of total deposits, QoQ. Cost of total deposits as well as cost of interest-bearing deposits increased 3bps during the quarter. The comparative increase to Q1 was led by higher cost brokered deposits in Q2 compared to public fund balances early on in Q1. Loan yield decreased 20bps quarter-over-quarter, driven by non-recurring purchase accounting and non-accrual impacts in Q1 totaling 29bps. Excluding these one-time benefits, core loan yield increased 9bps, led by higher coupon yield (8bps) and elevated loan fees. Investment yield decreased 5bps quarter-over-quarter due to a longer day count as well as continued runoff in the portfolio. Purchases made in the second half of Q2 should help drive an increase in Q3 securities income. Borrowing balances increased during the quarter to offset deposit swings, as well as the sub debt payoff. Cost on our borrowings decreased 7bps quarter-over-quarter to 4.24%. Quarter over Quarter Walk Net Interest Margin Quarter over Quarter -10bps Net Interest Income 4.27% Q1 4.17% Q2 Q1 Q2

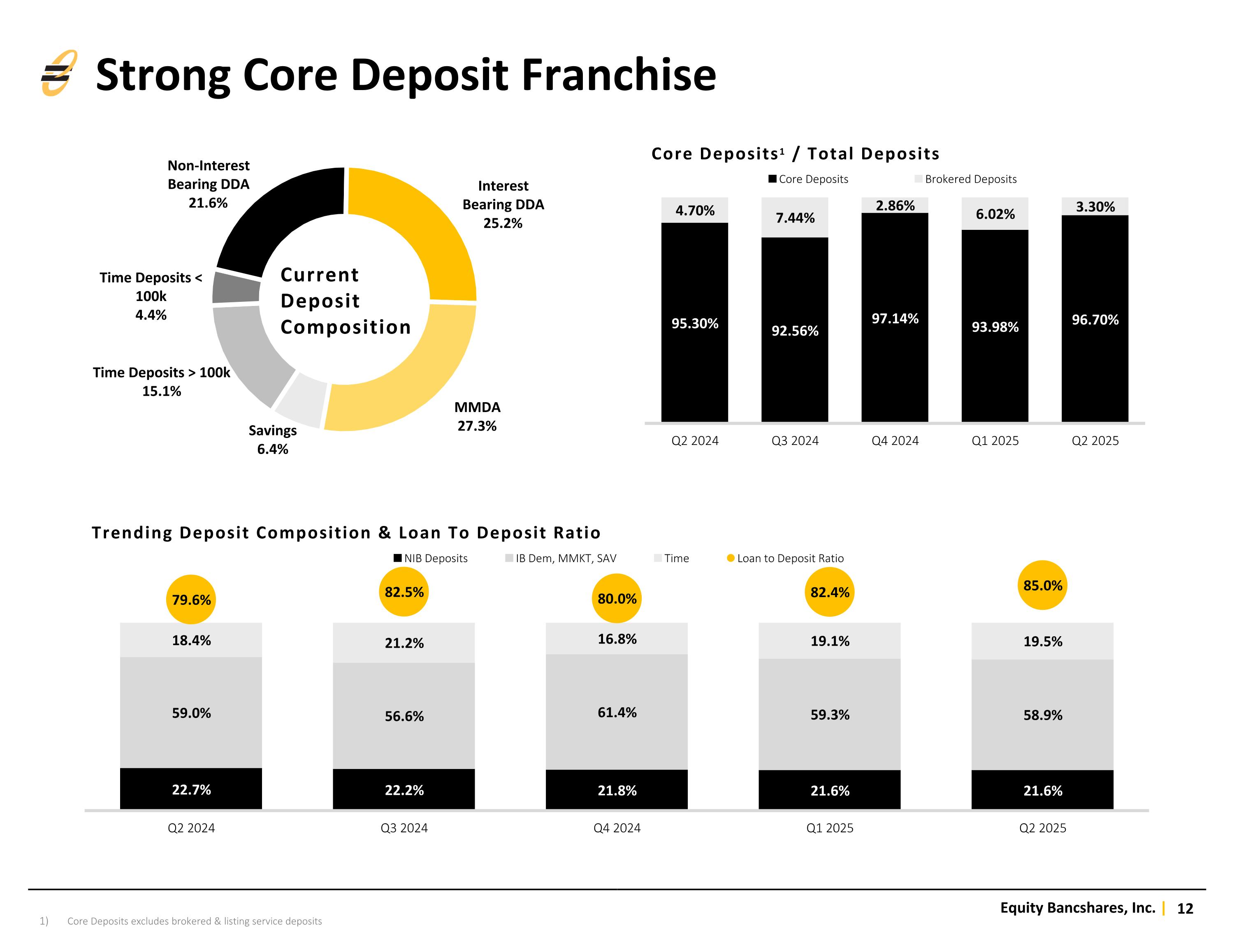

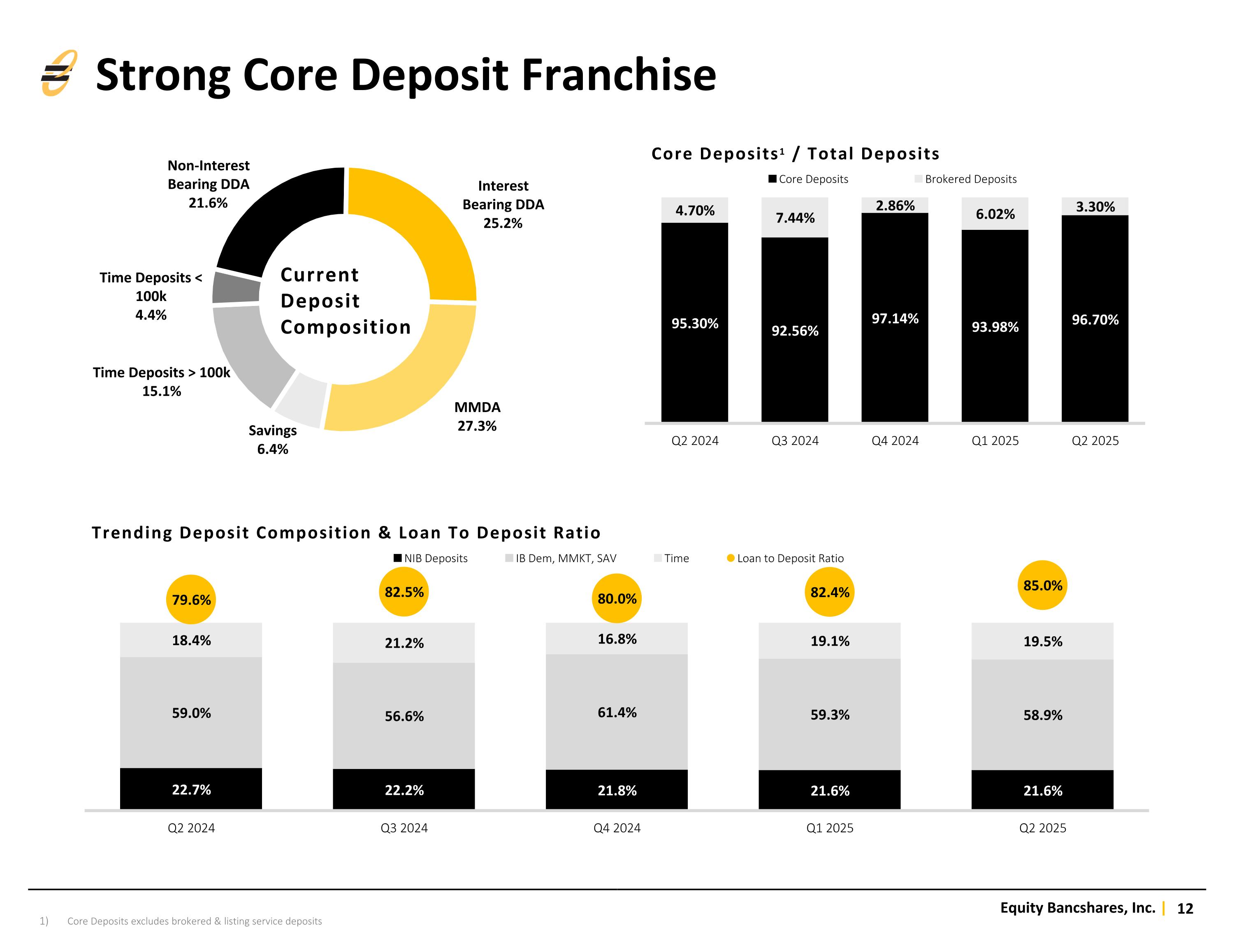

Current Deposit Composition Core Deposits excludes brokered & listing service deposits Trending Deposit Composition & Loan To Deposit Ratio Core Deposits1 / Total Deposits Strong Core Deposit Franchise

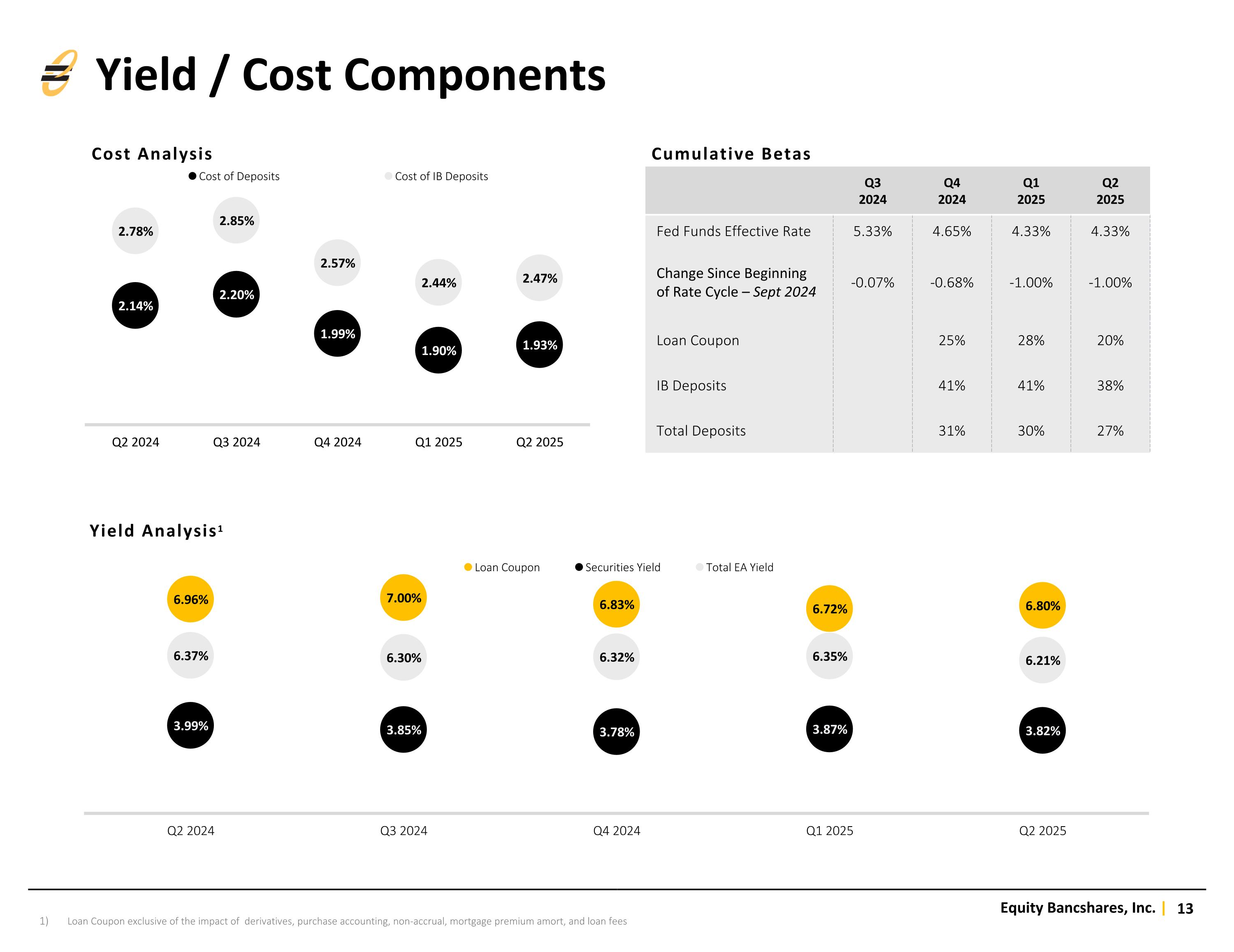

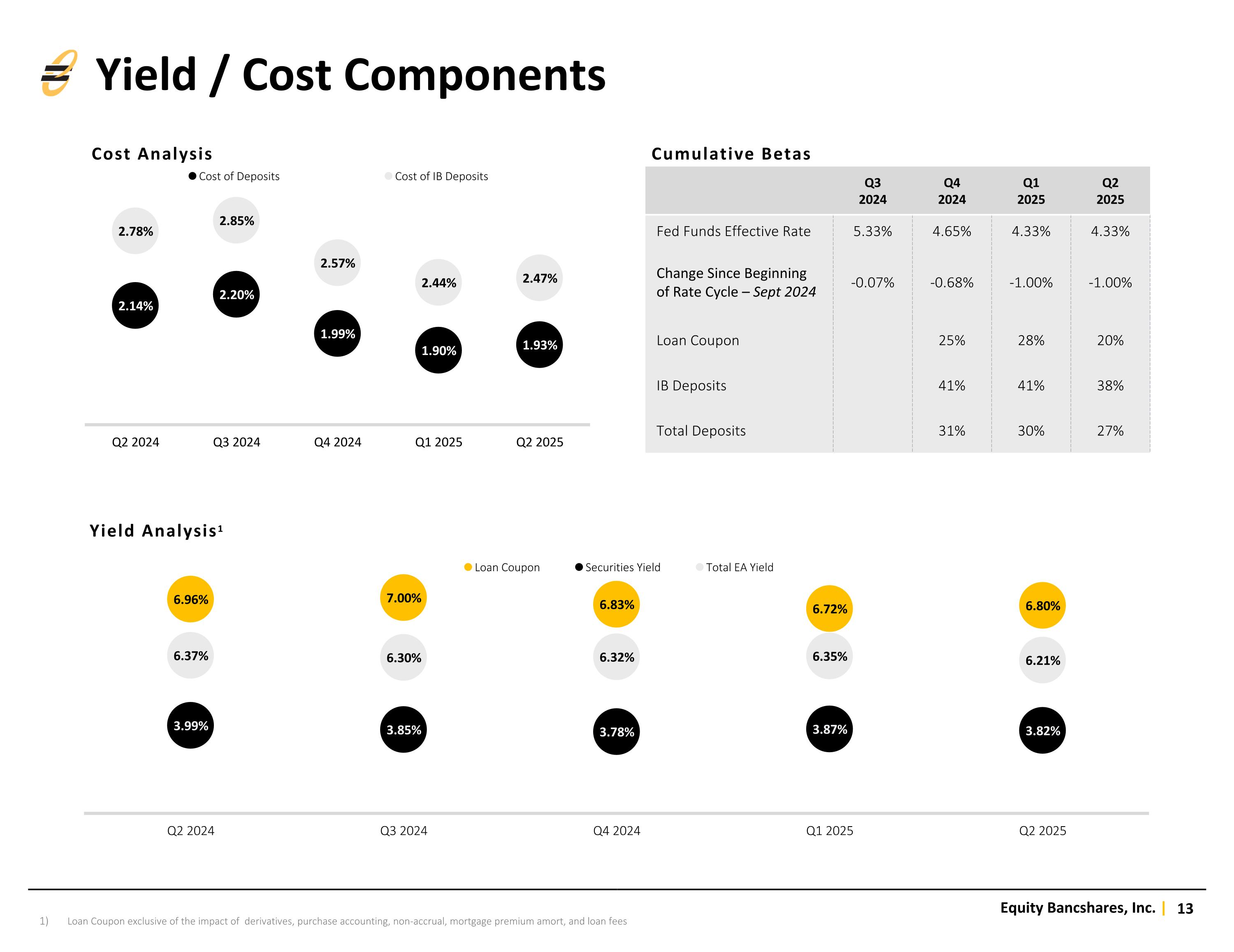

Yield Analysis1 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Fed Funds Effective Rate 5.33% 4.65% 4.33% 4.33% Change Since Beginning of Rate Cycle – Sept 2024 -0.07% -0.68% -1.00% -1.00% Loan Coupon 25% 28% 20% IB Deposits 41% 41% 38% Total Deposits 31% 30% 27% Yield / Cost Components Loan Coupon exclusive of the impact of derivatives, purchase accounting, non-accrual, mortgage premium amort, and loan fees Cost Analysis Cumulative Betas

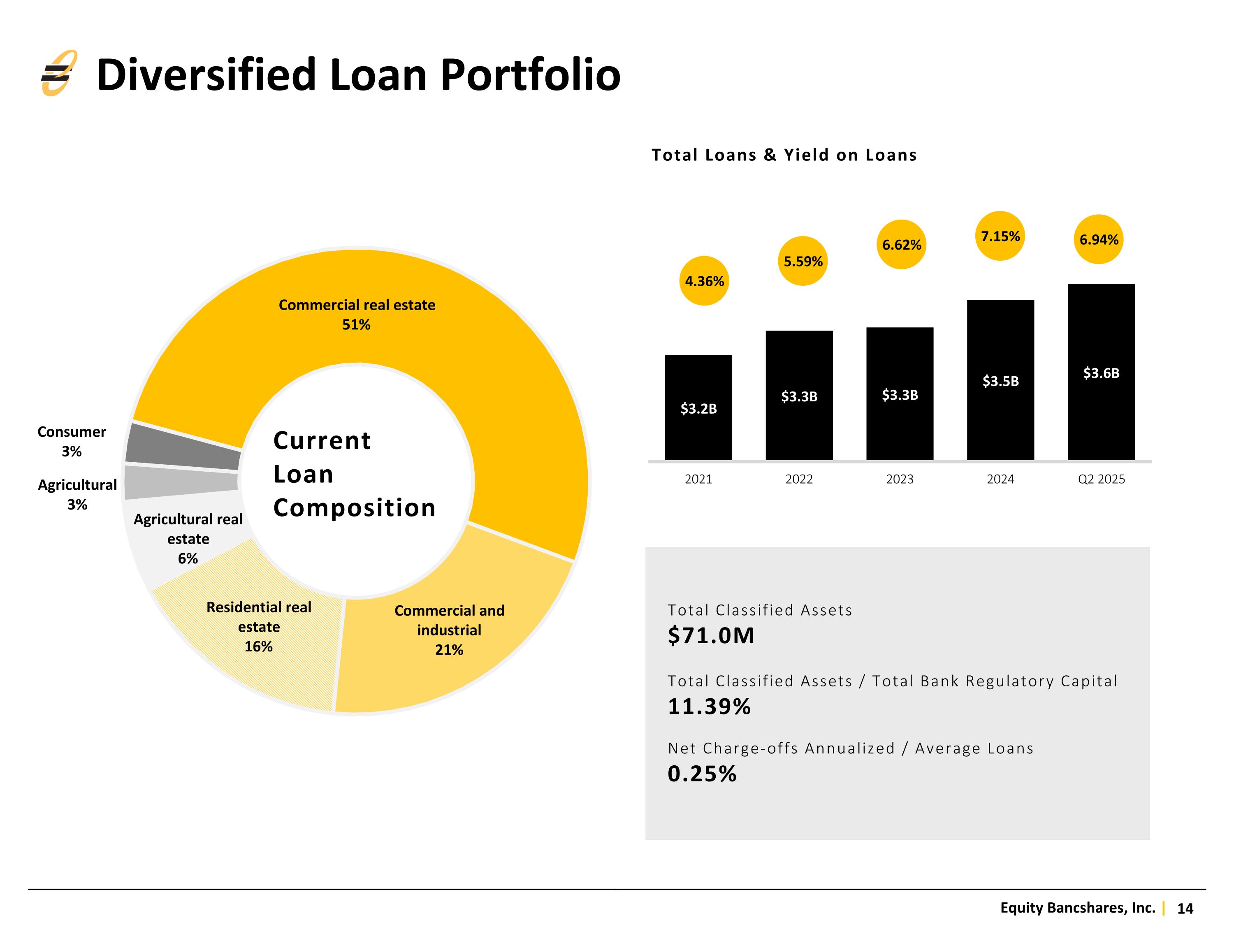

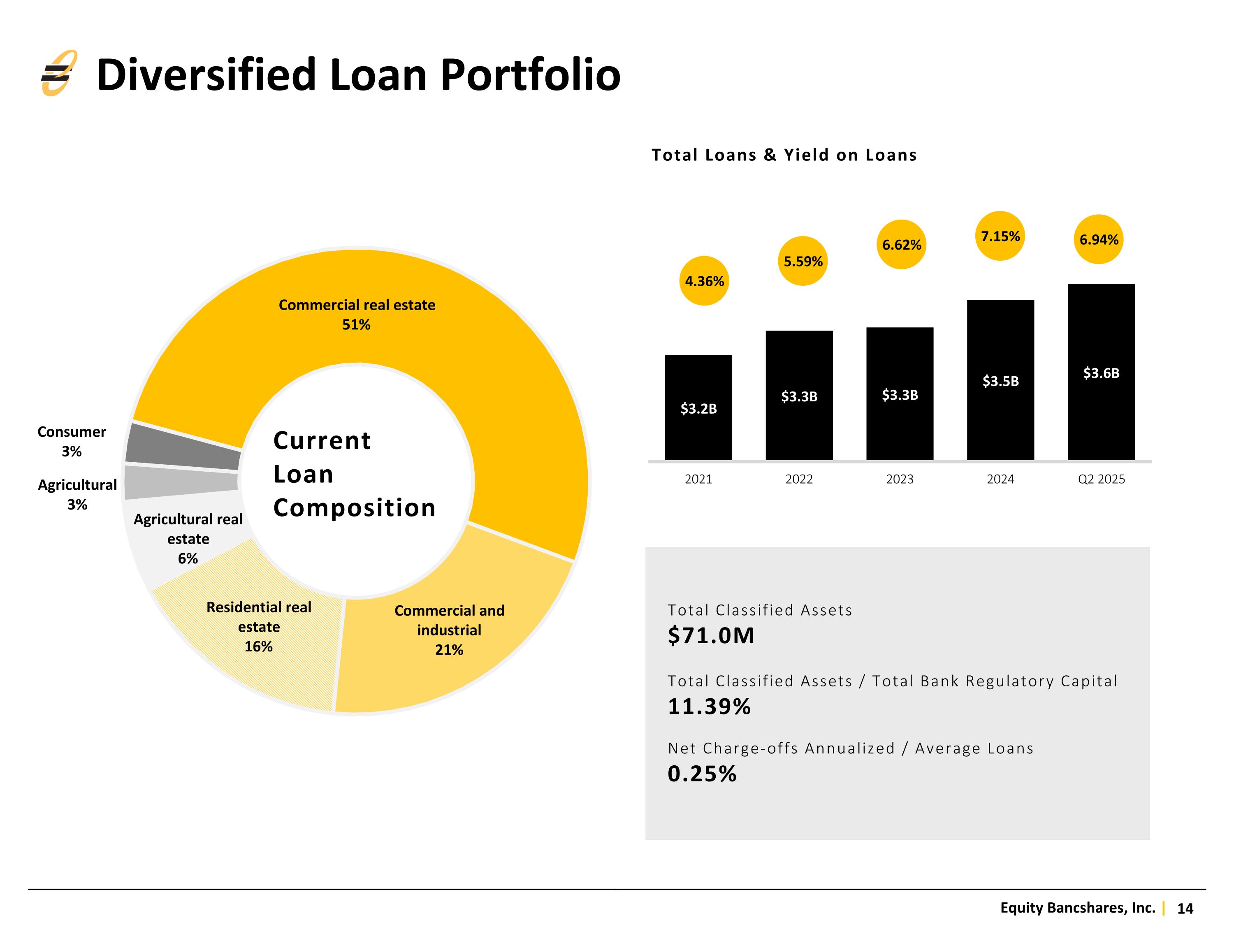

Total Classified Assets $71.0M Total Classified Assets / Total Bank Regulatory Capital 11.39% Net Charge-offs Annualized / Average Loans 0.25% Total Loans & Yield on Loans Diversified Loan Portfolio Current Loan Composition

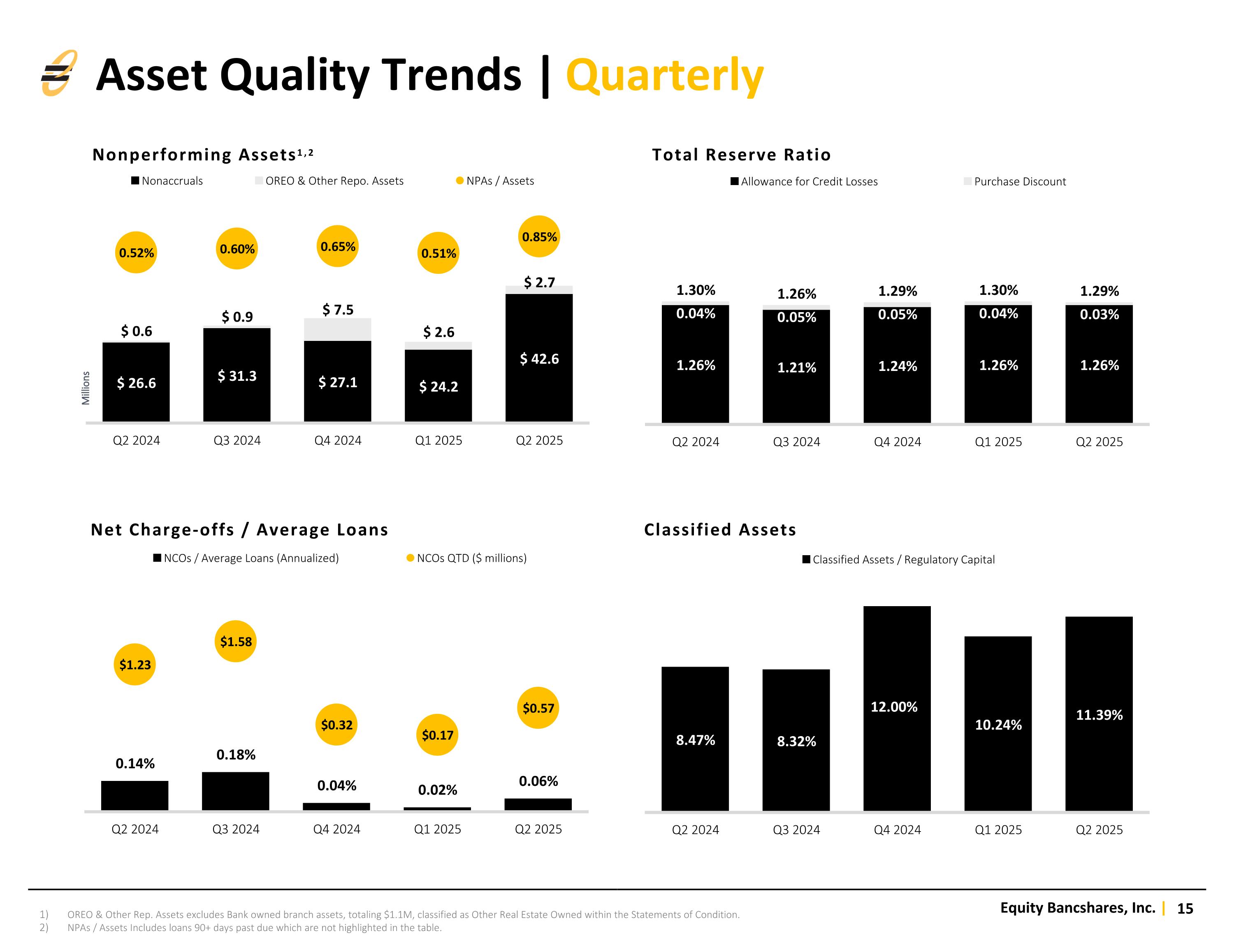

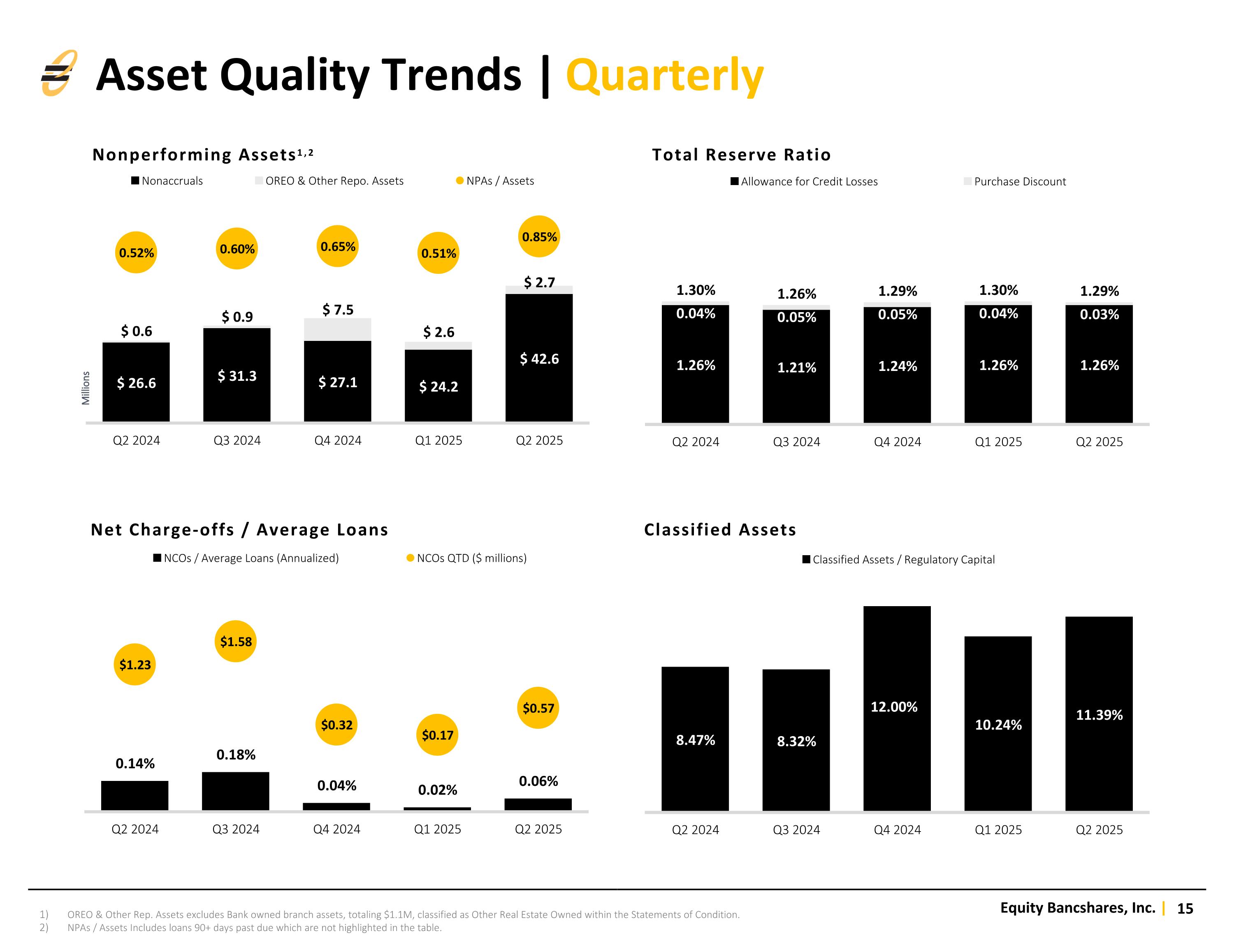

Nonperforming Assets1,2 Total Reserve Ratio OREO & Other Rep. Assets excludes Bank owned branch assets, totaling $1.1M, classified as Other Real Estate Owned within the Statements of Condition. NPAs / Assets Includes loans 90+ days past due which are not highlighted in the table. Net Charge-offs / Average Loans Classified Assets Asset Quality Trends | Quarterly

OREO & Other Rep. Assets excludes Bank owned branch assets, totaling $1.1M, classified as Other Real Estate Owned within the Statements of Condition. NPAs / Assets Includes loans 90+ days past due which are not highlighted in the table. Net Charge-offs / Average Loans Classified Assets Nonperforming Assets1,2 Total Reserve Ratio Asset Quality Trends | Annual

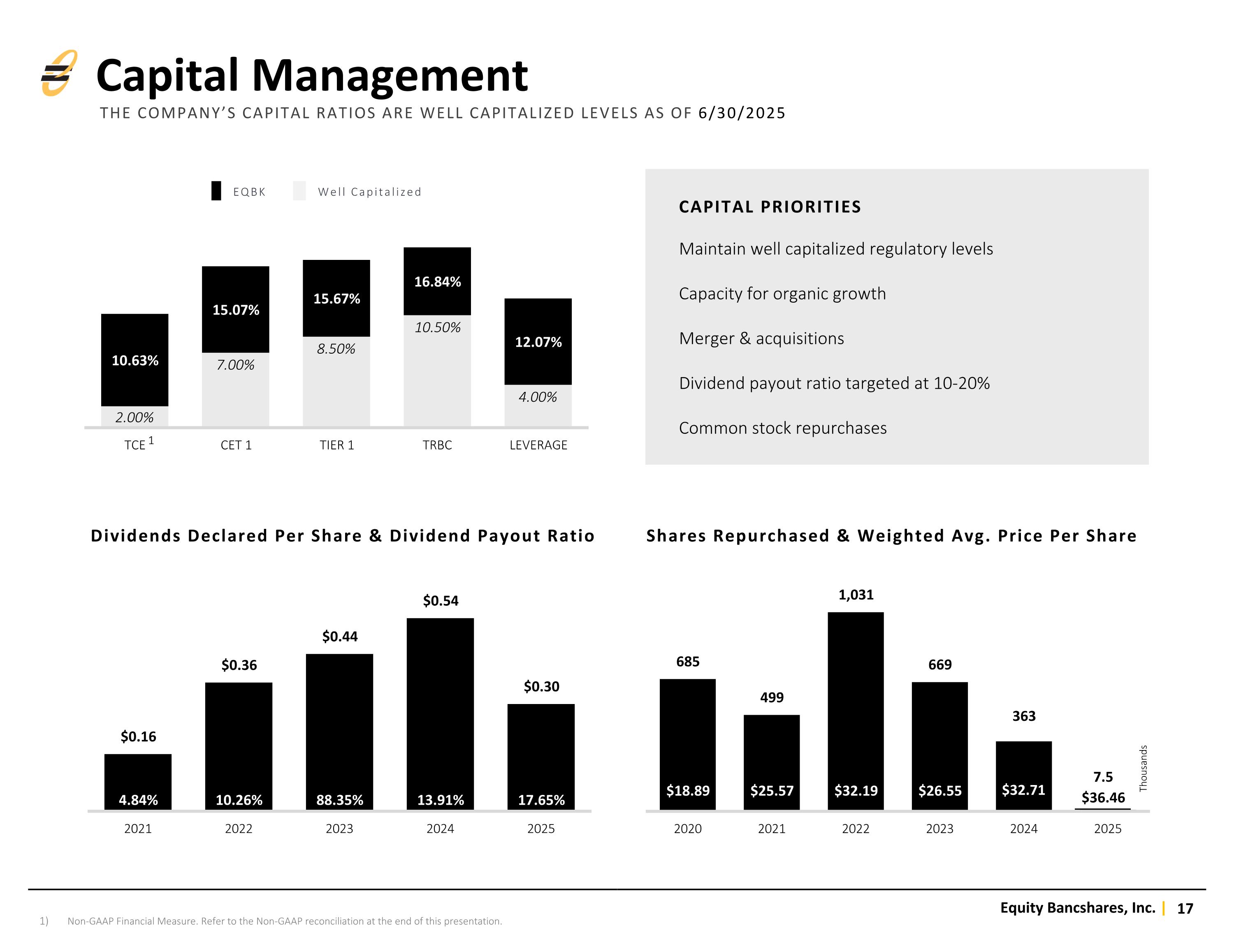

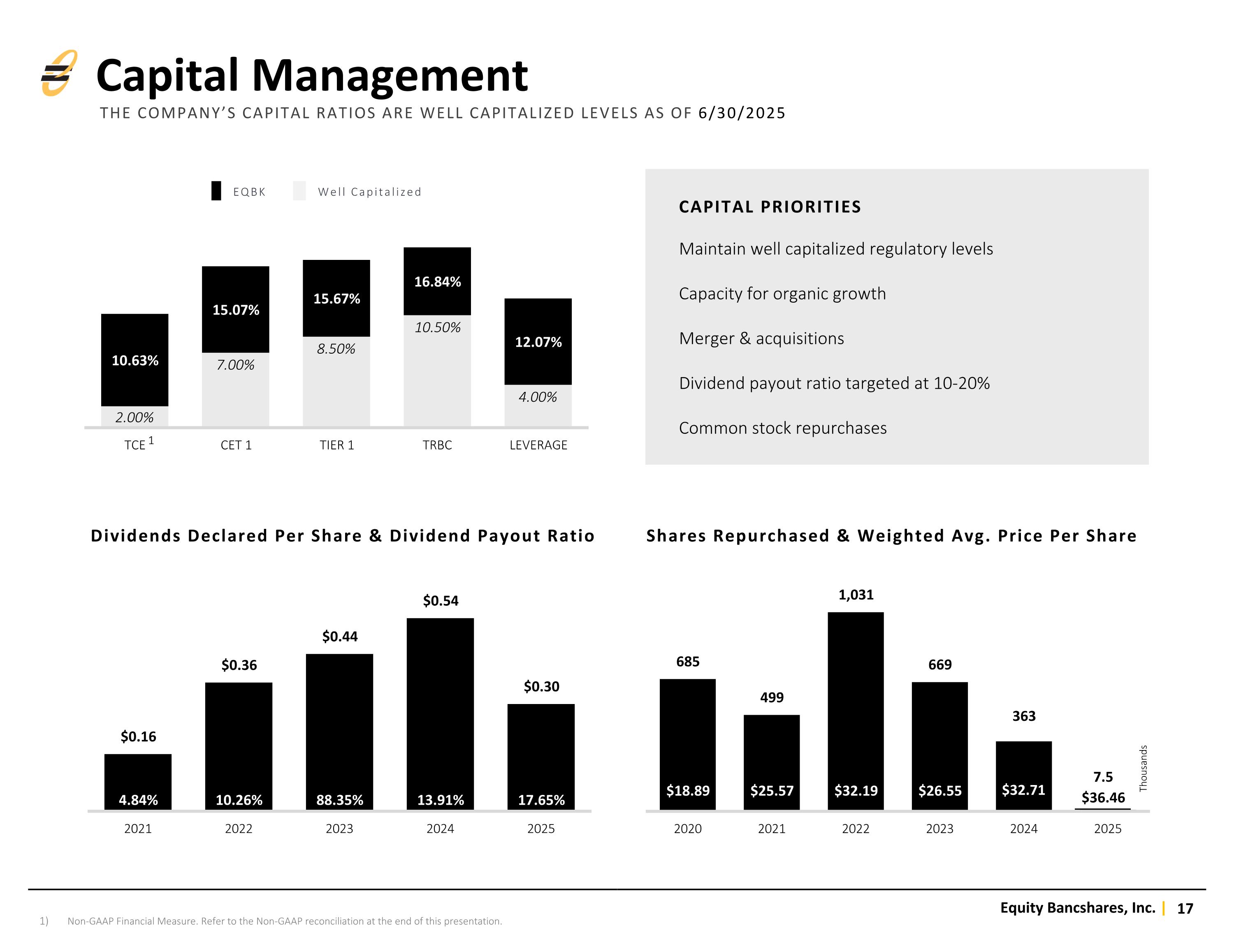

Non-GAAP Financial Measure. Refer to the Non-GAAP reconciliation at the end of this presentation. EQBK Well Capitalized CAPITAL PRIORITIES Maintain well capitalized regulatory levels Capacity for organic growth Merger & acquisitions Dividend payout ratio targeted at 10-20% Common stock repurchases Dividends Declared Per Share & Dividend Payout Ratio Shares Repurchased & Weighted Avg. Price Per Share 1 Thousands Capital Management THE COMPANY’S CAPITAL RATIOS ARE WELL CAPITALIZED LEVELS AS OF 6/30/2025

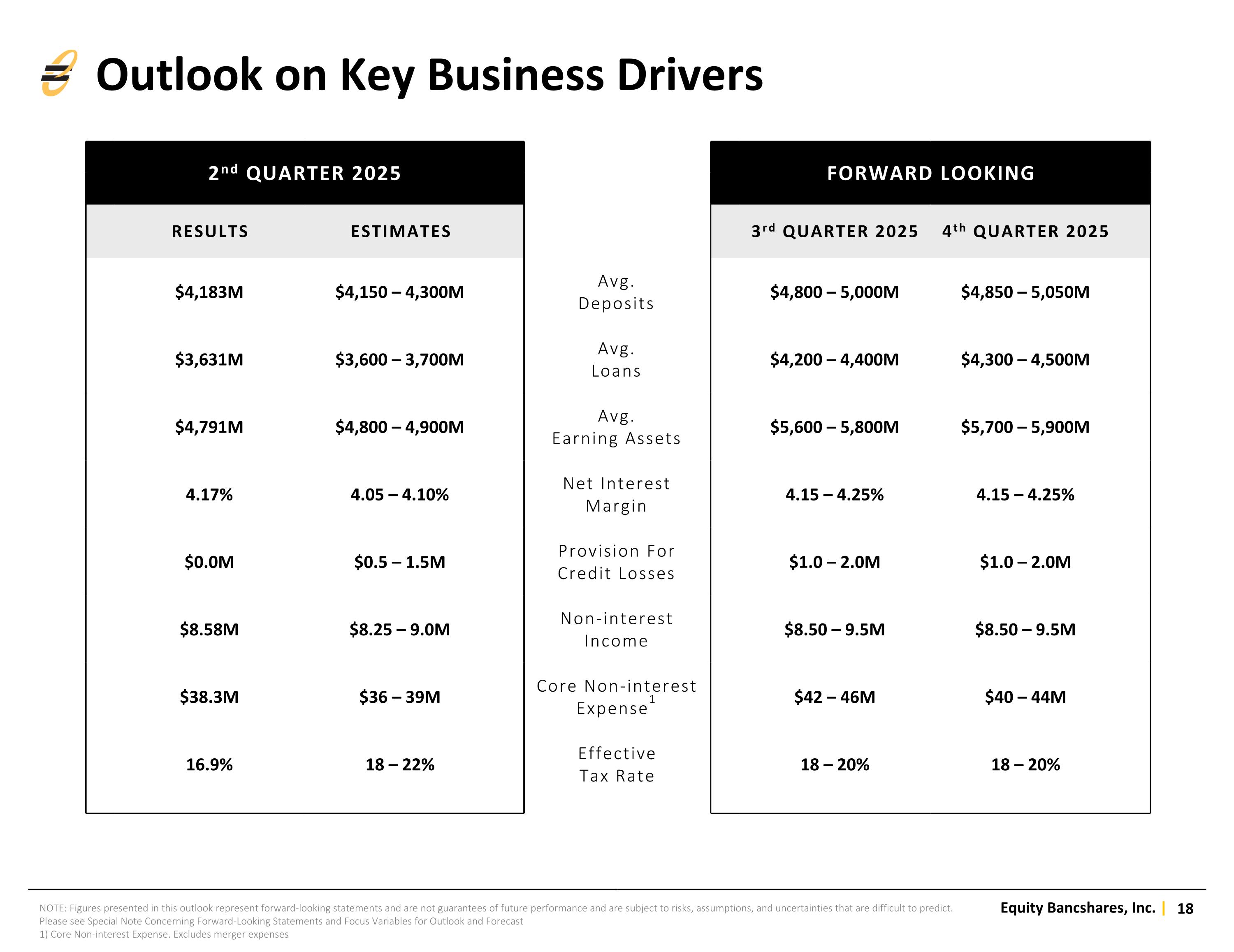

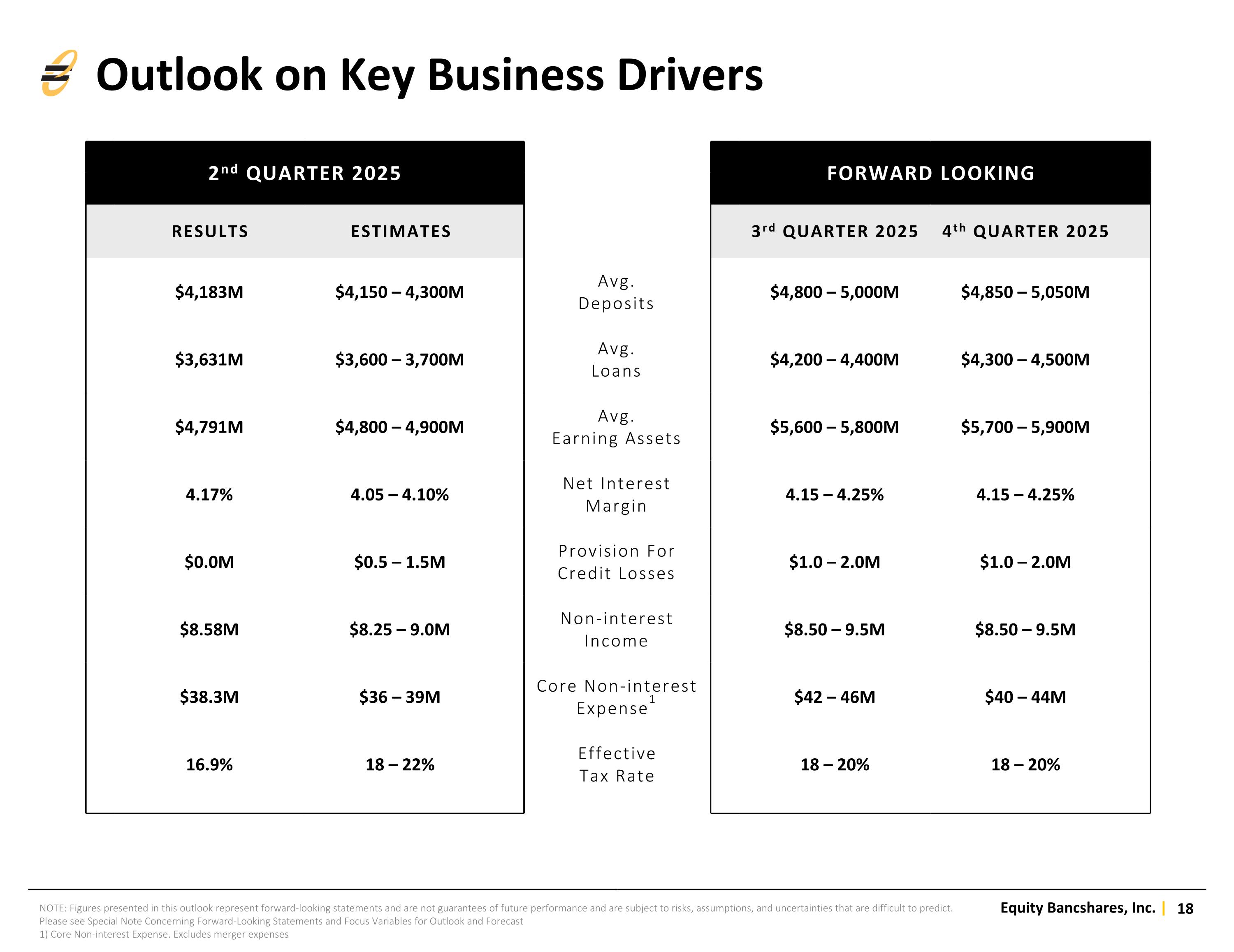

NOTE: Figures presented in this outlook represent forward-looking statements and are not guarantees of future performance and are subject to risks, assumptions, and uncertainties that are difficult to predict. Please see Special Note Concerning Forward-Looking Statements and Focus Variables for Outlook and Forecast 1) Core Non-interest Expense. Excludes merger expenses 2nd QUARTER 2025 RESULTS ESTIMATES $4,183M $4,150 – 4,300M Avg. Deposits $3,631M $3,600 – 3,700M Avg. Loans $4,791M $4,800 – 4,900M Avg. Earning Assets 4.17% 4.05 – 4.10% Net Interest Margin $0.0M $0.5 – 1.5M Provision For Credit Losses $8.58M $8.25 – 9.0M Non-interest Income $38.3M $36 – 39M Core Non-interest Expense1 16.9% 18 – 22% Effective Tax Rate FORWARD LOOKING 3rd QUARTER 2025 4th QUARTER 2025 $4,800 – 5,000M $4,850 – 5,050M $4,200 – 4,400M $4,300 – 4,500M $5,600 – 5,800M $5,700 – 5,900M 4.15 – 4.25% 4.15 – 4.25% $1.0 – 2.0M $1.0 – 2.0M $8.50 – 9.5M $8.50 – 9.5M $42 – 46M $40 – 44M 18 – 20% 18 – 20% Outlook on Key Business Drivers

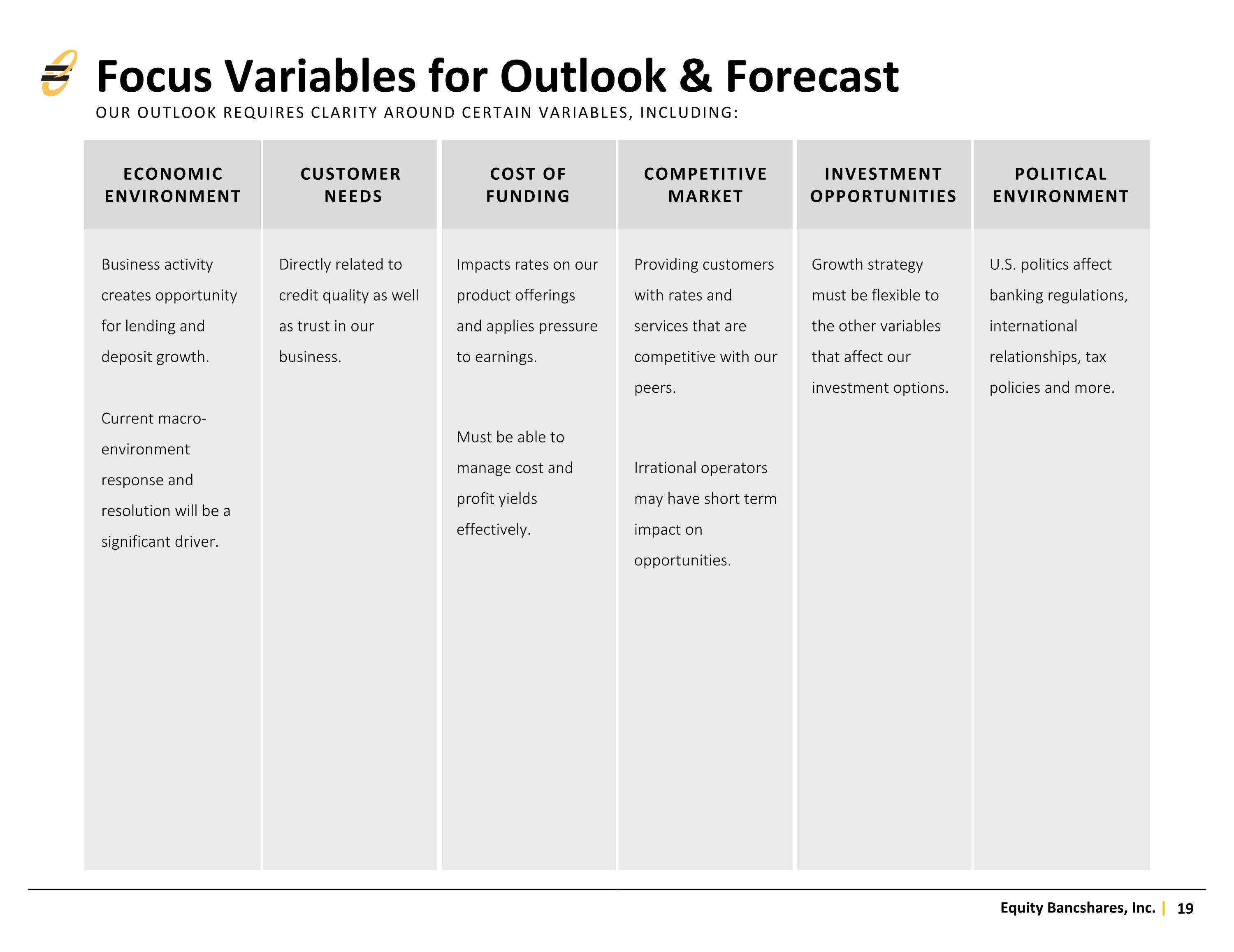

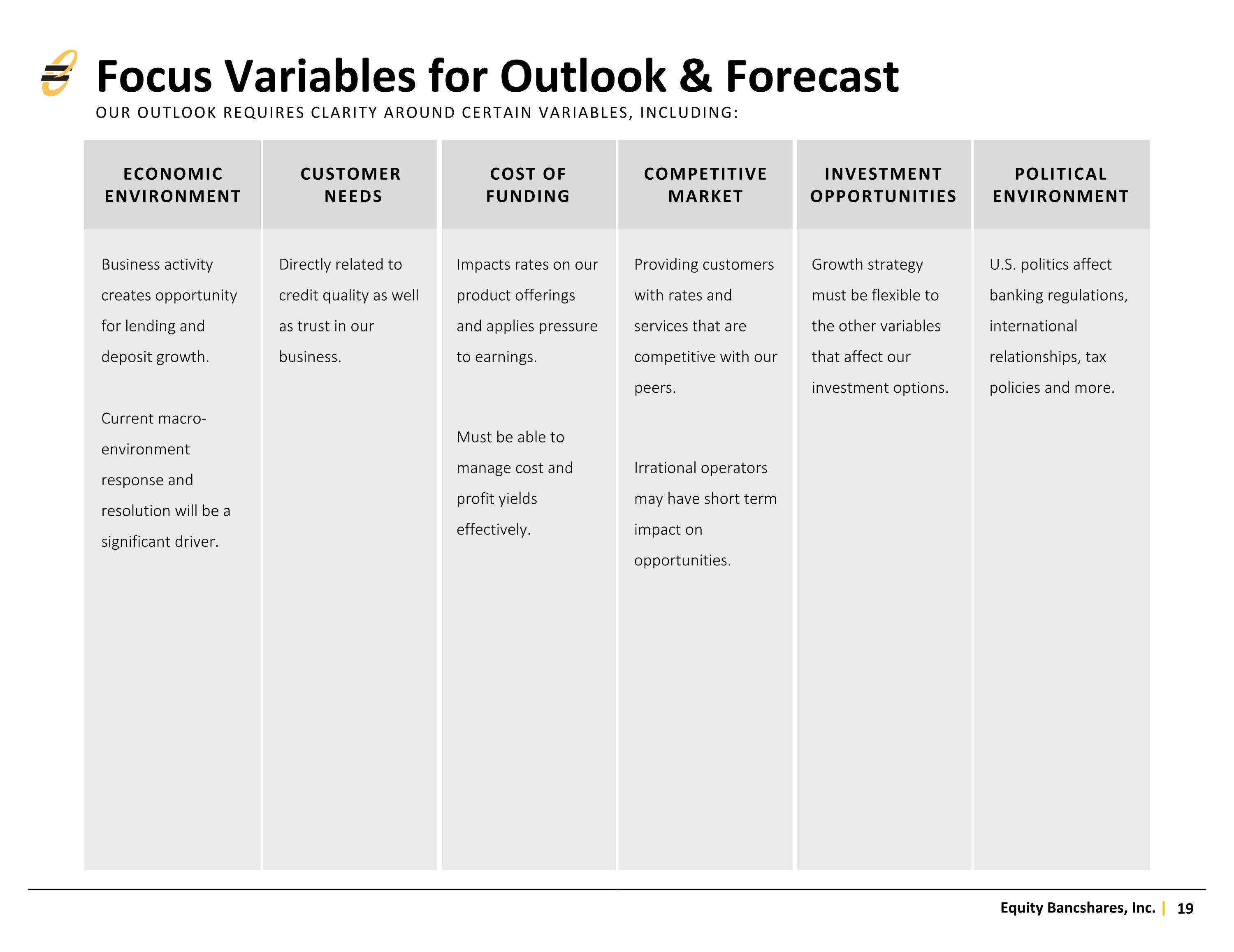

Focus Variables for Outlook & ForecastOUR OUTLOOK REQUIRES CLARITY AROUND CERTAIN VARIABLES, INCLUDING: ECONOMIC ENVIRONMENT CUSTOMER NEEDS COST OF FUNDING COMPETITIVE MARKET INVESTMENT OPPORTUNITIES POLITICAL ENVIRONMENT Business activity creates opportunity for lending and deposit growth. Current macro-environment response and resolution will be a significant driver. Directly related to credit quality as well as trust in our business. Impacts rates on our product offerings and applies pressure to earnings. Must be able to manage cost and profit yields effectively. Providing customers with rates and services that are competitive with our peers. Irrational operators may have short term impact on opportunities. Growth strategy must be flexible to the other variables that affect our investment options. U.S. politics affect banking regulations, international relationships, tax policies and more.

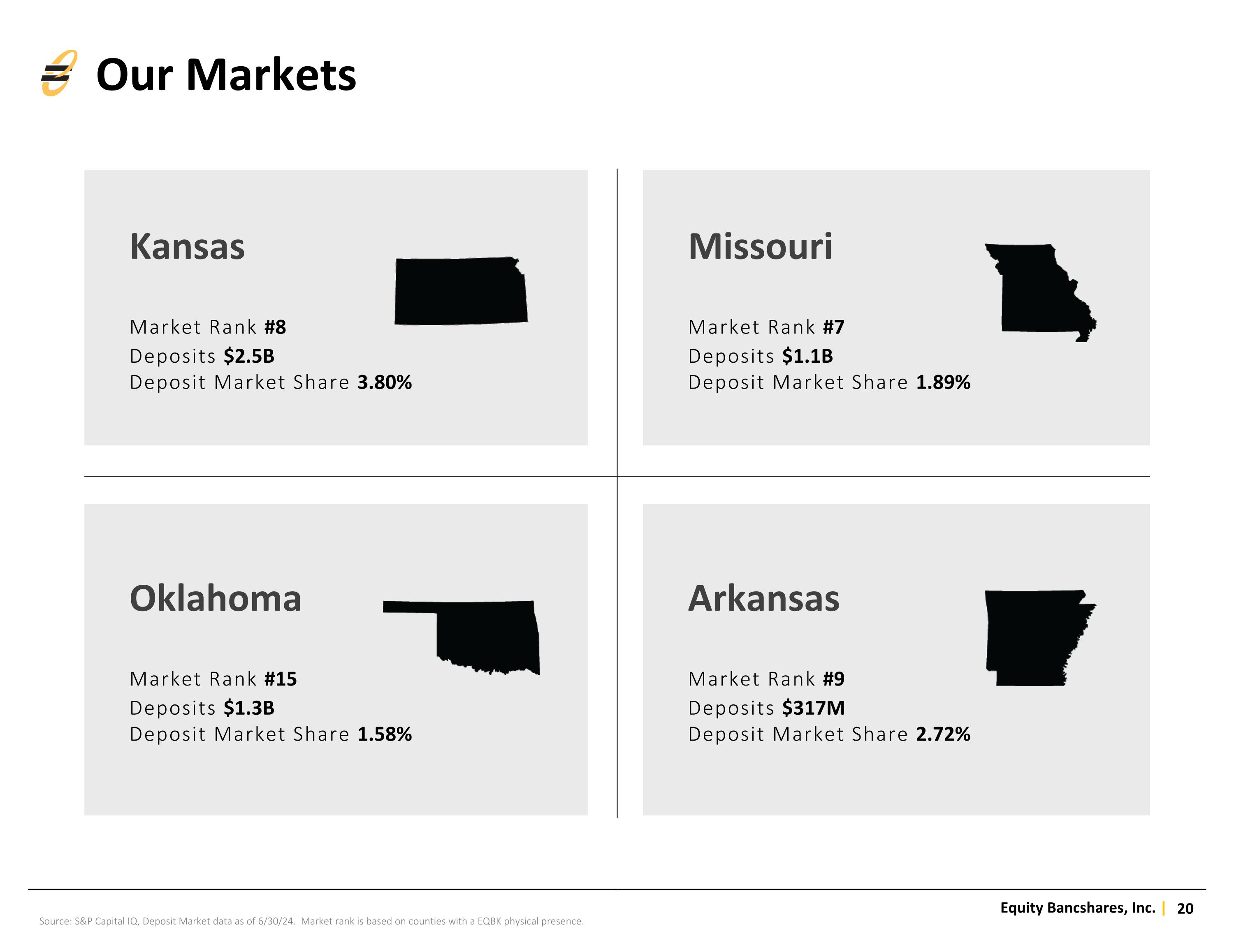

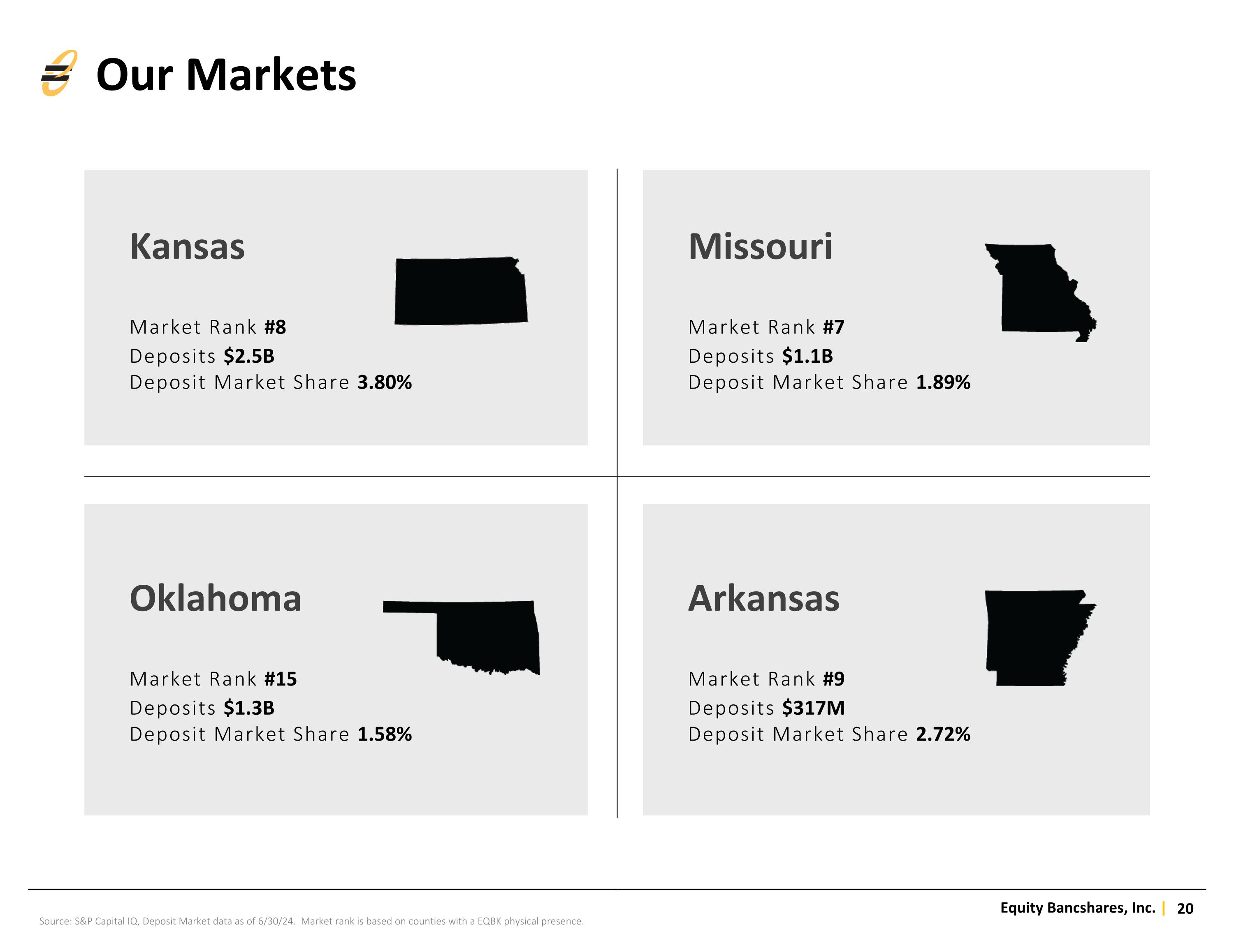

Our Markets Source: S&P Capital IQ, Deposit Market data as of 6/30/24. Market rank is based on counties with a EQBK physical presence. Kansas Market Rank #8 Deposits $2.5B Deposit Market Share 3.80% Missouri Market Rank #7 Deposits $1.1B Deposit Market Share 1.89% Oklahoma Market Rank #15 Deposits $1.3B Deposit Market Share 1.58% Arkansas Market Rank #9 Deposits $317M Deposit Market Share 2.72%

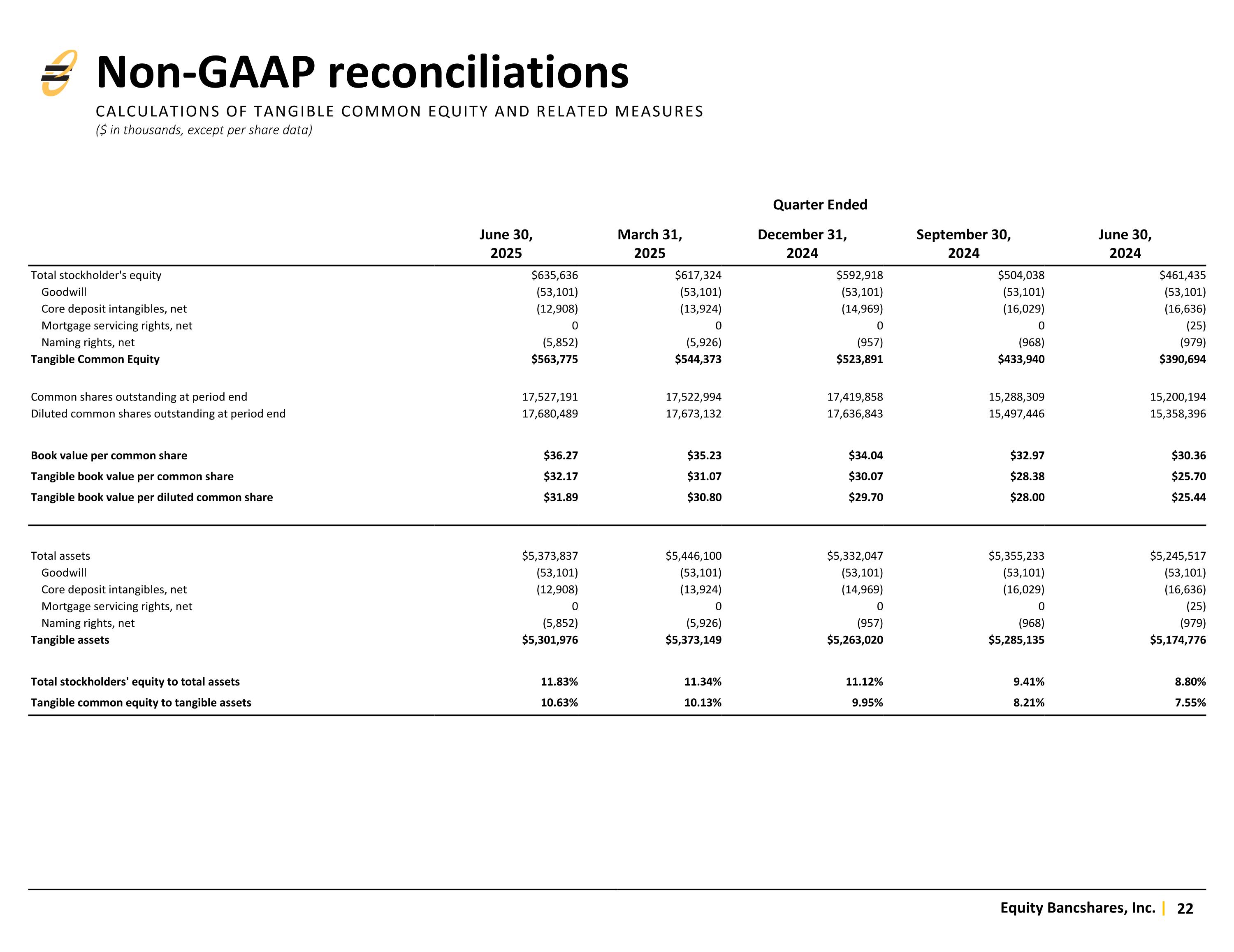

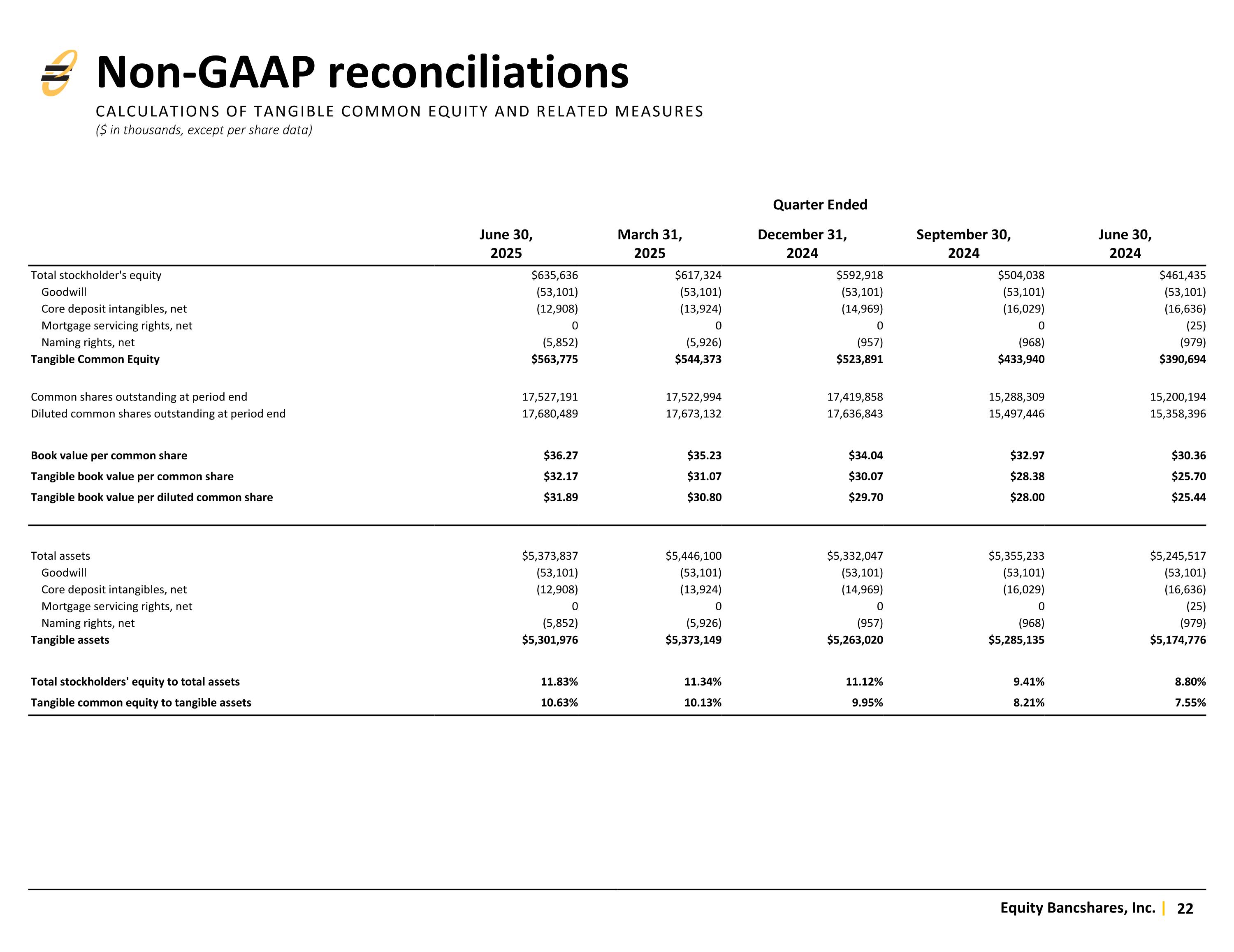

Quarter Ended June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 June 30, 2024 Total stockholder's equity $635,636 $617,324 $592,918 $504,038 $461,435 Goodwill (53,101) (53,101) (53,101) (53,101) (53,101) Core deposit intangibles, net (12,908) (13,924) (14,969) (16,029) (16,636) Mortgage servicing rights, net 0 0 0 0 (25) Naming rights, net (5,852) (5,926) (957) (968) (979) Tangible Common Equity $563,775 $544,373 $523,891 $433,940 $390,694 Common shares outstanding at period end 17,527,191 17,522,994 17,419,858 15,288,309 15,200,194 Diluted common shares outstanding at period end 17,680,489 17,673,132 17,636,843 15,497,446 15,358,396 Book value per common share $36.27 $35.23 $34.04 $32.97 $30.36 Tangible book value per common share $32.17 $31.07 $30.07 $28.38 $25.70 Tangible book value per diluted common share $31.89 $30.80 $29.70 $28.00 $25.44 Total assets $5,373,837 $5,446,100 $5,332,047 $5,355,233 $5,245,517 Goodwill (53,101) (53,101) (53,101) (53,101) (53,101) Core deposit intangibles, net (12,908) (13,924) (14,969) (16,029) (16,636) Mortgage servicing rights, net 0 0 0 0 (25) Naming rights, net (5,852) (5,926) (957) (968) (979) Tangible assets $5,301,976 $5,373,149 $5,263,020 $5,285,135 $5,174,776 Total stockholders' equity to total assets 11.83% 11.34% 11.12% 9.41% 8.80% Tangible common equity to tangible assets 10.63% 10.13% 9.95% 8.21% 7.55% Non-GAAP reconciliationsCALCULATIONS OF TANGIBLE COMMON EQUITY AND RELATED MEASURES($ in thousands, except per share data)

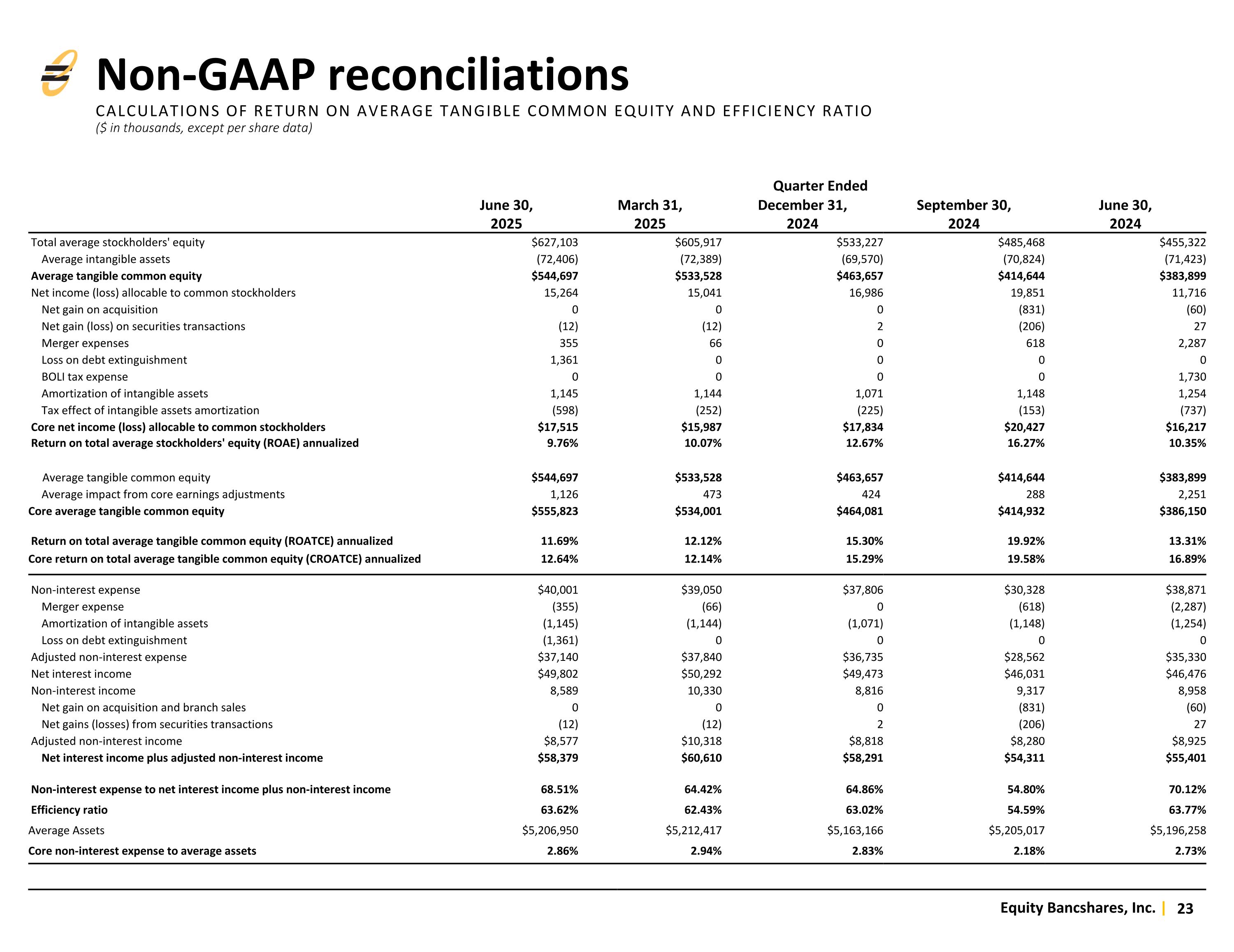

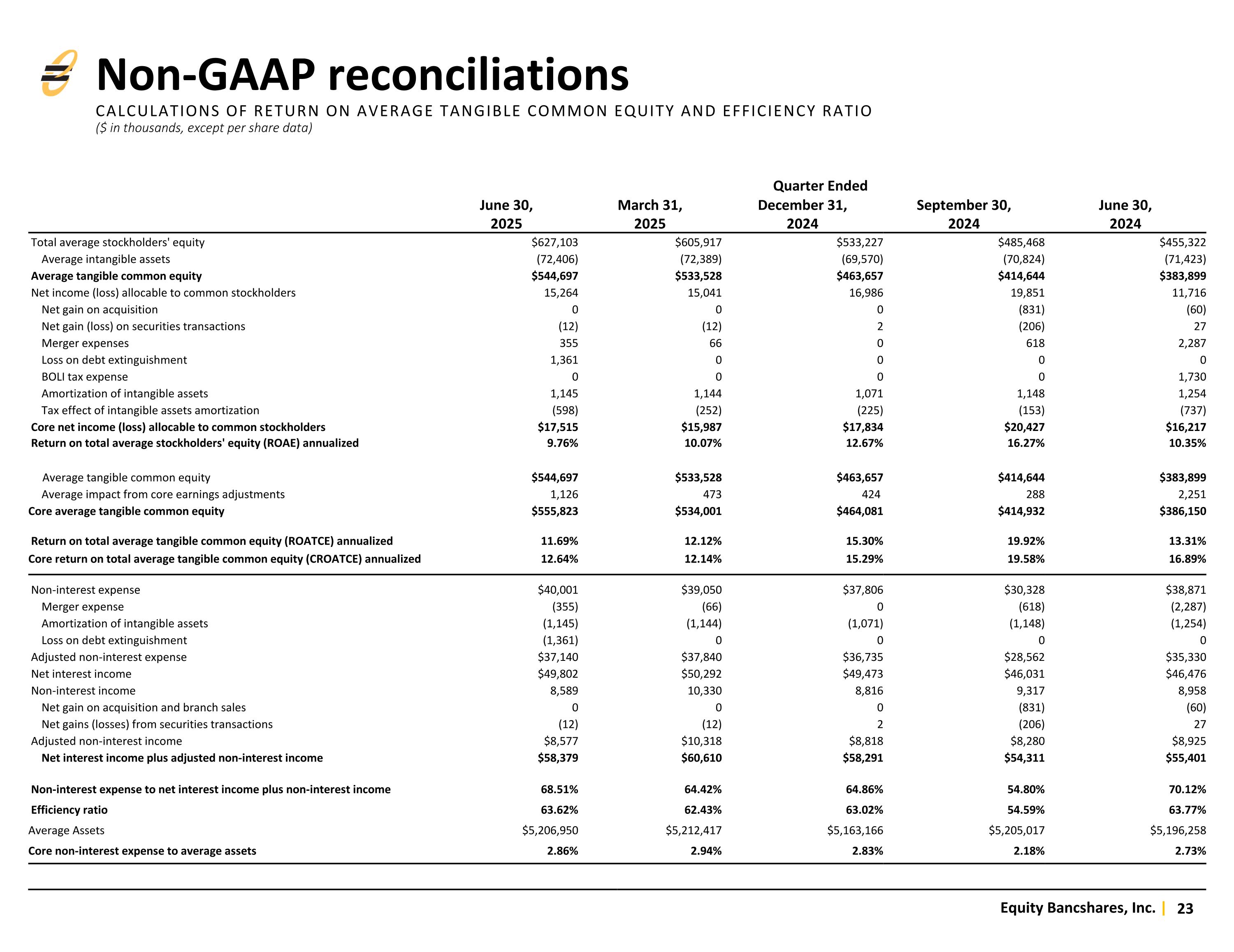

Quarter Ended June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 June 30, 2024 Total average stockholders' equity $627,103 $605,917 $533,227 $485,468 $455,322 Average intangible assets (72,406) (72,389) (69,570) (70,824) (71,423) Average tangible common equity $544,697 $533,528 $463,657 $414,644 $383,899 Net income (loss) allocable to common stockholders 15,264 15,041 16,986 19,851 11,716 Net gain on acquisition 0 0 0 (831) (60) Net gain (loss) on securities transactions (12) (12) 2 (206) 27 Merger expenses 355 66 0 618 2,287 Loss on debt extinguishment 1,361 0 0 0 0 BOLI tax expense 0 0 0 0 1,730 Amortization of intangible assets 1,145 1,144 1,071 1,148 1,254 Tax effect of intangible assets amortization (598) (252) (225) (153) (737) Core net income (loss) allocable to common stockholders $17,515 $15,987 $17,834 $20,427 $16,217 Return on total average stockholders' equity (ROAE) annualized 9.76% 10.07% 12.67% 16.27% 10.35% Average tangible common equity $544,697 $533,528 $463,657 $414,644 $383,899 Average impact from core earnings adjustments 1,126 473 424 288 2,251 Core average tangible common equity $555,823 $534,001 $464,081 $414,932 $386,150 Return on total average tangible common equity (ROATCE) annualized 11.69% 12.12% 15.30% 19.92% 13.31% Core return on total average tangible common equity (CROATCE) annualized 12.64% 12.14% 15.29% 19.58% 16.89% Non-interest expense $40,001 $39,050 $37,806 $30,328 $38,871 Merger expense (355) (66) 0 (618) (2,287) Amortization of intangible assets (1,145) (1,144) (1,071) (1,148) (1,254) Loss on debt extinguishment (1,361) 0 0 0 0 Adjusted non-interest expense $37,140 $37,840 $36,735 $28,562 $35,330 Net interest income $49,802 $50,292 $49,473 $46,031 $46,476 Non-interest income 8,589 10,330 8,816 9,317 8,958 Net gain on acquisition and branch sales 0 0 0 (831) (60) Net gains (losses) from securities transactions (12) (12) 2 (206) 27 Adjusted non-interest income $8,577 $10,318 $8,818 $8,280 $8,925 Net interest income plus adjusted non-interest income $58,379 $60,610 $58,291 $54,311 $55,401 Non-interest expense to net interest income plus non-interest income 68.51% 64.42% 64.86% 54.80% 70.12% Efficiency ratio 63.62% 62.43% 63.02% 54.59% 63.77% Average Assets $5,206,950 $5,212,417 $5,163,166 $5,205,017 $5,196,258 Core non-interest expense to average assets 2.86% 2.94% 2.83% 2.18% 2.73% Non-GAAP reconciliationsCALCULATIONS OF RETURN ON AVERAGE TANGIBLE COMMON EQUITY AND EFFICIENCY RATIO($ in thousands, except per share data)

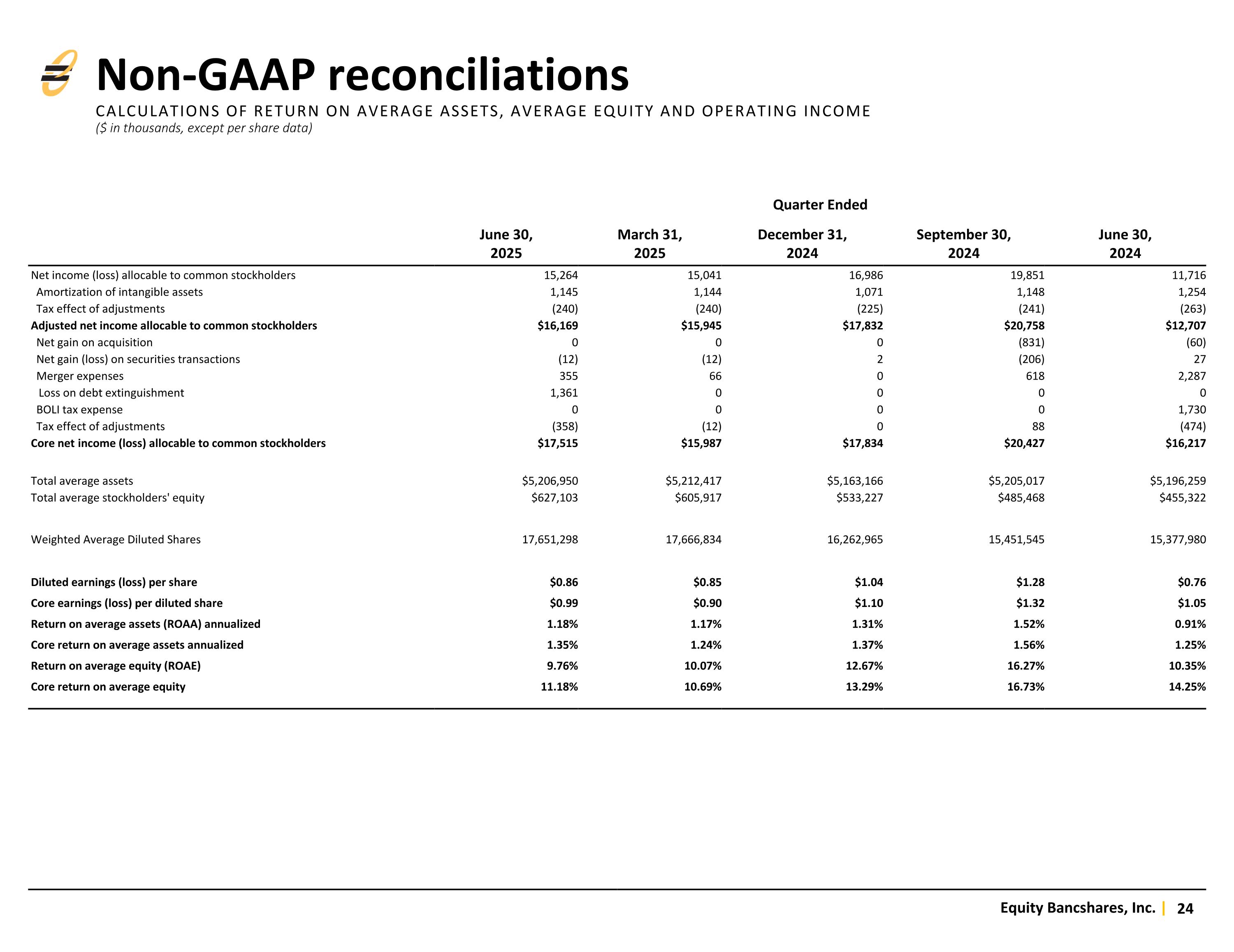

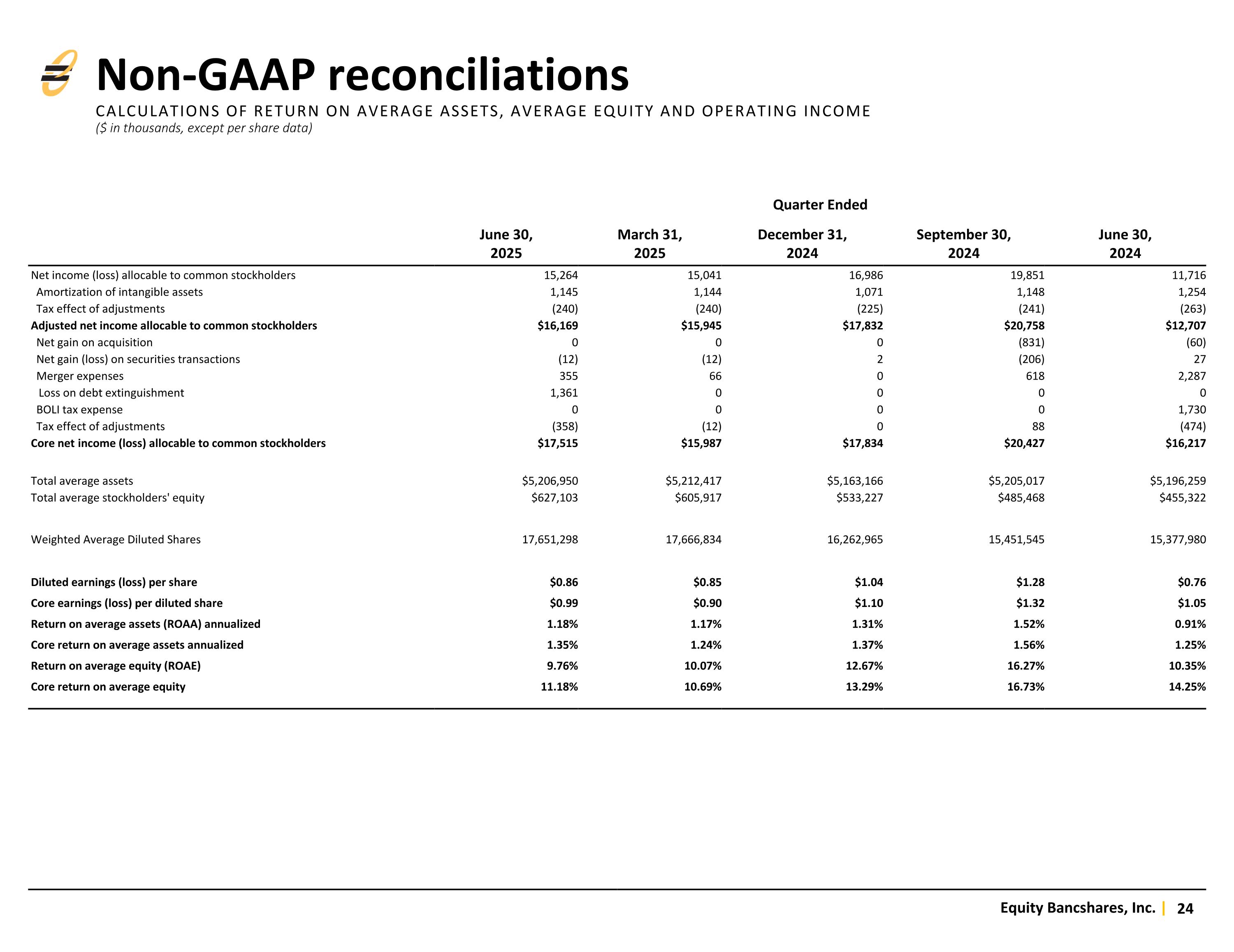

Quarter Ended June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 June 30, 2024 Net income (loss) allocable to common stockholders 15,264 15,041 16,986 19,851 11,716 Amortization of intangible assets 1,145 1,144 1,071 1,148 1,254 Tax effect of adjustments (240) (240) (225) (241) (263) Adjusted net income allocable to common stockholders $16,169 $15,945 $17,832 $20,758 $12,707 Net gain on acquisition 0 0 0 (831) (60) Net gain (loss) on securities transactions (12) (12) 2 (206) 27 Merger expenses 355 66 0 618 2,287 Loss on debt extinguishment 1,361 0 0 0 0 BOLI tax expense 0 0 0 0 1,730 Tax effect of adjustments (358) (12) 0 88 (474) Core net income (loss) allocable to common stockholders $17,515 $15,987 $17,834 $20,427 $16,217 Total average assets $5,206,950 $5,212,417 $5,163,166 $5,205,017 $5,196,259 Total average stockholders' equity $627,103 $605,917 $533,227 $485,468 $455,322 Weighted Average Diluted Shares 17,651,298 17,666,834 16,262,965 15,451,545 15,377,980 Diluted earnings (loss) per share $0.86 $0.85 $1.04 $1.28 $0.76 Core earnings (loss) per diluted share $0.99 $0.90 $1.10 $1.32 $1.05 Return on average assets (ROAA) annualized 1.18% 1.17% 1.31% 1.52% 0.91% Core return on average assets annualized 1.35% 1.24% 1.37% 1.56% 1.25% Return on average equity (ROAE) 9.76% 10.07% 12.67% 16.27% 10.35% Core return on average equity 11.18% 10.69% 13.29% 16.73% 14.25% Non-GAAP reconciliationsCALCULATIONS OF RETURN ON AVERAGE ASSETS, AVERAGE EQUITY AND OPERATING INCOME($ in thousands, except per share data)

investor.equitybank.com